UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

Commission File number: 001-33422

Empresa Distribuidora y Comercializadora Norte S.A.

(Exact name of registrant as specified in its charter)

| Distribution and Marketing Company of the North S.A. | Argentine Republic |

| (Translation of registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Avenida Del Libertador 6363

Ciudad de Buenos Aires, C1428ARG

Buenos Aires, Argentina

(Address of principal executive offices)

Ivana Del Rossi Tel.: +54 11 4346 5127 / Fax: +54 11 4346 5325

Avenida Del Libertador 6363 (C1428ARG)

Buenos Aires, Argentina Investor Relations Officer |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered |

| Class B Common Shares | New York Stock Exchange, Inc.* |

American Depositary Shares, or ADSs, evidenced by American

Depositary Receipts, each representing 20 Class B Common Shares | New York Stock Exchange, Inc. |

| | |

| * | Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:N/A

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:462,292,111 Class A Common Shares, 442,210,385 Class B Common Shares and 1,952,604 Class C Common Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YesoNoþ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Sections 13 or 15(d) of the Securities Exchange Act of 1934. Yeso Noþ

Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yesþ Noo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filero | Accelerated filerþ | Non-accelerated filero |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAPo | International Financial Reporting Standards as issued by the International Accounting Standards Boardo | Otherþ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17o Item 18þ

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yeso Noþ

| Item 1. | Identity of Directors, Senior Management and Advisors | 1 |

| Item 2. | Offer Statistics and Expected Timetable | 1 |

| Item 3. | Key Information | 1 |

| Item 4. | Information on the Company | 25 |

| Item 4A. | Unresolved Staff Comments | 72 |

| Item 5. | Operating and Financial Review and Prospects | 72 |

| Item 6. | Directors, Senior Management and Employees | 118 |

| Item 7. | Major Shareholders and Related Party Transactions | 130 |

| Item 8. | Financial Information | 134 |

| Item 9. | The Offer and Listing | 138 |

| Item 10. | Additional Information | 141 |

| Item 11. | Quantitative and Qualitative Disclosures about Market Risk | 169 |

| Item 12. | Description of Securities Other than Equity Securities | 170 |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 172 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 172 |

| Item 15. | Controls and Procedures | 172 |

| Item 16A. | Audit Committee Financial Expert | 173 |

| Item 16B. | Code of Ethics | 173 |

| Item 16C. | Principal Accountant Fees and Services | 174 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 174 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 174 |

| Item 16F. | Change in Registrant’s Certifying Accountant | 174 |

| Item 16G. | Corporate Governance | 174 |

| Item 16H. | Mine Safety Disclosures | 178 |

| Item 17. | Financial Statements | 179 |

| Item 18. | Financial Statements | 179 |

| Item 19. | Exhibits | 179 |

| Index to Financial Statements | F-1 |

PART I

| Item 1. | Identity of Directors, Senior Management and Advisors |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

In this annual report, except as otherwise specified, references to “we”, “us”, “our” and “the Company” are references to (i) Empresa Distribuidora y Comercializadora Norte S.A., or “Edenor”, on a standalone basis prior to March 1, 2011, (ii) Edenor, Empresa Distribuidora Eléctrica Regional S.A. (“Emdersa”) and Aeseba S.A. (“Aeseba”) when references are made to information as of any date within the period between March 1, 2011 and December 31, 2011 and (iii) Edenor and Aeseba as of each date after December 31, 2011. References to Edenor, Emdersa and/or Aeseba on a standalone basis are made by naming each company as the case may be.Our financial statements as of December 31, 2011, include the financial data of Emdersa, Aeseba and Empresa Distribuidora Eléctrica Regional Holding S.A. (“Emdersa Holding”). For more information, see “Item 4—Information on the Company—History and Development of the Company.”

FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements, principally under the captions “Item 3. Key Information—Risk factors,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting our business. Forward-looking statements may also be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. Many important factors, in addition to those discussed elsewhere in this annual report, could cause our actual results to differ materially from those expressed or implied in our forward-looking statements, including, among other things:

| · | the outcome and timing of the integral tariff revision process (Revisión TarifariaIntegral or “RTI”) and, more generally, uncertainties relating to future government approvals to increase or adjust our tariffs; |

| · | general political, economic, social, demographic and business conditions in the Republic of Argentina, or“Argentina” and particularly in the geographic market we serve; |

| · | the impact of regulatory reform and changes in the regulatory environment in which we operate; |

| · | potential disruption or interruption of our service; |

| · | restrictions on the ability to exchange Pesos into foreign currencies or to transfer funds abroad; |

| · | the revocation or amendment of our concession by the granting authority; |

| · | our ability to implement our capital expenditure plan, including our ability to arrange financing when required and on reasonable terms; |

| · | fluctuations in exchange rates, including a devaluation of the Peso; |

| · | the impact of high rates of inflation on our costs; |

| · | the successful integration of Aeseba; |

| · | our ability to access to financing under reasonable terms; |

| · | the successful sale of Edelar and Edesa; and |

| · | additional matters identified in “Risk factors”. |

Forward-looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or to revise any forward-looking statements after we file this annual report because of new information, future events or other factors. In light of these limitations, undue reliance should not be placed on forward-looking statements contained in this annual report.

SELECTED FINANCIAL DATA

The following table presents selected financial and operating data. This information should be read in conjunction with our audited consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report.

The financial data as of December 31, 2011 and 2010 and for each of the three years in the period ended December 31, 2011 are derived from our audited consolidated financial statements, which were audited by Price Waterhouse & Co. S.R.L. (“PWC”), member firm of PricewaterhouseCoopers network, whose report dated April 26, 2012 is included elsewhere herein. See Item 18 – “Financial Statements.” We have prepared our annual financial statements for the fiscal year ended December 31, 2011 included herein, assuming that we will continue as a going concern. Our independent auditors, PWC, issued a report dated April 26, 2012 on our financial statements as of and for the years ended December 31, 2011 and 2010, which contains an explanatory paragraph expressing substantial doubt as to our ability to continue as a going concern. As discussed in Notes 2 and 8.C to the financial statements, the delays in obtaining tariff increases, recognition of cost adjustments requested by the Company in accordance with the terms of the Adjustment Agreement and the continuous increase in operating expenses have affected significantly the economic and financial position of the Company and have raised substantial doubt with respect to our ability to continue as a going concern. Management's plans in response to these matters are also described in Note 2. However, our financial statements as of and for the year ended December 31, 2011 and 2010 do not include any adjustments or reclassifications that might result from the outcome of this uncertainty. See Item 3: “Key Information-Risk Factors - Risks Relating to Our Business - Failure or delay to negotiate further improvements to our tariff structure, including increases in our distribution margin, and/or to have our tariff adjusted to reflect increases in our distribution costs in a timely manner, could have a material adverse effect on our capacity to perform our financial and commercial obligations. As a result, there is substantial doubt with respect to the ability of the Company to continue as a going concern.” See Item 18: “Financial Statements.”

Our audited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in Argentina, which we refer to as Argentine GAAP and the regulations of theComisión Nacional de Valores (National Securities Commission or CNV), which differ in certain significant respects from United States Generally Accepted Accounting Principles (U.S.GAAP). Note 32 to our audited consolidated financial statements included elsewhere in this annual report provides a description of the significant differences between Argentine GAAP and U.S. GAAP, as they relate to us, and a reconciliation to United States GAAP of net (loss) income for the years then ended December 31, 2011, 2010 and 2009 and shareholders’ equity as of December 31, 2011 and 2010. In addition, note29 to our audited consolidated financial statements included elsewhere in this annual report provides a reconciliation between Argentine GAAP and IFRS of shareholders’s equity as of January 1, 2011(transition date) and December 31, 2011 and of net (loss) for the year ended December 31, 2011.

Our financial statements as of December 31, 2011,include the financial data of Emdersa, Aeseba and Emdersa Holding. The incorporation of Aeseba, including its subsidiary, Empresa Distribuidora de Energía Norte S.A., an electricity distribution company with the concession area in the northern part of the Province of Buenos Aires (“Eden”), was made on the basis of the general method ofline itemconsolidation, which is established in Technical Resolution No. 21 issued by theArgentine Federation of Professional Councils in Economic Sciences (the “FACPCE”). Furthermore, as of December 31, 2011, in accordance with the decision of the Board of Directors to divest and sell the subsidiaries of Emdersa and Emdersa Holding,including Empresa Distribuidora de San Luis S.A. (“Edesal”), Empresa Distribuidora de La Rioja S.A. (“Edelar”), Empresa Distribuidora de Salta S.A. (“Edesa”) and Emdersa Generación Salta S.A. (“Egssa”), we have classified these assets in the consolidated financial statements as of December 31,2011 as “Otherassets available for sale”. The corresponding charges to results have been included line by line inour consolidated statements of operations for the year ended December 31, 2011.

In this annual report, except as otherwise specified, references to “$”, “U.S. $” and “Dollars” are to U.S. Dollars, and references to “Ps. ” and “Pesos” are to Argentine Pesos. Solely for the convenience of the reader, Peso amounts as of and for the year ended December 31, 2011 have been translated into U.S. Dollars at the buying rate for U.S. Dollars quoted by Banco de la Nación Argentina (Banco Nación) on December 31, 2011 of Ps. 4.304 to U.S. $1.00. The U.S. Dollar equivalent information should not be construed to imply that the Peso amounts represent, or could have been or could be converted into, U.S. Dollars at such rates or any other rate. See “Item 3. Key Information—Exchange Rates.”

