YANKEE HOLDING CORP.

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that such registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YCC Holdings LLC and Yankee Holding Corp. are voluntary filers of reports required of companies with public securities under Section 13 or 15(d) of the Securities Exchange Act of 1934, and they will have filed all reports which would have been required of them during the past 12 months had they been subject to such provisions.

Indicate by check mark whether each registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that such registrant was required to submit and post such files).

Indicate by check mark whether each registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

YCC Holdings LLC does not issue common stock but has one member’s interest issued and outstanding. YCC Holdings LLC’s sole member is Yankee Candle Investments LLC.

As of May 4, 2012, there were 497,981 shares of Yankee Holding Corp. common stock, $0.01 par value, outstanding, all of which are owned by YCC Holdings LLC.

Yankee Holding Corp. meets the conditions set forth in General Instruction (H)(1)(a) and (b) of Form 10-Q and is therefore filing this Form 10-Q with the reduced disclosure format.

This quarterly report is a combined report of YCC Holdings LLC (“YCC Holdings”) and Yankee Holding Corp. (“Holding Corp.”), a direct 100% owned subsidiary of YCC Holdings. Unless the context indicates otherwise, any reference in this report to the “Companies,” “we,” “us” and “our” refers to YCC Holdings together with its direct and indirect subsidiaries, including Holding Corp.

The principal subsidiary of YCC Holdings and Holding Corp. is The Yankee Candle Company, Inc. (together with its subsidiaries, “Yankee Candle”). All of the operating results of YCC Holdings and Holding Corp. are derived from the operating results of Yankee Candle. Where information or an explanation is provided that is substantially the same for each company, such information or explanation has been combined. Where information or an explanation is not substantially the same for each company, we have provided separate information and explanation. In addition, separate financial statements for each company are included in Part I, Item 1.

This quarterly report contains a number of forward-looking statements. Any statements contained herein, including without limitation statements to the effect that together the Companies or their management “believes”, “expects”, “anticipates”, “plans” and similar expressions, that relate to prospective events or developments should be considered forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements. These factors include, without limitation, those set forth below in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Future Operating Results”. Management undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

1. BASIS OF PRESENTATION, ORGANIZATION AND CURRENT EVENTS

The unaudited interim condensed consolidated financial statements of YCC Holdings LLC (“YCC Holdings”) and Yankee Holding Corp. (“Holding Corp.” together with YCC Holdings and its direct and indirect subsidiaries the “Companies”) have been prepared in accordance with accounting principles generally accepted in the United States of America (“generally accepted accounting principles” or “GAAP”). The financial information included herein is unaudited; however, in the opinion of management such information reflects all adjustments (consisting of normal recurring accruals) necessary for a fair presentation of financial position, results of operations, and cash flows as of the date and for the periods indicated. All intercompany transactions and balances have been eliminated. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full fiscal year.

The accompanying unaudited condensed consolidated financial statements of YCC Holdings and Holding Corp. should be read in conjunction with the audited consolidated financial statements of YCC Holdings and Holding Corp. for the year ended December 31, 2011 included in the Companies Annual Report on Form 10-K.

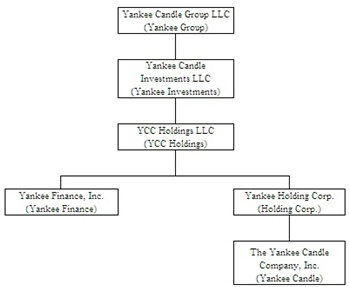

YCC Holdings and Holding Corp. are holding companies with no direct operations. Their principal assets are the indirect equity interests in The Yankee Candle Company, Inc. (“Yankee Candle”), and all of their operations are conducted through Yankee Candle, the wholly owned operating subsidiary of Holding Corp. Holding Corp. is a wholly owned subsidiary of YCC Holdings. YCC Holdings is a wholly owned subsidiary of Yankee Candle Investments LLC (“Yankee Investments”), which is in turn a wholly owned subsidiary of Yankee Candle Group LLC (“Yankee Group”). See the entity chart below:

2. RECENT ACCOUNTING PRONOUNCEMENTS

3. INVENTORY

The Companies value their inventory on the first–in first–out (“FIFO”) basis. The components of inventory were as follows (in thousands):

4. GOODWILL AND INTANGIBLE ASSETS

The Companies have determined that their tradenames have an indefinite useful life and, therefore, are not being amortized. In accordance with Accounting Standards Codification (“ASC”) Topic 350 “Intangibles - Goodwill and Other,” goodwill and indefinite lived intangible assets are not amortized but are subject to an annual impairment test. There were no changes in the carrying amount of goodwill during the thirteen weeks ended March 31, 2012 and April 2, 2011.

The carrying amount and accumulated amortization of intangible assets consisted of the following (in thousands):

Total amortization expense from finite–lived intangible assets was $1.3 million and $3.1 million for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively. These intangible assets are amortized on a straight line basis. Favorable lease agreements are amortized over the remaining lease term of each respective lease.

5. LONG-TERM DEBT

Long-term debt consisted of the following at March 31, 2012 and December 31, 2011 (in thousands):

As of March 31, 2012, Yankee Candle’s senior secured credit facility (the “Senior Secured Credit Facility”) consisted of a $650.0 million senior secured term loan facility (the “Term Facility”) with outstanding borrowings of $388.1 million, maturing on February 6, 2014 and a senior secured revolving credit facility (“Revolving Facility”) for $140.0 million, which expires on February 6, 2013. Amounts repaid under the Term Facility cannot be reborrowed. In April 2011, Yankee Candle entered into a Joinder Agreement to the Revolving Facility which provided a total of $15.0 million in new revolving loan commitments increasing Yankee Candle’s total revolving loan capacity under the Revolving Facility from $125.0 million to $140.0 million. See Note 13 “Subsequent Events,” for a discussion of the refinancing of Yankee Candle’s Senior Secured Credit Facility.

All borrowings under Yankee Candle’s Senior Secured Credit Facility bear interest at a rate per annum equal to an applicable margin, plus, at Yankee Candle’s option, (i) the higher of (a) the prime rate (as set forth on the British Banking Association Telerate Page 5) and (b) the federal funds effective rate, plus one-half percent (0.50%) per annum or (ii) the Eurodollar rate, and resets periodically. In addition to paying interest on outstanding principal under the senior secured credit facility, Yankee Candle is required to pay a commitment fee to the lenders in respect of unutilized loan commitments at a rate of 0.50% per annum. As of March 31, 2012, the weighted average combined interest rate on the Term Facility and the Revolving Facility was 4.16%.

Yankee Candle's Senior Secured Credit Facility contains a financial covenant which requires that Yankee Candle maintain at the end of each fiscal quarter, commencing with the quarter ended December 31, 2011 through the quarter ending December 31, 2013, a consolidated total secured debt (net of cash and cash equivalents not to exceed $30.0 million) to Consolidated Adjusted EBITDA ratio of no more than 2.75 to 1.00. As of March 31, 2012, Yankee Candle's actual secured leverage ratio was 2.08 to 1.00, as defined. As of March 31, 2012, total secured debt (including Yankee Candle's capital lease obligations of $5.3 million and net of $5.7 million in cash) was approximately $402.7 million. Under Yankee Candle's Senior Secured Credit Facility, Consolidated Adjusted EBITDA is defined as net income plus, interest, taxes, depreciation and amortization, further adjusted to add back extraordinary, unusual or non-recurring losses, non-cash stock option expense, fees and expenses related to the Merger, fees and expenses under the Management Agreement with our equity sponsor, restructuring charges or reserves, as well as other non-cash charges, expenses or losses, and further adjusted to subtract extraordinary, unusual or non-recurring gains, other non-cash income or gains, and certain cash contributions to our common equity.

As of March 31, 2012, Yankee Candle had outstanding letters of credit of $2.1 million and $15.0 million outstanding under the Revolving Facility, leaving $122.9 million in availability under the Revolving Facility.

See Note 13, “Subsequent Events,” for a description of the refinancing of the Senior Secured Credit Facility.

