UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

HEARTWARE LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

Information Memorandum

For schemes of arrangement between HeartWare Limited ABN 34 111 970 257 and the holders of shares, options and performance rights in HeartWare Limited in relation to the proposed redomiciling of the HeartWare Group from Australia to the United States and for the Extraordinary General Meeting.

Your directors unanimously recommend that you vote in favour of the schemes of arrangement and the resolution to be proposed at the Extraordinary General Meeting.

This document comprises:

| • | | an explanatory statement and notices of meeting in relation to the schemes of arrangement; |

| |

| • | | an explanatory statement and notice of meeting in relation to the Extraordinary General Meeting; |

| |

| • | | an information memorandum in relation to the listing of HeartWare International, Inc on ASX. |

The scheme meetings and Extraordinary General Meeting will be held on 22 October 2008 commencing at 10.00am. The meetings will be held at the Adelaide Room, Sofitel Sydney Wentworth Hotel, 61-101 Phillip Street, Sydney NSW 2000.

This Information Memorandum is dated 12 September 2008. Copies of this Information Memorandum will be sent to shareholders, optionholders and performance rights holders of HeartWare Limited.

This document is important and requires your immediate attention. It should be read in its entirety. If you are in any doubt as to how to deal with it, you should consult your legal, financial or other professional adviser.

