Filed by Crestwood Midstream Partners LP

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Crestwood Midstream Partners LP

Commission File No.: 001-33631

Building a Great Midstream Partnership

Additional Information and Where to Find it This communication contains information about the proposed merger transaction involving Crestwood Midstream Partners LP (“Crestwood”) and Inergy Midstream, L.P. (“Inergy”). In connection with the proposed merger transaction, Inergy will file with the SEC a registration statement on Form S-4 that will include a proxy statement/prospectus for the unitholders of Crestwood. Crestwood will mail the final proxy statement/prospectus to its unitholders. INVESTORS AND UNITHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CRESTWOOD, INERGY, THE PROPOSED MERGER TRANSACTION AND RELATED MATTERS. Investors and unitholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by Inergy and Crestwood through the website maintained by the SEC at www.sec.gov. In addition, investors and unitholders will be able to obtain free copies of documents filed by Crestwood with the SEC from Crestwood’s website, www.crestwoodlp.com, under the heading “SEC Filings” in the “Investor Relations” tab and free copies of documents filed by Inergy with the SEC from Inergy’s website, www.inergylp.com/midstream, under the heading “SEC Filings” in the “Investor Relations” tab. PARTICIPANTS IN THE SOLICITATION Crestwood, Inergy and their respective general partner’s directors and executive officers may be deemed to be participants in the solicitation of proxies from the unitholders of Crestwood in respect of the proposed merger transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the unitholders of Crestwood in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information regarding Crestwood’s directors and executive officers is contained in Crestwood’s Annual Report on Form 10-K for the year ended December 31, 2012, which is filed with the SEC. Information regarding Inergy’s directors and executive officers is contained in Inergy’s Annual Report on Form 10-K for the year ended September 30, 2012, which is filed with the SEC. Free copies of these documents may be obtained from the sources described above. SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS The statements in this communication regarding future events, occurrences, circumstances, activities, performance, outcomes and results are forward-looking statements. Although these statements reflect the current views, assumptions and expectations of Crestwood and Inergy management, the matters addressed herein are subject to numerous risks and uncertainties which could cause actual activities, performance, outcomes and results to differ materially from those indicated. Such forward-looking statements include, but are not limited to, statements about the future financial and operating results, objectives, expectations and intentions and other statements that are not historical facts. Factors that could result in such differences or otherwise materially affect Crestwood’s or Inergy’s financial condition, results of operations and cash flows include, without limitation, failure to satisfy closing conditions with respect to the merger; the risks that the Crestwood and Inergy businesses will not be integrated successfully or may take longer than anticipated; the possibility that expected synergies will not be realized, or will not be realized within the expected timeframe; fluctuations in oil, natural gas and NGL prices; the extent and success of drilling efforts, as well as the extent and quality of natural gas volumes produced within proximity of Crestwood or Inergy assets; failure or delays by customers in achieving expected production in their natural gas projects; competitive conditions in the industry and their impact on the ability of Crestwood or Inergy to connect natural gas supplies to Crestwood or Inergy gathering and processing assets or systems; actions or inactions taken or non-performance by third parties, including suppliers, contractors, operators, processors, transporters and customers; the ability of Crestwood or Inergy to consummate acquisitions, successfully integrate the acquired businesses, realize any cost savings and other synergies from any acquisition; changes in the availability and cost of capital; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond Crestwood or Inergy’s control; timely receipt of necessary government approvals and permits, the ability of Crestwood or Inergy to control the costs of construction, including costs of materials, labor and right-of-way and other factors that may impact either company’s ability to complete projects within budget and on schedule; the effects of existing and future laws and governmental regulations, including environmental and climate change requirements; the effects of existing and future litigation; and risks related to the substantial indebtedness of either company, as well as other factors disclosed in Crestwood and Inergy’s filings with the U.S. Securities and Exchange Commission. You should read filings made by Crestwood and Inergy with the U.S. Securities and Exchange Commission, including Annual Reports on Form 10-K for the year ended December 31, 2012 and September 30, 2012, respectively, and the most recent Quarterly Reports and Current Reports, for a more extensive list of factors that could affect results. Crestwood and Inergy do not assume any obligation to update these forward-looking statements.

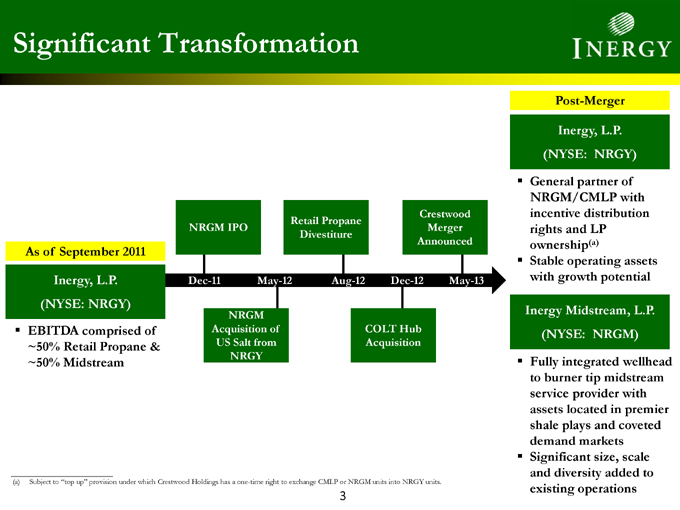

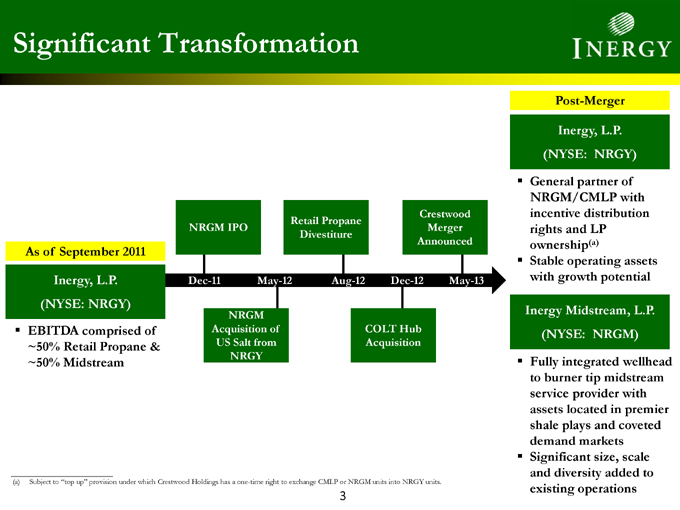

Significant Transformation Crestwood Retail Propane NRGM IPO Merger Divestiture Announced As of September 2011 Inergy, L.P. Dec-11 May-12 Aug-12 Dec-12 May-13 (NYSE: NRGY) NRGM EBITDA comprised of Acquisition of COLT Hub ~50% Retail Propane & US Salt from Acquisition NRGY ~50% Midstream Post-Merger Inergy, L.P. (NYSE: NRGY) General partner of NRGM/CMLP with incentive distribution rights and LP ownership(a) Stable operating assets with growth potential Inergy Midstream, L.P. (NYSE: NRGM) Fully integrated wellhead to burner tip midstream service provider with assets located in premier shale plays and coveted demand markets Significant size, scale and diversity added to existing operations (a) Subject to “top up” provision under which Crestwood Holdings has a one-time right to exchange CMLP or NRGM units into NRGY units.

