Second Quarter 2019 Earnings Slides August 6, 2019

Forward-Looking Statements This presentation includes forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. Many of these risk factors are outside of the company’s control, and as such, they involve risks which are not currently known to the company that could cause actual results to differ materially from forecasted results. Factors that could cause or contribute to such differences include those matters disclosed in the company’s Securities and Exchange Commission filings. The forward-looking statements in this document are made as of the date hereof and the company does not undertake to update its forward-looking statements. 2

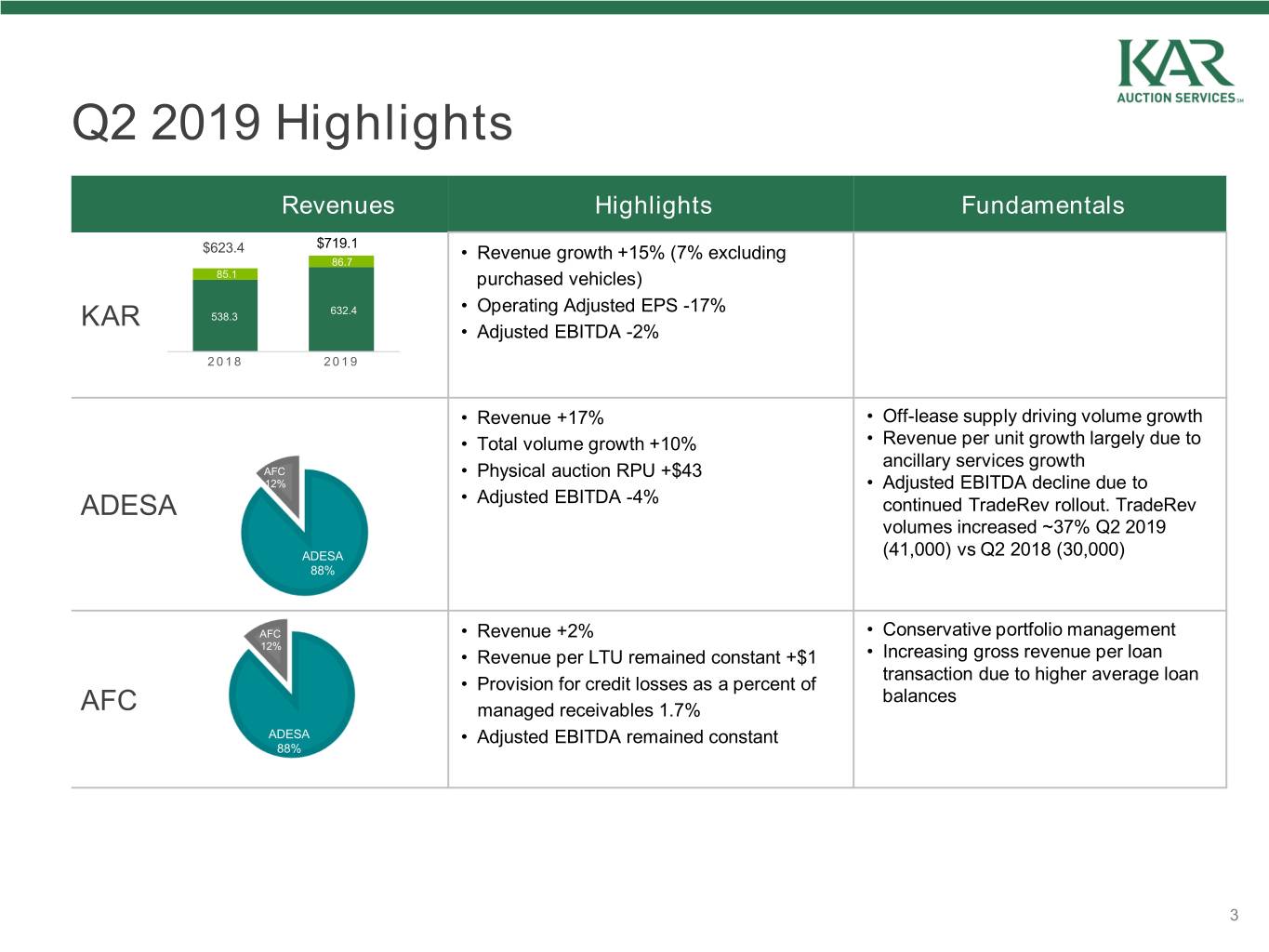

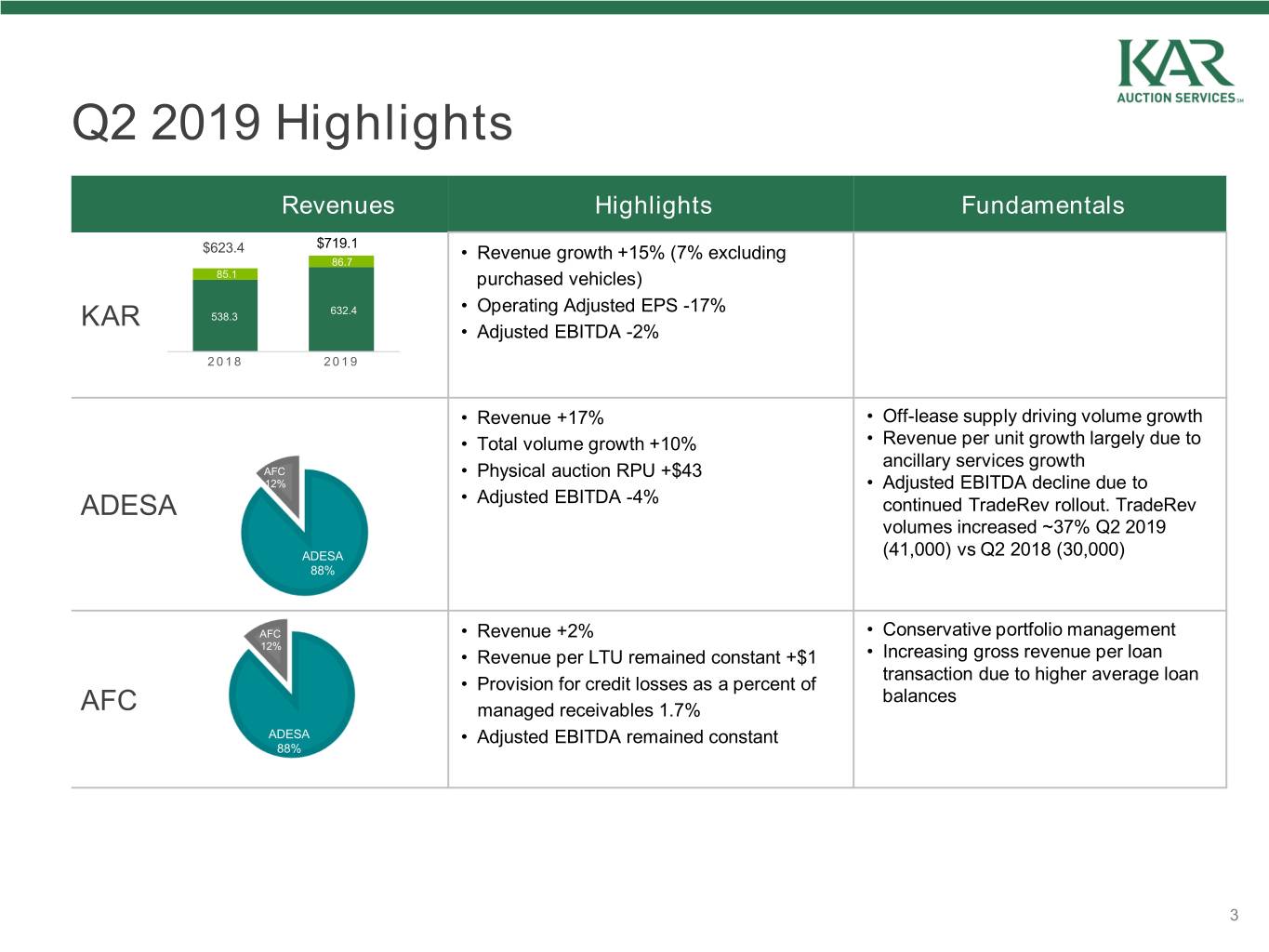

Q2 2019 Highlights Revenues Highlights Fundamentals $623.4 $719.1 86.7 • Revenue growth +15% (7% excluding 85.1 purchased vehicles) 632.4 • Operating Adjusted EPS -17% KAR 538.3 • Adjusted EBITDA -2% 2018 2019 • Revenue +17% • Off-lease supply driving volume growth • Total volume growth +10% • Revenue per unit growth largely due to ancillary services growth AFC • Physical auction RPU +$43 12% • Adjusted EBITDA decline due to ADESA • Adjusted EBITDA -4% continued TradeRev rollout. TradeRev volumes increased ~37% Q2 2019 ADESA (41,000) vs Q2 2018 (30,000) 88% AFC • Revenue +2% • Conservative portfolio management 12% • Revenue per LTU remained constant +$1 • Increasing gross revenue per loan transaction due to higher average loan • Provision for credit losses as a percent of balances AFC managed receivables 1.7% ADESA • Adjusted EBITDA remained constant 88% 3

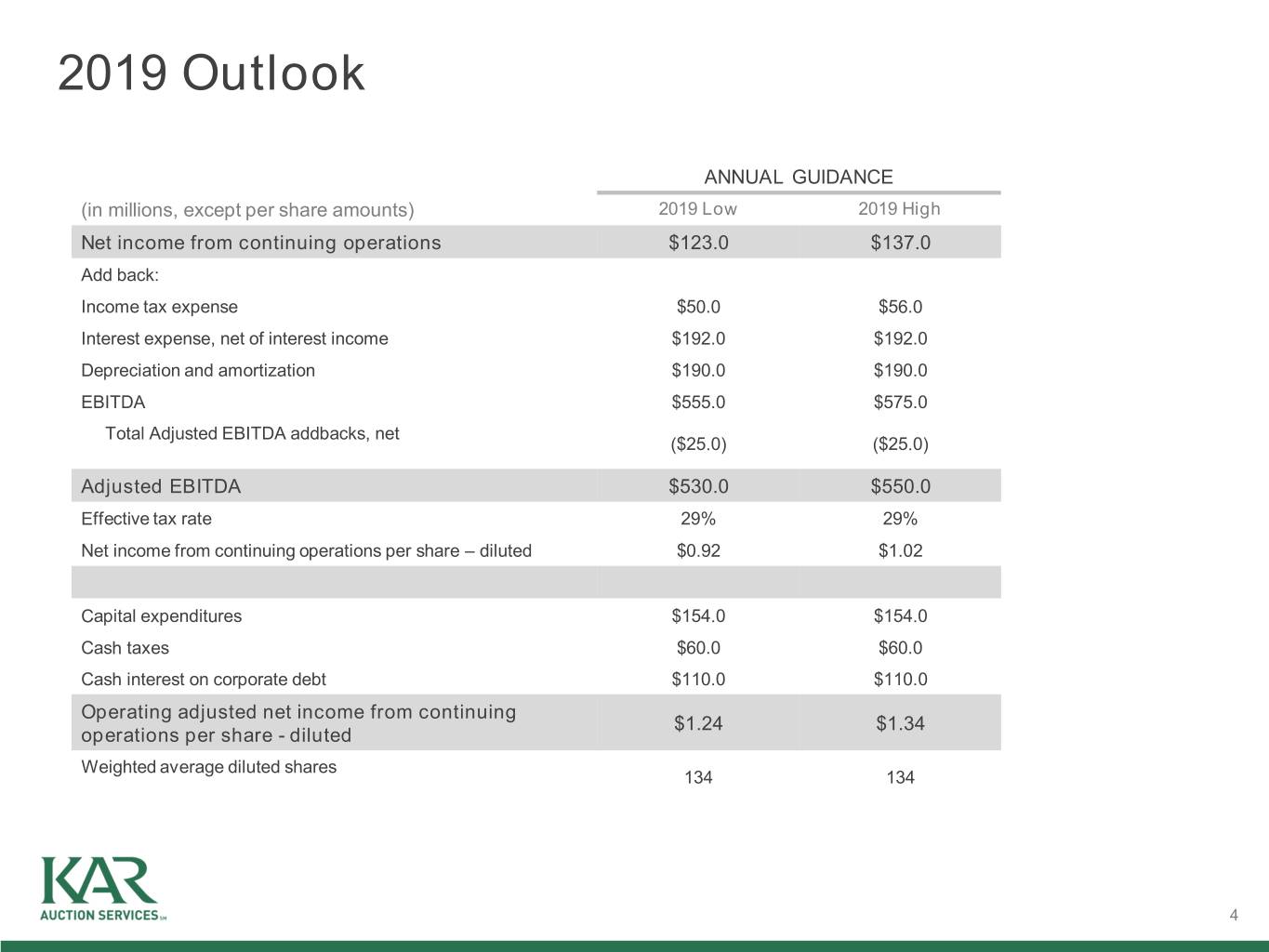

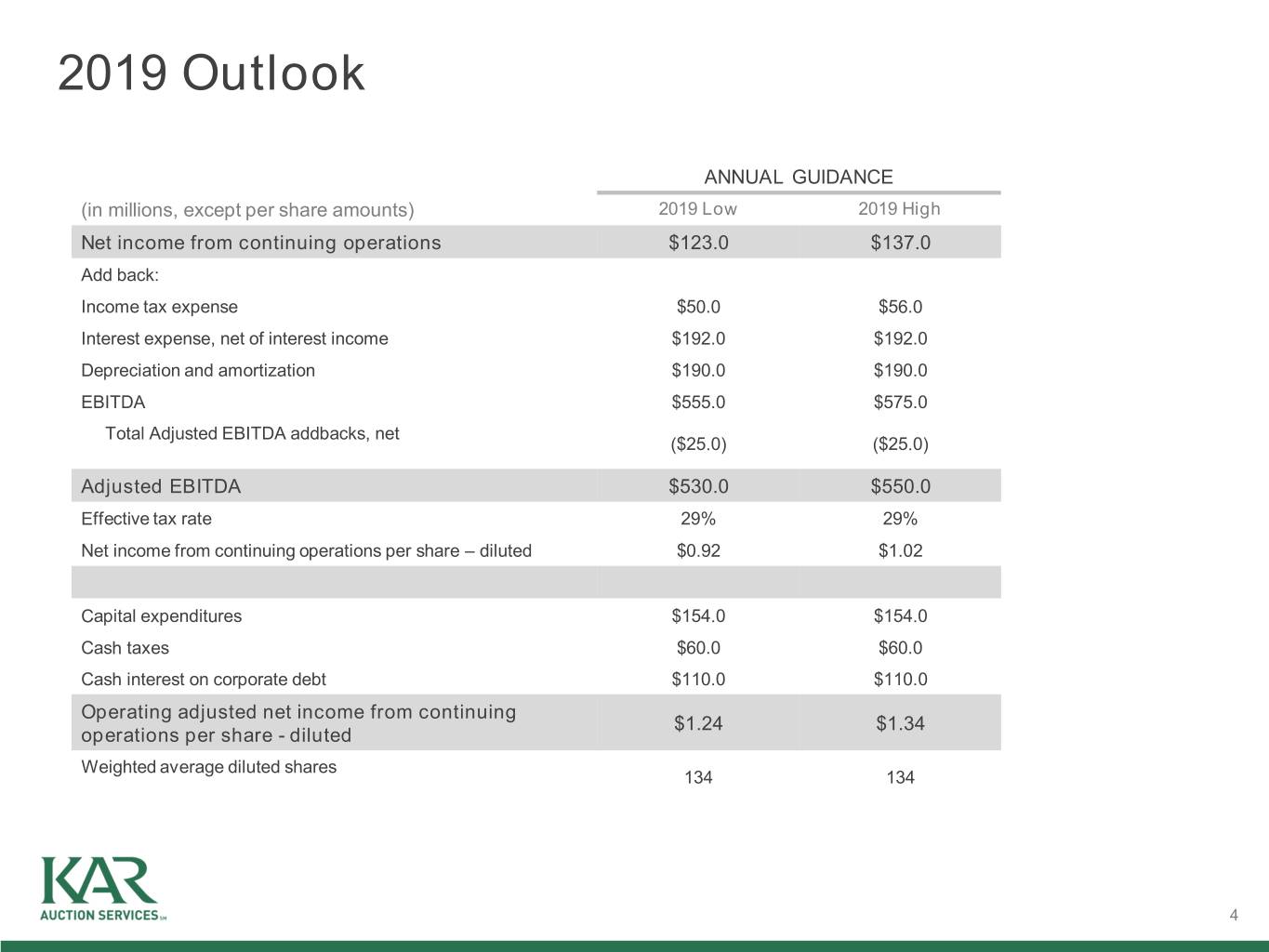

2019 Outlook ANNUAL GUIDANCE (in millions, except per share amounts) 2019 Low 2019 High Net income from continuing operations $123.0 $137.0 Add back: Income tax expense $50.0 $56.0 Interest expense, net of interest income $192.0 $192.0 Depreciation and amortization $190.0 $190.0 EBITDA $555.0 $575.0 Total Adjusted EBITDA addbacks, net ($25.0) ($25.0) Adjusted EBITDA $530.0 $550.0 Effective tax rate 29% 29% Net income from continuing operations per share – diluted $0.92 $1.02 Capital expenditures $154.0 $154.0 Cash taxes $60.0 $60.0 Cash interest on corporate debt $110.0 $110.0 Operating adjusted net income from continuing $1.24 $1.34 operations per share - diluted Weighted average diluted shares 134 134 4

