A. Highlights and Business Units

A.1 Business Units

As we have done in prior quarters, we will continue to present a specific section for each business unit, including their key operating data, and an analysis of the results, from net revenue to EBITDA.

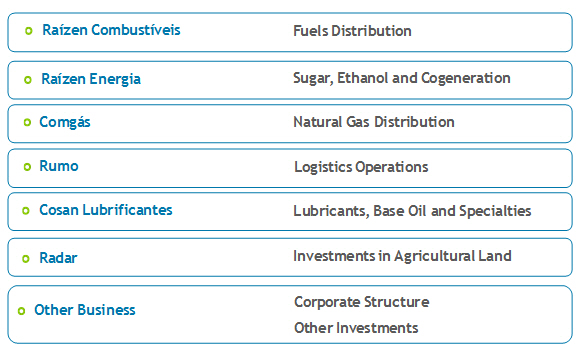

Our business units (reportable segments) are organized as follows:

| Earnings Release

1st Quarter of Fiscal Year 2014 |

A.2 Cosan Consolidated Result

For Cosan‘s Consolidated financial information, we considered 100% of the results of Comgás, Rumo, Cosan Lubrificantes, Radar, and Other Businesses. Starting April 1, 2013, with the adoption of IFRS 11, Raízen Energia e Combustíveis’s results are reported in the “Equity Pick-up” line, considering a proportionate interest (50%) in the result. Adjustments and Eliminations represent intercompany balances and transactions.

EBITDA reported herein is in compliance with CVM Rule 527/12, published by the Brazilian Securities and Exchange Commission on October 4, 2012, and may differ from the amounts disclosed in prior periods due to equity accounting adjustment. Consequently, the EBITDA now consists of operating profit before financial expenses, plus depreciation, amortization and equity pick-up.

| EBITDA (Reconciliation ICVM 527) | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Net Income | 256.1 | 27.1 | n/a |

| (-) Equity Pick-up | (221.8) | (92.6) | n/a |

| (-) Income from Discontinued Operations | - | 3.4 | n/a |

| (+) Minority Shareholders | 51.8 | 84.8 | -38.9% |

| (+) Income Taxes | 59.6 | 139.2 | -57.2% |

| (+) Net Financial Expense (Revenue) | 106.2 | 177.5 | -40.2% |

| (+) Depreciation and Amortization | 160.4 | 159.4 | 0.6% |

| EBITDA (before ICVM 527) | 412.3 | 498.9 | -17.4% |

| (+) Equity Pick-up | 221.8 | 92.6 | n/a |

| EBITDA (after ICVM 527) | 634.1 | 591.5 | 7.2% |

| (+) Reclassification of Discontinued Operations² | - | (3.4) | n/a |

| (-) Gross effect of Raízen formation | - | - | n/a |

| Adjusted EBITDA (after ICVM 527) | 634.1 | 588.1 | 7.8% |

Note 2: Due to the sale of the sugar t retail business represented by Cosan Alimentos, the Company reclassified this unit’s results to discontinued operations, as required by accounting rules IFRS5/CPC31 – Non-current Asset Held for Sale and Discontinued Operation.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Below we report the results for 1Q14 for each business unit for all segments detailed above. All information reflect 100% of their financial performance, regardless of Cosan’s interest.

For purposes of consolidated EBITDA reconciliation, the Adjustments and Eliminations column refers to the elimination of net incomes from businesses controlled by Cosan for consolidation purposes. The same adjustment is applied when we consider Raízen’s results for EBITDA calculation.

Results by Business Unit 1Q14 | Comgás | Rumo | Cosan Lubricants | Radar | Other Businesses | Adjusts and Eliminations | Consolidated | Raízen Combustíveis | Raízen Energia | 50% Raízen | Adjusts and Eliminations | Consolidated Pro forma |

| Net Revenue | 1,517.4 | 207.9 | 368.3 | 63.6 | 0.1 | - | 2,157.2 | 13,011.0 | 2,604.8 | (7,807.9) | (371.6) | 9,593.4 |

| Cost of Goods and Services | (1,069.0) | (123.5) | (290.0) | (38.3) | 0.0 | - | (1,520.8) | (12,340.7) | (2,113.0) | 7,226.8 | 371.6 | (8,376.0) |

| Gross Profit | 448.4 | 84.4 | 78.3 | 25.2 | 0.1 | - | 636.4 | 670.3 | 491.9 | (581.1) | - | 1,217.5 |

| Gross Margin(%) | 29.6% | 40.6% | 21.3% | 39.7% | 118.1% | n/a | 29.5% | 5.2% | 18.9% | 7.4% | - % | 12.7% |

| Selling Expenses | (150.3) | - | (56.3) | - | - | - | (206.6) | (283.5) | (163.2) | 223.3 | - | (430.0) |

| General and Administrative Expenses | (67.1) | (20.0) | (17.4) | (8.4) | (32.3) | - | (145.1) | (105.1) | (140.4) | 122.7 | - | (267.8) |

| Other Operating Revenues (Expenses) | (7.1) | 6.7 | 0.4 | (23.0) | (9.7) | - | (32.8) | 101.8 | 60.2 | (81.0) | - | 48.2 |

| Equity Pick-up | - | (0.0) | (1.3) | 0.0 | 369.8 | (146.7) | 221.8 | 5.3 | (10.4) | 2.6 | (235.2) | (16.0) |

| Depreciation and Amortization | (118.2) | (21.7) | (19.5) | (0.2) | (0.7) | - | (160.4) | (132.5) | (495.9) | 314.2 | - | (474.5) |

| EBITDA | 342.0 | 92.8 | 23.2 | (5.9) | 328.6 | (146.7) | 634.1 | 521.2 | 734.0 | (627.6) | (235.2) | 1,026.4 |

| EBITDA Margin (%) | 22.5% | 44.7% | 6.3% | -9.3% | n/a | n/a | 29.4% | 4.% | 28.2% | 8.% | - % | 10.7% |

| Earnings Release

1st Quarter of Fiscal Year 2014 |

B. Result by Business Unit

B.1 Raízen Combustíveis

Below you will find the results of Raízen Combustíveis, the business unit that distributes and trades fuels through a network of franchised Shell service stations, in addition to supplying fuels to industrial clients and distributing aviation fuel.

Following the adoption of IFRS 11 – Joint Arrangements, starting in April 2013 Cosan no longer consolidates Raízen in its balance sheet, statement of income and cash flows, and the result from this business unit has been reported under “Equity Accounting Result” ever since. Given Raízen’s materiality in Cosan’s financial information, we will report this segment’s performance separately.

Net Revenue

| Sales Breakdown | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Fuel Sales | 13,011.0 | 10,947.1 | 18.9% |

| Ethanol | 930.2 | 658.0 | 41.4% |

| Gasoline | 5,147.6 | 4,406.8 | 16.8% |

| Diesel | 5,435.3 | 4,463.8 | 21.8% |

| Aviation | 1,339.8 | 1,277.1 | 4.9% |

| Other Products | 158.1 | 141.4 | 11.8% |

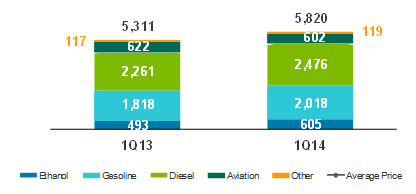

Raízen Combustíveis’ net revenue of 1Q14 grew 18.9% year-over-year to R$13.0 billion, chiefly due to the 9.6% increase in total fuel sales volume in the period, higher than the market’s growth, according to ANP data, especially ethanol and gasoline, which grew by 22.7% and 11.0% respectively.

This increase in volume sold is mainly due to the expansion of the network of service stations and the growth of the vehicle fleet between quarters. Additionally, the average price of products sold rose 8.5% year-over-year, basically due to the rise in Gasoline and Diesel prices by Petrobrás in 2013 as well as the average price of ethanol in the period.

