UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| þ | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

HEARTWARE LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

Notice of Extraordinary General Meeting

Notice of Meeting and Information for Shareholders

HeartWare Limited

Level 57

MLC Centre

19-29 Martin Place

Sydney NSW 2000

Australia

Extraordinary General Meeting information:

| | | |

| Date: | | 11 July 2008 |

| Time: | | 10.00AM (Australian Eastern Standard Time) |

| Location: | | Grant Thornton |

| | | Level 17, |

| | | 383 Kent Street |

| | | Sydney NSW 2000 |

HeartWare LimitedABN 34 111 970 257

Level 57, MLC Centre, 19-29 Martin Place, Sydney NSW 2000

Tel: +61 2 9238 2064 Fax: +61 2 9238 2063

TABLE OF CONTENTS

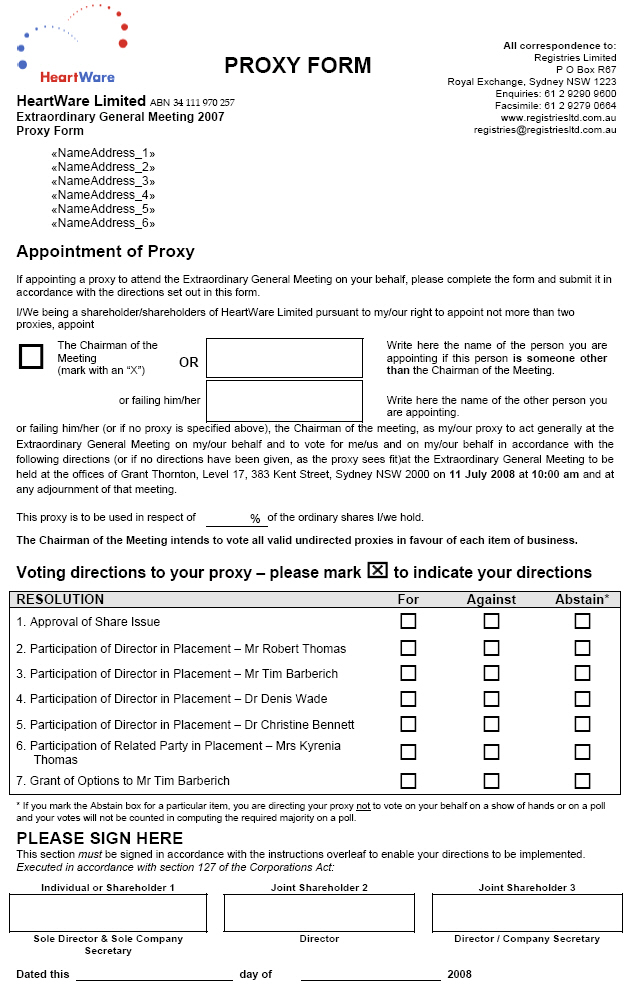

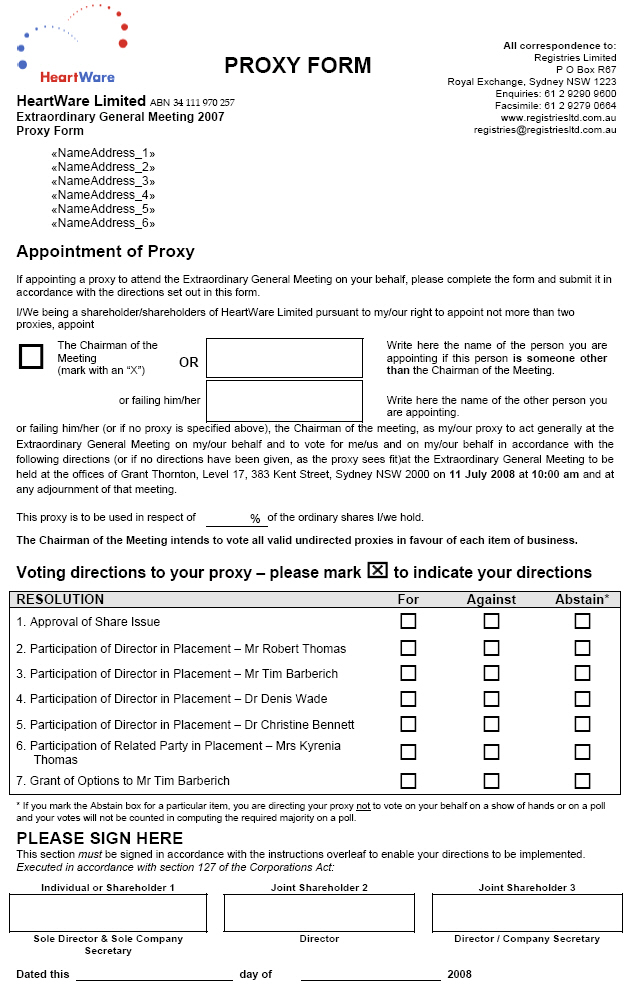

NOTICE OF EXTRAORDINARY GENERAL MEETING

An Extraordinary General Meeting of shareholders of HeartWare Limited (theCompanyorHeartWare) will be held at the offices of Grant Thornton, Level 17, 383 Kent Street, Sydney NSW 2000 on11 July 2008commencing at 10.00AM AEST. The purpose of the meeting is to transact the business referred to in this Notice of Extraordinary General Meeting.

The Explanatory Memorandum that accompanies and forms part of this Notice of Meeting provides information in relation to each of the matters to be considered and contains a glossary of defined terms. Under US law, the Notice of Meeting and the Explanatory Memorandum also constitute a solicitation by the Board of Directors of the Company, the cost of which is being borne by the Company. The Company’s directors, officers and employees also may solicit proxies personally and by telephone, facsimile or other electronic means of communication. These persons will not receive any additional or special compensation for their solicitation services.

This Notice of Meeting and Explanatory Memorandum should be read in their entirety. If shareholders are in doubt as to how they should vote, they should seek advice from their accountant, solicitor or other professional adviser prior to voting.

The Company intends to mail this Notice of Meeting, together with the enclosed Explanatory Memorandum, Proxy Form and related financial information, to shareholders on or about 6 June 2008.

The business of the Extraordinary General Meeting is as follows:

Resolution 1 — Approval of Share Issue

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“For the purposes of Listing Rule 7.1 and for all other purposes, shareholders of the Company approve and authorise the Directors to issue and allot up to 70 million Shares with an issue price per Share of $A0.50 under a private placement to sophisticated and professional investors in Australia and the United States on the terms and conditions contained in the Explanatory Memorandum.”

Voting Exclusion Statement

The Company will disregard any votes cast on Resolution 1 by a person who may participate in the proposed issue and a person who might obtain a benefit if the Resolution is passed (except a benefit solely in the capacity of a holder of ordinary securities) and any associate of those persons. However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy form, or it is cast by the person chairing the Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

| | |

| Notice of Extraordinary General Meeting | | 2 |

Resolution 2 — Participation of Director in Placement — Mr Robert Thomas

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, subject to the passing of Resolution 1, for the purposes of Listing Rule 10.11 and for all other purposes, Mr Robert Thomas, being a director of the Company, or his nominee, may participate in the placement referred to in Resolution 1 and the shareholders of the Company approve the issue of up to 200,000 Shares to Mr Robert Thomas or his nominee at an issue price per Share of A$0.50 and otherwise on the terms and conditions contained in the Explanatory Memorandum.”

Voting Exclusion Statement

The Company will disregard any votes cast on Resolution 2 by Mr Robert Thomas and any associate of Mr Robert Thomas. However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy form, or it is cast by the person chairing the Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

Resolution 3 — Participation of Director in Placement — Mr Tim Barberich

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, subject to the passing of Resolution 1, and for the purposes of Listing Rule 10.11 and for all other purposes, Mr Tim Barberich, being a director of the Company, or his nominee, may participate in the placement referred to in Resolution 1 and the shareholders of the Company approve the issue of up to 100,000 Shares to Mr Tim Barberich or his nominee at an issue price per Share of $A0.50 and otherwise on the terms and conditions contained in the Explanatory Memorandum.”

