EXHIBIT 10.3

TRANSITION SERVICES AGREEMENT

This TRANSITION SERVICES AGREEMENT (this “Agreement”), dated as of April 7, 2009, to be effective as of 11:59 PM CDT March 31, 2009 (the “Effective Date”), is entered into by and between SemGroup Energy Partners, L.P., SemGroup Energy Partners, L.L.C., SemGroup Crude Storage, L.L.C., SemPipe G.P., L.L.C. SemPipe, L.P., SemMaterials Energy Partners, L.L.C. and SGLP Asphalt L.L.C. (collectively, “Service Recipient”), and SemCrude, L.P., SemGroup, L.P., SemMaterials, L.P. and SemManagement, L.L.C. (collectively, “Service Provider”). Service Provider and Service Recipient are hereinafter collectively referred to as the “Parties” or individually, as applicable, as the “Party.”

W I T N E S S E T H

WHEREAS, Service Provider and Service Recipient have entered into a Master Agreement, dated as of the date hereof (the “Master Agreement”), pursuant to which, among other things, Service Provider will provide certain services for Service Recipient’s operations (the “Service Recipient Business”) for a limited transition period;

WHEREAS, after the date hereof, Service Recipient will operate the Service Recipient Business independently of the Service Provider’s other operations (the “Service Provider Business”);

WHEREAS, Service Recipient desires Service Provider to provide Service Recipient with certain transition services related to the Service Recipient Business, which are more particularly described on Exhibits A, B, C and D hereof (the “Services”); and

WHEREAS, the Parties will pay for transition services and expenses in accordance with the terms hereof on a basis reasonably related to cost of services rendered.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

SECTION 1. DEFINITIONS.

Unless otherwise expressly noted, the words “hereof,” “herein,” “hereunder,” and words of similar import shall refer to this Agreement as a whole and not to any particular section, subsection or clause of it, and references herein to an exhibit, schedule, section, subsection, or clause shall refer to those of or in this Agreement. The meanings of terms defined herein shall be equally applicable to both the singular and plural forms of those terms.

SECTION 2. SERVICES.

(a) Subject to the terms and conditions hereof, during the Term (as hereinafter defined), Service Provider shall provide to Service Recipient the Services set forth in Exhibits A, B, C, and D hereof.

(b) As may be required or at its option, and after receiving the written consent of Service Recipient, which shall not be unreasonably withheld, conditioned or delayed, Service Provider may cause any Service outlined hereunder to be provided by any third party (an “Outsourced Service”). Service Recipient hereby consents to any Outsourced Services that are in existence as of the date hereof. Notwithstanding anything to the contrary contained herein, Service Provider will not be responsible for the quality of any Outsourced Service so long as Service Provider reasonably selects the provider of such Services. In the event an Outsourced Service provider commits a breach of an Outsourced Service agreement that has, or in the reasonable judgment of Service Recipient has the potential to have, a material adverse impact on Service Recipient, Service Provider shall use commercially reasonable efforts to enforce any claims and pursue any rights or remedies Service Provider may have against the Outsourced Service provider for such breach or potential breach in the same manner with which Service Provider seeks to enforce such a claim or pursue such rights or remedies in respect of such a breach or potential breach adversely affecting Service Provider. Service Provider shall use commercially reasonable efforts to have Service Recipient be a third party beneficiary of any rights or remedies Service Provider may have against the Outsourced Service provider for any breach arising from or relating to any Outsourced Service. For greater clarity and subject to Section 11, nothing in this Agreement shall be interpreted as to relieve Service Provider from any of its obligations hereunder, including its obligation to provide the Services it is required to provide hereunder.

(c) Notwithstanding any other provision of this Agreement and without limiting the rights of Service Recipient for a breach of Service Provider of its obligations under this Agreement, Service Recipient shall have exclusive control and decision making authority with respect to the Service Recipient Business and shall be responsible for ensuring that the Service Recipient Business is in compliance with all Applicable Laws. Service Provider shall not be responsible for any Liabilities arising from (i) Service Provider’s compliance with any instruction, direction or parameter given by Service Recipient or any constraint imposed by Service Recipient or (ii) Service Recipient’s decision to not implement any actions recommended by Service Provider in connection with its provision of Services to Service Recipient.

SECTION 3. FUNDING OF EXPENSES.

The Parties agree that Service Recipient will accrue for and pay its direct expenses related to the Service Recipient Business, including, without limitation, licensing, registration fees, taxes, surety bonds, legal fees, auditing fees and other outside vendors with whom Service Recipient contracts; and the expense allocation payable under Exhibits A, B, C, and D hereto. Service Provider further agrees that it will apportion or chargeback any expenses at the end of each month, or any other applicable billing period, and will not true up any such expenses to Service Recipient at the end of any fiscal year.

SECTION 4. TERM AND TERMINATION.

4.1 Term. Exhibits A, B, C, and D specifically outline the term for which Services will be provided (the “Term”).

4.2 Effect of Termination. Each Party’s obligations to perform with respect to the particular Service or Services provided to or by it hereunder shall end as of the effective date of its termination in accordance with this Agreement; provided, however, that each Party shall remain liable to the other as provided for hereunder with respect to (a) any obligations accruing under this Agreement prior to the effective date of such termination, or (b) as otherwise provided in this Agreement. Notwithstanding anything in this Agreement to the contrary, Sections 4.2, 9, 10 and 13 shall survive the expiration or termination of this Agreement.

SECTION 5. COMPENSATION, PAYMENT AND AUDIT REVIEWS.

5.1 Payment of Service Fees to Service Provider. In consideration for Service Provider providing the Services to Service Recipient, Service Recipient shall pay Service Provider the Service Fees in accordance with Section 5.3 below.

5.2 Service Fees.

(a) Not later than fifteen (15) days following the end of each month, Service Provider shall deliver to Service Recipient a statement (the “Monthly Statement”) that details the actual cost allocable, to the extent applicable, for Services to Service Recipient for that month as set forth on Exhibits A, B, C and D (the “Service Fees”). Acceptable forms of delivery for the Monthly Statement include facsimile, electronic mail, postal mail and hand delivery.

(b) Service Recipient shall have the right to review the supporting documentation for such Monthly Statement pursuant to Section 5.4 and Service Recipient shall have thirty (30) days after its receipt of the Monthly Statement to deliver a written notice to Service Provider (the “Dispute Notice”) setting forth the items in dispute in reasonable details (the “Disputed Items”). During the thirty (30) day period following delivery of the Dispute Notice (the “Resolution Period”), the Parties will use commercially reasonable efforts to reach agreement on the Disputed Items set forth in the Dispute Notice. If the Parties are unable to reach an agreement during the Resolution Period, then they will appoint a mutually acceptable independent party to review the Dispute Notice and determine the final amount of the Disputed Items. If the Parties are unable to agree on a single independent party within fifteen (15) days after the end of the Resolution Period, then the Parties will each appoint one (1) independent party, who will jointly select a third independent party (singly or collectively, the “Referee”), within thirty (30) days after the end of the Resolution Period. The Referee shall deliver its determination to the Parties within thirty (30) days from the date of its engagement. The Referee’s report shall be final and binding upon the Parties. The cost of the Referee’s engagement and report shall be shared fifty percent (50%) by Service Provider and fifty percent (50%) by Service Recipient. Notwithstanding anything herein to the contrary, Service Provider shall continue providing Services during such time as a dispute exists and nonpayment by Service Recipient of any Disputed Items that are outstanding in accordance with this Section 5.2(b) shall not constitute a breach of this Agreement.

(c) In accordance with Service Provider’s normal practices as of the date hereof, Service Provider shall maintain reasonably complete and accurate records of and supporting documentation for all non Fixed Fee charges and costs and all other data and/or information created, generated, collected, processed or stored by Service Provider in connection with the provision of the Services as provided for in this Agreement (collectively, the “Service Records”). Service Provider shall retain the Service Records in accordance with Service Provider’s record retention policy; provided, that Service Provider will retain records for a minimum of the term of this Agreement. In the event of the termination of any Service provided by Service Provider under this Agreement, Service Provider shall provide to Service Recipient at Service Recipient’s request and cost a copy of all Service Records pertaining to such terminated Service to the extent not previously provided under Section 5.4.

