Exhibit 3.178

[ILLEGIBLE]

CHARTER

OF

CHILDREN’S COMPREHENSIVE SERVICES MANAGEMENT COMPANY

The undersigned, acting as the incorporator of a corporation under the Tennessee Business Corporation Act, adopts the following charter for such corporation.

1. The name of the corporation is Children’s Comprehensive Services Management Company.

2. The corporation is for profit.

3. The street address for the corporation’s principal office is:

805 South Church Street

Murfreesboro, Tennessee 37133

Rutherford County

(a) The name of the corporation’s initial registered agent is:

William J Ballard

(b) The street address of the corporation’s initial registered office in Tennessee is:

805 South Church Street

Murfreesboro, Tennessee 37133

Rutherford County

4. The name and address of the incorporator is:

Kevin P. O’Hara

2700 First American Center

Nashville, Tennessee 37238-2700

5. The number of shares of stock the corporation is authorized to issue is one thousand shares of common stock, no par value.

6. The shareholders of the corporation shall not have preemptive rights.

7. To the fullest extent permitted by the Tennessee Business Corporation Act as in effect on the date hereof and as hereafter amended from time to time, a director of the corporation shall not be liable to the corporation or its shareholders for monetary damages for breach of fiduciary duty as a director. If the Tennessee Business Corporation Act or any successor statute is amended after adoption of this provision to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the corporation shall be eliminated or limited to the fullest extent permitted by the Tennessee Business Corporation Act, as so amended from time to time. Any repeal or modification of this paragraph 7 by the shareholders of the corporation shall not adversely affect any right or protection of a director of the corporation existing at the time of such repeal or modification or with respect to events occurring prior to such time.

Dated: May 30, 1997

|

/s/ Kevin P. O’Hara |

| Kevin P. O’Hara, Incorporator |

[ILLEGIBLE]

ARTICLES OF MERGER

OF

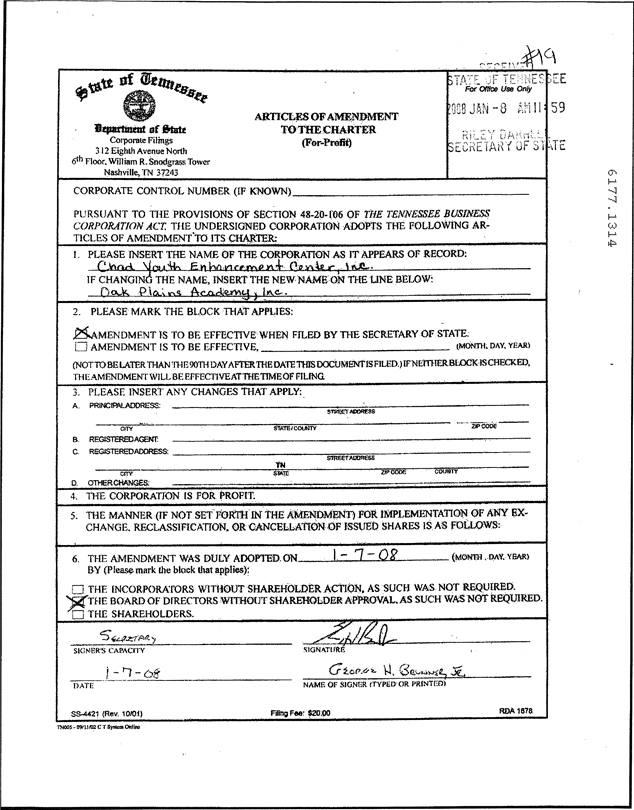

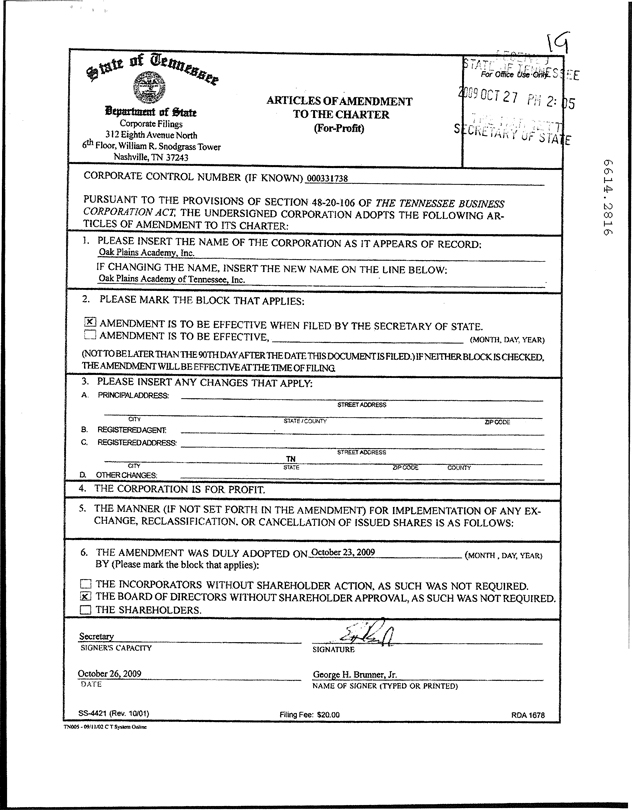

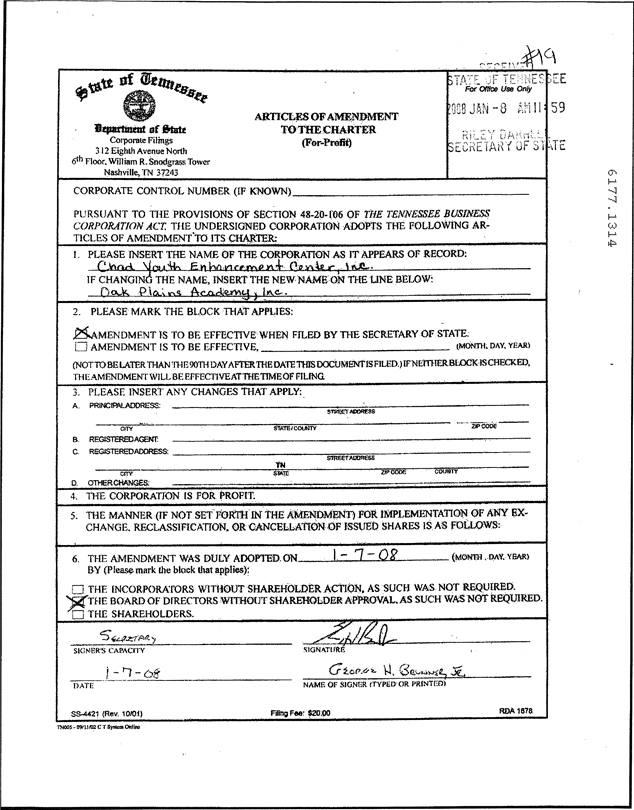

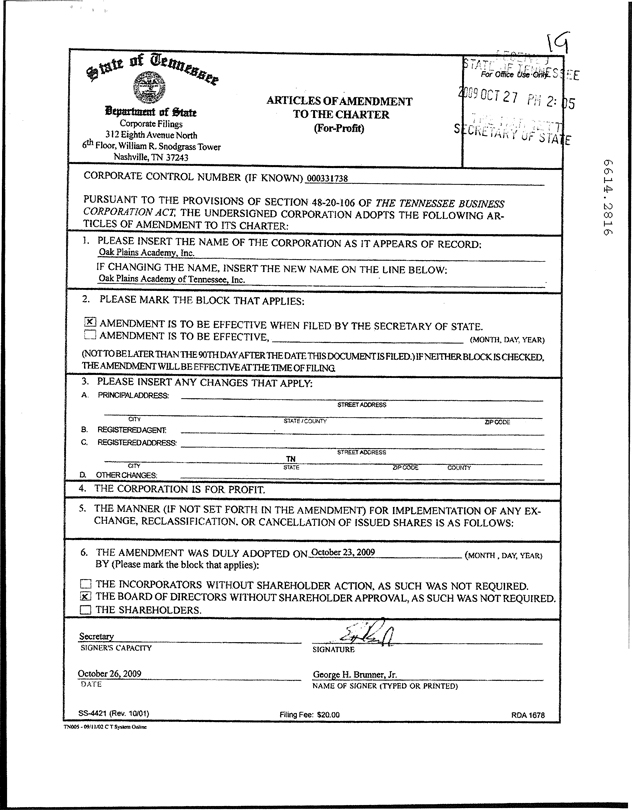

CHAD YOUTH ENHANCEMENT CENTER, INC.

INTO

CHILDREN’S COMPREHENSIVE SERVICES MANAGEMENT COMPANY

Pursuant to the provisions of Section 48-21-109 of the Tennessee Business Corporation Act, the undersigned corporations adopt the following articles of merger:

1. A copy of the Agreement and Plan of Merger is attached hereto asExhibit “A”.

2. As to CHAD Youth Enhancement Center, Inc. a Tennessee corporation, the plan was duly adopted by the sole shareholder on February 10, 1998.

3. As to Children’s Comprehensive Services Management Company, a Tennessee corporation, the plan was duly approved by the sole shareholder on February 11, 1998.

4. Upon completion of the merger, the Articles of Merger of the surviving corporation shall be amended to change the name of the surviving corporation to CHAD Youth Enhancement Center, Inc.

