UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22083

Fidelity Central Investment Portfolios II LLC

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | December 31 |

Date of reporting period: | June 30, 2023 |

Item 1.

Reports to Stockholders

Contents

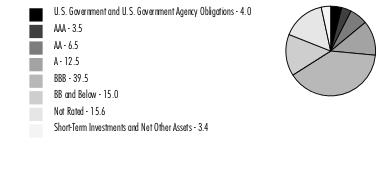

Quality Diversification (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

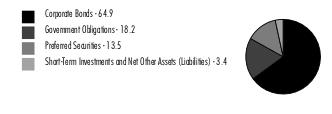

Asset Allocation (% of Fund's net assets) |

|

Futures and Swaps - 30.5% |

Forward foreign currency contracts - (77.9)% |

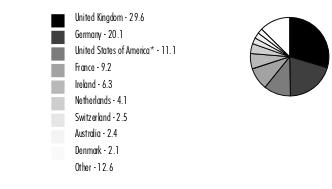

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Nonconvertible Bonds - 64.9% | |||

Principal Amount (a) | Value ($) | ||

| Australia - 1.9% | |||

| AusNet Services Holdings Pty Ltd. 1.625% 3/11/81 (Reg. S) (b) | EUR | 300,000 | 278,256 |

| Leighton Finance U.S.A. Pty Ltd. 1.5% 5/28/29 (Reg. S) | EUR | 1,255,000 | 1,065,472 |

| QBE Insurance Group Ltd.: | |||

| 2.5% 9/13/38 (Reg. S) (b) | GBP | 1,075,000 | 1,040,299 |

| 6.75% 12/2/44 (Reg. S) (b) | 2,200,000 | 2,172,500 | |

TOTAL AUSTRALIA | 4,556,527 | ||

| Belgium - 0.1% | |||

| Anheuser-Busch InBev SA NV 9.75% 7/30/24 | GBP | 165,000 | 216,789 |

| Canada - 0.8% | |||

| Royal Bank of Canada 4.125% 7/5/28 (Reg. S) | EUR | 1,800,000 | 1,951,679 |

| Denmark - 2.1% | |||

| Danske Bank A/S: | |||

| 2.25% 1/14/28 (Reg. S) (b) | GBP | 1,595,000 | 1,693,028 |

| 4.625% 4/13/27 (Reg. S) (b) | GBP | 565,000 | 675,796 |

| 4.75% 6/21/30 (Reg. S) (b) | EUR | 2,400,000 | 2,608,452 |

TOTAL DENMARK | 4,977,276 | ||

| Finland - 0.7% | |||

| Nordea Bank ABP 4.125% 5/5/28 (Reg. S) | EUR | 1,620,000 | 1,749,897 |

| France - 7.3% | |||

| BNP Paribas SA: | |||

| 2.159% 9/15/29 (b)(c) | 780,000 | 649,540 | |

| 2.5% 3/31/32 (Reg. S) (b) | EUR | 1,200,000 | 1,164,105 |

| 4.125% 5/24/33 (Reg. S) | EUR | 1,300,000 | 1,416,971 |

| BPCE SA: | |||

| 1.5% 1/13/42 (Reg. S) (b) | EUR | 3,000,000 | 2,751,415 |

| 4.75% 6/14/34 (Reg. S) (b) | EUR | 200,000 | 218,713 |

| Credit Agricole Assurances SA 4.75% 9/27/48 (b) | EUR | 400,000 | 418,590 |

| Credit Agricole SA: | |||

| UK Government Bonds 1 Year + 2.180% 6.375% 6/14/31 (Reg. S) (b)(d) | GBP | 1,000,000 | 1,250,615 |

| 4.875% 10/23/29 (Reg. S) | GBP | 400,000 | 472,300 |

| Electricite de France SA: | |||

| 5.5% 1/25/35 (Reg. S) | GBP | 1,600,000 | 1,811,764 |

| 5.7% 5/23/28 (c) | 850,000 | 848,717 | |

| 6.25% 5/23/33 (c) | 850,000 | 864,092 | |

| Holding d'Infrastructures et des Metiers de l'Environnement 0.625% 9/16/28 (Reg. S) | EUR | 645,000 | 574,309 |

| Lagardere S.C.A. 1.75% 10/7/27 (Reg. S) | EUR | 1,500,000 | 1,592,066 |

| Societe Generale: | |||

| 4.75% 11/24/25 (c) | 1,220,000 | 1,162,036 | |

| 6.691% 1/10/34 (b)(c) | 500,000 | 509,033 | |

| Technip Energies NV 1.125% 5/28/28 | EUR | 1,250,000 | 1,161,529 |

| Valeo SA 1% 8/3/28 (Reg. S) | EUR | 200,000 | 176,629 |

TOTAL FRANCE | 17,042,424 | ||

| Germany - 7.3% | |||

| ACCENTRO Real Estate AG 5.3596% 2/13/26 (Reg. S) (e) | EUR | 2,242,800 | 1,443,933 |

