UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22018 | |||||

| ||||||

Nuveen Diversified Currency Opportunities Fund | ||||||

(Exact name of registrant as specified in charter) | ||||||

| ||||||

Nuveen Investments | ||||||

(Address of principal executive offices) (Zip code) | ||||||

| ||||||

Kevin J. McCarthy Nuveen Investments 333 West Wacker Drive Chicago, IL 60606 | ||||||

(Name and address of agent for service) | ||||||

| ||||||

Registrant’s telephone number, including area code: | (312) 917-7700 |

| ||||

| ||||||

Date of fiscal year end: | December 31 |

| ||||

| ||||||

Date of reporting period: | June 30, 2014 |

| ||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

Nuveen Investments

Closed-End Funds

Semi-Annual Report June 30, 2014

JGG

Nuveen Global Income Opportunities Fund

JGT

Nuveen Diversified Currency Opportunities Fund

Nuveen Investments to be acquired by TIAA-CREF

On April 14, 2014, TIAA-CREF announced that it had entered into an agreement to acquire Nuveen Investments, the parent company of your fund's investment adviser, Nuveen Fund Advisors, LLC ("NFAL") and the Nuveen affiliates that act as sub-advisers to the majority of the Nuveen Funds. TIAA-CREF is a national financial services organization with approximately $569 billion in assets under management (as of March 31, 2014) and is a leading provider of retirement services in the academic, research, medical and cultural fields. Nuveen anticipates that it will operate as a separate subsidiary within TIAA-CREF's asset management business, and that its current leadership and key investment teams will stay in place.

Your fund investment will not change as a result of Nuveen's change of ownership. You will still own the same fund shares and the underlying value of those shares will not change as a result of the transaction. NFAL and your fund's sub-adviser(s) will continue to manage your fund according to the same objectives and policies as before, and we do not anticipate any significant changes to your fund's operations. Under the securities laws, the consummation of the transaction will result in the automatic termination of the investment management agreements between the funds and NFAL and the investment sub-advisory agreements between NFAL and each fund's sub-adviser(s).

New agreements will be presented to the funds' shareholders for approval (along with fund reorganizations described elsewhere in this report), and if approved, will take effect upon the consummation of Nuveen's transaction with TIAA-CREF or such later time as shareholder approval is obtained. Shareholder meetings for each fund will be held at 2:00 p.m., Central time, on Friday, October 31, 2014 at the offices of Nuveen Investments, 333 West Wacker Drive, Chicago, Illinois 60606.

Table

of Contents

Chairman's Letter to Shareholders | 4 | ||||||

Portfolio Managers' Comments | 5 | ||||||

Fund Leverage and Currency Investment Exposure | 10 | ||||||

Share Information | 11 | ||||||

Risk Considerations | 14 | ||||||

Performance Overview and Holding Summaries | 16 | ||||||

Portfolios of Investments | 20 | ||||||

Statement of Assets and Liabilities | 37 | ||||||

Statement of Operations | 38 | ||||||

Statement of Changes in Net Assets | 39 | ||||||

Statement of Cash Flows | 40 | ||||||

Financial Highlights | 42 | ||||||

Notes to Financial Statements | 44 | ||||||

Additional Fund Information | 59 | ||||||

Glossary of Terms Used in this Report | 60 | ||||||

Reinvest Automatically, Easily and Conveniently | 61 | ||||||

Annual Investment Agreement Approval Process | 62 | ||||||

Nuveen Investments

3

Chairman's Letter

to Shareholders

Dear Shareholders,

After significant growth in 2013, domestic and international equity markets have been less compelling during the first part of 2014. Concerns about deflation, political uncertainty in many places and the potential for more fragile economies to impact other countries have produced uncertainty in the markets.

Europe is beginning to emerge slowly from the recession in mid-2013, with improved GDP and employment trends in some countries. However, Japan's deflationary headwinds have resurfaced; and China shows signs of slowing from credit distress combined with declines in manufacturing and exports. Most recently, tensions between Russia and Ukraine may continue to hold back stocks and support government bonds in the near term.

Despite these headwinds, there are some encouraging signs of forward momentum in the markets. In the U.S., the news is more positive with financial risks slowly receding, positive GDP trends, downward trending unemployment and stronger household finances and corporate spending.

It is in such changeable markets that professional investment management is most important. Investment teams who have experienced challenging markets in the past understand how their asset class can behave in rapidly changing times. Remaining committed to their investment disciplines during these times is a critical component to achieving long-term success. In fact, many strong investment track records are established during challenging periods because experienced investment teams understand that volatile markets place a premium on companies and investment ideas that can weather the short-term volatility. By maintaining appropriate time horizons, diversification and relying on practiced investment teams, we believe that investors can achieve their long-term investment objectives.

As always, I encourage you to communicate with your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

William J. Schneider

Chairman of the Board

August 25, 2014

Nuveen Investments

4

Portfolio Managers'

Comments

Nuveen Global Income Opportunities Fund (JGG)

Nuveen Diversified Currency Opportunities Fund (JGT)

These Funds feature portfolio management by Nuveen Asset Management (NAM), LLC, an affiliate of Nuveen Investments, Inc. Steve S. Lee, CFA, and Timothy A. Palmer, CFA, manage these Funds.

Here they discuss their investment strategies and the performance of the Funds during the six-month reporting period ended June 30, 2014.

What key strategies were used to manage the Funds during this six-month reporting period ended June 30, 2014?

Both of the Funds continued to employ the same fundamental investment strategies and tactics used previously, although implementation of those strategies depended on the individual characteristics of the portfolios, as well as market conditions. The Funds' management team used a highly collaborative, research-driven approach that we believe offers the best opportunity to achieve consistent, superior long-term performance on a risk-adjusted basis across the full range of market environments. Going into the reporting period, the Funds were generally positioned for an environment of continued moderate economic growth and improving financial conditions, a posture we remained committed to during the reporting period. Nonetheless, we made shifts on an ongoing basis that were geared toward improving each Fund's profile in response to changing conditions and valuations. These strategic moves are discussed in more detail later in this report.

JGG's investment objective of high current income and gains with a secondary objective of seeking capital preservation remained unchanged. JGG features a more traditional, multi-sector global bond strategy that invests primarily in sovereign, corporate and other types of debt from developed and emerging markets around the world. JGG intends to actively manage its country, currency, sector and interest rate exposures as market conditions change. JGG currently invests at least 80% of its managed assets in global debt securities including, but not limited to, global sovereign and government-related debt, domestic and foreign debt securities, U.S. government securities, residential and commercial mortgage-backed securities and asset-backed securities. JGG will invest primarily in securities rated investment grade at the time of purchase, from issuers in both developed and emerging market (EM) countries.

During the six-month reporting period, JGG's key sector themes continued to include our positioning in favor of credit sectors (both investment grade and high yield), EM dollar-denominated corporates and EM local-denominated debt, with an underweight to developed market government debt. We also maintained a defensive interest rate posture overall in the Fund, with a bias to take interest rate exposure in select emerging markets. From a currency perspective, our high level themes were to underweight the yen and euro in favor of selected smaller currencies and some emerging markets.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's (S&P), Moody's Investors Service, Inc. (Moody's) or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Nuveen Investments

5

Portfolio Managers' Comments (continued)

During the period, we saw considerable opportunity to take advantage of market volatility and fundamental developments to make adjustments around these core themes. Earlier in the period, we made some asset class shifts to position the Fund to benefit from a recovery in emerging markets and a firming of global growth. We meaningfully increased the Fund's positions in foreign-denominated bonds, particularly in select EMs such as Mexico, South Africa, Poland, Brazil and Turkey. Many of these foreign markets remained attractively valued amid investor skepticism, despite improved fundamental conditions. Also, as the volatility of global currencies stabilized this year, we added to select EM currencies from countries where policymakers showed a willingness to improve competitiveness, promote structural reforms and enhance fiscal and monetary credibility. Within the corporate market, new issues and secondary market opportunities in individual credits proved fruitful as we repositioned based on relative values and took advantage of booking gains in some holdings. We reduced the Fund's investment-grade and high-yield weightings as some holdings hit target levels; these reductions were focused in European credit, which had outperformed significantly during the first few months of the reporting period. Overall, however, we retained the Fund's industry focus on financials as well as cyclically sensitive industries within the corporate segment. We actively managed the level of the Fund's global duration as well as the composition of interest rate risk by country, while remaining defensive throughout, ending the period at the lower end of our interest rate exposure range.

JGT seeks to provide the potential for an attractive level of current income and total return. The Fund offers actively managed diversified exposure to foreign currencies and short-term global yields by investing directly and indirectly in a portfolio of short-term international government securities denominated in unhedged, non-U.S. currencies. Indirect investments in international non-U.S. government securities are made by purchasing forward currency contracts and other derivative instruments that are collateralized by direct investments in U.S. cash equivalents, including U.S. government debt and agency paper. This strategy may create the economic effect of financial leverage. JGT also actively manages both long and short currency positions in multiple currencies.

