Item 1. Reports to Stockholders

Delaware Enhanced Global Dividend

and Income Fund

Annual report

November 30, 2016

The figures in the annual report for Delaware Enhanced Global Dividend and Income Fund represent past results, which are not a guarantee of future results. A rise or fall in interest rates can have a significant impact on bond prices. Funds that invest in bonds can lose their value as interest rates rise.

Closed-end fund

Table of contents

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services. For more information, including press releases, please visit delawareinvestments.com/closed-end.

Unless otherwise noted, views expressed herein are current as of Nov. 30, 2016, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services are provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

Neither Delaware Investments nor its affiliates referred to in this document are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited (MBL), a subsidiary of Macquarie Group Limited and an affiliate of Delaware Investments. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by U.S. laws and regulations.

© 2017 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

Portfolio management review

Delaware Enhanced Global Dividend and Income Fund

December 6, 2016

Performance preview (for the year ended November 30, 2016)

| | | | | | | | | | | | |

| | | | |

Delaware Enhanced Global Dividend and Income Fund @ market price | | | 1-year return | | | | | | | | +8.44 | % |

| | | |

Delaware Enhanced Global Dividend and Income Fund @ NAV | | | 1-year return | | | | | | | | +8.65 | % |

| | | |

Lipper Closed-end Global Funds Average @ market price | | | 1-year return | | | | | | | | +5.92 | % |

| | | |

Lipper Closed-end Global Funds Average @ NAV | | | 1-year return | | | | | | | | +1.32 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Enhanced Global Dividend and Income Fund, please see the table on page 3.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

For the fiscal year ended Nov. 30, 2016, Delaware Enhanced Global Dividend and Income Fund returned +8.65% at net asset value (NAV) and +8.44% at market price (both figures reflect all distributions reinvested). Complete annualized performance for the Fund is shown in the table on page 3.

Strength from equities and high yield bonds

Early in the Fund’s fiscal year, global stocks struggled amid concerns about economic growth worldwide. Beginning in February 2016, however, equities began a months-long rally driven in part by better U.S. economic data, improved commodity pricing, and stimulus efforts from monetary markets across Europe and Asia.

The stock market’s rally was briefly interrupted in June by the United Kingdom’s “Brexit” vote to end its involvement in the European Union. Although global stock prices immediately plunged, most equity indices soon rebounded sharply and returned to their previous levels within a few weeks, as investors apparently concluded that the immediate financial impact from Brexit would be manageable. Ongoing stimulus from global central banks also helped lift stock prices, led by economically sensitive companies that benefited from increased optimism on the part of investors.

Global stocks were again strong performers in November, when Donald Trump’s U.S. presidential victory gave Republicans unified control of the country’s federal government. Investors seemed to conclude that the incoming administration’s likely focus on deregulation, lower taxes, and increased fiscal spending could provide a near-term boost to the economy. Coupled with improved economic data, economically sensitive and more-speculative stocks benefited the most. U.S. interest rates rose along with concern about inflation, which in our view made yield-oriented investments, such as dividend-paying stocks, which had been strong performers earlier in the fiscal year, less attractive for investors.

For the full 12-month time frame, high yield bonds, as measured by the Bloomberg Barclays U.S. Corporate High-Yield Index, returned +12.1%, reflecting investors’ increased tolerance of credit risk and an improved financial backdrop for lower-rated issuers. U.S. large-cap value stocks enjoyed a strong performance environment, returning +12.0%, as measured by the Russell 1000® Value Index, for the fiscal year.

Global stocks trailed their U.S. counterparts — in part because of a stronger U.S. dollar that reduced returns for U.S. investors in foreign securities — with the MSCI ACWI (All CountryWorld Index) returning +3.7%. Meanwhile, convertible bonds, as measured by the BofA Merrill Lynch All U.S. Convertibles Index, returned +6.7% for the 12-month period.

Individual outperformers and underperformers

Substantial allocations to U.S. large-cap value stocks and high yield bonds — which together made up close to half of the Fund’s portfolio as of fiscal year end — were significantly positive performance factors. Allocations to international equities and convertibles, which produced lower but still positive returns for the fiscal year, were less helpful.

The Fund was generally positioned defensively. This stance helped performance overall but was a headwind in November 2016. The Fund’s lack of exposure to banks and other interest-rate-sensitive asset classes put it at a relative disadvantage during the market rally. November proved to be the exception, however, in what was otherwise a strong fiscal year for the Fund.

Among the Fund’s individual equity contributors, various holdings added to results. On the international side of the portfolio, Canadian gold producers Yamana Gold and Alamos Gold were strong performers, benefiting from rising gold prices. Generally higher commodity prices also lifted the shares of British-Australian mining company Rio Tinto. Other international equity stocks that added value were Mobile TeleSystems, a Russian telecommunication services company, and Samsung, a Korean electronics manufacturer.

Within the Fund’s U.S. large-cap value subportfolio, contributors included Spectra Energy, which announced a merger with Enbridge, and CSX, a rail company that benefited from an improved economy. Other notable stocks that added value included solid-waste company Waste Management and agricultural producer Archer-Daniels-Midland. Although the Fund’s U.S. large-cap equity investments enjoyed generally strong results, some holdings struggled. For example, we believe healthcare-related positions such as U.K.-based biopharmaceutical manufacturer AstraZeneca, drug distributor Cardinal Health, and healthcare products manufacturer

Portfolio management review

Delaware Enhanced Global Dividend and Income Fund

Abbott Laboratories were weighed down by investors’ concern about U.S. drug pricing trends. Among the Fund’s international equity detractors, we believe pharmaceutical manufacturer Shire was similarly affected by this concern.

Other international equity holdings that detracted from the Fund’s performance during the fiscal period included Italian bank UniCredit, U.K.-based utility company National Grid, and Swedish telecommunication services company Tele2, all of which produced subpar results.

In addition, the Fund used the following derivatives during the fiscal year: foreign currency exchange contracts to facilitate the purchase and sale of securities in the Fund, options contracts to receive premiums for writing options, and credit default swaps to hedge against credit events. Their net effect on Fund performance was minor (that is, less than 0.50 percentage points).

Of final note, the Fund’s use of leverage — a portfolio-management tool designed to obtain a higher return on our equity investments — added to performance in light of the stock market’s increase. Leverage has the effect of magnifying the impact of gains and losses. As a result, it added to the Fund’s results in a strong market environment.

Maintaining a yield-oriented approach

Throughout the fiscal year, we continued to emphasize securities offering competitive yields and the potential for dividend growth. We also maintained our focus on managing the portfolio’s downside risk and seeking to limit potential capital losses.

Turnover in the portfolio was modest throughout the fiscal year. Accordingly, the Fund’s asset allocations finished the period similar to where they began it. As of Nov. 30, 2016, the Fund’s largest asset allocation was in high yield bonds, which made up 35% of the portfolio. The mandate for this Fund is to maintain healthy exposure to international securities; accordingly, the Fund’s weighting in international equities was 29%, international bonds were 5%, and global real estate was 2% of the portfolio. Other meaningful allocations included a 15% stake in convertible securities and a 12% weighting in U.S. large-cap value equities.

Staying defensive amid uncertainty

In the wake of the Brexit vote, November’s U.S. elections, and the December Italian constitutional referendum — coupled with major elections next year in Germany and France — investors face considerable uncertainty about the future. In the U.S., this uncertainty includes questions about the economic effects of regulatory and tax policy, and the direction of interest rates. Against this backdrop, we think defensive positioning remains a prudent course of action, given a wide range of potential outcomes for investors.

For now, amid still low global rates, we continue to operate in a world in which income and yield remain in demand by investors. However, we believe investing for yield alone can be risky as it is dependent on interest rate policies rather than fundamentals. We believe an approach of investing in a diversified mix of securities, throughout the capital structure, has the potential to provide sustainable income and the ability to build capital over time.

Unless otherwise noted, views expressed herein are current as of Nov. 30, 2016, and subject to change for events occurring after such date.

2

Performance summary

Delaware Enhanced Global Dividend and Income Fund

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Please obtain the most recent performance data by calling 866 437-0252 or visiting our website at delawareinvestments.com/closed-end.

Fund performance

| | | | | | | | | | |

Average annual total returns through November 30, 2016 | | 1 year | | | 5 years | | | Lifetime |

| | | |

At market price (inception date June 29, 2007) | | | +8.44 | % | | | +6.06 | % | | +2.83% |

At net asset value (inception date June 29, 2007) | | | +8.65 | % | | | +8.86 | % | | +4.69% |

Diversification may not protect against market risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

The Funds may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover that approaches or exceeds 100%, which could result in higher transaction costs and tax liability.

If and when the Fund utilizes leverage, the Fund may not be permitted to declare dividends or other distributions with respect to its common shares or purchase its capital stock, unless the Fund meets certain asset coverage requirements.

To the extent the Fund engages in option overwriting, it may receive less total return in certain periods and in other periods greater total return from its option overwriting strategy.

The use of dividend capture strategies will expose the Fund to increased trading costs and potential for capital loss or gain, particularly in the event of significant short-term price movements of stocks subject to dividend capture trading, and resultant dividends may not be qualified dividends eligible to individuals for reduced federal income tax rates.

Closed-end funds, unlike open-end funds, are not continuously offered. After being issued during a one-time-only public offering, shares of closed-end funds are sold in the open market through a securities exchange. Net asset value (NAV) is calculated by subtracting total liabilities by total assets, then dividing by the number of shares outstanding. At the time of sale, your shares may have a market price that is above or below NAV, and may be worth more or less than your original investment.

Performance summary

Delaware Enhanced Global Dividend and Income Fund

The Fund may make distributions of ordinary income and capital gains at calendar year end. Those distributions temporarily cause extraordinarily high yields. There is no assurance that a Fund will repeat that yield in the future. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Returns reflect the reinvestment of all distributions. Dividends and distributions, if any, are assumed, for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment policy. Shares of the Fund were initially offered with a sales charge of 4.50%. Performance since inception does not include the sales charge or any other brokerage commission for purchases made since inception.

Past performance is not a guarantee of future results.