Voting Exclusion Statement

The Company will disregard any votes cast on Resolution 3 by Mr Tim Barberich and any associate of Mr Tim Barberich. However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy form, or it is cast by the person chairing the Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

Resolution 4 — Participation of Director in Placement — Dr Denis Wade

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, subject to the passing of Resolution 1, and for the purposes of Listing Rule 10.11 and for all other purposes, Dr Denis Wade, being a director of the Company, or his nominee, may participate in the placement referred to in Resolution 1 and the shareholders of the Company approve the issue of up to 400,000 Shares to Dr Denis Wade or his nominee at an issue price per Share of $A0.50 and otherwise on the terms and conditions contained in the Explanatory Memorandum.”

| | |

| Notice of Extraordinary General Meeting | | 3 |

Voting Exclusion Statement

The Company will disregard any votes cast on Resolution 4 by Dr Denis Wade and any associate of Dr Denis Wade. However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy form, or it is cast by the person chairing the Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

Resolution 5 — Participation of Director in Placement — Dr Christine Bennett

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, subject to the passing of Resolution 1, and for the purposes of Listing Rule 10.11 and for all other purposes, Dr Christine Bennett, being a director of the Company, or her nominee, may participate in the placement referred to in Resolution 1 and the shareholders of the Company approve the issue of up to 100,000 Shares to Dr Christine Bennett or her nominee at an issue price per Share of $A0.50 and otherwise on the terms and conditions contained in the Explanatory Memorandum.”

Voting Exclusion Statement

The Company will disregard any votes cast on Resolution 5 by Dr Christine Bennett and any associate of Dr Christine Bennett. However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy form, or it is cast by the person chairing the Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

Resolution 6 — Participation of related party in Placement — Mrs Kyrenia Thomas

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, subject to the passing of Resolution 1, and for the purposes of Listing Rule 10.11 and for all other purposes, Mrs Kyrenia Thomas, being a related party of the Company, or her nominee, may participate in the placement referred to in Resolution 1 and the shareholders of the Company approve the issue of up to 200,000 Shares to Mrs Kyrenia Thomas or her nominee at an issue price per Share of A$0.50 and otherwise on the terms and conditions contained in the Explanatory Memorandum.”

| | |

| Notice of Extraordinary General Meeting | | 4 |

Voting Exclusion Statement

The Company will disregard any votes cast on Resolution 6 by Mrs Kyrenia Thomas and any associate of Mrs Kyrenia Thomas. However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy form, or it is cast by the person chairing the Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

Resolution 7 — Grant of Options to Mr Tim Barberich

To consider and, if thought fit, to pass the following resolution as an ordinary resolution:

“That, for the purposes of Listing Rule 10.14 and for all other purposes, the shareholders of the Company approve the grant of 200,000 options to Mr Tim Barberich under the HeartWare Limited Employee Share Option Plan on the terms and conditions contained in the Explanatory Memorandum.”

Voting Exclusion Statement

The Company will disregard any votes cast on Resolution 7 by a Director and any associate of a Director. However, the Company need not disregard a vote if it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy form, or it is cast by the person chairing the Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy form to vote as the proxy decides.

Voting Entitlement

For the purposes of determining voting entitlements at the Extraordinary General Meeting, Shares will be taken to be held by the persons who are registered as holding Shares as at 7.00 p.m. (AEST) on 9 July 2008 (theEntitlement Time) (also known as the “record date”). Accordingly, only those persons registered as holders of Shares at the Entitlement Time will be entitled to attend and vote at the Extraordinary General Meeting.

As at 22 May 2008, being the latest practicable date prior to despatch of this Notice of Meeting, there were 248,100,277 Shares outstanding and entitled to vote at the Extraordinary General Meeting. The Company will announce the number of shares outstanding and entitled to vote at the Extraordinary General Meeting as at the Entitlement Time on 9 July 2008.

| | |

| Notice of Extraordinary General Meeting | | 5 |

Proxy Instructions

| 1. | | The Proxy Form is enclosed with this Notice of Meeting. Replacement Proxy Forms may be obtained by shareholders from the Company’s share registry, whose contact details are: |

| | | | | |

| | | Registries Limited | |

| | | | | |

| | | Office Address: | | Level 7, 207 Kent Street Sydney NSW, Australia |

| | | | | |

| | | Telephone: | | +61 2 9290 9600 |

| 2. | | A shareholder entitled to attend and vote at the meeting may appoint not more than two proxies to attend such meeting and vote on behalf of the shareholder. A proxy need not be a shareholder. Where more than one proxy is appointed, each proxy may be appointed to represent a specified proportion or number of the shareholder’s votes. If no such proportion is specified, each proxy may exercise half of the shareholder’s votes. Fractions of votes will be disregarded. |

| 3. | | A proxy form must be signed by a shareholder (or its attorney) and does not need to be witnessed. If the shareholder is a corporation, the proxy form must be executed in accordance with that corporation’s constitution or by a duly authorised attorney. If a Share is held jointly a proxy form should be signed by all of the joint holders. |

| 4. | | The proxy form and any power of attorney or other authority (if any) under which it is signed (or a certified copy) must be received by the Company’s share registrar, Registries Limited, by10.00AM AEST on 9 July 2008(being 48 hours before the time for holding the meeting), at: |

| | | | | |

| | | Hand deliveries: | | Level 7 |

| | | | | 207 Kent Street |

| | | | | Sydney NSW 2000 |

| | | | | |

| | | Postal address: | | GPO Box 3993 |

| | | | | Sydney NSW 2001 |

| | | | | |

| | | Fax number: | | +61 2 9279 0664 |

| | | Proxies received after that time will not be effective for the scheduled meeting. |

| |

| 5. | | A proxy may decide whether to vote on a Resolution, except where the proxy is required by law or the Company’s Constitution to vote or abstain from voting, in their capacity as a proxy. If a proxy is directed how to vote on a Resolution, the proxy may vote on that item only in accordance with that direction. If a proxy is not directed how to vote on an item of business, a proxy may vote as he or she thinks fit. If a shareholder appoints two proxies and the appointments specify different ways to vote on a Resolution, neither may vote on a show of hands. If a shareholder marks the Abstain box on the proxy form for a particular Resolution, the proxy is directed not to vote on the shareholder’s behalf on a show of hands or on a poll and the shareholder’s votes will not be counted in computing the required majority on a poll. |

| | |

| Notice of Extraordinary General Meeting | | 6 |

| 6. | | The Chairman of the Meeting intends to vote all valid undirected proxies which he receives in favour of all Resolutions at the Meeting. |

| 7. | | A shareholder may revoke, his or her proxy by (1) filing with the Company, at or before the taking of the vote at the Extraordinary General Meeting, a written notice of revocation or a duly executed Proxy Form appointing a new proxy, in either case dated later than the prior Proxy Form relating to the same Shares, or (2) attending the Extraordinary General Meeting and voting in person (although attendance at the Extraordinary General Meeting will not in and of itself revoke a proxy). Any written notice of revocation or subsequent Proxy Form must be received by the Company prior to the taking of the vote at the Extraordinary General Meeting. Such written notice of revocation or subsequent Proxy Form should be delivered to Registries Limited at the address referred to at 4 above. |

Proxy Solicitation

This solicitation of proxies is being made by the Company through the mail. The cost of this solicitation will be borne by the Company.

By Order of the Board

David McIntyre

Company Secretary

23 May 2008

| | |

| Notice of Extraordinary General Meeting | | 7 |

EXPLANATORY MEMORANDUM

This Explanatory Memorandum has been prepared for the information of shareholders in connection with the Extraordinary General Meeting of shareholders of the Company to be held at the offices of Grant Thornton, Level 17, 383 Kent Street, Sydney NSW 2000 on11 July 2008commencing at10.00AM AEST.

This Explanatory Memorandum should be read in conjunction with the accompanying Notice of Extraordinary General Meeting. A glossary of defined terms is contained at the end of this Explanatory Memorandum.

All Directors, other than Mr Robert Thomas, Mr Tim Barberich, Dr Denis Wade and Dr Christine Bennett recommend that shareholders vote in favour of all of the Resolutions.

