UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22083

Fidelity Central Investment Portfolios II LLC

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | September 30 |

Date of reporting period: | September 30, 2023 |

Item 1.

Reports to Stockholders

Contents

| Average Annual Total Returns | |||

Periods ended September 30, 2023 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Investment Grade Bond Central Fund | 1.43% | 1.10% | 1.99% |

| $10,000 Over 10 Years |

Let's say hypothetically that $10,000 was invested in Fidelity® Investment Grade Bond Central Fund on September 30, 2013. The chart shows how the value of your investment would have changed, and also shows how the Bloomberg U.S. Aggregate Bond Index performed over the same period. |

|

Quality Diversification (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (5.3)% |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

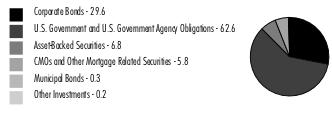

Asset Allocation (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (5.3)% |

Written options - (0.4)% |

Futures and Swaps - 0.7% |

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments. |

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Nonconvertible Bonds - 29.6% | |||

Principal Amount (a) | Value ($) | ||

| COMMUNICATION SERVICES - 2.3% | |||

| Diversified Telecommunication Services - 0.5% | |||

| AT&T, Inc.: | |||

| 2.55% 12/1/33 | 53,719,000 | 39,455,974 | |

| 3.8% 12/1/57 | 106,127,000 | 67,234,193 | |

| 4.3% 2/15/30 | 13,106,000 | 11,934,342 | |

| 4.75% 5/15/46 | 10,000,000 | 7,899,442 | |

| Verizon Communications, Inc.: | |||

| 2.987% 10/30/56 | 65,611,000 | 36,420,274 | |

| 3% 3/22/27 | 5,629,000 | 5,164,606 | |

| 3.15% 3/22/30 | 9,123,000 | 7,786,833 | |

| 4.862% 8/21/46 | 27,196,000 | 22,475,557 | |

| 5.012% 4/15/49 | 3,772,000 | 3,288,278 | |

| 201,659,499 | |||

| Entertainment - 0.1% | |||

| NBCUniversal, Inc. 5.95% 4/1/41 | 6,541,000 | 6,395,367 | |

| The Walt Disney Co.: | |||

| 3.6% 1/13/51 | 25,350,000 | 17,582,973 | |

| 3.8% 5/13/60 | 25,000,000 | 17,231,464 | |

| 41,209,804 | |||

| Media - 1.3% | |||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp.: | |||

| 4.4% 4/1/33 | 11,421,000 | 9,714,003 | |

| 4.908% 7/23/25 | 18,965,000 | 18,531,694 | |

| 5.25% 4/1/53 | 28,921,000 | 21,618,538 | |

| 5.375% 5/1/47 | 71,848,000 | 54,749,864 | |

| 5.5% 4/1/63 | 11,421,000 | 8,448,652 | |

| 5.75% 4/1/48 | 11,687,000 | 9,331,611 | |

| 6.484% 10/23/45 | 9,303,000 | 8,122,851 | |

| Comcast Corp.: | |||

| 3.3% 4/1/27 | 6,795,000 | 6,326,047 | |

| 3.4% 4/1/30 | 6,970,000 | 6,148,010 | |

| 3.75% 4/1/40 | 2,448,000 | 1,896,328 | |

| 3.9% 3/1/38 | 5,001,000 | 4,084,400 | |

| 4.65% 7/15/42 | 11,795,000 | 9,934,542 | |

| Discovery Communications LLC: | |||

| 3.625% 5/15/30 | 14,753,000 | 12,487,514 | |

| 4.65% 5/15/50 | 39,956,000 | 28,226,219 | |

| Fox Corp.: | |||

| 4.03% 1/25/24 | 6,266,000 | 6,221,566 | |

| 4.709% 1/25/29 | 9,069,000 | 8,579,976 | |

| 5.476% 1/25/39 | 8,943,000 | 7,728,804 | |

| 5.576% 1/25/49 | 5,934,000 | 4,970,647 | |

| Magallanes, Inc.: | |||

| 3.638% 3/15/25 | 10,102,000 | 9,743,276 | |

| 3.755% 3/15/27 | 19,757,000 | 18,240,010 | |

| 4.054% 3/15/29 | 6,847,000 | 6,100,411 | |

| 4.279% 3/15/32 | 28,666,000 | 24,332,231 | |

| 5.05% 3/15/42 | 14,442,000 | 11,169,275 | |

| 5.141% 3/15/52 | 98,717,000 | 73,350,725 | |

| Time Warner Cable LLC: | |||

| 4.5% 9/15/42 | 19,701,000 | 13,649,222 | |

| 5.5% 9/1/41 | 8,397,000 | 6,568,411 | |

| 5.875% 11/15/40 | 7,566,000 | 6,268,826 | |

| 6.55% 5/1/37 | 73,937,000 | 67,061,555 | |

| 6.75% 6/15/39 | 10,675,000 | 9,771,532 | |

| 7.3% 7/1/38 | 16,247,000 | 15,651,059 | |

| 489,027,799 | |||

| Wireless Telecommunication Services - 0.4% | |||

| Rogers Communications, Inc.: | |||

| 3.2% 3/15/27 | 21,204,000 | 19,394,372 | |

| 3.8% 3/15/32 | 21,179,000 | 17,600,305 | |

| T-Mobile U.S.A., Inc.: | |||

| 2.25% 11/15/31 | 40,000,000 | 30,481,281 | |

| 3.75% 4/15/27 | 25,540,000 | 23,865,076 | |

| 3.875% 4/15/30 | 36,970,000 | 32,754,346 | |

| 4.375% 4/15/40 | 5,513,000 | 4,429,849 | |

| 4.5% 4/15/50 | 10,830,000 | 8,304,767 | |

| 136,829,996 | |||

TOTAL COMMUNICATION SERVICES | 868,727,098 | ||

| CONSUMER DISCRETIONARY - 0.8% | |||

| Automobiles - 0.1% | |||

| General Motors Financial Co., Inc.: | |||

| 2.35% 2/26/27 | 17,500,000 | 15,423,159 | |

| 4% 1/15/25 | 14,536,000 | 14,117,702 | |

| 5.85% 4/6/30 | 13,062,000 | 12,511,731 | |

| 42,052,592 | |||

| Hotels, Restaurants & Leisure - 0.1% | |||

| McDonald's Corp.: | |||

| 3.3% 7/1/25 | 2,498,000 | 2,405,612 | |

| 3.5% 7/1/27 | 7,113,000 | 6,661,746 | |

| 3.6% 7/1/30 | 8,445,000 | 7,539,305 | |

| 4.2% 4/1/50 | 4,263,000 | 3,309,300 | |

| 19,915,963 | |||

| Household Durables - 0.1% | |||

| D.R. Horton, Inc. 2.6% 10/15/25 | 34,514,000 | 32,294,616 | |

| Toll Brothers Finance Corp. 4.875% 3/15/27 | 16,319,000 | 15,630,384 | |

| 47,925,000 | |||

| Leisure Products - 0.1% | |||

| Hasbro, Inc. 3% 11/19/24 | 19,745,000 | 19,052,052 | |

| Specialty Retail - 0.4% | |||

| AutoNation, Inc.: | |||

| 3.85% 3/1/32 | 21,966,000 | 17,853,925 | |

| 4.75% 6/1/30 | 3,310,000 | 2,982,310 | |

| AutoZone, Inc.: | |||

| 3.625% 4/15/25 | 4,758,000 | 4,600,693 | |

| 4% 4/15/30 | 22,128,000 | 19,935,717 | |

| Lowe's Companies, Inc.: | |||

| 3.35% 4/1/27 | 3,072,000 | 2,860,021 | |

| 3.75% 4/1/32 | 9,454,000 | 8,186,225 | |

| 4.25% 4/1/52 | 59,996,000 | 44,258,243 | |

| 4.45% 4/1/62 | 39,650,000 | 28,949,925 | |

| 4.5% 4/15/30 | 16,112,000 | 15,034,245 | |

| O'Reilly Automotive, Inc. 4.2% 4/1/30 | 4,968,000 | 4,531,413 | |

| The Home Depot, Inc. 2.5% 4/15/27 | 3,139,000 | 2,863,627 | |

| 152,056,344 | |||

| Textiles, Apparel & Luxury Goods - 0.0% | |||

| NIKE, Inc. 2.75% 3/27/27 | 6,632,000 | 6,126,022 | |

TOTAL CONSUMER DISCRETIONARY | 287,127,973 | ||

| CONSUMER STAPLES - 1.6% | |||

| Beverages - 1.1% | |||

| Anheuser-Busch Companies LLC / Anheuser-Busch InBev Worldwide, Inc. 4.9% 2/1/46 | 17,500,000 | 15,252,020 | |

| Anheuser-Busch InBev Finance, Inc.: | |||

| 4.7% 2/1/36 | 46,768,000 | 42,864,570 | |

| 4.9% 2/1/46 | 50,530,000 | 44,039,117 | |

| Anheuser-Busch InBev Worldwide, Inc.: | |||

| 3.5% 6/1/30 | 10,000,000 | 8,897,065 | |

| 4.35% 6/1/40 | 10,000,000 | 8,502,964 | |

| 4.5% 6/1/50 | 30,000,000 | 25,071,859 | |

| 4.6% 6/1/60 | 10,000,000 | 8,230,831 | |

| 4.75% 4/15/58 | 26,711,000 | 22,409,862 | |

| 5.45% 1/23/39 | 23,200,000 | 22,415,282 | |

| 5.55% 1/23/49 | 54,331,000 | 52,037,832 | |

| 5.8% 1/23/59 (Reg. S) | 55,947,000 | 54,729,815 | |

| Molson Coors Beverage Co.: | |||

| 3% 7/15/26 | 48,345,000 | 44,929,832 | |

| 5% 5/1/42 | 3,080,000 | 2,656,637 | |

| PepsiCo, Inc.: | |||

| 2.625% 3/19/27 | 2,862,000 | 2,638,972 | |

| 2.75% 3/19/30 | 18,600,000 | 16,111,220 | |

| The Coca-Cola Co.: | |||

| 3.375% 3/25/27 | 24,531,000 | 23,232,856 | |

| 3.45% 3/25/30 | 14,988,000 | 13,566,273 | |

| 407,587,007 | |||

| Consumer Staples Distribution & Retail - 0.1% | |||

| Sysco Corp.: | |||

| 3.25% 7/15/27 | 11,011,000 | 10,119,888 | |

| 6.6% 4/1/50 | 14,655,000 | 15,129,082 | |

| 25,248,970 | |||

| Food Products - 0.4% | |||

| Archer Daniels Midland Co. 3.25% 3/27/30 | 6,931,000 | 6,139,878 | |

| General Mills, Inc. 2.875% 4/15/30 | 3,013,000 | 2,546,359 | |

| JBS U.S.A. Lux SA / JBS Food Co.: | |||

| 2.5% 1/15/27 | 38,495,000 | 34,003,403 | |

| 3% 5/15/32 | 43,240,000 | 32,619,469 | |

| 3.625% 1/15/32 | 18,075,000 | 14,391,503 | |

| 5.125% 2/1/28 | 15,645,000 | 14,887,823 | |

| 5.5% 1/15/30 | 5,250,000 | 4,901,071 | |

| 5.75% 4/1/33 | 32,215,000 | 29,462,660 | |

| JBS U.S.A. Lux. SA / JBS U.S.A. Food 6.75% 3/15/34 (b) | 34,000,000 | 33,081,660 | |