5. The effective date of the merger shall be February 12, 1998.

| | | | | | |

| February 11, 1998 | | | | CHAD YOUTH ENHANCEMENT CENTER, INC. |

| | | |

| | | | By: | |

|

| | | | Its: | | President |

| | |

| February 11, 1998 | | | | CHILDREN’S COMPREHENSIVE SERVICES MANAGEMENT COMPANY |

| | | |

| | | | By: | |

|

| | | | Its: | | President |

[ILLEGIBLE]

[ILLEGIBLE]

EXHIBIT “A”

[Attach copy of Agreement and Plan of Merger]

[ILLEGIBLE]

AGREEMENT AND PLAN OF MERGER

BY AND AMONG

CHILDREN’S COMPREHENSIVE SERVICES MANAGEMENT COMPANY

and

CHAD YOUTH ENHANCEMENT CENTER, INC.

and

CLG MANAGEMENT COMPANY, LLC

February 12, 1998

[ILLEGIBLE]

Table of Contents

| | | | | | | | |

ARTICLE I. | | | | |

| | |

| | MERGER OF CONSTITUENT CORPORATIONS | | | 2 | |

| | 1.1 | | Effect of the Merger | | | 2 | |

| | 1.2 | | Assets of CHAD at Closing; Properties Acquired in the Merger | | | 2 | |

| | 1.3 | | Further Assurances | | | 4 | |

| | 1.4 | | Additional Parent Company Obligations | | | 4 | |

| | 1.5 | | Additional Governing Provisions | | | 4 | |

| |

ARTICLE II. | | | | |

| | |

| | CONVERSION AND EXCHANGE OF SHARES | | | 5 | |

| | 2.1 | | Conversion of Shares | | | 5 | |

| | 2.2 | | Shares Owned by CHAD | | | 5 | |

| | 2.3 | | Fractional Shares | | | 5 | |

| | 2.4 | | Exchange of Shares | | | 5 | |

| |

ARTICLE III. | | | | |

| | |

| | MERGER CONSIDERATION | | | 6 | |

| | 3.1 | | Merger Consideration | | | 6 | |

| | 3.2 | | Closing Statements | | | 7 | |

| |

ARTICLE IV. | | | | |

| | |

| | CERTIFICATE OF INCORPORATION; OFFICERS AND DIRECTORS FOLLOWING MERGER | | | 8 | |

| |

ARTICLE V. | | | | |

| | |

| | EFFECTIVE DATE OF MERGER; FILING OF MERGER DOCUMENTS | | | 8 | |

| | 5.1 | | Effective Date | | | 8 | |

| | 5.2 | | Filing of Certificate of Merger | | | 8 | |

| |

ARTICLE VI. | | | | |

| | |

| | ASSET ACQUISITION OF REAL ESTATE ASSETS OF CLG | | | 9 | |

| | 6.1 | | Real Estate Assets of CLG; Sale of Real Estate Assets to Merger Sub | | | 9 | |

| | 6.2 | | Retention of Irrevocable, Permanent Easement Rights | | | 9 | |

| | 6.3 | | Consideration for Real Estate Assets and Easements | | | 9 | |

| | 6.4 | | Conveyance of Real Estate Assets; Status of Title | | | 9 | |

| | 6.5 | | Excluded Items | | | 10 | |

| | 6.6 | | Restrictive Covenants | | | 10 | |

ii

[ILLEGIBLE]

| | | | | | | | |

ARTICLE VII. | | | | |

| | |

| | REPRESENTATIONS AND WARRANTIES OF SELLERS AND CLG | | | 10 | |

| | 7.1 | | Organization, Qualification and Authority | | | 10 | |

| | 7.2 | | Capitalization and Stock Ownership; Membership Interest in CLG | | | 11 | |

| | 7.3 | | Investments | | | 12 | |

| | 7.4 | | Absence of Default | | | 12 | |

| | 7.5 | | Financial Statements | | | 12 | |

| | 7.6 | | Operations since September 30, 1997 | | | 13 | |

| | 7.7 | | Litigation | | | 14 | |

| | 7.8 | | Licenses | | | 14 | |

| | 7.9 | | Medicare and Medicaid Matters | | | 15 | |

| | 7.10 | | Title to and Condition of CHAD Assets | | | 15 | |

| | 7.11 | | Contracts | | | 16 | |

| | 7.12 | | Environmental Matters | | | 17 | |

| | 7.13 | | CHAD Employees | | | 19 | |

| | 7.14 | | Employee Benefit Plans | | | 19 | |

| | 7.15 | | Insurance | | | 20 | |

| | 7.16 | | Conflicts of Interest | | | 20 | |

| | 7.17 | | Compliance with Laws | | | 20 | |

| | 7.18 | | WARN | | | 21 | |

| | 7.19 | | Tax Returns; Taxes | | | 21 | |

| | 7.20 | | Accredited Investor | | | 21 | |

| | 7.21 | | Purchase for Investment; Restrictions on Transfer | | | 21 | |

| | 7.22 | | Solvency | | | 22 | |

| |

ARTICLE VIII. | | | | |

| | |

| | REPRESENTATIONS AND WARRANTIES OF MERGER SUB AND PARENT | | | 22 | |

| | 8.1 | | Organization, Qualification and Authority | | | 22 | |

| | 8.2 | | Absence of Default | | | 23 | |

| | 8.3 | | SEC Reports | | | 23 | |

| | 8.4 | | Shares to be Issued | | | 23 | |

| | 8.5 | | WARN | | | 23 | |

| | 8.6 | | Solvency | | | 23 | |

| | 8.7 | | Nature of Merger Transaction; Control of Merger Sub; Consideration for Merger | | | 24 | |

| |

ARTICLE IX. | | | | |

| | |

| | COVENANTS OF PARTIES | | | 24 | |

| | 9.1 | | Certificate of Incorporation and Bylaws of CHAD; Capitalization | | | 24 | |

| | 9.2 | | Approval by Shareholder | | | 24 | |

| | 9.3 | | Approval by Members | | | 24 | |

| | 9.4 | | Preservation of Business and CHAD Assets | | | 24 | |

iii

[ILLEGIBLE]

| | | | | | | | |

| | 9.5 | | Books and Records | | | 25 | |

| | 9.6 | | Preserve Accuracy of Representations and Warranties | | | 25 | |

| | 9.7 | | Broker’s or Finder’s Fee | | | 26 | |

| | 9.8 | | Indebtedness; Liens | | | 26 | |

| | 9.9 | | Compliance with Laws and Regulatory Consents | | | 26 | |

| | 9.10 | | Maintain Insurance Coverage | | | 26 | |

| |

ARTICLE X. | | | | |

| | |

| | CHAD’S AND SELLERS’ CONDITIONS TO CLOSE | | | 27 | |

| | 10.1 | | Representations and Warranties True at Closing; Compliance with Agreement | | | 27 | |

| | 10.2 | | No Action/Proceeding | | | 27 | |

| | 10.3 | | Order Prohibiting Transaction | | | 27 | |

| | 10.4 | | Employment Agreement | | | 27 | |

| | 10.5 | | Other Matters, Etc. | | | 27 | |

| |

ARTICLE XI. | | | | |

| | |

| | CCSI COMPANIES’ CONDITIONS TO CLOSE | | | 28 | |

| | 11.1 | | Representations and Warranties True at Closing; Compliance with Agreement | | | 28 | |

| | 11.2 | | No Action/Proceeding | | | 28 | |

| | 11.3 | | Order Prohibiting Transaction | | | 28 | |

| | 11.4 | | Other Matters, Etc. | | | 28 | |

| | 11.5 | | Due Diligence; Inspection of CHAD Assets; U.C.C. Searches, Etc. | | | 28 | |

| | 11.6 | | Noncompetition Agreements | | | 29 | |

| | 11.7 | | Licenses and Permits | | | 29 | |

| | 11.8 | | Consents | | | 29 | |

| | 11.9 | | Opinion of CHAD’S Counsel; Opinion of CLG’s Counsel | | | 29 | |

| |

ARTICLE XII. | | | | |

| | |

| | OBLIGATIONS OF CHAD, CLG AND SHAREHOLDER AT CLOSING | | | 30 | |

| | 12.1 | | Documents Effecting Closing | | | 30 | |

| | 12.2 | | Opinion of Counsel | | | 30 | |

| | 12.3 | | Corporate Good Standing and Corporate Resolution | | | 30 | |

| | 12.4 | | Closing Certificate | | | 30 | |

| | 12.5 | | Third Party Consents | | | 30 | |

| | 12.6 | | Evidence of Repayment of the Peoples Bank Debt | | | 30 | |

| | 12.7 | | CHAD Closing Statement | | | 30 | |

| | 12.8 | | CLG Closing Statement | | | 31 | |

| | 12.9 | | Additionally Requested Documents; Post-Closing Assistance | | | 31 | |

| |

ARTICLE XIII. | | | | |

| | |

| | OBLIGATIONS OF MERGER SUB AT CLOSING | | | 31 | |

[ILLEGIBLE]

iv

[ILLEGIBLE]

| | | | | | | | |

| | 13.1 | | Merger Consideration | | | 31 | |

| | 13.2 | | Real Estate Assets Consideration | | | 31 | |

| | 13.3 | | Corporate Good Standing and Certified Board Resolutions | | | 31 | |

