CHINA WIND ENERGY LIMITED AND SUBSIDIARY

F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company) INDEX |

| | Page |

| Report of Independent Registered Public Accounting Firm | F-1 |

| Balance Sheet | F-2 |

| Statements of Operations (Singular) | F-3 |

| Statements of Changes (Singular) in Shareholders’ Equity (Deficit) | F-4 |

| Statements of Cash Flows (Singular) | F-5 |

| Notes to the Financial Statements | F-6 |

KEITH K. ZHEN, CPA

CERTIFIED PUBLIC ACCOUNTANT

2070 WEST 6TH STREET - BROOKLYN, NY 11223 - TEL (347) 408-0693 - FAX (347) 602-4868 - EMAIL :KEITHZHEN@GMAIL.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

China Wind Energy Limited

( A development stage company) |

We have audited the accompanying balance sheet of China Wind Energy Limited and subsidiary ( a development stage company) as of July 31, 2007 and the related statements of income, stockholders' equity and comprehensive income, and cash flows for the period November 27, 2006 (Inception) through July 31, 2007. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant esti mates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of China Wind Energy Limited and subsidiary ( a development stage company) as of July 31, 2007 and the results of its operations and its cash flows for the period November 27, 2006 through July 31, 2007 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company had an accumulated deficit of $37,817 at July 31, 2007 that includes all net losses of $37,817 since its inception. These factors raise substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 2. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/Keith K. Zhen, CPA

Keith K. Zhen, CPA

Brooklyn, New York

August 31, 2007 |

F-1

CHINA WIND ENERGY LIMITED AND SUBSIDIARY

F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

BALANCE SHEET

July 31, 2007 |

| ASSETS | | |

| Current Assets: | | |

| Cash and cash equivalents | | $1,278 |

| |

| Total Current Assets | |

$1,278 |

| |

| Contract security deposit (Note 4) | | 19,769 |

| |

| Total Assets | | $21,074

|

| |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | |

| |

| Current Liabilities: | | |

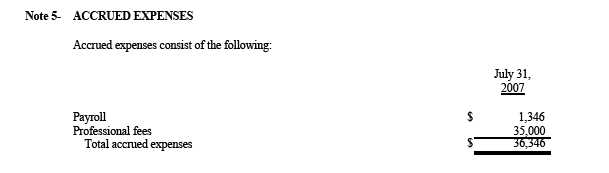

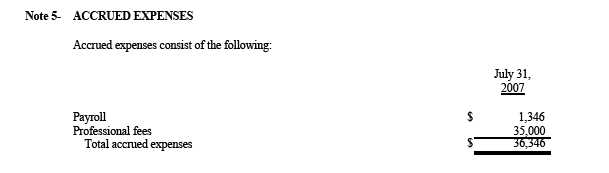

| Accrued expenses (Note 5) | | 36,346 |

| Loan from a shareholder (Note 6) Total Current Liabilities | | $22,664 |

| | |

59,010 |

| Stockholders' Equity: | | |

| Common stock, par value $0.13 (HK$1.00), 10,000 shares authorized; | | |

| 1 shares issued and outstanding as of July 31, 2007 | | 1 |

| Additional paid-in capital | | 100,000 |

| Subscription receivable | | (100,000) |

| Accumulated deficiency | | (37,817) |

| Accumulated other comprehensive income | | (120) |

| |

|

| Stockholders' deficiency | | (37,936) |

| Total Liabilities and Stockholders' Deficiency | |

$ 21,074 |

See Notes to Financial Statements

F-2

CHINA WIND ENERGY LIMITED AND SUBSIDIARY

F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

STATEMENT OF OPERATIONS |

| | For the Period |

| | November 27, 2006 |

| | (inception) through |

| | July 31, |

| | 2007 |

| |

| |

| Revenues | |

| Sales | $ -- |

| Costs of Sales | -- |

| Gross Profit | -- |

| Operating Expenses | |

| Payroll | 1,303 |

| Professional fees | 35,077 |

| Other general and administrative expenses | 1,437 |

| Total Operating Expenses | 37,817 |

| |

| Income (Loss) from Operation | (37,817) |

| |

| Other Income (Expenses) | -- |

| | |

| Income (Loss) before Provision for Income Tax | (37,817) |

| |

| Provision for Income Tax | -- |

| | |

| |

| Net Income (Loss) | 37,817) |

| | |

| |

| Other Comprehensive Income (Loss) | |

| Effects of Foreign Currency Conversion | (120) |

| | |

| |

| Comprehensive Income (Loss) | $ (37,937) |

| | |

| |

| Basic and fully diluted earnings (loss) per share | $ 37,817) |

| | |

| |

| Weighted average shares outstanding | 1 |

| | |

See Notes to Financial Statements

F-3 |

CHINA WIND ENERGY LIMITED AND SUBSIDIARY

F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY (DEFICIT)

