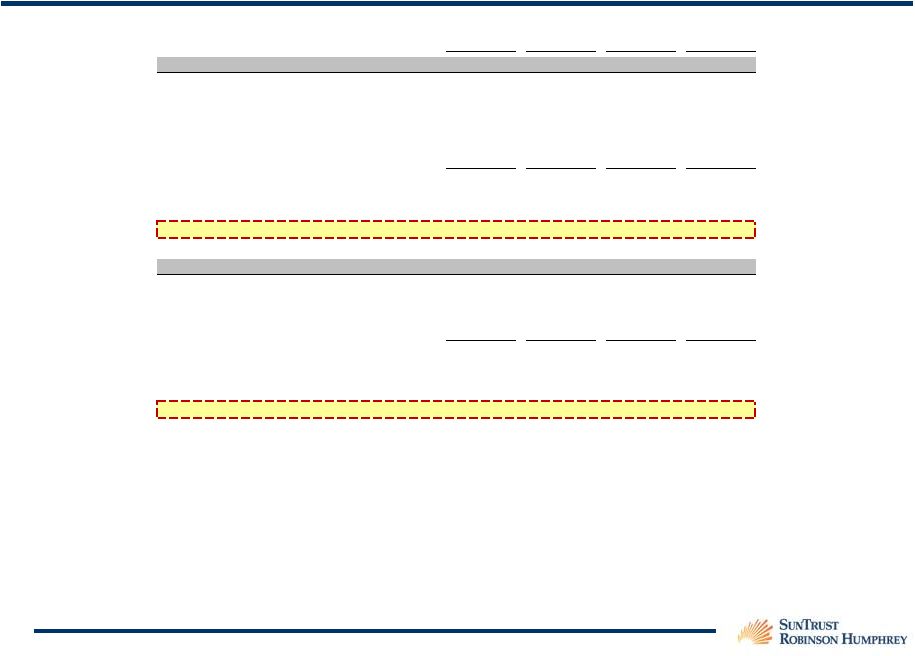

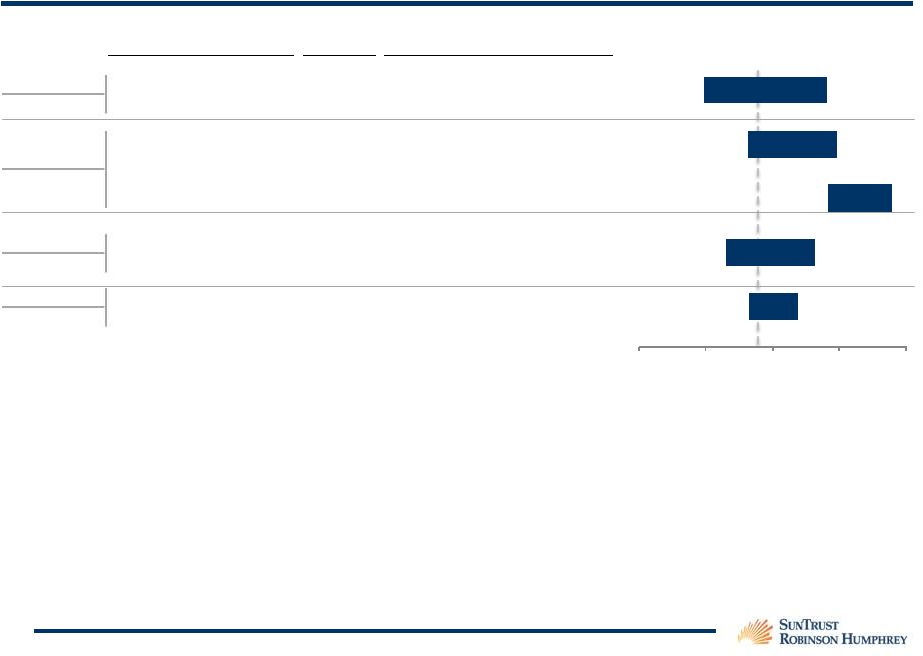

77 Announced Date Buyer Seller Enterprise Value TV / EBITDA TV / Developed EBITDA Assets Acquired 4/16/2013 Atlas Pipeline Partners, L.P. TEAK Midstream, L.L.C. $1,000.0 NA 6.9x (1) APL announced a definitive agreement to acquire TEAK Midstream, which owns a 200 MMcf/d cryogenic processing plant and 265 miles of rich gas gathering lines with 750 MMcf/d of capacity. TEAK is in the process of installing a second 200 MMcf/d processing plant which is expected to be in service during 2014. 2/27/2013 Regency Energy Partners LP Energy Transfer Equity, L.P. Energy Transfer Partners, L.P. 1,500.0 NA 13.0x RGP announced it would acquire Southern Union Gathering Company, LLC, the owner of Southern Union Gas Services, Ltd. (SUGS). SUGS' assets include a 5,600-mile gathering system and ~500 MMcf/d of processing and treating facilities in West TX and NM. 2/27/2013 Western Gas Partners, LP Chesapeake Energy Corporation 395.6 (2) 9.7x NA WES agreed to acquire a 33.75% interest in the Larry's Creek, Seely and Warrensville gas gathering systems from an affiliate of Chesapeake Energy Corporation. The assets are located in north-central Pennsylvania in the Marcellus Shale. 2/27/2013 Western Gas Partners, LP Anadarko Petroleum Corporation 1,451.9 (2) 7.6x NA WES acquired a 33.75% in the Liberty and Rome gas gathering systems in north-central Pennsylvania. 1/29/2013 Kinder Morgan Energy Partners, L.P. Copano Energy, LLC 4,746.6 (3) 15.8x NA Copano owns and operates assets primarily in Texas, Oklahoma and Wyoming, and is engaged in natural gas gathering, processing, treating and natural gas liquids fractionation. Copano owns an interest in or operates about 6,900 miles of pipelines with 2.7 Bcf/d of natural gas throughput capacity and 9 processing plants with more than 1 Bcf/d of processing capacity and 315 MMcf/d of treating capacity. 1/9/2013 Summit Midstream Partners, LLC GSO Capital Partners LP 513.0 NA NA Summit Investments executed a definitive agreement to acquire 100% of the equity interests of Bear Tracker Energy, LLC. Bear Tracker owns, operates and is developing various natural gas gathering and processing assets along with crude oil and water gathering assets to serve its exploration and production customers in Mountrail, Burke, Williams and Divide counties in North Dakota and in Weld County, Colorado. 12/11/2012 Access Midstream Partners, L.P. Chesapeake Energy Corporation 2,160.0 12.3x 7.7x ACMP agreed to acquire Chesapeake Midstream Operating, L.L.C., which owns natural gas gathering and processing assets in the Eagle Ford, Utica and Niobrara liquids-rich plays as well as in the Haynesville and Marcellus dry gas plays. 12/3/2012 Atlas Pipeline Partners, L.P. Cardinal Midstream, LLC 600.0 10.0x NA Atlas Pipeline agreed to acquire Cardinal Midstream, which owns 3 cryogenic processing plants totaling 220 MMcf/d in processing capacity, 66 miles of associated gathering pipelines, and a gas treating business that includes 17 treating facilities located in numerous hydrocarbon basins. 