April 25, 2007

UPDATE to the Structural and Collateral Information Free Writing Prospectus dated April 11, 2007 (the “Term Sheet FWP”) and the Free Writing Prospectus dated April 13, 2007 (the “April 13 FWP”)

GE Commercial Mortgage Corporation Commercial Mortgage Pass-Through Certificates Series 2007-C1— $3.95B** NEW ISSUE CMBS—Structural and Collateral Update

Collateral Update

1. Summary Pool Information. Annex A to this Update contains certain updated information concerning the Mortgage Pool.

2. General Loan Information Updates. Annexes B and C to this Update contains updates and corrections to certain Mortgage Loan information included in Annex A to the April 13 FWP.

3. Prospect Plaza La Jolla B Note. Annex D to this Update contains information regarding the Prospect Plaza La Jolla B Note.

4. Mall of America Loan Description. Annex E to this Update contains a summary of Loan No. 11, which becomes the tenth summary due to the removal of the summary of removed Loan No. 5 in the Term Sheet FWP and Annex B to the April 13 FWP.

The asset-backed securities referred to in these materials, and the asset pools backing them, are subject to modification or revision (including the possibility that one or more classes of securities may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these securities, a contract of sale will come into being no sooner than the date on which the relevant class has been priced and we have confirmed the allocation of securities to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Because the asset-backed securities are being offered on a “when, as and if issued” basis, any such contract will terminate, by its terms, without any further obligation or liability between us, if the securities themselves, or the particular class to which the contract relates, are not issued. Because the asset-backed securities are subject to modification or revision, any such contract also is conditioned upon the understanding that no material change will occur with respect to the relevant class of securities prior to the closing date. If a material change does occur with respect to such class, our contract will terminate, by its terms, without any further obligation or liability between us (the “Automatic Termination”). If an Automatic Termination occurs, we will provide you with revised offering materials reflecting the material change and give you an opportunity to purchase such class. To indicate your interest in purchasing the class, you must communicate to us your desire to do so within such timeframe as may be designated in connection with your receipt of the revised offering materials.

The information contained in these materials may be based on assumptions regarding market conditions and other matters as reflected herein. Banc of America Securities LLC and the other underwriters make no representation regarding the reasonableness of such assumptions or the likelihood that any such assumptions will coincide with actual market conditions or events, and these materials should not be relied upon for such purposes. The underwriters and their respective affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these materials, may, from time to time, have long or short positions in, and buy and sell, the securities mentioned herein or derivatives thereof (including options). Information in these materials is current as of the date appearing on the material only. This free writing prospectus is not required to contain all information that is required to be included in the base prospectus and the prospectus supplement. The information in this free writing prospectus is preliminary and subject to change. Information in these materials regarding any securities discussed herein supersedes all prior information regarding such securities. These materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send to you the prospectus if you request it by calling toll-free 1-800-294-1322 or you e-mail a request to dg.prospectus_distribution@bofasecurities.com. The securities may not be suitable for all investors. Banc of America Securities LLC and the other underwriters and their respective affiliates may acquire, hold or sell positions in these securities, or in related derivatives, and may have an investment or commercial banking relationship with the issuer.

IRS CIRCULAR 230 NOTICE: THIS FREE WRITING PROSPECTUS IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. THIS FREE WRITING PROSPECTUS IS WRITTEN AND PROVIDED BY THE UNDERWRITERS IN CONNECTION WITH THE PROMOTION OR MARKETING OF THE TRANSACTIONS OR MATTERS ADDRESSED HEREIN. INVESTORS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