The rise in Gasoline prices increased Ethanol’s competitiveness in only three Brazilian states (Mato Grosso, Paraná and São Paulo) where the parity between Ethanol and Gasoline prices remained below 70% in the quarter.

In the aviation segment, despite the lower volume sold in 1Q14 (3.1% lower compared to 1Q13), the average price grew by 8.3%, resulting in an increase of 4.9% in net revenue.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

The network of Shell service stations ended 1Q14 with nearly 4,970 stations and 900 convenience stores.

Fuels

Volume (million liters) and Average Unit Price (R$/cbm)

Inventories

| Fuels Inventories |

| | 03/31/2014 | 03/31/2014 | Chg. % |

| 000' cbm | 459.8 | 443.9 | 3.6% |

| R$'MM | 942.0 | 906.9 | 3.9% |

| R$/cbm | 2,048.9 | 2,042.8 | 0.3% |

Cost of Goods Sold

| COGS | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Fuel Sales | (12,340.7) | (10,351.6) | 19.2% |

In 1Q14, Raízen Combustíveis’ cost of goods sold totaled R$12.3 billion, an increase of 19.2% compared to 1Q13, mainly due to the higher volume sold and price increases.

Gross Profit

| Gross Profit | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Gross Profit | 670.3 | 595.5 | 12.6% |

| Gross Margin (%) | 5.2% | 5.4% | -0.2 p.p. |

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Gross profit in 1Q14 totaled R$670.3 million, an increase of 12.6% compared to the R$595.5 million recorded in 1Q13. Gross margin in the quarter was 5.2%, in line with the same period last year.

Selling, General, and Administrative Expenses

| SG&A Expenses | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Selling Expenses | (283.5) | (265.8) | 6.6% |

| G&A Expenses | (105.1) | (92.6) | 13.5% |

| Other Operational Revenues/Expenses | 101.8 | 67.3 | 51.2% |

Raízen Combustíveis’ selling expenses totaled R$283.5 million in 1Q14, 6.6% higher compared to 1Q13, mainly due to the increase of fuel sales volume in the period, which raises freight and logistics costs.

General and administrative expenses were R$105.1 million in 1Q14, up 13.5% compared to 1Q13, due to the increase in personnel expenses, mainly because of the collective wage agreement applied in the period.

Other operating revenues and expenses include merchandising fees, convenience store royalties, revenue from leases, fees for the sale of lubricants at Raízen Combustíveis services stations, and revenues from the sale of assets, and totaled R$101.8 million in 1Q14.

EBITDA

| EBITDA | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| EBITDA | 521.2 | 422.9 | 23.2% |

| EBITDA Margin (%) | 4.0% | 3.9% | 0.1 p.p. |

Raízen Combustíveis’s EBITDA was R$521.2 million in 1Q14, an increase of 23.2% over 1Q13. EBTIDA margin was 4.0%, up 0.1 p.p. compared to 1Q13.

Capex

| CAPEX | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| CAPEX | 277.8 | 153.5 | 81.0% |

Raízen Combustíveis’s capex totaled R$277.8 million in 1Q14, 81.0% higher than 1Q13. The main expenses are related to accelerated conversion of service stations in the period, as well as expenses with logistics, distribution and trading initiatives.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

As mentioned in the previous quarters, the reseller network growth model is chiefly based on bonuses for the achievement of volume targets. The bonus is accounted for as deduction from gross revenue, and totaled R$22.0 million in 1Q14, adversely impacting EBITDA. In 1Q13 bonus payment amounted to R$17.9 million.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

B.2 Raízen Energia

The following are the results for Raízen Energia, whose core business is the production and sale of a variety of products derived from sugarcane, including raw sugar (Very High Polarization - VHP), anhydrous and hydrous ethanol, as well as activities related to energy cogeneration from sugarcane bagasse and ethanol trading.

As mentioned in prior quarters, after adopting IFRS 11 – Joint Arrangements, Cosan no longer consolidates Raízen in its balance sheet, statement of income and cash flows, and the result from this business unit has been reported under “Equity Accounting Result” ever since. Given Raízen’s materiality in Cosan’s financial information, we will report this segment’s performance separately.

In this release, we are reporting Raízen Energia’s performance for the first quarter of 2014 as well as over the twelve month period to March 2014, which includes the end-of-crop results for the 2013/14 season. For comparison purposes, the crop for the same period of 2013/14 will also be presented.

Production Figures

Central-South Region

During the first quarter of 2014, the South Central region sugarcane producing regions of Brazil experienced severe drought, mainly in São Paulo state. In the period, rainfall was 28% lower than the average.

In 1Q14, mills in the South Central region of Brazil finished the crop and crushed a marginal volume of 1.6 million tons of sugarcane. The total recorded at harvest was 596 million tons of sugarcane, which represents a new crushing record in the sector and a growth of 12% compared to the previous crop.

Brazil’s drought in 1Q14, coupled with the high prices of ethanol and the volume of cane that was available but not processed in last year’s crops by some mills, led some units to start operations in mid-March for the crop of 2014/15.

During the 2013/14 crop, the region processed 596 million tons, and allocated 45.2% to sugar production, totaling a volume of 34.3 million tons compared to 34.1 million in 2012/13. Meanwhile, a total of 25.6 billion liters of ethanol were produced. Of this amount, 44% was anhydrous ethanol (approximately 11 billion liters), while hydrous ethanol totaled 14.6 billion liters (56%).

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Raízen Energia

In 1Q14, Raízen Energia operated 24 sugar, ethanol and energy cogeneration mills, with a crushing capacity of 65.5 million tons of sugarcane per crop year.

| 1Q14 | 1Q13 | Operational Figures | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | | (Apr/13-Mar/14) | (Apr/12-Mar/13) | Var. % |

| - | - | Crushed Sugarcane | 61,441 | 56,221 | 9.3% |

| - | - | Own (‘000 tons) | 31,009 | 28,299 | 9.6% |

| - | - | Suppliers (‘000 tons) | 30,432 | 27,922 | 9.0% |

| - | - | Sugarcane TRS (kg/ton) | 131 | 134 | -2.0% |

| - | - | Mechanization (%) | 94.8% | 91.7% | 3.1 p.p. |

| | | Production | | | |

| - | - | Sugar | 4,493 | 4,162 | 8.0% |

| - | - | Raw Sugar (‘000 tons) | 2,991 | 2,575 | 16.2% |

| - | - | White Sugar (‘000 tons) | 1,502 | 1,587 | -5.4% |

| - | - | Ethanol | 2,037 | 1,903 | 7.1% |

| - | - | Anhydrous Ethanol (‘000 cbm) | 987 | 833 | 18.5% |

| - | - | Hydrous Ethanol (‘000 cbm) | 1,050 | 1,070 | -1.8% |

All Raízen Energia mills ended activities in December 2013, and therefore there was no crushing or production in 1Q14.

The volume of cane crushed during the 2013/14 crop totaled 61.4 million tons, an increase of 9.3% compared to the 56.2 million tons of cane crushed in the 2012/13 crop. Nearly 49.5% of the crushed amount was third-party sugarcane while 50.5% was own sugarcane, including agricultural partners.

In the crop 2013/14, 94.8% of own sugarcane was harvested mechanically and the TRS of the sugarcane reached 130.9 kg/ton, down 2.0% year-over-year mainly due to unfavorable weather conditions during the harvest, causing the concentration of total sugars in the harvested cane to be diluted.

Agricultural productivity - measured in tons of sugarcane per hectare (TCH) - reached 83.9 t/ha in the 2013/14 crop, an increase of 3.5% compared to the 2012/13 crop, which reached 81.1 t/ha.