Yankee Candle's senior notes due 2015 (the “Senior Notes”) bear interest at a per annum rate equal to 8.50%. Interest is paid every six months on February 15 and August 15. Yankee Candle’s senior subordinated notes due 2017 (the “Senior Subordinated Notes”) bear interest at a per annum rate equal to 9.75%. Interest is paid every six months on February 15 and August 15. The Senior Notes mature on February 15, 2015 and the Senior Subordinated Notes mature on February 15, 2017. In April 2012, $315.0 million of the Senior Notes were redeemed in connection with the refinancing of the Senior Secured Credit Facility. See Note 13, “Subsequent Events,” for a complete description.

The indentures governing the senior notes and Senior Subordinated Notes restrict the ability of Holding Corp., Yankee Candle and most or all of Yankee Candle’s subsidiaries to: incur additional debt; pay dividends or make other distributions on the Company's capital stock or repurchase capital stock or subordinated indebtedness; make investments or other specified restricted payments; create liens; sell assets and subsidiary stock; enter into transactions with affiliates; and enter into mergers, consolidations and sales of substantially all assets.

Obligations under the Senior Notes are guaranteed on an unsecured senior basis and obligations under the Senior Subordinated Notes are guaranteed on an unsecured senior subordinated basis, by Holding Corp. and Yankee Candle's existing and future domestic subsidiaries. If Yankee Candle cannot make any payment on either or both series of notes, the guarantors must make the payment instead.

In the event of certain change in control events specified in the indentures governing these notes, Yankee Candle must offer to repurchase all or a portion of such notes at 101% of the principal amount of the such notes on the date of purchase, plus any accrued and unpaid interest to the date of repurchase.

In February 2011, YCC Holdings and Yankee Finance co-issued $315.0 million of Senior PIK Notes pursuant to an Indenture at a discount of $6.3 million for net proceeds of $308.7 million. Issuance costs related to the Senior PIK Notes were $9.7 million, of which $7.8 million were paid for by YCC Holdings and $1.9 million were paid for by Holding Corp.

Cash interest on the Senior PIK Notes accrues at a rate of 10.25% per annum, and PIK Interest (defined below) accrues at the cash interest rate plus 0.75%. YCC Holdings is required to pay interest on the Senior PIK Notes entirely in cash interest, unless the conditions described in the indenture are satisfied with respect to the related interest period, in which case, YCC Holdings may pay interest on the Senior PIK Notes for such interest period by increasing the principal amount of the Senior PIK Notes or by issuing new PIK Notes for up to the entire amount of the interest payment (in each case, “PIK Interest”) to the extent described in the related indenture.

YCC Holdings is indirectly dependent upon dividends from Yankee Candle to generate the funds necessary to meet its outstanding debt service obligations. Neither Yankee Candle nor Holding Corp. guarantees the Senior PIK Notes. Yankee Candle is not obligated to pay dividends to Holding Corp. and Holding Corp. is not obligated to pay dividends to YCC Holdings. Yankee Candle’s ability to pay dividends to Holding Corp. to permit Holding Corp. to pay dividends to YCC Holdings was restricted at March 31, 2012 by Yankee Candle’s Senior Secured Credit Facility and the indentures governing the senior notes and senior subordinated notes. See Note 13 “Subsequent Events,” for a discussion of the refinancing of Yankee Candle’s Senior Secured Credit Facility.

As of March 31, 2012, the ability of Yankee Candle to make dividends to Yankee Holdings was limited under the Senior Secured Credit Facility based upon available excess cash flow defined as the aggregate cumulative amount of excess cash flow for all fiscal years subsequent to the date of the credit agreement (February 2007) that is not required to prepay the term debt. On an annual basis, Yankee Candle is required to prepay the term debt by 50% of excess cash flow, which percentage is reduced to 25% if the consolidated total leverage ratio (as defined in the Senior Secured Credit Facility) is greater than 4.0 to 1.0 and not greater than 5.0 to 1.0. Yankee Candle is not required to make a payment if the consolidated total leverage ratio is not greater than 4.0 to 1.0.

For the fifty-two weeks ended December 31, 2011, Yankee Candle’s required excess cash flow payment was $12.0 million. This amount was classified as short-term debt on the accompanying condensed consolidated balance sheet at December 31, 2011. As of March 31, 2012, the $12.0 million was classified as long-term debt since the amount was refinanced on a long term basis in April 2012. See Note 13, “Subsequent Events,” for additional details related to the Company’s April 2012 refinancing.

The indentures governing Yankee Candle's Senior Notes and Senior Subordinated Notes permit Yankee Candle to pay dividends to Holding Corp. if: (i) there is no default or event of default under the indentures governing Yankee Candle’s notes; (ii) Yankee Candle would have a fixed charge coverage ratio of at least 2.0 to 1.0; and (iii) such dividend, together with the aggregate amount of all other “restricted payments” (as defined in such indentures) made by Yankee Candle and its restricted subsidiaries after February 6, 2007 (excluding certain restricted payments), is less than the sum (a) 50% of the Consolidated Net Income (as defined in such indentures) of Yankee Candle for the period (taken as one accounting period) from December 31, 2006 to the end of Yankee Candle’s most recently ended fiscal quarter for which internal financial statements are available at the time of such dividend (or, in the case such Consolidated Net Income for such period is a deficit, minus 100% of such deficit), plus (b) the proceeds from specified equity contributions or issuances of equity.

In addition to the capacity described above, Yankee Candle has a “basket” of $35.0 million under the indentures from which it may make dividends in amount not to exceed $35.0 million (since the date of the issuance of Yankee Candle’s notes), so long there is no default or event of defaults under the indentures. The ability of Yankee Candle and Holding Corp. to pay dividends to YCC Holdings and thus pay cash interest on the Senior PIK Notes is limited by Delaware law.

As of December 31, 2011, the amount available for dividends from Yankee Candle to YCC Holdings was approximately $153.0 million. During the thirteen weeks ended March 31, 2012 Holding Corp. paid a dividend of $16.2 million to YCC Holdings to fund interest payments for the Senior PIK Notes, which decreased the amount available for future dividends.

6. MEMBER’S DEFICIT, STOCKHOLDER’S EQUITY AND EQUITY-BASED COMPENSATION

In March 2012, the Board of Managers approved the issuance of 13,650 Class C common units to Vice President’s and above. These Class C common units are partially performance based and generally vest as follows, subject to the terms of the applicable agreements: (i) 25% of the units granted shall vest on a daily basis over five years, (ii) 25% of the units granted shall vest in the event that the Company’s Adjusted EBITDA performance in fiscal 2012 meets or exceeds a pre-approved target established by the Compensation Committee of the Board of Managers (the “2012 units”) and (iii) 50% of the units granted shall vest following the end of any fiscal year during which the Company attains an additional Adjusted EBITDA target established by the Compensation Committee of the Board of Managers. In the event the Company fails to achieve the 2012 Adjusted EBITDA target referenced in clause (ii) above, such 2012 units remain eligible for vesting under clause (iii) above in the event the Company subsequently achieves the applicable Adjusted EBITDA target.

A summary of Class A, B and C nonvested units for Yankee Group as of March 31, 2012 and YCC Holdings as of April 2, 2011, and the activity for the thirteen weeks ended March 31, 2012 and April 2, 2011 is presented below (there are no units remaining in Yankee Investments):

During the thirteen weeks ended March 31, 2012, 9 Class A common units, 4,322 vested Class B common units and 711 vested Class C common units were repurchased for $0.3 million. During the thirteen weeks ended April 2, 2011, 565 vested Class B common units and 900 vested Class C common units were repurchased for $0.1 million. Yankee Group anticipates that all of its nonvested common units will vest.

The total estimated fair value of equity awards vested during thirteen weeks ended March 31, 2012 and April 2, 2011 was $0.2 million. Equity-based compensation expense for the thirteen weeks ended March 31, 2012 and April 2, 2011 was $0.2 million and $3.3 million, respectively. Included in the $3.3 million of equity-based compensation for the thirteen weeks ended April 2, 2011 was the $3.0 million payment to the holders of Class B common units and Class C common units. The $3.0 million payment was recorded as additional paid in capital and is shown as a contribution by YCC Holdings LLC in Holding Corp.’s condensed consolidated statement of changes in stockholder’s equity and in Holding Corp.’s condensed consolidated statements of cash flows.

