Item 1

EARNINGS RELEASE 1Q15

São Paulo, May 06, 2015 – COSAN LIMITED (NYSE: CZZ e BM&FBovespa: CZLT33) announces today its results for the first quarter of 2015 (1Q15) composed by January, February and March 2015. The results are consolidated in accordance with the accounting principles adopted in Brazil and internationally (IFRS).

Highlights 1Q15

| | o | Consolidated net revenues growths 6% and reaches R$ 10.2 billion |

| | | Raízen Combustíveis’ EBITDA 13% up reaching R$ 590 million |

| | | Raízen Energia’s EBITDA 13% up and reaches R$ 830 million in 1Q15. For the harvest year 14/15, EBITDA totaled R$ 2.5 billion, 4% up versus 13/14 |

| | | Comgás’ normalized EBITDA of R$ 299 million in 1Q15 |

| | | Rumo reaches EBITDA of R$ 62 million in the quarter |

| Summary of Financial Information - Cosan Consolidated¹ | 1Q15 | 1Q14 | |

| Amount in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg.% |

| Net Revenue | 10,151.7 | 9,593.4 | 5.8% |

| Gross Profit | 1,180.1 | 1,217.5 | -3.1% |

| Gross Margin (%) | 11.6% | 12.7% | -8.4% |

| Operating Profit | 378.7 | 565.4 | -33.0% |

| EBITDA | 923.0 | 1,023.9 | -9.9% |

| EBITDA Margin (%) | 9.1% | 10.7% | -14.8% |

| Equity Pick-up | (4.4) | (16.0) | -72.3% |

| Net Income before non-controlling Interest | 31.7 | 292.8 | -89.2% |

| Net Income | 9.5 | 140.8 | -93.2% |

| Net Margin (%) | 0.1% | 1.5% | -93.6% |

| | | | |

| CAPEX | 768.4 | 835.6 | -8.0% |

| Shareholders' Equity and Minority Shareholders | 13,475.7 | 13,577.6 | -0.8% |

| Note 1: Considering the consolidation of 50% of Raízen Combustíveis and Raízen Energia | | | |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

| A. | Highlights and Business Units |

Business Units

Listed below are the business units that make up Cosan S/A and Cosan Logística S/A, companies that comprise Cosan Limited’s portfolio.

The business units (reportable segments) are organized as follows:

Cosan Limited’s Consolidated Result

Cosan Limited’s consolidated financial statements considers 100% of the results of Cosan S/A and Cosan Logística S/A.

EBITDA reported herein is in compliance with CVM Rule 527/12, published by the Brazilian Securities and Exchange Commission on October 4, 2012, and may differ from the amounts reported in prior periods as a result of the equity accounting income adjustment. Therefore, EBITDA now consists of operating profit before financial expenses, plus depreciation, amortization and equity accounting.

| EBITDA (Reconciliation ICVM 527) | 1Q15 | 1Q14 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Chg. % |

| Net Income | 9.5 | 140.8 | (93.)% |

| (-) Equity Pick-up | (153.1) | (221.8) | -25.9% |

| (+) Minority Shareholders | 16.2 | 148.4 | -88.2% |

| (+) Income Taxes | (79.7) | 59.6 | n/a |

| (+) Net Financial Expense (Revenue) | 258.4 | 122.5 | n/a |

| (+) Depreciation and Amortization | 165.3 | 160.4 | 3.% |

| EBITDA (before ICVM 527) | 216.6 | 409.8 | -47.2% |

| (+) Equity Pick-up | 153.1 | 221.8 | -25.9% |

| EBITDA (after ICVM 527) | 369.7 | 631.6 | -40.0% |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

Below we present 1Q15 results by business segment as previously detailed. All information reflect 100% of their financial performance, regardless of Cosan Limited’s interest.

For reconciliation purposes of the consolidated EBITDA, the Adjustments and Eliminations column refers to the elimination of net profits of the business controlled by Cosan for consolidation purposes.

Results by Business Unit 1Q15 | Cosan Energia Pro forma | Cosan Logística | CZZ (Controladora) | Adjustments and Eliminations | CZZ Pro forma |

| Net Revenue | 9,946.1 | 205.6 | - | - | 10,151.7 |

| Cost of Goods and Services | (8,825.3) | (146.3) | - | - | (8,971.6) |

| Gross Profit | 1,120.8 | 59.3 | - | (0.0) | 1,180.1 |

| Gross Margin(%) | 11.3% | 28.8% | n/a | -% | 11.6% |

| Selling Expenses | (451.8) | - | - | - | (451.8) |

| General and Administrative Expenses | (261.3) | (24.4) | (14.6) | - | (300.3) |

| Other Operating Revenues (Expenses) | (48.9) | (0.5) | - | - | (49.3) |

| Equity Pick-up | (4.4) | 0.0 | (22.6) | 22.6 | (4.4) |

| Depreciation and Amortization | 522.1 | 26.7 | - | - | 548.7 |

| EBITDA | 876.5 | 61.1 | (37.1) | 22.6 | 923.0 |

| EBITDA Margin (%) | 8.8% | 29.7% | n/a | -% | 9.1% |

| Financial income | (418.6) | (10.3) | (7.5) | - | (436.4) |

| Financial expense | 179.8 | 5.7 | 0.0 | - | 185.4 |

| Foreign exchange gain (losses), net | (957.7) | (56.2) | 32.9 | - | (980.9) |

| Derivatives | 799.1 | 40.5 | 21.2 | - | 860.8 |

| Income taxes expenses | 33.4 | (4.8) | - | - | 28.6 |

| Non-controlling interests | (34.1) | (1.6) | - | 13.5 | (22.2) |

| Profit (loss) for the period | (43.7) | 7.6 | 9.5 | 36.1 | 9.5 |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

B.1 Cosan S/A – Pro forma

We present below the main highlights of Cosan S/A’s results, the Company's business unit responsible for the operations of Raízen Fuels, Raizen Energia, Comgás, Lubricants, Radar and Other Businesses.

For complete information on Cosan S/A results, its Earning Release is available at ri.cosan.com.br.

| COSAN S/A PRO FORMA | 1Q15 | 1Q14 |

| (Jan-Mar) | (Jan-Mar) |

| Net Revenue | 9,946.1 | 9,385.5 |

| Cost of Goods and Services | (8,825.3) | (8,252.4) |

| Gross Profit | 1,120.8 | 1,133.1 |

| Gross Margin(%) | 11.3% | 12.1% |

| Selling Expenses | (451.8) | (430.0) |

| General and Administrative Expenses | (261.3) | (247.9) |

| Other Operating Revenues (Expenses) | (48.9) | 41.5 |

| Equity Pick-up | (4.4) | (18.6) |

| Depreciation and Amortization | 522.1 | 452.9 |

| EBITDA | 876.5 | 931.0 |

| EBITDA Margin (%) | 8.8% | 9.9% |

| Financial income | (418.6) | (246.9) |

| Financial expense | 179.8 | 77.3 |

| Foreign exchange gain (losses), net | (957.7) | 133.6 |

| Derivatives | 799.1 | (41.5) |

| Income taxes expenses | 33.4 | (141.4) |

| Non-controlling interests | (34.1) | (7.4) |

| Results of discontinued operations | - | (1.6) |

| Profit (loss) for the period | (43.7) | 253.5 |

Raízen Combustíveis

For comparison purposes, the following information presented consider 100% of Raízen Combustíveis operations, even though Cosan S/A holds 50% share in the segment.

Raízen Combustíveis closed 1T15 with growth of 3,3% of total volume sold, with a highlight to 28.1% ethanol volume growth. Net revenue for the quarter was 8.1% higher driven by higher volumes sold and growth of average prices, primarily by variations in petrol and diesel prices by Petrobras. EBITDA was R$ 590 million, a 13,1% growth compared to 1T15.

Raízen Combustíveis ended 1T15 with 5,427 Shell service stations and 951 convenience stores in its network.

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

Raízen Energia

For comparison purposes, the following information consider 100% of Raízen Energia operations, even though Cosan S/A holds 50% share in the segment. Additionally, it is worth mentioning that the analysis of Raizen Energia information should consider the crop year that began in April 2014 and will end in March 2015.

Raizen Energia ended the harvest season 2014/15 with a crushing volume of 57.1 million tons, 7.1% reduction versus harvest season 2013/14. The main factor for the reduction of the volume crushed was the dry climate throughout the year, which hampered the process of planting and growth of sugarcane, reducing agricultural productivity

The volume of sugar in the harvest season 2014/15 was down 1.1% while the ethanol volume grew 4.3%. The volume of energy sold was 1.0% higher reaching 2,202,000 MWh. Raízen Energia’s total net revenue in harvest season 2014/15 was R$9.7 billion, 18.2% higher compared to the same period last year. EBITDA was R$2.5 billion, up 4.0%, with an EBITDA margin of 26.0%. EBITDA adjusted by the effects of biological assets was R$2.6 million.

Comgás

Comgás’ volume sold was down 0.8% compared to 1Q14, with 1.3 million m³ sold in 1Q15. This reduction is due to the lower industrial activity which limited the volume expansion in the period. Comgás’ net revenue was R$1.5 billion in 1Q15, 1.1% higher than 1Q14. EBITDA normalized by the regulatory current account was R$299 million, 5.8% higher compared to the 1Q14, with an EBITDA margin of 19.5%.

Lubrificantes

Net revenue from the sale of lubricants, base oil resale and other goods and services increased 3.1% in 1Q15, reaching R$379.8 million. This result is due to higher average unit price of 5.7%. EBITDA was R$23.4 million in the quarter, with a margin of 6.2%.

Radar

Radar ended 1Q15 with 263,300 hectares of land under its management, with a market value of R$5.0 billion. Net income in the quarter was R$21.6 million, increased by the leasing of properties during 1Q15. In 1Q15, EBITDA was R$27.2 million, lower compared to 1Q14 due to the lower sale of properties in the quarter.

