UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission File number: 001-33422

Empresa Distribuidora y Comercializadora Norte S.A.

(Exact name of registrant as specified in its charter)

| Distribution and Marketing Company of the North S.A. | Argentine Republic |

| (Translation of registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Azopardo 1025

Ciudad de Buenos Aires, C1107ADQ

Buenos Aires, Argentina

(Address of principal executive offices)

Ivana Del Rossi

54 11 4346 5127 / 54 11 4346 5325

Azopardo 1025 (C1107ADQ) Bs. As.

Investor Relations Officer

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered |

| | |

| Class B Shares | New York Stock Exchange, Inc.* |

American Depositary Shares, or ADSs, evidenced by American Depositary Receipts, each representing 20 Class B Shares | New York Stock Exchange, Inc. |

| * | Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: N/A

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 462,292,111 Class A Ordinary Shares, 442,210,385 Class B Ordinary Shares and 1,952,604 Class C Ordinary Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Sections 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: U.S. GAAP ¨ IFRS ¨ Other þ

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ¨ Item 18 þ

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ¨ No þ

| Item 1. | Identity of Directors, Senior Management and Advisors | 2 |

| Item 2. | Offer Statistics and Expected Timetable | 2 |

| Item 3. | Key Information | 2 |

| Item 4. | Information on the Company | 21 |

| Item 4A. | Unresolved Staff Comments | 46 |

| Item 5. | Operating and Financial Review and Prospects | 46 |

| Item 6. | Directors, Senior Management and Employees | 86 |

| Item 7. | Major Shareholders and Related Party Transactions | 95 |

| Item 8. | Financial Information | 99 |

| Item 9. | The Offer and Listing | 103 |

| Item 10. | Additional Information | 106 |

| Item 11. | Quantitative and Qualitative Disclosures about Market Risk | 123 |

| Item 12. | Description of Securities Other than Equity Securities | 124 |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 126 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 126 |

| Item 15. | Controls and Procedures | 126 |

| Item 16A. | Audit Committee Financial Expert | 127 |

| Item 16B. | Code of Ethics | 128 |

| Item 16C. | Principal Accountant Fees and Services | 128 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 128 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 128 |

| Item 16G. | Corporate Governance | 129 |

| Item 17. | Financial Statements | 132 |

| Item 18. | Financial Statements | 132 |

| Item 19. | Exhibits | 132 |

| Index to Financial Statements | F-1 |

PART I

Introduction

Empresa Distribuidora y Comercializadora Norte S.A., or Edenor, is a sociedad anónima (limited liability corporation) organized under the laws of the Argentine Republic, or Argentina. Our principal executive offices are located at Azopardo 1025, Ciudad de Buenos Aires, C1107ADQ, Buenos Aires, Argentina.

| Item 1. | Identity of Directors, Senior Management and Advisors |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements, principally under the captions “Item 3. Key Information—Risk factors,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting our business. Forward-looking statements may also be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. Many important factors, in addition to those discussed elsewhere in this annual report, could cause our actual results to differ materially from those expressed or implied in our forward-looking statements, including, among other things:

| | · | the outcome and timing of the integral tariff revision process we are currently undertaking with the Ente Nacional Regulador de la Electricidad (Argentine National Electricity Regulator, or the ENRE) and, more generally, uncertainties relating to future government approvals to increase or adjust our tariffs; |

| | · | general political, economic, social, demographic and business conditions in Argentina and particularly in the geographic market we serve; |

| | · | the global financial crisis and its impact on liquidity and access to capital; |

| | · | the impact of regulatory reform and changes in the regulatory environment in which we operate; |

| | · | potential disruption or interruption of our service; |

| | · | restrictions on the ability to exchange Pesos into foreign currencies or to transfer funds abroad; |

| | · | the revocation or amendment of our concession by the granting authority; |

| | · | our ability to implement our capital expenditure plan, including our ability to arrange financing when required and on reasonable terms; |

| | · | fluctuations in inflation and exchange rates, including a devaluation of the Peso; and |

| | · | additional matters identified in “Risk factors.” |

Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or to revise any forward-looking statements after we file this annual report because of new information, future events or other factors. In light of these limitations, undue reliance should not be placed on forward-looking statements contained in this annual report.

SELECTED FINANCIAL DATA

The following table presents selected financial and operating data. This information should be read in conjunction with our audited financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report.

The financial data as of December 31, 2009 and 2008 and for each of the three years in the period ended December 31, 2009 are derived from our audited financial statements, which were audited by Price Waterhouse & Co. S.R.L., member firm of PricewaterhouseCoopers, for the years ended December 31, 2009 and 2008 and Deloitte & Co. S.R.L., member firm of Deloitte & Touche Tohmatsu, for the year ended December 31, 2007. We engaged Price Waterhouse & Co. S.R.L as our new auditors in April 2008, in order to consolidate our audit with that of our controlling shareholder, Pampa Energia S.A., also audited by Price Waterhouse & Co. S.R.L. Our audited financial statements have been prepared in accordance with generally accepted accounting principles in the City of Buenos Aires, which we refer to as Argentine GAAP and which differ in certain significant respects from U.S. Generally Accepted Accounting Principles (U.S.GAAP). Note 27 to our audited financial statements included elsewhere in this annual report provides a description of the significant differences between Argentine GAAP and U.S. GAAP, as they relate to us, and a reconciliation to U.S. GAAP of net income for the years then ended December 31, 2009, 2008 and 2007 and shareholders’ equity as of December 31, 2009 and2008.

In this annual report, except as otherwise specified, references to “$”, “U.S. $” and “Dollars” are to U.S. Dollars, and references to “Ps. ” and “Pesos” are to Argentine Pesos. Solely for the convenience of the reader, Peso amounts as of and for the year ended December 31, 2009 have been translated into U.S. Dollars at the buying rate for U.S. Dollars quoted by Banco de la Nación Argentina (Banco Nación) on December 31, 2009 of Ps. 3.80 to U.S. $1.00. The U.S. Dollar equivalent information should not be construed to imply that the Peso amounts represent, or could have been or could be converted into, U.S. Dollars at such rates or any other rate. See “Item 3. Key Information – Exchange rates.”

Under Argentine GAAP, we generally are not required to record the effects of inflation in our financial statements. However, because Argentina experienced a high rate of inflation in 2002, with the wholesale price index increasing by approximately 118%, we were required by Decree No. 1269/2002 and Comisión Nacional de Valores (National Securities Commission or CNV) Resolution No. 415/2002 to restate our financial statements in constant Pesos in accordance with Argentine GAAP. On March 25, 2003, Decree No. 664/2003 rescinded the requirement that financial statements be prepared in constant currency, effective for financial periods on or after March 1, 2003. As a result, we are not required to restate and have not restated our financial statements for inflation after February 28, 2003. See note 2 to our audited financial statements included in this annual report.

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals may not sum due to rounding.

| | | For the year ended December 31, | |

| | | 2009 | | | | | | | | | | | | | |

| | | (in millions, except for per share and per ADS data) | |

| Statement of operations data | | | | | | | | | | | | | | | | | | |

| Argentine GAAP | | | | | | | | | | | | | | | | | | |

Net sales(1) | | U.S. $ | 546.8 | | | Ps. | 2,077.9 | | | Ps. | 2,000.2 | | | Ps. | 1,981.9 | | | Ps. | 1,378.3 | | | Ps. | 1,262.2 | |

| Electric power purchases | | | (264.0 | ) | | | (1,003.4 | ) | | | (934.7 | ) | | | (889.9 | ) | | | (799.1 | ) | | | (757.7 | ) |

| Gross margin | | | 282.8 | | | | 1,074.5 | | | | 1,065.5 | | | | 1,092.0 | | | | 579.3 | | | | 504.5 | |

| Transmission and distribution expenses | | | (144.4 | ) | | | (548.6 | ) | | | (497.9 | ) | | | (417.6 | ) | | | (362.1 | ) | | | (346.1 | ) |

| Selling expenses | | | (41.8 | ) | | | (158.9 | ) | | | (126.0 | ) | | | (120.6 | ) | | | (87.9 | ) | | | (86.0 | ) |

| Administrative expenses | | | (46.5 | ) | | | (176.6 | ) | | | (138.7 | ) | | | (124.7 | ) | | | (93.3 | ) | | | (72.9 | ) |

| Net operating income (loss) | | | 50.1 | | | | 190.4 | | | | 302.9 | | | | 429.2 | | | | 35.9 | | | | (0.4 | ) |