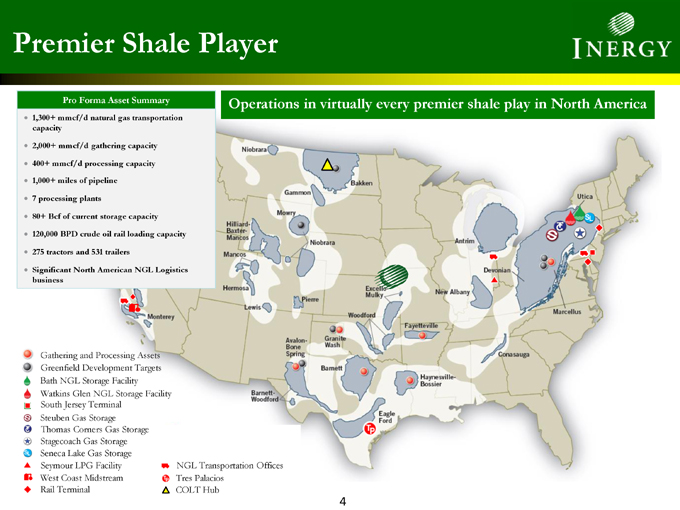

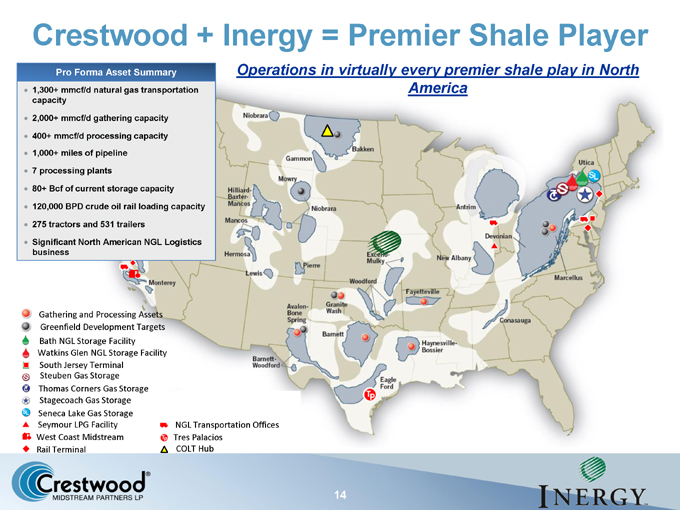

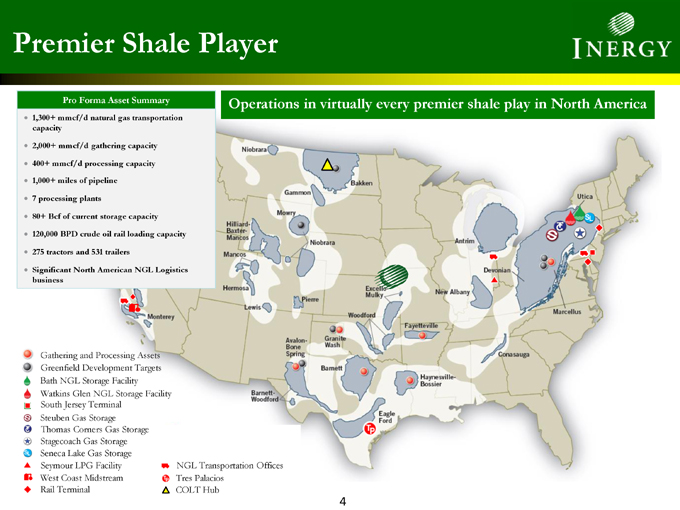

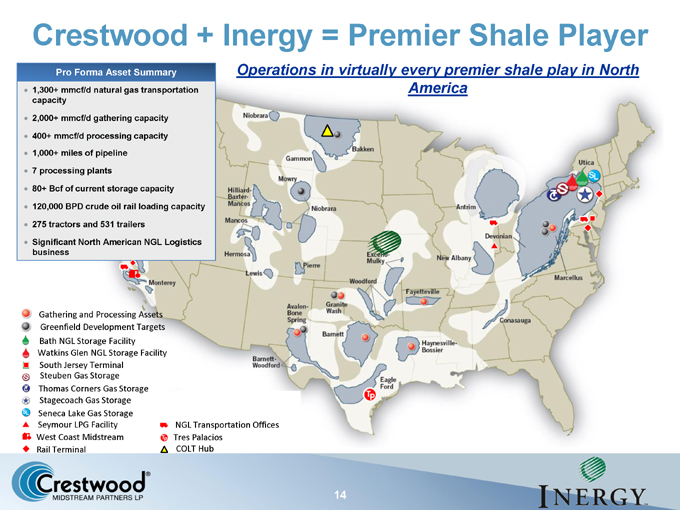

Premier Shale Player Pro Forma Asset Summary Operations in virtually every premier shale play in North America · 1,300+ mmcf/d natural gas transportation capacity · 2,000+ mmcf/d gathering capacity · 400+ mmcf/d processing capacity · 1,000+ miles of pipeline · 7 processing plants · 80+ Bcf of current storage capacity · 120,000 BPD crude oil rail loading capacity · 275 tractors and 531 trailers · Significant North American NGL Logistics business Gathering and Processing Assets Greenfield Development Targets Bath NGL Storage Facility Watkins Glen NGL Storage Facility South Jersey Terminal Steuben Gas Storage Thomas Corners Gas Storage Stagecoach Gas Storage Seneca Lake Gas Storage Seymour LPG Facility NGL Transportation Offices West Coast Midstream Tres Palacios Rail Terminal ` COLT Hub

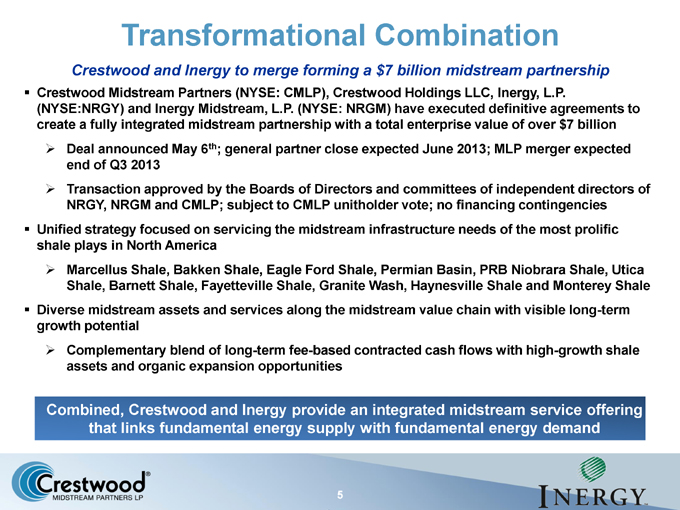

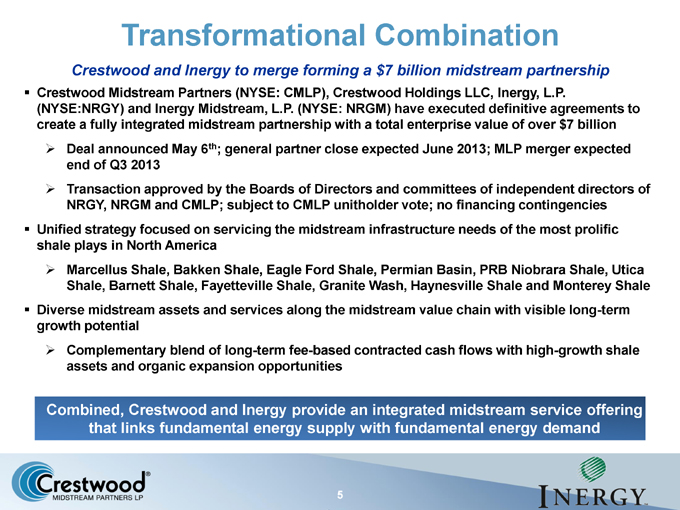

Transformational Combination Crestwood and Inergy to merge forming a $7 billion midstream partnership Crestwood Midstream Partners (NYSE: CMLP), Crestwood Holdings LLC, Inergy, L.P. (NYSE:NRGY) and Inergy Midstream, L.P. (NYSE: NRGM) have executed definitive agreements to create a fully integrated midstream partnership with a total enterprise value of over $7 billion Deal announced May 6th; general partner close expected June 2013; MLP merger expected end of Q3 2013 Transaction approved by the Boards of Directors and committees of independent directors of NRGY, NRGM and CMLP; subject to CMLP unitholder vote; no financing contingencies Unified strategy focused on servicing the midstream infrastructure needs of the most prolific shale plays in North America Marcellus Shale, Bakken Shale, Eagle Ford Shale, Permian Basin, PRB Niobrara Shale, Utica Shale, Barnett Shale, Fayetteville Shale, Granite Wash, Haynesville Shale and Monterey Shale Diverse midstream assets and services along the midstream value chain with visible long-term growth potential Complementary blend of long-term fee-based contracted cash flows with high-growth shale assets and organic expansion opportunities Combined, Crestwood and Inergy provide an integrated midstream service offering that links fundamental energy supply with fundamental energy demand 5

