Exhibit 99.2 Transaction Overview Materials th November 7 , 2024 America’s #1 Audio Company | Reaching 9 out of 10 Americans Every Month | Radio ∙ Podcasts ∙ Digital ∙ Social ∙ Influencers ∙ Data ∙ Events

Disclaimer Non-GAAP Measures: In addition to the financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this Presentation contains certain non-GAAP financial measures, including Adjusted EBITDA. The Company believes these non-GAAP financial measures are commonly used by analysts and investors to evaluate the performance of companies in its industry, and such non-GAAP financial measures help investors evaluate its operating and financial performance and trends in its business, consistent with how management evaluates such performance and trends. The Company also believes that these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other companies, although its non-GAAP financial measures are specific to the Company and the non-GAAP financial measures of other companies may not be calculated in the same manner. These non-GAAP measures should be considered only as supplemental to, and not as a substitute for or superior to, financial measures prepared in accordance with GAAP. The Company cannot provide a reconciliation between its non-GAAP projections and the most directly comparable GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. These items are uncertain, depend on various factors and could have a material impact on GAAP reported results. Financial Projections: This Presentation includes certain statements, claims, estimates, predictions and other information prepared and provided by the Company with respect to the anticipated future performance of this Company and its subsidiaries. Any assumptions, views or opinions (including statements, projections, forecasts or other forward-looking statements) contained in this Presentation represent the assumptions, views or opinions of the Company as at the date indicated and are subject to change without notice. These statements are subject to known and unknown risks, uncertainties, changes in circumstances, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results to differ materially and potentially adversely from the results discussed in the forward-looking statements. There is no guarantee that any of the forecasts, estimates or projections set forth herein will be achieved. Actual results may vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or the future performance of the Company or any of its subsidiaries or any of its or their businesses. FORWARD-LOOKING STATEMENTS. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the Act ). Such forward-looking statements involve known and unknown risks, uncertainties and other important factors which may cause the actual results, performance or achievements of iHeartMedia and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The words or phrases guidance, believe, expect, anticipate, will, potential, positioned, estimates, forecast, and words of similar meaning, as well as other words or expressions referencing future events, conditions or circumstances are intended to identify such forward-looking statements. These statements include, but are not limited to, statements related to the transactions described herein, including the Company’s ability to complete any of the transactions on the terms contemplated by the transaction support agreement, on the timeline contemplated or at all, and the Company’s ability to realize the intended benefits of any such transactions. In addition, any statements that refer to expectations or other characterizations of future events or circumstances, such as statements about positioning in uncertain economic environment and future economic recovery, driving shareholder value, the Company's expected costs savings and other capital and operating expense reduction initiatives, utilizing new technologies, improving operational efficiency, future advertising demand, trends in the advertising industry, including on other media platforms; strategies and initiatives, expected interest rates and interest expense savings, and the Company's anticipated financial performance, liquidity, and net leverage are forward- looking statements. Statements that describe or relate to iHeartMedia's plans, goals, intentions, strategies, or financial projections or outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other important factors, some of which are beyond iHeartMedia's control and are difficult to predict. Various risks that could cause future results to differ from those expressed by the forward-looking statements included in this Presentation include, but are not limited to: risks related to weak or uncertain global economic conditions and iHeartMedia's dependence on advertising revenues; competition, including increased competition from alternative media platforms and technologies; dependence upon the Company's brand and the performance of on-air talent, program hosts and management; fluctuations in operating costs; technological and industry changes and innovations; shifts in population and other demographics; risks related to iHeartMedia's use of artificial intelligence, impact of acquisitions, dispositions and other strategic transactions; risks related to the Company's indebtedness; legislative or regulatory requirements; impact of legislation, ongoing litigation or royalty audits on music licensing and royalties; regulations and concerns regarding privacy and data protection and breaches of information security measures; risks related to scrutiny of environmental, social and governance matters, risks related to the Company' Class A common stock; and regulations impacting the Company's business and the ownership of its securities. Other unknown or unpredictable factors also could have material adverse effects on the Company's future results, performance or achievements. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this Presentation and other materials provided by the Company may not occur. In particular, our projections are subject to inherent uncertainties and necessarily represent certain assumptions, and actual performance may differ. In addition, there is a risk the Company is unable to deliver the anticipated cost savings (or recognize the expected benefits therefrom) either from an inability to identify appropriate opportunities, anticipate implementation cost, delays in implementation or other factors. Do not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date hereof. Forward-looking statements are not guarantees of future performance. Additional risks that could cause future results to differ from those expressed by any forward-looking statement are described in the Company's reports filed with the U.S. Securities and Exchange Commission, including in the section entitled Part I, Item 1A. Risk Factors of the Company's Annual Reports on Form 10-K and Part II, Item 1A. Risk Factors of the Company's Quarterly Reports on Form 10-Q. The Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise. 22

