UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-33631

Crestwood Midstream Partners LP

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 56-2639586 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

717 Texas Avenue, Suite 3150, Houston, Texas | | 77002 |

| (Address of principal executive offices) | | (Zip Code) |

(832) 519-2200

(Registrant’s telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | þ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller Reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of the issuer’s common units and Class C units, as of the latest practicable date:

| | |

Title of Class | | Outstanding as of April 30, 2012 |

| Common Units | | 36,538,228 |

| Class C Units | | 6,716,730 |

CRESTWOOD MIDSTREAM PARTNERS LP

INDEX TO FORM 10-Q

For the Period Ended March 31, 2012

2

FORWARD-LOOKING INFORMATION

Certain statements contained in this report and other materials we file with the U.S. Securities and Exchange Commission (“SEC”), or in other written or oral statements made or to be made by us, other than statements of historical fact, are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect our current expectations or forecasts of future events. Words such as “may,” “assume,” “forecast,” “predict,” “strategy,” “expect,” “intend,” “plan,” “aim,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward-looking statements. Forward-looking statements can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward-looking statements can be guaranteed.

Important factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include, but are not limited to, the following risks and uncertainties:

| | • | | changes in general economic conditions; |

| | • | | fluctuations in oil, natural gas and natural gas liquids prices; |

| | • | | the extent and success of drilling efforts, as well as the extent and quality of natural gas volumes produced within proximity of our assets; |

| | • | | failure or delays by our customers in achieving expected production in their natural gas projects; |

| | • | | competitive conditions in our industry and their impact on our ability to connect natural gas supplies to our gathering and processing assets or systems; |

| | • | | actions or inactions taken or non-performance by third parties, including suppliers, contractors, operators, processors, transporters and customers; |

| | • | | our ability to consummate acquisitions, successfully integrate the acquired businesses, realize any cost savings and other synergies from any acquisition; |

| | • | | changes in the availability and cost of capital; |

| | • | | operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; |

| | • | | timely receipt of necessary government approvals and permits, our ability to control the costs of construction, including costs of materials, labor and right-of-way and other factors that may impact our ability to complete projects within budget and on schedule; |

| | • | | the effects of existing and future laws and governmental regulations, including environmental and climate change requirements; |

| | • | | the effects of existing and future litigation; |

| | • | | risks related to our substantial indebtedness; and |

| | • | | certain factors discussed elsewhere in this report. |

These factors do not necessarily include all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other factors could also have material adverse effects on future results. Consequently, all of the forward-looking statements made in this document are qualified by these cautionary statements, and we cannot assure you that actual results or developments that we anticipate will be realized or, even if substantially realized, will have the expected consequences to, or effect on, us or our business or operations. Also note that we provided additional cautionary discussion of risks and uncertainties in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2011.

Although the expectations in the forward-looking statements are based on our current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. Except as required by federal and state securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this report and in our future periodic reports filed with the SEC. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this report may not occur.

3

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

CRESTWOOD MIDSTREAM PARTNERS LP

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except for per unit data - Unaudited)

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2012 | | | 2011 | |

Revenue | | | | | | | | |

Gathering revenue - related party | | $ | 23,846 | | | $ | 23,351 | |

Gathering revenue | | | 11,837 | | | | 1,476 | |

Processing revenue - related party | | | 6,771 | | | | 6,637 | |

Processing revenue | | | 1,196 | | | | 516 | |

Product sales | | | 10,083 | | | | 400 | |

| | | | | | | | |

Total revenue | | | 53,733 | | | | 32,380 | |

| | | | | | | | |

Expenses | | | | | | | | |

Operations and maintenance | | | 9,711 | | | | 7,381 | |

Product purchases | | | 8,973 | | | | — | |

General and administrative | | | 6,738 | | | | 6,370 | |

Depreciation, amortization and accretion | | | 10,646 | | | | 6,025 | |

| | | | | | | | |

Total expenses | | | 36,068 | | | | 19,776 | |

| | | | | | | | |

Operating income | | | 17,665 | | | | 12,604 | |

Interest expense | | | 7,557 | | | | 3,006 | |

| | | | | | | | |

Income from operations before income taxes | | | 10,108 | | | | 9,598 | |

Income tax provision | | | 303 | | | | 222 | |

| | | | | | | | |

Net income | | $ | 9,805 | | | $ | 9,376 | |

| | | | | | | | |

General partner’s interest in net income | | $ | 3,368 | | | $ | 888 | |

Limited partners’ interest in net income | | $ | 6,437 | | | $ | 8,488 | |

Basic income per unit: | | | | | | | | |

Net income per limited partner unit | | $ | 0.15 | | | $ | 0.27 | |

Diluted income per unit: | | | | | | | | |

Net income per limited partner unit | | $ | 0.15 | | | $ | 0.27 | |

| | |

Weighted-average number of limited partner units: | | | | | | | | |

Basic | | | 42,694 | | | | 31,188 | |

Diluted | | | 42,877 | | | | 31,324 | |

Distributions declared per limited partner unit (attributable to the period ended) | | $ | 0.50 | | | $ | 0.44 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

CRESTWOOD MIDSTREAM PARTNERS LP

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for unit data - Unaudited)

| | | | | | | | |

| | | March 31,

2012 | | | December 31,

2011 | |

| ASSETS | | | | | | | | |

Current assets | | | | | | | | |

Cash and cash equivalents | | $ | 814 | | | $ | 797 | |

Accounts receivable | | | 14,037 | | | | 11,926 | |

Accounts receivable - related party | | | 23,220 | | | | 27,312 | |

Prepaid expenses and other | | | 1,204 | | | | 1,935 | |

| | | | | | | | |

Total current assets | | | 39,275 | | | | 41,970 | |

Investment in unconsolidated affiliate | | | 131,250 | | | | — | |

Property, plant and equipment, net | | | 749,816 | | | | 746,045 | |

Intangible assets, net | | | 126,097 | | | | 127,760 | |

Goodwill | | | 93,628 | | | | 93,628 | |

Deferred financing costs, net | | | 15,467 | | | | 16,699 | |

Other assets | | | 806 | | | | 790 | |

| | | | | | | | |

Total assets | | $ | 1,156,339 | | | $ | 1,026,892 | |

| | | | | | | | |

| LIABILITIES AND PARTNERS’ CAPITAL | | | | | | | | |

Current liabilities | | | | | | | | |

Accounts payable, accrued expenses and other | | $ | 28,619 | | | $ | 31,794 | |

Accrued additions to property, plant and equipment | | | 6,932 | | | | 7,500 | |

Accounts payable - related party | | | 1,764 | | | | 1,308 | |

Capital leases | | | 2,714 | | | | 2,693 | |

| | | | | | | | |

Total current liabilities | | | 40,029 | | | | 43,295 | |

Long-term debt | | | 553,250 | | | | 512,500 | |

Long-term capital leases | | | 3,242 | | | | 3,929 | |

Asset retirement obligations | | | 11,978 | | | | 11,545 | |

Commitments and contingent liabilities (Note 12) | | | | | | | | |

Partners’ capital | | | | | | | | |

Common unitholders (36,538,228 and 32,997,696 units issued and outstanding at March 31, 2012 and December 31, 2011, respectively) | | | 377,620 | | | | 286,945 | |

Class C unitholders (6,716,730 and 6,596,635 units issued and outstanding at March 31, 2012 and December 31, 2011, respectively) | | | 158,386 | | | | 157,386 | |

General partner | | | 11,834 | | | | 11,292 | |

| | | | | | | | |

Total partners’ capital | | | 547,840 | | | | 455,623 | |

| | | | | | | | |

| | $ | 1,156,339 | | | $ | 1,026,892 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

CRESTWOOD MIDSTREAM PARTNERS LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands – Unaudited)

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2012 | | | 2011 | |

Operating activities: | | | | | | | | |

Net income | | $ | 9,805 | | | $ | 9,376 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 10,482 | | | | 5,890 | |

Accretion of asset retirement obligations | | | 164 | | | | 135 | |

Equity-based compensation | | | 493 | | | | 283 | |

Amortization of deferred financing fees and debt issuance costs | | | 1,302 | | | | 678 | |