| Other income (expenses), net | | | 6.1 | | | | 23.2 | | | | (29.9 | ) | | | 1.0 | | | | (22.9 | ) | | | (0.7 | ) |

| Financial income (expenses) and holding gains (losses): | | | | | | | | | | | | | | | | | | | | | | | | |

| Generated by assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange difference | | | 5.6 | | | | 21.4 | | | | 8.1 | | | | (0.9 | ) | | | 2.6 | | | | 2.1 | |

| Interest | | | 4.3 | | | | 16.2 | | | | 9.8 | | | | 13.4 | | | | 13.9 | | | | 12.9 | |

| Holding results | | | 9.9 | | | | 37.6 | | | | (7.3 | ) | | | 0.1 | | | | 0.1 | | | | (0.6 | ) |

| Generated by liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial expenses | | | (3.1 | ) | | | (11.7 | ) | | | (10.0 | ) | | | (21.0 | ) | | | (25.4 | ) | | | (14.1 | ) |

| Exchange difference | | | (26.1 | ) | | | (99.1 | ) | | | (92.7 | ) | | | (29.9 | ) | | | (13.3 | ) | | | (29.0 | ) |

| Interest | | | (23.1 | ) | | | (87.7 | ) | | | (95.3 | ) | | | (74.5 | ) | | | (101.3 | ) | | | (119.5 | ) |

| Holding results | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.2 | ) |

Adjustment to present value of the retroactive tariff increase arising from the application of the new electricity rate schedule and other receivables(2) | | | 0.9 | | | | 3.4 | | | | 13.5 | | | | (29.6 | ) | | | — | | | | — | |

Gain on extinguishment of former debt(3) | | | — | | | | — | | | | — | | | | — | | | | 179.2 | | | | — | |

Adjustment to present value of notes(4) | | | (1.4 | ) | | | (5.2 | ) | | | (8.5 | ) | | | (21.5 | ) | | | 57.1 | | | | — | |

Gain (loss) from the purchase of notes(5) | | | 21.4 | | | | 81.4 | | | | 93.6 | | | | (10.2 | ) | | | — | | | | — | |

Adjustment to present value of purchased notes(4) | | | — | | | | — | | | | — | | | | (8.6 | ) | | | — | | | | — | |

| Income (loss) before taxes | | | 44.6 | | | | 169.9 | | | | 184.3 | | | | 247.4 | | | | 125.9 | | | | (149.6 | ) |

Income tax(6) | | | (20.9 | ) | | | (79.3 | ) | | | (61.2 | ) | | | (125.0 | ) | | | 167.2 | | | | — | |

| Net income (loss) | | U.S. $ | 23.7 | | | Ps. | 90.6 | | | Ps. | 123.1 | | | Ps. | 122.5 | | | Ps. | 293.1 | | | Ps. | (149.6) | |

| Net income (loss) per ordinary share – basic and diluted | | | 0.027 | | | | 0.101 | | | | 0.137 | | | | 0.135 | | | | 0.352 | | | | (0.180 | ) |

Dividends declared per ordinary share(7) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Net income per ADS(8) — basic and diluted | | | 0.54 | | | | 2.02 | | | | 2.716 | | | | 2.702 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of shares outstanding | | | 906,455,100 | | | | 906,455,100 | | | | 906,455,100 | | | | 906,455,100 | | | | 831,610,200 | | | | 831,610,200 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales/service revenues | | U.S. $ | 569.3 | | | Ps. | 2,163.3 | | | Ps. | 2,059.0 | | | Ps. | 1,937.0 | | | Ps. | 1,403.5 | | | Ps. | 1,334.9 | |

| Electric power purchases | | | (264.1 | ) | | | (1,003.4 | ) | | | (934.7 | ) | | | (889.9 | ) | | | (799.1 | ) | | | (757.7 | ) |

| Transmission and distribution expenses | | | (164.2 | ) | | | (624.0 | ) | | | (577.0 | ) | | | (477.5 | ) | | | (450.3 | ) | | | (425.3 | ) |

| Gross margin | | | 141.0 | | | | 535.9 | | | | 547.3 | | | | 569.6 | | | | 154.1 | | | | 151.0 | |

| Operating expenses, net | | | (86.1 | ) | | | (327.2 | ) | | | (296.6 | ) | | | (207.5 | ) | | | (194.1 | ) | | | 185.0 | |

| Net operating income (loss) | | | 54.9 | | | | 208.7 | | | | 250.7 | | | | 362.1 | | | | 40.0 | | | | (33.1 | ) |

| Financial (expense), net and holding gains | | | (11.2 | ) | | | (42.6 | ) | | | 82.0 | | | | (46.5 | ) | | | (133.3 | ) | | | (139.1 | ) |

| Net income (loss) before income taxes | | | 43.7 | | | | 166.2 | | | | 332.7 | | | | 315.7 | | | | (173.3 | ) | | | (172.1 | ) |

| Income tax | | | (24.5 | ) | | | (93.1 | ) | | | (68.2 | ) | | | (99.9 | ) | | | 128.0 | | | | 8.1 | |

| Net income (loss) for the year | | | 19.2 | | | | 73.1 | | | | 264.5 | | | | 215.8 | | | | (45.3 | ) | | | (164.0 | ) |

Net income (loss) per ordinary share – basic and diluted(7) | | | 0.021 | | | | 0.081 | | | | 0.295 | | | | 0.238 | | | | (0.054 | ) | | | (0.197 | ) |

Net income per ADS(8) — basic and diluted | | | 0.43 | | | | 1.62 | | | | 5.90 | | | | 4.761 | | | | — | | | | — | |

| (1) | Net sales for 2007 include the retroactive portion of the February 2007 tariff increase, which amounts in aggregate to Ps. 218.6 million, and is being invoiced in 55 equal and consecutive monthly installments, starting in February 2007. As of December 31, 2009 we had invoiced Ps. 149.4 million of this amount. |

| (2) | Reflects the adjustment to present value of the retroactive portion of the tariff increase that is being invoiced in 55 consecutive monthly installments, starting in February 2007, and the adjustment to present value of Ps. 38.4 million due under the payment plan agreement with the Province of Buenos Aires that is being invoiced in 18 installments, starting in January 2007. As of December 31, 2009 and 2008, Ps. 2.3 million was due under the payment plan agreement with the Province of Buenos Aires, and Ps. 69.2 million and Ps. 118.9 million of the retroactive tariff increase had not been invoiced in 2009 and 2008, respectively. In accordance with Argentine GAAP, we account for these long term receivables at their net present value, which we calculate at a discount rate of 10.5% for the retroactive tariff increase and 19.62% for the payment plan agreement, recording the resulting non-cash charge as an adjustment to present value of these two receivables. See “Item 4. Information on the Company —Framework agreement (Shantytowns).” |

| (3) | Our debt restructuring generated a one-time gain of Ps. 179.2 million in the year ended December 31, 2006, reflecting the recognition of a Ps. 55.3 million waiver of principal amount on our financial debt, a Ps. 75 million waiver of accrued interest on our financial debt and a Ps. 65.7 million waiver of penalties related to the non-payment of our financial debt, which more than offset Ps. 16.8 million in related restructuring costs. See “Item 5. Operating and Financial Review and Prospects—Liquidity and capital resources—Debt” for a description of the restructuring notes. |

| (4) | We record our financial debt in our balance sheet at fair value reflecting our management’s best estimate of the amounts expected to be paid at each year end, calculated at a discount rate of 10.5% for the years ended December 31, 2009, 2008 and 2007 and 10% for the year ended December 31, 2006. We did not record any adjustment to present value in any year before the year ended December 31, 2006 because our financial debt was in default. |

| (5) | In 2007, we repurchased U.S. $43.7 million principal amount of our outstanding Fixed Rate Par Notes due 2016 and redeemed and repurchased U.S. $240 million principal amount of our outstanding Discount Notes due 2014. In addition, in the year ended December 31, 2008 and 2009, we repurchased U.S. $32.5 million and U.S. $32.2 million principal amount of our outstanding Fixed Rate Par Notes due 2016, respectively and U.S. $17.5 million and U.S. $53.8 million principal amount of our outstanding Senior Notes due 2017, respectively. |

| (6) | In 2006, our income tax result reflects the reversal of net deferred tax assets, primarily due to the fact that, as a consequence of the ratification of the Adjustment Agreement in January 2007 and the renegotiation of our financial debt in April 2006, we generated taxable income that allowed us to offset a significant portion of the tax loss carryforwards we generated in 2002. |

| (7) | We have not declared or paid any dividends since August 14, 2001. |

| (8) | Each ADS represents 20 Class B ordinary shares. |

| | | As of December 31, | |

| | | | | | | | | | | | | | | | |

| | | (in millions) | |

| Balance sheet data | | | | | | | | | | | | | | | | | | |

| Argentine GAAP | | | | | | | | | | | | | | | | | | |

| Current Assets: | | | | | | | | | | | | | | | | | | |

| Cash and banks | | U.S.$ | 2.3 | | | Ps. | 8,7 | | | Ps. | 6.1 | | | Ps. | 3.5 | | | Ps. | 0.5 | | | Ps. | 11.7 | |

| Investments | | | 57.8 | | | | 219,7 | | | | 121.0 | | | | 97.7 | | | | 32.2 | | | | 296.5 | |