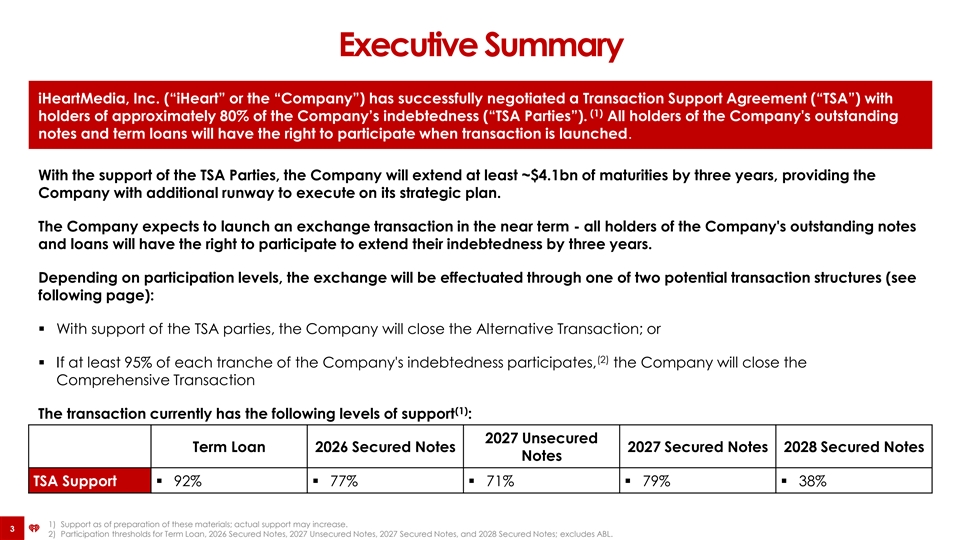

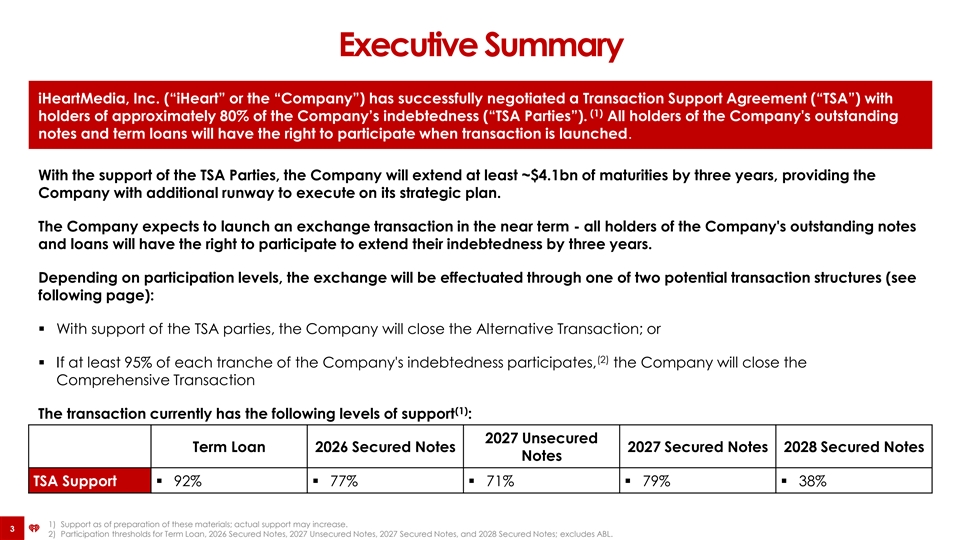

Executive Summary iHeartMedia, Inc. (“iHeart” or the “Company”) has successfully negotiated a Transaction Support Agreement (“TSA”) with (1) holders of approximately 80% of the Company’s indebtedness (“TSA Parties”). All holders of the Company's outstanding notes and term loans will have the right to participate when transaction is launched. With the support of the TSA Parties, the Company will extend at least ~$4.1bn of maturities by three years, providing the Company with additional runway to execute on its strategic plan. The Company expects to launch an exchange transaction in the near term - all holders of the Company's outstanding notes and loans will have the right to participate to extend their indebtedness by three years. Depending on participation levels, the exchange will be effectuated through one of two potential transaction structures (see following page): ▪ With support of the TSA parties, the Company will close the Alternative Transaction; or (2) ▪ If at least 95% of each tranche of the Company's indebtedness participates, the Company will close the Comprehensive Transaction (1) The transaction currently has the following levels of support : 2027 Unsecured Term Loan 2026 Secured Notes 2027 Secured Notes 2028 Secured Notes Notes TSA Support▪ 92%▪ 77%▪ 71%▪ 79%▪ 38% 1) Support as of preparation of these materials; actual support may increase. 3 2) Participation thresholds for Term Loan, 2026 Secured Notes, 2027 Unsecured Notes, 2027 Secured Notes, and 2028 Secured Notes; excludes ABL.

