UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[ü] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

Or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 333-142283

Verso Paper Holdings LLC

(Exact name of registrant as specified in its charter)

| Delaware | 56-2597634 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) |

| | |

| 6775 Lenox Center Court, Suite 400 | |

| Memphis, Tennessee 38115-4436 | (901) 369-4100 |

| (Address of principal executive offices) (Zip Code) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ü

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ü

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No ü

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. ü

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

Large accelerated filer ______ | Accelerated filer ______ | Non-accelerated filer __ü__ | Smaller reporting company ______ |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ü _

DOCUMENTS INCORPORATED BY REFERENCE: None

Cautionary Note Regarding Forward-Looking Statements

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and other factors include, among other things, those listed in Item 1A, “Risk Factors,” Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this annual report. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “assumption” or the negative of these terms or other comparable terminology. The forward-looking statements contained herein reflect our current views with respect to future events and are based on our currently available financial, economic and competitive data and on current business plans. Actual events or results may differ materially depending on risks and uncertainties that may affect the Company’s operations, markets, services, prices and other factors. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: economic factors such as an interruption in the supply of or increased pricing of raw materials due to natural disasters, competitive factors such as pricing actions by our competitors that could affect our operating margins, labor disruptions, and regulatory factors such as changes in governmental regulations involving our products that lead to environmental and legal matters.

We do not undertake any responsibility to release publicly any revisions to these forward-looking statements to take into account events or circumstances that occur after the date of this annual report. Additionally, we do not undertake any responsibility to update you on the occurrence of any unanticipated events which may cause actual results to differ from those expressed or implied by the forward-looking statements contained in this annual report.

Market and Industry Information

Market data and other statistical information used throughout this annual report are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates which are derived from our review of internal surveys, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information. Industry prices for coated paper provided in this annual report are, unless otherwise expressly noted, derived from Resource Information Systems, Inc., or “RISI, Inc.” data. “North American” data included in this annual report that has been derived from RISI, Inc. only includes data from the United States and Canada. U.S. industry pricing data included in this annual report has been derived from RISI, Inc. data; this data represents pricing from the eastern United States only (as defined by RISI, Inc.). Also, any reference to (i) grade No. 3, grade No. 4 and grade No. 5 coated paper relates to 60 lb. basis weight, 50 lb. basis weight and 34 lb. basis weight, respectively, (ii) lightweight coated groundwood paper refers to groundwood paper grades that are a 36 lb. basis weight or less, and (iii) ultra-lightweight coated groundwood paper refers to groundwood paper grades that are a 30 lb. basis weight or less. The RISI, Inc. data included in this annual report has been derived from the following RISI, Inc. publications: 2006 RISI World Graphic Paper forecast; RISI North American Graphic Paper forecast, September 2007; and RISI, Paper Trader: A Monthly Monitor of the North American Graphic Paper Market, December 2007.

PART I

Unless otherwise noted, the terms the “Company,” “Verso Paper,” “we,” “us,” “our” and “Successor” refer collectively to Verso Paper Holdings LLC, a Delaware limited liability company, and its subsidiaries after giving effect to the consummation of the Transactions described under “Business — The Transactions.” References to the “Division” or “Predecessor” refer to the Coated and Supercalendered Papers Division of International Paper Company.

The Transactions

On August 1, 2006, we acquired the assets and certain of the liabilities of the Coated and Supercalendered Papers Division of International Paper Company (“International Paper”) located at the mills in Jay, Maine, Bucksport, Maine, Quinnesec, Michigan and Sartell, Minnesota, together with other related facilities and assets and certain administrative and sales and marketing functions (collectively, the “Acquisition”) pursuant to an Agreement of Purchase and Sale that we entered into with International Paper on June 4, 2006.

We were formed by affiliates of Apollo Management, L.P. (“Apollo”) for the purpose of consummating the Acquisition. In connection with the Acquisition we issued a total of $1,185 million of debt (the “Financing”). The Financing consists of (1) a $285 million term loan B (“Term Loan B”), (2) $350 million of 9⅛% second priority senior secured fixed rate notes due 2014 (the “fixed rate notes”), (3) $250 million of second priority senior secured floating rate notes due 2014 (the “floating rate notes”), and (4) $300 million of 11⅜% senior subordinated notes due 2016 (the “senior subordinated notes”). We refer to the fixed rate notes and the floating rate notes collectively as the “second priority senior secured notes”; the second priority senior secured notes and the senior subordinated notes collectively as the “notes”; and the Acuqisition and the Financing collectively as the “Transactions.” We also obtained a $200 million revolving credit facility (together with Term Loan B, the “Senior Secured Credit Facilities”), which was undrawn at the closing of the Acquisition. In addition to the Financing, affiliates of Apollo, International Paper and certain members of our senior management contributed approximately $289 million of equity.

We are a Delaware limited liability company. Our principal executive offices are located at 6775 Lenox Center Court, Suite 400, Memphis, Tennessee 38115-4436. Our telephone number is (901) 369-4100. Our web site address is www.versopaper.com. Information on our web site is not considered part of this annual report.

General

We are a leading North American supplier of coated papers to catalog and magazine publishers. The market for coated paper, which is comprised of coated groundwood paper and coated freesheet paper, is one of the most attractive segments of the paper industry due to its prospects for volume growth, continued improvement in pricing and the high value-added nature of its products. Coated paper is used primarily in media and marketing applications, including catalogs, magazines and commercial printing applications, which include high-end advertising brochures, annual reports and direct mail advertising. We are North America’s second largest producer of coated groundwood paper, which is used primarily for catalogs and magazines. We also believe we are North America’s lowest cost producer of coated freesheet paper, which is used primarily for annual reports, brochures and magazine covers. In addition to coated paper, we have a strategic presence in supercalendered paper, which is primarily used for retail inserts. We also produce and sell market pulp, which is used in the manufacture of printing and writing paper grades and tissue products.

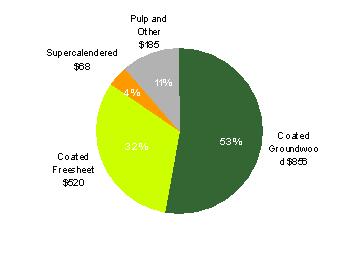

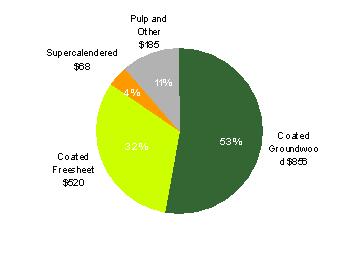

Our primary product lines include coated groundwood paper, coated freesheet paper, supercalendered paper and pulp. Our net sales by product line for the year ended December 31, 2007, are illustrated below:

Net Sales by Product Line

(dollars in millions)

We sell and market our products to approximately 100 customers which comprise 650 end-user accounts. We have long-standing relationships with many leading magazine and catalog publishers, commercial printers, specialty retail merchandisers and paper merchants. We reach our end-users through several distribution channels, including direct sales, commercial printers, paper merchants and brokers. The majority of our products are sold via contracts we maintain with our customers, which generally specify the volumes to be sold to the customer over the contract term, as well as the pricing parameters for those sales. Having a large portion of our sales volume under contract allows us to plan our production runs well in advance, optimizing production over our integrated mill system and thereby increasing overall efficiency and reducing our costs. Most of our contracts are negotiated on an annual basis. Typically, our contracts provide for quarterly price adjustments based on market price movements. Our key customers include leading magazine publishers, such as Condé Nast Publications, Inc., National Geographic Society and Time Inc.; leading catalog producers such as Avon Products, Inc., and Sears Holdings Corporation; leading commercial printers, such as Quad Graphics, Inc., and RR Donnelley & Sons Company; and leading paper merchants and brokers such as Unisource, Worldwide, Inc., the xpedx business unit of International Paper, A.T. Clayton & Co., Inc., and Clifford Paper, Inc.

