Form 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2010

Commission File Number: 001-33623

WuXi PharmaTech (Cayman) Inc.

288 Fute Zhong Road, Waigaoqiao Free Trade Zone

Shanghai 200131

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82-N/A

WuXi PharmaTech (Cayman) Inc.

Form 6-K

EXHIBIT INDEX

| | |

| | | Exhibit

|

| |

| Press Release dated July 13, 2010 | | 99.1 |

| |

| Charles River and WuXi Investor Presentation | | 99.2 |

| |

| WuXi Investor Presentation | | 99.3 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | | | | WuXi PharmaTech (Cayman) Inc. |

| | | |

| | | | | By: | | /S/ GE LI |

| | | | | Name: | | Ge Li |

| | | | | Title: | | Chairman and Chief Executive Officer |

| | | |

| Date: July 14, 2010 | | | | | | |

Exhibit 99.1

For Immediate Release

CHARLES RIVER AND WUXI FILE REVISED INVESTOR PRESENTATION

Combined Company Expects to Generate Annual Revenue Synergies of

at Least $75 Million to $100 Million by 2013

WILMINGTON, MA and SHANGHAI, CHINA, July 13, 2010— Charles River Laboratories International, Inc.(NYSE: CRL) and WuXi PharmaTech (NYSE:WX) today announced that they have issued an updated investor presentation in connection with Charles River’s proposed acquisition of WuXi. The additional materials include the companies’ expectation that the combined company will generate at least $75 million to $100 million of revenue synergies on an annual basis by 2013. Investors may access the full presentation at Charles River’s website atwww.criver.com/specialwuxi2010.

“We are confident that our proposed combination with WuXi will create not only the world’s premier early-stage contract research organization (CRO), but also significant additional shareholder value,” stated Charles River Chairman, President and Chief Executive Officer James C. Foster. “Among the many metrics that support this view are the estimated revenue synergies we expect to generate from the combination,” he said.

Mr. Foster continued, “This transaction will create the first fully integrated global early-stage CRO, uniquely positioned to address our pharmaceutical and biotechnology clients’ rapidly changing needs and desire for a broader range of global outsourced solutions. Combining Charles River and WuXi will provide a more efficient and cost-effective integrated platform of essential products and services – from molecule creation to first-in-human testing – on a global basis. It is therefore not surprising that even at this early stage, in meeting with our respective existing clients, we are receiving overwhelming support.”

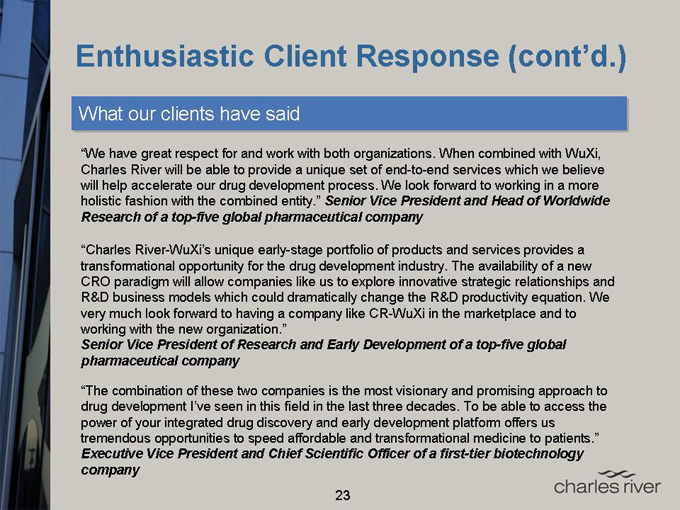

Examples of client responses include the following statements:

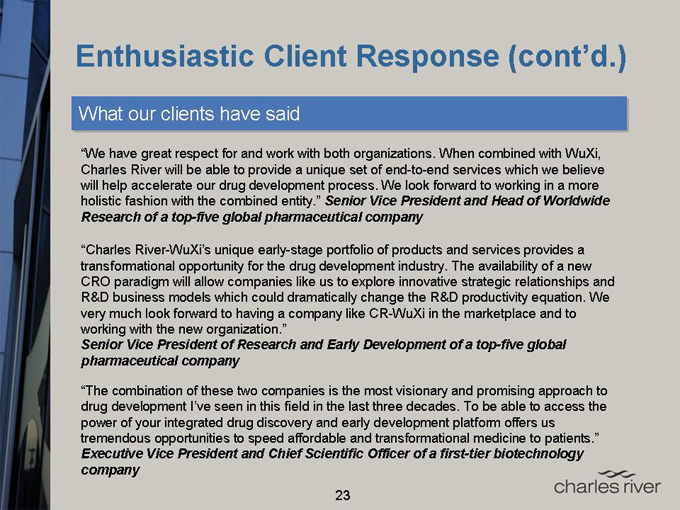

From a senior vice president and head of worldwide research of a top-five global pharmaceutical company, “We have great respect for and work with both organizations. When combined with WuXi, Charles River will be able to provide a unique set of end-to-end services which we believe will help accelerate our drug development process. We look forward to working in a more holistic fashion with the combined entity.”

From the senior vice president of research and early development of another top-five pharmaceutical company, “Charles River-WuXi’s unique early-stage portfolio of products and services provides a transformational opportunity for the drug development industry. The availability of a new CRO paradigm will allow companies like us to explore innovative strategic relationships and R&D business models which could dramatically change the R&D productivity equation. We very much look forward to having a company like Charles River-WuXi in the marketplace and to working with the new organization.”

1

The executive vice president and chief scientific officer of a first-tier biotechnology company said, “The combination of these two companies is the most visionary and promising approach to drug development I’ve seen in this field in the last three decades. To be able to access the power of your integrated drug discovery and early development platform offers us tremendous opportunities to speed affordable and transformational medicine to patients.”

“These remarks, typical of the many comments we have received from other clients, validate our belief that the proposed combination will provide significant benefits to our clients, as well as to our shareholders – including through increased revenue growth. Indeed, as a result of this preliminary client response, we now feel more comfortable in providing investors with greater transparency and quantification of the expected top-line synergies we can generate,” Mr. Foster concluded.

Both Charles River and WuXi urge investors to support the transaction by taking the time to vote promptly by completing and returning the proxy card previously provided or by submitting proxies by telephone or through the Internet. Charles River shareholders with questions about the combination or how to vote their shares may contact the company’s proxy solicitor, Innisfree M&A Incorporated, toll-free at 888-750-5834. WuXi shareholders with questions about the combination or how to vote their shares may contact the company’s proxy solicitor, MacKenzie Partners Inc., toll-free at 800-322-2885.

About Charles River

Accelerating Drug Development. Exactly. Charles River provides essential products and services to help pharmaceutical and biotechnology companies, government agencies and leading academic institutions around the globe accelerate their research and drug development efforts. Our approximately 8,000 employees worldwide are focused on providing clients with exactly what they need to improve and expedite the discovery, development through first-in-human evaluation, and safe manufacture of new therapies for the patients who need them. To learn more about our unique portfolio and breadth of services, visitwww.criver.com.

About WuXi PharmaTech

WuXi PharmaTech is a leading pharmaceutical, biotechnology, and medical device R&D outsourcing company, with operations in China and the United States. As a research-driven and customer-focused company, WuXi PharmaTech provides a broad and integrated portfolio of laboratory and manufacturing services throughout the drug and medical device R&D process. WuXi PharmaTech's services are designed to assist its global partners in shortening the cycle and lowering the cost of drug and medical device R&D. WuXi PharmaTech's operating subsidiaries are known as WuXi AppTec. For more information, please visit:http://www.wuxiapptec.com.

2

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements are based on current expectations and beliefs of Charles River Laboratories International, Inc. (Charles River) and WuXi PharmaTech (Cayman) Inc. (WuXi), and involve a number of risks and uncertainties that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties include, but are not limited to: 1) the possibility that the proposed combination may be delayed or not completed due to the failure to obtain stockholder or regulatory approvals or otherwise satisfy the conditions to the proposed combination as set forth in the acquisition agreement for the proposed combination; 2) problems may arise in successfully integrating the businesses of the two companies (including retention of key executives); 3) the acquisition may involve unexpected costs; 4) the combined company may be unable to achieve the expected transaction benefits, including the projected revenue synergies described above and improved customer service levels and anticipated cost synergies, or achieve potential revenue growth and non-GAAP margin expansion; 5) the businesses may suffer as a result of uncertainty surrounding the acquisition; and 6) the industry may be subject to future regulatory or legislative actions and other risks that are described in Securities and Exchange Commission (SEC) reports filed or furnished by Charles River and WuXi. For additional information on these and other important factors that could adversely affect Charles River’s or WuXi’s business, financial condition, results of operations and prospects, see "Risk Factors" (i) beginning on page 18 of Charles River’s Annual Report on Form 10-K and (ii) beginning on page 6 of WuXi’s 2009 Annual Report on Form 20-F, each filed at the SEC’s websitewww.sec.gov.

Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by Charles River and WuXi. Charles River and WuXi assume no obligation and expressly disclaim any duty to update information contained in this document except as required by law.

Additional Information

This press release may be deemed to be solicitation material in respect of the proposed combination of Charles River and WuXi. In connection with the proposed transaction, Charles River has filed a definitive proxy statement with the SEC. Before making any voting or investment decisions, Charles River’s stockholders are urged to read the definitive proxy statement and any other relevant documents filed with the SEC because they will contain important information. The definitive proxy statement has been mailed to the stockholders of Charles River seeking their approval of the proposed transaction. Charles River’s stockholders may also obtain a copy of the definitive proxy statement free of charge by directing a request to: Charles River Laboratories, 251 Ballardvale Street, Wilmington, MA 01887, Attention: General Counsel. In addition, the definitive proxy statement is available free of charge at the SEC’s website,www.sec.gov or stockholders may access copies of the documentation filed with the SEC by Charles River on Charles River’s website atwww.criver.com/specialwuxi2010.

3

This press release is not a solicitation of proxies from WuXi’s shareholders to approve the proposed combination. In connection with the proposed transaction, WuXi has filed a scheme document with the SEC on Form 6-K. Before making any voting or investment decisions, WuXi’s shareholders are urged to read the scheme document and any other relevant documents filed with the SEC because they will contain important information. The scheme document has been mailed to WuXi’s shareholders seeking their approval of the proposed combination. WuXi’s shareholders may also obtain a copy of the scheme document free of charge by directing a request to: 288 Fute Zhong Road, Waigaoqiao Free Trade Zone, Shanghai 200131, People’s Republic of China, Attention: Genyong Qiu. In addition, the scheme document is available free of charge at the SEC’s website, www.sec.gov. WuXi’s shareholders may also access copies of the documents filed with the SEC by WuXi on WuXi’s website atwww.wuxiapptec.com.

Charles River, WuXi and their respective directors and executive officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Charles River’s directors and executive officers is available in Charles River’s proxy statement for its 2010 annual meeting of stockholders, which was filed with the SEC on March 30, 2010. Information regarding the interests of Charles River’s directors and certain members of Charles River’s management in the proposed transaction is set forth in the definitive proxy statement, which was filed with the SEC on July 1, 2010. Information regarding WuXi’s directors and executive officers is available in WuXi’s annual report on Form 20-F for the fiscal year ended December 31, 2009, which was filed with the SEC on April 23, 2010. Information regarding the interests of WuXi’s directors and certain members of WuXi’s management in the proposed transaction is available in WuXi’s scheme document, which was filed on Form 6-K with the SEC on July 1, 2010.

This press release does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. The Charles River shares to be issued in the proposed transaction have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Charles River intends to issue such Charles River shares pursuant to the exemption from registration set forth in Section 3(a)(10) of the Securities Act.

Contacts

| | |

| For Charles River: | | For WuXi PharmaTech: |

| |

| Investor Contact: | | Investor Contact: |

| Susan E. Hardy | | Ronald Aldridge |

| Corporate Vice President, Investor Relations | | Director of Investor Relations, WuXi |

| Tel: 781.222.6190 | | Tel: 201.585.2048 |

| Email:susan.hardy@crl.com | | Email:ir@wuxiapptec.com |

4

| | |

| Media Contact: | | Media Contact: |

| Amy Cianciaruso | | George Sard/Brandy Bergman/ |

| Director, Public Relations | | Jonathan Doorley |

| Tel: 781.222.6168 | | Sard Verbinnen & Company |

| Email:amy.cianciaruso@crl.com | | Tel: 212.687.8080 |

# # #

5

Exhibit 99.2

Charles River and WuXi PharmaTech: The First Global Early-Stage CRO

© 2010 Charles River Laboratories International, Inc.

1

Safe Harbor Statement

This document includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements are based on current expectations and beliefs of Charles River Laboratories (“Charles River” or “CRL”) and WuXi PharmaTech (Cayman) Inc (“WuXi” or “WX”), and involve a number of risks and uncertainties that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties include, but are not limited to: 1) the possibility that the proposed combination may be delayed or not completed due to the failure to obtain stockholder or regulatory approvals or otherwise satisfy the conditions to the proposed combination as set forth in the acquisition agreement for the proposed combination; 2) problems may arise in successfully integrating the businesses of the two companies (including retention of key executives); 3) the acquisition may involve unexpected costs; 4) the combined company may be unable to achieve the expected transaction benefits, including improved customer service levels and anticipated cost and revenue synergies or achieve potential revenue growth and non-GAAP margin expansion; 5) the businesses may suffer as a result of uncertainty surrounding the acquisition; and 6) the industry may be subject to future regulatory or legislative actions and other risks that are described in Securities and Exchange Commission (“SEC”) reports filed or furnished by Charles River and WuXi. For additional information on these and other important factors that could adversely affect Charles River’s or WuXi’s business, financial condition, results of operations and prospects, see “Risk Factors” (i) beginning on page 18 of Charles River’s Annual Report on Form 10-K and (ii) beginning on page 6 of WuXi’s 2009 Annual Report on Form 20-F, each filed at the SEC’s website www.sec.gov.

Forward-looking statements are based on Charles River’s current expectations and beliefs, and involve a number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties include, but are not limited to: the ability to successfully integrate the businesses we acquire; the ability to successfully develop and commercialize SPC’s technology platform; a decrease in research and development spending, a decrease in the level of outsourced services, or other cost reduction actions by our customers; the ability to convert backlog to sales; special interest groups; contaminations; industry trends; new displacement technologies; USDA and FDA regulations; changes in law; continued availability of products and supplies; loss of key personnel; interest rate and foreign currency exchange rate fluctuations; changes in tax regulation and laws; changes in generally accepted accounting principles; and any changes in business, political, or economic conditions due to the threat of future terrorist activity in the U.S. and other parts of the world, and related U.S. military action overseas. A further description of these risks, uncertainties, and other matters can be found in the Risk Factors detailed in Charles River’s Annual Report on Form 10-K as filed on February 19, 2010 and Quarterly Report on Form 10-Q as filed on April 29, 2010, as well as other filings we make with the SEC.

Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by Charles River and WuXi. Charles River and WuXi assume no obligation and expressly disclaim any duty to update information contained in this document except as required by law.

2

Non-GAAP Financial Measures

This presentation includes discussion of non-GAAP financial measures. We believe that the inclusion of these non-GAAP financial measures provides useful information to allow investors to gain a meaningful understanding of our core operating results and future prospects, without the effect of one-time charges, consistent with the manner in which management measures and forecasts the Company’s performance. The non-GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for results of operations prepared in accordance with GAAP. The company intends to continue to assess the potential value of reporting non-GAAP results consistent with applicable rules and regulations.

Additional Information

This document may be deemed to be solicitation material in respect of the proposed combination of Charles River and WuXi. In connection with the proposed transaction, Charles River has filed a definitive proxy statement with the SEC. Before making any voting or investment decisions, stockholders are urged to read the definitive proxy statement and any other relevant documents filed with the SEC because they will contain important information. The definitive proxy statement has been mailed to the stockholders of Charles River seeking their approval of the proposed transaction. Charles River’s stockholders may also obtain a copy of the definitive proxy statement free of charge by directing a request to: Charles River Laboratories, 251 Ballardvale Street, Wilmington, MA 01887, Attention: General Counsel. In addition, the definitive proxy statement is available free of charge at the SEC’s website, www.sec.gov or stockholders may access copies of the documentation filed with the SEC by Charles River on Charles River’s website at www.criver.com/specialwuxi2010.

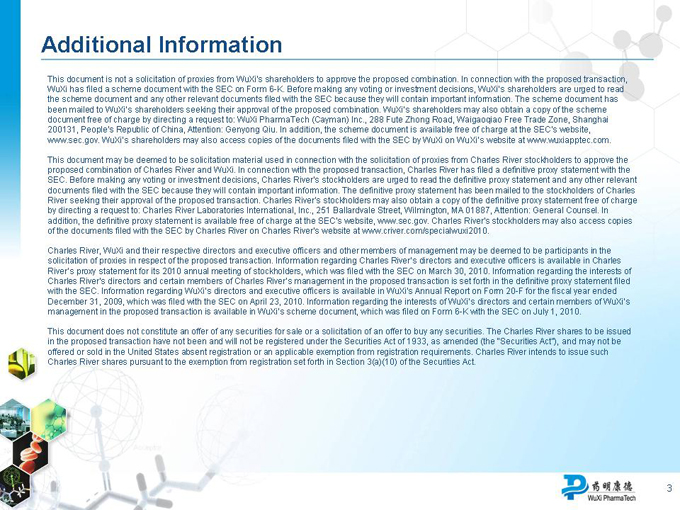

This document is not a solicitation of proxies from WuXi’s shareholders to approve the proposed combination. In connection with the proposed transaction, WuXi has filed a scheme document with the SEC on Form 6-K. Before making any voting or investment decisions, WuXi’s shareholders are urged to read the scheme document and any other relevant documents filed with the SEC because they will contain important information. The scheme document has been mailed to WuXi’s shareholders seeking their approval of the proposed combination. WuXi’s shareholders may also obtain a copy of the scheme document free of charge by directing a request to: 288 Fute Zhong Road, Waigaoqiao Free Trade Zone, Shanghai 200131, People’s Republic of China, Attention: Genyong Qiu. In addition, the scheme document is available free of charge at the SEC’s website, www.sec.gov. WuXi’s shareholders may also access copies of the documents filed with the SEC by WuXi on WuXi’s website at www.wuxiapptec.com.

Charles River, WuXi and their respective directors and executive officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Charles River’s directors and executive officers is available in Charles River’s proxy statement for its 2010 annual meeting of shareholders, which was filed with the SEC on March 30, 2010. Information regarding the interests of Charles River’s directors and certain members of Charles River’s management in the proposed transaction is set forth in the definitive proxy statement, which was filed with the SEC on July 1, 2010. Information regarding WuXi’s directors and executive officers is available in WuXi’s annual report on Form 20-F for the fiscal year ended December 31, 2009, which was filed with the SEC on April 23, 2010. Information regarding the interests of WuXi’s directors and certain members of WuXi’s management in the proposed transaction is available in WuXi’s scheme document, which was filed on Form 6-K with the SEC on July 1, 2010.

This document does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. The Charles River shares to be issued in the proposed transaction have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Charles River intends to issue such Charles River shares pursuant to the exemption from registration set forth in Section 3(a)(10) of the Securities Act.