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

B.2 Cosan Logística

| COSAN LOGÍSTICA | 1Q15 | 1Q14 |

| (Jan-Mar) | (Jan-Mar) |

| Net Revenue | 205.6 | 207.9 |

| Cost of Goods and Services | (146.3) | (123.5) |

| Gross Profit | 59.3 | 84.4 |

| Gross Margin(%) | 28.8% | 40.6% |

| General and Administrative Expenses | (24.4) | (20.0) |

| Other Operating Revenues (Expenses) | (0.5) | 25.3 |

| Depreciation and Amortization | 26.7 | 21.7 |

| EBITDA | 61.1 | 111.4 |

| EBITDA Margin (%) | 29.7% | 53.6% |

| Financial income | (10.3) | (8.5) |

| Financial expense | 5.7 | 12.2 |

| Foreign exchange gain (losses), net | (56.2) | 0.1 |

| Derivatives | 40.5 | - |

| Income taxes expenses | (4.8) | (25.2) |

| Non-controlling interests | (1.6) | (12.3) |

| Profit (loss) for the period | 7.6 | 56.1 |

Rumo

Rumo reported a volume of 2.5 million tons of sugar loaded at the port of Santos. Net revenue for the quarter was R$205.6 million, down 1.1% versus 1Q14. This reduction was due to the lower volumes transported and elevated. EBITDA was R$ 61.5 million in 1T15, with an EBITDA margin of 29.9%.

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

| C. | Other Items in the Consolidated Result |

Financial Result

| Financial Results | 1Q15 | 1Q14 | |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) | Var. % |

| Gross Debt Charges | (155.5) | (185.0) | -16.0% |

| Income from Cash Investments | 48.9 | 30.2 | 61.8% |

| (=) Subtotal: Net Debt Interests | (106.6) | (154.8) | -31.1% |

| Other Charges and Monetary Variation | (94.0) | 30.3 | n/a |

| Exchange Rate Variation | (591.8) | 75.7 | n/a |

| Gains (losses) with Derivatives | 555.2 | (61.1) | n/a |

| Banking Expenses, Fees and Other | (21.2) | (12.6) | 68.5% |

| (=) Financial, Net | (258.4) | (122.5) | n/a |

The financial result in the 1Q15 reported a net financial expense of R$ 258.4 million, compared to a net expense of R$ 122.5 million recorded in the 1Q14, impacted by (i) the net effect of exchange rate and derivatives and (ii) positive effect on the 1Q14 provision reversal for contingencies due to the success in a tax legal demand.

Net Income

| Net Income | 1Q15 | 1Q14 |

| Amounts in R$ MM | (Jan-Mar) | (Jan-Mar) |

| Net Income | 9.5 | 140.8 |

Cosan Limited had net income of R$ 9.5 million in 1Q15, lower than profit in 1Q14, which was R$ 140.8 million.

The main impacts to the change in net income for the period were (i) the negative impact of the current account in Comgás, (ii) other expenses related to fees and compensation arising from the merger of Rumo and ALL and (iii) exchange rate effect (Cosan and Raízen).

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

At the end of 1Q15, Cosan Limited's consolidated gross debt (excluding PESA) reached R$ 15.7 billion to R$ 15.5 billion, up 1.6% compared to 4Q14.

Cosan Limited pro forma consolidated

Cash and cash equivalents totaled R$ 4.3 billion at the end of 1Q15 compared to R$ 3.2 billion in 4Q14, mainly by reducing working capital in Raízen due to the end of the harvest.

| Debt per Business Units (Amount in R$ MM) | | | |

| 1Q15 | 4Q14 | |

| COSAN S/A PRO FORMA | (Jan-Mar) | (Oct-Dec) | Chg. % |

| Raízen (50%) | 5,060.8 | 5,583.9 | -9.4% |

| Comgás | 2,884.1 | 2,803.3 | 2.9% |

| Lubrificantes | 354.4 | 253.3 | 39.9% |

| Other business | 4,017.0 | 3,794.1 | 5.9% |

| Total Debt Pro forma | 12,316.4 | 12,434.6 | -1.0% |

| Cash and Cash Equivalents and Securities | (4,034.9) | (3,098.6) | 30.2% |

| Pro forma Net Debt | 8,281.5 | 9,335.9 | -11.3% |

| Preferred shareholders payable in subsidiaries | 1,988.6 | 1,926.9 | 3.2% |

| Pro forma Net Debt (w/ preferred shareholders payable in subsidiaries) | 10,270.0 | 11,262.8 | -8.8% |

| Pro forma Leverage (Net debt / EBITDA LTM) | 2.8 | 3.0 | -7.4% |

| COSAN LOGÍSTICA | | | |

| Rumo | 1,079.3 | 784.7 | 37.5% |

| Total Debt | 1,079.3 | 784.7 | 37.5% |

| Cash and Cash Equivalents and Securities | (251.1) | (86.5) | 190.3% |

| Net Debt | 828.2 | 698.2 | 18.6% |

| Leverage (Net debt / EBITDA LTM) | 3.0 | 11.4 | -73.4% |

| COSAN LIMITED | | | |

| Cosan Limited | 320.8 | 310.1 | 3.5% |

| Cosan S/A Pro forma | 14,305.0 | 14,361.4 | -0.4% |

| Cosan Logística | 1,079.3 | 784.7 | 37.5% |

| Pro forma Debt (w/ preferred shareholders payable in subsidiaries) | 15,705.0 | 15,456.3 | 1.6% |

| Cash and Cash Equivalents and Securities | (4,295.7) | (3,207.8) | 33.9% |

| Pro forma Net Debt (w/ preferred shareholders payable in subsidiaries) | 11,409.3 | 12,248.6 | -6.9% |

| Pro forma Leverage (Net debt / EBITDA LTM) | 2.9 | 3.0 | -4.5% |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

The ordinary shares of Cosan S.A. are listed on BM&FBovespa since 2005, year of his public offering “IPO” in the “New Market” segment, under the ticker symbol CSAN3, composing Ibovespa portfolio, IBrX, IBrX-50, IBrA, MLCX, ICO2, INDX, ICON, IVBX-2, IGC, IGCT and ITAG.

The shares issued by Cosan Limited have been listed on NYSE – New York Stock Exchange, since its IPO in 2007, under the ticker symbol CZZ. The company has also issued share deposit certificates (Brazilian Depositary Receipts – BDR) on the BM&FBovespa under the symbol CZLT33.

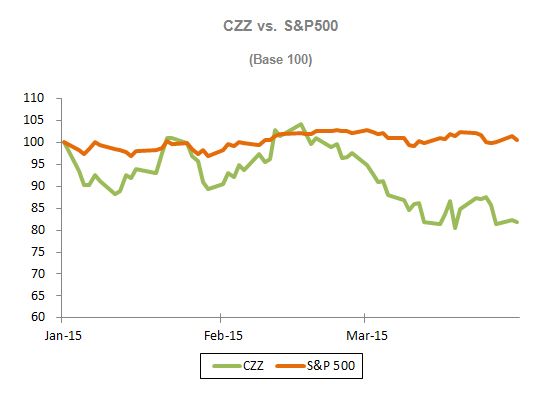

The tables and graphs below represent the performance of shares issued by the companies:

| 1Q15 Summary | | CSAN3 | | | RLOG3 | | | CZLT33 | | | CZZ | |

| Stock Type | | Common Share | | | Common Share | | | BDR | | | Class A | |

| Listed in | | BM&FBovespa | | | BM&FBovespa | | | BM&FBovespa | | | NYSE | |

| Closing Price in 03/31/2015 | | $ | 27.89 | | | $ | 2.67 | | | $ | 20.30 | | | USD | 6.33 | |

| Higher Price | | $ | 29.11 | | | $ | 3.33 | | | $ | 22.33 | | | USD | 10.24 | |

| Average Price | | $ | 26.65 | | | $ | 2.71 | | | $ | 20.31 | | | USD | 7.27 | |

| Lower Price | | $ | 23.44 | | | $ | 2.11 | | | $ | 17.45 | | | USD | 6.22 | |

| Average Daily Traded Volume | | R$ | 41.2 millions | | | R$ | 1.4 millions | | | R$ | 5.3 million | | | USD | 10.6 million | |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

Disclaimer

This document contains forward-looking statements and estimates. These forward-looking statements and estimates are solely forecasts and do not represent any guarantee of prospective results. All stakeholders should know that these statements and estimates are and will be, depending on the case, subject to risks, uncertainties and factors related to the operations and business environment of Cosan and its subsidiaries, and therefore the actual results of these companies may significantly differ from the estimated or implied prospective results contained in such forward-looking statements and estimates.

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

E.1 Cosan Energia

| Cosan Consolidated | 1Q15 | 1Q14 |

| Income statement for the period | 03/31/2015 | 03/31/2014 |

| Net operating revenue | 1,935,513 | 1,949,252 |

| Gross Profit | 490,522 | 551,988 |

| Sales, general and administrative expenses | (360,204) | (331,739) |

| Other operating income (expenses), net | (98,864) | (39,493) |

| Financial revenue | 64,109 | 35,504 |

| Financial expenses | (273,813) | (172,661) |

| Foreign exchange variation | (568,545) | 77,748 |

| Derivative | 493,536 | (50,622) |

| Equity pick up | 153,137 | 221,802 |

| Income and social contribution taxes | 84,524 | (34,319) |

| Equity attributable to non-controlling interests | (51,233) | (52,048) |

| Net Income from discontinued operations | 23,147 | 49,962 |

| Net Income (loss) | (43,683) | 256,122 |

| | | |

| Cosan Consolidated | 1Q15 | 4Q14 |

| Balance sheet | 03/31/2015 | 12/31/2014 |

| Cash and cash equivalents | 1,861,592 | 1,540,192 |

| Securities | 159,200 | 149,735 |

| Accounts receivable | 785,840 | 822,424 |

| Inventories | 317,790 | 347,903 |

| Other current assets | 612,665 | 548,134 |

| Investments | 8,642,451 | 8,535,180 |

| Investment property | 2,649,976 | 2,641,978 |

| Property, plant and equipment | 370,970 | 351,435 |

| Intangible | 9,417,620 | 9,426,120 |

| Other non-current assets | 3,589,675 | 2,740,611 |

| Total Assets | 28,407,779 | 27,103,713 |

| | | |

| Loans and financing | (8,384,823) | (7,397,602) |

| Suppliers | (1,192,167) | (971,170) |

| Salaries payable | (62,518) | (101,115) |

| Other current liabilities | (346,460) | (616,590) |

| Other non-current liabilities | (5,984,306) | (5,567,961) |

| Net Equity | (12,437,504) | (12,449,276) |

| Total Liabilities | (28,407,779) | (27,103,713) |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