Trade receivables | | | 102.4 | | | | 389,2 | | | | 400.4 | | | | 346.0 | | | | 270.9 | | | | 231.9 | |

| Other receivables | | | 16.1 | | | | 61,1 | | | | 42.8 | | | | 26.0 | | | | 30.2 | | | | 21.7 | |

| Supplies | | | 3.9 | | | | 14,8 | | | | 16.7 | | | | 23.2 | | | | 13.6 | | | | 13.8 | |

| Total current assets | | U.S.$ | 182.5 | | | Ps. | | | | Ps. | 587.0 | | | Ps. | 496.3 | | | Ps. | 347.5 | | | Ps. | 575.6 | |

| Non-Current Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Trade receivables | | | 22.9 | | | | 87.0 | | | | 111.4 | | | | 100.3 | | | | — | | | | — | |

| Other receivables | | | 23.4 | | | | 88.8 | | | | 99.5 | | | | 144.1 | | | | 256.5 | | | | 74.7 | |

| Investments in other companies | | | 0.1 | | | | 0.4 | | | | 0.4 | | | | 0.4 | | | | 0.4 | | | | 0.4 | |

| Investments | | | — | | | | — | | | | 67.2 | | | | — | | | | — | | | | — | |

| Supplies | | | 4.9 | | | | 18.6 | | | | 12.8 | | | | 13.8 | | | | 4.9 | | | | 36.5 | |

| Property, plant and equipment | | | 916.4 | | | | 3,482.4 | | | | 3,256.3 | | | | 3,092.7 | | | | 2,925.4 | | | | 2,889.3 | |

| Total non-current assets | | U.S.$ | 967.7 | | | Ps. | 3,677.2 | | | Ps. | 3,547.6 | | | Ps. | 3,351.3 | | | Ps. | 3,187.2 | | | Ps. | 3,000.9 | |

| Total assets | | U.S.$ | 1,150.2 | | | Ps. | 4,370.7 | | | Ps. | 4,134.6 | | | Ps. | 3,847.6 | | | Ps. | 3,534.7 | | | Ps. | 3,576.5 | |

| Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Trade account payable | | | 91.5 | | | | 347.8 | | | | 339.3 | | | | 316.2 | | | | 267.6 | | | | 205.1 | |

| Loans | | | 21.8 | | | | 83.0 | | | | 27.2 | | | | 29.3 | | | | 2.0 | | | | 1,620.1 | |

Salaries and social security taxes | | | 31.2 | | | | 118.4 | | | | 94.8 | | | | 59.9 | | | | 51.4 | | | | 34.1 | |

| Taxes | | | 36.9 | | | | 140.3 | | | | 111.0 | | | | 84.6 | | | | 62.2 | | | | 67.9 | |

| Other liabilities | | | 2.1 | | | | 8.0 | | | | 10.5 | | | | 9.7 | | | | 26.4 | | | | 175.8 | |

| Accrued litigation | | | 16.5 | | | | 62.8 | | | | 52.8 | | | | 39.9 | | | | 25.9 | | | | 18.3 | |

| Total current liabilities | | U.S.$ | 200.0 | | | Ps. | 760.3 | | | Ps. | 635.6 | | | Ps. | 539.6 | | | Ps. | 435.6 | | | Ps. | 2,121.3 | |

| Non-current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Trade account payable | | | 12.3 | | | | 46.8 | | | | 40.2 | | | | 35.5 | | | | 31.3 | | | | 26.8 | |

| Loans | | | 186.2 | | | | 707.5 | | | | 913.1 | | | | 949.1 | | | | 1,095.5 | | | | — | |

Salaries and social security taxes | | | 11.5 | | | | 43.7 | | | | 40.1 | | | | 24.7 | | | | 20.3 | | | | 12.4 | |

| Taxes | | | 2.5 | | | | 9.4 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Other liabilities | | | 160.7 | | | | 610.8 | | | | 369.0 | | | | 281.4 | | | | 241.1 | | | | — | |

| Accrued Litigation | | | 2.7 | | | | 10.0 | | | | 45.1 | | | | 42.8 | | | | 40.6 | | | | 38.7 | |

Total non-current liabilities | | | 375.9 | | | | 1,428.2 | | | | 1,407.5 | | | | 1,333.5 | | | | 1,428.7 | | | | 77.8 | |

| Total liabilities | | U.S.$ | 575.9 | | | Ps. | 2,188.5 | | | Ps. | 2,043.0 | | | Ps. | 1,873.0 | | | Ps. | 1,864.3 | | | Ps. | 2,199.2 | |

| Shareholders’ equity | | | 574.3 | | | | 2,182.2 | | | | 2,091.6 | | | | 1,974.6 | | | | 1,670.4 | | | | 1,377.3 | |

| Total liabilities and shareholders’ equity | | U.S.$ | 1,150.2 | | | Ps. | 4,370.7 | | | Ps. | 4,134.6 | | | Ps. | 3,847.6 | | | Ps. | 3,534.7 | | | Ps. | 3,576.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets | | U.S.$ | 185.1 | | | Ps. | 703.3 | | | Ps. | 666.7 | | | Ps. | 536.7 | | | Ps. | 547.0 | | | Ps. | 728.8 | |

| Property, plant and equipment, net | | | 934.8 | | | | 3,552.4 | | | | 3,331.2 | | | | 3,175.7 | | | | 3,016.4 | | | | 3,009.7 | |

| Other non-current assets | | | 68.5 | | | | 260.4 | | | | 258.4 | | | | 346.6 | | | | 201.5 | | | | 145.5 | |

| Total assets | | U.S.$ | 1,188.4 | | | Ps. | 4,516.1 | | | Ps. | 4,256.3 | | | Ps. | 4,059.0 | | | Ps. | 3,764.9 | | | Ps. | 3,884.0 | |

| Current liabilities | | U.S.$ | 208.1 | | | Ps. | 790.9 | | | Ps. | 707.5 | | | Ps. | 573.7 | | | Ps. | 470.0 | | | | Ps 2,124.8 | |

| Non-current liabilities | | | 506.3 | | | | 1,923.8 | | | | 1,821.6 | | | | 2,018.2 | | | | 2,225.1 | | | | 640.3 | |

| Total liabilities | | | 714.4 | | | | 2,714.7 | | | | 2,529.1 | | | | 2,591.9 | | | | 2,695.1 | | | | 2,765.1 | |

| Shareholders’ equity | | | 474.1 | | | | 1,801.4 | | | | 1,727.2 | | | | 1,467.1 | | | | 1,069.8 | | | | 1,118.8 | |

| Total liabilities and shareholders’ equity | | U.S.$ | 1,188.4 | | | Ps. | 4,516.1 | | | Ps. | 4,256.3 | | | Ps. | 4,059.0 | | | Ps. | 3,764.9 | | | Ps. | 3,884.0 | |

| | | Year ended December 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | (in millions) | |

| Cash flow data | | | | | | | | | | | | | | | | | | |

| Argentine GAAP | | | | | | | | | | | | | | | | | | |

| Operating activities: | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | U.S.$ | 23.8 | | | Ps. | 90.6 | | | Ps. | 123.1 | | | Ps. | 122.5 | | | Ps. | 293.1 | | | Ps. | (149.6 | ) |

| Adjustment to reconcile net income (loss) to net cash flows provided by (used in) operating activities: | | | | | | | | | | | | | | | | | | | |

| Depreciation of property, plant and equipment | | | 46.2 | | | | 175.4 | | | | 170.3 | | | | 174.4 | | | | 179.0 | | | | 178.4 | |