2

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | Mall of America | | TMA Balance: | | $104,000,000 |

| | | | TMA DSCR: | | 1.43x |

| | | | TMA LTV: | | 75.50% |

B-74

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | Mall of America | | TMA Balance: | | $104,000,000 |

| | | | TMA DSCR: | | 1.43x |

| | | | TMA LTV: | | 75.50% |

| | | | |

| Mortgage Loan Information |

| | |

| Loan Seller: | | GACC |

| | |

| Loan Purpose: | | Refinance |

| | |

| Original Balance(1): | | $104,000,000 |

| | |

| Cut-off Date Balance(1): | | $104,000,000 |

| | |

| % by Initial UPB: | | 2.63% |

| | |

| Interest Rate: | | 5.7990% |

| | |

| Payment Date: | | 1st of each month |

| | |

| First Payment Date: | | January 1, 2007 |

| | |

| Maturity Date: | | December 1, 2016 |

| | |

| Amortization: | | Interest Only |

| | |

| Call Protection: | | Lockout for 24 months after the securitization closing date, then defeasance is permitted. On or after October 1, 2016 prepayment is permitted without premium. |

| | |

| Sponsor: | | Triple Five National Development Corporation |

| | |

| Borrower: | | MOAC Mall Holdings LLC; MOA Entertainment Company LLC |

| | |

| Additional Financing: | | None |

| | |

| Lockbox: | | Hard |

| | | |

| Initial Reserves: | | Engineering: | | $25,000 |

| | | |

| Monthly Reserves(2): | | Tax / Insurance: | | Springing |

| | | |

| | | Replacement: | | Springing |

| | | |

| | | TI / LC: | | Springing |

| | | | | |

| (1) | | The cut-off date principal balance of $104,000,000 (the “TMA”) represents the pari passu A-4 Note from a first mortgage loan with an aggregate original balance of $755,000,000 (the “Mall of America Whole Loan”) which is comprised of four pari passu notes. A pari passu note in the amount of $345,000,000 was included in the COMM 2006-C8 mortgage trust and two pari passu notes with a combined balance of $306,000,000 were included in the CD 2007-CD4 mortgage trust. |

| (2) | | Upon the occurrence and continuation of a Trigger Event as defined under “Lock Box Account” herein, the borrower is required to deposit monthly reserves for: (i) taxes, (ii) leasing, (iii) capital expenditures and (iv) tenant improvement and leasing commissions. See “Reserves Section” herein for additional information. |

| | |

| Financial Information(1) |

| | |

| Cut-off Date Balance PSF: | | $273 |

| | |

| Balloon Balance PSF: | | $273 |

| | |

| LTV: | | 75.50% |

| | |

| Balloon LTV: | | 75.50% |

| | |

| UW DSCR: | | 1.43x |

| (1) | | Calculations are based on the Mall of America Whole Loan. |

| | |

| Property Information |

| | |

| Single Asset / Portfolio: | | Single Asset |

| | |

| Property Type: | | Retail, Regional Mall |

| | |

| Collateral: | | Fee simple and leased fee |

| | |

| Location: | | Bloomington, MN |

| | |

| Year Built/Renovated: | | 1992/2005 |

| | |

| Total Area(1): | | 2,769,954 square feet |

| | |

| Property Management: | | Triple Five National Development Corporation |

| | |

| Occupancy (As of 11/2/2006): | | 94.0% |

| | |

| Underwritten Net Cash Flow: | | $63,308,844 |

| | |

| Appraised Value: | | $1,000,000,000 |

| | |

| Appraisal Date: | | September 12, 2006 |

| | | |

| (1) | | Includes square footage for the borrowers’ leased fee interest with respect to the Macy’s, Bloomingdales and Sears stores. Excluding these tenants’ square footage results in 2,096,582 square feet. |

B-75

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | Mall of America | | TMA Balance: | | $104,000,000 |

| | | | TMA DSCR: | | 1.43x |

| | | | TMA LTV: | | 75.50% |

| | | | | | | | |

| Financial Information |

| | | 2004 | | 2005 | | T-12 8/31/2006 | | Underwritten |

Effective Gross Income | | $104,263,332 | | $110,855,344 | | $112,151,898 | | $115,016,535 |

| | | | | |

Total Expenses | | $51,422,378 | | $50,630,671 | | $52,780,467 | | $49,097,538 |

| | | | | |

Net Operating Income (NOI) | | $52,840,954 | | $60,224,673 | | $59,371,431 | | $65,918,997 |

