Item 1. Reports to Stockholders

Annual report

Closed-end fund

Delaware Enhanced Global Dividend and Income Fund

November 30, 2019

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by logging into your Investor Center account at computershare.com/investor and going to “Communication Preferences” or by calling Computershare and speaking to a representative.

You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 866437-0252. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Delaware Funds® by Macquarie or your financial intermediary.

The figures in the annual report for Delaware Enhanced Global Dividend and Income Fund represent past results, which are not a guarantee of future results. A rise or fall in interest rates can have a significant impact on bond prices. Funds that invest in bonds can lose their value as interest rates rise.

Table of contents

Delaware Enhanced Global Dividend and Income Fund (“DEX” or the “Fund”), acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the Fund’s Board of Trustees (the “Board”), has adopted a managed distribution policy (the “Plan”). Effective as of March 29, 2018, the Fund makes monthly distributions to common shareholders at a targeted annual distribution rate of 10% of the Fund’s average net asset value (“NAV”) per share. The Fund will calculate the average NAV per share from the previous three full months immediately prior to the distribution based on the number of business days in those three months on which the NAV is calculated. The distribution will be calculated as 10% of the prior three months’ average NAV per share, divided by 12. This distribution methodology is intended to provide shareholders with a consistent, but not guaranteed, income stream and a targeted annual distribution rate and is intended to narrow any discount between the market price and the NAV of the Fund’s common shares, but there is no assurance that the policy will be successful in doing so.

Under the Plan, the Fund is managed with a goal of generating as much of the distribution as possible from net investment income and short-term capital gains. The balance of the distribution will then come from long-term capital gains to the extent permitted, and if necessary, a return of capital. The Fund will generally distribute amounts necessary to satisfy the terms of the Fund’s Plan and the requirements prescribed by excise tax rules and Subchapter M of the Internal Revenue Code (the “Code”). Each monthly distribution to shareholders is expected to be at the fixed percentage described above, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code.

The Board may amend, suspend, or terminate the Fund’s Plan at any time without prior notice if it deems such action to be in the best interest of the Fund or its shareholders. The methodology for determining monthly distributions under the Plan will be reviewed at least annually by the Fund’s Board, and the Fund will continue to evaluate its distribution in light of ongoing market conditions. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above NAV) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain distributions under the Plan. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, increased market volatility, portfolio companies suspending or decreasing corporate dividend distributions, and changes in the Code.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amounts of these distributions or from the terms of the Plan. The Fund’s total investment return on NAV is presented in its financial highlights table.

A cumulative summary of the Section 19(a) notices for the Fund’s current fiscal period, if applicable, is included in Other Fund Information. Section 19(a) notices for the Fund, as applicable, are available on the Fund’s website atdelawarefunds.com/closed-end/performance/fund-distributions.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group. These include the following investment advisors: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, Macquarie Capital Investment Management LLC, and Macquarie Investment Management Europe S.A. For more information, including press releases, please visitdelawarefunds.com/closed-end.

Unless otherwise noted, views expressed herein are current as of Nov. 30, 2019, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor. Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by US laws and regulations.

All third-party marks cited are the property of their respective owners.

© 2020 Macquarie Management Holdings, Inc.

Portfolio management review (Unaudited)

Delaware Enhanced Global Dividend and Income Fund

December 10, 2019

Performance preview (for the year ended November 30, 2019)

| | | | | | | | | | | | |

| | | | |

Delaware Enhanced Global Dividend and Income Fund @ market price | | | 1-year return | | | | | | | | +18.05 | % |

| | | |

Delaware Enhanced Global Dividend and Income Fund @ NAV | | | 1-year return | | | | | | | | +13.53 | % |

| | | |

LipperClosed-end Global Funds Average @ market price | | | 1-year return | | | | | | | | +15.04 | % |

| | | |

LipperClosed-end Global Funds Average @ NAV | | | 1-year return | | | | | | | | +10.94 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Enhanced Global Dividend and Income Fund, please see the table on page 3.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

For the fiscal year ended Nov. 30, 2019, Delaware Enhanced Global Dividend and Income Fund returned +13.53% at net asset value (NAV) and +18.05% at market price (both figures reflect all distributions reinvested). Complete annualized performance for the Fund is shown in the table on page 3.

A shifting monetary backdrop

The Fund’s fiscal year ended Nov. 30, 2019, began with a sharp downturn, with most financial assets experiencing steep valuation drops. These asset-price declines primarily reflected investors’ worries about rising interest rates amid mounting global economic uncertainty.

By the first quarter of 2019, however, conditions for most asset classes had turned significantly positive and generally remained that way for the rest of the fiscal year. Global financial markets marched ahead, as central banks globally signaled their intent to provide monetary support for their respective economies.

These central banks included the US Federal Reserve, which gradually shifted from a policy of raising interest rates to one of cutting them. The shift took place against a backdrop of consistent US economic growth with few signs of inflation. In December 2018, the Fed raised its benchmark short-term interest rate by 0.25 percentage points – it was the central bank’s seventh such rate increase in the previous two years. The Fed then kept the federal funds rate steady until late July, when it initiated its first of three successive0.25-percentage-point rate cuts. By fiscal year end, the federal funds rate was within a range of 1.50% to 1.75% – where it had been inmid-2018.

The Fed’s monetary policy shift came amid the US economy’s weakest quarterly performance of the fiscal year. US gross domestic product (GDP), a measure of national economic output, grew by an annualized rate of just 1.1% in the final three months of 2018. By the first quarter of 2019, however, US annual GDP growth accelerated to 3.1%. The national economy subsequently expanded by 2.0% and an estimated 2.1% in the year’s second and third quarters, respectively. Meanwhile, the US unemployment rate declined further, reaching 3.5% in November 2019 – the lowest since 1969. (Sources: US Bureau of Economic Analysis and US Bureau of Labor Statistics.)

Favorable market conditions

The shift in Fed interest rate policy was the main driver behind the favorable results seen across all the Fund’s asset classes, as financial markets benefited strongly from the increase in global liquidity.

For the fiscal year ended Nov. 30, 2019, USlarge-cap value stocks, as measured by the Russell 1000® Value Index, gained 11.33%, as the equity market recovered from a December 2018 market correction to produce steady gains throughout the rest of the12-month period. In comparison, international developed market stocks, as measured by the MSCI EAFE (Europe, Australasia, Far East) Index (net), gained 12.44% over the same time frame. US stocks more broadly, as represented by the S&P 500® Index, which gained 16.11% for the12-month period, tended to outperform their international counterparts, reflecting better growth fundamentals in the United States.

High yield corporate bonds gained 9.68%, as reflected in the performance of the Bloomberg Barclays US Corporate High-Yield Index. During the fiscal year, high yield bonds benefited from narrowing credit spreads, indicating that investors were willing to accept gradually less income in exchange for taking on credit risk. US Investment grade debt rose 10.79%, as measured by the Bloomberg Barclays US Aggregate Index, while the Bloomberg Barclays Municipal Bond Index, a proxy for the US municipal bond market, gained 8.49%. Emerging markets debt also generated favorable results, with the J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified rising 14.29%. Meanwhile, convertible bonds, as measured by the ICE BofA US Convertible Index, gained 14.53%, and global real estate securities, as reflected by the FTSE EPRA Nareit Developed Index TR, rose 15.67% during the fiscal year.

Individual contributors and detractors

Within the USlarge-cap value equity subportfolio, we saw subpar results from several energy stocks, especiallyHalliburton Co., an energy-services provider, andOccidental Petroleum Corp., an exploration and production (E&P) company. Among the factors weighing on energy stocks during the fiscal period were declining capital investment activity and investors’ concerns about the potential for weaker crude oil demand.

Portfolio management review (Unaudited)

Delaware Enhanced Global Dividend and Income Fund

In contrast, several defense-related companies within the industrials sector contributed to the Fund’s relative performance, especiallyLockheed Martin Corp.andUnited Technologies Corp.We believe defense-company stocks generally fared well due to rising geopolitical tensions and potentially weaker fundamentals weighing on stocks in many other areas of the industrials sector.

Among the Fund’snon-US equity positions,Publicis Groupe S.A., a French advertising and public relations agency, was a notable detractor from performance, as we believe clients reduced ad spending and the company reported disappointing financial results.

On the positive side, the Fund benefited from positions in German apparel companyadidas AG;British clothing, footwear, and home-products retailerNext PLC;Irish food companyKerry Group PLC;and Danish pharmaceutical manufacturerNovo Nordisk A/S.

Sticking to our strategy

We regularly invest across multiple asset classes, searching for securities that offer a competitive yield and the opportunity for dividend growth. We also prioritize managing downside risk while also seeking to limit potential capital losses. Our asset shifts throughout the fiscal year reflected these priorities.

The Fund’s largest allocation remained in high yield bonds, reflecting the income opportunity we continued to see in this asset class. The Fund’s high yield exposure rose from 37% of the portfolio a year ago to 40% as of fiscal year end. In contrast, we reduced the Fund’s exposure to convertibles over the12-month period, from 16% of the portfolio to 10%.

Meanwhile, we reduced the Fund’s exposure to international equities to 25% as of Nov. 30, 2019, down from 33% the previous year. We moved many of the proceeds into USlarge-cap value equities, whose portfolio allocation grew from 7% to 13%. This shift reflected our

view that the US stock market offered investors a favorable combination of yield and upside potential following the market’s sharp correction in late 2018.

During the fiscal year, the Fund used foreign currency exchange contracts to facilitate the purchase and sale of securities, futures contracts to hedge the Fund’s existing portfolio securities against fluctuations in value caused by changes in interest rates or market conditions, and written options contracts to manage the Fund’s exposure to changes in securities prices caused by interest rates or market conditions. These derivative securities did not have a material effect on performance during the fiscal year.

