Prospector Capital Appreciation Fund

Prospector Opportunity Fund

Beginning on April 30, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, www.prospectorfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling (877) 734-7862.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call (877) 734-7862 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Funds.

Annual Report

| www.prospectorfunds.com | December 31, 2023 |

PROSPECTOR FUNDS, INC.

January 25, 2024

“A great business at a fair price is superior to a fair business at a great price.”

Charlie Munger

Dear Shareholders of the Prospector Capital Appreciation Fund and Prospector Opportunity Fund,

We would be remiss to not acknowledge the passing of legendary value investor, and long-time Warren Buffett partner, Charlie Munger. As has been written about many times over, Buffett credited Munger for transforming his approach to value investing – rather than looking for dirt cheap “cigar-butts,” Munger was a strong proponent of buying very good businesses at fair prices. At Prospector, we consider ourselves among the many value investors who have utilized a variation of this approach for decades. We owe a debt of gratitude to Charlie, and his contributions to the world of investing.

We entered 2023 in the midst of very restrictive monetary policy, a deeply inverted yield curve, significantly higher interest rates and the continued drying up of consumers’ post-pandemic excess savings. A Wall Street Journal survey of economists pegged the chances of a recession at 63% heading into the year. This foreboding backdrop was followed in March by the largest bank failures on record… Not the greatest setup for a bull market.

What would follow is one of the more bifurcated markets in memory – with technology stocks dominating virtually everything else. More specifically, a handful of mega-cap tech stocks, now known as the “Magnificent 7” captured headlines (and asset flows) much of the year, stemming from excitement over the prospects for artificial intelligence. These names, (which include: Microsoft, Amazon.com, Meta Platforms, Apple, Alphabet, Nvidia, and Tesla) gained an average of 105% for the year, with Apple being the laggard – up 49%. They alone contributed over 16 percentage points of the S&P 500’s 26.3% return for the year. Notably, the strength and size of these stocks masked investor unease elsewhere regarding the prospects for inflation and the economy. Indeed, the equal-weighted S&P 500 had produced a negative return through the end of October as 10-year Treasury yields peaked over 5%, fueling fears of a Fed-induced recession.

However, sentiment sharply reversed in November, when the Consumer Price Index (CPI) came in below expectations, seemingly putting an elusive “soft landing” for the U.S. economy into view. This kicked off a stock market rally, which only picked up steam in December, following what most thought was a dovish Federal Reserve meeting. Bonds rallied on expectations of an end to the Fed’s hiking cycle, and the decline in interest rates helped fuel what some have called a “dash for trash” rally, where the most levered and speculative stocks led the market. Unsurprisingly, given Prospector’s quality bias, the Funds participated in a portion of the year-end rally, but trailed on a relative basis.

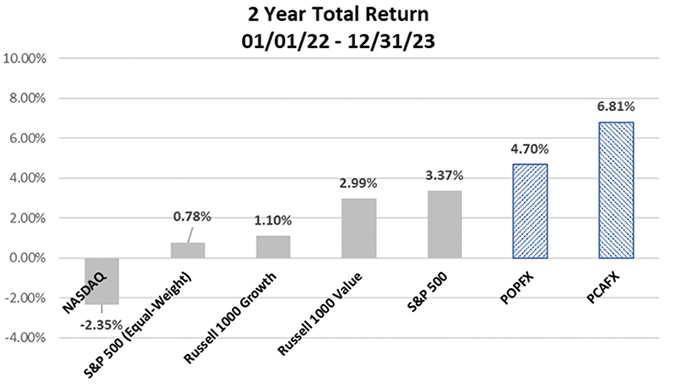

Despite the dramatic uplift in November and December, and the remarkable tech-stock rally during the year (which saw the NASDAQ return 45%, and Russell 1000 Growth Index gain 43%, outpacing its Value counterpart by over 31%), one could be forgiven had they awakened from a Rip Van Winkle-like two-year slumber, only to think not much had happened during their sleep. After all, while 2022 and 2023 both felt like wild rides at times, and had their share of volatility, cumulative returns for the aforementioned indices have been fairly unremarkable over the period (as seen in the chart below). We have also included Prospector Capital Appreciation Fund and Prospector Opportunity Fund returns for the period. We view investing as a marathon, not a sprint…over longer periods, quality companies that produce solid cash flows can often produce favorable returns (hat tip to the late Mr. Munger).

PROSPECTOR FUNDS, INC.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 877-734-7862. See Disclosure on page 6 for index descriptions.

Financial Services Update

The reemergence of inflation in recent years has had a significant impact on the insurance industry. Claims inflation from natural catastrophes, labor, repair costs and supplies, as well as legal settlements, has created a need for property-casualty (P-C) insurers to both increase their carried reserves for previously accrued claims as well as increase expected expenses for claims yet to occur. The companies have been raising prices now for years to get ahead of this significant change in loss trend. We have meaningful investments in companies who, in our view, have the ability to reserve accordingly and price at necessary levels to improve margins and returns. Insurance brokers (middle-men) have also benefited meaningfully from these price increases, as their commissions and fees have accelerated somewhat consistently with the higher premiums paid by their customers.

This new era of higher absolute interest rates has also had a meaningful impact on property-casualty investment portfolios. Insurers’ portfolios do not turnover 100% every year, but in general, property-casualty insurers’ portfolio durations tend to be about 3-4, and the benefit of investing today’s collected premiums at yields well in excess of existing portfolio yields will accrue for years to come. Insurance brokers have also benefited from the higher short-term yields attained on the “float” they manage (premiums collected from customers and remitted to insurance carriers).

Life insurance companies’ investment portfolios turn over even less rapidly than property-casualty insurers’, but the benefit does accrue to their financials as well (over a longer period of time). However, we have meaningful investments in companies whose cash generation and portfolio turnover compares favorably to others in the sector. Additionally, these companies have benefited from a meaningful normalization of mortality post the worst days of the pandemic.

PROSPECTOR FUNDS, INC.

We are pleased with how our investments in both P-C and Life insurers have performed with the aforementioned tailwinds. However, we are constantly reassessing the attractiveness of these investments versus other opportunities we find, and we have reduced our exposure in certain areas of insurance where pricing is no longer in excess of loss inflation and/or where valuations no longer appear to have room to expand. As always, we diligently strive to more heavily weight the Funds in the opportunities where we see the greatest asymmetry of returns and it is through this lens that reductions in insurance will be made.

During the second half of 2023 we added bank exposure in the Funds, which aided your participation in the late year bank rally. However, while we increased our weighting to banks over the second half of the year, both Funds remain poised to further increase exposure should potential headwinds abate.

At this point, banks have realized the majority of expected net interest margin compression. While this substantial overhang has been absorbed, there are other potential headwinds which keep us from getting significantly more bullish. The late 2023 bank rally was predicated on market optimism for a soft landing and rate cuts. This is well reflected in Street estimates for credit losses which are optimistic in nature as loss reserves remain materially below historical averages. A slowdown in the economy could result in a 15% to 25%+ reduction in forward EPS from higher loss provisioning. Other headwinds include: a modest loan growth outlook, rising capital levels, increasing regulatory costs, limited capital return, a weak M&A backdrop, non-bank market share gains and continued cost headwinds from inflation. We maintain a robust watchlist of potential ideas and patiently await a better entry point on fundamentals and valuations before we decide to further increase the Funds’ exposure.

