MASTER AGREEMENT

BY AND AMONG

SEMGROUP, L.P.,

SEMMANAGEMENT, L.L.C.,

SEMOPERATING G.P., L.L.C.,

SEMMATERIALS, L.P.,

K.C. ASPHALT, L.L.C.,

SEMCRUDE, L.P.,

EAGLWING, L.P.,

SEMGROUP HOLDINGS, L.P.

AND

SEMGROUP ENERGY PARTNERS, L.P.,

SEMGROUP ENERGY PARTNERS G.P., L.L.C.,

SEMGROUP ENERGY PARTNERS OPERATING, L.L.C.,

SEMGROUP ENERGY PARTNERS, L.L.C.,

SEMGROUP CRUDE STORAGE, L.L.C.,

SEMPIPE G.P., L.L.C.,

SEMPIPE, L.P.

SGLP MANAGEMENT, INC.

SEMMATERIALS ENERGY PARTNERS, L.L.C.

EFFECTIVE AS OF 11:59 PM CDT MARCH 31, 2009

| SETTLEMENT TRANSACTIONS | 2 |

| 1.1 | The Transactions | 2 |

| 1.2 | SemMaterials Transactions | 3 |

| 1.3 | Employees | 5 |

| 1.4 | Release of Liens | 5 |

| ARTICLE II | TREATMENT OF CERTAIN CONTRACTS IN BANKRUPTCY PROCEEDINGS | 6 |

| 2.1 | Rejection of Contracts | 6 |

| 2.2 | Allowed Claims | 7 |

| 2.3 | Termination of Guaranties | 7 |

| ARTICLE III | MUTUAL RELEASES | 7 |

| 3.1 | General Release of Certain Claims by SGLP Parties | 7 |

| 3.2 | General Release of Certain Claims by SemGroup Parties | 8 |

| 3.3 | Release of Certain Claims by SGLP Parties | 8 |

| ARTICLE IV | REPRESENTATIONS AND WARRANTIES OF SEMGROUP PARTIES | 9 |

| 4.1 | Organization and Good Standing | 9 |

| 4.2 | Authorization of Settlement Agreement and Transaction Documents | 9 |

| 4.3 | No Violation; Consents | 9 |

| 4.4 | Title to Property | 9 |

| 4.5 | Brokerage Fees | 10 |

| 4.6 | Acknowledgement of SemGroup Parties | 10 |

| 4.7 | Limitation of Representations and Warranties | 10 |

| ARTICLE V | REPRESENTATIONS AND WARRANTIES OF SGLP PARTIES | 11 |

| 5.1 | Organization and Good Standing | 11 |

| 5.2 | Authorization of Agreement and Transaction Documents | 11 |

| 5.3 | No Violation; Consents | 11 |

| 5.4 | Title to Property | 11 |

| 5.5 | Brokerage Fees | 12 |

| 5.6 | Acknowledgement of SGLP Parties | 12 |

| 5.7 | Limitation of Representations and Warranties | 12 |

| ARTICLE VI | ADDITIONAL COVENANTS | 12 |

| 6.1 | Expenses | 12 |

| 6.2 | Mutual Cooperation | 13 |

| 6.3 | Taxes | 13 |

| 6.4 | Tax Allocation | 13 |

| ARTICLE VII | MISCELLANEOUS | 14 |

| 7.1 | Effect of this Agreement | 14 |

| 7.2 | Binding Effect; Successors | 14 |

| 7.3 | Submission to Jurisdiction | 15 |

| 7.4 | Waiver of Jury Trial | 15 |

| 7.5 | Entire Agreement | 16 |

| 7.6 | Amendments and Waivers | 16 |

| 7.7 | Governing Law | 16 |

| 7.8 | Notices | 17 |

| 7.9 | Severability | 18 |

| 7.10 | Counterparts | 18 |

| 7.11 | Captions | 18 |

| 7.12 | Interpretation | 18 |

| 7.13 | Third Party Beneficiaries | 18 |

Exhibits

Exhibit A Kansas Transfer Documents

Exhibit B Shared Services Agreement

Exhibit C SCADA Transfer Document

Exhibit D-1 Oklahoma City Lease

Exhibit D-2 Cushing Lease

Exhibit E Line Fill and Tank Bottoms Transfer Document

Exhibit F New Throughput Agreement

Exhibit G-1 SGLP Dropdown Transfer Documents

Exhibit G-2 SemGroup Dropdown Transfer Documents

Exhibit H Cushing Land Rights Agreements

Exhibit I Trademark License Agreement

Exhibit J Asphalt Transfer Documents

Exhibit K New Terminalling Agreement

Exhibit L New Terminal Access Agreement

Exhibit M SemMaterials Transition Services Agreement

Exhibit N SemMaterials Software

Exhibit O SemMaterials Software Transfer Agreement

Exhibit P Final Order

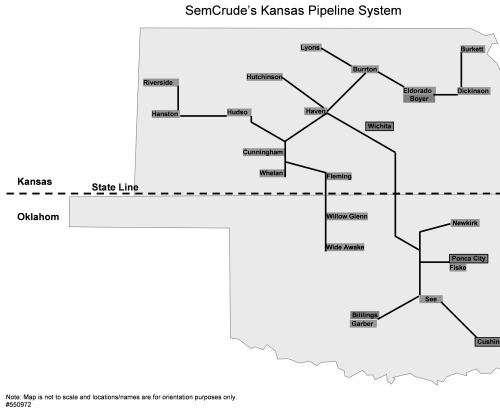

Exhibit Q Kansas Pipeline

Exhibit R SemGroup Lender Release

Exhibit S SGLP Lender Release

MASTER AGREEMENT

This Master Agreement (this “Agreement”), is entered into on April 7, 2009, to be effective as of 11:59 PM CDT March 31, 2009 (the “Effective Date”), by and among SemGroup, L.P. (“SemGroup”), SemManagement, L.L.C. (“SemManagement”), SemOperating G.P., L.L.C. (“SemOperating”), SemMaterials, L.P. (“SemMaterials”), K.C. Asphalt, L.L.C. (“KC Asphalt”), SemCrude, L.P. (“SemCrude”), Eaglwing, L.P. (“Eaglwing”), SemGroup Holdings, L.P. (“SemGroup Holdings”), SemGroup Energy Partners, L.P. (“SGLP”), SemGroup Energy Partners G.P., L.L.C. (“SGLP GP”), SemGroup Energy Partners Operating, L.L.C. (“SGLP Operating”), SemGroup Energy Partners, L.L.C. (“SGEP”), SemGroup Crude Storage, L.L.C. (“Crude Storage”), SemPipe, L.P. (“SemPipe LP”), SemPipe G.P., L.L.C. (“SemPipe”), SGLP Management, Inc. (“SGLP Management”) and SemMaterials Energy Partners, L.L.C. (“SMEP”). SemGroup, SemManagement, SemOperating, SemMaterials, KC Asphalt, SemCrude, Eaglwing and SemGroup Holdings are collectively referred to as the “SemGroup Parties.” SGLP, SGLP GP, SGLP Operating, SGEP, Crude Storage, SemPipe LP, SemPipe, SGLP Management and SMEP are collectively referred to as the “SGLP Parties.” The SemGroup Parties and the SGLP Parties are collectively referred to as the “Parties” and individually referred to as a “Party”.

Capitalized terms not otherwise defined herein shall have the meaning assigned to such terms in attached Appendix A, which is incorporated herein by reference.

PRELIMINARY STATEMENTS

WHEREAS, the Parties have engaged in extensive, arms’ length and good faith negotiations and discussions concerning a global settlement;

WHEREAS, the Parties signed that certain term sheet on March 6, 2009 (the “Term Sheet”), which set forth the principal terms of a settlement agreement;

WHEREAS, the Bankruptcy Court approved the Term Sheet on March 12, 2009;

WHEREAS, the Parties now desire to enter into a series of agreements to compromise and settle all matters among them as described in the Term Sheet and to effect the transactions described therein (the “Transactions”); and

WHEREAS, the Parties acknowledge and agree that the compromise and settlement reflected herein constitutes the exchange of reasonably equivalent value between the Parties to settle the matters among them as described in the Term Sheet and is both fair and reasonable to all the Parties.

NOW, THEREFORE, in consideration of the premises and the mutual agreements, covenants, representations and warranties set forth in this Agreement and for other good, valid and binding consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties to this Agreement, intending to be legally bound, hereby agree as follows:

ARTICLE I

SETTLEMENT TRANSACTIONS

1.1 The Transactions. The following Transactions, among others referenced herein, are occurring concurrently with the execution of this Agreement by the Parties, to be effective as of the Effective Date.

(a) Transfer of Kansas Assets. SGEP and its Affiliates are transferring the KC Crude Transferred Assets to SemCrude by executing and delivering the documents listed on Exhibit A hereto (the “Kansas Transfer Documents”).

