UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2012

OR

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-54283

PATHEON INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Canada | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

c/o Patheon Pharmaceuticals Services Inc. 4721 Emperor Boulevard, Suite 200 Durham, NC | | 27703 |

| (Address of principal executive offices) | | (Zip Code) |

(919) 226-3200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

Restricted Voting Shares

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

| Large accelerated filer | o | | Accelerated filer | x |

| | | | | |

| Non-accelerated filer | o (Do not check if a smaller reporting company) | | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of restricted voting shares held by non-affiliates of the registrant as of April 30, 2012, the last business day of the registrant's most recently completed second fiscal quarter, was $97,987,272 (based on the last reported closing sale price on the Toronto Stock Exchange on that date of $2.22 per share, as converted from C$2.19 using the closing rate of exchange from Reuters).

As of December 14, 2012, the registrant had 129,297,892 restricted voting shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement and Information Circular to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held March 28, 2013 are incorporated by reference into Part III.

TABLE OF CONTENTS

|

| | |

| | PART I | |

| Item 1. | Business | |

| Item 1A. | Risk Factors | |

| Item 1B. | Unresolved Staff Comments | |

| Item 2. | Properties | |

| Item 3. | Legal Proceedings | |

| Item 4. | Mine Safety Disclosures | |

| | PART II | |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities | |

| Item 6. | Selected Financial Data | |

| Item 7. | 'Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | Financial Statements and Supplementary Data | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | |

| | PART III | |

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accountant Fees and Services | |

| | PART IV | |

| Item 15. | Exhibits and Financial Statement Schedules | |

| | SIGNATURES | |

| | INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | |

| | EXHIBIT INDEX | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which reflect our expectations regarding our future growth, results of operations, performance (both operational and financial) and business prospects and opportunities. All statements, other than statements of historical fact, are forward-looking statements. Wherever possible, words such as "plans," "expects," or "does not expect," "forecasts," "anticipates" or "does not anticipate," "believes," "intends" and similar expressions or statements that certain actions, events or results "may," "could," "should," "would," "might" or "will" be taken, occur or be achieved have been used to identify these forward-looking statements. Although the forward-looking statements contained in this annual report on Form 10-K reflect our current assumptions based upon information currently available to us and based upon what we believe to be reasonable assumptions, we cannot be certain that actual results will be consistent with these forward-looking statements. Our current material assumptions include assumptions related to customer volumes, regulatory compliance, foreign exchange rates, employee severance costs associated with termination and projected integration savings related to the Banner Acquisition (as defined below). Forward-looking statements necessarily involve significant known and unknown risks, assumptions and uncertainties that may cause our actual results, performance, prospects and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, risks related to international operations and foreign currency fluctuations; customer demand for our services; regulatory matters affecting manufacturing and pharmaceutical development services; impacts of acquisitions, divestitures and restructurings, including our ability to achieve our intended objectives with respect to such transactions and integrate businesses that we may acquire; implementation of our new corporate strategy; our ability to effectively transfer business between facilities; the global economic environment; our exposure to complex production issues; our substantial financial leverage; interest rate risks; potential environmental, health and safety liabilities; credit and customer concentration; competition; rapid technological change; product liability claims; intellectual property; the existence of a significant shareholder; supply arrangements; pension plans; derivative financial instruments; and our dependence upon key management, scientific and technical personnel. These and other risks are described in greater detail in "Item 1A. Risk Factors" of this annual report on Form 10-K. Although we have attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. These forward-looking statements are made as of the date of this annual report on Form 10-K, and except as required by law, we assume no obligation to update or revise them to reflect new events or circumstances.

General

All references to "$" or "dollars" in this annual report are to U.S. dollars unless otherwise indicated. References in this Form 10-K to "Patheon," "we," "us," "our" and "our company" refer to Patheon Inc. and its consolidated subsidiaries.

PART I

Item 1. Business.

Overview

We are a leading provider of commercial manufacturing outsourcing services ("CMO") and outsourced pharmaceutical development services ("PDS") to the global pharmaceutical industry. We believe we are the world's third-largest CMO provider and the world's largest PDS provider based on calendar year 2011 revenues provided by PharmSource, a provider of pharmaceutical outsourcing business information. We offer a wide range of services throughout the lifecycle of a pharmaceutical molecule, from early development, through late development to commercial manufacturing, including lifecycle management services. During the fiscal year ended October 31, 2012 ("fiscal 2012"), we provided services to approximately 312 customers throughout the world, including 19 of the world's 20 largest pharmaceutical companies, eight of the world's 10 largest biotechnology companies and eight of the world's 10 largest specialty pharmaceutical companies. In fiscal 2012, we manufactured 12 of the top 100 selling drug compounds in the world based on revenues for the products reported by Evaluate Pharma, a provider of pharmaceutical industry data, and our products were distributed in approximately 60 countries. We are also currently developing 12 of the top 100 development stage drugs in the world on behalf of our customers based on potential revenues for the products reported by Evaluate Pharma.

Our CMO business focuses primarily on prescription products in a wide variety of solid and sterile dosage forms. We have also developed a range of specialized capabilities in high potency, controlled substances and modified release products.

Our PDS business provides a broad range of development services, including finished dosage formulation across approximately 40 dosage forms, early development services, analytical services, formulation expertise and life cycle management. We have established our position as a market leader by leveraging our scale, global reach, specialized capabilities, broad service offerings, scientific expertise and track record of product quality and regulatory compliance to provide cost-effective solutions to our customers.

Company History

The heritage of our company dates back to 1974, when we established Custom Pharmaceuticals Ltd., a contract manufacturing business, in Fort Erie, Canada. Since that time, we have expanded operations through acquisition of contract manufacturing facilities in Canada, Europe, Puerto Rico and the United States, entered into the PDS business and recently acquired additional capabilities with respect to proprietary soft-gel formulations. In addition, we continue to assess our footprint and as market conditions warrant consolidate or dispose of facilities.

In 2006 and 2007, we conducted a review of strategic and financial alternatives that resulted in a $150,000,000 investment in us by JLL Partners Inc., a New York private equity firm ("JLL Partners"), and a refinancing of our North American indebtedness. As a result of this investment, JLL Patheon Holdings, LLC ("JLL Patheon Holdings"), an affiliate of JLL Partners, received two series of preferred stock, one of which it converted into 38,018,538 voting shares in 2009, and the other of which entitles it to elect up to three members of our Board of Directors (our "Board").

JLL Patheon Holdings also made an unsolicited offer to acquire any or all of the outstanding restricted voting shares of Patheon ("JLL Offer") that it did not already own in 2009, which resulted in JLL Patheon Holdings and its affiliates ("JLL") acquiring an additional 33,854,708 restricted voting shares. The restricted voting shares that JLL purchased pursuant to the JLL Offer represented approximately 38% of the outstanding restricted voting shares of Patheon not already owned by JLL. As of October��31, 2012, JLL owned an aggregate of 72,358,181 restricted voting shares, representing approximately 56% of Patheon's total restricted voting shares outstanding.

