Exhibit 99.3 Company Presentation th November 7 , 2024 America’s #1 Audio Company | Reaching 9 out of 10 Americans Every Month | Radio ∙ Podcasts ∙ Digital ∙ S coc ers ia l ∙ ∙ Da Inf talu e n∙ Events

Table Of Contents 1. Executive Summary 2. Multiplatform Group 3. Digital Audio Group 4. Audio & Media Services 5. Data & Technology 6. Financial Projections 7. Appendix 2 2 2

Disclaimer This Investor Presentation (this Presentation ) is being furnished to a limited number of parties who have expressed an interest in a potential transaction (the Potential Transaction ) with iHeartMedia, Inc. ( iHeartMedia or the Company ). The Company does not intend for this Presentation to form the sole basis of any transaction decision. The recipients should conduct their own investigations and analyses of the Company in connection with any transaction. This Presentation is being made available only to parties who have signed and returned a non-disclosure agreement with the Company in connection with the Potential Transaction (the Non-Disclosure Agreement ). By accepting this Presentation or any portion hereof, recipients agree to use and maintain the information in this Presentation in accordance with its compliance policies, contractual obligations (including their Non-Disclosure Agreements) and applicable laws and regulations, including federal and state securities laws. None of the Company, PJT Partners (“PJT”), their respective affiliates or their respective employees, directors, ont fficer racs, to rco s, advisors, consultants, members, successors, representatives, agents or controlling persons or any representatives of the foregoing, has made or makes any representation or warranty (express or implied) in respect of the accuracy, completeness or fair presentation of any information or any conclusion contained in this Presentation or in any other information provided or made available to the recipient in the course of its evaluation of the Company, and none shall have any liability resulting from the use or content of this Presentation or any other such information provided or made available to the recipient including, for any representations or warranties (expressed or implied) contained in, or for any omissions from, this Presentation or any other written or oral communications. The only information that will have any legal effect and upon which an interested party may rely will be in such representations and warranties as may be contained in a definitive agreement providing for a Potential Transaction, when, as and if executed, and in accordance with such terms and subject to such conditions as may be specified therein. The information in this Presentation was provided by the Company or is from public or other sources. PJT has not assumed any responsibility for independently verifying such information and expressly disclaimers any liability to any recipient in connection with such information or any transaction with the Company. This Presentation is not an offer, nor a solicitation of an offer, of the sale or purchase of securities, nor shall any securities of the Company or any of its subsidiaries be offered or sold, in any jurisdiction in which such an offer, solicitation or sale would be unlawful. In furnishing this Presentation, the Company and PJT reserves the right to amend or replace this Presentation at any time, but undertake no obligation to update, correct, or supplement any information contained herein or to provide the recipient with access to any additional information. This Presentation does not purport to be all-inclusive or to contain all of the information that the recipient may require in order to make an informed investment decision. No investment or other financial decisions or actions should be based solely on the information in this Presentation. Non-GAAP Measures: In addition to the financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this Presentation contains certain -no GA nAP financial measures, including EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Segment Adjusted EBITDA Margin, Revenue to EBITDA Conversion, Revenue excluding Political revenue, Free Cash Flow, and Free Cash Flow Conversion. The Company believes these non-GAAP financial measures are commonly used by analysts and investors to evaluate the performance of companies in its industry, and such non- GAAP financial measures help investors evaluate its operating and financial performance and trends in its business, consistent with how management evaluates such performance and trends. The Company also believes that these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other companies, although its non-GAAP financial measures are specific to the Company and the non-GAAP financial measures of other companies may not be calculated in the same manner. These non-GAAP measures should be considered only as supplemental to, and not as a substitute for or superior to, financial measures prepared in accordance with GAAP. Reconciliation between the non-GAAP financial measures and the closest GAAP financial measures can be found in the Appendix section of this Presentation. The Company cannot provide a reconciliation between its non-GAAP projections and the most directly comparable GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. These items are uncertain, depend on various factors and could have a material impact on GAAP reported results. Financial Projections: This Presentation includes certain statements, claims, estimates, predictions and other information prepared and provided by the Company with respect to the anticipated future performance of this Company and its subsidiaries. Any assumptions, views or opinions (including statements, projections, forecasts or other forward-looking statements) contained in this Presentation represent the assumptions, views or opinions of the Company as at the date indicated and are subject to change without notice. These statements are subject to known and unknown risks, uncertainties, changes in circumstances, assumptions and other important factors, many of which are outside our control, that could cause actual results to differ materially and potentially adversely from the results discussed in the forward-looking statements. 3 3

Disclaimer (Cont’d) Forecasts and estimates regarding the Company’s industry and markets are based on sources the Company believes to ;b he owrel ever iabl,e there can be no assurance these forecasts and estimates will prove accurate in whole or in part. All information not separately sourced is from internal data of the Company and estimates. There is no guarantee that any of the forecasts, estimates or projections (including projections of revenue, expenses and earnings) set forth herein will be achieved. Actual results may vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or the future performance of the Company or any of its subsidiaries or any of its or their businesses. FORWARD-LOOKING STATEMENTS. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the Act ). Such forward-looking statements involve known and unknown risks, uncertainties and other important factors which may cause the actual results, performance or achievements of iHeartMedia and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The words or phrases guidance, believe, expect, anticipate, will, potential, positioned, estimates, forecast, and words of similar meaning, as well as other words or expressions referencing future events, conditions or circumstances are intended to identify such forward-looking statements. In addition, any statements that refer to expectations or other characterizations of future events or circumstances, such as statements about positioning in uncertain economic environment and future economic recovery, driving shareholder value, the Company's expected costs savings and other capital and operating expense reduction initiatives, utilizing new technologies, improving operational efficiency, future advertising demand, trends in the advertising industry, including on other media platforms; strategies and initiatives, expected interest rates and interest expense savings, and the Company's anticipated financial performance, liquidity, and net leverage are forward-looking statements. Statements that describe or relate to iHeartMedia's plans, goals, intentions, strategies, or financial projections or outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other important factors, some of which are beyond iHeartMedia's control and are difficult to predict. Various risks that could cause future results to differ from those expressed by the forward-looking statements included in this Presentation include, but are not limited to: risks related to weak or uncertain global economic conditions and iHeartMedia's dependence on advertising revenues; competition, including increased competition from alternative media platforms and technologies; dependence upon the Company's brand and the performance of on-air talent, program hosts and management; fluctuations in operating costs; technological and industry changes and innovations; shifts in population and other demographics; risks related to iHeartMedia's use of artificial intelligence, impact of acquisitions, dispositions and other strategic transactions; risks related to the Company's indebtedness; legislative or regulatory requirements; impact of legislation, ongoing litigation or royalty audits on music licensing and royalties; regulations and concerns regarding privacy and data protection and breaches of information security measures; risks related to scrutiny of environmental, social and governance matters, risks related to the Company' Class A common stock; and regulations impacting the Company's business and the ownership of its securities. Other unknown or unpredictable factors also could have material adverse effects on the Company's future results, performance or achievements. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this Presentation and other materials provided by the Company may not occur. In particular, our projections are subject to inherent uncertainties and necessarily represent certain assumptions, and actual performance may differ. In addition, there is a risk the Company is unable to deliver the anticipated cost savings (or recognize the expected benefits therefrom) either from an inability to identify appropriate opportunities, anticipate implementation cost, delays in implementation or other factors. Do not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date hereof. Forward-looking statements are not guarantees of future performance. Additional risks that could cause future results to differ from those expressed by any forward-looking statement are described in the Company's reports filed with the U.S. Securities and Exchange Commission, including in the section entitled Part I, Item 1A. Risk Factors of the Company's Annual Reports on Form 10-K and Part II, Item 1A. Risk Factors of the Company's Quarterly Reports on Form 10-Q. The Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise. Market Data: Certain market data information in this Presentation is based on management’s estimates. The Company ob e tai coned mpetth itive position data used throughout this Presentation from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties. The Company believes its estimates to be reasonably accurate as of the date of this Presentation or as of the date indicated with respect to such estimates, as applicable. However, this information may prove to be inaccurate because of the method by which the Company obtained some of the data or estimates or because this information cannot always be verified due to the limits of the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Unless otherwise indicated, the information contained herein speaks only as of the date hereof and is subject to change, completion, or amendment without notice. The Presentation contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend to use or display other companies’ trademarks, service marks, copyrights and trade names to imply a relationship with, or endorsement or spoof nso us b rshi y, p an y other companies. 4 4

The iHeartMedia Management Team Bob Pittman Rich Bressler Conal Byrne Wendy Goldberg Mike McGuinness Jordan Fasbender CEO Chief Communications EVP Chairman & President, COO & CFO; EVP, Deputy CFO & General Counsel Chief Executive Officer CEO, Multiplatform Group Digital Audio Group Officer Head of Investor Relations 55+ Years of Experience 45+ Years of Experience 24+ Years of Experience 20+ Years of Experience 24+ Years of Experience 15+ Years of Experience Ann Marie Licata Tony Coles Carter Brokaw Tom Poleman Adrienne Pabst John Sykes President Chief EVP Chief President President Multi-Cultural Business & National & Digital Sales Operations Programming Officer Strategic Partners Entertainment Enterprises Development, BIN Revenue Officer Interep Will Pearson Mark Gray Jenna Craig Joe Robinson Julie Donohue Hartley Adkins Justin Nesci President EVP CEO President President President President iHeartPodcasts Adv. Audio & Katz Media National Media Corporate Development Multi-Market Partnerships Markets Group Data Revenue 5 5

Executive Summary

Business Highlights 1 Strong market leader in growing consumer media category: Audio Diverse portfolio of growing digital audio assets, including the #1 podcast publisher globally and #1 digital radio 2 app in the US 3 Assets with unparalleled scale, reach and trust, demonstrating resilience in economic and advertising downturns Revenue upside from both broadcast radio and digital through improved inventory utilization, ad-tech platforms 4 and continued introduction of new products Experienced and battle-tested management team with proven track record of navigating challenges to 5 consistently deliver results 6 Organization that operates with financial discipline and focus (1) Strong adjusted EBITDA and free cash flow conversion from high operating leverage, limited capital 7 expenditures and limited working capital needs (1) Adjusted EBITDA and Free Cash Flow Conversion are non-GAAP financial measures. Please see Appendix for reconciliation of non-GAAP financial measures to their most comparable GAAP financial measures. 7

Advertising Follows Audiences Only Three Companies Have Mass Market US Reach Ad-Enabled Monthly Reach % - Adults 18+ Tier 2 - Mid Tier Tier 3- Niche Tier 1 - Mass Market 89% 76% 58% 35% 34% 34% 31% 31% 29% 26% * 20% 19% 18% * 17% 16% 13% 10% 9% 5% 4% iHM Facebook Google The New ABC Audacy CBS NBC TikTok iHeartRadio Spotify ESPN Cumulus WSJ Pandora SiriusXM Fox News CNN Univision BET Broadcast YouTube York Times Digital YOUTUBE Radio DIGITAL Source; Broadcast Radio: Nielsen Audio Nationwide, P18+, Fall 2023; Television: Nielsen nPower, P18+, May 2024, L+SD; Digital; News/Streaming Audio: Comscore Media Metrix Multi-Platform P18+, May 2024; Other Digital: Scarborough USA+ 2023 R2, P18+ 8 *Spotify & Pandora ad-enabled audience estimated based on SEC filings 8

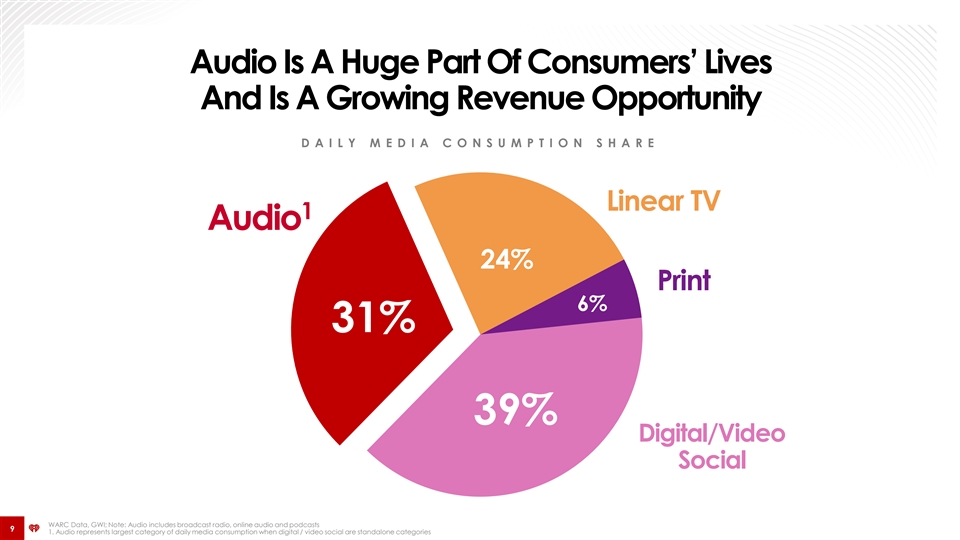

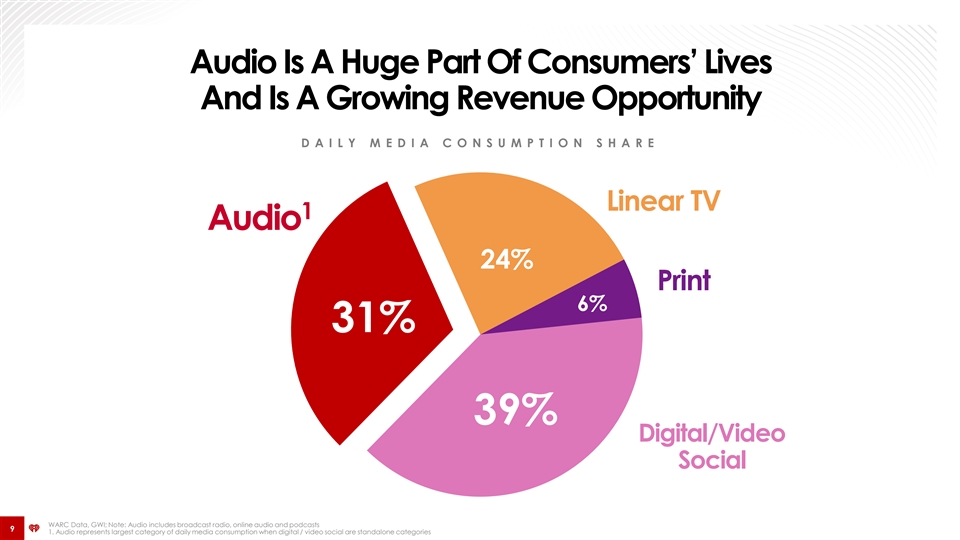

Audio Is A Huge Part Of Consumers’ Lives And Is A Growing Revenue Opportunity D A I L Y M E D I A C O N S U M P T I O N S H A R E Linear TV 1 Audio 24% Print 6% 31% 39% Digital/Video Social WARC Data, GWI; Note: Audio includes broadcast radio, online audio and podcasts 9 1. Audio represents largest category of daily media consumption when digital / video social are standalone categories

Vast Majority of the 31% of Audio Listening is Radio & Podcasts Percentage time with Ad-Enabled Audio Podcasts 19% Ad-Enabled Digital iHeartRadio Ad-Enabled Spotify 14% Audio Ad-Enabled Pandora Ad-Enabled SiriusXM Streaming AM/FM Radio 67% Source: Edison Share of Ear, Q2 2024, P18+ 10

Audio Has Quantifiable Advantages In Any Media Plan. Audio ads have 55% higher attention than digital, social, and TV. Radio is 10X more efficient than online video ads in driving attention. Social performs 83% better after the consumer hears the audio ad first. Source: Dentsu Attention Economy Study 2023; ARN Neurolab Study 2023 11

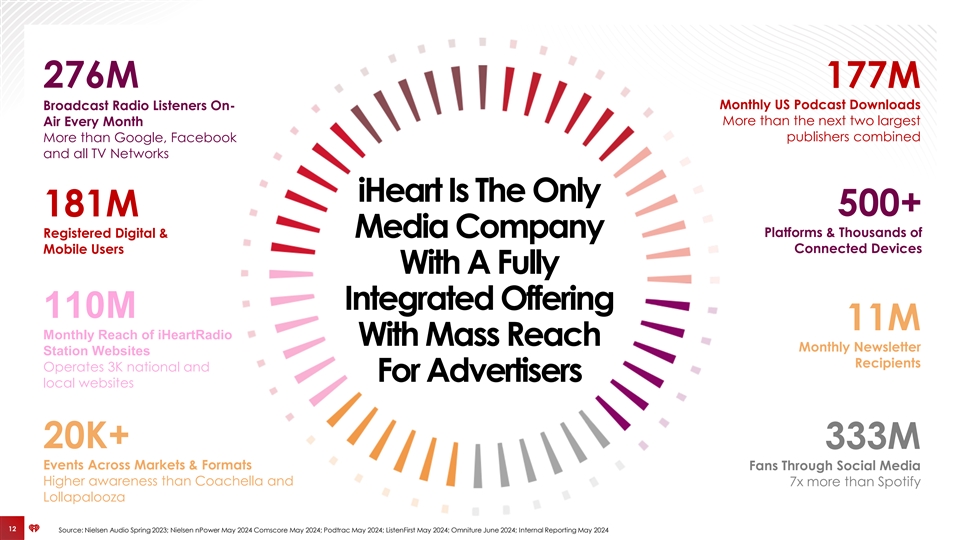

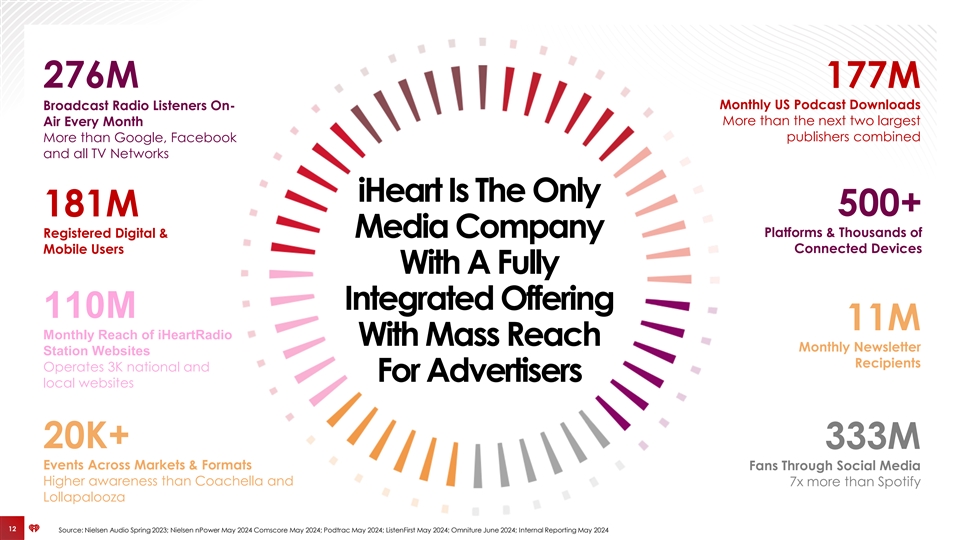

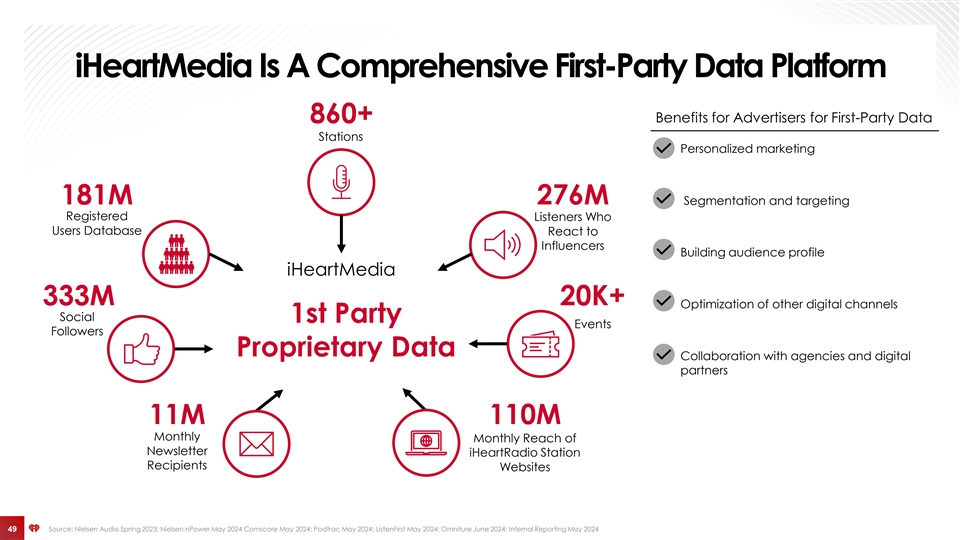

276M 177M Monthly US Podcast Downloads Broadcast Radio Listeners On- More than the next two largest Air Every Month publishers combined More than Google, Facebook and all TV Networks iHeart Is The Only 500+ 181M Platforms & Thousands of Registered Digital & Media Company Connected Devices Mobile Users With A Fully Integrated Offering 110M 11M Monthly Reach of iHeartRadio With Mass Reach Monthly Newsletter Station Websites Operates 3K national and Recipients Operates 3K national and local websites For Advertisers local websites 20K+ 333M Events Across Markets & Formats Fans Through Social Media Higher awareness than Coachella and 7x more than Spotify Lollapalooza 12 Source: Nielsen Audio Spring 2023; Nielsen nPower May 2024 Comscore May 2024; Podtrac May 2024; ListenFirst May 2024; Omniture June 2024; Internal Reporting May 2024

iHeart Also Has The Leadership Position In Podcast Publishing U.S. Podcast Downloads May 2024 Bigger Than The Next 177M 2 Publishers Combined 163M iHeartpodcasts Is The #1 Podcast Publisher In 117M The US With More Downloads Than The Next 2 Publishers 47M 35M 35M 30M Combined 20M 19M 19M 17M Source: Podtrac, Monthly Ranker, May 2024 (excludes Sales Networks) 13