Under Argentine GAAP, we generally are not required to record the effects of inflation in our financial statements. However, because Argentina experienced a high rate of inflation in 2002, with the wholesale price index increasing by approximately 118%, we were required by Decree No. 1269/2002 and CNV Resolution No. 415/2002 to restate our financial statements in constant Pesos in accordance with Argentine GAAP. On March 25, 2003, Decree No. 664/2003 rescinded the requirement that financial statements be prepared in constant currency, effective for financial periods on or after March 1, 2003. As a result, we are not required to restate and have not restated our financial statements for inflation after February 28, 2003. See note 2 to our audited consolidated financial statements included in this annual report. In connection with the adoption of IFRS and in accordance with General Resolution No 562/09 of the CNV, we have elected to recognize a deferred tax liability related to the effect of inflation on the value of other fixed assets. This adjustment has been recorded with impact in our accumulated deficit. At the 2012 shareholders’ meeting, we expect that our shareholders will resolve to reclassify this adjustment within equity, as required by the resolution of the CNV.

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals may not sum due to rounding.

| | | 2011(*) | | | 2011(*) | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Statement of operations data | | (in millions, except for per share and per ADS data) | | | |

| Argentine GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | U.S. $ | 828.3 | | | Ps. | 3,565.0 | | | Ps. | 2,173.6 | | | Ps. | 2,077.9 | | | Ps. | 2,000.2 | | | Ps. | 1,981.9 | |

| Electric power purchases | | | (370.3 | ) | | | (1,593.9 | ) | | | (1,069.7 | ) | | | (1,003.4 | ) | | | (934.7 | ) | | | (889.9 | ) |

| Gross margin | | | 458.0 | | | | 1,971.1 | | | | 1,103.9 | | | | 1,074.5 | | | | 1,065.5 | | | | 1,092.0 | |

| Transmission and distribution expenses | | | (276.2 | ) | | | (1,188.7 | ) | | | (636.3 | ) | | | (548.6 | ) | | | (497.9 | ) | | | (417.6 | ) |

| Selling expenses | | | (99.9 | ) | | | (429.9 | ) | | | (194.2 | ) | | | (159.0 | ) | | | (126.0 | ) | | | (120.6 | ) |

| Administrative expenses | | | (75.1 | ) | | | (323.4 | ) | | | (178.9 | ) | | | (144.0 | ) | | | (138.7 | ) | | | (124.7 | ) |

| Subtotal | | | 6.7 | | | | 29.0 | | | | 94.5 | | | | 222.9 | | | | 302.9 | | | | 429.2 | |

| Gain (loss) in permanent investments | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Negative Goodwill amortization(1) | | | 2.9 | | | | 12.3 | | | | — | | | | — | | | | — | | | | — | |

| Result from valuation of other assets available for sale at NRV(8) | | | (17.4 | ) | | | (75.0 | ) | | | — | | | | — | | | | — | | | | — | |

| Subtotal | | | (7.8 | ) | | | (33.7 | ) | | | 94.5 | | | | 222.9 | | | | 302.9 | | | | 429.2 | |

| Other (expenses) income , net | | | (5.9 | ) | | | (25.3 | ) | | | (9.8 | ) | | | 23.3 | | | | (29.8 | ) | | | 1.0 | |

| Financial income (expenses) and holding gains (losses): | | | | | | | | | | | | | | | | | | | | | | | | |

| Generated by assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange difference | | | 4.2 | | | | 18.0 | | | | 7.4 | | | | 21.4 | | | | 8.1 | | | | (0.9 | ) |

| Interest | | | 5.7 | | | | 24.4 | | | | 28.4 | | | | 16.2 | | | | 9.8 | | | | 13.4 | |

| Holding results | | | (0.3 | ) | | | (1.2 | ) | | | (14.7 | ) | | | 37.6 | | | | (7.3 | ) | | | 0.1 | |

| Taxes and sundry expenses(2) | | | (7.0 | ) | | | (30.1 | ) | | | (16.0 | ) | | | (13.4 | ) | | | — | | | | — | |

| Others | | | (0.6 | ) | | | (2.4 | ) | | | — | | | | — | | | | — | | | | — | |

| Generated by liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial expenses | | | (6.0 | ) | | | (25.7 | ) | | | (12.5 | ) | | | (11.7 | ) | | | (10.0 | ) | | | (21.0 | ) |

| Exchange difference | | | (25.1 | ) | | | (108.1 | ) | | | (40.3 | ) | | | (99.1 | ) | | | (92.7 | ) | | | (29.9 | ) |

| Interest | | | (44.1 | ) | | | (189.7 | ) | | | (91.3 | ) | | | (87.7 | ) | | | (95.3 | ) | | | (74.5 | ) |

| Taxes and sundry expenses(2) | | | (5.7 | ) | | | (24.7 | ) | | | (21.1 | ) | | | (19.2 | ) | | | — | | | | — | |

| Loss for debt restructuring | | | (0.6 | ) | | | (2.7 | ) | | | — | | | | — | | | | — | | | | — | |

| Others | | | (0.5 | ) | | | (2.2 | ) | | | — | | | | — | | | | — | | | | — | |

| Adjustment to present value of the retroactive tariff increase arising from the application of the new electricity rate schedule and other receivables(3) | | | 0.3 | | | | 1.2 | | | | 11.6 | | | | 3.4 | | | | 13.5 | | | | (29.6 | ) |

| Adjustment to present value of notes(4) | | | — | | | | — | | | | (4.2 | ) | | | (5.2 | ) | | | (8.5 | ) | | | (21.5 | ) |

| Gain (Loss) from the purchase of notes(5) | | | 1.5 | | | | 6.5 | | | | (7.1 | ) | | | 81.5 | | | | 93.5 | | | | (10.2 | ) |

| Adjustment to present value of purchased notes(4) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (8.6 | ) |

| Results holdings in related companies | | | 0.2 | | | | 0.9 | | | | — | | | | — | | | | — | | | | — | |

| (Loss) Income before taxes and minority interest | | | (91.7 | ) | | | (394.7 | ) | | | (75.2 | ) | | | 170.0 | | | | 184.3 | | | | 247.4 | |

| Income tax | | | (5.2 | ) | | | (22.4 | ) | | | 26.1 | | | | (79.3 | ) | | | (61.2 | ) | | | (125.0 | ) |

| Minority interest | | | (4.2 | ) | | | (18.2 | ) | | | — | | | | — | | | | — | | | | — | |

| Net (loss) income | | U.S. $ | (101.2) | | | Ps. | (435.4) | | | Ps. | (49.1) | | | Ps. | 90.6 | | | Ps. | 123.1 | | | Ps. | 122.5 | |

| Net (loss) income per ordinary share – basic and diluted | | | (0.113 | ) | | | (0.485 | ) | | | (0.055 | ) | | | 0.101 | | | | 0.137 | | | | 0.135 | |

| Dividends declared per ordinary share(6) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net (loss) income per ADS(7)— basic and diluted | | | (2.256 | ) | | | (9.707 | ) | | | (1.095 | ) | | | 2.020 | | | | 2.745 | | | | 2.702 | |

| Number of shares outstanding | | | 897,042,600 | | | | 897,042,600 | | | | 897,042,600 | | | | 897,042,600 | | | | 897,042,600 | | | | 906,455,100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales/service revenues | | U.S. $ | 662.9 | | | Ps. | 2,853.2 | | | Ps. | 2,253.7 | | | Ps. | 2,163.3 | | | Ps. | 2,059.0 | | | Ps. | 1,937.0 | |

| Electric power purchases | | | (311.7 | ) | | | (1,341.6 | ) | | | (1,069.7 | ) | | | (1,003.4 | ) | | | (934.7 | ) | | | (889.9 | ) |

| Transmission and distribution expenses | | | (259.7 | ) | | | (1,117.8 | ) | | | (731.8 | ) | | | (624.0 | ) | | | (577.0 | ) | | | (477.5 | ) |

| Gross margin | | | 91.5 | | | | 393.9 | | | | 452.1 | | | | 535.9 | | | | 547.3 | | | | 569.6 | |

| Operating expenses, net | | | (31.7 | ) | | | (136.5 | ) | | | (372.4 | ) | | | (294.7 | ) | | | (296.6 | ) | | | (207.5 | ) |

| Net operating income (loss) | | | 59.8 | | | | 257.3 | | | | 79.7 | | | | 241.3 | | | | 250.7 | | | | 362.1 | |

| Financial (expense), net and holding gains | | | (54.9 | ) | | | (236.4 | ) | | | (134.7 | ) | | | (75.0 | ) | | | 82.0 | | | | (46.5 | ) |

| Net income (loss) before income taxes | | | 4.9 | | | | 20.9 | | | | (54.9 | ) | | | 166.3 | | | | 332.7 | | | | 315.7 | |

| Income tax | | | (37.3 | ) | | | (160.6 | ) | | | 19.2 | | | | (93.2 | ) | | | (68.2 | ) | | | (99.9 | ) |

| Less: Net gain from continued operations attributable to non-controlling interest | | | 1.4 | | | | 5.8 | | | | — | | | | — | | | | — | | | | — | |

| Net (loss) income for the year | | | (33.8 | ) | | | (145.5 | ) | | | (35.7 | ) | | | 73.1 | | | | 264.5 | | | | 215.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss from discontinued operations before income tax and non-controlling interest | | | (37.3 | ) | | | (160.4 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income tax from discontinued operations | | | 5.3 | | | | 23.0 | | | | — | | | | — | | | | — | | | | — | |