Moderate global growth, low volatility and accommodative monetary policies supported high-yielding currencies throughout the period. However, underneath this positive backdrop, there were significant differences in the performance among currencies, driven by idiosyncratic, country-specific factors. Our core positions in Mexico, South Africa, Malaysia and Brazil remained intact, although position sizes were adjusted during the reporting period. Similarly, the Fund's core short position in the Japanese yen remained in place. We also maintained positions in higher yielding local debt, such as Brazil, as well as a significant positioning in high-yield corporate debt and international sovereign debt. Beyond these core positions, we actively repositioned the Fund's currency exposure, taking advantage of a carry-friendly, global macro environment and relative valuation shifts. After decreasing JGT's net exposure to foreign currencies that reached our target levels early in the period, we reversed course and increased exposure to select EM currencies in the second half. For example, we increased the Fund's currency exposures in Indonesia and Turkey as the balance of payment of those countries continued to improve. We also initiated a long position in the Indian rupee as the newly elected government with a strong mandate may implement structural reforms that could boost the country's long term economic growth rate. Conversely, we decreased currency exposures in Australia and New Zealand as those currencies reached our target levels and the terms of trade started deteriorating. We also covered short positions in the Korean won and Canadian dollar, but initiated a short currency position in the euro given domestic developments and as a portfolio hedge against potential U.S. dollar strength. We continued to find selective opportunities in corporates and mortgage-related securities with attractive short duration yields.

How did the Funds perform during this six-month reporting period ended June 30, 2014?

The tables in the Performance Overview and Holding Summaries section of this report provide total return performance for the Funds for the six-month, one-year, five-year and since inception periods ended June 30, 2014. For the six-month reporting period, the Funds' total returns at net asset value (NAV) outperformed their respective indexes.

Nuveen Investments

6

Nuveen Global Income Opportunities Fund (JGG)

During the reporting period, JGG outperformed the Barclays Global Aggregate Bond Index. The outperformance was driven by currency positioning and performance from credit sectors, both of which benefited from a market backdrop of muted volatility and well-contained Treasury rates. Currency positioning was the largest positive contributor to performance, followed by positioning in high yield corporate debt.

During the six-month reporting period, EM currencies performed well versus the U.S. dollar, as did several major currencies, as the market backed away from fears related to higher U.S. interest rates and potential declines in central bank liquidity. The Fund benefited from overweight positions in the Brazilian real, Mexican peso and New Zealand dollar, as well as short positions in the euro and Canadian dollar.

High yield spreads tightened by 45 basis points versus Treasuries on the strength of improved technicals with renewed investor inflows into the asset class and a market friendly outlook postured by the Federal Reserve (Fed) and the continued low default environment. The spread tightening continued unabated despite the geopolitical tensions that arose during the period and a greater-than-expected slowdown in the U.S. economy in 2014. The high yield bond segment of the market gained 5% over the six-month reporting period as measured by the Barclays U.S. Corporate High Yield Index. The Fund benefited from its exposure to high yield corporates, as well as security selection and tactical repositioning within the sector.

The Fund's ongoing overweight to investment grade credit also added value, as did our security selection within credit and focus on BBB-rated issues. During the reporting period, the investment grade corporate sector of the market slightly outpaced high yield, advancing 5% according to the Barclays U.S. Corporate Investment Grade Index. Credit selection within investment grade was strong, notably the Fund's positioning within basic industries. In addition, our downward bias in credit quality proved beneficial as lower rated investment grade securities outperformed higher rated investment grade securities over this time frame.

In addition, security selection within EM credit, both investment grade and high yield, added to performance. EMs started out the period underperforming, dragged down by weak currencies, capital outflows, increased geopolitical tensions and slowing growth in China and other EMs. However, the tide turned in the final months of the reporting period as EM credits rebounded strongly from their period of underperformance, supported by improvements in fundamentals and investor sentiment. EM debt ended up being one of the best performing segments of the fixed income market during the reporting period, advancing 7% in U.S. dollar terms as measured by the Barclays Emerging Markets Index.

The Fund's defensive interest rate positioning detracted marginally amid a general decline in interest rates, but this was more than offset by gains associated with bond market selection, particularly emerging markets such as Turkey, South Africa and Mexico.

Nuveen Diversified Currency Opportunities Fund (JGT)

JGT also outperformed its Comparative Benchmark, which is a 50% blend of the Citigroup Non-U.S. World Government Bond 1-3 Year Index and the JPMorgan Emerging Local Markets Index Plus. JGT outperformance can be largely attributed to strong currency returns, driven by a recovery in foreign currencies generally during the reporting period, but also significant gains due to currency selection. While EM and several key developed currencies had a difficult start to the year given concerns about U.S. interest rate policy, global growth, as well as events such as the devaluation of the Argentine peso and negative political headlines from different countries, a number of high yielding EM currencies ended up posting strong gains during the reporting period. Moderate global growth, low volatility and accommodative monetary policies generally supported these high yielding EM currencies. Improved global conditions also supported currencies such as the Australian dollar and New Zealand dollar. Both economies showed signs of improving domestic economic growth, while

Nuveen Investments

7

Portfolio Managers' Comments (continued)

the Reserve Bank of New Zealand was the first major central bank to start a tightening cycle by raising its policy rate by 75 basis points during the reporting period.

The Fund benefited from long positions in the Brazilian real, Turkish lira and Malaysian ringgit, which were some the best performing EM currencies as improving EM sentiment and attractive yields supported capital inflows into those asset markets. In developed markets, long positions in the New Zealand dollar and Australian dollar also contributed significantly to returns as they were two of the strongest performing developed market currencies. Short positions in the Canadian dollar and Norwegian krone also added value. A short position in the Japanese yen detracted from performance as the yen retraced prior losses in the face of softer U.S. interest rates and a lack of continued progress on fiscal reform in Japan. Short positioning in Korea also detracted given it was a hedge against other EM currencies in a period of generally firming valuations.

Significant exposures to EM local and external bonds, high yield and investment grade corporate bonds, and structured products also proved beneficial over this time frame. These positions benefited from high yields that contributed income to the Fund, as well as through price performance as these sectors witnessed tightening yield spreads during the reporting period, along with the general recovery in risk assets and improved global financial conditions. Exposure to peripheral European bond markets, including Greece and Portugal, added value during the reporting period in light of strong European bond performance. Local market EM bonds also added to Fund performance. Across EMs, rates generally fell based on reduced inflationary pressures, better external demand and traction on tightening policies implemented last year and in early 2014. Export growth improved across these markets with global purchasing managers indexes turning up marginally, while economic data and policy actions in China indicated stabilization. EM domestic conditions were further underpinned by the ECB's accommodation, the Fed's steady hand and renewed positive investor inflows.

Both JGG and JGT used foreign currency exchange forwards to reduce risk and to take active currency exposures. Currency forward contracts were used to reduce risk by hedging select foreign currency risks associated with each Fund's foreign debt investments. Each Fund also actively managed currency exposures through currency forwards in an attempt to benefit from potential appreciation of certain currencies. The effect of these activities in the period was positive.

Both JGG and JGT sold U.S. Treasury futures to hedge against potential increases in U.S. interest rates and purchased selected foreign bond futures to gain exposure to those markets. The effect of these activities in the period was negative.

In JGG, we used interest rate swaps as part of an overall portfolio interest rate strategy. The effect of these contracts on the Fund's performance was negative during the reporting period.

JGG also used credit default swaps as a way to take on credit risk and earn a commensurate credit spread. The effect of these contracts on the Fund's performance was positive during the reporting period.

These derivative exposures are integrated with the overall portfolio construction and such losses and gains may be naturally related to and/or may offset impacts elsewhere in the portfolio.

Proposed Fund Reorganization and Restructuring

On August 7, 2014, subsequent to the close of this reporting period, the Funds' Board of Trustees approved a proposal to restructure the Funds. Key elements, if approved at annual shareholder meetings scheduled for October 31, 2014, are:

• Combine JGG and JGT into a single fund with a new investment mandate. The combined fund would be called the Nuveen Global High Income Fund (JGH).

• The new combined fund would continue to be managed by NAM and would employ NAM's global high income investment strategy, which seeks to identify securities from around the world as well as across the capital structure and credit spectrum that offer attractive income and long-term performance potential.

Nuveen Investments

8

• The new combined fund will conduct a tender offer to purchase up to 25% of its outstanding common shares for cash at a price per share equal to 98% of the NAV as of the purchase date. Subject to the exercise by the Board of Trustees of their fiduciary duties in the event of a material change in circumstances, the tender offer's commencement date will be announced within one month after the completion of the Funds' reorganization, and participating shareholders will receive payment for tendered shares within three months after the completion of the reorganization.

The proposed restructuring seeks to increase demand for the new combined fund's common shares and may narrow its trading discount relative to JGG and JGT by implementing a more understandable investment mandate within a well-established market segment that offers enhanced income potential. Additionally, the combined fund could be expected to enjoy increased economies of scale relative to JGG and JGT and consequently could generate on-going fee and expense savings for shareholders.

The proposed restructuring is subject to certain conditions, including necessary approvals by the Funds' shareholders. Detailed information on the proposed restructuring, including a description of the proposed investment strategy and risk of the new combined fund, will be contained in proxy materials to be mailed to shareholders in connection with the Funds' annual meeting. Subject to market conditions, the restructuring is expected to be completed shortly after receipt of the necessary shareholder approvals.