| AGPS BondCo PLC 4.625% 1/14/26 (Reg. S) (b) | EUR | 8,300,000 | 3,482,401 |

| Bayer AG 4.625% 5/26/33 (Reg. S) | EUR | 850,000 | 940,886 |

| Commerzbank AG 8.625% 2/28/33 (Reg. S) (b) | GBP | 200,000 | 243,995 |

| Deutsche Annington Finance BV 5% 10/2/23 (c) | 950,000 | 943,217 | |

| Deutsche Bank AG: | |||

| 3.25% 5/24/28 (Reg. S) (b) | EUR | 1,700,000 | 1,709,809 |

| 4% 6/24/32 (Reg. S) (b) | EUR | 1,200,000 | 1,148,929 |

| 6.125% 12/12/30 (Reg. S) (b) | GBP | 2,000,000 | 2,328,338 |

| EnBW Energie Baden-Wuerttemberg AG 1.375% 8/31/81 (Reg. S) (b) | EUR | 1,900,000 | 1,648,258 |

| Robert Bosch GmbH: | |||

| 4% 6/2/35 (Reg. S) | EUR | 700,000 | 774,381 |

| 4.375% 6/2/43 (Reg. S) | EUR | 500,000 | 558,491 |

| Sirius Real Estate Ltd. 1.125% 6/22/26 (Reg. S) | EUR | 800,000 | 718,184 |

| ZF Europe Finance BV 2% 2/23/26 (Reg. S) | EUR | 500,000 | 495,814 |

| ZF Finance GmbH 2% 5/6/27 (Reg. S) | EUR | 700,000 | 663,586 |

TOTAL GERMANY | 17,100,222 | ||

| Greece - 0.4% | |||

| Alpha Bank SA 4.25% 2/13/30 (Reg. S) (b) | EUR | 930,000 | 898,060 |

| Hong Kong - 0.7% | |||

| Prudential Funding Asia PLC 2.95% 11/3/33 (Reg. S) (b) | 2,100,000 | 1,766,625 | |

| Ireland - 5.4% | |||

| AIB Group PLC: | |||

| 1.875% 11/19/29 (Reg. S) (b) | EUR | 760,000 | 779,304 |

| 2.25% 4/4/28 (Reg. S) (b) | EUR | 3,565,000 | 3,526,876 |

| Bank of Ireland Group PLC: | |||

| 1.375% 8/11/31 (Reg. S) (b) | EUR | 3,735,000 | 3,538,099 |

| 2.375% 10/14/29 (Reg. S) (b) | EUR | 785,000 | 816,735 |

| Cloverie PLC 4.5% 9/11/44 (Reg. S) (b) | 4,122,000 | 3,922,034 | |

TOTAL IRELAND | 12,583,048 | ||

| Italy - 1.0% | |||

| Enel SpA 3.375% (Reg. S) (b)(f) | EUR | 630,000 | 629,741 |

| UniCredit SpA: | |||

| 2.731% 1/15/32 (Reg. S) (b) | EUR | 1,224,000 | 1,164,938 |

| 5.861% 6/19/32 (b)(c) | 565,000 | 513,682 | |

TOTAL ITALY | 2,308,361 | ||

| Luxembourg - 1.9% | |||

| Alpha Trains Finance SA 2.064% 6/30/30 | EUR | 604,000 | 615,394 |

| Blackstone Property Partners Europe LP: | |||

| 1% 5/4/28 (Reg. S) | EUR | 3,510,000 | 2,866,816 |

| 1.75% 3/12/29 (Reg. S) | EUR | 355,000 | 287,327 |

| 2.625% 10/20/28 (Reg. S) | GBP | 660,000 | 612,865 |

TOTAL LUXEMBOURG | 4,382,402 | ||

| Mexico - 1.5% | |||

| Petroleos Mexicanos 6.5% 3/13/27 | 3,910,000 | 3,470,125 | |

| Netherlands - 3.7% | |||

| Demeter Investments BV: | |||

| 5.625% 8/15/52 (Reg. S) (b) | 1,220,000 | 1,146,800 | |

| 5.75% 8/15/50 (Reg. S) (b) | 2,355,000 | 2,263,979 | |

| ING Groep NV 4.75% 5/23/34 (Reg. S) (b) | EUR | 2,600,000 | 2,837,330 |

| JDE Peet's BV 2.25% 9/24/31 (c) | 431,000 | 333,754 | |

| Rabobank Nederland 4% 1/10/30 (Reg. S) | EUR | 900,000 | 962,370 |

| Universal Music Group NV 4% 6/13/31 (Reg. S) | EUR | 600,000 | 652,131 |

| VIA Outlets 1.75% 11/15/28 (Reg. S) | EUR | 665,000 | 581,542 |

TOTAL NETHERLANDS | 8,777,906 | ||

| Poland - 0.8% | |||

| GTC Aurora Luxembourg SA 2.25% 6/23/26 (Reg. S) | EUR | 2,155,000 | 1,790,083 |

| Portugal - 0.2% | |||

| Fidelidade-Companhia de Seguros SA 4.25% 9/4/31 (Reg. S) (b) | EUR | 600,000 | 563,301 |

| Spain - 0.7% | |||

| Iberdrola Finanzas SAU 7.375% 1/29/24 | GBP | 700,000 | 893,617 |

| Werfenlife SA 4.625% 6/6/28 (Reg. S) | EUR | 700,000 | 753,169 |

TOTAL SPAIN | 1,646,786 | ||

| Sweden - 1.2% | |||

| Akelius Residential Property AB 3.875% 10/5/78 (Reg. S) (b) | EUR | 893,000 | 966,258 |