Mr Barberich, Mr Wade, and Ms Bennett abstain from making a recommendation due to their personal interest in Resolutions 3, 4, and 5 respectively.

Mr Thomas abstains from making a recommendation on Resolution 2 and 6 due to his personal interest in Resolutions 2 and 6.

Mr Barberich abstains from making a recommendation on Resolution 7 due to his personal interest in Resolution 7.

Resolution 1 — Approval of Share Issue

The Company previously announced on 23 May 2008 that it has received commitments in excess of A$30 million at an issue price of $A0.50 per Share under a private placement to sophisticated and professional investors in Australia and the United States (Placement) which is conditional upon the approval of the shareholders of the Company.

The Company therefore seeks the approval of shareholders under Listing Rule 7.1 to issue up to 70 million Shares with an issue price per Share of $A0.50 (theNew Shares) under the Placement to sophisticated and professional investors within three months of the date of the Extraordinary General Meeting.

Under Listing Rule 7.1, the prior approval of shareholders is required to the issue of the New Shares because the total of those securities would represent more than 15% of the Company’s ordinary securities then on issue.

The Placement to investors outside the United States will be conducted pursuant to an exemption from registration under the United States Securities Act of 1933 (Securities Act) contained in Regulation S of the Securities Act (Regulation S). The Placement to investors in the United States will be conducted pursuant to an exemption from registration under the Securities Act contained in Regulation D of the Securities Act. The New Shares have not been registered under the Securities Act or any applicable state securities laws, and, unless so registered, may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws.

Funds raised by the issue of the New Shares will be primarily applied for the purposes of capital expenditure, meeting costs associated with the Company’s human clinical trials, marketing costs, research and development costs, manufacturing and operational costs, regulatory and other compliance costs as well as for general working capital and to meet the expenses of the issue of the New Shares.

| | |

| Notice of Extraordinary General Meeting | | 1 |

In addition to the information for shareholders set out above, for the purposes of Listing Rule 7.3 the following information is provided:

| 1. | | the maximum number of New Shares to be issued under Resolution 1 will be 70 million; |

| 2. | | the issue price of a New Share will be $A0.50; |

| 3. | | if approved, the New Shares are expected to be issued and allotted on the first business day after the Extraordinary General Meeting or such later date as agreed by the Board but in any event not later than three months from the date of the Extraordinary General Meeting or such later date as approved by the ASX; |

| 4. | | the allottees of the New Shares will be determined at the absolute discretion of the Directors from sophisticated and professional investors in Australia and the United States who applied for Shares in the Company under the Placement; |

| 5. | | Any New Shares issued will be fully paid ordinary shares and will rank equally in all respects with the existing fully paid ordinary shares in the capital of the Company. However, those New Shares issued under the Placement to investors outside the United States, which are being offered pursuant to the Regulation S exemption, cannot be offered or sold to “US persons” (as defined under Regulation S) except in limited circumstances set out in Regulation S. In order to comply with the requirements of Regulation S and so as to facilitate (electronic) trading of these New Shares on ASX, the Company is required to institute the FORUS designation on New Shares issued outside the United States. The FORUS designation on New Shares will prohibit the purchase of those New Shares by US persons but will not otherwise affect the rights or holdings of any of the Company’s current US shareholders. |

Resolutions 2, 3, 4, 5 and 6 — Participation of related parties in Placement — Mr Robert Thomas, Mr Tim Barberich, Dr Denis Wade, Dr Christine Bennett and Mrs Kyrenia Thomas

Mr Robert Thomas (or his nominee), Mr Tim Barberich (or his nominee), Dr Denis Wade (or his nominee), Dr Christine Bennett (or her nominee) and Mrs Kyrenia Thomas (or her nominee) have agreed to subscribe for 200,000, 100,000, 400,000, 100,000 and 200,000 Shares respectively under the Placement, subject to the approval of the Shareholders of the Company.

Under Listing Rule 10.11, the prior approval of shareholders is required to the issue of Shares to directors, their spouses and entities controlled by them as they are “related parties” of the Company.

The Company therefore seeks the approval of shareholders under Listing Rule 10.11 to issue 200,000 Shares to Mr Robert Thomas (or his nominee), 100,000 Shares to Mr Tim Barberich (or his nominee), 400,000 Shares to Dr Denis Wade (or his nominee), 100,000 Shares to Dr Christine Bennett (or her nominee) and 200,000 Shares to Mrs Kyrenia Thomas (or her nominee) under the Placement at an issue price per Share of $A0.50.

In addition to the information for shareholders set out above, for the purposes of Listing Rule 10.13 the following information is provided in relation to the proposed issue of Shares to Mr Robert Thomas, Mr Tim Barberich, Dr Denis Wade, Dr Christine Barberich and Mrs Kyrenia Thomas under the Placement:

| 1. | | The number of Shares to be issued to the Directors and related parties of the Company is: |

| | a. | | Robert Thomas — 200,000 Shares which will be issued to Rob Thomas as trustee of the Thomas Family Account; |

| | |

| Notice of Extraordinary General Meeting | | 2 |

| | b. | | Tim Barberich — 100,000 Shares; |

| | c. | | Denis Wade — 400,000 Shares which will be issued to Nickeli Pty Limited as trustee of the Wade Family Super Fund; |

| | d. | | Christine Bennett — 100,000 Shares; |

| | e. | | Kyrenia Thomas — 200,000 Shares. |

| 2. | | The Company will endeavour to issue the Shares to Rob Thomas as trustee of the Thomas Family Account, Mr Tim Barberich, Nickeli Pty Limited as trustee of the Wade Family Super Fund, Dr Christine Bennett and Mrs Kyrenia Thomas on the first business day after the Extraordinary General Meeting or such later date as agreed by the Board, but in any event not later than one month from the date of the Extraordinary General Meeting or such later date as approved by the ASX. |

| 3. | | The Rob Thomas Family Account is controlled by Mr Robert Thomas. |

| 4. | | Nickeli Pty Limited is controlled by Dr Denis Wade. |

| |

| 5. | | The issue price of the Shares is $A0.50. |

| 6. | | The proceeds of the issue of Shares to the Rob Thomas as Trustee of the Thomas Family Account, Mr Tim Barberich, Nickeli Pty Limited as Trustee of the Wade Family Super Fund, Dr Christine Bennett and Mrs Kyrenia Thomas under the Placement will be applied as described in the Resolution 1 section of this Explanatory Memorandum. |

Resolution 7 — Grant of Options to Mr Tim Barberich

The Board proposes that 200,000 options with an exercise price of A$0.60 (Options) be issued to Mr Tim Barberich under the Company’s Employee Share Option Plan as part of Mr Barberich’s overall remuneration package as a non-executive director of the Company.

The 200,000 ordinary shares underlying the 200,000 Options have a market value of A$0.505 based on the closing price of $A0.50 on 20 May 2008. One quarter of the Options will vest on each of the first, second, third and fourth anniversary of the date of grant of the Options and the Options will expire on the fifth anniversary of the date of grant of the Options (or earlier in the event Mr Barberich ceases to be a director of the Company). The Options will otherwise be subject to the terms of the Employee Share Option Plan.

Under Listing Rule 10.14, the prior approval of shareholders is required to the issue of Options to Mr Barberich under the HeartWare Limited Employee Share Option Plan as a director of the Company.