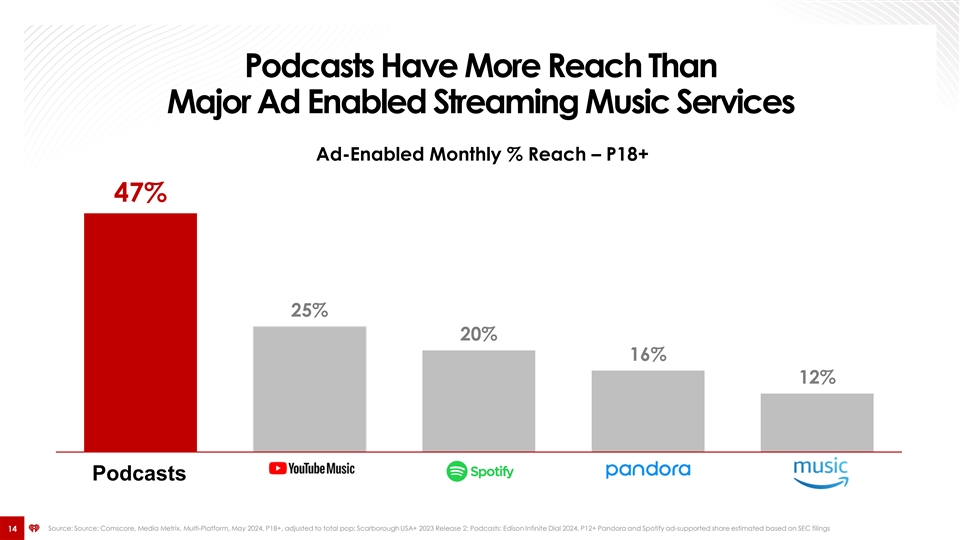

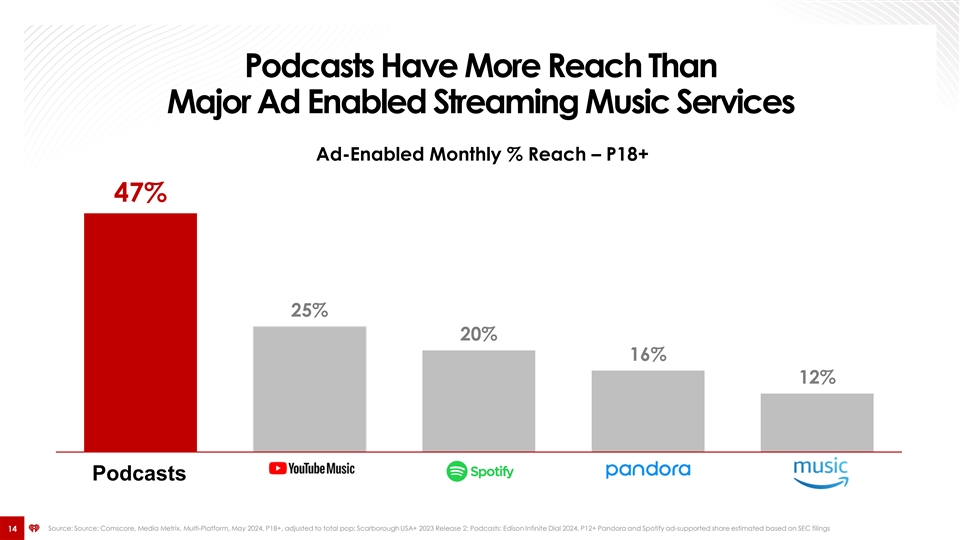

Podcasts Have More Reach Than Major Ad Enabled Streaming Music Services Ad-Enabled Monthly % Reach – P18+ 47% 25% 20% 16% 12% Podcasts YouTube Music Spotify Pandora Amazon Music Podcasts Source: Source: Comscore, Media Metrix, Multi-Platform, May 2024, P18+, adjusted to total pop; Scarborough USA+ 2023 Release 2; Podcasts: Edison Infinite Dial 2024, P12+ Pandora and Spotify ad-supported share estimated based on SEC filings 14

Podcast & Radio Are Complementary Advertising Services Share of Time Spent Listening by Location In-home Listening 65% 65% Out-of-home Listening 35% 35% Podcasts Radio 15 Source: Nielsen Audio Today Report, 2023, A18+; Edison Research Q4 2023

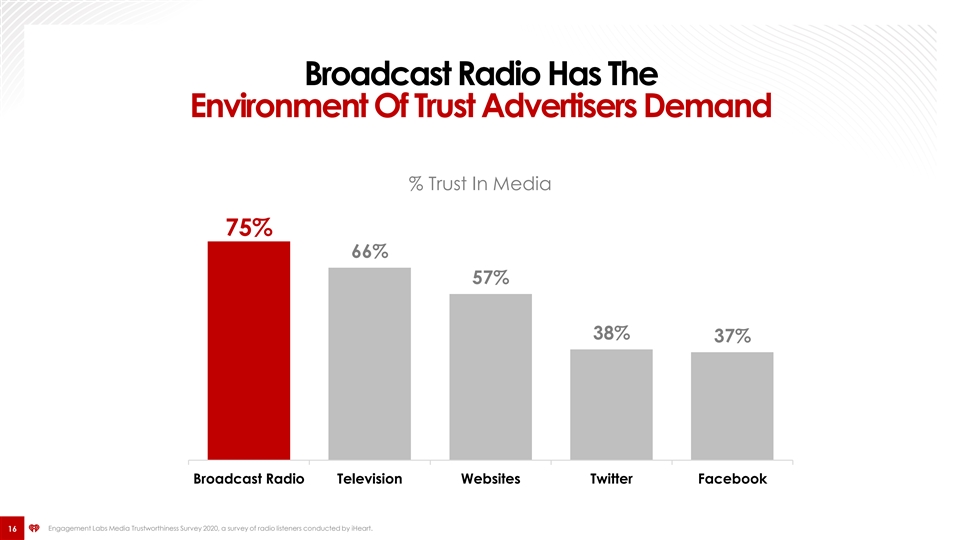

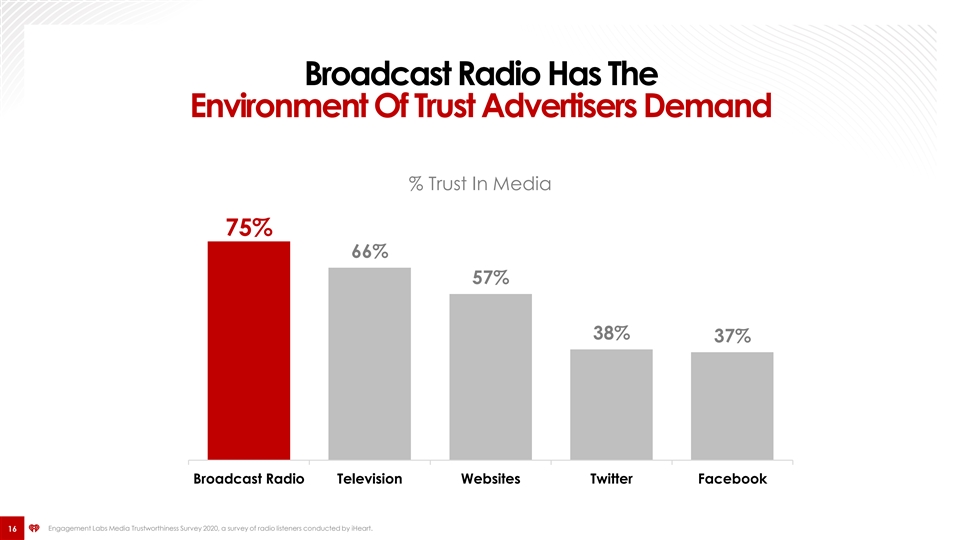

Broadcast Radio Has The Environment Of Trust Advertisers Demand % Trust In Media 75% 66% 57% 38% 37% Broadcast Radio Television Websites Twitter Facebook Engagement Labs Media Trustworthiness Survey 2020, a survey of radio listeners conducted by iHeart. 16

iHeart Covers All Consumer Segments With Trusted & Influential Personalities CHARLAMAGNE WILMER VALDERRAMA JAY SHETTY ANGELA YEE ENRIQUE SANTOS PARIS HILTON ELVIS DURAN MALCOLM GLADWELL CHELSEA HANDLER BOBBY BONES ANGIE MARTINEZ CLAY TRAVIS BUCK SEXTON NIKKI GLASER RYAN SEACREST QUESTLOVE DELILAH STEVE HARVEY COLIN COWHERD SEAN HANNITY EVA LANGORIA 17

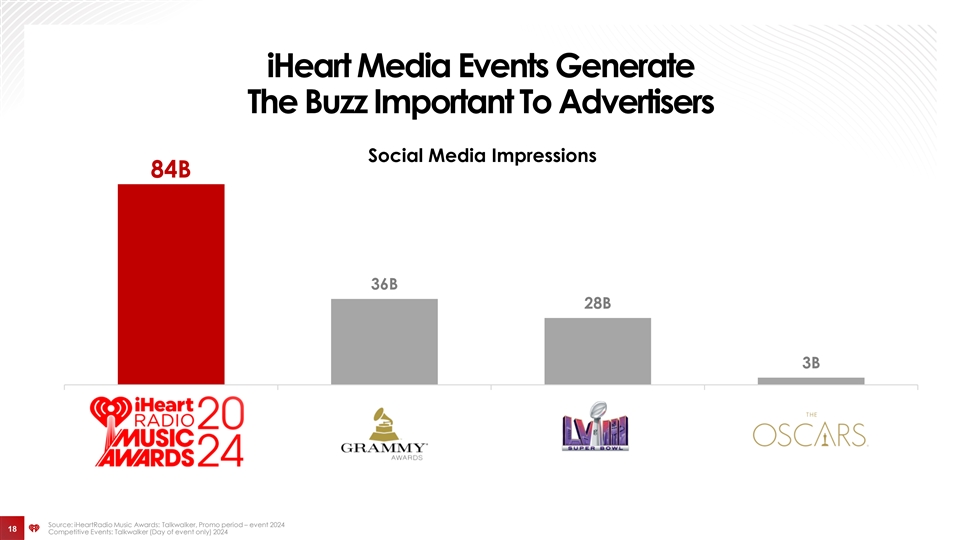

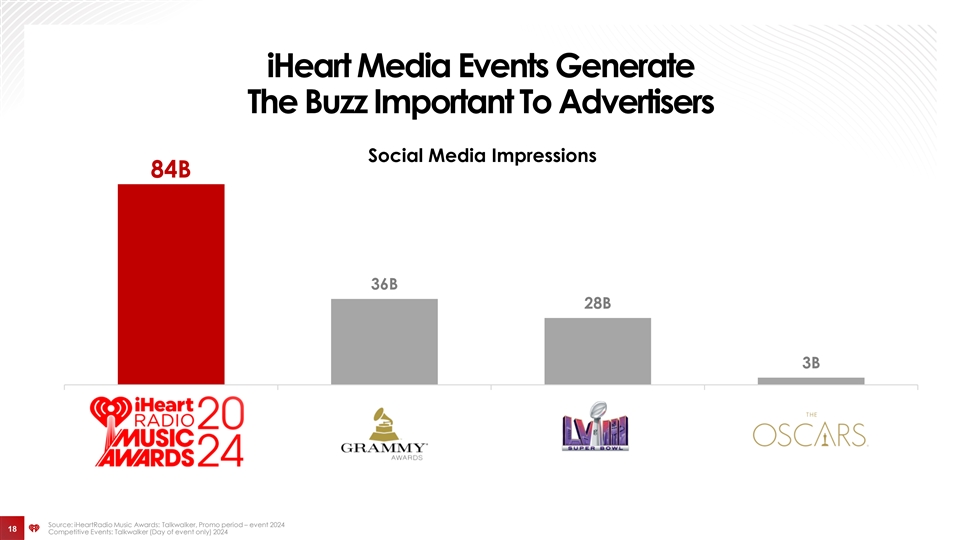

iHeart Media Events Generate The Buzz Important To Advertisers Social Media Impressions 84B 36B 28B 3B iHeartRadio Music Awards Grammys Superbowl Oscars Source: iHeartRadio Music Awards: Talkwalker, Promo period – event 2024 18 18 Competitive Events: Talkwalker (Day of event only) 2024

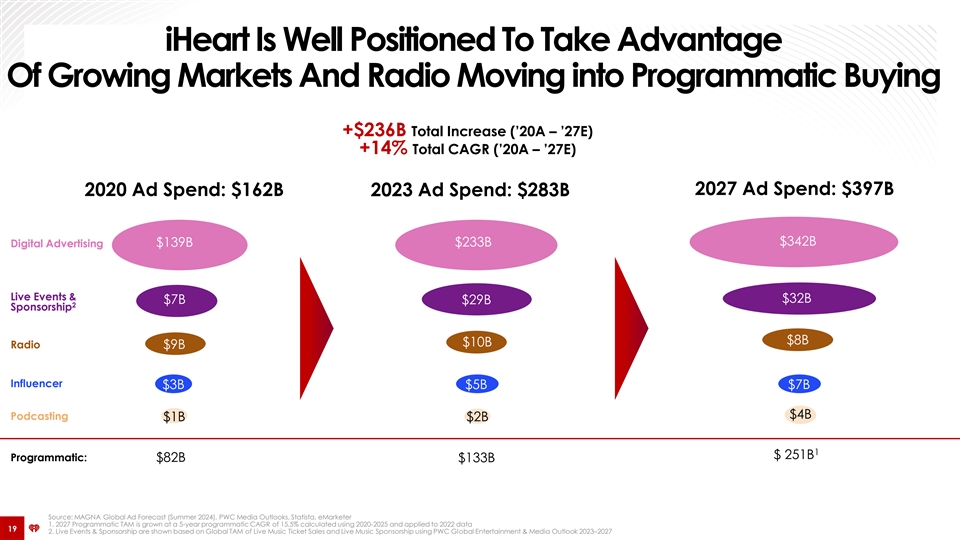

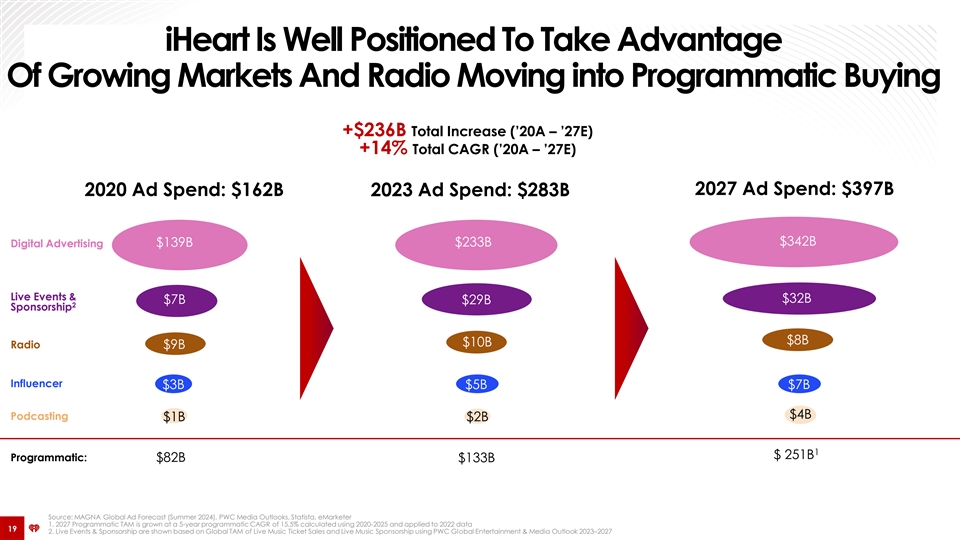

iHeart Is Well Positioned To Take Advantage Of Growing Markets And Radio Moving into Programmatic Buying +$236B Total Increase (’20A – ’27E) +14% Total CAGR (’20A – ’27E) 2027 Ad Spend: $397B 2020 Ad Spend: $162B 2023 Ad Spend: $283B $342B $139B $233B Digital Advertising Live Events & $32B $7B $29B 2 Sponsorship $8B $10B Radio $9B Influencer $3B $5B $7B $4B Podcasting $1B $2B $16B 1 $ 251B Programmatic: $82B $133B Source: MAGNA Global Ad Forecast (Summer 2024), PWC Media Outlooks, Statista, eMarketer 1. 2027 Programmatic TAM is grown at a 5-year programmatic CAGR of 15.5% calculated using 2020-2025 and applied to 2022 data 19 2. Live Events & Sponsorship are shown based on Global TAM of Live Music Ticket Sales and Live Music Sponsorship using PWC Global Entertainment & Media Outlook 2023–2027

Monetization & Growth Initiatives Programmatic • Introduce data enhanced Digital broadcast radio into digital ad buys, which will provide mass reach for programmatic • Continuous participation in Podcast audio inventory an expanding TAM, including audio, OTT, • Broadcast programmatic social, websites, streaming, • Benefits from market provides significant “plug - Political and broadcast radio in growing at ~40% and and play” top -line digital buying systems ~25% in ’24E and ’25E opportunity participating in 1 respectively the digital TAM • Enhanced • Leverage technology and Cost Rationalization demographic and data to enhance music • Growth enabled • Establish direct connections voter data to better programming and through existing, within the advertising supply service political scheduling by evaluating synergistic broadcasting chain to improve efficacy of • Utilize technology to create spenders listener sentiment and assets campaigns and use real-time more efficient operating engagement in real-time data to engage audiences structures• Bottom-line benefit • Leverage user data and from an increase in • Collaborate with agencies audience cohorts to • Automated planning and • Leverage AI / ML to drive high-margin business, in and clients to take monetize all inventory buying benefits unique efficiencies addition to upfront advantage of customized characteristics of broadcast cash payments • Application of AI in platforms radio • Continue to use scale to podcast translation, reduce costs • Strong annual political • Benefit from data cohorts enabling cost-effective revenue with significant served across all forms of international expansion bi-annual uplift audio including broadcast Source: 1. PWC Podcast Ad Revenue Study 20

Significant Value Generated From Cost Management Initiatives iHeartMedia management has a significant track record of successfully implementing cost saving initiatives • Reimagined operating structure and real estate needs reduced expenses by $325M run-rate since 2019. ▪ Reduced costs in Multiplatform Group by 7% since 2019 to 2023 to invest in new business opportunities in higher growth Digital Audio Group which grew Adjusted EBITDA by 270% over that same time period. • Continual streamlining of corporate and operating functions through strategic outsourcing and technology - including AI. 21

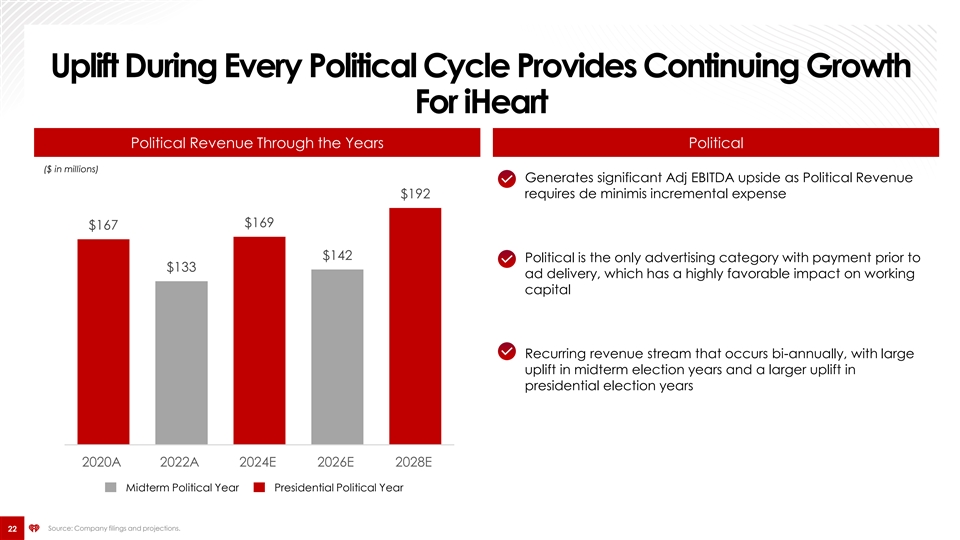

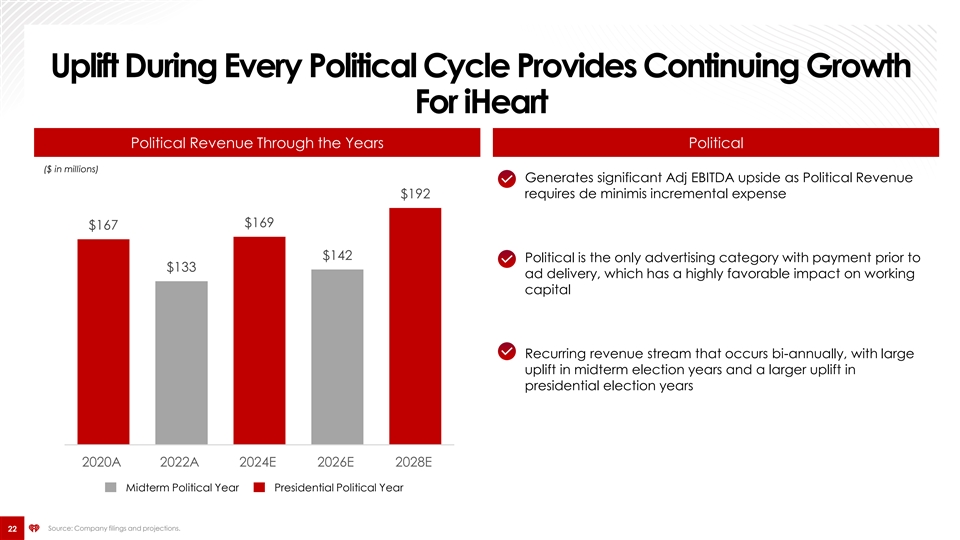

Uplift During Every Political Cycle Provides Continuing Growth For iHeart Political Revenue Through the Years Political ($ in millions) • Generates significant Adj EBITDA upside as Political Revenue $192 requires de minimis incremental expense $169 $167 $142 • Political is the only advertising category with payment prior to $133 ad delivery, which has a highly favorable impact on working capital • Recurring revenue stream that occurs bi-annually, with large uplift in midterm election years and a larger uplift in presidential election years 2020A 2022A 2024E 2026E 2028E Midterm Political Year Presidential Political Year Source: Company filings and projections. 22

And Leading Podcast Publisher Across All Podtrac Categories Most Shows In Podtrac Most Shows In Podtrac Most Shows In Podtrac RANKING THE TOP 10 1MM+ LISTENS* by category 100 29 37 15 10 8 13 4 7 #1 in total global Downloads #1 in unique U.S. Listeners The Only Network with shows in for 51 consecutive months for 48 consecutive months all 19 Podtrac Content Categories iHeartPodcasts has 100+ total shows that reach 1MM+ listeners/month Source: PodtracCategory Rankers ‘1MM+ Listens’ indicates average monthly listens, September 2024 23 *Only includes podcasts that appear in the Podtrac Category Ranker – an industry ranking of the top 30 most listened to podcasts in the U.S. by genre in a month

iHeart Is Monetizing Growing Digital Inventory Ability to serve O&O and third-party inventories presents significant growth opportunity Increasing Digital Inventory From Growing Markets… … Served by Be-sint -Class Ad-Tech Capabilities Websites Podcast OTT Streaming Social Audio Video Newsletter 24

Data And Programmatic Provide Important Growth Vector And Will Drive Digital Revenue For Broadcast Radio iHeartMedia SmartAudio AD PRODUCTS iHeartMedia iHeartMedia iHeartMedia SmartAudio SmartAudio SmartAudio ADVANCED ADVERTISING PLATFORM MEASUREMENT AUDIENCES iHeartMedia SmartAudio EXCHANGE iHeartMedia Investment Case Key Benefits for Advertisers • Significant top-line opportunity through the addition of programmatic radio • Activate iHeartMedia’s broadcast radio inventory programmatically in near inventory into the digital marketplace real-time • Access iHeartMedia’s broadcast radio, streaming radio, and podcast assets • Establishes iHeartMedia as the industry leader for programmatic ad sales in for inclusion in omnichannel, programmatic buys audio • Gain greater reach and efficiency • Makes it easier to buy iHeart as part of an omnichannel campaign • Deploy real-time bidding and a data-driven approach • Capitalizes on the iHeart’s scale and reach 25

Revenue Growth Revenue Historical & Projected ’20 – ’28E ($ in millions) CAGR Total $4,450 5% Group $4,171 $4,141 $3,912 $3,905 $3,908 332 Audio $3,751 $3,558 2% 271 297 Services 261 304 332 257 $2,948 248 2% Multiplatform 2,583 275 2,464 2,504 2,404 2,412 Total 2,597 2,435 16% 2,489 Digital Audio 2,207 27% Podcasting 703 639 581 529 454 408 Dig ex 358 253 11% 101 Podcasting 808 843 769 717 726 663 661 582 373 20'A 21'A 22'A 23'A 24'E 25'E 26'E 27'E 28'E Growth % 21% 10% (4%) 4% 0% 6% 1% 7% Growth 27% 7% (2%) 0% 3% 3% 3% 3% (1) (ex. Political) % Note: Total group revenue includes eliminations. 26 26 (1) Revenue ex. Political is a non-GAAP financial measure. Please see Appendix for reconciliation of non-GAAP financial measures to their most comparable GAAP financial measures.