Changes in assets and liabilities: | | | | | | | | |

Accounts receivable | | | (2,111 | ) | | | 296 | |

Prepaid expenses and other | | | 715 | | | | 468 | |

Accounts receivable - related party | | | 4,092 | | | | (6,174 | ) |

Accounts payable - related party | | | 456 | | | | 313 | |

Accounts payable, accrued expenses and other | | | (3,245 | ) | | | 6,097 | |

| | | | | | | | |

Net cash provided by operating activities | | | 22,153 | | | | 17,362 | |

| | | | | | | | |

Investing activities: | | | | | | | | |

Capital expenditures | | | (12,889 | ) | | | (13,076 | ) |

Investment in unconsolidated affiliate | | | (131,250 | ) | | | — | |

| | | | | | | | |

Net cash (used in) investing activities | | | (144,139 | ) | | | (13,076 | ) |

| | | | | | | | |

Financing activities: | | | | | | | | |

Proceeds from credit facility | | | 182,000 | | | | 38,400 | |

Repayments of credit facility | | | (141,250 | ) | | | (29,104 | ) |

Payments on capital leases | | | (666 | ) | | | — | |

Proceeds from issuance of Class C units | | | — | | | | 12,250 | |

Proceeds from issuance of common units, net | | | 103,050 | | | | — | |

Distributions to partners | | | (20,729 | ) | | | (14,288 | ) |

Taxes paid for equity-based compensation vesting | | | (402 | ) | | | — | |

| | | | | | | | |

Net cash provided by financing activities | | | 122,003 | | | | 7,258 | |

| | | | | | | | |

Net cash increase | | | 17 | | | | 11,544 | |

Cash and cash equivalents at beginning of period | | | 797 | | | | 2 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 814 | | | $ | 11,546 | |

| | | | | | | | |

Cash paid for interest | | $ | 2,561 | | | $ | 2,388 | |

Non-cash transactions: | | | | | | | | |

Working capital related to capital expenditures | | $ | 6,932 | | | $ | 4,209 | |

Paid-In-Kind value to Class C unitholders | | $ | 3,666 | | | $ | — | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

CRESTWOOD MIDSTREAM PARTNERS LP

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN PARTNERS’ CAPITAL

(In thousands – Unaudited)

| | | | | | | | | | | | | | | | |

| | | Partners’ Capital | |

| | | Limited Partners | | | | |

| | | Common | | | Class C

Unitholders | | | General Partner | | | Total | |

Balance at December 31, 2011 | | $ | 286,945 | | | $ | 157,386 | | | $ | 11,292 | | | $ | 455,623 | |

Equity-based compensation | | | 493 | | | | — | | | | — | | | | 493 | |

Taxes paid for equity-based compensation vesting | | | (402 | ) | | | — | | | | — | | | | (402 | ) |

Distributions paid | | | (17,903 | ) | | | — | | | | (2,826 | ) | | | (20,729 | ) |

Net income | | | 5,437 | | | | 1,000 | | | | 3,368 | | | | 9,805 | |

Issuance of units, net of offering costs | | | 103,050 | | | | — | | | | — | | | | 103,050 | |

| | | | | | | | | | | | | | | | |

Balance at March 31, 2012 | | $ | 377,620 | | | $ | 158,386 | | | $ | 11,834 | | | $ | 547,840 | |

| | | | | | | | | | | | | | | | |

| |

| | | Partners’ Capital | |

| | | Limited Partners | | | | |

| | | Common | | | Class C

Unitholders | | | General Partner | | | Total | |

Balance at December 31, 2010 | | $ | 258,069 | | | $ | — | | | $ | 684 | | | $ | 258,753 | |

Equity-based compensation | | | 283 | | | | — | | | | — | | | | 283 | |

Distributions paid | | | (13,411 | ) | | | — | | | | (877 | ) | | | (14,288 | ) |

Net income | | | 8,488 | | | | — | | | | 888 | | | | 9,376 | |

| | | | | | | | | | | | | | | | |

Balance at March 31, 2011 | | $ | 253,429 | | | $ | — | | | $ | 695 | | | $ | 254,124 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

CRESTWOOD MIDSTREAM PARTNERS LP

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

UNAUDITED

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Organization— Crestwood Midstream Partners LP (“CMLP”) is a publicly traded Delaware limited partnership formed for the purpose of acquiring and operating midstream assets. Crestwood Gas Services GP LLC, our general partner (“General Partner”), is owned by Crestwood Holdings Partners, LLC and its affiliates (“Crestwood Holdings”). Our common units are listed on the New York Stock Exchange (“NYSE”) under the symbol “CMLP.” In this report, unless the context requires otherwise, references to “we,” “us,” “our” or the “Partnership” are intended to mean the business and operations of CMLP and its subsidiaries.

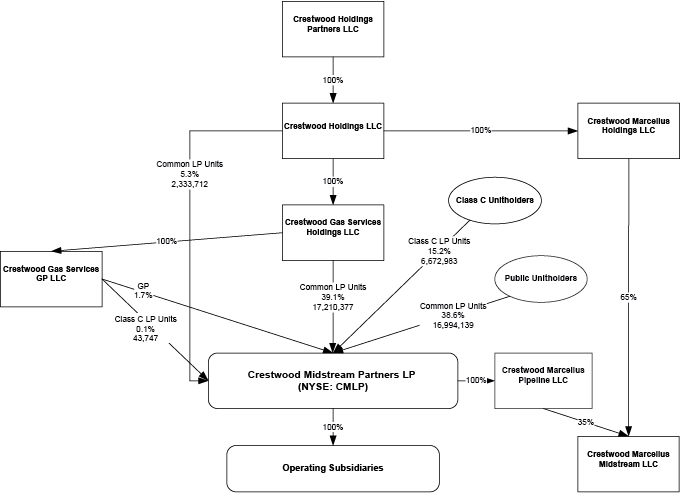

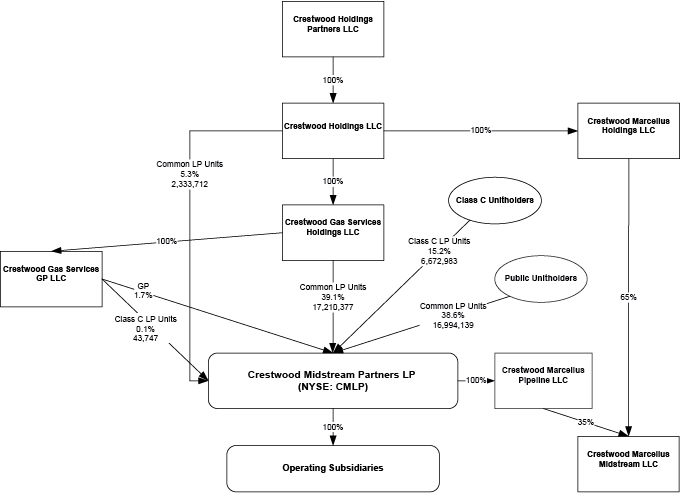

Organizational Structure

The following chart depicts our ownership structure as of March 31, 2012:

8

Our ownership is as follows:

| | | | | | | | | | | | |

| | | March 31, 2012 | |

| | | Crestwood

Holdings | | | Public | | | Total | |

General partner interest | | | 1.7 | % | | | — | | | | 1.7 | % |

Limited partner interest | | | | | | | | | | | | |

Common unitholders | | | 44.4 | % | | | 38.6 | % | | | 83.0 | % |

Class C unitholders | | | 0.1 | % | | | 15.2 | % | | | 15.3 | % |

| | | | | | | | | | | | |

Total | | | 46.2 | % | | | 53.8 | % | | | 100.0 | % |

| | | | | | | | | | | | |

See Note 16 — “Partners’ Capital and Distributions” for additional information concerning ownership interests.

Description of Business— We are primarily engaged in the gathering, processing, treating, compression, transportation and sales of natural gas and the delivery of natural gas liquids (“NGLs”) produced in the geological formations of the Barnett Shale in north Texas, the Avalon Shale area of southeastern New Mexico, the Fayetteville Shale in northwestern Arkansas, the Granite Wash in the Texas Panhandle, the Haynesville/Bossier Shale in western Louisiana and the Marcellus Shale in West Virginia.

On March 26, 2012, we invested $131 million for a 35% interest in Crestwood Marcellus Midstream LLC (“CMM”) which is held by our wholly-owned subsidiary. Crestwood Holdings LLC, invested an additional $244 million for the remaining 65% interest which is held by its wholly-owned subsidiary. CMM is a new joint venture formed for the purpose of acquiring certain of Antero Resources Appalachian Corporation’s (“Antero”) Marcellus Shale gathering system assets located in Harrison and Doddridge Counties, West Virginia. CMM’s purchase price to acquire the assets was $375 million, subject to normal purchase price adjustments, in cash, plus an earn-out which would allow Antero to earn additional purchase price payments of up to $40 million based upon average annual production levels achieved during 2012 and 2013.