We operate 11 paper machines at four mills located in Maine, Michigan and Minnesota. The mills have a combined annual production capacity of 1,726,000 tons of coated paper, 102,000 tons of supercalendered paper and 874,000 tons of kraft pulp, of which approximately 610,000 tons are consumed internally and the remainder is sold as market pulp. Over our integrated mill system, the total volume of pulp purchased from third parties is approximately balanced by the amount of pulp that we sell to the market. As a result, our business is generally insulated from fluctuations to earnings caused by fluctuations in the price of pulp. Our facilities are strategically located within close proximity to major publication printing customers, which affords us the ability to more quickly and cost-effectively deliver our products. Our facilities also benefit from convenient and cost-effective access to northern softwood fiber, which is required for the production of lightweight and ultra-lightweight coated groundwood papers, two of the more attractive grades of coated paper.

Industry

Coated Paper Industry Overview

Based on 2007 sales, the size of the global coated paper industry is estimated to be approximately $48 billion, or 54 million tons of coated paper shipments, including approximately $12 billion, or 13 million tons of coated paper shipments, in North America. The coating process adds a smooth uniform layer in the paper, which results in superior color and print definition. As a result, major uses of coated papers include the printing of catalogs, magazines, annual reports, directories and advertising materials. Demand is generally driven by North American advertising and print media trends, which in turn have historically been highly correlated with growth in Gross Domestic Product, or “GDP.”

In North America, coated papers are classified by brightness and fall into five grades, labeled No. 1 to No. 5, with No. 1 having the highest brightness level and No. 5 having the lowest brightness level. Papers graded No. 1, No. 2 and No. 3 are typically coated freesheet grades. No. 4 and No. 5 papers are predominantly groundwood containing grades. Coated groundwood grades are the preferred grades for catalogs and magazines, while coated freesheet is more commonly used in commercial print applications.

Products

We manufacture three main grades of paper: coated groundwood paper, coated freesheet paper and supercalendered paper. These paper grades are differentiated primarily by their respective brightness, weight, print quality, bulk, opacity and strength. We also produce Northern Bleached Hardwood Kraft (“NBHK”) pulp. The following table sets forth our principal products by 2007 tons sold and as a percentage of our 2007 net sales:

| Product | | Tons Sold | | | Net Sales | |

| (tons in thousands, dollars in millions) | | Kts | | | % | | | $ | | | % | |

| Coated groundwood paper | | | 1,063 | | | | 51 | | | $ | 856 | | | | 53 | |

| Coated freesheet paper | | | 600 | | | | 29 | | | | 520 | | | | 32 | |

| Supercalendared paper | | | 105 | | | | 5 | | | | 68 | | | | 4 | |

| Pulp | | | 281 | | | | 13 | | | | 148 | | | | 9 | |

| Other | | | 47 | | | | 2 | | | | 37 | | | | 2 | |

| Total | | | 2,096 | | | | 100 | | | $ | 1,629 | | | | 100 | |

As a result of our scale and technological capabilities, we are able to offer our customers a broad product offering, from ultra-lightweight coated groundwood to heavyweight coated freesheet and supercalendered papers. Our customers have the opportunity to sole-source all of their coated paper needs from us while optimizing their choice of paper products. As our customers’ preferences change, they can switch paper grades to meet their desired balance between cost and performance attributes while maintaining their relationship with us. This “one-stop shop” marketing approach engenders customer loyalty and contributes to the efficiency of our sales organization.

We are also one of the largest rotogravure lightweight coated paper manufacturers in North America. Rotogravure printing is a technique for transferring ink onto coated papers, which typically results in a sharper image with truer colors and less ink trapping than in other printing processes but generally requires a smaller and higher-quality paper. Additionally, we are the only manufacturer in North America with the technological expertise to supply both rotogravure coated groundwood and coated freesheet. This provides us with a significant competitive advantage when selling to customers with long-run, mass publishing needs, as they generally prefer rotogravure products.

Coated groundwood paper. Coated groundwood paper includes a fiber component produced through a mechanical pulping process. The use of such fiber results in a bulkier and more opaque paper that is better suited for applications where lighter weights and/or higher stiffness are required, such as catalogs and magazines. In addition to mechanical pulp, coated groundwood paper typically includes a kraft pulp component to improve brightness and print quality.

Coated freesheet paper. Coated freesheet paper is made from bleached kraft pulp, which is produced using a chemical process to break apart wood fibers and dissolve impurities such as lignin. The use of kraft pulp results in a bright, heavier-weight paper with excellent print qualities, which is well-suited for high-end commercial applications and premium magazines. Coated freesheet contains primarily kraft pulp, with less than 10% mechanical pulp in its composition.

Supercalendered paper. Supercalendered paper consists of groundwood fibers and a very high filler content but does not receive a separate surface coating. Instead, the paper is passed through a supercalendering process in which alternating steel and filled rolls “iron” the paper, giving it a gloss and smoothness that makes it resemble coated paper. Supercalendered papers are primarily used for retail inserts, due to their relatively low price point.

Pulp. We produce and sell NBHK pulp. NBHK pulp is produced through the chemical kraft process using hardwoods. Hardwoods typically have shorter length fibers than softwoods and are used to smooth paper. Kraft describes pulp produced using a chemical process, whereby wood chips are combined with chemicals and steam to separate the wood fibers. The fibers are then washed and pressure screened to remove the chemicals and lignin which originally held the fibers together. Finally, the pulp is bleached to the necessary whiteness and brightness. Kraft pulp is used in applications where brighter and whiter paper is required.

Over our integrated mill system, the total volume of pulp purchased from third parties is approximately balanced by the amount of pulp that we sell to the market. This feature substantially insulates our business from exposure to fluctuations in the price of pulp.

Other products. We also offer recycled paper to help meet specific customer requirements. Additionally, we offer customized product solutions for strategic accounts by producing paper grades with customer-specified weight, brightness and pulp mix characteristics, providing customers with cost benefits and/or brand differentiation.

Manufacturing

We operate 11 paper machines at four mills located in Maine, Michigan and Minnesota. The mills have a combined annual production capacity of 1,726,000 tons of coated paper, 102,000 tons of supercalendered paper and 874,000 tons of kraft pulp, of which approximately 610,000 tons are consumed internally and the remainder is sold as market pulp. Our facilities are strategically located within close proximity to major publication printing customers. The facilities also benefit from convenient and cost-effective access to northern softwood fiber, which is required for the production of lightweight and ultra-lightweight coated papers. All mills and machines operate seven days a week on a twenty-four hours per day basis.