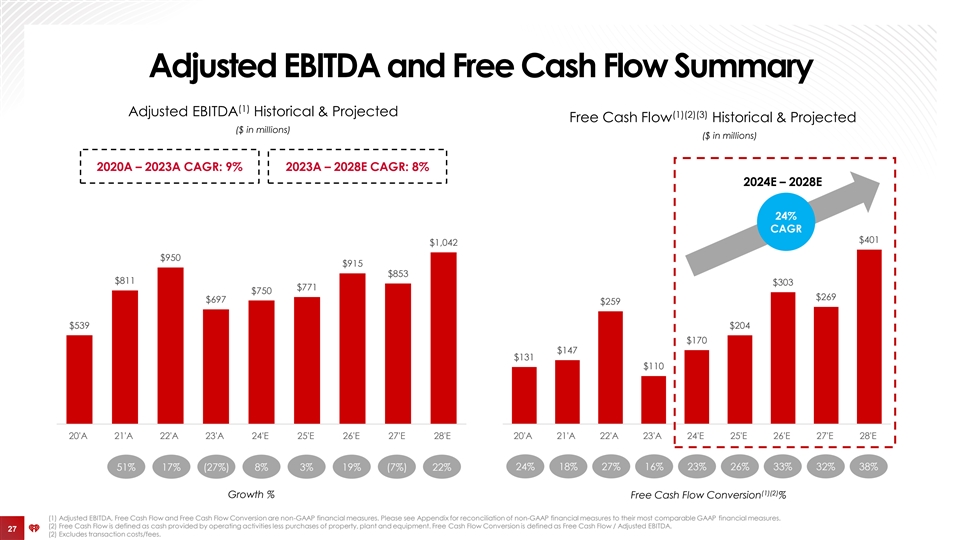

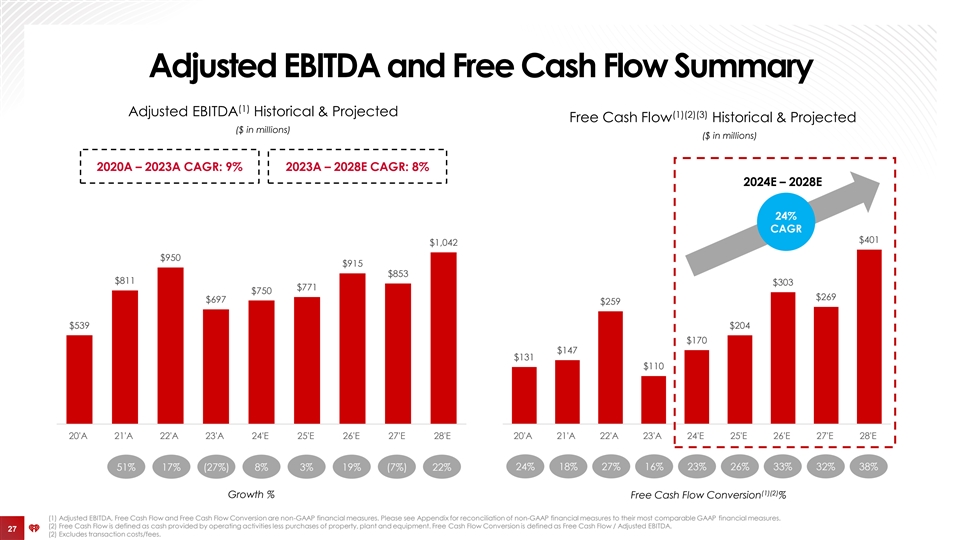

Adjusted EBITDA and Free Cash Flow Summary (1) Adjusted EBITDA Historical & Projected (1)(2)(3) Free Cash Flow Historical & Projected ($ in millions) ($ in millions) 2020A – 2023A CAGR: 9% 2023A – 2028E CAGR: 8% 2024E – 2028E 24% CAGR $401 $1,042 $950 $915 $853 $811 $303 $771 $750 $269 $697 $259 $539 $204 $170 $147 $131 $110 20'A 21'A 22'A 23'A 24'E 25'E 26'E 27'E 28'E 20'A 21'A 22'A 23'A 24'E 25'E 26'E 27'E 28'E 51% 17% (27%) 8% 3% 19% (7%) 22% 24% 18% 27% 16% 23% 26% 33% 32% 38% (1)(2) Growth % Free Cash Flow Conversion % (1) Adjusted EBITDA, Free Cash Flow and Free Cash Flow Conversion are non-GAAP financial measures. Please see Appendix for reconciliation of non-GAAP financial measures to their most comparable GAAP financial measures. (2) Free Cash Flow is defined as cash provided by operating activities less purchases of property, plant and equipment. Free Cash Flow Conversion is defined as Free Cash Flow / Adjusted EBITDA. 27 27 (2) Excludes transaction costs/fees.

Multiplatform Group 28 28

Multiplatform Group Overview FY 2023 Revenue: FY 2023 Segment $2,435M Adjusted EBITDA: $553M Events & Broadcast Radio Sponsorships Networks 29

iHeart Broadcast Radio Has The Largest National Reach Amongst U.S. Broadcasters iHeart Broadcast Audience Has Increased 18% Over Last 20 Years (persons in millions) (Broadcast) 276 (Broadcast) 233 Bigger Than The 860+ ~160 70 Next Two Largest Radio Competitors Owned + Markets Markets with Combined Operated Stations Served #1 Station Group 2003 2023 30 Source: Broadcast Radio: Nielsen Audio Nationwide, P6+, Spring 2022/2023; Television: Nelsen nPower, P6+, December 2022/2023, L+SD

The Enduring Power Of Broadcast Radio REACH USAGE Radio Leads Audio Audience Radio Remains Most Popular Option in Audio Ad-Supported Monthly Reach % US Population Time Spent With Ad-Enabled Audio (2023) (2023) iHM Total Satellite Radio 91% Reach: 89% Streaming 4% outube Music 25% 12% Spotify 20% Podcast 1 % Ad-Enabled Radio % Pandora 1 % Sirius M 1 % Amazon Music 12% 31 Source: Source: Nielsen Audio Today 2023; Comscore, Media Metrix, Multi-Platform, May 2024, P18+, adjusted to total pop; Scarborough USA+ 2023 Release 2

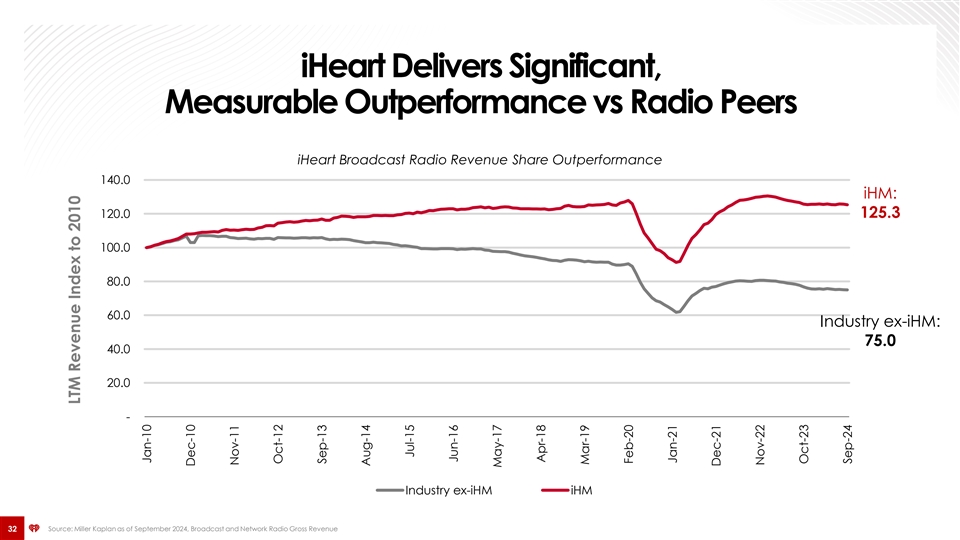

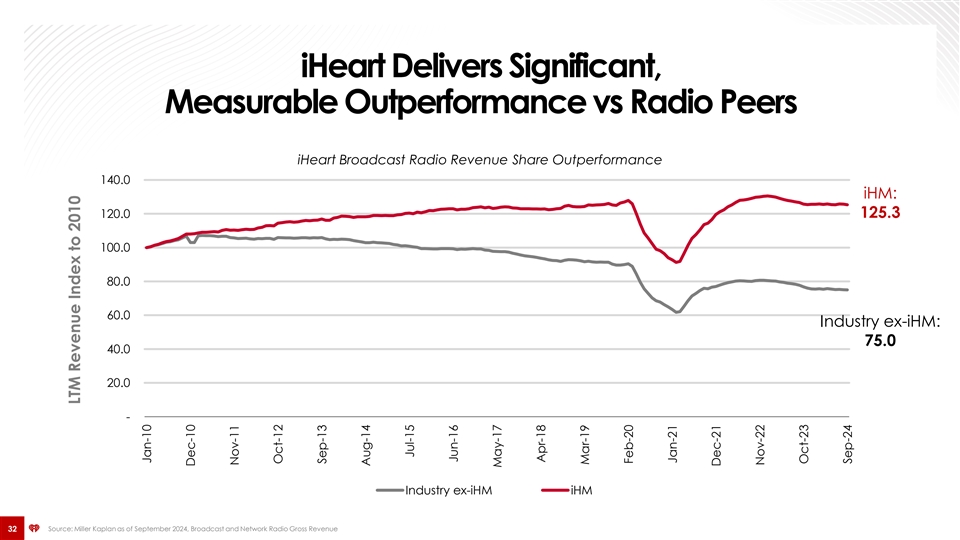

iHeart Delivers Significant, Measurable Outperformance vs Radio Peers iHeart Broadcast Radio Revenue Share Outperformance 140.0 iHM: 120.0 125.3 100.0 80.0 60.0 Industry ex-iHM: 75.0 40.0 20.0 - Industry ex-iHM iHM 32 Source: Miller Kaplan as of September 2024, Broadcast and Network Radio Gross Revenue LTM Revenue Index to 2010 Jan-10 Dec-10 Nov-11 Oct-12 Sep-13 Aug-14 Jul-15 Jun-16 May-17 Apr-18 Mar-19 Feb-20 Jan-21 Dec-21 Nov-22 Oct-23 Sep-24

Networks Overview Leading syndicator of domestic radio Industry leader in providing valuable real- programming, producing and distributing Description time traffic and weather content that serves content from top programs with significant the broader audio media ecosystem opportunity to increase international revenue Monthly Reach 245M+ 200M+ (Listeners) Affiliates 8.6K+ 2.4K+ Key Programs On Air with The Breakfast Hey, It’s ON with Steve Harvey Ryan Seacrest Club Delilah Mario Lopez Morning Show Elvis Duran and Ellen K Enrique Santos The Bobby Big Boy’s the Morning Show Morning Show Neighborhood Show Bones Show 33 33 Source: Nielsen Audio Nationwide and PPM Metros/Act 1, Spring 2022, P6+; internal affiliate databases

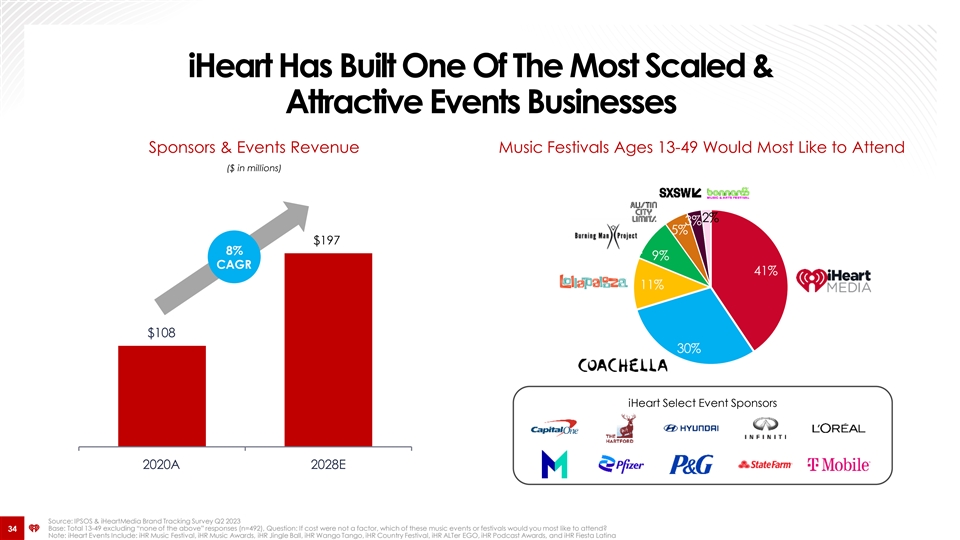

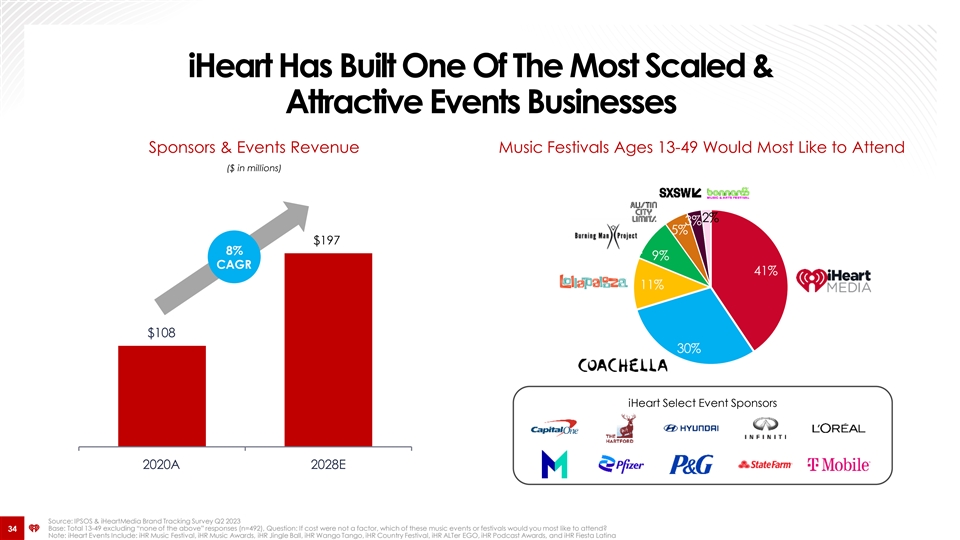

iHeart Has Built One Of The Most Scaled & Attractive Events Businesses Sponsors & Events Revenue Music Festivals Ages 13-49 Would Most Like to Attend ($ in millions) 2% % 5% 20 $197 9% 8% 9% CAGR 41% 11% 10 0% iHeart Select Event Sponsors 2020A 202 E Source: IPSOS & iHeartMedia Brand Tracking Survey Q2 2023 Base: Total 13-49 excluding “none of the above” responses (n=492), QuesItfi o cn o:st were not a factor, which of these music events or festivals would you most like to attend? 34 Note: iHeart Events Include: iHR Music Festival, iHR Music Awards, iHR Jingle Ball, iHR Wango Tango, iHR Country Festival, iHR ALTer EGO, iHR Podcast Awards, and iHR Fiesta Latina

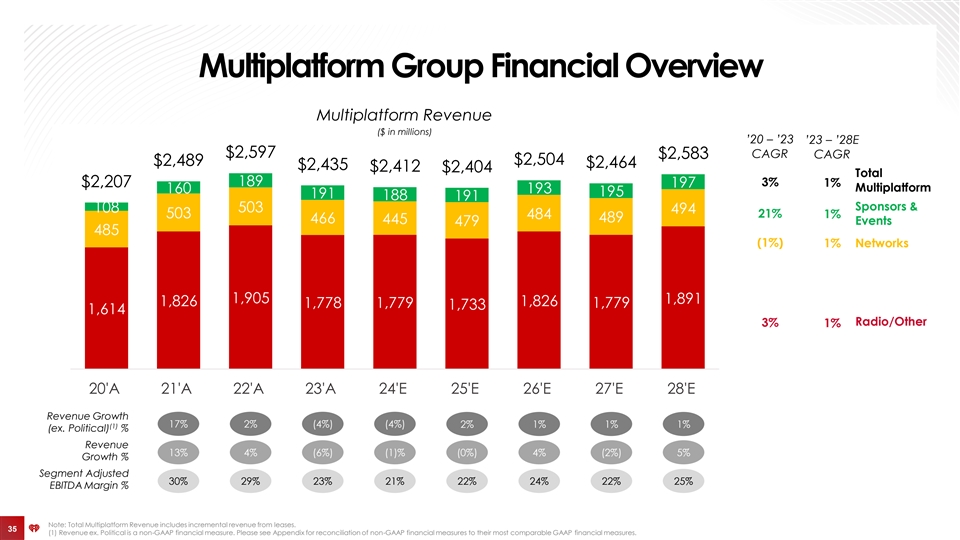

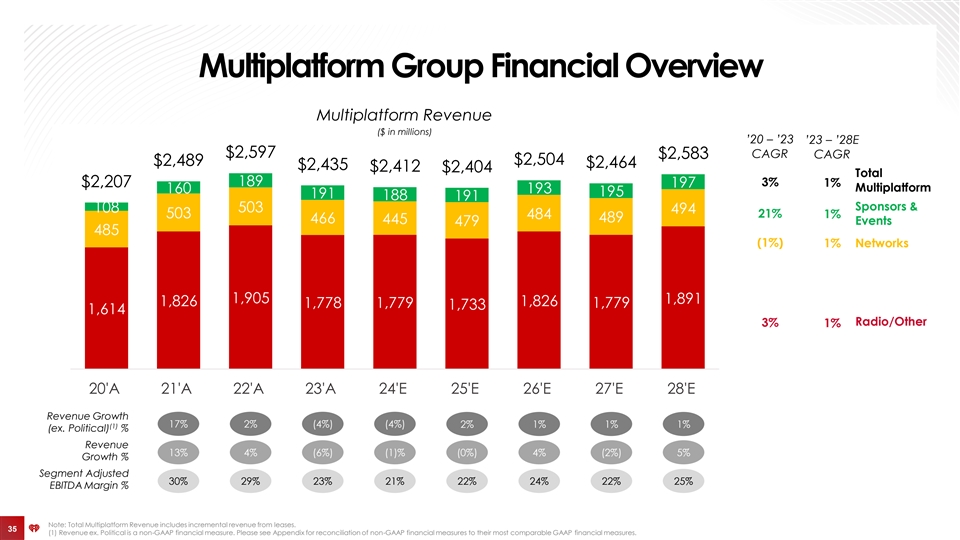

Multiplatform Group Financial Overview Multiplatform Revenue ($ in millions) ’20 – ’23 ’23 – ’28E $2,597 $2,583 CAGR CAGR $2,504 $2,489 $2,464 $2,435 $2,412 $2,404 Total 189 3% 1% $2,207 197 Multiplatform 160 193 195 191 188 191 Sponsors & 503 108 494 503 484 21% 1% 489 466 445 Events 479 485 (1%) 1% Networks 1,905 1,891 1,826 1,826 1,778 1,779 1,779 1,733 1,614 Radio/Other 3% 1% 20'A 21'A 22'A 23'A 24'E 25'E 26'E 27'E 28'E Revenue Growth 17% 2% (4%) (4%) 2% 1% 1% 1% (1) (ex. Political) % Revenue 13% 4% (6%) (1)% (0%) 4% (2%) 5% Growth % Segment Adjusted 30% 29% 23% 21% 22% 24% 22% 25% EBITDA Margin % Note: Total Multiplatform Revenue includes incremental revenue from leases. 35 35 (1) Revenue ex. Political is a non-GAAP financial measure. Please see Appendix for reconciliation of non-GAAP financial measures to their most comparable GAAP financial measures.