Contents

| | | | | |

| | | 1 | |

| | | | | |

| | | 2 | |

| | | | | |

| | | 4 | |

| | | | | |

| | | 14 | |

| | | | | |

| | | 19 | |

| | | | | |

| | | 26 | |

| | | | | |

| | | 30 | |

| | | | | |

| | | 34 | |

| | | | | |

| | | 45 | |

| | | | | |

| | | 48 | |

| | | | | |

| | | 65 | |

| | | | | |

| | | 66 | |

| | | | | |

| | | 73 | |

| | | | | |

| | | 90 | |

| | | | | |

| | | 98 | |

| | | | | |

| | | 103 | |

| | | | | |

| | | 119 | |

| | | | | |

| | | 195 | |

| | | | | |

| | | 205 | |

| | | | | |

| | | 212 | |

| | | | | |

| | | 219 | |

| | | | | |

| | | 223 | |

| | | | | |

| | | 227 | |

| | | | | |

| | | 231 | |

| | | | | |

| | | 242 | |

| | | | | |

| | | 255 | |

| | | | | |

| | | 260 | |

| | | | | |

| | | 268 | |

| | | | | |

| | | 271 | |

| | | | | |

| | | 284 | |

| | | | | |

| | | 303 | |

| | | | | |

| | | 305 | |

| | | | | |

| | | 307 | |

| | | | | |

| | | 309 | |

| | | | | |

| | | 313 | |

| | | | | |

HEARTWARE LIMITEDINFORMATION MEMORANDUM

Important Dates

| | | |

| Key Event | | Date |

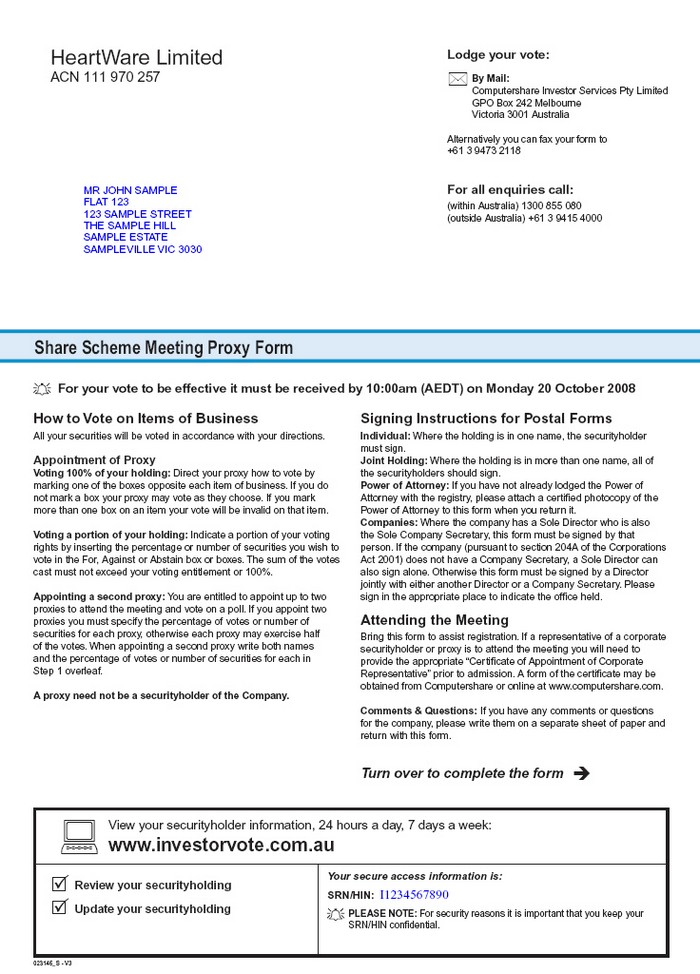

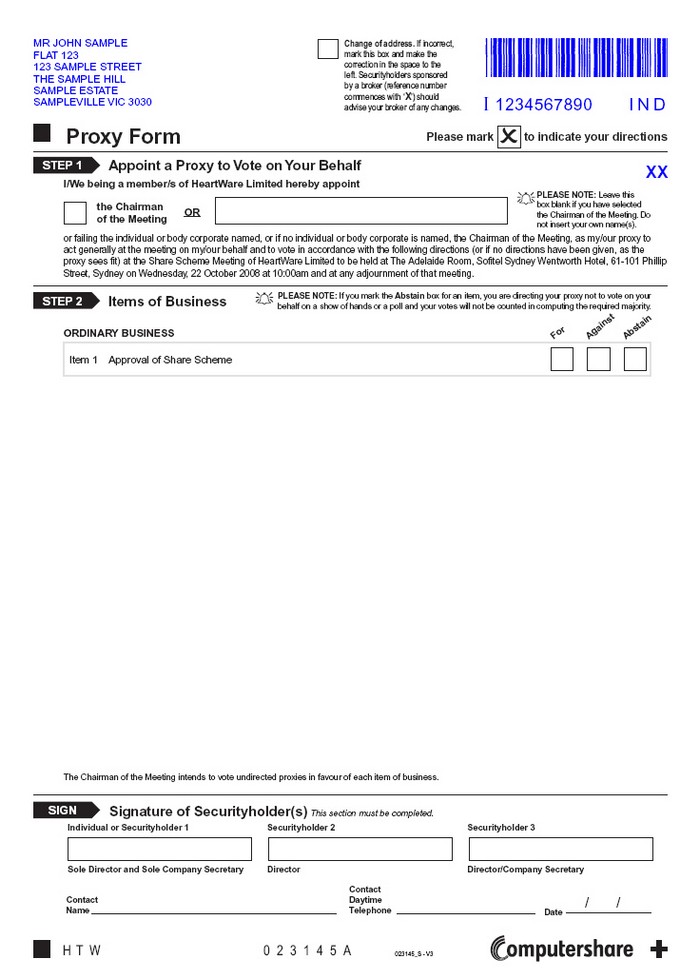

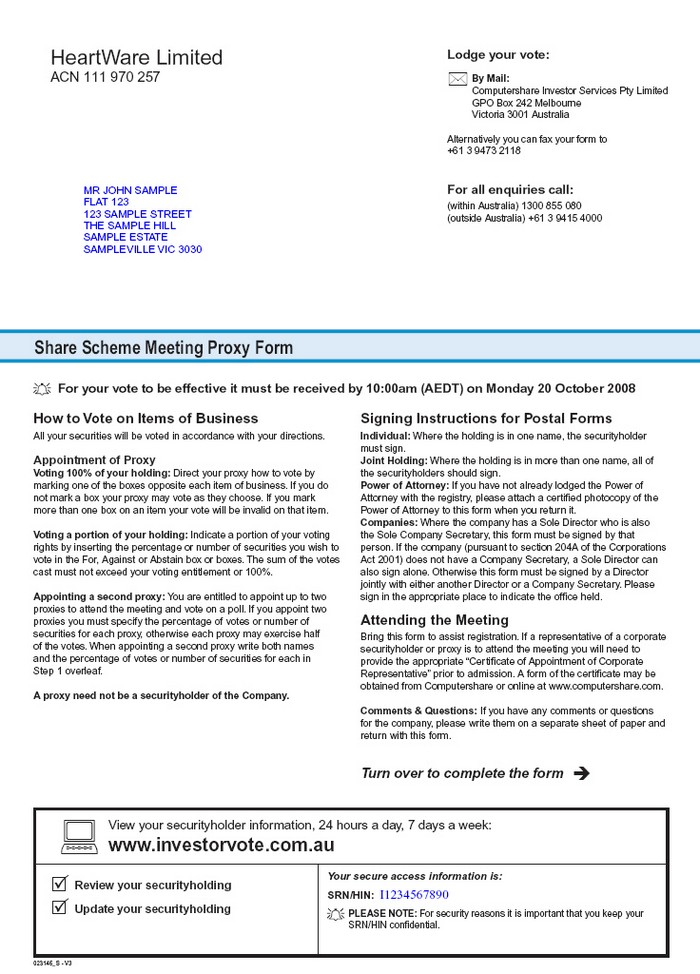

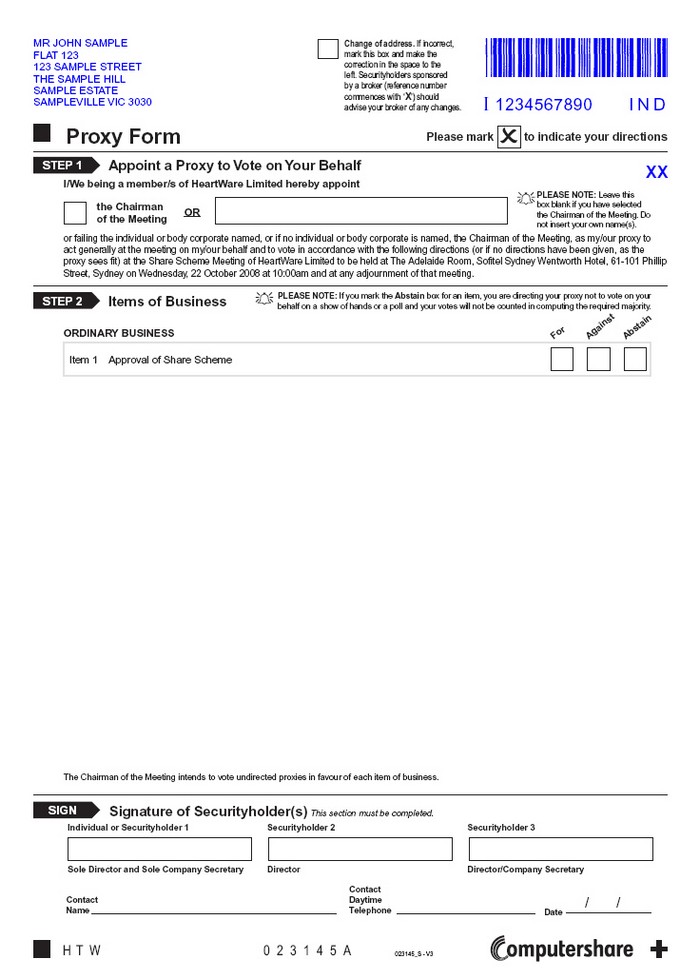

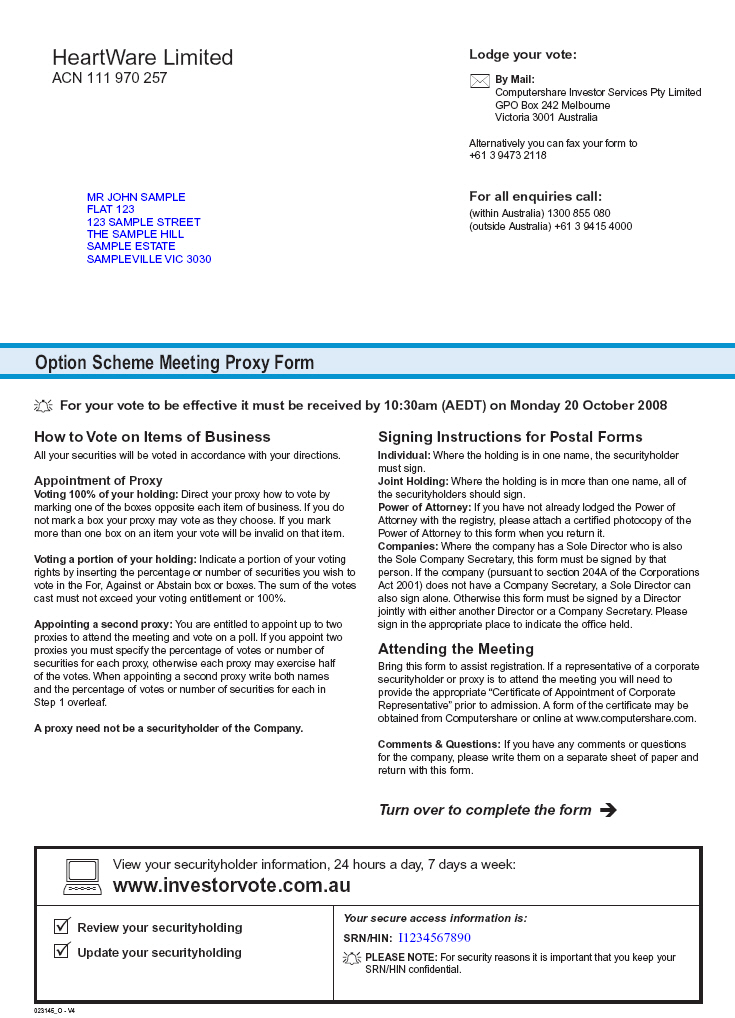

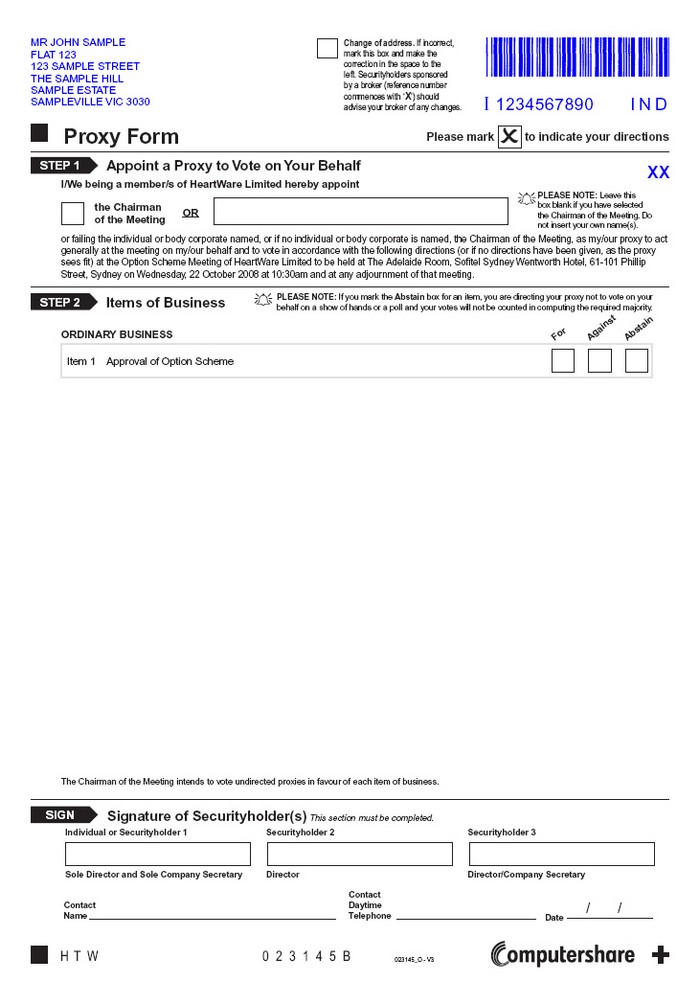

| Latest time and date for lodgement of completed proxy forms for Share Scheme Meeting | | 10.00am on 20 October 2008 |

| | | |

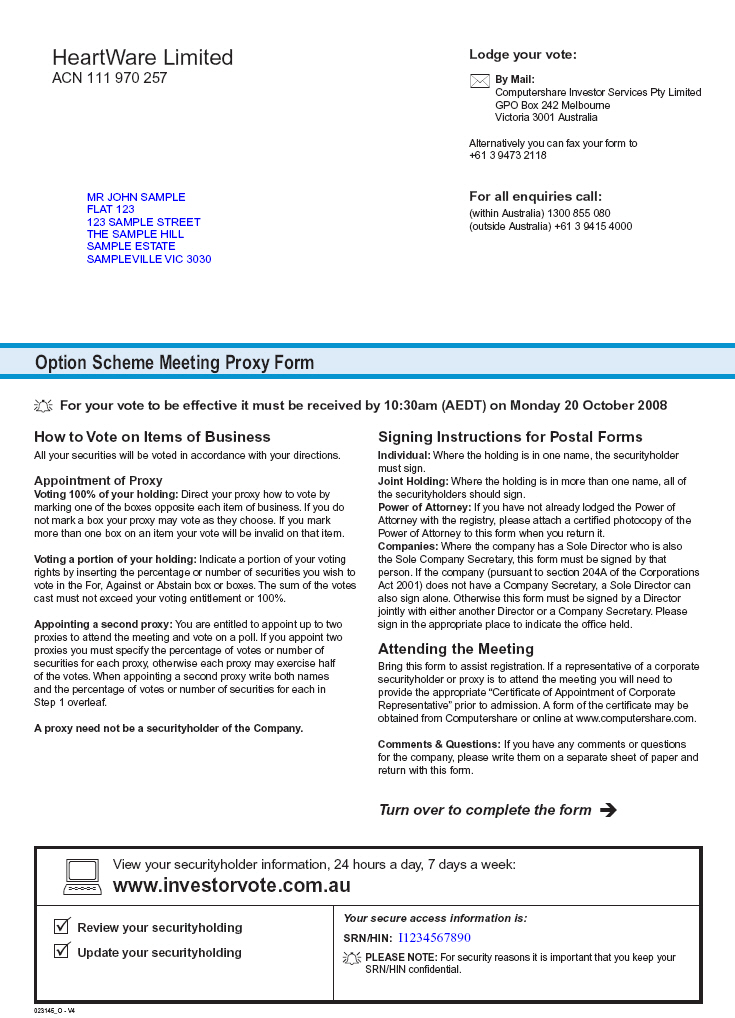

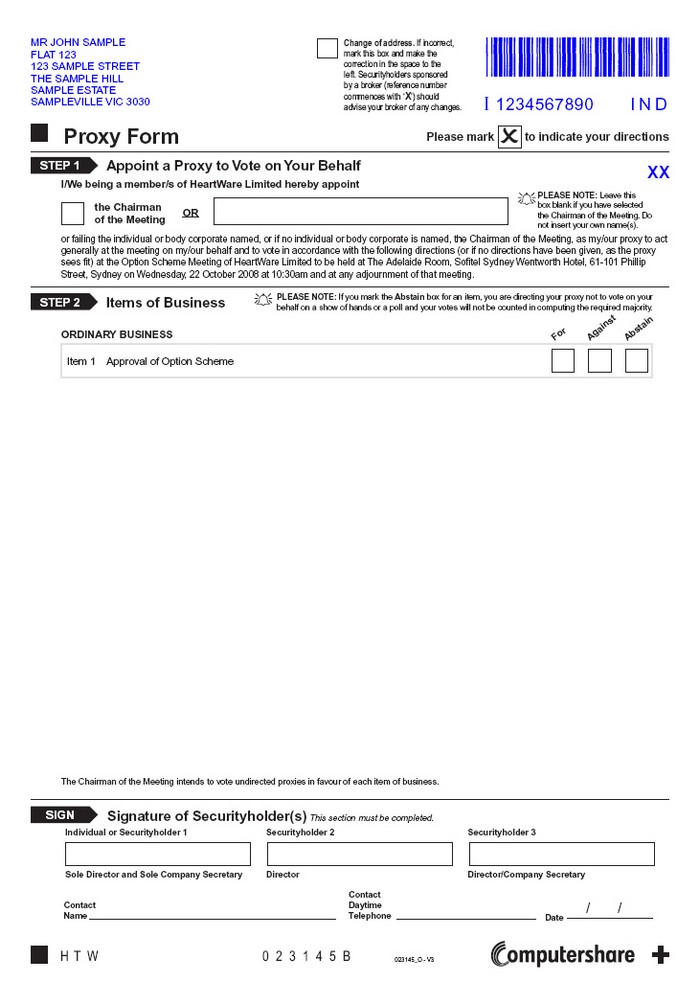

| Latest time and date for lodgement of completed proxy forms for Option Scheme Meeting | | 10.30am on 20 October 2008 |