(b) Shared Services Agreement. SGEP, SemCrude and certain of their Affiliates are executing and delivering the shared services agreement attached hereto as Exhibit B (the “Shared Services Agreement”).

(c) SCADA Agreements. SGEP and its Affiliates are transferring to SemCrude and its Affiliates all of their rights, title and interest, in and to the SCADA System by executing and delivering the bill of sale attached as Exhibit C hereto (the “SCADA Transfer Document”). SGEP, SemCrude and certain of their Affiliates are also executing and delivering the Shared Services Agreement, which includes SCADA Services on Exhibit C thereto.

(d) Office Leases. SGLP, SemCrude and certain of their Affiliates are executing and delivering (i) the lease attached hereto as Exhibit D-1 (the “Oklahoma City Lease”) regarding the lease by SemCrude of SGLP’s office space in the Oklahoma City operations building for its employees and equipment and (ii) the lease attached hereto as Exhibit D-2 (the “Cushing Lease”) regarding the lease by SemCrude of SGLP’s office space in the interchange building, one lab building and two maintenance buildings located in Cushing, Oklahoma for its employees and equipment.

(e) Line Fill and Tank Bottoms. SemCrude is transferring to SGEP as of the Effective Date 355,000 Barrels of crude oil owned by SemCrude and located in the pipelines or storage tanks of the SGLP Parties as of the Effective Date (the “Line Fill and Tank Bottoms”). If SemCrude does not own 355,000 Barrels of Line Fill and Tank Bottoms as of the Effective Date, then SemCrude will transfer Barrels located at other mutually convenient locations in order to achieve the total of 355,000 Barrels (the “Additional Barrels”). The Line Fill and Tank Bottoms and the Additional Barrels, if any, will be transferred by SemCrude executing and delivering the bill of sale attached as Exhibit E hereto (the “Line Fill and Tank Bottoms Transfer Document”), which sets forth the number of Barrels being transferred at each location. The SGLP Parties hereby acknowledge and agree that after the execution of this Agreement, SemCrude will continue to own its Barrels of crude oil located in the pipelines or storage tanks of the SGLP Parties (other than the Line Fill and Tank Bottoms and, if any, the Additional Barrels), which Barrels will be delivered to SemCrude at its direction pursuant to the New Throughput Agreement. The Parties will agree on the inventory process to be utilized to determine the number of Barrels owned by SemCrude after the Effective Date, which process shall be in accordance with customary industry practice.

(f) Throughput Agreement. SemCrude and SGLP are executing and delivering the throughput agreement attached hereto as Exhibit F (the “New Throughput Agreement”).

(g) Dropdown Items.

(i) SGEP and its Affiliates are transferring to SemCrude and its Affiliates the SGLP Outstanding Items to the SemGroup Parties by executing and delivering the documents listed on Exhibit G-1 hereto (the “SGLP Dropdown Transfer Documents”).

(ii) SemCrude and its Affiliates are transferring to SGEP and its Affiliates the SemGroup Outstanding Items to the SGLP Parties by executing and delivering the documents listed on Exhibit G-2 hereto (the “SemGroup Dropdown Transfer Documents”).

(h) Cushing Land Rights Agreements. SGLP, SemCrude and its respective Affiliates are executing and delivering the deeds, easements and memoranda listed on Exhibit H hereto (the “Cushing Land Rights Agreements”) to evidence the Parties’ respective land rights at Cushing, Oklahoma.

(i) Trademark License Agreements. SGLP and its Affiliates are executing and delivering the trademark license agreement attached hereto as Exhibit I (the “Trademark License Agreement”) regarding the license of certain trademarks by the SGLP Parties on and after the Effective Date.

(j) Transfer of Asphalt Transferred Assets. SemMaterials and its Affiliates are transferring the Asphalt Transferred Assets to SMEP and its Affiliates by executing and delivering the documents listed on Exhibit J hereto (the “Asphalt Transfer Documents”).

(k) Terminalling and Storage Agreement. SemMaterials and SMEP are executing and delivering the terminalling and storage agreement attached hereto as Exhibit K (the “New Terminalling Agreement”).

(l) Terminal Access and Use Agreement. SemMaterials and SMEP are executing and delivering the terminal access and use agreement attached hereto as Exhibit L (the “New Terminal Access Agreement”).

(m) Transition Services Agreement. SemMaterials and SMEP are executing and delivering the transition services agreement attached hereto as Exhibit M (the “SemMaterials Transition Services Agreement”).

1.2 SemMaterials Transactions. In connection with the orderly wind down of SemGroup’s SemMaterials operations, the Parties will enter into the following agreements:

(a) SGLP shall have the option (the “SemMaterials Contracts Option”) to have the SemGroup Parties transfer any of their existing subleases, storage agreements or leases with third parties relating to the Asphalt Transferred Assets (the “Asphalt Third Party Contracts”) to the SGLP Parties pursuant to the following terms and conditions:

(i) Promptly after the date hereof, SGLP will notify SemMaterials if it is aware of any Asphalt Third Party Contract that it wishes to assume and SemMaterials will provide information as reasonably requested by SGLP with respect to any Asphalt Third Party Contract, including whether any Asphalt Third Party Contract is needed by the SemGroup Parties in connection with its SemMaterials wind down and the cure and any other payments required in connection with the assumption and assignment of each Asphalt Third Party Contract;

(ii) To exercise the SemMaterials Contracts Option, SGLP must promptly deliver written notice to SemGroup of such exercise specifying each Asphalt Third Party Contracts to be assumed no later than April 30, 2009 (the “Contracts Option Deadline”). If SGLP exercises the SemMaterials Contracts Option with respect to any Asphalt Third Party Contract, and if such Asphalt Third Party Contract is assumed and assigned, then SGLP will be solely responsible for any cure or other payments required in connection with the assumption and assignment of such Asphalt Third Party Contract, regardless of when such assumption and assignment occurs or when such payment is due;

(iii) Upon receipt of written notice and payment from SGLP exercising the SemMaterials Contracts Option, the SemGroup Parties shall promptly file a motion with the Bankruptcy Court seeking to assume and assign all identified Asphalt Third Party Contracts free and clear of any Liens; and

(iv) If SemGroup does not receive such written notice as to any Asphalt Third Party Contract by the Contracts Option Deadline, then SGLP shall have waived its rights to have such Asphalt Third Party Contract assigned to it and the SemGroup Parties shall be permitted to accept or reject any Asphalt Third Party Contract in their sole discretion.

(b) SGLP shall have the option (the “SemMaterials Software Option”) to have the SemGroup Parties transfer any of the asphalt front-office systems and related software licenses described on Exhibit N hereto (the “SemMaterials Software”), to the extent permissible, to the SGLP Parties pursuant to the following terms and conditions:

(i) SemMaterials shall retain the SemMaterials Software in connection with the orderly wind down of its operations;

(ii) Promptly after the date hereof, SGLP will notify SemMaterials if it is aware of any SemMaterials Software that it wishes to assume and SemMaterials will provide information as reasonably requested by SGLP with respect to the SemMaterials Software, including (1) the date on which SemMaterials will no longer need to use the SemMaterials Software (the “Software Transfer Date”), (2) the cure and any other payments required in connection with the assumption and assignment of any contracts related to the SemMaterials Software (the “Software Third Party Contracts”), and (3) the amount of any prepaid maintenance, licensing or other costs related to the SemMaterials Software paid or to be paid by the SemGroup Parties as of the Software Transfer Date (the “Software Transfer Costs”);

(iii) To exercise the SemMaterials Software Option, SGLP must deliver written notice of such exercise to SemGroup no later than April 30, 2009 (the “Software Option Deadline”). If SGLP exercises the SemMaterials Software Option with respect to any Software Third Party Contract, and if such Software Third Party Contract is assumed and assigned, then SGLP will be solely responsible for any cure or other payments required in connection with the assumption and assignment of such Software Third Party Contract, regardless of when such assumption and assignment occurs or when such payment is due;

(iv) Upon receipt of written notice and payment from SGLP exercising the SemMaterials Software Option, the SemGroup Parties shall promptly file a motion with the Bankruptcy Court seeking to assume and assign all identified Software Third Party Contracts free and clear of any Liens; and

(v) If SGLP exercises the SemMaterials Software Option, then on the Software Transfer Date, and subject to any restrictions on transfer, SemMaterials, SMEP and certain of their Affiliates will execute and deliver the transfer agreement attached hereto as Exhibit O (the “SemMaterials Software Transfer Agreement”) relating to the transfer of the SemMaterials Software to the SGLP Parties and the SGLP Parties shall pay to the SemGroup Parties an amount equal to the Software Transfer Costs.

1.3 Employees.

(a) The Parties hereby acknowledge and agree that SGLP has made offers of employment to individuals as agreed with SemGroup.