Digital Audio Group 36 36

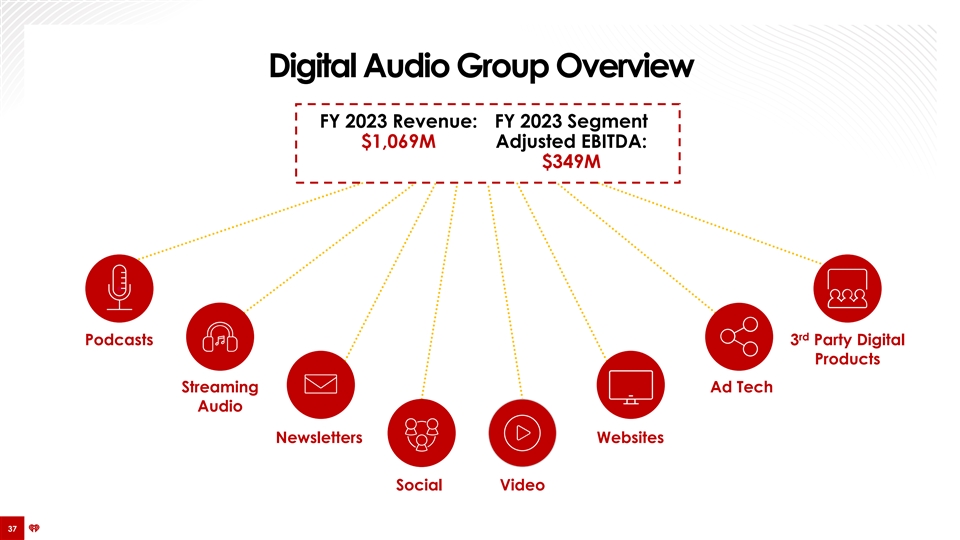

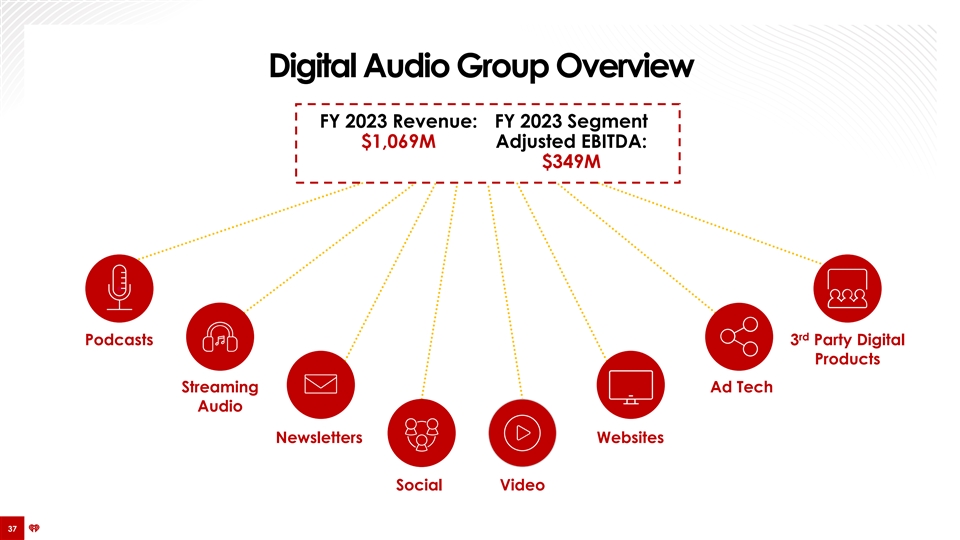

Digital Audio Group Overview FY 2023 Revenue: FY 2023 Segment $1,069M Adjusted EBITDA: $349M • rd Podcasts 3 Party Digital Products Streaming Ad Tech Audio Newsletters Websites Social Video 37

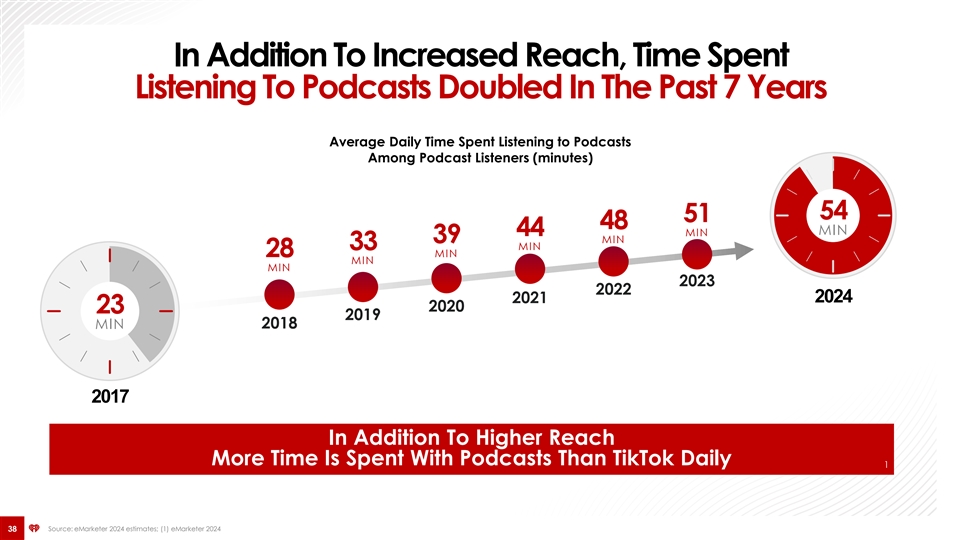

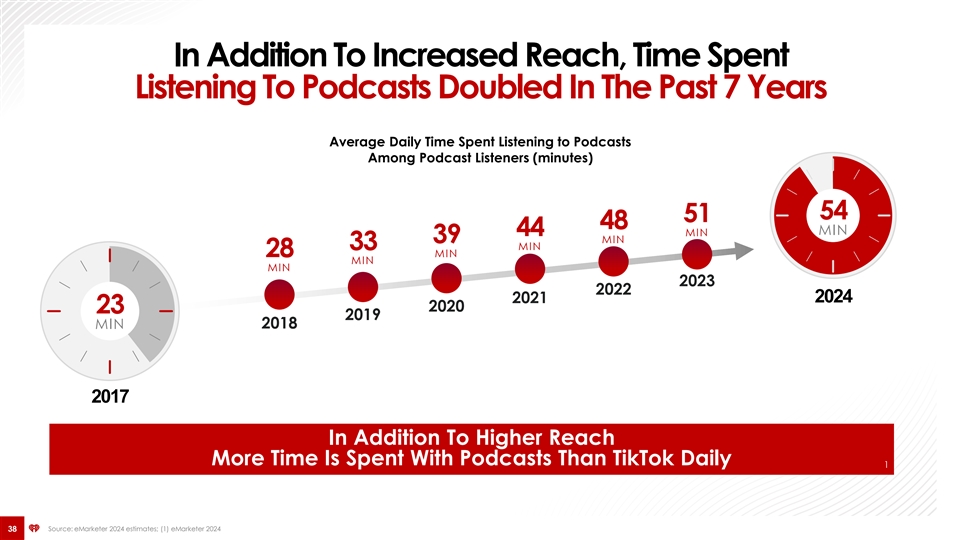

In Addition To Increased Reach, Time Spent Listening To Podcasts Doubled In The Past 7 Years Average Daily Time Spent Listening to Podcasts Among Podcast Listeners (minutes) 54 51 48 MIN 44 MIN 39 MIN 33 MIN 28 MIN MIN MIN 2023 2022 2024 2021 2020 23 2019 MIN 2018 2017 In Addition To Higher Reach 5 More Time Is Spent With Podcasts Than TikTok Daily 1 5 38 Source: eMarketer 2024 estimates; (1) eMarketer 2024

iHeartRadio Strategically Positioned in the 1 Podcast Value Chain High Value Low Value PODCAST PUBLISHERS PODCAST SALES REPS. DISTRIBUTORS • Carry podcasts on platform • Sell/backfill podcasts for • Control/produce all content • No economics unless for • Publish content across multiple certain Publishers another service • Small commission – with most distributors (subscriptions, consumer economics to Publisher • Full ad-revenue benefits captured by app, device sales) content Publishers Podtrac Industry Rankings – September Non-Publisher Sales Agents: Podcast RSS Feed: 2024 AUDIENCE NETWORK 39 (1) Companies listed represent the major players in each category.

iHeart Products Now Available Across Thousands Of Devices A B iHeart Diversified and High-Profile Product Suite iHeart App’s Ubiquitous Distribution Across Devices rd Digital Only Artist & Mood 3 Party Live Radio Stations Stations Products Taylor Swift Psychographic Audience Networks Dua Lipa Doja Cat 40

Digital Audio Group Financial Overview Digital Audio Revenue ($ in millions) ’20 – ’23 ’23 – ’28E $1,546 CAGR CAGR $1,447 31% 8% Total DAG $1,351 $1,254 $1,170 $1,069 703 $1,022 59% 12% Podcasting 639 581 $834 529 454 408 358 253 $474 Dig ex 21% 5% Podcasting 101 843 808 769 726 717 663 661 582 373 20'A 21'A 22'A 23'A 24'E 25'E 26'E 27'E 28'E Revenue 26% 76% 22% 5% 9% 7% 8% 7% 7% Growth % Segment Adjusted 28% 31% 30% 33% 33% 35% 35% 36% 36% EBITDA Margin % 41 41

Audio & Media Services Group 42 42

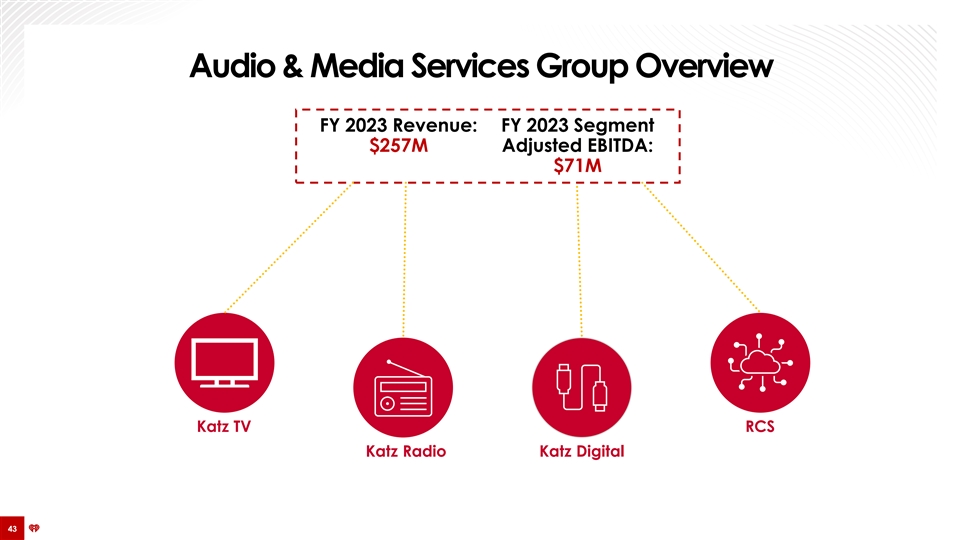

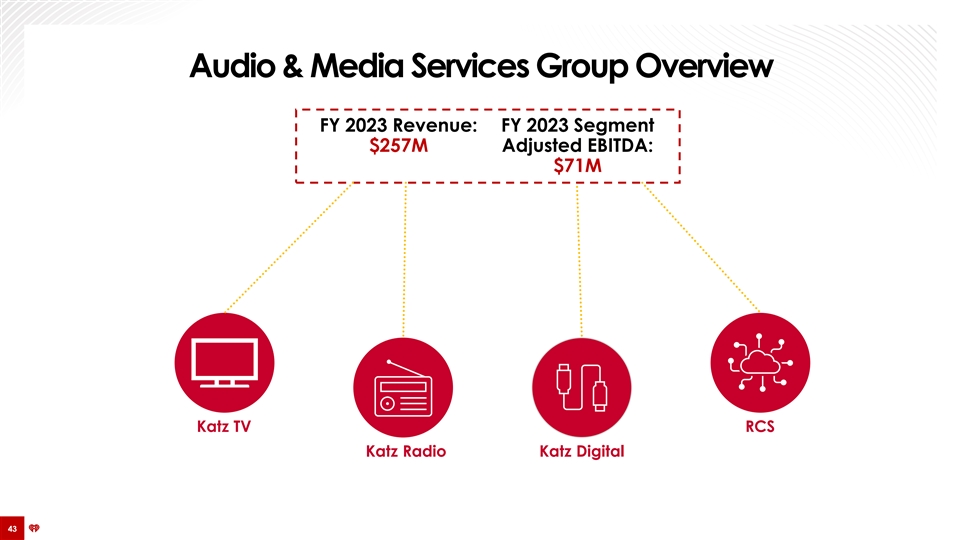

Audio & Media Services Group Overview FY 2023 Revenue: FY 2023 Segment $257M Adjusted EBITDA: $71M Katz TV RCS Katz Radio Katz Digital 43

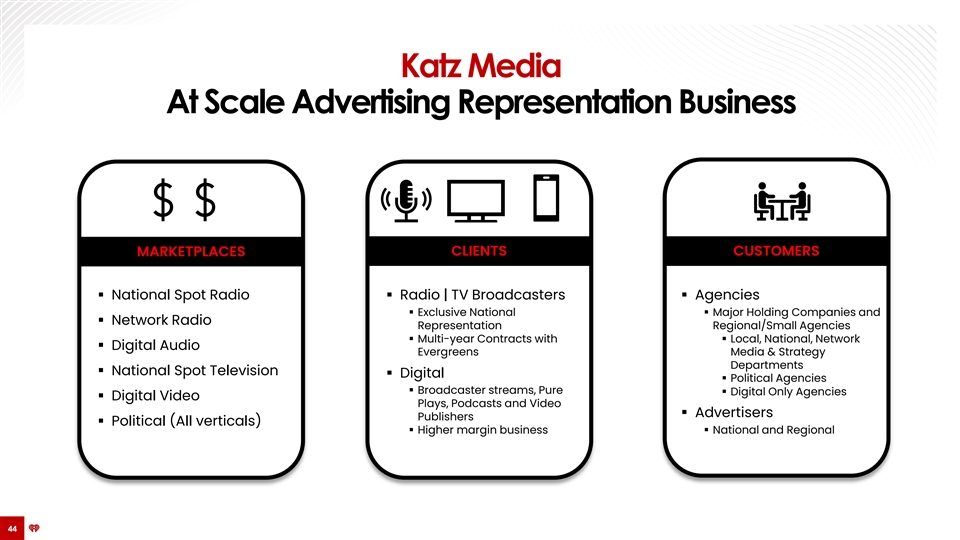

Katz Media At Scale Advertising Representation Business MARKETPLACES CLIENTS CUSTOMERS ▪ National Spot Radio▪ Radio | TV Broadcasters▪ Agencies ▪ Exclusive National ▪ Major Holding Companies and ▪ Network Radio Representation Regional/Small Agencies ▪ Multi-year Contracts with ▪ Local, National, Network ▪ Digital Audio Evergreens Media & Strategy Departments ▪ National Spot Television ▪ Digital ▪ Political Agencies ▪ Broadcaster streams, Pure ▪ Digital Only Agencies ▪ Digital Video Plays, Podcasts and Video ▪ Advertisers Publishers ▪ Political (All verticals) ▪ Higher margin business▪ National and Regional 44

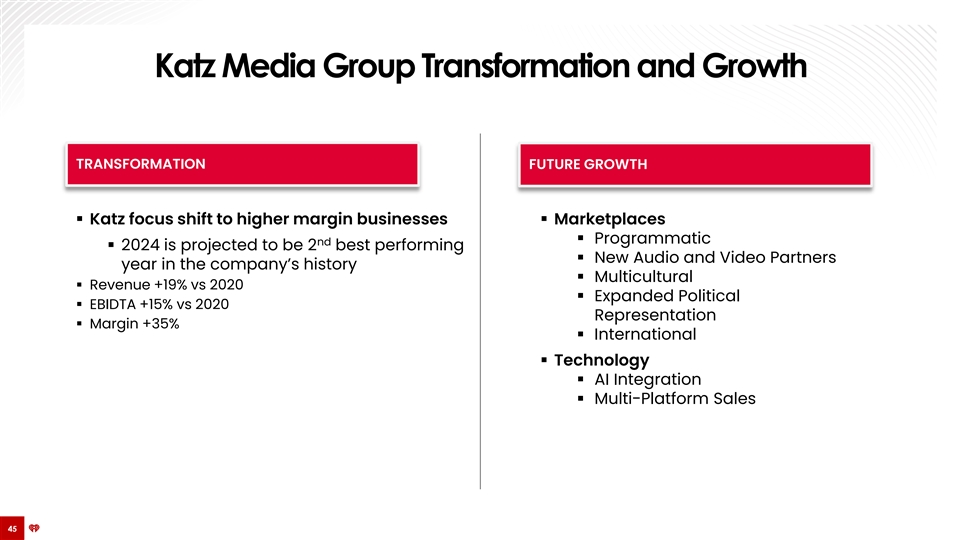

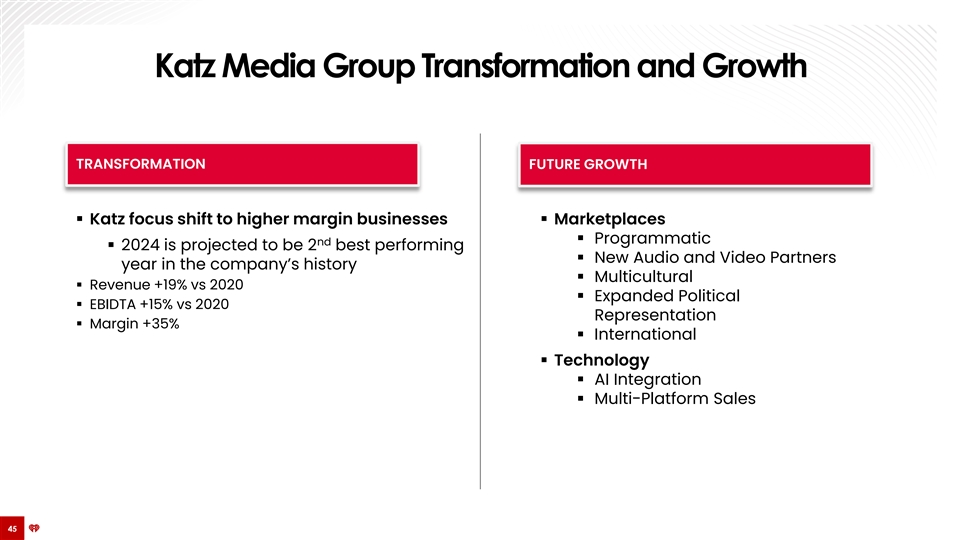

Katz Media Group Transformation and Growth TRANSFORMATION FUTURE GROWTH ▪ Katz focus shift to higher margin businesses▪ Marketplaces ▪ Programmatic nd ▪ 2024 is projected to be 2 best performing ▪ New Audio and Video Partners year in the company’s history ▪ Multicultural ▪ Revenue +19% vs 2020 ▪ Expanded Political ▪ EBIDTA +15% vs 2020 Representation ▪ Margin +35% ▪ International ▪ Technology ▪ AI Integration ▪ Multi-Platform Sales 45

RCS Overview Sound Software Powering The Global Broadcast Business CRM solution Multi-station music Radio newsroom Comprehensive Radio automation The nation’s leading local Online professional providing sales and scheduling software, system providing reporting service and playout system monitoring company, streaming solution inventory data, as enabling station newscast gathering, delivering crucial with a multitude of serving broadcast TV, with audio processing well as scheduling, creation, clock writing and editing, airplay information audio coaching cable, radio, print and and integrated billing and reporting design, and song and broadcast and analytical tools settings digital with real time listener reports options coding archiving for media experts intelligence One of The Leading Global Broadcast Software 10K+ Clients 60+ Broadcasting Patents Companies 46 46 Source: Company reports