Additionally, CMM entered into a 20-year, fixed fee, gas gathering and compression agreement with Antero, which will provide for an area of dedication of approximately 127,000 gross acres, or 104,000 net acres, largely located in the rich gas corridor of the southwestern core of the Marcellus Shale play. As part of the gas gathering and compression agreement, Antero committed to delivery of minimum annual volumes to CMM for a seven year period from 2012-2019, resulting in total guaranteed volume commitments over the seven year period to CMM of approximately 300 million cubic feet per day (“MMcfd”) to 450 MMcfd.

The assets acquired by CMM include 33 miles of low pressure gathering pipelines gathering approximately 210 MMcfd at closing from 59 existing horizontal Marcellus Shale wells. The gathering pipelines deliver Antero’s Marcellus Shale production to various regional pipeline systems including Columbia, Dominion and Equitrans.

Approximately 98% of our gross margin, which we define as total revenue less product purchases, is derived from fee-based service contracts, which minimizes our commodity price exposure and provides us with less volatile operating performance and cash flows. We have four systems located in basins that include NGL rich gas shale plays, (i) the Cowtown System, part of the Barnett segment, (ii) the Granite Wash System, (iii) and the two systems acquired by CMM in the Marcellus segment. For the three months ended March 31, 2012, our systems located in NGL rich basins or rich gas shale plays contributed approximately 51% of our total revenue. (See Note 4 — “Investment in Unconsolidated Affiliate” and Note 18— “Segment Information”)

See Note 1 to the consolidated financial statements in our 2011 Annual Report on Form 10-K for additional information about our business.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation— We prepared this Quarterly Report on Form 10-Q under the rules and regulations of the SEC. As an interim period filing presented using a condensed format, it does not include all of the disclosures required by U.S. generally accepted accounting principles (“GAAP”) and should be read along with our 2011 Annual Report on Form 10-K. The financial statements as of March 31, 2012, and for the three months ended March 31, 2012 and 2011, are unaudited. In management’s opinion, all necessary adjustments to fairly present our results of operations, financial position and cash flows for the periods presented have been made and all such adjustments are of a normal and recurring nature. Our disclosures in this Form 10-Q are an update to those provided in our 2011 Annual Report on Form 10-K.

9

Significant Accounting Policies

There were no changes in the significant accounting policies described in our 2011 Annual Report on Form 10-K, except as noted below.

Principles of Consolidation — We consolidate entities when we have the ability to control or direct the operating and financial decisions of the entity or when we have a significant interest in the entity that gives us the ability to direct the activities that are significant to that entity. The determination of our ability to control, direct or exert significant influence over an entity involves the use of judgment. We currently do not have ownership in any variable interest entities. We apply the equity method of accounting where we can exert significant influence over, but do not control or direct the policies, decisions or activities of the entity. We use the cost method of accounting where we are unable to exert significant influence over the entity.

Segment Information— We conduct all of our operations in the midstream sector with eight operating segments, four of which are reportable. Our operating segments reflect how we manage our operations and are generally reflective of the geographic areas in which we operate. Our reportable segments consist of Barnett, Fayetteville, Granite Wash and Marcellus. All of our operating segments are engaged in gathering, processing, treating, compression, transportation and sales of natural gas and delivery of NGLs in the United States.

Recently Issued Accounting Standards

Accounting standard-setting organizations frequently issue new or revised accounting rules. We regularly review all new pronouncements to determine their impact, if any, on our financial statements. There have been no new or revised accounting standards that are applicable to us since December 31, 2011.

See Note 2 to the consolidated financial statements in our 2011 Annual Report on Form 10-K for additional information regarding recent issued accounting standards.

3. ACQUISITIONS

2011 Acquisitions

Las Animas Acquisition

On February 16, 2011, we completed the acquisition of certain midstream assets in the Avalon Shale play from a group of independent producers for $5.1 million (“Las Animas Acquisition”).

The Las Animas Acquisition was recorded in property, plant and equipment at fair value of $5.1 million.

Frontier Gas Acquisition

On April 1, 2011, we completed the acquisition of certain midstream assets in the Fayetteville Shale and the Granite Wash from Frontier Gas Services, LLC for approximately $345 million (“Frontier Gas Acquisition”). In third quarter 2011, we finalized the Frontier Gas Acquisition purchase price, which resulted in the recognition of approximately $93.6 million in goodwill.

Tristate Acquisition

On November 1, 2011, we acquired Tristate Sabine, LLC (“Tristate”) from affiliates of Energy Spectrum Capital, Zwolle Pipeline, LLC, and Tristate’s management for approximately $73 million in cash consideration comprised of $65 million paid at closing plus a deferred payment of $8 million due on November 1, 2012, subject to customary post-closing adjustments (“Tristate Acquisition”). The final purchase price allocation is pending the completion of the valuation of the assets acquired, liabilities assumed and settlement of the deferred amounts due in the Tristate Acquisition.

10

The preliminary purchase price allocation is as follows (In thousands):

| | | | |

Purchase price: | | | | |

Cash | | $ | 65,000 | |

Deferred payment | | | 8,000 | |

| | | | |

Total purchase price | | $ | 73,000 | |

| | | | |

| |

Preliminary purchase price allocation: | | | | |

Cash | | $ | 589 | |

Accounts receivable | | | 2,564 | |

Prepaid expenses and other | | | 365 | |

Property, plant and equipment | | | 56,261 | |

Intangible assets | | | 16,000 | |

| | | | |

Total assets | | $ | 75,779 | |

| | | | |

| |

Accounts payable, accrued expenses and other | | | 1,915 | |

Asset retirement obligation | | | 864 | |

| | | | |

Total liabilities | | $ | 2,779 | |

| | | | |

| |

Total | | $ | 73,000 | |

| | | | |

The following table is the presentation of income for the three months ended March 31, 2011 as if we had completed the Frontier Gas, Tristate and Las Animas Acquisitions on January 1, 2011 (In thousands, except per unit data):

| | | | | | | | | | | | |

| | | Three Months Ended March 31, 2011 | |

| | | Crestwood

Midstream

Partners LP(1) | | | Proforma

Adjustment(2) | | | Combined | |

Revenue | | $ | 32,380 | | | $ | 19,329 | | | $ | 51,709 | |

Operating expenses | | | (19,776 | ) | | | (18,259 | ) | | | (38,035 | ) |

| | | | | | | | | | | | |

Operating income | | $ | 12,604 | | | $ | 1,070 | | | $ | 13,674 | |

| | | | | | | | | | | | |

| | | |

Basic earnings per unit: | | | | | | | | | | | | |

Net income per limited partner | | $ | 0.27 | | | | | | | $ | 0.13 | |

Diluted earnings per unit: | | | | | | | | | | | | |

Net income per limited partner | | $ | 0.27 | | | | | | | $ | 0.13 | |

| | | |

Weighted-average number of limited partner units: | | | | | | | | | | | | |

Basic | | | 31,188 | | | | | | | | 37,485 | |

Diluted | | | 31,324 | | | | | | | | 37,621 | |

| (1) | Includes approximately two months of operating income for the Las Animas Acquisition and no operating income for the Frontier Gas and Tristate Acquisitions. |

| (2) | Represents approximately one month of operating income for the Las Animas Acquisition, the first quarter of 2011 of operating income for the Frontier Gas Acquisition and the first quarter of 2011 of operating income for the Tristate Acquisition. |

11

4. INVESTMENT IN UNCONSOLIDATED AFFILIATE

On March 26, 2012, the Company contributed approximately $131 million in cash to CMM, in exchange for a 35% interest in CMM, which is held by our wholly-owned subsidiary. We funded our contribution to CMM with additional borrowings under our Credit Facility. Our 35% interest in CMM provides us with the ability to exercise significant influence over CMM, but we lack control. Accordingly, we account for our investment in CMM under the equity method of accounting. Income or loss for the three month period ended March 31, 2012 was not material.

CMM, indirectly owned 65% by Crestwood Holdings LLC and 35% by us, completed the acquisition of Antero’s gathering system assets located in Harrison and Doddridge Counties, West Virginia on March 26, 2012 for $375 million, subject to normal purchase price adjustments, in cash plus an earn-out which would allow Antero to earn additional payments of up to $40 million based upon average annual production levels achieved during 2012 and 2013.

Concurrent with the acquisition by CMM, the Company entered into an agreement with CMM to operate the acquired assets. The terms of the operating agreement provide for the reimbursement of costs incurred by the Company on behalf of CMM or in conjunction with operating CMM’s assets. For the three months ended March 31, 2012, there were no reimbursements of costs or fees under the operating agreement.