FOR PERIOD MARCH 26, 2007 (INCEPTION) THROUGH JUNE 30, 2007 |

| | | | | | | | | | | | | | | | | | | Accumulated | | |

| | | Common Stock | | | | Additional | | | | Retained | | | | other | | |

| | | Par Value $0.13 (HK$1.00) | | Paid-in | | Subscription | | Earnings | | comprehensive | | |

| | | Shares | | | | Amount | | | | Capital | | Receivable | | (Deficit) | | | | Income | | Totals |

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Balances at the date of inception on March 26, 2007 | | -$ | | -$ | | -$ | | -$ | | -$ | | -$ | | - |

| |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from issuance of common stock | | 1 | | | | 1 | | | | 100,000 | | (100,000) | | - | | | | - | | 1 |

| |

| Net income (loss) | | - | | | | - | | | | - | | - | | (37,817) | | | | - | | (37,817) |

| |

| Other comprehensive income | | - | | | | - | | | | - | | - | | - | | | | (120) | | (120) |

| | | |

| Balances at | | | | | | | | | | | | | | | | | | | | |

| March 31, 2007 | | 1 | | | | $ 1 | | | | $ 100,000 | | $ (100,000) | | $ (37,817) | | $ (120) | | $ (37,936) |

| | |

|

See Notes to Financial Statements

F-4 |

CHINA WIND ENERGY LIMITED AND SUBSIDIARY

F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

STATEMENT OF CASH FLOWS |

| | For the Period |

| | November 27, 2006 |

| | (inception) through |

| | July 31, |

| | 2007 |

| | |

| Operating Activities | |

|

| |

| Net income (loss) | $ (37,817) |

| |

| Adjustments to reconcile net income (loss) to | |

| net cash provided (used) by operating activities: | |

| |

| Changes in operating assets and liabilities: | |

| Decrease (increase) in contract security deposit | (19,796) |

| Increase (decrease) in accrued expenses | 36,346 |

| |

|

| |

| Net cash provided (used) by operating activities | (21,267) |

| |

| Investing Activities | |

| |

| |

| Net cash (used) by investing activities | -- |

| |

| Financing Activities | |

| |

| |

| Proceeds from issuance of common stock | 1 |

| Loans from a shareholder | 22,664 |

| |

|

| Net cash provided (used) by financing activities | 22,665 |

| |

| Increase (decrease) in cash | 1,398 |

| |

| Cash at beginning of period | -- |

| Effects of exchange rates on cash | (120) |

| |

|

| Cash at end of period | $ 1,278 |

| |

|

| |

| Supplemental Disclosures of Cash Flow Information: | |

| Cash paid (received) during year for: | |

| Interest | -- |

| |

|

| Income taxes | $ -- |

| |

|

See Notes to Financial Statements

F-5 |

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

| NOTES TO FINANCIAL STATEMENTS |

Note 1-ORGANIZATION AND BUSINESS BACKGROUND

China Wind Energy Limited ("China Wind" or the "Company") was incorporated on November 27, 2006 in Hong Kong under the Companies Ordinance as a limited liability company as Ego Sign Investments Limited. The Company was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship as defined by Statement of Financial Accounting Standards (SFAS) No. 7. On February 9, 2007, the Company changed its to China Wind Energy Limited. The Company has selected June 30 as its fiscal year ending.

On April 17, 2007, the Company establish a wholly owned subsidiary, Harbin Xinyue Wind Energy Limited ("Harbin Xinyue") in the Harbin City, Heilongjiang Province, the People's Republic of China ("PRC"). Harbin Xinyue was incorporated under the Company Law of PRC as a limited liability company with registered capital of $100,000. Harbin Xinyue plans on becoming involved in the business of providing management service to wind energy device manufactures in PRC.