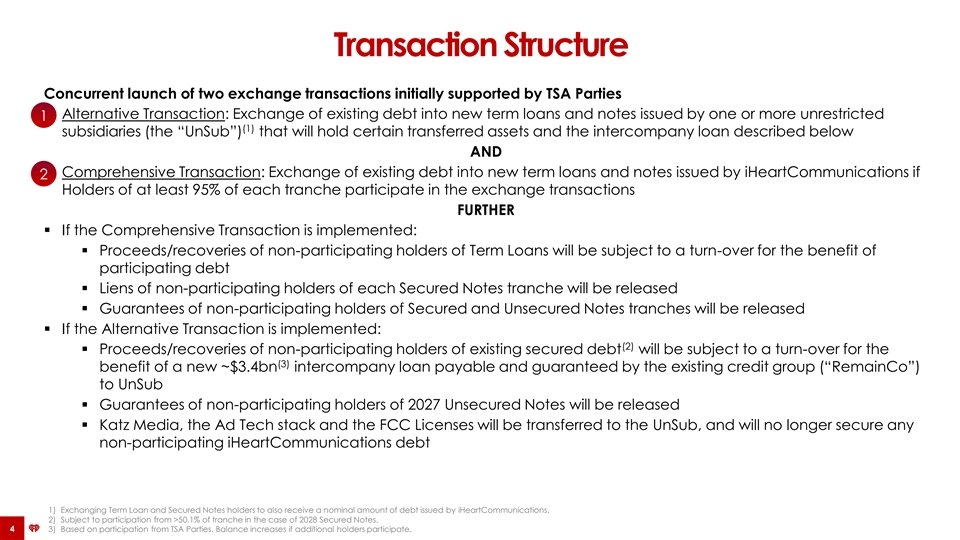

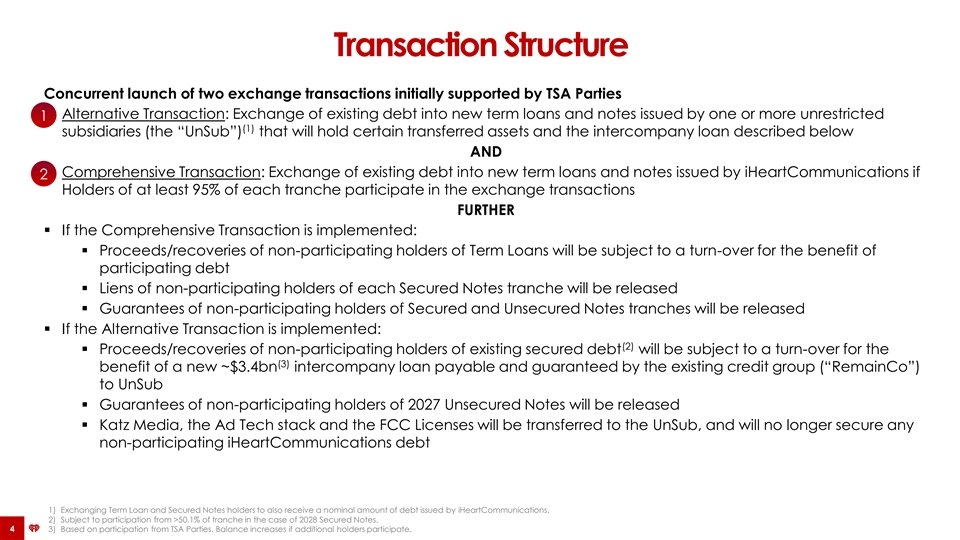

Transaction Structure Concurrent launch of two exchange transactions initially supported by TSA Parties ▪ Alternative Transaction: Exchange of existing debt into new term loans and notes issued by one or more unrestricted 1 (1) subsidiaries (the “UnSub”) that will hold certain transferred assets and the intercompany loan described below AND ▪ Comprehensive Transaction: Exchange of existing debt into new term loans and notes issued by iHeartCommunications if 2 Holders of at least 95% of each tranche participate in the exchange transactions FURTHER ▪ If the Comprehensive Transaction is implemented: ▪ Proceeds/recoveries of non-participating holders of Term Loans will be subject to a turn-over for the benefit of participating debt ▪ Liens of non-participating holders of each Secured Notes tranche will be released ▪ Guarantees of non-participating holders of Secured and Unsecured Notes tranches will be released ▪ If the Alternative Transaction is implemented: (2) ▪ Proceeds/recoveries of non-participating holders of existing secured debt will be subject to a turn-over for the (3) benefit of a new ~$3.4bn intercompany loan payable and guaranteed by the existing credit group (“RemainCo”) to UnSub ▪ Guarantees of non-participating holders of 2027 Unsecured Notes will be released ▪ Katz Media, the Ad Tech stack and the FCC Licenses will be transferred to the UnSub, and will no longer secure any non-participating iHeartCommunications debt 1) Exchanging Term Loan and Secured Notes holders to also receive a nominal amount of debt issued by iHeartCommunications. 2) Subject to participation from >50.1% of tranche in the case of 2028 Secured Notes. 4 3) Based on participation from TSA Parties. Balance increases if additional holders participate.

