Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22033

MFS SERIES TRUST XIV

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2013

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

SEMIANNUAL REPORT

February 28, 2013

MFS® INSTITUTIONAL MONEY MARKET PORTFOLIO

IMM-SEM

Table of Contents

MFS® INSTITUTIONAL MONEY MARKET PORTFOLIO

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

Table of Contents

LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholders:

Global financial markets began 2013 with greater optimism. U.S. and Asian economic trends have turned more positive. Europe continues to struggle through its economic

slump. However, even there, sentiment has improved. The U.S. Congress averted its year-end fiscal cliff, but a degree of uncertainty remains regarding upcoming negotiations over spending cuts and the debt ceiling. The U.S. Federal Reserve Board is continuing its accommodative monetary easing, while the U.S. housing and job markets have made steady gains. Corporate profits have been resilient, and investors have demonstrated increased tolerance for risk.

Overseas, the eurozone remains in a broad contraction, with economic output receding in France as well as Italy and Spain.

However, large-scale early repayments of European Central Bank loans by banks and Germany’s strong rebound in manufacturing activity are encouraging signs. In Asia, both China and Japan appear to be in the early stages of a turnaround. China’s economic activity has picked up from last year’s relative slowdown, and Japan’s sharp devaluation of the yen, an important anti-deflationary measure, seems to be having its desired impact: Japanese stocks have soared, corporate profits are rising and confidence is returning among consumers, businesses and investors.

As always, managing risk in the face of uncertainty remains a top priority for investors. At MFS®, our uniquely collaborative investment process employs global research and active risk management. Our global team of investment professionals shares ideas and evaluates opportunities across continents, investment disciplines and asset classes — all with a goal of building better insights, and ultimately better results, for our clients.

We remain mindful of the many economic challenges investors face today, and believe it is more important than ever to maintain a long-term view and employ time-tested principles, such as asset allocation and diversification. We also remain confident that our unique approach can serve investors well as they work with their financial advisors to identify and pursue the most suitable opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

April 12, 2013

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

Table of Contents

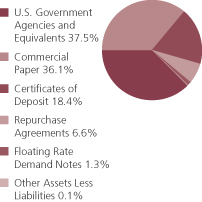

Portfolio structure (u)

| Composition including fixed income credit quality (a)(u) | ||||

| A-1+ | 24.4% | |||

| A-1 | 71.6% | |||

| A-2 | 3.9% | |||

| Not Rated | 0.0% | |||

| Cash & Other | 0.1% | |||

| Maturity breakdown (u) | ||||

| 0 - 7 days | 21.6% | |||

| 8 - 29 days | 6.6% | |||

| 30 - 59 days | 44.2% | |||

| 60 - 89 days | 13.2% | |||

| 90 - 365 days | 14.3% | |||

| Other Assets Less Liabilities | 0.1% | |||

| (a) | Ratings are assigned to portfolio securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Cash & Other portfolio assets that are not securities are not included in the categories mentioned above. Ratings are shown in the S&P scale. All ratings are subject to change. The fund is not rated by these agencies. |

| (u) | For purposes of this presentation, accrued interest, where applicable, is included. |

Percentages are based on net assets as of 2/28/13.

The portfolio is actively managed and current holdings may be different.

2

Table of Contents

Fund expenses borne by the shareholders during the period,

September 1, 2012 through February 28, 2013

As a shareholder of the fund, you incur ongoing costs, including fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2012 through February 28, 2013.

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Share Class | Annualized Expense Ratio | Beginning 9/01/12 | Ending 2/28/13 | Expenses Paid During Period (p) 9/01/12-2/28/13 | ||||||||||||||

| Actual | 0.01% | $1,000.00 | $1,000.78 | $0.05 | ||||||||||||||

| Hypothetical (h) | 0.01% | $1,000.00 | $1,024.74 | $0.05 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid are equal to the fund’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