China Wind and Harbin Xinyue are hereafter referred to as the "Company".

The Company has not yet generated revenues from planned principal operations and is considered a development stage company as defined in Statement of Financial Accounting Standards ("SFAS") No. 7. The Company plans on becoming involved in the business of providing management services to wind energy device manufactures in PRC. There is no assurance, however, that the Company will achieve its objectives or goals.

As of July 31, 2007, the Company incurred an accumulated deficit of $37,817 since its inception. This factor raise substantial doubt about its ability to continue as a going concern. Recoverability of a major portion of the recorded asset amounts shown in the accompanying consolidated balance sheet is dependent upon continued operations of the company, which in turn is dependent upon the Company's ability to raise additional capital, obtain financing and succeed in its future operations. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management has taken actions to revise its operating and financial requirements, which it believes are sufficient to provide the Company with the ability to continue as a going concern. The Company is actively pursuing additional funding and a potential merger or acquisition candidate and strategic partners, which would enhance stockholders' investment. Management believes that these actions will allow the Company to continue operations through the next fiscal year.

F-6

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

Note 3- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America ("US GAAP") and are presented in U.S. dollars.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results when ultimately realized could differ from these estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits in banks with maturities of three months or less, and all highly liquid investments which are unrestricted as to withdrawal or use, and which have original maturities of three months or less.

Concentrations of Credit Risk

Financial instruments that subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company maintains its cash and cash equivalents with high-quality institutions. Deposits held with banks may exceed the amount of insurance provided on such deposits. Generally these deposits may be redeemed upon demand and therefore bear minimal risk.

Fair Value of Financial Instruments

The carrying value of financial instruments including cash and cash equivalents, receivables, prepaid expenses, accounts payable, and accrued expenses, approximates their fair value due to the relatively short-term nature of these instruments.

Valuation of Long-Lived assets

The Company periodically analyzes its long-lived assets for potential impairment, assessing the appropriateness of lives and recoverability of unamortized balances through measurement of undiscounted operating cash flows on a basis consistent with accounting principles generally accepted in the United States of America.

Revenue Recognition

Revenues are recognized when finished products are shipped to unaffiliated customers, both title and the risks and rewards of ownership are transferred or services have been rendered and accepted, and collectibility is reasonably assured.

F-7

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

| NOTES TO FINANCIAL STATEMENTS |

Note 3- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Advertising Costs

Advertising costs will be expensed as incurred and included as part of selling and marketing expenses in accordance with the American Institute of Certified Public Accountants ("AICPA") Statement of Position 93-7, "Reporting for Adverting Costs". The Company did not incur any advertising costs during the period November 27, 2006 through July 31, 2007.

Research and Development Costs

Research and development costs will be charged to expense as incurred. The Company did not incur any research and development costs during the period November 27, 2006 through July 31, 2007.

Translation of foreign currencies

The financial position and results of operations for the Company and its subsidiary are measured using a currency other than the U. S. dollar as their functional currency. Accordingly, all assets and liabilities for the Company and its subsidiary are translated into U.S. dollars at the current exchange rates as of the respective balance sheet date. Revenue and expense items are translated at the average exchange rates prevailing during the period. Cumulated gains and losses from the translation of the financial statements are reported as accumulated other comprehensive income (loss) in the shareholders' equity. Foreign exchange gains and losses arising from transactions denominated in a currency other than the functional currency of the entity involved are included in operating results.

Income Taxes

The Company accounts for income tax using SFAS No. 109 "Accounting for Income Taxes", which requires the asset and liability approach for financial accounting and reporting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance related to deferred tax assets is recorded when it is more likely than not that some portion or all of the deferred tax assets will not be realized.

F-8

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

Note 3- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Comprehensive Income

Statement of Financial Accounting Standards (SFAS) No. 130, “Reporting Comprehensive Income,” establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources.

Related parties

For the purposes of these financial statements, parties are considered to be related if one party has the ability, directly or indirectly, to control the party or exercise significant influence over the party in making financial and operating decisions, or vice versa, or where the Company and the party are subject to common control or common significant influence. Related parties may be individuals or other entities.

Segment Reporting

SFAS No. 131 “Disclosures about Segments of an Enterprise and Related Information” establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in financial statements. The Company currently operates in one principal business segment. Therefore, segment disclosure is not presented.