Prospector Opportunity Fund Highlights

The Prospector Opportunity Fund increased 11.63% for the year 2023. This compared to a 17.23% increase for the Russell Midcap and a 16.93% gain for the Russell 2000 Index. Much of the relative underperformance to the benchmarks could be attributed to your portfolio’s underweight, and underperformance in technology holdings, as the Opportunity Fund’s allocation to high-quality technology companies significantly underperformed those of the benchmarks. Additionally, on a broader basis, the portfolio lagged the late-year rally, which, as discussed above, was led by lower-quality, more levered companies.

The top contributing sector to the Opportunity Fund’s performance for the year was industrials, where your portfolio of high-quality companies with exposure to automation, electrification, clean energy, and defense performed well during the year. Top contributors here included: Curtis Wright, Moog, Pentair, Carrier, and Eaton. The next top contributing sector was financial services, where the Fund’s insurance (both property-casualty and life/health) holdings, as well as insurance brokerage names, had significant gains during the period.

Prospector Capital Appreciation Fund Highlights

For the full year 2023, the Prospector Capital Appreciation Fund increased 11.34%. This compared to a 26.29% gain in the S&P 500. The majority of the relative underperformance to the S&P 500 is attributed to the Fund’s underweight, and underperformance in technology holdings given your portfolio’s allocation to high-quality technology companies significantly underperformed those of the benchmark. The Capital Appreciation Fund’s performance was more in line with the Russell 3000 Value’s 11.66% return for the year. Similar to the Opportunity Fund, on a broader basis, the Capital Appreciation Fund also had lower relative performance versus the benchmarks during the late-year rally, as our higher-quality names did not perform as well as those in the benchmarks.

PROSPECTOR FUNDS, INC.

The Capital Appreciation Fund’s return, similar to the Opportunity Fund, was led by industrials, where your portfolio of high-quality companies with exposure to automation, electrification, clean energy, and defense performed well during the year. The Fund’s largest contributors within industrials were Eaton, Pentair and Curtis Wright. Financial services was the second largest contributing sector during 2023. Property-casualty insurers and insurance brokers led performers here. Lastly, despite your portfolio’s underweight to the sector, technology was the third largest contributing sector for the period. Your portfolio’s Palo Alto convertible security (sold during the year), was the largest contributor among technology holdings.

Outlook

Since early 2022, the Federal Reserve has aggressively raised interest rates in an effort to lower inflation, causing significant uncertainty within stock and bond markets. While the rate of inflation has subsided, and the consensus appears to be we have reached an end to the Fed hiking cycle, declaring victory would be premature. The U.S. and rest of the world continue to manage the impacts of inflation, higher interest rates, and geopolitical events. In our assessment, there remains a possibility of Federal Reserve policy error and / or recession, though barring extraneous events, we still lean towards slowdown and not recession per se.

The biggest risk right now would seem to be from a “shock to the system” during this period of relative weakness while we are transitioning from the pandemic economy to a more normalized economy. Certainly, the traumatic events in Israel, and the risk of potential systemic shock that might spread from the Middle East in the months to come, keep us up at night as we are sure they do you as well. As always, with our bias towards quality, we strive to mitigate any downside, while also participating in the upside.

Meanwhile, employment remains strong. Heavy fiscal stimulus from already passed U.S. legislation for defense, infrastructure, semiconductors, and energy investment are only now beginning to be awarded. The spending will not peak until later in the decade. Relatively high energy costs in Europe, and Germany in particular, makes manufacturing here relatively more attractive. Political risk in China makes that country less attractive to do business in. All told, U.S. manufacturing is being called upon to step up. Barring a major crisis, Ronald Reagan’s termed “willing workers” should be able to find jobs…and pay their bills. Furthermore, supply / demand imbalances in the labor market suggest further wage gains to come which will partially mitigate the impact of inflation on the consumer. We expect continued pressure on housing prices as a result of higher interest rates and affordability concerns. However, the shortage of housing after over a decade of underinvestment following the Great Financial Crisis should prevent a disastrous decline in home prices. Lower-income consumers have been most impacted by the current inflationary environment, but consumer balance sheets remain generally healthy for the majority of Americans, and consumer credit quality remains strong at the moment.

While what we see argues for a more inflationary and higher interest rate environment than seen in the past ten years, it also does not argue for a recession. Nonetheless, the unexpected can occur. Should a recession happen in the near term, the factors highlighted above suggest it could be less significant than the previous two recessionary periods. We are also mindful that 2024 is an election year, the result of which could have implications on companies, sectors and the overall economy.

PROSPECTOR FUNDS, INC.

Following years of lower interest rates helping to drive ever-higher growth-stock valuations, we feel value investing is ripe for a period of outperformance. We continue to find opportunities to invest in quality businesses with solid balance sheets and cash flows, whose share prices have detached from our assessment of the fundamentals. The bargains inherent in your portfolio should attract acquirers and other investors over time.

Thank you for entrusting us with your money.

Respectfully submitted,

| | |

| Kevin R. O’Brien | Jason A. Kish | Steven R. Labbe |

Performance data quoted represents past performance; past performance does not guarantee future results.

This report must be preceded or accompanied by a prospectus.

Opinions expressed are those of the Funds and are subject to change, are not guaranteed, and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds invest in smaller and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may hold restricted securities purchased through private placements. Such securities can be difficult to sell without experiencing delays or additional costs. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. These risks are fully disclosed in the prospectus.

Growth and value investing each have unique risks and potential for rewards. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Russell 2000 Index is an unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell MidCap Index is an unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. You cannot invest directly in an index. The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The S&P 500 Equal Weighted Index (EWI) is the equal-weight version of the widely-used S&P500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance. The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000 Value Index measures the performance of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. All index returns include the effect of reinvested dividends.

Frank Russell Company “Russell” is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

Fund holdings and/or security allocations are subject to change at any time and are not recommendations to buy or sell any security. Please see the Schedule of Investments section in this report for a full listing of the Fund’s holdings.

Prospector Funds, Inc. are distributed by Quasar Distributors, LLC.

PROSPECTOR FUNDS, INC.

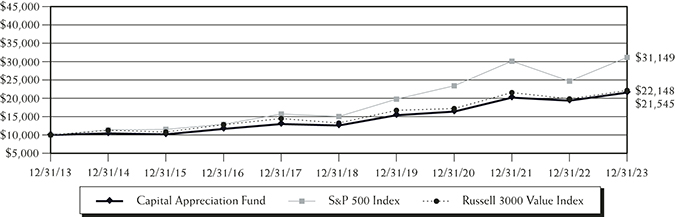

Capital Appreciation Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2.00% redemption fee on redemption of shares held 60 days or less. Performance data does not reflect the redemption fee. If reflected, total return would be reduced. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 877-734-7862. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – As of December 31, 2023

| | One Year | Three Year | Five Year | Ten Year | Since Inception(1) |

| Capital Appreciation Fund | 11.34% | 9.60% | 11.37% | 7.98% | 6.83% |

S&P 500 Index(2) | 26.29% | 10.00% | 15.69% | 12.03% | 9.41% |

Russell 3000 Value Index(3) | 11.66% | 8.81% | 10.84% | 8.28% | 6.69% |

| (1) | September 28, 2007 |

| (2) | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

| (3) | The Russell 3000 Value Index is a market-capitalization weighted index based on the Russell 3000 Index, which measures how U.S. stocks in the equity value segment perform by including only value stocks. This index cannot be invested in directly. |

The following is expense information for the Prospector Capital Appreciation Fund as disclosed in the Fund’s most recent prospectus dated April 28, 2023:

| Gross Expenses: 1.77% | Net Expenses: 1.26% |

Prospector Partners Asset Management, LLC (the “Adviser”) has contractually agreed to waive its management fees and pay Fund expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding interest, acquired fund fees and expenses, brokerage commissions and extraordinary expenses) do not exceed 1.25% of the average daily net assets of the Fund.The Adviser is permitted to recoup fee waivers and/or expense payments made in the prior three fiscal years from the date the fees were waived and/or Fund expenses were paid. The Operating Expenses Limitation Agreement is indefinite but cannot be terminated through at least September 30, 2024. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

PROSPECTOR FUNDS, INC.