| Heimstaden AB 4.375% 3/6/27 (Reg. S) | EUR | 1,400,000 | 910,879 |

| Samhallsbyggnadsbolaget I Norden AB: | |||

| 1% 8/12/27 (Reg. S) | EUR | 350,000 | 245,588 |

| 1.75% 1/14/25 (Reg. S) | EUR | 769,000 | 688,089 |

TOTAL SWEDEN | 2,810,814 | ||

| Switzerland - 2.1% | |||

| UBS Group AG: | |||

| 2.125% 11/15/29 (Reg. S) (b) | GBP | 1,170,000 | 1,158,743 |

| 4.194% 4/1/31 (b)(c) | 1,315,000 | 1,170,428 | |

| 4.75% 3/17/32 (Reg. S) (b) | EUR | 885,000 | 960,408 |

| 4.988% 8/5/33 (Reg. S) (b) | 500,000 | 463,315 | |

| 6.537% 8/12/33 (b)(c) | 470,000 | 481,474 | |

| Zurich Finance (Ireland) DAC 3.5% 5/2/52 (Reg. S) (b) | 970,000 | 768,405 | |

TOTAL SWITZERLAND | 5,002,773 | ||

| United Kingdom - 21.4% | |||

| Admiral Group PLC 8.5% 1/6/34 (Reg. S) | GBP | 300,000 | 385,446 |

| Anglian Water (Osprey) Financing PLC 2% 7/31/28 (Reg. S) | GBP | 465,000 | 441,950 |

| Barclays PLC: | |||

| 5.262% 1/29/34 (Reg. S) (b) | EUR | 550,000 | 598,855 |

| 5.746% 8/9/33 (b) | 397,000 | 383,956 | |

| 7.437% 11/2/33 (b) | 650,000 | 703,228 | |

| 8.407% 11/14/32 (Reg. S) (b) | GBP | 805,000 | 1,013,028 |

| Heathrow Funding Ltd.: | |||

| 2.625% 3/16/28 (Reg. S) | GBP | 1,340,000 | 1,379,817 |

| 7.125% 2/14/24 | GBP | 1,205,000 | 1,530,812 |

| HSBC Holdings PLC: | |||

| 4.787% 3/10/32 (Reg. S) (b) | EUR | 1,420,000 | 1,553,505 |

| 4.856% 5/23/33 (Reg. S) (b) | EUR | 1,300,000 | 1,424,538 |

| 7.39% 11/3/28 (b) | 1,105,000 | 1,166,198 | |

| 8.201% 11/16/34 (Reg. S) (b) | GBP | 785,000 | 1,009,370 |

| Imperial Tobacco Finance PLC 3.5% 7/26/26 (c) | 1,517,000 | 1,412,859 | |

| Inchcape PLC 6.5% 6/9/28 (Reg. S) | GBP | 900,000 | 1,109,624 |

| InterContinental Hotel Group PLC 3.375% 10/8/28 (Reg. S) | GBP | 1,010,000 | 1,087,255 |

| John Lewis PLC 6.125% 1/21/25 | GBP | 5,242,000 | 6,395,707 |

| Lloyds Banking Group PLC: | |||

| 1.985% 12/15/31 (b) | GBP | 1,120,000 | 1,174,769 |

| 4.5% 1/11/29 (Reg. S) (b) | EUR | 675,000 | 725,434 |

| 4.976% 8/11/33 (b) | 480,000 | 448,993 | |

| Marks & Spencer PLC 4.5% 7/10/27 (Reg. S) | GBP | 1,745,000 | 1,955,345 |

| National Grid Gas Finance PLC 4.25% 7/5/29 (Reg. S) | EUR | 775,000 | 840,420 |

| NatWest Group PLC: | |||

| 2.105% 11/28/31 (Reg. S) (b) | GBP | 1,655,000 | 1,729,041 |

| 3.619% 3/29/29 (Reg. S) (b) | GBP | 1,140,000 | 1,242,111 |

| 3.622% 8/14/30 (Reg. S) (b) | GBP | 615,000 | 718,657 |

| 7.416% 6/6/33 (Reg. S) (b) | GBP | 885,000 | 1,087,559 |

| NGG Finance PLC 2.125% 9/5/82 (Reg. S) (b) | EUR | 1,865,000 | 1,747,632 |

| Rolls-Royce PLC: | |||

| 1.625% 5/9/28 (Reg. S) | EUR | 875,000 | 806,825 |

| 3.375% 6/18/26 | GBP | 570,000 | 637,503 |

| Severn Trent Utilities Finance PLC: | |||

| 4.625% 11/30/34 (Reg. S) | GBP | 400,000 | 451,299 |

| 6.125% 2/26/24 | GBP | 385,000 | 487,786 |

| Southern Water Services Finance Ltd. 1.625% 3/30/27 (Reg. S) | GBP | 576,000 | 604,570 |

| Tesco Corporate Treasury Services PLC 5.5% 2/27/35 (Reg. S) | GBP | 1,470,000 | 1,721,357 |

| Thames Water Utility Finance PLC 1.875% 1/24/24 (Reg. S) | GBP | 770,000 | 919,239 |