5. NET INCOME PER LIMITED PARTNER UNIT

The following is a reconciliation of the limited partner units used in the basic and diluted earnings per unit calculations for the three months ended March 31, 2012 and 2011 (In thousands, except per unit data):

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2012 | | | 2011 | |

Limited partners’ interest in net income | | $ | 6,437 | | | $ | 8,488 | |

| | |

Weighted-average limited partner units - basic(1) | | | 42,694 | | | | 31,188 | |

Effect of unvested phantom units | | | 183 | | | | 136 | |

| | | | | | | | |

Weighted-average limited partner units - diluted | | | 42,877 | | | | 31,324 | |

| | | | | | | | |

Basic earnings per unit: | | | | | | | | |

Net income per limited partner | | $ | 0.15 | | | $ | 0.27 | |

Diluted earnings per unit: | | | | | | | | |

Net income per limited partner | | $ | 0.15 | | | $ | 0.27 | |

| | | | | | | | |

| (1) | Includes 6,716,730 Class C units as of March 31, 2012. |

There were no units excluded from our dilutive earnings per share as we do not have any anti-dilutive units for the three months ended March 31, 2012 and 2011, respectively.

12

6. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consists of the following (In thousands):

| | | | | | | | | | | | |

| | | Depreciable Life | | | March 31,

2012 | | | December 31,

2011 | |

Gathering systems | | | 20 years | | | $ | 298,434 | | | $ | 298,207 | |

Processing plants and compression facilities | | | 20-25 years | | | | 437,575 | | | | 429,908 | |

Rights-of-way and easements | | | 20 years | | | | 50,980 | | | | 50,085 | |

Buildings and other | | | 5-40 years | | | | 6,100 | | | | 5,958 | |

| | | | | | | | | | | | |

Total | | | | | | | 793,089 | | | | 784,158 | |

Accumulated depreciation | | | | | | | (98,677 | ) | | | (89,860 | ) |

| | | | | | | | | | | | |

Total, net of accumulated depreciation | | | | | | | 694,412 | | | | 694,298 | |

Land | | | | | | | 4,674 | | | | 4,674 | |

Construction in progress | | | | | | | 50,730 | | | | 47,073 | |

| | | | | | | | | | | | |

Property, plant and equipment, net | | | | | | $ | 749,816 | | | $ | 746,045 | |

| | | | | | | | | | | | |

We recognized $8.8 and $5.9 million of depreciation expense on property, plant and equipment for the three months ended March 31, 2012 and 2011, respectively.

We have capitalized costs in construction in progress relating to the Tygart Valley Pipeline project under the Amended Memorandum Of Understanding with Mountaineer Keystone LLC for the three months ended March 31, 2012 of approximately $2.0 million. There were no costs recognized under this agreement in the three month period ended March 31, 2011. Additionally under the Amended Memorandum Of Understanding with Mountaineer Keystone LLC, costs incurred for certain development costs for the Tygart Valley Pipeline project are reimbursable up to $2.25 million in the event of termination of the project.

7. INTANGIBLE ASSETS

Intangible assets consist of the assigned fair value associated with the acquired gas gathering and processing contracts. The following table summarizes our intangible assets (In thousands):

| | | | | | | | |

| | | March 31,

2012 | | | December 31,

2011 | |

Intangible Assets | | $ | 130,200 | | | $ | — | |

Additions | | | — | | | | 130,200 | |

| | | | | | | | |

Total intangible assets | | $ | 130,200 | | | $ | 130,200 | |

Accumulated amortization | | | (4,103 | ) | | | (2,440 | ) |

| | | | | | | | |

Intangible Assets, net | | $ | 126,097 | | | $ | 127,760 | |

| | | | | | | | |

The gas gathering and processing contracts have useful lives of 6 to 17 years, determined based upon the customer contract life. Amortization expense recorded for the three months ended March 31, 2012 was approximately $1.7 million. There was no amortization expense for the three month period ended March 31, 2011. The expected amortization of intangible assets is as follows (In thousands):

| | | | |

2012 (remaining) | | $ | 4,989 | |

2013 | | | 8,007 | |

2014 | | | 9,176 | |

2015 | | | 9,729 | |

Thereafter | | | 94,196 | |

| | | | |

Total | | $ | 126,097 | |

| | | | |

13

8. ACCOUNTS PAYABLE, ACCRUED EXPENSES AND OTHER

Accounts payable, accrued expenses and other consist of the following (In thousands):

| | | | | | | | |

| | | March 31, | | | December 31, | |

| | | 2012 | | | 2011 | |

Accrued expenses | | $ | 3,815 | | | $ | 3,175 | |

Accrued property taxes | | | 1,336 | | | | 5,204 | |

Accrued product purchases payable | | | 3,032 | | | | 3,594 | |

Tax payable | | | 1,819 | | | | 1,545 | |

Interest payable | | | 8,574 | | | | 4,788 | |

Accounts payable | | | 1,687 | | | | 5,128 | |

Tristate Acquisition deferred payment | | | 8,000 | | | | 8,000 | |

Other | | | 356 | | | | 360 | |

| | | | | | | | |

Total accounts payable, accrued expenses and other | | $ | 28,619 | | | $ | 31,794 | |

| | | | | | | | |

9. LONG-TERM DEBT

Debt consists of the following (In thousands):

| | | | | | | | |

| | | March 31, | | | December 31, | |

| | | 2012 | | | 2011 | |

Credit Facility | | $ | 353,250 | | | $ | 312,500 | |

Senior Notes | | | 200,000 | | | | 200,000 | |

| | | | | | | | |

| | | 553,250 | | | | 512,500 | |

Current maturities of debt | | | — | | | | — | |

| | | | | | | | |

Long-term debt | | $ | 553,250 | | | $ | 512,500 | |

| | | | | | | | |

The following table summarizes our debt payments due by period (In thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Payments Due by Period | |

Long-Term Debt | | Total | | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | Thereafter | |

Credit Facility, due October 2015 | | $ | 353,250 | | | $ | — | | | $ | — | | | $ | — | | | $ | 353,250 | | | $ | — | | | $ | — | |

Senior Notes, due April 2019 | | | 200,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 200,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total long-term debt | | $ | 553,250 | | | $ | — | | | $ | — | | | $ | — | | | $ | 353,250 | | | $ | — | | | $ | 200,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Credit Facility— Our Credit Facility allows for revolving loans, letters of credit and swingline loans in an aggregate amount of up to $500 million. On April 1, 2011, we entered into an agreement with certain lenders of our Credit Facility, which expanded our borrowing capacity from $400 million to $500 million. The Credit Facility is secured by substantially all of our and our subsidiaries’ assets and is guaranteed by our wholly-owned subsidiaries. Borrowings under the Credit Facility bear interest at London Interbank Offered Rate (“LIBOR”) plus an applicable margin or a base rate as defined in the credit agreement. Under the terms of the Credit Facility, the applicable margin under LIBOR borrowings was 3.0% at March 31, 2012. Based on our results through March 31, 2012, our total availability under the Credit Facility was $474 million and our borrowings were $353.3 million. For the

14

three months ended March 31, 2012, our average and maximum outstanding borrowings were $247.8 million and $364.8 million, respectively. The weighted-average interest rate as of March 31, 2012 was 3.37%. The Credit Facility’s carrying value at March 31, 2012 approximates its fair value.

On March 20, 2012, we amended our Credit Agreement to permit the acquisition of an equity interest in CMM and to allow for additional investments in CMM of up to $160,000,000.

Our Credit Facility requires us to maintain:

| | • | | a ratio of our consolidated trailing 12-month EBITDA (as defined in the credit agreement) to our net interest expense of not less than 2.5 to 1.0; and |

| | • | | a ratio of total indebtedness to consolidated trailing 12-month EBITDA (as defined in the credit agreement) of not more than 5.0 to 1.0, or not more than 5.5 to 1.0 for up to nine months following certain acquisitions. |

As of March 31, 2012, we were in compliance with these financial covenants.

The Credit Facility contains restrictive covenants that prohibit the declaration or payment of distributions by us if a default then exists or would result therefrom, and otherwise limits the amount of distributions that we can make. An event of default may result in the acceleration of our repayment of outstanding borrowings under the Credit Facility, the termination of the Credit Facility and foreclosure on collateral.

Bridge Loans— In February 2011, in connection with the Frontier Gas Acquisition, we obtained commitments from multiple lenders for senior unsecured bridge loans in an aggregate amount up to $200 million. The commitment was terminated on April 1, 2011 in connection with the closing of the Senior Notes described below.

