| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

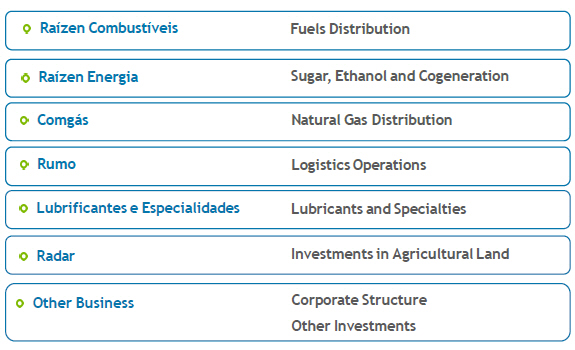

The increase in gasoline prices contributed to higher competitiveness of ethanol in the domestic market in four Brazilian states (São Paulo, Paraná, Goiás and Mato Grosso), where the price parity between ethanol and gasoline was below 70%.

In 3Q 2013, the aviation segment recorded a 4.8% reduction in volumes sold year-over-year, which was more than offset by the 10.9% increase in average price, resulting a growth of 5.6% in net revenue. Compared to 2Q 2012, volumes sold in this segment improved reporting an increase of 4.3%.

Fuels

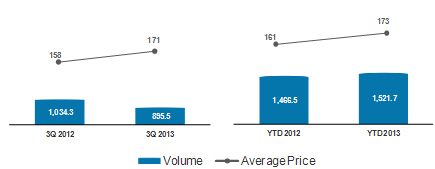

Volume Sold (million liters) and Average Unit Price (R$/cbm)

Inventories

| Fuels Inventories | | | 3Q 2013 | | | | 3Q 2012 | | | | |

| | | (jul - sep) | | | (jul - sep) | | | Chg.% | |

| 000' cbm | | | 731.9 | | | | 445.4 | | | | 64.3 | % |

| R$'MM | | | 1,302.8 | | | | 803.5 | | | | 62.1 | % |

| R$/cbm | | | 1,780.2 | | | | 1,804.0 | | | | -1.3 | % |

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Cost of Goods Sold

| | 3Q 2013 | | | | 3Q 2012 | | | | | COGS | | YTD 2013 | | | | YTD 2012 | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (12,077.2 | ) | | | (10,335.3 | ) | | | 16.9 | % | Fuel Sales | | | (33,652.3 | ) | | | (29,390.9 | ) | | | 14.5 | % |

| | Average Unitary Cost (R$/cbm) |

| | (1,975 | ) | | | (1,848 | ) | | | 6.9 | % | Fuel Sales | | | (1,971 | ) | | | (1,823 | ) | | | 8.1 | % |

In line with the growth in sales volume and rising prices of gasoline and diesel, the cost of goods sold by Raízen Combustíveis was R$12.1 billion in the 3Q 2013, up 16.9% compared to the 3Q 2012. Average unit cost rose 6.9% from R$1,848/cbm in the 3Q 2012 to R$1,975/cbm reported in 3Q 2013. When compared to 2Q 2013 the cost of goods sold grew 7.6%.

Gross Profit

| | 3Q 2013 | | | | 3Q 2012 | | | | | Gross Profit | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 660.0 | | | | 580.2 | | | | 13.8 | % | Gross Profit | | | 1,810.5 | | | | 1,792.3 | | | | 1.0 | % |

| | 5.2 | % | | | 5.3 | % | | -0.1 p.p. | | Gross Margin (%) | | | 5.1 | % | | | 5.7 | % | | -0.6 p.p. | |

| | 107.9 | | | | 103.7 | | | | 4.1 | % | Unitary Gross Margin (R$/cbm) | | | 106.0 | | | | 111.2 | | | | -4.6 | % |

Raízen Combustíveis reported gross income of R$660.0 million for 3Q 2013, an increase of 13.8% from the R$580.2 million recorded in 3Q 2012. Gross margin reached 5.2% and, measured in BRL per cbm, it totaled R$108/cbm, an increase of 4.1% year-over-year. Quarter-over-quarter, gross income rose 18.9%, and the gross margin measured in BRL per cbm was 10.2% higher than the R$98/cbm recorded in the previous quarter.

The key factors impacting the growth in gross margin for the quarter were the recovery in volumes of the aviation segment, which has a higher unit gross margin, compared to 2Q 2013 and initiatives to reduce logistics costs.

Selling, General and Administrative Expenses

| | 3Q 2013 | | | | 3Q 2012 | | | | | SG&A Expenses | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (263.1 | ) | | | (243.1 | ) | | | 8.2 | % | Selling Expenses | | | (776.0 | ) | | | (876.0 | ) | | | -11.4 | % |

| | (99.7 | ) | | | (92.3 | ) | | | 8.0 | % | G&A Expenses | | | (280.5 | ) | | | (293.1 | ) | | | -4.3 | % |

| | 66.3 | | | | (2.6 | ) | | | n/a | | Other Operational Revenues/Expenses | | | 213.6 | | | | 127.1 | | | | 68.0 | % |

Raízen Combustíveis’s selling expenses were up 8.2% in 3Q 2013, totaling R$ 263.1 million, chiefly due to higher volumes sold in the period in addition to institutional expenses related to marketing campaign. When compared to 2Q 2013 the cost of goods sold grew 6.5%.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

General and administrative expenses totaled R$99.7 million in 3Q 2013, up 8.0% y-o-y. When compared to 2Q 2013 the cost of goods sold grew 13.2%.

Other operating revenues and expenses reached R$66.3 million in 3Q 2013, comprised mainly of merchandise fees, convenience store royalties, revenue from leases, fees for the sale of lubricants at Raízen Combustíveis services stations, and revenues from assets sale. It is important to mention that Raízen Combustíveis had a non-recurring write-off of approximately R$25 million in its result in 3Q 2012 due to a revision in the base of property, plant and equipment disposed of in prior quarters.

EBITDA

| | 3Q 2013 | | | | 3Q 2012 | | | | | EBITDA | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 483.1 | | | | 375.5 | | | | 28.7 | % | EBITDA | | | 1,323.4 | | | | 1,093.8 | | | | 21.0 | % |

| | 3.8 | % | | | 3.4 | % | | 0.4 p.p | | EBITDA Margin (%) | | | 3.7 | % | | | 3.5 | % | | 0.2 p.p | |

In 3Q 2013, Raízen Combustíveis’ EBITDA increased by 28.7% compared to 3Q 2012, totaling R$483.1 million. EBITDA margin was 3.8%, a 0.4 p.p increase compared to 3Q 2012. Compared to the EBITDA of R$417.4 million reported 2Q 2013, the growth was 15.7%, which shows a recovery related to specific effects occurred in June 2013.