| Cosan Logística | 1Q15 | 1Q14 |

| Income statement for the period | 03/31/2015 | 03/31/2014 |

| Net operating revenue | 205,611 | 207,934 |

| Gross profit | 59,261 | 84,403 |

| Sales, general and administrative expenses | (24,370) | (19,974) |

| Other operating income (expenses), net | (460) | 25,291 |

| Financial revenue | 5,653 | 12,227 |

| Financial expenses | (10,323) | (8,487) |

| Foreign exchange variation | (56,217) | 113 |

| Equity pick up | 40,489 | - |

| Income and social contribution taxes | (4,832) | (25,243) |

| Equity attributable to non-controlling interests | (1,647) | (12,270) |

| Net Income (loss) | 7,553 | 56,061 |

| | | |

| Cosan Logística | 1Q15 | 4Q14 |

| Balance sheet | 03/31/2015 | 12/31/2014 |

| Cash and cash equivalents | 251.102 | 86.487 |

| Accounts receivable | 22.776 | 42.685 |

| Inventories | 6.911 | 5.817 |

| Other current assets | 22.119 | 24.175 |

| Accounts receivable – non-current | 509.695 | 446.693 |

| Property, plant and equipment | 1.139.393 | 1.084.455 |

| Intangible | 848.892 | 860.253 |

| Other non-current assets | 75.237 | 34.295 |

| Total Assets | 2.876.125 | 2.584.860 |

| | | |

| Loans and financing | (1.119.755) | (784.709) |

| Suppliers | (181.753) | (141.289) |

| Salaries payable | (14.578) | (19.302) |

| Other current liabilities | (70.754) | (89.460) |

| Other non-current liabilities | (226.648) | (221.851) |

| Net Equity | (1.262.637) | (1.328.250) |

| Total Liabilities | (2.876.125) | (2.584.860) |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

E.4 Cosan Limited

| Cosan Limited | 1Q15 | 1Q14 |

| Income statement for the period | 03/31/2015 | 03/31/2014 |

| Net Operating Revenue | 2,141,124 | 2,157,186 |

| Gross Profit | 549,784 | 636,392 |

| Sales, general and administrative expenses | (399,138) | (354,196) |

| Other operating income (expenses), net | (99,324) | (32,792) |

| Financial revenue | 69,791 | 48,352 |

| Financial expenses | (291,612) | (185,465) |

| Foreign exchange variation | (591,834) | 75,737 |

| Derivative | 555,232 | (61,082) |

| Equity pick up | 153,137 | 221,802 |

| Income and Social Contribution Taxes | 79,692 | (59,562) |

| Equity attributable to non-controlling interests | (16,188) | (148,380) |

| Net Income (loss) | 9,539 | 140,806 |

| | | |

| Cosan Limited | 1Q15 | 4Q14 |

| Balance sheet | 03/31/2015 | 12/31/2014 |

| Cash and cash equivalents | 2,122,385 | 1,649,340 |

| Securities | 159,200 | 149,735 |

| Accounts receivable | 808,616 | 865,109 |

| Inventories | 324,701 | 353,720 |

| Other current assets | 640,719 | 547,203 |

| Investments | 8,642,451 | 8,535,180 |

| Investment property | 2,649,976 | 2,641,978 |

| Property, plant and equipment | 1,510,363 | 1,435,890 |

| Intangible | 10,266,512 | 10,286,373 |

| Other non-current assets | 4,174,614 | 3,231,820 |

| Total Assets | 31,299,536 | 29,696,349 |

| | | |

| Loans and financing | (9,860,254) | (8,502,640) |

| Suppliers | (1,373,919) | (1,112,459) |

| Salaries payable | (77,096) | (120,416) |

| Other current liabilities | (393,320) | (681,716) |

| Other non-current liabilities | (6,210,956) | (5,789,813) |

| Net Equity | (13,383,990) | (13,489,304) |

| Total Liabilities | (31,299,536) | (29,696,349) |

| Cosan Limited - Press Release |

| 1st quarter of the Fiscal Year 2015 |

E.5 Consolidated, including Raízen

| Cosan Limited Pro forma | 1Q15 | 1Q14 |

| Income Statement for the period | 03/31/2015 | 03/31/2014 |

| Net Operating Revenue | 10,151,731 | 9,593,449 |

| Gross Profit | 1,180,101 | 1,217,476 |

| Sales, general and administrative expenses | (752,102) | (700,277) |

| Other operating income (expenses), net | (49,311) | 48,173 |

| Financial revenue | 185,439 | 90,141 |

| Financial expenses | (436,374) | (259,686) |

| Foreign exchange variation | (980,950) | 131,570 |

| Derivative | 860,786 | (51,939) |

| Equity pick up | (4,430) | (16,001) |

| Income and Social Contribution Taxes | 28,580 | (166,616) |

| Equity attributable to non-controlling interests | (22,199) | (152,034) |

| Net Income (loss) | 9,539 | 140,806 |

| | | |

| Cosan Limited Pro forma | 1Q15 | 4Q14 |

| Balance Sheet | 03/31/2015 | 12/31/2014 |

| Cash and cash equivalents | 4,136,500 | 3,058,050 |

| Securities | 159,200 | 149,735 |

| Accounts receivable | 1,611,203 | 2,007,869 |

| Inventories | 1,043,184 | 2,076,059 |

| Other current assets | 1,562,625 | 1,246,120 |

| Investments | 361,224 | 338,800 |

| Investment property | 2,649,976 | 2,641,978 |

| Biological assets | 979,929 | 914,152 |

| Property, plant and equipment | 7,965,103 | 7,584,036 |

| Intangible | 14,067,563 | 14,064,484 |

| Other non-current assets | 5,680,860 | 4,825,855 |

| Total Assets | 40,217,368 | 38,907,140 |

| | | |

| Loans and Financing | (15,797,617) | (14,470,323) |

| Suppliers | (2,039,386) | (1,695,764) |

| Salaries Payable | (289,433) | (279,925) |

| Other current liabilities | (940,310) | (1,369,293) |

| Other non-current liabilities | (7,674,950) | (7,531,602) |

| Net Equity | (13,475,672) | (13,560,232) |

| Total Liabilities | (40,217,368) | (38,907,140) |

Item 2

Cosan Limited

Consolidated interim financial statements at

March 31, 2015 and independent

auditors’ review report

Cosan Limited

Consolidated interim financial statements

March 31, 2015

Contents

| Independent auditors’ report on review of interim financial statements | 3 |

| | |

| Consolidated statement of financial position | 5 |

| | |

| Consolidated statement of profit or loss and other comprehensive (loss) income | 7 |

| | |

| Statement of changes in shareholders’ equity | 9 |

| | |

| Consolidated statement of cash flows | 11 |

| | |

| Notes to the consolidated interim financial statements | 13 |

Independent Auditor Report on review of Consolidated Interim Financial Statements

To the Board of Directors and Shareholders

Cosan Limited

Introduction

We have reviewed the accompanying consolidated interim financial information of Cosan Limited (“The Company”), comprised in the Quarterly Information Form - ITR for the quarter ended March 31, 2015, comprising the statement of financial position as of March 31, 2015 and the respective statements of profit and loss and comprehensive (loss) income, changes in shareholders’ equity and cash flows for the three months period then ended, including the footnotes.

Management is responsible for the preparation of the consolidated interim financial information in accordance with the international standard IAS 34 - Interim Financial Reporting, issued by the International Accounting Standards Board - IASB, such as for the presentation of these information in accordance with the regulations of the Brazilian Securities Commission – CVM, applicable to the preparation of Quarterly Information - ITR. Our responsibility is to express a conclusion on these consolidated interim financial information based on our review.

Review scope

We conducted our review in accordance with the Brazilian and International standards on reviews of interim information (NBC TR 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity and ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively). A review of interim information consists of making inquiries, primarily of persons responsible for the financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with the audit standards and, consequently, does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion on the consolidated interim financial information

Based on our review, nothing has come to our attention that causes us to believe that the consolidated interim financial information included in the Quarterly Information - ITR referred to above has not been prepared, in all material respects, in accordance with IAS 34 applicable to the preparation of Quarterly Information - ITR, and presented in accordance with the regulations of the Brazilian Securities Commission – CVM.

Other Matter

Corresponding values

The consolidated financial information for the year ended December 31, 2014 and the consolidated interim financial information for the three months period ended on March 31, 2014, presented for comparative purposes, were audited and reviewed, respectively, by other independent auditors, who issued an unqualified audit report on March 18, 2015 and an unqualified review report on May 13, 2014, respectively.

São Paulo, April 29, 2015.

