UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: October 1, 2011

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to _____________

Commission File Number: 333-141699-05

YCC HOLDINGS LLC

(Exact name of registrant as specified in its charter)

| DELAWARE | | 20-8284193 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

16 YANKEE CANDLE WAY

SOUTH DEERFIELD, MASSACHUSETTS 01373

(Address of principal executive office and zip code)

(413) 665-8306

(Registrant’s telephone number, including area code)

YANKEE HOLDING CORP.

(Exact name of registrant as specified in its charter)

| DELAWARE | | 20-8304743 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

16 YANKEE CANDLE WAY

SOUTH DEERFIELD, MASSACHUSETTS 01373

(Address of principal executive office and zip code)

(413) 665-8306

(Registrant’s telephone number, including area code)

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that such registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| | YCC Holdings LLC | Yes x No o |

| | Yankee Holding Corp. | Yes o No x |

Yankee Holding Corp. is a voluntary filer of reports required of companies with public securities under Section 13 or 15(d) of the Securities Exchange Act of 1934, and it will have filed all reports which would have been required of it during the past 12 months had it been subject to such provisions.

Indicate by check mark whether each registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that such registrant was required to submit and post such files).

| | YCC Holdings LLC | Yes x No o |

| | Yankee Holding Corp. | Yes x No o |

Indicate by check mark whether each registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| YCC Holdings LLC | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o | Non-accelerated filer | x | Smaller Reporting Company | o |

| |

| Yankee Holding Corp. | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o | Non-accelerated filer | x | Smaller Reporting Company | o |

Indicate by check mark whether either registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

YCC Holdings LLC does not issue common stock but has one member’s interest issued and outstanding. YCC Holdings LLC’s sole member is Yankee Candle Investments LLC.

As of November 11, 2011, there were 497,981 shares of Yankee Holding Corp. common stock, $0.01 par value, outstanding, all of which are owned by YCC Holdings LLC.

Yankee Holding Corp. meets the conditions set forth in General Instruction (H)(1)(a) and (b) of Form 10-Q and is therefore filing this Form 10-Q with the reduced disclosure format.

Explanatory Note

This quarterly report is a combined report of YCC Holdings LLC (“YCC Holdings”) and Yankee Holding Corp. (“Holding Corp.”), a direct 100% owned subsidiary of YCC Holdings. Unless the context indicates otherwise, any reference in this report to the “Companies,” “we,” “us” and “our” refers to YCC Holdings together with its direct and indirect subsidiaries, including Holding Corp.

The principal subsidiary of YCC Holdings and Holding Corp. is The Yankee Candle Company, Inc. (together with its subsidiaries, “Yankee Candle”). All of the operating results of YCC Holdings and Holding Corp. are derived from the operating results of Yankee Candle. Where information or an explanation is provided that is substantially the same for each company, such information or explanation has been combined. Where information or an explanation is not substantially the same for each company, we have provided separate information and explanation. In addition, separate financial statements for each company are included in Part I, Item 1.

Note Regarding Forward-Looking Statements

This quarterly report contains a number of forward-looking statements. Any statements contained herein, including without limitation statements to the effect that together the Companies or their management “believes”, “expects”, “anticipates”, “plans” and similar expressions, that relate to prospective events or developments should be considered forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements. These factors include, without limitation, those set forth below in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Future Operating Results”. Management undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

YCC HOLDINGS LLC AND SUBSIDIARIES

(in thousands)

(Unaudited)

| | | October 1, 2011 | | | January 1, 2011 | |

| ASSETS | | | | | | |

| CURRENT ASSETS: | | | | | | |

| Cash | | $ | 4,294 | | | $ | 12,713 | |

| Accounts receivable, net | | | 80,796 | | | | 46,937 | |

| Inventory | | | 130,418 | | | | 67,387 | |

| Prepaid expenses and other current assets | | | 25,403 | | | | 10,813 | |

| Deferred tax assets | | | 10,271 | | | | 11,642 | |

| | | | | | | | | |

| TOTAL CURRENT ASSETS | | | 251,182 | | | | 149,492 | |

| | | | | | | | | |

| PROPERTY AND EQUIPMENT, NET | | | 121,200 | | | | 118,786 | |

| GOODWILL | | | 643,570 | | | | 643,570 | |

| INTANGIBLE ASSETS | | | 272,532 | | | | 281,749 | |

| DEFERRED FINANCING COSTS | | | 20,980 | | | | 14,271 | |

| OTHER ASSETS | | | 1,949 | | | | 1,832 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 1,311,413 | | | $ | 1,209,700 | |

| | | | | | | | | |

| LIABILITIES AND MEMBER'S (DEFICIT) EQUITY | | | | | | | | |

| | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | |

| Accounts payable | | $ | 40,357 | | | $ | 26,291 | |

| Accrued payroll | | | 8,837 | | | | 12,669 | |

| Accrued interest | | | 10,117 | | | | 17,509 | |

| Accrued income taxes | | | - | | | | 18,840 | |

| Accrued purchases of property and equipment | | | 5,384 | | | | 2,269 | |

| Current portion of capital leases | | | 903 | | | | 667 | |

| Other accrued liabilities | | | 41,929 | | | | 45,508 | |

| | | | | | | | | |

| TOTAL CURRENT LIABILITIES | | | 107,527 | | | | 123,753 | |

| | | | | | | | | |

| DEFERRED TAX LIABILITIES | | | 100,985 | | | | 99,432 | |

| LONG-TERM DEBT | | | 1,327,447 | | | | 901,125 | |

| DEFERRED RENT | | | 12,991 | | | | 11,535 | |

| CAPITAL LEASES, NET OF CURRENT PORTION | | | 2,326 | | | | 1,677 | |

| OTHER LONG-TERM LIABILITIES | | | 3,024 | | | | 2,170 | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| MEMBER'S (DEFICIT) EQUITY | | | | | | | | |

| Common Units | | | 121,902 | | | | - | |

| Class A, B and C common units | | | - | | | | 419,885 | |

| Accumulated deficit | | | (361,364 | ) | | | (346,516 | ) |

| Accumulated other comprehensive loss | | | (3,425 | ) | | | (3,361 | ) |

| | | | | | | | | |

| Total member's (deficit) equity | | | (242,887 | ) | | | 70,008 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND MEMBER'S (DEFICIT) EQUITY | | $ | 1,311,413 | | | $ | 1,209,700 | |

See notes to condensed consolidated financial statements

YCC HOLDINGS LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands)

(Unaudited)

| | | Thirteen Weeks Ended October 1, 2011 | | | Thirteen Weeks Ended October 2, 2010 | |

| Sales | | $ | 195,109 | | | $ | 175,750 | |

| Cost of sales | | | 87,958 | | | | 74,103 | |

| | | | | | | | | |

| | | | | | | | | |

| Gross profit | | | 107,151 | | | | 101,647 | |

| Selling expenses | | | 57,865 | | | | 51,842 | |

| General and administrative expenses | | | 15,486 | | | | 15,676 | |

| | | | | | | | | |

| | | | | | | | | |

| Operating income | | | 33,800 | | | | 34,129 | |

| Interest expense | | | 26,665 | | | | 20,525 | |

| Other (income) expense, net | | | (2,372 | ) | | | 484 | |

| | | | | | | | | |

| | | | | | | | | |

| Income from continuing operations before provision for income taxes | | | 9,507 | | | | 13,120 | |

| Provision for income taxes | | | 3,090 | | | | 4,247 | |

| | | | | | | | | |

| | | | | | | | | |

| Income from continuing operations | | | 6,417 | | | | 8,873 | |

| Loss from discontinued operations, net of income taxes | | | (42 | ) | | | (49 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Net income | | $ | 6,375 | | | $ | 8,824 | |

See notes to condensed consolidated financial statements

YCC HOLDINGS LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands)

(Unaudited)

| | | Thirty-Nine Weeks Ended October 1, 2011 | | | Thirty-Nine Weeks Ended October 2, 2010 | |

| Sales | | $ | 469,136 | | | $ | 442,093 | |

| Cost of sales | | | 211,112 | | | | 192,102 | |

| | | | | | | | | |

| | | | | | | | | |

| Gross profit | | | 258,024 | | | | 249,991 | |

| Selling expenses | | | 163,055 | | | | 149,668 | |

| General and administrative expenses | | | 48,308 | | | | 46,307 | |

| Restructuring charges | | | - | | | | 829 | |

| | | | | | | | | |

| | | | | | | | | |

| Operating income | | | 46,661 | | | | 53,187 | |

| Interest expense | | | 75,719 | | | | 58,794 | |

| Other (income) expense, net | | | (5,332 | ) | | | 9,968 | |

| | | | | | | | | |

| | | | | | | | | |

| Loss from continuing operations before benefit from income taxes | | | (23,726 | ) | | | (15,575 | ) |

| Benefit from income taxes | | | (9,105 | ) | | | (6,051 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Loss from continuing operations | | | (14,621 | ) | | | (9,524 | ) |

| Loss from discontinued operations, net of income taxes | | | (227 | ) | | | (342 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Net loss | | $ | (14,848 | ) | | $ | (9,866 | ) |