Senior Notes — On April 1, 2011, we issued $200 million of senior notes, which accrue interest at the rate of 7.75% per annum and mature in April 2019 (“Senior Notes”). Our obligations under the Senior Notes are guaranteed on an unsecured basis by our current and future domestic subsidiaries. The accrued interest is payable in cash semi-annually in arrears on April 1 and October 1 of each year. Our Senior Notes require us to maintain a ratio of our consolidated trailing 12-month EBITDA (as defined in the indenture governing the Senior Notes) to fixed charges of at least 1.75 to 1.0. As of March 31, 2012, we were in compliance with this covenant.

The fair value of the Senior Notes is determined using Level 2 inputs from public sources in accordance with Accounting Standards Codification Topic 820,Fair Value Measurement. We obtain the quoted market price at the measurement date to calculate the fair value. As of March 31, 2012, the Senior Notes had a fair value of approximately $205.3 million.

Guarantor Subsidiaries— Our subsidiaries are wholly-owned by CMLP and they are full and unconditional, joint and several guarantors of our debt. CMLP has no independent assets and no operations.

15

10. ASSET RETIREMENT OBLIGATIONS

Activity for asset retirement obligations is as follows (In thousands):

| | | | | | | | |

| | | March 31, | | | December 31, | |

| | | 2012 | | | 2011 | |

Asset retirement obligations | | $ | 11,545 | | | $ | 9,877 | |

Incremental liability incurred | | | 269 | | | | 140 | |

Changes in estimates | | | — | | | | (724 | ) |

Acquisitions | | | — | | | | 1,744 | |

Accretion expense | | | 164 | | | | 508 | |

| | | | | | | | |

Asset retirement obligations | | $ | 11,978 | | | $ | 11,545 | |

| | | | | | | | |

As of March 31, 2012 and 2011, no assets were legally restricted for use in settling asset retirement obligations.

11. CAPITAL LEASES

We have compressor leases which are accounted for as capital leases. We recorded $0.7 million in amortization expense related to these capital leases for the three months ended March 31, 2012.

The total liability outstanding at March 31, 2012 related to these leases is $6.0 million. Future minimum lease payments related to capital leases are as follows (In thousands):

| | | | |

2012 (remaining) | | $ | 2,144 | |

2013 | | | 2,860 | |

2014 | | | 1,162 | |

| | | | |

Total payments | | | 6,166 | |

Imputed interest | | | (210 | ) |

| | | | |

Present value of future payments | | $ | 5,956 | |

| | | | |

12. COMMITMENTS AND CONTINGENT LIABILITIES

In May 2011, a putative class action lawsuit, Ginardi v. Frontier Gas Services, LLC, et al No 4:11-cv-0420 BRW, was filed in the United States District Court of the Eastern District of Arkansas against Frontier Gas Services, LLC, Chesapeake Energy Corporation, BHP Billiton Petroleum (“BHP”), Kinder Morgan Treating, LP, and Crestwood Arkansas Pipeline LLC (which was served in August 2011) . The lawsuit alleges that the defendants’ operations pollute the atmosphere, groundwater, and soil with allegedly harmful gases, chemicals, and compounds and the facilities create excessive noise levels constituting trespass, nuisance and annoyance (the “Ginardi case”). In March 2011, a putative class action lawsuit, George Bartlett, et al, v. Frontier Gas Services, LLC, et al including Crestwood Arkansas Pipeline, LLC, Chesapeake Energy Corporation, and Kinder Morgan Treating LP, was filed in the United States District Court of the Eastern District of Arkansas (No 4 11-cv-0910 BSM) alleging the same causes as in the Ginardi case (the “Bartlett case”). In each of the Ginardi and the Bartlett case, the plaintiffs seek compensatory and punitive damages of loss of use and enjoyment of property, contamination of soil and ground water, air and atmosphere and seek future monitoring. We have filed answers in the Ginardi and Bartlett cases denying any liability. On April 19, 2012, the court denied the certification of the class action in the Ginardi case. The court has not certified or conducted a hearing on class action status in the Bartlett lawsuit. While we cannot reasonably quantify our ultimate liability, if any, for the payment of any damages or other remedial actions, neither the Ginardi nor the Bartlett cases have had, nor are they expected to have, a material impact on our results of operation or financial condition. We intend to vigorously defend against both claims and to mitigate any claims by pursuing any and all indemnification obligations to which we may be entitled with respect to the properties as well as any coverage from our insurance.

From time-to-time, we are party to certain legal, regulatory or administrative proceedings that arise in the ordinary course and are incidental to our business. However, except as set forth above, there are currently no such pending proceedings to which we are a party that our management believes will have a material adverse effect on our results of operations, cash flows or financial condition.

16

However, future events or circumstances, currently unknown to management, will determine whether the resolution of any litigation or claims will ultimately have a material effect on our results of operations, cash flows or financial condition in any future reporting periods.

Casualties or Other Risks— We maintain coverage in various insurance programs, which provide us with property damage and other coverages which are customary for the nature and scope of our operations.

Management of our General Partner believes that we have adequate insurance coverage, although insurance will not cover every type of loss that we might occur. As a result of insurance market conditions, premiums and deductibles for certain insurance policies have increased substantially and, in some instances, certain insurance may become unavailable, or available for only reduced amounts of coverage. As a result, we may not be able to renew existing insurance policies or procure other desirable insurance on commercially reasonable terms, if at all.

If we were to incur a significant loss for which we were not adequately insured, the loss could have a material impact on our results of operations, cash flows or financial condition. In addition, the proceeds of any available insurance may not be paid in a timely manner and may be insufficient if such an event were to occur. Any event that interrupts our revenues, or which causes us to make significant expenditures not covered by insurance, could reduce our ability to meet our financial obligations.

Regulatory Compliance— In the ordinary course of our business, we are subject to various laws and regulations. In the opinion of our management, compliance with current laws and regulations will not have a material effect on our results of operations, cash flows or financial condition.

Environmental Compliance— Our operations are subject to stringent and complex laws and regulations pertaining to health, safety, and the environment. As an owner or operator of these facilities, we are subject to laws and regulations at the federal, state and local levels that relate to air and water quality, hazardous and solid waste management and disposal and other environmental matters. The cost of planning, designing, constructing and operating our facilities must incorporate compliance with environmental laws and regulations and safety standards. Failure to comply with these laws and regulations may trigger a variety of administrative, civil and potentially criminal enforcement measures. At March 31, 2012, we had recorded no liabilities for environmental matters.

13. INCOME TAXES

No provision for federal or state income taxes is included in our results of operations as such income is taxable directly to the partners.

However, we are subject to Texas Margin tax and our current tax liability will be assessed based on 0.7% of the gross revenue apportioned to Texas. The margin tax qualifies as an income tax under GAAP, which requires us to recognize currently the impact of this tax on the temporary differences between the financial statement assets and liabilities and their tax basis attributable to such tax.

See Note 14 to the consolidated financial statements in our 2011 Annual Report on Form 10-K for more information about our income taxes.

14. EQUITY PLAN

Awards of phantom units have been granted under our Third Amended and Restated 2007 Equity Plan (“2007 Equity Plan”). The following table summarizes information regarding 2012 phantom unit activity:

| | | | | | | | | | | | | | | | |

| | | Payable In Cash | | | Payable In Units | |

| | | Units | | | Weighted-

Average

Grant Date

Fair Value | | | Units | | | Weighted-

Average

Grant Date

Fair Value | |

Unvested - January 1, 2012 | | | 13,346 | | | $ | 26.40 | | | | 128,795 | | | $ | 27.22 | |

Vested - phantom units | | | — | | | | — | | | | (40,929 | ) | | $ | 27.21 | |

Vested - restricted units | | | — | | | | — | | | | (1,348 | ) | | $ | 25.32 | |

Issued - phantom units | | | — | | | | — | | | | 115,161 | | | $ | 30.30 | |

Issued - restricted units | | | — | | | | — | | | | 10,000 | | | $ | 30.04 | |

Canceled - phantom units | | | (384 | ) | | $ | 24.14 | | | | (5,795 | ) | | $ | 28.89 | |

| | | | | | | | | | | | | | | | |

Unvested - March 31, 2012 | | | 12,962 | | | $ | 26.47 | | | | 205,884 | | | $ | 29.03 | |

| | | | | | | | | | | | | | | | |

17

At December 31, 2011, we had total unvested compensation cost of $2.2 million related to phantom units. We recognized compensation expense of approximately $0.5 million during the three months ended March 31, 2012. Grants of phantom and restricted units during the three months ended March 31, 2012 had an estimated grant date fair value of $3.8 million. We had unearned compensation expense of $4.6 million at March 31, 2012, which is generally expected to be recognized over the vesting period of three years except for grants to non-employee directors of our General Partner in lieu of cash compensation, which vest after one year. We had 42,277 phantom and restricted units vest during the three months ended March 31, 2012. At March 31, 2012, 524,242 units were available for issuance under the 2007 Equity Plan.

