Consolidated Unaudited Balance Sheets as of September 30, 2009 and

for the Nine-Month Periods ended September 30, 2009 and 2008 of Gafisa S.A.

Gafisa S.A.

at September 30, 2009 (unaudited) and December 31, 2008

In thousands of Brazilian reais

| Assets | | Note | | | September 30, 2009 | | | December 31, 2008 | |

| | | | | | (Unaudited) | | | | |

| Current assets | | | | | | | | | |

Cash, cash equivalents and marketable securities | | | 4 | | | | 948,350 | | | | 528,574 | |

| Restricted cash in guarantee to loans | | | 4 | | | | 151,337 | | | | 76,928 | |

Receivables from clients | | | 5 | | | | 1,718,110 | | | | 1,254,594 | |

Properties for sale | | | 6 | | | | 1,376,236 | | | | 1,695,130 | |

Other accounts receivable | | | 7 | | | | 93,722 | | | | 182,775 | |

| Deferred taxes | | | 15 | | | | 13,099 | | | | - | |

Deferred selling expenses | | | | | | | 7,205 | | | | 13,304 | |

Prepaid expenses | | | | | | | 13,522 | | | | 25,396 | |

| | | | | | | | | | | | | |

| | | | | | | | 4,321,581 | | | | 3,776,701 | |

| | | | | | | | | | | | | |

| Non-current assets | | | | | | | | | | | | |

Receivables from clients | | | 5 | | | | 1,662,300 | | | | 863,950 | |

Properties for sale | | | 6 | | | | 386,196 | | | | 333,846 | |

Deferred taxes | | | 15 | | | | 250,846 | | | | 190,252 | |

| Escrow deposits | | | - | | | | 2,489 | | | | 41,807 | |

Other accounts receivable | | | 7 | | | | 49,651 | | | | 68,799 | |

| | | | | | | | | | | | | |

| | | | | | | | 2,351,482 | | | | 1,498,654 | |

| | | | | | | | | | | | | |

| Goodwill, net | | | 8 | | | | 195,088 | | | | 195,088 | |

| Property and equipment, net | | | - | | | | 53,698 | | | | 50,348 | |

| Intangible assets | | | - | | | | 9,690 | | | | 18,067 | |

| | | | | | | | | | | | | |

| | | | | | | | 258,476 | | | | 263,503 | |

| | | | | | | | | | | | | |

| | | | | | | | 2,609,958 | | | | 1,762,157 | |

| | | | | | | | | | | | | |

| Total assets | | | | | | | 6,931,539 | | | | 5,538,858 | |

Condensed Consolidated Balance Sheets

at September 30, 2009 (unaudited) and December 31, 2008

| In thousands of Brazilian reais | (continued) |

| Liabilities and shareholders' equity | | Note | | | September 30, 2009 | | | December 31, 2008 | |

| | | | | | (Unaudited) | | | | |

| Current liabilities | | | | | | | | | |

Loans and financing, net of swaps | | | 9 | | | | 570,307 | | | | 447,503 | |

Debentures | | | 10 | | | | 80,781 | | | | 61,945 | |

Obligations for purchase of land and advances from clients | | | 13 | | | | 488,935 | | | | 421,584 | |

Materials and service suppliers | | | - | | | | 194,302 | | | | 112,900 | |

Taxes and contributions | | | - | | | | 132,216 | | | | 113,167 | |

Salaries, payroll charges and profit sharing | | | - | | | | 61,206 | | | | 29,693 | |

Mandatory dividends | | | 14 | (a) | | | 26,106 | | | | 26,104 | |

Provision for contingencies | | | 12 | | | | 10,512 | | | | 17,567 | |

| Deferred taxes | | | 15 | | | | 52,375 | | | | - | |

Other accounts payable | | | 11 | | | | 181,312 | | | | 97,933 | |

| | | | | | | | | | | | | |

| | | | | | | | 1,798,052 | | | | 1,328,396 | |

| | | | | | | | | | | | | |

| Non-current liabilities | | | | | | | | | | | | |

Loans and financing, net of swaps | | | 9 | | | | 636,639 | | | | 600,673 | |

Debentures | | | 10 | | | | 1,244,000 | | | | 442,000 | |

Obligations for purchase of land and advances from clients | | | 13 | | | | 147,168 | | | | 231,199 | |

Deferred taxes | | | 15 | | | | 322,870 | | | | 239,131 | |

Provision for contingencies | | | 12 | | | | 59,509 | | | | 35,963 | |

Deferred gain on sale of investment | | | 8 | (b) | | | 11,594 | | | | 169,394 | |

Negative goodwill on acquisition of subsidiaries | | | 8 | (b) | | | 12,499 | | | | 18,522 | |

Other accounts payable | | | 11 | | | | 362,843 | | | | 389,759 | |

| | | | | | | | | | | | | |

| | | | | | | | 2,797,122 | | | | 2,126,641 | |

| | | | | | | | | | | | | |

| Noncontrolling interests | | | | | | | 552,889 | | | | 471,402 | |

| | | | | | | | | | | | | |

| Shareholders’ equity | | | 14 | | | | | | | | | |

Capital stock | | | | | | | 1,233,897 | | | | 1,229,517 | |

Treasury shares | | | | | | | (18,050 | ) | | | (18,050 | ) |

Capital reserves | | | | | | | 190,584 | | | | 182,125 | |

Income reserves | | | | | | | 218,827 | | | | 218,827 | |

| Retained earnings | | | | | | | 158,218 | | | | - | |

| | | | | | | | | | | | | |

| | | | | | | | 1,783,476 | | | | 1,612,419 | |

| | | | | | | | | | | | | |

| Total liabilities and shareholders' equity | | | | | | | 6,931,539 | | | | 5,538,858 | |

The accompanying notes are an integral part of these financial statements.

For the nine-month periods ended September 30, 2009 and 2008

In thousands of Brazilian reais, except number of shares and per share information

| | | Note | | | 2009 | | | 2008 |

| | | | | | (Unaudited) | | | (Unaudited) |

| Gross operating revenue | | | | | | | | |

Real estate development and sales | | | 3 | (a) | | | 2,184,117 | | | | 1,224,199 | |

Construction services rendered, net of costs | | | | | | | 30,352 | | | | 13,201 | |

Taxes on services and revenues | | | | | | | (89,663 | ) | | | (44,841 | ) |

| | | | | | | | | | | |

| Net operating revenue | | | | | | | 2,124,806 | | | | 1,192,559 | |

| | | | | | | | | | | |

| Operating costs | | | | | | | | | | |

Real estate development costs | | | | | | | (1,523,640 | ) | | | (814,201 | ) |

| | | | | | | | | | | |

| Gross profit | | | | | | | 601,166 | | | | 378,358 | |

| | | | | | | | | | | |

| Operating (expenses) income | | | | | | | | | | |

Selling expenses | | | | | | | (153,344 | ) | | | (87,504 | ) |

General and administrative expenses | | | | | | | (172,832 | ) | | | (104,990 | ) |

Depreciation and amortization | | | | | | | (24,166 | ) | | | (29,606 | ) |

Amortization of gain on partial sale of FIT Residential and other, net | | | | | | | 157,800 | | | | - | |

Other, net | | | | | | | (79,094 | ) | | | (13,303 | ) |

| | | | | | | | | | | |

| Operating profit before financial income (expenses) | | | | | | | 329,530 | | | | 142,955 | |

| | | | | | | | | | | |

| Financial income (expenses) | | | | | | | | | | |

Financial expenses | | | | | | | (159,336 | ) | | | (24,272 | ) |

Financial income | | | | | | | 106,399 | | | | 64,389 | |

| | | | | | | | | | | |

| Income before taxes on income and noncontrolling interests | | | | | | | 276,593 | | | | 183,072 | |

| | | | | | | | | | | |

Current income tax and social contribution expense | | | | | | | (15,659 | ) | | | (13,639 | ) |

Deferred tax | | | | | | | (49,245 | ) | | | (36,817 | ) |

| | | | | | | | | | | |

Total tax expenses | | | 15 | | | | (64,904 | ) | | | (50,456 | ) |

| | | | | | | | | | | |

| Income before noncontrolling interests | | | | | | | 211,689 | | | | 132,616 | |

| | | | | | | | | | | |

| Noncontrolling interests | | | | | | | (53,471 | ) | | | (35,540 | ) |

| | | | | | | | | | | |

| Net income for the nine-month period | | | | | | | 158,218 | | | | 97,076 | |

| | | | | | | | | | | |

| Outstanding shares at the end of the period (in thousands) | | | 14 | (a) | | | 130,508 | | | | 129,963 | |

| | | | | | | | | | | |

Net income per thousand outstanding shares at the end of the period - R$ | | | | | | | 1.2123 | | | | 0.7469 | |

The accompanying notes are an integral part of these financial statements.