The following table sets forth the locations of our mills, the products they produce and other key operating information:

| | | | | Paper | | Production |

| Mill/Location | | Product/Paper Grades | | Machines | | Capacity* |

| Jay (Androscoggin), ME | | Lightweight Coated Groundwood | | 2 | | 375,800 |

| | | Lightweight Coated Freesheet | | 1 | | 218,900 |

| | | Pulp | | - | | 422,500 |

| Bucksport, ME | | Lightweight and Ultra-Lightweight Coated | | | | |

| | | Groundwood and High Bulk Specialty | | | | |

| | | Coated Groundwood | | 4 | | 516,500 |

| Quinnesec, MI | | Coated Freesheet | | 1 | | 400,000 |

| | | Pulp | | - | | 451,500 |

| Sartell, MN | | Lightweight and Ultra-Lightweight Coated | | | | |

| | | Groundwood | | 1 | | 214,800 |

| | | Supercalendered | | 2 | | 102,000 |

| * We produce 874,000 tons of kraft pulp, of which approximately 610,000 tons are consumed internally and the remainder is sold as market pulp. This data does not include our production capacity for other pulp grades, the entirety of which is consumed internally in the production process for our coated paper. |

We believe we have the lowest cost coated freesheet assets in North America and a highly competitive cost position in coated groundwood. From 1985 to 2006, International Paper invested over $1.7 billion in growth capital expenditures for new machines, product enhancements and capacity expansions. In addition, over $800 million was spent for maintenance and repairs to this equipment as well as for certain environmental, health and safety projects. As a result of these expenditures, we believe that our capacity is sufficient to meet our current growth initiatives without significant additional spending.

The basic raw material of the papermaking process is wood pulp. The first stage of papermaking involves converting wood logs to pulp through either a mechanical or chemical process. Before logs can be processed into pulp, they are passed through a debarking drum to remove the bark. Once separated, the bark is burned as fuel in bark boilers. The wood logs are composed of small cellulose fibers which are bound together by a glue-like substance called lignin. The cellulose fibers are separated from each other through either a mechanical or a kraft pulping process.

After the pulping phase, the fiber furnish is run onto the forming fabric of the paper machine. On the forming fabric, the fibers become interlaced, forming a mat of paper, and much of the water is extracted. The paper web then goes through a pressing and drying process to extract the remaining water. After drying, the web receives a uniform layer of coating that makes the paper smooth and provides uniform ink absorption. After coating, the paper goes through a calendering process that provides a smooth finish by ironing the sheet between multiple soft nips that consist of alternating hard (steel) and soft (cotton or synthetic) rolls. At the dry end, the paper is wound onto spools to form a machine reel and then rewound and slit into smaller rolls on a winder. Finally, the paper is wrapped, labeled and shipped.

Catalog and magazine publishers with longer print runs tend to purchase paper in roll form for use in web printing, a process of printing from a reel of paper as opposed to individual sheets of paper, in order to minimize costs. In contrast, commercial printers typically buy large quantities of sheeted paper in order to satisfy the short-run printing requirements of their customers. We believe that sheeted paper is a less attractive product as it requires additional processing, bigger inventory stocks, a larger sales and marketing team and a different channel strategy. For this reason, we have pursued a deliberate strategy of configuring our manufacturing facilities to produce all web-based papers, which are shipped in roll form and have developed relationships with third-party converters to address any sheeted paper needs of our key customers.

We utilize a manufacturing excellence program, named R-GAP, to ensure timely and accurate reporting, encourage faster operator involvement and provide an overall culture of continuous process improvement. We use multi-variable testing, lean manufacturing, center of excellence teams, source-of-loss initiatives and best practice sharing to constantly improve our manufacturing processes and products. Since 2001, three of our four facilities have participated in OSHA’s Voluntary Protection Program which recognizes outstanding safety programs and performance.

Raw Materials and Suppliers

Our key cost inputs in the papermaking process are wood fiber, market pulp, chemicals and energy.

Wood Fiber. We source our wood fiber from a broad group of timberland and sawmill owners located in our regions.

Kraft Pulp. Overall, we produce 874,000 tons of kraft pulp, with 422,500 tons of pulp at the Androscoggin mill and 451,500 tons of pulp at the Quinnesec mill, of which a total of approximately 610,000 tons are consumed internally. We supplement our internal production of kraft pulp with purchases from third parties. In 2007, these purchases were approximately 187,000 tons of pulp. We purchase the pulp requirements from a variety of suppliers and are not dependent on any single supplier to satisfy our pulp needs. We offset pulp purchases with open-market sales. Over our integrated mill system, the total volume of pulp purchased from third parties is approximately balanced by the amount of pulp that we sell to the market. This feature substantially insulates our business from exposure to fluctuations in the price of pulp.

Chemicals. Chemicals utilized in the manufacturing of coated papers include latex, starch, calcium carbonate, titanium dioxide and others. We purchase these chemicals from a variety of suppliers and are not dependent on any single supplier to satisfy our chemical needs.

Energy. We produce a large portion of our energy requirements, historically producing approximately 50% of our energy needs for our coated paper mills from sources such as waste wood and paper, hydroelectric facilities, chemicals from our pulping process, our own steam recovery boilers and internal energy cogeneration facilities. Our external energy purchases vary across each one of our mills and include fuel oil, natural gas, coal and electricity. While our internal energy production capacity and ability to switch between certain energy sources mitigates the volatility of our overall energy expenditures, we expect prices for energy to remain volatile for the foreseeable future, and our energy costs will increase in a high energy cost environment. We also utilize derivative contracts as part of our risk management strategy to manage our exposure to market fluctuations in energy prices.

Sales, Marketing and Distribution

We reach our end-users through several sales channels. These include selling directly to end-users, through brokers, merchants, and printers. We sell and market products to approximately 100 customers, which comprise 650 end-user accounts.

Sales to End-Users. We sell approximately 43% of our manufacturing output directly to end-users, most of which are catalog and magazine publishers for our paper products. Customers for our pulp products are mostly other paper manufacturers. These customers are typically large, sophisticated buyers who have the scale, resources and expertise to procure paper directly from manufacturers.

Sales to Brokers and Merchants. Our largest indirect paper sales by volume are through brokers and merchants who resell the paper to end-users. In 2007, our total sales to brokers and merchants represented 48% of our total sales.

Brokers typically act as an intermediary between paper manufacturers and smaller end-users who do not have the scale or resources to cost effectively procure paper directly from manufacturers. The majority of sales to brokers are resold to catalog publishers. We work closely with brokers to achieve share targets in the catalog, magazine and insert end-user segments through collaborative selling.

Merchants are similar to brokers in that they act as an intermediary between the manufacturer and the end-user. However, merchants generally take physical delivery of the product and keep inventory on hand. Merchants tend to deal with smaller end-users that lack the scale to warrant direct delivery from the manufacturer. Coated freesheet comprises the majority of our sales to merchants. In most cases, because they are relatively small, the ultimate end-users of paper sold through merchants are generally regional or local catalog or magazine publishers. Our merchant customers include major paper distributors such as xpedx, a division of International Paper, and Unisource Worldwide, Inc., which are large organizations with a broad, diversified client base.

Sales to Printers. In 2007, our total sales to printers represented 8% of our total sales. Nearly all of our sales were to the five largest publication printers in the United States. Printers also effectively act as an intermediary between manufacturers and end-users in that they directly source paper for printing/converting and then resell it to their customers as a finished product.