| 172,033,826 | |||

| Household Products - 0.0% | |||

| Kimberly-Clark Corp. 3.1% 3/26/30 | 1,764,000 | 1,550,301 | |

TOTAL CONSUMER STAPLES | 606,420,104 | ||

| ENERGY - 3.0% | |||

| Energy Equipment & Services - 0.0% | |||

| Halliburton Co.: | |||

| 3.8% 11/15/25 | 207,000 | 200,143 | |

| 4.85% 11/15/35 | 7,402,000 | 6,656,598 | |

| 6,856,741 | |||

| Oil, Gas & Consumable Fuels - 3.0% | |||

| Canadian Natural Resources Ltd. 3.8% 4/15/24 | 619,000 | 610,994 | |

| Cenovus Energy, Inc. 5.25% 6/15/37 | 13,845,000 | 12,392,871 | |

| Columbia Pipeline Group, Inc. 4.5% 6/1/25 | 6,628,000 | 6,447,801 | |

| Columbia Pipelines Operating Co. LLC: | |||

| 5.927% 8/15/30 (b) | 5,327,000 | 5,258,421 | |

| 6.036% 11/15/33 (b) | 14,358,000 | 14,014,913 | |

| 6.497% 8/15/43 (b) | 4,293,000 | 4,181,776 | |

| 6.544% 11/15/53 (b) | 7,728,000 | 7,555,099 | |

| 6.714% 8/15/63 (b) | 4,626,000 | 4,516,524 | |

| DCP Midstream Operating LP: | |||

| 5.125% 5/15/29 | 15,661,000 | 14,919,719 | |

| 5.6% 4/1/44 | 13,506,000 | 11,918,503 | |

| 6.45% 11/3/36 (b) | 10,621,000 | 10,443,103 | |

| Enbridge, Inc.: | |||

| 4% 10/1/23 | 13,445,000 | 13,445,000 | |

| 4.25% 12/1/26 | 8,321,000 | 7,938,476 | |

| Energy Transfer LP: | |||

| 3.75% 5/15/30 | 27,891,000 | 24,295,671 | |

| 3.9% 5/15/24 (c) | 6,444,000 | 6,358,026 | |

| 4.5% 4/15/24 | 6,244,000 | 6,190,472 | |

| 4.95% 6/15/28 | 18,799,000 | 17,990,985 | |

| 5% 5/15/50 | 29,826,000 | 23,396,929 | |

| 5.25% 4/15/29 | 10,158,000 | 9,739,839 | |

| 5.4% 10/1/47 | 6,651,000 | 5,485,403 | |

| 5.8% 6/15/38 | 10,481,000 | 9,566,822 | |

| 6% 6/15/48 | 26,826,000 | 23,809,031 | |

| 6.25% 4/15/49 | 7,637,000 | 7,007,111 | |

| Enterprise Products Operating LP: | |||

| 3.7% 2/15/26 | 8,600,000 | 8,239,570 | |

| 3.75% 2/15/25 | 285,000 | 276,806 | |

| Hess Corp.: | |||

| 4.3% 4/1/27 | 23,059,000 | 21,903,225 | |

| 5.6% 2/15/41 | 5,656,000 | 5,107,196 | |

| 7.125% 3/15/33 | 4,791,000 | 5,059,146 | |

| 7.3% 8/15/31 | 6,610,000 | 7,001,539 | |

| 7.875% 10/1/29 | 20,178,000 | 21,879,203 | |

| Kinder Morgan Energy Partners LP 6.55% 9/15/40 | 1,645,000 | 1,575,513 | |

| MPLX LP: | |||

| 2.65% 8/15/30 | 9,000,000 | 7,267,834 | |

| 4.8% 2/15/29 | 5,370,000 | 5,094,856 | |

| 4.875% 12/1/24 | 12,572,000 | 12,393,799 | |

| 4.95% 9/1/32 | 30,925,000 | 28,163,752 | |

| 5.5% 2/15/49 | 16,108,000 | 13,633,331 | |

| Occidental Petroleum Corp.: | |||

| 5.55% 3/15/26 | 26,200,000 | 25,854,684 | |

| 6.2% 3/15/40 | 7,169,000 | 6,833,527 | |

| 6.45% 9/15/36 | 15,883,000 | 15,596,074 | |

| 6.6% 3/15/46 | 28,439,000 | 27,943,593 | |

| 7.5% 5/1/31 | 29,749,000 | 31,570,923 | |

| Ovintiv, Inc.: | |||

| 5.15% 11/15/41 | 5,000,000 | 3,889,459 | |

| 8.125% 9/15/30 | 13,383,000 | 14,545,615 | |

| Petroleos Mexicanos: | |||

| 4.5% 1/23/26 | 24,688,000 | 21,960,717 | |

| 5.35% 2/12/28 | 3,500,000 | 2,832,375 | |

| 5.95% 1/28/31 | 16,274,000 | 11,587,088 | |

| 6.35% 2/12/48 | 14,404,000 | 8,223,100 | |

| 6.49% 1/23/27 | 37,360,000 | 32,970,200 | |

| 6.5% 3/13/27 | 21,300,000 | 18,678,290 | |

| 6.75% 9/21/47 | 102,130,000 | 59,809,881 | |

| 6.84% 1/23/30 | 68,521,000 | 53,386,424 | |

| 6.95% 1/28/60 | 18,760,000 | 11,051,985 | |

| 7.69% 1/23/50 | 117,141,000 | 74,869,499 | |

| Plains All American Pipeline LP/PAA Finance Corp.: | |||

| 3.55% 12/15/29 | 5,964,000 | 5,126,819 | |

| 3.6% 11/1/24 | 6,641,000 | 6,460,848 | |

| 3.8% 9/15/30 | 15,976,000 | 13,722,546 | |

| Sabine Pass Liquefaction LLC 4.5% 5/15/30 | 33,855,000 | 31,047,094 | |

| Shell International Finance BV 4.375% 5/11/45 | 6,392,000 | 5,245,634 | |

| Southeast Supply Header LLC 4.25% 6/15/24 (b) | 10,683,000 | 10,215,619 | |

| The Williams Companies, Inc.: | |||

| 2.6% 3/15/31 | 5,542,000 | 4,413,951 | |

| 3.5% 11/15/30 | 45,537,000 | 39,263,270 | |

| 3.9% 1/15/25 | 4,336,000 | 4,219,490 | |

| 4.3% 3/4/24 | 20,381,000 | 20,226,648 | |

| 4.5% 11/15/23 | 6,265,000 | 6,249,349 | |

| 4.55% 6/24/24 | 70,596,000 | 69,831,212 | |

| 4.65% 8/15/32 | 32,200,000 | 29,291,332 | |

| 5.3% 8/15/52 | 7,294,000 | 6,199,207 | |

| Western Gas Partners LP: | |||

| 3.95% 6/1/25 | 3,918,000 | 3,760,201 | |

| 4.5% 3/1/28 | 3,100,000 | 2,884,721 | |

| 4.65% 7/1/26 | 9,376,000 | 9,005,986 | |

| 4.75% 8/15/28 | 5,504,000 | 5,147,658 | |

| 6.35% 1/15/29 | 13,343,000 | 13,370,513 | |

| 1,092,364,791 | |||

TOTAL ENERGY | 1,099,221,532 | ||

| FINANCIALS - 13.7% | |||

| Banks - 6.0% | |||

| Bank of America Corp.: | |||

| 2.299% 7/21/32 (c) | 80,000,000 | 60,618,414 | |

| 2.972% 2/4/33 (c) | 17,500,000 | 13,799,715 | |

| 3.419% 12/20/28 (c) | 23,187,000 | 20,799,865 | |

| 3.5% 4/19/26 | 34,343,000 | 32,423,532 | |

| 3.705% 4/24/28 (c) | 58,915,000 | 54,260,301 | |

| 3.95% 4/21/25 | 19,377,000 | 18,710,632 | |

| 4.183% 11/25/27 | 22,749,000 | 21,147,494 | |

| 4.2% 8/26/24 | 24,032,000 | 23,611,232 | |

| 4.25% 10/22/26 | 20,189,000 | 19,178,763 | |

| 4.271% 7/23/29 (c) | 2,000,000 | 1,843,289 | |

| 4.376% 4/27/28 (c) | 40,000,000 | 37,770,198 | |

| 4.45% 3/3/26 | 3,182,000 | 3,064,681 | |

| 5.015% 7/22/33 (c) | 50,000,000 | 46,002,258 | |

| Barclays PLC: | |||

| 2.852% 5/7/26 (c) | 34,514,000 | 32,558,707 | |

| 2.894% 11/24/32 (c) | 13,572,000 | 10,213,110 | |

| 4.375% 1/12/26 | 28,767,000 | 27,568,544 | |

| 5.088% 6/20/30 (c) | 35,020,000 | 31,296,960 | |

| 5.2% 5/12/26 | 11,811,000 | 11,378,597 | |

| 5.829% 5/9/27 (c) | 33,090,000 | 32,497,020 | |

| 6.224% 5/9/34 (c) | 31,185,000 | 29,541,220 | |

| 6.692% 9/13/34 (c) | 45,000,000 | 43,932,651 | |

| BNP Paribas SA 2.219% 6/9/26 (b)(c) | 32,804,000 | 30,613,100 | |

| Citigroup, Inc.: | |||

| 3.352% 4/24/25 (c) | 23,697,000 | 23,274,346 | |

| 3.785% 3/17/33 (c) | 17,500,000 | 14,599,114 | |

| 3.875% 3/26/25 | 35,450,000 | 34,245,855 | |

| 4.3% 11/20/26 | 52,072,000 | 49,370,179 | |

| 4.4% 6/10/25 | 11,010,000 | 10,683,383 | |

| 4.412% 3/31/31 (c) | 45,100,000 | 40,570,477 | |

| 4.45% 9/29/27 | 69,500,000 | 65,249,962 | |

| 4.91% 5/24/33 (c) | 47,460,000 | 43,184,167 | |

| 5.5% 9/13/25 | 42,579,000 | 42,065,023 | |

| 6.174% 5/25/34 (c) | 21,587,000 | 20,629,037 | |

| Citizens Financial Group, Inc. 2.638% 9/30/32 | 35,537,000 | 24,796,673 | |

| Commonwealth Bank of Australia: | |||

| 3.61% 9/12/34 (b)(c) | 12,091,000 | 10,165,229 | |

| 3.784% 3/14/32 (b) | 10,165,000 | 8,224,466 | |

| HSBC Holdings PLC: | |||

| 2.099% 6/4/26 (c) | 25,000,000 | 23,301,677 | |

| 3.973% 5/22/30 (c) | 9,000,000 | 7,914,768 | |

| 4.25% 3/14/24 | 10,444,000 | 10,352,880 | |

| 4.95% 3/31/30 | 6,013,000 | 5,618,847 | |

| 5.25% 3/14/44 | 2,847,000 | 2,371,457 | |

| Intesa Sanpaolo SpA: | |||

| 5.017% 6/26/24 (b) | 21,002,000 | 20,511,923 | |

| 5.71% 1/15/26 (b) | 48,607,000 | 46,412,979 | |

| JPMorgan Chase & Co.: | |||

| 2.95% 10/1/26 | 63,807,000 | 59,079,329 | |

| 2.956% 5/13/31 (c) | 18,323,000 | 15,054,629 | |

| 2.963% 1/25/33 (c) | 17,500,000 | 13,932,220 | |

| 3.875% 9/10/24 | 90,088,000 | 88,236,504 | |

| 4.125% 12/15/26 | 146,208,000 | 138,961,766 | |

| 4.203% 7/23/29 (c) | 3,000,000 | 2,780,273 | |

| 4.452% 12/5/29 (c) | 46,000,000 | 42,939,093 | |

| 4.586% 4/26/33 (c) | 70,000,000 | 63,101,169 | |

| 5.299% 7/24/29 (c) | 15,000,000 | 14,594,741 | |

| 5.35% 6/1/34 (c) | 60,000,000 | 56,896,610 | |

| 5.717% 9/14/33 (c) | 75,200,000 | 72,288,324 | |

| NatWest Group PLC: | |||

| 3.073% 5/22/28 (c) | 20,149,000 | 17,972,241 | |

| 5.125% 5/28/24 | 125,085,000 | 124,098,408 | |

| Rabobank Nederland 4.375% 8/4/25 | 36,518,000 | 35,239,537 | |

| Santander Holdings U.S.A., Inc.: | |||

| 2.49% 1/6/28 (c) | 25,589,000 | 22,218,346 | |

| 6.499% 3/9/29 (c) | 35,670,000 | 34,787,559 | |

| Societe Generale: | |||

| 1.038% 6/18/25 (b)(c) | 55,000,000 | 52,708,150 | |

| 1.488% 12/14/26 (b)(c) | 40,199,000 | 35,888,306 | |

| 3.337% 1/21/33 (b)(c) | 17,500,000 | 13,568,157 | |

| Synchrony Bank: | |||

| 5.4% 8/22/25 | 29,530,000 | 28,460,236 | |

| 5.625% 8/23/27 | 26,739,000 | 24,955,397 | |

| Wells Fargo & Co.: | |||

| 2.406% 10/30/25 (c) | 19,840,000 | 19,012,782 | |

| 3.526% 3/24/28 (c) | 42,125,000 | 38,686,486 | |

| 4.478% 4/4/31 (c) | 60,800,000 | 55,160,638 | |

| 5.389% 4/24/34 (c) | 30,000,000 | 28,047,217 | |

| Westpac Banking Corp. 4.11% 7/24/34 (c) | 17,722,000 | 15,304,800 | |

| 2,220,345,643 | |||

| Capital Markets - 2.8% | |||

| Affiliated Managers Group, Inc. 3.5% 8/1/25 | 27,065,000 | 25,709,384 | |

| Ares Capital Corp. 3.875% 1/15/26 | 54,729,000 | 51,210,710 | |

| Deutsche Bank AG 4.5% 4/1/25 | 67,655,000 | 65,087,556 | |

| Deutsche Bank AG New York Branch: | |||

| 3.035% 5/28/32 (c) | 4,469,000 | 3,419,839 | |

| 6.72% 1/18/29 (c) | 22,570,000 | 22,435,856 | |

| Goldman Sachs Group, Inc.: | |||

| 2.383% 7/21/32 (c) | 39,755,000 | 30,276,954 | |

| 3.102% 2/24/33 (c) | 47,500,000 | 37,986,072 | |

| 3.691% 6/5/28 (c) | 21,000,000 | 19,353,434 | |

| 3.75% 2/25/26 | 15,000,000 | 14,259,429 | |

| 3.8% 3/15/30 | 67,720,000 | 59,756,690 | |

| 4.25% 10/21/25 | 22,692,000 | 21,867,479 | |

| 4.411% 4/23/39 (c) | 3,000,000 | 2,469,198 | |

| 5.15% 5/22/45 | 9,000,000 | 7,712,253 | |

| 6.75% 10/1/37 | 30,816,000 | 31,205,736 | |

| Intercontinental Exchange, Inc. 3.75% 12/1/25 | 4,530,000 | 4,350,641 | |

| Moody's Corp.: | |||

| 3.25% 1/15/28 | 10,681,000 | 9,793,132 | |

| 3.25% 5/20/50 | 9,704,000 | 6,219,304 | |

| 3.75% 3/24/25 | 21,924,000 | 21,284,827 | |

| Morgan Stanley: | |||

| 2.943% 1/21/33 (c) | 17,500,000 | 13,781,387 | |

| 3.125% 7/27/26 | 24,646,000 | 22,891,087 | |

| 3.622% 4/1/31 (c) | 41,803,000 | 36,012,186 | |

| 3.7% 10/23/24 | 15,967,000 | 15,601,813 | |

| 4.21% 4/20/28 (c) | 40,000,000 | 37,611,253 | |

| 4.431% 1/23/30 (c) | 54,318,000 | 50,251,990 | |

| 5% 11/24/25 | 102,478,000 | 100,442,303 | |

| 5.424% 7/21/34 (c) | 47,424,000 | 44,734,672 | |

| 6.342% 10/18/33 (c) | 58,000,000 | 58,330,551 | |

| Peachtree Corners Funding Trust 3.976% 2/15/25 (b) | 25,500,000 | 24,617,500 | |

