EXHIBIT 99.1 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW HAMPSHIRE X In re: : Chapter 11 : GT ADVANCED TECHNOLOGIES INC., et. al., : Case No. 14-11916 (HJB) : : Jointly Administered X DEBTORS' ADDRESS: 243 Daniel Webster Highway Merrimack, NH 03054 DEBTORS' ATTORNEYS: PAUL HASTINGS LLP Park Avenue Tower 75 East 55th Street, First Floor New York, New York 10022 Telephone: (212) 318-6000 Facsimile: (212) 319-4090 Luc A. Despins, Esq. Andrew V. Tenzer, Esq. James T. Grogan, Esq. /s/Kanwardev Raja Singh Bal November 30, 2015 Kanwardev Raja Singh Bal Date Vice President and Chief Financial Officer Notes: [2] The Monthly Operating Report covers a period coinciding with the Debtors' standard reporting period. [1] The Debtors, along with the last four digits of each debtor’s tax identification number, as applicable, are: GT Advanced Technologies Inc. (6749), GTAT Corporation (1760), GT Advanced Equipment Holding LLC (8329), GT Equipment Holdings, Inc. (0040), Lindbergh Acquisition Corp. (5073), GT Sapphire Systems Holding LLC (4417), GT Advanced Cz LLC (9815), GT Sapphire Systems Group LLC (5126), and GT Advanced Technologies Limited (1721). The Debtors’ corporate headquarters are located at 243 Daniel Webster Highway, Merrimack, NH 03054. Monthly Operating Report For the Period of September 27, 2015 to October 31, 2015 [2] This Monthly Operating Report ("MOR") has been prepared solely for the purposes of complying with the monthly reporting requirements applicable in these Chapter 11 cases and is in a format that the Debtors believe is acceptable to the United States Trustee. The financial information contained herein is limited in scope and covers a limited time period. Moreover, such information is preliminary and unaudited, and is not prepared in accordance with accounting principles generally accepted in the United States ("GAAP"). I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Page 1 of 19

