Exhibit 3.256

83006891

CERTIFIED COPY

ARTICLES OF INCORPORATION

OF

UHS OF ARKANSAS, INC.

The undersigned, a natural person of the (illegible) twenty-one years or more, acting as Incorporator of a corporation under the Arkansas Business Corporation Act (Act 576 of 1965), adopts the following Articles of Incorporation for such corporation:

ARTICLE I

The name of the corporation is UHS of Arkansas, Inc.

ARTICLE II

The period of duration is perpetual.

ARTICLE III

The purposes for which the corporation is organized are to engage in any lawful activity for which corporations may be formed under the Arkansas Business Corporation Act, including the ownership, operation and management of hospitals, nursing homes and health care facilities of all types.

ARTICLE IV

The aggregate number of shares which the corporation shall have the authority to issue is 2,000 shares of common stock without par value.

ARTICLE V

This corporation will not transact any business until there has been paid in for the issuance of shares consideration of the value of at least three hundred dollars.

CERTIFIED COPY

83006891

ARTICLE VI

No shareholder shall have the preemptive right to acquire additional or treasury shares of the Corporation.

ARTICLE VII

The address of the initial registered office of this corporation is 417 Spring Street, Little Rock, Arkansas 72201 and the name of its initial registered agent at such address is the Corporation Company.

ARTICLE VIII

The number of directors constituting the initial Board of Directors is three (3), and the names and addresses of the persons who are to serve as directors until the first annual meeting of shareholders or until their successors are elected and shall qualify are:

| | |

NAME | | ADDRESS |

| Alan B. Miller | | One Presidential Blvd. Bala Cynwyd, PA. 19004 |

| |

| Sidney Miller | | One Presidential Blvd. Bala Cynwyd, PA. 19004 |

| |

| George H. Strong | | One Presidential Blvd. Bala Cynwyd, PA. 19004 |

ARTICLE IX

The name and address of the incorporator is:

| | |

| NAME | | STREET ADDRESS, CITY & STATE |

| Susan Winter | | 42nd Floor 345 Park Avenue New York, New York 10154 |

| | |

| | | SIGNATURE OF INCORPORATOR: |

| |

| |

|

DATED: January 28, 1983

-2-

CERTIFIED COPY

ARTICLES OF MERGER

OF

QUALICARE OF ARKANSAS, INC.

INTO

UHS OF ARKANSAS, INC.

Pursuant to the provisions of Section 64-704 of the Arkansas Business Corporation Act, the undersigned corporations adopt the following Articles of Merger for the purpose of merging Qualicare of Arkansas, Inc. into UHS of Arkansas, Inc.:

1. The name of the undersigned surviving corporation is UHS of Arkansas, Inc.

2. The effective date of the merger is March 27, 1984.

3. The Agreement and Plan of Merger (the “Plan”) attached hereto, was approved by the shareholders of each of the undersigned corporations in the manner prescribed by the Arkansas Business Corporation Act.

4. As to each of the undersigned corporations, the number of shares outstanding and the designation and number of outstanding shares of each class entitled to vote as a class of such Plan, are as follows:

| | |

NAME OF CORPORATION | | NUMBER OF SHARES OUTSTANDING |

| |

Qualicare of Arkansas, Inc. | | 300 |

| |

UHS of Arkansas, Inc. | | 300 |

5. As to each of the undersigned corporations, the total number of shares voted for and against such Plan,

CERTIFIED COPY

respectively, and, as to each class entitled to vote thereon for and against such Plan, respectively, are as follows:

| | | | |

NAME OF CORPORATION | | TOTAL VOTED

FOR | | TOTAL VOTED

AGAINST |

| | |

Qualicare of Arkansas, Inc. | | 300 | | 0 |

| | |

UHS of Arkansas, Inc. | | 300 | | 0 |

IN WITNESS WHEREOF each of the undersigned corporations has caused these Articles of Merger to be executed in its name by its/Vice President and its Secretary on this 27th day of March, 1984.

| | |

| QUALICARE OF ARKANSAS, INC. |

| |

| By | |

|

| | Vice President |

| | | | |

| Attest: | | | | |

| | |

[ILLEGIBLE] | | | | |

| Secretary | | | | |

| | |

| UHS OF ARKANSAS, INC. |

| |

| By | |

|

| | Vice President |

| | | | |

| Attest: | | | | |

| | |

[ILLEGIBLE] | | | | |

| Secretary | | | | |

-2-

CERTIFIED COPY

STATE OFPENNSYLVANIA )

) ss. :

COUNTY OFMONTGOMERY )

The undersigned hereby verifies that he is the duly elected Vice President of UHS of Arkansas, Inc., an Arkansas corporation, and duly authorized to execute this certificate; that he has read the foregoing document, understands the meaning and purport of the statements therein contained and the same are true to the best of his information and belief.

DATED at King of Prussia, Pennsylvania , this 27th day of March , 1984.

Subscribed and sworn to before me, a Notary Public, this 27th day of March ,1984.

|

|

| Notary Public |

| Montgomery County |

| East Norriton Township |

|

| My commission expires: |

|

| April 29, 1985 |

CERTIFIED COPY

STATE OFPENNSYLVANIA )

) ss. :

COUNTY OFMONTGOMERY )

The undersigned hereby verifies that he is the duly elected Vice President of Qualicare of Arkansas, Inc., an Arkansas corporation, and duly authorized to execute this certificate; that he has read the foregoing document, understands the meaning and purport of the statements therein contained and the same are true to the best of his information and belief.

DATED at King of Prussia, Pennsylvania , this 27th day of March , 1984.

Subscribed and sworn to before me, a Notary Public, this 27th day of March , 1984.

|

|

| Notary Public |

| Montgomery County |

| East Norriston Township |

|

| My commission expires: |

|

| April 29, 1985 |

CERTIFIED COPY

AGREEMENT AND PLAN OF MERGER

BY AND BETWEEN

UHS OF ARKANSAS, INC.

AND

QUALICARE OF ARKANSAS, INC.

February 4, 1983

CERTIFIED COPY

TABLE OF CONTENTS

| | | | | | | | |

Section | | | | | | Page | |

| 1. | | Procedure of the Merger | | | 1 | |

| | | |

| | 1.1 | | The Merger | | | 1 | |

| | 1.2 | | Filing | | | 1 | |

| | 1.3 | | Effective Time of the Merger | | | 2 | |

| | |

| 2. | | Articles of Incorporation and By-Laws | | | 2 | |

| | |

| 3. | | Directors, Officers and Employees | | | 2 | |

| | |

| 4. | | Conversion or Cancellation of Shares | | | 2 | |

| | | |

| | 4.1 | | Conversion or Cancellation of Shares | | | 2 | |

| | 4.2 | | Surrender and Payment | | | 4 | |

| | 4.3 | | No Further Transfers | | | 5 | |

| | 4.4 | | Certificate for Surviving Corporation’s Shares | | | 5 | |

| | |

| 5. | | Certain Effects of Merger | | | 5 | |

| | | |

| | 5.1 | | Effect of Merger | | | 5 | |

| | 5.2 | | Further Assurances | | | 6 | |

| | |

| 6. | | Representations and Warranties of the Company | | | 6 | |

| | | |

| | 6.1 | | Organization and Good Standing of the Company | | | 6 | |

| | 6.2 | | Organizational Documents | | | 7 | |

| | 6.3 | | Ownership of the Company | | | 7 | |

| | 6.4 | | Title to and Condition of the Assets | | | 7 | |

| | 6.5 | | The Company’s Authority and No Conflict | | | 7 | |

| | 6.6 | | Conduct of Operations since August 31, 1982 and Pending the Closing | | | 8 | |

| | 6.7 | | Litigation or Claims | | | 11 | |

| | 6.8 | | Licenses | | | 11 | |

| | 6.9 | | Books of Account | | | 11 | |

| | 6.10 | | Filing of Reports | | | 12 | |

| | 6.11 | | Consents | | | 12 | |

| | 6.12 | | No Untrue Representation or Warranty | | | 12 | |

CERTIFIED COPY

Bridgeway

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER, dated the 4th day of February, 1983, by and between UHS OF ARKANSAS, INC., an Arkansas corporation (“UHS Sub”), and QUALICARE OF ARKANSAS, INC., an Arkansas corporation (the “Company”).