On December 14, 2012, we completed our acquisition of all of the issued and outstanding shares of capital stock of Sobel USA Inc., a Delaware corporation, and Banner Pharmacaps Europe B.V., a private limited company organized under the laws of The Netherlands (collectively "Banner") for an aggregate purchase price of approximately $269.0 million, subject to post-closing working capital adjustments (the "Banner Acquisition"). Banner is the world's second largest pharmaceutical business focused on delivering proprietary softgel formulations, with four manufacturing facilities, significant proprietary technologies and products, and leading positions in some of the industry's fastest-growing product categories. Banner is headquartered in High Point, N.C., with additional research labs and manufacturing facilities in the Netherlands, Canada and Mexico.

Our Segments

We are organized into two operating segments: CMO and PDS. In addition, we categorize certain selling, general and administrative costs and certain foreign exchange gains and losses under a separate segment reporting line item referred to as "corporate costs." In fiscal 2012, our CMO and PDS segments accounted for 81.5% and 18.5% of our total revenues, respectively. Financial information about our CMO and PDS segments and information regarding net sales and long-lived assets attributable to operations in Canada, the United States, Europe and other countries is contained in "Note 15—Segmented Information" of our consolidated financial statements included in this Form 10-K. Additional financial information about our CMO and PDS segments is contained in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations." For a discussion of risks attendant to our foreign operations, please see "Item 1A. Risk Factors—Risks Related to our Business and Industry."

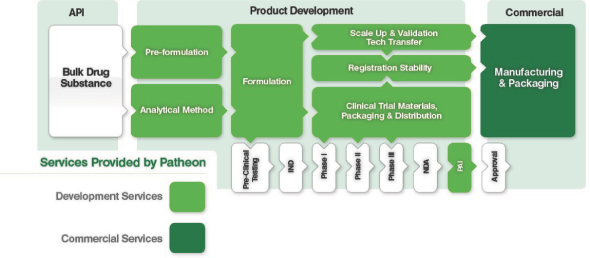

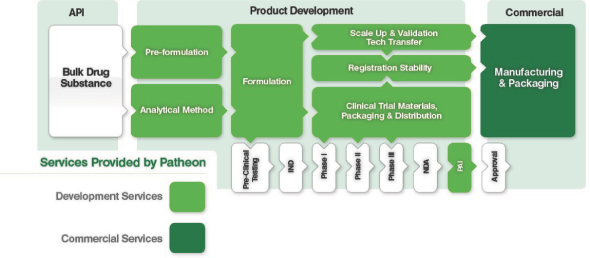

The illustration below sets forth the various stages of the drug development and manufacturing process; shaded processes are services that we provide.

Note: API: Active Pharmaceutical Ingredient

Note: API: Active Pharmaceutical IngredientPAI: Pre-Approval Inspection(s)

Commercial Manufacturing

We believe we are the world's third-largest CMO provider with an approximate 5% global market share in 2011 based on calendar year 2011 market size provided by PharmSource and publicly available information. We operate nine facilities located throughout North America and Europe. We manufacture various sterile dosage forms, as well as solid, conventional and specialized dosage forms. Our sterile dosage forms include aseptically (sterile) filled and terminally sterilized liquids and vials, bottles and pre-filled syringes and sterile lyophilized (freeze-dried) products in vials. Conventional dosage forms include both coated and uncoated compressed tablets and hard shell gelatin capsules. Currently, our capacity utilization is higher for our facilities for sterile dosage forms than for conventional dosage forms. We further differentiate ourselves by offering specialized capabilities relating to high potency, controlled substance and modified release products. In fiscal 2012, our CMO segment generated 81.5% of our total revenues.

Set forth below are our various dosage forms.

| |

| • | Immediate Release Tablets |

| |

| • | Powders/Granules/Coated Beads |

| |

| • | Fast Dispersible Tablets |

| |

| • | Controlled-Release Tablets |

| |

| • | Liquid Small Volume Parenteral (SVP) |

| |

| • | Liquid Large Volume Parenteral (LVP) |

| |

| • | Highly Regulated Products |

| |

| • | Patheon Certified Consultants |

In fiscal 2012, we had a diverse CMO customer base with large, mid-size and emerging pharmaceutical companies comprising 49%, 25% and 10% of our fiscal 2012 CMO revenues, respectively, with the remainder being derived from our early stage, generic and other pharmaceutical customers.

Pharmaceutical Development Services

We believe we are the world's largest PDS provider with an approximate 10% global market share in 2011 based on calendar year 2011 market size provided by PharmSource and publicly available information, offering a broad range of development services across approximately 40 different dosage forms. We operate eight development centers located throughout North America and Europe. Our PDS offerings support customers across various stages of the drug development process, including (i) early development; (ii) pre-formulation, formulation and development of dosage forms; (iii) manufacturing of development stage products during the regulatory drug approval process, including manufacturing of pilot batches; (iv) scale-up and technology transfer services designed to validate commercial-scale drug manufacturing processes; and (v) development of analytical methods and delivery of analytical services. In fiscal 2012, our PDS offerings were provided to a diverse customer base with large, mid-size and emerging pharmaceutical companies comprising 38%, 25% and 34% of our fiscal 2012 PDS revenues, respectively, with the remaining 3% being derived from our early stage pharmaceutical, generic and other customers.

During fiscal 2012, we worked on approximately 432 projects for our customers, including 12 drug candidates at the new drug application ("NDA") stage. Among the projects we worked on during fiscal 2012, 171 projects were at Phase I, 82 projects were at Phase II, 116 projects were at Phase III, and 63 projects were at the pre-clinical or post-approval stage. During the year ended October 31, 2011 ("fiscal 2011") and fiscal 2012, we developed 9 products for customers that received new market approval. Since the beginning of fiscal 2001, our PDS business has developed, on behalf of our customers, 38 new molecular entities ("NME") that have been approved for marketing by regulatory authorities, as well as numerous new formulations of existing NMEs. Any patent and drug approvals that we obtain, or help to obtain, belong to our customers, and we do not receive royalties or earn revenues from products or NMEs that we develop, or help to develop, other than for the development services we provide. Our development group, comprised of approximately 550 scientists and technicians, including approximately 80 holding doctoral degrees, has extensive development experience across a wide variety of pharmaceutical dosage forms. Our PDS business serves as a pipeline for future commercial manufacturing opportunities. Since most of these products are at the beginning of their patent life, these products typically present long-term manufacturing opportunities. During fiscal 2012 and fiscal 2011, we were awarded CMO contracts for 17 new products that had been developed by our PDS business. In fiscal 2012, our PDS segment generated 18.5% of our total revenues.