3

Table of Contents

2/28/13 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Certificates of Deposit - 18.4% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Major Banks - 7.1% | ||||||||

| Bank of Montreal/Chicago Branch, 0.15%, due 3/07/13 | $ | 56,870,000 | $ | 56,870,000 | ||||

| Bank of Montreal/Chicago Branch, 0.18%, due 3/21/13 | 13,925,000 | 13,925,000 | ||||||

| Bank of Montreal/Chicago Branch, 0.2%, due 4/08/13 | 81,850,000 | 81,850,000 | ||||||

| Bank of Montreal/Chicago Branch, 0.2%, due 4/19/13 | 45,715,000 | 45,715,000 | ||||||

| Toronto-Dominion Holdings (USA), Inc., 0.15%, due 5/06/13 | 65,250,000 | 65,250,000 | ||||||

| Toronto-Dominion Holdings (USA), Inc., 0.16%, due 4/26/13 | 91,380,000 | 91,380,000 | ||||||

|

| |||||||

| $ | 354,990,000 | |||||||

| Other Banks & Diversified Financials - 11.3% | ||||||||

| Branch Banking & Trust Co., 0.11%, due 4/15/13 | $ | 164,260,000 | $ | 164,260,000 | ||||

| Mizuho Corporate Bank (USA)/New York Branch, 0.13%, due 3/05/13 | 53,560,000 | 53,560,000 | ||||||

| Mizuho Corporate Bank (USA)/New York Branch, 0.15%, due 3/14/13 | 5,000,000 | 5,000,000 | ||||||

| Mizuho Corporate Bank (USA)/New York Branch, 0.23%, due 5/20/13 | 87,775,000 | 87,775,000 | ||||||

| Mizuho Corporate Bank (USA)/New York Branch, 0.27%, due 4/18/13 | 47,890,000 | 47,890,000 | ||||||

| Mizuho Corporate Bank (USA)/New York Branch, 0.31%, due 6/10/13 | 13,425,000 | 13,425,000 | ||||||

| National Bank of Canada/New York Branch, 0.18%, due 3/01/13 | 8,510,000 | 8,510,000 | ||||||

| National Bank of Canada/New York Branch, 0.2%, due 3/18/13 | 62,830,000 | 62,830,000 | ||||||

| National Bank of Canada/New York Branch, 0.2%, due 4/26/13 | 89,885,000 | 89,885,000 | ||||||

| National Bank of Canada/New York Branch, 0.23%, due 4/15/13 | 30,000,000 | 30,000,000 | ||||||

|

| |||||||

| $ | 563,135,000 | |||||||

| Total Certificates of Deposit, at Cost and Value | $ | 918,125,000 | ||||||

| Commercial Paper (y) - 36.1% | ||||||||

| Automotive - 5.4% | ||||||||

| American Honda Finance Corp., 0.15%, due 4/16/13 | $ | 40,000,000 | $ | 39,992,333 | ||||

| American Honda Finance Corp., 0.16%, due 3/22/13 | 21,780,000 | 21,777,967 | ||||||

| Toyota Motor Credit Corp., 0.09%, due 3/04/13 | 76,535,000 | 76,534,426 | ||||||

| Toyota Motor Credit Corp., 0.18%, due 4/02/13 | 14,757,000 | 14,754,639 | ||||||

| Toyota Motor Credit Corp., 0.19%, due 4/30/13 | 116,437,000 | 116,400,128 | ||||||

|

| |||||||

| $ | 269,459,493 | |||||||

| Conglomerates - 1.9% | ||||||||

| Siemens Capital Corp., 0.135%, due 3/19/13 (t) | $ | 92,000,000 | $ | 91,993,790 | ||||

4

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Commercial Paper (y) - continued | ||||||||

| Consumer Products - 1.1% | ||||||||

| Procter & Gamble Co., 0.11%, due 3/12/13 (t) | $ | 4,730,000 | $ | 4,729,841 | ||||

| Procter & Gamble Co., 0.13%, due 4/22/13 (t) | 50,000,000 | 49,990,611 | ||||||

|

| |||||||

| $ | 54,720,452 | |||||||

| Electronics - 0.3% | ||||||||

| Emerson Electric Co., 0.11%, due 4/16/13 (t) | $ | 16,990,000 | $ | 16,987,612 | ||||

| Financial Institutions - 3.9% | ||||||||

| General Electric Capital Corp., 0.2%, due 5/08/13 | $ | 59,470,000 | $ | 59,447,534 | ||||

| General Electric Capital Corp., 0.23%, due 7/16/13 | 133,575,000 | 133,458,085 | ||||||