WHEREAS the respective Boards of Directors of UHS Sub and the Company deem it advisable and in the best interests of such corporations and their respective stockholders that the Company be merged with and into UHS Sub (the “Merger”), with UHS Sub to continue as the surviving corporation, upon the terms and conditions set forth herein and in accordance with Section 64-701 of the Arkansas Business Corporation Act (the “Corporation Law”). UHS Sub and the Company are sometimes collectively referred to as the “Constituent Corporations”.

NOW, THEREFORE, in consideration of the mutual representations, warranties, covenants, agreements and conditions contained herein, and in order to set forth the terms and conditions of the Merger and the mode of carrying the same into effect, the parties hereto have agreed and do hereby agree as follows:

1.Procedure of the Merger.

1.1.The Merger. At the Effective Time (as defined in Section 1.3 herein), the Company shall be merged with and into UHS Sub upon the terms and conditions set forth herein as permitted by and in accordance with Section 64-701 of the Corporation Law. Thereupon, the separate existence of the Company shall cease, and UHS Sub, as the surviving corporation in the Merger (the “Surviving Corporation”), shall continue to exist under and be governed by the Corporation Law, with all its purposes, objects, rights, privileges, immunities, powers and franchises continuing unaffected and unimpaired by the Merger. The name of the Surviving Corporation shall be UHS of Arkansas, Inc.

1.2.Filing. As soon as practicable following fulfillment or waiver of the conditions specified in Sections 10 and 11 hereof, and provided that this Agreement has not been terminated pursuant to Section 15 hereof, UHS Sub and the Company will cause duplicate Articles of Merger in substantially the form of Exhibit A attached hereto (the “Articles of Merger”) to be executed, verified and filed with the Secretary of State of Arkansas as provided in

CERTIFIED COPY

Bridgeway

Section 64-117 of the Corporation Law, and a copy of the Articles of Merger, certified by the Secretary of State of the State of Arkansas, shall be recorded by the Surviving Corporation within60 days thereafter in the office of the country clerk of each county in which theregistered office of the Constituent Corporations and the Surviving Corporation is located, all in accordance with the provisions of Section 64-117 of the Corporation Law.

1.3.Effective Time of the Merger. The Merger shall become effective immediately upon the filing of the Articles of Merger with the Secretary of State of the State of Arkansas. The date and time of such filing is herein sometimes referred to as the “Effective Time”.

2.Articles of Incorporation and By-Laws. At the Effective Time, the Articles of Incorporation and By-Laws of UHS Sub, as in effect immediately prior to the Effective Time, shall be and continue to be the Articles of Incorporation and By-Laws of UHS Sub, as the Surviving Corporation, until duly amended in accordance with law.

3.Directors, Officers and Employees. The persons who constitute the entire Board of Directors of UHS Sub immediately prior to the Effective Time shall, after the Effective Time, continue as the entire Board of Directors of the Surviving Corporation without change until their successors have been elected and qualified in accordance with law and the Articles of Incorporation and By-Laws of the Surviving Corporation. The persons who constitute all the officers of the Company immediately prior to the Effective Time shall, after the Effective Time, continue as all the officers of the Surviving Corporation without change until their successors have been elected and qualified in accordance with law and the Articles of Incorporation and By-Laws of the Surviving Corporation or they have resigned. The employees of the Company immediately prior to the Effective Time shall, after the Effective Time, continue to be employees of the Surviving Corporation upon the same terms and conditions to which they were subject immediately prior thereto unless they have resigned.

4.Conversion or Cancellation of Shares.

4.1.Conversion or Cancellation of Shares. At the Effective Time, the issued and outstanding shares of Common Stock, One Dollar ($1.00) par value, of UHS Sub (“UHS

-2-

CERTIFIED COPY

Bridgeway

Sub Common Stock”) and the issued and outstanding shares of Common Stock, no par value, of the Company (“Company Common Stock”) shall, by virtue of the Merger and without any further action on the part of the Company or UHS Sub, or their respective stockholders, be converted into shares of the capital stock of the Surviving Corporation or into the right to receive cash or be cancelled, all as follows:

(a) Each issued and outstanding share of UHS Sub Common Stock immediately prior to the Effective Time shall be converted into one fully paid and nonassessable share of common stock, no par value, of the Surviving Corporation (“Surviving Corporation Common Stock”) .

(b) Each issued and outstanding share of Company Common Stock immediately prior to the Effective Time, excluding any such shares held in the treasury of the Company, shall be converted into the right to receive an amount equal to a fraction, the numerator of which is $5,000,000 and the denominator of which is the total number of shares of Company Common Stock outstanding immediately prior to the Effective Time, in cash, without interest, upon the surrender of the certificate representing such share in accordance with Section 4.2 hereof;provided,however, that no such conversion shall be made in respect of any share of Company Common Stock the holder of which shall have (i) filed with the Company, pursuant to Section 64-707 of the Corporation Law, before the taking of the stockholder vote on the adoption of this Agreement, a written objection to this Agreement; (ii) not voted in favor of the adoption of this Agreement; and (iii) delivered a written demand on the Surviving Corporation for payment of the fair value of his shares and as a result thereof is entitled to receive the payment of the fair value of his shares from the Surviving Corporation in accordance with the provisions of Section 64-707 of the Corporation Law and shall have only the rights provided in such Section 64-707. Notwithstanding the foregoing, any holder of less than 50% of the shares of Company Common Stock (“Minority Stockholders”) outstanding immediately prior to the Effective Time shall have the right, in lieu of the right to receive a cash payment as provided above, to convert each share of Company Common Stock held by such holder into one fully paid and nonassessable share of Surviving Corporation Common Stock. Immediately after the approval of this Agreement by the Stockholders of the Company in accordance with Section 16 hereof, the Company shall furnish the Minority Stockholders

-3-

CERTIFIED COPY

Bridgeway

with an election form on which such holders can specify their preference to have their shares of Company Common Stock converted into a cash payment or Surviving Corporation Common Stock. In order to be valid, an election form must be completed in accordance with the instructions contained therein and returned, together with the properly endorsed certificates evidencing the shares of Company Common Stock. Returns shall be made to Qualicare Inc., 938 Lafayette Street, New Orleans, Louisiana 70113, Attention: Francis J. Crosby, Esq., Vice President, not later than the close of business (5:00 p.m.) on the business day 21 days after the Stockholders’ Meeting, or such later date prior to the Effective Time which UHS Sub may specify. With the exception of shares for which an election to receive shares of Surviving Corporation Common Stock is timely received (“Electing Shares”) , all shares of Company Common Stock will be converted into the right to receive a cash payment.

(c) Each share of Company Common Stock, if any, held in the Company’s treasury immediately prior to the Effective Time shall be cancelled and retired and no payment shall be made in respect thereof.