As of March 31, 2012, there was approximately $1.7 million of total unrecognized compensation cost related to Yankee Group’s Class B and Class C common unit equity awards and there was no unrecognized expense related to Yankee Group’s Class A common unit equity awards. This cost is expected to be recognized over the remaining vesting period, of approximately 5 years (April 2012 to February 2017).

Presented below is a summary of assumptions for the thirteen weeks ended March 31, 2012. During the thirteen weeks ended March 31, 2012, there were 31,759 Class C grants and no Class B grants. There were no Class C or Class B grants during the thirteen weeks ended April 2, 2011.

With respect to the Class B and Class C common units, since YCC Holdings and Yankee Group are not publicly traded, the estimate of expected volatility is based on the median historical volatility of a group of eight comparable public companies, adjusted for differences in leverage. The historical volatilities of the comparable companies were measured over a 5-year historical period. The expected term of the Class B and Class C common units granted represents the period of time that the units are expected to be outstanding and is assumed to be approximately five years based on management’s estimate of the time to a liquidity event. Yankee Group does not expect to pay dividends, and accordingly, the dividend yield is zero. The risk free interest rate reflects a five-year period commensurate with the expected time to a liquidity event and was based on the U.S. Treasury yield curve.

7. RESTRUCTURING CHARGES

During the thirteen weeks ended March 31, 2012, the Company restructured its Wholesale and Retail operations. The Company also initiated a change in reporting structure and changes of roles and responsibilities within the organization that resulted in workforce reductions. These changes included changes to the executive committee, changes to the reporting structure and operational focus within the retail segment, alignment of the brand innovation and merchandising teams across all channels of the business, and other administrative changes. As a result of these changes the Company incurred restructuring charges of $0.7 million during the thirteen weeks ended March 31, 2012.

The Company made restructuring related payments of $0.2 million and $0.1 million during the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively. As of March 31, 2012, the balance of $1.4 million in the restructuring accrual was related to (i) continuing operations employee related expenses of $0.6 million as a result of the first quarter of 2012 organization changes detailed above, and (ii) discontinued operations of $0.8 million primarily related to lease agreements for one Illuminations retail store and a lease related the former Illuminations corporate headquarters in Petaluma, California. The lease for the Illuminations retail store expires in January 2017 and the lease for the property in Petaluma California expires in March 2013. These leases will be paid through the lease termination date unless the Company is able to structure a buyout agreement with the landlord.

The following is a summary of restructuring charge activity for the thirteen weeks ended March 31, 2012 and April 2, 2011 (in thousands):

8. DERIVATIVE FINANCIAL INSTRUMENTS

The Companies follow the guidance under ASC Topic 815 “Derivatives and Hedging,” which establishes accounting and reporting standards for derivative instruments. The guidance requires an entity to recognize all derivatives as either assets or liabilities in the statement of financial position and to measure those instruments at fair value. Additionally, the fair value adjustments will affect either stockholder’s equity or member’s deficit as accumulated other comprehensive income (loss) (“OCI”) or net income (loss) depending on whether the derivative instrument qualifies as a hedge for accounting purposes and, if so, the nature of the hedging activity.

Yankee Candle uses interest rate swaps to eliminate the variability of a portion of cash flows associated with the forecasted interest payments on its Term Facility. Yankee Candle’s interest rate swaps are not designated as cash flow hedges and the swaps are measured at fair value with changes in fair value recognized as other (income) expense.

The fair values of the Companies’ derivative instruments as of March 31, 2012 and December 31, 2011, were as follows (in thousands):

The effect of derivative instruments on the condensed consolidated statements of operations for the thirteen weeks ended March 31, 2012 and April 2, 2011, was as follows (in thousands):

9. FAIR VALUE MEASUREMENTS

The Companies follow the guidance prescribed by ASC Topic 820 “Fair Value Measurement.” ASC Topic 820 defines fair value and provides a consistent framework for measuring fair value under GAAP, including financial statement disclosure requirements. As specified under this Topic, valuation techniques are based on observable and unobservable inputs. Observable inputs reflect readily obtainable data from independent sources, while unobservable inputs reflect market assumptions. The Fair Value Measurement Topic classifies these inputs into the following hierarchy:

The following table represents the fair value hierarchy for those financial assets and liabilities measured at fair value on a recurring basis as of March 31, 2012 and December 31, 2011 (in thousands):

The Companies hold marketable securities in Yankee Candle’s deferred compensation plan. The marketable securities consist of investments in mutual funds and are recorded at fair value based on third party quotes. The Companies use an income approach to value the asset and liability for Yankee Candle’s interest rate swaps using a discounted cash flow model that takes into account the present value of future cash flows under the terms of the contract using current market information as of the reporting date such as the one month LIBOR curve and the creditworthiness of the Companies and their counterparties.

The Companies’ long-term debt is recorded at historical amounts. The Companies determine the fair value of their long-term debt based on current quoted market prices (Level 1 in the fair value hierarchy). The following table represents the carrying value and fair value of Yankee Candle’s senior notes, senior subordinated notes and Term Facility and YCC Holdings’ Senior PIK Notes as of March 31, 2012 and December 31, 2011 (in thousands):

The Companies have segmented their operations in a manner that reflects how their chief operating decision–maker (the “CEO”) currently reviews the results of the Companies and their subsidiaries’ businesses. The CEO evaluates its retail, wholesale, and international operations based on an “operating earnings” measure. Such measure gives recognition to specifically identifiable operating costs such as cost of sales and selling expenses. Costs and income not specifically identifiable are included within the unallocated/corporate/other column and include administrative charges, interest expense, fair value changes of derivative contracts, restructuring charges for continuing operations and other costs not allocated to specific operating segments. The Companies do not account for or report assets, capital expenditures or depreciation and amortization by segment to the CEO.

The following are the relevant data for the thirteen weeks ended March 31, 2012 and April 2, 2011 (in thousands):

Sales by geographic location are based on the location of the customer. The following tables set forth sales by geographic location:

Long lived assets of the Companies’ foreign operations were approximately $5.5 million and $3.9 million as of March 31, 2012 and December 31, 2011, respectively.

11. COMMITMENTS AND CONTINGENCIES

The Companies are engaged in various lawsuits, either as plaintiff or defendant. In the opinion of management, the ultimate outcome of these lawsuits will not have a material adverse effect on the Companies’ financial condition, results of operations or cash flows.

12. FINANCIAL INFORMATION RELATED TO GUARANTOR SUBSIDIARIES UNDER YANKEE CANDLE’S SENIOR NOTES AND SENIOR SUBORDINATED NOTES

Obligations under the senior notes of Yankee Candle are guaranteed on an unsecured senior basis and obligations under the senior subordinated notes are guaranteed on an unsecured senior subordinated basis by Holding Corp. and 100% of Yankee Candle’s existing and future domestic subsidiaries. The senior notes are fully and unconditionally guaranteed by all of Yankee Candle’s 100% owned U.S. subsidiaries (the “Guarantor Subsidiaries” and collectively with the Holding Corp., the “Guarantors”) on a senior unsecured basis. These guarantees are joint and several obligations of the Guarantors. Yankee Candle’s foreign subsidiary does not guarantee these notes.

The following tables present condensed consolidating supplementary financial information for Yankee Candle, as the issuer of the senior and senior subordinated notes, Holding Corp., Yankee Candle’s domestic guarantor subsidiaries and the non guarantor subsidiaries together with eliminations as of and for the periods indicated. Holding Corp. is also a guarantor of the notes. Separate complete financial statements of the respective Guarantors would not provide additional material information that would be useful in assessing the financial composition of the Guarantors.

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

YANKEE HOLDING CORP. AND SUBSIDIARIES

13. SUBSEQUENT EVENTS

On April 2, 2012, Yankee Candle entered into a Credit Agreement (the “New Term Loan Facility”) with the lenders party thereto, Bank of America, N.A. (“BofA”), as administrative agent, Barclays Bank PLC (“Barclays”), as syndication agent, and BofA and Barclays, as joint lead arrangers and joint book runners. Under the New Term Loan Facility, Yankee Candle borrowed $725.0 million. At closing, on April 2, 2012, a portion of the net proceeds from the New Term Loan Facility were used to (i) redeem $180.0 million of Yankee Candle’s Senior Notes, (ii) repay $403.1 million of outstanding debt on the Company’s existing Senior Secured Credit Facility (consisting of $388.1 million outstanding under the Term Facility and $15.0 outstanding under the Revolving Facility), and (iii) pay fees and expenses related to the foregoing. On April 13, 2012, the Company used the remaining net proceeds to redeem an additional $135.0 million of the Senior Notes. The New Term Loan Facility will mature on April 2, 2019; however, the maturity date of the New Term Loan Facility will accelerate if the Senior Subordinated Notes and the Senior PIK Notes are not defeased, repurchased, refinanced or redeemed 91 days prior to their respective maturity dates.

