March 14, 2018 Presentation to the Creditors Subject to Confidentiality Agreements For Discussion Purposes Only Exhibit 99.2

Disclaimer The information herein has been prepared by Lazard Frères & Co., LLC (“Lazard”), Akin Gump Strauss Hauer & Feld LLP (“Akin Gump”), and Alvarez & Marsal North America, LLC (“Alvarez & Marsal”) based upon information supplied by FirstEnergy Solutions Corp. (“FES” or the “Company”), and portions of the information herein may be based upon certain statements, estimates and projections provided by the Company with respect to the anticipated future performance of the Company. We have relied upon the accuracy and completeness of the forgoing information, and have not assumed any responsibility for any independent verification of such information or any independent valuation or appraisal of any of the assets or liabilities of the Company, or any other entity, or concerning solvency or fair value of the Company or any other entity. With respect to financial projections, we have assumed that they have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgements of management of the Company as to the future financial performance of the Company. We assume no responsibility for and express no view as to such projections or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise. These materials and the information contained herein are confidential and may not be disclosed publicly or made available to third parties without the prior written consent of Lazard, Akin Gump and Alvarez & Marsal. These materials are preliminary and summary in nature and do not include all of the information that parties should evaluate in considering a possible transaction. Nothing herein shall constitute a commitment or undertaking on the part of Lazard, Akin Gump, Alvarez & Marsal or any related party to provide any service. Lazard is acting as investment banker to the Company and Alvarez & Marsal is acting as financial advisor to the Company, and will not be responsible for and will not provide any tax, accounting, actuarial, legal or other specialist advice. Limitations of Report / Disclaimers Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

Business Overview Market Conditions Operations Summary of Debt Capitalization Financial Information Table of Contents $’s in millions unless otherwise noted throughout the report Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

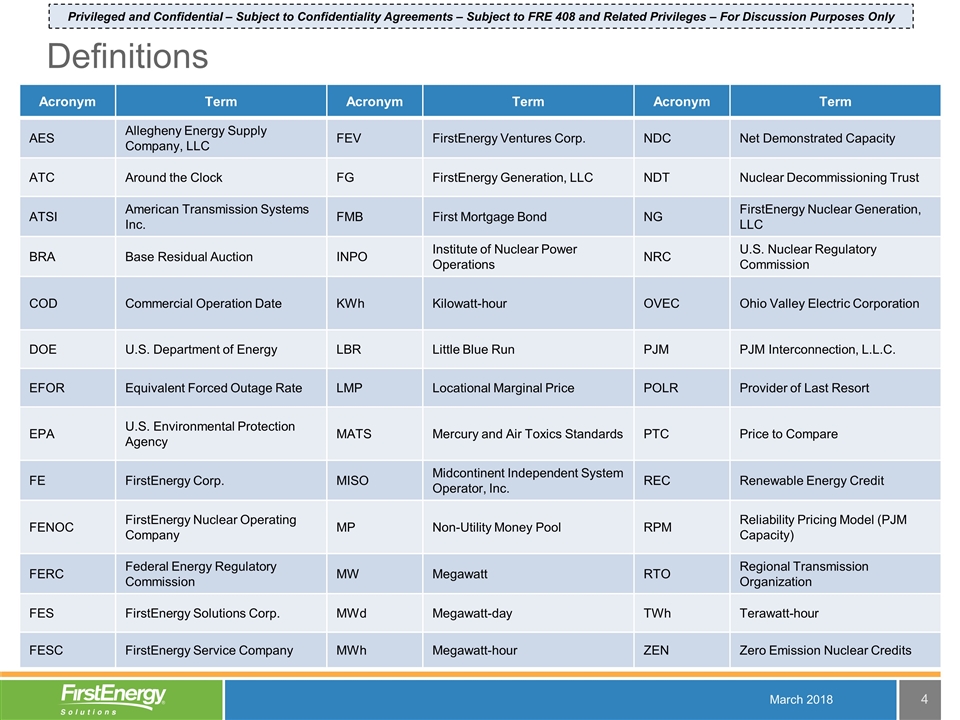

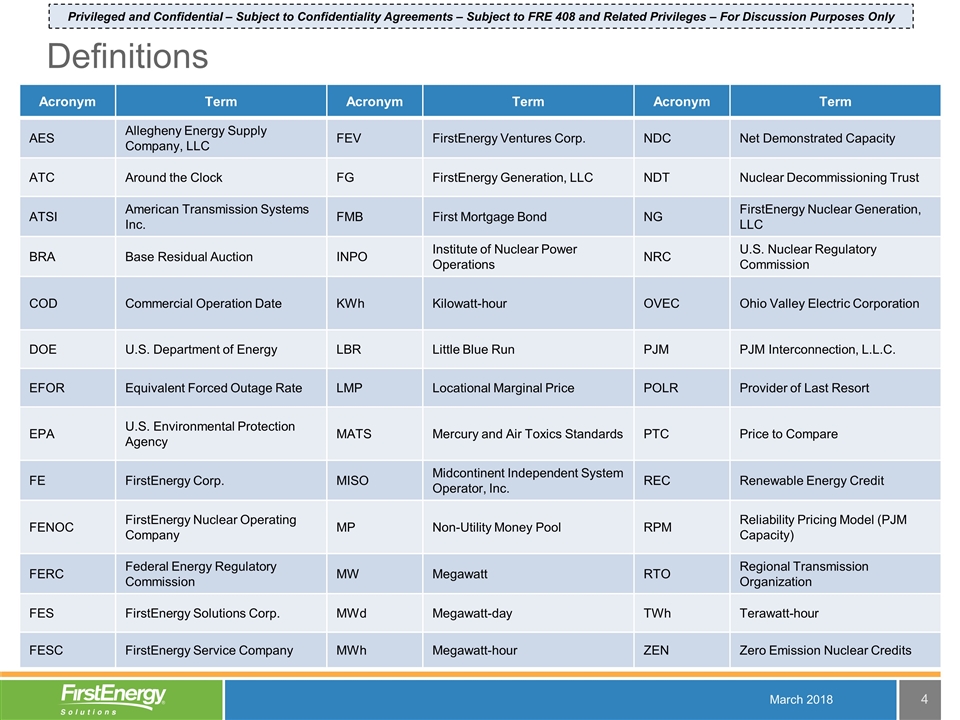

Definitions Acronym Term Acronym Term Acronym Term AES Allegheny Energy Supply Company, LLC FEV FirstEnergy Ventures Corp. NDC Net Demonstrated Capacity ATC Around the Clock FG FirstEnergy Generation, LLC NDT Nuclear Decommissioning Trust ATSI American Transmission Systems Inc. FMB First Mortgage Bond NG FirstEnergy Nuclear Generation, LLC BRA Base Residual Auction INPO Institute of Nuclear Power Operations NRC U.S. Nuclear Regulatory Commission COD Commercial Operation Date KWh Kilowatt-hour OVEC Ohio Valley Electric Corporation DOE U.S. Department of Energy LBR Little Blue Run PJM PJM Interconnection, L.L.C. EFOR Equivalent Forced Outage Rate LMP Locational Marginal Price POLR Provider of Last Resort EPA U.S. Environmental Protection Agency MATS Mercury and Air Toxics Standards PTC Price to Compare FE FirstEnergy Corp. MISO Midcontinent Independent System Operator, Inc. REC Renewable Energy Credit FENOC FirstEnergy Nuclear Operating Company MP Non-Utility Money Pool RPM Reliability Pricing Model (PJM Capacity) FERC Federal Energy Regulatory Commission MW Megawatt RTO Regional Transmission Organization FES FirstEnergy Solutions Corp. MWd Megawatt-day TWh Terawatt-hour FESC FirstEnergy Service Company MWh Megawatt-hour ZEN Zero Emission Nuclear Credits Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

Business Overview Privileged and Confidential – Subject to Confidentiality Agreements For Discussion Purposes Only – Subject to FRE 408 and Related Privileges March 2018

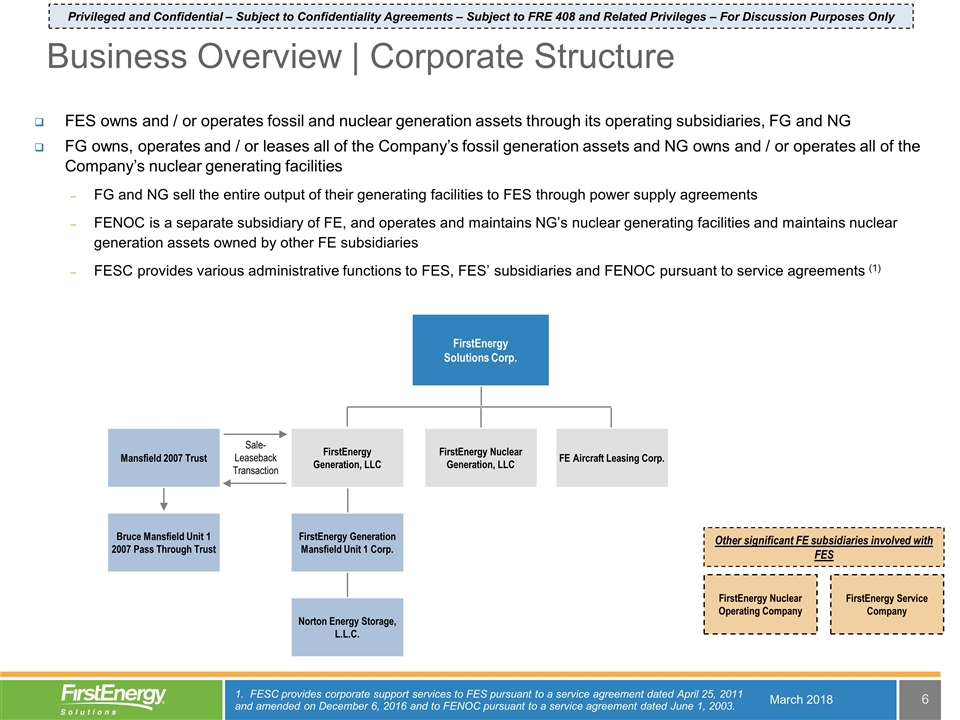

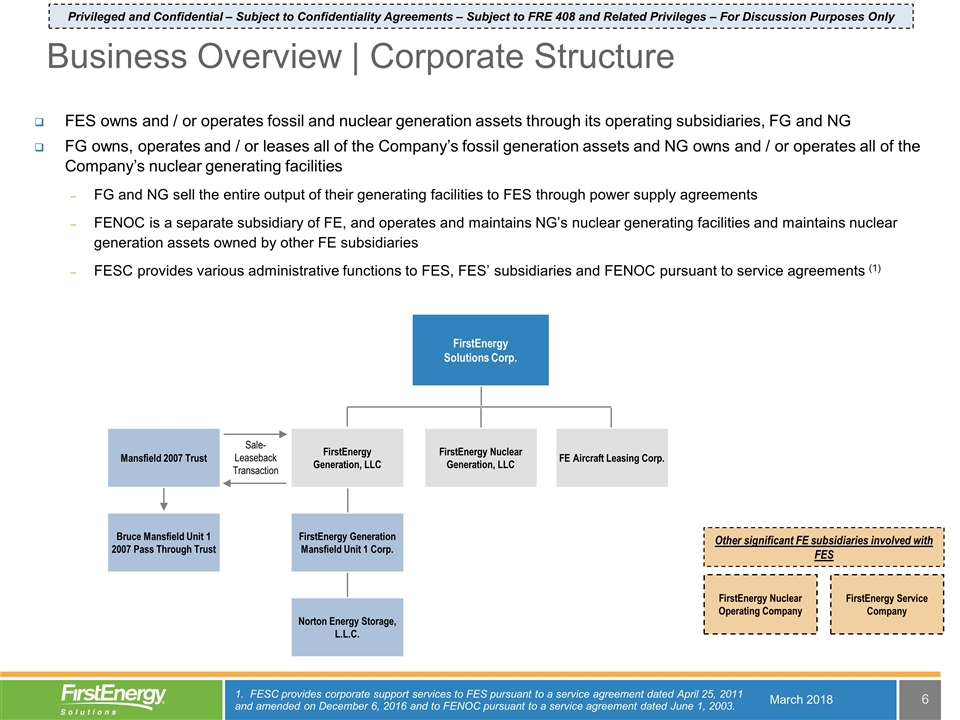

FES owns and / or operates fossil and nuclear generation assets through its operating subsidiaries, FG and NG FG owns, operates and / or leases all of the Company’s fossil generation assets and NG owns and / or operates all of the Company’s nuclear generating facilities FG and NG sell the entire output of their generating facilities to FES through power supply agreements FENOC is a separate subsidiary of FE, and operates and maintains NG’s nuclear generating facilities and maintains nuclear generation assets owned by other FE subsidiaries FESC provides various administrative functions to FES, FES’ subsidiaries and FENOC pursuant to service agreements (1) FirstEnergy Solutions Corp. FirstEnergy Nuclear Generation, LLC Mansfield 2007 Trust Bruce Mansfield Unit 1 2007 Pass Through Trust Sale-Leaseback Transaction FE Aircraft Leasing Corp. FirstEnergy Nuclear Operating Company FirstEnergy Generation Mansfield Unit 1 Corp. Norton Energy Storage, L.L.C. FirstEnergy Generation, LLC Business Overview | Corporate Structure FirstEnergy Service Company Other significant FE subsidiaries involved with FES 1. FESC provides corporate support services to FES pursuant to a service agreement dated April 25, 2011 and amended on December 6, 2016 and to FENOC pursuant to a service agreement dated June 1, 2003. Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

Primary sources of revenue for FES include: Energy markets – sell generation produced into the wholesale markets Intended to provide a margin over variable costs (e.g., fuel cost) Capacity markets – compensation from PJM to be an available generation resource when called upon Intended to cover fixed costs of operating the plants (e.g., operating expenses, capital investments) Retail business Approximately 895,000 customers Sells approximately 40 TWhs annually in retail / wholesale contract sales Retail contracts are primarily with large commercial and industrial customers, as well as governmental aggregation in Ohio, Pennsylvania, Illinois, New Jersey, Michigan, and Maryland Wholesale contracts are primarily with utilities, both affiliated and non-affiliated, and non-utility third parties Currently purchases generation from FG and NG to serve these retail and wholesale customers Annual FES Generation Capabilities Generation resources capable of approximately 65-75 TWhs annually Nuclear generation of approximately 30-35 TWhs Fossil generation of approximately 30-35 TWhs Purchased power agreements (wind / solar / OVEC) account for approximately 3 TWhs Business Overview | Output Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

