UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22023

Nuveen Managed Accounts Portfolios Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mark J. Czarniecki

Vice President and Secretary

333 West Wacker Drive,

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Nuveen Managed Accounts Portfolios Trust

| | |

| Fund Name | | |

| Nuveen Core Impact Bond Managed Accounts Portfolio | | NCIRX |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, by calling 800-257-8787 and selecting option #1. Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Annual Report

Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready. No more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund distributions and statements from your financial professional or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund distributions and statements directly from Nuveen.

Must be preceded by or accompanied by a prospectus.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

Table

of Contents

3

Chair’s Letter to Shareholders

Dear Shareholders,

As 2020 draws to a close, the concerns that dominated much of the year are beginning to show signs of easing. COVID-19 vaccines are being administered around the world, with several of the vaccine candidates announcing high efficacy rates during their phase 3 trials. Markets took a generally positive view of Joe Biden winning the Electoral College, with Congress’s final confirmation of the Electoral College vote anticipated on January 6, 2021. The U.S. economy has made a significant, although incomplete, turnaround from the depths of a historic recession. In December, Congress passed another $900 billion in aid to individuals and businesses, extending some of the programs enacted earlier in the crisis. The bill’s next step is the President’s review and his approval or disapproval. Ongoing fiscal and monetary stimulus along with widening vaccine distribution have bolstered confidence that a semblance of normalcy can return in 2021.

While the markets’ longer-term outlook has brightened, we expect intermittent bouts of volatility to continue into the new year. COVID-19 cases are still alarmingly high in some regions, and the renewed restrictions on social and business activity taken by local and, in some cases, national authorities will undoubtedly hinder the economy’s momentum. The pandemic’s course can still be unpredictable. The timeline of vaccine rollouts depends on many variables, public confidence can shift and real-world efficacy remains to be seen. Additionally, the outcome of the Senate majority – which determines whether the government will be under split control or a Democrat majority – rests with Georgia’s two run-off elections on January 5, 2021. Nevertheless, short-term market fluctuations can provide opportunities to invest in new ideas as well as upgrade existing positioning, within our goal of providing long-term value for our shareholders.

The new year can be an opportune time to assess your portfolio’s resilience and readiness for what may come next. We encourage you to review your time horizon, risk tolerance and investment goals with your financial professional. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Terence J. Toth

Chair of the Board

December 22, 2020

4

Portfolio Managers’ Comments

Nuveen Core Impact Bond Managed Accounts Portfolio

The Fund was developed exclusively for use within Nuveen-sponsored separately managed accounts, and is a specialized bond portfolio to be used in combination with selected individual securities to effectively model institutional-level investment strategies. The Fund enables certain Nuveen separately managed account investors to achieve greater diversification and return potential than smaller managed accounts might otherwise achieve by investing in additional fixed-income classes, including those that have a lower credit quality and potentially higher yielding securities in order to gain access to special investment opportunities normally available only to institutional investors.

The Fund is managed by Nuveen Asset Management LLC, an affiliate of Nuveen Fund Advisor, LLC, the Fund’s investment adviser. Stephen Liberatore, CFA, and Jessica M. Zarzycki, CFA, have served as portfolio managers for the Fund since its inception in July 2020. Here they discuss U.S. economic and fixed income markets, the Fund’s investment strategy and its performance during the abbreviated reporting period since the Fund’s inception.

What factors affected the U.S. economy and bond markets during the twelve-month annual reporting period ended October 31, 2020, which may have had an impact on the abbreviated reporting period?

The U.S. economy rebounded more quickly than expected from the deep downturn caused by the COVID-19 crisis and containment measures. As business and social activities were drastically restricted in March and April 2020 to slow the spread of COVID-19, U.S. gross domestic product (GDP) shrank 31.4% on an annualized basis in the second quarter of 2020 (following a 5% decline in the first quarter), according to the Bureau of Economic Analysis (BEA) “third” estimate. GDP measures the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. Government relief programs provided significant aid to individuals and businesses as the economy began reopening in May 2020, which helped the economy bounce back strongly over the summer months. GDP rose 33.1% in the third quarter of 2020, according to the BEA’s “second” estimate. While the third quarter gain was historic, the economy remained below pre-pandemic growth levels. GDP growth was 2.4% in the fourth quarter of 2019 and 2.2% for 2019 overall.

Consumer spending, the largest driver of the economy, was well supported earlier in this reporting period by low unemployment, wage gains and tax cuts. However, the COVID-19 crisis containment measures drove a significant drop in consumer spending and a sharp rise in unemployment starting in March 2020. The Bureau of Labor Statistics said the unemployment rate rose to 6.9% in October 2020 from 3.6% in October 2019. As of October 2020, slightly more than half of the 22 million jobs lost in March and April 2020 have been recovered. The average hourly earnings rate appeared to soar, growing at an annualized rate of 4.5% in October 2020, despite the spike in unemployment. Earnings data was skewed by the concentration of job losses in lower wage work, which effectively eliminated most of the low wage data, resulting in an average of mostly higher numbers. The overall trend of inflation

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or aninvestment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives orcircumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

remained muted, as decreases in gasoline, apparel and transportation prices offset an increase in food prices. The Bureau of Labor Statistics said the Consumer Price Index (CPI) increased 1.2% over the twelve-month reporting period ended October 31, 2020 before seasonal adjustment.

Prior to the COVID-19 crisis recession, the U.S. Federal Reserve (the Fed) had reduced its benchmark interest rate to support the economy’s slowing growth. The Fed also stopped shrinking its bond portfolio sooner than scheduled and began buying short-term Treasury bills to help money markets operate smoothly and maintain short-term borrowing rates at low levels.

As the health and economic crisis deepened, the Fed enacted an array of emergency measures in March 2020 to stabilize the financial system and support the markets, including cutting its main interest rate to near zero, offering lending programs to aid small and large companies and allowing unlimited bond purchases, known as quantitative easing. There were no policy changes at the Fed’s April, June and July 2020 meetings, where Chairman Powell reiterated a commitment to keep rates near zero until the economy recovers and maintained a cautious outlook for the U.S. economy. Also at the July 2020 meeting, the Fed extended some of its pandemic funding facilities by another three months to December 2020. At the annual Jackson Hole Economic Symposium, held virtually in August 2020, the Fed announced a change in inflation policy to average inflation targeting. Under this regime, the Fed will tolerate the inflation rate temporarily overshooting the target rate to offset periods of below-target inflation, so that inflation averages a 2% rate over time. The Fed provided further clarification of the new inflation policy and left the benchmark interest rate unchanged at its September 2020 meeting. (As expected, there were no policy changes at the Fed’s November 2020 meeting after the close of this reporting period.)