| Retirement of property, plant and equipment | | | 0.7 | | | | 2.8 | | | | 1.9 | | | | 1.1 | | | | 0.7 | | | | 0.9 | |

| Gain on extinguishment of former debt | | | — | | | | — | | | | — | | | | — | | | | (179.2 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain from investments in affiliated parties | | | — | | | | — | | | | — | | | | (0.1 | ) | | | (0.1 | ) | | | — | |

| Loss (Gain) from investments | | | 6.9 | | | | 26.4 | | | | (4.3 | ) | | | (8.5 | ) | | | — | | | | — | |

| Adjustment to present value of notes | | | 1.4 | | | | 5.2 | | | | 8.5 | | | | 21.5 | | | | (57.1 | ) | | | — | |

| (Gain) Loss from the purchase and redemption of notes | | | (21.4 | ) | | | (81.4 | ) | | | (93.6 | ) | | | 10.2 | | | | — | | | | — | |

| Adjustment to present value of the repurchased and redeemed notes | | | — | | | | — | | | | — | | | | 8.6 | | | | — | | | | — | |

| Exchange differences, interest and penalties on loans | | | 47.0 | | | | 178.6 | | | | 232.7 | | | | 69.5 | | | | 49.1 | | | | 139.0 | |

| Supplies recovered from third parties | | | — | | | | — | | | | — | | | | — | | | | (5.8 | ) | | | — | |

| Increase in trade receivables due to the unbilled portion of the retroactive tariff increase | | | — | | | | — | | | | — | | | | (171.3 | ) | | | — | | | | — | |

| Recovery of the accrual for tax contingencies | | | (9.3 | ) | | | (35.5 | ) | | | — | | | | — | | | | — | | | | — | |

| Income tax | | | 20.9 | | | | 79.3 | | | | 61.2 | | | | 125.0 | | | | (167.2 | ) | | | — | |

| Allowance for doubtful accounts | | | 3.5 | | | | 13.5 | | | | 17.1 | | | | — | | | | — | | | | — | |

| Reversal of the allowance for doubtful accounts | | | (7.1 | ) | | | (26.9 | ) | | | (24.0 | ) | | | — | | | | — | | | | — | |

| Allowance for other doubtful accounts | | | 0.9 | | | | 3.3 | | | | 1.7 | | | | — | | | | — | | | | — | |

| Adjustment to net present value of the retroactive tariff increase arising from the application of the new electricity rate schedule and of the Payment Plan Agreement with the Province of Buenos Aires | | | (0.9 | ) | | | (3.4 | ) | | | (13.5 | ) | | | 29.6 | | | | — | | | | — | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Decrease (Increase) in trade receivables (net of the unbilled portion of the retroactive tariff increase) | | | 12.7 | | | | 48.1 | | | | (49.5 | ) | | | (36.9 | ) | | | (39.0 | ) | | | (37.1 | ) |

| Net decrease (increase) in other receivables | | | 1.4 | | | | 5.3 | | | | (33.4 | ) | | | (8.4 | ) | | | (23.1 | ) | | | (27.2 | ) |

| (Increase) Decrease in supplies | | | (1.0 | ) | | | (3.9 | ) | | | 7.4 | | | | (18.4 | ) | | | 1.4 | | | | (5.4 | ) |

| Increase in trade accounts payable | | | 4.0 | | | | 15.2 | | | | 27.8 | | | | 52.7 | | | | 67.1 | | | | 54.4 | |

| Increase in salaries and social security taxes | | | 7.2 | | | | 27.2 | | | | 50.3 | | | | 12.9 | | | | 25.2 | | | | 4.5 | |

| (Decrease) Increase in taxes | | | (15.0 | ) | | | (56.9 | ) | | | 26.4 | | | | 22.5 | | | | (5.7 | ) | | | 23.6 | |

| Increase in other liabilities | | | 62.9 | | | | 239.1 | | | | 78.1 | | | | 17.7 | | | | 91.7 | | | | 36.8 | |

| Net increase in accrued litigation | | | 2.8 | | | | 10.6 | | | | 15.1 | | | | 16.2 | | | | 9.5 | | | | 7.7 | |

| Financial interest paid, net of interest capitalized | | | (20.2 | ) | | | (76.8 | ) | | | (62.7 | ) | | | (25.5 | ) | | | (26.7 | ) | | | (46.5 | ) |

| Financial and commercial interest collected | | | 8.5 | | | | 32.2 | | | | 6.9 | | | | 11.6 | | | | 2.2 | | | | 2.0 | |

| Net cash flow provided by operating activities | | | 175.8 | | | | 668.0 | | | | 547.5 | | | | 427.2 | | | | 215.0 | | | | 181.5 | |

| Investing activities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Additions of property, plant and equipment | | | (106.4 | ) | | | (404.2 | ) | | | (325.4 | ) | | | (336.9 | ) | | | (179.7 | ) | | | (124.5 | ) |

| Net cash flow used in investing activities | | | (106.4 | ) | | | (404.2 | ) | | | (325.4 | ) | | | (336.9 | ) | | | (179.7 | ) | | | (124.5 | ) |

| Financing activities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Decrease (Increase) in current and non-current investments | | | 3.6 | | | | 13.6 | | | | (67.9 | ) | | | — | | | | — | | | | — | |

| Net Decrease in loans | | | (46.2 | ) | | | (175.4 | ) | | | (122.9 | ) | | | (203.6 | ) | | | (310.8 | ) | | | — | |

| Capital increase | | | — | | | | — | | | | — | | | | 181.8 | | | | — | | | | — | |

| Treasury Shares | | | — | | | | — | | | | (6.1 | ) | | | — | | | | — | | | | — | |

| Net cash flows used in financing activities | | | (42.6 | ) | | | (161.8 | ) | | | (196.9 | ) | | | (21.8 | ) | | | (310.8 | ) | | | — | |

| Cash variations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents at beginning of year | | U.S.$ | 33.3 | | | Ps. | 126.4 | | | Ps. | 101.2 | | | Ps. | 32.7 | | | Ps. | 308.1 | | | Ps. | 251.1 | |

| Cash and cash equivalents at end of the year | | | 60.1 | | | | 228.4 | | | | 126.4 | | | | 101.2 | | | | 32.7 | | | | 308.1 | |

| Net increase (decrease) in cash and cash equivalents | | | 26.8 | | | | 102.0 | | | | 25.2 | | | | 68.5 | | | | (275.5 | ) | | | 57.0 | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Operating data | | | | | | | | | | | | | | | |

| Argentine GAAP | | | | | | | | | | | | | | | |

| Energy sales (in GWh): | | | | | | | | | | | | | | | |

| Residential | | | 7,344 | | | | 7,545 | | | | 7,148 | | | | 6,250 | | | | 5,819 | |

| Small Commercial | | | 1,470 | | | | 1,530 | | | | 1,485 | | | | 1,433 | | | | 1,387 | |

| Medium Commercial | | | 1,565 | | | | 1,597 | | | | 1,552 | | | | 1,446 | | | | 1,354 | |

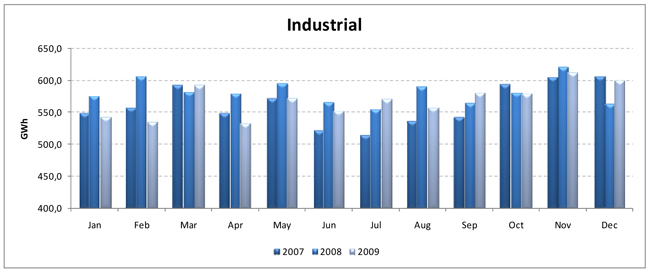

| Industrial | | | 3,204 | | | | 3,277 | | | | 3,628 | | | | 3,364 | | | | 3,195 | |