5.3 Payments of Service Fees by Service Recipient. Service Recipient shall pay all Service Fees promptly, but no later than fifteen (15) days after its receipt of the Monthly Statement to which such Service Fees apply, via wire transfer of immediately available funds into a bank account designated by Service Provider, except for Disputed Items that remain outstanding in accordance with Section 5.2(b) of this Agreement. If Service Recipient disputes any portion of a Monthly Statement, Service Recipient must pay the undisputed portion. Overdue amounts that are resolved in favor of Service Provider will accrue interest at the one-month London Interbank Offered Rate from the date that payment is due until paid in full. If overdue amounts are resolved in favor of Service Provider, then Service Recipient will pay all of Service Provider’s reasonable, out-of-pocket costs (including reasonable attorney’s fees) of collecting past due payments and late payment charges; provided, however, that the Parties will share the costs of a Referee in accordance with Section 5.2(b). If overdue amounts are resolved in favor of Service Recipient, then Service Provider will pay all of Service Recipient’s reasonable, out-of-pocket costs (including reasonable attorney’s fees) of defending itself; provided, however, that the Parties will share the costs of a Referee in accordance with Section 5.2(b). Any Disputed Items shall be resolved in accordance with Section 5.2(b) of this Agreement.

5.4 Audit Review. Upon the request of Service Recipient for an audit, Service Provider agrees to afford Service Recipient’s accountants (and internal and external auditors, inspectors, regulators and other representatives that Service Recipient may designate from time to time) reasonable access, during normal business hours and upon reasonable notice during the Term, to the Service Records, and shall furnish promptly such information concerning the Services and the Service Fees as Service Recipient’s accountants (and internal and external auditors, inspectors, regulators and other representatives that Service Recipient may designate from time to time) reasonably request; provided, however, that such investigation shall not unreasonably disrupt Service Provider’s operations. Service Recipient will be limited to one (1) audit review for the entirety of the Term of this Agreement, provided, however, if Service Recipient has a reasonable business need for one (1) additional audit review, Service Provider will facilitate one (1) additional audit review to the extent the request is reasonable. Notwithstanding any provision of this Article V to the contrary, Service Recipient and its internal and external auditors, inspectors, regulators and other representatives shall not be given access to (i) the proprietary information of customers of Service Provider or (ii) Service Provider’s facilities that are not related to the provision of the Services. Each Party will be responsible for its own costs associated with any audit activity pursuant to this Section 5.4.

5.5 Notification and Disclosure Matters. Service Provider will notify Service Recipient within forty-eight (48) hours regarding any issues pertaining to Service Recipient in accordance with the disclosure procedures in place as of the date hereof.

SECTION 6. TAXES.

Service Recipient shall pay all applicable sales and use taxes required to be paid on Services provided to Service Recipient that may be due or become due in connection with Service Provider’s performance of the Services. Service Provider shall reasonably cooperate with Service Recipient in order to permit Service Recipient to establish any exemption from or reduction to, or obtain any credit or refund of, any such sales and use Taxes.

SECTION 7. PURPOSE.

7.1 Rights and Obligations. The Parties hereby enter into this Agreement for the purpose of setting forth their respective rights and obligations relating to (i) the furnishing of Services and (ii) the sharing of costs associated therewith between Service Provider and Service Recipient.

7.2 Nature of the Relationship.

(a) The relationship of the Parties under this Agreement is and shall be limited to one of contract. Neither the contractual relationship between the Parties established hereby nor any provision of this Agreement shall be construed to create a partnership or joint venture between the Parties, or make either Party in any way responsible for the indebtedness, obligations, legal compliance or other liabilities of the other Party, except as specifically herein provided. Neither Party shall have any authority or power to act for or bind the other or to encumber, lease or convey any part of or interest in the other Party’s property. The Parties shall develop procedures and practices so that the interests of any Party are not favored or required to be preferred over the interests of the other, except as provided herein.

(b) Except as provided herein, this Agreement shall not in any manner (i) limit the Parties in carrying on their respective separate businesses or activities, (ii) impose upon either Party any fiduciary duty vis-a-vis the other or (iii) impose upon either Party any obligation or liability.

(c) The Parties recognize that some of their respective operations are located at shared sites and that necessary interactions result from the proximity of their businesses and the shared responsibilities resulting from the use of the shared sites. The businesses of the respective Parties will be managed by the Parties, as independent companies, and each will act and conduct business independently. Further, each Party recognizes its responsibility to support the capability of each other Party to continue to conduct their respective businesses for routine and non-routine activities (including but not limited to start-up, shut down, emergency and other infrequent or unanticipated opportunities or events).

SECTION 8. NON-LIABILITY OF THE PARTIES.

8.1 Standard of Care. Service Provider shall perform the Services in a good and workmanlike manner, exercising reasonable skill, care and diligence in performing the same, (i) consistent in all material respects with the practices and processes followed or implemented by Service Provider when performing the same Services in connection with the Service Provider Business, (ii) with the same priority it would afford Service Provider’s operations and (iii) in accordance with prudent industry practices and Applicable Law. Except as described herein or due to a breach hereof, unless caused by the gross negligence or willful misconduct of a Party, the respective Parties shall not be liable for any damage arising out of their performance of this Agreement, whether with respect to the person or property of the other Party or of any of its employees, agents, or invitees, or otherwise.

8.2 Disclaimer of Warranties; Limitation of Liability. SERVICE PROVIDER MAKES NO WARRANTIES OR GUARANTEES, EXPRESS OR IMPLIED, RELATING TO ANY OF THE SERVICES AND SERVICE PROVIDER DISCLAIMS ANY IMPLIED WARRANTIES OR WARRANTIES IMPOSED BY LAW, INCLUDING WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. EXCEPT FOR THE PARTIES’ INDEMNIFICATION OBLIGATIONS WITH RESPECT TO CLAIMS OF THIRD PARTIES, THE PARTIES’ LIABILITY FOR DAMAGES HEREUNDER IS LIMITED TO DIRECT, ACTUAL DAMAGES ONLY, AND NEITHER PARTY SHALL BE LIABLE TO THE OTHER FOR SPECIFIC PERFORMANCE, LOST PROFITS OR OTHER BUSINESS INTERRUPTION DAMAGES, OR SPECIAL, CONSEQUENTIAL, INCIDENTAL, PUNITIVE, EXEMPLARY OR INDIRECT DAMAGES, IN TORT, CONTRACT OR OTHERWISE, OF ANY KIND, ARISING OUT OF OR IN ANY WAY CONNECTED WITH THE PERFORMANCE, THE SUSPENSION OF PERFORMANCE, THE FAILURE TO PERFORM, OR THE TERMINATION OF THIS AGREEMENT.

SECTION 9. INDEMNIFICATION.

9.1 Subject to Section 8, each Party (each an “Indemnitor”) shall defend, indemnify, and hold harmless the other Party, each of such Party’s Affiliates, and the officers, employees, directors, representatives and agents of such Party and its Affiliates (collectively, “Indemnitees”) from and against any and all Liabilities to the extent that they result from, arise out of or relate to (a) an Indemnitor’s (i) breach of this Agreement, (ii) failure to comply with any contract with a third party relating to the Services or (iii) failure to comply with Applicable Law or (b) any gross negligence or willful misconduct of such Indemnitor, its Affiliates or its officers, employees, directors, managers, representatives or agents in connection with the performance of such Party’s obligations under this Agreement. Such Liabilities shall include, but not be limited to, reasonable attorneys’ fees and any other out-of-pocket expenses incurred by an Indemnitee in defending or prosecuting any lawsuit or action that arises out of the performance of this Agreement. Notwithstanding the foregoing, however, an Indemnitor shall not be liable to defend, indemnify or hold harmless any Indemnitee for any Liabilities arising out of or resulting from the gross negligence or willful misconduct of such Indemnitee.