In addition to the information for shareholders set out above, for the purposes of Listing Rule 10.15 the following information is provided in relation to the proposed issue of Options to Mr Tim Barberich under the Employee Share Option Plan:

| 1. | | There will be no issue price for the Options. |

| |

| 2. | | The number of Options to be issued to Tim Barberich is 200,000. |

| |

| 3. | | The Options will have an exercise price of A$0.60. |

| | |

| Notice of Extraordinary General Meeting | | 3 |

| 4. | | All executive and non-executive directors of the Company are eligible to participate in the Employee Share Option Plan. |

| 5. | | The Company will issue the Options to Tim Barberich as soon as practicable after the date of the Extraordinary General Meeting but in any event not later than three months from the date of the Extraordinary General Meeting. |

| 6. | | No Directors or any of their Associates have received any securities under the Employee Share Option Plan since last approval. |

Approval of a Resolution

Each of the Resolutions referred to in the Notice of Meeting shall be determined by a majority vote. Every shareholder of the Company having a Share in the Company as at the Entitlement Time is entitled to one vote on a show of hands and one vote per Share on a poll. Shareholders do not have cumulative voting rights. Where a Share is jointly held and more than one joint holder votes in respect of that Share, of the joint holders present only the vote of the joint holder whose name appears first on the Company’s register of shareholders will be counted. When a vote on a show of hands occurs:

| 1. | | each shareholder present in person or by representative has one vote (unless they are excluded from voting) and each proxy has one vote; |

| |

| 2. | | the number of Shares are not counted; and |

| |

| 3. | | a majority on a show of hands will carry the relevant Resolution |

Unless a poll is demanded, a declaration by the Chairman that a Resolution has on a show of hands been carried, carried unanimously, carried by a particular majority or lost is conclusive evidence of the fact.

If a poll is demanded, it may be taken in the manner and at the time and place (or places) as the Chairman directs.

US DISCLOSURES

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of March 31, 2008, information regarding beneficial ownership of our ordinary shares by the following:

| | • | | each person, or group of affiliated persons, who is known by us to beneficially own 5% or more of any class of our voting securities; |

| |

| | • | | each of our directors; |

| |

| | • | | each of our named executive officers; and |

| |

| | • | | all current directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC. Beneficial ownership generally includes voting or investment power of a security and includes shares underlying options that are currently exercisable or exercisable within 60 days after the measurement date. This table is based on information supplied by officers, directors and principal shareholders. Except as otherwise indicated, we believe that the beneficial owners of the ordinary shares listed below, based on the information each of them has given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply.

| | |

| Notice of Extraordinary General Meeting | | 4 |

Unless otherwise indicated, we deem ordinary shares subject to options that are exercisable within 60 days of March 31, 2008 to be outstanding and beneficially owned by the person holding the options for the purpose of computing percentage ownership of that person, but we do not treat them as outstanding for the purpose of computing the ownership percentage of any other person.

As of 23 May 2008, there were 248,100,277 ordinary shares outstanding.

| | | | | | | | | |

| | | Number of | | | | |

| | | Shares | | | Percent of | |

| | | Beneficially | | | Shares | |

| Name and Address of Beneficial Owner | | Owned | | | Outstanding | |

5% Shareholders | | | | | | | | |

Apple Tree Partners I, L.P.

| | | 93,101,476 | (1) | | | 38 | % |

| 54th Floor, 405 Lexington Avenue, New York, NY 10174 | | | | | | | | |

| | | | | | | | | |

Muneer A. Satter

| | | 36,750,000 | | | | 15 | % |

71 S. Wacker Drive, Suite 500

Chicago, IL 60606 | | | | | | | | |

| | | | | | | | | |

Directors and Named Executive Officers | | | | | | | | |

| Robert Thomas | | | 3,481,153 | (2) | | | 1 | % |

| Dr. Seth Harrison | | | 93,101,476 | (3) | | | 38 | % |

| Dr. Denis Wade | | | 1,258,333 | (4) | | | 1 | % |

| Dr. Christine Bennett | | | 250,000 | (5) | | | * | |

| Robert Stockman | | | 500,000 | | | | * | |

| Douglas Godshall | | | 1,495,621 | (6) | | | 1 | % |

| David McIntyre | | | 1,415,357 | (7) | | | 1 | % |

| Jeffrey LaRose | | | 1,972,102 | (8) | | | 1 | % |

| Dozier Rowe | | | 310,000 | (9) | | | * | |

| Ramon Paz | | | 182,500 | (10) | | | * | |

| James Schuermann | | | — | | | | * | |

| Jennifer Foley | | | 250,000 | (11) | | | * | |

| Barry Yomtov | | | 75,000 | (12) | | | * | |

| | | | | | | | |

| All directors and executive officers as a group (13 persons) | | | 104,291,542 | (13) | | | 42 | % |

| | | | | | | | |

| | | |

| * | | Indicates less than 1% |

| |

| (1) | | Includes 1,512,694 shares issuable as of March 31, 2008 upon conversion of a convertible note. |

| |

| (2) | | Includes 1,073,153 shares subject to options exercisable within 60 days of March 31, 2008, 1,350,000 shares held in trust and 1,100,000 shares held directly. |

| |

| (3) | | Represents shares held by Apple Tree Partners I, L.P., the Company’s largest shareholder. Dr. Harrison is Managing General Partner in Apple Tree Partners I, L.P. Dr. Harrison disclaims beneficial ownership of such shares, except to the extent of his pecuniary interest therein. |

| |

| (4) | | Represents 1,058,333 shares held by a family trust and 250,000 shares subject to options exercisable within 60 days of March 31, 2008. |

| | |

| Notice of Extraordinary General Meeting | | 5 |

| | | |

| (5) | | Represents shares subject to options exercisable within 60 days of March 31, 2008. |

| |

| (6) | | Includes 1,395,316 shares subject to options exercisable within 60 days of March 31, 2008. |

| |

| (7) | | Represents 1,387,357 shares subject to options exercisable within 60 days of March 31, 2008 and 28,000 shares held by Mr. McIntyre’s spouse. |

| |

| (8) | | Represents shares subject to options exercisable within 60 days of March 31, 2008. |

| |

| (9) | | Includes 300,000 shares subject to options exercisable within 60 days of March 31, 2008. Mr. Rowe resigned his position of Chief Operating Officer effective May 13, 2008. |

| |

| (10) | | Includes 167,500 shares subject to options exercisable within 60 days of March 31, 2008. |

| |

| (11) | | Represents shares subject to options exercisable within 60 days of March 31, 2008. |

| |

| (12) | | Represents shares subject to options exercisable within 60 days of March 31, 2008. (13) Includes 8,128,761 shares subject to options exercisable within 60 days of March 31, 2008. |

US Federal Income Tax Consequences of Issuance and Exercise of Options under the HeartWare Limited Employee Share Option Plan

The following is a brief description of the principal US federal income tax consequences under the Internal Revenue Code of 1986, as amended (“Internal Revenue Code”), based on current law, to recipients of options under the HeartWare Limited Employee Share Option Plan who are US taxpayers.

Tax Consequences to Participants. A participant who is a US taxpayer generally recognizes no income for US federal income tax purposes when an option is granted or becomes exercisable. However, if an option is granted with an exercise price below the fair market value of the underlying shares on the grant date, the participant may have to recognize income for US federal income tax purposes on each date that the option becomes exercisable, and each year thereafter until it is exercised, unless the option is designed to be exempt from or otherwise comply with the requirements of section 409A of the Internal Revenue Code regarding nonqualified deferred compensation arrangements.

Upon the exercise of an option, the participant generally recognizes ordinary income for US federal income tax purposes in an amount equal to the excess, if any, of the fair market value of the shares purchased over the exercise price paid. If the shares so acquired are later sold or disposed of, the difference, if any, between the amount realized from the sale or disposition and the fair market value of the shares on the date of exercise of the option generally is taxable as short- or long-term capital gain or loss, depending on whether the shares were held for more than one year after the exercise date.

Tax Consequences to the Company

The Company generally is entitled to a deduction at the same time as when and in the same amount that the participant recognizes ordinary income.

The foregoing summary of the US federal income tax consequences in respect of the HeartWare Limited Employee Share Option Plan is for general information only. Interested parties should consult their own advisors as to specific tax consequences, including the application and effect of state, local and non-US tax laws.

| | |

| Notice of Extraordinary General Meeting | | 6 |

Executive and Director Compensation

Executive Compensation

Compensation Discussion and Analysis

The following discussion and analysis of compensation arrangements of our named executive officers for 2007 should be read together with the compensation tables and related disclosures set forth below. This discussion contains forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. Actual compensation programs that we adopt may differ materially from currently planned programs as summarized in this discussion.

