Form 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of June 2010

Commission File Number: 001-33623

WuXi PharmaTech (Cayman) Inc.

288 Fute Zhong Road, Waigaoqiao Free Trade Zone

Shanghai 200131

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82-N/A

WuXi PharmaTech (Cayman) Inc.

Form 6-K

TABLE OF CONTENTS

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | WuXi PharmaTech (Cayman) Inc. |

| | |

| | By: | | /s/ GE LI |

| | Name: | | Ge Li |

| | Title: | | Chairman and Chief Executive Officer |

| | |

| Date: June 29, 2010 | | | | |

3

charles river

accelerating drug development. exactly.

Wuxi Pharma Tech

Creating a Leading Global CRO to Serve the Pharmaceutical Industry and Patients

Dr. Ge Li, WuXi Chairman/CEO Edward Hu, WuXi COO

Cautionary Note Regarding Forward-Looking Statements

Statements in this presentation contain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including those with respect to favorable industry trends, guidance for full-year 2010 performance, anticipated strong financial results for 2010 and beyond, and anticipated benefits of the proposed combination with Charles River Laboratories, are not historical facts but instead represent only our belief regarding future events, many of which, by their nature, are inherently uncertain and outside of our control. Our actual results and financial condition and other circumstances may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Risks with respect to the proposed combination include: (i) the possibility that the proposed combination may be delayed or not completed due to the failure to obtain stockholder or regulatory approvals or otherwise satisfy the conditions to the proposed combination as set forth in our acquisition agreement with Charles River; (ii) problems may arise in successfully integrating the businesses of the two companies; (iii) the acquisition may involve unexpected costs; (iv) the combined company may not achieve the anticipated transaction benefits; (v) restrictions in our acquisition agreement with Charles River that require us to conduct our business in the ordinary course consistent with past practices and in accordance with other specific limitations may delay or prevent us from taking advantage of business opportunities that may arise prior to the combination; and (vi) the businesses may suffer as a result of uncertainty surrounding the combination. In addition, the businesses may be subject to future regulatory or legislative actions and other risk factors. These other risk factors include: continued uncertainty in the global economy, the pressures being felt by our customers, and pharmaceutical industry consolidation may adversely impact our business and the trends for outsourced R&D and manufacturing for longer than expected or more severely than expected; we may be unable to successfully make our planned investments and capital expenditures on a timely basis, these investments may not yield the desired results, and we may need to modify the nature and level of our investments and capital expenditures; pharmaceutical companies may not change their business models as expected or in a manner favorable to us; we may fail to capitalize on the opportunities presented; we may not maintain our preferred provider status with our clients and may be unable to successfully expand our capabilities to meet client needs. In addition, other factors that could cause our actual results to differ from what we currently anticipate include failure to generate sufficient future cash flows or to secure any required future financing on acceptable terms or at all; failure to retain key personnel; effective integration of continuing products and services from AppTec; our reliance on a limited number of customers to continue to account for a high percentage of our revenues; risk of payment failure by any of our large customers, which could significantly harm our cash flows and profitability; dependence upon the continued service of our senior management and key scientific personnel; and our ability to retain our existing customers or expand our customer base. You should read the financial information contained in this presentation in conjunction with the consolidated financial statements and related notes thereto included in our 2009 Annual Report on Form 20-F filed with and available on the Securities and Exchange Commission’s (“SEC’s”) website at http://www.sec.gov. For additional information on these and other important factors that could adversely affect our or Charles River’s business, financial condition, results of operations and prospects, see “Risk Factors” (i) beginning on page 6 of our 2009 Annual Report on Form 20-F and (ii) beginning on page 18 of Charles River’s Annual Report on Form 10-K also filed at the SEC’s website. Our results of operations for first-quarter 2010 are not necessarily indicative of our operating results for any future periods. All projections in this presentation are based on limited information currently available to us, which is subject to change. Although these projections and the factors influencing them will likely change, we undertake no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this presentation, except as required by law. Such information speaks only as of the date of this presentation.

Use of Non-GAAP and Pro-Forma Financial Measures

We have provided 2009 and 2010 gross profit and operating income on a non-GAAP basis, which excludes share-based compensation expenses and amortization of acquired intangible assets and associated deferred tax impact. We believe both management and investors benefit from referring to these non-GAAP and pro-forma financial measures in assessing our financial performance and liquidity and when planning and forecasting future periods. These non-GAAP operating measures are useful for understanding and assessing underlying business performance and operating trends. We expect to continue providing gross profit and operating income on a non-GAAP basis using a consistent method on a quarterly basis. You should not view non-GAAP results on a stand-alone basis or as a substitute for results under GAAP, or as being comparable to results reported or forecasted by other companies, and should refer to the reconciliation of non-GAAP measures to GAAP measures for the indicated periods attached hereto.

WuXi PharmaTech

2

Key Discussion Points

Transaction Overview and Status Update

WuXi Overview

Positioning of Combined Company

Integration Update

WuXi PharmaTech

3

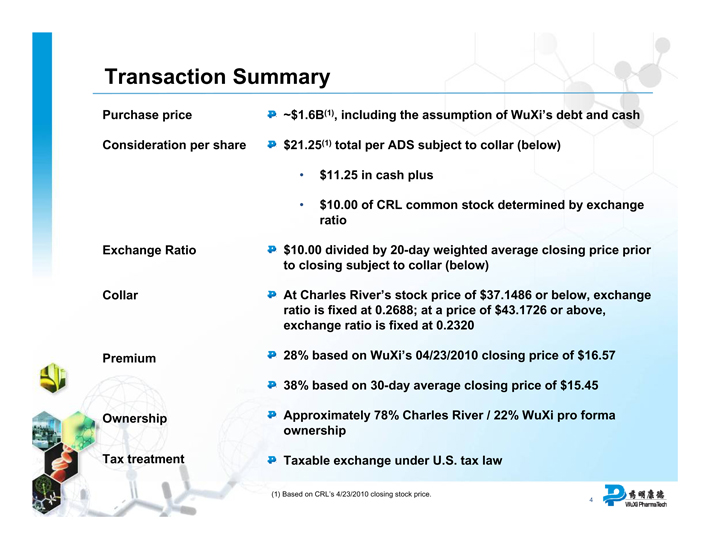

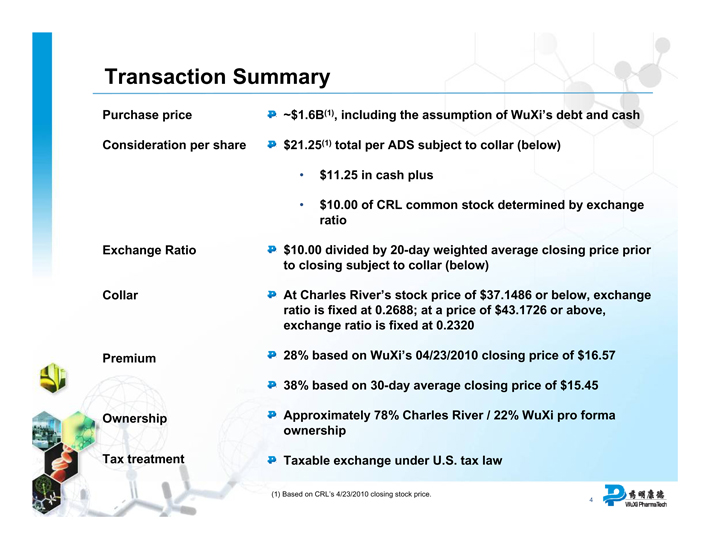

Transaction Summary

Purchase price ~$1.6B(1), including the assumption of WuXi’s debt and cash

Consideration per share $21.25(1) total per ADS subject to collar (below)

• $11.25 in cash plus

• $10.00 of CRL common stock determined by exchange ratio

Exchange Ratio $10.00 divided by 20-day weighted average closing price prior to closing subject to collar (below)

Collar At Charles River’s stock price of $37.1486 or below, exchange ratio is fixed at 0.2688; at a price of $43.1726 or above, exchange ratio is fixed at 0.2320

Premium 28% based on WuXi’s 04/23/2010 closing price of $16.57 38% based on 30-day average closing price of $15.45

Ownership Approximately 78% Charles River / 22% WuXi pro forma ownership

Tax treatment Taxable exchange under U.S. tax law

(1) Based on CRL’s 4/23/2010 closing stock price.