The majority of our products are delivered directly from our manufacturing facilities to the printer, regardless of the sales channel. In order to serve the grade No. 3 coated freesheet segment, we maintain a network of distribution centers located in the West, Midwest, South and Northeast close to our customer base to provide quick delivery. The majority of our pulp products are delivered to our customers’ paper mills.

Our sales force is organized around our sales channels. We maintain an active dialogue with all of our major customers and track product performance and demand across grades. We have a team of sales representatives and marketing professionals organized into three major sales groups that correspond with our sales channels: direct sales support; support to brokers and merchants; and printer support.

The majority of our products are sold via contracts that we maintain with our customers. Contracted sales are more prevalent for coated groundwood paper, as opposed to coated freesheet paper, which is more often sold without a contract. Our contracts generally specify the volumes to be sold to the customer over the contract term, as well as the pricing parameters for those sales. The large portion of contracted sales allows us to plan our production runs well in advance, optimizing production over our integrated mill system and thereby reducing costs and increasing overall efficiency.

Part of our strategy is to continually reduce the cost to serve our customer base through e-commerce initiatives such as our Online Order Management System, an online system which allows for simplified ordering, tracking and invoicing. In 2007, approximately 28%, or 495,000 tons, of our total coated paper sales volume were placed through our Online Order Management System. We are focused on further developing our technology platform and e-commerce capabilities. To this end, we operate Nextier Solutions, an Internet-based system that has become an industry standard for collaborative production planning, procurement and inventory management process throughout the supply chain. Our customers and competitors use the system to maximize supply chain efficiencies, improve communication and reduce operating costs. Nextier Solutions enables subscribers to monitor their inventories and place orders. Participants pay us subscription and transaction fees for system usage. By leveraging our leadership position in e-commerce for coated papers distribution and management, we should realize a meaningful competitive advantage in our sales, marketing and distribution functions.

Customers

We serve the catalog, magazine, insert and commercial printing markets and have developed long-standing relationships with the premier North American catalog and magazine publishers. The length of our relationships with our top ten customers averages more than 20 years and no single customer accounted for more than 10% of our net sales in 2007. Our key customers include leading magazine publishers such as Condé Nast Publications, Inc., National Geographic Society and Time Inc.; leading catalog producers such as Avon Products, Inc. and Sears Holding Corporation; leading commercial printers such as Quad/Graphics, Inc., and RR Donnelley & Sons Company; and leading paper merchants and brokers, such as A.T. Clayton & Co., Inc., Unisource Worldwide, Inc., the xpedx business unit of International Paper, and Clifford Paper, Inc. See “Risk Factors—We depend on a small number of customers for a significant portion of our business.”

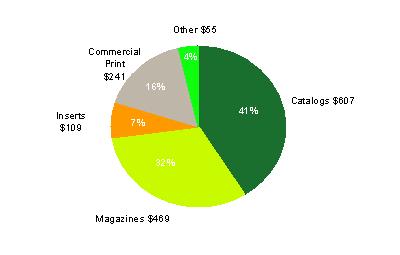

Our net sales, excluding pulp sales, by end-user segment for the year ended December 31, 2007, are illustrated below (dollars in millions):

Research and Development

The primary function of our research and development efforts is to work with customers in developing and modifying products to accommodate their evolving needs and to identify cost saving opportunities within our operations.

Examples of our research and development efforts implemented over the past several years include:

· high-bulk offset and rotogravure coated groundwood;

· lightweight grade No. 4 coated groundwood;

· ultra-lightweight grade No. 5 coated groundwood; and

· rotogravure coated freesheet.

Intellectual Property

We have several patents and patent applications in the United States and various foreign countries. These patents and patent applications generally relate to various paper manufacturing methods and equipment which may become commercially viable in the future. In addition, we have filed trademark applications for “Verso” and “Verso Paper” and, in connection with the Acquisition, acquired several trademarks relating to our products, including Influence®, Velocity®, Liberty®, Advocate® and Trilogy®. In addition to the intellectual property that we own, a significant portion of intellectual property used in our business is licensed on a perpetual, royalty-free, non-exclusive basis from International Paper

Although, in the aggregate, our patents, trademarks, copyrights, and the intellectual property licensed from International Paper are material to our business, financial condition and results of operations, we believe that the loss of any one or any related group of intellectual property rights would not have a material adverse effect on our business, financial condition or results of operations.

Competition

Our business is highly competitive. A significant number of North American competitors produce coated and supercalendered papers, and several overseas manufacturers, principally from Europe, export to North America. We compete based on a number of factors, including:

| · | price; |

| · | product availability; |

| · | the quality of our products; |

| · | our breadth of product offerings; |

| · | our ability to maintain plant efficiencies and high operating rates and thus lower our average; |

| · | manufacturing costs per ton; |

| · | customer service and our ability to distribute our products on time; and |

| · | the availability and/or cost of wood fiber, market pulp, chemicals, energy and other raw materials and labor. |

Foreign competition in North America is also affected by the exchange rate of the U.S. dollar relative to other currencies, especially the euro, market prices in North America and other markets, worldwide supply and demand, and the cost of ocean-going freight.

While our product offering is broad in terms of grades produced (from supercalendered and ultra-lightweight coated groundwood offerings to heavier-weight coated freesheet products), we are focused on producing coated groundwood and coated freesheet in roll form. This strategy is driven by our alignment with catalog and magazine end-users which tend to purchase paper in roll form for use in long runs of web printing in order to minimize costs. Our principal competitors include NewPage Corporation, Bowater Incorporated, UPM-Kymmene Corporation and Sappi Limited, all of which have North American assets. UPM and Sappi are headquartered overseas and also have overseas manufacturing facilities.. See “Risk Factors—The markets in which we operate are highly competitive.”

Employees

As of December 31, 2007, we had approximately 2,900 employees, of whom approximately 35% are unionized and 77% are hourly employees. Employees at two of our four mills are represented by labor unions under a total of four collective bargaining agreements. In 2007, we completed successful labor negotiations for three agreements that were up for renewal during the year. The new agreements will expire in 2011.

We have not experienced any work stoppages during the past several years. We believe that we have good relations with our employees.

Environmental and Other Governmental Regulations

We are subject to federal, state and local environmental, health and safety laws and regulations, including, but not limited to, the Federal Water Pollution Control Act of 1972 (the “Clean Water Act”), the Federal Clean Air Act, the Federal Resource Conservation and Recovery Act and the Comprehensive Environmental Response, Compensation and Liability Act of 1980, (“CERCLA”), the Federal Occupational Health and Safety Act and analogous state and local laws. Among our activities subject to environmental regulation are the emissions of air pollutants, discharges of wastewater and stormwater, operation of dams, storage, treatment and disposal of materials and waste, and remediation of soil, surface water and ground water contamination. Many environmental laws and regulations provide for substantial fines or penalties and criminal sanctions for any failure to comply. In addition, failure to comply with these laws and regulations could result in the interruption of our operations and, in some cases, facility shutdowns.