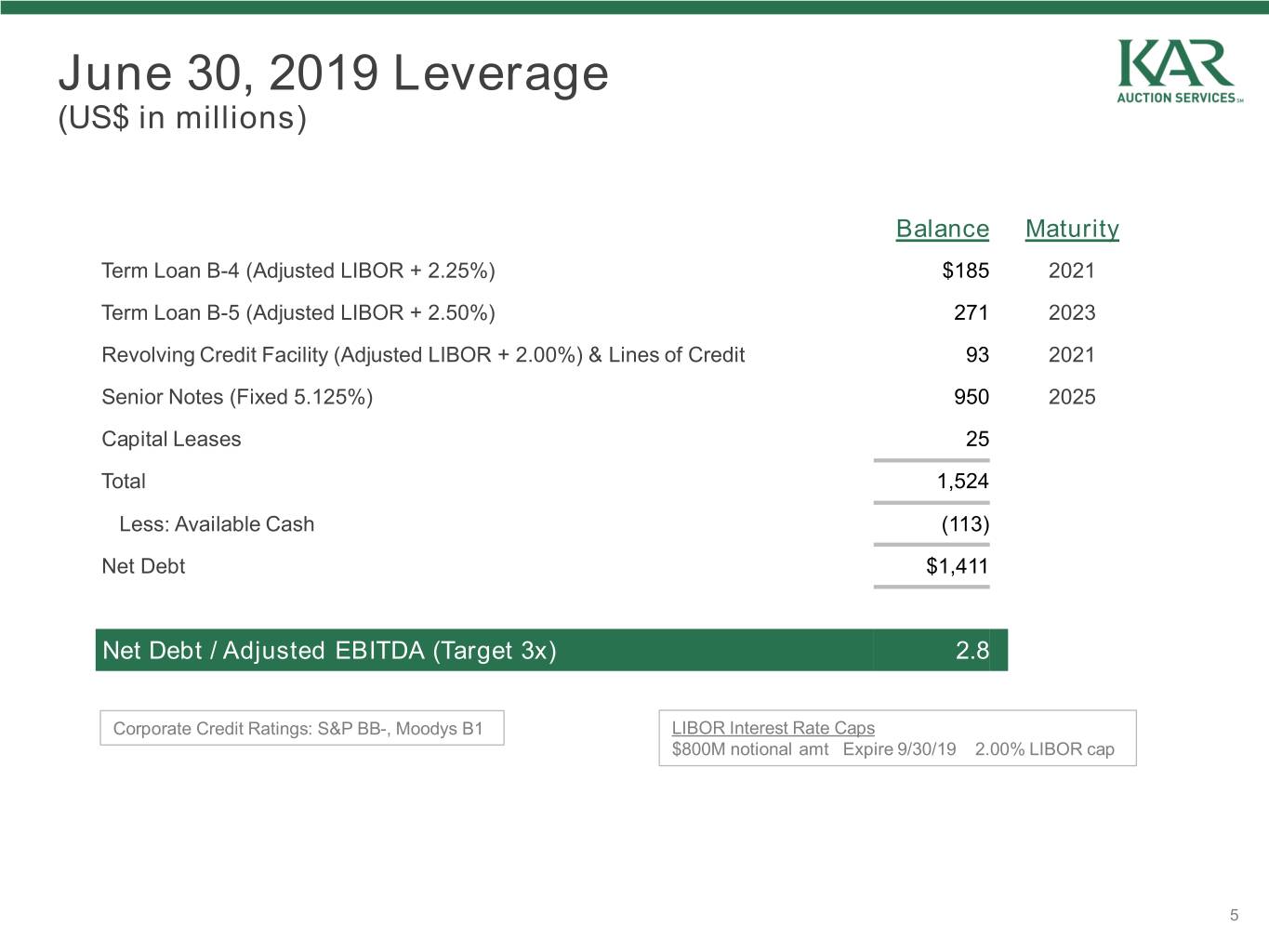

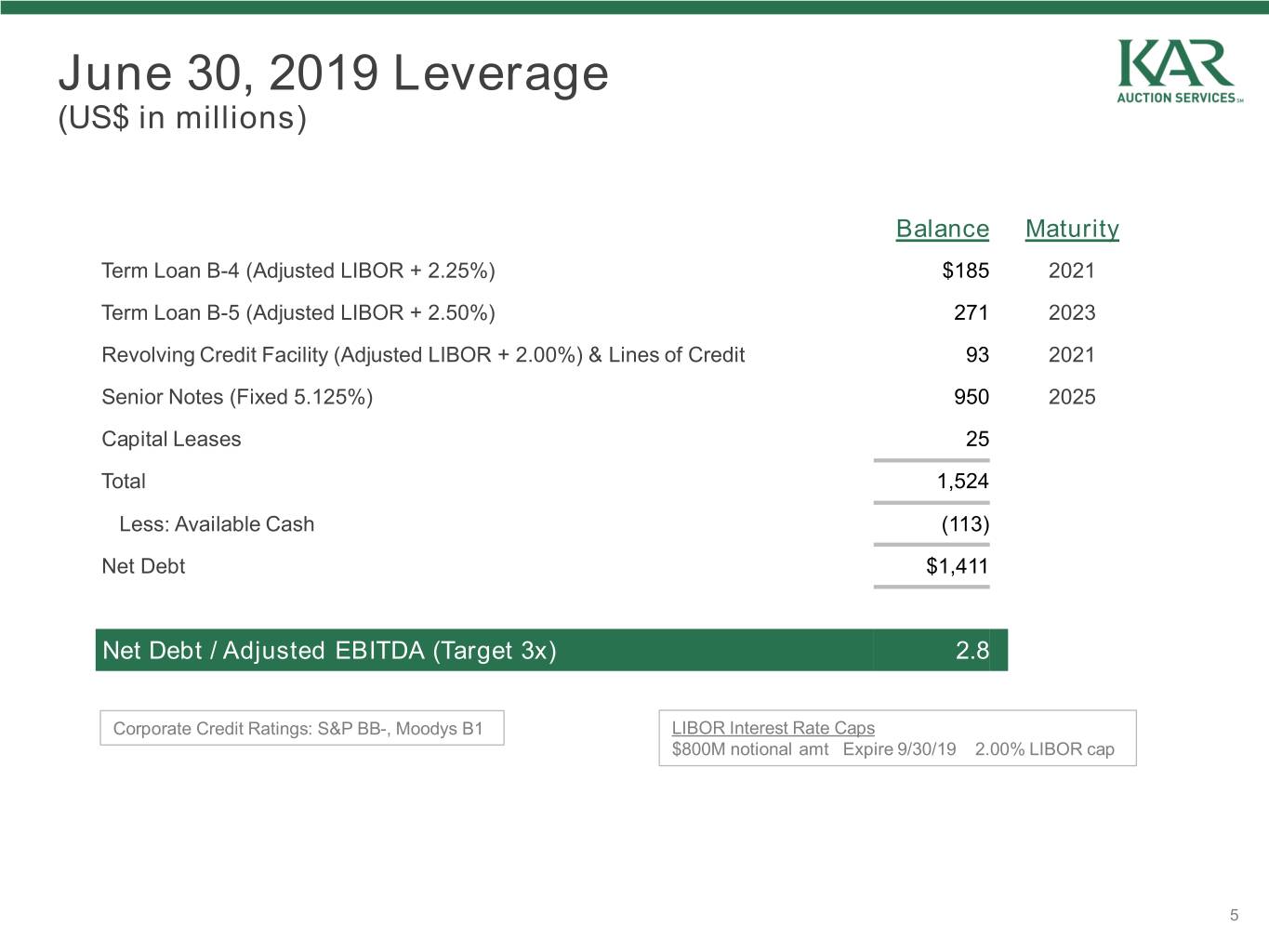

June 30, 2019 Leverage (US$ in millions) Balance Maturity Term Loan B-4 (Adjusted LIBOR + 2.25%) $185 2021 Term Loan B-5 (Adjusted LIBOR + 2.50%) 271 2023 Revolving Credit Facility (Adjusted LIBOR + 2.00%) & Lines of Credit 93 2021 Senior Notes (Fixed 5.125%) 950 2025 Capital Leases 25 Total 1,524 Less: Available Cash (113) Net Debt $1,411 Net Debt / Adjusted EBITDA (Target 3x) 2.8 Corporate Credit Ratings: S&P BB-, Moodys B1 LIBOR Interest Rate Caps $800M notional amt Expire 9/30/19 2.00% LIBOR cap 5

Second Quarter Results 6

KAR Q2 2019 Highlights ($ in millions, except per share amounts) Q2 Q2 KAR Highlights* 2019 2018 Total operating revenues $719.1 $623.4 $51.2M acquisitions Gross profit** $301.7 $293.2 % of revenue 42.0% 47.0% SG&A $163.2 $149.9 TradeRev +$7.1M, $6.1M acquired SG&A EBITDA $139.0 $142.8 Adjusted EBITDA $135.9 $138.8 Net income from continuing operations $27.4 $37.4 Interest expense increased $7.2M Net income from continuing operations per $0.20 $0.28 share – diluted Operating adjusted net income from continuing $0.30 $0.36 operations per share – diluted Weighted average diluted shares 134.1 135.6 Dividends declared per common share $0.35 $0.35 Effective tax rate 24.1% 29.8% * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the three months ended June 30, 2019. ** Exclusive of depreciation and amortization 7

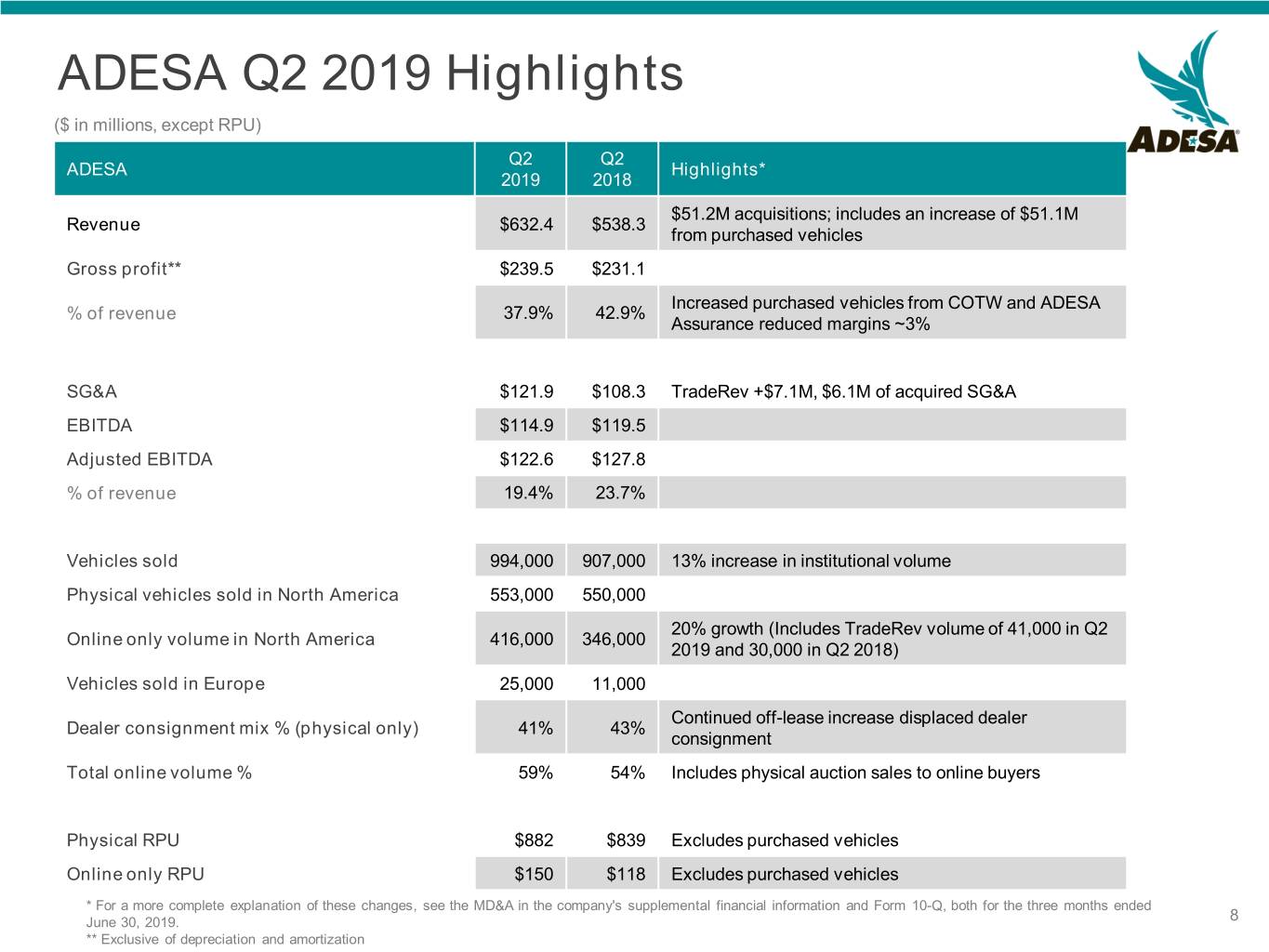

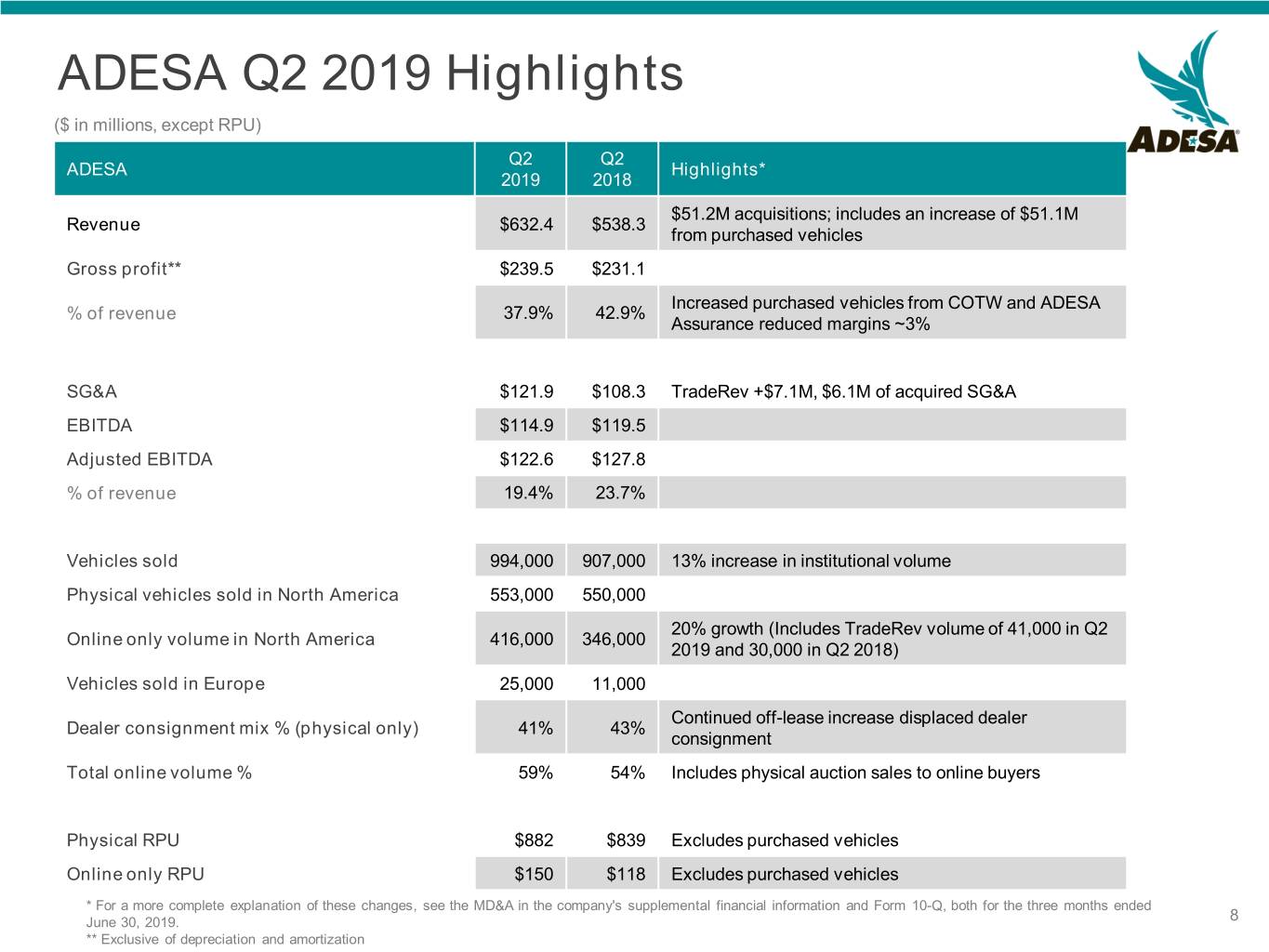

ADESA Q2 2019 Highlights ($ in millions, except RPU) Q2 Q2 ADESA Highlights* 2019 2018 $51.2M acquisitions; includes an increase of $51.1M Revenue $632.4 $538.3 from purchased vehicles Gross profit** $239.5 $231.1 Increased purchased vehicles from COTW and ADESA % of revenue 37.9% 42.9% Assurance reduced margins ~3% SG&A $121.9 $108.3 TradeRev +$7.1M, $6.1M of acquired SG&A EBITDA $114.9 $119.5 Adjusted EBITDA $122.6 $127.8 % of revenue 19.4% 23.7% Vehicles sold 994,000 907,000 13% increase in institutional volume Physical vehicles sold in North America 553,000 550,000 20% growth (Includes TradeRev volume of 41,000 in Q2 Online only volume in North America 416,000 346,000 2019 and 30,000 in Q2 2018) Vehicles sold in Europe 25,000 11,000 Continued off-lease increase displaced dealer Dealer consignment mix % (physical only) 41% 43% consignment Total online volume % 59% 54% Includes physical auction sales to online buyers Physical RPU $882 $839 Excludes purchased vehicles Online only RPU $150 $118 Excludes purchased vehicles * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the three months ended June 30, 2019. 8 ** Exclusive of depreciation and amortization