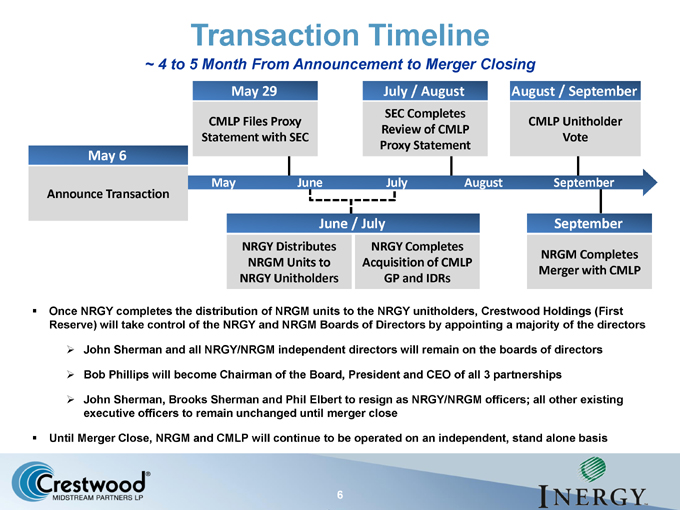

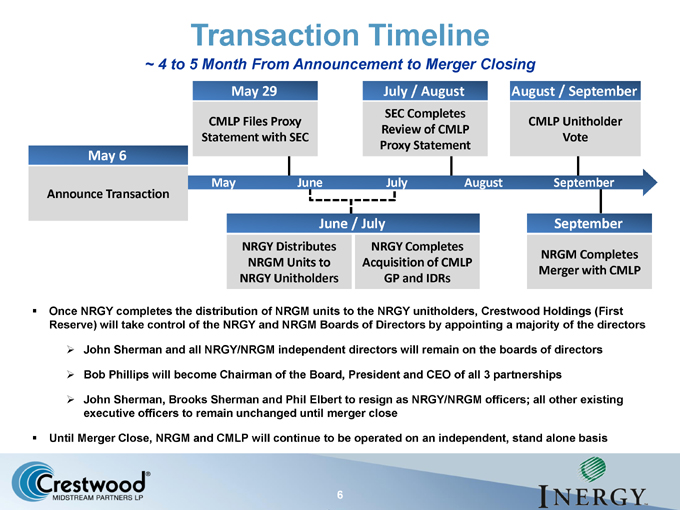

Transaction Timeline ~ 4 to 5 Month From Announcement to Merger Closing May 29 July / August August / September SEC Completes CMLP Files Proxy CMLP Unitholder Review of CMLP Statement with SEC Vote May 6 Proxy Statement May June July August September Announce Transaction June / July September NRGY Distributes NRGY Completes NRGM Completes NRGM Units to Acquisition of CMLP Merger with CMLP NRGY Unitholders GP and IDRs Once NRGY completes the distribution of NRGM units to the NRGY unitholders, Crestwood Holdings (First Reserve) will take control of the NRGY and NRGM Boards of Directors by appointing a majority of the directors John Sherman and all NRGY/NRGM independent directors will remain on the boards of directors Bob Phillips will become Chairman of the Board, President and CEO of all 3 partnerships John Sherman, Brooks Sherman and Phil Elbert to resign as NRGY/NRGM officers; all other existing executive officers to remain unchanged until merger close Until Merger Close, NRGM and CMLP will continue to be operated on an independent, stand alone basis 6

Introduction To Crestwood

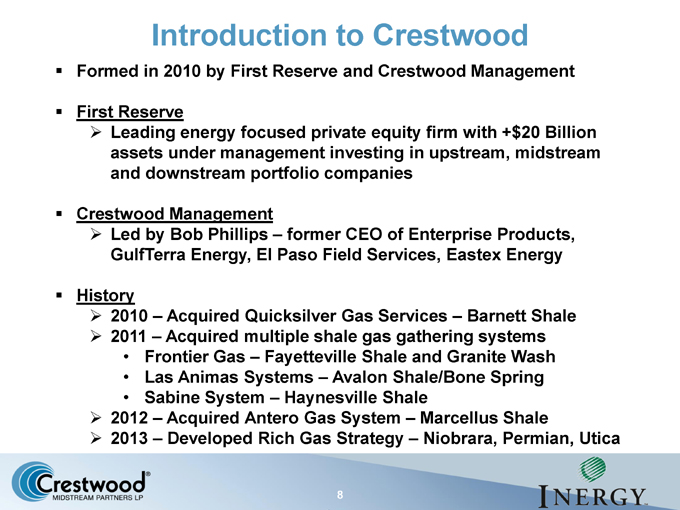

Introduction to Crestwood Formed in 2010 by First Reserve and Crestwood Management First Reserve Leading energy focused private equity firm with +$20 Billion assets under management investing in upstream, midstream and downstream portfolio companies Crestwood Management Led by Bob Phillips – former CEO of Enterprise Products, GulfTerra Energy, El Paso Field Services, Eastex Energy History 2010 – Acquired Quicksilver Gas Services – Barnett Shale 2011 – Acquired multiple shale gas gathering systems • Frontier Gas – Fayetteville Shale and Granite Wash • Las Animas Systems – Avalon Shale/Bone Spring • Sabine System – Haynesville Shale 2012 – Acquired Antero Gas System – Marcellus Shale 2013 – Developed Rich Gas Strategy – Niobrara, Permian, Utica

Crestwood Midstream Partners Shale focused partnership well positioned to participate in the long-term build-out of midstream infrastructure Crestwood Asset Summary · 1.0 Bcf/d of gathering volumes across six resource plays · 850 miles of gathering pipelines · 6 processing plants · 260,000 horsepower of compression · > 450,000 acres of production dedicated under long term contracts · 98% fee-based revenues

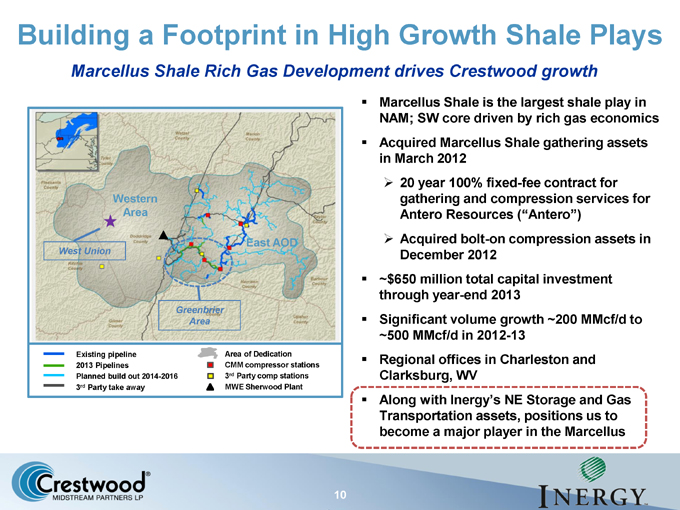

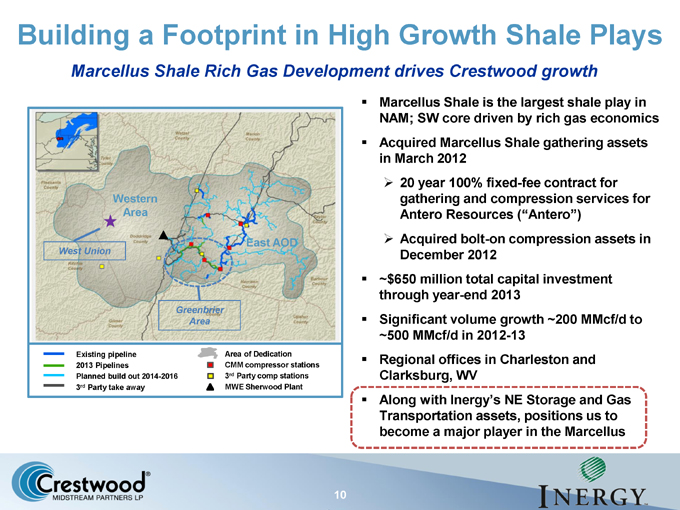

Building a Footprint in High Growth Shale Plays Marcellus Shale Rich Gas Development drives Crestwood growth Marcellus Shale is the largest shale play in NAM; SW core driven by rich gas economics Acquired Marcellus Shale gathering assets in March 2012 20 year 100% fixed-fee contract for Western gathering and compression services for Area Antero Resources (“Antero”) East AOD Acquired bolt-on compression assets in West Union December 2012 ~$650 million total capital investment through year-end 2013 Greenbrier Area Significant volume growth ~200 MMcf/d to ~500 MMcf/d in 2012-13 Existing pipeline Area of Dedication Regional offices in Charleston and 2013 Pipelines CMM compressor stations Planned build out 2014-2016 3rd Party comp stations Clarksburg, WV 3rd Party take away MWE Sherwood Plant Along with Inergy’s NE Storage and Gas Transportation assets, positions us to become a major player in the Marcellus