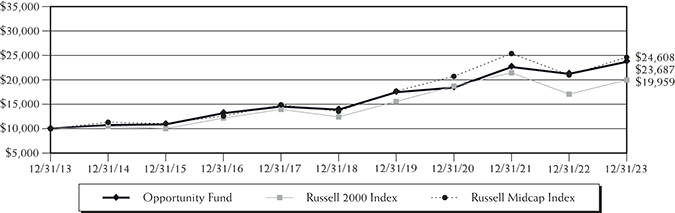

Opportunity Fund

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2.00% redemption fee on redemption of shares held 60 days or less. Performance data does not reflect the redemption fee. If reflected, total return would be reduced. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 877-734-7862. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Rates of Return (%) – As of December 31, 2023

| | One Year | Three Year | Five Year | Ten Year | Since Inception(1) |

| Opportunity Fund | 11.63% | 8.76% | 11.27% | 9.01% | 9.09% |

Russell 2000 Index(2) | 16.93% | 2.22% | 9.97% | 7.16% | 7.24% |

Russell Midcap Index(3) | 17.23% | 5.92% | 12.68% | 9.42% | 8.56% |

| (1) | September 28, 2007 |

| (2) | An unmanaged small-cap index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index. This index cannot be invested in directly. |

| (3) | An unmanaged mid-cap index that measures the performance of the 800 smallest companies in the Russell 1000 Index. This index cannot be invested in directly. |

The following is expense information for the Prospector Opportunity Fund as disclosed in the Fund’s most recent prospectus dated April 28, 2023:

| Gross Expenses: 1.35% | Net Expenses: 1.26% |

Prospector Partners Asset Management, LLC (the “Adviser”) has contractually agreed to waive its management fees and pay Fund expenses, in order to ensure that Total Annual Fund Operating Expenses (excluding interest, acquired fund fees and expenses, brokerage commissions and extraordinary expenses) do not exceed 1.25% of the average daily net assets of the Fund.The Adviser is permitted to recoup fee waivers and/or expense payments made in the prior three fiscal years from the date the fees were waived and/or Fund expenses were paid. The Operating Expenses Limitation Agreement is indefinite but cannot be terminated through at least September 30, 2024. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser.

PROSPECTOR FUNDS, INC.

Expense Example (Unaudited)

December 31, 2023

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, redemption fees, wire transfer fees, maintenance fee (IRA accounts), and exchange fees; and (2) ongoing costs, including investment advisory fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2023 – December 31, 2023).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. The example below includes, but is not limited to, investment advisory fees, shareholder servicing fees and other Fund expenses. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (07/01/23) | Value (12/31/23) | (07/01/23 to 12/31/23) |

Capital Appreciation Actual(2) | $1,000.00 | $1,061.60 | $6.50 |

| Capital Appreciation Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.90 | 6.36 |

Opportunity Actual(2) | 1,000.00 | 1,069.10 | 6.52 |

| Opportunity Hypothetical | | | |

| (5% return before expenses) | 1,000.00 | 1,018.90 | 6.36 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.25% and 1.25% for Capital Appreciation Fund and Opportunity Fund, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended December 31, 2023 of 6.16% and 6.91% for Capital Appreciation Fund and Opportunity Fund, respectively. |

PROSPECTOR FUNDS, INC.

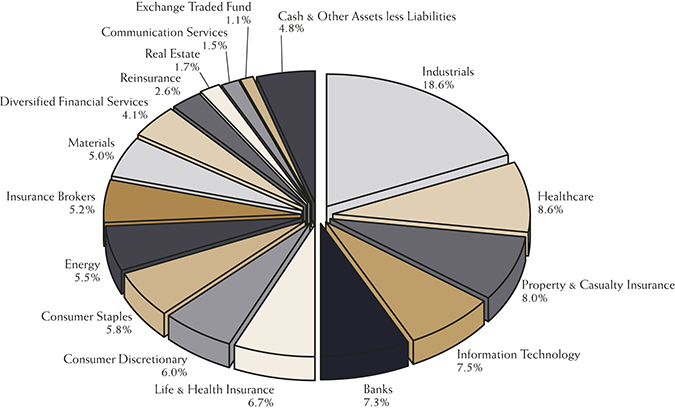

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2023(1)(2)

Capital Appreciation Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2023(1)(3)

Capital Appreciation Fund

| | Eaton | 3.8% |

| | Akamai Technologies, 0.38%, 09/01/2027 | 2.8% |

| | Globe Life | 2.7% |

| | BioMarin Pharmaceutical, 0.60%, 08/01/2024 | 2.7% |

| | Brown & Brown | 2.7% |

| | Merck & Co. | 2.6% |

| | Leidos Holdings | 2.6% |

| | Dropbox, 0.00%, 03/01/2028 | 2.5% |

| | Curtiss-Wright | 2.5% |

| | Hess | 2.5% |

| | (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. | |

| | (2) | Sector allocation includes all investment types. | |

| | (3) | First American Treasury Obligations Fund excluded from top 10 holdings. | |

PROSPECTOR FUNDS, INC.

Sector Allocation (% of net assets) (Unaudited)

as of December 31, 2023(1)(2)

Opportunity Fund

Top 10 Holdings (% of net assets) (Unaudited)

as of December 31, 2023(1)(3)

| | Curtiss-Wright | 4.2% |

| | Littelfuse | 3.5% |

| | Globe Life | 3.1% |

| | Leidos Holdings | 2.8% |

| | Primerica | 2.7% |

| | Arthur J. Gallagher & Co. | 2.6% |

| | Brown & Brown | 2.6% |

| | Fairfax Financial Holdings | 2.4% |

| | Trimble | 2.2% |

| | Carrier Global | 2.2% |

| | (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. | |

| | (2) | Sector allocation includes all investment types. | |

| | (3) | First American Treasury Obligations Fund excluded from top 10 holdings. | |

| | | | |

PROSPECTOR FUNDS, INC.