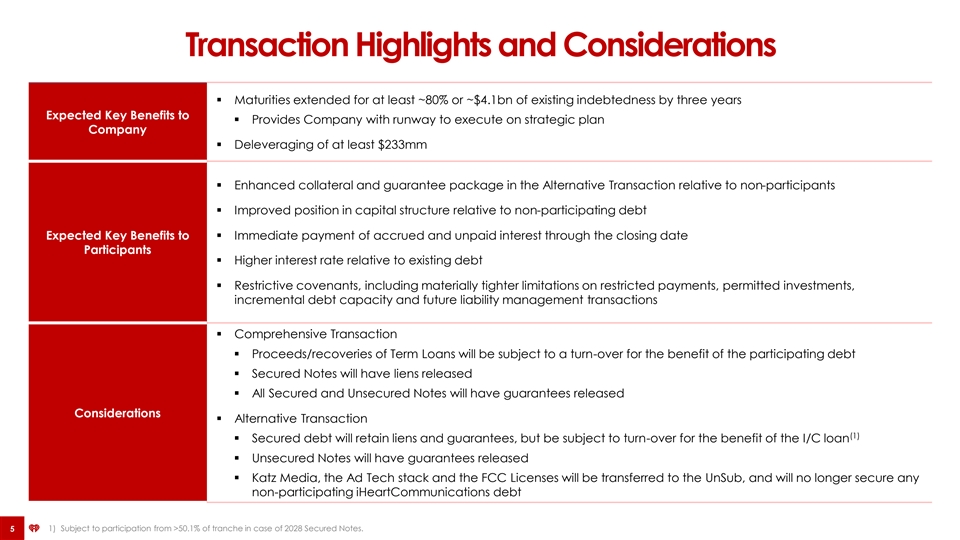

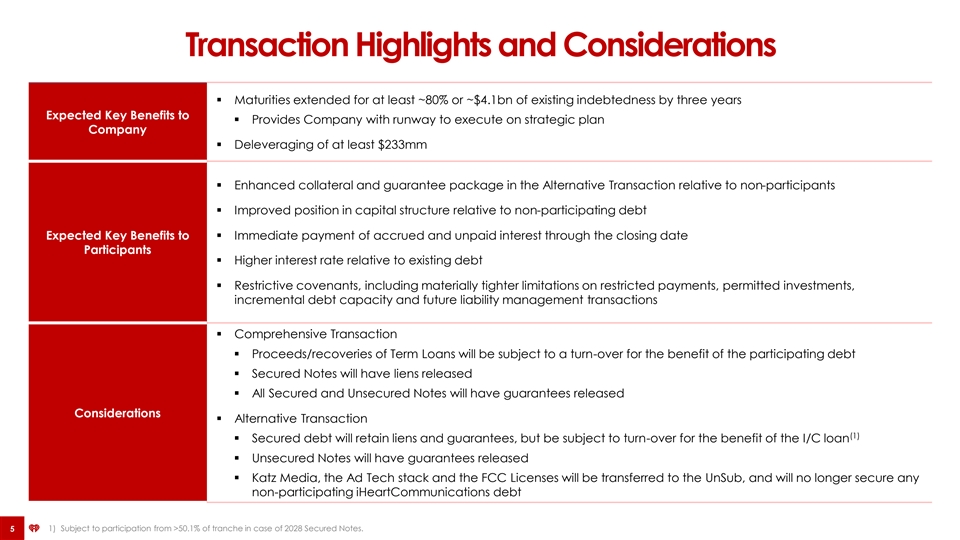

Transaction Highlights and Considerations ▪ Maturities extended for at least ~80% or ~$4.1bn of existing indebtedness by three years Expected Key Benefits to ▪ Provides Company with runway to execute on strategic plan Company ▪ Deleveraging of at least $233mm ▪ Enhanced collateral and guarantee package in the Alternative Transaction relative to non-participants ▪ Improved position in capital structure relative to non-participating debt Expected Key Benefits to ▪ Immediate payment of accrued and unpaid interest through the closing date Participants ▪ Higher interest rate relative to existing debt ▪ Restrictive covenants, including materially tighter limitations on restricted payments, permitted investments, incremental debt capacity and future liability management transactions ▪ Comprehensive Transaction ▪ Proceeds/recoveries of Term Loans will be subject to a turn-over for the benefit of the participating debt ▪ Secured Notes will have liens released ▪ All Secured and Unsecured Notes will have guarantees released Considerations ▪ Alternative Transaction (1) ▪ Secured debt will retain liens and guarantees, but be subject to turn-over for the benefit of the I/C loan ▪ Unsecured Notes will have guarantees released ▪ Katz Media, the Ad Tech stack and the FCC Licenses will be transferred to the UnSub, and will no longer secure any non-participating iHeartCommunications debt 5 1) Subject to participation from >50.1% of tranche in case of 2028 Secured Notes.

Pro Forma Maturity Profile COMPREHENSIVE ALTERNATIVE (1) (2) STATUS QUO TRANSACTION TRANSACTION Exchange Debt Exchange Debt $3,000 2,500 2,000 1,500 1,000 500 0 2026 2027 2028 2029 2030 2031 2026 2027 2028 2029 2030 2031 2026 2027 2028 2029 2030 2031 2026 2027 2028 2029 2030 2031 Term Loan Facility due 2026 Incremental Term Loan Facility due 2026 6.375% Senior Secured Notes due 2026 5.25% Senior Secured Notes due 2027 4.75% Senior Secured Notes due 2028 8.375% Senior Unsecured Notes due 2027 1) Assumes 95% participation from all debt holders. 6 2) Assumes participation of TSA Parties. $3,000 Debt ($)