| | | |

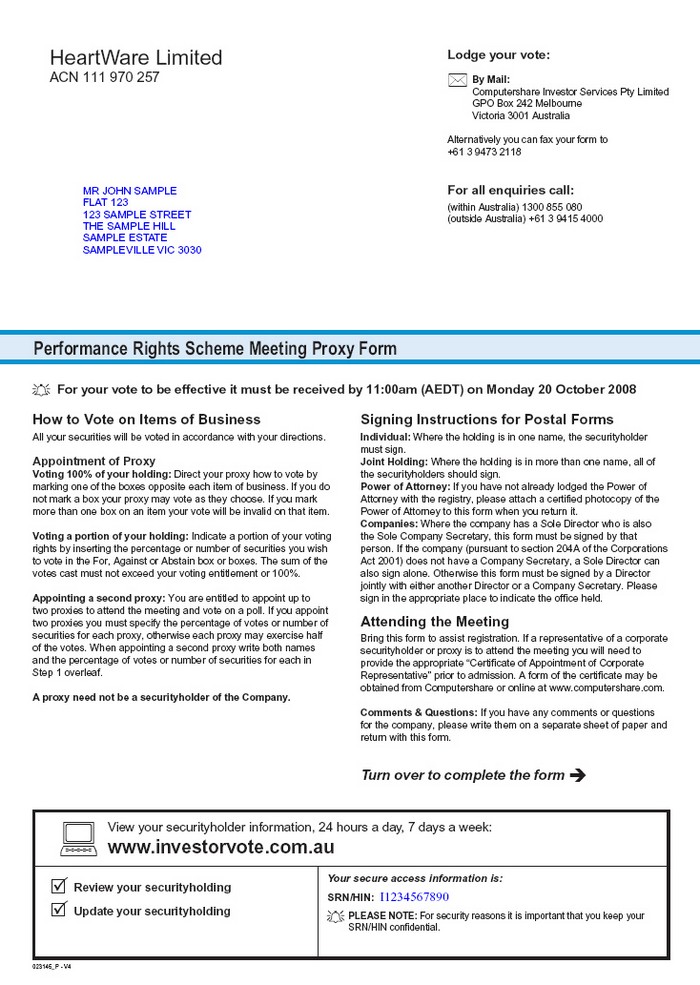

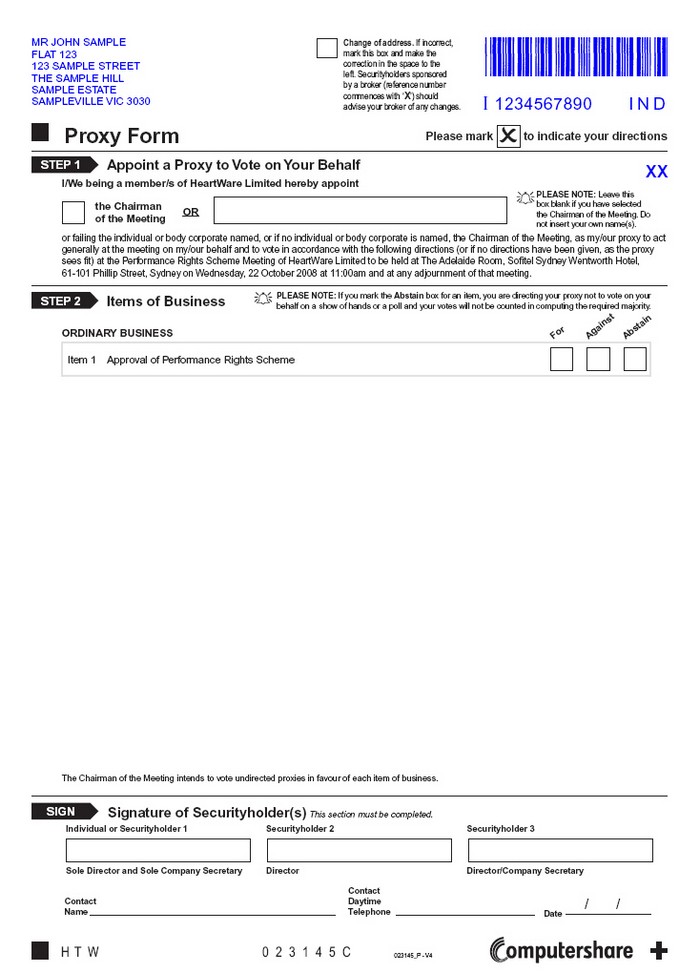

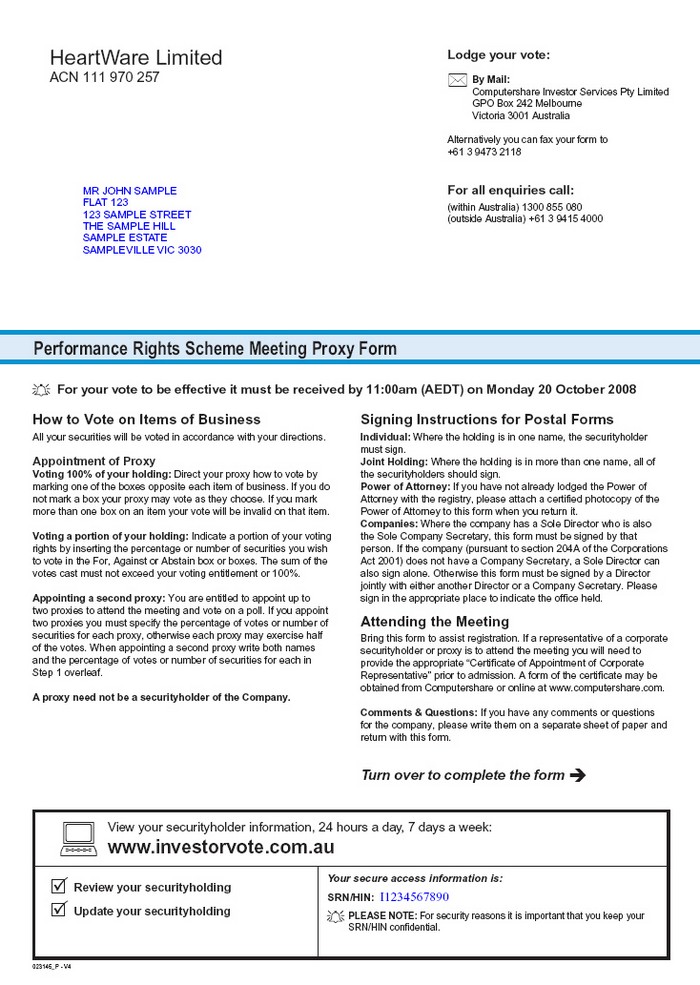

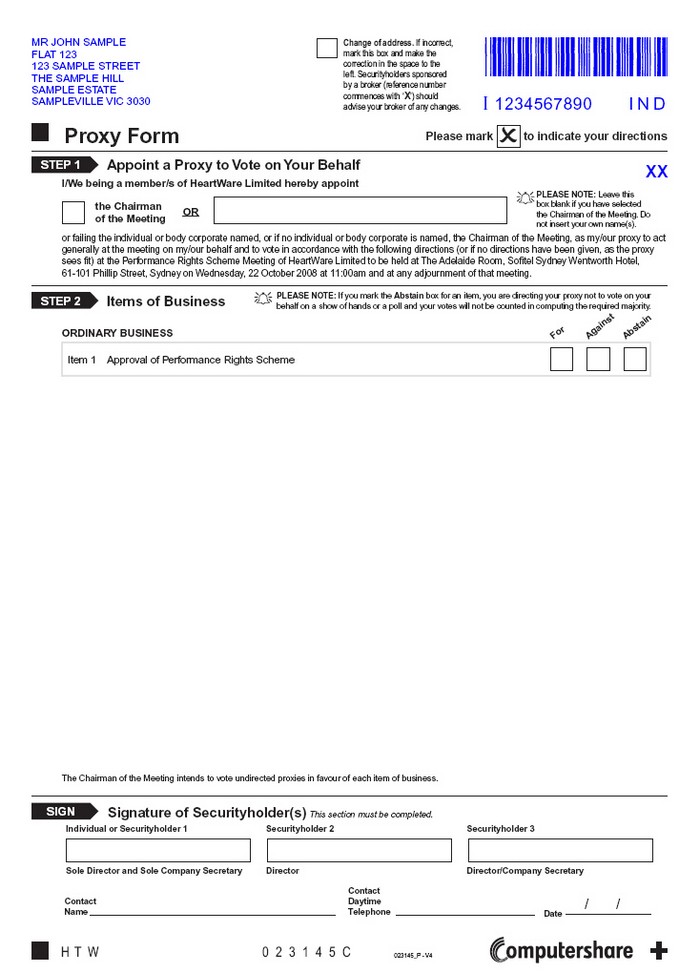

| Latest time and date for lodgement of completed proxy forms for Performance Rights Scheme Meeting | | 11.00am on 20 October 2008 |

| | | |

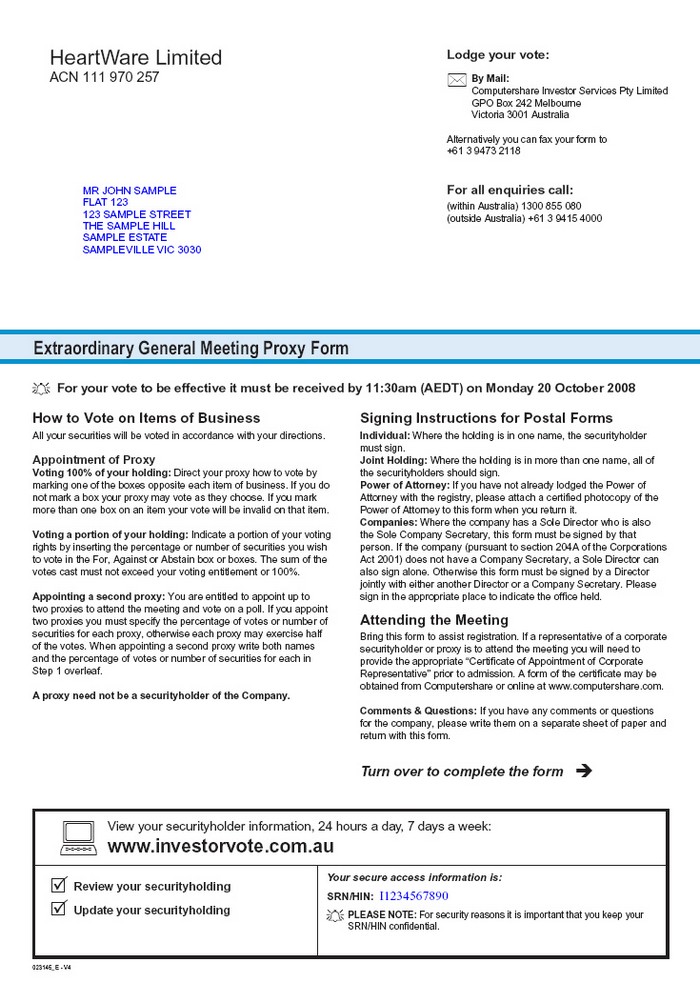

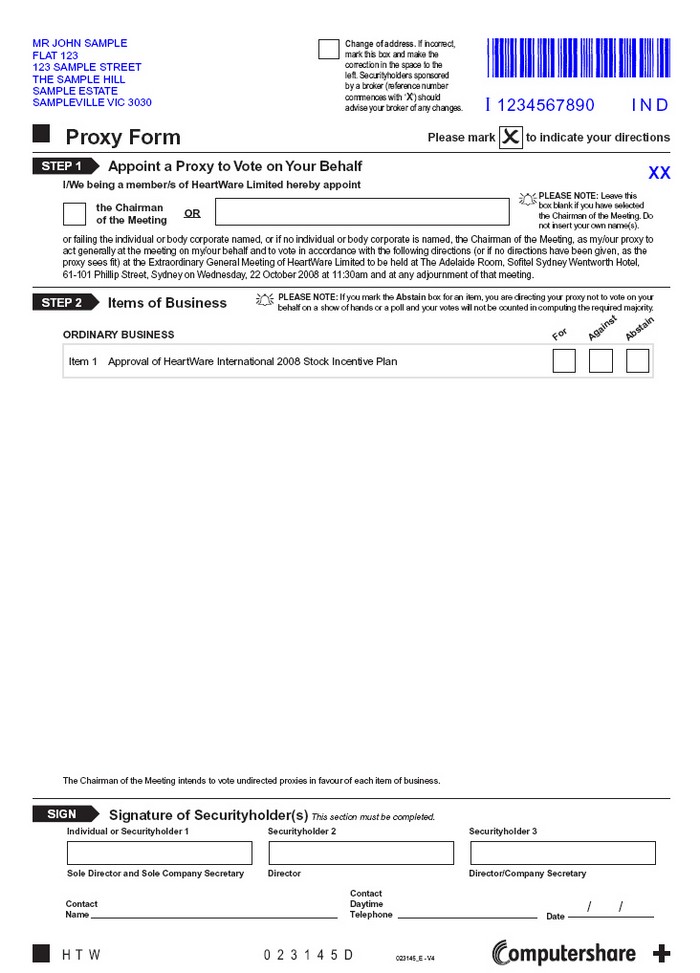

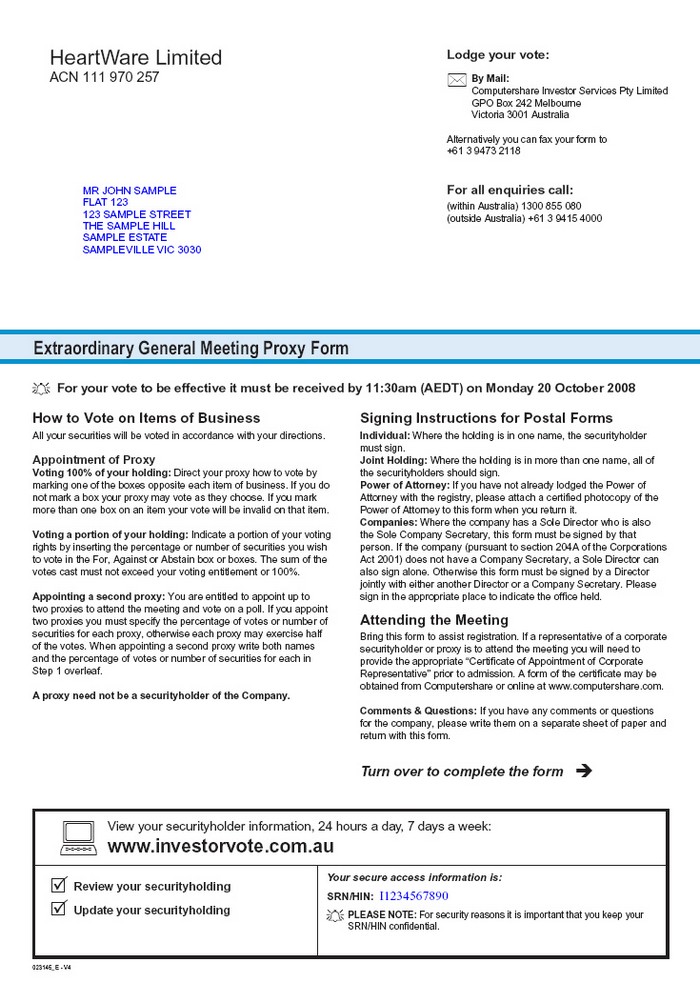

| Latest time and date for lodgement of completed proxy forms for EGM | | 11.30am on 20 October 2008 |

| | | |

| Time and date for determining eligibility to vote at Scheme Meetings | | 7.00pm on 20 October 2008 |

| | | |

| Time and date for determining eligibility to vote at the EGM | | 7.00pm on 20 October 2008 |

| | | |

| Share Scheme Meeting* | | 10.00am on 22 October 2008 |

| | | |

| Option Scheme Meeting* | | 10.30am on 22 October 2008 |

| | | |

| Performance Rights Scheme Meeting* | | 11.00am on 22 October 2008 |

| | | |

| EGM* | | 11.30am on 22 October 2008 |

| | | |

| Court hearing for approval of the Schemes | | 30 October 2008 |

| | | |

| Effective Date of Schemes | | 31 October 2008 |

| | | |

| Suspension of the Shares from trading on ASX | | 31 October 2008 |

| | | |

| CDIs commence trading on ASX on a deferred settlement basis | | 3 November 2008 |

| | | |

| Scheme Record Date | | 7 November 2008 |

| | | |

| Implementation Date for Schemes | | 11 November 2008 |

| | | |

| Despatch of CDI holding statements and transmittal letters | | 14 November 2008 |

| | | |

| CDIs commence trading on normal T+3 basis | | 17 November 2008 |

All dates after the dates of the Scheme Meetings and EGM are indicative only and, among other things, are subject to the Court approval process and ASX approval. All dates and times are Sydney, Australia times.

