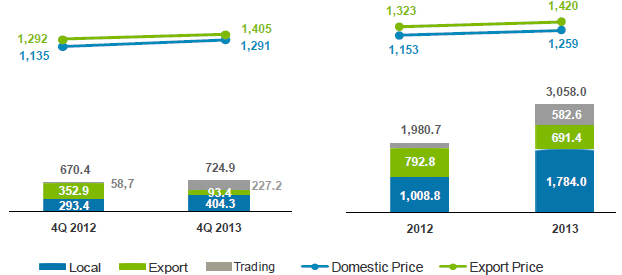

Net revenue from sales and services totaled R$1.6 billion in 4Q13, an increase of 9.1% year-over-year. Comgás recorded net revenue of R$6.3 billion in 2013, an increase of 20% over 2012, when net revenue amounted to R$5.3 billion.

Increased rates, as approved by ARSESP resolutions no. 421 and 455, were the main drivers of the changes in Revenue from the Sale of Natural Gas. To establish the new rates, the São Paulo State Sanitation and Energy Regulatory Agency (ARSESP) considered the increased cost of natural gas, especially imported gas (subject to agency review), impacted by the appreciation of the dollar and the higher average contracted oil price per barrel, key elements for natural gas price formation in Brazil.

Capex

| 4Q 2013 | 4Q 2012 | | CAPEX | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg.% | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 209.4 | 189.3 | 10.6% | CAPEX | 852.2 | 615.8 | 38.4% | 677.7 | 294.4 |

In 4Q13, Capex reached R$209.4 million, an increase of 10.6% year-over-year (R$189.3 million in 4Q12). In 2013, Capex totaled R$852.2 million, the largest amount ever invested by Comgás in one single year, and up 38.4% year-over-year.

Of total investments made during the year, approximately 64% was in gas distribution network expansion. A total of 1,629 kilometers of network were added in 2013 (459 kilometers in the fourth quarter alone), up 26% year-over-year. This expansion allowed for the network to reach cities that were not served by Comgás, and also helped consolidate the operations in cities already served by the Company.

Another project that stood out in the period was the RETAP, improvement of the high-pressure network with the purpose of meeting the increased demand for natural gas in the Metropolitan Region of São Paulo, with investments of nearly R$113 million during 2013.

25 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

B.4 Rumo

Below we report on Rumo’s results, the company responsible for providing integrated logistics services, consisting of transportation, storage and port elevation for sugar and other agricultural commodities.

Net Revenue

| 4Q 2013 | 4Q 2012 | | Sales Breakdown | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg.% | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 206.5 | 221.6 | -6.8% | Net Operating Revenue | 917.7 | 618.6 | 48.4% | 749.4 | 712.7 |

| 154.4 | 176.8 | -12.6% | Transportation | 726.0 | 474.4 | 53.0% | 597.5 | 549.3 |

| 46.9 | 41.1 | 14.2% | Loading | 174.8 | 130.9 | 33.6% | 138.2 | 150.0 |

| 5.2 | 3.7 | 39.5% | Other | 16.9 | 13.3 | 27.4% | 13.6 | 13.3 |

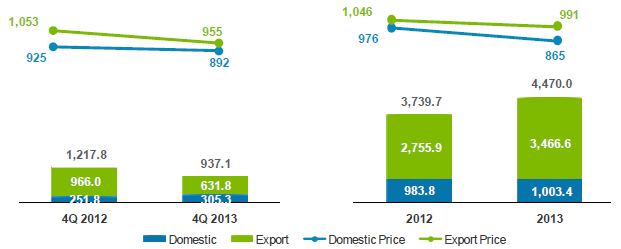

Rumo’s net revenue totaled R$206.5 million for 4Q13, down 6.8% year-over-year due to lower transportation and elevation volumes in the period. In 2013, net revenue reached R$917.7 million, an increase of 48.4% year-over-year;

Net revenue from transportation totaled R$726 million in 2013, an increase of 53% year-over-year especially due to (1) increase in sugar volumes transported, and (2) recognition by Rumo of a reimbursement of additional costs for the contracting of highway transportation compared to the cost of railway freight set in the contract with America Latina Logística (ALL).

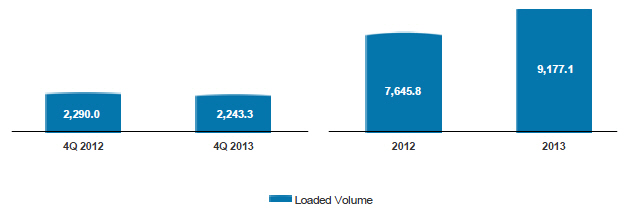

Rumo’s sugar elevation volume was 9.2 million tonnes in 2013, an increase of 20% compared to 2012. Revenue from elevation rose 33.6% in the period, driven by the growth in volumes, especially due to new contracts signed in the period.

Elevation Volume

(thousand t)

26 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

Cost of Services Provided

| 4Q 2013 | 4Q 2012 | | Costs of Services | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg.% | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| (113.0) | (121.4) | -6.9% | Cost of Services | (542.6) | (402.8) | 34.7% | (447.4) | (420.6) |

Rumo’s cost of services provided includes railway and highway freight, port elevation, transshipment and storage costs in upstate São Paulo and at the Port of Santos.

In 2013, cost of services provided totaled R$542.6 million, up 34.7% year-over-year, resulting from the increase in volumes and freight cost, especially impacted by the contingent contracting of highway transportation to the Port of Santos.

Gross Profit

| 4Q 2013 | 4Q 2012 | | Gross Profit | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg.% | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 93.5 | 100.1 | -6.6% | Gross Profit | 375.1 | 215.8 | 3.3% | 301.9 | 292.1 |

| 45.3% | 45.2% | 0.1 p.p | Gross Margin (%) | 40.9% | 34.9% | 6.0 p.p | 40.3% | 41.0% |

Rumo’s gross profit totaled R$375.1 million in 2013, up 3.3% year-over-year, while gross margin rose 6 p.p. to 40.9% in the year, versus 34.9% in 2012.

General and Administrative Expenses

| 4Q 2013 | 4Q 2012 | | G&A Expenses | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg.% | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| (22.6) | (15.2) | 48.5% | G&A Expenses | (74.3) | (53.1) | 39.8% | (57.6) | (58.1) |

Adapting Rumo’s administrative structure for the new growth projects resulted in general and administrative expenses of R$74.3 million in 2013.

EBITDA

| 4Q 2013 | 4Q 2012 | | EBITDA | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg.% | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 89.0 | 98.9 | -10.1% | EBITDA | 358.0 | 248.2 | 44.2% | 288.9 | 296.7 |

| 43.1% | 44.6% | -1.5 p.p. | Margin EBITDA (%) | 39.0% | 40.1% | -1.1 p.p. | 38.6% | 41.6% |

Rumo reported EBITDA of R$358 million for 2013, up 44.2% over the R$248.2 million reported in 2012, with a margin of 39%.

In October 2013, Rumo filed an arbitrage claim against ALL, demanding that the contractual relation between the companies be complied with. Due to the filing of the lawsuit, Rumo stopped recognizing some revenues under the agreement, which totaled R$18.6 million in 4Q13. Rumo’s not accounting for these amounts as revenue does not eliminate the validity of the relative collection, and Rumo is certain that it will receive these amounts of the ongoing lawsuits.

27 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

Considering the amounts of the provision for doubtful accounts and those not recognized in revenue during 2013 (R$34.4 million), Rumo’s EBITDA would have been R$392.4 million.

Capex

| 4Q 2013 | 4Q 2012 | | CAPEX | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg.% | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 41.8 | 79.3 | -47.3% | CAPEX | 255.0 | 255.2 | -0.1% | 198.0 | 266.7 |

Rumo’s capital expenditures amounted to R$255 million in 2013, and were invested in the following:

| (i) | R$124.8 million in railways on the network operated by ALL; |

| (ii) | R$89.7 million in improvements in the port terminal of Santos, including increase in unloading capacity, improvement of the terminal’s reception and expedition conveyor routes, construction of the coverage of the South terminal’s quay; and recurring investments in warehouse equipment and infrastructure; |

| (iii) | R$40.5 million in other initiatives, especially investments in transshipment terminals in upstate São Paulo. |

28 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

B.5 Cosan Lubrificantes

Results of the lubricants segment include the manufacturing and distribution of Mobil and Comma lubricants, resale of base oil and automotive specialties in Brazil and in 40 other countries through two plants located in Rio de Janeiro, Brazil, and in Kent, U.K.