Capex

| | 3Q 2013 | | | | 3Q 2012 | | | | | CAPEX | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 143.4 | | | | 197.4 | | | | -27.3 | % | CAPEX | | | 386.2 | | | | 554.1 | | | | -30.3 | % |

Raízen Combustíveis’s Capex was R$143.4 million in 3Q 2013, decrease of 27.3% y-o-y mainly due to the completion of the “Esso” to “Shell” rebranding process, postponement of investments and the consolidation of the network growth based on rebates to dealers according to volumes targets.

These rebates are accounted as deductions from gross revenue totaling R$26.7 million this quarter impacting EBITDA margin in R$4.4/cbm, while in 3Q 2012 this bonus was of R$13.4 million or R$2.4/cbm. In the 2Q 2013 the same impact in EBITDA margin was R$33.6 million or R$5.9/cbm.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

B.2 Raízen Energia

The following are the results for Raízen Energia, whose core business is the production and sale of a variety of products derived from sugarcane, including raw sugar (Very High Polarization VHP), anhydrous and hydrous ethanol, as well as activities related to energy cogeneration from sugarcane bagasse and ethanol trading.

As mentioned in the previous quarter, due to the adoption of accounting rule IFRS 11 – Joint Arrangements, Cosan no longer consolidates Raízen in its balance sheet, financial statement and cash flow statement, Raízen’s result is reported under the “Equity Pick-up” line. Due to Raízen’s relevance to Cosan’s financial information, we will report the performance of this segment separately.

Year-to-date results for 2013 (YTD 2013) are pro forma, and consider the first nine months (January 2013 to September 2013) of Raízen Energia operations, to enable comparability of the periods. The same applies to the year-to-date results for 2012 (YTD 2012), which considers the months of January through September 2012.

Production Figures

CenterSouth Region

The rainy weather in the beginning of the harvest season affected not only the crushing in the period – especially between May and June—but also the sugar and ethanol production after that period. The rain in most of the Central-South region of Brazil has changed the physiology of the sugarcane which, from then on, was expected to strongly concentrate sugar in the cane. But the TRS levels were below expectations – an average 1.3% lower than in the previous year between June and September – and the sugar production was also affected, since the lower quality cane favors the production of ethanol.

From July to September, mills managed to maximize the crushing pace and crushed nearly 260 million tons of sugarcane. But they also faced weather issues, which prevented this figure from being even higher. The second half of September, for instance, recorded a decrease of over 20% in processed volumes compared to the first half of the month.

The number of crushing days lost this harvest due to rain in the Central-South region is above the average of the past years. Also, a higher mechanization level demands a longer time to resume crushing right after the rains, which delays the mills’ operation pace.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Out of the processed sugarcane volume until the end of September, 45.1% was used in sugar production, resulting in 25.2 million tons, while ethanol production totaled 18.8 billion liters – of which 8.1 billion liters were anhydrous and 10.8 billion, hydrous. All products increased year-over-year, however, although the cane crushing is 15.4% higher than the previous year, low levels of TRS caused an increase of only 5% in the sugar production volume in the period.

Raízen Energia

During 3Q 2013, Raízen Energia operated 24 sugar, ethanol and energy cogeneration mills, with a crushing capacity of 65.6 million tons of sugarcane per year.

| | 3Q 2013 | | | | 3Q 2012 | | | | | Operational Figures | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 26,824 | | | | 27,314 | | | | -1.8 | % | Crushed Sugarcane | | | 45,358 | | | | 38,378 | | | | 18.2 | % |

| | 11,745 | | | | 12,612 | | | | -6.9 | % | Own (‘000 tonnes) | | | 22,767 | | | | 19,068 | | | | 19.4 | % |

| | 15,079 | | | | 14,702 | | | | 2.6 | % | Suppliers (‘000 tonnes) | | | 22,591 | | | | 19,310 | | | | 17.0 | % |

| | 135.4 | | | | 147.0 | | | | -7.9 | % | Sugarcane TRS (kg/tonne) | | | 128.4 | | | | 132.1 | | | | -2.8 | % |

| | 94.0 | % | | | 91.3 | % | | 2.7 p.p | | Mechanization (%) | | | 94.0 | % | | | 91.3 | % | | 2.7 p.p | |

| | | | | | | | | | | | Production | | | | | | | | | | | | |

| | 2,128 | | | | 2,152 | | | | -1.1 | % | Sugar | | | 3,318 | | | | 2,800 | | | | 18.5 | % |

| | 1,337 | | | | 1,275 | | | | 4.9 | % | Raw Sugar (‘000 tonnes) | | | 2,203 | | | | 1,671 | | | | 31.9 | % |

| | 791 | | | | 877 | | | | -9.8 | % | White Sugar (‘000 tonnes) | | | 1,114 | | | | 1,129 | | | | -1.3 | % |

| | 884 | | | | 924 | | | | -4.3 | % | Ethanol | | | 1,479 | | | | 1,274 | | | | 16.1 | % |

| | 456 | | | | 408 | | | | 11.8 | % | Anhydrous Ethanol (‘000 cbm) | | | 716 | | | | 539 | | | | 32.8 | % |

| | 428 | | | | 516 | | | | -17.1 | % | Hydrous Ethanol (‘000 cbm) | | | 763 | | | | 735 | | | | 3.9 | % |

Raízen Energia recorded 26.8 million tons of crushed sugarcane in 3Q 2013, a decrease of 1.8% over 3Q 2012 (27.3 million tons). About 44% of which was own sugarcane, and 56% from suppliers.

During 3Q 2013, the mechanization of own sugarcane harvesting reached 94.0% and the TRS of the sugarcane reached 135.4 kg/ton in the same period, down 7.9% compared to 3Q 2012 when the TRS level was 147.0 kg/ton, thanks to the increased occurrence of rain early in the crop season which ultimately diluted the concentration of total sugars in the harvested cane.

Agricultural productivity measured in tons of sugarcane per hectare (TCH) reached 86.8 t/ha in 3Q 2013, a 6.2% growth compared to the 81.7 t/ha reported in 3Q 2012.