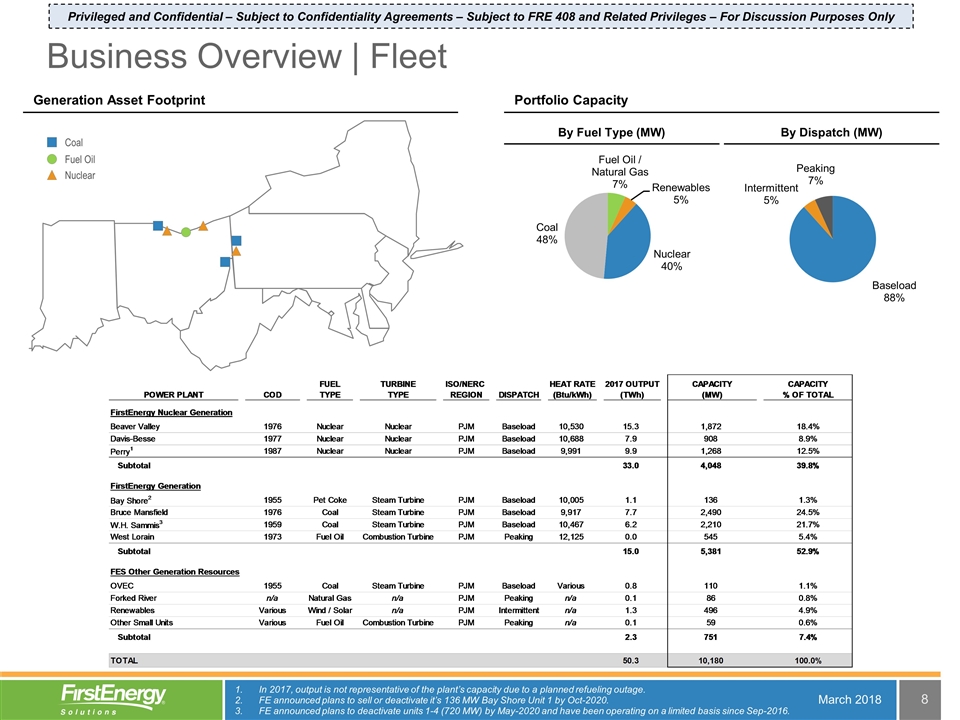

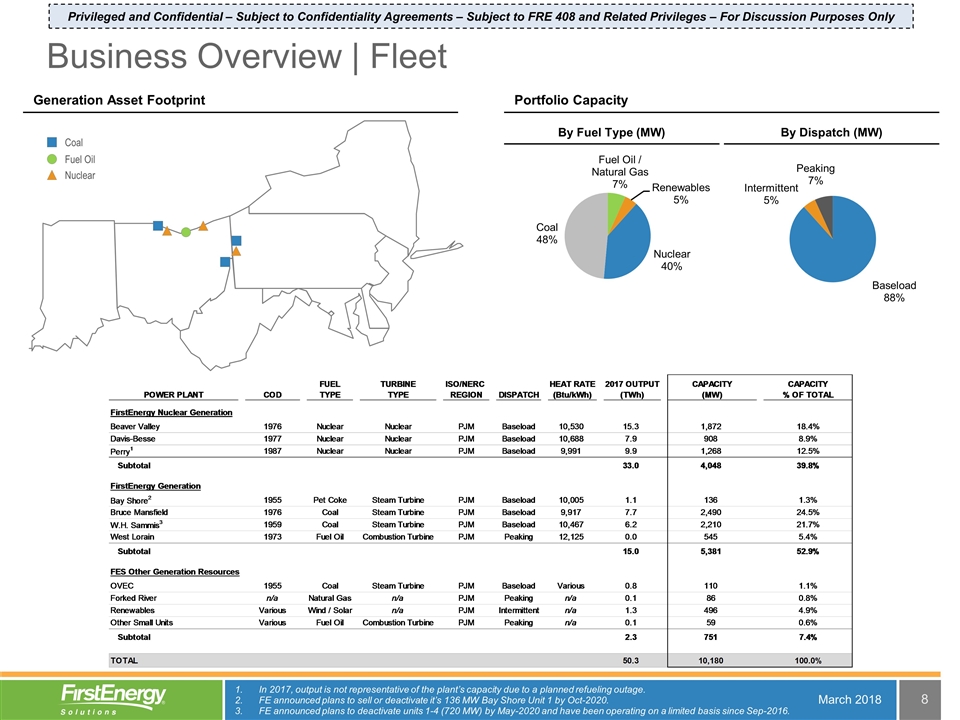

Fuel Oil Coal Nuclear In 2017, output is not representative of the plant’s capacity due to a planned refueling outage. FE announced plans to sell or deactivate it’s 136 MW Bay Shore Unit 1 by Oct-2020. FE announced plans to deactivate units 1-4 (720 MW) by May-2020 and have been operating on a limited basis since Sep-2016. Generation Asset Footprint Portfolio Capacity By Fuel Type (MW) By Dispatch (MW) Business Overview | Fleet March 2018 Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

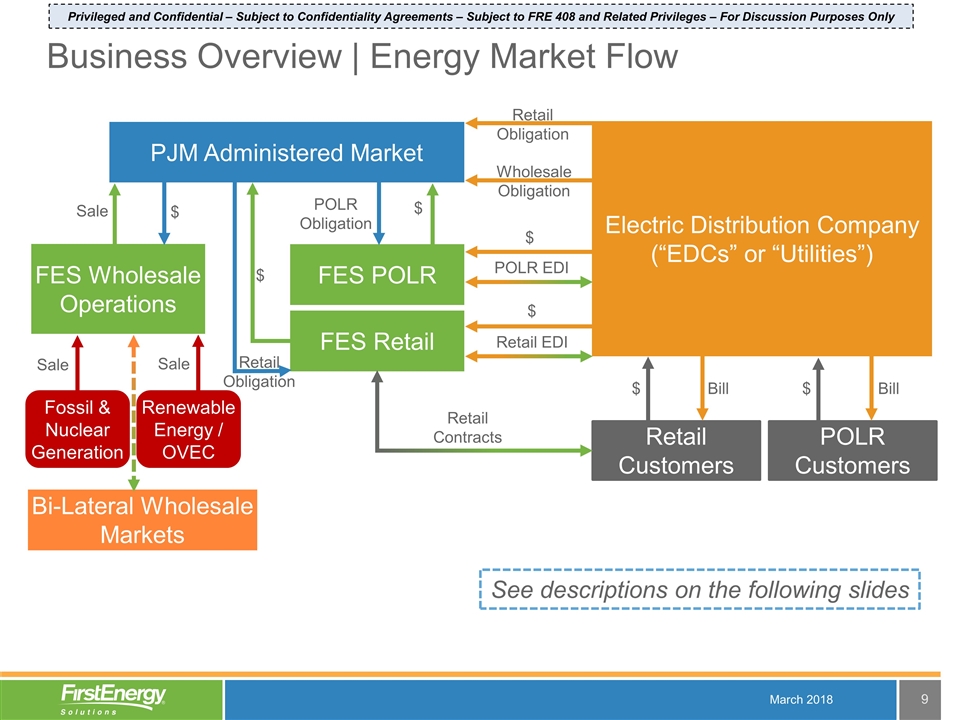

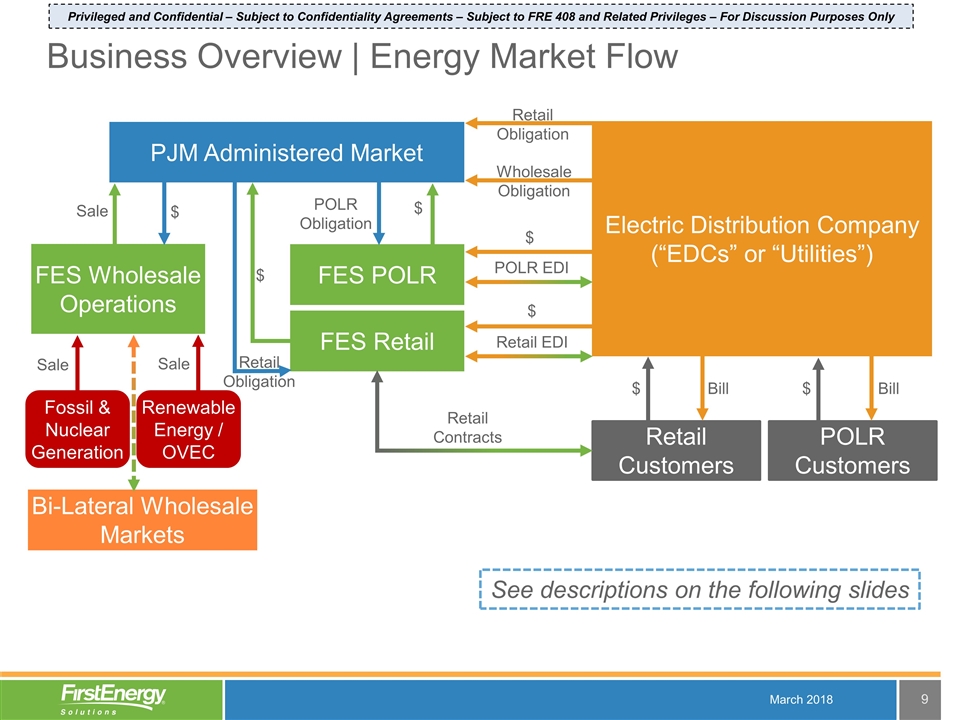

PJM Administered Market Electric Distribution Company (“EDCs” or “Utilities”) POLR Customers Retail Customers $ Bill $ Bill Retail Obligation POLR EDI FES Wholesale Operations FES POLR FES Retail Sale $ POLR Obligation $ Retail Obligation $ Retail Contracts $ Wholesale Obligation Retail EDI $ Fossil & Nuclear Generation Sale Renewable Energy / OVEC Sale Bi-Lateral Wholesale Markets See descriptions on the following slides Business Overview | Energy Market Flow Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

Generation Assets Fossil and Nuclear Generation – Fossil and nuclear assets generate power which is sold through purchase power agreements (“PPAs”) to FES which in turn sells to the market (i.e., PJM) Renewable Energy / OVEC – Purchased power from renewable providers and OVEC (through PPAs) and sold to the market (i.e., PJM) Competitive Generation Operations FES Wholesale Operations – Various activities, including, but not limited to: Calculate dispatch offer for generation and purchased power from the market; Derive strategy for capacity offers and track all capacity requirements; Schedule day ahead load with RTO’s (e.g., PJM and MISO) for all 22 EDCs; and, Execute wholesale and basis hedging FES POLR – Purchase power from RTOs to provide power to utility POLR customers. POLR revenue is collected by the EDCs and paid to FES FES Retail – Purchase power from RTOs to provide power to retail customers. Retail revenue is collected by the EDCs and paid to FES Regional Transmission Operators PJM and MISO Administered Markets – Purchase and sell energy, capacity, and ancillary power and manage supply and demand of energy markets Electric Distribution Company (“EDCs” or “Utilities”) Utilities – Various activities, including but not limited to: Provide load obligations for RTOs and POLR providers; Bill and collect revenue from customers; Pay retail and POLR providers; and, Depending on state, utilities may cover network transmission services and Renewable Rec requirements, otherwise the responsibility of retail and POLR provider Financial Hedging Bi-Lateral Wholesale Markets – Market where counterparties can transact to hedge energy, capacity, basis volumes, and prices Business Overview | Energy Market Flow Descriptions Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

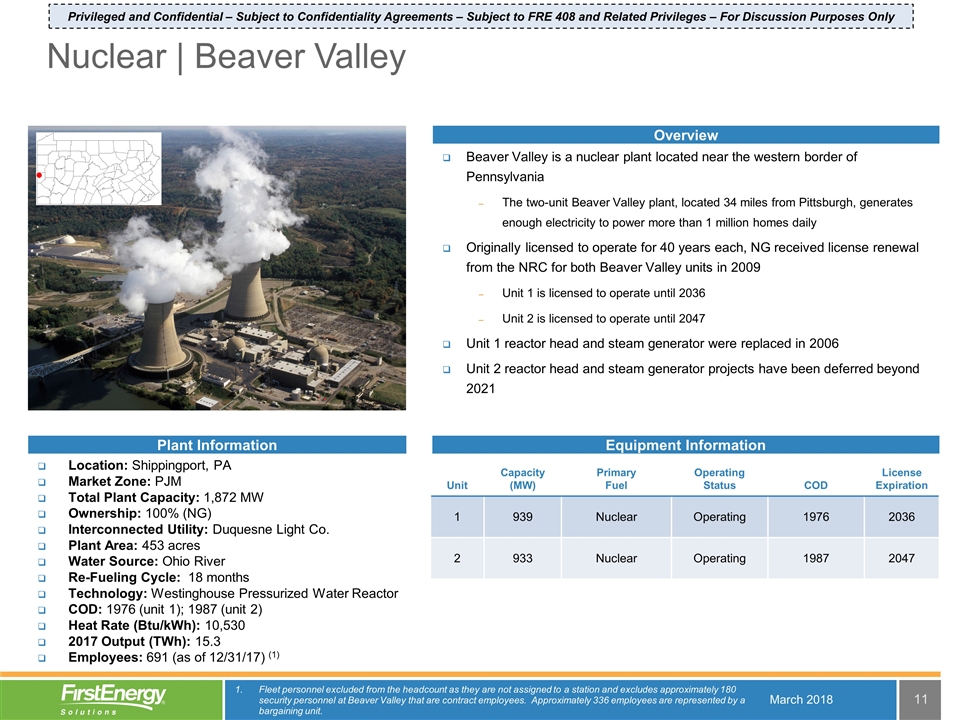

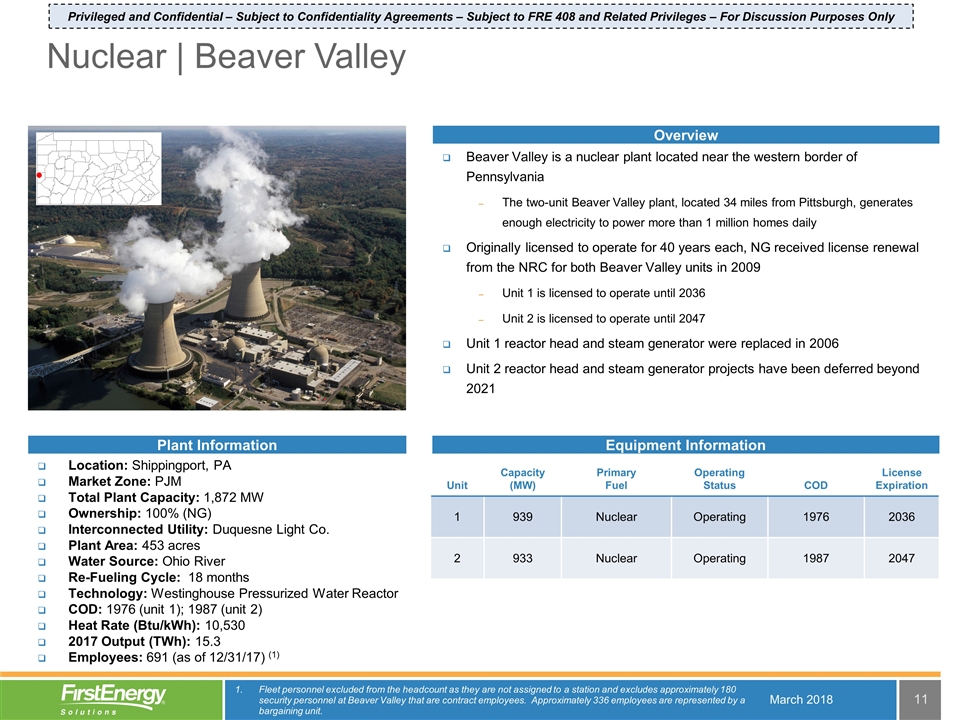

Beaver Valley is a nuclear plant located near the western border of Pennsylvania The two-unit Beaver Valley plant, located 34 miles from Pittsburgh, generates enough electricity to power more than 1 million homes daily Originally licensed to operate for 40 years each, NG received license renewal from the NRC for both Beaver Valley units in 2009 Unit 1 is licensed to operate until 2036 Unit 2 is licensed to operate until 2047 Unit 1 reactor head and steam generator were replaced in 2006 Unit 2 reactor head and steam generator projects have been deferred beyond 2021 Nuclear | Beaver Valley Overview Equipment Information Plant Information Location: Shippingport, PA Market Zone: PJM Total Plant Capacity: 1,872 MW Ownership: 100% (NG) Interconnected Utility: Duquesne Light Co. Plant Area: 453 acres Water Source: Ohio River Re-Fueling Cycle: 18 months Technology: Westinghouse Pressurized Water Reactor COD: 1976 (unit 1); 1987 (unit 2) Heat Rate (Btu/kWh): 10,530 2017 Output (TWh): 15.3 Employees: 691 (as of 12/31/17) (1) Unit Capacity (MW) Primary Fuel Operating Status COD License Expiration 1 939 Nuclear Operating 1976 2036 2 933 Nuclear Operating 1987 2047 Fleet personnel excluded from the headcount as they are not assigned to a station and excludes approximately 180 security personnel at Beaver Valley that are contract employees. Approximately 336 employees are represented by a bargaining unit. Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