See Notes to Financial Statements, Note 10 – Subsequent Events, Proposed Fund Restructuring for further information.

Nuveen Investments

9

Fund Leverage and

Currency Investment Exposure

IMPACT OF JGG'S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the return of JGG relative to its benchmarks was the Fund's use of leverage through the use of bank borrowings. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, use of leverage also can expose shareholders to additional volatility. For example, as the prices of securities held by the Fund decline, the negative impact of these valuation changes on share NAV and shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance share returns during periods when the prices of securities held by the Fund generally are rising. Leverage had a positive impact on the performance of JGG during this reporting period.

JGG also continued to use interest rate swap contracts in order to hedge leverage costs. The impact on performance was negative during this reporting period.

JGT's investment strategies did not create the economic effects of leverage for the Fund during this reporting period.

As of June 30, 2014, JGG's percentages of leverage are shown in the accompanying table.

JGG | |||||||

Effective Leverage* | 28.03 | % | |||||

Regulatory Leverage* | 30.67 | % | |||||

* Effective leverage is the Fund's effective economic leverage and includes regulatory leverage. Effective leverage attempts to measure the extent to which the return and risk of an investment in the Fund's shares are magnified through the use of certain forms of leverage. This Fund uses leverage in the form of borrowings from a credit facility, and may also use derivatives that increase or decrease investment risk compared to the exposure level of the securities in the portfolio. This measure includes the notional value of certain of these derivatives considered to increase investment risk. The Fund's borrowings are considered regulatory leverage as they are part of the Fund's capital structure. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940.

JGG'S REGULATORY LEVERAGE

Bank Borrowings

As discussed previously, JGG employs regulatory leverage through the use of bank borrowings. As of June 30, 2014, the Fund has outstanding bank borrowings of $56,000,000.

Refer to Notes to Financial Statements, Note 8 – Borrowing Arrangements for further details.

THE FUNDS' CURRENCY INVESTMENT EXPOSURE IN EXCESS OF MANAGED ASSETS

Currency investment exposure in excess of managed assets is a Fund's net exposure to currencies other than the U.S. dollar greater than the amount of managed assets resulting from:

(i) the purchase of non-U.S. dollar denominated securities, and

(ii) the use of foreign exchange contracts such as forwards or options.

As of June 30, 2014, JGT's currency investment exposure in excess of the Fund's managed assets is as shown in the accompanying table.

JGT | |||||||

Currency Investment Exposure in Excess of Managed Assets | 4.31 | % | |||||

JGG's investment strategies did not create currency investment exposure for the Fund that exceeded its managed assets as of the end of this reporting period.

Nuveen Investments

10

Share

Information

DISTRIBUTION INFORMATION

The following information regarding each Fund's distributions is current as of June 30, 2014. Each Fund's distribution levels may vary over time based on the Fund's investment activities and portfolio investment value changes.

Each Fund has a managed distribution program. The goal of this program is to provide shareholders with relatively consistent and predictable cash flow by systematically converting the Fund's expected long-term return potential into regular distributions. As a result, regular distributions throughout the year are likely to include a portion of expected long-term gains (both realized and unrealized), along with net investment income.

Important points to understand about a managed distribution program are:

• Each Fund seeks to establish a relatively stable distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about a Fund's past or future investment performance from its current distribution rate.

• Actual returns will differ from projected long-term returns (and therefore a Fund's distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value.

• Each distribution is expected to be paid from some or all of the following sources:

• net investment income (regular interest and dividends),

• realized capital gains, and

• unrealized gains, or, in certain cases, a return of principal (non-taxable distributions).

• A non-taxable distribution is a payment of a portion of a Fund's capital. When a Fund's returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when a Fund's returns fall short of distributions, the shortfall will represent a portion of your original principal, unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when a Fund's total return exceeds distributions.

• Because distribution source estimates are updated during the year based on a Fund's performance and forecast for its current fiscal year (which is the calendar year for each Fund), estimates on the nature of your distributions provided at the time the distributions are paid may differ from both the tax information reported to you in your Fund's IRS Form 1099 statement provided at year end, as well as the ultimate economic sources of distributions over the life of your investment.

Nuveen Investments

11

Share Information (continued)

The following table provides estimated information regarding each Fund's distributions and total return performance for the six months ended June 30, 2014. This information is provided on a tax basis rather than a generally accepted accounting principles (GAAP) basis. This information is intended to help you better understand whether the Funds' returns for the specified time period were sufficient to meet their distributions.

As of June 30, 2014 | JGG | JGT | |||||||||

Inception date | 6/27/06 | 4/25/07 | |||||||||

Six months ended June 30, 2014: | |||||||||||

Per share distribution: | |||||||||||

From net investment income | $ | 0.43 | $ | 0.40 | |||||||

From realized capital gains | 0.00 | 0.00 | |||||||||

Return of capital | 0.00 | 0.00 | |||||||||

Total per share distribution | $ | 0.43 | $ | 0.40 | |||||||

Annualized distribution rate on NAV | 6.17 | % | 6.44 | % | |||||||

Current distribution rate* | 6.75 | % | 7.12 | % | |||||||

Average annual total returns: | |||||||||||

Excluding retained gain tax credit/refund**: | |||||||||||

6-Month (Cumulative) on NAV | 9.43 | % | 6.21 | % | |||||||

| 1-Year on NAV | 9.21 | % | 2.91 | % | |||||||

| 5-Year on NAV | 3.53 | % | 1.71 | % | |||||||

Since inception on NAV | 4.41 | % | 2.86 | % | |||||||

Including retained gain tax credit/refund**: | |||||||||||

6-Month (Cumulative) on NAV | N/A | 6.21 | % | ||||||||

| 1-Year on NAV | N/A | 2.91 | % | ||||||||

| 5-Year on NAV | N/A | 1.71 | % | ||||||||

Since inception on NAV | N/A | 2.95 | % | ||||||||

* Current distribution rate is based each Fund's current annualized quarterly distribution divided by the Fund's current market price. Each Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

** JGT elected to retain a portion of its realized long-term capital gains for the tax year ended December 31, 2007, and pay required federal corporate income taxes on this amount. As reported on Form 2439, shareholders on record date must include their pro-rata share of these gains on their applicable federal tax returns, and are entitled to take offsetting tax credits, for their pro-rata share of the taxes paid by the Fund. The total returns "Including retained gain tax credit/refund" include the economic benefit to shareholders on record date of these tax credits/refunds. The Fund had no retained capital gains for the tax years ended December 31, 2008 through December 31, 2013.

Nuveen Investments

12

SHARE REPURCHASES

As of June 30, 2014, and since the inception of the Funds' repurchase programs, the Funds have cumulatively repurchased and retired shares as shown in the accompanying table.

JGG | JGT | ||||||||||

Shares Cumulatively Repurchased and Retired | 305,000 | 4,751,500 | |||||||||

Shares Authorized for Repurchase | 935,000 | 4,635,000 | |||||||||

During the current reporting period, the Funds repurchased and retired shares at a weighted average price per share and a weighted average discount per share as shown in the accompanying table.

JGG | JGT | ||||||||||

Shares Repurchased and Retired | 209,500 | 1,230,000 | |||||||||

Weighted Average Price Per Share Repurchased and Retired | $ | 12.56 | $ | 11.08 | |||||||

Weighted Average Discount Per Share Repurchased and Retired | 9.61 | % | 11.10 | % | |||||||

OTHER SHARE INFORMATION

As of June 30, 2014, and during the current reporting period, the Funds' share prices were trading at a premium/(discount) to their NAVs as shown in the accompanying table.

JGG | JGT | ||||||||||

Share NAV | $ | 13.94 | $ | 12.42 | |||||||

Share Price | $ | 12.75 | $ | 11.23 | |||||||

Premium/(Discount) to NAV | (8.54 | )% | (9.58 | )% | |||||||

6-Month Average Premium/(Discount) to NAV | (12.69 | )% | (13.89 | )% | |||||||

Nuveen Investments

13

Risk

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Shares of closed-end funds are subject to investment risks, including the possible loss of principal invested. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the corporate securities owned by the Funds, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like the Funds frequently trade at a discount to their NAV. Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Leverage Risk. A Fund's use of leverage creates the possibility of higher volatility for the Fund's per share NAV, market price, and distributions. Leverage risk can be introduced through regulatory leverage (issuing preferred shares or debt borrowings at the Fund level) or through certain derivative investments held in a Fund's portfolio. Leverage typically magnifies the total return of a Fund's portfolio, whether that return is positive or negative. The use of leverage creates an opportunity for increased common share net income, but there is no assurance that a Fund's leveraging strategy will be successful.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations. This is particularly true for funds employing a managed distribution program.

Below-Investment Grade Risk. Investments in securities below-investment grade quality are predominantly speculative and subject to greater volatility and risk of default.

Non-U.S. Securities Risk. Investments in non-U.S securities involve special risks not typically associated with domestic investments including currency risk and adverse political, social and economic development. These risks often are magnified in emerging markets.

Call Risk or Prepayment Risk. Issuers may exercise their option to prepay principal earlier than scheduled, forcing the Funds to reinvest in lower-yielding securities.