3

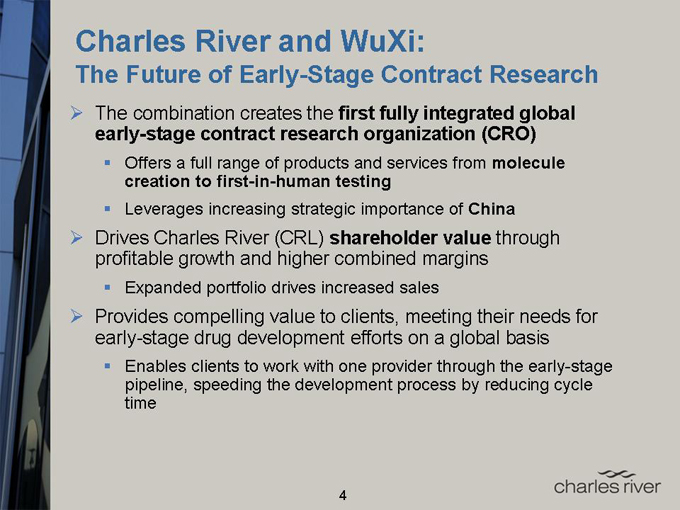

Charles River and WuXi:

The Future of Early-Stage Contract Research

The combination creates the first fully integrated global early-stage contract research organization (CRO)

Offers a full range of products and services from molecule creation to first-in-human testing

Leverages increasing strategic importance of China

Drives Charles River (CRL) shareholder value through profitable growth and higher combined margins

Expanded portfolio drives increased sales

Provides compelling value to clients, meeting their needs for early-stage drug development efforts on a global basis

Enables clients to work with one provider through the early-stage pipeline, speeding the development process by reducing cycle time

4

Table of Contents

1. Transaction Timing Update

2. Charles River Overview

3. WuXi Overview

4. Strategic Rationale for Transaction

5. Financial Rationale for Investors

5

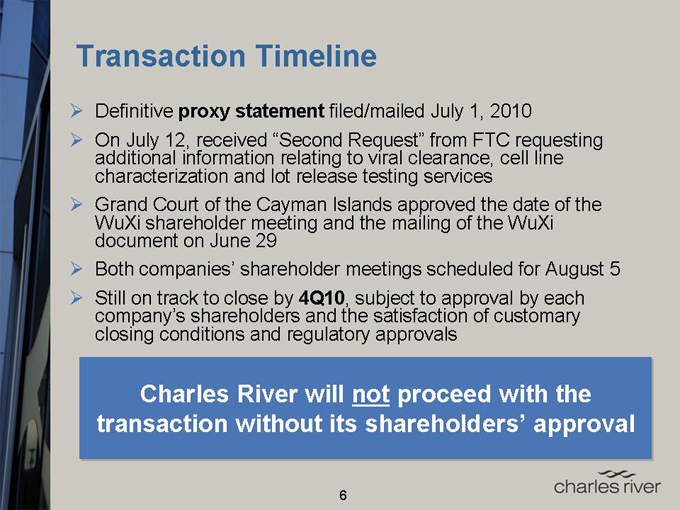

Transaction Timeline

Definitive proxy statement filed/mailed July 1, 2010

On July 12, received “Second Request” from FTC requesting additional information relating to viral clearance, cell line characterization and lot release testing services

Grand Court of the Cayman Islands approved the date of the WuXi shareholder meeting and the mailing of the WuXi document on June 29

Both companies’ shareholder meetings scheduled for August 5

Still on track to close by 4Q10, subject to approval by each company’s shareholders and the satisfaction of customary closing conditions and regulatory approvals

Charles River will not proceed with the transaction without its shareholders’ approval

6

Table of Contents

1. Transaction Timing Update

2. Charles River/WuXi Overview

3. Strategic Rationale for Transaction

4. Financial Rationale for Investors

7

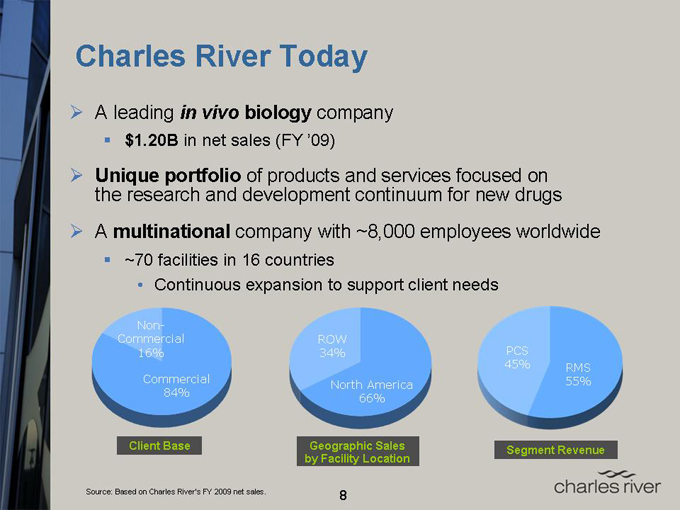

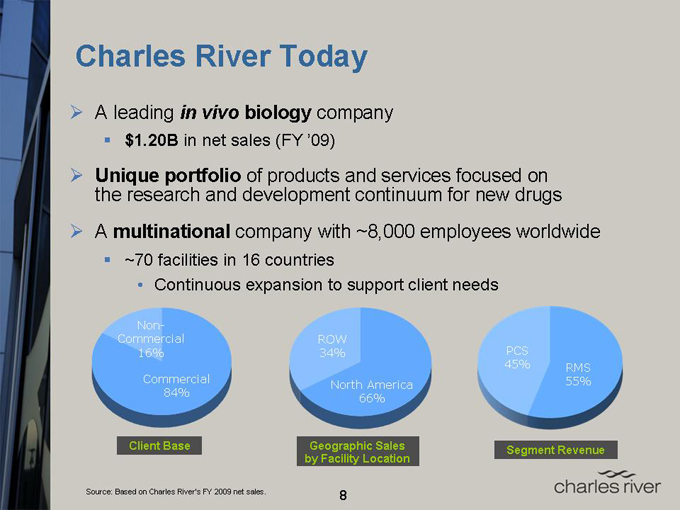

Charles River Today

A leading in vivo biology company

$1.20B in net sales (FY’09)

Unique portfolio of products and services focused on the research and development continuum for new drugs

A multinational company with ~8,000 employees worldwide ~70 facilities in 16 countries

Continuous expansion to support client needs

Non-Commercial 16%

Commercial 84%

Client Base

ROW 34%

North America 66%

Geographic Sales by Facility Location

PCS 45%

RMS 55%

Segment Revenue

Source: Based on Charles River’s FY 2009 net sales.

8

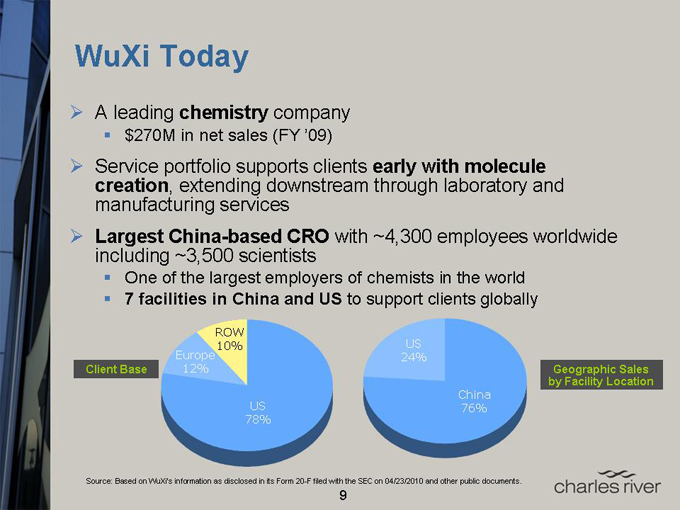

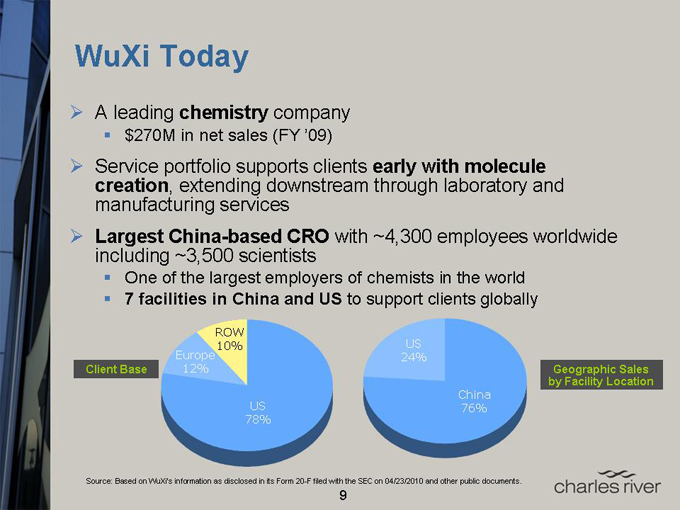

WuXi Today

A leading chemistry company $270M in net sales (FY ’09)

Service portfolio supports clients early with molecule creation, extending downstream through laboratory and manufacturing services

Largest China-based CRO with ~4,300 employees worldwide including ~3,500 scientists One of the largest employers of chemists in the world

7 facilities in China and US to support clients globally

Client Base

Europe 12%

ROW 10%

US 78%

US 24%

China 76%

Geographic Sales by Facility Location

Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

9

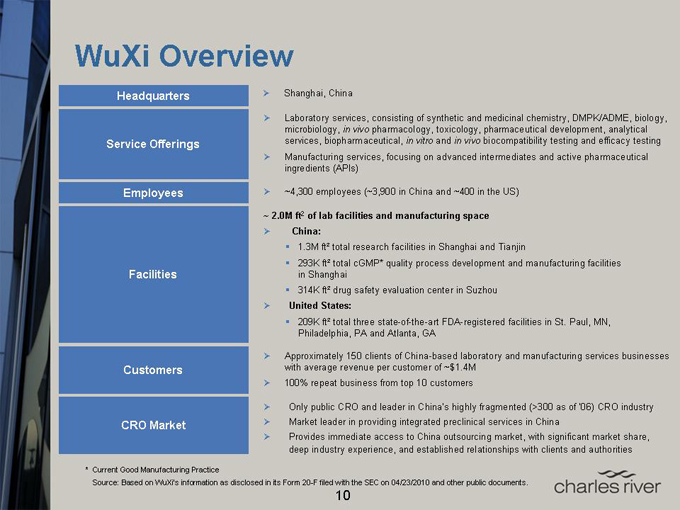

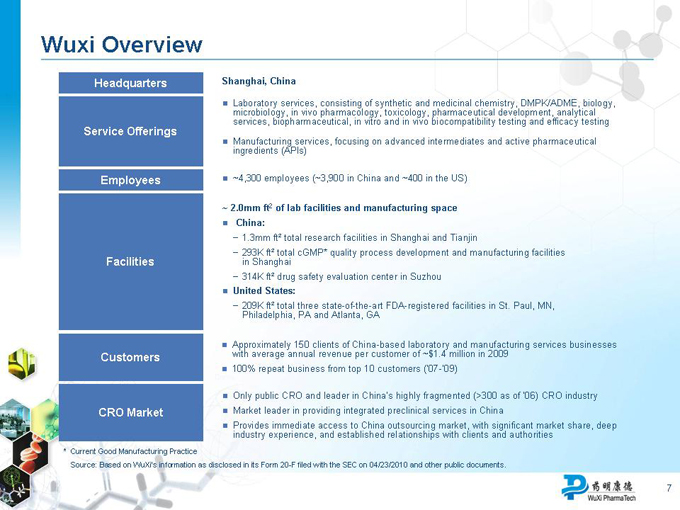

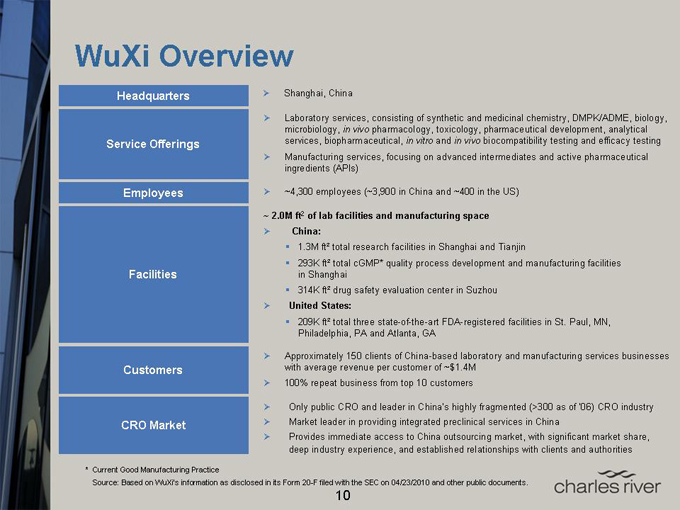

WuXi Overview

Headquarters

Service Offerings

Employees

Facilities

Customers

CRO Market

Shanghai, China

Laboratory services, consisting of synthetic and medicinal chemistry, DMPK/ADME, biology, microbiology, in vivo pharmacology, toxicology, pharmaceutical development, analytical services, biopharmaceutical, in vitro and in vivo biocompatibility testing and efficacy testing

Manufacturing services, focusing on advanced intermediates and active pharmaceutical ingredients (APIs)

~4,300 employees (~3,900 in China and ~400 in the US)

~ 2.0M ft2 of lab facilities and manufacturing space

China:

1.3M ft² total research facilities in Shanghai and Tianjin

293K ft² total cGMP* quality process development and manufacturing facilities in Shanghai 314K ft² drug safety evaluation center in Suzhou

United States:

209K ft² total three state-of-the-art FDA-registered facilities in St. Paul, MN, Philadelphia, PA and Atlanta, GA

Approximately 150 clients of China-based laboratory and manufacturing services businesses with average revenue per customer of ~$1.4M

100% repeat business from top 10 customers

Only public CRO and leader in China’s highly fragmented (>300 as of ‘06) CRO industry

Market leader in providing integrated preclinical services in China

Provides immediate access to China outsourcing market, with significant market share, deep industry experience, and established relationships with clients and authorities

* Current Good Manufacturing Practice

Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

10

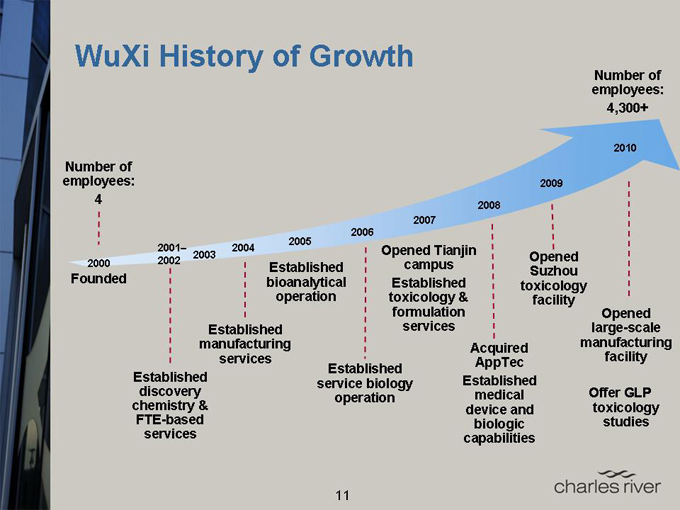

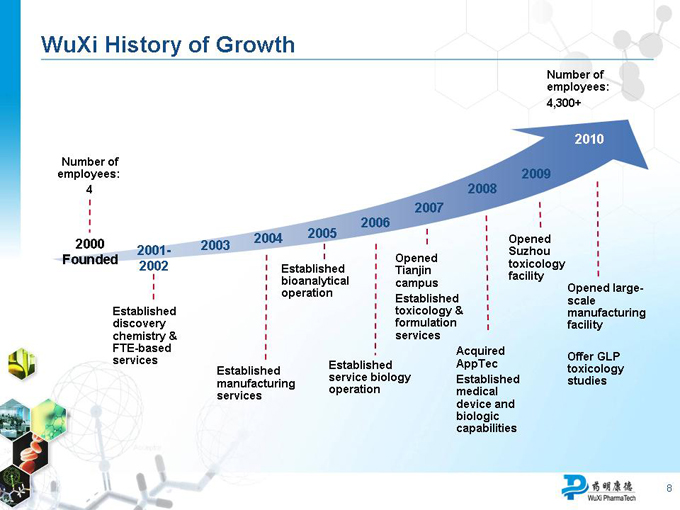

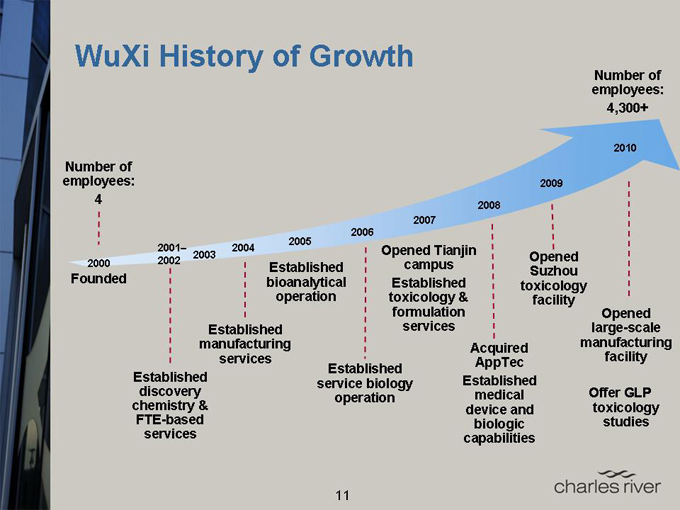

WuXi History of Growth

Number of employees: 4,300+

Number of employees: 4

2000

Founded

2001–2002

2003 2004 2005 2006 2007 2008 2009 2010

Established discovery chemistry & FTE-based services

Established manufacturing services

Established bioanalytical operation

Established service biology operation

Opened Tianjin campus Established toxicology & formulation services

Acquired AppTec Established medical device and biologic capabilities

Opened Suzhou toxicology facility

Opened large-scale manufacturing facility

Offer GLP toxicology studies

11

WuXi is the Leading CRO in China

Employees / Facilities

WuXi

ShangPharma

BioDuro

Medicilon

~4,300

~2M ft2 in both China and the US

~1,500

~600K ft2, mainly in Shanghai

>650

~110K ft2 Beijing laboratory

>400

~218K ft2

Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other companies’ public documents.

12

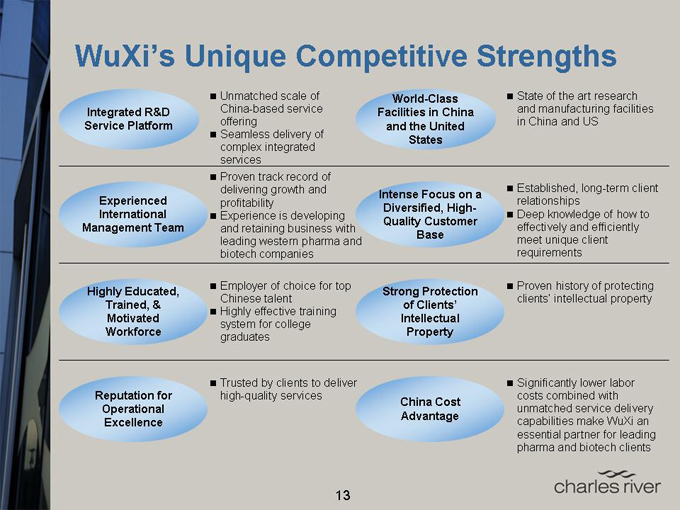

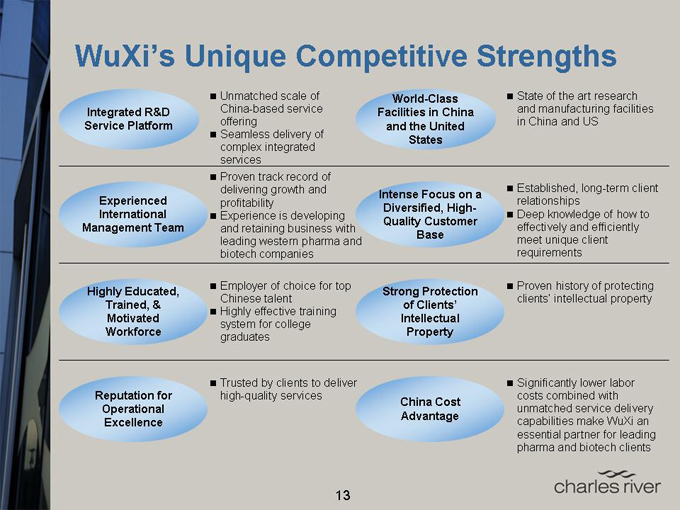

WuXi’s Unique Competitive Strengths

Integrated R&D Service Platform

Experienced International Management Team

Highly Educated, Trained, & Motivated Workforce

Reputation for Operational Excellence

Unmatched scale of China-based service offering

Seamless delivery of complex integrated services

Proven track record of delivering growth and profitability

Experience is developing and retaining business with leading western pharma and biotech companies

Employer of choice for top Chinese talent

Highly effective training system for college graduates

Trusted by clients to deliver high-quality services

World-Class Facilities in China and the United States

Intense Focus on a Diversified, High-Quality Customer Base

Strong Protection of Clients’ Intellectual Property

China Cost Advantage

State of the art research and manufacturing facilities in China and US

Established, long-term client relationships

Deep knowledge of how to effectively and efficiently meet unique client requirements

Proven history of protecting clients’ intellectual property

Significantly lower labor costs combined with unmatched service delivery capabilities make WuXi an essential partner for leading pharma and biotech clients