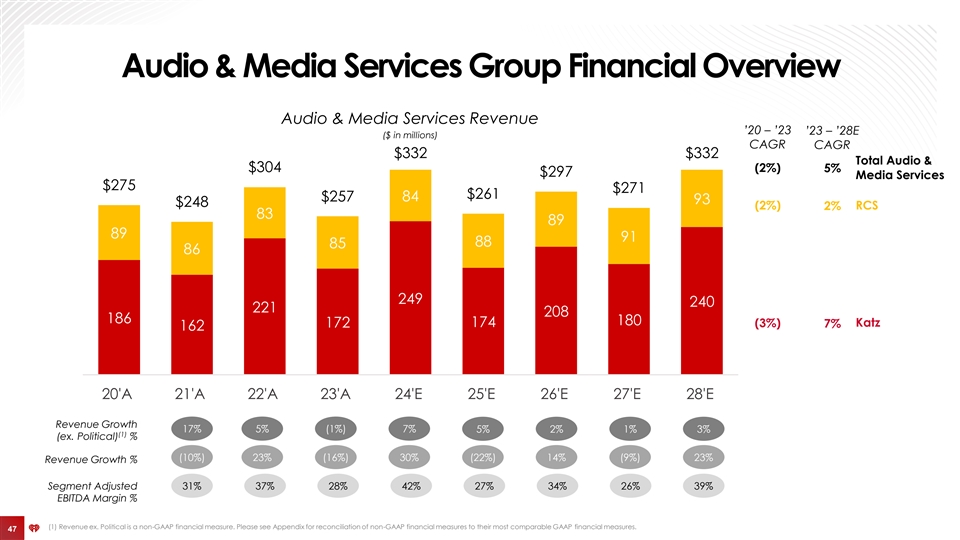

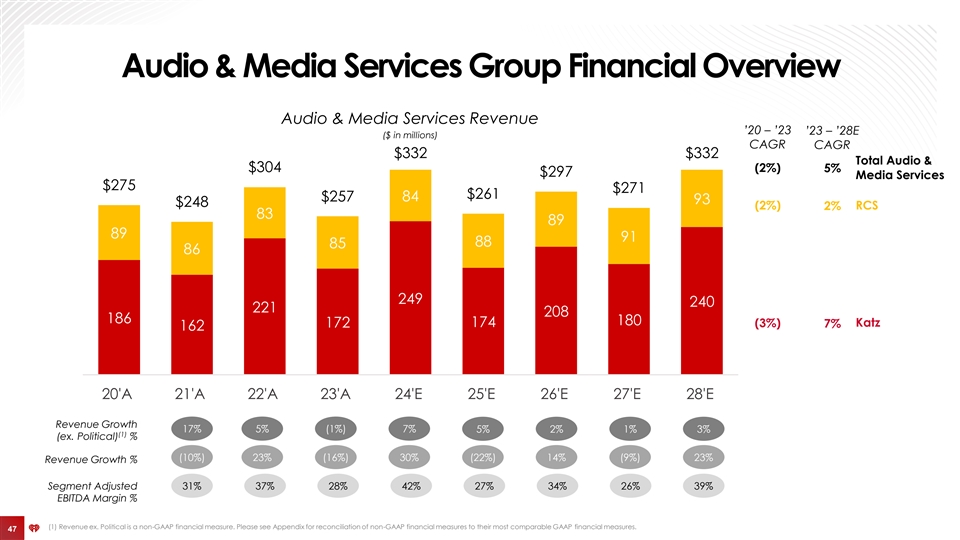

Audio & Media Services Group Financial Overview Audio & Media Services Revenue ’20 – ’23 ’23 – ’28E ($ in millions) CAGR CAGR $332 $332 Total Audio & $304 (2%) 5% $297 Media Services $275 $271 $261 $257 84 93 $248 (2%) RCS 2% 83 89 89 91 88 85 86 249 240 221 208 186 180 Katz 172 174 (3%) 7% 162 20'A 21'A 22'A 23'A 24'E 25'E 26'E 27'E 28'E Revenue Growth 17% 5% (1%) 7% 5% 2% 1% 3% (1) (ex. Political) % (10%) 23% (16%) 30% (22%) 14% (9%) 23% Revenue Growth % Segment Adjusted 31% 37% 28% 42% 27% 34% 26% 39% EBITDA Margin % (1) Revenue ex. Political is a non-GAAP financial measure. Please see Appendix for reconciliation of non-GAAP financial measures to their most comparable GAAP financial measures. 47 47

Data & Technology 48 48

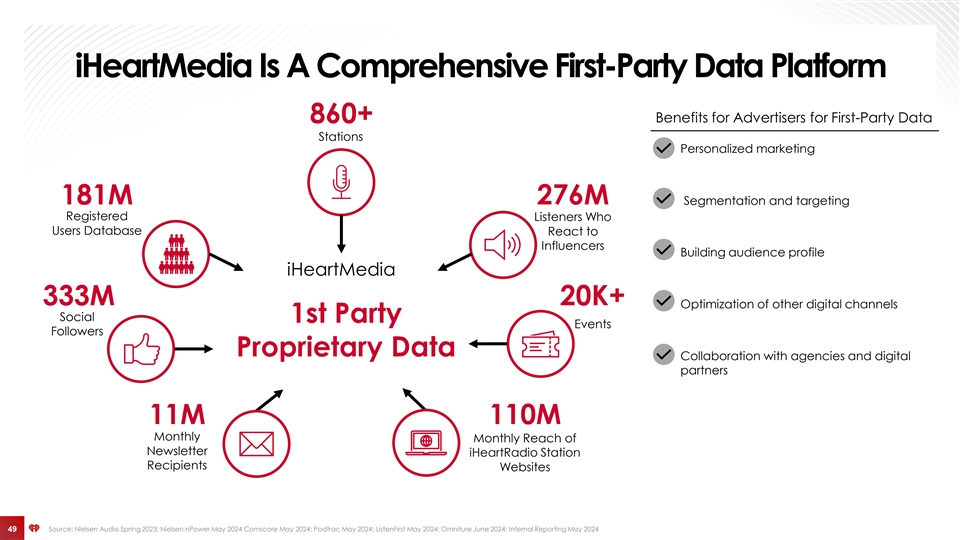

iHeartMedia Is A Comprehensive First-Party Data Platform Benefits for Advertisers for First-Party Data 860+ Stations • Personalized marketing c 181M 276M• Segmentation and targeting Registered Listeners Who Users Database React to c Influencers • Building audience profile c iHeartMedia 333M 20K+ • Optimization of other digital channels Social 1st Party Events Followers c c Proprietary Data • Collaboration with agencies and digital partners 11M 110M Monthly Monthly Reach of c c Newsletter iHeartRadio Station Recipients Websites 49 49 Source: Nielsen Audio Spring 2023; Nielsen nPower May 2024 Comscore May 2024; Podtrac May 2024; ListenFirst May 2024; Omniture June 2024; Internal Reporting May 2024

50

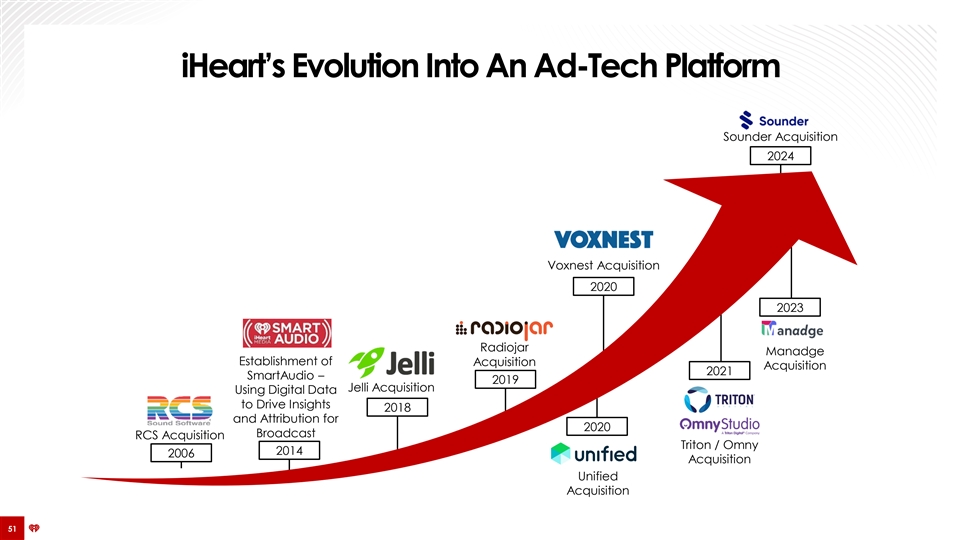

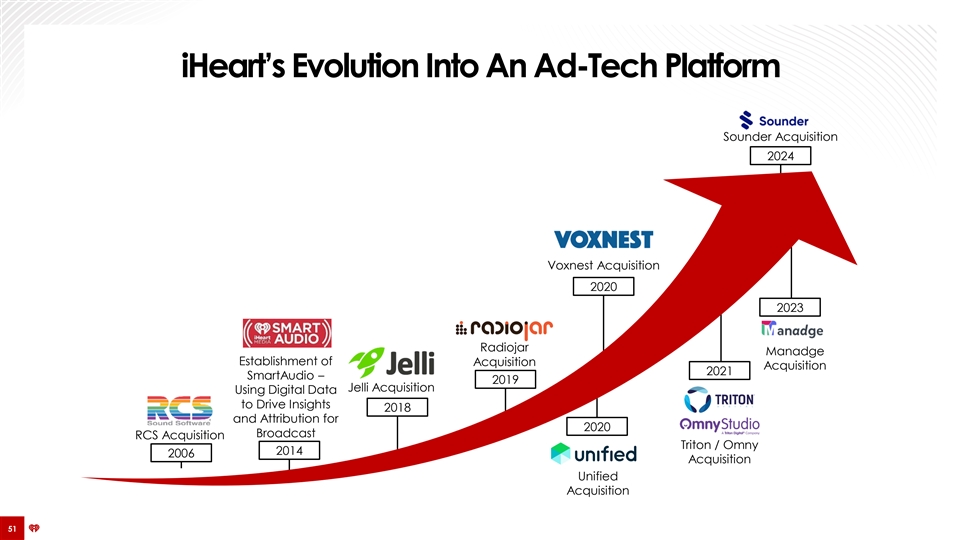

iHeart’s Evolution Into An Ad-Tech Platform Sounder Acquisition 2024 Voxnest Acquisition 2020 2023 Radiojar Manadge Establishment of Acquisition Acquisition 2021 SmartAudio – 2019 Jelli Acquisition Using Digital Data to Drive Insights 2018 and Attribution for 2020 Broadcast RCS Acquisition Triton / Omny 2014 2006 Acquisition Unified Acquisition 51

Extensive Portfolio Of Adtech Assets Description Leading end-to-end audio management platform empowering creators with free hosting, analytics, in-audio search, and a scalable cloud environment to build audience and maximize content reach Advertising intelligence platform that specializes in programmatic advertising with advanced analytics and automation platform designed for Publishers, empowering them to take control on all demand actors and maximize ad revenues. Provides access to a massive audience across 2,000+ radio stations and leverages predictive modeling to target specific listener demographics, empowering broadcasters and podcasters to significantly grow revenue and optimize operations Developer of a comprehensive on-demand audio platform for distribution, analysis, monetization, and archiving, empowering creators to streamline workflows and maximize the value of their content Developer of podcasting tools that offer a set of comprehensive podcast management, monetization and analytics tracking systems Developer of an enterprise marketing technology platform designed to empower brands to mobilize social audiences and drive measurable consumer actions Provider of a cloud-based advertising platform with an automated radio advertising tool that facilitates global connections between publishers and radio listeners Leverages the power of iHeartMedia’s programmatic solution to empower advertisers to efficiently evaluate, plan, and p bruoad rcha csa est radio advertising inventory Develops broadcasting software to manage radio stations and entertainment channels around the world Provider of an online radio broadcasting platform designed to empower radio stations to transition to the internet era 52 Technology Infra Measurement Measurement & Infrastructure

Financial Projections 53 53

(1) Adjusted EBITDA Bridge ($ in millions) Better / (Worse) 2021-22 2022-23 2023-24E 2024-25E 2025-26E 2026-27E 2027-28E Adjusted EBITDA (Beginning of Period, or BoP) $ 811 $ 950 $ 697 $ 750 $ 771 $ 915 $ 853 Podcast ex. Political 104 51 45 72 53 58 64 Digital ex. Podcast and ex. Political 76 4 40 17 44 38 35 National Spot ex. Political 11 (72) (0) (6) 6 6 6 Local Spot ex. Political 9 (63) (53) 41 13 13 7 Networks (Non-Digital) ex. Political (1) (40) (26) 44 5 5 5 Other Revenue ex. Political 40 66 (6) (26) 6 6 6 Audio & Media Services Revenue ex. Political 13 ( 4) 16 (13) 6 4 7 iHM Political Revenue 103 (102) 138 (126) 100 (100) 150 Total Revenue $ 354 $ ( 161) $ 154 $ 3 $ 232 $ 30 $ 279 Costs $ ( 215) $ (92) $ (101) $ 18 $ (89) $ (92) $ ( 91) Adjusted EBITDA (End of Period, or EoP) $ 950 $ 697 $ 750 $ 771 $ 915 $ 853 $ 1 ,042 (1) Adjusted EBITDA is a non-GAAP financial measure. Please see Appendix for reconciliation of non-GAAP financial measures to their most comparable GAAP financial measures. 54

(1)(2) Financial Projections – Summary Forecast ($ in millions) FY'24E FY'25E FY'26E FY'27E FY'28E Revenue: Multiplatform Group $2,412 $2,404 2,504 $2,464 $2,583 Digital Audio Group 1,170 1,254 1,351 1,447 1,546 Audio & Media Services Group 332 261 297 271 332 Eliminations (10) (11) (11) (11) (11) Total Revenue $3,905 $3,908 $4,141 $4,171 $4,450 YoY growth % 4.1% 0.1% 5.9% 0.7% 6.7% Adj. EBITDA: Multiplatform Group $501 $524 $603 $542 $640 Digital Audio Group 383 437 479 517 558 Audio & Media Services Group 140 71 101 71 129 Corporate (274) (261) (269) (277) (285) Total Adj. EBITDA $750 $771 $915 $853 $1,042 Adj. EBITDA Margin % 19.2% 19.7% 22.1% 20.5% 23.4% YoY growth % 7.6% 2.8% 18.6% (6.7%) 22.1% (-) Interest Payments ($387) ($371) ($358) ($354) ($353) (-) Cash Taxes (31) (104) (132) (123) (156) (-) Capex (95) (90) (90) (90) (90) (-) Restructuring Expenses (100) (40) (30) (30) (30) (-) Change in NWC 33 38 (1) 12 (11) Free Cash Flow $170 $204 $303 $269 $401 (+/-) Other 94 2 1 1 1 Net increase (decrease) in cash⁽³⁾ $265 $206 $304 $269 $401 BOP Cash $346 $611 $817 $1,121 $1,390 EOP Cash 611 817 1,121 1,390 1,792 Note: The projections shown above are status quo and do not reflect the impacts of the contemplated transaction. (1) Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. Please see Appendix for reconciliation of historical non-GAAP financial measures to their most comparable GAAP financial measures. (2) The Company cannot provide a reconciliation between its non-GAAP projections and the most directly comparable GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. These items are uncertain, depend on various factors and could have a material impact on GAAP reported results. (3) Represents Net increase (decrease) in cash, cash equivalents and restricted cash in the Consolidated Statement of Cash Flows. 55

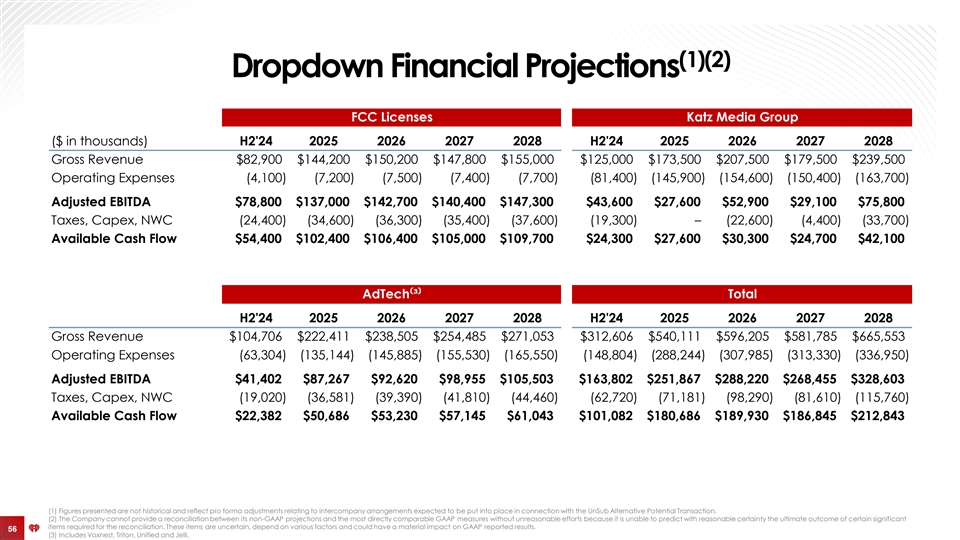

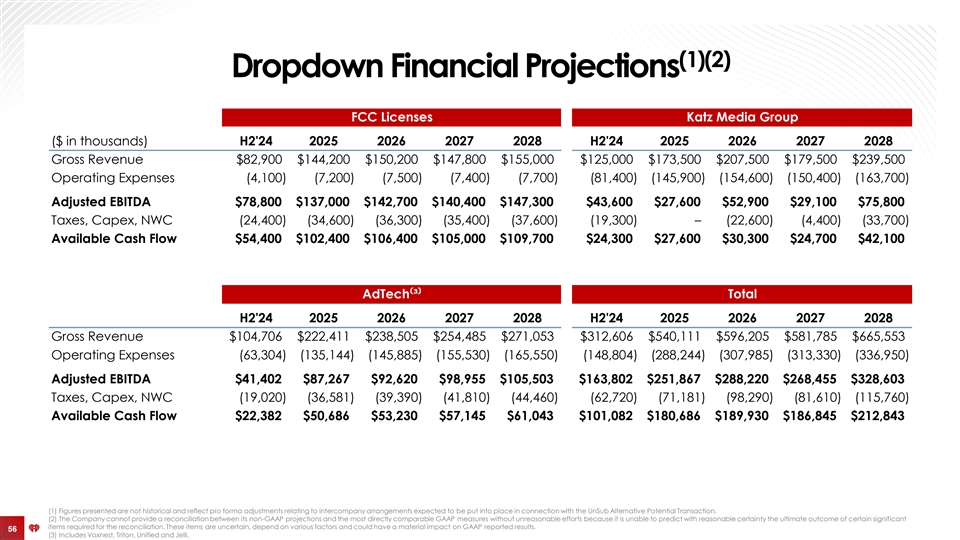

(1)(2) Dropdown Financial Projections FCC Licenses Katz Media Group ($ in thousands) H2'24 2025 2026 2027 2028 H2'24 2025 2026 2027 2028 Gross Revenue $82,900 $144,200 $150,200 $147,800 $155,000 $125,000 $173,500 $207,500 $179,500 $239,500 Operating Expenses (4,100) (7,200) (7,500) (7,400) (7,700) (81,400) (145,900) (154,600) (150,400) (163,700) Adjusted EBITDA $78,800 $137,000 $142,700 $140,400 $147,300 $43,600 $27,600 $52,900 $29,100 $75,800 Taxes, Capex, NWC (24,400) (34,600) (36,300) (35,400) (37,600) (19,300) – (22,600) (4,400) (33,700) Available Cash Flow $54,400 $102,400 $106,400 $105,000 $109,700 $24,300 $27,600 $30,300 $24,700 $42,100 AdTech⁽³⁾ Total H2'24 2025 2026 2027 2028 H2'24 2025 2026 2027 2028 Gross Revenue $104,706 $222,411 $238,505 $254,485 $271,053 $312,606 $540,111 $596,205 $581,785 $665,553 Operating Expenses (63,304) (135,144) (145,885) (155,530) (165,550) (148,804) (288,244) (307,985) (313,330) (336,950) Adjusted EBITDA $41,402 $87,267 $92,620 $98,955 $105,503 $163,802 $251,867 $288,220 $268,455 $328,603 Taxes, Capex, NWC (19,020) (36,581) (39,390) (41,810) (44,460) (62,720) (71,181) (98,290) (81,610) (115,760) Available Cash Flow $22,382 $50,686 $53,230 $57,145 $61,043 $101,082 $180,686 $189,930 $186,845 $212,843 (1) Figures presented are not historical and reflect pro forma adjustments relating to intercompany arrangements expected to be put into place in connection with the UnSub Alternative Potential Transaction. (2) The Company cannot provide a reconciliation between its non-GAAP projections and the most directly comparable GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. These items are uncertain, depend on various factors and could have a material impact on GAAP reported results. 56 56 (3) Includes Voxnest, Triton, Unified and Jelli.

Appendix 57 57 57

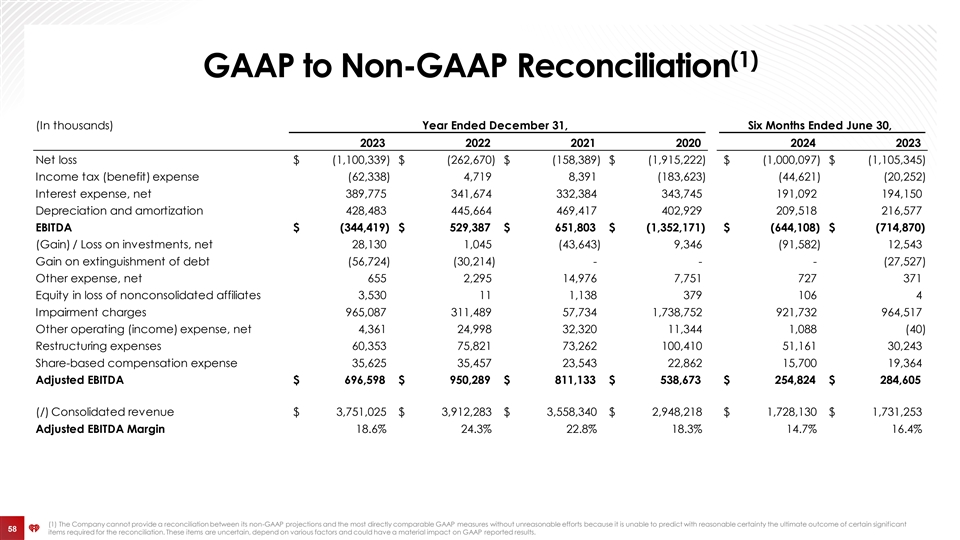

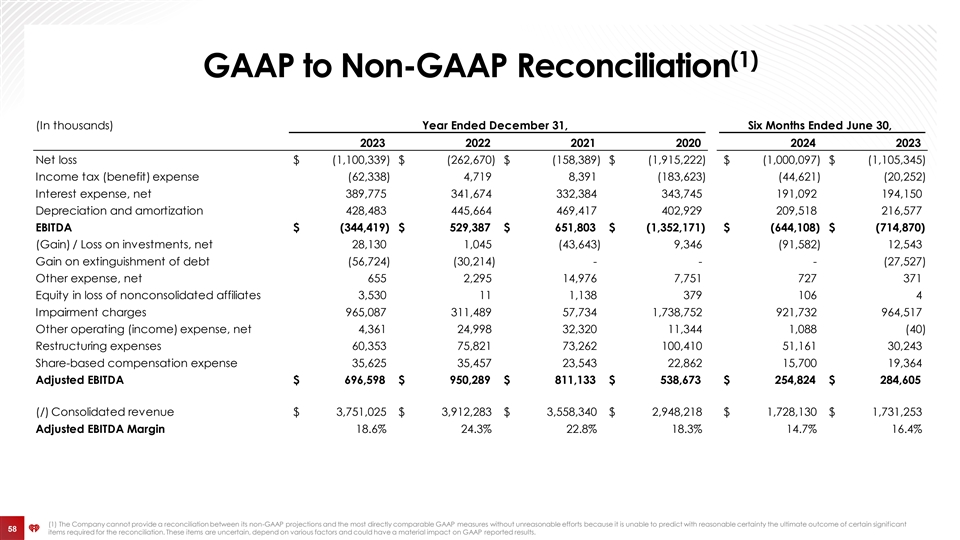

(1) GAAP to Non-GAAP Reconciliation (In thousands) Year Ended December 31, Six Months Ended June 30, 2023 2022 2021 2020 2024 2023 Net loss $ (1,100,339) $ (262,670) $ (158,389) $ (1,915,222) $ (1,000,097) $ (1,105,345) Income tax (benefit) expense (62,338) 4,719 8,391 (183,623) (44,621) (20,252) Interest expense, net 389,775 341,674 332,384 343,745 191,092 194,150 Depreciation and amortization 428,483 445,664 469,417 402,929 209,518 216,577 EBITDA $ ( 344,419) $ 529,387 $ 651,803 $ ( 1,352,171) $ ( 644,108) $ ( 714,870) (Gain) / Loss on investments, net 28,130 1,045 (43,643) 9,346 (91,582) 12,543 Gain on extinguishment of debt (56,724) (30,214) - - - (27,527) Other expense, net 655 2,295 14,976 7,751 727 371 Equity in loss of nonconsolidated affiliates 3,530 11 1,138 379 106 4 Impairment charges 965,087 311,489 57,734 1,738,752 921,732 964,517 Other operating (income) expense, net 4,361 24,998 32,320 11,344 1,088 (40) Restructuring expenses 60,353 75,821 73,262 100,410 51,161 30,243 Share-based compensation expense 35,625 35,457 23,543 22,862 15,700 19,364 Adjusted EBITDA $ 696,598 $ 950,289 $ 811,133 $ 538,673 $ 254,824 $ 284,605 (/) Consolidated revenue $ 3,751,025 $ 3,912,283 $ 3,558,340 $ 2,948,218 $ 1,728,130 $ 1,731,253 Adjusted EBITDA Margin 18.6% 24.3% 22.8% 18.3% 14.7% 16.4% (1) The Company cannot provide a reconciliation between its non-GAAP projections and the most directly comparable GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant 58 items required for the reconciliation. These items are uncertain, depend on various factors and could have a material impact on GAAP reported results.