| The Berkeley Group PLC 2.5% 8/11/31 (Reg. S) | GBP | 955,000 | 787,857 |

| Travis Perkins PLC: | |||

| 3.75% 2/17/26 (Reg. S) | GBP | 862,000 | 979,792 |

| 4.5% 9/7/23 (Reg. S) | GBP | 1,330,000 | 1,673,222 |

| Tritax EuroBox PLC 0.95% 6/2/26 (Reg. S) | EUR | 510,000 | 469,315 |

| Virgin Money UK PLC 5.125% 12/11/30 (Reg. S) (b) | GBP | 415,000 | 473,072 |

| Vodafone Group PLC: | |||

| 4.875% 10/3/78 (Reg. S) (b) | GBP | 480,000 | 569,976 |

| 6.25% 10/3/78 (Reg. S) (b) | 1,109,000 | 1,094,317 | |

| Western Power Distribution PLC 3.625% 11/6/23 (Reg. S) | GBP | 735,000 | 924,937 |

| Whitbread PLC: | |||

| 2.375% 5/31/27 (Reg. S) | GBP | 645,000 | 680,848 |

| 3.375% 10/16/25 (Reg. S) | GBP | 3,130,000 | 3,640,063 |

TOTAL UNITED KINGDOM | 50,188,087 | ||

| United States of America - 3.7% | |||

| Blackstone Private Credit Fund 4.875% 4/14/26 | GBP | 1,560,000 | 1,750,596 |

| Duke Energy Corp. 3.85% 6/15/34 | EUR | 1,060,000 | 1,054,267 |

| Ford Motor Credit Co. LLC 6.86% 6/5/26 | GBP | 950,000 | 1,175,746 |

| General Motors Financial Co., Inc. 5.15% 8/15/26 (Reg. S) | GBP | 475,000 | 571,607 |

| Morgan Stanley 4.656% 3/2/29 (b) | EUR | 725,000 | 794,754 |

| MPT Operating Partnership LP/MPT Finance Corp. 2.5% 3/24/26 | GBP | 930,000 | 922,321 |

| Southern Co. 1.875% 9/15/81 (b) | EUR | 2,965,000 | 2,526,485 |

TOTAL UNITED STATES OF AMERICA | 8,795,776 | ||

| TOTAL NONCONVERTIBLE BONDS (Cost $179,183,397) | 152,578,961 | ||

| U.S. Government and Government Agency Obligations - 4.0% | |||

Principal Amount (a) | Value ($) | ||

| U.S. Treasury Obligations - 4.0% | |||

| U.S. Treasury Bonds: | |||

| 3.25% 5/15/42 (g) | 7,380,000 | 6,585,497 | |

| 6.25% 5/15/30 | 1,000,000 | 1,134,297 | |

| U.S. Treasury Notes 4.125% 1/31/25 | 1,655,000 | 1,629,011 | |

| TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $9,361,298) | 9,348,805 | ||

| Foreign Government and Government Agency Obligations - 14.2% | |||

Principal Amount (a) | Value ($) | ||

| Germany - 8.5% | |||

| German Federal Republic: | |||

| 0% 5/15/35 (Reg. S) | EUR | 5,605,000 | 4,594,600 |

| 1% 5/15/38(Reg. S) | EUR | 2,450,000 | 2,179,918 |

| 1.25% 8/15/48 (g) | EUR | 4,070,000 | 3,523,618 |

| 2.2% 12/12/24(Reg. S) | EUR | 7,430,000 | 7,978,186 |

| 2.5% 3/13/25(Reg. S) | EUR | 1,540,000 | 1,659,375 |

TOTAL GERMANY | 19,935,697 | ||

| United Kingdom - 5.7% | |||

| United Kingdom, Great Britain and Northern Ireland: | |||

| 1% 4/22/24(Reg. S) | GBP | 1,955,000 | 2,398,811 |

| 2.25% 9/7/23 | GBP | 8,645,000 | 10,919,839 |

TOTAL UNITED KINGDOM | 13,318,650 | ||

| TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $36,633,200) | 33,254,347 | ||