Schedule of Investments

December 31, 2023

Capital Appreciation Fund

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 75.3% | | | | | | |

| | | | | | | |

| Banks – 3.3% | | | | | | |

| Ameris Bancorp | | | 9,922 | | | $ | 526,362 | |

| First Bancorp | | | 17,985 | | | | 295,853 | |

| SouthState | | | 3,445 | | | | 290,930 | |

| | | | | | | | 1,113,145 | |

| Communication Services – 1.8% | | | | | | | | |

Alphabet, Inc. – Class A(a) | | | 4,205 | | | | 587,396 | |

| | | | | | | | | |

| Consumer Discretionary – 3.3% | | | | | | | | |

| Darden Restaurants | | | 2,355 | | | | 386,927 | |

Expedia Group(a) | | | 2,713 | | | | 411,806 | |

| Texas Roadhouse | | | 2,525 | | | | 308,631 | |

| | | | | | | | 1,107,364 | |

| Consumer Staples – 6.1% | | | | | | | | |

| Church & Dwight | | | 4,055 | | | | 383,441 | |

| Colgate-Palmolive | | | 8,700 | | | | 693,477 | |

| Mondelez International – Class A | | | 8,965 | | | | 649,335 | |

| Nestle | | | 2,555 | | | | 296,223 | |

| | | | | | | | 2,022,476 | |

| Diversified Financial Services – 3.0% | | | | | | | | |

Berkshire Hathaway – Class B(a) | | | 1,035 | | | | 369,143 | |

| Federated Hermes – Class B | | | 6,425 | | | | 217,551 | |

| Fidelity National Information Services | | | 7,095 | | | | 426,196 | |

| | | | | | | | 1,012,890 | |

| Energy – 4.5% | | | | | | | | |

| Hess | | | 5,750 | | | | 828,920 | |

| Pioneer Natural Resources | | | 3,020 | | | | 679,138 | |

| | | | | | | | 1,508,058 | |

| Health Care – 7.9% | | | | | | | | |

| Abbott Laboratories | | | 6,410 | | | | 705,549 | |

| AstraZeneca – ADR | | | 4,855 | | | | 326,984 | |

| Dentsply Sirona | | | 14,455 | | | | 514,453 | |

Hologic(a) | | | 3,400 | | | | 242,930 | |

| Merck & Co. | | | 7,875 | | | | 858,533 | |

| | | | | | | | 2,648,449 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments – Continued

December 31, 2023

Capital Appreciation Fund

Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 75.3% (Continued) | | | | | | |

| | | | | | | |

| Industrials – 14.5% | | | | | | |

| Curtiss-Wright | | | 3,805 | | | $ | 847,716 | |

| Eaton | | | 5,310 | | | | 1,278,755 | |

| Leidos Holdings | | | 7,890 | | | | 854,013 | |

| Paychex | | | 2,475 | | | | 294,797 | |

| Pentair | | | 9,205 | | | | 669,296 | |

| Raytheon Technologies | | | 5,400 | | | | 454,356 | |

| Sensata Technologies Holding | | | 11,730 | | | | 440,696 | |

| | | | | | | | 4,839,629 | |

| Information Technology – 5.7% | | | | | | | | |

| Littelfuse | | | 1,333 | | | | 356,657 | |

| Microsoft | | | 1,210 | | | | 455,008 | |

Trimble(a) | | | 14,355 | | | | 763,686 | |

Zebra Technologies – Class A(a) | | | 1,235 | | | | 337,563 | |

| | | | | | | | 1,912,914 | |

| Insurance Brokers – 5.1% | | | | | | | | |

| Arthur J. Gallagher & Co. | | | 3,630 | | | | 816,314 | |

| Brown & Brown | | | 12,520 | | | | 890,298 | |

| | | | | | | | 1,706,612 | |

| Life & Health Insurance – 3.7% | | | | | | | | |

| Globe Life | | | 7,545 | | | | 918,378 | |

| Voya Financial | | | 4,415 | | | | 322,118 | |

| | | | | | | | 1,240,496 | |

| Materials – 3.5% | | | | | | | | |

Axalta Coating Systems(a) | | | 17,295 | | | | 587,511 | |

| Louisiana-Pacific | | | 3,790 | | | | 268,446 | |

| PPG Industries | | | 2,043 | | | | 305,530 | |

| | | | | | | | 1,161,487 | |

| Property & Casualty Insurance – 8.3% | | | | | | | | |

| Fairfax Financial Holdings | | | 840 | | | | 773,440 | |

Fidelis Insurance Holdings(a) | | | 21,902 | | | | 277,498 | |

| First American Financial | | | 3,525 | | | | 227,151 | |

| Progressive | | | 2,490 | | | | 396,607 | |

| W.R. Berkley | | | 8,100 | | | | 572,832 | |

| White Mountains Insurance Group | | | 341 | | | | 513,208 | |

| | | | | | | | 2,760,736 | |

| | | | | | | | | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments – Continued

December 31, 2023

Capital Appreciation Fund

Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 75.3% (Continued) | | | | | | |

| | | | | | | |

| Real Estate – 2.1% | | | | | | |

| Four Corners Property Trust | | | 13,470 | | | $ | 340,791 | |

Howard Hughes Holdings(a) | | | 4,381 | | | | 374,795 | |

| | | | | | | | 715,586 | |

| Reinsurance – 2.5% | | | | | | | | |

| Everest Re Group | | | 1,745 | | | | 616,997 | |

| RenaissanceRe Holdings | | | 1,194 | | | | 234,024 | |

| | | | | | | | 851,021 | |

| Total Common Stocks | | | | | | | | |

| (Cost $16,926,646) | | | | | | | 25,188,259 | |

| | | | | | | | | |

| | | Par | | | | | |

| CONVERTIBLE BONDS – 17.4% | | | | | | | | |

| | | | | | | | | |

| Health Care – 3.9% | | | | | | | | |

| BioMarin Pharmaceutical, 0.60%, 08/01/2024 | | | 921,000 | | | | 907,738 | |

| NuVasive, 0.38%, 03/15/2025 | | | 445,000 | | | | 409,400 | |

| | | | | | | | 1,317,138 | |

| Industrials – 1.9% | | | | | | | | |

| Chart Industries, 1.00%, 11/15/2024 | | | 72,000 | | | | 167,314 | |

| Middleby, 1.00%, 09/01/2025 | | | 377,000 | | | | 459,186 | |

| | | | | | | | 626,500 | |

| Information Technology – 9.9% | | | | | | | | |

| Akamai Technologies, 0.38%, 09/01/2027 | | | 826,000 | | | | 919,750 | |

Dropbox, 0.00%, 03/01/2028(b) | | | 843,000 | | | | 848,269 | |

| Verint Systems, 0.25%, 04/15/2026 | | | 827,000 | | | | 726,209 | |

| Vishay Intertechnology, 2.25%, 06/15/2025 | | | 837,000 | | | | 811,726 | |

| | | | | | | | 3,305,954 | |

| Real Estate – 1.7% | | | | | | | | |

| Zillow Group, 2.75%, 05/15/2025 | | | 521,000 | | | | 572,475 | |

| Total Convertible Bonds | | | | | | | | |

| (Cost $5,551,282) | | | | | | | 5,822,067 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments – Continued