GAAP to Non-GAAP Reconciliation (In thousands) Year Ended December 31, Six Months Ended June 30, 2023 2022 2021 2020 2024 2023 Cash provided by (used for) operating activities $ 213,062 $ 420,075 $ 330,573 $ 215,945 $ (32,548) $ (37,211) Purchases of property, plant and equipment (102,670) (160,969) (183,372) (85,205) (42,754) (61,938) Free cash flow $ 110,392 $ 259,106 $ 147,201 $ 130,740 $ (75,302) $ (99,149) (/) Adjusted EBITDA $ 696,598 $ 950,289 $ 811,133 $ 538,673 $ 254,824 $ 284,605 Free cash flow conversion 15.8% 27.3% 18.1% 24.3% (29.6%) (34.8%) 59

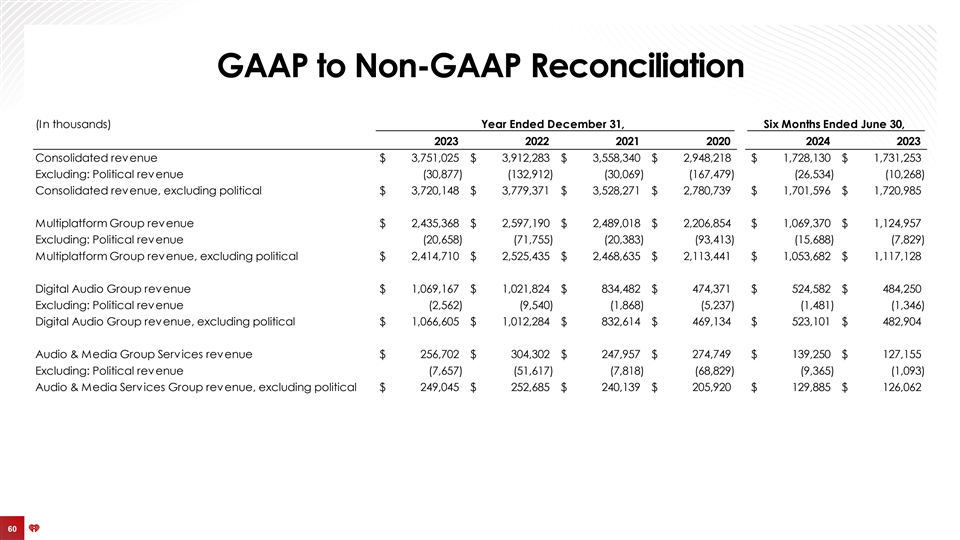

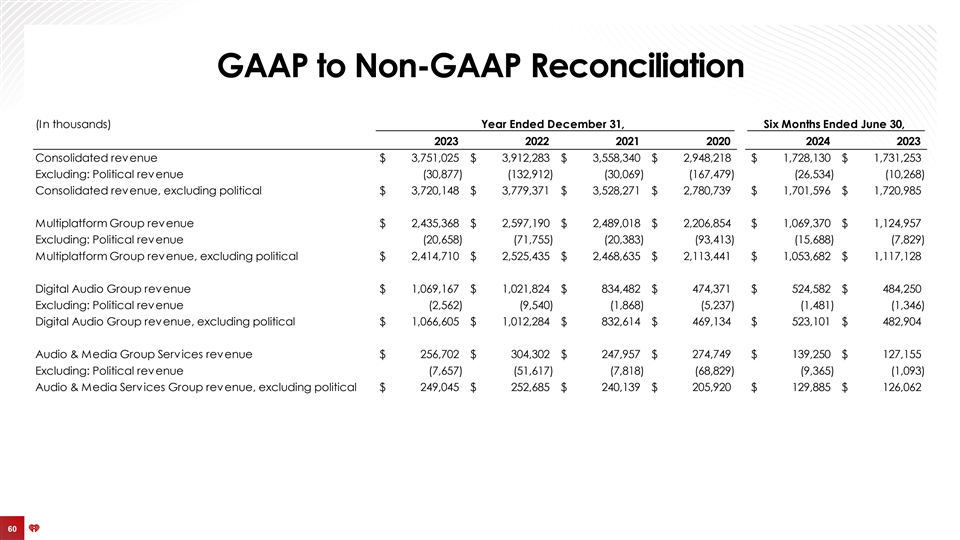

GAAP to Non-GAAP Reconciliation (In thousands) Year Ended December 31, Six Months Ended June 30, 2023 2022 2021 2020 2024 2023 Consolidated revenue $ 3,751,025 $ 3,912,283 $ 3,558,340 $ 2,948,218 $ 1,728,130 $ 1,731,253 Excluding: Political revenue (30,877) (132,912) (30,069) (167,479) (26,534) (10,268) Consolidated revenue, excluding political $ 3,720,148 $ 3,779,371 $ 3,528,271 $ 2,780,739 $ 1,701,596 $ 1,720,985 Multiplatform Group revenue $ 2,435,368 $ 2,597,190 $ 2,489,018 $ 2,206,854 $ 1,069,370 $ 1,124,957 Excluding: Political revenue (20,658) (71,755) (20,383) (93,413) (15,688) (7,829) Multiplatform Group revenue, excluding political $ 2,414,710 $ 2,525,435 $ 2,468,635 $ 2,113,441 $ 1,053,682 $ 1,117,128 Digital Audio Group revenue $ 1,069,167 $ 1,021,824 $ 834,482 $ 474,371 $ 524,582 $ 484,250 Excluding: Political revenue (2,562) (9,540) (1,868) (5,237) (1,481) (1,346) Digital Audio Group revenue, excluding political $ 1,066,605 $ 1,012,284 $ 832,614 $ 469,134 $ 523,101 $ 482,904 Audio & Media Group Services revenue $ 256,702 $ 304,302 $ 247,957 $ 274,749 $ 139,250 $ 127,155 Excluding: Political revenue (7,657) (51,617) (7,818) (68,829) (9,365) (1,093) Audio & Media Services Group revenue, excluding political $ 249,045 $ 252,685 $ 240,139 $ 205,920 $ 129,885 $ 126,062 60

November 7, 2024 Project Tunes TRANSACTION OVERVIEW

This Investor Presentation (this Presentation ) is being furnished to a limited number of parties who have expressed an interest in a potential transaction (the Potential Transaction ) with iHeartMedia, Inc. ( iHeartMedia or the Company ). The Company does not intend for this Presentation to form the sole basis of any transaction decision. The recipients should conduct their Disclaimer own investigations and analyses of the Company in connection with any transaction. This Presentation is being made available only to parties who have signed and returned a non-disclosure agreement with the Company in connection with the Potential Transaction (the Non- Disclosure Agreement ). By accepting this Presentation or any portion hereof, recipients agree to use and maintain the information in this Presentation in accordance with its compliance policies, contractual obligations (including their Non-Disclosure Agreements) and applicable laws and regulations, including federal and state securities laws. None of the Company, PJT Partners (“PJT”), their respective affiliates or their respective employees, directors, officers, contractors, advisors, consultants, members, successors, representatives, agents or controlling persons or any representatives of the foregoing, has made or makes any representation or warranty (express or implied) in respect of the accuracy, completeness or fair presentation of any information or any conclusion contained in this Presentation or in any other information provided or made available to the recipient in the course of its evaluation of the Company, and none shall have any liability resulting from the use or content of this Presentation or any other such information provided or made available to the recipient including, for any representations or warranties (expressed or implied) contained in, or for any omissions from, this Presentation or any other written or oral communications. The only information that will have any legal effect and upon which an interested party may rely will be in such representations and warranties as may be contained in a definitive agreement providing for a Potential Transaction, when, as and if executed, and in accordance with such terms and subject to such conditions as may be specified therein. The information in this Presentation was provided by the Company or is from public or other sources. PJT has not assumed any responsibility for independently verifying such information and expressly disclaimers any liability to any recipient in connection with such information or any transaction with the Company. This Presentation is not an offer, nor a solicitation of an offer, of the sale or purchase of securities, nor shall any securities of the Company or any of its subsidiaries be offered or sold, in any jurisdiction in which such an offer, solicitation or sale would be unlawful. In furnishing this Presentation, the Company and PJT reserves the right to amend or replace this Presentation at any time, but undertake no obligation to update, correct, or supplement any information contained herein or to provide the recipient with access to any additional information. This Presentation does not purport to be all-inclusive or to contain all of the information that the recipient may require in order to make an informed investment decision. No investment or other financial decisions or actions should be based solely on the information in this Presentation. Non-GAAP Measures: In addition to the financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this Presentation contains certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, and Free Cash Flow. The Company believes these non-GAAP financial measures are commonly used by analysts and investors to evaluate the performance of companies in its industry, and such non-GAAP financial measures help investors evaluate its operating and financial performance and trends in its business, consistent with how management evaluates such performance and trends. The Company also believes that these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other companies, although its non-GAAP financial measures are specific to the Company and the non-GAAP financial measures of other companies may not be calculated in the same manner. These non-GAAP measures should be considered only as supplemental to, and not as a substitute for or superior to, financial measures prepared in accordance with GAAP. The Company cannot provide a reconciliation between its non-GAAP projections and the most directly comparable GAAP measures without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation. These items are uncertain, depend on various factors and could have a material impact on GAAP reported results. Financial Projections: This Presentation includes certain statements, claims, estimates, predictions and other information prepared and provided by the Company with respect to the anticipated future performance of this Company and its subsidiaries. Any assumptions, views or opinions (including statements, projections, forecasts or other forward-looking statements) contained in this Presentation represent the assumptions, views or opinions of the Company as at the date indicated and are subject to change without notice. These statements are subject to known and unknown risks, uncertainties, changes in circumstances, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results to differ materially and potentially adversely from the results discussed in the forward-looking statements. 2

There is no guarantee that any of the forecasts, estimates or projections (including projections of revenue, expenses and earnings) set forth herein will be achieved. Actual results may vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or the future performance of the Company Disclaimer (Cont’d) or any of its subsidiaries or any of its or their businesses. FORWARD-LOOKING STATEMENTS. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the Act ). Such forward-looking statements involve known and unknown risks, uncertainties and other important factors which may cause the actual results, performance or achievements of iHeartMedia and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The words or phrases guidance, believe, expect, anticipate, will, potential, positioned, estimates, forecast, and words of similar meaning, as well as other words or expressions referencing future events, conditions or circumstances are intended to identify such forward-looking statements. In addition, any statements that refer to expectations or other characterizations of future events or circumstances, such as statements about positioning in uncertain economic environment and future economic recovery, driving shareholder value, the Company's expected costs savings and other capital and operating expense reduction initiatives, utilizing new technologies, improving operational efficiency, future advertising demand, trends in the advertising industry, including on other media platforms; strategies and initiatives, expected interest rates and interest expense savings, and the Company's anticipated financial performance, liquidity, and net leverage are forward-looking statements. Statements that describe or relate to iHeartMedia's plans, goals, intentions, strategies, or financial projections or outlook, and statements that do not relate to historical or current fact, are examples of forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other important factors, some of which are beyond iHeartMedia's control and are difficult to predict. Various risks that could cause future results to differ from those expressed by the forward-looking statements included in this Presentation include, but are not limited to: risks related to weak or uncertain global economic conditions and iHeartMedia's dependence on advertising revenues; competition, including increased competition from alternative media platforms and technologies; dependence upon the Company's brand and the performance of on-air talent, program hosts and management; fluctuations in operating costs; technological and industry changes and innovations; shifts in population and other demographics; risks related to iHeartMedia's use of artificial intelligence, impact of acquisitions, dispositions and other strategic transactions; risks related to the Company's indebtedness; legislative or regulatory requirements; impact of legislation, ongoing litigation or royalty audits on music licensing and royalties; regulations and concerns regarding privacy and data protection and breaches of information security measures; risks related to scrutiny of environmental, social and governance matters, risks related to the Company' Class A common stock; and regulations impacting the Company's business and the ownership of its securities. Other unknown or unpredictable factors also could have material adverse effects on the Company's future results, performance or achievements. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this Presentation and other materials provided by the Company may not occur. In particular, our projections are subject to inherent uncertainties and necessarily represent certain assumptions, and actual performance may differ. In addition, there is a risk the Company is unable to deliver the anticipated cost savings (or recognize the expected benefits therefrom) either from an inability to identify appropriate opportunities, anticipate implementation cost, delays in implementation or other factors. Do not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date hereof. Forward-looking statements are not guarantees of future performance. Additional risks that could cause future results to differ from those expressed by any forward-looking statement are described in the Company's reports filed with the U.S. Securities and Exchange Commission, including in the section entitled Part I, Item 1A. Risk Factors of the Company's Annual Reports on Form 10-K and Part II, Item 1A. Risk Factors of the Company's Quarterly Reports on Form 10-Q. The Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise. 3

Table of Contents I 5 Background II Transaction Summary 8 III 16 Model Outputs A Comprehensive Transaction 20 B Alternative Transaction 23 4

I. Background 5

Introduction Based on market feedback, iHeartMedia, Inc. (“iHeart” or the “Company”) concluded that an extension of its maturities through a consensual transaction with existing stakeholders is appropriate As such, the Company engaged in discussions with its stakeholders regarding a consensual debt maturity extension transaction The Company’s objectives in implementing a consensual transaction include: > Avoid the costs of a non-consensual recapitalization > Provide time to realize the benefits of the investments the Company has made in the Multiplatform Group > Continue to invest in and realize growth in the Digital Audio Group > Achieve the transaction quickly and efficiently to minimize customer, talent, and employee disruptions Management hopes to complete a transaction by mid-December that has broad consensus and respects the rights and priorities of our stakeholders 6

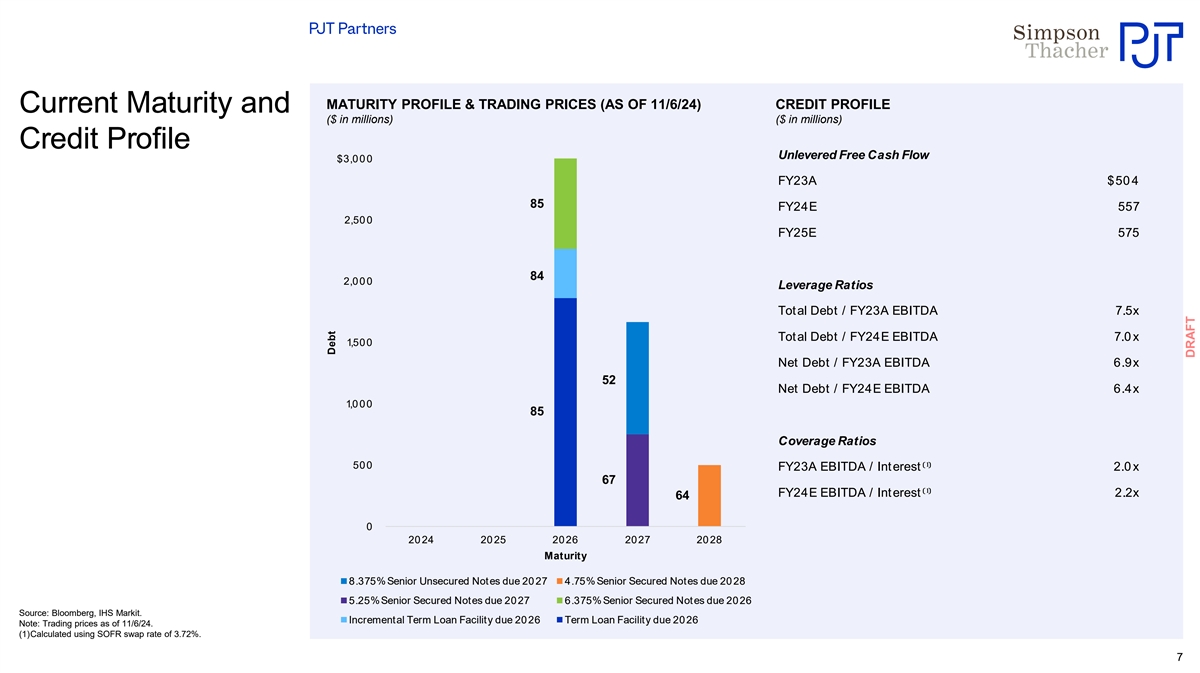

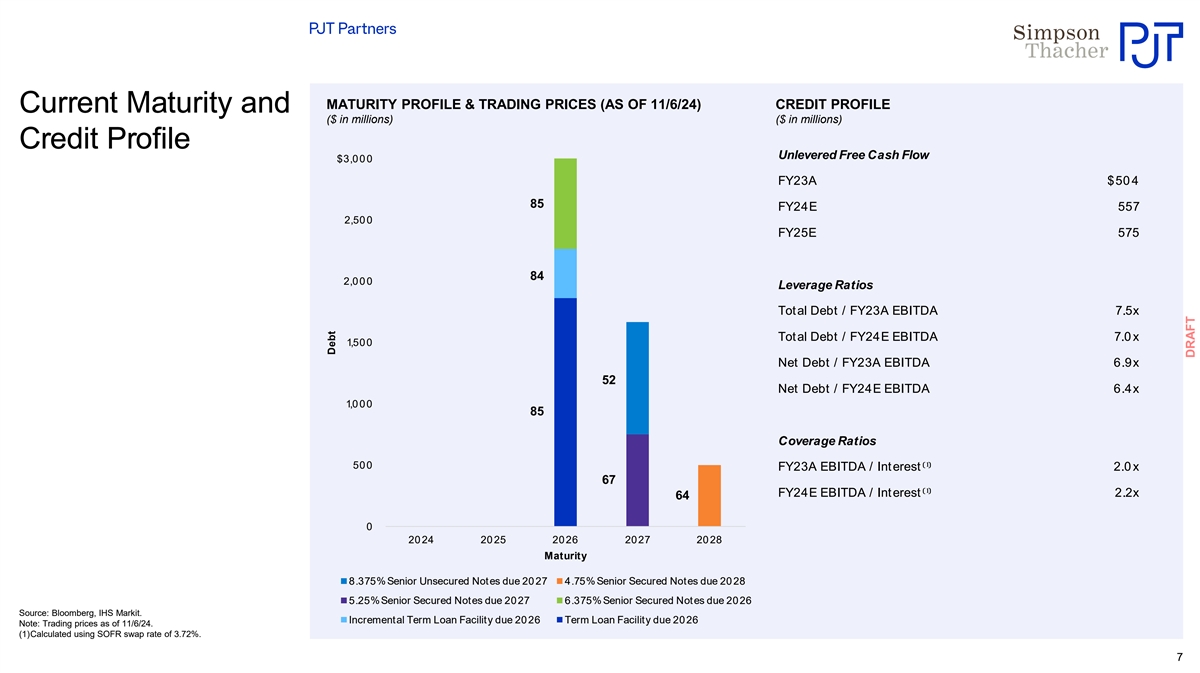

MATURITY PROFILE & TRADING PRICES (AS OF 11/6/24) CREDIT PROFILE Current Maturity and ($ in millions) ($ in millions) Credit Profile Unlevered Free Cash Flow $3,00 0 FY23A $50 4 85 FY24E 557 2,50 0 FY25E 575 84 2,00 0 Leverage Ratios Total Debt / FY23A EBITDA 7.5x Total Debt / FY24E EBITDA 7.0 x 1,500 Net Debt / FY23A EBITDA 6.9x 52 Net Debt / FY24E EBITDA 6.4x 1,0 00 85 Coverage Ratios 500 FY23A EBITDA / Interest ¹ 2.0 x ⁽⁾ 67 FY24E EBITDA / Interest ¹ 2.2x ⁽⁾ 64 0 20 24 20 25 2026 2027 20 28 Maturity 8.375% Senior Unsecured Notes due 20 27 4.75% Senior Secured Notes due 20 28 5.25% Senior Secured Notes due 2027 6.375% Senior Secured Notes due 2026 Source: Bloomberg, IHS Markit. Incremental Term Loan Facility due 2026 Term Loan Facility due 2026 Note: Trading prices as of 11/6/24. (1)Calculated using SOFR swap rate of 3.72%. 7 Debt

