UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

| |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

o Preliminary Proxy Statement |

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement |

o Definitive Additional Materials |

o Soliciting Material under §240.14a-12 |

| |

| |

| LPL Financial Holdings Inc. |

| |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

|

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| | | | |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

75 State Street, Boston, MA 02109-1827

March 26, 2014

Dear Fellow Stockholders:

It is my pleasure to invite you to attend the 2014 Annual Meeting of Stockholders of LPL Financial Holdings Inc. The meeting will be held on Tuesday, May 6, 2014, at 4:00 p.m., local time, at our offices located at 75 State Street, Boston, Massachusetts 02109. Holders of record of our common stock as of March 13, 2014, are entitled to notice of and to vote at the 2014 Annual Meeting.

The Notice of Annual Meeting of Stockholders and the proxy statement that follow describe the business to be conducted at the meeting.

We are pleased to take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to their stockholders over the Internet. We believe this approach will allow us to provide you with the information you need while expediting your receipt of these materials, lowering our costs of delivery, and reducing the environmental impact of our annual meeting. If you would like us to send you printed copies of our proxy statement and accompanying materials, we will be happy to do so at no charge upon your request. For more information, please refer to the Notice of Internet Availability of Proxy Materials that we mailed to you on or about March 26, 2014.

YOUR VOTE IS VERY IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

You are welcome to attend the annual meeting. However, even if you plan to attend, please vote your shares promptly to ensure they are represented at the meeting. You may submit your proxy by Internet or telephone, as described in the following materials, or if you request printed copies of these materials, by completing and signing the proxy card and returning it in the envelope provided. If you decide to attend the meeting and wish to change your proxy, you may do so automatically by voting in person at the meeting.

We ask you to RSVP if you intend to attend the annual meeting. Please refer to page 1 of the accompanying proxy statement for further information concerning attendance at the annual meeting.

On behalf of the Board of Directors, I thank you for your continued support of LPL Financial Holdings Inc.

|

| | |

| | | Sincerely, |

| | | |

| | | Mark S. Casady Chairman and CEO |

LPL FINANCIAL HOLDINGS INC.

75 State Street

Boston, Massachusetts 02109

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the Annual Meeting of Stockholders (the "Annual Meeting") of LPL Financial Holdings Inc. (the "Company") will be held on Tuesday, May 6, 2014, at 4:00 p.m., local time, at the offices of the Company, 75 State Street, Boston, Massachusetts 02109.

The purpose of the meeting is to:

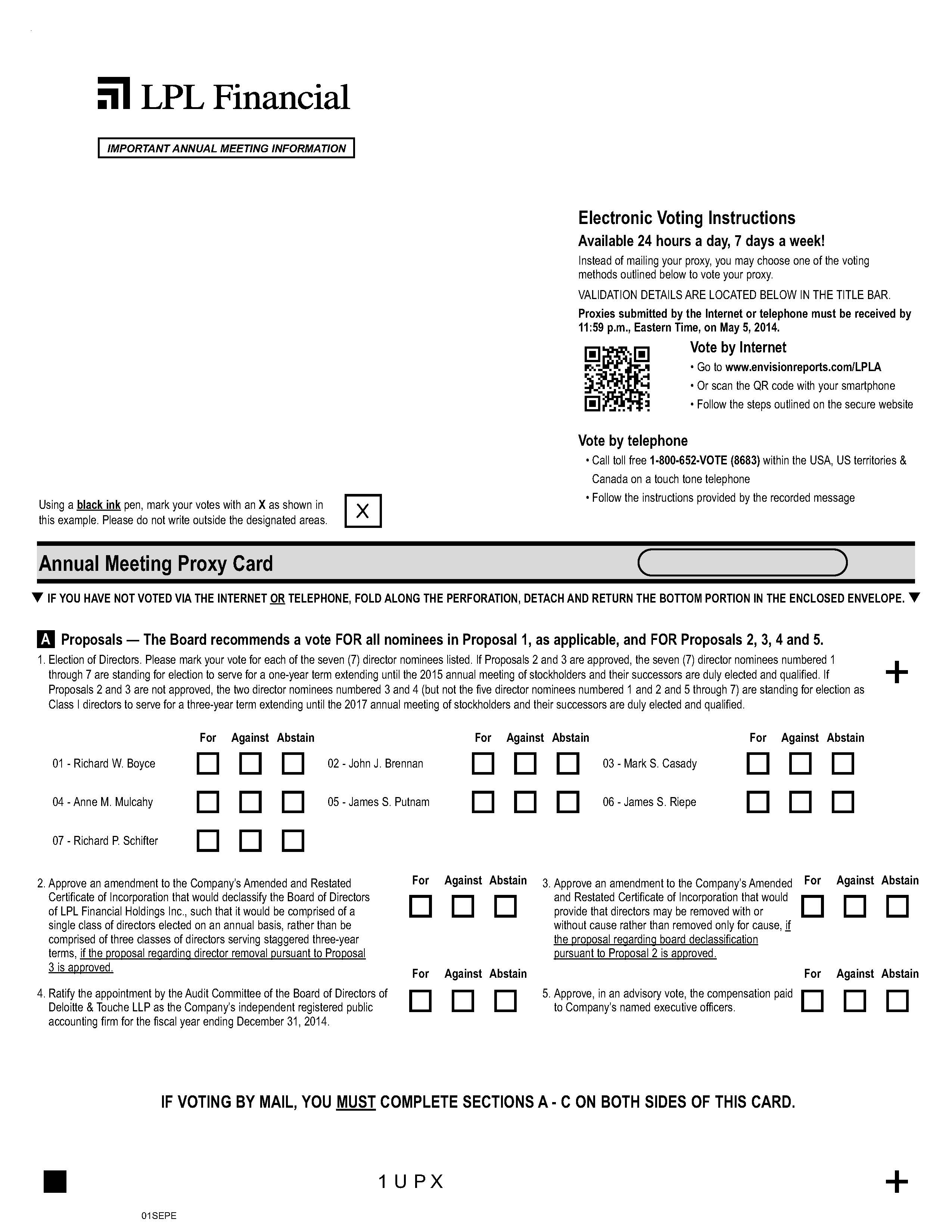

1. Elect all of our director nominees consisting of (a) the seven nominees named in the accompanying proxy statement for a one-year term if the amendments to the Company’s Amended and Restated Certificate of Incorporation eliminating the classification of the Company's board of directors (the "Board of Directors") and providing for removal of directors with or without cause are approved by our stockholders or (b) the two nominees identified in the accompanying proxy statement to serve as Class I directors for a three-year term if the amendments to the Company’s Amended and Restated Certificate of Incorporation are not approved by our stockholders;

2. Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation that would declassify the Board of Directors, such that it would be comprised of a single class of directors elected on an annual basis, rather than be comprised of three classes of directors serving staggered three-year terms, if the proposal regarding director removal pursuant to Proposal 3 is approved;

3. Approve an amendment to the Company’s Amended and Restated Certificate of Incorporation that would provide that directors may be removed with or without cause rather than removed only for cause, if the proposal regarding the declassification of the Board of Directors pursuant to Proposal 2 is approved;

4. Ratify the appointment by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2014;

5. Hold an advisory vote on executive compensation; and

6. Consider and act upon any other business properly coming before the Annual Meeting and at any adjournment or postponement thereof.

Stockholders of record at the close of business on March 13, 2014 will be entitled to vote at the Annual Meeting and any postponements or adjournments thereof. Information relating to the matters to be considered and voted on at the Annual Meeting is set forth in the proxy statement accompanying this Notice.

Everyone attending the Annual Meeting will be required to present both proof of ownership of the Company's common stock and valid picture identification, such as a driver's license or passport. If your shares are held in the name of a bank, broker, or other holder of record, you will need a recent brokerage account statement or letter from your bank, broker, or other holder reflecting stock ownership as of the record date. If you do not have both proof of ownership of the Company's common stock and valid picture identification, you may not be admitted to the Annual Meeting.