| State Street Corp. 2.901% 3/30/26 (c) | 2,660,000 | 2,537,445 | |

| UBS Group AG: | |||

| 1.494% 8/10/27 (b)(c) | 24,731,000 | 21,586,680 | |

| 2.593% 9/11/25 (b)(c) | 48,618,000 | 46,793,833 | |

| 3.091% 5/14/32 (b)(c) | 13,398,000 | 10,582,401 | |

| 3.75% 3/26/25 | 24,390,000 | 23,458,531 | |

| 3.869% 1/12/29 (b)(c) | 9,005,000 | 8,156,579 | |

| 4.125% 9/24/25 (b) | 17,678,000 | 16,943,419 | |

| 4.194% 4/1/31 (b)(c) | 40,079,000 | 34,998,771 | |

| 4.55% 4/17/26 | 5,038,000 | 4,838,769 | |

| 6.537% 8/12/33 (b)(c) | 30,000,000 | 29,649,399 | |

| 1,038,219,063 | |||

| Consumer Finance - 2.8% | |||

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust: | |||

| 1.65% 10/29/24 | 47,436,000 | 45,123,071 | |

| 2.45% 10/29/26 | 17,295,000 | 15,491,054 | |

| 2.875% 8/14/24 | 28,486,000 | 27,668,176 | |

| 3% 10/29/28 | 18,114,000 | 15,532,360 | |

| 3.3% 1/30/32 | 19,378,000 | 15,403,801 | |

| 4.45% 4/3/26 | 15,328,000 | 14,715,594 | |

| 4.875% 1/16/24 | 28,044,000 | 27,931,631 | |

| 6.5% 7/15/25 | 15,770,000 | 15,788,188 | |

| Ally Financial, Inc.: | |||

| 1.45% 10/2/23 | 9,655,000 | 9,655,000 | |

| 4.75% 6/9/27 | 60,000,000 | 55,309,052 | |

| 5.125% 9/30/24 | 9,461,000 | 9,314,186 | |

| 5.75% 11/20/25 | 16,947,000 | 16,461,595 | |

| 5.8% 5/1/25 | 68,233,000 | 67,032,842 | |

| 6.7% 2/14/33 | 50,000,000 | 43,404,517 | |

| 7.1% 11/15/27 | 37,620,000 | 37,615,232 | |

| 8% 11/1/31 | 11,577,000 | 11,688,542 | |

| Capital One Financial Corp.: | |||

| 2.636% 3/3/26 (c) | 21,697,000 | 20,476,936 | |

| 3.273% 3/1/30 (c) | 32,130,000 | 26,876,728 | |

| 3.65% 5/11/27 | 57,194,000 | 52,286,611 | |

| 3.8% 1/31/28 | 29,870,000 | 26,940,202 | |

| 4.985% 7/24/26 (c) | 31,384,000 | 30,450,420 | |

| 5.247% 7/26/30 (c) | 40,470,000 | 37,516,332 | |

| 5.468% 2/1/29 (c) | 26,778,000 | 25,490,008 | |

| 5.817% 2/1/34 (c) | 46,541,000 | 41,942,713 | |

| Discover Financial Services: | |||

| 3.95% 11/6/24 | 41,289,000 | 40,152,651 | |

| 4.1% 2/9/27 | 5,722,000 | 5,228,259 | |

| 4.5% 1/30/26 | 23,106,000 | 22,097,828 | |

| 6.7% 11/29/32 | 7,907,000 | 7,643,149 | |

| Ford Motor Credit Co. LLC: | |||

| 4.063% 11/1/24 | 79,422,000 | 76,889,224 | |

| 5.584% 3/18/24 | 30,750,000 | 30,555,463 | |

| Synchrony Financial: | |||

| 3.95% 12/1/27 | 37,530,000 | 32,988,129 | |

| 4.25% 8/15/24 | 29,533,000 | 28,841,992 | |

| 4.375% 3/19/24 | 24,886,000 | 24,581,114 | |

| 5.15% 3/19/29 | 40,161,000 | 35,970,061 | |

| Toyota Motor Credit Corp.: | |||

| 3% 4/1/25 | 29,531,000 | 28,457,191 | |

| 3.375% 4/1/30 | 9,583,000 | 8,476,231 | |

| 1,031,996,083 | |||

| Financial Services - 1.0% | |||

| Blackstone Private Credit Fund: | |||

| 2.625% 12/15/26 | 30,000,000 | 25,822,317 | |

| 4.7% 3/24/25 | 43,143,000 | 41,853,450 | |

| 7.05% 9/29/25 | 39,080,000 | 39,139,975 | |

| Brixmor Operating Partnership LP: | |||

| 3.85% 2/1/25 | 450,000 | 433,517 | |

| 4.05% 7/1/30 | 22,047,000 | 19,247,104 | |

| 4.125% 6/15/26 | 26,610,000 | 25,059,309 | |

| 4.125% 5/15/29 | 24,028,000 | 21,402,126 | |

| Corebridge Financial, Inc.: | |||

| 3.5% 4/4/25 | 9,337,000 | 8,958,113 | |

| 3.65% 4/5/27 | 33,012,000 | 30,560,101 | |

| 3.85% 4/5/29 | 13,061,000 | 11,732,481 | |

| 3.9% 4/5/32 | 15,550,000 | 13,085,262 | |

| 4.35% 4/5/42 | 3,537,000 | 2,674,467 | |

| 4.4% 4/5/52 | 10,459,000 | 7,651,554 | |

| Jackson Financial, Inc.: | |||

| 3.125% 11/23/31 | 5,636,000 | 4,319,557 | |

| 5.17% 6/8/27 | 14,655,000 | 14,126,580 | |

| 5.67% 6/8/32 | 27,163,000 | 25,409,034 | |

| MasterCard, Inc.: | |||

| 3.3% 3/26/27 | 3,028,000 | 2,844,109 | |

| 3.35% 3/26/30 | 4,213,000 | 3,766,465 | |

| Park Aerospace Holdings Ltd. 5.5% 2/15/24 (b) | 29,300,000 | 29,154,032 | |

| Pine Street Trust I 4.572% 2/15/29 (b) | 27,943,000 | 25,143,994 | |

| Pine Street Trust II 5.568% 2/15/49 (b) | 29,500,000 | 24,264,524 | |

| 376,648,071 | |||

| Insurance - 1.1% | |||

| AFLAC, Inc. 3.6% 4/1/30 | 9,937,000 | 8,800,287 | |

| AIA Group Ltd.: | |||

| 3.2% 9/16/40 (b) | 15,222,000 | 10,247,258 | |

| 3.375% 4/7/30 (b) | 30,867,000 | 27,024,824 | |

| American International Group, Inc. 2.5% 6/30/25 | 33,734,000 | 31,822,290 | |

| Aon PLC 4% 11/27/23 | 13,880,000 | 13,819,555 | |

| Five Corners Funding Trust II 2.85% 5/15/30 (b) | 48,444,000 | 40,392,920 | |

| Liberty Mutual Group, Inc.: | |||

| 3.951% 10/15/50 (b) | 4,626,000 | 3,105,979 | |

| 4.569% 2/1/29 (b) | 27,600,000 | 26,034,705 | |

| Lincoln National Corp. 3.4% 1/15/31 | 34,132,000 | 27,593,987 | |

| Marsh & McLennan Companies, Inc.: | |||

| 4.375% 3/15/29 | 19,688,000 | 18,672,081 | |

| 4.75% 3/15/39 | 9,035,000 | 7,929,740 | |

| Massachusetts Mutual Life Insurance Co. 3.729% 10/15/70 (b) | 20,812,000 | 12,667,294 | |

| New York Life Insurance Co. 3.75% 5/15/50 (b) | 7,429,000 | 5,128,028 | |

| Northwestern Mutual Life Insurance Co. 6.063% 3/30/40 (b) | 2,000 | 1,951 | |

| Pacific LifeCorp 5.125% 1/30/43 (b) | 15,610,000 | 13,606,862 | |

| Progressive Corp. 3.2% 3/26/30 | 3,815,000 | 3,319,714 | |

| Prudential Financial, Inc. 6% 9/1/52 (c) | 55,017,000 | 50,365,241 | |

| Swiss Re Finance Luxembourg SA 5% 4/2/49 (b)(c) | 11,400,000 | 10,681,800 | |

| Teachers Insurance & Annuity Association of America: | |||

| 3.3% 5/15/50 (b) | 16,941,000 | 10,709,808 | |

| 4.9% 9/15/44 (b) | 29,277,000 | 24,639,255 | |

| TIAA Asset Management Finance LLC 4.125% 11/1/24 (b) | 8,401,000 | 8,178,744 | |