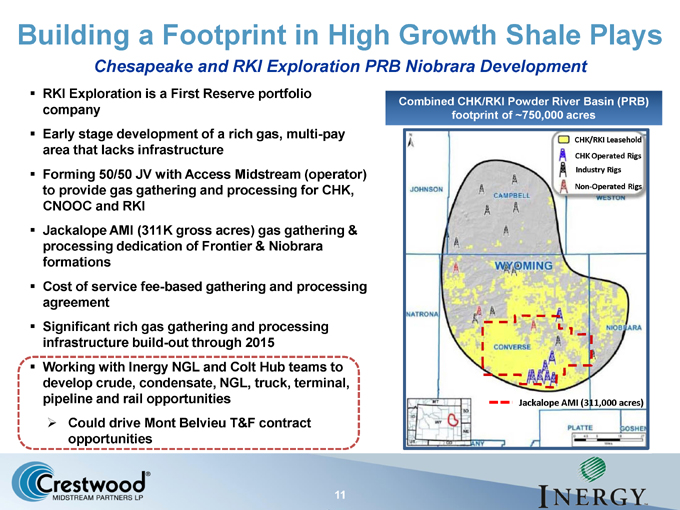

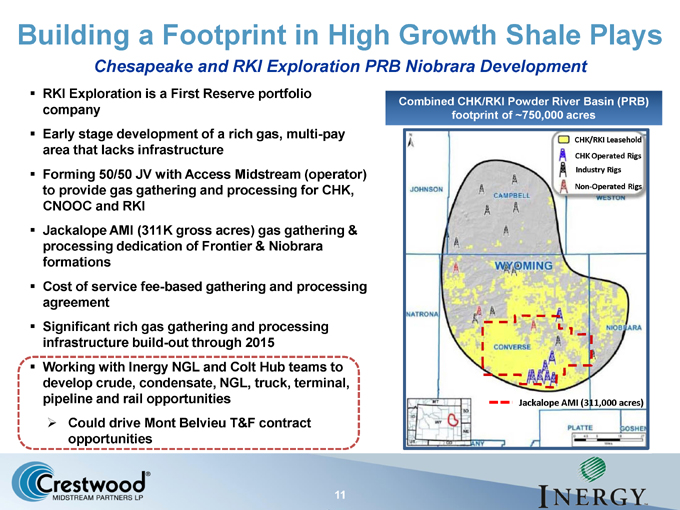

Building a Footprint in High Growth Shale Plays Chesapeake and RKI Exploration PRB Niobrara Development RKI Exploration is a First Reserve portfolio Combined CHK/RKI Powder River Basin Combined CHK/RKI Powder River Basin (PRB) company footprint of ~750,000 acres Early stage development of a rich gas, multi-pay area that lacks infrastructure CHK/RKI Leasehold CHK Operated Rigs Forming 50/50 JV with Access Midstream (operator) Industry Rigs to provide gas gathering and processing for CHK, Non-Operated Rigs CNOOC and RKI Jackalope AMI (311K gross acres) gas gathering & processing dedication of Frontier & Niobrara formations Cost of service fee-based gathering and processing agreement Significant rich gas gathering and processing infrastructure build-out through 2015 Working with Inergy NGL and Colt Hub teams to develop crude, condensate, NGL, truck, terminal, pipeline and rail opportunities Jackalope AMI (311,000 acres) Could drive Mont Belvieu T&F contract opportunities

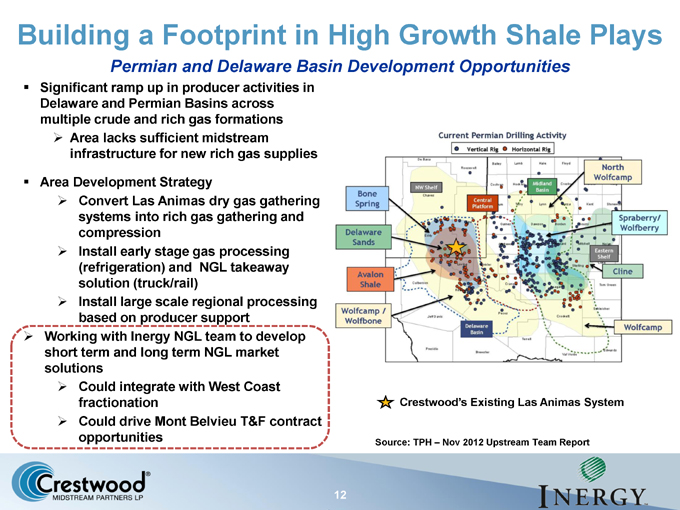

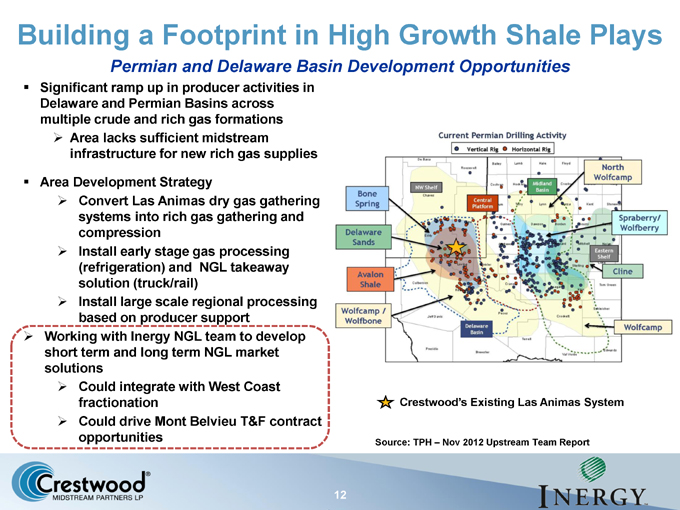

Building a Footprint in High Growth Shale Plays Permian and Delaware Basin Development Opportunities Significant ramp up in producer activities in Delaware and Permian Basins across multiple crude and rich gas formations Area lacks sufficient midstream infrastructure for new rich gas supplies Area Development Strategy Convert Las Animas dry gas gathering systems into rich gas gathering and compression Install early stage gas processing (refrigeration) and NGL takeaway solution (truck/rail) Install large scale regional processing based on producer support Working with Inergy NGL team to develop short term and long term NGL market solutions Could integrate with West Coast fractionation Crestwood?s Existing Las Animas System Could drive Mont Belvieu T&F contract opportunities Source: TPH ? Nov 2012 Upstream Team Report 12

A Merger That Makes Sense!

Crestwood + Inergy = Premier Shale Player Pro Forma Asset Summary Operations in virtually every premier shale play in North ? 1,300+ mmcf/d natural gas transportation America capacity ? 2,000+ mmcf/d gathering capacity ? 400+ mmcf/d processing capacity ? 1,000+ miles of pipeline ? 7 processing plants ? 80+ Bcf of current storage capacity ? 120,000 BPD crude oil rail loading capacity ? 275 tractors and 531 trailers ? Significant North American NGL Logistics business Gathering and Processing Assets Greenfield Development Targets Bath NGL Storage Facility Watkins Glen NGL Storage Facility South Jersey Terminal Steuben Gas Storage Thomas Corners Gas Storage Stagecoach Gas Storage Seneca Lake Gas Storage Seymour LPG Facility NGL Transportation Offices West Coast Midstream Tres Palacios Rail Terminal ` COLT Hub 14

Strategic Benefits Support the Merger Materially Increased Size, Strong Scale and Complementary Sponsorship and Diversity Growth Alignment of Strategies Interest with LPs Significant Expanded Management Participation in Experience & Midstream Track Record Value Chain Low Cost Capital Enhanced Credit Profile Cash Flow Drives Organic Stability and Growth Visibility 15

Expanding the Value Chain Offers Growth The combined partnership represents a fully integrated midstream service provider with complementary business platforms positioned to compete across the midstream value chain Offering customers a more comprehensive and competitive suite of services Capturing incremental fee opportunities that expand margins and maximize returns on investment Intrastate Intrastate & Gas Gathering CO2 & Interstate Gas Storage Interstate Pipelines Treating Pipelines Pipelines Gas Residue Ethane Propane NGL Gas Gathering Gas Mixed NGL NGL Iso-Butane Storage & NGL Rich Gas Pipelines Processing Pipelines Fractionation Butane Pipelines Nat Gasoline Crestwood Inergy Trucks, Rail Barges & Crude Oil Barges & Crude Oil Refined Storage & Storage Crude Refining Products Terminals Pipelines Pipelines 16

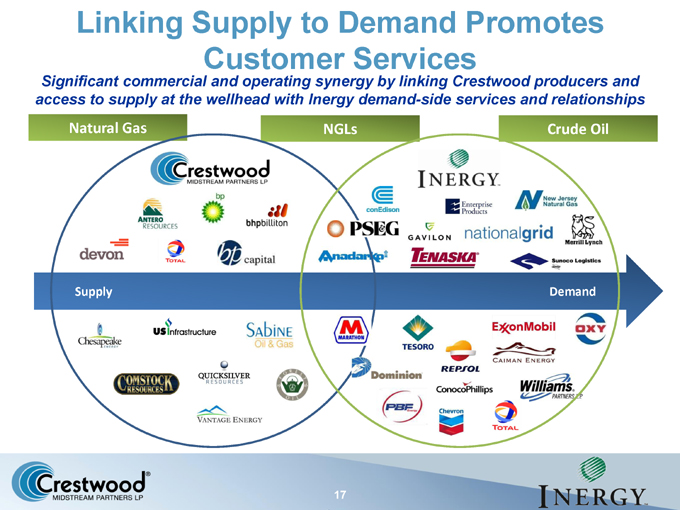

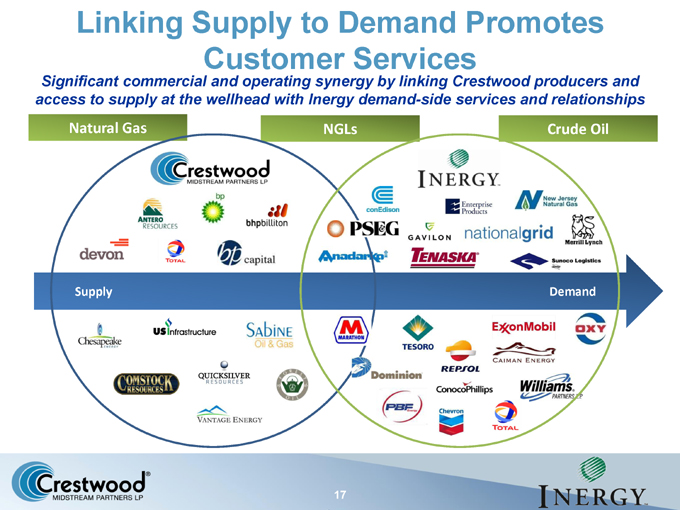

Linking Supply to Demand Promotes Customer Services Significant commercial and operating synergy by linking Crestwood producers and access to supply at the wellhead with Inergy demand-side services and relationships Natural Gas NGLs Crude Oil Supply Demand 17