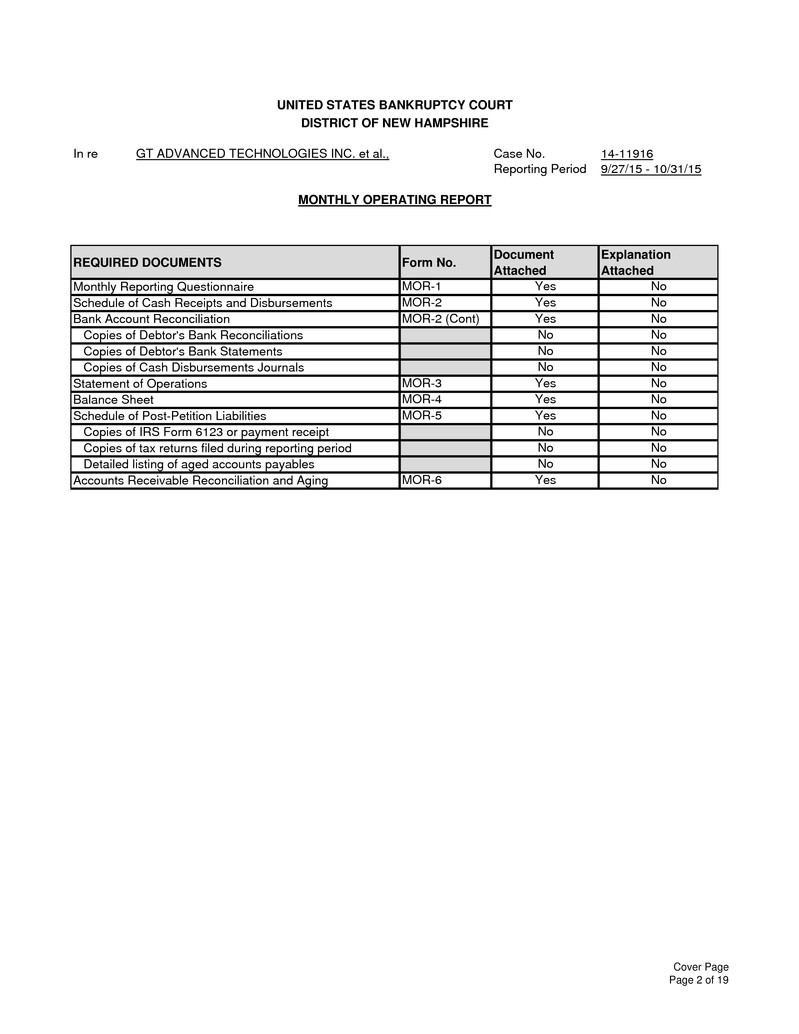

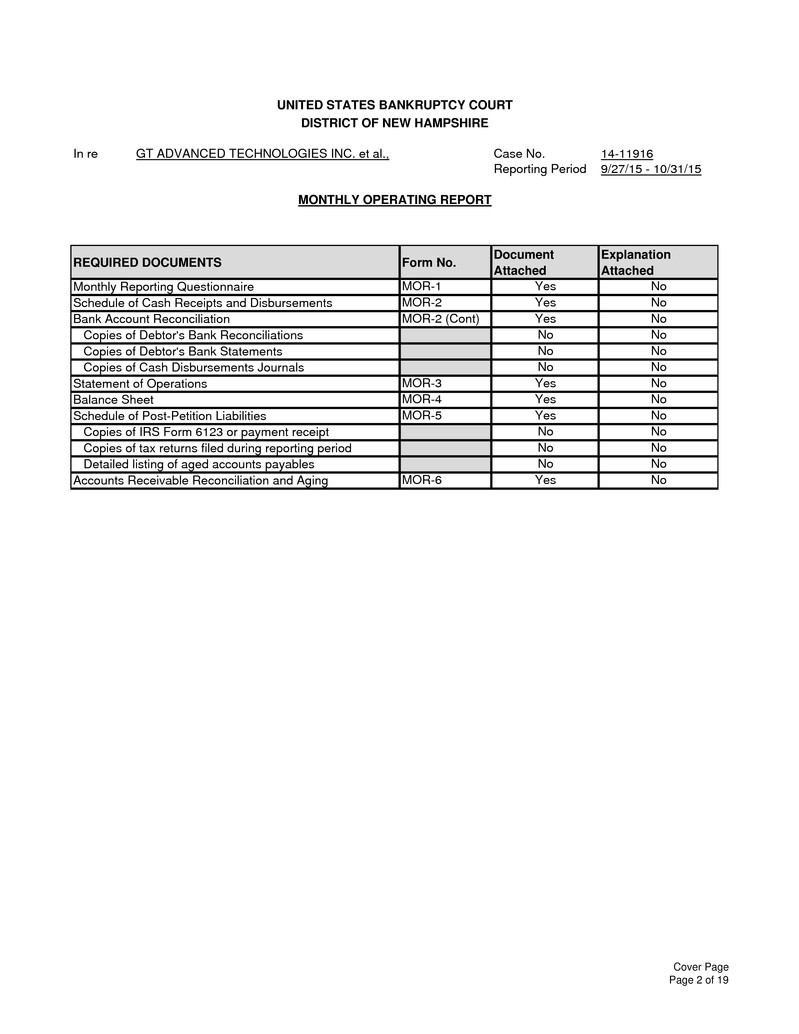

UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW HAMPSHIRE In re GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Reporting Period 9/27/15 - 10/31/15 MONTHLY OPERATING REPORT REQUIRED DOCUMENTS Form No. Document Attached Explanation Attached Monthly Reporting Questionnaire MOR-1 Yes No Schedule of Cash Receipts and Disbursements MOR-2 Yes No Bank Account Reconciliation MOR-2 (Cont) Yes No Copies of Debtor's Bank Reconciliations No No Copies of Debtor's Bank Statements No No Copies of Cash Disbursements Journals No No Statement of Operations MOR-3 Yes No Balance Sheet MOR-4 Yes No Schedule of Post-Petition Liabilities MOR-5 Yes No Copies of IRS Form 6123 or payment receipt No No Copies of tax returns filed during reporting period No No Detailed listing of aged accounts payables No No Accounts Receivable Reconciliation and Aging MOR-6 Yes No Cover Page Page 2 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 MONTHLY REPORTING QUESTIONNAIRE Must be completed each month Yes No 5. If the answer to question 3 and/or 4 is yes, were all such payments approved by the Court? 7. Have all postpetition tax returns been timely filed? If no, provide an explanation below. 8. Is the estate current on the payment of post-petition taxes? 10. Is workers' compensation insurance in effect? 12. Are a plan and disclosure statement on file? 13. Was there any post-petition borrowing during this reporting period? Explanations: Have any payments been made on pre-petition debt, other than payments in the normal course to secured creditors or lessors? If yes, attach listing including date of payment, amount of payment, and name of payee. [1] 1. 2. Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. [1] Have any funds been disbursed from any account other than a debtor-in-possession account this reporting period? If yes, provide an explanation below. 9. 11. Have any payments been made to professionals? If yes, attach listing including date of payment, amount of payment, and name of payee. [1] Have any payments been made to officers, insiders, shareholders, or relatives? If yes, attach listing including date of payment, amount and reason for payment, and name of payee. [1] Is the estate insured for the replacement cost of assets and for general liability? If no, provide an explanation below. [1] See attached schedules for numbers 1, 4 and 6. 6. 4. Have all current insurance payments been made? Attach copies of all new and renewed insurance policies. 3. MOR-1 Page 3 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS CASE NO. CASE NAME BANK CASH RECEIPTS [1] BANK CASH DISBURSEMENTS [2] Inter-Debtor Transfers 14-11916 GT Advanced Technologies Inc. -$ -$ -$ 14-11917 GT Equipment Holdings, Inc. -$ -$ -$ 14-11919 GTAT Corporation 1,303,575$ (11,203,329)$ 572,800$ 14-11920 GT Advanced Technologies Limited 10,631$ (984,622)$ (572,800)$ 14-11922 Lindbergh Acquisition Corp. -$ (521)$ -$ 14-11923 GT Sapphire Systems Group LLC -$ (2,641)$ -$ 14-11924 GT Sapphire Systems Holding LLC -$ -$ -$ 14-11925 GT Advanced CZ LLC -$ (974)$ -$ 14-11929 GT Advanced Equipment Holding LLC -$ (1,009)$ -$ Total Debtors 1,314,206$ (12,193,096)$ -$ TOTAL DISBURSEMENTS 12,193,096$ LESS: TRANSFERS TO DEBTOR IN POSSESSION ACCOUNTS -$ PLUS: ESTATE DISBURSEMENTS MADE BY OUTSIDE SOURCES (i.e. from escrow accounts) $ TOTAL DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES 12,193,096$ Notes: [1] Represents all receipts (excluding intercompany funding activity by and among Debtors). [2] Represents operating disbursements, payroll, I/C funding to non debtors, restructuring disbursements and bank fees (excluding intercompany funding activity between Debtors and mandatory/voluntary paydowns of DIP loan). DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES: MOR-2 Page 4 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 BANK ACCOUNT RECONCILIATIONS [1] Entity Bank Account No. [2] Description Ending Bank Balance GT Advanced Cz LLC Bank of America 5023 Deposit Account 204,780$ GT Advanced Cz LLC Bank of America 6497 Deposit Account - GT Advanced Equipment Holding LLC Bank of America 8144 Deposit Account 8,006 GT Advanced Equipment Holding LLC Bank of America 3803 Investment Account [10] - GT Advanced Technologies Limited Bank of America US 7350 Deposit Account 4,480,653 GT Advanced Technologies Limited Bank of America Hong Kong 2014 Deposit Account 135,619 GT Advanced Technologies Limited Bank of America Hong Kong 2022 Deposit Account 2,972,237 GT Advanced Technologies Limited Bank of America Hong Kong 2030 Deposit Account - GT Advanced Technologies Limited Bank of America Hong Kong 2048 Deposit Account - GT Advanced Technologies Limited Bank of America Hong Kong 2056 Deposit Account 2,231 GT Advanced Technologies Limited Bank of America Hong Kong 9201 Deposit Account - GT Advanced Technologies Limited Bank of America US 5316 Collateral Account [11] 901,244 GT Sapphire Systems Group LLC Bank of America 7965 Deposit Account 3,350,981 GT Sapphire Systems Group LLC Bank of America 9105 Deposit Account - GT Sapphire Systems Group LLC Wells Fargo 2633 Operating Account [3] - GTAT Corporation Bank of America 3294 Deposit Account 75,355,151 GTAT Corporation Bank of America 5002 Deposit Account [7] - GTAT Corporation Bank of America 5254 Investment Account [8] - GTAT Corporation Bank of America 4718 Investment Account [9] - GTAT Corporation Santander Bank 8960 Money market Account [4] - GTAT corporation Bank of America 4487 Deposit Account - GTAT corporation Bank of America 6508 Utility Account [5] 84,289 GTAT corporation Bank of America 9956 Collateral Account [6][12] - GTAT Corporation d/b/a Crystal Systems Bank of America 1546 Deposit Account 11,575,028 GTAT Corporation d/b/a Crystal Systems Bank of America 7590 Deposit Account - Lindbergh Acquisition Corp Bank of America 8343 Deposit Account 74,918 Total Debtors Bank Cash 99,145,137$ Notes: [7] BOA EUR account (5002) was closed on January 26, 2015 [8] BOA investment account (5254) was closed on February 12, 2015 [9] BOA investment account (4718) was closed on February 12, 2015 [10] account closed in February 2015 [11] BOA Collateral account for Kerry freight payment opened in April 2015 [12] BOA collateral acct 9956 was closed on July 3, 2015 [6] Subsequent to the period end, the Bank of America collateral account (account no. 9956) was opened for purposes of holding funds for cash collateralized standby letters of credit. [5] Pursuant to a final order on October 30, 2014, the Company created an account for adequate assurance for utility providers (Docket No. 0388). [1] As part of the Debtors monthly close process, all bank accounts have been reconciled to the applicable bank statements without exception. The Debtors were authorized to use these accounts on a postpetition basis pursuant to the final order signed on October 9, 2014 approving use of the existing cash management system, banks and financial institutions to honor and process checks and transfers, continued use of intercompany transactions, and authorizing debtors to use existing bank accounts and existing business forms (Docket No. 0064). [2] Last four digits of the account number. [4] The Santander money market account (account no. 8960) was closed in October 2014 [3] The Wells Fargo operating account (account no. 2633) was closed January 26, 2015. MOR-2 (cont) Page 5 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 STATEMENT OF OPERATIONS See Exhbit A. MOR-3 Page 6 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 BALANCE SHEET See Exhbit A. MOR-4 Page 7 of 19