Certain of these environmental laws, such as CERCLA and analogous state laws, provide for strict, and under certain circumstances, joint and several liability for investigation and remediation of the release of hazardous substances into the environment, including soil and groundwater. These laws may apply to properties presently or formerly owned or operated by an entity or its predecessors, as well as to conditions at properties at which wastes attributable to an entity or its predecessors were disposed. Under these environmental laws, a current or previous owner or operator of real property, and parties that generate or transport hazardous substances that are disposed of at real property, may be held liable for the cost to investigate or clean up such real property and for related damages to natural resources. We handle and dispose of wastes arising from our mill operations, including disposal at on-site landfills. We are required to maintain financial assurance for the expected cost of landfill closure and post-closure care. We may be subject to liability, including liability for investigation and cleanup costs, if contamination is discovered at one of our paper mills or another location where we have disposed of, or arranged for the disposal of, wastes. We could be subject to potentially significant liabilities under, or fines or penalties for any failure to comply with, any environmental rule or regulation. See “Risk Factors — We are subject to various environmental, health and safety regulations that could impose substantial costs or other liabilities upon us and may adversely affect our operating performance and financial condition.”

Compliance with environmental laws and regulations is a significant factor in our business. We have made, and will continue to make, significant expenditures to comply with these requirements. We anticipate that environmental compliance will continue to require increased capital expenditures over time as environmental laws or regulations, or interpretations thereof, change or the nature of our operations require us to make significant additional capital expenditures. A significant portion of anticipated environmental capital expenditures in 2007 will be spent in connection with emission control technology and wastewater effluent controls required to comply with the Federal Clean Air Act and Clean Water Act. Integrated pulp and paper mills are required to install control equipment to limit the release of certain pollutants into the air and water under so-called “Cluster Rule” regulations promulgated by the Environmental Protection Agency in 1998. In addition, our mills will incur increased operating expenses associated with compliance with the Cluster Rule regulations and the operation of the control equipment. We incurred environmental capital expenditures of $3.4 million in 2007 and $10.3 million in 2006, and we expect to incur additional environmental capital expenditures of $5.8 million in 2008.

Permits are required for the operation of our mills and related facilities. The permits are subject to renewal, modification and revocation. We and others have the right to challenge our permit conditions through administrative and legal appeals and review processes. Governmental authorities have the power to enforce compliance with the permits, and violators are subject to civil and criminal penalties, including fines, injunctions or both. Other parties also may have the right to pursue legal actions to enforce compliance with the permits.

You should carefully consider the risks described below as well as the other information contained in this annual report. Any of the following risks could materially adversely affect our business, financial condition or results of operations.

We have limited ability to pass through increases in our costs to our customers. Increases in our costs or decreases in coated or supercalendered paper prices could adversely affect our business, financial condition or results of operations.

Our earnings are sensitive to price changes in coated or supercalendered paper. Fluctuations in paper prices (and coated paper prices in particular) historically have had a direct effect on our net income (loss) and EBITDA for several reasons:

| • | Market prices for paper products are a function of supply and demand, factors over which we have limited control. We therefore have limited ability to control the pricing of our products. Market prices of grade No. 3, 60 lb. basis weight paper, which is an industry benchmark for coated freesheet paper pricing, have fluctuated since 2000 from a high of $980 per ton to a low of $705 per ton. In addition, market prices of grade No. 5, 34 lb. basis weight paper, which is an industry benchmark for coated groundwood paper pricing, have fluctuated between a high of $1,040 per ton to a low of $795 per ton over the same period. Because market conditions determine the price for our paper products, the price for our products could fall below our cash production costs; |

| • | Market prices for paper products typically are not directly affected by raw material costs or other costs of sales, and consequently we have limited ability to pass through increases in our costs to our customers absent increases in the market price. In addition, a significant portion of our sales are pursuant to contracts that limit price increases. Thus, even though our costs may increase, we may not have the ability to increase the prices for our products, or the prices for our products may decline; and |

| • | The manufacturing of coated paper is highly capital-intensive and a large portion of our operating costs are fixed. Additionally, paper machines are large, complex machines that operate more efficiently when operated continuously. Consequently, both we and our competitors typically continue to run our machines whenever marginal sales exceed the marginal costs, adversely impacting prices at times of lower demand. |

Therefore, our ability to achieve acceptable margins is principally dependent on (i) managing our cost structure, (ii) managing changes in raw materials prices, which represent a large component of our operating costs and fluctuate based upon factors beyond our control and (iii) general conditions in the paper market. If the prices of our products decline, or if our raw material costs increase, it could have a material adverse effect on our business, financial condition and results of operations.

The paper industry is cyclical. Fluctuations in supply and demand for our products could materially adversely affect our business, financial condition and results of operations.

The paper industry is a commodity market to a significant extent and is subject to cyclical market pressures. North American demand for coated and supercalendered paper products tends to decline during a weak U.S. economy. Accordingly, general economic conditions and demand for magazines and catalogs may have a material adverse impact on the demand for our products, which could have a material adverse effect on our business, financial condition and results of operations. In addition, currency fluctuations can have a significant impact on the supply of coated paper products in North America. If the U.S. dollar strengthens, imports may increase, which would cause the supply of paper products available in the North American market to increase. Foreign overcapacity also could result in an increase in the supply of paper products available in the North American market. An increased supply of paper available in North America could put downward pressure on prices and/or cause us to lose sales to competitors, either of which could have a material adverse effect on our business, financial condition and results of operations.

We have a limited operating history as a separate company. Accordingly, our Predecessor combined historical financial data may not be representative of our results as a separate company.

We operated as a division of International Paper prior to the Acquisition. Therefore, we have a very limited operating history as a separate company. Our business strategy as an independent entity may not be successful on a long-term basis. Although International Paper, after the completion of the Acquisition, generally no longer sells coated or supercalendered paper, we cannot assure you that our customers will continue to do business with us on the same terms as when we were a division of International Paper or at all. We may not be able to grow our business as planned and may not remain a profitable business. In addition, the historical combined financial data included in this annual report may not necessarily reflect what our results of operations, financial condition and cash flows would have been had we been a separate independent entity pursuing our own strategies during the periods presented. Our limited operating history as a separate entity makes evaluating our business and our future financial prospects difficult. As a result, our business, financial condition and results of operations may differ materially from our expectations based on the historical financial data contained in the annual report.

Our cost structure following the Acquisition is not comparable to the cost structure that we experienced in prior periods. Our management has limited experience managing our business as a separate company with a significant amount of indebtedness. We cannot assure you that our cost structure in future periods will be consistent with our current expectations or will permit us to operate our business profitably.

The markets in which we operate are highly competitive.

Our business is highly competitive. Competition is based largely on price. We compete with foreign producers, some of which are lower cost producers than we are or are subsidized by governments. We also face competition from numerous North American coated and supercalendered paper manufacturers. Some of our competitors have advantages over us, including lower raw material and labor costs and fewer environmental and governmental regulations to comply with than we do. Furthermore, some of our competitors have greater financial and other resources than we do or may be better positioned than we are to compete for certain opportunities.

Our non-U.S. competitors may develop a competitive advantage over us and other U.S. producers if the U.S. dollar strengthens in comparison to the home currency of those competitors or ocean shipping rates decrease. If the U.S. dollar strengthens, if shipping rates decrease or if overseas supply exceeds demand, imports may increase, which would cause the supply of coated paper products available in the North American market to increase. An increased supply of coated paper could cause us to lower our prices or lose sales to competitors, either of which could have a material adverse effect on our business, financial condition and results of operations.