|

| |||||||

| $ | 192,905,619 | |||||||

| Food & Beverages - 5.1% | ||||||||

| Anheuser-Busch InBev Worldwide, Inc., 0.2%, due 4/11/13 (t) | $ | 15,000,000 | $ | 14,996,583 | ||||

| Anheuser-Busch InBev Worldwide, Inc., 0.24%, due 4/29/13 (t) | 12,382,000 | 12,377,130 | ||||||

| Coca-Cola Co., 0.1%, due 4/18/13 (t) | 49,052,000 | 49,045,460 | ||||||

| Coca-Cola Co., 0.2%, due 3/13/13 (t) | 13,330,000 | 13,329,111 | ||||||

| Coca-Cola Co., 0.24%, due 3/08/13 (t) | 66,000,000 | 65,996,920 | ||||||

| Pepsico, Inc., 0.11%, due 4/09/13 (t) | 100,000,000 | 99,988,083 | ||||||

|

| |||||||

| $ | 255,733,287 | |||||||

| Machinery & Tools - 2.2% | ||||||||

| Deere and Co., 0.09%, due 3/01/13 (t) | $ | 110,000,000 | $ | 110,000,000 | ||||

| Major Banks - 10.0% | ||||||||

| ANZ National (International) Ltd., 0.2%, due 4/24/13 (t) | $ | 97,870,000 | $ | 97,840,639 | ||||

| JPMorgan Chase & Co., 0.16%, due 4/23/13 | 119,000,000 | 118,971,969 | ||||||

| JPMorgan Chase & Co., 0.18%, due 4/03/13 | 24,132,000 | 24,128,018 | ||||||

| JPMorgan Chase & Co., 0.25%, due 7/15/13 | 55,037,000 | 54,985,021 | ||||||

| National Australia Funding (Delaware), Inc., 0.18%, due 5/22/13 (t) | �� | 150,306,000 | 150,244,375 | |||||

| National Australia Funding (Delaware), Inc., 0.185%, due 4/22/13 (t) | 51,688,000 | 51,674,188 | ||||||

|

| |||||||

| $ | 497,844,210 | |||||||

| Pharmaceuticals - 1.2% | ||||||||

| Merck & Co., Inc., 0.14%, due 5/20/13 (t) | $ | 60,000,000 | $ | 59,981,333 | ||||

| Retailers - 1.6% | ||||||||

| Wal-Mart Stores, Inc., 0.08%, due 3/06/13 (t) | $ | 80,000,000 | $ | 79,999,111 | ||||

5

Table of Contents

Portfolio of Investments (unaudited) – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Commercial Paper (y) - continued | ||||||||

| Tobacco - 3.4% | ||||||||

| Philip Morris International, Inc., 0.11%, due 3/05/13 (t) | $ | 23,280,000 | $ | 23,279,715 | ||||

| Philip Morris International, Inc., 0.15%, due 3/04/13 (t) | 147,400,000 | 147,398,339 | ||||||

|

| |||||||

| $ | 170,678,054 | |||||||

| Total Commercial Paper, at Amortized Cost and Value | $ | 1,800,302,961 | ||||||

| U.S. Government Agencies and Equivalents (y) - 37.5% | ||||||||

| Fannie Mae, 0.075%, due 3/27/13 | $ | 9,944,000 | $ | 9,943,461 | ||||

| Fannie Mae, 0.095%, due 4/03/13 | 50,000,000 | 49,995,646 | ||||||

| Fannie Mae, 0.1%, due 4/01/13 | 45,220,000 | 45,216,106 | ||||||

| Fannie Mae, 0.11%, due 5/15/13 | 79,373,000 | 79,354,810 | ||||||

| Fannie Mae, 0.125%, due 3/06/13 | 7,848,000 | 7,847,864 | ||||||

| Federal Home Loan Bank, 0.075%, due 3/20/13 | 17,037,000 | 17,036,326 | ||||||

| Federal Home Loan Bank, 0.085%, due 4/12/13 | 30,370,000 | 30,366,988 | ||||||

| Federal Home Loan Bank, 0.09%, due 3/01/13 | 300,000 | 300,000 | ||||||

| Federal Home Loan Bank, 0.095%, due 3/20/13 | 88,519,000 | 88,514,562 | ||||||

| Federal Home Loan Bank, 0.11%, due 4/17/13 | 183,710,000 | 183,683,617 | ||||||