WuXi PharmaTech

4

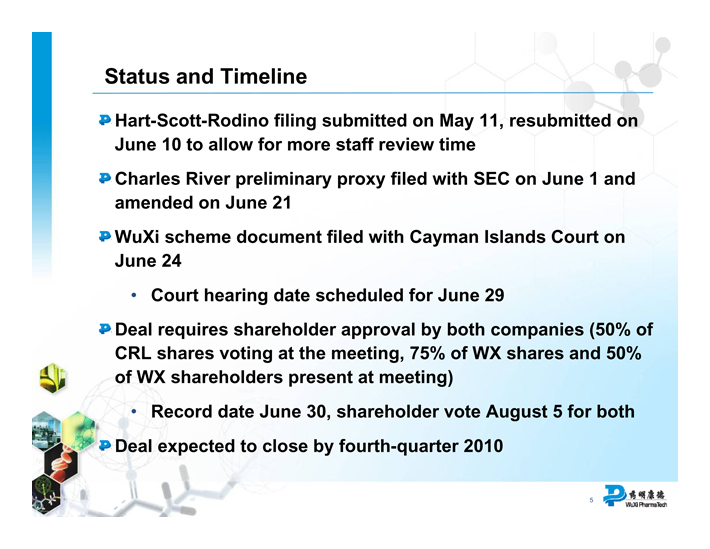

Status and Timeline

Hart-Scott-Rodino filing submitted on May 11, resubmitted on June 10 to allow for more staff review time Charles River preliminary proxy filed with SEC on June 1 and amended on June 21 WuXi scheme document filed with Cayman Islands Court on June 24

• Court hearing date scheduled for June 29

Deal requires shareholder approval by both companies (50% of CRL shares voting at the meeting, 75% of WX shares and 50% of WX shareholders present at meeting)

• Record date June 30, shareholder vote August 5 for both Deal expected to close by fourth-quarter 2010

WuXi PharmaTech

5

Key Discussion Points

Transaction Overview and Status Update

WuXi Overview

Positioning of Combined Company Integration Update

WuXi PharmaTech

6

Profile of WuXi

Leading China-based contract research organization serving the pharmaceutical, biotech, and medical device industries

• Virtually all of the largest pharmaceutical companies are customers, several for nearly a decade

World-class operations in China and the United States

• One of the largest employers of chemists in the pharmaceutical industry

Founded in 2000 to provide compound synthesis services

Has diversified throughout the past decade, adding downstream drug discovery and preclinical services

Now offers a broad and integrated portfolio of laboratory and manufacturing services

WuXi PharmaTech

7

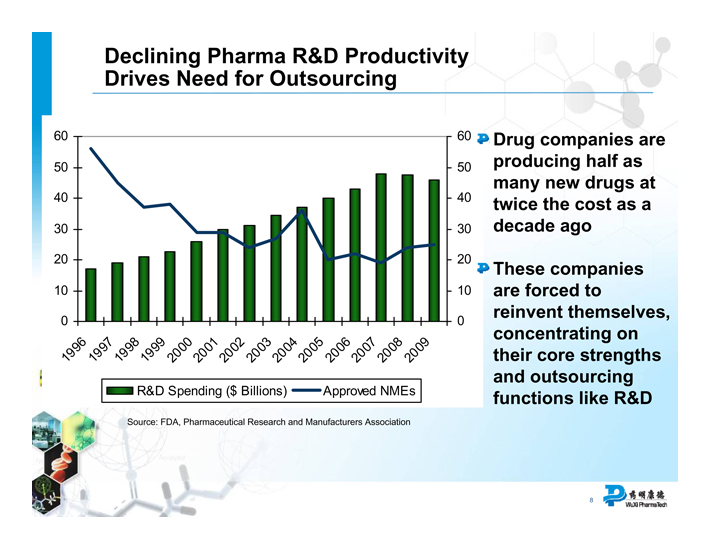

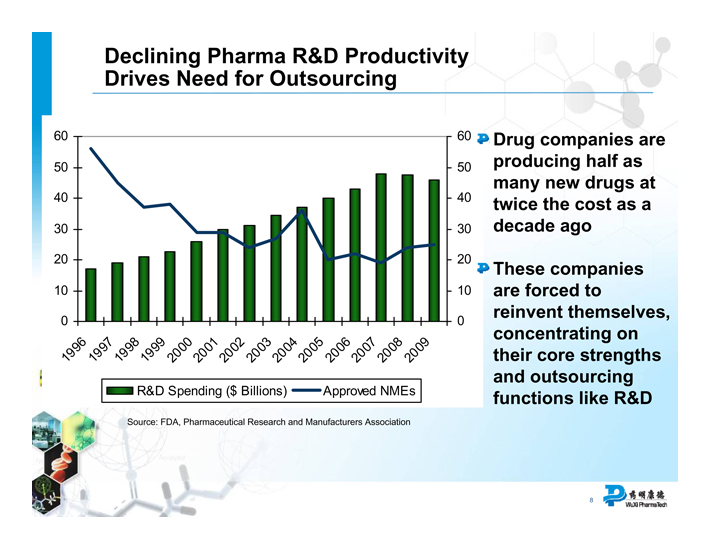

Declining Pharma R&D Productivity Drives Need for Outsourcing

60

50

40

30

20

10

0

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

60

50

40

30

20

10

0

R&D Spending ($ Billions) Approved NMEs

Source: FDA, Pharmaceutical Research and Manufacturers Association

Drug companies are producing half as many new drugs at twice the cost as a decade ago

These companies are forced to reinvent themselves, concentrating on their core strengths and outsourcing functions like R&D

WuXi PharmaTech

8

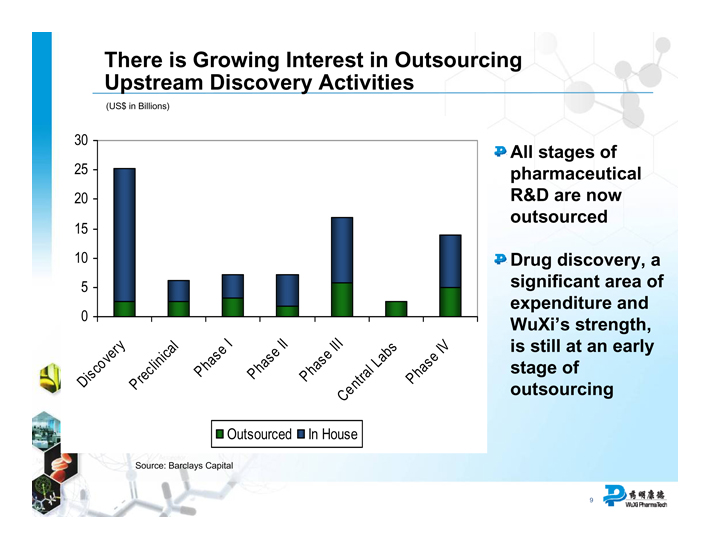

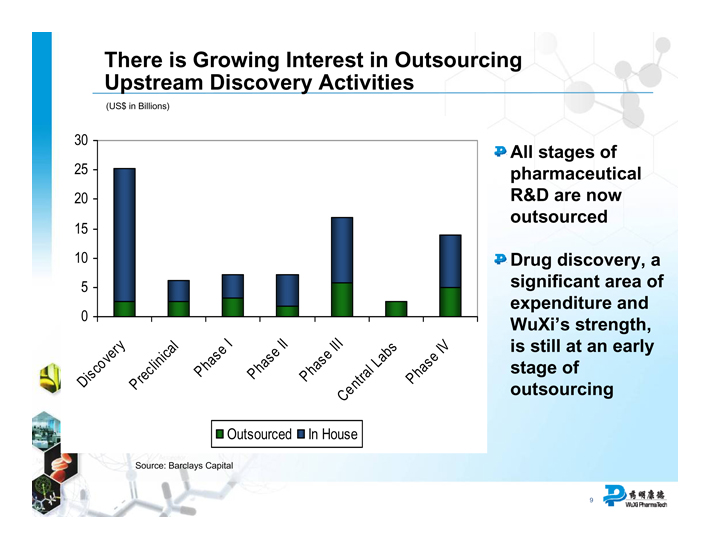

There is Growing Interest in Outsourcing Upstream Discovery Activities

(US$ in Billions)

30

25

20

15

10

5

0

Discovery Preclinical Phase I Phase II Phase III Central Labs Phase IV

Outsourced In House

Source: Barclays Capital

All stages of pharmaceutical R&D are now outsourced

Drug discovery, a significant area of expenditure and WuXi’s strength, is still at an early stage of outsourcing

WuXi PharmaTech

9

WuXi’s Unique Competitive Strengths

Wuxi Apptec

Integrated R&D Service Platform

Experienced International Management Team

Highly Educated, Trained, & Motivated Workforce

Reputation for Operational Excellence

World-Class Facilities in China and the United States

Intense Focus on a Diversified, High-Quality Customer Base

Strong Protection of Customers’ Intellectual Property

China Cost Advantage

WuXi PharmaTech

10

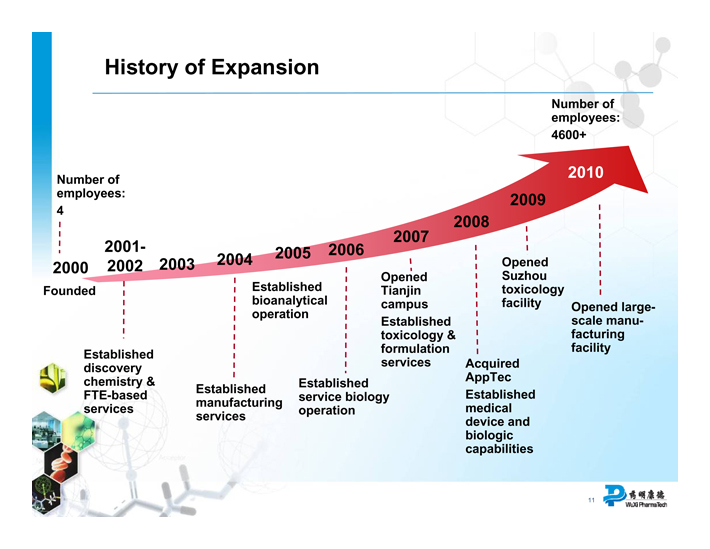

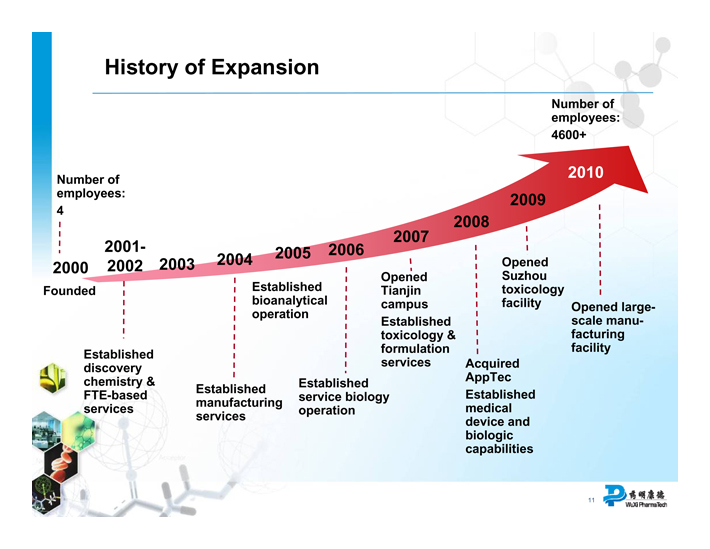

History of Expansion

Number of employees:

