|

Important Notes (Continued) [GRAPHIC OMITTED]

- --------------------------------------------------------------------------------

6. This Valuation Report indicates an estimate only, at our discretion, of the

value obtained from application of valuation methodologies used in companies'

financial valuations, and does not evaluate any other aspect or implication of

the Transaction or any contract, agreement or understanding entered into in

relation to the Transaction. We do not express our opinion in relation to the

exchange ratio, amount to be paid for the shares under the Transaction or the

value at which the Companies' shares may be traded in the security market at

any time. Additionally, this Valuation Report may not be interpreted by

any person obtaining access to the valuation report to constitute a fairness

opinion or any indication of fairness from Itau BBA in relation to the

Transaction. Additionally, this Valuation Report does not deal with the

strategic and commercial merits of the Transaction, nor does it deal with any

possible strategic and commercial decision of the Companies to carry out the

Transaction. The results presented in this Valuation Report refer to the

Transaction only and shall not be applied to any other present or future

decision or operation related to the Companies, the economic group to which they

belong or the market in which they operate. This Valuation Report does not

constitute a judgment, opinion or recommendation to the management of Tenda and

the Independent Committee or any third party in relation to the convenience and

opportunity of the Transaction, as it is not intended to serve as a basis for

any investment or any other decision.

7. Our Valuation Report is necessarily based on information that was made

available to us until the date hereof and considering market, economic and

other conditions as they are presented and as they may be evaluated on the date

hereof. Although future events and other developments may affect the

conclusions presented in this Valuation Report, we have no obligation to

update, review, rectify or revoke this Valuation Report, in whole or in part,

as a result of any subsequent development or due to any other reason

whatsoever.

8. Our analyses do not include operating, tax or other benefits or losses of

any type whatsoever, including any possible premium, nor do they include any

synergies, incremental value and/or costs, if any, as of the closing of the

Transaction, if closed, or of any other operation. Our analyses are not and

shall not be considered as a recommendation in relation to how the Independent

Committee, Tenda and/or Gafisa's shareholders must vote or perform in relation

to the Transaction. We have not been requested to take part and we will not

take part in the negotiation or structuring of the Transaction.

9. Tenda has agreed to reimburse us for our expenses and to indemnify us as

well as some persons as a result of our engagement. We will receive a fee in

relation to the preparation of this Valuation Report regardless of the

Transaction completion.

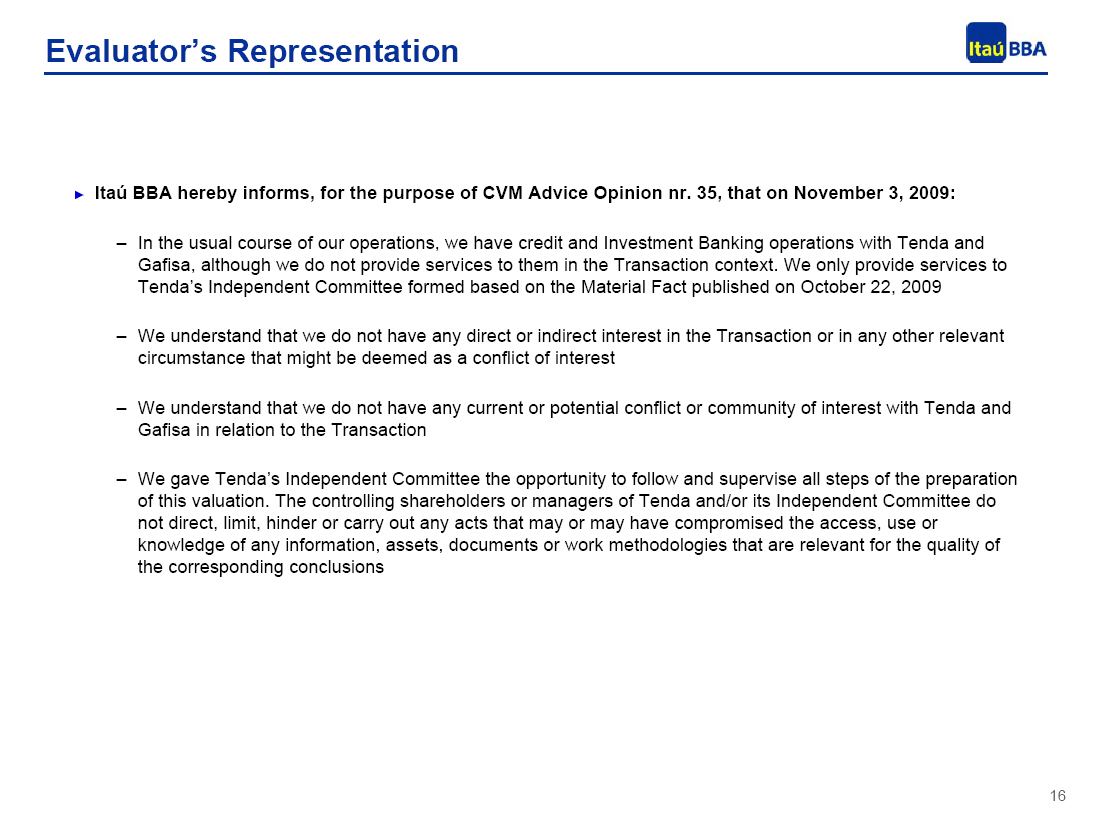

10. We provided investment banking and banking services and financial services

in general as well as other financial services to Tenda and to Gafisa and to

their respective affiliates from time to time in the past, for which we were

compensated, and we may, in the future, provide such services to Tenda and to

Gafisa and to their respective affiliates, for which we expect to be

compensated. We and our affiliates provide a variety of financial services and

other services related to securities, brokerage and investment banking. In the

usual course of our activities we may purchase, hold or sell, on our behalf or

on the behalf and at the behest of our customers, shares, doubt instruments and

other securities and financial instruments (including bank loans and other

liabilities) of Tenda and Gafisa and of any other companies that may be

involved in the Transaction, and we may provide investment banking services and

other financial services to such companies and their respective subsidiaries or

parent companies. The professionals of the securities analyses department

(research) and other divisions of Itau Group, including Itau BBA, may base

their analyses and publications on different operating and market assumptions

and on different analysis methodologies when compared with those used in the

preparation of this Valuation Report, so that the research reports and other

publications prepared by them may contain results and conclusions that are

different from those prepared herein, considering that such analyses and

reports are performed by analysts who are independent from any relationship

with the professionals who performed in the preparation of this Valuation

Report. We adopt policies and procedures designed to protect the independence

of our security analysts, whose views may differ from those of our investment

banking department. We also adopt policies and procedures designed to protect

the independence between the investment banking and the other areas and

departments of Itau BBA and other companies of Itau Group, including but not

limited to asset management, proprietary share trading desk, debt instruments,

securities and other financial instruments.

11. We have not provided any accounting, auditing, legal, tax or fiscal

services in relation to this Valuation Report.

12. The financial calculations contained in this Valuation Report may not

always result in an accurate sum due to rounding.

13. This Valuation Report is the intellectual property of Itau BBA.

Banco Itau BBA S.A. 3

slide03

|