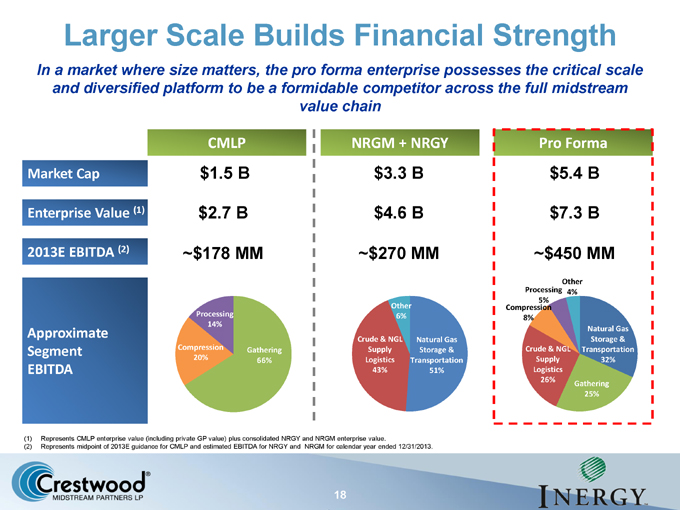

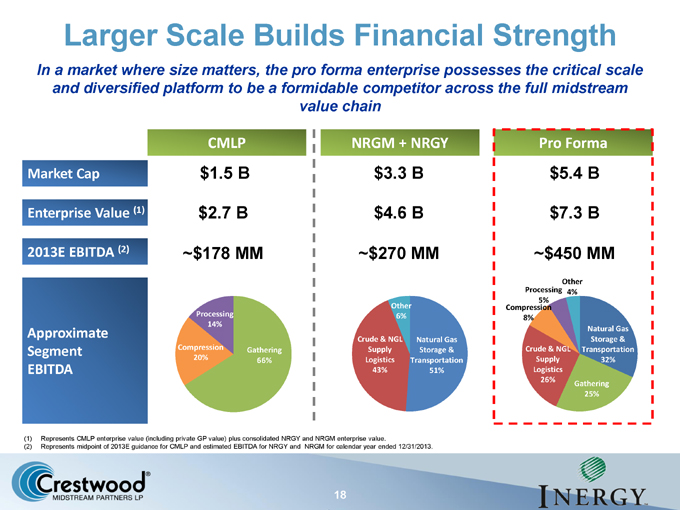

Larger Scale Builds Financial Strength In a market where size matters, the pro forma enterprise possesses the critical scale and diversified platform to be a formidable competitor across the full midstream value chain CMLP NRGM + NRGY Pro Forma Market Cap $1.5 B $3.3 B $5.4 B Enterprise Value (1) $2.7 B $4.6 B $7.3 B 2013E EBITDA (2) ~$178 MM ~$270 MM ~$450 MM Other Processing 4% 5% Other Compression Processing 6% 14% 8% Approximate Natural Gas Crude & NGL Natural Gas Storage & Segment Compression Gathering Supply Storage & Crude & NGL Transportation 20% 66% Logistics Transportation Supply 32% EBITDA 43% 51% Logistics 26% Gathering 25% (1) Represents CMLP enterprise value (including private GP value) plus consolidated NRGY and NRGM enterprise value. (2) Represents midpoint of 2013E guidance for CMLP and estimated EBITDA for NRGY and NRGM for calendar year ended 12/31/2013. 18

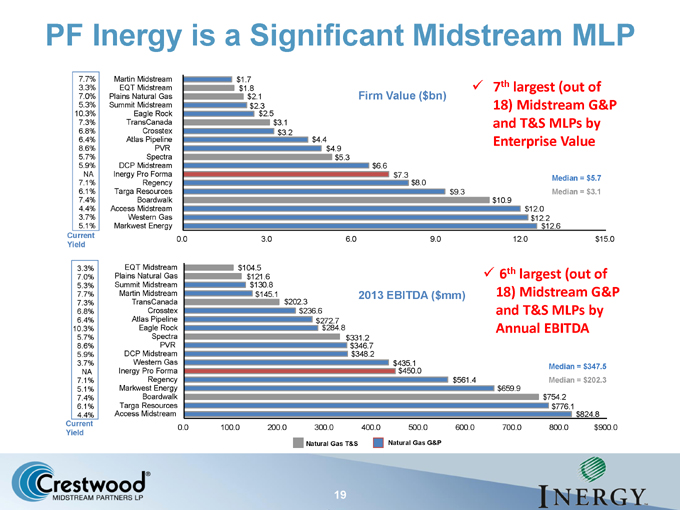

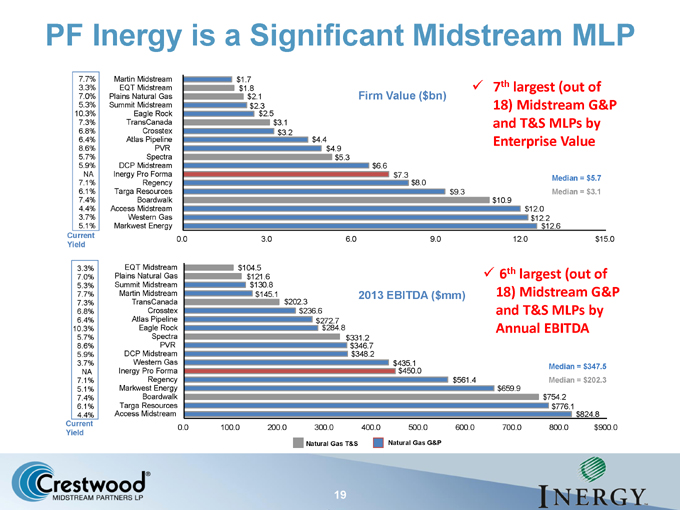

PF Inergy is a Significant Midstream MLP 7.7% Martin Midstream $1.7 th 3.3% EQT Midstream $1.8 7 largest (out of 7.0% Plains Natural Gas $2.1 Firm Value ($bn) 5.3% Summit Midstream $2.3 18) Midstream G&P 10.3% Eagle Rock $2.5 7.3% TransCanada $3.1 and T&S MLPs by 6.8% Crosstex $3.2 6.4% Atlas Pipeline $4.4 Enterprise Value 8.6% PVR $4.9 5.7% Spectra $5.3 5.9% DCP Midstream $6.6 NA Inergy Pro Forma $7.3 Median = $5.7 7.1% Regency $8.0 6.1% Targa Resources $9.3 Median = $3.1 7.4% Boardwalk $10.9 4.4% Access Midstream $12.0 3.7% Western Gas $12.2 5.1% Markwest Energy $12.6 Current 0.0 3.0 6.0 9.0 12.0 $15.0 Yield 3.3% EQT Midstream $104.5 th 7.0% Plains Natural Gas $121.6 6 largest (out of 5.3% Summit Midstream $130.8 7.7% Martin Midstream $145.1 2013 EBITDA ($mm) 18) Midstream G&P 7.3% TransCanada $202.3 6.8% Crosstex $236.6 and T&S MLPs by 6.4% Atlas Pipeline $272.7 10.3% Eagle Rock $284.8 Annual EBITDA 5.7% Spectra $331.2 8.6% PVR $346.7 5.9% DCP Midstream $348.2 3.7% Western Gas $435.1 Median = $347.5 NA Inergy Pro Forma $450.0 7.1% Regency $561.4 Median = $202.3 5.1% Markwest Energy $659.9 7.4% Boardwalk $754.2 6.1% Targa Resources $776.1 4.4% Access Midstream $824.8 Current 0.0 100.0 200.0 300.0 400.0 500.0 600.0 700.0 800.0 $900.0 Yield Natural Gas T&S Natural Gas G&P 19