4

2000

Founded

2001-

2002

Established discovery chemistry & FTE-based services

2003

2004

Established manufacturing services

2005

Established bioanalytical operation

2006

Established service biology operation

2007

Opened Tianjin campus Established toxicology & formulation services

2008

Acquired AppTec Established medical device and biologic capabilities

2009

Opened Suzhou toxicology facility

Number of employees:

4600+

2010

Opened large-scale manufacturing facility

WuXi PharmaTech

11

WuXi’s Businesses

Wuxi Apptec

China-Based Laboratory Services

U.S.-Based Laboratory Services

China-Based Toxicology

China-Based Commercial Manufacturing

China-Based Research Manufacturing

WuXi PharmaTech

12

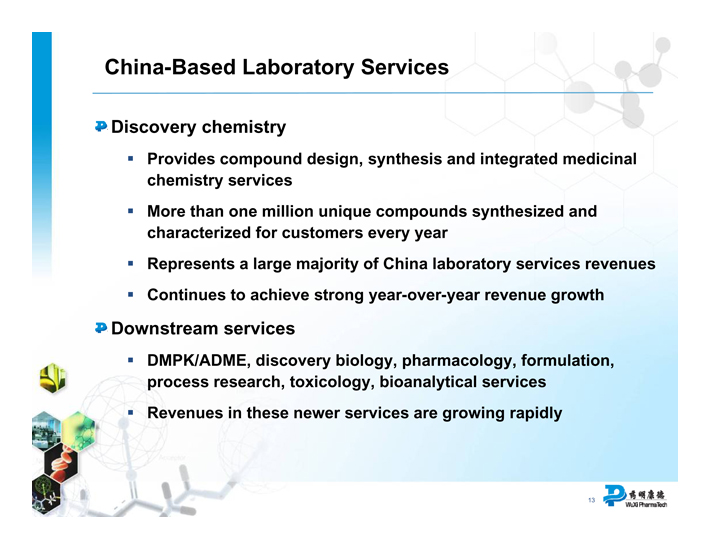

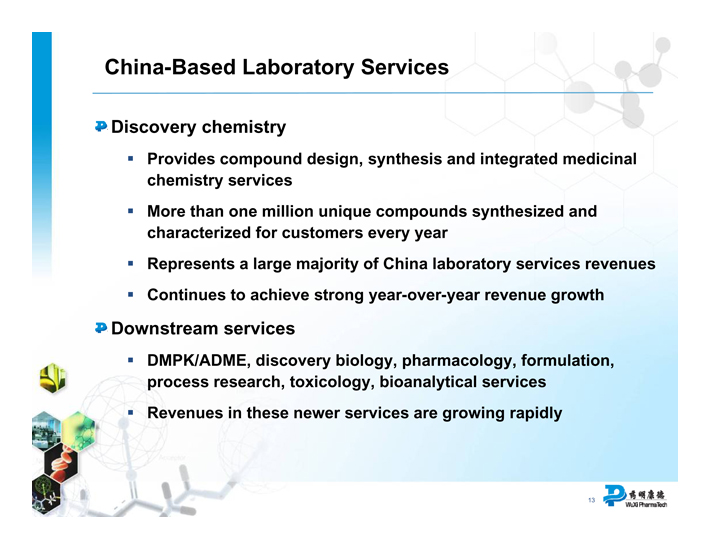

China-Based Laboratory Services

Discovery chemistry

Provides compound design, synthesis and integrated medicinal chemistry services

More than one million unique compounds synthesized and characterized for customers every year

Represents a large majority of China laboratory services revenues

Continues to achieve strong year-over-year revenue growth

Downstream services

• DMPK/ADME, discovery biology, pharmacology, formulation, process research, toxicology, bioanalytical services

• Revenues in these newer services are growing rapidly

WuXi PharmaTech

13

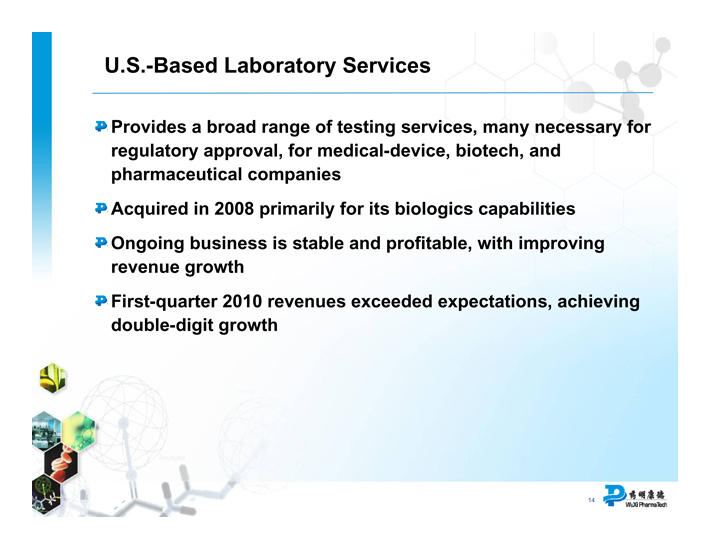

U.S.-Based Laboratory Services

Provides a broad range of testing services, many necessary for regulatory approval, for medical-device, biotech, and pharmaceutical companies

Acquired in 2008 primarily for its biologics capabilities

Ongoing business is stable and profitable, with improving revenue growth

First-quarter 2010 revenues exceeded expectations, achieving double-digit growth

WuXi PharmaTech

14

China-Based Research Manufacturing

Driven by superior capabilities of more than 200 WuXi process chemists

Revenue and profitability dependent on project mix

Depressed revenue in 2009 caused by constrained pharmaceutical R&D budgets; however, demand is substantially improving in 2010

Serves as a valuable feeder for future commercial manufacturing

WuXi PharmaTech

15

China-Based Commercial Manufacturing

Recently opened facility in Jinshan quadruples our manufacturing capacity

Expected to start generating revenues in second-half of 2010

Multiple commercial manufacturing programs being considered

Significant commercial manufacturing revenues expected in 2011 and beyond

WuXi PharmaTech

16

China-Based Toxicology

China, with less than 1% of the world’s toxicology market, is expected to be a major player in 5-10 years

Suzhou toxicology facility is the largest in China

Signed collaboration agreement with Johnson & Johnson

Non-GLP toxicology, client-sponsored GLP validation studies under way

GLP inspections by SFDA and OECD completed

Expect to offer GLP toxicology services in very near future

Significant revenue ramp-up beginning in 2011

WuXi PharmaTech

17

Management Team with Broad International Experience

Dr. Ge Li Chairman and CEO – US

Mr. Edward Hu COO Tanox – US

Dr. Shuhui Chen CSO – US

Dr. Suhan Tang CMO Schering Plough – US

Mr. Xiaozhong Liu EVP Entrepreneur

Mr. Felix Hsu SVP - US – US

Dr. Richard Soll SVP, Integrated Services – US

Mr. Hao Zhou CFO – US

Ms. Trabue Bryans VP/GM – Atlanta – US

Dr. Hui Cai VP, BD – US

Dr. Chichung Chan VP, Pharmacology – US

Mr. Wei-Min Chang VP, Operations GM STA – US

Dr. Minzhang Chen VP, Process R&D – US

Mr. Bob Coldreck VP, GLP QA – US

Dr. Tao Guo VP, Medicinal Chemistry – US

Dr. Deepak Hegde VP, PDS USV – India

Dr. Joseph Hughes VP, Testing- Philadelphia – US

Mr. Scott Kramer VP, Finance & Admin, US Operations – US

Dr. Qiang Lü VP, Biology – US

Dr. Rujian Ma VP, Synthetic Chemistry

Dr. Masai Naruhito VP, BD Japan – Japan

Ms. Lisa Olson VP/GM, St. Paul – US

Mr. Yifeng Shi VP, Operations Head of Waigaoqiao Site – US

Dr. Garry Takle VP Philadelphia Operations – US

Ms. Teri Tanquist VP, Process Improvement and Operations - US – US

Dr. Angela Wong VP, DMPK/ADME – US

Dr. Chengde Wu VP, Medicinal Chemistry – US

Dr. Jinsong Xing VP, Bioanalytical Services BMS – US

Mr. Zhaohui Zhang VP, Domestic Marketing Entrepreneur

Dr. Ning Zhao Lead Advisor, Analytical BMS – US

An average of 15 years of experience in major pharmaceutical, biotech and medical device companies; over 100 senior managers are oversea returnees.