See notes to condensed consolidated financial statements

YCC HOLDINGS LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN MEMBER’S EQUITY (DEFECIT) (in thousands, except units)

(Unaudited)

| | Common Units | | | Class A | | | Class B | | | Class C | | | Total A, B and C | | | | | | | | | | | | Total Member's | |

| | Units | | | Amount | | | Common Units | | | Amount | | | Common Units | | | Amount | | | Common Units | | | Amount | | | Common Units | | | Accumulated Deficit | | | Accumulated Other Loss | | | Comprehensive Loss | | | Equity (Deficit) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, JANUARY 2, 2010 | | - | | | $ | - | | | | 4,268,723 | | | $ | 417,127 | | | | 363,080 | | | $ | 2,407 | | | | 97,564 | | | $ | 282 | | | $ | 419,816 | | | $ | (388,425 | ) | | $ | (8,148 | ) | | | | | $ | 23,243 | |

| Issuance of Class A and C common units | | - | | | | - | | | | 276 | | | | 30 | | | | - | | | | - | | | | 42,812 | | | | - | | | | 30 | | | | - | | | | - | | | | | | | 30 | |

| Repurchase of Class A, B and C common units | | - | | | | - | | | | (1,740 | ) | | | (204 | ) | | | (28,428 | ) | | | (377 | ) | | | (52,560 | ) | | | (306 | ) | | | (887 | ) | | | - | | | | - | | | | | | | (887 | ) |

| Equity-based compensation | | - | | | | - | | | | - | | | | - | | | | - | | | | 482 | | | | | | | | 234 | | | | 716 | | | | - | | | | - | | | | | | | 716 | |

| Comprehensive loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (9,866 | ) | | | - | | | $ | (9,866 | ) | | | (9,866 | ) |

| Foreign currency translation | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 358 | | | | 358 | | | | 358 | |

| Unrealized gain on interest rate swap, net of tax | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 4,537 | | | | 4,537 | | | | 4,537 | |

| Comprehensive loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (4,971 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, OCTOBER 2, 2010 | | - | | | $ | - | | | | 4,267,259 | | | $ | 416,953 | | | | 334,652 | | | $ | 2,512 | | | | 87,816 | | | $ | 210 | | | $ | 419,675 | | | $ | (398,291 | ) | | $ | (3,253 | ) | | | | | | $ | 18,131 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, JANUARY 1, 2011 | | - | | | $ | - | | | | 4,267,228 | | | $ | 416,956 | | | | 333,466 | | | $ | 2,637 | | | | 86,826 | | | $ | 292 | | | $ | 419,885 | | | $ | (346,516 | ) | | $ | (3,361 | ) | | | | | | $ | 70,008 | |

| Issuance of Class A and C common units | | - | | | | - | | | | - | | | | 3 | | | | - | | | | - | | | | - | | | | - | | | | 3 | | | | - | | | | - | | | | | | | | 3 | |

| Repurchase of Class A, B and C common units | | - | | | | - | | | | - | | | | - | | | | (21,423 | ) | | | (47 | ) | | | (900 | ) | | | (39 | ) | | | (86 | ) | | | - | | | | - | | | | | | | | (86 | ) |

| Conversion of Class A, B and C common units to Common Units | | 1,000 | | | | 419,888 | | | | (4,267,228 | ) | | | (416,959 | ) | | | (312,043 | ) | | | (2,648 | ) | | | (85,926 | ) | | | (281 | ) | | | (419,888 | ) | | | - | | | | - | | | | | | | | - | |

| Return of capital to Common Units | | - | | | | (297,825 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | | | | | (297,825 | ) |

| Issuance of Common Units | | - | | | | 17 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | | | | | 17 | |

| Repurchase of Common Units | | - | | | | (725 | ) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | | | | | (725 | ) |

| Equity-based compensation | | - | | | | 547 | | | | - | | | | - | | | | - | | | | 58 | | | | - | | | | 28 | | | | 86 | | | | - | | | | - | | | | | | | | 633 | |

| Comprehensive loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | - | | | | | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (14,848 | ) | | | - | | | $ | (14,848 | ) | | | (14,848 | ) |

| Foreign currency translation | | - | | | | | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (776 | ) | | | (776 | ) | | | (776 | ) |

| Unrealized gain on interest rate swap, net of tax | | - | | | | | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 712 | | | | 712 | | | | 712 | |

| Comprehensive loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (14,912 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, OCTOBER 1, 2011 | | 1,000 | | | $ | 121,902 | | | | - | | | $ | - | | | | - | | | $ | - | | | | - | | | $ | - | | | $ | - | | | $ | (361,364 | ) | | $ | (3,425 | ) | | | | | | $ | (242,887 | ) |

See notes to condensed consolidated financial statements

YCC HOLDINGS LLC AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands)

(Unaudited)

| | | Thirty-Nine Weeks Ended October 1, 2011 | | | Thirty-Nine Weeks Ended October 2, 2010 | |

| CASH FLOWS USED IN OPERATING ACTIVITIES: | | | | | | |

| Net loss | | $ | (14,848 | ) | | $ | (9,866 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Realized (gain) loss on derivative contracts | | | (4,333 | ) | | | 11,109 | |

| Depreciation and amortization | | | 32,181 | | | | 31,608 | |

| Unrealized loss (gain) on marketable securities | | | 122 | | | | (41 | ) |

| Equity-based compensation expense | | | 633 | | | | 716 | |

| Deferred taxes | | | 2,325 | | | | 630 | |

| Non-cash adjustments related to restructuring | | | - | | | | 10 | |

| Loss on disposal and impairment of property and equipment | | | 782 | | | | 64 | |

| Changes in assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (33,795 | ) | | | (31,825 | ) |

| Inventory | | | (62,950 | ) | | | (40,660 | ) |

| Prepaid expenses and other assets | | | (2,260 | ) | | | (2,645 | ) |

| Accounts payable | | | 14,061 | | | | 18,904 | |

| Income taxes | | | (31,392 | ) | | | (8,250 | ) |

| Accrued expenses and other liabilities | | | (7,761 | ) | | | (18,292 | ) |

| | | | | | | | | |

| NET CASH USED IN OPERATING ACTIVITIES | | | (107,235 | ) | | | (48,538 | ) |

| | | | | | | | | |

| CASH FLOWS USED IN INVESTING ACTIVITIES: | | | | | | | | |

| Purchases of property and equipment | | | (17,267 | ) | | | (13,443 | ) |

| Proceeds from sale of property and equipment | | | 38 | | | | 197 | |

| | | | | | | | | |

| NET CASH USED IN INVESTING ACTIVITIES | | | (17,229 | ) | | | (13,246 | ) |

| | | | | | | | | |

| CASH FLOWS PROVIDED BY FINANCING ACTIVITIES: | | | | | | | | |

| Borrowings under Senior Secured Credit Facility | | | 137,000 | | | | 76,000 | |

| Repayments under Senior Secured Credit Facility | | | (20,000 | ) | | | (20,174 | ) |

| Borrowings under Senior PIK Notes | | | 308,700 | | | | - | |

| Financing costs | | | (10,478 | ) | | | - | |

| Return of capital | | | (297,825 | ) | | | - | |

| Proceeds from issuance of Class A and C common units | | | 3 | | | | 30 | |

| Proceeds from issuance of Common Units | | | 17 | | | | - | |

| Repurchase of Class A, B and C common units | | | (86 | ) | | | (887 | ) |

| Repurchase of Common Units | | | (725 | ) | | | - | |

| Principal payments on capital lease obligations | | | (567 | ) | | | (234 | ) |

| | | | | | | | | |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 116,039 | | | | 54,735 | |

| | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | | | 6 | | | | (43 | ) |

| | | | | | | | | |

| NET DECREASE IN CASH | | | (8,419 | ) | | | (7,092 | ) |

| CASH, BEGINNING OF PERIOD | | | 12,713 | | | | 9,095 | |

| | | | | | | | | |

| CASH, END OF PERIOD | | $ | 4,294 | | | $ | 2,003 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | $ | 78,409 | | | $ | 65,293 | |

| Income taxes | | $ | 19,790 | | | $ | 1,310 | |

| Net change in accrued purchases of property and equipment | | $ | (3,115 | ) | | $ | 770 | |

| Capital lease obligations related to equipment purchase | | $ | 1,452 | | | $ | 1,974 | |

| Noncash Financing Activities: | | | | | | | | |

| Conversion of Class A, B and C common units to Common Units | | $ | 419,888 | | | $ | - | |

See notes to condensed consolidated financial statements

YANKEE HOLDING CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands except share data)