For the Nine-month Period Ended September 30, 2009 (unaudited)

In thousands of Brazilian reais

| | | | | | | | | Capital reserves | | | Income reserves | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Capital stock | | | Treasury shares | | | Stock options reserve | | | Capital reserves | | | Legal reserve | | | Statutory reserve | | | For investments | | | Retained earnings | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At December 31, 2008 | | | 1,229,517 | | | | (18,050 | ) | | | 47,829 | | | | 134,296 | | | | 21,081 | | | | 159,213 | | | | 38,533 | | | | - | | | | 1,612,419 | |

| Capital increase - exercise of stock options | | | 4,380 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 4,380 | |

Stock option plan | | | - | | | | - | | | | 8,459 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 8,459 | |

Net income for the period | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 158,218 | | | | 158,218 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At September 30, 2009 (unaudited) | | | 1,233,897 | | | | (18,050 | ) | | | 56,288 | | | | 134,296 | | | | 21,081 | | | | 159,213 | | | | 38,533 | | | | 158,218 | | | | 1,783,476 | |

The accompanying notes are an integral part of these financial statements.

For the nine-month periods ended September 30, 2009 and 2008

In thousands of Brazilian reais

| | | 2009 | | | 2008 | |

| | | (Unaudited ) | | | (Unaudited ) | |

| Cash flows from operating activities | | | | | | |

Net income | | | 158,218 | | | | 97,076 | |

| | | | | | | | | |

Expenses (income) not affecting cash and cash equivalents | | | | | | | | |

Depreciation and amortization | | | 30,189 | | | | 30,253 | |

| Goodwill / Negative goodwill amortization | | | (6,023 | ) | | | (647 | ) |

Disposal of fixed assets | | | 4,980 | | | | - | |

Stock option expenses | | | 15,062 | | | | 16,550 | |

Deferred gain on sale of investment | | | (157,800 | ) | | | - | |

Unrealized interest and charges, net | | | 123,347 | | | | 86,114 | |

Deferred tax | | | 49,245 | | | | 36,082 | |

Noncontrolling interests | | | 39,919 | | | | 30,768 | |

Decrease (increase) in assets | | | | | | | | |

Receivables from clients | | | (1,261,866 | ) | | | (590,489 | ) |

Properties for sale | | | 266,545 | | | | (517,440 | ) |

Other accounts receivable | | | 57,759 | | | | (114,676 | ) |

Deferred selling expenses | | | 223 | | | | 117 | |

Prepaid expenses | | | 8,889 | | | | (11,668 | ) |

Increase (decrease) in liabilities | | | | | | | | |

Obligations for purchase of land | | | (94,395 | ) | | | 337,694 | |

Taxes and contributions | | | 31,595 | | | | 30,472 | |

Provision for contingencies | | | 62,610 | | | | 2,270 | |

Materials and service suppliers | | | 81,602 | | | | 13,860 | |

Advances from clients | | | 76,637 | | | | (38,631 | ) |

Salaries, payroll charges and profit sharing | | | 31,518 | | | | (14,236 | ) |

Other accounts payable | | | 35,829 | | | | (13,880 | ) |

| | | | | | | | | |

| Cash used in operating activities | | | (445,917 | ) | | | (620,411 | ) |

| | | | | | | | | |

| Cash flows from investing activities | | | | | | | | |

Property and equipment | | | (34,999 | ) | | | (32,714 | ) |

Restricted cash in guarantee to loans | | | (74,409 | ) | | | - | |

| | | | | | | | | |

| Cash used in investing activities | | | (109,408 | ) | | | (32,714 | ) |

| | | | | | | | | |

| Cash flows from financing activities | | | | | | | | |

Capital increase | | | 4,380 | | | | 7,672 | |

Loans and financing obtained | | | 1,418,227 | | | | 692,663 | |

Repayment of loans and financing | | | (567,655 | ) | | | (102,695 | ) |

Contributions from venture partners | | | - | | | | 300,000 | |

Assignment of credits, net | | | 860 | | | | 42,463 | |

| Proceeds from subscription of redeemable equity interest in securitization | | | 49,973 | | | | - | |

Assignment of credits receivable - CCI | | | 69,316 | | | | - | |

| Dividends paid | | | - | | | | (26,970 | ) |

| | | | | | | | | |

| Cash provided by financing activities | | | 975,101 | | | | 913,133 | |

| | | | | | | | | |

| Net increase in cash and cash equivalents | | | 419,776 | | | | 260,008 | |

| | | | | | | | | |

Cash and cash equivalents (net of restricted cash in guarantee to loans) | | | | | | | | |

At the beginning of the period | | | 528,574 | | | | 517,420 | |

At the end of the period | | | 948,350 | | | | 777,428 | |

| | | | | | | | | |

| Net increase in cash and cash equivalents | | | 419,776 | | | | 260,008 | |

The accompanying notes are an integral part of these financial statements.

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

Gafisa S.A. (the "Company") started its commercial operations in 1997 with the objectives of: (a) promoting and managing all forms of real estate ventures on its own behalf or for third parties; (b) purchasing, selling and negotiating real estate properties in general, including provision of financing to real estate clients; (c) carrying out civil construction and civil engineering services; (d) developing and implementing marketing strategies related to its own or third party real estate ventures; and (e) investing in other Brazilian or foreign companies which have similar objectives as the Company's.

The Company forms jointly-controlled ventures (Special Purpose Entities - SPEs) and participates in consortia and condominiums with third parties as a means of meeting its objectives. The controlled entities share the structure and corporate, managerial and operating costs with the Company.

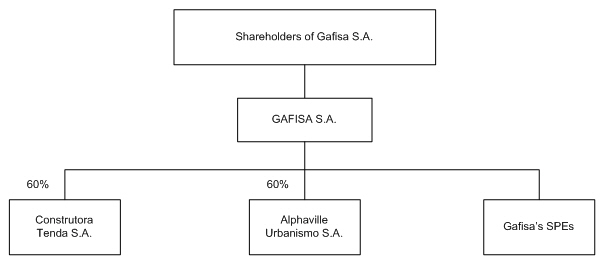

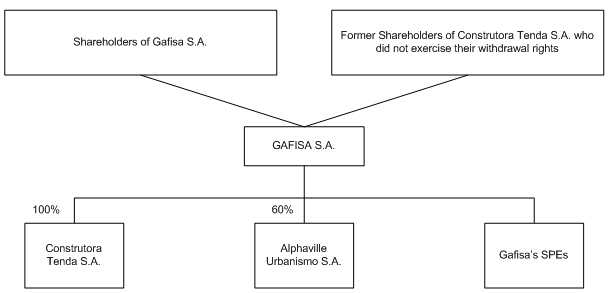

On September 1, 2008, the Company and Construtora Tenda S.A. ("Tenda") merged Tenda and Fit Residencial Empreendimentos Imobiliários Ltda. (“Fit Residencial”), by means of a Merger Protocol and Justification. On October 3, 2008, this Merger Protocol and Justification was approved by Gafisa’s Board of Directors, as well as the first Amendment to the Protocol. Upon exchange of Fit Residencial quotas for Tenda shares, the Company received 240,391,470 common shares, representing 60% of total and voting capital of Tenda after the merger of Fit Residencial, in exchange for 76,757,357 quotas of Fit Residencial. The Tenda shares received by the Company in exchange for Fit Residencial quotas will have the same rights, attributed on the date of the merger of the shares by the Company, and will receive all benefits, including dividends and distributions of capital that may be declared by Tenda as from the merger approval date. On October 21, 2008, the merger of Fit Residencial into Tenda was approved at an Extraordinary Shareholders’ Meeting by the Company’s shareholders (Note 8).

On February 27, 2009, Gafisa and Odebrecht Empreendimentos Imobiliários S.A. announced the dissolution of their partnership in Bairro Novo Empreendimentos Imobiliários S.A., terminating the Shareholders’ Agreement in effect between the partners. Accordingly, Gafisa is no longer a partner in Bairro Novo Empreendimentos Imobiliários S.A.. The real estate ventures that were being conducted together by the parties began started to be carried out separately, Gafisa will develop the Bairro Novo Cotia real estate venture, whereas Odebrecht Empreendimentos Imobiliários S.A. will develop other ventures of the dissolved partnership, in addition to operating Bairro Novo Empreendimentos Imobiliários S.A..

On June 29, 2009, Gafisa S.A. and Construtora Tenda S.A. entered into a Private Instrument for Assignment and Transfer of Quotas and Other Covenants, in which Gafisa assigns and transfers to Tenda 41,341,895 quotas of Cotia1 Empreendimento Imobiliário for the net book value of R$ 41,342.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

On October 21, 2009, the Company informed that it intends to present to its shareholders by the end of 2009 a proposal for merging all shares of its subsidiary, which conditions are still being negotiated with the Independent Special Committee. If the merger is approved, Tenda, which is currently a 60% owned subsidiary of Gafisa, will become a wholly-owned subsidiary of Gafisa (Note 20).

| 2 | Presentation of the nine-month period Information |

The condensed consolidated financial statements as at September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008 are unaudited. These condensed financial statements include all adjustments consisting of normal recurring adjustments which, in the opinion of our management, are necessary for a fair presentation of our condensed consolidated financial position, results of operations and cash flows for the interim periods presented.