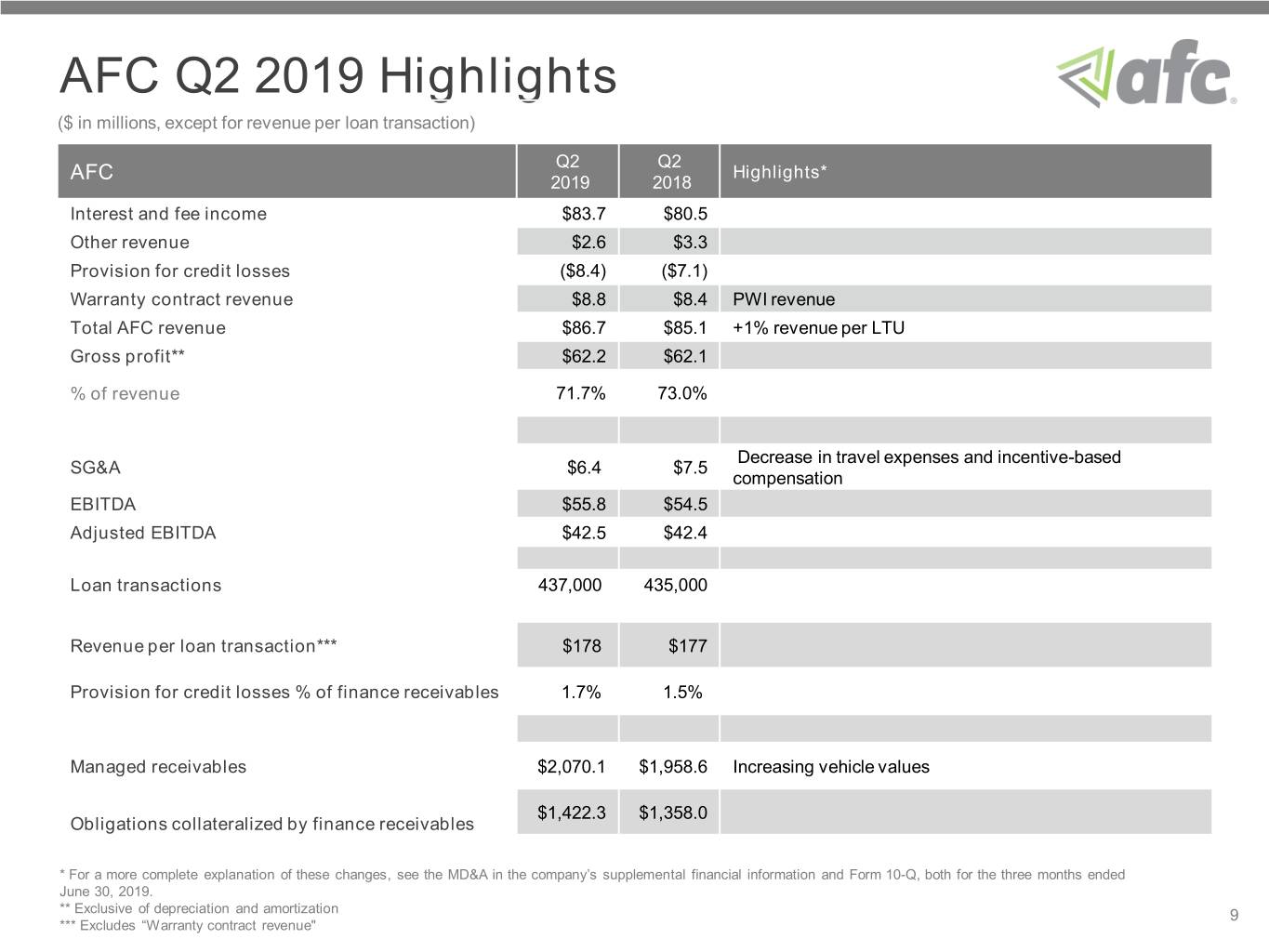

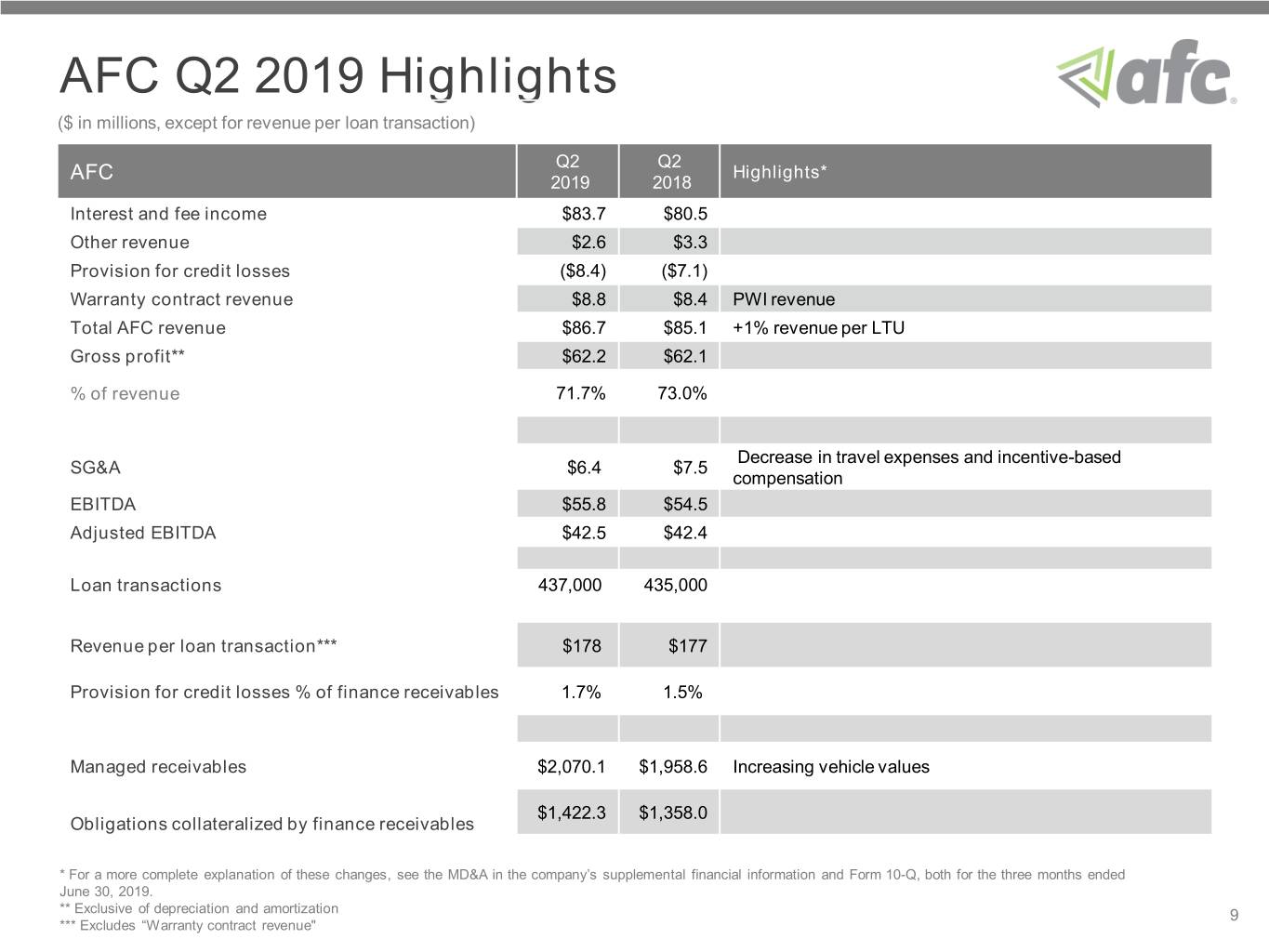

AFC Q2 2019 Highlights ($ in millions, except for revenue per loan transaction) Q2 Q2 Highlights* AFC 2019 2018 Interest and fee income $83.7 $80.5 Other revenue $2.6 $3.3 Provision for credit losses ($8.4) ($7.1) Warranty contract revenue $8.8 $8.4 PWI revenue Total AFC revenue $86.7 $85.1 +1% revenue per LTU Gross profit** $62.2 $62.1 % of revenue 71.7% 73.0% Decrease in travel expenses and incentive-based SG&A $6.4 $7.5 compensation EBITDA $55.8 $54.5 Adjusted EBITDA $42.5 $42.4 Loan transactions 437,000 435,000 Revenue per loan transaction*** $178 $177 Provision for credit losses % of finance receivables 1.7% 1.5% Managed receivables $2,070.1 $1,958.6 Increasing vehicle values $1,422.3 $1,358.0 Obligations collateralized by finance receivables * For a more complete explanation of these changes, see the MD&A in the company’s supplemental financial information and Form 10-Q, both for the three months ended June 30, 2019. ** Exclusive of depreciation and amortization 9 *** Excludes “Warranty contract revenue"

Y e a r - to- Date Results 10

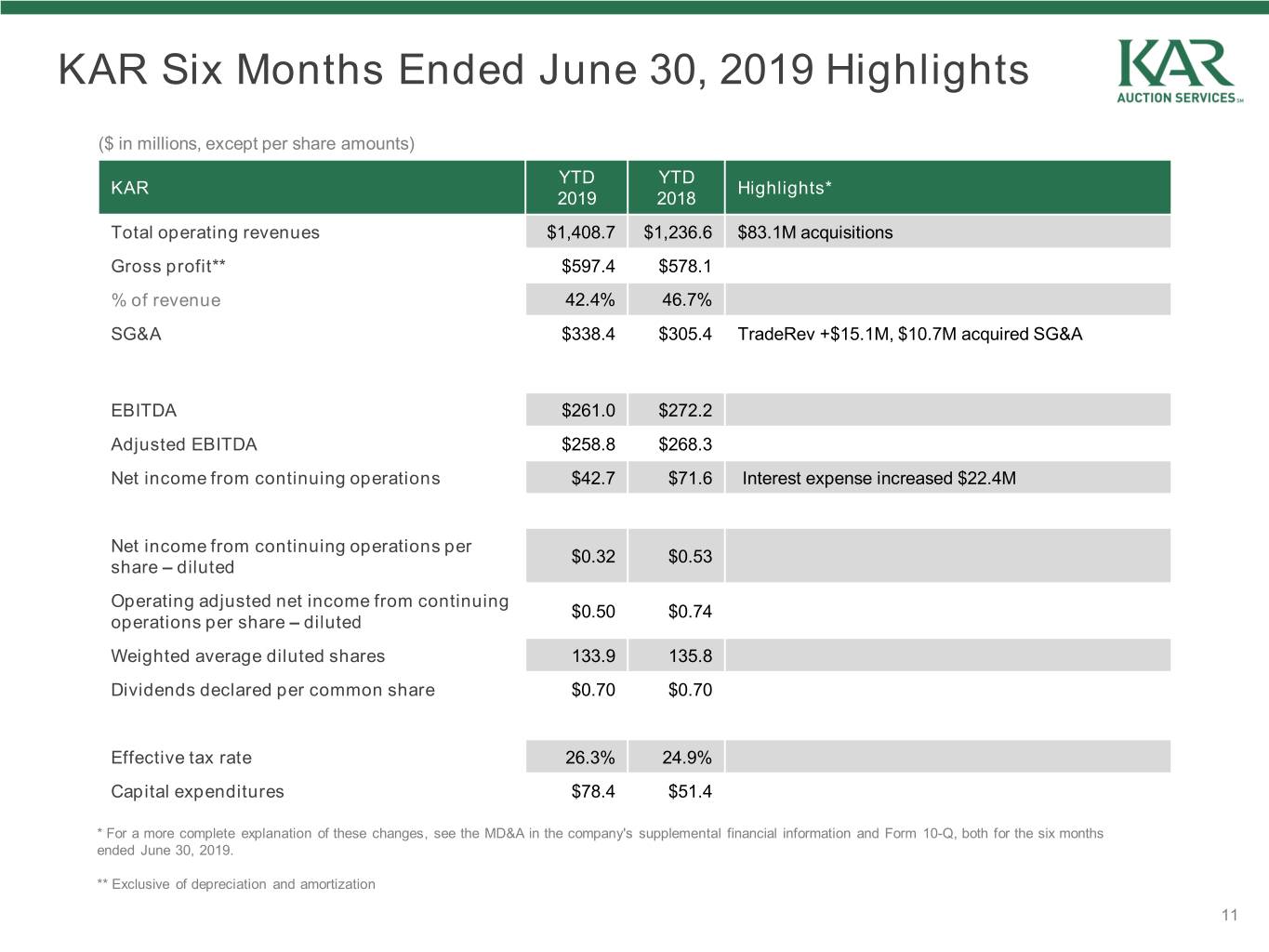

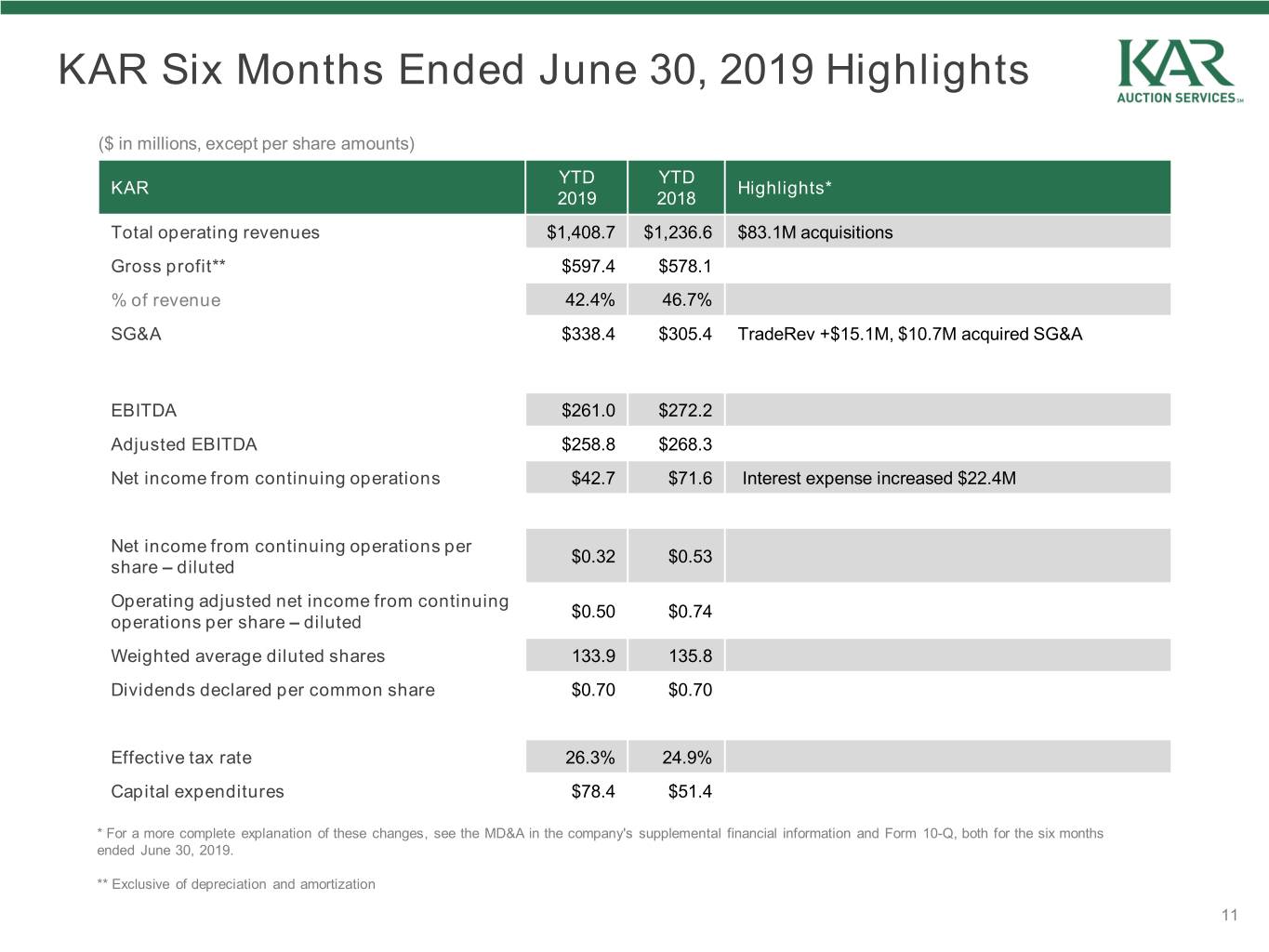

KAR Six Months Ended June 30, 2019 Highlights ($ in millions, except per share amounts) YTD YTD KAR Highlights* 2019 2018 Total operating revenues $1,408.7 $1,236.6 $83.1M acquisitions Gross profit** $597.4 $578.1 % of revenue 42.4% 46.7% SG&A $338.4 $305.4 TradeRev +$15.1M, $10.7M acquired SG&A EBITDA $261.0 $272.2 Adjusted EBITDA $258.8 $268.3 Net income from continuing operations $42.7 $71.6 Interest expense increased $22.4M Net income from continuing operations per $0.32 $0.53 share – diluted Operating adjusted net income from continuing $0.50 $0.74 operations per share – diluted Weighted average diluted shares 133.9 135.8 Dividends declared per common share $0.70 $0.70 Effective tax rate 26.3% 24.9% Capital expenditures $78.4 $51.4 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the six months ended June 30, 2019. ** Exclusive of depreciation and amortization 11