Derivatives Strategy Risk. Derivative securities, such as calls, puts, warrants, swaps and forwards, carry risks different from, and possibly greater than, the risks associated with the underlying investments.

Issuer Credit Risk. This is the risk that a security in a Fund's portfolio will fail to make dividend or interest payments when due.

Interest Rate Risk. Fixed-income securities such as bonds, preferred, convertible and other debt securities will decline in value if market interest rates rise.

Currency Risk. Changes in exchange rates will affect the value of a Fund's investments.

Counterparty Risk. To the extent that a Fund's derivative investments are purchased or sold in over-the-counter transactions, the Fund will be exposed to the risk that counterparties to these transactions will be unable to meet their obligations.

Nuveen Investments

14

Interest Rate Swaps Risk. The risk that yields will move in the direction opposite to the direction anticipated by a Fund, which would cause a Fund to make payments to its counterparty in the transaction that could adversely affect the Fund's performance.

Forward Currency Contracts Risk. Forward currency contracts are not standardized and are substantially unregulated. Principals are not required to continue to make markets in the securities or currencies they trade and these markets can experience periods of illiquidity, sometimes of significant duration. In addition, trading forward currency contracts can have the effect of financial leverage by creating additional investment exposure.

Reinvestment Risk. If market interest rates decline, income earned from a Fund's portfolio may be reinvested at rates below that of the original bond that generated the income.

Nuveen Investments

15

JGG

Nuveen Global Income Opportunities Fund

Performance Overview and Holding Summaries as of June 30, 2014

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2014

Cumulative | Average Annual | ||||||||||||||||||

6-Month | 1-Year | 5-Year | Since Inception1 | ||||||||||||||||

JGG at NAV | 9.43 | % | 9.21 | % | 3.53 | % | 4.41 | % | |||||||||||

JGG at Share Price | 15.94 | % | 12.33 | % | 3.15 | % | 3.23 | % | |||||||||||

Barclays Global Aggregate Bond Index | 4.93 | % | 7.39 | % | 4.60 | % | 5.52 | % | |||||||||||

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund's shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

Nuveen Investments

16

This data relates to the securities held in the Fund's portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's Group, Moody's Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

$25 Par (or similar) Retail Preferred | 2.8 | % | |||||

Corporate Bonds | 62.7 | % | |||||

| $1,000 Par (or similar) Institutional Preferred | 5.6 | % | |||||

Sovereign Debt | 64.7 | % | |||||

| Asset-Backed and Mortgage-Backed Securities | 6.0 | % | |||||

Short-Term Investments | 4.7 | % | |||||

Borrowings | (44.2 | )% | |||||

Other Assets Less Liabilities | (2.3 | )% | |||||

Country Allocation

(% of total investments)2

United States | 41.5 | % | |||||

Mexico | 12.7 | % | |||||

Turkey | 6.5 | % | |||||

South Africa | 6.0 | % | |||||

United Kingdom | 5.2 | % | |||||

South Korea | 3.5 | % | |||||

Brazil | 2.8 | % | |||||

Canada | 2.5 | % | |||||

Poland | 2.3 | % | |||||

Germany | 1.9 | % | |||||

Portugal | 1.8 | % | |||||

Other Countries | 13.3 | % | |||||

Credit Quality

(% of total investments)2

AAA/U.S. Guaranteed | 5.4 | % | |||||

AA | 6.8 | % | |||||

A | 24.4 | % | |||||

BBB | 35.6 | % | |||||

BB or Lower | 21.0 | % | |||||

N/R (not rated) | 3.6 | % | |||||

N/A (not applicable) | 3.2 | % | |||||

1 Since inception returns are from 6/27/06.

2 Excluding investments in derivatives.

Nuveen Investments

17

JGT

Nuveen Diversified Currency Opportunities Fund

Performance Overview and Holding Summaries as of June 30, 2014

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2014

Cumulative | Average Annual | ||||||||||||||||||

| 6-Month | 1-Year | 5-Year | Since Inception1 | ||||||||||||||||

JGT at NAV | 6.21 | % | 2.91 | % | 1.71 | % | 2.86 | % | |||||||||||

JGT at Share Price | 15.61 | % | 8.99 | % | 3.47 | % | 1.91 | % | |||||||||||

JGT Blended Index (Comparative Index) | 2.18 | % | 3.47 | % | 1.96 | % | 3.48 | % | |||||||||||

Average Annual Total Returns as of June 30, 20142

(including retained gain tax credit/refund)

Cumulative | Average Annual | ||||||||||||||||||

6-Month | 1-Year | 5-Year | Since Inception1 | ||||||||||||||||

JGT at NAV | 6.21 | % | 2.91 | % | 1.71 | % | 2.95 | % | |||||||||||

JGT at Share Price | 15.61 | % | 8.99 | % | 3.47 | % | 2.01 | % | |||||||||||

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund's shares at NAV only. Indexes are not available for direct investment.

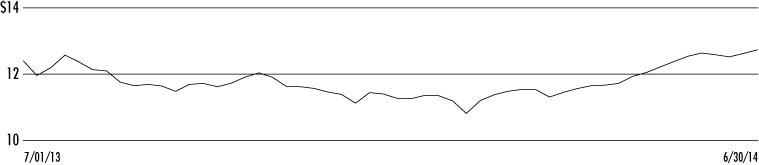

Share Price Performance — Weekly Closing Price

Nuveen Investments

18

This data relates to the securities held in the Fund's portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor's Group, Moody's Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

$25 Par (or similar) Retail Preferred | 0.3 | % | |||||

Corporate Bonds | 14.8 | % | |||||

| $1,000 Par (or similar) Institutional Preferred | 0.6 | % | |||||

Sovereign Debt | 72.8 | % | |||||

| Asset-Backed and Mortgage-Backed Securities | 5.2 | % | |||||

Short-Term Investments | 3.7 | % | |||||

Other Assets Less Liabilities | 2.6 | % | |||||

Country Allocation

(% of total investments)3

Brazil | 17.2 | % | |||||

United States | 14.9 | % | |||||

Mexico | 11.7 | % | |||||

Canada | 8.1 | % | |||||

South Africa | 5.1 | % | |||||

Turkey | 4.9 | % | |||||

Malaysia | 4.9 | % | |||||

Italy | 4.6 | % | |||||

Spain | 3.4 | % | |||||

Indonesia | 3.0 | % | |||||

Portugal | 2.7 | % | |||||

Other Countries | 19.5 | % | |||||

Credit Quality

(% of total investments)3

AAA/U.S. Guaranteed | 6.2 | % | |||||

AA | 9.9 | % | |||||

A | 24.1 | % | |||||

BBB | 45.2 | % | |||||

BB or Lower | 12.7 | % | |||||

N/R (not rated) | 1.8 | % | |||||

N/A (not applicable) | 0.1 | % | |||||

1 Since inception returns are from 4/25/07.

2 As previously explained in the Share Information section of this report, the Fund elected to retain a portion of its realized long-term capital gains for the tax year ended December 31, 2007, and pay required federal corporate income taxes on these amounts. These standardized total returns include the economic benefit to shareholders of record of this tax credit/refund. The Fund had no retained capital gains for the tax years ended December 31, 2008 through December 31, 2013.

3 Excluding investments in derivatives.

Nuveen Investments

19

JGG

Nuveen Global Income Opportunities Fund

Portfolio of Investments June 30, 2014 (Unaudited)

| Shares | Description (1) | Coupon | Ratings (2) | Value | |||||||||||||||||||

LONG-TERM INVESTMENTS – 141.8% (96.8% of Total Investments) | |||||||||||||||||||||||

$25 PAR (OR SIMILAR) RETAIL PREFERRED – 2.8% (1.9% of Total Investments) | |||||||||||||||||||||||

Banks – 1.5% | |||||||||||||||||||||||

| 18,425 | Citigroup Inc. | 7.125 | % | BB+ | $ | 509,433 | |||||||||||||||||

| 30,000 | PNC Financial Services | 6.125 | % | BBB | 823,800 | ||||||||||||||||||

| 20,000 | Regions Financial Corporation | 6.375 | % | BB | 500,600 | ||||||||||||||||||

| Total Banks | 1,833,833 | ||||||||||||||||||||||

Capital Markets – 0.3% | |||||||||||||||||||||||

| 15,000 | Morgan Stanley | 7.125 | % | BB+ | 418,050 | ||||||||||||||||||

Consumer Finance – 0.4% | |||||||||||||||||||||||

| 20,000 | Discover Financial Services | 6.500 | % | BB | 502,000 | ||||||||||||||||||

Insurance – 0.6% | |||||||||||||||||||||||

| 25,000 | Hartford Financial Services Group Inc. | 7.875 | % | BB+ | 748,500 | ||||||||||||||||||

| Total $25 Par (or similar) Retail Preferred (cost $3,424,811) | 3,502,383 | ||||||||||||||||||||||