Cameras and electronic recording devices are not permitted at the Annual Meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, PLEASE SUBMIT YOUR PROXY BY FOLLOWING THE INSTRUCTIONS SET FORTH IN THE FOLLOWING MATERIALS. YOU MAY VOTE YOUR SHARES AND SUBMIT A PROXY BY USING THE INTERNET OR TELEPHONE AS DESCRIBED HEREIN OR BY SIGNING AND RETURNING A PROXY CARD, IF YOU REQUESTED PRINTED COPIES OF THESE MATERIALS.

|

| | |

| | | By Order of the Board of Directors, |

| | | |

| | | Gregory M. Woods Secretary |

Boston, Massachusetts

March 26, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 6, 2014:

THIS PROXY STATEMENT AND LPL FINANCIAL HOLDINGS INC.'S 2013 ANNUAL REPORT ON FORM 10-K ARE AVAILABLE AT WWW.LPL.COM. ADDITIONALLY, IN ACCORDANCE WITH SEC RULES, YOU MAY ACCESS THESE MATERIALS ON THE WEBSITE INDICATED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, WHICH YOU HAVE RECEIVED FROM COMPUTERSHARE SHAREOWNER SERVICES.

TABLE OF CONTENTS

LPL FINANCIAL HOLDINGS INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

Introduction

This proxy statement and the accompanying Notice of Annual Meeting of Stockholders are being furnished to the holders of common stock, $0.001 par value (the "Common Stock"), of LPL Financial Holdings Inc., a Delaware corporation (the "Company"), in connection with the solicitation of proxies on behalf of our Board of Directors (the "Board" or the "Board of Directors") for use at the 2014 Annual Meeting of Stockholders (the "Annual Meeting") and any adjournment or postponement thereof. The Annual Meeting will be held on Tuesday, May 6, 2014, at the offices of LPL Financial, 75 State Street, Boston, Massachusetts 02109 at 4:00 p.m., local time. Stockholders who wish to attend the Annual Meeting in person must follow the instructions under the section below entitled "Attending the Annual Meeting."

The Board has made this proxy statement and the Company's 2013 Annual Report on Form 10-K (the "annual report") available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the Board's solicitation of proxies for use at the Annual Meeting. As a stockholder of the Company as of March 13, 2014 (the "record date"), you are invited to attend the Annual Meeting and are entitled to and requested to vote on the items of business described in this proxy statement.

Record Date, Shares Outstanding, and Quorum

On the record date, there were 100,522,905 outstanding shares of Common Stock. Only stockholders of record at the close of business on the record date will be entitled to vote at the Annual Meeting. A list of stockholders of record entitled to vote will be available at the meeting. In addition, you may contact our corporate secretary, at our address as set forth above, to make arrangements to review a copy of the stockholder list at our offices, for any purpose germane to the meeting, between the hours of 9:00 a.m. and 5:00 p.m., local time, on any business day from April 22, 2014 up to the time of the Annual Meeting.

The presence in person or by proxy of a majority of shares of Common Stock outstanding and entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Both abstentions and broker non-votes will be counted as present in determining the presence of a quorum. A "broker non-vote" is a proxy from a broker or other nominee indicating that such person has not received instructions from the beneficial owner on a particular matter with respect to which the broker or other nominee does not have discretionary voting power. Brokers have the discretion to vote their clients' proxies only on routine matters. At our Annual Meeting, only the ratification of our auditors is a routine matter. Each share of Common Stock is entitled to one vote.

Notice of Electronic Availability of Proxy Statement and Annual Report

As permitted by the Securities and Exchange Commission (the "SEC"), we are making this proxy statement and our annual report available to our stockholders electronically via the Internet. On or about March 26, 2014, a Notice of Internet Availability of Proxy Materials (the "Notice") was mailed to stockholders of record at the close of business on the record date. We are furnishing our proxy materials to our stockholders on the Internet in lieu of mailing a printed copy of our proxy materials to each record holder of Common Stock. You will not receive a printed copy of our proxy materials unless you request one. The Notice instructs you as to how you may access and review on the Internet all of the important information contained in these proxy materials or request a printed copy of those materials. The Notice also instructs you as to how you may vote your proxy.

Attending the Annual Meeting

We invite all stockholders to attend the Annual Meeting. If you are a record holder of our Common Stock, which means that your shares are represented by ledger entries in your own name directly registered with our transfer agent, Computershare Shareowner Services, you must bring valid picture identification with you to the Annual Meeting to allow us to verify your ownership. If your Common Stock is held in "street name," which means that the shares are held for your benefit in the name of a broker, bank, or other intermediary, you must bring a brokerage account statement or letter from your broker, bank, or other intermediary reflecting stock ownership in order to be admitted to the Annual Meeting. Please note that if you hold your Common Stock in street name, you may not vote your shares in person unless you obtain a legal proxy from your broker, giving you the right to vote the shares at the Annual Meeting.

If you do not have both proof of ownership of Common Stock and valid picture identification, you may not be admitted to the Annual Meeting.

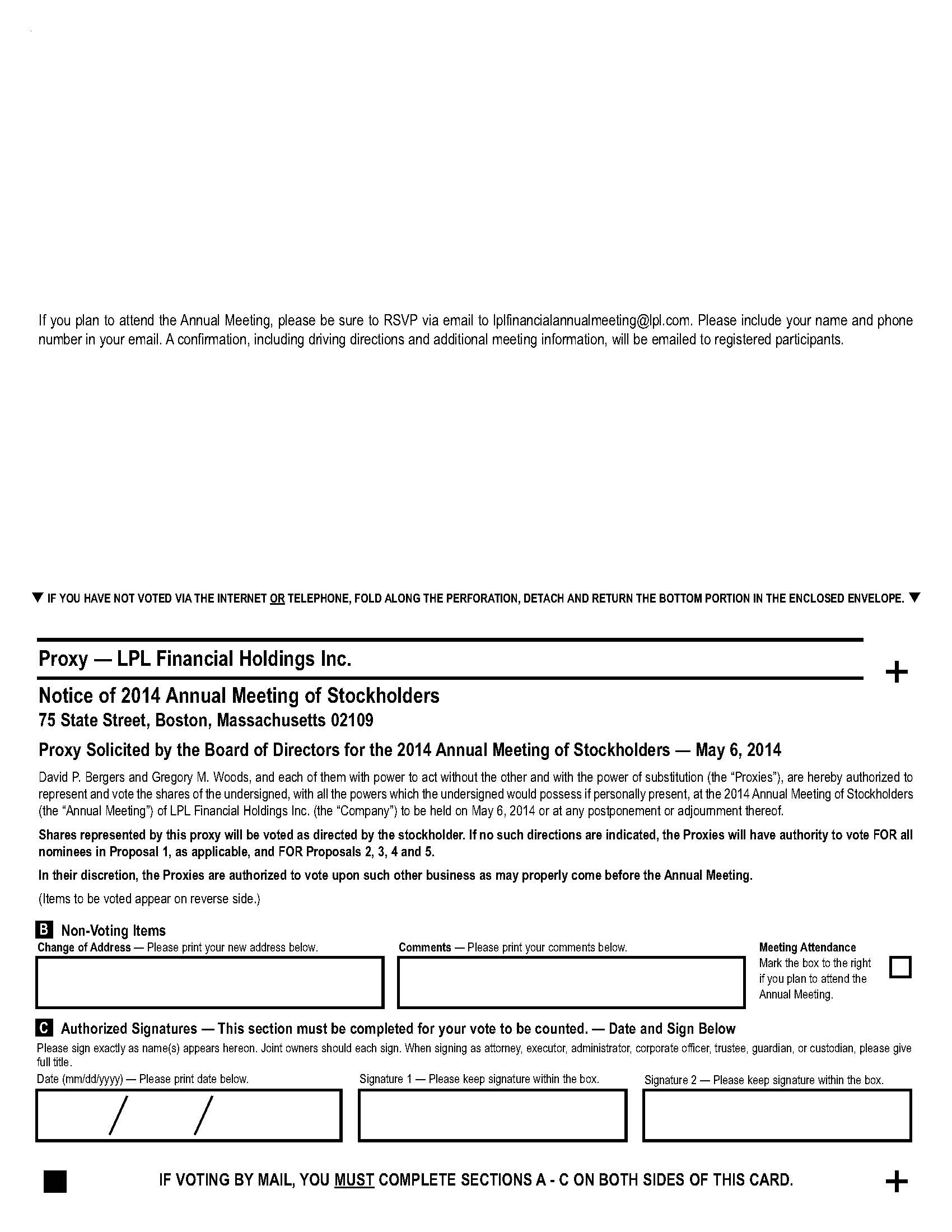

If you plan to attend the Annual Meeting, please be sure to RSVP via email to lplfinancialannualmeeting@lpl.com. Please include your name and phone number in your response. A confirmation, including driving directions and additional meeting information, will be emailed to registered participants.