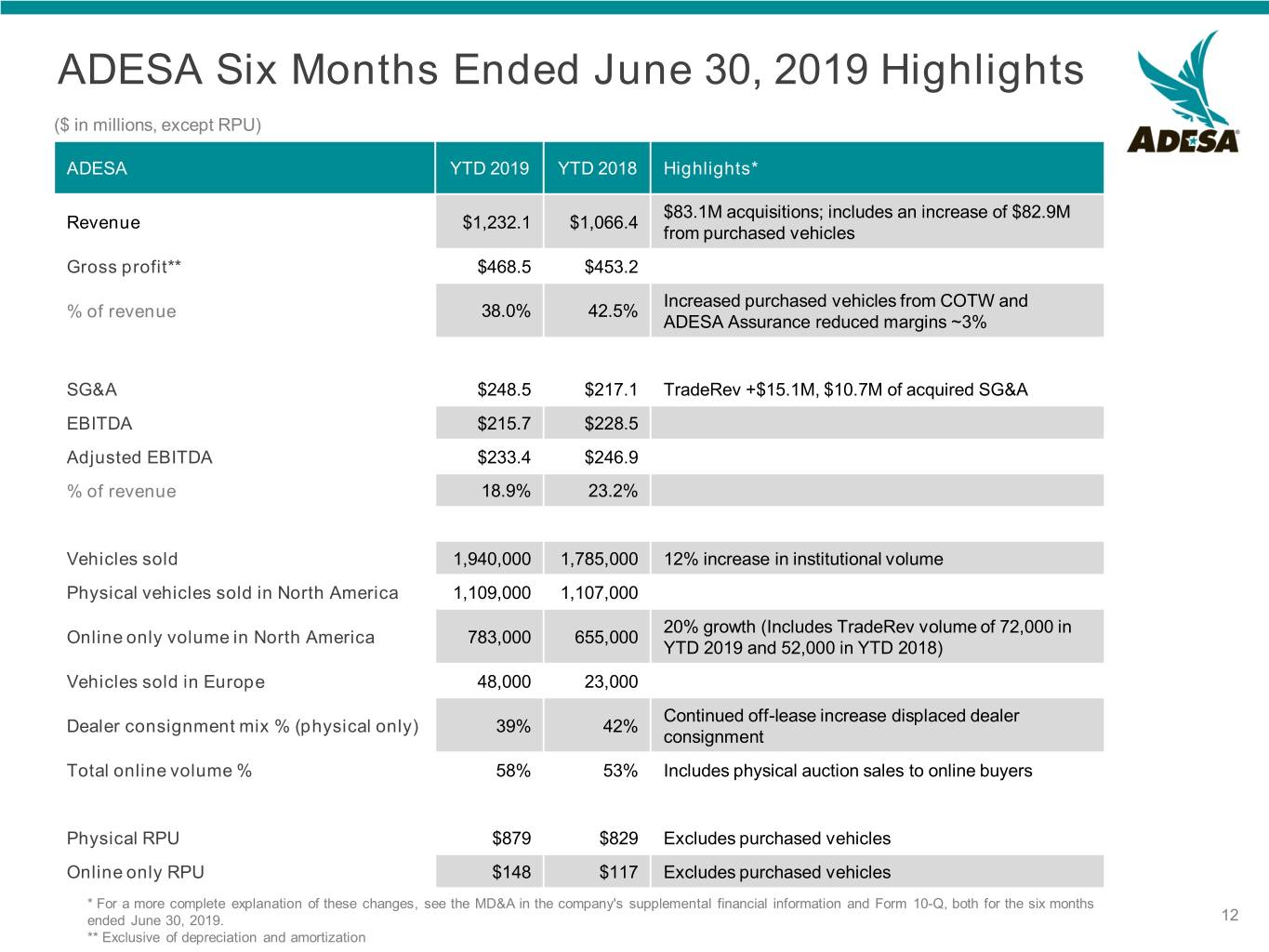

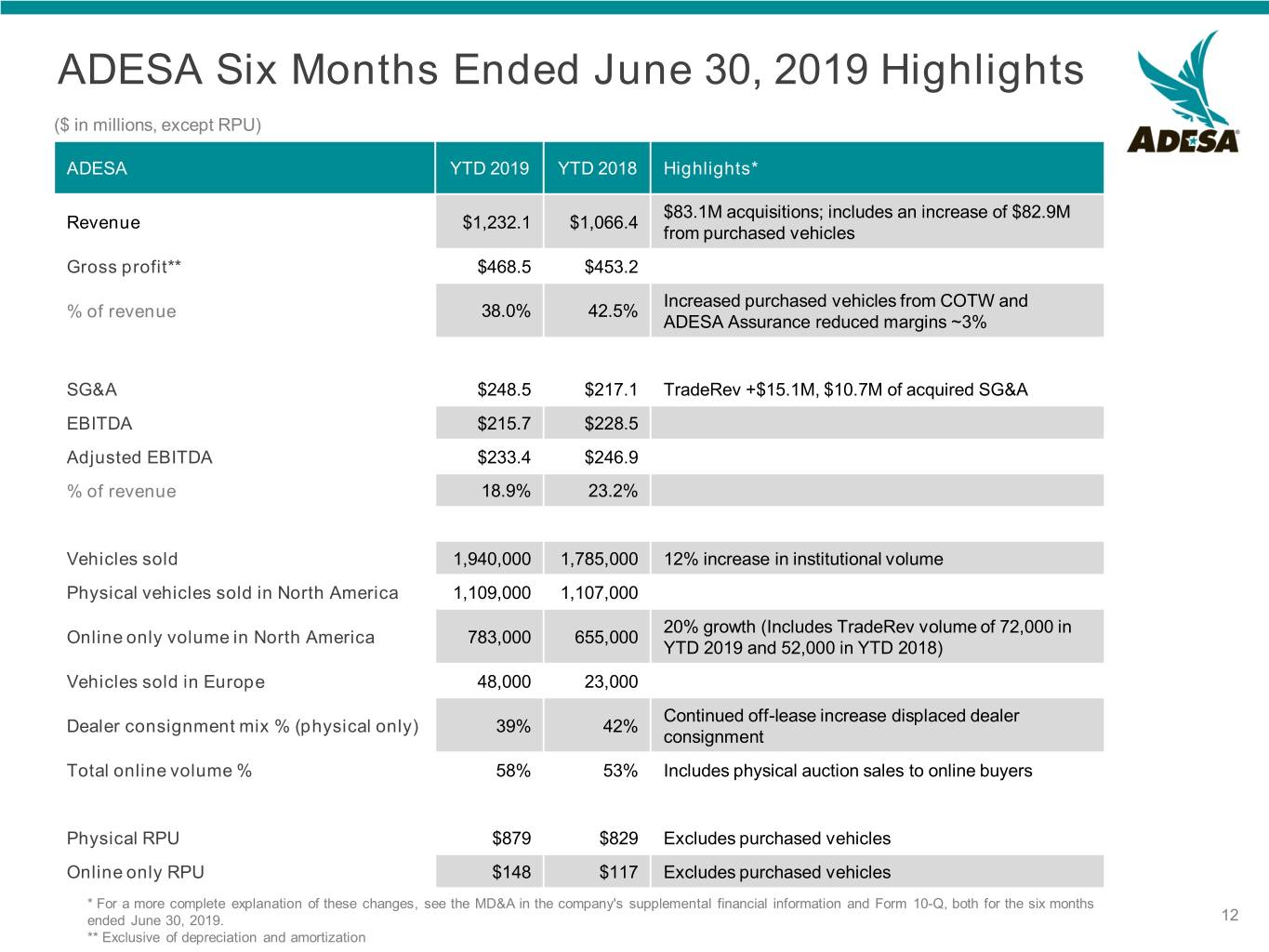

ADESA Six Months Ended June 30, 2019 Highlights ($ in millions, except RPU) ADESA YTD 2019 YTD 2018 Highlights* $83.1M acquisitions; includes an increase of $82.9M Revenue $1,232.1 $1,066.4 from purchased vehicles Gross profit** $468.5 $453.2 Increased purchased vehicles from COTW and % of revenue 38.0% 42.5% ADESA Assurance reduced margins ~3% SG&A $248.5 $217.1 TradeRev +$15.1M, $10.7M of acquired SG&A EBITDA $215.7 $228.5 Adjusted EBITDA $233.4 $246.9 % of revenue 18.9% 23.2% Vehicles sold 1,940,000 1,785,000 12% increase in institutional volume Physical vehicles sold in North America 1,109,000 1,107,000 20% growth (Includes TradeRev volume of 72,000 in Online only volume in North America 783,000 655,000 YTD 2019 and 52,000 in YTD 2018) Vehicles sold in Europe 48,000 23,000 Continued off-lease increase displaced dealer Dealer consignment mix % (physical only) 39% 42% consignment Total online volume % 58% 53% Includes physical auction sales to online buyers Physical RPU $879 $829 Excludes purchased vehicles Online only RPU $148 $117 Excludes purchased vehicles * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-Q, both for the six months ended June 30, 2019. 12 ** Exclusive of depreciation and amortization

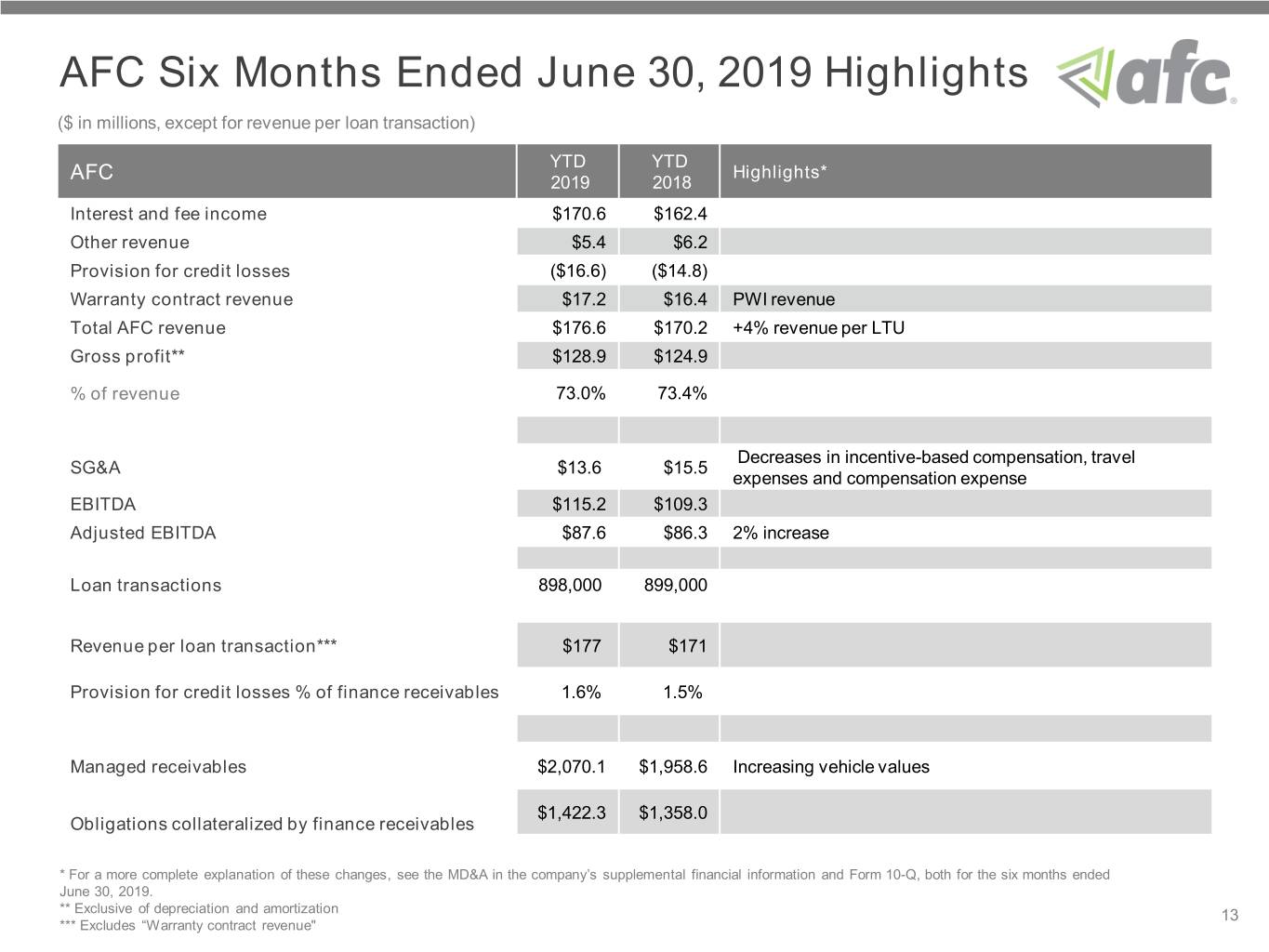

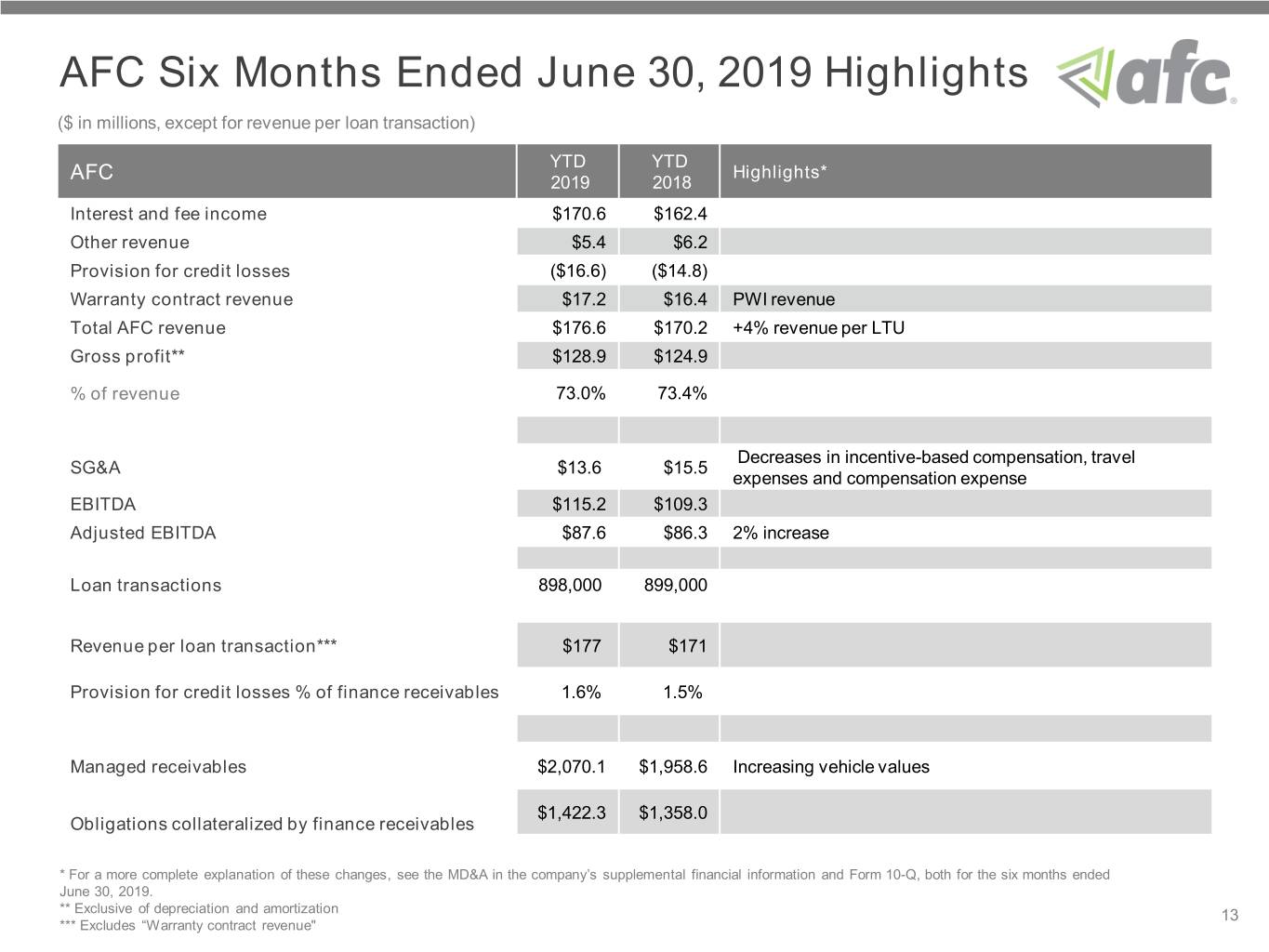

AFC Six Months Ended June 30, 2019 Highlights ($ in millions, except for revenue per loan transaction) YTD YTD Highlights* AFC 2019 2018 Interest and fee income $170.6 $162.4 Other revenue $5.4 $6.2 Provision for credit losses ($16.6) ($14.8) Warranty contract revenue $17.2 $16.4 PWI revenue Total AFC revenue $176.6 $170.2 +4% revenue per LTU Gross profit** $128.9 $124.9 % of revenue 73.0% 73.4% Decreases in incentive-based compensation, travel SG&A $13.6 $15.5 expenses and compensation expense EBITDA $115.2 $109.3 Adjusted EBITDA $87.6 $86.3 2% increase Loan transactions 898,000 899,000 Revenue per loan transaction*** $177 $171 Provision for credit losses % of finance receivables 1.6% 1.5% Managed receivables $2,070.1 $1,958.6 Increasing vehicle values $1,422.3 $1,358.0 Obligations collateralized by finance receivables * For a more complete explanation of these changes, see the MD&A in the company’s supplemental financial information and Form 10-Q, both for the six months ended June 30, 2019. ** Exclusive of depreciation and amortization 13 *** Excludes “Warranty contract revenue"