December 31, 2023

Capital Appreciation Fund

Description | | Shares | | | Value | |

| | | | | | | |

| EXCHANGE TRADED FUNDS – 0.9% | | | | | | |

Aberdeen Standard Physical Platinum Shares Fund(a) | | | 3,290 | | | $ | 299,916 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $292,393) | | | | | | | 299,916 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 6.4% | | | | | | | | |

| Money Market Funds – 6.4% | | | | | | | | |

First American Treasury Obligations Fund – Class X, 5.29%(c) | | | 2,135,365 | | | | 2,135,365 | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $2,135,365) | | | | | | | 2,135,365 | |

| Total Investments – 100.0% | | | | | | | | |

| (Cost $24,905,686) | | | | | | | 33,445,607 | |

| Liabilities in Excess of Other Assets – (0.0)% | | | | | | | (17,812 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 33,427,795 | |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Zero coupon bonds make no periodic interest payments but are issued at a discount from par value. |

| (c) | The rate shown represents the 7-day effective yield as of December 31, 2023. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments

December 31, 2023

Opportunity Fund

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 94.1% | | | | | | |

| | | | | | | |

| Banks – 7.3% | | | | | | |

| Ameris Bancorp | | | 60,824 | | | $ | 3,226,713 | |

| Citigroup | | | 64,070 | | | | 3,295,760 | |

| First Bancorp | | | 129,715 | | | | 2,133,812 | |

| Origin Bancorp | | | 49,950 | | | | 1,776,722 | |

| PNC Financial Services Group | | | 17,410 | | | | 2,695,939 | |

| SouthState | | | 19,125 | | | | 1,615,106 | |

| Stellar Bancorp | | | 77,509 | | | | 2,157,851 | |

| | | | | | | | 16,901,903 | |

| Communication Services – 1.5% | | | | | | | | |

Alphabet, Inc. – Class C(a) | | | 13,700 | | | | 1,930,741 | |

Alphabet, Inc. – Class A(a) | | | 10,575 | | | | 1,477,222 | |

| | | | | | | | 3,407,963 | |

| Consumer Discretionary – 6.0% | | | | | | | | |

| Darden Restaurants | | | 26,450 | | | | 4,345,734 | |

| eBay | | | 40,800 | | | | 1,779,696 | |

Expedia Group(a) | | | 19,040 | | | | 2,890,082 | |

| Home Depot | | | 7,850 | | | | 2,720,418 | |

| Texas Roadhouse | | | 17,610 | | | | 2,152,470 | |

| | | | | | | | 13,888,400 | |

| Consumer Staples – 5.8% | | | | | | | | |

| Church & Dwight | | | 49,900 | | | | 4,718,544 | |

| Colgate-Palmolive | | | 51,930 | | | | 4,139,340 | |

| Mondelez International – Class A | | | 63,425 | | | | 4,593,873 | |

| | | | | | | | 13,451,757 | |

| Diversified Financial Services – 4.1% | | | | | | | | |

| CBOE Global Markets | | | 21,800 | | | | 3,892,607 | |

| Federated Hermes – Class B | | | 88,025 | | | | 2,980,527 | |

| Fidelity National Information Services | | | 42,525 | | | | 2,554,477 | |

| | | | | | | | 9,427,611 | |

| Energy – 5.5% | | | | | | | | |

| Devon Energy | | | 45,850 | | | | 2,077,005 | |

| Hess | | | 13,700 | | | | 1,974,992 | |

| Pioneer Natural Resources | | | 21,197 | | | | 4,766,781 | |

| Schlumberger | | | 28,100 | | | | 1,462,324 | |

| Suncor Energy | | | 73,100 | | | | 2,342,124 | |

| | | | | | | | 12,623,226 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments – Continued

December 31, 2023

Opportunity Fund

Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 94.1% (Continued) | | | | | | |

| | | | | | | |

| Health Care – 8.6% | | | | | | |

| Abbott Laboratories | | | 44,050 | | | $ | 4,848,583 | |

| Cigna | | | 10,505 | | | | 3,145,722 | |

| Dentsply Sirona | | | 100,340 | | | | 3,571,101 | |

Henry Schein(a) | | | 34,500 | | | | 2,611,995 | |

Hologic(a) | | | 15,650 | | | | 1,118,193 | |

| Merck & Co. | | | 35,598 | | | | 3,880,894 | |

| Pfizer | | | 28,625 | | | | 824,114 | |

| | | | | | | | 20,000,602 | |

| Industrials – 18.6% | | | | | | | | |

| Carrier Global | | | 87,675 | | | | 5,036,929 | |

| Curtiss-Wright | | | 43,425 | | | | 9,674,655 | |

| Eaton | | | 8,070 | | | | 1,943,417 | |

| Leidos Holdings | | | 59,040 | | | | 6,390,489 | |

| Moog – Class A | | | 27,520 | | | | 3,984,346 | |

| Otis Worldwide | | | 43,875 | | | | 3,925,496 | |

| Pentair | | | 52,500 | | | | 3,817,275 | |

| Sensata Technologies Holding | | | 109,350 | | | | 4,108,280 | |

| Tecnoglass | | | 30,225 | | | | 1,381,585 | |

V2X(a)

| | | 58,300 | | | | 2,707,452 | |

| | | | | | | | 42,969,924 | |

| Information Technology – 7.5% | | | | | | | | |

| Littelfuse | | | 30,145 | | | | 8,065,596 | |

| Teradyne | | | 15,650 | | | | 1,698,338 | |

Trimble(a) | | | 97,295 | | | | 5,176,094 | |

Zebra Technologies – Class A(a) | | | 8,645 | | | | 2,362,938 | |

| | | | | | | | 17,302,966 | |

| Insurance Brokers – 5.2% | | | | | | | | |

| Arthur J. Gallagher & Co. | | | 27,200 | | | | 6,116,736 | |

| Brown & Brown | | | 84,950 | | | | 6,040,795 | |

| | | | | | | | 12,157,531 | |

| Life & Health Insurance – 6.7% | | | | | | | | |

| Globe Life | | | 59,250 | | | | 7,211,910 | |

| Primerica | | | 30,050 | | | | 6,183,088 | |

| Voya Financial | | | 30,600 | | | | 2,232,576 | |

| | | | | | | | 15,627,574 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments – Continued

December 31, 2023

Opportunity Fund

Description | | Shares | | | Value | |

| | | | | | | |

COMMON STOCKS – 94.1% (Continued) | | | | | | |

| | | | | | | |

| Materials – 5.0% | | | | | | |

Axalta Coating Systems(a) | | | 122,825 | | | $ | 4,172,365 | |

| Newmont Goldcorp | | | 59,600 | | | | 2,466,844 | |

| PPG Industries | | | 25,680 | | | | 3,840,444 | |

Victoria Gold(a) | | | 192,036 | | | | 1,021,632 | |

| | | | | | | | 11,501,285 | |

| Property & Casualty Insurance – 8.0% | | | | | | | | |

| Fairfax Financial Holdings | | | 6,140 | | | | 5,653,475 | |

Fidelis Insurance Holdings(a) | | | 152,376 | | | | 1,930,604 | |

| First American Financial | | | 24,180 | | | | 1,558,159 | |

| Progressive | | | 17,620 | | | | 2,806,514 | |

| W.R. Berkley | | | 57,020 | | | | 4,032,454 | |

| White Mountains Insurance Group | | | 1,744 | | | | 2,624,737 | |

| | | | | | | | 18,605,943 | |

| Real Estate – 1.7% | | | | | | | | |

Howard Hughes Holdings(a) | | | 45,950 | | | | 3,931,023 | |

| | | | | | | | | |

| Reinsurance – 2.6% | | | | | | | | |

| Everest Re Group | | | 12,550 | | | | 4,437,429 | |

| RenaissanceRe Holdings | | | 8,560 | | | | 1,677,760 | |

| | | | | | | | 6,115,189 | |

| Total Common Stocks | | | | | | | | |

| (Cost $148,778,473) | | | | | | | 217,912,897 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS – 1.1% | | | | | | | | |