| Federal Home Loan Bank, 0.115%, due 3/01/13 | 33,420,000 | 33,420,000 | ||||||

| Federal Home Loan Bank, 0.115%, due 4/10/13 | 11,000,000 | 10,998,594 | ||||||

| Federal Home Loan Bank, 0.12%, due 4/08/13 | 20,276,000 | 20,273,432 | ||||||

| Federal Home Loan Bank, 0.12%, due 4/12/13 | 88,000,000 | 87,987,680 | ||||||

| Federal Home Loan Bank, 0.12%, due 4/17/13 | 5,165,000 | 5,164,191 | ||||||

| Federal Home Loan Bank, 0.12%, due 5/29/13 | 9,280,000 | 9,277,247 | ||||||

| Federal Home Loan Bank, 0.12%, due 6/19/13 | 20,375,000 | 20,367,529 | ||||||

| Federal Home Loan Bank, 0.125%, due 3/06/13 | 18,273,000 | 18,272,683 | ||||||

| Federal Home Loan Bank, 0.13%, due 4/24/13 | 48,275,000 | 48,265,586 | ||||||

| Freddie Mac, 0.085%, due 4/08/13 | 13,300,000 | 13,298,807 | ||||||

| Freddie Mac, 0.095%, due 4/15/13 | 137,845,000 | 137,828,631 | ||||||

| Freddie Mac, 0.109%, due 7/22/13 | 61,860,000 | 61,833,216 | ||||||

| Freddie Mac, 0.11%, due 6/04/13 | 50,210,000 | 50,195,425 | ||||||

| U.S. Treasury Bill, 0.06%, due 4/04/13 | 50,000,000 | 49,997,167 | ||||||

| U.S. Treasury Bill, 0.065%, due 5/09/13 | 32,460,000 | 32,455,956 | ||||||

| U.S. Treasury Bill, 0.07%, due 4/25/13 | 80,000,000 | 79,991,444 | ||||||

| U.S. Treasury Bill, 0.085%, due 4/04/13 | 97,500,000 | 97,492,173 | ||||||

| U.S. Treasury Bill, 0.105%, due 7/05/13 | 100,000,000 | 99,963,250 | ||||||

| U.S. Treasury Bill, 0.105%, due 7/11/13 | 100,000,000 | 99,961,500 | ||||||

| U.S. Treasury Bill, 0.12%, due 11/14/13 | 49,800,000 | 49,757,172 | ||||||

| U.S. Treasury Bill, 0.125%, due 5/30/13 | 127,200,000 | 127,160,250 | ||||||

| U.S. Treasury Bill, 0.128%, due 4/25/13 | 103,205,000 | 103,184,897 | ||||||

| U.S. Treasury Bill, 0.13%, due 4/25/13 | 100,000,000 | 99,980,139 | ||||||

| Total U.S. Government Agencies and Equivalents, at Amortized Cost and Value | $ | 1,869,386,349 | ||||||

6

Table of Contents

Portfolio of Investments (unaudited) – continued

| Floating Rate Demand Notes - 1.3% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Industrial Revenue - Other - 1.3% | ||||||||

| Lincoln County, WY, Pollution Control Rev. (Exxon Mobil Corp.), 0.1%, due 3/01/13 | $ | 1,000,000 | $ | 1,000,000 | ||||

| Lincoln County, WY, Pollution Control Rev. (Exxon Mobil Corp.), “A”, 0.1%, due 3/01/13 | 16,500,000 | 16,500,000 | ||||||

| Lincoln County, WY, Pollution Control Rev. (Exxon Mobil Corp.), “B”, 0.1%, due 3/01/13 | 6,600,000 | 6,600,000 | ||||||

| Lincoln County, WY, Pollution Control Rev. (Exxon Mobil Corp.), “C”, 0.1%, due 3/01/13 | 17,900,000 | 17,900,000 | ||||||

| Sublette County, WY, Pollution Control Rev. (Exxon Mobil Corp.), 0.1%, due 3/01/13 | 23,500,000 | 23,500,000 | ||||||

| Total Floating Rate Demand Notes, at Cost and Value | $ | 65,500,000 | ||||||

| Repurchase Agreements - 6.6% | ||||||||

| Goldman Sachs Repurchase Agreement, 0.18%, dated 2/28/13, due 3/01/13, total to be received $193,337,953 (secured by Federal Agency obligations valued at $197,203,741 in an individually traded account) | $ | 193,337,000 | $ | 193,337,000 | ||||