Fund basics

As of November 30, 2016

| | |

Fund objectives | | Fund start date |

The Fund’s primary investment objective is to seek current income. Capital appreciation is a secondary objective. | | June 29, 2007 |

Total Fund net assets | | NYSE symbol |

$181 million | | DEX |

Number of holdings | | |

670 | | |

4

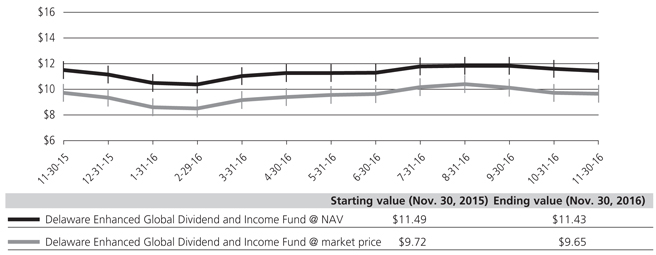

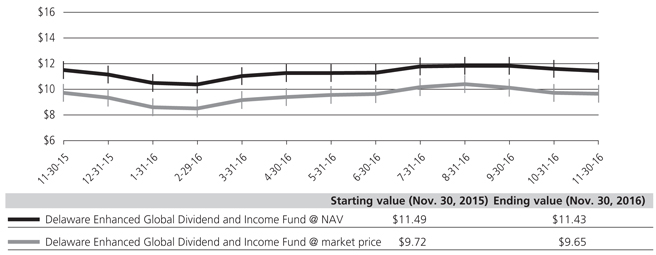

Market price versus net asset value (see notes below)

November 30, 2015 through November 30, 2016

Past performance is not a guarantee of future results.

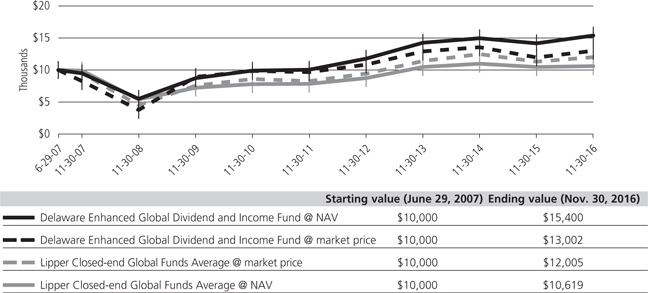

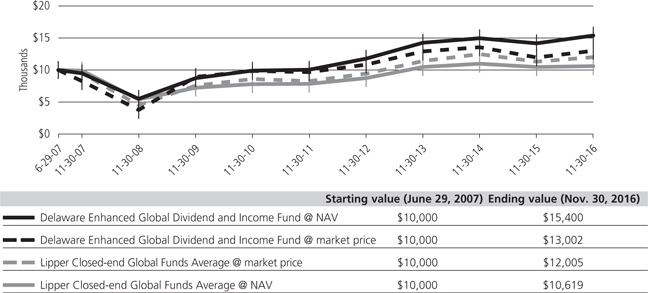

Performance of a $10,000 investment

Average annual total returns from June 29, 2007 (Fund’s inception) through November 30, 2016

The “Performance of a $10,000 investment” graph assumes $10,000 invested in the Fund on June 29, 2007, and includes the reinvestment of all distributions at market value. The graph assumes $10,000 invested in the Lipper Closed-end Global Funds Average at market price and at NAV. Performance of the Fund and the Lipper class at market value is based on market performance during the period. Performance of the Fund and Lipper class at NAV is based on the fluctuations in NAV during the period. Delaware Enhanced Global Dividend and Income Fund was initially offered with a sales charge of 4.50%. The Fund is currently traded on the secondary market without a sales load. For market price,

Performance summary

Delaware Enhanced Global Dividend and Income Fund

performance shown in both graphs above does not include fees, the initial sales charge, or any brokerage commissions for purchases. For NAV, performance shown in both graphs above does include fees, but does not include the initial sales charge or any brokerage commissions for purchases. Investments in the Fund are not available at NAV.

The Lipper Closed-end Global Funds Average represents the average return of closed-end funds that invest at least 25% of their portfolio in securities traded outside of the United States and that may own U.S. securities as well (source: Lipper).

The Bloomberg Barclays U.S. Corporate High-Yield Index, mentioned on page 1, is composed of U.S. dollar–denominated, non-investment-grade corporate bonds for which the middle rating among Moody’s Investors Service, Inc., Fitch, Inc., and Standard & Poor’s is Ba1/BB+/BB+ or below.

The Russell 1000 Value Index, mentioned on page 1, measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

The MSCI ACWI Index, mentioned on page 1, is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance across developed and emerging markets worldwide.

The BofA Merrill Lynch All U.S. Convertibles Index, mentioned on page 1, tracks the performance of domestic corporate convertible bonds and convertible preferred stock issues of all qualities that have a market value of $50 million or more at issuance.

Market price is the price an investor would pay for shares of the Fund on the secondary market. NAV is the total value of one fund share, generally equal to a fund’s net assets divided by the number of shares outstanding.

Past performance is not a guarantee of future results.

6

Security type / sector and country allocations

Delaware Enhanced Global Dividend and Income Fund

As of November 30, 2016 (Unaudited)

Sector designations may be different than the sector designations presented in other fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | | | |

| Security type / sector | | Percentage

of net assets | |

Common Stock | | | 68.92% | |

Consumer Discretionary | | | 9.09% | |

Consumer Staples | | | 6.80% | |

Diversified REITs | | | 0.63% | |

Energy | | | 5.57% | |

Financials | | | 9.28% | |

Healthcare | | | 8.97% | |

Healthcare REITs | | | 0.32% | |

Hotel REITs | | | 0.70% | |

Industrial REITs | | | 0.48% | |

Industrials | | | 10.00% | |

Information Technology | | | 5.57% | |

Mall REITs | | | 0.52% | |

Manufactured Housing REIT | | | 0.12% | |

Materials | | | 1.94% | |

Mixed REIT | | | 0.03% | |

Mortgage REITs | | | 0.30% | |

Multifamily REITs | | | 0.91% | |

Office REITs | | | 1.28% | |

Self-Storage REIT | | | 0.04% | |

Shopping Center REITs | | | 1.11% | |

Single Tenant REIT | | | 0.24% | |

Telecommunications | | | 3.89% | |

Utilities | | | 1.13% | |

Convertible Preferred Stock | | | 2.15% | |

Exchange-Traded Note | | | 0.02% | |

Agency Collateralized Mortgage Obligations | | | 0.03% | |

Agency Commercial Mortgage-Backed Securities | | | 0.01% | |

Agency Mortgage-Backed Securities | | | 0.03% | |

Commercial Mortgage-Backed Securities | | | 0.02% | |

Convertible Bonds | | | 15.57% | |

Brokerage | | | 0.54% | |

Communications | | | 2.24% | |

Consumer Cyclical | | | 0.98% | |

Consumer Non-Cyclical | | | 2.90% | |

Energy | | | 0.35% | |

Financials | | | 2.01% | |

Industrials | | | 0.53% | |

Real Estate Investment Trusts | | | 1.86% | |

Technology | | | 4.16% | |

Corporate Bonds | | | 44.59% | |

Automotive | | | 0.11% | |

| | | | |

| Security type / sector | | Percentage

of net assets | |

Banking | | | 1.81% | |

Basic Industry | | | 4.63% | |

Brokerage | | | 0.24% | |

Capital Goods | | | 3.42% | |

Communications | | | 3.75% | |

Consumer Cyclical | | | 4.06% | |

Consumer Non-Cyclical | | | 2.58% | |

Electric | | | 0.43% | |

Energy | | | 6.74% | |

Financials | | | 0.50% | |

Healthcare | | | 3.02% | |

Insurance | | | 0.80% | |

Media | | | 5.00% | |

Natural Gas | | | 0.35% | |

Real Estate Investment Trusts | | | 1.48% | |

Services | | | 1.66% | |

Technology | | | 2.56% | |

Transportation | | | 0.38% | |

Utilities | | | 1.07% | |

Non-Agency Asset-Backed Security | | | 0.01% | |

Non-Agency Collateralized Mortgage Obligations | | | 0.06% | |

Senior Secured Loans | | | 2.37% | |

Sovereign Bonds | | | 4.26% | |

U.S. Treasury Obligations | | | 0.72% | |

Leveraged Non-Recourse Security | | | 0.00% | |

Limited Partnership | | | 0.43% | |

Master Limited Partnership | | | 0.23% | |

Preferred Stock | | | 0.92% | |

Rights | | | 0.02% | |

Warrant | | | 0.00% | |

Short-Term Investments | | | 3.91% | |

Total Value of Securities | | | 144.27% | |

Borrowing Under Line of Credit | | | (45.25%) | |

Receivables and Other Assets Net of Liabilities | | | 0.98% | |

Total Net Assets | | | 100.00% | |

Security type / sector and country allocations

Delaware Enhanced Global Dividend and Income Fund

| | | | |

| Country* | | Percentage

of net assets | |

Australia | | | 1.44% | |

Barbados | | | 0.28% | |

Belgium | | | 0.03% | |

Canada | | | 2.81% | |

Cayman Islands | | | 0.92% | |

China/Hong Kong | | | 2.85% | |

Colombia | | | 0.28% | |

Denmark | | | 0.82% | |

France | | | 8.81% | |

Germany | | | 3.26% | |

Indonesia | | | 3.37% | |

Ireland | | | 0.48% | |

Israel | | | 1.14% | |

Italy | | | 0.55% | |

Jamaica | | | 0.52% | |

Japan | | | 11.02% | |

Luxembourg | | | 0.85% | |

Mexico | | | 3.16% | |

Netherlands | | | 3.52% | |

Puerto Rico | | | 0.32% | |

Republic of Korea | | | 1.36% | |

Russia | | | 0.42% | |

Singapore | | | 0.03% | |

Sweden | | | 2.04% | |

Switzerland | | | 2.51% | |

United Kingdom | | | 6.79% | |

United States | | | 80.78% | |

Total | | | 140.36% | |

*Allocation includes all investments except for short-term

investments.

The percentage of net assets exceeds 100.00% because the Fund utilizes a line of credit with The Bank of New York Mellon, as described in Note 7 in “Notes to financial statements.” The Fund utilizes leveraging techniques in an attempt to obtain a higher return for the Fund. There is no assurance that the Fund will achieve its investment objectives through the use of such techniques.