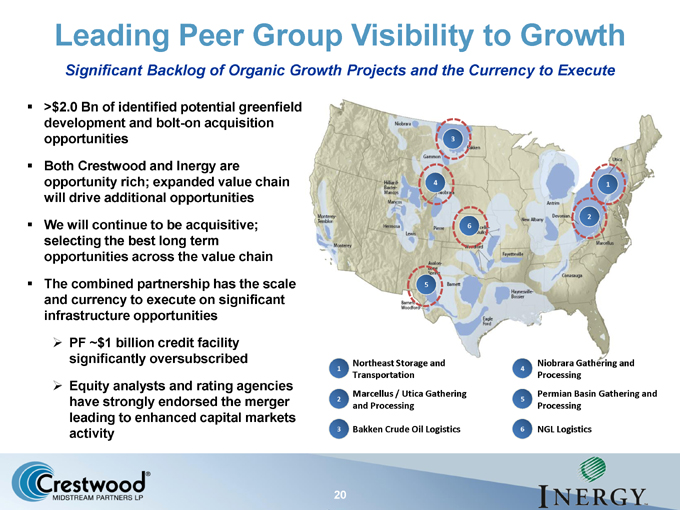

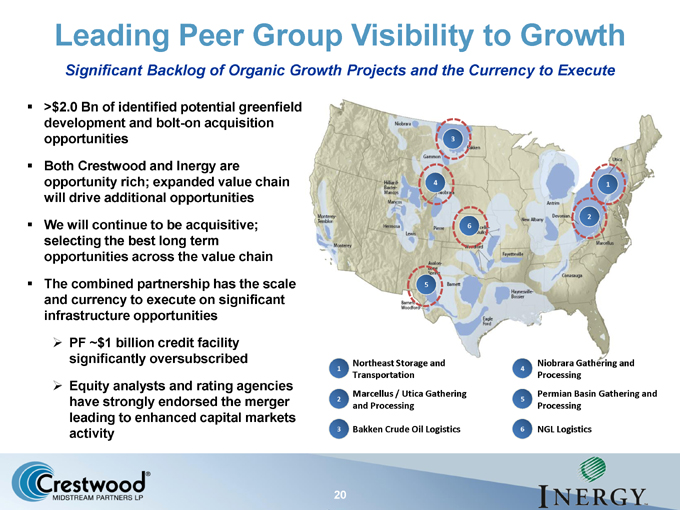

Leading Peer Group Visibility to Growth Significant Backlog of Organic Growth Projects and the Currency to Execute >$2.0 Bn of identified potential greenfield development and bolt-on acquisition opportunities 3 Both Crestwood and Inergy are opportunity rich; expanded value chain 4 1 will drive additional opportunities 2 We will continue to be acquisitive; 6 selecting the best long term opportunities across the value chain The combined partnership has the scale 5 and currency to execute on significant infrastructure opportunities PF ~$1 billion credit facility significantly oversubscribed Northeast Storage and Niobrara Gathering and 1 Transportation 4 Processing Equity analysts and rating agencies Marcellus / Utica Gathering Permian Basin Gathering have strongly endorsed the merger 2 and Processing 5 Processing leading to enhanced capital markets activity 3 Bakken Crude Oil Logistics 6 NGL Logistics 20

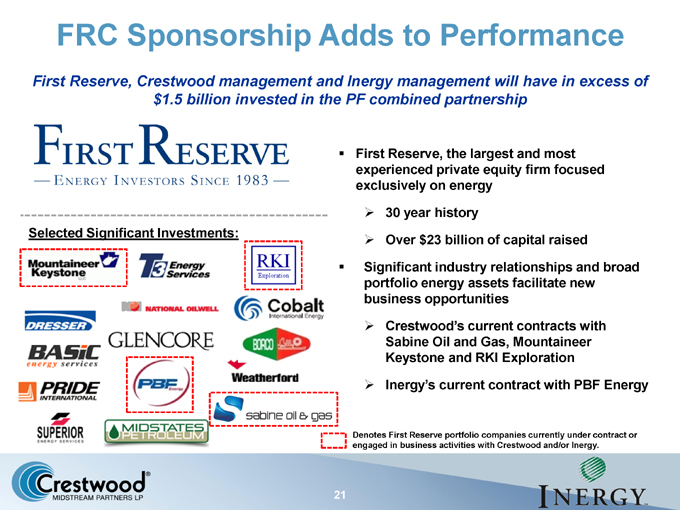

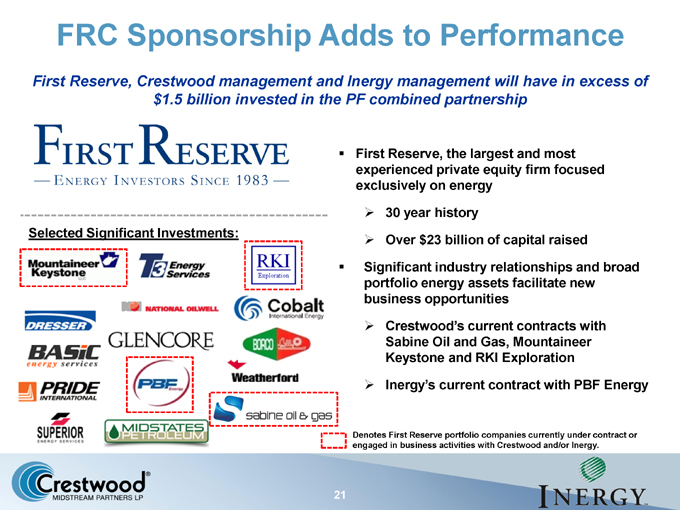

FRC Sponsorship Adds to Performance First Reserve, Crestwood management and Inergy management will have in excess of $1.5 billion invested in the PF combined partnership First Reserve, the largest and most experienced private equity firm focused exclusively on energy 30 year history Selected Significant Investments: Over $23 billion of capital raised Significant industry relationships and broad portfolio energy assets facilitate new business opportunities Crestwood’s current contracts with Sabine Oil and Gas, Mountaineer Keystone and RKI Exploration Inergy’s current contract with PBF Energy Denotes First Reserve portfolio companies currently under contract or engaged in business activities with Crestwood and/or Inergy. 21

Market Research Endorses the Merger “The deal provides CMLP with (1) an enhanced set of midstream logistics assets beyond gathering and processing in several attractive basins (Marcellus, Bakken, etc.), (2) improves the organic growth profile for partnership, and (3) provides further scale, geographic diversification, and a larger platform from which to pursue additional organic and acquisition related growth.” —Wells Fargo “The combined entity will have a diverse asset mix (nat gas storage and transportation 32%, crude /NGL supply logistics 26%, gathering 25%) and an EBITDA base of ~$450 mm, with a lower cost of capital and $2 billion of potential green field and bolt-on acquisition opportunities across various producing basins.” —Barclays “The merger should provide better access to capital and allow the partnership to execute on more sizable organic and acquisition opportunities. —RBC “We support the view that this combination could drive attractive synergies given the limited customer overlap and enhanced service offerings leading to cross-selling opportunities. Moreover, we believe this merger could lead to an overall lower cost of capital given the diversification and scale.” —JP Morgan “In our view the Crestwood merger has the potential to be transformational for Inergy. While integration risks remain, we believe the merger will significantly enhance the long-term distribution growth potential of the partnership… In our view, NRGY’s biggest challenge prior to the merger was growth. This merger directly addresses this issue.” —Credit Suisse “The transaction will transform NRGM from a smaller storage and transportation MLP to a financial sponsor-backed integrated midstream MLP. The transaction will be a credit positive, setting NRGM on a path towards an investment grade rating.” —Guzman & Co 22

What We Are Trying to Build? 23

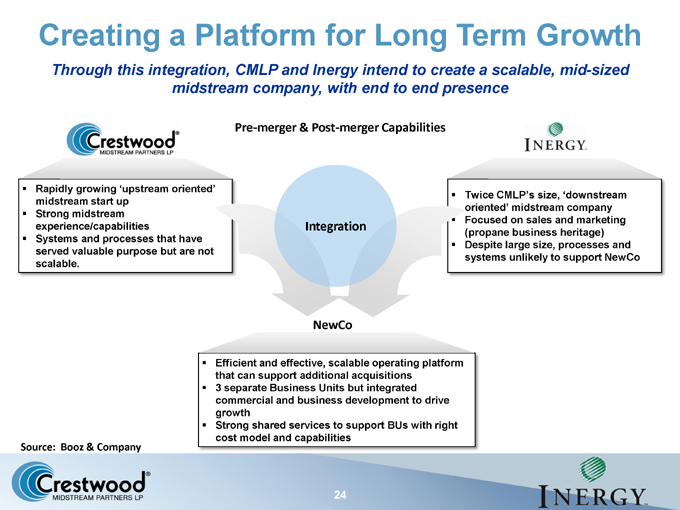

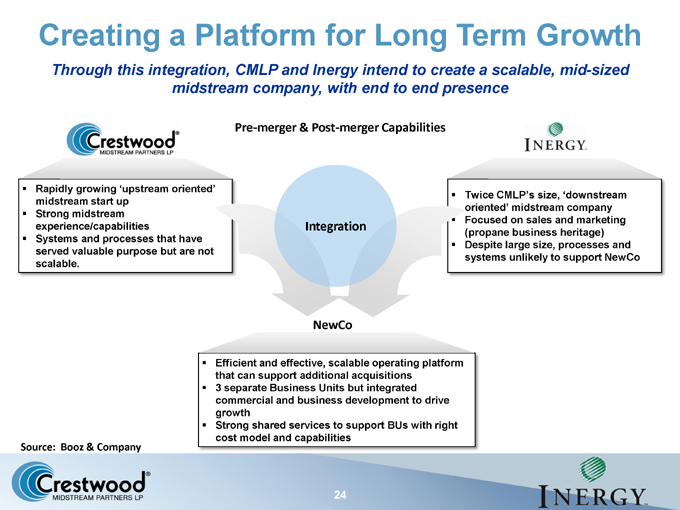

Creating a Platform for Long Term Growth Through this integration, CMLP and Inergy intend to create a scalable, mid-sized midstream company, with end to end presence Pre-merger & Post-merger Capabilities Rapidly growing ‘upstream oriented’ Twice CMLP’s size, ‘downstream midstream start up oriented’ midstream company Strong midstream Focused on sales and marketing experience/capabilities Integration (propane business heritage) Systems and processes that have Despite large size, processes and served valuable purpose but are not systems unlikely to support NewCo scalable. NewCo Efficient and effective, scalable operating platform that can support additional acquisitions 3 separate Business Units but integrated commercial and business development to drive growth Strong shared services to support BUs with right cost model and capabilities Source: Booz & Company 24