Wheeling system(1) | | | 3,622 | | | | 3,700 | | | | 3,111 | | | | 3,211 | | | | 2,984 | |

| Others: | | | | | | | | | | | | | | | | | | | | |

| Public Lighting | | | 644 | | | | 644 | | | | 643 | | | | 650 | | | | 642 | |

| Shantytowns | | | 351 | | | | 304 | | | | 301 | | | | 261 | | | | 279 | |

Others(2) | | | 19 | | | | 19 | | | | 18 | | | | 18 | | | | 17 | |

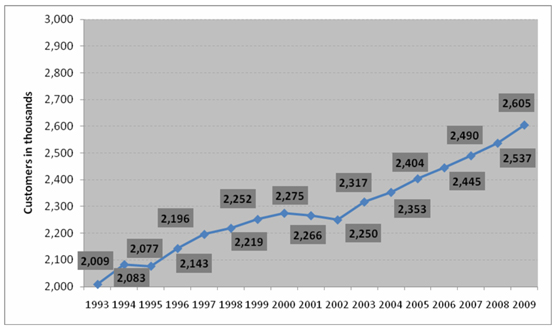

Customers (in thousands)(3) | | | 2,605 | | | | 2,537 | | | | 2,490 | | | | 2,445 | | | | 2,404 | |

| Energy losses (%) | | | 11.9 | % | | | 10.8 | % | | | 11.6 | % | | | 11.1 | % | | | 11.0 | % |

| MWh sold by employee | | | 6,936.1 | | | | 7,392.8 | | | | 7,230.6 | | | | 6,736.6 | | | | 6,395.9 | |

| Customers per employee | | | 978 | | | | 997 | | | | 998 | | | | 982 | | | | 971 | |

| (1) | Wheeling charges represent our tariffs for large users, which consist of a fixed charge for recognized technical losses and a charge for our distribution margins but exclude charges for electric power purchases, which are undertaken directly between generators and large users. |

| (2) | Represents energy consumed internally by our company and our facilities. |

| (3) | We define a customer as one meter. We may supply more than one consumer through a single meter. In particular, because we measure our energy sales to each shantytown collectively using a single meter, each shantytown is counted as a single customer. |

From April 1, 1991 until the end of 2001, the Convertibility Law established a fixed exchange rate under which the Central Bank was obliged to sell U.S. Dollars at a fixed rate of one Peso per U.S. Dollar. On January 6, 2002, the Argentine Congress enacted the Public Emergency Law, formally putting an end to the regime of the Convertibility Law and abandoning over ten years of U.S. Dollar-Peso parity. The Public Emergency Law grants the executive branch of the Argentine government the power to set the exchange rate between the Peso and foreign currencies and to issue regulations related to the foreign exchange market. The Public Emergency law has been extended until December 31, 2011. For a brief period following the end of the Convertibility Regime, the Public Emergency Law established a temporary dual exchange rate system. Since February 2002, the Peso has been allowed to float freely against other currencies.

The following table sets forth the annual high, low, average and period-end exchange rates for U.S. Dollars for the periods indicated, expressed in Pesos per U.S. Dollar at the purchasing exchange rate and not adjusted for inflation. When preparing our financial statements, we utilize the selling exchange rates for U.S. Dollars quoted by Banco Nación to translate our U.S. Dollar denominated assets and liabilities into Pesos. The Federal Reserve Bank of New York does not report a noon buying rate for Pesos.

| | | | | | | | | | | | | |

| | | (Pesos per U.S. Dollar) | |

| Year ended December 31, | | | | | | | | | | | | |

| 2005 | | | 2.86 | | | | 3.04 | | | | 2.92 | (1) | | | 3.03 | |

| 2006 | | | 3.03 | | | | 3.11 | | | | 3.07 | (1) | | | 3.06 | |

| 2007 | | | 3.06 | | | | 3.18 | | | | 3.12 | (1) | | | 3.15 | |

| 2008 | | | 3.01 | | | | 3.47 | | | | 3.16 | (1) | | | 3.45 | |

| 2009 | | | 3.45 | | | | 3.88 | | | | 3.73 | (1) | | | 3.80 | |

| | | | | | | | | | | | | | | | | |

| Month | | | | | | | | | | | | | | | | |

| December 2009 | | | 3.79 | | | | 3.82 | | | | 3.80 | (2) | | | 3.80 | |

| January 2010 | | | 3.79 | | | | 3.83 | | | | 3.80 | (2) | | | 3.83 | |

| February 2010 | | | 3.83 | | | | 3.86 | | | | 3.85 | (2) | | | 3.86 | |

| March 2010 | | | 3.86 | | | | 3.88 | | | | 3.86 | (2) | | | 3.88 | |

| April 2010 | | | 3.86 | | | | 3.89 | | | | 3.88 | (2) | | | 3.89 | |

May 2010(3) | | | 3.89 | | | | 3.91 | | | | 3.90 | (2) | | | 3.90 | |

Source: Banco Nación

| (1) | Represents the average of the exchange rates on the last day of each month during the period. |

| (2) | Average of the lowest and highest daily rates in the month. |

| (3) | Represents the corresponding exchange rates from May 1 through May 26. |

Risks related to Argentina

Overview

We are a sociedad anónima (limited liability corporation) incorporated under the laws of the Republic of Argentina and all of our revenues are earned in Argentina and all of our operations, facilities, and customers are located in Argentina. Accordingly, our financial condition and results of operations depend to a significant extent on macroeconomic and political conditions prevailing in Argentina. For example, lower economic growth or economic recession could lead to lower demand for electricity in our concession area or a decline in purchasing power of our customers, which, in turn, could lead to lower collections from our clients or growth in energy losses due to illegal use of our service. Argentine government actions concerning the economy, including decisions with respect to inflation, interest rates, price controls, foreign exchange controls and taxes, have had and could continue to have a material adverse effect on private sector entities, including us. To address Argentina’s economic crisis in 2001 and 2002, for example, the Argentine government took measures, such as the freeze of electricity distribution margins and pesification of our tariffs, which had a severe effect on our financial condition and led us to suspend payments on our financial debt. We cannot provide any assurance whether the Argentine government will adopt other policies that could adversely affect the economy or our business. In addition, we cannot provide any assurance that future economic, social and political developments in Argentina, over which we have no control, will not impair our business, financial condition or results of operations.

The global financial crisis and unfavorable credit and market conditions that commenced in 2007 have affected and could continue to negatively affect the Argentine economy and may negatively affect our liquidity, customers, business, and results of operations

The ongoing effects of the global credit crisis and related turmoil in the global financial system may have a negative impact on our business, financial condition and results of operations, an impact that is likely to be more severe on an emerging market economy, such as Argentina. The effect of this current economic crisis on our customers and on us cannot be predicted. Weak economic conditions could lead to reduced demand for energy, which could have a negative effect on our revenues. In addition, our ability to access the credit or capital markets may be restricted at a time when we would need financing, which could have an impact on our flexibility to react to changing economic and business conditions. For these reasons, any of the foregoing factors or a combination of these factors could have an adverse effect on our results of operations and financial condition and cause the market value of our ADSs to decline.

Argentina’s economic recovery since the 2001 economic crisis may not be sustainable in light of current economic conditions, and any significant decline could adversely affect our financial condition

During 2001 and 2002, Argentina went through a period of severe political, economic and social crisis. Although the economy has recovered significantly since the 2001 crisis, uncertainty remains as to the sustainability of economic growth and stability. Although Argentina’s economy continued to grow in 2009, growth occurred at a less rapid pace than in the previous six years, due to the economic slowdown that started in the last quarter of 2008 and that continued into 2009. Sustainable economic growth is dependent on a variety of factors, including international demand for Argentine exports, the stability and competitiveness of the Peso against foreign currencies, confidence among consumers and foreign and domestic investors and a stable and relatively low rate of inflation.

The Argentine economy remains fragile, as reflected by the following economic conditions:

| | · | unemployment remains high; |

| | · | the availability of long-term fixed rate credit is scarce; |

| | · | investment as a percentage of GDP remains low; |

| | · | the current fiscal surplus is at risk of becoming a fiscal deficit; |

| | · | inflation has risen recently and threatens to accelerate; |

| | · | the regulatory environment continues to be uncertain; |

| | · | the country’s public debt remains high and international financing is limited; and |

| | · | the recovery has depended to some extent on high commodity prices, which are volatile and beyond the control of the Argentine government. |

As in the recent past, Argentina’s economy may suffer if political and social pressures inhibit the implementation by the Argentine government of policies designed to maintain price stability, generate growth and enhance consumers and investor confidence. This, in turn, could lead to lower demand for our services as well as lower collection rates from clients and growth in energy losses due to illegal use of our services, which could materially adversely affect our financial condition and results of operations. Furthermore, as it has done in the past, the Argentine government could respond to a lack of economic growth or stability by adopting measures that affect private sector enterprises, including the tariff restrictions imposed on public utility companies such as several of our subsidiaries.

We cannot provide any assurance that a decline in economic growth or increased economic instability, developments over which we have no control, would not have an adverse effect on our business, financial condition or results of operations or would not have a negative impact on the market value of our ADSs and Class B common shares.