13

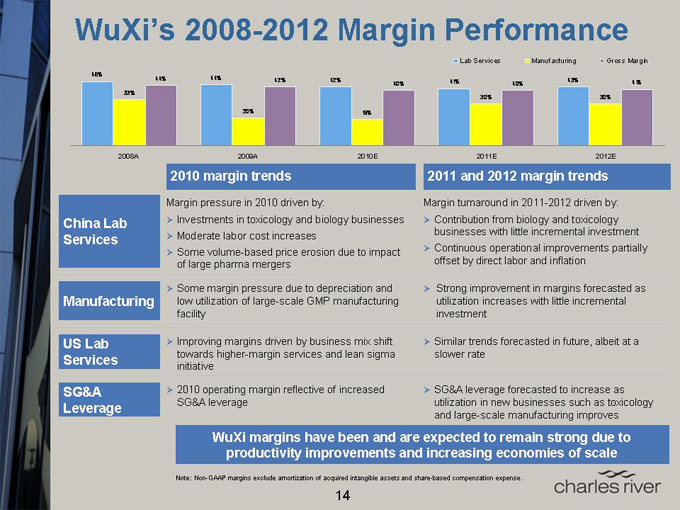

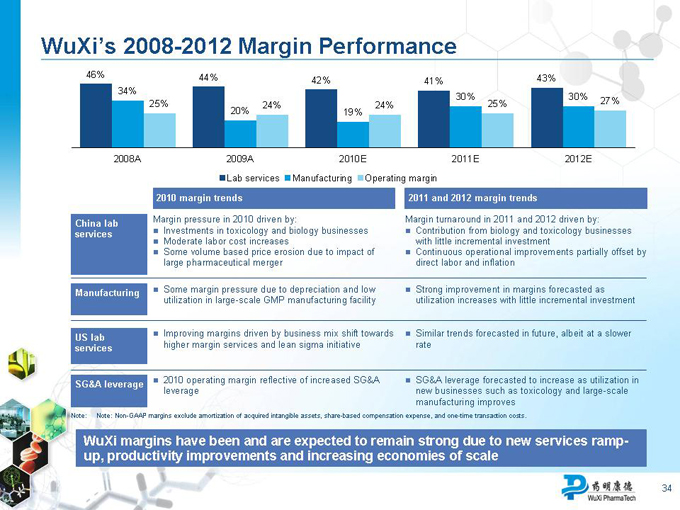

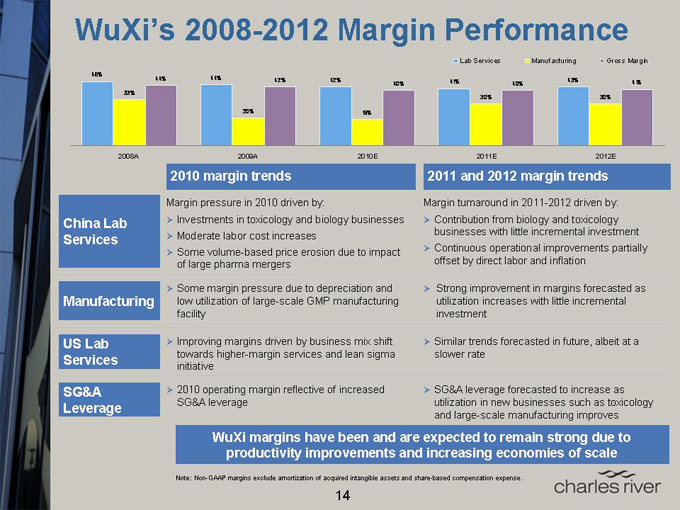

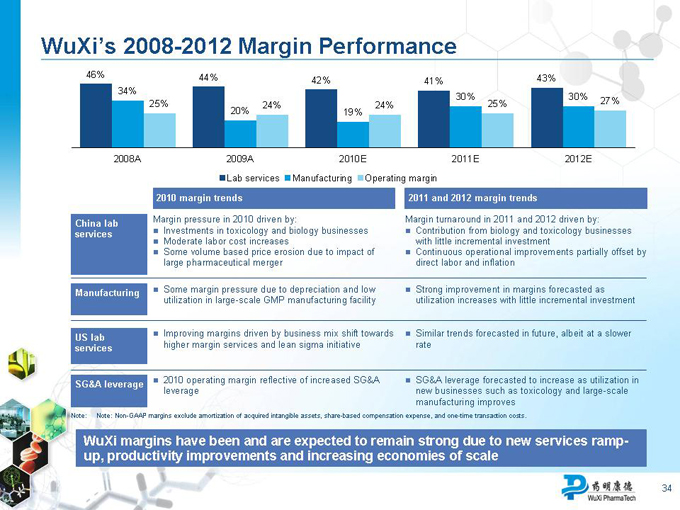

WuXi’s 2008-2012 Margin Performance

Lab Services Manufacturing Gross Margin

46% 44% 44% 42% 42% 43%

40% 41% 40% 41%

33%

30% 30%

20% 19%

2008A 2009A 2010E 2011E 2012E

China Lab Services

Manufacturing

US Lab Services

SG&A Leverage

2010 margin trends

Margin pressure in 2010 driven by:

Investments in toxicology and biology businesses

Moderate labor cost increases

Some volume-based price erosion due to impact of large pharma mergers

Some margin pressure due to depreciation and low utilization of large-scale GMP manufacturing facility

Improving margins driven by business mix shift towards higher-margin services and lean sigma initiative

2010 operating margin reflective of increased SG&A leverage

2011 and 2012 margin trends

Margin turnaround in 2011-2012 driven by:

Contribution from biology and toxicology businesses with little incremental investment

Continuous operational improvements partially offset by direct labor and inflation

Strong improvement in margins forecasted as utilization increases with little incremental investment

Similar trends forecasted in future, albeit at a slower rate

SG&A leverage forecasted to increase as utilization in new businesses such as toxicology and large-scale manufacturing improves

WuXi margins have been and are expected to remain strong due to productivity improvements and increasing economies of scale

Note: Non-GAAP margins exclude amortization of acquired intangible assets and share-based compensation expense.

14

Table of Contents

1. Transaction Timing Update

2. Charles River/WuXi Overview

3. Strategic Rationale for Transaction

4. Financial Rationale for Investors

15

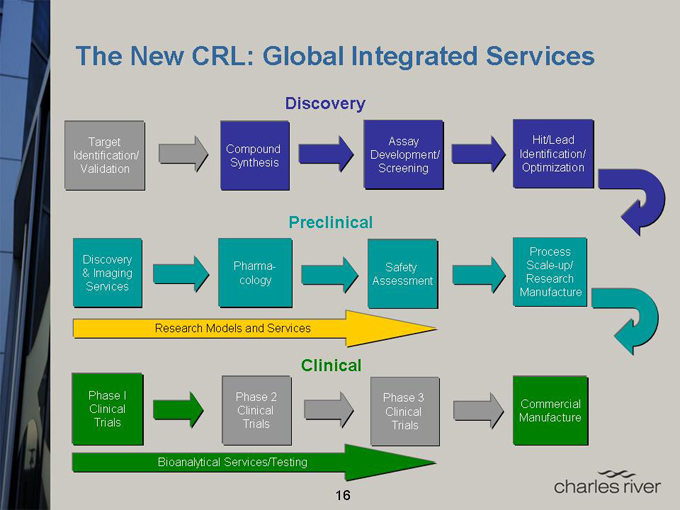

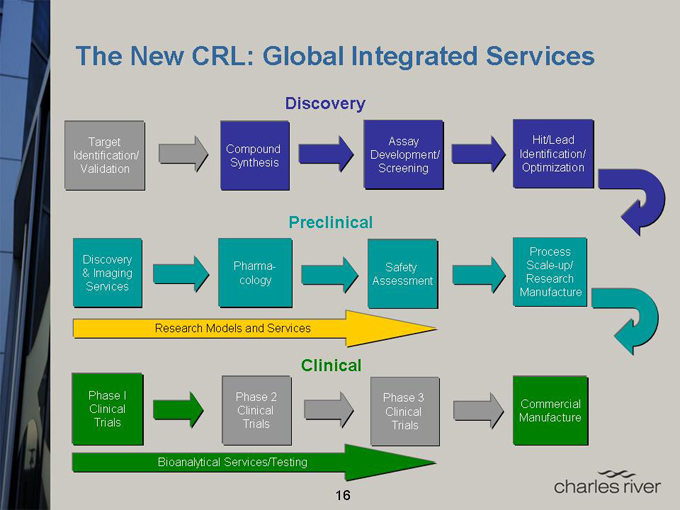

The New CRL: Global Integrated Services

Discovery

Target Assay Hit/Lead

Identification/ Compound Development/ Identification/

Validation Synthesis Screening Optimization

Preclinical

Process

Discovery

& Imaging Pharma- Safety Scale-up/

Services cology Assessment Research

Manufacture

Research Models and Services

Clinical

Phase I Phase 2 Phase 3

Clinical Clinical Clinical Commercial

Trials Trials Trials Manufacture

Bioanalytical Services/Testing

16

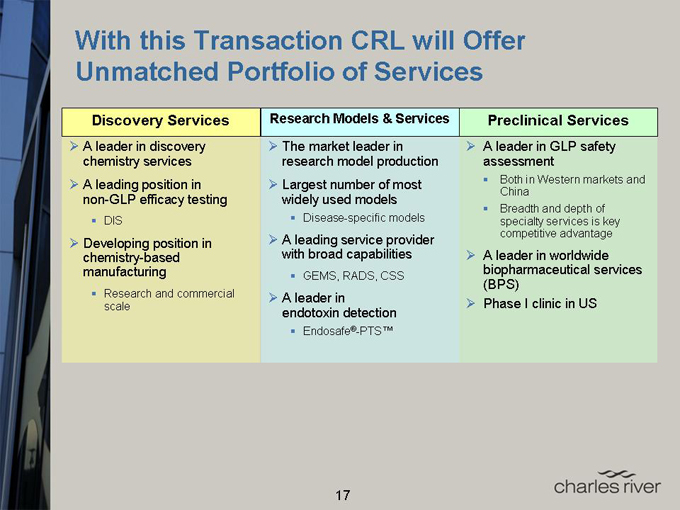

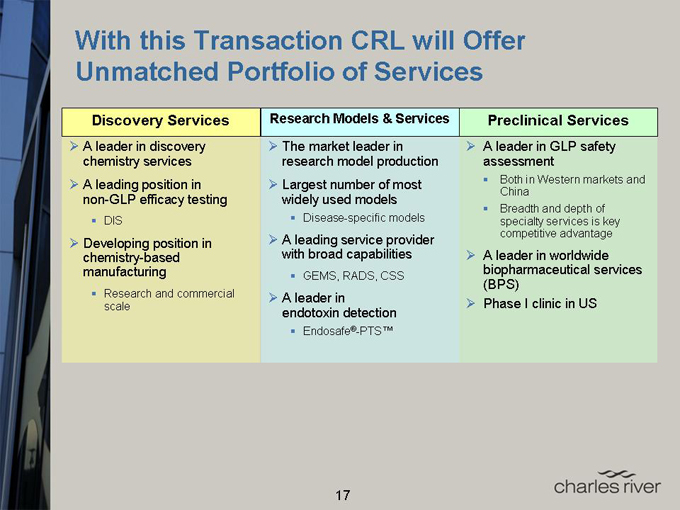

With this Transaction CRL will Offer Unmatched Portfolio of Services

Discovery Services

A leader in discovery chemistry services

A leading position in non-GLP efficacy testing DIS

Developing position in chemistry-based manufacturing Research and commercial scale

Research Models & Services

The market leader in research model production

Largest number of most widely used models

Disease-specific models

A leading service provider with broad capabilities

GEMS, RADS, CSS

A leader in endotoxin detection Endosafe®-PTS™

Preclinical Services

A leader in GLP safety assessment

Both in Western markets and China

Breadth and depth of specialty services is key competitive advantage

A leader in worldwide biopharmaceutical services (BPS)

Phase I clinic in US

17

Leverages Increasing Strategic Importance of China

Supportive of global pharmas who view China as the new frontier for drug development

Pharmas are taking advantage of cost leverage by placing chemistry in China Lower cost, highly skilled scientists with advanced degrees

Emerging opportunities for chemistry, safety assessment and manufacturing services as clients advance development activities in China Charles River gains largest early-stage provider in China

Enables clients to choose where to place work

18

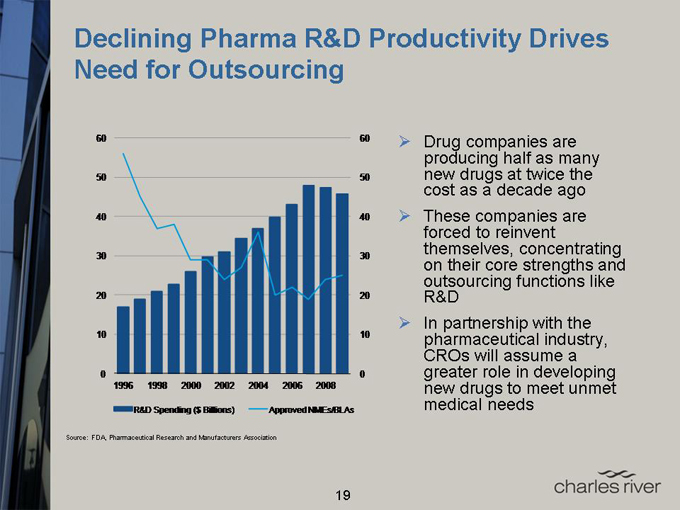

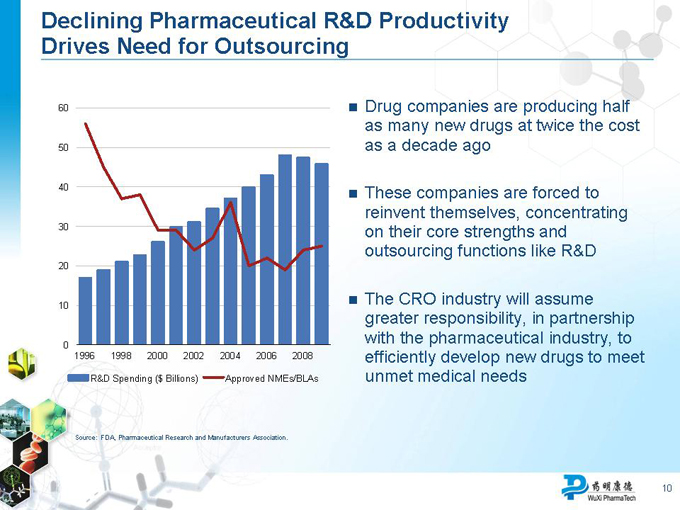

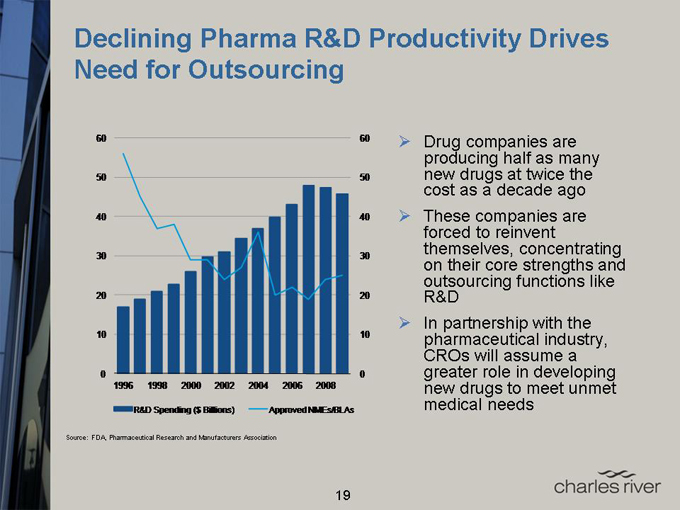

Declining Pharma R&D Productivity Drives Need for Outsourcing

60 60

50 50

40 40

30 30

20 20

10 10

0 0

1996 1998 2000 2002 2004 2006 2008

R&D Spending ($ Billions) Approved NMEs/BLAs

Drug companies are producing half as many new drugs at twice the cost as a decade ago

These companies are forced to reinvent themselves, concentrating on their core strengths and outsourcing functions like R&D

In partnership with the pharmaceutical industry, CROs will assume a greater role in developing new drugs to meet unmet medical needs

Source: FDA, Pharmaceutical Research and Manufacturers Association

19

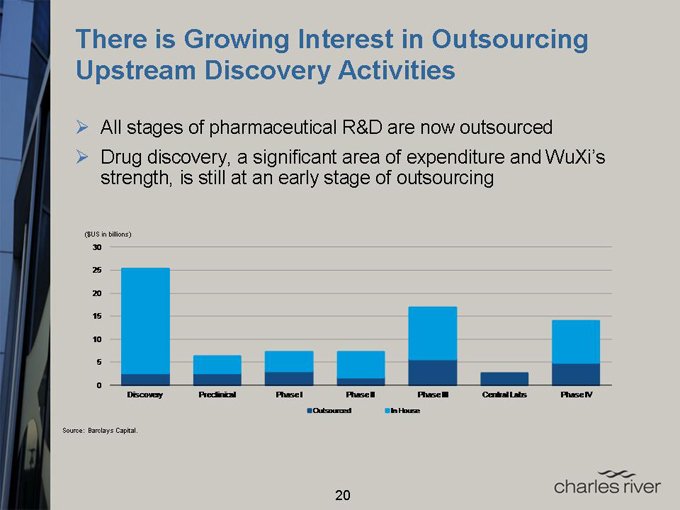

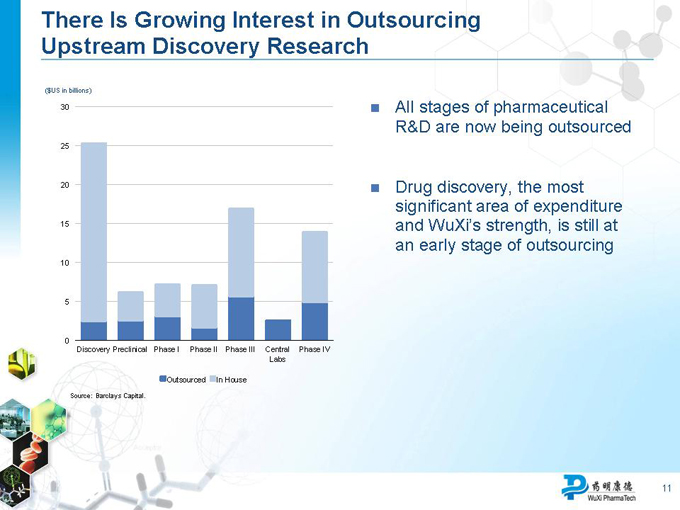

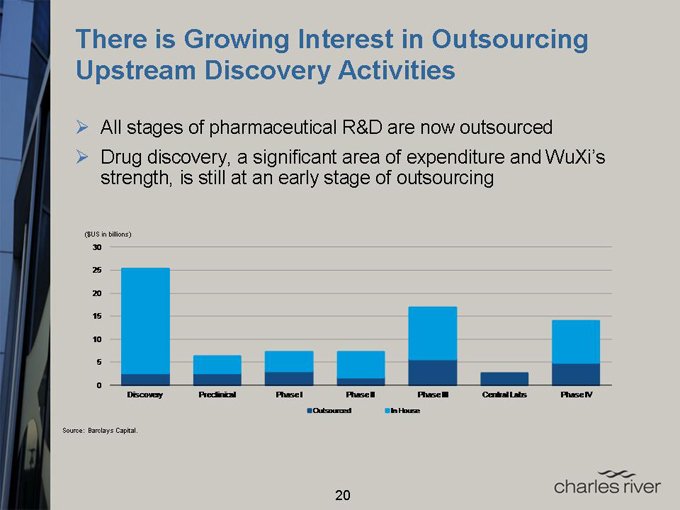

There is Growing Interest in Outsourcing Upstream Discovery Activities

All stages of pharmaceutical R&D are now outsourced

Drug discovery, a significant area of expenditure and WuXi’s strength, is still at an early stage of outsourcing

($US in billions)

30

25

20

15

10

5

0

Discovery Preclinical Phase I Phase II Phase III Central Labs Phase IV

Outsourced In House

Source: Barclays Capital.