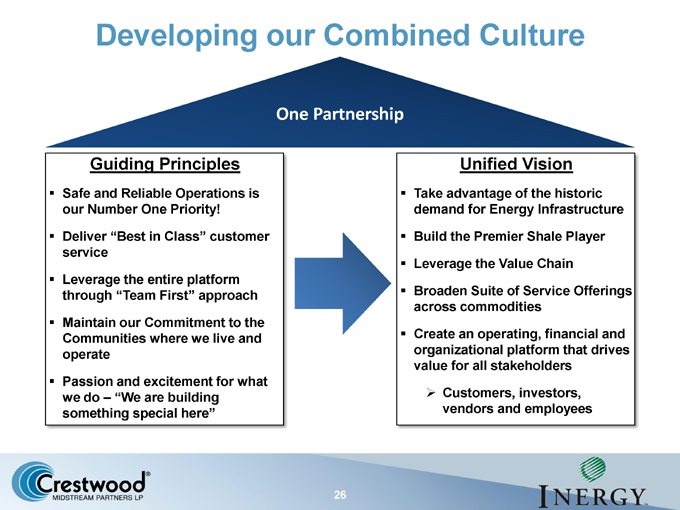

Building a Unified Partnership One Partnership Culture Corporate Development Gathering & NGL & Crude Gas Storage & Drawing from the Processing Services Transportation best of both Leveraging the organizations to Combined utilize core guiding Operating Platform principles to to create new realize a unified avenues of growth vision SHARED SERVICES PLATFORM (Accounting, Legal, HR, IT) 25

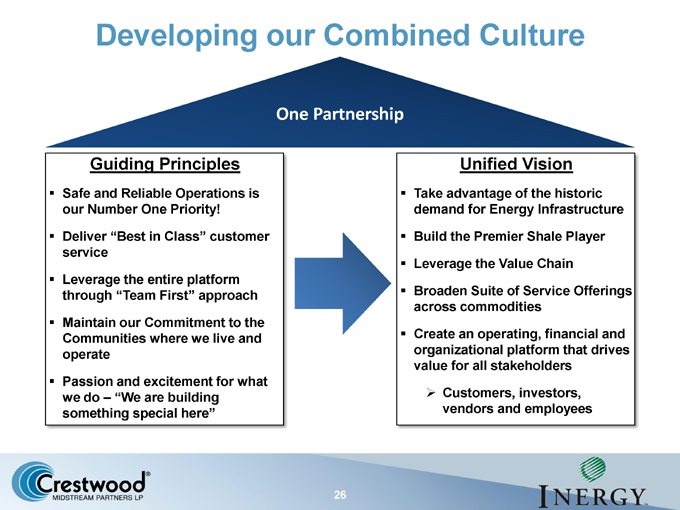

Developing our Combined Culture One Partnership Guiding Principles Unified Vision Safe and Reliable Operations is Take advantage of the historic our Number One Priority! demand for Energy Infrastructure Deliver “Best in Class” customer Build the Premier Shale Player service Leverage the Value Chain Leverage the entire platform Broaden Suite Service Offerings through “Team First” approach of across commodities Maintain our Commitment to the Communities where we live and Create an operating, financial and operate organizational platform that drives value for all stakeholders Passion and excitement for what we do – “We are building Customers, investors, something special here” vendors and employees 26

How We Plan To Build It! 27

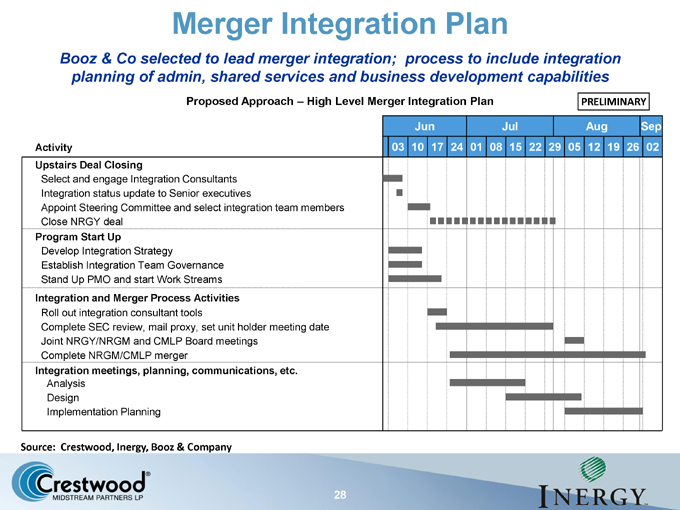

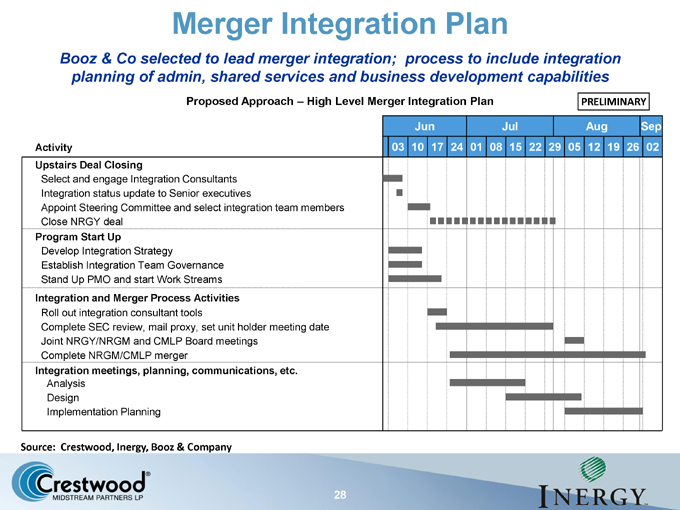

Merger Integration Plan Booz & Co selected to lead merger integration; process to include integration planning of admin, shared services and business development capabilities Proposed Approach – High Level Merger Integration Plan PRELIMINARY Jun Jul Aug Sep Activity 03 10 17 24 01 08 15 22 29 05 12 19 26 02 Upstairs Deal Closing Select and engage Integration Consultants Integration status update to Senior executives Appoint Steering Committee and select integration team members Close NRGY deal Program Start Up Develop Integration Strategy Establish Integration Team Governance Stand Up PMO and start Work Streams Integration and Merger Process Activities Roll out integration consultant tools Complete SEC review, mail proxy, set unit holder meeting date Joint NRGY/NRGM and CMLP Board meetings Complete NRGM/CMLP merger Integration meetings, planning, communications, etc. Analysis Design Implementation Planning Source: Crestwood, Inergy, Booz & Company 28