Performance Enhancement Initiatives

We are committed to providing quality products and services to our customers.

Our new corporate strategy includes accelerating and revising the Patheon Advantage™ program, which combines "lean" manufacturing practices with "six sigma" manufacturing to streamline operations, remove production bottlenecks, increase capacity utilization and improve performance throughout the network; assessing strategic options for the Swindon commercial operation; continuing the evolution of our existing commercial sites into centers of excellence focusing on specific technologies or production types; and focusing improvements in other areas of the business including working capital, pricing, and selling, general and administrative costs.

In addition, we have developed an information technology master plan that sets the overall direction for systems and services for our business. It centers on the development of strategic information technology assets that we believe will drive competitive advantages for our business and includes both the addition of new information technology assets and the enhancement of existing information technology assets.

Customers

In fiscal 2012, we provided services to approximately 300 customers throughout the world, including 19 of the world's 20 largest pharmaceutical companies, eight of the world's 10 largest biotechnology companies and eight of the world's 10 largest specialty pharmaceutical companies. We are also currently developing on behalf of our customers 12 of the 100 top development stage drugs in the world, based on potential revenues for the products reported by EvaluatePharma®. During fiscal 2012, Merck & Co., Inc. accounted for approximately 11.0% of our consolidated revenues. In fiscal 2012, our top 20 customers in our CMO segment accounted for approximately 80% of our CMO revenues.

We have entered into several master service agreements with customers that contemplate long-term multi-product and multi-site commercial manufacturing and/or PDS, including a seven-year manufacturing agreement that led to construction of a

new manufacturing facility within one of our existing sites with significant financing from the customer, a five-year master supply agreement with a global pharmaceutical company to provide development and manufacturing services and "carve-out" arrangements at certain of our facilities under which sizeable parts of our current production have been transferred to us from facilities owned by our customers that were slated for closure or downsizing. These arrangements are part of a trend towards developing broader and longer-term relationships with our customers. We have developed master service agreement templates for both our development and commercial services to allow for the addition of new projects and products without having to renegotiate terms and conditions.

Our CMO customers typically provide a yearly forecast of anticipated product demand. Customers also deliver firm purchase orders, typically three months prior to scheduled production, after which time they may adjust contract quantities or delivery dates within certain limits, provided that we are reimbursed for any expenses incurred in connection with such adjustments. Upon delivery to us of a customer purchase order confirming the quantity and delivery date, the order is scheduled for production. Our CMO customer contracts, typically with multi-year terms, formalize the standard business arrangements outlined above, including production based on the delivery of firm purchase orders. In addition, the contracts typically provide for 12 to 18 months' advance notice for the transfer or discontinuance of any product. The customer assumes liability for all material commitments made in accordance with purchase orders. We maintain the right to pass on price increases to the customer over and above some predetermined minimum percentage. The actual revenues generated by our major customer agreements are based on volumes that are determined by market demands for the customer's product from time to time.

Our PDS business provides services on a fee-for-service basis. We typically respond to a customer request and prepare a quotation which, if accepted, typically forms the basis of the contract with the customer. Our PDS contracts typically require us to perform development services within a designated scope. Frequently, the continuation of our work on a particular project will depend on various factors such as research results and the customer's needs.

Sales and Marketing

Our global sales and marketing group is responsible for generating new business for our CMO and PDS businesses. Our sales team is broken into two distinct groups-territory-based sales executives and key account executives with direct support from the project managers generating additional sales from existing project with existing clients. Each of our territory-based sales teams is responsible for identifying new customers and generating sales from these customers within its territory that are not named as a key account. Our North America territory-based sales team is comprised of 15 members and covers the United States and Canada. We also have a territory-based sales team covering Europe and Japan, which is comprised of 10 members. In addition, we have 11 global key account executives who act as our primary interface with our most significant accounts; currently, approximately 35 of our customers have key account status. Despite the functional and geographical delineation of our sales teams, each sales team or executive seeks to generate sales in both our CMO and PDS segments across our entire network. Determination of which site, or sites, will perform specific services is dictated by the nature of the customer's product, our capabilities and customer preferences.

The projects of our existing customers are managed by site-based project managers and business managers, who also play an integral role in the sales process by ensuring that the existing projects meet our customers' expectations and understanding our customers' projects and evolving needs. These activities can assist the site-based teams in obtaining additional work on existing projects and identifying new projects with existing customers.

Our sales team is supported by global marketing, sales operations and business intelligence groups located at our U.S. headquarters in Research Triangle Park, North Carolina, and regional support resources in Europe and Japan.

Supply Arrangements

For our commercial manufacturing operations, we are required to source various active pharmaceutical ingredients ("APIs"), excipients, raw materials and packaging components from third-party suppliers and/or our actual customers. Our customers specify these components, raw materials and packaging materials in line with their product registration files, and in some cases, they specify the actual supplier from whom we must purchase these inputs. In most cases, our customers manage the sourcing and physical delivery of the API to us at no cost. We generally source and procure all other input materials from established local or regional suppliers specializing in serving the pharmaceutical sector. With the exception of certain patented APIs and excipients, most inputs are available from multiple sources.

Supply arrangements are an inherent part of our ability to produce products for our customers in a timely manner and thus create a degree of dependence that could negatively impact revenues if such supply is interrupted. Such interruptions can be either localized to a specific supplier issue or as a result of wider supply interruptions due to natural disasters or international disruptions caused by geopolitical issues or other events. See "Item 1A. Risk Factors—Risks Related to Our Business and Industry." We work closely with suppliers at both a local and corporate level to establish clear supply agreements that set forth

the supply relationship expectations and the legal terms and conditions of the agreements, including potential liabilities for supply interruption situations. These agreements are critical to our ability to manage and mitigate risk across our supply chain.

Competition

We operate in a market that is highly competitive. We compete to provide CMO and PDS to pharmaceutical companies around the world.

Our competition in the CMO market includes full-service pharmaceutical outsourcing companies; contract manufacturers focusing on a limited number of dosage forms; contract manufacturers providing multiple dosage forms; and large pharmaceutical companies offering third-party manufacturing services to fill their excess capacity. In addition, in Europe, there are a large number of privately owned, dedicated outsourcing companies that serve only their local or national markets. Also, large pharmaceutical companies have been seeking to divest portions of their manufacturing capacity, and any such divested businesses may compete with us in the future. We compete primarily on the basis of the security of supply (quality, regulatory compliance and financial stability), service (on-time delivery and manufacturing flexibility) and cost-effective manufacturing (prices and a commitment to continuous improvement).