| | | | | |

Cash Flow (CF) | | $52,840,954 | | $60,224,673 | | $59,371,431 | | $63,308,844 |

| | | | | |

DSCR on NOI | | 1.19x | | 1.36x | | 1.34x | | 1.48x |

| | | | | |

DSCR on CF | | 1.19x | | 1.36x | | 1.34x | | 1.43x |

| | | | | | | | | | | | | | |

| Anchor Tenants Summary(1) |

| Tenant Name | | Ratings S/F/M(2) | | NRSF(3) | | %

NRSF | | Base

Rent

PSF | | Annual

Base Rent | | % of

Total

Base

Rent | | Lease Expiration |

| | | | | | | | |

Macy’s | | BBB/BBB/Baa2 | | 276,581 | | 10.0% | | $0.00 | | $10 | | 0.0% | | 08/01/15 |

| | | | | | | | |

Bloomingdales(4) | | BBB/BBB/Baa2 | | 218,887 | | 7.9% | | $0.04 | | $9,000 | | 0.0% | | 08/31/12 |

| | | | | | | | |

Nordstrom | | A/A–/Baa1 | | 210,664 | | 7.6% | | $4.00 | | $842,656 | | 1.7% | | 08/06/22 |

| | | | | | | | |

Sears | | BB+/BB/Ba1 | | 177,904 | | 6.4% | | $0.00 | | $0 | | 0.0% | | 08/31/22 |

| | | | | | | | | | | | | | | |

| | | | | | | | |

Total Anchor Tenants | | | | 884,036 | | 31.9% | | $0.96 | | $851,666 | | 1.7% | | |

| (1) | | Information obtained from underwritten rent roll except for the ratings (S&P/Fitch/Moody’s) and unless otherwise stated. |

| (2) | | Certain ratings are those of the parent company whether or not the parent company guarantees the lease. |

| (3) | | Net rentable area (SF) includes Macy’s, Bloomingdales and Sears, which are all subject to ground lease agreements with the Borrowers. |

| (4) | | Under the Mall of America Loan documents, the Borrowers are permitted to redevelop the premises currently occupied by Bloomingdales. |

| | | | | | | | | | | | | | |

| Tenant Summary(1) |

| Tenant Name | | Ratings S/F/M(2) | | NRSF(3) | | %

NRSF | | Base

Rent

PSF | | Annual

Base Rent | | % of

Total

Base

Rent | | Lease

Expiration |

| | | | | | | | |

| Sports Authority | | B/NAP/NAP | | 73,714 | | 2.7% | | $0.00 | | $ 0 | | 0.0% | | 01/31/08 |

| | | | | | | | |

| AMC Theatres | | B/B/Ba1 | | 62,389 | | 2.3% | | $0.00 | | $ 0 | | 0.0% | | 08/31/12 |

| | | | | | | | |

| Underwaterworld at MOA | | NAP/NAP/NAP | | 45,209 | | 1.6% | | $0.00 | | $ 0 | | 0.0% | | 01/31/21 |

| | | | | | | | |

| Old Navy | | BB+/BB+/Ba1 | | 43,851 | | 1.6% | | $16.43 | | $720,472 | | 1.5% | | 01/31/12 |

| | | | | | | | |

| Barnes & Noble | | NAP/NAP/NAP | | 41,000 | | 1.5% | | $9.88 | | $405,000 | | 0.8% | | 04/30/14 |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | $1,125,472 | | | | |

| | | | | | | | |

| Total Top 5 In-Line Tenants | | | | 266,163 | | 9.6% | | $4.23 | | $1,125,472 | | 2.3% | | |

| | | | | | | | |

| Non-major Tenants | | | | 1,453,351 | | 52.5% | | $32.80 | | $47,666,598 | | 96.0% | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| Total Anchor Tenants | | | | 884,036 | | 31.9% | | $0.96 | | $851,666 | | 1.7% | | |

| | | | | | | | |

| Occupied Total | | | | 2,603,550 | | 94.0% | | $19.07 | | $49,643,736 | | 100.0% | | |

| | | | | | | | |

| Vacant Space | | | | 166,404 | | 6.0% | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | |

| Collateral Total | | | | 2,769,954 | | 100.0% | | | | | | | | |

| (1) | | Information obtained from underwritten rent roll except for the ratings (S&P/Fitch/Moody’s) and unless otherwise stated. |

| (2) | | Certain ratings are those of the parent company whether or not the parent company guarantees the lease. |

| (3) | | Net rentable area (SF) includes Macy’s, Bloomingdales and Sears, which are all subject to ground lease agreements with the Borrowers. |

