Exhibit 99.1

HEARTWARE LIMITED

ABN 34 111 970 257

Level 57, MLC Centre

19-29 Martin Place

Sydney NSW 2000

Ph: (+61) 2 9238 2064

Fax: (+61) 2) 9238 2063

www.heartware.com.au

31 July 2008

Dear Shareholder

HeartWare today released its cash flow statement for the quarter ended 30 June 2008 and expects to release its Interim Financial Report during mid-August 2008.

During the quarter, the Company’s expenditure peaked at approximately $2.5M per month. This is linked to a number of important non-recurring costs incurred in recent months as well as a heightened level of activity in support of various milestones. These include relocation and validation costs in relation to the Company’s recent facility move, professional fees and costs associated with the Company’s intended redomiciliation from Australia to the United States and costs incurred in preparation for the commencement of our US clinical trial as well as increased preparatory work in support of our forthcoming CE Mark submission. It is expected that our net monthly burn will begin to ease as we progress through these milestones and begin to generate revenues through reimbursement for devices implanted in our US clinical trial.

The following provides a summary of key recent activities and an update on our clinical, regulatory and operational status.

Capital Raising

On 23 May 2008 we announced that we had received commitments of over $30M in a private placement of shares to sophisticated and institutional investors in Australia and the US, priced at 50c per share. The share issue was approved at an Extraordinary General Meeting of shareholders on 11 July 2008.

HeartWare is very fortunate to have the support of a number of large private and institutional shareholders. Indicative of this support is the fact that four participants in the placement together contributed over $20M of the total. As a consequence of the financing, two existing US institutional investors, Fidelity Investments and Deephaven Capital Management, increased their positions to 7.29% and 6.61% respectively.

US Clinical Trial

On 5 May 2008 we announced that the US Food and Drug Administration had granted HeartWare conditional approval to commence a clinical trial in the United States. Over the intervening period the Company has allocated significant resources towards addressing the few remaining conditions. Our latest amendment was submitted to the FDA on 3 July 2008 and we are awaiting their response. We are hopeful that the FDA will confirm either a further reduction in the few outstanding conditions or, potentially, a full approval of the trial.

| | | | | |

| | |

-2- | |  |

We are working through the training requirements and the clinical trial contractual arrangements with our lead centers. We continue to expect our first centers to begin implanting this quarter.

International Clinical Trial

On 8 July 2008 St Vincent’s Hospital in Sydney conducted their 9th implant of the HeartWare device, bringing the total number of implants in our international clinical trial to 40. As previously advised we have approval to enroll up to 50 patients in our international trial and anticipate further implants over coming weeks.

The clinical results from these initial patients remain extremely encouraging. Our cumulative support time now stands at 9,400 days, or over 25 years. The average support duration is 235 days per patient. Of the total 40 implants, 4 patients have unfortunately died, including 3 patients within 180 days of their implant and one patient beyond the 180 day point. Of the remaining 36 patients, 10 patients have undergone successful heart transplantation (after an average of 275 days on support), 2 patients have had their devices explanted due to recovery of their hearts, and 24 patients remain on LVAD support.

As always, we reiterate that these results are based on a relatively small sample size. However, the apparent patterns of device reliability and high patient survival rates, particularly in light of the seemingly low transplant rates, remain extremely encouraging early indicators.

CE Mark Update

HeartWare remains on track to receive CE Mark before the end of the year. The two key components of the CE Mark requirements are firstly the submission of a “Technical Dossier” which includes, among other information, a detailed clinical report and secondly the accreditation of our manufacturing facility following an independent audit of our processes and Quality systems.

Compilation of the Technical Dossier documentation will be completed during the third quarter. We are also actively preparing for an ISO audit of our new facility at Miami Lakes. We remain on track for being awarded CE Mark in the fourth quarter, which will trigger the start of commercial sales in Europe. We have recently engaged a Director of Marketing based in Europe who, with some 6 months lead time, has been charged with establishing the necessary commercial infrastructure to facilitate a product rollout across multiple European sites beginning early in 2009.

Our greatest challenge over recent weeks has been to manage the very significant volume of regulatory documentation which has been flowing through the Company, with IDE, CE Mark and filing for our facility move all taking place concurrently.

