ASSIGNMENT AND ASSUMPTION OF LOAN

This Assignment and Assumption of Loan (this “Assignment”) is dated as of the 29th day of October, 2009 (the “Effective Date”), by JDI ULTIMATE, L.L.C., a Delaware limited liability company, having an address at 852 N. Elston Avenue, Chicago, Illinois 60622 (“Assignor”), for the benefit of ULTIMATE RESORT HOLDINGS, LLC, a Delaware limited liability company, having an address at 3501 W. Vine Street, Suite 225, Kissimmee, Florida 34741 (“Assignee”).

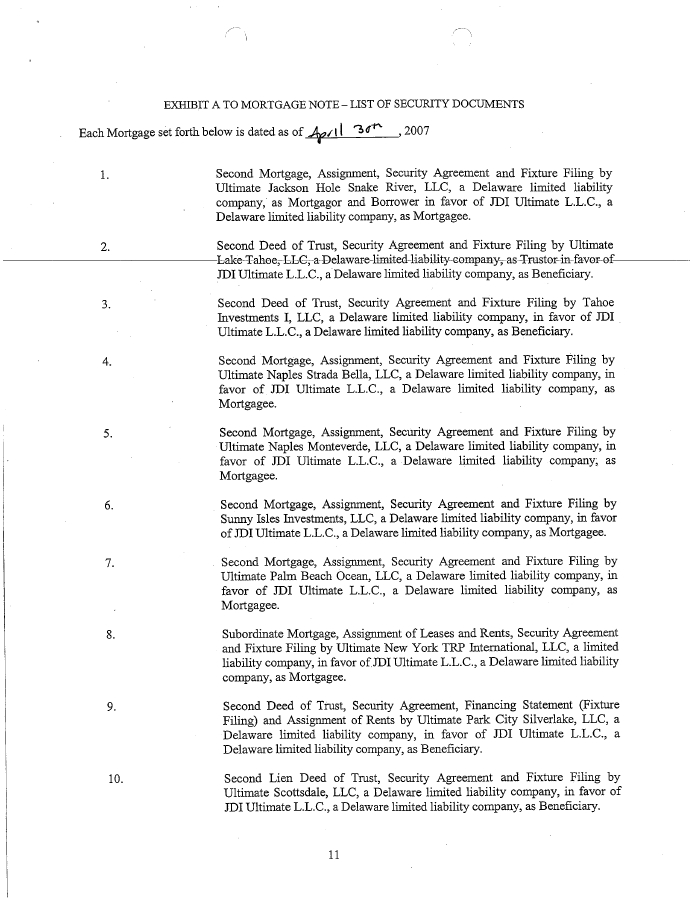

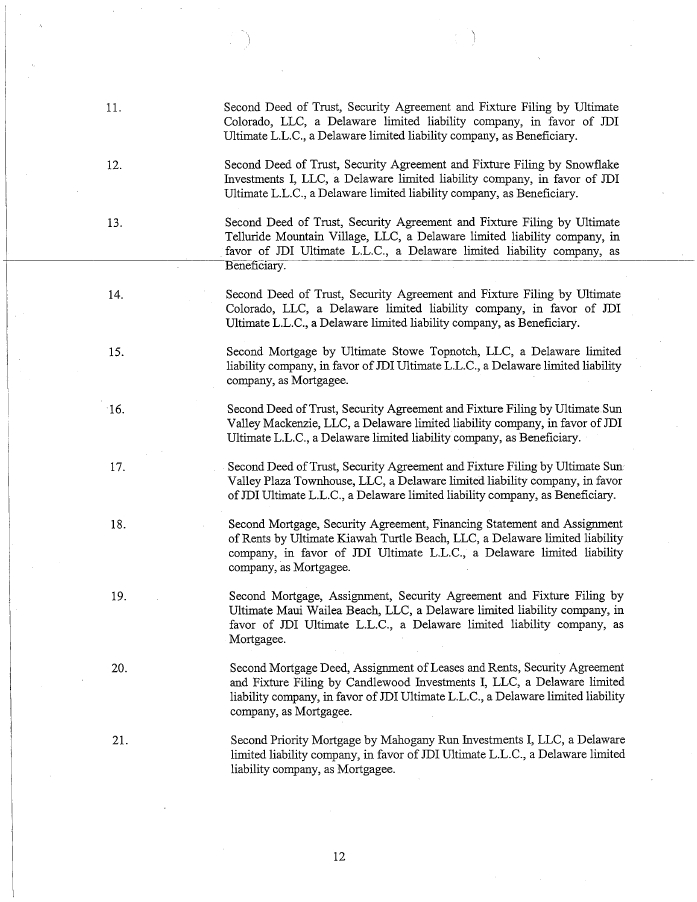

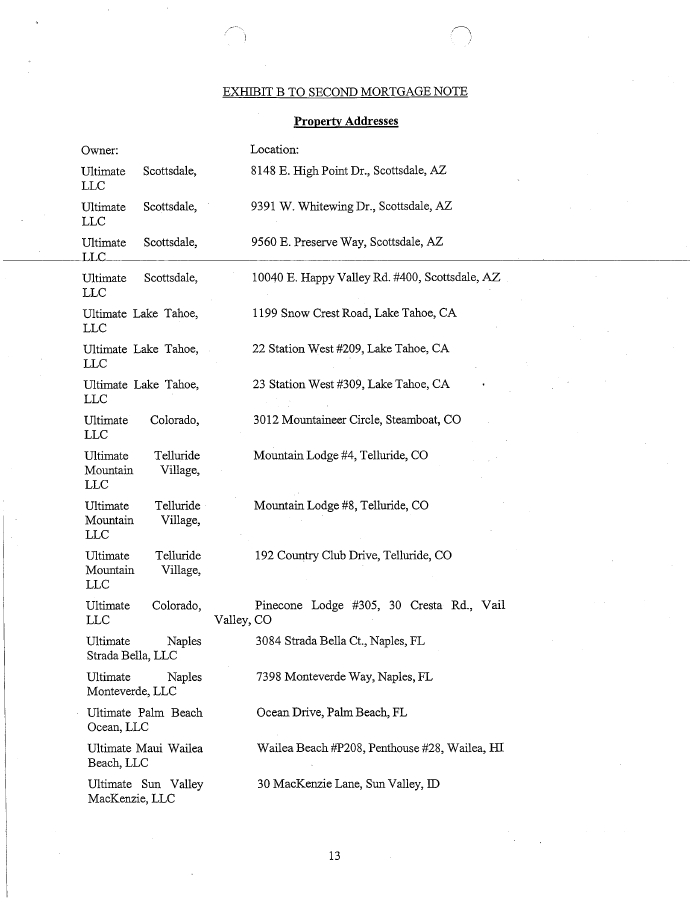

Assignor is the holder of a certain loan in the original principal amount of $10,000,000 (the “Loan”) made in favor of each of the entities listed on Schedule A attached hereto (individually and collectively the “Borrowers”), pursuant to that certain Second Mortgage Note dated April 30, 2007 (as amended and in effect from time to time, the “Note Agreement”); the Loan is guaranteed and secured by, among other things, the guarantees and security instruments listed on Schedule B attached hereto (collectively, together with the Note Agreement and all other documents, instruments and agreements from time to time executed in connection therewith, the “Note Documents”).

Assignor desires to sell, transfer and convey all of its rights, title and interests in and to the Loan, the Note Agreement, and the other Note Documents to Assignee, and Assignee desires to purchase all of Assignor’s rights, title and interests in and to the Loan, the Note Agreement and all other Note Documents, subject to Participant’s retention of an economic interest in the Loan on the terms set forth in the Participation Agreement executed by the parties concurrently with this Assignment in the form attached hereto as Exhibit C (the “Participation Agreement”).

NOW, THEREFORE in consideration of the foregoing and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Assignor and Assignee agree as follows:

1. Subject to the terms and conditions of this Assignment and in exchange for the Transferred Interests (defined below) to be assigned by Assignee to Assignor, Assignor agrees to sell, and Assignee agrees to purchase, the Loan, subject to the terms, provisions and conditions set forth in this Assignment.

2. As of the date hereof, Assignor hereby irrevocably and absolutely assigns, sells and transfers, without recourse, to Assignee, free and clear of any and all liens, encumbrances, pledges, claims, charges, equities, agreements, options or other restrictions of any kind, nature or description whatsoever (other than the restrictions contained in the Subordination Agreement and Intercreditor Agreement (as defined in the Note Agreement), all of Assignor’s right, title and interest in and to the Loan and the Note Documents subject to Assignor’s retention of its Participation Interest (as such term is defined in the Participation Agreement), and Assignee hereby agrees to and accepts same and assumes and agrees to discharge all of the obligations, responsibilities and liabilities of Assignor under the Note Documents as the holder of the Loan arising and/or accruing from and after the Effective Date. This assignment is subject to the terms of a certain Letter Agreement dated same date herewith between, among others, Assignor and Assignee (the “Letter Agreement”).