The average age of the sugarcane fields reached 3.1 years, reflecting the appropriate renewal of the own sugarcane plantation areas during the crop 2013/2014. The production mix was concentrated in sugar again, with 58.0% of sugarcane crushed used to make this product, totaling 4.5 million tons of sugar and 2.0 billion liters of ethanol produced.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Net Revenue

| 1Q14 | 1Q13 | | Sales Breakdown | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | Chg.% | Amounts in R$ MM | (Apr/13-Mar/14) | (Apr/12-Mar/13) | Chg.% |

| 2,604.8 | 2,350.4 | 10,8% | Net Operating Revenue | 9,455.2 | 8,468.2 | 11.7% |

| 1,225.5 | 1,176.7 | 4.1% | Sugar Sales | 4,353.1 | 4,354.0 | 0.0% |

| 270.9 | 198.3 | 36.6% | Domestic Market | 940.4 | 899.2 | 4.6% |

| 954.5 | 978.4 | -2.4% | Foreign Market | 3,412.7 | 3,454.8 | -1.2% |

| 1,321.3 | 1,123.3 | 17.6% | Ethanol Sales | 4,464.5 | 3,313.3 | 34.7% |

| 663.9 | 528.9 | 25.5% | Domestic Market | 2,379.3 | 1,328.4 | 79.1% |

| 210.1 | 323.2 | -35.0% | Foreign Market | 868.7 | 1,266.2 | -31.4% |

| 447.2 | 271.2 | 64.9% | Trading | 1,216.5 | 718.8 | 69.2% |

| 27.3 | 13.1 | n/a | Energy Cogeneration | 403.8 | 569.7 | -29.1% |

| 30.8 | 37.2 | -17.2% | Other Products and Services | 233.8 | 231.2 | 1.1% |

Raízen Energia’s net revenue in 1Q14 totaled R$2.6 billion, an increase of 10.8% compared to 1Q13, when the reported revenue was R$2.4 billion.

The main reasons for the net revenue increase during the quarter was the higher volume of all products sold, as well as an increase in the average ethanol prices, both domestic and foreign markets, and energy (electricity) prices.

In the 2013/14 crop, net revenue reached R$9.5 billion, compared to the R$8.5 billion recorded in 2012/13, an increase of 11.7% between crops, mainly due to the higher volume of sales and higher average price of ethanol in the period.

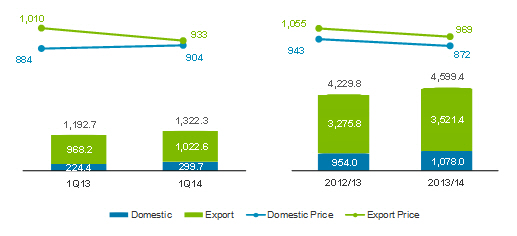

Sugar Sales

In 1Q14, net revenue from sugar sales totaled R$1.2 billion, 4.1% higher than reported in 1Q13. Sugar sales accounted for 47.0% of Raízen Energia’s overall net revenue in 1Q14.

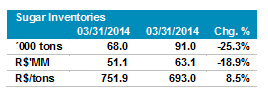

During the quarter, the total volume of sugar sold was 1.3 million tons, an increase of 10.9% compared to 1Q13, generating an effect equivalent to R$127.9 million in net revenue. This increase was partially offset by a decrease of 6.1% in the average price, which went from R$986.6/t in 1Q13 to R$926.8/t in 1Q14. This lower average price is due a decrease in sugar sales to the foreign market in 1Q14 (77.3% compared to 81.2% in 1Q13). The devaluation of the Brazilian real against the US dollar and Raízen’s successful fixed price strategy offset lower commodity prices.

Net revenue from sugar sales in the 2013/14 crop finished in line with the crop in 2012/13, totaling R$4.4 billion. There was an increase of 8.7% in the total volume of sugar sold during the 2013/14 crop, mainly in the domestic market, which grew 13.1% year-over-year, impacted by the lower average prices in the 2013/14 crop - both in the domestic and foreign markets.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Sugar

Volume Sold (‘000 tons) and Average Unit Price (R$/ton)

Sugar Inventories

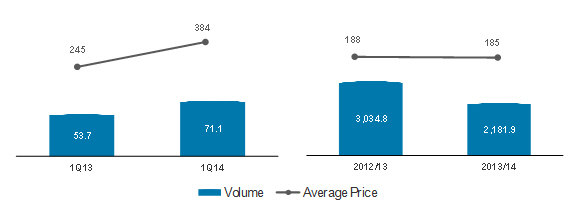

Net revenue from ethanol sales in 1Q14 reached R$1.3 billion, 17.6% up from 1Q13 (R$1.1 billion). Ethanol sales accounted for 50.7% of Raízen Energia. This increase is explained by the rise of 6.9% in sales volumes, and the increase of 10.0% of the average price, which was up from R$1.424/cbm in 1Q13 to R$1.566/cbm in 1Q14.

Sales of ethanol in the domestic market reached 55.8% of total sales in 1Q14, mainly driven by the higher demand that caused an increase from 20% to 25% in the mandatory mix of ethanol in gasoline, and the increased competitiveness of hydrous ethanol versus gasoline in three Brazilian states (Mato Grosso, Paraná and São Paulo).

Ethanol exports were lower in 1Q14 year-over-year due to a lower demand from the international market, and to the stronger competitiveness of corn ethanol, produced in the United States.

Net revenue from ethanol sales in the 2013/14 crop totaled R$4.5 billion compared to R$3.3 billion in the 2012/13 crop, an increase of 34.7% year-over-

| Earnings Release

1st Quarter of Fiscal Year 2014 |

year. This growth is mostly due to the higher volume sold of 32.0%, as well as the increase of 2.1% in the average price.

Net revenue from ethanol trading operations totaled R$1.2 billion in the 2013/14 crop, 69.2% higher than reported in the 2012/13 crop, due to the higher volume handled, which totaled approximately 679 million liters, representing an increase of 110.8% compared to the 2012/13 crop.

Ethanol

Volume Sold (million liters) and Average Unit Price (R$/cbm)

Ethanol Inventories

| Ethanol Inventories |

| | 03/31/2014 | 03/31/2013 | Chg. % |

| ´000 cbm | 108.0 | 61.0 | 77.2% |

| R$'MM | 124.5 | 71.4 | 74.5% |

| R$/cbm | 1,153.0 | 1,170.0 | -1.4% |

Energy Cogeneration

All of Raízen Energia’s 24 mills generate energy and are self-sufficient, and 13 sell surplus energy from cogeneration.

In 1Q14, net revenue from energy sales totaled R$27.3 million, an increase of 107.5% compared to 1Q13, when the value reported was R$13.1 million. During the quarter, total energy sold increased by 32.4%, reaching 71,100 MWh, reflex of extended cogeneration initiatives in the period between harvests. The average price was R$384/MWh, 56.8% higher than the average price in 1Q13, due to the higher volume of transactions in the spot market in 1Q14.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

In the 2013/14 crop, net revenue from energy sales totaled R$403.8 million, a decrease of 29.1% compared to the 2012/13 crop, when the reported value was R$569.7 million. The decrease in net revenue was mainly due to a 28.1% drop in the volume sold, as well as in the average price, going from R$188/MWh in the 2012/13 crop to R$185/MWh in the 2013/14 crop.

Electric Energy

Volume Sold (’000 MWh) and Average Unit Price (R$/MWh)

Other Products and Services

In 1Q14, net revenue from other products and services totaled R$30.8 million, down 17.2% year-over-year. In the 2013/14 crop, this revenue totaled R$233.8 million, 1.1% lower than reported in the 2012/13 crop. These revenues are relative to the sale of sugarcane, steam, molasses and raw materials to service providers in the agricultural industry.

