UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________ |

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

_________________________________________________________________ |

| Date of Report (Date of earliest event reported): November 27, 2007 |

K-CARE NUTRITIONAL PRODUCTS INC.

(Exact Name of Registrant as Specified in Charter) |

| Nevada | 333-141271 | N/A |

|

|

|

| (State or other jurisdiction ofincorporation) | (Commission FileNumber) | (IRS Employer Identification No.) |

| | | |

No.2 Haibin Road, Binxi Developing Area

Heilongjiang Province, People’s Republic of China

(Address of principal executive offices)

| Registrant’s telephone number, including area code: +86 451 87009618 |

|

| Unit D – 1275 East 27thStreet |

| North Vancouver, British Columbia, Canada V7J 1S5 |

| (Former name or former address, if changed since lastreport) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a -12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e -4(c))

CURRENT REPORT ON FORM 8-K

K-CARE NUTRITIONAL PRODUCTS INC.

TABLE OF CONTENTS

| Item 2.01 | | Completion of Acquisition or Disposition of Assets |

| Item 5.01 | | Changes in Control of Registrant. |

As used in this Current Report on Form 8-K, all references to the “Company” “we,” “our” and “us” prior to November 27, 2007, the date of closing of our acquisition of China Wind Energy Limited, refer to the registrant, K-Care Nutritional Products Inc. All references to the “Company,” “we,” “our” and “us” for periods after November 27, 2007 refer to K-Care Nutritional Products Inc. and our subsidiaries.

Acquisition and Share Purchase

On November 20, 2007 our President and Chief Executive Officer Eva Dudas agreed to sell 5,950,000 common shares to Jian Ren (“Ren”) for $50,000 (the “Share Purchase Agreement”). The agreement closed on November 27, 2007 resulting in a change of control whereby Ren became the owner of 81% of our issued and outstanding common stock.

Also, on November 20, 2007 we entered into an agreement with Ren and China Wind Energy Limited (“China Wind’), a company owned by Ren, whereby Ren agreed to transfer all the share capital in China Wind to us for $1 (the “Acquisition Agreement”). The consummation of the Acquisition Agreement was conditioned on the completion of the transactions contemplated by the Share Purchase Agreement. On November 27, 2007 we completed the transactions contemplated by the Acquisition Agreement and China Wind became our wholly owned subsidiary.

China Wind is a corporation organized and existing under the laws of the Hong Kong SAR of the People’s Republic of China. It has one wholly owned subsidiary,Harbin XingYe Wind Energy Technology Limited (“XingYe”), a company established under the Law of thePeople’s Republic of China(“PRC”) with registered capital US$100,000.XingYe provides management consulting services to a company in China which manufactures variable pitch blades for wind turbine generators.

7,377,450 shares of our common stock were issued and outstanding before and after the closings of the Acquisition Agreement (the “Acquisition”) and the Share Purchase Agreement (the “Share Purchase”). Of these shares, approximately 1,377,450 shares represented our “public float” prior to and after the Acquisition. The shares sold in the Share Purchase were sold in a private transaction in reliance upon an exemption from registration pursuant to “Section 4-1-1/2” and pursuant to Regulation S under the Securities Act of 1933 as amended (the “Securities Act”). The shares in the public float will continue to represent the shares of our common stock held for resale without further registration by the holders thereof.

We had no options or warrants to purchase shares of capital stock or any other derivative securities outstanding immediately prior to or following the Acquisition.

Prior to our entry into the Acquisition Agreement and Share Purchase Agreement, there were no material relationships between us, China Wind or any of our respective affiliates, directors or officers, or any associates of our respective officers or directors.

3

Further details of the Acquisition Agreement and the Share Purchase Agreement are contained in Exhibits 10.1 and 10.2, incorporated herein by reference. Neither agreement contained terms regarding a forward split of our common stock or regarding a change of management. However, on November 26, 2007 we initiated a 5 or 1 forward split of our common stock, which will increase our issued and outstanding stock to 36,887,250, and on November 29, 2007, two days after the Acquisition, we changed our management.

On November 29, 2007 we submitted a certificate of amendment to the Nevada Secretary of State to change our name from K-Care Nutritional Products Inc. to China Wind Energy Inc. We expect our name change to be in effect in the first week of December 2007.

Changes Resulting from the Acquisition

We intend to carry on China Wind’s business as our sole line of business.

Changes to our Board of Directors and Officers

On November 29, 2007, our sole officer, Eva Dudas, resigned from the positions she held as President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and Director of the Company effective immediately. In her place, Ren was appointed as the President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and a Director. We also increased the number of directors to be appointed to our board of directors to three and we appointed Xian Sun and Huaiwen Zheng as our directors. Please refer to the information contained under “Security Ownership Of Certain Beneficial Owners And Management” in this report for further details pertaining to our former and new management.

All directors hold office for one-year terms until the election and qualification of their successors. Officers are elected by the board of directors and serve at the discretion of the board of directors.

Accounting Treatment

The Acquisition is being accounted for as a reverse merger, since Ren owns a majority of the outstanding shares of our common stock immediately following the Acquisition and Share Purchase. China Wind is deemed to be the acquirer in the merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Acquisition will be those of China Wind and will be recorded at the historical cost basis of China Wind. Whereas, the consolidated financial statements after completion of the Acquisition will include the assets and liabilities of us and China Wind, the historical operations of China Wind, and our operations from the closing date of the Acquisition. Except as described in the previous paragraphs, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our board of directors and, to our knowledge , no other arrangements exist that might result in a change of control of us. Further, as a result of the purchase of shares by Ren pursuant to the Share Purchase Agreement, a change in control of us occurred on the date of consummation of the Acquisition and the Share Purchase (being November 27, 2007). We continue to be a “small business issuer,” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), following the Acquisition and the Share Purchase.