Our competition in the PDS market includes a large number of laboratories that offer only a limited range of developmental services, generally at a small scale; providers focused on specific technologies and/or dosage forms; and a few fully integrated companies that can provide the full complement of services necessary to develop, scale-up and manufacture a wide range of dosage forms. We also compete in the PDS market with major pharmaceutical and chemical companies, specialized contract research organizations, research and development firms, universities and other research institutions. We may also compete with the internal operations of pharmaceutical companies that choose to source PDS internally. We compete primarily on the basis of scientific expertise, knowledge and experience in dosage form development, availability of a broad range of equipment, on-time delivery of clinical materials, compliance with current good manufacturing practices ("cGMPs"), regulatory compliance, cost effective services and financial stability.

Some of our competitors may have substantially greater financial, marketing, technical or other resources than we do. Additional competition may emerge and may, among other things, result in a decrease in the fees paid for our services.

One of the many factors affecting competition is the current excess capacity within the pharmaceutical industry of facilities capable of manufacturing drugs in solid dosage forms. Thus, customers currently have a wide range of supply alternatives for these dosage forms. Another factor causing increased competition is that a number of companies in Asia, particularly India, have been entering the CMO and PDS sectors over the past few years, have begun obtaining approval from the U.S. Food and Drug Administration (the "FDA") for certain of their plants and have acquired additional plants in Europe and North America. One or more of these companies may become a significant competitor to us.

Employees

As of November 30, 2012, we had approximately 4,700 employees. National works councils are active at all of our facilities in the United Kingdom, France and Italy consistent with local labor laws. There is no union representation at any of our North American sites. Our management believes that we generally have a good relationship with our employees around the world and the works councils that represent a portion of our European employee base.

Intellectual Property

We rely on a combination of trademark, patent, trade secret and other intellectual property laws of the United States and other countries. We have applied in the United States and in certain foreign countries for registration of a limited number of trademarks and patents, some of which have been registered or issued. Also, many of the formulations used by us in manufacturing products to customer specifications are subject to patents or other intellectual property rights owned by or licensed to the relevant customer. Further, we rely on non-disclosure agreements and other contractual provisions to protect our intellectual property rights and typically enter into mutual confidentiality agreements with customers that own or are licensed users of patented formulations.

We have developed and continue to develop knowledge and expertise ("know-how") and trade secrets in the provision of services in both our PDS and CMO businesses, and we have acquired know how and trade secrets related to soft-gel and other technologies in connection with the Banner Acquisition. Our know-how and trade secrets may not be patentable, but they are valuable in that they enhance our ability to provide high-quality services to our customers.

To the extent that we determine that certain aspects of the services we provide are innovative and patentable, we have filed and pursued, and plan to continue to file and pursue, patent applications to protect such inventions, as well as applications for registration of other intellectual property rights, as appropriate. However, we do not consider any particular patent, trademark, license, franchise or concession to be material to our CMO or PDS segments.

Regulatory Matters

We are required to comply with the regulatory requirements of various local, state, provincial, national and international regulatory bodies having jurisdiction in the countries or localities where we manufacture products or where our customers' products are distributed. In particular, we are subject to laws and regulations concerning research and development, testing, manufacturing processes, equipment and facilities, including compliance with cGMPs, labeling and distribution, import and export, and product registration and listing. As a result, most of our facilities are subject to regulation by the FDA, as well as regulatory bodies of other jurisdictions, such as the European Medicines Agency of the European Union ("EMA") and/or the National Health Surveillance Agency in Brazil ("Anvisa"), depending on the countries in which our customers market and sell the products we manufacture and/or package on their behalf. We are also required to comply with environmental, health and safety laws and regulations, as discussed in "Environmental Matters" below. These regulatory requirements impact many aspects of our operations, including manufacturing, developing, labeling, packaging, storage, distribution, import and export and record keeping related to customers' products. Noncompliance with any applicable regulatory requirements can result in government refusal to approve (i) facilities for testing or manufacturing products or (ii) products for commercialization. The FDA and other regulatory agencies can delay, limit or deny approval for many reasons, including:

| |

| • | Changes to the regulatory approval process, including new data requirements, for product candidates in those jurisdictions, including the United States, in which we or our customers may be seeking approval; |

| |

| • | A product candidate may not be deemed to be safe or effective; |

| |

| • | The ability of the regulatory agency to provide timely responses as a result of its resource constraints; and |

| |

| • | The manufacturing processes or facilities may not meet the applicable requirements. |

In addition, if new legislation or regulations are enacted or existing legislation or regulations are amended or are interpreted or enforced differently, we may be required to obtain additional approvals or operate according to different manufacturing or operating standards or pay additional product or establishment user fees. This may require a change in our research and development and manufacturing techniques or additional capital investments in our facilities.

Our pharmaceutical development and manufacturing projects generally involve products that must undergo pre-clinical and clinical evaluations relating to product safety and efficacy before they are approved as commercial therapeutic products. The regulatory authorities having jurisdiction in the countries in which our customers intend to market their products may delay or put on hold clinical trials, delay approval of a product or determine that the product is not approvable. The FDA or other regulatory agencies can delay approval of a drug if our manufacturing facility is not able to demonstrate compliance with cGMPs, pass other aspects of pre-approval inspections (i.e., compliance with filed submissions) or properly scale up to produce commercial supplies. The FDA and comparable government authorities having jurisdiction in the countries in which our customers intend to market their products have the authority to withdraw product approval or suspend manufacture if there are significant problems with raw materials or supplies, quality control and assurance or the product is deemed adulterated or misbranded.

Some of our manufactured products are listed as controlled substances. Controlled substances are those products that present a risk of substance abuse. In the United States, these types of products are classified by the U.S. Drug Enforcement Agency (the "DEA") as Schedule II, III and IV substances under the Controlled Substances Act of 1970. The DEA classifies substances as Schedule I, II, III, IV or V substances, with Schedule I substances considered to present the highest risk of substance abuse and Schedule V substances the lowest risk. Scheduled substances are subject to DEA regulations relating to manufacturing, storage, distribution, import and export and physician prescription procedures. For example, scheduled drugs are subject to distribution limits and a higher level of recordkeeping requirements. Furthermore, the total amount of controlled substances for manufacture or commercial distribution is limited by the DEA and allocated through quotas. Our quotas or our customers' quotas, if any, may not be sufficient to meet commercial demand or to economically produce the product.

Entities must be registered annually with the DEA to manufacture, distribute, dispense, import, export and conduct research using controlled substances. State controlled substance laws also require registration for similar activities. In addition, the DEA requires entities handling controlled substances to maintain records, file reports, follow specific labeling and packaging requirements and provide appropriate security measures to control against diversion of controlled substances. If we fail to follow these requirements, we may be subject to significant civil and/or criminal penalties and possibly a revocation of one of our DEA registrations.