B-76

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | Mall of America | | TMA Balance: | | $104,000,000 |

| | | | TMA DSCR: | | 1.43x |

| | | | TMA LTV: | | 75.50% |

| | | | | | | | | | | | | | |

| Lease Rollover Schedule(1)(2) |

| Year of Expiration | | # of

Leases

Expiring | | % of

Total

SF | | Cumulative

Total SF | | Cumulative

% of Total

SF | | Base Rent

Expiring | | % of

Base

Rent

Rolling | | Cumulative

% of Base

Actual

Rent

Rolling |

| | | | | | | | |

MTM | | 13 | | 0.7% | | 18,548 | | 0.7% | | $1,243,652 | | 2.5% | | 2.5% |

| | | | | | | | |

2007 | | 16 | | 2.1% | | 57,309 | | 2.7% | | $1,503,603 | | 3.0% | | 5.5% |

| | | | | | | | |

2008 | | 35 | | 10.5% | | 291,708 | | 13.3% | | $5,406,542 | | 10.9% | | 16.4% |

| | | | | | | | |

2009 | | 25 | | 1.9% | | 53,921 | | 15.2% | | $2,640,917 | | 5.3% | | 21.7% |

| | | | | | | | |

2010 | | 22 | | 3.3% | | 91,869 | | 18.5% | | $3,177,843 | | 6.4% | | 28.1% |

| | | | | | | | |

2011 | | 22 | | 3.1% | | 85,723 | | 21.6% | | $3,650,056 | | 7.4% | | 35.5% |

| | | | | | | | |

2012 | | 25 | | 13.8% | | 381,006 | | 35.4% | | $4,537,355 | | 9.1% | | 44.6% |

| | | | | | | | |

2013 | | 60 | | 6.6% | | 182,138 | | 42.0% | | $9,189,305 | | 18.5% | | 63.1% |

| | | | | | | | |

2014 | | 31 | | 5.6% | | 153,943 | | 47.5% | | $5,715,883 | | 11.5% | | 74.7% |

| | | | | | | | |

2015 | | 32 | | 14.5% | | 401,113 | | 62.0% | | $5,262,329 | | 10.6% | | 85.3% |

| | | | | | | | |

2016 | | 29 | | 3.4% | | 94,675 | | 65.4% | | $4,112,491 | | 8.3% | | 93.5% |

| | | | | | | | |

Thereafter | | 13 | | 28.6% | | 791,597 | | 94.0% | | $3,203,760 | | 6.5% | | 100.0% |

| | | | | | | | |

Vacant | | — | | 6.0% | | 166,404 | | 100.0% | | — | | — | | — |

| | | | | | | | | | | | | | | |

Total: | | 323 | | 100.0% | | 2,769,954 | | 100.0% | | | | | | |

| (1) | | The information in this schedule assumes that no tenant exercises an early termination option. |

| (2) | | Information obtained from the Underwritten Rent Roll. |

The Loan. The Mall of America Loan is a $104.0 million 10-year interest only fixed rate loan secured by a first mortgage on the borrower’s fee simple interest in an approximately 2.8 million sq. ft. retail space and amusement complex located in Bloomington, Minnesota, which is in the Minneapolis-St. Paul metropolitan statistical area (“MSA”). The $104.0 million loan is part of a $755.0 million whole loan which also consists of a $345.0 million A-1 Note and $306.0 million ofpari passuindebtedness securitized in CD 2007-CD4, evidence by the A-2 and A-3 Notes. The respective rights of the holders of the pari passu notes evidencing the Mall of America Whole Loan will be governed by a co-lender agreement described under the “Description of the Mortgage Pool—Mall of America Whole Loan” in the Prospectus Supplement. The Mall of America Loan proceeds were used to refinance existing debt on the Mall of America Property (as defined below) and to buy out the Previous Partners (as defined below) to provide the Mall of America Loan sponsor, Triple Five National Development Corporation (“Triple Five” or the “Sponsor”), with 100% ownership of the fee interest in the Mall of America Property. The Mall of America Loan matures on December 1, 2016.