All terms and expressions used in this Information Memorandum have the meaning set out in the Glossary in section 12 of this Information Memorandum.

HEARTWARE LIMITEDINFORMATION MEMORANDUM 1

Chairman’s Letter

Dear Shareholders and Incentive Holders

As Shareholders or Incentive Holders, you will be aware that the Company has previously announced its intention to redomicile to the United States. In light of the fact that the United States represents the HeartWare Group’s largest single target market and as the Company already has a substantial majority of its operational and institutional Shareholder base located in the United States, redomiciliation represents an obvious and natural evolution for the HeartWare Group.

This Information Memorandum sets out the Board’s rationale in support of the decision to redomicile to the United States (by way of the Proposed Transaction as described in this Information Memorandum), together with the steps required to effect the redomiciliation and other important information concerning this important decision.

If Shareholders and Incentive Holders approve the redomiciliation, HeartWare International will become the ultimate parent company of the HeartWare Group and the entity which is listed on ASX. In simple terms, HeartWare International, which is incorporated in Delaware in the United States, will acquire all of the ordinary shares in the Company and, in return, will issue shares in HeartWare International which may be received in the form CHESS Depositary Interests (CDIs) or common stock, with only the former being traded on ASX. Each CDI will, in general terms, be broadly equivalent to one existing ordinary share in the Company. Likewise, all existing Options and Performance Rights in the Company will be replaced with equivalent interests in HeartWare International.

The redomiciliation will be implemented by way of three schemes of arrangement, being court-approved agreements between the Company and its Shareholders and other holders of equity securities.Approval of the Schemes will be sought from Shareholders, Optionholders and Performance Rights Holders at a series of meetings which will be held at The Adelaide Room, Sofitel Sydney Wentworth Hotel, 61-101 Phillip Street, Sydney NSW 2000 on 22 October 2008.

In presenting the redomiciliation for your consideration, your Directors believe that the transactions contemplated herein are in the best interests of Shareholders, Optionholders and Performance Rights Holders and it is our unanimous recommendation that you vote in favour of the redomiciliation. In making this recommendation, we believe that the HeartWare Group will receive a number of benefits from redomiciliation to the United States, including:

| • | | redomiciliation will enhance the HeartWare Group’s ability to access the large pool of equity capital available in the US market. In addition, US investors who were previously prevented from investing in the Company due to the Company being a non-US based company will now be able to invest in HeartWare International; |

| |

| • | | the Company is subject to reporting and compliance requirements in both the US and Australia and is not able to benefit from the lesser requirements associated with being a “foreign company” in either jurisdiction. Redomiciliation to the US will reduce certain of the HeartWare Group’s reporting and related compliance obligations thereby significantly reducing the costs, administrative overheads and the general management time that is associated with the current dual compliance requirements; |

| |

| • | | redomiciliation will enhance HeartWare International’s ability to move quickly to a listing on a US Exchange, should it determine to take this step; |

| |

| • | | virtually all of the HeartWare Group’s operating and manufacturing activities are based in the US which, as stated above, is also the largest market for the Company’s products. Redomiciliation will more appropriately align the Company’s corporate structure with its operating activities and target market; and |

| |

| • | | redomiciliation will enable the HeartWare Group to maintain an ASX listing while at the same time facilitating more efficient access to US and international capital markets. |

2 HEARTWARE LIMITEDINFORMATION MEMORANDUM

In summary, the Board believes that redomiciliation to the US will produce significant long-term benefits for the HeartWare Group. The Board also believes that these benefits outweigh the potential disadvantages associated with the redomicilation which are outlined in section 4 of this Information Memorandum.

The Board has appointed BDO Kendalls as an independent expert to review and opine on the merits of the Proposed Transaction and I am pleased to confirm that BDO Kendalls has formed the view that the redomiciliation to the US is in the best interests of Shareholders, Optionholders and Performance Rights Holders. The full report of the Independent Expert is set out in Appendix 2 of this Information Memorandum and should be read in full.

Closing Comments

The Directors believe that the Company is in an extremely promising position. Our international clinical trial for the HeartWare® Left Ventricular Assist System continues to generate excellent clinical results and this has allowed the Company to springboard into its US clinical trial which commenced on 18 August 2008. As at 31 August 2008, 44 patients had been implanted with the device on a global basis. On a cumulative basis, these patients have been supported for approximately 28 years. Following a successful capital raising earlier this year, the Company is well financed, with a cash balance at 31 July 2008 of approximately $43 million.

The Company remains firm in its objective of becoming a significant medical device business, and is in pursuit of a leadership position in the market for mechanical circulatory support systems. The ability over the longer term to access and maintain strong ties with the world’s larger capital markets will be critical for the financial viability of the Company. Redomiciliation to the US represents a critical step towards ensuring the HeartWare Group’s ability to directly access the US capital markets and, equally importantly, to expand its penetration in the large US market.

I strongly encourage you to review this Information Memorandum and the supporting documentation carefully and recommend that you seek professional advice in relation to the Schemes in light of your personal financial, investment and taxation circumstances. I sincerely hope that you will vote in favour of the redomiciliation by attending the Scheme Meetings and EGM or if, you are unable to attend, completing and returning the relevant proxy forms.

Your Directors unanimously recommend approval of the proposed redomiciliation of the HeartWare Group to the United States.

Thank you for your continued support of the HeartWare Group.

Yours sincerely

Rob Thomas

Chairman

HEARTWARE LIMITEDINFORMATION MEMORANDUM 3

What is the Proposed Transaction?

| | | |

| Overview | | Section |

• The HeartWare Group will redomicile in the United States of America. | | Section 3 |

| | | |

• HeartWare International (a new company incorporated in the US) will become the parent company of the HeartWare Group. | | Sections

3 and 6 |

| | | |

• HeartWare International will replace HeartWare Limited as the ASX listed entity with HeartWare International CDIs being quoted for trading on ASX. | | Section 3 |

| | | |

• Three separate schemes of arrangement in relation to the Shares, Options and Performance Rights: | | Section 3 and Appendices 3, 4 and 5 |

| | | | |

• | Share Scheme – Shares in the Company will be exchanged for CDIs or HeartWare International Shares. | | Section 3 and

Appendix 3 |

| | | |

| • | Option Scheme – Options in the Company will be exchanged for options in HeartWare International. | | Section 3 and

Appendix 4 |

| | | | |

| • | Performance Rights Scheme – Performance Rights in the Company will be exchanged for restricted stock units in HeartWare International. | | Section 3 and

Appendix 5 |

| | | |

• Standalone Options in the Company will be exchanged for replacement options in HeartWare International. | | Section 3 |

4 HEARTWARE LIMITEDINFORMATION MEMORANDUM

HeartWare Group Structure

Current Structure

| | | | | |

| Parent Entity | | HeartWare Limited | |

| Type of Securities on Issue | | Ordinary Shares |

| Number of Shares on Issue | | | 310,356,839 | |

| Type of Securities Quoted on ASX | | Ordinary Shares | |

| Number of Shares (Ordinary) Quoted on ASX | | | 310,356,839 | |

| ASX Share Price | | | $A0.60 | (1) |

| Number of Optionsˆ on Issue | | | 29,596,464 | |

| Weighted Average Exercise Price of Optionsˆ | | | A$0.64 | (2) |

| Type of Securities Issued on Exercise of Optionsˆ | | Ordinary Shares | |

| Number of Securities Issued on Conversation of Optionsˆ | | | | |

| – Ordinary Shares | | | 29,596,464 | |

| – Common Stock | | Not applicable | |

Proposed Structure

| | | | | |

| Parent Entity | | HeartWare International, Inc. | |

| Type of Securities on Issue | | Common Stock | |

| Number of Securities on Issue | | | 8,867,338 | |

| Type of Securities Quoted on ASX | | CDIs | |

| Number of Securities (CDIs) Quoted on ASX | | | 310,356,839 | (3) |

| ASX Share Price | | | $A0.60 | (4) |

| Number of Options on Issueˆ | | | 845,613 | |

| Weighed Average Exercise Price of Optionsˆ | | | A$22.40 | (2) |

| Type of Securities Issued on Exercise of Optionsˆ | | | Common Stock | (5) |

| Number of Securities Issued on Conversion of Optionsˆ | | | | |

| – Ordinary Shares | | Not applicable | |

| – Common Stock | | | 845,613 | (5) |

| | | |

| (1) | | As at close of trade on 8 September 2008. |

| |

| (2) | | Excludes performance rights. |

| |

| (3) | | Assumes all Shareholders receive CDIs only, that is, that all common stock has been “converted” into CDIs. |

| |

| (4) | | Estimated closing trade price on 8 September 2008 assuming (a) all Shareholders receive CDIs instead of common stock and (b) identical market conditions. |

| |

| (5) | | The holder may elect to convert these into CDIs in which case the holder will receive 35 CDIs for each security. |

| |

| * | | Assumes all Shareholders receive CDIs only, that is, that all common stock has been “converted” in CDIs. |

| |

| ˆ | | Includes all forms of options, together with all performance rights. |

Note: The number of securities and share price under the Proposed Structure in this diagram are indicative only and are calculated prior to the rounding down of fractional entitlements which will occur in connection with the Schemes.