20

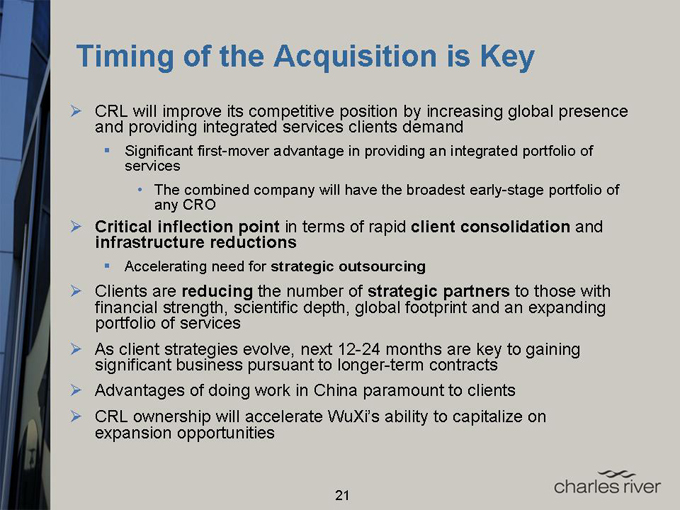

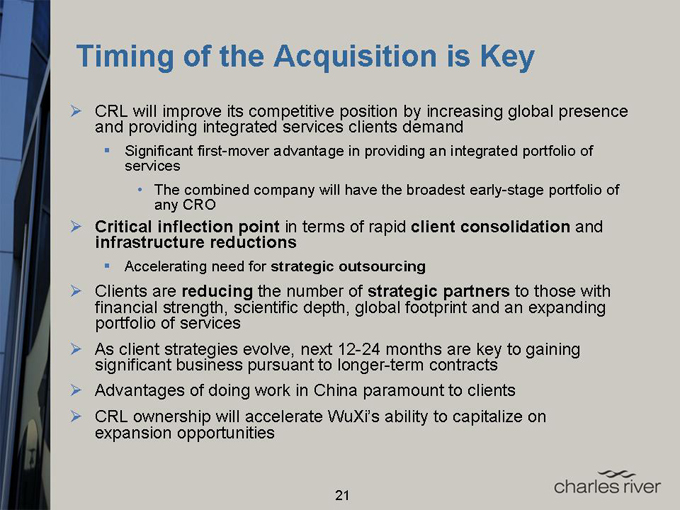

Timing of the Acquisition is Key

CRL will improve its competitive position by increasing global presence and providing integrated services clients demand Significant first-mover advantage in providing an integrated portfolio of services

• The combined company will have the broadest early-stage portfolio of any CRO

Critical inflection point in terms of rapid client consolidation and infrastructure reductions

Accelerating need for strategic outsourcing

Clients are reducing the number of strategic partners to those with financial strength, scientific depth, global footprint and an expanding portfolio of services

As client strategies evolve, next 12-24 months are key to gaining significant business pursuant to longer-term contracts

Advantages of doing work in China paramount to clients

CRL ownership will accelerate WuXi’s ability to capitalize on expansion opportunities

21

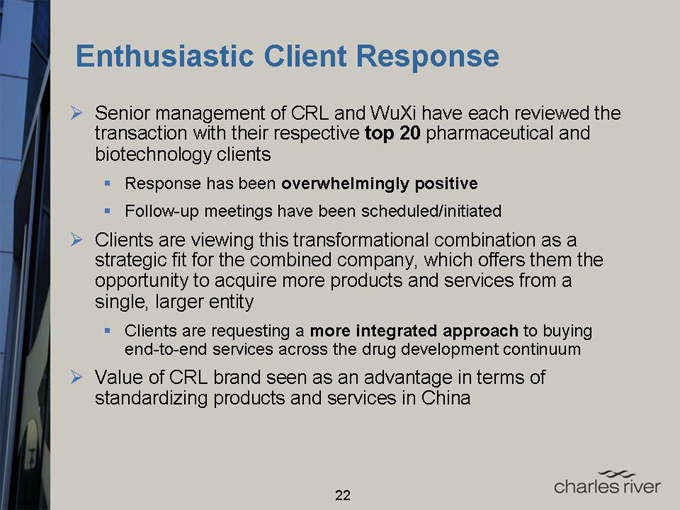

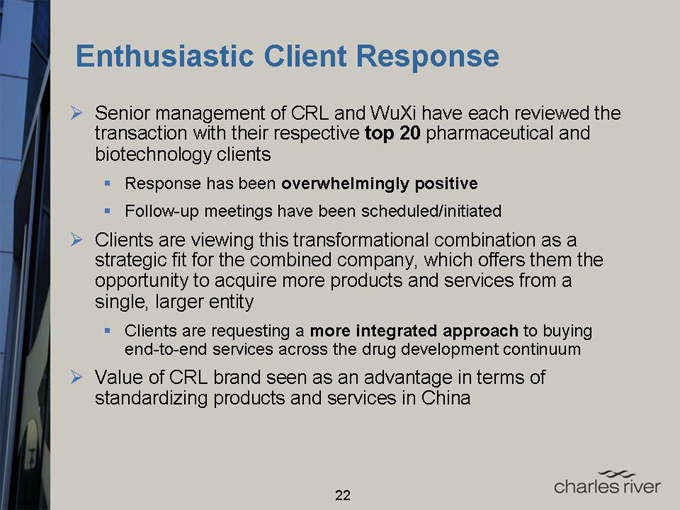

Enthusiastic Client Response

Senior management of CRL and WuXi have each reviewed the transaction with their respective top 20 pharmaceutical and biotechnology clients

Response has been overwhelmingly positive

Follow-up meetings have been scheduled/initiated

Clients are viewing this transformational combination as a strategic fit for the combined company, which offers them the opportunity to acquire more products and services from a single, larger entity Clients are requesting a more integrated approach to buying end-to-end services across the drug development continuum

Value of CRL brand seen as an advantage in terms of standardizing products and services in China

22

Enthusiastic Client Response (cont’d.)

What our clients have said

“We have great respect for and work with both organizations. When combined with WuXi, Charles River will be able to provide a unique set of end-to-end services which we believe will help accelerate our drug development process. We look forward to working in a more holistic fashion with the combined entity.” Senior Vice President and Head of Worldwide Research of a top-five global pharmaceutical company

“Charles River-WuXi’s unique early-stage portfolio of products and services provides a transformational opportunity for the drug development industry. The availability of a new CRO paradigm will allow companies like us to explore innovative strategic relationships and R&D business models which could dramatically change the R&D productivity equation. We very much look forward to having a company like CR-WuXi in the marketplace and to working with the new organization.”

Senior Vice President of Research and Early Development of a top-five global pharmaceutical company

“The combination of these two companies is the most visionary and promising approach to drug development I’ve seen in this field in the last three decades. To be able to access the power of your integrated drug discovery and early development platform offers us tremendous opportunities to speed affordable and transformational medicine to patients.”

Executive Vice President and Chief Scientific Officer of a first-tier biotechnology company

23

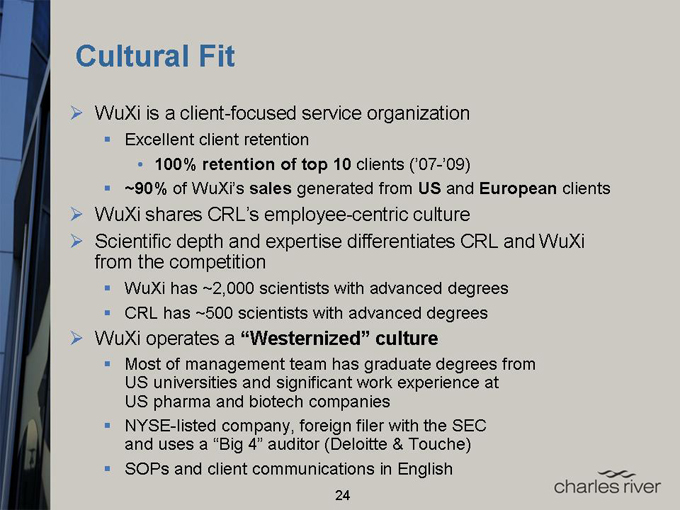

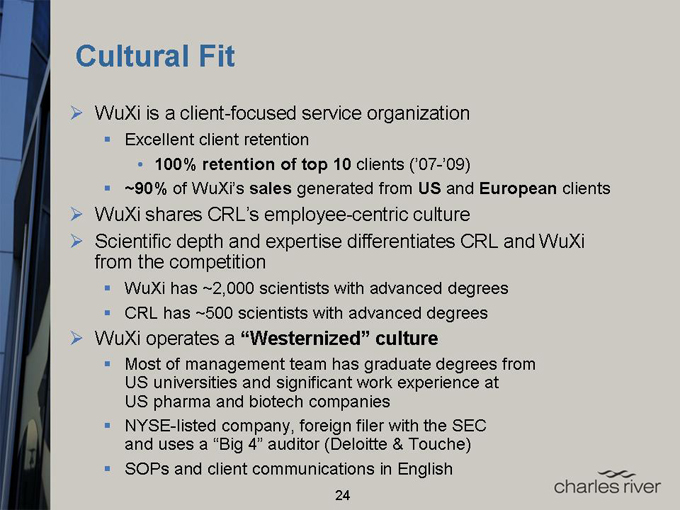

Cultural Fit

WuXi is a client-focused service organization Excellent client retention

• 100% retention of top 10 clients (‘07-’09)

~90% of WuXi’s sales generated from US and European clients

WuXi shares CRL’s employee-centric culture

Scientific depth and expertise differentiates CRL and WuXi from the competition WuXi has ~2,000 scientists with advanced degrees CRL has ~500 scientists with advanced degrees

WuXi operates a “Westernized” culture

Most of management team has graduate degrees from US universities and significant work experience at US pharma and biotech companies NYSE-listed company, foreign filer with the SEC and uses a “Big 4” auditor (Deloitte & Touche) SOPs and client communications in English

24

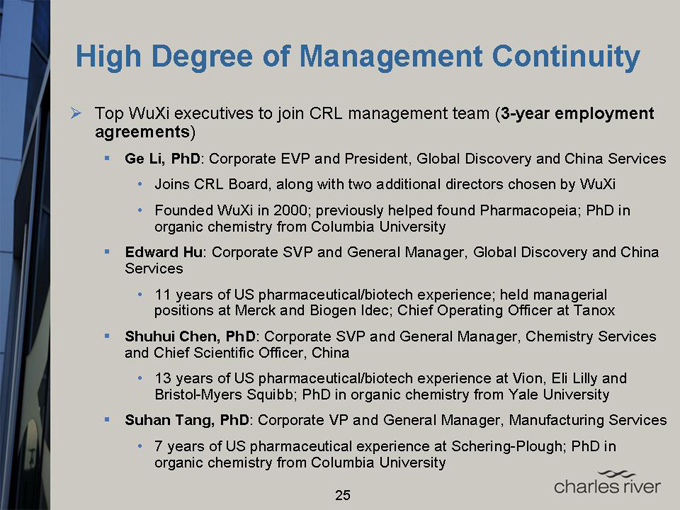

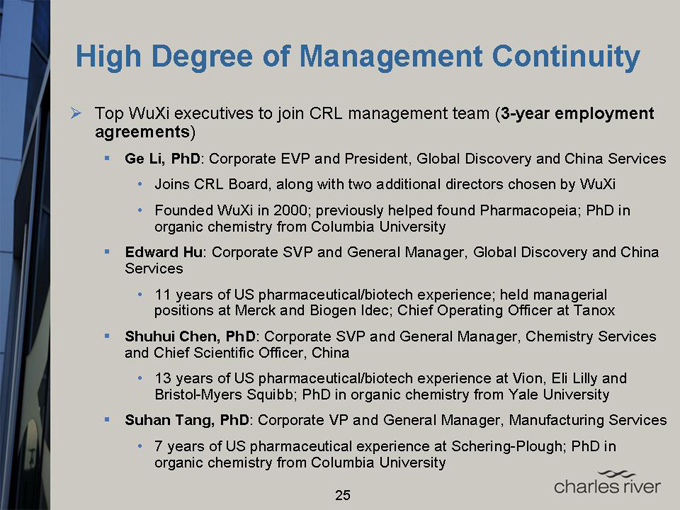

High Degree of Management Continuity

Top WuXi executives to join CRL management team (3-year employment agreements)

Ge Li, PhD: Corporate EVP and President, Global Discovery and China Services

• Joins CRL Board, along with two additional directors chosen by WuXi

• Founded WuXi in 2000; previously helped found Pharmacopeia; PhD in organic chemistry from Columbia University Edward Hu: Corporate SVP and General Manager, Global Discovery and China Services

• 11 years of US pharmaceutical/biotech experience; held managerial positions at Merck and Biogen Idec; Chief Operating Officer at Tanox Shuhui Chen, PhD: Corporate SVP and General Manager, Chemistry Services and Chief Scientific Officer, China

• 13 years of US pharmaceutical/biotech experience at Vion, Eli Lilly and Bristol-Myers Squibb; PhD in organic chemistry from Yale University Suhan Tang, PhD: Corporate VP and General Manager, Manufacturing Services

• 7 years of US pharmaceutical experience at Schering-Plough; PhD in organic chemistry from Columbia University

25

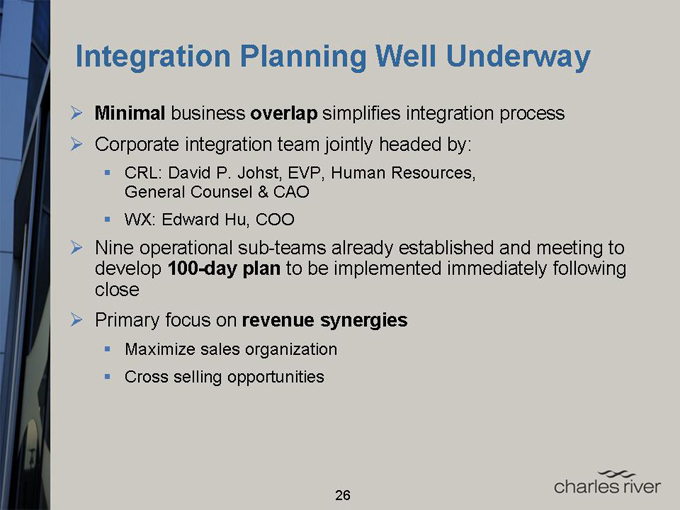

Integration Planning Well Underway

Minimal business overlap simplifies integration process

Corporate integration team jointly headed by: CRL: David P. Johst, EVP, Human Resources, General Counsel & CAO

WX: Edward Hu, COO

Nine operational sub-teams already established and meeting to develop 100-day plan to be implemented immediately following close

Primary focus on revenue synergies Maximize sales organization Cross selling opportunities

26

Table of Contents

1. Transaction Timing Update

2. Charles River/WuXi Overview

3. Strategic Rationale for Transaction

4. Financial Rationale for Investors

27

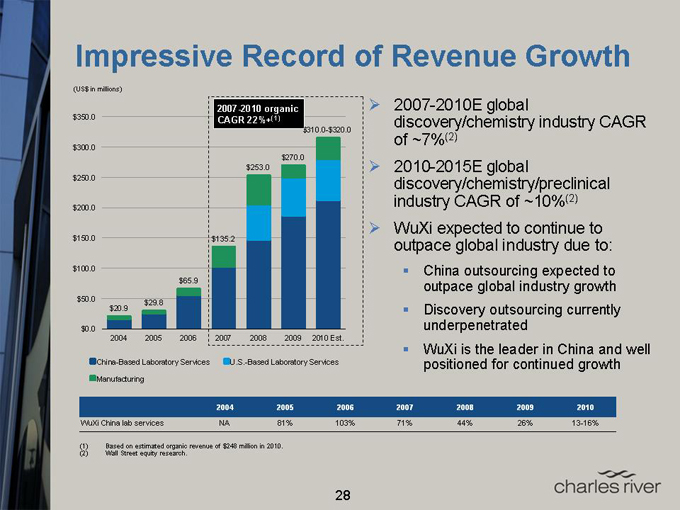

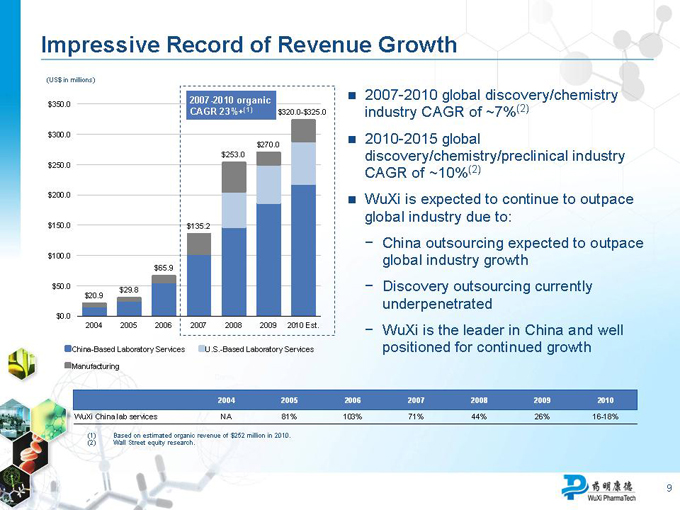

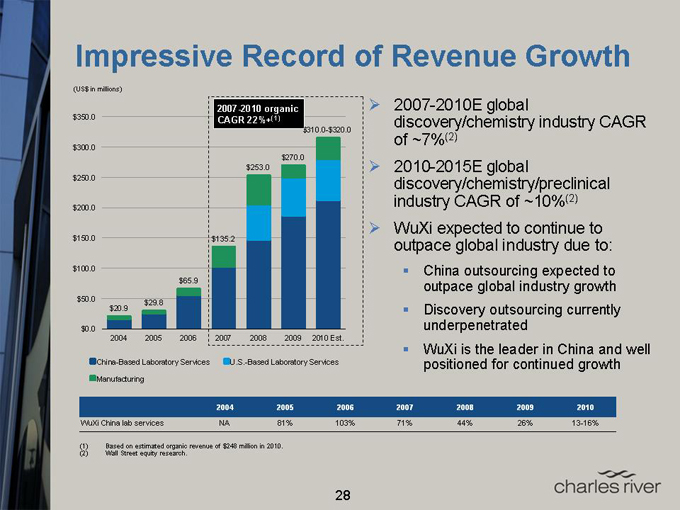

Impressive Record of Revenue Growth

(US$ in millions)

2007-2010 Organic CAGR 22%+(1)

$350.0

$310.0-$320.0

$300.0

$270.0

$253.0

$250.0

$200.0

$150.0

$135.2

$100.0

$65.9

$50.0

$29.8

$20.9

$0.0

2004 2005 2006 2007 2008 2009 2010 Est.

China-Based Laboratory Services U.S.-Based Laboratory Services

Manufacturing

2007-2010E global discovery/chemistry industry CAGR of ~7%(2) 2010-2015E global discovery/chemistry/preclinical industry CAGR of ~10%(2) WuXi expected to continue to outpace global industry due to: China outsourcing expected to outpace global industry growth Discovery outsourcing currently underpenetrated WuXi is the leader in China and well positioned for continued growth

2004 2005 2006 2007 2008 2009 2010

WuXi China lab services NA 81% 103% 71% 44% 26% 13-16%

(1) Based on estimated organic revenue of $248 million in 2010.

(2) Wall Street equity research.