Net Revenue

| 4Q 2013 | 4Q 2012 | | Sales Breakdown | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 391.8 | 377.9 | 3.7% | Net Operating Revenue | 1,542.9 | 1,325.1 | 16.4% | 1,185.2 | 1,417.5 |

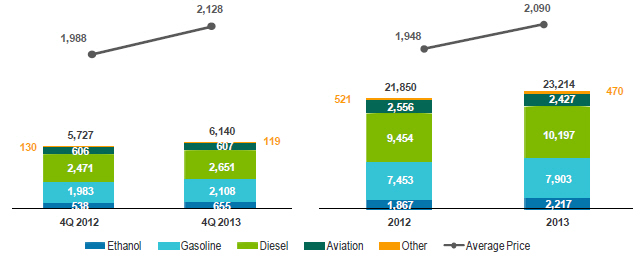

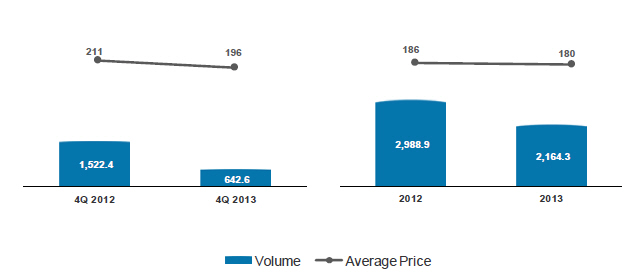

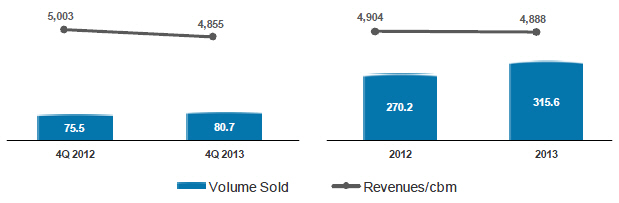

Net revenue from the sale of lubricants, resale of base oil and other products and services of Cosan Lubrificantes totaled R$391.8 million in 4Q13, up 3.7% year-over-year (R$377.9 million in 4Q12). In 2013, net revenue rose 16.4% year-over-year, reaching R$1.5 billion, due to the increase of 16.8% in volume sold, especially of base oils.

Total unit average revenue was down 0.3%, from R$4,904/m³ in 2012 to R$4,888/m³ in 2013, reflecting a larger stake of base oil in the mix, which is a product with lower unit value.

Lubricants, Base Oils, and Other Products

Volume (million liters) and Average Unit Revenue (R$/’000 liters)

29 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

Cost of Goods Sold and Services Provided

| 4Q 2013 | 4Q 2012 | | COGS | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| (306.2) | (275.3) | 11.2% | Cost of Goods and Services | (1,158.4) | (985.4) | 17.6% | (900.5) | (1,050.7) |

In 2013, cost of goods sold and services provided by Cosan Lubrificantes rose 17.6% year-over-year, reaching R$1.2 billion. This increase was due to higher volumes sold and the increase in the foreign exchange rate, which has a direct impact on imports of base oil and other inputs.

Total unit average cost remained unchanged year-over-year, reaching R$3,670/m³ in 2013, reflecting a larger stake of base oil in the mix, which is a product with lower unit cost.

Gross Profit

| 4Q 2013 | 4Q 2012 | | Gross Profit | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 85.6 | 102.6 | -16.5% | Gross Profit | 384.5 | 339.7 | 13.2% | 284.7 | 366.8 |

| 21.9% | 27.2% | -5.3 p.p. | Gross Margin (%) | 24.9% | 25.6% | -0.7 p.p. | 24.0% | 25.9% |

Gross profit rose 13.2% year-over-year to R$384.5 million in 2013 (R$339.7 million in 2012). Gross margin reached 24.9% in 2013, practically unchanged year-over-year.

Selling, General & Administrative Expenses

| 4Q 2013 | 4Q 2012 | | SG&A | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| (76.2) | (75.8) | 0.6% | Total expenses | (301.9) | (253.7) | 19.0% | (234.1) | (272.4) |

Selling, general, and administrative expenses rose 19% year-over-year in 2013, totaling R$301.9 million, mainly due to the expansion of trading activities in Brazil and higher volumes sold by international operations.

EBITDA

| 4Q 2013 | 4Q 2012 | | EBITDA | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 26.5 | 38.8 | -31.6% | EBITDA | 140.1 | 121.1 | 15.7% | 92.7 | 137.4 |

| 6.8% | 10.3% | -3.5 p.p. | EBITDA Margin (%) | 9.1% | 9.1% | 0.0 p.p | 7.8% | 9.7% |

Cosan Lubrificantes’s EBITDA was R$140.1 million for 2013, with a margin of 9.1%, down 0.1 p.p. The 15.7% growth is due to the higher sales volume in the period.

30 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

B.6 Radar

Below we report on Radar’s results, whose main activity is investment in agricultural properties, land leasing in the Brazilian rural real estate market, and portfolio management.

Radar’s 2012 results are proforma, considering twelve months (January to December 2012) of the combination of Radar’s operations with Cosan’s land results for better comparability.

Assets Portfolio

| State | Culture | % | | | | |

| | | | | | | |

| Third-party land | - | - | 124,726 | 308,072 | 1,541 | |

| Owned Land | - | 100% | 107,279 | 264,980 | 2,596 | |

| São Paulo | Sugarcane | 66% | 70,281 | 173,593 | 2,192 | |

| Maranhão | Grains | 16% | 16,651 | 41,129 | 142 | |

| Mato Grosso | Grains | 11% | 12,303 | 30,388 | 164 | |

| Bahia | Grains | 7% | 7,155 | 17,674 | 80 | |

| Goiás | Sugarcane | 1% | 672 | 1,659 | 16 | |

| Mato Grosso do Sul | Sugarcane | 0% | 218 | 538 | 2 | |

| Total | | | 232,005 | 573,052 | 4,137 | |

Radar closed 2013 with a land portfolio of R$2.6 billion, and total area of 107,3 thousand hectares (265,0 thousand acres), distributed throughout six Brazilian states. Considering third-party assets managed by Radar, total area under management is 232,0 thousand hectares (573,1 thousand acres), equivalent to R$4.1 billion.

Net Revenue

| 4Q 2013 | 4Q 2012 | | | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 18.7 | 15.6 | 19.9% | Net Revenue | 70.1 | 91.7 | -23.5% | 54.8 | 51.9 |

| - | - | - | Property Sale | 5.7 | 22.0 | -74.2% | 5.7 | 4.7 |

| 18.7 | 15.6 | 19.9% | Land Lease | 64.4 | 69.6 | -7.5% | 49.1 | 47.2 |

| - | - | - | Cost of Property Sales | (6.1) | (20.1) | -69.8% | (6.1) | (1.7) |

| - | - | - | Property Sale | (6.1) | (20.1) | -69.8% | (6.1) | (1.7) |

| 18.7 | 15.6 | 19.9% | Gross Profit | 64.1 | 71.6 | -10.5% | 48.7 | 50.2 |

| 100.0% | 100.0% | 0.0 p.p | Gross Margin (%) | 91.4% | 78.1% | 13.3 p.p | 88.9% | 96.6% |

Radar’s net revenue was R$18.7 million in 4Q13, up 19.9% year-over-year (R$15.6 million in 4Q12). In 2013, Radar recorded net revenue of R$70.1 million, down 23.5% year-over-year, mainly impacted by lower sales of land, and the reduction in leasing prices due to the fluctuation of variables that make up agricultural commodities prices and impact the agreements’ indexes.

31 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

Cost of services provided by Radar reached R$6.1 million in 2013, and refers to the sale of assets in 2Q13.

Gross profit was R$64.1 million, down 10.5% year-over-year.

General and Administrative Expenses

| 4Q 2013 | 4Q 2012 | | G&A Expenses | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| (8.1) | (6.1) | 32.1% | G&A Expenses | (23.2) | (18.8) | 23.5% | (18.3) | (14.9) |

Radar’s general and administrative expenses totaled R$23.5 million in 2013, up 23.5% year-over-year. Other operating revenues are the gain from valuation of Radar’s own portfolio and portfolio under management.