/s/ KPMG Auditores Independentes

KPMG Auditores Independentes

CRC 2SP014428/O-6

Carlos Augusto Pires

Contador CRC 1SP184830/O-7

Cosan Limited

Consolidated statement of financial position

(In thousands of Brazilian Reais - R$)

| | | Note | | | March 31, 2015 | | | December 31,

2014 | |

| Assets | | | | | | | | | |

| Cash and cash equivalents | | | 4 | | | | 2,122,385 | | | | 1,649,340 | |

| Investment securities | | | | | | | 159,200 | | | | 149,735 | |

| Trade receivables | | | 5 | | | | 808,616 | | | | 865,109 | |

| Derivative financial instruments | | | 23 | | | | 197,415 | | | | 30,069 | |

| Inventories | | | | | | | 324,701 | | | | 353,720 | |

| Receivables from related parties | | | 7 | | | | 39,484 | | | | 38,357 | |

| Income tax receivable | | | | | | | 92,276 | | | | 94,100 | |

| Other current tax receivable | | | | | | | 96,766 | | | | 78,818 | |

| Other financial assets | | | 6 | | | | 71,730 | | | | 69,683 | |

| Dividends receivable | | | | | | | 47,351 | | | | 36,130 | |

| Assets held for sale | | | 10 | | | | 29,673 | | | | 25,089 | |

| Other current assets | | | | | | | 66,025 | | | | 174,957 | |

| | | | | | | | | | | | | |

| Total current assets | | | | | | | 4,055,622 | | | | 3,565,107 | |

| | | | | | | | | | | | | |

| Trade receivables | | | 5 | | | | 542,155 | | | | 480,992 | |

| Deferred tax assets | | | 16 | | | | 255,182 | | | | 214,164 | |

| Receivables from related parties | | | 7 | | | | 194,484 | | | | 212,527 | |

| Income tax receivable | | | | | | | 8,778 | | | | 8,778 | |

| Taxes recoverable | | | | | | | 16,410 | | | | 17,299 | |

| Judicial deposits | | | 17 | | | | 423,171 | | | | 418,385 | |

| Other financial assets | | | 6 | | | | 378,072 | | | | 370,497 | |

| Derivative financial instruments | | | 23 | | | | 1,597,834 | | | | 860,509 | |

| Other non-current assets | | | | | | | 758,527 | | | | 648,669 | |

| Investment in associates | | | 8 | | | | 135,692 | | | | 130,677 | |

| Investment in joint ventures | | | 9 | | | | 8,506,759 | | | | 8,404,503 | |

| Investment property | | | 10 | | | | 2,649,976 | | | | 2,641,978 | |

| Property, plant and equipment | | | 11 | | | | 1,510,363 | | | | 1,435,890 | |

| Intangible assets and goodwill | | | 12 | | | | 10,266,512 | | | | 10,286,373 | |

| | | | | | | | | | | | | |

| Total non-current assets | | | | | | | 27,243,915 | | | | 26,131,241 | |

| | | | | | | | | | | | | |

| Total assets | | | | | | | 31,299,537 | | | | 29,696,348 | |

| The accompanying notes are an integral part of these consolidated interim financial statements. |

Cosan Limited

Consolidated statement of financial position

(In thousands of Brazilian Reais - R$)

| | | Note | | | March 31, 2015 | | | December 31,

2014 | |

| Liabilities | | | | | | | | | |

| Loans and borrowings | | | 13 | | | | 1,297,455 | | | | 1,056,353 | |

| Derivative financial instruments | | | 23 | | | | 38,726 | | | | 13,803 | |

| Trade payables | | | 14 | | | | 1,373,919 | | | | 1,112,459 | |

| Employee benefits payable | | | | | | | 77,096 | | | | 120,416 | |

| Income tax payable | | | | | | | 21,063 | | | | 30,905 | |

| Other taxes payable | | | 15 | | | | 121,864 | | | | 307,741 | |

| Dividends payable | | | | | | | 33,354 | | | | 33,354 | |

| Payables to related parties | | | 7 | | | | 96,577 | | | | 137,441 | |

| Other current liabilities | | | | | | | 81,735 | | | | 158,471 | |

| | | | | | | | | | | | | |

| Total current liabilities | | | | | | | 3,141,789 | | | | 2,970,943 | |

| | | | | | | | | | | | | |

| Loans and borrowings | | | 13 | | | | 8,562,798 | | | | 7,446,287 | |

| Derivative financial instruments | | | 23 | | | | 553,313 | | | | 319,632 | |

| Other taxes payable | | | 15 | | | | 507,565 | | | | 334,565 | |

| Provision for legal proceedings | | | 17 | | | | 675,710 | | | | 657,779 | |

| Pension and post-employment benefits | | | 25 | | | | 307,083 | | | | 301,850 | |

| Deferred tax liabilities | | | 16 | | | | 1,696,108 | | | | 1,739,274 | |

| Preferred shareholders payable in subsidiaries | | | 18 | | | | 1,988,596 | | | | 1,926,888 | |

| Other non-current liabilities | | | | | | | 482,582 | | | | 509,823 | |

| | | | | | | | | | | | | |

| Total non-current liabilities | | | | | | | 14,773,755 | | | | 13,236,098 | |

| | | | | | | | | | | | | |

| Total liabilities | | | | | | | 17,915,544 | | | | 16,207,041 | |

| | | | | | | | | | | | | |

| Shareholders' equity | | | 19 | | | | | | | | | |

| Share capital | | | | | | | 5,328 | | | | 5,328 | |

| Additional paid in capital | | | | | | | 3,888,940 | | | | 3,887,109 | |

| Other comprehensive loss | | | | | | | (225,616 | ) | | | (165,618 | ) |

| Retained earnings | | | | | | | 2,127,278 | | | | 2,117,739 | |

| | | | | | | | | | | | | |

| Equity attributable to owners of the parent | | | | | | | 5,795,930 | | | | 5,844,558 | |

| Non-controlling interests | | | 8 | | | | 7,588,063 | | | | 7,644,749 | |

| | | | | | | | | | | | | |

| Total shareholders' equity | | | | | | | 13,383,993 | | | | 13,489,307 | |

| | | | | | | | | | | | | |

| Total shareholders' equity and liabilities | | | | | | | 31,299,537 | | | | 29,696,348 | |

| | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated interim financial statements. | |

Consolidated statement of profit or loss and other comprehensive income

For the quarter ended March 31, 2015 and 2014

(In thousands of Brazilian Reais – R$, except earnings per share)

| | | Note | | | March 31, 2015 | | | March 31, 2014 | |

| Net sales | | | | | | 2,141,124 | | | | 2,157,186 | |

| Cost of sales | | | | | | (1,591,340 | ) | | | (1,520,794 | ) |

| | | | | | | | | | | | |

| Gross profit | | | | | | 549,784 | | | | 636,392 | |

| | | | | | | | | | | | |

| Selling expenses | | | | | | (219,326 | ) | | | (206,618 | ) |

| General and administrative expenses | | | | | | (179,812 | ) | | | (147,577 | ) |

| Other expense, net | | | 22 | | | | (99,324 | ) | | | (32,792 | ) |

| | | | | | | | | | | | | |

| Operating expense | | | | | | | (498,462 | ) | | | (386,987 | ) |

| | | | | | | | | | | | | |

Income before financial results, equity in earnings of investees and income taxes | | | | | | | 51,322 | | | | 249,405 | |

| | | | | | | | | | | | | |

| Equity in earnings of investees | | | | | | | | | | | | |

| Equity in earnings of associates | | | 8 | | | | (4,635 | ) | | | (1,189 | ) |

| Equity in earnings of joint ventures | | | 9 | | | | 157,772 | | | | 222,990 | |

| | | | | | | | 153,137 | | | | 221,801 | |

| Financial results | | | 21 | | | | | | | | | |

| Finance expense | | | | | | | (291,612 | ) | | | (185,465 | ) |

| Finance income | | | | | | | 69,791 | | | | 48,352 | |

| Foreign exchange (losses) gains, net | | | | | | | (591,834 | ) | | | 75,737 | |

| Derivatives | | | | | | | 555,232 | | | | (61,082 | ) |

| | | | | | | | (258,423 | ) | | | (122,458 | ) |

| | | | | | | | | | | | | |

| (Loss) profit before taxes | | | | | | | (53,964 | ) | | | 348,748 | |

| | | | | | | | | | | | | |

| Income tax (expense) benefit | | | 16 | | | | | | | | | |

| Current | | | | | | | (4,838 | ) | | | (30,539 | ) |

| Deferred | | | | | | | 84,529 | | | | (29,023 | ) |

| | | | | | | | 79,691 | | | | (59,562 | ) |

| | | | | | | | | | | | | |

| Profit for the period | | | | | | | 25,727 | | | | 289,186 | |

| | | | | | | | | | | | | |

| Other comprehensive income | | | 19 | | | | | | | | | |

| Items that will not be reclassified to profit or loss: | | | | | | | | | | | | |

| Actuarial loss on defined benefit plan | | | | | | | - | | | | (359 | ) |

Taxes on items that will not be reclassified to profit or loss | | | | | | | - | | | | 122 | |

| | | | | | | | - | | | | (237 | ) |

Cosan Limited

Consolidated statement of profit or loss and other comprehensive income

For the quarter ended March 31, 2015 and 2014

(In thousands of Brazilian Reais – R$, except earnings per share)

| | | Note | | | March 31, 2015 | | | March 31, 2014 | |

| Items that may be reclassified to profit or loss: | | | | | | | | | | | | |

| Foreign currency translation effect | | | | | | | (80,686 | ) | | | (3,523 | ) |

Gain (loss) on cash flow hedge in joint ventures and subsidiary | | | | | | | 20,735 | | | | (49,109 | ) |

Changes in fair value of available for sale securities | | | | | | | 1,486 | | | | 914 | |

Taxes on items that may be reclassified to profit or loss | | | | | | | (505 | ) | | | (311 | ) |

| | | | | | | | (58,970 | ) | | | (52,029 | ) |

| | | | | | | | | | | | | |

Total other comprehensive loss, net of tax | | | | | | | (58,970 | ) | | | (52,266 | ) |

| | | | | | | | | | | | | |

| Total comprehensive (loss) income | | | | | | | (33,243 | ) | | | 236,920 | |

| | | | | | | | | | | | | |

| Net income attributable to: | | | | | | | | | | | | |

| Owners of the Parent | | | | | | | 9,539 | | | | 140,806 | |

| Non-controlling interests | | | | | | | 16,188 | | | | 148,380 | |

| | | | | | | | | | | | | |

Total comprehensive (loss) income attributable to: | | | | | | | | | | | | |

| Owners of the Parent | | | | | | | (50,459 | ) | | | 110,826 | |

| Non-controlling interests | | | | | | | 17,216 | | | | 126,094 | |

| | | | | | | | | | | | | |

| Basic earnings per share | | | 20 | | | R$ | 0.04 | | | R$ | 0.53 | |

| Diluted earnings per share (as revised - Note 20) | | | | | | R$ | (0.02 | ) | | R$ | 0.47 | |

| | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated interim financial statements. | |