In March and April 2020, the U.S. government approved three aid packages. These included $2 trillion allocated across direct payments to Americans, an expansion of unemployment insurance, loans to large and small businesses, funding to hospitals and health agencies and support to state and local governments, as well as more than $100 billion in funding to health agencies and employers offering paid leave. As some of these programs began to expire, additional relief measures were under discussion in Congress, but a final deal had not been reached as of the end of this reporting period. The election outcome, subsequent to the close of the reporting period, did not change expectations for a stimulus bill, but the timing and size remained uncertain.

The COVID-19 crisis rapidly dwarfed all other market concerns starting in late February 2020. Equity and commodity markets sold-off and safe-haven assets rallied in March 2020 as China, other countries and then the United States initiated quarantines, restricted travel and shuttered factories and businesses. The potential economic shock was particularly difficult to assess, which amplified market volatility. An ill-timed oil price war between the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC member Russia, which caused oil prices to plunge in March 2020, exacerbated the market sell-off.

Geopolitical uncertainty remained elevated with the U.S. presidential election, the Brexit transition period winding down and U.S. – China relations deteriorating. While markets remained concerned about the potential for a disputed outcome, the next round of fiscal stimulus was expected to follow the presidential election. In Europe, the EU and U.K. continued to negotiate, but had not yet reached, a final Brexit agreement after the U.K. formally exited at the end of January 2020 and triggered the one-year transition period (which ends on December 31, 2020). Although China and the U.S. signed a “phase one” trade deal in January 2020, tensions continued to flare over other trade and technology/security issues, Hong Kong’s sovereignty and the management of the COVID-19 crisis.

During the abbreviated reporting period, macroeconomic data showed the economy rebounding sharply, albeit partially, from the historic downturn in the first half of 2020. The labor market continued to improve, additional fiscal stimulus was expected materialize after the November election and Fed policymakers telegraphed their intent to leave the federal funds rate at its current level through 2023. In addition, progress toward a COVID-19 vaccine continued to look promising. These events pushed longer-term Treasury yields higher, while short-term rates remained constrained by the Fed’s near zero target. With yield rising (and prices falling), the U.S. fixed income market posted negative performance in the abbreviated reporting period, as represented by the Bloomberg Barclays U.S. Aggregate Bond Index. Buoyed by the effects of Fed liquidity, economic upside surprises and hope for coronavirus treatments, spread sectors outperformed Treasury bonds.

6

How did the Fund perform during the abbreviated reporting period ended October 31, 2020?

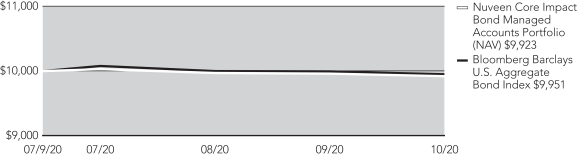

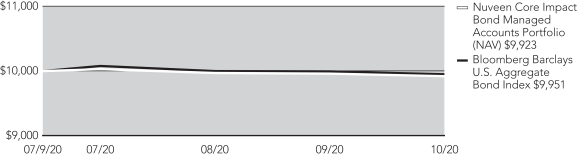

The table in the Fund’s Performance Overview and Holding Summaries section of this report provides the Fund’s total return at net asset value (NAV) for the period ended October 31, 2020. The Fund’s total return at NAV is compared with the performance of a corresponding market index.

For the abbreviated reporting period ended October 31, 2020, the total return at NAV for the Fund underperformed the Bloomberg Barclays U.S. Aggregate Bond Index.

What strategies were used to manage the Fund during the abbreviated reporting period ended October 31, 2020 and how did these strategies influence performance?

The investment objective of the Portfolio is to seek total return, primarily through current income, while giving special consideration to certain environmental, social and governance (“ESG”) criteria. Under normal circumstances, the Portfolio invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in bonds. For these purposes bonds include fixed-income securities of all types, including but not limited to, corporate bonds, residential and commercial mortgage-backed and other asset-backed securities, U.S. government securities (securities issued or guaranteed by the U.S. government or its agencies or instrumentalities), senior loans and loan participations and assignments, and taxable and tax-exempt municipal bonds. The Portfolio may invest up to 10% of its assets in securities rated lower than investment grade or unrated securities of comparable quality as determined by the Portfolio’s sub-adviser (securities commonly referred to as “high-yield” securities or “junk” bonds). The Portfolio may invest in fixed-income securities of any maturity or duration.

The Fund began operations in July 2020 and since then we have worked to invest the portfolio in a broadly diversified portfolio with overweights to spread sectors tempered by a defensive, up-in-quality bias that should continue to benefit from liquidity programs implemented by the Fed. As spreads tightened, we continued to favor securities that allowed us to get closer to high quality assets and cash flows because of the uncertainty associated with the evolution and economic impact of the pandemic. We kept duration long versus the benchmark with the portfolio positioned to benefit from a flatter yield curve. Holdings continued to be selected based on our impact framework or on ESG leadership criteria.

During the abbreviated reporting period, the Fund’s relative performance benefited from yield curve and duration positioning and asset allocation decisions, especially the overweight to corporate debt and underweights to mortgage-backed securities and Treasury bonds. However, security selection in corporate bonds detracted from relative performance.

7

Risk Considerations and Dividend Information

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. The Fund will include only holdings deemed consistent with the applicable Environmental Social Governance (ESG) guidelines. As a result, the universe of investments available to the Fund will be more limited than other funds that do not apply such guidelines. ESG criteria risk is the risk that because the Fund’s ESG criteria exclude securities of certain issuers for nonfinancial reasons, the Fund may forgo some market opportunities available to funds that don’t use these criteria. Credit risk arises from an issuer’s ability to make interest and principal payments when due, as well as the prices of bonds declining when an issuer’s credit quality is expected to deteriorate. Interest rate risk occurs when interest rates rise causing bond prices to fall. The issuer of a debt security may be able to repay principal prior to the security’s maturity, known as prepayment (call) risk, because of an improvement in its credit quality or falling interest rates. In this event, this principal may have to be reinvested in securities with lower interest rates than the original securities, reducing the potential for income. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. Investments in below investment grade or high yield securities are subject to liquidity risk and heightened credit risk. These and other risk considerations, such as active management, extension, issuer, illiquid investments, income volatility, and derivatives risk, are described in detail in the Fund’s prospectus.

Dividend Information

The Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by the Fund during the current reporting period, were paid from net investment income. If a portion of the Fund’s monthly distributions was sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of the Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for the Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

8

Fund Performance

and Expense Ratios

This is a specialized bond Fund developed exclusively for use within Nuveen-sponsored seperately managed accounts.

Fund Performance

Returns quoted represent past performance, which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown.

Total returns for a period less than one year are not annualized (i.e. cumulative returns). Since inception returns are shown for share classes that have less than 10-years of performance. Fund shares have no sales charge. Returns assume reinvestment of dividends and capital gains. For performance, current to the most recent month-end visit nuveen.com or call (800) 257-8787.

Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect fee waivers and/or expense reimbursements by the investment adviser during the periods presented. If any such waivers and/or reimbursements had not been in place, returns would have been reduced. See Notes to Financial Statements, Note 7—Management Fees and Other Transactions with Affiliates for more information.

Expense Ratios

The expense ratios shown are as of the Fund’s most recent prospectus. The expense rations shown reflect total operating expenses (before fee waivers and/or expense reimbursements).

9

Fund Performance and Expense Ratios (continued)

Nuveen Core Impact Bond Managed Accounts Portfolio

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance and Expense Ratios

| | | | | | | | | | | | | | | | |

| | | | | | Total Returns as of

October 31, 2020 | | | | | | | |

| | | Inception

Date | | | Cumulative | | | Expense Ratios* | |

| | | Since

Inception | | | Gross | | | Net | |

Shares at NAV | | | 7/9/20 | | | | (0.77)% | | | | —% | | | | —% | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | — | | | | (0.49)% | | | | — | | | | — | |

| * | The Fund’s investment adviser has contractually agreed irrevocably during the existence of the Fund to waive all fees and pay or reimburse all expenses of the Fund, except for interest expense, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses. |

Growth of an Assumed $10,000 Investment as of October 31, 2020

The graphs do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

10

Yields as of October 31, 2020

Dividend Yield is the most recent dividend per share (annualized) divided by the offering price per share.

The SEC 30-Day Yield is a standardized measure of a Fund’s yield that accounts for the future amortization of premiums or discounts of bonds held in the fund’s portfolio. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. Subsidized yields reflect fee waivers and/or expense reimbursements from the investment adviser during the period. If any such waivers and/or reimbursements had not been in place, yields would have been reduced. Unsubsidized yields do not reflect waivers and/or reimbursements from the investment adviser during the period. If the fund did not receive a fee waiver/expense reimbursement during the period under its most recent agreement, subsidized and unsubsidized yields will be equal. Refer to the Notes to Financial Statements, Note 7 – Management Fees and Other Transactions with Affiliates for further details on the investment adviser’s most recent agreement with the Fund to waive fees and/or reimburse expenses, where applicable. Dividend Yield may differ from the SEC 30-Day Yield because the fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium.

| | | | |

Dividend Yield | | | 1.39% | |

SEC 30-Day Yield – Subsidized | | | 1.69% | |

SEC 30-Day Yield – Unsubsidized | | | (0.49)% | |

11

Holding

Summaries October 31, 2020

This data relates to the securities held in the Fund’s portfolio of investments as of the end of this reporting period. It

should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Nuveen Core Impact Bond Managed Accounts Portfolio

Fund Allocation

(% of net assets)

| | | | |

| | |

Corporate Bonds | | | 56.5% | |

| |

Asset-Backed and Mortgage-Backed Securities | | | 23.6% | |

| |

Municipal Bonds | | | 8.0% | |

| |

Soverign Debt | | | 7.7% | |

| |

Long-Term U.S. Government and Agency Obligations | | | 2.9% | |

| |

Short-Term U.S. Government and Agency Obligations | | | 4.2% | |

| |

Other Assets Less Liabilities | | | (2.9)% | |

| |

Net Assets | | | 100% | |

Portfolio Composition

(% of net assets)

| | | | |

| | |

Asset-Backed and Mortgage-Backed Securities | | | 23.6% | |

| |

Electric Utilities | | | 19.4% | |

| |

Banks | | | 13.4% | |

| |

Equity Real Estate Investment Trust | | | 6.8% | |

| |

Water and Sewar | | | 4.4% | |

| |

Education and Civic Organizations | | | 3.5% | |

| |

Semiconductors & Semiconductor Equipment | | | 2.7% | |

| |

Chemicals | | | 2.7% | |

| |

Other1 | | | 19.3% | |

| |

U.S. Government and Agency Obligations | | | 7.1% | |

| |

Other Assets Less Liabilities | | | (2.9)% | |

| |

Net Assets | | | 100% | |

Bond Credit Quality

(% of total investment exposure)

| | | | |

| | |

AAA | | | 11.7% | |

| |

AA | | | 10.8% | |

| |

A | | | 25.0% | |

| |

BBB | | | 21.3% | |

| |

BB or Lower | | | 5.5% | |

| |

N/R | | | 25.7% | |

| |

Total | | | 100% | |

| 1 | See Portfolio of Investments for details on “other” Portfolio Composition. |

12

Expense

Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Since the Fund’s expense example below reflects only the first 115 days of the Fund’s operations, it may not provide a meaningful understanding of the Fund’s ongoing expenses.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held through the period ended October 31, 2020.

The beginning of the period is July 9, 2020 (commencement of operations).

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the following tables are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 992.30 | |

Expenses Incurred During the Period | | $ | — | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,025.07 | |

Expenses Incurred During the Period | | $ | — | |

Expenses are equal to Fund’s annualized net expense ratio of 0.00% multiplied by the average account value over the period, multiplied by 115/366 (to reflect the 115 days in the period since commencement of operations).

13

Report of Independent Registered

Public Accounting Firm

To the Board of Trustees of Nuveen Managed Accounts Portfolios Trust and Shareholders of

Nuveen Core Impact Bond Managed Accounts Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Nuveen Core Impact Bond Managed Accounts Portfolio (the “Fund”) as of October 31, 2020, and the related statements of operations and changes in net assets, including the related notes, and the financial highlights for the period July 9, 2020 (commencement of operations) through October 31, 2020 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2020, and the results of its operations, changes in its net assets, and the financial highlights for the period July 9, 2020 (commencement of operations) through October 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31 ,2020 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, Illinois

December 28, 2020

We have served as the auditor of one or more investment companies in Nuveen Funds since 2002.