9.2 In addition to the indemnification obligations contained in Section 9.1 above, Service Recipient shall defend, indemnify, and hold harmless Service Provider, each of Service Recipient’s Affiliates, and the officers, employees, directors, representatives and agents of Service Provider and its Affiliates from and against any and all Liabilities to the extent that they result from, arise out of or relate to any allegation, claim, administrative finding or judicial determination that Service Provider, by virtue of its performance of this Agreement is an ‘operator’ or ‘generator’ under the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, or analogous state laws, of any real property owned, operated, leased or occupied by Service Recipient. For purposes of this Article IX, Service Recipient shall be an “Indemnitor” and Service Providers and its Affiliates and their respective officers, employees, directors and agents shall be “Indemnitees”.

9.3 The Parties’ obligations to defend, indemnify and hold each other harmless under the terms of this Agreement shall not vest any rights in or be enforceable by any third party, whether a Governmental Authority or private entity, nor shall they be considered an admission of liability or responsibility for any purposes other than those enumerated in this Agreement. The terms of this Agreement are enforceable only by the Parties and their permitted successors and assigns, and no third party, including a member of Service Recipient, shall have a separate right to enforce any provision of this Agreement, or to compel any Party to comply with the terms of this Agreement.

9.4 The Indemnitee shall notify the Indemnitor as soon as practicable after receiving notice of any claim or proceeding brought against it that might give rise to an indemnity claim under this Agreement (an “Indemnification Claim”) and shall furnish to the Indemnitor the complete details within its knowledge. Any delay or failure by the Indemnitee to give notice to the Indemnitor shall not relieve the Indemnitor of its obligations except to the extent, if any, that the Indemnitor shall have been materially prejudiced by reason of such delay or failure.

9.5 The Indemnitor shall have the right to assume the defense, at its own expense and by its own counsel, of any Indemnification Claim; provided, however, that such counsel is reasonably acceptable to the Indemnitee Notwithstanding the Indemnitor’s appointment of counsel to represent an Indemnitee, the Indemnitee shall have the right to employ separate counsel reasonably acceptable to the Indemnitor, and the Indemnitor shall bear the reasonable fees, costs and expenses of such separate counsel if in the Indemnitee’s reasonable judgment (a) the use of counsel chosen by the Indemnitor to represent the Indemnitee would present such counsel with a conflict of interest or defenses that are available to the Indemnitee that are not available to the Indemnitor or (b) the Indemnitor shall not have employed counsel to represent the Indemnitee within a reasonable time after notice of the institution of such Indemnification Claim. If requested by the Indemnitor, the Indemnitee Party agrees to reasonably cooperate with the Indemnitor and its counsel in contesting any claim or proceeding that the Indemnitor defends, including, if appropriate, making any counterclaim or cross-complaint. All reasonably incurred costs and expenses incurred in connection with the Indemnitee’s cooperation shall be borne by the Indemnitor.

9.6 No Indemnification Claim may be settled or compromised by (a) the Indemnitee without the written consent of the Indemnitor or (b) by the Indemnitor without the written consent of the Indemnitee.

SECTION 10. CONFIDENTIALITY.

From and after the date hereof, each Party shall not and shall cause their directors, officers, employees and Affiliates not to, directly or indirectly, disclose, reveal, divulge or communicate to any person other than authorized officers, directors and employees and Affiliates of the Party or use or otherwise exploit for its own benefit any Confidential Information (as defined below). No Party shall have any obligation to keep confidential (or cause its officers, directors or Affiliates to keep confidential) any Confidential Information if and to the extent disclosure thereof is specifically required by Applicable Law or a dispute between the Parties; provided, however, that in the event disclosure is required by Applicable Law or by regulation and as required by regulatory authorities, the relevant Party shall, to the extent reasonably possible, provide the other Party with prompt notice of such requirement prior to making any disclosure so that the other Party may seek an appropriate protective order. For purposes of this Agreement, “Confidential Information” means any information with respect to the operations and business practices of the other Party, including methods of operation, customer lists, products, prices, fees, costs, inventions, trade secrets, know-how, marketing methods, plans, personnel, suppliers, competitors, markets or other specialized information or proprietary matters. “Confidential Information” does not include, and there shall be no obligation hereunder with respect to, information that (i) is generally available to the public on the date of this Agreement or (ii) becomes generally available to the public other than as a result of a disclosure not otherwise permissible hereunder. The Parties consent to the filing of this Agreement (i) with the Bankruptcy Court in connection with the Bankruptcy Cases and (ii) with the Securities and Exchange Commission.

SECTION 11. FORCE MAJEURE.

11.1 If Service Provider shall be delayed, hindered in or prevented from performing any act required to be performed by it hereunder by any cause or circumstance which is beyond its control including, without limitation, an act of god, strikes, lockouts or other labor troubles occurring with respect to those sites for which Services are being provided hereunder, inability to procure materials (including energy), power failure, casualty, restrictive governmental laws, orders or regulations, riots, insurrection, war or other reason of a like nature not the fault of Service Provider, then performance of any such act shall be extended for a period equivalent to the period of such delay and a reasonable period of recovery thereafter.

11.2 If for any of the reasons set forth above Service Provider shall be unable to perform any obligation when due, Service Provider shall promptly notify Service Recipient of such delay (and the estimated time that such delay shall continue), in writing, and state the cause for the same. Service Provider shall have the obligation to do everything reasonably within its power to remove such cause, but shall not be required to incur any substantial additional expense or materially depart from its normal business practices. Service Recipient shall not be required to pay for any disrupted Services during the period in which they are not being provided to Service Recipient pursuant to the terms of this Agreement.

SECTION 12. NOTICES.

12.1 Any notices and other communications hereunder shall be in writing and shall be deemed to have been duly given upon receipt if (i) hand delivered personally, (ii) mailed by certified or registered mail, return receipt requested, (iii) sent by Federal Express or other express carrier, fee prepaid, (iv) sent via facsimile with receipt confirmed or (v) sent via electronic email with receipt confirmed, provided that such notice or communication is addressed to the respective Parties at the following addresses:

SemCrude, L.P.

Two Warren Place

6120 S. Yale Avenue, Suite 700

Tulsa, Oklahoma 74136

Phone: (918) 524-8100

Fax: (918) 524-8290

Attention: Chief Financial Officer

With a copy to:

Weil, Gotshal & Manges LLP

200 Crescent Court, Suite 300

Dallas, Texas 75201

Phone: 214-746-7700

Fax: 214-746-7777

Attention: Michael A. Saslaw, Esq.

SemGroup Energy Partners, L.L.C.

Two Warren Place

6120 S. Yale Avenue, Suite 500

Tulsa, Oklahoma 74136

Phone: (918) 524-5500

Fax: (918) 524-5805

Attention: Chief Financial Officer

With a copy to:

Baker Botts L.L.P.

2001 Ross Avenue, Suite 700

Dallas, Texas 75201

Phone: (214) 953-6500

Fax: (214) 953-6503

Attention: Doug Rayburn, Esq.

12.2 Any Party may change the person and address to which notices or other communications to it hereunder are to be sent by giving written notice of any such change to the other Party in the manner provided in this Section 12.

SECTION 13. GENERAL PROVISIONS.

13.1 Entire Agreement; Exhibits and Schedules. This Agreement, and the Exhibits hereto, represent the entire understanding and agreement between the Parties hereto with respect to the subject matter hereof and supersede any previous agreements or correspondence between the Parties with respect to the same. All Exhibits annexed hereto or referred to herein are hereby incorporated in and made a part of this Agreement as if set forth in full herein. Any capitalized terms used in any Exhibit but not otherwise defined therein shall be defined as set forth in this Agreement.

13.2 Amendments and Waivers. This Agreement and the Exhibits hereto can be amended, supplemented or changed, and any provision hereof can be waived, only by written instrument making specific reference to this Agreement or the Exhibit hereto signed by the Party against whom enforcement of any such amendment, supplement, modification or waiver is sought. The Parties hereby acknowledge and agree that a material amendment to this Agreement or any of the Exhibits requires the approval of the Bankruptcy Court prior to the effective date of the plan of reorganization in the Bankruptcy Cases. The waiver by any Party hereto of a breach of any provision of this Agreement shall not operate or be construed as a further or continuing waiver of such breach or as a waiver of any other or subsequent breach. No failure on the part of any Party to exercise, and no delay in exercising, any right, power or remedy hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of such right, power or remedy by such Party preclude any other or further exercise thereof or the exercise of any other right, power or remedy.