Aberdeen Standard Physical Platinum Shares Fund(a) | | | 27,960 | | | | 2,548,834 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $2,393,570) | | | | | | | 2,548,834 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Schedule of Investments – Continued

December 31, 2023

Opportunity Fund

Description | | Shares | | | Value | |

| | | | | | | |

| SHORT-TERM INVESTMENTS – 4.8% | | | | | | |

| | | | | | | |

| Money Market Funds – 4.8% | | | | | | |

First American Treasury Obligations Fund – Class X, 5.29%(b) | | | 11,075,317 | | | $ | 11,075,317 | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $11,075,317) | | | | | | | 11,075,317 | |

| Total Investments – 100.0% | | | | | | | | |

| (Cost $162,247,360) | | | | | | | 231,537,048 | |

| Other Assets in Excess of Liabilities – 0.0% | | | | | | | 152,238 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 231,689,286 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate shown represents the 7-day effective yield as of December 31, 2023. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Statements of Assets and Liabilities

December 31, 2023

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| ASSETS: | | | | | | |

| Investments, at market value | | | | | | |

| (Cost of $24,905,686 and $162,247,360 respectively) | | $ | 33,445,607 | | | $ | 231,537,048 | |

| Cash | | | 3,996 | | | | — | |

| Receivable for dividends and interest | | | 37,410 | | | | 163,167 | |

| Receivable for capital shares sold | | | 100 | | | | 276,526 | |

| Prepaid expenses | | | 15,211 | | | | 21,559 | |

| Total assets | | | 33,502,324 | | | | 231,998,300 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payable to Investment Adviser, net | | | 11,198 | | | | 176,018 | |

| Payable for administration fees | | | 6,601 | | | | 38,197 | |

| Payable for audit & tax fees | | | 51,933 | | | | 51,932 | |

| Accrued distribution fees | | | — | | | | 13,565 | |

| Accrued expenses and other liabilities | | | 4,797 | | | | 29,302 | |

| Total liabilities | | | 74,529 | | | | 309,014 | |

| | | | | | | | | |

| NET ASSETS | | $ | 33,427,795 | | | $ | 231,689,286 | |

| | | | | | | | | |

| COMPOSITION OF NET ASSETS: | | | | | | | | |

| Portfolio capital | | $ | 24,926,205 | | | $ | 162,886,077 | |

| Total distributable earnings | | | 8,501,590 | | | | 68,803,209 | |

| Total net assets | | $ | 33,427,795 | | | $ | 231,689,286 | |

| | | | | | | | | |

| CAPITAL STOCK, $0.001 par value | | | | | | | | |

| Authorized | | | 500,000,000 | | | | 500,000,000 | |

| Issued and outstanding | | | 1,606,228 | | | | 9,024,639 | |

| | | | | | | | | |

| NET ASSET VALUE, REDEMPTION PRICE, | | | | | | | | |

| AND OFFERING PRICE PER SHARE | | $ | 20.81 | | | $ | 25.67 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Statements of Operations

For the Year Ended December 31, 2023

| | | Capital Appreciation Fund | | | Opportunity Fund | |

| INVESTMENT INCOME: | | | | | | |

| Interest income | | $ | 155,669 | | | $ | 720,695 | |

| Dividend income | | | 379,139 | | | | 3,400,396 | |

| Less: Foreign taxes withheld | | | (4,475 | ) | | | (35,795 | ) |

| Total investment income | | | 530,333 | | | | 4,085,296 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees | | | 287,172 | | | | 2,169,543 | |

| Audit & tax fees | | | 53,174 | | | | 53,174 | |

| Administration fees | | | 45,220 | | | | 235,210 | |

| Registration fees | | | 26,191 | | | | 34,550 | |

| Compliance expenses | | | 23,402 | | | | 23,404 | |

| Transfer agent fees | | | 21,394 | | | | 42,707 | |

| Legal fees | | | 11,709 | | | | 113,216 | |

| Distribution fees | | | 9,295 | | | | 193,263 | |

| Other expenses | | | 8,863 | | | | 25,840 | |

| Custodian fees | | | 7,014 | | | | 16,007 | |

| Directors’ fees | | | 6,908 | | | | 53,102 | |

| Fund accounting fees | | | 3,266 | | | | 4,768 | |

| Postage and printing fees | | | 1,185 | | | | 10,999 | |

| Total expenses | | | 504,793 | | | | 2,975,783 | |

| Less: Fee waivers | | | (145,828 | ) | | | (264,247 | ) |

| Total net expenses | | | 358,965 | | | | 2,711,536 | |

| NET INVESTMENT INCOME | | | 171,368 | | | | 1,373,760 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | | | | | |

| Net realized gain (loss) on investments | | | 764,890 | | | | (1,265,464 | ) |

| Net change in unrealized | | | | | | | | |

| appreciation/depreciation of investments | | | 2,340,936 | | | | 24,109,477 | |

| Net gain on investments | | | 3,105,826 | | | | 22,844,013 | |

| NET INCREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | $ | 3,277,194 | | | $ | 24,217,773 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Statements of Changes in Net Assets

| | | Capital Appreciation Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2023 | | | December 31, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 171,368 | | | $ | 159,261 | |

| Net realized gain on investments | | | 764,890 | | | | 1,084,861 | |

| Net change in unrealized appreciation/ | | | | | | | | |

| depreciation of investments | | | 2,340,936 | | | | (2,427,505 | ) |

| Net increase (decrease) resulting from operations | | | 3,277,194 | | | | (1,183,383 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 4,847,335 | | | | 736,594 | |

| Proceeds from reinvestment of distributions | | | 955,918 | | | | 1,502,026 | |

| Payments for shares redeemed | | | (2,112,791 | ) | | | (1,885,568 | ) |

| Redemption fees | | | 6,010 | | | | — | |

| Net increase from capital share transactions | | | 3,696,472 | | | | 353,052 | |

| | | | | | | | | |

| DISTRIBUTIONS PAID TO SHAREHOLDERS | | | (990,607 | ) | | | (1,563,757 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 5,983,059 | | | | (2,394,088 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 27,444,736 | | | | 29,838,824 | |

| End of year | | $ | 33,427,795 | | | $ | 27,444,736 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 240,535 | | | | 36,114 | |

| Shares issued in reinvestment of distributions | | | 47,323 | | | | 74,914 | |

| Shares redeemed | | | (104,990 | ) | | | (91,044 | ) |

| Net increase | | | 182,868 | | | | 19,984 | |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Statements of Changes in Net Assets

| | | Opportunity Fund | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2023 | | | December 31, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 1,373,760 | | | $ | 1,478,901 | |

| Net realized gain (loss) on investments | | | (1,265,464 | ) | | | 6,742,021 | |

| Net change in unrealized appreciation/ | | | | | | | | |

| depreciation of investments | | | 24,109,477 | | | | (23,067,084 | ) |

| Net increase (decrease) resulting from operations | | | 24,217,773 | | | | (14,846,162 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 16,910,139 | | | | 23,652,634 | |