Earnings (Loss) Per Share

The Company reports earnings per share in accordance with the provisions of SFAS No. 128, “Earnings Per Share.” SFAS No. 128 requires presentation of basic and diluted earnings per share in conjunction with the disclosure of the methodology used in computing such earnings per share. Basic earnings (loss) per share is computed by dividing income (loss) available to common shareholders by the weighted-average number of common shares outstanding during the period. Diluted earnings per share is computed similar to basic earnings per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There are no potentially dilutive securities outstanding (options and warrants) for the period November 27, 2006 through July 31, 2007.

F-9

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

Note 3- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Recent Accounting Pronouncements

In September 2006, the SEC issued SAB No. 108, which provides guidance on the process of quantifying financial statement misstatements. In SAB No. 108, the SEC staff establishes an approach that requires quantification of financial statements errors, under both the iron-curtain and the roll-over methods, based on the effects of the error on each of the Company’s financial statements and the related financial statement disclosures. SAB No. 108 is generally effective for annual financial statements in the first fiscal year ending after November 15, 2006. The transition provisions of SAB No. 108 permits existing public companies to record the cumulative effect in the first year ending after November 15, 2006 by recording correcting adjustments to the carrying values of assets and liabilities as of the beginning of that year with the offsetting adjustment recorded to the opening balance of retained earnings. Management does not expect that the adoption of SAB No. 108 wo uld have a material effect on the Company’s financial position or results of operations.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158, "Employer's Accounting for Defined Benefit Pension and Other Postretirement Plans - an amendment of FASB Statements No. 87, 88, 106, and 132(R)" ("SFAS 158"). SFAS 158 requires an employer to recognize the over funded or under funded status of a defined benefit postretirement plan (other than a multiemployer plan) as an asset or liability in its statement of financial position and to recognize changes in that funded status in the year in which the changes occur through comprehensive income of a business entity or changes in unrestricted net assets of a not-for-profit organization. The standard also requires an employer to measure the funded status of a plan as of the date of its year-end statement of financial position, with limited exceptions.

An employer with publicly traded equity securities is required to initially recognize the funded status of a defined benefit postretirement plan and to provide the required disclosures as of the end of the fiscal year ending after December 15, 2006. An employer without publicly traded equity securities is required to recognize the funded status of a defined benefit postretirement plan and to provide the required disclosures as of the end of the fiscal year ending after June 15, 2007. The adoption of SFAS 158 is not expected to have a material effect on the Company's financial position or results of operations.

F-10

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

| NOTES TO FINANCIAL STATEMENTS |

Note 3- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Recent Accounting Pronouncements (continued)

In September 2006, the FASB issued SFAS No. 157 “Fair Value Measurements”. SFAS No. 157 defines fair values, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. This Statement shall be effective for financial statements issued for fiscal years beginning after November 25, 2007, and interim periods within those fiscal years. Earlier application is encouraged provided that the reporting entity has not yet issued financial statements for that fiscal year, including financial statements for an interim period with that fiscal year. The provisions of this statement should be applied, except in some circumstances where the statement shall be applied retrospectively. The Company is currently evaluating the impact of adopting SFAS No. 157 on its financial position and results of operations.

In July 2006, the FASB issued FASB Interpretation (“FIN”) No. 48, “ Accounting for Uncertainty in Income Taxes,” which prescribes a comprehensive model for how a company should recognize, measure, present and disclose in its financial statements uncertain tax positions that the company has taken or expects to take on a tax return (including a decision whether to file or not to file a return in a particular jurisdiction). The accounting provisions of FIN No. 48 are effective for fiscal years beginning after December 15, 2006. The Company is currently assessing whether adoption of this Interpretation will have an impact on its financial position and results of operations.

In March 2006, the FASB issued SFAS No. 156, "Accounting for Servicing of Financial Assets" ("FAS 156"), which amends SFAS No. 140. FAS 156 specifically provides guidance addressing the recognition and measurement of separately recognized servicing assets and liabilities, common with mortgage securitization activities, and provides an approach to simplify efforts to obtain hedge accounting treatment. FAS 156 is effective for all separately recognized servicing assets and liabilities acquired or issued after the beginning of an entity's fiscal year that begins after September 15, 2006, with early adoption being permitted. The adoption of SFAS No. 156 did not have a material effect on the Company's financial position or results of operations.