13.3 Assignment; Successors. This Agreement shall be personal to each Party and no Party may assign or transfer (directly or indirectly, by merger, consolidation, operation of law or otherwise) its rights or obligations hereunder without the prior written consent of the other Party, such consent not to be unreasonably withheld, conditioned or delayed; provided, however, that a Party may assign, without the prior written consent of each other Party, this Agreement or their respective rights and obligations hereunder, in whole or in part, to an Affiliate or any successor in interest of such Party, including the purchaser of all or substantially all of the assets of such Party. This Agreement shall inure to the benefit of, and shall be binding upon, the Parties and their respective permitted successors and assigns, including with respect to Service Provider, any reorganized debtor entity appointed pursuant to the plan of reorganization of Service Provider.

13.4 Counterparts. This Agreement may be executed in any number of counterparts each of which, when so executed and delivered (including by facsimile or electronic mail transmission), will be deemed an original but all of which together will constitute one and the same instrument.

13.5 Headings. The captions of this Agreement are for convenience only and are not a part of this Agreement and do not in any way limit or amplify the terms and provisions of this Agreement and shall have no effect on its interpretation.

13.6 Severability. If any term or provision of this Agreement is invalid, illegal or incapable of being enforced by Law or public policy, all other terms and provisions of this Agreement shall nevertheless remain in full force and effect so long as the legal and economic substance of the transactions contemplated hereby is not affected in any manner materially adverse to any Party. Upon such determination that any term or provision is invalid, illegal or incapable of being enforced, the parties hereto shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties as closely as possible in an acceptable manner in order that the transactions contemplated hereby are consummated as originally contemplated to the greatest extent possible.

13.7 Governing Law; Waiver of Jury Trial. THIS AGREEMENT, THE RIGHTS AND OBLIGATIONS OF THE PARTIES UNDER THIS AGREEMENT, AND ANY CLAIM OR CONTROVERSY DIRECTLY OR INDIRECTLY BASED UPON OR ARISING OUT OF THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT (WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY), INCLUDING ALL MATTERS OF CONSTRUCTION, VALIDITY AND PERFORMANCE, SHALL IN ALL RESPECTS BE GOVERNED BY AND INTERPRETED, CONSTRUED, AND DETERMINED IN ACCORDANCE WITH, THE INTERNAL LAWS OF THE STATE OF OKLAHOMA (WITHOUT REGARD TO ANY CONFLICT OF LAWS PROVISION THAT WOULD REQUIRE THE APPLICATION OF THE LAW OF ANY OTHER JURISDICTION). THE PARTIES HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVE, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT THAT THEY MAY HAVE TO TRIAL BY JURY OF ANY CLAIM OR CAUSE OF ACTION, OR IN ANY PROCEEDING, DIRECTLY OR INDIRECTLY BASED UPON OR ARISING OUT OF THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT (WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY). EACH PARTY CERTIFIES THAT NO REPRESENTATIVE, AGENT, OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER.

13.8 Enforcement.

(a) Without limiting any Party’s right to appeal any Order of the Bankruptcy Court, (i) the Bankruptcy Court shall retain exclusive jurisdiction to enforce the terms of this Agreement and to decide any claims or disputes which may arise or result from, or be connected with, this Agreement, any breach or default hereunder, or the transactions contemplated hereby, and (ii) any and all actions related to the foregoing shall be filed and maintained only in the Bankruptcy Court, and the Parties hereby consent to and submit to the jurisdiction and venue of the Bankruptcy Court and shall receive notices at such locations as indicated in Section 12.1; provided, however, that if a plan of reorganization has become effective in the Bankruptcy Cases, the Parties agree to and hereby unconditionally and irrevocably submit to the jurisdiction of any federal or state court in Oklahoma and any appellate court from any thereof, for the resolution of any such claim or dispute.

(b) The Parties hereby unconditionally and irrevocably waive, to the fullest extent permitted by Applicable Law, any objection which they may now or hereafter have to the laying of venue of any dispute arising out of or relating to this Agreement or any of the transactions contemplated hereby brought in any court specified in paragraph (a) above, or any defense of inconvenient forum for the maintenance of such dispute. Each of the Parties hereto agrees that a judgment in any such dispute may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law.

(c) Each of the Parties hereto hereby consents to process being served by any Party to this Agreement in any suit, action or proceeding by the mailing of a copy thereof in accordance with the provisions of Section 12.1(ii); provided, however, that such service shall not be effective until the actual receipt thereof by the Party being served.

[Signature page follows.]

IN WITNESS WHEREOF, the Parties hereto have made and executed this Agreement as of the day and year first above written to be effective as of the Effective Date.

SERVICE PROVIDER

SEMGROUP, L.P.

By: SemGroup G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMCRUDE, L.P.

By: SemOperating G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMMATERIALS, L.P.

By: SemOperating G.P., L.L.C., its general partner

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SEMMANAGEMENT, L.L.C.

By: /s/ Terrence Ronan

Name: Terrence Ronan

Title: President & CEO

SERVICE RECIPIENT

SEMGROUP ENERGY PARTNERS, L.P.

By: SemGroup Energy Partners G.P., L.L.C., its general partner

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMGROUP ENERGY PARTNERS, L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMGROUP CRUDE STORAGE, L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMPIPE G.P., L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMPIPE, L.P.

By: SemPipe G.P., L.L.C.,

its general partner

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SEMMATERIALS ENERGY PARTNERS, L.L.C.

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

SGLP ASPHALT L.L.C.

By: SemMaterials Energy Partners, L.L.C.,

its sole member

By: /s/ Alex G. Stallings

Name: Alex G. Stallings

Title: Chief Financial Officer and Secretary

EXHIBIT A

CORPORATE TRANSITION SERVICES

ARTICLE I. TERM AND TERMINATION.

Section 1.01 Term. Subject to earlier termination in accordance with the provisions of Section 1.02 of this Exhibit A, Service Provider may provide the Services on this Exhibit A for an initial period of one (1) month, commencing on the Effective Date, or for such shorter period as provided in this Exhibit A. Services under Sections 2.03 and 2.05 of this Exhibit A will be for an initial period of two (2) months. Parties may mutually agree to extend the term of the sections in this Exhibit A, except for Section 2.05, for up to two additional one (1) month periods. The term of Section 2.05 of this Exhibit A cannot be extended beyond the initial period of two (2) months.

Section 1.02 Early Termination. This Agreement may be terminated with respect to the transition services in this Exhibit A in the following cases:

| (a) | by Service Recipient upon not less than five (5) days’ prior written notice to Service Provider with respect to all or any portion of the Services provided to it to it by Service Provider; provided, however, that the Parties may mutually agree in writing to shorten such notice period prior to termination of Services; |

| (b) | by Service Provider with respect to the Services provided to Service Recipient upon not less than fifteen (15) days’ prior written notice to Service Recipient in the event of a material breach by Service Recipient of any term or provision of this Agreement, unless such breach has been cured within five (5) days from receipt by Service Recipient of such notice; provided, however; that nonpayment of any Disputed Items that remain outstanding in accordance with Section 5.2(b) of this Agreement shall not constitute a breach of this Agreement; |

| (c) | by Service Provider with respect to any Service outlined in this Exhibit A provided to Service Recipient upon not less than fifteen (15) days’ prior written notice to Service Recipient in the event Service Provider experiences a loss of employees that results in Service Provider being unable to fulfill any Service outlined in this Exhibit A; provided, however, that Service Recipient and Service Provider may agree to a temporary suspension, allow Service Provider to cover with other employees, allow Service Provider five (5) days prior written notice if employees terminate employment with no notice period to Service Provider, or allow Service Provider to use Outsourced Service for Services rather than termination; and |

| (d) | by Service Provider and Service Recipient upon mutual agreement. |

ARTICLE II. SERVICES PROVIDED AND CHARGES.