| | 13.4 | | Closing Certificate | | | 31 | |

| | 13.5 | | Opinion of Merger Sub’s Counsel | | | 31 | |

| | 13.6 | | CHAD Closing Statement | | | 32 | |

| | 13.7 | | CLG Closing Statement | | | 32 | |

| |

ARTICLE XIV. | | | | |

| | |

| | TERMINATION | | | 32 | |

| | 14.1 | | Circumstances of Termination | | | 32 | |

| | 14.2 | | Effect of Termination | | | 33 | |

| |

ARTICLE XV. | | | | |

| | |

| | SURVIVAL OF PROVISIONS, INDEMNIFICATION, AND DISPUTE RESOLUTION | | | 33 | |

| | 15.1 | | Survival | | | 33 | |

| | 15.2 | | Indemnification by Shareholder | | | 33 | |

| | 15.3 | | Indemnification by Merger Sub and Parent | | | 33 | |

| | 15.4 | | Rules Regarding Indemnification | | | 34 | |

| | 15.5 | | Exclusivity | | | 35 | |

| | 15.6 | | Mandatory Binding Arbitration | | | 35 | |

| |

ARTICLE XVI. | | | | |

| | |

| | MISCELLANEOUS | | | 37 | |

| | 16.1 | | Assignment | | | 37 | |

| | 16.2 | | Other Expenses | | | 37 | |

| | 16.3 | | Notices | | | 37 | |

| | 16.4 | | Confidentiality; Prohibition on Trading | | | 39 | |

| | 16.5 | | Confidential Information | | | 39 | |

| | 16.6 | | Partial Invalidity; Waiver | | | 39 | |

| | 16.7 | | Interpretation; Knowledge | | | 40 | |

| | 16.8 | | Limitation of Actions | | | 40 | |

| | 16.9 | | Legal Fees and Costs | | | 40 | |

| | 16.10 | | Controlling Law | | | 40 | |

| | 16.11 | | Representatives | | | 40 | |

| | 16.12 | | Parent Guarantee | | | 40 | |

| | 16.13 | | Entire Agreement; Counterparts | | | 40 | |

[ILLEGIBLE]

v

[ILLEGIBLE]

AGREEMENT AND PLAN OF MERGER

ThisAGREEMENT AND PLAN OF MERGER (“Agreement”) is entered into on February 12, 1998 by and amongCHAD YOUTH ENHANCEMENT CENTER, INC., a Tennessee corporation (“CHAD”),CLG MANAGEMENT, LLC, a Tennessee limited liability company (“CLG”),ROBERT DUWAYNE GLASNER, Psy.D. (“Shareholder”).BECKYE LYNN GLASNER (“Member”) (the Shareholder and the Member are referred to herein collectively as the “Sellers” or the “Members”),CHILDREN’S COMPREHENSIVE SERVICES MANAGEMENT COMPANY, a Tennessee corporation (“Merger Sub”) (the Merger Subsidiary and CHAD sometimes collectively herein referred to as the “Constituent Corporations”), andCHILDREN’S COMPREHENSIVE SERVICES, INC, a Tennessee corporation (“Parent”),

RECITALS:

WHEREAS, CHAD owns and operates a residential treatment center (the “Facility”) providing behavioral health care services to children and adolescents (the “Business”); and

WHEREAS, the land, buildings and improvements comprising the Facility and containing approximately twenty (20) acres (herein the “Real Estate Assets”) are owned by CLG and leased to CHAD; and

WHEREAS, Shareholder owns all of the issued and outstanding capital stock of CHAD (the “CHAD Stock”) and the Shareholder and the Member are the sole members of CLG; and

WHEREAS, the Shareholder desires to transfer the CHAD Stock and Parent desires to acquire the same from the Shareholder in a stock-for-stock reorganization under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), subject to the terms and conditions set forth in this Agreement; and

WHEREAS, Parent through the Merger Sub also desires to acquire and CLG desires to sell the Real Estate Assets to the Merger Sub, subject to the terms and conditions set forth in this Agreement; and

WHEREAS, Parent desires to guarantee performance by the Merger Sub under this Agreement of all of the representations, warranties, covenants, conditions and agreements to be performed and observed by each of them.

NOW, THEREFORE, in consideration of the foregoing premises and the mutual agreements and covenants contained in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties, intending to be legally bound hereby, agree (a) that CHAD shall be merged (herein the “Merger”) into the Merger Sub, and (b) Merger Sub shall acquire the Real Estate Assets contemporaneously with the Merger, all in accordance with the terms of this Agreement.

[ILLEGIBLE]

ARTICLE I.

MERGER OF CONSTITUENT CORPORATIONS

1.1Effect of the Merger. On the Effective Date of the Merger (as such date is defined in Section 5.1), CHAD shall be merged into Merger Sub, the separate legal existence of CHAD shall cease, and Merger Sub, as the surviving corporation, shall continue its corporate existence under the laws of the State of Tennessee under the name of CHAD Youth Enhancement Center, Inc. (or such other name as Parent may subsequently elect). Subsequent to the Merger, the Merger Sub shall possess all the rights, privileges, powers, and franchises of a public as well as of a private nature and be subject to all the restrictions, disabilities, and duties of CHAD. All rights, privileges, powers, and franchises of CHAD and all property, real, personal, and mixed, belonging to CHAD shall be vested in Merger Sub and all property, rights, privileges, powers, and franchises and every other interest shall be thereafter as effectually the property of Merger Sub as they were of CHAD. The title to real estate, if any, vested by deed or otherwise in CHAD, shall not revert or be in any way impaired by reason of this Merger, provided that all rights of creditors and all liens upon any property of CHAD shall be preserved unimpaired and all debts, liabilities, and duties of CHAD shall thenceforth attach to the Merger Sub and may be enforced against the Merger Sub to the same extent as if said debts, liabilities, and duties had been incurred or contracted by the Merger Sub.

1.2Assets of CHAD at Closing; Properties Acquired in the Merger. At the closing of the Merger (the “Closing”), CHAD will own or lease, as applicable, all assets, tangible and intangible, real and personal, that are currently used to operate the Business (the “CHAD Assets”), free and clear of all encumbrances, mortgages, pledges, liens, and security interests, other than Permitted Encumbrances as herein defined, “Permitted Encumbrances” are defined as (a) mechanic’s, materialmen’s and similar liens with respect to any amounts not yet due and payable which are being contested in good faith through appropriate proceedings, (b) liens for taxes not yet due and payable or for taxes which are being contested in good faith through appropriate proceedings, (c) liens securing rental payments under capital lease agreements, if any, (d) the Easement described in Section 6.2, (e) to the extent constituting a lien or claim on assets, current liabilities of CHAD as reflected on the Balance Sheet (as defined herein) that is contained inExhibit 7.5(1)(“Current Liabilities”) and (f) encumbrances and restrictions on any real property owned or leased by CHAD (including easements, covenants, rights of way and similar restrictions of record) which are reflected in the Title Commitment (as defined herein) and approved by the Parent in accordance with the provisions of this Agreement and which do not materially interfere with the present uses of such real property. The CHAD Assets will include, without limitation, the following:

(1) All right, title and interest of CHAD as lessee in and to all of the real property leased by CHAD from CLG and used in connection with the Business, if any, including, without

[ILLEGIBLE]

2

[ILLEGIBLE]

limitation, the real property listed and described onExhibit 1.2(1) attached hereto, and in and to all structures, improvements, fixed assets and fixtures including fixed machinery and fixed equipment leased by CHAD and situated thereon or forming a part thereof and all appurtenances, easements and rights-of-way related thereto (collectively, the “Leased Real Estate”);

(2) All equipment, machinery (including the copier leased by CHAD), data processing hardware and software, furniture, furnishings, appliances, vehicles (including the pick-up truck or van owned by CHAD) and other tangible personal property and all replacement parts therefor used in connection with the Business including, without limitation, the equipment listed onExhibit 1.2(2) attached hereto (collectively, the “Equipment and Furnishings”);

(3) All inventory of goods and supplies used or maintained in connection with the Business reflected on the Financial Statements (collectively, the “Inventory”);

(4) All accounts and notes receivables (the “Receivables”) of CHAD;

(5) Subject to the provisions of Section 3.1 relative to payment of CHAD’s obligations to the Peoples Bank, Dickson, Tennessee (“Peoples Bank”) all cash, including funds on hand, bank accounts including, without limitation, those accounts listed by name and address of banking institution, account name and account and routing numbers onExhibit 1.2(5) attached hereto, money market accounts, other accounts, certificates of deposit and other investments of CHAD (the “Cash and Cash Equivalents”), and all prepaid expenses, all prepaid taxes, any and all tax attributes (as the term “tax attributes” is defined in Section 381 of the Code) and CHAD Assets as of Closing, including without limitation, and all net operating loss carry forwards (if any, to the extent permitted by Section 382 of the Code); [provided,that, all actual cash on hand at Closing shall be deemed included in any computation of net working capital for the purposes of this Agreement and all financial statements prepared in connection herewith or referred to herein];

(6) All personnel, corporate and other records related to the Business, including both hard and microfiche copies, and all manuals, books and records used in operating the Business, including, without limitation, personnel policies and files and manuals, accounting records, and computer software;

(7) To the full extent not legally required to be reissued or transferred as a consequence of the Merger, all federal, state and local licenses, permits, registrations, certificates, consents, accreditations, approvals and franchises, if any, held by CHAD in connection with the Business as currently conducted (collectively, the “Licenses”);

(8) All goodwill, and, to the extent assignable by CHAD, all warranties express or implied and rights and claims related to the CHAD Assets or the operation of the Business;

(9) Contract rights and interests held by CHAD arising out of or related to the Business, including but not limited to those certain consultation service agreements, management service agreements and other similar contracts identified onExhibit 1.2(9) hereto;

[ILLEGIBLE]

3

[ILLEGIBLE]

(10) All intangible or intellectual property owned, leased, licensed or possessed by CHAD or the Shareholder and utilized in connection with the Business, including without limitation, the name “CHAD Youth Enhancement Center, Inc.” and all variations and derivations thereof, to the extent CHAD or the Shareholder has rights in or to each such name; and

(11) All of CHAD’S right, title and interest in any partnerships, joint ventures or similar arrangements (If any, but only to the extent transferable as of right by CHAD).

