November 28, 2015 Dave W. Keck President and Chief Executive Officer GT Advanced Technologies, Inc. 243 Daniel Webster Highway Merrimack, NH 03054 Re: Financing Support Commitment Dear Mr. Keck: GT Advanced Technologies Inc. (“GT Inc”) and its affiliated debtors1 (collectively, the “Debtors”) have advised the undersigned financing support parties (the “Financing Support Parties”) that the undersigned Debtors, in connection with their pending chapter 11 cases (the “Chapter 11 Cases”)2, require exit financing to facilitate the effectiveness of a plan of reorganization with respect to all of the Debtors, which includes, among other things, financing to fund the ongoing working capital requirements of the Debtors, as reorganized. Each of the Financing Support Parties is pleased to advise you of its commitment to provide an exit financing facility in an amount that, when added to the amount of the commitments of all the other Exit Financing Support Parties as specified herein, will total the aggregate amount of $80,000,000 (the “Exit Facility”), on the terms and conditions set forth in this commitment letter. The Financing Support Parties’ commitment to provide the Exit Facility is, in all respects, subject only to, and conditioned only on, the satisfaction of the Exit Facility Conditions (as defined below). The specific amount of the Exit Facility committed by each Financing Support Party is set forth in Exhibit A to the Plan Term Sheet attached hereto as Annex 1 and incorporated herein by reference (the “Term Sheet”)3 under the heading “Commitment Amounts”. For the avoidance of doubt, no Financing Support Party shall, in any event, be liable to provide the amount of the Exit Facility committed by any other Financing Support Party. By execution of this commitment letter, each Financing Support Party represents and warrants that it or its Financing Support Party Affiliate (defined below) has the funds necessary to fund its respective share of the financing commitment. By its execution hereof and its acceptance of the commitment contained herein and, to the extent required, subject to the approval of the Bankruptcy Court, each of the Debtors signatory hereto agrees to indemnify and hold harmless the Financing Support Parties and each of their respective assignees and affiliates (including Financing Support Party Affiliates (defined below)) and their respective directors, partners, members, officers, employees, attorneys and agents (each an 1 The affiliated debtors of GT Inc are: GTAT Corporation (“GT Corp”), GT Advanced Equipment Holding LLC, GT Equipment Holdings, Inc., Lindbergh Acquisition Corp., GT Sapphire Systems Holding LLC, GT Advanced Cz LLC, GT Sapphire Systems Group LLC, and GT Advanced Technologies Limited (“GT HK”). 2 The Debtors commenced cases in the United States Bankruptcy Court for the District of New Hampshire (the “Bankruptcy Court”) by filing for relief under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101- 1532 (the “Bankruptcy Code”), which Chapter 11 Cases are being jointly administered and are captioned In re GT Advanced Technologies Inc., et. al., Case No. 14-11916-HJB. 3 Capitalized terms not otherwise defined in this commitment letter have the meaning ascribed to them in the Term Sheet. EXHIBIT 10.1

“Indemnified Party”) from and against any and all losses, claims, damages, liabilities or other expenses to which such Indemnified Party may become subject, insofar as such losses, claims, damages, liabilities or other expenses arise out of or result from, this commitment letter or the extension of the Exit Facility contemplated by this commitment letter, or in any way arise from any use or intended use of this commitment letter or the proceeds of the Exit Facility contemplated by this commitment letter, and each of the Debtors signatory hereto agrees to reimburse each Indemnified Party for any legal or other expenses incurred in connection with investigating, defending or participating in any such loss, claim, damage, liability or action or other proceeding (whether or not such Indemnified Party is a party to any action or proceeding out of which indemnified expenses arise) (“Indemnified Expenses”), but excluding therefrom all Indemnified Expenses, losses, claims, damages and liabilities (i) which are finally determined in a non-appealable decision of a court of competent jurisdiction to have resulted from the gross negligence or willful misconduct of the Indemnified Party or (ii) arising out of any claim, litigation, investigation or proceeding that does not involve an act or omission of a Debtor and that is brought by an Indemnified Party against any other Indemnified Party. In the event of any litigation or dispute involving this commitment letter or the Exit Facility, no party hereto shall be responsible or liable to any other such party or any other person for any special, indirect, consequential, incidental or punitive damages. In addition, each of the Debtors signatory hereto agrees to reimburse the Financing Support Parties and their Financing Support Party Affiliates (defined below) for all reasonable and documented out-of-pocket expenses of Wilmer Cutler Pickering Hale and Dorr, LLP and one local bankruptcy counsel in New Hampshire (the “Expenses”) incurred by or on behalf of the Financing Support Parties and their Financing Support Party Affiliates (defined below) in connection with the negotiation, preparation, execution and delivery of this commitment letter and any and all definitive documentation relating hereto and thereto. The obligations of the Debtors signatory hereto under this paragraph shall remain effective whether or not definitive documentation is executed and notwithstanding any termination of this commitment letter. Upon the execution and acceptance of this commitment letter by the Debtors signatory hereto, but subject to approval of this commitment letter by the Bankruptcy Court, each of the Debtors signatory hereto hereby agrees that the Put Option Premium, referred to in Exhibit A to the Term Sheet shall be fully earned and payable as set forth under the heading “Put Option Premium” in the Term Sheet. The Debtors’ obligations under this letter are, to the extent required, subject to the approval of the Bankruptcy Court, and the Debtors agree to use their reasonable efforts to obtain such approval of the Bankruptcy Court on or before December 2, 2015. The Financing Support Parties’ commitment to provide the Exit Facility is subject to and conditioned on (i) the absence, after the date hereof, of any material adverse change with respect to the condition, financial or otherwise, business, operations, assets or liabilities of the Debtors or their subsidiaries taken as a whole, as determined by the Majority Financing Support Parties in their reasonable discretion (a “Material Adverse Change”), provided, however, that for purposes of determining whether a Material Adverse Change has occurred, any change resulting solely from the continuation of the Chapter 11 Cases or the process relating to the implementation of

the Plan, shall be disregarded, (ii) the entry of the Confirmation Order by the Bankruptcy Court confirming the Plan which shall in all respects be in accordance with the terms therefor set forth in the Term Sheet, and which Confirmation Order shall remain in full force and effect and not be stayed or vacated, (iii) the occurrence of the Effective Date and (iv) the amendment of the DIP Facility on the terms set forth in Exhibit C to the Term Sheet (this paragraph, the “Exit Facility Conditions”). This commitment letter is delivered to the Debtors upon the condition that, prior to the Debtors’ acceptance of this offer, neither the existence of this commitment letter or the Term Sheet, nor any of their contents, shall be disclosed by the Debtors, except (a) as may be compelled to be disclosed in a judicial or administrative proceeding or as otherwise required by law (including as may be required by the Bankruptcy Court, including for purposes of having this commitment letter approved), (b) on a confidential and “need to know” basis, solely to the directors, officers, employees, advisors, accountants, counsel or agents of (i) the Debtors, (ii) the Office of the United States Trustee, or (iii) the official committee of unsecured creditors appointed in the Chapter 11 Cases and (c) upon notice to the Financing Support Parties, in connection with any public filing requirement a Debtor is legally obligated to satisfy. In addition, each of the Debtors agrees that it will (i) consult with the Financing Support Parties prior to the making of any filing in which reference is made to the Financing Support Parties or the commitment contained herein, and (ii) obtain the prior approval of the Financing Support Parties (not to be unreasonably withheld, delayed or conditioned) before releasing any public announcement in which reference is made to the Financing Support Parties or to the commitment contained herein. For the avoidance of doubt, after execution of this commitment letter by the Debtors and the Financing Support Parties, and in connection with the Debtors’ efforts to obtain Bankruptcy Court approval thereof, the Debtors may file this commitment letter with the Bankruptcy Court. The Debtors acknowledge that the Financing Support Parties and their respective affiliates may now or hereafter provide financing or advisory services to, or own or obtain other interests in, other companies in respect of which one or more of the Debtors or their affiliates may be business competitors, and that the Financing Support Parties and their affiliates will have no obligation to provide to the Debtors or any of their affiliates any information (whether or not confidential) obtained from or in respect of such other companies. No Financing Support Party and no affiliate of a Financing Support Party will use confidential information obtained from the Debtors or the Debtors’ affiliates or on the Debtors’ or their behalf by virtue of the transactions contemplated hereby in connection with the performance by such Financing Support Party and its affiliates of services for other companies or persons and such Financing Support Party and its affiliates will not furnish any such information to any of their other customers. In addition, please note that the Financing Support Parties and their affiliates do not provide accounting, tax or legal advice. Nothing in this commitment letter creates or shall be construed to create a fiduciary, financial advisory or similar relationship between the Financing Support Parties or their affiliates on the one hand and any of the Debtors, their affiliates or any other person on the other hand. No Financing Support Party’s commitments under this commitment letter may be assigned without the prior written consent of the Debtors signatory hereto. Notwithstanding the

foregoing, a Financing Support Party may without consent employ the services of its affiliates in providing services contemplated hereby, and to satisfy its obligations hereunder through, or assign its rights and obligations hereunder to, one or more of its affiliates or funds or accounts managed by it (collectively, “Financing Support Party Affiliates”); and to allocate, in whole or in part, to its affiliates certain fees payable to such Financing Support Party in such manner as such Financing Support Party and the Financing Support Party Affiliate may agree in their sole discretion; provided that, no delegation or assignment to a Financing Support Party Affiliate shall relieve such Financing Support Party from its obligations hereunder to the extent that any Financing Support Party Affiliate fails to satisfy the commitments hereunder at the time required. Without limiting the conditions to the Financing Support Parties’ commitment to provide the Exit Facility as set forth in this comment letter, the offer made by the Financing Support Parties in this letter shall expire, unless otherwise agreed by the Financing Support Parties in writing, upon the earlier of (i) 5:00 p.m. (New York City time) on December 2, 2015, unless prior thereto the Financing Support Parties have received (A) a copy of this commitment letter, signed by the Debtors accepting the terms and conditions of this commitment letter and the Term Sheet, and (B) an order of the Bankruptcy Court, in form and substance reasonably acceptable to the Majority Financing Support Parties, authorizing the Debtors to deliver a signed copy of this commitment letter to the Financing Support Parties (it being understood that the Debtors’ obligation to pay all amounts in respect of indemnification, the Put Option Premium and Expenses shall survive termination of this commitment letter). This commitment letter, including the Term Sheet (which is incorporated herein by reference), (i) supersedes all prior discussions, agreements, commitments, arrangements, negotiations or understandings, whether oral or written, of the parties with respect thereto, (ii) shall be governed by the law of the State of New York and the Bankruptcy Code, to the extent applicable, (iii) shall be binding upon the parties and their respective successors and assigns, (iv) may not be relied upon or enforced by any other person or entity, and (v) may be signed in multiple counterparts and delivered by facsimile or other electronic transmission (e.g., “pdf” or “tif”), each of which shall be deemed an original and all of which together shall constitute one and the same instrument. If this commitment letter becomes the subject of a dispute, each of the parties hereto hereby waives trial by jury. This commitment letter may be amended, modified or waived only in a writing signed by each of the parties hereto. [Remainder of page intentionally blank]