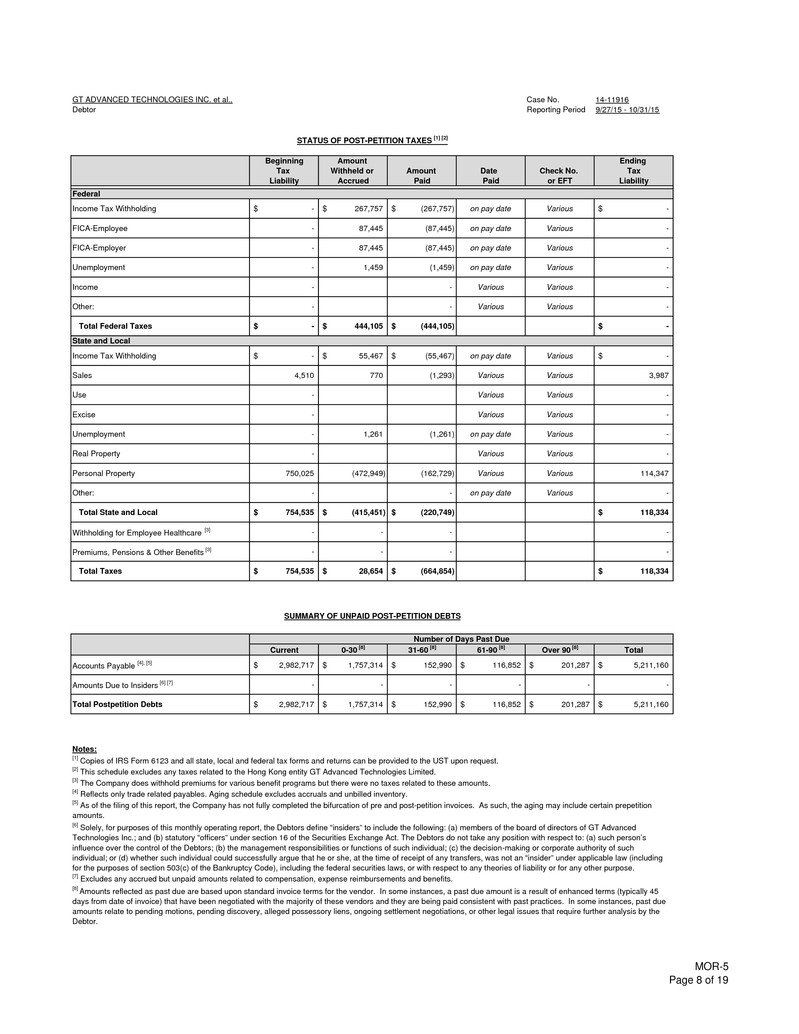

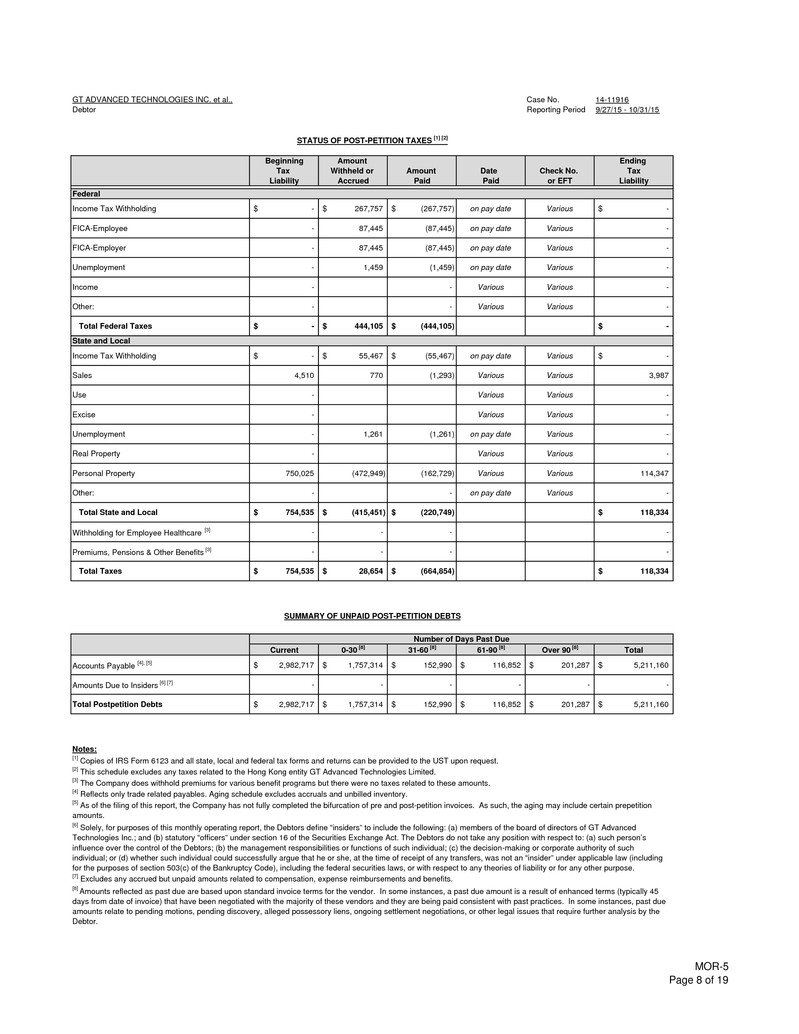

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 STATUS OF POST-PETITION TAXES [1] [2] Beginning Amount Ending Tax Withheld or Amount Date Check No. Tax Liability Accrued Paid Paid or EFT Liability Federal Income Tax Withholding -$ 267,757$ (267,757)$ on pay date Various -$ FICA-Employee - 87,445 (87,445) on pay date Various - FICA-Employer - 87,445 (87,445) on pay date Various - Unemployment - 1,459 (1,459) on pay date Various - Income - - Various Various - Other: - - Various Various - Total Federal Taxes -$ 444,105$ (444,105)$ -$ State and Local Income Tax Withholding -$ 55,467$ (55,467)$ on pay date Various -$ Sales 4,510 770 (1,293) Various Various 3,987 Use - Various Various - Excise - Various Various - Unemployment - 1,261 (1,261) on pay date Various - Real Property - Various Various - Personal Property 750,025 (472,949) (162,729) Various Various 114,347 Other: - - on pay date Various - Total State and Local 754,535$ (415,451)$ (220,749)$ 118,334$ Withholding for Employee Healthcare [3] - - - - Premiums, Pensions & Other Benefits [3] - - - - Total Taxes 754,535$ 28,654$ (664,854)$ 118,334$ SUMMARY OF UNPAID POST-PETITION DEBTS Number of Days Past Due Current 0-30 [8] 31-60 [8] 61-90 [8] Over 90 [8] Total Accounts Payable [4], [5] 2,982,717$ 1,757,314$ 152,990$ 116,852$ 201,287$ 5,211,160$ Amounts Due to Insiders [6] [7] - - - - - - Total Postpetition Debts 2,982,717$ 1,757,314$ 152,990$ 116,852$ 201,287$ 5,211,160$ Notes: [1] Copies of IRS Form 6123 and all state, local and federal tax forms and returns can be provided to the UST upon request. [2] This schedule excludes any taxes related to the Hong Kong entity GT Advanced Technologies Limited. [3] The Company does withhold premiums for various benefit programs but there were no taxes related to these amounts. [8] Amounts reflected as past due are based upon standard invoice terms for the vendor. In some instances, a past due amount is a result of enhanced terms (typically 45 days from date of invoice) that have been negotiated with the majority of these vendors and they are being paid consistent with past practices. In some instances, past due amounts relate to pending motions, pending discovery, alleged possessory liens, ongoing settlement negotiations, or other legal issues that require further analysis by the Debtor. [7] Excludes any accrued but unpaid amounts related to compensation, expense reimbursements and benefits. [4] Reflects only trade related payables. Aging schedule excludes accruals and unbilled inventory. [5] As of the filing of this report, the Company has not fully completed the bifurcation of pre and post-petition invoices. As such, the aging may include certain prepetition amounts. [6] Solely, for purposes of this monthly operating report, the Debtors define “insiders” to include the following: (a) members of the board of directors of GT Advanced Technologies Inc.; and (b) statutory “officers” under section 16 of the Securities Exchange Act. The Debtors do not take any position with respect to: (a) such person’s influence over the control of the Debtors; (b) the management responsibilities or functions of such individual; (c) the decision-making or corporate authority of such individual; or (d) whether such individual could successfully argue that he or she, at the time of receipt of any transfers, was not an “insider” under applicable law (including for the purposes of section 503(c) of the Bankruptcy Code), including the federal securities laws, or with respect to any theories of liability or for any other purpose. MOR-5 Page 8 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 ACCOUNTS RECEIVABLE RECONCILIATION AND AGING Accounts Receivable Reconciliation Amount Total Accounts Receivable at the beginning of the reporting period 4,831,086$ + Amounts billed during the period 1,862,145 - Amounts collected during the period (Book Cash Receipts) (960,311) Total Accounts Receivable at the end of the reporting period 5,732,921$ Accounts Receivable Aging Amount 0 - 30 days old 2,331,646$ 31 - 60 days old 12,967 61 - 90 days old 46,525 91+ days old 3,341,782 Total Accounts Receivable 5,732,920$ Amount considered uncollectible (Bad Debt) (3,160,826) Accounts Receivable (Net) 2,572,094$ MOR-6 Page 9 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 ASSETS SOLD OR TRANSFERRED Monthly Reporting Questionnaire - #1 Entity Buyer Description Sale Proceeds GTAT Corporation Various on eBay IT Equipment 11,664$ GTAT Corporation Apple Inc. Chain Link Fencing and Gates 700$ Total 12,364$ MORQ-#1 Page 10 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 Entity Title Description Amount GTAT Corporation AKIN GUMP Professional Fees 606,425$ GTAT Corporation PAUL HASTINGS,LLP Professional Fees 494,169 GTAT Corporation KELLEY DRYE AND WARREN Professional Fees 214,481 GTAT Corporation ROTHSCHILD INC. Professional Fees 166,174 GTAT Corporation ROPES & GRAY, LLP Professional Fees 140,716 GTAT Corporation PRICEWATERHOUSECOOPERS LLP Professional Fees 122,658 GTAT Corporation HOULIHAN LOKEY CAPITAL, INC Professional Fees 116,624 GTAT Corporation ALVAREZ & MARSAL NORTH AMERICA, LLC Professional Fees 108,606 GTAT Corporation STONETURN GROUP LLP Professional Fees 40,023 GTAT Corporation CIARDI CIARDI & ASTIN LLC Professional Fees 30,548 GTAT Corporation EISNERAMPER, LLP Professional Fees 27,813 GTAT Corporation MODUS EDISCOVERY, INC Professional Fees 25,737 GTAT Corporation KURTZMAN CARSON CONSULTANTS, LLC Professional Fees 21,313 GTAT Corporation WHISMAN, GIORDANO & ASSOCIATES, LLC Professional Fees 13,979 GTAT Corporation DEVINE, MILLIMET & BRANCH Professional Fees 10,990 GTAT Corporation QUINN EMANUEL URQUHART & SULLIVAN Professional Fees 7,716 GTAT Corporation NIXON PEABODY LLP Professional Fees 3,100 Total 2,151,071$ Notes: [1] Excludes payments to professionals retained under the Court’s order, dated December 15, 2014, pursuant to sections 105(a), 327, 328, and 330 of the Bankruptcy Code authorizing the GTAT to retain and compensate professionals utilized by GTAT in the ordinary course of business (the “OCP Order”) [Docket No. 807]. Compensation for professionals retained under the OCP Order is separately reported. Monthly Reporting Questionnaire - #4 PAYMENTS TO PROFESSIONALS [1] [2] [2] 15% of all GTAT Corporation payments to professionals are reimbursed by GT Advanced Technologies Limited per the intercompany settlement agreement. MORQ-#4 Page 11 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 9/27/15 - 10/31/15 PAYMENTS TO INSIDERS [1] Monthly Reporting Questionnaire - #6 Description Title Description Amount Keck, David President and Chief Executive Officer Payroll / Expenses 70,943$ Newsted, Richard Board of Director Expenses/Fees Qrt 58,593 Greylock, John Ray Board of Director Expenses/Fees Qrt 56,250 Kim, Hoil Vice President, Chief Administrative Officer, General Counsel & Secretary Payroll / Expenses 54,658 Davis, Eugene I. Board of Director Expenses/Fees Qrt 50,000 Drivetrain Advisors Ltd. Board of Director Expenses/Fees Qrt 50,000 Ford, Jeffrey Vice President and General Manager, DSS Business Development Payroll / Expenses 44,892 Bal, Kanwardev R Vice President and Chief Financial Officer Payroll / Expenses 44,642 Massengil, Matthew Board of Director Expenses/Fees Qrt 23,750 Conaway, Michal Board of Director Expenses/Fees Qrt 22,794 Switz, Robert Board of Director Expenses/Fees Qrt 19,153 Godshalk, Ernest Board of Director Expenses/Fees Qrt 18,906 Cote, Kathleen Board of Director Expenses/Fees Qrt 17,500 Watson, Noel Board of Director Expenses/Fees Qrt 16,875 Wroe, Thomas Board of Director Expenses/Fees Qrt 16,875 Total 565,832$ Notes: [1] Solely, for purposes of this monthly operating report, the Debtors define “insiders” to include the following: (a) members of the board of directors of GT Advanced Technologies Inc.; and (b) statutory “officers” under section 16 of the Securities Exchange Act. The Debtors do not take any position with respect to: (a) such person’s influence over the control of the Debtors; (b) the management responsibilities or functions of such individual; (c) the decision-making or corporate authority of such individual; or (d) whether such individual could successfully argue that he or she, at the time of receipt of any transfers, was not an “insider” under applicable law (including for the purposes of section 503(c) of the Bankruptcy Code), including the federal securities laws, or with respect to any theories of liability or for any other purpose. MORQ-#6 Page 12 of 19