Under the 2007 Equity Plan, participants who have grants of issued restricted units may elect to have us withhold common units to satisfy minimum statutory tax withholding obligations arising in connection with the vesting of non-vested common units. Any such common units withheld are returned to the Equity Plan on the applicable vesting dates, which correspond to the times at which income is recognized by the employee. When we withhold these common units, we are required to remit to the appropriate taxing authorities the fair value of the units withheld as of the vesting date. The number of units withheld is determined based on the closing price per common unit as reported on the NYSE on such dates. During the quarter ended March 31, 2012, we withheld 414 common units to satisfy employee tax withholding obligations. The withholding of common units by us could be deemed a purchase of the common units.

See Note 15 to the consolidated financial statements in our 2011 Annual Report on Form 10-K, for a more complete description of our 2007 Equity Plan.

15. TRANSACTIONS WITH RELATED PARTIES

Omnibus Agreement— In October 2010, concurrent with Quicksilver Resources Inc.’s (“Quicksilver”) sale of all of its ownership interests in CMLP to Crestwood Holdings (“Crestwood Transaction”), we entered into an Omnibus Agreement with Crestwood Holdings and our General Partner that addresses the following matters:

| | • | | restrictions on Crestwood Holdings’ ability to engage in certain midstream business activities or own certain related assets in the Hood, Somervell, Johnson, Tarrant, Hill, Parker, Bosque and Erath Counties in Texas; |

| | • | | Crestwood Holdings’ obligation to indemnify us for certain liabilities and our obligation to indemnify Crestwood Holdings for certain liabilities; |

| | • | | our obligation to reimburse Crestwood Holdings for all expenses incurred by Crestwood Holdings (or payments made on our behalf) in conjunction with Crestwood Holdings’ provision of general and administrative services to us, including salary and benefits of Crestwood Holdings personnel, our public company expenses, general and administrative expenses and salaries and benefits of our executive management who are Crestwood Holdings’ employees; |

| | • | | our obligation to reimburse Crestwood Holdings for all insurance coverage expenses it incurs or payments it makes with respect to our assets; and |

| | • | | our obligation to reimburse Crestwood Holdings for all expenses incurred by Crestwood Holdings (or payments made on our behalf) in conjunction with Crestwood Holdings’ provision of services necessary to operate, manage and maintain our assets. |

Any or all of the provisions of the Omnibus Agreement are terminable by Crestwood Holdings at its option if our General Partner is removed without cause and units held by our General Partner and its affiliates are not voted in favor of that removal. The Omnibus Agreement terminates on the earlier of August 10, 2017 or at such times as Crestwood Holdings ceases to own or control a majority of the issued and outstanding voting securities of our General Partner.

Reimbursements to Crestwood Holdings pursuant to the Omnibus Agreement consisted of payments of $4.7 million and $3.8 million for the three months ended March 31, 2012 and 2011, respectively, related to expenses and payments incurred on our behalf under the Omnibus Agreement.

Quicksilver is entitled to appoint a director to our General Partner’s board of directors until the later of the second anniversary of the closing or such time as Quicksilver generates less than 50% of our consolidated revenue in any fiscal year. Pursuant to this provision, Quicksilver has designated a director to our General Partner’s board of directors. Because this Quicksilver executive serves on our General Partner’s board of directors, Quicksilver qualifies as a related party.

On April 18, 2012, Philip Cook resigned as Quicksilver’s representative on the General Partner’s board of directors and John E. Hinton, Vice President of Finance and Investor Relations of Quicksilver, was named to replace Mr. Cook effective April 18, 2012.

18

We entered into a number of other agreements with Quicksilver prior to and in conjunction with the Crestwood Transaction. A description of those agreements follows:

Gas Gathering and Processing Agreements— Quicksilver has agreed to dedicate all of the natural gas produced on properties operated by Quicksilver within the areas served by our Alliance, Cowtown, and Lake Arlington Systems through 2020. We recognized $30.6 million and $30.0 million in Revenue — related party for the three months ended March 31, 2012 and 2011, respectively.

We also entered into an agreement with Quicksilver to lease pipeline assets attached to the Alliance System. We recognized $0.1 million and $0.2 million of expense related to this agreement for the three months ended March 31, 2012 and 2011, respectively.

Hill County Dry System— We operated the Hill County Dry System pursuant to an operating agreement with Quicksilver effective as of the Crestwood Transaction and ended in October 2011. There were no reimbursements by Quicksilver for the three months ended March 31, 2012 and $0.1 million for the three months ended March 31, 2011, related to this agreement.

Joint Operating Agreement— We entered into an agreement with Quicksilver for the joint development of areas governed by certain of our existing commercial agreements. Quicksilver reimbursed us $0.2 million and $0.4 million for the three months ended March 31, 2012 and 2011, respectively, for services rendered related to this agreement.

Other Agreements — During 2010 we entered in an agreement with Quicksilver to lease office space in Glen Rose, Texas. We recognized $22,000 and $22,000 in expense for the three months ended March 31, 2012 and 2011, respectively, related to this agreement.

16. PARTNERS’ CAPITAL AND DISTRIBUTIONS

Partnership Agreement

Our Second Amended and Restated Agreement of Limited Partnership, dated February 19, 2008, as amended, requires that, within 45 days after the end of each quarter, we distribute all of our available cash to unitholders of record on the applicable record date, as determined by our General Partner. See Note 17 to the consolidated financial statements in our 2011 Annual Report for a more complete description of our distribution policy.

On January 13, 2012, we completed a public offering of 3,500,000 common units, representing limited partner interests in us, at a price of $30.73 per common unit ($29.50 per common unit, net of underwriting discounts), providing net proceeds of approximately $103.1 million. The net proceeds from the offering were used to reduce indebtedness under our Credit Facility. In connection with issuance of the common units, our General Partner did not make an additional capital contribution resulting in a reduction in our General Partner’s general partner interest in us to approximately 1.74%.

On April 12, 2012, our General Partner made an additional capital contribution of $3.4 million to us in exchange for the issuance of an additional 118,862 General Partner units, increasing the General Partner interest from 1.74% to 2%.

The following table presents distributions for 2012 and 2011 (In millions, except per unit data):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Distribution Paid | | | | |

| | | | | | | | Limited Partners | | | General Partner | | | | | | | |

Payment Date | | Attributable to the

Quarter Ended | | Per Unit

Distribution | | | Common | | | Paid-In-Kind Value

to Class C

unitholders | | | General

Partner

interest

and IDR | | | Paid-In-

Kind Value

to Class C

unitholders | | | Total

Cash | | | Total

Distribution | |

2012 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

May 11, 2012 | | March 31, 2012 | | $ | 0.50 | | | $ | 18.2 | | | $ | 3.4 | | | $ | 3.3 | | | $ | 0.5 | | | $ | 21.5 | | | $ | 25.4 | |

February 10, 2012 | | December 31, 2011 | | $ | 0.49 | | | $ | 17.9 | | | $ | 3.2 | | | $ | 2.8 | | | $ | 0.5 | | | $ | 20.7 | | | $ | 24.4 | |

| | | | | | | | |

2011 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 10, 2011 | | September 30, 2011 | | $ | 0.48 | | | $ | 15.8 | | | $ | 3.1 | | | $ | 2.3 | | | $ | 0.4 | | | $ | 18.1 | | | $ | 21.6 | |

August 12, 2011 | | June 30, 2011 | | $ | 0.46 | | | $ | 15.2 | | | $ | 2.9 | | | $ | 1.6 | | | $ | 0.2 | | | $ | 16.8 | | | $ | 19.9 | |

May 13, 2011 | | March 31, 2011 | | $ | 0.44 | | | $ | 13.7 | | | $ | 2.7 | | | $ | 1.1 | | | $ | 0.2 | | | $ | 14.8 | | | $ | 17.7 | |

February 11, 2011 | | December 31, 2010 | | $ | 0.43 | | | $ | 13.4 | | | $ | — | | | $ | 0.9 | | | $ | — | | | $ | 14.3 | | | $ | 14.3 | |

19

Cash distributions include amounts paid to common unitholders. We have the option to pay distributions to our Class C unitholders with cash or by issuing additional Paid-In-Kind Class C units based upon the volume weighted-average price of our common units for the 10 trading days immediately preceding the date the distribution is declared. For the distribution that was paid February 10, 2012, attributable to the quarter ended December 31, 2011, we issued 120,095 additional Class C units. For the distribution that will be paid May 11, 2012, attributable to the quarter ended March 31, 2012, we will issue an additional 136,128 Class C units.