3. In consideration of such assignment, Assignee shall execute and deliver to Assignor that certain Assignment of Units (the “Assignment of Units”) in Ultimate Escapes Holdings, LLC, a Delaware limited liability company (“UEH”), assigning and transferring Assignee’s right, title, and interest to Units (as such term is defined in the Amended and Restated Operating Agreement of UEH (the “Operating Agreement”)) in UEH as set forth in Schedule I to the Operating Agreement (the “Transferred Interests”) together with all rights of a member contained therein.

4. Upon Assignor’s receipt of the Transferred Interests and amounts due under that certain Letter Agreement dated October 28, 2009, by and between Assignor, Assignee, UEH and Ultimate Resort, LLC, Assignor shall have no further right, title, or interest in the Loan or the Note Documents, and no further right to any payments thereunder, including, but not limited to, accrued interest in respect of the Loan. Assignor hereby authorizes Assignee to cause the filing of such UCC-3 amendment documents, mortgage assignments and other documents reasonably determined by Assignor as necessary to evidence the assignment of the Loan, the Note Documents and all collateral therefor to Assignee.

5. The effectiveness of this Assignment is subject to the following conditions precedent:

5.1 Conditions to Assignee’s Obligations.

(a) Assignor shall have delivered this Assignment properly executed to Assignee;

(b) Assignor shall have delivered to Assignee the original Note Agreement and all originals of the other Note Documents in Assignor’s possession, including, without limitation, all title policies relating to any mortgages securing the Loan;

(c) Assignor shall have delivered to Assignee an allonge to the Note Agreement, in the form attached hereto as Exhibit A, endorsing the Note Agreement to Assignee;

(d) Assignor shall have delivered to Assignee a release, in the form attached hereto as Exhibit B, releasing Assignee from its obligations as a borrower pursuant to the Note Agreement and Note Documents.

5.2 Conditions to Assignor’s Obligations.

(a) Assignee shall have delivered this Assignment properly executed to Assignor;

(b) Assignee shall have delivered the Assignment of Units properly executed to the Assignor; and

(c) Assignee shall have paid to Assignor all amounts required to be paid under the letter agreement referred to in Section 4 above.

6. Assignee hereby represents, warrants and covenants, to Assignor that:

6.1 Authorization; Enforcement; Validity. Assignee is a validly existing limited liability company and has the requisite power and authority to execute and deliver this Assignment, the Assignment of Units, and all other documents, instruments and agreements contemplated hereby (collectively, the “Transaction Documents”), and to perform in accordance herewith and therewith; the execution, delivery and performance of this Assignment and the other Transaction Documents (including all instruments of transfer to be delivered pursuant to this Assignment) by it and the consummation of the transactions contemplated hereby have been duly and validly authorized by all requisite action; this Assignment and the other Transaction Documents evidences its valid, binding and enforceable obligation except as such enforcement may be limited by bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditor’s rights generally and by general principles of equity (regardless of whether such enforcement is considered in a proceeding in equity or at law); and all requisite company action has been taken by it to make this Assignment valid and binding upon it in accordance with its terms.

6.2 No Brokers. Assignee has had no dealings, negotiations or consultations with any broker, salesman, finder, or other intermediary to whom compensation is due by Assignor in connection with the transaction contemplated by this Assignment.

6.3 Compliance With Other Documents. The execution and delivery of this Assignment and the other Transaction Documents by Assignee do not, and consummation of the transactions and performance of this Assignment and such other Transaction Documents will not, result in (a) a violation of or a conflict with any provision of the formation or governing documents of Assignee, (b) a violation of any statute, rule, regulation, ordinance, order, judgment, writ, injunction, or decree to which Assignee or its assets are subject or bound, or (c) a violation of or a conflict with any of the terms, covenants, conditions or provisions of, or constitute a default in respect of, any agreement, contract or instrument to which Assignee is a party or by which any of Assignee’s properties or assets is bound or to which any of them may be subject.