EBITDA

| 4Q 2013 | 4Q 2012 | | EBITDA | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 86.3 | 96.6 | -10.7% | EBITDA | 227.5 | 146.5 | 55.3% | 162.3 | 180.4 |

Radar’s EBITDA reached R$227.5 million in 2013, an increase of 55.3% year-over-year, impacted by the valuation of 7.2% of its land portfolio based on an independent appraisal.

32 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

B.7 Other Businesses

Below we report on the results of the Other Businesses segment, which comprises Cosan’s corporate structure, effects of contingencies from businesses contributed to Raízen prior to its formation, and other investments.

| 4Q 2013 | 4Q 2012 | | | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| (26.2) | (38.1) | -31.2% | G&A Expenses | (121.2) | (134.3) | -9.8% | (96.3) | (127.0) |

| 0.8 | (5.4) | n/a | Other Revenues (Expenses) | 0.8 | 54.4 | -98.6% | (26.5) | 57.7 |

| 4Q 2013 | 4Q 2012 | | EBITDA | 2013 | 2012 | | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Chg. % | Amounts in R$ MM | (jan-dec) | (jan-dec) | Chg.% | (mar/13-dec/13) | (apr/12-mar/13) |

| 202.9 | 273.3 | -25.8% | EBITDA | 732.1 | 795.8 | -8.0% | 533.3 | 836.9 |

| - | - | - | (-) Gross Effects of Raizen's formation | - | 100.3 | n/a | - | - |

| (227.5) | (316.3) | -28.1% | (-) Equity Pick-up | (850.2) | (964.1) | -11.8% | (654.2) | (899.7) |

| (24.7) | (43.0) | -42.6% | Adjusted EBITDA | (118.1) | (68.0) | 73.7% | (120.9) | (62.8) |

Cosan’s general and administrative expenses mostly consist of personnel expenses, which include payroll, charges, and consulting services, and totaled R$121.2 million in 2013, down 9.8% year-over-year.

Other revenues and expenses of this segment totaled R$0.8 million in 2013, and consist of provision net effects, reversals, and payment of contingencies and attorney’s fees, in addition to the result from the sale of assets. In 2012, other revenues and expenses totaled R$54.4 million, impacted by the sale of aviation fuel distribution infrastructure assets, as determined by the Brazilian Antitrust Board (CADE).

In 2013, this segment’s EBITDA amounted to R$732.1 million, exclusively due to the equity accounting result. Adjusted for this effect, the segment’s EBITDA was a negative R$118.1 million.

33 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

C. Other Items in the Consolidated Result

Financial Result

| 4Q 2013 | 4Q 2012 | Financial Results | 2013 | 2012 | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Amounts in R$ MM | (jan-dec) | (jan-dec) | (mar/13-dec/13) | (apr/12-mar/13) |

| (198.6) | (111.0) | Gross Debt Charges | (717.4) | (225.6) | (555.0) | (189.4) |

| 31.3 | 27.1 | Income from Financial Investments | 107.4 | 74.5 | 99.2 | 83.3 |

| (167.3) | (83.9) | (=) Subtotal: Net Debt Interests | (610.1) | (151.1) | (455.8) | (106.1) |

| (55.3) | (31.4) | Other Charges and Monetary Variation | (81.5) | (132.2) | (89.9) | (199.1) |

| (105.7) | (5.6) | Exchange Rate Variation | (311.1) | (65.9) | (323.8) | (81.0) |

| 93.0 | 43.3 | Gains (losses) with Derivatives | 211.3 | 78.9 | 213.5 | 74.5 |

| (16.8) | (9.5) | Amortization, Debt Cost and Other | (86.5) | (36.9) | (44.3) | (99.2) |

| (252.1) | (87.0) | (=) Financial, Net | (877.8) | (307.2) | (700.3) | (410.9) |

Net financial result for 4Q13 was an expense of R$252.1 million, versus an expense of R$87 million in 4Q12.

In 4Q13, debt charges were up by R$90.7 million year-over-year, mainly due to the consolidation of Comgás’s results starting in November 2012, and the effect of the cost of the debt incurred for its acquisition and an increment in the reference interest rate for most debts (increase of the CDI to 2.31%p.a. in 4Q13 from 1.41%p.a. in 4Q12).

Revenue from financial investments reached R$31.3 million in 4Q13, up from R$27.1 million in 4Q12, also reflecting the consolidation of Comgás’s results starting in November 2012, and the increase in the CDI rate year-over-year.

The negative result from the foreign exchange rate variation in the quarter reflects the appreciation of the dollar against the Brazilian real by 5.1% (R$2.3426/US$ on December 31, 2013 versus R$2.2300/US$ on September 30, 2013), and the impact on debts denominated in dollars, causing a non-cash effect on the consolidated financial result. But it is important to note that all debts denominated in foreign currency are hedged by foreign exchange swaps, except for the principal of the Perpetual Bond in the amount of US$500 million. In 4Q12 the dollar also appreciated versus the real (R$2.0435/US$ on December 31, 2012 versus R$2.0306/US$ on September 30, 2012), but at a lower rate of 0.6%.

In 4Q13 we recorded a positive result with foreign exchange derivatives in the amount of R$117.2 million, which offset the currency depreciation over debts hedged through foreign exchange derivatives as mentioned above.

The financial result for 2013 was a net expense of R$877.8 million, up from R$ 307.2 million in 2012. This increment is due to the consolidation of Comgás for only two months of 2012, while in 2013 both Comgás’s debt and the funding for its acquisition were consolidated for the whole year.

34 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

Income Tax and Social Contribution

| 4Q 2013 | 4Q 2012 | Income Tax and Social Contribution | 2013 | 2012 | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Amounts in R$ MM | (jan-dec) | (jan-dec) | (mar/13-dec/13) | (apr/12-mar/13) |

| 196.7 | 342.2 | Income (Loss) before Income Tax | 816.9 | 698.0 | 562.4 | 831.5 |

| 155.6 | (38.4) | Total of Tax and Social Contribution | (178.4) | 40.7 | (39.2) | (126.4) |

| | | | | | | |

| 160.8 | 11.0 | Deferred Income Tax Expenses | (20.7) | 116.0 | 90.8 | (26.3) |

| (5.1) | (49.4) | Current Income Tax Expenses | (157.7) | (75.3) | (130.0) | (100.0) |

| -2.6% | -14.4% | Effective Rate - Current (%) | -19.3% | -10.8% | -23.1% | -12.0% |

In 4Q13, the result with income tax and social security was a gain of R$155.6 million, basically due to the accounting for a deferred income tax asset over tax losses and social security negative bases that had not been accounted for in prior quarters. We have resumed the accounting for such tax credits because of a revision of future scenarios and the corresponding projects of taxable results.

In 2013, the consolidated income tax expense totaled R$178.4 million, representing an effective rate of 19.3%. The difference from the nominal rate of 34% is mainly due to the different taxation (estimated profit taxation system) used at subsidiary Radar, and the equity accounting result of Raízen, which is not taxable.

For a better understanding, below are the income tax and social security expenses broken down by business unit.