Section 2.01 General.

| (a) | Service Provider will provide Service Recipient with the services of such employees as are needed to provide the Services outlined in this Exhibit A. The charges and other terms and conditions relating to such Services are more particularly described in Sections 2.02-2.05 below. |

| (b) | Services will be provided (i) consistent in all material respects with practices and processes for the performance of such Services as historically provided by the Service Provider to Service Recipient and those the Service Provider provides for its own operations, to the extent applicable, (ii) as specifically noted in Sections 2.02-2.05 below, (iii) with the same priority that Service Provider would afford Service Provider’s operations except as provided in Section 2.01(c), and (iv) in accordance with Applicable Law. |

| (c) | To the extent applicable, Service Recipient acknowledges that Service Provider must also facilitate its own business operations and may be required to prioritize work from time to time. In such instances, Service Provider will notify Service Recipient of any delay or issues in providing the Service. If Service Recipient is unsatisfied with the delay, Service Recipient may exercise its rights in Section 1.02(a). |

Section 2.02 Corporate Accounting Support.

| (a) | Service Provider will provide continued applicable access to and applicable support for Service Provider’s accounting systems to enable Service Recipient to close their March 2009 accounting books. To the extent applicable and in compliance with Service Provider’s legal limitations, Service Provider will work with Service Recipient to migrate needed accounting records to Service Recipient. Together these services represent the corporate accounting support (“Corporate Accounting Service”) Service Provider will provide to Service Recipient. |

| (b) | Service Provider will not have access to Service Recipient’s accounting system and as such will not directly make any accounting entry into Service Recipient’s accounting system; provided, that Service Provider will provide Service Recipient appropriate documentation to support accounting entries related to the services provided under this Section 2.02 by Service Provider. Service Provider will not have access to Service Recipient’s bank accounts and as such will not process payments for any accounts payable or accounts receivable for Service Recipient. |

| (c) | Service Recipient’s access to Service Provider’s accounting system will be limited to entries relating to the time period prior to March 31, 2009. |

| (d) | Corporate Accounting Charge = Corporate Accounting Fixed Fee + Corporate Accounting Outsourced Service Charges |

| (i) | Charges related to Service Provider’s internal costs will be charged at a fixed rate of $21,000 (“Corporate Accounting Base Fee”). Upon the termination of this service, the fixed rate will be prorated for the portion of the calendar month the service is provided. |

| 1) | Corporate Accounting Fixed Fee = Corporate Accounting Base Fee * (Month Calendar Days for Service/Month Total Calendar Days). |

| (ii) | Outsourced Service charges related to Corporate Accounting Services (“Corporate Accounting Outsourced Service Charges”) incurred by Service Provider in providing Corporate Accounting Services to Service Recipient will be charged to Service Recipient. |

Section 2.03 Property and Sales and Use Tax Support.

| (a) | Service Provider will provide to Service Recipient property and sales and use tax compliance support to Service Recipient (“Tax Service”). Compliance support will include the preparation of the applicable property, sales and use tax returns based upon information provided by Service Recipient. Service Recipient will be responsible for the review, signature and filing/mailing of the returns |

| (b) | Service Provider will not have access to Service Recipient’s accounting system and as such will not directly make any accounting entry into Service Recipient’s accounting system; provided, that Service Provider will provide Service Recipient appropriate documentation to support accounting entries related to the services provided by Service Provider under this Section 2.03. Service Provider will not have access to Service Recipient’s bank accounts and as such will not process any tax related accounts payable or accounts receivable for Service Recipient. |

| (c) | Service Provider will work with Service Recipient to transition the Tax Service to a tax service provider as designated by Service Recipient during the Term of this Exhibit A. If Service Recipient needs additional transition time after the Term of this Exhibit A, the Parties will work in good faith to enter into an agreement to provide such Tax Services. |

| (i) | If Service Recipient chooses to use the same tax service provider as Service Provider and the tax service provider is willing to credit a portion of Service Provider’s 2009 prepaid fees to such tax service provider to Service Recipient, Service Recipient will reimburse Service Provider for such prepaid fees. |

| (d) | Tax Service Charge = Tax Service Fixed Fee + Tax Service Outsourced Service Charges |

| (i) | Charges related to Service Provider’s internal costs will be charged at a fixed rate of $30,000 (“Tax Service Base Fee”). Upon the termination of this service, the fixed rate will be prorated for the portion of the calendar month the service is provided. |

| 1) | Tax Fixed Fee = Tax Base Fee * (Month Calendar Days for Service/Month Total Calendar Days). |

| (ii) | Outsourced Service charges related to Tax Services (“Tax Outsourced Service Charges”) incurred by Service Provider in providing Tax Services to Service Recipient will be charged to Service Recipient. |

| (e) | Service Provider will rely on information provided by Service Recipient in providing Tax Services. Service Provider is not responsible for the accuracy of any data provided by Service Recipient. |

Section 2.04 Information Technology Support.

| (a) | Service Provider will provide applicable access to and support for Service Provider’s information technology platform that Service Recipient had immediately prior to the Effective Date, including, without limitation, telecommunication services, and excluding any exceptions noted in this Exhibit A (“IT Service”). |

| (b) | To the extent applicable and in compliance with Service Provider’s legal limitations and to the extent such actions do not jeopardize Service Provider’s own records, Service Provider will work with Service Recipient to migrate to Service Recipient needed electronic data files to operate their business. Electronic data files will include historical files related to Service Recipient’s operations and electronic mail. Service Recipient will continue efforts to establish its own information technology capabilities and Service Provider will work with Service Recipient to establish a mutually agreeable cutover date for information technology across Service Recipient’s businesses. |

| (c) | Through December 31, 2009, Service Provider agrees to forward any and all electronic mail or other communications intended for Service Recipient or any of its officers, directors, employees, contractors, and agents at no cost to the extent the volume is reasonable and Service Recipient has made reasonable efforts to notify parties of Service Recipient’s new electronic addresses. |

| (d) | IT Charge = IT Fixed Fee + IT Outsourced Service Charges |

| (i) | Charges related to Service Provider’s internal costs will be charged at a fixed rate of $42,000 (“IT Base Fee”). Upon the termination of this service, the fixed rate will be prorated for the portion of the calendar month the service is provided. |

| 1) | IT Fixed Fee = IT Base Fee * (Month Calendar Days for Service/Month Total Calendar Days). |

| (ii) | Outsourced Service charges related to IT Services (“IT Outsourced Service Charges”) incurred by Service Provider in providing IT Services to Service Recipient will be charged to Service Recipient. |

Section 2.05 Warren Place Sub Lease.

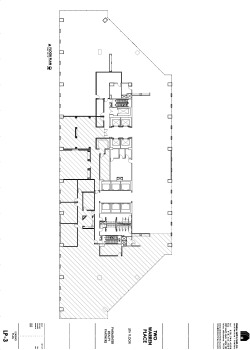

| (a) | Service Recipient will reimburse Service Provider for office space and associated operating costs for office space that Service Recipient subleases in suite 500 (“Service Recipient Office Sub Lease”) from Service Provider at 6120 South Yale Avenue, Tulsa, Oklahoma (“Service Provider Office Lease”). A graphical representation of the square footage associated with such Service Recipient Office Sub Lease is attached hereto as Schedule 2.05(a). |

| (b) | Service Provider acknowledges that Service Recipient owns all office furniture and furnishings, computer hardware, printers, telephones and other communications devices, televisions, office supplies, copiers, equipment, fixtures, cubicles, leasehold improvements and other tangible personal property (“Furniture and Equipment”) located within the office space that is the subject of the Service Recipient Office Sub Lease. Service Recipient acknowledges that, except for personal effects, including artwork, owned by Service Recipient's or its Affiliates’ employees, Service Provider owns the art work in the Service Recipient Office Sub Lease, including, but not limited to, the art work listed on Schedule 2.05(b), and Service Provider will remove such art work from Service Recipient Office Sub Lease within thirty (30) days of the Effective Date of this Agreement. |