4.2.Surrender and Payment. After the Effective Time, each holder of a certificate which immediately prior to the Effective Time represented an issued and outstanding share of Company Common Stock (other than Electing Shares) shall be entitled upon surrender thereof to the Surviving Corporation to receive payment therefor in cash. Universal Health Services, Inc. (“UHS”), the parent company of UHS Sub, hereby agrees to furnish or cause to be furnished to the Surviving Corporation all funds required for it to make such payments. Until so surrendered, each certificate which immediately prior to the Effective Time represented an issued and outstanding share of Company Common Stock (other than Electing Shares) shall, upon and after the Effective Time, be deemed for all purposes to represent and evidence only the right to receive payment therefor as set forth in Section 4.1(b). With respect to shares of Company Common Stock (other than Electing Shares) which have not been delivered for payment in accordance herewith, promptly after the Effective Time, the Surviving Corporation shall cause to be mailed to each person who was, immediately prior to the Effective Time, a holder of record of issued and outstanding shares of Company Common Stock a form (mutually agreed to by UHS Sub and the Company) of letter of transmittal and instructions

-4-

CERTIFIED COPY

Bridgeway

for use in effecting the surrender of the certificates therefor. If any payment for shares of Company Common Stock is to be made in a name other than that in which the certificate therefor surrendered for exchange is registered, it shall be a condition of such payment that the certificate so surrendered be properly endorsed or otherwise in proper form for transfer and that the person requesting such payment either pay to the Surviving Corporation any transfer or other similar taxes required by reason of the payment to a person other than the registered holder of the certificate surrendered or establish to the satisfaction of the Surviving Corporation that such tax has been paid or is not payable.

4.3.No Further Transfers. On and after the Effective Time, no transfer of the shares of Company Common Stock issued and outstanding immediately prior to the Effective Time shall be made on the stock transfer books of the Surviving Corporation.

4.4.Certificate for Surviving Corporation’s Shares. At or after the Effective Time, the holders of a certificate or certificates which prior thereto represented shares of UHS Sub Common Stock and the holders of Electing Shares may surrender the same to the Surviving Corporation and receive in exchange therefor a certificate or certificates representing the shares of Surviving Corporation. Common Stock into which the shares of UHS Sub Common Stock or Electing Shares represented by the surrendered certificate or certificates were converted pursuant to this Agreement.

5.Certain Effects of Merger.

5.1.Effect of Merger.On and after the Effective Time, the separate existence of the company shall cease, except as otherwise provided by the Corporation Law and the Company shall be merged with and into UHS Sub, which as the Surviving Corporation shall, consistently with its Articles of Incorporation possess all the rights, privileges, immunities, powers and franchises of public as well as private nature, and be subject to all restrictions, disabilities and duties of, each of the Constituent Corporations; and all rights, privileges, immunities, powers and franchises of each of the Constituent Corporations, and all property, real, personal and mixed, causes of action and every other asset of, and all debts due to either of, the Constituent Corporations on whatever account as well as stock subscriptions and all other

-5-

CERTIFIED COPY

Bridgeway

things in action or belonging to each of the Constituent Corporations, shall vest in the Surviving Corporation; and all property, rights, privileges, immunities, powers and franchises, and all and every other interest shall be thereafter as effectually the property of the Surviving Corporation as they were of the respective Constituent Corporations, and the title to any real estate vested by deed or otherwise, under the laws of the State of Arkansas, in either of the Constituent Corporations, shall not revert or be in any way impaired but all rights of creditors and all liens upon any property of either of the Constituent Corporations shall be preserved unimpaired, and all debts, liabilities and duties of the Constituent Corporations shall thenceforth attach to the Surviving Corporation, and may be enforced against it to the same extent as if such debts, liabilities and duties had been incurred or contracted by it. Any claim existing or action or proceeding pending by or against the Constituent Corporations may be prosecuted as if the Merger has not taken place.

5.2.Further Assurances. If at any time after the Effective Time the Surviving Corporation shall consider any further deeds, assignments or assurances in law or any other action necessary, desirable or proper (a) to vest, perfect or confirm, of record or otherwise, in the Surviving Corporation the title to any property or rights of the Constituent Corporations acquired or to be acquired by reason of, or as a result of, the Merger, or (b) otherwise to carry out the purposes of this Agreement, the Constituent Corporations agree that the Surviving Corporation and its proper officers and directors shall and will execute and deliver all such property, deeds, assignments and assurances in law and take all other action necessary, desirable or proper to vest, perfect or confirm title to such property or right in the Surviving Corporation and otherwise to carry out the purposes of this Agreement.

6.Representations and Warranties of the Company. The Company represents, warrants and agrees that:

6.1.Organization and Good Standing of the Company. The Company is, or prior to the Effective Time will be, a corporation duly organized, validly existing and in good standing under the laws of the state of its incorporation with full power and authority to own and operate its assets or properties and to conduct its business as now being conducted and is, or prior to the Effective Time will be,

-6-

CERTIFIED COPY

Bridgeway

qualified as a foreign corporation and in good standing as such in each jurisdiction in which the Company owns or leases property or maintains employees.

6.2.Organizational Documents. The copy of the Articles of Incorporation and all amendments thereto to date and the By-Laws, as amended to date, of the Company which have been delivered to UHS Sub, are complete and correct and represent the presently effective Articles of Incorporation and By-Laws of the Company. The Company’s minute books and ownership records exhibited to UHS Sub and its representatives are true, accurate and complete in all material respects.

6.3.Ownership of the Company. The authorized and outstanding capital stock of the Company and the ownership thereof is as set forth in a writing previously delivered to UHS Sub. No contract, commitment or undertaking of any kind has been made for the issuance of additional shares of capital stock of the Company; nor is there in effect or outstanding any subscription, option, warrant or other right to acquire any of such shares or any outstanding securities or other instruments convertible into or exchangeable for any such shares except as otherwise disclosed in writing to UHS Sub.

6.4.Title to and Condition of the Company Assets. The Company has good title to the assets and properties owned by it (in fee simple as to all the real property owned by it (the “Real Property”)), free and clear of any claims, charges, equities, liens (including tax liens), security interests and encumbrances whatsoever which would have a material adverse effect on the value or use of such property or asset as now used or proposed to be used except for (i) liens for taxes not yet due and payable, (ii) liens listed in a writing previously delivered to UHS Sub and (iii) in the case of the Real Property, minor imperfections of title or encumbrances which do not affect the marketability of title or use of the Real Property as now used or proposed to be used. On the date hereof, all the Company’s machinery, equipment and personalty are in operating condition and repair, reasonable wear and tear excepted, and are suitable for use in the ordinary conduct of the Company’s business and no maintenance, repair or replacement thereof has knowingly been deferred.

6.5.The Company’s Authority and No Conflict. The Company has the full right, power and authority to execute, deliver and carry out the terms of this Agreement and

-7-

CERTIFIED COPY

Bridgeway

all documents and agreements necessary to give effect to the provisions of this Agreement. This Agreement has been duly authorized, executed and delivered by the Company and, except as previously disclosed to UHS Sub in writing, the execution of this Agreement and the consummation of the transactions contemplated hereby will not result in any conflict with, breach, violation or termination of, or default under any charter, by-law, law, statute, rule, regulation, judgment, order, decree, mortgage, agreement, deed of trust, indenture or other instrument to which the Company is a party or by which it is bound. All corporate action and other authorizations prerequisite to the execution of this Agreement and the consummation of the transactions contemplated by this Agreement have been, or prior to the Effective Time will be, taken or obtained by the Company. This is a valid and binding agreement of the Company, enforceable against the Company in accordance with its terms.