Cosan Limited

Statement of changes in shareholders’ equity

For the quarter ended March 31, 2015 and 2014

(In thousands of Brazilian Reais - R$)

| | | | | | Capital reserve | | | | | | | | | | | | | | | | |

| | | | | | Additional | | | Other | | | | | | Equity attributable | | | Non- | | | | |

| | | Share | | | paid in | | | comprehensive | | | Retained | | | to owners | | | controlling | | | Total | |

| | | capital | | | capital | | | (loss) income | | | earnings | | | of the parent | | | interests | | | equity | |

| At January 1, 2015 | | | 5,328 | | | | 3,887,109 | | | | (165,618 | ) | | | 2,117,739 | | | | 5,844,558 | | | | 7,644,749 | | | | 13,489,307 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the period | | | - | | | | - | | | | - | | | | 9,539 | | | | 9,539 | | | | 16,188 | | | | 25,727 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation effects | | | - | | | | - | | | | (72,952 | ) | | | - | | | | (72,952 | ) | | | (7,734 | ) | | | (80,686 | ) |

| Gain on cash flow hedge in | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| joint ventures and subsidiary | | | - | | | | - | | | | 12,962 | | | | - | | | | 12,962 | | | | 7,773 | | | | 20,735 | |

| Changes in fair value of | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| available for sale Securities | | | - | | | | - | | | | (8 | ) | | | - | | | | (8 | ) | | | 989 | | | | 981 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive income for the period | | | - | | | | - | | | | (59,998 | ) | | | 9,539 | | | | (50,459 | ) | | | 17,216 | | | | (33,243 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share based compensation | | | - | | | | 1,831 | | | | - | | | | - | | | | 1,831 | | | | 1,098 | | | | 2,929 | |

| Dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | (75,000 | ) | | | (75,000 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | - | | | | 1,831 | | | | - | | | | - | | | | 1,831 | | | | (73,902 | ) | | | (72,071 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At March 31, 2015 | | | 5,328 | | | | 3,888,940 | | | | (225,616 | ) | | | 2,127,278 | | | | 5,795,930 | | | | 7,588,063 | | | | 13,383,993 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated interim financial statements. | |

Cosan Limited

Statement of changes in shareholders’ equity

For the quarter ended March 31, 2015 and 2014

(In thousands of Brazilian Reais - R$)

| | | | | | Capital reserve | | | | | | | | | | | | | | | | |

| | | | | | Additional | | | Other | | | | | | Equity attributable | | | Non- | | | | |

| | | Share | | | paid in | | | comprehensive | | | Retained | | | to owners | | | controlling | | | Total | |

| | | capital | | | capital | | | (loss) income | | | earnings | | | of the parent | | | interests | | | equity | |

| At January 1, 2014 | | | 5,328 | | | | 3,828,858 | | | | (84,887 | ) | | | 2,136,975 | | | | 5,886,274 | | | | 7,433,490 | | | | 13,319,764 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit for the period | | | - | | | | - | | | | - | | | | 140,806 | | | | 140,806 | | | | 148,380 | | | | 289,186 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation effects | | | - | | | | - | | | | 534 | | | | - | | | | 534 | | | | (4,057 | ) | | | (3,523 | ) |

| Loss on cash flow hedge in | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| joint ventures and subsidiary | | | - | | | | - | | | | (30,596 | ) | | | - | | | | (30,596 | ) | | | (18,513 | ) | | | (49,109 | ) |

Actuarial loss on defined benefit plan | | | - | | | | - | | | | (96 | ) | | | - | | | | (96 | ) | | | (141 | ) | | | (237 | ) |

| Changes in fair value of | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| available for sale Securities | | | - | | | | - | | | | 178 | | | | - | | | | 178 | | | | 425 | | | | 603 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive income for the period | | | - | | | | - | | | | (29,980 | ) | | | 140,806 | | | | 110,826 | | | | 126,094 | | | | 236,920 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share options exercised | | | - | | | | 2,861 | | | | - | | | | - | | | | 2,861 | | | | 1,731 | | | | 4,592 | |

| Share based compensation | | | - | | | | 1,597 | | | | - | | | | - | | | | 1,597 | | | | 966 | | | | 2,563 | |

| Dividends | | | - | | | | - | | | | - | | | | - | | | | - | | | | (57,187 | ) | | | (57,187 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total contributions by and distributions to | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| owners of the Parent | | | - | | | | 4,458 | | | | - | | | | - | | | | 4,458 | | | | (54,490 | ) | | | (50,032 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At March 31, 2014 | | | 5,328 | | | | 3,833,316 | | | | (114,867 | ) | | | 2,277,781 | | | | 6,001,558 | | | | 7,505,094 | | | | 13,506,652 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated interim financial statements. | |

Cosan Limited

Consolidated statement of cash flows

For the quarter ended March 31, 2015 and 2014

(In thousands of Brazilian Reais - R$)

| | | Note | | | March 31, 2015 | | | March 31, 2014 | |

| Cash flows from operating activities | | | | | | | | | |

| (Loss) profit before taxes | | | | | | (53,964 | ) | | | 348,748 | |

| Adjustments for: | | | | | | | | | | | |

| Depreciation and amortization | | | 11 / 12 | | | | 165,391 | | | | 160,378 | |

| Equity in earnings of associates | | | 8 | | | | 4,635 | | | | 1,189 | |

| Equity in earnings of joint ventures | | | 9 | | | | (157,772 | ) | | | (222,990 | ) |

| Loss on disposal of assets | | | | | | | 1,281 | | | | 2,052 | |

| Share-based compensation expense | | | | | | | 2,929 | | | | 2,563 | |

| Change in fair value of investment property | | | 10 / 22 | | | | (14,320 | ) | | | 22,920 | |

| Provisions for legal proceedings | | | 22 | | | | 9,200 | | | | 18,491 | |

| Indexation charges, interest and | | | | | | | | | | | | |

| exchange gains/losses, net | | | | | | | 331,986 | | | | 149,321 | |

| Other | | | | | | | 20,131 | | | | 17,965 | |

| | | | | | | | 309,497 | | | | 500,637 | |

| Changes in: | | | | | | | | | | | | |

| Trade receivables | | | | | | | (8,280 | ) | | | (58,421 | ) |

| Securities | | | | | | | (1,362 | ) | | | (29,050 | ) |

| Inventories | | | | | | | 33,468 | | | | 41,623 | |

| Recoverable taxes | | | | | | | (34,796 | ) | | | 666 | |

| Related parties | | | | | | | (46,693 | ) | | | (52,651 | ) |

| Advances to suppliers | | | | | | | 1,147 | | | | - | |

| Trade payables | | | | | | | 213,518 | | | | (83,936 | ) |

| Employee benefits | | | | | | | (54,012 | ) | | | (44,683 | ) |

| Provisions for legal proceedings | | | | | | | (312 | ) | | | (6,595 | ) |

| Income and other taxes | | | | | | | (990 | ) | | | (57,758 | ) |

| Other assets and liabilities, net | | | | | | | (110,753 | ) | | | 34,630 | |

| | | | | | | | (9,065 | ) | | | (256,175 | ) |

| | | | | | | | | | | | | |

| Net cash generated by operating activities | | | | | | | 300,432 | | | | 244,462 | |

| | | | | | | | | | | | | |

| Cash flows from investing activities | | | | | | | | | | | | |

| Capital contribution in associates | | | | | | | (22,555 | ) | | | (6,944 | ) |

| Dividends received from joint ventures | | | | | | | 93,925 | | | | 197,000 | |

| Acquisition of property, plant and | | | | | | | | | | | | |

| equipment and intangible assets | | | 11 / 12 | | | | (181,685 | ) | | | (192,169 | ) |

| Proceeds from sale of property, plant | | | | | | | | | | | | |

| and equipment, intangibles and investments | | | | | | | - | | | | 100 | |

| | | | | | | | | | | | | |

| Net cash used in investing activities | | | | | | | (110,315 | ) | | | (2,013 | ) |

Cosan Limited

Consolidated statement of cash flows

For the quarter ended March 31, 2015 and 2014

(In thousands of Brazilian Reais - R$)

| Cash flows from financing activities | | | | | | | | | | | | |

| Loans and borrowings raised | | | | | | | 705,479 | | | | 191,150 | |

| Payment of principal and | | | | | | | | | | | | |

| interest on loans and borrowings | | | | | | | (694,726 | ) | | | (733,829 | ) |

| Interest paid | | | | | | | 167,633 | | | | 316,961 | |

| Derivative financial instruments | | | | | | | 178,832 | | | | (30,997 | ) |

| Dividends paid | | | | | | | (75,000 | ) | | | - | |

| Proceeds from exercise of share options | | | | | | | - | | | | 4,592 | |

| | | | | | | | | | | | | |

| Net cash generated by | | | | | | | | | | | | |

| (used in) financing activities | | | | | | | 282,218 | | | | (252,123 | ) |

| | | | | | | | | | | | | |

| Increase (decrease) in cash and cash equivalents | | | | | | | 472,335 | | | | (9,674 | ) |

| | | | | | | | | | | | | |

| Cash and cash equivalents at beginning of period | | | | | | | 1,649,340 | | | | 1,509,565 | |

| Effects of exchange rate changes on cash held | | | | | | | 710 | | | | 5,436 | |

| | | | | | | | | | | | | |

| Cash and cash equivalents at ended of period | | | | | | | 2,122,385 | | | | 1,505,327 | |

| | | | | | | | | | | | | |

| Supplemental cash flow information | | | | | | | | | | | | |

| Income taxes paid | | | | | | | (24,082 | ) | | | 27,874 | |

| | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated interim financial statements. | |

Cosan Limited

Notes to the consolidated interim financial statements

For the quarter ended March 31, 2015 and 2014

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

Cosan Limited (“Cosan”) was incorporated in Bermuda on April 30, 2007. Cosan’s class A common shares are traded on the New York Stock Exchange (NYSE) (ticker - CZZ). The BDRs (Brazilian Depositary Receipts) representing Cosan’s class A common shares are listed on the Brazilian Stock Exchange (BM&FBovespa) (ticker - CZLT33). Mr. Rubens Ometto Silveira Mello is the ultimate controlling shareholder of Cosan. Cosan controls its subsidiaries Cosan S.A. Indústria e Comércio (“Cosan S.A.”), Cosan Logística S.A. (“Cosan Log”) through a 62.51 % interest. Cosan, Cosan S.A., Cosan Log and its subsidiaries are collectively referred to as the “Company”.