| Unum Group: | |||

| 3.875% 11/5/25 | 16,863,000 | 16,118,827 | |

| 4% 6/15/29 | 21,076,000 | 18,951,197 | |

| 5.75% 8/15/42 | 29,395,000 | 25,583,792 | |

| 415,396,139 | |||

TOTAL FINANCIALS | 5,082,604,999 | ||

| HEALTH CARE - 2.0% | |||

| Biotechnology - 0.5% | |||

| AbbVie, Inc. 3.2% 11/21/29 | 17,500,000 | 15,442,846 | |

| Amgen, Inc.: | |||

| 1.65% 8/15/28 | 65,000,000 | 54,722,532 | |

| 5.15% 3/2/28 | 20,069,000 | 19,737,776 | |

| 5.25% 3/2/30 | 18,321,000 | 17,899,374 | |

| 5.25% 3/2/33 | 20,683,000 | 19,772,098 | |

| 5.6% 3/2/43 | 19,649,000 | 18,267,335 | |

| 5.65% 3/2/53 | 9,768,000 | 9,142,093 | |

| 5.75% 3/2/63 | 17,801,000 | 16,421,078 | |

| 171,405,132 | |||

| Health Care Providers & Services - 1.1% | |||

| Centene Corp.: | |||

| 2.45% 7/15/28 | 32,380,000 | 27,355,099 | |

| 2.625% 8/1/31 | 15,205,000 | 11,648,776 | |

| 3.375% 2/15/30 | 17,480,000 | 14,579,579 | |

| 4.25% 12/15/27 | 19,645,000 | 18,110,922 | |

| 4.625% 12/15/29 | 30,530,000 | 27,496,234 | |

| Cigna Group: | |||

| 3.05% 10/15/27 | 67,800,000 | 61,634,132 | |

| 4.375% 10/15/28 | 29,050,000 | 27,487,400 | |

| 4.8% 8/15/38 | 18,087,000 | 15,932,344 | |

| 4.9% 12/15/48 | 18,071,000 | 15,228,853 | |

| 5.4% 3/15/33 | 30,000,000 | 29,086,373 | |

| CVS Health Corp.: | |||

| 3% 8/15/26 | 2,965,000 | 2,756,568 | |

| 3.625% 4/1/27 | 7,479,000 | 6,987,529 | |

| 3.875% 7/20/25 | 20,803,000 | 20,099,740 | |

| 5% 1/30/29 | 15,279,000 | 14,780,935 | |

| 5.25% 1/30/31 | 6,265,000 | 6,019,553 | |

| HCA Holdings, Inc.: | |||

| 3.5% 9/1/30 | 18,350,000 | 15,524,568 | |

| 3.625% 3/15/32 | 4,185,000 | 3,468,899 | |

| 5.625% 9/1/28 | 19,094,000 | 18,620,125 | |

| 5.875% 2/1/29 | 21,003,000 | 20,662,303 | |

| Humana, Inc. 3.7% 3/23/29 | 12,046,000 | 10,988,635 | |

| Sabra Health Care LP: | |||

| 3.2% 12/1/31 | 39,949,000 | 29,892,349 | |

| 3.9% 10/15/29 | 10,094,000 | 8,381,322 | |

| Toledo Hospital 5.325% 11/15/28 | 9,969,000 | 7,863,049 | |

| 414,605,287 | |||

| Pharmaceuticals - 0.4% | |||

| Bayer U.S. Finance II LLC 4.25% 12/15/25 (b) | 63,993,000 | 61,615,170 | |

| Elanco Animal Health, Inc. 6.65% 8/28/28 (c) | 6,362,000 | 6,187,045 | |

| Mylan NV 4.55% 4/15/28 | 6,911,000 | 6,356,828 | |

| Utah Acquisition Sub, Inc. 3.95% 6/15/26 | 12,375,000 | 11,592,219 | |

| Viatris, Inc.: | |||

| 1.65% 6/22/25 | 4,370,000 | 4,036,585 | |

| 2.7% 6/22/30 | 39,716,000 | 31,048,190 | |

| 3.85% 6/22/40 | 9,677,000 | 6,302,511 | |

| 4% 6/22/50 | 16,712,000 | 10,102,962 | |

| 137,241,510 | |||

TOTAL HEALTH CARE | 723,251,929 | ||

| INDUSTRIALS - 0.9% | |||

| Aerospace & Defense - 0.1% | |||

| BAE Systems PLC 3.4% 4/15/30 (b) | 9,575,000 | 8,337,713 | |

| The Boeing Co.: | |||

| 5.805% 5/1/50 | 29,870,000 | 27,047,800 | |

| 5.93% 5/1/60 | 12,640,000 | 11,349,685 | |

| 46,735,198 | |||

| Ground Transportation - 0.0% | |||

| CSX Corp. 3.8% 4/15/50 | 5,875,000 | 4,240,456 | |

| Industrial Conglomerates - 0.0% | |||

| 3M Co.: | |||

| 2.65% 4/15/25 | 1,885,000 | 1,792,633 | |

| 3.05% 4/15/30 | 1,519,000 | 1,313,028 | |

| 3.7% 4/15/50 | 1,875,000 | 1,336,708 | |

| 4,442,369 | |||

| Machinery - 0.3% | |||

| Daimler Trucks Finance North America LLC: | |||

| 1.125% 12/14/23 (b) | 30,000,000 | 29,705,195 | |

| 1.625% 12/13/24 (b) | 28,773,000 | 27,335,184 | |

| 2% 12/14/26 (b) | 30,000,000 | 26,801,499 | |

| Deere & Co.: | |||

| 2.75% 4/15/25 | 3,746,000 | 3,595,108 | |

| 3.1% 4/15/30 | 9,897,000 | 8,701,594 | |

| 96,138,580 | |||

| Professional Services - 0.1% | |||

| Leidos, Inc. 3.625% 5/15/25 | 12,349,000 | 11,872,647 | |

| Thomson Reuters Corp. 3.85% 9/29/24 | 3,021,000 | 2,948,436 | |

| 14,821,083 | |||

| Trading Companies & Distributors - 0.2% | |||

| Air Lease Corp.: | |||

| 3.375% 7/1/25 | 28,656,000 | 27,223,037 | |

| 4.25% 2/1/24 | 28,366,000 | 28,168,646 | |

| 4.25% 9/15/24 | 16,843,000 | 16,543,260 | |

| 71,934,943 | |||

| Transportation Infrastructure - 0.2% | |||

| Avolon Holdings Funding Ltd.: | |||

| 3.95% 7/1/24 (b) | 10,113,000 | 9,898,564 | |

| 4.375% 5/1/26 (b) | 21,306,000 | 20,004,976 | |

| 5.25% 5/15/24 (b) | 21,769,000 | 21,559,634 | |

| 6.375% 5/4/28 (b) | 33,577,000 | 32,989,537 | |

| 84,452,711 | |||

TOTAL INDUSTRIALS | 322,765,340 | ||

| INFORMATION TECHNOLOGY - 0.9% | |||

| Electronic Equipment, Instruments & Components - 0.2% | |||

| Dell International LLC/EMC Corp.: | |||

| 5.25% 2/1/28 | 28,212,000 | 27,781,273 | |

| 5.3% 10/1/29 | 11,000,000 | 10,678,446 | |

| 5.85% 7/15/25 | 5,417,000 | 5,409,779 | |

| 6.02% 6/15/26 | 7,709,000 | 7,739,057 | |

| 6.1% 7/15/27 | 9,944,000 | 10,067,756 | |

| 6.2% 7/15/30 | 8,607,000 | 8,677,471 | |

| 70,353,782 | |||

| Semiconductors & Semiconductor Equipment - 0.4% | |||

| Broadcom, Inc.: | |||

| 1.95% 2/15/28 (b) | 7,184,000 | 6,124,355 | |

| 2.45% 2/15/31 (b) | 61,131,000 | 47,780,300 | |

| 2.6% 2/15/33 (b) | 61,131,000 | 45,584,413 | |

| 3.5% 2/15/41 (b) | 49,365,000 | 34,310,764 | |

| 3.75% 2/15/51 (b) | 23,167,000 | 15,488,263 | |

| 149,288,095 | |||

| Software - 0.3% | |||

| Oracle Corp.: | |||

| 2.5% 4/1/25 | 24,552,000 | 23,376,387 | |

| 2.8% 4/1/27 | 24,552,000 | 22,292,458 | |

| 2.95% 4/1/30 | 24,600,000 | 20,700,565 | |

| 3.6% 4/1/40 | 24,550,000 | 17,738,396 | |

| 3.6% 4/1/50 | 24,550,000 | 15,880,229 | |

| 3.85% 4/1/60 | 24,600,000 | 15,643,537 | |

| 115,631,572 | |||

TOTAL INFORMATION TECHNOLOGY | 335,273,449 | ||

| MATERIALS - 0.2% | |||

| Chemicals - 0.2% | |||

| Celanese U.S. Holdings LLC: | |||

| 6.35% 11/15/28 | 18,666,000 | 18,431,403 | |

| 6.55% 11/15/30 | 18,931,000 | 18,526,449 | |

| 6.7% 11/15/33 | 11,063,000 | 10,768,884 | |

| The Dow Chemical Co. 4.55% 11/30/25 | 13,459,000 | 13,064,471 | |

| 60,791,207 | |||

| REAL ESTATE - 2.9% | |||

| Equity Real Estate Investment Trusts (REITs) - 2.4% | |||

| Alexandria Real Estate Equities, Inc.: | |||

| 2% 5/18/32 | 19,486,000 | 14,166,629 | |

| 4.9% 12/15/30 | 17,745,000 | 16,538,543 | |

| American Homes 4 Rent LP: | |||

| 2.375% 7/15/31 | 3,169,000 | 2,416,139 | |

| 3.625% 4/15/32 | 14,296,000 | 11,829,045 | |

| 4.3% 4/15/52 | 9,909,000 | 7,167,025 | |

| Boston Properties, Inc.: | |||

| 3.25% 1/30/31 | 16,564,000 | 13,027,474 | |

| 4.5% 12/1/28 | 18,628,000 | 16,866,890 | |

| 6.75% 12/1/27 | 24,397,000 | 24,525,945 | |

| Corporate Office Properties LP: | |||

| 2% 1/15/29 | 2,896,000 | 2,268,273 | |

| 2.25% 3/15/26 | 7,272,000 | 6,547,011 | |

| 2.75% 4/15/31 | 7,105,000 | 5,332,686 | |

| Healthcare Trust of America Holdings LP: | |||

| 3.1% 2/15/30 | 6,066,000 | 5,050,806 | |

| 3.5% 8/1/26 | 6,318,000 | 5,869,089 | |

| Healthpeak OP, LLC: | |||

| 3.25% 7/15/26 | 2,733,000 | 2,568,914 | |

| 3.4% 2/1/25 | 912,000 | 880,288 | |

| 3.5% 7/15/29 | 3,125,000 | 2,756,501 | |

| Hudson Pacific Properties LP 4.65% 4/1/29 | 37,205,000 | 28,009,616 | |

| Invitation Homes Operating Partnership LP 4.15% 4/15/32 | 21,143,000 | 18,184,541 | |

| Kite Realty Group Trust: | |||

| 4% 3/15/25 | 27,373,000 | 26,210,175 | |

| 4.75% 9/15/30 | 42,235,000 | 37,603,736 | |

| LXP Industrial Trust (REIT): | |||

| 2.7% 9/15/30 | 7,890,000 | 6,109,738 | |

| 4.4% 6/15/24 | 8,117,000 | 7,967,214 | |

| Omega Healthcare Investors, Inc.: | |||

| 3.25% 4/15/33 | 26,948,000 | 19,720,472 | |

| 3.375% 2/1/31 | 14,471,000 | 11,313,317 | |

| 3.625% 10/1/29 | 26,970,000 | 22,482,576 | |

| 4.5% 1/15/25 | 12,446,000 | 12,095,572 | |

| 4.5% 4/1/27 | 86,567,000 | 80,644,541 | |

| 4.75% 1/15/28 | 28,933,000 | 26,776,130 | |

| 4.95% 4/1/24 | 6,427,000 | 6,381,453 | |

| 5.25% 1/15/26 | 28,200,000 | 27,484,058 | |

| Piedmont Operating Partnership LP 2.75% 4/1/32 | 6,300,000 | 4,105,173 | |

| Prologis LP 3.25% 6/30/26 | 2,124,000 | 2,002,111 | |

| Realty Income Corp.: | |||

| 2.2% 6/15/28 | 3,445,000 | 2,944,188 | |

| 2.85% 12/15/32 | 4,238,000 | 3,310,638 | |

| 3.25% 1/15/31 | 4,502,000 | 3,782,993 | |

| 3.4% 1/15/28 | 7,083,000 | 6,449,583 | |

| Regency Centers LP 3.7% 6/15/30 | 25,000,000 | 21,750,181 | |

| Retail Opportunity Investments Partnership LP: | |||

| 4% 12/15/24 | 4,615,000 | 4,463,981 | |

| 5% 12/15/23 | 3,475,000 | 3,465,944 | |

| Simon Property Group LP 2.65% 2/1/32 | 30,000,000 | 23,421,480 | |

| SITE Centers Corp.: | |||

| 3.625% 2/1/25 | 10,990,000 | 10,461,935 | |

| 4.25% 2/1/26 | 15,247,000 | 14,274,825 | |

| Store Capital Corp.: | |||

| 2.75% 11/18/30 | 8,515,000 | 6,099,957 | |

| 4.625% 3/15/29 | 8,847,000 | 7,567,314 | |

| Sun Communities Operating LP: | |||

| 2.3% 11/1/28 | 7,110,000 | 5,900,833 | |

| 2.7% 7/15/31 | 18,176,000 | 13,988,723 | |

| Ventas Realty LP: | |||

| 2.5% 9/1/31 | 53,031,000 | 40,629,486 | |

| 3% 1/15/30 | 35,454,000 | 29,422,480 | |

| 3.5% 2/1/25 | 7,488,000 | 7,205,436 | |

| 3.75% 5/1/24 | 7,900,000 | 7,790,003 | |

| 4% 3/1/28 | 10,351,000 | 9,500,813 | |

| 4.125% 1/15/26 | 7,649,000 | 7,320,726 | |

| 4.375% 2/1/45 | 3,802,000 | 2,730,115 | |

| 4.75% 11/15/30 | 41,973,000 | 38,385,979 | |

| VICI Properties LP: | |||

| 4.375% 5/15/25 | 3,704,000 | 3,579,998 | |

| 4.75% 2/15/28 | 29,291,000 | 27,394,974 | |

| 4.95% 2/15/30 | 38,231,000 | 34,980,127 | |

| 5.125% 5/15/32 | 10,549,000 | 9,442,128 | |

| Vornado Realty LP 2.15% 6/1/26 | 7,918,000 | 6,731,469 | |

| Welltower OP LLC 4% 6/1/25 | 4,568,000 | 4,413,485 | |

| WP Carey, Inc.: | |||

| 3.85% 7/15/29 | 6,097,000 | 5,389,175 | |

| 4% 2/1/25 | 26,847,000 | 26,106,612 | |

| 4.6% 4/1/24 | 14,578,000 | 14,432,358 | |

| 878,239,620 | |||

| Real Estate Management & Development - 0.5% | |||

| Brandywine Operating Partnership LP: | |||

| 3.95% 11/15/27 | 20,195,000 | 16,708,663 | |

| 4.1% 10/1/24 | 23,803,000 | 23,070,316 | |

| 4.55% 10/1/29 | 27,295,000 | 21,211,490 | |

| 7.8% 3/15/28 | 33,242,000 | 30,945,451 | |

| CBRE Group, Inc.: | |||

| 2.5% 4/1/31 | 23,518,000 | 18,229,643 | |

| 4.875% 3/1/26 | 19,900,000 | 19,360,683 | |

| Essex Portfolio LP 3.875% 5/1/24 | 5,285,000 | 5,209,735 | |

| Mid-America Apartments LP 4% 11/15/25 | 3,541,000 | 3,425,690 | |

| Tanger Properties LP: | |||

| 2.75% 9/1/31 | 18,732,000 | 13,511,089 | |

| 3.125% 9/1/26 | 16,602,000 | 15,002,001 | |

| 3.875% 7/15/27 | 28,881,000 | 25,463,274 | |

| 192,138,035 | |||

TOTAL REAL ESTATE | 1,070,377,655 | ||

| UTILITIES - 1.3% | |||

| Electric Utilities - 0.5% | |||

| Alabama Power Co. 3.05% 3/15/32 | 29,471,000 | 24,606,200 | |

| Cleco Corporate Holdings LLC: | |||

| 3.375% 9/15/29 | 15,724,000 | 13,134,564 | |

| 3.743% 5/1/26 | 60,730,000 | 56,627,390 | |

| Cleveland Electric Illuminating Co. 5.95% 12/15/36 | 1,128,000 | 1,065,901 | |

| Duquesne Light Holdings, Inc.: | |||

| 2.532% 10/1/30 (b) | 10,574,000 | 8,223,008 | |

| 2.775% 1/7/32 (b) | 19,219,000 | 14,292,529 | |

| Exelon Corp.: | |||

| 2.75% 3/15/27 | 6,523,000 | 5,923,456 | |

| 3.35% 3/15/32 | 7,920,000 | 6,591,273 | |

| 4.05% 4/15/30 | 7,291,000 | 6,561,974 | |

| 4.1% 3/15/52 | 5,867,000 | 4,242,892 | |

| 4.7% 4/15/50 | 3,246,000 | 2,594,246 | |

| IPALCO Enterprises, Inc. 3.7% 9/1/24 | 9,552,000 | 9,329,347 | |

| Southern Co. 5.7% 3/15/34 | 27,735,000 | 27,162,080 | |

| 180,354,860 | |||

| Gas Utilities - 0.0% | |||

| Nakilat, Inc. 6.067% 12/31/33 (b) | 6,263,992 | 6,307,652 | |

| Independent Power and Renewable Electricity Producers - 0.3% | |||

| Emera U.S. Finance LP 3.55% 6/15/26 | 6,732,000 | 6,323,636 | |

| The AES Corp.: | |||

| 1.375% 1/15/26 | 30,500,000 | 27,160,684 | |

| 2.45% 1/15/31 | 28,885,000 | 22,214,456 | |

| 3.3% 7/15/25 (b) | 37,234,000 | 35,267,162 | |

| 3.95% 7/15/30 (b) | 42,717,000 | 36,818,637 | |

| 127,784,575 | |||

| Multi-Utilities - 0.5% | |||

| Berkshire Hathaway Energy Co.: | |||

| 3.7% 7/15/30 | 4,149,000 | 3,681,524 | |

| 4.05% 4/15/25 | 53,700,000 | 52,309,934 | |

| Consolidated Edison Co. of New York, Inc. 3.35% 4/1/30 | 3,290,000 | 2,888,264 | |