The Borrower. The borrowers are MOAC Mall Holdings LLC and MOA Entertainment Company LLC (together, the “Borrowers”) each of which are single-purpose, bankruptcy-remote entities with independent directors, for which non-consolidation opinions were obtained at closing.

Prior to the Mall of America Loan closing, the ownership of the Mall of America Borrowers was divided between three entities: Triple Five, Teachers Insurance and Annuity Association (“TIAA”), and Simon Property Group (“Simon,” and together with TIAA, the “Previous Partners”). For several years there has been outstanding litigation among the Previous Partners and Triple Five. In connection with the buyout and at closing, Triple Five and the Previous Partners entered into a global settlement which released all outstanding litigation associated with the ownership interests in the Mall of America Property and the Previous Partners. A significant portion of the loan proceeds went towards the buyout of the Previous Partners’ interest in the Mall of America property with the buyout valuation for the property predicated on a $1 billion value.

The Borrowers are sponsored by Triple Five, an entity owned by the Ghermezian family of Canada. Triple Five has developed numerous commercial, industrial and residential projects throughout the United States and Canada. The

B-77

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | Mall of America | | TMA Balance: | | $104,000,000 |

| | | | TMA DSCR: | | 1.43x |

| | | | TMA LTV: | | 75.50% |

company has developed various real estate projects in California, Washington, Colorado, Minnesota, Arizona, Nevada, New York and Florida. In addition to this property, Triple Five developed and owns the West Edmonton Mall in Edmonton, Canada (approximately 5.2 million sq. ft.), the largest retail, hospitality and entertainment complex in the world. Triple Five is a repeat sponsor of a Deutsche Bank borrower. Based on the appraised value of $1.0 billion, Triple Five has $245.0 million of implied equity in the Mall of America Property (24.5%).