(Unaudited)

| | | October 1, 2011 | | | January 1, 2011 | |

| ASSETS | | | | | | |

| CURRENT ASSETS: | | | | | | |

| Cash | | $ | 4,294 | | | $ | 12,713 | |

| Accounts receivable, net | | | 80,796 | | | | 46,937 | |

| Inventory | | | 130,418 | | | | 67,387 | |

| Prepaid expenses and other current assets | | | 25,403 | | | | 10,813 | |

| Deferred tax assets | | | 10,271 | | | | 11,642 | |

| | | | | | | | | |

| TOTAL CURRENT ASSETS | | | 251,182 | | | | 149,492 | |

| | | | | | | | | |

| PROPERTY AND EQUIPMENT, NET | | | 121,200 | | | | 118,786 | |

| GOODWILL | | | 643,570 | | | | 643,570 | |

| INTANGIBLE ASSETS | | | 272,532 | | | | 281,749 | |

| DEFERRED FINANCING COSTS | | | 11,959 | | | | 14,271 | |

| OTHER ASSETS | | | 1,949 | | | | 1,832 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 1,302,392 | | | $ | 1,209,700 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDER'S EQUITY | | | | | | | | |

| | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | |

| Accounts payable | | $ | 40,357 | | | $ | 26,291 | |

| Accrued payroll | | | 8,837 | | | | 12,669 | |

| Accrued interest | | | 5,994 | | | | 17,509 | |

| Accrued income taxes | | | - | | | | 18,840 | |

| Accrued purchases of property and equipment | | | 5,384 | | | | 2,269 | |

| Current portion of capital leases | | | 903 | | | | 667 | |

| Other accrued liabilities | | | 41,873 | | | | 45,508 | |

| | | | | | | | | |

| TOTAL CURRENT LIABILITIES | | | 103,348 | | | | 123,753 | |

| | | | | | | | | |

| DEFERRED TAX LIABILITIES | | | 100,985 | | | | 99,432 | |

| LONG-TERM DEBT | | | 1,018,125 | | | | 901,125 | |

| DEFERRED RENT | | | 12,991 | | | | 11,535 | |

| CAPITAL LEASES, NET OF CURRENT PORTION | | | 2,326 | | | | 1,677 | |

| OTHER LONG-TERM LIABILITIES | | | 3,024 | | | | 2,170 | |

| COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| STOCKHOLDER'S EQUITY: | | | | | | | | |

Common stock: $.01 par value; 500,000 issued and 497,981 outstanding at October 1, 2011 and 500,000 issued and 498,042 outstanding at January 1, 2011 | | | 417,462 | | | | 418,187 | |

| Additional paid-in capital | | | 15,331 | | | | 3,421 | |

Treasury stock: at cost, 2,019 shares at October 1, 2011 and 1,958 shares at January 1, 2011 | | | (1,809 | ) | | | (1,723 | ) |

| Accumulated deficit | | | (365,966 | ) | | | (346,516 | ) |

| Accumulated other comprehensive loss | | | (3,425 | ) | | | (3,361 | ) |

| | | | | | | | | |

| Total stockholder's equity | | | 61,593 | | | | 70,008 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDER'S EQUITY | | $ | 1,302,392 | | | $ | 1,209,700 | |

See notes to condensed consolidated financial statements

YANKEE HOLDING CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands)

(Unaudited)

| | | Thirteen Weeks Ended October 1, 2011 | | | Thirteen Weeks Ended October 2, 2010 | |

| Sales | | $ | 195,109 | | | $ | 175,750 | |

| Cost of sales | | | 87,958 | | | | 74,103 | |

| | | | | | | | | |

| | | | | | | | | |

| Gross profit | | | 107,151 | | | | 101,647 | |

| Selling expenses | | | 57,865 | | | | 51,842 | |

| General and administrative expenses | | | 15,273 | | | | 15,676 | |

| | | | | | | | | |

| | | | | | | | | |

| Operating income | | | 34,013 | | | | 34,129 | |

| Interest expense | | | 17,847 | | | | 20,525 | |

| Other (income) expense, net | | | (2,372 | ) | | | 484 | |

| | | | | | | | | |

| | | | | | | | | |

| Income from continuing operations before provision for income taxes | | | 18,538 | | | | 13,120 | |

| Provision for income taxes | | | 6,044 | | | | 4,247 | |

| | | | | | | | | |

| | | | | | | | | |

| Income from continuing operations | | | 12,494 | | | | 8,873 | |

| Loss from discontinued operations, net of income taxes | | | (42 | ) | | | (49 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Net income | | $ | 12,452 | | | $ | 8,824 | |

See notes to condensed consolidated financial statements

YANKEE HOLDING CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands)

(Unaudited)

| | | Thirty-Nine Weeks Ended October 1, 2011 | | | Thirty-Nine Weeks Ended October 2, 2010 | |

| Sales | | $ | 469,136 | | | $ | 442,093 | |

| Cost of sales | | | 211,112 | | | | 192,102 | |

| | | | | | | | | |

| | | | | | | | | |

| Gross profit | | | 258,024 | | | | 249,991 | |

| Selling expenses | | | 163,055 | | | | 149,668 | |

| General and administrative expenses | | | 47,891 | | | | 46,307 | |

| Restructuring charges | | | - | | | | 829 | |

| | | | | | | | | |

| | | | | | | | | |

| Operating income | | | 47,078 | | | | 53,187 | |

| Interest expense | | | 53,303 | | | | 58,794 | |

| Other (income) expense, net | | | (5,332 | ) | | | 9,968 | |

| | | | | | | | | |

| | | | | | | | | |

| Loss from continuing operations before benefit from income taxes | | | (893 | ) | | | (15,575 | ) |

| Benefit from income taxes | | | (848 | ) | | | (6,051 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Loss from continuing operations | | | (45 | ) | | | (9,524 | ) |

| Loss from discontinued operations, net of income taxes | | | (227 | ) | | | (342 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Net loss | | $ | (272 | ) | | $ | (9,866 | ) |

See notes to condensed consolidated financial statements

YANKEE HOLDING CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDER’S EQUITY (in thousands, except treasury shares)

(Unaudited)

| | | Common Stock | | | Additional Paid in | | | Treasury Stock | | | Accumulated | | | Accumulated Other Comprehensive | | | Comprehensive | | | | |

| | | Shares | | | Amount | | | Capital | | | Shares | | | Amount | | | Deficit | | | Loss | | | Loss | | | Total | |

| BALANCE, JANUARY 2, 2010 | | | 500 | | | $ | 418,187 | | | $ | 2,419 | | | | 1120 | | | $ | (790 | ) | | $ | (388,425 | ) | | $ | (8,148 | ) | | | | | $ | 23,243 | |

| Issuance of common stock | | | — | | | | — | | | | 30 | | | | — | | | | — | | | | — | | | | — | | | | | | | 30 | |

| Repurchase of common stock | | | — | | | | — | | | | — | | | | 801 | | | | (887 | ) | | | — | | | | — | | | | | | | (887 | ) |

| Equity-based compensation expense | | | — | | | | — | | | | 716 | | | | — | | | | — | | | | — | | | | — | | | | | | | 716 | |

| Comprehensive loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (9,866 | ) | | | — | | | $ | (9,866 | ) | | | (9,866 | ) |

| Foreign currency translation | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 358 | | | | 358 | | | | 358 | |

| Unrealized gain on interest rate swaps, net of tax | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4,537 | | | | 4,537 | | | | 4,537 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comprehensive loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (4,971 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, OCTOBER 2, 2010 | | | 500 | | | $ | 418,187 | | | $ | 3,165 | | | | 1,921 | | | $ | (1,677 | ) | | $ | (398,291 | ) | | $ | (3,253 | ) | | | | | | $ | 18,131 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, JANUARY 1, 2011 | | | 500 | | | $ | 418,187 | | | $ | 3,421 | | | | 1,958 | | | $ | (1,723 | ) | | $ | (346,516 | ) | | $ | (3,361 | ) | | | | | | $ | 70,008 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock | | | — | | | | — | | | | 20 | | | | — | | | | — | | | | — | | | | — | | | | | | | | 20 | |

| Repurchase of common stock | | | — | | | | (725 | ) | | | — | | | | 61 | | | | (86 | ) | | | — | | | | — | | | | | | | | (811 | ) |

| Equity-based compensation expense | | | — | | | | — | | | | 633 | | | | — | | | | — | | | | — | | | | — | | | | | | | | 633 | |

| Contributions by YCC Holdings LLC | | | — | | | | — | | | | 11,257 | | | | — | | | | — | | | | — | | | | — | | | | | | | | 11,257 | |

| Dividend to YCC Holdings LLC | | | — | | | | — | | | | — | | | | — | | | | — | | | | (19,178 | ) | | | — | | | | | | | | (19,178 | ) |

| Comprehensive loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (272 | ) | | | — | | | $ | (272 | ) | | | (272 | ) |

| Foreign currency translation | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (776 | ) | | | (776 | ) | | | (776 | ) |

| Unrealized gain on interest rate swaps, net of tax | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 712 | | | | 712 | | | | 712 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Comprehensive loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (336 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, OCTOBER 1, 2011 | | | 500 | | | $ | 417,462 | | | $ | 15,331 | | | | 2,019 | | | $ | (1,809 | ) | | $ | (365,966 | ) | | $ | (3,425 | ) | | | | | | $ | 61,593 | |