17. SUBSEQUENT EVENTS

Subsequent to March 31, 2012, our General Partner made an additional capital contribution of $3.4 million to us in exchange for the issuance of an additional 118,862 General Partner units, increasing the General Partner interest from 1.74% to 2%.

18. SEGMENT INFORMATION

Our operations include four reportable operating segments. These operating segments reflect the way we internally report the financial information used to make decisions and allocate resources in connection with our operations. We evaluate the performance of our operating segments based on EBITDA, which represents operating income plus, depreciation, amortization and accretion expense.

Our business segments reflect the primary geographic areas in which we operate and consist of Barnett, Fayetteville, Granite Wash, Marcellus and Other, all of which are located within the United States of America. Each of our business segments are engaged in the gathering, processing, treating, compression, transportation and sales of natural gas and delivery of NGLs.

Other consists of those operating segments or reporting units that did not meet quantitative reporting thresholds. For the three months ended March 31, 2012, two customers accounted for 57% and 10.1% of total revenue in the Barnett and Fayetteville segments, respectively.

20

The following tables summarize the reportable segment data for the three months ended March 31, 2012 and 2011 (In thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2012 | |

| | | Barnett | | | Fayetteville | | | Granite

Wash | | | Marcellus | | | Other | | | Corporate | | | Total | |

Revenue | | $ | 3,327 | | | $ | 6,864 | | | $ | 9,597 | | | $ | — | | | $ | 3,328 | | | $ | — | | | $ | 23,116 | |

Revenue - related party | | | 30,617 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 30,617 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 33,944 | | | $ | 6,864 | | | $ | 9,597 | | | $ | — | | | $ | 3,328 | | | $ | — | | | $ | 53,733 | |

Operations and maintenance expense | | | 6,131 | | | | 2,313 | | | | 517 | | | | — | | | | 750 | | | | — | | | | 9,711 | |

Product purchases | | | — | | | | 83 | | | | 8,300 | | | | — | | | | 590 | | | | — | | | | 8,973 | |

General and administrative expense | | | — | | | | — | | | | — | | | | — | | | | — | | | | 6,738 | | | | 6,738 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 27,813 | | | | 4,468 | | | | 780 | | | | — | | | | 1,988 | | | | (6,738 | ) | | | 28,311 | |

Depreciation, amortization and accretion expense | | | 6,150 | | | | 2,647 | | | | 628 | | | | — | | | | 1,183 | | | | 38 | | | | 10,646 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | $ | 21,663 | | | $ | 1,821 | | | $ | 152 | | | $ | — | | | $ | 805 | | | $ | (6,776 | ) | | $ | 17,665 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Goodwill | | $ | — | | | $ | 76,767 | | | $ | 16,861 | | | $ | — | | | $ | — | | | $ | — | | | $ | 93,628 | |

Total assets | | $ | 539,073 | | | $ | 307,765 | | | $ | 77,960 | | | $ | 131,250 | | | $ | 83,009 | | | $ | 17,282 | | | $ | 1,156,339 | |

Capital Expenditures | | $ | 1,866 | | | $ | 8,146 | | | $ | 1,288 | | | $ | — | | | $ | 1,447 | | | $ | 142 | | | $ | 12,889 | |

| |

| | | Three Months Ended March 31, 2011 | |

| | | Barnett | | | Fayetteville | | | Granite

Wash | | | Marcellus | | | Other(1) | | | Corporate | | | Total | |

Revenue | | $ | 1,911 | | | $ | — | | | $ | — | | | $ | — | | | $ | 481 | | | $ | — | | | $ | 2,392 | |

Revenue - related party | | | 29,988 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 29,988 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 31,899 | | | $ | — | | | $ | — | | | | | | | $ | 481 | | | $ | — | | | $ | 32,380 | |

Operations and maintenance expense | | | 6,928 | | | | — | | | | — | | | | — | | | | 453 | | | | — | | | | 7,381 | |

Product purchases | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

General and administrative expense | | | — | | | | — | | | | — | | | | — | | | | — | | | | 6,370 | | | | 6,370 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 24,971 | | | | — | | | | — | | | | — | | | | 28 | | | | (6,370 | ) | | | 18,629 | |

Depreciation, amortization and accretion expense | | | 5,983 | | | | — | | | | — | | | | — | | | | 40 | | | | 2 | | | | 6,025 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | $ | 18,988 | | | $ | — | | | $ | — | | | $ | — | | | $ | (12 | ) | | $ | (6,372 | ) | | $ | 12,604 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Total assets | | $ | 556,434 | | | $ | — | | | $ | — | | | $ | — | | | $ | 5,668 | | | $ | 24,955 | | | $ | 587,057 | |

Capital Expenditures | | $ | 7,972 | | | $ | — | | | $ | — | | | $ | — | | | $ | 5,104 | | | $ | — | | | $ | 13,076 | |

| (1) | Includes approximately two months of operating income for Las Animas System, from February 1, 2011 to March 31, 2011, subsequent to the acquisition. |

21

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following is a discussion of our historical consolidated financial condition and results of operations that is intended to help the reader understand our business, results of operations and financial condition.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations includes the following sections:

| | • | | Overview and Performance Metrics |

| | • | | Current Quarter Highlights |

| | • | | Liquidity and Capital Resources |

| | • | | Total Contractual Obligations |

| | • | | Critical Accounting Estimates |

Overview and Performance Metrics

We are a growth-oriented publicly traded Delaware master limited partnership engaged in the gathering, processing, treating, compression, transportation and sales of natural gas and the delivery of NGLs produced from the geological formations of the Barnett Shale in north Texas, the Avalon Shale area of southeastern New Mexico, the Fayetteville Shale in northwestern Arkansas, the Granite Wash in the Texas Panhandle, the Haynesville/Bossier Shale in western Louisiana and the Marcellus Shale in northern West Virginia. We began operations in 2004 to provide midstream services primarily to Quicksilver as well as to other natural gas producers in the Barnett Shale. For the three months ended March 31, 2012, Quicksilver accounted for 57% of our total consolidated revenue, including approximately 9% that is comprised of natural gas purchased by Quicksilver from Eni SpA and gathered under Quicksilver’s Alliance System gathering agreement.

We conduct all of our operations in the midstream sector with eight operating segments, four of which are reportable. Our operating segments reflect how we manage our operations and are generally reflective of the geographic areas in which we operate. Our reportable segments consist of Barnett, Fayetteville, Granite Wash and Marcellus. All of our operating segments are engaged in gathering, processing, treating, compression, transportation and sales of natural gas and delivery of NGLs in the United States.

The results of our operations are significantly influenced by the volumes of natural gas gathered and processed through our systems. We gather, process, treat, compress, transport and sell natural gas pursuant to fee-based and percent-of-proceeds contracts. Under our fixed fee contracts, we do not take title to the natural gas or associated NGLs, and therefore, we avoid direct commodity price exposure. Under our percent-of-proceeds contracts, we take title to the residue gas, NGLs and condensate and remit a portion of the sale proceeds to the producer based on prevailing commodity prices. For the three months ended March 31, 2012, the net revenues from percent-of-proceeds contracts accounted for approximately 2% of gross margin, which we define as total revenue less product purchases.

Although we do not have significant direct commodity price exposure, lower natural gas prices could have a potential negative impact on the pace of drilling in dry gas areas — such as areas in the Barnett Shale, gathered by the Alliance and Lake Arlington Dry Systems, the Fayetteville System and the Sabine System. We have four systems located in basins that include NGL rich gas shale plays, (i) the Cowtown System, part of the Barnett segment, (ii) the Granite Wash System, (iii) and the two systems acquired by CMM in the Marcellus segment. For the three months ended March 31, 2012, our systems located in NGL rich basins contributed approximately 51% of our total revenue. A prolonged decrease in the commodity price environment could result in our customers reducing their production volumes which would cause a resulting decrease in our revenue.

Our management uses a variety of financial and operational measures to analyze our performance. We view these measures as important factors affecting our profitability and unitholder value and therefore we review them monthly for consistency and to identify trends in our operations. These performance measures are outlined below.