28

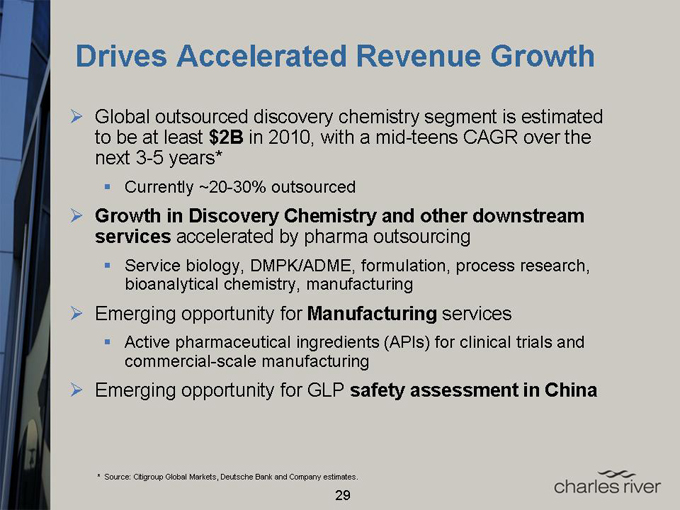

Drives Accelerated Revenue Growth

Global outsourced discovery chemistry segment is estimated to be at least $2B in 2010, with a mid-teens CAGR over the next 3-5 years* Currently ~20-30% outsourced

Growth in Discovery Chemistry and other downstream services accelerated by pharma outsourcing Service biology, DMPK/ADME, formulation, process research, bioanalytical chemistry, manufacturing

Emerging opportunity for Manufacturing services

Active pharmaceutical ingredients (APIs) for clinical trials and commercial-scale manufacturing

Emerging opportunity for GLP safety assessment in China

* | Source: Citigroup Global Markets, Deutsche Bank and Company estimates. |

29

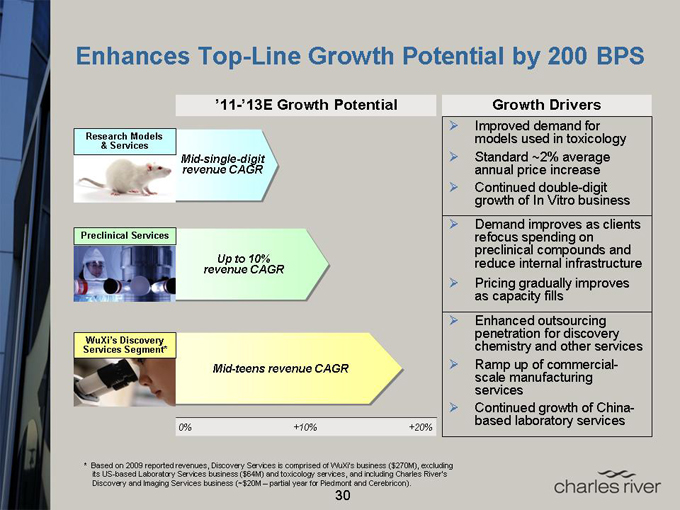

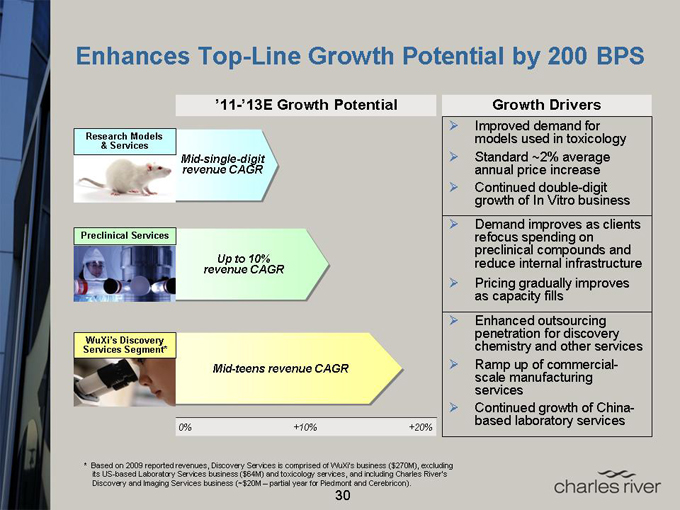

Enhances Top-Line Growth Potential by 200 BPS

’11-’13E Growth Potential

Research Models

& Services

Mid-single-digit revenue CAGR

Preclinical Services

Up to 10% revenue CAGR

WuXi’s Discovery Services Segment*

Mid-teens revenue CAGR

0% +10% +20%

Growth Drivers

Improved demand for models used in toxicology

Standard ~2% average annual price increase

Continued double-digit growth of In Vitro business

Demand improves as clients refocus spending on preclinical compounds and reduce internal infrastructure

Pricing gradually improves as capacity fills

Enhanced outsourcing penetration for discovery chemistry and other services

Ramp up of commercial-scale manufacturing services

Continued growth of China-based laboratory services

* Based on 2009 reported revenues, Discovery Services is comprised of WuXi’s business ($270M), excluding its US-based Laboratory Services business ($64M) and toxicology services, and including Charles River’s Discovery and Imaging Services business (~$20M – partial year for Piedmont and Cerebricon).

30

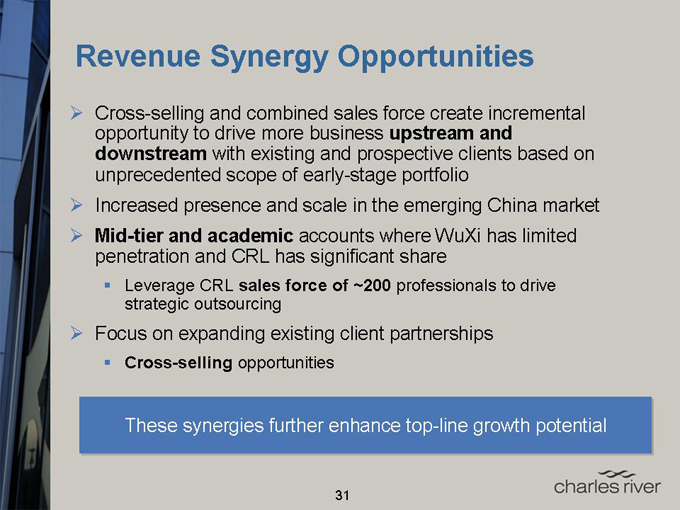

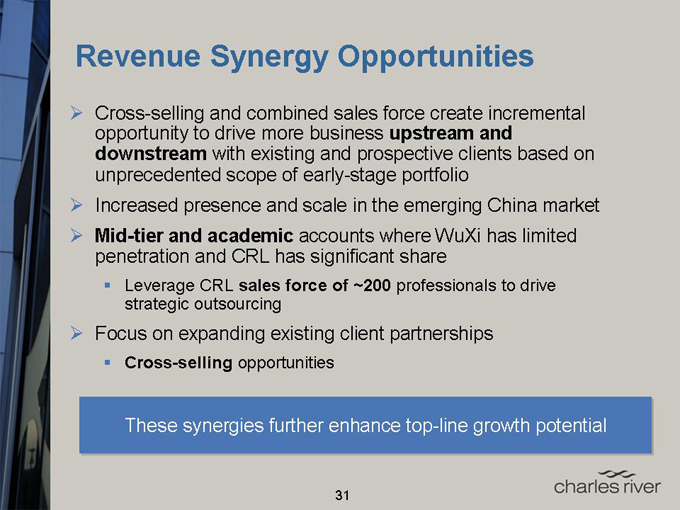

Revenue Synergy Opportunities

Cross-selling and combined sales force create incremental opportunity to drive more business upstream and downstream with existing and prospective clients based on unprecedented scope of early-stage portfolio

Increased presence and scale in the emerging China market

Mid-tier and academic accounts where WuXi has limited penetration and CRL has significant share Leverage CRL sales force of ~200 professionals to drive strategic outsourcing

Focus on expanding existing client partnerships

Cross-selling opportunities

These synergies further enhance top-line growth potential

31

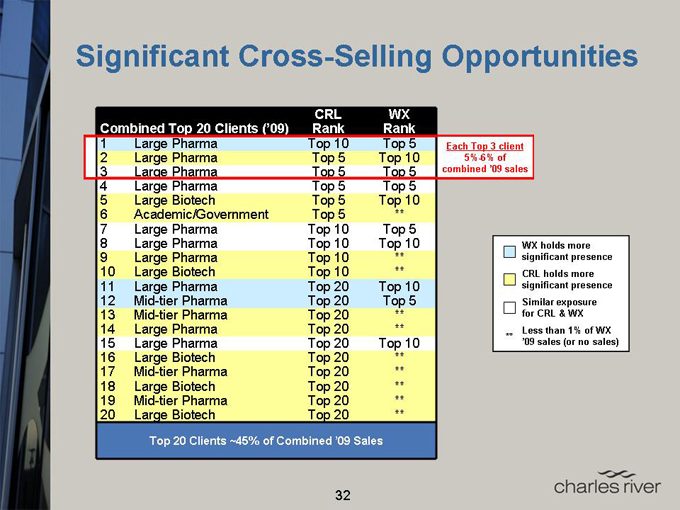

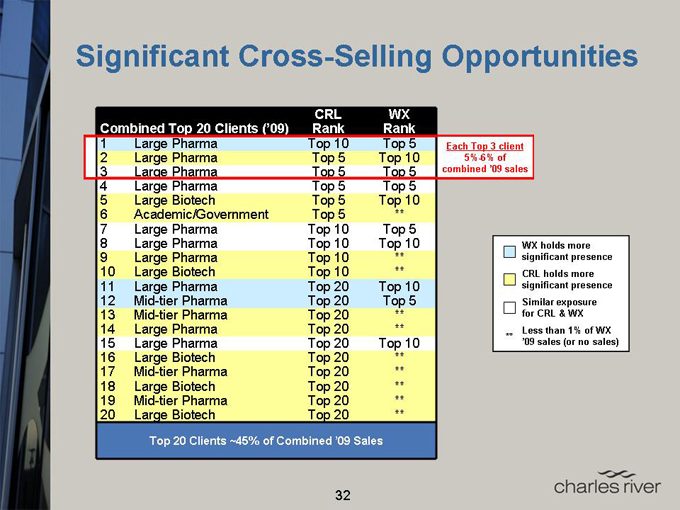

Significant Cross-Selling Opportunities

CRL WX

Combined Top 20 Clients (’09) Rank Rank

1 Large Pharma Top 10 Top 5

2 Large Pharma Top 5 Top 10

3 Large Pharma Top 5 Top 5

4 Large Pharma Top 5 Top 5

5 Large Biotech Top 5 Top 10

6 Academic/Government Top 5 **

7 Large Pharma Top 10 Top 5

8 Large Pharma Top 10 Top 10

9 Large Pharma Top 10 **

10 Large Biotech Top 10 **

11 Large Pharma Top 20 Top 10

12 Mid-tier Pharma Top 20 Top 5

13 Mid-tier Pharma Top 20 **

14 Large Pharma Top 20 **

15 Large Pharma Top 20 Top 10

16 Large Biotech Top 20 **

17 Mid-tier Pharma Top 20 **

18 Large Biotech Top 20 **

19 Mid-tier Pharma Top 20 **

20 Large Biotech Top 20 **

Top 20 Clients ~45% of Combined ’09 Sales

Each Top 3 client

5%-6% of combined ’09 sales

WX holds more significant presence CRL holds more significant presence Similar exposure for CRL & WX

** Less than 1% of WX ’09 sales (or no sales)

32

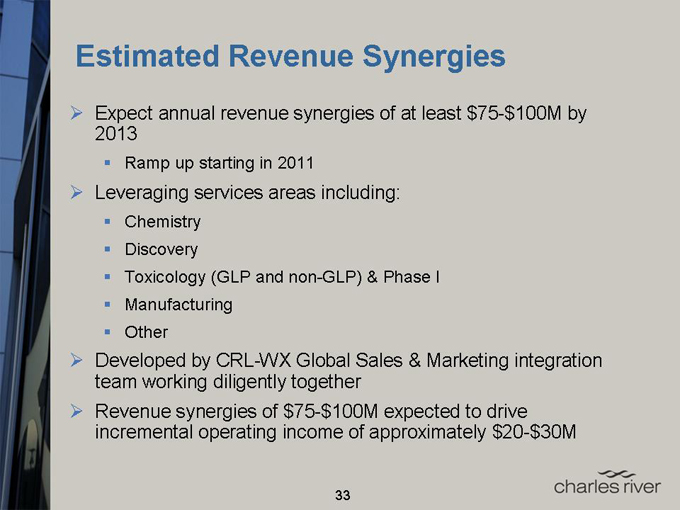

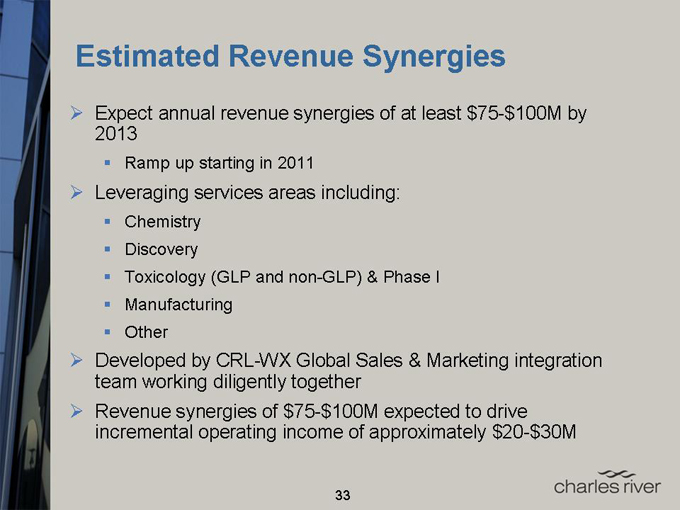

Estimated Revenue Synergies

Expect annual revenue synergies of at least $75-$100M by 2013 Ramp up starting in 2011

Leveraging services areas including: Chemistry Discovery Toxicology (GLP and non-GLP) & Phase I Manufacturing Other

Developed by CRL-WX Global Sales & Marketing integration team working diligently together

Revenue synergies of $75-$100M expected to drive incremental operating income of approximately $20-$30M

33

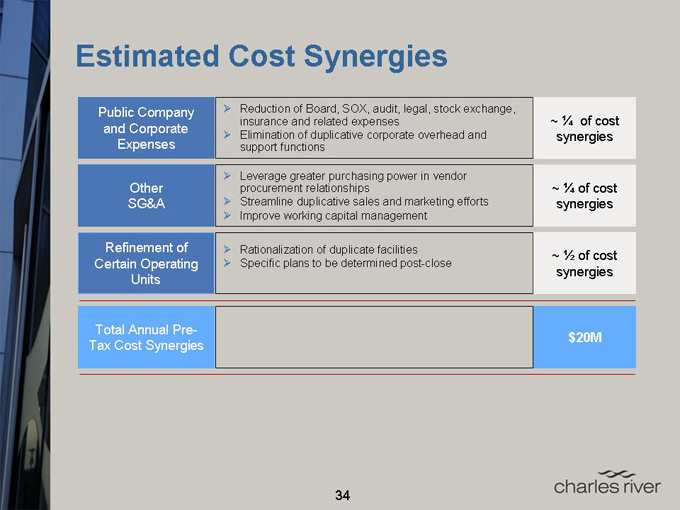

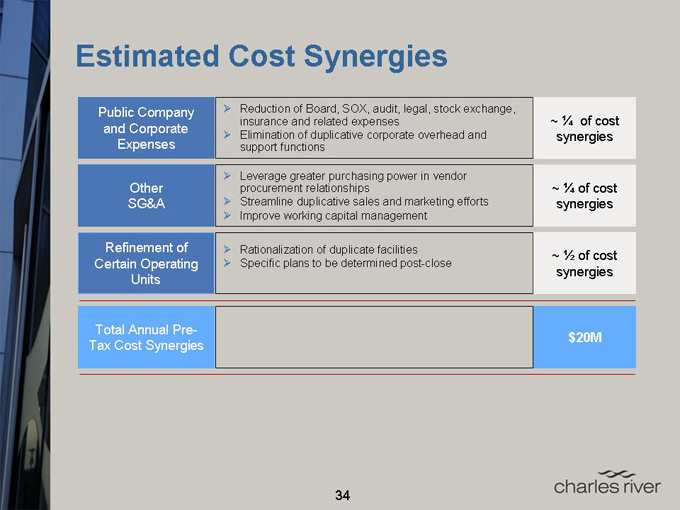

Estimated Cost Synergies

Public Company and Corporate Expenses

Other SG&A

Refinement of Certain Operating Units

Total Annual Pre-Tax Cost Synergies

Reduction of Board, SOX, audit, legal, stock exchange, insurance and related expenses

Elimination of duplicative corporate overhead and support functions

Leverage greater purchasing power in vendor procurement relationships Streamline duplicative sales and marketing efforts Improve working capital management

Rationalization of duplicate facilities Specific plans to be determined post-close

~ 1/4 of cost synergies

~ 1/4 of cost synergies

~ 1/2 of cost synergies

$20M

34

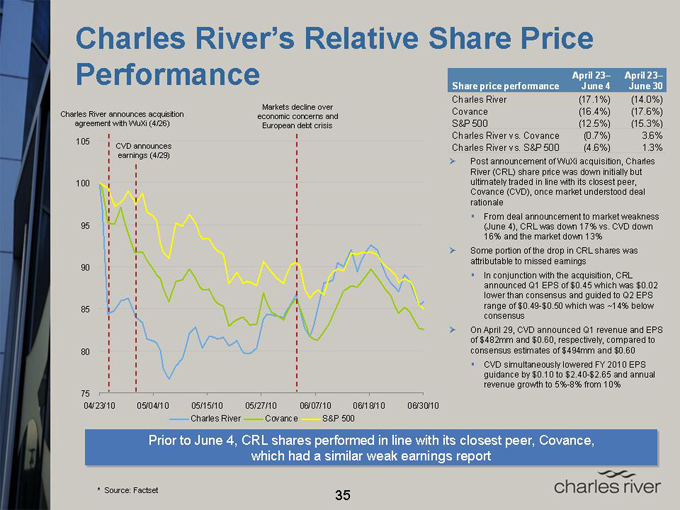

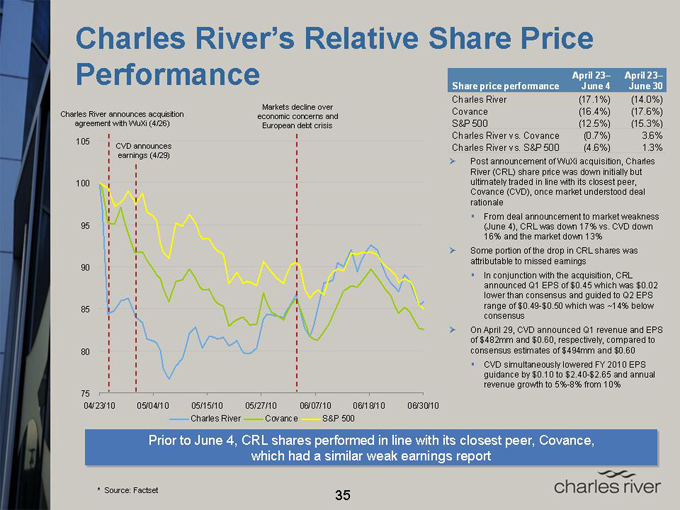

Charles River’s Relative Share Price

Performance

Charles River announces acquisition agreement with WuXi (4/26)

Markets decline over economic concerns and European debt crisis

105

CVD announces

earnings (4/29)

100

95

90

85

80

75

04/23/10 05/04/10 05/15/10 05/27/10 06/07/10 06/18/10 06/30/10

Charles River Covance S&P 500

April 23– April 23–

Share price performance June 4 June 30

Charles River (17.1%) (14.0%)

Covance (16.4%) (17.6%)

S&P 500 (12.5%) (15.3%)

Charles River vs. Covance (0.7%) 3.6%

Charles River vs. S&P 500 (4.6%) 1.3%

Post announcement of WuXi acquisition, Charles River (CRL) share price was down initially but ultimately traded in line with its closest peer, Covance (CVD), once market understood deal rationale From deal announcement to market weakness (June 4), CRL was down 17% vs. CVD down 16% and the market down 13%

Some portion of the drop in CRL shares was attributable to missed earnings In conjunction with the acquisition, CRL announced Q1 EPS of $0.45 which was $0.02 lower than consensus and guided to Q2 EPS range of $0.49-$0.50 which was ~14% below consensus

On April 29, CVD announced Q1 revenue and EPS of $482mm and $0.60, respectively, compared to consensus estimates of $494mm and $0.60 CVD simultaneously lowered FY 2010 EPS guidance by $0.10 to $2.40-$2.65 and annual revenue growth to 5%-8% from 10%

Prior to June 4, CRL shares performed in line with its closest peer, Covance, which had a a similar weak earnings report

* Source: Factset

35

Charles River and WuXi:

The Future of Early-Stage Contract Research

The combination creates the first fully integrated global early-stage CRO

Offers a full range of products and services from molecule creation to first-in-human testing

Leverages increasing strategic importance of China

Drives Charles River shareholder value through profitable growth and higher combined margins Expanded portfolio drives increased sales

Provides compelling value to clients, meeting their needs for early-stage drug development efforts on a global basis Enables clients to work with one provider through the early-stage pipeline, speeding the development process by reducing cycle time

36

Accelerating Drug Development. Exactly.

© 2010 Charles River Laboratories International, Inc.