6.6.Conduct of Operations since August 31, 1982 and Pending the Closing. (a) Except as previously disclosed to UHS Sub in writing, since August 31, 1982, there has not been:

(i) any material adverse change in the properties, condition (financial or otherwise), assets, liabilities, business, operations or prospects of the Company, except such changes which may result from laws or regulations of general applicaton to the hospital industry;

(ii) any damage, destruction or loss of any properties or assets of the Company (whether or not covered by insurance) which materially adversely affects the conduct of the Company’s business;

(iii) any declaration, setting aside or payment or other distribution in respect of any of the capital stock of the Company, or any direct or indirect redemption, purchase or other acquisition of any such stock by the Company;

(iv) any increase in compensation payable to, or any employment, bonus or compensation agreement entered into with, any employees or consultants (except in the ordinary course of business) of the Company whose annual compensation equals or exceeds $30,000;

-8-

CERTIFIED COPY

Bridgeway

(v) any issue or split-up of, or grant of any option or other right to acquire any security of the Company;

(vi) any material obligation or liability (absolute or contingent) incurred by the Company, or to which the Company has become subject, except current liabilities incurred in the ordinary course of business and obligations under contracts entered in the ordinary course of business;

(vii) any entering into, amendment or termination by the Company of any material contract, agreement, permit or lease;

(viii) any amendment of the Articles of Incorporation or By-Laws of the Company;

(ix) any commitment to borrow money entered into by the Company or mortgage of, pledge of, or subjecting to lien, charge or encumbrance of any of its assets or properties;

(x) any sale or transfer of any of the assets or properties or cancellation of any debt or claim which would constitute an asset or property of the Company in the ordinary course of conduct of its business;

(xi) any labor dispute which affects the Company’s conduct of its business; or

(xii) any event or condition of any character, materially adversely affecting the operation or prospects of the Company, except such changes which may result from laws or regulations of general application to the hospital industry;

(b) Except as previously disclosed to UHS Sub in writing, since August 31, 1982, the Company has:

(i) carried on the conduct of its business only in the ordinary course and in substantially the same manner as it has heretofore;

(ii) kept in full force and effect all insurance relating to its properties and operations comparable in amount and scope of coverage to that now maintained by it;

-9-

CERTIFIED COPY

Bridgeway

(iii) performed all its obligations under contracts, leases and documents relating to or affecting its conduct of its business, all in the same manner as heretofore performed;

(iv) used its best efforts to maintain and preserve, and to the best of its knowledge has maintained and preserved, its properties, assets, and business organizations intact, used its best efforts to maintain, and to the best of its knowledge has maintained, its good will and relationships with its present officers, employees, suppliers, medical staff and others having a business relationship with it, and has maintained all material licenses and permits requisite to the conduct of its business as now conducted;

(v) not committed itself to any capital expenditure in excess of $100,000;

(vi) not waived any right or cancelled any debt or claim under any contract, lease, agreement or commitment which involves the payment of more than $50,000;

(vii) not taken any other action which the Company reasonably expects will have a material adverse effect on any of its properties, assets or business operations;

(viii) maintained in working condition all its buildings, equipment, fixtures and other property, reasonable wear and tear excepted;

(ix) not allowed the outstanding capital stock of the Company to be increased, decreased, changed into or exchanged for a different number or kind of shares or securities in any manner including without limitation, through reorganization, reclassification, stock dividend, stock split or reverse stock split;

(x) duly and timely filed all tax and information returns with the appropriate Federal, State and local governmental agencies and has promptly paid when due all taxes, excise taxes, assessments, charges, penalties and interest lawfully levied or assessed upon it or any of its property; and

-10-

CERTIFIED COPY

Bridgeway

(xi) made no change in its existing banking and safe deposit arrangements or granted any powers of attorney, except that the persons authorized to sign checks in the ordinary course of business may be changed upon written notice to Buyer.

6.7.Litigation or Claims. Except as previously disclosed to UHS Sub in writing, there are no actions, suits, arbitrations, governmental investigations, inquiries or proceedings pending against, or, to the knowledge of the Company, threatened against or relating to the Company, any of its assets, properties or business operations or any of the transactions contemplated by this Agreement before any court or governmental or administrative body or agency, or any private arbitration tribunal, nor does the Company know or have reasonable grounds to know of any basis for any such action, suit, arbitration, investigation, inquiry or proceeding pending before any court or governmental or administrative body or agency or any private arbitration tribunal. In connection with the conduct of its business, the Company has complied in all material respects with all applicable statutes and regulations of all governmental authorities having jurisdiction over the Company, or any of its assets, properties or business operations. Except as previously disclosed to UHS Sub in writing, there is no outstanding order, writ, injunction or decree of any court or arbitrator, government or governmental agency against, or, to the knowledge of the Company, affecting, the Company, any of its assets, properties or business operations.

6.8.Licenses. The Company has all material contracts, licenses, permits, consents and approvals required by law or governmental regulations from all applicable Federal, State and local authorities and any other regulatory agencies for its lawful conduct of the operations of its business, and the Company is not in default in any material respect under such licenses, permits, consents and approvals. The Company has all other franchises, permits, licenses and other authorities as are necessary to enable it to conduct its business as now being conducted, and all such franchises, permits, licenses or other authorities are in full force and effect.

6.9.Books of Account. At the Effective Time the Company shall deliver to UHS Sub the minute books, Articles of Incorporation, By-laws, stock transfer records and books of account of the Company. All other records of

-11-

CERTIFIED COPY

Bridgeway

the Company shall be delivered to UHS Sub at the principal offices of the Company concurrently with the Effective Time. The books of account and other records of the Company are complete and correct in all material respects and accurately present and reflect, in accordance with generally accepted accounting principles consistently applied, all the transactions to which the Company is a party or by which it is bound.

6.10.Filing of Reports. Other than claims or reports pertaining to individual patients, the Company has timely filed or caused to be timely filed all cost reports and other reports of every kind whatsoever required by law or by written or oral contract or otherwise to be made with respect to the purchase of services by third party purchasers, including, but not limited to, Medicare and Medicaid programs and other insurance carriers, and all such reports are, or will be when filed, complete and accurate. The Company has paid or caused to be paid all refunds, discounts or adjustments which have become due pursuant to said reports and there is no further liability (whether or not disclosed in any report heretofore or hereafter made) for any such refund, discount or adjustment, and no interest or penalties accruing with respect thereto, except as may be disclosed in the financial statements of the Company previously furnished to UHS Sub.

6.11.Consents. The Company shall neither do nor perform any act which shall prevent UHS Sub from securing the consent and full and final approval of all Federal, state and local agencies or authorities to operate The Bridgeway and the other businesses conducted by the Company and the Company shall use its best efforts to assist UHS Sub in its application for any such consents or approvals. The Company also agrees to use its best efforts to assist UHS Sub in obtaining such consents from lenders and other persons with whom the Company has contractual obligations to permit the transactions contemplated hereby.

6.12.No Untrue Representation or Warranty. No representation or warranty contained in this Agreement, nor any statement, schedule or certificate furnished or to be furnished to UHS Sub pursuant hereto, or in connection with the transactions contemplated hereby, contains or will contain any untrue statement of a material fact, or omits or will omit to state a material fact necessary to make the statements contained therein not misleading.

-12-

CERTIFIED COPY

Bridgeway

7.Representations and Warranties of UHS Sub. UHS Sub represents, warrants and agrees that:

7.1.Organization and Good Standing. UHS Sub is a corporation duly organized, validly existing and in good standing under the laws of its jurisdiction of incorporation with full corporate power and authority to own and lease properties and to carry on its business as now being conducted.

