UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22023

Nuveen Managed Accounts Portfolios Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: July 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

NUVEEN INVESTMENTS MUTUAL FUNDS

| | |

| | |

Annual Report dated July 31, 2007 | | Dependable, tax-free income because

it’s not what you earn, it’s what you keep.® |

Nuveen Investments

Municipal Bond Funds

Municipal Total Return Managed Accounts Portfolio

NOW YOU CAN RECEIVE YOUR

NUVEEN INVESTMENTS FUND REPORTS FASTER.

NO MORE WAITING.

SIGN UP TODAY TO RECEIVE NUVEEN INVESTMENTS FUND INFORMATION BY

E-MAIL.

It only takes a minute to sign up for E-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Investments Fund information is ready — no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report, and save it on your computer if your wish.

IT’S FAST, EASY & FREE:

www.investordelivery.com

if you get your Nuveen Investments Fund dividends and statements from your financial advisor or brokerage account.

(Be sure to have the address sheet that accompanied this report handy. You’ll need it to complete the enrollment process.)

OR

www.nuveen.com/accountaccess

if you get your Nuveen Investments Fund dividends and statements directly from Nuveen Investments.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

“No one knows

what the future

will bring, which

is why we think

a well-balanced

portfolio ... is

an important

component in

achieving your

long-term

financial goals.”

Dear Shareholder,

I am very pleased to introduce the new Municipal Total Return Managed Accounts Portfolio covered by this report. This Fund began investment operations on May 31, 2007. For more information on the Fund’s performance, please read the Portfolio Manager’s Comments and the Fund Spotlight sections of this report.

I also wanted to take this opportunity to report some important news about Nuveen Investments. The company has accepted a buyout offer from a private equity investment firm. While this may affect the corporate structure of Nuveen Investments, it will have no impact on the investment objectives of the Funds, their portfolio management strategies or their dividend policies. We will provide you with additional information about this transaction as more details become available.

With the recent volatility in the market, many have begun to wonder which way the market is headed, and whether they need to adjust their holdings of investments. No one knows what the future will bring, which is why we think a well-balanced portfolio that is structured and carefully monitored with the help of an investment professional is an important component in achieving your long-term financial goals. A well-diversified portfolio may actually help to reduce your overall investment risk, and we believe that investments like your Nuveen Investments Fund can be important building blocks in a portfolio crafted to perform well through a variety of market conditions.

Since 1898, Nuveen Investments has offered financial products and solutions that incorporate careful research, diversification, and the application of conservative risk-management principles. We are grateful that you have chosen us as a partner as you pursue your financial goals. We look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Timothy R. Schwertfeger

Chairman of the Board

September 14, 2007

Annual Report l Page 1

Portfolio Manager’s Comments

Portfolio manager Marty Doyle examines the investment strategy of and how it was applied to the Municipal Total Return Managed Accounts Portfolio. Marty, who has 20 years of investment experience, has managed the Municipal Total Return Managed Accounts Portfolio since its inception.

What is the Fund’s investment strategy and how was it applied during the reporting period?

From the period since the Fund’s inception, May 31, 2007, we have been in the initial invest up phase.

The investment strategy used for the Fund is a value-oriented one which looks for higher-yielding and undervalued municipal bonds that offer potentially above-average total return. During the initial invest-up phase of the portfolio, we sought value opportunities within an overall framework that emphasizes diversification along the credit and yield curve spectrum. When available, we purchased higher coupon bonds as well, which potentially lessen risk on longer maturity securities and may lead to less portfolio duration volatility.

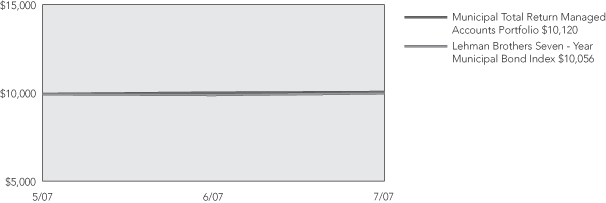

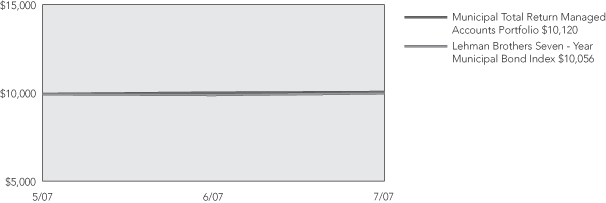

Cumulative Total Returns as of 7/31/07

| | |

| | | Since inception

(5/31/07) |

Municipal Total Return Managed Accounts Portfolio | | 1.20% |

Lehman Brothers 7-Year Municipal Bond Index1 | | 0.56% |

Returns quoted represent past performance, which is no guarantee of future results. Returns less than one year are cumulative. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. Returns reflect a voluntary expense limitation by the Funds’ investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance, visit www.nuveen.com or call (800) 257-8787.

| 1 | The Lehman Brothers 7-Year Municipal Bond Index is an unmanaged index composed of a broad range of investment-grade municipal bonds and does not reflect any initial or ongoing expenses. This index more closely compares to the duration of the bonds in the Fund’s portfolio. An index is not available for direct investment. |

Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The views expressed herein represent those of the portfolio manager as of the date of this report and are subject to change at any time, based on market conditions and other factors. The Fund disclaims any obligation to advise shareholders of such changes.

Annual Report l Page 2

Municipal Total Return Managed Accounts Portfolio

Growth of an Assumed $10,000 Investment

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of shares.

The index comparisons show the change in value of a $10,000 investment in the Municipal Total Return Managed Accounts Portfolio compared with the corresponding index. The Lehman Brothers Seven-Year Municipal Bond Index is an unmanaged index composed of a broad range of investment-grade municipal bonds. The index returns assume reinvestment of dividends and do not reflect any initial or ongoing expenses. You cannot invest directly in an index. The Municipal Total Return Managed Accounts Portfolio returns include reinvestment of all dividends and distributions. The performance data quoted represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance shown.

Annual Report l Page 3

Fund Spotlight as of 7/31/07 Municipal Total Return Managed

Accounts Portfolio

| | |

| Quick Facts | | |

| | | |

NAV | | $10.12 |

Inception Date | | 5/31/07 |

Returns quoted represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Fund returns assume reinvestment of dividends and capital gains. Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| | | | |

| Cumulative Total Return as of 7/31/07 |

| | |

| | | NAV | | |

Since Inception | | 1. 20% | | |

| Cumulative Total Return as of 6/30/07 |

| | |

| | | NAV | | |

Since Inception | | .70% | | |

| Tax-Free Yields |

| | |

| | | NAV | | |

SEC 30-day yield | | 4.57% | | |

Taxable Equivalent Yield2 | | 6.35% | | |

| | | | | | |

| Expense Ratios | | | | | | |

| | | |

| | | Gross

Expense

Ratio | | Net

Expense

Ratio | | As of

Date |

| | | 0.10% | | 0.00% | | 5/31/07 |

The expense ratios shown are estimated for the first fiscal year. The net expense ratio reflects a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses. Absent the waiver and reimbursement, expenses would be higher and total returns would be less. These expense ratios may vary from the expense ratio shown elsewhere in this report.