The New Term Loan Facility is subject to quarterly amortization of principal equal to 0.25% of the original aggregate principal amount of the New Term Loan Facility, with the balance payable at final maturity. Interest is payable on the New Term Loan Facility at either (i)the Eurodollar Rate (subject to a 1.25% floor) plus 4.00% or (ii) the ABR (subject to a 2.25% floor) plus 3.00%. The default rate of interest will accrue (i) on the overdue principal amount of any loan at a rate of 2% in excess of the rate otherwise applicable to such loan and (ii) on any overdue interest or any other outstanding overdue amount at a rate of 2% in excess of the non-default interest rate then applicable to ABR loans.

The New Term Loan Facility requires Holding Corp. and its subsidiaries to maintain a maximum consolidated net total leverage ratio. In addition, the New Term Loan Facility contains customary covenants and restrictions on Holding Corp. and its subsidiaries’ activities, including but not limited to, limitations on the incurrence of additional indebtedness, liens, negative pledges, guarantees, investments, loans, asset sales, mergers, acquisitions, prepayment of other debt, distributions, dividends, the repurchase of capital stock, transactions with affiliates and the ability to change the nature of its business or its fiscal year. All obligations under the New Term Loan Facility are guaranteed by Holding Corp.’s and Yankee Candle’s domestic subsidiaries and secured by a lien on substantially all of the assets of Holding Corp. and its domestic subsidiaries.

On April 2, 2012, Yankee Candle, together with certain of its foreign subsidiaries, also entered into a Credit Agreement (the “ABL Facility”) with BofA, as agent, the other lenders party thereto, Barclays, as syndication agent, U.S. Bank National Association and Wells Fargo Capital Finance LLC, as co-documentation agents, and Merrill Lynch, Pierce, Fenner & Smith Incorporated and Barclays, as joint lead arrangers and joint book runners.

The ABL Facility is scheduled to expire on April 2, 2017; however, the expiration date of the ABL Facility will accelerate if the Senior Subordinated Notes and the Senior PIK Notes are not defeased, repurchased, refinanced or redeemed 91 days prior to their respective maturity dates The ABL Facility permits revolving borrowings of up to $175.0 million subject to eligible inventory and trade accounts receivable balances. The ABL Facility is inclusive of sub-facilities for up to $25.0 million in swing line advances, up to $25.0 million for letters of credit, up to $10.0 million for borrowings by Yankee Candle’s Canadian subsidiary, up to $10.0 million for borrowings by Yankee Candle’s German subsidiary and up to $75.0 million for borrowing by Yankee Candle’s United Kingdom subsidiary. Borrowings under the ABL Facility bear interest at a rate equal to either (i)LIBOR or the BofA rate plus the applicable margin or (ii) the prime rate plus the applicable margin. The applicable margin ranges from 0.50% to 2.00%, dependent on the currency of the borrowing. For purposes of determining interest rates, the applicable margin is subject to a variable grid, dependent on average daily excess availability calculated as of the immediately preceding fiscal quarter.

The unused line fee payable under the ABL Facility is equal to (i) 0.50% per annum if less than 50% of the ABL Facility has been used on average during the immediately preceding fiscal quarter or (ii) 0.375% per annum if 50% or more of the ABL Facility has been utilized on average during the immediately preceding fiscal quarter.

The ABL Facility requires Yankee Candle and its subsidiaries to maintain a consolidated fixed charge coverage ratio of at least 1.0: 1.0 during a covenant compliance event, which occurs if unused borrowing availability is less than the greater of (x) 10% of the maximum amount that can be borrowed under the ABL Facility, which amount is the lesser of $175.0 million and a borrowing formula based on receivables and inventory (the “ABL Loan Cap”) or (y) $15.0 million and continues until excess availability has exceeded the amounts set forth herein for 30 consecutive days. In addition, the ABL Facility contains customary covenants and restrictions on Yankee Candle and its subsidiaries’ activities, including but not limited to, limitations on the incurrence of additional indebtedness, liens, negative pledges, guarantees, investments, loans, asset sales, mergers, acquisitions, prepayment of other debt, distributions, dividends, the repurchase of capital stock, transactions with affiliates, the ability to change the nature of its business or its fiscal year, enter into certain hedging agreements and enter into certain burdensome agreements. All obligations under the ABL Facility are guaranteed by Yankee Candle’s domestic subsidiaries and secured by a lien on substantially all of the assets of Yankee Candle and its domestic subsidiaries. Certain of the obligations under the ABL Facility are guaranteed by Yankee Candle’s foreign subsidiaries and are secured by a lien on substantially all of the assets of such foreign subsidiaries, which consist primarily of inventory and receivables.

ORGANIZATION

YCC Holdings LLC (“YCC Holdings”) and Yankee Holding Corp. (“Holding Corp.”) are holding companies with no direct operations. Their principal assets are the indirect equity interests in The Yankee Candle Company, Inc. (“Yankee Candle”), and all of their operations are conducted through Yankee Candle, the wholly owned operating subsidiary of Holding Corp. Holding Corp. is a wholly owned subsidiary of YCC Holdings. YCC Holdings is a wholly owned subsidiary of Yankee Candle Investments LLC (“Yankee Investments”), which is in turn a wholly owned subsidiary of Yankee Candle Group LLC (“Yankee Group”).

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” discusses our condensed consolidated financial statements for both YCC Holdings and Holding Corp. and their subsidiaries, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about operating results and the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. There have been no significant changes to our critical accounting policies as discussed in YCC Holdings’ and Holding Corp.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011.

Except where otherwise indicated, this discussion relates to the consolidated financial statements for both YCC Holdings and Holding Corp. (together, the “Companies”).

OVERVIEW

General Business Information

We are the largest specialty branded premium scented candle company in the United States based on our annual sales. We sell our products in multiple channels of distribution across many countries. Our customer touchpoints include our own company-operated retail stores, our Consumer Direct business, our Fundraising business, and a global network of both national account and independent specialty gift customers and channels. We have a 42-year history of category leadership and growth by marketing Yankee Candle products as affordable luxuries, consumable products, and valued gifts. We offer a wide variety of jar candles, Samplers® votive candles, Tarts® wax potpourri, pillars and other candle products, the vast majority of which are marketed under the Yankee Candle® brand. We also sell a wide range of other home fragrance products, including electric plug home fragrancers, decorative reed diffusers, room sprays, potpourri, scented oils and coordinated candle related and home decor accessories. Additionally, we offer products such as the Yankee Candle Car Jars® auto air freshener product line, travel sprays and other products to fragrance cars and small spaces.

Candle products are the foundation of our business, and are available in a wide range of fragrances and colors across a variety of jar candles. Our candle prices range from $1.99 for a Samplers® votive candle to $27.99 for a large 22-ounce jar candle. This variety ensures each customer can find Yankee Candle products appropriate for the consumer's lifestyle and budget. In addition to our "everyday" product offerings, we also offer seasonally-appropriate fragrances, products, home décor accessories, and giftsets on a limited edition, seasonal basis. These themed temporary programs occur four times a year: Spring, Summer, Fall, and the Christmas/Holiday season.