7.2.Authority of UHS Sub. UHS Sub has the full corporate right, power and authority to execute, deliver and carry out the terms of this Agreement and all documents and agreements necessary to give effect to the provisions of this Agreement. This Agreement has been duly authorized, executed and delivered by UHS Sub and the execution of this Agreement and the consummation of the transactions contemplated hereby will not result in any conflict, breach or violation of or default under any charter, by-law, law, statute, rule, regulation, judgment, order, decree, mortgage, agreement, deed of trust, indenture or other instrument to which UHS Sub is a party or by which it is bound. All corporate action and other authorizations prerequisite to the execution of this Agreement and the consummation of the transactions contemplated by this Agreement have been taken or obtained by UHS Sub. This Agreement is a valid and binding agreement of UHS Sub, enforceable against UHS Sub in accordance with its terms.

7.3.No Untrue Representation or Warranty. No representation or warranty by UHS Sub in this Agreement, nor any statement or certificate furnished or to be furnished to the Company pursuant hereto or in connection with the transactions contemplated hereby contains or will contain any untrue statement of a material fact, or omits or will omit to state a material fact necessary to make the statements contained therein not misleading.

8.Survival of Representations and Warranties. The representations, warranties, covenants, agreements and indemnifications of UHS Sub and the Company contained in this Agreement shall be true and correct at the Effective Time as if made on that date (except to the extent that such representations and warranties expressly relate to an earlier date and except for changes expressly contemplated by this Agreement or in other writings delivered to the parties), shall survive the Effective Time for a period of three years and shall be deemed to be material and to have been relied upon by UHS Sub and the Company.

-13-

CERTIFIED COPY

Bridgeway

9.Hart-Scott-Rodino Act Filings. The Company and UHS Sub shall make, or cause to be made, any and all filings which are required under the Hart-Scott-Rodino Anti-trust Improvements Act of 1976 (the “HSR Act”) and each will furnish, or cause to be furnished, to the other such information and assistance as may be reasonably requested in connection with the preparation of their respective filings thereunder. UHS Sub and the Company shall cooperate with each other in filing any necessary documents under the HSR Act with all Federal and other authorities having jurisdiction with respect to the transactions contemplated hereby.

10.UHS Sub’s Conditions Precedent to the Effective Time. UHS Sub’s agreement to consummate the Merger is subject to compliance with and the occurrence of each of the following conditions prior to the Effective Time except as any thereof may be waived by it:

(a) Each of the representations and warranties set forth in Section 6 hereof and in the written information delivered to UHS Sub in connection herewith shall be true and correct in all material respects at and as if made at the Effective Time (except to the extent that such representations and warranties expressly relate to an earlier date and except for changes expressly contemplated by this Agreement or in other writings delivered to the parties), and the covenants, agreements and conditions required by this Agreement to be performed and complied with by the Company shall have been performed and complied with in all material respects.

(b) UHS Sub shall have been able, prior to the Effective Time, to obtain all appropriate and necessary licenses, permits, consents, certifications and full and final approvals required to own and operate The Bridgeway from all Federal, state and local authorities and other regulatory agencies, and to participate in all third party reimbursement programs from all third party payors, including, without limitation, Blue Cross, Medicare and Medicaid in which the Company participates on the date hereof.

-14-

CERTIFIED COPY

Bridgeway

(c) UHS Sub shall have obtained all required consents to the assignment to UHS Sub of all leases and contracts of the Company which UHS Sub deems necessary.

(d) There shall have been no materially adverse changes in the condition or operations of the Company from August 31, 1982 to the Effective Date not consented to by UHS Sub in writing.

(e) The applicable waiting period under the HSR Act with respect to the transactions contemplated hereby shall have expired and no Federal, State or other authority having jurisdiction over the transactions contemplated hereby shall have taken any action to enjoin or prevent the consummation of such transactions.

(f) The adoption of this Agreement and all actions contemplated hereby which require the approval of the stockholders of the Company shall have been approved by the affirmative vote, in person or by proxy, of the holders of such percentage of the outstanding shares of the Company’s capital stock entitled to vote thereon as is required by the Corporation Law.

(g) The Arkansas Health Planning and Development Agency of the State Department of Health (the “Department”) shall have ruled that no certificate of need is required for the transactions contemplated hereby, under Act 558 of the State of Arkansas (the “Act”), in response to a notice of the acquisition contemplated hereby having been given by UHS Sub to the Department more than thirty (30) days prior to the Effective Time. It is agreed between UHS Sub and Company that this Agreement shall be executory and shall not be deemed to be an acquisition or obligation of funds within the meaning of the Act until thirty (30) days have elapsed after receipt of such notice by the Department.

11.The Company’s Conditions Precedent to the Effective Time.

The Company’s agreement to consummate the Merger is subject to compliance with and the occurrence of each of the following conditions, except as any thereof may be waived by it:

-15-

CERTIFIED COPY

Bridgeway

(a) Each of the representations and warranties set forth in Section 7 hereof shall be true and correct in all material respects at and as if made at the Effective Time and the covenants, agreements and conditions required by this Agreement to be performed and complied with by UHS Sub shall have been performed and complied with in all material respects.

(b) The applicable waiting period under the HSR Act with respect to the transactions contemplated hereby shall have expired and no Federal, State or other authority having jurisdiction over the transactions contemplated hereby shall have taken any action to enjoin or prevent the consummation of such transactions.

12.Effective Time. The Effective Time shall take place as soon as practicable after the execution of, and the fulfillment of the conditions precedent set forth in, this Agreement; provided however, that in no event shall the Effective Time take place earlier than November 15, 1983 without the prior written consent of all the stockholders of the Company. Evidence of the fulfillment or waiver of the conditions set forth in Section 10 and 11 hereof shall be provided by the parties hereto to each other (a) at the offices of Reavis & McGrath, 345 Park Avenue, New York, New York 10154 at 10:00 A.M., on the later of November 15, 1983, or the business day on which the last of the conditions set forth in Section 10 and 11 hereof is fulfilled or waived or

| (b) | at such other place and time as the parties hereto may agree. |

13.Indemnification. The Company shall indemnify and hold harmless UHS Sub, UHS and their successors and assigns, at all times after the Effective Time against and in respect of:

(a) any damage, loss, cost, expense or liability (including reasonable attorney’s fees) resulting to UHS Sub from any materially false, misleading or inaccurate representation, breach of warranty or nonfulfillment of any agreement or condition on the part of the Company under this Agreement or from any misrepresentation in or any omission from any certificate, list, schedule or other instrument furnished or to be furnished to UHS Sub hereunder; and

(b) all claims, actions, suits, proceedings, demands, assessments, judgments, costs and expenses incident to any of the foregoing.

-16-

CERTIFIED COPY

Bridgeway

14.Access, Information and Confidentiality. The Company shall give to UHS Sub and its officers, attorneys, accountants and representatives full access during normal business hours throughout the period prior to the Effective Time to all the Company’s properties, books, records, contracts, commitments and all other documents relative to the operations and businesses of the Company and shall furnish UHS Sub during such period with all such information concerning its affairs as UHS Sub may reasonably request, including, without limitation, all such information and financial statements as UHS Sub or UHS, with the advice of counsel, determines are necessary to comply with the requirements of federal securities laws or to file a registration statement thereunder. UHS Sub shall maintain the confidentiality of all information furnished by the Company until after the Effective Time and thereafter if the Merger pursuant to this Agreement is not consummated; and in the event that the transactions contemplated herein fail to close for any reason, UHS and UHS Sub shall return or destroy all information, documents and copies thereof furnished. Notwithstanding the foregoing, (i) UHS or UHS Sub may disclose any such information to any bank or other financial institution in connection with any proposed financing requested by UHS or UHS Sub and (ii) in the event that UHS, with the advice of counsel, determines that disclosure is necessary to comply with the requirements of federal securities laws (including, without limitation, the inclusion of any such information in a registration statement filed thereunder), such disclosure shall be permissible.

15.Termination.