4

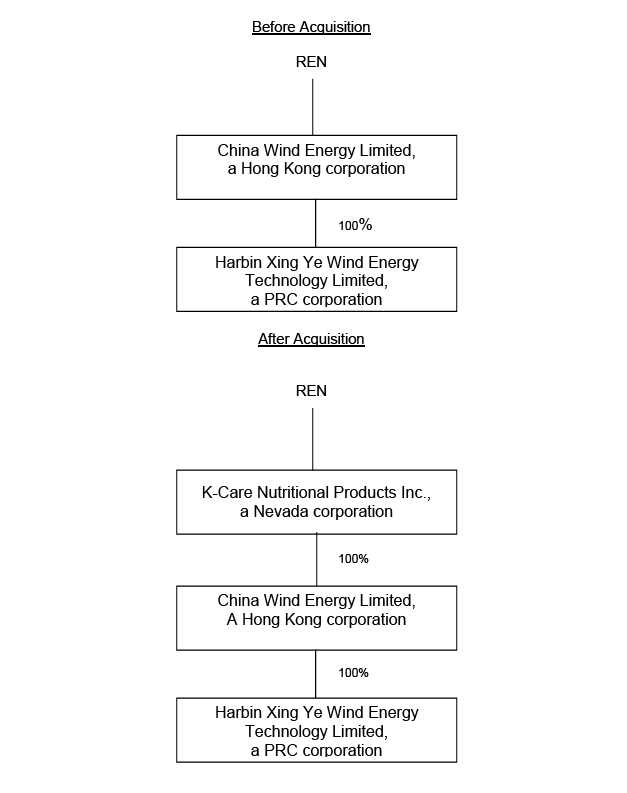

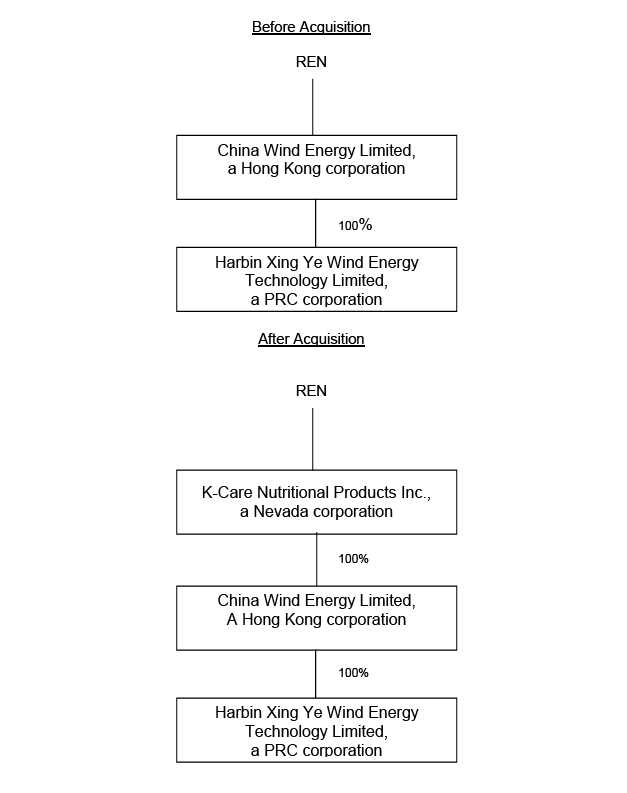

Organizational Charts

We have set out below an organizational chart below, which shows the entities that existed prior to and after the Acquisition and the Share Purchase.

5

Company Overview

Following the Acquisition Agreement, our sole line of business will be that of China Wind’s wholly owned subsidiary,Harbin XingYe Wind Energy Technology Limited(“XingYe”), which provides management consulting services to Harbin Lian Chuang Co., Ltd (“Lian Chuang”), a wind turbine blade manufacturing enterprise incorporated under the laws of the PRC with registered capital of US$11.6 million. The principal business of Lian Chuang includes research and development, production and sales of wind turbine blade products.

Summary of the terms of our management consulting agreement with Lian Chuang

On July 15, 2007, XingYe and Lian Chuang entered into a management consulting agreement, pursuant to which Xing Ye agreed to oversee the management and operation of Lian Chuang’s business for a period of three years, from July 15, 2007 to July 14, 2010 (the “Management Agreement”). Lian Chuang is focused primarily on the production of turbine blades.

Pursuant to the agreement, Xing Ye provides services including recruiting and managing employees, implementing and meeting applicable quality control standards, and overseeing all aspects of turbine blade production by Lian Chuang. XingYe has been granted the usage rights, administration rights, operational rights and beneficial rights on all intangible and tangible assets of Lian Chuang’s turbine blade projects, including the right to receive twelve percent of the revenue of Lian Chuang at the end of every quarter from the operation of Lian Chuang’s business during the term of the Management Agreement. Lian Chuang will continue to oversee the financial aspect of operations and the purchase of any new assets or equipment is subject to the approval of Lian Chuang. For all intents and purposes, Xing Ye runs and manages Lian Chuang.

Further details of Management Agreement can be found in translated version of the agreement, which is attached as exhibit 10.3 hereto and incorporated by reference herein.

Lian Chuang is our sole management consulting client

The major product of Lian Chuang is a variable pitch blade for wind turbine generators. Different from other blades of the 600KW and 750KW type produced in China with a fixed pitch blade for low wind energy usage, the blade products of Lian Chuang are variable speed and pitch adjusted with high efficiency. Lian Chuang has pursued invention patents for its blades and design.

How much revenues we derive

We had no revenues from our consulting agreement with Lian Chuang for the year ended July 31, 2007.

6

Source of Lian Chuang’s revenues

The revenues of Lian Chuang’s wind turbine blades business will come from sales to customers who install turbines and other equipment in wind farms.

Factors that affect sales volumes for wind turbine blades include:

- World gross domestic product growth;

- Availability of alternative sources of energy; and

- The growth in demand for wind powered energy.

Factors that affect the prices for wind turbine blades include:

- World economic environment;

- Industry operating rate, which is based on the supply and demand; and

- Relative strength of the Chinese RMB.

Sales by Type of Blade

The following table shows Lian Chuang’s total sales volume broken down by blade category and percentage for the yearly period August 1, 2006 through July 31, 2007.

| | Product Varieties | Percentage of the total sales |

| 1 | 4L0.8 | 20% |

| 2 | 4L1.0 | 25% |

| 3 | 4L1.5 | 40% |

| 4 | 4L2.0 | 15% |

Location

Lian Chuang’s manufacturing facilities are located at 2 Haibin Road, Binxi Development, Heilongjiang Province, PRC, which is also our principal executive office. Lian Chuang will continue to operate at these facilities until its growth requires additional plants and equipment.

The Market for Wind Turbine Blades

Wind energy is considered a “green” energy without pollution, and is attractive to many countries in the world. The PRC has a shortage of energy resources. The Chinese wind energy industry, while in its infancy could grow to be an important source of energy production. The PRC is urgently looking into the development of large capacity wind power plants on a large scale. On the eve of the 2005 Beijing International Renewable Energy Conference, a 2005 report released by the Chinese Renewable Energy Industries Association and sponsored by Greenpeace and the European Wind Energy Association showed that China could at least double its current wind energy target for 2020.

Wind energy is a rapidly growing market segment for the composites industry and is a fast growing energy sector. According to researchandmarkets.com, on average, the global wind energy market has grown at a rate of 23% per year for the last ten years.According to the German Engineering Federation, worldwide, 15,200 megawatts of new wind generating capacity was installed in 2006, with about 15 billion euros (US$19.5 billion) invested, an increase of 32 percent compared the previous year.