WuXi PharmaTech

18

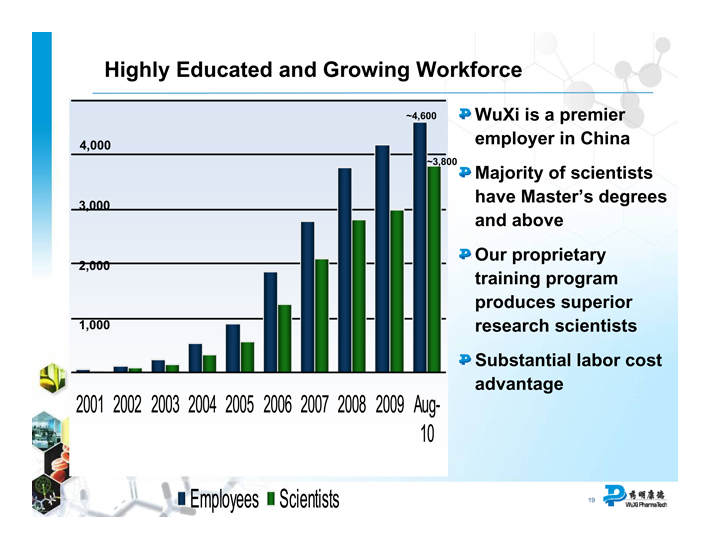

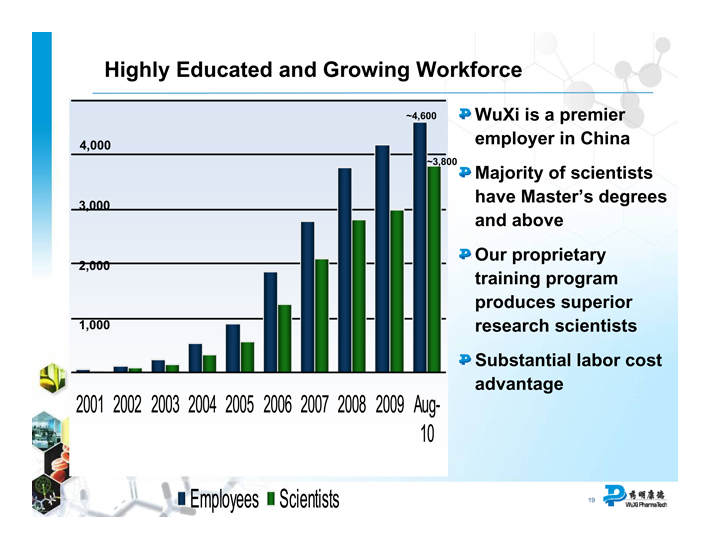

Highly Educated and Growing Workforce

4,000

3,000

2,000

1,000

2001

2002 2003 2004 2005 2006 2007 2008 2009 Aug-

10

Employees Scientists

WuXi is a premier employer in China

Majority of scientists have Master’s degrees and above

Our proprietary training program produces superior research scientists

Substantial labor cost advantage

WuXi PharmaTech

19

World-Class Facilities in China

1,006,000 ft2 of R&D facilities for chemistry, bioanalytical services, service biology, process research, and other services in Shanghai

253,000 ft2 of R&D facilities for chemistry in Tianjin

71,000 ft2 cGMP-quality process development and manufacturing plant and 222,000 ft2 large-scale manufacturing plant in Jinshan

314,000 ft2 GLP preclinical drug safety evaluation center in Suzhou

Shanghai

Tianjin

Jinshan

Suzhou

WuXi PharmaTech

20

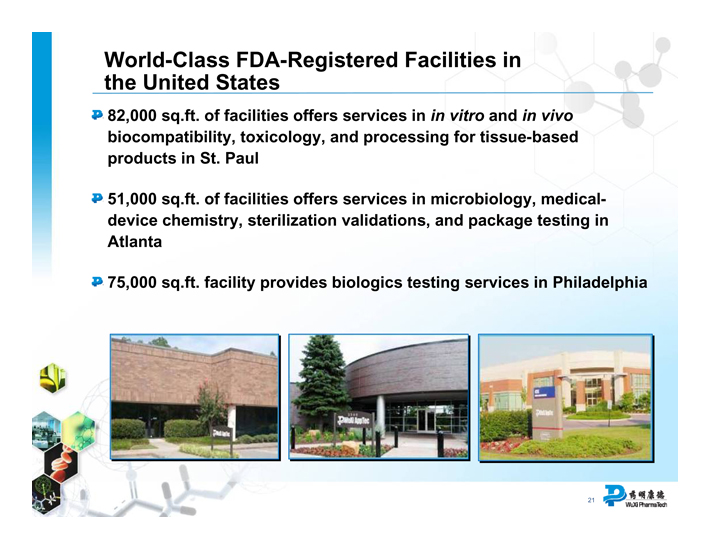

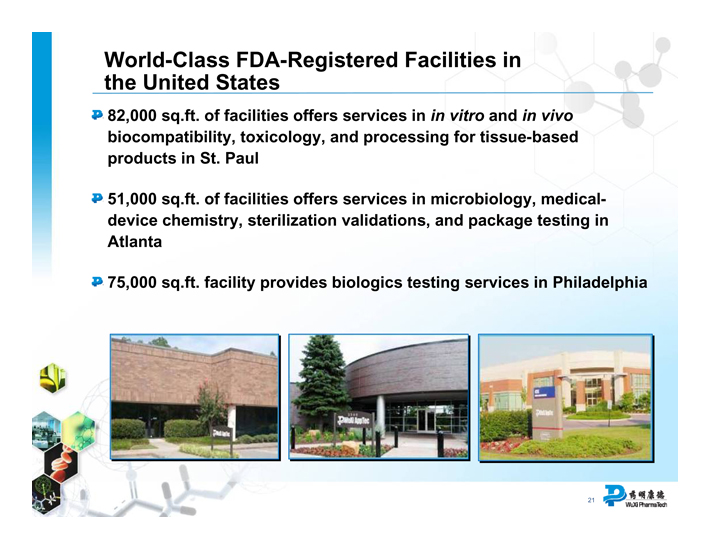

World-Class FDA-Registered Facilities in the United States

82,000 sq.ft. of facilities offers services in in vitro and in vivo biocompatibility, toxicology, and processing for tissue-based products in St. Paul

51,000 sq.ft. of facilities offers services in microbiology, medical- device chemistry, sterilization validations, and package testing in Atlanta

75,000 sq.ft. facility provides biologics testing services in Philadelphia

WuXi PharmaTech

21

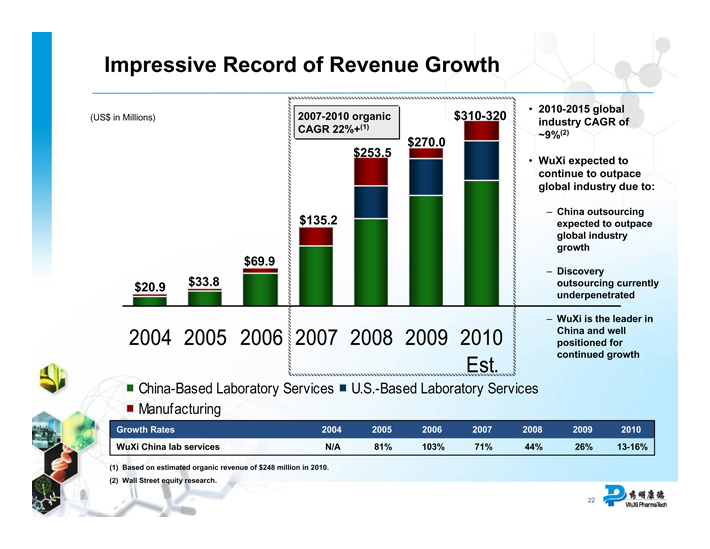

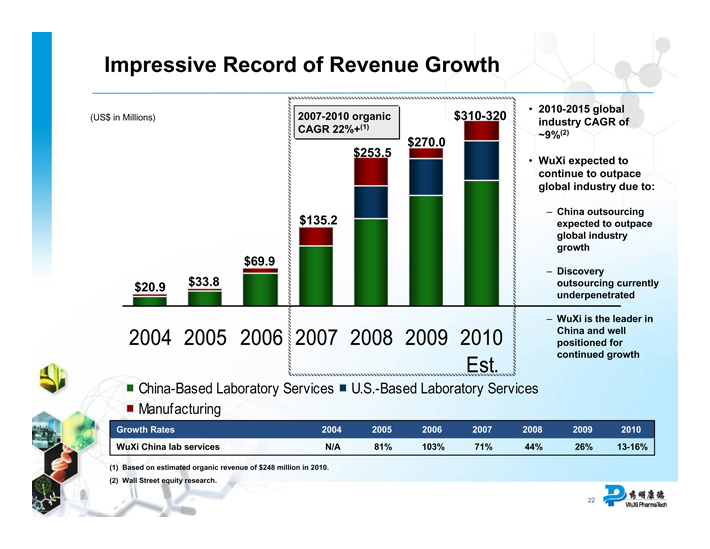

Impressive Record of Revenue Growth

(US$ in Millions)

$20.9

$33.8

$69.9

$135.2

$253.5

$270.0

$310-320

2007-2010 organic CAGR 22%+(1)

China-Based Laboratory Services

U.S.-Based Laboratory Services

Manufacturing

2010-2015 global industry CAGR of 9%(2)

WuXi expected to continue to outpace global industry due to:

– China outsourcing expected to outpace global industry growth

– Discovery outsourcing currently underpenetrated

– WuXi is the leader in China and well positioned for continued growth

Growth Rates 2004 2005 2006 2007 2008 2009 2010

WuXi China lab services N/A 81% 103% 71% 44% 26% 13-16%

(1) Based on estimated organic revenue of $248 million in 2010. (2) Wall Street equity research.