4Q 2013 Income Tax and Social Contribution Amount in R$ MM | | Comgás | | | Rumo | | | Lubricants | | | Radar7 | | | | | | Adjusts and Eliminations | | | Consolidated | |

| Net Income before Taxes | | | 174.4 | | | | 70.9 | | | | 2.5 | | | | 87.6 | | | | (1.2 | ) | | | (137.4 | ) | | | 196.8 | |

| Nominal Rate of Income Tax and Social Contribution (%) | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % |

| Income Tax and Social Contribtions Theoretical Expense | | | (59.3 | ) | | | (24.1 | ) | | | (0.8 | ) | | | (29.8 | ) | | | 0.4 | | | | 46.7 | | | | (66.9 | ) |

| Non-taxable Permanent Differences / Equity Pick-up | | | (1.1 | ) | | | (0.0 | ) | | | (0.4 | ) | | | (0.0 | ) | | | 77.2 | | | | (46.7 | ) | | | 28.9 | |

| Tax Loss and Negative Basis | | | - | | | | - | | | | - | | | | - | | | | 188.6 | | | | - | | | | 188.6 | |

| Interest on Capital | | | - | | | | - | | | | - | | | | 24.3 | | | | 0.0 | | | | - | | | | 24.3 | |

| Different Tax Regime for Entities Taxed on Presumed Profits | | | 38.2 | | | | - | | | | - | | | | - | | | | (53.5 | ) | | | - | | | | (15.3 | ) |

| Other | | | 1.1 | | | | 0.3 | | | | (8.6 | ) | | | (0.0 | ) | | | 3.1 | | | | - | | | | (4.0 | ) |

| Income Tax Effective Expenses | | | (21.0 | ) | | | (23.8 | ) | | | (9.9 | ) | | | (5.5 | ) | | | 215.8 | | | | - | | | | 155.6 | |

| Income Tax and Social Contribution Effective Rate (%) | | | 12 | % | | | 34 | % | | | n/d | | | | 6 | % | | | n/d | | | | 0 | % | | | -79 | % |

| Expenses (Revenues) com IR/CS | | | (21.0 | ) | | | (23.8 | ) | | | (9.9 | ) | | | (5.5 | ) | | | 215.8 | | | | - | | | | 155.6 | |

| Current | | | 8.9 | | | | (16.9 | ) | | | (3.7 | ) | | | 0.5 | | | | 6.2 | | | | - | | | | (5.1 | ) |

| Effective Rate - Current Rate (%) | | | -5 | % | | | 24 | % | | | 150 | % | | | -1 | % | | | 512 | % | | | 0 | % | | | 3 | % |

| Deferred | | | (29.9 | ) | | | (6.9 | ) | | | (6.1 | ) | | | (5.9 | ) | | | 209.7 | | | | - | | | | 160.8 | |

| 2013 Income Tax and Social Contribution Amount in R$ MM | | Comgás | | | Rumo | | | Lubricants | | | Radar7 | | | | | | Adjusts and Eliminations | | | Consolidated | |

| Net Income before Taxes | | | 702.4 | | | | 293.0 | | | | 42.8 | | | | 229.9 | | | | 51.1 | | | | (502.3 | ) | | | 816.9 | |

| Nominal Rate of Income Tax and Social Contribution (%) | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % | | | -34 | % |

| Income Tax and Social Contribtions Theoretical Expense | | | (238.8 | ) | | | (99.6 | ) | | | (14.5 | ) | | | (78.2 | ) | | | (17.4 | ) | | | 170.8 | | | | (277.8 | ) |

| Non-taxable Permanent Differences / Equity Pick-up | | | (3.2 | ) | | | (0.6 | ) | | | (2.7 | ) | | | 0.0 | | | | 288.1 | | | | (170.8 | ) | | | 110.9 | |

| Tax Loss and Negative Basis | | | - | | | | - | | | | - | | | | 63.8 | | | | (0.5 | ) | | | - | | | | 63.3 | |

| Different Tax Regime for Entities Taxed on Presumed Profits | | | 38.2 | | | | - | | | | - | | | | - | | | | (60.3 | ) | | | - | | | | (22.1 | ) |

| Other | | | 2.5 | | | | 0.5 | | | | (21.9 | ) | | | 0.8 | | | | (34.5 | ) | | | - | | | | (52.8 | ) |

| Income Tax Effective Expenses | | | (201.3 | ) | | | (99.7 | ) | | | (39.1 | ) | | | (13.7 | ) | | | 175.4 | | | | - | | | | (178.4 | ) |

| Income Tax and Social Contribution Effective Rate (%) | | | 29 | % | | | 34 | % | | | 92 | % | | | 6 | % | | | n/d | | | | 0 | % | | | 22 | % |

| Expenses (Revenues) com IR/CS | | | (201.3 | ) | | | (99.7 | ) | | | (39.1 | ) | | | (13.7 | ) | | | 175.4 | | | | - | | | | (178.4 | ) |

| Current | | | (144.1 | ) | | | (15.3 | ) | | | 0.4 | | | | (5.3 | ) | | | 6.5 | | | | - | | | | (157.7 | ) |

| Effective Rate - Current Rate (%) | | | 21 | % | | | 5 | % | | | -1 | % | | | 2 | % | | | -13 | % | | | 0 | % | | | 19 | % |

| Deferred | | | (57.2 | ) | | | (84.4 | ) | | | (39.5 | ) | | | (8.4 | ) | | | 168.9 | | | | - | | | | (20.7 | ) |

Note7: Radar adopts tax regime for entities taxed on presumed profits

Current income tax and social security expenses represents the calculated tax amount payable/(recoverable). The amount effectively paid may still be deducted from existing tax credits

35 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

Net Income

| 4Q 2013 | 4Q 2012 | Net Income | 2013 | 2012 | 9M 2013 | FY 12/13 |

| (oct - dec) | (oct - dec) | Amounts in R$ MM | (jan-dec) | (jan-dec) | (mar/13-dec/13) | (apr/12-mar/13) |

| 229.8 | 339.3 | Net Income | 261.3 | 746.8 | 234.1 | 626.4 |

Cosan’s net income was R$229.8 million for 4Q13, down 32.3% from the R$339.3 million reported for 4Q12.

The key drivers of this decrease in 4Q13 were the following:

| 4Q 2013 | | Net Income | | 2013 | |

| (oct-dec) | | Amount in R$ MM | | (jan-dec) | |

| | 339.3 | | Net Income Previous Period | | | 746.8 | |

| | | | | | | | |

| | | | EBIT Businesses | | | | |

| | 144.2 | | Comgás | | | 814.4 | |

| | (12.1 | ) | Rumo | | | 110.2 | |

| | (10.3 | ) | Radar | | | 111.9 | |

| | (16.0 | ) | Lubrificantes | | | 9.1 | |

| | 18.1 | | Outros | | | 50.9 | |

| | 123.9 | | EBIT Businesses Total | | | 1,096.6 | |

| | | | | | | | |

| | (165.1 | ) | Financial Result | | | (570.6 | ) |

| | (104.2 | ) | Equity Pick-up | | | (407.0 | ) |

| | 194.1 | | Income Taxes | | | (219.2 | ) |

| | (20.7 | ) | Non-controlling Interest | | | (243.1 | ) |

| | (137.4 | ) | Dicountinued operation | | | (142.2 | ) |

| | | | | | | | |

| | 229.8 | | Net Income | | | 261.3 | |

| | (i) | An increase in net financial expenses of R$165.1 million, mainly due to the acquisition and consolidation of Comgás, and the effect of the foreign exchange rate variation over dollar-denominated debts in the period. In 2013, this effect totaled R$570.6 million; |

| | (ii) | A decrease in Raízen’s equity accounting result in the amount of R$107.1 million due to the strategy of forming inventories, to biological assets, and to the foreign exchange rate variation over debts; |

| | (iii) | A decrease of R$137.4 million due to the disposal of the control of the Sugar Retail business in October 2012. In 2013, this impact was of R$142.2 million; |

| | (iv) | Offset by a better performance of the businesses in the period, as commented above, and the consolidation of Comgás starting in November 2012; |

| | (v) | Income tax increment of R$194 million (non-cash effect). |

36 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

D. Indebtedness

At the close of 4Q13, Cosan’s proforma consolidated debt (excluding PESA) was R$12.6 billion, compared to R$12 billion in 3Q13. Below are the separate debts of Cosan and Subsidiaries, and also Raízen’s debts, which are proforma at a proportion of 50%.

Cosan and Subsidiaries

Gross debt totaled R$8.6 billion in 4Q13, an increase of 1.8% from 3Q13.

The key events in the period were:

| | (i) | Funding of nearly R$553.4 million through the issue of debentures at Comgás; |

| | (ii) | Amortization of principal and interest in the amount of R$666,5 million, in the modality of Resolution 4,131 and in Promissory Notes, mainly at Comgás; |

| | (iii) | Accrual for interest, foreign exchange variation, and derivatives fair value result, in the amount of R$269.2 million in the period. |

Raízen

The combined gross debt of Raízen totaled R$7.9 billion in 4Q13, up 11.9% year-over-year.