EXHIBIT A Page 13 of 19

/s/Kanwardev Raja Singh Bal NOTES AND SPECIFIC DISCLOSURES REGARDING DEBTORS’ STATEMENTS OF OPERATIONS AND BALANCE SHEET 1. Basis of Presentation The accompanying consolidated financial statements of the Debtors have been prepared solely for the purpose of complying with the monthly reporting requirements of the U.S. Bankruptcy Court of the District of New Hampshire (referred to herein as the "Monthly Operating Report"). The Monthly Operating Report is limited in scope, covers a limited time period and the schedules contained herein were not audited or reviewed by independent accountants nor are they intended to reconcile to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors' affiliates. Furthermore, because the Debtors’ accounting systems, policies, and practices were developed with a view to producing consolidated financial reporting on a quarterly basis, rather than by legal entity on a monthly basis, it is possible that not all assets or liabilities have been recorded at the correct legal entity of either the Debtors or the non-Debtor affiliates. The Debtors reserve all rights to supplement or amend any schedules contained in this Monthly Operating Report. The information presented herein is unaudited, subject to further review and material adjustments, and has not been subject to all procedures that would typically be applied to financial information presented in accordance with Generally Accepted Accounting Principles in the United States of America (“US GAAP”), including, but not limited to, accruals, impairment adjustments, fair value assessments (including fair value adjustment required to present the post petition Debtor In Possession financing in accordance with GAAP), tax provision, and other recurring adjustments considered necessary by the Debtors to fairly state the financial position and results of operations for the interim period(s) presented. As part of this Monthly Operating Report, intangibles, fixed assets and other long lived assets have not been formally tested for impairment as required pursuant to US GAAP. However, certain assets reflect the Debtors view of estimated fair value. If a formal US GAAP impairment test was completed at a later date, the results may lead to material adjustments. See additional discussion in Note 3. This Monthly Operating Report does not reflect certain quarter-end and year-end adjustments to assets, liabilities and operating results; such adjustments would be reflected in future Monthly Operating Reports. As part of their restructuring efforts, the Debtors are reviewing their assets and liabilities on an ongoing basis, including without limitation with respect to intercompany claims and obligations, and nothing contained in this Monthly Operating Report shall constitute a waiver of any of the Debtors’ rights with respect to such assets, liabilities, claims and obligations that may exist. The Debtors caution readers not to place undue reliance upon the information contained in this Monthly Operating Report. The results herein are not necessarily indicative of results which may be expected from any other period or for the full year and may not necessarily reflect the combined results and financial position of the Debtors in the future. 2. Treatment of Intercompany Transactions The Monthly Operating Report does not include intercompany balances because the Debtors and their advisors are continuing to review the Debtors’ books and records to determine the accuracy of certain intercompany charges that may be contained in or missing from those books and records. For example, prior to the Petition Date, the parent company, GT Advanced Technologies Inc., did not maintain a ledger of intercompany transactions. Furthermore, the Debtors have not made any determination that tax refunds or attributes are assets or liabilities of a particular Debtor and the Debtors reserve all of their rights on this issue. While the Debtors have not finalized their analysis they do expect it to result in significant adjustments to previously disclosed intercompany balances. Pursuant to Bankruptcy Code Sections 105(A), 345(B), 363(C)(1), 364(A), 364(B), and 503(B)(1), Bankruptcy Rules 6003 and 6004, (A) Authorizing Debtors to Use Existing Cash Management System, (B) Authorizing and Directing Banks and Financial Institutions to Honor and Process Checks and Transfers, (C) Authorizing Continued Use of Intercompany Transactions, (D)Waiving Requirements of Section 345(B) of Bankruptcy Code and (E) Authorizing Debtors to Use Existing Bank Accounts and Existing Business Forms [Docket No. 64], the Debtors have kept detailed information on all post-Petition Date transfers of cash among the Debtors and such transfers amounted to approximately $572.8 thousand during the period covered by the Monthly Operating Report, and are laid out in further detail on page 4. Page 14 of 19