| NiSource, Inc.: | |||

| 2.95% 9/1/29 | 40,740,000 | 35,112,954 | |

| 3.6% 5/1/30 | 22,835,000 | 19,890,869 | |

| Puget Energy, Inc.: | |||

| 4.1% 6/15/30 | 25,767,000 | 22,451,506 | |

| 4.224% 3/15/32 | 27,319,000 | 23,311,026 | |

| Sempra 6% 10/15/39 | 5,386,000 | 5,116,080 | |

| WEC Energy Group, Inc. CME Term SOFR 3 Month Index + 2.110% 7.7387% 5/15/67 (c)(d) | 12,629,000 | 11,303,139 | |

| 176,065,296 | |||

TOTAL UTILITIES | 490,512,383 | ||

| TOTAL NONCONVERTIBLE BONDS (Cost $12,427,064,287) | 10,947,073,669 | ||

| U.S. Treasury Obligations - 40.4% | |||

Principal Amount (a) | Value ($) | ||

| U.S. Treasury Bonds: | |||

| 1.75% 8/15/41 | 896,321,000 | 558,169,902 | |

| 1.875% 11/15/51 | 120,053,000 | 66,915,478 | |

| 2% 8/15/51 | 733,544,000 | 423,277,811 | |

| 2.375% 2/15/42 | 95,700,000 | 66,044,503 | |

| 2.875% 5/15/52 | 556,400,000 | 394,500,642 | |

| 3% 2/15/49 | 794,760,000 | 580,950,931 | |

| 3.375% 8/15/42 | 485,600,000 | 393,449,815 | |

| 3.625% 2/15/53 | 242,364,000 | 200,442,602 | |

| 3.625% 5/15/53 | 222,790,000 | 184,463,158 | |

| 4.125% 8/15/53 | 495,593,000 | 449,905,520 | |

| U.S. Treasury Notes: | |||

| 1.25% 4/30/28 | 2,172,413,000 | 1,870,311,800 | |

| 1.5% 11/30/28 | 800,000,000 | 685,531,248 | |

| 2.375% 3/31/29 | 504,000,000 | 448,717,500 | |

| 2.625% 7/31/29 | 273,317,000 | 245,227,272 | |

| 2.75% 8/15/32 | 913,762,000 | 791,260,782 | |

| 2.875% 5/15/32 | 763,588,000 | 670,257,266 | |

| 3.375% 5/15/33 | 465,000,000 | 421,696,875 | |

| 3.5% 4/30/30 | 528,900,000 | 494,996,685 | |

| 3.5% 2/15/33 | 470,900,000 | 432,050,750 | |

| 3.75% 5/31/30 | 514,100,000 | 488,073,688 | |

| 3.75% 6/30/30 | 543,000,000 | 515,383,357 | |

| 3.875% 12/31/27 | 700,000,000 | 678,546,330 | |

| 3.875% 11/30/29 | 255,000,000 | 244,401,563 | |

| 3.875% 8/15/33 | 477,166,000 | 450,847,313 | |

| 4% 6/30/28 | 175,000,000 | 170,331,054 | |

| 4% 7/31/30 | 1,606,800,000 | 1,547,800,313 | |

| 4.125% 11/15/32 | 1,530,767,000 | 1,476,353,009 | |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $17,231,119,897) | 14,949,907,167 | ||

| U.S. Government Agency - Mortgage Securities - 23.4% | |||

Principal Amount (a) | Value ($) | ||

| Fannie Mae - 7.2% | |||

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.310% 4.438% 5/1/34 (c)(d) | 31,429 | 31,422 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.390% 4.322% 5/1/33 (c)(d) | 1,328 | 1,323 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.420% 4.572% 9/1/33 (c)(d) | 74,787 | 74,381 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.440% 3.945% 4/1/37 (c)(d) | 16,537 | 16,598 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.460% 3.846% 1/1/35 (c)(d) | 16,549 | 16,659 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.480% 5.73% 7/1/34 (c)(d) | 2,144 | 2,159 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.500% 4.724% 1/1/35 (c)(d) | 34,155 | 34,288 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.510% 7.023% 2/1/33 (c)(d) | 188 | 189 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.530% 4.371% 3/1/35 (c)(d) | 23,711 | 23,756 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.530% 4.785% 12/1/34 (c)(d) | 13,127 | 13,149 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.550% 5.803% 6/1/36 (c)(d) | 31,727 | 32,086 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.550% 6.44% 10/1/33 (c)(d) | 2,892 | 2,919 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.560% 4.065% 3/1/37 (c)(d) | 17,476 | 17,597 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.560% 7.103% 7/1/35 (c)(d) | 2,955 | 2,987 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.620% 4.293% 3/1/33 (c)(d) | 16,849 | 16,930 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.630% 3.815% 9/1/36 (c)(d) | 9,143 | 9,218 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.630% 5.468% 7/1/35 (c)(d) | 73,751 | 74,518 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.640% 3.895% 6/1/47 (c)(d) | 25,914 | 26,488 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.640% 4.911% 11/1/36 (c)(d) | 106,733 | 107,603 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.640% 5.87% 5/1/35 (c)(d) | 30,769 | 31,011 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.680% 4.634% 7/1/43 (c)(d) | 273,924 | 277,012 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.700% 5.192% 6/1/42 (c)(d) | 30,118 | 30,495 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.710% 4.737% 3/1/36 (c)(d) | 54,412 | 54,978 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.730% 4.021% 3/1/40 (c)(d) | 34,452 | 34,963 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.730% 5.105% 5/1/36 (c)(d) | 71,717 | 72,570 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.740% 5.469% 5/1/36 (c)(d) | 26,984 | 27,330 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 4.454% 7/1/35 (c)(d) | 20,651 | 20,789 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 6% 8/1/41 (c)(d) | 51,671 | 52,299 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.800% 4.055% 1/1/42 (c)(d) | 75,899 | 77,036 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.800% 4.8% 12/1/40 (c)(d) | 1,012,094 | 1,026,671 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.800% 6.05% 7/1/41 (c)(d) | 14,015 | 14,218 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 4.06% 12/1/39 (c)(d) | 10,717 | 10,880 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 4.068% 9/1/41 (c)(d) | 11,622 | 11,772 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 4.304% 2/1/42 (c)(d) | 45,035 | 45,637 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 6.051% 7/1/41 (c)(d) | 22,704 | 23,061 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.820% 4.295% 2/1/35 (c)(d) | 45,698 | 46,104 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.830% 4.08% 10/1/41 (c)(d) | 9,583 | 9,494 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.950% 5.771% 7/1/37 (c)(d) | 78,278 | 79,646 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.960% 4.746% 9/1/35 (c)(d) | 4,572 | 4,621 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.500% 5.75% 3/1/36 (c)(d) | 45,578 | 46,510 | |

| U.S. TREASURY 1 YEAR INDEX + 2.200% 4.583% 3/1/35 (c)(d) | 16,656 | 16,806 | |

| U.S. TREASURY 1 YEAR INDEX + 2.220% 4.405% 8/1/36 (c)(d) | 88,419 | 89,682 | |

| U.S. TREASURY 1 YEAR INDEX + 2.270% 4.395% 6/1/36 (c)(d) | 24,064 | 24,513 | |

| U.S. TREASURY 1 YEAR INDEX + 2.280% 4.474% 10/1/33 (c)(d) | 28,108 | 28,467 | |

| U.S. TREASURY 1 YEAR INDEX + 2.420% 4.878% 5/1/35 (c)(d) | 11,402 | 11,581 | |

| U.S. TREASURY 1 YEAR INDEX + 2.460% 5.303% 7/1/34 (c)(d) | 31,607 | 32,055 | |

| 1.5% 11/1/35 to 9/1/51 (e) | 216,681,876 | 166,833,393 | |

| 2% 2/1/28 to 3/1/52 | 627,582,439 | 501,505,198 | |

| 2.5% 1/1/28 to 5/1/53 | 849,957,680 | 696,280,043 | |

| 3% 12/1/28 to 3/1/52 (f) | 370,619,008 | 318,972,568 | |

| 3.25% 12/1/41 | 17,459 | 15,603 | |

| 3.4% 7/1/42 to 9/1/42 | 346,406 | 308,271 | |

| 3.5% 10/1/33 to 4/1/52 (f)(g) | 251,067,087 | 220,246,860 | |

| 3.65% 5/1/42 to 8/1/42 | 103,553 | 92,557 | |

| 3.9% 4/1/42 | 28,037 | 25,438 | |

| 4% 3/1/36 to 4/1/52 | 124,187,926 | 113,362,140 | |

| 4.25% 11/1/41 | 55,119 | 51,617 | |

| 4.5% to 4.5% 6/1/24 to 1/1/53 | 184,165,382 | 172,543,300 | |

| 5% 6/1/24 to 12/1/52 | 135,429,390 | 129,231,046 | |

| 5.283% 8/1/41 (c) | 664,201 | 653,035 | |

| 5.5% 9/1/24 to 10/1/53 | 190,749,659 | 185,002,333 | |

| 6% to 6% 9/1/29 to 6/1/53 | 72,732,418 | 72,331,253 | |

| 6.5% 12/1/23 to 9/1/53 | 59,770,990 | 60,247,340 | |

| 6.691% 2/1/39 (c) | 334,677 | 337,547 | |

| 7% to 7% 11/1/23 to 7/1/37 | 359,331 | 368,186 | |

| 7.5% to 7.5% 7/1/25 to 11/1/31 | 269,210 | 275,160 | |

| 8% 3/1/37 | 8,801 | 9,423 | |

TOTAL FANNIE MAE | 2,641,396,782 | ||

| Freddie Mac - 5.8% | |||

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.120% 4.424% 8/1/37 (c)(d) | 23,459 | 23,194 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.320% 3.575% 1/1/36 (c)(d) | 12,302 | 12,230 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.370% 3.873% 3/1/36 (c)(d) | 65,346 | 65,301 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.500% 3.824% 3/1/36 (c)(d) | 38,159 | 38,221 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.650% 6.391% 4/1/35 (c)(d) | 54,236 | 54,867 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 4% 12/1/40 (c)(d) | 363,068 | 367,724 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 4.991% 9/1/41 (c)(d) | 178,154 | 180,206 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 6% 7/1/41 (c)(d) | 85,471 | 86,199 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.800% 5.626% 5/1/35 (c)(d) | 76,686 | 77,302 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.860% 5.239% 4/1/36 (c)(d) | 25,932 | 26,163 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.880% 4.787% 10/1/36 (c)(d) | 63,390 | 63,740 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.880% 5.255% 4/1/41 (c)(d) | 4,600 | 4,635 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.880% 5.675% 9/1/41 (c)(d) | 17,531 | 17,744 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.900% 5.671% 10/1/42 (c)(d) | 57,307 | 57,224 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 5.212% 5/1/41 (c)(d) | 32,449 | 32,777 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 5.568% 5/1/41 (c)(d) | 37,659 | 38,050 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 5.698% 6/1/41 (c)(d) | 34,989 | 35,394 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 6.16% 6/1/41 (c)(d) | 11,470 | 11,620 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.990% 5.001% 10/1/35 (c)(d) | 30,789 | 30,978 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.020% 4.936% 4/1/38 (c)(d) | 21,487 | 21,673 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.020% 7.385% 6/1/37 (c)(d) | 13,829 | 14,060 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.030% 6.158% 3/1/33 (c)(d) | 454 | 454 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.040% 6.256% 7/1/36 (c)(d) | 25,806 | 26,135 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.200% 4.45% 12/1/36 (c)(d) | 44,280 | 45,099 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.680% 7.546% 10/1/35 (c)(d) | 28,061 | 28,863 | |