| Merrill Lynch Pierce Fenner & Smith Repurchase Agreement, 0.13%, dated 2/28/13, due 3/01/13, total to be received $133,735,476 (secured by Federal Agency obligations valued at $136,411,417 in an individually traded account) | 133,735,000 | 133,735,000 | ||||||

| Total Repurchase Agreements, at Cost and Value | $ | 327,072,000 | ||||||

| Total Investments, at Amortized Cost and Value | $ | 4,980,386,310 | ||||||

| Other Assets, Less Liabilities - 0.1% | 4,107,539 | |||||||

| Net Assets - 100.0% | $ | 4,984,493,849 | ||||||

| (t) | Security exempt from registration with the U.S. Securities and Exchange Commission under Section 4(2) of the Securities Act of 1933. |

| (y) | The rate shown represents an annualized yield at time of purchase. |

See Notes to Financial Statements

7

Table of Contents

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 2/28/13 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | ||||

Investments, at amortized cost and value | $4,980,386,310 | |||

Cash | 4,018,813 | |||

Interest receivables | 136,227 | |||

Other assets | 26,549 | |||

Total assets | $4,984,567,899 | |||

| Liabilities | ||||

Payable to affiliate for shareholder servicing costs | $215 | |||

Accrued expenses and other liabilities | 73,835 | |||

Total liabilities | $74,050 | |||

Net assets | $4,984,493,849 | |||

| Net assets consist of | ||||

Paid-in capital | $4,984,675,067 | |||

Accumulated net realized gain (loss) on investments | (181,218 | ) | ||

Net assets | $4,984,493,849 | |||

Shares of beneficial interest outstanding | 4,984,675,182 | |||

Net asset value per share (net assets of $4,984,493,849 / 4,984,675,182 shares of beneficial interest outstanding) | $1.00 |

See Notes to Financial Statements

8

Table of Contents

Financial Statements

Six months ended 2/28/13 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income | ||||

Interest income | $3,463,241 | |||

Expenses | ||||

Shareholder servicing costs | $486 | |||

Insurance fee | 17,637 | |||

Independent chief compliance officer fee | 11,399 | |||

Custodian fee | 88,455 | |||

Shareholder communications | 3,084 | |||

Audit and tax fees | 14,559 | |||

Legal fees | 18,067 | |||

Commitment fee | 10,334 | |||

Miscellaneous | 4,025 | |||

Total expenses | $168,046 | |||

Fees paid indirectly | (4,198 | ) | ||

Reduction of expenses by investment adviser | (3,829 | ) | ||

Net expenses | $160,019 | |||

Net investment income | $3,303,222 | |||

Change in net assets from operations | $3,303,222 | |||

See Notes to Financial Statements

9

Table of Contents

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| Six months ended 2/28/13 | Year ended 8/31/12 | |||||||

| Change in net assets | (unaudited) | |||||||

| From operations | ||||||||

Net investment income | $3,303,222 | $3,122,122 | ||||||

Change in net assets from operations | $3,303,222 | $3,122,122 | ||||||

| Distributions declared to shareholders | ||||||||

From net investment income | $(3,303,222 | ) | $(3,122,122 | ) | ||||

| Fund share (principal) transactions at net asset value of $1 per share | ||||||||

Net proceeds from sale of shares | 18,087,653,497 | 29,057,598,328 | ||||||

Net asset value of shares issued to shareholders in reinvestment of distributions | 3,303,424 | 3,122,122 | ||||||

Cost of shares reacquired | (16,295,434,583 | ) | (28,089,715,189 | ) | ||||

Change in net assets from fund share transactions | $1,795,522,338 | $971,005,261 | ||||||

Total change in net assets | $1,795,522,338 | $971,005,261 | ||||||

| Net assets | ||||||||

At beginning of period | 3,188,971,511 | 2,217,966,250 | ||||||

At end of period | $4,984,493,849 | $3,188,971,511 | ||||||

See Notes to Financial Statements

10

Table of Contents

Financial Statements

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

Six months (unaudited) | Years ended 8/31 | |||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||||||