NOTES AND SPECIFIC DISCLOSURES REGARDING DEBTORS’ STATEMENTS OF OPERATIONS AND BALANCE SHEET (cont.) 3. Treatment of Certain Assets, Liabilities and GAAP Disclosures The Monthly Operating Report does not contain all disclosures that would be required for presentation in accordance with US GAAP and there can be no assurance that, from the perspective of an investor or potential investor, the Monthly Operating Report is complete. The Debtors provide the following general and limited comments regarding certain assets and liabilities which should be considered by parties reviewing this Monthly Operating Report. Notes regarding certain liabilities: • Pursuant to the Order, Pursuant to Bankruptcy Code Sections 105, 361, 362, 363(B), 363(C), 363(E), 364, 503(B), and 507 and Bankruptcy Rules 2002, 4001, 6004(H), and 9014: (I) Authorizing Debtors to Obtain Postpetition Financing; (Ii) Granting Liens and Super-Priority Claims; (III) Authorizing Debtors to Pay Put Option Premium and Expenses in Connection with Postpetition Financing Commitment; (IV) Approving Information Sharing Obligations and Indemnity Thereunder; and (V) Granting Related Relief, the Debtor was authorized to obtain post-petition financing, consisting of a senior secured superpriority term loan facility in an aggregate principal amount of up to $95M. The amount represented on the balance sheet includes the principal amount of borrowings, net of the original issue discount, plus any PIK interest accrued through October 31, 2015. • The 2017 and 2020 convertible notes with a principal balance of $220M and $214M are recorded at a carrying value of $177M and $123M, respectively. The amount represented in the liabilities subject to compromise is net of $7M of deferred financing costs. The difference between the carrying value and principal balances reflect fair value adjustments. • The amounts received from Apple under the Prepayment Agreement are recorded at the principal balance of $439M, less payments made as a result of the settlement approved on December 15, 2014. As of October 31, 2015 payments of $384 thousand have been made against this liability. • For the period commencing on October 6, 2014 and thereafter, the Debtors stopped accruing interest on both series of the Convertible Notes and the Prepayment amounts until further review of these obligations is completed. • Share-based compensation expenses for employee awards are reflected in the Statement of Operations in the third month of each quarter. Prior to the second calendar quarter share-based compensation was recorded each month. Such expenses have been calculated using a methodology consistent with past practice. Share-based compensation expense will continue to be recognized until the final outcome of the equity awards is determined. Notes regarding certain assets: • As of October 31, 2015, the Debtors have not yet completed their formal US GAAP required analysis regarding the fair value of goodwill, and certain intangibles and fixed assets. Based upon the Debtors’ estimates, as previously disclosed in the Amended December Monthly Operating Report, certain intangibles relating to previous acquisitions have been written down to zero. Additionally certain fixed assets located primarily in the Mesa and Salem facilities and other minor product lines located in other facilities, have been written down to their estimated liquidation value. • As previously disclosed in the Amended December Monthly Operating Report, reflected in the financial statements is the transfer of Advanced Sapphire Furnaces from fixed assets to inventory, including a write off of previously capitalized amounts related to the setup and installation of the equipment and write off for any material related to products the Debtors expect to discontinue. Notes regarding Income Taxes: • As of October 31, 2015, Refundable Income Taxes reflects an estimated $25M tax refund for which the Debtors intend to carry back US losses generated in the year ended 2014. Notes regarding Income (Loss) from Discontinued Operations: • As of October 31, 2015, the Company reported $58 thousand net loss from discontinued operations, which represents the costs of the wind down after offset from sales of equipment at the Mesa facility. The Debtors’ financial statements presented herein have been prepared on a going concern basis, which contemplates continuity of operations, realization of assets and liquidation of liabilities in the ordinary course of business. Certain prepetition liabilities have been reclassified as liabilities subject to compromise. Liabilities subject to compromise currently include debt obligations, amounts due to third parties for goods and services received prior to October 6, 2014, (the date of the voluntary bankruptcy petition) and certain known potential settlement claim amounts. Page 15 of 19

NOTES AND SPECIFIC DISCLOSURES REGARDING DEBTORS’ STATEMENTS OF OPERATIONS AND BALANCE SHEET (cont.) 3. Treatment of Certain Assets, Liabilities and GAAP Disclosures (cont.) The Debtors continue to analyze and reconcile assets and liabilities included on the balance sheet, and, therefore, the amounts reflected herein are current estimates and subject to material change as additional analysis and decisions are completed. Page 16 of 19