| Loss on discontinued operations attributable to Edenor shareholders’ | | | (33.5 | ) | | | (144.3 | ) | | | — | | | | — | | | | — | | | | — | |

| Less: Net gain on discontinued operations attributable to non-controlling interest | | | 1.6 | | | | 6.9 | | | | — | | | | — | | | | — | | | | — | |

| Net (loss) income under US GAAP attributable to EDENOR shareholders’ | | | (67.3 | ) | | | (289.8 | ) | | | — | | | | — | | | | — | | | | — | |

| Net gain under US GAAP attributable to non-controlling interest | | | 2.9 | | | | 12.7 | | | | — | | | | — | | | | — | | | | — | |

| Net (loss) income per ordinary share – basic and diluted | | | (0.036 | ) | | | (0.156 | ) | | | (0.040 | ) | | | 0.081 | | | | 0.295 | | | | 0.238 | |

| (Loss) Earning per share from discontinuing operations – Basic and diluted | | | (0.036 | ) | | | (0.153 | ) | | | — | | | | — | | | | — | | | | — | |

| Net (loss)income per ADS(7) — basic and diluted | | | (724.9 | ) | | | (3.120 | ) | | | (0.796 | ) | | | 1.630 | | | | 5.897 | | | | 4.761 | |

| (*) | Consolidated financial data. |

| (1) | Represents the amortization of the negative goodwill recognized as a result of the excess of the fair value of the assets acquired and liabilities assumed at the moment of the acquisition of Aeseba and Emdersa over the purchase price. |

| (2) | For the years ended December 31, 2008 and 2007, taxes on financial transactions were included in administrative expenses. For the years ended December 31, 2009, 2010 and 2011, taxes on financial transactions were included as a separate line item, as taxes and sundry expenses under financial income (expenses) and holding gains (losses) generated by assets and liabilities. |

| (3) | Reflects the adjustment to present value, as of December 31, 2011, of the retroactive portion of the tariff increase that was invoiced in 55 consecutive monthly installments,beginning in February 2007. As of December 31,2011, no amounts were due under this transaction.Also reflects, as of December 31,2010,the adjustment to present value of the retroactive portion of the tariff increase that was invoiced in 55 consecutive monthly installments,beginning in February 2007, and the adjustment to present value of Ps. 38.4 million due under the payment plan agreement with the Province of Buenos Aires that was invoiced in 18 installments, starting in January 2007. As of December 31, 2010, no amounts were due under the payment plan agreement with the Province of Buenos Aires. As of December 31, 2009 and 2008, Ps. 2.3 million was due under the payment plan agreement with the Province of Buenos Aires and Ps. 21.4 million, Ps. 69.2 million and Ps. 118.8 million of the retroactive tariff increase had been invoiced in 2010, 2009 and 2008, respectively. In accordance with Argentine GAAP, we account for these long term receivables at their net present value, which we calculate at a discount rate that reasonably reflects the market evaluation of the time value of money and specific risks, net of issuance expenses, for the retroactive tariff increase, recording the resulting non-cash charge as an adjustment to present value of this receivable. See “Item 5. Operating and Financial Review and Prospects—Factors Affecting Our Results of Operations—)Tariffs.” |

| (4) | We record our financial debt in our balance sheet at fair value reflecting our management’s best estimate of the amounts expected to be paid at each year end, calculated at a discount rate that reasonably reflects the market evaluation of the time value of money and specific risks, net of issuance expenses, for the years ended December 31, 2011, 2010, 2009, 2008 and 2007. |

| (5) | In 2007, we repurchased U.S. $43.7 million principal amount of our outstanding Fixed Rate Par Notes due 2016 and redeemed and repurchased U.S. $240 million principal amount of our outstanding Discount Notes due 2014. In the years ended December 31, 2008, 2009 and 2010, we repurchased U.S. $32.5 million, U.S. $32.2 million and U.S. $15.3 million principal amount of our outstanding Fixed Rate Par Notes due 2016, respectively, and U.S. $17.5 million, U.S. $53.8 million and U.S. $123.9 million principal amount of our outstanding Senior Notes due 2017, respectively. In addition, in the year ended December 31, 2011, we repurchased U.S. $12.7 million and U.S. $41.5 million principal amount of our outstanding Senior Notes due 2019 and Senior Notes due 2022, respectively. See “Item 5. Operating and Financial Review and Prospects—Liquidity and Capital Resources—Debt.” |

| (6) | Edenor have not declared or paid any dividends since August 14, 2001. |

| (7) | Each ADS represents 20 Class B common shares. |

| (8) | As of December 31, 2011, corresponds to investments in EMDERSA and EMDERSA HOLDING that have been valued at their estimated realizable value, which is lower than their equity value. |

| | | 2011(*) | | | 2011(*) | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | | (in millions) | | | | | |

| | | | | | | | | |

| Balance sheet data | | | | | | | | | | | | | | | | | | | | | | | | |

| Argentine GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and banks | | U.S. $ | 5.4 | | | Ps. | 23.4 | | | Ps. | 8.6 | | | Ps. | 8.7 | | | Ps. | 6.1 | | | Ps. | 3.5 | |

| Investments | | | 25.5 | | | | 109.5 | | | | 668.2 | | | | 219.7 | | | | 121.0 | | | | 97.7 | |

| Trade receivables | | | 124.2 | | | | 534.7 | | | | 421.2 | | | | 389.2 | | | | 400.5 | | | | 346.0 | |

| Other receivables | | | 56.9 | | | | 244.9 | | | | 43.4 | | | | 61.1 | | | | 42.8 | | | | 26.0 | |

| Supplies | | | 5.3 | | | | 22.9 | | | | 12.4 | | | | 14.9 | | | | 16.7 | | | | 23.2 | |

| Other assets available for sale | | | 50.3 | | | | 216.5 | | | | — | | | | — | | | | — | | | | — | |

| Total current assets | | U.S. $ | 267.7 | | | Ps. | 1,152.0 | | | Ps. | 1,153.8 | | | Ps. | 693.6 | | | Ps. | 587.1 | | | Ps. | 496.3 | |

| Non-current assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Trade receivables | | | 10.6 | | | | 45.7 | | | | 45.5 | | | | 87.0 | | | | 111.4 | | | | 100.3 | |

| Other receivables | | | 16.4 | | | | 70.7 | | | | 14.8 | | | | 88.8 | | | | 99.5 | | | | 144.1 | |

| Investments in other companies | | | 0.1 | | | | 0.4 | | | | 0.4 | | | | 0.4 | | | | 0.4 | | | | 0.4 | |

| Investments | | | — | | | | — | | | | — | | | | — | | | | 67.2 | | | | — | |

| Supplies | | | 6.2 | | | | 26.9 | | | | 23.2 | | | | 18.6 | | | | 12.8 | | | | 13.8 | |

| Property, plant and equipment | | | 1,100.9 | | | | 4,738.3 | | | | 3,689.5 | | | | 3,482.4 | | | | 3,256.3 | | | | 3,092.7 | |

| Goodwill | | | (67.3 | ) | | | (289.6 | ) | | | — | | | | — | | | | — | | | | — | |

| Total non-current assets | | U.S. $ | 1,067.0 | | | Ps. | 4,592.4 | | | Ps. | 3,773.5 | | | Ps. | 3,677.2 | | | Ps. | 3,547.6 | | | Ps. | 3,351.3 | |

| Total assets | | U.S. $ | 1,334.7 | | | Ps. | 5,744.4 | | | Ps. | 4,927.3 | | | Ps. | 4,370.7 | | | Ps. | 4,134.6 | | | Ps. | 3,847.6 | |

| Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Trade accounts payable | | | 153.0 | | | | 658.3 | | | | 378.5 | | | | 347.8 | | | | 339.3 | | | | 316.2 | |

| Loans | | | 13.7 | | | | 59.0 | | | | 54.1 | | | | 83.0 | | | | 27.2 | | | | 29.3 | |

| Salaries and social security taxes | | | 66.7 | | | | 287.1 | | | | 180.4 | | | | 118.4 | | | | 94.8 | | | | 59.9 | |

| Taxes | | | 39.3 | | | | 169.0 | | | | 111.1 | | | | 140.3 | | | | 111.0 | | | | 84.6 | |

| Other liabilities | | | 33.6 | | | | 144.8 | | | | 4.5 | | | | 8.0 | | | | 10.5 | | | | 9.7 | |

| Accrued litigation | | | 2.4 | | | | 10.3 | | | | 57.8 | | | | 62.8 | | | | 52.8 | | | | 39.9 | |

| Total current liabilities | | U.S. $ | 308.7 | | | Ps. | 1,328.6 | | | Ps. | 786.5 | | | Ps. | 760.3 | | | Ps. | 635.6 | | | Ps. | 539.6 | |

| Non-current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Trade accounts payable | | | 12.6 | | | | 54.3 | | | | 51.0 | | | | 46.9 | | | | 40.2 | | | | 35.5 | |

| Loans | | | 276.5 | | | | 1,189.9 | | | | 1,035.1 | | | | 707.5 | | | | 913.1 | | | | 949.1 | |

| Salaries and social security taxes | | | 16.2 | | | | 69.5 | | | | 50.6 | | | | 43.7 | | | | 40.1 | | | | 24.7 | |

| Taxes | | | 67.6 | | | | 290.9 | | | | 262.8 | | | | 9.4 | | | | 0 | | | | 0 | |