Bond Credit Quality1

| | |

| Portfolio Statistics |

Net Assets ($000) | | $5,569 |

Average Effective Maturity (Years) | | 18.70 |

Average Duration | | 6.73 |

| 1 | As a percentage of total long-term investments as of July 31, 2007. Holdings are subject to change. |

| 2 | The Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis at a specified tax rate. With respect to investments that generate qualified dividend income that is taxable at a maximum rate of 15%, the Taxable-Equivalent Yield is lower. The Taxable-Equivalent Yield is based on the Fund’s SEC 30-Day Yield on the indicated date and a federal income tax rate of 28%. |

Annual Report l Page 4

Fund Spotlight as of 7/31/07 Municipal Total Return Managed

Accounts Portfolio

Industries1

| | |

Health Care | | 41.4% |

Education and Civic Organizations | | 20.9% |

Tax Obligation/General | | 17.6% |

Transportation | | 6.8% |

Long-Term Health | | 5.4% |

Other | | 7.9% |

States1

| | |

Indiana | | 9.9% |

Oklahoma | | 8.8% |

Ohio | | 8.8% |

Colorado | | 8.3% |

Michigan | | 7.6% |

Florida | | 7.5% |

Illinois | | 5.0% |

Washington | | 4.9% |

Texas | | 4.8% |

California | | 4.8% |

New Mexico | | 4.7% |

Louisiana | | 4.6% |

Connecticut | | 3.9% |

Pennsylvania | | 3.7% |

Other | | 12.7% |

| 1 | As a percentage of total long-term investments as of July 31, 2007. Holdings are subject to change. |

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including front and back end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Since the expense examples below reflect only the first 62 days of the Fund’s operations they may not provide a meaningful understanding of the Fund’s ongoing expenses.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front and back end sales charges (loads) or redemption fees, where applicable. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | | | | | | | Hypothetical Performance |

| | | Actual Performance | | (5% annualized return before expenses) |

| | | | | | |

| | | | | | | | | | | | | |

Beginning Account Value (5/31/07) | | | | $

| 1,000.00

| | | | | | $ | 1,000.00 | | |

Ending Account Value (7/31/07) | | | | $

| 1,012.00

| | | | | | $ | 1,008.49 | | |

Expenses Incurred During Period | | | | $

| —

| | | | | | $ | — | | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of 0.00% multiplied by the average account value over the period, multiplied by 62/365 (to reflect the one-half year period).

Annual Report l Page 5

Portfolio of Investments

Municipal Total Return Managed Accounts Portfolio

July 31, 2007

| | | | | | | | | | |

Principal

Amount (000) | | Description | | Optional Call

Provisions (1) | | Ratings (2) | | Value |

| | | | | | | | | | |

| | | Alaska – 2.8% | | | | | | | |

| | | | |

| $ | 145 | | Alaska Municipal Bond Bank Authority, General Obligation Bonds, Series 2006-2, 5.500%, 12/01/21 - MBIA Insured (Alternative Minimum Tax) | | 12/16 at 100.00 | | AAA | | $ | 156,630 |

| | | California – 4.6% | | | | | | | |

| | | | |

| | 250 | | Lompoc Healthcare District, California, General Obligation Bonds, Series 2005B, 5.000%, 8/01/34

(WI/DD, Settling 08/07/07) - XLCA Insured | | 8/14 at 100.00 | | Aaa | | | 256,363 |

| | | Colorado – 8.0% | | | | | | | |

| | | | |

| | 200 | | Colorado Health Facilities Authority, Revenue Bonds, Evangelical Lutheran Good Samaritan Society,

Series 2006, 5.250%, 6/01/17 | | 6/16 at 100.00 | | A– | | | 209,632 |

| | | | |

| | 75 | | Colorado Health Facilities Authority, Revenue Bonds, Yampa Valley Medical Center, Series 2007,

5.000%, 6/15/15 | | No Opt. Call | | BBB– | | | 76,273 |

| | | | |

| | 150 | | Denver City and County, Colorado, Airport System Revenue Refunding Bonds, Series 2001A,

5.500%, 11/15/14 - FGIC Insured | | 11/11 at 100.00 | | AAA | | | 158,178 |

| | 425 | | Total Colorado | | | | | | | 444,083 |

| | | Connecticut – 3.7% | | | | | | | |

| | | | |

| | 200 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Hospital For Special Care,

Series 2007C, 5.250%, 7/01/27 - RAAI Insured | | 7/17 at 100.00 | | AA | | | 207,748 |

| | | Florida – 7.3% | | | | | | | |

| | | | |

| | 200 | | South Miami Health Facilities Authority, Florida, Hospital Revenue, Baptist Health System Obligation Group, Series 2007, 5.000%, 8/15/32 | | 8/17 at 100.00 | | AA– | | | 201,016 |

| | | | |

| | 200 | | University of Florida Research Foundation, Inc , Capital Improvement Revenue Bonds, Series 2003, 5.125%, 9/01/33 - - AMBAC Insured | | 9/09 at 100.00 | | Aaa | | | 203,726 |

| | 400 | | Total Florida | | | | | | | 404,742 |

| | | Illinois – 4.8% | | | | | | | |

| | | | |

| | 250 | | DuPage and Will Counties Community School District 204 - Indian Prairie, Illinois, General Obligation Bonds, Series 2007A, 5.250%, 12/30/23 - FGIC Insured | | 6/17 at 100.00 | | AAA | | | 269,735 |

| | | Indiana – 9.6% | | | | | | | |

| | | | |

| | 250 | | Central Nine Career Charter School Building Corporation, Indiana, General Obligation Bonds,

Series 2007, 5.500%, 1/15/17 | | No Opt. Call | | A | | | 270,478 |

| | | | |

| | 260 | | Indiana Health and Educational Facilities Financing Authority, Revenue Bonds, Ascension Health,

Series 2006B-6, 5.000%, 11/15/36 | | 11/16 at 100.00 | | AA | | | 261,612 |

| | 510 | | Total Indiana | | | | | | | 532,090 |

| | | Kansas – 1.2% | | | | | | | |

| | | | |

| | 65 | | Labette County Medical Center, Kansas, Revenue Bonds, Series 2007A, 5.750%, 9/01/29 | | 9/17 at 100.00 | | N/R | | | 67,095 |

| | | Louisiana – 4.4% | | | | | | | |

| | | | |

| | 235 | | Louisiana Public Facilities Authority, Grambling University Black and Gold Facilities Project Revenue Bonds, Series 2006A, 5.000%, 7/01/22 - CIFG Insured | | 7/16 at 100.00 | | AAA | | | 246,271 |

| | | Maryland – 1.7% | | | | | | | |

| | | | |

| | 100 | | Maryland Community Development Administration, Department of Housing and Community Development, Residential Revenue Bonds, Series 2006P, 4.700%, 3/01/37 | | 3/16 at 100.00 | | Aa2 | | | 94,694 |

| | | Michigan – 7.3% | | | | | | | |

| | | | |

| | 200 | | Michigan Higher Education Student Loan Authority, Revenue Bonds, Series 2003, XVII-I,

4.750%, 3/01/18 - AMBAC Insured (Alternative Minimum Tax) | | 3/14 at 100.00 | | AAA | | | 201,454 |

| | | | |

| | 100 | | Royal Oak Hospital Finance Authority, Michigan, Hospital Revenue Refunding Bonds, William Beaumont Hospital, Series 1996, 6.250%, 1/01/10 | | No Opt. Call | | AA– | | | 105,177 |

| | | | |

| | 100 | | Wayne County, Michigan, Airport Revenue Bonds, Detroit Metropolitan Wayne County Airport,