Cost of Goods Sold

Raízen Energia's cost of goods sold is reported together with the average unit costs, net of the effects of depreciation and amortization (cash cost).

| 1Q14 | 1Q13 | | COGS per Product | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | Chg. % | Amounts in R$ MM | (Apr/13-Mar/14) | (Apr/12-Mar/13) | Chg. % |

| (2,113.0) | (2,091.0) | 1.1% | Cost of Goods Sold | (7,703.0) | (6,881.9) | 11.9% |

| (958.4) | (825.6) | 16.1% | Sugar | (3,276.0) | (2,997.4) | 9.3% |

| (721.2) | (730.5) | -1.3% | Ethanol | (2,787.9) | (2,317.9) | 20.3% |

| (428.4) | (273.2) | 56.8% | Trading | (1,170.0) | (705.5) | 65.8% |

| (14.9) | (10.9) | 36.6% | Energy Cogeneration | (163.6) | (399.0) | -59.0% |

| 10.0 | (250.7) | n/a | Others | (305.5) | (462.0) | -33.9% |

| | | | Average Unitary Costs² | | | |

| (529.9) | (505.2) | 4.9% | Cash Cost of Sugar (R$/ton) | (511.6) | (493.4) | 3.7% |

| (834.1) | (816.5) | 2.2% | Cash Cost of Ethanol (R$/’000 liters) | (852.7) | (775.4) | 10.0% |

Note 2: Average unit costs represent the cash cost, which is net of plantation and cultural treat depreciation and amortization, agricultural depreciation (machinery and equipment), industrial depreciation, and harvest off-season maintenance.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Raízen Energia’s cost of goods sold was R$2.1 billion in 1Q14, in line with the value reported in the same period last year. In the 2013/14 crop, the cost of goods sold totaled R$7.7 billion, 11.9% higher than in the 2012/13 crop, mainly due to the higher volumes of sugar and ethanol sold.

Also, the lower dilution of fixed costs caused by a decrease of 1.9% in the TSR level, which went from 133.4 kg/ton in the 2012/13 crop to 130.9 kg/ton in the 2013/14 crop, directly impacted the sugarcane cost.

The unit cost of products made by Raízen Energia was also impacted by the following factors:

| · | Decrease in the cost of the TSR kilo released by CONSECANA of 3.3%, from R$0.4728 in 1Q13 to R$0.4572 in 1Q14; |

| · | Increase in the agricultural productivity of sugarcane fields, represented by a higher TCH (ton of cane per hectare) level of 83.9 in the 2013/14 crop compared to 81.1 in the 2012/13 crop. |

Gross Profit

| 1Q14 | 1Q13 | | Gross Profit and Gross Margin | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | Chg. % | Amounts in R$ MM | (Apr/13-Mar/14) | (Apr/12-Mar/13) | Chg. % |

| 491.9 | 259.4 | 89.6% | Gross Profit | 1,752.2 | 1,586.3 | 10.5% |

| 267.0 | 351.1 | -23.9% | Sugar | 1,077.1 | 1,356.6 | -20.6% |

| 21.8% | 29.8% | -7.9 p.p. | Sugar Gross Margin (%) | 24.7% | 31.2% | -6.3 p.p. |

| 42.8% | 48.8% | -5.9 p.p. | Sugar (Cash) Gross Margin (%) | 45.9% | 52.1% | -6.0 p.p. |

| 152.8 | 121.7 | 25.6% | Ethanol | 460.2 | 276.6 | 66.4% |

| 17.5% | 14.3% | 3.3 p.p. | Ethanol Gross Margin (%) | 14.2% | 10.7% | 3.5 p.p. |

| 42.2% | 38.1% | 4.2 p.p. | Ethanol (Cash) Gross Margin (%) | 36.1% | 39.1% | -3.0 p.p. |

| 18.8 | (2.1) | n/a | Trading | 46.5 | 13.3 | n/a |

| 4.2% | -0.8% | 5.0 p.p. | Ethanol Trading Margin (%) | 3.8% | 1.8% | 2.2 p.p. |

| 12.3 | 2.2 | n/a | Energy Cogeneration | 240.3 | 170.7 | 40.8% |

| 45.2% | 16.8% | 28.4 p.p. | Energy Cogeneration Margin (%) | 59.5% | 30.0% | 29.7 p.p. |

| 40.9 | (213.5) | n/a | Other Products and Services | (71.7) | (231.4) | -69.0% |

In 1Q14, Raízen Energia’s gross profit totaled R$491.9 million, an increase of 89.6% compared to 1Q13, when the gross profit reported was R$259.4 million.

Gross profit from the sale of sugar reached R$267.0 million in 1Q14, a decrease of 23.9% year-over-year. The result from the sale of ethanol rose 25.6% year-over-year to R$152.8 million in 4Q13. The sale of electric energy resulted in gross profit of R$12.3 million, significantly up year-over-year.

The result from the sale of other products and services totaled R$ 40.9 million in the quarter and was mostly impacted by the gain (non-cash impact) of R$54.7

| Earnings Release

1st Quarter of Fiscal Year 2014 |

million from the positive effect of the biological asset’s fair value and agricultural produce.

In the 2013/14 crop, gross profit totaled R$1.8 billion, an increase of 10.5% compared to the gross profit reported in the previous period, which reached R$1.6 billion.

The gross profit from sugar sales was R$1.1 billion, 20.6% lower than reported in the 2012/13 crop. The gross profit from ethanol sales was 66.4% higher than reported in the 2012/13 crop, totaling R$460.2 million. Meanwhile, the sales of energy (electricity) resulted in gross profit of R$240.3 million, 40.8% higher than reported in the previous crop.

The result from the sale of other products and services in the 2013/14 crop was negative by R$71.7 million, impacted by the loss (non-cash impact) of R$73.4 million, due to the negative effect variation of the biological asset’s fair value and agricultural produce.

Selling, General & Administrative Expenses

| 1Q14 | 1Q13 | | SG & A Expenses | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | Chg. % | Amounts in R$ MM | (Apr/13-Mar/14) | (Apr/13-Mar/14) | Chg. % |

| (163.2) | (196.7) | -17.0% | Selling Expenses | (637.3) | (638.8) | -0.2% |

| (140.4) | (135.3) | 3.7% | General and Administrative Expenses | (552.0) | (490.2) | 12.6% |

Raízen Energia’s selling expenses totaled R$163.2 million in 1Q14, a decrease of 17.0% year-over-year, mainly due to the lower volume of sugar sales in the foreign market, reducing freight, logistics and port elevation costs. In the 2013/14 crop, selling expenses totaled R$637.3 million, remaining in line with the value reported in the previous crop.

General and administrative expenses reached R$140.4 million in 1Q14, 3.7% higher than reported in 1Q13, which amounted R$135.3 million. In the 2013/14 crop, general and administrative expenses were R$552.0 million, an increase of 12.6% compared to the 2012/13 crop, mostly because of higher compensation and benefits costs.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

EBITDA

| 1Q14 | 1Q13 | | EBITDA | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | Chg. % | Amounts in R$ MM | (Apr/13-Mar/14) | (Apr/12-Mar/13) | Chg. % |

| 734.0 | 410.5 | 78.8% | EBITDA | 2,435.9 | 2,408.3 | 1.1% |

| 28.2% | 17.5% | 10.7 p.p. | EBITDA Margin (%) | 25.8% | 28.4% | -2.7 p.p. |

Raízen Energia's EBITDA totaled R$734.0 million in 1Q14, an increase of 78.8% compared to 1Q13, when the reported value reached R$410.5 million. In the 2013/14 crop, EBITDA was R$2.4 billion, remaining flat compared to the 2012/13 crop.