Should the terms and conditions of the offer contained herein meet with your approval, please indicate your acceptance by signing and returning a copy of this letter to Dennis Jenkins, Esq., at Wilmer Cutler Pickering Hale and Dorr, LLP, 60 State Street, Boston, MA 02109, dennis.jenkins@wilmerhale.com. Very truly yours, THE FOLLOWING FINANCING SUPPORT PARTIES: -WBOX 2014-3 LTD. -JEFFERIES LLC -QPB HOLDINGS LTD. -WOLVERINE FLAGSHIP FUND TRADING LIMITED -PRIVET FUND MANAGEMENT LLC -CITIGROUP FINANCIAL PRODUCTS INC. -CASPIAN CAPITAL LP -CORRE PARTNERS MANAGEMENT LLC -EMPYREAN CAPITAL PARTNERS, LP (Signature pages attached) [Remainder of page intentionally blank]

THE DISTRESSED DEBT TRADING DESK OF CITIGROUP FINAN [Financing Support Party Signature Page] Joelle Gavlick Authorized Signatory

JEFFERIES LLC B G~~~ //~~G✓1 Y• Name: ,//~,~ %~ ~f ~L~,,~ h/~i✓ Title: S1li~ [Financing Support Party Signature Page]

Agreed and accepted on this 29th day of November, 2015 GT ADVANCED TECHNOLOGIES INC. GTAT CORPORATION GT EQUIPMENT HOLDINGS, INC. LINDBERGH ACQUISITION CORP. GT SAPPHIRE SYSTEMS HOLDING LLC GT ADVANCED CZ LLC GT SAPPHIRE SYSTEMS GROUP LLC By:_________________________________ Name: Title: Vice President and General Counsel Hoil Kim

Agreed and accepted on this3O day ofM- , 2015, solely in its capacity as a Consenting Party and DIP Lender under the attached term sheet, and not in any capacity as a Financing Support Party. LATIGO PARTNERS, LP By: __________________________ Name: Sc c’II ,‘M 3 c_— Title: ,l,f-h.’--: -A F.j ActiveUS 149675857v.2

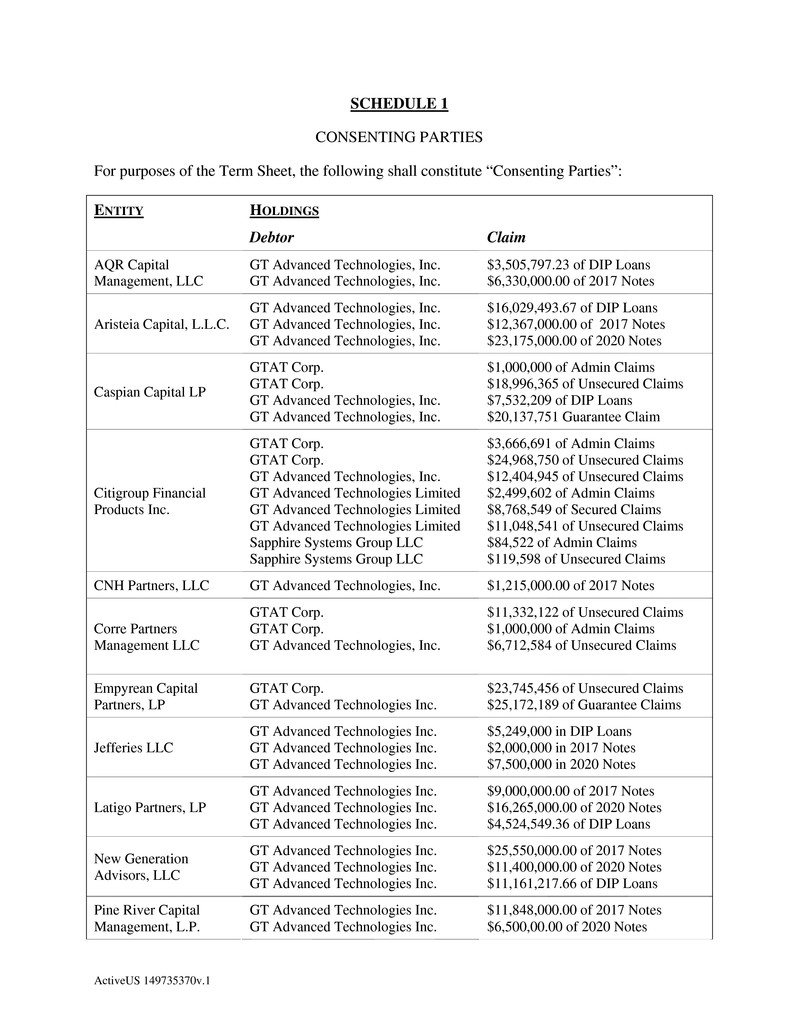

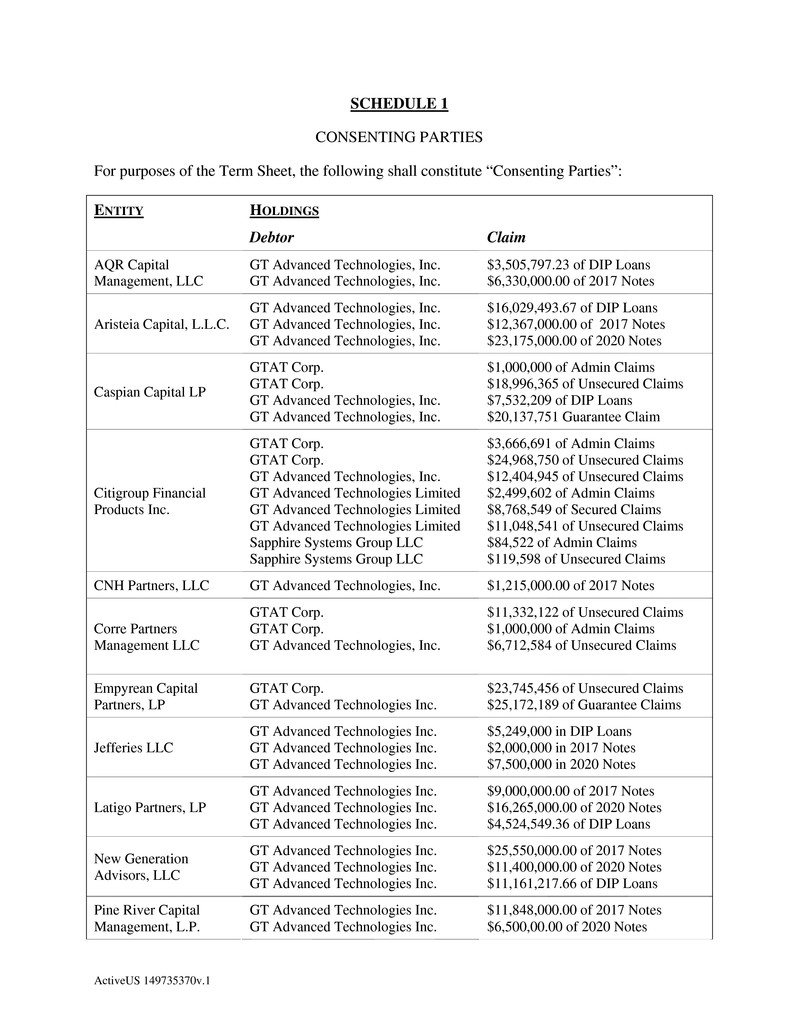

ActiveUS 149807593v.3 SUBJECT TO FRE 408 Plan Term Sheet November 28, 2015 This Term Sheet (as amended, the “Term Sheet”)1 is for the proposed restructuring of the obligations of GT Advanced Technologies Inc. (“GT Inc”) and each of its direct and indirect subsidiaries that are or have become debtors (each a “Debtor” and, collectively, the “Debtors” or the “Company”)2 by commencing cases under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of New Hampshire (the “Bankruptcy Court”). This Term Sheet sets forth certain of the principal terms for a plan of reorganization for the Company (the “Plan”), which Plan has the support of the Financing Support Parties (defined below), certain lenders under that the Senior Secured Superpriority Debtor-In-Possession Credit Agreement, dated July 27, 2015 (the “DIP Facility”) that are also holders of the 3% Convertible Senior Notes issued by GT Inc (the “Notes”), and certain other holders of claims against one or more of the Debtors (collectively, the “Consenting Parties”). The Consenting Parties and the claims they hold as of the date of this Term Sheet are listed on Schedule 1 to this Term Sheet. This Term Sheet does not include a description of all of the terms, conditions and other provisions that are to be contained in the definitive documentation necessary for the consummation of the Plan and the transactions contemplated therein, which remain subject to discussion and negotiation in good faith between and among the Debtors, the official committee of unsecured creditors of the Debtors (the “Committee”), and the Consenting Parties. Subject to the preceding sentence, the Committee is one of the parties to this Term Sheet. This Term Sheet has been prepared for settlement discussion purposes and shall not constitute an admission of liability by any party, nor be admissible in any action relating to any of the subject matter addressed herein other than to enforce the terms thereof. This Term Sheet shall not constitute an offer to sell or buy, nor the solicitation of an offer to sell or buy, any of the securities referred to herein, or the solicitation of acceptances or rejections of a chapter 11 plan. Any such offer or solicitation shall only be made in compliance with all applicable laws. Further, nothing herein shall be an admission of fact or liability. 1 For the avoidance of doubt, the “Term Sheet” shall include any exhibits annexed hereto. The Term Sheet has been amended by that that certain letter from Dennis L. Jenkins, dated as of December 4, 2015, concerning the sale of ASF Furnaces (the “Letter Amendment”). The Letter Amendment has not been submitted to the Court with this Term Sheet because it contains confidential information not suitable for public disclosure. However, upon request of the Court, the parties will file the Letter Amendment under seal. 2 The Debtors are: (a) GT Inc, (b) GTAT Corporation, GT Advanced Equipment Holding LLC, GT Equipment Holdings, Inc., Lindbergh Acquisition Corp., GT Sapphire Systems Holding LLC, GT Advanced Cz LLC, GT Sapphire Systems Group LLC (together, the “Corp Debtors”), and GT Advanced Technologies Limited (“GT HK”). The Debtors’ cases (the “Chapter 11 Cases”) are jointly administered under Case No. 14-11916.