In the quarter, changes in debt principal and interest were as follows:

| | (i) | Raising of R$1.4 billion, mainly through the issue of debentures for the amount of R$750 million, and other rural credit, ACC and other funding transactions. |

| | (ii) | Amortization of principal and interest in the amount of R$928.4 million related to prepayment, foreign exchange contract advances, rural credit, BNDES, and others; |

| | (iii) | Accrual for interest of R$139.6 million, and for foreign exchange variation in the amount of R$212.8 million. |

Cosan – proforma Consolidated

Cash available totaled R$2.3 billion in 4Q13, up from R$2.1 billion in 3Q13. Net proforma indebtedness totaled R$10.3 billion for the quarter, as compared to R$9.9 billion in 3Q13, equal to a leverage of 2.6x proforma LTM EBITDA (R$4 billion).

37 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

| Debt per Business Units (Amount in R$ MM) | | | | |

| | 4Q 2013 | 3Q 2013 | | |

| Comgás | (oct - dec) | (jul-sep) | % ST | Chg.% |

| Leasing | 1.1 | 1.4 | 100% | -22.9% |

| Promissory Notes | - | 418.4 | 0% | n/a |

| EIB | 633.2 | 602.6 | 6% | 5.1% |

| 4131 Resolution | 413.5 | 504.8 | 1% | -18.1% |

| BNDES | 1,215.1 | 1,230.6 | 21% | -1.3% |

| Debentures | 588.9 | 33.9 | 7% | n/a |

| Debt Notes Allocation | (10.4) | (3.9) | 21% | n/a |

| Financial Instruments - MTM | (209.8) | (180.0) | -23% | 16.6% |

| Total Comgás | 2,631.6 | 2,607.8 | - | 0.9% |

| Rumo | | | | |

| Finame | 707.5 | 731.9 | 15% | -3.3% |

| Expenses with Placement of Debt | (1.5) | (1.5) | 11% | -2.6% |

| Total Rumo | 706.0 | 730.4 | - | -3.3% |

| Cosan Lubricants | | | | |

| Finame | 0.2 | 0.2 | 6% | 0.0% |

| Foreing Loan | 209.3 | 196.9 | 0% | 6.3% |

| Total Lubricants | 209.6 | 197.2 | - | 6.3% |

| Other Business | | | | |

| Perpetual Bonds | 1,186.1 | 1,129.1 | 1% | 5.0% |

| Credit Notes | 395.4 | 385.6 | 100% | 2.5% |

| Debentures | 1,464.2 | 1,423.6 | 4% | 2.8% |

| FINEP | 89.9 | 89.9 | 0% | 0.0% |

| Senior Notes 2018 | 873.8 | 853.6 | 3% | 2.4% |

| Senior Notes 2023 | 1,110.0 | 1,067.1 | 2% | 4.0% |

| Expenses with Placement of Debt | (51.2) | (52.6) | 18% | -2.7% |

| Bonus over Perpetual Bonds | 5.1 | 5.5 | 52% | -7.1% |

| Financial Instruments - MTM | 24.8 | 51.9 | 0% | -52.3% |

| Total Other Business | 5,098.0 | 4,953.7 | - | 2.9% |

| Cosan Consolidated | | | | |

| Total Debt | 8,645.2 | 8,489.1 | - | 1.8% |

| Cash and Cash Equivalents and Secutities | (1,562.5) | (1,307.9) | - | 19.5% |

| Net Debt | 7,082.6 | 7,181.3 | - | -1.4% |

| | | | | |

| Raízen | | | | |

| Senior Notes 2014 | 849.1 | 789.8 | 100.0% | 7.5% |

| BNDES | 1,370.7 | 1,419.2 | 14% | -3.4% |

| Term Loan | 1,121.6 | 1,123.4 | 6% | -0.2% |

| Prepaid Exports | 1,119.5 | 1,277.6 | 1% | -12.4% |

| Senior Notes 2017 | 964.2 | 902.2 | 3% | 6.9% |

| Advances on Exchange Contracts | 189.5 | 179.7 | 100% | 5.4% |

| Credit Notes | 628.0 | 613.4 | 1% | 2.4% |

| Finame | 100.9 | 115.7 | 45% | -12.8% |

| Finem | 627.4 | 545.5 | 9% | 15.0% |

| Rural Credit | 767.1 | - | 2% | n/a |

| Debt Notes Allocation | 49.6 | 78.5 | 100% | -36.8% |

| Other | (24.5) | (22.5) | 37% | 9.2% |

Total Raízen8 | 96.7 | 0.1 | 100% | n/a |

| Raízen's Debt ( 50% ) | 7,859.8 | 7,022.8 | - | 11.9% |

| Cash and Cash Equivalents and Secutities Raízen | 3,929.9 | 3,511.4 | - | 11.9% |

| Net Debt Raízen | (693.7) | (800.5) | - | -13.3% |

| Consolidated Proforma | 3,236.2 | 2,710.9 | - | 19.4% |

| Total Debt (including Raízen) | | | | |

| Cash and Cash Equivalents and Secutities (including Raízen) | 12,575.0 | 12,000.5 | - | 4.8% |

| Cash and Cash Equivalents and Secutities | (2,256.3) | (2,108.4) | - | 7.0% |

| Pro forma Net Debt | 10,318.8 | 9,892.1 | - | 4.3% |

Note 8: Excluding the PESA debt.

38 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

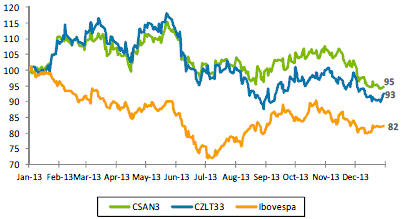

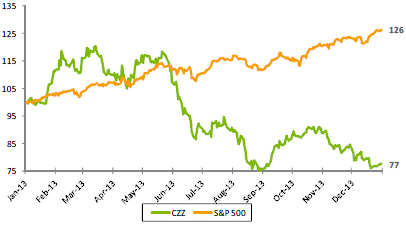

E. Stock Performance

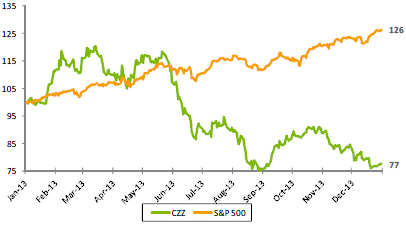

The common shares issued by Cosan S.A. have been listed on BM&FBovespa since 2005, the year of its IPO on the “Novo Mercado” segment under the ticker symbol CSAN3, and are included in the portfolios of the Ibovespa, IBrX, IBrX-50, IBrA, MLCX, ICO2, INDX, ICON, IVBX-2, IGC, IGCT and ITAG indexes.

The shares issued by Cosan Limited, Cosan S.A.'s parent company, have been listed on NYSE since its IPO in 2007, under the ticker symbol CZZ. The company has also issued share deposit certificates (Brazilian Depositary Receipts - BDR) on the BM&FBovespa under the symbol CZLT33.

The tables and graphs below represent the performance of shares issued by the companies:

| 4Q 2013 Summary | CSAN3 | CZLT33 | CZZ |

| Stock Type | Common Share | BDR | Class A |

| Listed in | BM&FBovespa | BM&FBovespa | NYSE |

| Closing Price in december 12/31/2013 | R$ | 39.58 | R$ | 33.00 | USD 13.72 |

| Higher Price | R$ | 48.17 | R$ | 42.34 | USD 21.31 |

| Average Price | R$ | 43.44 | R$ | 36.71 | USD 17.11 |

| Lower Price | R$ | 39.28 | R$ | 32.05 | USD 13.20 |

| Average Daily Traded Volume | R$50.6 million | R$9 million | USD17,9million |

| CSAN3 vs. CZLT33 vs. Ibovespa (Base 100) | | CZZ vs. S&P500

(Base 100) |

| | | |

| |  |

39 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

F. Guidance

This section contains the guidance broken down by variation range for some key parameters in Cosan’s consolidated results for the 2014. In addition, other parts of this Earnings Release may contain forecasts. Such projections and guidance are but estimates and indications, and as such these do not represent any guarantee of prospective results.

This guidance considers the operations of the Cosan group today, which include Comgás, Rumo, Cosan Lubrificantes e Especialidades, Radar, and Other Businesses, as well as the operations of Raízen Combustíveis and Raízen Energia.