Series 1998A, 5.000%, 12/01/28 - MBIA Insured (Alternative Minimum Tax) | | 12/08 at 101.00 | | AAA | | | 101,063 |

| | 400 | | Total Michigan | | | | | | | 407,694 |

6

| | | | | | | | | | | |

Principal

Amount (000) | | Description | | Optional Call

Provisions (1) | | Ratings (2) | | Value | |

| | | | �� | | | | | | | |

| | | Missouri – 1.4% | | | | | | | | |

| | | | |

| $ | 75 | | St Louis County Industrial Development Authority, Missouri, Revenue Bonds, Friendship Village of West County, Series 2007A, 5.250%, 9/01/15 | | No Opt. Call | | N/R | | $ | 77,414 | |

| | | New Mexico – 4.5% | | | | | | | | |

| | | | |

| | 250 | | Farmington, New Mexico, Pollution Control Revenue Bonds, Public Service Company of New Mexico San Juan Project, Series 2007A, 5.150%, 6/01/37 - FGIC Insured (Alternative Minimum Tax) | | 6/12 at 100.00 | | AAA | | | 252,375 | |

| | | North Carolina – 1.9% | | | | | | | | |

| | | | |

| | 100 | | Albemarle Hospital Authority, North Carolina, Health Care Facilities Revenue Bonds, Series 2007,

5.250%, 10/01/21 | | 10/17 at 100.00 | | BBB | | | 102,810 | |

| | | Ohio – 8.4% | | | | | | | | |

| | | | |

| | 240 | | Cuyahoga County, Ohio, Revenue Refunding Bonds, Cleveland Clinic Health System, Series 2003A, 6.000%, 1/01/32 | | 7/13 at 100.00 | | AA– | | | 260,191 | |

| | | | |

| | 200 | | Huron County, Ohio, Hospital Facilities Revenue Bonds, Fisher-Titus Medical Center, Series 2007,

5.250%, 12/01/17 | | 6/17 at 100.00 | | A | | | 209,612 | |

| | 440 | | Total Ohio | | | | | | | 469,803 | |

| | | Oklahoma – 8.5% | | | | | | | | |

| | | | |

| | 200 | | Norman Regional Hospital Authority, Oklahoma, Revenue Bonds, Series 2007, 5.250%, 9/01/21 - RAAI Insured | | 9/17 at 100.00 | | AA | | | 209,318 | |

| | | | |

| | 260 | | Tulsa County Industrial Authority, Oklahoma, Health Care Revenue Bonds, Saint Francis Health System, Series 2006, 5.000%, 12/15/36 | | 12/16 at 100.00 | | AA | | | 261,630 | |

| | 460 | | Total Oklahoma | | | | | | | 470,948 | |

| | | Pennsylvania – 3.6% | | | | | | | | |

| | | | |

| | 200 | | Erie Higher Education Building Authority, Pennsylvania, College Revenue Bonds, Gannon University,

Series 2007-GG3, 5.000%, 5/01/35 - RAAI Insured | | 5/17 at 100.00 | | AA | | | 199,538 | |

| | | Texas – 4.7% | | | | | | | | |

| | | | |

| | 250 | | North Texas Health Facilities Development Corporation, Revenue Bonds, United Regional Health Care System, Inc , Series 2007, 5.000%, 9/01/23 - FSA Insured | | 9/17 at 100.00 | | AAA | | | 259,930 | |

| | | Virginia – 1.9% | | | | | | | | |

| | | | |

| | 100 | | Metropolitan Washington D. C. Airports Authority, Airport System Revenue Bonds, Series 2002A,

5.250%, 10/01/32 - FGIC Insured | | 10/12 at 100.00 | | AAA | | | 102,906 | |

| | | Washington – 4.7% | | | | | | | | |

| | | | |

| | 250 | | Washington State, General Obligation Bonds, Series 2005D, 5.000%, 1/01/19 - FSA Insured | | 1/15 at 100.00 | | AAA | | | 262,868 | |

| | | Wisconsin – 1.4% | | | | | | | | |

| | | | |

| | 75 | | Badger Tobacco Asset Securitization Corporation, Wisconsin, Tobacco Settlement Asset-Backed Bonds, Series 2002, 6.125%, 6/01/27 | | 6/12 at 100.00 | | BBB | | | 78,297 | |

| $ | 5,180 | | Total Long-Term Investments (cost $5,328,967) – 96.4% | | | | | | | 5,364,034 | |

| | | | | | | | | | | | |

| | | Short-Term Investments – 7.6% | | | | | | | | |

| | | | |

| $ | 426 | | State Street Global Advisors Money Market Fund, Tax Free Obligation | | | | | | | 425,596 | |

| | | | | | | | | | | | |

| | | Total Short-Term Investments (cost – $425,596) | | | | | | | 425,596 | |

| | | | |

| | | Total Investments (cost $5,754,563) – 104.0% | | | | | | | 5,789,630 | |

| | | | |

| | | Other Assets Less Liabilities – (4.0)% | | | | | | | (220,748 | ) |

| | | | |

| | | Net Assets – 100% | | | | | | $ | 5,568,882 | |

| | | | |

| | (1) | | Optional Call Provisions (not covered by the report of independent registered public accounting firm): Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. |

| | (2) | | Ratings (not covered by the report of independent registered public accounting firm): Using the higher of Standard & Poor’s or Moody’s rating. Ratings below BBB by Standard & Poor’s Group or Baa by Moody’s Investor Service, Inc. are considered to be below investment grade. |

| | WI/DD | | Purchased on a when-issued or delayed delivery basis. |

See accompanying notes to financial statements.

7

Statement of Assets and Liabilities

Municipal Total Return Managed Accounts Portfolio

July 31, 2007

| | | | |

Assets | | | | |

Investments, at value (cost $5,754,563) | | $ | 5,789,630 | |

Cash | | | 130 | |

Receivables: | | | | |

Fund Manager | | | 5,037 | |

Interest | | | 38,839 | |

Total assets | | | 5,833,636 | |

Liabilities | | | | |

Payable for investments purchased | | | 253,230 | |

Accrued other expenses | | | 11,524 | |

Total liabilities | | | 264,754 | |

Net assets | | $ | 5,568,882 | |

Shares outstanding | | | 550,040 | |

Net asset value per share | | $ | 10.12 | |

| |

Net Assets Consist of: | | | | |

Capital paid-in | | $ | 5,500,857 | |

Undistributed (Over-distribution of) net investment income | | | 36,223 | |

Accumulated net realized gain (loss) from investments | | | (3,265 | ) |

Net unrealized appreciation (depreciation) of investments | | | 35,067 | |

Net assets | | $ | 5,568,823 | |

See accompanying notes to financial statements.