STATEMENTS OF OPERATIONS EXCLUDING INTERCOMPANY ACTIVITY FOR THE PERIOD ENDED OCTOBER 31, 2015 ($ in 000's) Case No. 14-11916 14-11919 14-11929 14-11917 14-11922 14-11925 14-11924 14-11923 14-11920 GT Advanced Technologies Inc. GTAT Corporation GT Advanced Equipment Holding LLC GT Equipment Holdings, Inc. Lindberg Acquisition Corp GT Advanced Cz LLC GT Sapphire Systems Holdings LLC GT Sapphire Systems Group LLC GT Advanced Technologies Limited [1] Non-Debtor Entities Consolidated Revenue - 977 - - - - - - 1 - 978 Total Cost of revenue - 872 - - - - - - 704 (229) 1,348 Gross (loss) Profit - 105 - - - - - - (703) 229 (370) Research and development - 2,021 - - - - - - - - 2,021 Selling and marketing - 285 - - - - - - 37 88 410 General and administrative - 2,160 - - - - - - 5 140 2,305 Contingent consideration (income) expense - - - - - - - - - - - Restructuring charges and asset impairments - - - - - - - - 21 63 84 Amortization of Intangible Assets - - - - - - - - - - - Total Operating Expenses - 4,467 - - - - - - 62 291 4,820 Income (loss) from Operations [2] - (4,362) - - - - - - (766) (62) (5,190) Interest Income - - - - - - - - - 0 0 Interest (Expense) - (886) - - - - - - 0 - (885) Reorganization Items, income (expense) - 379 - - - - - - (799) - (420) Other Inc (Exp) - (29) - - - - - - (67) 138 43 Income (loss) before Tax - (4,896) - - - - - - (1,632) 76 (6,452) (Benefit) provision for income taxes - - - - - - - - - 16 16 Net Income (loss) from continuing operations - (4,896) - - - - - - (1,632) 60 (6,468) Income (loss) from discontinued operations, net of tax - (58) - - - - - - - - (58) Net Income (loss) - (4,954) - - - - - - (1,632) 60 (6,526) Notes: [1] Includes immaterial amounts from GT Advanced Technologies GmbH, a non-debtor entity. [2] Does not include any share-based compensation expense. Share-based compensation is recorded in the third month of each fiscal quarter. These financial statements and accompanying notes do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States of America, nor are they intended to be fully reconciled to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. This information is unaudited and is subject to further review and potential adjustments. The accompanying disclaimers and notes are an integral part of these financial statements. Page 17 of 19

BALANCE SHEET EXCLUDING INTERCOMPANY BALANCES AS OF OCTOBER 31, 2015 ($ in 000's) Case No. 14-11916 14-11919 14-11929 14-11917 14-11922 14-11925 14-11924 14-11923 14-11920 GT Advanced Technologies Inc. GTAT Corporation GT Advanced Equipment Holding LLC GT Equipment Holdings, Inc. Lindbergh Acquisition Corp. GT Advanced Cz LLC GT Sapphire Systems Holdings LLC GT Sapphire Systems Group LLC GT Advanced Technologies Limited [1] Non-Debtor Entities Consolidated Current Assets Cash and cash equivalents - 86,496 10 - - 283 - 3,356 8,488 1,132 99,764 Restricted cash - 84 - - - - - - - - 84 Accounts receivable, net - 1,560 - - - - - 0 844 168 2,572 Inventories - 398,173 - - - - - - 48,299 911 447,382 Deferred costs - 2,167 - - - - - - 2,540 - 4,707 Vendor advances - 3,459 - - - - - - 7,914 58 11,431 Deferred income taxes - - - - - - - - - 1,398 1,398 Refundable income taxes - 26,046 - - - (1) - - - - 26,045 Prepaid expenses and other current assets - 10,456 - - - - - - 447 140 11,044 Total current assets - 528,442 10 - - 281 - 3,356 68,531 3,807 604,428 Property, plant and equipment, net [4] - 50,774 - - - 0 - - 3,955 248 54,977 Intangible assets, net [4] - 22,974 - - - - - - - - 22,974 Goodwill - 51,370 - - - 1,197 - - - 4,280 56,847 Deferred cost - (27) - - - - - - 27,550 - 27,523 Other assets - 10,038 - - - 9 - - 59,844 297 70,188 Total Assets [2] [3] - 663,572 10 - - 1,487 - 3,356 159,879 8,632 836,937 Current Liabilities Prepayment obligation - 438,616 - - - - - - - 438,616 Debtor In Possession Term Loan 92,796 - - - - - - - - 92,796 Accounts payable - 5,384 - - - (0) - - 371 446 6,200 Accrued expenses and other current liabilities - 14,781 - - - - - - 3,091 902 18,774 Contingent consideration - - - - - - - - - 3,038 3,038 Customer deposits - 467 - - - 1,987 - 504 10,937 22 13,917 Deferred revenue - 14,073 - - - - - 175 7,470 - 21,718 Accrued income taxes (8,762) - - - 8,608 - - 2 93 (59) Total current liabilities - 557,355 - - - 10,595 - 679 21,870 4,501 595,000 Liabilities Subject to Compromise 292,557 125,572 - - - 4,925 - 1,231 50,310 - 474,594 Convertible notes - - - - - - - - - - - Deferred income taxes - (0) - - - - - - - (35) (35) Customer deposits - - - - - - - - 55,598 - 55,598 Deferred revenue - 151 - - - - - - 41,335 - 41,486 Contingent consideration - - - - - - - - - 214 214 Other non-current liabilities - (0) - - - - - - - - (0) Accrued Income Taxes - 5,424 - - - - - - - - 5,424 Total Non-Current Liabilities - 5,575 - - - - - - 96,933 180 102,687 Stockholder's Equity - (126,740) 34 - - (43,372) - (16,360) (26,111) (122,794) (335,345) Total Liabilities and Stockholder's Equity [3] 292,557 561,762 34 - - (27,852) - (14,450) 143,002 (118,114) 836,937 Notes: $293 $102 ($) $ $ $29 $ $18 $17 $127 $ [1] Includes immaterial amounts from GT Advanced Technologies GmbH, a non-debtor entity. [2] It would be prohibitively expensive, unduly burdensome, and an inefficient use of estate assets for the Debtors to obtain current market valuation of each of their assets. Accordingly, unless otherwise indicated, this monthly operating report reflect net book values as of the period end. Parties are also cautioned that book value is not, in any way, indicative of the fair market value of any of the Debtors’ assets. [3] Due to the exclusion of intercompany balances, Total Assets may not equal Total Liabilities and Stockholder's Equity. [4] Reflects Management's estimated Fair Value. These financial statements and accompanying notes do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States of America, nor are they intended to be fully reconciled to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. This information is unaudited and is subject to further review and potential adjustments. The accompanying disclaimers and notes are an integral part of these financial statements. Page 18 of 19