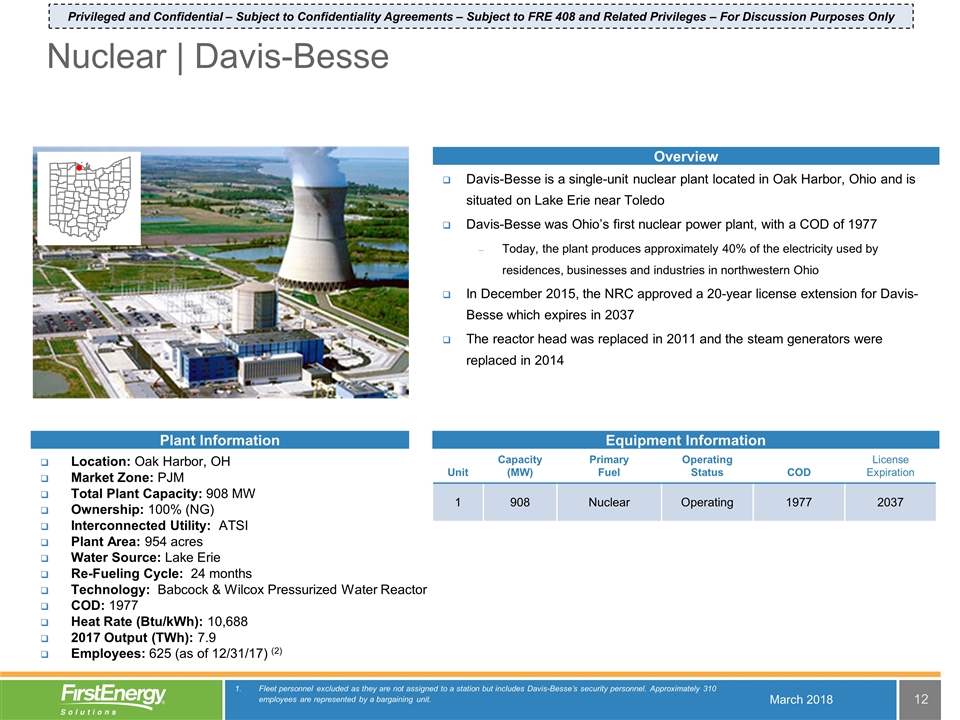

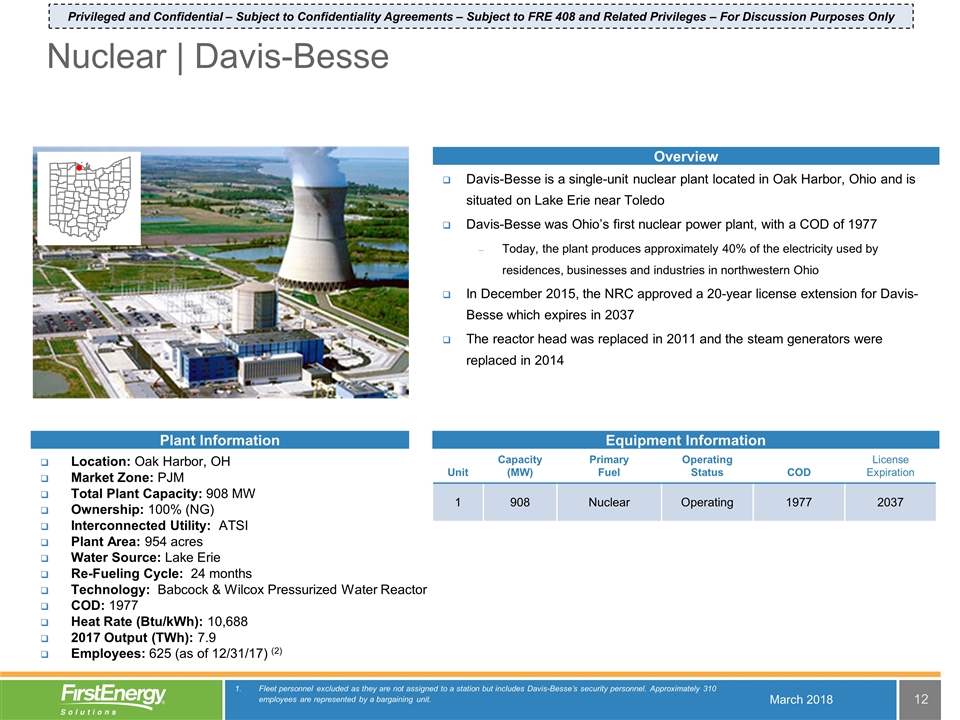

Unit Capacity (MW) Primary Fuel Operating Status COD License Expiration 1 908 Nuclear Operating 1977 2037 Davis-Besse is a single-unit nuclear plant located in Oak Harbor, Ohio and is situated on Lake Erie near Toledo Davis-Besse was Ohio’s first nuclear power plant, with a COD of 1977 Today, the plant produces approximately 40% of the electricity used by residences, businesses and industries in northwestern Ohio In December 2015, the NRC approved a 20-year license extension for Davis-Besse which expires in 2037 The reactor head was replaced in 2011 and the steam generators were replaced in 2014 Nuclear | Davis-Besse Overview Equipment Information Plant Information Location: Oak Harbor, OH Market Zone: PJM Total Plant Capacity: 908 MW Ownership: 100% (NG) Interconnected Utility: ATSI Plant Area: 954 acres Water Source: Lake Erie Re-Fueling Cycle: 24 months Technology: Babcock & Wilcox Pressurized Water Reactor COD: 1977 Heat Rate (Btu/kWh): 10,688 2017 Output (TWh): 7.9 Employees: 625 (as of 12/31/17) (2) Fleet personnel excluded as they are not assigned to a station but includes Davis-Besse’s security personnel. Approximately 310 employees are represented by a bargaining unit. Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

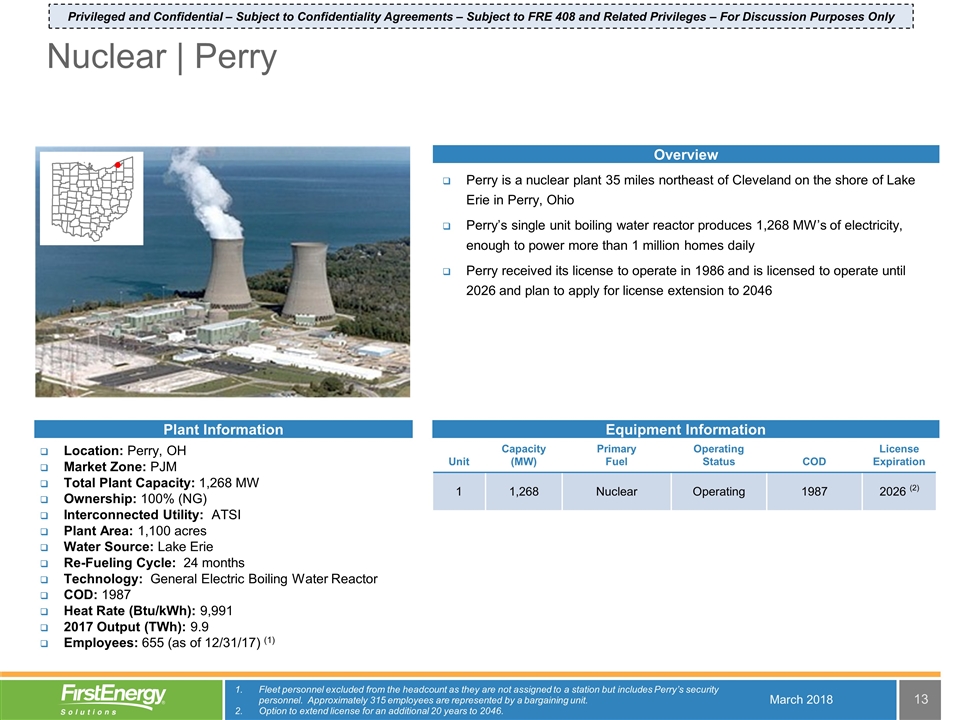

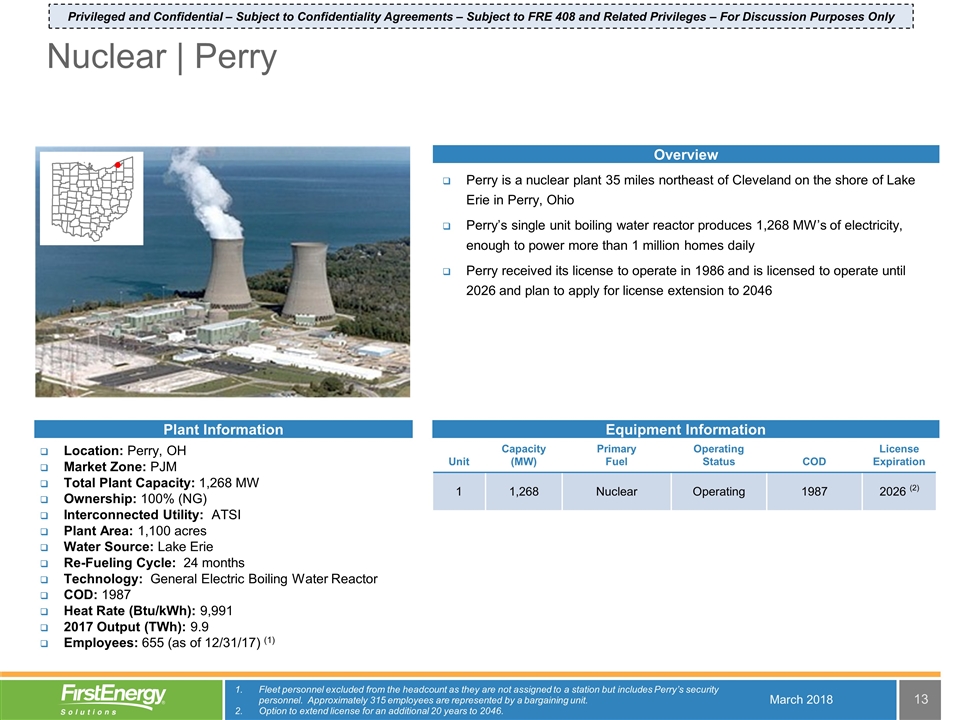

Unit Capacity (MW) Primary Fuel Operating Status COD License Expiration 1 1,268 Nuclear Operating 1987 2026 (2) Perry is a nuclear plant 35 miles northeast of Cleveland on the shore of Lake Erie in Perry, Ohio Perry’s single unit boiling water reactor produces 1,268 MW’s of electricity, enough to power more than 1 million homes daily Perry received its license to operate in 1986 and is licensed to operate until 2026 and plan to apply for license extension to 2046 Nuclear | Perry Overview Equipment Information Plant Information Location: Perry, OH Market Zone: PJM Total Plant Capacity: 1,268 MW Ownership: 100% (NG) Interconnected Utility: ATSI Plant Area: 1,100 acres Water Source: Lake Erie Re-Fueling Cycle: 24 months Technology: General Electric Boiling Water Reactor COD: 1987 Heat Rate (Btu/kWh): 9,991 2017 Output (TWh): 9.9 Employees: 655 (as of 12/31/17) (1) Fleet personnel excluded from the headcount as they are not assigned to a station but includes Perry’s security personnel. Approximately 315 employees are represented by a bargaining unit. Option to extend license for an additional 20 years to 2046. Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

Unit Capacity (MW) Primary Fuel Operating Status COD Retirement Year 1 136 Pet Coke Operating 1955 (2002) 2020 2 138 Subbituminous Coal Retired 1959 2012 3 142 Subbituminous Coal Retired 1963 2012 4 215 Subbituminous Coal Retired 1968 2012 Bay Shore is a power plant located on the northern border of Ohio situated on Lake Erie near Toledo The last remaining operating unit at the Bay Shore facility is the steam turbine unit (Unit 1), which is owned by FG and fueled by steam from the Bay Shore Power Company The purchase of Pet Coke and the generation of steam is conducted by the Bay Shore Power Company, which is a subsidiary of FirstEnergy Ventures (a FE owned entity) Units 2-4 generated power via coal-fired generation units, which were retired in 2012 In July 2016, FE announced its plan to sell or deactivate Bay Shore Unit 1 by October 2020, commensurate with the termination date of the Pet Coke contract. The counterparty to the Pet Coke contract has expressed interest in entering into a new agreement for Pet Coke and steam. Effective May 2017, Bay Shore Unit 1 is no longer offered in the capacity market, but will receive capacity revenue through May 2020 (3 year auction period) Overview Equipment Information Plant Information & Operating Performance Location: Oregon, OH Market Zone: PJM Total Plant Capacity: 136 MW Ownership: 100% (FG) (1) Interconnected Utility: ATSI Plant Area: 571 acres Water Source: Lake Erie Primary Fuel: Petroleum Coke (“Pet Coke”) Technology: Steam Turbine COD: 1955 Heat Rate (Btu/kWh): 10,005 2017 Output (TWh): 1.1 Employees: 67 (as of 12/31/17) (2) Represents ownership of the electric generation facility. FirstEnergy Ventures (owned by FE) owns the portion of the facility that produces steam from Pet Coke. Approximately 47 employees are represented by a bargaining unit. Fossil | Bay Shore March 2018 Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

Unit Capacity (MW) Primary Fuel Operating Status COD Retirement Year 1 830 Bituminous Coal Operating 1976 N/A 2 830 Bituminous Coal Operating 1977 N/A 3 830 Bituminous Coal Operating 1980 N/A Bruce Mansfield is a power plant located in Shippingport, Pennsylvania, along the Ohio River, approximately 25 miles northwest of Pittsburgh At full capacity, the plant’s generating units can produce 60 thousand MWhs of electricity daily The plant has the capability to consume 7 million tons of coal annually (all 3 units) The Bruce Mansfield plant is compliant with the U.S. Environmental Protection Agency’s MATS The plant is equipped with full-scale air quality control systems designed to remove virtually all particulates and 95% of the sulfur dioxide from boiler flue gases FG owns units 2 and 3. Approximately 94% of Unit 1 is subject to an operating lease, but is operated by FG. Fossil | Bruce Mansfield Overview Equipment Information Plant Information & Operating Performance Location: Shippingport, PA Market Zone: PJM Total Plant Capacity: 2,490 MW Ownership / Leasehold Interest: 100% (FG) (1) Interconnected Utility: ATSI Plant Area: 473 acres Water Source: Ohio River Primary Fuel: Bituminous Coal Technology: Steam Turbine COD: 1976 – 1980 Heat Rate (Btu/kWh): 9,917 2017 Output (TWh): 7.7 Employees: 277 (as of 12/31/17) (2) Approximately 94% of Mansfield Unit 1 is subject to an operating lease. Approximately 203 employees are represented by a bargaining unit. Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

Unit Capacity (MW) Primary Fuel Operating Status COD Retirement Year 1 180 Bituminous Coal Operating 1959 2020 2 180 Bituminous Coal Operating 1960 2020 3 180 Bituminous Coal Operating 1961 2020 4 180 Bituminous Coal Operating 1962 2020 5 290 Bituminous Coal Operating 1967 N/A 6 600 Bituminous Coal Operating 1969 N/A 7 600 Bituminous Coal Operating 1971 N/A W.H. Sammis is a power plant located in Stratton, Ohio, along the Ohio River The plant is capable of consuming up to 18,000 tons of coal daily or an annual average of 6.6 million tons (units 1-7) The plant is equipped with a $1.8 billion state-of-the-art air quality control system that was placed in service in 2010 and is compliant with MATS Flue gas scrubbers were installed on all seven coal units which removes in excess of 95% of the sulfur dioxide Nitrogen oxide control equipment removes up to 90% of nitrogen oxide from the flue gases In July 2016, FE announced plans to deactivate Sammis units 1 – 4 by May 2020 and have been operating on a limited basis since September 2016 (1) Fossil | W.H. Sammis Overview Equipment Information Plant Information Location: Stratton, OH Market Zone: PJM Total Plant Capacity: 2,210 MW Ownership: 100% (FG) Interconnected Utility: ATSI Plant Area: 187 acres Water Source: Ohio River Primary Fuel: Bituminous Coal Technology: Steam Turbine COD: 1959 – 1971 Heat Rate (Btu/kWh): 10,467 2017 Output (TWh): 6.2 Employees: 303 (as of 12/31/17) (2) Effective May 2017, Sammis Units 1-4 are no longer offered in the capacity market, but will receive capacity revenue through May 2020 (3 year auction period). Approximately 228 employees are represented by a bargaining unit. Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