A final note: The Fund’s use of leverage – a portfolio management tool designed to obtain a potentially higher return on the Fund’s investments – added to performance in light of the stock market’s increase. Leverage magnifies the effect of gains and losses. As a result, leverage added to the Fund’s results in what was a positive market environment.

Monitoring market conditions

We continue to believe that income-generating securities, including many of the asset classes we prioritize in the Fund, have the potential to perform well as markets remain uneven and volatile.

We will continue to closely monitor market conditions as we seek to provide a favorable total return to investors while managing downside risk and seeking potential upside via income-generating securities across multiple asset classes and regions. We also may seek to take advantage of market shifts to increase or decrease exposure to certain asset classes as relative value opportunities emerge.

Unless otherwise noted, views expressed herein are current as of Nov. 30, 2019, and subject to change.

2

Performance summary (Unaudited)

Delaware Enhanced Global Dividend and Income Fund

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Please obtain the most recent performance data by calling 866437-0252 or visiting our website atdelawarefunds.com/closed-end.

Fund performance

| | | | | | | | |

Average annual total returns through November 30, 2019 | | 1 year | | 5 years | | 10 years | | Lifetime |

At market price (inception date June 29, 2007) | | +18.05% | | +5.56% | | +7.15% | | +4.75% |

At net asset value (inception date June 29, 2007) | | +13.53% | | +5.31% | | +8.28% | | +5.47% |

Diversification may not protect against market risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding,non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

The Fund borrows through a line of credit for purposes of leveraging. Leveraging may result in higher degrees of volatility because the Fund’s net asset value could be subject to fluctuations in short-term interest rates and changes in market value of portfolio securities attributable to leverage. Leverage magnifies the potential for gain and the risk of loss. As a result, a relatively small decline in the value of the underlying investments could result in a relatively large loss. In addition, the leverage through the line of credit is dependent on the credit provider’s ability to fulfill its contractual obligations.

To the extent the Fund engages in option overwriting, it may receive less total return in certain periods and in other periods greater total return from its option overwriting strategy.

The use of dividend capture strategies will expose the Fund to increased trading costs and potential for capital loss or gain, particularly in the event of significant short-term price movements of stocks subject to dividend capture trading, and resultant dividends may not be qualified dividends eligible to individuals for reduced federal income tax rates.

Closed-end fund shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation or any other government agency.

Performance summary (Unaudited)

Delaware Enhanced Global Dividend and Income Fund

Closed-end funds, unlikeopen-end funds, are not continuously offered. After being issued during aone-time-only public offering, shares ofclosed-end funds are sold in the open market through a securities exchange. Net asset value (NAV) is calculated by subtracting total liabilities by total assets, then dividing by the number of shares outstanding. At the time of sale, your shares may have a market price that is above or below NAV, and may be worth more or less than your original investment.

The Fund may make distributions of ordinary income and capital gains at calendar year end. Those distributions temporarily cause extraordinarily high yields. There is no assurance that a Fund will repeat that yield in the future. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Returns reflect the reinvestment of all distributions. Dividends and distributions, if any, are assumed, for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment policy. Shares of the Fund were initially offered with a sales charge of 4.50%. Performance since inception does not include the sales charge or any other brokerage commission for purchases made since inception.

Past performance is not a guarantee of future results.

Fund basics

As of November 30, 2019

| | | | |

| | |

| Fund objectives | | | | Fund start date |

The Fund’s primary investment objective is to seek current income. Capital appreciation is a secondary objective. | | | | June 29, 2007 |

| | |

| Total Fund net assets | | | | NYSE symbol |

$132 million | | | | DEX |

| | |

| Number of holdings | | | | |

| 420 | | | | |

4

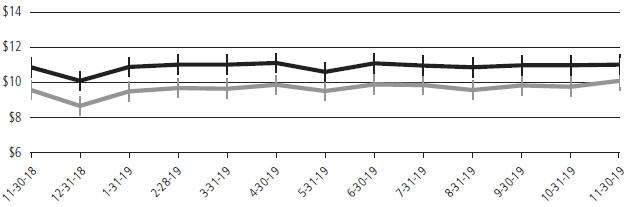

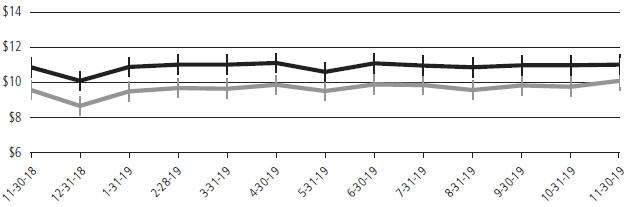

Market price versus net asset value(see notes below and on next page)

November 30, 2018 through November 30, 2019

| | | | | | |

| | | Starting value (Nov. 30, 2018) Ending value (Nov. 30, 2019) |

| | | |

| | Delaware Enhanced Global Dividend and Income Fund @ NAV | | $10.88 | | $11.03 |

| | | |

| | Delaware Enhanced Global Dividend and Income Fund @ market price | | $9.60 | | $10.12 |

Past performance is not a guarantee of future results.

Performance of a $10,000 investment

Average annual total returns from November 30, 2009 through November 30, 2019

| | | | | | |

| | | | | Starting value (Nov. 30, 2009) | | Ending value (Nov. 30, 2019) |

| | | |

| | Delaware Enhanced Global Dividend and Income Fund @ NAV | | $10,000 | | $22,162 |

| | | |

| | LipperClosed-end Global Funds Average @ market price | | $10,000 | | $22,159 |

| | | |

| | Delaware Enhanced Global Dividend and Income Fund @ market price | | $10,000 | | $19,953 |

| | | |

| | LipperClosed-end Global Funds Average @ NAV | | $10,000 | | $18,900 |

The “Performance of a $10,000 investment” graph assumes $10,000 invested in the Fund on Nov. 30, 2009, and includes the reinvestment of all distributions at market value. The graph assumes $10,000 in the LipperClosed-end Global Funds Average at market price and at NAV.

Performance of the Fund and the Lipper class at market value is based on market performance during the period. Performance of the Fund and Lipper class at NAV is based on the fluctuations in NAV during the period. Delaware Enhanced Global Dividend and Income Fund was initially

Performance summary (Unaudited)

Delaware Enhanced Global Dividend and Income Fund

offered with a sales charge of 4.50%. For market price, performance shown in both graphs above does not include fees, the initial sales charge, or any brokerage commissions for purchases. For NAV, performance shown in both graphs above includes fees, but does not include the initial sales charge or any brokerage commissions for purchases. Investments in the Fund are not available at NAV.

The LipperClosed-end Global Funds Average represents the average return ofclosed-end funds that invest at least 25% of their portfolios in securities traded outside of the United States and that may own US securities as well.

The Russell 1000 Value Index, mentioned on page 1, measures the performance of thelarge-cap value segment of the US equity universe. It includes those Russell 1000 companies with lowerprice-to-book ratios and lower forecasted growth values.

The MSCI EAFE (Europe, Australasia, Far East) Index, mentioned on page 1, represents large- andmid-cap stocks across 21 developed markets, excluding the United States and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

The S&P 500 Index, mentioned on page 1, measures the performance of 500 mostlylarge-cap stocks weighted by market value, and is often used to represent performance of the US stock market.

The Bloomberg Barclays US Corporate High-Yield Index, mentioned on page 1, is composed of US dollar-denominated, noninvestment-grade corporate bonds for which the middle rating among Moody’s Investors Service, Inc., Fitch, Inc., and Standard & Poor’s is Ba1/BB+/BB+ or below.

The Bloomberg Barclays US Aggregate Index, mentioned on page 1, is a broad composite that tracks the investment grade domestic bond market.

The Bloomberg Barclays Municipal Bond Index, mentioned on page 1, measures the total return performance of the long-term, investment gradetax-exempt bond market.

The J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified, mentioned on page 1, tracks total returns for US dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities, including Brady bonds, loans, and Eurobonds, and limits the weights of the index countries by only including a specified portion of those countries’ eligible current face amounts of debt outstanding.

The ICE BofA US Convertible Index, mentioned on page 1, tracks the performance of publicly issued US dollar-denominated convertible securities of US companies. Qualifying securities must have at least $50 million face amount outstanding and at least one month remaining to the final conversion date.

The FTSE EPRA Nareit Developed Index, mentioned on page 1, tracks the performance of listed real estate companies and real estate investment trusts (REITs) worldwide, based in US dollars. The TR “total return” index reflects no deduction for fees, expenses, or taxes.

Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

Gross domestic product is a measure of all goods and services produced by a nation in a year.

Market price is the price an investor would pay for shares of the Fund on the secondary market. NAV is the total value of one fund share, generally equal to a fund’s net assets divided by the number of shares outstanding.

Past performance is not a guarantee of future results.