8

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

November 30, 2016

| | | | | | | | |

| | | Number of

shares | | | Value (U.S. $) | |

| |

Common Stock – 68.92%v | | | | | |

| |

Consumer Discretionary – 9.09% | | | | | |

Bayerische MotorenWerke | | | 19,619 | | | $ | 1,671,981 | |

Ford Motor | | | 80,100 | | | | 957,996 | |

Kering | | | 6,363 | | | | 1,382,484 | |

Mattel | | | 23,600 | | | | 745,052 | |

Nitori Holdings | | | 11,708 | | | | 1,221,918 | |

Publicis Groupe | | | 10,779 | | | | 699,499 | |

Sumitomo Rubber Industries | | | 94,800 | | | | 1,565,292 | |

Target | | | 13,100 | | | | 1,011,844 | |

Techtronic Industries | | | 372,000 | | | | 1,450,783 | |

Toyota Motor | | | 45,905 | | | | 2,667,911 | |

Valeo | | | 16,810 | | | | 937,304 | |

Yue Yuen Industrial Holdings | | | 597,000 | | | | 2,151,247 | |

| | | | | | | | |

| | | | | | | 16,463,311 | |

| | | | | | | | |

Consumer Staples – 6.80% | | | | | |

Archer-Daniels-Midland | | | 12,700 | | | | 549,021 | |

Aryzta † | | | 35,635 | | | | 1,518,352 | |

Carlsberg Class B | | | 17,433 | | | | 1,482,476 | |

Coca-Cola Amatil | | | 150,652 | | | | 1,066,878 | |

Japan Tobacco | | | 55,300 | | | | 1,907,380 | |

Kimberly-Clark | | | 8,700 | | | | 1,005,807 | |

Kraft Heinz | | | 13,200 | | | | 1,077,780 | |

Procter & Gamble | | | 13,600 | | | | 1,121,456 | |

Reynolds American | | | 14,764 | | | | 798,732 | |

Tesco † | | | 485,223 | | | | 1,267,041 | |

Wal-Mart Stores | | | 7,400 | | | | 521,182 | |

| | | | | | | | |

| | | | | | | 12,316,105 | |

| | | | | | | | |

Diversified REITs – 0.63% | | | | | |

Cousins Properties | | | 17,020 | | | | 134,628 | |

Gramercy Property Trust | | | 45,084 | | | | 394,034 | |

Investors Real Estate Trust | | | 10,260 | | | | 64,535 | |

Lexington Realty Trust | | | 14,178 | | | | 146,459 | |

Mapletree Logistics Trust | | | 70,996 | | | | 50,274 | |

Orix JREIT | | | 40 | | | | 60,522 | |

Vornado Realty Trust | | | 1,973 | | | | 192,861 | |

Wereldhave | | | 2,500 | | | | 104,422 | |

| | | | | | | | |

| | | | | | | 1,147,735 | |

| | | | | | | | |

Energy – 5.57% | | | | | |

Chevron | | | 7,300 | | | | 814,388 | |

CNOOC | | | 1,006,000 | | | | 1,268,443 | |

ConocoPhillips | | | 19,200 | | | | 931,584 | |

Occidental Petroleum | | | 7,200 | | | | 513,792 | |

Royal Dutch Shell ADR | | | 20,400 | | | | 1,105,068 | |

Spectra Energy | | | 18,500 | | | | 757,575 | |

Suncor Energy | | | 43,500 | | | | 1,385,342 | |

TOTAL | | | 34,321 | | | | 1,635,243 | |

TOTAL ADR | | | 22,800 | | | | 1,086,648 | |

| | | | | | | | |

| | | Number of

shares | | | Value (U.S. $) | |

| |

Common Stockv (continued) | | | | | |

| |

Energy (continued) | | | | | |

Williams | | | 19,100 | | | $ | 586,370 | |

| | | | | | | | |

| | | | | | | 10,084,453 | |

| | | | | | | | |

Financials – 9.28% | | | | | |

Arthur J. Gallagher | | | 23,800 | | | | 1,198,330 | |

Ashford † | | | 632 | | | | 28,440 | |

AXA | | | 87,876 | | | | 2,070,399 | |

Bank Rakyat Indonesia Persero | | | 1,504,700 | | | | 1,210,200 | |

BB&T | | | 28,800 | | | | 1,303,200 | |

ING Groep | | | 131,792 | | | | 1,794,885 | |

Mitsubishi UFJ Financial Group | | | 495,028 | | | | 2,898,210 | |

Nordea Bank | | | 186,853 | | | | 1,963,184 | |

Nordea Bank FDR | | | 44,231 | | | | 464,329 | |

Solar Capital | | | 8,309 | | | | 168,257 | |

Standard Chartered † | | | 209,663 | | | | 1,681,800 | |

UniCredit | | | 357,559 | | | | 766,255 | |

Wells Fargo & Co. | | | 23,900 | | | | 1,264,788 | |

| | | | | | | | |

| | | | | | | 16,812,277 | |

| | | | | | | | |

Healthcare – 8.97% | | | | | |

Abbott Laboratories | | | 23,400 | | | | 890,838 | |

AbbVie | | | 15,900 | | | | 966,720 | |

Amgen | | | 3,500 | | | | 504,245 | |

AstraZeneca ADR | | | 33,600 | | | | 878,304 | |

Cardinal Health | | | 10,600 | | | | 752,706 | |

Johnson & Johnson | | | 6,300 | | | | 701,190 | |

Merck & Co. | | | 18,500 | | | | 1,132,015 | |

Novartis | | | 31,589 | | | | 2,182,677 | |

Pfizer | | | 38,460 | | | | 1,236,104 | |

Sanofi | | | 32,720 | | | | 2,639,365 | |

Shire | | | 25,114 | | | | 1,464,295 | |

STADA Arzneimittel | | | 21,919 | | | | 1,070,710 | |

Teva Pharmaceutical

Industries ADR | | | 48,900 | | | | 1,843,530 | |

| | | | | | | | |

| | | | | | | 16,262,699 | |

| | | | | | | | |

Healthcare REITs – 0.32% | | | | | |

Alexandria Real Estate Equities | | | 1,552 | | | | 170,084 | |

Healthcare Trust of America Class A | | | 3,897 | | | | 110,207 | |

MedEquities Realty Trust | | | 19,000 | | | | 206,910 | |

Welltower | | | 1,589 | | | | 99,757 | |

| | | | | | | | |

| | | | | | | 586,958 | |

| | | | | | | | |

Hotel REITs – 0.70% | | | | | |

Ashford Hospitality Prime | | | 14,889 | | | | 190,877 | |

Ashford Hospitality Trust | | | 61,800 | | | | 434,454 | |

Hospitality Properties Trust | | | 10,500 | | | | 304,447 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Number of