7

Competition

Domestic Blade Producers

The table below contains a description of our principal competitors as of March, 2007

| No | | Enterprises | | Form | | Shareholders | | Location | | Establish | | Output and | | Other |

| | | | | | | | | | | Date | | Scale | | |

|

| 1 | | LM Fiber | | Foreign Capital | | Denmark LM Co. | | Wuqing | | August, | | 600 Sets per | | Area of Factory: |

| | | Reinforced | | | | | | Development, | | 2001 | | year | | 70,000 Sq; Staffs: |

| | | Plastics | | | | | | Tientsin | | | | | | 280; including, |

| | | (Tianjin) Ltd | | | | | | | | | | | | Administrators: |

| | | | | | | | | | | | | | | 140 |

|

| 2 | | LM Urumchi | | Joint Venture | | Denmark LM Co. | | Urumchi | | Put into | | Products | | 1-1.5MW Blade |

| | | Blade Works | | using Chinese | | and Sinkiang | | | | production in | | Supply for | | |

| | | | | and foreign | | Jinfeng | | | | August 2007 | | Sinkiang | | |

| | | | | investment | | Stock-joint Co. | | | | | | Jinfeng | | |

| | | | | | | | | | | | | Stock=joint Co. | | |

|

| 3 | | Denmark | | Foreign Capital | | Denmark | | West District in | | May 2005 | | 1.5MW 200 | | 1.5MW both in |

| | | VESTAS Wind | | | | VESTAS Limited | | Tientsin | | | | sets per year | | first and second |

| | | Energy | | | | | | Development | | | | | | periods, 2MW |

| | | Electricity | | | | | | | | | | | | the third period |

| | | Equipment | | | | | | | | | | | | |

| | | Limited | | | | | | | | | | | | |

|

| 4 | | SUZLON | | Foreign Capital | | India SUZLON | | HuaYuan | | 2006 | | 300-500 Sets | | Can manufacture |

| | | Resource | | | | | | Technology | | | | per year | | the whole set of |

| | | Limited | | | | | | Development, | | | | | | wind power |

| | | (Tientsin) | | | | | | Tientsin | | | | | | electricity |

| | | | | | | | | Development | | | | | | equipment |

|

| 5 | | Tientsin | | Joint-stock | | Orient Electric | | Chemic Industry | | August 2006 | | Invest | | Invest |

| | | Dongqi Wind | | | | Group | | Garden in Tientsin | | | | 279,000,000 | | 227,700,000 RM |

| | | Energy Blade | | | | | | Development | | | | RMB in first | | in the second |

| | | Engineering | | | | | | | | | | period, | | period, 2.5MW |

| | | Co. | | | | | | | | | | 1.5MW600 per | | 100 sets per |

| | | | | | | | | | | | | year | | 5MW, 50sets |

| | | | | | | | | | | | | | | year, the total |

| | | | | | | | | | | | | | | value of the whole |

| | | | | | | | | | | | | | | equipment is 1 |

| | | | | | | | | | | | | | | billion RMB |

|

| 6 | | Baoding China | | Joint-Venture | | NORDEX | | Baoding New | | August 2005 | | 1.3MW Blades | | They can make |

| | | Air Huiteng | | using Chinese | | German Co. | | High-technology | | | | and provide to | | 600MW blade |

| | | Wind Power | | and Foreign | | | | Development | | | | the customers | | varieties. Total |

| | | Equipment | | Investment | | | | | | | | of Nordex in | | sales in 2003 |

| | | Limited | | | | | | | | | | China | | were 24,000,000 |

| | | | | | | | | | | | | | | RMB. In 2004 |

| | | | | | | | | | | | | | | revenue was |

| | | | | | | | | | | | | | | 60,000,000 RMB |

| | | | | | | | | | | | | | | In 2005 the |

| | | | | | | | | | | | | | | revenue was |

| | | | | | | | | | | | | | | 120,000,0000 |

| | | | | | | | | | | | | | | RMB.I In 2006 |

| | | | | | | | | | | | | | | sales were |

| | | | | | | | | | | | | | | 570,000,0000 |

| | | | | | | | | | | | | | | RMB. The |

| | | | | | | | | | | | | | | forecast of 2007 |

| | | | | | | | | | | | | | | was 2 billion |

8

Competitive Advantages and Strategy

Our management believes that Lian Chuang’s product formulations, price points, relationships, infrastructure, proven quality control standards, and reputation represent substantial competitive advantages. Lian Chuang is currently able to maintain a substantially lower cost structure than competitors based in the United States and Europe. Furthermore, our management believes that Lian Chuang’s competitive advantage in the PRC is protected by its significant knowledge of government regulations, business practices, and strong relationships.

Our management believes that Lian Chuang has superior technological expertise, products, marketing knowledge, and global relationships to its Chinese competitors.

Business Strategy

As part of the Management Agreement, we have been developing and plan to implement the following strategies to develop the business of Lian Chuang:

| 1. | Management and Innovation Strategies |

| |

| | Lian Chuang has implemented a scientific approach to blade manufacture relying on innovation. Lian Chuang has a rigorous quality control program in place. |

| |

| 2. | Broaden Development Strategies |

| |

| | Lian Chuang improved the reputation of its products by developing and implementing a marketing plan. |

| |

| 3. | Optimize Service |

| |

| | Lian Chuang has implemented standardized safety procedures for its employees. |

| |

| 4. | Cost Strategies |

| |

| | Lian Chuang plans to implement cost control measures so that it can compete with other blade manufacturers. |

| |

Our management’s goal is to make Lian Chuang a leading blade manufacturer and to widen its

sales channels to the international market.

pursuing the following strategies: |

We intend to grow Lian Chuang’s business by

- Grow capacity and capabilities in line with increased market demand;

- Enhance leading-edge technology through continuous innovation, research and study;

- Continue to improve operational efficiencies;

- Further expand into higher value-added segments of the blade manufacturingindustry; and

- Build a strong market reputation to foster and capture future growth in PRC andabroad.

9

Intellectual Property

Lian Chuang owns five patents in the wind energy industry:

ZL200620021590.7 -This is a belt drive accelerator which is fitted to wind power electricity equipment. The patent was obtained in 2006 and expires in 2016. The belt drive accelerator is especially important to us because it speeds up the blades in a dynamotor. This patent lowers the cost and the useful life of blades.

ZL200520020555.9 -This is a frame structure tower of wind energy equipment. The patent was obtained in 2005 and expires in 2015.

ZL200220020019.9 –This is an integer-stand wind energy dynamotor. The patent was obtained in 2002 and expires in 2012.

ZL200220020018.4– This is a super-high, binding and auto-rising tower crane for wind energy dynamotor. The patent was obtained in 2002 and expires in 2012.

ZL200520020020.1 –This is equipment for motional wind energy blade production. The patent was obtained in 2005 and expires in 2015.