- 2 - ActiveUS 149807593v.3 I. Overview3 The proposed restructuring of the Company will be implemented through the Plan to be filed by the Company in the Chapter 11 Cases. The purposes of the restructuring contemplated by the Plan, consistent with the material terms and conditions described in this Term Sheet, are, among other things, to (a) settle various intercompany disputes, (b) provide the Company with sufficient liquidity and working capital (through the purchase by the Financing Support Parties of certain debt and equity securities to be issued by the Reorganized Debtors (as defined below) pursuant to the Exit Financing (defined in Exhibit A)) to satisfy administrative and priority claims against the Debtors (including claims pursuant to the DIP Facility) in accordance with the Bankruptcy Code and execute their business plan post-emergence, and (c) provide a recovery to unsecured claims against the Debtors. II. Settlement and Compromise Incorporated into the Plan Settlement and Compromise of Intercompany and Intercreditor Issues The Plan shall contain and effect a compromise and settlement (the “Settlement”), pursuant to section 1123(b)(3) and Rule 9019 of the Federal Rules of Bankruptcy Procedure. The distributions and other consideration granted under the Plan to holders of unsecured claims against GT Inc, the Corp Debtors and GT HK shall reflect a settlement and compromise of all intercompany and intercreditor disputes, including, without limitation, substantive consolidation, recharacterization of intercompany claims, and ownership of certain tax attributes. Amendment to DIP Facility Subject to the approval of the Bankruptcy Court, the Consenting Parties that are lenders under the DIP Facility will agree to amend the DIP Facility consistent with the terms and conditions provided in Exhibit B (the “DIP Amendment”), and the other Consenting Parties will support Bankruptcy Court approval of the DIP Amendment; provided, that: (a) the Debtors shall have executed the Commitment Letter (defined below); and (b) the DIP Amendment shall not be effective unless and until the Commitment Letter has been approved by the Bankruptcy Court; and (c) notwithstanding anything in this Term Sheet or in the DIP Amendment to the contrary, the Debtors shall pay 50% of the DIP Prepayment Fee (as defined in Exhibit B) upon the effective date of the DIP Amendment, with the remaining 50% of the DIP Prepayment Fee to be paid on the earlier of (i) the effective date of the Plan (the “Effective Date”) and (ii) payoff in full of the DIP 3 Capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in the Bankruptcy Code.

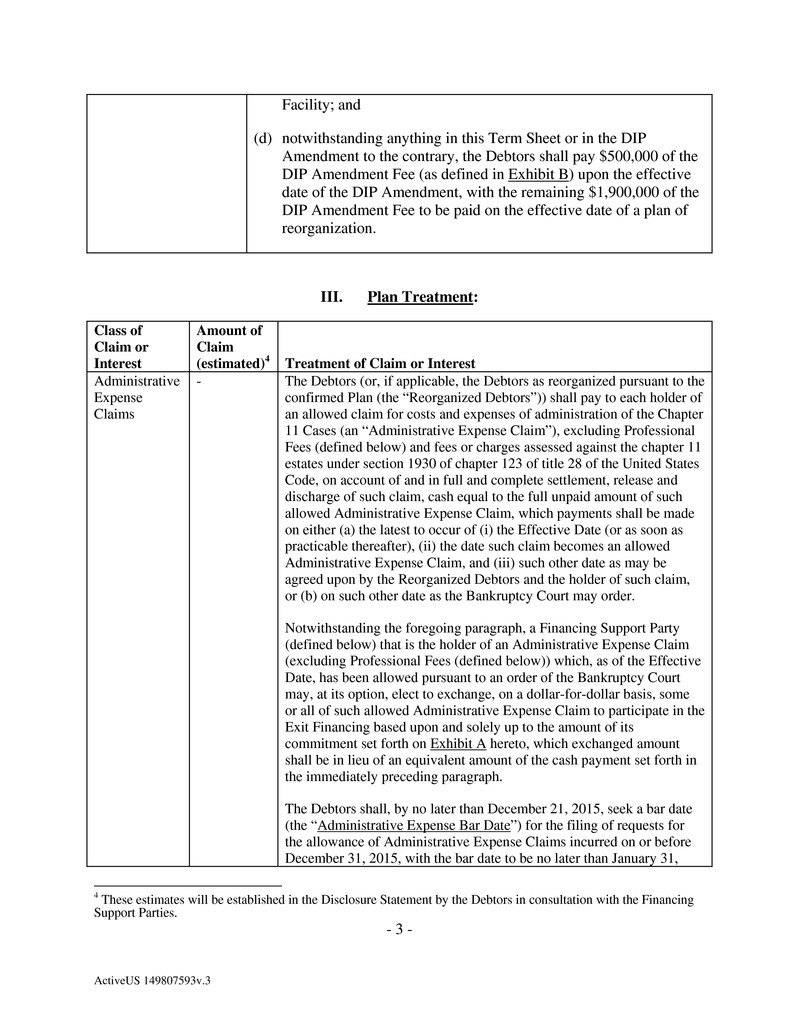

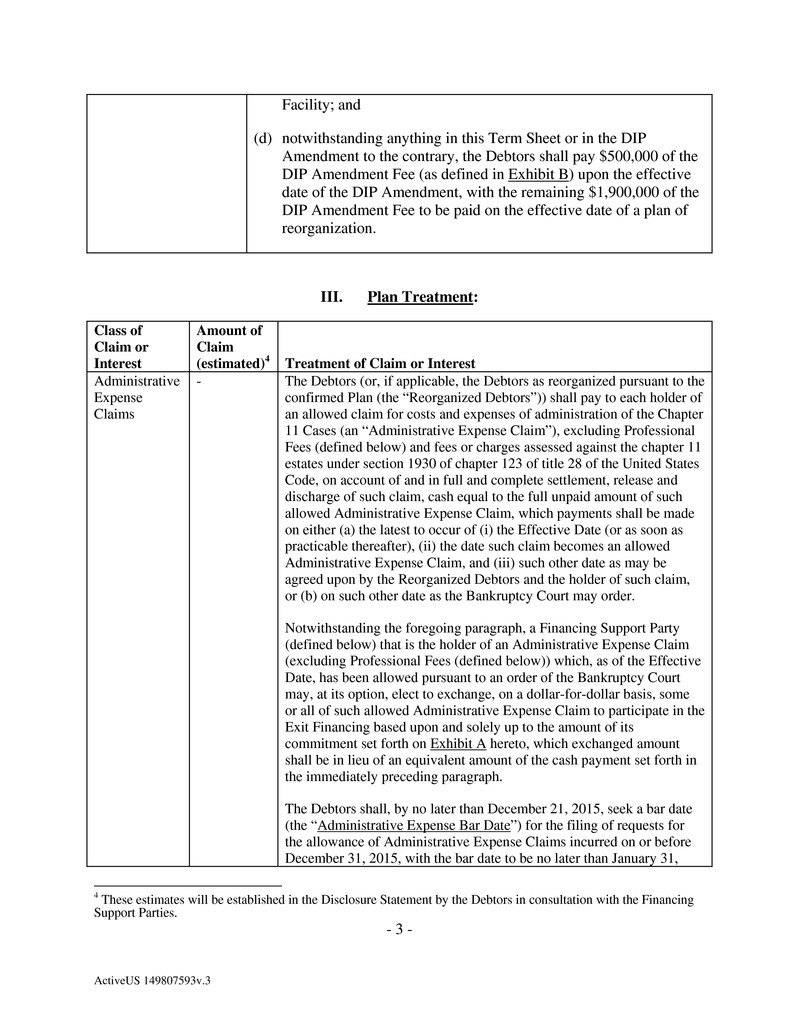

- 3 - ActiveUS 149807593v.3 Facility; and (d) notwithstanding anything in this Term Sheet or in the DIP Amendment to the contrary, the Debtors shall pay $500,000 of the DIP Amendment Fee (as defined in Exhibit B) upon the effective date of the DIP Amendment, with the remaining $1,900,000 of the DIP Amendment Fee to be paid on the effective date of a plan of reorganization. III. Plan Treatment: Class of Claim or Interest Amount of Claim (estimated)4 Treatment of Claim or Interest Administrative Expense Claims - The Debtors (or, if applicable, the Debtors as reorganized pursuant to the confirmed Plan (the “Reorganized Debtors”)) shall pay to each holder of an allowed claim for costs and expenses of administration of the Chapter 11 Cases (an “Administrative Expense Claim”), excluding Professional Fees (defined below) and fees or charges assessed against the chapter 11 estates under section 1930 of chapter 123 of title 28 of the United States Code, on account of and in full and complete settlement, release and discharge of such claim, cash equal to the full unpaid amount of such allowed Administrative Expense Claim, which payments shall be made on either (a) the latest to occur of (i) the Effective Date (or as soon as practicable thereafter), (ii) the date such claim becomes an allowed Administrative Expense Claim, and (iii) such other date as may be agreed upon by the Reorganized Debtors and the holder of such claim, or (b) on such other date as the Bankruptcy Court may order. Notwithstanding the foregoing paragraph, a Financing Support Party (defined below) that is the holder of an Administrative Expense Claim (excluding Professional Fees (defined below)) which, as of the Effective Date, has been allowed pursuant to an order of the Bankruptcy Court may, at its option, elect to exchange, on a dollar-for-dollar basis, some or all of such allowed Administrative Expense Claim to participate in the Exit Financing based upon and solely up to the amount of its commitment set forth on Exhibit A hereto, which exchanged amount shall be in lieu of an equivalent amount of the cash payment set forth in the immediately preceding paragraph. The Debtors shall, by no later than December 21, 2015, seek a bar date (the “Administrative Expense Bar Date”) for the filing of requests for the allowance of Administrative Expense Claims incurred on or before December 31, 2015, with the bar date to be no later than January 31, 4 These estimates will be established in the Disclosure Statement by the Debtors in consultation with the Financing Support Parties.