Operations Update

Our move into our new facility is largely complete. Products are now being produced in both Miramar and Miami Lakes so as to ensure continuity of supply until all processes at Miami Lakes have been completely verified. We are also seeking to modestly expand our office in Framingham, MA where our US headquarters and our electrical engineering group are located.

It is pleasing to report that our manufacturing output has reached a reliable steady-state, with production levels and yields the highest they have ever been, enabling the Company to be well positioned to begin US implants.

| | | | | |

| | |

-3- | |  |

Redomiciliation

As previously announced, the Company is actively working towards a corporate restructure which will lead to our ultimate parent entity being changed from an Australian incorporated company to a company incorporated in the United States.

While the proposed restructure remains subject to both regulatory review and court and shareholder approvals, a redomiciliation to the US would give rise to several important advantages for the Company and its shareholders. In particular, it is hoped that the restructure will help to facilitate greater access to global medical device investors and potentially stimulate demand for HeartWare’s shares. The removal of the current FORUS restriction on the Company’s securities is expected to enhance significantly the Company’s ability to attract US investor interest.

Aligning the Company’s corporate structure with its operating structure and thereby consolidating corporate, manufacturing, research and clinical efforts in the United States will both streamline management processes and help significantly to reduce administrative overheads. For instance, the Company currently prepares both Australian financial statements under Australian equivalents to International Financial Reporting Standards (IFRS) as well as US financial reports under US GAAP. The proposed redomiciliation would largely eliminate this duplication, allowing all reporting to shift to US GAAP.

Importantly, while the restructure would not be linked directly to either a capital raising or a US listing, a redomiciliation to the US would provide the Company with the flexibility to pursue a listing on a US Exchange at an opportune time. Should the Company proceed with the redomiciliation then, following the restructure, HeartWare shares will continue to trade on the ASX in the form of Chess Depository Interests (CDIs). The ownership interest and underlying economic value that each shareholder has in HeartWare today will be largely unchanged.

The Company expects to provide an update on this important project in coming weeks.

Closing Comments

Our team has made tremendous strides on multiple fronts. We are on the verge of achieving several very meaningful milestones with IDE, US clinical trial commencement, first revenues, facility transfer and CE submission all lined up to occur in this current quarter. In addition, our planned redomiciliation to the US will provide HeartWare significant additional flexibility to take advantage of future strategic and financing opportunities.

Thank you to all our shareholders for your continued support.