(b) For a period of one (1) year following the date hereof, the SGLP Parties shall not directly or indirectly, through any Affiliate, officer, director, stockholder, member, partner, agent or otherwise, cause, solicit, induce or encourage any employee of a SemGroup Party after the date hereof to leave such employment or solicit the employment of or employ or retain as a consultant any such employee; provided, however, that the hiring of any such employee that the Parties mutually agree can be offered employment by the SGLP Parties and the hiring of any such employee through the use of general advertisements in publications (including external websites) shall be deemed not to violate this provision.

(c) For a period of one (1) year following the date hereof, the SemGroup Parties shall not directly or indirectly, through any Affiliate, officer, director, stockholder, member, partner, agent or otherwise, cause, solicit, induce or encourage any employee of a SGLP Party after the date hereof to leave such employment or solicit the employment of or employ or retain as a consultant any such employee; provided, however, that the hiring of any such employee that the Parties mutually agree can be offered employment by the SemGroup Parties and the hiring of any such employee through the use of general advertisements in publications (including external websites) shall be deemed not to violate this provision.

1.4 Release of Liens.

(a) The SGLP Parties will deliver the SGLP Lender Release evidencing the release of any Liens of the SGLP Lenders on the SGLP Transferred Assets (as defined herein). As soon as practicable after the date hereof, (i) the SemGroup Parties will file the appropriate documents to evidence the release of the SGLP Lenders’ Liens on the SGLP Transferred Assets and (ii) the SemGroup Parties will file a notice of bankruptcy filing of the SemGroup Parties in the relevant jurisdictions.

(b) The SemGroup Parties will deliver the SemGroup Lender Release confirming the removal of any Liens of the SemGroup Lenders on the SemGroup Transferred Assets (as defined herein). The SemGroup Parties will use their commercially reasonable efforts to work with the SemGroup Lenders to take all reasonable action to confirm the removal of any and all Liens on the SemGroup Transferred Assets by the SemGroup Lenders. As soon as practicable after the date hereof, (i) the SGLP Parties will file the appropriate documents to evidence the release of the SemGroup Lenders’ Liens on the SemGroup Transferred Assets and (ii) the SGLP Parties will file the SGLP Lender Security Documents.

ARTICLE II

TREATMENT OF CERTAIN CONTRACTS

IN BANKRUPTCY PROCEEDINGS

2.1 Rejection of Contracts.

(a) Pursuant to the Final Order, the Terminalling and Storage Agreement, the Throughput Agreement, the Omnibus Agreement, the Terminal Access and Use Agreement and the SemGroup Guaranty (collectively, the “Rejected Contracts”) shall be deemed rejected effective as of the Effective Date in accordance with the provisions of section 365 of the Bankruptcy Code. The Parties agree that each Party that is a party to any Rejected Contract shall be relieved of any obligation to such other Parties as are party thereto to make any payments, including payment on any prepetition or postpetition Claim for damages or otherwise, under the Rejected Contracts or to otherwise perform under such agreements for the benefit of any such other Party; provided that (i) the SGLP Parties shall be entitled to payment in the Bankruptcy Cases with respect to the Allowed Claims (as defined herein) and (ii) the SemGroup Parties will be responsible for all amounts owing to the SGLP Parties, and the SGLP Parties will be responsible for all amounts owing to the SemGroup Parties, under each Rejected Contract for periods up to the date that such contract is rejected, which amounts may be netted in accordance with the September Order. The Parties hereby acknowledge and agree that the following waivers apply for the period from March 1, 2009 through March 31, 2009: (1) SGLP and its Affiliates hereby waive amounts due by SemGroup and its Affiliates under the Terminalling and Storage Agreement, (2) SemGroup and its Affiliates hereby waive the administrative fee due by SGLP and its Affiliates under the Omnibus Agreement and (3) SemGroup and its Affiliates hereby waive the charges for operational services related solely to SemMaterials due by SGLP and its Affiliates under the Omnibus Agreement.

(b) The Parties acknowledge and agree that all amounts owed by any SGLP Party under the Omnibus Agreement prior to the Filing Date shall be netted against all amounts owed by any SemGroup Party under the Terminalling and Storage Agreement and the Throughput Agreement for services provided prior to the Filing Date. The Parties hereby waive any remaining positive balance owing under the Rejected Contracts after such netting of pre-Filing Date account balances, regardless of whether the balance is owing to the SemGroup Parties, on the one hand, or the SGLP Parties, on the other hand.

(c) Subject to Section 2.2 below, each proof of claim filed by or on behalf of any Parties hereto against the SemGroup Parties in connection with the Rejected Contracts shall be deemed irrevocably withdrawn, with prejudice, and to the extent applicable expunged and all claims set forth therein disallowed in their entirety.

2.2 Allowed Claims. Pursuant to the Final Order, the following claims shall be allowed as general unsecured claims in the Bankruptcy Cases:

(a) SMEP will have a general unsecured claim against SemMaterials, KC Asphalt and SemGroup (joint and several) in the amount of $35,000,000 as a result of the rejection of the Terminalling and Storage Agreement (the “Terminalling Agreement Allowed Claim”); and

(b) SGLP and SGEP will have a general unsecured claim against SemCrude, Eaglwing and SemGroup (joint and several) in the amount of $20,000,000 as a result of the rejection of the Throughput Agreement (the “Throughput Agreement Allowed Claim”).

2.3 Termination of Guaranties. Effective as of the Effective Date, the SGLP Guaranty and the SemGroup Guaranty (if and to the extent not deemed to be an executory contract and rejected pursuant to Section 2.1 hereof) shall be deemed terminated with respect to the Parties and each Party that is a party thereto shall be relieved of any obligation to such other Parties as are party thereto to make any payments, including, without limitation, payment on any prepetition or postpetition Claim for damages or otherwise, under such terminated guaranties or to otherwise perform under such guaranties for the benefit of any such other Party.

ARTICLE III

MUTUAL RELEASES

3.1 General Release of Certain Claims by SGLP Parties. Effective as of the execution of this Agreement, each of the SGLP Parties, on its own behalf and on behalf of each of its respective Affiliates, subsidiaries, members, managers, partners, principals, parent companies, stockholders, officers, employees, creditors, directors, agents, representatives, attorneys, successors and assigns, hereby knowingly and voluntarily, generally, fully, unconditionally, absolutely, finally and forever waives, releases, acquits and discharges each of the SemGroup Parties and the SemGroup Lenders, solely in their capacity as a lender of the SemGroup Parties (or an agent to such lender or lenders), together with each of the SemGroup Parties’ and the SemGroup Lenders’ respective Affiliates, subsidiaries, members, managers, partners, principals, parent companies, stockholders, post-Filing Date financial advisors, attorneys, bankruptcy estates, successors and assigns (collectively, the “SemGroup Released Parties”), from, and covenants not to sue each of the SemGroup Released Parties for or on, and holds each of the SemGroup Released Parties harmless against, any and all Claims relating or attributable to, or arising out of or in connection with, (i) the transfer of assets by the SGLP Parties pursuant to or in connection with the Dropdown Agreements, including the SGLP Outstanding Items (the “SemGroup Dropdown Assets”), and the transactions related thereto or the ownership, operation or maintenance of any of the SemGroup Dropdown Assets by the SemGroup Parties and (ii) the Rejected Contracts and the transactions related thereto (the “Released Contract Claims”), including for rejection damages (collectively, the “Specified SGLP Released Claims”). Notwithstanding anything to the contrary herein, this release shall not release or discharge (x) any Claims other than the Specified SGLP Released Claims, (y) any Claims against any officers, directors, employees, managers or outside accountants of any of the SemGroup Parties or (z) any Claims relating to or arising out of this Agreement, including those described in Section 2.1(a), 2.2(a) and 2.2(b), or any of the Transaction Documents.

3.2 General Release of Certain Claims by SemGroup Parties. Effective as of the execution of this Agreement, each of the SemGroup Parties, on its own behalf and on behalf of each of its respective bankruptcy estates, Affiliates, subsidiaries, members, managers, partners, principals, parent companies, stockholders, officers, employees, creditors, directors, agents, representatives, attorneys, successors and assigns, hereby knowingly and voluntarily, generally, fully, unconditionally, absolutely, finally and forever waives, releases, acquits and forever discharges each of the SGLP Parties and the SGLP Lenders, solely in their capacity as a lender of the SGLP Parties (or an agent to such lender or lenders), together with each of the SGLP Parties’ and SGLP Lenders’ respective Affiliates, subsidiaries, members, managers, partners, principals, parent companies, stockholders, post-Filing Date financial advisors, attorneys, successors and assigns (collectively, the “SGLP Released Parties”), from, and covenants not to sue each of the SGLP Released Parties for or on, and holds each of the SGLP Released Parties harmless against, any and all Claims, including, without limitation, any claims under Chapter 5 of the Bankruptcy Code, relating or attributable to, or arising out of or in connection with (i) the transfer of assets by the SemGroup Parties pursuant to or in connection with the Dropdown Agreements, including the SemGroup Outstanding Items (the “SGLP Dropdown Assets”), and the transactions related thereto or the ownership, operation or maintenance of any of the SGLP Dropdown Assets by the SGLP Parties and (ii) the Released Contract Claims, including any Claims under Chapter 5 of the Bankruptcy Code for payments made under the Rejected Contracts (collectively, the “Specified SemGroup Released Claims”). Notwithstanding anything to the contrary herein, this release shall not release or discharge (x) any Claims other than the Specified SemGroup Released Claims, (y) any Claims against any officers, directors, employees, managers or outside accountants of any of the SGLP Parties or (z) any Claims relating to or arising out of this Agreement, including those described in Section 2.1(a), 2.2(a) and 2.2(b), or any of the Transaction Documents.