1.3Further Assurances. From time to time as and when requested in writing by the Merger Sub or any other Parent Company Affiliate (as defined herein), and at the expense of the requesting party, the officers, the directors and the Shareholder of CHAD last in office shall execute and deliver such deeds and other instruments and shall take or cause to be taken such other actions as shall be necessary to vest or perfect in or to confirm of record or otherwise the Merger Sub’s title to, and possession of, all the property, interests, assets, rights, privileges, immunities, powers, franchises, and authority of CHAD described in Section 1.2, and otherwise necessary to carry out the purposes of this Agreement.

1.4Additional Parent Company Obligations. Parent Company shall do or cause to be done all of the following:

(1) Obtain the release of Shareholder’s obligations from all Contracts (as defined herein) listed onExhibit 1.4(1), but only to the extent such obligations relate to or arise from periods after Closing or otherwise constitute a current liability being assumed by Merger Sub as a consequence of the Merger. In the event that Parent elects not to obtain the release of the Shareholder, or is unable to obtain any one or more releases, then such obligation shall be deemed to be covered by the indemnification obligations of the Parent set forth in this Agreement;

(2) For at least three (3) from the Effective Date (as defined herein) the Parent Company shall remain at all times current in its public reporting requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and maintain its registration under the Exchange Act. For at least three (3) years from the Effective Date, the Parent Company also shall continuously, without interruption, maintain its listing on the New York Stock Exchange, the American Stock Exchange, or the National Association of Securities Dealers, Inc. Automated Quotation System or other recognized securities exchange (collectively, the “Stock Exchanges”) reasonably acceptable to Shareholder.

(3) Provide to the person(s) receiving the Parent Company Shares as the Merger Consideration the incidental (“piggy-back”) registration rights specified inExhibit 1.4(3) and shall perform the obligations therein specified; and

(4) As to the copier and van acquired pursuant to Section 1.2(2), the Merger Sub shall assume the related obligations, whether classified as a long-term or short-term liability.

1.5Additional Governing Provisions. It is understood by the parties hereto that the Real Estate Assets and the CHAD Assets are presently encumbered by liens that secure certain

[ILLEGIBLE]

4

[ILLEGIBLE]

obligations owed to Peoples Bank. The existence of such liens shall not constitute violations of this Agreement so long as the Sellers arrange, prior to or contemporaneously with the Closing hereof for the repayment in full of such obligations to Peoples Bank and such liens are actually released by Peoples Bank. The other terms of this Agreement shall be read in connection with this Section 1.5.

ARTICLE II.

CONVERSION AND EXCHANGE OF SHARES

2.1Conversion of Shares. The manner of converting or exchanging the shares of each of the Constituent Corporations shall be as follows:

(1) The Merger shall effect no change in any of the shares of the Merger Sub stock, and none of its shares shall be converted as a result of the Merger.

(2) Each share of CHAD Stock issued and outstanding on the Effective Date of the Merger (except shares of CHAD Stock issued and held in the treasury of CHAD) shall, by virtue of the Merger and on the Effective Date of the Merger, be converted into and become, without action on the part of the holder thereof, shares of fully paid and nonassessable Parent Common Stock (as defined herein) in an amount sufficient to comprise the Merger Consideration as set forth in Article III below.

2.2Shares Owned by CHAD. Each share of CHAD Stock issued and held in the treasury of CHAD (if any) shall be canceled and retired, and no shares of stock or other securities of Parent shall be issuable, and no cash shall be exchangeable, with respect thereto.

2.3Fractional Shares. No fractional shares of Parent Common Stock shall be issued pursuant to Section 2.1(2), but in lieu thereof, cash shall be paid to the holder thereof in an amount based on the closing price of Parent Common Stock on the NASDAQ Stock Market’s NASDAQ National Market on the Effective Date of the Merger or, if such shares were not traded on such date, based on the closing price thereof on the next preceding day on which such shares were traded. Such amounts shall be paid within ten (10) days after the Closing. No interest shall be payable thereon.

2.4Exchange of Shares. On and after the Effective Date of the Merger, the Shareholder shall be entitled to receive in exchange for his shares of CHAD Stock a certificate or certificates representing the number of shares of Parent Common Stock (as defined herein) to which he is entitled as provided in Section 2.1(2), and any cash to which he maybe entitled on account of fractional shares as provided in Section 2.3. The Shareholder may elect to have the shares of Parent Common Stock issued to the Sellers as joint tenants with a right of survivorship. Until so presented and surrendered in exchange for a certificate representing Parent Common Stock, each certificate which represented issued and outstanding shares of CHAD Stock on the Effective Date of the Merger shall be deemed for all purposes to evidence ownership of the

[ILLEGIBLE]

5

[ILLEGIBLE]

number of shares of Parent Common Stock into which such shares of CHAD Stock have been converted pursuant to the Merger. Until surrender of such certificates in exchange for certificates representing Parent Common Stock, the holder thereof shall not be entitled to vote at any meeting of Parent stockholders or to receive any dividend or other distribution payable to holders of shares of Parent Common Stock; provided, however, that upon surrender of such certificates representing CHAD Stock in exchange for certificates representing Parent Common Stock, there shall be paid to the record holder of the certificate representing Parent Common Stock issued upon such surrender the amount of dividends or other distributions (without interest) that theretofore became payable with respect to the number of shares of Parent Common Stock represented by the certificate issued upon such surrender. Each of the parties obligated to deliver shares of stock under this Agreement shall deliver such certificates, duly executed and/or endorsed, as the case may be, at the Closing.

ARTICLE III.

MERGER CONSIDERATION

3.1Merger Consideration.

(1) The merger consideration (“Merger Consideration”) shall be Fifty Eight Thousand (58,000) shares of the common voting stock. $0.01 par value, of the Parent (the “Parent Common Stock”), subject to adjustment as set forth in this Article III. The Merger Consideration will be subject to adjustment as follows:

(a) subject to the provisions of this Section 3.1 relative to repaying Peoples Bank, the Merger Consideration shall be increased or decreased, as appropriate, for any change in net working capital of CHAD between the amount shown on the Balance Sheet of CHAD as of September 30, 1997 and the amount of net working capital shown on the Balance Sheet of CHAD as of January 31, 1998;

(b) the Merger Consideration shall be increased or decreased, as appropriate, to account for additions or deletions of property, plant, equipment or other non-current assets, if any, purchased or sold between September 30, 1997 and January 31, 1998, subject, however, to the prior written consent of the Merger Sub for material (individually or in the aggregate) transactions, which consent will not be unreasonably withheld;

(c) the Merger Consideration shall also be increased or decreased, as appropriate, to account for any other Adjustments which are not otherwise included in net working capital at Closing as of January 31, 1998; and

(d) the Merger Consideration shall be adjusted as necessary to take into account the effects of any stock splits or stock dividends, or comparable actions by either Parent or CHAD, prior to Closing. For purposes of the preceding sentence, the term “Adjustment” shall mean financial statement entries relative to salaries and wages, related payroll taxes, sick leave, holiday, vacation benefits, retirement and any other fringe benefits that will have accrued or should be accrued to CHAD’s employees through January 31, 1998.

[ILLEGIBLE]

6

[ILLEGIBLE]

In making the various adjustments called for in Section 3.1(1), the parties acknowledge and agree that it is their mutual intention to make the transaction have the same economic effect as if the Closing had actually occurred on January 31, 1998 even though the Merger will not be legally effective until the Effective Time (as herein defined). The parties agree that the same kinds of Adjustments made to the January 31, 1998 financial statements shall also be made to the September 30, 1997 financial statements.

Notwithstanding the provisions of Subsection 3.1(1)(a) above, CHAD is specifically authorized to repay the existing term loan liability owed to Peoples Bank as to which CHAD is an obligor in an amount not to exceed Three Hundred Twenty Thousand and No/100 Dollars ($320,000.00) without causing a reduction in the number of shares payable to the Shareholder as Merger Consideration.

(2) The Parent Common Stock will constitute restricted securities the resale of which shall be subject to the requirements of Rule 144 or any similar exemption under federal or state securities laws in effect from time to time. All aspects of the proposed transaction shall be subject to applicable state and federal securities laws. Parent acknowledges and agrees that the Sellers are not now and will not become, as a result of the transactions contemplated by this Agreement, “affiliates,” “controlling persons” or “principal shareholders” of Parent within the meaning of the Securities Act of 1933, as amended, the Exchange Act, or any applicable provision of the Tennessee Securities Act, as amended.