11/26/2012 Crestwood Marcellus Midstream LLC Enerven Compression, LLC 95.0 NA 8.3x (3) Crestwood Marcellus Midstream LLC acquired natural gas compression and dehydration assets from Enerven Compression, LLC for $95 million.The assets are connected to CMM's gathering systems in Harrison and Doddridge Counties, West Virginia. The assets are currently operating under a five-year compression services agreement with Antero and provide aggregate capacity of 295 MMcf/d. 11/15/2012 Targa Resources Partners LP Saddle Butte Pipeline, LLC 1,000.0 (4) 14.4x NA Targa agreed to acquire 100% of Saddle Butte Pipeline's Williston Basin crude oil pipeline and terminal system and natural gas gathering and processing operations in the Bakken Shale Play in North Dakota, including 155 miles of crude oil pipelines, crude oil storage capacity of 70,000 barrels, 95 miles of natural gas gathering pipelines and a 20 MMcf/d natural gas processing plant. 10/1/2012 Honeywell International Thomas Russell Co. 593.0 NA NA Honeywell (HON) announced its UOP business has signed a definitive agreement to purchase a 70% stake in Thomas Russell Co., a privately-held provider of technology and equipment for natural gas processing and treating. Thomas Russell specializes in the design, engineering, fabrication and start-up of skid-mounted modular packaged plants systems for the recovery and upgrading of natural gas liquids (NGLs). 9/14/2012 Summit Midstream Partners, LLC Energy Transfer Partners, L.P. 207.0 NA NA Summit acquired the ETC Canyon Pipeline, which gathers and processes natural gas in the Piceance and Uinta Basins in Colorado and Utah. ETC Canyon consists of more than 1,600 miles of pipelines, 44,000 hp of compression, processing assets with capacity of 97 MMcf/d and 2 NGL injection stations. 9/12/2012 Undisclosed company(ies) Chesapeake Energy Corporation 300.0 NA NA Chesapeake Energy Corp has sold or entered into purchase and sale agreements with two undisclosed companies to sell certain US Mid- Continent midstream assets and also expects to enter into a third agreement with an undisclosed buyer to sell certain oil gathering assets in the Eagle Ford Shale for combined proceeds of approximately $300 million 8/10/2012 Eagle Rock Energy Partners, LP BP America Production Company 227.5 NA 6.0x (5) EROC agreed to acquire BP's Sunray and Hemphill processing plants and associated 2,500 mile gathering system serving the Texas Panhandle (aggregate capacity of 220 MMcf/d). In connection with the acquisition EROC and BP entered into a 20 yr. fixed fee G&P agreement. 