The Company’s primary activities are in the following business segments: (i) Piped natural gas distribution to part of the State of São Paulo through its subsidiary Companhia de Gás de São Paulo – COMGÁS (“COMGÁS”), which has been consolidated since November 2012; (ii) Logistics services including transportation, port loading and storage of sugar, through its indirect subsidiary Rumo Logística Operadora Multimodal S.A. (“Rumo”); (iii) Purchase, sale and leasing of agricultural land through its subsidiary, Radar Propriedades Agrícolas S.A. ("Radar"); (iv) Production and distribution of lubricants under the Mobil licensed trademark in Brazil, Bolivia, Uruguay and Paraguay, in addition to the European and Asian market using the Comma brand and corporate activities; and (v) other investments, in addition to the corporate structures of the Company (“Cosan’s other business”).

The Company also holds interests in two joint ventures ("JVs"): (i) Raízen Combustíveis S.A. (“Raízen Combustíveis”), a fuel distribution business, and (ii) Raízen Energia S.A. (“Raízen Energia”), which operates in the production and marketing of sugar, ethanol and energy cogeneration, produced from sugar cane bagasse.

On October 1, 2014 at the Extraordinary General Meeting (EGM), the Cosan S.A. shareholders’ approved the partial spin-off (the “Partial Spin-off”) of Cosan S.A. and merger of the spun-off portion into Cosan Log, composed of Cosan’s logistics operations. The Partial Spin-off seeks to segregate the Company’s activities in order to allow each business segment to focus on its sector, establishing suitable capital structures for each company. It also seeks to provide the market with greater transparency on each company’s performance, which will allow a better evaluation from shareholders and investors of the individual businesses permitting that resources be allocated in accordance with the shareholder’s interests and investment strategy. This partial spin-off that didn’t carry changes to the consolidated financial statements of Cosan Limited.

| | 2.1 | Statement of compliance |

The interim consolidated financial statements have been prepared in accordance with IAS 34 Interim Financial Reporting, as issued by the International Accounting Standards Board (IASB), and in accordance with the regulations issued by the Brazilian Securities Commission - CVM applicable to the preparation of the Quarterly Information - ITR. They do not include all the information required for a complete set of IFRS financial statements. However, selected explanatory notes are included to explain events and transactions that are significant to an understanding of the changes in the Company’s financial position and performance since the last annual consolidated financial statements as at and for the year ended December 31, 2014.

Cosan Limited

Notes to the consolidated interim financial statements

For the quarter ended March 31, 2015 and 2014

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

The significant judgments made by management in applying the Company’s accounting policies and the key sources of estimation uncertainty were the same as those that applied to the consolidated financial statements as at and for the year ended December 31, 2014.

These consolidated interim financial statements were authorized for issue by the Board of Directors on April 29, 2015.

| | 2.2 | Basis of consolidation |

The consolidated interim financial statements include the accounts of Cosan and its subsidiaries as are listed below:

| | | Ownership percentage | |

| | | March 31, 2015 | | | December 31, 2014 | |

| Directly owned subsidiaries | | | | | | |

| Cosan Logística S.A. | | | 62.51 | | | | 62.51 | |

| Cosan S.A. Indústria e Comércio | | | 62.51 | | | | 62.51 | |

| | | | | | | | | |

| Interest of Cosan S.A. in its subsidiaries | | | | | | | | |

| Águas da Ponte Alta S.A. | | | 65.00 | | | | 65.00 | |

| Bioinvestments Negócios e Participações S.A. | | | 65.00 | | | | 65.00 | |

| Comma Oil Chemicals Limited | | | 100.00 | | | | 100.00 | |

| Companhia de Gás de São Paulo - COMGÁS | | | 60.69 | | | | 60.69 | |

| Cosan Biomassa S.A. | | | 100.00 | | | | 100.00 | |

| Cosan Cayman II Limited | | | 100.00 | | | | 100.00 | |

| Cosan Global Limited | | | 100.00 | | | | 100.00 | |

| Cosan Investimentos e Participações S.A. | | | 100.00 | | | | 100.00 | |

| Cosan Lubes Investments Limited | | | 100.00 | | | | 100.00 | |

| Cosan Lubrificantes e Especialidades S.A. | | | 100.00 | | | | 100.00 | |

| Cosan Luxembourg S.A. | | | 100.00 | | | | 100.00 | |

| Cosan Overseas Limited | | | 100.00 | | | | 100.00 | |

| Cosan Paraguay S.A. | | | 100.00 | | | | 100.00 | |

| Cosan US, Inc. | | | 100.00 | | | | 100.00 | |

| Nova Agrícola Ponte Alta S.A. | | | 29.50 | | | | 29.50 | |

| Nova Amaralina S.A. Propriedades Agrícolas | | | 29.50 | | | | 29.50 | |

| Nova Santa Barbara Agrícola S.A. | | | 29.50 | | | | 29.50 | |

| Pasadena Empreendimentos e Participações S.A. | | | 100.00 | | | | 100.00 | |

| Proud Participações S.A. | | | 65.00 | | | | 65.00 | |

| Radar II Propriedades Agrícolas S.A. | | | 65.00 | | | | 65.00 | |

| Radar Propriedades Agrícolas S.A. | | | 29.50 | | | | 29.50 | |

| Terras da Ponte Alta S.A. | | | 29.50 | | | | 29.50 | |

| Vale da Ponte Alta S.A. | | | 65.00 | | | | 65.00 | |

| | | | | | | | | |

| Interest of Cosan Log in its subsidiaries | | | | | | | | |

| Logispot Armazéns Gerais S.A. | | | 38.25 | | | | 38.25 | |

| Rumo Logística Operadora Multimodal S.A. | | | 75.00 | | | | 75.00 | |

Cosan Limited

Notes to the consolidated interim financial statements

For the quarter ended March 31, 2015 and 2014

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

| | 2.3 | New standards and interpretations not yet adopted |

A number of new standards and amendments to standards and interpretations are effective for annual periods beginning after January 1, 2015, and have not been applied in preparing these consolidated financial statements. None of these is expected to have a significant effect on the consolidated financial statements of the Company, except the following:

| | · | IFRS 9, ‘Financial instruments’, addresses the classification, measurement and recognition of financial assets and financial liabilities. IFRS 9 is effective for annual reporting periods beginning on or after January 1, 2018. The Company will also consider the impact of the remaining phases of IFRS 9 when completed by the Board; |

| | · | IFRS 15, ‘Revenue from contracts with customers’ deals with revenue recognition and establishes principles for reporting useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows arising from an entity’s contracts with customers. The standard is effective for annual periods beginning on or after January 1, 2017. The standard replaces IAS 18 ‘Revenue’ and IAS 11 ‘Construction contracts’ and related interpretations. The Company is currently assessing the potential impacts of adopting IFRS 15. |

There are no other Standards or Interpretations that are not yet effective that would be expected to have a material impact on the Company.

| | 2.4 | Correction of an error |

During 2014, the Company identified an immaterial mathematical error in the calculation of diluted earnings per share impacting the quarter ended March 31, 2014. The error consisted of a mathematical inaccurate calculation on the monetary effect of dilution on the profit attributable to shareholders of the parent.

The diluted earnings per share from continuing operations for the quarter ended March 31, 2014 was originally presented, in error, as R$ 0.41. The amount has being revised on the face of statement of profit or loss and other comprehensive and in the Note 20 as R$0.47.

Cosan Limited

Notes to the consolidated interim financial statements

For the quarter ended March 31, 2015 and 2014

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

Segment information

The following segment information is used by Cosan's senior management (the “Chief Operating Decision Maker”) to assess the performance of the operating segments and to make decisions with regards to the allocation of resources. This information is prepared on a basis consistent with the accounting policies used in the preparation of the financial statements. Cosan evaluates the performance of its operating segments based on the measure of Earnings Before Interest Tax, Depreciation and Amortization (“EBITDA”). A reconciliation of EBITDA to profit (loss) is presented below.

Operating segments

| | I. | Raízen Energia: production and marketing of a variety of products derived from sugar cane, including raw sugar (VHP), anhydrous and hydrated ethanol, and activities related to energy cogeneration from sugarcane bagasse. In addition, this segment holds interests in companies engaged in research and development on new technology; |

| | II. | Raízen Combustíveis: distribution and marketing of fuels, mainly through a franchised network of service stations under the brand Shell and Esso throughout Brazil; |

| | III. | COMGÁS: distribution of piped natural gas to part of the State of São Paulo (approximately 180 municipalities, including the region called Greater São Paulo) to customers in the industrial, residential, commercial, automotive, thermo generation and cogeneration sectors; |

| | IV. | Cosan Log: logistics services for transport, storage and port loading of commodities, mainly for sugar products; |

| | V. | Radar: management, buying, selling and leasing of agricultural; |

| | VI. | Lubricants: production and distribution of lubricants under the Mobil brand in Brazil, Bolivia, Uruguay and Paraguay, as well as European and Asian market with a Comma trademark; Upon adoption of IFRS 11, whereby the Company no longer proportionally consolidates the results of Raízen Energia and Raízen Combustíveis, the Lubricants segment met the quantitative thresholds to be separately reportable, and the comparative segment information has been adjusted retroactively; and |

| | | Other business: other investments, in addition to the corporate activities of the Company. |

Although Raízen Energia and Raízen Combustíveis are equity accounted joint-ventures and are no longer proportionally consolidated since adoption of IFRS 11, senior management continues to review segment information. A reconciliation of these segments is presented in the column “Deconsolidation IFRS 11”.