Cosan’s consolidated EBITDA is proforma, including 50% of the results of Raízen Combustíveis and Raízen Energia. As mentioned before, following the adoption of IFRS 11 – Joint Arrangements, Raízen is not longer proportionately consolidated in Cosan, and is only reported under “Equity Accounting Result,” considering our 50% interest in Net Income. Moreover, Comgás’s EBITDA continues to be reported under Brazilian accounting principles (IFRS), which does not consider the effects of the Regulatory Current Account.

| | | FY13 | 2013 dec | 2014 dec |

| | | (abr/2012 - mar/2013) | (jan/2013 - dec/2013) | (jan/2014 - dec/2014) |

| Cosan | EBITDA (R$MM) | 3,124 | 3,964 | 4.150 | ≤ ∆ ≤ 4.650 |

| Consolidado | Capex (R$MM) | 2,178 | 2,895 | 2.500 | ≤ ∆ ≤ 2.800 |

| | | | | |

| Raízen | EBITDA (R$MM) | 1,658 | 1,928 | 2.000 | ≤∆ ≤ 2.200 |

| Combustíveis9 | CAPEX (R$MM) | 524 | 835 | 750 | ≤ ∆ ≤ 850 |

| | | | | |

| | Volume of Sugar Cane Crushed (thousand tonnes) | 56,221 | 61,441 | 61.000 | ≤∆ ≤ 63.000 |

| | Volume of Sugar Sold (thousand tonnes) | 4,230 | 4,470 | 4.400 | ≤ ∆ ≤ 4.700 |

| Raízen Energia | Volume of Ethanol Sold (million liters) | 2,323 | 2,475 | 2.300 | ≤ ∆ ≤ 2.600 |

| | Volume of Energy Sold (thousand of MWh) | 3,035 | 2,165 | 2.000 | ≤ ∆ ≤ 2.200 |

| | EBITDA (R$MM) | 2,408 | 2,112 | 2.300 | ≤ ∆ ≤ 2.700 |

| | CAPEX (R$MM) | 2,405 | 2,531 | 2.000 | ≤ ∆ ≤ 2.200 |

| | | | | | |

| | Volume of Loading (thousand tonnes) | 8,566 | 9,177 | 10.500 | ≤ ∆ ≤ 12.500 |

| Rumo | EBITDA (R$MM) | 297 | 358 | 400 | ≤ ∆ ≤ 450 |

| | CAPEX (R$MM) | 267 | 255 | 250 | ≤ ∆ ≤ 300 |

| | | | | | |

| Radar | EBITDA (R$MM) | 180 | 228 | 170 | ≤ ∆ ≤ 200 |

| | | | | | |

| Cosan | Total Volume Sold (million Liters) | 287 | 316 | 270 | ≤ ∆ ≤ 310 |

| Lubrificantes | EBITDA (R$MM) | n/a | 140 | 140 | ≤ ∆ ≤ 170 |

| | | 2012 | 2013 | 2014 |

| | | (jan/2012 - dec/2012) | (jan/2013 - dec/2013) | (jan/2014 - dec/2014) |

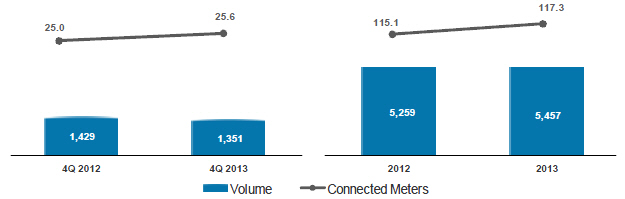

| | Number of Clients (thousand) | 1,215 | 1,334 | 1.420 | ≤ ∆ ≤ 1.450 |

| Comgás | Total Volume of Gas Sold (thousand cbm) | 5,259 | 5,457 | 5.200 | ≤ ∆ ≤ 5.700 |

| | EBITDA IFRS (R$MM) | 962 | 1,338 | 1.300 | ≤ ∆ ≤ 1.550 |

| | CAPEX (R$MM) | 546 | 852 | 680 | ≤ ∆ ≤ 780 |

Note 9: Preliminary figures subject to revision after Raízen’s budget proceeding is finalized.

40 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

Disclaimer

This document contains forward-looking statements and estimates. These forward-looking statements and estimates are solely forecasts and do not represent any guarantee of prospective results. All stakeholders should know that these statements and estimates are and will be, depending on the case, subject to risks, uncertainties and factors related to the operations and business environment of Cosan and its subsidiaries, and therefore the actual results of these companies may significantly differ from the estimated or implied prospective results contained in such forward-looking statements and estimates.

41 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

E. Financial Statements

E.1 Cosan S/A consolidated

| Cosan Consolidated | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 2,217,765 | | | | 1,566,314 | |

| Gross Profit | | | 652,361 | | | | 463,624 | |

| Sales, general and administrative expenses | | | (367,925 | ) | | | (300,657 | ) |

| Other operating income (expenses), net | | | 75,557 | | | | 73,160 | |

| Financial revenue | | | 73,354 | | | | 51,940 | |

| Financial expenses | | | (445,535 | ) | | | (176,861 | ) |

| Foreign exchange variation | | | 2,916 | | | | (5,380 | ) |

| Derivative | | | 117,150 | | | | 43,318 | |

| Equity pick up | | | 88,870 | | | | 193,052 | |

| Income and Social Contribution Taxes | | | 155,649 | | | | (38,422 | ) |

| Equity attributable to non-controlling interests | | | (122,611 | ) | | | (101,948 | ) |

| Net Income from discontinued operations | | | - | | | | 137,449 | |

| Net Income (loss) | | | 229,786 | | | | 339,276 | |

| Cosan Consolidated | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 1,474,553 | | | | 1,202,229 | |

| Securities | | | 87,978 | | | | 105,658 | |

| Accounts Rreceivable | | | 844,483 | | | | 997,114 | |

| Inventories | | | 311,980 | | | | 292,076 | |

| Other Current Assets | | | 827,648 | | | | 733,857 | |

| Investments | | | 103,316 | | | | 89,516 | |

| Investments in Jointly Owned Subsidiaries | | | 8,498,259 | | | | 8,468,438 | |

| Investment Property | | | 2,281,509 | | | | 2,523,405 | |

| Property, Plant and Equipment | | | 1,271,910 | | | | 1,249,958 | |

| Intangible | | | 10,078,040 | | | | 9,973,855 | |

| Other Non-Current Assets | | | 2,818,698 | | | | 2,466,499 | |

| Total Assets | | | 28,598,374 | | | | 28,102,605 | |

| | | | | | | | | |

| Loans and Financing | | | (8,830,159 | ) | | | (8,617,159 | ) |

| Suppliers | | | (862,431 | ) | | | (841,972 | ) |

| Salaries Payable | | | (103,295 | ) | | | (105,593 | ) |

| Other current liabilities | | | (683,938 | ) | | | (627,022 | ) |

| Other non-current liabilities | | | (4,603,182 | ) | | | (4,653,842 | ) |

| Net Equity | | | (13,515,369 | ) | | | (13,257,017 | ) |

| Total Liabilities | | | (28,598,374 | ) | | | (28,102,605 | ) |

42 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

E.2 Raízen Combustiveis

| Raízen Combustíveis | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 13,064,848 | | | | 11,383,783 | |

| Gross Profit | | | 701,019 | | | | 610,536 | |

| Sales, general and administrative expenses | | | (395,908 | ) | | | (363,045 | ) |

| Other operating income (expenses), net | | | 145,956 | | | | 114,134 | |

| Financial revenue | | | 17,161 | | | | 23,083 | |

| Financial expenses | | | (24,502 | ) | | | (19,092 | ) |

| Foreign exchange variation | | | (63,656 | ) | | | (5,426 | ) |

| Derivative | | | 28,889 | | | | 8,996 | |

| | | | | | | | | |

| Income and Social Contribution Taxes | | | (91,236 | ) | | | (109,053 | ) |

| Equity attributable to non-controlling interests | | | (4,402 | ) | | | (7,330 | ) |

| Net Income (loss) | | | 318,147 | | | | 252,803 | |

| Raízen Combustíveis | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 328,992 | | | | 354,503 | |