HISTORICAL DATA 14

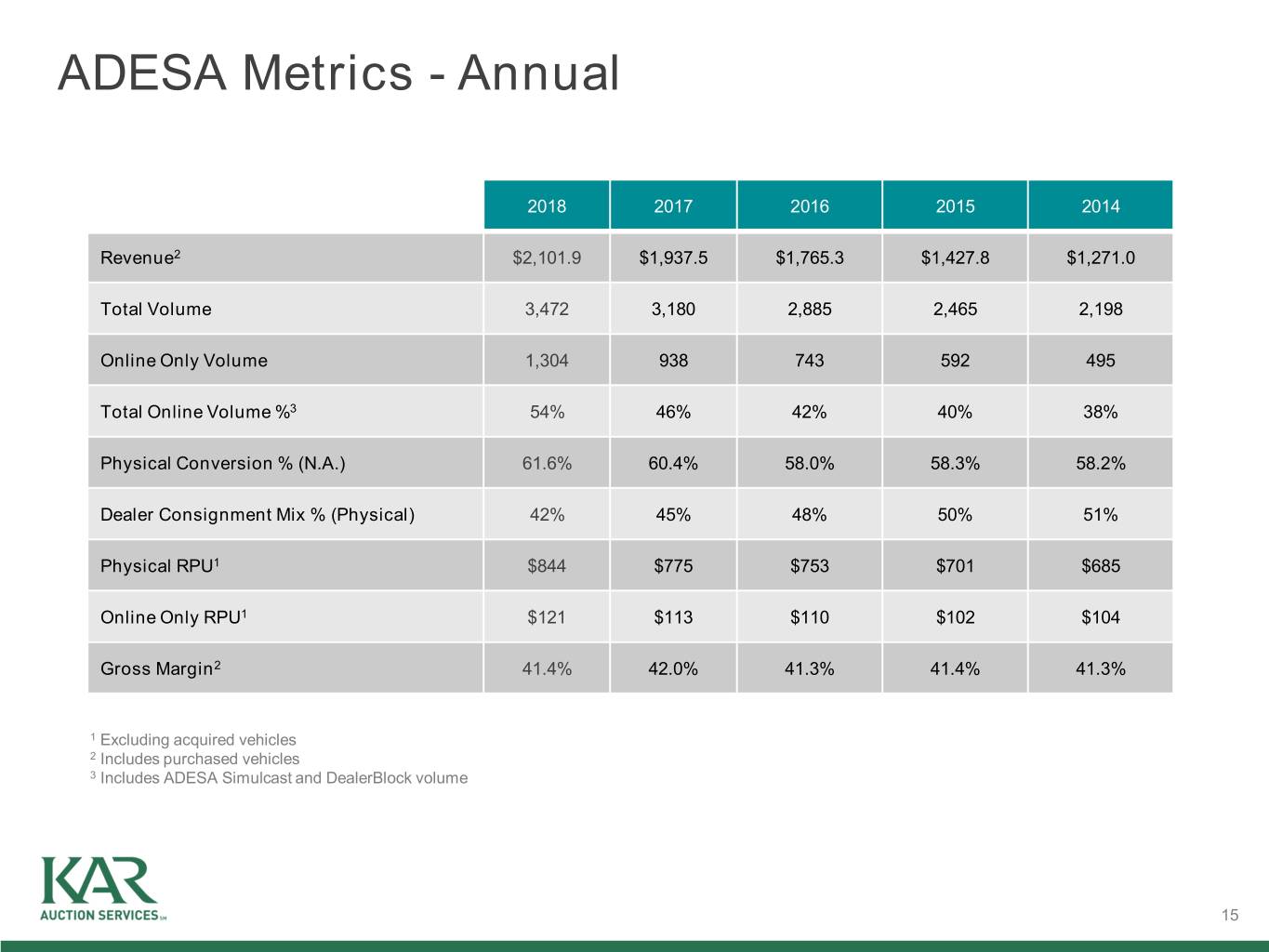

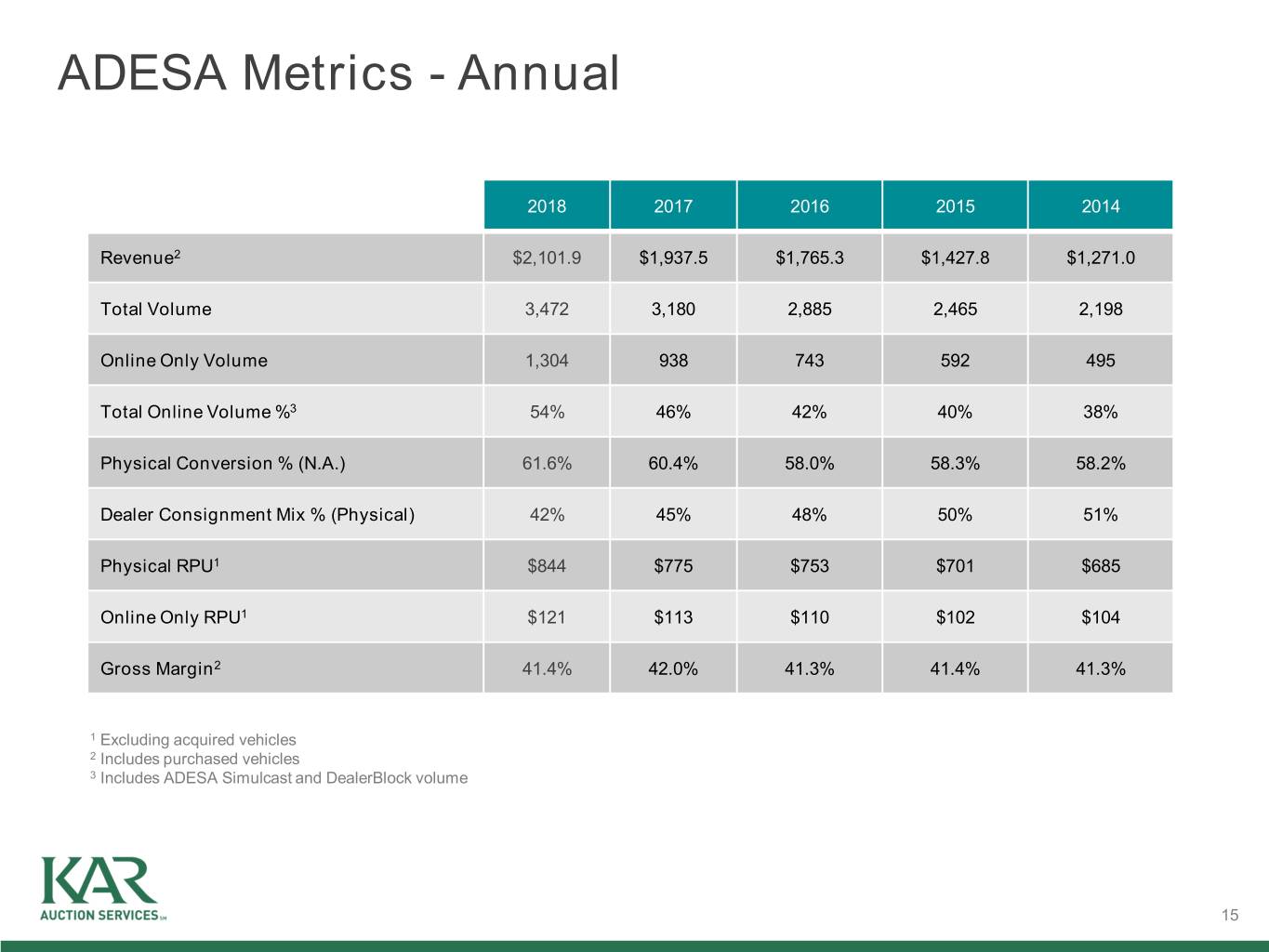

ADESA Metrics - Annual 2018 2017 2016 2015 2014 Revenue2 $2,101.9 $1,937.5 $1,765.3 $1,427.8 $1,271.0 Total Volume 3,472 3,180 2,885 2,465 2,198 Online Only Volume 1,304 938 743 592 495 Total Online Volume %3 54% 46% 42% 40% 38% Physical Conversion % (N.A.) 61.6% 60.4% 58.0% 58.3% 58.2% Dealer Consignment Mix % (Physical) 42% 45% 48% 50% 51% Physical RPU1 $844 $775 $753 $701 $685 Online Only RPU1 $121 $113 $110 $102 $104 Gross Margin2 41.4% 42.0% 41.3% 41.4% 41.3% 1 Excluding acquired vehicles 2 Includes purchased vehicles 3 Includes ADESA Simulcast and DealerBlock volume 15

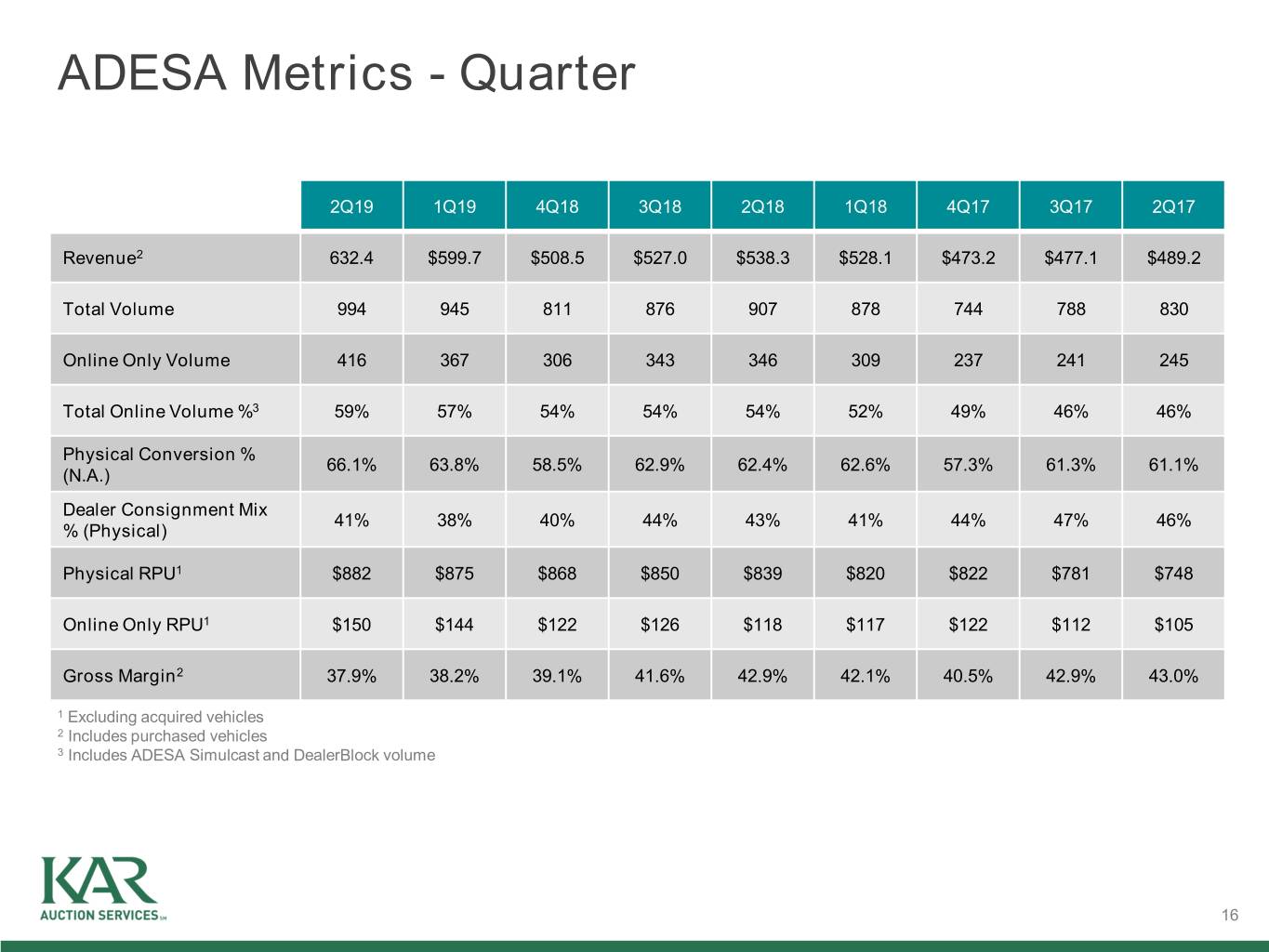

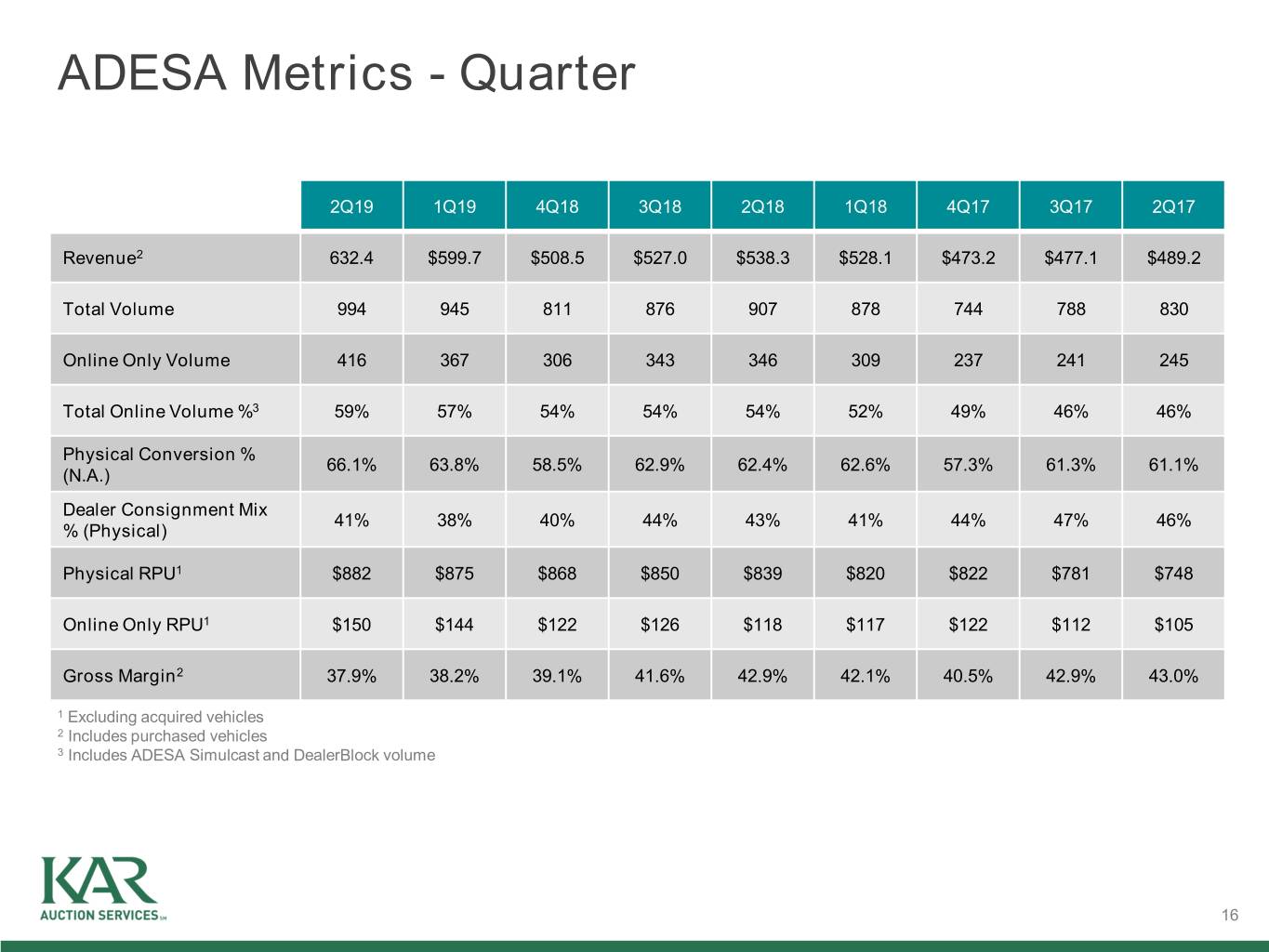

ADESA Metrics - Quarter 2Q19 1Q19 4Q18 3Q18 2Q18 1Q18 4Q17 3Q17 2Q17 Revenue2 632.4 $599.7 $508.5 $527.0 $538.3 $528.1 $473.2 $477.1 $489.2 Total Volume 994 945 811 876 907 878 744 788 830 Online Only Volume 416 367 306 343 346 309 237 241 245 Total Online Volume %3 59% 57% 54% 54% 54% 52% 49% 46% 46% Physical Conversion % 66.1% 63.8% 58.5% 62.9% 62.4% 62.6% 57.3% 61.3% 61.1% (N.A.) Dealer Consignment Mix 41% 38% 40% 44% 43% 41% 44% 47% 46% % (Physical) Physical RPU1 $882 $875 $868 $850 $839 $820 $822 $781 $748 Online Only RPU1 $150 $144 $122 $126 $118 $117 $122 $112 $105 Gross Margin2 37.9% 38.2% 39.1% 41.6% 42.9% 42.1% 40.5% 42.9% 43.0% 1 Excluding acquired vehicles 2 Includes purchased vehicles 3 Includes ADESA Simulcast and DealerBlock volume 16

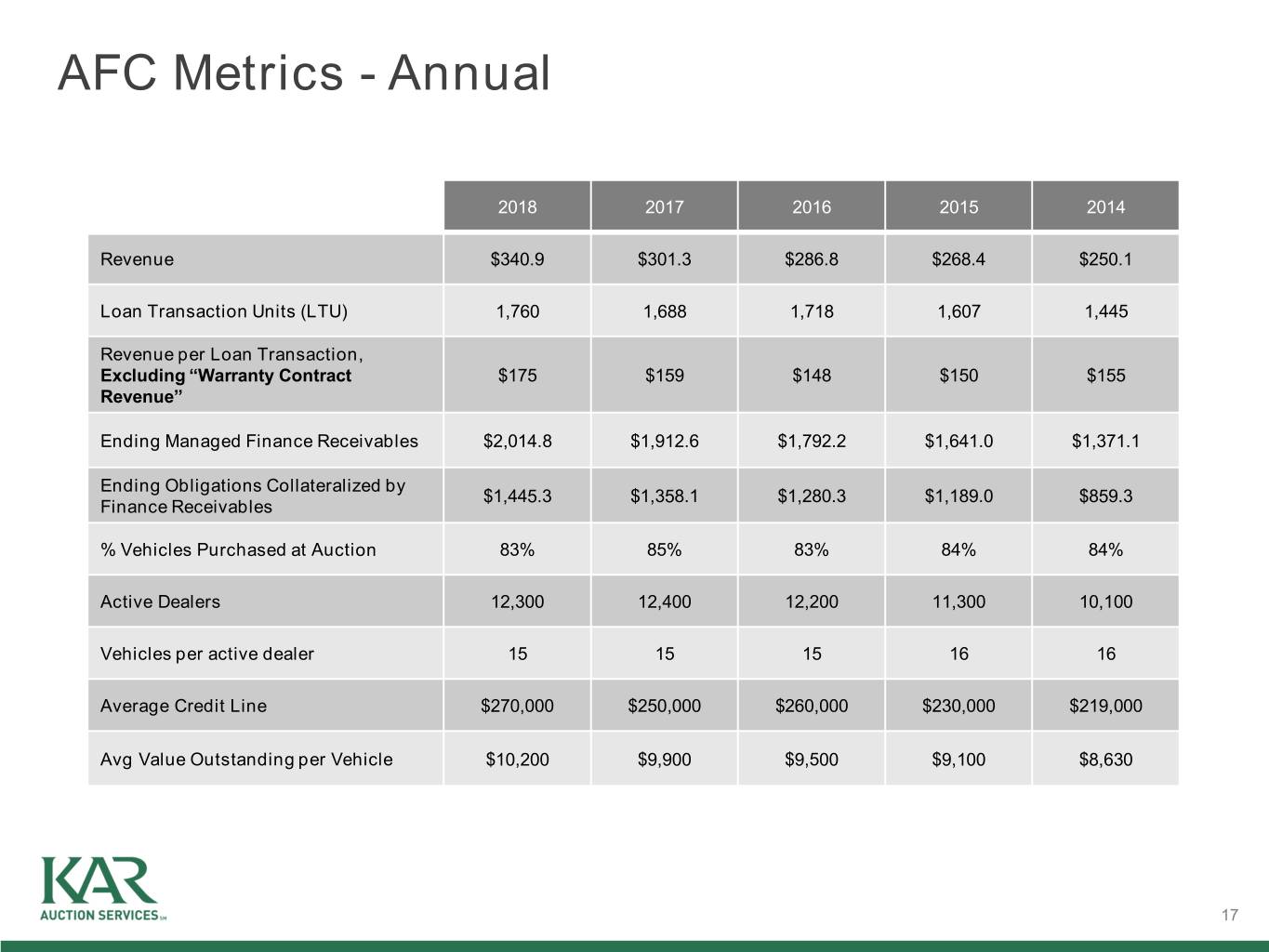

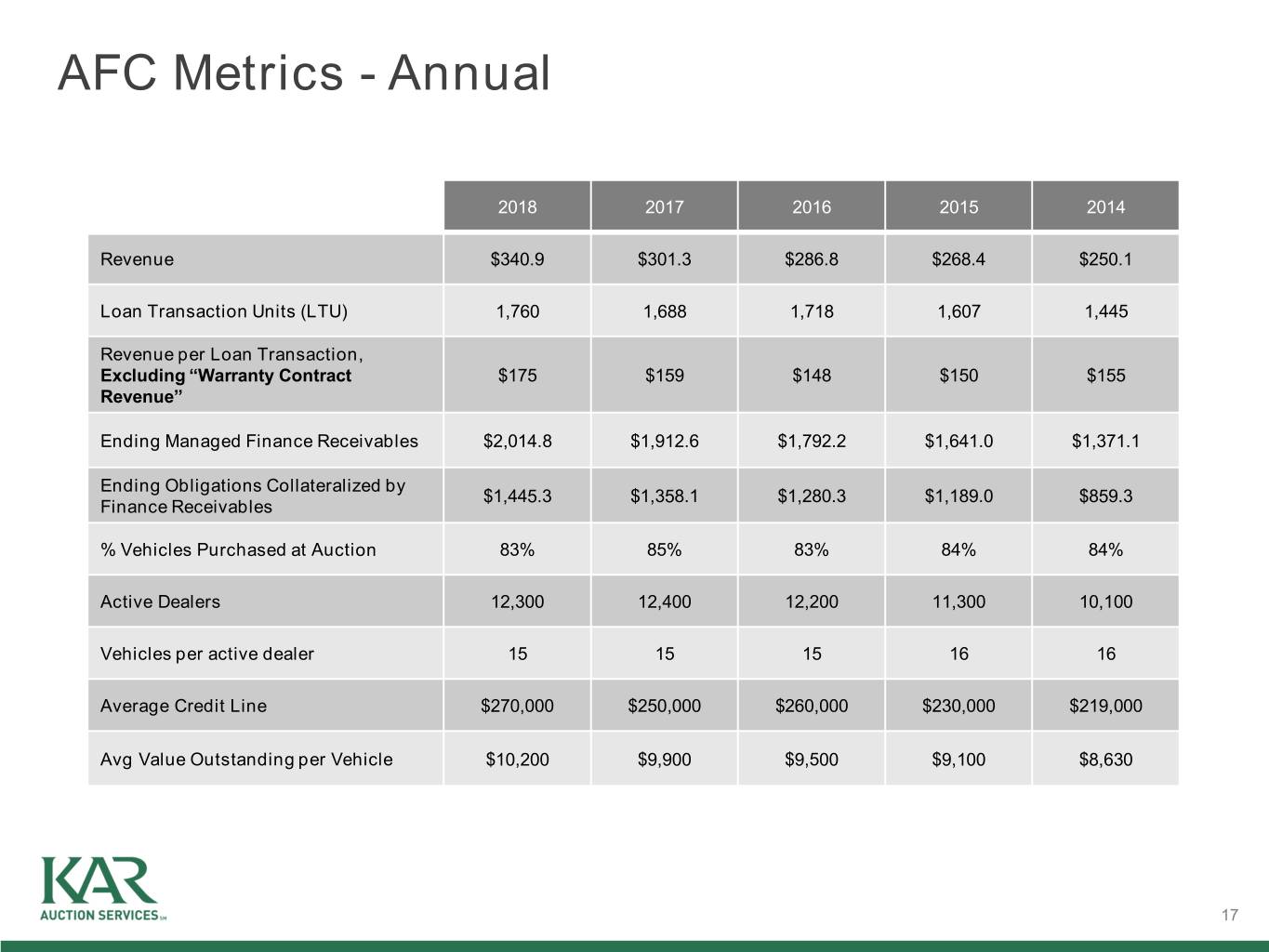

AFC Metrics - Annual 2018 2017 2016 2015 2014 Revenue $340.9 $301.3 $286.8 $268.4 $250.1 Loan Transaction Units (LTU) 1,760 1,688 1,718 1,607 1,445 Revenue per Loan Transaction, Excluding “Warranty Contract $175 $159 $148 $150 $155 Revenue” Ending Managed Finance Receivables $2,014.8 $1,912.6 $1,792.2 $1,641.0 $1,371.1 Ending Obligations Collateralized by $1,445.3 $1,358.1 $1,280.3 $1,189.0 $859.3 Finance Receivables % Vehicles Purchased at Auction 83% 85% 83% 84% 84% Active Dealers 12,300 12,400 12,200 11,300 10,100 Vehicles per active dealer 15 15 15 16 16 Average Credit Line $270,000 $250,000 $260,000 $230,000 $219,000 Avg Value Outstanding per Vehicle $10,200 $9,900 $9,500 $9,100 $8,630 17