The significant increase in Raízen Energia's EBITDA compared to previous quarters is due to the successful strategy of building and carrying over stocks of sugar and ethanol from 4Q 2013 to 1Q14, which were sold at higher prices.

| 1Q14 | 1Q13 | | EBITDA Ex-Biological Asset | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | Chg. % | Amounts in R$ MM | (Apr/13-Mar/14) | (Apr/13-Mar/14) | Chg. % |

| 734.0 | 410.5 | 78.8% | EBITDA | 2,435.9 | 2,408.3 | 1.1% |

| (54.7) | 209.7 | n/a | (+) Biological Asset Effect | 73.4 | 227.7 | -67,8% |

| 679.3 | 620.2 | 9.5% | EBITDA Ex-Biological Asset | 2,509.3 | 2,636.0 | -4.8% |

When the effects of the biological asset are adjusted in Raízen Energia’s EBITDA, we notice a growth of 9.5%, totaling R$679.3 million in 1Q14. In the accumulated harvest, EBITDA remained almost unchanged, from R$2.64 billion in the 2012/13 crop to R$2.51 billion in the 2013/14 crop.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Hedge

Volume positions and fixed sugar prices agreed with traders or through derivative financial instruments as of March 31, 2014, and foreign exchange derivatives contracted by Raízen Energia to hedge future cash flows, are as follows:

Summary of Hedge Operations at Mar 31, 20144 |

| Sugar | 2014/15 | 2015/16 |

| NY11 | | |

| Volume (‘000 ton) | 1,647.4 | 25.0 |

| Average Price (¢US$/lb) | 18.16 | 18.50 |

| Exchange Rate | | |

| US$ | | |

| Volume (US$ mm) | 686.2 | 10.6 |

| Average Price (R$/US$) | 2.41 | 2.71 |

Note 4: The table above shows the hedging coverage onsidering the crop years ending on 3/31/2014 and 3/31/2015 respectively.

Impacts of Hedge Accounting

Raízen Energia has been using cash flow hedge accounting for certain derivative financial instruments in order to hedge against the price risk for sugar over revenues from sugar exports.

The table below shows the expected transfer of gain/loss balances from the shareholders’ equity as at March 31, 2014 to the net operating income of Raízen Energia5 in future years, broken down by coverage period for the following hedging instruments:

| Expiration Period - (R$MM) |

| Derivative | Market | Risk | 2014 | 2015 | Total |

| Futures | OTC/NYBOT | NY#11 | (16.4) | (0.9) | (17.4) |

| (=) Hedge Accounting impact | | | (16.4) | (0.9) | (17.4) |

| (-) Deferred Income Tax | | | 5.6 | 0.3 | 5.9 |

| (=) Asset Valuation Adjustment | | | (10.8) | (0.6) | (11.4) |

Note 5 The table above shows 100% of the hedge accounting gains/losses reclassified to shareholders’ equity. As Cosan holds a 50% interest at Raízen Energia, hedge accounting will have a proportionate impact on Other Comprehensive Income in Cosan’s shareholders’ equity.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Capex

| 1Q14 | 1Q13 | | CAPEX | 2013/14 | 2012/13 | |

| (Jan-Mar) | (Jan-Mar) | Chg. % | Amounts in R$ MM | (Apr/13-Mar/14) | (Apr/12-Mar/13) | Chg. % |

| 1,009.1 | 1,017.2 | -0.8% | Total CAPEX | 2,522.4 | 2,404.6 | 4.9% |

| 698.4 | 749.1 | -6.8% | Operating CAPEX | 1,777.9 | 1,934.1 | -8.1% |

| 166.3 | 184.0 | -9.6% | Biological Assets | 917.6 | 948.8 | -3.3% |

| 370.3 | 403.7 | -8.3% | Inter-Harvest Maintenance Costs | 570.9 | 602.3 | -5.2% |

| 63.1 | 18.2 | 247.6% | SSMA and Sustaining | 120.6 | 64.6 | 86.7% |

| 89.3 | 84.6 | 5.5% | Mechanization | 148.8 | 205.3 | -27.5% |

| 9.5 | 58.6 | -83.8% | Industrial | 20.0 | 113.1 | -82.3% |

| 310.7 | 268.2 | 15.9% | Expasion CAPEX | 744.5 | 470.4 | 58.3% |

| 63.1 | 18.2 | -88.7% | Cogeneration Projects | 120.6 | 64.6 | -81.3% |

| 89.3 | 84.6 | 30.0% | Expansion and Other Projects | 148.8 | 205.3 | 97.3% |

Raízen Energia recorded Capex of R$1.0 billion in 1Q14, remaining almost in line with 1Q13.

The main operating capital expenditures in the quarter were focused on investments in biological assets, agricultural and industrial interharvest maintenance, crushing expansion projects in Paraguaçu and Caarapó, and 2G Ethanol.

The expenditures in biological assets totaled R$166.3 million, 9.6% lower than the same period last year. The reduction in the industrial line compared to 1Q13 is due to finalization of investment in the Diamante, Zanin and Jataí units.

Investments in the cogeneration projects had a decrease of 88.8% compared to the same quarter of the previous period, mainly due to the completion of the Univalem project.

The Expansion and other projects line totaled R$307.0 million of expenditure in crushing expansion projects at the Paraguaçu and Caarapó units. This line also includes other initiatives such as projects for vinasse concentration, biomass projects, expansion of mechanized planting, and operating improvements.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

B.3 Comgás

In this section we report on the results of Comgás, our natural gas distribution business unit operating in the concession area consisting of the Metropolitan Region of São Paulo, the Administrative Region of Campinas, Baixada Santista, and Vale do Paraíba in São Paulo state.

Volumes Sold

| Volume Sold | 1Q14 | 1Q13 | |

| Volume ('000 cbm) | (Jan-Mar) | (Jan-Mar) | Chg.% |

| Total Gas Sales | 1,313,066 | 1,367,015 | -3.9% |

| Gas Sales - without thermal power | 1,106,133 | 1,138,373 | -2.8% |

| Residential | 37,908 | 41,815 | -9.3% |

| Commercial | 27,322 | 25,793 | 5.9% |

| Industrial | 912,916 | 928,145 | -1.6% |

| Cogeneration | 74,891 | 82,659 | -9.4% |

| Vehicular | 53,095 | 59,961 | -11.5% |

| Thermal Power | 206,933 | 228,642 | -9.5% |

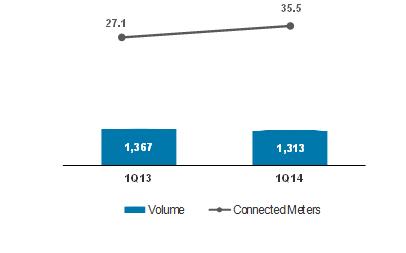

Comgás’s business strategy is focused on growing the residential and commercial segments, and on developing the cogeneration and VNG segments. The industrial segment growth - the most representative in terms of volume - has its performance linked to the industrial activity in the concession area. The Company's distribution network totaled 11,273 km in March 2014, of which 335 km were added in 1Q14.

In 1Q14, the company distributed 37.9 million cbm of gas in the residential segment, 9.3% less than the volume distributed in 1Q13, which reached 41.8 million cbm. The difference of volume in this segment is mainly explained by high temperatures in the first quarter of 2014 compared to the same period of 2013, which reduced the consumption for heating water for bathing/showering throughout the customer base with natural gas heaters. The segment closed the quarter with 970,439 meters connected, an increase of 8.1% compared to 1Q13 (897,974 meters). The residential segment accounted for 3% of the total volume distributed in 1Q14, representing 18% of Comgás’s total margin.