| Other liabilities(1) | | | 319.2 | | | | 1,373.7 | | | | 984.5 | | | | 610.8 | | | | 369.0 | | | | 281.4 | |

| Accrued litigation | | | 15.4 | | | | 66.1 | | | | 6.8 | | | | 10.1 | | | | 45.1 | | | | 42.8 | |

| Total non-current liabilities | | | 707.4 | | | | 3,044.5 | | | | 2,390.9 | | | | 1,428.3 | | | | 1,407.5 | | | | 1,333.5 | |

| Total liabilities | | U.S. $ | 1,016.0 | | | Ps. | 4,373.0 | | | Ps. | 3,177.4 | | | Ps. | 2,188.5 | | | Ps. | 2,043.1 | | | Ps. | 1,873.0 | |

| Minority interest | | | 13.2 | | | | 56.9 | | | | — | | | | — | | | | — | | | | — | |

| Shareholders’ equity | | | 305.4 | | | | 1,314.5 | | | | 1,749.9 | | | | 2,182.2 | | | | 2,091.6 | | | | 1,974.6 | |

| Total liabilities and shareholders’ equity | | U.S. $ | 1,334.7 | | | Ps. | 5,744.4 | | | Ps. | 4,927.3 | | | Ps. | 4,370.7 | | | Ps. | 4,134.6 | | | Ps. | 3,847.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets | | U.S. $ | 217.4 | | | Ps. | 935.5 | | | Ps. | 1,155.4 | | | Ps. | 703.3 | | | Ps. | 666.7 | | | Ps. | 536.7 | |

| Property, plant and equipment, net | | | 1,114.9 | | | | 4,798.4 | | | | 3,754.6 | | | | 3,552.4 | | | | 3,331.2 | | | | 3,175.7 | |

| Other non-current assets | | | 52.0 | | | | 223.7 | | | | 274.6 | | | | 260.4 | | | | 258.4 | | | | 346.6 | |

| Assets of disposal groups classified as held for sale | | | 264.6 | | | | 1,138.8 | | | | — | | | | — | | | | — | | | | — | |

| Total assets | | U.S. $ | 1,648.8 | | | Ps. | 7,096.4 | | | Ps. | 5,184.6 | | | Ps. | 4,516.1 | | | Ps. | 4,256.3 | | | Ps. | 4,059.0 | |

| Current liabilities | | U.S. $ | 308.7 | | | Ps. | 1,328.6 | | | Ps. | 818.1 | | | Ps. | 790.9 | | | Ps. | 707.5 | | | Ps. | 573.7 | |

| Non-current liabilities | | | 772.5 | | | | 3,324.7 | | | | 2,598.5 | | | | 1,923.8 | | | | 1,821.6 | | | | 2,018.2 | |

| Liabilities of disposal groups classified as held for sale | | | 214.3 | | | | 922.2 | | | | — | | | | — | | | | — | | | | — | |

| Total liabilities | | | 1,295.4 | | | | 5,575.5 | | | | 3,416.6 | | | | 2,714.7 | | | | 2,529.1 | | | | 2,591.9 | |

| Shareholders’ equity | | | 353.4 | | | | 1,520.9 | | | | 1,768.0 | | | | 1,801.4 | | | | 1,727.2 | | | | 1,467.1 | |

| Total liabilities and shareholders’ equity | | U.S. $ | 1,648.8 | | | Ps. | 7,096.4 | | | Ps. | 5,184.6 | | | Ps. | 4,516.1 | | | Ps. | 4,256.3 | | | Ps. | 4,059.0 | |

| (*) | Consolidated financial data. |

| (1) | Includes the amounts collected through the Program for the Rational Use of Electricity Power (PUREE), which as of December 31, 2011, 2010, 2009 and 2008 amounted to Ps. 928.7 million, Ps. 529.1 million, Ps. 233.3 million and Ps. 33.5 million, respectively. For the year ended December 31, 2011, Ps. 61.6 million correspond to PUREE funds collected by Aeseba, included under current liabilities, and Ps. 867.1 million correspond to PUREE funds collected by Edenor, included under non-current liabilities. Edenor is permitted to retain funds from the PUREE that it would otherwise be required to transfer to CAMMESA according to Resolution SS.EE. 1037/07. |

| | | 2011 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | (in millions) | |

| Cash flow data | | | | | | | | | | | | | | | | | | | | | | | | |

| Argentine GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating activities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net (loss) income | | U.S.$ | (101.2 | ) | | Ps. | (435.4 | ) | | Ps. | (49.1 | ) | | Ps. | 90.6 | | | Ps. | 123.1 | | | Ps. | 122.5 | |

| Adjustment to reconcile net (loss) income to net cash flows provided by (used in) operating activities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation of property, plant and equipment | | | 58.6 | | | | 252.2 | | | | 178.4 | | | | 175.4 | | | | 170.3 | | | | 174.4 | |

| Retirement of property, plant and equipment | | | 5.1 | | | | 22.0 | | | | 1.1 | | | | 2.8 | | | �� | 1.9 | | | | 1.1 | |

| Gain from the sale of real property | | | — | | | | — | | | | (5.3 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain from investments in affiliated parties | | | (0.2 | ) | | | (0.9 | ) | | | 0 | | | | — | | | | — | | | | (0.1 | ) |

| Negative Goodwill amortization | | | (2.9 | ) | | | (12.3 | ) | | | — | | | | — | | | | — | | | | — | |

| (Gain) Loss from investments | | | (10.4 | ) | | | (44.8 | ) | | | (55.7 | ) | | | 26.4 | | | | (4.3 | ) | | | (8.5 | ) |

| Adjustment to present value of notes | | | — | | | | — | | | | 4.2 | | | | 5.2 | | | | 8.5 | | | | 21.5 | |

| Loss (Gain) from the purchase and redemption of notes | | | (1.5 | ) | | | (6.5 | ) | | | 7.1 | | | | (81.5 | ) | | | (93.5 | ) | | | 10.2 | |

| Loss for debt restructuring | | | 0.6 | | | | 2.7 | | | | — | | | | — | | | | — | | | | — | |

| Adjustment to present value of the repurchased and redeemed notes | | | — | | | | — | | | | — | | | | — | | | | — | | | | 8.6 | |

| Results from valuation of other assets available for sale at NRV | | | 17.4 | | | | 75.0 | | | | — | | | | — | | | | — | | | | — | |

| Exchange differences, interest and penalties on loans | | | 71.3 | | | | 306.8 | | | | 49.5 | | | | 178.6 | | | | 232.7 | | | | 69.5 | |

| Increase in trade receivables due to the unbilled portion of the retroactive tariff increase | | | — | | | | — | | | | — | | | | — | | | | — | | | | (171.3 | ) |

| Recovery of the accrual for tax contingencies | | | — | | | | — | | | | — | | | | (35.6 | ) | | | — | | | | — | |

| Income tax | | | (5.2 | ) | | | 22.4 | | | | (26.1 | ) | | | 79.3 | | | | 61.2 | | | | 125.0 | |

| Allowance for doubtful accounts | | | 8.8 | | | | 37.9 | | | | 16.3 | | | | 13.5 | | | | 17.1 | | | | — | |

| Reversal of the allowance for doubtful accounts | | | — | | | | — | | | | — | | | | (27.0 | ) | | | (24.0 | ) | | | — | |

| Allowance for other doubtful accounts | | | 0.3 | | | | 1.5 | | | | 4.9 | | | | 3.3 | | | | 1.7 | | | | — | |

| Results holdings in related companies | | | 4.2 | | | | 18.2 | | | | — | | | | — | | | | — | | | | — | |

| Adjustment to net present value of the retroactive tariff increase arising from the application of the new electricity rate schedule and of the Payment Plan Agreement with the Province of Buenos Aires | | | (0.3 | ) | | | (1.2 | ) | | | (11.6 | ) | | | (3.4 | ) | | | (13.5 | ) | | | 29.6 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| (Increase) decrease in trade receivables (net of the unbilled portion of the retroactive tariff increase) | | | (36.5 | ) | | | (157.2 | ) | | | 0.2 | | | | 48.1 | | | | (49.5 | ) | | | (36.9 | ) |

| Net (increase) decrease in other receivables | | | (60.2 | ) | | | (258.9 | ) | | | (0.3 | ) | | | 5.3 | | | | (33.4 | ) | | | (8.4 | ) |

| (Increase) decrease in supplies | | | (3.5 | ) | | | (15.2 | ) | | | (2.2 | ) | | | (3.9 | ) | | | 7.4 | | | | (18.4 | ) |

| Increase in other available for sale assets | | | (67.7 | ) | | | (291.6 | ) | | | — | | | | — | | | | — | | | | — | |

| Increase in trade accounts payable | | | 65.8 | | | | 283.2 | | | | 34.9 | | | | 15.2 | | | | 27.8 | | | | 52.7 | |

| Increase in salaries and social security taxes | | | 29.2 | | | | 125.6 | | | | 69.0 | | | | 27.2 | | | | 50.3 | | | | 12.9 | |

| Increase (decrease) in taxes | | | 14.8 | | | | 63.5 | | | | (45.8 | ) | | | (56.9 | ) | | | 26.4 | | | | 22.5 | |

| Increase in other liabilities | | | 39.0 | | | | 167.8 | | | | 74.5 | | | | 39.3 | | | | 78.1 | | | | 17.7 | |

| Increase in funds obtained from the Program for the Rational Use of Electric Power (PUREE)(1 | | | 92.8 | | | | 399.6 | | | | 295.8 | | | | 199.8 | | | | — | | | | — | |