8

Statement of Operations

Municipal Total Return Managed Accounts Portfolio

For the Period May 31, 2007

(commencement of operations) through July 31, 2007

| | | | |

Investment Income | | $ | 36,241 | |

Expenses | | | | |

Shareholders’ servicing agent fees and expenses | | | 5 | |

Custodian’s fees and expenses | | | 385 | |

Trustees’ fees and expenses | | | 43 | |

Professional fees | | | 8,429 | |

Shareholders’ reports – printing and mailing expenses | | | 2,500 | |

Federal and state registration fees | | | 170 | |

Other expenses | | | 74 | |

Total expenses before expense reimbursement | | | 11,606 | |

Expense reimbursement | | | (11,606 | ) |

Net expenses | | | — | |

Net investment income | | | 36,241 | |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from investments | | | (3,283 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | 35,067 | |

Net realized and unrealized gain (loss) | | | 31,784 | |

Net increase (decrease) in net assets from operations | | $ | 68,025 | |

See accompanying notes to financial statements.

9

Statement of Changes in Net Assets

Municipal Total Return Managed Accounts Portfolio

For the Period May 31, 2007

(commencement of operations) through July 31, 2007

| | | | |

| | | | |

Operations | | | | |

Net investment income | | $ | 36,241 | |

Net realized gain (loss) from investments | | | (3,283 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | 35,067 | |

Net increase (decrease) in net assets from operations | | | 68,025 | |

Fund Share Transactions | | | | |

Proceeds from sale of shares | | | 5,400,000 | |

Net increase (decrease) in net assets from Fund share transactions | | | 5,400,000 | |

Capital contribution from Adviser | | | 857 | |

Net increase (decrease) in net assets | | | 5,468,882 | |

Net assets at the beginning of period | | | 100,000 | |

Net assets at the end of period | | $ | 5,568,882 | |

Undistributed (Over-distribution of) net investment income at the end of period | | $ | 36,223 | |

See accompanying notes to financial statements.

10

Notes to Financial Statements

1. General Information and Significant Accounting Policies

The Nuveen Managed Accounts Portfolios Trust (the “Trust”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Trust is comprised of the Municipal Total Return Managed Accounts Portfolio (the “Fund”). The Trust was organized as a Massachusetts business trust on November 14, 2006.

The Fund is developed exclusively for use within Nuveen-sponsored separately managed accounts, the Fund is a specialized municipal bond fund to be used in combination with selected individual securities to effectively model institutional-level investment strategies. Certain securities in which the Fund invests are highly speculative. The Fund enables certain Nuveen municipal separately managed account investors to achieve greater diversification and return potential by using lower quality, higher yielding securities than smaller managed accounts might otherwise achieve and to gain access to special investment opportunities normally available only to institutional investors.

Prior to the commencement of operations, the Fund had no operations other than those related to organizational matters. The initial capital contribution of $100,000 was made by Nuveen Asset Management (the “Adviser”), a wholly owned subsidiary of Nuveen Investments, Inc. (“Nuveen”). Nuveen Investments, LLC (the “Distributor”), also a wholly owned Subsidiary of Nuveen, assumed all of the organization costs approximately ($6,000) and offering costs approximately ($85,000).

The Fund primarily seeks to provide attractive total return. The Fund also seeks to provide high current income exempt from regular and federal income taxes. Under normal circumstances the Fund invests in various types of municipal securities, including investment grade rated BBB/Baa or better, below investment grade rated BB/Ba or lower (high yield), and unrated leveraged municipal securities. The Fund will focus on securities with intermediate to longer term maturities.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements in accordance with accounting principles generally accepted in the United States.

Investment Valuation

The prices of municipal bonds in the Fund’s investment portfolio are provided by a pricing service approved by the Fund’s Board of Trustees. When market price quotes are not readily available (which is usually the case for municipal securities), the pricing service may establish fair value based on yields or prices of municipal bonds of comparable quality, type of issue, coupon, maturity and rating, indications of value from securities dealers, evaluations of anticipated cash flows or collateral and general market conditions. If the pricing service is unable to supply a price for a municipal bond, the Fund may use a market price or fair market value quote provided by a major broker/dealer in such investments. If it is determined that the market price or fair market value for an investment is unavailable or inappropriate, the Board of Trustees of the Fund, or its designee, may establish a fair value for the investment. Short-term investments are valued at amortized cost, which approximates market value.

Investment Transactions

Investment transactions are recorded on a trade date basis. Realized gains and losses from transactions are determined on the specific identification method. Investments purchased on a when-issued/delayed delivery basis may have extended settlement periods. Any investments so purchased are subject to market fluctuation during this period. The Fund has instructed the custodian to segregate assets with a current value at least equal to the amount of the when-issued/delayed delivery purchase commitments. At July 31, 2007, the Fund had outstanding when-issued/delayed delivery purchase commitments of $253,230.

Investment Income

Interest income, which includes the amortization of premiums and accretion of discounts for financial reporting purposes, is recorded on an accrual basis. Investment income also includes paydown gains and losses, if any.

Federal Income Taxes

The Fund intends to distribute substantially all net investment income and net capital gains to shareholders and to otherwise comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no federal income tax provision is required. Furthermore, the Fund intends to satisfy conditions which will enable interest from municipal securities, which is exempt from regular federal income tax, to retain such tax-exempt status when distributed to shareholders of the Fund. Net realized capital gains and ordinary income distributions paid by the Fund are subject to federal taxation.

Dividends and Distributions to Shareholders

Tax-exempt net investment income is declared monthly as a dividend. Generally, payment is made or reinvestment is credited to shareholder accounts on the first business day after month-end. Net realized capital gains and/or market discount from investment transactions, if any, are distributed to shareholders not less frequently than annually. Furthermore, capital gains are distributed only to the extent they exceed available capital loss carryforwards.

Distributions to shareholders of tax-exempt net investment income, net realized capital gains and/or market discount, if any, are recorded on the ex-dividend date. The amount and timing of distributions are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States.

11

Notes to Financial Statements (continued)

Municipal Money Market Funds

The Fund is authorized to invest in municipal money market funds that pay interest income exempt from regular federal, and in some cases state and local, income taxes. The Fund indirectly bears its proportionate share of the money market fund’s fees and expenses. The Adviser does, however, reimburse the Fund for the 12b-1 fees it indirectly incurs from its investments in money market funds. During the period May 31, 2007 (commencement of operations) through July 31, 2007, the Adviser reimbursed the Fund $857 for such indirectly incurred 12b-1 fees.

Indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts that provide general indemnifications to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results may differ from those estimates.

2. Fund Shares

During the period May 31, 2007 (commencement of operations) through July 31, 2007, the Fund sold 540,040 shares with a value of $5,400,000.

3. Investment Transactions

Purchases and sales (including maturities but excluding short-term investments) during the period May 31, 2007 (commencement of operations) through July 31, 2007, aggregated $5,575,536 and $241,735, respectively.

4. Income Tax Information

The following information is presented on an income tax basis. Differences between amounts for financial statement and federal income tax purposes are primarily due to the treatment of paydown gains and losses, timing differences in recognizing taxable market discount and timing differences in recognizing certain gains and losses on investment transactions. To the extent that differences arise that are permanent in nature, such amounts are reclassified within the capital accounts on the Statement of Assets and Liabilities presented in the annual report, based on their federal tax basis treatment; temporary differences do not require reclassification. Temporary and permanent differences do not impact the net asset values of the Fund.

At July 31, 2007, the cost of investments was $5,754,552.