The sugarcane field reached an average age of 3.1 years due to renewal of approximately 20% of the company’s own fields in the interseason period. Production mix was concentrated in sugar, with approximately 60% of sugarcane crushed used to make this product, totaling 2.1 million tons of sugar and 884 million liters of ethanol produced

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Net revenue

| | 3Q 2013 | | | | 3Q 2012 | | | | | Sales Breakdown | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 3,246.7 | | | | 2,248.4 | | | | 44.4 | % | Net Operating Revenue | | | 7,075.3 | | | | 4,705.8 | | | | 50.4 | % |

| | 1,492.3 | | | | 1,302.2 | | | | 14.6 | % | Sugar Sales | | | 3,428.2 | | | | 2,592.6 | | �� | | 32.2 | % |

| | 211.7 | | | | 261.1 | | | | -18.9 | % | Domestic Market | | | 595.3 | | | | 726.7 | | | | -18.1 | % |

| | 1,280.6 | | | | 1,041.1 | | | | 23.0 | % | Foreign Market | | | 2,832.8 | | | | 1,865.9 | | | | 51.8 | % |

| | 1,519.8 | | | | 717.0 | | | | 112.0 | % | Ethanol Sales | | | 3,223.8 | | | | 1,753.9 | | | | 83.8 | % |

| | 870.4 | | | | 281.5 | | | | 209.2 | % | Domestic Market | | | 1,722.4 | | | | 830.6 | | | | 107.4 | % |

| | 339.7 | | | | 286.9 | | | | 18.4 | % | Foreign Market | | | 850.5 | | | | 624.4 | | | | 36.2 | % |

| | 309.7 | | | | 148.6 | | | | 108.4 | % | Trading | | | 650.8 | | | | 299.0 | | | | 117.7 | % |

| | 153.3 | | | | 163.9 | | | | -6.5 | % | Energy Cogeneration | | | 263.6 | | | | 236.2 | | | | 11.6 | % |

| | 81.4 | | | | 65.3 | | | | 24.7 | % | Other Products and Services | | | 159.8 | | | | 123.0 | | | | 29.9 | % |

Raízen Energia’s net revenue reached R$3.2 billion in 3Q 2013, up 44.4% compared to the 3Q 2012, when the reported amount was R$2.2 billion. The key drivers of the growth in net revenue in the period were the higher volumes of sugar and ethanol sold, and the better prices of ethanol both in domestic and international markets.

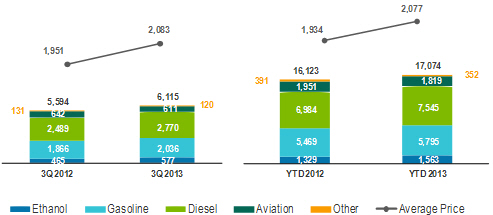

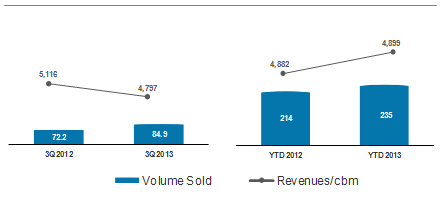

Sugar Sales

During 3Q 2013 net revenue from sugar sales totaled R$1.5 billion, 14.6% higher than the R$1.3 billion recorded in 3Q 2012. Revenue from sugar sales represented approximately 46% of Raízen Energia’s net revenue in the 3Q 2013.

The main driver of net revenue increase in the 3Q 2013 was the 23.8% expansion in volumes sold, equivalent to R$310.5 million, which more than offset the 7.5% decrease in the average price, from R$ 1.068/ton in 3Q 2012 to R$ 988/ton in 3Q 2013.

Sugar

Sales Volume (’000 tons) and Average Unit Price (R$/ton)

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Sugar Inventories

| Sugar Inventories | | | 3Q 2013 | | | | 3Q 2012 | | | | |

| | | (jul - sep) | | | (jul - sep) | | | Chg.% | |

| ´000 tonne | | | 1,087.0 | | | | 1,134.4 | | | | -4.2 | % |

| R$'MM | | | 746.6 | | | | 794.8 | | | | -6.1 | % |

| R$/tonne | | | 686.8 | | | | 700.6 | | | | -2.0 | % |

Ethanol Sales

Net revenue from ethanol sales totaled R$1.5 billion in 3Q 2013, up 112.0% compared to 3Q 2012, which was R$717.0 million. The revenue increase is justified by a 4.6% increase in average price as well as by an increase of 103.6% in sales volume in the quarter.

Sales of ethanol in the domestic market reached 65% of total sales in 3Q 2013, mainly driven by the higher demand for anhydrous ethanol in the Central-South region—38% higher than in the same period last year – mainly due to the mandatory increase to 25% in the gasoline blend.

In the 3Q 2013, net revenue from ethanol trading, which represents purchase and sale transactions in the international market, totaled R$309.7 million, moving approximately 174 million liters in the period.

Ethanol

Sales Volume (million liters) and Average Unit Price (R$/cbm)

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Ethanol Inventories

| Ethanol Inventories | | | 3Q 2013 | | | | 3Q 2012 | | | | |

| | | (jul - sep) | | | (jul - sep) | | | Chg.% | |

| ´000 cbm | | | 653.0 | | | | 656.5 | | | | -0.5 | % |

| R$'MM | | | 720.4 | | | | 743.0 | | | | -3.0 | % |

| R$/cbm | | | 1,103.2 | | | | 1,131.7 | | | | -2.5 | % |

Energy Cogeneration

All of Raízen Energia’s 24 mills generate energy and are self-sufficient, and 13 sell surplus energy from cogeneration.

Net revenue from energy sales in 3Q 2013 reached R$153.3 million, down 6.5% compared to 3Q 2012. During the quarter, total energy sales volume amounted to 895.5 thousand MWh with an average price of R$ 171/MWh, 8.0% above the average price of R$158/MWh in 3Q 2012.

The reduction in energy resale operations in the spot market contributed to the 13.4% decline in the total volume of energy sold, and was the main driver for the drop in net revenue in the quarter.