14

Nuveen Core Impact Bond Managed Accounts Portfolio

Portfolio of Investments October 31, 2020

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | LONG-TERM INVESTMENTS – 98.7% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | CORPORATE BONDS – 56.5% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Banks – 10.7% | | | | | | | | | | | | |

| | | | | |

| $ | 200 | | | Bank of America Corp | | | 0.981% | | | | 9/25/25 | | | | A+ | | | $ | 199,788 | |

| | | | | |

| | 250 | | | Bank of America Corp | | | 2.456% | | | | 10/22/25 | | | | A+ | | | | 263,875 | |

| | | | | |

| | 250 | | | Citigroup Inc | | | 0.776% | | | | 10/30/24 | | | | A | | | | 249,908 | |

| | | | | |

| | 150 | | | International Bank for Reconstruction & Development | | | 3.125% | | | | 11/20/25 | | | | AAA | | | | 169,070 | |

| | | | | |

| | 200 | | | Kookmin Bank, 144A | | | 2.500% | | | | 11/04/30 | | | | BBB+ | | | | 199,502 | |

| | 1,050 | | | Total Banks | | | | | | | | | | | | | | | 1,082,143 | |

| | | | | |

| | | | Beverages – 2.6% | | | | | | | | | | | | |

| | | | | |

| | 250 | | | PepsiCo Inc | | | 2.875% | | | | 10/15/49 | | | | A+ | | | | 266,047 | |

| | | | | |

| | | | Building Products – 2.5% | | | | | | | | | | | | |

| | | | | |

| | 250 | | | Johnson Controls International plc / Tyco Fire & Security Finance SCA | | | 1.750% | | | | 9/15/30 | | | | BBB+ | | | | 248,547 | |

| | | | | |

| | | | Chemicals – 2.7% | | | | | | | | | | | | |

| | | | | |

| | 250 | | | LG Chem Ltd, 144A | | | 3.625% | | | | 4/15/29 | | | | BBB+ | | | | 274,859 | |

| | | | | |

| | | | Commercial Services & Supplies – 2.5% | | | | | | | | | | | | |

| | | | | |

| | 250 | | | Rockefeller Foundation | | | 2.492% | | | | 10/01/50 | | | | AAA | | | | 248,995 | |

| | | | | |

| | | | Electric Utilities – 17.0% | | | | | | | | | | | | |

| | | | | |

| | 200 | | | Avangrid Inc | | | 3.800% | | | | 6/01/29 | | | | Baa1 | | | | 228,763 | |

| | | | | |

| | 250 | | | Electricite de France SA, 144A | | | 3.625% | | | | 10/13/25 | | | | A3 | | | | 279,192 | |

| | | | | |

| | 250 | | | Interstate Power and Light Co | | | 4.100% | | | | 9/26/28 | | | | A- | | | | 295,031 | |

| | | | | |

| | 250 | | | MidAmerican Energy Co | | | 3.150% | | | | 4/15/50 | | | | Aa2 | | | | 273,754 | |

| | | | | |

| | 250 | | | Niagara Mohawk Power Corp, 144A | | | 1.960% | | | | 6/27/30 | | | | A- | | | | 254,739 | |

| | | | | |

| | 100 | | | Pattern Energy Operations LP / Pattern Energy Operations Inc, 144A | | | 4.500% | | | | 8/15/28 | | | | BB- | | | | 104,263 | |

| | | | | |

| | 250 | | | Southwestern Public Service Co | | | 3.750% | | | | 6/15/49 | | | | A | | | | 286,162 | |

| | 1,550 | | | Total Electric Utilities | | | | | | | | | | | | | | | 1,721,904 | |

| | | | | |

| | | | Equity Real Estate Investment Trust – 6.8% | | | | | | | | | | | | |

| | | | | |

| | 325 | | | HAT Holdings I LLC / HAT Holdings II LLC, 144A | | | 3.750% | | | | 9/15/30 | | | | BB+ | | | | 324,594 | |

| | | | | |

| | 225 | | | Regency Centers LP | | | 3.750% | | | | 6/15/24 | | | | BBB+ | | | | 238,159 | |

| | | | | |

| | 125 | | | Starwood Property Trust Inc, 144A, (WI/DD) | | | 5.500% | | | | 11/01/23 | | | | Ba3 | | | | 123,880 | |

| | 675 | | | Total Equity Real Estate Investment Trust | | | | | | | | | | | | | | | 686,633 | |

| | | | | |

| | | | Food & Staples Retailing – 2.5% | | | | | | | | | | | | |

| | 250 | | | Sysco Corp | | | 2.400% | | | | 2/15/30 | | | | Baa1 | | | | 253,786 | |

| | | | | |

| | | | Interactive Media & Services – 1.7% | | | | | | | | | | | | |

| | | | | |

| | 175 | | | Alphabet Inc | | | 1.100% | | | | 8/15/30 | | | | AA+ | | | | 170,587 | |

15

Nuveen Core Impact Bond Managed Accounts Portfolio (continued)

Portfolio of Investments October 31, 2020

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | Machinery – 2.5% | | | | | | | | | | | | |

| | | | | |

| $ | 250 | | | Xylem Inc/NY | | | 1.950% | | | | 1/30/28 | | | | BBB | | | $ | 258,074 | |

| | | | | |

| | | | Oil, Gas & Consumable Fuels – 2.3% | | | | | | | | | | | | |

| | | | | |

| | 225 | | | Chevron Corp | | | 2.236% | | | | 5/11/30 | | | | AA | | | | 235,476 | |

| | | | | |

| | | | Semiconductors & Semiconductor Equipment – 2.7% | | | | | | | | | | | | |

| | | | | |

| | 250 | | | NXP BV / NXP Funding LLC / NXP USA Inc, 144A | | | 3.400% | | | | 5/01/30 | | | | BBB | | | | 274,972 | |

| $ | 5,425 | | | Total Corporate Bonds (cost $5,799,777) | | | | | | | | | | | | | | | 5,722,023 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | ASSET-BACKED AND MORTGAGE-BACKED SECURITIES – 23.6% | | | | | | | | | | | | | | | | |

| | | | | |

| $ | 250 | | | BFLD Trust 2020-EYP, 144A, (1-Month LIBOR reference rate + 2.100% spread), (3) | | | 2.248% | | | | 10/15/35 | | | | A- | | | $ | 250,000 | |

| | | | | |

| | 250 | | | CPT Mortgage Trust, 144A | | | 2.997% | | | | 11/13/39 | | | | N/R | | | | 230,779 | |

| | | | | |

| | 237 | | | Fannie Mae Mortgage Pool FN MA4121 | | | 3.000% | | | | 9/01/50 | | | | N/R | | | | 248,570 | |

| | | | | |

| | 110 | | | Fannie Mae Mortgage Pool FN MA4159 | | | 2.500% | | | | 10/01/50 | | | | N/R | | | | 114,302 | |

| | | | | |

| | 45 | | | Fannie Mae Mortgage Pool FN MA4182 | | | 2.000% | | | | 11/01/50 | | | | N/R | | | | 46,408 | |

| | | | | |

| | 10 | | | Freddie Mac Structured Agency Credit Risk Debt Notes, REMIC Trust 2020-DNA2, 144A, (1-Month LIBOR reference rate + 1.850% spread), (3) | | | 1.999% | | | | 2/25/50 | | | | BB | | | | 9,783 | |

| | | | | |

| | 5 | | | Freddie Mac Structured Agency Credit Risk Debt Notes, Series STACR 2018-SPI3 M2, 144A | | | 4.140% | | | | 8/25/48 | | | | BB | | | | 5,206 | |

| | | | | |

| | 104 | | | Ginnie Mae II Pool G2 MA6820 | | | 3.000% | | | | 8/20/50 | | | | N/R | | | | 109,932 | |