The condensed consolidated financial statements should be read in conjunction with our financial statements prepared for the year ended December 31, 2008. The results for the nine-month period ended September 30, 2009 are not necessarily indicative of the results to be reported for the entire year ending December 31, 2009, or for periods in the future. The accounting policies adopted in preparing these unaudited interim financial statements are consistent with those used in the preparation of the audited financial statements for the year ended December 31, 2008, except that goodwill is no longer amortized pursuant to new Brazilian generally accepted accounting practices adopted from 2009 on.

The condensed consolidated balance sheet at December 31, 2008 has been derived from the audited financial statements at that date but does not include all of the information and footnotes required by accounting practices adopted in Brazil for presentation of complete annual financial statements. The financial statements presented herein do not include the parent company´s stand alone financial statements and are not intended to be used for statutory purposes. The Summary of Principal Differences between Brazilian GAAP and US GAAP (Note 21) is not required by Corporate Law and is presented only for purposes of these financial statements.

Certain amounts in the comparative financial statements as of December 31, 2008 and the notes thereto have been reclassified to be consistent with the current presentation.

The condensed consolidated interim financial statements were prepared in accordance with accounting practices adopted in Brazil as determined by the Brazilian Corporate Law ("Corporate Law"), the Accounting Standards Committee ("CPC"), the Federal Accounting Council ("CFC"), the IBRACON - Institute of Independent Auditor of Brazil ("IBRACON") and additional regulations and resolutions of the Brazilian Securities Commission ("CVM") (collectively, "Brazilian GAAP").

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

The Company and its subsidiaries opted as provided for by the CVM/SNC/SEP Circular Letter No. 02/2009, to present information for the nine-month period ended September 30, 2008 on a comparative basis to the current period.

Law No. 11.638/07 enacted on December 28, 2007 introduced changes to the Corporate Law to be applied as from financial statements presented for the year ended December 31, 2008. To assure consistency of presentation, the Company and it subsidiaries have retroactively applied changes to Brazilian GAAP, introduced by the newly formed CPC and the provisions of Law No. 11.638/07 from January 1, 2006. The effects of changes to Brazilian GAAP on the unaudited results of operations for the nine-month period ended September 30, 2008 are as follows:

| | | (Unaudited) | |

| | | | |

| As originally reported | | | 139,781 | |

Adjustment to present value of assets and liabilities | | | 4,418 | |

Stock option plans | | | (16,550 | ) |

Warranty provision | | | (3,494 | ) |

Depreciation of sales stands, facilities, model apartments and related furnishings | | | (9,334 | ) |

Noncontrolling interest | | | (8,018 | ) |

Other, including deferred taxes | | | (9,727 | ) |

| | | | | |

| As presented herein | | | 97,076 | |

The income tax and social contribution effects arising from the initial adoption of the Law 11.638/07, upon election to adopt the provisions of Law 11,941/09 were recorded based on the pre-existing tax regulations. Gafisa S.A. and its subsidiaries’ elections to follow the provisions of the RTT (Transitory Tax Regime), as provided for by Law 11,941/09, were declared in the corporate income tax returns filed in 2009.

The preparation of nine-month period information in conformity with Brazilian GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the nine-month period information and the reported amounts of revenues and expenses during the reporting period. The nine-month period information includes estimates that are used to determine certain items, including, among others, the estimated costs of the ventures,

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

allowance for doubtful accounts, warranty provision, provisions necessary for the impairment of assets, the provision for credits not recognized related to deferred tax, and the recognition of contingent liabilities. Actual results may differ from the estimates.

| (c) | Consolidation principles |

The consolidated nine-month period information includes the accounts of Gafisa S.A. and those of all of its subsidiaries (Note 8), with separate disclosure of the participation of noncontrolling shareholders. The proportional consolidation method is used for investments in jointly-controlled investees, which are all governed by shareholder agreements; as a consequence, assets, liabilities, revenues and costs are consolidated based on the proportion of the equity interest the Company holds in the capital of the investee.

All significant intercompany accounts and transactions are eliminated upon consolidation, including investments, current accounts, dividends receivable, income and expenses and unrealized results among consolidated companies, net of taxes.The accounting policies are applied consistently, in all consolidated companies. Transactions and balances with related parties, shareholders and investees are disclosed in the respective notes. The statement of changes in shareholders' equity reflects the changes in Gafisa S.A.'s parent company's books.

| 3 | Significant Accounting Practices |

The most significant accounting practices adopted in the preparation of the nine-month period information are as follows:

| (a) | Recognition of results |

| (i) | Real estate development and sales |

Revenues, as well as costs and expenses directly related to real estate development units sold and not yet finished, are recognized over the course of the construction period and the following procedures are adopted:

For completed units, the result is recognized when the sale is made, regardless of the receipt of the contractual amount, provided that the following conditions are met: (a) the result is

determinable, that is, the collectibility of the sale price is reasonably assured or the amount that will not be collected can be estimated, and (b) the earnings process is virtually complete,

that is, the Company is not obliged to perform significant activities after the sale to earn the profit. The collectibility of the sales price is demonstrated by the client's commitment to pay, which in turn is supported by initial and continuing investment.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

In the sales of unfinished units, the following procedures and rules were observed:

| . | The incurred cost (including the costs related to land) corresponding to the units sold is fully appropriated to the result. |

| . | The percentage of incurred cost (including costs related to land) is measured in relation to total estimated cost, and this percentage is applied on the revenues from units sold, determined in accordance with the terms established in the sales contracts, thus determining the amount of revenues and selling expenses to be recognized. |

| . | Any amount of revenues recognized that exceeds the amount received from clients is recorded as current or non-current assets. Any amount received in connection with the sale of units that exceeds the amount of revenues recognized is recorded as "Obligations for purchase of land and advances from clients". |

| . | Interest and inflation-indexation charges on accounts receivable as from the time the client takes possession of the property, as well as the adjustment to present value of accounts receivable, are appropriated to the result from the development and sale of real estate using the accrual basis of accounting. |

| . | The financial charges on accounts payable for the acquisition of land and real estate credit operations during the construction period are appropriated to the cost incurred, and recognized in results upon the sale of the units of the venture to which they are directly related. |

Deferred taxes on the difference between the revenues from real estate development and the accumulated revenues subject to tax are calculated and recognized when the difference in revenues is recognized.

The other income and expenses, including advertising and publicity, are appropriated to the results as they are incurred using the accrual basis of accounting.

| (ii) | Construction services |

Revenues from real estate services consist primarily of amounts received in connection with construction management activities for third parties, technical management and management of real estate; revenues are recognized as services are rendered.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| (iii) | Revenues and costs related to barter transactions |

As per CPC (O) 01, “Real Estate Development Entities”, for barter transactions of land in exchange for units, the value of land acquired by the Company is calculated based on the fair value of real estate units to be delivered, and recorded in inventories of Properties for sale against liabilities for Advances from clients, at the time the barter agreement is signed. Revenues, as well as costs incurred from barter transactions are appropriated to income over the course of construction period of the projects based on the financial measure of completion.

| (b) | Cash and cash equivalents |

Consist primarily of bank certificates of deposit and investment funds, denominated in reais, having a ready market and original maturity of 90 days or less or in regard to which there are no penalties or other restrictions for early redemption, recognized at market value.

Investment funds in which the Company is the sole owner are fully consolidated.

| (c) | Receivables from clients |

These are stated at cost plus accrued interest and indexation adjustments, net of adjustment to present value. The allowance for doubtful accounts, when necessary, is provided in an amount considered sufficient by management to meet expected losses.

The installments due are indexed based on the National Civil Construction Index (INCC) during the construction phase, and based on the General Market Prices Index (IGP-M) after delivery of the units.

| (d) | Certificates of real estate receivables (CRI) |

The Company assigns receivables for the securitization and issuance of mortgage-backed securities ("CRI"). When this assignment does not involve right of recourse, it is recorded as a reduction of accounts receivable. When the transaction involves recourse against the Company, the accounts receivable sold is maintained on the balance sheet. The financial guarantees, when a participation is acquired (subordinated CRI) and maintained to secure the receivables that were assigned, are recorded in the balance sheet in non-current receivables at fair value.

| (e) | Investment Fund of Receivables ("FIDC”) |

The Company consolidates Investment Funds of Receivables (FIDC) in which it holds subordinated quotas, subscribed and paid in by the Company in receivables.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

Pursuant to CVM Instruction No. 408, the consolidation by the Company of FDIC arises from the evaluation of the underlying and economic reality of these investments, considering, among others: (a) whether the Company still have control over the assigned receivables, (b) whether it still retains any right in relation to assigned receivables, (c) whether it still bears the risks and responsibilities for the assigned receivables, and (d) whether the Company fundamentally or usually pledges guarantees to FIDC investors in relation to the expected receipts and interests, even informally.