7. Assignor hereby represents and warrants to Assignee that:

7.1 Authorization. Assignor is a validly existing limited liability company and has the requisite power and authority to execute and deliver this Assignment and the other Transaction Documents and to perform in accordance herewith and therewith; the execution, delivery and performance of this Assignment and such other Transaction Documents (including all instruments of transfer to be delivered pursuant to this Assignment) by Assignor and the consummation of the transactions contemplated hereby have been duly and validly authorized; this Assignment and the other Transaction Documents evidences the valid, binding and enforceable obligation of Assignor except as such enforcement may be limited by bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity (regardless of whether such enforcement is considered in a proceeding in equity or at law); and all requisite company action has been taken by Assignor to make this Assignment and the other Transaction Documents valid and binding upon such Assignor in accordance with its terms.

7.2 Title. Assignor owns the Loan. The Loan, and the other Note Documents have not been assigned or pledged by Assignor and are subject to no participation interests, and Assignor has full right and authority, subject to no interest of, or agreement with, any other party, to sell and assign the same pursuant to this Assignment and the other Transaction Documents (subject to compliance with the terms of the Subordination Agreement and Intercreditor Agreement). No liens, mortgages, security interests, encumbrances or charges of any kind exist upon or with respect to the Loan or any interest therein or any Loan Document (other than the restrictions set forth in the Subordination Agreement and Intercreditor Agreement), and upon delivery and payment for the Loan, Assignee will acquire title to the Loan, free and clear of any lien, mortgage, security interest or other encumbrance (other than the restrictions set forth in the Subordination Agreement). Assignor has not used the Loan, or any interest therein, or any Loan Document as security or collateral or otherwise encumbered the Loan or any Loan Document and has not previously transferred the Loan or any interest therein to any person or entity.

7.3 Approvals. No approval, consent or authorization of the transactions contemplated by this Assignment and the other Transaction Documents from any Person or governmental agency is required which has not been obtained as of the Effective Date except as may be required by CapitalSource Finance, LLC. No filing with any governmental agency is required to be made in connection with the transactions contemplated by this Assignment which has not been made as of the Effective Date.

7.4 Compliance With Other Documents. The execution and delivery of this Assignment and the other Transaction Documents do not, and consummation of the transactions and performance of this Assignment and the other Transaction Documents will not, result in (a) a violation of or a conflict with any provision of the formation or governing documents of Assignor, (b) a violation of any statute, rule, regulation, ordinance, order, judgment, writ, injunction, or decree to which Assignor or its assets are subject or bound, or (c) a violation of or a conflict with any of the terms, covenants, conditions or provisions of, or constitute a default in respect of, any agreement, contract or instrument to which Assignor is a party or by which any of Assignor’s properties or assets is bound or to which any of them may be subject except for the Intercreditor Agreement and Subordination Agreement.

7.5 Transfer. Assignor will take all steps reasonably requested by Assignee to effect transfer of the Loan and any Note Document in Assignee’s name, including, without limitation, the execution and delivery of any assignments of mortgage or deed of trust in recordable form required by the Assignee in order to effectuate the assignment of the mortgages referenced on Schedule B attached hereto at Assignee’s cost.

7.6 No Brokers. Assignor has had no dealings, negotiations or consultations with any broker, salesman, finder, or other intermediary to whom compensation is due by Assignee in connection with the transaction contemplated by this Assignment and the other Transaction Documents.

7.7 Loan Balance. As of the Effective Date, pursuant to the terms and conditions of the Note Documents, the aggregate outstanding balance of the Loan is as follows:

| Principal | $10,000,000 |

| | |

| Accrued interest | $297,222.22 |

| | |

| Per diem | $1,388.89 |

| | |

| Fees, expenses and other amounts | $0.00 |

7.8 AS IS, WHERE IS. EXCEPT AS EXPRESSLY SET FORTH IN THIS ARTICLE 7, ASSIGNOR MAKES NO OTHER REPRESENTATIONS OR WARRANTIES REGARDING THE LOAN, NOTE OR NOTE DOCUMENTS, EACH AND ALL BEING “AS IS” “WHERE IS” INCLUDING WITHOUT LIMITATION AN EXPLCIIT DISCLAIMER REGARDING ANY COLLECTIBILITY THEREOF.

8. Assignor agrees to execute and deliver to Assignee such other documents as may be reasonably necessary in order to effectuate the transactions contemplated hereby.