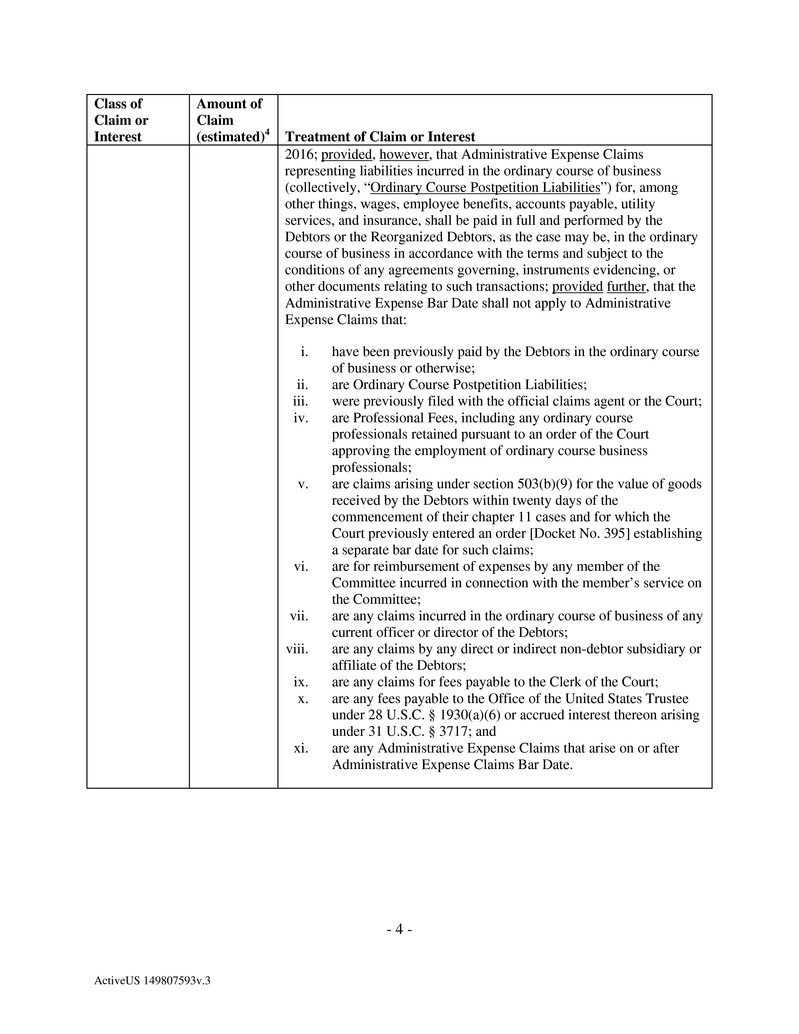

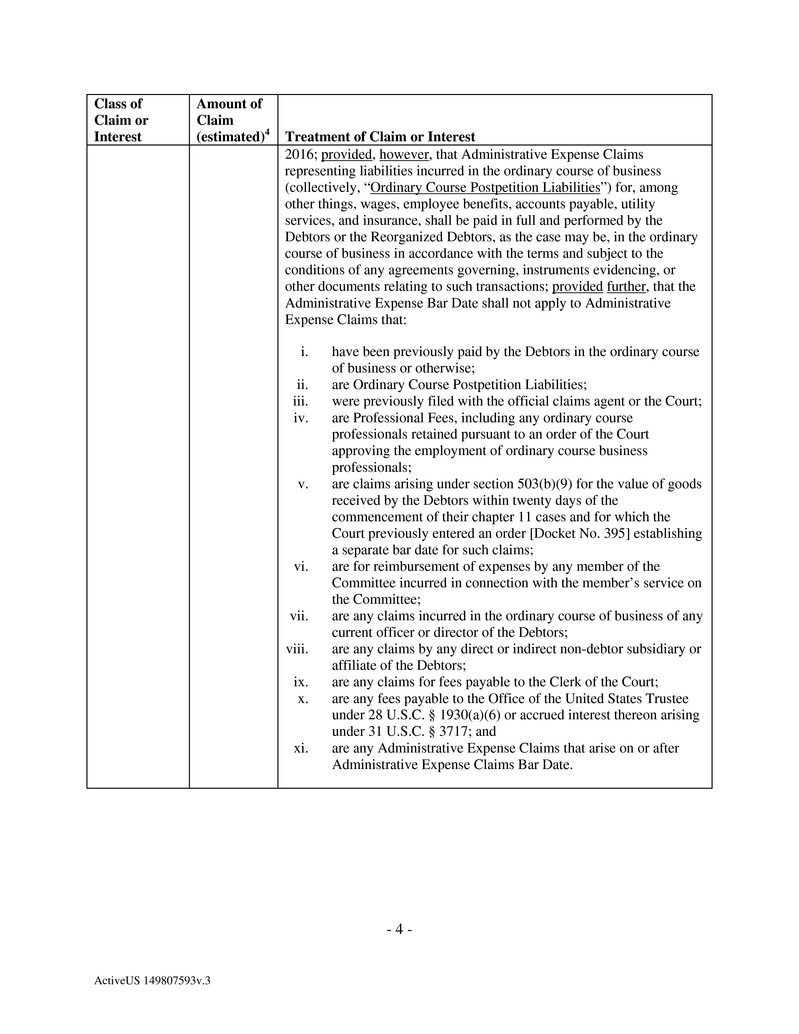

- 4 - ActiveUS 149807593v.3 Class of Claim or Interest Amount of Claim (estimated)4 Treatment of Claim or Interest 2016; provided, however, that Administrative Expense Claims representing liabilities incurred in the ordinary course of business (collectively, “Ordinary Course Postpetition Liabilities”) for, among other things, wages, employee benefits, accounts payable, utility services, and insurance, shall be paid in full and performed by the Debtors or the Reorganized Debtors, as the case may be, in the ordinary course of business in accordance with the terms and subject to the conditions of any agreements governing, instruments evidencing, or other documents relating to such transactions; provided further, that the Administrative Expense Bar Date shall not apply to Administrative Expense Claims that: i. have been previously paid by the Debtors in the ordinary course of business or otherwise; ii. are Ordinary Course Postpetition Liabilities; iii. were previously filed with the official claims agent or the Court; iv. are Professional Fees, including any ordinary course professionals retained pursuant to an order of the Court approving the employment of ordinary course business professionals; v. are claims arising under section 503(b)(9) for the value of goods received by the Debtors within twenty days of the commencement of their chapter 11 cases and for which the Court previously entered an order [Docket No. 395] establishing a separate bar date for such claims; vi. are for reimbursement of expenses by any member of the Committee incurred in connection with the member’s service on the Committee; vii. are any claims incurred in the ordinary course of business of any current officer or director of the Debtors; viii. are any claims by any direct or indirect non-debtor subsidiary or affiliate of the Debtors; ix. are any claims for fees payable to the Clerk of the Court; x. are any fees payable to the Office of the United States Trustee under 28 U.S.C. § 1930(a)(6) or accrued interest thereon arising under 31 U.S.C. § 3717; and xi. are any Administrative Expense Claims that arise on or after Administrative Expense Claims Bar Date.

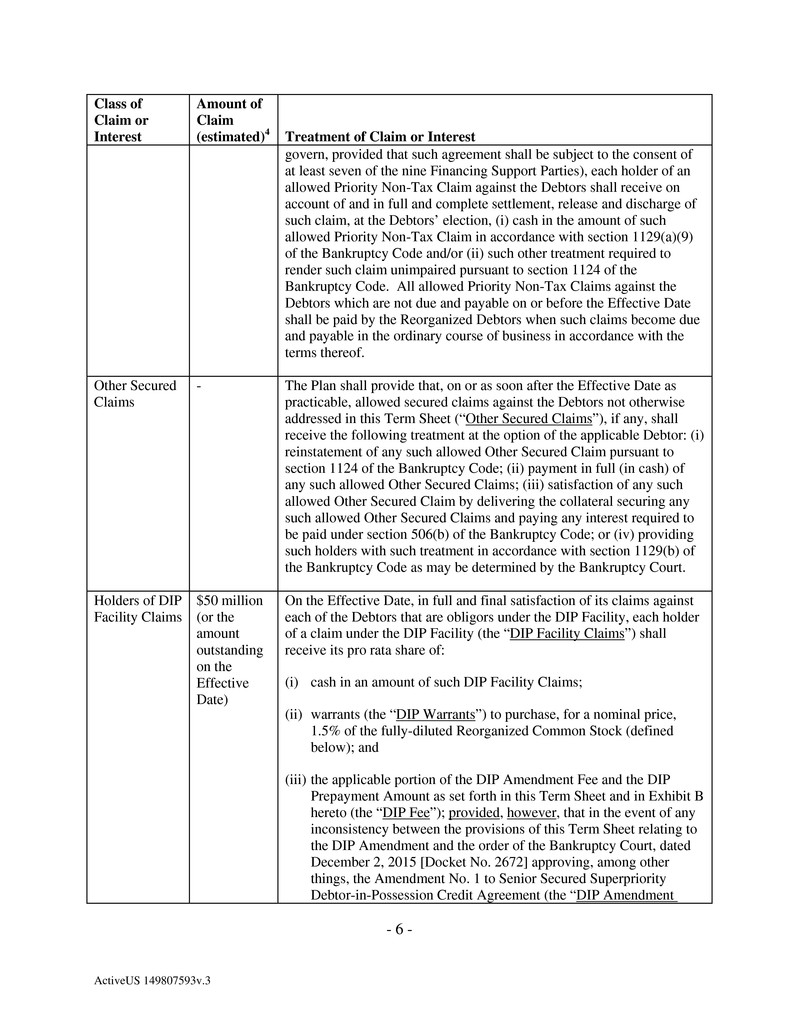

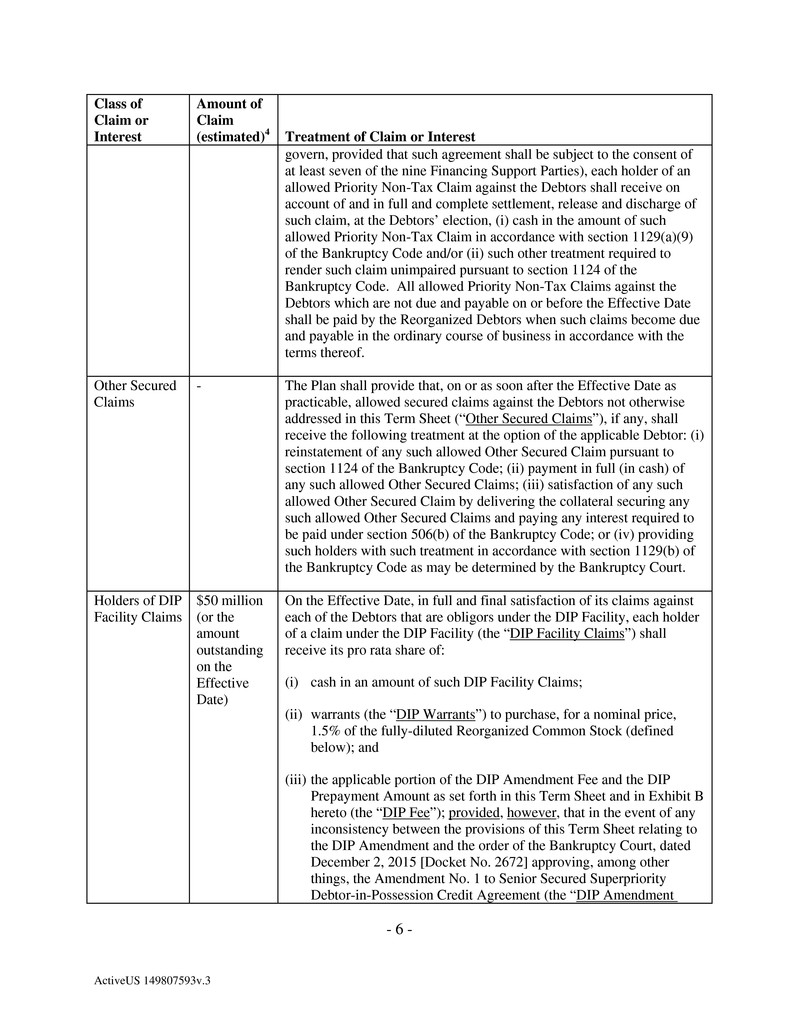

- 5 - ActiveUS 149807593v.3 Class of Claim or Interest Amount of Claim (estimated)4 Treatment of Claim or Interest Professional Compensation - All persons seeking awards by the Bankruptcy Court of compensation for services rendered or reimbursement of expenses incurred through and including the Effective Date under section 330, 331, 503(b)(2), 503(b)(3), 503(b)(4) or 503(b)(5) of the Bankruptcy Code (collectively, the “Professional Fees”) shall (a) file, on or before the date that is forty five (45) days after the Effective Date, their respective applications for final allowances of compensation for services rendered and reimbursement of expenses incurred and (b) be paid in full, in cash, in such amounts as are allowed by the Bankruptcy Court in accordance with the order relating to or allowing any such Administrative Expense Claim. The unpaid amounts of Professional Fees sought by the estate professionals for services rendered and costs incurred through the Effective Date will be escrowed by the Debtors prior to the Effective Date. At least five (5) business days prior to the Effective Date, all estate professionals will provide the Debtors and the Financing Support Parties a statement of all billed but unpaid Professional Fees that have been incurred and an estimate of any additional Professional Fees to be incurred through the Effective Date. Priority Tax Claims - Unless otherwise agreed to by the Reorganized Debtors and the holder of an allowed claim of a governmental unit of the kind specified in section 507(a)(8) of the Bankruptcy Code (a “Priority Tax Claim”) (in which event such other agreement will govern, provided that such agreement shall be subject to the consent of at least seven of the nine Financing Support Parties), each holder of an allowed Priority Tax Claim against any of the Debtors that is due and payable on or before the Effective Date shall receive, on account of and in full and complete settlement, release and discharge of such claim, cash equal to the amount of such allowed Priority Tax Claim (a) on the later of (i) the Effective Date (or as soon as practicable thereafter) and (ii) the date such Priority Tax Claim becomes an allowed claim, or as soon as practicable thereafter, or (b) in regular payments over a period of time not to exceed five (5) years after the petition date pursuant to section 1129(a)(9) of the Bankruptcy Code, with interest at a rate determined in accordance with section 511 of the Bankruptcy Code. All allowed Priority Tax Claims against any of the Debtors which are not due and payable on or before the Effective Date shall be paid in the ordinary course of business by the Reorganized Debtors in accordance with the terms thereof. Priority Non- Tax Claims - On or as soon after the Effective Date as practicable, unless otherwise agreed to by the Reorganized Debtors and the holder of an allowed claim entitled to priority under section 507(a) of the Bankruptcy Code (other than a Priority Tax Claim and Administrative Expense Claim) (a “Priority Non-Tax Claim”) (in which event such other agreement will