Retail Operations: We are the largest specialty retailer of premium scented candles in the U.S. Our retail operations include our retail stores, our Consumer Direct business, our Fundraising business, and Chandler's restaurant (located at our South Deerfield, Massachusetts flagship store). We operate 554 specialty retail stores under the Yankee Candle ® name as of March 31, 2012. Our retail stores, excluding our two flagship stores, average approximately 1,629 gross square feet and are primarily located in high traffic shopping malls and lifestyle centers. We operate two flagship stores, a 90,000-square-foot store in South Deerfield, Massachusetts, which is a major tourist destination in Massachusetts, and a second 42,000-square-foot store in Williamsburg, Virginia. These stores promote our brand image and culture and allow us to test new product and fragrance introductions. In addition to our retail stores, we also sell our products directly to consumers through the Consumer Direct business and the Fundraising business. We believe these two businesses will continue to serve as important sources of revenue growth and profitability, while also helping to build brand awareness, introduce our products to new customers and drive traffic to our retail stores.

Wholesale Operations: We have an attractive and growing wholesale segment with a diverse customer base. As of March 31, 2012, we had approximately 28,500 wholesale locations in North America, including independent gift stores, leading national gift retailers such as Hallmark, leading home specialty retailers such as Bed, Bath & Beyond, national department stores such as Kohl’s and JC Penney, regional department stores, “premium mass” retailers such as Target and Meijer, home improvement retailers and selected club stores and other national accounts. We believe the Yankee Candle® brand name is the most recognized brand in the premium scented candle market. Our wholesale customers are also loyal, with approximately 79% of our U.S. wholesale accounts having been customers for more than five years. We believe that our ability to provide industry leading category management expertise to our wholesale customers regarding product knowledge, display suggestions, promotional ideas and geographical consumer preferences is a significant competitive advantage that we plan to continue to leverage.

International Operations: We sell our products in the United Kingdom and elsewhere in Europe primarily through international distributors and our wholly-owned subsidiary Yankee Candle (Europe), LTD (“YCE”), which has an international wholesale customer network of approximately 6,000 store locations and distributors covering 57 countries as of March 31, 2012. YCE sells our products through multiple channels, with the majority of its sales occurring in the United Kingdom and Ireland through independent gift stores, national accounts and also through its "store within a store" retail concessions business. YCE also sells directly to wholesale accounts in countries such as Germany, Italy and France, and to numerous other countries through distributors. We intend to continue to grow our business outside of North America by leveraging our wholesale distribution network and our existing distribution center in Bristol, England, and by further expanding our international business, including further geographic expansion in Asia, primarily in Japan, China and Korea and in Latin America.

Due to the seasonal nature of our business, interim results are not necessarily indicative of results for the entire fiscal year. Our revenue and earnings are typically greater during our fiscal fourth quarter, which includes the majority of the holiday selling season.

Discontinued Operations

During 2009, we discontinued the operations of our Illuminations and Aroma Naturals businesses. Accordingly, we have classified the results of operations of the Illuminations and Aroma Naturals businesses as discontinued operations for all periods presented.

RESULTS OF OPERATIONS

The following table sets forth the various components of our condensed consolidated statements of operations, expressed as a percentage of sales, for the periods indicated that are used in connection with the discussion herein.

| | | Thirteen | | | Thirteen | |

| | | Weeks Ended | | | Weeks Ended | |

| | | March 31, 2012 | | | April 2, 2011 | |

| YCC Holdings LLC Statements of Operations Data: | | | | | | |

| Sales: | | | | | | |

| Retail | | | 52.2 | % | | | 51.9 | % |

| Wholesale | | | 32.4 | | | | 32.9 | |

| International | | | 15.4 | | | | 15.2 | |

| Total sales | | | 100.0 | | | | 100.0 | |

| Cost of sales | | | 46.0 | | | | 45.0 | |

| Gross profit | | | 54.0 | | | | 55.0 | |

| Selling expenses | | | 35.8 | | | | 36.8 | |

| General and administrative expenses | | | 10.9 | | | | 13.0 | |

| Restructuring charges | | | 0.4 | | | | - | |

| Operating income | | | 6.9 | | | | 5.2 | |

| Other expense, net | | | 16.0 | | | | 14.5 | |

| Loss from continuing operations before benefit from income taxes | | | (9.1 | ) | | | (9.3 | ) |

| Benefit from income taxes | | | (3.4 | ) | | | (3.5 | ) |

| Loss from continuing operations | | | (5.7 | ) | | | (5.9 | ) |

| Loss from discontinued operations, net of taxes | | | - | | | | - | |

| Net loss | | | (5.7 | ) % | | | (5.9 | ) % |

| | | Thirteen | | | Thirteen | |

| | | Weeks Ended | | | Weeks Ended | |

| | | March 31, 2012 | | | April 2, 2011 | |

| Yankee Holding Corp. Statements of Operations Data: | | | | | | |

| Sales: | | | | | | |

| Retail | | | 52.2 | % | | | 51.9 | % |

| Wholesale | | | 32.4 | | | | 32.9 | |

| International | | | 15.4 | | | | 15.2 | |

| Total sales | | | 100.0 | | | | 100.0 | |

| Cost of sales | | | 46.0 | | | | 45.0 | |

| Gross profit | | | 54.0 | | | | 55.0 | |

| Selling expenses | | | 35.8 | | | | 36.8 | |

| General and administrative expenses | | | 10.9 | | | | 12.9 | |

| Restructuring charges | | | 0.4 | | | | - | |

| Operating income | | | 6.9 | | | | 5.3 | |

| Other expense, net | | | 10.4 | | | | 11.0 | |

| Loss from continuing operations before benefit from income taxes | | | (3.5 | ) | | | (5.7 | ) |

| Benefit from income taxes | | | (1.2 | ) | | | (2.0 | ) |

| Loss from continuing operations | | | (2.3 | ) | | | (3.7 | ) |

| Loss from discontinued operations, net of taxes | | | - | | | | - | |

| Net loss | | | (2.3 | ) % | | | (3.7 | ) % |

The results of operations discussion that follows for the thirteen weeks ended March 31, 2012 versus the thirteen weeks ended April 2, 2011 is for continuing operations only. The results of operations of the Aroma Naturals and the Illuminations divisions have been treated as discontinued operations for all periods presented and are not included in the discussion below.

Thirteen weeks ended March 31, 2012 versus the Thirteen weeks ended April 2, 2011

SALES

Sales increased 7.6% to $155.1 million for the thirteen weeks ended March 31, 2012 from $144.1 million for the thirteen weeks ended April 2, 2011.

Retail Sales

Retail sales increased 8.3% to $81.0 million for the thirteen weeks ended March 31, 2012, from $74.8 million for the thirteen weeks ended April 2, 2011. The increase in retail sales was primarily due to (i) sales attributable to stores opened in 2011 that have not yet entered the comparable store base (which in 2011 were open for less than a full year) of approximately $2.8 million, (ii) increased sales in our catalog and internet business (“Consumer Direct”) of approximately $2.0 million, (iii) an increase in sales from our Yankee Candle Fundraising division of approximately $1.7 million and (iv) the addition of 10 new Yankee Candle stores during 2012 which contributed $0.4 million, these increases were partially offset by decreased comparable store sales of approximately $0.7 million.

Comparable sales for our Retail business, including Consumer Direct, increased 1.8% for the thirteen weeks ended March 31, 2012 compared to the thirteen weeks ended April 2, 2011. Yankee Candle comparable store sales for the thirteen weeks ended March 31, 2012 decreased 1.2% compared to the thirteen weeks ended April 2, 2011. Comparable store sales represent a comparison of sales during the corresponding fiscal periods on stores in our comparable stores sales base. A store first enters our comparable store sales base in the fourteenth fiscal month of operation. Permanently closed stores are excluded from the comparable store calculation beginning in the month in which the store closes. The decrease in comparable store sales was driven by an increase in average ticket price of 4.9% offset by decreased traffic of 6.1%. There were 509 stores included in the Yankee Candle comparable store base as of March 31, 2012 as compared to 486 stores included in the Yankee Candle comparable store base as of April 2, 2011. There were 554 total retail stores open as of March 31, 2012, compared to 518 total retail stores open as of April 2, 2011.

Wholesale Sales

Wholesale sales increased 5.7% to $50.2 million for the thirteen weeks ended March 31, 2012 from $47.5 million for the thirteen weeks ended April 2, 2011.

The increase in wholesale sales was primarily due to (i) increased sales in our all other channel consisting of various accounts outside of our premium mass and gift channels of approximately $2.5 million and (ii) increased sales to domestic premium mass and department store channels of approximately $1.2 million, partially offset by (i) decreased sales in our domestic gift store account channel of approximately $0.8 million coupled with (ii) decreased sales from co-packing and licensing activities of approximately $0.1 million.