shares | | | Value (U.S. $) | |

| |

Common Stockv (continued) | | | | | |

| |

Hotel REITs (continued) | | | | | |

Host Hotels & Resorts | | | 5,587 | | | $ | 99,672 | |

Pebblebrook Hotel Trust | | | 3,985 | | | | 114,609 | |

Summit Hotel Properties | | | 9,300 | | | | 132,246 | |

| | | | | | | | |

| | | | | | | 1,276,305 | |

| | | | | | | | |

Industrial REITs – 0.48% | | | | | |

Duke Realty | | | 8,297 | | | | 210,993 | |

Goodman Group | �� | | 49,447 | | | | 243,914 | |

Prologis Property Mexico | | | 116,800 | | | | 168,082 | |

Terreno Realty | | | 9,357 | | | | 254,698 | |

| | | | | | | | |

| | | | | | | 877,687 | |

| | | | | | | | |

Industrials – 10.00% | | | | | |

CSX | | | 18,200 | | | | 651,742 | |

Deutsche Post | | | 62,609 | | | | 1,956,843 | |

East Japan Railway | | | 24,961 | | | | 2,130,756 | |

ITOCHU | | | 190,502 | | | | 2,600,971 | |

Koninklijke Philips | | | 65,458 | | | | 1,882,855 | |

Meggitt | | | 235,529 | | | | 1,392,134 | |

Minebea | | | 144,900 | | | | 1,436,271 | |

Rexel | | | 48,829 | | | | 755,053 | |

Teleperformance | | | 13,929 | | | | 1,360,231 | |

United Technologies | | | 5,400 | | | | 581,688 | |

Vinci | | | 33,037 | | | | 2,143,923 | |

Waste Management | | | 17,600 | | | | 1,223,552 | |

| | | | | | | | |

| | | | | | | 18,116,019 | |

| | | | | | | | |

Information Technology – 5.57% | | | | | |

CA | | | 35,200 | | | | 1,124,992 | |

Canon ADR | | | 25,100 | | | | 725,641 | |

CGI Group Class A † | | | 33,440 | | | | 1,584,000 | |

Cisco Systems | | | 35,800 | | | | 1,067,556 | |

Intel | | | 31,400 | | | | 1,089,580 | |

Playtech | | | 145,240 | | | | 1,561,012 | |

Samsung Electronics | | | 1,646 | | | | 2,458,335 | |

Xerox | | | 51,700 | | | | 483,395 | |

| | | | | | | | |

| | | | | | | 10,094,511 | |

| | | | | | | | |

Mall REITs – 0.52% | | | | | |

General Growth Properties | | | 5,724 | | | | 145,046 | |

Pennsylvania Real Estate Investment Trust | | | 8,500 | | | | 162,945 | |

Simon Property Group | | | 3,570 | | | | 641,351 | |

| | | | | | | | |

| | | | | | | 949,342 | |

| | | | | | | | |

Manufactured Housing REIT – 0.12% | | | | | |

Equity LifeStyle Properties | | | 3,156 | | | | 219,121 | |

| | | | | | | | |

| | | | | | | 219,121 | |

| | | | | | | | |

Materials – 1.94% | | | | | |

Alamos Gold | | | 73,388 | | | | 467,109 | |

| | | | | | | | |

| | | Number of

shares | | | Value (U.S. $) | |

| |

Common Stockv (continued) | | | | | |

| |

Materials (continued) | | | | | |

Dow Chemical | | | 12,700 | | | $ | 707,644 | |

EI du Pont de Nemours & Co. | | | 9,700 | | | | 714,017 | |

Rio Tinto | | | 29,836 | | | | 1,116,191 | |

Tarkett | | | 6,400 | | | | 219,906 | |

Yamana Gold | | | 97,666 | | | | 291,551 | |

| | | | | | | | |

| | | | | | | 3,516,418 | |

| | | | | | | | |

Mixed REIT – 0.03% | | | | | |

PS Business Parks | | | 400 | | | | 44,692 | |

| | | | | | | | |

| | | | | | | 44,692 | |

| | | | | | | | |

Mortgage REITs – 0.30% | | | | | |

Colony Capital | | | 3,765 | | | | 77,220 | |

Starwood Property Trust | | | 20,900 | | | | 469,623 | |

| | | | | | | | |

| | | | | | | 546,843 | |

| | | | | | | | |

Multifamily REITs – 0.91% | | | | | |

ADO Properties 144A # | | | 9,915 | | | | 336,269 | |

American Homes 4 Rent | | | 10,926 | | | | 230,211 | |

Apartment Investment & Management | | | 3,765 | | | | 158,507 | |

Equity Residential | | | 10,265 | | | | 616,003 | |

Gecina | | | 893 | | | | 117,265 | |

Post Properties | | | 2,221 | | | | 144,409 | |

Vonovia | | | 1,371 | | | | 44,216 | |

| | | | | | | | |

| | | | | | | 1,646,880 | |

| | | | | | | | |

Office REITs – 1.28% | | | | | |

alstria office REIT † | | | 33,657 | | | | 411,648 | |

Champion REIT | | | 125,000 | | | | 71,069 | |

Easterly Government Properties | | | 38,559 | | | | 748,045 | |

Equity Commonwealth † | | | 11,822 | | | | 343,784 | |

Hudson Pacific Properties | | | 2,339 | | | | 81,561 | |

Intervest Offices & Warehouses | | | 2,500 | | | | 63,194 | |

Kenedix Office Investment | | | 50 | | | | 266,597 | |

Mack-Cali Realty | | | 6,123 | | | | 165,627 | |

Parkway † | | | 2,127 | | | | 41,689 | |

SL Green Realty | | | 1,235 | | | | 130,120 | |

| | | | | | | | |

| | | | | | | 2,323,334 | |

| | | | | | | | |

Self-Storage REIT – 0.04% | | | | | |

Jernigan Capital | | | 4,000 | | | | 79,560 | |

| | | | | | | | |

| | | | | | | 79,560 | |

| | | | | | | | |

Shopping Center REITs – 1.11% | | | | | |

Brixmor Property Group | | | 4,622 | | | | 112,546 | |

Charter Hall Retail REIT | | | 71,117 | | | | 223,194 | |

DDR | | | 3,924 | | | | 59,723 | |

First Capital Realty | | | 2,922 | | | | 44,288 | |

Kimco Realty | | | 5,734 | | | | 146,446 | |

10

| | | | | | | | |

| | | Number of

shares | | | Value (U.S. $) | |

| |

Common Stockv (continued) | | | | | |

| |

Shopping Center REITs (continued) | | | | | |

Kite Realty Group Trust | | | 12,316 | | | $ | 296,200 | |

Klepierre | | | 1,425 | | | | 53,139 | |

Link REIT | | | 33,000 | | | | 227,190 | |

Ramco-Gershenson Properties Trust | | | 19,634 | | | | 333,189 | |

Retail Properties of America | | | 5,858 | | | | 89,393 | |

Scentre Group | | | 40,548 | | | | 126,957 | |

Urban Edge Properties | | | 2,941 | | | | 79,672 | |

Westfield | | | 16,989 | | | | 114,666 | |

Wheeler Real Estate Investment Trust | | | 68,360 | | | | 111,427 | |

| | | | | | | | |

| | | | | | | 2,018,030 | |

| | | | | | | | |

Single Tenant REIT – 0.24% | | | | | |

STORE Capital | | | 17,193 | | | | 425,011 | |

| | | | | | | | |

| | | | | | | 425,011 | |

| | | | | | | | |

Telecommunications – 3.89% | | | | | |

AT&T | | | 34,400 | | | | 1,328,872 | |

Century Communications =† | | | 125,000 | | | | 0 | |

Mobile TeleSystems ADR | | | 96,900 | | | | 758,727 | |

Nippon Telegraph & Telephone | | | 61,402 | | | | 2,482,271 | |

Tele2 Class B | | | 167,326 | | | | 1,278,149 | |

Verizon Communications | | | 24,200 | | | | 1,207,580 | |

| | | | | | | | |

| | | | | | | 7,055,599 | |

| | | | | | | | |

Utilities – 1.13% | | | | | |

American Water Works | | | 800 | | | | 57,976 | |

Edison International | | | 7,600 | | | | 522,652 | |

National Grid | | | 74,656 | | | | 853,016 | |

National Grid ADR | | | 10,600 | | | | 604,942 | |

| | | | | | | | |

| | | | | | | 2,038,586 | |

| | | | | | | | |

Total Common Stock

(cost $121,478,718) | | | | | | | 124,901,476 | |

| | | | | | | | |

|

| |

Convertible Preferred Stock – 2.15% | |

| |

A Schulman 6.00% exercise price $52.33, expiration date 12/31/49 | | | 440 | | | | 371,268 | |

Bank of America 7.25%exercise price $50.00,expiration date 12/31/49 | | | 566 | | | | 662,786 | |

El Paso Energy Capital Trust I 4.75% exercise price $50.00, expiration date 3/31/28 | | | 10,323 | | | | 518,834 | |

Exelon 6.50% exercise price $43.75, expiration date 6/1/17 | | | 12,500 | | | | 573,125 | |

| | | | | | | | |

| | | Number of

shares | | | Value (U.S. $) | |

| |

Convertible Preferred Stock (continued) | | | | | |

| |

Huntington Bancshares

8.50% exercise price

$11.95, expiration date 12/31/49 | | | 517 | | | $ | 723,826 | |

Teva Pharmaceutical

Industries 7.00% exercise price $75.00, expiration date 12/15/18 | | | 329 | | | | 215,166 | |

Wells Fargo & Co. 7.50%

exercise price $156.71,

expiration date 12/31/49 | | | 695 | | | | 835,647 | |

| | | | | | | | |

Total Convertible Preferred

Stock

(cost $3,773,354) | | | | | | | 3,900,652 | |

| | | | | | | | |

|

| |

Exchange-Traded Note – 0.02% | | | | | |

| |

iPATH S&P 500 VIX

Short-Term Futures ETN † | | | 1,562 | | | | 43,564 | |

| | | | | | | | |

Total Exchange-Traded Note

(cost $1,177,623) | | | | 43,564 | |

| | | | | | | | |

| | |

| | | Principal

amount° | | | | |

| |

Agency Collateralized Mortgage Obligations – 0.03% | |

| |

Fannie Mae REMICS

Series 2001-50 BA

7.00% 10/25/41 | | | 49,814 | | | | 56,959 | |

Freddie Mac REMICS

Series 2557WE

5.00% 1/15/18 | | | 3,913 | | | | 3,971 | |

| | | | | | | | |

Total Agency Collateralized Mortgage Obligations

(cost $54,793) | | | | | | | 60,930 | |

| | | | | | | | |

|

| |

Agency Commercial Mortgage-Backed Securities – 0.01% | | | | | |

| |

FREMF Mortgage Trust | | | | | | | | |

Series 2011-K15 B 144A 5.116% 8/25/44 #● | | | 10,000 | | | | 10,882 | |

Series 2012-K22 B 144A 3.811% 8/25/45 #● | | | 10,000 | | | | 10,297 | |

| | | | | | | | |

Total Agency Commercial Mortgage-Backed

Securities

(cost $21,214) | | | | | | | 21,179 | |

| | | | | | | | |

|

| |

Agency Mortgage-Backed Securities – 0.03% | |

| |

Fannie Mae ARM | | | | | | | | |

2.414% 5/1/43 ● | | | 3,759 | | | | 3,803 | |

2.553% 6/1/43 ● | | | 1,740 | | | | 1,759 | |

2.567% 3/1/38 ● | | | 5,558 | | | | 5,841 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Agency Mortgage-Backed Securities (continued) | |

| |

Fannie Mae ARM | | | | | | | | |

2.834% 4/1/36 ● | | | 13,980 | | | $ | 14,767 | |

2.868% 4/1/36 ● | | | 5,042 | | | | 5,276 | |

2.928% 11/1/35 ● | | | 3,782 | | | | 3,980 | |

2.952% 10/1/36 ● | | | 4,402 | | | | 4,604 | |

3.096% 10/1/36 ● | | | 6,403 | | | | 6,744 | |

3.275% 9/1/43 ● | | | 3,097 | | | | 3,190 | |

Fannie Mae S.F. 30 yr | | | | | | | | |

5.50% 9/1/34 | | | 470 | | | | 529 | |

6.50% 5/1/40 | | | 1,010 | | | | 1,157 | |

Freddie Mac ARM | | | | | | | | |

2.681% 10/1/36 ● | | | 7,503 | | | | 7,926 | |

| | | | | | | | |

Total Agency Mortgage-Backed Securities

(cost $57,555) | | | | | | | 59,576 | |

| | | | | | | | |

|

| |

Commercial Mortgage-Backed Securities – 0.02% | |

| |

Banc of America Commercial Mortgage Trust

Series 2007-4 AM

6.007% 2/10/51 ● | | | 35,000 | | | | 35,842 | |

LB-UBS Commercial

Mortgage Trust

Series 2006-C6 AJ

5.452% 9/15/39 ● | | | 8,685 | | | | 8,078 | |

| | | | | | | | |

Total Commercial Mortgage-Backed Securities

(cost $47,825) | | | | | | | 43,920 | |

| | | | | | | | |

|

| |

Convertible Bonds – 15.57% | |

| |

Brokerage – 0.54% | |

Jefferies Group 3.875%

exercise price $44.04,

maturity date 11/1/29 | | | 968,000 | | | | 981,310 | |

| | | | | | | | |

| | | | | | | 981,310 | |

| | | | | | | | |

Communications – 2.24% | |

Alaska Communications Systems Group 6.25%

exercise price $10.28,

maturity date 5/1/18 | | | 1,349,000 | | | | 1,338,883 | |

Clearwire Communications 144A 8.25% exercise price $7.08, maturity date

12/1/40 # | | | 1,291,000 | | | | 1,355,550 | |

DISH Network 144A 3.375%

exercise price $65.18,

maturity date 8/15/26 # | | | 449,000 | | | | 504,003 | |

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Convertible Bonds (continued) | |

| |

Communications (continued) | |

Liberty Interactive 144A

1.75% exercise price

$341.10, maturity date

9/30/46 # | | | 639,000 | | | $ | 678,139 | |

Liberty Media 144A 2.25%

exercise price $104.55,

maturity date 9/30/46 # | | | 178,000 | | | | 185,120 | |

| | | | | | | | |

| | | | | | | 4,061,695 | |

| | | | | | | | |

Consumer Cyclical – 0.98% | |

Huron Consulting Group

1.25% exercise price

$79.89, maturity date

10/1/19 | | | 597,000 | | | | 588,418 | |

Meritor 4.00% exercise price

$26.73, maturity date

2/15/27 f | | | 1,149,000 | | | | 1,177,725 | |

| | | | | | | | |

| | | | | | | 1,766,143 | |

| | | | | | | | |

Consumer Non-Cyclical – 2.90% | |

Brookdale Senior Living

2.75% exercise price

$29.33, maturity date

6/15/18 | | | 1,136,000 | | | | 1,104,050 | |

HealthSouth 2.00% exercise

price $37.16, maturity date

12/1/43 | | | 701,000 | | | | 836,381 | |

Hologic 2.00% exercise price

$31.18, maturity date

3/1/42 f | | | 597,000 | | | | 791,025 | |

NuVasive 144A 2.25%

exercise price $59.82,

maturity date 3/15/21 # | | | 285,000 | | | | 353,756 | |

Spectrum Pharmaceuticals

2.75% exercise price

$10.53, maturity date

12/15/18 | | | 922,000 | | | | 811,360 | |

Vector Group

1.75% exercise price

$23.46, maturity date

4/15/20 ● | | | 1,007,000 | | | | 1,135,393 | |

2.50% exercise price $15.22, maturity date 1/15/19 ● | | | 157,000 | | | | 228,004 | |

| | | | | | | | |

| | | | | | | 5,259,969 | |

| | | | | | | | |

Energy – 0.35% | |

Helix Energy Solutions Group

4.25% exercise price

$13.89, maturity date

5/1/22 | | | 569,000 | | | | 621,988 | |

| | | | | | | | |

| | | | | | | 621,988 | |

| | | | | | | | |

12

| | | | | | | | |

| | | Principal

amount° | | | Value (U.S. $) | |

| |

Convertible Bonds (continued) | | | | | |

| |

Financials – 2.01% | | | | | |

Ares Capital 4.75% exercise price $19.87, maturity date 1/15/18 | | | 1,059,000 | | | $ | 1,091,432 | |