A return to a high inflation environment may have adverse effects on the Argentine economy, which could, in turn, have a material adverse effect on our results of operations

According to data published by the Instituto Nacional de Estadística y Censos (National Statistics and Census Institute, or INDEC), the rate of inflation reached 7.7% in 2009, 7.2% in 2008 and 8.5% in 2007. Over the course of the past several years, the Argentine government has implemented several programs to control inflation and monitor prices for most relevant goods and services. These government actions included price support arrangements agreed to by the Argentine government and private sector companies in several industries and markets.

Despite the relatively flat rate of change in inflation in the past two years, uncertainty surrounding future inflation and the current economic situation could slow economic recovery. In the past, inflation has materially undermined the Argentine economy and the government’s ability to create conditions that permit growth. A return to a high inflation environment would also undermine Argentina’s foreign competitiveness by diluting the effects of the Peso devaluation, with the same negative effects on the level of economic activity. In turn, a portion of the Argentine debt is adjusted by the Coeficiente de Estabilización de Referencia (Stabilization Coefficient, or CER Index), a currency index, which is strongly related to inflation. Therefore, any significant increase in inflation would cause an increase in the external debt and consequently in Argentina’s financial obligations, which could further exacerbate the stress on the Argentine economy. A high inflation environment could also temporarily undermine our results of operations as a result of a lag in cost adjustments, and we may be unable to adjust our tariffs accordingly. In addition, a return to high inflation would undermine the confidence in Argentina’s banking system in general, which would further limit the availability of domestic and international credit to businesses, which could adversely affect our ability to finance our working capital needs on favorable terms, and adversely affect our results of operations.

The credibility of several Argentine economic indices has been called into question, which may lead to a lack of confidence in the Argentine economy and may in turn limit our ability to access the credit and capital markets

In January 2007, INDEC modified its methodology used to calculate the consumer price index (CPI), which is calculated as the monthly average of a weighted basket of consumer goods and services that reflects the pattern of consumption of Argentine households. Several economists as well as the international and Argentine press have suggested that this change in methodology was related to the Argentine government’s policy aimed at curbing inflation. Further, at the time that INDEC adopted this change in methodology, the Argentine government also replaced several key personnel at INDEC. The alleged governmental interference prompted complaints from the technical staff at INDEC, which, in turn, has led to the initiation of several judicial investigations involving members of the Argentine government and aimed at determining whether there was a breach of classified statistical information relating to the collection of data used in the calculation of the CPI. These events have affected the credibility of the CPI index published by INDEC, as well as other indexes published by INDEC that require the CPI for their own calculation, including the poverty index, the unemployment index as well as the calculation of the GDP, among others. If these investigations result in a finding that the methodologies used to calculate the CPI or other INDEC indexes derived from the CPI were manipulated by the Argentine government, or if it is determined that it is necessary to correct the CPI and the other INDEC indexes derived from the CPI as a result of the methodology used by INDEC, there could be a significant decrease in confidence in the Argentine economy. With credit to emerging market nations already tenuous as a result of the global economic crisis, our ability to access credit and capital markets to finance our operations and growth in the future could be further limited by the uncertainty relating to the accuracy of the economic indices in question which could adversely affect our results of operations and financial conditions and cause the market value of our ADSs and Class B common shares to decline.

Argentina’s ability to obtain financing from international markets is limited, which may impair its ability to implement reforms and foster economic growth, and consequently, may affect our business, results of operations and prospects for growth

In 2005, Argentina restructured part of its sovereign debt that had been in default since the end of 2001. The Argentine government announced that as a result of the restructuring, it had approximately U.S. $126.6 billion in total outstanding debt remaining. Of this amount, approximately U.S. $19.5 billion correspond to defaulted bonds owned by creditors who did not participate in the restructuring of the external financial debt. Some bondholders in the United States, Italy and Germany have filed legal actions against Argentina, and holdout creditors may initiate new suits in the future. Additionally, foreign shareholders of several Argentine companies, including public utilities and a group of bondholders that did not participate in the sovereign restructuring, have filed claims totaling approximately U.S. $17.0 billion before the International Centre for Settlement of Investment Disputes (ICSID) alleging that certain government measures are inconsistent with the fair and equitable treatment standards set forth in various bilateral investment treaties to which Argentina is a party. To date, ICSID has rendered decisions against Argentina in eight of these cases, requiring the Argentine government to pay U.S. $913 million plus interest in claims and legal fees. In 2009, three groups of bondholders that declined to participate in the restructuring of the external public debt presented claims before ICSID totaling over U.S. $4.4 billion.

Argentina’s past default and its failure to restructure completely its remaining sovereign debt and fully negotiate with the holdout creditors may limit Argentina’s ability to reenter the international capital markets. Litigation initiated by holdout creditors as well as ICSID claims have resulted and may continue to result in judgments against the Argentine government which, if not paid, could prevent Argentina from obtaining credit from multilateral organizations. Judgment creditors have sought and may continue to seek attachment orders or injunctions relating to assets of Argentina that the government intended for other uses. In addition, in May 2009, a number of members of the United States Congress supported by a civil society group called the American Task Force Argentina introduced legislation that would deny foreign states in default of U.S. court judgments exceeding U.S.$100 million for more than two years, such as Argentina, access to U.S. capital markets. Although the United States Congress has not taken any significant steps towards adopting such legislation, we can make no assurance that this legislation or other political actions designed to limit Argentina’s access to capital markets will not take effect. As a result of Argentina’s default and the events that have followed it, the government may not have the financial resources necessary to implement reforms and foster economic growth, which, in turn, could have a material adverse effect on the country’s economy and, consequently, our businesses and results of operations. Furthermore, Argentina’s inability to obtain credit in international markets could have a direct impact on our own ability to access international credit markets to finance our operations and growth.

Significant fluctuations in the value of the Peso against the U.S. Dollar may adversely affect the Argentine economy, which could, in turn adversely affect our results of operations

Despite the positive effects the depreciation of the Peso in 2002 had on the export-oriented sectors of the Argentine economy, the depreciation has also had a far-reaching negative impact on a range of businesses and on individuals’ financial positions. The devaluation of the Peso had a negative impact on the ability of Argentine businesses to honor their foreign currency-denominated debt, led to very high inflation initially, significantly reduced real wages, had a negative impact on businesses whose success is dependent on domestic market demand, including public utilities and the financial industry, and adversely affected the government’s ability to honor its foreign debt obligations. If the Peso devalues significantly, all of the negative effects on the Argentine economy related to such devaluation could recur, with adverse consequences to our businesses, our results of operations and the market value of our ADSs and Class B common shares. Moreover, it would likely result in a decline in the value of our shares and ADSs as measured in U.S. Dollars.

Similarly, a substantial increase in the value of the Peso against the U.S. Dollar also presents risks for the Argentine economy, including, for example, a reduction in exports. This could have a negative effect on economic growth and employment and reduce the Argentine public sector’s revenues by reducing tax collection in real terms, all of which could have a material adverse effect on our business as a result of the weakening of the Argentine economy in general.

Government measures to address social unrest may adversely affect the Argentine economy and thereby affect our business and results of operations.

During the economic crisis in 2001 and 2002, Argentina experienced social and political turmoil, including civil unrest, riots, looting, nationwide protests, strikes and street demonstrations. Despite the economic recovery and relative stabilization since 2002, the social and political tensions and high levels of poverty and unemployment continue. Future government policies to preempt, or respond to, social unrest may include expropriation, nationalization, forced renegotiation or modification of existing contracts, suspension of the enforcement of creditors’ rights and shareholders’ rights, new taxation policies, including royalty and tax increases and retroactive tax claims, and changes in laws, regulations and policies affecting foreign trade and investment. These policies could destabilize the country, both socially and politically, and adversely and materially affect the Argentine economy.

More recently, in March 2008, the Argentine Ministry of Economy and Production announced the adoption of new taxes on exports of a number of agricultural products. The new taxes were to be calculated at incremental rates as the price for the exported products increase, and represented a significant increase in taxes on exports by the agricultural sector in Argentina. The adoption of these taxes met significant opposition from various political and economic groups with ties to the Argentine agricultural sector, including strikes by agricultural producers around the country, roadblocks to prevent the circulation of agricultural goods within Argentina and massive demonstrations in the City of Buenos Aires and other major Argentine cities. Although these measures did not pass the Argentine congress, we cannot make assurances that the Argentine government will not seek to reintroduce the export taxes or adopt other measures affecting this or other sectors of the economy (including the electricity sector) to compensate for the lost revenues associated with these taxes. These uncertainties could lead to further social unrest that could adversely affect the Argentine economy. In addition, economic distress may lead to lower demand for energy, lower collections from our clients, as well as growth of energy losses due to illegal use of our services. We may also experience increased damages to our networks as a result of protesters or illicit activity, which may increase as a result of the decline in economic conditions, all of which, in turn may have a material adverse effect on our financial condition and results of operations and the market value of our ADSs and Class B common shares.