Exhibit 99.3

Exhibit 99.3

WuXi PharmaTech, A Leading China-Based CRO

July 15, 2010

Dr. Ge Li, WuXi Chairman / CEO Edward Hu, WuXi COO

Cautionary Note Regarding Forward-Looking Statements

Statements in this presentation contain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including those with respect to favorable industry trends, guidance for full-year 2010 performance, anticipated strong financial results for 2010 and beyond, and anticipated benefits of the proposed combination with Charles River Laboratories, are not historical facts but instead represent only our belief regarding future events, many of which, by their nature, are inherently uncertain and outside of our control. Our actual results and financial condition and other circumstances may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Risks with respect to the proposed combination include: (i) the possibility that the proposed combination may be delayed or not completed due to the failure to obtain stockholder or regulatory approvals or otherwise satisfy the conditions to the proposed combination as set forth in our acquisition agreement with Charles River; (ii) problems may arise in successfully integrating the businesses of the two companies; (iii) the acquisition may involve unexpected costs; (iv) the combined company may not achieve the anticipated transaction benefits, including improved customer service levels and anticipated cost and revenue synergies, or achieve potential revenue growth and non-GAAP margin expansion; (v) restrictions in our acquisition agreement with Charles River that require us to conduct our business in the ordinary course consistent with past practices and in accordance with other specific limitations may delay or prevent us from taking advantage of business opportunities that may arise prior to the combination; and (vi) the businesses may suffer as a result of uncertainty surrounding the combination. In addition, the businesses may be subject to future regulatory or legislative actions and other risk factors. These other risk factors include: continued uncertainty in the global economy, the pressures being felt by our customers, and pharmaceutical industry consolidation may adversely impact our business and the trends for outsourced R&D and manufacturing for longer than expected or more severely than expected; we may be unable to successfully make our planned investments and capital expenditures on a timely basis, these investments may not yield the desired results, and we may need to modify the nature and level of our investments and capital expenditures; pharmaceutical companies may not change their business models as expected or in a manner favorable to us; we may fail to capitalize on the opportunities presented; and we may not maintain our preferred provider status with our clients and may be unable to successfully expand our capabilities to meet client needs. In addition, other factors that could cause our actual results to differ from what we currently anticipate include failure to generate sufficient future cash flows or to secure any required future financing on acceptable terms or at all; failure to retain key personnel; effective integration of continuing products and services from AppTec; our reliance on a limited number of customers to continue to account for a high percentage of our revenues; risk of payment failure by any of our large customers, which could significantly harm our cash flows and profitability; dependence upon the continued service of our senior management and key scientific personnel; and our ability to retain our existing customers or expand our customer base. You should read the financial information contained in this presentation in conjunction with the consolidated financial statements and related notes thereto included in our 2009 Annual Report on Form 20-F filed with and available on the Securities and Exchange Commission’s (“SEC’s”) website at http://www.sec.gov. For additional information on these and other important factors that could adversely affect our or Charles River’s business, financial condition, results of operations and prospects, see “Risk Factors” (i) beginning on page 6 of our 2009 Annual Report on Form 20-F and (ii) beginning on page 18 of Charles River’s Annual Report on Form 10-K also filed at the SEC’s website. Our results of operations for first-quarter 2010 are not necessarily indicative of our operating results for any future periods. All projections in this presentation are based on limited information currently available to us, which is subject to change. Although these projections and the factors influencing them will likely change, we undertake no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this presentation, except as required by law. Such information speaks only as of the date of this presentation.

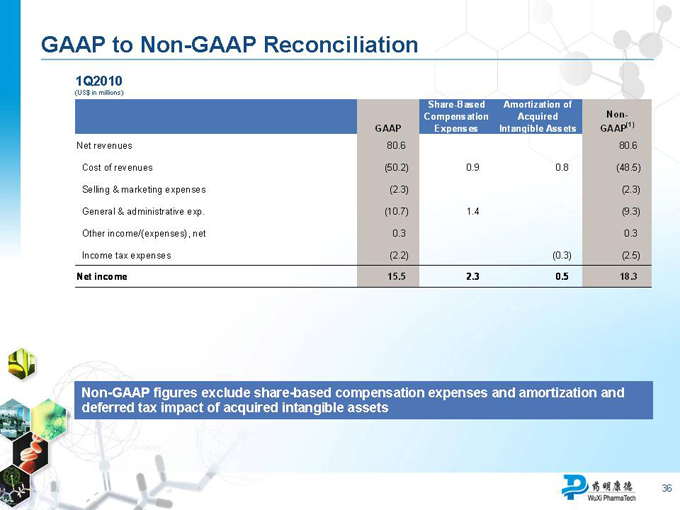

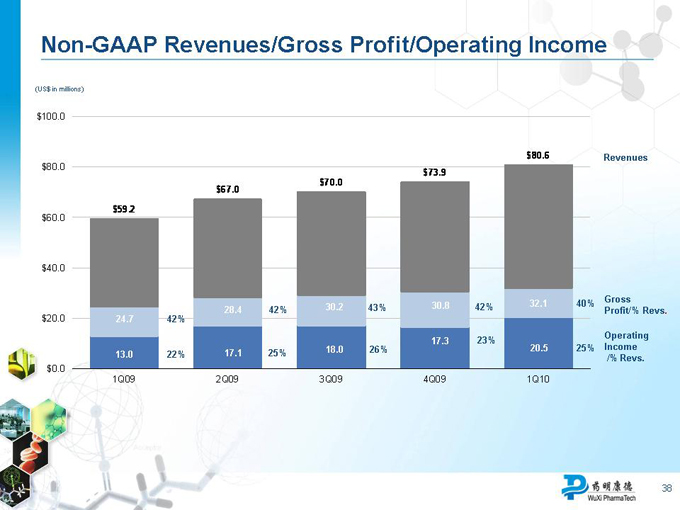

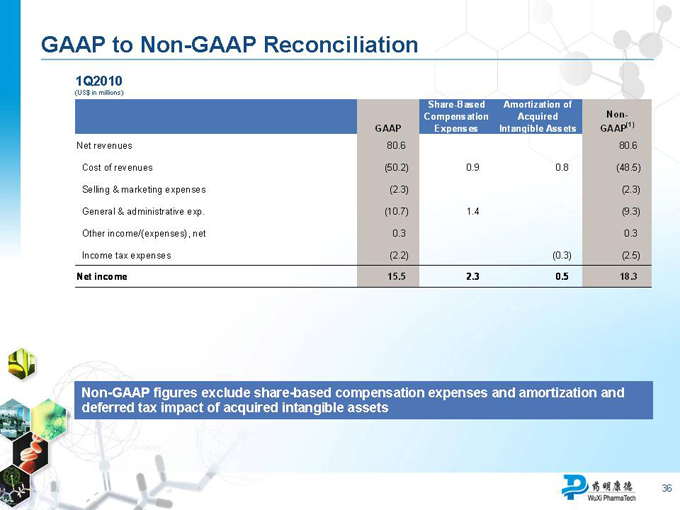

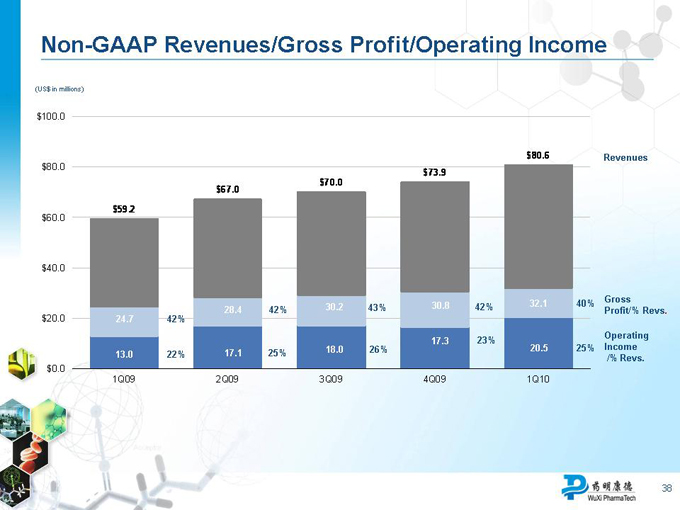

Use of Non-GAAP Financial Measures

We have provided 2009 and 2010 gross profit and operating income on a non-GAAP basis, which excludes share-based compensation expenses and amortization of acquired intangible assets and associated deferred tax impact. We believe both management and investors benefit from referring to these non-GAAP financial measures in assessing our financial performance and liquidity and when planning and forecasting future periods. These non-GAAP operating measures are useful for understanding and assessing underlying business performance and operating trends. We expect to continue providing gross profit and operating income on a non-GAAP basis using a consistent method on a quarterly basis. You should not view non-GAAP results on a stand-alone basis or as a substitute for results under GAAP, or as being comparable to results reported or forecasted by other companies, and should refer to the reconciliation of non-GAAP measures to GAAP measures for the indicated periods attached hereto.

Additional Information

This document is not a solicitation of proxies from WuXi’s shareholders to approve the proposed combination. In connection with the proposed transaction, WuXi has filed a scheme document with the SEC on Form 6-K. Before making any voting or investment decisions, WuXi’s shareholders are urged to read the scheme document and any other relevant documents filed with the SEC because they will contain important information. The scheme document has been mailed to WuXi’s shareholders seeking their approval of the proposed combination. WuXi’s shareholders may also obtain a copy of the scheme document free of charge by directing a request to: WuXi PharmaTech (Cayman) Inc., 288 Fute Zhong Road, Waigaoqiao Free Trade Zone, Shanghai 200131, People’s Republic of China, Attention: Genyong Qiu. In addition, the scheme document is available free of charge at the SEC’s website, www.sec.gov. WuXi’s shareholders may also access copies of the documents filed with the SEC by WuXi on WuXi’s website at www.wuxiapptec.com.

This document may be deemed to be solicitation material used in connection with the solicitation of proxies from Charles River stockholders to approve the proposed combination of Charles River and WuXi. In connection with the proposed transaction, Charles River has filed a definitive proxy statement with the SEC. Before making any voting or investment decisions, Charles River’s stockholders are urged to read the definitive proxy statement and any other relevant documents filed with the SEC because they will contain important information. The definitive proxy statement has been mailed to the stockholders of Charles River seeking their approval of the proposed transaction. Charles River’s stockholders may also obtain a copy of the definitive proxy statement free of charge by directing a request to: Charles River Laboratories International, Inc., 251 Ballardvale Street, Wilmington, MA 01887, Attention: General Counsel. In addition, the definitive proxy statement is available free of charge at the SEC’s website, www.sec.gov. Charles River’s stockholders may also access copies of the documents filed with the SEC by Charles River on Charles River’s website at www.criver.com/specialwuxi2010.

Charles River, WuXi and their respective directors and executive officers and other members of management may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Charles River’s directors and executive officers is available in Charles River’s proxy statement for its 2010 annual meeting of stockholders, which was filed with the SEC on March 30, 2010. Information regarding the interests of Charles River’s directors and certain members of Charles River’s management in the proposed transaction is set forth in the definitive proxy statement filed with the SEC. Information regarding WuXi’s directors and executive officers is available in WuXi’s Annual Report on Form 20-F for the fiscal year ended December 31, 2009, which was filed with the SEC on April 23, 2010. Information regarding the interests of WuXi’s directors and certain members of WuXi’s management in the proposed transaction is available in WuXi’s scheme document, which was filed on Form 6-K with the SEC on July 1, 2010.

This document does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities. The Charles River shares to be issued in the proposed transaction have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Charles River intends to issue such Charles River shares pursuant to the exemption from registration set forth in Section 3(a)(10) of the Securities Act.

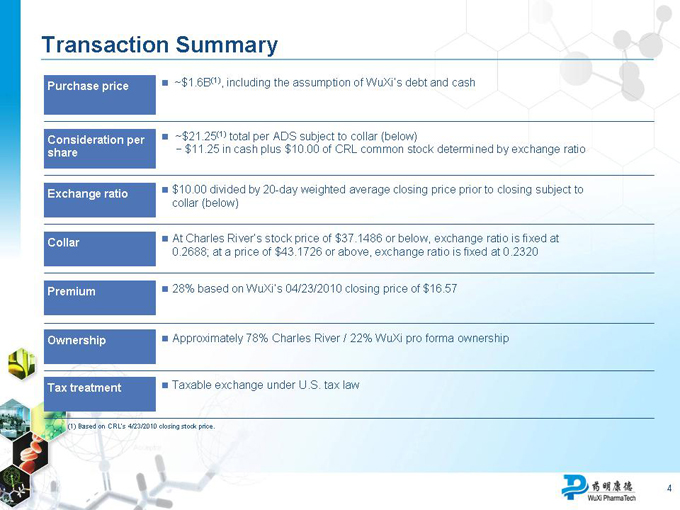

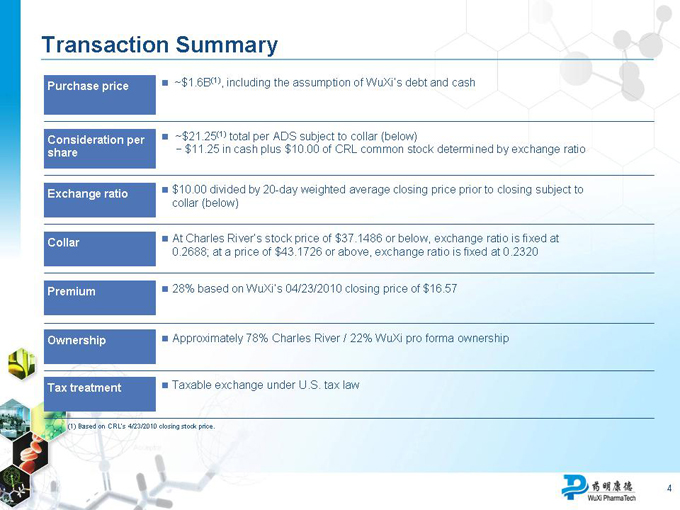

Transaction Summary

Purchase price

~$1.6B(1), including the assumption of WuXi’s debt and cash

Consideration per share

~$21.25(1) total per ADS subject to collar (below)

$11.25 in cash plus $10.00 of CRL common stock determined by exchange ratio

Exchange ratio

$10.00 divided by 20-day weighted average closing price prior to closing subject to

collar (below)

Collar

At Charles River’s stock price of $37.1486 or below, exchange ratio is fixed at

0.2688; at a price of $43.1726 or above, exchange ratio is fixed at 0.2320

Premium

28% based on WuXi’s 04/23/2010 closing price of $16.57

Ownership

Approximately 78% Charles River / 22% WuXi pro forma ownership

Tax treatment

Taxable exchange under U.S. tax law

(1) Based on CRL’s 4/23/2010 closing stock price.

4

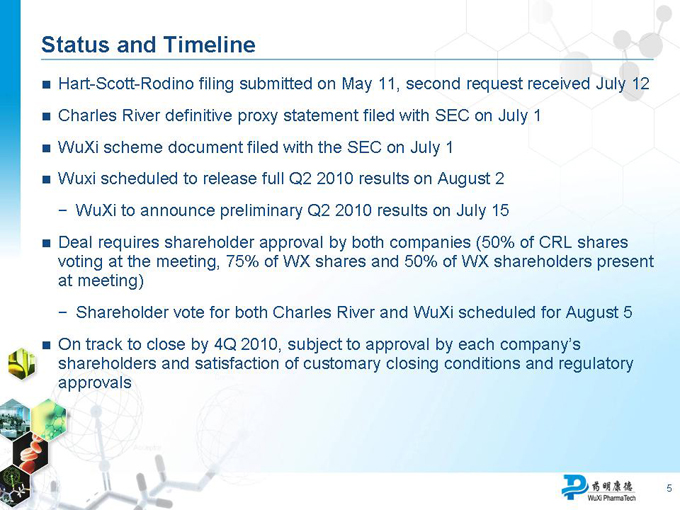

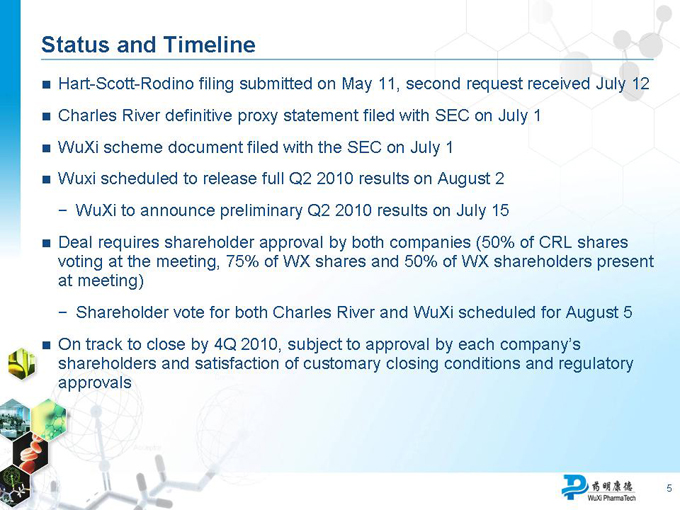

Status and Timeline

Hart-Scott-Rodino filing submitted on May 11, second request received July 12

Charles River definitive proxy statement filed with SEC on July 1

WuXi scheme document filed with the SEC on July 1

Wuxi scheduled to release full Q2 2010 results on August 2

WuXi to announce preliminary Q2 2010 results on July 15

Deal requires shareholder approval by both companies (50% of CRL shares voting at the meeting, 75% of WX shares and 50% of WX shareholders present at meeting)

Shareholder vote for both Charles River and WuXi scheduled for August 5

On track to close by 4Q 2010, subject to approval by each company’s shareholders and satisfaction of customary closing conditions and regulatory approvals

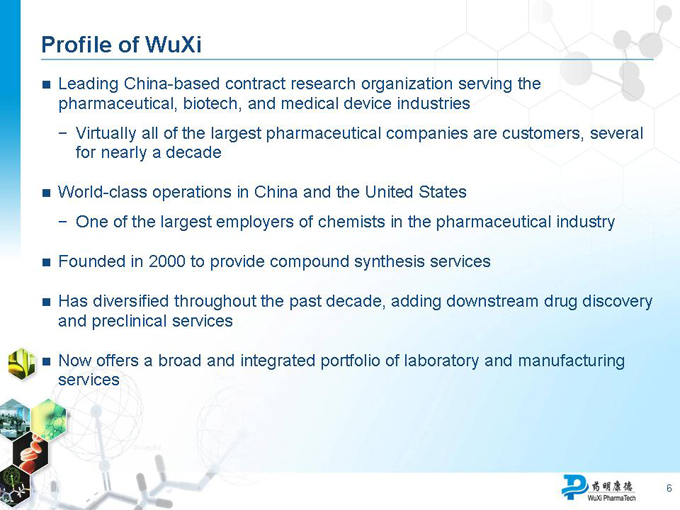

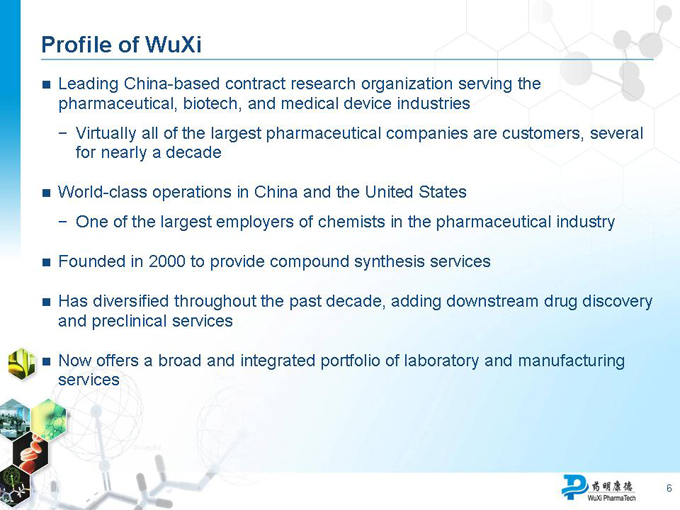

Profile of WuXi

Leading China-based contract research organization serving the pharmaceutical, biotech, and medical device industries

Virtually all of the largest pharmaceutical companies are customers, several for nearly a decade

World-class operations in China and the United States

One of the largest employers of chemists in the pharmaceutical industry

Founded in 2000 to provide compound synthesis services

Has diversified throughout the past decade, adding downstream drug discovery and preclinical services

Now offers a broad and integrated portfolio of laboratory and manufacturing services