Products containing controlled substances may generate significant public health and safety issues, and in such instances, federal or state authorities can withdraw or limit the marketing rights or regulatory approvals for these products. For some scheduled substances, the FDA may require us or our customers to develop product attributes or a risk evaluation and mitigation strategy to reduce the inappropriate use of the products, including the manner in which they are marketed and sold, so as to reduce the risk of diversion or abuse of the product. Developing such a program may be time-consuming and could delay approval of product candidates containing controlled substances. Such a program or delays of any approval from the FDA could adversely affect our business, results of operations and financial condition.

Audits are an important means by which prospective and existing customers gain confidence that our operations are conducted in accordance with applicable regulatory requirements. In fiscal 2012, our facilities and development centers were audited by 222 separate customer audit teams, representing both prospective and existing customers. These audits contribute to our ongoing improvement of our manufacturing and development practices. In addition to customer audits, we, like all commercial drug manufacturers, are subject to audits by various regulatory authorities. In fiscal 2012, regulatory authorities conducted 21 such audits, which involved multiple products, at our sites in North America and Europe. Responses to audit observations were submitted to address observations noted. We have yet to receive feedback from most of the inspections conducted in the third and fourth quarters of fiscal 2012. It is not unusual for regulatory agencies or customers to request further clarification and/or follow-up on the responses we provide.

Environmental Matters

Our operations are subject to a variety of environmental, health and safety laws and regulations in each of the jurisdictions in which we operate. These laws and regulations govern, among other things, air emissions, wastewater discharges, the handling and disposal of hazardous substances and wastes, soil and groundwater contamination and employee health and safety. We are also subject to laws and regulations governing the destruction and disposal of raw materials and non-compliant products, the handling of regulated material that is included in our offerings and the disposal of our offerings at the end of their useful life. These laws and regulations have increasingly become more stringent, and we may incur additional expenses to ensure compliance with existing or new requirements in the future. Any failure by us to comply with environmental, health and safety requirements could result in the limitation or suspension of our operations. We also could incur monetary fines, civil or criminal sanctions, third-party claims or cleanup or other costs as a result of violations of or liabilities under such requirements. In addition, compliance with environmental, health and safety requirements could restrict our ability to expand our facilities or require us to acquire costly pollution control equipment, incur other significant expenses or modify our manufacturing processes.

Our manufacturing facilities, in varying degrees, use, store and dispose of hazardous substances in connection with their processes. At some of our facilities, these substances are stored in underground storage tanks or used in refrigeration systems. Some of our facilities, including those in Puerto Rico, have been utilized over a period of years as manufacturing facilities, with operations that may have included on-site landfill or other waste disposal activities and have certain known or potential conditions that may require remediation in the future, and several of these have undergone remediation activities in the past by former owners or operators. Some of our facilities are located near third-party industrial sites and may be impacted by contamination migrating from such sites. A number of our facilities use groundwater from onsite wells for process and potable water, and if these onsite sources became contaminated or otherwise unavailable for future use, we could incur expenses for obtaining water from alternative sources. In addition, our operations have grown through acquisitions, and it is possible that facilities that we have acquired may expose us to environmental liabilities associated with historical site conditions that have not yet been discovered. Some environmental laws impose liability for contamination on current and former owners and operators of affected sites, regardless of fault. If remediation costs or potential claims for personal injury or property or natural resource damages resulting from contamination arise, they may be material and may not be recoverable under any contractual indemnity or otherwise from prior owners or operators or any insurance policy. Additionally, we may not be able to successfully enforce any such indemnity or insurance policy in the future. In the event that new or previously unknown contamination is discovered or new cleanup obligations are otherwise imposed at any of our currently or previously owned or operated facilities, we may be required to take additional, unplanned remedial measures and record charges for which no reserves have been recorded.

Seasonality

Revenues from some of our CMO and PDS operations have traditionally been lower in our first fiscal quarter, being the three months ending January 31. We attribute this trend to several factors, including (i) the reassessment by many customers of their need for additional product in the last quarter of the calendar year in order to use existing inventories of products; (ii) the lower production of seasonal cough and cold remedies in the first fiscal quarter; (iii) limited project activity towards the end of the calendar year by many small pharmaceutical and biotechnology customers involved in PDS projects in order to reassess

progress on their projects and manage cash resources; and (iv) the Patheon-wide facility shutdown during a portion of the traditional holiday period in December and January.

Research and Development

We have not spent any material amount in the last three fiscal years on company-sponsored research and development activities.

Available Information

We maintain a website with the address www.patheon.com. We are not including the information contained on our website as part of, or incorporating it by reference into, this annual report on Form 10-K. We make available, free of charge, on or through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission ("SEC").

Risks Related to Our Business and Industry

We are dependent on our customers' spending on and demand for our manufacturing and development services. A reduction in spending or demand could have a material adverse effect on our business.

The amount of customer spending on pharmaceutical development and manufacturing, particularly the amount our customers choose to spend on outsourcing these services, has a large impact on our sales and profitability. Consolidation in the pharmaceutical industry may impact such spending as customers integrate acquired operations, including research and development departments and manufacturing operations.

Many of our customers finance their research and development spending from private and public sources. We have experienced slowdowns in our customers' spending on pharmaceutical development and related services, which we believe have been primarily due to the lack or decreased availability of capital for specialty and emerging pharmaceutical companies and the consolidation within the pharmaceutical industry, which resulted in the postponement of certain projects. Any reduction in customer and potential customer spending on pharmaceutical development and related services may have a material adverse effect on our business, results of operations and financial condition.

Furthermore, demand for our CMO segment is driven, in part, by products we bring to market for our PDS customers. Due to the long lead times associated with obtaining regulatory approvals for many of these products, particularly dosage forms, and the competitive advantage that can come from gaining early approval, it is important that we maintain a sufficiently large portfolio of pharmaceutical products and such products are brought to market on a timely basis. If we experience a reduction in research and development by our customers, the decrease in activity in our PDS segment could also negatively affect activity levels in our CMO business. Any decline in demand for our services may have a material adverse effect on our business, results of operations and financial condition.

The consumers of the products we manufacture for our customers may significantly influence our business, results of operations and financial condition.

We are dependent on demand for the products we manufacture for our customers and have no control or influence over the market demand for our customers' products. Demand for our customers' products can be adversely affected by, among other things, delays in health regulatory approval, the loss of patent and other intellectual property rights protection, the emergence of competing products, including generic drugs, the degree to which private and government drug plans subsidize payment for a particular product and changes in the marketing strategies for such products.

If the products we manufacture for our customers do not gain market acceptance, our revenues and profitability will be adversely affected. The degree of market acceptance of our customers' products will depend on a number of factors, including:

| |

| • | the ability of our customers to publicly establish and demonstrate the efficacy and safety of such products, including compared to competing products; |

| |

| • | the costs to potential consumers of using such products; and |

| |

| • | marketing and distribution support for such products. |

If production volumes of key products that we manufacture for our customers and related revenues are not maintained, it may have a material adverse effect on our business, results of operations and financial condition. Additionally, any changes in product mix due to market acceptance of our customers' products may adversely affect our margins.