Customers

For the twelve month period from August 1, 2006 through July 31, 2007, Lian Chuang had revenues of $800,000. During the same time period, Lian Chuang’s top ten customers – ranked by the sales amount sold to each customer – contributed $533,000 in revenues. The following table outlines the top ten customers for the twelve-month period from August 1, 2006 through July 31, 2007.

| | | Customers | | | | | | Sales | | Percentageof total |

| | | | | | | | | | | |

| 1 | | Dongyuan Drive-Engine Co. | | | | | | $180,000 | | 22.5% |

| 2 | | Zhenhua Science &Technology Ltd | | | | | | $60,000 | | 7.5% |

| 3 | | Longhui Ltd | | | | | | $55,000 | | 6.88% |

| 4 | | Wenchang Industry Ltd | | | | | | $46,000 | | 5.75% |

| 5 | | Fuli Energy-saving technology Ltd | | | | | | $40,000 | | 5% |

| 6 | | Naer Technology Ltd | | | | | | $37,000 | | 4.63% |

| 7 | | Pengwei Engine & Electricity Ltd | | | | | | $32,000 | | 4% |

| 8 | | Tejia International Industrial Co | | | | | | $30,000 | | 3.75% |

| 9 | | Kaili Equipments Ltd | | | | | | $28,000 | | 3.5% |

| 10 | | Datong Science & Technology Ltd | | | | | | $25,000 | | 3.13% |

| Total amount of the top 10 customers | | | | | | $533,000 | | 66.6% |

| Total sales of the Lian Chuang | | | | | | $800,000 | | 100% |

10

Regulation

Lian Chuang is subject to environmental regulation by both the PRC central government and by local government agencies. Since its inception, Lian Chuang has been in compliance with applicable regulations. Of particular relevance to our business are the following:

- Nonrenewable Resources Law of China. Implemented on January 1, 2006,promulgated by the President of the PRC.

- Development and Restructuring Commission on wind energy construction andgovernance.Implemented on July 4, 2005, promulgated by the State Development andRestructuring Commission.

Legal Proceedings

Lian Chuang is not aware of any significant pending legal proceedings against it.

Employees

Lian Chuang has 180 employees, 120 of whom are full time employees and 60 of whom are part time. Of the part time employees, 15 are in sales and administration, and 45 are engineers and technicians. To the best of its knowledge, Lian Chuang is compliant with local prevailing wage, contractor licensing and insurance regulations, and has good relations with its employees.

China Wind has 12 employees, 10 of whom are full time employees and 2 of whom are part time. To the best of its knowledge, China Wind is compliant with local prevailing wage, contractor licensing and insurance regulations, and has good relations with its employees.

Our only full time employee is our President and Chief Executive Officer, Jian Ren. We also engage consultants in the areas of business development, legal and accounting.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “may,” “anticipates,” believes,” “should,” “intends,” “estimates,” and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties are outlined in “Risk Factors” and include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability, and the marketability of ou r products; legal and regulatory risks associated with the Acquisition; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

11

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources, and cannot assure investors of the accuracy or completeness of the data included in this report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

Our principal executive offices are located at 2 Haibin Road, Binxi Development, Heilongjiang Province, PRC, where we carry out the management of the Lian Chuang factory. We do not pay any fee to Lian Chuang to occupy this space but we provide it with management consulting services. The property consists of a factory of 63,638 square meters (approximately 208,787 square feet) and an office building of 20,000 square meters (approximately 65,616 square feet). Lian Chuang carries out the manufacture of its wind turbine blades at this location.

Management’s Discussion and Analysis or Plan of Operations

The following discussion highlights the principal factors that have affected our financial condition and results of operations as well as our liquidity and capital resources for the periods described. This discussion contains forward-looking statements. Please see “Special cautionary statement concerning forward-looking statements” and “Risk factors” for a discussion of the uncertainties, risks and assumptions associated with these forward-looking statements. The operating results for the periods presented were not significantly affected by inflation.

Company Overview

We were incorporated as a Nevada company on May 8, 2006. Prior to November 27, 2007, we were in the business of manufacturing water for dogs that contained nutritional supplements with added flavors, and had developed a website) to sell our product. Due to a lack of demand for our product we sought a partner with whom to conduct a reverse merger.

In November 2007 our management determined that it was in the best interests of our stockholders to enter into the Acquisition Agreement and acquire China Wind, a Hong Kong company that is engaged in the business of management consulting services in Hong Kong, China. As part of the reverse merger, we have ceased engaging in the beverage manufacturing business.

Pursuant to the Acquisition, China Wind became our wholly-owned subsidiary. China Wind has one wholly owned subsidiary XingYe, which became an indirectly wholly-owned subsidiary of us. We have succeeded to the business of China Wind, which provides management consulting services to a company which produces wind turbines in China. Further details of the Acquisition and the business of China Wind and XingYe are outlined above, under the heading “Description of Business”.

12

The financial results summarized below are based on China Wind’s audited balance sheet as of July 31, 2007 and related audited statements of operations and retained earnings and statements of cash flows for the period from inception to July 31, 2007. These audited financial statements are attached hereto as Exhibit 99.1.

Results of Operations for China Wind - Period from Inception on November 27, 2006 to July 31, 2007

Lack of Revenues. China Wind did not have any revenues for the period from inception to July 31, 2007.

Liabilities.As of July 31, 2007, China Wind had total liabilities of $59,010, and assets of $21,074.

Professional Fees . China Wind’s professional fees for the period from inception to July 31, 2007 were $35,077.

General and Administrative Expenses. General and administrative expenses for China Wind for the period from inception to July 31, 2007 were $2,740, comprised of $1,303 for payroll and $1,347 in other expenses.

Net Loss. Net loss for China Wind for the period from inception to July 31, 2007 was $37,817.

Plan of Operation

Our plan is to generate revenues primarily through the Management Agreement with Lian Chuang. We intend to continue the development of Lian Chuang’s business with the following strategies for Lian Chuang:

- Capitalizing on Lian Chuang’s competitive advantages of large local demand andtechnical support;

- Specializing in wind turbine blades using advanced techniques and high efficiency;

- Utilization of flexible materials and resins in blade manufacture, which are widelyavailable;

- Designing specialized blades for European applications;

- Delivering innovative blade technology to Lian Chuang customers;

- Leveraging technology to improve our processes and systems to provide customerswith performance based proprietary products;

- Achieving operating excellence through the raw material stage to delivery of theproduct;

- Taking advantage of Lian Chuang’s expertise and breadth of products that make itunique in serving the market; and

- Continuing to improve or remove underperforming and non-strategic assets from LianChuang’s business.

13

Our goal is to manage Lian Chuang to achieve the following sales:

- In 2008, 10 sets of blades

- In 2009, 15 sets of blades

- In 2010, 20 sets of blades

- In 2011, 40 sets of blades

- In 2012, 80 sets of blades

Liquidity and Capital Resources

As of July 31, 2007, China Wind had cash and cash equivalents of $1,278 and a working capital deficiency of ($37,936), comprised of current assets totaling $21,074, which includes cash and cash equivalents of $1,278, and $19,796 paid as a contract security deposit to Lian Chuang, and current liabilities totaling $59,010. The latter figure includes accrued payroll and professional fee expenses of $36,346 and a shareholder loan of $22,664.