3.3 Release of Certain Claims by SGLP Parties. Effective as of the execution of this Agreement, each of the SGLP Parties, on its own behalf and on behalf of each of its respective Affiliates, subsidiaries, members, managers, partners, principals, parent companies, stockholders, officers, employees, creditors, directors, agents, representatives, attorneys, successors and assigns, hereby knowingly and voluntarily, generally, fully, unconditionally, absolutely, finally and forever waives, releases, acquits and discharges the SemGroup Released Parties from, and covenants not to sue each of the SemGroup Released Parties for or on, and holds each of the SemGroup Released Parties harmless against, any and all Claims which exist prior to or exist as of the Effective Date, against (i) the Existing Asphalt Inventory and any proceeds thereof or (ii) the crude inventory of the SemGroup Parties located in pipelines or storage tanks of the SGLP Parties (other than the Line Fill and Tank Bottoms and, if any, the Additional Barrels) and any proceeds thereof.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF SEMGROUP PARTIES

Each SemGroup Party hereby represents and warrants, as to itself, to each SGLP Party as of the date hereof as follows:

4.1 Organization and Good Standing. Each SemGroup Party is duly formed, validly existing and in good standing under the laws of the state of its formation.

4.2 Authorization of Settlement Agreement and Transaction Documents. Each SemGroup Party has the requisite corporate, partnership or limited liability company power and authority, as applicable, to execute this Agreement and the other Transaction Documents to which it is a party, and to consummate the Transactions contemplated by this Agreement and the other Transaction Documents to which it is a party. The execution and delivery by each SemGroup Party of this Agreement and the other Transaction Documents to which it is a party and the consummation by each SemGroup Party of the transactions contemplated by this Agreement and the other Transaction Documents to which it is a party have been duly authorized by all necessary corporate, partnership or limited liability company action, as applicable, on the part of each SemGroup Party and by the Bankruptcy Court. This Agreement and the other Transaction Documents to which it is a party have been or will be duly executed and delivered by each SemGroup Party, and, assuming due execution and delivery by each SGLP Party which is a party thereto, constitute valid and binding obligations of such SemGroup Party, enforceable against such SemGroup Party in accordance with their respective terms, except that such enforceability may be limited by equitable principles which may limit the availability of certain equitable remedies (such as specific performance).

4.3 No Violation; Consents. The execution and delivery of this Agreement and the consummation of the transactions contemplated by each of the SemGroup Parties does not and will not (a) conflict with or violate the provisions of the certificate of incorporation or bylaws, or certificate of limited partnership or limited partnership agreement, or certificate of formation or limited liability company agreement, as applicable, of any SemGroup Party, (b) violate any Applicable Law and (c) violate, conflict with or result in a violation or breach of, or constitute a default (with or without due notice or lapse of time or both) under, or require the consent of any other party to any contract to which any of the SemGroup Parties is a party or by which any of their assets may be bound (other than any that are not enforceable against the SemGroup Parties by reason of their bankruptcy filings).

4.4 Title to Property. The execution and delivery by the SemGroup Parties of the SemGroup Dropdown Transfer Documents, the Line Fill and Tank Bottoms Transfer Document and the Asphalt Transfer Documents (collectively, the “SemGroup Transfer Documents”) conveys, subject to any requisite governmental filings, to the SGLP Parties good title to, respectively, the SemGroup Outstanding Items, the Line Fill and Tank Bottoms and the Asphalt Transferred Assets (collectively, the “SemGroup Transferred Assets”), free and clear of any and all Liens and interests (ownership or otherwise) of any other Person, and liabilities, pursuant to sections 105(a), 363(f) and 365 of the Bankruptcy Code and will be a legal, valid and effective transfer of the SemGroup Transferred Assets. The foregoing representation and warranty regarding title to the SemGroup Transferred Assets is hereby qualified by Permitted Exceptions, if any, but such qualification is not intended to limit the scope of paragraph 8 of the Initial Order. Each SemGroup Party acknowledges and agrees that such SemGroup Party forever disclaims any right, title or interest of any nature, whether legal, equitable, beneficial, or otherwise, in any of the SemGroup Transferred Assets and agrees that all of its respective current and future rights, title and interests therein have been fully conveyed to the SGLP Parties without any reservation of interest of any nature. Notwithstanding anything to the contrary herein, this paragraph shall not be construed as providing a warranty as to the title to the SemGroup Transferred Assets.

4.5 Brokerage Fees. No SemGroup Party has retained any financial advisor, broker, agent, or finder or paid or agreed to pay any financial advisor, broker, agent, or finder specifically on account of this Agreement or the Transactions contemplated hereby for which any SGLP Party shall have any responsibility or liability.

4.6 Acknowledgement of SemGroup Parties. Each of the SemGroup Parties acknowledges that: (i) it has relied on its own independent investigation, and has not relied on any information or representations furnished by the SGLP Parties or any representative or agent thereof with respect to the Rejected Contracts or the Dropdown Agreements or in determining whether or not to enter into this Agreement, other than the representations set forth in this Agreement, (ii) it has conducted its own due diligence, including a review of the Rejected Contracts, Dropdown Agreements and Applicable Law in connection therewith, as well as undertaken the opportunity to review information, ask questions and receive satisfactory answers concerning the Rejected Contracts, Dropdown Agreements and the terms and conditions of this Agreement, (iii) it possesses the knowledge, experience and sophistication to allow it to fully evaluate and accept the merits and risks of entering into the transactions contemplated by this Agreement and (iv) it has made its own independent determination in light of its economic interests to reject each of the Rejected Contracts.

4.7 Limitation of Representations and Warranties. THE SEMGROUP TRANSFERRED ASSETS ARE BEING TRANSFERRED AND ACCEPTED IN THEIR CURRENT CONDITION, “AS IS, WHERE IS AND WITH ALL FAULTS” AND EXCEPT AS MAY BE SPECIFICALLY SET FORTH HEREIN, WITHOUT REPRESENTATION OR WARRANTY OR INDEMNIFICATION OF ANY KIND, EXPRESS OR IMPLIED, EACH AND ALL OF WHICH ARE HEREBY EXPRESSLY DISCLAIMED BY THE SEMGROUP PARTIES, INCLUDING, WITHOUT LIMITATION, ANY REPRESENTATION OR WARRANTY WITH RESPECT TO QUALITY, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR USE OR PURPOSE. EACH OF THE VARIOUS TRANSFER DOCUMENTS TO BE DELIVERED TO THE SGLP PARTIES CONCURRENTLY HEREWITH SHALL CONTAIN A DISCLAIMER TO THIS EFFECT. THE PARTIES AGREE THAT THIS PROVISION IS A MATERIAL PART OF THIS SETTLEMENT AGREEMENT AND HAS BEEN BARGAINED FOR.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF SGLP PARTIES

Each of the SGLP Parties hereby represents and warrants, as to itself, to the SemGroup Parties as of the date hereof as follows:

5.1 Organization and Good Standing. Each SGLP Party is duly formed, validly existing and in good standing under the laws of the state of its formation.

5.2 Authorization of Agreement and Transaction Documents. Each SGLP Party has the requisite corporate, partnership or limited liability company power and authority, as applicable, to execute this Agreement and the other Transaction Documents to which it is a party, and to consummate the Transactions contemplated by this Agreement and the other Transaction Documents to which it is a party. The execution and delivery by each SGLP Party of this Agreement and the other Transaction Documents to which it is a party and the consummation by each SGLP Party of the transactions contemplated by this Agreement and the other Transaction Documents to which it is a party have been duly authorized by all necessary corporate, partnership or limited liability company action, as applicable, on the part of such SGLP Party. This Agreement and the other Transaction Documents to which it is a party have been or will be duly executed and delivered by each SGLP Party and, assuming such agreements constitute a valid and binding obligation of each SemGroup Party which is a party thereto (and subject to any necessary approval from the Bankruptcy Court), are valid and binding obligations of such SGLP Party enforceable against it in accordance with its terms, subject to (a) applicable bankruptcy, insolvency, reorganization, moratorium and similar laws of general application affecting enforcement of creditors’ rights generally, and (b) general principles of equity, regardless of whether asserted in a proceeding in equity or at law.