Items of Business to be Voted upon at Annual Meeting

The items of business scheduled to be voted on at the Annual Meeting are:

| |

| • | To elect all of the nominees to the Board of Directors consisting of (a) the seven nominees named in this proxy statement for a one-year term if the amendments to the Company’s Amended and Restated Certificate of Incorporation eliminating the classification of the Board of Directors and providing for removal of directors with or without cause are approved by our stockholders or (b) the two nominees identified in this proxy statement to serve as Class I directors for a three-year term if the amendments to the Company’s Amended and Restated Certificate of Incorporation are not approved by our stockholders; |

| |

| • | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation that would declassify the Board of Directors, such that it would be comprised of a single class of directors elected on an annual basis, rather than be comprised of three classes of directors serving staggered three-year terms, if the proposal regarding director removal pursuant to Proposal 3 is approved; |

| |

| • | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation that would provide that directors may be removed with or without cause rather than removed only for cause, if the proposal regarding the declassification of the Board of Directors pursuant to Proposal 2 is approved; |

| |

| • | To ratify the appointment by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| |

| • | To hold an advisory vote on executive compensation; and |

| |

| • | To consider and act upon any other business properly coming before the Annual Meeting and at any adjournment or postponement thereof. |

Manner of Voting

If you are a record holder of our Common Stock, you may vote in one of the following ways:

| |

| • | By Internet: by following the Internet voting instructions included in the proxy card at any time up until 11:59 p.m., Eastern Time, on May 5, 2014. |

| |

| • | By Telephone: by following the telephone voting instructions included in the proxy card at any time up until 11:59 p.m., Eastern Time, on May 5, 2014. |

| |

| • | By Mail: by marking, dating, and signing your printed proxy card (if received by mail) in accordance with the instructions on it and returning it by mail in the pre-addressed reply envelope provided with the proxy materials for receipt prior to the Annual Meeting. |

| |

| • | In Person: by voting your shares in person at the Annual Meeting (if you satisfy the admission requirements, as described above). Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet, telephone, or mail so that your vote will be counted in the event you later decide not to attend the Annual Meeting. |

If you are a beneficial owner of our Common Stock, you can vote in the following way:

| |

| • | If your shares are held in street name through a broker, bank, or other intermediary, your broker, bank, or other intermediary should give you instructions for voting your shares. In these cases, you may vote by Internet, telephone, or mail, as instructed by your broker, bank, or other intermediary. You may also vote in person if you obtain a legal proxy from your broker, giving you the right to vote the shares at the Annual Meeting. |

Shares of Common Stock represented by properly executed proxy cards received by the Company in time for the meeting will be voted in accordance with the instructions specified in the proxies. If you submit a proxy but do not indicate any voting instructions, your shares will be voted "FOR" the election as directors of the nominees named in this proxy statement; "FOR" the approval of the amendment to the Company’s Amended and Restated Certificate of Incorporation that would declassify the Board; "FOR" the approval of the amendment to the Company’s Amended and Restated Certificate of Incorporation that would

provide that directors may be removed with or without cause; "FOR" the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm; and "FOR" the proposal regarding an advisory vote on executive compensation.

Our management and Board of Directors know of no other matters to be brought before the Annual Meeting. If other matters are properly presented to the stockholders for action at the Annual Meeting or any adjournments or postponements thereof, it is the intention of the proxy holders named in the proxy card to vote in their discretion on all matters on which the shares of Common Stock represented by such proxy are entitled to vote.

Voting Requirements

Proposal One—Election of Directors

Our bylaws provide that a nominee for director will be elected if the number of votes properly cast “for” such nominee’s election exceeds the number of votes properly cast “against” such nominee’s election; however, if the number of persons properly nominated for election to the Board of Directors exceeds the number of directors to be elected, the directors will be elected by the plurality of the votes properly cast. A vote to abstain or a broker non-vote will have no direct effect on the outcome of the election of directors.

Proposal Two—Approval of Amendment to Amended and Restated Certificate of Incorporation Regarding Board Declassification

The proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation that would declassify the Board of Directors requires the affirmative vote on the matter of 66 2/3% of our outstanding shares of Common Stock. A vote to abstain or a broker non-vote will have the same effect as a vote against the proposal.

Please note that stockholders must also approve Proposal 3 in order to implement this proposal to declassify the Board of Directors in accordance with the General Corporation Law of the State of Delaware, or Delaware law. The implementation of this proposal is expressly conditioned upon the approval of Proposal 3 and vice versa. Therefore, a failure to approve Proposal 3 will prevent the declassification of the Board of Directors even if stockholders approve Proposal 2. Similarly, the Board of Directors is not proposing any amendment to our Amended and Restated Certificate of Incorporation regarding director removal if Proposal 2 is not approved by stockholders. As a result, if Proposal 2 is not approved, there will be no change to the director removal provisions in our current Amended and Restated Certificate of Incorporation even if Proposal 3 is approved by stockholders.

Proposal Three—Approval of Amendment to Amended and Restated Certificate of Incorporation Regarding Director Removal

The proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation that would provide that directors may be removed with or without cause rather than removed only for cause requires the affirmative vote on the matter of 66 2/3% of our outstanding shares of Common Stock. A vote to abstain or a broker non-vote will have the same effect as a vote against the proposal.

Please note that because this proposed amendment to the Company’s Amended and Restated Certificate of Incorporation is required in order to implement the declassification of the Board of Directors in accordance with Delaware law, the implementation of this amendment is expressly conditioned upon the approval of Proposal 2 and vice versa. Therefore, a failure to approve Proposal 3 will prevent the declassification of the Board of Directors even if stockholders approve Proposal 2. Similarly, the Board of Directors is not proposing any amendment to our Amended and Restated Certificate of Incorporation regarding director removal if Proposal 2 is not approved by stockholders. As a result, if Proposal 2 is not approved, there will be no change to the director removal provisions in our current Amended and Restated Certificate of Incorporation even if this Proposal 3 is approved by stockholders.

Proposal Four—Ratification of Appointment of Deloitte & Touche LLP

The proposal to ratify the appointment of Deloitte & Touche LLP requires the affirmative vote of a majority of the shares cast on the matter affirmatively or negatively in person or by proxy at the Annual Meeting. A vote to abstain or a broker non-vote will have no direct effect on the outcome of the proposal.

Proposal Five—Advisory Vote on Executive Compensation

Because the proposal to approve, on an advisory basis, the compensation awarded to named executive officers for the fiscal year ended December 31, 2013 is a non-binding, advisory vote, there is no required vote that would constitute approval. The vote is advisory and non-binding in nature but our Compensation and Human Resources Committee (the "Compensation

Committee") will take into account the outcome of the vote when considering future executive compensation arrangements. A vote to abstain or a broker non-vote will have no direct effect on the outcome of the proposal.

Revocation of Proxies

If you submit a proxy, you are entitled to revoke your proxy at any time before it is exercised in one of the following ways: by attending the Annual Meeting and voting in person, by submitting a duly executed proxy bearing a later date, or by sending written notice of revocation to our corporate secretary at LPL Financial Holdings Inc., 75 State Street, Boston, Massachusetts 02109. A stockholder of record who voted by the Internet or by telephone may also change his or her vote with a timely and valid later Internet or telephone vote, as the case may be. Any stockholder of record as of the record date attending the Annual Meeting may vote in person whether or not a proxy has previously been given, but the presence (without further action) of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy. If you hold your shares in street name and would like to change your voting instructions, please follow the instructions provided to you by your broker, bank or other intermediary.