II. Transaction Summary 8

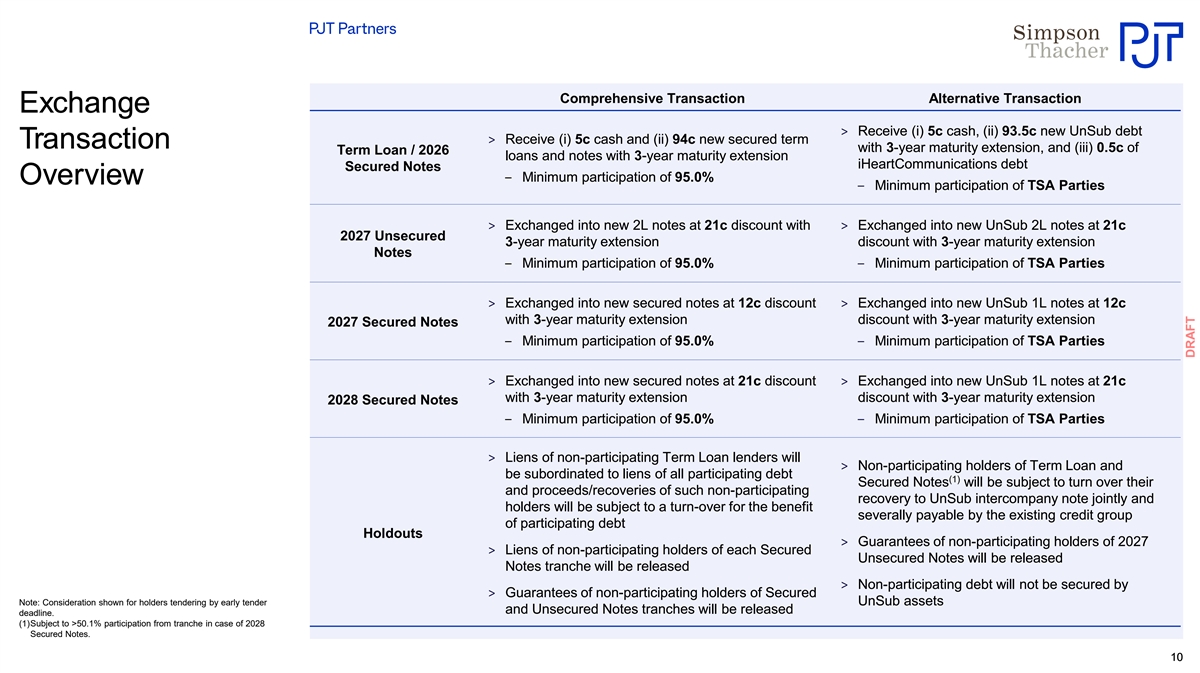

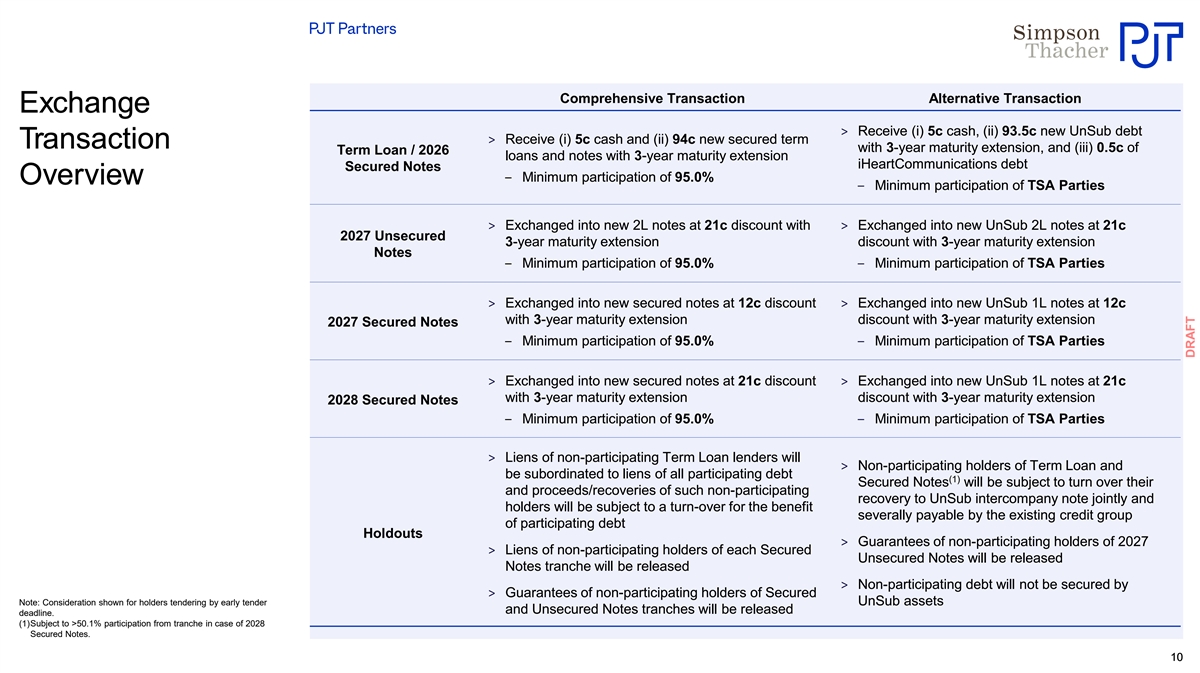

Concurrent launch of two exchange transactions initially supported by TSA Parties Transaction > Alternative Transaction: Exchange of existing debt into new term loans and notes issued by one or more 1 Summary (1) unrestricted subsidiaries (the “UnSub”), which will hold certain drop down assets . The TSA parties constitute requisite majorities needed to close the Alternative Transaction. AND > Comprehensive Transaction: Exchange of existing debt into new term loans and notes issued by 2 iHeartCommunications if Holders of at least 95% of each tranche participate in the exchange transactions FURTHER > If the Comprehensive Transaction is implemented: ‒ Liens of non-participating Term Loan lenders will be subordinated to liens of all participating debt and proceeds/recoveries of such non-participating holders will be subject to a turn-over for the benefit of participating debt ‒ Liens of non-participating holders of each Secured Notes tranche will be released ‒ Guarantees of non-participating holders of Secured and Unsecured Notes tranches will be released > If the Alternative Transaction is implemented: (2) ‒ Proceeds/recoveries to non-participating holders of existing secured debt will be subject to a turn-over for (3) the benefit of a new ~$3.4bn intercompany loan jointly and severally payable by the existing credit group (“RemainCo”) to UnSub (1)Exchanging Term Loan and Secured Notes holders to also receive a ‒ Katz Media, the Ad Tech stack and the FCC Licenses will be moved into the UnSub, and will no longer nominal amount of debt issued by iHeartCommunications. (2)Subject to >50.1% participation from tranche in case of 2028 Secured secure any stub RemainCo debt Notes. (3)Based on participation from parties to transaction support agreement (“TSA”) as of preparation of these materials (“TSA Parties”); actual support may increase. I/C loan balance increases if additional holders participate. 9 9

Comprehensive Transaction Alternative Transaction Exchange > Receive (i) 5c cash, (ii) 93.5c new UnSub debt > Receive (i) 5c cash and (ii) 94c new secured term Transaction with 3-year maturity extension, and (iii) 0.5c of Term Loan / 2026 loans and notes with 3-year maturity extension iHeartCommunications debt Secured Notes ‒ Minimum participation of 95.0% Overview ‒ Minimum participation of TSA Parties > Exchanged into new 2L notes at 21c discount with > Exchanged into new UnSub 2L notes at 21c 2027 Unsecured 3-year maturity extension discount with 3-year maturity extension Notes ‒ Minimum participation of 95.0%‒ Minimum participation of TSA Parties > Exchanged into new secured notes at 12c discount > Exchanged into new UnSub 1L notes at 12c with 3-year maturity extension discount with 3-year maturity extension 2027 Secured Notes ‒ Minimum participation of 95.0%‒ Minimum participation of TSA Parties > Exchanged into new secured notes at 21c discount > Exchanged into new UnSub 1L notes at 21c with 3-year maturity extension discount with 3-year maturity extension 2028 Secured Notes ‒ Minimum participation of 95.0%‒ Minimum participation of TSA Parties > Liens of non-participating Term Loan lenders will > Non-participating holders of Term Loan and be subordinated to liens of all participating debt (1) Secured Notes will be subject to turn over their and proceeds/recoveries of such non-participating recovery to UnSub intercompany note jointly and holders will be subject to a turn-over for the benefit severally payable by the existing credit group of participating debt Holdouts > Guarantees of non-participating holders of 2027 > Liens of non-participating holders of each Secured Unsecured Notes will be released Notes tranche will be released > Non-participating debt will not be secured by > Guarantees of non-participating holders of Secured Note: Consideration shown for holders tendering by early tender UnSub assets and Unsecured Notes tranches will be released deadline. (1)Subject to >50.1% participation from tranche in case of 2028 Secured Notes. 1 10 0

Comprehensive Transaction Exchange Debt Terms 2027 Unsecured Notes Exchange 2026 Term Loan Exchange Debt 2026 Secured Notes Exchange Debt 2027 Secured Notes Exchange Debt 2028 Secured Notes Exchange Debt Debt Exchange Terms Min. Participation > 95.0% > 95.0% > 95.0% > 95.0% > 95.0% (1) Exchange Price > 99c > 99c > 79c > 88c > 79c (1) Consideration > 5c in cash and 94c in 1L Term Loans > 5c in cash and 94c in 1L Notes > 79c in 2L Notes > 88c in 1L Notes > 79c in 1L Notes > Turn over recovery first to exchange debt of existing secured debt and second to exchange debt of existing > Liens released > Remain unsecured > Liens released > Liens released Holdout Treatment unsecured debt > Guarantees released > Guarantees released > Guarantees released > Guarantees released > Liens subordinated to liens of all participating debt Debt Terms Issuer / Borrower > Same as existing > Same as existing > Same as existing > Same as existing > Same as existing Security > 1L on all existing collateral > 1L on all existing collateral > 2L on all existing collateral > 1L on all existing collateral > 1L on all existing collateral Amount > Up to $2,152mm > Up to $760mm > Up to $733mm > Up to $668mm > Up to $400mm Maturity > May 2029 (3-year extension) > May 2029 (3-year extension) > May 2030 (3-year extension) > August 2030 (3-year extension) > January 2031 (3-year extension) > S+577.5bps (277.5/252.5bps (2) Interest Rate > 9.125% (275bps increase) > 10.875% (250bps increase) > 7.75% (250bps increase) > 7.00% (225bps increase) (3) increase) > NC 2 / 103 / 101 / Par > NC 2 / 103 / 101 / Par > NC 2 / 50% / 25% / Par > NC 2 / 75% / 25% / Par > NC 2 / 50% / 25% / Par Call Protection / (4) Make Whole > To include bankruptcy make-whole > To include bankruptcy make-whole > To include bankruptcy make-whole > To include bankruptcy make-whole > To include bankruptcy make-whole > Tighter debt, liens, investment and > Tighter debt, liens, investment and > Tighter debt, liens, investment and > Tighter debt, liens, investment and > Tighter debt, liens, investment and RP baskets RP baskets RP baskets RP baskets RP baskets > Protections against future LM (e.g., > Protections against future LM (e.g., > Protections against future LM (e.g., > Protections against future LM (e.g., > Protections against future LM (e.g., Covenants limitation on Alternative limitation on Alternative limitation on Alternative limitation on Alternative limitation on Alternative Transactions, Chewy / J. Crew / Transactions, Chewy / J. Crew / Transactions, Chewy / J. Crew / Transactions, Chewy / J. Crew / Transactions, Chewy / J. Crew / Serta protections) Serta protections) Serta protections) Serta protections) Serta protections) (1)Consideration shown for holders tendering by early tender deadline. (2)Subject to various levels of stepdowns associated with certain ratings actions. (3)Interest rate increase for Initial Term Loan and Incremental Term Loan, respectively. (4)Notwithstanding individual call schedules, all call protection to sunset in May 2028 (i.e., no premium payable after 5/1/28). 1 11 1

Alternative Transaction Exchange Debt Terms 2027 Unsecured Notes Exchange 2026 Term Loan Exchange Debt 2026 Secured Notes Exchange Debt 2027 Secured Notes Exchange Debt 2028 Secured Notes Exchange Debt Intercompany Loan Debt Exchange Terms Min. Participation > TSA Parties > TSA Parties > TSA Parties > TSA Parties > TSA Parties > N/A (1) Exchange Price > 99c > 99c > 79c > 88c > 79c > N/A > 5c in cash, 93.5c in 1L Term > 5c in cash, 93.5c in 1L Notes at > 87.5c in 1L Notes at UnSub, 0.5c > 78.5c in 1L Notes at UnSub, 0.5c (1) Consideration Loans at UnSub, 0.5c in 1L Term UnSub, 0.5c in 1L Notes at > 79c in 2L Notes > N/A in 1L Notes at RemainCo in 1L Notes at RemainCo Loans at RemainCo RemainCo > Liens retained > Liens retained > Liens retained > Liens retained > Guarantees retained > Guarantees retained > Guarantees retained > Guarantees retained Holdout Treatment > Guarantees released > N/A > Upon ≥50.1% participation, turns > Turns over its recovery to > Turns over its recovery to > Turns over its recovery to over its recovery to Intercompany Intercompany Loan Intercompany Loan Intercompany Loan Loan Debt Terms > IH Media + Entertainment I, LLC > IH Media + Entertainment I, LLC > IH Media + Entertainment II, LLC > IH Media + Entertainment I, LLC > IH Media + Entertainment I, LLC Issuer > RemainCo (“UnSub Holdco”) (“UnSub Holdco”) (“UnSub”) (“UnSub Holdco”) (“UnSub Holdco”) > UnSub Holdco and its wholly > UnSub Holdco and its wholly > All wholly owned subsidiaries of > UnSub Holdco and its wholly > UnSub Holdco and its wholly Guarantors > Same as existing secured debt owned subsidiaries owned subsidiaries Unsub and Unsub Holdco owned subsidiaries owned subsidiaries > 1L on UnSub collateral, including > 1L on UnSub collateral, including > 2L on UnSub collateral, including > 1L on UnSub collateral, including > 1L on UnSub collateral, including Security > 1L on all collateral under existing secured debt ~$3bn pari 1L intercompany loan ~$3bn pari 1L intercompany loan ~$3bn pari 1L intercompany loan ~$3bn pari 1L intercompany loan ~$3bn pari 1L intercompany loan (2) Amount > Up to $2,149mm > Up to $759mm > Up to $730mm > Up to $665mm > Up to $396mm > Approximately $3.4bn Maturity > May 2029 (3-year extension) > May 2029 (3-year extension) > May 2030 (3-year extension) > August 2030 (3-year extension) > January 2031 (3-year extension) > January 2031 > S+577.5bps (277.5/252.5bps (3) (5) Interest Rate > 9.125% (275bps increase) > 10.875% (250bps increase) > 7.75% (250bps increase) > 7.00% (225bps increase) > 15.0% (10.0% cash plus 5.0% PIK) (4) increase) > NC 2 / 103 / 101 / Par > NC 2 / 103 / 101 / Par > NC 2 / 50% / 25% / Par > NC 2 / 75% / 25% / Par > NC 2 / 50% / 25% / Par > NC-Life (6) Call Protection > To include bankruptcy make- > To include bankruptcy make- > To include bankruptcy make- > To include bankruptcy make- > To include bankruptcy make- > To include bankruptcy make-whole whole whole whole whole whole > Limitations on issuance of debt, > Limitations on issuance of debt, > Limitations on issuance of debt, > Limitations on issuance of debt, > Limitations on issuance of debt, > Limitations on issuance of debt, liens, and Covenants liens, and investments liens, and investments liens, and investments liens, and investments liens, and investments investments > I/C claim vote in Chapter 11 will be held by the Governance > N/A > N/A > N/A > N/A > N/A independent directors of the UnSub at the direction of the creditors (1)Consideration shown for holders tendering by early tender deadline. (4)Interest rate increase for Initial Term Loan and Incremental Term Loan, respectively. (2)Based on participation from TSA Parties. Balance increases if additional holders participate. (5)RemainCo able to PIK up to $150mm of cash interest per year. (3)Subject to various levels of stepdowns associated with certain ratings actions. (6)Notwithstanding individual call schedules, all call protection to sunset in May 2028 (i.e., no premium payable after 5/1/28). 1 12 2

Post-Closing Recovery Status Quo Comprehensive Transaction Alternative Transaction Waterfall RemainCo Priorities ABL Recovery ABL ABL ABL Stub ’28 ’26 Secured New Term New ’29 Secured Notes Term Loan Notes Loan Secured Notes First-Level Recovery ’27 Secured ’28 Secured New ’30 New ’31 I/C Loan Notes Notes Secured Notes Secured Notes Stub Term Stub ’26 Loan Secured Notes ’27 Unsecured New ’30 2L Second-Level Notes Notes Recovery Stub ’27 Secured Notes Third-Level Stub Term Stub ’27 (1) Loan Unsecured Recovery Stub ’27 Stub ’26 Secured Notes Secured Notes Fourth-Level Recovery Stub ’27 Stub ’28 Unsecured Secured Notes Note: The ABL only has liens on the working capital assets of the Stub non-2028 secured debt to retain liens but is subject to turn-over for benefit of I/C Company. The 1L debt currently has a first lien on fixed assets of loan. Upon 50.1% participation of 2028 Secured Notes, non-participants of that tranche the Company and a second lien on ABL assets. will be subject to the same turn-over. (1)Liens securing stub term loan will be subordinated to liens securing participating debt and stub term loan is subject to turn- over for the benefit of participating debt. 1 13 3

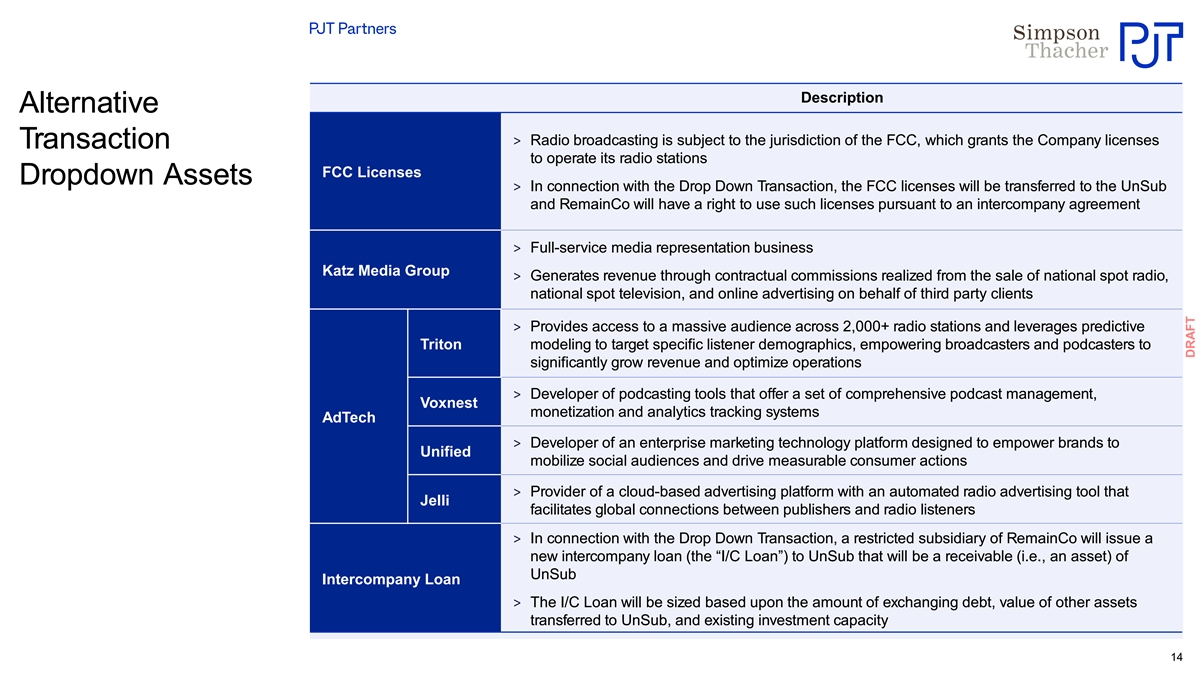

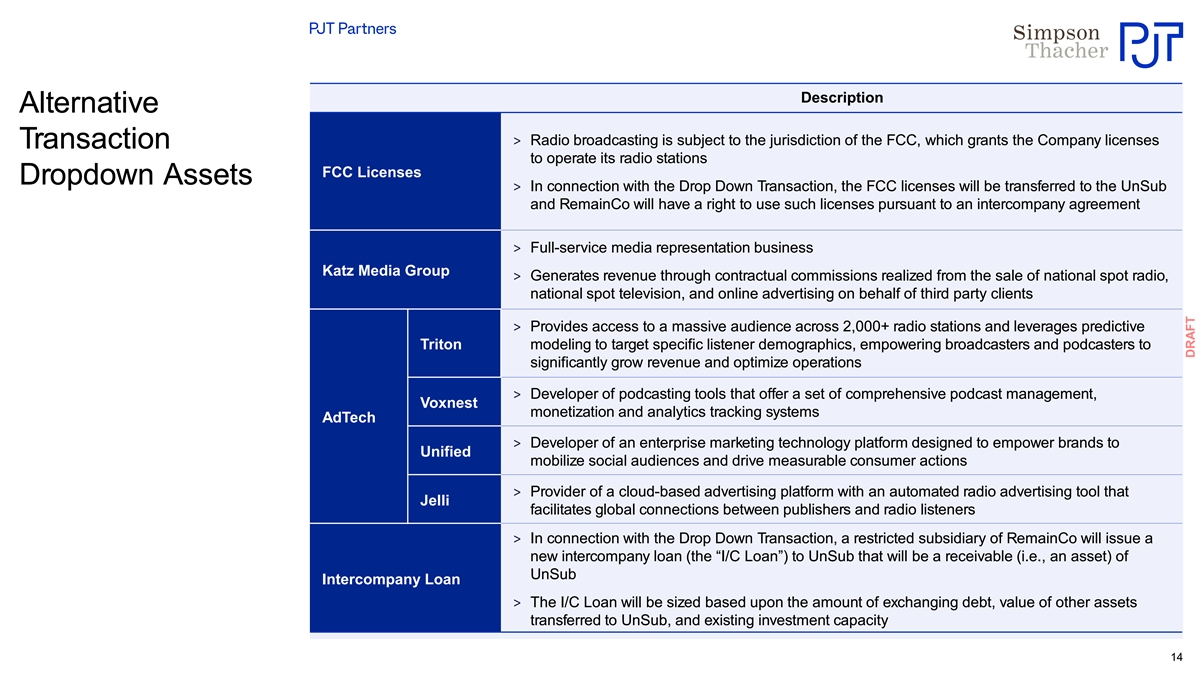

Description Alternative > Radio broadcasting is subject to the jurisdiction of the FCC, which grants the Company licenses Transaction to operate its radio stations FCC Licenses Dropdown Assets > In connection with the Drop Down Transaction, the FCC licenses will be transferred to the UnSub and RemainCo will have a right to use such licenses pursuant to an intercompany agreement > Full-service media representation business Katz Media Group > Generates revenue through contractual commissions realized from the sale of national spot radio, national spot television, and online advertising on behalf of third party clients > Provides access to a massive audience across 2,000+ radio stations and leverages predictive Triton modeling to target specific listener demographics, empowering broadcasters and podcasters to significantly grow revenue and optimize operations > Developer of podcasting tools that offer a set of comprehensive podcast management, Voxnest monetization and analytics tracking systems AdTech > Developer of an enterprise marketing technology platform designed to empower brands to Unified mobilize social audiences and drive measurable consumer actions > Provider of a cloud-based advertising platform with an automated radio advertising tool that Jelli facilitates global connections between publishers and radio listeners > In connection with the Drop Down Transaction, a restricted subsidiary of RemainCo will issue a new intercompany loan (the “I/C Loan”) to UnSub that will be a receivable (i.e., an asset) of UnSub Intercompany Loan > The I/C Loan will be sized based upon the amount of exchanging debt, value of other assets transferred to UnSub, and existing investment capacity 14