Electric Energy

Sales Volume (‘000 MWh) and Average Unit Price (R$/MWh)

Other Products and Services

In 3Q 2013, revenue from other products and services totaled R$81.4 million, representing growth of 24.7% over 3Q 2012, relative to the sale of steam, molasses and raw materials to service providers in the agricultural industry.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Cost of Goods Sold

Raízen Energia's cost of goods sold is reported together with the average unit costs, net of the effects of depreciation and amortization (cash cost).

| | 3Q 2013 | | | | 3Q 2012 | | | | | COGS per Product | | YTD 2013 | | | YTD 2012 | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (2,520.7 | ) | | | (1,667.9 | ) | | | 51.1 | % | Cost of Goods Sold | | | (5,864.1 | ) | | | (3,519.2 | ) | | | 66.6 | % |

| | (1,048.2 | ) | | | (858.8 | ) | | | 22.1 | % | Sugar | | | (2,486.4 | ) | | | (1,830.9 | ) | | | 35.8 | % |

| | (1,037.6 | ) | | | (497.5 | ) | | | 108.6 | % | Ethanol | | | (2,240.1 | ) | | | (1,315.5 | ) | | | 70.3 | % |

| | (297.2 | ) | | | (138.4 | ) | | | 114.8 | % | Trading | | | (636.4 | ) | | | (283.4 | ) | | | 124.6 | % |

| | (59.2 | ) | | | (91.5 | ) | | | -35.2 | % | Energy Cogeneration | | | (119.4 | ) | | | (134.8 | ) | | | -11.4 | % |

| | (78.4 | ) | | | (81.8 | ) | | | -4.1 | % | Others | | | (381.8 | ) | | | 45.4 | | | | -940.4 | % |

| | | | | | | | | | | | Average Unitary Costs3 | | | | | | | | | | | | |

| | (500.0 | ) | | | (483.2 | ) | | | 3.5 | % | Cash Cost of Sugar (R$/tonne) | | | (501.6 | ) | | | (510.6 | ) | | | -1.8 | % |

| | (895.0 | ) | | | (650.4 | ) | | | 37.6 | % | Cash Cost of Ethanol (R$/’000 liters) | | | (860.4 | ) | | | (768.3 | ) | | | 12.0 | % |

Note 3: Average unit costs represent the cash cost, which is net of plantation and cultivation area depreciation and amortization, agricultural depreciation (machinery and equipment), industrial depreciation, and harvest off-season maintenance.

In 3Q 2013, Raízen Energia’s cost of goods sold totaled R$2.5 billion, up 51.1% (compared to a 44.4% increase in net revenues) from the R$1.7 billion recorded in 3Q 2012. The higher volumes of sugar and ethanol sold, were the main drivers for the cost increase in this quarter. Important to mention that approximately 35% of the total ethanol sold in 3Q 2013 was originated in from domestic market, which explains the higher costs.

In addition, there was less dilution on planting and treatment costs, due to a 7.9% drop in the level of TRS, from 147.0 kg/ton in 3Q 2012 to 135.4 kg/ton in 3Q 2013.

Some factors offsetting the rise in Raízen Energia’s cost of goods sold were the following:

| · | 6.2% increase in sugarcane field productivity – represented by a higher TCH, which was 86.8 in 3Q 2013 compared to 81.7 in 3Q 2012; |

| · | 7.6% decrease in the cost of CONSECANA’s TCH, from R$0.4806 in 3Q 2012 to R$0.4439 in 3Q 2013, which has a direct impact on the cost of sugarcane from suppliers; |

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Gross Profit

| | 3Q 2013 | | | | 3Q 2012 | | | | | Gross Profit and Gross Margin | | YTD 2013 | | | YTD 2012 | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 726.1 | | | | 580.4 | | | | 25.1 | % | Gross Profit | | | 1,211.2 | | | | 1,186.6 | | | | 2.1 | % |

| | 444.1 | | | | 443.4 | | | | 0.2 | % | Sugar | | | 941.8 | | | | 761.7 | | | | 23.6 | % |

| | 29.8 | % | | | 34.1 | % | | -4.3 p.p. | | Sugar Gross Margin (%) | | | 27.5 | % | | | 29.4 | % | | -1.9 p.p. | |

| | 49.4 | % | | | 54.8 | % | | -5.3 p.p. | | Sugar (Cash) Gross Margin (%) | | | 48.3 | % | | | 50.3 | % | | -2.0 p.p. | |

| | 172.5 | | | | 70.9 | | | | 143.3 | % | Ethanol | | | 332.9 | | | | 139.4 | | | | 138.7 | % |

| | 14.3 | % | | | 12.5 | % | | 1.8 p.p | | Ethanol Gross Margin (%) | | | 12.9 | % | | | 9.6 | % | | 3.4 p.p | |

| | 29.7 | % | | | 46.6 | % | | -16.9 p.p. | | Ethanol (Cash) Gross Margin (%) | | | 33.9 | % | | | 39.0 | % | | -5.1 p.p. | |

| | 12.4 | | | | 10.2 | | | | 21.6 | % | Trading | | | 14.4 | | | | 15.6 | | | | -7.7 | % |

| | 4.0 | % | | | 6.9 | % | | -2.9 p.p. | | Ethanol Trading Margin (%) | | | 2.2 | % | | | 5.2 | % | | -3.0 p.p. | |

| | 94.0 | | | | 72.5 | | | | 29.8 | % | Energy Cogeneration | | | 144.1 | | | | 101.5 | | | | 42.1 | % |

| | 3.0 | | | | (16.5 | ) | | | n/a | | Other Products and Services | | | (222.0 | ) | | | 168.4 | | | | n/a | |

Raízen Energia recorded gross profit of R$726.1 million in 3Q 2013, representing an increase of 25.1% compared to the R$580.4 million recorded in 3Q 2012.

The gross profit from the sale of sugar reached R$444.1 million, 0.2% higher than the 3Q 2012 result. This result represented nearly 61% of Raízen Energia’s gross profit. The result from the sale of ethanol increased by 143.3% in the period to R$172.5 million and was the main driver for the increase in this line in the period. The sale of electricity resulted in gross profit of R$94.0 million, up 29.8% year-over-year.

Other products and services totaled R$3.0 million and was impacted by the non-cash loss of R$6.4 million from the negative variation of the biological asset’s fair value, in addition to the R$6.7 million in amortization of business combination, recognized at cost in 3Q 2013.

Selling, General and Administrative Expenses

| | 3Q 2013 | | | | 3Q 2012 | | | | | SG & A Expenses | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (223.8 | ) | | | (167.9 | ) | | | 33.3 | % | Selling Expenses | | | (533.6 | ) | | | (333.6 | ) | | | 60.0 | % |

| | (134.8 | ) | | | (121.3 | ) | | | 11.1 | % | General and Administrative Expenses | | | (401.6 | ) | | | (368.4 | ) | | | 9.0 | % |

Raízen Energia’s selling expenses amounted to R$223.8 million in 3Q 2013, up 33.3% compared to 3Q 2012. Higher expenses with freight, logistics and ship loading at the port were the main drivers for the selling expenses and were caused by increase in exports volumes.