3.2Closing Statements. The adjustments to the Merger Consideration specified in Section 3.1(1) shall be estimated by the parties hereto in good faith at the Closing to the extent reasonably possible based on the most current interim financial statements; and provisional adjustments as shall be mutually agreed at Closing shall be reflected in one certain “Preliminary Closing Statement”. Attached asExhibit 3.2(1) is the format of the Preliminary Closing Statement. No later than sixty-five (65) days after the Closing, the parties hereto shall prepare the “Final Closing Statement” reflecting the items listed above prepared consistent with the past preparation of the internal financial statements of CHAD on an accrual basis applied consistently with prior periods. Adjustments made after the Closing based on the Final Closing Statement shall be payable in cash by the Parent or, if to be paid by the Shareholder, in the discretion of the Shareholder, in cash or by a combination of cash and shares of Parent Common Stock received as Merger Consideration, on or before the tenth day following the day the Final Closing Statement is agreed upon by the parties. If Merger Sub and the Sellers are unable to agree on the Final Closing Statement within sixty-five (65) days after delivery of the Final Closing Statement, they shall appoint a firm of independent certified public accountants upon which the parties mutually and in good faith agree (the “Accountants”) to make such determination, which determination, shall be final and binding on the parties hereto for the purpose of this Agreement, and Merger Sub and Shareholder shall each pay one-half the cost of the Accountants. The format of the Final Closing Statement is attached hereto asExhibit 3.2(2).

[ILLEGIBLE]

7

[ILLEGIBLE]

ARTICLE IV.

CERTIFICATE OF INCORPORATION; OFFICERS AND

DIRECTORS FOLLOWING MERGER

The Certificate of Incorporation of Merger Sub is hereby amended, effective on the Effective Date of the Merger, by changing Article I thereof so as to read in its entirety as follows: “The name of the corporation is “CHAD Youth Enhancement Center, Inc.”

On the Effective Date of the Merger, the Certificate of Incorporation of Merger Sub, as hereby amended, shall be the Certificate of Incorporation of the surviving corporation.

The officers and directors of the Merger Sub on the Effective Date shall, from and after the Effective Time (as defined herein), be the initial officers and directors of the Merger Sub after the Merger until their respective successors have been duly elected or appointed and qualified or until their earlier death, resignation or removal in accordance with the Certificate of Incorporation and Bylaws of the Merger Sub.

Neither CHAD, CLG nor either of the Sellers, officers, directors or employees thereof immediately prior to the Effective Time of the Merger shall be responsible for accomplishing such filing(s).

ARTICLE V.

EFFECTIVE DATE OF MERGER; FILING OF MERGER DOCUMENTS

5.1Effective Date. The Merger shall become effective on the filing this Agreement (or appropriate Certificate(s) of Merger) (such documentation herein the “Certificate of Merger”) in the manner required by applicable law (the date of such filing being herein called the “Effective Date of the Merger” and the time of the filing thereof with the Tennessee Secretary of State shall be called the “Effective Time of the Merger”).

5.2Filing of Certificate of Merger. Unless this Agreement shall have been terminated prior thereto under the provisions of Article XIV hereof, the Certificate of Merger shall be so filed and recorded as promptly as possible after Closing which shall occur upon satisfaction of the conditions precedent to Closing and in no event later than the end of the next business day following Closing.

[ILLEGIBLE]

8

[ILLEGIBLE]

ARTICLE VI.

ASSET ACQUISITION OF REAL ESTATE ASSETS OF CLG

6.1Real Estate Assets of CLG; Sale of Real Estate Assets to Merger Sub. Simultaneously with closing of the Merger, the Merger Sub shall also acquire, and CLG shall sell, transfer, convey and deliver to the Merger Sub all of CLG’s right, title and interest in fee to all of the Real Estate Assets. The Real Estate Assets include all of the approximately twenty (20) acres of real property, other than the Retained Real Estate, as shown on the survey (the “Survey”) dated January 21, 1998 and attached hereto asExhibit 6.1(a). The Real Estate Assets shall include CLG’s right, title and interest in fee in and to all structures, improvements, fixed assets, fixtures (including fixed machinery and fixed equipment) owned in fee by CLG and situated at, on, or under the Real Estate Assets, together with all existing appurtenances, easements and rights-of-way related thereto. CLG shall provide a title insurance commitment (the “Title Commitment”) prior to Closing, and a title insurance policy (the “Title Policy”) consistent therewith promptly after Closing from a title issuer reasonably acceptable to Merger Sub, and all of CLG’s liability to any of the CCSI Companies for representations and warranties concerning matters of title to the Real Estate Assets herein and in the Deed shall be deemed to be limited to the coverage of such Title Policy. The Title Commitment and the Title Policy shall not contain any exceptions other than the Permitted Exceptions and other exceptions (if any) agreed upon by the Parent or the Merger Sub in their sole discretion at or before Closing as disclosed in the Title Commitment. The Title Commitment shall become a part of this Agreement asExhibit 6.1(b) and the Title Policy shall become a part of this Agreement asExhibit 6.1(c).

6.2Retention of Irrevocable, Permanent Easement Rights. The Merger Sub shall acquire all non-public roads located contiguous to the Real Estate Assets that are owned by CLG from CLG. The Merger Sub agrees that CLG shall retain an irrevocable, insurable, mortgageable easement (the “Easement”) in respect of such roads, which Easement shall entitle CLG to reasonable ingress and egress to and from the Real Estate Assets on existing roads, to perpetual use of the existing roads to and from the Facility, and to provide current and future utility access mutually and reasonably acceptable to both parties to the Retained Real Estate.

6.3Consideration for Real Estate Assets and Easements. As consideration for the conveyance by CLG of the Real Estate Assets, the Merger Sub shall pay to CLG at Closing the sum of One Million Two Hundred Thousand and No/100 Dollars (US$1,200,000.00) in cash in immediately available funds (the ���Cash Consideration”). The Cash Consideration shall be subject, however, to adjustment at Closing for 1998 real estate taxes, which shall be pro-rated between CLG and the Merger Sub through Closing.

6.4Conveyance of Real Estate Assets; Status of Title. CLG shall convey the Real Estate Assets and retain the Easement by execution and delivery of a Special Warranty Deed (the “Deed”) in the usual and customary form appropriate for recording with the applicable Register of Deeds for the county in which the Real Estate Assets are located. The Deed shall convey good and marketable title to the Real Estate Assets to the Merger Sub free and clear of all encumbrances, mortgage pledges, liens and security interests other than Permitted Encumbrances

9

[ILLEGIBLE]

as defined in Section 1.3 hereof and as set forth in Section 6.1 hereof. The form of the Deed is attached hereto asExhibit 6.4. The Deed shall recite that CLG retains the Easement for the benefit of CLG, Robert DuWayne Glasner, and all of CLG’s successors in title forever.

6.5Excluded Items. Notwithstanding any other provision contained in this Agreement to the contrary. CLG shall not sell, transfer, convey or deliver to the Merger Sub, and the Merger Sub shall not acquire any interest in the real estate and other property rights described in the Survey (Exhibit 6.1(a)) other than that marked as part of the approximately twenty (20) acres used for the Facility as described on the Survey and in the Deed. CLG is retaining all such property (the “Retained Real Estate”).

6.6Restrictive Covenants. At Closing, the parties shall execute mutual restrictive covenants that shall run with the land and be binding on their respective successors until January 31, 2018 in the form ofExhibit 6.6. CLG agrees that it shall not, as of the Closing or at any time thereafter, permit the Retained Real Estate to be used for any Competitive Business (as defined herein). Parent and Merger Sub agree that they shall not, as of the Closing or at any time thereafter, permit the Real Estate Assets to be used for any purpose that is toxic or hazardous to the use of the Retained Real Estate for residential, commercial, or office purposes. “Competitive Business” means any commercial or not-for-profit enterprise involving the use of the Retained Real Estate as a group residential facility of any type including by way of example and not by way of limitation a treatment center for delivery of behavioral health services or a nursing home.

ARTICLE VII.

REPRESENTATIONS AND WARRANTIES OF SELLERS AND CLG

As a material inducement to Parent and Merger Sub to enter into this Agreement, to consummate the Merger and to acquire the Real Estate Assets, CLG and the Shareholder each hereby jointly and severally represent and warrant to Parent and Merger Sub, which representations and warranties will be true and correct on the date of Closing the matters set forth in this Article VII. In addition, Beckye Lynn Glasner, individually, acknowledges and agrees that she has read and carefully reviewed all of the representations and warranties set forth in this Article VII, and, to her knowledge, such representations and warranties are true, correct and accurate.

7.1Organization, Qualification and Authority. CHAD is a corporation duly organized and validly existing under the laws of the State of Tennessee and is in good standing and duly qualified to do business as a foreign corporation in all states required by its Business as set forth onExhibit 7.1, except where the failure to be so qualified would not have a material adverse effect on the Business or results of operations of CHAD. CHAD has full corporate power and authority to own, lease and operate its facilities and assets as presently owned, leased and operated, and to carry on its business as it is now being conducted. CHAD and Sellers each have the full right, power and authority to execute, deliver and carry out the terms of this Agreement and all documents and agreements executed and delivered in connection with this Agreement, to

[ILLEGIBLE]

10

[ILLEGIBLE]

consummate the Merger and other transactions contemplated on the part of each such party hereby and to take all actions necessary, in their respective capacities, to permit or approve the actions of each of CHAD and Sellers. The execution, delivery and consummation of this Agreement, and all other agreements and documents executed in connection herewith by each of CHAD and Sellers, have been duly authorized by all necessary action on the part of such parties. No other action, consent or approval on the part of any of CHAD, Sellers or any other person or entity is necessary to authorize due and valid execution, delivery and consummation, of this Agreement and all other agreements and documents executed in connection herewith. This Agreement and all other agreements executed in connection herewith by CHAD and/or Sellers, upon due execution and delivery thereof, will constitute the valid and binding obligations of CHAD and/or Sellers, as the case may be, enforceable in accordance with their respective terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization or similar laws affecting creditors’ rights generally and by general principles of equity.