WuXi PharmaTech

22

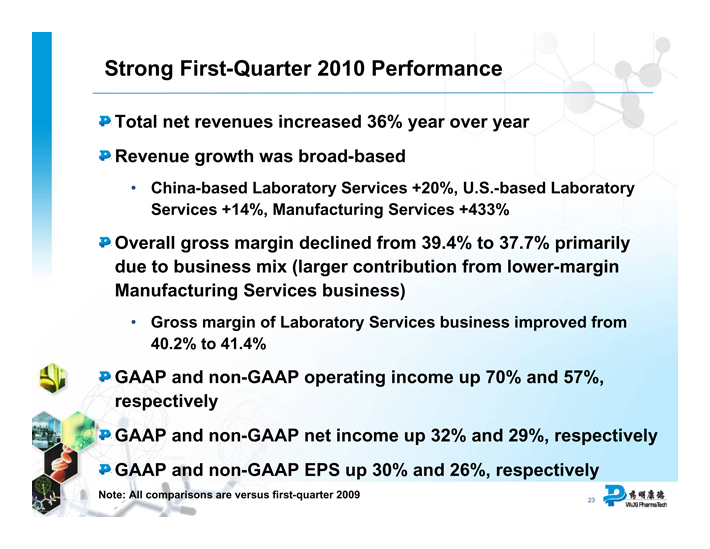

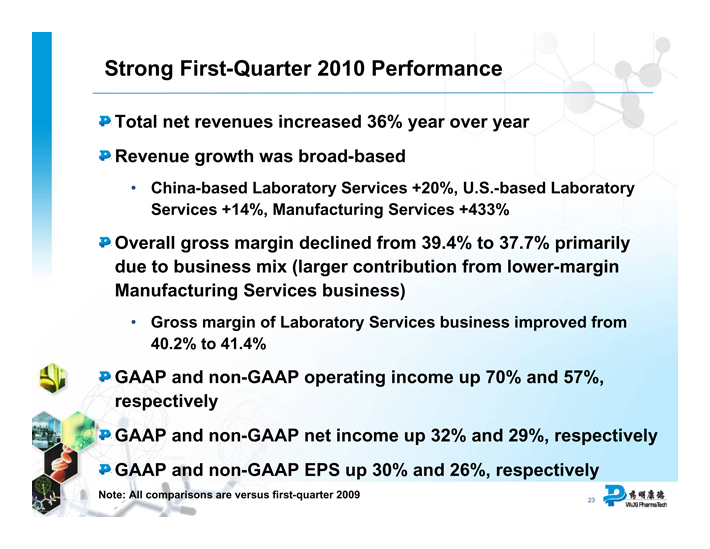

Strong First-Quarter 2010 Performance

Total net revenues increased 36% year over year

Revenue growth was broad-based

China-based Laboratory Services +20%, U.S.-based Laboratory Services +14%, Manufacturing Services +433%

Overall gross margin declined from 39.4% to 37.7% primarily due to business mix (larger contribution from lower-margin Manufacturing Services business)

Gross margin of Laboratory Services business improved from 40.2% to 41.4%

GAAP and non-GAAP operating income up 70% and 57%, respectively

GAAP and non-GAAP net income up 32% and 29%, respectively

GAAP and non-GAAP EPS up 30% and 26%, respectively

Note: All comparisons are versus first-quarter 2009

WuXi PharmaTech

23

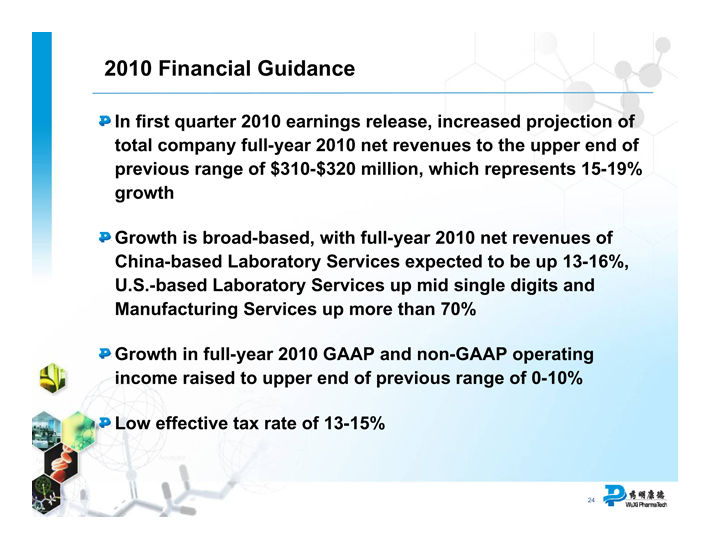

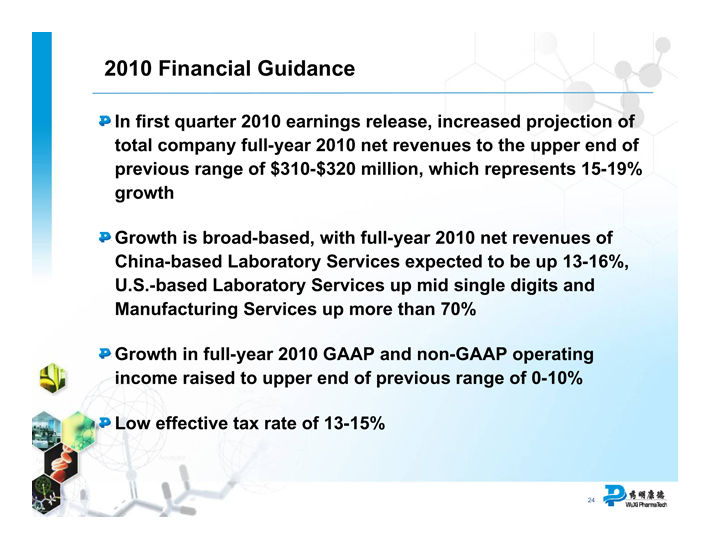

2010 Financial Guidance

In first quarter 2010 earnings release, increased projection of total company full-year 2010 net revenues to the upper end of previous range of $310-$320 million, which represents 15-19% growth

Growth is broad-based, with full-year 2010 net revenues of China-based Laboratory Services expected to be up 13-16%, U.S.-based Laboratory Services up mid single digits and Manufacturing Services up more than 70%

Growth in full-year 2010 GAAP and non-GAAP operating income raised to upper end of previous range of 0-10%

Low effective tax rate of 13-15%

WuXi PharmaTech

24

2011-2012 Growth Prospects

Strong revenue growth, driven by

•Continued solid growth in discovery chemistry

•Continued rapid growth in newer, downstream China-based laboratory services such as DMPK/ADME, discovery biology, pharmacology, formulation, process research, bioanalytical services

• Beginning of substantial revenue ramp-up from toxicology

• Significant revenues contribution from large-scale manufacturing

• Steady growth in small-scale research manufacturing

• Steady growth in U.S. laboratory services

WuXi PharmaTech

25

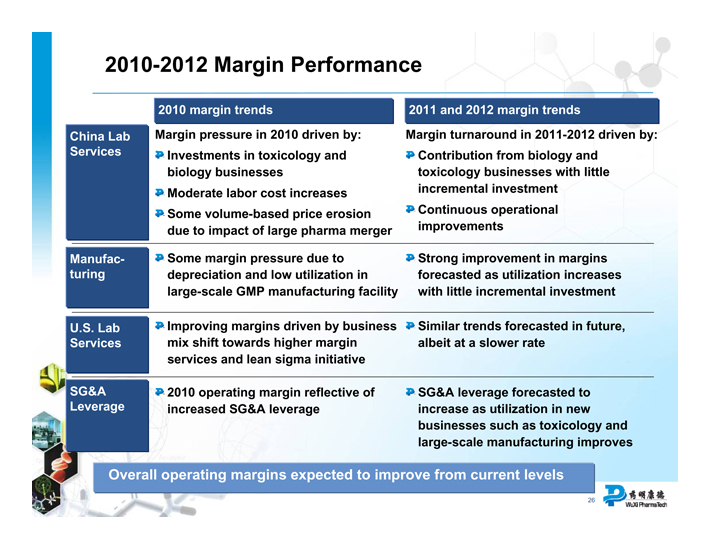

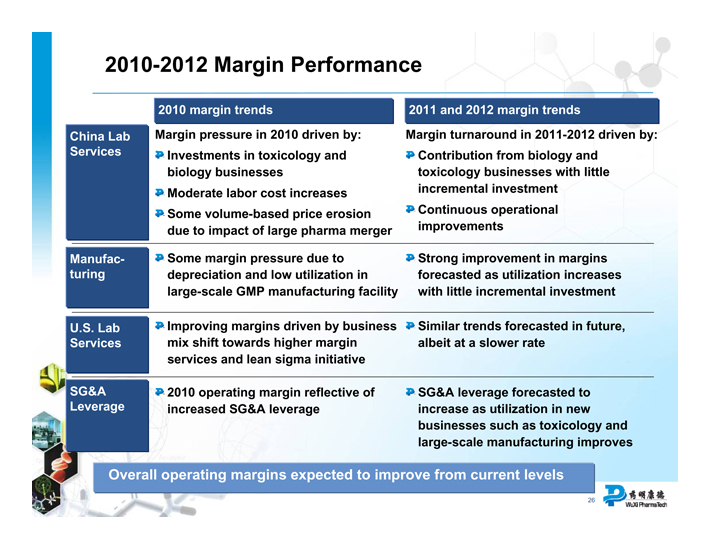

2010-2012 Margin Performance

China Lab Services

2010 margin trends

2011 and 2012 margin trends

Margin pressure in 2010 driven by:

Investments in toxicology and biology businesses

Moderate labor cost increases

Some volume-based price erosion due to impact of large pharma merger

Margin turnaround in 2011-2012 driven by:

Contribution from biology and toxicology businesses with little incremental investment

Continuous operational improvements

Manufacturing

Some margin pressure due to depreciation and low utilization in large-scale GMP manufacturing facility

Strong improvement in margins forecasted as utilization increases with little incremental investment

U.S. Lab Services

Improving margins driven by business

mix shift towards higher margin

services and lean sigma initiative

Similar trends forecasted in future,

albeit at a slower rate

SG&A Leverage

2010 operating margin reflective of increased SG&A leverage

SG&A leverage forecasted to

increase as utilization in new

businesses such as toxicology and

large-scale manufacturing improves

Overall operating margins expected to improve from current levels

WuXi PharmaTech

26

Key Discussion Points

Transaction Overview and Status Update

WuXi Overview

Positioning of Combined Company

Integration Update

WuXi PharmaTech

27

Compelling Benefits of the Charles River/WuXi Combination

Strong long-term trend toward greater outsourcing and offshoring of pharmaceutical R&D, particularly to China