In 3Q 2013, general and administrative expenses totaled R$134.8 million, representing 11.1% increase compared to the R$121.3 million reported in 3Q 2012. This increase is related to personnel expenses mainly connected to the collective bargaining agreement, as well as institutional expenses linked to marketing campaigns continuing from the previous quarter.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

EBITDA

| | 3Q 2013 | | | | 3Q 2012 | | | | | EBITDA | | YTD 2013 | | | YTD 2012 | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 900.5 | | | | 849.5 | | | | 6.0 | % | EBITDA | | | 1,724.2 | | | | 1,652.4 | | | | 4.3 | % |

| | 27.7 | % | | | 37.8 | % | | -10.0 p.p. | | Margin EBITDA (%) | | | 24.4 | % | | | 35.1 | % | | -10.7 p.p. | |

Raízen Energia’s EBITDA reached R$900.5 million in 3Q 2013, 6.0% increase compared to the R$849.5 million reported in 3Q 2012, despite a reduction of 9.4% of the average of sugar equivalent price (which accounts for the sale of both sugar and ethanol) in the period.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Hedge

Volume positions and fixed sugar prices agreed with traders or through derivative financial instruments as of September 30, 2013, and foreign exchange derivatives contracted by Raízen Energia to hedge future cash flows, are summarized as follows:

Summary of Hedge Operations at Sep 30, 20134 | |

| | | | | | | |

| Sugar | | | 2013 / 2014 | | | | 2014 / 2015 | |

| NY #11 | | | | | | | | |

| Volume (‘000 ton) | | | 2,695.8 | | | | 961.1 | |

| Average Price (¢US$/lb) | | | 18.59 | | | | 17.90 | |

| Exchange Rate | | | | | | | | |

| US$ | | | | | | | | |

| Volume (US$ mm) | | | 1,145.1 | | | | 397.7 | |

| Average Price (R$/US$) | | | 2.18 | | | | 2.41 | |

Note 4: The table presents hedge coverage taking into consideration the crop-years ending on 03/31/2014 and 03/31/2015, respectively.

Hedge Accounting Impacts

Raízen Energia has been using cash flow hedge accounting for certain derivative financial instruments in order to hedge against the sugar price risk for revenues from exports.

The table below shows the expected transfer of gain/loss balances from shareholders’ equity as at September 30, 2013 to the net operating income of Raízen Energia5 in future years, broken down by coverage period for the following hedging instruments.

| | Expiration Period - (R$MM) | | | | | | | |

| Derivative | Market | Risk | | 2013 | | | 2014 | | | Total | |

| Futures | OTC/NYBOT | NY#11 | | | 23.9 | | | | (9.5 | ) | | | 14.4 | |

| (=) Hedge Accounting impact | | | | | 23.9 | | | | (9.5 | ) | | | 14.4 | |

| (-) Deferred Income Tax | | | | | (8.1 | ) | | | 3.2 | | | | (4.9 | ) |

| (=) Asset Valuation Adjustment | | | | | 15.8 | | | | (6.3 | ) | | | 9.5 | |

Note 5: The table above shows 100% of the hedge accounting gains/losses reclassified to shareholders’ equity. As Cosan has a 50% stake in Raízen Energia, the hedge accounting will proportionally impact the Other Comprehensive Income in Cosan’s shareholders’ equity.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Capex

| | 3Q 2013 | | | | 3Q 2012 | | | | | CAPEX | | YTD 2013 | | | | YTD 2012 | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 433.6 | | | | 360.8 | | | | 20.2 | % | Total CAPEX | | | 1,927.0 | | | | 1,815.4 | | | | 6.1 | % |

| | 309.3 | | | | 277.1 | | | | 11.6 | % | Operating CAPEX | | | 1,427.7 | | | | 1,483.5 | | | | -3.8 | % |

| | 250.6 | | | | 233.2 | | | | 7.5 | % | Biological Assets | | | 709.4 | | | | 776.8 | | | | -8.7 | % |

| | 9.7 | | | | 7.7 | | | | 26.0 | % | Inter-Harvest Maintenance Costs | | | 483.0 | | | | 443.9 | | | | 8.8 | % |

| | 15.5 | | | | 10.6 | | | | 46.2 | % | SSMA and Sustaining | | | 48.4 | | | | 92.6 | | | | -47.8 | % |

| | 30.4 | | | | 15.1 | | | | 101.3 | % | Mechanization | | | 122.4 | | | | 140.0 | | | | -12.6 | % |

| | 3.1 | | | | 10.5 | | | | -70.5 | % | Industrial | | | 64.5 | | | | 30.2 | | | | 113.6 | % |

| | 124.3 | | | | 83.7 | | | | 48.5 | % | Expasion CAPEX | | | 499.3 | | | | 331.9 | | | | 50.4 | % |

| | 3.7 | | | | 16.0 | | | | -76.9 | % | Cogeneration Projects | | | 46.5 | | | | 165.7 | | | | -72.0 | % |

| | 120.6 | | | | 67.7 | | | | 78.1 | % | Expansion and Other Projects | | | 452.8 | | | | 166.2 | | | | 172.4 | % |

Raízen Energia’s Capex totaled R$433.6 million in 3Q 2013, representing an increase of 20.2% over the R$360.8 million reported in 3Q 2012.

Investments in biological assets amounted to R$250.6 million in 3Q 2013, 7.5% higher compared to the same quarter of the previous period, due to the field renovation strategy to maintain sugarcane fields at high productivity levels.

Investment in cogeneration in the 3Q 2013 decreased by 76.9% compared to 3Q 2012 due to the completion of these projects.

Expansion-related and other projects increased 78.1% q-o-q and totaled R$120.6 million due to the beginning of expenditure related to new expansion in crushing capacity projects at the Paraguaçu and Caarapó units. Also, this line includes other projects such as initiatives aiming at vinasse concentration, conversion of hydrous into anhydrous ethanol, biomass projects, expansion of mechanized fields, as well as operational improvements.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

B.3 Comgás

We present below the results of Comgás, the business unit that distributes and commercializes natural gas in the concession region in the State of São Paulo.