HEARTWARE LIMITEDINFORMATION MEMORANDUM 5

Your vote on the Proposed Transaction

SCHEME MEETINGS AND EGM

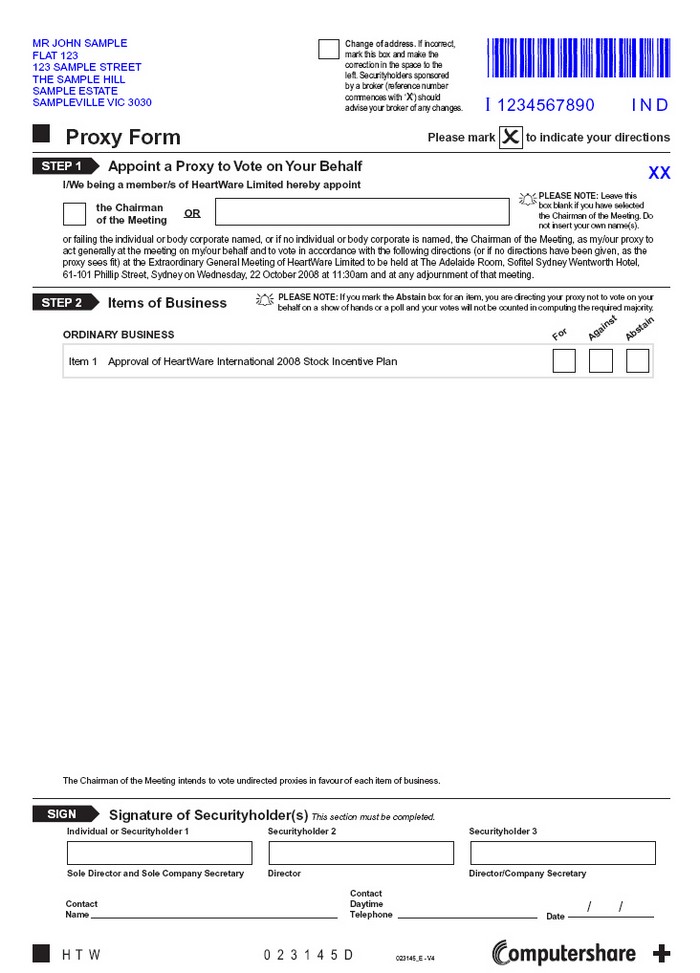

The Proposed Transaction requires the approval of Shareholders, Optionholders and Performance Rights Holders. The resolutions which you are being asked to vote on are set out in full in the Notices of Meeting in Appendices 16–19 to this Information Memorandum, but in summary:

Shareholdersare being asked to approve the Share Scheme under which all of the Shares will be transferred to HeartWare International in exchange for the issue of HeartWare International Shares. Under the Share Scheme, Shareholders will receive their HeartWare International Shares in the form of CDIs unless they elect otherwise. Shareholders are also being asked to approve the HeartWare International 2008 Stock Incentive Plan at the EGM.

Optionholdersare being asked to approve the Option Scheme under which all of the existing Options will be cancelled in exchange for the issue of HeartWare International Options.

Performance Rights Holdersare being asked to approve the Performance Rights Scheme under which all of the Performance Rights will be cancelled in exchange for the issue of HeartWare International Restricted Stock Units.

YOUR DIRECTORS’ RECOMMENDATION

Your Directors unanimously recommend that you vote in favour of all of the resolutions to be proposed at the Scheme Meetings and in favour of the resolution to be proposed at the EGM.

WHAT SHOULD YOU DO?

| | | |

| Step 1: | | Carefully read this Information Memorandum, the Notices of Meeting and all other documents you have been provided with. |

| | | |

| Step 2: | | If you have any queries concerning the Schemes or the Resolution, please consult your legal, financial or other professional adviser or contact the enquiry line on 1800 707 861 (Australia toll free) or +61 2 8256 3387 (International). |

| | | |

| Step 3: | | Attend and vote at the Scheme Meetings and the EGM or, if you are unable to attend, vote by proxy, attorney or corporate representative. |

6 HEARTWARE LIMITEDINFORMATION MEMORANDUM

Your vote is important

WHO CAN VOTE?

If you are registered as a Shareholder or an Incentive Holder at 7.00pm on 20 October 2008, you will be entitled to vote at the relevant Scheme Meetings and EGM, as the case may be. Optionholders and Performance Rights Holders on the register at that time will be entitled to vote whether or not their Options or Performance Rights have vested.

HOW TO VOTE

You may vote:

| • | | in person by attending the relevant Meeting; |

| |

| • | | by proxy; |

| |

| • | | by attorney; or |

| |

| • | | where the Shareholder or Incentive Holder is a body corporate, by a representative of that body corporate, each of which is described in more detail below. |

VOTING IN PERSON

The Meetings to approve the Proposed Transaction are four separate meetings which will be held on the same day at the times set out below.

The Meetings will be held on 22 October 2008 at The Adelaide Room, Sofitel Sydney Wentworth Hotel, 61-101 Phillip Street, Sydney NSW 2000 at the following times:

| • | | Share Scheme Meeting – 10.00am; |

| |

| • | | Option Scheme Meeting – estimated to take place at 10.30am immediately following the Share Scheme Meeting; |

| |

| • | | Performance Rights Scheme Meeting – estimated to take place at 11.00am immediately following the Option Scheme Meeting; and |

| |

| • | | EGM – estimated to take place at 11.30am immediately following the Performance Rights Scheme Meeting. |

VOTING BY PROXY

If you are entitled to vote and wish to do so by proxy, you must complete and return your personalised proxy form(s) accompanying this Information Memorandum (together with any power of attorney or other authority under which the proxy form(s) is signed or a certified copy of that power or authority, and a declaration or statement by the proxy that he or she has not received any notice of revocation of appointment) so that it is received by the Company’s share registry by no later than 48 hours prior to the Meetings on 22 October 2008.

Please read the instructions on the proxy form(s) carefully when completing the form.

You may return your proxy form(s) (and any supporting documents) by delivering, posting or faxing them to the Company’s share registry at:

Computershare Investor Services Pty Limited

Delivery address: Level 3, 60 Carrington Street, Sydney NSW Australia 2000

Postal address: GPO Box 2975, Victoria, Australia 3001

Facsimile number: + 61 3 9473 2500

Additional or replacement proxy forms may be obtained from the Company’s share registry at the address above.

The sending of a proxy form will not preclude you from attending and voting at the Meetings and you may revoke your proxy at any time prior to the start of the relevant Meeting:

| (a) | | by providing a written revocation to the Company’s share registry at the above address before the relevant Meeting; or |

| |

| (b) | | by properly executing and delivering a later dated proxy; or |

| |

| (c) | | by attending the relevant Meeting, requesting a return of the proxy before the start of the Meeting and voting in person at that Meeting. |

HEARTWARE LIMITEDINFORMATION MEMORANDUM 7

VOTING BY ATTORNEY

If you wish your attorney to attend and vote at the Meetings on your behalf, the original or a certified copy of the power of attorney authorising your attorney to attend and vote at the Meetings, and a declaration or statement by the attorney that he or she has not received any notice of revocation of appointment, must be lodged with the Company’s share registry by the closing time for receipt of proxies for the Meetings (i.e. 48 hours prior to the Meetings on 22 October 2008).

You may lodge the power of attorney (and any supporting documents) by delivering, posting or faxing them to the Company’s share registry at:

Computershare Investor Services Pty Limited

Delivery address: Level 3, 60 Carrington Street, Sydney NSW Australia 2000

Postal address: GPO Box 2975, Victoria, Australia 3001

Facsimile number: + 61 3 9473 2500

VOTING BY CORPORATE REPRESENTATIVE

A body corporate may attend and vote at the Meetings by corporate representative. The appointment of the corporate representative must comply with the requirements of section 250D of the Corporations Act and an instrument purporting to appoint a corporate representative, including any authority under which the appointment is signed, must be lodged with the Company’s share registry by the closing time for receipt of proxies for the Meetings (i.e. 48 hours prior to the Meetings on 22 October 2008). A form of the certificate used to appoint a corporate representative can be obtained from the Company’s share registry.

QUESTIONS

Further information concerning the resolutions and the voting procedures for the Meetings is set out in the Notices of Meeting in Appendices 16–19 to this Information Memorandum.

If you have any further questions about the Meetings or about the Proposed Transaction, please call the enquiry line on 1800 707 861 (Australia toll free) or +61 2 8256 3387 (international).

8 HEARTWARE LIMITEDINFORMATION MEMORANDUM

Important notices

DEFINED TERMS AND INTERPRETATION

Capitalised terms used in this Information Memorandum are defined in the Glossary set out in section 12 of this Information Memorandum. The Glossary also sets out certain rules of interpretation which apply to this Information Memorandum.

PURPOSE OF INFORMATION MEMORANDUM

This Information Memorandum contains the explanatory statement required under Part 5.1 of the Corporations Act in relation to the Schemes. The purpose of this Information Memorandum is to explain the terms of the Schemes and the manner in which they will be implemented (if approved) and to provide information material to the decision of Shareholders and Incentive Holders whether to approve the Schemes.

This Information Memorandum is also an information memorandum for the listing of HeartWare International on ASX and for the CDIs to be granted official quotation on the financial market operated by ASX.

This Information Memorandum also contains the explanatory statement in relation to the EGM.

Under US law, this Information Memorandum is also a solicitation by the Board, the cost of which will be borne by the Company. The Company’s directors, officers and employees may also solicit proxies personally, by telephone, facsimile or other electronic means of communication. The Company’s directors, officers and employees will not receive any additional or special compensation for their solicitation services.

This Information Memorandum complies with Australian and US disclosure requirements and Australian and US accounting standards. These requirements and standards may be different from those in other countries.

READ THIS DOCUMENT

This document is important. You should read this document in its entirety before you decide whether to vote in favour of the resolutions to be considered at the Meetings. If you are in any doubt as to what you should do, you should consult your legal, financial or other professional adviser.

INVESTMENT DECISIONS

This Information Memorandum does not take into account your individual investment objectives, financial situation or needs. The information in this document should not be relied upon as the sole basis for any investment decision in relation to your Shares, Options or Performance Rights.

You should seek independent legal, financial and tax advice before making any investment decision in relation to your Shares, Options or Performance Rights.

RESPONSIBILITY STATEMENT

The information contained in this Information Memorandum has been prepared by the Company and HeartWare International and is the responsibility of the Company and HeartWare International other than:

| • | | the Independent Expert’s Report in relation to the Proposed Transaction (contained in Appendix 2 to this Information Memorandum), which has been prepared by BDO Kendalls, who take responsibility for that Appendix; |

| |

| • | | the information in sections 10.1 and 10.2 of this Information Memorandum with respect to Australian tax consequences of the Proposed Transaction, which has been prepared by PWC Australia and PWC Australia takes responsibility for those sections. |

| |

| • | | the information in Appendix 11 of this Information Memorandum with respect to the summary of US federal income tax consequences of the HeartWare International 2008 Stock Incentive Plan, which has been prepared by DLA Piper LLP who take responsibility for that summary; and |

| |

| • | | the information in sections 1.2.5, 2 (Question 22), 4.5 and 10.3 of this Information Memorandum, which has been prepared by the Company and reviewed by PwC Australia in the case of the Australian tax consequences or PwC LLP in the case of the US tax consequences of the Proposed Transaction as indicated in section 10 of this Information Memorandum, and each such PwC partnership takes responsibility for the relevant section that such firm reviewed. |

HEARTWARE LIMITEDINFORMATION MEMORANDUM 9

| | | The information contained in this Information Memorandum for which PwC is responsible does not constitute “financial product advice” within the meaning of the Corporations Act. The PwC partnerships which are providing this advice are not licensed to provide financial product advice under the Corporations Act. To the extent that this Information Memorandum contains any information about a “financial product” within the meaning of the Corporations Act, taxation is only one of the matters that must be considered when making a decision about the relevant financial product. The material for which PwC is responsible, has been prepared for general circulation and does not take into account the objectives, financial situation or needs of any recipient. Accordingly, you should, before acting on the material for which PwC is responsible, consider taking advice from a person who is licensed to provide financial product advice under the Corporations Act. In addition, before acting on the material for which PwC is responsible, you should also consider the appropriateness of this material having regard to your objectives, financial situation and needs and consider obtaining independent financial advice. |

Neither the Company, HeartWare International nor any of their respective directors, officers or advisers (other than as referred to above) assumes any responsibility for the accuracy or completeness of any of the information in the Appendicies and sections referred to above.

ROLE OF ASIC AND ASX

A copy of this Information Memorandum has been given to ASIC pursuant to section 411(2) of the Corporations Act and registered with ASIC pursuant to section 412(6) of the Corporations Act. ASIC has been requested to provide a statement, in accordance with section 411(17)(b) of the Corporations Act, that it has no objection to the Schemes. If ASIC provides the statement, then it will be produced to the Court at the time of the Second Court Hearing. Neither ASIC nor any of its officers takes any responsibility for the contents of this Information Memorandum.

A copy of this Information Memorandum has been lodged with ASX. Neither ASX nor any of its officers takes any responsibility for the contents of this Information Memorandum.