6

Security type / sector and country allocations

Delaware Enhanced Global Dividend and Income Fund

As of November 30, 2019 (Unaudited)

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | | | | |

| Security type / sector | | Percentage of net assets |

Common Stock | | | | 62.43 | % |

Communication Services | | | | 6.62 | % |

Consumer Discretionary | | | | 5.26 | % |

Consumer Staples | | | | 16.14 | % |

Energy | | | | 2.47 | % |

Financials | | | | 4.60 | % |

Healthcare | | | | 12.44 | % |

Industrials | | | | 5.59 | % |

Information Technology | | | | 2.21 | % |

Materials | | | | 2.85 | % |

REIT Healthcare | | | | 0.02 | % |

REIT Mortgage | | | | 1.03 | % |

REIT Multifamily | | | | 0.64 | % |

REIT Office | | | | 0.67 | % |

REIT Shopping Center | | | | 0.23 | % |

REIT Single Tenant | | | | 0.05 | % |

Technology | | | | 0.50 | % |

Utilities | | | | 1.11 | % |

Convertible Preferred Stock | | | | 2.53 | % |

Exchange-Traded Fund | | | | 0.72 | % |

Limited Partnerships | | | | 1.16 | % |

Agency Commercial Mortgage-Backed Securities | | | | 0.01 | % |

Agency Mortgage-Backed Securities | | | | 0.73 | % |

Convertible Bonds | | | | 11.99 | % |

Brokerage | | | | 0.79 | % |

Capital Goods | | | | 1.26 | % |

Communications | | | | 1.54 | % |

Consumer Cyclical | | | | 0.55 | % |

ConsumerNon-Cyclical | | | | 1.36 | % |

Electric | | | | 0.30 | % |

Energy | | | | 1.85 | % |

Financials | | | | 0.16 | % |

Real Estate Investment Trusts | | | | 0.44 | % |

Technology | | | | 3.74 | % |

Corporate Bonds | | | | 54.39 | % |

Automotive | | | | 0.94 | % |

Banking | | | | 2.25 | % |

Basic Industry | | | | 6.02 | % |

Brokerage | | | | 0.34 | % |

Capital Goods | | | | 3.28 | % |

Communications | | | | 3.71 | % |

Consumer Cyclical | | | | 3.69 | % |

| | | | | |

| Security type / sector | | Percentage of net assets |

ConsumerNon-Cyclical | | | | 3.10 | % |

Electric | | | | 0.81 | % |

Energy | | | | 7.27 | % |

Financials | | | | 0.96 | % |

Healthcare | | | | 4.76 | % |

Insurance | | | | 1.66 | % |

Media | | | | 6.32 | % |

Real Estate Investment Trusts | | | | 1.36 | % |

Services | | | | 1.37 | % |

Technology | | | | 3.45 | % |

Transportation | | | | 0.57 | % |

Utilities | | | | 2.53 | % |

Non-Agency Commercial Mortgage-Backed Securities | | | | 0.32 | % |

Sovereign Bonds | | | | 1.19 | % |

US Treasury Obligations | | | | 0.88 | % |

LeveragedNon-Recourse Security | | | | 0.00 | % |

Preferred Stock | | | | 0.56 | % |

Right | | | | 0.00 | % |

Short-Term Investments | | | | 7.23 | % |

Total Value of Securities | | | | 144.14 | % |

Borrowing Under Line of Credit | | | | (45.75 | %) |

Receivables and Other Assets Net of Liabilities | | | | 1.61 | % |

Total Net Assets | | | | 100.00 | % |

Security type / sector and country allocations

Delaware Enhanced Global Dividend and Income Fund

| | | | | |

| Country* | | Percentage of net assets |

Argentina | | | | 0.03 | % |

Austria | | | | 0.21 | % |

Bermuda | | | | 0.17 | % |

Canada | | | | 2.57 | % |

Cayman Islands | | | | 0.66 | % |

China/Hong Kong | | | | 0.18 | % |

Colombia | | | | 0.18 | % |

Denmark | | | | 2.41 | % |

Dominican Republic | | | | 0.18 | % |

Egypt | | | | 0.19 | % |

El Salvador | | | | 0.18 | % |

France | | | | 10.67 | % |

Germany | | | | 2.41 | % |

Indonesia | | | | 0.27 | % |

Ireland | | | | 0.98 | % |

Israel | | | | 0.21 | % |

Italy | | | | 0.18 | % |

Japan | | | | 7.97 | % |

Kazakhstan | | | | 0.19 | % |

Luxembourg | | | | 0.00 | % |

Mexico | | | | 0.66 | % |

Mongolia | | | | 0.15 | % |

Netherlands | | | | 4.03 | % |

Puerto Rico | | | | 0.53 | % |

Saudi Arabia | | | | 0.16 | % |

Sweden | | | | 1.41 | % |

Switzerland | | | | 5.85 | % |

Ukraine | | | | 0.19 | % |

United Arab Emirates | | | | 0.33 | % |

United Kingdom | | | | 5.59 | % |

United States | | | | 88.17 | % |

Total | | | | 136.91 | % |

*Allocation includes all investments except for short-term investments.

The percentage of net assets exceeds 100.00% because the Fund utilizes a line of credit with The Bank of New York Mellon, as described in Note 7 in “Notes to financial statements.” The Fund utilizes leveraging techniques in an attempt to obtain a higher return for the Fund. There is no assurance that the Fund will achieve its investment objectives through the use of such techniques.

8

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

November 30, 2019

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

| |

Common Stock – 62.43%v | | | | | |

| |

Communication Services – 6.62% | | | | | |

AT&T | | | 30,900 | | | $ | 1,155,006 | |

Century Communications =† | | | 125,000 | | | | 0 | |

KDDI | | | 74,100 | | | | 2,125,073 | |

Orange † | | | 125,420 | | | | 2,072,628 | |

Publicis Groupe | | | 52,710 | | | | 2,319,340 | |

Verizon Communications | | | 18,200 | | | | 1,096,368 | |

| | | | | | | | |

| | | | | | | 8,768,415 | |

| | | | | | | | |

Consumer Discretionary – 5.26% | | | | | |

adidas AG | | | 2,480 | | | | 772,534 | |

General Motors | | | 17,700 | | | | 637,200 | |

Next | | | 8,550 | | | | 747,309 | |

Sodexo | | | 18,520 | | | | 2,158,689 | |

Swatch Group | | | 5,240 | | | | 1,467,200 | |

Target | | | 6,200 | | | | 775,062 | |

Whirlpool | | | 2,900 | | | | 414,990 | |

| | | | | | | | |

| | | | | | | 6,972,984 | |

| | | | | | | | |

Consumer Staples – 16.14% | | | | | | | | |

Archer-Daniels-Midland | | | 10,100 | | | | 433,593 | |

Asahi Group Holdings | | | 30,300 | | | | 1,457,766 | |

British American Tobacco ADR | | | 14,440 | | | | 571,968 | |

Conagra Brands | | | 31,800 | | | | 918,066 | |

Danone | | | 38,660 | | | | 3,182,453 | |

Diageo | | | 49,810 | | | | 2,038,949 | |

Kao | | | 10,600 | | | | 834,016 | |

Kerry Group Class A | | | 5,610 | | | | 719,414 | |

Kirin Holdings | | | 28,200 | | | | 624,262 | |

Koninklijke Ahold Delhaize | | | 139,630 | | | | 3,597,323 | |

Kraft Heinz | | | 13,200 | | | | 402,600 | |

Lawson | | | 19,300 | | | | 1,050,916 | |

Nestle | | | 25,810 | | | | 2,682,175 | |

Procter & Gamble | | | 3,700 | | | | 451,622 | |

Seven & i Holdings | | | 64,900 | | | | 2,418,000 | |

| | | | | | | | |

| | | | | | | 21,383,123 | |

| | | | | | | | |

Energy – 2.47% | | | | | | | | |

Halliburton | | | 24,200 | | | | 507,958 | |

Occidental Petroleum | | | 19,900 | | | | 767,543 | |

Royal Dutch Shell ADR Class B | | | 13,000 | | | | 748,930 | |

TOTAL ADR | | | 15,200 | | | | 798,608 | |

Williams | | | 19,500 | | | | 443,040 | |

| | | | | | | | |

| | | | | | | 3,266,079 | |

| | | | | | | | |

Financials – 4.60% | | | | | | | | |

American International Group | | | 15,400 | | | | 810,964 | |

| | | | | | | | |

| | | Number of

shares | | | Value (US $) | |

| |

Common Stockv(continued) | | | | | |

| |

Financials (continued) | | | | | |

Ashford † | | | 632 | | | $ | 14,890 | |

Bank of New York Mellon | | | 12,400 | | | | 607,228 | |

BB&T | | | 18,000 | | | | 984,960 | |

Hercules Capital | | | 15,480 | | | | 221,828 | |

MetLife | | | 11,200 | | | | 558,992 | |

Principal Financial Group | | | 35,646 | | | | 1,964,095 | |

Wells Fargo & Co. | | | 17,100 | | | | 931,266 | |

| | | | | | | | |

| | | | | | | 6,094,223 | |

| | | | | | | | |

Healthcare – 12.44% | | | | | | | | |

AbbVie | | | 9,500 | | | | 833,435 | |

Amgen | | | 2,200 | | | | 516,384 | |

AstraZeneca ADR | | | 17,200 | | | | 833,856 | |

Brookdale Senior Living † | | | 308,879 | | | | 2,205,396 | |

Cardinal Health | | | 13,100 | | | | 720,893 | |

CVS Health | | | 6,300 | | | | 474,201 | |

Fresenius Medical Care AG & Co. | | | 33,030 | | | | 2,422,062 | |

Johnson & Johnson | | | 4,400 | | | | 604,956 | |

Merck & Co. | | | 9,800 | | | | 854,364 | |

Novo Nordisk Class B | | | 56,720 | | | | 3,188,049 | |

Pfizer | | | 19,460 | | | | 749,599 | |

Roche Holding | | | 9,970 | | | | 3,072,754 | |

| | | | | | | | |

| | | | | | | 16,475,949 | |

| | | | | | | | |

Industrials – 5.59% | | | | | | | | |

G4S | | | 688,850 | | | | 1,862,922 | |

Lockheed Martin | | | 2,300 | | | | 899,369 | |

Makita | | | 37,200 | | | | 1,230,314 | |

Raytheon | | | 1,900 | | | | 413,098 | |

Secom | | | 7,800 | | | | 663,237 | |

Securitas Class B | | | 112,334 | | | | 1,862,431 | |

United Technologies | | | 3,200 | | | | 474,688 | |

| | | | | | | | |

| | | | | | | 7,406,059 | |

| | | | | | | | |

Information Technology – 2.21% | | | | | |

Broadcom | | | 3,300 | | | | 1,043,493 | |

Cisco Systems | | | 12,500 | | | | 566,375 | |

Intel | | | 13,400 | | | | 777,870 | |

International Business Machines | | | 4,000 | | | | 537,800 | |

| | | | | | | | |

| | | | | | | 2,925,538 | |

| | | | | | | | |

Materials – 2.85% | | | | | | | | |

Air Liquide | | | 19,400 | | | | 2,629,945 | |

Corteva | | | 13,800 | | | | 359,076 | |

Dow | | | 14,800 | | | | 789,876 | |

| | | | | | | | |

| | | | | | | 3,778,897 | |

| | | | | | | | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Number of shares | | | Value (US $) | |