Exchange controls, transfer restrictions and other policies of the Argentine government have limited and can be expected to continue to limit the availability of international and local credit or otherwise adversely affect our business

In 2001 and the first half of 2002, Argentina experienced a massive withdrawal of deposits from the Argentine financial system in a short period of time, which precipitated a liquidity crisis within the Argentine financial system and prompted the Argentine government to impose exchange controls and restrictions on the ability of depositors to withdraw their deposits. These restrictions have been substantially eased; however, in June 2005 the Argentine government adopted various other rules and regulations that established restrictive controls on capital inflows. See “Item 10. Additional Information—Exchange Controls.” In the event of a future shock, the Argentine government could impose further exchange controls or restrictions on the movement of capital and take other measures that could limit our ability to access international capital markets, impair our ability to make dividend payments abroad or adversely affect our business and results of operations, which may adversely affect the market value of our ADSs and Class B common shares.

In recent years a significant portion of the local demand for debt of Argentina companies has come from the private Argentine pension funds. In response to the global economic crisis, in December 2008, the Argentine Congress passed a law unifying the Argentine pension and retirement system into a system publicly administered by the Administración Nacional de la Seguridad Social (National Social Security Agency, or ANSES) and eliminating the retirement savings system previously administered by private pension funds. In accordance with the new law, private pension funds transferred all of the assets administered by them under the retirement savings system to the ANSES. It is difficult to evaluate the real impact of this measure, but after these changes the demand for local debt in Argentina has been negatively affected. A significant decrease in the demand for local debt could have an adverse impact on our ability to raise capital to refinance our indebtedness or finance capital expenditures, which may adversely affect the market value of our ADSs and Class B common shares.

The Argentine economy could be adversely affected by economic developments in other global markets

Financial and securities markets in Argentina are influenced, to varying degrees, by economic and market conditions in other global markets. Although economic conditions vary from country to country, investors’ perception of the events occurring in one country may substantially affect capital flows into and securities from issuers in other countries, including Argentina. The Argentine economy was adversely impacted by the political and economic events that occurred in several emerging economies in the 1990s, including Mexico in 1994, the collapse of several Asian economies between 1997 and 1998, the economic crisis in Russia in 1998 and the Brazilian devaluation of its currency in January 1999. In addition, Argentina continues to be affected by events in the economies of its major regional partners, including, for example, currency devaluations caused by the global economic crisis.

Furthermore, the Argentine economy may be affected by events in developed economies which are trading partners or that impact the global economy. Economic conditions and credit availability in Argentina were affected by an economic and banking crisis in the United States in 2008 and 2009. When the crisis began, major financial institutions suffered considerable losses, investor confidence in the global financial system was shaken and various financial institutions required government bailouts or ceased operations altogether. The deterioration in any area of the global economy, as well as the economic conditions in our principal regional partners, including the members of Mercosur, could have an adverse material effect on the Argentine economy and, indirectly, on our business, financial condition and results of operations.

Risks relating to the electricity distribution sector

The Argentine government has intervened in the electricity sector in the past, and is likely to continue intervening

To address the Argentine economic crisis in 2001 and 2002, the Argentine government adopted the Public Emergency Law and other resolutions, which made a number of material changes to the regulatory framework applicable to the electricity sector. These changes, which severely affected electricity distribution companies, included the freezing of distribution margins, the revocation of adjustment and inflation indexation mechanisms and a limitation on charging our customers the increases of certain regulatory charges. In addition, a new price-setting mechanism was introduced in the wholesale electricity market, which had a significant impact on electricity generators and has led to significant price mismatches between participants in our market. The Argentine government continues to intervene in this sector, including granting temporary margin increases, proposing a new social tariff regime for residents of poverty-stricken areas, creating specific charges to raise funds that are transferred to government-managed trust funds that finance investments in distribution infrastructure and mandating investments for the construction of new generation plants and the expansion of existing transmission and distribution networks. We cannot make assurances that these or other measures that may be adopted by the Argentine government will not have a material adverse effect on our business and results of operations or on the market value of our ADSs and Class B common shares or that the Argentine government will not adopt emergency legislation similar to the Public Emergency Law, or other similar resolutions, in the future that may further increase our regulatory obligations, including increased taxes, unfavorable alterations to our tariff structures and other regulatory obligations, compliance with which would increase our costs and have a direct negative impact on our results of operations.

Electricity distributors were severely affected by the emergency measures adopted during the economic crisis, many of which remain in effect

Distribution tariffs include a regulated margin that is intended to cover the costs of distribution and provide an adequate return over the distributor’s asset base. Under the Convertibility regime, distribution tariffs were calculated in U.S. Dollars and distribution margins were adjusted periodically to reflect variations in U.S. inflation indexes. Pursuant to the Public Emergency Law, in January 2002 the Argentine government froze all distribution margins, revoked all margin adjustment provisions in distribution concessions and converted distribution tariffs into Pesos at a rate of Ps. 1.00 per U.S. $1.00. These measures, coupled with the effect of high inflation and the devaluation of the Peso, led to a decline in distribution revenues in real terms and an increase of distribution costs in real terms, which could no longer be recovered through adjustments to the distribution margin. This situation, in turn, led many public utility companies, including us and other important distribution companies, to suspend payments on their financial debt (which continued to be denominated in U.S. Dollars despite the pesification of revenues), which effectively prevented these companies from obtaining further financing in the domestic or international credit markets and making additional investments. Although the Argentine government has recently granted temporary relief to some distribution companies, including an increase in distribution margins and a temporary cost adjustment mechanism, distribution companies are currently involved in discussions with regulators on additional, permanent measures needed to adapt the current tariff scheme to the post-crisis situation of this sector. We cannot make assurances that these measures will be adopted or implemented or that, if adopted, they will be sufficient to address the structural problems created for our company by the economic crisis and its aftermath.

Electricity demand has grown significantly in recent periods and may be affected by recent or future tariff increases, which could lead distribution companies, such as us, to record lower revenues

During the 2001 economic crisis, electricity demand in Argentina decreased due to the decline in the overall level of economic activity and the deterioration in the ability of many consumers to pay their electricity bills. Despite the decline in the electricity demand registered in 2009, in the years following the economic crisis of 2001 electricity demand has experienced significant growth, increasing an estimated average of approximately 5.8% per annum from 2003 through 2008. This increase in demand reflects the relative low cost, in real terms, of electricity to consumers due to the freeze of distribution margins and the elimination of the inflation adjustment provisions in distribution concessions coupled with the devaluation of the Peso and inflation. The executive branch of the Argentine government granted temporary increases in distribution margins, and we are currently negotiating further increases and adjustments to our tariff schemes with the Argentine government. Although the increases in electricity distribution margins, which increased the cost of electricity to residential customers, have not had a significant negative effect on demand, we cannot make any assurances that these increases or any future increases in the relative cost of electricity (including increases on tariffs for residential users) will not have a material adverse effect on electricity demand or a decline in collections from customers which, in turn, may lead electricity distribution companies, such as us, to record lower revenues and results of operations than currently anticipated, and may have a material adverse effect on the market value of our ADSs and Class B common shares.

Energy shortages may act as a brake on growing demand for electricity and disrupt distribution companies’ ability to deliver electricity to their customers, which could result in customer claims and material penalties imposed on these companies

In recent years, the condition of the Argentine electricity market has provided little incentive to generators to further invest in increasing their generation capacity, which would require material long-term financial commitments. As a result, Argentine electricity generators are currently operating at near full capacity and could be required to ration supply in order to meet a national energy demand that exceeds the current generation capacity. In addition, the economic crisis and the resulting emergency measures had a material adverse effect on other energy sectors, including oil and gas companies, which has led to a significant reduction in natural gas supplies to generation companies that use this commodity in their generation activities. In an attempt to address this situation, in September 2006 the Argentine government adopted measures requiring large industrial users to limit their energy consumption to their “base demand” (equal to their demand in 2005) and to secure any additional energy needs in excess of their base demand from sources other than the national grid. Large users that do not comply with these measures can be subject to penalties imposed by the Argentine government. These measures, however, have not led to a significant reduction in demand by these users, despite requests from, and penalties imposed by, the Argentine government. As a result, electricity generators may not to be able to guarantee the supply of electricity to distribution companies, which, in turn, could prevent these companies, including our company, from experiencing continued growth in their businesses and could lead to failures to provide electricity to customers. Under Argentine law, distribution companies are responsible to their customers for any disruption in the supply of electricity. As a result, distribution companies may face customer claims and fines and penalties for disruptions caused by energy shortages unless the relevant Argentine authorities determine that energy shortages constitute force majeure. To date, the Argentine authorities have not been called upon to decide under which conditions energy shortages may constitute force majeure. In the past, however, the Argentine authorities have recognized the existence of force majeure only in limited circumstances, such as internal malfunctions at the customer’s facilities, extraordinary meteorological events (such as major storms) and third party work in public thoroughfares. We cannot make assurances that we will not experience a lack of energy supply that could adversely affect our business, financial condition and results of operations.