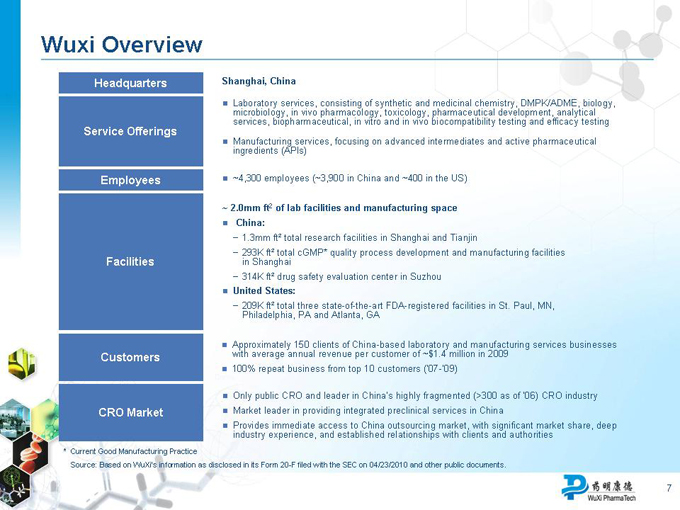

Wuxi Overview

Headquarters Shanghai, China

Laboratory services, consisting of synthetic and medicinal chemistry, DMPK/ADME, biology, microbiology, in vivo pharmacology, toxicology, pharmaceutical development, analytical services, biopharmaceutical, in vitro and in vivo biocompatibility testing and efficacy testing

Service Offerings

Manufacturing services, focusing on advanced intermediates and active pharmaceutical ingredients (APIs)

Employees ~4,300 employees (~3,900 in China and ~400 in the US)

~ 2.0mm ft2 of lab facilities and manufacturing space

China:

1.3mm ft² total research facilities in Shanghai and Tianjin

293K ft² total cGMP* quality process development and manufacturing facilities in Shanghai

314K ft² drug safety evaluation center in Suzhou

United States:

209K ft² total three state-of-the-art FDA-registered facilities in St. Paul, MN, Philadelphia, PA and Atlanta, GA

Approximately 150 clients of China-based laboratory and manufacturing services businesses with average annual revenue per customer of ~$1.4 million in 2009

100% repeat business from top 10 customers (‘07-’09)

Only public CRO and leader in China’s highly fragmented (>300 as of ‘06) CRO industry Market leader in providing integrated preclinical services in China

Provides immediate access to China outsourcing market, with significant market share, deep industry experience, and established relationships with clients and authorities

* | | Current Good Manufacturing Practice |

Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

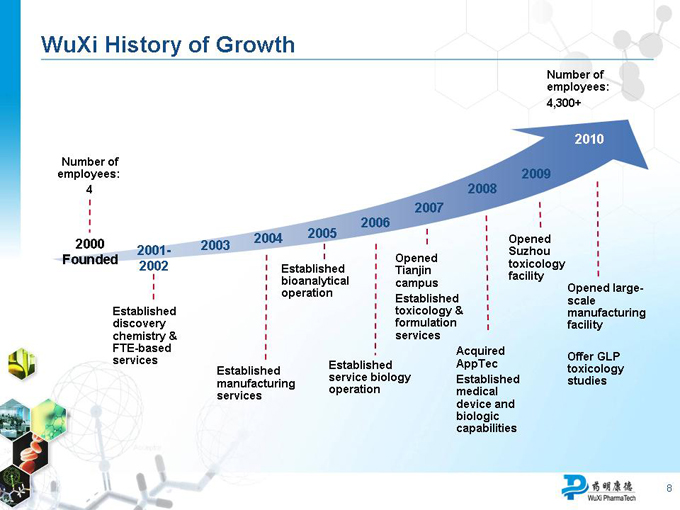

WuXi History of Growth

Number of employees: 4,300+

2010

Number of employees: 2009

2000 2001- 2002 2003 2004

Founded

Established discovery chemistry & FTE-based

Established manufacturing services

Established bioanalytical operation

Established service biology operation

Opened Tianjin campus

Established toxicology & formulation services

Acquired AppTec

Established medical device and bioloigc capabilities

Opened Suzhou toxicology facility

Opened large-scale manufacturing facility

Offer GLP toxicology studies

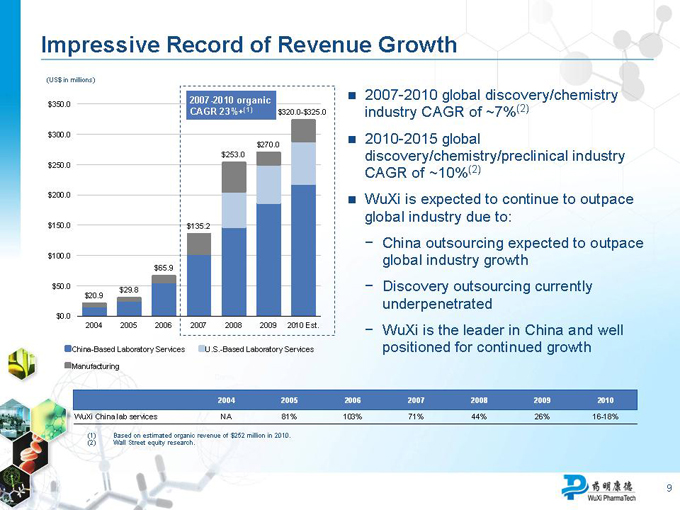

Impressive Record of Revenue Growth

(US$ in millions)

$350.0 2007-2010 organic

CAGR 23%+(1) $320.0-$325.0

$300.0 $270.0 $253.0 $250.0

$200.0

$150.0 $135.2

$100.0

$65.9

$50.0

$29.8

$20.9

$0.0

2004 2005 2006 2007 2008 2009 2010 Est.

China-Based Laboratory Services U.S.-Based Laboratory Services

Manufacturing

(1) | | Based on estimated organic revenue of $252 million in 2010. (2) Wall Street equity research. |

2007-2010 global discovery/chemistry industry CAGR of ~7%(2)

2010-2015 global discovery/chemistry/preclinical industry CAGR of ~10%(2)

WuXi is expected to continue to outpace global industry due to:

China outsourcing expected to outpace global industry growth

Discovery outsourcing currently underpenetrated

WuXi is the leader in China and well positioned for continued growth

2004 2005 2006 2007 2008 2009 2010

WuXi China lab services NA 81% 103% 71% 44% 26% 16-18%

9

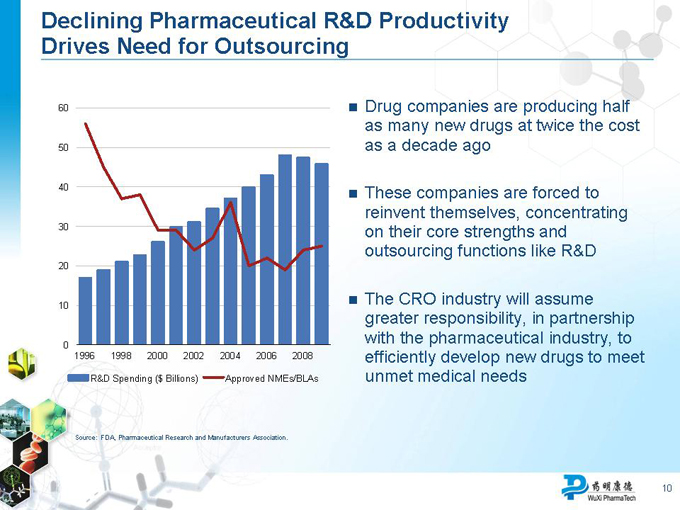

Declining Pharmaceutical R&D Productivity Drives Need for Outsourcing

60 50 40 30 20 10 0

1996 1998 2000 2002 2004 2006 2008

R&D Spending ($ Billions) Approved NMEs/BLAs

Source: FDA, Pharmaceutical Research and Manufacturers Association.

Drug companies are producing half as many new drugs at twice the cost as a decade ago

These companies are forced to reinvent themselves, concentrating on their core strengths and outsourcing functions like R&D

The CRO industry will assume greater responsibility, in partnership with the pharmaceutical industry, to efficiently develop new drugs to meet unmet medical needs

10

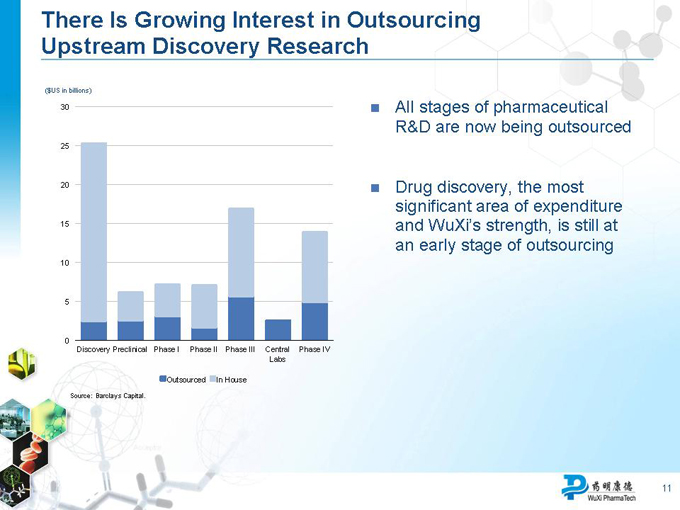

There Is Growing Interest in Outsourcing Upstream Discovery Research

($US in billions)

30

25

20

15

10

0

Discovery Preclinical Phase I Phase II Phase III Central Phase IV Labs

Outsourced In House

Source: Barclays Capital.

All stages of pharmaceutical R&D are now being outsourced

Drug discovery, the most significant area of expenditure and WuXi’s strength, is still at an early stage of outsourcing

11

Increasing Strategic Importance of China

Major global pharmaceutical companies and international CROs view China as the most attractive prospective location for R&D, ahead of US and India

China has competitive advantages in providing R&D outsourcing services

Labor cost advantage

Large pool of technical talent

Good research and IT infrastructure and facilities

Global customers entering China

Emerging opportunities for chemistry, safety assessment and manufacturing services as clients advance development activities in China

Enables clients to choose where to place work

12

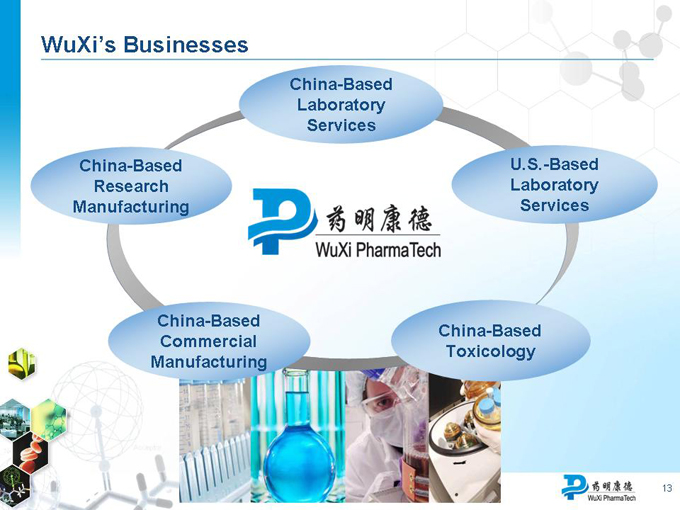

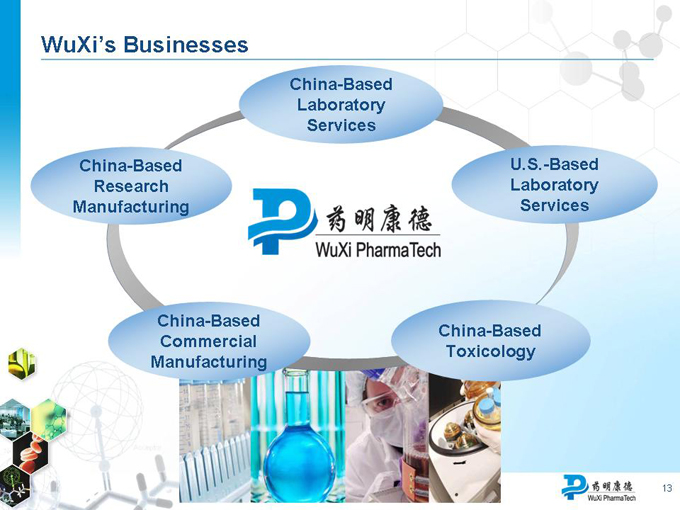

WuXi’s Businesses

China-Based Laboratory Services

China-Based Research Manufacturing

U.S.-Based Laboratory Services

China-Based Toxicology

China-Based Commercial Manufacturing

13

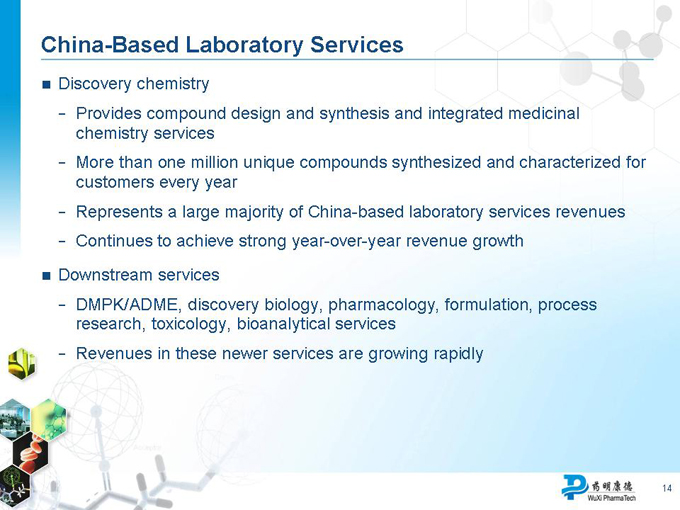

China-Based Laboratory Services

Discovery chemistry

Provides compound design and synthesis and integrated medicinal chemistry services

More than one million unique compounds synthesized and characterized for customers every year

Represents a large majority of China-based laboratory services revenues

Continues to achieve strong year-over-year revenue growth

Downstream services

DMPK/ADME, discovery biology, pharmacology, formulation, process research, toxicology, bioanalytical services

Revenues in these newer services are growing rapidly

14

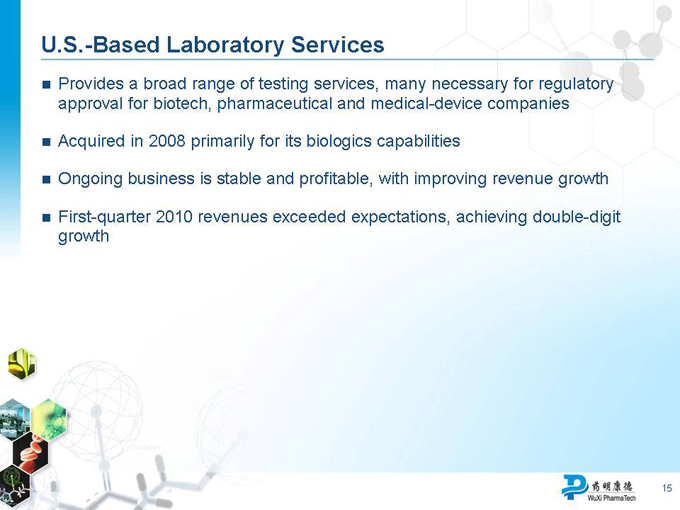

U.S.-Based Laboratory Services

Provides a broad range of testing services, many necessary for regulatory approval for biotech, pharmaceutical and medical-device companies

Acquired in 2008 primarily for its biologics capabilities

Ongoing business is stable and profitable, with improving revenue growth

First-quarter 2010 revenues exceeded expectations, achieving double-digit growth

15

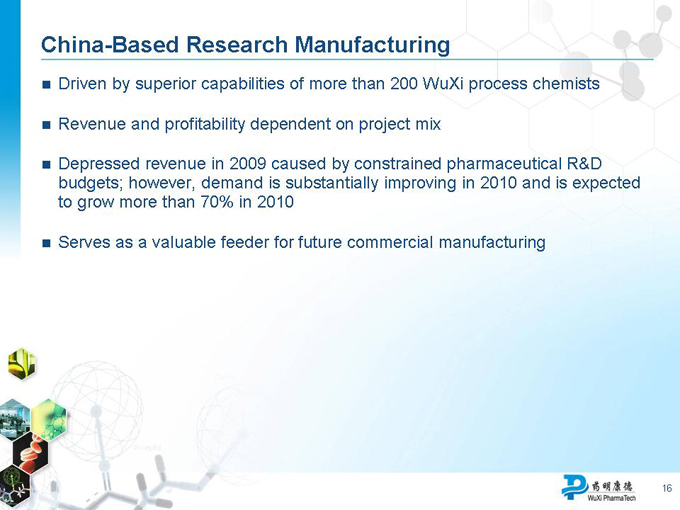

China-Based Research Manufacturing

Driven by superior capabilities of more than 200 WuXi process chemists

Revenue and profitability dependent on project mix

Depressed revenue in 2009 caused by constrained pharmaceutical R&D budgets; however, demand is substantially improving in 2010 and is expected to grow more than 70% in 2010

Serves as a valuable feeder for future commercial manufacturing

16

China-Based Commercial Manufacturing

Recently opened facility in Jinshan, Shanghai quadruples our manufacturing capacity

Expected to start generating revenues in late 2010

Multiple commercial manufacturing programs being considered

Significant commercial manufacturing revenues expected in 2011 and beyond

17

China-Based Toxicology

China, with less than 1% of the world’s toxicology market, is expected to be a major player in 5-10 years

Suzhou toxicology facility is the largest in China

Signed collaboration agreement with Johnson & Johnson

Non-GLP toxicology, client-sponsored GLP validation studies under way

GLP inspections by SFDA and OECD completed

Expect to offer GLP toxicology services in very near future

Significant revenue ramp-up beginning in 2011

18

WuXi’s Unique Competitive Strengths

Integrated R&D Service Platform

Experienced International Management Team

China Cost Advantage

Strong Protection of Clients’ Intellectual Property

Highly Educated, Trained, & Motivated Workforce

Intense Focus on a Diversified, High- Quality Customer Base

Reputation for Operational Excellence

World-Class Facilities in China and the United States

19

WuXi’s Unique Competitive Strengths (cont’d)

Integrated R&D Service Platform

Experienced International Management Team

Highly Educated, Trained, & Motivated Workforce

Reputation for Operational Excellence

Unmatched scale of China-based service offering

Seamless delivery of complex integrated services

Proven track record of delivering growth and profitability

Experience in developing and retaining business with leading western pharma and biotech companies

Employer of choice for top Chinese talent

Highly effective training system for college graduates

Trusted by clients to deliver high-quality services

World-Class Facilities in China and the United States

Intense Focus on a Diversified, High-Quality Customer Base

Strong Protection of Clients’ Intellectual Property

China Cost Advantage

State of art research and mfg facilities in China and USA

Established, long-term client relationships

Deep knowledge of how to effectively and efficiently meet unique client requirements

Proven history of protecting clients’ intellectual property

Significantly lower labor costs in addition to unmatched service delivery capabilities

20

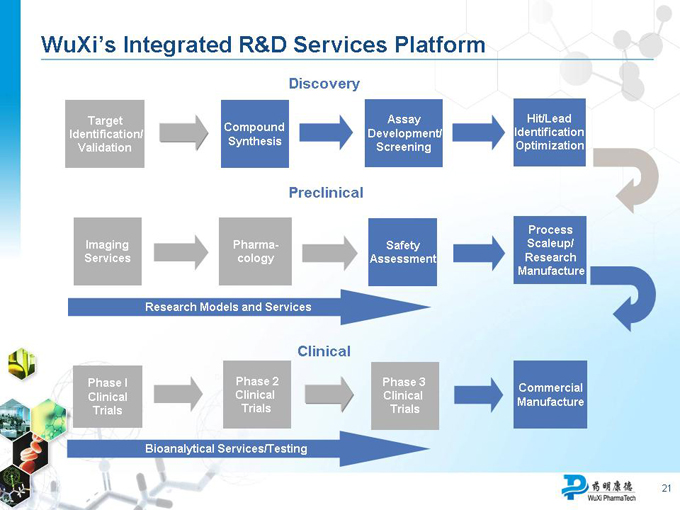

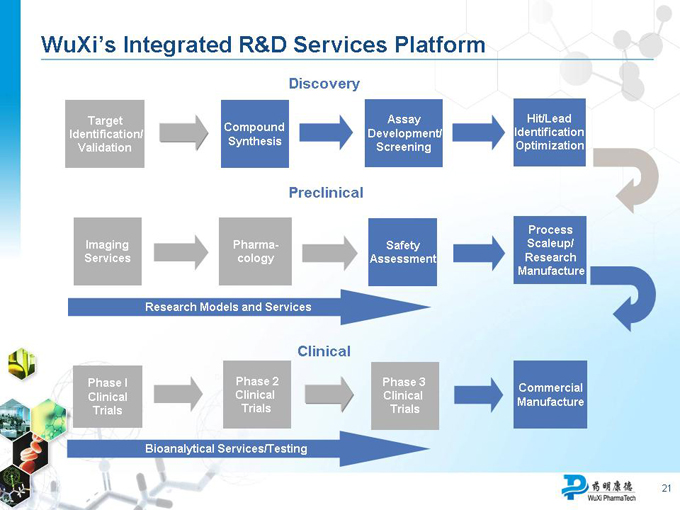

WuXi’s Integrated R&D Services Platform

Discovery

Target Assay Hit/Lead Compound Identification Identification/ Development/ Synthesis Optimization Validation Screening