Summary of Key Terms – Exchange Economics Current Pro Forma (Comprehensive and Alternative) Exchange Consideration Amount Maturity Rate ($ in millions) By Early Tender After Early Tender (1) Maturity Rate Deadline Deadline > 5c Cash + 94c > 1c Cash + 94c > S+300/325 > S+577.5bps Term Loan > $2,265 > May 2026 Exchange Exchange > May 2029 (2) bps (+2.775%/2.525%) Debt Debt > 5c Cash + 94c > 1c Cash + 94c 2026 Secured > $800 > May 2026 > 6.375% Exchange Exchange > May 2029 > 9.125% (+2.75%) Notes Debt Debt 2027 > 79c Exchange > 75c Exchange Unsecured > $916 > May 2027 > 8.375% > May 2030 > 10.875% (+2.50%) Debt Debt Notes 2027 Secured > 88c Exchange > 84c Exchange > $750 > Aug 2027 > 5.25% > Aug 2030 > 7.75% (+2.50%) Notes Debt Debt 2028 Secured > 79c Exchange > 75c Exchange > $500 > Jan 2028 > 4.75% > Jan 2031 > 7.00% (+2.25%) Notes Debt Debt 1) Subject to various levels of stepdowns associated with certain ratings actions. 7 2) Rate increase for Initial Term Loan and Incremental Term Loan, respectively.