The following statement of financial position and profit or loss selected information by segment was prepared on the same basis as the accounting practices used in the preparation of consolidated information:

Cosan Limited

Notes to the consolidated interim financial statements

For the quarter ended March 31, 2015 and 2014

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

| | | March 31, 2015 | | | Additional information | |

| | | Raízen Energia | | | Raízen Combustíveis | | | COMGÁS | | | Radar | | | Lubricants | | | Cosan Log | | | Other business | | | Deconsolidated effects IFRS 11 | | | Segment elimination | | | Total consolidated | | | Cosan Energia | | | Cosan Log | |

| |

| Statement of profit or loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | | 3,080,040 | | | | 14,061,510 | | | | 1,534,064 | | | | 21,606 | | | | 379,843 | | | | 205,611 | | | | - | | | | (17,141,550 | ) | | | - | | | | 2,141,124 | | | | 1,935,513 | | | | 205,611 | |

| Domestic market | | | 1,166,359 | | | | 14,061,510 | | | | 1,534,064 | | | | 21,606 | | | | 305,666 | | | | 176,847 | | | | - | | | | (15,227,869 | ) | | | - | | | | 2,038,183 | | | | 1,861,336 | | | | 176,847 | |

| External market | | | 1,913,681 | | | | - | | | | - | | | | - | | | | 74,177 | | | | 28,764 | | | | - | | | | (1,913,681 | ) | | | - | | | | 102,941 | | | | 74,177 | | | | 28,764 | |

| Gross profit | | | 459,213 | | | | 801,421 | | | | 379,387 | | | | 19,867 | | | | 91,268 | | | | 59,262 | | | | - | | | | (1,260,634 | ) | | | - | | | | 549,784 | | | | 490,522 | | | | 59,262 | |

| Selling expenses | | | (149,073 | ) | | | (315,933 | ) | | | (154,521 | ) | | | - | | | | (64,805 | ) | | | - | | | | - | | | | 465,006 | | | | - | | | | (219,326 | ) | | | (219,326 | ) | | | - | |

General and administrative expenses | | | (140,651 | ) | | | (100,271 | ) | | | (86,596 | ) | | | (7,207 | ) | | | (16,147 | ) | | | (24,370 | ) | | | (45,492 | ) | | | 240,922 | | | | - | | | | (179,812 | ) | | | (140,878 | ) | | | (24,370 | ) |

| Other income (expense), net | | | 39,099 | | | | 60,926 | | | | (2,080 | ) | | | 14,324 | | | | 160 | | | | (460 | ) | | | (111,268 | ) | | | (100,025 | ) | | | - | | | | (99,324 | ) | | | (98,864 | ) | | | (460 | ) |

| Financial results | | | (238,303 | ) | | | 12,953 | | | | (73,957 | ) | | | 1,692 | | | | 3,768 | | | | (20,398 | ) | | | (169,528 | ) | | | 225,350 | | | | - | | | | (258,423 | ) | | | (284,713 | ) | | | (20,398 | ) |

| Financial expense | | | (204,842 | ) | | | (38,955 | ) | | | (103,891 | ) | | | (354 | ) | | | (8,446 | ) | | | (10,323 | ) | | | (172,421 | ) | | | 243,797 | | | | 3,823 | | | | (291,612 | ) | | | (273,813 | ) | | | (10,323 | ) |

Financial income | | | 147,793 | | | | 37,777 | | | | 37,314 | | | | 2,070 | | | | 328 | | | | 5,652 | | | | 28,250 | | | | (185,570 | ) | | | (3,823 | ) | | | 69,791 | | | | 64,109 | | | | 5,652 | |

| Foreign exchange losses, net | | | (605,426 | ) | | | (172,806 | ) | | | (242,512 | ) | | | (24 | ) | | | 2,614 | | | | (56,217 | ) | | | (295,695 | ) | | | 778,232 | | | | - | | | | (591,834 | ) | | | (568,545 | ) | | | (56,217 | ) |

Derivatives | | | 424,172 | | | | 186,937 | | | | 235,132 | | | | - | | | | 9,272 | | | | 40,490 | | | | 270,338 | | | | (611,109 | ) | | | - | | | | 555,232 | | | | 493,536 | | | | 40,490 | |

| Equity in earnings of associates | | | (5,990 | ) | | | 4,048 | | | | - | | | | - | | | | (4,960 | ) | | | - | | | | 8,960 | | | | 1,942 | | | | (8,635 | ) | | | (4,635 | ) | | | (4,635 | ) | | | - | |

Equity in earnings of joint ventures | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 157,772 | | | | - | | | | - | | | | 157,772 | | | | 157,772 | | | | - | |

| Income tax expense benefit | | | 42,751 | | | | (144,976 | ) | | | (31,841 | ) | | | (3,344 | ) | | | (5,704 | ) | | | (4,833 | ) | | | 125,413 | | | | 102,225 | | | | - | | | | 79,691 | | | | 84,524 | | | | (4,833 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit (loss) for the period | | | 7,046 | | | | 318,168 | | | | 30,392 | | | | 25,332 | | | | 3,580 | | | | 9,201 | | | | (34,143 | ) | | | (325,214 | ) | | | (8,635 | ) | | | 25,727 | | | | (15,598 | ) | | | 9,201 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other selected data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 627,614 | | | | 139,333 | | | | 119,451 | | | | 245 | | | | 17,928 | | | | 26,653 | | | | 974 | | | | (766,947 | ) | | | - | | | | 165,251 | | | | 138,598 | | | | 26,653 | |

| EBITDA | | | 830,212 | | | | 589,524 | | | | 255,641 | | | | 27,229 | | | | 23,444 | | | | 61,085 | | | | 10,946 | | | | (1,419,736 | ) | | | (8,635 | ) | | | 369,710 | | | | 323,189 | | | | 61,085 | |

| Additions to PP&E, intangible | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| and biological assets (cash) | | | 828,526 | | | | 239,699 | | | | 123,566 | | | | 668 | | | | 8,300 | | | | 30,989 | | | | 18,162 | | | | (1,068,225 | ) | | | - | | | | 181,685 | | | | 150,696 | | | | 30,989 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of EBITDA: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit (loss) for the period | | | 7,046 | | | | 318,168 | | | | 30,392 | | | | 25,332 | | | | 3,580 | | | | 9,201 | | | | (34,143 | ) | | | (325,214 | ) | | | (8,635 | ) | | | 25,727 | | | | (15,598 | ) | | | 9,201 | |

Income tax and social contribution | | | (42,751 | ) | | | 144,976 | | | | 31,841 | | | | 3,344 | | | | 5,704 | | | | 4,833 | | | | (125,413 | ) | | | (102,225 | ) | | | - | | | | (79,691 | ) | | | (84,524 | ) | | | 4,833 | |

| Financial result, net | | | 238,303 | | | | (12,953 | ) | | | 73,957 | | | | (1,692 | ) | | | (3,768 | ) | | | 20,398 | | | | 169,528 | | | | (225,350 | ) | | | - | | | | 258,423 | | | | 284,713 | | | | 20,398 | |

| Depreciation and amortization | | | 627,614 | | | | 139,333 | | | | 119,451 | | | | 245 | | | | 17,928 | | | | 26,653 | | | | 974 | | | | (766,947 | ) | | | - | | | | 165,251 | | | | 138,598 | | | | 26,653 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA | | | 830,212 | | | | 589,524 | | | | 255,641 | | | | 27,229 | | | | 23,444 | | | | 61,085 | | | | 10,946 | | | | (1,419,736 | ) | | | (8,635 | ) | | | 369,710 | | | | 323,189 | | | | 61,085 | |

Cosan Limited

Notes to the consolidated interim financial statements

For the quarter ended March 31, 2015 and 2014

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

| | | March 31, 2014 | | | Additional information | |

| | | Raízen Energia | | | Raízen Combustíveis | | | COMGÁS | | | Radar | | | Lubricants | | | Rumo | | | Other business | | | Deconsolidated effects IFRS 11 | | | Segment elimination | | | Total consolidated | | | Cosan Energia | | | Cosan Log | |

| |

| Statement of profit or loss: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | | 2,604,831 | | | | 13,010,956 | | | | 1,517,379 | | | | 63,552 | | | | 368,269 | | | | 207,934 | | | | 52 | | | | (15,615,787 | ) | | | - | | | | 2,157,186 | | | | 1,949,252 | | | | 207,934 | |

| Domestic market | | | 992,920 | | | | 13,010,956 | | | | 1,517,379 | | | | 63,552 | | | | 294,185 | | | | 178,930 | | | | 52 | | | | (14,003,876 | ) | | | - | | | | 2,054,098 | | | | 1,875,168 | | | | 178,930 | |

| External market | | | 1,611,911 | | | | - | | | | - | | | | - | | | | 74,084 | | | | 29,004 | | | | - | | | | (1,611,911 | ) | | | - | | | | 103,088 | | | | 74,084 | | | | 29,004 | |

| Gross profit | | | 491,873 | | | | 670,295 | | | | 448,410 | | | | 25,244 | | | | 78,273 | | | | 84,403 | | | | 62 | | | | (1,162,168 | ) | | | - | | | | 636,392 | | | | 551,989 | | | | 84,403 | |

| Selling expenses | | | (163,199 | ) | | | (283,468 | ) | | | (150,332 | ) | | | - | | | | (56,286 | ) | | | - | | | | - | | | | 446,667 | | | | - | | | | (206,618 | ) | | | (206,618 | ) | | | - | |

General and administrative expenses | | | (140,359 | ) | | | (105,135 | ) | | | (67,130 | ) | | | (8,350 | ) | | | (17,370 | ) | | | (19,974 | ) | | | (34,753 | ) | | | 245,494 | | | | - | | | | (147,577 | ) | | | (125,120 | ) | | | (19,974 | ) |

| Other income (expense), net | | | 60,169 | | | | 101,760 | | | | (7,112 | ) | | | (23,045 | ) | | | 408 | | | | 6,702 | | | | (9,745 | ) | | | (161,929 | ) | | | - | | | | (32,792 | ) | | | (39,494 | ) | | | 25,291 | |

| Financial results | | | 64,426 | | | | 661 | | | | (56,549 | ) | | | 3,145 | | | | 25,266 | | | | 3,853 | | | | (98,173 | ) | | | (65,087 | ) | | | - | | | | (122,458 | ) | | | (110,031 | ) | | | 3,853 | |

| Financial expense | | | (128,398 | ) | | | (20,044 | ) | | | (71,389 | ) | | | (268 | ) | | | 42,683 | | | | (8,487 | ) | | | (151,120 | ) | | | 148,442 | | | | 3,116 | | | | (185,465 | ) | | | (172,660 | ) | | | (8,487 | ) |