| U.S. TREASURY 1 YEAR INDEX + 2.030% 4.865% 6/1/33 (c)(d) | 42,362 | 42,413 | |

| U.S. TREASURY 1 YEAR INDEX + 2.240% 4.372% 1/1/35 (c)(d) | 3,484 | 3,511 | |

| U.S. TREASURY 1 YEAR INDEX + 2.260% 5.196% 6/1/33 (c)(d) | 84,808 | 85,175 | |

| U.S. TREASURY 1 YEAR INDEX + 2.430% 5.466% 3/1/35 (c)(d) | 153,489 | 155,395 | |

| 1.5% 7/1/35 to 6/1/51 | 299,182,401 | 225,785,925 | |

| 2% 6/1/35 to 4/1/52 | 639,571,667 | 508,890,410 | |

| 2.5% 1/1/28 to 8/1/53 | 388,766,778 | 321,502,229 | |

| 3% 12/1/30 to 3/1/52 | 241,580,171 | 206,251,504 | |

| 3.5% 12/1/29 to 4/1/52 (f) | 268,067,076 | 236,851,537 | |

| 4% 1/1/36 to 10/1/52 (e)(g) | 144,505,697 | 131,696,767 | |

| 4% 4/1/48 | 27,938 | 25,321 | |

| 4.5% 6/1/25 to 4/1/53 | 80,008,785 | 74,678,345 | |

| 5% 8/1/33 to 8/1/53 | 154,118,364 | 146,688,276 | |

| 5.5% 10/1/52 to 8/1/53 (e) | 233,057,093 | 226,101,577 | |

| 6% 7/1/28 to 7/1/53 | 35,129,157 | 34,961,500 | |

| 6.5% 5/1/26 to 10/1/53 | 27,222,687 | 27,557,793 | |

| 7% 3/1/26 to 9/1/36 | 266,892 | 274,391 | |

| 7.5% 7/1/26 to 6/1/32 | 61,309 | 63,031 | |

| 8% 7/1/24 to 4/1/32 | 10,625 | 10,954 | |

| 8.5% 1/1/25 to 1/1/28 | 4,022 | 4,113 | |

TOTAL FREDDIE MAC | 2,142,990,020 | ||

| Ginnie Mae - 4.5% | |||

| 3% 5/15/42 to 5/20/50 | 16,974,840 | 14,456,465 | |

| 3.5% 9/20/40 to 2/20/50 | 47,142,979 | 42,289,494 | |

| 4% 7/15/39 to 5/20/49 | 52,104,191 | 48,057,079 | |

| 4.5% 6/20/33 to 8/15/41 | 25,345,244 | 24,148,605 | |

| 5.5% 7/15/33 to 9/15/39 | 909,962 | 909,266 | |

| 6% to 6% 10/15/30 to 5/15/40 | 860,730 | 872,630 | |

| 7% to 7% 3/15/24 to 11/15/32 | 790,800 | 804,964 | |

| 7.5% to 7.5% 11/15/23 to 9/15/31 | 95,715 | 96,988 | |

| 8% 4/15/24 to 11/15/29 | 11,254 | 11,426 | |

| 8.5% 11/15/27 to 11/15/31 | 19,459 | 20,271 | |

| 2% 10/20/50 to 4/20/51 | 188,814,122 | 149,918,342 | |

| 2% 10/1/53 (h) | 13,100,000 | 10,359,659 | |

| 2% 10/1/53 (h) | 163,950,000 | 129,653,906 | |

| 2% 10/1/53 (h) | 94,300,000 | 74,573,732 | |

| 2% 10/1/53 (h) | 31,100,000 | 24,594,306 | |

| 2% 10/1/53 (h) | 50,200,000 | 39,698,848 | |

| 2% 10/1/53 (h) | 16,400,000 | 12,969,345 | |

| 2.5% 6/20/51 to 9/20/51 | 61,591,590 | 50,407,531 | |

| 2.5% 10/1/53 (h) | 34,450,000 | 28,150,538 | |

| 2.5% 10/1/53 (h) | 103,850,000 | 84,860,186 | |

| 2.5% 10/1/53 (h) | 68,550,000 | 56,015,077 | |

| 2.5% 10/1/53 (h) | 34,300,000 | 28,027,967 | |

| 2.5% 10/1/53 (h) | 13,700,000 | 11,194,844 | |

| 2.5% 10/1/53 (h) | 34,300,000 | 28,027,967 | |

| 2.5% 10/1/53 (h) | 25,500,000 | 20,837,118 | |

| 2.5% 11/1/53 (h) | 128,950,000 | 105,435,929 | |

| 3% 10/1/53 (h) | 84,400,000 | 71,524,426 | |

| 3% 10/1/53 (h) | 85,500,000 | 72,456,616 | |

| 3% 10/1/53 (h) | 59,750,000 | 50,634,887 | |

| 3% 11/1/53 (h) | 55,700,000 | 47,220,143 | |

| 3% 11/1/53 (h) | 55,400,000 | 46,965,815 | |

| 3.5% 10/1/53 (h) | 22,850,000 | 20,017,827 | |

| 3.5% 10/1/53 (h) | 76,650,000 | 67,149,516 | |

| 3.5% 10/1/53 (h) | 23,700,000 | 20,762,473 | |

| 3.5% 10/1/53 (h) | 24,300,000 | 21,288,105 | |

| 3.5% 10/1/53 (h) | 14,800,000 | 12,965,595 | |

| 3.5% 10/1/53 (h) | 8,850,000 | 7,753,075 | |

| 4% 10/1/53 (h) | 41,300,000 | 37,210,168 | |

| 4.5% 10/1/53 (h) | 35,500,000 | 32,790,072 | |

| 5% 12/15/32 to 4/20/48 | 10,819,489 | 10,556,240 | |

| 5% 10/1/53 (h) | 37,100,000 | 35,166,619 | |

| 5% 10/1/53 (h) | 34,700,000 | 32,891,689 | |

| 5.5% 10/1/53 (h) | 87,400,000 | 84,822,006 | |

| 6.5% 3/20/31 to 6/15/37 | 118,917 | 121,194 | |

TOTAL GINNIE MAE | 1,658,688,949 | ||

| Uniform Mortgage Backed Securities - 5.9% | |||

| 1.5% 10/1/38 (h) | 37,300,000 | 31,046,655 | |

| 2% 10/1/53 (h) | 114,200,000 | 86,809,187 | |

| 2% 10/1/53 (h) | 45,650,000 | 34,700,870 | |

| 2% 10/1/53 (h) | 45,650,000 | 34,700,870 | |

| 2% 10/1/53 (h) | 68,500,000 | 52,070,309 | |

| 2% 10/1/53 (h) | 129,300,000 | 98,287,460 | |

| 2% 10/1/53 (h) | 43,800,000 | 33,294,592 | |

| 2% 10/1/53 (h) | 63,500,000 | 48,269,557 | |

| 2% 10/1/53 (h) | 16,400,000 | 12,466,468 | |

| 2% 10/1/53 (h) | 29,400,000 | 22,348,425 | |

| 2% 10/1/53 (h) | 90,050,000 | 68,451,553 | |

| 2% 10/1/53 (h) | 45,850,000 | 34,852,900 | |

| 2% 10/1/53 (h) | 45,400,000 | 34,510,833 | |

| 2% 10/1/53 (h) | 33,300,000 | 25,313,012 | |

| 2% 10/1/53 (h) | 26,400,000 | 20,067,973 | |

| 2% 10/1/53 (h) | 26,600,000 | 20,220,003 | |

| 2% 11/1/53 (h) | 45,850,000 | 34,906,632 | |

| 2% 11/1/53 (h) | 97,900,000 | 74,533,463 | |

| 2% 11/1/53 (h) | 90,050,000 | 68,557,082 | |

| 2% 11/1/53 (h) | 45,400,000 | 34,564,037 | |

| 2% 11/1/53 (h) | 89,900,000 | 68,442,884 | |

| 2% 11/1/53 (h) | 55,650,000 | 42,367,592 | |

| 2% 11/1/53 (h) | 44,400,000 | 33,802,715 | |

| 2.5% 10/1/53 (h) | 48,450,000 | 38,428,772 | |

| 2.5% 10/1/53 (h) | 74,800,000 | 59,328,630 | |

| 2.5% 11/1/53 (h) | 79,350,000 | 63,018,112 | |

| 2.5% 11/1/53 (h) | 38,000,000 | 30,178,806 | |

| 3% 10/1/53 (h) | 58,150,000 | 48,075,989 | |

| 3% 10/1/53 (h) | 116,300,000 | 96,151,979 | |

| 3% 10/1/53 (h) | 18,625,000 | 15,398,371 | |

| 3% 10/1/53 (h) | 12,400,000 | 10,251,802 | |

| 3% 10/1/53 (h) | 37,700,000 | 31,168,784 | |

| 3% 10/1/53 (h) | 18,900,000 | 15,625,730 | |

| 3% 10/1/53 (h) | 37,000,000 | 30,590,053 | |

| 3% 10/1/53 (h) | 24,400,000 | 20,172,900 | |

| 3% 11/1/53 (h) | 78,500,000 | 64,974,120 | |

| 3% 11/1/53 (h) | 84,350,000 | 69,816,141 | |

| 3.5% 10/1/53 (h) | 24,700,000 | 21,238,137 | |

| 3.5% 10/1/53 (h) | 14,100,000 | 12,123,795 | |

| 3.5% 11/1/53 (h) | 24,850,000 | 21,388,470 | |

| 4% 10/1/53 (h) | 62,425,000 | 55,597,241 | |

| 4% 10/1/53 (h) | 56,675,000 | 50,476,149 | |

| 4% 10/1/53 (h) | 16,100,000 | 14,339,056 | |

| 4% 10/1/53 (h) | 37,300,000 | 33,220,298 | |

| 5% 10/1/38 (h) | 28,200,000 | 27,453,146 | |

| 5% 10/1/38 (h) | 28,200,000 | 27,453,146 | |

| 5% 10/1/38 (h) | 34,600,000 | 33,683,647 | |

| 5% 11/1/38 (h) | 46,700,000 | 45,461,362 | |

| 5% 10/1/53 (h) | 5,925,000 | 5,591,028 | |

| 6.5% 10/1/53 (h) | 37,600,000 | 37,779,720 | |

| 6.5% 10/1/53 (h) | 27,300,000 | 27,430,489 | |

| 6.5% 10/1/53 (h) | 79,900,000 | 80,281,906 | |

| 6.5% 10/1/53 (h) | 50,000,000 | 50,238,990 | |

| 6.5% 10/1/53 (h) | 17,000,000 | 17,081,257 | |

| 6.5% 10/1/53 (h) | 23,700,000 | 23,813,281 | |

TOTAL UNIFORM MORTGAGE BACKED SECURITIES | 2,192,416,379 | ||

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $9,402,135,639) | 8,635,492,130 | ||

| Asset-Backed Securities - 6.8% | |||

Principal Amount (a) | Value ($) | ||

| AASET Trust: | |||

| Series 2018-1A Class A, 3.844% 1/16/38 (b) | 10,582,967 | 6,826,102 | |

| Series 2019-1 Class A, 3.844% 5/15/39 (b) | 7,144,584 | 5,358,635 | |

| Series 2019-2: | |||

Class A, 3.376% 10/16/39 (b) | 19,116,392 | 16,630,030 | |

Class B, 4.458% 10/16/39 (b) | 4,664,187 | 1,865,417 | |

| Series 2021-1A Class A, 2.95% 11/16/41 (b) | 22,042,377 | 19,397,733 | |

| Series 2021-2A Class A, 2.798% 1/15/47 (b) | 42,894,074 | 36,672,730 | |

| AASET, Ltd. Series 2022-1A Class A, 6% 5/16/47 (b) | 28,853,462 | 27,777,516 | |

| Aimco Series 2018-BA Class AR, CME Term SOFR 3 Month Index + 1.360% 6.6696% 1/15/32 (b)(c)(d) | 7,556,000 | 7,523,811 | |

| AIMCO CLO Ltd. Series 2021-11A Class AR, CME Term SOFR 3 Month Index + 1.390% 6.6996% 10/17/34 (b)(c)(d) | 17,910,000 | 17,800,373 | |

| AIMCO CLO Ltd. / AIMCO CLO LLC Series 2021-14A Class A, CME Term SOFR 3 Month Index + 1.250% 6.5778% 4/20/34 (b)(c)(d) | 46,919,000 | 46,396,088 | |

| Allegro CLO XV, Ltd. / Allegro CLO VX LLC Series 2022-1A Class A, CME Term SOFR 3 Month Index + 1.500% 6.8261% 7/20/35 (b)(c)(d) | 25,047,000 | 24,934,940 | |

| Allegro CLO, Ltd. Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.400% 6.7278% 7/20/34 (b)(c)(d) | 21,007,000 | 20,813,568 | |

| American Express Credit Account Master Trust Series 2023-1 Class A, 4.87% 5/15/28 | 19,110,000 | 18,873,949 | |

| Apollo Aviation Securitization Equity Trust Series 2020-1A: | |||

| Class A, 3.351% 1/16/40 (b) | 6,093,411 | 5,301,267 | |

| Class B, 4.335% 1/16/40 (b) | 1,196,541 | 616,362 | |

| Ares CLO Series 2019-54A Class A, CME Term SOFR 3 Month Index + 1.580% 6.8896% 10/15/32 (b)(c)(d) | 24,769,000 | 24,780,196 | |