When consolidating the FIDC in its financial statements, the Company discloses the receivables in the group of accounts of receivables from clients and the FIDC net worth is reflected in consolidated noncontrolling interests, the balance of subordinated quotas held by the Company being eliminated in this consolidation process.

The financial costs of these transactions are appropriated on pro rata basis in the adequate heading of financial expenses.

| (f) | Real estate credit certificate (“CCI”) |

The Company carries out the assignment and/or securitization of receivables related to credits of statutory lien on completed real estate ventures. This securitization is carried out upon the issuance of the real estate credit certificate (CCI), which is assigned to financial institutions that grant credit.

Land is stated at cost of acquisition. Land is recorded only after the deed of property is registered, not registered in the financial statements during the negotiation phase, not depending on the success probability or stage of negotiation. The Company and its subsidiaries also acquire land through barter transactions where, in exchange for the land acquired, it undertakes to deliver (a) real estate units under development or (b) part of the sales revenues originating from the sale of the real estate units. Land acquired through barter transaction is stated at fair value.

Properties are stated at construction cost, which does not exceed the net realizable value. In the case of real estate developments in progress, the portion in inventories corresponds to the cost incurred for units that have not yet been sold. The cost comprises construction (materials, own or outsourced labor and other related items) and land, including financial charges appropriated to the development as incurred during the construction phase.

When the cost of construction of properties for sale exceeds the expected cash flow from sales, once completed or still under construction, an impairment charge is recognized in the period when the book value is considered no longer to be recoverable. This analysis is

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

consistently applied to residential ventures targeted at the low, medium and high income markets, regardless of their geographic region or construction phase.

Properties for sale are reviewed to evaluate the recovery of the book value of each real estate development when events or changes in macroeconomic scenarios indicate that the book value may not be recoverable. If the book value of a real estate development is not recoverable, compared to its realizable value through expected cash flows, a provision is recorded.

The Company capitalizes interest on developments during the construction phase, arising from the National Housing System and other credit lines that are used for financing the construction of developments (limited to the corresponding financial expense amount).

| (h) | Deferred selling expenses |

Brokerage expenditures are recorded in results following the same percentage-of-completion criteria adopted for the recognition of revenues and costs of units sold, based on the cost incurred in relation to the budgeted cost. The charges related to sales commission of the buyer are not recognized as revenue or expense of the Company.

As per CPC (O) 01, “Real Estate Development Entities”, the Company and its subsidiaries presented at September 30, 2009 and December 31, 2008 a provision to cover expenditures for repairing construction defects covered during the warranty period, amounting to R$ 15,707 and R$ 14,452, respectively, except for the subsidiaries that operate with outsourced companies, which are the own guarantors of the constructions services provided. The warranty period is five years from the delivery of the unit.

These are taken to income in the period to which they relate.

| (k) | Property and equipment |

Recorded at cost. Depreciation is calculated based on the straight-line method considering the estimated useful life of the assets, as follows: vehicles - 5 years; (ii) office equipment and other installations - 10 years; and (iii) sales stands, facilities, model apartments and related furnishings - 1 year.

As per CPC (O) 01, “Real Estate Development Entities”, expenditures incurred for the construction of sales stands, facilities, model apartments and related furnishings are capitalized as Property and equipment. Depreciation commences upon launch of the development and is recorded over the average term of one year and subject to periodical analysis of asset impairment.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

Intangible assets relate to the acquisition and development of computer systems and software licenses, recorded at acquisition cost, and are amortized over a period of up to five years.

| (m) | Investments in subsidiaries and jointly-controlled investees |

If the Company holds more than half of the voting capital of another company, the latter is considered a subsidiary and is consolidated. In situations where shareholder agreements grant the other party veto rights affecting the Company's business decisions with regards to its subsidiary, such affiliates are considered to be jointly-controlled companies and are recorded on the equity method.

Cumulative movements after acquisitions are adjusted in cost of investment. Unrealized gains or transactions between the Company and its affiliates and subsidiary companies are eliminated in proportion to the Company.'s interest; unrealized losses are also eliminated, unless the transaction provides evidence of impairment of the asset transferred.

When the Company's interest in the losses of subsidiaries is equal to or higher than the amount invested, the Company recognizes the residual portion of the net capital deficiency since it assumes obligations to make payments on behalf of these companies or for advances for future capital increase.

The accounting practices of acquired subsidiaries are aligned with those of the parent company, in order to ensure consistency with the practices adopted by the Company.

| (ii) | Goodwill and negative goodwill on the acquisition of investments |

The Company’s investments in subsidiaries include goodwill when the acquisition cost exceeds the book value of net tangible assets of the acquired subsidiary and negative goodwill when the acquisition cost is lower.

Up to December 31, 2008, the goodwill is amortized in accordance with the underlying economic basis which considers factors such as the land bank, the ability to generate results

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

from developments launched and/or to be launched and other inherent factors. Pursuant to OCPC02, from January 1, 2009 goodwill is no longer amortized in results for the period.

The Company annually evaluates at the balance sheet date whether there are any indications of permanent loss and potential adjustments to measure the residual portion not amortized of recorded goodwill, and records an impairment provision, if required, to adjust the carrying value of goodwill to recoverable amounts or to realizable values. If the book value exceeds the recoverable amount, the amount thereof is reduced.

Goodwill that cannot be justified economically is immediately charged to results for the year.

Negative goodwill that is justified economically is appropriated to results at the extent the assets which originated it are realized. Negative goodwill that is not justified economically is recognized in results only upon disposal of the investment.

| (n) | Obligations for purchase of land and advances from clients (barter transactions) |

These are contractual obligations established for purchases of land in inventory (Property for sale) which are stated at amortized cost plus interest and charges proportional to the period (pro rata basis), when applicable, net of adjustment to present value.

The obligations related to barter transactions of land in exchange for real estate units are stated at fair value, as advances from clients.

Selling expenses include advertising, promotion, brokerage fees and similar expenses, are appropriated to results when incurred.

Taxes on income in Brazil comprise Federal income tax (25%) and social contribution (9%), as recorded in the statutory accounting records, for entities on the taxable profit regime, for which the composite statutory rate is 34%. Deferred taxes are provided on all temporary tax differences, including those related to changes in accounting practices.

As permitted by tax legislation, certain subsidiaries and jointly-controlled companies, the Company opted for the presumed profit regime. For these companies, the income tax basis is calculated at the rate of 8% on gross revenues plus financial income and for the social contribution basis at 12% on gross revenues plus financial income, upon which the income tax and social contribution rates, 25% and 9%, respectively, are applied.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

The deferred tax assets are recognized to the extent that future taxable income is expected to be available to be used to offset temporary differences based on the budgeted future results prepared based on internal assumptions. New circumstances and economic scenarios may change the estimates.

Deferred tax assets arising from net operating losses have no expiration dates, though offset is restricted to 30% of annual taxable income. Taxable entities on the presumed profit regime cannot offset prior year losses against tax payable.

In the event realization of deferred tax assets is not considered to be probable, no amount is recorded (Note 15).

| (q) | Other current and non-current liabilities |

These liabilities are stated on the accrual basis at their known or estimated amounts, plus, when applicable, the corresponding indexation charges and foreign exchange gains and losses.

The liability for future compensation of employee vacations earned is fully accrued.

The Company and its subsidiaries do not offer private pension plans or retirement plan or other post-employment benefits to employees.

As approved by its Board of Directors, the Company offers to its selected executives share-based compensation plans ("Stock Options").

CPC 10, “Share-based Compensation”, requires that the options, calculated at the grant date, be recognized as an expense against shareholders' equity, at the extent service is rendered.

The fair value of services received from the plan participants, in exchange for options, is determined in relation to the fair value of shares, on the grant date of each plan, and recognized as expense through the vesting period.

| (s) | Profit sharing program for employees and officers |

The Company and its subsidiaries provide for the distribution of profit sharing benefits and bonuses to employees recognized in results in General and administrative expenses.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

Additionally, the Company and its subsidiaries’ bylaws establish the distribution of profit sharing to executive officers (in an amount that does not exceed the lower of (i) their annual compensation or (ii) 10% of the Company's net income).

The bonus systems operate on a three-tier performance-based structure in which the corporate efficiency targets as approved by the Board of Directors must first be achieved, followed by targets for the business units and finally individual performance targets.

| (t) | Present value adjustment |

In conformity with CPC 12, "Adjustment to Present Value", the assets and liabilities arising from long-term transactions were adjusted to present value.