- 6 - ActiveUS 149807593v.3 Class of Claim or Interest Amount of Claim (estimated)4 Treatment of Claim or Interest govern, provided that such agreement shall be subject to the consent of at least seven of the nine Financing Support Parties), each holder of an allowed Priority Non-Tax Claim against the Debtors shall receive on account of and in full and complete settlement, release and discharge of such claim, at the Debtors’ election, (i) cash in the amount of such allowed Priority Non-Tax Claim in accordance with section 1129(a)(9) of the Bankruptcy Code and/or (ii) such other treatment required to render such claim unimpaired pursuant to section 1124 of the Bankruptcy Code. All allowed Priority Non-Tax Claims against the Debtors which are not due and payable on or before the Effective Date shall be paid by the Reorganized Debtors when such claims become due and payable in the ordinary course of business in accordance with the terms thereof. Other Secured Claims - The Plan shall provide that, on or as soon after the Effective Date as practicable, allowed secured claims against the Debtors not otherwise addressed in this Term Sheet (“Other Secured Claims”), if any, shall receive the following treatment at the option of the applicable Debtor: (i) reinstatement of any such allowed Other Secured Claim pursuant to section 1124 of the Bankruptcy Code; (ii) payment in full (in cash) of any such allowed Other Secured Claims; (iii) satisfaction of any such allowed Other Secured Claim by delivering the collateral securing any such allowed Other Secured Claims and paying any interest required to be paid under section 506(b) of the Bankruptcy Code; or (iv) providing such holders with such treatment in accordance with section 1129(b) of the Bankruptcy Code as may be determined by the Bankruptcy Court. Holders of DIP Facility Claims $50 million (or the amount outstanding on the Effective Date) On the Effective Date, in full and final satisfaction of its claims against each of the Debtors that are obligors under the DIP Facility, each holder of a claim under the DIP Facility (the “DIP Facility Claims”) shall receive its pro rata share of: (i) cash in an amount of such DIP Facility Claims; (ii) warrants (the “DIP Warrants”) to purchase, for a nominal price, 1.5% of the fully-diluted Reorganized Common Stock (defined below); and (iii) the applicable portion of the DIP Amendment Fee and the DIP Prepayment Amount as set forth in this Term Sheet and in Exhibit B hereto (the “DIP Fee”); provided, however, that in the event of any inconsistency between the provisions of this Term Sheet relating to the DIP Amendment and the order of the Bankruptcy Court, dated December 2, 2015 [Docket No. 2672] approving, among other things, the Amendment No. 1 to Senior Secured Superpriority Debtor-in-Possession Credit Agreement (the “DIP Amendment

- 7 - ActiveUS 149807593v.3 Class of Claim or Interest Amount of Claim (estimated)4 Treatment of Claim or Interest Order”), the DIP Amendment Order shall control. provided further, any holder of DIP Facility Claims that is also a Financing Support Party (defined below) may, at its option, elect to exchange, on a dollar-for-dollar basis, some or all of its DIP Facility Claims to participate in the Exit Financing based upon and solely up to the amount of its commitment set forth on Exhibit A hereto, which exchanged amount shall be in lieu of the cash distribution set forth in clause (i) above. Holders of General Unsecured Claims against GT Inc. [] Holders of general unsecured claims against GT Inc. will be classified into two classes, one consisting of all claims with respect to the Notes (the “Note Claims”) and one consisting of all other general unsecured claims against GT Inc other than the Note Claims (the “GT Inc General Unsecured Claims”). On or as soon after the Effective Date as practicable, in full and final satisfaction of its claims, each holder of an allowed Note Claim against GT Inc shall receive its pro rata share of (i) the GT Inc Excess Proceeds Pool (defined below), if any, (ii) 21.6% of the Reorganized Common Stock Pool (defined below), (iii) 12.5% of the beneficial interests in the GUC Litigation Trust (defined below), and (iv) warrants for 3.0% of the Reorganized Stock (subject to dilution by the Management Incentive Plan and the DIP Warrants) with a strike price equal to a total enterprise value for the Reorganized Debtors of $160 million and a 3 year term (the “3% Warrants”), and (v) warrants for 2.0% of the Reorganized Common Stock (subject to dilution by the Management Incentive Plan and the DIP Warrants) with a strike price equal to a total enterprise value for the Reorganized Debtors of $200 million and a 3 year term (the “2% Warrants”; together with the 3% Warrants, the “Warrants”). On or as soon after the Effective Date as practicable, in full and final satisfaction of its claims, each holder of an allowed GT Inc General Unsecured Claim shall receive a distribution of cash in an amount designed to provide a recovery to such holder substantially equal, as a percentage of its allowed claim, to the recovery, calculated as of the Effective Date and as a percentage of its allowed claim, that a holder of Note Claims is to obtain under the Plan; provided, however, that any such distribution shall not reduce the distributions to be made to holders of Note Claims pursuant to this Term Sheet; and provided further that the amount of cash distributed to all holders of GT Inc. General Unsecured Claims pursuant to this provision shall in no event exceed $500,000 in the aggregate. The “Reorganized Common Stock Pool” means 14.0% of the Reorganized Common Stock, subject to dilution by the Management

- 8 - ActiveUS 149807593v.3 Class of Claim or Interest Amount of Claim (estimated)4 Treatment of Claim or Interest Incentive Plan and the DIP Warrants. “GT Inc Excess Proceeds Pool” shall mean 12.5% of Excess Proceeds (defined below). Holders of General Unsecured Claims against the Corp Debtors [] On or as soon after the Effective Date as practicable, in full and final satisfaction of its claims, each holder of an allowed general unsecured claim against the Corp Debtors shall receive its pro rata share of (i) the Corp Excess Proceeds Pool (as defined below), if any, (ii) 62% of the Reorganized Common Stock Pool, and (iii) 71.1% of the beneficial interests in the GUC Litigation Trust; provided, however, in no event shall any holder of an allowed general unsecured claim against the Corp Debtors be entitled to receive more than the allowed amount of its claim. “Corp Excess Proceeds Pool” shall mean 71.1% of Excess Proceeds. Holders of General Unsecured Claims against GT HK [] On or as soon after the Effective Date as practicable, in full and final satisfaction of its claims, each holder of an allowed general unsecured claim against GT HK shall receive its pro rata share of (i) the GT HK Excess Proceeds Pool, if any, (ii) 16.4% of the Reorganized Common Stock Pool, and (iii) 16.4% of the beneficial interests in the GUC Litigation Trust; provided, however, in no event shall any holder of an allowed general unsecured claim against GT HK be entitled to receive more than the allowed amount of its claim. “GT HK Excess Proceeds Pool” shall mean 16.4% of Excess Proceeds. Apple Claim [ ] The claims of Apple Inc. and its affiliates will be treated and satisfied in accordance with the revised Apple settlement agreement dated as of November 26, 2015 (the “Revised Apple Settlement”). Intercompany Claims At the election of the applicable Debtor intercompany claims shall (A) be reinstated, (B) remain in place subject to certain revised documentation, (C) be modified or cancelled as of the Effective Date, (D) include cash transfers on intercompany claims to address the treatment of certain foreign obligations, and/or (E) with respect to certain intercompany claims in respect of goods, services, interest and other amounts that would have been satisfied in cash directly or indirectly in the ordinary course of business had they not been outstanding as of the Petition Date, may be settled in cash; provided, however, nothing in this section shall affect or otherwise alter the distribution of Excess Proceeds or Reorganized Common Stock as contemplated by this Term Sheet. For purposes of clarification, under no circumstances will distributions of Excess Proceeds or Reorganized Common Stock be made on account of any intercompany claim.

- 9 - ActiveUS 149807593v.3 Class of Claim or Interest Amount of Claim (estimated)4 Treatment of Claim or Interest Existing Equity Interest Holders - Existing GT Inc. Equity Interests shall be extinguished, cancelled and discharged as of the Effective Date, and holders of Existing GT Inc Equity Interests shall receive no distribution in respect of their equity interests. Subordinated Securities Claims (including all claims arising pursuant to 11 U.S.C. § 510(b), including, without limitation, for damages arising from the sale or purchase of any debt or equity security of any of the Debtors) - Subordinated Securities Claims, if any, shall be extinguished, cancelled and discharged as of the Effective Date, and holders thereof shall receive no distributions in respect of their claims. Intercompany Equity Interests - Intercompany Equity Interests shall receive no distribution in respect of their equity interests and shall be reinstated for administrative purposes only at the election of the Reorganized Debtors. IV. Other: Exit Financing: The Plan shall provide for the Reorganized Debtors to enter into an $80 million exit financing (the “Exit Financing”) on the Effective Date, the material terms and conditions of which are set forth on Exhibit A to this Term Sheet. Means of Implementation The Plan shall contain standard means of implementation, including provisions for the continued corporate existence of the Reorganized Debtors, the cancellation of certain prepetition debt and debt agreements, the cancellation of prepetition equity interests in GT Inc, the issuance of the Reorganized Common Stock, the DIP Warrants, the Warrants, the Senior Secured Notes, and the Preferred Stock and the revesting of the Debtors’ assets in the Reorganized Debtors. The “Plan Documents” means the Plan, the disclosure statement with respect to the Plan to be filed in the Chapter 11 Cases (the “Disclosure Statement”), the proposed