During the period from inception to July 31, 2007, China Wind raised a total of $22,665 from financing activities. $22,664 was raised from shareholder loans and $1 was raised for the issuance of one common share in China Wind’s stock.

We intend to derive revenues primarily through the Management Agreement with Lian Chuang More information about this agreement is set out above under the heading “Description of Business”.

Future Financings

We will require additional financing in order to proceed with the development and implementation of our business plan. We plan to complete private placement sales of our common stock in order to raise the funds necessary to pursue our plan of operations. Issuances of additional shares will result in dilution to our existing shareholders. We currently do not have any arrangements in place for the completion of any private placement financings and there is no assurance that we will be successful in completing any private placement financings.

Critical Accounting Policies and Estimates

The discussion and analysis of China Wind’s financial condition presented in this section is based upon the audited consolidated financial statements of China Wind, which have been prepared in accordance with the generally accepted accounting principles in the United States. During the preparation of the financial statements China Wind is required to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, China Wind evaluates its estimates and judgments, including those related to sales, returns, pricing concessions, bad debts, inventories, investments, fixed assets, intangible assets, income taxes and other contingencies. China Wind bases its estimates on historical experience and on various other assumptions that it believes are reasonable under current conditions. Actual results may differ from these e stimates under different assumptions or conditions.

14

In response to the SEC’s Release No. 33-8040, “Cautionary Advice Regarding Disclosure About Critical Accounting Policy,” China Wind identified the most critical accounting principals upon which its financial status depends. China Wind determined that those critical accounting principles are related to the translation of foreign currencies and related parties. China Wind presents these accounting policies in the relevant sections in this management’s discussion and analysis, including the Recently Issued Accounting Pronouncements discussed below.

Translation of Foreign Currencies.The financial position and results of operations for China Wind and its subsidiary are measured using a currency other than the U. S. dollar as their functional currency. Accordingly, all assets and liabilities for the Company and its subsidiary are translated into U.S. dollars at the current exchange rates as of the respective balance sheet date. Revenue and expense items are translated at the average exchange rates prevailing during the period. Cumulated gains and losses from the translation of the financial statements are reported as accumulated other comprehensive income (loss) in the shareholders' equity. Foreign exchange gains and losses arising from transactions denominated in a currency other than the functional currency of the entity involved are included in operating results.

Related Parties.For the purposes of these financial statements, parties are considered to be related if one party has the ability, directly or indirectly, to control the party or exercise significant influence over the party in making financial and operating decisions, or vice versa, or where the Company and the party are subject to common control or common significant influence. Related parties may be individuals or other entities.

Risk Factors

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this Current Report on Form 8-K, before purchasing shares in our common stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. The risks described below are not the only ones we will face. If any of these risks actually occurs, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment. The risks and uncertainties described below are not exclusive and are intended to reflect the material risks that are specific to us, material risks related to our industry and material risks related to companies that undertake a public offering or seek to maintain a class of securities that is registered or traded on any exchange or over-the-counter market.

Our future revenues will be derived from management and consulting services provided to a manufacturer of wind turbines operating in the wind energy industry in China. There are numerous risks, known and unknown, that may prevent us from achieving our goals including, but not limited to, those described below. Additional unknown risks may also impair our financial performance and business operations. Our business, financial condition and/or results of operations may be materially adversely affected by the nature and impact of these risks. In such case, the market value of our securities could be detrimentally affected, and investors may lose part or all of their investment. Please refer to the information contained under “Business” in this report for further details pertaining to our business and financial condition.

15

Risks Related To Our Company

Unanticipated problems in expanding our wind energy production business may harm our business and viability.

Our future cash flow depends on our ability to expand Lian Chuang’s customer base for the sale of wind turbines. If our operations are disrupted and/or the economic integrity of our distribution operation is threatened for unexpected reasons (including, but not limited to, technical difficulties, production difficulties, poor weather conditions, and business interruptions due to terrorism or otherwise), our business may experience a substantial setback. Moreover, the occurrence of significant unforeseen conditions or events may require us to reexamine our business model. Any change to our business model may adversely affect our business.

If we do not obtain financing when needed, our business will fail.

As of July 31, 2007, China Wind had cash and cash equivalents on hand in the amount of approximately $1,278 (audited). We predict that our newly restructured business will need significant funding to implement our business plan and meet our capital expenditure needs over the next three years. We currently do not have any arrangements for additional financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for our products, production costs, availability of credit, prevailing interest rates and the market price for our common stock.

Future sales of our equity securities will dilute existing stockholders.

To fully execute our long-term business plan, we will need to raise additional equity capital. Such additional equity capital, when and if it is raised, would result in dilution to our existing stockholders.

Risks Related to the Wind Energy Business

The market for alternative energy products, technologies or services is emerging and rapidly evolving and its future success is uncertain. Insufficient demand for our alternative energy products or services would prevent us from achieving or sustaining profitability.

The market for alternative energy is emerging and unproven and its future success is dependent on widespread acceptance and the adoption of environmental sustainability products or technologies. The technologies that we produce may prove unsuitable for widespread commercial deployment. It is possible that we may spend large sums of money to bring alternative energy products, technologies or services to the market, but demand for our technologies, services or alternative energy products in the market may not develop or may develop more slowly than we anticipate.

16

Our future success is dependent on:

(a) our ability to quickly react to technological innovations;

(b) the cost-effectiveness of our technologies;

(c) the performance and reliability of alternative energy products and services that we develop; (d) our ability to formalize marketing relationships or secure commitments for our technologies, products and services;

(e) realization of sufficient funding to support our marketing and business development plan; and (f) availability of government incentives for the development or use of any products and services that we develop.

If we cannot keep pace with the technological developments, we risk becoming uncompetitive, and we may not be able to generate sufficient revenues, or any existing revenues may materially decrease.

Risks Related to Doing Business in the PRC

We face the risk that changes in the policies of the PRC government could have a significant impact upon our business affect how we may be able to conduct in the PRC and the profitability of our business.

The PRC’s economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case. A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of sup plies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social life.

A slowdown or other adverse developments in the PRC economy may materially and adversely affect our customers, demand for our products and our business.

All of our operations are conducted in the PRC and all of our revenue is generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure investors that such growth will continue. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC could materially reduce the demand for our products and materially and adversely affect our business.

17

Governmental control of currency conversion may affect the value of an investment in us.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive all of our revenues in Renminbi, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency dominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of its expenses as they come due.

The fluctuation of the Renminbi may materially and adversely affect investments in us.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. As we rely principally on revenues earned in the PRC, any significant revaluation of the Renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. dollars we receive from an offering of our securities into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of making payments for dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of the Renminbi that we convert would be reduced. In addition, the depreciation of significant U.S. dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximately 3.2% appreciation of the Renminbi against the U.S. dollar as of May 15, 2006. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against the U.S. dollar.