As specified by CPC (O) 01, "Real Estate Development Entities", for inflation-indexed receivables arising from installment sales of unfinished units, the receivables formed prior to delivery of the units which does not accrue interest, were discounted to present value. The reversal of the adjustment to present value, considering that an important part of the Company’s activities is to finance its customers, was made as a contra-entry to the real estate development revenue group itself, consistent with the interest accrued on the portion of accounts receivable related to the “after the keys” period.

The financial charges of funds used in the construction and finance of real estate ventures shall be capitalized. As interest from funds used to finance the acquisition of land for development and construction is capitalized, the accretion of the present value adjustment arising from the obligation is recorded in Real estate development operating costs or against inventories of Properties for sale, as the case may be, until the construction phase of the venture is completed.

Accordingly, certain asset and liability items are adjusted to present value based on discount rates that reflect management's best estimate of the value of money over time and the specific risks of the asset and the liability.

| (u) | Cross-currency interest rate swap and derivative transactions |

The Company has derivative instruments for the purposes of mitigating the risk of its exposure to the volatility of currencies, indices and interest rates, recognized at fair value directly in income. In accordance with its treasury policies, the Company does not acquire or issue derivative financial instruments for speculative purposes.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| (v) | Financial liabilities recorded at fair value |

Pursuant to CPC 14, "Financial Instruments: Recognition, Measurement and Evidence", financial instruments are classified among four categories: (i) financial assets or liabilities measured at fair value through income, (ii) held to maturity, (iii) loans and receivables, and (iv) available for sale. The classification depends upon the purpose for which the financial assets and liabilities were acquired. Management classifies its financial assets and liabilities when initially recognized. At September 30, 2009, the Company has financial assets and liabilities that are categorized as (i) and (iii).

At September 30, 2009 and December 31, 2008, the Company recorded certain loans denominated in foreign currency as financial liabilities at fair value through income. These transactions are directly linked to the cross-currency interest rate swaps and are recognized at fair value. Changes in the fair value of financial liabilities are directly recognized in results.

| (w) | Impairment of financial assets |

At each balance sheet date, or when events or changes in circumstances indicate that the carrying value of an asset or group of assets may not be recoverable, the Company evaluates whether there are any indications of impairment of a financial asset or group of financial assets in relation to the market value, and its ability to generate positive cash flows to support its realization. A financial asset or group of financial assets is considered impaired when there is objective evidence of a decrease in recoverable value as a result of one or more events that occurred after the initial recognition of the asset, which impact estimated future cash flows.

| (x) | Debenture and initial public offering expenses |

As per CPC 08, "Transaction Costs and Premiums on Issuance of Securities", share issuance expenses are accounted for as a direct reduction of capital raised. In addition, transaction costs and premiums on issuance of debt securities are amortized over the terms of the security and the balance is presented net of issuance expenses.

Earnings per share are calculated based on the number of shares outstanding at the balance sheet date, net of treasury shares.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| 4 | Cash, Cash Equivalents and Marketable Securities |

| | | September 30, 2009 | | | December 31, 2008 | |

| | | (Unaudited ) | | | | |

| Cash and cash equivalents | | | | | | |

Cash and banks | | | 215,133 | | | | 73,538 | |

Cash equivalents | | | | | | | | |

Bank Certificates of Deposits – CDBs | | | 490,491 | | | | 185,334 | |

Investment funds | | | 161,125 | | | | 149,772 | |

Securities purchased under agreement to resell | | | 81,601 | | | | 114,286 | |

Other | | | - | | | | 5,644 | |

| | | | | | | | | |

| Total cash and cash equivalents | | | 948,350 | | | | 528,574 | |

| | | | | | | | | |

| Restricted cash in guarantee to loans (Note 9) | | | 151,337 | | | | 76,928 | |

| | | | | | | | | |

| Total cash, cash equivalents and financial investments | | | 1,099,687 | | | | 605,502 | |

At September 30, 2009, Bank Deposit Certificates – CDBs include earned interest from 95% to 104% (December 31, 2008 - 95% to 107%) of Interbank Deposit Certificate – CDI, invested in first class financial institutions.

At September 30, 2009 and December 31, 2008 the amount related to investment funds is recorded at market value. Pursuant to CVM Instruction No. 408/04, financial investments in investment funds in which the Company has an exclusive interest are consolidated.

| 5 | Receivables from clients |

| | | September 30, 2009 | | | December 31, 2008 | |

| | | (Unaudited ) | | | | |

| | | | | | | |

| Real state development and sales | | | 3,369,569 | | | | 2,115,498 | |

| (-) Adjustment to present value | | | (79,942 | ) | | | (51,929 | ) |

| Services and construction | | | 79,511 | | | | 54,096 | |

| Other receivables | | | 11,272 | | | | 879 | |

| | | | | | | | | |

| | | | 3,380,410 | | | | 2,118,544 | |

| | | | | | | | | |

| Current | | | 1,718,110 | | | | 1,254,594 | |

| Non-current | | | 1,662,300 | | | | 863,950 | |

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

The balance of accounts receivable from units sold and not yet delivered is limited to the portion of revenues accounted for net of the amounts already received.

The balances of advances from clients (development and services), which exceed the revenues recorded in the period, amount to R$ 128,384 in consolidated at September 30, 2009 (December 31, 2008 - R$169,658), and are classified in Obligations for purchase of land and advances from clients.

Accounts receivable from completed real estate units delivered are in general subject to annual interest of 12%, the financial income being recorded in income as "Revenue from real estate development "; the interest recognized for the periods ended September 30, 2009 and 2008 totaled R$ 38,915 and R$ 32,105, respectively.

The allowance for doubtful accounts for Tenda totaled R$ 19,628 and R$18,815 at September 30, 2009 and December 31, 2008, respectively, and is considered sufficient by the Company's management to cover future losses on the realization of accounts receivable of this subsidiary.

An allowance for doubtful accounts is not considered necessary, except for Tenda, since the history of losses on accounts receivable is insignificant. The Company's evaluation of the risk of loss takes into account that these credits refer mostly to developments under construction, where the transfer of the property deed only takes place after the settlement and/or negotiation of the client receivables.

The total reversal value of the adjustment to present value recognized in the real estate development revenue for the periods ended September 30, 2009 and 2008 amounted to R$ (16,904) and R$ (8,337), respectively.

On March 31, 2009, the Company carried out a securitization of receivables transaction, which consists of an assignment of a portfolio comprising select residential and commercial real estate receivables arising from Gafisa and its subsidiaries. This portfolio was assigned and transferred to “Gafisa FIDC” which issued Senior and Subordinated quotas. This first issuance of senior quotas was made through an offering restricted to qualified investors. Subordinated quotas were subscribed exclusively by Gafisa. Gafisa FDIC acquired the portfolio of receivables at a discount rate equivalent to the interest rate of finance contracts.

Gafisa was hired by Gafisa FDIC and will be remunerated for performing, among other duties, the conciliation of the receipt of receivables owned by the fund and the collection of past due receivables. The transaction structure provides for the substitution of the Company as collection agent in case of non-fulfillment of the responsibilities described in the collection service contract.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

The Company assigned its receivables portfolio amounting to R$ 119,622 to Gafisa FIDC in exchange for cash, at the transfer date, discounted to present value, for R$ 88,664. The following two quota types were issued: Senior and Subordinated. The subordinated quotas were exclusively subscribed by Gafisa S.A., representing approximately 21% of the amount issued, totaling R$ 18,958 (present value) – (Note 8). At September 30, 2009, it totaled R$ 14,041. Senior and Subordinated quota receivables are indexed by IGP-M and incur interest at 12% per year.

The Company consolidated Gafisa FIDC in its financial statements, accordingly, it discloses at September 30, 2009 receivables amounting to R$ 64,014 in the group of accounts of receivables from clients, and R$ 49,973 is reflected in consolidated noncontrolling interests, the balance of subordinated quotas held by the Company being eliminated in this consolidation process.

On June 26, 2009, the Company carried out a CCI transaction, which consists of an assignment of a portfolio comprising select residential real estate credits from Gafisa and its subsidiaries. The Company assigned its receivables portfolio amounting to R$ 89,102 in exchange for cash, at the transfer date, discounted to present value, of R$ 69,315, classified into the heading "Other accounts payable - - Credit Assignments".

8 book CCIs were issued, amounting to R$69,315 at the date of issue. These 8 CCIs are backed by Receivables which installments fall due on and up to June 26, 2014 (“CCI-Investor”).

CCI-Investor, pursuant to Article 125 of the Brazilian Civil Code, carry general guarantees represented by statutory liens on real estate units, effective as soon as the conditional restrictions included in the registration are lifted, as reflected in the real estate deed, (i) of the assignment of receivables from the assignors to SPEs, as provided for in Article 167, item II, (21) of Law No. 6,015, of December 31, 1973; and (ii) of the issue of CCI – Investor by SPEs, as provided for in Article 18, paragraph 5 of Law No. 10,931/04.