| Net increase (decrease) in accrued litigation | | | 2.8 | | | | 11.8 | | | | (8.2 | ) | | | 10.6 | | | | 15.1 | | | | 16.2 | |

| Financial interest paid, net of interest capitalized | | | (24.7 | ) | | | (106.2 | ) | | | (64.9 | ) | | | (76.8 | ) | | | (62.7 | ) | | | (25.5 | ) |

| Financial and commercial interest collected | | | 12.0 | | | | 51.5 | | | | 60.2 | | | | 32.2 | | | | 6.9 | | | | 11.6 | |

| Net cash flow provided by operating activities | | | 118.9 | | | | 511.8 | | | | 526.9 | | | | 668.0 | | | | 547.5 | | | | 427.2 | |

| Investing activities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Additions of property, plant and equipment | | | (151.8 | ) | | | (653.4 | ) | | | (388.8 | ) | | | (404.2 | ) | | | (325.4 | ) | | | (336.9 | ) |

| Acquisition of permanent investments | | | (131.9 | ) | | | (567.6 | ) | | | — | | | | — | | | | — | | | | — | |

| Cash increase due to the acquisition of permanent investmentsi | | | 27.7 | | | | 119.0 | | | | — | | | | — | | | | — | | | | — | |

| Collection of other investments sold | | | 29.4 | | | | 126.7 | | | | | | | | — | | | | — | | | | — | |

| Collection of PPE sold | | | — | | | | — | | | | 7.4 | | | | — | | | | — | | | | — | |

| Net cash flow used in investing activities | | | (226.6 | ) | | | (975.2 | ) | | | (381.3 | ) | | | (404.2 | ) | | | (325.4 | ) | | | (336.9 | ) |

| Financing activities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Decrease (increase) in current and non-current investments | | | — | | | | — | | | | — | | | | 13.6 | | | | (67.9 | ) | | | — | |

| Net (decrease) increase in loans | | | (18.8 | ) | | | (81.1 | ) | | | 302.9 | | | | (175.5 | ) | | | (122.9 | ) | | | (203.6 | ) |

| Capital increase | | | — | | | | — | | | | — | | | | — | | | | — | | | | 181.8 | |

| Increase in minority interest | | | 9.0 | | | | 38.6 | | | | — | | | | — | | | | — | | | | — | |

| Treasury shares purchased | | | — | | | | — | | | | — | | | | — | | | | (6.1 | ) | | | — | |

| Payment of dividends(2) | | | (8.8 | ) | | | (38.0 | ) | | | — | | | | — | | | | — | | | | — | |

| Net cash flows (used in) provided by financing activities | | | (18.7 | ) | | | (80.4 | ) | | | 302.9 | | | | (161.8 | ) | | | (197.0 | ) | | | (21.8 | ) |

| Cash variations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents at beginning of year | | U.S.$ | 157.3 | | | Ps. | 676.8 | | | Ps. | 228.4 | | | Ps. | 126.4 | | | Ps. | 101.2 | | | Ps. | 32.7 | |

| Cash and cash equivalents at end of the year | | | 30.9 | | | | 133.0 | | | | 676.8 | | | | 228.4 | | | | 126.4 | | | | 101.2 | |

| Net (decrease) increase in cash and cash equivalents | | | (126.4 | ) | | | (543.9 | ) | | | 448.5 | | | | 102.0 | | | | 25.2 | | | | 68.5 | |

| (1) | For the year ended December 31, 2008, funds obtained from the PUREE were included under “Increase in other liabilities”. |

| (2) | Corresponds to dividend payments declared by Aeseba before it was acquired by Edenor. |

| | | Year ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | Edenor | | | Aeseba (1) | | | Emdersa (1) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Operating data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Energy sales (in GWh): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential | | | 8,139 | | | | 619 | | | | 1,390 | | | | 7,796 | | | | 7,344 | | | | 7,545 | | | | 7,148 | |

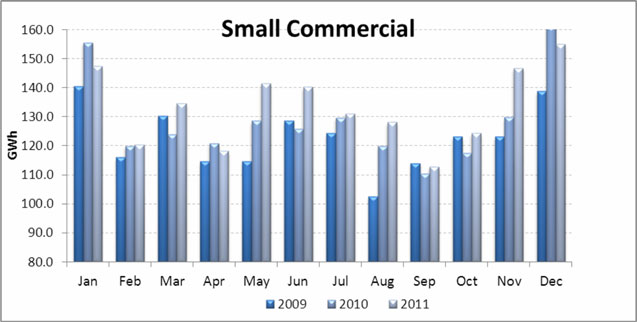

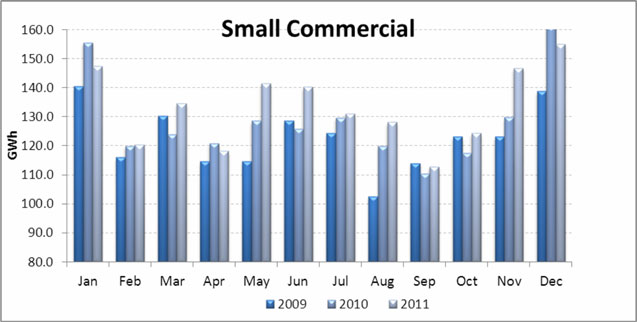

| Small commercial | | | 1,601 | | | | 227 | | | | - | | | | 1,543 | | | | 1,470 | | | | 1,530 | | | | 1,485 | |

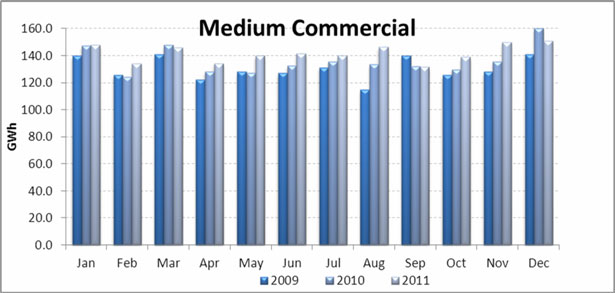

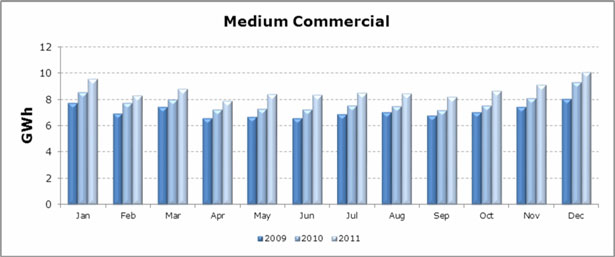

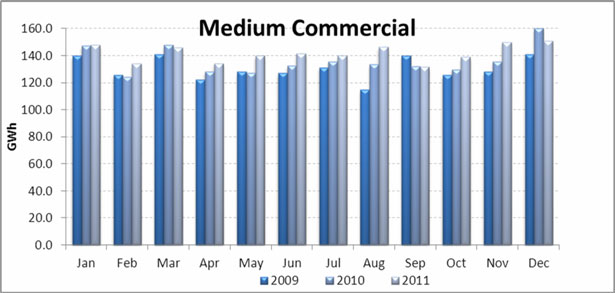

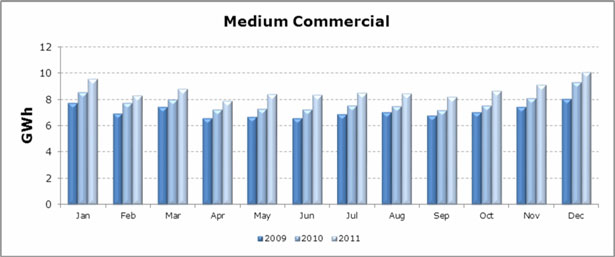

| Medium commercial | | | 1,700 | | | | 104 | | | | 1,191 | | | | 1,634 | | | | 1,565 | | | | 1,597 | | | | 1,552 | |

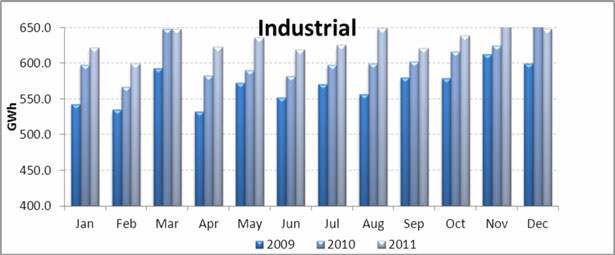

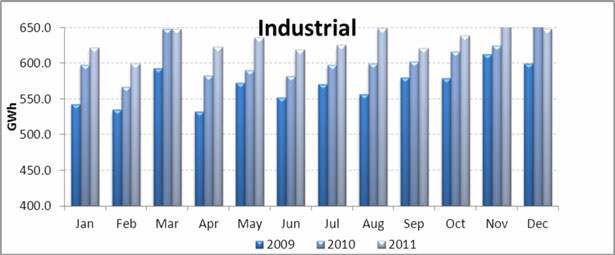

| Industrial | | | 3,442 | | | | 807 | | | | 385 | | | | 3,378 | | | | 3,204 | | | | 3,277 | | | | 3,628 | |

| Wheeling system(2) | | | 4,156 | | | | 291 | | | | 699 | | | | 3,891 | | | | 3,622 | | | | 3,700 | | | | 3,111 | |

| Others: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Public lighting | | | 656 | | | | 80 | | | | 189 | | | | 654 | | | | 644 | | | | 644 | | | | 643 | |

| Shantytowns | | | 384 | | | | 657 | | | | - | | | | 377 | | | | 351 | | | | 304 | | | | 301 | |

| Others(3) | | | 20 | | | | 6 | | | | - | | | | 20 | | | | 20 | | | | 19 | | | | 18 | |