Because our principal assets are located outside of the United States and all of our directors and officers reside outside of the United States, it may be difficult for investors to enforce their rights based on U.S. federal securities laws against us and our officers and directors in the U.S. or to enforce U.S. court judgment against us or them in the PRC.

18

All of our directors and officers reside outside of the United States. In addition, China Wind is located in the PRC and substantially all of its assets are located outside of the United States; it may therefore be difficult or impossible for investors in the United States to enforce their legal rights based on the civil liability provisions of the U.S. federal securities laws against us in the courts of either the U.S. or the PRC and, even if civil judgments are obtained in U.S. courts, to enforce such judgments in PRC courts. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement against us or our officers and directors of criminal penalties, under the U.S. federal securities laws or otherwise.

Risks Relating to the Acquisition

Because China Wind became public by means of the Acquisition, we may not be able to attract the attention of major brokerage firms.

There may be risks associated with China Wind becoming a public company through the Acquisition. Specifically, securities analysts of major brokerage firms may not provide coverage of us since there is no incentive to brokerage firms to recommend the purchase of our common stock. No assurance can be given that brokerage firms will, in the future, want to conduct any secondary offerings on behalf of us.

Risks Relating to the Common Stock

Our common stock may be deemed a “penny stock”, which would make it more difficult for investors to sell their shares.

Our common stock may be subject to the “penny stock” rules adopted under section 15(g) of the Exchange Act. The penny stock rules apply to companies whose common stock is not listed on the NASDAQ Stock Market or other national securities exchange and trades at less than $5.00 per share or that have tangible net worth of less than $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose our securities.

Furthermore, for companies whose securities are quoted on the OTC Bulletin Board, it is more difficult (1) to obtain accurate quotations, (2) to obtain coverage for significant news events because major wire services generally do not publish press releases about such companies, and (3) to obtain needed capital.

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of November 30, 2007, the number of shares of our common stock owned of record or beneficially by each person known to be the beneficial owner of 5% or more of the issued and outstanding shares of our voting stock, and by each of our directors and executive officers and by all its directors and executive officers as a group.

Except as otherwise specified below, the address of each beneficial owner listed below is No.2 Haibin Road, Binxi Developing Area, Heilongjiang Province, People’s Republic of China.

| Title of Class | | Name | | Shares Owned(1) | | Voting Power(2) |

|

| Common | | Jian Ren | | 5,950,000 | | 80.65% |

| Common | | All Officers and Directorsas a Group | | 5,950,000 | | 80.65% |

(1)Except as otherwise indicated, the shares are owned of record and beneficially by the persons named in the table.

(2)Based on 7,377,450 shares issued and outstanding as of November 30, 2007.

Changes in Control

We are not aware of any planned changes of control other than as described in this filing.

Directors and Executive Officers

The following table sets forth information regarding the members of our board of directors and our executive officers and other significant employees. All directors hold office for one-year terms until the election and qualification of their successors. Officers are elected annually by the board of directors and serve at the discretion of the board.

| Name | Age | Position |

|

| Jian Ren | 24 | Our current President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and Director |

| Sun Xiya | 21 | Director |

| Zheng Huaiwen | 27 | Director |

20

Biographies

Jian Ren, President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and Director

Mr. Ren was appointed our President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and Director and November 29, 2007. He has been a director of Harbin XingYe Wind Energy Technology Limited since April, 2007, assisting the General Manager in redesigning the company’s administrative structure. Mr. Ren attended the Secondary Technical School of Food Supply in Hegang City in the PRC from 1999 to 2000, completing studies in engineering. Following this, he served in the Cannon Force of the National Military Service of the PRC from 2000 to 2002. He spend the years from 2002 to 2006 studying and in 2006, he completed training in administrative skills, including human resource management and organization structure; management training, rewarding and performance; and recruitment schedule planning.

Sun Xiya, Director

Sun Xiya was appointed as our Director on November 29, 2007. In April 2007, Ms. Xiya was appointed as a director of Harbin XingYe Wind Energy Technology Limited. Ms. Xiya obtained a bachelor degree from Northeast Agriculture University in Harbin, which she attended from 2002 to 2006. During her time at university, Ms. Xiya received a number of scholarships and awards. She followed up her degree with training in administrative skills, including human resource management and organization structure; management training, rewarding and performance; and recruitment schedule planning from 2006 to April 2007.

Zheng Huaiwen, Director

We appointed Zheng Huaiwen as our director on November 29, 2007. Mr. Huaiwen attended Harbin Industrial University in Harbin from September 1998 to July 2002, where he received a degree in engineering. Thereafter, from July 2002 to July 2006, he worked at Harbin XingYe Wind Energy Technology Limited, where he played a key role in the quality control of blade designing and three-dimensional sculpting of the blades, as well as supervising the blade shaking analysis, module tire processing and production, and blade production and testing. From July 2006 to April 2007, he completed an administrative skills training course in human resource management and organization structure; management training, rewarding and performance; and recruitment schedule planning. He became the assistant engineer at Harbin XingYe Wind Energy Technology Limited, overseeing blade design in April 2007.

Meetings of Our Board of Directors

Prior to November 29, 2007 our Board of Directors consisted of a sole director, Ms. Eva Dudas, who conducted meetings by consent resolution. Ms. Dudas resigned her position as a director and officer of us on November 29, 2007. On this day, we elected a new board which consists of three directors, Mr. Ren, Ms. Xiya and Mr. Huaiwen, and we intend to hold regular board meetings in the future.

21

Board Committees

Audit Committee.We intend to establish an audit committee of the board of directors, which will consist of soon-to-be-nominated independent directors. The audit committee’s duties would be to recommend to our Board of Directors the engagement of independent auditors to audit our financial statements and to review our accounting and auditing principles. The audit committee would review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent public accountants, including their recommendations to improve the system of accounting and internal controls. The audit committee would at all times be composed exclusively of directors who are, in the opinion of our Board of Directors, free from any relationship which would in terfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

Compensation Committee.We intend to establish a compensation committee of the Board of Directors. The compensation committee would review and approve our salary and benefits policies, including compensation of executive officers.

Director Compensation

We did not pay our director for her services from inception to July 31, 2007. However, in the future, we will evaluate the benefits of implementing a market-based director compensation program.

Significant Employees

There are no individuals other than our executive officer who are expected to make a significant contribution to our business.

Family Relationships

There are no family relationships among directors, executive officers, or persons nominated or chosen by us to become directors or executive officers.

22

Legal Proceedings

There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholders are an adverse party or have a material interest adverse to us.

None of our directors, executive officers, promoters or control persons has been involved in any of the following events during the past five years:

- any bankruptcy petition filed by or against any business of which such person was ageneral partner or executive officer either at the time of the bankruptcy or within two yearsprior to that time;

- any conviction in a criminal proceeding or being subject to a pending criminal proceeding(excluding traffic violations and other minor offenses);

- being subject to any order, judgment, or decree, not subsequently reversed, suspended orvacated, of any court of competent jurisdiction, permanently or temporarily enjoining,barring, suspending or otherwise limiting his involvement in any type of business,securities or banking activities; or

- being found by a court of competent jurisdiction (in a civil action), the SEC or theCommodity Futures Trading Commission to have violated a federal or state securities orcommodities law, and the judgment has not been reversed, suspended, or vacated.