| (c) | Service Provider currently provides services relating to the security of the office space that is the subject of the Service Recipient Office Sub Lease, including access to and from such office space. Service Provider will continue to provide such services and agrees to work with Service Recipient to transition these security services to another provider on or before the expiration of the Term of this Section 2.06 of Exhibit A to the extent applicable. |

| (d) | Office Sub Lease Charge = Office Sub Lease Rent + Office Sub Lease Outsourced Service Charge |

| (i) | Office Sub Lease Rent = (Office Sub Lease Square Feet * (Sub Lease Rental Rate + Sub Lease Operating Rate))/12 |

| 1) | Service Recipient currently sub-leases 12,476 square feet from Service Provider; however, to the extent Service Recipient increases or decreases their office space the square feet will be adjusted accordingly upon mutual agreement by both Parties (“Office Sub Lease Square Feet”). |

| 2) | Service Recipient will be charged a lease rental rate of $17.50 per square foot, to the extent Service Provider’s lease rental rate increases or decreases such increase or decrease will be applied to Service Recipient’s lease rental rate (“Sub Lease Rental Rate”). |

| 3) | Service Recipient will be charged an operating cost of $2.00 per square foot (“Sub Lease Operating Rate”). Sub Lease Operating Rate excludes costs of parking associated with the Service Recipient Office Sub Lease. |

| 4) | Sub Lease Rental Rate and Sub Lease Operating Rate are annual rates and will be divided by twelve (12) calendar months in the annual period. |

| (ii) | Outsourced Service charges related to the Service Provider Office Lease (“Office Lease Outsourced Service Charges”) incurred by Service Provider will be allocated to Service Provider or Service Recipient, as applicable, when charges can be identified to a specific Party or, when such charges cannot be so identified, will be allocated to Service Recipient based on Office Sub Lease Square Feet compared to the total square feet of Service Provider Office Lease. Parking associated with Service Recipient Office Sub Lease will be charged as Office Lease Outsourced Service Charges. |

| (e) | If Service Recipient wants to make a modification to the Office Sub Lease Square Feet prior to May 31, 2009, Service Recipient will first obtain Service Provider’s consent which may be conditioned on receiving Service Provider’s landlord consent. If Service Recipient receives consent from Service Provider to make a modification, Service Recipient is responsible for any costs associated with making the modification and any modification will be consistent with the modification plan that was provided to the Service Provider to gain consent. |

| (f) | Service Provider may choose to formalize the Service Recipient Office Sub Lease with a formal sub lease agreement the terms of which will be consistent with those outlined herein. Service Recipient agrees to cooperate and work in good faith to negotiate and execute such agreement if requested by Service Provider. |

| (g) | Service Recipient is responsible for negotiating a direct lease with the Service Provider Office Lease landlord or procuring alternate office space by May 31, 2009. Service Provider (i) no longer intends to lease the office space that is the subject of the Service Recipient Office Sub Lease as of May 31, 2009, (ii) intends to notify the landlord of the Service Provider Office Lease regarding such intent, and (iii) agrees to take all reasonably necessary actions to terminate the office space that is the subject of the Service Recipient Office Sub Lease with the landlord of the Service Provider Office Lease on or prior to May 31, 2009. In no event shall Service Recipient be responsible for costs, expenses, fees or penalties associated with such termination. |

Section 2.06 Administrative Charge.

| (a) | Service Provider will add an administrative charge of 25% to all fixed fees, except Office Sub Lease Rent, beginning with the second calendar month from the Effective Date; provided, however, such administrative charge will not exceed $25,000 per calendar month. For clarity, there will be no administrative charge for the first calendar month from the Effective Date. |

| (b) | Administrative Charge is; |

| (i) | For calendar month one, Administrative Charge = $0.00; |

| (ii) | For calendar months two and three, Administrative Charge = Lessor of $25,000 or (.25 * (Corporate Accounting Fixed Fee + Tax Service Fixed Fee + IT Fixed Fee)). |

Section 2.07 Payment of Charges.

| (a) | Services outlined in this Exhibit A will be invoiced monthly in accordance with Section 5 of this Agreement. |

Section 2.08 Amendment to Exhibit.

| (a) | Changes to the Services provided under this Exhibit A must be formalized as an amendment to this Exhibit A and accepted in writing by the Parties. |

EXHIBIT B

CRUDE TRANSITION SERVICES

ARTICLE I. TERM AND TERMINATION.

Section 1.01 Term. Subject to earlier termination in accordance with the provisions of Section 1.02 of this Exhibit B, Service Provider may provide the Services on this Exhibit B for a period of one (1) month, commencing on the Effective Date, or for such shorter period as provided in this Exhibit B. Parties may mutually agree to extend the Term of this Exhibit B for up to three additional one (1) month periods, provided, however, the decision to extend the Term of this Exhibit B is at the sole election of the Service Recipient if Service Provider has not complied with Section 2.01(b). In no event shall the Term of this Exhibit B extend beyond four (4) months from the Effective Date.

Section 1.02 Early Termination. This Agreement may be terminated with respect to the transition services in this Exhibit B in the following cases:

| (a) | by Service Recipient upon not less than five (5) days’ prior written notice to Service Provider with respect to all or any portion of the Services provided to it to it by Service Provider; provided, however, that the Parties may mutually agree in writing to shorten such notice period prior to termination of Services; |

| (b) | by Service Provider with respect to the Services provided to Service Recipient upon not less than fifteen (15) days’ prior written notice to Service Recipient in the event of a material breach by Service Recipient of any term or provision of this Agreement, unless such breach has been cured within five (5) days from receipt by Service Recipient of such notice; provided, however; that nonpayment of any Disputed Items that remain outstanding in accordance with Section 5.2(b) of this Agreement shall not constitute a breach of this Agreement; |

| (c) | by Service Provider with respect to any Service outlined in this Exhibit B provided to Service Recipient upon not less than fifteen (15) days’ prior written notice to Service Recipient in the event Service Provider experiences a loss of employees that results in Service Provider being unable to fulfill any Service outlined in this Exhibit B; provided, however, that Service Recipient and Service Provider can agree to a temporary suspension, allow Service Provider to cover with other employees, allow Service Provider five (5) days prior written notice if employees terminate employment with no notice to Service Provider or Service Provider has complied with Section 2.01(b), or allow Service Provider to use Outsourced Service for Services rather than termination; and |

| (d) | by Service Provider and Service Recipient upon mutual agreement. |

ARTICLE II. SERVICES PROVIDED AND CHARGES.

Section 2.01 General.

| (a) | Service Provider will provide Service Recipient with the services of such employees as are needed to provide the Services outlined in this Exhibit B. The charges and other terms and conditions relating to such Services are more particularly described in Section 2.02 below. |

| (b) | The Parties acknowledge that the Services are being provided to allow sufficient time for Service Recipient to hire accounting employees to perform Service Recipient’s crude accounting. Such employees may be hired from Service Provider’s crude oil accounting staff. Service Provider agrees to take all reasonable actions such that Service Recipient can make an offer of employment to such Service Provider employees prior to the expiration of the Term and Service Provider will be in compliance with this Section 2.01 to the extent such actions are taken. The Parties acknowledge that the acceptance of employment is solely at the discretion of the individuals being offered employment. |

| (c) | Services will be provided (i) consistent in all material respects with practices and processes for the performance of such Services as historically provided by the Service Provider and those the Service Provider provides for its own operations, to the extent applicable, (ii) as specifically noted in Section 2.02 below, (iii) with the same priority that Service Provider would afford Service Provider’s operations, and (iv) in accordance with Applicable Law. |

Section 2.02 Crude Oil Accounting Support.