CLG is a limited liability company duly organized and validly existing under the laws of the State of Tennessee and is in good standing in the State of Tennessee. CLG conducts no operations and has no property outside the State of Tennessee. CLG has full authority and power to own, lease and operate its facilities and assets as presently owned, leased and operated and to carry on its Business as it is now being conducted. CLG has the full right, power and authority to execute, deliver and carry out the terms of this Agreement and all documents and agreements executed and delivered in connection with this Agreement to consummate the sale of the Real Estate Assets contemplated herein and to take all action necessary to effectuate the consummation of the sale of the Real Estate Assets. The execution, delivery and consummation of this Agreement, and all other agreements and documents executed in connection herewith by CLG and/or its Members have been, or by the date of Closing, will have been duly authorized by all necessary action on the part of such parties. No other action, consent or approval on the part of CLG, its Members, or any other person is necessary to authorize due and valid execution, delivery and consummation, of this Agreement and all other agreements and documents executed in connection with the sale of the Real Estate Assets to the Merger Sub. This Agreement and all other agreements executed in connection herewith by CLG and/or its Members, upon due execution and delivery thereof, will constitute the valid and binding obligations of CLG enforceable in accordance with their respective terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization or similar laws affecting creditors’ rights generally and by general principles of equity. A copy of each of the Articles of Organization and the Certificate of Existence of CLG are attached to the opinion of counsel to be supplied by the Sellers pursuant to Section 11.9.

7.2Capitalization and Stock Ownership; Membership Interest in CLG. Except for the Shareholder, no other person or entity owns or holds, has any interest in, whether legal, equitable or beneficial, or has the right to purchase, any capital stock or other security of CHAD. CHAD has issued and outstanding One Thousand (1,000) shares of its par value common stock which constitute all the issued and outstanding securities of CHAD (the “CHAD Stock”). The CHAD Stock is duly authorized, validly issued, fully paid and nonassessable, and is owned free and clear of any liens, charges, security interests, pledges or other encumbrances other than the lien to Peoples Bank. At Closing. CHAD will not have any outstanding subscriptions, options,

[ILLEGIBLE]

11

[ILLEGIBLE]

warrants, calls, contracts, convertible securities or other instruments, agreements or arrangements of any nature whatsoever under which CHAD is or may be obligated or compelled to issue any capital stock, security or interest of any kind, or to transfer or modify any right with respect to any capital stock, security or other interest, and, as of the Closing, no one will have any preemptive rights, right of first refusal or similar rights with respect to the CHAD Stock or, other than the Shareholder, any equity interest in CHAD. Neither CHAD nor Shareholder is a party to any, and there exist no, voting trusts, stockholder agreements, pledge agreements or other agreements relating to or restricting the transferability of any shares of the CHAD Stock or equity interests of CHAD.

The Members are also the sole members of CLG.

7.3Investments. CHAD owns no capital stock, securities, interest or other right or any option or warrant convertible into the same, of any corporation, partnership, limited liability company, joint venture or other business enterprise.

7.4Absence of Default. The execution, delivery and consummation of this Agreement, and all other agreements and documents executed in connection herewith by CHAD, CLG and Sellers will not constitute a violation of, or be in conflict with, will not, with or without the giving of notice or the passage of time, or both, result in a breach of, constitute a default under, create or cause the acceleration of the maturity of any debt, indenture, obligation or liability affecting CHAD, CLG, the Sellers, the Business. CHAD Assets or Real Estate Assets or rights in the CHAD Stock, result in the creation or imposition of any security interest, lien, charge or other encumbrance upon any of the CHAD Stock, the CHAD Assets or the Real Estate Assets under: (a) any term or provision of the Charter or Bylaws of CHAD or the Operating Agreement of CLG; (b) any contract, lease, purchase order, agreement, document, instrument, indenture, mortgage, pledge, assignment, permit, license, approval or other commitment to which CHAD, CLG and/or any Seller is a party or by which either CHAD, CLG, any Seller, the CHAD Stock, the CHAD Assets and/or the Real Estate Assets are bound; (c) any judgment, decree, order, regulation or rule of any court or regulatory authority; or (d) any law, statute, rule, regulation, order, writ, injunction, judgment or decree of any court or governmental authority or arbitration tribunal to which CHAD, CLG, any Seller, the CHAD Stock, the CHAD Assets and/or the Real Estate Assets are subject.

7.5Financial Statements.

(1) Attached hereto asExhibit 7.5(1) are true and correct copies of CHAD’s compiled balance sheets and income statements for the year ended September 30, 1997 (the “Fiscal Year Financial Statements”), and the interim unaudited balance sheets and income statements of CHAD for the one (1) month period ended October 31, 1997 (the “Interim Financial Statements.” which, with the Fiscal Year Financial Statements, will be referred to as the “Financial Statements”). The Financial Statements are based on the books and records of CHAD. Except as set forth in the Interim Financial Statements or onExhibit 7.5(1). CHAD has, and as of the Closing will have, no material contingent liabilities or obligations, except for such liabilities and obligations (none of which individually or in the aggregate shall be material) which are incurred in the ordinary course of business.

[ILLEGIBLE]

12

[ILLEGIBLE]

(2) To the best knowledge of CHAD and the Sellers, the books and records of CHAD are in such order and completeness so that an unqualified audit may be performed for any period prior to Closing not already audited. The Sellers will cooperate in all reasonable respects with the Merger Sub in attempting to perform an audit of CHAD for any period prior to Closing not already audited at Merger Sub’s expense.

7.6Operations since September 30, 1997. Except as set forth inExhibit 7.6, since September 30, 1997 there has been no:

(1) change in the condition of CHAD, financial or otherwise, which has, or could reasonably be expected to have, a material adverse effect on any of the CHAD Assets, the Real Estate Assets, the Business or on the results of the operations of CHAD as a whole;

(2) material loss, damage or destruction of or to any of the CHAD Assets or the Real Estate Assets, whether or not covered by insurance;

(3) sale, lease, transfer or other disposition by CHAD or CLG of, or mortgages or pledges of, or the imposition of any lien, charge or encumbrance (other than taxes and fees imposed by the governmental authorities none of which are delinquent) on, any portion of the CHAD Assets or the Real Estate Assets, except inventory and equipment held for use in the ordinary course of business and the disposal of obsolete assets in non-material amounts in the ordinary course of business;

(4) increase in the compensation payable by CHAD, the Shareholder, officers of directors or any increase in the compensation payable to CHAD to any other employees, independent contractors or agents, or increase in, or institution of, any bonus, insurance, pension, profit-sharing or other employee benefit plan or arrangements made to, for or with the employees, independent contractors or agents of CHAD outside the ordinary course of business. A list of employees and their compensation as of February 10, 1998 is attached hereto asExhibit 7.6(4);

(5) adjustment or write-off of Receivables or reduction in reserves for Receivables outside of the ordinary course of business, or change in the accounting methods or practices employed by CHAD or change in adopted depreciation or amortization policies;

(6) issuance or sale by CHAD, or contract or other commitment entered into by CHAD or any Seller for the issuance or sale, of any shares of capital stock or securities convertible into or exchangeable for capital stock of CHAD;

(7) payment by CHAD of any dividend, distribution or extraordinary or unusual disbursement or expenditure or intercompany payable other than lease payments to CLG under the CLG Lease (as defined herein) and the conveyance of a garage to the Shareholder as additional compensation to the Shareholder;

[ILLEGIBLE]

13

[ILLEGIBLE]

(8) merger, consolidation or similar transaction; or solicitation therefor;

(9) security interest, guarantee or other encumbrance, other than in the ordinary course of business, obligation or liability, in each case whether absolute, accrued, contingent or otherwise, or whether due or to become due, incurred or paid by CHAD to any person or entity; or the making by CHAD of any loan or advance to, or an investment in, any person or entity other than prepayments for goods and services actually used in the Business in non-material amounts made in the ordinary course of business;

(10) federal, state, or local statute, rule, regulation, order or case adopted, promulgated or decided that, to the knowledge of CHAD or the Sellers, materially and adversely affects CHAD, the CHAD Stock, the Business, the CHAD Assets or the Real Estate Assets;

(11) strike, work stoppage or other labor dispute adversely affecting the Business; or

(12) termination, waiver or cancellation of any material rights or claims of CHAD, under any contract of CHAD or otherwise,

7.7Litigation. Except as disclosed inExhibit 7.7, no person or party including, without limitation, any governmental agency has asserted, or, to the knowledge of CHAD or CLG or Sellers, has threatened to assert, any claim for any action or proceeding, against CHAD or CLG (or any officer, director, employee, agent or Shareholder of CHAD or CLG) arising out of any statute, ordinance or regulation relating to wages, collective bargaining, discrimination in employment or employment practices or occupational safety and health standards (including, without limitation, the Fair Labor Standards Act. Title VII of the Civil Rights Act of 1964, as amended, the Occupational Safety and Health Act, the Age Discrimination in Employment Act of 1967, or the Americans With Disabilities Act or the Family Medical Leave Act of 1993). Neither CHAD nor CLG nor Sellers have received notice of any violation of any law, rule, regulation, ordinance or order of any court or federal, state, municipal or other governmental department, commission, board, bureau, agency or instrumentality (including, without limitation, legislation and regulations applicable to environmental protection, civil rights, public health and safety and occupational health). Except as set forth inExhibit 7.7, there are no lawsuits, proceedings, actions, arbitrations, governmental investigations, claims, inquiries or proceedings pending or threatened involving CHAD, CLG, the Sellers, the CHAD Stock, any of the CHAD Assets, the Real Estate Assets or the Business Disclosure of such matters onExhibit 7.7 shall not limit or vitiate the indemnity for such pre-Closing claims provided in Article XV.