Role of the Compensation Committee

Our named executive officer compensation program is overseen and administered by the Nomination and Remuneration Committee (“Compensation Committee”) of the Board of Directors. The members of the Compensation Committee are Mr. Thomas (Chairman), Dr. Harrison, Dr. Wade and Dr. Bennett.

The Compensation Committee advises the Board on compensation policies and practices generally. In addition, the Compensation Committee makes specific recommendations on compensation packages and other terms of employment for our senior executives and non-executive directors and considers recommendations from senior management regarding amendments to existing employee entitlements. In order for the Compensation Committee to make recommendations to the Board of Directors regarding compensation and incentive packages, the Compensation Committee requests that senior management obtain information on behalf of the Compensation Committee in order to assist the Compensation Committee with its decision-making. The Board considers the recommendations of the Compensation Committee and makes the final determination of compensation.

Philosophy

The market for medical device employees is highly competitive and, accordingly, employees in the medical device sector are generally relatively highly compensated, particularly in the United States. It is also well-recognized that companies like HeartWare that are early-stage, pre-revenue companies, have limited clinical experience, are largely dependent on their ability to raise capital in order to remain viable and are perceived by employees to have a significantly higher risk profile than other more established medical device companies. This higher risk profile, combined with fierce competition for employees, creates an environment where attracting and retaining employees is challenging for HeartWare.

We believe that we need to take account of a number of factors when negotiating and determining compensation levels for our executives. For example, we consider the relevant executive’s compensation level prior to joining HeartWare as well as wider medical device industry compensation practices, especially those compensation practices adopted by other development-stage companies. We also consider each executive’s current or anticipated future contribution, responsibilities, previous experience, perceived importance to the Company, work ethic and seniority following commencement with the Company.

| | |

| Notice of Extraordinary General Meeting | | 7 |

In order to confirm the appropriateness of the Company’s compensation practices the Company retained an external consultant in 2007 to assist in reviewing our executives’ compensation. This review, which is discussed below under the heading “Benchmark Exercise”, was undertaken to enable the Company to compare our executives’ compensation with compensation practices of other medical device companies who are at a similar development stage. Using the benchmark exercise as a guide, we then considered each individual on a case-by-case basis and took into account the factors referred to above as well as years of experience, actual performance, the executives’ role and importance and each individual executives’ compensation and employment history.

While we believe that equity-based compensation is an important financial motivator for our executives, the Board of Directors recognizes that the Company’s risk profile is such that the salary component of each executive’s compensation will continue to constitute a critical component of an executive’s total compensation from an executive’s perspective.

Above all, we believe that that a combination of cash and equity compensation is currently appropriate to ensure that we are able to attract and retain talented executives to manage the business and affairs of the Company, to become a significant player in the growing circulatory assist market and to increase shareholder value. We continue to monitor both our cash and equity compensation approaches to ensure that they are competitive and motivating.

Compensation Objectives and Principles

We believe that our compensation policies and practices are central to our ability to attract and retain our executives, and that this will be especially critical as we transition from a development company to an early-stage manufacturer of implantable circulatory assist devices. Moreover, on a global basis, there are a limited number of individuals with significant and applicable medical device experience, and competition for executives with relevant experience is intense. We also recognize that because the bulk of our facilities are located in the southeastern United States, many potential new executives are forced to consider the additional burden of both travel and relocation into their decision-making process.

During this period of growth and development, we acknowledge that we depend on a concentrated pool of employees who, consequently, are imparted with a wider set of responsibilities and obligations than would normally be expected in larger, more mature organizations. For this reason, the retention of these employees, together with their accumulated knowledge and experiences, are of great importance and directly impact our ability to achieve our corporate objectives in a timely manner.

Our compensation policies are therefore designed to attract, retain and motivate executive officers as well as the entire staff of the organization and to align compensation and related financial incentives with the interests of shareholders.

The key principles of our compensation policies are as follows:

| | • | | offer sufficient rewards to attract and retain executives in light of current employment market conditions in our industry; |

| | • | | link rewards for executives to the achievement of corporate goals thereby aligning the interest of our executives and our shareholders; |

| | • | | ensure parity in terms of compensation among executives; and |

| | • | | assess and reward executives using a variety of measures of performance. |

| | |

| Notice of Extraordinary General Meeting | | 8 |

Benchmark Exercise

During 2007, the Company retained Frederick W. Cook & Co., Inc. (“F W Cook”) to examine the compensation practices of a peer group of companies and to compare that data to our senior executives’ compensation. F W Cook is an independent, third party, specialist in United States-based compensation norms.

The exercise included representatives of F W Cook:

| | • | | Meeting with management and selected members of the Board of Directors for the purposes of learning about the Company, its background, historical compensation practices and perceived shareholder views. |

| | • | | Collecting and analyzing company-specific background data from management for the purposes of independent analysis. |

| | • | | Identifying and examining the compensation practices of a peer group of comparable, publicly traded, development stage, biotechnology and medical device companies located in the United States, and comparing that data to HeartWare’s data. |

The analysis undertaken by F W Cook focused on base salaries, annual bonuses, long-term incentives and total “carried-interest ownership”, which is a form of measurement of the equity awards received by each executive during the course of their employment. Carried-interest measures the amount of future increase in value captured by each executive arising through their equity awards and is calculated as the aggregate holding of options and shares plus recent share sales of an executive, divided by the number of Company shares outstanding.

The peer group consisted of 16 publicly traded biotechnology and medical device companies with market capitalizations ranging between approximately US$100 and US$450 million. Because of the nature and scope of the Company’s business, only companies located in the United States were considered. The peer group comprised Aspect Medical Systems, Possis Medical, NeuorMetrix, VNUS Medical Technologies, Tutogen Medical, AtriCure, NMT Medical, NxStage Medical, SenoRx, Artes Medical, Dyax, XTENT, Hansen Medical, Inovio Biomedical, DexCom and Northstar Neuroscience (collectively, “the Peer Group”). In reviewing the compensation data of the Peer Group, F W Cook commented that there would be no impact on the resultant equity compensation benchmarks of the Peer Group if the larger revenue companies were excluded from the Peer Group data. Further, salary and cash benchmarks would be reduced by approximately 5-10% should these larger revenue companies be excluded from the Peer Group calculations.

In summary, the conclusions from the F W Cook review were as follows:

| | • | | Overall, base salaries for Company executives were lower than the median and most executives are almost 10% below the median of the Peer Group. |

| | • | | HeartWare has not established an annual cash bonus despite most pre-commercial biotech companies maintaining a common annual bonus structure for their senior executives. HeartWare had pre-established target annual bonus for only 3 executives (i.e., Mr. Godshall, Mr. Rowe and Ms. Foley). |

| | • | | Actual 2006 cash compensation (i.e., salary plus bonus) was approximately 10% below median for HeartWare’s eight most highly compensated executives. |

| | |

| Notice of Extraordinary General Meeting | | 9 |

| | • | | HeartWare’s senior executives have an aggregate carried-interest ownership that is below the 25th percentile of the Peer Group and the actual value of this ownership is diminished because the Company historically granted premium-priced equity (i.e., equity that is priced higher than the fair market value of the underlying security at the relevant grant date). |

Elements of Compensation

Compensation packages are set at levels that are intended to attract and retain executives capable of managing our diverse operations and achieving our strategic objectives in a timely manner.

Base Salary

For the short term, the base salary component is the most significant component in executive compensation. Base salaries are set by reference to the scope of the executive’s responsibilities, the nature of the relevant individual’s role and the extent of the executive’s ongoing contributions to our strategic goals. Other relevant considerations include perceived long-term value to HeartWare, succession planning, retention and the executives’ compensation history.

As noted above, the Company retained F W Cook during 2007 to undertake a benchmark exercise for our senior executives and this included a review of base salaries. The Company then considered the existing base salaries of our named executive officers in light of the information provided by F W Cook, together with the executives’ historical salary level, overall contribution, work ethic, responsibilities, tenure with the Company and other subjective case-by-case factors such as replaceability or the perceived importance of that individual to the Company.