Our services and offerings are highly complex, and if we are unable to provide quality and timely offerings to our customers, our business could suffer.

The services we offer are highly exacting and complex, due in part to strict regulatory requirements. As a result of the Banner Acquisition, we have entered into new lines of business, and there may be factors that affect these lines of business with which we are not as familiar compared to our existing business lines. Moreover, it is possible that the integration process with Banner could result in the distraction of our management, the disruption of our ongoing business or inconsistencies in our products, services, standards, controls, procedures and policies. A failure of our quality control systems in our new and existing business units and facilities could cause problems to arise in connection with facility operations or during preparation or provision of products, in both cases, for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with raw materials or environmental factors. Such problems could affect production of a particular batch or series of batches, requiring the destruction of products, or could halt facility production altogether. In addition, our failure to meet required quality standards may result in our failure to timely deliver products to our customers, which in turn could damage our reputation for quality and service. Any such incident could, among other things, lead to increased costs, lost revenue, reimbursement to customers for lost APIs, damage to and possibly termination of existing customer relationships, time and expense spent investigating the cause and, depending on the cause, similar losses with respect to other batches or products. If problems are not discovered before the product is released to the market, we may be subject to regulatory actions, including product recalls, product seizures, injunctions to halt manufacture and distribution, restrictions on our operations, civil sanctions, including monetary sanctions, and criminal actions. In addition, such issues could subject us to litigation, the cost of which could be significant.

Our PDS projects are typically for a shorter term than our CMO projects, and any failure by us to maintain a high volume of PDS projects, including due to lower than expected success rates of the products for which we provide services, could adversely affect our business, results of operations and financial condition.

Unlike our CMO segment, where our contracts are typically multi-year in duration, our PDS segment contracts are generally shorter in term and typically require us to provide development services within a designated scope. Since our PDS business focuses on products that are still in the developmental stages, the viability of many of our PDS projects is not certain. As a result, many of these projects fail to progress to the subsequent development phase. Even if a customer wishes to proceed with a project, the product we are developing on its behalf may fail to receive necessary regulatory approval, or other factors, such as the development of a competing product, may hinder the development of the product.

If we are unable to continue to obtain new projects from existing and new customers, our PDS segment could be adversely affected. Furthermore, although our PDS business acts as a pipeline for our CMO segment, we cannot predict the turnover rate of our PDS projects or how successful we will be in winning new projects that lead to a viable product. As such, an increase in the turnover rate of our PDS projects may negatively affect our CMO segment at a later time. In addition, the discontinuation of a project as a result of our failure to satisfy a customer's requirements may also affect our ability to obtain future projects from the customer involved or from new customers.

Continued volatility and disruption to the global capital and credit markets and the global economy have adversely affected, and may continue to adversely affect, our business and results of operations and have adversely affected, and may continue to adversely affect, our customers and suppliers.

In recent years, the global capital and credit markets and the global economy have experienced a period of significant uncertainty, characterized by the bankruptcy, failure, collapse or sale of various financial institutions and a considerable level of intervention from governments around the world. These conditions have adversely affected the demand for our products and services, which has negatively affected our business and results of operations. In addition, interest rate fluctuations, financial market volatility or credit market disruptions may limit our access to capital, and may also negatively affect our customers' and our suppliers' ability to obtain credit to finance their businesses on acceptable terms or at all. As a result, customers' need for and ability to purchase our products or services may decrease. For example, certain of our customers have decreased their research and development spending due to their lack of access to capital. In addition, lack of access to capital may cause our suppliers to increase their prices, reduce their output or change their terms of sale. If our customers' or suppliers' operating and financial performance deteriorates, or if they are unable to make scheduled payments or obtain credit, our customers may not be able to pay, or may delay payment of, accounts receivable owed to us, and our suppliers may restrict credit or impose different payment terms. Any inability of our customers to pay us for our products and services or any demands by suppliers for different payment terms may adversely affect our earnings and cash flow.

As the contraction of the global capital and credit markets has spread throughout the broader economy, the United States and other major markets around the world have experienced very weak or negative economic growth, a major contributor of which has been continued high unemployment. These recessionary conditions have impacted, and will continue to impact, consumer demand for the products we manufacture for our customers.

Our operations outside the United States and Canada are subject to a number of economic, political and regulatory risks.

We are an international company incorporated and listed in Canada with facilities and offices in eight countries. Although we have had significant international operations for a number of years, the Banner Acquisition has increased our geographic presence in Latin America, including significant manufacturing operations in Mexico with exports to 17 countries in Central America, the Caribbean and South America. In fiscal 2012, we provided services to customers in approximately 60 countries, and nearly half of our revenues were attributable to customers outside the United States and Canada. Our operations outside the United States and Canada could be substantially affected by foreign economic, political and regulatory risks. These risks include:

| |

| • | fluctuations in currency exchange rates; |

| |

| • | the difficulty of enforcing agreements and collecting receivables through some foreign legal systems; |

| |

| • | customers in some foreign countries potentially having longer payment cycles; |

| |

| • | changes in local tax laws, tax rates in some countries that may exceed those of Canada or the United States and lower earnings due to withholding requirements or the imposition of tariffs, exchange controls or other restrictions; |

| |

| • | seasonal reductions in business activity; |

| |

| • | the credit risk of local customers and distributors; |

| |

| • | general economic and political conditions; |

| |

| • | unexpected changes in legal, regulatory or tax requirements; |

| |

| • | relationships with labor unions and works councils; |

| |

| • | the difficulties associated with managing a large global organization; |

| |

| • | the risk that certain governments may adopt regulations or take other actions that would have a direct or indirect adverse impact on our business and market opportunities, including nationalization of private enterprise; |

| |

| • | non-compliance with applicable currency exchange control regulations, transfer pricing regulations or other similar regulations; |

| |

| • | violations of the Foreign Corrupt Practices Act by acts of agents and other intermediaries whom we have limited or no ability to control; and |

| |

| • | violations of regulations enforced by the U.S. Department of The Treasury's Office of Foreign Asset Control ("OFAC"). |

In addition to the foregoing, in July 2010, Sobel USA Inc.'s Mexican subsidiary submitted a voluntary disclosure regarding potential violations of Cuban Asset Control Regulations to OFAC. The subject transactions involved shipments to Cuba of Mexican-origin medicine and agricultural products by this subsidiary. Sobel USA Inc. and its Mexican subsidiary obtained a letter of no enforcement by OFAC and were granted a license by OFAC to engage in transactions with Cuba through January 31, 2013. Although OFAC granted Sobel USA Inc.'s Mexican subsidiary a license to engage in these transactions, our inability to renew this license or the imposition of more restrictive regulations resulting from geopolitical tensions with Cuba may impede our ability to conduct business in Cuba in the future. If any of these economic or political risks materialize and we have failed to anticipate and effectively manage them, we may experience adverse effects on our business and results of operations. If we do not remain in compliance with current regulatory requirements or fail to comply with future regulatory requirements, then such non-compliance may subject us to liability and have a material adverse effect on our business and results of operations.