Gafisa was hired and will be remunerated for performing, among other duties, the conciliation of the receipt of receivables, guarantee the CCIs, and the collection of past due receivables. The transaction structure provides for the substitution of Gafisa as collection agent in case of non-fulfillment of the responsibilities described in the collection service contract.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| | | September 30, 2009 | | | December 31, 2008 | |

| | | (Unaudited ) | | | | |

| | | | | | | |

| Land | | | 767,990 | | | | 745,850 | |

| Property under construction | | | 827,042 | | | | 1,181,930 | |

| Completed units | | | 148,507 | | | | 96,491 | |

| Adjustment to present value | | | 18,893 | | | | 4,705 | |

| | | | | | | | | |

| | | | 1,762,432 | | | | 2,028,976 | |

| | | | | | | | | |

| Current portion | | | 1,376,236 | | | | 1,695,130 | |

| Non-current portion | | | 386,196 | | | | 333,846 | |

The Company has undertaken commitments to build units bartered for land, accounted for based on the fair value of the bartered units. At September 30, 2009 and December 31, 2008, the balance of land acquired through barter transactions totaled R$ 80,680 and R$ 169,658.

As mentioned in Note 9, the balance of financial charges at September 30, 2009 and September 30, 2008 amounts to R$ 96,511 and R$ 67,119, respectively.

The present value adjustment included in the balance of property for sale account is related to the balancing entry of the present value adjustment related to liabilities incurred for acquisition of properties with no impact in the results (Note 13).

| 7 | Other accounts receivable |

| | | September 30, 2009 | | | December 31, 2008 | |

| | | (Unaudited ) | | | | |

| | | | | | | |

| Current accounts related to real estate ventures (*) | | | 8,249 | | | | 107,982 | |

| Advances to suppliers | | | 49,519 | | | | 58,274 | |

| Recoverable taxes | | | 32,888 | | | | 18,905 | |

| Deferred PIS and COFINS | | | 2,773 | | | | 11,213 | |

| Credit assignment receivables | | | 4,087 | | | | 7,990 | |

| Client refinancing to be released | | | 5,266 | | | | 4,392 | |

| Advances for future capital increase | | | - | | | | 1,645 | |

| Other | | | 40,591 | | | | 41,173 | |

| | | | | | | | | |

| | | | 143,373 | | | | 251,574 | |

| Current | | | 93,722 | | | | 182,775 | |

| Non-current | | | 49,651 | | | | 68,799 | |

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| (*) | The Company participates in the development of real estate ventures with other partners, directly or through related parties, through condominiums and/or consortia. The management structure of these enterprises and the cash management are centralized in the lead partner of the enterprise, which manages the construction schedule and budgets. Thus, the lead partner ensures that the investments of the necessary funds are made and allocated as planned. The sources and use of resources of the venture are reflected in these balances, observing the respective participation percentage, which are not subject to indexation or financial charges and do not have a predetermined maturity date. The average term for the development and completion of the projects in which the resources are invested is between 24 and 30 months. |

| 8 | Investments in subsidiaries |

In January 2007, upon the acquisition of 60% of Alphaville, arising from the merger of Catalufa Participações Ltda., a capital increase of R$ 134,029 was approved upon the issuance for public subscription of 6,358,116 common shares. This transaction generated goodwill of R$ 170,941 recorded based on expected future profitability, which was being partially amortized through December 31, 2008 to match the estimated profit before taxes of Alphaville. From January 1, 2009, the goodwill from the acquisition of Alphaville is no longer amortized consistent with the changes to Brazilian GAAP; however, goodwill is evaluated for impairment, at least annually. The Company has a commitment to purchase the remaining 40% of Alphaville's capital stock based on the fair value of Alphaville, to be determined at the future acquisition dates, the purchase consideration for which cannot yet be calculated and, consequently, is not recognized. The acquisition agreement provides that the Company undertakes to purchase the remaining 40% of Alphaville (20% within three years from the acquisition date and the remaining 20% within five years from the acquisition date) for settlement in cash or shares, at the Company's sole discretion.

On October 26, 2007, the Company acquired 70% of Cipesa whereupon Gafisa S.A. and Cipesa incorporated a new company, Cipesa Empreendimentos Imobiliários Ltda. ("Nova Cipesa"), in which the Company holds a 70% interest and Cipesa has 30%. Gafisa S.A. made a contribution in Nova Cipesa of R$ 50,000 in cash and acquired the shares which Cipesa held in Nova Cipesa amounting for R$ 15,000, paid on October 26, 2008. Cipesa is entitled to

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

receive from the Company a variable portion corresponding to 2% of the Total Sales Value (VGV), as defined, of the projects launched by Nova Cipesa through 2014, not to exceed R$ 25,000. Accordingly, the Company’s purchase consideration totaled R$ 90,000 and goodwill amounting to R$ 40,686 was recorded, based on expected future profitability. From January 1, 2009, consistent with the changes to Brazilian GAAP, the goodwill from the acquisition of Nova Cipesa is no longer amortized but evaluated for impairment at least annually.

In November 2007, the Company acquired for R$ 40,000 the remaining interest in certain ventures with Redevco do Brasil Ltda. ("Redevco"). As a result of this transaction, the Company recognized negative goodwill of R$ 32,222, based on expected future results to match the estimated profit of these SPEs. In the nine-month period ended September 30, 2009, the Company amortized negative goodwill amounting to R$ 7,008 arising from the acquisition of these SPEs (September 30, 2008 – R$ 7,423).

On October 21, 2008, as part of the acquisition of its interest in Tenda (Note 1), the Company contributed the net assets of Fit Residencial amounting to R$ 411,241, acquiring 60% of the shareholders' equity of Tenda, which at that date presented shareholders' equity book value of R$ 1,036,072, with an investment of R$ 621,643. The sale of the 40% quotas of Fit Residencial to Tenda shareholders in exchange for the Tenda shares generated negative goodwill of R$ 210,402, which is based on expected future results, reflecting the gain on the sale of the interest in Fit Residencial (Gain on the exchange of shares). This negative goodwill is being amortized over the average construction period (through delivery of the units) of the real estate ventures of Fit Residencial at October 21, 2008. In the nine-month period ended September 30, 2009, the Company amortized R$ 157,800 of the gain on the partial sale of Fit Residencial.

| (i) | Information on investees |

| | | Interest - % | 3 | Shareholders’ Equity | 4 | Net Income (Loss) | 5 |

| | | | | | | | | | | | | | |

| Investees | | September 30, 2009 | | December 31, 2008 | | September 30, 2009 | | December 31, 2008 | | September 30, 2009 | | September 30, 2008 | |

| | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | (Unaudited) | |

| Tenda | | 60.00 | | 60.00 | | 1,121,372 | | 1,062,213 | | 55,711 | | - | |

| Fit Residencial | | - | | - | | - | | - | | - | | (5,892) | |

| Bairro Novo | | - | | 50.00 | | - | | 8,164 | | - | | (13,338) | |

| AUSA | | 60.00 | | 60.00 | | 89,346 | | 69,211 | | 19,359 | | 41,691 | |

| Cipesa Holding | | 70.00 | | 100.00 | | 42,518 | | 62,157 | | (992) | | (1,047) | |

| Península SPE1 S.A. | | 50.00 | 6 | 50.00 | 7 | (4,698) | 8 | (1,139 | ) | (3,009) | 9 | 858 | 10 |

| Península SPE2 S.A. | | 50.00 | 11 | 50.00 | 12 | 180 | 13 | 98 | 14 | 82 | 15 | 879 | 16 |

| Res. das Palmeiras SPE Ltda. | | 100.00 | 17 | 100.00 | 18 | 2,296 | 19 | 2,545 | 20 | 6 | 21 | 169 | 22 |

| Gafisa SPE 27 Ltda | | 100.00 | 23 | - | 24 | 13,561 | 25 | - | 26 | (1,331) | 27 | - | 28 |