Blackhawk Network Holdings 144A 1.50% exercise price $49.83, maturity date 1/15/22 # | | | 734,000 | | | | 752,350 | |

GAIN Capital Holdings 4.125% exercise price $12.00, maturity date 12/1/18 | | | 824,000 | | | | 798,250 | |

New Mountain Finance 5.00% exercise price $15.80, maturity date 6/15/19 | | | 974,000 | | | | 1,005,046 | |

| | | | | | | | |

| | | | | | | 3,647,078 | |

| | | | | | | | |

Industrials – 0.53% | | | | | | | | |

Chart Industries 2.00%exercise price $69.03,maturity date 8/1/18 | | | 962,000 | | | | 954,184 | |

| | | | | | | | |

| | | | | | | 954,184 | |

| | | | | | | | |

Real Estate Investment Trusts – 1.86% | | | | | |

Blackstone Mortgage Trust 5.25% exercise price $27.99, maturity date 12/1/18 | | | 1,069,000 | | | | 1,190,599 | |

Spirit Realty Capital 3.75%exercise price $13.10,maturity date 5/15/21 | | | 916,000 | | | | 960,660 | |

VEREIT 3.75% exercise price $14.99, maturity date 12/15/20 | | | 1,219,000 | | | | 1,225,101 | |

| | | | | | | | |

| | | | | | | 3,376,360 | |

| | | | | | | | |

Technology – 4.16% | | | | | |

Cardtronics 1.00% exercise price $52.35, maturity date 12/1/20 | | | 1,096,000 | | | | 1,219,300 | |

Ciena 144A 3.75% exercise price $20.17, maturity date 10/15/18 # | | | 469,000 | | | | 587,423 | |

Electronics For Imaging 0.75% exercise price $52.72, maturity date 9/1/19 | | | 631,000 | | | | 668,860 | |

j2 Global 3.25% exercise price $69.08, maturity date 6/15/29 | | | 789,000 | | | | 975,401 | |

| | | | | | | | |

| | | Principal

amount° | | | Value (U.S. $) | |

| |

Convertible Bonds (continued) | | | | | |

| |

Technology (continued) | | | | | |

Knowles 144A 3.25%exercise price $18.43,maturity date 11/1/21 # | | | 504,000 | | | $ | 573,930 | |

Nuance Communications 2.75% exercise price $32.30, maturity date 11/1/31 | | | 758,000 | | | | 764,159 | |

NXP Semiconductors 1.00%exercise price $102.84,maturity date 12/1/19 | | | 711,000 | | | | 814,095 | |

PROS Holdings 2.00%exercise price $33.79, maturity date 12/1/19 | | | 862,000 | | | | 883,011 | |

Verint Systems 1.50%exercise price $64.46,maturity date 6/1/21 | | | 1,101,000 | | | | 1,056,960 | |

| | | | | | | | |

| | | | | | | 7,543,139 | |

| | | | | | | | |

Total Convertible Bonds

(cost $26,725,430) | | | | | | | 28,211,866 | |

| | | | | | | | |

|

| |

Corporate Bonds – 44.59% | |

| |

Automotive – 0.11% | | | | | |

Gates Global 144A 6.00% 7/15/22 # | | | 215,000 | | | | 206,400 | |

| | | | | | | | |

| | | | | | | 206,400 | |

| | | | | | | | |

Banking – 1.81% | | | | | |

Bank of America | | | | | | | | |

4.183% 11/25/27 | | | 5,000 | | | | 5,000 | |

4.45% 3/3/26 | | | 25,000 | | | | 25,736 | |

Bank of New York Mellon | | | | | | | | |

2.20% 8/16/23 | | | 5,000 | | | | 4,767 | |

2.50% 4/15/21 | | | 10,000 | | | | 10,007 | |

4.625% 12/29/49 ● | | | 5,000 | | | | 4,587 | |

BB&T 2.45% 1/15/20 | | | 35,000 | | | | 35,222 | |

Capital One Financial | | | | | | | | |

4.20% 10/29/25 | | | 5,000 | | | | 5,017 | |

Citigroup 3.20% 10/21/26 | | | 5,000 | | | | 4,802 | |

Citizens Financial Group | | | | | | | | |

4.30% 12/3/25 | | | 5,000 | | | | 5,066 | |

Credit Suisse Group 144A | | | | | | | | |

6.25% 12/29/49 #● | | | 485,000 | | | | 457,641 | |

Goldman Sachs Group | | | | | | | | |

3.50% 11/16/26 | | | 5,000 | | | | 4,923 | |

5.15% 5/22/45 | | | 5,000 | | | | 5,170 | |

Huntington Bancshares | | | | | | | | |

2.30% 1/14/22 | | | 5,000 | | | | 4,868 | |

JPMorgan Chase & Co. | | | | | | | | |

3.625% 12/1/27 | | | 10,000 | | | | 9,751 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Banking (continued) | | | | | |

JPMorgan Chase & Co. | | | | | | | | |

4.25% 10/1/27 | | | 15,000 | | | $ | 15,447 | |

6.75% 8/29/49 ● | | | 715,000 | | | | 769,519 | |

Lloyds Banking Group | | | | | | | | |

7.50% 4/30/49 ● | | | 245,000 | | | | 250,513 | |

Morgan Stanley | | | | | | | | |

3.125% 7/27/26 | | | 5,000 | | | | 4,800 | |

3.95% 4/23/27 | | | 60,000 | | | | 59,525 | |

PNC Financial Services Group | | | | | | | | |

5.00% 12/29/49 ● | | | 5,000 | | | | 4,863 | |

5.625% 2/1/17 | | | 35,000 | | | | 35,227 | |

Popular 7.00% 7/1/19 | | | 570,000 | | | | 587,100 | |

Royal Bank of Scotland Group | | | | | | | | |

8.625% 12/29/49 ● | | | 455,000 | | | | 448,744 | |

Santander UK Group Holdings | | | | | | | | |

2.875% 10/16/20 | | | 15,000 | | | | 14,833 | |

State Street | | | | | | | | |

2.55% 8/18/20 | | | 5,000 | | | | 5,050 | |

3.10% 5/15/23 | | | 5,000 | | | | 5,001 | |

3.55% 8/18/25 | | | 5,000 | | | | 5,144 | |

Suntrust Banks | | | | | | | | |

2.70% 1/27/22 | | | 5,000 | | | | 5,007 | |

Toronto-Dominion Bank | | | | | | | | |

2.125% 4/7/21 | | | 5,000 | | | | 4,942 | |

2.50% 12/14/20 | | | 5,000 | | | | 5,038 | |

UBS Group | | | | | | | | |

6.875% 12/29/49 ● | | | 400,000 | | | | 388,228 | |

US Bancorp 3.10% 4/27/26 | | | 5,000 | | | | 4,897 | |

USB Capital IX | | | | | | | | |

3.50% 10/29/49 ● | | | 80,000 | | | | 65,420 | |

Westpac Banking | | | | | | | | |

4.322% 11/23/31 ● | | | 5,000 | | | | 4,971 | |

Zions Bancorporation | | | | | | | | |

4.50% 6/13/23 | | | 5,000 | | | | 5,074 | |

| | | | | | | | |

| | | | | | | 3,271,900 | |

| | | | | | | | |

Basic Industry – 4.63% | | | | | |

AK Steel | | | | | | | | |

7.625% 5/15/20 | | | 271,000 | | | | 279,130 | |

7.625% 10/1/21 | | | 135,000 | | | | 141,075 | |

Alcoa Nederland Holding | | | | | | | | |

144A 7.00% 9/30/26 # | | | 200,000 | | | | 212,500 | |

BMC East 144A | | | | | | | | |

5.50% 10/1/24 # | | | 255,000 | | | | 255,000 | |

Boise Cascade 144A | | | | | | | | |

5.625% 9/1/24 # | | | 425,000 | | | | 417,563 | |

Builders FirstSource | | | | | | | | |

144A 5.625% 9/1/24 # | | | 215,000 | | | | 216,881 | |

144A 10.75% 8/15/23 # | | | 540,000 | | | | 621,000 | |

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Basic Industry (continued) | | | | | |