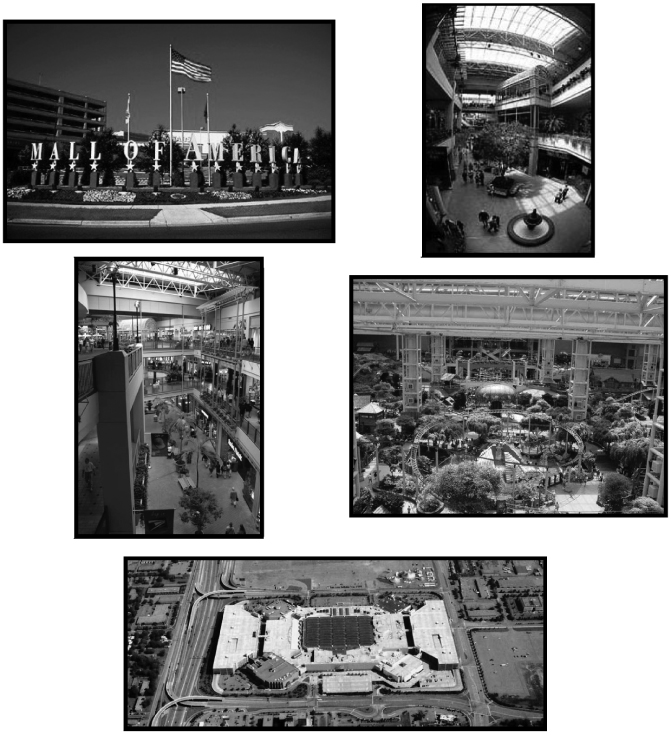

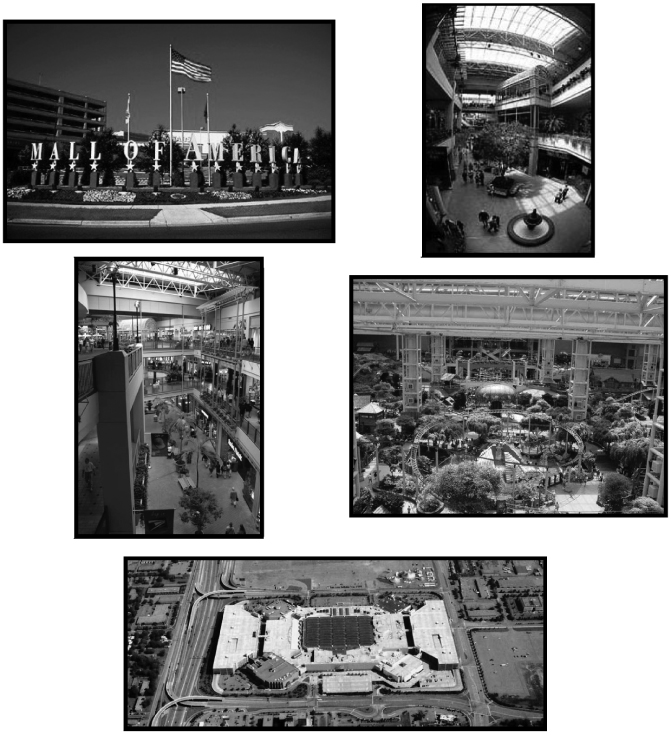

The Property. The collateral for the Mall of America Loan is a 2,769,954 square foot super regional mall and amusement park situated on a 78.07-acre land parcel located in Bloomington, Minnesota, which is part of the Minneapolis-St. Paul metropolitan statistical area (the “Mall of America Property”). The Borrowers have a leased fee interest in the property occupied by Macy’s, Bloomingdales and Sears stores. Excluding these tenants’ square footage, the Mall of America Property is 2,096,582 square feet. The Mall of America Property was constructed in 1992 and renovated in 2005. As of November 2, 2006, the Mall of America Property exhibited occupancy of 94.0% and 2005 in-line sales of $594 per square foot (for all tenants under 10,000 square feet).

The Mall of America Property is configured as a rectangle, with an anchor store situated in each corner (Macy’s, Bloomingdales, Nordstrom and Sears). In the center is the seven-acre (292,060 square feet) amusement center known as “The Park at MOA” (part of the collateral for the Mall of America Whole Loan). The Park at MOA, which has 27 rides including a 74-foot high ferris wheel, is surrounded by four, three-level retail “avenues” and a fourth floor “entertainment district.” Each of the four corridors or “avenues” between the anchors are distinguished by a theme and color scheme which makes it easier for shoppers to navigate the mall. The Mall of America Property also includes Underwater World (a 1.2 million gallon walk-through aquarium) and a LEGO Imagination Center (an interactive play center for children). Additional attractions include, among other things, 20 full-service restaurants, 36 specialty food stores, 30 fast food restaurants, 8 nightclubs, a 14-screen movie theater, and three food courts. Overall, these specialized retail spaces and amenities provide synergy with the Park at MOA that creates a unique entertainment component to the Mall of America Property. Attached to the Mall of America Property are two parking structures that offer a total of 12,500 enclosed parking spaces. In addition, there are 1,282 open air and underground parking spaces surrounding the Mall of America Property.

The Mall of America Property is the nation’s largest retail and entertainment complex. There are more than 35 hotels located within an 8-mile radius of the Mall of America Property. The 11.6 mile Hiawatha Corridor Light Rail Transit links three of the region’s most popular destinations: Downtown Minneapolis, Minneapolis-St. Paul International Airport and the Mall of America property. The Mall of America Property’s size and tenant mix further allow it to draw tourists from multiple states.

Significant Tenants. As of November 2, 2006 the Mall of America Property was 94.0% occupied. The following are the four largest tenant representing 31.9% of the net rentable area.