5.3 No Violation; Consents. The execution and delivery of this Agreement and the consummation of the transactions contemplated by each of the SGLP Parties does not and will not (a) conflict with or violate the provisions of the certificate of incorporation or bylaws, or certificate of limited partnership or limited partnership agreement, or certificate of formation or limited liability company agreement, as applicable, of any SGLP Party, (b) violate any Applicable Law and (c) violate, conflict with or result in a violation or breach of, or constitute a default (with or without due notice or lapse of time or both) under, or require the consent of any other party to any contract to which any of the SGLP Parties is a party, which consent has not been obtained as of the date hereof.

5.4 Title to Property. The execution and delivery by the SGLP Parties of the SGLP Dropdown Transfer Documents, the Kansas Transfer Documents and the SCADA Transfer Document (collectively, the “SGLP Transfer Documents”) conveys, subject to any requisite governmental filings, to the SemGroup Parties good title to, respectively, the SGLP Outstanding Items, the KS Crude Transferred Assets and the SCADA System (collectively, the “SGLP Transferred Assets”), free and clear of any and all Liens (other than Permitted Exceptions) and interests (ownership or otherwise) of any other Person and liabilities, and will be a legal, valid and effective transfer of the SGLP Transferred Assets. Each SGLP Party acknowledges and agrees that such SGLP Party forever disclaims any right, title or interest of any nature, whether legal, equitable, beneficial, or otherwise, in any of the SGLP Transferred Assets and agrees that all of its respective current and future rights, title and interests therein have been fully conveyed to the SemGroup Parties without any reservation of interest of any nature. Notwithstanding anything to the contrary herein, this paragraph shall not be construed as providing a warranty as to the title to the SGLP Transferred Assets.

5.5 Brokerage Fees. No SGLP Party has retained any financial advisor, broker, agent, or finder or paid or agreed to pay any financial advisor, broker, agent, or finder specifically on account of this Agreement or the Transactions contemplated hereby for which any SemGroup Party shall have any responsibility or liability.

5.6 Acknowledgement of SGLP Parties. Each of the SGLP Parties acknowledges that: (i) it has relied on its own independent investigation, and has not relied on any information or representations furnished by the SemGroup Parties or any representative or agent thereof with respect to the Rejected Contracts or the Dropdown Agreements or in determining whether or not to enter into this Agreement, other than the representations set forth in this Agreement, (ii) it has conducted its own due diligence, including a review of the Rejected Contracts, Dropdown Agreements and Applicable Law in connection therewith, as well as undertaken the opportunity to review information, ask questions and receive satisfactory answers concerning the Rejected Contracts, Dropdown Agreements and the terms and conditions of this Agreement, (iii) it possesses the knowledge, experience and sophistication to allow it to fully evaluate and accept the merits and risks of entering into the transactions contemplated by this Agreement and (iv) it has made its own independent determination in light of its economic interests to accept the amount of the Allowed Claims with respect to the Rejected Contracts.

5.7 Limitation of Representations and Warranties. THE SGLP TRANSFERRED ASSETS ARE BEING TRANSFERRED AND ACCEPTED IN THEIR CURRENT CONDITION, “AS IS, WHERE IS AND WITH ALL FAULTS” AND EXCEPT AS MAY BE SPECIFICALLY SET FORTH HEREIN, WITHOUT REPRESENTATION OR WARRANTY OR INDEMNIFICATION OF ANY KIND, EXPRESS OR IMPLIED, EACH AND ALL OF WHICH ARE HEREBY EXPRESSLY DISCLAIMED BY THE SGLP PARTIES, INCLUDING, WITHOUT LIMITATION, ANY REPRESENTATION OR WARRANTY WITH RESPECT TO QUALITY, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR USE OR PURPOSE. EACH OF THE VARIOUS TRANSFER DOCUMENTS TO BE DELIVERED TO THE SEMGROUP PARTIES CONCURRENTLY HEREWITH SHALL CONTAIN A DISCLAIMER TO THIS EFFECT. THE PARTIES AGREE THAT THIS PROVISION IS A MATERIAL PART OF THIS SETTLEMENT AGREEMENT AND HAS BEEN BARGAINED FOR.

ARTICLE VI

ADDITIONAL COVENANTS

6.1 Expenses. Except as otherwise set forth in this Agreement, each Party shall bear its own expenses incurred in connection with the negotiation and execution of this Agreement and the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby, including, without limitation, obtaining the Final Order. Except as provided in Section 6.3 hereof, all sales, use, transfer, filing, recordation, registration and similar Taxes and fees arising from or associated with any particular transfer of assets under this Agreement shall be borne by the Party who owns such transferred assets after giving effect to the Transactions contemplated by this Agreement, to the extent such Taxes are not discharged by the Bankruptcy Court or otherwise relieved. If a SemGroup Party pays any such Taxes and fees that are allocated to a SGLP Party, or a SGLP Party pays any such Taxes and fees that are allocated to a SemGroup Party, then the SGLP Party or the SemGroup Party, as applicable, shall reimburse promptly upon demand the SemGroup Party or the SGLP Party, as applicable, for such documented Taxes and fees. To the extent any ad valorem Taxes are payable on any assets transferred pursuant to this Agreement, the Party owning such asset at the time such Tax statement is received shall be responsible for paying such Taxes and shall be entitled to seek reimbursement from the other Party for its allocated portion of such Taxes. For clarification, if an asset was transferred from a SGLP Party to a SemGroup Party on the Effective Date, then the SGLP Party would pay the ad valorem Taxes for the fiscal year ended December 31, 2009 and would seek reimbursement of 25% of such ad valorum Taxes from the SemGroup Party.

6.2 Mutual Cooperation. On and after the date hereof, each of the Parties agrees to use its commercially reasonable efforts to take, or cause their respective Affiliates to take, all action to do or cause to be done, and to assist and cooperate with each other Party in doing, all things necessary, proper or advisable to consummate and make effective, in the most expeditious manner practicable, the Transactions (in each case, to the extent that the same is within the control of such Party), including, without limitation, (i) compliance with any Bankruptcy Court approvals, consents and orders, (ii) the obtaining of all necessary waivers, consents and approvals from Governmental Authorities and the making of all necessary registrations and filings and the taking of all reasonable steps as may be necessary to obtain any approval or waiver from, or to avoid any action or proceeding by, any Governmental Authority, (iii) the obtaining of all necessary consents, approvals or waivers from third parties, (iv) the transfer (to the extent transferable) of all operating, environmental and regulatory permits associated with the SemGroup Transferred Assets or the SGLP Transferred Assets, as applicable, and (v) the defending of any lawsuits or any other legal proceedings whether judicial or administrative, challenging this Agreement or the consummation of the Transactions.

6.3 Taxes. The Parties acknowledge and agree that, with respect to any Taxes owed in connection with any items transferred pursuant to the Dropdowns, the Party intended to have ownership interests after giving effect to the transactions contemplated by the relevant Dropdown Agreements shall be responsible for any Taxes relating to periods or portions thereof beginning after the effective date of the relevant Dropdown Agreement (in each case, a “Dropdown Effective Date”), and the Party transferring such ownership interests shall be responsible for any Taxes relating to periods or portions thereof ending on or prior to the relevant Dropdown Effective Date, in each case regardless of whether the transfer occurred as of such Dropdown Effective Date or as of the Effective Date.

6.4 Tax Allocation. The Parties shall cooperate with each other in determining, and shall agree on the date hereof on the valuation of, those SGLP Transferred Assets and SemGroup Transferred Assets (if any) whose transfer hereunder is subject to sales, use, or other transfer Taxes under the applicable Laws of any jurisdiction (each, a "Taxable Asset"). The Parties acknowledge that the SemGroup Parties intend to engage a third party evaluator during the second quarter of 2009 to appraise all of the assets of the SemGroup Parties, including the SGLP Transferred Assets. If the appraised value determined by such third party evaluator for any Taxable Asset is different than the value originally agreed to by the parties for such Taxable Asset then, if necessary under applicable Law, the Parties agree to amend any sales, use, or other transfer Tax return to reflect the appraised value determined by such third party evaluator.