See notes to condensed consolidated financial statements

YANKEE HOLDING CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands)

(Unaudited)

| | | Thirty-Nine Weeks Ended October 1, 2011 | | | Thirty-Nine Weeks Ended October 2, 2010 | |

| CASH FLOWS USED IN OPERATING ACTIVITIES: | | | | | | |

| Net loss | | $ | (272 | ) | | $ | (9,866 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Realized (gain) loss on derivative contracts | | | (4,333 | ) | | | 11,109 | |

| Depreciation and amortization | | | 30,570 | | | | 31,608 | |

| Unrealized loss (gain) on marketable securities | | | 122 | | | | (41 | ) |

| Equity-based compensation expense | | | 633 | | | | 716 | |

| Deferred taxes | | | 2,325 | | | | 630 | |

| Non-cash adjustments related to restructuring | | | - | | | | 10 | |

| Loss on disposal and impairment of property and equipment | | | 782 | | | | 64 | |

| Changes in assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (33,795 | ) | | | (31,825 | ) |

| Inventory | | | (62,950 | ) | | | (40,660 | ) |

| Prepaid expenses and other assets | | | (2,260 | ) | | | (2,645 | ) |

| Accounts payable | | | 14,061 | | | | 18,904 | |

| Income taxes | | | (23,135 | ) | | | (8,250 | ) |

| Accrued expenses and other liabilities | | | (11,940 | ) | | | (18,292 | ) |

| | | | | | | | | |

| NET CASH USED IN OPERATING ACTIVITIES | | | (90,192 | ) | | | (48,538 | ) |

| | | | | | | | | |

| CASH FLOWS USED IN INVESTING ACTIVITIES: | | | | | | | | |

| Purchases of property and equipment | | | (17,267 | ) | | | (13,443 | ) |

| Proceeds from sale of property and equipment | | | 38 | | | | 197 | |

| | | | | | | | | |

| NET CASH USED IN INVESTING ACTIVITIES | | | (17,229 | ) | | | (13,246 | ) |

| | | | | | | | | |

| CASH FLOWS PROVIDED BY FINANCING ACTIVITIES: | | | | | | | | |

| Borrowings under Senior Secured Credit Facility | | | 137,000 | | | | 76,000 | |

| Repayments under Senior Secured Credit Facility | | | (20,000 | ) | | | (20,174 | ) |

| Financing costs | | | (468 | ) | | | - | |

| Contributions by YCC Holdings LLC | | | 3,000 | | | | - | |

| Dividend to YCC Holdings LLC | | | (19,178 | ) | | | - | |

| Proceeds from issuance of common stock | | | 20 | | | | 30 | |

| Repurchase of common stock | | | (811 | ) | | | (887 | ) |

| Principal payments on capital lease obligations | | | (567 | ) | | | (234 | ) |

| | | | | | | | | |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 98,996 | | | | 54,735 | |

| | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | | | 6 | | | | (43 | ) |

| | | | | | | | | |

| NET DECREASE IN CASH | | | (8,419 | ) | | | (7,092 | ) |

| CASH, BEGINNING OF PERIOD | | | 12,713 | | | | 9,095 | |

| | | | | | | | | |

| CASH, END OF PERIOD | | $ | 4,294 | | | $ | 2,003 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest | | $ | 61,727 | | | $ | 65,293 | |

| | | | | | | | | |

| Income taxes | | $ | 19,790 | | | $ | 1,310 | |

| | | | | | | | | |

| Net change in accrued purchases of property and equipment | | $ | (3,115 | ) | | $ | 770 | |

| | | | | | | | | |

| Capital lease obligations related to equipment purchase | | $ | 1,452 | | | $ | 1,974 | |

| | | | | | | | | |

| Noncash Financing Activities: | | | | | | | | |

| Noncash contribution by YCC Holdings LLC | | $ | 8,257 | | | $ | - | |

See notes to condensed consolidated financial statements

YCC HOLDINGS LLC AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

1. BASIS OF PRESENTATION AND ORGANIZATION

Basis of Presentation

The unaudited interim condensed consolidated financial statements of YCC Holdings LLC (“YCC Holdings”) and Yankee Holding Corp. (“Holding Corp.” and together with YCC Holdings, the “Companies”) have been prepared in accordance with accounting principles generally accepted in the United States of America (“generally accepted accounting principles” or “GAAP”). The financial information included herein is unaudited; however, in the opinion of management such information reflects all adjustments (consisting of normal recurring accruals) necessary for a fair presentation of financial position, results of operations, and cash flows as of the date and for the periods indicated. All intercompany transactions and balances have been eliminated. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full fiscal year.

The accompanying unaudited condensed financial statements of Holding Corp. should be read in conjunction with the audited consolidated financial statements of Holding Corp. for the year ended January 1, 2011 included in Holding Corp.’s Annual Report on Form 10-K. The accompanying unaudited condensed financial statements of YCC Holdings should be read in conjunction with the audited consolidated financial statements of YCC Holdings for the year ended January 1, 2011 included in YCC Holdings’ Registration Statement on Form S-4 originally filed with the Securities and Exchange Commission (the “SEC”) on April 14, 2011. The registration statement was declared effective on August 4, 2011.

Organization and Current Events

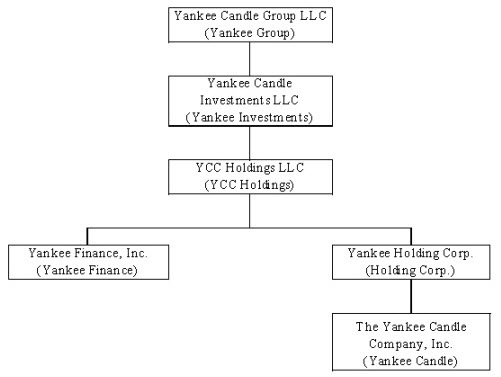

YCC Holdings and Holding Corp. are holding companies with no direct operations. Their principal assets are the indirect equity interests in The Yankee Candle Company, Inc. (“Yankee Candle”), and all of their operations are conducted through Yankee Candle, the wholly owned operating subsidiary of Holding Corp. Holding Corp. is a wholly owned subsidiary of YCC Holdings. YCC Holdings is a wholly owned subsidiary of Yankee Candle Investments LLC (“Yankee Investments”), which is in turn a wholly owned subsidiary of Yankee Candle Group LLC (“Yankee Group”). See the entity chart below:

February 2011 Senior Note Issuance.

In February 2011, Yankee Investments and Yankee Finance, Inc. (“Yankee Finance”) were formed in connection with the co-issuance of $315.0 million Senior PIK Notes (as defined below) by YCC Holdings and Yankee Finance. In connection with the issuance of the Senior PIK Notes, the equity interests in YCC Holdings were exchanged for new equity interests in its newly formed parent, Yankee Investments. Pursuant to this exchange, holders of Class A, Class B and Class C common units in YCC Holdings exchanged such units on a one for one basis for an identical interest in Class A, Class B, and Class C common units of Yankee Investments. After the exchange, each unit holder had the same ownership interest with the same rights and features in Yankee Investments that it previously had in YCC Holdings. Subsequent to the exchange, all outstanding Class A, B and C common units in YCC Holdings were converted to 1,000 Common Units in YCC Holdings, all of which are now held by its parent and sole member, Yankee Investments.

In February 2011, YCC Holdings and Yankee Finance co-issued $315.0 million of 10.25%/11.00% Senior Notes due 2016 (the “Senior PIK Notes”) pursuant to an Indenture at a discount of $6.3 million for net proceeds of $308.7 million. Issuance costs related to the Senior PIK Notes were $9.7 million, of which $7.8 million were paid for by YCC Holdings and $1.9 million were paid for by Holding Corp. The costs paid for by Holding Corp. have been reflected as a dividend to YCC Holdings in the accompanying Holding Corp.’s condensed consolidated statement of stockholder’s equity. The Senior PIK Notes were issued in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”); however, the issuers have filed a registration statement with the SEC relating to an offer to exchange the original notes for identical notes which are registered under the Securities Act. The registration statement was declared effective on August 4, 2011 and all notes were subsequently exchanged.