Risks relating to our business

Our business and prospects depend on our ability to negotiate further improvements to our tariff structure, including increases in our distribution margin

We are currently engaged in a Revisión Tarifaria Integral (integral tariff revision process, or RTI) with the ENRE. The goal of the RTI is to achieve a comprehensive revision of our tariff structure, including further increases in our distribution margins and periodic adjustments based on changes in our cost base, to provide us with an adequate return on our asset base. Although we believe the RTI will result in a new tariff structure, we cannot make assurances that the RTI will conclude in a timely manner or at all, or that the new tariff structure will effectively cover all of our costs and provide us with an adequate return on our asset base. Moreover, the RTI could result in the adoption of an entirely new regulatory framework for our business, with additional terms and restrictions on our operations and the imposition of mandatory investments. We also cannot predict whether a new regulatory framework will be implemented and what terms or restrictions could be imposed on our operations. If we are not successful in achieving a satisfactory renegotiation of our tariff structure, our business, financial condition and results of operations may be materially adversely affected and the value of our Class B common shares and ADSs may decline.

We may not be able to adjust our tariffs to reflect increases in our distribution costs in a timely manner, or at all, which may have a material adverse effect on our results of operations

The Adjustment Agreement currently contemplates a cost adjustment mechanism for the transition period during which the RTI is being conducted. This mechanism, known as the Cost Monitoring Mechanism (CMM), requires the ENRE to review our actual distribution costs every six months (in May and November of each year) and adjust our distribution margins to reflect variations of 5% or more in our distribution cost base. We may also request that the ENRE apply the CMM at any time that the variation in our distribution cost base is at least 10% or more. Any adjustments, however, are subject to the ENRE’s assessment of variations in our costs, and we cannot guarantee that the ENRE will approve adjustments that are sufficient to cover our actual incremental costs. In the past, even when the ENRE has approved adjustments to our tariffs, there has been a lag from when we actually experience increases in our distribution costs and when we receive increased revenues following the corresponding adjustments to our distribution margins pursuant to the CMM. Despite the adjustment we were granted under the CMM in October 2007 and July 2008, we cannot make assurances that we will receive similar adjustments in the future. As of the date of this annual report we have requested four increases under the CMM that are still subject to ENRE´s review. If we are not able to recover all of these incremental costs or there is a significant lag time between when we incur the incremental costs and when we receive increased revenues, we may experience a decline in our results of operations, which may have a material adverse effect on the value of our ADSs and Class B common shares.

Our tariff adjustments may be subject to challenge by Argentine consumer and other groups

In November 2006, two Argentine consumer associations, Asociación Civil por la Igualdad y la Justicia (Civil Association for Equality and Justice, or ACIJ) and Consumidores Libres Cooperativa Limitada de Provisión de Servicios de Acción Comunitaria (Consumers’ Cooperative for Community Action), brought an action against us and the Argentine government before a federal administrative court seeking to block the ratification of the adjustment of our tariffs on the grounds that the approval mechanism was unconstitutional. Because the court dismissed these claims and ruled in our favor, in April 2008, the ACIJ filed another complaint challenging the procedures utilized by the Argentine congress in approving these adjustments. In addition, in January 2009, the defensor del pueblo (Public Ombudsman) filed a complaint opposing the October 2008 adjustment to our tariffs, and naming us as a third-party defendant. On January 27, 2009, the ENRE notified us of a preliminary injunction, as a result of the Ombudsman’s claim, pursuant to which we were ordered to refrain from cutting the energy supply to customers challenging the October 2008 tariff increase until a decision is reached with respect to the claim. We and the Argentine government have appealed the injunction several times, the resolution of which is still pending as of the date of this annual report. See “Item 8. Financial Information—Legal Proceedings—Distribution—Proceedings challenging the renegotiation of our concession.” We cannot make assurances regarding how these complaints will be resolved nor can we make assurances that other actions or requests for injunctive relief will not be brought by these or other groups seeking to reverse the adjustments we have obtained or to block any further adjustments to our distribution tariffs. If these legal challenges are successful and prevent us from implementing tariff adjustments granted by the Argentine government, we could face a decline in collections from distribution customers, and a decline in our results of operations, which may have a material adverse effect on our financial condition and the market value of our ADSs and our Class B common shares.

We have been, and may continue to be, subject to fines and penalties that could have a material adverse effect on our results of operations

We operate in a highly regulated environment and have been and in the future may continue to be subject to significant fines and penalties by regulatory authorities, including for reasons outside our control, such as service disruptions attributable to problems at generation facilities or in the transmission network that result in a lack of electricity supply. After 2001, the amount of fines and penalties imposed on our company has increased significantly, which we believe is mainly due to the economic and political environment in Argentina following the recent economic crisis. Although the Argentine government has agreed to forgive a significant portion of our accrued fines and penalties pursuant to the Adjustment Agreement and to allow us to repay the remaining balance over time, this forgiveness and repayment plan is subject to a number of conditions, including compliance with quality of service standards, reporting obligations and required capital investments. As of December 31, 2009, our accrued fines and penalties totaled Ps. 377.5 million (taking into account our adjustment to fines and penalties following the ratification of the Adjustment Agreement). If we fail to comply with any of these requirements, the Argentine government may seek to obtain payment of these fines and penalties by our company. In addition, we cannot make assurances that we will not incur material fines in the future, which could have a material adverse effect on our results of operations.

If we are unable to control our energy losses, our results of operations could be adversely affected

Our concession does not allow us to pass through to our customers the cost of additional energy purchased to cover any energy losses that exceed the loss factor contemplated by our concession, which is, on average, 10%. As a result, if we experience energy losses in excess of those contemplated by our concession, we may record lower operating profits than we anticipate. Prior to the economic crisis in 2001, we had been able to reduce the high level of energy losses experienced at the time of the privatization to the levels contemplated (and reimbursed) under our concession. However, during the economic crisis and during the year ended December 31, 2009, our level of energy losses, particularly our non-technical losses, started to grow again, in part as a result of the increase in poverty levels and, with it, the number of delinquent accounts and fraud. Our energy losses amounted to 11.9% in 2009. We cannot make assurances that our energy losses will not grow in future periods, which may lead us to have lower margins and could adversely affect our results of operations and financial condition.

The Argentine government could foreclose its pledge over our Class A shares under certain circumstances, which could have a material adverse effect on our business and financial condition

Pursuant to our concession and the provisions of the Adjustment Agreement, the Argentine government will have the right to foreclose its pledge over our Class A shares and sell these shares to a third party buyer if:

| | · | the fines and penalties we incur in any given year exceed 20% of our gross energy sales, net of taxes (which corresponds to our energy sales); |

| | · | we repeatedly and materially breach our concession and do not remedy these breaches upon the request of the ENRE; |

| | · | our controlling shareholder, EASA, creates any lien or encumbrance over our Class A shares (other than the existing pledge in favor of the Argentine government); |

| | · | we or EASA obstruct the sale of Class A shares at the end of any management period under our concession; |

| | · | EASA fails to obtain the ENRE’s approval in connection with the disposition of our Class A shares; |

| | · | our shareholders amend our articles of incorporation or voting rights in a way that modifies the voting rights of the Class A shares without the ENRE’s approval; or |

| | · | EASA does not desist from its ICSID claims against the Argentine government following completion of the RTI and the approval of a new tariff regime. |

In 2009, the fines and penalties imposed on us by the ENRE amounted to Ps. 58.5 million, which represented 2.8% of our energy sales. See “Item 4. Information on the Company—Our concession—Fines and penalties.”