- 10 - ActiveUS 149807593v.3 order confirming the Plan (the “Confirmation Order”), and any other documents or agreements filed with the Bankruptcy Court by the Debtors that are necessary to implement the Plan, including any appendices, amendments, modifications, supplements, exhibits and schedules relating to the Plan or the Disclosure Statement, including without limitation: (a) any operative documents for the Exit Financing (including, without limitation, the indenture for the Senior Secured Notes and the certificate of designation for the Preferred Stock); (b) any documents disclosing the identity of the members of the board of directors of any of the Reorganized Debtors and the nature of and compensation for any “insider” under the Bankruptcy Code who is proposed to be employed or retained by any of the Reorganized Debtors; (c) any list of material executory contracts and unexpired leases to be assumed, assumed and assigned, or rejected; (d) a list of any material retained causes of action (other than causes of action that are released pursuant to the Plan); (e) the amended certificate of incorporation and amended bylaws for each of the Reorganized Debtors; (f) any documents governing the Management Incentive Plan; (g) any documents governing the Warrants and the DIP Warrants; (h) [intentionally omitted]; and (i) the Litigation Trust Agreement; each of which shall be consistent in all material respects with this Term Sheet and in form and substance acceptable to the Debtors and the Majority Financing Support Parties (defined below), and, excluding the items referenced in clauses (a)-(d) and (f) above, also in form and substance acceptable to the Majority Consenting Parties (defined below), and excluding the items referenced in clauses (a)-(h) above, also in form and substance acceptable to the Committee; provided, that notwithstanding the foregoing, the list of material executory contracts and unexpired leases to be assumed, assumed and assigned, or rejected by GT Inc, other than any executory contract or unexpired lease assumed, assumed and assigned, or rejected under the Plan, shall also be reasonably acceptable to the Majority Consenting Parties. “Majority Financing Support Parties” means at least seven of nine of the Financing Support Parties under the Exit Financing, provided that the consent or acceptance, as applicable, of the Majority Financing Support Parties shall be deemed given if, within three business days after the Debtors make a written request to counsel to the Financing Support Parties, the Majority Financing Support Parties fail to object in writing to such request. “Majority Consenting Parties” means a majority in number of the Consenting Parties (other than the Financing Support Parties), provided that the consent or acceptance, as applicable, of the Majority Consenting Parties shall be deemed given if, within three business days after the Debtors make a written request to counsel to the Consenting Parties, the Majority Consenting Parties under the Exit Financing fail to object in writing to such request.5 Reorganized Common Stock The Plan will provide for the cancellation of all outstanding GT Inc common stock and the issuance of new common stock, par value $0.001 per share (the “Reorganized Common Stock”), in GT Inc, as reorganized pursuant to the confirmed Plan (“Reorganized GTAT”). Holders of general unsecured claims who receive 5 For purposes of determining the “Majority Consenting Parties” only the following entities shall be considered: AQR Capital Management, LLC; Aristeia Capital, L.L.C.; Latigo Partners, LP; New Generation Advisors, LLC; and Pine River Capital Management, L.P.

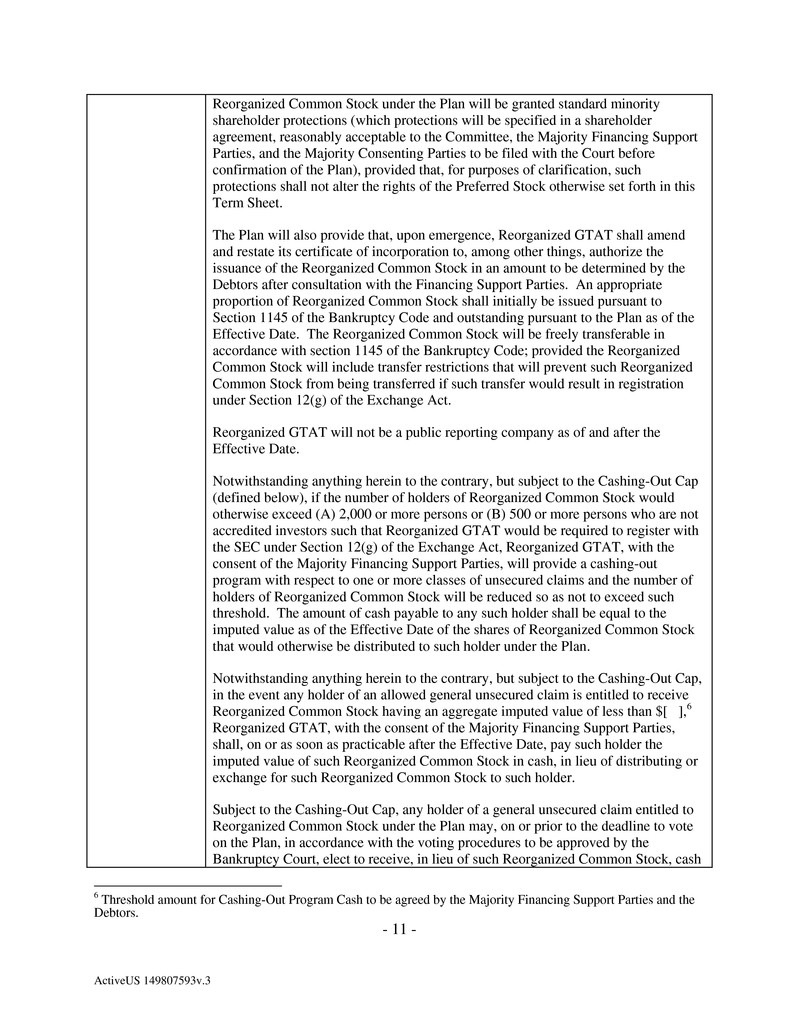

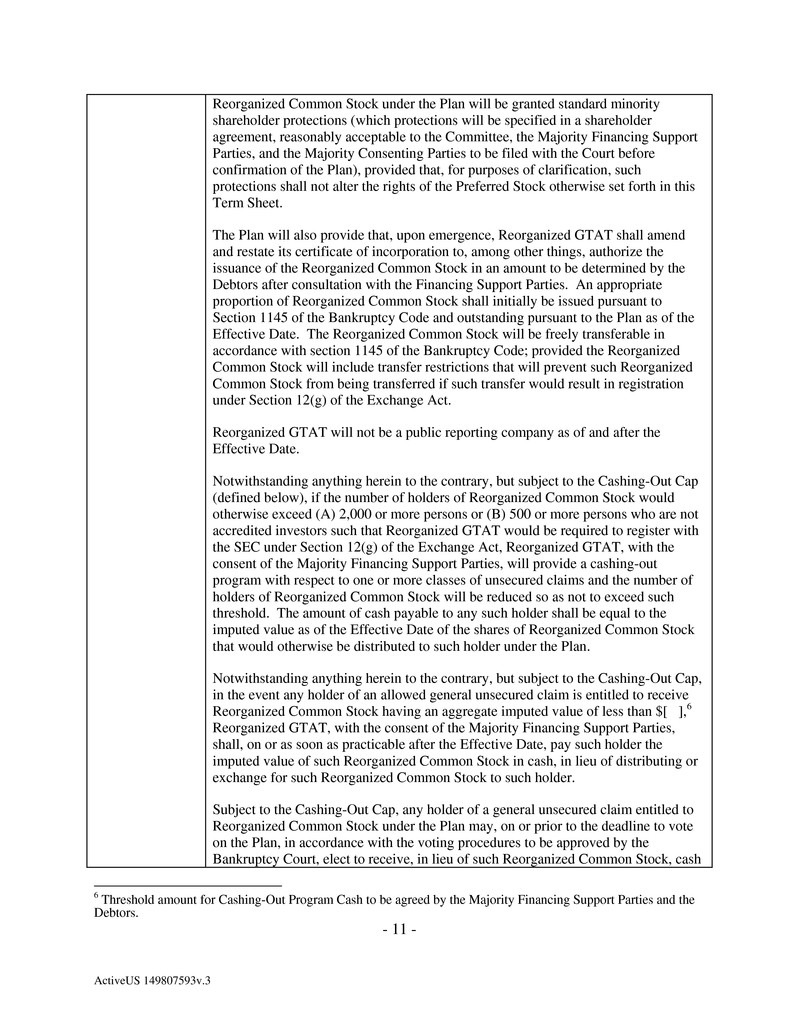

- 11 - ActiveUS 149807593v.3 Reorganized Common Stock under the Plan will be granted standard minority shareholder protections (which protections will be specified in a shareholder agreement, reasonably acceptable to the Committee, the Majority Financing Support Parties, and the Majority Consenting Parties to be filed with the Court before confirmation of the Plan), provided that, for purposes of clarification, such protections shall not alter the rights of the Preferred Stock otherwise set forth in this Term Sheet. The Plan will also provide that, upon emergence, Reorganized GTAT shall amend and restate its certificate of incorporation to, among other things, authorize the issuance of the Reorganized Common Stock in an amount to be determined by the Debtors after consultation with the Financing Support Parties. An appropriate proportion of Reorganized Common Stock shall initially be issued pursuant to Section 1145 of the Bankruptcy Code and outstanding pursuant to the Plan as of the Effective Date. The Reorganized Common Stock will be freely transferable in accordance with section 1145 of the Bankruptcy Code; provided the Reorganized Common Stock will include transfer restrictions that will prevent such Reorganized Common Stock from being transferred if such transfer would result in registration under Section 12(g) of the Exchange Act. Reorganized GTAT will not be a public reporting company as of and after the Effective Date. Notwithstanding anything herein to the contrary, but subject to the Cashing-Out Cap (defined below), if the number of holders of Reorganized Common Stock would otherwise exceed (A) 2,000 or more persons or (B) 500 or more persons who are not accredited investors such that Reorganized GTAT would be required to register with the SEC under Section 12(g) of the Exchange Act, Reorganized GTAT, with the consent of the Majority Financing Support Parties, will provide a cashing-out program with respect to one or more classes of unsecured claims and the number of holders of Reorganized Common Stock will be reduced so as not to exceed such threshold. The amount of cash payable to any such holder shall be equal to the imputed value as of the Effective Date of the shares of Reorganized Common Stock that would otherwise be distributed to such holder under the Plan. Notwithstanding anything herein to the contrary, but subject to the Cashing-Out Cap, in the event any holder of an allowed general unsecured claim is entitled to receive Reorganized Common Stock having an aggregate imputed value of less than $[ ],6 Reorganized GTAT, with the consent of the Majority Financing Support Parties, shall, on or as soon as practicable after the Effective Date, pay such holder the imputed value of such Reorganized Common Stock in cash, in lieu of distributing or exchange for such Reorganized Common Stock to such holder. Subject to the Cashing-Out Cap, any holder of a general unsecured claim entitled to Reorganized Common Stock under the Plan may, on or prior to the deadline to vote on the Plan, in accordance with the voting procedures to be approved by the Bankruptcy Court, elect to receive, in lieu of such Reorganized Common Stock, cash 6 Threshold amount for Cashing-Out Program Cash to be agreed by the Majority Financing Support Parties and the Debtors.