Comgás distributed 27.3 million cbm of gas in the commercial segment during 1Q14, 5.9% higher than 1Q13, in which the total volume of distribution was 25.8 million cbm. This variation is explained by the addition of 1,280 new clients in the last 12 months - 418 added in the first quarter of 2014. This market represents 2% of the total volume of gas distributed in the quarter and 8% of Comgás’s total margin.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

The industrial segment totaled 912.9 million cbm in 1Q14, 1.6% lower than 1Q13 (928,100,000 cbm). This variation is related to the performance of the economy and the low industrial activity in the period. At the quarter end, Comgás had 1,033 clients in this segment, accounting for 70% of the total distributed in the period, representing 68% of the total margin.

The cogeneration segment saw a reduction of 9.4% in the volume of gas distributed, reaching 74.9 million cbm in 1Q14 compared to 82.6 million cbm in 1Q13. This decrease is mainly due to lower production of some plants, because of preventive or corrective maintenance, as well as reducing the level of activity, especially in the textile sector. The segment represents 6% of the total volume of natural gas distributed by Comgás in the year, contributing 3% to the gross margin.

In 1Q14, the automotive segment represented 4% of the total volume of gas distributed by the company, totaling 53.1 million cbm. However, this number is 11.5% less than the volume of gas sold in 1Q13. This segment contributed 1% to Comgás’s gross margin. Despite the lower volume sold, this was the first quarter that the number of installations of the VNG kit in vehicles has increased in recent years, with 670 conversions in 1Q14, 4.5% higher than 1Q13 with 641 conversions.

In the thermal generation segment, sales reached 206.9 million cbm in 1Q14, a decrease of 9.5% compared to 1Q13. The segment accounted for 16% of the total volume of gas sold by Comgás in 1Q14, representing 2% of the total margin. It is important to note that Comgás’s gas supply contracts do not include thermal power plants. If thermal power plants need to dispatch gas, Petrobras will supply the Company the additional volume, because these are “back to back” contracts.

Natural Gas

Volume of Gas Sold (million cbm) and New Customers Connected (thousand units)

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Operating Revenue

| Sales Breakdown | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg.% |

| Gross Operating Revenue | 1,864.6 | 1,771.5 | 5.3% |

| Gas Sales | 1,737.3 | 1,629.5 | 6.6% |

| Residential | 142.4 | 144.7 | -1.6% |

| Commercial | 70.2 | 61.8 | 13.6% |

| Industrial | 1,302.2 | 1,200.9 | 8.4% |

| Cogeneration | 75.5 | 80.3 | -6.0% |

| Thermal Power | 87.6 | 84.7 | 3.4% |

| Vehicular | 59.4 | 57.1 | 4.1% |

| Construction Revenue | 117.6 | 135.2 | -13.0% |

| Other | 9.6 | 6.8 | 41.6% |

| Tax on Sales | (347.2) | (323.8) | 7.2% |

| Net Operating Revenue | 1,517.4 | 1,447.7 | 4.8% |

| Gas Sales | 1,391.3 | 1,305.1 | 6.6% |

| Construction Revenue | 117.6 | 135.2 | -13.0% |

| Other | 8.5 | 7.4 | 14.2% |

Comgás’s net revenue from sales and services reached R$1.5 billion in 1Q14, an increase of 4.8% compared to 1Q13, when the total was R$1.4 billion.

Increased rates, as approved by ARSESP resolutions no. 421 and 455, were the main drivers of the changes in Revenue from the Sale of Natural Gas. To establish the new rates, the ARSESP considered the period's inflation, as well as the increased cost of natural gas, especially imported gas. This cost is impacted by the appreciation of the dollar and the average contracted oil price per barrel, key elements for Bolivian natural gas price formation.

Cost of Goods Sold and Services Provided

| COGS | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg.% |

| Cost of Goods and Services | (1,069.0) | (1,032.4) | 3.5% |

| Natural Gas | (951.3) | (897.2) | 6.0% |

| Construction - ICPC 01 | (117.6) | (135.2) | -13.0% |

In 1Q14, the cost of goods sold and services by Comgás totaled R$1.1 billion, an increase of 3.5% compared to 1Q13, in which the value was reported at R$1.0 billion.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

The rising cost of natural gas can be explained mainly by the increase in the cost of natural gas in supply contracts priced in dollars. The variation in the construction cost line is directly linked to lower levels of investment during 1Q14.

The rise of the US dollar against the Brazilian Real strongly impacted the cost of gas, and the ARSESP’s transfers were not enough to fully recover the amount of the regulatory current account for the quarter. The Agency authorizes the rate updates so as to pass through the natural gas cost. Because the billed gas is indexed to the US dollar by Petrobrás, the amounts are passed on to users.

It is worth noting that the differences between the actual cost incurred and the cost of gas included in the rate and billed to clients, according to the rate structure defined by ARSESP, are accumulated in the regulatory current account and passed through/billed as determined by the regulatory authority in the periodic price adjustments or rate revisions. This balance is adjusted on a monthly basis at the SELIC rate. On March 31, 2014, the regulatory current account recorded a balance of R$296.7 million for Comgás, after a recovery of R$50.7 million in 1Q14.

The regulatory current account represents a receivable or payable balance according to the difference between the price of the natural gas acquired by Comgás and the price considered to form the rate. This balance is not accounted for, and therefore when we refer to its normalization, it means we consider this asset and/or liability as if it had been accounted for.

Gross Profit

| Gross Profit | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Gross Profit | 448.4 | 415.4 | 8.0% |

| Gross Margin (%) | 29.6% | 28.7% | 0.9 p.p. |

In 1Q14, Comgás reported gross profit of R$448.4 million, up 7.9% year-over-year (R$415.4 million in 1Q13).

Selling, General, and Administrative Expenses

| SG&A Expenses | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Selling Expenses | (150.3) | (151.5) | -0.8% |

| G&A Expenses | (67.1) | (70.5) | -4.7% |

| Other Operating Revenues (Expenses) | (7.1) | (1.4) | n/a |

Comgás’ selling expenses totaled R$150.3 million in 1Q14, 0.8% lower than the R$151.5 million reported in 1Q13.

In 1Q14, general and administrative expenses were R$67.1 million, 4.7% lower than the R$70.5 million reported in 1Q13.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

EBITDA

| EBITDA | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| EBITDA | 342.0 | 314.4 | 8.8% |

| EBITDA Margin (%) | 22.5% | 21.7% | 0.8 p.p. |

| Normalizade EBITDA | 282.8 | 262.0 | 7.9% |

| Normalized EBITDA Margin (%) | 18.6% | 18.1% | 0.5 p.p. |

Comgás’ EBITDA reached R$342.0 million in 1Q14, an increase of 8.8% year-over-year, with EBITDA margin of 22.5%. Normalized by the regulatory current account, EBITDA totaled R$282.8 million for the quarter, up 7.9% year-over-year.

Capex

| CAPEX | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| CAPEX | 155.8 | 174.5 | -10.7% |

In 1Q14, capex reached R$155.8 million, a decrease of 10.7% compared to the R$174.5 million spent in the same period of 2013. This variation can be explained by high investments in the RETAP project during 2013.

Of the total investments made during the quarter, approximately 69% was in the expansion of the gas distribution network. A total of 335 km of network was added during the quarter, 11.5% higher than in 1Q13.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

B.4 Rumo

Below we report on Rumo’s results, the company responsible for providing integrated logistics services, consisting of transportation, storage and port elevation for sugar and other agricultural commodities.

Net Revenue

| Net Revenue Breakdown | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg.% |

| Net Operating Revenue | 207.9 | 168.4 | 23.5% |

| Transportation | 154.9 | 128.5 | 20.6% |

| Loading | 49.4 | 36.6 | 34.9% |

| Other | 3.6 | 3.3 | 9.5% |

Rumo’s net revenue totaled R$207.9 million in 1Q14, 23.5% higher than reported in 1Q13, due to higher transportation and elevation volumes in the period.