Fluctuations in exchange rates could have a material adverse effect on our results of operations and financial performance.

Our most significant transaction exposures arise in our Canadian operations. In addition, approximately 90% of the revenues of the Canadian operations and approximately 10% of its operating expenses are transacted in U.S. dollars. As a result, we may experience transaction exposures because of volatility in the exchange rate between the Canadian and U.S. dollar. Based on our current U.S. denominated net inflows, as of October 31, 2012, fluctuations of +/-10% would, everything else being equal, have an annual effect on loss from continuing operations before taxes of approximately +/- $17.8 million, prior to hedging activities.

The objective of our foreign exchange risk management activities is to minimize transaction exposures and the resulting volatility of our earnings. To mitigate exchange-rate risk, we utilize foreign exchange forward contracts and collars in certain circumstances to lock in exchange rates with the objective that the gain or loss on the forward contracts and collars will approximately offset the loss or gain that results from the transaction or transactions being hedged. As of October 31, 2012, we had entered into foreign exchange forward contracts and collars to cover approximately 80% of our Canadian-U.S. dollar cash flow exposures for fiscal 2012.

Translation gains and losses related to certain foreign currency denominated intercompany loans are included as part of

the net investment in certain foreign subsidiaries and are included in accumulated other comprehensive income in shareholders' equity. We do not currently hedge translation exposures.

While we attempt to mitigate our foreign exchange risk by engaging in foreign currency hedging activities using derivative financial instruments, we may not be successful. We may not be able to engage in hedging transactions in the future, and if we do, we may not be able to eliminate foreign currency risk, and foreign currency fluctuations may have a material adverse effect on our results of operations and financial performance.

We are, or may be, party to certain derivative financial instruments, and our results of operations may be negatively affected in the event of non-performance by the counterparties to such instruments.

From time to time, we enter into interest rate swaps and foreign exchange forward contracts and collars to limit our exposure to changes in variable interest rates and foreign exchange rates. Such instruments may result in economic losses if exchange rates decline to a point lower than our fixed rate commitments. When we enter into such swaps and contracts, we are exposed to credit-related losses, which could impact our results of operations and financial condition in the event of non-performance by the counterparties to such instruments. For more information about our foreign currency risks, please see "Item 7A. Quantitative and Qualitative Disclosures About Market Risk."

Because a significant portion of our revenues comes from a limited number of customers, any decrease in sales to these customers could harm our business, results of operations and financial condition.

In fiscal 2012, our top 20 customers in our CMO segment accounted for approximately 80% of our CMO revenues. In addition we had one customer in our CMO segment that accounted for approximately 13% of our CMO revenues and two customers in our CMO segment that each accounted for approximately 10% of our CMO revenues. This customer concentration increases credit risk and other risks associated with particular customers and particular products, including risks related to market demand for customer products and regulatory and other operating risks. Disruptions in the production of major products could damage our customer relationships and adversely impact our results of operations in the future. Revenues from customers that have accounted for significant sales in the past, either individually or as a group, may not reach or exceed historical levels in any future period. The loss or a significant reduction of business from any of our major customers may have a material adverse effect on our business, results of operations and financial condition.

The success of the Banner Acquisition will depend on, among other things, our ability to realize the revenue enhancements we anticipate and to combine the businesses in a manner that does not materially disrupt Banner's existing customer relationships of Banner or result in decreased revenues resulting from any loss of customers and that permits growth opportunities to occur. If we are not able to successfully achieve these objectives, the anticipated benefits of the Banner Acquisition may not be realized fully or at all or may take longer to realize than expected.

We operate in highly competitive markets, and continue to expand into new markets including through the Banner Acquisition, and competition may adversely affect our business.

We operate in a market that is highly competitive. We compete to provide CMO and PDS to pharmaceutical companies around the world.

Our competition in the CMO market includes full-service pharmaceutical outsourcing companies; contract manufacturers focusing on a limited number of dosage forms; contract manufacturers providing multiple dosage forms; and large pharmaceutical companies offering third-party manufacturing services to fill their excess capacity. In addition, in Europe, there are a large number of privately owned, dedicated outsourcing companies that serve only their local or national markets. Also, large pharmaceutical companies have been seeking to divest portions of their manufacturing capacity, and any such divested businesses may compete with us in the future. We compete primarily on the basis of the security of supply (quality, regulatory compliance and financial stability), service (on-time delivery and manufacturing flexibility) and cost-effective manufacturing (prices and a commitment to continuous improvement).

Our competition in the PDS market includes a large number of laboratories that offer only a limited range of developmental services, generally at a small scale; providers focused on specific technologies and/or dosage forms; and a few fully integrated companies that can provide the full complement of services necessary to develop, scale-up and manufacture a wide range of dosage forms. We also compete in the PDS market with major pharmaceutical and chemical companies, specialized contract research organizations, research and development firms, universities and other research institutions. We may also compete with the internal operations of pharmaceutical companies that choose to source PDS services internally. We compete primarily on the basis of scientific expertise, knowledge and experience in dosage form development, availability of a broad range of equipment, on-time delivery of clinical materials, compliance with cGMPs, regulatory compliance, cost effective services and financial stability.

Some of our competitors may have substantially greater financial, marketing, technical or other resources than we do. Additional competition may emerge and may, among other things, result in a decrease in the fees paid for our services, which would affect our results of operations and financial condition.

One of the many factors affecting competition is the current excess capacity within the pharmaceutical industry of facilities capable of manufacturing drugs in solid and semi-solid dosage forms. Thus, customers currently have a wide range of supply alternatives for these dosage forms. Another factor causing increased competition is that a number of companies in Asia, particularly India, that have been entering the CMO and PDS sectors over the past few years, have begun obtaining approval from the FDA for certain of their plants and have acquired additional plants in Europe and North America. One or more of these companies may become a significant competitor to us. Competition may mean lower prices and reduced demand for CMO and PDS, which could have an adverse effect on our business, results of operations and financial condition.

We may not be able to successfully offer new services.

In order to successfully compete, we will need to offer and develop new services. The related development costs may require a substantial investment, and we may not have the financial resources to fund such initiatives.