- 12 - ActiveUS 149807593v.3 in an amount equal to the imputed value as of the Effective Date of the shares of Reorganized Common Stock that would otherwise be distributed to such holder under the Plan, which amount shall be paid by Reorganized GTAT as soon as practicable after such claim becomes an allowed general unsecured claim. The cash, as of the Effective Date, used or reserved for use in paying holders of general unsecured claims as contemplated in the preceding three paragraphs shall be referred to herein as the “Cashing-Out Program Cash”. In no event shall the Debtors be required (though with the consent of the Majority Financing Support Parties they will be permitted) to fund the foregoing cashing-out program and the cash-out options in an aggregate amount of more than $1.5 million (the “Cashing-Out Cap”). Any Reorganized Common Stock that is not distributed pursuant to the Plan to a holder of general unsecured claims, because the holder receives Cashing-Out Program Cash, shall be retained by or reallocated to the Financing Support Parties proportionately in accordance with their holdings of Preferred Stock. Notwithstanding the foregoing, no Consenting Party may be required to accept cash for the Reorganized Common Stock distributable to it under this Plan without the consent of such Consenting Party. Excess Proceeds “Excess Proceeds” shall mean an amount of cash, determined in a manner consistent with this Term Sheet and in consultation with the Committee, the Consenting Parties, and the Financing Support Parties as of the Effective Date, of the Reorganized Debtors, equal to the following: (a) 0% of the first $40 million of Unrestricted Cash (defined below); (b) 30% of the next $21.43 million of Unrestricted Cash; and (c) 100% of all remaining Unrestricted Cash. Conditions to Confirmation The conditions precedent to confirmation of the Plan shall be customary for a reorganization of this size and type, including, without limitation, the following: (a) The Debtors shall have filed the Plan and Disclosure Statement with the Bankruptcy Court on or before December 21, 2015; (b) The Bankruptcy Court shall have entered an order, in form and substance reasonably acceptable to the Debtors, the Committee, and the Majority Financing Support Parties and the Majority Consenting Parties, approving the adequacy of the Disclosure Statement (the “Disclosure Statement Order”) on or before January 22, 2016, and such order shall not have been stayed or vacated. (c) An order approving the Revised Apple Settlement consistent with this Term Sheet in all material respects, in form and substance reasonably acceptable to the Debtors, the Majority Financing Support Parties, shall have been entered by the Bankruptcy Court on or prior to December 2, 2015, and shall not have been

- 13 - ActiveUS 149807593v.3 stayed or vacated. (d) An order, in form and substance reasonably acceptable to the Debtors and the Majority Financing Support Parties approving, the commitment letter with respect to the Exit Financing (the “Commitment Letter”) shall have been entered by the Bankruptcy Court on or prior to December 4, 2015, and shall not have been stayed, modified or vacated; provided that the Commitment Letter and any exhibits thereto shall be in form and substance consistent with this Term Sheet. (e) The Bankruptcy Court shall have entered an order confirming the Plan (the “Confirmation Order”), which Plan shall be consistent with this Term Sheet in all material respects, in form and substance reasonably acceptable to the Debtors, the Committee, the Majority Financing Support Parties and the Majority Consenting Parties on or prior to February 22, 2016. (f) All Plan Documents shall be consistent with this Term Sheet in all material respects and in form and substance reasonably acceptable to the Majority Financing Support Parties; all Plan Documents other than those listed in clauses (a)-(d) and (f) of the definition of Plan Documents shall also be in form and substance reasonably acceptable to the Majority Consenting Parties; and the Litigation Trust Agreement shall also be in form and substance reasonably acceptable to the Committee. (g) Each of the foregoing may be waived or modified by the Debtors, with the consent of the Majority Financing Support Parties and, in the case of subsections (a), (b), (e), and, to the extent applicable (f), the Majority Consenting Parties; provided, however, any waiver or modification that is not consistent with the other terms of this Term Sheet in all material respects shall require the consent of all Financing Support Parties and the Majority Consenting Parties; provided, further, any waiver or modification that is not consistent with the other terms of this Term Sheet and is materially adverse to the Consenting Parties that are not Financing Support Parties shall also require the consent of the Majority Consenting Parties; provided, further, that any waiver or modification that is not consistent with the other terms of this Term Sheet and is materially adverse to any general unsecured creditors shall also require the consent of the Committee. Conditions to Consummation The conditions precedent to the occurrence of the Effective Date of the Plan shall be customary for a reorganization of this size and type, and shall include, without limitation, the Conditions to Confirmation set forth in this Term Sheet and the following: (a) The Confirmation Order shall be in full force and effect; and shall have become final and no longer subject to appeal (“Final”) or, if not Final, shall not be subject to any stay or have been vacated. (b) All documents and agreements, and all consents, approvals and other conditions, necessary to consummate the Plan shall have been effected or executed, and the Effective Date, shall occur by March 7, 2016. (c) The Debtors shall not, without the consent of the Majority Financing Support

- 14 - ActiveUS 149807593v.3 Parties, amend or propose to amend any terms of the DIP Facility (other than the DIP Amendment). (d) The Debtors shall have received a tax refund from the Internal Revenue Service in an amount not less than $23 million (the “Minimum Tax Refund”). (e) All reasonable and documented fees and expenses of (i) WilmerHale and New Hampshire local counsel, as attorneys for the Financing Support Parties, and (ii) if requested by the Financing Support Parties, one financial advisor to the Financing Support Parties (with the Debtors’ reimbursement obligation with respect to such financial advisor limited to a monthly fee in an amount not to exceed $125,000 and the Debtors shall have no obligations for any completion, transaction, or success fee), in each case incurred in connection with the Debtors’ Chapter 11 Cases and incurred from November 1, 2015 through the Effective Date, shall have been paid in full in cash. (f) All reasonable and documented fees and expenses of the Indenture Trustee as and to the extent set forth in this Term Sheet shall have been paid in cash. (g) Without the consent of the Majority Financing Support Parties, from and after November 28, 2015, none of the Debtors shall have sold, conveyed, transferred or otherwise disposed, whether in a single transaction or a series of related transactions, of property or assets of the Debtors or their estates, other than (i) sales of the ASF Furnaces pursuant to the ASF Auction pursuant to the auction procedures approved by the Bankruptcy Court on November 20, 2015 (the “ASF Auction”), (ii) sales of equipment, materials and other excess assets pursuant to the online auction procedures [Docket No. 1671] or the excess assets procedures order [Docket No. 811], and (iii) dispositions of assets in the ordinary course of business. (h) Without the consent of Majority Financing Support Parties, which consent shall not be unreasonably withheld, from and after November 28, 2015, none of the Debtors shall have entered into any proposed settlement (other than as contemplated by this Term Sheet) or allowance of any Priority Claim (defined below) or any proposed settlements, releases or dismissals of any material causes of action, claims or litigation. (i) As of the Effective Date, the Closing Cash (defined below) shall be in an amount no less than $27.5 million (the “Minimum Closing Cash Threshold Amount”); provided, however, that, if the Majority Financing Support Parties refuse to consent to a proposed sale by the Debtors of the Merlin business, then the Minimum Closing Cash Threshold Amount shall be reduced by the amount of any cash losses incurred after such refusal as a result of the continued operation of the Merlin business pursuant to a budget approved by the Majority Financing Support Parties. (j) Each of the foregoing may be waived or modified by the Debtors, with the consent of the Majority Financing Support Parties and, in the case of subsections (a), (b), (d), and (f), the Majority Consenting Parties; provided, however, any waiver or modification that is not consistent with the other terms

- 15 - ActiveUS 149807593v.3 of this this Term Sheet in all material respects shall require the consent of all Financing Support Parties and the Majority Consenting Parties; provided, further, any waiver or modification that is not consistent with the other terms of this Term Sheet and is materially adverse to the Consenting Parties that are not Financing Support Parties shall also require the consent the Majority Consenting Parties; provided, further, that any waiver or modification that is not consistent with the other terms of this Term Sheet and is materially adverse to any general unsecured creditors shall also require the consent of the Committee. “Closing Cash” means all Unrestricted Cash (as defined below) of the Reorganized Debtors as of the Effective Date (other than any Unrestricted Cash included in Excess Proceeds distributed or to be distributed under the Plan to general unsecured creditors), after the receipt of the proceeds of the Exit Financing. For the avoidance of doubt, Closing Cash shall not include any amount of cash included in Excess Proceeds that are or will be distributed to general unsecured creditors and any other amount of cash required to be paid by the Debtors or the Reorganized Debtors under the Plan, whether on or after the Effective Date, or reserved or escrowed for potential payment under the Plan, including but not limited to amounts to be paid or reserved for potential payment pursuant to the Exit Financing and the Revised Apple Settlement and amounts payable or reserved for potential payment to the holders of the DIP Facility Claims, Administrative Expense Claims, Professional Fees, Priority Tax Claims, Priority Non-Tax Claims, Secured Claims, general unsecured claims and all other amounts to be paid on or after the Effective Date pursuant to the Plan. “Unrestricted Cash” means (x) all cash of the Reorganized Debtors, as of the Effective Date, available for the Reorganized Debtors to use without restriction and not needed to fund any cash payments required under the Plan (other than the distribution of Excess Proceeds to general unsecured creditors), minus (y) the amount of cash, if any, equal to any cash obtained by the Debtors after November 28, 2015, from any of the following (collectively, the “Excluded Proceeds”): (i) the sale, scrapping, transfer, or other disposition of any assets outside the ordinary course of business, including without limitation the HiCz assets, Merlin, part or all of the patent portfolio of any of the Debtors, ASMG, furnaces (other than the ASF Furnaces sold pursuant to the ASF Auction), the core solar business, and real property, (ii) amendments to material contracts, including supply agreements with GT HK, (iii) insurance proceeds in excess of $2 million on account of the fire at the Mesa facility, (iv) avoidance actions, or other litigation, or any other filed or threatened causes of action, (v) contract extension fees, (vi) tax refunds (other than the Minimum Tax Refund), and (vii) other receipts outside the ordinary course of business not reflected in the most recent 13-week cash flow projections dated before November 5, 2015, provided by the Debtors. For the avoidance of doubt, Unrestricted Cash shall not include any amount of cash required to be paid by the Debtors or the Reorganized Debtors under the Plan, whether on or after the Effective Date, or reserved or escrowed for potential payment under the Plan, including but not limited to, amounts to be paid or reserved for potential payment pursuant to the Exit Financing and the Revised Apple Settlement and amounts payable or reserved for potential payment to the holders of the DIP Facility Claims, Administrative Expense Claims, Professional Fees, Priority Tax Claims, Priority Non-Tax Claims, Secured Claims, and all other

- 16 - ActiveUS 149807593v.3 amounts to be paid on or after the Effective Date pursuant to the Plan (other than the distribution (or reserve for distribution) of Excess Proceeds to general unsecured creditors). On the Effective Date, the Debtors or Reorganized Debtors shall reserve or escrow cash sufficient to pay all Priority Claims that are disputed, unresolved, or otherwise have not been allowed in the full amount that would be payable on such claims in cash under the Plan if all such claims were allowed in the full amount asserted or sought by the holders of such claims. Such reserved or escrowed cash shall in no event become Unrestricted Cash whether or not any such claims are ultimately not allowed in the full amount asserted or sought by the claimants or estimated by the Bankruptcy Court for distribution purposes, unless otherwise agreed by the Majority Financing Support Parties, the Majority Consenting Parties, and the Debtors. “Priority Claim” means any Administrative Expense Claim, Priority Tax Claim, Priority Non-Tax Claim, Professional Fees, DIP Facility Claim, or other priority claim. Corporate Governance Matters On the Effective Date, the term of any current members of the board of directors of GT Inc not identified as members of the New Board (defined below) shall expire and such persons shall tender their resignation effective on the Effective Date. The initial Board of Directors for Reorganized GTAT as of the Effective Date (the “New Board”) shall consist of seven directors, including David Keck, and six additional directors each of whom shall be nominated by the Financing Support Parties in consultation with David Keck. The foregoing board designation rights shall relate solely to the New Board as of the Effective Date and shall not continue after the selection of the initial New Board. Thereafter, the board designation rights shall be held by the holders of the Preferred Stock in a manner to be determined by at least seven of the nine Financing Support Parties. The boards of directors of the direct and indirect subsidiaries of Reorganized GTAT shall be identified and selected by the New Board; provided, any current members of the board of directors of the direct and indirect subsidiaries of Reorganized GTAT that are current members of the board of directors of GT Inc shall tender their resignation effective on the Effective Date. Management Incentive Plan Promptly following the Effective Date, the New Board shall adopt a management incentive plan, which will provide for (i) options and other stock-based compensation awards covering 10% of the fully-diluted Reorganized Common Stock, (ii) a “kicker” option pool for additional Reorganized Common Stock, and (iii) an emergence bonus in the form of cash, Preferred Stock, or combination thereof with an aggregate value not to exceed $500,000 (the “Management Incentive Plan”). GTAT, after consultation with the Committee, will agree with at least seven of the nine Financing Support Parties on the terms of the Management Incentive Plan, and will file with the Bankruptcy Court, at least five (5) days prior to the deadline to vote on the Plan, such Management Incentive Plan. Annual Incentive The Reorganized GTAT will implement an annual cash bonus plan for management and other employees on terms to be determined by the New Board of Reorganized