The proceeds from the Senior PIK Notes were used to pay transaction costs (exclusive of the amounts paid by Holding Corp.) and make a payment of $300.8 million to Yankee Investments which in turn made payments of $297.8 million to holders of Yankee Investments’ Class A common units and payments of $3.0 million in aggregate to holders of Yankee Investments’ Class B and Class C common units. The payments to the Class A common unit holders represent a partial return of their original investment and are reflected as an equity transaction by Yankee Investments. The payments to the Class B and Class C common unit holders who are members of management and directors of Holding Corp. did not affect the liquidation amounts for such units and accordingly are reflected as general and administrative expense in both YCC Holdings’ and Holding Corp.’s accompanying condensed consolidated statements of operations for the thirty-nine weeks ended October 1, 2011 and as a contribution by YCC Holdings in Holding Corp.’s accompanying condensed consolidated statement of stockholder’s equity for the thirty-nine weeks ended October 1, 2011.

Subsequent Exchange.

In the fiscal second quarter of 2011, the Companies formed Yankee Group, a Delaware limited liability company. Yankee Group is the parent of Yankee Investments. The members of Yankee Group include certain funds affiliated with Madison Dearborn Partners, LLC (“Madison Dearborn”), as well as certain management and directors of Yankee Holdings. In connection with the formation of Yankee Group, a second exchange of equity interests occurred, whereby holders of Class A, Class B and Class C common units in Yankee Investments exchanged such units on a one for one basis for an identical interest in Class A, Class B, and Class C common units of Yankee Group. After the exchange, each unit holder had the same ownership interest with the same rights and features in Yankee Group that it previously had in Yankee Investments. All outstanding interests in Yankee Investments were exchanged pursuant to this transaction with the exception of 1,600 common units held by former employees of Yankee Candle whose employment had been terminated since the February 2011 transaction described above. These 1,600 units are to remain held in Yankee Investments pending the planned repurchase of the units by Yankee Investments at the time and in the manner contemplated by the applicable equity documents. During the thirteen weeks ended October 1, 2011, 470 common units were repurchased leaving 1,130 common units in Yankee Investments. Following the planned repurchase of these remaining units, all outstanding common units of Yankee Investments will be owned by Yankee Group.

2. INVENTORY

The Companies value their inventory on the first–in first–out (“FIFO”) basis. The components of inventory were as follows (in thousands):

| | | October 1, 2011 | | | January 1, 2011 | |

| Finished goods | | $ | 113,540 | | | $ | 58,153 | |

| Work-in-process | | | 738 | | | | 362 | |

| Raw materials and packaging | | | 16,140 | | | | 8,872 | |

| | | | | | | | | |

| | | | | | | | | |

| Total inventory | | $ | 130,418 | | | $ | 67,387 | |

3. GOODWILL AND INTANGIBLE ASSETS

The Companies have determined that their tradenames have an indefinite useful life and, therefore, are not being amortized. In accordance with Accounting Standards Codification (“ASC”) Topic 350 “Intangibles - Goodwill and Other,” goodwill and indefinite lived intangible assets are not amortized but are subject to an annual impairment test. There were no changes in the carrying amount of goodwill during the thirty-nine weeks ended October 1, 2011 and October 2, 2010.

Intangible Assets

The carrying amount and accumulated amortization of intangible assets consisted of the following (in thousands):

| | | Weighted Average Useful Life (in years) | | | Gross Carrying Amount | | | Accumulated Amortization | | | Net Book Value | |

| October 1, 2011 | | | | | | | | | | | | |

| Indefinite life: | | | | | | | | | | | | |

| Tradenames | | | N/A | | | $ | 267,755 | | | $ | - | | | $ | 267,755 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Finite-lived intangible assets: | | | | | | | | | | | | | | | | |

| Customer lists | | | 5 | | | | 63,652 | | | | (59,303 | ) | | | 4,349 | |

| Favorable lease agreements | | | 5 | | | | 2,330 | | | | (1,903 | ) | | | 427 | |

| Other | | | 3 | | | | 36 | | | | (35 | ) | | | 1 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total finite-lived intangible assets | | | | | | | 66,018 | | | | (61,241 | ) | | | 4,777 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total intangible assets | | | | | | $ | 333,773 | | | $ | (61,241 | ) | | $ | 272,532 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| January 1, 2011 | | | | | | | | | | | | | | | | |

| Indefinite life: | | | | | | | | | | | | | | | | |

| Tradenames | | | N/A | | | $ | 267,755 | | | $ | - | | | $ | 267,755 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Finite-lived intangible assets: | | | | | | | | | | | | | | | | |

| Customer lists | | | 5 | | | | 63,650 | | | | (50,234 | ) | | | 13,416 | |

| Favorable lease agreements | | | 5 | | | | 2,330 | | | | (1,755 | ) | | | 575 | |

| Other | | | 3 | | | | 36 | | | | (33 | ) | | | 3 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total finite-lived intangible assets | | | | | | | 66,016 | | | | (52,022 | ) | | | 13,994 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total intangible assets | | | | | | $ | 333,771 | | | $ | (52,022 | ) | | $ | 281,749 | |

Total amortization expense from finite–lived intangible assets was $3.1 million for each of the thirteen weeks ended October 1, 2011 and October 2, 2010. Total amortization expense from finite–lived intangible assets was $9.2 million and $9.4 million for the thirty-nine weeks ended October 1, 2011 and October 2, 2010, respectively. These intangible assets are amortized on a straight line basis. Favorable lease agreements are amortized over the remaining lease term of each respective lease.

4. LONG-TERM DEBT

Long-term debt consisted of the following at October 1, 2011 and January 1, 2011 (in thousands):

| | | October 1, 2011 | | | January 1, 2011 | |

| Holding Corp. | | | | | | |

| Senior secured revolving credit facility | | $ | 117,000 | | | $ | - | |

| Senior secured term loan facility | | | 388,125 | | | | 388,125 | |

| Senior notes due 2015 | | | 325,000 | | | | 325,000 | |

| Senior subordinated notes due 2017 | | | 188,000 | | | | 188,000 | |

| Total Holding Corp. | | | 1,018,125 | | | | 901,125 | |

| Senior PIK notes due 2016, net of unamortized discount of $5,678 | | | 309,322 | | | | - | |

| Total YCC Holdings | | $ | 1,327,447 | | | $ | 901,125 | |

Senior Secured Credit Facility

Yankee Candle’s senior secured credit facility (the “Credit Facility”) consists of a $650.0 million senior secured term loan facility (“Term Facility”) maturing on February 6, 2014 and a senior secured revolving credit facility (“Revolving Facility”), which expires on February 6, 2013. Amounts repaid under the Term Facility cannot be reborrowed. In April 2011, Yankee Candle entered into a Joinder Agreement to the Revolving Facility which provided a total of $15.0 million in new revolving loan commitments increasing Yankee Candle’s total revolving loan capacity under the Revolving Facility from $125.0 million to $140.0 million.

All borrowings under Yankee Candle’s Credit Facility bear interest at a rate per annum equal to an applicable margin, plus, at Yankee Candle’s option, (i) the higher of (a) the prime rate (as set forth on the British Banking Association Telerate Page 5) and (b) the federal funds effective rate, plus one-half percent (0.50%) per annum or (ii) the Eurodollar rate, and resets periodically. In addition to paying interest on outstanding principal under the senior secured credit facility, Yankee Candle is required to pay a commitment fee to the lenders in respect of unutilized loan commitments at a rate of 0.50% per annum. As of October 1, 2011, the weighted average combined interest rate on the Term Facility and the Revolving Facility was 2.1%.

Yankee Candle’s Credit Facility contains a financial covenant which requires that Yankee Candle maintain at the end of each fiscal quarter, commencing with the quarter ended January 1, 2011 through the quarter ending October 1, 2011, a consolidated total secured debt (net of cash and cash equivalents not to exceed $30.0 million) to Consolidated Adjusted EBITDA ratio of no more than 3.25 to 1.00. The consolidated total secured debt to Consolidated Adjusted EBITDA ratio will change to no more than 2.75 to 1.00 for the fourth quarter ending December 31, 2011. As of October 1, 2011, Yankee Candle’s actual secured leverage ratio was 2.65 to 1.00, as calculated in accordance with the Credit Facility. As of October 1, 2011, total secured debt was $504.1 million (net of $4.3 million of cash and including capital lease obligations of $3.2 million). Under the Credit Facility, Consolidated Adjusted EBITDA is defined as net income plus, interest, taxes, depreciation and amortization, further adjusted to add back extraordinary, unusual or non-recurring losses, non-cash stock option expense, fees and expenses related to the completion of the merger (the “Merger”), fees and expenses under the Management Agreement with our equity sponsor, restructuring charges or reserves, as well as other non-cash charges, expenses or losses, and further adjusted to subtract extraordinary, unusual or non-recurring gains, other non-cash income or gains, and certain cash contributions to Yankee Candle’s common equity.

As of October 1, 2011, Yankee Candle had outstanding letters of credit of $2.2 million and $117.0 million outstanding under the Revolving Facility, leaving $20.8 million in availability under the Revolving Facility.