| |

Common Stockv(continued) | | | | | |

| |

REIT Healthcare – 0.02% | | | | | |

Sabra Health Care REIT | | | 1,108 | | | $ | 24,686 | |

| | | | | | | | |

| | | | | | | 24,686 | |

| | | | | | | | |

REIT Mortgage – 1.03% | | | | | |

Annaly Capital Management | | | 89,530 | | | | 835,315 | |

Starwood Property Trust | | | 21,605 | | | | 529,323 | |

| | | | | | | | |

| | | | | | | 1,364,638 | |

| | | | | | | | |

REIT Multifamily – 0.64% | | | | | |

Equity Residential | | | 9,900 | | | | 842,490 | |

| | | | | | | | |

| | | | | | | 842,490 | |

| | | | | | | | |

REIT Office – 0.67% | | | | | |

Kenedix Office Investment | | | 20 | | | | 151,478 | |

Postal Realty Trust Class A | | | 6,000 | | | | 95,160 | |

VEREIT | | | 65,159 | | | | 635,952 | |

| | | | | | | | |

| | | | | | | 882,590 | |

| | | | | | | | |

REIT Shopping Center – 0.23% | |

Brixmor Property Group | | | 12,022 | | | | 263,763 | |

Link REIT | | | 4,000 | | | | 40,879 | |

| | | | | | | | |

| | | | | | | 304,642 | |

| | | | | | | | |

REIT Single Tenant – 0.05% | | | | | |

STORE Capital | | | 1,738 | | | | 70,754 | |

| | | | | | | | |

| | | | | | | 70,754 | |

| | | | | | | | |

Technology – 0.50% | | | | | |

Microsoft | | | 4,361 | | | | 660,168 | |

| | | | | | | | |

| | | | | | | 660,168 | |

| | | | | | | | |

Utilities – 1.11% | | | | | |

Edison International | | | 12,700 | | | | 877,570 | |

National Grid ADR | | | 10,275 | | | | 590,401 | |

| | | | | | | | |

| | | | | | | 1,467,971 | |

| | | | | | | | |

| |

Total Common Stock

(cost $78,748,213) | | | | 82,689,206 | |

| | | | | | | | |

| | | | | | | | |

| |

Convertible Preferred Stock – 2.53% | | | | | |

| |

A Schulman 6.00% exercise price

$52.33y | | | 775 | | | | 796,227 | |

AMG Capital Trust II 5.15% exercise price $195.47, maturity date 10/15/37 | | | 8,900 | | | | 432,040 | |

Bank of America 7.25% exercise price

$50.00y | | | 453 | | | | 670,440 | |

El Paso Energy Capital Trust I 4.75% exercise price $34.49, maturity date 3/31/28 | | | 12,617 | | | | 623,406 | |

| | | | | | | | |

| | | Number

of shares | | | Value (US $) | |

| |

Convertible Preferred Stock (continued) | | | | | |

| |

QTS Realty Trust 6.50% exercise price $46.99y | | | 6,552 | | | $ | 827,059 | |

| | | | | | | | |

Total Convertible Preferred Stock

(cost $3,060,190) | | | | 3,349,172 | |

| | | | | | | | |

| | | | | | | | |

| |

Exchange-Traded Fund – 0.72% | |

| |

Vanguard FTSE Developed Markets ETF | | | 22,170 | | | | 952,645 | |

| | | | | | | | |

Total Exchange-Traded Fund

(cost $917,747) | | | | | | | 952,645 | |

| | | | | | | | |

| | | | | | | | |

| |

Limited Partnerships@ – 1.16% | |

| |

Merion Champion’s Walk =p† | | | 1,085,000 | | | | 914,438 | |

Merion Countryside =p† | | | 780,938 | | | | 629,748 | |

| | | | | | | | |

Total Limited Partnerships

(cost $974,466) | | | | | | | 1,544,186 | |

| | | | | | | | |

| | |

| | | Principal amount° | | | | |

| |

Agency Commercial Mortgage-Backed Securities – 0.01% | |

| |

FREMF Mortgage Trust | | | | | | | | |

Series 2011-K15 B 144A 5.129% 8/25/44 #● | | | 10,000 | | | | 10,397 | |

Series 2012–K22 B 144A 3.812% 8/25/45 #● | | | 10,000 | | | | 10,360 | |

| | | | | | | | |

Total Agency Commercial Mortgage-Backed Securities(cost $21,214) | | | | | | | 20,757 | |

| | | | | | | | |

| | | | | | | | |

| |

Agency Mortgage-Backed Securities – 0.73% | |

| |

Fannie Mae ARM

4.238% (LIBOR12M + 1.69%, Cap 10.14%, Floor 1.69%) 11/1/35 ● | | | 2,741 | | | | 2,870 | |

Fannie Mae S.F. 30 yr | | | | | | | | |

3.00% 10/1/49 | | | 62,690 | | | | 63,708 | |

3.50% 2/1/48 | | | 100,532 | | | | 105,169 | |

3.50% 6/1/49 | | | 50,193 | | | | 51,513 | |

3.50% 11/1/49 | | | 41,832 | | | | 43,048 | |

4.00% 4/1/48 | | | 15,000 | | | | 15,732 | |

4.50% 5/1/46 | | | 34,106 | | | | 36,933 | |

4.50% 4/1/48 | | | 187,635 | | | | 203,196 | |

4.50% 1/1/49 | | | 18,929 | | | | 20,471 | |

4.50% 11/1/49 | | | 7,934 | | | | 8,354 | |

5.00% 6/1/44 | | | 2,837 | | | | 3,141 | |

5.00% 5/1/48 | | | 44,813 | | | | 47,975 | |

5.00% 7/1/49 | | | 99,633 | | | | 107,819 | |

5.50% 5/1/44 | | | 38,416 | | | | 43,189 | |

10

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Agency Mortgage-Backed Securities (continued) | |

| |

Fannie Mae S.F. 30 yr | | | | | | | | |

6.00% 6/1/41 | | | 1,592 | | | $ | 1,827 | |

6.00% 7/1/41 | | | 4,086 | | | | 4,690 | |

6.00% 7/1/41 | | | 650 | | | | 746 | |

Freddie Mac S.F. 30 yr | | | | | | | | |

3.00% 12/1/48 | | | 129,132 | | | | 131,834 | |

4.00% 10/1/47 | | | 23,458 | | | | 24,576 | |

5.50% 6/1/41 | | | 38,702 | | | | 43,514 | |

GNMA II S.F. 30 yr

6.00% 2/20/40 | | | 1,620 | | | | 1,840 | |

| | | | | | | | |

Total Agency Mortgage-Backed

Securities(cost $962,952) | | | | | | | 962,145 | |

| | | | | | | | |

| | | | | | | | |

| |

Convertible Bonds – 11.99% | | | | | |

| |

Brokerage – 0.79% | | | | | |

FTI Consulting 2.00% exercise price $101.38, maturity date 8/15/23 | | | 343,000 | | | | 427,893 | |

GAIN Capital Holdings 5.00% exercise price $8.20, maturity date 8/15/22 | | | 709,000 | | | | 621,549 | |

| | | | | | | | |

| | | | | | | 1,049,442 | |

| | | | | | | | |

Capital Goods – 1.26% | | | | | |

Aerojet Rocketdyne Holdings 2.25% exercise price $26.00, maturity date 12/15/23 | | | 138,000 | | | | 243,835 | |

Cemex 3.72% exercise price $10.88, maturity date 3/15/20 | | | 669,000 | | | | 671,521 | |

Chart Industries 144A 1.00% exercise price $58.73, maturity date 11/15/24 # | | | 310,000 | | | | 358,453 | |

Dycom Industries 0.75% exercise price $96.89, maturity date 9/15/21 | | | 400,000 | | | | 389,795 | |

| | | | | | | | |

| | | | | | | 1,663,604 | |

| | | | | | | | |

Communications – 1.54% | | | | | |

DISH Network 2.375% exercise price $82.22, maturity date 3/15/24 | | | 592,000 | | | | 536,686 | |

GCI Liberty 144A 1.75% exercise price $370.52, maturity date 9/30/46 # | | | 286,000 | | | | 384,506 | |

InterDigital 144A 2.00% exercise price $81.29, maturity date 6/1/24 # | | | 482,000 | | | | 485,462 | |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Convertible Bonds (continued) | | | | | |

| |

Communications (continued) | | | | | | | | |

Liberty Media 2.25% exercise price $34.28, maturity date 9/30/46 | | | 1,116,000 | | | $ | 631,380 | |

| | | | | | | | |

| | | | | �� | | 2,038,034 | |

| | | | | | | | |

Consumer Cyclical – 0.55% | | | | | |

Meritor 3.25% exercise price $39.92, maturity date 10/15/37 | | | 242,000 | | | | 259,274 | |

Team 5.00% exercise price $21.70, maturity date 8/1/23 | | | 452,000 | | | | 473,777 | |

| | | | | | | | |

| | | | | | | 733,051 | |

| | | | | | | | |

ConsumerNon-Cyclical – 1.36% | | | | | |

BioMarin Pharmaceutical 0.599% exercise price $124.67, maturity date 8/1/24 | | | 493,000 | | | | 508,368 | |