WuXi is by far the largest China-based CRO capable of providing integrated drug discovery and development

WuXi has excellent current and forecasted revenue growth

WuXi has solid operating margins

Strong interest from customers in integration of R&D services, vendor consolidation

Two leaders in complementary services: WuXi in discovery chemistry, Charles River in in vivo biology

Opportunity for revenue synergies from cross-selling

Strong financial outlook for 2011 and beyond

WuXi PharmaTech

28

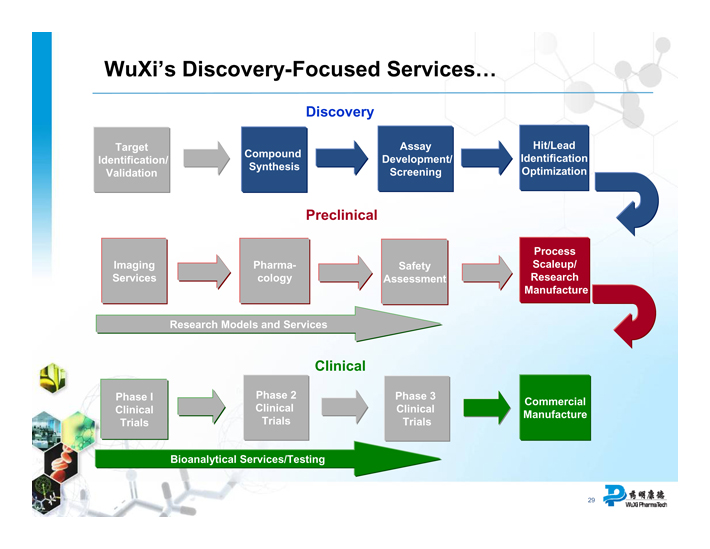

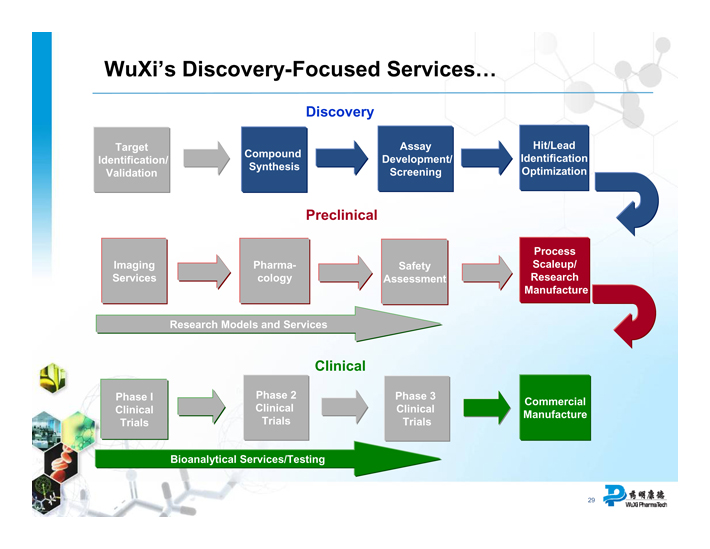

WuXi’s Discovery-Focused Services…

Discovery

Target Identification/ Validation

Compound Synthesis

Assay Development/ Screening

Hit/Lead Identification Optimization

Preclinical

Imaging Services

Pharmacology

Safety Assessment

Process Scaleup/ Research Manufacture

Research Models and Services

Clinical

Phase I Clinical Trials

Phase 2 Clinical Trials

Phase 3 Clinical Trials

Commercial Manufacture

Bioanalytical Services/Testing

WuXi PharmaTech

29

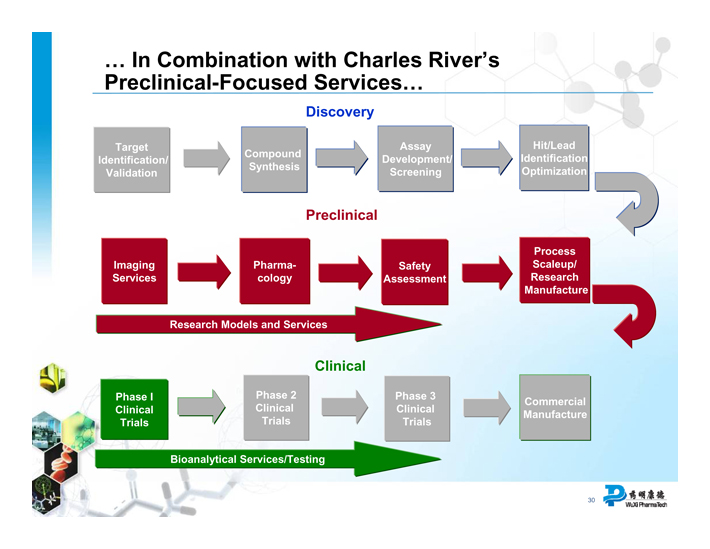

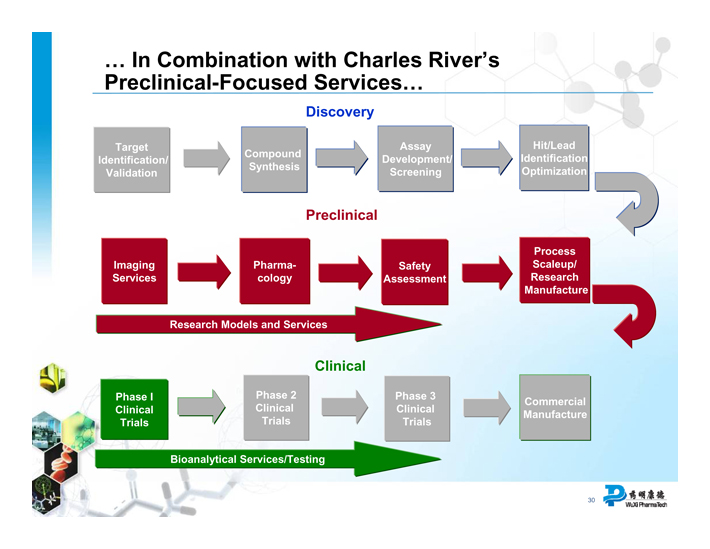

... In Combination with Charles River’s Preclinical-Focused Services...