The 3Q 2012 and YTD 2012 periods reflect Comgás’ accounting information disclosed prior to its consolidation to Cosan’s financial statements, or represent a combination of quarters of calendar years 2012 and 2013

Volumes Sold

| | 3Q 2013 | | | | 3Q 2012 | | | | | Volume Sold | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Volume ('000 cbm) | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 1,307,881 | | | | 1,294,207 | | | | 1.1 | % | Total Gas Sales | | | 4,106,242 | | | | 3,829,720 | | | | 7.2 | % |

| | 1,222,369 | | | | 1,218,851 | | | | 0.3 | % | Gas Sales | | | 3,557,146 | | | | 3,559,497 | | | | -0.1 | % |

| | 65,372 | | | | 56,789 | | | | 15.1 | % | Residential | | | 165,916 | | | | 148,403 | | | | 11.8 | % |

| | 31,503 | | | | 29,293 | | | | 7.5 | % | Commercial | | | 87,438 | | | | 83,388 | | | | 4.9 | % |

| | 984,268 | | | | 970,248 | | | | 1.4 | % | Industrial | | | 2,871,410 | | | | 2,851,469 | | | | 0.7 | % |

| | 79,450 | | | | 92,440 | | | | -14.1 | % | Cogeneration | | | 247,510 | | | | 268,186 | | | | -7.7 | % |

| | 61,776 | | | | 70,081 | | | | -11.9 | % | Vehicular | | | 184,872 | | | | 208,050 | | | �� | -11.1 | % |

| | 85,511 | | | | 75,356 | | | | 13.5 | % | Thermal Power | | | 549,096 | | | | 270,224 | | | | 103.2 | % |

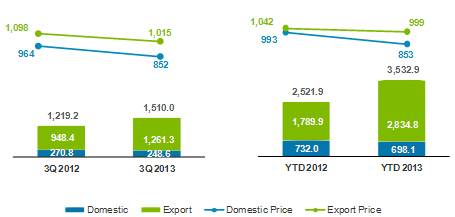

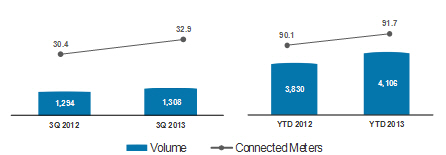

Comgás focuses its business on the expansion of both residential and commercial markets and on the development of the cogeneration and NGV. The industrial segment, which growth is linked to the GDP evolution in the concession area, is the most relevant in terms of volumes.

During 3Q 2013, the company distributed 65.4 million cbm of gas to the residential segment, an increase of 15.1% compared to the 50.7 million cbm volume distributed in 3Q 2012, reaching 56.8 million cbm. Volume variations in the segment are explained basically by the connection of new customers to the network. The segment ended September with 936,034 meters connected, a 7.4% growth compared to 3Q 2012, when meters connected amounted to 871,934. In 3Q 2013, the residential segment contributed with 28% to the margin and represented 5% of the total distributed volume.

The commercial segment accounted for 31.5 million cbm of gas distributed by Comgás in 3Q 2013, representing growth of 7.5% compared to 3Q 2012, when total volume distributed was 29.3 million cbm. This volume represents 2% of the total distributed volume of gas in 3Q 2013, with a 8% margin contribution. During 3Q 2013, 101 new commercial clients were connected.

The industrial segment totaled 984.3 million cbm of gas distributed in 3Q 2013, up 1.4% compared to the 970.3 million cbm distributed in 3Q 2012. Comgás’ strategy contemplates the maintenance and loyalty of this customer base, by means of developing new applications for natural gas while working to add new customers in its concession area. At the close of 3Q 2013, Comgás had 1,018 clients in this segment, accounting for 75% of the total gas sales for the quarter with a contribution to the margin of 60%.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Thanks to the downtime for maintenance at two clients, volume sold to the cogeneration market fell 14.1% over 3Q 2012, from 92.4 million cbm in 3Q 2012 to 79.5 million cbm in 3Q 2013, and represented 6% of total volume distributed with a 2% contribution to the margin.

In 3Q 2013 the automotive segment represented 5% of total distributed volume, reaching 61.8 million cbm. The 11.9% decrease in volume sold compared to 3Q 2012 is explained by the segment’s high sensitivity to price changes and the competition from other fuels.

The volume distributed to the thermal power generation segment in the 3Q 2013 reached 85.5 million cbm, up 13.5% compared to the 3Q 212, when the volume sold was 75.4 million cbm. In the quarter, this segment represented 7% of the total volume of gas sold contributing with 2% contribution to the margin.

Comgás’ gas supply contracts do not include thermal power plants volumes. If thermal power plants need to dispatch gas, Petrobras will supply the Company the additional volume, as these are “back to back” contracts.

Natural Gas

Volume of Gas Sold (million cbm) and New AHU6 Connected (thousand units)

Note 6: New AHU (autonomous home units) connected in the period.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Operating Revenue

| | 3Q 2013 | | | | 3Q 2012 | | | | | Sales Breakdown | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 2,065.1 | | | | 1,753.9 | | | | 17.7 | % | Gross Operating Revenue | | | 5,796.9 | | | | 4,727.8 | | | | 22.6 | % |

| | 1,851.5 | | | | 1,623.8 | | | | 14.0 | % | Gas Sales | | | 5,257.6 | | | | 4,395.0 | | | | 19.6 | % |

| | 239.8 | | | | 191.5 | | | | 25.2 | % | Residential | | | 591.8 | | | | 479.1 | | | | 23.5 | % |

| | 80.7 | | | | 68.7 | | | | 17.6 | % | Commercial | | | 216.6 | | | | 185.8 | | | | 16.6 | % |

| | 1,357.2 | | | | 1,172.9 | | | | 15.7 | % | Industrial | | | 3,827.0 | | | | 3,197.1 | | | | 19.7 | % |

| | 74.0 | | | | 100.3 | | | | -26.2 | % | Cogeneration | | | 228.3 | | | | 260.6 | | | | -12.4 | % |

| | 35.7 | | | | 28.3 | | | | 26.2 | % | Thermal Power | | | 210.9 | | | | 98.8 | | | | 113.5 | % |

| | 64.0 | | | | 62.1 | | | | 3.2 | % | Vehicular | | | 183.0 | | | | 173.6 | | | | 5.4 | % |

| | 204.4 | | | | 105.0 | | | | 94.8 | % | Construction Revenue | | | 513.7 | | | | 294.2 | | | | 74.6 | % |

| | 9.2 | | | | 25.2 | | | | -63.5 | % | Other | | | 25.6 | | | | 38.6 | | | | -33.7 | % |

| | (382.6 | ) | | | (340.5 | ) | | | 12.4 | % | Tax on Sales | | | (1,061.0 | ) | | | (915.4 | ) | | | 15.9 | % |

| | 1,682.5 | | | | 1,413.5 | | | | 19.0 | % | Net Operating Revenue | | | 4,735.9 | | | | 3,812.4 | | | | 24.2 | % |

| | 1,469.2 | | | | 1,285.7 | | | | 14.3 | % | Gas Sales | | | 4,201.1 | | | | 3,483.3 | | | | 20.6 | % |

| | 204.4 | | | | 105.0 | | | | 94.8 | % | Construction Revenue | | | 513.7 | | | | 294.2 | | | | 74.6 | % |

| | 8.9 | | | | 22.8 | | | | -60.8 | % | Other | | | 21.1 | | | | 34.8 | | | | -39.5 | % |

Comgás recorded gross revenue of R$2.1 billion in 3Q 2013, up 17.7% compared to the R$1.8 billion reported in 3Q 2012. Net revenue from sales and services totaled R$ 1.7 billion, a 19.0% increase compared to the same period of the previous year.