Net revenue from transportation totaled R$154.9 million in 1Q14, up 20.6% year-over-year. This increase was mainly due to growth of approximately 60% of the sugar volume transported following the sale of inventories built in 4Q 2013 by leading producers in the market.

Rumo’s sugar elevation volume totaled 2.7 million tons in 1Q14, 27.3% higher than 1Q13. Revenue from elevation was R$49.4 million, an increase of 34.9% compared to the same period last year due to new contracts signed during 1Q14 and the dislocation of sugar volume shipments following the same dynamic explained in the transportation operation.

Port Elevation Volume

(thousand t)

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Cost of Services Provided

| Costs of Services | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Cost of Services | (123.5) | (95.2) | 29.8% |

Rumo’s cost of services provided includes railway and highway freight, port elevation, transshipment and storage costs in upstate São Paulo and at the Port of Santos.

The cost of services provided by Rumo in 1Q14 was R$123.5 million, 29.8% higher than the R$95.2 million reported in 1Q13. This growth is mostly due to higher transportation and elevation volumes in the period, as well as higher freight costs, mainly impacted by the contingent contracting of highway transportation to the port of Santos.

Gross Profit

| Gross Profit | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Gross Profit | 84.4 | 73.2 | 15.3% |

| Gross Margin (%) | 40.6% | 43.5% | -2.9 p.p. |

Rumo had a 15.3% growth in its gross profit, from R$73.2 million in 1Q13 to R$84.4 million in 1Q14, and the gross margin was 40.6%.

General and Administrative Expenses

| G&A Expenses | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| G&A Expenses | (20.0) | (16.7) | 19.6% |

Rumo’s general and administrative expenses totaled R$20.0 million in 1Q14, 19.6% higher than the R$16.7 million reported in 1Q13, reflecting the adjustment in the administrative structure for new logistics projects in ports and rail.

EBITDA

| EBITDA | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| EBITDA | 92.8 | 69.1 | 34.4% |

| EBITDA Margin (%) | 44.7% | 41.0% | 3.6 p.p. |

Rumo’s EBITDA totaled R$92.8 million in 1Q14, representing an increase of 34.4% compared to the R$69.1 million reported in 1Q13. The EBITDA margin rose by 3.6 percentage points, from 41.0% in 1Q13 to 44.7% in 1Q14.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

Capex

| CAPEX | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| CAPEX | 14.0 | 57.0 | -75.5% |

In 1Q14, Rumo’s capital expenditure totaled R$14.0 million, and was invested in the following initiatives:

| | (i) | R$9.5 million in improvements to the port terminal of Santos, including increased unloading capacity, construction of the coverage of the South terminal and improvements in the rail yard between terminals XVI and XIX. |

| | (ii) | R$1.3 million in improvements in the internal logistics of the transfer terminal in Sumaré, São Paulo. |

| | (iii) | R$3.2 million related to several initiatives undertaken during the maintenance shutdown of the terminals in the sugar interharvest period. |

| Earnings Release

1st Quarter of Fiscal Year 2014 |

B.5 Cosan Lubrificantes

Results of the lubricants segment include the manufacturing and distribution of Mobil and Comma lubricants, resale of base oil and automotive specialties in Brazil and in 40 other countries through two plants located in Rio de Janeiro, Brazil, and in Kent, U.K.

Net Revenue

| Sales Breakdown | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg.% |

| Net Operating Revenue | 368.3 | 357.7 | 3.0% |

Net revenues from the sales of lubricants, resale of base oil and other products and services of Cosan Lubrificantes totaled R$368.3 million in 1Q14, 3.0% higher than the R$357.7 million reported in 1Q13, due to the increase of international business sales.

As a result, the total unit average revenue grew 2.4% in the quarter, from R$4,933/cbm reported in 1Q13 to R$5,050/cbm.

Lubricants, Base Oils, and Other Products

Volume (million liters) and Average Unit Revenue (R$/’000 liters)

Cost of Goods Sold and Services Provided

| COGS | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Cost of Goods and Services | (290.0) | (257.8) | 12.5% |

| COGS (R$/cbm) | | | |

| Lubrificants and Base Oil | (3,977) | (3,557) | 11.8% |

The cost of goods sold and services provided by Cosan Lubrificantes in 1Q14 rose 12.5% compared to 1Q13, reaching R$290.0 million, an increase caused

| Earnings Release

1st Quarter of Fiscal Year 2014 |

mainly by the foreign exchange rate impact, which affects the costs of importing base oil.

Consequently, the average total unit cost in 1Q14 was R$3,977/cbm, 11.8% higher than the R$3,556/cbm reported in 1Q13.

Gross Profit

| Gross Profit | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Gross Profit | 78.3 | 99.9 | -21.6% |

| Gross Margin (%) | 21.3% | 27.9% | -6.7 p.p. |

Gross profit totalled R$78.3 million in 1Q14, and the gross margin was 21.3%, 6.6 percentage points less than in 1Q13, which was 27.9%.

Selling, General & Administrative Expenses

| SG&A | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Total Expenses | (73.7) | (67.6) | 9.0% |

Selling, general and administrative expenses grew 9.0% in 1Q14, reaching R$73.7 million, mainly due to the expansion of international trading activities impacted by the exchange rate effect linked to these operations.

EBITDA

| EBITDA | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| EBITDA | 23.2 | 47.6 | -51.1% |

| EBITDA Margin (%) | 6.3% | 13.3% | -7.0 p.p. |

Cosan Lubrificantes’ EBITDA was R$23.2 million in 1Q14 with a margin of 6.3%.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

B.6 Radar

Below we report on Radar’s results, whose main activity is investment in agricultural properties, land leasing in the Brazilian rural real estate market, and portfolio management.

Assets Portfolio

| State | Culture | % | Area (hectare) | Area (acre) | Market Value ( R$MM) |

| Third-party Land | - | - | 129,041 | 318,730 | 1,617 |

| Owned Land | - | 100.0% | 106,259 | 262,461 | 2,534 |

| São Paulo | Sugarcane | 65% | 69,260 | 171,073 | 2,129 |

| Maranhão | Grains | 16% | 16,651 | 41,129 | 145 |

| Mato Grosso | Grains | 12% | 12,303 | 30,388 | 164 |

| Bahia | Grains | 7% | 7,155 | 17,674 | 80 |

| Goiás | Sugarcane | 1% | 672 | 1,659 | 16 |

| Mato Grosso do Sul | Sugarcane | 0% | 218 | 538 | 2 |

| Total | | | | | |

Radar closed 1Q14 with a land portfolio of R$2.5 billion, and total area of 106.3 thousand hectares (262.5 thousand acres), distributed throughout six Brazilian states. Considering third-party assets managed by Radar, total area under management is 235.3 thousand hectares (581.2 thousand acres), equivalent to R$4.2 billion.

Net Revenue, Cost of Products and Gross Profit

| | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Net Revenue | 63.6 | 15.4 | n/a |

| Property Sale | 45.6 | - | n/a |

| Land Lease | 16.1 | 15.4 | 4.8% |

| Cost of Property Sales | 1.8 | - | n/a |

| Property Sale | (38.3) | 0.0 | n/a |

| Gross Profit | 25.2 | 15.4 | 64.1% |

| Gross Margin (%) | 39.7% | 100.0% | -60.3 p.p. |

Radar’s net revenue was R$63.6 million in 1Q14, mainly impacted by (i) sales of land in amount of R$45.6 million, (ii) and the increase in leasing prices due to the fluctuation of variables that make up agricultural commodities prices and impact the agreements’ indexes in amount of R$17.9 million.

Radar’s cost of goods sold in 1Q14 was R$38.3 million and refers to the sale of assets during the period.