Gross unrealized appreciation and gross unrealized depreciation of investments at July 31, 2007, were as follows:

| | | | |

Gross unrealized: | | | | |

Appreciation | | $ | 38,291 | |

Depreciation | | | (3,213 | ) |

Net unrealized appreciation (depreciation) of investments | | $ | 35,078 | |

The tax components of undistributed net tax-exempt income, net ordinary income and net long-term capital gains at July 31, 2007, were as follows:

| | | |

Undistributed net tax-exempt income | | $ | 36,212 |

Undistributed net ordinary income* | | | — |

Undistributed net long-term capital gains | | | — |

* Net ordinary income consists of taxable market discount income and net short-term capital gains, if any.

During the period May 31, 2007 (commencement of operations) through July 31, 2007, the Fund made no distributions to its shareholders.

The Fund elected to defer net realized losses from investments incurred from November 1, 2006 through July 31, 2007 (“post-October losses”) in accordance with Federal income tax regulations. Post-October losses of $3,265 were treated as having arisen on the first day of the following taxable year.

5. Management Fee and Other Transactions with Affiliates

The Adviser does not charge any investment advisory or administrative fees directly to the Fund. The Adviser also agreed to reimburse all expenses of the Fund (excluding interest expense, taxes, fees incurred in acquiring and disposing of portfolio securities, and extraordinary expenses). The Adviser is compensated for its services to the Fund from the fee charged at the separately managed account level.

At July 31, 2007, Nuveen owned all of the shares of the Fund.

12

Agreement and Plan of Merger

On June 20, 2007, Nuveen Investments announced that it had entered into a definitive Agreement and Plan of Merger (“Merger Agreement”) with Windy City Investments, Inc. (“Windy City”), a corporation formed by investors led by Madison Dearborn Partners, LLC, pursuant to which Windy City would acquire Nuveen Investments. Madison Dearborn Partners, LLC is a private equity investment firm based in Chicago, Illinois. The investors include an affiliate of Merrill Lynch. It is anticipated that Merrill Lynch and its affiliates will be indirect “affiliated persons” (as that term is defined in the Investment Company Act of 1940) of the Fund upon and after the acquisition. One important implication of this is that the Fund will not be able to buy securities from or sell securities to Merrill Lynch, but the portfolio management team and Fund management do not expect that this will significantly impact the ability of the Fund to pursue its investment objectives and policies. Under the terms of the merger, each outstanding share of Nuveen Investments’ common stock (other than dissenting shares) will be converted into the right to receive a specified amount of cash, without interest. The merger is expected to be completed by the end of the year, subject to customary conditions, including obtaining necessary fund and client consents sufficient to satisfy the terms of the Merger Agreement. The obligations of Windy City to consummate the merger are not conditioned on its obtaining financing.

The consummation of the merger will be deemed to be an “assignment” (as defined in the 1940 Act) of the investment management agreement between the Fund and the Adviser, and will result in the automatic termination of the Fund’s agreement. The Board of Trustees of the Fund has approved a new investment management agreement with the Adviser. The agreement is being presented to the Fund’s shareholders for approval, and, if so approved by shareholders, would take effect upon consummation of the merger. There can be no assurance that the merger described above will be consummated as contemplated or that necessary shareholder approvals will be obtained.

6. New Accounting Pronouncements

Financial Accounting Standards Board Interpretation No. 48

On July 13, 2006, the Financial Accounting Standards Board (FASB) released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the effective date, however, SEC guidance allows funds which commence operations after December 15, 2006 to delay implementing FIN 48 into NAV calculations until the fund’s last NAV calculations in the second required financial statement reporting period. As a result, the Fund must begin to incorporate FIN 48 into its NAV calculations by January 31, 2008. At this time, management is continuing to evaluate the implications of FIN 48 and does not expect the adoption of FIN 48 will have a significant impact on the net assets or results of operations of the Fund.

Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157

In September 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this standard relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of July 31, 2007, management does not believe the adoption of SFAS No. 157 will impact the financial statement amounts; however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements included within the Statement of Operations for the period.

7. Subsequent Events

Distributions to Shareholders

On September 10, 2007, the Fund declared its first dividend distribution from its tax-exempt net investment income of $.1042. The distribution will be paid on October 1, 2007, to shareholders of record on September 7, 2007.

13

Financial Highlights

Selected data for a share outstanding throughout each period:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Investment Operations | | Less Distributions | | | | | | | Ratios/Supplemental Data | |

| | | | | | | | | | | | | | | | | | | | Ratios to Average

Net Assets Before

Reimbursement | | | Ratios to Average

Net Assets After

Reimbursement(c) | | | | |

Year Ended

July 31, | | Beginning

Net

Asset

Value | | Net

Invest-

ment

Income(a) | | Net

Realized/

Unrealized

Gain

(Loss) | | Total | | Net

Invest-

ment

Income | | Capital

Gains | | Total | | Ending

Net

Asset

Value | | Total

Return(b) | | | Ending

Net

Assets

(000) | | Expenses | | | Net

Invest-

ment

Income | | | Expenses | | | Net

Invest-

ment

Income | | | Portfolio

Turnover

Rate | |

2007(d) | | $ | 10.00 | | $ | .07 | | $ | .05 | | $ | .12 | | $ | — | | $ | — | | $ | — | | $ | 10.12 | | 1.20 | % | | $ | 5,569 | | 1.26 | % | | 2.67 | % | | — | % | | 3.92 | % | | 7 | % |

| (a) | Per share Net Investment Income is calculated using the average daily shares method. |

| (b) | Total return is the combination of changes in net asset value, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. Total return is not annualized. |

| (c) | After expense reimbursement from Adviser. |

| (d) | For the period May 31, 2007 (commencement of operations) through July 31, 2007. |

See accompanying notes to financial statements.

14

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Nuveen Managed Accounts Portfolios Trust:

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statement of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Municipal Total Return Managed Accounts Portfolio (comprising the Nuveen Managed Accounts Portfolios Trust, hereafter referred to as the “Fund”) at July 31, 2007, and the results of its operations, the changes in its net assets and the financial highlights for the period May 31, 2007 (commencement of operations) through July 31, 2007, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). These standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at July 31, 2007 by correspondence with the custodian and brokers, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, IL

September 21, 2007

15

Annual Investment Management Agreement Approval Process

The Board Members are responsible for overseeing the performance of the investment adviser to the Fund and determining whether to approve the advisory arrangements. At a meeting held on November 14-16, 2006 (the “Initial Approval Meeting”), the Board Members of the Fund, including the Independent Board Members, unanimously approved the Investment Management Agreement between the Fund and Nuveen Asset Management (“NAM”). The Fund is sometimes referred to herein as a “New Fund.” The foregoing Investment Management Agreement with NAM is hereafter referred to as an “Original Investment Management Agreement.”

Subsequent to the Initial Approval Meeting, Nuveen Investments, Inc. (“Nuveen”), the parent company of NAM, entered into a merger agreement providing for the acquisition of Nuveen by Windy City Investments, Inc., a corporation formed by investors led by Madison Dearborn Partners, LLC (“MDP”), a private equity investment firm (the “Transaction”). The Original Investment Management Agreement, as required by Section 15 of the Investment Company Act of 1940 (the “1940 Act”) provides for its automatic termination in the event of its “assignment” (as defined in the 1940 Act). Any change in control of the adviser is deemed to be an assignment. The consummation of the Transaction will result in a change of control of NAM as well as its affiliated sub-advisers and therefore cause the automatic termination of the Original Investment Management Agreement, as required by the 1940 Act. Accordingly, in anticipation of the Transaction, at a meeting held on July 31, 2007 (the “July Meeting”), the Board Members, including the Independent Board Members, unanimously approved a new Investment Management Agreement (the “New Investment Management Agreement”) with NAM on behalf of the Fund to take effect immediately after the Transaction or shareholder approval of the new advisory contract, whichever is later. The 1940 Act also requires that the New Investment Management Agreement be approved by the Fund’s shareholders in order for it to become effective. Accordingly, to ensure continuity of advisory services, the Board Members, including the Independent Board Members, unanimously approved an Interim Investment Management Agreement to take effect upon the closing of the Transaction if shareholders have not yet approved the New Investment Management Agreement.