PF Maturity Profile COMPREHENSIVE ALTERNATIVE (1) (2) STATUS QUO TRANSACTION TRANSACTION Pro Forma Credit Statistics 6.4x 5.9x 6.0x Net Debt at Close / FY24 EBITDA 6.2x 5.7x 5.8x Net Debt at Close / FY25 EBITDA 4.6x 4.2x 4.3x Net Debt at Close / FY28 EBITDA $370 -$380 $370 -$380 $370 -$380 FY25E Cash Interest Pro Forma Maturity Wall Exchange Debt Exchange Debt $3,000 2,500 2,00 0 1,500 1,0 00 500 0 20 26 20 27 20 28 2029 20 30 2031 2026 2027 2028 2029 20 30 2031 2026 2027 20 28 2029 2030 20 31 Term Loan Facility due 2026 Incremental Term Loan Facility due 2026 6.375% Senior Secured Notes due 2026 5.25% Senior Secured Notes due 2027 4.75% Senior Secured Notes due 2028 8.375% Senior Unsecured Notes due 2027 Note: Leverage figures based on pro forma net debt at illustrative transaction close of 12/31/24. (1)Assumes 95% participation from all debt holders. (2)Assumes participation of TSA Parties. 1 15 5 Debt

III. Model Outputs 16

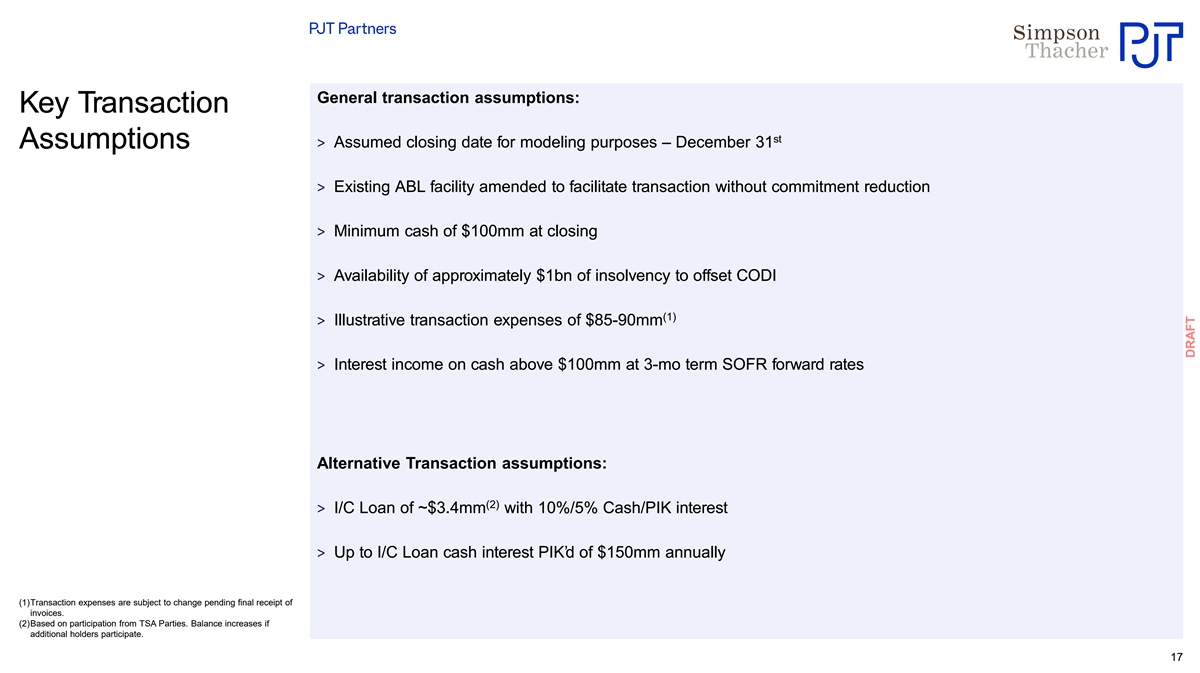

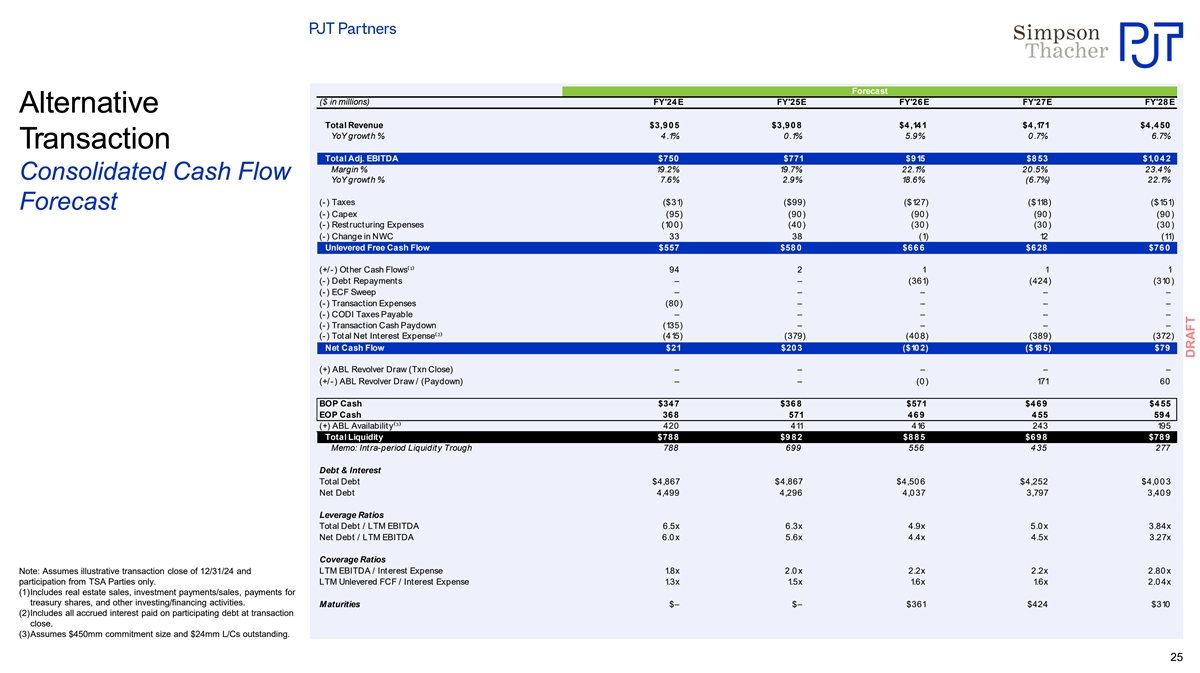

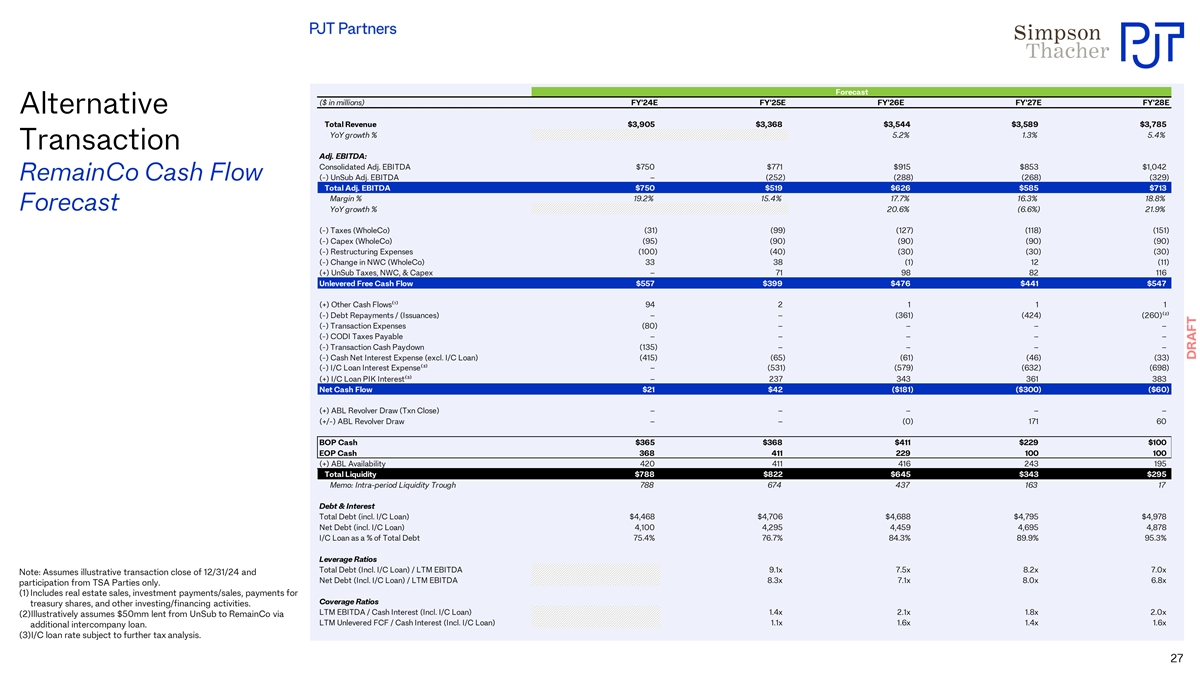

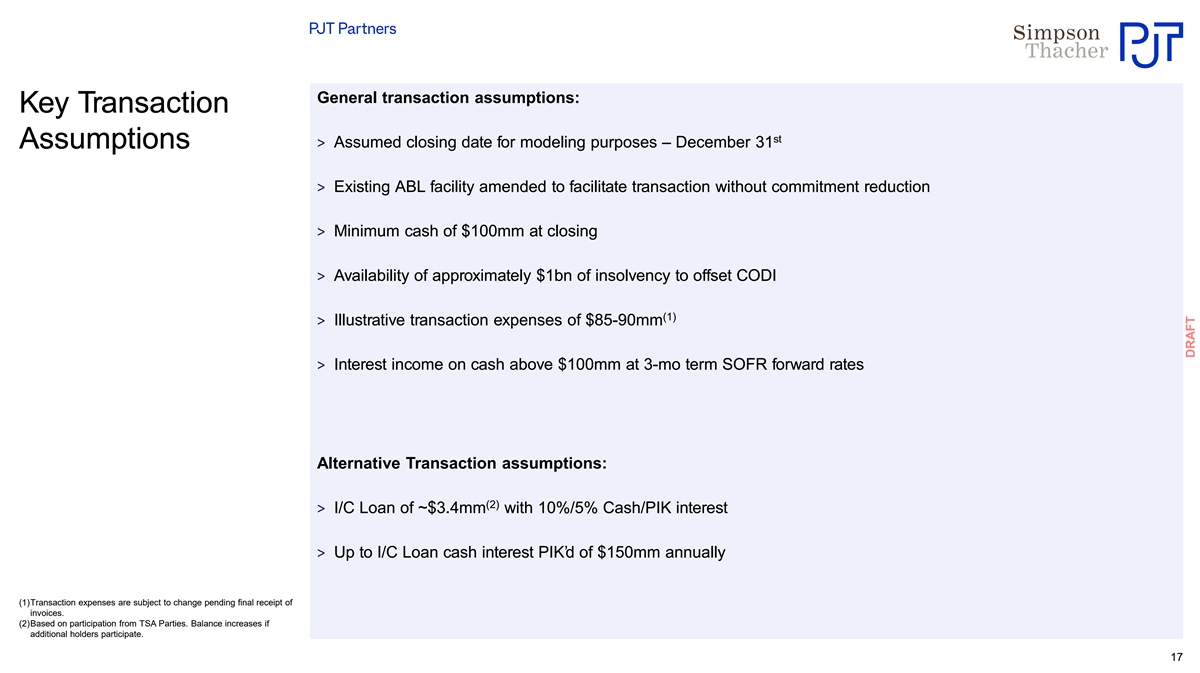

General transaction assumptions: Key Transaction st > Assumed closing date for modeling purposes – December 31 Assumptions > Existing ABL facility amended to facilitate transaction without commitment reduction > Minimum cash of $100mm at closing > Availability of approximately $1bn of insolvency to offset CODI (1) > Illustrative transaction expenses of $85-90mm > Interest income on cash above $100mm at 3-mo term SOFR forward rates Alternative Transaction assumptions: (2) > I/C Loan of ~$3.4mm with 10%/5% Cash/PIK interest > Up to I/C Loan cash interest PIK’d of $150mm annually (1)Transaction expenses are subject to change pending final receipt of invoices. (2)Based on participation from TSA Parties. Balance increases if additional holders participate. 17

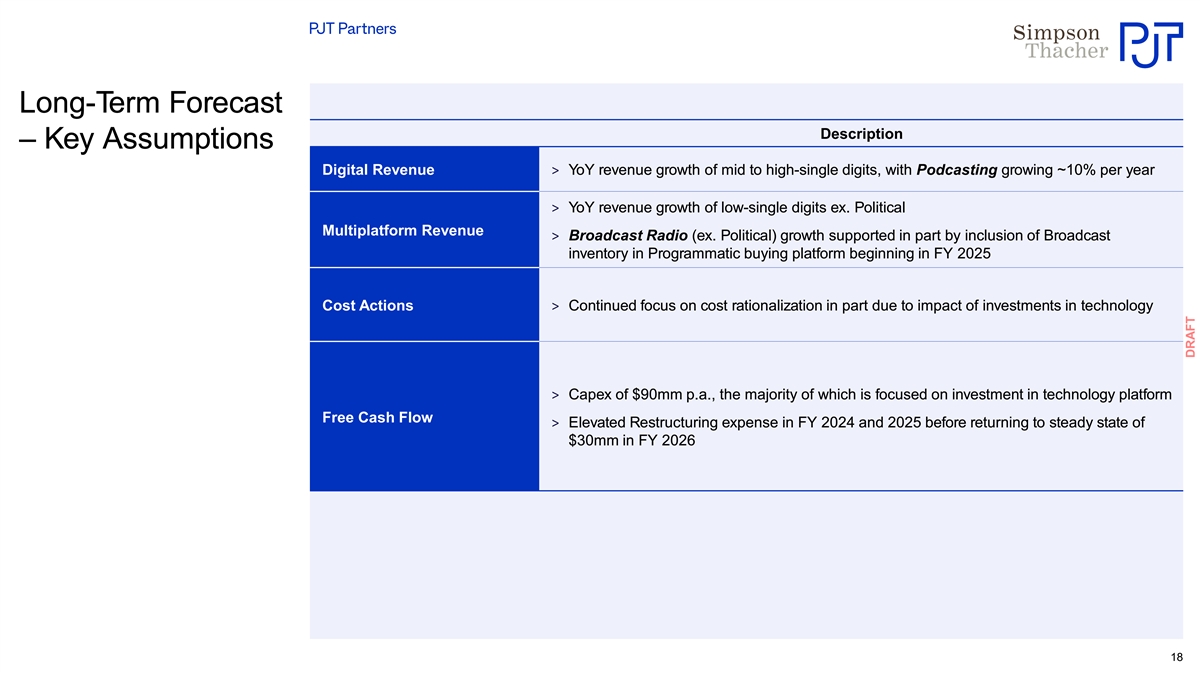

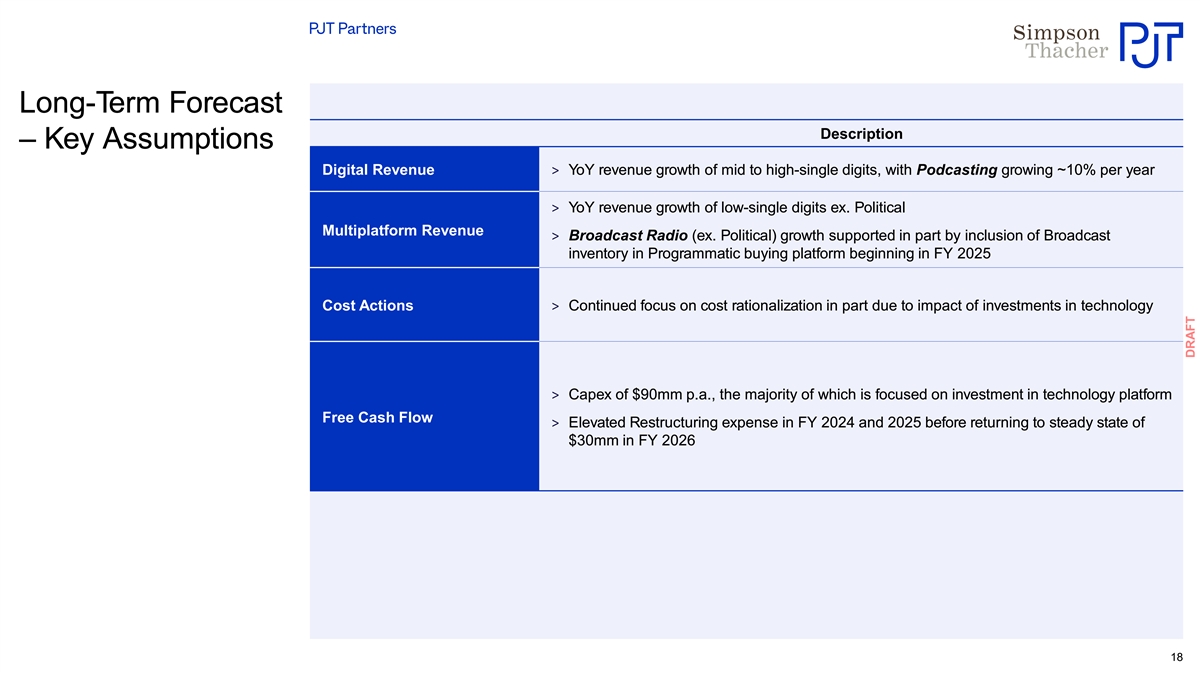

Long-Term Forecast Description – Key Assumptions Digital Revenue > YoY revenue growth of mid to high-single digits, with Podcasting growing ~10% per year > YoY revenue growth of low-single digits ex. Political Multiplatform Revenue > Broadcast Radio (ex. Political) growth supported in part by inclusion of Broadcast inventory in Programmatic buying platform beginning in FY 2025 Cost Actions > Continued focus on cost rationalization in part due to impact of investments in technology > Capex of $90mm p.a., the majority of which is focused on investment in technology platform Free Cash Flow > Elevated Restructuring expense in FY 2024 and 2025 before returning to steady state of $30mm in FY 2026 18

Actual Forecast ($ in millions) FY'22A FY'23A FY'24 E FY'25E FY'26E FY'27E FY'28E Forecast Revenue: Multiplatform Group $2,597 $2,435 $2,412 $2,40 4 2,50 4 $2,464 $2,583 Digital Audio Group 1,0 22 1,0 69 1,170 1,254 1,351 1,447 1,546 Audio & Media Services Group 30 4 257 332 261 297 271 332 Corporate – – – – – – – Eliminations (11) (10 ) (10 ) (11) (11) (11) (11) Total Revenue $3,912 $3,751 $3,90 5 $3,90 8 $4 ,14 1 $4 ,171 $4 ,4 50 YoY growth % 9.9% (4 .1%) 4 .1% 0 .1% 5.9% 0 .7% 6.7% Adj. EBITDA: Multiplatform Group 766 553 50 1 524 60 3 542 640 Digital Audio Group 30 9 349 383 437 479 517 558 Audio & Media Services Group 113 71 140 71 10 1 71 129 Corporate (237) (277) (274) (261) (269) (277) (285) Total Adj. EBITDA $950 $697 $750 $771 $915 $853 $1,0 4 2 Margin % 24 .3% 18.6% 19.2% 19.7% 22.1% 20 .5% 23.4 % YoY growth % 17.2% (26.7%) 7.6% 2.9% 18.6% (6.7%) 22.1% YoY Revenue Growth % by Category Multiplatform Group (6.2%) (1.0 %) (0 .3%) 4 .2% (1.6%) 4 .8% Digital Audio Group 4 .6% 9.4 % 7.2% 7.7% 7.1% 6.8% Audio & Media Services Group (15.6%) 29.3% (21.4 %) 13.7% (8.8%) 22.8% EBITDA Margin % Multiplatform Group 29.5% 22.7% 20 .8% 21.8% 24 .1% 22.0 % 24 .8% Digital Audio Group 30 .2% 32.6% 32.7% 34 .9% 35.5% 35.8% 36.1% Audio & Media Services Group 37.1% 27.8% 4 2.2% 27.1% 34 .0 % 26.2% 38.7% 19

A.Comprehensive Transaction 20