ROLE OF THE COURT

A copy of this Information Memorandum has been lodged with the Court to obtain an order of the Court approving the convening of the Scheme Meetings. Orders made by the Court pursuant to section 411(1) of the Corporations Act convening the Scheme Meetings to approve the Schemes do not constitute an endorsement by the Court of, or any expression of opinion on, the Schemes.

If Shareholders and Incentive Holders approve the Schemes at the required meetings, the Court will be asked to approve the Schemes. The Federal Court Rules provide a procedure for Shareholders and Incentive Holders to oppose the approval by the Court of the Share Scheme, Option Scheme and Performance Rights Scheme, respectively. If you wish to oppose the approval of the Schemes by the Court at the Second Court Hearing, you may do so by filing with the Court, and serving on the Company, a notice of appearance in the prescribed form, together with any affidavit on which you wish to rely at the hearing. The notice of appearance and affidavit must be served on the Company at least one day before the Second Court Date. The Second Court Date is currently expected to be 30 October 2008. Any change to this date will be announced through ASX, the SEC and notified on the Company’s website.

NOTICE TO SHAREHOLDERS RESIDENT IN NEW ZEALAND

The Information Memorandum is being distributed in New Zealand under the Securities Act (Overseas Companies) Exemption Notice 2002 as amended, re-enacted and/or replaced.

NOTICE TO SHAREHOLDERS, OPTIONHOLDERS AND PERFORMANCE RIGHTS HOLDERS RESIDENT IN THE US

The HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units which will be issued pursuant to the Schemes and the HeartWare International Standalone Options have not been, and will not be, registered under the US Securities Act or the securities laws of any state in the United States. The HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units issued pursuant to the Schemes will be issued in reliance on the exemption from the US Securities Act registration requirements provided in Section 3(a)(10) of the US Securities Act based on the Court’s approval of the Schemes, and will not be “restricted securities” within the meaning of the US Securities Act, except for those HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units held by Affiliates of HeartWare International at the time of issue. However, HeartWare International Options and HeartWare International Restricted Stock Units will not be transferable by their terms (except in limited circumstances).

10 HEARTWARE LIMITEDINFORMATION MEMORANDUM

HeartWare International will register the HeartWare International Shares to be issued pursuant to exercise of options and restricted stock units issued under the HeartWare International Employee Stock Option Plan and HeartWare International Restricted Stock Unit Plan respectively and on registration HeartWare International Shares issued pursuant to such plans, except for the HeartWare International Shares issued to Affiliates of HeartWare International, will be freely transferable, subject to US federal securities law and the HeartWare International stock trading policy.

Affiliates of HeartWare International can only sell HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units issued to them under the Schemes subject to certain restrictions on resale in a public market including:

| • | | the Company and HeartWare International as its successor having complied with their US reporting obligations; |

| |

| • | | the volume of securities that can be sold in any three month period is limited to an amount equal to the greater of 1% of HeartWare International’s Shares on issue and 1% of the average weekly trading volume of HeartWare International’s Shares (measured over the previous four weeks); and |

| |

| • | | sales must be conducted by way of unsolicited broker’s transactions and a Form 144 filed with the SEC. |

Such limitations on the ability of an Affiliate to sell HeartWare International securities will cease three months after the person ceases to be an Affiliate. Persons who are Affiliates solely because they are directors or officers of HeartWare International may also sell shares under Regulation 904 of Regulation S so long as that exemption is available to them, which will generally be the case so long as the HeartWare International Shares are listed solely on the ASX.

The HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units issued pursuant to the Schemes have neither been approved or disapproved by the SEC, or by any other securities regulatory authority of any state of the US or of any international jurisdiction. Neither the SEC nor any other securities regulatory authority has approved or disapproved the adequacy or accuracy of this Information Memorandum, and any representation to the contrary will be a criminal offence under applicable US law.

US investors should note that the Schemes will be conducted in accordance with the laws in force in Australia and the Listing Rules. As a result, it may be difficult for you to enforce your rights, including any claim you may have arising under US federal securities laws, as the Company is presently located in a foreign country and some of its officers and directors may be residents of a foreign country. As such, you may not be able to take legal action against the Company or its officers and directors in Australia for violations of US securities laws and it may be difficult to compel the Company and its officers and directors to subject themselves to a US court’s judgement.

NOTICE TO SHAREHOLDERS IN JURISDICTIONS OUTSIDE AUSTRALIA, NEW ZEALAND AND THE UNITED STATES

As an investigation of, and compliance with, the potential securities law restrictions in every country in which the Company has Shareholders would be prohibitively costly, Shareholders whose addresses are recorded in the Share Register as outside Australia, New Zealand and the United States will not receive HeartWare International Shares under the Share Scheme unless (without being obliged to conduct any investigations into the matter) the Company is satisfied that HeartWare International Shares can lawfully be issued to such persons pursuant to the Share Scheme.

Instead, CDIs which would otherwise have been issued to Ineligible Overseas Shareholders will be issued to a nominee appointed by HeartWare International, who will procure the nominee to sell those CDIs on ASX at such price and on such terms as the nominee determines. The nominee will then distribute to those Ineligible Overseas Shareholders the net proceeds received (calculated on an averaged basis so that all Ineligible Overseas Shareholders receive the same price per CDI, subject to rounding to the nearest whole cent) after deduction of any brokerage, taxes or other costs of sale (such amounts to be paid in A$).

FORWARD LOOKING STATEMENTS

Certain statements in this Information Memorandum are about the future and are forward looking in nature. Generally, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “could”, “would”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “projects”, “predicts”, “potential” and other similar expressions that are intended to identify forward-looking statements, which are generally not historical in nature.

You should be aware that there are a number of risks (both known and unknown), uncertainties, assumptions and other important factors, some of which are beyond the control of the Company and HeartWare International that could cause the actual conduct, results, performance or achievements of the Company or HeartWare International to be materially different from those expressed or implied by such statements or that could cause future conduct or results to be materially different from the historical conduct or results. Deviations as to future conduct, results, performance and achievements are both normal and to be expected.

HEARTWARE LIMITEDINFORMATION MEMORANDUM 11

The following are some examples of factors which could affect the results and performance of the Company:

| • | | the Schemes including whether or not they are implemented; |

| |

| • | | continued losses and lack of profitability; |

| |

| • | | inability to raise capital; |

| |

| • | | inability to obtain necessary funding; |

| |

| • | | unsuccessful results of the Company’s clinical trials and failure to obtain regulatory approvals; |

| |

| • | | failure to prove the safety and efficacy of the Company’s products; |

| |

| • | | failure to comply with quality standards applicable to the Company’s manufacturing and quality processes; |

| |

| • | | inability to gain market acceptance of the Company’s products or to otherwise penetrate or grow the market in which the Company operates (now or in the future); |

| |

| • | | failure to obtain or maintain an adequate level of reimbursement by third party payers; |

| |

| • | | limited manufacturing, sales, marketing and distribution experience; |

| |

| • | | reliance on specialised suppliers for certain components and materials; |

| |

| • | | inability to protect the Company’s intellectual property; |

| |

| • | | litigation and product liability; |

| |

| • | | inability to manage growth; |

| |

| • | | inability to attract and retain qualified personnel; |

| |

| • | | failure to achieve and maintain effective internal control over financial reporting; |

| |

| • | | fluctuations in foreign exchange rates; and |

| |

| • | | any other factors described by the Company in its filings with the SEC. |

Neither the Company, HeartWare International, their respective directors, officers and advisers, or any other person makes any representation, or gives any assurance or guarantee that the occurrence of the events expressed or implied in any forward looking statements in this Information Memorandum will occur. Investors are cautioned about relying on forward looking statements included in this Information Memorandum.

In particular, neither the Company, HeartWare International, their respective directors, officers or advisers is responsible for any forward looking statement in the Independent Expert’s Report or any forward looking statement contained in section 10 of this Information Memorandum.

The forward looking statements in this Information Memorandum reflect views held as at the date of this Information Memorandum, unless otherwise specified. Subject to the Corporations Act, the Listing Rules and any other applicable laws or regulations, including SEC rules, the Company and HeartWare International disclaim any duty to update these statements other than with respect to information that the Company and HeartWare International respectively become aware of prior to the:

| • | | Share Scheme Meeting, which is material to the making of a decision by a Shareholder regarding whether or not to vote in favour of the Share Scheme; |

| |

| • | | Option Scheme Meeting, which is material to the making of a decision by an Optionholder regarding whether or not to vote in favour of the Option Scheme; |

| |

| • | | Performance Rights Scheme Meeting, which is material to the making of a decision by a Performance Rights Holder regarding whether or not to vote in favour of the Performance Rights Scheme; or |

| |

| • | | EGM, which is material to the making of a decision by a Shareholder regarding whether or not to vote in favour of the Resolution. |

NO OFFER

This Information Memorandum does not constitute an offer to issue or sell to you, or an offer to buy from you, any securities in the Company or HeartWare International in any jurisdiction in which such an offer would be illegal.

12 HEARTWARE LIMITEDINFORMATION MEMORANDUM

PRIVACY AND PERSONAL INFORMATION

The Company will need to collect personal information to implement the Schemes. The personal information may include the names, contact details and details of the holdings of Shareholders and Incentive Holders and their proxies, body corporate representatives or attorneys at the Meetings. The collection of some of this information is required or authorised by the Corporations Act.

Shareholders and Incentive Holders who are individuals, and other individuals in respect of whom personal information is collected, have certain rights to access the personal information collected about them and may contact the Company by email on scheme@heartwareinc.com if they wish to exercise those rights.

This personal information may be disclosed to print and mail service providers, and to the Company’s advisers to the extent necessary to effect the Schemes and convene the EGM.

If the information outlined above is not collected, the Company may be hindered in, or prevented from, conducting the Meetings or implementing the Schemes effectively or at all.

Shareholders and Incentive Holders who appoint an individual as their proxy, corporate representative or attorney to vote at the EGM or Scheme Meetings should inform that individual of the matters outlined above.

You should also note that all persons are entitled, under section 173 of the Corporations Act, to inspect and copy the Share Register, Option Register and Performance Rights Register. These Registers contain personal information about the Company’s Shareholders, Optionholders and Performance Rights Holders.

If you have any questions in relation to the Meetings or the Schemes, please contact your legal, financial or other professional adviser.

HEARTWARE LIMITEDINFORMATION MEMORANDUM 13

| 1 | | Summary of the Proposed Transaction |

This summary highlights selected information that is described in greater detail elsewhere in this Information Memorandum. This summary does not contain all of the important information contained in this Information Memorandum. Shareholders and Incentive Holders should carefully read this entire Information Memorandum and other documents referred to or accompanying this Information Memorandum for a greater understanding of the Proposed Transaction.

| 1.1 | | THE PROPOSED TRANSACTION |

| |

| 1.1.1 | | Overview |

This Information Memorandum outlines the Proposed Transaction, as a result of which the HeartWare Group will redomicile in the United States, whilst maintaining a listing on ASX. The Proposed Transaction will be implemented by the establishment of a new corporate structure under which HeartWare International (a new company incorporated in the US) will become the ultimate parent company of the HeartWare Group.