ARTICLE VII

MISCELLANEOUS

7.1 Effect of this Agreement. This Agreement and each of the terms contained herein have been entered into as a matter of settlement and compromise of disputes as to matters of fact and Applicable Law. The settlement and compromise contained herein have been entered into solely to avoid the burden, expense, and uncertainty of litigation concerning the Parties’ respective positions on such matters. Therefore, this Agreement shall not constitute, or be argued or asserted by any Party to constitute, any admission or acknowledgement of any fact or proposition of Law, of the occurrence or nonoccurrence of any event or of any liability or lack thereof on the part of any Party hereto. It is expressly understood and agreed that this Agreement, and any negotiations or proceedings in connection herewith, do not constitute and may not be construed as, or deemed to be, either evidence or an admission or concession on the party of the SemGroup Parties or the SGLP Parties of any merit or lack of merit whatsoever as to any claims each Party has asserted respecting the matters expressly compromised herein. The act of entering into or carrying out this Agreement and any negotiations or proceedings related thereto shall not be used, offered or received into evidence in any action or proceeding in any court, administrative agency or other tribunal for any purpose whatsoever other than to enforce or interpret the provisions of this Agreement; provided, however, that this Agreement may be filed or submitted by the SemGroup Parties or the SGLP Parties to support a claim of release, discharge or satisfaction. The SemGroup Parties and the SGLP Parties each separately intend the settlement to be a final and complete resolution of all disputes between them with respect to the subject matter of this Agreement and the mutual releases herein. Each of the Parties represents that it has not assigned or transferred to any Person any right to recovery for any claim or potential claim that otherwise would be released under this Agreement.

7.2 Binding Effect; Successors. The provisions of this Agreement shall be binding upon and inure to the benefit of the Parties and the respective successors and assigns of each of the Parties, including, without limitation, any trustee hereinafter appointed in the Bankruptcy Cases as the representative of the estates of the SemGroup Parties, or any other representative of the SemGroup Parties who qualifies in a case under the Bankruptcy Code or in connection with any other state, provincial, or federal proceeding. The terms and conditions of this Agreement shall survive:

(a) the entry of any subsequent Order converting any of the SemGroup Parties’ Bankruptcy Cases from chapter 11 of the Bankruptcy Code to chapter 7 of the Bankruptcy Code;

(b) the appointment of any trustee in any of the SemGroup Parties’ Bankruptcy Cases in any ensuing chapter 7 cases under the Bankruptcy Code;

(c) the confirmation of a plan of reorganization for any of the SemGroup Parties under the Bankruptcy Code;

(d) the dismissal of any of the SemGroup Parties’ Bankruptcy Cases or an Order withdrawing the reference from the Bankruptcy Court;

(e) an Order from the Bankruptcy Court abstaining from handling any of the SemGroup Parties’ Bankruptcy Cases; or

(f) a sale, assignment or other disposition of all or part of the SemGroup Parties’ assets or this Agreement to any third party and/or assignee.

7.3 Submission to Jurisdiction.

(a) Without limiting any Party’s right to appeal any Order of the Bankruptcy Court, (i) the Bankruptcy Court shall retain exclusive jurisdiction to enforce the terms of this Agreement and to decide any claims or disputes which may arise or result from, or be connected with, this Agreement, any breach or default hereunder, or the transactions contemplated hereby, and (ii) any and all Actions related to the foregoing shall be filed and maintained only in the Bankruptcy Court, and the Parties hereby consent to and submit to the jurisdiction and venue of the Bankruptcy Court and shall receive notices at such locations as indicated in Section 7.8; provided, however, that if a plan of reorganization has become effective in the Bankruptcy Cases, the Parties agree to and hereby unconditionally and irrevocably submit to the exclusive jurisdiction of any federal or state court in United States District Court for the Southern District of New York sitting in New York County or the Commercial Division, Civil Branch of the Supreme Court of the State of New York sitting in New York County and any appellate court from any thereof, for the resolution of any such claim or dispute.

(b) The Parties hereby unconditionally and irrevocably waive, to the fullest extent permitted by Applicable Law, any objection which they may now or hereafter have to the laying of venue of any dispute arising out of or relating to this Agreement or any of the transactions contemplated hereby brought in any court specified in paragraph (a) above, or any defense of inconvenient forum for the maintenance of such dispute. Each of the Parties hereto agrees that a judgment in any such dispute may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law.

(c) Each of the Parties hereto hereby consents to process being served by any Party to this Agreement in any suit, action or proceeding by the mailing of a copy thereof in accordance with the provisions of Section 7.8; provided, however, that such service shall not be effective until the actual receipt thereof by the Party being served.

7.4 Waiver of Jury Trial. THE PARTIES HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVE, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT THAT THEY MAY HAVE TO TRIAL BY JURY OF ANY CLAIM OR CAUSE OF ACTION, OR IN ANY PROCEEDING, DIRECTLY OR INDIRECTLY BASED UPON OR ARISING OUT OF THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT (WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY). EACH PARTY (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT, OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS IN THIS AGREEMENT.

7.5 Entire Agreement. This Agreement, the Exhibits hereto and the other Transaction Documents represent the entire understanding and agreement between the Parties hereto with respect to the subject matter hereof and shall supersede the Term Sheet; provided, however, that in the event of any dispute, this Agreement, the Exhibits hereto and the other Transaction Documents shall be interpreted to be consistent with the SGLP Settlement Orders.

7.6 Amendments and Waivers.

(a) This Agreement, the Exhibits hereto and the other Transaction Documents can be amended, supplemented or changed, and any provision hereof can be waived, only by written instrument making specific reference to this Agreement or any Transaction Document signed by the Party against whom enforcement of any such amendment, supplement, modification or waiver is sought. The Parties hereby acknowledge and agree that, prior to the date that a plan of reorganization has become effective in the Bankruptcy Cases, a material amendment to this Agreement or any of the Transaction Documents requires the approval of the Bankruptcy Court.

(b) No action taken pursuant to this Agreement or any Transaction Document, including any investigation by or on behalf of any Party, shall be deemed to constitute a waiver by the Party taking such action of compliance with any representation, warranty, covenant or agreement contained herein. The waiver by any Party hereto of a breach of any provision of this Agreement or any other Transaction Document shall not operate or be construed as a further or continuing waiver of such breach or as a waiver of any other or subsequent breach. No failure on the part of any Party to exercise, and no delay in exercising, any right, power or remedy hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of such right, power or remedy by such Party preclude any other or further exercise thereof or the exercise of any other right, power or remedy.

7.7 Governing Law. THIS AGREEMENT, THE RIGHTS AND OBLIGATIONS OF THE PARTIES UNDER THIS AGREEMENT, AND ANY CLAIM OR CONTROVERSY DIRECTLY OR INDIRECTLY BASED UPON OR ARISING OUT OF THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT (WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY), INCLUDING ALL MATTERS OF CONSTRUCTION, VALIDITY AND PERFORMANCE, SHALL IN ALL RESPECTS BE GOVERNED BY AND INTERPRETED, CONSTRUED, AND DETERMINED IN ACCORDANCE WITH, THE INTERNAL LAWS OF THE STATE OF NEW YORK (WITHOUT REGARD TO ANY CONFLICT OF LAWS PROVISION THAT WOULD REQUIRE THE APPLICATION OF THE LAW OF ANY OTHER JURISDICTION).

7.8 Notices. All notices and other communications under this Agreement shall be in writing and shall be deemed duly given (i) when delivered personally or by prepaid overnight courier, with a record of receipt, (ii) when actually received if mailed by certified mail, return receipt requested, or (iii) the day of transmission, if sent by facsimile or telecopy during regular business hours or the business day after transmission, if sent after regular business hours (with a copy promptly sent by prepaid overnight courier with record of receipt or by certified mail, return receipt requested), to the Parties at the following addresses or telecopy numbers (or to such other address or telecopy number as a Party may have specified by notice given to the other Party pursuant to this provision):

If to SemGroup Parties:

SemCrude, L.P.

Two Warren Place

6120 S. Yale Avenue, Suite 700

Tulsa, Oklahoma 74136

Phone: (918) 524-8100

Fax: (918) 524-8290

Attention: Chief Financial Officer

With a copy to:

Weil, Gotshal & Manges LLP

200 Crescent Court, Suite 300

Dallas, Texas 75201

Phone: 214-746-7700

Fax: 214-746-7777

Attention: Michael A. Saslaw, Esq.

If to SGLP Parties:

SemGroup Energy Partners, L.P.

Two Warren Place

6120 S. Yale Avenue, Suite 500

Tulsa, Oklahoma 74136

Phone: (918) 524-5500

Fax: (918) 524-5805

Attention: Chief Financial Officer

With a copy to:

Baker Botts L.L.P.

2001 Ross Avenue, Suite 700

Dallas, Texas 75201

Phone: (214) 953-6500

Fax: (214) 953-6503

Attention: Doug Rayburn, Esq.

7.9 Severability. If any term or provision of this Agreement is invalid, illegal or incapable of being enforced by Law or public policy, all other terms and provisions of this Agreement shall nevertheless remain in full force and effect so long as the legal and economic substance of the Transactions is not affected in any manner materially adverse to any party. Upon such determination that any term or provision is invalid, illegal or incapable of being enforced, the parties hereto shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties as closely as possible in an acceptable manner in order that the Transactions are consummated as originally contemplated to the greatest extent possible.

7.10 Counterparts. This Agreement may be executed in any number of counterparts, each of which, when so executed and delivered (including by facsimile or electronic mail transmission), will be deemed an original, but all of which together will constitute one and the same instrument.