Senior PIK Notes of YCC Holdings

In February 2011, YCC Holdings and Yankee Finance co-issued $315.0 million of Senior PIK Notes pursuant to an Indenture at a discount of $6.3 million for net proceeds of $308.7 million. Issuance costs related to the Senior PIK Notes were $9.7 million, of which $7.8 million were paid for by YCC Holdings and $1.9 million were paid for by Holding Corp.

Cash interest on the Senior PIK Notes accrues at a rate of 10.25% per annum, and PIK Interest (defined below) accrues at the cash interest rate plus 0.75%. YCC Holdings is required to pay interest on the Senior PIK Notes (1) for the first interest payment date, entirely in cash and (2) for all subsequent interest payment dates, entirely in cash interest, unless the conditions described in the indenture are satisfied with respect to the related interest period, in which case, YCC Holdings may pay interest on the Senior PIK Notes for such interest period by increasing the principal amount of the Senior PIK Notes or by issuing new PIK Notes for up to the entire amount of the interest payment (in each case, “PIK Interest”) to the extent described in the related indenture.

YCC Holdings is indirectly dependent upon dividends from Yankee Candle to generate the funds necessary to meet its outstanding debt service obligations. Neither Yankee Candle nor Holding Corp. guarantees the Senior PIK Notes. Yankee Candle is not obligated to pay dividends to Holding Corp. and Holding Corp. is not obligated to pay dividends to YCC Holdings. Holding Corp. is allowed to make dividends to YCC Holdings (from dividends made by Yankee Candle to Holding Corp.) based upon the lower of (a) available excess cash flow based on provisions determined in Yankee Candle’s Credit Facility agreement, together with certain equity and debt issuances which, to date, have not occurred and (b) amounts available for restricted payments based on provisions included in the indentures governing Yankee Candle's senior notes and senior subordinated notes.

Available excess cash flow for Yankee Candle’s Credit Facility is defined as the aggregate cumulative amount of excess cash flow for all fiscal years subsequent to the date of the credit agreement (February 2007) that is not required to prepay the term debt. On an annual basis, Yankee Candle is required to prepay the term debt by 50% of excess cash flow, which percentage is reduced to 25% if the consolidated total leverage ratio (as defined in the Credit Facility) is greater than 4.0 to 1.0 and not greater than 5.0 to 1.0. Yankee Candle is not required to make a payment if the consolidated total leverage ratio is not greater than 4.0 to 1.0. Excess cash flow is defined in the Credit Facility agreement as consolidated net income of Yankee Candle and its restricted subsidiaries plus all non cash charges including depreciation, amortization, deferred tax expense, non-cash losses on disposition of certain property, decreases in working capital and the net increase in deferred tax liabilities or net decrease in deferred tax assets , decreased by non-cash gains including gains or credits, cash paid for capital expenditures, acquisitions, certain other investments, regularly scheduled principal payments, voluntary prepayments and certain mandatory prepayments of principal on debt, transaction costs for certain debt, equity, recapitalization, acquisition and investment transactions, purchase price adjustments in connection with acquisitions and certain payments to Madison Dearborn, increases in working capital and the net decrease in deferred tax liabilities or net increase in deferred tax assets.

The indentures governing Yankee Candle's Senior Notes and Senior Subordinated notes permit Yankee Candle to pay dividends to Holding Corp. if: (i) there is no default or event of default under the indentures governing Yankee Candle’s notes; (ii) Yankee Candle would have a fixed charge coverage ratio of at least 2.0 to 1.0; and (iii) such dividend, together with the aggregate amount of all other “restricted payments” (as defined in such indentures) made by Yankee Candle and its restricted subsidiaries after February 6, 2007 (excluding certain restricted payments), is less than the sum (a) 50% of the Consolidated Net Income (as defined in such indentures) of Yankee Candle for the period (taken as one accounting period) from December 31, 2006 to the end of Yankee Candle’s most recently ended fiscal quarter for which internal financial statements are available at the time of such dividend (or, in the case such Consolidated Net Income for such period is a deficit, minus 100% of such deficit), plus (b) the proceeds from specified equity contributions or issuances of equity.

In addition to the capacity described above, Yankee Candle has a “basket” of $35 million under the indentures from which it may make dividends in amount not to exceed $35.0 million (since the date of the issuance of Yankee Candle’s notes), so long there is no default or event of defaults under the indentures. The ability of Yankee Candle and Holding Corp. to pay dividends to YCC Holdings and thus pay cash interest on the Senior PIK Notes is limited by Delaware law.

As of January 1, 2011, the amount available for dividends from Yankee Candle to YCC Holdings was approximately $138.0 million. During the thirty-nine weeks ended October 1, 2011 Holding Corp. made a dividend of $19.2 million to YCC Holdings, which decreased the amount available for future dividends.

Holding Corp.’s income tax receivable reflects the tax benefit of the related interest expense as a result of YCC Holdings’ issuance of Senior PIK Notes. As such, in the first thirty-nine weeks of fiscal 2011 Holding Corp. received a non cash contribution of $8.3 million from YCC Holdings which increased Holding Corp.’s income tax receivable. The $8.3 million contribution is shown as a contribution by YCC Holdings LLC in Holding Corp.’s condensed consolidated statement of changes in stockholder’s equity and in Holding Corp.’s non-cash financing section of the condensed consolidated statements of cash flows.

5. MEMBER’S (DEFICIT) EQUITY, STOCKHOLDER’S EQUITY AND EQUITY-BASED COMPENSATION

Prior to February 2011, member’s equity was held in the form of Class A, Class B and Class C common units in YCC Holdings. As discussed in Note 1, in February 2011 equity interests in YCC Holdings were exchanged for new equity interests in its newly formed parent, Yankee Investments. Pursuant to this exchange, holders of Class A, Class B and Class C common units in YCC Holdings exchanged such units on a one for one basis for an identical interest in Class A, Class B, and Class C common units of Yankee Investments. After the exchange, each unit holder had the same ownership interest with the same rights and features in Yankee Investments that it previously had in YCC Holdings. Subsequent to the exchange, all outstanding Class A, B and C common units in YCC Holdings were converted to 1,000 Common Units in YCC Holdings, all of which are now held by its parent and sole member, Yankee Investments.

Subsequently, in the second fiscal quarter of 2011, in connection with the formation of Yankee Group a second exchange of equity interests occurred, whereby holders of Class A, Class B and Class C common units in Yankee Investments exchanged such units on a one for one basis for an identical interest in Class A, Class B, and Class C common units of Yankee Group. After the exchange, each unit holder had the same ownership interest with the same rights and features in Yankee Group that it previously had in Yankee Investments. All outstanding interests in Yankee Investments were exchanged pursuant to this transaction with the exception of 1,600 common units held by former employees of Yankee Candle whose employment had been terminated since the February 2011 transaction described above. These 1,600 units will be held in Yankee Investments pending the planned repurchase of the units by Yankee Investments at the time and in the manner contemplated by the applicable equity documents. During the thirteen weeks ended October 1, 2011, 470 common units were repurchased leaving 1,130 common units in Yankee Investments. Following the planned repurchase of these remaining units, all outstanding common units of Yankee Investments will be owned by Yankee Group.

A summary of nonvested units for Yankee Group as of October 1, 2011 and for YCC Holdings as of October 2, 2010, and the activity for the thirty-nine weeks ended October 1, 2011 and October 2, 2010 is presented below (there are no nonvested units remaining in Yankee Investments):

| | | Class A Common Units | | | Weighted Average Calculated Value | | | Class B Common Units | | | Weighted Average Calculated Value | | | Class C Common Units | | | Weighted Average Calculated Value | |

| Nonvested stock at January 1, 2011 | | | - | | | | - | | | | 73,293 | | | $ | 9.39 | | | | 62,747 | | | $ | 23.16 | |

| Granted | | | 213 | | | | - | | | | - | | | | - | | | | 11,650 | | | | 28.97 | |

| Forfeited | | | - | | | | - | | | | (23,626 | ) | | $ | 9.39 | | | | (397 | ) | | $ | 36.33 | |

| Vested | | | (213 | ) | | | - | | | | (34,044 | ) | | $ | 9.39 | | | | (14,587 | ) | | $ | 21.23 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Nonvested stock at October 1, 2011 | | | - | | | | - | | | | 15,623 | | | $ | 9.39 | | | | 59,413 | | | $ | 24.69 | |

| | | Class A Common Units | | | Weighted Average Calculated Value | | | Class B Common Units | | | Weighted Average Calculated Value | | | Class C Common Units | | | Weighted Average Calculated Value | |

| Nonvested stock at January 2, 2010 | | | - | | | | - | | | | 152,136 | | | $ | 9.39 | | | | 75,037 | | | $ | 11.56 | |

| Granted | | | 277 | | | | - | | | | - | | | | — | | | | 42,812 | | | $ | 34.25 | |

| Forfeited | | | - | | | | - | | | | (11,128 | ) | | $ | 9.39 | | | | (35,141 | ) | | $ | 11.70 | |

| Vested | | | (277 | ) | | | - | | | | (50,859 | ) | | $ | 9.39 | | | | (14,958 | ) | | $ | 18.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Nonvested stock at October 2, 2010 | | | - | | | | - | | | | 90,149 | | | $ | 9.39 | | | | 67,750 | | | $ | 24.25 | |

During the thirty-nine weeks ended October 1, 2011, 619 Class A common units, 12,816 vested Class B common units and 948 vested Class C common units were repurchased for $0.8 million. During the thirty-nine weeks ended October 2, 2010, 1,741 vested Class A common units, 17,299 vested Class B common units and 17,419 vested Class C common units were repurchased for $0.9 million. Yankee Group anticipates that all of its nonvested common units will vest.