8/1/2012 Western Gas Partners LP Anadarko Petroleum Corp. 562.5 (6) 7.9x NA WES agreed to acquire an additional 24% interest in Chipeta Processing LLC from Anadarko Petroleum Corp. The Chipeta natural gas processing plant complex includes three processing trains: a 240 MMcf/d capacity refrigeration unit, a 250 MMcf/d capacity cryogenic unit, and a 300 MMcf/d capacity cryogenic unit which is scheduled to come on line in the third quarter of 2012. 7/23/2012 Crestwood Midstream Partners LP Devon Energy Corporation 90.0 NA NA CMLP agreed to acquire a 74 mile low pressure natural gas gathering system, a 100 MMcf/d cryogenic processing facility and 23,100 horsepower of compression equipment located in the western portion of Johnson County, Texas. 6/25/2012 DCP Midstream Partners, LP DCP Midstream, LLC 200.0 NA NA DPM acquired a 12.5% interest in the Enterprise fractionator (operated by Enterprise Products Partners) and a 20% interest in the Mont Belvieu 1 fractionator (operated by ONEOK Partners) 6/19/2012 Centerpoint Energy Resources Corp. Martin Midstream Partners, LP 275.0 12.0x NA Centerpoint agreed to acquire a 50% interest in Waskom Gas Processing Co. (320 MMcf/d processing facility, 14,500 bpd fractionation facility and 75 MMcf/d gathering system), the Woodlawn plant and gathering system (30 MMcf/d), and the McLeod, Hallsville and Darco gathering systems (40 MMcf/d) 6/18/2012 DCP Midstream Partners, LP Penn Virginia Resource Partners, L.P. 63.0 14.0x NA DCP agreed to acquire the Crossroads processing plant and associated gathering system in East Texas. The Crossroads plant has 80 MMc/d of capacity. 6/8/2012 Global Infrastructure Partners, LP Chesapeake Energy Corporation 2,000.0 9.1x NA GIP agreed to acquire CHK's LP and GP interests in Chesapeake Midstream Partners, LP 6/1/2012 American Midstream Partners LP Quantum Resources Management, LLC 62.9 7.9x NA AMID agreed to acquire an 87.4% interest in the Chatom Processing and Fractionation Plant which consists of a 25 MMcf/d refrigeration processing plant, 1,900 bpd fractionation unit, a 160 LT/d sulfur recovery unit and 29-mile gas gathering system. Chatom is located in Washington County, Alabama. 5/7/2012 MarkWest Energy Partners, L.P. Stonehenge Energy Resources LP Rex Energy Corporation Sumitomo Corporation 512.0 NA 7.8x (7) MarkWest announced the acquisition of Keystone Midstream Services, LLC. Keystone's assets are located in Butler County, PA and include 2 cryogenic gas processing plants totaling 90 MMcf/d of capacity, a gas gathering system and associated field compression. Mean $843.4 11.0x 8.3x Median $512.5 10.0x 7.7x CMLP – Selected Transactions Analysis Source: Capital IQ, Thomson One, Public Filings and other public information (1) Based on 2014E EBITDA; Includes $100MM of future capital expenditures (2) Implied based on 33.75% stake acquired (3) Transaction value as of announcement date (4) Includes $50MM in contingent earnout (5) Based on 2013E EBITDA (6) Implied based on 24% stake acquired (7) Based on 2014E EBITDA per management guidance provided in acquisition announcement |