| | | | | |

| | 10 | | | Ginnie Mae II Pool G2 BX3679 | | | 3.000% | | | | 8/20/50 | | | | N/R | | | | 10,955 | |

| | | | | |

| | 15 | | | Ginnie Mae II Pool G2 BX3680 | | | 3.000% | | | | 8/20/50 | | | | N/R | | | | 16,366 | |

| | | | | |

| | 5 | | | Ginnie Mae II Pool G2 BX3681 | | | 3.000% | | | | 8/20/50 | | | | N/R | | | | 5,406 | |

| | | | | |

| | 5 | | | Ginnie Mae II Pool G2 BY0338 | | | 3.500% | | | | 8/20/50 | | | | N/R | | | | 5,552 | |

| | | | | |

| | 5 | | | Ginnie Mae II Pool G2 BY0339 | | | 3.500% | | | | 8/20/50 | | | | N/R | | | | 5,543 | |

| | | | | |

| | 5 | | | Ginnie Mae II Pool G2 BY0340 | | | 3.500% | | | | 8/20/50 | | | | N/R | | | | 5,493 | |

| | | | | |

| | 30 | | | Ginnie Mae II Pool G2 MA6864 | | | 2.000% | | | | 9/20/50 | | | | N/R | | | | 31,072 | |

| | | | | |

| | 34 | | | Ginnie Mae II Pool G2 BY0325 | | | 2.500% | | | | 10/20/50 | | | | N/R | | | | 35,306 | |

| | | | | |

| | 235 | | | Hudson Yards 2019-30HY Mortgage Trust, 144A | | | 3.228% | | | | 7/10/39 | | | | AAA | | | | 259,943 | |

| | | | | |

| | 250 | | | Mosaic Solar Loan Trust 2020-2, 144A | | | 1.440% | | | | 8/20/46 | | | | N/R | | | | 247,555 | |

| | | | | |

| | 250 | | | Natixis Commercial Mortgage Securities Trust 2019-MILE, 144A, (1-Month LIBOR reference rate + 1.500% spread), (3) | | | 1.648% | | | | 7/15/36 | | | | N/R | | | | 247,558 | |

| | | | | |

| | 250 | | | Tesla Auto Lease Trust 2020-A, 144A | | | 0.780% | | | | 12/20/23 | | | | Aaa | | | | 251,306 | |

| | | | | |

| | 250 | | | Vivint Solar Financing VII LLC, 144A | | | 2.210% | | | | 7/31/51 | | | | N/R | | | | 250,370 | |

| $ | 2,355 | | | Total Asset-Backed and Mortgage-Backed Securities (cost $2,395,964) | | | | | | | | | | | | | | | 2,387,405 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | | | | Optional Call

Provisions (4) | | | Ratings (2) | | | Value | |

| | | | | |

| | | | MUNICIPAL BONDS – 8.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | California – 1.9% | | | | | | | | | | | | |

| | | | | |

| $ | 190 | | | San Francisco City and County Public Utilities Commission, California, Power Revenue Bonds, Taxable Refunding Series 2020E, 2.825%, 11/01/41 | | | | | | | 11/30 at 100.00 | | | | Aa2 | | | $ | 190,944 | |

16

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | | Optional Call

Provisions (4) | | | Ratings (2) | | | Value | |

| | | | | |

| | | | Michigan – 2.6% | | | | | | | | | | | | |

| | | | | |

| $ | 250 | | | Great Lakes Water Authority, Michigan, Sewer Disposal System Revenue Bonds, Taxable Refunding Senior Lien Series 2020A, 3.056%, 7/01/39 | | | | | | | No Opt. Call | | | | AA- | | | $ | 258,370 | |

| | | | | |

| | | | New York – 3.5% | | | | | | | | | | | | |

| | | | | |

| | 355 | | | New York State Energy Research and Development Authority, Residential Solar & Energ Efficiency Financing, Taxable Green Series 2020A, 1.624%, 10/01/22 | | | | | | | 4/21 at 100.00 | | | | N/R | | | | 354,865 | |

| $ | 795 | | | Total Municipal Bonds (cost $819,322) | | | | | | | | | | | | | | | 804,179 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | SOVEREIGN DEBT – 7.7% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Chile – 2.6% | | | | | | | | | | | | |

| | | | | |

| $ | 250 | | | Chile Government International Bond | | | 2.550% | | | | 1/27/32 | | | | A+ | | | $ | 260,000 | |

| | | | | |

| | | | Indonesia – 2.4% | | | | | | | | | | | | |

| | | | | |

| | 225 | | | Perusahaan Penerbit SBSN Indonesia III, 144A | | | 3.900% | | | | 8/20/24 | | | | BBB | | | | 246,548 | |

| | | | | |

| | | | Netherlands – 2.7% | | | | | | | | | | | | |

| | | | | |

| | 250 | | | Nederlandse Waterschapsbank NV, 144A | | | 2.375% | | | | 3/24/26 | | | | AAA | | | | 272,249 | |

| $ | 725 | | | Total Sovereign Debt (cost $784,389) | | | | | | | | | | | | | | | 778,797 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | U.S. GOVERNMENT AND AGENCY OBLIGATIONS – 2.9% | | | | | | | | | | | | | | | | |

| | | | | |

| $ | 250 | | | United States Department of Housing and Urban Development | | | 2.738% | | | | 8/01/25 | | | | N/R | | | $ | 275,977 | |

| | | | | |

| | 20 | | | United States Treasury Note/Bond | | | 1.250% | | | | 5/15/50 | | | | Aaa | | | | 18,056 | |

| | | | | |

| $ | 270 | | | Total U.S. Government and Agency Obligations (cost $294,795) | | | | | | | | | | | | | | | 294,033 | |

| | | | Total Long-Term Investments (cost $10,094,247) | | | | | | | | | | | | | | | 9,986,437 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | SHORT-TERM INVESTMENTS – 4.2% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | U.S. GOVERNMENT AND AGENCY OBLIGATIONS – 4.2% | | | | | | | | | | | | | | | | |

| | | | | |

| $ | 430 | | | Federal Agricultural Mortgage Corporation Discount Notes | | | 0.000% | | | | 11/02/20 | | | | N/R | | | $ | 430,000 | |

| $ | 430 | | | Total Short-Term Investments (cost $430,000) | | | | | | | | | | | | | | | 430,000 | |

| | | | Total Investments (cost $10,524,247) – 102.9% | | | | | | | | | | | | | | | 10,416,437 | |

| | | | Other Assets Less Liabilities – (2.9)% | | | | | | | | | | | | | | | (294,039 | ) |

| | | | Net Assets – 100% | | | | | | | | | | | | | | $ | 10,122,398 | |

17

Nuveen Core Impact Bond Managed Accounts Portfolio (continued)

Portfolio of Investments October 31, 2020

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. |

| (2) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm. |

| (3) | Variable rate security. The rate shown is the coupon as of the end of the reporting period. |

| (4) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public accounting firm. |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. |

| WI/DD | Purchased on a when issued or delayed delivery basis. |

See accompanying notes to financial statements.