Net asset value, | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | ||||||||||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||||||

Net investment | $0.00 | (w) | $0.00 | (w) | $0.00 | (w) | $0.00 | (w) | $0.01 | $0.04 | ||||||||||||||

Net realized and | — | — | 0.00 | (w) | — | 0.00 | (w) | 0.00 | (w) | |||||||||||||||

Total from investment | $0.00 | (w) | $0.00 | (w) | $0.00 | (w) | $0.00 | (w) | $0.01 | $0.04 | ||||||||||||||

| Less distributions declared to shareholders | ||||||||||||||||||||||||

From net investment | $0.00 | (w) | $(0.00 | )(w) | $(0.00 | )(w) | $(0.00 | )(w) | $(0.01 | ) | $(0.04 | ) | ||||||||||||

Net asset value, end of | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | ||||||||||||||||||

Total return (%) (r) | 0.08 | (n) | 0.11 | 0.17 | 0.19 | 0.66 | 3.80 | |||||||||||||||||

| Ratios (%) (to average net assets) and Supplemental data: | ||||||||||||||||||||||||

Expenses before expense | 0.01 | (a) | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 | |||||||||||||||||

Expenses after expense | 0.01 | (a) | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | |||||||||||||||||

Net investment income | 0.16 | (a) | 0.11 | 0.17 | 0.19 | 0.51 | 3.86 | |||||||||||||||||

Net assets at end of | $4,984,494 | $3,188,972 | $2,217,966 | $2,186,310 | $1,790,266 | $701,840 | ||||||||||||||||||

| (a) | Annualized. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (w) | Per share amount was less than $0.01. |

See Notes to Financial Statements

11

Table of Contents

(unaudited)

(1) Business and Organization

MFS Institutional Money Market Portfolio (the fund) is a series of MFS Series Trust XIV (the trust). The trust is organized as Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. This fund is available only to investment companies managed by MFS.

(2) Significant Accounting Policies

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued.

In January 2013, the Financial Accounting Standards Board issued Accounting Standards Update 2013-01 (“ASU 2013-01”) entitled Balance Sheet (Topic 210) – Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities which is intended to clarify the scope of Accounting Standards Update 2011-11 (“ASU 2011-11”), Balance Sheet (Topic 210) – Disclosures about Offsetting Assets and Liabilities. Consistent with the effective date for ASU 2011-11, ASU 2013-01 is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. ASU 2013-01 limits the scope of ASU 2011-11’s disclosure requirements on offsetting to financial assets and financial liabilities related to derivatives, repurchase and reverse repurchase agreements, and securities lending and securities borrowing transactions. Although still evaluating the potential impacts of these two ASUs to the fund, management expects that the impact of the fund’s adoption will be limited to additional financial statement disclosures.

Investment Valuations – Pursuant to procedures approved by the Board of Trustees, investments held by the fund are generally valued at amortized cost, which approximates market value. Amortized cost involves valuing an instrument at its cost as adjusted for amortization of premium or accretion of discount rather than its current market value. The amortized cost value of an instrument can be different from the market value of an instrument.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other

12

Table of Contents

Notes to Financial Statements (unaudited) – continued

significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of February 28, 2013 in valuing the fund’s assets or liabilities:

| Investments at Value | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Short Term Securities | $— | $4,980,386,310 | $— | $4,980,386,310 | ||||||||||||

For further information regarding security characteristics, see the Portfolio of Investments.

Repurchase Agreements – The fund entered into repurchase agreements with approved counterparties. Each repurchase agreement is recorded at cost. The fund requires that the securities collateral in a repurchase transaction be transferred to a custodian. The fund monitors, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the fund under each such repurchase agreement.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the six months ended February 28, 2013, is shown as a reduction of total expenses in the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net

13

Table of Contents

Notes to Financial Statements (unaudited) – continued

investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income, expenses, or distributions for financial statement and tax purposes.

During the year ended August 31, 2012, there were no significant adjustments due to differences between book and tax accounting.