Solicitation of Proxies

The Board of Directors of LPL Financial Holdings Inc. is soliciting proxies. We have not hired a proxy solicitation firm to assist in the solicitation of proxies. Stockholders who elect to vote over the Internet or telephone may incur costs such as telecommunication and Internet access charges for which the stockholder is solely responsible. The telephone and Internet voting facilities for stockholders of record will close at 11:59 p.m. Eastern Time on May 5, 2014.

Householding

Only one copy of the Notice is being delivered to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders. We will undertake to deliver promptly, upon written or oral request, a separate copy of the Notice to a stockholder at a shared address to which a single copy of the Notice was delivered. You may make a written or oral request by sending a written notification to our corporate secretary at LPL Financial Holdings Inc., 75 State Street, Boston, Massachusetts 02109, or by calling our offices at (617) 423-3644, extension 0, and providing your name, your shared address, and the address to which we should direct the additional copy of the Notice. Multiple stockholders sharing an address who have received one copy of the Notice and would prefer us to mail each stockholder a separate copy of future mailings should contact us at our principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of the Notice and would prefer us to mail one copy of future mailings to stockholders at the shared address, notification of that request may also be made through our principal executive offices.

Access to Corporate Documents

Stockholders may receive a copy of our 2013 Annual Report on Form 10-K or copies of our Audit Committee charter, Compensation and Human Resources Committee charter, Nominating and Governance Committee charter, and Code of Conduct free of charge by writing to us at the following address:

LPL Financial Holdings Inc.

75 State Street

Boston, MA 02109

Attn: Investor Relations

PROPOSAL 1: ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation currently provides for the classification of our Board into three classes. The terms of service of the three classes are staggered so that the three-year term of one class expires each year. See “Proposal 2: Approval of Amendment to Amended and Restated Certificate of Incorporation Regarding Board Declassification,” “Proposal 3: Approval of Amendment to Amended and Restated Certificate of Incorporation Regarding Director Removal” and additional information below regarding our proposal to declassify the Board.

Our Board of Directors currently consists of six independent directors and our chief executive officer. Class I consists of Mark S. Casady and Anne M. Mulcahy, each with a term ending in 2014. Class II consists of Richard W. Boyce, John J. Brennan and Jim S. Putnam, each with a term ending in 2015. Class III consists of James S. Riepe and Richard P. Schifter, each with a term ending in 2016. Our independent directors have nominated each of the current directors standing for election, all to hold office until the Annual Meeting of Stockholders in 2017 and until their respective successors shall have been elected.

Nominations to our Board of Directors are governed by our bylaws and our Stockholders Agreement, dated November 23, 2010 (“Stockholders Agreement”), among the Company, Hellman & Friedman Capital Partners V, L.P., Hellman & Friedman Capital Partners V (Parallel), L.P., Hellman & Friedman Capital Associates V, L.P., TPG Partners IV, L.P. and the other signatories party thereto. Hellman & Friedman Capital Partners V, L.P., Hellman & Friedman Capital Partners V (Parallel), L.P. and Hellman & Friedman Capital Associates V, L.P. are together referred to as “H&F.” TPG Partners IV, L.P. is referred to (collectively with its affiliates) as “TPG.” H&F and TPG are collectively referred to as the “Sponsors.”

The Stockholders Agreement provides that so long as certain ownership thresholds have been maintained by the Sponsors, the stockholders who are party to the Stockholders Agreement will vote to cause the Board of Directors to consist at least of (i) two individuals designated by H&F and (ii) two individuals designated by TPG. In August 2013, H&F completed the distribution of its remaining shares in the Company to H&F’s investors (the “H&F Distribution”), and ceased to maintain its ownership threshold under the Stockholders Agreement. In connection with the H&F Distribution, the two directors designated by H&F resigned from their positions as directors. As of March 26, 2014, TPG continued to maintain its ownership threshold and the two individuals designated by TPG continue to serve on our Board of Directors.

In May 2013, H&F and TPG each distributed a portion of their holdings of Common Stock and, as a result, ceased collectively to beneficially own at least 40% of the outstanding shares of Common Stock. Under our Amended and Restated Certificate of Incorporation, the Board of Directors was divided into three classes with staggered three-year terms, with the class composition determined in the discretion of the Board. In this proxy statement, we are seeking stockholder approval to amend our Amended and Restated Certificate of Incorporation to remove the classification structure and reinstate an annual election of our full slate of directors.

As described below under “Proposal 2: Approval of Amendment to Amended and Restated Certificate of Incorporation Regarding Board Declassification” and “Proposal 3: Approval of Amendment to Amended and Restated Certificate of Incorporation Regarding Director Removal,” our Board of Directors is recommending that stockholders approve the declassification of our Board of Directors so that all directors will be elected annually and that such directors can be removed with or without cause. As a result, this Proposal 1 concerns the election of directors under two alternative scenarios:

| |

| • | If stockholders approve both Proposal 2 and Proposal 3, the amendments to our Amended and Restated Certificate of Incorporation will eliminate our classified Board structure in accordance with Delaware law, which will have the effect of reducing the current terms of our three incumbent Class II directors and two incumbent Class III directors so that they expire at the Annual Meeting, or until their successors are duly elected and qualified. Accordingly, if stockholders approve both Proposal 2 and Proposal 3, the following seven individuals recommended by our Board of Directors are standing for election to serve a one-year term extending until the 2015 annual meeting of stockholders and until their successors are duly elected and qualified, unless they resign or are removed: Richard W. Boyce, John J. Brennan, Mark S. Casady, Anne M. Mulcahy, James S. Putnam, James S. Riepe, and Richard P. Schifter. |

| |

| • | If stockholders do not approve either Proposal 2 or Proposal 3, the election of our two Class I director nominees will proceed under our Amended and Restated Certificate of Incorporation as currently in effect, and our Class II and Class III directors will continue to serve the remainder of their current three-year terms. Accordingly, if stockholders do not approve either Proposal 2 or Proposal 3, the following two individuals recommended by our Board of Directors are standing for election as Class I directors to serve a three-year term extending until the 2017 annual meeting of stockholders and until their successors are duly elected and qualified, unless they resign or are removed: Mark S. Casady and Anne M. Mulcahy. |

As described in detail below, our nominees have considerable professional and business expertise. The recommendation of our Board of Directors is based on its carefully considered judgment that the experience, qualifications, attributes and skills of our nominees qualify them to serve on our Board of Directors.

If any of our nominees is unable to serve on our Board of Directors, the shares represented by your proxy will be voted for the election of such other person as may be nominated by our Board of Directors. In addition, in full compliance with all applicable state and federal laws and regulations, we will file an amended proxy statement and proxy card that, as applicable, (1) identifies the alternate nominee(s), (2) discloses that such nominees have consented to being named in the revised proxy statement and to serve if elected and (3) includes the disclosure required by Item 7 of Schedule 14A with respect to such nominees. We know of no reason why any nominee would be unable to accept nomination or election. All nominees have consented to be named in this proxy statement and to serve if elected.

If any nominee is unable to serve or will not serve for any reason, the persons designated on the accompanying form of proxy will vote in accordance with their judgment, but in no event will proxies be voted for more than seven nominees for director. We know of no reason why the nominees would not be able to serve if elected.

Director Qualifications and Experience

We seek a Board that, as a whole, possesses the experiences, skills, backgrounds, and qualifications appropriate to function effectively in light of the Company's current and evolving business circumstances. The Company seeks directors with established records of significant accomplishment in business and areas relevant to our strategies. We seek individuals with integrity, independence of thought and judgment, energy, forthrightness, analytical skills, and a commitment to the Company and the interests of all stockholders. We believe that all of our director nominees possess these characteristics.

Although we do not have a formal policy regarding diversity, our goal is a balanced and diverse Board, with members whose skills, background and experience are complementary and, together, cover the spectrum of areas that impact our business. The Board believes that the current composition of the Board reflects a group of highly talented individuals with diverse skills, backgrounds, and professional and industry experience.