| Proceeds from reinvestment of distributions | | | 1,267,736 | | | | 7,679,303 | |

| Payments for shares redeemed | | | (19,917,787 | ) | | | (38,656,260 | ) |

| Redemption fees | | | 625 | | | | 785 | |

| Net decrease from capital share transactions | | | (1,739,287 | ) | | | (7,323,538 | ) |

| | | | | | | | | |

| DISTRIBUTIONS PAID TO SHAREHOLDERS | | | (1,376,520 | ) | | | (8,373,387 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 21,101,966 | | | | (30,543,087 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 210,587,320 | | | | 241,130,407 | |

| End of year | | $ | 231,689,286 | | | $ | 210,587,320 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES: | | | | | | | | |

| Shares sold | | | 699,684 | | | | 978,935 | |

| Shares issued in reinvestment of distributions | | | 51,304 | | | | 317,458 | |

| Shares redeemed | | | (825,965 | ) | | | (1,606,706 | ) |

| Net decrease | | | (74,977 | ) | | | (310,313 | ) |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Financial Highlights

| | | Capital Appreciation Fund | |

| | | Year Ended December 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the year | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of year | | $ | 19.28 | | | $ | 21.26 | | | $ | 19.60 | | | $ | 18.80 | | | $ | 16.34 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.11 | | | | 0.11 | | | | 0.09 | | | | 0.12 | | | | 0.14 | |

| Net realized and unrealized gain (loss) on investments | | | 2.06 | | | | (0.93 | ) | | | 4.32 | | | | 1.07 | | | | 3.47 | |

| Total from operations | | | 2.17 | | | | (0.82 | ) | | | 4.41 | | | | 1.19 | | | | 3.61 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.11 | ) | | | (0.11 | ) | | | (0.20 | ) | | | (0.02 | ) | | | (0.12 | ) |

| From net realized gains | | | (0.53 | ) | | | (1.05 | ) | | | (2.55 | ) | | | (0.37 | ) | | | (1.03 | ) |

| Total distributions | | | (0.64 | ) | | | (1.16 | ) | | | (2.75 | ) | | | (0.39 | ) | | | (1.15 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of year | | $ | 20.81 | | | $ | 19.28 | | | $ | 21.26 | | | $ | 19.60 | | | $ | 18.80 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(3) | | | 11.34 | % | | | (4.07 | )% | | | 23.25 | % | | | 6.40 | % | | | 22.33 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 33,428 | | | $ | 27,445 | | | $ | 29,839 | | | $ | 26,163 | | | $ | 29,371 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.76 | % | | | 1.76 | % | | | 1.78 | % | | | 2.00 | % | | | 1.95 | % |

| After expense reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.29 | %(2) |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 0.09 | % | | | 0.07 | % | | | (0.17 | )% | | | (0.09 | )% | | | 0.08 | % |

| After expense reimbursement | | | 0.60 | % | | | 0.58 | % | | | 0.36 | % | | | 0.66 | % | | | 0.74 | % |

| Portfolio turnover rate | | | 41 | % | | | 33 | % | | | 32 | % | | | 40 | % | | | 25 | % |

| (1) | Per share amounts calculated using the Pre-ROC method of calculation. The Pre-ROC method of calculation subtracts the prior undistributed net investment income per share from the current year undistributed net investment income per share and adds in an current year income distribution amounts per share. |

| (2) | On September 5, 2019, the Adviser lowered the limit of annual operating expenses from 1.30% to 1.25% of average daily net assets. |

| (3) | Total return is a measure of the change in the value of an investment in the Fund over the years covered and assumes the reinvestment of capital gains and income distributions. Returns shown reflect waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Financial Highlights

| | | Opportunity Fund | |

| | | Year Ended December 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| For a Fund share outstanding | | | | | | | | | | | | | | | |

| throughout the year | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | |

| Beginning of year | | $ | 23.14 | | | $ | 25.63 | | | $ | 22.78 | | | $ | 22.18 | | | $ | 18.47 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.15 | | | | 0.17 | | | | 0.11 | | | | 0.13 | | | | 0.23 | |

| Net realized and unrealized gain (loss) on investments | | | 2.53 | | | | (1.71 | ) | | | 4.99 | | | | 1.06 | | | | 4.49 | |

| Total from operations | | | 2.68 | | | | (1.54 | ) | | | 5.10 | | | | 1.19 | | | | 4.72 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.03 | ) | | | (0.17 | ) | | | (0.10 | ) | | | (0.17 | ) | | | (0.23 | ) |

| From net realized gains | | | (0.12 | ) | | | (0.78 | ) | | | (2.15 | ) | | | (0.42 | ) | | | (0.78 | ) |

| Total distributions | | | (0.15 | ) | | | (0.95 | ) | | | (2.25 | ) | | | (0.59 | ) | | | (1.01 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE: | | | | | | | | | | | | | | | | | | | | |

| End of year | | $ | 25.67 | | | $ | 23.14 | | | $ | 25.63 | | | $ | 22.78 | | | $ | 22.18 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(3) | | | 11.63 | % | | | (6.20 | )% | | | 22.88 | % | | | 5.43 | % | | | 25.73 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 231,689 | | | $ | 210,587 | | | $ | 241,130 | | | $ | 224,011 | | | $ | 142,685 | |

| Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 1.37 | % | | | 1.34 | % | | | 1.34 | % | | | 1.39 | % | | | 1.50 | % |

| After expense reimbursement | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.29 | %(2) |

| Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement | | | 0.51 | % | | | 0.58 | % | | | 0.28 | % | | | 0.63 | % | | | 0.85 | % |

| After expense reimbursement | | | 0.63 | % | | | 0.67 | % | | | 0.37 | % | | | 0.77 | % | | | 1.06 | % |

| Portfolio turnover rate | | | 32 | % | | | 44 | % | | | 29 | % | | | 52 | % | | | 27 | % |

| (1) | Per share amounts calculated using the Pre-ROC method of calculation. The Pre-ROC method of calculation subtracts the prior undistributed net investment income per share from the current year undistributed net investment income per share and adds in an current year income distribution amounts per share. |

| (2) | On September 5, 2019, the Adviser lowered the limit of annual operating expenses from 1.30% to 1.25% of average daily net assets. |

| (3) | Total return is a measure of the change in the value of an investment in the Fund over the years covered and assumes the reinvestment of capital gains and income distributions. Returns shown reflect waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See Notes to the Financial Statements

PROSPECTOR FUNDS, INC.

Notes to the Financial Statements

December 31, 2023

1. ORGANIZATION

Prospector Funds, Inc. (the “Corporation”) was organized as a Maryland corporation on June 6, 2007 and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end diversified management investment company. The Corporation issues its shares in series, each series representing a distinct portfolio with its own investment objectives and policies. There are two series presently authorized, the Prospector Capital Appreciation Fund and the Prospector Opportunity Fund (individually a “Fund” and collectively the “Funds”). Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The Funds commenced operations on September 28, 2007.

2. FAIR VALUE MEASUREMENT

The following is a summary of significant accounting policies consistently followed by the Funds:

Security Valuation – The Funds have adopted fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, discounts and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Funds’ major categories of assets and liabilities measured at fair value on a recurring basis. The Funds’ investments are carried at fair value.