8.1 Notices. All notices, demands, requests, consents, approvals and other communications (any of the foregoing, a “Notice”) required, permitted, or desired to be given hereunder shall be in writing sent by telefax (confirmed by sender with recipient) or by registered or certified mail, postage prepaid, return receipt requested or delivered by hand or reputable overnight courier addressed to the party to be so notified at its address hereinafter set forth, or to such other address as such party may hereafter. Any Notice shall be deemed to have been received: (a) three (3) days after the date such Notice is mailed, (b) on the date of sending by telefax if sent during business hours on a Business Day (otherwise on the next Business Day), (c) on the date of delivery by hand if delivered during business hours on a Business Day (otherwise on the next Business Day), and (d) on the next Business Day if sent by an overnight commercial courier, in each case addressed to the parties as follows:

| | If to Assignor: | JDI Ultimate, L.L.C. |

852 N. Elston Avenue

Chicago, Illinois 60622

Attn: Mr. Jeff Aeder

Fax: (312) 433-0555

| | with a copy to: | Fredric D. Tannenbaum, Esq. |

Gould & Ratner LLP

222 N. LaSalle Street

Suite 800

Chicago, Illinois 60601

Fax: 312-236-3241

| | If to Assignee: | c/o Ultimate Resort Holdings, LLC |

| | Attention: James M. Tousignant |

Fax: ________________

| | with a copy to: | Greenberg Traurig, LLP |

| | Boston, Massachusetts 20110 |

| | Attention: Jeffrey M. Wolf, Esq. |

9. The terms and provisions of this Assignment shall inure to the benefit of, and shall be binding upon, the successors and assigns of the parties hereto.

10. This Assignment shall be construed and enforced according to the laws of the State of New York.

11. This Agreement may be executed by facsimile or other electronic transmission and in one or more counterparts, each of which shall be deemed an original and all of which together will constitute one and the same instrument.

[SIGNATURE COUNTERPARTS FOLLOW ON SUBSEQUENT PAGE]

IN WITNESS WHEREOF, Assignor and Assignee have caused these presents to be duly executed as of the day and year first above written.

| | ASSIGNOR: JDI ULTIMATE, L.L.C., a Delaware limited liablity company | |

| | | | |

| | By: | /s/ Jeffrey Aeder | |

| | | Name: Jeffrey Aeder | |

| | | Title: Manager | |

| | | | |

| | ASSIGNEE: ULTIMATE RESORT HOLDINGS, LLC a Delaware limited liability company | |

