UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2019

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

City of Buenos Aires, August 9, 2019

Messrs.

BUENOS AIRES STOCK EXCHANGE

Messrs.

NATIONAL SECURITIES COMMISSION

Issuers Division

Dear Sirs,

In compliance with the provisions of section 63 of the Listing Regulations of Bolsas y Mercados Argentinos S.A., I hereby inform you that this Company’s Board of Directors, at its meeting held today, approved the Condensed Interim Financial Statements, Statement of Financial Position, Statement of Comprehensive Income, Statement of Changes in Equity, Statement of Cash Flows, Notes to the Financial Statements, Informative Summary and the information required by section 12 of General Resolution No. 622 of the National Securities Commission, relating to the six-month interim period ended June 30, 2019.

The amounts disclosed below are stated in thousands of Argentine pesos and arise from the Condensed Interim Financial Statements:

Six-month interim period

ended June 30, 2019

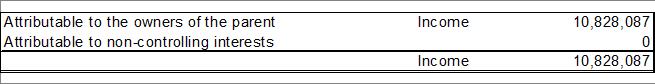

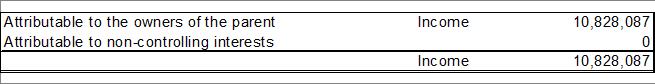

Profit for the period

Other comprehensive income for the period

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5102 / 5113 – Fax: (54-11) 4346-5301

Total comprehensive income for the period

The profit for the period includes a one-time-only extraordinary profit as a result of the Agreement on the Regularization of Obligations entered into by and between the Company and the Governmental Secretariat of Energy within the framework of the Agreement on the Implementation of the transfer of jurisdiction of the public service of electricity distribution from the Federal Government to the Province of Buenos Aires and the City of Buenos Aires.

The implementation of the aforementioned agreement implied the partial recognition of the claim made by the Company for an amount of $ 6,906.4 million as compensation for the Federal Government’s failure to comply with obligations for 10 years during the Transitional Tariff Period, as well as the adjustment of the recorded liabilities at the time of the agreement, replicating the conditions applied to all the sector’s distributors, generating a one-time-only profit of $ 6,160.0 million. These effects are included in the profit for the period, and do not imply any inflow of funds whatsoever for the Company; on the contrary, the Company must comply in the next 5 years with an investment plan, aimed at contributing to improving the reliability and/or safety of the service as a whole, in addition to that provided for in the RTI, which together with the penalties payable to users and the payment of the generated income tax amount implies an actual disbursement of funds for a total approximate amount of $ 7,600 million, in a 5-year term.

The normalization of the financial statements, which still reflected the consequences of the freeze on tariffs during the 2006-2017 Transitional Tariff period, will make it possible for the Company to focus on improving service quality, carrying out planned investments, and meeting customer demand.

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5102 / 5113 – Fax: (54-11) 4346-5301

Furthermore, and as required by sub-sections 6), 7) and 8) of section 62, we inform the following:

Class of shares | Number of shares | % on Share Capital |

| | |

A | 462,292,111 | 51.00 |

B | 442,210,385 | 48.78 |

C | 1,952,604 | 0.22 |

Total | 906,455,100 | 100.00 |

The class “A” shares are owned by Pampa Energía S.A. (PAMPA), domiciled at Maipú 1 of the City of Buenos Aires. The class “B” shares are currently listed on the New York Stock Exchange (through American Depositary Shares –“ADSs”) and the Buenos Aires Stock Exchange. As of June 30, 2019, the Company has 31,380,871 treasury shares.

An amount of 1,952,604 class “C” shares, which are held by Banco de la Nación Argentina as trustee of the Company Employee Stock Ownership Program, remains outstanding.

The Company does not have debt securities convertible into shares, nor there exist stock options of the Company’s shares.

Yours sincerely,

VICTOR A RUIZ |

Officer in charge of Market Relations |

(1) Includes 31,381 relating to treasury shares.

(2) Includes 458,962 relating to treasury shares.

Empresa Distribuidora y Comercializadora Norte S.A.

Av. Del Libertador 6363 Piso 1° – (C1428ARG) Capital Federal – Tel.: (54-11) 4346-5102 / 5113 – Fax: (54-11) 4346-5301

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Empresa Distribuidora y Comercializadora Norte S.A. |

| | |

| | |

| By: | /s/ Leandro Montero |

| Leandro Montero |

| Chief Financial Officer |

Date:August 13, 2019