Unit Capacity (MW) Primary Fuel Operating Status COD Retirement Year 1A 60 Fuel Oil Operating 1973 N/A 1B 60 Fuel Oil Operating 1973 N/A 2 85 Fuel Oil Operating 2001 N/A 3 85 Fuel Oil Operating 2001 N/A 4 85 Fuel Oil Operating 2001 N/A 5 85 Fuel Oil Operating 2001 N/A 6 85 Fuel Oil Operating 2001 N/A West Lorain is a peaking, combustion turbine plant located on the northern border of Ohio, near Lake Erie In 2001, five combustion turbines were installed (units 2-6), increasing the plant’s output West Lorain units 2-6 have the ability to operate on natural gas or fuel oil, however, have only operated on fuel oil since 2012 Due to the marginal cost of generating electricity, the plant is operating as a peaking facility Fossil | West Lorain Overview Equipment Information Plant Information & Operating Performance Location: Lorain, OH Market Zone: PJM Total Plant Capacity: 545 MW Ownership: 100% (FG) Interconnected Utility: ATSI Plant Area: 457 acres Water Source: Lake Erie Fuel: Natural Gas/Distillate Fuel Oil Technology: Combustion Turbine COD: 1973 (units 1A, 1B); 2001 (units 2-6) Heat Rate (Btu/kWh): 12,125 2017 Output (TWh): 0.0 Capacity Factor: 0.0% Employees: 5 (as of 12/31/17) (1) March 2018 Approximately 4 employees are represented by a bargaining unit. Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

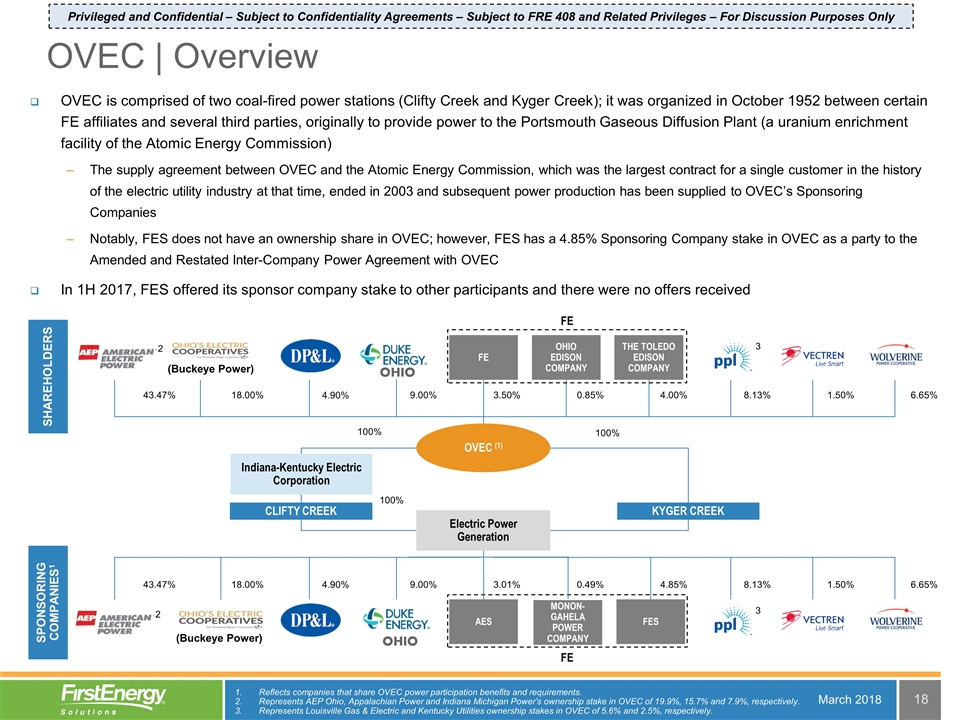

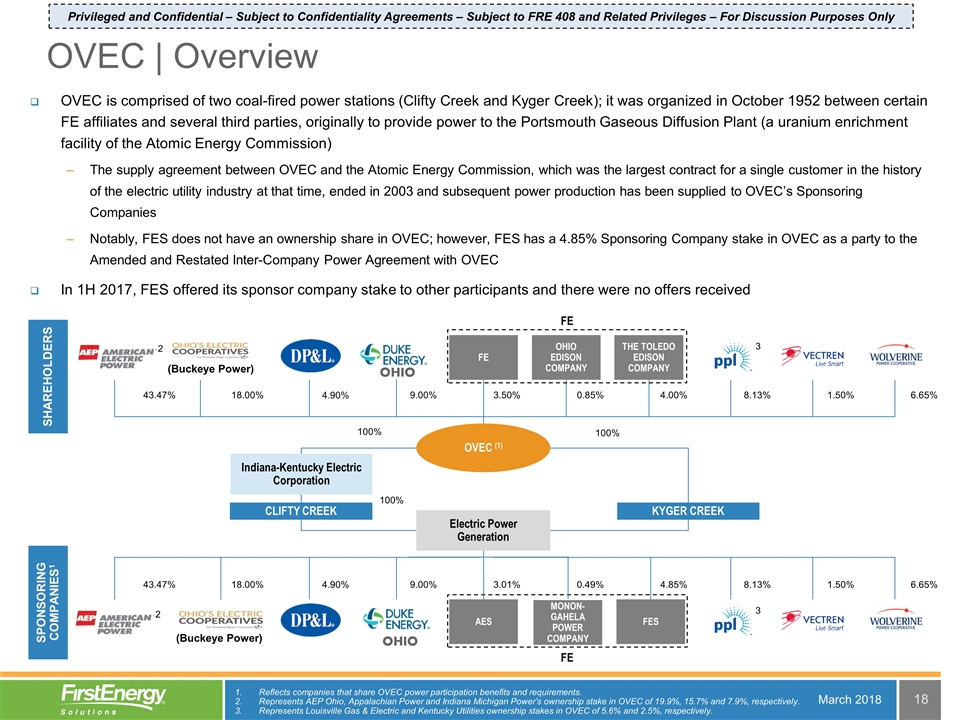

OVEC | Overview Reflects companies that share OVEC power participation benefits and requirements. Represents AEP Ohio, Appalachian Power and Indiana Michigan Power’s ownership stake in OVEC of 19.9%, 15.7% and 7.9%, respectively. Represents Louisville Gas & Electric and Kentucky Utilities ownership stakes in OVEC of 5.6% and 2.5%, respectively. OVEC is comprised of two coal-fired power stations (Clifty Creek and Kyger Creek); it was organized in October 1952 between certain FE affiliates and several third parties, originally to provide power to the Portsmouth Gaseous Diffusion Plant (a uranium enrichment facility of the Atomic Energy Commission) The supply agreement between OVEC and the Atomic Energy Commission, which was the largest contract for a single customer in the history of the electric utility industry at that time, ended in 2003 and subsequent power production has been supplied to OVEC’s Sponsoring Companies Notably, FES does not have an ownership share in OVEC; however, FES has a 4.85% Sponsoring Company stake in OVEC as a party to the Amended and Restated Inter-Company Power Agreement with OVEC In 1H 2017, FES offered its sponsor company stake to other participants and there were no offers received FE Ohio Edison Company AEP Buckeye Power Duke Energy PPL Vectren Wolverine Power Supply AES FE CLIFTY CREEK KYGER CREEK 100% 100% 43.47% 18.00% 9.00% 3.50% 0.85% 4.00% 8.13% 1.50% 6.65% 4.90% (Buckeye Power) OHIO 2 3 Indiana-Kentucky Electric Corporation 100% The Toledo Edison Company AES FES AEP Buckeye Power Duke Energy PPL Vectren Wolverine Power Supply AES FE (Buckeye Power) OHIO 2 3 Monon-gahela Power Company 43.47% 18.00% 9.00% 3.01% 0.49% 4.85% 8.13% 1.50% 6.65% 4.90% Shareholders Sponsoring Companies1 OVEC (1) Electric Power Generation March 2018 Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

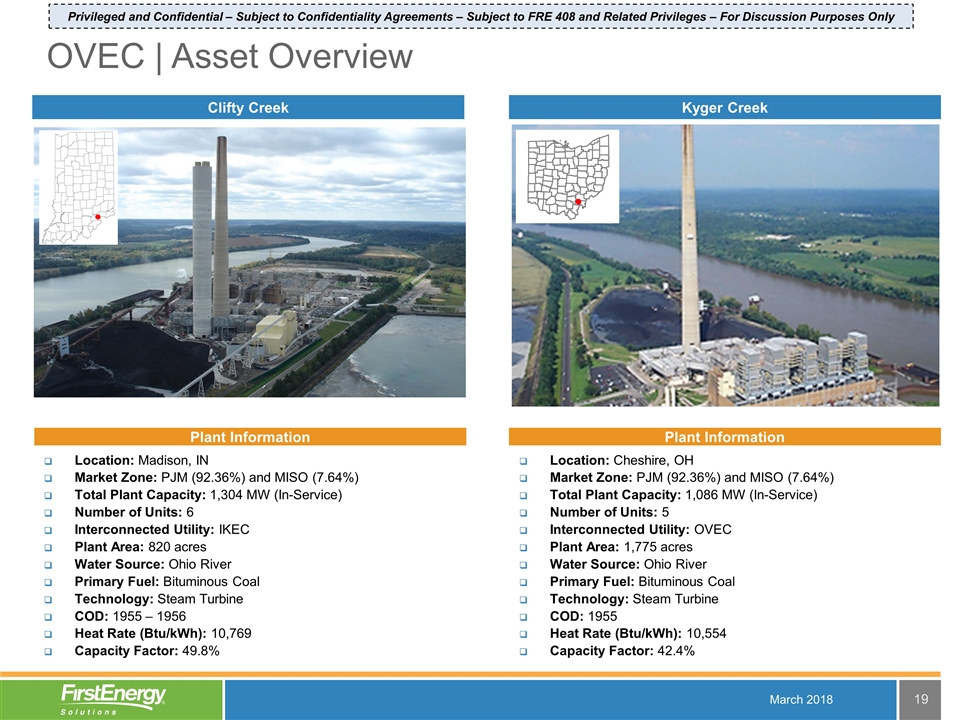

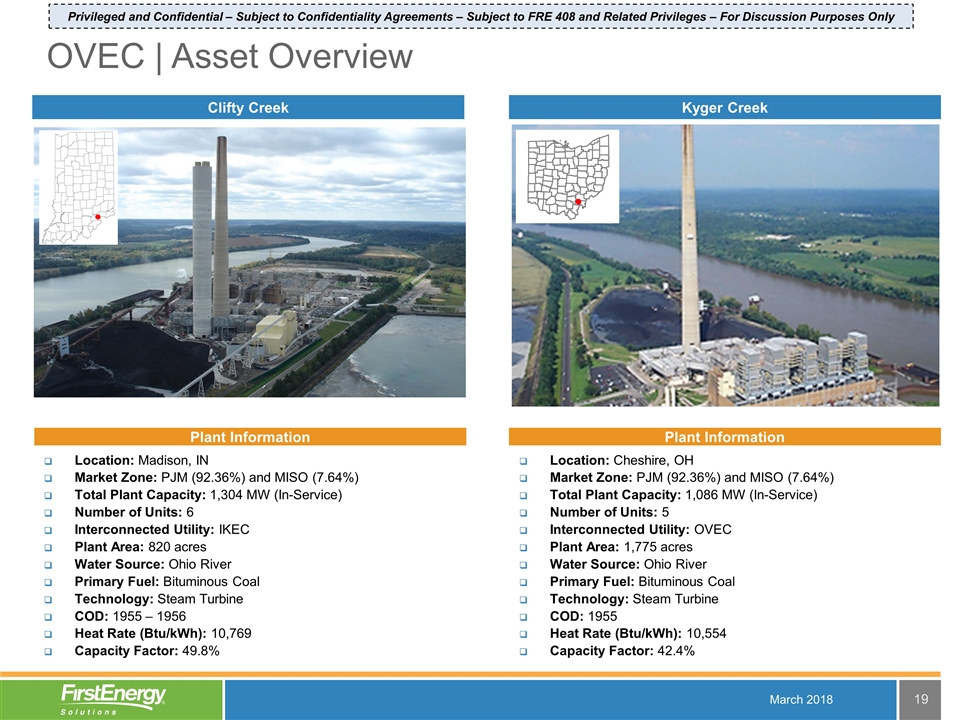

OVEC | Asset Overview Kyger Creek Location: Madison, IN Market Zone: PJM (92.36%) and MISO (7.64%) Total Plant Capacity: 1,304 MW (In-Service) Number of Units: 6 Interconnected Utility: IKEC Plant Area: 820 acres Water Source: Ohio River Primary Fuel: Bituminous Coal Technology: Steam Turbine COD: 1955 – 1956 Heat Rate (Btu/kWh): 10,769 Capacity Factor: 49.8% Clifty Creek Plant Information Plant Information Location: Cheshire, OH Market Zone: PJM (92.36%) and MISO (7.64%) Total Plant Capacity: 1,086 MW (In-Service) Number of Units: 5 Interconnected Utility: OVEC Plant Area: 1,775 acres Water Source: Ohio River Primary Fuel: Bituminous Coal Technology: Steam Turbine COD: 1955 Heat Rate (Btu/kWh): 10,554 Capacity Factor: 42.4% March 2018 Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

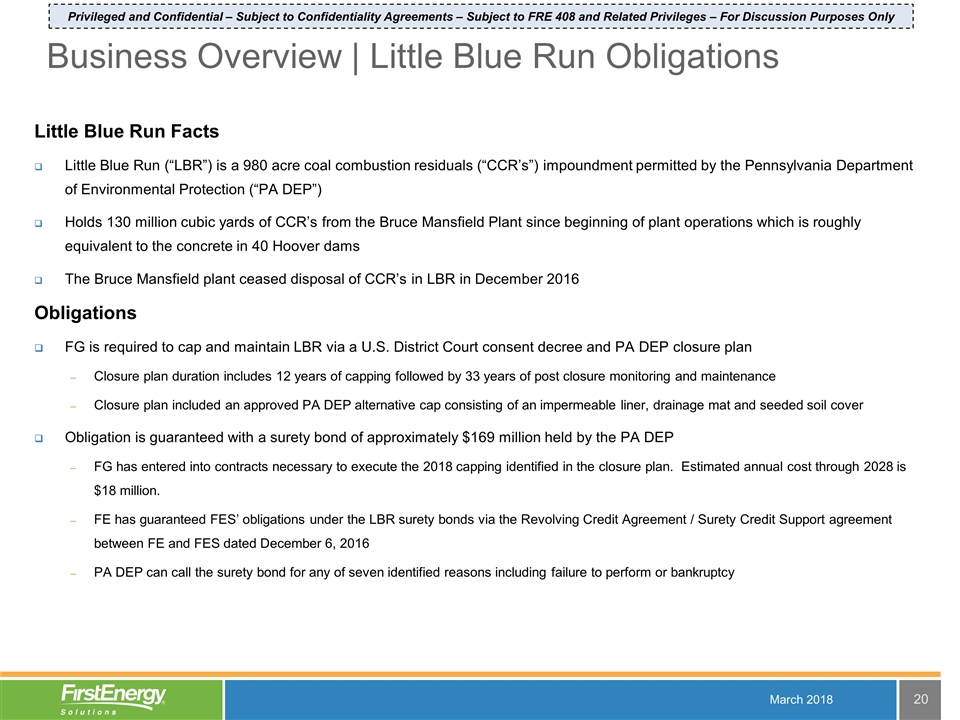

Little Blue Run Facts Little Blue Run (“LBR”) is a 980 acre coal combustion residuals (“CCR’s”) impoundment permitted by the Pennsylvania Department of Environmental Protection (“PA DEP”) Holds 130 million cubic yards of CCR’s from the Bruce Mansfield Plant since beginning of plant operations which is roughly equivalent to the concrete in 40 Hoover dams The Bruce Mansfield plant ceased disposal of CCR’s in LBR in December 2016 Obligations FG is required to cap and maintain LBR via a U.S. District Court consent decree and PA DEP closure plan Closure plan duration includes 12 years of capping followed by 33 years of post closure monitoring and maintenance Closure plan included an approved PA DEP alternative cap consisting of an impermeable liner, drainage mat and seeded soil cover Obligation is guaranteed with a surety bond of approximately $169 million held by the PA DEP FG has entered into contracts necessary to execute the 2018 capping identified in the closure plan. Estimated annual cost through 2028 is $18 million. FE has guaranteed FES’ obligations under the LBR surety bonds via the Revolving Credit Agreement / Surety Credit Support agreement between FE and FES dated December 6, 2016 PA DEP can call the surety bond for any of seven identified reasons including failure to perform or bankruptcy March 2018 Business Overview | Little Blue Run Obligations Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