15.1.Termination. This Agreement may be terminated and the Merger herein contemplated may be abandoned at any time prior to Effective Time:

(a) By mutual action of the Boards of Directors of UHS Sub and the Company; or

(b)On March 31, 1984, if the Merger is not consummated pursuant to this Agreement on or before said date, unless the the Boards of Directors of UHS Sub and the Company shall have agreed in writing upon an extension of time in which to consummate the Merger.

-17-

CERTIFIED COPY

Bridgeway

15.2.Effect of Termination. In the event of the termination of this Agreement pursuant to Section 15.1 hereof, this Agreement shall thereafter become null and void and of no force or effect whatsoever, and no party hereto shall have any liability to any other party hereto or its stockholders or directors or officers in respect thereof, and except that nothing herein will relieve any party from liability for any breach of this Agreement prior to such termination.

16.Stockholders’ Meeting. As soon as reasonably practicable after the execution of this Agreement, the Company agrees that it will call a special meeting of its stockholders (the “Stockholders’ Meeting”) pursuant to the Corporation Law for the purpose of considering and voting upon a proposal to approve the adoption of this Agreement and all actions contemplated hereby which require the approval of the Company’s stockholders. The Company and its Board of Directors will recommend to the Company’s stockholders such approval and use their best efforts to obtain such approvals.

17.Miscellaneous.

17.1.Successors and Assigns. All the terms and provisions of this Agreement shall be binding upon and inure to the benefit of and be enforceable by the respective successors and assigns of the parties hereto, whether so expressed or not.

17.2.Governing Law. This Agreement will be consummated in the State of Arkansas and is to be governed by and interpreted under the laws of said State, without giving effect to the principles of conflicts of laws thereof.

17.3.Notices. All notices, requests, consents and other communications hereunder shall be in writing and shall be mailed first class, registered, with postage prepaid as follows:

If to the Company

addressed to:

A. Russell Chandler, III

938 Lafayette Street

New Orleans, Louisiana 70113

-18-

CERTIFIED COPY

Bridgeway

with a copy to:

Leon H. Rittenberg, Esq.

Polack, Rosenberg, Rittenberg & Endom

938 Lafayette Street

New Orleans, Louisiana 70113

If to UHS Sub or UHS, addressed to:

Universal Health Services, Inc.

One Presidential Boulevard

Bala Cynwyd, Pennsylvania 19004

Attn: Mr. Alan B. Miller President

with a copy to:

Anthony Pantaleoni, Esq.

Reavis & McGrath

345 Park Avenue

New York, New York 10154

or such other address as any person may request by notice given as aforesaid. Notices sent as provided herein shall be deemed filed on the date mailed.

17.4.Payment of Expenses. The Company and UHS Sub shall each pay their own expenses, including without limitation, the disbursements and fees of all their respective attorneys, accountants, advisors, agents and other representatives, incidental to the preparation and carrying out of this Agreement, whether or not the transactions contemplated hereby are consummated.

17.5.Merger. This Agreement, and all other written information, agreements and documents referred to herein or executed in connection herewith, constitutes the entire agreement between the parties hereto with respect to the subject hereof and no amendment, alteration or modification of this Agreement shall be valid unless in each instance such amendment, alteration or modification is expressed in a written instrument duly executed by the party or parties making such amendment, alteration or modification.

17.6.Counterparts. This Agreement may be executed simultaneously in any number of counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

-19-

CERTIFIED COPY

Bridgeway

17.7.Headings. The headings contained in this Agreement have been inserted for the convenience of reference only and shall in no way restrict or modify any of the terms or provisions hereof.

17.8.Other Documents. Each party to this Agreement will, at the request of the other, execute and deliver to such other party all such further assignments, endorsements and other documents as such other party may reasonably request in order to effect the transactions contemplated hereby.

17.9.Waiver. The failure of any party to insist, in any one or more instances, on performance of any of the terms and conditions of this Agreement shall not be construed as a waiver or relinquishment of any rights granted hereunder or of the future performance of any such term, covenant or condition, but the obligations of the parties with respect thereto shall continue in full force and effect.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the date first above written.

| | |

UHS OF ARKANSAS, INC. |

| |

By: | |

|

| | |

QUALICARE OF ARKANSAS, INC. |

| |

| By: | |

|

-20-

CERTIFIED COPY

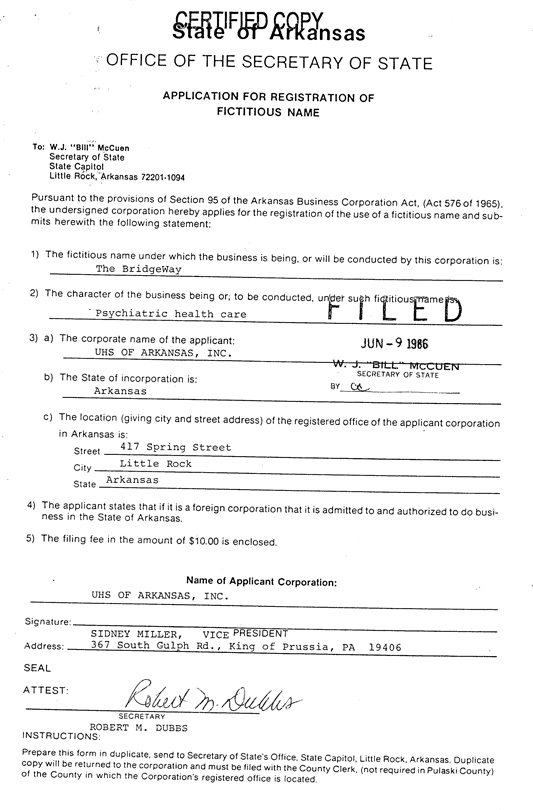

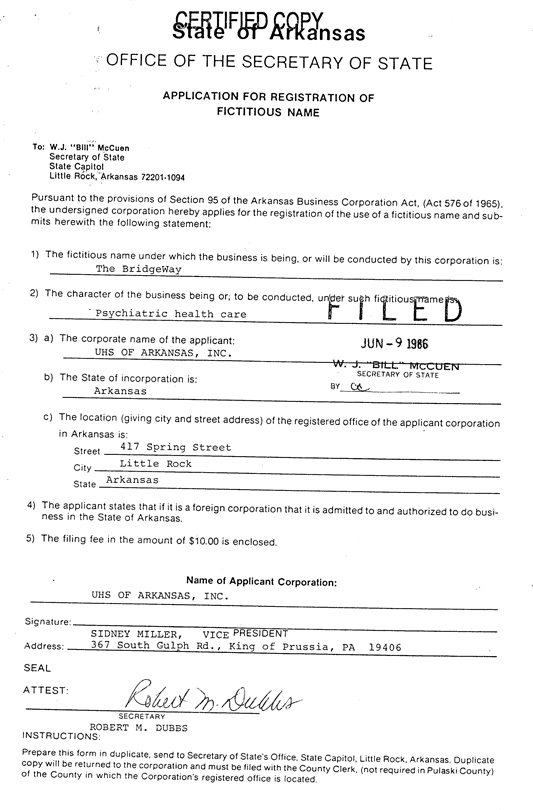

State of Arkansas

OFFICE OF THE SECRETARY OF STATE

APPLICATION FOR REGISTRATION OF

FICTITIOUS NAME

To: W.J. “Bill” McCuen Secretary of State State Capitol Little Rock, Arkansas 72201-1094

Pursuant to the provisions of Section 95 of the Arkansas Business Corporation Act, (Act 576 of 1965), the undersigned corporation hereby applies for the registration of the use of a fictitious name and submits herewith the following statement:

1) The fictitious name under which the business is being, or will be conducted by this corporation is:

The BridgeWay 2) The character of the business being or; to be conducted, under such fictitious name is Psychiatric health care

3) a) The corporate name of the applicant: UHS OF ARKANSAS, INC.

b) The State of incorporation is: Arkansas

C) The location (giving city and street address) of the registered office of the applicant corporation in Arkansas is:

Street 417 Spring Street City Little Rock State Arkansas

4) The applicant states that if it is a foreign corporation that it is admitted to and authorized to do business in the State of Arkansas.