18

Statement of Assets and Liabilities

October 31, 2020

| | | | |

| | |

Assets | | | | |

| |

Long-term investments, at value (cost $10,094,247) | | $ | 9,986,437 | |

| |

Short-term investments, at value (cost approximates value) | | | 430,000 | |

| |

Receivable for: | | | | |

| |

Interest | | | 43,967 | |

| |

Investments sold | | | 151,219 | |

| |

Reimbursement from Adviser | | | 19,210 | |

| |

Total assets | | | 10,630,833 | |

| |

Liabilities | | | | |

| |

Cash overdraft | | | 107,703 | |

| |

Payable for: | | | | |

| |

Investments purchased – regular settlement | | | 199,684 | |

| |

Investments purchased – when-issued/delayed-delivery settlement | | | 125,000 | |

| |

Accrued expenses: | | | | |

| |

Trustees fees | | | 20 | |

| |

Professional fees | | | 66,564 | |

| |

Other | | | 9,464 | |

| |

Total liabilities | | | 508,435 | |

| |

Net assets | | $ | 10,122,398 | |

| |

Shares outstanding | | | 1,022,265 | |

| |

Net assets value (“NAV”) per share | | $ | 9.90 | |

| |

Fund level net assets consist of: | | | | |

| |

Capital paid-in | | $ | 10,222,471 | |

| |

Total distributable earnings | | | (100,073 | ) |

| |

Fund level net assets | | $ | 10,122,398 | |

| |

Authorized shares | | | Unlimited | |

| |

Par value per share | | $ | 0.01 | |

See accompanying notes to financial statements.

19

Statement of Operations

For the period July 9, 2020 (commencement of operations) through October 31, 2020

| | | | |

| | |

Investment income | | $ | 36,275 | |

| |

Expenses | | | | |

| |

Shareholder servicing agent fees | | | 220 | |

| |

Custodian fees | | | 5,211 | |

| |

Trustees fees | | | 79 | |

| |

Professional fees | | | 67,945 | |

| |

Shareholder reporting expenses | | | 2,605 | |

| |

Federal and state registration fees | | | 1,800 | |

| |

Other | | | 418 | |

| |

Total expenses before fee waiver/expense reimbursement | | | 78,278 | |

| |

Fee waiver/expense reimbursement | | | (78,278 | ) |

| |

Net expenses | | | — | |

| |

Net investment income (loss) | | | 36,275 | |

| |

Realized and Unrealized Gain (Loss) | | | | |

| |

Net realized gain (loss) from investments | | | (5,067 | ) |

| |

Change in net unrealized appreciation (depreciation) of investments | | | (107,810 | ) |

| |

Net realized and unrealized gain (loss) | | | (112,877 | ) |

| |

Net increase (decrease) in net assets from operations | | $ | (76,602 | ) |

See accompanying notes to financial statements.

20

Statement of Changes in Net Assets

| | | | |

| | | For the period July 9, 2020 (commencement of operations)

through October 31, 2020 | |

| | |

Operations | | | | |

| |

Net investment income (loss) | | $ | 36,275 | |

| |

Net realized gain (loss) from investments | | | (5,067 | ) |

| |

Change in net unrealized appreciation (depreciation) of investments | | | (107,810 | ) |

| |

Net increase (decrease) in net assets from operations | | | (76,602 | ) |

| |

Distributions to Shareholders | | | | |

| |

Dividends | | | (23,471 | ) |

| |

Decrease in net assets from distributions to shareholders | | | (23,471 | ) |

| |

Fund Share Transactions | | | | |

| |

Proceeds from sale of shares | | | 10,199,000 | |

| |

Proceeds from shares issued to shareholders due to reinvestment of distributions | | | 23,471 | |

| |

Net increase (decrease) in net assets from Fund share transactions | | | 10,222,471 | |

| |

Net increase (decrease) in net assets | | | 10,122,398 | |

| |

Net assets at the beginning of period | | | — | |

| |

Net assets at the end of period | | $ | 10,122,398 | |

See accompanying notes to financial statements.

21

Financial Highlights

Selected data for a share outstanding throughout the period:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | Investment Operations | | | | | | Less Distributions | | | | |

| | | | | | | | | |

| Year ended October 31, | | Beginning

NAV | | | Net

Investment

Income

(Loss)(a) | | | Net

Realized/

Unrealized

Gain (Loss) | | | Total | | | | | | From

Net

Investment

Income | | | From

Accumulated

Net Realized

Gains | | | Total | | | Ending

NAV | |

| | | | | | | | | |

2020(e) | | $ | 10.00 | | | $ | 0.04 | | | $ | (0.12 | ) | | $ | (0.08 | ) | | | | | | $ | (0.02 | ) | | $ | — | | | $ | (0.02 | ) | | $ | 9.90 | |

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Ratios/Supplemental Data | |

| | | | | | | | | | Ratios to Average

Net Assets Before

Waiver/Reimbursement | | | | | | Ratios to Average

Net Assets After

Waiver/Reimbursement(c) | | | | |

| | | | | | | | |

Total

Return(b) | | | Ending

Net

Assets

(000) | | | | | | Expenses | | | Net

Investment

Income

(Loss) | | | | | | Expenses | | | Net

Investment

Income

(Loss) | | | Portfolio

Turnover

Rate(d) | |

| | | | | | | | |

| | (0.77)% | | | $ | 10,122 | | | | | | | | 0.99 | %* | | | (1.31 | )%* | | | | | | | — | %* | | | 1.13 | %* | | | 113 | % |

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily shares method. | |

| (b) | Total return is the combination of changes in NAV without any sales charge, reinvested dividend income at NAV and reinvested capital gains distributions at NAV, if any. Total returns are not annualized. | |

| (c) | After fee waiver and/or expense reimbursement from the Adviser, where applicable. See Note 7 – Management Fees for more information. | |

| (d) | Portfolio Turnover Rate is calculated based on the lesser of long-term purchases or sales (as disclosed in Note 4 – Portfolio Securities and Investments in Derivatives) divided by the average long-term market value during the period. | |

| (e) | For the period July 9, 2020 (commencement of operations) through October 31, 2020. | |

See accompanying notes to financial statements.

23

Notes to Financial Statements

1. General Information

Trust and Fund Information

The Nuveen Managed Accounts Portfolios Trust (the “Trust”) is an open-end management investment company registered under the Investment Company Act of 1940 (the “1940 Act”), as amended. The Trust is comprised of Nuveen Core Impact Bond Managed Accounts Portfolio (the “Fund”), as a diversified fund, among others. The Trust was organized as a Massachusetts business trust on November 14, 2006.