| Ares LV CLO Ltd. Series 2021-55A Class A1R, CME Term SOFR 3 Month Index + 1.390% 6.6996% 7/15/34 (b)(c)(d) | 26,517,000 | 26,277,976 | |

| Ares LVIII CLO LLC Series 2022-58A Class AR, CME Term SOFR 3 Month Index + 1.330% 6.638% 1/15/35 (b)(c)(d) | 37,068,000 | 36,536,000 | |

| Ares XLI CLO Ltd. / Ares XLI CLO LLC Series 2021-41A Class AR2, CME Term SOFR 3 Month Index + 1.330% 6.6396% 4/15/34 (b)(c)(d) | 29,947,000 | 29,583,294 | |

| Ares XXXIV CLO Ltd. Series 2020-2A Class AR2, CME Term SOFR 3 Month Index + 1.510% 6.8196% 4/17/33 (b)(c)(d) | 69,645,000 | 69,283,403 | |

| Babson CLO Ltd. Series 2021-1A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7196% 10/15/36 (b)(c)(d) | 17,946,000 | 17,829,477 | |

| Bank of America Credit Card Master Trust Series 2023-A1 Class A1, 4.79% 5/15/28 | 23,400,000 | 23,064,912 | |

| Barings CLO Ltd. Series 2021-4A Class A, CME Term SOFR 3 Month Index + 1.480% 6.8078% 1/20/32 (b)(c)(d) | 28,600,000 | 28,541,256 | |

| Beechwood Park CLO Ltd. Series 2022-1A Class A1R, CME Term SOFR 3 Month Index + 1.300% 6.608% 1/17/35 (b)(c)(d) | 38,048,000 | 37,636,359 | |

| BETHP Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.390% 6.6996% 1/15/35 (b)(c)(d) | 27,114,000 | 26,892,750 | |

| Blackbird Capital Aircraft: | |||

| Series 2016-1A: | |||

Class A, 4.213% 12/16/41 (b) | 29,730,327 | 27,371,820 | |

Class AA, 2.487% 12/16/41 (b)(c) | 1,815,201 | 1,749,437 | |

| Series 2021-1A Class A, 2.443% 7/15/46 (b) | 30,230,360 | 25,808,202 | |

| Bristol Park CLO, Ltd. Series 2020-1A Class AR, CME Term SOFR 3 Month Index + 1.250% 6.5596% 4/15/29 (b)(c)(d) | 26,197,714 | 26,116,318 | |

| Capital One Multi-Asset Execution Trust Series 2023-A1 Class A, 4.42% 5/15/28 | 21,500,000 | 20,973,278 | |

| Castlelake Aircraft Securitization Trust Series 2019-1A: | |||

| Class A, 3.967% 4/15/39 (b) | 21,040,338 | 18,711,478 | |

| Class B, 5.095% 4/15/39 (b) | 10,307,675 | 6,606,659 | |

| Castlelake Aircraft Structured Trust: | |||

| Series 2018-1 Class A, 4.125% 6/15/43 (b) | 10,074,317 | 9,159,404 | |

| Series 2021-1A Class A, 3.474% 1/15/46 (b) | 5,090,488 | 4,695,873 | |

| Cedar Funding Ltd.: | |||

| Series 2021-10A Class AR, CME Term SOFR 3 Month Index + 1.360% 6.6878% 10/20/32 (b)(c)(d) | 21,787,000 | 21,614,970 | |

| Series 2022-15A Class A, CME Term SOFR 3 Month Index + 1.320% 6.6461% 4/20/35 (b)(c)(d) | 35,314,000 | 35,012,348 | |

| Cedar Funding XII CLO Ltd. / Cedar Funding XII CLO LLC Series 2021-12A Class A1R, CME Term SOFR 3 Month Index + 1.390% 6.7428% 10/25/34 (b)(c)(d) | 16,882,000 | 16,732,763 | |

| Cedar Funding Xvii Clo Ltd. Series 2023-17A Class A, CME Term SOFR 3 Month Index + 1.850% 7.2758% 7/20/36 (b)(c)(d) | 25,314,000 | 25,307,013 | |

| CEDF Series 2021-6A Class ARR, CME Term SOFR 3 Month Index + 1.310% 6.6378% 4/20/34 (b)(c)(d) | 26,059,000 | 25,733,289 | |

| Cent CLO Ltd. / Cent CLO Series 2021-29A Class AR, CME Term SOFR 3 Month Index + 1.430% 6.7578% 10/20/34 (b)(c)(d) | 27,352,000 | 26,918,936 | |

| CFMT LLC Series 2023 HB12 Class A, 4.25% 4/25/33 (b) | 13,798,250 | 13,208,600 | |

| Chesapeake Funding II LLC Series 2023-2A Class A1, 6.16% 10/15/35 (b) | 11,600,000 | 11,607,033 | |

| CNH Equipment Trust Series 2023 A Class A2, 5.34% 9/15/26 | 10,063,000 | 10,015,797 | |

| Columbia Cent CLO 31 Ltd. Series 2021-31A Class A1, CME Term SOFR 3 Month Index + 1.460% 6.7878% 4/20/34 (b)(c)(d) | 28,400,000 | 28,126,536 | |

| Columbia Cent Clo 32 Ltd. / Coliseum Series 2022-32A Class A1, CME Term SOFR 3 Month Index + 1.700% 7.0456% 7/24/34 (b)(c)(d) | 37,609,000 | 37,434,870 | |

| Columbia Cent CLO Ltd. / Columbia Cent CLO Corp. Series 2021-30A Class A1, CME Term SOFR 3 Month Index + 1.570% 6.8978% 1/20/34 (b)(c)(d) | 37,850,000 | 37,651,893 | |

| DB Master Finance LLC Series 2017-1A Class A2II, 4.03% 11/20/47 (b) | 36,167,985 | 32,836,190 | |

| Discover Card Execution Note Trust Series 2023-A2 Class A, 4.93% 6/15/28 | 15,200,000 | 15,015,548 | |

| Dllaa 2023-1A Series 2023-1A: | |||

| Class A2, 5.93% 7/20/26 (b) | 5,800,000 | 5,797,491 | |

| Class A3, 5.64% 2/22/28 (b) | 7,444,000 | 7,431,833 | |

| Dominos Pizza Master Issuer LLC Series 2019-1A Class A2, 3.668% 10/25/49 (b) | 20,921,200 | 18,095,729 | |

| Dryden 98 CLO Ltd. Series 2022-98A Class A, CME Term SOFR 3 Month Index + 1.300% 6.6261% 4/20/35 (b)(c)(d) | 19,817,000 | 19,542,376 | |

| Dryden CLO, Ltd.: | |||

| Series 2021-76A Class A1R, CME Term SOFR 3 Month Index + 1.410% 6.7378% 10/20/34 (b)(c)(d) | 18,048,000 | 17,928,486 | |

| Series 2021-83A Class A, CME Term SOFR 3 Month Index + 1.480% 6.7915% 1/18/32 (b)(c)(d) | 22,160,000 | 22,119,381 | |

| Dryden Senior Loan Fund: | |||

| Series 2020-78A Class A, CME Term SOFR 3 Month Index + 1.440% 6.7496% 4/17/33 (b)(c)(d) | 20,000,000 | 19,740,540 | |

| Series 2021-85A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7196% 10/15/35 (b)(c)(d) | 23,913,000 | 23,697,998 | |

| Series 2021-90A Class A1A, CME Term SOFR 3 Month Index + 1.390% 6.7714% 2/20/35 (b)(c)(d) | 14,569,000 | 14,399,023 | |

| Eaton Vance CLO, Ltd.: | |||

| Series 2021-1A Class AR, CME Term SOFR 3 Month Index + 1.360% 6.6696% 4/15/31 (b)(c)(d) | 12,634,000 | 12,552,397 | |

| Series 2021-2A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7196% 1/15/35 (b)(c)(d) | 32,919,000 | 32,565,746 | |

| Eaton Vance CLO, Ltd. / Eaton Vance CLO LLC Series 2021-1A Class A13R, CME Term SOFR 3 Month Index + 1.510% 6.8196% 1/15/34 (b)(c)(d) | 6,000,000 | 5,950,140 | |

| Flatiron CLO Ltd. Series 2021-1A: | |||

| Class A1, 3 month U.S. LIBOR + 1.110% 6.6917% 7/19/34 (b)(c)(d) | 19,090,000 | 18,965,858 | |

| Class AR, CME Term SOFR 3 Month Index + 1.340% 6.7134% 11/16/34 (b)(c)(d) | 27,750,000 | 27,518,843 | |

| Flatiron CLO Ltd. / Flatiron CLO LLC Series 2020-1A Class A, CME Term SOFR 3 Month Index + 1.560% 6.9414% 11/20/33 (b)(c)(d) | 36,187,000 | 36,118,136 | |

| Ford Credit Auto Owner Trust Series 2019-1 Class A, 3.52% 7/15/30 (b) | 11,685,000 | 11,604,377 | |

| Ford Credit Floorplan Master Owner Trust Series 2023-1 Class A1, 4.92% 5/15/28 (b) | 31,100,000 | 30,521,916 | |

| GM Financial Automobile Leasing Series 2023-2 Class A2A, 5.44% 10/20/25 | 9,961,000 | 9,923,607 | |

| Gm Financial Consumer Automobile Re Series 2023-3 Class A3, 5.45% 6/16/28 | 15,130,000 | 15,106,733 | |

| GM Financial Consumer Automobile Receivables Series 2023 2 Class A3, 4.47% 2/16/28 | 23,205,000 | 22,687,784 | |

| Gm Financial Leasing Trust 202 Series 2023-3 Class A3, 5.38% 11/20/26 | 7,660,000 | 7,630,315 | |

| Horizon Aircraft Finance I Ltd. Series 2018-1 Class A, 4.458% 12/15/38 (b) | 11,011,688 | 9,429,177 | |

| Horizon Aircraft Finance Ltd. Series 2019-1 Class A, 3.721% 7/15/39 (b) | 12,161,478 | 10,459,138 | |

| Hyundai Auto Lease Securitizat Series 2023-B Class A2A, 5.47% 9/15/25 (b) | 23,378,000 | 23,304,413 | |

| Invesco CLO Ltd. Series 2021-3A Class A, CME Term SOFR 3 Month Index + 1.390% 6.7372% 10/22/34 (b)(c)(d) | 19,246,000 | 19,074,653 | |

| KKR CLO Ltd. Series 2022-41A Class A1, CME Term SOFR 3 Month Index + 1.330% 6.638% 4/15/35 (b)(c)(d) | 46,050,000 | 45,459,777 | |

| Long Beach Mortgage Loan Trust Series 2003-3 Class M1, CME Term SOFR 1 Month Index + 1.230% 6.5592% 7/25/33 (c)(d) | 594,514 | 579,696 | |

| Lucali CLO Ltd. Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.470% 6.7796% 1/15/33 (b)(c)(d) | 13,900,000 | 13,894,704 | |

| Madison Park Funding L Ltd. / Madison Park Funding L LLC Series 2021-50A Class A, CME Term SOFR 3 Month Index + 1.400% 6.7217% 4/19/34 (b)(c)(d) | 30,470,000 | 30,302,963 | |

| Madison Park Funding LII Ltd. / Madison Park Funding LII LLC Series 2021-52A Class A, CME Term SOFR 3 Month Index + 1.360% 6.7072% 1/22/35 (b)(c)(d) | 32,026,000 | 31,763,259 | |

| Madison Park Funding XLV Ltd./Madison Park Funding XLV LLC Series 2021-45A Class AR, CME Term SOFR 3 Month Index + 1.380% 6.6896% 7/15/34 (b)(c)(d) | 27,800,000 | 27,570,622 | |

| Madison Park Funding XXXII, Ltd. / Madison Park Funding XXXII LLC Series 2021-32A Class A2R, CME Term SOFR 3 Month Index + 1.460% 6.8072% 1/22/31 (b)(c)(d) | 7,913,000 | 7,835,445 | |

| Magnetite CLO LTD Series 2023-36A Class A, CME Term SOFR 3 Month Index + 1.800% 6.9585% 4/22/36 (b)(c)(d) | 17,468,000 | 17,483,896 | |

| Magnetite CLO Ltd. Series 2021-27A Class AR, CME Term SOFR 3 Month Index + 1.400% 6.7278% 10/20/34 (b)(c)(d) | 6,442,000 | 6,407,194 | |

| Magnetite IX, Ltd. / Magnetite IX LLC Series 2021-30A Class A, CME Term SOFR 3 Month Index + 1.390% 6.7428% 10/25/34 (b)(c)(d) | 32,900,000 | 32,720,892 | |

| Magnetite XXI Ltd. Series 2021-21A Class AR, CME Term SOFR 3 Month Index + 1.280% 6.6078% 4/20/34 (b)(c)(d) | 25,147,000 | 24,859,821 | |

| Magnetite XXIII, Ltd. Series 2021-23A Class AR, CME Term SOFR 3 Month Index + 1.390% 6.7428% 1/25/35 (b)(c)(d) | 23,616,000 | 23,481,153 | |

| Magnetite XXIX, Ltd. / Magnetite XXIX LLC Series 2021-29A Class A, CME Term SOFR 3 Month Index + 1.250% 6.5596% 1/15/34 (b)(c)(d) | 26,100,000 | 25,963,158 | |

