Presentation Title FES RETAIL SALE PROCESS 23 March 2018 CONFIDENTIAL Presentation2 Time Stamp : 9 March 2017 10:42:26 Exhibit 99.3

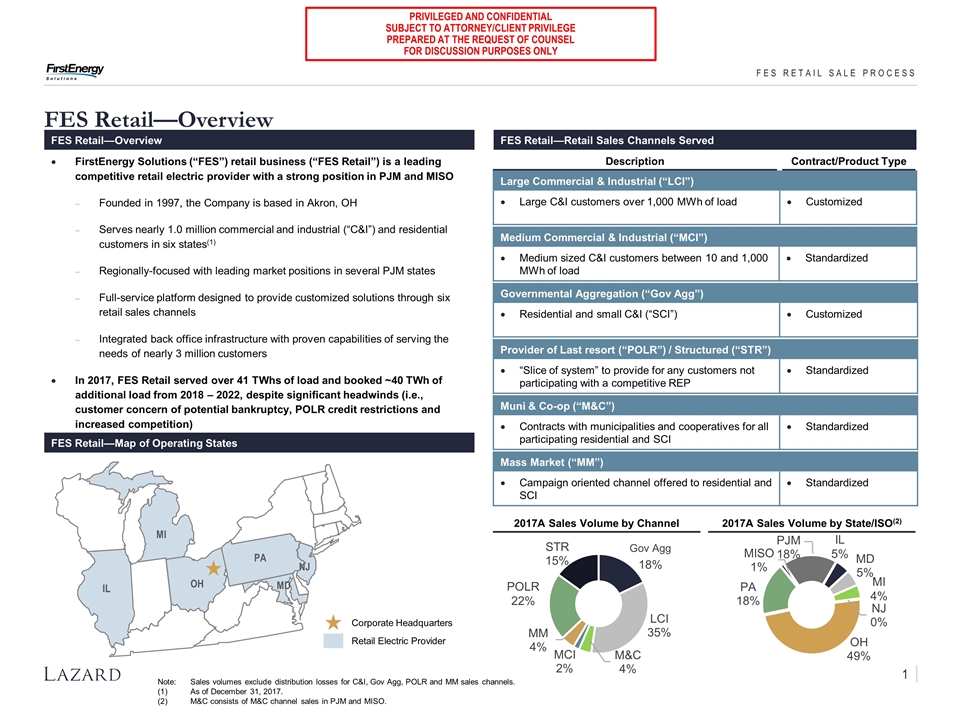

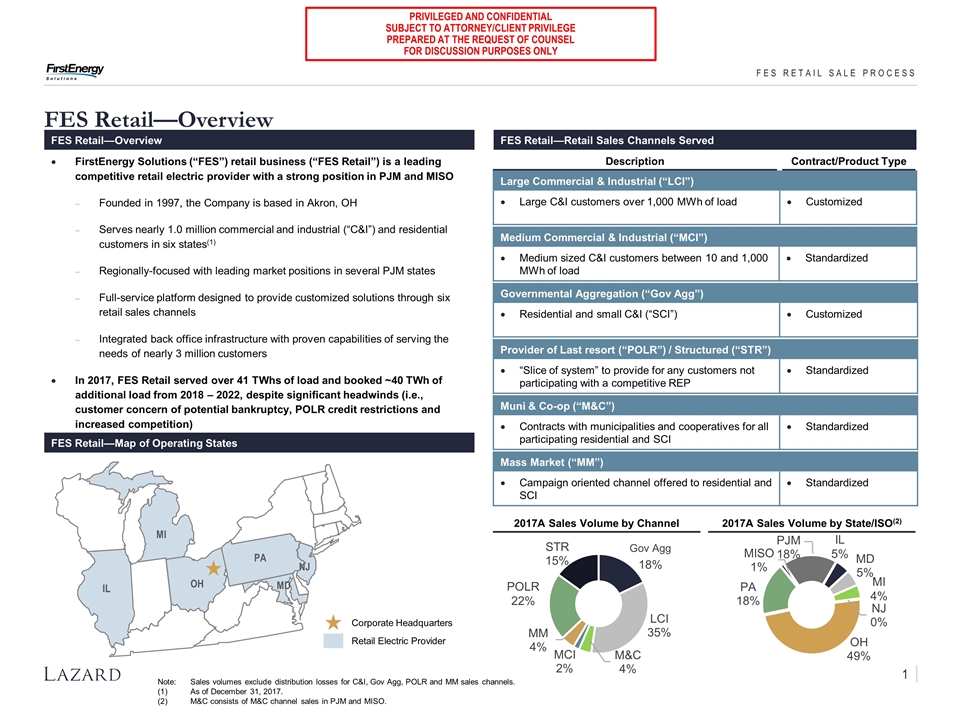

Description Contract/Product Type FES Retail—Overview FES Retail Sale Process FES RETAIL SALE PROCESS FES Retail—Overview FES Retail—Retail Sales Channels Served FES Retail—Map of Operating States FirstEnergy Solutions (“FES”) retail business (“FES Retail”) is a leading competitive retail electric provider with a strong position in PJM and MISO Founded in 1997, the Company is based in Akron, OH Serves nearly 1.0 million commercial and industrial (“C&I”) and residential customers in six states(1) Regionally-focused with leading market positions in several PJM states Full-service platform designed to provide customized solutions through six retail sales channels Integrated back office infrastructure with proven capabilities of serving the needs of nearly 3 million customers In 2017, FES Retail served over 41 TWhs of load and booked ~40 TWh of additional load from 2018 – 2022, despite significant headwinds (i.e., customer concern of potential bankruptcy, POLR credit restrictions and increased competition) Note:Sales volumes exclude distribution losses for C&I, Gov Agg, POLR and MM sales channels. As of December 31, 2017. M&C consists of M&C channel sales in PJM and MISO. Retail Electric Provider Corporate Headquarters IL MI OH PA MD NJ 2017A Sales Volume by Channel 2017A Sales Volume by State/ISO(2) Large Commercial & Industrial (“LCI”) Large C&I customers over 1,000 MWh of load Customized Medium Commercial & Industrial (“MCI”) Medium sized C&I customers between 10 and 1,000 MWh of load Standardized Governmental Aggregation (“Gov Agg”) Residential and small C&I (“SCI”) Customized Provider of Last resort (“POLR”) / Structured (“STR”) “Slice of system” to provide for