| Preferred Securities - 13.5% | |||

Principal Amount (a) | Value ($) | ||

| Australia - 0.5% | |||

| QBE Insurance Group Ltd. 5.25% (Reg. S) (b)(f) | 1,315,000 | 1,215,737 | |

| Canada - 0.6% | |||

| Bank of Nova Scotia: | |||

| 3 month U.S. LIBOR + 2.640% 7.8459% (b)(d)(f) | 850,000 | 719,002 | |

| 4.9% (b)(f) | 770,000 | 729,600 | |

TOTAL CANADA | 1,448,602 | ||

| Czech Republic - 0.2% | |||

| CPI Property Group SA 3.75% (Reg. S) (b)(f) | EUR | 1,525,000 | 557,182 |

| Finland - 0.2% | |||

| Citycon Oyj 4.496% (Reg. S) (b)(f) | EUR | 665,000 | 476,447 |

| France - 1.9% | |||

| BNP Paribas SA 6.625% (Reg. S) (b)(f) | 1,215,000 | 1,188,973 | |

| Electricite de France SA 5.625% (Reg. S) (b)(f) | 1,490,000 | 1,502,833 | |

| Societe Generale 7.875% (Reg. S) (b)(f) | 1,060,000 | 1,039,337 | |

| Veolia Environnement SA 2% (Reg. S) (b)(f) | EUR | 800,000 | 731,408 |

TOTAL FRANCE | 4,462,551 | ||

| Germany - 4.3% | |||

| Aroundtown SA 3.375% (Reg. S) (b)(f) | EUR | 3,900,000 | 1,832,106 |

| AT Securities BV 5.25% (Reg. S) (b)(f) | 4,250,000 | 1,868,399 | |

| Grand City Properties SA 1.5% (Reg. S) (b)(f) | EUR | 2,900,000 | 1,261,324 |

| Volkswagen International Finance NV: | |||

| 3.748% (Reg. S) (b)(f) | EUR | 800,000 | 774,845 |

| 3.875% (Reg. S) (b)(f) | EUR | 3,900,000 | 3,564,984 |

| 4.625% (Reg. S) (b)(f) | EUR | 690,000 | 725,668 |

TOTAL GERMANY | 10,027,326 | ||

| Ireland - 0.9% | |||

| AerCap Holdings NV 5.875% 10/10/79 (b) | 1,860,000 | 1,778,697 | |

| AIB Group PLC 6.25% (Reg. S) (b)(f) | EUR | 360,000 | 370,740 |

TOTAL IRELAND | 2,149,437 | ||

| Netherlands - 0.4% | |||

| Stichting AK Rabobank Certificaten 6.5% (Reg. S) (b)(d)(f) | EUR | 859,075 | 869,791 |

| Spain - 0.9% | |||

| Banco Bilbao Vizcaya Argentaria SA 5.875% (Reg. S) (b)(f) | EUR | 1,000,000 | 1,081,517 |

| Telefonica Europe BV 3.875% (Reg. S) (b)(f) | EUR | 1,100,000 | 1,144,071 |

TOTAL SPAIN | 2,225,588 | ||

| Sweden - 0.7% | |||

| Heimstaden Bostad AB 3.248% (Reg. S) (b)(f) | EUR | 1,785,000 | 1,178,967 |

| Samhallsbyggnadsbolaget I Norden AB 2.624% (Reg. S) (b)(f) | EUR | 1,750,000 | 371,335 |

TOTAL SWEDEN | 1,550,302 | ||

| Switzerland - 0.4% | |||

| Credit Suisse Group AG 7.5% (Reg. S) (b)(f)(h) | 9,515,000 | 333,025 | |

| UBS Group AG 7% (Reg. S) (b)(f) | 500,000 | 487,243 | |

TOTAL SWITZERLAND | 820,268 | ||

| United Kingdom - 2.5% | |||

| Barclays PLC: | |||

| 5.875% (Reg. S) (b)(f) | GBP | 330,000 | 374,858 |

| 7.125% (b)(f) | GBP | 200,000 | 230,680 |

| 8.875% (b)(f) | GBP | 700,000 | 819,774 |

| British American Tobacco PLC 3% (Reg. S) (b)(f) | EUR | 2,555,000 | 2,376,136 |

| Lloyds Banking Group PLC 5.125% (b)(f) | GBP | 280,000 | 320,347 |

| National Express Group PLC 4.25% (Reg. S) (b)(f) | GBP | 525,000 | 590,610 |

| SSE PLC 3.74% (Reg. S) (b)(f) | GBP | 1,020,000 | 1,178,480 |

TOTAL UNITED KINGDOM | 5,890,885 | ||

| TOTAL PREFERRED SECURITIES (Cost $57,180,171) | 31,694,116 | ||

| Money Market Funds - 1.3% | |||

| Shares | Value ($) | ||

Fidelity Cash Central Fund 5.14% (i) (Cost $3,103,205) | 3,102,584 | 3,103,205 | |

| Purchased Swaptions - 0.0% | ||||

Expiration Date | Notional Amount (a) | Value ($) | ||

| Put Options - 0.0% | ||||

Option with an exercise rate of 4.625% on a credit default swap with Goldman Sachs Bank U.S.A. to buy protection on the 5-Year iTraxx Europe Crossover Series 39 Index expiring June 2028, paying 5% quarterly. (Cost $271,338) | 8/16/23 | EUR | 20,900,000 | 70,864 |

| TOTAL INVESTMENT IN SECURITIES - 97.9% (Cost $285,732,609) | 230,050,298 |

NET OTHER ASSETS (LIABILITIES) - 2.1% | 4,919,962 |

| NET ASSETS - 100.0% | 234,970,260 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) | |

| Purchased | |||||

| Bond Index Contracts | |||||

| Eurex Euro-Bobl Contracts (Germany) | 5 | Sep 2023 | 631,314 | (47) | (47) |

| Eurex Euro-Bund Contracts (Germany) | 1 | Sep 2023 | 145,937 | (99) | (99) |

| Eurex Euro-Schatz Contracts (Germany) | 81 | Sep 2023 | 9,267,398 | (78,924) | (78,924) |

| TME 10 Year Canadian Note Contracts (Canada) | 85 | Sep 2023 | 7,861,898 | (43,598) | (43,598) |

| TOTAL BOND INDEX CONTRACTS | (122,668) | ||||

| Treasury Contracts | |||||

| ASX 10 Year Treasury Bond Index Contracts (Australia) | 21 | Sep 2023 | 1,625,152 | (8,614) | (8,614) |