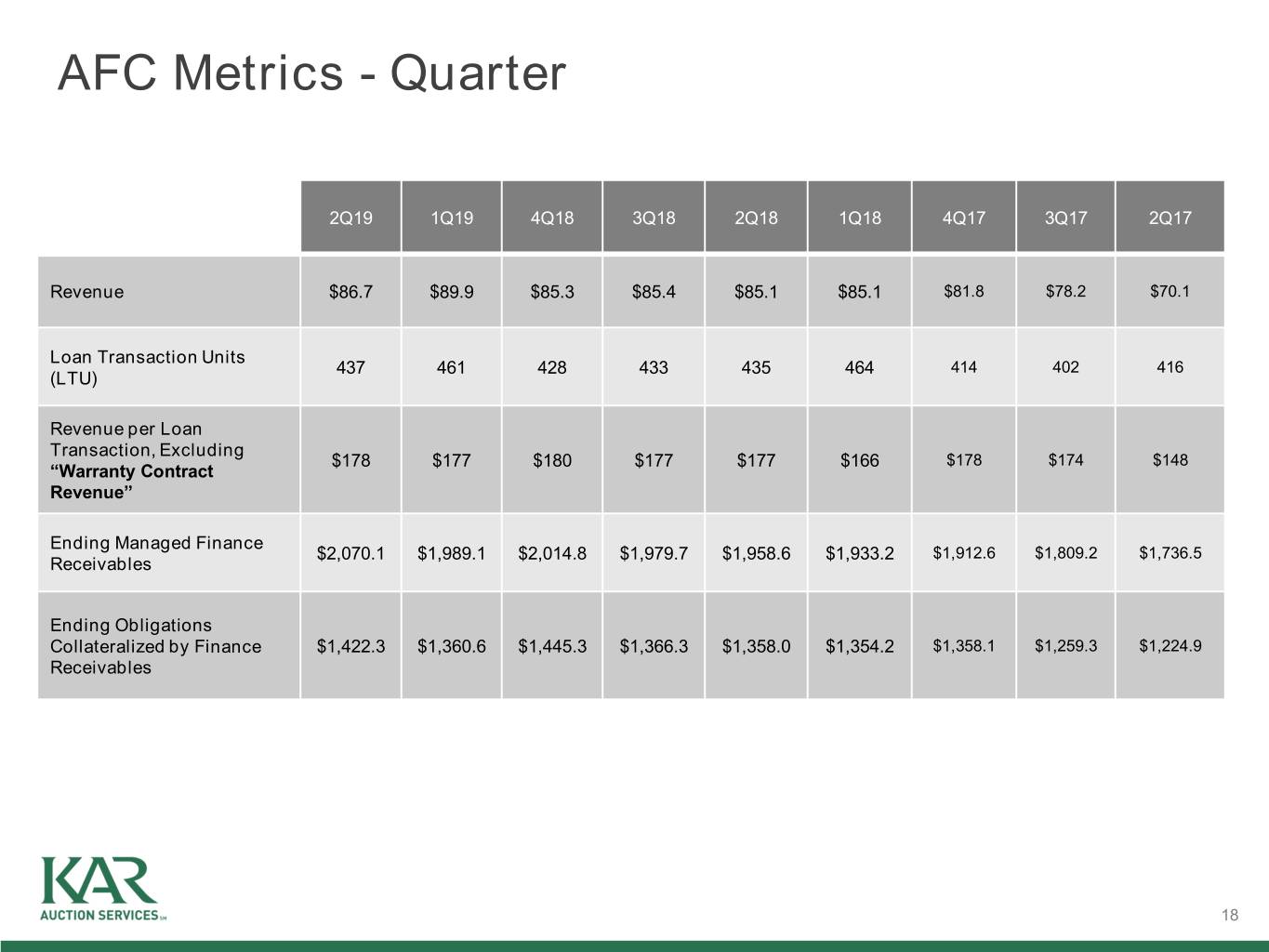

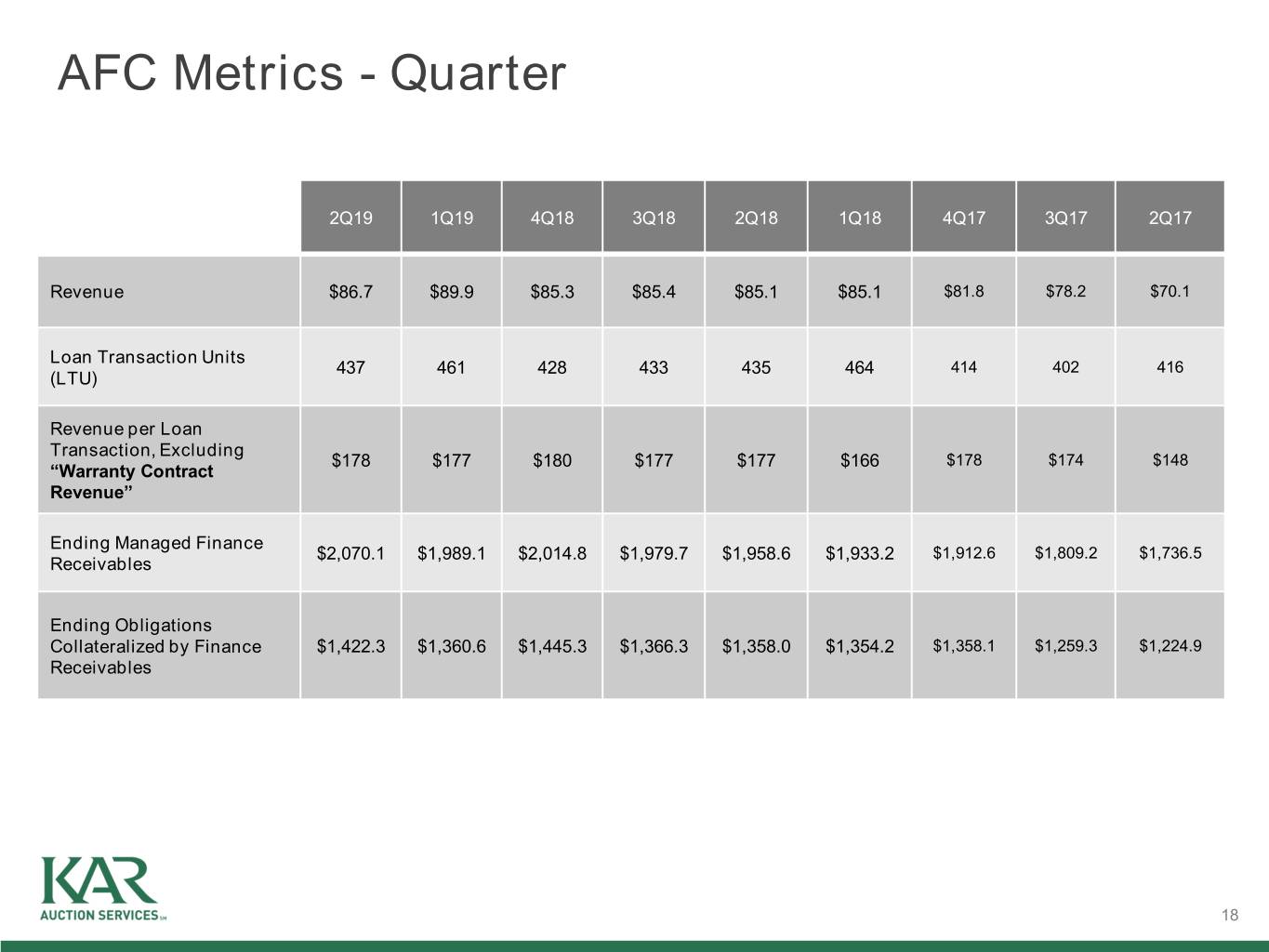

AFC Metrics - Quarter 2Q19 1Q19 4Q18 3Q18 2Q18 1Q18 4Q17 3Q17 2Q17 Revenue $86.7 $89.9 $85.3 $85.4 $85.1 $85.1 $81.8 $78.2 $70.1 Loan Transaction Units 437 461 428 433 435 464 414 402 416 (LTU) Revenue per Loan Transaction, Excluding $178 $177 $180 $177 $177 $166 $178 $174 $148 “Warranty Contract Revenue” Ending Managed Finance $2,070.1 $1,989.1 $2,014.8 $1,979.7 $1,958.6 $1,933.2 $1,912.6 $1,809.2 $1,736.5 Receivables Ending Obligations Collateralized by Finance $1,422.3 $1,360.6 $1,445.3 $1,366.3 $1,358.0 $1,354.2 $1,358.1 $1,259.3 $1,224.9 Receivables 18

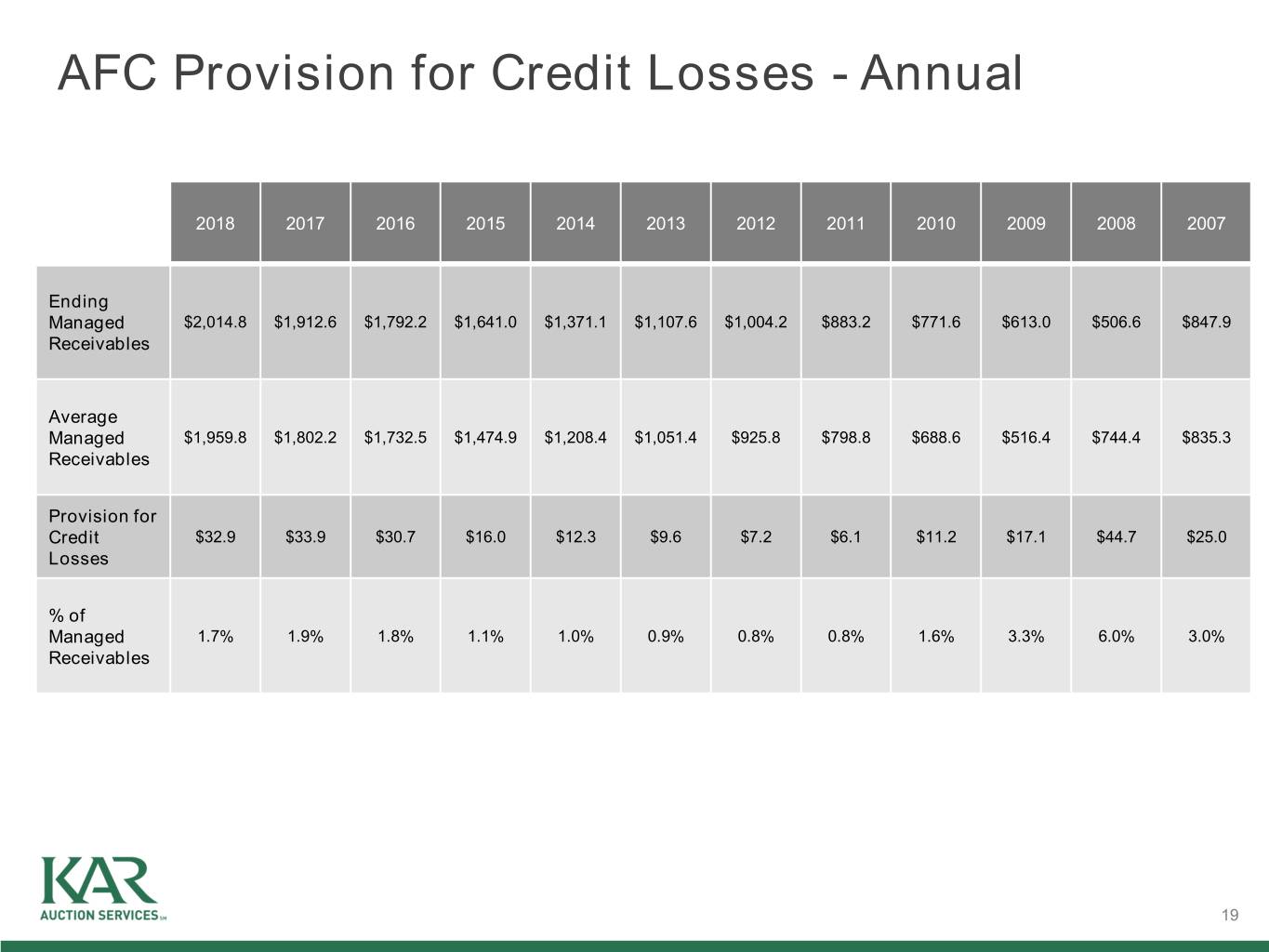

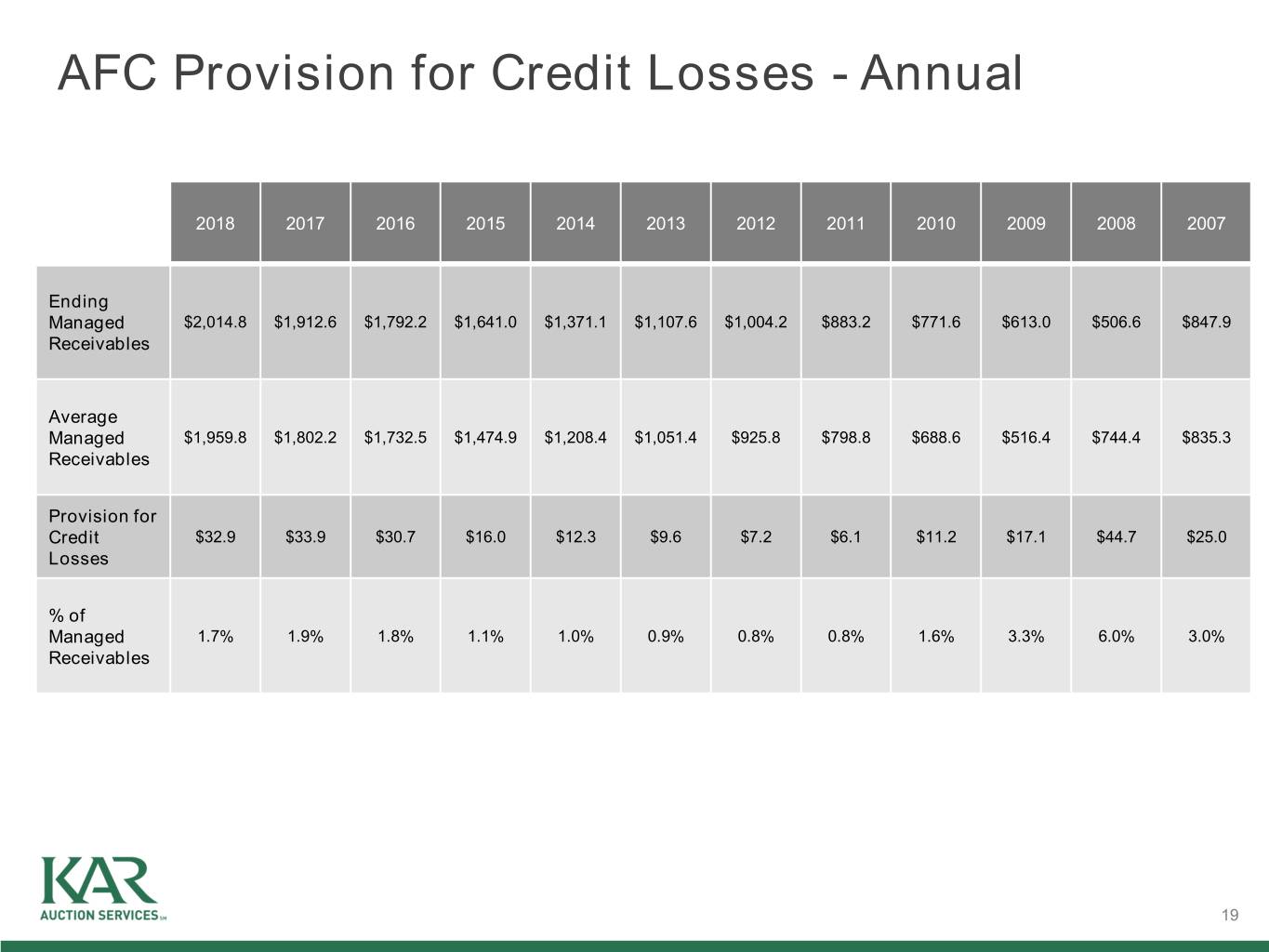

AFC Provision for Credit Losses - Annual 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 Ending Managed $2,014.8 $1,912.6 $1,792.2 $1,641.0 $1,371.1 $1,107.6 $1,004.2 $883.2 $771.6 $613.0 $506.6 $847.9 Receivables Average Managed $1,959.8 $1,802.2 $1,732.5 $1,474.9 $1,208.4 $1,051.4 $925.8 $798.8 $688.6 $516.4 $744.4 $835.3 Receivables Provision for Credit $32.9 $33.9 $30.7 $16.0 $12.3 $9.6 $7.2 $6.1 $11.2 $17.1 $44.7 $25.0 Losses % of Managed 1.7% 1.9% 1.8% 1.1% 1.0% 0.9% 0.8% 0.8% 1.6% 3.3% 6.0% 3.0% Receivables 19