7.8Licenses. CHAD has all Licenses necessary for CHAD to operate and conduct the Business, and there does not exist any waivers or exemptions relating thereto, except where the failure to hold such licenses would not have a material adverse effect. There is no material default on the part of CHAD or any other party under any of the Licenses. To the best knowledge of CHAD and the Shareholder, there exists no grounds for revocation, suspension or limitation of any of the Licenses, except to the extent the Merger may have such effect. Copies of each of the Licenses are attached hereto and are listed onExhibit 7.8. No notices have been received by CHAD or either of the Sellers with respect to any threatened, pending, or possible revocation, termination, suspension or limitation of the Licenses.

[ILLEGIBLE]

14

[ILLEGIBLE]

7.9Medicare and Medicaid Matters. To the extent applicable to CHAD, CHAD has complied, and, to CHAD’S best knowledge, as it might relate to CHAD or the Business, each of the providers, if any, with which CHAD contracts (herein a “CHAD Provider”) has complied in all material respects with all laws, rules and regulations of the Medicare. Medicaid and other governmental health care programs, and has filed all claims, invoices, returns, cost reports and other forms substantially in the manner prescribed. All cost reports, claims, invoices, filings and other forms made or filed by CHAD, if applicable, and, to CHAD’S best knowledge, made or filed by each CHAD Provider with Medicare. Medicaid or any other governmental health or welfare related entity or any third party payor since the inception of the Business, are in all respects true, complete, correct and accurate in all material respects. To the best of CHAD’S knowledge, no deficiency, either individually or in the aggregate, in any such cost reports, claims, invoices and other filings, including claims for over-payments or deficiencies or for late filings, has been asserted or threatened by any federal or state agency or instrumentality or other provider reimbursement entities relating to Medicare or Medicaid claims or any other third party payor, and there is no reasonable basis known to CHAD or the Sellers for any claims or requests for reimbursement. Neither CHAD nor, to the best of its knowledge, any CHAD Provider has been subject to any audit relating to fraudulent procedures or practices. To the best of CHAD’s knowledge, there is no basis for any claim or request for recoupment or reimbursement from CHAD or, to the best of its knowledge, any CHAD Provider, of any federal or state agency or instrumentality or other provider reimbursement entities.

7.10Title to and Condition of CHAD Assets.

(1) CHAD is the sole legal and beneficial owner of the personal property included in the CHAD Assets, free and clear of all mortgages, security interests, liens, leases, covenants, assessments, easements, options, rights of refusal, restrictions, reservations, defects in title, encroachments, and other encumbrances, except for Permitted Encumbrances. The CHAD Assets are all the assets set forth on the Interim Financial Statements or currently used in the operation of the Business. The description of the Real Estate Assets and retained Easement contained inExhibit 6.1(a) is based on the Survey and includes all real property leased from CLG pursuant to the CLG lease attached hereto asExhibit 7.10(1) (the “CLG Lease”). Subject to the CLG Lease, CLG is in lawful possession of the Real Estate Assets including without limitation the buildings, structures and improvements situated thereon and appurtenances thereto, free of all mortgages, liens, and other encumbrances and restrictions except for Permitted Encumbrances.

(2) CHAD is in lawful possession of all the Real Estate Assets including, without limitation, the buildings, structures and improvements situated thereon and appurtenances thereto, in each case free and clear of all mortgages, liens and other encumbrances or restrictions, except for Permitted Encumbrances and the CLG Lease.

(3) The Equipment and Furnishings are all of the “Equipment” reflected on the Interim Financial Statements, other than those items sold and replaced in the ordinary course of business. All of the Equipment and Furnishings in all material respects (a) operate in accordance

[ILLEGIBLE]

15

[ILLEGIBLE]

with their intended use, (b) perform the functions they are used for by CHAD, (c) are free of known structural, installation, engineering, or mechanical defects or problems, and (d) are otherwise in good working order. Neither CHAD nor CLG has received any written recommendation from any insurer to repair or replace any of the material CHAD Assets or Real Estate Assets with which CHAD has not complied to the best of its understanding of each such recommendation.

(4) All motor vehicles used in the Business, whether owned or leased, are listed inExhibit 1.2(2) attached hereto, are properly licensed and are registered in accordance with applicable law. If such vehicles are leased, the leases are in full force and effect, and CHAD has complied with all terms of such leases in all material respects,

(5) All trademarks, service marks, trade names, patents, inventions, processes, copyrights and applications therefor, whether registered or at common law (collectively, the “Intellectual Property”), owned or used by CHAD are listed and described inExhibit 7.10(5) attached hereto. No proceedings have been instituted or are pending that have been served on the Sellers or CHAD or as to which any of them has actual notice or, to the knowledge of CHAD or either of the Sellers, threatened that challenge the validity of the ownership by CHAD of any such Intellectual Property. CHAD has licensed no one to use any such Intellectual Property, and neither CHAD nor the Sellers has any knowledge of the use or the infringement of any of such Intellectual Property by any other person. CHAD owns or possesses adequate and enforceable licenses or other rights to use all Intellectual Property now used in the conduct of the Business, except as enforcement may be limited by bankruptcy, insolvency, reorganization or similar laws affecting creditors’ rights generally and by general principles of equity,

7.11Contracts.

(1)Exhibit 7.11(1) sets forth a complete and accurate list of all material provider agreements, service agreements or other similar agreements comprising the Business, together with all contracts, leases, subleases, options and commitments, oral or written, and all assignments and amendments thereof, affecting or relating to the Business, the CHAD Stock or any CHAD Asset or any interest therein, to which CHAD, CLG and/or either of the Sellers is a party or by which CHAD, the CHAD Assets, the Real Estate Assets or the Business is bound or affected (collectively, the “Contracts”).Exhibit 7.11(1), as well as the term “contracts”, may exclude Contracts involving annual amounts of $5,000,00 or less. Accurate, complete and unredacted copies of all written Contracts will be made a part ofExhibit 7.11(1) which also includes written summaries of key terms of all oral Contracts.

(2) Except as reflected inExhibit 7.11(2), and except for consents required as a result of the Merger and other transactions contemplated herein, a list of which consents is included inExhibit 7.11(2), none of the Contracts has been modified, amended, assigned or transferred and each is in full force and effect and is valid, binding and enforceable in accordance with its respective terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization or similar laws affecting creditors’ rights generally and by general principles of equity. No event or condition has happened or presently exists which constitutes a default or

[ILLEGIBLE]

16

[ILLEGIBLE]

breach or, after notice or lapse of time or both, would constitute a default or breach by any party under any of the Contracts. To the best knowledge of the Sellers, there are no counterclaims or off sets under any of the Contracts.

(3) Except as therein stated, there does not exist any security interest, lien, encumbrance or claim of others created or suffered to exist on any interest created under any of the Contracts. No purchase commitment by CHAD is in excess of CHAD’s ordinary and/or reasonably anticipated business requirements.

(4)Exhibit 7.11(4) lists every repair and maintenance obligation of CHAD or CLG pursuant to the Contracts over $10,000.00 required to be performed on or before the Closing, if any, but which will remain unperformed at the Closing.

7.12Environmental Matters.

(1)Hazardous Substances. As used in this Section 7.12(1). the term “Hazardous Substances” means any hazardous or toxic substances, materials or wastes, including but not limited to those substances, materials, and wastes defined in Paragraph 101 of the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (“CERCLA”), listed in the United States Department of Transportation Table (49 CFR 172.101) or by the Environmental Protection Agency as hazardous substances pursuant to 40 CFR Part 302, or which are regulated under any other Environmental Law (as such term is defined herein), and any of the following: hydrocarbons, petroleum and petroleum products (except as they exist in the ordinary course of business and in material compliance with Environmental Law, asbestos, polychlorinated biphenyls, formaldehyde, radioactive substances (other than naturally occurring materials in place), flammables and explosives.

(2)Compliance with Laws and Regulations. All operations or activities on, and any use or occupancy of any property owned leased or managed by CHAD or CLG, any Affiliates of CHAD or CLG (wherein the term “Affiliates” will mean any person or entity controlling, controlled by or under common control at any time with CHAD or CLG, and the term “control” will mean the power, directly or indirectly to direct the management or policies of such person or entity), and any agent, contractor or employee of any agent or contractor of CHAD or CLG or their respective Affiliates (“Agents”), or to the knowledge of either of the Sellers (including any tenant or subtenant of CHAD or CLG) is and has been in compliance with any and all laws, regulations, orders, codes, judicial decisions, decrees, licenses, permits and other applicable requirements of governmental authorities with respect to Hazardous Substances, pollution or protection of human health and safety (collectively, “Environmental Laws”), including but not limited to the release, emission, discharge, storage and removal of Hazardous Substances, CHAD or CLG, Affiliates and Agents have kept the property owned, leased or managed by CHAD or CLG free of any lien imposed pursuant to Environmental Laws. To the knowledge of CHAD, CLG and each of the Sellers, all prior owners, operators, managers and other occupants of such premises have complied with Environmental Law. Except for uses and storage or presence of Hazardous Substances reasonably necessary or incidental to the customary operation of a business similar to the Business, as appropriate which, if required, was stored or present in material compliance with Environmental Law;

[ILLEGIBLE]

17

[ILLEGIBLE]