| CBOT 2-Year U.S. Treasury Note Contracts (United States) | 174 | Sep 2023 | 35,381,813 | (508,252) | (508,252) |

| CBOT 5-Year U.S. Treasury Note Contracts (United States) | 12 | Sep 2023 | 1,285,125 | (6,957) | (6,957) |

| CBOT Long Term U.S. Treasury Bond Contracts (United States) | 211 | Sep 2023 | 26,777,219 | (20,376) | (20,376) |

| TOTAL TREASURY CONTRACTS | (544,199) | ||||

| TOTAL PURCHASED | (666,867) | ||||

| Sold | |||||

| Bond Index Contracts | |||||

| ICE Long Gilt Contracts (United Kingdom) | 71 | Sep 2023 | 8,593,201 | 64,002 | 64,002 |

| TOTAL FUTURES CONTRACTS | (602,865) | ||||

| The notional amount of futures purchased as a percentage of Net Assets is 35.3% | |||||

| The notional amount of futures sold as a percentage of Net Assets is 3.7% | |||||

| Forward Foreign Currency Contracts | ||||||

Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation/ (Depreciation) ($) | ||

| EUR | 700,000 | USD | 763,723 | BNP Paribas S.A. | 7/03/23 | 117 |

| CAD | 162,000 | USD | 122,556 | Bank of America, N.A. | 9/15/23 | (128) |

| CAD | 21,000 | USD | 15,961 | HSBC Bank | 9/15/23 | (91) |

| EUR | 176,000 | USD | 193,875 | Brown Brothers Harriman & Co | 9/15/23 | (1,119) |

| EUR | 175,000 | USD | 191,025 | Brown Brothers Harriman & Co | 9/15/23 | 637 |

| EUR | 5,916,000 | USD | 6,506,340 | Brown Brothers Harriman & Co | 9/15/23 | (27,098) |

| EUR | 14,691,000 | USD | 16,094,245 | HSBC Bank | 9/15/23 | (4,564) |

| GBP | 183,000 | USD | 232,862 | Brown Brothers Harriman & Co | 9/15/23 | (401) |

| GBP | 7,354,000 | USD | 9,297,280 | Brown Brothers Harriman & Co | 9/15/23 | 44,357 |

| GBP | 103,000 | USD | 129,861 | Brown Brothers Harriman & Co | 9/15/23 | 978 |

| GBP | 544,000 | USD | 693,454 | Canadian Imperial Bk. of Comm. | 9/15/23 | (2,422) |

| GBP | 158,000 | USD | 201,517 | Royal Bank of Canada | 9/15/23 | (813) |

| USD | 171,661 | AUD | 249,000 | Bank of America, N.A. | 9/15/23 | 5,445 |

| USD | 384,145 | CAD | 507,000 | Royal Bank of Canada | 9/15/23 | 990 |

| USD | 134,166,499 | EUR | 122,035,000 | Bank of America, N.A. | 9/15/23 | 512,962 |

| USD | 83,896,803 | GBP | 65,411,000 | BNP Paribas S.A. | 9/15/23 | 806,537 |

| USD | 131,354 | GBP | 103,000 | State Street Bank and Trust Co | 9/15/23 | 515 |

| TOTAL FORWARD FOREIGN CURRENCY CONTRACTS | 1,335,902 | |||||

| Unrealized Appreciation | 1,372,538 | |||||

| Unrealized Depreciation | (36,636) | |||||

| Credit Default Swaps | ||||||||||

| Underlying Reference | Maturity Date | Clearinghouse / Counterparty | Fixed Payment Received/ (Paid) | Payment Frequency | Notional Amount (1) | Value ($) | Upfront Premium Received/ (Paid) ($) | Unrealized Appreciation/ (Depreciation) ($) | ||

| Buy Protection | ||||||||||

| Intesa Sanpaolo SpA | Jun 2028 | JPMorgan Chase Bank, N.A. | (1%) | Quarterly | EUR | 2,630,000 | (66) | 3,791 | 3,725 | |

| AUD | - | Australian dollar |

| CAD | - | Canadian dollar |

| EUR | - | European Monetary Unit |

| GBP | - | British pound sterling |

| USD | - | U.S. dollar |

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $8,888,832 or 3.8% of net assets. |

| (d) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (e) | Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

| (f) | Security is perpetual in nature with no stated maturity date. |

| (g) | Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $2,139,686. |

| (h) | Non-income producing - Security is in default. |

| (i) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.14% | 12,016,704 | 63,583,559 | 72,497,058 | 331,353 | - | - | 3,103,205 | 0.0% |

| Total | 12,016,704 | 63,583,559 | 72,497,058 | 331,353 | - | - | 3,103,205 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Corporate Bonds | 152,578,961 | - | 152,578,961 | - |

| U.S. Government and Government Agency Obligations | 9,348,805 | - | 9,348,805 | - |

| Foreign Government and Government Agency Obligations | 33,254,347 | - | 33,254,347 | - |

| Preferred Securities | 31,694,116 | - | 31,694,116 | - |

| Money Market Funds | 3,103,205 | 3,103,205 | - | - |

| Purchased Swaptions | 70,864 | - | 70,864 | - |

| Total Investments in Securities: | 230,050,298 | 3,103,205 | 226,947,093 | - |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 64,002 | 64,002 | - | - |