Gafisa S.A.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| | | Interest - % | 3 | Shareholders’ Equity | 4 | Net Income (Loss) | 5 |

| | | | | | | | | | | | | | |

| Investees | | September 30, 2009 | | December 31, 2008 | | September 30, 2009 | | December 31, 2008 | | September 30, 2009 | | September 30, 2008 | |

| | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | (Unaudited) | |

| Gafisa SPE 28 Ltda | | 100.00 | 29 | - | 30 | (3,388) | | - | | (1,683) | | - | |

| Gafisa SPE 30 Ltda | | 100.00 | 31 | - | 32 | 17,816 | 33 | - | 34 | (747) | 35 | - | 36 |

| Gafisa SPE 31 Ltda | | 100.00 | 37 | - | 38 | 26,880 | 39 | - | 40 | (553) | 41 | - | 42 |

| Gafisa SPE 35 Ltda | | 100.00 | 43 | - | 44 | 5,334 | 45 | - | 46 | (1,334) | | - | |

| Gafisa SPE 36 Ltda | | 100.00 | 47 | - | 48 | 3,841 | 49 | - | 50 | (1,454) | 51 | - | 52 |

| Gafisa SPE 37 Ltda | | 100.00 | 53 | - | 54 | 3,760 | 55 | - | 56 | (400) | 57 | - | 58 |

| Gafisa SPE 38 Ltda | | 100.00 | 59 | - | 60 | 7,421 | 61 | - | 62 | 595 | 63 | - | |

| Gafisa SPE 39 Ltda | | 100.00 | | - | | 7,658 | | - | | 1,314 | | - | |

| Gafisa SPE 41 Ltda | | 100.00 | | - | | 29,298 | | - | | (5,178) | | - | |

| Villagio Trust | | 50.00 | | - | | 4,239 | | - | | (616) | | - | |

| Gafisa SPE 40 Ltda. | | 50.00 | | 50.00 | | 5,789 | | 5,841 | | 237 | | 1,535 | |

| Gafisa SPE 42 Ltda. | | 100.00 | 64 | 50.00 | 65 | 12,358 | 66 | 6,997 | 67 | 2,357 | 68 | 6,990 | 69 |

| Gafisa SPE 44 Ltda. | | 40.00 | 70 | 40.00 | 71 | 3,590 | 72 | (377 | ) | (150) | 73 | (157) | 74 |

| Gafisa SPE 45 Ltda. | | 100.00 | 75 | 99.80 | 76 | 453 | 77 | 1,058 | 78 | (1,570) | 79 | (4,078) | 80 |

| Gafisa SPE 46 Ltda. | | 60.00 | 81 | 60.00 | 82 | 5,946 | 83 | 5,498 | 84 | (1,713) | 85 | 3,605 | 86 |

| Gafisa SPE 47 Ltda. | | 80.00 | 87 | 80.00 | 88 | 16,673 | 89 | 6,639 | 90 | (255) | 91 | (181) | 92 |

| Gafisa SPE 48 Ltda. | | 100.00 | 93 | 99.80 | 94 | - | 95 | 21,656 | 96 | 1,674 | 97 | 3,745 | 98 |

| Gafisa SPE 49 Ltda. | | 100.00 | 99 | 99.80 | 100 | 206 | 101 | (58 | ) | (3) | 102 | (11) | 103 |

| Gafisa SPE 53 Ltda. | | 80.00 | 104 | 60.00 | 105 | 4,839 | 106 | 2,769 | 107 | 1,847 | 108 | 2,449 | 109 |

| Gafisa SPE 55 Ltda. | | 100.00 | 110 | 99.80 | | - | | 20,540 | | 2,776 | | (2,830) | |

| Gafisa SPE 65 Ltda. | | 80.00 | 111 | 70.00 | 112 | 3,452 | 113 | (281 | ) | 605 | 114 | (346) | 115 |

| Gafisa SPE 68 Ltda. | | 100.00 | 116 | 99.80 | 117 | - | 118 | - | 119 | (92) | 120 | (1) | 121 |

| Gafisa SPE 72 Ltda. | | 80.00 | 122 | 60.00 | 123 | 1,189 | | (22 | ) | (238) | | (31) | |

| Gafisa SPE 73 Ltda. | | 80.00 | 124 | 70.00 | 125 | 3,556 | 126 | (155 | ) | (52) | 127 | (203) | 128 |

| Gafisa SPE 74 Ltda. | | 100.00 | 129 | 99.80 | 130 | (342) | 131 | (330 | ) | (13) | 132 | (245) | 133 |

| Gafisa SPE 59 Ltda. | | 100.00 | 134 | 99.80 | 135 | (5) | 136 | (2 | ) | (3) | 137 | - | 138 |

| Gafisa SPE 76 Ltda. | | 50.00 | 139 | 99.80 | 140 | 84 | 141 | - | 142 | (1) | 143 | (1) | 144 |

| Gafisa SPE 78 Ltda. | | 100.00 | 145 | 99.80 | 146 | - | 147 | - | 148 | - | 149 | (1) | |

| Gafisa SPE 79 Ltda. | | 100.00 | 150 | 99.80 | 151 | (2) | 152 | (1 | ) | (2) | 153 | (1) | 154 |

| Gafisa SPE 75 Ltda. | | 100.00 | 155 | 99.80 | 156 | (72) | 157 | (27 | ) | (45) | 158 | - | 159 |

| Gafisa SPE 80 Ltda. | | 100.00 | 160 | 99.80 | 161 | (2) | 162 | - | | (2) | | (1) | |

| Gafisa SPE-85 Empr. Imob. | | 80.00 | 163 | 60.00 | 164 | 5,609 | 165 | (756 | ) | 3,304 | 166 | - | 167 |

| Gafisa SPE-86 Ltda. | | - | 168 | 99.80 | 169 | - | 170 | (82 | ) | (228) | 171 | - | 172 |

| Gafisa SPE-81 Ltda. | | 100.00 | 173 | 99.80 | 174 | 1 | 175 | 1 | 176 | - | | - | |

| Gafisa SPE-82 Ltda. | | 100.00 | 177 | 99.80 | 178 | 1 | 179 | 1 | 180 | - | 181 | - | 182 |

| Gafisa SPE-83 Ltda. | | 100.00 | 183 | 99.80 | 184 | 1 | 185 | 1 | 186 | - | 187 | - | 188 |

| Gafisa SPE-87 Ltda. | | 100.00 | 189 | 99.80 | 190 | 201 | 191 | 1 | 192 | - | 193 | - | 194 |

| Gafisa SPE-88 Ltda. | | 100.00 | 195 | 99.80 | 196 | 5,660 | 197 | 1 | 198 | 3,865 | 199 | - | 200 |

| Gafisa SPE-89 Ltda. | | 100.00 | 201 | 99.80 | 202 | 34,151 | 203 | 1 | 204 | 6,316 | 205 | - | 206 |

| Gafisa SPE-90 Ltda. | | 100.00 | 207 | 99.80 | 208 | 1 | | 1 | | - | | - | |

| Gafisa SPE-84 Ltda. | | 100.00 | | 99.80 | | 10,477 | | 1 | | 2,871 | | - | |

| Dv Bv SPE S.A. | | 50.00 | | 50.00 | | 464 | | (439 | ) | 903 | | 889 | |

| DV SPE S.A. | | 50.00 | | 50.00 | | 1,871 | | 932 | | 939 | | (172) | |

| Gafisa SPE 22 Ltda. | | 100.00 | 209 | 100.00 | 210 | 5,934 | 211 | 5,446 | 212 | 488 | 213 | 1,151 | 214 |

| Gafisa SPE 29 Ltda. | | 70.00 | 215 | 70.00 | 216 | (210) | 217 | 257 | 218 | (317) | 219 | 345 | 220 |

| Gafisa SPE 32 Ltda. | | 80.00 | 221 | 80.00 | | 4,903 | | (760 | ) | 584 | | (185) | |

| Gafisa SPE 69 Ltda. | | 100.00 | 222 | 99.80 | 223 | 1,893 | 224 | (401 | ) | (247) | 225 | (4) | 226 |

| Gafisa SPE 70 Ltda. | | 55.00 | 227 | 55.00 | 228 | 12,685 | 229 | 6,696 | 230 | (63) | 231 | (1) | 232 |

| Gafisa SPE 71 Ltda. | | 80.00 | 233 | 70.00 | | 2,765 | | (794 | ) | 1,776 | | (747) | |

| Gafisa SPE 50 Ltda. | | 80.00 | 234 | 80.00 | 235 | 10,359 | 236 | 7,240 | 237 | 3,354 | 238 | 1,367 | 239 |

| Gafisa SPE 51 Ltda. | | 95.00 | 240 | 90.00 | 241 | - | 242 | 15,669 | 243 | 8,096 | 244 | 6,112 | 245 |