| (a) | Service Provider will provide to Service Recipient crude oil accounting support in Oklahoma City, Oklahoma consistent with historical services provided to Service Recipient by Service Provider (“Crude Oil Accounting Service”). |

| (b) | Service Provider will not have access to Service Recipient’s accounting system and as such will not directly make any accounting entry into Service Recipient’s accounting system; provided, that Service Provider will provide Service Recipient appropriate documentation to support accounting entries related to the Crude Oil Accounting Service provided by Service Provider. Service Provider will not have access to Service Recipient’s bank accounts and as such cannot process any accounts payable or accounts receivable on behalf of Service Recipient. |

| (c) | Crude Accounting Charge = Crude Accounting Fixed Fee + Crude Accounting Outsourced Service Charges |

| (i) | Charges related to Service Provider’s internal costs will be charged at a fixed rate of $23,000 (“Crude Accounting Base Fee”). Upon the termination of this service, the fixed rate will be prorated for the portion of the calendar month the service is provided. |

| 1) | Crude Accounting Fixed Fee = Crude Accounting Base Fee * (Month Calendar Days for Service/Month Total Calendar Days). |

| (ii) | Outsourced Service charges related to Crude Accounting Services (“Crude Accounting Outsourced Service Charges”) incurred by Service Provider in providing Crude Accounting Services to Service Recipient will be charged to Service Recipient. |

| (d) | If Service Provider desires to change historical operating practices in crude oil accounting, Service Provider will first consult with Service Recipient and procure Service Recipient’s concurrence with the desired change. If Service Recipient does not concur with the desired change, Service Provider will not make any changes to historical practice. |

Section 2.03 Administrative Charge.

| (a) | Service Provider will not apply an administrative charge for the Services provided under this Exhibit B. |

Section 2.04 Payment of Charges.

| (a) | Services outlined in this Exhibit B will be invoiced monthly in accordance with Section 5 of this Agreement. |

Section 2.05 Amendment to Exhibit.

| (a) | Changes to the Services provided under this Exhibit B must be formalized as an amendment to this Exhibit B and accepted in writing by the Parties. |

EXHIBIT C

MATERIALS TRANSITION SERVICES

ARTICLE I. TERM AND TERMINATION.

Section 1.01 Term. Subject to earlier termination in accordance with the provisions of Section 1.02 of this Exhibit C, Service Provider may provide the Services on this Exhibit C for a period of three (3) months, commencing on the Effective Date, or for such shorter period as provided in this Exhibit C. Parties may mutually agree to extend the term of this Exhibit C for up to two additional one (1) month periods. Notwithstanding the foregoing, the Term for the Utility Deposit Transition Period shall be as indicated in Section 2.04.

Section 1.02 Early Termination. This Agreement may be terminated with respect to the transition services in this Exhibit C in the following cases:

| (a) | by Service Recipient upon not less than fifteen (15) days’ prior written notice to Service Provider with respect to all or any portion of the Services provided to it to it by Service Provider; provided, however, that the Parties may mutually agree in writing to shorten such notice period prior to termination of Services; |

| (b) | by Service Provider with respect to the Services provided to Service Recipient upon not less than fifteen (15) days’ prior written notice to Service Recipient in the event of a material breach by Service Recipient of any term or provision of this Agreement, unless such breach has been cured within five (5) days from receipt by Service Recipient of such notice; provided, however; that nonpayment of any Disputed Items that remain outstanding in accordance with Section 5.2(b) of this Agreement shall not constitute a breach of this Agreement; |

| (c) | by Service Provider with respect to any Service outlined in this Exhibit C provided to Service Recipient upon not less than fifteen (15) days’ prior written notice to Service Recipient in the event Service Provider eliminates the employees, such employees terminate their employment with notice, or Service Recipient hires the employees that enable Service Provider to fulfill any Service outlined in this Exhibit C; provided, however, that Service Recipient may allow Service Provider five (5) days prior written notice if employees terminate employment with no notice period to Service Provider; and |

| (d) | by Service Provider and Service Recipient upon mutual agreement. |

ARTICLE II. SERVICES PROVIDED AND CHARGES.

Section 2.01 General.

| (a) | Service Provider will provide Service Recipient with the services of such employees as are needed to provide the Services outlined in this Exhibit C and the Parties will provide to each other the Services outlined in this Exhibit C. The charges and other terms and conditions relating to such Services are more particularly described in Sections 2.02-2.04 below. |

| (b) | Service Recipient acknowledges that Service Provider is in the process of winding down Service Provider’s SemMaterials operations and that the winding down of the operations will impact employee staffing and may impact operational practices. To the extent Service Provider’s wind down of SermMaterials results in elimination of employees providing the Service, Service Provider may terminate the Service provided in accordance with Section 1.02. |

| (i) | To the extent Service Recipient is interested in offering employment to SemMaterials’ employees, Service Recipient and Service Provider will work together in good faith to develop a process to facilitate employment offers to employees. |

| (c) | To the extent Service Recipient has provided the SemMaterials Tulsa, Oklahoma office as a mailing address to receive correspondence of any nature, Service Recipient is responsible for contacting parties and providing parties with an alternate mailing address. During the term of this Exhibit C, Service Provider will use its reasonable best efforts to forward Service Recipient correspondence to Service Recipient to the extent the office is open and Service Provider has adequate staffing. |

| (d) | SemMaterials will transfer operational responsibility for each Asphalt Site to Service Recipient during the term of this Exhibit C. The date Service Provider notifies Service Recipient of the transfer of operational responsibility for each Asphalt Site will be the “Asphalt Site Transfer Date”. Service Provider will terminate Outsourced Service associated with each Asphalt Site on or before the Asphalt Site Transfer Date with the exception of utilities which are covered in Section 2.04 of this Exhibit C. |

| (e) | As of the Effective Date, Service Provider will carry insurance coverage pertaining to SemMaterials’ assets owned by Service Provider. Service Recipient is responsible for any insurance coverage related to assets owned by it as of the Effective Date. |

| (f) | The Parties acknowledge and agree that the Services provided hereunder will allow Service Recipient to provide asphalt cement and other product terminalling and storage services on behalf of Service Provider and other third parties, subject to the limitations referenced in this Exhibit C. |

| (i) | To the extent Service Recipient services to other third parties significantly increases the Services provided under this Exhibit C, Parties agree to negotiate in good faith to modify this agreement to reflect such increases in Service levels. |

| (g) | Services will be provided (i) consistent with Services the Service Provider provides for its own operations, to the extent applicable, (ii) as specifically noted in Sections 2.02-2.04 below, (iii) with the same priority that Service Provider would afford Service Provider’s operations except as provided in Section 2.01(h) and (iv) in accordance with prudent industry practices, if applicable, and Applicable Law. |

| (h) | To the extent applicable, Service Recipient acknowledges that Service Provider must facilitate its own business operations and may be required to prioritize work from time to time. In such instances, Service Provider will notify Service Recipient of any delay or issues in providing the Service. If Service Recipient is unsatisfied with the delay, Service Recipient may exercise its rights in Section 1.02(a). |

Section 2.02 Operational Support

| (a) | Service Provider will provide operational services, including operational management, engineering and environmental, health, and safety, to Service Recipient to support operations of the Asphalt Sites (“Operational Service”). To the extent Service Recipient hires employees to perform any services covered in this Section 2.02, Service Provider will no longer provide such service. |

| (b) | Operational Charge = Operational Labor Fee + Operational Outsourced Service Charges |

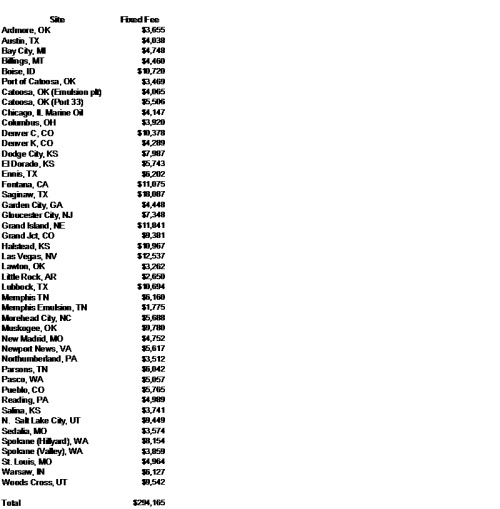

| (i) | Charges related to Service Provider’s labor costs will be charged at a fixed rate per Asphalt Site as outlined in Schedule 2.02 (“Operational Base Fee”) up until the Asphalt Site Transfer Date. Upon the Asphalt Site Transfer Date, the fixed rate for the applicable Asphalt Site will be prorated for the portion of the calendar month the service is provided. |

| (ii) | On and after the Asphalt Site Transfer Date and to the extent the Service Provider continues to employee operational staff at an Asphalt Site that is expected to transfer to Service Recipient, Service Recipient will reimburse Service Provider the Labor Cost of Service Recipient’s operational staff that is employed by Service Provider at such Asphalt Site. If applicable, Labor Cost will be prorated for the portion of the calendar month the service is provided. |

| 1) | Operational Labor Fee = Sum of all (Operational Base Fee * (Month Calendar Days for Service/Month Total Calendar Days)) + Sum of all (Labor Cost * (Month Calendar Days for Service/Month Total Calendar Days)). |

| (iii) | Outsourced Service charges related to Operational Services (“Operational Outsourced Service Charges”) incurred by Service Provider in providing Operational Services to Service Recipient will be charged to Service Recipient as outlined in Section 2.03(d) of this Exhibit C. |