Forward Foreign Currency Contracts | 1,372,538 | - | 1,372,538 | - |

| Total Assets | 1,436,540 | 64,002 | 1,372,538 | - |

| Liabilities | ||||

Futures Contracts | (666,867) | (666,867) | - | - |

Forward Foreign Currency Contracts | (36,636) | - | (36,636) | - |

Swaps | (66) | - | (66) | - |

| Total Liabilities | (703,569) | (666,867) | (36,702) | - |

| Total Derivative Instruments: | 732,971 | (602,865) | 1,335,836 | - |

Primary Risk Exposure / Derivative Type | Value | |

| Asset ($) | Liability ($) | |

| Credit Risk | ||

Purchased Swaptions (a) | 70,864 | 0 |

Swaps (d) | 0 | (66) |

| Total Credit Risk | 70,864 | (66) |

| Foreign Exchange Risk | ||

Forward Foreign Currency Contracts (b) | 1,372,538 | (36,636) |

| Total Foreign Exchange Risk | 1,372,538 | (36,636) |

| Interest Rate Risk | ||

Futures Contracts (c) | 64,002 | (666,867) |

| Total Interest Rate Risk | 64,002 | (666,867) |

| Total Value of Derivatives | 1,507,404 | (703,569) |

| Statement of Assets and Liabilities | ||||

June 30, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $282,629,404) | $ | 226,947,093 | ||

Fidelity Central Funds (cost $3,103,205) | 3,103,205 | |||

| Total Investment in Securities (cost $285,732,609) | $ | 230,050,298 | ||

| Foreign currency held at value (cost $2,744,163) | 2,744,500 | |||

| Receivable for investments sold | 855,719 | |||

| Unrealized appreciation on forward foreign currency contracts | 1,372,538 | |||

| Receivable for fund shares sold | 275 | |||

| Interest receivable | 3,004,147 | |||

| Distributions receivable from Fidelity Central Funds | 28,074 | |||

| Receivable for daily variation margin on futures contracts | 234,305 | |||

Total assets | 238,289,856 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 3,181,079 | ||

| Unrealized depreciation on forward foreign currency contracts | 36,636 | |||

| Payable for fund shares redeemed | 98,429 | |||

| Bi-lateral OTC swaps, at value | 66 | |||

| Other payables and accrued expenses | 3,386 | |||

| Total Liabilities | 3,319,596 | |||

| Net Assets | $ | 234,970,260 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 367,749,297 | ||

| Total accumulated earnings (loss) | (132,779,037) | |||

| Net Assets | $ | 234,970,260 | ||

Net Asset Value , offering price and redemption price per share ($234,970,260 ÷ 3,050,097 shares) | $ | 77.04 | ||

| Statement of Operations | ||||

Six months ended June 30, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 2,275,481 | ||

| Interest | 4,256,022 | |||

| Income from Fidelity Central Funds | 331,353 | |||

| Total Income | 6,862,856 | |||

| Expenses | ||||

| Custodian fees and expenses | $ | 7,363 | ||

| Independent trustees' fees and expenses | 625 | |||

| Total expenses before reductions | 7,988 | |||

| Expense reductions | (1,920) | |||

| Total expenses after reductions | 6,068 | |||

| Net Investment income (loss) | 6,856,788 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (42,425,130) | |||

| Forward foreign currency contracts | (7,018,909) | |||

| Foreign currency transactions | 45,909 | |||

| Futures contracts | 165,170 | |||

| Swaps | (48,800) | |||

| Total net realized gain (loss) | (49,281,760) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 43,502,574 | |||

| Forward foreign currency contracts | 1,148,374 | |||

| Assets and liabilities in foreign currencies | (60,149) | |||

| Futures contracts | (731,646) | |||

| Swaps | 7,290 | |||

| Total change in net unrealized appreciation (depreciation) | 43,866,443 | |||

| Net gain (loss) | (5,415,317) | |||

| Net increase (decrease) in net assets resulting from operations | $ | 1,441,471 | ||

| Statement of Changes in Net Assets | ||||

Six months ended June 30, 2023 (Unaudited) | Year ended December 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 6,856,788 | $ | 14,705,780 |

| Net realized gain (loss) | (49,281,760) | (19,087,653) | ||

| Change in net unrealized appreciation (depreciation) | 43,866,443 | (96,564,382) | ||

| Net increase (decrease) in net assets resulting from operations | 1,441,471 | (100,946,255) | ||

| Distributions to shareholders | (2,796,708) | (27,874,672) | ||

| Distributions to shareholders from tax return of capital | - | (92,865) | ||

| Total Distributions | (2,796,708) | (27,967,537) | ||

| Affiliated share transactions | ||||

| Proceeds from sales of shares | 2,823,245 | 26,968,985 | ||

| Reinvestment of distributions | 2,796,708 | 27,967,537 | ||

| Cost of shares redeemed | (130,948,360) | (219,671,418) | ||

Net increase (decrease) in net assets resulting from share transactions | (125,328,407) | (164,734,896) | ||