In addition, the success of enhanced or new services will depend on several factors, including our ability to:

| |

| • | properly anticipate and satisfy customer needs, including increasing demand for lower cost services; |

| |

| • | enhance, innovate, develop and manufacture new offerings in an economical and timely manner; |

| |

| • | differentiate our offerings from competitors' offerings; |

| |

| • | meet quality requirements and other regulatory requirements of government agencies; |

| |

| • | obtain valid and enforceable intellectual property rights; and |

| |

| • | avoid infringing the proprietary rights of third parties. |

Even if we were to succeed in creating enhanced or new services, those services may not produce revenues in excess of the costs of development and capital investment and may be quickly rendered obsolete by changing customer preferences or by technologies or features offered by our competitors. In addition, innovations may not be accepted quickly in the marketplace because of, among other things, entrenched patterns of clinical practice, the need for regulatory clearance and uncertainty over third-party reimbursement. Moreover, the Banner Acquisition could compound the challenges of integrating complementary products, services and technologies in the future. The integration of Banner could divert a significant amount of management resources, resulting in less employee time and resources available to focus on developing and offering new services, and we may be unable to commit the resources necessary to develop and offer new services.

We rely on our customers to supply many of the necessary ingredients for our products, and for other ingredients, we rely on other third parties. Our inability to obtain the necessary materials or ingredients for the products we manufacture on behalf of our customers may adversely impact our business, results of operations and financial condition.

Our operations require various APIs, components, compounds and raw materials supplied primarily by third parties, including our customers. Our customers specify the components, raw materials and packaging materials required for their products and, in some cases, specify the suppliers from which we must purchase these inputs. In most cases, the customers supply the APIs to us at no cost pursuant to our standard services agreements.

We generally source our components, compounds and raw materials locally, and most of the materials required by us for our CMO business are readily available from multiple sources.

In some cases, we manage the supply chain for our customers, including the sourcing of certain ingredients and packaging material from third-party suppliers. In certain instances, such ingredients or packaging material can only be supplied by a limited number of suppliers or in limited quantities. If our customers or third-party suppliers do not supply API or other raw materials on a timely basis, we may be unable to manufacture products for our customers. Although no one product or customer is material to our operations, a sustained disruption in the supply chain involving multiple customers or vendors at one time could have a material adverse effect on our results of operations.

Furthermore, customers or third-party suppliers may fail to provide us with raw materials and other components that meet the qualifications and standards required by us or our customers. If third-party suppliers are not able to provide us with products that meet our or our customers' specifications on a timely basis, we may be unable to manufacture products, or products may be available only at a higher cost or after a long delay, which could prevent us from delivering products to our customers within required timeframes. Any such delay in delivering our products may create liability for us to our customers for breach of contract or cause us to experience order cancellations and loss of customers. In the event that we produce products with inferior quality components and raw materials, we may become subject to product liability or warranty claims

caused by defective raw materials or components from a third-party supplier or from a customer, or our customer may be required to recall its products from the market.

It is also possible that any of our supplier relationships could be interrupted due to natural disasters, international supply disruptions caused by geopolitical issues or other events or could be terminated in the future. Any sustained interruption in our receipt of adequate supplies could have an adverse effect on our business and financial results. In addition, while we have supply chain processes intended to reduce volatility in component and material pricing, we may not be able to successfully manage price fluctuations. Price fluctuations or shortages may have an adverse effect on our results of operations and financial condition.

Technological change may cause our offerings to become obsolete over time. If customers decrease their purchases of our offerings, our business, results of operations and financial condition may be adversely affected.

The healthcare industry is characterized by rapid technological change. Demand for our services may change in ways that we may not anticipate because of evolving industry standards or as a result of evolving customer needs that are increasingly sophisticated and varied or because of the introduction by competitors of new services and technologies. Any such decreased demand may adversely affect our business, results of operations and financial condition.

We are dependent on key management, scientific and technical personnel.

We are dependent upon the continued support and involvement of our key management, scientific and technical personnel, the majority of whom have employment agreements with us that impose noncompetition and nonsolicitation restrictions following cessation of employment. Because our ability to manage our business activities and, hence, our success depend in large part on the collective efforts of such personnel, our inability to continue to attract and retain such personnel could have a material adverse effect on our business. Moreover, retaining key personnel from Banner who will be instrumental in integrating our businesses will be important to our ability to successfully achieve our business objectives in the future.

In addition, we are not retaining certain members of Banner senior management, which will require existing members of our senior management to assume control or managerial responsibilities of our new businesses. If such personnel are unable to adequately assume such responsibilities or if we are not able to maintain existing relationships between Banner and its customers, business partners or regulators as a result of such personnel changes, it could have a material adverse effect on our business, financial condition or results of operations.

Certain of our pension plans are underfunded, and additional cash contributions may be required, which may reduce the cash available for our business.

Certain of our employees in Canada, France and the United Kingdom are participants in defined benefit pension plans that we sponsor. In addition, Banner employees in the Netherlands and Mexico are also covered by a defined benefit pension plan. As of October 31, 2012, the unfunded pension liability on our pension plans was approximately $22.3 million in the aggregate. The amount of future contributions to our defined benefit plans will depend upon asset returns and a number of other factors and, as a result, the amounts we will be required to contribute to such plans in the future may vary. Such cash contributions to the plans will reduce the cash available for our business.

In relation to our U.K. pension plan, the trustees are authorized to accelerate the required payment of future contribution obligations if they have received actuarial advice that the plan is incapable of paying all the benefits that have or will become due for payment as they become due. If the trustees of our U.K. pension plan were to be so advised and took such a step, our U.K. subsidiary would be required to meet the full balance of the cost of securing the benefits provided by the plan through the purchase of annuities from an insurance company, to the extent that it was able to do so. The cost would be likely to exceed the amount of any deficit under the plan while the plan was ongoing.

Any failure of our information systems, such as from data corruption, cyber-based attacks or network security breaches, could adversely affect our business and results of operations.

We rely on information systems in our business to obtain, rapidly process, analyze and manage data to:

| |

| • | facilitate the manufacture and distribution of thousands of inventory items to and from our facilities; |

| |

| • | receive, process and ship orders on a timely basis; |

| |

| • | manage the accurate billing of, and collections from, our customers; |

| |

| • | manage the accurate accounting for, and payment to, our vendors; and |

| |

| • | schedule and operate our global network of manufacturing and development facilities. |

Security breaches of this infrastructure can create system disruptions, shutdowns or unauthorized disclosure of confidential information. If we are unable to prevent such breaches, our operations could be disrupted, or we may suffer financial damage or loss because of lost or misappropriated information. We cannot be certain that advances in criminal capabilities, new discoveries in the field of cryptography or other developments will not compromise or breach the technology protecting the networks that access our products and services. If these systems are interrupted, damaged by unforeseen events or fail for any extended period of time, including due to the actions of third parties, then we may not be able to effectively manage our business, and our results of operations could be adversely affected.

From time to time, we may seek to restructure our operations and may divest non-strategic businesses or assets, which may require us to incur restructuring charges, and we may not be able to achieve the cost savings that we expect from any such restructuring efforts or divestitures.