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| | | Interest - % | 3 | Shareholders’ Equity | 4 | Net Income (Loss) | 5 |

| | | | | | | | | | | | | | |

| Investees | | September 30, 2009 | | December 31, 2008 | | September 30, 2009 | | December 31, 2008 | | September 30, 2009 | | September 30, 2008 | |

| | | (Unaudited) | | | | (Unaudited) | | | | (Unaudited) | | (Unaudited) | |

| Gafisa SPE 61 Ltda. | | 100.00 | 246 | 99.80 | 247 | (18) | 248 | (14 | ) | (3) | 249 | (14) | 250 |

| Tiner Empr. e Part. Ltda. | | 45.00 | 251 | 45.00 | 252 | 15,629 | 253 | 26,736 | 254 | (893) | 255 | 11,761 | 256 |

| O Bosque Empr. Imob. Ltda. | | 60.00 | 257 | 30.00 | 258 | 8,761 | 259 | 15,854 | 260 | (811) | 261 | - | 262 |

| Alta Vistta | | 50.00 | 263 | 50.00 | 264 | (2,452) | 265 | 3,428 | 266 | (5,881) | 267 | 2,535 | 268 |

| Dep. José Lages | | 50.00 | 269 | 50.00 | 270 | 651 | | 34 | | 767 | | 161 | |

| Sitio Jatiuca | | 50.00 | | 50.00 | | 9,088 | | 1,259 | | 7,829 | | 2,517 | |

| Spazio Natura | | 50.00 | | 50.00 | | 1,400 | | 1,400 | | (1) | | (20) | |

| Parque Águas | | 50.00 | | 50.00 | | (190) | | (1,661 | ) | 438 | | (1,214) | |

| Parque Arvores | | 50.00 | 271 | 50.00 | 272 | 363 | 273 | (1,906 | ) | 1,266 | 274 | (1,081) | 275 |

| Dubai Residencial | | 50.00 | 276 | 50.00 | 277 | 8,017 | 278 | 5,374 | 279 | 683 | 280 | (229) | 281 |

| Cara de Cão | | - | 282 | 65.00 | 283 | - | 284 | 40,959 | | - | | - | |

| Costa Maggiore | | 50.00 | 285 | 50.00 | 286 | 3,302 | 287 | 3,892 | 288 | 1,374 | 289 | 3,430 | 290 |

| Gafisa SPE-91 Ltda. | | 100.00 | 291 | - | 292 | 1 | 293 | - | 294 | - | 295 | - | 296 |

| Gafisa SPE-92 Ltda. | | 100.00 | 297 | - | 298 | (107) | 299 | - | 300 | (108) | | - | |

| Gafisa SPE-93 Ltda. | | 100.00 | 301 | - | 302 | (26) | 303 | - | 304 | (27) | 305 | - | 306 |

| Gafisa SPE-94 Ltda. | | 100.00 | 307 | - | 308 | (1) | 309 | - | 310 | (2) | 311 | - | 312 |

| Gafisa SPE-95 Ltda. | | 100.00 | 313 | - | 314 | (3) | 315 | - | 316 | (4) | 317 | - | 318 |

| Gafisa SPE-96 Ltda. | | 100.00 | 319 | - | 320 | (63) | 321 | - | 322 | (64) | 323 | - | 324 |

| Gafisa SPE-97 Ltda. | | 100.00 | 325 | - | 326 | 2 | 327 | - | 328 | 1 | 329 | - | 330 |

| Gafisa SPE-98 Ltda. | | 100.00 | 331 | - | 332 | (38) | 333 | - | 334 | (39) | 335 | - | 336 |

| Gafisa SPE-99 Ltda. | | 100.00 | 337 | - | 338 | (25) | 339 | - | 340 | (26) | 341 | - | 342 |

| Gafisa SPE-100 Ltda. | | 100.00 | 343 | - | 344 | 1 | 345 | - | 346 | - | 347 | - | 348 |

| Gafisa SPE-101 Ltda. | | 100.00 | 349 | - | 350 | 1 | 351 | - | 352 | - | 353 | - | 354 |

| Gafisa SPE-102 Ltda. | | 100.00 | 355 | - | 356 | 1 | 357 | - | 358 | - | 359 | - | 360 |

| Gafisa SPE-103 Ltda. | | 100.00 | 361 | - | 362 | (43) | 363 | - | 364 | (44) | 365 | - | 366 |

| Gafisa SPE-104 Ltda. | | 100.00 | 367 | - | 368 | 1 | 369 | - | 370 | - | 371 | - | 372 |

| Gafisa SPE-105 Ltda. | | 100.00 | 373 | - | 374 | 1 | 375 | - | 376 | - | 377 | - | 378 |

| Gafisa SPE-106 Ltda. | | 100.00 | 379 | - | 380 | 1 | 381 | - | 382 | - | 383 | - | 384 |

| Gafisa SPE-107 Ltda. | | 100.00 | 385 | - | 386 | 1 | 387 | - | 388 | - | 389 | - | 390 |

| Gafisa SPE-108 Ltda. | | 100.00 | 391 | - | 392 | 1 | 393 | - | 394 | - | 395 | - | 396 |

| Gafisa SPE-109 Ltda. | | 100.00 | 397 | - | 398 | 1 | 399 | - | 400 | - | 401 | - | 402 |

| Gafisa SPE-110 Ltda. | | 100.00 | 403 | - | 404 | 1 | 405 | - | 406 | - | 407 | - | 408 |

| Gafisa SPE-111 Ltda. | | 100.00 | | - | | 1 | | - | | - | | - | |

| Gafisa SPE-112 Ltda. | | 100.00 | | - | | 1 | | - | | - | | - | |

| Gafisa SPE-113 Ltda. | | 100.00 | | - | | 1 | | - | | - | | - | |

| City Park Brotas Emp. Imob. Ltda | | 50.00 | | - | | 846 | | - | | 826 | | - | |

| City Park Acupe Emp. Imob. Ltda | | 50.00 | | - | | 1,309 | | - | | 809 | | - | |

| Gafisa FDIC | | 100.00 | | - | | 14,041 | | - | | - | | - | |

| (b) | Goodwill (negative goodwill) on acquisition of subsidiaries and deferred gain on partial sale of investments |

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| | | September 30, 2009 (Unaudited) | | | December 31, 2008 | |

| | | | | | | | | | | | | |

| | | | | | Accumulated | | | | | | | |

| | | Cost | | | amortization | | | Net | | | Net | |

| | | | | | | | | | | | | |

| Goodwill | | | | | | | | | | | | |

Alphaville | | | 170,941 | | | | (18,085 | ) | | | 152,856 | | | | 152,856 | |

Nova Cipesa | | | 40,686 | | | | - | | | | 40,686 | | | | 40,686 | |

Other | | | 3,741 | | | | (2,195 | ) | | | 1,546 | | | | 1,546 | |

| | | | | | | | | | | | | | | | | |

| | | | 215,368 | | | | (20,280 | ) | | | 195,088 | | | | 195,088 | |

| Negative goodwill | | | | | | | | | | | | | | | | |

Redevco | | | (32,222 | ) | | | 19,723 | | | | (12,499 | ) | | | (18,522 | ) |

Deferred gain on partial sale of FIT Residencial investment | | | | | | | | | | | | | | | | |

Tenda transaction | | | (210,402 | ) | | | 198,808 | | | | (11,594 | ) | | | (169,394 | ) |

| 9 | Loans and Financing, net of Cross-Currency Interest Rate Swaps |

| Type of operation | | Annual interest rates | | | September 30, 2009 | | | December 31, 2008 | |

| | | | | | (Unaudited) | | | | |

| Working capital | | | | | | | | | |

Denominated in Yen (i) | | | 1.4% | | | | 131,305 | | | | 166,818 | |

Swaps - Yen/CDI (ii) | | Yen + 1.4%/105% CDI | | | | (7,296 | ) | | | (53,790 | ) |

Denominated in US$ (i) | | | 7% | | | | | | | | 146,739 | |

Swaps - US$/CDI (ii) | | US$ + 7%/104% CDI | | | | - | | | | (32,962 | ) |

Other | | 0.66% to 3.29% + CDI | | | | 608,118 | | | | 435,730 | |

| | | | | | | | | | | | | |

| | | | | | | | 732,127 | | | | 662,535 | |

| National Housing System – SFH (iv) | | | TR + 6.2% to 11.4% | | | | 473,615 | | | | 372,255 | |

| Downstream merger obligations (iii) | | | TR + 10% to 12.0% | | | | - | | | | 8,810 | |

| Other | | | TR+ 6.2% | | | | 1,204 | | | | 4,576 | |

| | | | | | | | | | | | | |

| | | | | | | | 1,206,946 | | | | 1,048,176 | |

| | | | | | | | | | | | | |

| Current portion | | | | | | | 570,307 | | | | 447,503 | |

| Non-current portion | | | | | | | 636,639 | | | | 600,673 | |

(i) Loans and financing classified at fair value through income (Note 16(b)(ii)).

(ii) Derivatives classified as financial assets at fair value through income (Note 16(b)(ii)).

Gafisa S.A.

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

As of September 30, 2009 and for the nine-month periods ended September 30, 2009 and 2008

All information with respect to September 30, 2009 and 2008 is unaudited

In thousands of Brazilian reais, unless otherwise stated

| . | CDI – Interbank Deposit Certificate. |

(iii) Downstream merger obligations correspond to debt assumed from former shareholders with maturities up to 2013.

(iv) Funding for working capital – SFH and for developments correspond to credit lines from financial institutions.

The Company has financing agreements with the SFH, the resources from which are released to the Company as construction progresses. At September 30, 2009, the Company has resources approved to be released for approximately 93 ventures amounting to R$ 1,650,046 that will be used in future periods, at the extent these developments progress physically and financially, according to the Company’s project schedule.