- 17 - ActiveUS 149807593v.3 Plan GTAT. Assumption of Senior Management Employment Agreements As part of confirmation of the Plan and subject to confirmation of the Plan, the Debtors will either (i) assume the employment agreements and any modifications and amendments thereto as in effect as of November 23, 2015 (including, without limitation, the agreement between GTAT Corporation and David Keck, dated as of October 12, 2012) (the “Existing Management Agreements”) with Hoil Kim, Raja Bal, and David Keck (collectively, the “Senior Executives”), or (ii) if mutually acceptable to the Debtors, the Majority Financing Support Parties, and the Senior Executives, enter into new employment agreements (the “New Management Agreements”) with such Senior Executives, having substantially the same terms for salary, termination rights, and benefits as contained in the Existing Management Agreements, in each case if such managers are employed by the Debtors as of the Effective Date; provided, however, notwithstanding anything in this Term Sheet to the contrary, the Debtors shall not assume under any Existing Management Agreements or include in any New Management Agreements (x) any indemnification or other similar obligations or liabilities with respect to any acts or omissions that occurred prior to the Petition Date, or (y) any obligations or liabilities to provide any stock-based compensation or awards. Exculpation None of the (i) Debtors, (ii) the Reorganized Debtors, (iii) the D&O Releasees (defined below), (iv) the Plan Support Party Releasees (defined below), (v) the DIP Facility Lender Releasees (defined below), and (vi) the Committee and the members of the Committee as of the date of this Term Sheet (and all of their respective current and former direct and indirect officers, directors, employees, equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing members, officers, directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents, and other representatives (including their respective officers, directors, employees, equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing members, officers, directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents and other representatives) in each case in their respective capacity as such) shall have or incur any liability for any claim, cause of action or other assertion of liability for any act taken or omitted to be taken in connection with, relating to or arising out of the Chapter 11 Cases, the formulation, dissemination, implementation, approval, confirmation, consummation or administration of the Plan, property to be distributed under the Plan or any other act or omission in connection with, relating to or arising out of the Chapter 11 Cases, the Plan, the Disclosure Statement or any contract, instrument, document or other agreement related thereto; provided, however, that the foregoing shall not (1) release, impair or otherwise affect (a) the liability of any person resulting from any such act or omission to the extent such act or omission is determined by a final order to have constituted willful misconduct or gross negligence, or (b) the obligations of the Debtors and Reorganized Debtors under the Plan, the Exit Financing, and the Plan Documents, or (2) apply to any persons who are not D&O Releasees, Plan Support Party Releasees, or DIP Facility Lender Releasees. This exculpation shall be in addition to, and not in limitation of, all other releases, indemnities, discharges and any other applicable law or rules protecting such persons from liability. Furthermore, this exculpation is not intended to violate any requirement of the New York Rules of Professional Conduct.

- 18 - ActiveUS 149807593v.3 Claims of Financing Support Parties The Debtors, after consultation with the Committee, will work in good faith to reconcile and agree, subject to Court approval, to the allowance of all general unsecured claims held by the Financing Support Parties (and their affiliates) in amounts reasonably agreed to by the Debtors and applicable Financing Support Party on or before December 15, 2015. Plan Support Each Consenting Party and each Financing Support Party agrees that it will vote all its claims against the Debtors, including, without limitation, the claims identified on Schedule 1 hereto and any claims acquired after the date hereof, to accept the Plan. Each Consenting Party and each Financing Support Party agrees that it shall not sell, transfer, hypothecate or assign (each, a “Transfer”) any of its claims against the Debtors or any right or interest (voting or otherwise) therein; provided, however, that any Consenting Party or Financing Support Party may Transfer any of its claims (so long as such Transfer is not otherwise prohibited by any order of the Bankruptcy Court) to an entity (each, a “Transferee”) if (a) the Transferee is another Financing Support Party or otherwise agrees or has already agreed in writing to support the Plan and be bound by the terms of this Term Sheet and the commitment hereunder, and (b) the Consenting Party or the Financing Support Party, as applicable, provides the Debtors with a copy of any applicable Transfer agreement. D&O Releases In consideration of, among other things, the efforts expended and to be expended by the Debtors’ officers and directors in conjunction with the Debtors’ operational and financial restructuring during the Chapter 11 Cases, on the Effective Date, the Debtors and the Reorganized Debtors automatically shall release and shall be deemed to release the D&O Releasees from any and all claims, obligations, rights, suits damages, causes of action, remedies and liabilities whatsoever, whether known or unknown, foreseen or unforeseen, existing or hereafter arising, in law, equity or otherwise, that the Debtors or their estates would have been legally entitled to assert in their own right or on behalf of the holder of any claim or interest or other person (including, for the avoidance of doubt, any causes of action under Chapter 5 of the Bankruptcy Code), based in whole or in part upon any actions, conduct or omissions occurring prior to the Effective Date and including any actions, conduct or omissions occurring in connection with the Chapter 11 Cases; provided, however, such releases shall not impair any claims or causes of action against parties that are not D&O Releasees. “D&O Releasees” means all officers, directors, employees, attorneys, financial advisors, accountants, investment bankers, agents and representatives of the Debtors and their subsidiaries who serve in such capacity on the date of this Term Sheet, in each case in their respective capacity as such; provided, however, that in no event shall “D&O Releasees” include any officer, director, or employee who is terminated for cause on or between the date of this Term Sheet and the day prior to the Effective Date. Financing Support Party and Consenting Party To the fullest extent permitted by applicable law, the Plan shall include a full release from liability of the Financing Support Parties and the Consenting Parties, and all of their respective current and former direct and indirect officers, directors, employees, equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing

- 19 - ActiveUS 149807593v.3 Releases members, officers, directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents, and other representatives (including their respective officers, directors, employees, equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing members, officers, directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents and other representatives) by the Company, all of its creditors and all of its interest holders (collectively, the “Plan Support Party Releasees”), from any claims and causes of action arising from or related to the Company, the Plan or the Debtors’ Chapter 11 cases arising on or before the Effective Date; provided, however, (i) the foregoing release shall not apply to obligations arising under the Plan or the Exit Financing; and (ii) the foregoing release shall not be construed to prohibit a party in interest from seeking to enforce the terms of the Plan or Exit Financing; provided further, however that such releases shall not impair claims or causes of action against parties that are not Plan Support Party Releasees. DIP Facility Lender Releases To the fullest extent permitted by applicable law, the Plan shall include a full release from liability of the holders of DIP Facility Claims, and all of their respective current and former direct and indirect officers, directors, employees, equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing members, officers, directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents, and other representatives (including their respective officers, directors, employees, equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing members, officers, directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents and other representatives) by the Company, all of its creditors and all of its interest holders (collectively, the “DIP Facility Lender Releasees”), from any claims and causes of action arising from or related to the Company, the Plan or the Debtors’ Chapter 11 cases arising on or before the Effective Date; provided, however, (i) the foregoing release shall not apply to obligations arising under the Plan; and (ii) the foregoing release shall not be construed to prohibit a party in interest from seeking to enforce the terms of the Plan; provided further, however that such releases shall not impair claims or causes of action against parties that are not DIP Facility Lender Releasees.

- 20 - ActiveUS 149807593v.3 Releases by Financing Support Parties and Consenting Parties In exchange for the distributions to be made under the Plan, the Plan shall release from liability the Debtors and all of their respective current direct and indirect equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing members, officers (except for any officer who is terminated for cause on or between the date of this Term Sheet and the day prior to the Effective Date), directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents, and other representatives (including their respective equityholders, members, partners, subsidiaries, affiliates, funds, managers, managing members, officers, directors, employees, advisors, principals, attorneys, professionals, accountants, investment bankers, consultants, agents and other representatives) (the “Mutual Releasees”) by the Financing Support Parties and the Consenting Parties from any claims and causes of action arising from or related to the Company, the Plan or the Debtors’ Chapter 11 cases arising on or before the Effective Date; provided, however, (i) the foregoing release shall not apply to obligations arising under the Plan or the Exit Financing; and (ii) the foregoing release shall not be construed to prohibit a party in interest from seeking to enforce the terms of the Plan or Exit Financing; provided, further, that such release shall be effective only with respect to Mutual Releasees who provide reciprocal releases on comparable terms for the benefit of each of the Plan Support Party Releasees. Indenture Trustee Fees The reasonable and documented unpaid fees and expenses that are (a) subject to the charging lien of the indenture trustee pursuant to those certain indentures governing the Notes (the “Indenture Trustee”) and (b) invoiced by (i) Loeb & Loeb LLP and (ii) Akin Gump Strauss Hauer & Feld LLP, and PJT Partners, will be paid by the Debtors in full, in cash, on the Effective Date of the Plan; provided that, fees and expenses of Akin Gump Strauss Hauer & Feld LLP and PJT Partners are subject to this paragraph solely to the extent incurred from November 1, 2015 through the Effective Date of the Plan; provided further, however, that the aggregate amount of the Indenture Trustee’s fees and expenses shall not exceed $3,300,000 minus (i) the fees and expenses to be reimbursed to the Financing Support Parties under the section immediately below and minus (ii) the fees and expenses to be reimbursed under section 11.04(a) of the DIP Facility and paragraph 30 of the order approving the Debtors’ entry into the DIP Facility [Docket No. 2122] after the date of the most recent reimbursement under the foregoing provisions. To the extent required for such payment, the Confirmation Order shall include a finding that the Indenture Trustee has made “substantial contributions” to the Chapter 11 Cases under section 503(b)(3) of the Bankruptcy Code. Fees and Expenses of Financing Support Parties The reasonable and documented fees and expenses of (i) Wilmer Cutler Pickering Hale and Dorr and New Hampshire local counsel, as attorneys for the Financing Support Parties and (ii) one financial advisor to the Financing Support Parties (with the Debtors’ reimbursement obligation with respect to such financial advisor limited to a monthly fee in an amount not to exceed $125,000 and the Debtors shall have no obligation for any completion, transaction, or success fee), in each case incurred from November 1, 2015 through the Effective Date in connection with these Chapter 11 Cases will be paid by the Debtors in full in cash. To the extent required for such