Tariff increases, as approved by the São Paulo State Sanitation and Energy Regulatory Agency (ARSESP) resolutions nos. 340, 379 and 421, were the main drivers of the variations in Natural Gas Sales Revenue. In order to establish the new tariff, ARSESP considered the increased cost of natural gas, especially imported gas (subject to agency review), which was impacted by the stronger dollar and the higher average contracted oil price per barrel, key elements for natural gas price formation in Brazil.

Cost of Goods and Services

| | 3Q 2013 | | | | 3Q 2012 | | | | | COGS | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (1,198.6 | ) | | | (990.0 | ) | | | 21.1 | % | Cost of Goods and Services | | | (3,410.4 | ) | | | (2,798.6 | ) | | | 21.9 | % |

| | (887.8 | ) | | | (791.8 | ) | | | 12.1 | % | Natural Gas | | | (2,593.2 | ) | | | (2,230.5 | ) | | | 16.3 | % |

| | (106.3 | ) | | | (93.2 | ) | | | 14.0 | % | Transportation and other Gas services | | | (303.4 | ) | | | (273.9 | ) | | | 10.8 | % |

| | (204.4 | ) | | | (105.0 | ) | | | 94.8 | % | Construction | | | (513.7 | ) | | | (294.2 | ) | | | 74.6 | % |

Comgás’ cost of goods and services sold, comprised of commodity costs, transportation and construction totaled R$1.2 billion in 3Q 2013, representing an increase of 21.1% to R$900.0 million recorded in 3Q 2012.

The increase in the natural gas cost and transportation & other lines are chiefly due to the increase in gas cost due to supply agreements priced in dollars, and the lower amount of gas offered in auctions by Petrobras in 2013. The change in the construction cost line directly relates to the higher level of investment during the year.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

The differences between actual costs incurred and the cost of gas included in the tariff charged to customers (as per the ARSESP tariff structure) are accrued to the regulatory account and are passed through or charged according to regulatory resolutions in periodic adjustments or tariff reviews. This balance is monthly adjusted by the SELIC rate. On September 30, 2013, the Regulatory account had a positive balance of approximately R$350 million payable to Comgás.

The regulatory account represents a balance payable or receivable related to the difference between the prices of the gas bought by Comgás and the one used in the tariff composition. This balance is not recorded, so when we refer to its normalization, it means to consider this asset and/or liability as if it was recorded.

Gross Profit

| | 3Q 2013 | | | | 3Q 2012 | | | | | Gross Profit | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 484.0 | | | | 423.5 | | | | 14.3 | % | Gross Profit | | | 1,325.6 | | | | 1,013.7 | | | | 30.8 | % |

| | 28.8 | % | | | 30.0 | % | | -1.2 p.p. | | Gross Margin (%) | | | 28.0 | % | | | 26.6 | % | | 1.4 p.p | |

Comgás recorded gross profit of R$484.0 million in 3Q 2013, growth of 14.3% compared to the 3Q 2012. This variation is primarily explained by (i) activity in the Regulatory Account; (ii) 6.16% weighted average tariff adjustment in May 2013; and (iii) increased volume sold in 3Q 2013.

Selling, General and Administrative Expense

| | 3Q 2013 | | | | 3Q 2012 | | | | | SG&A Expenses | | YTD 2013 | | | YTD 2012 | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (157.2 | ) | | | (104.6 | ) | | | 50.3 | % | Selling Expenses | | | (429.4 | ) | | | (303.3 | ) | | | 41.6 | % |

| | (72.8 | ) | | | (75.7 | ) | | | -3.8 | % | G&A Expenses | | | (219.4 | ) | | | (210.5 | ) | | | 4.2 | % |

| | (0.0 | ) | | | (2.2 | ) | | | -99.2 | % | Other Operating Revenues (Expenses) | | | (6.5 | ) | | | (7.9 | ) | | | -17.8 | % |

Comgás’ selling expenses totaled R$157.2 million in 3Q 2013, representing an increase of 50.3% compared to the 3Q 2012 figure of R$104.6 million. Excluding the effect in the amount of R$30.9 million of the goodwill amortization (concession rights) allocated under selling expenses in the 3Q 2013, the increase in selling expenses would have been 20.8% q-o-q due to allowance for doubtful accounts.

General and administrative expenses totaled R$72.8 million in 3Q 2013, representing a 3.8% decrease compared to the R$75.7 million reported in 3Q 2012.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

EBITDA

| | 3Q 2013 | | | | 3Q 2012 | | | | | EBITDA | | YTD 2013 | | | YTD 2012 | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 369.0 | | | | 318.3 | | | | 15.9 | % | EBITDA | | | 997.7 | | | | 708.6 | | | | 40.8 | % |

| | 21.9 | % | | | 22.5 | % | | -0.6 p.p. | | EBITDA Margin (%) | | | 21.1 | % | | | 18.6 | % | | 2.5 p.p | |

| | 348.8 | | | | 312.3 | | | | 11.7 | % | Normalizade EBITDA | | | 941.6 | | | | 900.0 | | | | 4.6 | % |

| | 20.7 | % | | | 22.1 | % | | -1.4 p.p. | | Normalized EBITDA Margin (%) | | | 19.9 | % | | | 23.6 | % | | -3.7 p.p. | |

Comgás’s EBITDA reached R$369.0 million in 3Q 2013, an increase of 15.9% compared to the figure reported in 3Q 2012, of R$318.3 million.

EBITDA margin for the quarter reached 21.9%, 0.6 p.p. below the 3Q 2012. When normalized by the Regulatory Account, EBITDA reached R$348.8 million in the period, up 11.7% compared to the R$312.3 million reported in 3Q 2012.