The Proposed Transaction will take place under Australian law and will be implemented by way of three separate schemes of arrangement in relation to the Shares, Options and Performance Rights. The terms of the Schemes are set out in full at Appendices 3, 4 and 5.

| 1.1.2 | | Effect of the Proposed Transaction |

As a result of the Proposed Transaction:

| | • | | all of the existing Shares will be transferred to HeartWare International with the result that the Company will become a wholly-owned subsidiary of HeartWare International; |

| |

| | • | | in consideration for Shareholders transferring their Shares to HeartWare International, those Shareholders will be issued HeartWare International Shares. Unless a Shareholder elects otherwise, they will receive their HeartWare International Shares in the form of CDIs, which can be traded on ASX. Subject to rounding, a CDI will be equivalent to one Share. Shareholders whose addresses are recorded as outside Australia, New Zealand or the United States will not receive HeartWare International Shares, but will instead be entitled to the net proceeds of the sale of HeartWare International Shares (in the form of CDIs) to which they would have otherwise been entitled; |

| |

| | • | | those Shareholders who do not elect to receive CDIs will receive one HeartWare International Share for every 35 Shares they hold. The effect of this will be that HeartWare International Shares will be priced above the required and recommended price necessary to facilitate a listing on NASDAQ should the HeartWare Group determine to pursue such a listing; |

| |

| | • | | all existing Options and Performance Rights will be cancelled in exchange for the issue of new options and restricted stock units in HeartWare International to Optionholders and Performance Rights Holders; |

| |

| | • | | the existing Standalone Options will be cancelled in exchange for equivalent securities or rights in HeartWare International; |

| |

| | • | | HeartWare International will seek a listing and quotation of the CDIs on ASX thereby “replacing” the Company as the ASX listed entity in the HeartWare Group; and |

| |

| | • | | the Company will eventually be converted into a proprietary company and will remain largely inactive. |

| 1.1.3 | | Potential Advantages |

The potential advantages of the Proposed Transaction are set out in section 4.2 of this Information Memorandum. The Directors believe that the implementation of the Proposed Transaction will better position the Company to achieve its strategic goals, as it is expected to:

| | • | | allow the HeartWare Group to align its corporate structure with its operating structure including manufacturing, development, research and clinical efforts which are all undertaken in the US; |

| |

| | • | | enhance HeartWare International’s ability to effectively manage and grow its business in key markets; |

| |

| | • | | enhance HeartWare International’s ability to pursue growth and diversification opportunities in accordance with its strategic plans; |

| |

| | • | | enable HeartWare International to continue to be an Australian-listed publicly owned company as it grows internationally; |

| |

| | • | | facilitate further US-based demand for HeartWare International’s securities. The Directors believe that in excess of 65% of the Company’s Shares are already held by Shareholders who are resident in the US; |

14 HEARTWARE LIMITEDINFORMATION MEMORANDUM

| | • | | remove the FORUS restriction on the Company’s Shares allowing HeartWare International unfettered access to US investors, which the Directors believe should ultimately result in increased demand for HeartWare International securities; |

| |

| | • | | allow for the adoption of a US corporate structure for the HeartWare Group which will be more digestible and understandable for both US investors and US employees and enhance HeartWare International’s ability to attract and retain employees, especially key management with industry specific knowledge and experience who can enhance the development and commercialisation of the Company’s products; |

| |

| | • | | provide easier access to capital as certain US investors who were previously prevented from investing in the Company due to the Company being a non-US based company will now be able to invest in HeartWare International; |

| |

| | • | | reduce compliance costs of the HeartWare Group by eliminating the need to prepare Australian financial statements under Australian equivalents to International Financial Reporting Standards (IFRS) in addition to US GAAP financial statements thereby also eliminating the need to have Australian financial statements audited under Australian auditing standards; and |

| |

| | • | | reduce the resources used and time spent by management of the Company in reconciling and managing the differences between US and Australian law, particularly those differences associated with securities law. |

| 1.1.4 | | Potential disadvantages and risks |

Before voting on the Schemes, the Directors advise you to consider the potential disadvantages and risks relating to the Proposed Transaction which are set out more fully in section 4 of this Information Memorandum. The potential disadvantages and risks of the Proposed Transaction may include:

| | • | | the effect of different legal regimes (please see Appendix 14 for a comparison of the Australian and US legal regimes); |

| |

| | • | | potential exposure of the HeartWare Group to a higher tax burden in the US (please see section 10.3 of this Information Memorandum for further details); |

| |

| | • | | exposure to US estate taxes in certain circumstances; |

| |

| | • | | potential loss of demand for HeartWare International’s Shares in the Australian market; |

| |

| | • | | exposure to the more litigious environment of the US; and |

| |

| | • | | loss of future dividend franking credit benefits should the Company make a dividend payment in the future (although the Company does not presently make dividend payments nor does it currently contemplate making dividend payments in the foreseeable future). |

| 1.2 | | WHAT WILL SHAREHOLDERS AND INCENTIVE HOLDERS RECEIVE UNDER THE SCHEMES? |

As a result of the Proposed Transaction, Shareholders, Optionholders and Performance Rights Holders will receive HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units respectively.

| 1.2.1 | | Share Scheme Consideration |

Under the Share Scheme, Scheme Shareholders will receive an equivalent interest in HeartWare International which can be taken in the form of CDIs or HeartWare International Shares.

Unless a Scheme Shareholder elects otherwise, the HeartWare International Shares will be issued in the form of CDIs to enable Shareholders to trade them on ASX. Each CDI will be equivalent to an interest in one thirty-fifth of a HeartWare International Share and accordingly Shareholders will essentially receive one CDI for each Share held by them on the Scheme Record Date. If you make an election to receive HeartWare International Shares you will receive:

One HeartWare International Share for every 35 Shares held.

Fractional entitlements to Share Scheme Consideration will be rounded down to the nearest whole number of HeartWare International Shares (if a Shareholder has elected to receive HeartWare International Shares) or nearest multiple of 35 CDIs, after aggregating all holdings of the relevant Shareholder.

Ineligible Overseas Shareholders will not receive HeartWare International Shares, but will instead be entitled to the net proceeds that result from the sale of HeartWare International Shares (in the form of CDIs) to which they would have otherwise been entitled.

HEARTWARE LIMITEDINFORMATION MEMORANDUM 15

HeartWare International intends to seek a listing for HeartWare International Shares on NASDAQ before the end of 2009, subject to HeartWare International’s performance and achievement of milestones such as regulatory approvals, market conditions and the satisfaction of relevant legal requirements. However, there is no guarantee as to when this will occur or that it will occur at all. Accordingly, you should be aware that in the meantime following implementation of the Schemes, the only market for trading HeartWare International Shares will be ASX, where they will only trade in the form of CDIs.

If HeartWare International is approved for listing on NASDAQ in the future, Shareholders holding CDIs will be able to convert their CDIs into HeartWare International Shares so that they will be able to trade HeartWare International Shares on NASDAQ.

| 1.2.2 | | Option Scheme Consideration |

Under the Option Scheme, Scheme Optionholders will receive:

One HeartWare International Option for every 35 Options held.

Each HeartWare International Option will be issued under the HeartWare International Employee Stock Option Plan and will be on essentially the same terms as the current Options including having an exercise period equal to the unexpired exercise period of, and a vesting schedule identical to, the Option it replaces. However, the exercise price per HeartWare International Option will be equal to 35 times the exercise price of the Options that the HeartWare International Options replace, to reflect the effective consolidation of Shares under the Share Scheme. The exercise price will remain in Australian dollars.

Fractional entitlements to Option Scheme Consideration will be rounded down to the nearest whole number of HeartWare International Options after aggregating all holdings of the relevant Optionholder.

| 1.2.3 | | Performance Rights Scheme Consideration |

Under the Performance Rights Scheme, Scheme Performance Rights Holders will receive:

One HeartWare International Restricted Stock Unit for every 35 Performance Rights held.

Each HeartWare International Restricted Stock Unit will be issued on the terms set out in the HeartWare International Restricted Stock Unit Plan and will be on essentially the same terms as the existing Performance Rights, including having equivalent vesting conditions to the Performance Rights that the HeartWare International Restricted Stock Units replace.

Fractional entitlements to Performance Rights Scheme Consideration will be rounded down to the nearest whole number of HeartWare International Restricted Stock Units after aggregating all holdings of the relevant Performance Rights Holder.

| 1.2.4 | | Treatment of Fractional Entitlements to Scheme Consideration |

Under US taxation law, fractional entitlements to Option Scheme Consideration held by US taxpayers are not able to be rounded up to the nearest whole number of HeartWare International Options.

As a result, and to ensure all Shareholders and Incentive Holders receive equal treatment under the Schemes, all fractional entitlements to Scheme Consideration will be rounded down. An example of how this will affect holdings of Shareholders and Incentive Holders is set out in section 3.6.

Australian Tax Consequences

The Company has been advised that the exchange of Shares, Options and Performance Rights for HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units (as relevant) under the Schemes will not cause any Australian tax to be paid by Shareholders and Incentive Holders that are eligible for capital gains tax or Division 13A employee share/option scheme tax rollover.

In addition to the tax advice from PwC Australia set out in section 10 of this Information Memorandum, class ruling applications have been lodged with the ATO seeking confirmation that the conditions for capital gains scrip for scrip rollover relief and Division 13A employee share/option scheme rollover relief are satisfied and that rollover relief is available in relation to the transfer of Shares to HeartWare International under the Share Scheme, the cancellation of Options under the Option Scheme and the cancellation of Performance Rights under the Performance Rights Scheme. Shareholders and Incentive Holders will be advised of the outcome of the ruling process once the final rulings have been issued. There is, however, no guarantee that the ATO will provide their rulings prior to the Scheme Meetings and receipt of the final ruling is not a condition to the implementation of the Schemes.

16 HEARTWARE LIMITEDINFORMATION MEMORANDUM

US Tax consequences

Shareholders and Incentive Holders should be aware that as a result of the implementation of the Proposed Transaction US estate taxes may be payable in certain circumstances.

Subject to the limitations and qualifications set forth in section 10 of this Information Memorandum, the Company has also been advised that:

| | • | | the exchange of Shares for HeartWare International Shares should not cause any US federal income tax to be paid by Shareholders who are otherwise not subject to US federal income tax; |

| |

| | • | | for Shareholders otherwise subject to US federal income tax (and except for Ineligible Overseas Shareholders), the exchange of Shares for HeartWare International Shares should not cause any US federal income tax to be paid by such Shareholders if certain US federal income tax filings are made by Shareholders in connection with the Share Scheme (further details of these filings are set out in section 10 of this Information Memorandum); |

| |

| | • | | the exchange of Options, Standalone Options and Performance Rights for HeartWare International Options, HeartWare International Standalone Options or HeartWare International Restricted Stock Units, respectively, should not cause any US federal income tax to be paid by Optionholders, Standalone Optionholders and Performance Rights Holders who are otherwise not subject to US federal income tax; and |

| |

| | • | | for Optionholders, Standalone Optionholders and Performance Rights Holders who are subject to US federal income tax, it is more likely than not that the exchange of Options, Standalone Options and Performance Rights for HeartWare International Options, HeartWare International Standalone Options and HeartWare International Restricted Stock Units (as relevant) under the Proposed Transaction will not cause any US federal income tax to be paid by such Optionholders, Standalone Optionholders and Performance Rights Holders. |

Further information on the tax implications for Shareholders and Incentive Holders under the Proposed Transaction is set out in section 10 of this Information Memorandum.