The tax character of distributions made during the current period will be determined at fiscal year end. The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| 8/31/12 | ||||

| Ordinary income (including any short-term capital gains) | $3,122,122 | |||

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 2/28/13 | ||||

| Cost of investments | $4,980,386,310 | |||

| As of 8/31/12 | ||||

| Undistributed ordinary income | 4,131 | |||

| Capital loss carryforwards | (181,218 | ) | ||

| Other temporary differences | (4,131 | ) | ||

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized for fund fiscal years beginning after August 31, 2011 may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses (“post-enactment losses”). Previously, net capital losses were carried forward for eight years and treated as short-term losses (“pre-enactment losses”). As a transition rule, the Act requires that all post-enactment net capital losses be used before pre-enactment net capital losses.

As of August 31, 2012, the fund had capital loss carryforwards available to offset future realized gains. Such losses expire as follows:

| 8/31/17 | $(181,218 | ) |

(3) Transactions with Affiliates

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. MFS receives no compensation under this agreement.

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, provides transfer agent and recordkeeping functions in connection with the issuance, transfer, and redemption of shares of the fund under a Shareholder Servicing Agent Agreement. MFSC is not paid a fee for providing these services. MFSC receives payment from the fund for out-of-pocket expenses paid by MFSC on behalf of the fund. For the six months ended February 28, 2013, these costs amounted to $486. The fund may also pay shareholder servicing related costs to non-related parties.

14

Table of Contents

Notes to Financial Statements (unaudited) – continued

Administrator – MFS provides the fund with certain financial, legal, shareholder, and other administrative services under a Master Administrative Services Agreement between the fund and MFS. MFS is not paid a fee for providing these services.

Trustees’ and Officers’ Compensation – The fund may pay compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC. The independent Trustees do not currently receive compensation from the fund.

Other – This fund and certain other funds managed by MFS (the funds) have entered into services agreements (the Agreements) which provide for payment of fees by the funds to Tarantino LLC and Griffin Compliance LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO) and Assistant ICCO, respectively, for the funds. The ICCO and Assistant ICCO are officers of the funds and the sole members of Tarantino LLC and Griffin Compliance LLC, respectively. The funds can terminate the Agreements with Tarantino LLC and Griffin Compliance LLC at any time under the terms of the Agreements. For the six months ended February 28, 2013, the aggregate fees paid by the fund to Tarantino LLC and Griffin Compliance LLC were $11,399. MFS has agreed to reimburse the fund for a portion of the payments made by the fund in the amount of $3,829, which is shown as a reduction of total expenses in the Statement of Operations. Additionally, MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO and Assistant ICCO.

(4) Shares of Beneficial Interest

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest.

The fund is solely invested in by other MFS funds for the purpose of investing excess cash balances on a short-term basis. The MFS funds do not invest in this fund for the purpose of exercising management or control. At the end of the period, the MFS Emerging Markets Debt, MFS Government Securities Fund, MFS International Value Fund, MFS Research Bond Fund, MFS Value Fund, and MFS Government Securities Portfolio were the owners of record of approximately 14%, 10%, 9%, 8%, 6%, and 5%, respectively, of the value of outstanding voting shares of the fund. No other MFS fund owned more than 5% of the value of outstanding voting shares of the fund.

(5) Line of Credit

The fund and certain other funds managed by MFS participate in a $1.1 billion unsecured committed line of credit, subject to a $1 billion sublimit, provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the higher of the Federal Reserve funds rate or one month LIBOR plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating

15

Table of Contents

Notes to Financial Statements (unaudited) – continued

funds at the end of each calendar quarter. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus an agreed upon spread. For the six months ended February 28, 2013, the fund’s commitment fee and interest expense were $10,334 and $0, respectively, and are seperately reported on the Statement of Operations.

16

Table of Contents

PROXY VOTING POLICIES AND INFORMATION

A general description of the MFS funds’ proxy voting policies and procedures is available without charge, upon request, by calling 1-800-225-2606, by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

Information regarding how the fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

QUARTERLY PORTFOLIO DISCLOSURE

The fund will file a complete schedule of portfolio holdings with the Securities and Exchange Commission (the Commission) for the first and third quarters of each fiscal year on Form N-Q. A shareholder can obtain the quarterly portfolio holdings report at mfs.com. The fund’s Form N-Q is also available on the EDGAR database on the Commission’s Internet Web site at http://www.sec.gov, and may be reviewed and copied at the:

Public Reference Room

Securities and Exchange Commission

100 F Street, NE, Room 1580

Washington, D.C. 20549

Information on the operation of the Public Reference Room may be obtained by calling the Commission at 1-800-SEC-0330. Copies of the fund’s Form N-Q also may be obtained, upon payment of a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the Public Reference Section at the above address.