Financial income | | | 65,911 | | | | 17,667 | | | | 15,459 | | | | 3,413 | | | | (207 | ) | | | 12,227 | | | | 20,576 | | | | (83,578 | ) | | | (3,116 | ) | | | 48,352 | | | | 35,503 | | | | 12,227 | |

| Foreign exchange losses, net | | | 78,784 | | | | 32,882 | | | | 35,266 | | | | - | | | | (9,989 | ) | | | 113 | | | | 50,347 | | | | (111,666 | ) | | | - | | | | 75,737 | | | | 77,749 | | | | 113 | |

Derivatives | | | 48,129 | | | | (29,844 | ) | | | (35,885 | ) | | | - | | | | (7,221 | ) | | | - | | | | (17,976 | ) | | | (18,285 | ) | | | - | | | | (61,082 | ) | | | (50,623 | ) | | | - | |

| Equity in earnings of associates | | | (10,363 | ) | | | 5,254 | | | | - | | | | - | | | | (1,298 | ) | | | - | | | | 146,823 | | | | 5,109 | | | | (146,714 | ) | | | (1,189 | ) | | | (1,189 | ) | | | - | |

Equity in earnings of joint ventures | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 222,990 | | | | - | | | | - | | | | 222,990 | | | | 222,990 | | | | - | |

| Income tax expense benefit | | | (96,089 | ) | | | (118,019 | ) | | | (58,963 | ) | | | (2,726 | ) | | | (20,792 | ) | | | (25,241 | ) | | | 48,160 | | | | 214,108 | | | | - | | | | (59,562 | ) | | | (34,319 | ) | | | (25,243 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit (loss) for the period | | | 206,458 | | | | 271,348 | | | | 108,324 | | | | (5,732 | ) | | | 8,201 | | | | 49,743 | | | | 275,364 | | | | (477,806 | ) | | | (146,714 | ) | | | 289,186 | | | | 258,208 | | | | 68,330 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other selected data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 495,854 | | | | 132,466 | | | | 118,168 | | | | 242 | | | | 19,517 | | | | 21,716 | | | | 736 | | | | (628,320 | ) | | | - | | | | 160,379 | | | | 138,663 | | | | 21,716 | |

| EBITDA | | | 733,975 | | | | 521,172 | | | | 342,004 | | | | (5,909 | ) | | | 23,244 | | | | 92,847 | | | | 326,113 | | | | (1,255,147 | ) | | | (146,714 | ) | | | 631,585 | | | | 541,221 | | | | 111,436 | |

| Additions to PP&E, intangible | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| and biological assets (cash) | | | 1,009,050 | | | | 277,800 | | | | 155,810 | | | | 40 | | | | 5,916 | | | | 13,947 | | | | 16,456 | | | | (1,286,850 | ) | | | - | | | | 192,169 | | | | 178,222 | | | | 13,947 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of EBITDA: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profit (loss) for the period | | | 206,458 | | | | 271,348 | | | | 108,324 | | | | (5,732 | ) | | | 8,201 | | | | 49,743 | | | | 275,364 | | | | (477,806 | ) | | | (146,714 | ) | | | 289,186 | | | | 258,208 | | | | 68,330 | |

Income tax and social contribution | | | 96,089 | | | | 118,019 | | | | 58,963 | | | | 2,726 | | | | 20,792 | | | | 25,241 | | | | (48,160 | ) | | | (214,108 | ) | | | - | | | | 59,562 | | | | 34,319 | | | | 25,243 | |

| Financial result, net | | | (64,426 | ) | | | (661 | ) | | | 56,549 | | | | (3,145 | ) | | | (25,266 | ) | | | (3,853 | ) | | | 98,173 | | | | 65,087 | | | | - | | | | 122,458 | | | | 110,031 | | | | (3,853 | ) |

| Depreciation and amortization | | | 495,854 | | | | 132,466 | | | | 118,168 | | | | 242 | | | | 19,517 | | | | 21,716 | | | | 736 | | | | (628,320 | ) | | | - | | | | 160,379 | | | | 138,663 | | | | 21,716 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA | | | 733,975 | | | | 521,172 | | | | 342,004 | | | | (5,909 | ) | | | 23,244 | | | | 92,847 | | | | 326,113 | | | | (1,255,147 | ) | | | (146,714 | ) | | | 631,585 | | | | 541,221 | | | | 111,436 | |

Cosan Limited

Notes to the consolidated interim financial statements

For the quarter ended March 31, 2015 and 2014

(Amounts in thousands of Brazilian Reais – R$, unless otherwise stated)

| | | March 31, 2015 | | | Additional information | |

| | | Raízen Energia | | | Raízen Combustíveis | | | COMGÁS | | | Radar | | | Lubricants | | | Cosan Log | | | Other business | | | Deconsolidated effects IFRS 11 | | | Segment elimination | | | Total consolidated | | | Cosan Energia | | | Cosan Log | |

| |

| |

| Statement of financial position: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 3,795,287 | | | | 232,943 | | | | 1,328,237 | | | | 1,120 | | | | 62,442 | | | | 251,101 | | | | 479,485 | | | | (4,028,230 | ) | | | - | | | | 2,122,385 | | | | 1,861,592 | | | | 251,101 | |

| Investment securities | | | - | | | | - | | | | - | | | | 159,200 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 159,200 | | | | 159,200 | | | | - | |

| Trade receivables | | | 331,638 | | | | 1,273,536 | | | | 570,125 | | | | 21,802 | | | | 193,672 | | | | 22,776 | | | | 241 | | | | (1,605,174 | ) | | | - | | | | 808,616 | | | | 785,840 | | | | 22,776 | |

| Inventories | | | 357,881 | | | | 1,079,085 | | | | 126,280 | | | | - | | | | 191,508 | | | | 6,911 | | | | 2 | | | | (1,436,966 | ) | | | - | | | | 324,701 | | | | 317,790 | | | | 6,911 | |

| Other current assets | | | 2,092,496 | | | | 722,419 | | | | 219,110 | | | | 36,598 | | | | 53,777 | | | | 22,365 | | | | 378,991 | | | | (2,814,915 | ) | | | (70,121 | ) | | | 640,720 | | | | 612,665 | | | | 22,365 | |

| Other non-current assets | | | 2,895,315 | | | | 2,683,782 | | | | 717,010 | | | | 20,486 | | | | (213,107 | ) | | | 584,932 | | | | 3,073,276 | | | | (5,579,097 | ) | | | (7,984 | ) | | | 4,174,613 | | | | 3,589,675 | | | | 584,932 | |

| Investment in associates | | | 210,586 | | | | 258,977 | | | | - | | | | - | | | | 13,222 | | | | - | | | | 11,870,159 | | | | (469,563 | ) | | | (11,747,689 | ) | | | 135,692 | | | | 127,197 | | | | - | |

| Investment in joint ventures | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 8,506,759 | | | | - | | | | - | | | | 8,506,759 | | | | 8,515,254 | | | | - | |

| Biological assets | | | 1,959,859 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,959,859 | ) | | | - | | | | - | | | | - | | | | - | |

| Investment property | | | - | | | | - | | | | - | | | | 2,649,976 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,649,976 | | | | 2,649,976 | | | | - | |

| Property, plant and equipment | | | 10,466,223 | | | | 2,460,249 | | | | - | | | | 11,386 | | | | 224,571 | | | | 1,139,393 | | | | 135,013 | | | | (12,926,472 | ) | | | - | | | | 1,510,363 | | | | 370,970 | | | | 1,139,393 | |

| Intangible assets and goodwill | | | 3,287,923 | | | | 4,314,179 | | | | 8,598,286 | | | | 499 | | | | 811,561 | | | | 848,892 | | | | 7,274 | | | | (7,602,102 | ) | | | - | | | | 10,266,512 | | | | 9,417,620 | | | | 848,892 | |

| Loans and borrowings | | | (10,381,777 | ) | | | (1,492,950 | ) | | | (3,407,733 | ) | | | - | | | | (362,932 | ) | | | (1,119,754 | ) | | | (4,969,834 | ) | | | 11,874,727 | | | | - | | | | (9,860,253 | ) | | | (8,384,823 | ) | | | (1,119,754 | ) |

| Trade payables | | | (568,296 | ) | | | (762,638 | ) | | | (1,084,420 | ) | | | (889 | ) | | | (102,905 | ) | | | (181,752 | ) | | | (3,953 | ) | | | 1,330,934 | | | | - | | | | (1,373,919 | ) | | | (1,192,167 | ) | | | (181,752 | ) |

| Employee benefits payable | | | (321,116 | ) | | | (103,558 | ) | | | (35,274 | ) | | | (3,383 | ) | | | (12,547 | ) | | | (14,578 | ) | | | (11,314 | ) | | | 424,674 | | | | - | | | | (77,096 | ) | | | (62,518 | ) | | | (14,578 | ) |

| Other current liabilities | | | (773,824 | ) | | | (1,290,495 | ) | | | (98,303 | ) | | | (17,857 | ) | | | (83,362 | ) | | | (70,997 | ) | | | (191,490 | ) | | | 2,064,319 | | | | 68,690 | | | | (393,319 | ) | | | (346,461 | ) | | | (70,997 | ) |

| Other non-current liabilities | | | (2,876,438 | ) | | | (2,618,916 | ) | | | (1,030,664 | ) | | | (94,668 | ) | | | (167,134 | ) | | | (226,651 | ) | | | (4,701,255 | ) | | | 5,495,354 | | | | 9,415 | | | | (6,210,957 | ) | | | (5,984,306 | ) | | | (226,651 | ) |

| Total assets (net of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

liabilities) allocated by segment | | | 10,475,757 | | | | 6,756,613 | | | | 5,902,654 | | | | 2,784,270 | | | | 608,766 | | | | 1,262,638 | | | | 14,573,354 | | | | (17,232,370 | ) | | | (11,747,689 | ) | | | 13,383,993 | | | | 12,437,504 | | | | 1,262,638 | |