Chefs’ Warehouse 144A 1.875% exercise price $44.20, maturity date 12/1/24 # | | | 234,000 | | | | 243,492 | |

Paratek Pharmaceuticals 4.75% exercise price $15.90, maturity date 5/1/24 | | | 550,000 | | | | 339,424 | |

Vector Group 1.75% exercise price $20.27, maturity date 4/15/20● | | | 687,000 | | | | 714,051 | |

| | | | | | | | |

| | | | | | | 1,805,335 | |

| | | | | | | | |

Electric – 0.30% | | | | | |

NRG Energy 2.75% exercise price $47.74, maturity date 6/1/48 | | | 346,000 | | | | 390,662 | |

| | | | | | | | |

| | | | | | | 390,662 | |

| | | | | | | | |

Energy – 1.85% | | | | | |

Cheniere Energy 4.25% exercise price $138.38, maturity date 3/15/45 | | | 860,000 | | | | 679,421 | |

Helix Energy Solutions Group 4.25% exercise price $13.89, maturity date 5/1/22 | | | 944,000 | | | | 968,673 | |

PDC Energy 1.125% exercise price $85.39, maturity date 9/15/21 | | | 874,000 | | | | 806,145 | |

| | | | | | | | |

| | | | | | | 2,454,239 | |

| | | | | | | | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Convertible Bonds (continued) | | | | | |

| |

Financials – 0.16% | | | | | | | | |

Jazz Investments I 1.875% exercise price $199.77, maturity date 8/15/21 | | | 200,000 | | | $ | 206,129 | |

| | | | | | | | |

| | | | | | | 206,129 | |

| | | | | | | | |

Real Estate Investment Trusts – 0.44% | | | | | |

Blackstone Mortgage Trust 4.75% exercise price $36.23, maturity date 3/15/23 | | | 545,000 | | | | 578,413 | |

| | | | | | | | |

| | | | | | | 578,413 | |

| | | | | | | | |

Technology – 3.74% | | | | | | | | |

Boingo Wireless 1.00% exercise price $42.32, maturity date 10/1/23 | | | 913,000 | | | | 804,690 | |

CSG Systems International 4.25% exercise price $56.87, maturity date 3/15/36 | | | 408,000 | | | | 481,512 | |

Knowles 3.25% exercise price $18.43, maturity date 11/1/21 | | | 395,000 | | | | 527,917 | |

Ligand Pharmaceuticals 0.75% exercise price $248.48, maturity date 5/15/23 | | | 297,000 | | | | 259,370 | |

Pluralsight 144A 0.375% exercise price $38.76, maturity date 3/1/24 # | | | 621,000 | | | | 537,381 | |

Quotient Technology 1.75% exercise price $17.36, maturity date 12/1/22 | | | 625,000 | | | | 614,653 | |

Retrophin 2.50% exercise price $38.80, maturity date 9/15/25 | | | 427,000 | | | | 333,756 | |

Synaptics 0.50% exercise price $73.02, maturity date 6/15/22 | | | 396,000 | | | | 412,390 | |

Verint Systems 1.50% exercise price $64.46, maturity date 6/1/21 | | | 466,000 | | | | 480,231 | |

Vishay Intertechnology 2.25% exercise price $31.45, maturity date 6/15/25 | | | 518,000 | | | | 507,267 | |

| | | | | | | | |

| | | | | | | 4,959,167 | |

| | | | | | | | |

Total Convertible Bonds

(cost $15,589,512) | | | | | | | 15,878,076 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds – 54.39% | | | | | |

| |

Automotive – 0.94% | | | | | | | | |

Allison Transmission 144A 5.875% 6/1/29 # | | | 930,000 | | | $ | 1,005,397 | |

KAR Auction Services 144A 5.125% 6/1/25 # | | | 237,000 | | | | 241,441 | |

| | | | | | | | |

| | | | | | | 1,246,838 | |

| | | | | | | | |

Banking – 2.25% | | | | | | | | |

Ally Financial | | | | | | | | |

5.75% 11/20/25 | | | 702,000 | | | | 774,833 | |

8.00% 11/1/31 | | | 250,000 | | | | 345,319 | |

Bank of America | | | | | | | | |

2.456% 10/22/25 µ | | | 5,000 | | | | 5,018 | |

3.194% 7/23/30 µ | | | 25,000 | | | | 25,854 | |

3.458% 3/15/25 µ | | | 20,000 | | | | 20,868 | |

Branch Banking & Trust 2.636% 9/17/29 µ | | | 34,000 | | | | 33,885 | |

Credit Suisse Group

144A 6.25% #µy | | | 485,000 | | | | 524,501 | |

JPMorgan Chase & Co. | | | | | | | | |

4.023% 12/5/24 µ | | | 30,000 | | | | 31,921 | |

5.00% µy | | | 15,000 | | | | 15,656 | |

Morgan Stanley 3.124% (LIBOR03M + 1.22%)

5/8/24● | | | 10,000 | | | | 10,183 | |

5.00% 11/24/25 | | | 20,000 | | | | 22,536 | |

PNC Financial Services Group 2.60% 7/23/26 | | | 45,000 | | | | 45,578 | |

Popular 6.125% 9/14/23 | | | 655,000 | | | | 704,397 | |

Royal Bank of Scotland Group 8.625% µy | | | 315,000 | | | | 340,824 | |

State Street 3.30% 12/16/24 | | | 35,000 | | | | 36,884 | |

US Bancorp | | | | | | | | |

3.00% 7/30/29 | | | 5,000 | | | | 5,173 | |

3.10% 4/27/26 | | | 15,000 | | | | 15,639 | |

3.375% 2/5/24 | | | 10,000 | | | | 10,510 | |

USB Capital IX 3.50% (LIBOR03M + 1.02%)y● | | | 10,000 | | | | 8,803 | |

| | | | | | | | |

| | | | | | | 2,978,382 | |

| | | | | | | | |

Basic Industry – 6.02% | | | | | | | | |

BMC East 144A 5.50% 10/1/24 # | | | 312,000 | | | | 324,999 | |

Boise Cascade 144A 5.625% 9/1/24 # | | | 600,000 | | | | 625,749 | |

Builders FirstSource 144A 5.625% 9/1/24 # | | | 353,000 | | | | 367,999 | |

Chemours 5.375% 5/15/27 | | | 456,000 | | | | 384,191 | |

Freeport-McMoRan | | | | | | | | |

4.55% 11/14/24 | | | 365,000 | | | | 384,513 | |

5.45% 3/15/43 | | | 400,000 | | | | 385,040 | |

12

| | | | | | | | |

| | | Principal

amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Basic Industry (continued) | | | | | | | | |

HD Supply 144A 5.375% 10/15/26 # | | | 345,000 | | | $ | 366,501 | |

Hudbay Minerals 144A 7.625% 1/15/25 # | | | 465,000 | | | | 467,320 | |

Joseph T Ryerson & Son 144A 11.00% 5/15/22 # | | | 272,000 | | | | 288,182 | |

Koppers 144A 6.00%

2/15/25 # | | | 484,000 | | | | 491,255 | |

Lennar 5.875% 11/15/24 | | | 155,000 | | | | 173,277 | |

Methanex 5.25% 12/15/29 | | | 35,000 | | | | 35,633 | |

Minera Mexico 144A 4.50% 1/26/50 # | | | 200,000 | | | | 197,187 | |

Newmont Goldcorp 2.80% 10/1/29 | | | 35,000 | | | | 34,713 | |

NOVA Chemicals 144A 5.00% 5/1/25 # | | | 285,000 | | | | 287,135 | |

Novelis 144A 6.25%

8/15/24 # | | | 255,000 | | | | 268,778 | |

Olin | | | | | | | | |

5.00% 2/1/30 | | | 380,000 | | | | 378,109 | |

5.125% 9/15/27 | | | 478,000 | | | | 497,035 | |

PulteGroup 5.00% 1/15/27 | | | 170,000 | | | | 185,695 | |

RPM International 4.55% 3/1/29 | | | 30,000 | | | | 32,609 | |

Standard Industries | | | | | | | | |

144A 5.00% 2/15/27 # | | | 430,000 | | | | 447,124 | |

144A 6.00% 10/15/25 # | | | 50,000 | | | | 52,437 | |

Steel Dynamics 5.00% 12/15/26 | | | 665,000 | | | | 707,991 | |

Suzano Austria 6.00% 1/15/29 | | | 250,000 | | | | 277,587 | |

Univar Solutions USA 144A 5.125% 12/1/27 # | | | 305,000 | | | | 312,686 | |

| | | | | | | | |

| | | | | | | 7,973,745 | |

| | | | | | | | |

Brokerage – 0.34% | | | | | | | | |

E*TRADE Financial

5.875% µy | | | 400,000 | | | | 419,374 | |

Jefferies Group 4.15% 1/23/30 | | | 35,000 | | | | 36,099 | |

| | | | | | | | |

| | | | | | | 455,473 | |

| | | | | | | | |

Capital Goods – 3.28% | | | | | | | | |

Ardagh Packaging Finance 144A 6.00% 2/15/25 # | | | 360,000 | | | | 378,900 | |

Ashtead Capital 144A 4.375% 8/15/27 # | | | 375,000 | | | | 387,787 | |

Bombardier 144A 6.00% 10/15/22 # | | | 560,000 | | | | 562,800 | |

Crown Americas 4.75% 2/1/26 | | | 334,000 | | | | 351,234 | |

| | | | | | | | |

| | | Principal

amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Capital Goods (continued) | | | | | | | | |