| Milos CLO, Ltd. Series 2020-1A Class AR, CME Term SOFR 3 Month Index + 1.330% 6.6578% 10/20/30 (b)(c)(d) | 31,761,746 | 31,689,425 | |

| Park Place Securities, Inc. Series 2005-WCH1 Class M4, CME Term SOFR 1 Month Index + 1.350% 6.6792% 1/25/36 (c)(d) | 646,710 | 631,243 | |

| Peace Park CLO, Ltd. Series 2021-1A Class A, 3 month U.S. LIBOR + 1.130% 6.7178% 10/20/34 (b)(c)(d) | 26,956,000 | 26,750,703 | |

| Planet Fitness Master Issuer LLC: | |||

| Series 2019-1A Class A2, 3.858% 12/5/49 (b) | 22,143,275 | 18,460,118 | |

| Series 2022-1A: | |||

Class A2I, 3.251% 12/5/51 (b) | 32,408,470 | 28,964,973 | |

Class A2II, 4.008% 12/5/51 (b) | 20,158,025 | 16,248,457 | |

| Project Silver Series 2019-1 Class A, 3.967% 7/15/44 (b) | 18,859,212 | 15,988,463 | |

| Rockland Park CLO Ltd. Series 2021-1A Class A, CME Term SOFR 3 Month Index + 1.380% 6.7078% 4/20/34 (b)(c)(d) | 35,857,000 | 35,597,646 | |

| RR 7 Ltd. Series 2022-7A Class A1AB, CME Term SOFR 3 Month Index + 1.340% 6.648% 1/15/37 (b)(c)(d) | 38,243,000 | 37,814,564 | |

| Sapphire Aviation Finance Series 2020-1A: | |||

| Class A, 3.228% 3/15/40 (b) | 18,508,995 | 15,662,127 | |

| Class B, 4.335% 3/15/40 (b) | 2,231,281 | 1,595,410 | |

| SBA Tower Trust: | |||

| Series 2019, 2.836% 1/15/50 (b) | 28,285,000 | 27,074,422 | |

| 1.884% 7/15/50 (b) | 10,516,000 | 9,509,097 | |

| 2.328% 7/15/52 (b) | 8,041,000 | 6,840,057 | |

| Store Master Funding Series 2021-1A Class A1, 2.12% 6/20/51 (b)(i) | 9,590,875 | 7,900,297 | |

| Stratus CLO, Ltd. Series 2022-1A Class A, CME Term SOFR 3 Month Index + 1.750% 7.0761% 7/20/30 (b)(c)(d) | 5,314,425 | 5,314,526 | |

| SYMP Series 2022-32A Class A1, CME Term SOFR 3 Month Index + 1.320% 6.6656% 4/23/35 (b)(c)(d) | 39,612,000 | 39,008,709 | |

| Symphony CLO XIX, Ltd. / Symphony CLO XIX LLC Series 2018-19A Class A, CME Term SOFR 3 Month Index + 1.220% 6.5296% 4/16/31 (b)(c)(d) | 16,060,621 | 16,022,204 | |

| Symphony CLO XXI, Ltd. Series 2021-21A Class AR, CME Term SOFR 3 Month Index + 1.320% 6.6296% 7/15/32 (b)(c)(d) | 3,663,000 | 3,641,051 | |

| Symphony CLO XXV Ltd. / Symphony CLO XXV LLC Series 2021-25A Class A, CME Term SOFR 3 Month Index + 1.240% 6.5617% 4/19/34 (b)(c)(d) | 15,000,000 | 14,803,320 | |

| Symphony CLO XXVI Ltd. / Symphony CLO XXVI LLC Series 2021-26A Class AR, CME Term SOFR 3 Month Index + 1.340% 6.6678% 4/20/33 (b)(c)(d) | 30,228,000 | 29,979,919 | |

| Terwin Mortgage Trust Series 2003-4HE Class A1, CME Term SOFR 1 Month Index + 0.970% 6.2942% 9/25/34 (c)(d) | 50,373 | 48,176 | |

| Tesla Auto Lease Trust 23-A Series 2023-A Class A3, 5.89% 6/22/26 (b) | 17,400,000 | 17,335,469 | |

| Thunderbolt Aircraft Lease Ltd. Series 2018-A Class A, 4.147% 9/15/38 (b)(c) | 27,131,764 | 23,062,270 | |

| Thunderbolt III Aircraft Lease Ltd. Series 2019-1 Class A, 3.671% 11/15/39 (b) | 28,611,051 | 24,070,477 | |

| Toyota Lease Owner Trust Series 2023 A: | |||

| Class A2, 5.3% 8/20/25 (b) | 18,196,522 | 18,112,739 | |

| Class A3, 4.93% 4/20/26 (b) | 18,007,000 | 17,783,204 | |

| Trapeza CDO XII Ltd./Trapeza CDO XII, Inc. Series 2007-12A Class B, CME Term SOFR 3 Month Index + 0.820% 6.0904% 4/6/42 (b)(c)(d)(i) | 3,641,000 | 2,577,828 | |

| Upstart Securitization Trust: | |||

| Series 2021-4 Class A, 0.84% 9/20/31 (b) | 3,395,488 | 3,360,862 | |

| 3.12% 3/20/32 (b) | 5,477,107 | 5,385,111 | |

| Valley Stream Park Clo Ltd. / Vy Series 2022-1A Class A, CME Term SOFR 3 Month Index + 2.400% 7.7261% 10/20/34 (b)(c)(d) | 34,250,000 | 34,262,604 | |

| Verizon Master Trust Series 2023 2 Class A, 4.89% 4/13/28 | 10,900,000 | 10,761,134 | |

| Voya CLO Ltd. Series 2019-2A Class A, CME Term SOFR 3 Month Index + 1.530% 6.8578% 7/20/32 (b)(c)(d) | 31,233,000 | 31,187,462 | |

| Voya CLO Ltd./Voya CLO LLC: | |||

| Series 2021-2A Class A1R, CME Term SOFR 3 Month Index + 1.420% 6.7417% 7/19/34 (b)(c)(d) | 21,162,000 | 21,017,019 | |

| Series 2021-3A Class AR, CME Term SOFR 3 Month Index + 1.410% 6.7378% 10/20/34 (b)(c)(d) | 36,484,000 | 36,066,222 | |

| Voya CLO, Ltd. Series 2021-1A Class AR, 3 month U.S. LIBOR + 1.150% 6.7196% 7/16/34 (b)(c)(d) | 17,721,000 | 17,471,577 | |

| World Omni Auto Receivables Trust: | |||

| Series 2023 B: | |||

Class A2A, 5.25% 11/16/26 | 10,380,000 | 10,332,082 | |

Class A3, 4.66% 5/15/28 | 19,065,000 | 18,704,523 | |

| Series 2023-C Class A3, 5.15% 11/15/28 | 9,413,000 | 9,345,780 | |

| World Omni Automobile Lease Series 2023-A Class A2A, 5.47% 11/17/25 | 18,938,118 | 18,870,490 | |

| TOTAL ASSET-BACKED SECURITIES (Cost $2,583,175,164) | 2,495,362,829 | ||

| Collateralized Mortgage Obligations - 1.6% | |||

Principal Amount (a) | Value ($) | ||

| Private Sponsor - 0.5% | |||

| Ajax Mortgage Loan Trust sequential payer: | |||

| Series 2021-C Class A, 2.115% 1/25/61 (b) | 3,572,138 | 3,320,858 | |

| Series 2021-E Class A1, 1.74% 12/25/60 (b) | 10,221,779 | 8,373,588 | |

| Binom Securitization Trust 202 Series 2022-RPL1 Class A1, 3% 2/25/61 (b) | 13,315,754 | 11,754,266 | |

| Brass PLC Series 2021-10A Class A1, 0.669% 4/16/69 (b)(c) | 6,226,772 | 5,980,173 | |

| BRAVO Residential Funding Trust sequential payer Series 2022-RPL1 Class A1, 2.75% 9/25/61 (b) | 14,724,514 | 12,804,836 | |

| Cascade Funding Mortgage Trust: | |||

| Series 2021-EBO1 Class A, 0.9849% 11/25/50 (b)(c) | 10,400,291 | 9,578,294 | |

| Series 2021-HB5 Class A, 0.8006% 2/25/31 (b) | 7,135,465 | 6,965,961 | |

| Series 2021-HB6 Class A, 0.8983% 6/25/36 (b) | 8,886,174 | 8,608,729 | |

| Series 2021-HB7 Class A, 1.1512% 10/27/31 (b) | 15,721,532 | 14,997,737 | |

| Cfmt 2022-Ebo2 sequential payer Series 2022-EBO2 Class A, 3.169% 7/25/54 (b) | 5,615,385 | 5,528,857 | |

| Finance of America HECM Buyout sequential payer Series 2022-HB1 Class A, 2.6948% 2/25/32 (b)(c) | 14,864,720 | 13,982,557 | |

| New Residential Mortgage Loan Trust Series 2020-1A Class A1B, 3.5% 10/25/59 (b) | 8,685,273 | 7,782,933 | |

| New York Mortgage Trust sequential payer Series 2021-SP1 Class A1, 1.6696% 8/25/61 (b) | 8,586,571 | 7,749,604 | |

| NYMT Loan Trust sequential payer Series 2021-CP1 Class A1, 2.0424% 7/25/61 (b) | 13,353,326 | 11,789,509 | |

| Ocwen Ln Investment Trust 2023-Hb1 Series 2023-HB1 Class A, 3% 6/25/36 (b) | 5,948,909 | 5,608,009 | |

| Preston Ridge Partners Mortgage Trust Series 2021-RPL2 Class A1, 1.455% 10/25/51 (b)(c) | 5,870,641 | 5,120,952 | |

| RMF Buyout Issuance Trust: | |||

| sequential payer Series 2022-HB1 Class A, 4.272% 4/25/32 (b) | 7,165,341 | 6,757,292 | |

| Series 2020-HB1 Class A1, 1.7188% 10/25/50 (b) | 4,685,437 | 4,303,635 | |

| Sequoia Mortgage Trust floater Series 2004-6 Class A3B, 6 month U.S. LIBOR + 0.880% 6.546% 7/20/34 (c)(d) | 10,114 | 8,915 | |

| Thornburg Mortgage Securities Trust floater Series 2003-4 Class A1, CME Term SOFR 1 Month Index + 0.750% 6.0742% 9/25/43 (c)(d) | 667,622 | 625,129 | |

| Towd Point Mortgage Trust sequential payer Series 2022-K147 Class A2, 3.75% 7/25/62 (b) | 19,028,599 | 17,103,789 | |

TOTAL PRIVATE SPONSOR | 168,745,623 | ||

| U.S. Government Agency - 1.1% | |||

| Fannie Mae: | |||

| floater: | |||

Series 2002-18 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.910% 6.2294% 2/25/32 (c)(d) | 6,191 | 6,153 | |

Series 2002-39 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4278% 3/18/32 (c)(d) | 11,566 | 11,563 | |

Series 2002-60 Class FV, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4294% 4/25/32 (c)(d) | 12,825 | 12,815 | |

Series 2002-63 Class FN, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4294% 10/25/32 (c)(d) | 15,614 | 15,601 | |

Series 2002-7 Class FC, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.860% 6.1794% 1/25/32 (c)(d) | 5,771 | 5,729 | |

Series 2003-118 Class S, 7.980% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 2.6706% 12/25/33 (c)(j)(k) | 229,357 | 28,065 | |

Series 2006-104 Class GI, 6.560% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2506% 11/25/36 (c)(j)(k) | 164,882 | 12,001 | |

Series 2012-154 Class F, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.410% 5.7294% 1/25/43 (c)(d) | 666,821 | 639,639 | |

Series 2017-36 Class FB, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.460% 5.7794% 5/25/47 (c)(d) | 1,325,901 | 1,258,901 | |

Series 2018-32 Class FB, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.410% 5.7294% 5/25/48 (c)(d) | 753,236 | 712,652 | |

Series 2018-38 Class FG, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.410% 5.7294% 6/25/48 (c)(d) | 1,772,123 | 1,672,688 | |

| planned amortization class: | |||

Series 1993-207 Class H, 6.5% 11/25/23 | 530 | 528 | |

Series 1996-28 Class PK, 6.5% 7/25/25 | 1,283 | 1,279 | |

Series 1999-17 Class PG, 6% 4/25/29 | 60,715 | 60,578 | |

Series 1999-32 Class PL, 6% 7/25/29 | 73,494 | 73,425 | |

Series 1999-33 Class PK, 6% 7/25/29 | 54,843 | 54,790 | |

Series 1999-54 Class PH, 6.5% 11/18/29 | 22,303 | 22,260 | |

Series 1999-57 Class PH, 6.5% 12/25/29 | 165,751 | 165,422 | |

Series 2001-52 Class YZ, 6.5% 10/25/31 | 8,155 | 8,233 | |

Series 2005-102 Class CO 11/25/35 (l) | 34,865 | 29,059 | |

Series 2005-73 Class SA, 17.500% x U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 3.4335% 8/25/35 (c)(d)(k) | 7,979 | 7,764 | |

Series 2005-81 Class PC, 5.5% 9/25/35 | 108,162 | 107,965 | |

Series 2006-12 Class BO 10/25/35 (l) | 167,876 | 142,266 | |

Series 2006-15 Class OP 3/25/36 (l) | 222,187 | 182,317 | |