Preclinical

Process Imaging Pharma- Safety Scaleup/ Services cology Assessment Research Manufacture

Research Models and Services

Clinical

Phase I Phase 2 Phase 3

Commercial Clinical Clinical Clinical Manufacture Trials Trials Trials

Bioanalytical Services/Testing

21

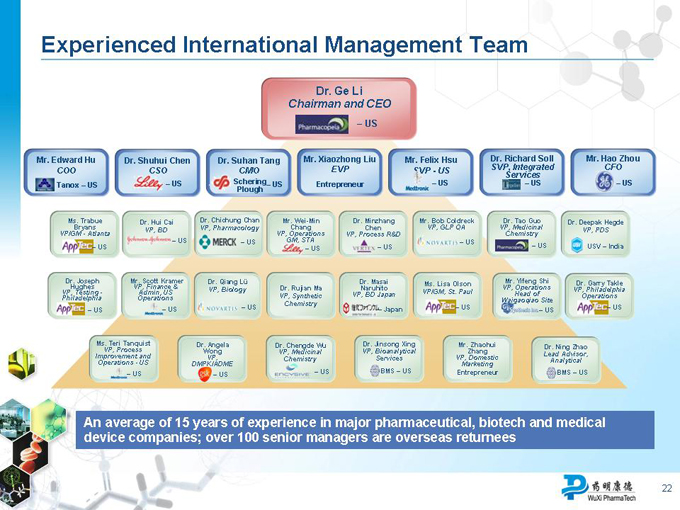

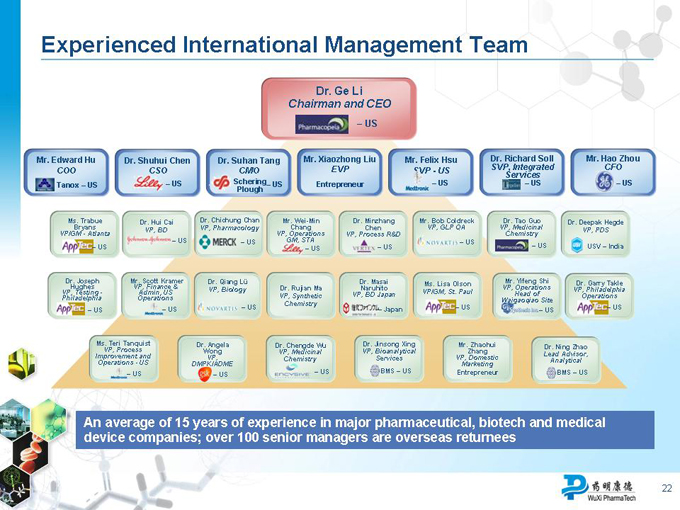

Experienced International Management Team

Dr. Ge Li

Chairman and CEO

– US

Mr. Edward Hu Dr. Shuhui Chen Dr. Suhan Tang Mr. Xiaozhong Liu Mr. Felix Hsu Dr. Richard Soll Mr. Hao Zhou

COO EVP SVP—US SVP, Integrated CFO CSO CMO

Services

– US Schering Entrepreneur – US – US – US

Tanox – US – US Plough

Ms. Trabue Dr. Hui Cai Dr. Chichung Chan Mr. Wei-Min Dr. Minzhang Mr. Bob Coldreck Dr. Tao Guo Dr. Deepak Hegde

VP/GM Bryans —Atlanta VP, BD VP, Pharmacology Chang Chen VP, GLP QA VP, Chemistry Medicinal VP, PDS VP,GM, Operations STA VP, Process R&D

– US – US – US

– US – US – US USV – India

– US

Dr Hughes . Joseph Mr VP, . Scott Finance Kramer & Dr. Qiang Lü Dr. Masai Ms. Lisa Olson VP, Mr. Operations Yifeng Shi Dr. Garry Takle

VP, Biology Dr. Rujian Ma Naruhito VP, Philadelphia VP, Testing—Admin, US VP/GM, St. Paul Head of VP, Synthetic VP, BD Japan Operations Philadelphia Operations Chemistry Waigaoqiao Site

– US – US – Japan – US – US

– US – US

Ms. Teri Tanquist Dr. Angela Dr. Chengde Wu Dr. Jinsong Xing Mr. Zhaohui

VP, Process Dr. Ning Zhao Wong VP, Medicinal VP, Bioanalytical Zhang Lead Advisor, Improvement and VP, Services VP, Domestic Chemistry Analytical Operations—US DMPK/ADME Marketing

– US – US BMS – US Entrepreneur BMS – US

– US

An average of 15 years of experience in major pharmaceutical, biotech and medical device companies; over 100 senior managers are overseas returnees

22

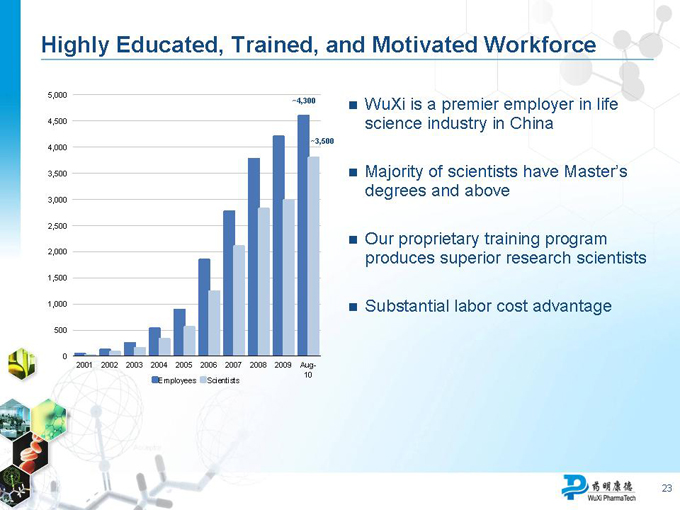

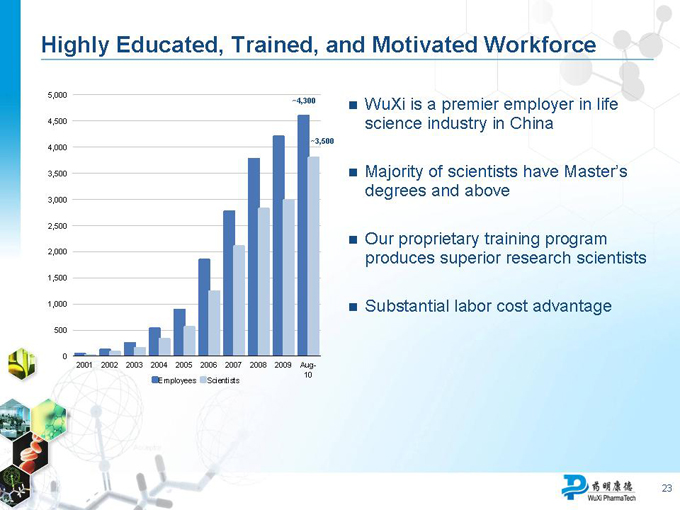

Highly Educated, Trained, and Motivated Workforce

5,000

~4,300

4,500

~3,500

4,000 3,500 3,000 2,500 2,000 1,500 1,000 500

0

2001 2002 2003 2004 2005 2006 2007 2008 2009 Aug-10 Employees Scientists

WuXi is a premier employer in life science industry in China

Majority of scientists have Master’s degrees and above

Our proprietary training program produces superior research scientists

Substantial labor cost advantage

23

Reputation for Operational Excellence

Relentless focus on satisfying customers’ needs

100% repeat business from Top 10 customers

Awards

[Graphic Appears Here]

“Strategic Supplier in Discovery Award” from AstraZeneca in 2009

“Award for Excellence” from Millennium in 2009

“Excellent Service Award” from Schering-Plough in 2009

“Excellent Service Award” from Takeda in 2009 and 2008

“Excellent Service Award” from BASF in 2009

“Excellent Service Award” from Glaxo SmithKline (Virtual Proof of Concept) in 2009

“Global Supplier Award” from Lilly in 2009

[Graphic Appears Here]

“Excellent Service Award” from Abbott in 2008

“Special Achievement Award” from Novartis in 2008

“Outstanding Collaborator Award” from Genentech in 2008

“2007 Top Chemistry CRO” from Pfizer in 2008

“High Performer Recognition Award” from Millennium in 2008

“Outstanding Strategic Collaboration Award” from AstraZeneca in 2007

“Outstanding Strategic Collaboration Award” from Merck in 2007

“Outstanding Collaboration Award” from Novartis in 2007

24

World-Class Facilities in China

1,006,000 ft² of R&D facilities for chemistry, bioanalytical services, service biology, process research, and other services in Shanghai

253,000 ft² of R&D facilities for chemistry in Tianjin

71,000 ft² cGMP-quality process development and manufacturing plant and 222,000 ft² large-scale manufacturing plant in Jinshan

314,000 ft² GLP preclinical drug safety evaluation center in Suzhou

Jinshan Shanghai

Tianjin Suzhou

25

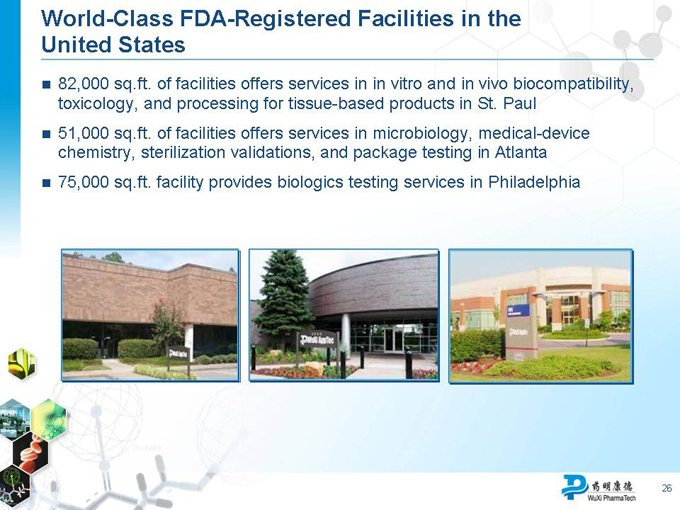

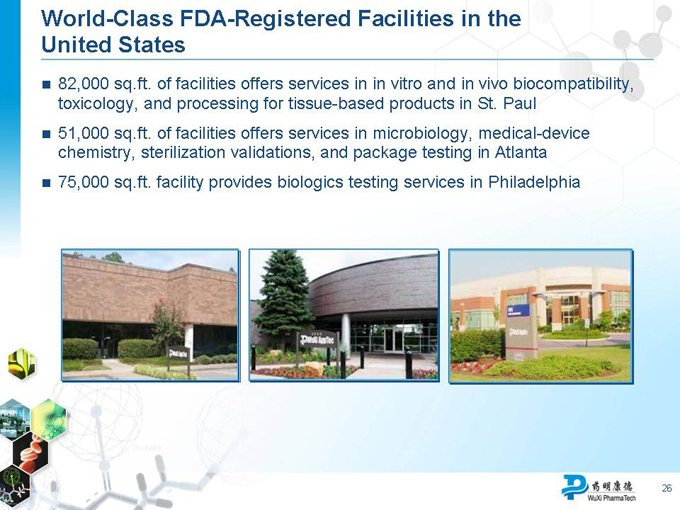

World-Class FDA-Registered Facilities in the United States

82,000 sq.ft. of facilities offers services in in vitro and in vivo biocompatibility, toxicology, and processing for tissue-based products in St. Paul

51,000 sq.ft. of facilities offers services in microbiology, medical-device chemistry, sterilization validations, and package testing in Atlanta

75,000 sq.ft. facility provides biologics testing services in Philadelphia

26

Strong Protection of Clients’ Intellectual Property

Strict procedures in place to ensure that customers’ intellectual property (IP) is protected

There have been no known incidents of customers’ IP being compromised throughout WuXi’s entire history

The best measure of customers’ confidence in WuXi’s IP protection is our ongoing business with virtually all large pharmaceutical companies: They all trust WuXi

27

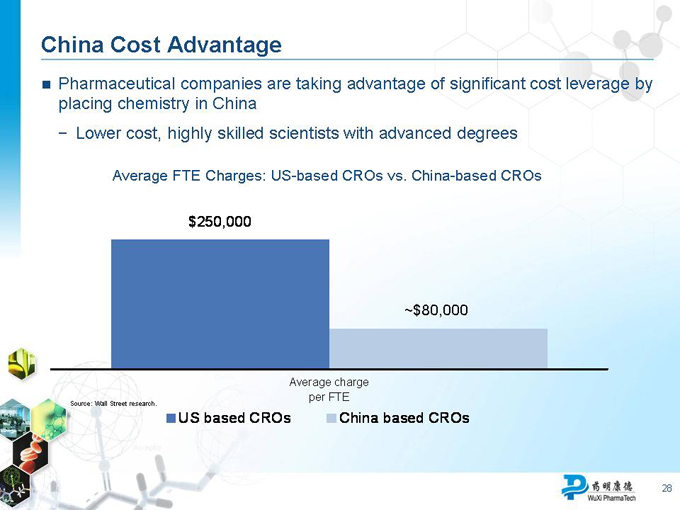

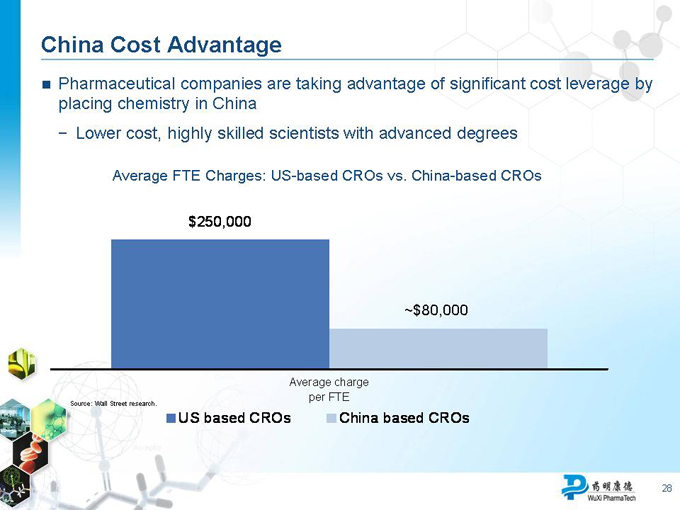

China Cost Advantage

Pharmaceutical companies are taking advantage of significant cost leverage by placing chemistry in China

Lower cost, highly skilled scientists with advanced degrees

Average FTE Charges: US-based CROs vs. China-based CROs

$250,000

~$80,000

Average charge per FTE

Source: Wall Street research.

US based CROs China based CROs

28

WuXi Is the Leading CRO in China

WuXi ShangPharma BioDuro Medicilon

Employees / Facilities

~4,300

~2mm sq. ft. in both China and the US

~1,500

~600,000 sq. ft., mainly in Shanghai

>650

~3,000 sq. ft. rodent vivarium on site

~110,000 sq. ft. in Beijing

>400

~218,000 sq. ft.

Source: Based on WuXi’s information as disclosed in its Form 20-F filed with the SEC on 04/23/2010 and other public documents.

29

WuXi Is a Leading Company in China

Deloitte Technology Fast 50 China list in 2009 for fifth consecutive year (one of only two companies), and Deloitte Technology Fast 500 Asia Pacific list in 2009 for sixth consecutive year

Top Ten Pharmaceutical Industry Employer for New Graduates in China in 2009, by ChinaHR.com

Top Ten Chinese Outsourcing Enterprise in 2009 by China’s Ministry of Commerce

No. 8 in 50 Most Innovative Companies in 2009 by Fast Company

2008 Frost & Sullivan Award for Best in Class

Outsourced R&D in Pharmaceuticals and Biotechnology

Top 20 China Most Innovative Enterprises in 2008 by Chinese Enterprise Innovation Forum

BCG 50 Local Dynamos by the Boston Consulting Group

One of the Top 103 National Innovative Companies by China Ministry of Science and Technology

30

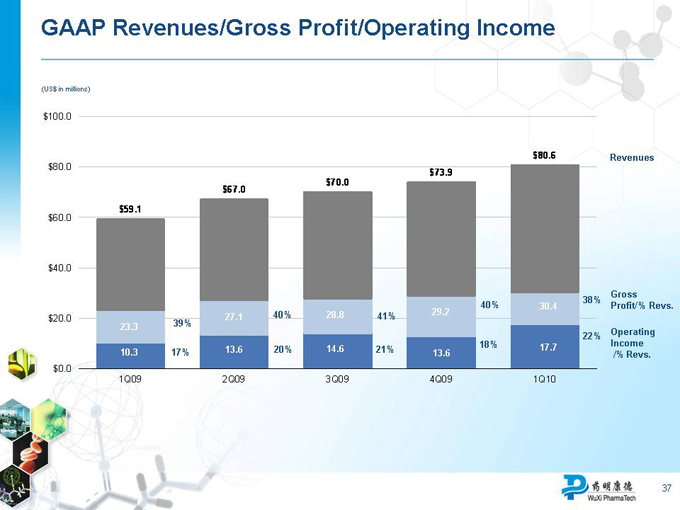

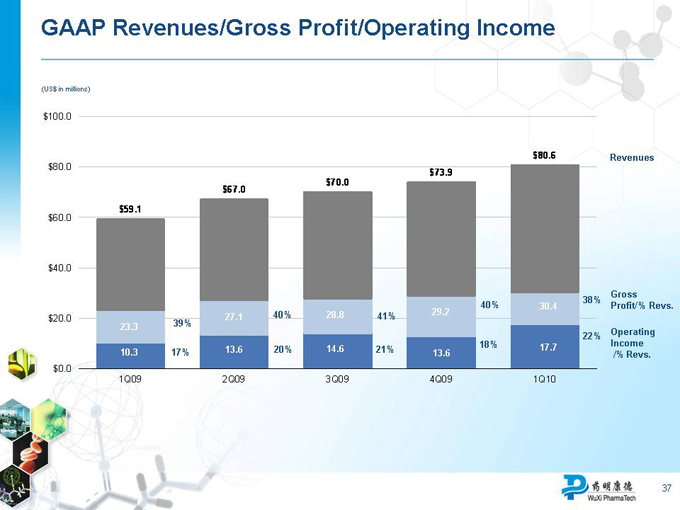

Strong First-Quarter 2010 Performance

Total net revenues increased 36% year over year

Revenue growth was broad-based

China-based Laboratory Services +20%, U.S.-based Laboratory Services +14%, Manufacturing Services +433%

Overall gross margin declined from 39.4% to 37.7% primarily due to business mix (larger contribution from lower-margin Manufacturing Services business)

Gross margin of Laboratory Services business improved from 40.2% to

41.4%

GAAP and non-GAAP operating income up 70% and 57%, respectively

GAAP and non-GAAP net income up 32% and 29%, respectively

GAAP and non-GAAP EPS up 30% and 26%, respectively

WuXi scheduled to announce preliminary earnings results for Second-Quarter 2010 before market open on July 15, 2010

Note: All comparisons are versus first-quarter 2009.

31

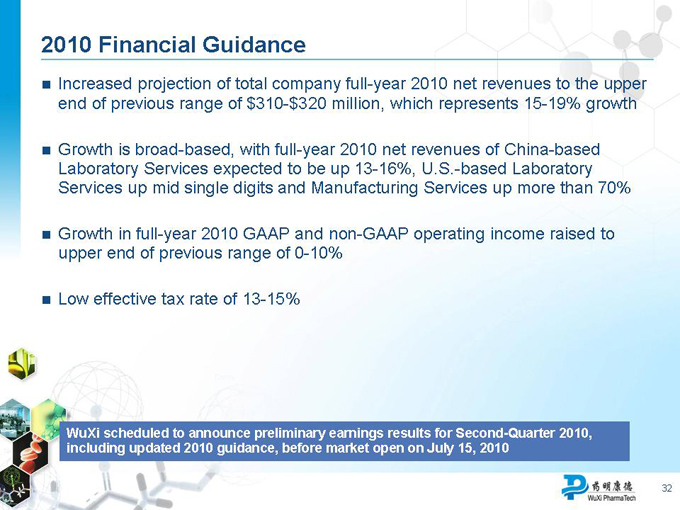

2010 Financial Guidance