any customers not participating with a competitive REP Standardized Muni & Co-op (“M&C”) Contracts with municipalities and cooperatives for all participating residential and SCI Standardized Mass Market (“MM”) Campaign oriented channel offered to residential and SCI Standardized Gov Agg 1 POLR22% IL5% MI4%

FES Retail—Sale Process Overview FES Retail Sale Process FES RETAIL SALE PROCESS Sale Process Overview Lazard formally launched the sale process for FES Retail on February 27, 2018 Outreach to 35+ potential counterparties, consisting of broadly-focused financial investors, power- and energy-focused financial investors, strategic retail/power generation companies and others who have expressed inbound interest 25+ potential counterparties expressed interest in pursuing further As of March 23, 2018: 17 NDAs executed between FES and interested counterparties Dataroom access has been provided to 17 interested counterparties that have executed a NDA with FES Confidential information memorandum (“CIM”) and financial projections have been provided to 17 interested counterparties that have executed a NDA with FES The deadline for interested counterparties to submit indicative bid is March 29, 2018 FES and Lazard will evaluate the indicative Bids and may invite a selected group of interested counterparties to conduct further due diligence during Phase II This will include access to additional diligence information in the Phase II online dataroom, participation in a management presentation and receipt of the draft asset purchase agreement (“APA”) and bidding procedures FES may enter into an APA with a stalking horse at the conclusion of Phase II, file for bankruptcy, and subject to Bankruptcy Court approval of the agreed upon bidding procedures, FES may conduct an in-person auction and ultimately consummate a sale of FES Retail pursuant to section 363 of the U.S. Bankruptcy Code 2