The Company did not attribute any specific weighting to the elements of individual performance or contribution or otherwise adopt any other formal mechanism in its determination of the relevant salary level for the named executive officers. The assessment of each individual, including base salary, was therefore undertaken following consideration of all of the above factors on an aggregated basis with particular emphasize on how the relevant executives’ base salary compared with the Peer Group. Salaries are typically reviewed annually, and it is expected that another benchmark exercise will be undertaken not less than every second year.

The base salary for Mr. Godshall (Chief Executive Officer), Mr. McIntyre (Chief Financial Officer), Mr. LaRose (Chief Scientific Officer), Mr. Rowe (Chief Operating Officer) and Ms. Foley (Vice-President, Clinical & Regulatory Affairs) did not change during 2007 and their base salary will not be re-assessed until late in 2008. No changes were made to the named executive officers’ salaries because each of those executives accept and acknowledge that the Company has limited financial resources at this time and therefore they did not seek, or otherwise request, an increase in their respective base salary levels.

With the exception of Mr. Godshall, the base salary of each of the above named executive officers was approximately 4%-19% less than the equivalent benchmarked position in the Peer Group. Mr. Godshall’s base salary is substantially equivalent to the median base salary of chief executive officers in the Peer Group. Set out below is the relevant benchmark data.

| | |

| Notice of Extraordinary General Meeting | | 10 |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Base Salary of Peer Group | | | Actual | |

| | | | | | | 25th | | | | | | | 75th | | | Base | |

| | | | | | | Percentile | | | Average | | | Percentile | | | Salary | |

| Name | | Title | | ($) | | | ($) | | | ($) | | | ($) | |

| Godshall, Doug | | CEO | | | 319,000 | | | | 357,000 | | | | 371,000 | | | | 350,000 | |

| McIntyre, David | | CFO | | | 216,000 | | | | 239,000 | | | | 252,000 | | | | 225,000 | |

| LaRose, Jeff | | CSO | | | 196,000 | | | | 227,000 | | | | 241,000 | | | | 225,000 | |

| Rowe, Dozier | | COO | | | 246,000 | | | | 275,000 | | | | 359,000 | | | | 225,000 | |

| Foley, Jennifer | | VP. Clin & Reg | | | 171,000 | | | | 203,000 | | | | 224,000 | | | | 220,000 | |

The base salary of Ms. Reedy, our former Vice-President, Sales and Marketing, increased from $200,000 to $220,000 on January 2, 2007 in consideration of the change in Ms Reedy’s responsibilities associated with Ms Reedy adopting the role of Vice-President, Sales & Marketing with effect from that date. Ms. Reedy’s salary was not otherwise altered during 2007.

Bonus

Sign-on bonus and performance-based bonuses are an important element of our compensation strategy. These bonuses are used to attract new executives and to reward the achievement of significant corporate milestones in circumstances where this can be linked to the delivery of improved shareholder value, subject to corporate cash flow and general working capital considerations.

We rarely pay sign-on bonuses. We would typically only pay a sign-on bonus when we believe that an upfront payment to an executive would significantly influence that individual’s decision to join the Company. The decision to offer such bonuses generally evolves as part of the employment negotiation process and is dependent on the perceived importance of the relevant appointment, the availability of suitable candidates and the individual qualities and experience of the individual. A sign-on bonus is also beneficial where a potential executive becomes ineligible to receive a bonus at their existing employer if the executive decides to join HeartWare.

In 2007, we hired Ms. Foley to be our new Vice-President, Clinical & Regulatory Affairs with effect from January 2, 2007. Ms. Foley was paid $30,000 as a sign-on bonus immediately following the commencement of her employment. Ms. Foley is a highly experienced and well-regarded clinical specialist who, prior to joining the Company, was one of the most senior executives within Boston Scientific Corporation’s clinical affairs organization where she was responsible for overseeing the execution of clinical trials across nine of that company’s divisions. We agreed to pay this bonus to Ms. Foley because we determined that it was imperative that we attract Ms. Foley to the Company given the Company’s impending expansion of its human clinical trials and in consideration of her extensive experience in the field. The amount of the sign-on bonus was not set by reference to any benchmark or other external source and was determined at the discretion of the Chief Executive Officer and with the consent of the Chairman as being a sufficiently substantive enough inducement for Ms. Foley to join the Company.

| | |

| Notice of Extraordinary General Meeting | | 11 |

The Compensation Committee and the Board of Directors also determined to pay a discretionary bonus on October 31, 2007 in recognition of the Company’s completion of enrolment in its international clinical trial and the filing of its submission with the US Food & Drug Administration for an investigational device exemption for the commencement of human clinical trials in the United States and following due consideration of the overall progress made by the Company since it conducted its previous performance evaluation in June 2006. These accomplishments were achieved through an enormous contribution and personal sacrifice by the Company’s employees and the Board determined that the payment of this bonus was appropriate in the circumstances. As the above bonus was both discretionary and retrospective in nature, there were no objectives established for any of the named executive officers in relation to this bonus.

All of our executives who were employed by us prior to January 1, 2007 and who did not have an established, pre-determined bonus were eligible to receive this discretionary bonus. Those individuals who had a pre-established bonus pursuant to their employment agreement were assessed based on their actual performance relative to the thresholds for that bonus (as set out in their respective employment agreements). For all others, the bonus of each individual executive was determined in conjunction with the benchmark data provided by the F W Cook review together with the outcome of the annual review process. Factors considered also included the employees’ position and rank within the organization, their specific roles and responsibilities and their performance therein.

The executives who received this bonus were:

| | • | | Mr Godshall, who received $71,250; |

| |

| | • | | Mr. McIntyre, who received $45,000; |

| |

| | • | | Mr. LaRose, who received $45,000; |

| |

| | • | | Ms. Foley, who received $30,000; and |

| |

| | • | | Mr. Rowe, who received $27,000. |

The bonus for Mr. Godshall was determined by Mr. Thomas, Chairman, following due consideration of Mr. Godshall’s actual performance against the pre-agreed milestones as follows:

| | | | | | | | | | | | | | | | | |

| | | Target | | | Maximum | | | Actual | | | Actual | |

| Criteria | | % | | | Bonus | | | % | | | Bonus | |

| Completion of capital raise | | | 40 | % | | $ | 30,000 | | | | 40 | % | | $ | 30,000 | |

| Completion of CE Mark Enrollment | | | 20 | % | | | 15,000 | | | | 20 | % | | | 15,000 | |

| Submission of the HVAD IDE application | | | 15 | % | | | 11,250 | | | | 15 | % | | | 11,250 | |

| Development of a shareholder communication strategy | | | 15 | % | | | 11,250 | | | | 10 | % | | | 7,500 | |

| Overall leadership and development of the Company | | | 10 | % | | | 7,500 | | | | 10 | % | | | 7,500 | |

| | | | | | | | | | | | | | | |

| | | | | | | $ | 75,000 | | | | | | | $ | 71,250 | |

| | | | | | | | | | | | | | | |

| | |

| Notice of Extraordinary General Meeting | | 12 |

Except for Ms. Foley, each of the bonuses paid to our executives was determined by the Chief Executive Officer in his discretion and after taking into account the benchmark data for the Peer Group (see below).

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Bonus as a Percentage of Base | | | | |

| | | | | | | Salary | | | | |

| | | | | | | Peer Group | | | | |

| | | | | | | 25th | | | | | | | 75th | | | Actual Bonus | |

| Name | | Title | | | Percentile | | | Average | | | Percentile | | | Percentage | | | $ | |

| McIntyre, David | | CFO | | | 12 | % | | | 21 | % | | | 31 | % | | | 20 | % | | | 45,000 | |

| LaRose, Jeff | | CSO | | | 0 | % | | | 17 | % | | | 28 | % | | | 20 | % | | | 45,000 | |

| Rowe, Dozier | | COO | | | 17 | % | | | 22 | % | | | 30 | % | | | 12 | % | | | 27,000 | |

The Chief Executive Officer determined at his discretion that, after taking into account the Company’s limited financial resources, the maximum bonus payable to any named executive would not exceed 20% of the relevant executive’s base salary and notwithstanding that this amount was significantly less than the cash bonuses provided in all cases by the Peer Group.