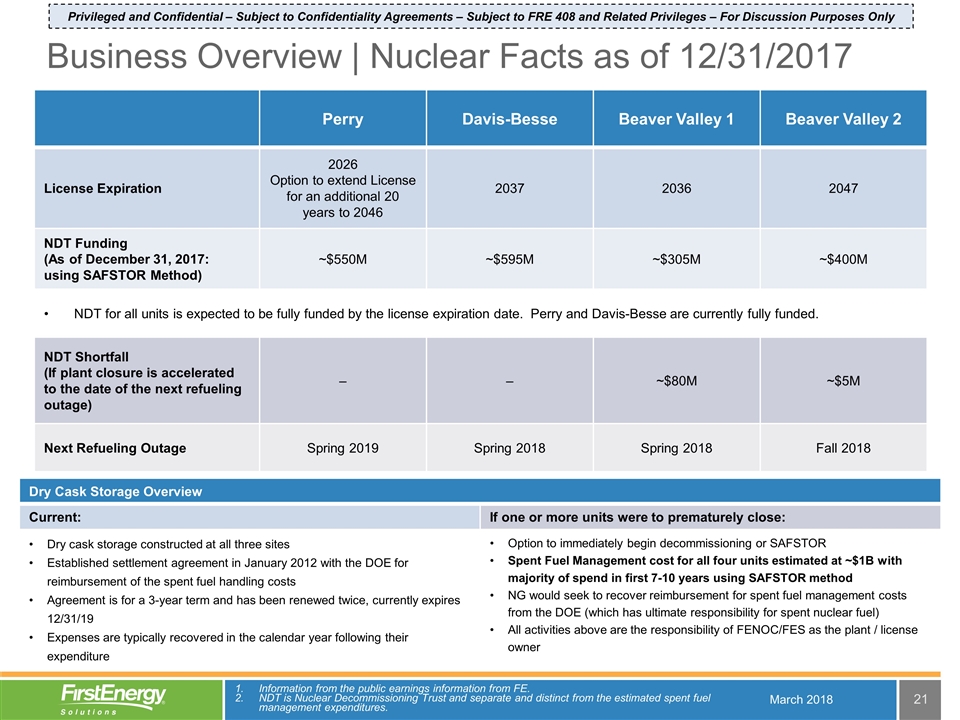

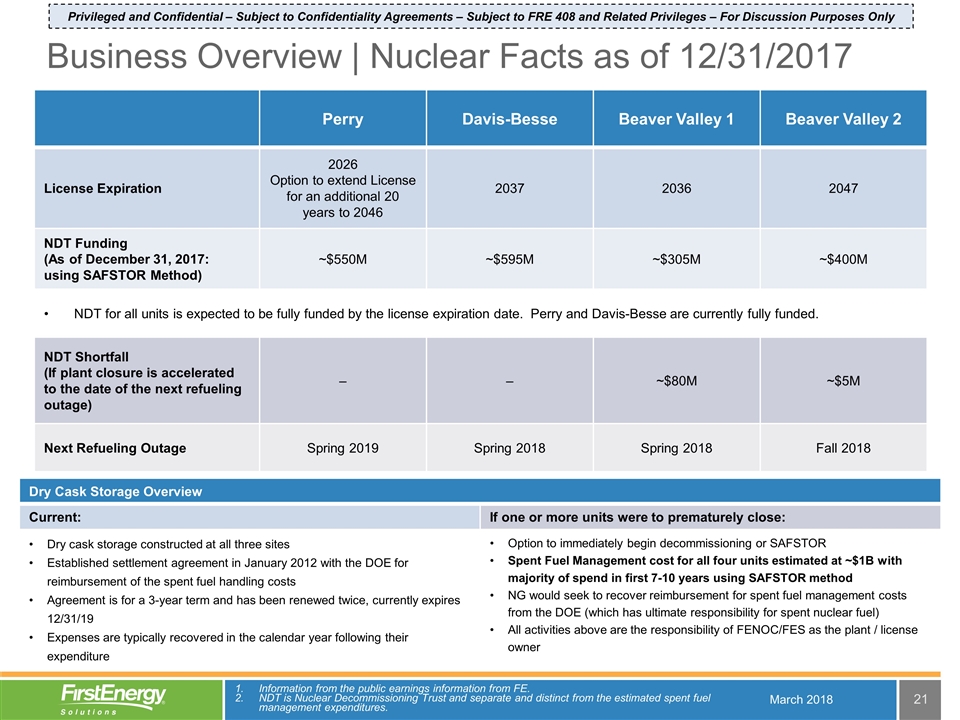

March 2018 Business Overview | Nuclear Facts as of 12/31/2017 Information from the public earnings information from FE. NDT is Nuclear Decommissioning Trust and separate and distinct from the estimated spent fuel management expenditures. Perry Davis-Besse Beaver Valley 1 Beaver Valley 2 License Expiration 2026 Option to extend License for an additional 20 years to 2046 2037 2036 2047 NDT Funding (As of December 31, 2017: using SAFSTOR Method) ~$550M ~$595M ~$305M ~$400M NDT for all units is expected to be fully funded by the license expiration date. Perry and Davis-Besse are currently fully funded. NDT Shortfall (If plant closure is accelerated to the date of the next refueling outage) – – ~$80M ~$5M Next Refueling Outage Spring 2019 Spring 2018 Spring 2018 Fall 2018 Dry Cask Storage Overview Current: If one or more units were to prematurely close: Dry cask storage constructed at all three sites Established settlement agreement in January 2012 with the DOE for reimbursement of the spent fuel handling costs Agreement is for a 3-year term and has been renewed twice, currently expires 12/31/19 Expenses are typically recovered in the calendar year following their expenditure Option to immediately begin decommissioning or SAFSTOR Spent Fuel Management cost for all four units estimated at ~$1B with majority of spend in first 7-10 years using SAFSTOR method NG would seek to recover reimbursement for spent fuel management costs from the DOE (which has ultimate responsibility for spent nuclear fuel) All activities above are the responsibility of FENOC/FES as the plant / license owner Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

Market Conditions March 2018 Privileged and Confidential – Subject to Confidentiality Agreements For Discussion Purposes Only – Subject to FRE 408 and Related Privileges

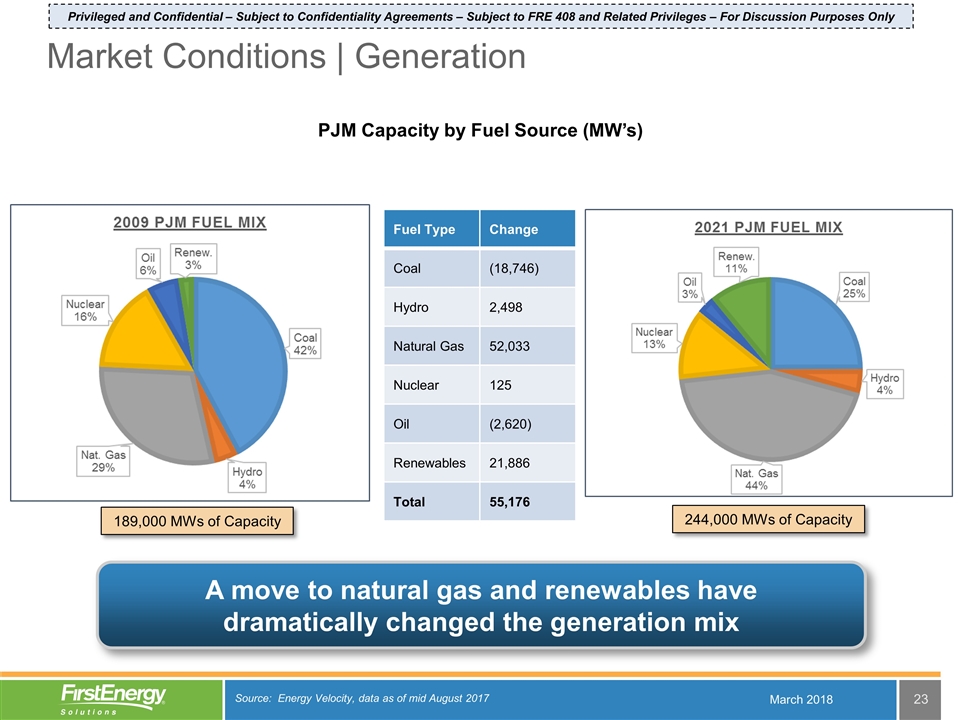

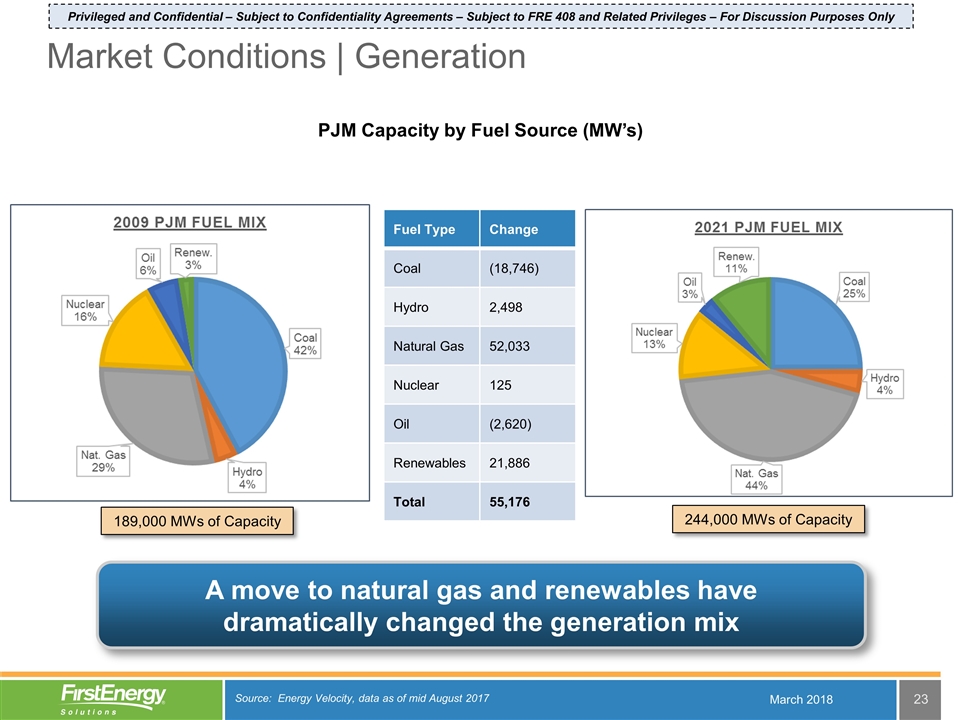

PJM Capacity by Fuel Source (MW’s) March 2018 Market Conditions | Generation A move to natural gas and renewables have dramatically changed the generation mix Fuel Type Change Coal (18,746) Hydro 2,498 Natural Gas 52,033 Nuclear 125 Oil (2,620) Renewables 21,886 Total 55,176 Source: Energy Velocity, data as of mid August 2017 189,000 MWs of Capacity 244,000 MWs of Capacity Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

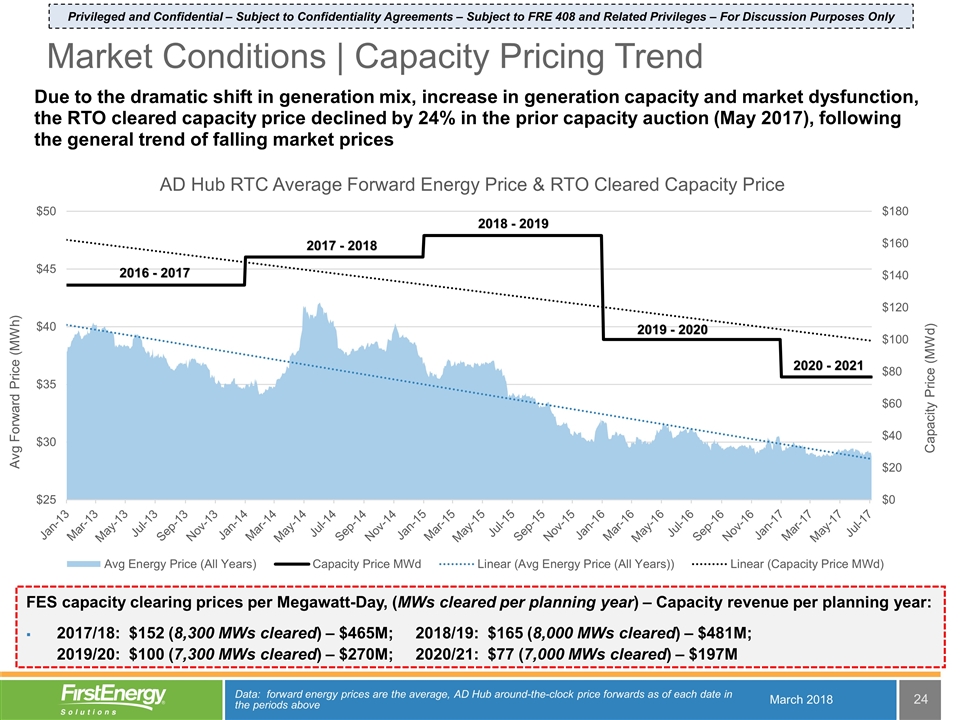

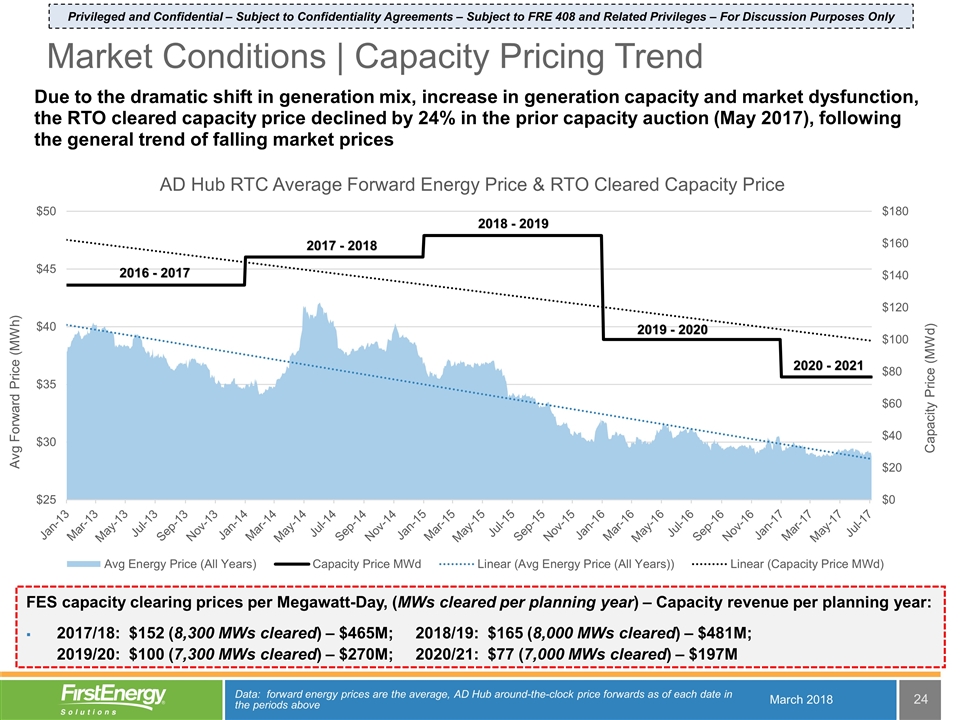

Due to the dramatic shift in generation mix, increase in generation capacity and market dysfunction, the RTO cleared capacity price declined by 24% in the prior capacity auction (May 2017), following the general trend of falling market prices Market Conditions | Capacity Pricing Trend 2016 - 2017 2016 - 2017 2017 - 2018 2018 - 2019 2019 - 2020 2020 - 2021 Data: forward energy prices are the average, AD Hub around-the-clock price forwards as of each date in the periods above Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only FES capacity clearing prices per Megawatt-Day, (MWs cleared per planning year) – Capacity revenue per planning year: 2017/18: $152 (8,300 MWs cleared) – $465M; 2018/19: $165 (8,000 MWs cleared) – $481M; 2019/20: $100 (7,300 MWs cleared) – $270M; 2020/21: $77 (7,000 MWs cleared) – $197M March 2018