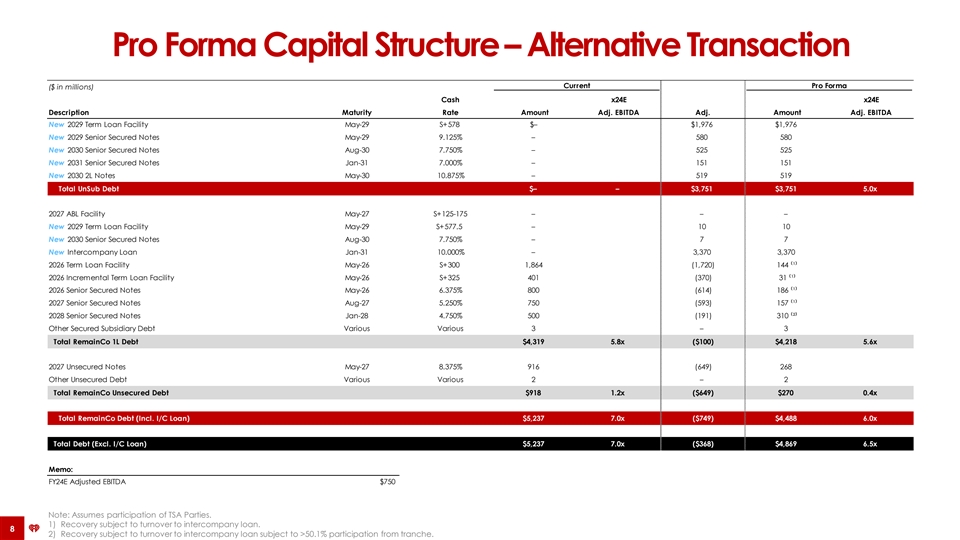

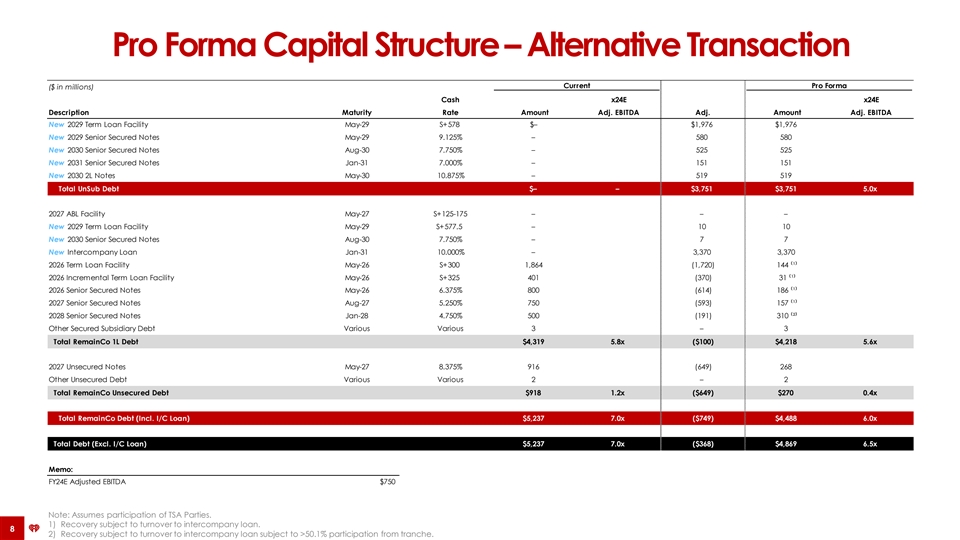

Pro Forma Capital Structure – Alternative Transaction Current Pro Forma ($ in millions) Cash x24E x24E Description Maturity Rate Amount Adj. EBITDA Adj. Amount Adj. EBITDA New 2029 Term Loan Facility May-29 S+578 $– $1,976 $1,976 New 2029 Senior Secured Notes May-29 9.125% – 580 580 New 2030 Senior Secured Notes Aug-30 7.750% – 525 525 New 2031 Senior Secured Notes Jan-31 7.000% – 151 151 New 2030 2L Notes May-30 10.875% – 519 519 Total UnSub Debt $– – $3,751 $3,751 5.0x 2027 ABL Facility May-27 S+125-175 – – – New 2029 Term Loan Facility May-29 S+577.5 – 10 10 New 2030 Senior Secured Notes Aug-30 7.750% – 7 7 New Intercompany Loan Jan-31 10.000% – 3,370 3,370 2026 Term Loan Facility May-26 S+300 1,864 (1,720) 144⁽¹⁾ 2026 Incremental Term Loan Facility May-26 S+325 401 (370) 31⁽¹⁾ 2026 Senior Secured Notes May-26 6.375% 800 (614) 186⁽¹⁾ 2027 Senior Secured Notes Aug-27 5.250% 750 (593) 157⁽¹⁾ 2028 Senior Secured Notes Jan-28 4.750% 500 (191) 310⁽²⁾ Other Secured Subsidiary Debt Various Various 3 – 3 Total RemainCo 1L Debt $4,319 5.8x ($100) $4,218 5.6x 2027 Unsecured Notes May-27 8.375% 916 (649) 268 Other Unsecured Debt Various Various 2 – 2 Total RemainCo Unsecured Debt $918 1.2x ($649) $270 0.4x Total RemainCo Debt (Incl. I/C Loan) $5,237 7.0x ($749) $4,488 6.0x Total Debt (Excl. I/C Loan) $5,237 7.0x ($368) $4,869 6.5x Memo: FY24E Adjusted EBITDA $750 Note: Assumes participation of TSA Parties. 1) Recovery subject to turnover to intercompany loan. 8 2) Recovery subject to turnover to intercompany loan subject to >50.1% participation from tranche.