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

CORPORATE BONDS – 62.7% (42.8% of Total Investments) | |||||||||||||||||||||||

Aerospace & Defense – 0.8% | |||||||||||||||||||||||

$ | 325 | Bombardier Inc., 144A | 6.000 | % | 10/15/22 | BB– | $ | 333,125 | |||||||||||||||

| 680 | Exelis, Inc. | 5.550 | % | 10/01/21 | BBB+ | 730,804 | |||||||||||||||||

| 1,005 | Total Aerospace & Defense | 1,063,929 | |||||||||||||||||||||

Airlines – 0.3% | |||||||||||||||||||||||

| 300 | Air Canada, 144A | 6.750 | % | 10/01/19 | BB | 326,250 | |||||||||||||||||

Auto Components – 1.3% | |||||||||||||||||||||||

| 300 | Allison Transmission Inc., 144A | 7.125 | % | 5/15/19 | B+ | 321,000 | |||||||||||||||||

| 400 | American & Axle Manufacturing Inc. | 6.625 | % | 10/15/22 | B+ | 438,000 | |||||||||||||||||

| 250 | Gestamp Funding Luxembourg SA, 144A | 5.625 | % | 5/31/20 | BB | 260,625 | |||||||||||||||||

| 300 | Stackpole International Intermediate Company, 144A | 7.750 | % | 10/15/21 | B+ | 313,500 | |||||||||||||||||

| 350 | TRW Automotive Inc., 144A | 4.450 | % | 12/01/23 | BBB– | 358,750 | |||||||||||||||||

| 1,600 | Total Auto Components | 1,691,875 | |||||||||||||||||||||

Automobiles – 0.5% | |||||||||||||||||||||||

| 200 | EUR | Fiat Finance & Trade SA | 7.000 | % | 3/23/17 | BB– | 300,644 | ||||||||||||||||

| 275 | General Motors Financial Company Inc. | 4.250 | % | 5/15/23 | BB+ | 274,656 | |||||||||||||||||

| Total Automobiles | 575,300 | ||||||||||||||||||||||

Banks – 7.5% | |||||||||||||||||||||||

| 1,775 | Bank of America Corporation | 4.000 | % | 4/01/24 | A | 1,811,443 | |||||||||||||||||

| 535 | CIT Group Inc. | 5.000 | % | 8/01/23 | BB | 547,706 | |||||||||||||||||

| 550 | Citigroup Inc. | 4.500 | % | 1/14/22 | A | 597,851 | |||||||||||||||||

| 515 | General Electric Capital Corporation | 6.875 | % | 1/10/39 | AA+ | 691,788 | |||||||||||||||||

| 285 | HSBC Holdings PLC | 6.800 | % | 6/01/38 | A+ | 363,628 | |||||||||||||||||

| 545 | JPMorgan Chase & Company | 6.400 | % | 5/15/38 | A+ | 691,792 | |||||||||||||||||

| 1,320 | JPMorgan Chase & Company | 6.750 | % | 1/29/49 | BBB | 1,420,650 | |||||||||||||||||

| 355 | Royal Bank of Scotland Group PLC | 6.100 | % | 6/10/23 | BBB– | 388,581 | |||||||||||||||||

| 400 | Santander UK PLC, 144A | 5.000 | % | 11/07/23 | A– | 432,012 | |||||||||||||||||

| 740 | Societe Generale, 144A | 5.000 | % | 1/17/24 | BBB+ | 773,919 | |||||||||||||||||

Nuveen Investments

20

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

| Banks (continued) | |||||||||||||||||||||||

$ | 445 | Standard Chartered PLC, 144A | 5.700 | % | 3/26/44 | A+ | $ | 466,432 | |||||||||||||||

| 1,000 | State Bank of India London, 144A | 3.622 | % | 4/17/19 | BBB– | 1,006,072 | |||||||||||||||||

| 340 | Wells Fargo & Company | 3.450 | % | 2/13/23 | A+ | 338,336 | |||||||||||||||||

| 8,805 | Total Banks | 9,530,210 | |||||||||||||||||||||

Building Products – 0.5% | |||||||||||||||||||||||

| 645 | Owens Corning Incorporated | 4.200 | % | 12/15/22 | BBB– | 662,311 | |||||||||||||||||

Capital Markets – 2.8% | |||||||||||||||||||||||

| 1,210 | Goldman Sachs Group, Inc. | 6.000 | % | 6/15/20 | A | 1,410,382 | |||||||||||||||||

| 1,000 | Goldman Sachs Group, Inc. | 5.250 | % | 7/27/21 | A | 1,122,933 | |||||||||||||||||

| 300 | Lazard Group LLC | 4.250 | % | 11/14/20 | BBB+ | 314,309 | |||||||||||||||||

| 450 | Morgan Stanley | 4.875 | % | 11/01/22 | BBB+ | 483,038 | |||||||||||||||||

| 250 | Morgan Stanley | 3.750 | % | 2/25/23 | A | 254,320 | |||||||||||||||||

| 3,210 | Total Capital Markets | 3,584,982 | |||||||||||||||||||||

Chemicals – 2.8% | |||||||||||||||||||||||

| 300 | Eagle Spinco Inc. | 4.625 | % | 2/15/21 | BB | 297,750 | |||||||||||||||||

| 745 | Eastman Chemical Company | 3.600 | % | 8/15/22 | BBB | 763,963 | |||||||||||||||||

| 300 | Ineos Group Holdings SA, 144A | 6.125 | % | 8/15/18 | B– | 310,500 | |||||||||||||||||

| 600 | Mexichem SAB de CV, 144A | 4.875 | % | 9/19/22 | BBB | 624,000 | |||||||||||||||||

| 1,000 | Office Cherifien Des Phosphates SA, 144A | 5.625 | % | 4/25/24 | BBB– | 1,048,750 | |||||||||||||||||

| 300 | PolyOne Corporation | 5.250 | % | 3/15/23 | BB | 308,250 | |||||||||||||||||

| 225 | Taminco Global Chemical Corporation, 144A | 9.750 | % | 3/31/20 | B– | 251,438 | |||||||||||||||||

| 3,470 | Total Chemicals | 3,604,651 | |||||||||||||||||||||

Commercial Services & Supplies – 1.5% | |||||||||||||||||||||||

| 200 | ABX Group Inc. | 6.375 | % | 12/01/19 | Ba3 | 207,500 | |||||||||||||||||

| 300 | ADT Corporation | 6.250 | % | 10/15/21 | BBB– | 318,000 | |||||||||||||||||

| 250 | Casella Waste Systems Inc. | 7.750 | % | 2/15/19 | Caa1 | 261,250 | |||||||||||||||||

| 300 | Clean Harbors Inc. | 5.250 | % | 8/01/20 | BB+ | 309,375 | |||||||||||||||||

| 235 | EUR | Europcar Groupe SA, 144A | 11.500 | % | 5/15/17 | B– | 369,620 | ||||||||||||||||

| 375 | R.R. Donnelley & Sons Company | 7.625 | % | 6/15/20 | BB | 425,625 | |||||||||||||||||

| Total Commercial Services & Supplies | 1,891,370 | ||||||||||||||||||||||

Computers & Peripherals – 0.3% | |||||||||||||||||||||||

| 300 | NCR Escrow Corporation, 144A | 6.375 | % | 12/15/23 | BB | 325,500 | |||||||||||||||||

Construction Materials – 0.2% | |||||||||||||||||||||||

| 300 | Norbord Inc., 144A | 5.375 | % | 12/01/20 | Ba2 | 303,000 | |||||||||||||||||

Consumer Finance – 0.2% | |||||||||||||||||||||||

| 195 | First Data Corporation, 144A | 6.750 | % | 11/01/20 | BB– | 211,088 | |||||||||||||||||

Containers & Packaging – 0.5% | |||||||||||||||||||||||

| 300 | Ball Corporation | 4.000 | % | 11/15/23 | BB+ | 285,750 | |||||||||||||||||

| 350 | CAD | Cascades Inc., 144A | 5.500 | % | 7/15/21 | Ba3 | 327,597 | ||||||||||||||||

| Total Containers & Packaging | 613,347 | ||||||||||||||||||||||

Diversified Consumer Services – 0.2% | |||||||||||||||||||||||

| 230 | Nine West Holdings Incorporated, 144A | 8.250 | % | 3/15/19 | CCC | 231,150 | |||||||||||||||||

Diversified Financial Services – 0.3% | |||||||||||||||||||||||

| 350 | Nationstar Mortgage LLC Capital Corporation | 7.875 | % | 10/01/20 | B+ | 367,938 | |||||||||||||||||

Diversified Telecommunication Services – 2.1% | |||||||||||||||||||||||

| 450 | AT&T, Inc. | 5.550 | % | 8/15/41 | A | 504,563 | |||||||||||||||||

| 375 | CyrusOne LP Finance | 6.375 | % | 11/15/22 | B+ | 404,063 | |||||||||||||||||

Nuveen Investments

21

JGG Nuveen Global Income Opportunities Fund

Portfolio of Investments (continued) June 30, 2014 (Unaudited)

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

| Diversified Telecommunication Services (continued) | |||||||||||||||||||||||

$ | 595 | Qwest Corporation | 6.750 | % | 12/01/21 | BBB– | $ | 688,855 | |||||||||||||||

| 555 | Verizon Communications | 5.150 | % | 9/15/23 | A– | 621,097 | |||||||||||||||||

| 200 | Verizon Communications | 6.550 | % | 9/15/43 | A– | 251,688 | |||||||||||||||||

| 200 | Windstream Corporation | 6.375 | % | 8/01/23 | BB | 202,750 | |||||||||||||||||

| 2,375 | Total Diversified Telecommunication Services | 2,673,016 | |||||||||||||||||||||