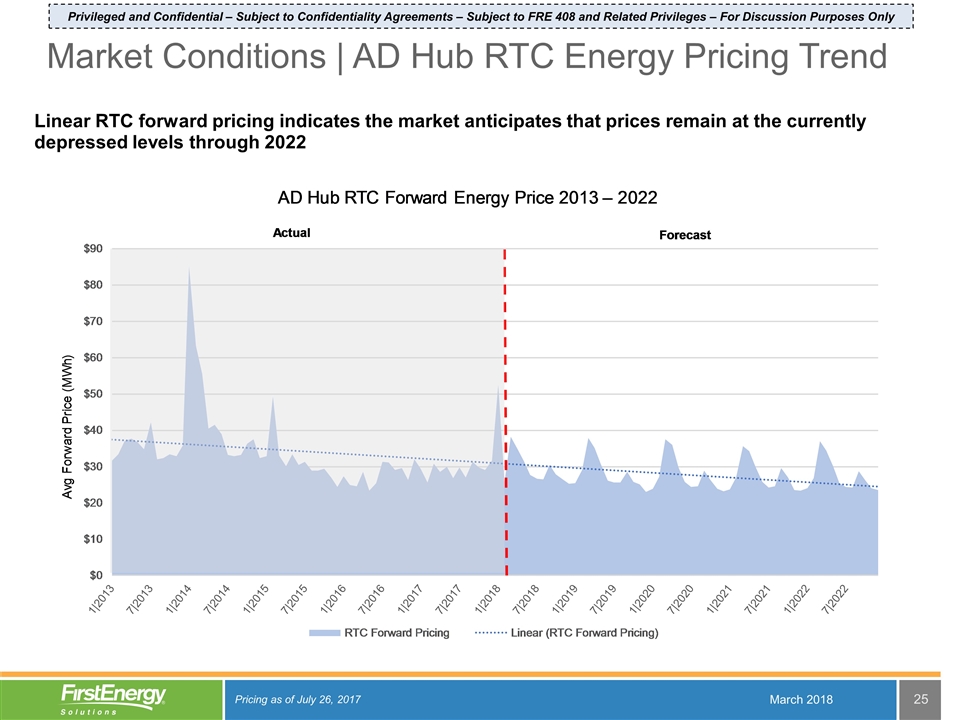

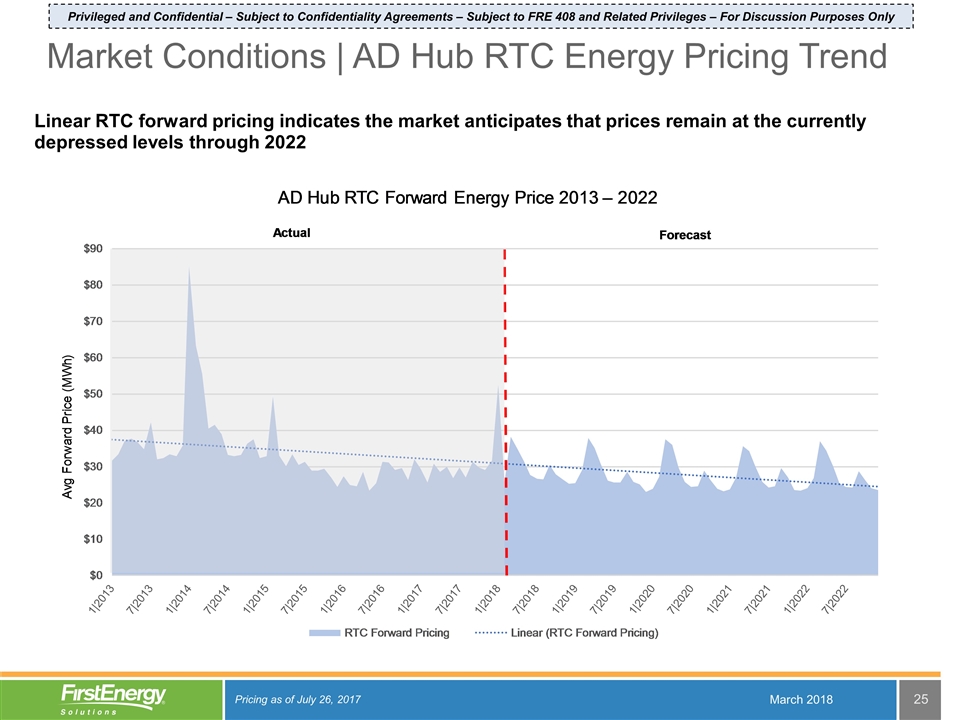

Linear RTC forward pricing indicates the market anticipates that prices remain at the currently depressed levels through 2022 Market Conditions | AD Hub RTC Energy Pricing Trend Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018 Pricing as of July 26, 2017

Operations March 2018 Privileged and Confidential – Subject to Confidentiality Agreements For Discussion Purposes Only – Subject to FRE 408 and Related Privileges

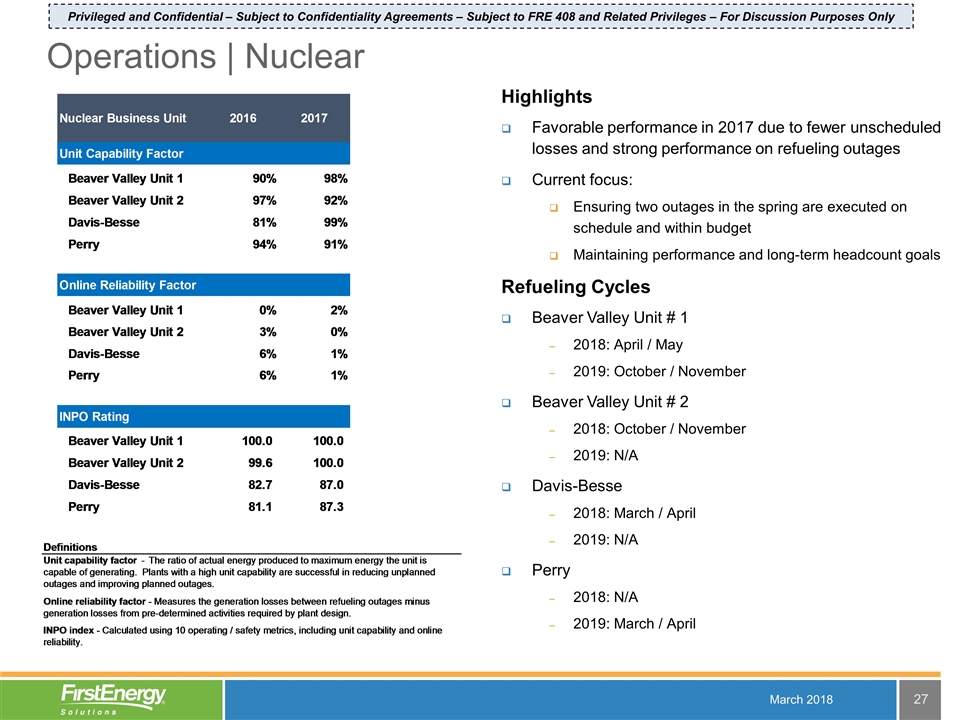

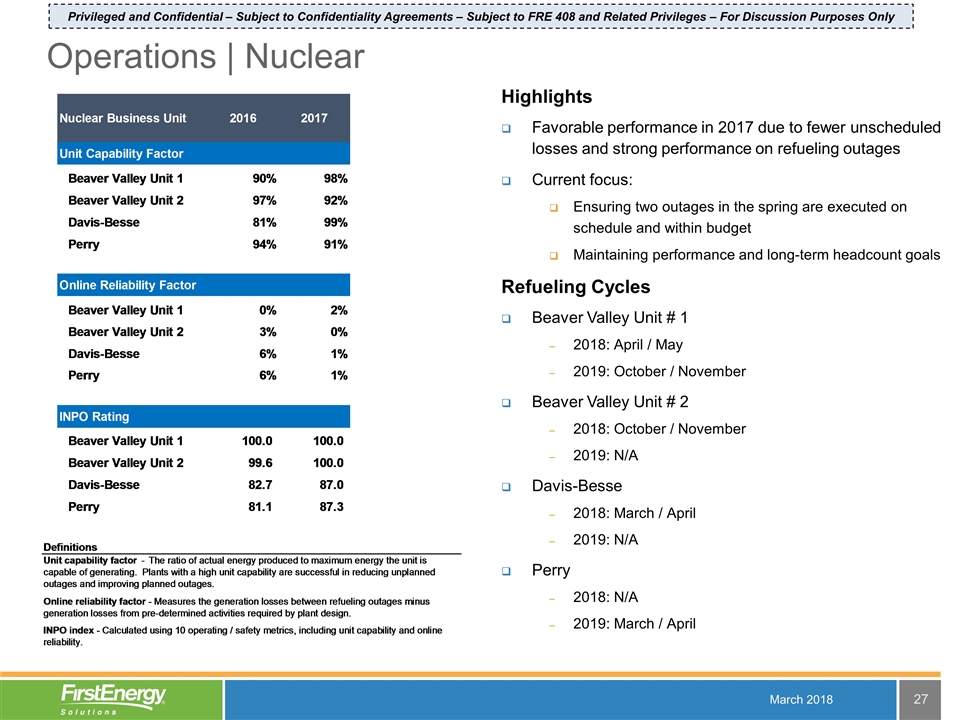

Highlights Favorable performance in 2017 due to fewer unscheduled losses and strong performance on refueling outages Current focus: Ensuring two outages in the spring are executed on schedule and within budget Maintaining performance and long-term headcount goals Refueling Cycles Beaver Valley Unit # 1 2018: April / May 2019: October / November Beaver Valley Unit # 2 2018: October / November 2019: N/A Davis-Besse 2018: March / April 2019: N/A Perry 2018: N/A 2019: March / April March 2018 Operations | Nuclear Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only

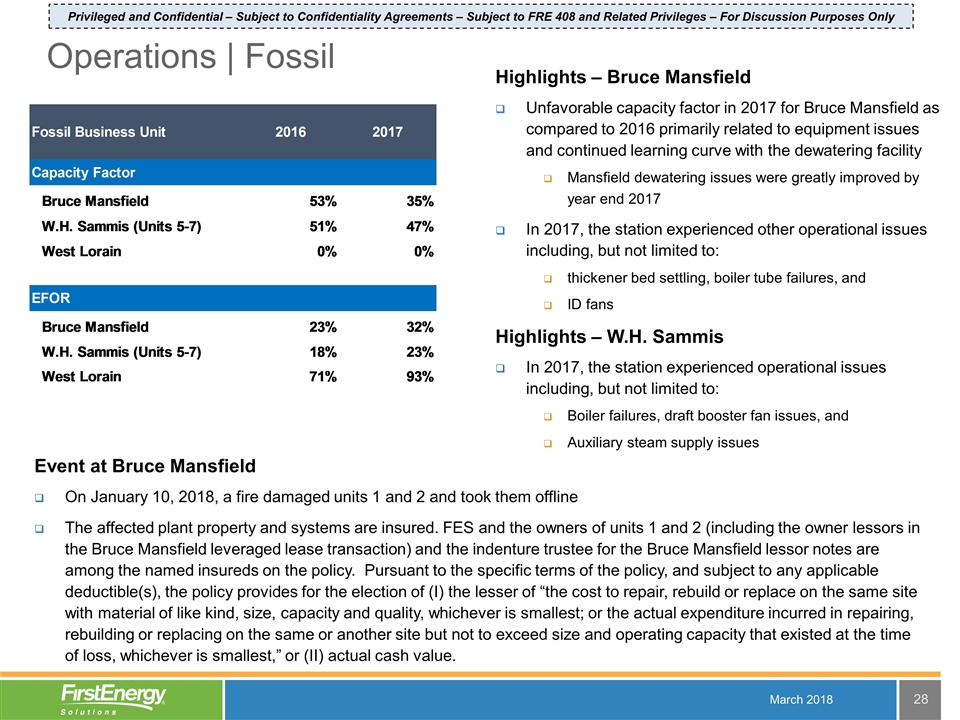

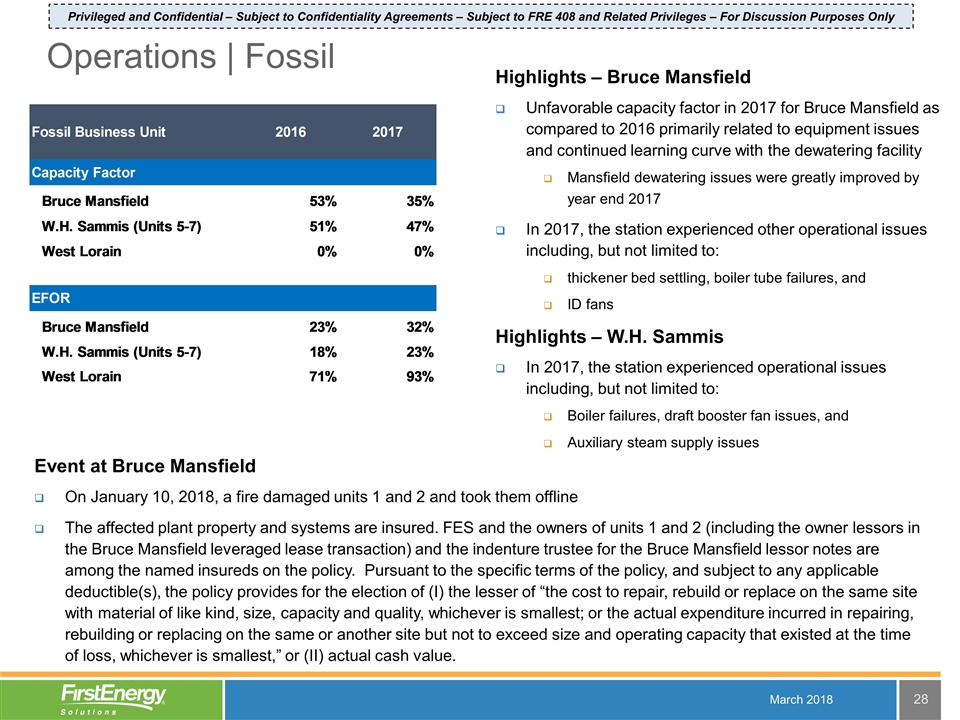

Highlights – Bruce Mansfield Unfavorable capacity factor in 2017 for Bruce Mansfield as compared to 2016 primarily related to equipment issues and continued learning curve with the dewatering facility Mansfield dewatering issues were greatly improved by year end 2017 In 2017, the station experienced other operational issues including, but not limited to: thickener bed settling, boiler tube failures, and ID fans Highlights – W.H. Sammis In 2017, the station experienced operational issues including, but not limited to: Boiler failures, draft booster fan issues, and Auxiliary steam supply issues Operations | Fossil Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018 Event at Bruce Mansfield On January 10, 2018, a fire damaged units 1 and 2 and took them offline The affected plant property and systems are insured. FES and the owners of units 1 and 2 (including the owner lessors in the Bruce Mansfield leveraged lease transaction) and the indenture trustee for the Bruce Mansfield lessor notes are among the named insureds on the policy. Pursuant to the specific terms of the policy, and subject to any applicable deductible(s), the policy provides for the election of (I) the lesser of “the cost to repair, rebuild or replace on the same site with material of like kind, size, capacity and quality, whichever is smallest; or the actual expenditure incurred in repairing, rebuilding or replacing on the same or another site but not to exceed size and operating capacity that existed at the time of loss, whichever is smallest,” or (II) actual cash value.