Mr. McIntyre and Mr. LaRose received the maximum bonus of 20% of base salary in consideration of their exceptional service, performance and commitment to the Company. The bonuses for the remaining executives were then determined by the Chief Executive Officer on a reducing, sliding scale taking into account the relevant executive’s performance and contributions in the preceding fifteen months.

Ms. Foley was paid a bonus of $30,000. The target amount of $30,000 was agreed between the Chief Executive Officer and Ms. Foley during the course of her employment negotiations in late 2006. The bonus was payable provided that the Company filed its investigational device exemption with the US Food & Drug Administration within ninety days of the completion of enrolment in the Company’s international clinical trial. This target was successfully completed and the bonus was therefore paid in full.

No discretionary bonus was paid to Ms. Reedy as, at the time of payment of the bonus, Ms. Reedy had determined to cease her employment with the Company.

Option Awards

We have adopted the HeartWare Limited Employee Share Option Plan, or ESOP. The ESOP is utilized for the purpose of attracting new executives, retention and as a long-term incentive program. We perceive, and the benchmark data from the Peer Group confirms, that it is a generally accepted practice in the medical device industry that potential employers offer senior executives compensation packages that include a significant option component. In line with this perception, we often make an initial grant of options to an incoming senior executive with effect from the commencement of employment, with subsequent “refresher” awards being given at the sole discretion of the Board of Directors. We have offered our Chief Executive Officer an option package roughly equal to 3% of our then-outstanding equity. Other executive officers are granted an initial option package that ranges from 0.75% to 1.5% of our then-outstanding equity, however, specific grants are negotiated on a case-by-case basis that considers a range of employment factors, including specific roles and responsibilities, historical compensation and market information. Compensation packages are often determined and negotiated with the assistance of an independent executive recruiter if one is utilized or, in the absence of the Company using such a recruiter, by reference to salary data sourced from the American Society of Human Resource Management.

| | |

| Notice of Extraordinary General Meeting | | 13 |

In the interest of promoting long-term shareholder value, we have historically granted options that progressively vest in four annual tranches, commencing on the first anniversary of the date of grant. Further, all options granted under the ESOP prior to February, 2007 were granted at a premium to the then-current or fair market value of the underlying security but the Board has discontinued this practice following confirmation from F W Cook that it is common practice in the United States for options to be priced “at market”.

See “Equity Awards” below for further information on our option awards.

Performance Rights Awards

During 2007, we adopted the HeartWare Limited Performance Rights Plan (“PRP”). The Company adopted the PRP in light of recommendations arising from F W Cook’s compensation review and after taking account of the total carried-interest ownership of our executives compared with the Peer Group.

The PRP is utilized, in conjunction with the ESOP, for the purpose of retaining and incentivizing the Company’s “key employees”, being those employees who the Board of Directors or management considers must be retained by the Company in the medium to long-term. For this reason, the use of the PRP has been selective and has therefore only been made available to 14 employees to date.

See “Equity Grants” below for further information on our grants of performance rights.

Pensions

All executives receive retirement benefits.

In the United States, our executives are eligible to participate in a 401(k) retirement plan after 90 days of employment. We have not provided matching funds through December 31, 2007 and do not expect to do so for the foreseeable future.

In Australia, we are legally obliged to contribute “superannuation”, at the rate of 9% of the relevant annual gross salary, with respect to each Australian employee. Superannuation is a retirement or pension contribution that is made to a pension fund selected by the employee. The amount is not available to the employee until retirement.

Perquisites and Other Benefits

In the United States, we maintain health, dental and life insurance plans for the benefit of eligible executives. Each of these benefit plans requires the executive to pay a portion of the premium, with the Company paying the remainder of the premiums. These benefits are offered on the same basis to all employees. We also maintain a non-matching, 401(k) retirement plan that is available to all eligible US employees.

Life, accidental death, dismemberment and disability, and short and long-term disability insurance coverage is also offered to all eligible executives, and we pay these premiums in full. No other voluntary benefits, such as vision insurance, supplemental life and specific coverage insurance supplements, tuition assistance and work-life balance programs are currently made available to any executive.

| | |

| Notice of Extraordinary General Meeting | | 14 |

Some executives may, generally on commencement of employment with us, be required to relocate residences in order to fulfill their job responsibilities. In this case, we negotiate a relocation allowance with the relevant executive on a case-by-case basis, and this allowance may include our making contributions toward the cost of relocation, establishment of housing and utilities, travel and, in rare cases, rental assistance. No such relocation occurred during 2007.

We also provide Blackberry communication devices to various executives at no cost to the executive in circumstances where we consider that it is reasonable to do so.

Equity Grants

We have adopted the ESOP and the PRP that allow us to grant equity to employees and directors. The ESOP is primarily designed to provide employees and directors with the opportunity to participate in our growth and success and to provide an incentive for such participants to have a greater involvement with, and to focus on, our long-term goals. The PRP, which was adopted on November 13, 2007, is designed to provide a distinctive financial incentive for a limited pool of employees who have been identified as key individuals the Company must strive to retain in the medium to long-term. We believe that the use of both the ESOP and the PRP is an important component of executive retention and central to our long-term development.

Each option issued under the ESOP and each performance right granted under the PRP allows the holder to subscribe for and be issued one of our ordinary shares. In accordance with the Company’s ESOP rules (as adopted by shareholders on May 23, 2006), all ESOP options issued after we became listed on the ASX must have an exercise price which is not less than the weighted average sale price of ordinary shares sold during the 5 days (or such other period as our Board may determine) prior to the issue of the ESOP option. Distinct from the ESOP, performance rights granted under the PRP may entitle the holder to acquire one of our ordinary shares with a zero exercise price, provided that relevant performance hurdles are satisfied.

Options and performance rights may generally be exercised after they have vested and prior to the specified expiration date if the applicable exercise conditions are met. The expiration date can be for periods of up to ten years after the grant.

Exercise conditions or performance hurdles, if any, are determined by the Board. Except as set out below, no exercise conditions, other than continued employment, have been applied to any grants of options to executives at this stage. In addition and subject to the approval by the Board, options and performance rights may be exercised at any time if we enter into a scheme of arrangement or a takeover occurs, or if an entity acquires a relevant interest in sufficient number of our ordinary shares to enable them to replace all or a majority of the Board.

There are a number of events that may cause options to lapse under the ESOP or the PRP including, for example, where a performance hurdle is not satisfied or where a participant ceases to be an employee or director, for whatever reason. If we issue our ordinary shares as a share dividend, the number of ordinary shares which an option holder is entitled to receive upon the exercise of the option will be adjusted accordingly.

ESOP options and performance rights granted under the PRP are not listed for quotation on the ASX or any other exchange or market. Options issued under the ESOP and performance rights granted under the PRP are not transferable, except on the death of an employee or during a takeover.

| | |

| Notice of Extraordinary General Meeting | | 15 |

In connection with the benchmark exercise which considered, among other things, the carried-interest ownership of our executives as compared to the Peer Group, F W Cook determined that our top 10 executives have aggregated carried-interest ownership that is below the 25 th percentile of the Peer Group. Further, due to the Company’s historical practice of granting premium priced options, this carried-interest ownership was determined to be less valuable than that made available to the Peer Group. The carried-interest ownership of the 10 most senior executives was 6.55% while the Peer Group had carried-interest ownership of 7.20% (25th percentile), 9.12% (median) or 13.02% (75th percentile).

Further, F W Cook considered the quantum of “refresher” grants of options that a Peer Group executive received based on the relevant tenure of each executive. Following this review, F W Cook recommended that the Company utilize performance rights so as to bring the Company’s executives in line with the carried-interest ownership of executives of the Peer Group and as a means to correct the previous practice of granting premium-priced options. Specifically, F W Cook recommended that the Company grant approximately 3.7 million performance rights to the Company’s top 10 executives with no provision or recommendation for wider grants of performance rights to other employees.