Mauser Packaging Solutions Holding | | | | | | | | |

144A 5.50% 4/15/24 # | | | 699,000 | | | $ | 716,468 | |

144A 7.25% 4/15/25 # | | | 250,000 | | | | 237,497 | |

Roper Technologies 2.35% 9/15/24 | | | 45,000 | | | | 45,004 | |

TransDigm 144A 6.25% 3/15/26 # | | | 288,000 | | | | 309,780 | |

United Rentals North America | | | | | | | | |

5.50% 5/15/27 | | | 877,000 | | | | 938,412 | |

5.875% 9/15/26 | | | 30,000 | | | | 32,176 | |

Waste Management | | | | | | | | |

3.45% 6/15/29 | | | 20,000 | | | | 21,496 | |

4.15% 7/15/49 | | | 5,000 | | | | 5,805 | |

Zekelman Industries 144A 9.875% 6/15/23 # | | | 333,000 | | | | 351,523 | |

| | | | | | | | |

| | | | | | | 4,338,882 | |

| | | | | | | | |

Communications – 3.71% | | | | | | | | |

Altice France 144A 7.375%

5/1/26 # | | | 910,000 | | | | 973,723 | |

AT&T 4.35% 3/1/29 | | | 30,000 | | | | 33,125 | |

Charter Communications Operating | | | | | | | | |

4.80% 3/1/50 | | | 5,000 | | | | 5,218 | |

4.908% 7/23/25 | | | 5,000 | | | | 5,486 | |

5.05% 3/30/29 | | | 20,000 | | | | 22,551 | |

Crown Castle International 5.25% 1/15/23 | | | 30,000 | | | | 32,683 | |

Discovery Communications 4.125% 5/15/29 | | | 25,000 | | | | 26,792 | |

Level 3 Financing 144A 3.875% 11/15/29 # | | | 576,000 | | | | 580,775 | |

Ooredoo International Finance 144A 5.00% 10/19/25 # | | | 200,000 | | | | 223,496 | |

Sprint | | | | | | | | |

7.125% 6/15/24 | | | 918,000 | | | | 991,440 | |

7.625% 3/1/26 | | | 30,000 | | | | 32,812 | |

7.875% 9/15/23 | | | 40,000 | | | | 44,075 | |

Sprint Communications 7.00% 8/15/20 | | | 302,000 | | | | 309,702 | |

Time Warner Cable 7.30% 7/1/38 | | | 10,000 | | | | 12,837 | |

Time Warner Entertainment 8.375% 3/15/23 | | | 5,000 | | | | 5,932 | |

T-Mobile USA | | | | | | | | |

6.375% 3/1/25 = | | | 199,000 | | | | 0 | |

6.50% 1/15/26 | | | 720,000 | | | | 772,218 | |

6.50% 1/15/26 = | | | 505,000 | | | | 0 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal

amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | |

| |

Communications (continued) | | | | | |

Verizon Communications | | | | | |

4.50% 8/10/33 | | | 25,000 | | | $ | 29,266 | |

4.522% 9/15/48 | | | 5,000 | | | | 6,023 | |

Viacom 4.375% 3/15/43 | | | 30,000 | | | | 31,039 | |

Vodafone Group | | | | | | | | |

4.25% 9/17/50 | | | 20,000 | | | | 20,834 | |

4.875% 6/19/49 | | | 15,000 | | | | 17,064 | |

Zayo Group | | | | | | | | |

144A 5.75% 1/15/27 # | | | 165,000 | | | | 168,770 | |

6.375% 5/15/25 | | | 550,000 | | | | 567,182 | |

| | | | | | | | |

| | | | | | | 4,913,043 | |

| | | | | | | | |

Consumer Cyclical – 3.69% | | | | | |

AMC Entertainment Holdings 6.125% 5/15/27 | | | 661,000 | | | | 596,569 | |

Boyd Gaming 6.375% 4/1/26 | | | 513,000 | | | | 548,819 | |

General Motors Financial 4.35% 4/9/25 | | | 15,000 | | | | 15,796 | |

5.25% 3/1/26 | | | 15,000 | | | | 16,354 | |

GLP Capital / GLP Financing II 5.375% 4/15/26 | | | 122,000 | | | | 134,719 | |

Hilton Worldwide Finance 4.875% 4/1/27 | | | 435,000 | | | | 462,110 | |

KFC Holding / Pizza Hut Holdings / Taco Bell of America 144A 5.25% 6/1/26 # | | | 490,000 | | | | 520,686 | |

Lowe’s 4.55% 4/5/49 | | | 30,000 | | | | 34,893 | |

MGM Resorts International 5.75% 6/15/25 | | | 435,000 | | | | 486,652 | |

Penn National Gaming 144A 5.625% 1/15/27 # | | | 563,000 | | | | 585,716 | |

Royal Caribbean Cruises 3.70% 3/15/28 | | | 35,000 | | | | 36,010 | |

Scientific Games International | | | | | | | | |

144A 8.25% 3/15/26 # | | | 535,000 | | | | 580,194 | |

10.00% 12/1/22 | | | 547,000 | | | | 562,043 | |

Yum! Brands 144A 4.75% 1/15/30 # | | | 295,000 | | | | 306,070 | |

| | | | | | | | |

| | | | | | | 4,886,631 | |

| | | | | | | | |

Consumer Non-Cyclical – 3.10%

AbbVie | | | | | |

144A 2.60% 11/21/24 # | | | 5,000 | | | | 5,028 | |

144A 2.95% 11/21/26 # | | | 10,000 | | | | 10,115 | |

Anheuser-Busch InBev Worldwide | | | | | | | | |

3.65% 2/1/26 | | | 30,000 | | | | 32,199 | |

4.75% 1/23/29 | | | 10,000 | | | | 11,641 | |

| | | | | | | | |

| | | Principal

amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | |

| |

ConsumerNon-Cyclical (continued) | | | | | |

Aramark Services 144A 5.00% 2/1/28 # | | | 530,000 | | | $ | 557,838 | |

Cott Holdings 144A 5.50% 4/1/25 # | | | 603,000 | | | | 633,144 | |

CVS Health 4.30% 3/25/28 | | | 45,000 | | | | 49,115 | |

DH Europe Finance II 3.25% 11/15/39 | | | 5,000 | | | | 5,085 | |

Gilead Sciences 4.15% 3/1/47 | | | 30,000 | | | | 33,563 | |

JBS USA | | | | | | | | |

144A 5.75% 6/15/25 # | | | 377,000 | | | | 392,236 | |

144A 6.50% 4/15/29 # | | | 360,000 | | | | 399,725 | |

144A 6.75% 2/15/28 # | | | 40,000 | | | | 44,260 | |

Pilgrim’s Pride 144A 5.875% 9/30/27 # | | | 815,000 | | | | 882,093 | |

Post Holdings | | | | | | | | |

144A 5.00% 8/15/26 # | | | 244,000 | | | | 256,762 | |

144A 5.625% 1/15/28 # | | | 400,000 | | | | 427,929 | |

144A 5.75% 3/1/27 # | | | 345,000 | | | | 370,389 | |

| | | | | | | | |

| | | | | | | 4,111,122 | |

| | | | | | | | |

Electric – 0.81% | | | | | | | | |

CenterPoint Energy | | | | | | | | |

3.85% 2/1/24 | | | 15,000 | | | | 15,784 | |

4.25% 11/1/28 | | | 15,000 | | | | 16,319 | |

Duke Energy 4.875% µy | | | 15,000 | | | | 15,737 | |

Duke Energy Indiana 3.25% 10/1/49 | | | 20,000 | | | | 20,192 | |

Entergy Mississippi 2.85% 6/1/28 | | | 10,000 | | | | 10,295 | |

Entergy Texas 3.55% 9/30/49 | | | 20,000 | | | | 20,789 | |

Evergy Metro 3.65% 8/15/25 | | | 15,000 | | | | 15,997 | |

Israel Electric 144A 4.25% 8/14/28 # | | | 250,000 | | | | 272,576 | |

MidAmerican Energy 3.15% 4/15/50 | | | 20,000 | | | | 20,277 | |

Mong Duong Finance Holdings 144A 5.125% 5/7/29 # | | | 500,000 | | | | 512,213 | |

National Rural Utilities Cooperative Finance | | | | | | | | |

2.85% 1/27/25 | | | 20,000 | | | | 20,530 | |

5.25% 4/20/46 µ | | | 10,000 | | | | 10,771 | |

NextEra Energy Capital Holdings | | | | | | | | |

2.90% 4/1/22 | | | 10,000 | | | | 10,184 | |

3.15% 4/1/24 | | | 15,000 | | | | 15,521 | |

5.65% 5/1/79 µ | | | 10,000 | | | | 11,070 | |

14

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Electric (continued) | | | | | | | | |

PacifiCorp 3.50% 6/15/29 | | | 20,000 | | | $ | 21,658 | |

Southern California Edison | | | | | | | | |

4.00% 4/1/47 | | | 5,000 | | | | 5,265 | |

4.20% 3/1/29 | | | 15,000 | | | | 16,512 | |

4.875% 3/1/49 | | | 10,000 | | | | 11,982 | |

Southwestern Electric Power 4.10% 9/15/28 | | | 30,000 | | | | 32,998 | |

| | | | | | | | |

| | | | | | | 1,076,670 | |

| | | | | | | | |

Energy – 7.27% | | | | | | | | |

Abu Dhabi Crude Oil Pipeline 144A 3.65% 11/2/29 # | | | 412,000 | | | | 441,119 | |