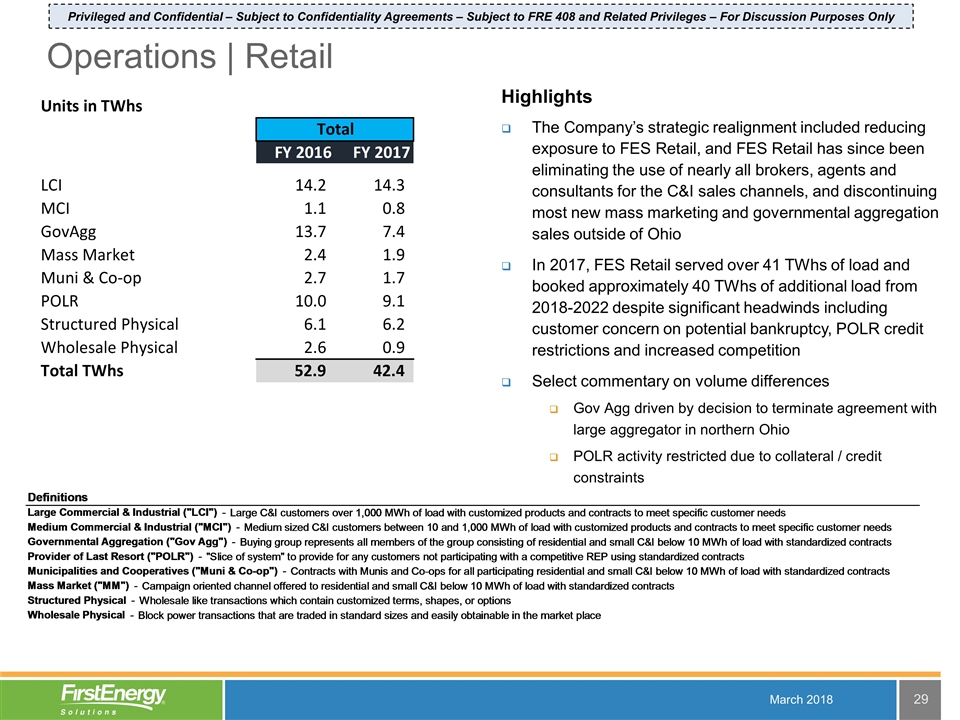

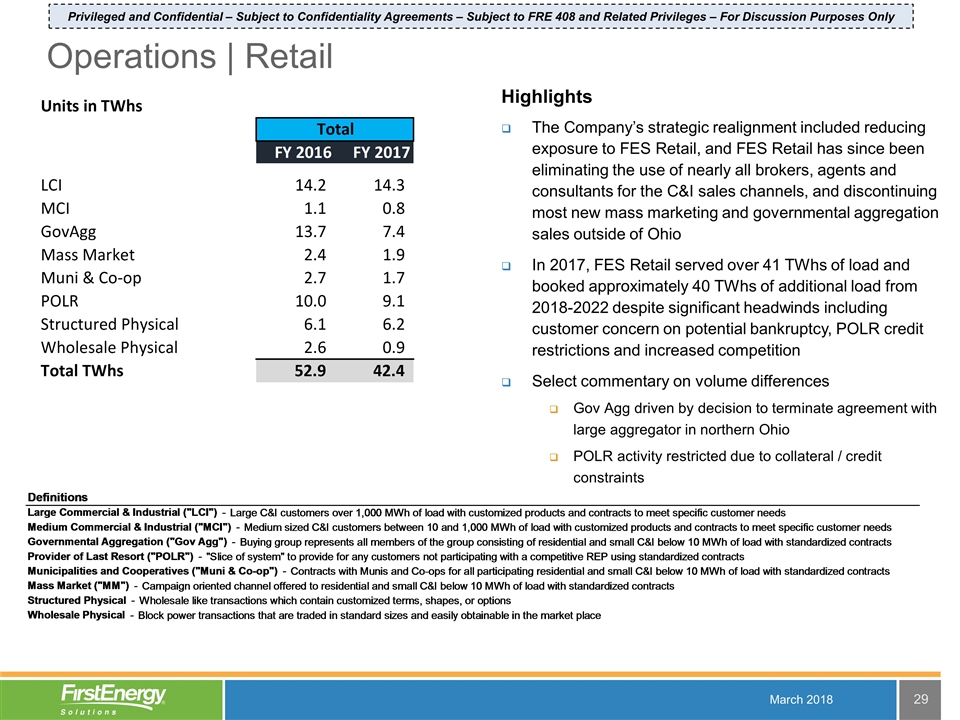

Operations | Retail Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018 Highlights The Company’s strategic realignment included reducing exposure to FES Retail, and FES Retail has since been eliminating the use of nearly all brokers, agents and consultants for the C&I sales channels, and discontinuing most new mass marketing and governmental aggregation sales outside of Ohio In 2017, FES Retail served over 41 TWhs of load and booked approximately 40 TWhs of additional load from 2018-2022 despite significant headwinds including customer concern on potential bankruptcy, POLR credit restrictions and increased competition Select commentary on volume differences Gov Agg driven by decision to terminate agreement with large aggregator in northern Ohio POLR activity restricted due to collateral / credit constraints

Summary of Debt Capitalization March 2018 Privileged and Confidential – Subject to Confidentiality Agreements For Discussion Purposes Only – Subject to FRE 408 and Related Privileges

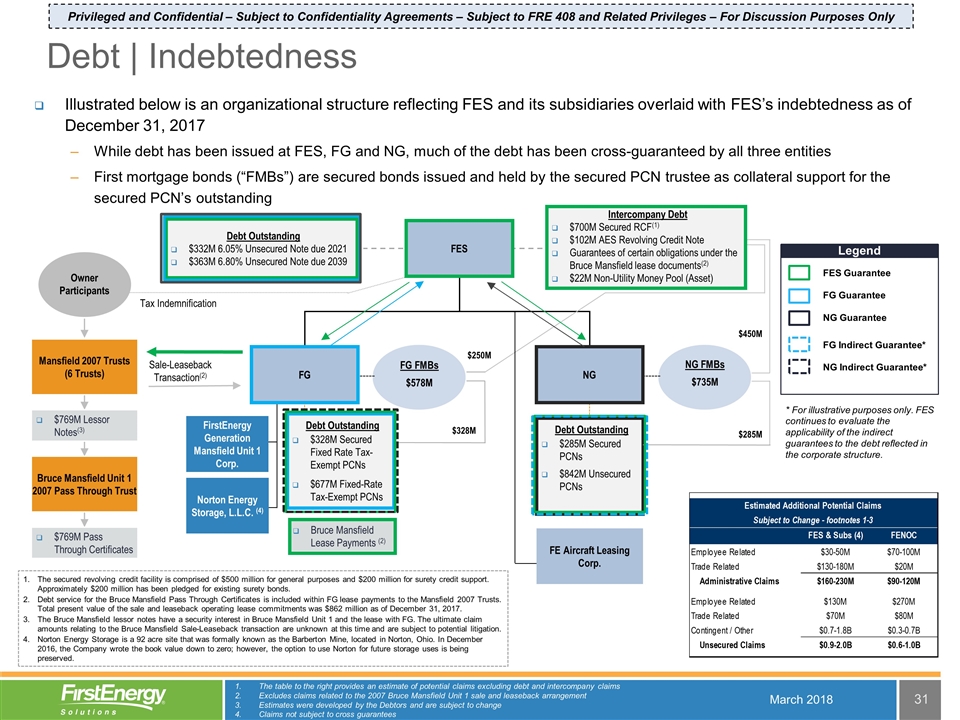

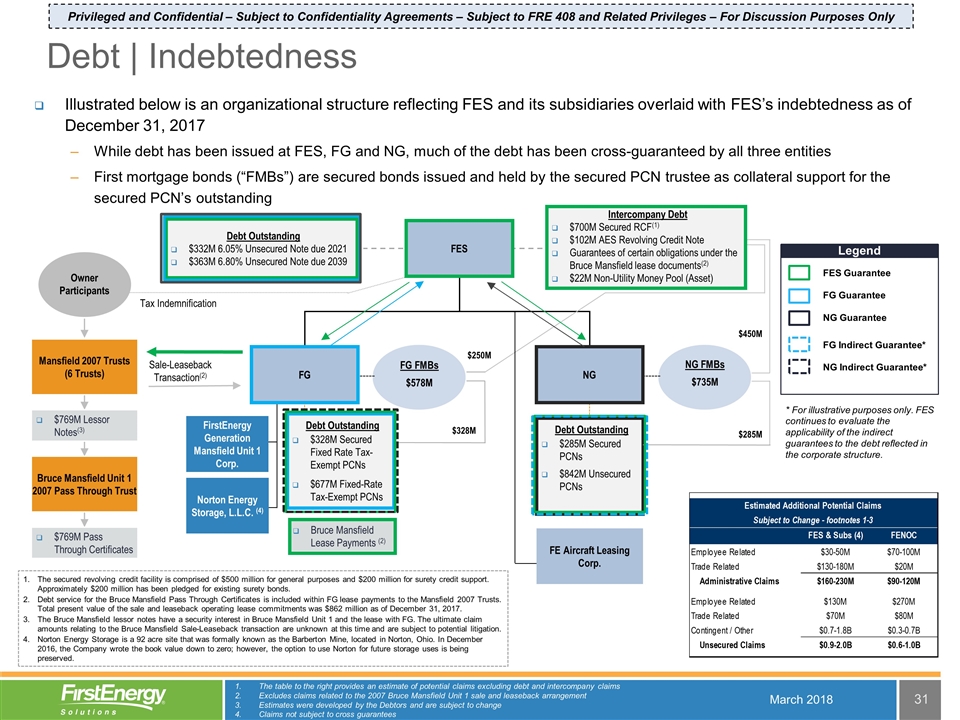

Illustrated below is an organizational structure reflecting FES and its subsidiaries overlaid with FES’s indebtedness as of December 31, 2017 While debt has been issued at FES, FG and NG, much of the debt has been cross-guaranteed by all three entities First mortgage bonds (“FMBs”) are secured bonds issued and held by the secured PCN trustee as collateral support for the secured PCN’s outstanding FES FG NG Debt Outstanding $332M 6.05% Unsecured Note due 2021 $363M 6.80% Unsecured Note due 2039 Debt Outstanding $328M Secured Fixed Rate Tax-Exempt PCNs $677M Fixed-Rate Tax-Exempt PCNs Debt Outstanding $285M Secured PCNs $842M Unsecured PCNs Sale-Leaseback Transaction(2) FirstEnergy Generation Mansfield Unit 1 Corp. Norton Energy Storage, L.L.C. (4) FE Aircraft Leasing Corp. Intercompany Debt $700M Secured RCF(1) $102M AES Revolving Credit Note Guarantees of certain obligations under the Bruce Mansfield lease documents(2) $22M Non-Utility Money Pool (Asset) NG FMBs $735M $285M $450M FG FMBs $578M $328M $250M Tax Indemnification Legend FES Guarantee FG Guarantee NG Guarantee FG Indirect Guarantee* NG Indirect Guarantee* * For illustrative purposes only. FES continues to evaluate the applicability of the indirect guarantees to the debt reflected in the corporate structure. Mansfield 2007 Trusts (6 Trusts) Bruce Mansfield Unit 1 2007 Pass Through Trust $769M Lessor Notes(3) $769M Pass Through Certificates Owner Participants The secured revolving credit facility is comprised of $500 million for general purposes and $200 million for surety credit support. Approximately $200 million has been pledged for existing surety bonds. Debt service for the Bruce Mansfield Pass Through Certificates is included within FG lease payments to the Mansfield 2007 Trusts. Total present value of the sale and leaseback operating lease commitments was $862 million as of December 31, 2017. The Bruce Mansfield lessor notes have a security interest in Bruce Mansfield Unit 1 and the lease with FG. The ultimate claim amounts relating to the Bruce Mansfield Sale-Leaseback transaction are unknown at this time and are subject to potential litigation. Norton Energy Storage is a 92 acre site that was formally known as the Barberton Mine, located in Norton, Ohio. In December 2016, the Company wrote the book value down to zero; however, the option to use Norton for future storage uses is being preserved. March 2018 Debt | Indebtedness Bruce Mansfield Lease Payments (2) Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only The table to the right provides an estimate of potential claims excluding debt and intercompany claims Excludes claims related to the 2007 Bruce Mansfield Unit 1 sale and leaseback arrangement Estimates were developed by the Debtors and are subject to change Claims not subject to cross guarantees

Financial Information March 2018 Privileged and Confidential – Subject to Confidentiality Agreements For Discussion Purposes Only – Subject to FRE 408 and Related Privileges

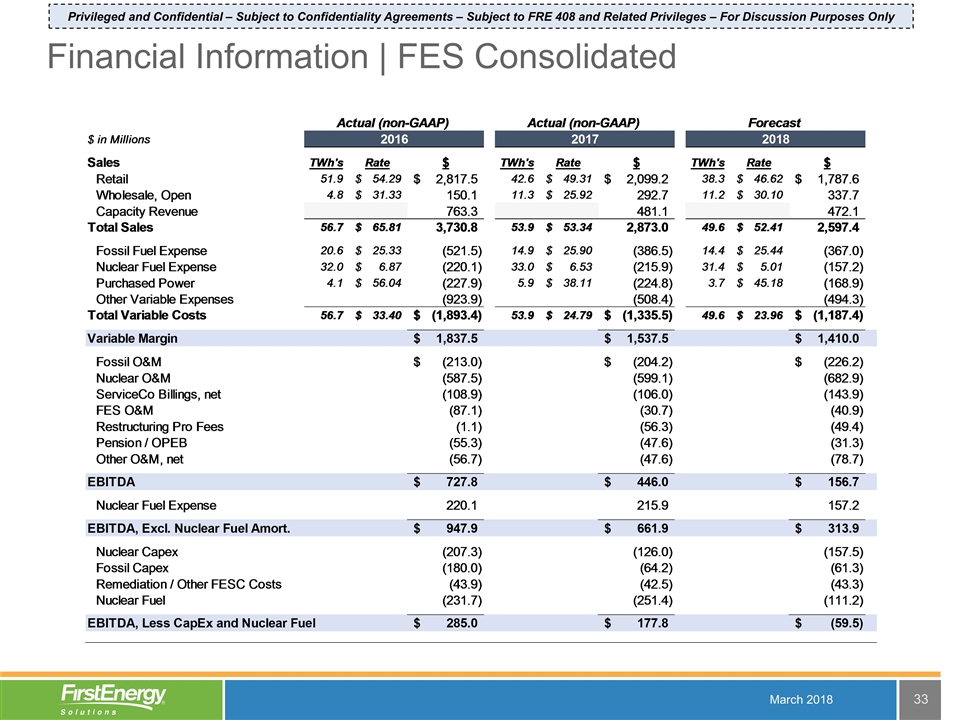

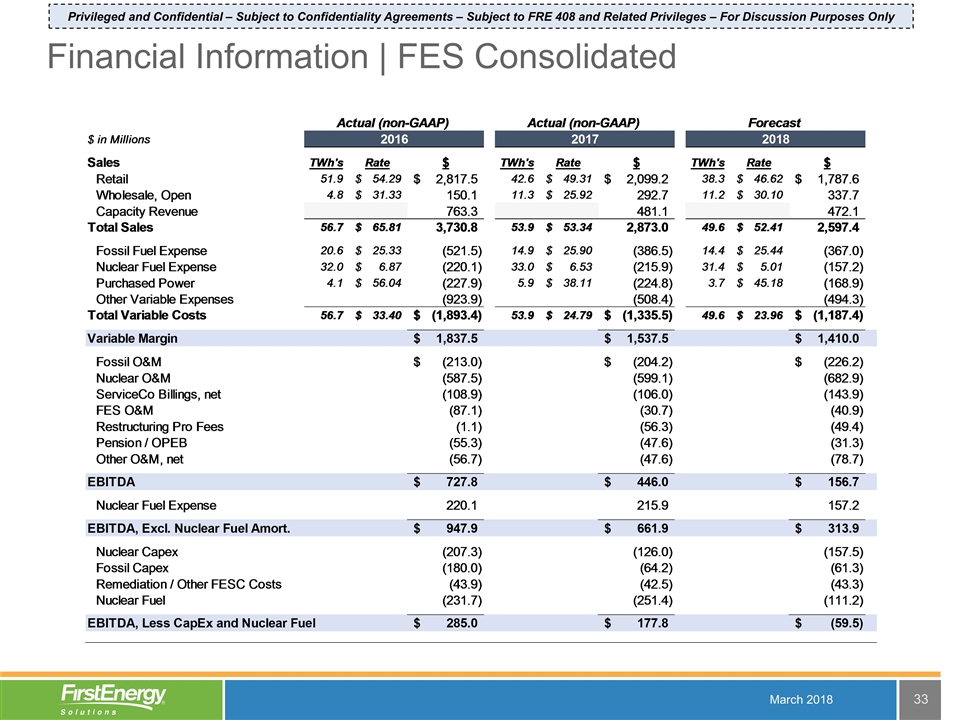

Financial Information | FES Consolidated Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