Yours sincerely

Doug Godshall

Chief Executive Officer

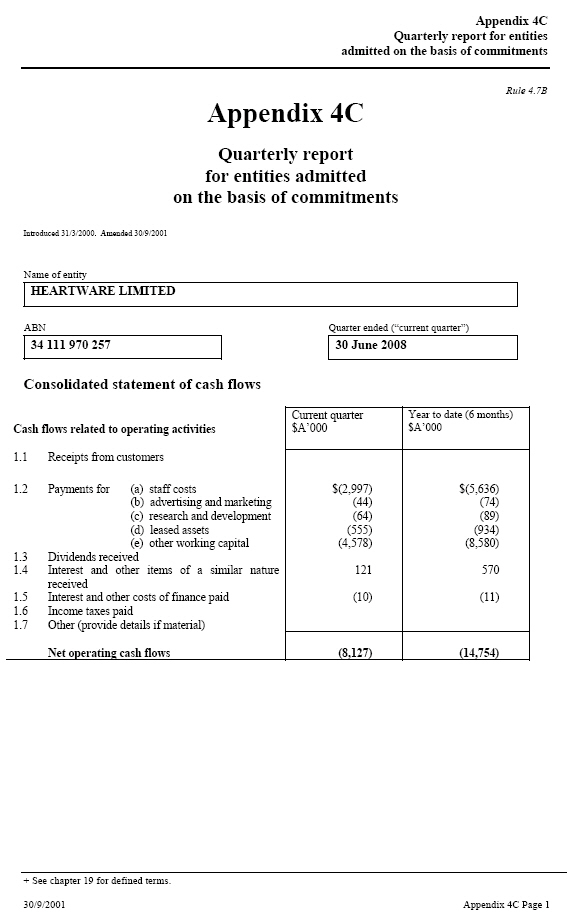

| Rule 4.7B Appendix 4C Quarterly report for entities admitted on the basis of commitments Introduced 31/3/2000. Amended 30/9/2001 Name of entity HEARTWARE LIMITED ABN _____ Quarter ended (“current quarter”) 34 111 970 257 30 June 2008 Consolidated statement of cash flows Cash flows related to operating activities _____ Current quarter _____ Year to date (6 $A’000 months) $A’000 1.1 Receipts from customers 1.2 Payments for (a) staff costs (b) $(2,997) (44) (64) $(5,636) (74) (89) advertising and marketing (c) (555) (4,578) (934) (8,580) research and development (d) leased assets (e) other working capital 1.3 Dividends received 1.4 Interest and other items of a similar 121 570 |

| nature received 1.5 Interest and other costs of finance paid (10) (11) |

| 1.6 Income taxes paid 1.7 Other (provide details if material) Net operating cash flows (8,127) (14,754) |