AmeriGas Partners | | | | | | | | |

5.625% 5/20/24 | | | 20,000 | | | | 21,400 | |

5.875% 8/20/26 | | | 351,000 | | | | 386,038 | |

Cheniere Corpus Christi Holdings | | | | | | | | |

5.125% 6/30/27 | | | 92,000 | | | | 101,017 | |

5.875% 3/31/25 | | | 222,000 | | | | 248,684 | |

7.00% 6/30/24 | | | 370,000 | | | | 425,441 | |

Cheniere Energy Partners 5.25% 10/1/25 | | | 360,000 | | | | 371,696 | |

Crestwood Midstream Partners 6.25% 4/1/23 | | | 495,000 | | | | 497,470 | |

Energy Transfer Operating | | | | | |

5.25% 4/15/29 | | | 15,000 | | | | 16,569 | |

5.50% 6/1/27 | | | 260,000 | | | | 287,782 | |

6.25% 4/15/49 | | | 10,000 | | | | 11,793 | |

Genesis Energy | | | | | | | | |

6.50% 10/1/25 | | | 80,000 | | | | 72,598 | |

6.75% 8/1/22 | | | 376,000 | | | | 368,243 | |

Hilcorp Energy I 144A 5.00% 12/1/24 # | | | 229,000 | | | | 204,567 | |

KazMunayGas National 144A 5.375% 4/24/30 # | | | 216,000 | | | | 248,983 | |

Marathon Oil 4.40% 7/15/27 | | | 30,000 | | | | 32,324 | |

MPLX | | | | | | | | |

4.00% 3/15/28 | | | 5,000 | | | | 5,126 | |

4.125% 3/1/27 | | | 5,000 | | | | 5,192 | |

5.50% 2/15/49 | | | 15,000 | | | | 16,472 | |

Murphy Oil | | | | | | | | |

5.875% 12/1/27 | | | 465,000 | | | | 468,004 | |

6.875% 8/15/24 | | | 314,000 | | | | 329,430 | |

Murphy Oil USA 5.625% 5/1/27 | | | 936,000 | | | | 1,011,790 | |

Newfield Exploration 5.375% 1/1/26 | | | 662,000 | | | | 710,930 | |

Noble Energy 3.25% 10/15/29 | | | 15,000 | | | | 14,887 | |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Energy (continued) | | | | | | | | |

Noble Energy | | | | | | | | |

3.90% 11/15/24 | | | 5,000 | | | $ | 5,244 | |

4.95% 8/15/47 | | | 10,000 | | | | 10,668 | |

NuStar Logistics 5.625% 4/28/27 | | | 402,000 | | | | 415,999 | |

Precision Drilling 144A 7.125% 1/15/26 # | | | 650,000 | | | | 570,149 | |

Sabine Pass Liquefaction 5.625% 3/1/25 | | | 30,000 | | | | 33,526 | |

Saudi Arabian Oil 144A 4.25% 4/16/39 # | | | 200,000 | | | | 215,551 | |

Sinopec Group Overseas Development 2018 144A 2.50% 8/8/24 # | | | 200,000 | | | | 199,634 | |

Southwestern Energy 7.75% 10/1/27 | | | 465,000 | | | | 405,143 | |

Targa Resources Partners | | | | | | | | |

5.375% 2/1/27 | | | 708,000 | | | | 722,034 | |

5.875% 4/15/26 | | | 40,000 | | | | 42,163 | |

Transocean 144A 9.00% 7/15/23 # | | | 482,000 | | | | 492,990 | |

Transocean Proteus 144A 6.25% 12/1/24 # | | | 218,250 | | | | 221,069 | |

| | | | | | | | |

| | | | | | | 9,631,725 | |

| | | | | | | | |

Financials – 0.96% | | | | | | | | |

AerCap Global Aviation Trust 144A 6.50% 6/15/45 #µ | | | 400,000 | | | | 440,040 | |

Avolon Holdings Funding | | | | | | | | |

144A 3.95% 7/1/24 # | | | 10,000 | | | | 10,381 | |

144A 4.375% 5/1/26 # | | | 25,000 | | | | 26,404 | |

DAE Funding 144A 5.75% 11/15/23 # | | | 710,000 | | | | 749,345 | |

International Lease Finance 8.625% 1/15/22 | | | 35,000 | | | | 39,497 | |

| | | | | | | | |

| | | | | | | 1,265,667 | |

| | | | | | | | |

Healthcare – 4.76% | | | | | | | | |

Bausch Health 144A 5.50% 11/1/25 # | | | 1,000,000 | | | | 1,047,500 | |

Charles River Laboratories International | | | | | | | | |

144A 4.25% 5/1/28 # | | | 270,000 | | | | 272,700 | |

144A 5.50% 4/1/26 # | | | 745,000 | | | | 795,155 | |

Encompass Health | | | | | | | | |

5.75% 11/1/24 | | | 420,000 | | | | 426,821 | |

5.75% 9/15/25 | | | 361,000 | | | | 380,102 | |

HCA | | | | | | | | |

5.375% 2/1/25 | | | 1,076,000 | | | | 1,191,659 | |

5.875% 2/15/26 | | | 166,000 | | | | 187,792 | |

7.58% 9/15/25 | | | 194,000 | | | | 232,557 | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Healthcare (continued) | | | | | | | | |

Hill-Rom Holdings 144A

5.00% 2/15/25 # | | | 378,000 | | | $ | 395,167 | |

Hologic 144A 4.625%

2/1/28 # | | | 370,000 | | | | 391,404 | |

Tenet Healthcare | | | | | | | | |

5.125% 5/1/25 | | | 415,000 | | | | 427,450 | |

8.125% 4/1/22 | | | 509,000 | | | | 557,355 | |

| | | | | | | | |

| | | | | | | 6,305,662 | |

| | | | | | | | |

Insurance – 1.66% | | | | | | | | |

HUB International 144A

7.00% 5/1/26 # | | | 460,000 | | | | 472,661 | |

USI 144A 6.875%

5/1/25 # | | | 782,000 | | | | 787,857 | |

WellCare Health Plans 144A 5.375% 8/15/26 # | | | 880,000 | | | | 939,244 | |

| | | | | | | | |

| | | | | | | 2,199,762 | |

| | | | | | | | |

Media – 6.32% | | | | | | | | |

AMC Networks 4.75%

8/1/25 | | | 805,000 | | | | 800,975 | |

CCO Holdings | | | | | | | | |

144A 5.125% 5/1/27 # | | | 250,000 | | | | 265,631 | |

144A 5.375% 6/1/29 # | | | 370,000 | | | | 397,297 | |

144A 5.50% 5/1/26 # | | | 39,000 | | | | 41,236 | |

144A 5.75% 2/15/26 # | | | 442,000 | | | | 467,871 | |

144A 5.875% 5/1/27 # | | | 506,000 | | | | 540,065 | |

CSC Holdings | | | | | | | | |

6.75% 11/15/21 | | | 895,000 | | | | 965,257 | |

144A 7.50% 4/1/28 # | | | 200,000 | | | | 225,715 | |

144A 7.75% 7/15/25 # | | | 325,000 | | | | 349,375 | |

Gray Television 144A 5.875% 7/15/26 # | | | 747,000 | | | | 793,820 | |

Lamar Media 5.75% 2/1/26 | | | 399,000 | | | | 425,243 | |

Netflix 5.875% 11/15/28 | | | 685,000 | | | | 750,092 | |

Sinclair Television Group 144A 5.125% 2/15/27 # | | | 453,000 | | | | 458,820 | |

Sirius XM Radio | | | | | | | | |

144A 5.00% 8/1/27 # | | | 905,000 | | | | 954,798 | |

144A 5.375% 4/15/25 # | | | 479,000 | | | | 496,958 | |

VTR Finance 144A 6.875% 1/15/24 # | | | 430,000 | | | | 441,466 | |

| | | | | | | | |

| | | | | | | 8,374,619 | |

| | | | | | | | |

Real Estate Investment Trusts – 1.36% | | | | | |

CubeSmart 3.00% 2/15/30 | | | 5,000 | | | | 4,963 | |

CyrusOne 5.375% 3/15/27 | | | 212,000 | | | | 233,804 | |

ESH Hospitality | | | | | | | | |

144A 4.625% 10/1/27 # | | | 160,000 | | | | 161,172 | |

144A 5.25% 5/1/25 # | | | 656,000 | | | | 678,960 | |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Real Estate Investment Trusts (continued) | | | | | |

MGM Growth Properties Operating Partnership 144A 5.75% 2/1/27 # | | | 195,000 | | | $ | 218,644 | |

SBA Communications 4.875% 9/1/24 | | | 480,000 | | | | 499,044 | |

| | | | | | | | |

| | | | | | | 1,796,587 | |

| | | | | | | | |

Services – 1.37% | | | | | | | | |

Advanced Disposal Services 144A 5.625% 11/15/24 # | | | 551,000 | | | | 576,712 | |

Prime Security Services Borrower | | | | | | | | |

144A 5.75% 4/15/26 # | | | 495,000 | | | | 517,965 | |

144A 9.25% 5/15/23 # | | | 332,000 | | | | 349,638 | |

Service Corp. International 4.625% 12/15/27 | | | 360,000 | | | | 374,336 | |

| | | | | | | | |

| | | | | | | 1,818,651 | |

| | | | | | | | |

Technology – 3.45% | | | | | | | | |

Apple 2.20% 9/11/29 | | | 40,000 | | | | 39,486 | |

CDK Global | | | | | | | | |

5.00% 10/15/24 | | | 404,000 | | | | 437,831 | |

5.875% 6/15/26 | | | 570,000 | | | | 610,511 | |

CDW Finance 5.00% 9/1/25 | | | 239,000 | | | | 249,753 | |

CommScope Technologies 144A 5.00% 3/15/27 # | | | 232,000 | | | | 204,170 | |

Global Payments | | | | | | | | |

2.65% 2/15/25 | | | 30,000 | | | | 30,116 | |

3.20% 8/15/29 | | | 10,000 | | | | 10,174 | |

Infor US 6.50% 5/15/22 | | | 443,000 | | | | 452,433 | |

Intel | | | | | | | | |

2.45% 11/15/29 | | | 5,000 | | | | 5,013 | |

3.25% 11/15/49 | | | 5,000 | | | | 5,077 | |

Iron Mountain US Holdings 144A 5.375% 6/1/26 # | | | 838,000 | | | | 873,906 | |

Microchip Technology 4.333% 6/1/23 | | | 30,000 | | | | 31,648 | |

NXP 144A 4.875% 3/1/24 # | | | 30,000 | | | | 32,595 | |

RP Crown Parent 144A 7.375% 10/15/24 # | | | 70,000 | | | | 72,654 | |

Sensata Technologies UK Financing 144A 6.25% 2/15/26 # | | | 350,000 | | | | 376,842 | |