Cemex Finance 144A | | | | | | | | |

6.00% 4/1/24 # | | | 200,000 | | | $ | 199,270 | |

CF Industries 6.875% 5/1/18 | | | 10,000 | | | | 10,550 | |

Chemours | | | | | | | | |

6.625% 5/15/23 | | | 130,000 | | | | 129,025 | |

7.00% 5/15/25 | | | 123,000 | | | | 121,770 | |

Dow Chemical | | | | | | | | |

8.55% 5/15/19 | | | 34,000 | | | | 39,086 | |

Eastman Chemical | | | | | | | | |

4.65% 10/15/44 | | | 10,000 | | | | 9,712 | |

FMG Resources August 2006 | | | | | | | | |

144A 6.875% 4/1/22 # | | | 655,000 | | | | 679,563 | |

144A 9.75% 3/1/22 # | | | 75,000 | | | | 86,895 | |

Freeport-McMoRan | | | | | | | | |

4.55% 11/14/24 | | | 270,000 | | | | 257,850 | |

Georgia-Pacific | | | | | | | | |

8.00% 1/15/24 | | | 20,000 | | | | 25,415 | |

International Paper | | | | | | | | |

4.40% 8/15/47 | | | 5,000 | | | | 4,628 | |

5.15% 5/15/46 | | | 5,000 | | | | 5,064 | |

INVISTA Finance 144A | | | | | | | | |

4.25% 10/15/19 # | | | 10,000 | | | | 10,049 | |

James Hardie International Finance 144A | | | | | | | | |

5.875% 2/15/23 # | | | 415,000 | | | | 434,194 | |

Joseph T Ryerson & Son 144A | | | | | | | | |

11.00% 5/15/22 # | | | 165,000 | | | | 180,263 | |

Kraton Polymers 144A | | | | | | | | |

10.50% 4/15/23 # | | | 380,000 | | | | 422,750 | |

NCI Building Systems 144A | | | | | | | | |

8.25% 1/15/23 # | | | 340,000 | | | | 369,750 | |

New Gold | | | | | | | | |

144A 6.25% 11/15/22 # | | | 146,000 | | | | 147,460 | |

144A 7.00% 4/15/20 # | | | 150,000 | | | | 154,875 | |

NOVA Chemicals 144A | | | | | | | | |

5.00% 5/1/25 # | | | 285,000 | | | | 278,587 | |

Novelis | | | | | | | | |

144A 5.875% 9/30/26 # | | | 65,000 | | | | 65,081 | |

144A 6.25% 8/15/24 # | | | 525,000 | | | | 544,687 | |

PQ 144A 6.75% 11/15/22 # | | | 400,000 | | | | 424,000 | |

Rio Tinto Finance USA | | | | | | | | |

3.75% 6/15/25 | | | 5,000 | | | | 5,165 | |

Steel Dynamics 144A | | | | | | | | |

5.00% 12/15/26 # | | | 245,000 | | | | 246,837 | |

Summit Materials | | | | | | | | |

6.125% 7/15/23 | | | 420,000 | | | | 428,400 | |

8.50% 4/15/22 | | | 120,000 | | | | 132,750 | |

US Concrete 6.375% 6/1/24 | | | 405,000 | | | | 423,225 | |

14

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Basic Industry (continued) | | | | | | | | |

Vale Overseas

6.25% 8/10/26 | | | 385,000 | | | $ | 401,844 | |

| | | | | | | | |

| | | | | | | 8,381,894 | |

| | | | | | | | |

Brokerage – 0.24% | | | | | | | | |

E*TRADE Financial 5.875% 12/29/49 • | | | 400,000 | | | | 399,000 | |

Jefferies Group | | | | | | | | |

5.125% 1/20/23 | | | 10,000 | | | | 10,349 | |

6.45% 6/8/27 | | | 5,000 | | | | 5,420 | |

6.50% 1/20/43 | | | 5,000 | | | | 4,990 | |

Lazard Group

6.85% 6/15/17 | | | 6,000 | | | | 6,170 | |

| | | | | | | | |

| | | | | | | 425,929 | |

| | | | | | | | |

Capital Goods – 3.42% | | | | | | | | |

Ardagh Packaging Finance 144A 7.25% 5/15/24 # | | | 400,000 | | | | 419,500 | |

Ball 5.25% 7/1/25 | | | 200,000 | | | | 208,875 | |

BWAY Holding 144A 9.125% 8/15/21 # | | | 473,000 | | | | 494,285 | |

CCL Industries 144A 3.25% 10/1/26 # | | | 5,000 | | | | 4,783 | |

Cemex | | | | | | | | |

144A 5.70% 1/11/25 # | | | 1,000,000 | | | | 975,000 | |

144A 7.75% 4/16/26 # | | | 400,000 | | | | 430,000 | |

Crane 4.45% 12/15/23 | | | 10,000 | | | | 10,339 | |

Fortive 144A

3.15% 6/15/26 # | | | 5,000 | | | | 4,894 | |

Fortune Brands Home & Security 3.00% 6/15/20 | | | 5,000 | | | | 5,056 | |

Gardner Denver 144A 6.875% 8/15/21 # | | | 714,000 | | | | 706,860 | |

General Electric | | | | | | | | |

2.10% 12/11/19 | | | 35,000 | | | | 35,220 | |

5.55% 5/4/20 | | | 5,000 | | | | 5,553 | |

6.00% 8/7/19 | | | 10,000 | | | | 11,096 | |

KLX 144A 5.875% 12/1/22 # | | | 385,000 | | | | 395,587 | |

Lennox International 3.00% 11/15/23 | | | 5,000 | | | | 4,853 | |

Masco 3.50% 4/1/21 | | | 5,000 | | | | 5,053 | |

Plastipak Holdings 144A 6.50% 10/1/21 # | | | 285,000 | | | | 299,250 | |

Reynolds Group Issuer

8.25% 2/15/21 | | | 187,268 | | | | 193,450 | |

Signode Industrial Group Lux

144A 6.375% 5/1/22 # | | | 360,000 | | | | 364,500 | |

StandardAero Aviation Holdings 144A 10.00% 7/15/23 # | | | 190,000 | | | | 201,637 | |

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Capital Goods (continued) | | | | | | | | |

TransDigm 144A

6.375% 6/15/26 # | | | 765,000 | | | $ | 782,213 | |

United Technologies

3.75% 11/1/46 | | | 5,000 | | | | 4,705 | |

Zekelman Industries

144A 9.875% 6/15/23 # | | | 590,000 | | | | 634,250 | |

| | | | | | | | |

| | | | | | | 6,196,959 | |

| | | | | | | | |

Communications – 3.75% | | | | | | | | |

21st Century Fox America 4.95% 10/15/45 | | | 5,000 | | | | 5,175 | |

Activision Blizzard 144A

3.40% 9/15/26 # | | | 5,000 | | | | 4,746 | |

American Tower Trust I 144A 3.07% 3/15/23 # | | | 20,000 | | | | 19,781 | |

AT&T | | | | | | | | |

4.35% 6/15/45 | | | 5,000 | | | | 4,400 | |

144A 4.50% 3/9/48 # | | | 10,000 | | | | 8,946 | |

CC Holdings GS V

3.849% 4/15/23 | | | 5,000 | | | | 5,105 | |

CenturyLink | | | | | | | | |

5.80% 3/15/22 | | | 210,000 | | | | 207,637 | |

6.75% 12/1/23 | | | 370,000 | | | | 371,387 | |

7.50% 4/1/24 | | | 130,000 | | | | 134,536 | |

Charter Communications | | | | | | | | |

Operating 144A | | | | | | | | |

4.908% 7/23/25 # | | | 10,000 | | | | 10,456 | |

Cogent Communications | | | | | |

Finance 144A | | | | | | | | |

5.625% 4/15/21 # | | | 250,000 | | | | 251,250 | |

Cogent Communications | | | | | |

Group 144A | | | | | | | | |

5.375% 3/1/22 # | | | 215,000 | | | | 218,494 | |

Crown Castle Towers 144A 4.883% 8/15/20 # | | | 30,000 | | | | 32,123 | |

Digicel Group 144A

7.125% 4/1/22 # | | | 1,250,000 | | | | 934,375 | |

Frontier Communications | | | | | |

10.50% 9/15/22 | | | 365,000 | | | | 378,231 | |

11.00% 9/15/25 | | | 19,000 | | | | 19,119 | |

Historic TW 6.875% 6/15/18 | | | 25,000 | | | | 26,845 | |

Lamar Media 5.75% 2/1/26 | | | 360,000 | | | | 381,402 | |

Level 3 Financing

5.375% 5/1/25 | | | 360,000 | | | | 359,100 | |

Sable International Finance 144A 6.875% 8/1/22 # | | | 290,000 | | | | 302,325 | |

Sprint 7.125% 6/15/24 | | | 725,000 | | | | 722,738 | |

Sprint Communications | | | | | | | | |

144A 7.00% 3/1/20 # | | | 190,000 | | | | 204,843 | |

7.00% 8/15/20 | | | 302,000 | | | | 314,080 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Communications (continued) | | | | | |

TimeWarner Cable

7.30% 7/1/38 | | | 10,000 | | | $ | 11,959 | |

T-Mobile USA | | | | | | | | |

6.00% 3/1/23 | | | 195,000 | | | | 204,750 | |

6.00% 4/15/24 | | | 85,000 | | | | 89,463 | |

6.375% 3/1/25 | | | 155,000 | | | | 166,044 | |

6.50% 1/15/26 | | | 320,000 | | | | 346,400 | |

Verizon Communications | | | | | |

1.75% 8/15/21 | | | 5,000 | | | | 4,798 | |

4.125% 8/15/46 | | | 15,000 | | | | 13,434 | |

Viacom 3.45% 10/4/26 | | | 5,000 | | | | 4,788 | |

Wind Acquisition Finance

144A 7.375% 4/23/21 # | | | 605,000 | | | | 618,613 | |

Zayo Group 6.375% 5/15/25 | | | 400,000 | | | | 417,500 | |

| | | | | | | | |

| | | | | | | 6,794,843 | |

| | | | | | | | |

Consumer Cyclical – 4.06% | | | | | |

American Tire Distributors 144A 10.25% 3/1/22 # | | | 460,000 | | | | 431,250 | |

Beacon Roofing Supply 6.375% 10/1/23 | | | 290,000 | | | | 309,575 | |

Boyd Gaming 144A 6.375% 4/1/26 # | | | 870,000 | | | | 911,325 | |

Brinker International 144A 5.00% 10/1/24 # | | | 340,000 | | | | 340,850 | |

CVS Health 3.875% 7/20/25 | | | 5,000 | | | | 5,139 | |

General Motors Financial | | | | | | | | |

3.45% 4/10/22 | | | 10,000 | | | | 9,876 | |

3.70% 5/9/23 | | | 5,000 | | | | 4,925 | |

4.00% 10/6/26 | | | 5,000 | | | | 4,775 | |

Golden Nugget 144A

8.50% 12/1/21 # | | | 120,000 | | | | 126,300 | |

Group 1 Automotive 144A

5.25% 12/15/23 # | | | 255,000 | | | | 250,537 | |

HD Supply 144A

5.75% 4/15/24 # | | | 205,000 | | | | 210,125 | |

Hyundai Capital America 144A

2.55% 2/6/19 # | | | 10,000 | | | | 10,061 | |

JC Penney 8.125% 10/1/19 | | | 400,000 | | | | 434,500 | |

L Brands | | | | | | | | |

6.75% 7/1/36 | | | 200,000 | | | | 198,500 | |

6.875% 11/1/35 | | | 415,000 | | | | 417,075 | |

Landry’s 144A

6.75% 10/15/24 # | | | 410,000 | | | | 411,025 | |

Lennar 4.75% 5/30/25 | | | 215,000 | | | | 206,937 | |

Live Nation Entertainment 144A

4.875% 11/1/24 # | | | 404,000 | | | | 402,990 | |

Lowe’s | | | | | | | | |

3.375% 9/15/25 | | | 5,000 | | | | 5,121 | |

3.70% 4/15/46 | | | 5,000 | | | | 4,595 | |

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Consumer Cyclical (continued) | | | | | |