Electric Utilities – 0.6% | |||||||||||||||||||||||

| 485 | Constellation Energy Group | 5.150 | % | 12/01/20 | BBB+ | 546,633 | |||||||||||||||||

| 225 | Intergen NV, 144A | 7.000 | % | 6/30/23 | B+ | 232,313 | |||||||||||||||||

| 710 | Total Electric Utilities | 778,946 | |||||||||||||||||||||

Energy Equipment & Services – 2.8% | |||||||||||||||||||||||

| 820 | Ensco PLC | 4.700 | % | 3/15/21 | BBB+ | 893,301 | |||||||||||||||||

| 155 | Gulfmark Offshore Inc. | 6.375 | % | 3/15/22 | BB– | 161,200 | |||||||||||||||||

| 350 | Hercules Offshore LLC, 144A | 7.500 | % | 10/01/21 | B | 347,375 | |||||||||||||||||

| 675 | Nabors Industries Inc. | 4.625 | % | 9/15/21 | BBB | 731,151 | |||||||||||||||||

| 290 | Offshore Group Investment Limited | 7.500 | % | 11/01/19 | B– | 306,675 | |||||||||||||||||

| 600 | Origin Energy Finance Limited, 144A | 3.500 | % | 10/09/18 | BBB | 622,665 | |||||||||||||||||

| 420 | Weatherford International Limited | 7.000 | % | 3/15/38 | BBB– | 521,627 | |||||||||||||||||

| 3,310 | Total Energy Equipment & Services | 3,583,994 | |||||||||||||||||||||

Food Products – 0.6% | |||||||||||||||||||||||

| 500 | BRF Brasil Foods SA, 144A | 4.750 | % | 5/22/24 | BBB– | 492,500 | |||||||||||||||||

| 300 | JBS Investments GmbH, 144A | 7.250 | % | 4/03/24 | BB | 310,500 | |||||||||||||||||

| 800 | Total Food Products | 803,000 | |||||||||||||||||||||

Gas Utilities – 0.3% | |||||||||||||||||||||||

| 375 | AmeriGas Finance LLC | 7.000 | % | 5/20/22 | Ba2 | 415,313 | |||||||||||||||||

Health Care Equipment & Supplies – 0.2% | |||||||||||||||||||||||

| 250 | Tenet Healthcare Corporation | 4.375 | % | 10/01/21 | BB | 248,438 | |||||||||||||||||

Hotels, Restaurants & Leisure – 0.4% | |||||||||||||||||||||||

| 200 | Shearer's Foods LLC, 144A | 9.000 | % | 11/01/19 | B1 | 219,000 | |||||||||||||||||

| 250 | Wynn Macau Limited, 144A | 5.250 | % | 10/15/21 | BB | 256,875 | |||||||||||||||||

| 450 | Total Hotels, Restaurants & Leisure | 475,875 | |||||||||||||||||||||

Household Products – 0.7% | |||||||||||||||||||||||

| 865 | Macys Retail Holdings Inc. | 3.875 | % | 1/15/22 | BBB+ | 902,913 | |||||||||||||||||

Independent Power & Renewable Electricity Producers – 0.5% | |||||||||||||||||||||||

| 300 | Dynegy Inc. | 5.875 | % | 6/01/23 | B+ | 302,250 | |||||||||||||||||

| 300 | Genon Energy Inc. | 9.500 | % | 10/15/18 | B | 329,250 | |||||||||||||||||

| 600 | Total Independent Power & Renewable Electricity Producers | 631,500 | |||||||||||||||||||||

Industrial Conglomerates – 1.2% | |||||||||||||||||||||||

| 800 | Alfa SAB de CV, 144A | 5.250 | % | 3/25/24 | BBB– | 834,800 | |||||||||||||||||

| 2,000 | NOK | Grieg Seafood ASA | 8.820 | % | 12/21/15 | N/R | 342,362 | ||||||||||||||||

| 300 | Stena AB, 144A | 7.000 | % | 2/01/24 | BB | 319,500 | |||||||||||||||||

| Total Industrial Conglomerates | 1,496,662 | ||||||||||||||||||||||

Insurance – 2.0% | |||||||||||||||||||||||

| 750 | AFLAC Insurance | 6.450 | % | 8/15/40 | A | 951,573 | |||||||||||||||||

| 495 | Genworth Holdings Inc. | 4.800 | % | 2/15/24 | BBB– | 528,946 | |||||||||||||||||

| 385 | Liberty Mutual Group Inc., 144A | 4.950 | % | 5/01/22 | Baa2 | 421,096 | |||||||||||||||||

| 510 | UnumProvident Corporation | 5.625 | % | 9/15/20 | BBB | 585,078 | |||||||||||||||||

| 2,140 | Total Insurance | 2,486,693 | |||||||||||||||||||||

Nuveen Investments

22

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

Machinery – 1.1% | |||||||||||||||||||||||

$ | 1,000 | Eaton Corporation | 4.150 | % | 11/01/42 | A– | $ | 967,603 | |||||||||||||||

| 425 | Terex Corporation | 6.000 | % | 5/15/21 | BB | 457,938 | |||||||||||||||||

| 1,425 | Total Machinery | 1,425,541 | |||||||||||||||||||||

Media – 3.5% | |||||||||||||||||||||||

| 300 | Altice S.A, 144A | 7.750 | % | 5/15/22 | B | 320,250 | |||||||||||||||||

| 325 | Cequel Communication Holdings I, 144A | 5.125 | % | 12/15/21 | B– | 323,781 | |||||||||||||||||

| 720 | Comcast Corporation | 6.400 | % | 5/15/38 | A– | 917,640 | |||||||||||||||||

| 620 | DIRECTV Holdings LLC | 3.800 | % | 3/15/22 | BBB | 640,222 | |||||||||||||||||

| 300 | Gannett Company Inc., 144A | 5.125 | % | 7/15/20 | BB+ | 307,875 | |||||||||||||||||

| 555 | News America Holdings Inc. | 6.650 | % | 11/15/37 | BBB+ | 704,705 | |||||||||||||||||

| 400 | Numericable Group SA, 144A | 6.000 | % | 5/15/22 | Ba3 | 416,000 | |||||||||||||||||

| 200 | Sinclair Television Group | 6.375 | % | 11/01/21 | B1 | 212,750 | |||||||||||||||||

| 300 | Sirius XM Radio Inc., 144A | 5.750 | % | 8/01/21 | BB | 315,000 | |||||||||||||||||

| 250 | CAD | Videotron Limited, 144A | 5.625 | % | 6/15/25 | BB | 237,805 | ||||||||||||||||

| Total Media | 4,396,028 | ||||||||||||||||||||||

Metals & Mining – 5.1% | |||||||||||||||||||||||

| 975 | Alcoa Inc. | 5.400 | % | 4/15/21 | BBB– | 1,057,683 | |||||||||||||||||

| 200 | Anglogold Holdings PLC | 6.500 | % | 4/15/40 | Baa3 | 191,972 | |||||||||||||||||

| 485 | ArcelorMittal | 6.750 | % | 2/25/22 | BB+ | 543,200 | |||||||||||||||||

| 720 | Cliffs Natural Resources Inc. | 4.800 | % | 10/01/20 | BBB– | 704,568 | |||||||||||||||||

| 300 | Coeur d'Alene Mines Corporation, Convertible Bond | 7.875 | % | 2/01/21 | B+ | 301,500 | |||||||||||||||||

| 250 | Eldorado Gold Corporation, 144A | 6.125 | % | 12/15/20 | BB | 252,500 | |||||||||||||||||

| 230 | First Quantum Minerals Limited, 144A | 6.750 | % | 2/15/20 | BB | 236,900 | |||||||||||||||||

| 230 | First Quantum Minerals Limited, 144A | 7.000 | % | 2/15/21 | BB | 236,613 | |||||||||||||||||

| 300 | FMG Resources, 144A | 8.250 | % | 11/01/19 | BB+ | 326,625 | |||||||||||||||||

| 640 | Freeport McMoRan Copper & Gold, Inc. | 3.550 | % | 3/01/22 | BBB | 633,792 | |||||||||||||||||

| 400 | Imperial Metals Corporation, 144A | 7.000 | % | 3/15/19 | B– | 410,500 | |||||||||||||||||

| 700 | Newmont Mining Corporation | 3.500 | % | 3/15/22 | BBB | 674,899 | |||||||||||||||||

| 320 | Teck Resources Limited | 6.250 | % | 7/15/41 | BBB | 347,389 | |||||||||||||||||

| 285 | Vale Overseas Limited | 6.875 | % | 11/10/39 | A– | 316,506 | |||||||||||||||||

| 200 | Vedanta Resources PLC, 144A | 6.000 | % | 1/31/19 | BB | 206,760 | |||||||||||||||||