SS&C Technologies 144A 5.50% 9/30/27 # | | | 1,055,000 | | | | 1,130,775 | |

| | | | | | | | |

| | | | | | | 4,562,984 | |

| | | | | | | | |

Transportation – 0.57% | | | | | | | | |

Avis Budget Car Rental 144A 6.375% 4/1/24 # | | | 111,000 | | | | 115,902 | |

FedEx 4.05% 2/15/48 | | | 35,000 | | | | 34,319 | |

16

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Corporate Bonds (continued) | | | | | |

| |

Transportation (continued) | | | | | |

Rutas 2 and 7 Finance 144A 3.413% 9/30/36 # | | | 200,000 | | | $ | 129,937 | |

XPO Logistics 144A 6.125% 9/1/23 # | | | 455,000 | | | | 470,920 | |

| | | | | | | | |

| | | | | | | 751,078 | |

| | | | | | | | |

Utilities – 2.53% | | | | | | | | |

AES | | | | | | | | |

5.50% 4/15/25 | | | 345,000 | | | | 358,384 | |

6.00% 5/15/26 | | | 57,000 | | | | 60,979 | |

Calpine | | | | | | | | |

144A 5.25% 6/1/26 # | | | 320,000 | | | | 335,185 | |

144A 5.875% 1/15/24 # | | | 195,000 | | | | 199,468 | |

Covanta Holding 5.875% 7/1/25 | | | 557,000 | | | | 583,689 | |

Emera 6.75% 6/15/76 µ | | | 390,000 | | | | 439,343 | |

Empresas Publicas de Medellin 144A 4.25% 7/18/29 # | | | 238,000 | | | | 245,818 | |

Enel 144A 8.75%

9/24/73 #µ | | | 200,000 | | | | 234,520 | |

Vistra Energy 144A 8.00% 1/15/25 # | | | 371,000 | | | | 388,623 | |

Vistra Operations | | | | | | | | |

144A 5.50% 9/1/26 # | | | 105,000 | | | | 110,756 | |

144A 5.625% 2/15/27 # | | | 375,000 | | | | 394,696 | |

| | | | | | | | |

| | | | | | | 3,351,461 | |

| | | | | | | | |

Total Corporate Bonds

(cost $69,681,422) | | | | | | | 72,038,982 | |

| | | | | | | | |

| | | | | | | | |

| |

Non-Agency Commercial Mortgage-Backed Securities – 0.32% | |

| |

BANK

Series 2019-BN20 A3 3.011% 9/15/61 | | | 50,000 | | | | 51,832 | |

CD Mortgage Trust | | | | | | | | |

Series2016-CD2 A3 3.248% 11/10/49 | | | 50,000 | | | | 52,468 | |

Series2019-CD8 A4 2.912% 8/15/57 | | | 50,000 | | | | 51,280 | |

COMM Mortgage Trust Series 2016-CR28 A4 3.762% 2/10/49 | | | 70,000 | | | | 75,196 | |

DB-JPM Mortgage Trust | | | | | | | | |

Series2016-C1 A4 3.276% 5/10/49 | | | 50,000 | | | | 52,455 | |

Series2016-C3 A5 2.89% 8/10/49 | | | 50,000 | | | | 51,389 | |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

| |

Non-Agency Commercial Mortgage-Backed Securities (continued) | |

| |

GS Mortgage Securities Trust Series2017-GS6 A3 3.433% 5/10/50 | | | 80,000 | | | $ | 85,156 | |

| | | | | | | | |

TotalNon-Agency Commercial Mortgage-Backed Securities

(cost $426,880) | | | | | | | 419,776 | |

| | | | | | | | |

| | | | | | | | |

| |

Sovereign Bonds – 1.19%D | | | | | |

| |

Argentina – 0.03% | | | | | | | | |

Argentine Republic Government International Bond 5.625% 1/26/22 | | | 93,000 | | | | 40,577 | |

| | | | | | | | |

| | | | | | | 40,577 | |

| | | | | | | | |

Dominican Republic – 0.18% | | | | | | | | |

Dominican Republic International Bond 144A 6.00% 7/19/28 # | | | 224,000 | | | | 245,080 | |

| | | | | | | | |

| | | | | | | 245,080 | |

| | | | | | | | |

Egypt – 0.19% | | | | | | | | |

Egypt Government International Bond 144A 8.70% 3/1/49 # | | | 231,000 | | | | 248,971 | |

| | | | | | | | |

| | | | | | | 248,971 | |

| | | | | | | | |

El Salvador – 0.18% | | | | | | | | |

El Salvador Government International Bond 144A 7.125% 1/20/50 # | | | 235,000 | | | | 239,144 | |

| | | | | | | | |

| | | | | | | 239,144 | |

| | | | | | | | |

Indonesia – 0.27% | | | | | | | | |

Indonesia Government International Bond 144A 5.125% 1/15/45 # | | | 299,000 | | | | 354,963 | |

| | | | | | | | |

| | | | | | | 354,963 | |

| | | | | | | | |

Mongolia – 0.15% | | | | | | | | |

Mongolia Government International Bond 144A 5.625% 5/1/23 # | | | 200,000 | | | | 205,335 | |

| | | | | | | | |

| | | | | | | 205,335 | |

| | | | | | | | |

Ukraine – 0.19% | | | | | | | | |

Ukraine Government International Bond 144A 7.75% 9/1/21 # | | | 237,000 | | | | 248,397 | |

| | | | | | | | |

| | | | | | | 248,397 | |

| | | | | | | | |

Total Sovereign Bonds

(cost $1,498,899) | | | | | | | 1,582,467 | |

| | | | | | | | |

Schedule of investments

Delaware Enhanced Global Dividend and Income Fund

| | | | | | | | |

| | | Principal

amount° | | | Value (US $) | |

| |

US Treasury Obligations – 0.88% | | | | | |

| |

US Treasury Floating Rate Note

1.786% (USBMMY3M + 0.22%) 7/31/21● | | | 345,000 | | | $ | 345,165 | |

US Treasury Notes | | | | | | | | |

1.50% 9/30/24 | | | 320,000 | | | | 317,963 | |

1.625% 8/15/29 | | | 515,000 | | | | 507,466 | |

| | | | | | | | |

Total US Treasury Obligations

(cost $1,174,105) | | | | | | | 1,170,594 | |

| | | | | | | | |

| | | | | | | | |

| |

LeveragedNon-Recourse Security – 0.00% | |

| |

JPMorgan Fixed Income Auction Pass Through Trust Series2007-C 144A 0.241%

1/15/87 #¨= | | | 500,000 | | | | 500 | |

| | | | | | | | |

Total LeveragedNon-Recourse Security

(cost $425,000) | | | | | | | 500 | |

| | | | | | | | |

| | |

| | | Number of shares | | | | |

| |

Preferred Stock – 0.56% | | | | | |

| |

Bank of America 6.50% µ | | | 470,000 | | | | 532,611 | |

GMAC Capital Trust I 7.695% (LIBOR03M + 5.785%)● | | | 6,000 | | | | 155,580 | |

Washington Prime Group 6.875% | | | 2,511 | | | | 52,006 | |

| | | | | | | | |

Total Preferred Stock

(cost $688,752) | | | | | | | 740,197 | |

| | | | | | | | |

| | | | | | | | |

| |

Right – 0.00% | | | | | | | | |

| |

DISH Network † | | | 389 | | | | 265 | |

| | | | | | | | |

Total Right(cost $0) | | | | | | | 265 | |

| | | | | | | | |

| | |

| | | | | | | | |

| |

Short-Term Investments – 7.23% | | | | | |

| |

Money Market Mutual Funds – 7.23% | | | | | |

BlackRock

FedFund – Institutional Shares(seven-day effective yield 1.55%) | | | 1,914,528 | | | | 1,914,528 | |

Fidelity Investments Money Market Government Portfolio – Class I(seven-day effective yield 1.53%) | | | 1,914,528 | | | | 1,914,528 | |

| | | | | | | | |

| | | Number of

shares | | | Value (US $) | |

| |

Short-Term Investments (continued) | | | | | |

| |

Money Market Mutual Funds (continued) | | | | | |

GS Financial Square Government Fund – Institutional Shares(seven-day effective yield 1.54%) | | | 1,914,528 | | | $ | 1,914,528 | |

Morgan Stanley Government Portfolio – Institutional Share Class(seven-day effective yield 1.52%) | | | 1,914,528 | | | | 1,914,528 | |

State Street Institutional US Government Money Market Fund – Investor Class(seven-day effective yield 1.51%) | | | 1,914,528 | | | | 1,914,528 | |

| | | | | | | | |

Total Short-Term Investments

(cost $9,572,640) | | | | 9,572,640 | |

| | | | | | | | |

Total Value of

Securities – 144.14%

(cost $183,741,992) | | | | | | $ | 190,921,608 | |

| | | | | | | | |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At Nov. 30, 2019, the aggregate value of Rule 144A securities was $43,664,455,which represents 32.97% of the Fund’s net assets. See Note 11 in “Notes to financial statements.” |

| @ | Invests in multi-family real estate properties. |

| ¨ | Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes. |

| v | Securities have been classified by type of business. Aggregate classification by country of origin has been presented in “Security type / sector and country allocations” on page 7. |

| = | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security in the disclosure table located in Note 3 in “Notes to financial statements.” |