CAPEX

| | 3Q 2013 | | | | 3Q 2012 | | | | | CAPEX | | YTD 2013 | | | YTD 2012 | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 248.4 | | | | 158.4 | | | | 56.8 | % | CAPEX | | | 642.8 | | | | 426.5 | | | | 50.7 | % |

Comgás’ investments totaled R$248.4 million during 3Q 2013, 56.8% higher y-o-y. Of this total, 65% were invested in network expansion, reinforcing the expansion strategy to regions not served by Comgás, in addition to network penetration.

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

B.4 Rumo Logística

We present below the results of Rumo Logística, company responsible for providing integrated logistics solutions for sugar and other agricultural commodities exports, offering transportation, storage and port loading services.

Net revenue

| | 3Q 2013 | | | | 3Q 2012 | | | | | Sales Breakdown | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 328.5 | | | | 217.9 | | | | 50.8 | % | Net Operating Revenue | | | 711.2 | | | | 397.1 | | | | 79.1 | % |

| | 270.9 | | | | 166.4 | | | | 62.8 | % | Transportation | | | 571.5 | | | | 297.7 | | | | 92.0 | % |

| | 54.5 | | | | 47.6 | | | | 14.4 | % | Loading | | | 127.9 | | | | 89.8 | | | | 42.5 | % |

| | 3.1 | | | | 3.9 | | | | -19.7 | % | Other | | | 11.8 | | | | 9.6 | | | | 22.8 | % |

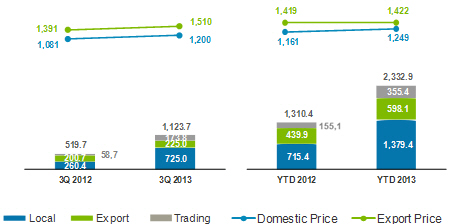

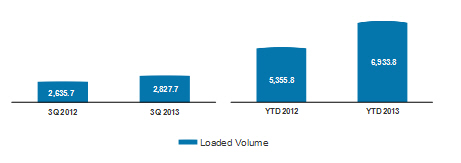

In 3Q 2013, Rumo’s net revenue totaled R$328.5 million, up 50.8% compared to the same period of the previous year.

Net revenue from transportation in 3Q 2013 totaled R$270.9 million, up 62.8% compared to the same period of the previous year, mostly due to (i) increased sugar volumes transported; (ii) higher average prices for transportation; and (iii) reimbursement for road transportation additional costs compared to the negotiated rail freight under the contract with America Latina Logística (ALL).

Rumo’s loading volume in the quarter was 7.3% higher than 3Q 2012, reaching 2.8 million tons of sugar. Loading revenue increased by 14.4% in the period, leveraging not only from the increase in volume, but also from higher average prices when compared to the same period last year.

Loading Volume

(‘000 ton)

| Earnings Release

3rd Quarter of Fiscal Year 2013 – July, August and September 2013 |

Cost of Services Provided

| | 3Q 2013 | | | | 3Q 2012 | | | | | Costs of Services | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (203.4 | ) | | | (133.7 | ) | | | 52.1 | % | Cost of Services | | | (429.6 | ) | | | (281.4 | ) | | | 52.7 | % |

Cost of services provided includes railway and highway freight, port elevation, transshipment and storage costs in upstate São Paulo and at the Port of Santos.

In 3Q 2013, cost of services provided by Rumo was R$203.4 million, an increase of 52.1% compared to 3Q 2012, as a result of increased volume and cost of freight, mainly due to contingent contracting on road transportation to the Port of Santos.

Gross Profit

| | 3Q 2013 | | | | 3Q 2012 | | | | | Gross Profit | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 125.1 | | | | 84.2 | | | | 48.6 | % | Gross Profit | | | 281.6 | | | | 115.7 | | | | 143.4 | % |

| | 38.1 | % | | | 38.6 | % | | -0.5 p.p. | | Gross Margin (%) | | | 39.6 | % | | | 29.1 | % | | 10.5 p.p | |

In 3Q 2013, Rumo reported gross profit of R$125.1 million, 48.6% higher than in 3Q 2012. Gross margin for the quarter decreased by 0.5 p.p., reaching 38.1% in 3Q 2013 compared to 38.6% in 3Q 2012.

General and Administrative Expenses

| | 3Q 2013 | | | | 3Q 2012 | | | | | G&A Expenses | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | (17.3 | ) | | | (14.1 | ) | | | 22.6 | % | G&A Expenses | | | (51.7 | ) | | | (37.9 | ) | | | 36.4 | % |

The adequacy in Rumo’s administrative structure for new growth projects led general and administrative expenses to the amount of R$17.3 million in 3Q 2013.

EBITDA

| | 3Q 2013 | | | | 3Q 2012 | | | | | EBITDA | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 115.0 | | | | 85.9 | | | | 33.9 | % | EBITDA | | | 269.0 | | | | 149.3 | | | | 80.2 | % |

| | 35.0 | % | | | 39.4 | % | | -4.4 p.p. | | Margin EBITDA (%) | | | 37.8 | % | | | 37.6 | % | | 0.2 p.p | |

In 3Q 2013, Rumo recorded EBITDA of R$115.0 million, and EBITDA margin of 35.0%, a decrease of 4.4 p.p. year-over-year, negatively impacted by the allowance for doubtful accounts in the amount of R$15.8 million recognized in September 2013, under the accounting policy adopted by the company.

CAPEX

| | 3Q 2013 | | | | 3Q 2012 | | | | | CAPEX | | YTD 2013 | | | YTD 2012 | | | | |

| (jul - sep) | | | (jul - sep) | | | Chg.% | | Amounts in R$ MM | | (jan - sep) | | | (jan - sep) | | | Chg.% | |

| | 87.2 | | | | 82.8 | | | | 5.3 | % | CAPEX | | | 213.3 | | | | 175.9 | | | | 21.2 | % |

Rumo’s investments in 3Q 2013 totaled R$87.2 million, 5.3% above the R$82.8 million reported in 3Q 2012.

The main investments were directed to the following initiatives:

| (i) | R$47.0 million in permanent railroad operated by América Latina Logística (ALL); |

| (ii) | R$20.4 million in improvements at the Santos port terminal, including discharging capacity increase, improvements on reception rout belts and shipping terminal, works to cover the South terminal quay (ongoing) and recurring investments related to equipment and warehouse infrastructure; |

| (iii) | R$19.8 million in other initiatives, mainly investments in transshipment terminals at the countryside of São Paulo state |