The total estimated fair value of equity awards vested during thirty-nine weeks ended October 1, 2011 and October 2, 2010 was $0.6 million and $0.8 million, respectively. Equity-based compensation expense for the thirty-nine weeks ended October 1, 2011 and October 2, 2010 was $3.7 million and $0.7 million, respectively. Included in the $3.7 million of equity-based compensation for the thirty-nine weeks ended October 1, 2011 was the $3.0 million payment to the holders of Class B common units and Class C common units discussed in Note 1.

As of October 1, 2011, there was approximately $1.6 million of total unrecognized compensation cost related to Yankee Group’s Class B and Class C common unit equity awards and there was no unrecognized expense related to Yankee Group’s Class A common unit equity awards. This cost is expected to be recognized over the remaining vesting period, of approximately 5 years (October 2011 to June 2016).

Presented below is a summary of assumptions for the indicated periods. There were 11,650 Class C grants and no Class B grants for the thirty-nine weeks ended October, 2011. There were 42,812 Class C grants and no Class B grants for the thirty-nine weeks ended October 2, 2010.

| Assumptions | | Thirty-Nine Weeks Ended October 1, 2011 | | | Thirty-Nine Weeks Ended October 2, 2010 | |

| Weighted average calculated value of awards granted | | $ | 28.97 | | | $ | 34.25 | |

| Weighted average volatility | | | 76.1 | % | | | 39.7 | % |

| Weighted average expected term (in years) | | | 5.0 | | | | 5.0 | |

| Dividend yield | | | — | | | | — | |

| Weighted average risk-free interest rate | | | 2.2 | % | | | 2.6 | % |

With respect to the Class B and Class C common units, since YCC Holdings and Yankee Group are not publicly traded, the estimate of expected volatility is based on the median historical volatility of a group of eight comparable public companies, adjusted for differences in leverage. The historical volatilities of the comparable companies were measured over a 5-year historical period. The expected term of the Class B and Class C common units granted represents the period of time that the units are expected to be outstanding and is assumed to be approximately five years based on management’s estimate of the time to a liquidity event. Yankee Group does not expect to pay dividends, and accordingly, the dividend yield is zero. The risk free interest rate reflects a five-year period commensurate with the expected time to a liquidity event and was based on the U.S. Treasury yield curve.

6. DERIVATIVE FINANCIAL INSTRUMENTS

The Companies follow the guidance under ASC Topic 815 “Derivatives and Hedging,” which establishes accounting and reporting standards for derivative instruments. The guidance requires an entity to recognize all derivatives as either assets or liabilities in the statement of financial position and to measure those instruments at fair value. Additionally, the fair value adjustments will affect either stockholder’s or member’s equity as accumulated other comprehensive income (loss) (“OCI”) or net income (loss) depending on whether the derivative instrument qualifies as a hedge for accounting purposes and, if so, the nature of the hedging activity.

Interest Rate Swaps

Yankee Candle uses interest rate swaps to eliminate the variability of a portion of cash flows associated with the forecasted interest payments on its Term Facility. This is achieved through converting a portion of the floating rate Term Facility to a fixed rate by entering into pay-fixed interest rate swaps. During the second quarter of 2009 Yankee Candle changed the interest rate election on its Term Facility from the three-month LIBOR rate to the one-month LIBOR rate. As a result, Yankee Candle’s existing interest rate swaps were de-designated as cash flow hedges and Yankee Candle no longer accounts for these instruments using hedge accounting. Accordingly, changes in fair value are now recognized in the condensed consolidated statements of operations as a component of other (income) expense. The unrealized loss of $21.7 million which was included in OCI on the date Yankee Candle changed their interest rate election was amortized to other expense over the remaining term of the respective interest rate swap agreements. The unrealized loss was fully amortized during the thirty-nine weeks ended October 1, 2011.

Simultaneous with the de-designations, Yankee Candle entered into new interest rate swap agreements to further reduce the variability of cash flows associated with the forecasted interest payments on Yankee Candle’s Term Facility. These swaps are not designated as cash flow hedges and are measured at fair value with changes in fair value recognized in the condensed consolidated statements of operations as a component of other (income) expense. One of Yankee Candle’s original interest rate swaps terminated in March 2010 and the remaining original swap agreement terminated on March 31, 2011.

During the second and third quarters of 2009, Yankee Candle entered into forward starting, amortizing, interest rate swaps in the aggregate notional amount of $320.7 million with a blended fixed rate of 3.49% to eliminate the variability in future interest payments on its Term Facility by having Yankee Candle pay fixed-rate amounts in exchange for receipt of floating-rate interest payments. The effective date of the forward starting swaps was March 31, 2011 after the original swaps terminated. These new swaps are not designated as cash flow hedges and are measured at fair value with changes in fair value recognized in the condensed consolidated statements of operations as a component of other (income) expense. The new swap agreements terminate in March 2013.

The fair values of the Companies’ derivative instruments as of October 1, 2011 and January 1, 2011, were as follows (in thousands):

| | Fair Values of Derivative Instruments Asset Derivatives | |

| | Balance Sheet Location | | October 1, | | | January 1, | |

| | 2011 | | | 2011 | |

| Derivatives not designated as hedging instruments | | | | | | | |

| Interest rate swap agreements | Prepaid expenses and other current assets | | $ | - | | | $ | 1,030 | |

| | | | | | | | | | |

| Total Derivative Assets | | | $ | - | | | $ | 1,030 | |

| | Fair Value of Derivative Instruments Liability Derivatives | |

| | Balance Sheet Location | October 1, | | January 1, | |

| 2011 | | 2011 | |

| Derivatives not designated as hedging instruments | | | | | | | |

| Interest rate swap agreements | Other accrued liabilities | | $ | 11,479 | | | $ | 18,011 | |

| | | | | | | | | | |

| Total Derivative Liabilities | | | $ | 11,479 | | | $ | 18,011 | |

The effect of derivative instruments on the condensed consolidated statements of operations for the thirteen and thirty-nine weeks ended October 1, 2011 and October 2, 2010, was as follows (in thousands):

| | | | Amount of Realized Gain Recognized on Derivatives | | | Amount of Realized Loss Recognized on Derivatives | |

| | Location of Realized Loss Recognized on Derivatives | | Thirteen Weeks Ended October 1, 2011 | | | Thirteen Weeks Ended October 2, 2010 | |

| Derivatives not designated as hedging instruments | | | | | | | |

| Interest rate swap agreements | Other expense | | $ | (2,200 | ) | | $ | 2,119 | |

| | | | | | | | | | |

| Total | | | $ | (2,200 | ) | | $ | 2,119 | |

| | | | Amount of Realized Gain Recognized on Derivatives | | | Amount of Realized Loss Recognized on Derivatives | |

| | Location of Realized Loss Recognized on Derivatives | | Thirty-Nine Weeks Ended October 1, 2011 | | | Thirty-Nine Weeks Ended October 2, 2010 | |

| Derivatives not designated as hedging instruments | | | | | | | |

| Interest rate swap agreements | Other expense | | $ | (4,333 | ) | | $ | 11,109 | |

| | | | | | | | | | |

| Total | | | $ | (4,333 | ) | | $ | 11,109 | |

| | | | Amount of Loss Reclassified from Accumulated OCI Into Income (Effective Portion) | | | Amount of Loss Reclassified from Accumulated OCI Into Income (Effective Portion) | |

| | Location of Loss Reclassified from Accumulated OCI into Income (Effective Portion) | | Thirteen Weeks Ended October 1, 2011 | | | Thirteen Weeks Ended October 2, 2010 | |

| Cash Flow Hedges | | | | | | | |

| Interest rate swap agreements | Other expense | | $ | - | | | $ | 1,169 | |

| | | | | | | | | | |

| Total | | | $ | - | | | $ | 1,169 | |

| | | | Amount of Loss Reclassified from Accumulated OCI Into Income (Effective Portion) | | | Amount of Loss Reclassified from Accumulated OCI Into Income (Effective Portion) | |

| | Location of Loss Reclassified from Accumulated OCI into Income (Effective Portion) | | Thirty-Nine Weeks Ended October 1, 2011 | | | Thirty-Nine Weeks Ended October 2, 2010 | |

| Cash Flow Hedges | | | | | | | |

| Interest rate swap agreements | Other expense | | $ | 1,169 | | | $ | 7,453 | |

| | | | | | | | | | |

| Total | | | $ | 1,169 | | | $ | 7,453 | |

7. FAIR VALUE MEASUREMENTS

The Companies follow the guidance prescribed by ASC Topic 820 “Fair Value Measurement.” ASC Topic 820 defines fair value and provides a consistent framework for measuring fair value under GAAP, including financial statement disclosure requirements. As specified under this Topic, valuation techniques are based on observable and unobservable inputs. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect market assumptions. The Fair Value Measurement Topic classifies these inputs into the following hierarchy:

Level 1 Inputs– Quoted prices for identical instruments in active markets.