Summary Compensation Table

The following Summary Compensation Table sets forth, for the years indicated, all cash compensation paid, distributed or accrued for services, including salary and bonus amounts, rendered in all capacities by our chief executive officer and all other executive officers who received or are entitled to receive remuneration in excess of $100,000 during the stated periods.

| Name of Officer | Year | Salary | Bonus | Stock Awards | Option Awards | Non-Equity Compensation | NonqualifiedDeferredIncentive PlanCompensation | All Other Compensation | Total |

| | |

| Eva Dudas | 2007 | - | - | - | - | - | - | 0 |

| | 2006 | - | - | - | - | - | - | 0 |

| | 2005 | - | - | - | - | - | - | 0 |

Option Grants in Last Fiscal Year

There were no options granted to any of the named executive officer from inception to July 31, 2007.

For the period from inception to July 31, 2007, the named executive officer did not exercise any stock options.

23

Employment Agreements

We have no employment agreements with any of our employees.

Equity Compensation Plan Information

We currently do not have any equity compensation plans; however we are currently deliberating on implementing an equity compensation plan.

Directors’ and Officers’ Liability Insurance

We currently do not have insurance insuring directors and officers against liability; however, we may investigate the availability of such insurance in the future.

Certain Relationships and Related Transactions and Director Independence

As of November 14, 2007, Eva Dudas, our former sole officer and director, had advanced us an aggregate of $8,228 representing expenses paid on our behalf by Ms. Dudas, none of which has been repaid by us. The aggregate advance is unsecured, bears no interest, and has no terms of repayment. We recognize donated management services provided by Eva Dudas at a rate of $500 per month. For the period from inception November 27, 2006 to July 31, 2007, we recognized a total of $4,500 in donated services.

Pursuant to the Acquisition Agreement, Ren transferred 100% of the share capital of China Wind to us for $1, and completed the Share Purchase Agreement, in which Ren purchased 5,950,000 shares of the capital stock of us from the then President, CEO, CFO, Secretary and Treasurer, Eva Dudas, for $50,000.00. These transactions with Mr. Ren, a director and our current sole officer, have been disclosed in prior filings with the SEC and are discussed in depth therein. Other than as described above, we have not entered into any transactions with our officers, directors, persons nominated for these positions, beneficial owners of 5% or more of our common stock, or family members of these persons wherein the amount involved in the transaction or a series of similar transactions exceeded the lesser of $120,000 or 1% of the average of our total assets for the last two fiscal years.

Director Independence

None of our directors is independent. We have no committees of the board of directors at this time as we are a development stage company with limited operations. We use the definition of an “independent director” provided by the NASDAQ Marketplace Rules to determine whether each of our directors is independent. The definition states that a director is independent if he or she is not an executive officer or employee of the company, or if the board affirmatively determines that the director has no relationship with the company which, in the board's opinion, would interfere with the director's exercise of independent judgment in carrying out a director's responsibilities. The definition, which is found in Rule 4200, lists six relationships that preclude an independence finding, including if the director is an employee of a parent or subsidiary of the company. As Jian Ren is our executive officer, and Zheng Huaiwen and Sun Xiya are empl oyed by Xing Ye, the subsidiary of China Wind, our directors do not qualify as independent directors.

24

| Recent Sales of Unregistered Securities |

Since our inception on May 8, 2006 to November 30, 2007, we have completed the following sales of unregistered securities.

- On May 9, 2006, we issued 6,000,000 common shares to our President Eva Dudas at aprice of $0.0001 per share for total proceeds of $600.

- On July 30, 2006, we issued 395,500 common shares to seven shareholders at a price of$0.04 per share for total proceeds of $15,820.

- On December 15, 2006, we issued 120,000 common shares to two shareholders at a priceof $0.10 per share for total proceeds of $12,000.

We completed all of these offerings of the common stock pursuant to Rule 903 of Regulation S of the Securities Act on the basis that the sale of the common stock was completed in an "offshore transaction", as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the shares. Each investor was not a U.S. person, as defined in Regulation S, and was not acquiring the shares for the account or benefit of a U.S. person.

| Description of Securities |

We are authorized to issue 80,000,000 shares of common stock, $0.0001 par value. We are also authorized to issue 20,000,000 shares of preferred stock, with the same par value as the common stock. Immediately following the Acquisition, on November 27, 2007, there were 7,377,450 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding.

On November 26, 2007, we initiated a 5 for 1 forward split of our common stock, which will increase the number of our authorized share capital of common stock to 400,000,000 and of our issued and outstanding common stock to 36,887,250. The par value of each common share will remain the same, at $0.0001. The authorized number of preferred shares will remain unchanged at 20,000,000, with a par value of $0.0001. We anticipate the forward split will be effected it the first week of December 2007.

Common Stock

Holders of the common stock have no preemptive rights to purchase additional shares of common stock or other subscription rights. The common stock carries no conversion rights and is not subject to redemption or to any sinking fund provisions. All shares of common stock are entitled to share equally in dividends from sources legally available, therefore, when, as and if declared by the Board of Directors, and upon liquidation or dissolution of us, whether voluntary or involuntary, to share equally in our assets available for distribution to stockholders.

The Board of Directors is authorized to issue additional shares of common stock not to exceed the amount authorized by our Articles of Incorporation, on such terms and conditions and for such consideration as the Board may deem appropriate without further stockholder action.

25

Voting Rights

Each holder of common stock is entitled to one vote per share on all matters on which such stockholders are entitled to vote. Since the shares of common stock do not have cumulative voting rights, the holders of more than fifty percent of the shares voting for the election of directors can elect all the directors if they choose to do so and, in such event, the holders of the remaining shares will not be able to elect any person to the Board of Directors.

Dividend Policy

Holders of our common stock are entitled to dividends if declared by the Board of Directors out of funds legally available therefore. We do not anticipate the declaration or payment of any dividends in the foreseeable future. We intend to retain earnings, if any, to pursue new business opportunities. Future dividend policy will be subject to the discretion of the Board of Directors and will be contingent upon future earnings, if any, our financial condition, capital requirements, general business conditions and other factors. Therefore, there can be no assurance that any dividends of any kind will ever be paid.

Preferred Stock

We are authorized to issue up to 20,000,000 shares of $0.0001 par value preferred stock. We have no shares of preferred stock outstanding. Under our Articles of Incorporation, the Board of Directors has the power, without further action by the holders of the common stock, to determine the relative rights, preferences, privileges and restrictions of the preferred stock, and to issue the preferred stock in one or more series as determined by the Board of Directors. The designation of rights, preferences, privileges and restrictions could include preferences as to liquidation, redemption and conversion rights, voting rights, dividends or other preferences, any of which may be dilutive of the interest of the holders of the common stock or the preferred stock of any other series.