Discovery

Target Identification/ Validation

Compound Synthesis

Assay Development/ Screening

Hit/Lead Identification Optimization

Preclinical

Imaging Services

Pharmacology

Safety Assessment

Process Scaleup/ Research Manufacture

Research Models and Services

Clinical

Phase I Clinical Trials

Phase 2 Clinical Trials

Phase 3 Clinical Trials

Commercial Manufacture

Bioanalytical Services/Testing

WuXi PharmaTech

30

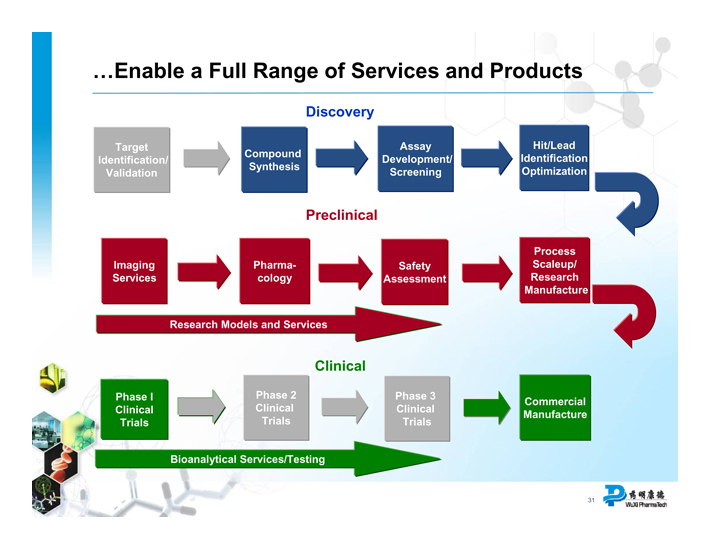

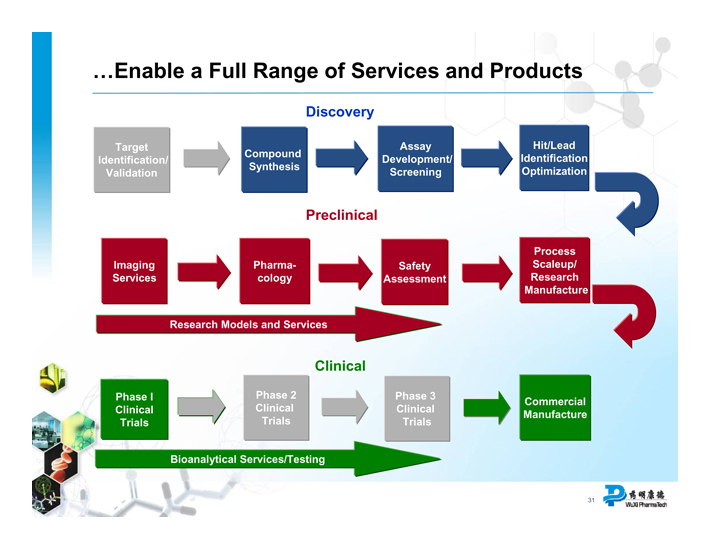

... Enable a Full Range of Services and Products

Discovery

Target Identification/ Validation

Compound Synthesis

Assay Development/ Screening

Hit/Lead Identification Optimization

Preclinical

Imaging Services

Pharmacology

Safety Assessment

Process Scaleup/ Research Manufacture

Research Models and Services

Clinical

Phase I Clinical Trials

Phase 2 Clinical Trials

Phase 3 Clinical Trials

Commercial Manufacture

Bioanalytical Services/Testing

WuXi PharmaTech

31

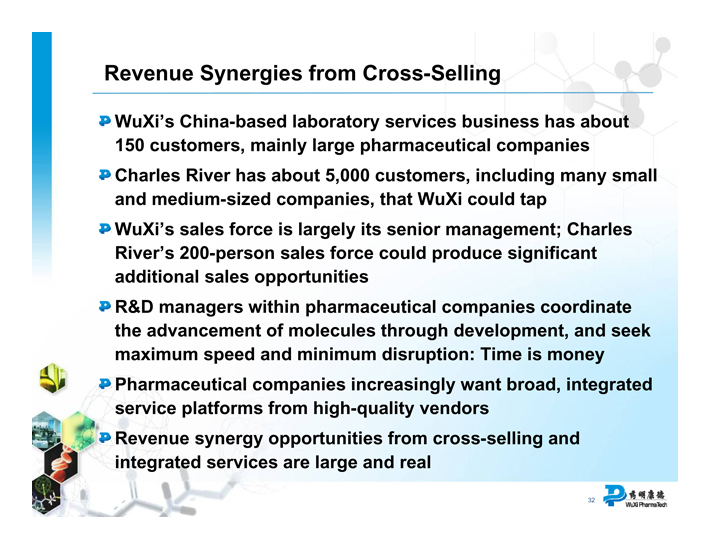

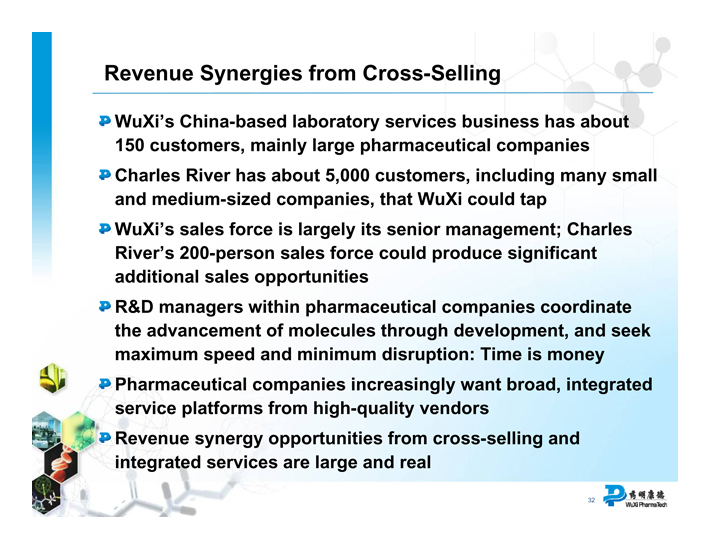

Revenue Synergies from Cross-Selling

WuXi’s China-based laboratory services business has about 150 customers, mainly large pharmaceutical companies

Charles River has about 5,000 customers, including many small and medium-sized companies, that WuXi could tap

WuXi’s sales force is largely its senior management; Charles River’s 200-person sales force could produce significant additional sales opportunities

R&D managers within pharmaceutical companies coordinate the advancement of molecules through development, and seek maximum speed and minimum disruption: Time is money

Pharmaceutical companies increasingly want broad, integrated service platforms from high-quality vendors

Revenue synergy opportunities from cross-selling and integrated services are large and real

WuXi PharmaTech

32

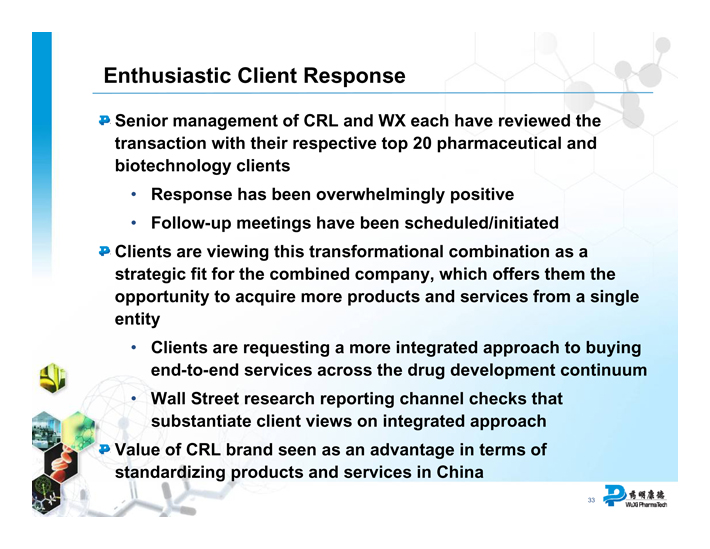

Enthusiastic Client Response

Senior management of CRL and WX each have reviewed the transaction with their respective top 20 pharmaceutical and biotechnology clients

Response has been overwhelmingly positive

Follow-up meetings have been scheduled/initiated

Clients are viewing this transformational combination as a strategic fit for the combined company, which offers them the opportunity to acquire more products and services from a single entity

Clients are requesting a more integrated approach to buying end-to-end services across the drug development continuum

Wall Street research reporting channel checks that substantiate client views on integrated approach

Value of CRL brand seen as an advantage in terms of standardizing products and services in China

WuXi PharmaTech

33

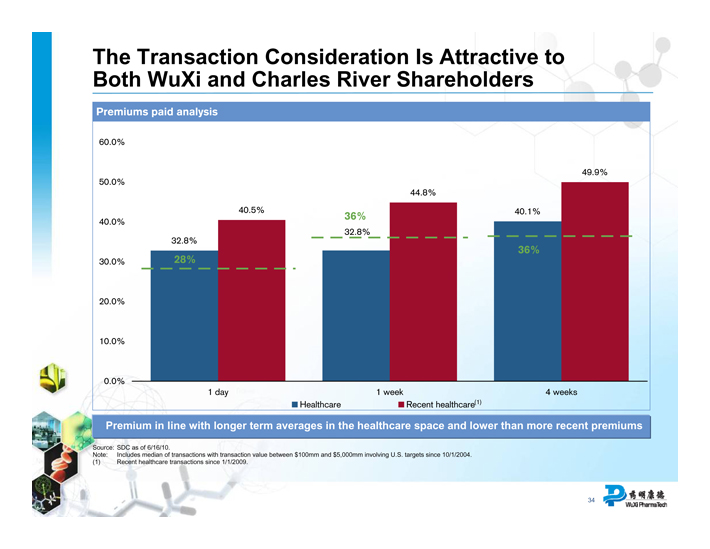

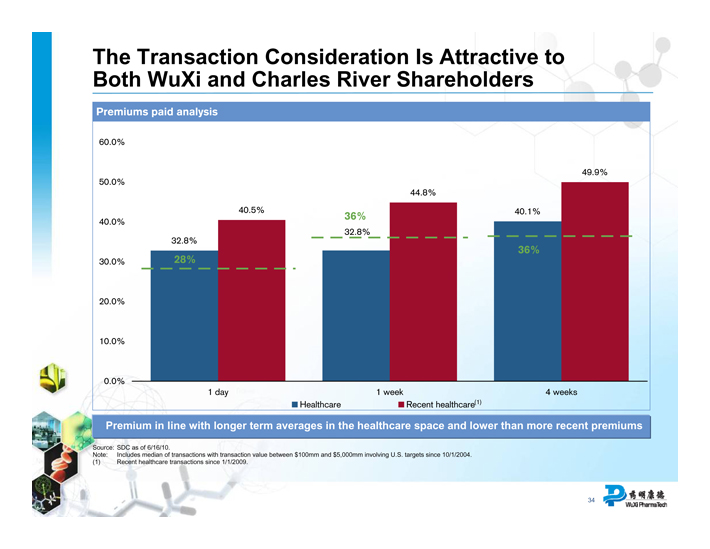

The Transaction Consideration Is Attractive to Both WuXi and Charles River Shareholders

Premiums paid analysis

60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0%

32.8%

28%

40.5%

36%

32.8%

44.8%

40.1%

36%

49.9%

1 day

Healthcare

1 week

Recent healthcare(1)

4 weeks

Premium in line with longer term averages in the healthcare space and lower than more recent premiums

Source: SDC as of 6/16/10.

Note: Includes median of transactions with transaction value between $100mm and $5,000mm involving U.S. targets since 10/1/2004. (1) Recent healthcare transactions since 1/1/2009.

WuXi PharmaTech

34

Key Discussion Points

Transaction Overview and Status Update

WuXi Overview

Positioning of Combined Company

Integration Update

WuXi PharmaTech

35

Limited Integration Risk

Four highest-ranking members of WuXi senior management will

remain, signed three-year contracts

All key members of WuXi senior management expected to stay

Three board members will join the CRL board

Both companies’ managements are very knowledgeable about

each others’ business

WuXi management is fully bi-cultural and bilingual

Most grew up in China and received extensive education at elite

U.S. universities and work experience in the U.S.

biopharmaceutical industry

Little overlap in operations, pointing to smooth transition

Integration planning is well advanced

WuXi PharmaTech

36

Additional Information

This document may be deemed to be solicitation material used in connection with the solicitation of proxies from Charles River shareholders to approve the proposed combination of Charles River and WuXi. In connection with the proposed transaction, Charles River has filed a preliminary proxy statement and will file a definitive proxy statement with the SEC. The information contained in the preliminary filing is not complete and may be changed. Before making any voting or investment decisions, Charles River’s investors and security holders are urged to read the definitive proxy statement when it becomes available and any other relevant documents filed with the SEC because they will contain important information. The definitive proxy statement will be mailed to the shareholders of Charles River seeking their approval of the proposed transaction. Charles River’s shareholders will also be able to obtain a copy of the definitive proxy statement free of charge by directing a request to: Charles River Laboratories, 251 Ballardvale Street, Wilmington, MA 01887, Attention: General Counsel. In addition, the preliminary proxy statement is and the definitive proxy statement will be available free of charge at the SEC’s website, www.sec.gov. Charles River’s shareholders may also access copies of the documents filed with the SEC by Charles River on Charles River’s website at www.criver.com.