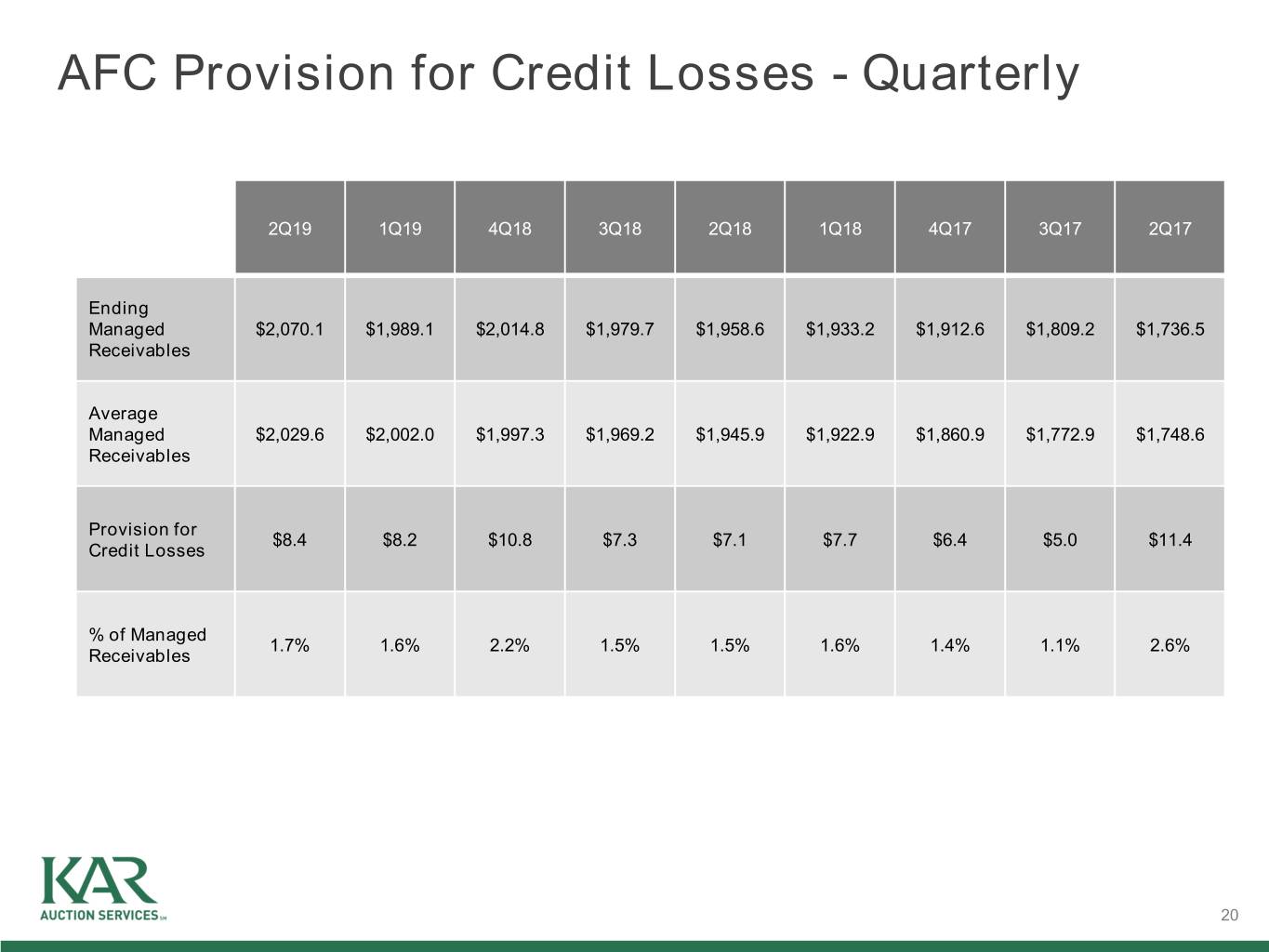

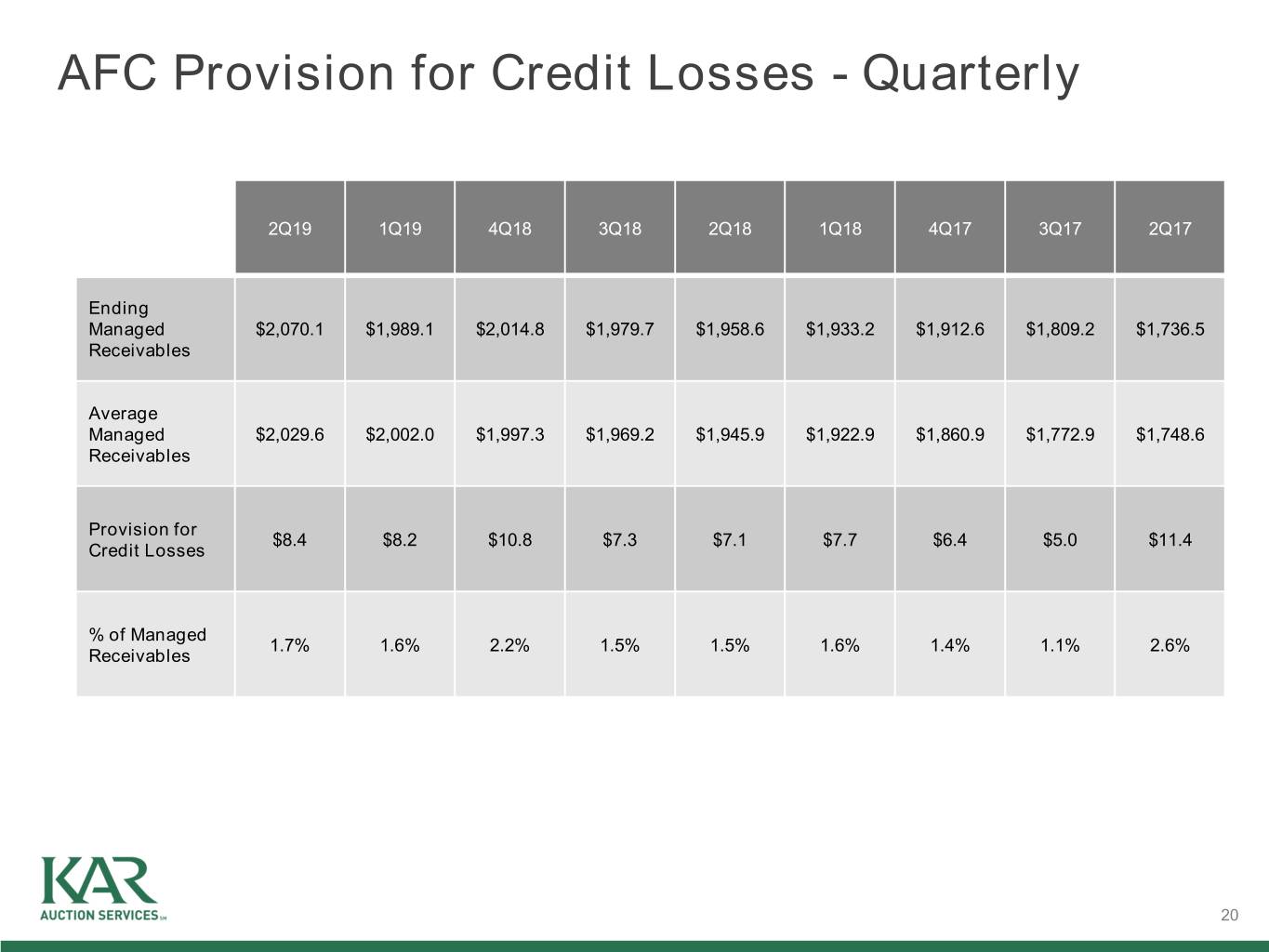

AFC Provision for Credit Losses - Quarterly 2Q19 1Q19 4Q18 3Q18 2Q18 1Q18 4Q17 3Q17 2Q17 Ending Managed $2,070.1 $1,989.1 $2,014.8 $1,979.7 $1,958.6 $1,933.2 $1,912.6 $1,809.2 $1,736.5 Receivables Average Managed $2,029.6 $2,002.0 $1,997.3 $1,969.2 $1,945.9 $1,922.9 $1,860.9 $1,772.9 $1,748.6 Receivables Provision for $8.4 $8.2 $10.8 $7.3 $7.1 $7.7 $6.4 $5.0 $11.4 Credit Losses % of Managed 1.7% 1.6% 2.2% 1.5% 1.5% 1.6% 1.4% 1.1% 2.6% Receivables 20

APPENDIX 21

Non-GAAP Financial Measures EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in the company's senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by the company’s creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the company’s performance. Depreciation expense for property and equipment and amortization expense of capitalized internally developed software costs relate to ongoing capital expenditures; however, amortization expense associated with acquired intangible assets, such as customer relationships, software, tradenames and non-compete agreements are not representative of ongoing capital expenditures, but have a continuing effect on our reported results. Non-GAAP financial measures of operating adjusted net income from continuing operations and operating adjusted net income from continuing operations per share, in the opinion of the company, provide comparability to other companies that may not have incurred these types of non-cash expenses or that report a similar measure. In addition, net income and net income per share have been adjusted for certain other charges, as seen in the following reconciliation. EBITDA, Adjusted EBITDA, operating adjusted net income from continuing operations and operating adjusted net income from continuing operations per share have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies. 22

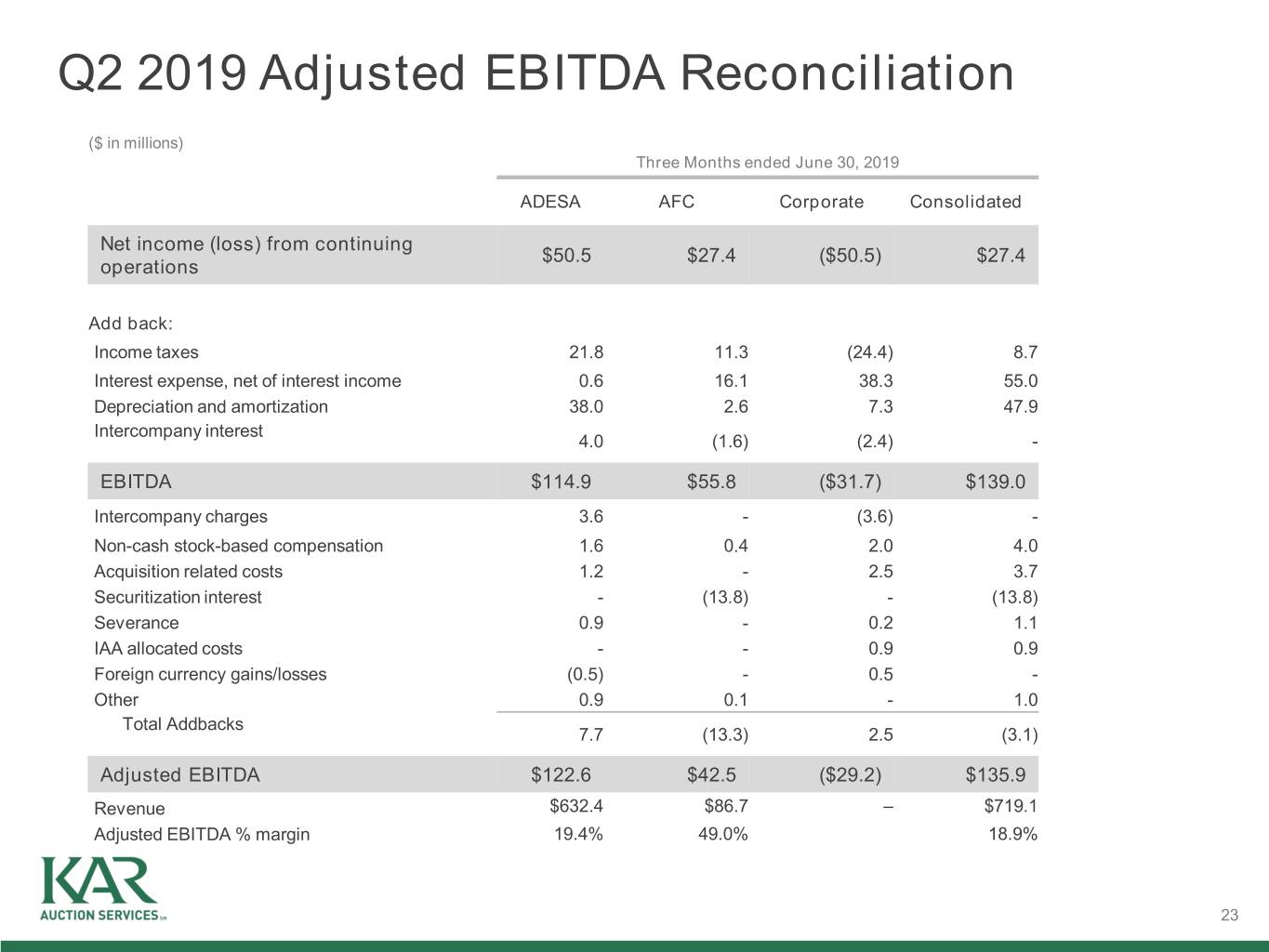

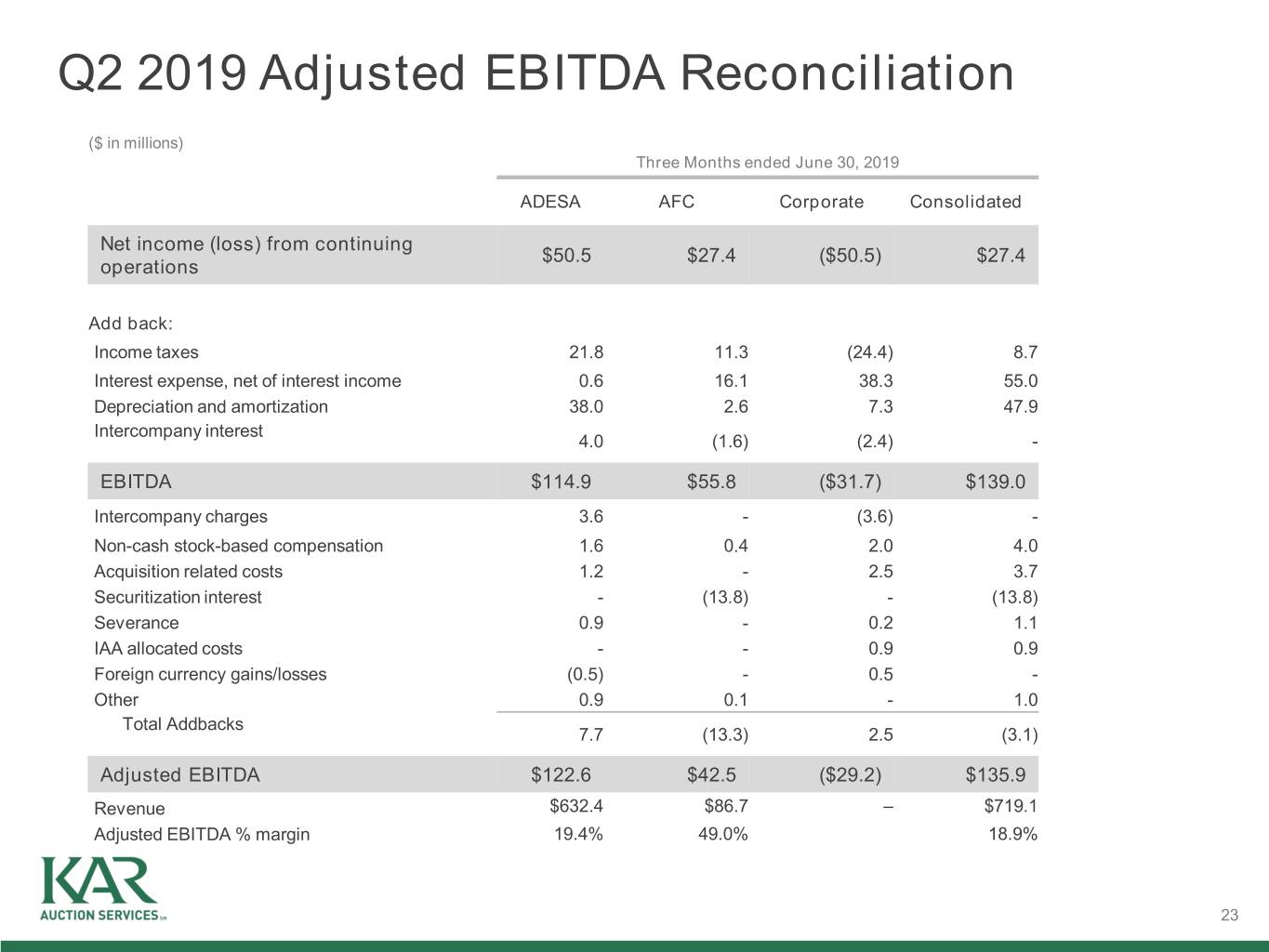

Q2 2019 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended June 30, 2019 ADESA AFC Corporate Consolidated Net income (loss) from continuing $50.5 $27.4 ($50.5) $27.4 operations Add back: Income taxes 21.8 11.3 (24.4) 8.7 Interest expense, net of interest income 0.6 16.1 38.3 55.0 Depreciation and amortization 38.0 2.6 7.3 47.9 Intercompany interest 4.0 (1.6) (2.4) - EBITDA $114.9 $55.8 ($31.7) $139.0 Intercompany charges 3.6 - (3.6) - Non-cash stock-based compensation 1.6 0.4 2.0 4.0 Acquisition related costs 1.2 - 2.5 3.7 Securitization interest - (13.8) - (13.8) Severance 0.9 - 0.2 1.1 IAA allocated costs - - 0.9 0.9 Foreign currency gains/losses (0.5) - 0.5 - Other 0.9 0.1 - 1.0 Total Addbacks 7.7 (13.3) 2.5 (3.1) Adjusted EBITDA $122.6 $42.5 ($29.2) $135.9 Revenue $632.4 $86.7 – $719.1 Adjusted EBITDA % margin 19.4% 49.0% 18.9% 23

Q2 2018 Adjusted EBITDA Reconciliation ($ in millions) Three Months ended June 30, 2018 ADESA AFC Corporate Consolidated Net income (loss) from continuing $60.0 $27.7 ($50.3) $37.4 operations Add back: Income taxes 23.5 9.3 (16.9) 15.9 Interest expense, net of interest income 0.4 14.7 32.3 47.4 Depreciation and amortization 31.3 3.5 7.3 42.1 Intercompany interest 4.3 (0.7) (3.6) - EBITDA $119.5 $54.5 ($31.2) $142.8 Intercompany charges 3.3 - (3.3) - Non-cash stock-based compensation 2.3 0.6 1.5 4.4 Acquisition related costs 1.0 - 0.5 1.5 Securitization interest - (12.7) - (12.7) Severance 0.9 - - 0.9 IAA allocated costs - - 1.3 1.3 Other 0.8 - - 0.8 Total Addbacks 8.3 (12.1) - (3.8) Adjusted EBITDA $127.8 $42.4 ($31.2) $139.0 Revenue $538.3 $85.1 – $623.4 Adjusted EBITDA % margin 23.7% 49.8% 22.3% 24