Section 2.03 Corporate Support

| (a) | Service Provider will provide corporate employee support, including inventory, accounts payable and accounting data transfer, permit, utilities, engineering, environmental, health, and safety support to Service Recipient to support operations of the Asphalt Sites (“Corporate Service”). To the extent Service Recipient hires employees to perform any services covered in this Section 2.03, Service Provider will no longer provide such service. |

| (b) | Corporate Service Charge = Corporate Fixed Fee + Corporate Outsourced Service Charges |

| (i) | Charges related to Service Provider’s internal costs will be charged at a fixed rate of $166,000 (“Corporate Base Fee”). Upon the termination of any service of this Corporate Service, the fixed rate will be prorated for the portion of the calendar month the service is provided. |

| 1) | Corporate Fixed Fee = Sum of (Corporate Base Fee * Applicable Corporate Percentage * Applicable (Month Calendar Days for Service/Month Total Calendar Days)) |

| 2) | Each service of the Corporate Service represents a percentage of the Corporate Base Fee (“Corporate Percentage”). For each service of the Corporate Service, the Corporate Percentage is as shown below with sum equaling 100%: |

| a) | Inventory Service equals 20%; |

| b) | Accounts Payable and Accounting Data Transfer Service equals 22%; |

| c) | Permit Service equals 22%; |

| d) | Utilities Support equals 11%; |

| e) | Engineering Service equals 9%, and; |

| f) | Health Safety and Environmental Service equals 16%. |

| (ii) | Outsourced Service charges related to Corporate Services (“Corporate Outsourced Service Charges”) incurred by Service Provider in providing Corporate Services to Service Recipient will be charged to Service Recipient. |

| (c) | Inventory Reporting Support |

| (i) | Service Provider will provide inventory services, including, without limitation, the reporting and calculation of inflows and outflows of volumes of asphalt cement or other product at the Asphalt Sites (“Inventory Service”). Inventory Service shall include, without limitation, the preparation and delivery by Service Provider of the BAPCO Weekly Inventory Report to Service Recipient consistent with historical practice.; provided, however, to the extent Service Recipient has access to the applicable SemMaterials Software that generates such reporting, Service Provider will only provide Inventory Service for up to thirty (30) days after such applicable SemMaterials Software is available to Service Recipient. |

| 1) | Service Provider will keep records and reports relating to the recording of the volume of asphalt cement and other product received into and delivered from the terminals and storage tanks at the Asphalt Sites and calculated in accordance with historical practice. All such records and reports for the prior month will be delivered to Service Recipient within ten (10) days of the end of each month. |

| (ii) | Service Provider will not have access to Service Recipient’s accounting system and, as such, will not directly make any accounting entry into Service Recipient’s accounting system; provided, that Service Provider will provide documentation for services in this Section 2.03 necessary for the making of such entries by Service Recipient. |

| (d) | Accounts Payable and Accounting Data Transfer Support. |

| (i) | Service Provider will provide accounts payable support for SemMaterials consistent with historical practice and accounting data transfer support as outlined in Exhibit E of this Agreement (“Accounts Payable and Accounting Data Transfer Service”) to the extent applicable given certain limitations as outlined herein. Accounts payable support will be limited to receiving invoices, coding invoices, and delivering invoices to Service Recipient for processing. |

| (ii) | Invoices covering services that relate to the Asphalt Site up to the Asphalt Site Transfer Date will be coded to Service Recipient or Service Provider consistent with historical practices. For invoices covering services on and after the Asphalt Site Transfer Date all invoices will be coded directly to Service Recipient. Any such invoices relating to Service Recipient’s business will be sent directly to Service Recipient for payment to such vendor. |

| (iii) | Service Provider will not have access to Service Recipient’s accounting system and as such will not directly make any accounting entry into Service Recipient’s accounting systems; provided, that Service Provider will provide Service Recipient appropriate documentation to support accounting entries related to this service by Service Recipient. Service Provider will not have access to Service Recipient’s bank accounts and as such will not process payments for any accounts payable. |

| (i) | Service Provider will work in good faith with Service Recipient to transfer all environmental, regulatory, and operating permits for the Asphalt Sites to Service Recipient and its Affiliates to the extent permitted by law. If a transfer is not permitted by law, Service Provider and its Affiliates will work in good faith to have permits issued to Service Recipient (“Permit Service”) by the applicable agency. |

| (ii) | Service Recipient acknowledges that the transfer of permits is dependent on regulatory actions and is not in the control of Service Provider. |

| (i) | Service Provider will support and cooperate in good faith with Service Recipient to transfer utilities associated with Asphalt Transferred Assets to Service Recipient (“Utilities Support Service”). |

| (i) | Service Provider will provide engineering support for operations associated with the Asphalt Sites (“Engineering Service”). |

| (h) | Health Safety and Environmental Support. |

| (i) | Service Provider will provide health, safety, and environmental support for operations associated with the Asphalt Sites (“Health Safety and Environmental Service”). |

Section 2.04 Utilities.

| (a) | The Parties will negotiate in good faith regarding the transfer of utilities including deposits that may be posted with a Utility Service Provider for such utilities. In some instances Service Provider and Service Recipient may determine the best course of action will be for Service Provider to terminate utility service rather than transfer the utility service to the Service Recipient. To the extent applicable, during and after the transfer of utilities, each Party will appropriately reimburse the other Party for any utilities paid on its behalf. The transfer of utilities for Asphalt Sites may occur on different dates, the date the utility is transferred for an Asphalt Site or Asphalt Sites will be the date the utility or utilities are transferred for that site or sites (“Utility Transfer Date”). |

| (i) | Service Recipient acknowledges that Service Provider will take into account the full financial impact to transition utilities including pre-petition cure amounts or claims which may impact if utilities will be transitioned between the Parties. |

| (b) | Utilities = Service Recipient Utilities – Service Provider Utilities + Prepaid Utilities + Service Recipient Utility Deposit Reimbursements |

| (i) | Prior to the Utility Transfer Date, Service Provider will charge Service Recipient utilities associated with an Asphalt Site where Service Provider is no longer storing Existing Asphalt Inventory (“Service Recipient Utilities”). Utilities will be allocated equally over the calendar month and each Party will pay their portion of the utilities prior to or after the Utility Transfer Date as applicable. |

| (ii) | After the Utility Transfer Date for each Asphalt Sites, Service Provider will pay Service Recipient for utilities associated with any Asphalt Site where Service Provider continues to store Existing Asphalt Inventory (“Service Provider Utilities”) up to the Asphalt Site Transfer Date. Utilities will be allocated equally over the calendar month and Service Provider will pay their portion of the utilities prior to Asphalt Site Transfer Date. |

| (iii) | If as of the Utility Transfer Date the Service Provider has prepaid utilities on account with Utility Service Provider (“Prepaid Utility Service Provider”) and services with the Prepaid Utility Service Provider are transferred to Service Recipient, Service Recipient will reimburse Service Provider for any prepaid utilities. If services with the Prepaid Utility Service Provider are not transferred to Service Recipient, then Service Provider will terminate the service with the Prepaid Utility Service Provider and collect any prepaid utilities directly from the Prepaid Utility Service Provider. |