5) The filing fee in the amount of $10.00 is enclosed. Name of Applicant Corporation: UHS OF ARKANSAS, INC.

Signature: SIDNEY MILLER, VICE PRESIDENT Address: 367 South Gulph Rd., King of Prussia, PA 19406 SEAL

ATTEST: SECRETARY ROBERT M. DUBBS INSTRUCTIONS:

Prepare this form in duplicate, send to Secretary of State’s Office, State Capitol, Little Rock, Arkansas. Duplicate copy will be returned to the corporation and must be filed with the County Clerk, (not required in Pulaski County) of the County in which the Corporation’s registered office is located.

CERTIFIED COPY

State of Arkansas — Office of the Secretary of State

Certificate of Amendment

UHS of Arkansas, Inc. , corporation duly organized, created and existing under and by virtue of the laws of the State of Arkansas, by its President and its Secretary,

DOES HERE CERTIFY:

A. That a written or printed notice setting forth the proposed Amendment was given to each shareholder entitled to vote thereon within the time and manner as provided in the “Arkansas Business Corporation Act” (Act 576 of 1965), and that this Amendment(s) is filed pursuant to said Act.

B. That at a special (or regular) meeting of the stockholders of said corporation, duly called and held at the office of the Company, in the City of King of Prussia , State of PA , onOctober 4, 1993, the Amendment to the Articles of Incorporation, as herein stated, was (were) offered and adopted.

C. That the number of shares outstanding are 300 , and the number of shares entitled to vote thereon are 300 (100%). The number of shares which voted for are 300 . The number of shares which voted against are -0- . (If the shares are entitled to vote thereon as a class, the designation and number of outstanding shares entitled to vote thereon of each such class, and the number of shares of each class which voted for and against are required.)

D. That the following Article(xx) of the Articles of Incorporation of this corporation were amended, Articles First , , , to read as follows:

“The name of the Corporation is The Bridgeway, Inc.”

DO-14/Rev. 5-1-88

CERTIFIED COPY

IN WITNESS WHEREOF, the said Corporation, UHS of Arkansas, Inc. has caused its corporate name to be subscribed by its President, who hereby verifies that the statements contained in the foregoing Certificate of Amendment are true and correct to the best of his/her knowledge and beliefs, and its corporate seal hereto affixed and duly attested by its Secretary, on this date,November 15,1993.

| | | | |

| Corporate Seal | | | | |

| | | | UHS of Arkansas, Inc. |

| | | | Corporate Name |

| | |

| | | | /s/ Alan B. Miller |

| | | | Alan B. Miller President |

| | |

| | | | 367 South Gulph Road |

| | | | King of Prussia, PA 19406 |

| | | | Address |

| ATTEST: | | | | |

| | |

/s/ Bruce R. Gilbert | | | | |

Secretary | | | | |

| Bruce R. Gilbert | | | | |

Instructions: File in DUPLICATE with theSecretary of State, State Capitol, Little Rock, AR 72201, with payment of fees. Duplicate copy will be returned to the corporation at the listed address, and must be filed in the office of the county clerk in which the corporation’s registered office is located, (in other than Pulaski County) within 60 days after the date of filing with the Secretary of State.

Filing Fee: $50.00

CERTIFIED COPY

| | | | |

| | | | FILED |

| | | | CORPORATIONS DIVISION |

| | | | CP00052506 |

| NOTICE OF CHANGE OF REGISTERED OFFICE | | | | 98 AUG 03 AM 9:00 |

| BY THE REGISTERED AGENT | | | | SHARON PRIEST |

| for Corporations | | | | SECRETARY OF STATE |

| | | | STATE OF ARKANSAS |

| | |

| | BY | |

|

| | | | |

| To: | | Sharon Priest | | |

| | Secretary of State | | |

| | Corporations Division | | |

| | State Capitol | | |

| | Little Rock, Arkansas 72201-1094 | | |

| |

| | Pursuant to the Corporation Laws of the State of Arkansas, the undersigned registered agent submits the following statement for the purpose of changing its registered office address for the below named corporation in the state of Arkansas. |

| | |

| | | | ¨ Foreign |

| | | | x Domestic |

| | |

| 1. | | Name of Corporation: THE BRIDGEWAY, INC. | | |

| | |

| 2. | | Address of its present registered office: | | |

| |

| | 417 Spring Street, Little Rock, Arkansas 72201 |

| | Street Address, City, State, Zip |

| | |

| 3. | | Address to which registered office is to be changed: | | |

| |

| | 425 West Capitol Avenue, Suite 1700, Little Rock, Arkansas 72201 |

| | Street Address, City, State, Zip |

| |

| 4. | | Name of present registered agent:The Corporation Company |

| |

| 5. | | The address of its registered office and the address of the business office of its registered agent, as changed, will be identical. |

| |

| 6. | | The above named corporation has been notified of the change of address of its registered office. |