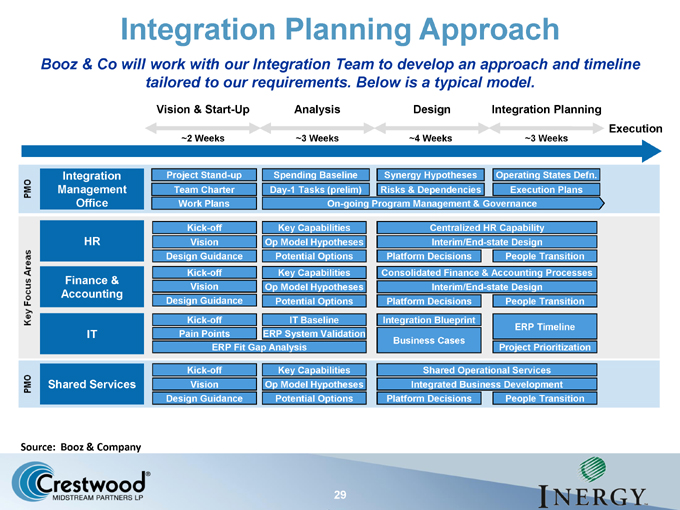

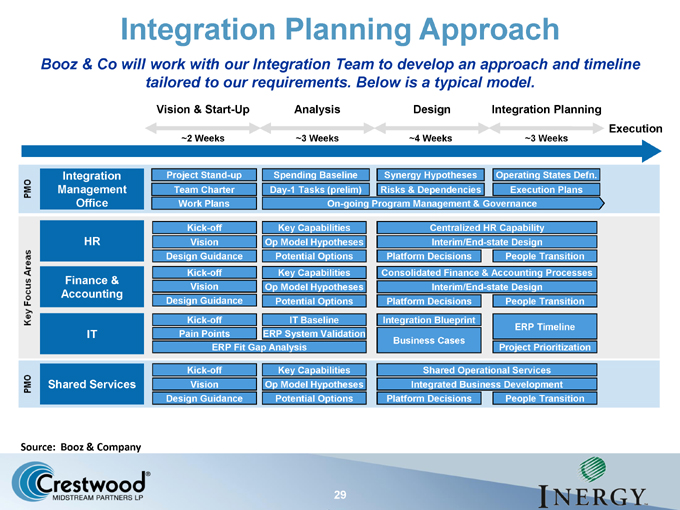

Integration Planning Approach Booz & Co will work with our Integration Team to develop an approach and timeline tailored to our requirements. Below is a typical model. Vision & Start-Up Analysis Design Integration Planning Execution ~2 Weeks ~3 Weeks ~4 Weeks ~3 Weeks Integration Project Stand-up Spending Baseline Synergy Hypotheses Operating States Defn. Management Team Charter Day-1 Tasks (prelim) Risks & Dependencies Execution Plans Office Work Plans On-going Program Management & Governance Kick-off Key Capabilities Centralized HR Capability HR Vision Op Model Hypotheses Interim/End-state Design Design Guidance Potential Options Platform Decisions People Transition Kick-off Key Capabilities Consolidated Finance & Accounting Processes Finance & Vision Op Model Hypotheses Interim/End-state Design Accounting Design Guidance Potential Options Platform Decisions People Transition Kick-off IT Baseline Integration Blueprint ERP Timeline IT Pain Points ERP System Validation Business Cases ERP Fit Gap Analysis Project Prioritization Kick-off Key Capabilities Shared Operational Services Shared Services Vision Op Model Hypotheses Integrated Business Development Design Guidance Potential Options Platform Decisions People Transition Source: Booz & Company 29

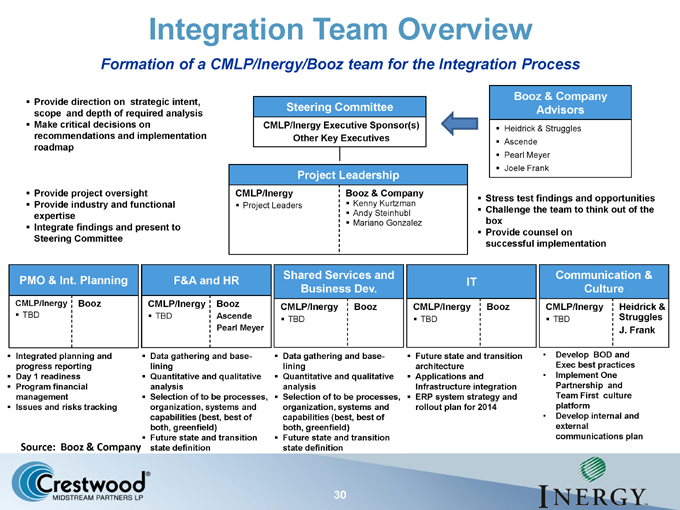

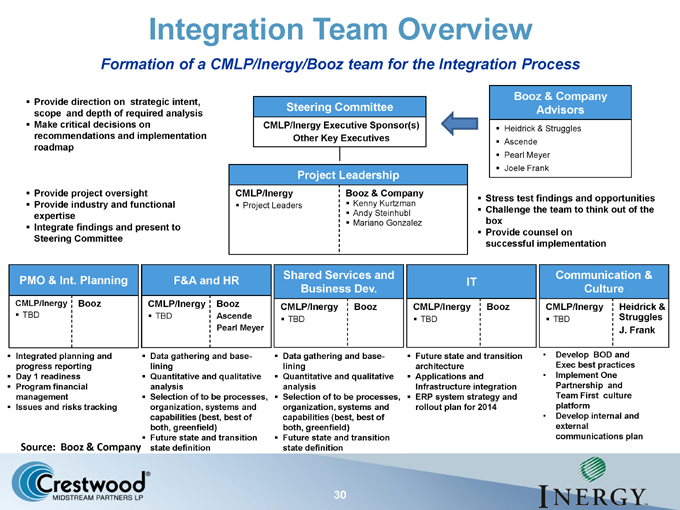

Integration Team Overview Formation of a CMLP/Inergy/Booz team for the Integration Process Booz & Company Provide direction on strategic intent, Steering Committee Advisors scope and depth of required analysis Make critical decisions on CMLP/Inergy Executive Sponsor(s) Heidrick & Struggles recommendations and implementation Other Key Executives Ascende roadmap Pearl Meyer Joele Frank Project Leadership Provide project oversight CMLP/Inergy Booz & Company Stress test findings and opportunities Provide industry and functional Project Leaders Kenny Kurtzman Andy Steinhubl Challenge the team to think out of the expertise Mariano Gonzalez box Integrate findings and present to Provide counsel on Steering Committee successful implementation Shared Services and Communication & PMO & Int. Planning F&A and HR IT Business Dev. Culture CMLP/Inergy Booz CMLP/Inergy Booz CMLP/Inergy Booz CMLP/Inergy Booz CMLP/Inergy Heidrick & TBD TBD Ascende Struggles TBD TBD TBD Pearl Meyer J. Frank Integrated planning and Data gathering and base- Data gathering and base- Future state and transition • Develop BOD and progress reporting lining lining architecture Exec best practices Day 1 readiness Quantitative and qualitative Quantitative and qualitative Applications and • Implement One Program financial analysis analysis Infrastructure integration Partnership and management Selection of to be processes, Selection of to be processes, ERP system strategy and Team First culture Issues and risks tracking organization, systems and organization, systems and rollout plan for 2014 platform capabilities (best, best of capabilities (best, best of • Develop internal and both, greenfield) both, greenfield) external Future state and transition Future state and transition communications plan Source: Booz & Company state definition state definition 30

FAQ 31

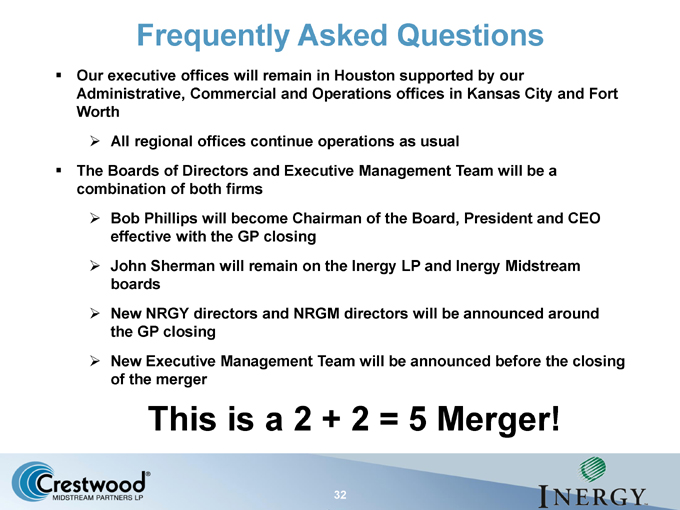

Frequently Asked Questions Our executive offices will remain in Houston supported by our Administrative, Commercial and Operations offices in Kansas City and Fort Worth All regional offices continue operations as usual The Boards of Directors and Executive Management Team will be a combination of both firms Bob Phillips will become Chairman of the Board, President and CEO effective with the GP closing John Sherman will remain on the Inergy LP and Inergy Midstream boards New NRGY directors and NRGM directors will be announced around the GP closing New Executive Management Team will be announced before the closing of the merger This is a 2 + 2 = 5 Merger! 32

Frequently Asked Questions We will maintain Inergy LP (NRGY), Inergy Midstream (NRGM) and Crestwood Midstream Partners (CMLP) as stand alone partnerships until the merger is complete Each organization’s operations consistent with status quo; “BUSINESS AS USUAL” The merger integration process will be conducted throughout June to September 2013; implementation begins in the 4th quarter 2013 Goal is to operate as one organization with one culture beginning in the 4th quarter 2013 2014 will be a year of continued corporate, organizational and cultural development with important projects such as the implementation of a company-wide ERP system adding to merger synergies We will determine the new name, logo and brand after the merger is complete Compensation and benefits plans will be evaluated as a part of the merger integration process This is a 2 + 2 = 5 Merger! 33