7.11 Captions. The captions of this Agreement are for convenience only and are not a part of this Agreement and do not in any way limit or amplify the terms and provisions of this Agreement and shall have no effect on its interpretation.

7.12 Interpretation. The words “include”, “includes” and “including” shall be deemed to be followed by the phrase “without limitation”. The words “hereof”, “herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement, and Section and Exhibit references are to this Agreement unless otherwise specified. The meanings given to terms defined herein shall be equally applicable to both the singular and plural forms of such terms.

7.13 Third Party Beneficiaries. Except with respect to the releases contained in Article III of this Agreement, this Agreement shall be solely for the benefit of the Parties hereto and no other Person shall be a third party beneficiary hereof.

IN WITNESS WHEREOF, each of the parties have executed and delivered this Agreement as of the date first set forth above to be effective as of the Effective Date.

SEMGROUP, L.P.

By: SemGroup G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMMANAGEMENT, L.L.C.

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMOPERATING G.P., L.L.C.

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMMATERIALS, L.P.

By: SemOperating G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SIGNATURE PAGE TO MASTER AGREEMENT

K.C. ASPHALT, L.L.C.

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMCRUDE, L.P.

By: SemOperating G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

EAGLWING, L.P.

By: SemOperating G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMGROUP HOLDINGS, L.P.

By: SemGroup Holdings G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMGROUP ENERGY PARTNERS, L.P.

By: SemGroup Energy Partners G.P., L.L.C.,

its general partner

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMGROUP ENERGY PARTNERS G.P., L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMGROUP ENERGY PARTNERS OPERATING, L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMGROUP ENERGY PARTNERS, L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMGROUP CRUDE STORAGE, L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SIGNATURE PAGE TO MASTER AGREEMENT

SEMPIPE G.P., L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMPIPE, L.P.

By: SemPipe G.P., L.L.C.,

its general partner

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMMATERIALS ENERGY PARTNERS, L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: �� Chief Financial Officer and Secretary

SGLP MANAGEMENT, INC.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SIGNATURE PAGE TO MASTER AGREEMENT

APPENDIX A

DEFINED TERMS

“Affiliate” (and, with a correlative meaning “affiliated”) means, with respect to any Person, any direct or indirect subsidiary of such Person, and any other Person that directly, or through one or more intermediaries, controls or is controlled by or is under common control with such first Person. As used in this definition, “control” (including with correlative meanings, “controlled by” and “under common control with”) means possession, directly or indirectly, of power to direct or cause the direction of management or policies (whether through ownership of securities or partnership or other ownership interests, by contract or otherwise). For purposes of this Agreement, (i) no SGLP Party shall be considered an Affiliate of any SemGroup Party and (ii) no SemGroup Party shall be considered an Affiliate of any SGLP Party.

“Allowed Claims” means, collectively, the Terminalling Agreement Allowed Claim and the Throughput Agreement Allowed Claim.

“Applicable Law” means, with respect to any Person, any Law applicable to such Person or its business, properties or assets.

“Asphalt Transferred Assets” means all of the SemGroup Parties’ assets that are connected to, adjacent to, or otherwise contiguous with the SGLP Parties’ liquid asphalt cement facilities, including, without limitation, all asphalt cement and residual fuel oil storage tanks, related equipment and associated easement and leasehold land rights; provided, however that the Asphalt Transferred Asphalts shall not include the Existing Asphalt Inventory.

“Bankruptcy Cases” means (i) the chapter 11 cases commenced by SemGroup and certain of its direct and indirect subsidiaries (other than SemGroup Holdings) on July 22, 2008, jointly administered under Case No. 08-11525 (BLS) and (ii) the chapter 11 case commenced by SemGroup Holdings on October 22, 2008 under Case No. 08-12504 (BLS).

“Bankruptcy Code” means title 11 of the United States Code, as amended.

“Bankruptcy Court” means the United States Bankruptcy Court for the District of Delaware or any other court having jurisdiction over the Bankruptcy Cases from time to time.

“Barrel” means forty-two (42) Gallons.

“Claims” shall mean claims, counterclaims, liabilities, demands, agreements, contracts, covenants, suits, actions, causes of action, obligations, controversies, compensation, losses, costs, expenses, attorneys’ fees, damages, judgments, orders and liabilities of whatever kind, type, nature, character or description, in law, equity or otherwise, whether now known or unknown, whether or not asserted, whether in contract or in tort, or any other potential claims of any nature, kind or description, including, but not limited to, any right to contribution, lender liability, usury, course of dealing, counterclaim or set off, whether or not made by or payable to a third party, inchoate or choate, contingent or vested, liquidated or unliquidated, suspected or unsuspected, and whether or not sealed or hidden, including, but not limited to, any and all claims as defined in section 101(5) of the Bankruptcy Code.

“Dropdown Agreements” mean, collectively, (i) the Contribution, Conveyance, Assignment and Assumption Agreement, dated as of May 23, 2007, by and among SemCrude, SemGroup, SemOperating, SemPipe GP and SGEP, (ii) the Closing Contribution, Conveyance, Assignment and Assumption Agreement, dated as of July 20, 2007, by and among SGLP, SGLP GP, SGLP Operating, SemGroup Holdings, SemCrude and SemGroup, (iii) the Purchase and Sale Agreement, dated as of January 14, 2008, by and between SemMaterials and SGLP Operating, (iv) the Contribution Agreement, dated as of January 28, 2008, by and among SemMaterials, KC Asphalt and SMEP, (v) the Purchase and Sale Agreement, dated as of May 12, 2008, by and between SemCrude and SGEP, (vi) the Contribution Agreement, dated as of May 30, 2008, by and between SemCrude and SGLP Crude Storage and (vii) the Purchase and Sale Agreement, dated as of May 20, 2008, by and between SemCrude and SGEP.

“Dropdowns” mean the following transfers from the SemGroup Parties to the SGLP Parties: (i) the contribution of certain crude oil assets on July 20, 2007, (ii) the sale of liquid asphalt assets on February 20, 2008, (iii) the sale of the Eagle North Pipeline System on May 12, 2008 and (iv) the sale of additional crude oil assets on May 30, 2008.

“Existing Asphalt Inventory” means any asphalt cement, residual fuel oil or other product or inventory of the SemGroup Parties that is stored in the Asphalt Transferred Assets or in the SGLP Parties’ liquid asphalt cement facilities as of the Effective Date.

“Filing Date” means July 22, 2008.

“Final Order” means a final and non-appealable order of the Bankruptcy Court approving this Agreement and the consummation of the Transactions, in form and substance identical in all material respects to the form of the order attached hereto as Exhibit P.

“Gallon” means a U.S. gallon of 231 cubic inches corrected to 60 degrees Fahrenheit.

“Governmental Authority” means any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government, including any governmental authority, agency, department, board, commission or instrumentality of the United States, including, without limitation, the IRS, any state of the United States or any political subdivision thereof, and any tribunal, court or arbitrator(s) of competent jurisdiction, and shall include the Bankruptcy Court.

“Initial Order” means the order of the Bankruptcy Court approving a compromise and settlement agreement with SGLP dated March 19, 2009.

“IRS” means the United States Internal Revenue Service.

“Kansas Pipeline” means the SemCrude pipeline in Kansas and Northern Oklahoma reflected in Exhibit Q attached hereof.

“KC Crude Transferred Assets” means the storage tanks, related equipment and associated easement and leasehold land rights owned by the SGLP Parties that are connected to, adjacent to, or otherwise contiguous with the Kansas Pipeline; provided, however that the KC Crude Transferred Assets do not include (i) the truck unloading equipment and related assets of the SGLP Parties or (ii) any storage tanks, related equipment and associated easement and leasehold land rights owned by the SGLP Parties at Cushing, Oklahoma.

“Law” means any U.S. or foreign federal, state or local law (including common law), statute, code, ordinance, Order, rule, regulation or other requirement enacted, promulgated, issued or entered by a Governmental Authority.

“Lien” means (i) any and all liens, pledges, mortgages, deeds of trust, security interests, leases, subleases, charges, options, rights of first refusal or negotiation, easements, servitudes, transfer restrictions under any shareholder or similar agreement and other encumbrances of any kind or nature, including any and all liens as defined in section 101(37) of the Bankruptcy Code and (ii) any and all Claims.

“Omnibus Agreement” means the Amended and Restated Omnibus Agreement, dated as of February 20, 2008 (as amended from time to time), by and among SemGroup, SemManagement, SemMaterials, SGLP, SGLP GP and SMEP.

“Order” means any order, injunction, judgment, decree, ruling, writ, finding, assessment or arbitration award.