| Accounts Receivable | | | 1,435,095 | | | | 1,326,865 | |

| Inventories | | | 1,057,049 | | | | 1,302,834 | |

| Other Current Assets | | | 484,475 | | | | 857,282 | |

| Investments | | | 254,826 | | | | - | |

| Property, Plant and Equipment | | | 2,494,488 | | | | 2,519,491 | |

| Intangible | | | 4,038,312 | | | | 4,028,655 | |

| Other Non-Current Assets | | | 1,403,117 | | | | 1,110,940 | |

| Total Assets | | | 11,496,354 | | | | 11,500,570 | |

| | | | | | | | | |

| Loans and Financing | | | (862,521 | ) | | | (787,527 | ) |

| Suppliers | | | (551,176 | ) | | | (529,708 | ) |

| Salaries Payable | | | (60,091 | ) | | | (254,561 | ) |

| Other current liabilities | | | (525,188 | ) | | | (712,163 | ) |

| Other non-current liabilities | | | (2,715,727 | ) | | | (2,615,511 | ) |

| Net Equity | | | (6,781,651 | ) | | | (6,601,100 | ) |

| Total Liabilities | | | (11,496,354 | ) | | | (11,500,570 | ) |

43 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

| Raízen Energia | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 2,125,399 | | | | 2,605,413 | |

| Gross Profit | | | 308,436 | | | | 576,578 | |

| Sales, general and administrative expenses | | | (282,514 | ) | | | (309,329 | ) |

| Other operating income (expenses), net | | | (24,471 | ) | | | 10,235 | |

| Financial revenue | | | 64,517 | | | | 38,408 | |

| Financial expenses | | | (123,093 | ) | | | (97,253 | ) |

| Foreign exchange variation | | | (127,314 | ) | | | (16,375 | ) |

| Derivative | | | (56,454 | ) | | | (7,832 | ) |

| Equity pick up | | | (11,738 | ) | | | (3,210 | ) |

| Income and Social Contribution Taxes | | | 97,106 | | | | (67,167 | ) |

| Equity attributable to non-controlling interests | | | - | | | | (347 | ) |

| Net Income (loss) | | | (155,525 | ) | | | 123,709 | |

| Raízen Energia | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 1,058,483 | | | | 1,246,573 | |

| Accounts Rreceivable | | | 416,746 | | | | 494,724 | |

| Inventories | | | 2,026,925 | | | | 1,707,606 | |

| Other Current Assets | | | 1,279,553 | | | | 1,275,795 | |

| Investments | | | 408,591 | | | | 1,936,168 | |

| Biological Assets | | | 1,867,765 | | | | - | |

| Property, Plant and Equipment | | | 9,504,874 | | | | 9,485,631 | |

| Intangible | | | 3,100,227 | | | | 3,062,760 | |

| Other Non-Current Assets | | | 1,534,557 | | | | 1,822,915 | |

| Total Assets | | | 21,197,721 | | | | 21,032,172 | |

| | | | | | | | | |

| Loans and Financing | | | (7,732,778 | ) | | | (6,963,654 | ) |

| Suppliers | | | (633,505 | ) | | | (730,321 | ) |

| Salaries Payable | | | (249,919 | ) | | | (872,731 | ) |

| Other current liabilities | | | (495,240 | ) | | | (279,758 | ) |

| Other non-current liabilities | | | (1,693,036 | ) | | | (1,676,670 | ) |

| Net Equity | | | (10,393,243 | ) | | | (10,509,038 | ) |

| Total Liabilities | | | (21,197,721 | ) | | | (21,032,172 | ) |

44 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

| Comgás | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 1,600,715 | | | | 1,467,168 | |

| Gross Profit | | | 454,516 | | | | 383,914 | |

| Sales, general and administrative expenses | | | (234,860 | ) | | | (223,628 | ) |

| Other operating income (expenses), net | | | 3,552 | | | | (1,521 | ) |

| Financial revenue | | | 20,012 | | | | 9,811 | |

| Financial expenses | | | (70,028 | ) | | | (53,717 | ) |

| Foreign exchange variation | | | (49,032 | ) | | | (129 | ) |

| Derivative | | | 50,205 | | | | 15,077 | |

| Income and Social Contribution Taxes | | | (21,035 | ) | | | (19,426 | ) |

| Net Income (loss) | | | 153,328 | | | | 110,381 | |

| Comgás | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 535,957 | | | | 459,598 | |

| Accounts Rreceivable | | | 582,889 | | | | 564,233 | |

| Inventories | | | 121,253 | | | | 113,330 | |

| Other Current Assets | | | 248,803 | | | | 252,383 | |

| Intangible | | | 8,450,541 | | | | 8,353,844 | |

| Other Non-Current Assets | | | 332,918 | | | | 285,227 | |

| Total Assets | | | 10,272,361 | | | | 10,028,615 | |

| | | | | | | | | |

| Loans and Financing | | | (2,841,387 | ) | | | (2,787,767 | ) |

| Suppliers | | | (706,397 | ) | | | (694,029 | ) |

| Salaries Payable | | | (59,417 | ) | | | (49,274 | ) |

| Other current liabilities | | | (301,089 | ) | | | (160,832 | ) |

| Other non-current liabilities | | | (863,768 | ) | | | (854,055 | ) |

| Net Equity | | | (5,500,303 | ) | | | (5,482,658 | ) |

| Total Liabilities | | | (10,272,361 | ) | | | (10,028,615 | ) |

45 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

| Rumo | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 206,512 | | | | 221,568 | |

| Gross Profit | | | 93,478 | | | | 100,132 | |

| Sales, general and administrative expenses | | | (22,574 | ) | | | (15,203 | ) |

| Other operating income (expenses), net | | | (1,934 | ) | | | (3,855 | ) |

| Financial revenue | | | 12,644 | | | | 8,757 | |

| Financial expenses | | | (11,016 | ) | | | (8,757 | ) |

| Foreign exchange variation | | | 341 | | | | (67 | ) |

| Income and Social Contribution Taxes | | | (23,788 | ) | | | (26,817 | ) |

| Equity attributable to non-controlling interests | | | 1,409 | | | | 623 | |

| Net Income (loss) | | | 48,560 | | | | 54,814 | |

| Rumo | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 497,753 | | | | 547,287 | |

| Securities | | | - | | | | 8,864 | |

| Accounts Rreceivable | | | 32,506 | | | | 195,739 | |

| Inventories | | | 5,237 | | | | 4,667 | |

| Other Current Assets | | | 22,389 | | | | 47,643 | |

| Property, Plant and Equipment | | | 1,013,149 | | | | 1,003,323 | |

| Intangible | | | 755,635 | | | | 743,679 | |

| Other Non-Current Assets | | | 234,965 | | | | 11,025 | |

| Total Assets | | | 2,561,634 | | | | 2,562,227 | |

| | | | | | | | | |

| Loans and Financing | | | (705,974 | ) | | | (730,424 | ) |

| Suppliers | | | (82,872 | ) | | | (81,923 | ) |

| Salaries Payable | | | (12,522 | ) | | | (12,230 | ) |

| Other current liabilities | | | (127,287 | ) | | | (158,422 | ) |

| Other non-current liabilities | | | (198,620 | ) | | | (192,017 | ) |

| Net Equity | | | (1,434,359 | ) | | | (1,387,211 | ) |

| Total Liabilities | | | (2,561,634 | ) | | | (2,562,227 | ) |

46 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

E.5 Cosan Lubricants & Specialties

| Lubricants and Specialties | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 391,822 | | | | 377,932 | |

| Gross Profit | | | 85,650 | | | | 102,615 | |

| Sales, general and administrative expenses | | | (76,208 | ) | | | (75,788 | ) |

| Other operating income (expenses), net | | | (2,295 | ) | | | (3,668 | ) |

| Financial revenue | | | (3,389 | ) | | | (3,071 | ) |

| Financial expenses | | | - | | | | - | |

| Foreign exchange variation | | | - | | | | - | |

| Derivative | | | - | | | | - | |

| Equity pick up | | | (1,278 | ) | | | (67 | ) |

| Income and Social Contribution Taxes | | | (9,865 | ) | | | (3,875 | ) |

| Net Income (loss) | | | (7,385 | ) | | | 16,145 | |

| Lubricants and Specialties | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 57,892 | | | | 68,905 | |