Policy with Respect to the Consideration of Director Candidates Recommended or Nominated by Stockholders

Our nominating and governance committee of the Board (the "Nominating and Governance Committee") will consider director candidates recommended by stockholders. For a stockholder to make any nomination for election to the Board of Directors at an annual meeting, the stockholder must provide notice and certain information about the recommending stockholder and the nominee to the Company, which notice must be delivered to, or mailed and received at, the Company's principal executive offices (i) no later than the close of business on the 90th calendar day nor earlier than the close of business on the 120th calendar day, prior to the anniversary date of the prior year's annual meeting; or (ii) if there was no annual meeting in the prior year or if the date of the current year's annual meeting is more than 30 days before or after the anniversary date of the prior year's annual meeting, on or before 10 days after the day on which the date of the current year's annual meeting is first disclosed in a public announcement. Submissions must be in writing and addressed to the Nominating and Governance Committee, care of the Company's corporate secretary. Electronic submissions will not be considered.

Board of Director Nominees

The name, age, and a description of the business experience, principal occupation, and past employment and directorships of each of the nominees during the last five years are set forth below. In addition, we have summarized the particular experience, qualifications, attributes, and/or skills that led the Board of Directors, including our Nominating and Governance Committee, to determine that each nominee should serve as a director.

Richard W. Boyce, Director Since 2009

Mr. Boyce, 59, retired in 2013 from the partnership at TPG, one of the largest global investment partnerships, owning 107 companies with over $140 billion in revenue. He founded and led TPG's operating group, which drives performance improvement across all TPG companies. In his first role with TPG, he served as chief executive officer of J. Crew Group, Inc., from 1997 to 1999, and as a board member from 1997 to 2006. He became chairman of Burger King Corporation in 2002 and served on that board through 2010. Prior to joining TPG, Mr. Boyce was employed by PepsiCo, Inc. from 1992 to 1997, most recently as senior vice president of operations for Pepsi-Cola North America and was previously a partner at Bain & Company. He has previously served on the board of directors of several other TPG companies, including Del Monte Foods, ON Semiconductor, Gate Gourmet, and Direct General Corporation. He currently serves on the Wake Forest University School of Business Board of Visitors and the board of directors of Torrent Technologies, and is a member of the Board of Overseers of the Hoover Institution at Stanford. Mr. Boyce received a B.S.E. from Princeton University and received his M.B.A. from the Stanford Graduate School of Business.

Mr. Boyce's pertinent experience, qualifications, attributes, and skills include his:

| |

| • | high level of financial, operating, and management experience, gained through his roles as chief executive officer of J. Crew Group, Inc. and chairman of the board of directors of Burger King Corporation; |

| |

| • | high level of financial literacy gained through his investment experience as a partner at TPG; and |

| |

| • | knowledge and experience gained through service on the boards of other public companies. |

John J. Brennan, Director Since 2010

Mr. Brennan, 59, is chairman emeritus and senior advisor of The Vanguard Group, Inc. ("Vanguard"), a global investment management company. Mr. Brennan joined Vanguard in July 1982. He was elected president in 1989 and served as chief executive officer from 1996 to 2008 and chairman of the board from 1998 to 2009. Mr. Brennan is a member of the board of directors of General Electric Company and Guardian Life Insurance Company of America; trustee and past chairman of the Financial Accounting Foundation; lead governor of the Financial Industry Regulatory Authority, Inc. ("FINRA") board of governors; and a trustee of the University of Notre Dame. He also served on the board of directors of The Hanover Insurance Group from 2011 until 2013. He graduated from Dartmouth College and received his M.B.A. from the Harvard Business School. He has received honorary degrees from Curry College and Drexel University.

Mr. Brennan's pertinent experience, qualifications, attributes, and skills include his:

| |

| • | high level of financial literacy and operating and management experience, gained through his roles as chief executive officer and chairman of the board of directors of Vanguard as well as through his service with the Financial Accounting Foundation; and |

| |

| • | expertise in the financial industry, underscored by his current role as lead governor of the board of governors of FINRA. |

Mark S. Casady, Chief Executive Officer, Director and Chairman of the Board Since 2005

Mr. Casady, 53, is chairman of the Board of Directors and our chief executive officer. He joined us in May 2002 as chief operating officer and also served as our president from April 2003 to December 2005. He became our chief executive officer and chairman in December 2005. Before joining our firm, Mr. Casady was managing director, mutual fund group for Deutsche Asset Management, Americas—formerly Scudder Investments ("Scudder"). He joined Scudder in 1994 and held roles as managing director, Americas; head of global mutual fund group; and head of defined contribution services. He was also a member of the Scudder, Stevens and Clark Board of Directors and Management Committee. He is a current board member of the Financial Services Roundtable and Eze Software Group and serves on the FINRA board of governors. Mr. Casady received his B.S. from Indiana University and his M.B.A. from DePaul University.

Mr. Casady's pertinent experience, qualifications, attributes, and skills include his:

| |

| • | unique perspective and insights into our operations as our current chairman and chief executive officer, including knowledge of our business relationships, competitive and financial positioning, senior leadership, and strategic opportunities and challenges; |

| |

| • | operating, business, and management experience as chief executive officer; and |

| |

| • | expertise in the financial industry, underscored by his experience as a current member of the board of governors of FINRA and a former member of the board of the Insured Retirement Institute. |

Anne M. Mulcahy, Director Since 2013

Ms. Mulcahy, 61, is chairman of the board of trustees of Save The Children Federation, Inc., a non-profit organization dedicated to creating lasting change in the lives of children throughout the world, a position she has held since March 2010. She previously served as chairman of the board of Xerox Corp. ("Xerox"), a document management company, from January 2002 to May 2010, and chief executive officer of Xerox from August 2001 to July 2009. She is a director of Graham Holdings Company, Target Corp., and Johnson & Johnson. From 2004 to 2009, Ms. Mulcahy also served as a director of Citigroup Inc.

Ms. Mulcahy's pertinent experience, qualifications, attributes, and skills include her:

| |

| • | extensive experience in all areas of business management as she led Xerox through a transformational turnaround; and |

| |

| • | leadership roles in business trade associations and public policy activities, which will provide the Board of Directors with additional expertise in the areas of organizational effectiveness, financial management, and corporate governance. |

James S. Putnam, Director Since 2005

Mr. Putnam, 59, has been chief executive officer of Global Portfolio Advisors ("GPA"), a global brokerage clearing services provider, since September 2004. He has served on the board of directors of GPA since 1998, and has been vice chairman since December 2005. Prior to his tenure with GPA, Mr. Putnam was employed by LPL Financial beginning in 1983 where he held several positions, culminating in managing director of national sales, responsible for branch development, attraction, retention, and management of LPL Financial advisors. He was also responsible for marketing and all product sales. Mr. Putnam began his securities career as a retail representative with Dean Witter Reynolds in 1979. Mr. Putnam received a B.A. in Law Enforcement Administration from Western Illinois University.

Mr. Putnam's pertinent experience, qualifications, attributes, and skills include his:

| |

| • | unique historical perspective and insights into our operations as our former managing director of national sales; |

| |

| • | operating, business, and management experience as the current chief executive officer at GPA; and |

| |

| • | expertise in the financial industry and deep familiarity with our advisors. |

James S. Riepe, Director Since 2008

Mr. Riepe, 70, is a senior advisor and retired vice chairman of the board of directors of T. Rowe Price Group, Inc. ("TRP"), a global investment management firm, where he worked for nearly 25 years. Previously, he served on TRP's management committee, oversaw TRP's mutual fund activities, and served as chairman of the T. Rowe Price Mutual Funds. He served as chairman of the board of governors of the Investment Company Institute and was a member of the board of governors of the National Association of Securities Dealers (now FINRA) and chaired its Investment Companies Committee. Mr. Riepe is a member of the board of directors of The NASDAQ OMX Group, Genworth Financial Inc. (as non-executive chairman), UTI Asset Management Company of India, and the Baltimore Equitable Society. He also served as chairman of the board of trustees of the University of Pennsylvania from which he earned a B.S. and an M.B.A.