Following due consideration, the Compensation Committee and the Board of Directors exercised their discretion and reduced the quantum of performance rights recommended by F W Cook by approximately 15% with the result that the Company determined to grant not more than 3.15 million performance rights to its “key” employees. The Compensation Committee, based on recommendations of the Chief Executive Officer, allocated the 3.15 million performance rights to 14 key employees, including our named executive officers.

We made the following grants of options during 2007 to our named executive officers:

| | • | | In connection with the appointment of Ms. Foley as Vice-President, Clinical and Regulatory Affairs with effect from January 2, 2007, Ms. Foley was granted 1,000,000 options on commencement of her employment with us and otherwise in accordance with the terms of her employment agreement. The exercise price of these options was AU$1.10, which constituted a 57% premium to the share price at the date of grant, which was AU$0.70. |

| | • | | On November 13, 2007, we approved of the grant of up to an aggregate of 3.15 million performance rights under the PRP to our named executive officers. Accordingly, on November 16, 2007, Mr. McIntyre received 400,000 performance rights, Mr. LaRose received 300,000 performance rights and each of Mr. Rowe and Ms. Foley received 200,000 performance rights. Mr. Godshall was allocated 1.1 million performance rights, subject to shareholders approving such grant (as required by the ASX Listing Rules) (shareholders approved the grant at our annual general meeting held on May 9, 2008 and the 1.1 million performance rights were issued that day). The exercise price for the performance rights is zero and the performance rights lapse if they have not vested within 5 years of the grant date. Vesting of the performance rights is subject to the performance hurdles set out below. The share price at the date of grant was AU$0.75. |

Vesting of each of the performance rights approved on November 13, 2007 is subject to satisfaction of the following performance hurdles:

| | • | | Vesting for the first tranche, representing 25% of each allotment, occurs on the last to occur of the first anniversary of the grant date, the Company receiving CE mark in Europe, the Company filing its application for Therapeutic Goods Association approval in Australia and the commencement of the Company’s Bridge-to-Transplant trial in the United States. |

| | |

| Notice of Extraordinary General Meeting | | 16 |

| | • | | Vesting for the second tranche, representing 25% of each allotment, occurs on the last to occur of the second anniversary of the grant date and the completion of enrollment under the Company’s Bridge-to-Transplant trial in the United States. |

| | • | | Vesting for the third tranche, representing 25% of the each allotment, occurs on the last to occur of the third anniversary of the grant date, the Company filing an application for Pre-Market Approval with the United States Food and Drug Administration as a Bridge- to-Transplant therapy and the completion of enrollment under the Company’s Destination Therapy clinical trial in the United States. |

| | • | | Vesting for the fourth tranche, representing 25% of the each allotment, occurs on the last to occur of the fourth anniversary of the grant date and the Company completing a human feasibility study for its next generation device, the MVAD. |

The Board considers potential options grants to executives upon commencement of employment and as part of our annual employee performance review process with the next contemplated review expected to occur at the end of the 2008 calendar year.

Employment Agreements and Severance Arrangements

All of our named executive officers have employment agreements, including the Chief Executive Officer and the Chief Financial Officer. These contracts do not have a fixed term, and the executives serve on an “at will” basis. The employment agreements of Mr. Godshall, Mr. McIntyre, Mr. Rowe and Ms. Reedy contain provisions that will entitle these executives to certain payments or benefits if their employment is terminated under certain circumstances, including after a “change in control” of the Company occurs.

The material terms of each named executive officer’s employment agreement, and the payments or benefits which the named executive officers would receive under different termination circumstances, are set forth below in “-Employment Agreements” and “-Potential Post-Employment Payments”, respectively.

Material Change

Since December 31, 2007, and except as described herein, there has been no material change to the compensation arrangements of the named executive officers.

Share Ownership

We do not have share ownership guidelines or requirements for employees or directors.

Compensation Components of Named Executive Officers

The following summary compensation table sets forth compensation information for our last 2 fiscal years with regard to (i) our Chief Executive Officer, (ii) our Chief Financial Officer, (iii) our other 3 most highly compensated executive officers during fiscal 2007 and (iv) one additional individual for whom disclosure would have been provided but for the fact that the individual was not serving as an executive officer at the end of fiscal 2007, to whom we refer collectively as the “named executive officers.”

| | |

| Notice of Extraordinary General Meeting | | 17 |

SUMMARY COMPENSATION TABLE

For the Years Ended December 31, 2007 and 2006

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Change in | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Pension | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Value and | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | Non-Equity | | | Nonqualified | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | Incentive | | | Deferred | | | | | | | |

| | | | | | | | | | | | | | | Stock | | | Option | | | Plan | | | Compensation | | | | | | | |

| | | | | | | | | | | Bonus | | | Awards | | | Awards | | | Compensation | | | Earnings | | | All Other | | | | |

| Name and Principal | | | | | | Salary | | | (1) | | | (2) | | | (3) | | | (4) | | | (5) | | | Compensation | | | Total | |

| Position | | Year | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| Douglas Godshall | | | 2007 | | | | 350,000 | | | | — | | | | — | | | | — | | | | 71,250 | | | | — | | | | — | | | | 421,250 | |

| Chief Executive Officer (6) | | | 2006 | | | | 87,500 | | | | 75,000 | (7) | | | — | | | | 2,217,984 | | | | — | | | | — | | | | — | | | | 2,380,484 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| David McIntyre | | | 2007 | | | | 225,000 | | | | 45,000 | | | | 262,717 | | | | — | | | | — | | | | — | | | | 108,000 | (9) | | | 640,717 | |

| Chief Financial Officer | | | 2006 | | | | 186,834 | | | | 35,000 | | | | — | | | | 79,367 | | | | — | | | | 5,003 | | | | 111,127 | (10)

(11) | | | 417,331 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dozier Rowe | | | 2007 | | | | 225,000 | | | | 27,000 | | | | 131,358 | | | | — | | | | — | | | | — | | | | — | | | | 383,358 | |

| Chief Operating Officer | | | 2006 | | | | 147,212 | | | | — | | | | — | | | | 79,367 | | | | — | | | | — | | | | — | | | | 226,579 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jeffrey LaRose | | | 2007 | | | | 225,000 | | | | 45,000 | | | | 197,038 | | | | — | | | | — | | | | — | | | | — | | | | 467,038 | |

| Chief Scientific Officer | | | 2006 | | | | 211,539 | | | | 45,000 | | | | — | | | | 79,367 | | | | — | | | | — | | | | — | | | | 335,906 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jennifer Foley | | | 2007 | | | | 211,539 | | | | 30,000 | | | | 131,358 | | | | 376,736 | | | | 30,000 | (12) | | | — | | | | — | | | | 779,633 | |

| Vice-President, Clinical | | | 2006 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| and Regulatory | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jane Reedy | | | 2007 | | | | 439,231 | (13) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 439,231 | |

| Former Vice President, | | | 2006 | | | | 200,000 | | | | 25,000 | | | | — | | | | 79,367 | | | | — | | | | — | | | | — | | | | 304,367 | |

| Sales and Marketing | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| (1) | | Unless otherwise stated, the amount specified represents a cash bonus paid on October 31, 2007 as part of a Company-wide discretionary bonus in recognition of the completion of enrolment in the Company’s international clinical trials, the filing of an investigational device exemption, or IDE, with the US Food & Drug Administration and the Company’s overall progress since June 2006. |

| |

| (2) | | All performance rights, or stock awards, are issued with an exercise price of nil. The amount referenced is calculated by multiplying the number of stock awards granted by the closing market price of the Company’s stock on the relevant grant date as published by the Australian Securities Exchange. The stock awards were granted on November 16, 2007 when the closing market price was AU$0.745 and was converted using the exchange rate at December 31, 2007 of AU$1.00 = US$0.8816. The amount referenced could also have been calculated, and generated the same grant date fair value, using the Black-Scholes valuation model adopting the assumptions described in Note 3 and Note 12 of the Notes to Consolidated Financial Statements included in our audited Consolidated Financial Statements for the fiscal years ended December 31, 2007, 2006 and 2005 appearing elsewhere in this document. |

| |