Common Stock – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the last bid price on the day of valuation. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Convertible and Corporate Bonds – Convertible and corporate bonds, including listed issues, are valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Convertible and corporate bonds are generally categorized in Level 2 of the fair value hierarchy.

PROSPECTOR FUNDS, INC.

Notes to the Financial Statements – Continued

December 31, 2023

Investment Companies – Investments in open-end mutual funds, including money market funds, are valued at their net asset value per share. Exchange Traded Funds (“ETFs”) are valued at the closing exchange price. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

The Board of Directors (the “Board”) has adopted a pricing and valuation policy for use by the Funds and its Valuation Designee (as defined below) in calculating the Funds’ NAV. Pursuant to Rule 2a-5 under the 1940 Act, the Funds have designated Prospector Partners Asset Management, LLC (the “Investment Adviser”) as its “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of December 31, 2023, neither the Capital Appreciation Fund nor the Opportunity Fund held any fair valued securities. As of December 31, 2023, the Funds’ investments in securities were classified as follows:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Capital Appreciation Fund | | | | | | | | | | | | |

| Common Stocks | | $ | 25,188,259 | | | $ | — | | | $ | — | | | $ | 25,188,259 | |

| Convertible Bonds | | | — | | | | 5,822,067 | | | | — | | | | 5,822,067 | |

| Exchange Traded Fund | | | 299,916 | | | | — | | | | — | | | | 299,916 | |

| Short-Term Investment | | | 2,135,365 | | | | — | | | | — | | | | 2,135,365 | |

| Total Investments | | $ | 27,623,540 | | | $ | 5,822,067 | | | $ | — | | | $ | 33,445,607 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Opportunity Fund | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 217,912,897 | | | $ | — | | | $ | — | | | $ | 217,912,897 | |

| Exchange Traded Fund | | | 2,548,834 | | | | — | | | | — | | | | 2,548,834 | |

| Short-Term Investment | | | 11,075,317 | | | | — | | | | — | | | | 11,075,317 | |

| Total Investments | | $ | 231,537,048 | | | $ | — | | | $ | — | | | $ | 231,537,048 | |

Refer to the Funds’ Schedule of Investments for further sector breakout.

The Funds may invest in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. The Funds’ investment objectives allow the Funds to enter into various types of derivative contracts, including, but not limited to, futures contracts, forward foreign exchange contracts, and purchased and written options. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements which may expose the funds to gains or losses in excess of the amounts shown on the Statements of Assets and Liabilities. As of and for the year ended December 31, 2023, the Funds held no derivative instruments.

PROSPECTOR FUNDS, INC.

Notes to the Financial Statements – Continued

December 31, 2023

3. SIGNIFICANT ACCOUNTING POLICIES

Cash – The Funds may invest a portion of their assets in cash or cash equivalents. These cash equivalents may include money market instruments, such as securities issued by the U.S. Government and its agencies, bankers’ acceptances, commercial paper, bank certificates of deposit and investment companies that invest primarily in such instruments. As of December 31, 2023, cash held by the Funds represents cash held at financial institutions, and money market instruments held were not considered to be cash equivalents and were classified as investments.

Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. The character of distributions made during the period from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. All net short-term capital gains are included in ordinary income for tax purposes.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds intend to meet the requirements of subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Funds. Therefore, no federal income or excise tax provision is required. As of December 31, 2023, the Funds did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. Generally, each of the tax years in the four-year period ended December 31, 2023 remains subject to examination by taxing authorities.

Reclassification of Capital Accounts – U.S. GAAP requires that certain components of net assets relating to permanent differences primarily related to tax equalization debits be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the fiscal year ended December 31, 2023, the Capital Appreciation Fund increased portfolio capital by $27,989 and decreased distributable earnings by $27,989. For the fiscal year ended December 31, 2023, the Opportunity Fund did not make any reclassifications. The difference between book and tax relates primarily to equalization, and reclassification of dividends.

Foreign Currency Translation – The books and records relating to the Funds’ non-U.S. dollar denominated investments are maintained in U.S. dollars on the following bases: (1) market value of investment securities, assets, and liabilities if any, are translated at the current rate of exchange; and (2) purchases and sales of investment securities, income, and expenses are translated at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate the portion of realized and unrealized gains and losses on investments in equity securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. The Funds report certain foreign currency-related transactions as components of realized gains for financial reporting purposes, whereas such components are treated as ordinary income for federal income tax purposes.

Illiquid or Restricted Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Funds. Illiquid securities may be valued

PROSPECTOR FUNDS, INC.

Notes to the Financial Statements – Continued

December 31, 2023

under methods approved by the Board as reflecting fair value. The Funds intends to invest no more than 15% of its total assets in illiquid securities. Certain restricted securities may be considered illiquid. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Board as reflecting fair value. Certain restricted securities eligible for resale to qualified institutional investors, including Rule 144A securities, are not subject to the limitation on the Funds’ investment in illiquid securities if they are determined to be liquid in accordance with procedures adopted by the Board. As of December 31, 2023, neither Funds hold Rule 144A securities. At December 31, 2023, the Funds had no investments in illiquid securities and no restricted securities. Refer to the Schedule of Investments for further detail.

Expenses – Expenses directly attributable to a Fund are charged to that Fund, while expenses attributable to more than one Fund are allocated among the respective Funds based on relative net assets or another appropriate basis.

Other – Investment and shareholder transactions are recorded on the trade date. The Funds determine the gain or loss realized from the investment transactions on the basis of identified cost. Dividend income is recognized on the ex-dividend date. Interest income, including amortization of bond premium and discount, is recognized on an accrual basis. Shareholders may be subject to a redemption fee equal to 2% of the amount redeemed if Funds’ shares are sold within 60 days or less following the date of their purchase.

Other Regulatory Matters – In October 2022, the Securities and Exchange Commission (the “SEC”) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Funds to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective on January 24, 2023. There is an 18-month transition period after the effective date of the amendment.

Market Risk Factors – In the normal course of operations and in pursuit of their investment objectives, the Funds are exposed to the following market risk factors:

| | • | Stock Market Risk, which is the chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. When the stock market is subject to significant volatility, the risks associated with an investment in the Fund may increase. Markets may experience periods of high volatility and reduced liquidity and, during such periods, the Fund may experience high levels of shareholder redemptions, and may have to sell securities at times when the Fund would otherwise not do so, potentially at unfavorable prices. |

| | | |

| | • | Convertible Securities Risk, which is the risk that, with respect to a convertible security and prior to its conversion to equity, the price of the convertible security will normally vary with changes in the price of the underlying equity security, and the convertible security will generally offer interest or dividend yields that are lower than nonconvertible debt securities of similar quality. |

| | | |

| | • | Interest Rate Risk, which is the chance that the value of debt securities overall will decline because of rising interest rates. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations, but increasing interest rates may have an adverse effect on the value of the Funds’ investment portfolio as a whole. The Funds may be subject to a greater risk of rising interest rates than would normally |

PROSPECTOR FUNDS, INC.

Notes to the Financial Statements – Continued

December 31, 2023

| | | be the case due to the recent end of a period of historically low rates and the effects of potential central bank monetary policy, and government fiscal policy, initiatives and resulting market reactions to those initiatives. |

| | | |

| | • | Income Risk, which is the chance that the Funds’ income will decline because of falling interest rates. |

| | | |