| | | | |

| | By: | /s/ James Tousignant | |

| | | Name: James Tousignant | |

| | | Title: President and CEO | |

| | | | |

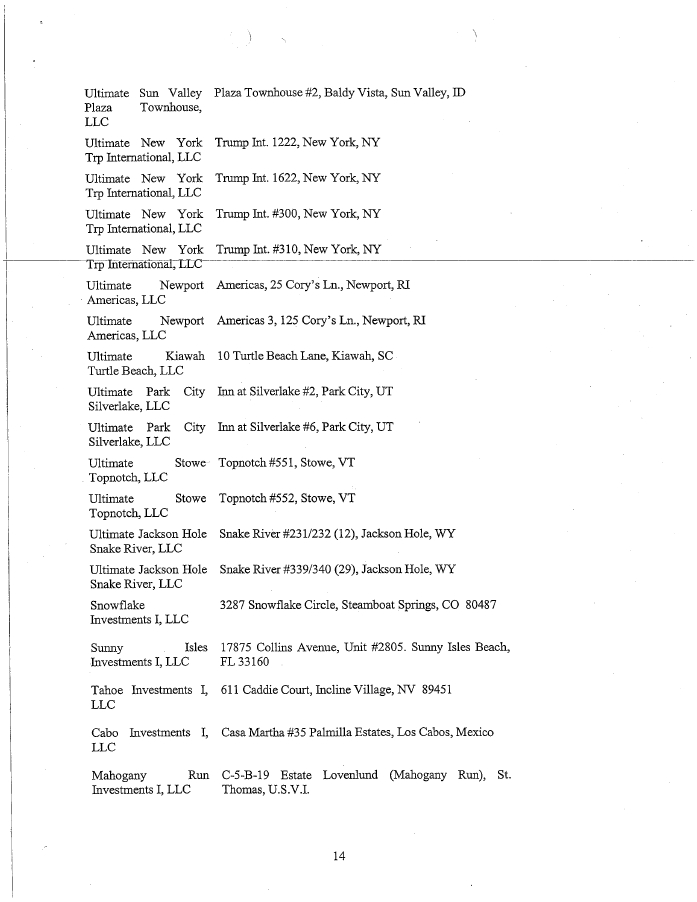

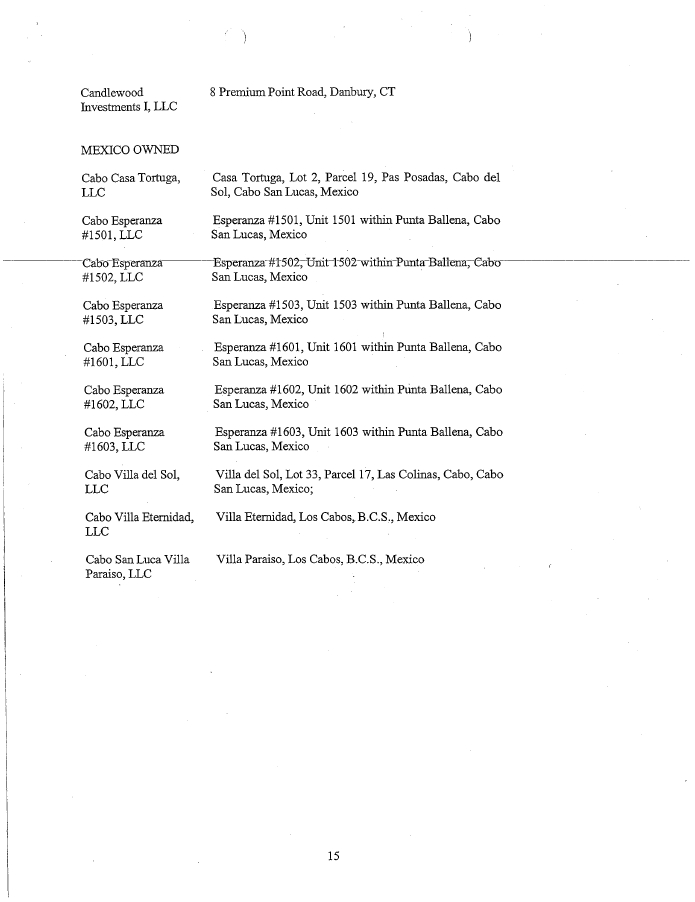

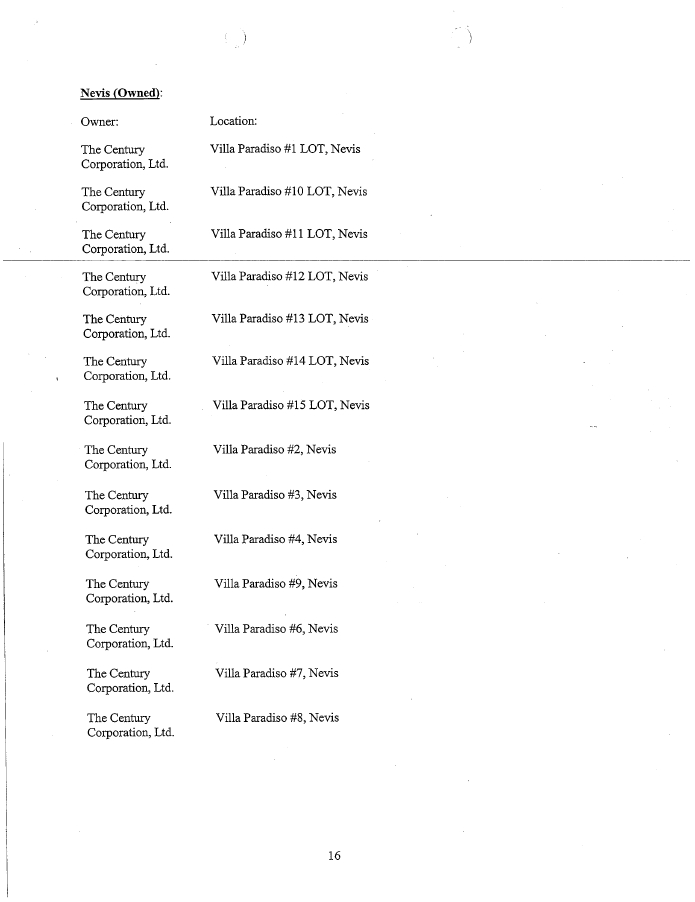

Schedule A

Borrowers

Schedule B

Exhibit A

Form of Allonge

Exhibit B

Form of Release