M/I Homes 6.75% 1/15/21 | | | 400,000 | | | $ | 418,000 | |

Marriott International

3.125% 6/15/26 | | | 5,000 | | | | 4,774 | |

MGM Resorts International

4.625% 9/1/26 | | | 435,000 | | | | 416,513 | |

Mohegan Tribal Gaming | | | | | | | | |

Authority 144A | | | | | | | | |

7.875% 10/15/24 # | | | 610,000 | | | | 613,050 | |

Neiman Marcus Group

144A 8.00% 10/15/21 # | | | 225,000 | | | | 177,750 | |

Penske Automotive Group

5.50% 5/15/26 | | | 395,000 | | | | 381,700 | |

PulteGroup 5.00% 1/15/27 | | | 215,000 | | | | 203,175 | |

Scientific Games International

10.00% 12/1/22 | | | 440,000 | | | | 414,700 | |

Starbucks 2.70% 6/15/22 | | | 5,000 | | | | 5,054 | |

Starwood Hotels & Resorts Worldwide 3.75% 3/15/25 | | | 5,000 | | | | 5,002 | |

Target 3.625% 4/15/46 | | | 5,000 | | | | 4,611 | |

Toyota Motor Credit

2.80% 7/13/22 | | | 5,000 | | | | 5,083 | |

Walgreens Boots Alliance | | | | | | | | |

3.10% 6/1/23 | | | 10,000 | | | | 9,888 | |

3.45% 6/1/26 | | | 10,000 | | | | 9,817 | |

| | | | | | | | |

| | | | | | | 7,364,598 | |

| | | | | | | | |

Consumer Non-Cyclical – 2.58% | | | | | |

Abbott Laboratories

4.90% 11/30/46 | | | 10,000 | | | | 10,124 | |

AbbVie 3.20% 5/14/26 | | | 5,000 | | | | 4,760 | |

Albertsons 144A

6.625% 6/15/24 # | | | 390,000 | | | | 404,079 | |

Altria Group

3.875% 9/16/46 | | | 5,000 | | | | 4,638 | |

Anheuser-Busch InBev

Finance 3.65% 2/1/26 | | | 25,000 | | | | 25,243 | |

Becton Dickinson & Co. | | | | | | | | |

3.734% 12/15/24 | | | 5,000 | | | | 5,130 | |

6.375% 8/1/19 | | | 10,000 | | | | 11,107 | |

Biogen 5.20% 9/15/45 | | | 5,000 | | | | 5,365 | |

Celgene | | | | | | | | |

3.25% 8/15/22 | | | 5,000 | | | | 5,062 | |

3.875% 8/15/25 | | | 5,000 | | | | 5,092 | |

Coca-Cola 2.25% 9/1/26 | | | 5,000 | | | | 4,668 | |

Covidien International

Finance 4.20% 6/15/20 | | | 20,000 | | | | 21,316 | |

Dean Foods 144A | | | | | | | | |

6.50% 3/15/23 # | | | 310,000 | | | | 323,175 | |

16

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Consumer Non-Cyclical (continued) | |

Gilead Sciences

4.15% 3/1/47 | | | 5,000 | | | $ | 4,694 | |

inVentiv Group Holdings

144A 7.50% 10/1/24 # | | | 230,000 | | | | 234,025 | |

JBS USA 144A

5.75% 6/15/25 # | | | 1,430,000 | | | | 1,408,550 | |

Kraft Heinz Foods

3.00% 6/1/26 | | | 5,000 | | | | 4,734 | |

Kronos Acquisition Holdings

144A 9.00% 8/15/23 # | | | 680,000 | | | | 676,600 | |

Molson Coors Brewing

4.20% 7/15/46 | | | 5,000 | | | | 4,637 | |

Mylan 144A

3.95% 6/15/26 # | | | 10,000 | | | | 9,411 | |

Nature’s Bounty 144A

7.625% 5/15/21 # | | | 425,000 | | | | 420,219 | |

Pepsico 2.375% 10/6/26 | | | 5,000 | | | | 4,718 | |

Pfizer 3.00% 12/15/26 | | | 5,000 | | | | 4,935 | |

Post Holdings 144A

7.75% 3/15/24 # | | | 320,000 | | | | 354,400 | |

Prestige Brands 144A

5.375% 12/15/21 # | | | 70,000 | | | | 72,275 | |

Revlon Consumer Products

144A 6.25% 8/1/24 # | | | 230,000 | | | | 227,700 | |

Reynolds American

4.45% 6/12/25 | | | 5,000 | | | | 5,306 | |

Shire Acquisitions Investments Ireland | | | | | | | | |

2.40% 9/23/21 | | | 5,000 | | | | 4,841 | |

2.875% 9/23/23 | | | 5,000 | | | | 4,775 | |

St. Jude Medical

2.80% 9/15/20 | | | 5,000 | | | | 5,000 | |

Sysco 3.30% 7/15/26 | | | 10,000 | | | | 9,803 | |

Teva Pharmaceutical Finance | | | | | | | | |

Netherlands III | | | | | | | | |

2.80% 7/21/23 | | | 10,000 | | | | 9,439 | |

Thermo Fisher Scientific

3.00% 4/15/23 | | | 10,000 | | | | 9,925 | |

US Foods 144A

5.875% 6/15/24 # | | | 335,000 | | | | 345,050 | |

Zimmer Biomet Holdings

4.625% 11/30/19 | | | 30,000 | | | | 31,850 | |

| | | | | | | | |

| | | | | | | 4,682,646 | |

| | | | | | | | |

Electric – 0.43% | | | | | | | | |

Ameren 3.65% 2/15/26 | | | 5,000 | | | | 5,045 | |

Ameren Illinois | | | | | | | | |

9.75% 11/15/18 | | | 45,000 | | | | 51,805 | |

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Electric (continued) | | | | | | | | |

American Transmission Systems 144A 5.25% 1/15/22 # | | | 15,000 | | | $ | 16,711 | |

Berkshire Hathaway Energy

3.75% 11/15/23 | | | 10,000 | | | | 10,492 | |

Black Hills 3.15% 1/15/27 | | | 5,000 | | | | 4,822 | |

Cleveland Electric Illuminating

5.50% 8/15/24 | | | 15,000 | | | | 16,800 | |

CMS Energy 6.25% 2/1/20 | | | 5,000 | | | | 5,562 | |

Commonwealth Edison

5.80% 3/15/18 | | | 5,000 | | | | 5,272 | |

Dominion Resources

3.90% 10/1/25 | | | 5,000 | | | | 5,128 | |

DTE Energy | | | | | | | | |

2.85% 10/1/26 | | | 5,000 | | | | 4,677 | |

3.30% 6/15/22 | | | 5,000 | | | | 5,114 | |

Duke Energy

4.80% 12/15/45 | | | 5,000 | | | | 5,253 | |

Emera 6.75% 6/15/76 ● | | | 395,000 | | | | 423,637 | |

Emera US Finance 144A

4.75% 6/15/46 # | | | 10,000 | | | | 9,868 | |

Entergy Louisiana

4.05% 9/1/23 | | | 15,000 | | | | 15,832 | |

Exelon 3.95% 6/15/25 | | | 10,000 | | | | 10,278 | |

Fortis 144A

3.055% 10/4/26 # | | | 10,000 | | | | 9,398 | |

Great Plains Energy

4.85% 6/1/21 | | | 5,000 | | | | 5,344 | |

IPALCO Enterprises

5.00% 5/1/18 | | | 10,000 | | | | 10,457 | |

Kansas City Power & Light

3.65% 8/15/25 | | | 10,000 | | | | 10,020 | |

LG&E & KU Energy

4.375% 10/1/21 | | | 20,000 | | | | 21,414 | |

Massachusetts Electric 144A

4.004% 8/15/46 # | | | 10,000 | | | | 9,545 | |

National Rural Utilities Cooperative Finance | | | | | | | | |

2.85% 1/27/25 | | | 5,000 | | | | 4,938 | |

4.75% 4/30/43 ● | | | 10,000 | | | | 10,125 | |

New York State Electric & Gas

144A 3.25% 12/1/26 # | | | 5,000 | | | | 4,981 | |

NextEra Energy Capital

Holdings 2.40% 9/15/19 | | | 10,000 | | | | 10,082 | |

NV Energy 6.25% 11/15/20 | | | 5,000 | | | | 5,684 | |

Pennsylvania Electric

5.20% 4/1/20 | | | 10,000 | | | | 10,635 | |

PPL Electric Utilities

3.00% 9/15/21 | | | 10,000 | | | | 10,192 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Electric (continued) | | | | | | | | |

Public Service Co. of New Hampshire 3.50% 11/1/23 | | | 5,000 | | | $ | 5,134 | |

Public Service Co. of Oklahoma

5.15% 12/1/19 | | | 30,000 | | | | 32,368 | |

SCANA 4.125% 2/1/22 | | | 10,000 | | | | 10,151 | |

Southern 3.25% 7/1/26 | | | 10,000 | | | | 9,764 | |

Xcel Energy 3.30% 6/1/25 | | | 5,000 | | | | 5,016 | |

| | | | | | | | |

| | | | | | | 781,544 | |

| | | | | | | | |

Energy – 6.74% | | | | | | | | |

Anadarko Petroleum

6.60% 3/15/46 | | | 10,000 | | | | 11,699 | |

Antero Resources

5.625% 6/1/23 | | | 615,000 | | | | 629,606 | |

Baytex Energy 144A

5.625% 6/1/24 # | | | 340,000 | | | | 286,450 | |

BP Capital Markets | | | | | | | | |

3.216% 11/28/23 | | | 5,000 | | | | 5,002 | |

3.723% 11/28/28 | | | 5,000 | | | | 5,039 | |

Buckeye Partners

3.95% 12/1/26 | | | 5,000 | | | | 4,804 | |

Cheniere Corpus Christi Holdings 144A 7.00% 6/30/24 # | | | 205,000 | | | | 219,350 | |