International Sales

International sales increased 9.3% to $23.9 million for the thirteen weeks ended March 31, 2012 from $21.9 million for the thirteen weeks ended April 2, 2011.

The increase in international sales was primarily due to (i) increased sales in our retail concession channel of $1.1 million, (ii) increased sales in our export direct channel of $0.9 million and (iii) an increase in our international distributor channel of $0.6 million, partially offset by decreased sales in our United Kingdom wholesale business of $0.5 million coupled with a decrease of $0.3 million due to the effect of changes in foreign currency exchange rates, primarily the British Pound.

GROSS PROFIT

Gross profit is sales less cost of sales. Included within cost of sales are the cost of the merchandise we sell through our retail, wholesale and international segments, inbound and outbound freight costs, the operational costs of our distribution facilities, which include receiving costs, inspection and warehousing costs, and salaries and expenses incurred by our buying and merchandising operations.

Gross profit increased 5.7% to $83.8 million for the thirteen weeks ended March 31, 2012 from $79.3 million for the thirteen weeks ended April 2, 2011. As a percentage of sales, gross profit decreased to 54.0% for the thirteen weeks ended March 31, 2012 from 55.0% for the thirteen weeks ended April 2, 2011. Included in gross profit for the thirteen weeks ended March 31, 2012 and April 2, 2011 are purchase accounting costs of $0.5 million and $0.1 million respectively. These costs were not allocated to our segments.

Retail Gross Profit

Retail gross profit dollars increased 7.8% to $51.1 million for the thirteen weeks ended March 31, 2012 compared to $47.4 million for the thirteen weeks ended April 2, 2012. The increase in gross profit dollars over the prior year quarter was primarily due to (i) price increases taken during the second quarter of 2011 and first quarter of 2012, which assuming no elasticity contributed $3.5 million, (ii) increased sales volume which increased gross profit by approximately $3.0 million, (iii) sales volume increases from our Yankee Candle fundraising division which contributed additional gross profit of approximately $0.7 million and (iv) decreased costs in our supply chain operations of approximately $0.5 million, offset by increased promotional and marketing activity of approximately $3.7 million, coupled with unfavorable product mix of approximately $0.3 million.

As a percentage of sales, retail gross profit decreased slightly to 63.1% for the thirteen weeks ended March 31, 2012 from 63.3% for the thirteen weeks ended April 2, 2011. The decrease in gross profit rate was primarily the result of (i) increased promotional activity which decreased gross profit by approximately 1.6%, (ii) unfavorable product mix of approximately 0.4% and (iii) decreased gross profit rate of our Yankee Candle fundraising division of 0.5%, offset by (i) price increases taken during the second quarter of 2011, which assuming no elasticity increased gross profit by approximately 1.7% and (ii) decreased costs in our supply chain operations resulting in an increase in gross profit rate of 0.6%.

Wholesale Gross Profit

Wholesale gross profit dollars increased 2.2% to $23.2 million for the thirteen weeks ended March 31, 2012 from $22.7 million for the thirteen weeks ended April 2, 2011. The increase in wholesale gross profit dollars was primarily attributable to (i) price increases taken during the second quarter of 2011 and first quarter of 2012, which assuming no elasticity increased gross profit by approximately $2.4 million, (ii) increased sales volume which increased gross profit by approximately $2.3 million, and (iii) decreased costs in our supply chain operations of approximately $0.5 million, partially offset by an unfavorable product cost related to shift in channel mix of approximately $2.7 million, coupled with increased promotional and marketing activity of approximately $2.0 million.

As a percentage of sales, wholesale gross profit decreased to 46.2% for the thirteen weeks ended March 31, 2012 from 47.8% for the thirteen weeks ended April 2, 2011. The decrease in gross profit rate was primarily attributable to (i) unfavorable product cost related to shift in channel mix of 3.4% and (ii) increased allowances and promotional and marketing activity which decreased gross profit rate by 2.0%, partially offset by (i) price increases taken during the second quarter of 2011and first quarter of 2012, which assuming no elasticity contributed approximately 2.7% (ii) decreased costs in our supply chain operations which increased gross profit rate by approximately 1.0%, and (iii) slight increases in our other wholesale market gross profit rate of 0.1% .

International Gross Profit

International gross profit dollars increased 8.6% to $10.1 million for the thirteen weeks ended March 31, 2012 from $9.3 million for the thirteen weeks ended April 2, 2011. The increase in international gross profit dollars was primarily attributable to (i) increased sales volume of $1.7 million and (ii) favorable product cost and channel mix of $0.7 million, partially offset by increased allowances and promotional and marketing activity which decreased gross profit by approximately $1.6 million.

As a percentage of sales, international gross profit showed a slight decrease to 42.2% for the thirteen weeks ended March 31, 2012 from 42.6% for the thirteen weeks ended April 2, 2011. The decrease in gross profit rate was primarily attributable by increased allowances and promotional and marketing activity which decreased gross profit rate by 3.6%, offset by (i) favorable channel mix of approximately 2.7% driven primarily by increased sales within our retail concessions channel, which has the highest margins within our international business and (ii) decreased supply chain operations costs which contributed an increase of gross profit of 0.5%.

SELLING EXPENSES

Selling expenses increased 4.5% to $55.5 million for the thirteen weeks ended March 31, 2012 from $53.1 million for the thirteen weeks ended April 2, 2011. These expenses are related to our wholesale, retail and international operations and consist of payroll, occupancy, advertising and other operating costs, as well as store pre-opening costs, which are expensed as incurred. As a percentage of sales, selling expenses were 35.8% and 36.8% for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively.

Included in selling expenses for the thirteen weeks ended March 31, 2012 and April 2, 2011 are purchase accounting costs of $1.6 million and $3.5 million respectively, consisting primarily of the amortization of intangible assets. These costs were not allocated to our segments.

Retail Selling Expenses

Retail selling expenses increased 9.0% to $44.8 million for the thirteen weeks ended March 31, 2012 from $41.1 million for the thirteen weeks ended April 2, 2011. As a percentage of retail sales, retail selling expenses were 55.3% and 55.0% for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively. The increase in retail selling expenses in dollars was primarily related to selling expenses incurred in the new Yankee Candle retail stores opened in 2012 and 2011, which together represented an increase of approximately $3.0 million.

Wholesale Selling Expenses

Wholesale selling expenses decreased 6.3% to $3.0 million for the thirteen weeks ended March 31, 2012 from $3.2 million for the thirteen weeks ended April 2, 2011. These expenses relate to payroll, advertising and other operating costs. As a percentage of wholesale sales, wholesale selling expenses were 6.0% and 6.8% for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively. The decrease in selling expenses and as a percentage of sales was attributable to decreased marketing costs and commissions coupled with a decrease in labor costs year over year.

International Selling Expenses

International selling expenses increased 17.3% to $6.1 million for the thirteen weeks ended March 31, 2012 from $5.2 million for the thirteen weeks ended April 2, 2011. These expenses relate to payroll, advertising and other operating costs. As a percentage of international sales, international selling expenses were 25.6% and 23.9% for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively. The increase in selling expenses was attributable to increased commissions, labor and other related selling costs of approximately $0.7 million related to the increased sales volume in this business. The increase in selling expenses as a percentage of sales was largely related to increased allowances and promotional and marketing activity.

General and Administrative Expenses

General and administrative expenses, which are shown in our unallocated/corporate/other column of the Companies’ segment footnote, consist primarily of personnel–related costs including senior management, accounting, information systems, human resources, legal, marketing, management incentive programs and bonus and other costs that are not readily allocable to either the retail, wholesale or international operations. General and administrative expenses decreased 10.1% to $16.9 million for the thirteen weeks ended March 31, 2012 compared to $18.8 million for the thirteen weeks ended April 2, 2011. As a percentage of sales, general and administrative expenses were approximately 10.9% and 13.0% for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively.

The general and administrative expenses of $18.8 million for the thirteen weeks ended April 2, 2011 includes the $3.0 million paid to Class B and Class C common unit holders in February 2011 in connection with the issuance of the Senior PIK Notes. Excluding such expenses, general and administrative costs were unfavorable by $1.1 million driven largely by increased medical costs and as a percentage of sales decreased slightly year over year at 10.9% and 11.0% for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively.