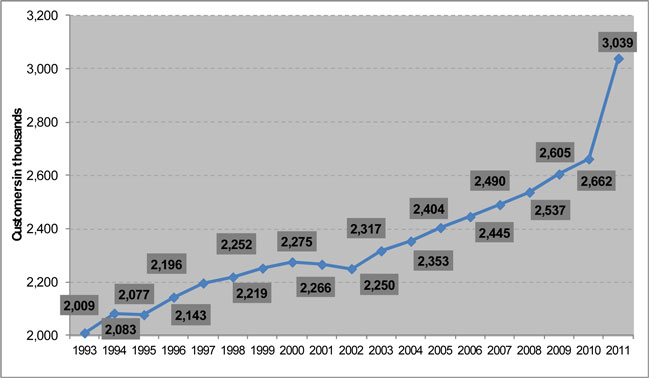

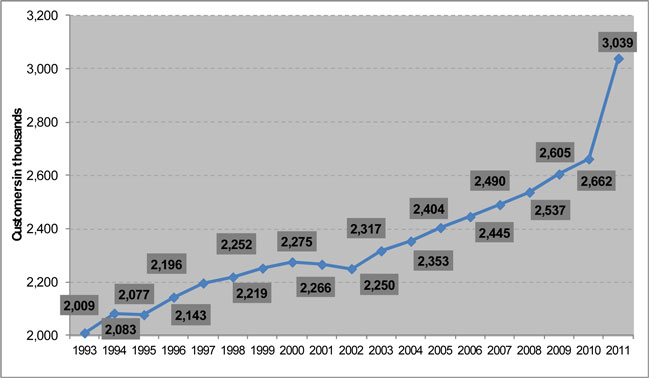

| Customers (in thousands)(4) | | | 2,699 | | | | 340 | | | | 550 | | | | 2,662 | | | | 2,605 | | | | 2,537 | | | | 2,490 | |

| Energy losses (%) | | | 12.6 | % | | | 10.4 | % | | | 11.2 | % | | | 12.5 | % | | | 11.9 | % | | | 10.8 | % | | | 11.6 | % |

| MWh sold per employee | | | 7,188.1 | | | | 3,771.2 | | | | 9,421.5 | | | | 7,123.9 | | | | 6,936.1 | | | | 7,392.8 | | | | 7,230.6 | |

| Customers per employee | | | 965 | | | | 460 | | | | 1,345 | | | | 971 | | | | 978 | | | | 997 | | | | 998 | |

| (1) | Financial data and other operating information for the year ended December 31, 2011 may not be representative of the results recorded in our Consolidated financial statements for the year ended December 31, 2011, which includes financial information of Emdersa and Aeseba for the period commencing March 1, 2011 and ended December 31, 2011. |

| (2) | Wheeling system charges represent our tariffs for large users, which consist of a fixed charge for recognized technical losses and a charge for our distribution margins but exclude charges for electric power purchases, which are undertaken directly between generators and large users. |

| (3) | Represents energy consumed internally by us and our facilities. |

| (4) | We define a customer as one meter. We may supply more than one consumer through a single meter. In particular, because we measure our energy sales to each shantytown collectively using a single meter, each shantytown is counted as a single customer. |

EXCHANGE RATES

From April 1, 1991 until the end of 2001, the Convertibility Law established a fixed exchange rate under which the Central Bank was obliged to sell U.S. Dollars at a fixed rate of one Peso per U.S. Dollar (the “Convertibility Regime”). On January 6, 2002, the Argentine Congress enacted the Public Emergency Law, formally putting an end to the regime of the ConvertibilityRegime and abandoning over ten years of U.S. Dollar-Peso parity. The Public Emergency Law grants the executive branch of the Argentine government the power to set the exchange rate between the Peso and foreign currencies and to issue regulations related to the foreign exchange market. The Public Emergency law has been extended until December 31, 2013. For a brief period following the end of the Convertibility Regime, the Public Emergency Law established a temporary dual exchange rate system. Since February 2002, the Peso has been allowed to float freely against other currencies.

The following table sets forth the annual high, low, average and period-end exchange rates for U.S. Dollars for the periods indicated, expressed in Pesos per U.S. Dollar at the purchasing exchange rate and not adjusted for inflation. When preparing our financial statements, we utilize the selling exchange rates for U.S. Dollars quoted by Banco Nación to translate our U.S. Dollar denominated assets and liabilities into Pesos. The Federal Reserve Bank of New York does not report a noon buying rate for Pesos.

| | | Low | | | High | | | Average | | | Period End | |

| | | (Pesos per U.S. Dollar) | |

| Year ended December 31, | | | | | | | | | | | | |

| 2007 | | | 3.06 | | | | 3.18 | | | | 3.12 | (1) | | | 3.15 | |

| 2008 | | | 3.01 | | | | 3.47 | | | | 3.16 | (1) | | | 3.45 | |

| 2009 | | | 3.45 | | | | 3.88 | | | | 3.73 | (1) | | | 3.80 | |

| 2010 | | | 3.79 | | | | 3.99 | | | | 3.91 | (1) | | | 3.98 | |

| 2011 | | | 3.97 | | | | 4.30 | | | | 4.13 | (1) | | | 4.30 | |

| Month | | | | | | | | | | | | | | | | |

| January 2012 | | | 4.30 | | | | 4.34 | | | | 4.321 | (2) | | | 4.34 | |

| February 2012 | | | 4.33 | | | | 4.36 | | | | 4.35 | (2) | | | 4.36 | |

| March 2012 | | | 4.34 | | | | 4.38 | | | | 4.36 | (2) | | | 4.38 | |

| April 2012(3) | | | 4.38 | | | | 4.41 | | | | 4.40 | (4) | | | 4.41 | |

Source: Banco Nación

| (1) | Represents the average of the exchange rates on the last day of each month during the period. |

| (2) | Average of the lowest and highest daily rates in the month. |

| (3) | Represents the corresponding exchange rates from April 1 through April 24, 2012. |

| (4) | Represents the average of the lowest and highest daily rates from April 1 through April 24, 2012. |

RISK FACTORS

Risks Related to Argentina

Overview

We are a limited liability corporation (sociedad anónima) incorporated under the laws of the Republic of Argentina and all of our revenues are earned in Argentina and all of our operations, facilities, and customers are located in Argentina. Accordingly, our financial condition and results of operations depend to a significant extent on macroeconomic, regulatory, and political and financial conditions prevailing in Argentina, including growth, inflation rates, currency exchange rates, interest rates and other local, regional and international events and conditions that may affect Argentina in any manner. For example, slower economic growth or economic recession could lead to a decreased demand for electricity in our concession area or a decline in the purchasing power of our customers, which, in turn, could lead to a decrease in collection rates from our customers or increased energy losses due to illegal use of our service. Actions of the Argentine government concerning the economy, including decisions with respect to inflation, interest rates, price controls, foreign exchange controls and taxes, have had and could continue to have a material adverse effect on private sector entities, including us.For example, during the Argentine economic crisis of 2001, the Argentine government froze electricity distribution margins and caused the pesification of our tariffs, which had a materially adverse effect on our business and financial condition and led us to suspend payments on our financial debt at the time. We cannot assure you that the Argentine government will not adopt other policies that could adversely affect the Argentine economy or our business, financial condition or results of operations. In addition, we cannot assure you that future economic, regulatory, social and political developments in Argentina, will not impair our businesses, financial condition, or results of operations or cause the market value of our ADSs and Class B common shares to decline.

The global financial crisis and unfavorable credit and market conditions that commenced in 2007 may negatively affect our liquidity, customers, business, and results of operations

The ongoing effects of the global credit crisis and related turmoil in the global financial system may have a negative impact on our business, financial condition and results of operations, an impact that is likely to be more severe on an emerging market economy, such as Argentina. The effect of this economic crisis on our customers and on us cannot be predicted. Weak economic conditions could lead to reduced demand for energy, which could have a negative effect on our revenues. Economic factors such as unemployment, inflation levels and the availability of credit could also have a material adverse effect on demand for energy and therefore on our financial condition and operating results. In addition, our ability to access the credit or capital markets may be restricted at a time when we would need financing, which could have an impact on our flexibility to react to changing economic and business conditions. For these reasons, any of the foregoing factors or a combination of these factors could have an adverse effect on our results of operations and financial condition and cause the market value of our ADSs and Class B common shares to decline.

Argentina’s economic recovery since the 2001 economic crisis may not be sustainable in light of current economic conditions, and any significant decline could adversely affect our financial condition

During 2001 and 2002, Argentina went through a period of severe political, economic and social crisis. Although the economy has recovered significantly since the 2001 crisis, uncertainty remains as to the sustainability of economic growth and stability. After the significant slowdown in the Argentine economy in 2009, which started in the last quarter of 2008 and continued into much of 2009 (impacted by the largest global crisis in decades and negative domestic factors), the Argentine economy experienced a growth of about 0.9% and during 2009 and 2010, respectively, according to preliminary official public estimates. Similarly, during 2011, the Argentine economy registered a growth of 8.9%. However, uncertainty remains about the sustainability of this growth. Sustainable economic growth is dependent on a variety of factors, including international demand for Argentine exports, the stability and competitiveness of the Peso against foreign currencies, confidence among consumers and foreign and domestic investors and a stable rate of inflation.