In addition, the following factors will affect our ability to compete:

· product availability;

· the quality of our products;

· our breadth of product offerings;

· our ability to maintain plant efficiencies and high operating rates;

· manufacturing costs per ton;

· customer service and our ability to distribute our products on time; and

· the availability and/or cost of wood fiber, market pulp, chemicals, energy and other raw materials and labor.

If we are unable to obtain energy or raw materials at favorable prices, or at all, it could adversely impact our business, financial condition and results of operations.

We purchase wood fiber, market pulp, chemicals, energy and other raw materials from third parties. We may experience shortages of energy supplies or raw materials or be forced to seek alternative sources of supply. If we are forced to seek alternative sources of supply, we may not be able to do so on terms as favorable as our current terms or at all. In addition, the prices for energy and many of our raw materials, especially petroleum-based chemicals, have been volatile and have increased over the last year. Prices are expected to remain volatile for the foreseeable future. Chemical suppliers that use petroleum-based products in the manufacture of their chemicals may, due to a supply shortage and cost increase, ration the amount of chemicals available to us and/or we may not be able to obtain the chemicals we need to operate our business at favorable prices, if at all. In addition, certain specialty chemicals that we purchase are available only from a small number of suppliers. If any of these suppliers were to cease operations or cease doing business with us, we may be unable to obtain such chemicals at favorable prices, if at all.

The supply of energy or raw materials may be adversely affected by, among other things, hurricanes and other natural disasters or an outbreak or escalation of hostilities between the United States and any foreign power and, in particular, events in the Middle East. For example, timber supply is sometimes limited by fire, insect infestation, disease, ice and wind storms, floods, or other weather conditions. Additionally, due to increased fuel costs, suppliers, distributors and freight carriers have charged fuel surcharges, which have increased our costs. Any significant shortage or significant increase in our energy or raw material costs in circumstances where we cannot raise the price of our products due to market conditions could have a material adverse effect on our business, financial condition and results of operations. Any disruption in the supply of energy or raw materials could also affect our ability to meet customer demand in a timely manner and could harm our reputation. Furthermore, we may be required to post letters of credit or other financial assurance obligations with certain of our energy and other suppliers, which could limit our financial flexibility.

We are involved in continuous manufacturing processes with a high degree of fixed costs. Any interruption in the operations of our manufacturing facilities may affect our operating performance.

We seek to run our paper machines on a nearly continuous basis for maximum efficiency. Any unplanned plant downtime at any of our paper mills results in unabsorbed fixed costs that negatively affect our results of operations for the period in which we experience the downtime. Due to the extreme operating conditions inherent in some of our manufacturing processes, we may incur unplanned business interruptions from time to time and, as a result, we may not generate sufficient cash flow to satisfy our operational needs. In addition, many of the geographic areas where our production is located and where we conduct our business may be affected by natural disasters, including snow storms, forest fires and flooding. Such natural disasters could cause our mills to stop running, which could have a material adverse effect on our business, financial condition and results of operations. Furthermore, during periods of weak demand for paper products, we have in the past and may in the future experience market-related downtime, which could have a material adverse effect on our financial condition and results of operations.

Our operations require substantial ongoing capital expenditures, and we may not have adequate capital resources to fund all of our required capital expenditures.

Our business is capital intensive, and we incur capital expenditures on an ongoing basis to maintain our equipment and comply with environmental laws, as well as to enhance the efficiency of our operations. Our total capital expenditures were $69 million in 2007, including $39 million for maintenance and environmental capital expenditures. We expect to spend approximately $80 million on capital expenditures during 2008, with approximately $69 million for maintenance and environmental capital expenditures, which includes our normal level of approximately $40 million for maintenance and environmental capital expenditures. We anticipate that our available cash resources and cash generated from operations will be sufficient to fund our operating needs and capital expenditures for at least the next year. However, if we require additional funds to fund our capital expenditures, we may not be able to obtain them on favorable terms, or at all. If we cannot maintain or upgrade our facilities and equipment as we require or as necessary to ensure environmental compliance, it could have a material adverse effect on our business, financial condition and results of operations.

We depend on a small number of customers for a significant portion of our business.

Our largest customer, International Paper, accounted for approximately 9% of our net sales in 2007. In 2007, our ten largest customers (including International Paper, Inc.) accounted for approximately 52% of our net sales, while our ten largest end-users accounted for approximately 29% of our net sales. The loss of, or reduction in orders from, any of these customers or other customers could have a material adverse effect on our business, financial condition and results of operations, as could significant customer disputes regarding shipments, price, quality or other matters.

We may not realize certain productivity enhancements or improvements in costs.

As part of our business strategy, we intend to identify opportunities to improve profitability by reducing costs and enhancing productivity. Any cost savings or productivity enhancements that we realize from such efforts may differ materially from our estimates. For example, we have several productivity enhancement initiatives to reduce waste and increase the amount of uptime on our paper machines. We cannot assure you that these initiatives will be completed as anticipated or that the benefits we expect will be achieved on a timely basis or at all.

Rising postal costs could weaken demand for our paper products.

A significant portion of paper is used in magazines, catalogs and other promotional mailings. Many of these materials are distributed through the mail. Future increases in the cost of postage could reduce the frequency of mailings, reduce the number of pages in magazine and advertising materials and/or cause catalog and magazine publishers to use alternate methods to distribute their materials. Any of the foregoing could decrease the demand for our products, which could materially adversely affect our business, financial condition and results of operations.

Our business may suffer if we do not retain our senior management.

We depend on our senior management. The loss of services of members of our senior management team could adversely affect our business until suitable replacements can be found. There may be a limited number of persons with the requisite skills to serve in these positions and we may be unable to locate or employ qualified personnel on acceptable terms. In addition, our future success requires us to continue to attract and retain competent personnel.

A large percentage of our employees are unionized. Wage increases or work stoppages by our unionized employees may have a material adverse effect on our business, financial condition and results of operations.

As of December 31, 2007, approximately 35%, of our employees were represented by labor unions under four collective bargaining agreements at two of our mills. In 2007, we completed successful labor negotiations for three agreements that were up for renewal in during the year, and the new agreements will expire in 2011. We may become subject to material cost increases or additional work rules imposed by agreements with labor unions. This could increase expenses in absolute terms and/or as a percentage of net sales. In addition, although we believe we have good relations with our employees, work stoppages or other labor disturbances may occur in the future. Any of these factors could negatively affect our business, financial condition and results of operations.

We depend on third parties for certain transportation services.

We rely primarily on third parties for transportation of our products to our customers and transportation of our raw materials to us, in particular, by truck and train. If any of our third-party transportation providers fail to deliver our products in a timely manner, we may be unable to sell them at full value. Similarly, if any of our transportation providers fail to deliver raw materials to us in a timely manner, we may be unable to manufacture our products on a timely basis. Shipments of products and raw materials may be delayed due to weather conditions, strikes or other events. Any failure of a third-party transportation provider to deliver raw materials or products in a timely manner could harm our reputation, negatively impact our customer relationships and have a material adverse effect on our business, financial condition and results of operations. In addition, our ability to deliver our products on a timely basis could be adversely affected by the lack of adequate availability of transportation services, especially rail capacity, whether because of work stoppages or otherwise. Furthermore, increases in the cost of our transportation services, including as a result of rising fuel costs, could cause a material adverse effect on our business, financial condition and results of operations.