In February 2006, the FASB issued SFAS No. 155, "Accounting for Certain Hybrid Financial Instruments-an amendment of FASB Statements No. 133 and 140." SFAS No. 155 amends SFAS No. 133, "Accounting for Derivative Instruments and Hedging Activities", to permit fair value remeasurement for any hybrid financial instrument with an embedded derivative that otherwise would require bifurcation, provided that the whole instrument is accounted for on a fair value basis. SFAS No. 155 amends SFAS No. 140, "Accounting for the Impairment or Disposal of Long-Lived Assets", to allow a qualifying special-purpose entity (SPE) to hold a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument. SFAS No. 155 applies to all financial instruments acquired or issued after the beginning of an entity's first fiscal year that begins after September 15, 2006, with earlier application allowed. The adoption of SFAS No. 155 had no impact on the Company's financial position or results of operations.

F-11

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

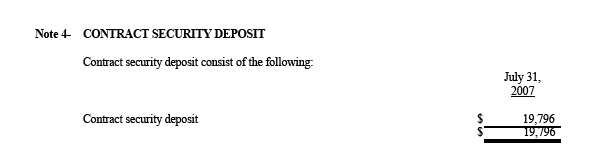

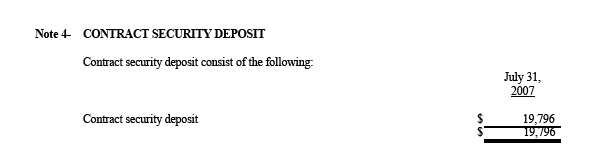

On July 15, 2007, the Company entered into a service contract with Harbin Lian Chuang Co., Ltd. ("Harbin Lian Chuang"), pursuant to which the Company provides management services to the wind energy device manufacture division of Harbin Lian Chuang July 15, 2006 through July 15, 2009. The Company paid $19,796 to Harbin Lian Chuang as contract security deposit.

Note 6- LOAN FROM A SHAREHOLDER

Loan from a shareholder is a temporally short-term loans from the sole shareholder, Mr. Man Ha to finance the Company’s operation due to lack of cash resources. These loans are unsecured, non-interest bearing and have no fixed terms of repayment, therefore, deemed payable on demand. Cash flow from this activity is classified as cash flow from financing activity. The total borrowing from Mr. Man Ha was $22,664 for the period November 27, 2006 though July 31, 2007.

F-14

CHINA WIND ENERGY LIMITED AND SUBSIDIARY F/K/A EGO SIGN INVESTMENTS LIMITED

(A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS |

| Note 7- | | COMMON STOCK |

| |

| | | The Articles of Incorporation authorized the Company to issue 10,000 shares of common stock with a |

| | | par value of $0.13 (HK$1.00). Upon formation of the Company, 1 share of common stock was issued |

| | | for $100,000. As of July 17, 2007, only $0.13 has been paid, leaving $100,000 in subscription |

| | | receivable. |

| |

| Note 8- | | COMMITMENTS AND CONTINGENCIES |

| |

| | | |

PRC

The Company faces a number of risks and challenges not typically associated with companies in North America and Western Europe, since its assets exist solely in the PRC, and its revenues are derived from its operations therein. The PRC is a developing country with an early stage market economic system, overshadowed by the state. Its political and economic systems are very different from the more developed countries and are in a state of change. The PRC also faces many social, economic and political challenges that may produce major shocks and instabilities and even crises, in both its domestic arena and in its relationships with other countries, including the United States. Such shocks, instabilities and crises may in turn significantly and negatively affect the Company's performance.

One client as of July 31, 2007

The Company plans on becoming involved in the business of providing management services to wind energy device manufactures in PRC. On July 15, 2007, the Company entered into a service contract with Harbin Lian Chuang Co., Ltd. ("Harbin Lian Chuang"), pursuant to which the Company provides management services to the wind energy device manufacture division of Harbin Lian Chuang July 15, 2006 through July 15, 2009. The management services fee is based on the revenue of the division. Harbin Lian Chuang is engaged in the business of manufacture of agriculture machinery and is developing a division of wind energy device manufacture. Harbin Lian Chuang is the only client that the Company was engaged as of July 31, 2007.

F-13