Restructuring Charges

During the first quarter of 2012, the Company restructured its Wholesale and Retail operations. The Company also initiated a change in reporting structure and changes of roles and responsibilities within the organization that resulted in workforce reductions. These changes included changes to the executive committee, changes to the reporting structure and operational focus within the retail segment, alignment of the brand innovation and merchandising teams across all channels of the business, and other administrative changes. As a result of these changes the Company incurred restructuring charges of $0.7 million during the thirteen weeks ended March 31, 2012.

Interest and Other Expense, Net

YCC Holdings’ interest and other (income) expense, net, which is shown in YCC Holdings’ unallocated/corporate/other column of YCC Holdings’ segment footnote was $24.9 million for the thirteen weeks ended March 31, 2012 compared to $20.9 million for the thirteen weeks ended April 2, 2011. The primary component of this expense is interest expense, which was $25.9 million and $22.7 million for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively. The increase in interest expense primarily relates to $3.3 million of interest expense related to the Senior PIK Notes.

Holding Corp.’s interest and other expense, net, which is shown in Holding Corp.’s unallocated/corporate/other column of Holding Corp.’s segment footnote was $16.1 million for the thirteen weeks ended March 31, 2012 compared to $15.8 million for the thirteen weeks ended April 2, 2011. The primary component of this expense is interest expense, which was $17.2 million and $17.7 million for the thirteen weeks ended March 31, 2012 and April 2, 2011 respectively.

Changes in the fair value of Yankee Candle’s derivative contracts are recognized in the condensed consolidated statement of operations. During the thirteen weeks ended March 31, 2012 and April 2, 2011, Yankee Candle recognized a gain related to its derivative contracts of $1.6 million and $1.4 million, respectively.

Benefit From Income Taxes

The benefit from income taxes for YCC Holdings for the thirteen weeks ended March 31, 2012 and April 2, 2011 was approximately $5.2 million and $5.0 million, respectively. The effective tax rates for the thirteen weeks ended March 31, 2012 and April 2, 2011 were 36.9% and 37.1%, respectively.

The provision for income taxes for Holding Corp. for the thirteen weeks ended March 31, 2012 was $1.9 million compared to $2.9 million for the thirteen weeks ended April 2, 2011. The effective tax rates for the thirteen weeks ended March 31, 2012 and April 2, 2011 were 35.6% and 35.5%, respectively.

Loss from Discontinued Operations, Net of Tax

During 2009, we discontinued the operations of our Illuminations and Aroma Naturals businesses. Accordingly, the Companies have classified the results of operations of the Illuminations and Aroma Naturals businesses as discontinued operations for all periods presented. The loss from discontinued operations was minimal for both the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively.

LIQUIDITY AND CAPITAL RESOURCES

Senior Secured Credit Facility

Yankee Candle’s Senior Secured Credit Facility as of March 31, 2012 consisted of a 7-year Term Facility with outstanding borrowings of $388.1 million and a 6-year $140.0 million Revolving Facility. See Note 13 “Subsequent Events,” for a discussion of the refinancing of Yankee Candle’s Senior Secured Credit Facility. All borrowings under the Senior Secured Credit Facility bear interest at a rate per annum equal to an applicable margin, plus, at our option, (i) the higher of (x) the prime rate (as set forth on the British Banking Association Telerate Page 5) and (y) the federal funds effective rate, plus one-half percent (0.50%) per annum or (ii) the Eurodollar rate, and resets periodically. In addition to paying interest on outstanding principal under the Senior Secured Credit Facility, Yankee Candle is required to pay a commitment fee to the lenders in respect of unutilized loan commitments at a rate of 0.50% per annum. The Term Facility matures on February 6, 2014 and the Revolving Facility matures on February 6, 2013.

As of March 31, 2012, Yankee Candle had outstanding letters of credit of $2.1 million and $15.0 million outstanding under the Revolving Facility, leaving $122.9 million in availability under the Revolving Facility. As of March 31, 2012, Yankee Candle was in compliance with all covenants under the Senior Secured Credit Facility.

Yankee Candle uses interest rate swaps to eliminate the variability of a portion of cash flows associated with the forecasted interest payments on the Term Facility. During the second and third quarters of 2009, Yankee Candle entered into forward starting amortizing interest rate swaps to eliminate the variability in future interest payments by having Yankee Candle pay fixed-rate amounts in exchange for receipt of floating-rate interest payments. The effective date of the forward starting swaps was March 31, 2011. The aggregate notional value amortizes over the life of the swaps. As of March 31, 2012, the aggregate notional value of the swaps was $276.1 million, or 71.1% of the Term Facility, resulting in a blended fixed rate of 3.49%. The forward starting swaps are not designated as cash flow hedges and, are measured at fair value with changes in fair value recognized in the consolidated statements of operations as a component of other income (expense). The forward starting swap agreements terminate in March 2013.

All obligations under the Senior Secured Credit Facility are guaranteed by Yankee Candle and each of Yankee Candle's existing and future domestic subsidiaries. In addition, the Senior Secured Credit Facility is secured by first priority perfected liens on all of Yankee Candle's capital stock and substantially all of Yankee Candle's existing and future material assets and the existing and future material assets of Yankee Candle's guarantors, except that only up to 66% of the voting capital stock of the first tier foreign subsidiaries and 100% of the non-voting capital stock of such foreign subsidiaries will be pledged in favor of the Senior Secured Credit Facility and each of the guarantor's assets.

The Senior Secured Credit Facility permits all or any portion of the loans outstanding to be prepaid at any time and commitments to be terminated in whole or in part at Yankee Candle's option without premium or penalty. Yankee Candle is required to repay amounts borrowed under the Term Facility in equal quarterly installments in an aggregate annual amount equal to one percent (1.0%) of the original principal amount of the Term Facility with the balance being payable on the maturity date of the Term Facility.

Subject to certain exceptions, the Senior Secured Credit Facility requires that 100% of the net proceeds from certain asset sales, casualty insurance, condemnations and debt issuances, and 50% (subject to step downs) from excess cash flow, as defined, for each fiscal year must be used to pay down outstanding borrowings. The calculation to determine if Yankee Candle has excess cash flow per the Senior Secured Credit Facility is on an annual basis at the end of each fiscal year.

Yankee Candle's Credit Facility contains a financial covenant which requires that Yankee Candle maintain at the end of each fiscal quarter, commencing with the quarter ended December 31, 2011 through the quarter ending December 31, 2013, a consolidated total secured debt (net of cash and cash equivalents not to exceed $30.0 million) to Consolidated Adjusted EBITDA ratio of no more than 2.75 to 1.00. As of March 31, 2012, Yankee Candle's actual secured leverage ratio was 2.08 to 1.00, as defined. As of March 31, 2012, total secured debt (including Yankee Candle's capital lease obligations of $5.3 million) was approximately $402.7 million (net of $5.7 million in cash). Under Yankee Candle's Credit Facility, Consolidated Adjusted EBITDA is defined as net income plus, interest, taxes, depreciation and amortization, further adjusted to add back extraordinary, unusual or non-recurring losses, non-cash stock option expense, fees and expenses related to the Merger, fees and expenses under the Management Agreement with our equity sponsor, restructuring charges or reserves, as well as other non-cash charges, expenses or losses, and further adjusted to subtract extraordinary, unusual or non-recurring gains, other non-cash income or gains, and certain cash contributions to our common equity. Set forth below is a reconciliation of Yankee Candle’s Consolidated Adjusted EBITDA, as calculated under Yankee Candle's Credit Facility, to EBITDA and net income for the thirteen weeks ended March 31, 2012 (in thousands):

| Net income | | $ | 56,382 | |

| Income tax provision | | | 31,488 | |

| Interest expense, net (excluding amortization of deferred financing fees) | | | 59,392 | |