We are subject to various environmental, health and safety regulations that could impose substantial costs or other liabilities upon us and may adversely affect our operating performance and financial condition.

We are subject to a wide range of federal, state and local general and industry-specific environmental, health and safety laws and regulations, including those relating to air emissions, wastewater discharges, solid and hazardous waste management and disposal and site remediation. Compliance with these laws and regulations is a significant factor in our business. We have made, and will continue to make, significant expenditures to comply with these requirements. In addition, we handle and dispose of wastes arising from our mill operations and operate a number of on-site landfills to handle that waste. We maintain financial assurance for the projected cost of closure and post-closure care for these landfill operations. We could be subject to potentially significant fines, penalties, criminal sanctions, plant shutdowns or interruptions in operations for any failure to comply with applicable environmental, health and safety laws and regulations. Moreover, under certain environmental laws, a current or previous owner or operator of real property, and parties that generate or transport hazardous substances that are disposed of at real property, may be held liable for the full cost to investigate or clean up such real property and for related damages to natural resources. We may be subject to liability, including liability for investigation and cleanup costs, if contamination is discovered at one of our current or former paper mills, other properties or other locations where we have disposed of, or arranged for the disposal of, wastes. International Paper has agreed to indemnify us, subject to certain limitations, for former properties and former off-site shipments, as well as certain other environmental liabilities. There can be no assurance that International Paper will perform under any of its environmental indemnity obligations, which could have a material adverse effect on our financial condition and results of operations. We also could be subject to claims brought pursuant to applicable laws, rules or regulations for property damage or personal injury resulting from the environmental impact of our operations, including due to human exposure to hazardous substances. Increasingly stringent environmental requirements, more aggressive enforcement actions or policies, the discovery of unknown conditions or the bringing of future claims may cause our expenditures for environmental matters to increase, and we may incur material costs associated with these matters. For a further discussion of environmental laws, rules and regulations that affect our business, see “Business — Environmental and Other Governmental Regulations” and “Business – Legal Proceedings.”

Our substantial indebtedness could adversely affect our financial health.

We have and will continue to have a significant amount of indebtedness. On December 31, 2007, we had total indebtedness of $1,156.4 million. The total amount of payments we will need to make on our outstanding indebtedness for each of the next three fiscal years is equal to $109.3 million, $109.0 million and $108.8 million, respectively (assuming the current prevailing interest rates on our outstanding floating rate indebtedness remain the same).

Our substantial indebtedness could have important consequences to you. For example, it could:

| | · | increase our vulnerability to general adverse economic and industry conditions; |

| | | |

| | · | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes; |

| | | |

| | · | increase our vulnerability to and limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| | | |

| | · | expose us to the risk of increased interest rates as borrowings under our senior secured credit facilities and our floating rate notes will be subject to variable rates of interest; |

| | | |

| | · | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| | | |

| | · | limit our ability to borrow additional funds. |

In addition, the indentures and our senior secured credit facilities contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our debts.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future because the terms of the indentures governing our outstanding notes and our senior secured credit facilities do not fully prohibit us or our subsidiaries from doing so. If new indebtedness is added to our and our subsidiaries’ current debt levels, the related risks that we and they now face could intensify.

Because a small number of equity holders own a significant percentage of our common equity interests, they may control all major corporate decisions and our other equity holders may not be able to influence these corporate decisions.

An affiliate of Apollo Management, L.P. (“Apollo”) controls a majority of our common equity and, therefore, Apollo has the power to control our affairs and policies. Apollo also controls the election of our directors, the appointment of our management and the entering into of business combinations or dispositions and other extraordinary transactions. The directors so elected have the authority, subject to the terms of the indentures and our senior secured credit facilities, to issue additional equity interests, implement equity repurchase programs, declare dividends and make other decisions that could be detrimental to owners of the exchange notes.

The interests of Apollo could conflict with the interests of our note holders. For example, if we encounter financial difficulties or are unable to pay our debts as they mature, the interests of Apollo, as equity holders, might conflict with the interests of our note holders. Affiliates of Apollo may also have an interest in pursuing acquisitions, divestitures, financings and other transactions that, in their judgment, could enhance their equity investments, even though such transactions might involve risks to a note holder.

Not Applicable.

Our corporate headquarters are located in Memphis, Tennessee. We operate 11 paper machines at four mills located in Maine, Michigan and Minnesota. We own our principal manufacturing facilities. We also own five hydroelectric dams, four of which provide hydroelectric power to our Androscoggin mill and the fifth of which services our Sartell mill. In addition, we own 16 and lease four woodyards for the purpose of storage and loading of forest products and lease a number of sales offices.

Our headquarters and material facilities as of December 31, 2007, are shown in the following table:

| Location | | Use | | Owned/Leased |

| Memphis, TN | | corporate headquarters | | leased |

| Jay (Androscoggin), ME | | paper mill/kraft pulp mill | | owned |

| Bucksport, ME | | paper mill | | owned |

| Quinnseec, MI | | paper mill/kraft pulp mill | | owned |

| Sartell, MN | | paper mill | | owned |

| West Chester, OH | | sales, distribution and customer service | | leased |

We are involved from time to time in legal proceedings incidental to the conduct of our business. Although the amount of liability that may result from these proceedings cannot be ascertained, we believe that, in the aggregate, they will not result in liabilities that are material to our business, financial condition, results of operations, or cash flows.

In 2005, the Maine Department of Environmental Protection issued a wastewater discharge permit to International Paper for the Androscoggin mill. Shortly thereafter, International Paper, a local public utility company and several environmental interest groups challenged the terms of the permit in an administrative review proceeding before the Maine Board of Environmental Protection, or “BEP.” The review of the Androscoggin mill’s permit was consolidated with reviews of other parties’ permits affecting water quality in the portion of the Androscoggin River downstream from our mill. In February 2008, the BEP issued a final order that imposed more stringent limits on the wastewater discharges for the Androscoggin mill. We anticipate that the new discharge limits will necessitate increased operational and maintenance costs as well as capital expenditures for additional wastewater controls and related improvements. These costs and expenditures may be covered, subject to certain limitations, by an indemnity from International Paper.

Not applicable.

PART II

Our senior secured credit facilities and the indentures governing our second priority senior secured notes and our senior subordinated notes limit our ability to, among other things, pay dividends or make distributions or repurchase or redeem our stock. As of December 31, 2007, we were in compliance with these restrictive covenants.

The following table sets forth our selected historical financial data. The selected historical balance sheet data as of December 31, 2005 and historical statement of operations data for the for the seven months ended July 31, 2006, and for the years ended December 31, 2005 and 2004 have been derived from the combined financial statements of the Coated and Supercalendered Papers Division of International Paper (the “Predecessor” or the “Division”) which have been audited by Deloitte & Touche LLP, independent registered public accounting firm. The selected historical combined statement of operations data for the year ended December 31, 2003, and the combined balance sheet data as of December 31, 2004 and 2003 have been derived from the combined financial statements of the Coated and Supercalendered Papers Division of International Paper that are not included in this annual report. The selected balance sheet data as of December 31, 2007 and 2006 and the statement of operations data for the year ended December 31, 2007, and for the five months ended December 31, 2006, have been derived from the consolidated financial statements of Verso Paper Holdings LLC (the “Successor”) which have been audited by Deloitte & Touche LLP, independent registered public accounting firm.