| Total increase (decrease) in net assets | (126,683,644) | (293,648,688) | ||

| Net Assets | ||||

| Beginning of period | 361,653,904 | 655,302,592 | ||

| End of period | $ | 234,970,260 | $ | 361,653,904 |

| Other Information | ||||

| Shares | ||||

| Sold | 36,025 | 295,639 | ||

| Issued in reinvestment of distributions | 35,943 | 339,843 | ||

| Redeemed | (1,688,738) | (2,478,557) | ||

| Net increase (decrease) | (1,616,770) | (1,843,075) | ||

| Fidelity® International Credit Central Fund |

Six months ended (Unaudited) June 30, 2023 | Years ended December 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 77.49 | $ | 100.66 | $ | 104.23 | $ | 101.26 | $ | 94.83 | $ | 99.80 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.647 | 2.720 | 2.309 | 3.060 | 2.744 | 2.597 | ||||||

| Net realized and unrealized gain (loss) | (1.481) | (20.165) | (2.501) | 5.002 | 9.957 | (3.725) | ||||||

| Total from investment operations | .166 | (17.445) | (.192) | 8.062 | 12.701 | (1.128) | ||||||

| Distributions from net investment income | (.616) | (5.143) | (2.087) C | (3.418) | (3.022) C | (2.398) | ||||||

| Distributions from net realized gain | - | (.563) | (1.291) C | (1.674) | (3.040) C | (1.444) | ||||||

| Tax return of capital | - | (.019) | - | - | (.209) | - | ||||||

| Total distributions | (.616) | (5.725) | (3.378) | (5.092) | (6.271) | (3.842) | ||||||

| Net asset value, end of period | $ | 77.04 | $ | 77.49 | $ | 100.66 | $ | 104.23 | $ | 101.26 | $ | 94.83 |

Total Return D,E | .21% | (17.51)% | (.18)% | 8.11% | 13.57% | (1.13)% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | -% H,I | -% I | -% I | .01% | .01% | .01% | ||||||

| Expenses net of fee waivers, if any | -% H,I | -% I | -% I | .01% | .01% | .01% | ||||||

| Expenses net of all reductions | -% H,I | -% I | -% I | .01% | .01% | .01% | ||||||

| Net investment income (loss) | 4.20% H | 3.08% | 2.27% | 2.97% | 2.72% | 2.66% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 234,970 | $ | 361,654 | $ | 655,303 | $ | 455,948 | $ | 310,543 | $ | 172,196 |

Portfolio turnover rate J | 53% H | 25% | 52% | 67% | 84% | 85% |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $5,222,026 |

| Gross unrealized depreciation | (59,576,433) |

| Net unrealized appreciation (depreciation) | $(54,354,407) |

| Tax cost | $285,141,467 |

| Short-term | $(16,688,233) |

| Long-term | (29,413,233) |

| Total capital loss carryforward | $(46,101,466) |

| Credit Risk | Credit risk relates to the ability of the issuer of a financial instrument to make further principal or interest payments on an obligation or commitment that it has to a fund. |

| Foreign Exchange Risk | Foreign exchange rate risk relates to fluctuations in the value of an asset or liability due to changes in currency exchange rates. |

| Interest Rate Risk | Interest rate risk relates to the fluctuations in the value of interest-bearing securities due to changes in the prevailing levels of market interest rates. |

| Primary Risk Exposure / Derivative Type | Net Realized Gain (Loss) | Change in Net Unrealized Appreciation (Depreciation) |

| Fidelity International Credit Central Fund | ||

| Credit Risk | ||

| Purchased Options | $(974,746) | $55,740 |

| Swaps | (48,800) | 7,290 |

| Total Credit Risk | (1,023,546) | 63,030 |

| Foreign Exchange Risk | ||

| Forward Foreign Currency Contracts | (7,018,909) | 1,148,374 |

| Total Foreign Exchange Risk | (7,018,909) | 1,148,374 |

| Interest Rate Risk | ||

| Futures Contracts | 165,170 | (731,646) |

| Total Interest Rate Risk | 165,170 | (731,646) |

| Totals | $(7,877,285) | $479,758 |

| Purchases ($) | Sales ($) | |

| Fidelity International Credit Central Fund | 59,133,127 | 181,474,544 |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2023 to June 30, 2023). |

Annualized Expense Ratio- A | Beginning Account Value January 1, 2023 | Ending Account Value June 30, 2023 | Expenses Paid During Period- C January 1, 2023 to June 30, 2023 | |||||||

| Fidelity® International Credit Central Fund | 0.0049% | |||||||||

| Actual | $ 1,000 | $ 1,002.10 | $ .02 | |||||||

Hypothetical- B | $ 1,000 | $ 1,024.77 | $ .02 | |||||||

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Central Investment Portfolios II LLC’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Central Investment Portfolios II LLC’s (the “Trust”) disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Item 12.

Disclosure of Securities Lending Activities for Closed-End Management

Investment Companies

Not applicable.

Item 13.

Exhibits

(a) | (1) | Not applicable. |

(a) | (2) | |

(a) | (3) | Not applicable. |

(b) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Central Investment Portfolios II LLC

By: | /s/Laura M. Del Prato |

Laura M. Del Prato | |

President and Treasurer | |

Date: | August 22, 2023 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Laura M. Del Prato |

Laura M. Del Prato | |

President and Treasurer | |

Date: | August 22, 2023 |

By: | /s/John J. Burke III |

John J. Burke III | |

Chief Financial Officer | |

Date: | August 22, 2023 |