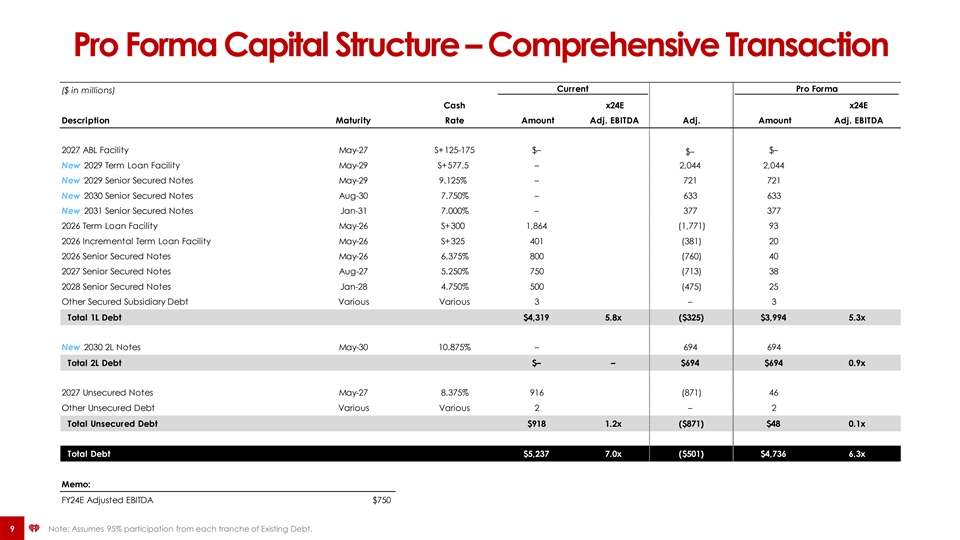

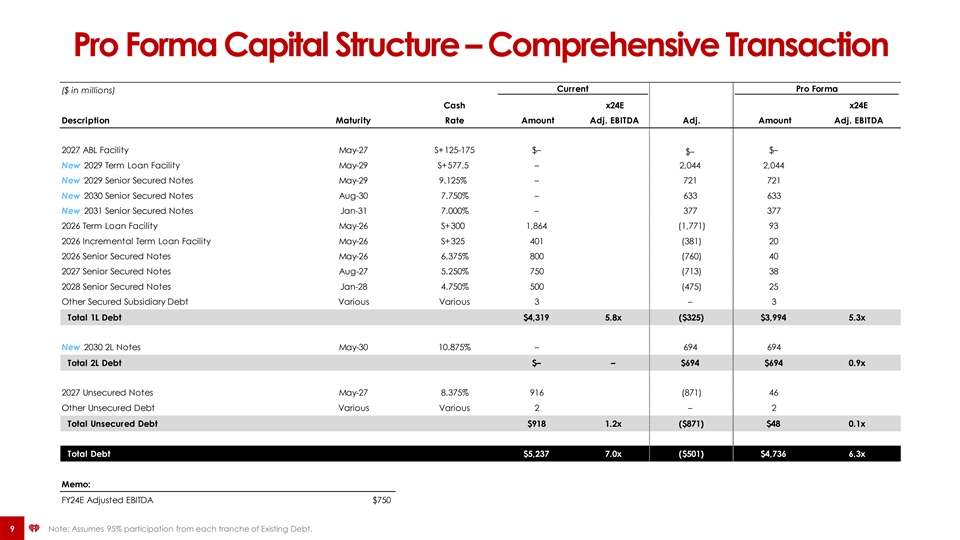

Pro Forma Capital Structure – Comprehensive Transaction Current Pro Forma ($ in millions) Cash x24E x24E Description Maturity Rate Amount Adj. EBITDA Adj. Amount Adj. EBITDA 2027 ABL Facility May-27 S+125-175 $– $– $– New 2029 Term Loan Facility May-29 S+577.5 – 2,044 2,044 New 2029 Senior Secured Notes May-29 9.125% – 721 721 New 2030 Senior Secured Notes Aug-30 7.750% – 633 633 New 2031 Senior Secured Notes Jan-31 7.000% – 377 377 2026 Term Loan Facility May-26 S+300 1,864 (1,771) 93 2026 Incremental Term Loan Facility May-26 S+325 401 (381) 20 2026 Senior Secured Notes May-26 6.375% 800 (760) 40 2027 Senior Secured Notes Aug-27 5.250% 750 (713) 38 2028 Senior Secured Notes Jan-28 4.750% 500 (475) 25 Other Secured Subsidiary Debt Various Various 3 – 3 Total 1L Debt $4,319 5.8x ($325) $3,994 5.3x New 2030 2L Notes May-30 10.875% – 694 694 Total 2L Debt $– – $694 $694 0.9x 2027 Unsecured Notes May-27 8.375% 916 (871) 46 Other Unsecured Debt Various Various 2 – 2 Total Unsecured Debt $918 1.2x ($871) $48 0.1x Total Debt $5,237 7.0x ($501) $4,736 6.3x Memo: FY24E Adjusted EBITDA $750 9 Note: Assumes 95% participation from each tranche of Existing Debt.

America’s #1 Audio Company | Reaching 9 out of 10 Americans Every Month | Radio ∙ Podcasts ∙ Digital ∙ Social ∙ Influencers ∙ Data ∙ Events