Dominion Gas Holdings

4.60% 12/15/44 | | | 5,000 | | | | 4,971 | |

Ecopetrol 5.875% 5/28/45 | | | 615,000 | | | | 506,453 | |

Energy Transfer Equity

7.50% 10/15/20 | | | 245,000 | | | | 275,013 | |

Energy Transfer Partners | | | | | | | | |

6.125% 12/15/45 | | | 5,000 | | | | 5,061 | |

9.70% 3/15/19 | | | 7,000 | | | | 8,067 | |

Freeport-McMoran Oil & Gas | | | | | | | | |

6.50% 11/15/20 | | | 425,000 | | | | 439,663 | |

6.875% 2/15/23 | | | 300,000 | | | | 322,500 | |

Genesis Energy | | | | | | | | |

5.75% 2/15/21 | | | 360,000 | | | | 363,600 | |

6.00% 5/15/23 | | | 80,000 | | | | 80,400 | |

6.75% 8/1/22 | | | 244,000 | | | | 250,710 | |

Gulfport Energy

144A 6.00% 10/15/24 # | | | 425,000 | | | | 432,969 | |

Hilcorp Energy I | | | | | | | | |

144A 5.00% 12/1/24 # | | | 208,000 | | | | 211,120 | |

144A 5.75% 10/1/25 # | | | 154,000 | | | | 157,080 | |

Holly Energy Partners

144A 6.00% 8/1/24 # | | | 225,000 | | | | 235,125 | |

Laredo Petroleum

6.25% 3/15/23 | | | 690,000 | | | | 705,525 | |

Murphy Oil 6.875% 8/15/24 | | | 555,000 | | | | 585,525 | |

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | | | | |

| |

Energy (continued) | | | | | | | | |

Murphy Oil USA

6.00% 8/15/23 | | | 395,000 | | | $ | 413,763 | |

Noble Energy

5.05% 11/15/44 | | | 5,000 | | | | 4,770 | |

Noble Holding International

5.25% 3/16/18 | | | 210,000 | | | | 208,425 | |

NuStar Logistics

6.75% 2/1/21 | | | 360,000 | | | | 388,800 | |

Oasis Petroleum

6.875% 3/15/22 | | | 430,000 | | | | 445,050 | |

PDC Energy

1.125% 9/15/21 | | | 395,000 | | | | 440,672 | |

Petroleos Mexicanos | | | | | | | | |

5.50% 6/27/44 | | | 164,000 | | | | 127,674 | |

6.625% 6/15/35 | | | 1,000,000 | | | | 922,600 | |

144A 6.75% 9/21/47 # | | | 326,000 | | | | 286,756 | |

Plains All American Pipeline

8.75% 5/1/19 | | | 10,000 | | | | 11,408 | |

QEP Resources

5.25% 5/1/23 | | | 420,000 | | | | 409,500 | |

Regency Energy Partners

5.00% 10/1/22 | | | 10,000 | | | | 10,592 | |

Sabine Pass Liquefaction

144A 5.00% 3/15/27 # | | | 190,000 | | | | 188,100 | |

Shell International Finance | | | | | | | | |

3.75% 9/12/46 | | | 5,000 | | | | 4,498 | |

4.00% 5/10/46 | | | 5,000 | | | | 4,652 | |

Southwestern Energy

6.70% 1/23/25 | | | 640,000 | | | | 636,800 | |

Targa Resources Partners | | | | | | | | |

144A 5.375% 2/1/27 # | | | 425,000 | | | | 420,750 | |

6.75% 3/15/24 | | | 375,000 | | | | 399,375 | |

Tesoro Logistics

5.25% 1/15/25 | | | 415,000 | | | | 421,225 | |

Transcanada Trust

5.875% 8/15/76 ● | | | 5,000 | | | | 5,187 | |

Transocean 5.55% 10/15/22 | | | 535,000 | | | | 474,813 | |

Williams Partners

7.25% 2/1/17 | | | 20,000 | | | | 20,170 | |

Woodside Finance 144A

8.75% 3/1/19 # | | | 15,000 | | | | 17,009 | |

WPX Energy 7.50% 8/1/20 | | | 200,000 | | | | 212,000 | |

| | | | | | | | |

| | | | | | | 12,220,321 | |

| | | | | | | | |

Financials – 0.50% | | | | | | | | |

AerCap Global Aviation Trust

144A 6.50% 6/15/45 #● | | | 400,000 | | | | 399,500 | |

Affiliated Managers Group

3.50% 8/1/25 | | | 5,000 | | | | 4,747 | |

Air Lease 3.00% 9/15/23 | | | 5,000 | | | | 4,784 | |

18

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Financials (continued) | | | | | | | | |

Ally Financial

5.75% 11/20/25 | | | 485,000 | | | $ | 481,969 | |

Aviation Capital Group 144A

4.875% 10/1/25 # | | | 5,000 | | | | 5,377 | |

| | | | | | | | |

| | | | | | | 896,377 | |

| | | | | | | | |

Healthcare – 3.02% | | | | | | | | |

Air Medical Group Holdings 144A

6.375% 5/15/23 # | | | 615,000 | | | | 585,019 | |

DaVita | | | | | | | | |

5.00% 5/1/25 | | | 450,000 | | | | 439,875 | |

5.125% 7/15/24 | | | 145,000 | | | | 143,459 | |

Envision Healthcare 144A

6.25% 12/1/24 # | | | 100,000 | | | | 103,750 | |

HCA | | | | | | | | |

5.375% 2/1/25 | | | 715,000 | | | | 700,700 | |

5.875% 2/15/26 | | | 110,000 | | | | 109,863 | |

7.58% 9/15/25 | | | 175,000 | | | | 192,281 | |

HealthSouth | | | | | | | | |

5.75% 11/1/24 | | | 420,000 | | | | 423,150 | |

5.75% 9/15/25 | | | 205,000 | | | | 205,513 | |

Hill-Rom Holdings 144A

5.75% 9/1/23 # | | | 395,000 | | | | 408,825 | |

IASIS Healthcare

8.375% 5/15/19 | | | 550,000 | | | | 484,000 | |

Immucor 11.125% 8/15/19 | | | 85,000 | | | | 78,200 | |

Mallinckrodt International Finance | | | | | | | | |

4.75% 4/15/23 | | | 195,000 | | | | 165,750 | |

144A 5.50% 4/15/25 # | | | 80,000 | | | | 68,400 | |

144A 5.625% 10/15/23 # | | | 245,000 | | | | 222,950 | |

MPH Acquisition Holdings

144A 7.125% 6/1/24 # | | | 575,000 | | | | 605,906 | |

Tenet Healthcare

8.125% 4/1/22 | | | 580,000 | | | | 533,600 | |

| | | | | | | | |

| | | | | | | 5,471,241 | |

| | | | | | | | |

Insurance – 0.80% | | | | | | | | |

American International Group

4.125% 2/15/24 | | | 5,000 | | | | 5,212 | |

Berkshire Hathaway Finance

2.90% 10/15/20 | | | 35,000 | | | | 35,893 | |

Chubb INA Holdings

3.35% 5/3/26 | | | 5,000 | | | | 5,038 | |

HUB International | | | | | | | | |

144A 7.875% 10/1/21 # | | | 435,000 | | | | 445,331 | |

144A 9.25% 2/15/21 # | | | 110,000 | | | | 113,850 | |

Liberty Mutual Group 144A

4.95% 5/1/22 # | | | 5,000 | | | | 5,429 | |

MetLife 6.40% 12/15/36 | | | 100,000 | | | | 108,500 | |

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Insurance (continued) | | | | | | | | |

Principal Life Global Funding II 144A 3.00% 4/18/26 # | | | 5,000 | | | $ | 4,868 | |

Prudential Financial

5.375% 5/15/45 ● | | | 5,000 | | | | 5,113 | |

TIAA Asset Management Finance | | | | | | | | |

144A 2.95% 11/1/19 # | | | 5,000 | | | | 5,095 | |

144A 4.125% 11/1/24 # | | | 10,000 | | | | 10,139 | |

USI 144A 7.75% 1/15/21 # | | | 420,000 | | | | 428,400 | |

XLIT | | | | | | | | |

4.45% 3/31/25 | | | 5,000 | | | | 4,951 | |

6.50% 12/29/49 ● | | | 365,000 | | | | 279,225 | |

| | | | | | | | |

| | | | | | | 1,457,044 | |

| | | | | | | | |

Media – 5.00% | | | | | | | | |

Altice Luxembourg 144A

7.75% 5/15/22 # | | | 430,000 | | | | 451,500 | |

CCO Holdings | | | | | | | | |

144A 5.50% 5/1/26 # | | | 25,000 | | | | 25,313 | |

144A 5.75% 2/15/26 # | | | 325,000 | | | | 334,750 | |

144A 5.875% 5/1/27 # | | | 460,000 | | | | 470,350 | |

Cequel Communications Holdings I 144A 7.75% 7/15/25 # | | | 325,000 | | | | 349,375 | |

Columbus Cable Barbados

144A 7.375% 3/30/21 # | | | 470,000 | | | | 501,725 | |

CSC Holdings | | | | | | | | |

144A 5.50% 4/15/27 # | | | 200,000 | | | | 197,875 | |

144A | | | | | | | | |

10.875% 10/15/25 # | | | 600,000 | | | | 700,500 | |

DISH DBS 7.75% 7/1/26 | | | 382,000 | | | | 422,587 | |

Gray Television 144A

5.875% 7/15/26 # | | | 615,000 | | | | 588,672 | |

Midcontinent Communications

144A 6.875% 8/15/23 # | | | 315,000 | | | | 332,719 | |

Nexstar Escrow 144A

5.625% 8/1/24 # | | | 580,000 | | | | 575,650 | |

RCN Telecom Services 144A

8.50% 8/15/20 # | | | 315,000 | | | | 334,294 | |

SFR Group 144A

7.375% 5/1/26 # | | | 860,000 | | | | 861,075 | |

Sinclair Television Group

144A 5.125% 2/15/27 # | | | 435,000 | | | | 405,637 | |

Sirius XM Radio 144A

5.375% 4/15/25 # | | | 380,000 | | | | 380,004 | |

Tribune Media

5.875% 7/15/22 | | | 425,000 | | | | 416,585 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal

amount° | | | Value

(U.S. $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Media (continued) | | | | | | | | |

Unitymedia 144A

6.125% 1/15/25 # | | | 400,000 | | | $ | 409,000 | |

Virgin Media Secured Finance

144A 5.25% 1/15/26 # | | | 410,000 | | | | 398,213 | |

VTR Finance 144A

6.875% 1/15/24 # | | | 430,000 | | | | 437,525 | |