Our selected historical financial data should be read in conjunction with our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the related notes thereto included elsewhere in this annual report.

| | | Successor | | | Successor | | | Predecessor | | | | | | | | | | |

| | | Consolidated | | | Consolidated | | | Combined | | | Predecessor Combined | |

| | | Year | | | Five Months | | | Seven Months | | | | | | | | | |

| | | Ended | | | Ended | | | Ended | | | | | | | | | | |

| | | December 31, | | | December 31, | | | July 31, | | | Year Ended December 31, | |

| (In millions of U.S. dollars) | | 2007 | | | 2006 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 1,628.8 | | | $ | 706.8 | | | $ | 904.4 | | | $ | 1,603.8 | | | $ | 1,463.3 | | | $ | 1,343.1 | |

| Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of products sold - (exclusive of depreciation | | | | | | | | | | | | | | | | | | | | | |

| and amortization) | | | 1,403.2 | | | | 589.3 | | | | 771.6 | | | | 1,338.2 | | | | 1,272.5 | | | | 1,154.1 | |

| Depreciation and amortization | | | 123.1 | | | | 48.3 | | | | 72.7 | | | | 129.4 | | | | 130.5 | | | | 138.3 | |

| Selling, general and administrative expenses | | | 52.0 | | | | 14.0 | | | | 34.3 | | | | 65.6 | | | | 65.3 | | | | 81.4 | |

| Restructuring and other charges | | | 19.4 | | | | 10.1 | | | | (0.3 | ) | | | 10.4 | | | | 0.6 | | | | 4.5 | |

| Operating income (loss) | | | 31.1 | | | | 45.1 | | | | 26.1 | | | | 60.2 | | | | (5.6 | ) | | | (35.2 | ) |

| Interest income | | | (1.5 | ) | | | (1.8 | ) | | | - | | | | - | | | | (0.2 | ) | | | (0.1 | ) |

| Interest expense | | | 113.9 | | | | 48.7 | | | | 8.4 | | | | 14.8 | | | | 16.0 | | | | 16.3 | |

| Income (loss) before income taxes and cumulative | | | | | | | | | | | | | | | | | | | | | |

| effect of change in accounting principle | | | (81.3 | ) | | | (1.8 | ) | | | 17.7 | | | | 45.4 | | | | (21.4 | ) | | | (51.4 | ) |

| Provision (benefit) for income taxes | | | - | | | | - | | | | 7.0 | | | | 17.9 | | | | (8.2 | ) | | | (19.8 | ) |

| Income (loss) before cumulative effect | | | (81.3 | ) | | | (1.8 | ) | | | 10.7 | | | | 27.5 | | | | (13.2 | ) | | | (31.6 | ) |

| of change in accounting principle | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative effect of change in accounting principle | | | - | | | | - | | | | - | | | | - | | | | - | | | | (0.7 | ) |

| Net income (loss) | | $ | (81.3 | ) | | $ | (1.8 | ) | | $ | 10.7 | | | $ | 27.5 | | | $ | (13.2 | ) | | $ | (32.3 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash provided by operating activities | | $ | 38.8 | | | $ | 128.8 | | | $ | 39.3 | | | $ | 116.8 | | | $ | 123.7 | | | $ | 81.0 | |

| Cash used in investing activities | | $ | (67.8 | ) | | $ | (1,391.8 | ) | | $ | (27.6 | ) | | $ | (53.0 | ) | | $ | (111.5 | ) | | $ | (135.2 | ) |

| Cash (used in) provided by financing activities | | $ | (24.9 | ) | | $ | 1,375.4 | | | $ | (11.6 | ) | | $ | (63.8 | ) | | $ | (12.2 | ) | | $ | 54.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Financial and Operating Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | $ | 69.6 | | | $ | 27.5 | | | $ | 27.7 | | | $ | 53.1 | | | $ | 111.3 | | | $ | 133.3 | |

| Ratio of earnings to fixed charges (1) | | | - | | | | - | | | | 3.47 | | | | 3.69 | | | | - | | | | - | |

| Total tons sold | | | 2,096.3 | | | | 866.4 | | | | 1,145.0 | | | | 2,024.9 | | | | 2,064.6 | | | | 1,934.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Working capital (2) | | $ | 95.6 | | | $ | 154.0 | | | | | | | $ | 87.8 | | | $ | 58.6 | | | $ | 78.9 | |

| Property, plant and equipment, net | | $ | 1,159.9 | | | $ | 1,212.0 | | | | | | | $ | 1,287.0 | | | $ | 1,363.9 | | | $ | 1,384.3 | |

| Total assets | | $ | 1,577.0 | | | $ | 1,692.4 | | | | | | | $ | 1,534.1 | | | $ | 1,585.0 | | | $ | 1,603.4 | |

| Total debt | | $ | 1,156.4 | | | $ | 1,159.3 | | | | | | | $ | 301.2 | | | $ | 302.1 | | | $ | 303.5 | |

| Equity | | $ | 174.9 | | | $ | 279.7 | | | | | | | $ | 1,040.0 | | | $ | 1,075.3 | | | $ | 1,097.0 | |

| (1) For purpose of computing the ratio of earnings to fixed charges, earnings consist of income (loss) before income taxes and cumulative effect of change in accounting principle plus fixed charges. Fixed charges consist of interest expense, amortization of debt issuance costs and a portion of rental expense that management believes is representative of the interest component of rental expense. For the years ended December 31, 2003, 2004, and 2007 and for the five months ended December 31, 2006, earnings were insufficient to cover fixed charges and there was a deficiency of $44.7 million, $14.5 million, $82.5 milliion and $2.0 million, respectively. | |

| | |

| (2) Working capital is defined as current assets net of current liabilities, excluding the current portion of long-term debt and the Division’s accounts payable to International Paper Company—net. | |

The following discussion and analysis of our financial condition and results of operations covers periods prior to the Acquisition. For comparison purposes, the results of operations for the year ended December 31, 2006, are presented on a combined basis, consisting of the historical results of our predecessor for the seven months ended July 31, 2006, and the results of the successor for the period beginning August 1, 2006, and ending on December 31, 2006. Accordingly, the discussion and analysis of historical periods do not fully reflect the significant impact that the Acquisition has had on our financial statements. In addition, the statements in the discussion and analysis regarding industry outlook, our expectations regarding the performance of our business and the other non-historical statements in the discussion and analysis are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described in “Risk Factors.” Our actual results may differ materially from those contained in or implied by any forward-looking statements. You should read the following discussion together with “Risk Factors” and the consolidated and combined financial statements included elsewhere in this annual report.

Overview

We are one of the leading North American suppliers of coated papers to catalog and magazine publishers. Coated paper is used primarily in media and marketing applications, including catalogs, magazines, commercial printing applications, such as high-end advertising brochures, annual reports and direct mail advertising. Within the overall North American coated paper market, we have a leading market share in North American coated groundwood production capacity, which is used primarily for catalogs and magazines. We are also one of North America’s largest producers of coated freesheet paper, which is used primarily for upscale catalogs and magazines, annual reports and magazine covers. To complete our product offering to catalog and magazine customers, we have a strategic presence in supercalendered paper, which is primarily used for retail inserts due to its relatively low cost. In addition, we produce and sell market pulp, which is used in the manufacture of printing and writing paper grades and tissue products.

Stand-Alone Company