Macy’s (rated “BBB” by S&P, “BBB” by Fitch and “Baa2” by Moody’s) occupies 276,581 square feet, or approximately 10.0% of the net rentable area. Macy’s is a department store chain operated by Federated Department Stores (‘‘Federated’’). Federated operates 825 Macy’s stores in 45 states, Washington, D.C., Puerto Rico and Guam. Federated was founded in 1820 and is based in Cincinnati, Ohio. In August 2005, Federated acquired The May Department Stores Company in a transaction valued at approximately $11.0 billion plus approximately $6.0 billion in assumed debt.

Bloomingdale’s (rated “BBB” by S&P, “BBB” by Fitch and “Baa2” by Moody’s) occupies 218,887 square feet or approximately 7.9% of the net rentable area. Bloomingdale’s is a department store operated by Federated, which operates 36 Bloomingdale’s stores in 12 states. Under the Mall of America Loan documents, the Borrowers may pursue the redevelopment of the premises currently occupied by Bloomingdale’s and terminate the Bloomingdale’s lease subject to certain conditions. The Bloomingdale’s lease expires in August 2012.

B-78

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | Mall of America | | TMA Balance: | | $104,000,000 |

| | | | TMA DSCR: | | 1.43x |

| | | | TMA LTV: | | 75.50% |

Nordstrom, Inc. (“Nordstrom”) (rated “A by S&P, “A-” by Fitch and “Baa1” by Moody’s) occupies 210,664 square feet, or approximately 7.6% of the net rentable area. Nordstrom, through Nordstrom, Nordstrom Rack, Last Chance and Façonnable retail stores, sells apparel, shoes, cosmetics, and accessories. The company operates 98 Nordstrom stores, 50 Nordstrom Racks, 4 Façonnable boutiques in the United States and 36 Façonnable boutiques in Europe. Nordstrom was founded in 1901 and is based in Seattle, Washington.

Sears (rated “BB+” by S&P, “BB” by Fitch and “Ba1” by Moody’s) occupies 177,904 square feet, or approximately 6.4% of the net rentable area. Sears, which operates in the United States and Canada, and its wholly owned subsidiary Kmart, offer an array of household, recreational and apparel products. The company operates 2,400 Sears-branded and affiliated stores in the United States and Canada. At the Mall of America Property, Sears, which is not required to report earnings, operates under a thirty-one year lease expiring August 31, 2022.

The following are key facts about the Mall of America Property: (i) the total store front footage is approximately 4.3 miles; (ii) walking distance around one level of Mall of America Property is 0.6 miles; (iii) the Mall of America Property contributes more than $1.7 billion during summers and holidays; (v) it is one of the top producing regional malls in the country as measured by its 2005 total sales of $705 million; and (vi) it is the largest super regional mall with the highest customer draw in the United States with more than 40 million visitors annually.

The Sponsor owns a 42-acre adjacent land parcel to the north of the Mall of America Property and plans to construct a Mall of America Phase II development (the “Phase II”), which is not part of the collateral. The Phase II will be connected to the Mall of America Property and is expected to complement the existing shops and attractions at the Mall of America Property. The Phase II is a mixed-use complex zoned for up to 5.6 million square feet of new development, which may include premier hotels, office complex/business center with conference facilities, retail offerings, restaurants, recreational/fitness/spa facilities, entertainment/cultural attractions, performing arts center, a dinner theater (1,200 seats) and a water park. The first element of the Phase II expansion occurred in 2004, when IKEA opened a new 306,000 square foot store. The Mall of America Property draws more than 40 million visits a year and the Sponsor anticipates that the Phase II will attract an additional 20 million visitors a year, with nearly 40 percent of those visitors arriving at the Mall of America Property from beyond a 150 mile radius.

The Market. The Mall of America Property is located in Hennepin County within the Minneapolis-St. Paul MSA. As of 2005, the Minneapolis-St. Paul MSA had a population of approximately 3,138,324 and Hennepin County had a population of 1,128,667. For the same period, the average household income was $79,143 and $70,983 for Hennepin County and Minneapolis-St. Paul MSA, respectively. Within a three, seven and ten mile radius of the Mall of America Property the population in 2005 was 51,207, 454,035 and 973,825 respectively and average household income was $60,467, $78,214 and $74,009, respectively.