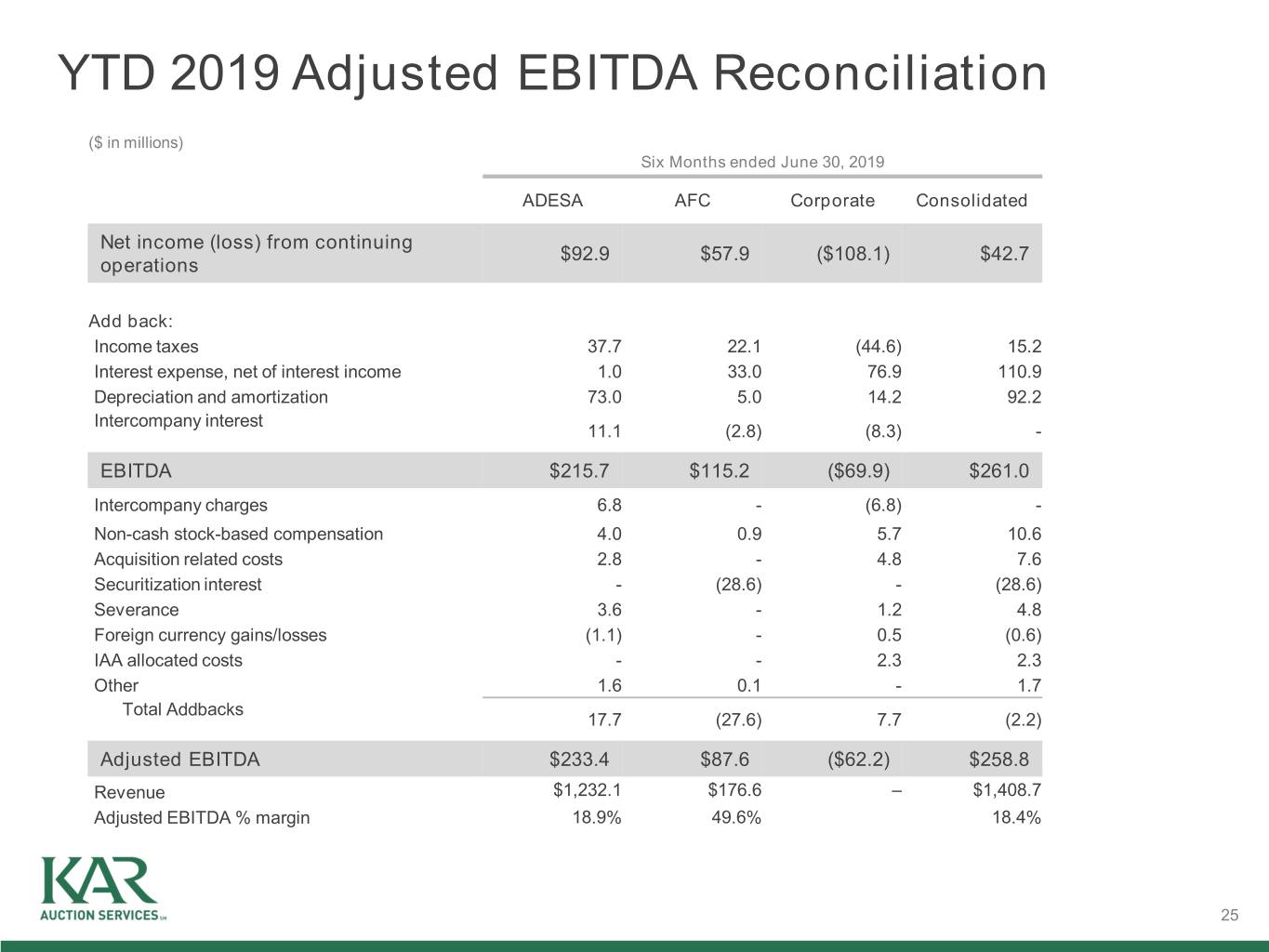

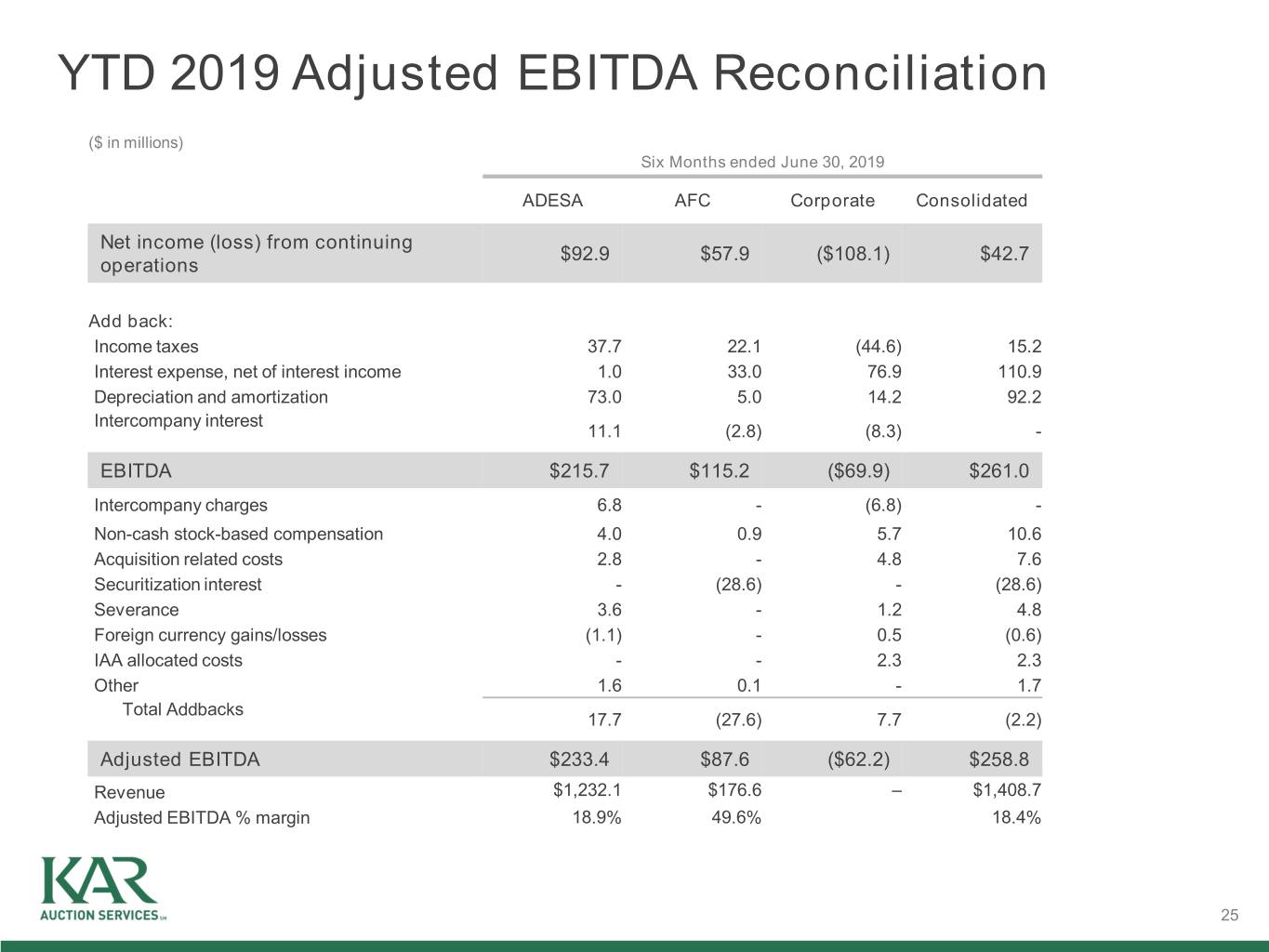

YTD 2019 Adjusted EBITDA Reconciliation ($ in millions) Six Months ended June 30, 2019 ADESA AFC Corporate Consolidated Net income (loss) from continuing $92.9 $57.9 ($108.1) $42.7 operations Add back: Income taxes 37.7 22.1 (44.6) 15.2 Interest expense, net of interest income 1.0 33.0 76.9 110.9 Depreciation and amortization 73.0 5.0 14.2 92.2 Intercompany interest 11.1 (2.8) (8.3) - EBITDA $215.7 $115.2 ($69.9) $261.0 Intercompany charges 6.8 - (6.8) - Non-cash stock-based compensation 4.0 0.9 5.7 10.6 Acquisition related costs 2.8 - 4.8 7.6 Securitization interest - (28.6) - (28.6) Severance 3.6 - 1.2 4.8 Foreign currency gains/losses (1.1) - 0.5 (0.6) IAA allocated costs - - 2.3 2.3 Other 1.6 0.1 - 1.7 Total Addbacks 17.7 (27.6) 7.7 (2.2) Adjusted EBITDA $233.4 $87.6 ($62.2) $258.8 Revenue $1,232.1 $176.6 – $1,408.7 Adjusted EBITDA % margin 18.9% 49.6% 18.4% 25

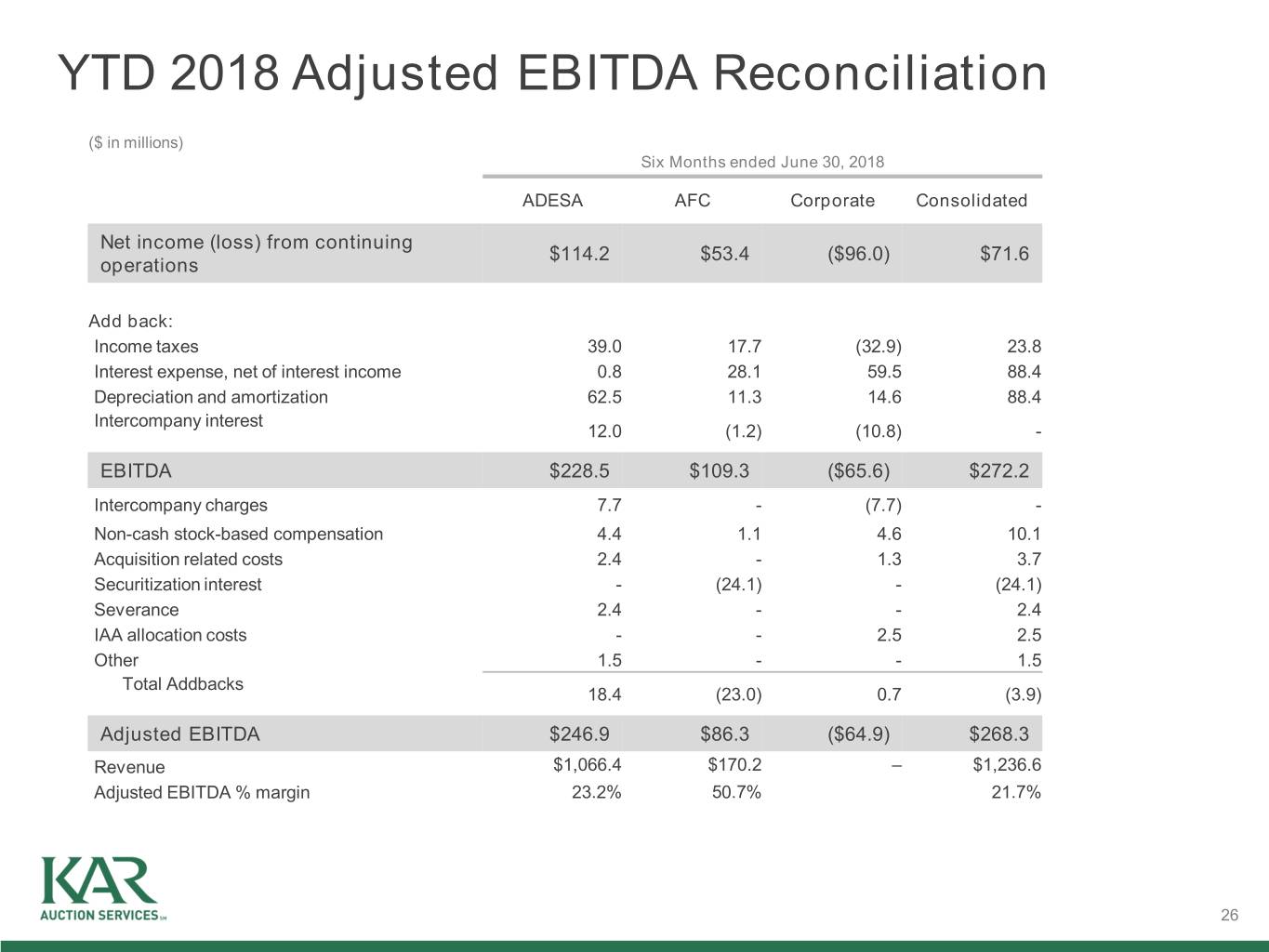

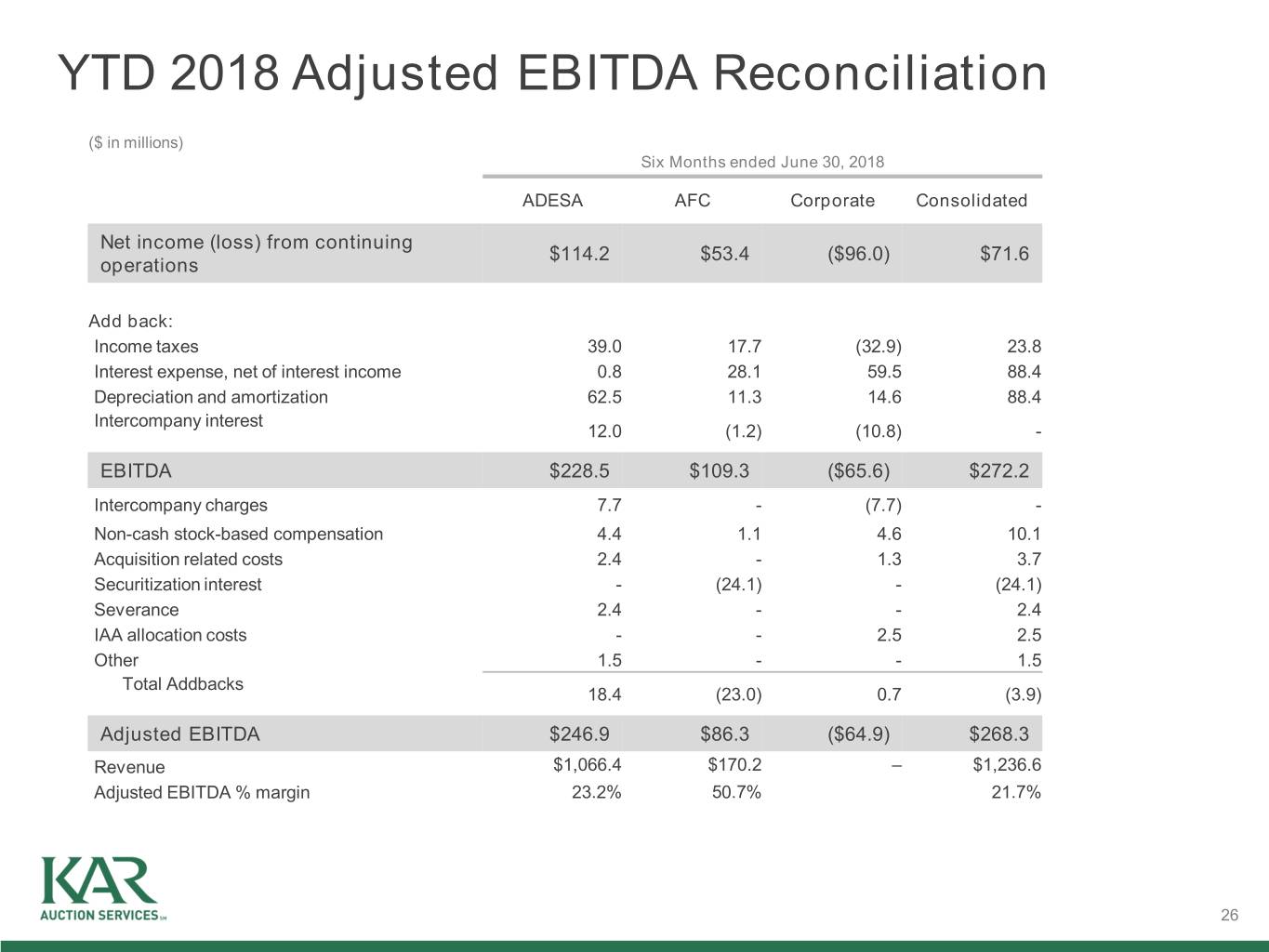

YTD 2018 Adjusted EBITDA Reconciliation ($ in millions) Six Months ended June 30, 2018 ADESA AFC Corporate Consolidated Net income (loss) from continuing $114.2 $53.4 ($96.0) $71.6 operations Add back: Income taxes 39.0 17.7 (32.9) 23.8 Interest expense, net of interest income 0.8 28.1 59.5 88.4 Depreciation and amortization 62.5 11.3 14.6 88.4 Intercompany interest 12.0 (1.2) (10.8) - EBITDA $228.5 $109.3 ($65.6) $272.2 Intercompany charges 7.7 - (7.7) - Non-cash stock-based compensation 4.4 1.1 4.6 10.1 Acquisition related costs 2.4 - 1.3 3.7 Securitization interest - (24.1) - (24.1) Severance 2.4 - - 2.4 IAA allocation costs - - 2.5 2.5 Other 1.5 - - 1.5 Total Addbacks 18.4 (23.0) 0.7 (3.9) Adjusted EBITDA $246.9 $86.3 ($64.9) $268.3 Revenue $1,066.4 $170.2 – $1,236.6 Adjusted EBITDA % margin 23.2% 50.7% 21.7% 26

Operating Adjusted Net Income from Continuing Operations per Share Reconciliation ($ in millions, except per share amounts), (unaudited) Three Months ended Six Months ended June 30, June 30, 2019 2018 2019 2018 Net income $55.6 $93.2 $133.4 $183.2 Less: Income from discontinued operations (28.2) (55.8) (90.7) (111.6) Net income from continuing operations $27.4 $37.4 $42.7 $71.6 Acquired amortization expense 14.8 15.4 29.4 35.7 IAA allocated costs 0.9 1.3 2.3 2.5 Acceleration of debt issuance costs 1.8 - 1.8 - Income taxes (1) (4.2) (5.0) (8.8) (9.5) Operating adjusted net income from continuing operations $40.7 $49.1 $67.4 $100.3 Net income from continuing operations per share − diluted $0.20 $0.28 $0.32 $0.53 Acquired amortization expense 0.11 0.11 0.22 0.26 IAA allocated costs 0.01 0.01 0.02 0.02 Acceleration of debt issuance costs 0.01 - 0.01 - Income taxes (0.03) (0.04) (0.07) (0.07) Operating adjusted net income from continuing operations $0.30 $0.36 $0.50 $0.74 per share − diluted Weighted average diluted shares 134.1 135.6 133.9 135.8 (1) The effective tax rate at the end of each period presented was used to determine the amount of income tax on the adjustments to net income. 27