| 6,235 | Total Metals & Mining | 6,441,407 | |||||||||||||||||||||

Oil, Gas & Consumable Fuels – 11.0% | |||||||||||||||||||||||

| 165 | Anadarko Petroleum Corporation | 6.200 | % | 3/15/40 | BBB– | 208,056 | |||||||||||||||||

| 350 | Antero Resources Finance Corporation, 144A | 5.125 | % | 12/01/22 | BB– | 359,625 | |||||||||||||||||

| 875 | Apache Corporation | 4.250 | % | 1/15/44 | A– | 860,556 | |||||||||||||||||

| 400 | CAD | Athabasca Oil Corporation, 144A | 7.500 | % | 11/19/17 | B | 382,831 | ||||||||||||||||

| 350 | Atlas Pipeline LP Finance | 5.875 | % | 8/01/23 | B+ | 356,125 | |||||||||||||||||

| 375 | Bill Barrett Corporation | 7.000 | % | 10/15/22 | B1 | 397,500 | |||||||||||||||||

| 1,000 | CNPC General Capital Limited, 144A | 3.400 | % | 4/16/23 | A+ | 962,625 | |||||||||||||||||

| 200 | Concho Resources Inc. | 5.500 | % | 10/01/22 | BB+ | 215,250 | |||||||||||||||||

| 200 | CONSOL Energy Inc. | 8.250 | % | 4/01/20 | BB | 216,500 | |||||||||||||||||

| 300 | EnQuest PLC, 144A | 7.000 | % | 4/15/22 | B | 309,750 | |||||||||||||||||

| 400 | Key Energy Services Inc. | 6.750 | % | 3/01/21 | BB– | 416,000 | |||||||||||||||||

| 300 | Martin Mid-Stream Partners LP Finance | 7.250 | % | 2/15/21 | B– | 318,000 | |||||||||||||||||

| 350 | MEG Energy Corportation, 144A | 7.000 | % | 3/31/24 | BB | 385,875 | |||||||||||||||||

| 250 | Murphy Oil USA Inc. | 6.000 | % | 8/15/23 | BB | 263,125 | |||||||||||||||||

| 200 | Niska Gas Storage Canada ULC Finance Corporation, 144A | 6.500 | % | 4/01/19 | B | 192,000 | |||||||||||||||||

| 400 | Linn Energy Finance LLC | 6.250 | % | 11/01/19 | B+ | 419,000 | |||||||||||||||||

| 300 | Rose Rock Midstream Finance, 144A | 5.625 | % | 7/15/22 | B1 | 303,750 | |||||||||||||||||

| 300 | Oasis Petroleum Inc., 144A | 6.875 | % | 3/15/22 | B+ | 327,000 | |||||||||||||||||

| 350 | CAD | Paramount Resources Limited, 144A | 7.625 | % | 12/04/19 | B | 350,148 | ||||||||||||||||

| 400 | PetroBakken Energy Limited, 144A | 8.625 | % | 2/01/20 | B– | 420,000 | |||||||||||||||||

| 900 | Petrobras Global Finance BV | 6.250 | % | 3/17/24 | Baa1 | 957,960 | |||||||||||||||||

| 210 | Petrobras International Finance Company | 5.375 | % | 1/27/21 | Baa1 | 218,868 | |||||||||||||||||

| 500 | Petrohawk Energy Corporation | 7.250 | % | 8/15/18 | A | 522,500 | |||||||||||||||||

| 250 | Range Resources Corporation | 5.000 | % | 8/15/22 | BB | 265,000 | |||||||||||||||||

Nuveen Investments

23

JGG Nuveen Global Income Opportunities Fund

Portfolio of Investments (continued) June 30, 2014 (Unaudited)

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

| Oil, Gas & Consumable Fuels (continued) | |||||||||||||||||||||||

$ | 1,000 | Rowan Companies Inc. | 4.875 | % | 6/01/22 | BBB– | $ | 1,071,158 | |||||||||||||||

| 250 | Sabine Pass Liquefaction LLC | 5.625 | % | 2/01/21 | BB+ | 264,375 | |||||||||||||||||

| 350 | Sandridge Energy Inc. | 8.125 | % | 10/15/22 | B2 | 385,438 | |||||||||||||||||

| 250 | Seadrill Limited, 144A | 6.625 | % | 9/15/20 | N/R | 254,375 | |||||||||||||||||

| 300 | Seventy Seven Energy Inc., 144A | 6.500 | % | 7/15/22 | B | 307,500 | |||||||||||||||||

| 2,000 | NOK | Ship Finance International Limited | 6.610 | % | 10/19/17 | N/R | 339,102 | ||||||||||||||||

| 250 | Targa Resources Inc. | 4.250 | % | 11/15/23 | BB | 248,438 | |||||||||||||||||

| 700 | Thai Oil PCL, 144A | 3.625 | % | 1/23/23 | Baa1 | 669,250 | |||||||||||||||||

| 765 | Transocean Inc. | 3.800 | % | 10/15/22 | BBB– | 757,138 | |||||||||||||||||

| Total Oil, Gas & Consumable Fuels | 13,924,818 | ||||||||||||||||||||||

Paper & Forest Products – 1.3% | |||||||||||||||||||||||

| 715 | Domtar Corporation | 4.400 | % | 4/01/22 | BBB– | 736,108 | |||||||||||||||||

| 720 | Domtar Corporation | 6.750 | % | 2/15/44 | BBB– | 858,221 | |||||||||||||||||

| 1,435 | Total Paper & Forest Products | 1,594,329 | |||||||||||||||||||||

Personal Products – 0.3% | |||||||||||||||||||||||

| 300 | Albea Beauty Holdings SA, 144A | 8.375 | % | 11/01/19 | B+ | 326,250 | |||||||||||||||||

Pharmaceuticals – 0.7% | |||||||||||||||||||||||

| 400 | AbbVie Inc. | 2.900 | % | 11/06/22 | A | 386,814 | |||||||||||||||||

| 300 | Endo Finance Company, 144A | 7.000 | % | 12/15/20 | B+ | 321,000 | |||||||||||||||||

| 220 | VP Escrow Corporation, 144A | 6.375 | % | 10/15/20 | B1 | 233,750 | |||||||||||||||||

| 920 | Total Pharmaceuticals | 941,564 | |||||||||||||||||||||

Real Estate Investment Trust (REIT) – 4.1% | |||||||||||||||||||||||

| 870 | American Tower Company | 5.000 | % | 2/15/24 | BBB | 944,931 | |||||||||||||||||

| 475 | ARC Property Operating Partnership LP, Clasrk Acquisition LLC, 144A | 4.600 | % | 2/06/24 | BBB– | 487,121 | |||||||||||||||||

| 1,000 | CommomWealth REIT | 5.875 | % | 9/15/20 | BBB– | 1,088,873 | |||||||||||||||||

| 480 | HCP Inc. | 3.750 | % | 2/01/19 | BBB+ | 511,478 | |||||||||||||||||

| 1,000 | Liberty Property Trust | 3.375 | % | 6/15/23 | Baa1 | 970,511 | |||||||||||||||||

| 1,000 | Senior Housing Properties Trust | 6.750 | % | 4/15/20 | BBB– | 1,155,299 | |||||||||||||||||

| 4,825 | Total Real Estate Investment Trust (REIT) | 5,158,213 | |||||||||||||||||||||

Real Estate Management & Development – 0.6% | |||||||||||||||||||||||

| 350 | Country Garden Holding Company, 144A | 11.125 | % | 2/23/18 | BB | 381,920 | |||||||||||||||||

| 200 | Gemdale International Investment Limited | 7.125 | % | 11/16/17 | BB– | 205,500 | |||||||||||||||||

| 200 | Kaisa Group Holdings Limited, 144A | 8.875 | % | 3/19/18 | BB– | 205,500 | |||||||||||||||||

| 750 | Total Real Estate Management & Development | 792,920 | |||||||||||||||||||||

Road & Rail – 0.2% | |||||||||||||||||||||||

| 265 | Hertz Corporation | 7.375 | % | 1/15/21 | B | 287,525 | |||||||||||||||||

Semiconductors & Equipment – 0.3% | |||||||||||||||||||||||

| 325 | Micron Technology, Inc., 144A | 5.875 | % | 2/15/22 | BB | 348,563 | |||||||||||||||||

Software – 0.7% | |||||||||||||||||||||||

| 250 | BMC Software Finance Inc., 144A | 8.125 | % | 7/15/21 | CCC+ | 257,188 | |||||||||||||||||

| 565 | Computer Sciences Corporation | 4.450 | % | 9/15/22 | BBB+ | 592,425 | |||||||||||||||||

| 815 | Total Software | 849,613 | |||||||||||||||||||||

Specialty Retail – 0.3% | |||||||||||||||||||||||

| 415 | Swiss Re Treasury US Corporation, 144A | 4.250 | % | 12/06/42 | AA– | 399,747 | |||||||||||||||||

Tobacco – 0.8% | |||||||||||||||||||||||

| 1,030 | Reynolds American Inc. | 3.250 | % | 11/01/22 | Baa2 | 993,705 | |||||||||||||||||