(a) CHAD utilizes commercially available cleaning and waxing materials, gasoline, diesel fuel, and sewage treatment chemicals in the operation of the Business. Other than these materials, which are transported, stored, utilized and disposed of in the ordinary course of Business in compliance with Environmental Law and except as reflected in the Environmental Reports (as defined herein), neither CHAD, CLG nor the Sellers nor any employees or persons hired by any of the foregoing have used, generated, treated, handled, manufactured, voluntarily transmitted or stored any Hazardous Substances on any property owned or leased by CHAD, including the Real Estate Assets, or in connection with the Business, nor, to the knowledge of CHAD, CLG or either of the Sellers, has any premises owned, leased or managed by CHAD or CLG ever been used for any of the foregoing; and

(b) Neither CHAD nor CLG nor any Affiliates or Agents have installed on any premises owned, leased or managed by CHAD or CLG friable asbestos or any substance containing asbestos in condition or amount deemed hazardous by Environmental Law; and

(c) Neither CHAD nor CLG has at any time engaged in any dumping, discharge, disposal, spillage or leakage (whether legal or illegal, accidental or intentional) of such Hazardous Substances that would subject CHAD, CLG, either of the Sellers or Merger Sub to clean-up obligations imposed by governmental authorities; and

(d) To the knowledge of the Sellers, neither CHAD nor CLG nor the prior owners of any premises owned, leased or managed by CHAD or CLG (i) have either received or been issued a notice, demand, request for information, citations, summons or complaint regarding an alleged failure to comply with Environmental Law, or (ii) is subject to any existing, pending, or, to the knowledge of CHAD, CLG or either of the Sellers, threatened investigation or inquiry by any governmental authority for noncompliance with, or any remedial obligations under Environmental Law. and there are no circumstances known to CHAD, CLG or either of the Sellers which could serve as a basis therefor. Neither CHAD nor CLG has assumed any liability of a third party for clean-up under or noncompliance with Environmental Law; and

(e) CHAD or CLG or their respective Affiliates or Agents have not transported or arranged for the transportation of any Hazardous Substances to any location which is listed or, to the knowledge of CHAD, CLG or either of the Sellers, proposed for listing under Environmental Law or is the subject of any enforcement action, investigation or other inquiry under Environmental Law.

(3)Other Environmental Matters. CHAD has furnished or caused to be furnished to counsel to the Merger Sub the environmental report that CLG obtained prior to the acquisition of the Real Estate Assets, and CHAD has cooperated with the Parent and its agents in the engineering and environmental audit conducted by them in connection with the transaction and the acquisition of the Real Estate Assets by the Merger Sub, The environmental report obtained by CHAD and the environmental report obtained by Merger Sub constitute the “Environmental Reports.”

[ILLEGIBLE]

18

[ILLEGIBLE]

(4)Environmental Reports. Notwithstanding anything contained in this Section 7.12. CHAD shall hot be liable to the Merger Sub or to the Parent for any matters disclosed in the Environmental Reports,

7.13CHAD Employees.

(1)Exhibit 7.13(1)(a) attached hereto sets forth: (i) a complete list of all of CHAD’s employees, (ii) their respective rates of pay, (iii) the employment dates and job titles of each such person, (iv) categorization of each such person as a full-time or part-time employee of CHAD, (v) the amount of accrued vacation with respect to such person, and (vi) the amount of accrued sick pay with respect to such person. For purposes of this paragraph, “part-time employee” means an employee who is employed for an average of fewer than twenty (20) hours per week or who has been employed for fewer than six (6) of the twelve (12) months preceding the date on which notice is required pursuant to the “Worker Adjustment and Retraining Notification Act” (“WARN”). 29 U.S.C. §2102, et seq. Except as provided inExhibit 7.13(1)(a), CHAD has no employment agreements with its employees and all such employees are employed on an “at will” basis.Exhibit 7.13(1)(b)(i) contains a list and copies of all employee fringe benefits and personnel policies, and (ii) lists all ex-employees of CHAD utilizing or eligible to utilize COBRA. CHAD has or prior to Closing will have adequately accrued and included in the Financial Statements, all salaries and wages, related payroll taxes and all sick leave, holiday, vacation benefits, retirement and other fringe benefits that will have accrued to CHAD’s employees through the Closing Date, including related payroll taxes.

(2) CHAD is not a party to any labor contract, collective bargaining agreement, contract, letter of understanding, or any other arrangement, formal or informal, with any labor union or organization that obligates CHAD to compensate employees at prevailing rates or union scale, nor are any of its employees represented by any labor union or organization. There is no pending or, to the knowledge of CHAD or either of the Sellers, threatened labor dispute, work stoppage, unfair labor practice complaint, strike, administrative or court proceeding or order between CHAD and any present or former employee(s) of CHAD, Except as provided inExhibit 7.13(2), there is no pending or, to the knowledge of CHAD or either of the Sellers, threatened suit, action, investigation or claim between CHAD and any present or former employee(s) of CHAD, other than unemployment claims filed and/or pending from time to time in the ordinary course of business. To the best knowledge of either of the Sellers, there has not been any labor union organizing activity with respect to CHAD’s employees.

7.14Employee Benefit Plans.

(1)Benefit Plans. Except for health and life insurance plans offered in the ordinary course of Business (if and to the extent such plans may be considered, for any purpose, to be an “employee welfare benefit plan”). CHAD has not instituted any (a) “employee welfare benefit plan” (as defined in Paragraph 3(1) of the Employee Retirement Income Security Act of

[ILLEGIBLE]

19

[ILLEGIBLE]

1974 as amended (“ERISA”)) maintained by CHAD or to which CHAD contributes or is required to contribute, and (b) “employee pension benefit plan” (as defined in Paragraph 3(2) of ERISA) maintained by CHAD, to which CHAD contributes or is required to contribute, or which covers employees of such CHAD during the period of their employment with any predecessor of CHAD, including any multi-employer pension plan as defined under The Code Paragraph 414(f) (such employee welfare benefit plans and pension benefit plans being hereinafter collectively referred to as the “Benefit Plans”). Copies of all Benefit Plans and health and life insurance plans have previously been provided to Merger Sub.

(2)Liabilities. There are no unfunded liabilities under any Benefit Plan.

7.15Insurance. CHAD has in effect and has for at least five (5) years or the period of its existence, whichever is less, continuously maintained insurance coverage for all of its operations, personnel and assets, and for the CHAD Assets and the Business. A complete and accurate list of ail current insurance policies is included inExhibit 7.11(1).Exhibit 7.15 attached hereto sets forth a summary of CHAD’S current insurance coverage (listing type, carrier and limits), includes a list of any pending insurance claims relating to CHAD or the Business, and includes a recent three (3)-year claims history relating to CHAD and the Business as prepared by the applicable insurance carrier(s). To the best of its knowledge. CHAD is not in default or breach with respect to any provision contained in any such insurance policies, nor has CHAD failed to give any notice or to present any claim thereunder in due and timely fashion.

7.16Conflicts of Interest. Except as set forth onExhibit 7.16, none of the following is either a supplier of goods or services to CHAD, or directly or indirectly controls or is a director, officer, employee or agent of any corporation, firm, association, partnership or other business entity that is a supplier of goods or services to CHAD: (a) either of the Sellers, (b) any director or officer of CHAD, or (c) any entity under common control with CHAD or controlled by or related to either of the Sellers.

7.17Compliance with Laws. Neither CHAD nor either of the Sellers has made any kickback or bribe to any person or entity, directly or indirectly, for referring, recommending or arranging business with, to or tor CHAD. CHAD is in material compliance (without obtaining waivers, variances or extensions) with all federal, state and local laws, rules and regulations that relate to the operations of the Business, except where the failure to be in compliance would not have a material adverse effect on the Business. All tax and other returns, reports, plans and filings of any nature required to be or otherwise filed by CHAD or either of the Sellers with any governmental authorities have been properly completed, except where the failure to be so completed or filed could not have a material adverse effect on the Business, and timely filed in compliance with all applicable requirements. Each return, report, plan and filing contains no materially untrue or misleading statements and does not omit anything which would cause it to be misleading or inaccurate in any material respect. The final tax return for CHAD shall be prepared and timely filed by the Merger Sub with such assistance from the Shareholder’s and CHAD’S respective accountants as Merger Sub may require at Merger Sub’s reasonable expense as to the accountants and such taxes shall be paid by Merger Sub with any excess or shortfall to be adjusted on the Final Closing Statement.

[ILLEGIBLE]

20

[ILLEGIBLE]

7.18WARN. Since ninety (90) days prior to Effective Date, CHAD has not temporarily or permanently closed or shut down any single site of employment or any facility or any operating unit, department or service within a single site of employment, as such terms are used in WARN.

7.19Tax Returns; Taxes. CHAD and each of Sellers have filed all federal, state and local tax returns and tax reports required by such authorities to be filed as of the time of Closing. CHAD and each of the Sellers, as applicable, have paid or accrued for all material taxes, assessments, governmental charges, penalties, interest and fines due as of the time of Closing (including, without limitation, taxes on properties, income, franchises, licenses, sales and payrolls) by any governmental authority. Additionally, the reserves for taxes, if any, shown in the Final Closing Statement are and will be adequate to accurately reflect all material tax liabilities accrued or owing as of the Closing. Except as set forth onExhibit 7.19, there is no pending tax examination or audit of, nor any action, suit, investigation or claim asserted or to the knowledge of CHAD or either of the Sellers, threatened against CHAD or either of the Sellers by any governmental authority; and neither CHAD nor either of the Sellers has been granted any extension of the limitation period applicable to any tax claims.