From time to time, MFS may post important information about the fund or the MFS funds on the MFS web site (mfs.com). This information is available by visiting the “News & Commentary” section of mfs.com.

17

Table of Contents

Save paper with eDelivery.

| MFS® will send you prospectuses, |

reports, and proxies directly via e-mail so you will get information faster with less mailbox clutter.

To sign up:

1. Go to mfs.com.

2. Log in via MFS® Access.

3. Select eDelivery.

If you own your MFS fund shares through a financial institution or a retirement plan, MFS® TALK, MFS® Access, or eDelivery may not be available to you.

WEB SITE

mfs.com

MFS TALK

1-800-637-8255

24 hours a day

ACCOUNT SERVICE AND LITERATURE

Shareholders

1-800-225-2606

Financial advisors

1-800-343-2829

Retirement plan services

1-800-637-1255

MAILING ADDRESS

MFS Service Center, Inc.

P.O. Box 55824

Boston, MA 02205-5824

OVERNIGHT MAIL

MFS Service Center, Inc.

c/o Boston Financial Data Services

30 Dan Road

Canton, MA 02021-2809

Table of Contents

| ITEM 2. | CODE OF ETHICS. |

During the period covered by this report, the Registrant has not amended any provision in its Code of Ethics (the “Code”) that relates to an element of the Code’s definitions enumerated in paragraph (b) of Item 2 of this Form N-CSR. During the period covered by this report, the Registrant did not grant a waiver, including an implicit waiver, from any provision of the Code.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable for semi-annual reports.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable for semi-annual reports.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable to the Registrant.

| ITEM 6. | INVESTMENTS |

A schedule of investments for each series of the Registrant is included as part of the report to shareholders of such series under Item 1 of this Form N-CSR.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable to the Registrant.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable to the Registrant.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable to the Registrant.

Table of Contents

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

There were no material changes to the procedures by which shareholders may send recommendations to the Board for nominees to the Registrant’s Board since the Registrant last provided disclosure as to such procedures in response to the requirements of Item 407 (c)(2)(iv) of Regulation S-K or this Item.

| ITEM 11. | CONTROLS AND PROCEDURES. |

| (a) | Based upon their evaluation of the effectiveness of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as conducted within 90 days of the filing date of this report on Form N-CSR, the registrant’s principal financial officer and principal executive officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. |

| (b) | There were no changes in the registrant’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by the report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| ITEM 12. | EXHIBITS. |

| (a) | File the exhibits listed below as part of this form. Letter or number the exhibits in the sequence indicated. |

| (1) | Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit. |

| (2) | A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2): Attached hereto. |

| (b) | If the report is filed under Section 13(a) or 15(d) of the Exchange Act, provide the certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)), Rule 13a-14(b) or Rule 15d-14(b) under the Exchange Act (17 CFR 240.13a-14(b) or 240.15d-14(b)) and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) as an exhibit. A certification furnished pursuant to this paragraph will not be deemed “filed” for the purposes of Section 18 of the Exchange Act (15 U.S.C. 78r), or otherwise subject to the liability of that section. Such certification will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except to the extent that the registrant specifically incorporates it by reference: Attached hereto. |

Table of Contents

Notice

A copy of the Declaration of Trust, as amended, of the Registrant is on file with the Secretary of State of The Commonwealth of Massachusetts and notice is hereby given that this instrument is executed on behalf of the Registrant by an officer of the Registrant as an officer and not individually and the obligations of or arising out of this instrument are not binding upon any of the Trustees or shareholders individually, but are binding only upon the assets and property of the respective constituent series of the Registrant.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) MFS SERIES TRUST XIV

| By (Signature and Title)* | JOHN M. CORCORAN | |

| John M. Corcoran, President |

Date: April 12, 2013

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | JOHN M. CORCORAN | |

| John M. Corcoran, President (Principal Executive Officer) |

Date: April 12, 2013

| By (Signature and Title)* | DAVID L. DILORENZO | |

David L. DiLorenzo, Treasurer (Principal Financial Officer and Accounting Officer) |

Date: April 12, 2013

| * | Print name and title of each signing officer under his or her signature. |