Gross profit in the quarter was R$25.2 million, compared to R$15.4 million during the same period last year.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

General and Administrative Expenses

| G&A Expenses | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| G&A Expenses | (8.4) | (4.8) | 73.2% |

| Other Operational Revenues (Expenses) | (23.0) | 54.4 | n/a |

In 1Q14, Radar’s general and administrative expenses totaled R$8.4 million, up 73.2% compared to 1Q13, mainly due to increased compensation and benefits expenses. Other operating revenues are the gain/loss from valuation of Radar’s own portfolio.

EBITDA

| EBITDA | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| EBITDA | (5.9) | 65.2 | n/a |

Radar’s EBITDA was negative by R$5.9 million in 1Q14, impacted by the devaluation of 0.9% of its land portfolio in the period, following the change in market indexes.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

B.7 Other Businesses

Below we report on the results of the Other Businesses segment, which comprises Cosan’s corporate structure, effects of contingencies from businesses contributed to Raízen prior to its formation, and other investments.

| General and Administrative Expenses | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| G&A Expenses | (32.3) | (25.2) | 28.2% |

| Other Revenues (Expenses) | (9.7) | 27.3 | n/a |

| | | | |

| EBITDA | 1Q14 | 1Q13 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| EBITDA | 328.6 | 201.4 | 63.2% |

| (-) Equity Pick-up | (369.8) | (195.9) | 88.8% |

| Adjusted EBITDA | (41.2) | 5.4 | n/a |

Cosan’s general and administrative expenses mostly consist of personnel expenses, which include payroll, charges, and consulting services. In 1Q14, general and administrative expenses totaled R$32.3 million, 28.2% higher than reported in 1Q13, due to higher spending on its own and contracted labor force during the period.

In 1Q14, other revenues and expenses of this segment totaled R$9.7 million, and consist of provision net effects, reversals, and payment of contingencies and attorneys’ fees. During 1Q13, other revenues and expenses totalled R$27.3 million, mainly due to the positive impact of the sale of land in Rio de Janeiro.

In 1Q14, this segment’s EBITDA totaled R$328.6 million, exclusively due to the equity accounting result in the period. Adjusted for this effect, this segment’s EBITDA was negative by R$41.2 million.

| Earnings Release

1st Quarter of Fiscal Year 2014 |

C. Other Items in the Consolidated Result

Financial Result

In 1Q14, debt charges were up by R$25.4 million compared to 1Q13, due to the variation in the interest rate between the periods, since the level of debt did not show any significant variations.

Revenue from financial investments closed 1Q14 with a positive amount of R$30.2 million, compared to R$22.8 million in 1Q13.

Other charges and monetary variations, consisting of interest on contingencies, interest on tax, monetary variation and other interests, totaled a net revenue of R$29.7 million in 1Q14, compared to R$3.9 million in 1Q13.

In 1Q14 we recorded a negative result with derivatives totaling R$50.6 million, offsetting the costs on the debt hedges mentioned above.

Amortization, debt cost and others closed 1Q14 with expenses of R$12.6 million, compared to expenses of R$43.5 million in 1Q13, when there was amortization of transaction costs on the issue of Debentures, due to liquidation of the first series, with proceeds equivalent to the 2018 and 2023 Senior Notes at the end of 1Q13.

In 1Q13, the expense with Income Tax and Social Contribution showed a decrease from R$79.6 million to R$59.6 million in 1Q14, mainly from the constitution of tax credit on accumulated losses from 4Q13. The effective rate was 8.3% in 1Q14, against 10.9% in 1Q13.

The table below shows the Income Tax and Social Contribution expenses broken down by business unit:

Current income tax and social security expenses represents the calculated tax amount payable/(recoverable). The amount effectively paid may still be deducted from existing tax credits

Cosan’s net income was R$256.1 million in 1Q14, higher than the R$27.1 million reported in 1Q13.

D. Indebtedness

At the close of 1Q14, Cosan’s pro forma consolidated gross debt (excluding PESA) was R$12.4 billion, compared to R$12 billion in 4Q13. Below are the separate debts of Cosan and Subsidiaries, and also Raízen’s debts, which are pro forma at a proportion of 50%.

Gross debt totaled R$8.6 billion in 1Q14, a decrease of 1% from 4Q13.

The combined gross debt of Raízen totaled R$7.9 billion in 4Q13, up 11.9% year-over-year.

The combined gross debt of Raízen totaled R$7.6 billion at the end of 1Q14, a reduction of 2.8% compared to 4T2013.

Cash available totaled R$2.8 billion in 1Q14, up from R$2.3 billion in 4Q 2013. Net pro forma indebtedness totaled R$9.6 billion for the quarter, as compared to R$10.3 billion in 4Q13, equal to a leverage of 2.4x pro forma LTM EBITDA (R$4.1 billion).

Note 6: Excluding PESA debt.

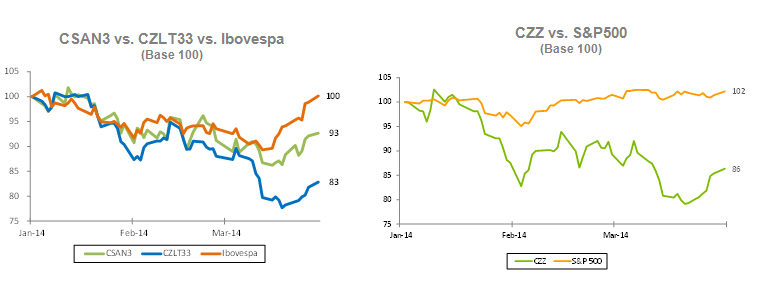

E. Stock Performance

The common shares issued by Cosan S.A. have been listed on BM&FBovespa since 2005, the year of its IPO on the “Novo Mercado” segment under the ticker symbol CSAN3, and are included in the portfolios of the Ibovespa, IBrX, IBrX-50, IBrA, MLCX, ICO2, INDX, ICON, IVBX-2, IGC, IGCT and ITAG indexes.

The shares issued by Cosan Limited, Cosan S.A.'s parent company, have been listed on NYSE since its IPO in 2007, under the ticker symbol CZZ. The company has also issued share deposit certificates (Brazilian Depositary Receipts - BDR) on the BM&FBovespa under the symbol CZLT33.

The tables and graphs below represent the performance of shares issued by the companies:

F. Guidance

This section contains the guidance broken down by variation range for some key parameters in Cosan’s consolidated results for the 2014. In addition, other parts of this Earnings Release may contain forecasts. Such projections and guidance are but estimates and indications, and as such these do not represent any guarantee of prospective results.

This guidance considers the operations of the Cosan group today, which include Comgás, Rumo, Cosan Lubrificantes e Especialidades, Radar, and Other Businesses, as well as the operations of Raízen Combustíveis and Raízen Energia.

Cosan’s consolidated EBITDA is pro forma, including 50% of the results of Raízen Combustíveis and Raízen Energia. As mentioned before, following the adoption of IFRS 11 – Joint Arrangements, Raízen is not longer proportionately consolidated in Cosan, and is only reported under “Equity Accounting Result,” considering our 50% interest in Net Income. Moreover, Comgás’s EBITDA continues to be reported under Brazilian accounting principles (IFRS), which does not consider the effects of the Regulatory Current Account.

This document contains forward-looking statements and estimates. These forward-looking statements and estimates are solely forecasts and do not represent any guarantee of prospective results. All stakeholders should know that these statements and estimates are and will be, depending on the case, subject to risks, uncertainties and factors related to the operations and business environment of Cosan and its subsidiaries, and therefore the actual results of these companies may significantly differ from the estimated or implied prospective results contained in such forward-looking statements and estimates.

G. Financial Statements

H. Financial Statements including Raízen