Volume— We must continually obtain new supplies of natural gas to maintain or increase throughput volumes on our gathering and processing systems. We routinely monitor producer activity in the areas we serve to identify new supply opportunities. Our ability to achieve these objectives is impacted by:

| | • | | the level of successful drilling and production activity in areas where our systems are located; |

| | • | | our ability to compete with other midstream companies for production volumes; and |

| | • | | our pursuit of new acquisition opportunities. |

22

Operating and Maintenance Expenses— We consider operating and maintenance expenses in evaluating the performance of our operations. These expenses are comprised primarily of labor, parts and materials, insurance, taxes, repair and maintenance costs, utilities and contract services. Our ability to manage operating and maintenance expenses has a significant impact on our profitability and ability to pay distributions.

EBITDA and Adjusted EBITDA— We believe that EBITDA and Adjusted EBITDA are widely accepted financial indicators of a company’s operational performance and its ability to incur and service debt, fund capital expenditures and make distributions. EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP, as they do not include deductions for items such as depreciation, amortization and accretion, interest and income taxes, which are necessary to maintain our business. In addition, Adjusted EBITDA considers certain non-recurring expenses identified in a specific reporting period. EBITDA and Adjusted EBITDA should not be considered an alternative to net income, operating cash flow or any other measure of financial performance presented in accordance with GAAP. EBITDA and Adjusted EBITDA calculations may vary among entities, so our computation may not be comparable to measures of other entities. In evaluating EBITDA and Adjusted EBITDA, we believe that investors should also consider, among other things, the amount by which EBITDA or Adjusted EBITDA exceeds interest costs, how EBITDA or Adjusted EBITDA compares to principal payments on debt and how EBITDA or Adjusted EBITDA compares to capital expenditures for each period. A reconciliation of EBITDA and Adjusted EBITDA to amounts reported under GAAP is presented below.

EBITDA and Adjusted EBITDA are also used as a supplemental performance measure by our management and by readers of our financial statements such as investors, commercial banks, research analysts and others, to assess:

| | • | | financial performance of our assets without regard to financing methods, capital structure or historical cost basis; |

| | • | | the ability of our assets to generate cash sufficient to pay interest costs, support our indebtedness and make cash distributions to our unitholders and General Partner; |

| | • | | our operating performance as compared to those of other companies in the midstream energy industry, without regard to financing methods, capital structure or historical cost basis; and |

| | • | | the viability of acquisitions and capital expenditure projects and the returns on investment opportunities. |

See our reconciliation of Net Income to EBITDA and Adjusted EBITDA in “Results of Operations”.

23

Current Quarter Highlights

The following events took place during the three months ended March 31, 2012, and have impacted or are likely to impact our financial condition and results of operations.

Operational and Industry Highlights

Shale gas production in the United States has grown rapidly in recent years as the natural gas industry has improved drilling and extraction methods while increasing exploration efforts. The United States has a wide distribution of shale formations containing vast resources of natural gas, NGLs and crude oil. Led by the rapid development of the Barnett Shale in Texas, shale gas activity has expanded into other areas such as the Marcellus, Fayetteville and Haynesville/Bossier shale plays.

Growth through Diversification —Our operating results reflect our ability to diversify our shale play portfolio and increase volumes not only through our base business located in the Barnett Shale, but also through strategic acquisitions in a number of lucrative shale plays in the United States. We gathered 611 MMcfd during the three months ended March 31, 2012 which is an increase of 40% from 438 MMcfd during the same period 2011. Additionally, our processed volumes increased from 122 MMcfd for the three months ended March 31, 2011 to 147 MMcfd for the same period in 2012, which represents an increase of 21% period-over-period. The increase in processing volumes reflects the operations in NGL rich areas, including the Cowtown System in our Barnett segment and the Granite Wash System, which was acquired as part of the Frontier Gas Acquisition on April 1, 2011.

Additionally in March 2012, we made an equity investment in a joint venture that purchased gathering assets in the Marcellus Shale. This investment continues to support our growth-oriented business model, and we believe this investment will enhance our ability to provide growth during 2012 and in the future.

Distribution Growth — Our strong operating cash flows during the three months ended March 31, 2012 as compared to the same period in 2011 have enabled us to raise our distribution to $0.50 per limited partner unit for the first quarter of 2012. This represents a 14% increase over the distribution for the first quarter of 2011.

Investment in an Unconsolidated Affiliate

On March 26, 2012, we invested $131 million for a 35% interest in Crestwood Marcellus Midstream LLC (“CMM”) which is held by our wholly-owned subsidiary. Crestwood Holdings LLC, invested an additional $244 million for the remaining 65% interest which is held by its wholly-owned subsidiary. CMM is a new joint venture formed for the purpose of acquiring certain of Antero Resources Appalachian Corporation’s (“Antero”) Marcellus Shale gathering system assets located in Harrison and Doddridge Counties, West Virginia. CMM’s purchase price to acquire the assets was $375 million, subject to normal purchase price adjustments, in cash, plus an earn-out which would allow Antero to earn additional purchase price payments of up to $40 million based upon average annual production levels achieved during 2012 and 2013.

Additionally, CMM entered into a 20-year, fixed fee, gas gathering and compression agreement with Antero, which will provide for an area of dedication of approximately 127,000 gross acres, or 104,000 net acres, largely located in the rich gas corridor of the southwestern core of the Marcellus Shale play. As part of the gas gathering and compression agreement, Antero committed to delivery of minimum annual volumes to CMM for a seven year period from 2012-2019, resulting in total guaranteed volume commitments over the seven year period to CMM of approximately 300 MMcfd, increasing to 450 MMcfd.

The assets acquired by CMM include 33 miles of low pressure gathering pipelines gathering approximately 210 MMcfd at closing from 59 existing horizontal Marcellus Shale wells. The gathering pipelines deliver Antero’s Marcellus Shale production to various regional pipeline systems including Columbia, Dominion and Equitrans.

Financing Activities

Equity Offering — On January 13, 2012, we completed a public offering of 3,500,000 common units, representing limited partner interests in us, at a price of $30.73 per common unit ($29.50 per common unit, net of underwriting discounts), providing net proceeds of approximately $103.1 million. The net proceeds from the offering were used to reduce indebtedness under our Credit Facility. In connection with issuance of the common units, our General Partner did not make an additional capital contribution resulting in a reduction in our General Partner’s general partner interest in us to approximately 1.74%.

24

Results of Operations

The following table summarizes our results of operations (In thousands):

| | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2012 | | | 2011 | |

Total revenues | | $ | 53,733 | | | $ | 32,380 | |

Operations and maintenance | | | 9,711 | | | | 7,381 | |

Product purchases | | | 8,973 | | | | — | |

General and administrative | | | 6,738 | | | | 6,370 | |

Depreciation, amortization and accretion | | | 10,646 | | | | 6,025 | |

| | | | | | | | |

Operating income | | | 17,665 | | | | 12,604 | |

Interest expense | | | 7,557 | | | | 3,006 | |

Income tax provision | | | 303 | | | | 222 | |

| | | | | | | | |

Net income | | $ | 9,805 | | | $ | 9,376 | |

Add: | | | | | | | | |

Interest expense | | | 7,557 | | | | 3,006 | |

Income tax provision | | | 303 | | | | 222 | |

Depreciation, amortization and accretion expense | | | 10,646 | | | | 6,025 | |

| | | | | | | | |

EBITDA | | $ | 28,311 | | | $ | 18,629 | |

Non-recurring expenses | | | 51 | | | | 1,965 | |

| | | | | | | | |

Adjusted EBITDA | | $ | 28,362 | | | $ | 20,594 | |

| | | | | | | | |

The following table summarizes our gathering and processing volumes by segment (In MMcf):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | |

| | | Gathering | | | Processing | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Barnett | | | 40,654 | | | | 38,883 | | | | 12,057 | | | | 10,960 | |

Fayetteville | | | 7,535 | | | | — | | | | — | | | | — | |

Granite Wash | | | 1,352 | | | | — | | | | 1,345 | | | | — | |

Marcellus | | | — | | | | — | | | | — | | | | — | |

Other | | | 6,063 | | | | 518 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total | | | 55,604 | | | | 39,401 | | | | 13,402 | | | | 10,960 | |

| | | | | | | | | | | | | | | | |

25

The following table summarizes our revenues by category and by segment (In thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | |

| | | Gathering | | | Processing | | | Product Sales | | | Total | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | | | 2012 | | | 2011 | | | 2012 | | | 2011 | |