The Fund is developed exclusively for use within separately managed accounts by Nuveen LLC (“Nuveen”). The Fund is a specialized bond portfolio to be used in combination with selected individual securities to effectively model institutional-level investment strategies. The Fund enables certain Nuveen separately managed account investors to achieve greater diversification and return potential than smaller managed accounts might otherwise achieve by investing in additional fixed-income classes, including those that have a lower credit quality and potentially higher yielding securities in order to gain access to special investment opportunities normally available only to institutional investors.

The end of the reporting period for the Fund is October 31, 2020, and the period covered by these Notes to Financial Statements is for the fiscal period July 9, 2020 (commencement of operations) through October 31, 2020 (the “current fiscal period”).

Investment Adviser and Sub-Adviser

The Fund’s investment adviser is Nuveen Fund Advisors, LLC (the “Adviser”), a subsidiary of Nuveen. Nuveen is the investment management arm of Teachers Insurance and Annuity Association of America (TIAA). The Adviser has overall responsibility for management of the Fund, oversees the management of the Fund’s portfolio, manages the Fund’s business affairs and provides certain clerical, bookkeeping and other administrative services, and, if necessary, asset allocation decisions. The Adviser has entered into a sub-advisory agreement with Nuveen Asset Management, LLC (the “Sub-Adviser”), a subsidiary of the Adviser, under which the Sub-Adviser manages the investment portfolio of the Fund.

Other Matters

The outbreak of the novel coronavirus (“COVID-19”) and subsequent global pandemic began significantly impacting the U.S. and global financial markets and economies during the calendar quarter ended March 31, 2020. The worldwide spread of COVID-19 has created significant uncertainty in the global economy. The duration and extent of COVID-19 over the long-term cannot be reasonably estimated at this time. The ultimate impact of COVID-19 and the extent to which COVID-19 impacts the Fund’s normal course of business, results of operations, investments, and cash flows will depend on future developments, which are highly uncertain and difficult to predict. Management continues to monitor and evaluate this situation.

2. Significant Accounting Policies

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require the use of estimates made by management and the evaluation of subsequent events. Actual results may differ from those estimates. The Fund is an investment company and follows accounting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946, Financial Services – Investment Companies. The net asset value (“NAV”) for financial reporting purposes may differ from the NAV for processing security and shareholder transactions. The NAV for financial reporting purposes includes security and shareholder transactions through the date of the report. Total return is computed based on the NAV used for processing security and shareholder transactions. The following is a summary of the significant accounting policies consistently followed by the Fund.

Compensation

The Trust pays no compensation directly to those of its trustees who are affiliated with the Adviser or to its officers, all of whom receive remuneration for their services to the Trust from the Adviser or its affiliates. The Fund’s Board of Trustees (the “Board”) has adopted a deferred compensation plan for independent trustees that enables trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from certain Nuveen-advised funds. Under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of select Nuveen-advised funds.

Distributions to Shareholders

Distributions to shareholders are recorded on the ex-dividend date. The amount, character and timing of distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP.

Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts that provide general indemnifications to other parties.

24

The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Investments and Investment Income

Securities transactions are accounted for as of the trade date for financial reporting purposes. Realized gains and losses on securities transactions are based upon the specific identification method. Investment income is comprised of interest income, which is recorded on an accrual basis and included the accretion of discounts and the amortization of premiums for financial reporting purposes. Investment income also reflects payment-in-kind (“PIK”) interest and paydown gains and losses, if any. PIK interest represents income received in the form of securities in lieu of cash.

Netting Agreements

In the ordinary course of business, the Fund may enter into transactions subject to enforceable International Swaps and Derivatives Association, Inc. (ISDA) master agreements or other similar arrangements (“netting agreements”). Generally, the right to offset in netting agreements allows each Fund to offset certain securities and derivatives with a specific counterparty, when applicable, as well as any collateral received or delivered to that counter-party based on the terms of the agreements. Generally, the Fund manages its cash collateral and securities collateral on a counterparty basis.

The Fund’s investments subject to netting agreements as of the end of the reporting period, if any, are further described in Note 4 – Portfolio Securities and Investments in Derivatives.

New Accounting Pronouncements and Rule Issuances

Reference Rate Reform

In March 2020, FASB issued Accounting Standards Update (“ASU”) 2020-04, Reference Rate Reform: Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The main objective of the new guidance is to provide relief to companies that will be impacted by the expected change in benchmark interest rates at the end of 2021, when participating banks will no longer be required to submit London Interbank Offered Rate (LIBOR) quotes by the UK Financial Conduct Authority (FCA). The new guidance allows companies to, provided the only changes to existing contracts are a change to an approved benchmark interest rate, account for modifications as a continuance of the existing contract without additional analysis. For new and existing contracts, the Fund may elect to apply the optional expedients as of March 12, 2020 through December 31, 2022. Management has not yet elected to apply the optional expedients, but is currently assessing the impact of the ASU’s adoption to the Fund’s financial statements and various filings.

3. Investment Valuation and Fair Value Measurements

The Funds’ investments in securities are recorded at their estimated fair value utilizing valuation methods approved by the Board. Fair value is defined as the price that would be received upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. U.S. GAAP establishes the three-tier hierarchy which is used to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect management’s assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. The following is a summary of the three-tiered hierarchy of valuation input levels.

| | |

| Level 1 – | | Inputs are unadjusted and prices are determined using quoted prices in active markets for identical securities. |

| Level 2 – | | Prices are determined using other significant observable inputs (including quoted prices for similar securities, interest rates, credit spreads, etc.). |

| Level 3 – | | Prices are determined using significant unobservable inputs (including management’s assumptions in determining the fair value of investments). |

A description of the valuation techniques applied to the Funds’ major classifications of assets and liabilities measured at fair value follows:

Prices of fixed-income securities are generally provided by an independent pricing service (“pricing service”) approved by the Board. The pricing service establishes a security’s fair value using methods that may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and analysis, including the obligor’s credit characteristics considered relevant. In pricing certain securities, particularly less liquid and lower quality securities, the pricing service may consider information about a security, its issuer or market activity, provided by the Adviser. These securities are generally classified as Level 2.

Any portfolio security or derivative for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued at fair value, as determined in good faith using procedures approved by the Board. As a general principle, the fair value of a security would appear to be the amount that the owner might reasonably expect to receive for it in a current sale. A variety of factors may be considered in determining the fair value of such securities, which may include consideration of the following: yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated

25

Notes to Financial Statements (continued)

cash flows or collateral, general market conditions and other information and analysis, including the obligor’s credit characteristics considered relevant. To the extent the inputs are observable and timely, the values would be classified as Level 2 of the fair value hierarchy; otherwise they would be classified as Level 3.