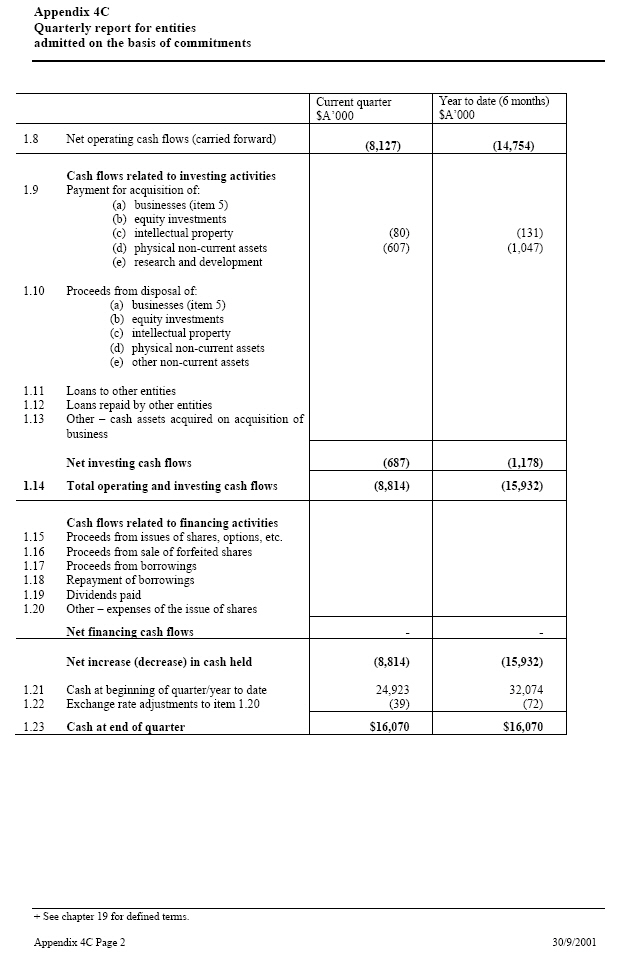

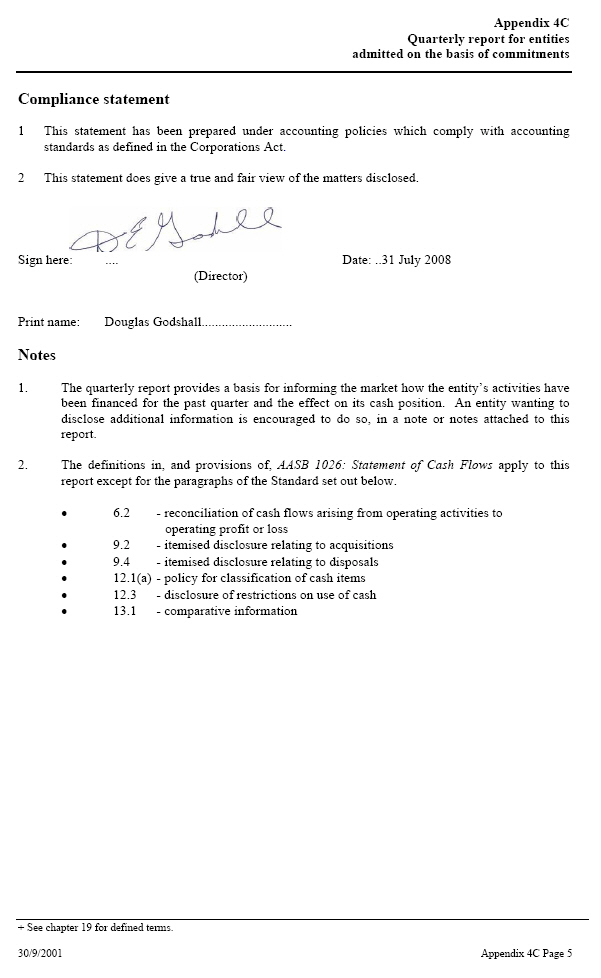

| Current quarter _____ Year to date (6 $A’000 months) $A’000 1.8 Net operating cash flows (carried forward) (8,127) (14,754) Cash flows related to investing activities 1.9 Payment for acquisition of: (a) businesses (80)(607) (131) (1,047) (item 5) (b) equity investments (c) intellectual property (d) physical non-current assets (e) research and development 1.10 Proceeds from disposal of: (a) businesses (item 5) (b) equity investments (c) intellectual property (d) physical non-current assets (e) other non-current assets 1.11 Loans to other entities 1.12 Loans repaid by other entities 1.13 Other — cash assets acquired on acquisition of business Net investing cash flows (687) (1,178) 1.14 Total operating and investing cash flows (8,814) (15,932) Cash flows related to financing activities 1.15 Proceeds from issues of shares, options, etc. 1.16 Proceeds from sale of forfeited shares 1.17 Proceeds from borrowings 1.18 Repayment of borrowings 1.19 Dividends paid 1.20 Other — expenses of the issue of shares Net financing cash flows — - Net increase (decrease) in cash held (8,814) (15,932) 1.21 Cash at beginning of quarter/year to date 24,923 32,074 1.22 Exchange rate adjustments to item 1.20 (39) (72) 1.23 Cash at end of quarter $16,070 $16,070 |