This document is not a solicitation of proxies from WuXi’s security holders to approve the proposed combination. In connection with the proposed transaction, WuXi has filed a preliminary scheme document and will file a final scheme document that has been approved by the Grand Court of the Cayman Islands with the SEC on Form 6-K. The information contained in the preliminary scheme document is not complete and may be changed. Before making any voting or investment decisions, WuXi’s security holders are urged to read the final scheme document when it becomes available and any other relevant documents filed with the SEC because they will contain important information. The final scheme document will be mailed to WuXi’s security holders seeking their approval of the proposed combination. WuXi’s security holders will also be able to obtain a copy of the final scheme document free of charge by directing a request to: 288 Fute Zhong Road, Waigaoqiao Free Trade Zone, Shanghai 200131, People’s Republic of China, Attention: Genyong Qiu. In addition, the final scheme document will be available free of charge at the SEC’s website, www.sec.gov. WuXi’s security holders may also access copies of the documents filed with the SEC by WuXi on WuXi’s website at www.wuxiapptec.com.

Charles River, WuXi and their respective directors and executive officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Charles River’s directors and executive officers is available in Charles River’s proxy statement for its 2010 annual meeting of shareholders, which was filed with the SEC on March 30, 2010. Information regarding the interests of Charles River’s directors and certain members of Charles River’s management in the proposed transaction is set forth in the preliminary proxy statement filed with the SEC. Information regarding WuXi’s directors and executive officers is available in WuXi’s annual report on Form 20-F for the fiscal year ended December 31, 2009, which was filed with the SEC on April 23, 2010. Information regarding the interests of WuXi’s directors and certain members of WuXi’s management in the proposed transaction is available in WuXi’s preliminary scheme document, which was filed on Form 6-K with the SEC on June 24, 2010.

This document does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. The Charles River shares to be issued in the proposed transaction have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Charles River intends to issue such Charles River shares pursuant to the exemption from registration set forth in Section 3(a)(10) of the Securities Act.

WuXi PharmaTech

37

charles river

accelerating drug development. exactly.

Wuxi Pharmatech

Creating a CRO Powerhouse to Serve the Pharmaceutical Industry and Patients

Dr. Ge Li, WuXi Chairman/CEO

Edward Hu, WuXi COO

charles river

accelerating drug development. exactly.

Wuxi PharmaTech

Appendix

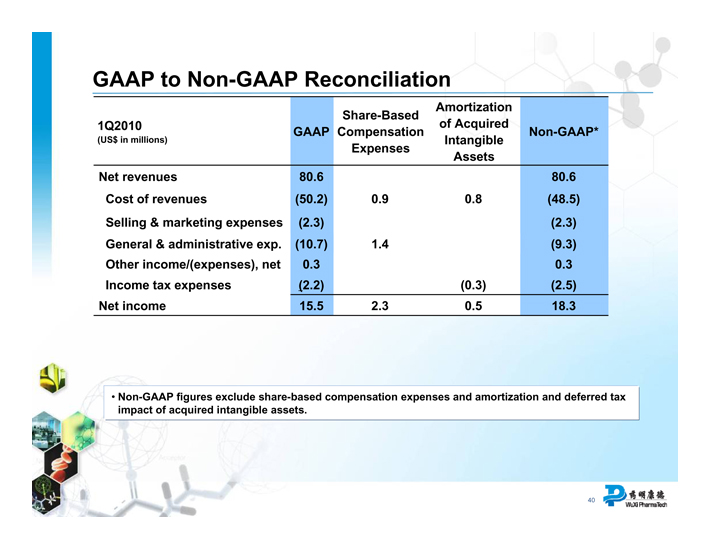

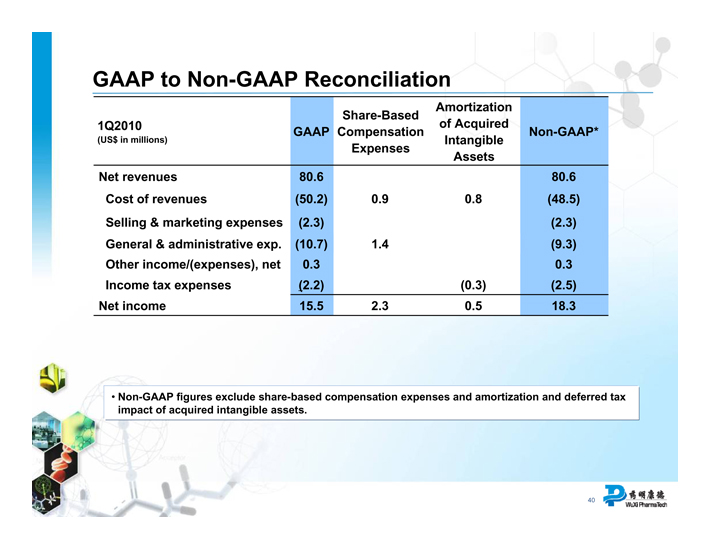

GAAP to Non-GAAP Reconciliation

Share-Based Amortization

1Q2010 of Acquired

GAAP Compensation Non-GAAP*

(US$ in millions) Intangible

Expenses Assets

Net revenues 80.6 80.6

Cost of revenues (50.2) 0.9 0.8 (48.5)

Selling & marketing expenses (2.3) (2.3)

General & administrative exp. (10.7) 1.4 (9.3)

Other income/(expenses), net 0.3 0.3

Income tax expenses (2.2) (0.3) (2.5)

Net income 15.5 2.3 0.5 18.3

Non-GAAP figures exclude share-based compensation expenses and amortization and deferred tax impact of acquired intangible assets.

WuXi PharmaTech

40

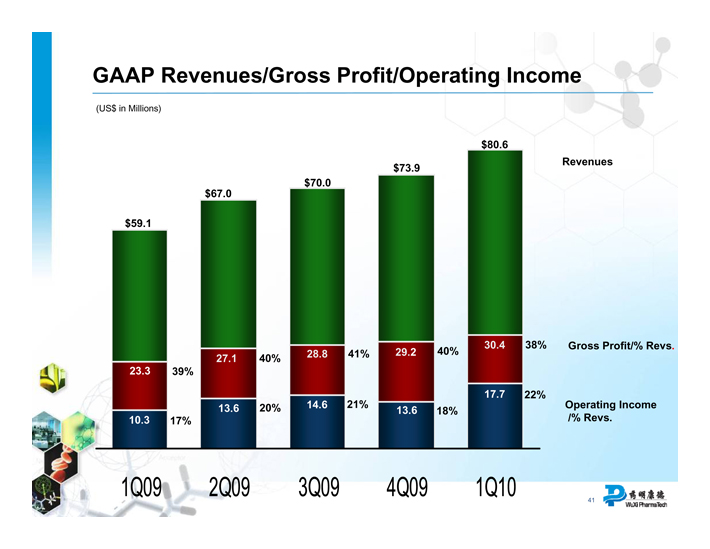

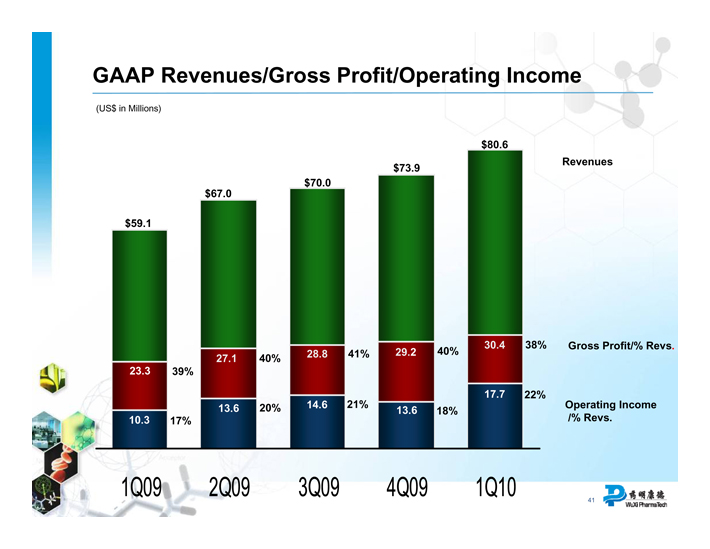

GAAP Revenues/Gross Profit/Operating Income

(US$ in Millions)

$59.1

$67.0

$70.0

$73.9

$80.6

23.3 39%

10.3 17%

27.1 40%

13.6 20%

28.8 41%

14.6 21%

29.2 40%

13.6 18%

30.4 38%

17.7 22%

Revenues

Gross Profit/% Revs.

Operating Income

/% Revs.

1Q09 2Q09 3Q09 4Q09 1Q10

WuXi PharmaTech

41

Non-GAAP Revenues/Gross Profit/Operating Income

(US$ in Millions)

$59.1

$67.0

$70.0

$73.9

$80.6

Revenues

24.7 42%

13.0 22%

28.4 42%

17.1 25%

30.2 43%

18.0 26%

30.8 42%

17.3 23%

32.1 40%

20.5 25%

Gross Profit/% Revs.

Operating Income/

% Revs.

1Q09 2Q09 3Q09 4Q09 1Q10

WuXi PharmaTech

42