The following table summarizes the market value of the Fund’s investments as of the end of the reporting period, based on the inputs used to value them:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Long-Term Investments*: | | | | | | | | | | | | | | | | |

Corporate Bonds | | $ | — | | | $ | 5,722,023 | | | $ | — | | | $ | 5,722,023 | |

Asset-Backed and Mortgage-Backed Securities | | | — | | | | 2,387,405 | | | | — | | | | 2,387,405 | |

Municipal Bonds | | | — | | | | 804,179 | | | | — | | | | 804,179 | |

Sovereign Debt | | | — | | | | 778,797 | | | | — | | | | 778,797 | |

U.S. Government and Agency Obligations | | | — | | | | 294,033 | | | | — | | | | 294,033 | |

| Short-Term Investments: | | | | | | | | | | | | | | | | |

U.S. Government and Agency Obligations | | | — | | | | 430,000 | | | | — | | | | 430,000 | |

| Total | | $ | — | | | $ | 10,416,437 | | | $ | — | | | $ | 10,416,437 | |

| * | Refer to the Fund’s Portfolio of Investments for industry and country classifications, where applicable. |

4. Portfolio Securities and Investments in Derivatives

Portfolio Securities

Zero Coupon Securities

A zero coupon security does not pay a regular interest coupon to its holders during the life of the security. Income to the holder of the security comes from accretion of the difference between the original purchase price of the security at issuance and the par value of the security at maturity and is effectively paid at maturity. The market prices of zero coupon securities generally are more volatile than the market prices of securities that pay interest periodically.

Investment Transactions

Long-term purchases and sales (including maturities) during the current fiscal period aggregated $20,738,683 and $10,609,579, respectively.

The Fund may purchase securities on a when-issued or delayed-delivery basis. Securities purchased on a when-issued or delayed-delivery basis may have extended settlement periods; interest income is not accrued until settlement date. Any securities so purchased are subject to market fluctuation during this period. The Fund has earmarked securities in its portfolio with a current value at least equal to the amount of the when-issued/delayed delivery purchase commitments. If the Fund has outstanding when-issued/delayed-delivery purchases commitments as of the end of the reporting period, such amounts are recognized on the Statement of Assets and Liabilities.

Investments in Derivatives

The Fund is authorized to invest in certain derivative instruments, such as futures, options and swap contracts. The Fund records derivative instruments at fair value, with changes in fair value recognized on the Statement of Operations, when applicable. Even though the Fund’s investments in derivatives may represent economic hedges, they are not considered to be hedge transactions for financial reporting purposes.

Although the Fund is authorized to invest in derivative instruments, and may do so in the future, it did not make any such investments during the current fiscal period.

Market and Counterparty Credit Risk

In the normal course of business the Fund may invest in financial instruments and enter into financial transactions where risk of potential loss exists due to changes in the market (market risk) or failure of the other party to the transaction to perform (counterparty credit risk). The potential loss could exceed the value of the financial assets recorded on the financial statements. Financial assets, which potentially expose the Fund to counterparty credit risk, consist principally of cash due from counterparties on forward, option and swap transactions, when applicable. The extent of the Fund’s exposure to counterparty credit risk in respect to these financial assets approximates their carrying value as recorded on the Statement of Assets and Liabilities.

The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor their obligations and by having the Adviser monitor the financial stability of the counterparties. Additionally, counterparties may be required to pledge collateral daily (based on the daily valuation of the financial asset) on behalf of the Fund with a value approximately equal to the amount of any unrealized gain above a pre-determined threshold. Reciprocally, when the Fund has an unrealized loss, the Fund has instructed the custodian to pledge assets of the Fund as collateral with a value approximately equal to the amount of the unrealized loss above a pre-determined threshold. Collateral pledges are monitored and subsequently adjusted if and when the valuations fluctuate, either up or down, by at least the pre-determined threshold amount.

26

5. Fund Shares

Transactions in Fund shares during the current fiscal period were as follows:

| | | | | | | | |

| | | For the Period 7/09/20

(commencement of operations)

through 10/31/20 | |

| | | Shares | | | Amount | |

| Shares sold | | | 1,019,900 | | | $ | 10,199,000 | |

| Shares issued to shareholders due to reinvestment of distributions | | | 2,365 | | | | 23,471 | |

| Net increase (decrease) | | | 1,022,265 | | | $ | 10,222,471 | |

6. Income Tax Information

The Fund intends to distribute substantially all of its net investment income and net capital gains to shareholders and to otherwise comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. In any year when the Fund realizes net capital gains, the Fund may choose to distribute all or a portion of its net capital gains to shareholders, or alternatively, to retain all or a portion of its net capital gains and pay federal corporate income taxes on such retained gains.

For all open tax years and all major taxing jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Open tax years are those that are open for examination by taxing authorities (i.e., generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

The following information is presented on an income tax basis. Differences between amounts for financial statement and federal income tax purposes are primarily due to timing differences in recognizing certain gains and losses on investment transactions. To the extent that differences arise that are permanent in nature, such amounts are reclassified within the capital accounts as detailed below. Temporary differences do not require reclassification. Temporary and permanent differences do not impact the NAV of the Fund.

The table below presents the cost and unrealized appreciation (depreciation) of the Fund’s investment portfolio, as determined on a federal income tax basis, as of October 31, 2020.

| | | | |

| Tax cost of investments | | $ | 10,526,487 | |

| Gross unrealized: | | | | |

Appreciation | | $ | 20,286 | |

Depreciation | | | (130,336 | ) |

| Net unrealized appreciation (depreciation) of investments | | $ | (110,050 | ) |

Permanent differences, primarily due to bond premium amortization adjustments, and paydowns resulted in reclassifications among the Fund’s components of net assets as of October 31, 2020, the Fund’s tax year end.

The tax components of undistributed net ordinary income as of October 31, 2020, the Fund’s tax year end, were as follows:

| | | | |

| Undistributed net ordinary income1 | | $ | 25,899 | |

| 1 | Net ordinary income consists of taxable market discount income and net short-term capital gains, if any. |

The tax character of distributions paid during the Fund’s tax year ended October 31, 2020 was designated for purposes of the dividends paid deduction as follows:

| | | | |

| Distributions from net ordinary income1 | | $ | 23,471 | |

| 1 | Net ordinary income consists of taxable market discount income and net short-term capital gains, if any. |

As of October 31, 2020, the Fund’s tax year end, the Fund had unused capital losses carrying forward available for federal income tax purposes to be applied against future capital gains, if any. The capital losses are not subject to expiration.

| | | | |

| Not subject to expiration: | | | | |

Short-term | | $ | 4,180 | |

Long-term | | | — | |

| Total | | $ | 4,180 | |

27

Notes to Financial Statements (continued)

7. Management Fees