As NAM serves as adviser to other Nuveen funds, the Board Members already have a good understanding of the organization, operations and personnel of NAM. At a meeting held on May 21, 2007 (the “May Meeting”), many of the investment management contracts with other Nuveen funds advised by NAM (“Existing Funds”) were subject to their annual review. Although the Original Investment Management Agreement with the New Fund was recently initially approved and therefore not subject to the annual review at the May Meeting, the information provided and considerations made regarding NAM at the annual review as well as the initial approval continue to be relevant with respect to the evaluation of the New Investment Management Agreement. The Board therefore considered the foregoing as part of its deliberations of the New Investment Management Agreement. Accordingly, as indicated, the discussions immediately below outline the materials and information presented to the Board in connection with the Board’s prior annual review of NAM (to the extent applicable) and the analysis undertaken and the conclusions reached by the Board Members when determining to approve the Original Investment Management Agreement.

I. Approval of the Original Investment Management Agreement

During the course of the year, the Board received a wide variety of materials relating to the services provided by NAM and the performance of the Nuveen funds (as applicable). At each of its quarterly meetings, the Board reviewed investment performance (as applicable) and various matters relating to the operations of the Fund and other Nuveen funds, including the compliance program, shareholder services, valuation, custody, distribution and other information relating to the nature, extent and quality of services provided by NAM. Between the regularly scheduled quarterly meetings, the Board Members received information on particular matters as the need arose. In addition, as noted, because NAM already serves as adviser to other Nuveen funds, the information provided regarding NAM at the annual review at the May Meeting supplemented the information received at the initial approval.

In preparation for their consideration of NAM at the May Meeting, the Independent Board Members also received extensive materials, well in advance of the meeting, which outlined or are related to, among other things:

| | • | | the nature, extent and quality of services provided by NAM; |

| | • | | the organization and business operations of NAM, including the responsibilities of various departments and key personnel; |

| | • | | each Existing Fund’s past performance as well as the Existing Fund’s performance compared to funds with similar investment objectives based on data and information provided by an independent third party and to recognized and/or customized benchmarks (as appropriate); |

| | • | | the profitability of NAM and certain industry profitability analyses for unaffiliated advisers; |

| | • | | the expenses of NAM in providing the various services; |

| | • | | the advisory fees and total expense ratios of each Existing Fund, including comparisons of such fees and expenses with those of comparable, unaffiliated funds based on information and data provided by an independent third party (the “Peer Universe”) as well as compared to a subset of funds within the Peer Universe (the “Peer Group”) of the respective Existing Fund (as applicable); |

16

| | • | | the advisory fees NAM assesses to other types of investment products or clients; |

| | • | | the soft dollar practices of NAM, if any; and |

| | • | | from independent legal counsel, a legal memorandum describing among other things, applicable laws, regulations and duties in reviewing and approving advisory contracts. |

At the Initial Approval Meeting, the Board Members received in advance of such meeting or at prior meetings similar materials, including the nature, extent and quality of services expected to be provided; the organization and operations of NAM (including the responsibilities of various departments and key personnel); the expertise and background of NAM; the profitability of Nuveen (which includes its wholly-owned advisory subsidiaries); the proposed management fees, including comparisons with peers; the expected expenses of the New Fund, including comparisons of the expense ratios with peers; and the soft dollar practices of NAM. However, unlike Existing Funds, the New Fund did not have actual past performance at the time of approval.

At the May Meeting, NAM made a presentation to, and responded to questions from, the Board. At the May Meeting and applicable Initial Approval Meeting, the Independent Board Members met privately with their legal counsel to review the Board’s duties in reviewing advisory contracts and considering the approval or renewal of the advisory contracts. The Independent Board Members, in consultation with independent counsel, reviewed the factors set out in judicial decisions and Securities and Exchange Commission (“SEC”) directives relating to the approval or renewal of advisory contracts. As outlined in more detail below, the Board Members considered all factors they believed relevant with respect to the New Fund, including, but not limited to, the following: (a) the nature, extent and quality of the services to be provided by NAM; (b) the investment performance of the Fund and NAM (as applicable); (c) the costs of the services to be provided and profits to be realized by NAM and its affiliates; (d) the extent to which economies of scale would be realized; and (e) whether fee levels reflect those economies of scale for the benefit of the Fund’s investors. In addition, as noted, the Board Members met regularly throughout the year to oversee the Nuveen funds. In evaluating the advisory contracts, the Board Members also relied upon their knowledge of NAM, its services and the Nuveen funds resulting from their meetings and other interactions throughout the year. It is with this background that the Board Members considered each advisory contract.

A. Nature, Extent and Quality of Services

In considering the approval of the Original Investment Management Agreement, the Board Members considered the nature, extent and quality of NAM’s services. The Board Members reviewed materials outlining, among other things, NAM’s organization and business; the types of services that NAM or its affiliates provide or are expected to provide to the Fund. At the annual review, the Board Members reviewed materials outlining any initiatives Nuveen had taken for the municipal fund product line. As noted, the Board Members were already familiar with the organization, operations and personnel of NAM due to the Board Members’ experience in governing the other Nuveen funds and working with NAM on matters relating to the Nuveen funds.

At the May Meeting, the Board Members also recognized NAM’s investment in additional qualified personnel throughout the various groups in the organization and recommended to NAM that it continue to review staffing needs as necessary. In addition, with respect to the municipal funds advised by NAM, the Trustees reviewed materials describing the current status and, in particular, the developments in 2006 with respect to NAM’s investment process, investment strategies (including additional tools used in executing such strategies), personnel (including portfolio management and research teams), trading process, hedging activities, risk management operations (e.g., reviewing credit quality, duration limits, and derivatives use, as applicable), and investment operations (such as enhancements to trading procedures, pricing procedures, and client services). The Board Members also recognized NAM’s investment of resources and efforts to continue to enhance and refine its investment processes.

In addition to advisory services, the Independent Board Members considered the quality of administrative and non-advisory services provided by NAM and noted that NAM and its affiliates provide the Fund with a wide variety of services and officers and other personnel as are necessary for the operations of the Fund, including:

| | • | | oversight by shareholder services and other fund service providers; |

| | • | | administration of Board relations; |

| | • | | regulatory and portfolio compliance; and |

However, at the Initial Approval Meeting, the Board Members noted that the Fund is offered via separate managed accounts and may require less shareholder services than a typical retail open-end fund.

As the Fund operates in a highly regulated industry and given the importance of compliance, the Board Members considered, in particular, NAM’s compliance activities for the Fund and enhancements thereto. In this regard, the Board Members recognized the

17

Annual Investment Management Agreement Approval Process (continued)

quality of NAM’s compliance team. The Board Members further noted NAM’s negotiations with other service providers and the corresponding reduction in certain service providers’ fees at the May Meeting.