However, this Information Memorandum only provides general information and, accordingly, you should consult with your own tax adviser regarding the consequences of acquiring, holding or disposing of Shares, Options, Standalone Options, Performance Rights, HeartWare International Shares, HeartWare International Options, HeartWare International Standalone Options or HeartWare International Restricted Stock Units in light of current tax laws and your particular investment circumstances.

| 1.3 | | STRUCTURE OF THE HEARTWARE GROUP IF THE SCHEMES BECOME EFFECTIVE |

| |

| | | As a result of the Proposed Transaction, the Company will become a wholly owned subsidiary of HeartWare International and will be delisted from ASX. HeartWare International will apply for admission and for quotation of the CDIs on ASX and will, subject to obtaining the necessary approvals, replace the Company as the ASX listed entity in the HeartWare Group. |

| |

| | | The board of HeartWare International immediately after the Proposed Transaction will be the same as the current Board. Further information about these directors can be found in sections 5 and 6 of this Information Memorandum. |

| |

| | | Once the Schemes become Effective, Shareholders and Incentive Holders will hold HeartWare International Shares or CDIs, HeartWare International Options and HeartWare International Restricted Stock Units respectively with each being bound by the Scheme to which they are a party (including Shareholders, Optionholders and Performance Rights Holders who did not vote or voted against the Schemes). |

| |

| 1.4 | | INDEPENDENT EXPERT’S OPINION |

| |

| | | The Company has appointed an independent expert, BDO Kendalls, to comment on the Proposed Transaction. The Independent Expert has concluded that the Proposed Transaction and the Schemes are in the best interests of the Shareholders (excluding Ineligible Overseas Shareholders), Optionholders and Performance Rights Holders. The Independent Expert has not provided an opinion with respect to the impact of the Proposed Transaction on Ineligible Overseas Shareholders. |

| |

| | | A copy of the Independent Expert’s Report is set out in Appendix 2 to this Information Memorandum. |

| |

| | | The Company has not retained BDO Kendalls to consider redomiciliation of the HeartWare Group in any jurisdiction other than Delaware, as the Company believes (having consulted with its advisers) Delaware to be a widely accepted and appropriate jurisdiction of incorporation for a company based in the US and which may seek a listing on NASDAQ. As such, the Independent Expert has not sought to analyse why the HeartWare Group has chosen to redomicile to Delaware as opposed to another jurisdiction in the US or elsewhere. |

HEARTWARE LIMITEDINFORMATION MEMORANDUM 17

| 1.5 | | RESOLUTION |

| |

| | | In conjunction with the Schemes, an EGM will be held at which an ordinary resolution will be proposed to approve the new 2008 Stock Incentive Plan for HeartWare International for use following implementation of the Proposed Transaction. |

| |

| 1.6 | | DIRECTORS’ RECOMMENDATION |

| |

| | | The directors of the Company and HeartWare International believe that the Proposed Transaction is in the best interests of the HeartWare Group and that the Schemes are in the best interests of Shareholders, Optionholders and Performance Rights Holders respectively. |

| |

| | | The directors of the Company and HeartWare International believe that the approval of the 2008 Stock Incentive Plan is in the best interests of HeartWare International and Shareholders. |

| |

| | | The Directors unanimously recommend that: |

| | • | | Shareholders vote in favour of the Share Scheme at the Share Scheme Meeting; |

| |

| | • | | Optionholders vote in favour of the Option Scheme at the Option Scheme Meeting; |

| | • | | Performance Rights Holders vote in favour of the Performance Rights Scheme at the Performance Rights Scheme Meeting; and |

| |

| | • | | Shareholders vote in favour of the Resolution at the EGM. |

All Directors who hold or control the right to vote Shares, Options or Performance Rights intend to vote all such Shares, Options and Performance Rights in favour of the Schemes and the Resolution.

| 1.7 | | OTHER INFORMATION |

| |

| | | This overview does not contain all of the information which is material to a Shareholder or Incentive Holder to assess how to vote. You are urged to read this Information Memorandum in its entirety and, if in any doubt, seek advice from your legal, financial or other professional adviser. |

18 HEARTWARE LIMITEDINFORMATION MEMORANDUM

| 2 | | Frequently asked questions |

This section sets out frequently asked questions that Shareholders and Incentive Holders may have in relation to the Proposed Transaction. The answers to these questions should be read in conjunction with this entire Information Memorandum and, if you are in any doubt, you should seek advice from your legal, financial or other professional adviser.

| | | | | | | |

| | | | | Relevant |

| | | | | Section of |

| | | | | Information |

| Question | | Answer | | Memorandum |

THE PROPOSED TRANSACTION | | | |

| | | | | | | |

1 Why have I received this Information Memorandum? | | This Information Memorandum has been sent to you because you are a Shareholder, Optionholder or Performance Rights Holder. The Information Memorandum contains information relevant to your consideration of the Proposed Transaction. Its purpose is to assist you in making a decision as to whether or not to approve the Schemes and the Resolution being proposed. | | | 3 | |

| | | | | | | |

2 What is the Proposed Transaction? | | The Proposed Transaction is a transaction to redomicile the HeartWare Group in the US. | | 1 and 3 |

| | | | | | | |

3 How will the Proposed Transaction be implemented? | | The Proposed Transaction will be implemented by:

• a new US company, HeartWare International, acquiring all of the existing Shares from Shareholders in exchange for the issue of new HeartWare International Shares or CDIs to Shareholders under the Share Scheme; | | 3 and 9 |

| | | | | | | |

| | | • all of the existing Options being cancelled in exchange for HeartWare International issuing HeartWare International Options to Optionholders under the Option Scheme; | | | | |

| | | | | | | |

| | | • all of the existing Performance Rights being cancelled in exchange for HeartWare International issuing HeartWare International Restricted Stock Units to Performance Rights Holders under the Performance Rights Scheme; and | | | | |

| | | | | | | |

| | | • all of the existing Standalone Options being cancelled in exchange for HeartWare International issuing HeartWare International Standalone Options. | | | | |

| | | | | | | |

| | | The Option Scheme and Performance Rights Scheme are conditional on the Share Scheme becoming Effective. | | | | |

| |

4 What is the effect of approving the Schemes? | | If the Schemes are approved, the Proposed Transaction will be implemented and the HeartWare Group will redomicile in the US with HeartWare International becoming the ultimate parent company of the HeartWare Group. Shareholders and Incentive Holders (other than Ineligible Overseas Shareholders) will receive new HeartWare International Shares or CDIs, HeartWare International Options and HeartWare International Restricted Stock Units respectively and HeartWare International will become the listed entity on ASX. | | | 4 | |

| | | | | | | |

5 Is The Proposed Transaction subject to any conditions? | | The Proposed Transaction is subject to Shareholder, Optionholder, Performance Rights Holder and Court approvals, as well as a number of regulatory and other approvals, including with respect to the listing of HeartWare International on ASX. | | | 9 | |

| | | | | | | |

6 Who is HeartWare International? | | HeartWare International is a newly incorporated Delaware company which is presently a subsidiary of the Company and which, if the Share Scheme becomes Effective, will become the ultimate parent company of the HeartWare Group. Subject to the Share Scheme becoming Effective and ASX approval, HeartWare International will become listed on ASX. | | | 6 | |

HEARTWARE LIMITEDINFORMATION MEMORANDUM 19

| | | | | | | |

| | | | | Relevant |

| | | | | Section of |

| | | | | Information |

| Question | | Answer | | Memorandum |

7 Who will be the directors of HeartWare International following implementation of the Share Scheme. | | Upon the Share Scheme becoming Effective, all members of the Board will be appointed to the board of HeartWare International. | | | 6 | |

| | | | | | | |

8 Why is HeartWare International incorporated in Delaware? | | Over 50% of all US publicly listed companies are incorporated in the State of Delaware. Delaware is usually chosen because of its well developed corporations laws. | | | 6 | |

| | | | | | | |

9 Will there be changes to the operations or strategy of the HeartWare Group as a result of the Proposed Transaction? | | Following the Proposed Transaction, the HeartWare Group will continue to have the same assets and liabilities. The Directors expect very few changes to the HeartWare Group’s operations as a result of the Proposed Transaction. It is the intention of the Directors that the business of the HeartWare Group will largely remain the same as before the Proposed Transaction and the HeartWare Group does not intend to change its strategy as a result of the Proposed Transaction. | | | 5 | |

| | | | | | | |

| | | Following implementation of the Proposed Transaction, the Directors will convert the present Company to a proprietary company limited by shares. In addition, the Directors may also consider an internal restructure of the HeartWare Group as discussed in section 6.9. | | | | |

| | | | | | | |

10 Where will HeartWare International’s annual meetings be held in the future? | | HeartWare International intends to alternate the venue for holding its annual meetings between Sydney and the US. | | — |

| | | | | | | |

SCHEME CONSIDERATION | | | | | | |

| | | | | | | |

11 What will I receive if the Share Scheme becomes Effective? | | Unless you elect otherwise, if you hold Shares in the Company and the Share Scheme becomes Effective, you will receive your HeartWare International Shares in the form of CDIs to allow you to trade them on ASX. Subject to rounding, a CDI will be equivalent to one Share. If you make an election to receive HeartWare International Shares you will receive one HeartWare International Share in exchange for every 35 Shares you hold as at the Scheme Record Date (subject to rounding of fractional entitlements). | | 3 and 9 |

| | | | | | | |

12 What will I receive if the Option Scheme becomes Effective? | | If you hold Options and the Option Scheme becomes Effective, you will receive one HeartWare International Option in exchange for every 35 Options you hold as at the Scheme Record Date (subject to rounding of fractional entitlements). | | 3 and 9 |

| | | | | | | |

13 What will I receive if the Performance Rights Scheme becomes Effective? | | If you hold Performance Rights and the Performance Rights Scheme becomes Effective you will receive one HeartWare International Restricted Stock Unit in exchange for every 35 Performance Rights you hold as at the Scheme Record Date (subject to rounding of fractional entitlements). | | 3 and 9 |

| | | | | | | |

14 When will I receive HeartWare International Shares, HeartWare International Options or HeartWare International Restricted Stock Units if the Schemes become Effective? | | If the Schemes become Effective, it is expected that implementation of the Proposed Transaction will take place approximately 15 days after the Scheme Meetings. The HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units will be issued on the Implementation Date and holding statements and transmittal letters will be mailed shortly thereafter. | | | 9 | |

20 HEARTWARE LIMITEDINFORMATION MEMORANDUM

| | | | | | | |

| | | | | Relevant |

| | | | | Section of |

| | | | | Information |

| Question | | Answer | | Memorandum |

15 Can I trade HeartWare International Shares, HeartWare International Options and HeartWare International Restricted Stock Units on ASX? | | Subject to ASX approval, after the Share Scheme becomes Effective, HeartWare International will be listed and HeartWare International Shares will be able to be traded on ASX in the form of CDIs. As is the case with the current Options and Performance Rights, HeartWare International Options and HeartWare International Restricted Stock Units will not be quoted and will not be able to be traded on ASX. | | | 9 | |

| | | | | | | |

| | Unless and until HeartWare International Shares are listed for trading on NASDAQ or another exchange, there will be no US public market for HeartWare International Shares. HeartWare International intends to seek a NASDAQ listing before the end of 2009, subject to HeartWare International’s performance and achievement of milestones such as regulatory approvals, market conditions and the satisfaction of relevant legal requirements. However, there can be no assurance that a listing on NASDAQ or other exchange will be sought or achieved by HeartWare International in any particular time frame or at all. | | | | |

| | | | | | | |

16 Are there differences between my Shares and the HeartWare International Shares I will receive under the Share Scheme? | | Yes. While the rights attaching to HeartWare International Shares are based on the rights of the existing Shares, there are certain important differences. In addition, there are a number of significant differences between US/Delaware law and Australian law. A summary of these differences is set out in Appendix 14 to this Information Memorandum. | | 6

Appendix 14 |

| | | | | | | |

| | The electronic transfer system used on ASX, known as CHESS, cannot be used directly for the transfer of securities of foreign companies. To enable companies such as HeartWare International to have their securities cleared and settled electronically through CHESS, depositary instruments called CHESS Depositary Interests (CDIs) are issued. | | Appendix 13 |

| | | | | | | |

| | | CDIs confer beneficial interests in securities traded on ASX. CDI holders receive all of the economic benefits of actual ownership of the underlying shares. | | | | |

| | | | | | | |

| | | Each CDI will represent an interest in one thirty-fifth of an underlying HeartWare International Share. As one HeartWare International Share will be issued for every 35 Shares, it is expected that CDIs will begin to trade on ASX at or near the trading price of the Shares prior to implementation of the Proposed Transaction. | | | | |

| | | | | | | |

| | | A more detailed description of CDIs is set out in Appendix 13 to this Information Memorandum. | | | | |

| | | | | | | |

18 Will my HeartWare International Options be granted under the same plans and on the same terms as my existing Options? | | The HeartWare International Options will have largely the same terms as your current Options. The HeartWare International Options will be granted under the new HeartWare International Employee Stock Option Plan. A copy of the HeartWare International Employee Stock Option Plan is set out in Appendix 9 to this Information Memorandum. | | Appendix 9 |

| | | | | | | |

19 How will my Standalone Options be treated as a result of the Proposed Transaction? | | In accordance with the terms of the Implementation Agreement, the Company has agreed with each Standalone Optionholder to cancel the Standalone Options held by such holder upon the Share Scheme becoming Effective. In consideration for that cancellation, HeartWare International will grant to each Standalone Optionholder HeartWare International Standalone Options. | | | 9 | |

HEARTWARE LIMITEDINFORMATION MEMORANDUM 21

| | | | | | | |

| | | | | Relevant |

| | | | | Section of |

| | | | | Information |

| Question | | Answer | | Memorandum |