Nuveen Investments

24

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

Wireless Telecommunication Services – 1.6% | |||||||||||||||||||||||

$ | 350 | Digicel Limited, 144A | 7.000 | % | 2/15/20 | B1 | $ | 369,250 | |||||||||||||||

| 400 | Frontier Comminications Corporation | 8.500 | % | 4/15/20 | Ba2 | 472,000 | |||||||||||||||||

| 200 | Millicom International Cellular SA, 144A | 6.625 | % | 10/15/21 | BB+ | 215,000 | |||||||||||||||||

| 275 | Softbank Corporation, 144A | 4.500 | % | 4/15/20 | BB+ | 279,463 | |||||||||||||||||

| 400 | Sprint Nextel Corporation, 144A | 7.000 | % | 3/01/20 | BB+ | 460,000 | |||||||||||||||||

| 300 | Wind Acquisition Finance SA, 144A, WI/DD | 4.750 | % | 7/15/20 | BB | 302,250 | |||||||||||||||||

| 1,925 | Total Wireless Telecommunication Services | 2,097,963 | |||||||||||||||||||||

| Total Corporate Bonds (cost $77,975,589) | 79,457,437 | ||||||||||||||||||||||

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

$1,000 PAR (OR SIMILAR) INSTITUTIONAL PREFERRED – 5.6% (3.8% of Total Investments) | |||||||||||||||||||||||

Banks – 2.9% | |||||||||||||||||||||||

| 690 | EUR | Barclays PLC | 6.500 | % | N/A (4) | BB+ | $ | 951,903 | |||||||||||||||

$ | 1,100 | General Electric Capital Corporation | 7.125 | % | N/A (4) | AA– | 1,298,220 | ||||||||||||||||

| 1,400 | Wachovia Capital Trust III | 5.570 | % | N/A (4) | BBB+ | 1,358,000 | |||||||||||||||||

| Total Banks | 3,608,123 | ||||||||||||||||||||||

Capital Markets – 0.2% | |||||||||||||||||||||||

| 200 | EUR | Baggot Securities Limited, 144A | 10.240 | % | N/A (4) | N/R | 301,246 | ||||||||||||||||

Diversified Financial Services – 0.4% | |||||||||||||||||||||||

| 355 | Rabobank Nederland, 144A | 11.000 | % | N/A (4) | A– | 476,655 | |||||||||||||||||

Electric Utilities – 0.3% | |||||||||||||||||||||||

| 360 | Electricite de France, 144A | 5.250 | % | N/A (4) | A3 | 367,247 | |||||||||||||||||

Insurance – 1.6% | |||||||||||||||||||||||

| 570 | Catlin Insurance Company Limited, 144A | 7.249 | % | N/A (4) | BBB+ | 588,525 | |||||||||||||||||

| 250 | Genworth Financial Inc. | 6.150 | % | 11/15/66 | Ba1 | 237,813 | |||||||||||||||||

| 355 | Lincoln National Corporation | 6.050 | % | 4/20/67 | BBB | 358,994 | |||||||||||||||||

| 305 | Prudential Financial Inc. | 5.200 | % | 3/15/44 | BBB+ | 311,100 | |||||||||||||||||

| 530 | ZFS Finance USA Trust V, 144A | 6.500 | % | 5/09/37 | A | 567,100 | |||||||||||||||||

| 2,010 | Total Insurance | 2,063,532 | |||||||||||||||||||||

Oil, Gas & Consumable Fuels – 0.2% | |||||||||||||||||||||||

| 250 | Odebrecht Oil and Gas Finance, 144A | 7.000 | % | N/A (4) | BBB– | 258,124 | |||||||||||||||||

| Total $1,000 Par (or similar) Institutional Preferred (cost $7,031,405) | 7,074,927 | ||||||||||||||||||||||

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

SOVEREIGN DEBT – 64.7% (44.2% of Total Investments) | |||||||||||||||||||||||

Bermuda – 0.8% | |||||||||||||||||||||||

$ | 900 | Bermuda Government, 144A | 5.603 | % | 7/20/20 | AA– | $ | 1,003,500 | |||||||||||||||

Brazil – 2.3% | |||||||||||||||||||||||

| 1,000 | Federative Republic of Brazil | 2.625 | % | 1/05/23 | Baa2 | 923,500 | |||||||||||||||||

| 5,200 | BRL | Letra De Tesouro Nacional de Brazil | 0.000 | % | 1/01/16 | BBB+ | 2,001,740 | ||||||||||||||||

| Total Brazil | 2,925,240 | ||||||||||||||||||||||

Germany – 2.7% | |||||||||||||||||||||||

| 2,360 | EUR | Deutschland Republic | 2.500 | % | 8/15/46 | Aaa | 3,459,050 | ||||||||||||||||

Greece – 1.1% | |||||||||||||||||||||||

| 980 | EUR | Hellenic Republic, 144A | 4.750 | % | 4/17/19 | B | 1,371,061 | ||||||||||||||||

Nuveen Investments

25

JGG Nuveen Global Income Opportunities Fund

Portfolio of Investments (continued) June 30, 2014 (Unaudited)

| Principal Amount (000) (3) | Description (1) | Coupon | Maturity | Ratings (2) | Value | ||||||||||||||||||

Indonesia – 1.1% | |||||||||||||||||||||||

$ | 1,300 | Republic of Indonesia, 144A | 5.875 | % | 3/13/20 | Baa3 | $ | 1,443,000 | |||||||||||||||

Malaysia – 2.3% | |||||||||||||||||||||||

| 9,250 | MYR | Republic of Malaysia | 3.172 | % | 7/15/16 | A | 2,873,881 | ||||||||||||||||

Mexico – 17.4% | |||||||||||||||||||||||

| 15,000 | MXN | Mexico Bonos de DeSarrollo | 8.000 | % | 12/17/15 | A | 1,234,320 | ||||||||||||||||

| 85,800 | MXN | Mexico Bonos de DeSarrollo | 4.750 | % | 6/14/18 | A | 6,689,192 | ||||||||||||||||

| 65,300 | MXN | Mexico Bonos de DeSarrollo | 8.000 | % | 12/07/23 | A | 5,880,398 | ||||||||||||||||

| 40,100 | MXN | Mexico Bonos de DeSarrollo | 7.750 | % | 11/13/42 | A | 3,500,172 | ||||||||||||||||

| 60,000 | MXN | United Mexican States | 9.500 | % | 12/18/14 | A | 4,759,612 | ||||||||||||||||

| 266,200 | MXN | Total Mexico | 22,063,694 | ||||||||||||||||||||

Norway – 2.2% | |||||||||||||||||||||||

| 15,000 | NOK | Norwegian Government Bond | 4.500 | % | 5/22/19 | AAA | 2,758,874 | ||||||||||||||||

Poland – 3.3% | |||||||||||||||||||||||

| 6,850 | PLN | Republic of Poland | 2.500 | % | 7/25/18 | A | 2,224,011 | ||||||||||||||||

| 2,800 | PLN | Republic of Poland | 5.750 | % | 9/23/22 | A | 1,077,810 | ||||||||||||||||

| 2,600 | PLN | Republic of Poland | 4.000 | % | 10/25/23 | A | 892,950 | ||||||||||||||||

| 12,250 | PLN | Total Poland | 4,194,771 | ||||||||||||||||||||

Portugal – 2.7% | |||||||||||||||||||||||

| 1,300 | EUR | Portugal Obrigacoes do Tesouro, 144A | 4.750 | % | 6/14/19 | BB | 1,973,729 | ||||||||||||||||

| 900 | EUR | Portugal Obrigacoes do Tesouro, 144A | 5.650 | % | 2/15/24 | BB+ | 1,428,391 | ||||||||||||||||

| 2,200 | EUR | Total Portugal | 3,402,120 | ||||||||||||||||||||

Romania – 0.4% | |||||||||||||||||||||||

| 400 | Republic of Romania, 144A | 6.125 | % | 1/22/44 | BBB– | 454,540 | |||||||||||||||||

South Africa – 8.6% | |||||||||||||||||||||||

| 62,000 | ZAR | Republic of South Africa | 7.250 | % | 1/15/20 | BBB+ | 5,687,443 | ||||||||||||||||

| 43,000 | ZAR | Republic of South Africa | 6.750 | % | 3/31/21 | Baa1 | 3,787,882 | ||||||||||||||||

| 12,800 | ZAR | Republic of South Africa | 10.500 | % | 12/21/26 | BBB+ | 1,403,763 | ||||||||||||||||

| 117,800 | ZAR | Total South Africa | 10,879,088 | ||||||||||||||||||||

South Korea – 5.1% | |||||||||||||||||||||||

| 6,500,000 | KRW | South Korea Monetary Stability Bond | 2.840 | % | 12/02/14 | AA | 6,430,599 | ||||||||||||||||

Sweden – 1.1% | |||||||||||||||||||||||

| 8,500 | SEK | Republic of Sweden, 144A | 3.500 | % | 6/01/22 | AAA | 1,460,198 | ||||||||||||||||

Turkey – 9.5% | |||||||||||||||||||||||

| 12,300 | TRY | Republic of Turkey, Government Bond | 9.000 | % | 3/08/17 | BBB | 5,918,874 | ||||||||||||||||

| 5,975 | TRY | Republic of Turkey, Government Bond | 10.500 | % | 1/15/20 | BBB | 3,067,031 | ||||||||||||||||