Mr. Riepe's pertinent experience, qualifications, attributes, and skills include his:

| |

| • | high level of financial literacy and operating and management experience, gained through his executive management positions and role as vice chairman of the board of directors of TRP; |

| |

| • | expertise in the financial industry, underscored by his over 35 years of experience in investment management and his prior roles as a member of the board of governors of FINRA and as chairman of the board of governors of the Investment Company Institute; and |

| |

| • | knowledge and experience gained through service on the board of other public companies. |

Richard P. Schifter, Director Since 2005

Mr. Schifter, 61, is a TPG senior advisor. He was a partner at TPG from 1994 through 2013. Prior to joining TPG, Mr. Schifter was a partner at the law firm of Arnold & Porter in Washington, D.C., where he specialized in bankruptcy law and corporate restructuring. He joined Arnold & Porter in 1979 and was a partner from 1986 through 1994. Mr. Schifter currently serves on the boards of directors of American Beacon Advisors, Inc., Direct General Corporation, EverBank Financial Corp., ProSight Specialty Insurance Holdings, Inc., and American Airlines Group and on the board of overseers of the University of Pennsylvania Law School. Mr. Schifter is also a member of the board of directors of Youth, I.N.C. (Improving Non-Profits for Children). Mr. Schifter received a B.A. with distinction from George Washington University and a J.D. cum laude from the University of Pennsylvania Law School in 1978.

Mr. Schifter's pertinent experience, qualifications, attributes, and skills include his:

| |

| • | high level of financial literacy gained through his investment experience as a TPG partner; |

| |

| • | experience on other company boards and board committees; and |

| |

| • | nearly 15 years of experience as a corporate attorney with an internationally-recognized law firm. |

In the vote on the election of the director nominees, stockholders may:

| |

| • | Vote FOR any of the nominees; |

| |

| • | Vote AGAINST any of the nominees; or |

| |

| • | ABSTAIN from voting as to any of the nominees. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE

ELECTION OF EACH OF THE ABOVE-NAMED NOMINEES AS A DIRECTOR.

PROPOSAL 2: APPROVAL OF AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION REGARDING BOARD DECLASSIFICATION

The Board of Directors regularly reviews the Company's corporate governance policies and procedures. Through this review, the Board determined that it would be in the best interest of the Company and its stockholders to amend the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors and institute annual voting for each director to serve a one-year term beginning with this Annual Meeting. The declassified Board of Directors would be comprised of a single class of directors elected on an annual basis rather than three classes of directors serving staggered three-year terms.

By declassifying the Board, we would further our goal of ensuring that our corporate governance policies maximize the accountability of our Board of Directors to our stockholders. First, our stockholders would be able to register their views on performance of all directors on an annual basis. In addition, as a consequence of declassification, our stockholders would gain additional rights to remove directors. Delaware law provides that if a company has a single class of directors, any director may be removed with or without cause by stockholders. In contrast, our Amended and Restated Certificate of Incorporation currently provides that our directors may only be removed for cause. The amendment that we propose to our Amended and Restated Certificate of Incorporation in this Proposal 2 provides for a single class of directors. We also propose to modify the director removal provision of our Amended and Restated Certificate of Incorporation to provide for removal with or without cause in accordance with Delaware law, which is the subject of Proposal 3. See “Proposal 3: Approval of Amendment to Amended and Restated Certificate of Incorporation Regarding Director Removal.”

Please note that because Delaware law requires that if a company has a single class of directors, any director may be removed with or without cause by stockholders, in addition to approving this proposal, stockholders must also approve Proposal 3 in order for the board to implement this proposal to declassify the Board of Directors. The implementation of this proposal is expressly conditioned upon the approval of Proposal 3 and vice versa. Therefore, a failure to approve Proposal 3 will prevent the declassification of the Board of Directors even if stockholders approve this Proposal 2. Similarly, the Board of Directors is not proposing any amendment to our Amended and Restated Certificate of Incorporation regarding director removal if this Proposal 2 is not approved by stockholders. As a result, if this Proposal 2 is not approved, there will be no change to the director removal provisions in our current Amended and Restated Certificate of Incorporation even if Proposal 3 is approved by stockholders.

The text of the proposed amendment (specifically the amendment to Article V(a) of our Amended and Restated Certificate of Incorporation), which is subject to stockholder approval pursuant to this Proposal 2, is attached as Appendix A to this proxy statement. You are urged to read the amendment in its entirety.

The Board recommends stockholder approval of this amendment to declassify the Board of Directors pursuant to Article VIII(b)(ii) of the Company's Amended and Restated Certificate of Incorporation. Under our Amended and Restated Certificate of Incorporation, an amendment to the certificate of incorporation requires the affirmative vote or written consent of at least 66 2/3% of the outstanding shares of Common Stock.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THIS PROPOSAL.

PROPOSAL 3: APPROVAL OF AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION REGARDING DIRECTOR REMOVAL

As described in Proposal 2 above, the Board has determined that it would be in the best interest of the Company and its stockholders to amend the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors and institute annual voting for each director to serve a one-year term beginning with this Annual Meeting.

As a consequence of declassification, the Company’s Amended and Restated Certificate of Incorporation would no longer be permitted under Delaware law to provide that directors may be removed only for cause. Instead, Delaware law provides that if a company has a single class of directors, any director may be removed with or without cause by stockholders. Because our Amended and Restated Certificate of Incorporation currently provides that our directors may only be removed for cause, we are also proposing that the amendment to our Amended and Restated Certificate of Incorporation modify the director removal provision to provide for removal with or without cause in accordance with Delaware law.

Please note that because the proposed amendment to the Company’s Amended and Restated Certificate of Incorporation described in this Proposal 3 is required under Delaware law in order to implement the declassification of the Board of Directors described under Proposal 2, the implementation of this provision of the proposed amendment is expressly conditioned upon the approval of Proposal 2 and vice versa. Therefore, a failure to approve this Proposal 3 will prevent the declassification of the Board of Directors even if stockholders approve Proposal 2. Similarly, the Board of Directors is not proposing any amendment to our Amended and Restated Certificate of Incorporation regarding director removal if Proposal 2 is not approved by stockholders. As a result, if Proposal 2 is not approved, there will be no change to the director removal provisions in our current Amended and Restated Certificate of Incorporation, even if this Proposal 3 is approved by stockholders.

The text of the proposed amendment (specifically the amendment to Article V(b) of our Amended and Restated Certificate of Incorporation), which is subject to stockholder approval under this Proposal 3, is attached as Appendix A to this proxy statement. You are urged to read the amendment in its entirety.

The Board recommends stockholder approval of this amendment regarding director removal pursuant to Article VIII(b)(ii) of the Company's Amended and Restated Certificate of Incorporation. Under our Amended and Restated Certificate of Incorporation, an amendment to the certificate of incorporation requires the affirmative vote or written consent of at least 66 2/3% of the outstanding shares of Common Stock.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THIS PROPOSAL.

INFORMATION REGARDING BOARD AND COMMITTEE STRUCTURE

During 2013, the Board of Directors held eight meetings, of which three were held by conference call. Each of our incumbent directors attended at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors during 2013 and (ii) the total number of meetings held by all committees of the Board on which the director served during 2013.

Our Corporate Governance Guidelines provide that each director who is nominated for election is expected to attend the Annual Meeting. It is our expectation that each of our directors will be in attendance.

Corporate Governance, Committee Charters, and Code of Conduct

We believe that good corporate governance is important to ensure that we are managed for the long-term benefit of our stockholders. Our Board of Directors has adopted a set of Corporate Governance Guidelines to set clear parameters for the operation of our Board functions. Our Board of Directors has also adopted charters for its audit committee, nominating and governance committee, and compensation and human resources committee. We have adopted a Code of Conduct that applies to, among others, our principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. Copies of our committee charters, our Corporate Governance Guidelines, and our Code of Conduct are available, free of charge, by writing to us at the following address:

LPL Financial Holdings Inc.