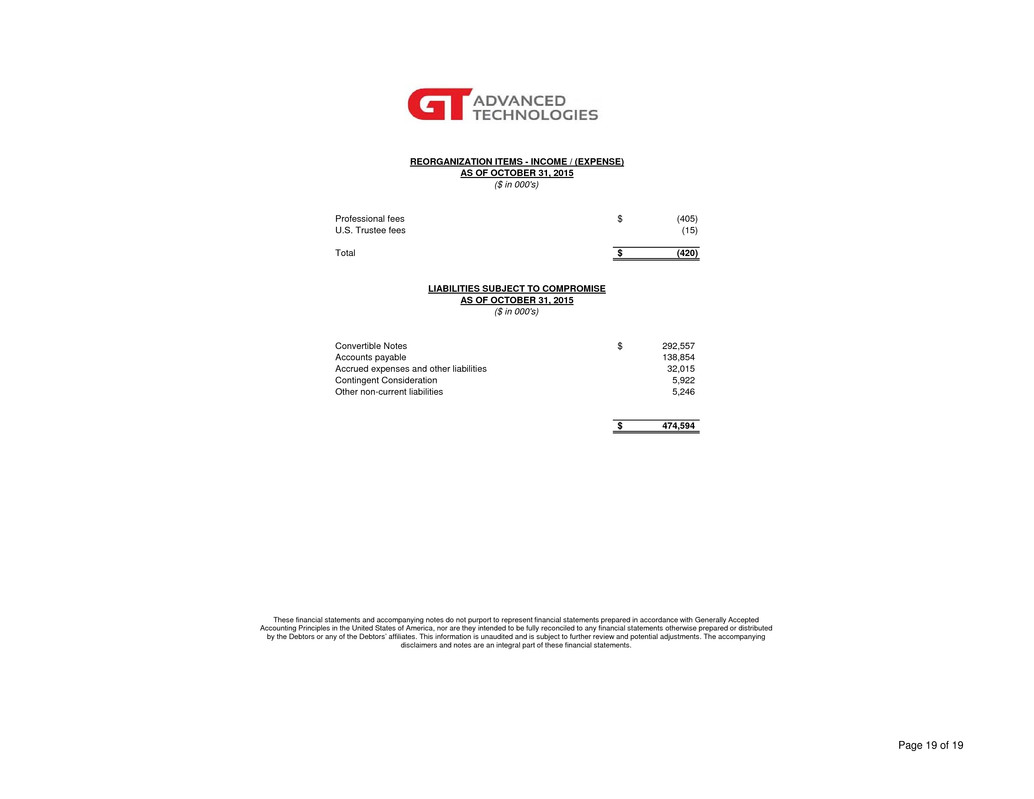

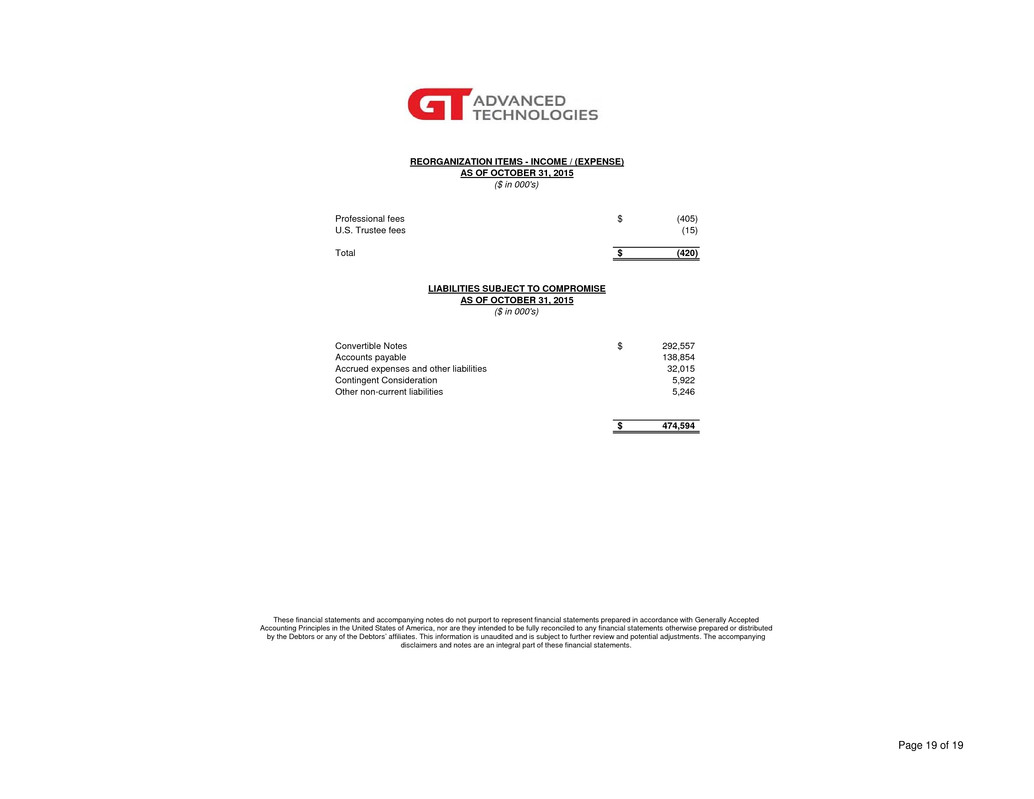

REORGANIZATION ITEMS - INCOME / (EXPENSE) AS OF OCTOBER 31, 2015 ($ in 000's) Professional fees (405)$ U.S. Trustee fees (15) Total (420)$ LIABILITIES SUBJECT TO COMPROMISE AS OF OCTOBER 31, 2015 ($ in 000's) Convertible Notes 292,557$ Accounts payable 138,854 Accrued expenses and other liabilities 32,015 Contingent Consideration 5,922 Other non-current liabilities 5,246 474,594$ These financial statements and accompanying notes do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States of America, nor are they intended to be fully reconciled to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. This information is unaudited and is subject to further review and potential adjustments. The accompanying disclaimers and notes are an integral part of these financial statements. Page 19 of 19