According to the third quarter of 2006 Grubb & Ellis Report, the Minneapolis market contains approximately 15.0 million sq. ft. of super regional retail space and has a market vacancy of 1.8%. The Mall of America Property is located in the East Hennepin County/Minneapolis submarket which contains approximately 9.7 million sq. ft. in 86 retail properties. According to the Cushman & Wakefield survey, the regional mall properties viewed as being competitive with the Mall of America Property show rent levels that range from $18.00-$44.00 per sq. ft. per year for in-line shops. At the Mall of America Property, rental rates currently range from approximately $37.00-$40.00 per sq. ft. for in-line tenants (excluding major anchors and food court).

The Mall of America Property is the nation’s largest retail and entertainment complex. There are more than 35 hotels located within an 8-mile radius of the property. The 11.6 mile Hiawatha Corridor Light Rail Transit links three of the region’s most popular destinations: Downtown Minneapolis, Minneapolis-St. Paul International Airport and the Mall of America property. The Mall of America Property’s tenant mix and sheer size lends it to having the power to draw tourists from multiple states.

B-79

GE Commercial Mortgage Corporation

Commercial Mortgage Pass-Through Certificates

Series 2007-C1

| | | | | | |

| | | Mall of America | | TMA Balance: | | $104,000,000 |

| | | | TMA DSCR: | | 1.43x |

| | | | TMA LTV: | | 75.50% |

The Mall of America Property has a stable operating performance as evidenced by a high occupancy level of 94.00% and strong 2005 in-line sales of $594 per square foot (for all tenants under 10,000 sq. ft.).

| | | | | | |

| Competitive Set |

| Competition | | Sq. Ft. | | Distance from

Subject | | Anchors |

| | | | |

| Southdale Shopping Center | | 1,240,888 | | 5.0 miles | | Dayton’s, JC Penney, Mervyn’s, Marshall’s |

| | | | |

| Burnsville Center | | 1,078,855 | | 19.0 miles | | Dayton’s, JC Penny, Mervyn’s, Sears |

| | | | |

| Rosedale Shopping Center | | 1,138,884 | | 8.5 miles | | Dayton’s, JC Penney, Mervyn’s, Montgomery Ward |

| | | | |

| Ridgedale Center | | 1,157,764 | | 13.5 miles | | Dayton’s, JC Penney, Mervyn’s, Montgomery Ward |

Lockbox/Cash Management. The Mall of America Loan has been structured with a hard lockbox. Cash management becomes effective upon the occurrence of a “Trigger Event” which is triggered by an Event of Default (as defined in the Mall of America Loan documents) or if the DSCR is less than 1.10x for two consecutive quarters.

Reserves. Upon the occurrence and continuation of a Trigger Event, the borrower is required to deposit monthly reserves for: (i) taxes, in the amount of 1/12 of the amount the lender reasonably estimates will be required to pay taxes and assessments, (ii) insurance, in the amount of 1/12 of the amount the lender reasonably estimates will be required to pay the insurance premiums, (iii) capital expenditures, in the amount of 1/12 of the amount the lender reasonably estimates will be necessary and (iv) tenant improvement and leasing commissions, in the amount of $30,000.

Partial Release. The Mall of America Loan documents permit the free release of certain identified vacant out-parcels, provided certain conditions specified in the Mall of America Loan documents are satisfied. In addition, in lieu of a release of the vacant out-parcels, the borrower is permitted to lease such parcels pursuant to a ground lease.

Property Management. Triple Five is the property manager for the Mall of America Property. Triple Five owns and/or manages approximately 12.2 million square feet of retail space, which includes the Mall of America complex (approximately 4.0 million square feet), West Edmonton Mall in Edmonton, Canada (the largest mall in the world totalling approximately 5.4 million square feet) and approximately 2.6 million square feet of additional retail space in the western United States.

Current Mezzanine or Subordinate Debt. None.

Future Mezzanine or Subordinate Indebtedness. Not permitted.

B-80