75 State Street

Boston, MA 02109

Our committee charters, our Corporate Governance Guidelines, and our Code of Conduct are also available on our website at www.lpl.com. If we make substantive amendments to, or grant waivers from, the Code of Conduct for certain of our executive officers, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Recent Governance and Policy Changes

In the course of our regular review of our corporate governance policies and compensation practices, we have recently implemented several important measures that are designed to promote long-term shareholder value:

| |

| • | Our Board has approved amendments to our Amended and Restated Certificate of Incorporation to declassify our Board such that it would be comprised of a single class of directors elected on an annual basis who may be removed with or without cause, rather than three classes of directors serving staggered three-year terms who may be removed only for cause. If stockholders approve these amendments by voting in favor of both Proposal 2 and Proposal 3, our stockholders will be able to register their views on the performance of all directors on an annual basis, enhancing the accountability of our Board to our stockholders. |

| |

| • | We have amended our bylaws to provide for a majority voting standard in uncontested director elections. We have also adopted a director resignation policy in our Corporate Governance Guidelines pursuant to which a director who does not receive support from holders of a majority of shares voted in an uncontested election must tender his or her resignation and, if our Board accepts the resignation, step down from our Board. This makes director elections more meaningful for our stockholders and, like the proposed Board de-classification, promotes accountability. |

| |

| • | We have amended our Insider Trading Policy to be more explicit in its prohibition of pledging and hedging practices in order to further the alignment between stockholders and our executives that our equity awards are designed to create. |

| |

| • | We have implemented several executive compensation-related improvements as described below under the heading “Compensation Discussion and Analysis — How Compensation Decisions Were Made — Recent Compensation Program Developments,” including establishing a compensation claw-back policy that provides for the recoupment of incentive compensation in the event of certain financial restatements and revising our stock ownership guidelines for executive officers to set ownership thresholds at a multiple of base salary. |

| |

| • | We have adopted robust stock ownership guidelines for directors, which provide that within five years of the date of his or her election to the Board, each non-employee director must maintain ownership of shares of Common Stock equal to five times the annual base retainer then in effect for our non-employee directors. |

| |

| • | We have re-evaluated our practice of holding say-on-pay votes on a triennial basis and have determined to seek an advisory vote on our compensation practices annually instead. This underscores the careful consideration we give to our stockholders’ views on our compensation practices. |

Director Independence

The listing standards of The NASDAQ Global Select Market ("NASDAQ") require that, subject to specified exceptions, each member of a listed company's audit, compensation and human resources and nominating and governance committees be independent. Rule 5605(a)(2) of the listing rules of NASDAQ further provides that a director will only qualify as an "independent director" if, in the opinion of that company's board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and compensation and human resources committee members are also subject to heightened independence criteria under NASDAQ rules.

After its evaluation of director independence, the Board of Directors has affirmatively determined that Messrs. Boyce, Brennan, Putnam, Riepe, and Schifter and Ms. Mulcahy are independent directors under the applicable rules of NASDAQ. Messrs. Riepe and Brennan and Ms. Mulcahy are also independent directors as such term is defined in Rule 10A-3(b)(1) under the Exchange Act, and Messrs. Brennan, Boyce and Riepe are independent under the heightened criteria applicable to compensation and human resources committee members. In accordance with listing standards of NASDAQ, a majority of our directors are independent.

Board Composition and Leadership Structure of the Board of Directors

Our business and affairs are managed under the direction of the Board of Directors. Our Board of Directors is currently composed of seven directors. Under our Amended and Restated Certificate of Incorporation, the number of directors shall be not fewer than three and not more than 15. The authorized number of directors may be changed only by resolution of the Board of Directors.

In May 2013, the Board of Directors was divided into three classes with staggered three-year terms, with the class composition determined by the Board using its discretion. Under our Amended and Restated Certificate of Incorporation as

currently in effect, at each annual meeting of stockholders, one of three classes of directors will be elected to serve a three-year term, until the earlier of their death, resignation or removal, or until their successors have been elected and qualified. Our Amended and Restated Certificate of Incorporation currently provides that our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of the voting power of our outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class.

If both Proposal 2 and Proposal 3 are approved by stockholders, our directors will be elected to serve one-year terms, until the earlier of their death, resignation or removal, or until their successors have been elected and qualified. In addition, if both Proposal 2 and Proposal 3 are approved by stockholders, our directors may be removed with or without cause by at least two-thirds of the voting power of our outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class. In any case, vacancies and newly-created directorships on the Board may be filled by the remaining directors.

The Board does not have a fixed policy regarding the separation of the offices of chairman of the Board and chief executive officer and believes that it should maintain the flexibility to select the chairman of the Board and its Board leadership structure, from time to time, based on the criteria that it deems to be in the best interests of the Company and its stockholders. At this time, the offices of the chairman of the Board and the chief executive officer are combined, with Mr. Casady serving as chairman and chief executive officer. He has served in this role since December 2005. With 32 years of experience in the financial services industry, including 12 years with us, Mr. Casady has the knowledge, expertise, and experience to understand the opportunities and challenges facing us, as well as the leadership and management skills to promote and execute our values and strategy.

In connection with our initial public offering in November 2010, in accordance with best practices, the Board established the position of lead director. In 2013, Mr. Schifter served in that role, performing many of the functions that an independent chairman would perform for the Company. Those functions include serving as a key source of communication between the independent directors and the chief executive officer, and coordinating the agenda for and leading meetings of the independent directors, as needed. In March 2014, Mr. Riepe succeeded Mr. Schifter as our new lead director.

The Company believes that having the same person serve as chief executive officer and chairman focuses leadership, responsibility and accountability in a single person and that having a lead director provides for effective checks and balances and the ability of the independent directors to work effectively in the Board setting.

Board Committees

The current standing committees of the Board of Directors are the audit committee (the "Audit Committee"), the Nominating and Governance Committee and the Compensation Committee, each with the composition and responsibilities described below. The members of each committee are appointed by the Board of Directors and serve until their successors are elected and qualified, unless they are removed earlier or resign. In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to address specific issues. Each of the standing committees of our Board is chaired by an independent director.

During 2013, our Board also established a special committee (the "NestWise Special Committee") that assisted in overseeing the operations of NestWise LLC, a former subsidiary of the Company ("NestWise"). The NestWise Special Committee was not chaired by an independent director. Under NestWise's operating agreement, members of the NestWise Special Committee served as members of the board of directors of NestWise, along with our former executive Esther Stearns. The NestWise Special Committee was disbanded in January 2014.

Audit Committee

Our Audit Committee is composed of the following members: John J. Brennan, Anne M. Mulcahy, and James S. Riepe. Mr. Brennan serves as the Chairperson of the Audit Committee.

Each of our Audit Committee members is independent under the listing standards of NASDAQ and under Rule 10A-3 of the Exchange Act. None of our Audit Committee members is or has been an employee of ours or any of our subsidiaries, nor simultaneously serves on the audit committees of more than three public companies, including ours. All of our Audit Committee members meet the requirements for financial literacy and are able to read and understand fundamental financial statements, including the Company's balance sheet, income statement and cash flow statement. Our Board has affirmatively determined Mr. Brennan qualifies as an audit committee financial expert under the applicable rules and regulations of the SEC.

Our Audit Committee is responsible for, among other things, appointing, overseeing, and replacing, if necessary, the independent auditor and assisting the Board in overseeing:

| |

| • | the integrity of the Company's consolidated financial statements; |

| |

| • | the integrity of the accounting and financial reporting processes of the Company; |

| |

| • | the Company's compliance with legal and regulatory requirements; |

| |

| • | the Company's independent auditor's qualifications and independence; and |

| |

| • | the performance of the Company's independent auditor and internal audit function. |

In addition, the Audit Committee prepares the Audit Committee report required by the SEC to be included in our Annual Report on Form 10-K or our proxy statement.

The Audit Committee has authority under its charter to obtain advice and assistance from outside legal counsel, accounting, or other outside advisors as deemed appropriate to perform its duties and responsibilities.

Our Audit Committee met ten times during 2013.

Nominating and Governance Committee

Our Nominating and Governance Committee is composed of the following members: John J. Brennan, James S. Riepe, Anne M. Mulcahy and Richard P. Schifter. Mr. Schifter serves as Chairperson of the Nominating and Governance Committee, which recommended individuals for election as directors of the Company at the Annual Meeting. Each member of our Nominating and Governance Committee is independent under the listing standards of NASDAQ.