Based on their review, the Board Members found that, overall, the nature, extent and quality of services provided (and expected to be provided) to the Fund under the Original Investment Management Agreement were satisfactory.

B. The Investment Performance of the New Fund and NAM

The Fund did not have its own performance history at its Initial Approval Meeting. The Board Members, however, were familiar with NAM’s performance record on other Existing Funds.

C. Fees, Expenses and Profitability

1. Fees and Expenses

With respect to the New Fund, at the Initial Approval Meeting, the Board considered such Fund’s proposed fee structure and expected expense ratios in absolute terms as well as compared with the fee and expense ratios of comparable unaffiliated funds and comparable affiliated funds (if any). The Board Members recognized that the fee structure of the Fund differs from other Nuveen retail open-end funds. The Fund does not pay NAM a management fee. Rather, the Fund is sold via separate managed accounts. NAM therefore receives its advisory fees via the managed account management fee. The Board Members reviewed comparisons of the effective fee rate attributed to the Fund with the management fees of funds in a comparable category of funds established by an independent third party.

2. Comparisons with the Fees of Other Clients

Due to their experience with other Nuveen funds, the Board Members are familiar with the fees assessed to other clients of Nuveen or its affiliates. As noted above, at the Initial Approval Meeting, the Board Members recognized that the Fund is sold via separate managed accounts. Accordingly, the Fund may not incur the shareholder servicing costs to the same extent associated with typical retail funds. NAM further receives its fee pursuant to the managed account management fee. Such fee is essentially a blended rate comprised of Fund fees pro-rated to the portion of the total product represented by the Fund and the managed account fees associated with the proportion of individual securities in the overall product. The Board Members therefore considered the management fee attributed to this Fund compared to the management fees of comparable funds and the managed fee attributed to managing the individual securities to rates assessed for separate accounts.

3. Profitability

In conjunction with its review of fees at the May Meeting, the Board Members also considered the profitability of Nuveen for its advisory activities (which incorporated Nuveen’s wholly-owned affiliated sub-advisers) and its financial condition. At the annual review, the Board Members reviewed the revenues and expenses of Nuveen’s advisory activities for the last three years, the allocation methodology used in preparing the profitability data as well as the 2006 Annual Report for Nuveen. The Board Members noted this information supplemented the profitability information requested and received during the year to help keep them apprised of developments affecting profitability (such as changes in fee waivers and expense reimbursement commitments). In this regard, the Board Members noted the enhanced dialogue and information regarding profitability with NAM during the year, including more frequent meetings and updates from Nuveen’s corporate finance group. The Board Members considered Nuveen’s profitability compared with other fund sponsors prepared by three independent third party service providers as well as comparisons of the revenues, expenses and profit margins of various unaffiliated management firms with similar amounts of assets under management prepared by Nuveen.

In reviewing profitability, the Board Members recognized the subjective nature of determining profitability which may be affected by numerous factors, including the allocation of expenses. Further, the Board Members recognized the difficulties in making comparisons as the profitability of other advisers generally is not publicly available and the profitability information that is available for certain advisers or management firms may not be representative of the industry and may be affected by, among other things, the adviser’s particular business mix, capital costs, types of funds managed and expense allocations.

Notwithstanding the foregoing, the Board Members reviewed Nuveen’s methodology at the annual review and assumptions for allocating expenses across product lines to determine profitability. Last year, the Board Members also designated an Independent Board Member as a point person for the Board to review the methodology determinations during the year and any refinements thereto, which relevant information produced from such process was reported to the full Board. In reviewing profitability, the Board Members recognized Nuveen’s increased investment in its fund business. Based on its review, the Board Members concluded that Nuveen’s level of profitability for its advisory activities was reasonable in light of the services provided.

In evaluating the reasonableness of the compensation, the Board Members also considered other amounts paid to NAM by the Fund as well as any indirect benefits (such as soft dollar arrangements, if any) NAM and its affiliates receive, or are expected to receive, that are directly attributable to the management of the Fund, if any. See Section E below for additional information on indirect benefits NAM may receive as a result of its relationship with the Fund.

D. Economies of Scale and Whether Fee Levels Reflect These Economies of Scale

In reviewing compensation, the Board Members have long understood the benefits of economies of scale as the assets of a fund grow and have sought to ensure that shareholders share in these benefits. One method for shareholders to share in economies of

18

scale is to include breakpoints in the advisory fee schedules that reduce fees as fund assets grow. However, at the Initial Approval Meeting, the Board Members noted that the Fund’s fee schedule did not include fund-level breakpoints given its novel fee structure.

E. Indirect Benefits

In evaluating fees, the Board Members also considered any indirect benefits or profits NAM or its affiliates may receive as a result of its relationship with the Fund. The Board Members considered whether NAM received any benefits from soft dollar arrangements whereby a portion of the commissions paid by a Fund for brokerage may be used to acquire research that may be useful to NAM in managing the assets of the Fund and other clients. With respect to NAM, the Board Members noted that NAM does not currently have any soft dollar arrangements; however, to the extent certain bona fide agency transactions that occur on markets that traditionally trade on a principal basis and riskless principal transactions are considered as generating “commissions,” NAM intends to comply with the applicable safe harbor provisions.

Based on their review, the Board Members concluded that any indirect benefits received by NAM as a result of its relationship with the Fund were reasonable and within acceptable parameters.

F. Other Considerations

The Board Members did not identify any single factor discussed previously as all-important or controlling in their considerations to initially approve an advisory contract. The Board Members, including the Independent Board Members, unanimously concluded that the terms of the Original Investment Management Agreement are fair and reasonable, that NAM’s fees are reasonable in light of the services provided to the Fund and that the Original Investment Management Agreement be approved.

II. Approval of the New Investment Management Agreements

Following the May Meeting, the Board Members were advised of the potential Transaction. As noted above, the completion of the Transaction would terminate the Original Investment Management Agreement. Accordingly, at the July Meeting, the Board of the New Fund, including the Independent Board Members, unanimously approved the New Investment Management Agreement on behalf of the Fund. Leading up to the July Meeting, the Board Members had several meetings and deliberations with and without Nuveen management present, and with the advice of legal counsel, regarding the proposed Transaction as outlined below.

On June 8, 2007, the Board Members held a special telephonic meeting to discuss the proposed Transaction. At that meeting, the Board Members established a special ad hoc committee comprised solely of Independent Board Members to focus on the Transaction and to keep the Independent Board Members updated with developments regarding the Transaction. On June 15, 2007, the ad hoc committee discussed with representatives of NAM the Transaction and modifications to the complex-wide fee schedule that would generate additional fee savings at specified levels of complex-wide asset growth. Following the foregoing meetings and several subsequent telephonic conferences among Independent Board Members and independent counsel, and between Independent Board Members and representatives of Nuveen, the Board met on June 18, 2007 to further discuss the proposed Transaction. Immediately prior to and then again during the June 18, 2007 meeting, the Independent Board Members met privately with their independent legal counsel. At that meeting, the Board met with representatives of MDP, of Goldman Sachs, Nuveen’s financial adviser in the Transaction, and of the Nuveen Board to discuss, among other things, the history and structure of MDP, the terms of the proposed Transaction (including the financing terms), and MDP’s general plans and intentions with respect to Nuveen (including with respect to management, employees, and future growth prospects). On July 9, 2007, the Board also met to be updated on the Transaction as part of a special telephonic Board meeting. The Board Members were further updated at a special in-person Board meeting held on July 19, 2007 (one Independent Board Member participated telephonically). Subsequently, on July 27, 2007, the ad hoc committee held a telephonic conference with representatives of Nuveen and MDP to further discuss, among other things, the Transaction, the financing of the Transaction, retention and incentive plans for key employees, the effect of regulatory restrictions on transactions with affiliates after the Transaction, and current volatile market conditions and their impact on the Transaction.