Level 2 Inputs– Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable.

Level 3 Inputs– Instruments with primarily unobservable value drivers.

The following table represents the fair value hierarchy for those financial assets and liabilities measured at fair value on a recurring basis as of October 1, 2011 and January 1, 2011 (in thousands):

| | | Fair Value Measurements on a Recurring Basis | |

| | | as of October 1, 2011 | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Marketable securities | | $ | 1,514 | | | $ | - | | | $ | - | | | $ | 1,514 | |

| | | | | | | | | | | | | | | | |

| Total Assets | | $ | 1,514 | | | $ | - | | | $ | - | | | $ | 1,514 | |

| | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Interest rate swap agreements | | $ | - | | | $ | 11,479 | | | $ | | | | $ | 11,479 | |

| | | | | | | | | | | | | | | | |

| Total Liabilities | | $ | - | | | $ | 11,479 | | | $ | - | | | $ | 11,479 | |

| | | Fair Value Measurements on a Recurring Basis | |

| | | as of January 1, 2011 | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Marketable securities | | $ | 1,182 | | | $ | - | | | $ | - | | | $ | 1,182 | |

| Interest rate swap agreements | | | - | | | | 1,030 | | | | - | | | | 1,030 | |

| | | | | | | | | | | | | | |

| Total Assets | | $ | 1,182 | | | $ | 1,030 | | | $ | - | | | $ | 2,212 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Interest rate swap agreements | | $ | - | | | $ | 18,011 | | | $ | - | | | $ | 18,011 | |

| | | | | | | | | | | | | | |

| Total Liabilities | | $ | - | | | $ | 18,011 | | | $ | - | | | $ | 18,011 | |

The Companies hold marketable securities in Yankee Candle’s deferred compensation plan. The marketable securities consist of investments in mutual funds and are recorded at fair value based on third party quotes. The Companies use an income approach to value the asset and liability for Yankee Candle’s interest rate swaps using a discounted cash flow model that takes into account the present value of future cash flows under the terms of the contract using current market information as of the reporting date such as the one month LIBOR curve and the creditworthiness of the Companies and their counterparties.

Financial Instruments Not Measured at Fair Value

The Companies’ long-term debt is recorded at historical amounts. The Companies determine the fair value of their long-term debt based on current quoted market prices. The following table represents the carrying value and fair value of Yankee Candle’s senior notes, senior subordinated notes and Term Facility and YCC Holdings’ Senior PIK Notes as of October 1, 2011 and January 1, 2011 (in thousands):

| | | October 1, 2011 | |

| | | Carrying Value | | | Fair Value | |

| Senior secured term loan facility | | $ | 388,125 | | | $ | 370,970 | |

| Senior notes due 2015 | | | 325,000 | | | | 313,625 | |

| Senior subordinated notes due 2017 | | | 188,000 | | | | 175,780 | |

| Senior PIK notes due 2016, net of unamortized discount of $5,678 (YCC Holdings only) | | | 309,322 | | | | 266,017 | |

| | | January 1, 2011 | |

| | | Carrying Value | | | Fair Value | |

| Senior secured term loan facility | | $ | 388,125 | | | $ | 384,244 | |

| Senior notes due 2015 | | | 325,000 | | | | 338,000 | |

| Senior subordinated notes due 2017 | | | 188,000 | | | | 195,990 | |

It is impracticable for the Companies to estimate the fair value of the Revolving Facility.

8. SEGMENTS OF ENTERPRISE AND RELATED INFORMATION

The Companies have segmented their operations in a manner that reflects how their chief operating decision–maker (the “CEO”) currently reviews the results of the Companies and their subsidiaries’ businesses. In the prior fiscal year the Companies had two reportable segments, retail and wholesale. Wholesale had been an aggregation of the wholesale and international operating segments. Because of the increased importance of the international segment to the Companies’ operations, as evidenced by higher sales volumes and the appointment of a full time international president, the Companies have now disaggregated the international operations from the domestic wholesale operations. The Companies have restated the prior year information to conform to the current period presentation.

The CEO evaluates its retail, wholesale, and international operations based on an “operating earnings” measure. Such measure gives recognition to specifically identifiable operating costs such as cost of sales and selling expenses. Costs and income not specifically identifiable are included within the unallocated/corporate/other column and include administrative charges, interest expense, fair value changes of derivative contracts, restructuring charges for continuing operations and other costs not allocated to specific operating segments and are accordingly reflected in the unallocated/corporate/other column. The Companies do not account for or report assets, capital expenditures or depreciation and amortization by segment to the CEO.

The following are the relevant data for the thirteen and thirty-nine weeks ended October 1, 2011 and October 2, 2010 (in thousands):

| YCC Holdings | |

| Thirteen Weeks Ended October 1, 2011 | | Retail | | | Wholesale | | | International | | | Unallocated/ Corporate/ Other | | | Balance per Condensed Consolidated Statement of Operations | |

| Sales | | $ | 84,860 | | | $ | 83,230 | | | $ | 27,019 | | | $ | - | | | $ | 195,109 | |

| Gross profit | | | 56,518 | | | | 39,880 | | | | 10,919 | | | | (166 | ) | | | 107,151 | |

| Selling expenses | | | 45,474 | | | | 3,508 | | | | 5,445 | | | | 3,438 | | | | 57,865 | |

| Operating income | | | 11,044 | | | | 36,372 | | | | 5,474 | | | | (19,090 | ) | | | 33,800 | |

| Interest and other expense, net | | | - | | | | - | | | | - | | | | (24,293 | ) | | | (24,293 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations before provision for income taxes | | | | | | | | | | | | | | | | | | $ | 9,507 | |

| Thirteen Weeks Ended October 2, 2010 | | Retail | | | Wholesale | | | International | | | Unallocated/ Corporate/ Other | | | Balance per Condensed Consolidated Statement of Operations | |

| Sales | | $ | 79,585 | | | $ | 76,244 | | | $ | 19,921 | | | $ | - | | | $ | 175,750 | |

| Gross profit | | | 55,095 | | | | 39,130 | | | | 7,510 | | | | (88 | ) | | | 101,647 | |

| Selling expenses | | | 41,245 | | | | 2,985 | | | | 4,110 | | | | 3,502 | | | | 51,842 | |

| Operating income | | | 13,850 | | | | 36,145 | | | | 3,400 | | | | (19,266 | ) | | | 34,129 | |

| Interest and other expense, net | | | - | | | | - | | | | - | | | | (21,009 | ) | | | (21,009 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations before provision for income taxes | | | | | | | | | | | | | | | | | | $ | 13,120 | |

| Holding Corp. | |

| Thirteen Weeks Ended October 1, 2011 | | Retail | | | Wholesale | | | International | | | Unallocated/ Corporate/ Other | | | Balance per Condensed Consolidated Statement of Operations | |

| Sales | | $ | 84,860 | | | $ | 83,230 | | | $ | 27,019 | | | $ | - | | | $ | 195,109 | |

| Gross profit | | | 56,518 | | | | 39,880 | | | | 10,919 | | | | (166 | ) | | | 107,151 | |

| Selling expenses | | | 45,474 | | | | 3,508 | | | | 5,445 | | | | 3,438 | | | | 57,865 | |

| Operating income | | | 11,044 | | | | 36,372 | | | | 5,474 | | | | (18,877 | ) | | | 34,013 | |

| Interest and other expense, net | | | - | | | | - | | | | - | | | | (15,475 | ) | | | (15,475 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations before provision for income taxes | | | | | | | | | | | | | | | | | | $ | 18,538 | |

| Thirteen Weeks Ended October 2, 2010 | | Retail | | | Wholesale | | | International | | | Unallocated/ Corporate/ Other | | | Balance per Condensed Consolidated Statement of Operations | |

| Sales | | $ | 79,585 | | | $ | 76,244 | | | $ | 19,921 | | | $ | - | | | $ | 175,750 | |

| Gross profit | | | 55,095 | | | | 39,130 | | | | 7,510 | | | | (88 | ) | | | 101,647 | |

| Selling expenses | | | 41,245 | | | | 2,985 | | | | 4,110 | | | | 3,502 | | | | 51,842 | |

| Operating income | | | 13,850 | | | | 36,145 | | | | 3,400 | | | | (19,266 | ) | | | 34,129 | |