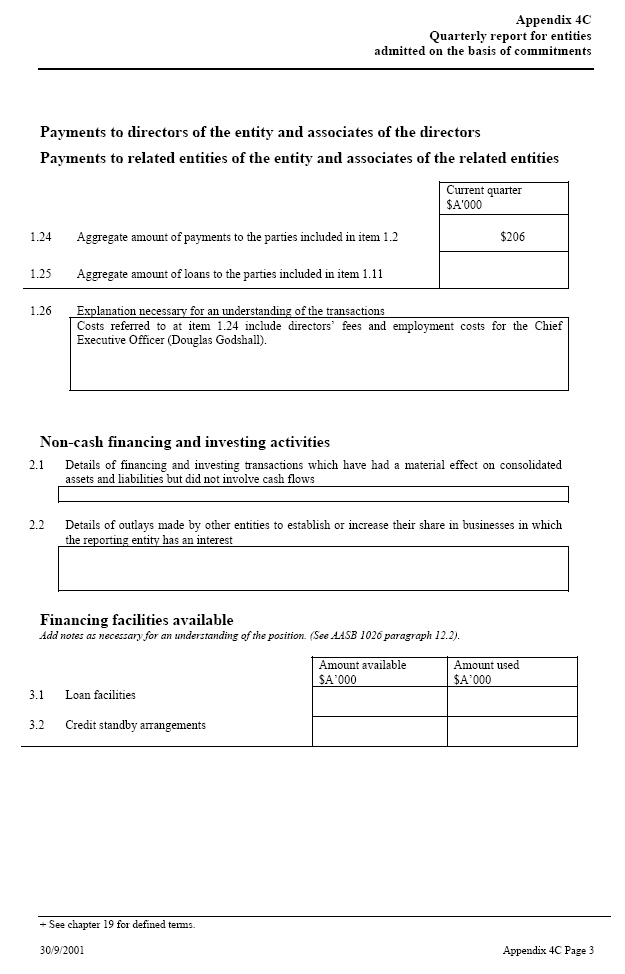

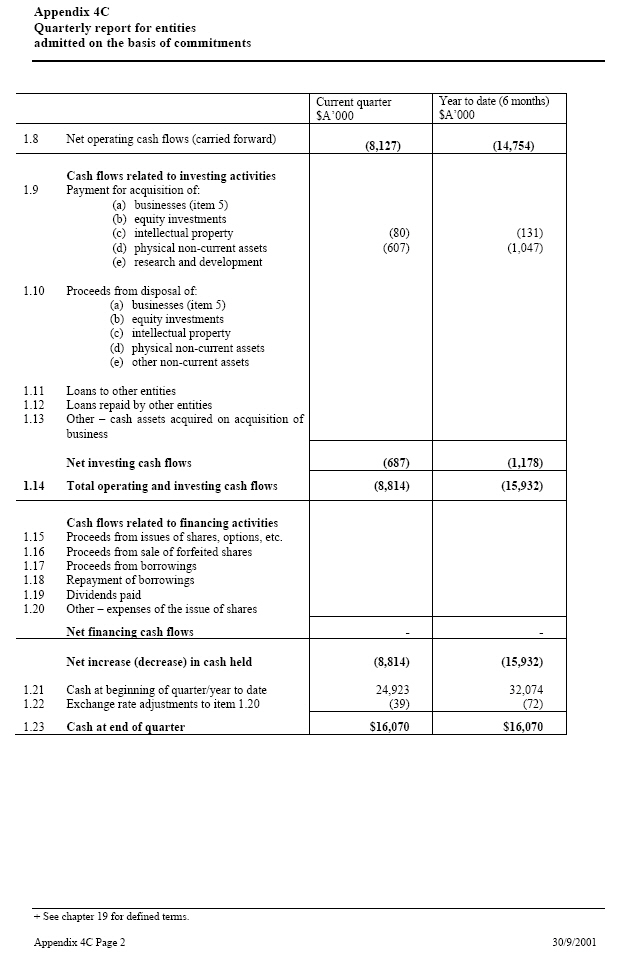

| Payments to directors of the entity and associates of the directors Payments to related entities of the entity and associates of the related entities Current quarter $A’000 1.24 Aggregate amount of payments to the parties included in item $206 1.2 1.25 Aggregate amount of loans to the parties included in item 1.11 1.26 Explanation necessary for an understanding of the transactions Costs referred to at item 1.24 include directors’ fees and employment costs for the Chief Executive Officer (Douglas Godshall). Non-cash financing and investing activities 2.1 Details of financing and investing transactions which have had a material effect on consolidated assets and liabilities but did not involve cash flows 2.2 Details of outlays made by other entities to establish or increase their share in businesses in which the reporting entity has an interest Financing facilities available Add notes as necessary for an understanding of the position. (See AASB 1026 paragraph 12.2). Amount available _____ Amount used $A’000 $A’000 3.1 Loan facilities 3.2 Credit standby arrangements |

