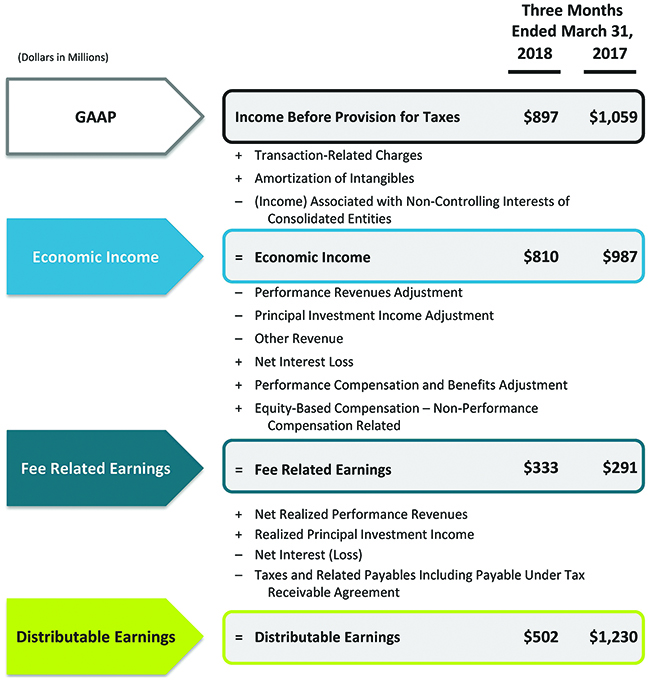

Three Months Ended March 31, 2018 Compared to Three Months Ended March 31, 2017

Revenues

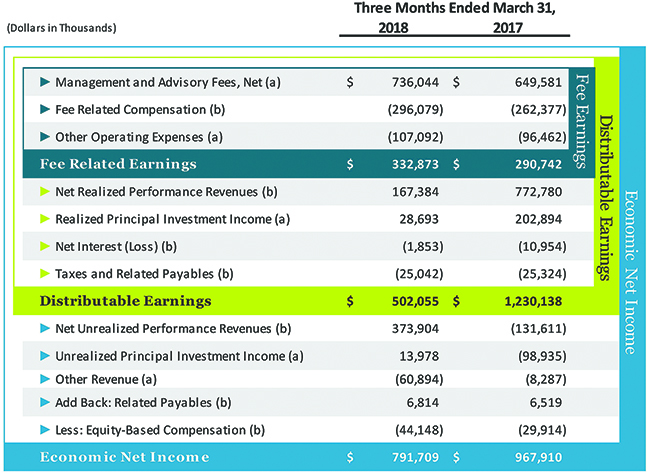

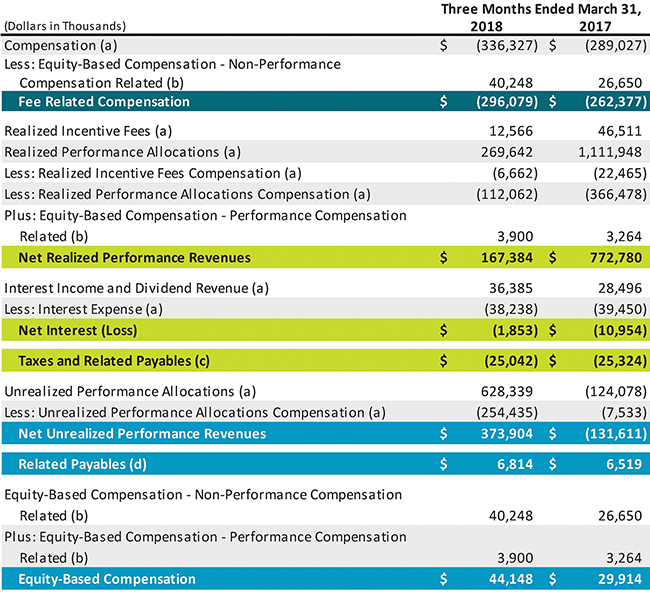

Revenues were $681.1 million for the three months ended March 31, 2018, an increase of $56.6 million compared to $624.5 million for the three months ended March 31, 2017. The increase in revenues was primarily attributable to increases of $76.2 million in Performance Revenues and $10.2 million in Total Management and Advisory Fees, Net, partially offset by a decrease of $17.1 million in Principal Investment Income.

Revenues in our Private Equity segment in the first quarter of 2018 were higher compared to the first quarter of 2017, primarily driven by increased Performance Revenues largely due to appreciation in Strategic Partners and Tactical Opportunities, as well as positive performance in our corporate private equity private investments. The market environment in early 2018 continues to be generally characterized by high prices and as a result, the market for new investments remains challenging. Nonetheless, in the first quarter of 2018 our Private Equity funds were able to deploy $4.0 billion of capital. U.S. tax reform is expected to have a neutral to slightly positive impact for our U.S. private equity investments. Volatility was also a factor in fewer realizations in the quarter and could be a factor going forward. Although we and our portfolio companies are operating against a backdrop of continuing economic strength and improving fundamentals that we expect will benefit our businesses, interest rates are expected to rise throughout 2018 and will likely increase the cost of debt financing for us and our portfolio companies. Revenues in the Private Equity segment would likely be negatively impacted if the costs of wages and other inputs and rising interest rates increasingly pressure profit margins, we experience a period of high inflation without corresponding economic growth or global, regional or sector economic conditions were to deteriorate. See “Item 1A. Risk Factors — Risks Related to Our Business — Difficult market conditions can adversely affect our business in many ways, including by reducing the value or performance of the investments made by our investment funds and reducing the ability of our investment funds to raise or deploy capital, each of which could materially reduce our revenue, earnings and cash flow and adversely affect our financial prospects and condition.” in our Annual Report on Form10-K for the year ended December 31, 2017.

Performance Revenues were $474.4 million for the three months ended March 31, 2018, an increase of $76.2 million, compared to $398.2 million for the three months ended March 31, 2017, driven primarily by Strategic Partners and Tactical Opportunities. Strategic Partners carrying value increased 6.9% in the three months ended March 31, 2018 versus 4.6% in the three months ended March 31, 2017. Tactical Opportunities carrying value increased 5.2% in the three months ended March 31, 2018 versus 3.6% in the three months ended March 31, 2017.

Total Management and Advisory Fees, Net were $190.9 million for the three months ended March 31, 2018, an increase of $10.2 million compared to $180.7 million for the three months ended March 31, 2017, driven primarily by an increase in Base Management Fees, partially offset by a decrease in Transaction, Advisory and Other Fees, Net. Base Management Fees were $183.0 million for the three months ended March 31, 2018, an increase of $6.3 million compared to $176.7 million for the three months ended March 31, 2017, primarily due to the increase infee-earning assets across the segment. Transaction, Advisory and Other Fees, Net were $11.1 million for the three months ended March 31, 2018, a decrease of $5.1 million compared to $16.2 million for the three months ended March 31, 2017, principally due to decreased capital market deal activity.

Principal Investment Income was $23.7 million for the three months ended March 31, 2018, a decrease of $17.1 million compared to $40.8 million for the three months ended March 31, 2017, driven primarily by a decrease in the appreciation of our investment holdings.

Expenses

Expenses were $352.9 million for the three months ended March 31, 2018, an increase of $88.8 million, compared to $264.1 million for the three months ended March 31, 2017. The increase was primarily attributable to an increase of $85.7 million in Total Compensation and Benefits. The increase in Total Compensation and Benefits was attributable to increases of $69.6 million in Performance Compensation and $16.1 million in Compensation.

91