The Argentine economy remains fragile, as reflected by the following economic conditions:

| · | the availability of long-term credit is scarce; |

| · | investment as a percentage of GDP remains too low to sustain the growth rate of recent years; |

| · | fiscal surplus shows a steady decline, with risk of becoming a fiscal deficit in the near term; |

| · | public debt remains high, as payments have increased (in line with post-default payment terms), while international financing remains limited; |

| · | inflation has accelerated recently and threatens to continue at levels that risk economic stability; |

| · | the regulatory environment continues to be uncertain; |

| · | controls to exchange Pesos into foreign currencies or to transfer funds abroad continue to increase; |

| · | the recovery has depended to some extent on high commodity prices, which despite having a favorable long-term trend, are volatile in the short-term and beyond the control of the Argentine government; and |

| · | the trade balance surplus (and the fiscal surplus, to a lesser extent) is largelydependent on the production of grains and soybeans, such that risk to economic stability is magnified by the possibility of a new major drought affecting these crops (as was the case in 2008 and 2009). |

As in the recent past, Argentina’s economy may be adversely affected if political and social pressures inhibit the implementation by the Argentine government of policies designed to maintain price stability, generate growth and enhance consumer and investor confidence. This, in turn, could lead to decreased demand for our services as well as a decrease in collection rates from customers and increased energy losses due to illegal use of our services, which could materially adversely affect our financial condition and results of operations, or cause the market value of our ADSs and Class B common shares to decline. Furthermore, the Argentine government could respond to a lack of economic growth or stability by adopting measures that affect private sector enterprises, as it has done in the past, including the tariff restrictions imposed on public utility companies such as several of our subsidiaries.

We cannot assure you that a decline in economic growth or increased economic instability, developments over which we have no control, would not have an adverse effect on our business, financial condition or results of operations or would not have a negative impact on the market value of our ADSs and Class B common shares.

The impact of inflation in Argentina on our costs could have a material adverse effect on our results of operations

Inflation has, in the past, materially undermined the Argentine economy and the Argentine government’s ability to create conditions that permit growth. According to data published by theInstituto Nacional de Estadística y Censos (National Statistics and Census Institute or INDEC), the rate of inflation reached 9.5% in 2011, 10.9% in2010 and 7.7% in 2009. Inflation rates reported by several Argentine provinces on average refer to annual rates of inflation significantly in excess of those published by INDEC. Average inflation in the 11 provinces that publish independent inflation data was 14.2%, 23.8% and 20% for 2009, 2010 and 2011, respectively. The Argentine government has implemented programs to control inflation and monitor prices for essential goods and services, including price support arrangements agreed between the Argentine government and private sector companies in several industries and markets.

A return to a high inflation environment would undermine Argentina’s foreign competitiveness by diluting the effects of the Peso devaluation, negatively impact the level of economic activity and employment and undermine confidence in Argentina’s banking system, which could further limit the availability of domestic and international credit to businesses. In turn, a portion of the Argentine debt is adjusted by theCoeficiente de Estabilización de Referencia (Stabilization Coefficient or CER), a currency index, that is strongly related to inflation. Therefore, any significant increase in inflation would cause an increase in the Argentine external debt and consequently in Argentina’s financial obligations, which could exacerbate the stress on the Argentine economy. A high inflation environment could also temporarily undermine our results of operations if we are temporarily unable, or if we are not able at all, to adjust our tariffs accordingly and could adversely affect our ability to finance the working capital needs of our businesses on favorable terms, and adversely affect our results of operations and cause the market value of our ADSs and Class B common shares to decline.

The credibility of several Argentine economic indexes has been called into question, which may lead to a lack of confidence in the Argentine economy and may in turn limit our ability to access the credit and capital markets

In January 2007, INDEC modified its methodology used to calculate the consumer price index (CPI), which is calculated as the monthly average of a weighted basket of consumer goods and services that reflects the pattern of consumption of Argentine households. Further, at the time that INDEC adopted this change in methodology, the Argentine government also replaced certain key personnel at INDEC. The alleged governmental interference prompted complaints from the technical staff at INDEC, which, in turn, has led to the initiation of several judicial investigations involving members of the Argentine government aimed at determining whether there was a breach of classified statistical information relating to the collection of data used in the calculation of the CPI. These events have affected the credibility of the CPI index published by INDEC, as well as other indexes published by INDEC the calculation of which are based on the CPI, including poverty rates, the unemployment rate and the calculation of the GDP, among others. As a result, the inflation rate of Argentina and the other rates calculated by INDEC could be higher than as indicated in official reports. The International Monetary Fund is currently providing technical assistance to the Argentine government to improve the calculation and collection of inflation data. If these investigations result in a finding that the methodologies used to calculate the CPI or other INDEC indexes derived from the CPI were manipulated by the Argentine government, or if it is determined that it is necessary to correct the CPI and the other INDEC indexes derived from the CPI as a result of the methodology used by INDEC, there could be a significant decrease in confidence in the Argentine economy. Given the limited credit available to emerging market nations as a result of the global economic crisis, our ability to access credit in the capital markets could be limited by the uncertainty relating to the inaccuracy of the economic indexes and rates in question which could adversely affect our results of operations and financial conditions and cause the market value of our ADSs and Class B common shares to decline.

Argentina’s ability to obtain financing from international markets is limited, which may impair its ability to implement reforms and foster economic growth, and consequently, may affect our business, results of operations and prospects for growth

In 2005, Argentina restructured part of its sovereign debt that had been in default since the end of 2001. The Argentine government announced that as a result of this restructuring, it had approximately U.S. $129.2 billion in total gross public debt as of December 31, 2005. Certain bondholders that did not participate in that restructuring, mainly from the United States, Italy and Germany, have filed legal actions against Argentina to collect on the defaulted bonds. Many of these proceedings are still pending as of this date and holdout creditors may initiate new suits in the future.

On January 3, 2006, Argentina repaid in full its debt of approximately U.S. $9.8 billion with the International Monetary Fund.

In September 2008, Argentina announced its intention to cancel its external public debt to Paris Club creditor nations using reserves of the Central Bank in an amount equal to approximately U.S. $6.5 billion. However, as of the date of this annual report, the Argentine government has not yet cancelled such debt. Indeed, negotiations in this respect remain stagnant. If no agreement with the Paris Club creditor nations is reached, financing from multilateral financial institutions may be limited or not available, which could adversely affect economic growth in Argentina and Argentina’s public finances.

Certain groups of holders that did not participate in the 2005 restructuring have filed claims against Argentina and it is possible that new claims will be filed in the future. In addition, foreign shareholders of several Argentine companies have filed claims before the ICSID (International Centre for Settlement of Investment Disputes) alleging that certain government measures adopted during the country’s 2001 crisis were inconsistent with the fair and equitable treatment standards set forth in various bilateral investment treaties to which Argentina is a party. Since May 2005, the ICSID tribunals have issued several awards against Argentina. Only the cases “CMS v. Argentina”, “Azurix v. Argentina” and “Vivendi v. Argentina” are currentlyfinal and unappealable, which decisions required that the Argentine government pay U.S. $133.2 million, U.S. $165.2 million and U.S. $105 million, respectively. As of the date of this annual report, Argentina has not yet paid the amounts referred to above.

On April 30, 2010, Argentina launched a new debt exchange to holders of the securities issued in the 2005 debt exchange and to holders of the securities that were eligible to participate in the 2005 debt exchange (other than brady bonds) to exchange such debt for new securities and, in certain cases, a cash payment. As a result of the 2005 and 2010 exchange offers, Argentina restructured over 91% of the defaulted debt eligible for the 2005 and 2010 exchange offers. The creditors who did not participate in the 2005 or 2010 exchange offers may continue with legal action against Argentina for the recovery of debt, which could adversely affect Argentina’s access to the international capital markets.

Argentina’s past default and its failure to restructure completely its remaining sovereign debt and fully negotiate with the holdout creditors may limit Argentina’s ability to reenter the international capital markets. Litigation initiated by holdout creditors as well as ICSID claims have resulted and may continue to result in judgments and awards against the Argentine government which, if not paid, could prevent Argentina from obtaining credit from multilateral organizations. Judgment creditors have sought and may continue to seek to attach or enjoin assets of Argentina. In addition, various creditors have organized themselves into associations to engage in lobbying and public relations concerning Argentina’s default on its public indebtedness. Such groups have over the years unsuccessfully urged passage of federal and New York state legislation directed at Argentina’s defaulted debt and aimed at limiting Argentina’s access to the U.S. capital markets. Although neither the United States Congress nor the New York state legislature has adopted such legislation, we can make no assurance that legislation or other political actions designed to limit Argentina’s access to capital markets will not take effect.

In April 2010, a Court of New York granted an attachment over reserves of the Argentine Central Bank in the United States requested by creditors of Argentina on the theory that the Central Bank was its alter ego. In July 2011, an appeals court reversed that ruling, stating that the assets of the Central Bank were protected by law. Plaintiffs have petitioned the United States Supreme Court to review the appeals court decision and, as of the date of this annual report, the United States Supreme Court has not ruled if it will hear the case.