| Securities | | | - | | | | 580 | |

| Accounts Rreceivable | | | 200,796 | | | | 214,428 | |

| Inventories | | | 185,490 | | | | 174,077 | |

| Other Current Assets | | | 45,227 | | | | 64,672 | |

| Investments | | | 15,364 | | | | 15,864 | |

| Property, Plant and Equipment | | | 197,137 | | | | 192,552 | |

| Intangible | | | 867,826 | | | | 873,680 | |

| Other Non-Current Assets | | | (93,658 | ) | | | (64,430 | ) |

| Total Assets | | | 1,476,074 | | | | 1,540,328 | |

| | | | | | | | | |

| Loans and Financing | | | (209,579 | ) | | | (197,185 | ) |

| Suppliers | | | (70,102 | ) | | | (63,547 | ) |

| Salaries Payable | | | (13,039 | ) | | | (15,362 | ) |

| Other current liabilities | | | (107,826 | ) | | | (95,731 | ) |

| Other non-current liabilities | | | (327,564 | ) | | | (327,301 | ) |

| Net Equity | | | 747,964 | | | | (841,202 | ) |

| Total Liabilities | | | (1,476,074 | ) | | | (1,540,328 | ) |

47 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

| Radar | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 18,704 | | | | 15,568 | |

| Gross Profit | | | 18,704 | | | | 15,568 | |

| Sales, general and administrative expenses | | | (8,057 | ) | | | (6,118 | ) |

| Other operating income (expenses), net | | | 75,410 | | | | 86,917 | |

| Financial revenue | | | 1,822 | | | | 1,175 | |

| Financial expenses | | | (306 | ) | | | (953 | ) |

| Income and Social Contribution Taxes | | | (5,469 | ) | | | (6,338 | ) |

| Net Income (loss) | | | 82,104 | | | | 90,251 | |

| Radar | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 13,408 | | | | 13,524 | |

| Securities | | | 87,978 | | | | 94,685 | |

| Accounts Rreceivable | | | 28,051 | | | | 22,473 | |

| Other Current Assets | | | 323,476 | | | | 8,300 | |

| Investment Property | | | 2,281,509 | | | | 2,523,405 | |

| Property, Plant and Equipment | | | 11,195 | | | | 11,437 | |

| Intangible | | | 89 | | | | 85 | |

| Other Non-Current Assets | | | 4,884 | | | | 4,864 | |

| Total Assets | | | 2,750,590 | | | | 2,678,773 | |

| | | | | | | | | |

| Suppliers | | | (1,216 | ) | | | (936 | ) |

| Salaries Payable | | | (4,247 | ) | | | (15,928 | ) |

| Other current liabilities | | | (31,020 | ) | | | (27,185 | ) |

| Other non-current liabilities | | | (85,951 | ) | | | (76,997 | ) |

| Net Equity | | | (2,628,156 | ) | | | (2,557,727 | ) |

| Total Liabilities | | | (2,750,590 | ) | | | (2,678,773 | ) |

48 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

| Other Businesses | | 4Q 2013 | | | 4Q 2012 | |

| Income Statement for the period | | Dec 31, 2013 | | | Dec 31, 2012 | |

| Net Operating Revenue | | | 15 | | | | (0 | ) |

| Gross Profit | | | 15 | | | | (0 | ) |

| Sales, general and administrative expenses | | | (26,224 | ) | | | (38,101 | ) |

| Other operating income (expenses), net | | | 826 | | | | (5,372 | ) |

| Financial revenue | | | (203,366 | ) | | | (70,390 | ) |

| Financial expenses | | | - | | | | - | |

| Foreign exchange variation | | | - | | | | - | |

| Derivative | | | - | | | | - | |

| Equity pick up | | | 227,546 | | | | 316,298 | |

| Income and Social Contribution Taxes | | | 215,809 | | | | (2,494 | ) |

| Equity attributable to non-controlling interests | | | - | | | | (1,110 | ) |

| Net Income from discontinued operations | | | - | | | | 137,449 | |

| Net Income (loss) | | | 214,607 | | | | 336,279 | |

| Other Businesses | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 369,543 | | | | 112,915 | |

| Securities | | | - | | | | 1,529 | |

| Accounts Rreceivable | | | 241 | | | | 241 | |

| Inventories | | | - | | | | 2 | |

| Other Current Assets | | | 332,014 | | | | 413,259 | |

| Investments | | | 6,101,361 | | | | 6,086,566 | |

| Investments in Jointly Owned Subsidiaries | | | 8,498,259 | | | | 8,468,439 | |

| Property, Plant and Equipment | | | 50,429 | | | | 42,646 | |

| Intangible | | | 3,949 | | | | 2,567 | |

| Other Non-Current Assets | | | 2,755,373 | | | | 2,638,097 | |

| Total Assets | | | 18,111,169 | | | | 17,766,261 | |

| | | | | | | | | |

| Loans and Financing | | | (5,073,219 | ) | | | (4,901,783 | ) |

| Suppliers | | | (1,562 | ) | | | (1,537 | ) |

| Salaries Payable | | | (14,070 | ) | | | (12,799 | ) |

| Other current liabilities | | | (260,977 | ) | | | (243,656 | ) |

| Other non-current liabilities | | | (3,543,346 | ) | | | (3,605,350 | ) |

| Net Equity | | | (9,217,995 | ) | | | (9,001,136 | ) |

| Total Liabilities | | | (18,111,169 | ) | | | (17,766,261 | ) |

49 of 50

| Earnings Release 4th Quarter and Fiscal Year 2013 |

F. Financial Statements including Raízen

F.1 Cosan S/A consolidated, including Raízen

| Cosan Consolidated | | 4Q 2013 | | | 3Q 2013 | |

| Income Statement for the period | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Net Operating Revenue | | | 9,389,991 | | | | 8,397,096 | |

| Gross Profit | | | 1,156,547 | | | | 1,057,181 | |

| Sales, general and administrative expenses | | | (707,136 | ) | | | (636,844 | ) |

| Other operating income (expenses), net | | | 136,300 | | | | 135,344 | |

| Financial revenue | | | 114,193 | | | | 82,685 | |

| Financial expenses | | | (519,333 | ) | | | (235,033 | ) |

| Foreign exchange variation | | | (92,569 | ) | | | (16,280 | ) |

| Derivative | | | 103,367 | | | | 43,900 | |

| Equity pick up | | | 4,461 | | | | 3,192 | |

| Income and Social Contribution Taxes | | | 158,767 | | | | (126,532 | ) |

| Equity attributable to non-controlling interests | | | (124,812 | ) | | | (105,786 | ) |

| Net Income from discontinued operations | | | - | | | | 137,449 | |

| Net Income (loss) | | | 229,787 | | | | 339,276 | |

| Cosan Consolidated | | 4Q 2013 | | | 3Q 2013 | |

| Balance Sheet | | Dec 31, 2013 | | | Sep 30, 2013 | |

| Cash and Cash Equivalents | | | 2,168,291 | | | | 2,002,767 | |

| Securities | | | 87,978 | | | | 105,658 | |

| Accounts Rreceivable | | | 1,770,403 | | | | 1,814,482 | |

| Inventories | | | 1,840,976 | | | | 1,784,846 | |

| Other Current Assets | | | 1,576,808 | | | | 1,260,112 | |

| Investments | | | 418,755 | | | | 201,793 | |

| Investment Property | | | 2,281,509 | | | | 2,523,405 | |

| Biological Assets | | | 933,882 | | | | 968,084 | |

| Property, Plant and Equipment | | | 7,263,095 | | | | 7,244,022 | |

| Intangible | | | 13,647,310 | | | | 13,519,563 | |

| Other Non-Current Assets | | | 3,822,569 | | | | 3,389,893 | |

| Total Assets | | | 35,811,576 | | | | 34,814,625 | |

| | | | | | | | | |

| Loans and Financing | | | (13,127,808 | ) | | | (12,492,749 | ) |

| Suppliers | | | (1,454,769 | ) | | | (1,471,986 | ) |

| Salaries Payable | | | (258,301 | ) | | | (287,748 | ) |

| Other current liabilities | | | (1,056,318 | ) | | | (979,143 | ) |

| Other non-current liabilities | | | (6,343,162 | ) | | | (6,272,335 | ) |

| Net Equity | | | (13,571,218 | ) | | | (13,310,665 | ) |

| Total Liabilities | | | (35,811,576 | ) | | | (34,814,626 | ) |