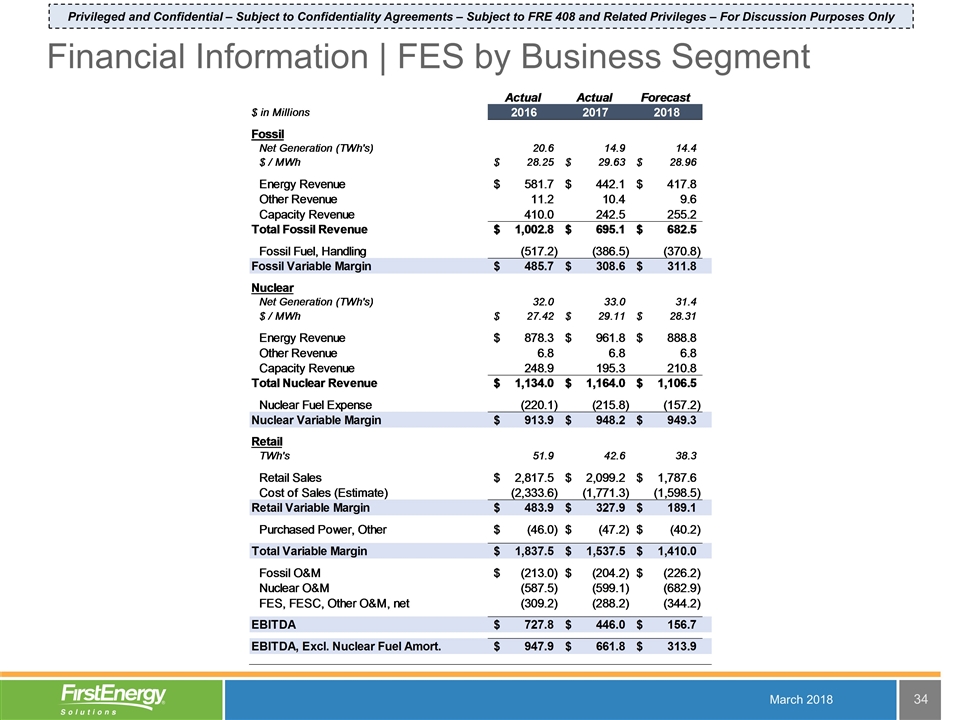

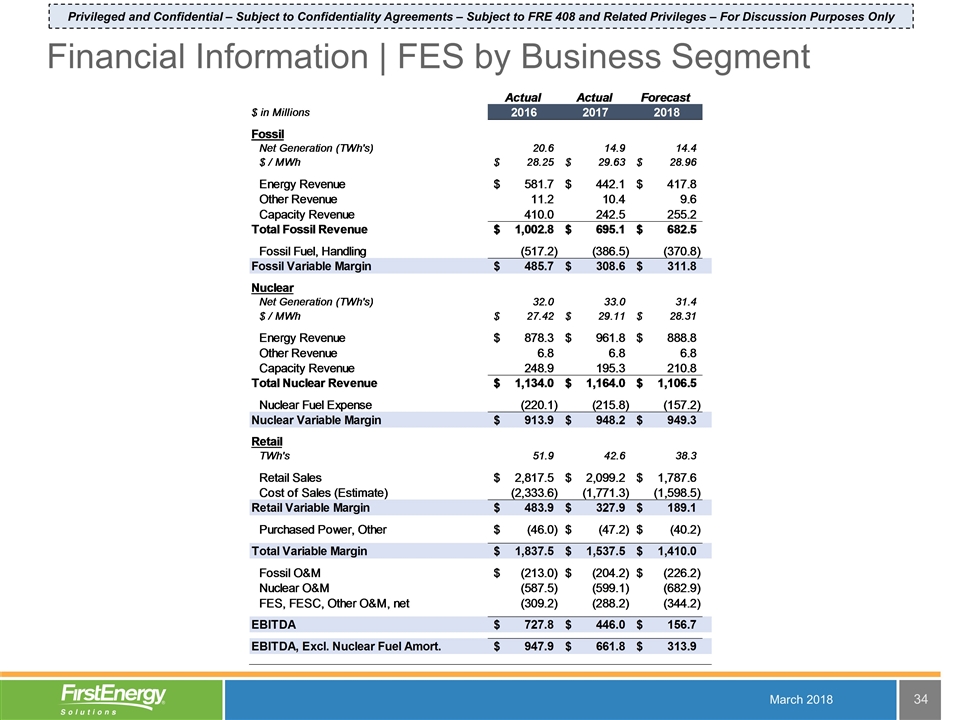

Financial Information | FES by Business Segment Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

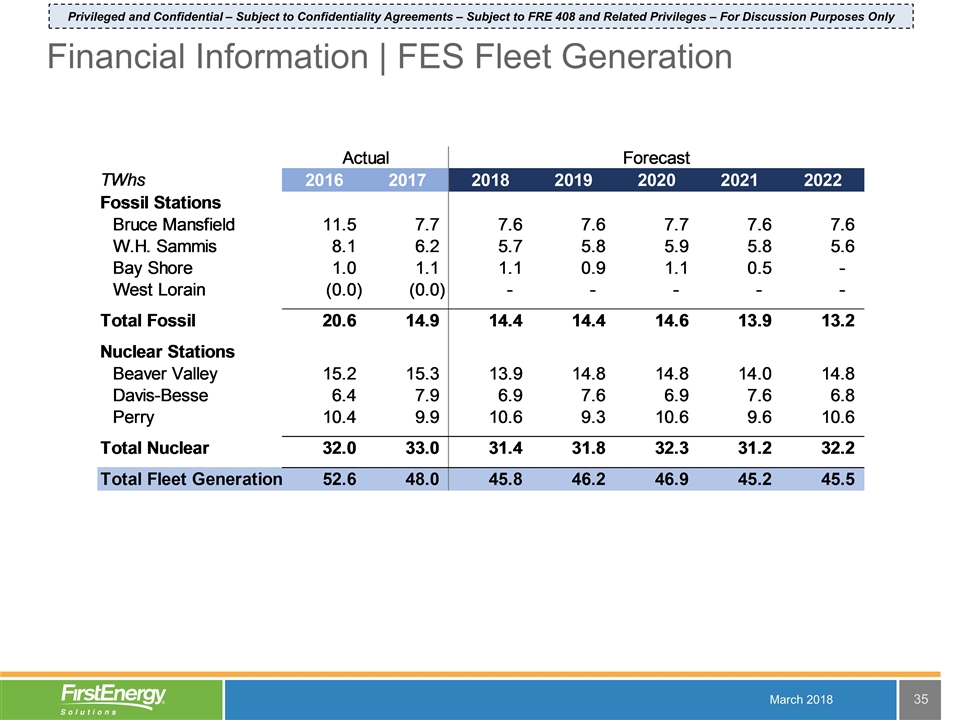

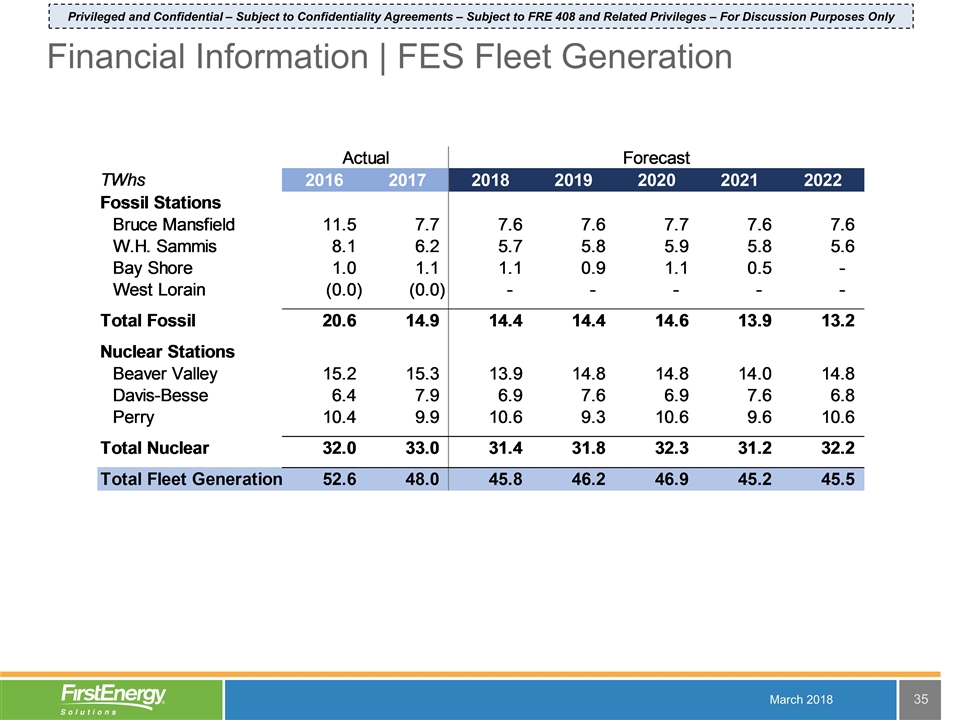

Financial Information | FES Fleet Generation Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018

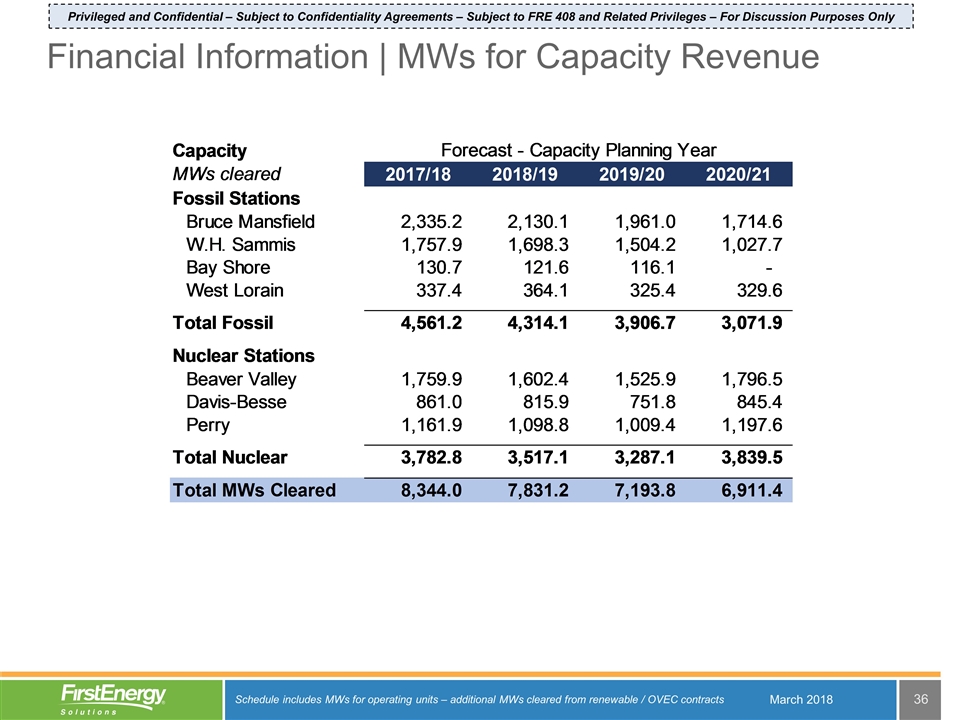

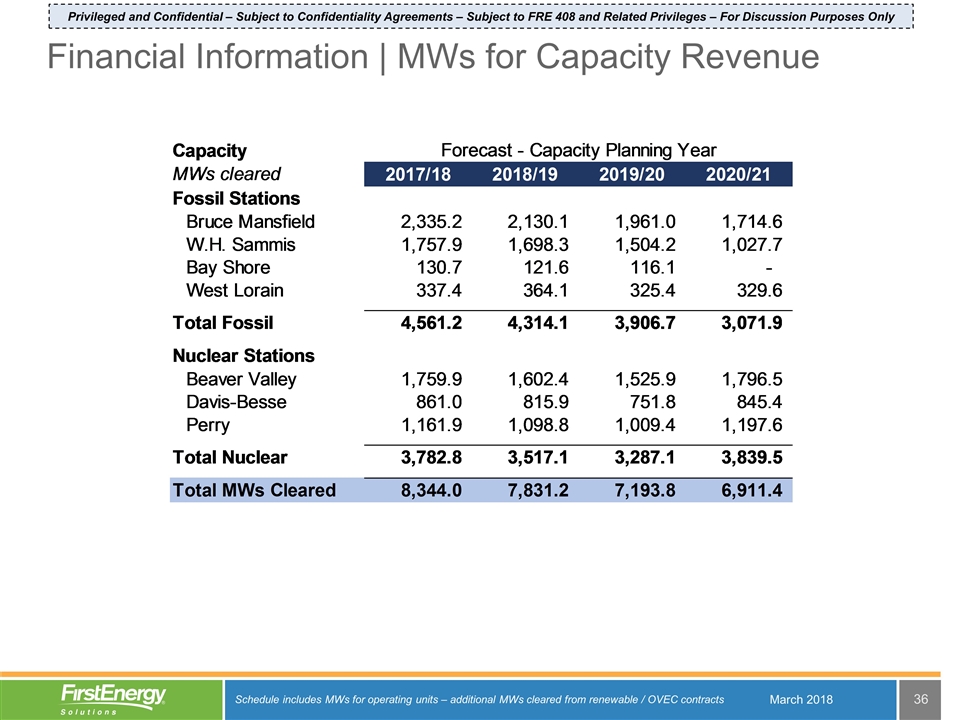

Financial Information | MWs for Capacity Revenue Privileged and Confidential – Subject to Confidentiality Agreements – Subject to FRE 408 and Related Privileges – For Discussion Purposes Only March 2018 Schedule includes MWs for operating units – additional MWs cleared from renewable / OVEC contracts

End March 2018 Privileged and Confidential – Subject to Confidentiality Agreements For Discussion Purposes Only – Subject to FRE 408 and Related Privileges