As a result of Argentina’s default and the events that have followed it, the Argentine government may not have the financial resources necessary to implement reforms and foster economic growth, which, in turn, could have a material adverse effect on the country’s economy and, consequently, our businesses and results of operations. Furthermore, Argentina’s inability to obtain credit in international markets could have a direct impact on our own ability to access international credit markets to finance our operations and growth, which could adversely affect our results of operations and financial condition and cause the market value of our ADSs and Class B common shares to decline.

Significant fluctuations in the value of the Peso could adversely affect the Argentine economy, which could, in turn adversely affect our results of operations

The devaluation of the Peso in 2002 (a 238% decline against the U.S. Dollar) had a far-reaching negative impact on the financial condition of many businesses and individuals. The devaluation of the Peso had a negative impact on the ability of Argentine businesses to honor their foreign currency-denominated debt, led to very high inflation initially, significantly reduced real wages, had a negative impact on businesses whose success is dependent on domestic market demand, including public utilities and the financial industry, and adversely affected the Argentine government’s ability to honor its foreign debt obligations. If the Peso devalues significantly, the negative effects on the Argentine economy could have adverse consequences to our businesses, our results of operations and the market value of our ADSs.

On the other hand, a substantial increase in the value of the Peso against the U.S. Dollar also presents risks for the Argentine economy, including a reduction in exports. Any such increase could have a negative effect on economic growth and employment, reduce the Argentine public sector’s revenues from collection in real terms and have a material adverse effect on our business our result of operations and the market value of our ADSs as a result of the weakening of the Argentine economy in general.

Measures taken by the Argentine government to address social unrest may adversely affect the Argentine economy and our business and results of operations

During the economic crisis in 2001 and 2002, Argentina experienced social and political turmoil, including civil unrest, riots, looting, nationwide protests, strikes and street demonstrations. Despite the economic recovery and relative stability since 2002, social and political tensions and high levels of poverty and unemployment continue. Future government policies to preempt, or respond to, social unrest may include expropriation, nationalization, forced renegotiation or modification of existing contracts, suspension of the enforcement of creditors’ rights and shareholders’ rights, new taxation policies, including royalty and tax increases and retroactive tax claims, and changes in laws, regulations and policies affecting foreign trade and investment. These policies or significant protests resulting therefrom could destabilize the country and adversely and materially affect the Argentine economy.

In March 2008, the Argentine Ministry of Economy and Production announced the adoption of new taxes on exports of a number of agricultural products. The taxes were to be calculated at incremental rates as the price for the exported products increased, and represented a significant increase in taxes on exports by the agricultural sector in Argentina. The adoption of these taxes met significant opposition from various political and economic groups with ties to the Argentine agricultural sector, including strikes by agricultural producers around the country, roadblocks to prevent the circulation of agricultural goods within Argentina and massive demonstrations in the City of Buenos Aires and other major Argentine cities. Although the Argentine congress did not pass these measures, we cannot assure you that the Argentine government will not reintroduce new export taxes or adopt other similar measures. In addition, further social unrest caused by such measures that could adversely affect the Argentine economy, increased damages to our networks as a result of protesters or illicit activity, which could have a material adverse effect on our financial condition, results of operations and the market value of our ADSs.

Exchange controls and restrictions on capital inflows and outflows may continue to limit the availability of international credit and could threaten the financial system and lead to renewed political and social tensions, adversely affecting the Argentine economy, and, as a result, our business

In 2001 and 2002, Argentina experienced a massive withdrawal of deposits from the Argentine financial system in a short period of time, which precipitated a liquidity crisis within the Argentine financial system and prompted the Argentine government to impose exchange controls and restrictions on the ability of depositors to withdraw their deposits and send funds abroad in an attempt to prevent capital flight and further depreciation of the Argentine Peso. Although some of these restrictions have been suspended, terminated or substantiallyrelaxed, in June 2005 the Argentine government adopted various rules and regulations that established new restrictive controls on capital inflows into the country, including a requirement that for certain funds remitted into Argentina an amount equal to 30% of the funds must be deposited into an account with a local financial institution as a U.S. Dollar deposit for a one-year period without any accrual of interest, benefit or other use as collateral for any transaction. Since October 2011, the Argentine government has strengthened certain restrictions on the sale of foreign currency to non residents in connection with the repatriation of direct investments, and on the creation of foreign assets belonging to residents. See “Exchange Rates” and “Item 10. Exchange Controls.” The Argentine government could impose new exchange controls or restrictions on the movement of capital and take other measures that could limit our ability to access the international capital markets and impair our ability to make interest or principal payments abroad or payments. Argentina may re-impose exchange controls, transfer restrictions or other measures in the future in response to capital flight or a significant depreciation of the Peso.

In the event of a future shock, such as the failure of one or more banks or a crisis in depositor confidence, the Argentine government could impose further exchange controls or transfer restrictions and take other measures that could lead to renewed political and social tensions and undermine the Argentine government’s public finances, which could adversely affect Argentina’s economy and prospects for economic growth, which, in turn, could adversely affect our business and results of operations and the market value of our ADSs. In addition, the Argentine government or the Central Bank may reenact certain restrictions on the transfers of funds abroad, impairing our ability to make dividend payments to holders of the ADSs, which may adversely affect the market value of our ADSs. As of the date of this annual report, however, the transfer of funds abroad to pay dividends is permitted to the extent such dividend payments are made in connection with audited financial statements approved by a shareholders’ meeting.

The nationalization of Argentina’s private pension funds caused an adverse effect in the Argentine capital markets and increased the Argentine government’s interest in certain stock exchange listed companies, such that the Argentine government became a significant shareholder of such companies

In recent years a significant portion of the local demand for securities of Argentine companies came from the Argentine private pension funds. In response to the global economic crisis, in December 2008, by means of Argentine Law No. 26,425, the Argentine Congress unified the Argentine pension and retirement system into a system publicly administered by theAdministración Nacional de la Seguridad Social(National Social Security Agency or ANSES), eliminating the pension and retirement system previously administered by private managers. In accordance with the new law, private pension managers transferred all of the assets administered by them under the pension and retirement system to the ANSES. With the nationalization of Argentina’s private pension funds, the local capital markets decreased in size and became substantially concentrated. In addition, the Argentine government became a significant shareholder in many of the country’s public companies. In April 2011, the Argentine government lifted certain restrictions pursuant to which ANSES was prevented from exercising more than 5% of its voting rights in anystock exchange listedcompany (regardless of the equity interest held by ANSES in such companies). ANSES has publicly stated that it intends to exercise its voting rights in excess of such 5% limit in order to appoint directors in different stock exchange listed companies in which it holds an interest exceeding 5%. ANSES’ interests may differ from those of other investors, and consequently, if ANSES acquires a more prevailing role in any Argentine listed companies in which it owns shares, ANSES’ actions might have an adverse effect on such companies and, to a certain extent, on domestic capital markets. As of the date of this annual report ANSES owns shares representing 20.96% of the capital stock of our subsidiary Emdersa and 25.3% of the capital stock of Edenor.

The Argentine government has stated its intention to exert a stronger influence on the operation of stock exchange listed companies. We cannot assure you that these or other similar actions taken by the Argentine government will not have an adverse effect on the Argentine economy and consequently on our financial condition and results of operations.

The Argentine economy could be adversely affected by economic developments in other global markets

Argentine financial and securities markets are influenced, to varying degrees, by economic and financial conditions in other markets. Although economic conditions can vary from country to country, investors’ perception of the events occurring in one country may substantially affect capital flows to other countries and the value of securities in other countries, including Argentina. The Argentine economy was adversely impacted by the political and economic events that occurred in several emerging economies in the 1990s, including those in Mexico in 1994, the collapse of several Asian economies between 1997 and 1998, the economic crisis in Russia in 1998 and the Brazilian devaluation of its currency in January 1999. In addition, Argentina may be affected by events in the economies of its major regional trading partners, including, for example, currency devaluations caused by the global economic crisis that continue to affect it.

Also, the Argentine economy might be affected by occurring events in developed countries that are its commercial partners or which may have an impact on the global economy. In addition, the global financial crisis that commenced in the last quarter of 2008 has affected and may continue to negatively affect the economies of several countries around the world including Argentina and certain of its trading partners. Developed economies like the United States have sustained some of the most severe effects while some emerging economies like that of China and Brazil have suffered comparatively milder effects. More recently, several European countries, such as Ireland, Greece, Portugal, Spain, the United Kingdom and Italy, have revealed significant macroeconomic imbalances. In addition, on August 5, 2011, Standard & Poor’s Financial Services LLC downgraded the debt instruments issued by the United States and on January 13, 2012, Standard & Poor’s Rating Services downgraded the instruments of nine European countries including France and Italy. Financial markets have reacted adversely curtailing the ability of certain of these countries to refinance their outstanding debt. The impact of this crisis on Argentina could include a reduction in exports and foreign direct investment, a decline in national tax revenues and an inability to access international capital markets, which could adversely affect our business, results of operations and the market value of our ADSs. The realization of any or all of these risk factors, as well as events that may arise in the main regional partners, including members of Mercosur, could have a material adverse effect on the Argentine economy and, indirectly, on our business, financial condition and results of operations and the market value of our ADSs.

The actions taken by the Argentine government to reduce imports may affect our ability to purchase significant capital goods

The Argentine government has recently adopted some initiatives designed to limit the import of goods in order to prevent further deterioration of the Argentine balance of trade. The restriction of imports may limit our ability to purchase capital goods that are necessary for our operations, which may, in turn, adversely affect our business, financial condition and results of operations.

Risks Relating to the Electricity Distribution Sector

The Argentine government has intervened in the electricity sector in the past, and is likely to continue intervening