Market Price and Dividends on Common Equity and Related Stockholder Matters

China Wind is, and has always been, a privately-held company and now is our wholly-owned subsidiary. There is not, and never has been, a public market for the securities of China Wind.

Market Information

Our common stock is currently approved for quotation on the OTC Bulletin Board maintained by the FINRA under the symbol “KCNU,” but there is currently no liquid trading market. The challenge for us will be to educate the market as to the values inherent in wind energy products manufactured in China, and to develop an actively trading market.

The transfer agent for our common stock is Island Stock Transfer, 100 Second Avenue South, Suite 104N, St. Petersburg, Florida 33701, telephone: (727)-289-0010.

26

The following table sets forth the high and low last bid prices for the Common Stock for each fiscal quarter during the past two fiscal years and for the interim periods since the last fiscal year. These prices do not reflect retail mark-ups, markdowns or commissions and may not represent actual transactions.

| Quarter Ended | High | Low |

|

|

|

| January 31, 2007 | No Trades | No Trades |

|

|

|

| April 30, 2007 | No Trades | No Trades |

|

|

|

| July 31, 2007 | No Trades | No Trades |

|

|

|

| July 31, 2007 through to November 29, 2007 | $0.40 | $0.25 |

|

|

|

Holders

As of November 29, 2007, the number of holders of record of shares of common stock, excluding the number of beneficial owners whose securities are held in street name was 35.

Dividend Policy

We do not anticipate paying any cash dividends on our common stock in the foreseeable future because we intend to retain our earnings to finance the expansion of our business. Thereafter, declaration of dividends will be determined by the Board of Directors in light of conditions then existing, including without limitation our financial condition, capital requirements and business condition.

Equity Compensation Plans

K-Care has not issued any equity compensation plans to date.

27

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party against us. None of our directors, officers or affiliates are (i) a party adverse to us in any legal proceedings, or (ii) have an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings that have been threatened against us.

Changes In And Disagreements With Accountants

Since inception, we have had no changes in or disagreements with our accountants. Audited financial statements of China Wind from inception to July 31, 2007 have been referenced in this Form 8-K in reliance upon Malone & Bailey, PC, as experts in accounting and auditing. We have also provided audited pro forma financial for the period ended July 31, 2007.

| Indemnification of Directors and Officers |

The only statute, charter provision, bylaw, contract, or other arrangement under which any controlling person, director or officer of us is insured or indemnified in any manner against any liability which he or she may incur in his or her capacity as such, is as follows:

- Article V of our Bylaws, attached hereto as Exhibit 3.3; and

- Nevada Revised Statutes, Chapter 78.

The general effect of the foregoing is to indemnify a control person, officer or director from liability, thereby making us responsible for any expenses or damages incurred by such control person, officer or director in any action brought against them based on their conduct in such capacity, provided they did not engage in fraud or criminal activity.

We have no directors and officers’ liability insurance at this time. At present, there is no pending litigation or proceeding involving any director, officer, employee or agent where indemnification would be required or permitted.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

On November 29, 2007, our sole officer and director, Eva Dudas, tendered her resignation as a director and officer to the Board of Directors, and Jian Ren was appointed as CEO, CFO, Secretary, Treasurer and a Director.

The biographies of each of the new directors and officers are set forth in the section entitled “Directors and Executive Officers” in this report.

28

We disclose that there are no transactions since the beginning of our last fiscal year, or any currently proposed transaction, in which we were or are to be a participant and the amount involved exceeds the lesser of $120,000 or one percent of the average of our total assets at the year-end July 31, 2007, and in which Mr. Ren, Ms. Xiya, or Mr. Huaiwen had or will have a direct or indirect material interest, other than the ownership of shares of common stock in us as a result of the transactions herein disclosed. Such beneficial ownership is set forth in the table under the caption “Security Ownership of Certain Beneficial Owners and Management.” In addition, we do not have an employment contract with any of Mr. Ren, Ms. Xiya or Mr. Huaiwen.

Item 5.03 Amendment to Articles of Incorporation or Bylaws

On November 30, 2007 we filed a Certificate of Amendment to our Articles of Incorporation with the Nevada Secretary of State changing our name from K-Care Nutritional Products Inc. to China Wind Energy Inc. We expect the name change to be effective on the OTC Bulletin Board during the first week of December 2007.

Item 5.06Change in Shell Company Status

As a result of the consummation of the Acquisition described in Item 2.01 of this Current Report on Form 8-K, we believe that we are no longer a “shell corporation,” as that term is defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act.

| Item 9.01 | | Financial Statements and Exhibits |

(a)

| | Financial Statements of Businesses Acquired. |

In accordance with Item 9.01(a), China Wind’s audited financial statements for the period from inception to July 31, 2007 are filed in this Current Report on Form 8-K as Exhibit 99.1. See the description of the financial statements set forth in Exhibit No. 99.1 set forth below.

(b) Pro Forma Financial Information.

In accordance with Item 9.01(b), the Company’s pro forma financial statements are filed in this Current Report on Form 8-K as Exhibit 99.2.

29

(d) Exhibits.

The exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

| Exhibit No. | | Description |

|

| 3.1 | | Articles of Incorporation of K-Care (incorporated by reference from Exhibit 3to K-Care’s Registration Statement on Form SB-2 filed with the Commissionon March 14, 2007.) |

| 3.2 | | By-laws of K-Care (incorporated by reference from Exhibit 3 to K-Care’s Registration Statement on Form SB-2 filed with the Commission on May 13,2005.) |

| 3.3 | | Certificate of Amendment dated November 29, 2007 changing the name toChina Wind Energy Inc., filed with the Nevada Secretary of State. |

| 10.1 | | Acquisition Agreement by andamong K-Care and China Wind |

| 10.2 | | Share Purchase Agreement by and among Eva Dudas and Jian Ren |

| 10.3 | | Management Agreement between XingYe and Liang Chuang |

| 21.1 | | List ofSubsidiaries |

| 99.1 | | China Wind’s audited Balance Sheet dated July 31, 2007 and related audited statements of operations, changes in owner’s equity and cash flowsfor the period from inception to July 31, 2007. |

| 99.2 | | Unaudited Pro Forma Balance Sheet as of July 31, 2007, andUnauditedPro Forma Statements of Operations for the period ended July 31, 2007. |

Pursuant to the requirements of the Securities Exchange Act of 1934, K-Care has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: November 30, 2007 | K-CARE NUTRITION PRODUCTS INC. |

| |

| | By: | /s/ Jian Ren |

| | | Mr. Jian Ren |

| | | President, Chief Executive Officer, Chief |

| | | Financial Officer, Principal Accounting |

| | | Officer, Director, Secretary, Treasurer |

30