“Permitted Exceptions” means: (i) statutory rights to assert carriers’, warehousemen’s, mechanics’, materialmen’s, repairmen’s and other like liens imposed by Law, arising in the ordinary course of business and securing obligations that are not yet due and payable or are being contested in good faith and (ii) minor irregularities in title, boundaries, or other survey defects, easements, leases, restrictions, servitudes, permits, reservations, exceptions, zoning restrictions, rights-of-way, conditions, covenants, and rights of others in any property for streets, roads, bridges, railroads, electric transmission and distribution lines, telegraph and telephone lines, flood control, water rights, rights of others with respect to navigable waters, sewage and drainage rights existing as of the date hereof and other similar charges or encumbrances, in each case that do not adversely interfere with the occupation, use and enjoyment of the assets as they are currently being used as of the date hereof.

“Person” or “person” means and includes natural persons, corporations, limited partnerships, limited liability companies, general partnerships, joint stock companies, joint ventures, associations, companies, trusts, banks, trust companies, land trusts, business trusts or other organizations, whether or not legal entities, and all Governmental Authorities.

“SCADA System” means the software and hardware related to the operation of the crude oil pipelines, storage tanks and related equipment.

“SemGroup Agent” means Bank of America, N.A., as administrative agent under the SemGroup Pre-Petition Credit Agreement and the SemGroup DIP Credit Agreement.

“SemGroup DIP Credit Agreement” means that certain Debtor-in-Possession Credit Agreement, dated as of August 8, 2008, among SemCrude as Borrower and as Debtor and Debtor-in-Possession, SemGroup as a Guarantor and as Debtor and Debtor-in-Possession, SemOperating as a Guarantor and as Debtor and Debtor-in-Possession, Bank of America, N.A., as Administrative Agent and L/C Issuer, and the other lenders party thereto from time to time, as the same has been or may hereafter be amended, restated, supplemented or otherwise modified from time to time.

“SemGroup Guaranty” means the Guaranty, dated as of February 20, 2008, of SemGroup in favor of SMEP.

“SemGroup Lender Release” means the release attached hereto as Exhibit R, pursuant to which the SemGroup Agent confirms the removal of the Liens of the SemGroup Lenders on the SemGroup Transferred Assets.

“SemGroup Lender Security Documents” means the documents reasonably requested by the SemGroup Lenders to evidence their security interest in the SGLP Transferred Assets, which may include mortgages, deeds of trust or UCC financing statements.

“SemGroup Lenders” means (i) the financial institutions party (whether as a lender, letter of credit issuer or an agent) to the SemGroup Pre-Petition Credit Agreement and (ii) the financial institutions party (whether as a lender, letter of credit issuer or an agent) to SemGroup DIP Credit Agreement.

“SemGroup Outstanding Items” means the items set forth on Schedule 2 to the Term Sheet.

“SemGroup Pre-Petition Credit Agreement” means that certain Amended and Restated Credit Agreement, dated as of October 18, 2005, among SemCrude, as US Borrower, SemCams ULC (formerly known as SemCams Midstream Company), as Canadian Borrower, certain affiliates thereof, the lenders party thereto from time to time, Bank of America, N.A., as Administrative Agent, and the other parties thereto, as the same has been or may hereafter be amended, restated, supplemented or otherwise modified from time to time.

“September Order” means the agreed order approved by the Bankruptcy Court on September 8, 2008 with respect to SGLP’s motion seeking adequate protection and modification of the stay filed on August 15, 2008.

“SGLP Guaranty” means the Guaranty dated as of February 20, 2008, of SGLP in favor of SemMaterials.

“SGLP Lender Release” means the release attached hereto as Exhibit S, pursuant to which the SGLP Lenders, among other things, (i) consent to the Transactions and (ii) release their security interests in the SGLP Transferred Assets.

“SGLP Lender Security Documents” means the documents reasonably requested by the SGLP Lenders to evidence their security interest in the SemGroup Transferred Assets, which may include mortgages, deeds of trust or UCC financing statements.

“SGLP Lenders” means the financial institutions party (whether as a lender, letter of credit issuer or an agent) to the Credit Agreement dated as of July 20, 2007, by and among, inter alia, SGLP and Wachovia Bank, N.A. as administrative agent, as the same has been or may hereafter be amended, restated, supplemented or otherwise modified from time to time.

“SGLP Outstanding Items” means the items set forth on Schedule 2 to the Term Sheet.

“SGLP Settlement Orders” means (i) the Initial Order and (ii) the Final Order.

“Tax” or “Taxes” means (i) all federal, state, local or foreign taxes, charges, imposts, levies or other like assessments, including all net income, gross receipts, capital, sales, use, ad valorem, value added, transfer, franchise, profits, inventory, capital stock, license, withholding, payroll, employment, social security, unemployment, excise, severance, stamp, occupation, property and estimated taxes, customs duties, assessments and charges of any kind whatsoever, and (ii) all interest, penalties, fines, additions to tax or additional amounts imposed by any Taxing Authority in connection with any item described in clause (i).

“Taxing Authority” means any Governmental Authority responsible for the administration of any Tax.

“Terminal Access and Use Agreement” means the Terminal Access and Use Agreement, dated as of January 28, 2008 (as amended from time to time), by and among SemMaterials, KC Asphalt and SMEP.

“Terminalling and Storage Agreement” means the Terminalling and Storage Agreement, dated as of February 20, 2008 (as amended from time to time), by and between SemMaterials and SMEP.

“Throughput Agreement” means the Throughput Agreement, dated as of July 20, 2007 (as amended from time to time), by and among SGLP, SGEP, SemCrude, SemGroup and Eaglwing.

“Transaction Documents” means this Agreement, the Kansas Transfer Documents, the Shared Services Agreement, the SCADA Transfer Document, the Oklahoma City Lease, the Cushing Lease, the Line Fill and Tank Bottoms Transfer Document, the New Throughput Agreement, the SGLP Dropdown Transfer Documents, the SemGroup Dropdown Transfer Documents, the Cushing Land Rights Agreements, the Trademark License Agreement, the Asphalt Transfer Documents, the New Terminalling Agreement, the New Terminal Access Agreement, the SemMaterials Transition Services Agreement and the SemMaterials Software Transfer Agreement, and all other instruments delivered by the Parties on the date hereof or intended or required to be delivered then or thereafter in accordance with this Agreement.

Terms Defined Elsewhere in this Agreement. For purposes of this Agreement, the following terms have meanings set forth in the sections indicated.

| Term | Section |

| | |

| Additional Barrels | 1.1(e) |

| Agreement | Preamble |

| Asphalt Third Party Contracts | 1.2(a) |

| Asphalt Transfer Documents | 1.1(j) |

| Contracts Option Deadline | 1.2(a)(ii) |

| Crude Storage | Preamble |

| Cushing Land Rights Agreements | 1.1(h) |

| Cushing Lease | 1.1(d) |

| Dropdown Effective Date | 6.3 |

| Eaglwing | Preamble |

| Effective Date | Preamble |

| Kansas Transfer Documents | 1.1(a) |

| KC Asphalt | Preamble |

| Line Fill and Tank Bottoms | 1.1(e) |

| Line Fill and Tank Bottoms Transfer Document | 1.1(e) |

| New Terminal Access Agreement | 1.1(l) |

| New Terminalling Agreement | 1.1(k) |

| New Throughput Agreement | 1.1(f) |

| Oklahoma City Lease | 1.1(d) |

| Party / Parties | Preamble |

| Rejected Contracts | 2.1(a) |

| Released Contract Claims | 3.1 |

| SCADA Transfer Document | 1.1(c) |

| SemCrude | Preamble |

| SemGroup | Preamble |

| SemGroup Dropdown Assets | 3.1 |

| SemGroup Dropdown Transfer Documents | 1.1(g)(ii) |

| SemGroup Holdings | Preamble |

| SemGroup Parties | Preamble |

| SemGroup Released Parties | 3.1 |

| SemGroup Transferred Assets | 4.4 |

| SemGroup Transfer Documents | 4.4 |

| SemManagement | Preamble |

| SemMaterials | Preamble |

| SemMaterials Contracts Option | 1.2(a) |

| SemMaterials Software | 1.2(b) |

| SemMaterials Software Option | 1.2(b) |

| SemMaterials Software Transfer Agreement | 1.2(b)(v) |

| SemMaterials Transition Services Agreement | 1.1(m) |

| SemOperating | Preamble |

| SemPipe | Preamble |

| SGEP | Preamble |

| SGLP | Preamble |

| SGLP Dropdown Assets | 3.2 |

| SGLP Dropdown Transfer Documents | 1.1(g)(i) |

| SGLP GP | Preamble |

| SGLP Operating | Preamble |

| SGLP Parties | Preamble |

| SGLP Released Parties | 3.2 |

| SGLP Transferred Assets | 5.4 |

| SGLP Transfer Documents | 5.4 |

| Shared Services Agreement | 1.1(b) |

| SMEP | Preamble |

| Software Option Deadline | 1.2(b)(iii) |

| Software Third Party Contracts | 1.2(b)(ii) |