| Depreciation and amortization | | | 40,032 | |

| EBITDA | | | 187,294 | |

| Share-based compensation expense | | | 830 | |

| Restructuring charges | | | 655 | |

| Fees paid pursuant to the Management Agreement | | | 1,500 | |

| Other non-cash expense | | | 3,679 | |

| Consolidated Adjusted EBITDA under the Credit Facility | | $ | 193,958 | |

Senior PIK Notes of YCC Holdings

In February 2011 YCC Holdings formed a 100% owned subsidiary, Yankee Finance, for the purpose of co-issuing in conjunction with YCC Holdings $315.0 million Senior PIK Notes. Cash interest accrues at a rate of 10.25% per annum, and PIK Interest (defined below) accrues at the cash interest rate plus 0.75%. YCC Holdings is required to pay interest on the Senior PIK Notes entirely in cash interest, unless the conditions described in the indenture are satisfied with respect to the related interest period, in which case, YCC Holdings may pay interest on Senior PIK Notes for such interest period by increasing the principal amount of the Senior PIK Notes or by issuing new PIK Notes for up to the entire amount of the interest payment (in each case, "PIK Interest"), to the extent described in the related indenture. The amount of cash interest required to be paid for an interest period is determined prior to the beginning of an interest period and is calculated based upon the amount that would be permitted to be paid as a dividend as of such determination date to YCC Holdings by its subsidiaries for the purpose of paying cash interest on the Senior PIK Notes (based upon restrictions imposed by applicable law and such subsidiaries' debt agreements) plus the amount of cash on hand at YCC Holdings on the determination date (subject to certain exceptions set forth in the indenture). If the amount that would be available is less than the amount of interest due for that interest period, then YCC Holdings is permitted to pay all or a specified portion of such interest as PIK Interest rather than in cash on the interest payment date as provided in the indenture. As of March 31, 2012, the Senior PIK Notes are structurally subordinated to approximately $916.1 million of indebtedness of Holding Corp.

The $315.0 million aggregate principal amount of the Senior PIK Notes were issued at a discount of $6.3 million and YCC Holdings paid deferred financing fees of $7.8 million. YCC Holdings is amortizing the discount and the deferred financing fees using the effective interest rate method over the terms of the Senior PIK Notes. The proceeds from the Senior PIK Notes were used to pay transaction costs (exclusive of the amounts paid by Holding Corp.) and to make a payment of $300.8 million to Yankee Investments, which in turn made payments of $297.8 million to holders of Yankee Investments' Class A common units and payments of $3.0 million to holders of Yankee Investments' Class B and Class C common units.

YCC Holdings is a holding company with no direct operations. Its principal asset is the indirect equity interests it holds in Yankee Candle, and all of its operations are conducted through Yankee Candle. As a result, YCC Holdings is indirectly dependent upon dividends from Yankee Candle to generate the funds necessary to meet its outstanding debt service obligations. Neither Yankee Candle nor Holding Corp. guaranteed the Senior PIK Notes. Yankee Candle is not obligated to pay dividends to Holding Corp. and Holding Corp. is not obligated to pay dividends to YCC Holdings. Yankee Candle’s ability to pay dividends to Holding Corp. to permit Holding Corp. to pay dividends to YCC Holdings was restricted at March 31, 2012 by Yankee Candle’s Secured Credit Facility and the indentures governing the senior notes and senior subordinated notes. See Note 13 “Subsequent Events,” for a discussion of the refinancing of Yankee Candle’s Senior Secured Credit Facility.

The New Term Loan Facility and ABL Facility discussed below restrict Yankee Candle’s ability to pay dividends to YCC Holdings. For a further description of these limitations, see the discussion below under “--Refinancing of the Senior Secured Credit Facility and Repurchase of $315 million of Yankee Candle’s 8 1/2% Senior Notes due 2015.”

The indentures governing the Yankee Candle notes permit Yankee Candle to pay dividends to Holding Corp. if: (i) there is no default or event of default under the indentures governing the Yankee Candle Notes; (ii) Yankee Candle would have a fixed charge coverage ratio of at least 2.0 to 1.0; and (iii) such dividend, together with the aggregate amount of all other "restricted payments" (as defined in such indentures) made by Yankee Candle and its restricted subsidiaries after February 6, 2007 (excluding certain restricted payments), is less than the sum of (a) 50% of the Consolidated Net Income (as defined in such indentures) of Yankee Candle for the period (taken as one accounting period) from December 31, 2006 to the end of Yankee Candle's most recently ended fiscal quarter for which internal financial statements are available at the time of such dividend (or, in the case such Consolidated Net Income for such period is a deficit, minus 100% of such deficit), plus (b) the proceeds from specified equity contributions or issuances of equity.

In addition to the capacity described above, Yankee Candle has a "basket" of $35.0 million under the indentures from which it may make dividends in amount not to exceed $35.0 million (since the date of the issuance of Yankee Candle's notes), so long there is no default or event of defaults under the indentures.

Because the New Term Loan Facility, ABL Facility and the indentures governing Yankee Candle’s senior notes and senior subordinated notes each contain limitations on dividends, Yankee Candle is permitted to make dividends only to the extent it is permitted to do so under each of these agreements.

During the thirteen weeks ended March 31, 2012 Holding Corp. made a dividend of $16.2 million to YCC Holdings primarily to fund interest payments for the Senior PIK Notes, which decreased the amount available for future dividends under the indentures governing Yankee Candle’s senior notes and senior subordinated notes and under the Senior Secured Credit Facility. We currently anticipate that Yankee Candle will be permitted under the terms of its debt agreements to make dividends sufficient to pay cash interest on the PIK Notes in the next twelve months.

Refinancing of the Senior Secured Credit Facility and Repurchase of $315 million of Yankee Candle’s 8 ½% Senior Notes Due 2015

On April 2, 2012, Yankee Candle entered into a Credit Agreement (the “New Term Loan Facility”) with the lenders party thereto, Bank of America, N.A. (“BofA”), as administrative agent, Barclays Bank PLC (“Barclays”), as syndication agent, and BofA and Barclays, as joint lead arrangers and joint book runners. Under the New Term Loan Facility, Yankee Candle borrowed $725.0 million. At closing, on April 2, 2012, a portion of the net proceeds from the New Term Loan Facility were used, at closing, to (i) redeem $180.0 million of Yankee Candle’s Senior Notes, (ii) repay $403.1 million of outstanding debt on the Company’s existing Senior Secured Credit Facility (consisting of $388.1 outstanding under the Term Facility and $15.0 million outstanding under the Revolving Facility) and (iii) pay fees and expenses related to the foregoing. On April 13, 2012, the Company used the remaining net proceeds to redeem an additional $135.0 million of the Senior Notes. The New Term Loan Facility will mature on April 2, 2019; however the maturity date of the New Term Loan Facility will accelerate if the senior subordinated notes and Senior PIK Notes are not defeased, repurchased, refinanced or redeemed 91 days prior to their respective maturity dates.

The New Term Loan Facility is subject to quarterly amortization of principal equal to 0.25% of the original aggregate principal amount of the New Term Loan Facility, with the balance payable at final maturity. Interest is payable on the New Term Loan Facility at either (i)the Eurodollar Rate (subject to a 1.25% floor) plus 4.00% or (ii) the ABR (subject to a 2.25% floor) plus 3.00%. The default rate of interest will accrue (i) on the overdue principal amount of any loan at a rate of 2% in excess of the rate otherwise applicable to such loan and (ii) on any overdue interest or any other outstanding overdue amount at a rate of 2% in excess of the non-default interest rate then applicable to ABR loans.

The New Term Loan Facility requires Yankee Candle and its subsidiaries to maintain a maximum consolidated net total leverage ratio, and the ABL Facility requires Yankee Candle and its subsidiaries to maintain a maximum consolidated fixed charge coverage ratio. In addition, the New Term Loan Facility and the ABL Facility contain customary covenants and restrictions on Yankee Candle and its subsidiaries’ activities, including but not limited to, limitations on the incurrence of additional indebtedness, liens, negative pledges, guarantees, investments, loans, asset sales, mergers, acquisitions, prepayment of other debt, distributions, dividends, the repurchase of capital stock, transactions with affiliates and the ability to change the nature of its business or its fiscal year. All obligations under the New Term Loan Facility and ABL Facility are guaranteed by Yankee Holdings’ and Yankee Candle’s domestic subsidiaries and secured by a lien on substantially all of the assets of Yankee Holdings and its domestic subsidiaries.