| |

| DatedJuly 29, 1998 | | /s/ Kenneth J. Uva |

| | |

| | | | Kenneth J. Uva Name of Authorized Officer |

| | |

| | | | Vice-President The Corporation Company |

| | | | Title of Authorized Officer |

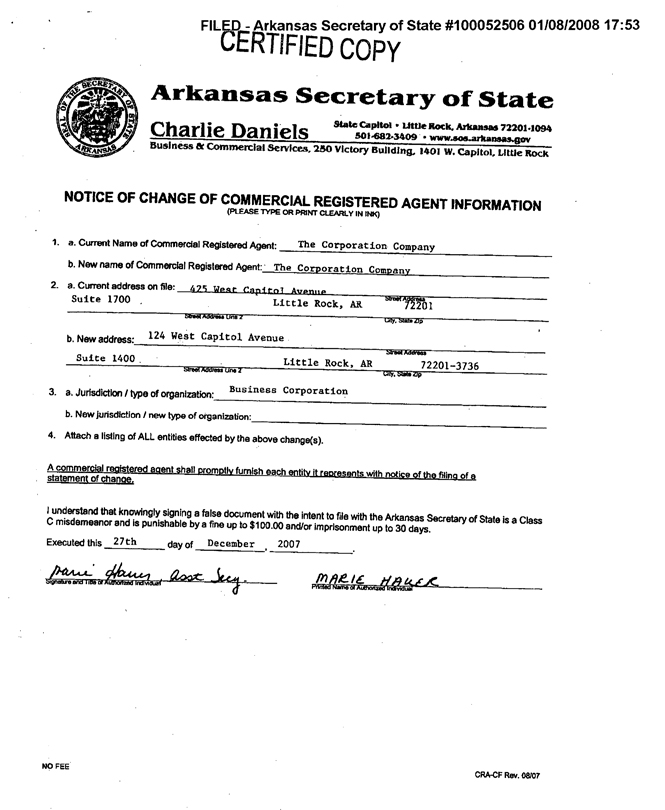

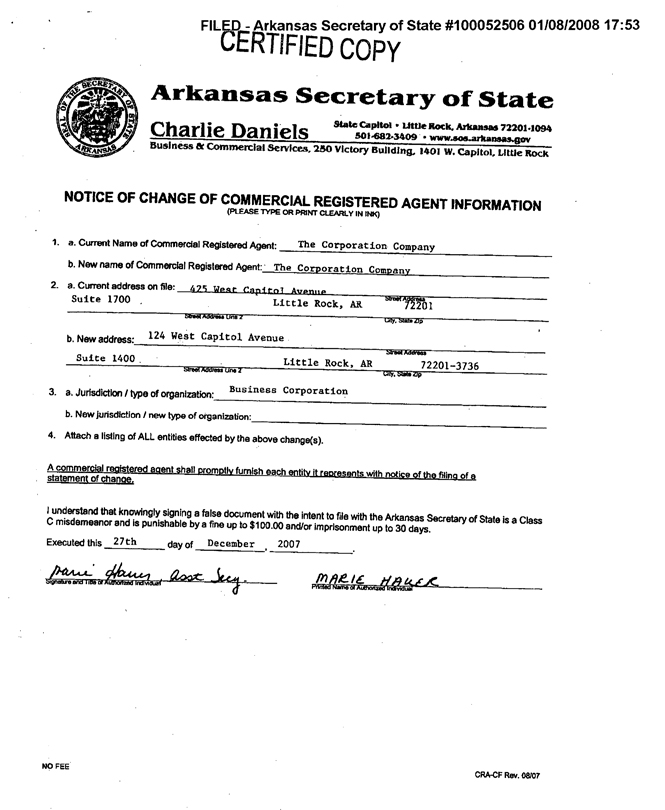

FILED—Arkansas Secretary of State #100052506 01/08/2008 17:53 CERTIFIED COPY Arkansas Secretary of State Charlie Daniels

State Capitol Little Rock, Arkansas 72201-1094

501-682-3409 www.sos.arkansas.gov Business & Commercial Services, 250 Victory Building, 1401 W. Capitol, Little Rock

NOTICE OF CHANGE OF COMMERCIAL REGISTERED AGENT INFORMATION

(PLEASE TYPE OR PRINT CLEARLY IN INK) 1. a. Current Name of Commercial Registered Agent: The Corporation Company

b. New name of Commercial Registered Agent: The Corporation Company 2. a. Current address on file: 425 West Capitol Avenue

Suite 1700 Little Rock, AR Street Address 72201 Street address line 2 City, State Zip b. New address: 124 West Capitol Avenue

Suite 1400 Street Address Little Rock, AR 72201- 3736 Street Address line City, State Zip

3. a. Jurisdiction / type of organization: BUSINESS CORPORATION b. New jurisdiction/ new type of organization:

4. Attach a listing of ALL entities effected by the above change(s).

A commercial registered agent shall promptly furnish each entity. It represents with notice of the filing of a statement of change.

I understand that knowingly signing a false document with the intent to file with the Arkansas Secretary of State is a Class C misdemeanor and is punishable by a fine up to $100.00 and/or imprisonment up to 30 days.

Executed this 27th day of December, 2007. Signature and Title of Authorized Individual Printed Name of Authorized Individual

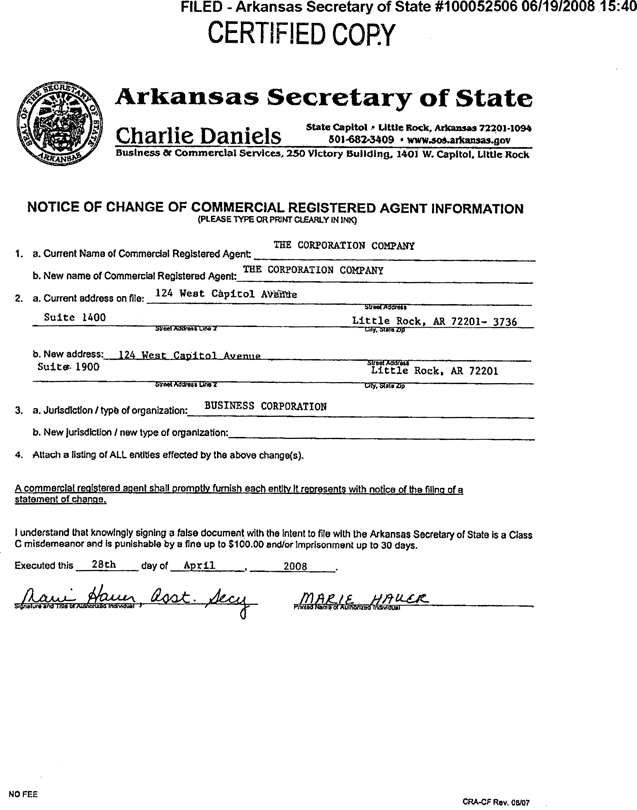

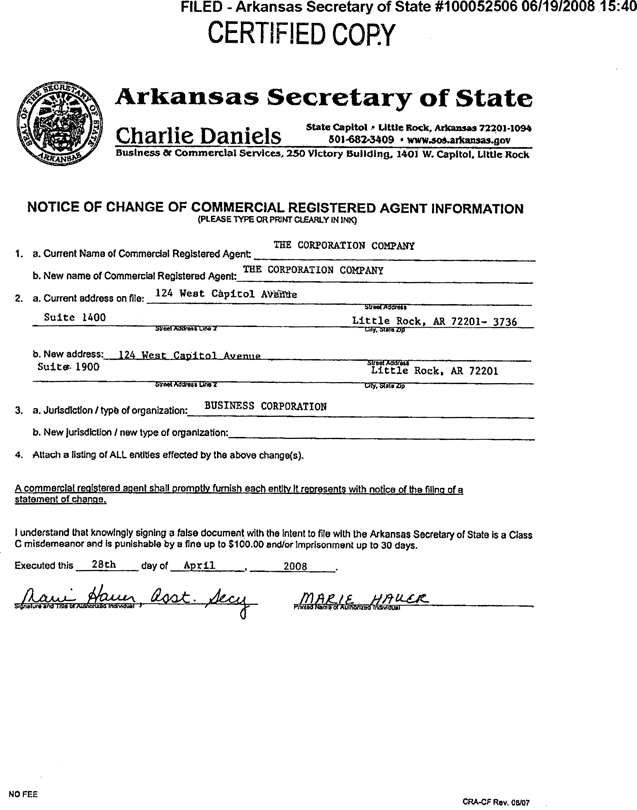

FILED—Arkansas Secretary of State #100052506 06/19/2008 15:40

CERTIFIED COPY

Arkansas Secretary of State

Charlie Daniels

State Capitol Little Rock. Arkansas 72201-1094

501-682-3409 www.sos.arkansas.gov

Business & Commercial Services. 250 Victory Building. 1401 W. Capitol. Little Rock

NOTICE OF CHANGE OF COMMERCIAL REGISTERED AGENT INFORMATION

(PLEASE TYPE OR PRINT CLEARLY IN INK)

1 a. Current Name of Commercial Registered Agent: The Corporation Company

b. New name of Commercial Registered Agent: The Corporation Company

2 a. Current address on file: 124 West Capitol Avenue

Suite 1400 Street address Little Rock, AR. Street address 72201-3736

Street address line 2 City, State Zip

b. New address: 124 West Capitol Avenue.

Suite 1900 street address

Little Rock, AR 72201

Street address line 2 city, state Zip

3 a. Jurisdiction / type of organization: business corporation

b. New jurisdiction/ new type of organization:

4. Attach a listing of ALL entities effected by the above change(s).

A commercial registered agent shall promptly fumish each entity it represents with notice of the filing statement of change.

I understand that knowingly signing a false document with the intent to file with the Arkansas Secretary of State is a Class C misdemeanor and is punishable by a fine up to $100.00 and/or imprisonment up to 30 days.

Executed this 28th day of April 2008

Signature and the title of authorized individual

printed name of authorized individual

NO FEE

CRA-CF Rev. 08/07