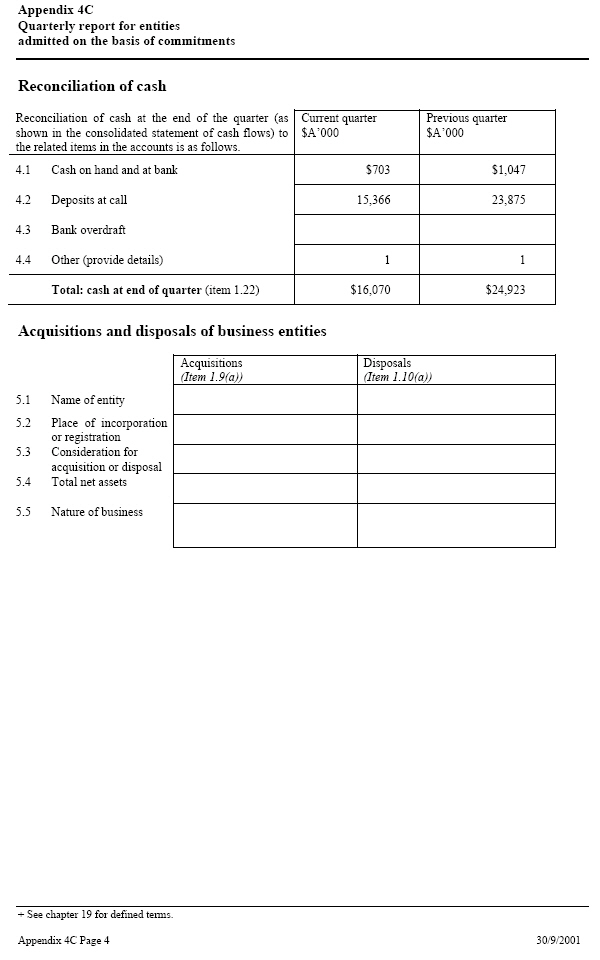

| Reconciliation of cash Reconciliation of cash at the end of the quarter (as Current quarter _____ Previous quarter shown in the consolidated statement of cash flows) to $A’000 $A’000 the related items in the accounts is as follows. 4.1 Cash on hand and at bank $ 703 $ 1,047 4.2 Deposits at call 15,366 23,875 4.3 Bank overdraft 4.4 Other (provide details) 1 1 Total: cash at end of quarter (item 1.22) $16,070 $24,923 Acquisitions and disposals of business entities Acquisitions (Item 1.9(a)) Disposals (Item 1.10(a)) 5.1 Name of entity 5.2 Place of incorporation or registration 5.3 Consideration for acquisition or disposal 5.4 Total net assets 5.5 Nature of business |

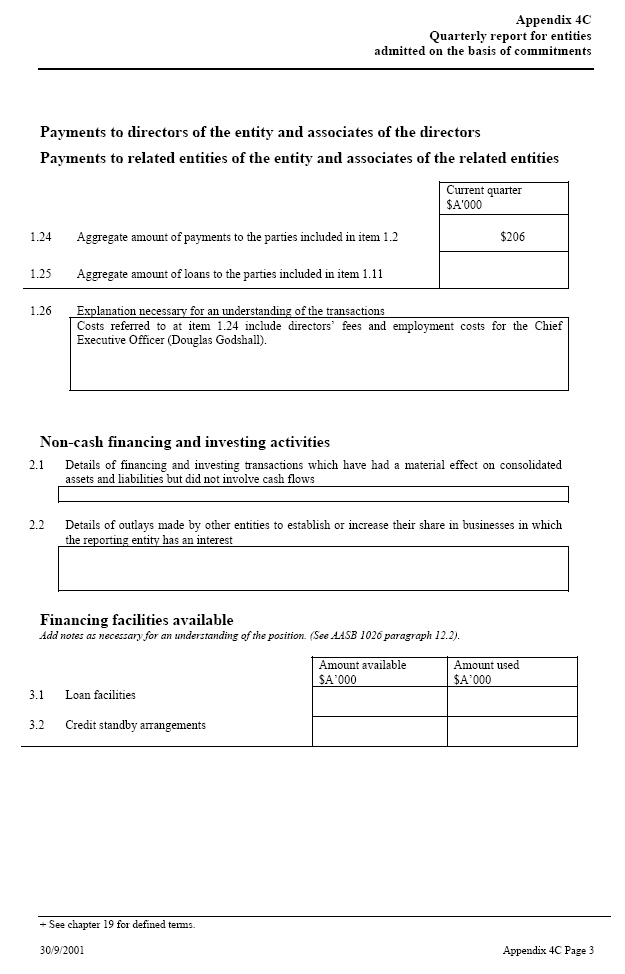

| Compliance statement 1 This statement has been prepared under accounting policies which comply with accounting standards as defined in the Corporations Act. 2 This statement does give a true and fair view of the matters disclosed. Sign here: Date: ..31 July 2008 (Director) Print name: Douglas Godshall... Notes 1. The quarterly report provides a basis for informing the market how the entity’s activities have been financed for the past quarter and the effect on its cash position. An entity wanting to disclose additional information is encouraged to do so, in a note or notes attached to this report. 2. The definitions in, and provisions of, AASB 1026: Statement of Cash Flows apply to this report except for the paragraphs of the Standard set out below. ·6.2 - reconciliation of cash flows arising from operating activities to operating profit or loss ·9.2 — itemised disclosure relating to acquisitions ·9.4 - itemised disclosure relating to disposals ·12.1(a) — policy for classification of cash items ·12.3 — disclosure of restrictions on use of cash ·13.1 — comparative information |