The Nominating and Governance Committee is responsible for and oversees:

| |

| • | recruiting and retention of qualified persons to serve on our Board of Directors; |

| |

| • | proposing such individuals to the Board of Directors for nomination for election as directors; and |

| |

| • | evaluating the performance, size, and composition of our Board of Directors. |

Our Board of Directors has adopted a written charter under which the Nominating and Governance Committee operates.

Our Nominating and Governance Committee met once during 2013. Our Board as a whole also considered the recruitment and nomination of directors.

Compensation and Human Resources Committee

Our Compensation Committee is composed of the following members: John J. Brennan, Richard W. Boyce, and James S. Riepe. Mr. Riepe serves as the Chairperson of the Compensation Committee. Each member of our Compensation Committee is independent under the listing standards of NASDAQ, including the heightened standards that apply to compensation committee members.

The Compensation Committee is responsible for:

| |

| • | reviewing and approving goals and objectives relevant to executive officer compensation and evaluating the performance of executive officers in light of the goals and objectives; |

| |

| • | reviewing and approving executive officer compensation; |

| |

| • | reviewing and approving the chief executive officer's compensation based upon the Compensation Committee's evaluation of the chief executive officer's performance; |

| |

| • | making recommendations to the Board of Directors regarding the adoption of new incentive compensation and equity-based plans, and administering our existing incentive compensation and equity-based plans; |

| |

| • | making recommendations to the Board of Directors regarding compensation of the Board members and its committee members; |

| |

| • | reviewing and discussing with management the compensation discussion and analysis to be included in our proxy statement and preparing an annual Compensation Committee report for inclusion in our annual proxy statement; |

| |

| • | reviewing and approving generally any significant non-executive compensation and benefits plans; |

| |

| • | reviewing our significant policies, practices, and procedures concerning human resource-related matters; and |

| |

| • | overseeing any other such matters as the Board of Directors shall deem appropriate from time to time. |

The Compensation Committee has authority under its charter to access such internal and external resources, including retaining legal, financial, or other advisors, as the Compensation Committee deems necessary or appropriate to fulfill its responsibilities. In 2013, the Compensation Committee engaged Meridian Compensation Partners, LLC (the "Compensation Consultant") to advise on compensation matters and provide experiential guidance on what is considered fair and competitive practice in the industry, primarily with respect to the compensation of the executive officers.

The Compensation Committee also has the authority to delegate to subcommittees of the Compensation Committee any responsibilities of the full committee. The Compensation Committee has established a subcommittee, composed entirely of “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code and “non-employee directors” within the meaning of Rule 16b-3 under the Exchange Act, to administer our LPL Financial Holdings Inc. Corporate Executive Bonus Plan (the "Executive Bonus Plan") and approve equity issuances in accordance with Section 16(b) of the Exchange Act. The Compensation Committee may also delegate to a committee of one or more directors, or one or more of our executive officers, subject to certain restrictions, the power to grant stock options, restricted stock units, or other equity awards, and amend the terms of such awards, pursuant to our equity plans. References to the Compensation Committee in this proxy statement also refer to its subcommittees and its delegates, where applicable.

Our Compensation Committee met five times during 2013.

Equity Grants Practices

The exercise price of each stock option awarded under the 2010 Omnibus Equity Incentive Plan (the "2010 Plan") is the closing price of Common Stock on the date of grant, and the 2010 Plan prohibits the re-pricing of stock options.

The Compensation Committee has delegated to a committee, consisting in accordance with Delaware law of the chairman of the Board (the "Equity Committee"), the authority to grant to an eligible participant under the 2010 Plan, other than an executive officer:

| |

| • | stock options to purchase up to a number of shares of Common Stock as determined by dividing $300,000 by the estimated value per option on the date of grant based on the Black-Scholes model and related assumptions; and |

| |

• | restricted stock units ("RSUs"), with any individual grant limited to the number of RSUs determined by dividing $300,000 by the closing price of the Common Stock on the grant date. |

The stock options and RSUs currently granted pursuant to this delegated authority vest, in the discretion of the Equity Committee, either (i) ratably over three years or (ii) in full on the second or third anniversary of the grant date. Options granted pursuant to this delegated authority prior to December 17, 2013 vest either (i) ratably over four or five years or (ii) in full on the second or third anniversary of the grant date.

In addition, the Compensation Committee has delegated to our Chief Human Capital Officer the authority to grant to an employee of the Company, other than an executive officer:

| |

| • | stock options to purchase up to such number of shares of Common Stock as determined by dividing $300,000 by the estimated value per option on the date of grant based on the Black-Scholes model and related assumptions; and |

| |

• | RSUs, with any individual grant limited to the number of RSUs determined by dividing $300,000 by the closing price of the Common Stock on the grant date. |

The stock options and RSUs currently granted pursuant to this delegated authority vest ratably over three years, and, in addition to the individual limits described above, the total aggregate number of shares of Common Stock underlying stock options and RSUs granted by the Chief Human Capital Officer in any fiscal year may not exceed one million. Stock options granted pursuant to this delegated authority prior to December 17, 2013 vest ratably over four or five years.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is or has been an officer or employee of ours or any of our subsidiaries. None of our executive officers serves or has served as a member of the board of directors, compensation committee, or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Risk Management and Compensation Policies and Practices

We employ an enterprise risk management framework ("ERM") that is intended to address key risks and responsibilities, enable us to execute our business strategy, and protect our firm and its franchise. Our framework is designed to promote clear lines of risk management accountability and a structured escalation process for key risk information and events. In addition to the ERM framework, we have written policies and procedures that govern the conduct of business by our advisors and employees, and the terms and conditions of our relationships with product manufacturers. Our client and advisor policies address the extension of credit for client accounts, data and physical security, compliance with industry regulation and codes of ethics to govern employee and advisor conduct, among other matters.

Our risk management governance approach is discussed in our annual report on Form 10-K for the year ended December 31, 2013, under “Item 7A. Quantitative and Qualitative Disclosures about Market Risk - Risk Management.” The ERM framework includes the Board of Directors, the Audit Committee and the Compensation Committee, as well as our Risk Oversight Committee (the “ROC”) and its subcommittees, our Internal Audit department, our Governance, Risk and Compliance department and business line management.

Role of the Audit Committee. In addition to its other responsibilities, the Audit Committee reviews our policies with respect to risk assessment and risk management, as well as our major financial risk exposures and the steps management has undertaken to control them. The Audit Committee provides reports to the Board at each of the Board’s regularly scheduled quarterly meetings.

The Audit Committee has mandated that the ROC oversee our risk management activities, including those of our subsidiaries. The chair of the ROC provides reports to the Audit Committee at each of the Audit Committee’s regularly scheduled quarterly meetings and, as necessary or requested, to the Board. The reports generally cover topics addressed by the ROC at its meetings since the immediately preceding report. If warranted, matters of material risk are escalated to the Audit Committee or Board more frequently. In addition, our Internal Audit department provides independent verification of the effectiveness of the Company’s internal controls by conducting risk assessments and audits designed to identify and cover important risk categories. Our Internal Audit department provides regular reports to the ROC and reports to the Audit Committee at least as often as quarterly.

Role of the Compensation Committee. In addition to its other responsibilities, the Compensation Committee assesses whether our compensation arrangements encourage inappropriate risk-taking, and whether risks arising from our compensation arrangements are reasonably likely to have a material adverse effect on the Company.

Our Compensation Committee has reviewed and evaluated the philosophy and standards on which our compensation practices have been developed and implemented across our Company. It is our belief that our compensation practices do not encourage inappropriate actions by our executive officers. Specifically, we believe that our compensation practices and process avoid:

| |

| • | a compensation mix overly weighted toward annual bonus awards; |

| |

| • | an excessive focus on short-term equity incentive awards that would cause behavior to drive short-term stock price gains in lieu of long-term value creation; and |

| |

| • | unreasonable financial goals or thresholds that would encourage efforts to generate near-term revenue with an adverse impact on long-term success. |

We believe that our current business process and planning cycle fosters the following behaviors and controls that would mitigate the potential for adverse risk caused by the action of our executive officers:

| |