In connection with their review of the New Investment Management Agreement, the Independent Board Members, through their independent legal counsel, also requested in writing and received additional information regarding the proposed Transaction and its impact on the provision of services by NAM and its affiliates.

The Independent Board Members received, well in advance of the July Meeting, materials which outlined, among other things:

| | • | | the structure and terms of the Transaction, including MDP’s co-investor entities and their expected ownership interests, and the financing arrangements that will exist for Nuveen following the closing of the Transaction; |

| | • | | the strategic plan for Nuveen following the Transaction; |

| | • | | the governance structure for Nuveen following the Transaction; |

| | • | | any anticipated changes in the operations of the Nuveen funds following the Transaction, including changes to NAM’s and Nuveen’s day-to-day management, infrastructure and ability to provide advisory, distribution or other applicable services to the Fund; |

19

Annual Investment Management Agreement Approval Process (continued)

| | • | | any changes to senior management or key personnel who work on Fund related matters (including portfolio management, investment oversight, and legal/compliance) and any retention or incentive arrangements for such persons; |

| | • | | any anticipated effect on the Fund’s expense ratio (including advisory fees) following the Transaction; |

| | • | | any benefits or undue burdens imposed on the Fund as a result of the Transaction; |

| | • | | any legal issues for the Fund as a result of the Transaction; |

| | • | | the nature, quality and extent of services expected to be provided to the Fund following the Transaction, changes to any existing services and policies affecting the Fund, and cost-cutting efforts, if any, that may impact such services or policies; |

| | • | | any conflicts of interest that may arise for Nuveen or MDP with respect to the Fund; |

| | • | | the costs associated with obtaining necessary shareholder approvals and who would bear those costs; and |

| | • | | from legal counsel, a memorandum describing the applicable laws, regulations and duties in approving advisory contracts, including, in particular, with respect to a change of control. |

Immediately preceding the July Meeting, representatives of MDP met with the Board to further respond to questions regarding the Transaction. After the meeting with MDP, the Independent Board Members met with independent legal counsel in executive session. At the July Meeting, Nuveen also made a presentation and responded to questions. Following the presentations and discussions of the materials presented to the Board, the Independent Board Members met again in executive session with their counsel. As outlined in more detail below, the Independent Board Members considered all factors they believed relevant with respect to the Fund, including the impact that the Transaction could be expected to have on the following: (a) the nature, extent and quality of services to be provided; (b) the investment performance of the Fund; (c) the costs of the services and profits to be realized by Nuveen and its affiliates; (d) the extent to which economies of scale would be realized; and (e) whether fee levels reflect those economies of scale for the benefit of investors. As noted above, during the past year, the Board Members had completed their annual review of various investment management agreements with NAM and the Existing Funds and initially approved the Original Investment Management Agreement and many of the factors considered at such reviews were applicable to their evaluation of the New Investment Management Agreement. Accordingly, in evaluating such agreement, the Board Members relied upon their knowledge and experience with NAM and considered the information received and their evaluations and conclusions drawn at the reviews. While the Board reviewed many Nuveen funds at the July Meeting, the Independent Board Members evaluated all information available to them on a fund-by-fund basis, and their determinations were made separately in respect of the Fund.

A. Nature, Extent and Quality of Services

In evaluating the nature, quality and extent of the services expected to be provided by NAM under the New Investment Management Agreement, the Independent Board Members considered, among other things, the expected impact, if any, of the Transaction on the operations, facilities, organization and personnel of NAM; the potential implications of regulatory restrictions on the Fund following the Transaction; the ability of NAM and its affiliates to perform their duties after the Transaction; and any anticipated changes to the current investment and other practices of the Fund.

The Board noted that the terms of the New Investment Management Agreement, including the fees payable thereunder, are substantially identical to those of the Original Investment Management Agreement. The Board considered that the services to be provided and the standard of care under the New Investment Management Agreement are the same as the corresponding original agreement. The Board Members further noted that key personnel of the Adviser who have responsibility for the Fund in each area, including portfolio management, investment oversight, fund management, fund operations, product management, legal/compliance and board support functions, are expected to be the same following the Transaction. The Board Members considered and are familiar with the qualifications, skills and experience of such personnel. The Board also considered certain information regarding any anticipated retention or incentive plans designed to retain key personnel. Further, the Board Members noted that no changes to Nuveen’s infrastructure (including at the affiliated sub-adviser level) or operations as a result of the Transaction were anticipated other than potential enhancements as a result of an expected increase in the level of investment in such infrastructure and personnel. The Board noted MDP’s representations that it does not plan to have a direct role in the management of Nuveen, appointing new management personnel, or directly impacting individual staffing decisions. The Board Members also noted that there were not any planned “cost cutting” measures that could be expected to reduce the nature, extent or quality of services. After consideration of the foregoing, the Board Members concluded that no diminution in the nature, quality and extent of services provided to the Fund and its shareholders by NAM is expected.

In addition to the above, the Board Members considered potential changes in the operations of the Fund. In this regard, the Board Members considered the potential effect of regulatory restrictions on the Fund’s transactions with future affiliated persons. During their deliberations, it was noted that, after the Transaction, a subsidiary of Merrill Lynch is expected to have an ownership interest in Nuveen at a level that will make Merrill Lynch an affiliated person of Nuveen. The Board Members recognized that applicable law would generally prohibit the Fund from engaging in securities transactions with Merrill Lynch as principal, and would also impose

20

restrictions on using Merrill Lynch for agency transactions. They recognized that having MDP and Merrill Lynch as affiliates may restrict the Nuveen funds’ ability to invest in securities of issuers controlled by MDP or issued by Merrill Lynch and its affiliates even if not bought directly from MDP or Merrill Lynch as principal. They also recognized that various regulations may require the Nuveen funds to apply investment limitations on a combined basis with affiliates of Merrill Lynch. The Board Members considered information provided by NAM regarding the potential impact on the Nuveen funds’ operations as a result of these regulatory restrictions. The Board Members considered, in particular, the Nuveen funds that may be impacted most by the restricted access to Merrill Lynch, including: municipal funds (particularly certain state-specific funds), senior loan funds, taxable fixed income funds, preferred security funds and funds that heavily use derivatives. The Board Members considered such funds’ historic use of Merrill Lynch as principal in their transactions and information provided by NAM regarding the expected impact resulting from Merrill Lynch’s affiliation with Nuveen and available measures that could be taken to minimize such impact. NAM informed the Board Members that, although difficult to determine with certainty, its management did not believe that MDP’s or Merrill Lynch’s status as an affiliate of Nuveen would have a material adverse effect on any Nuveen fund’s ability to pursue its investment objectives and policies.