24 February 2017 KENNEDY WILSON EUROPE REAL ESTATE PLC (“KWE”, the “Company” or the “Group”) FULL-YEAR RESULTS FOR THE YEAR ENDED 31 DECEMBER 2016 KWE DELIVERS 23% INCOME GROWTH Kennedy Wilson Europe Real Estate Plc (LSE: KWE), an LSE listed property company that invests in real estate across the UK, Ireland, Spain and Italy, today announces its audited full-year results for the year ended 31 December 2016. Income statement 31 December 2016 31 December 2015 Change (%) Net operating income (“NOI”) (£m) 160.3 130.1 23.2 IFRS net profit after taxation (£m) 66.0 259.0 -74.5 Adjusted earnings (£m) 74.1 65.0 14.0 Adjusted earnings per share (p) 55.2 47.9 15.2 DPS paid (p) 48.0 35.0 37.1 Quarterly DPS announced (p) 12.0 12.0 - Balance sheet 31 December 20161 31 December 2015 Change (%) Adjusted NAV (£m) 1,533.7 1,596.5 -3.9 IFRS NAV (£m) 1,535.9 1,629.2 -5.8 Adjusted NAV per share (p) 1,215.9 1,174.5 3.5 IFRS NAV per share (p) 1,217.6 1,198.5 1.6 Valuation movement (£m) -8.6 211.8 Na Net debt (£m) 1,234.8 1,109.6 11.3 Loan to value (LTV) (%) 42.8 39.7 3.1pp Operational highlights: Portfolio value at £2,882.2 million1 generating annualised topped-up NOI2 of £163.7 million across 223 properties Solid asset management progress having completed 140 commercial lease transactions (1.1 million sq ft), delivering an uplift over previous passing rent of 11.4% and outperforming valuers’ preceding ERVs by 3.1% Secure and sustainable income underpinned by strong portfolio occupancy of 95% and long WAULTs of 7.1 years (8.9 years to expiry) £413.1 million of sales across 89 properties3, at an average exit yield of 5.8%, a spread of 180bps over entry yield on cost; delivering a premium to book value of 4.8% and generating an attractive return on cost of 31.8%; £200 million non-core disposal programme completed ahead of June 2017 target Practical completion of Baggot Plaza and Block K, Vantage, our two largest developments in Dublin, together expected to add £8.1 million of annualised NOI Financial highlights: 3.5% increase in Adjusted NAV per share to 1,215.9 pence (Dec-15: 1,174.5 pence) 37% increase in dividends paid of 48.0 pence per share (FY-15: 35.0 pence per share) or £64.4 million of dividends paid in 2016 Raised a further £318.6 million of unsecured financing by tapping the 2025 Euro bond by a further €150 million to a benchmark size of €550 million and the 2022 Sterling bond by a further £200 million to £500 million Low weighted average cost of debt of 3.0%, with 92% of debt fixed or hedged Long debt term of 6.1 years; LTV of 42.8% and well within target range Completed £100 million share buyback of 9.8 million shares at an average price of 1,020 pence per share, representing a 17.7% discount to Q3-16 adjusted NAV per share Post year end achievements: Strong leasing momentum continues with 17 lease transactions completed, adding a further £0.7 million of incremental annualised income; delivering a rental uplift of 18.1% ahead of previous passing and outperforming valuers’ preceding ERVs by 11.4% Agreement for lease signed with Tesco at Stillorgan Shopping Centre, Co. Dublin, for a new 25-year lease (term certain 15 years) and planning permission received for new extension unit unlocking asset management opportunities

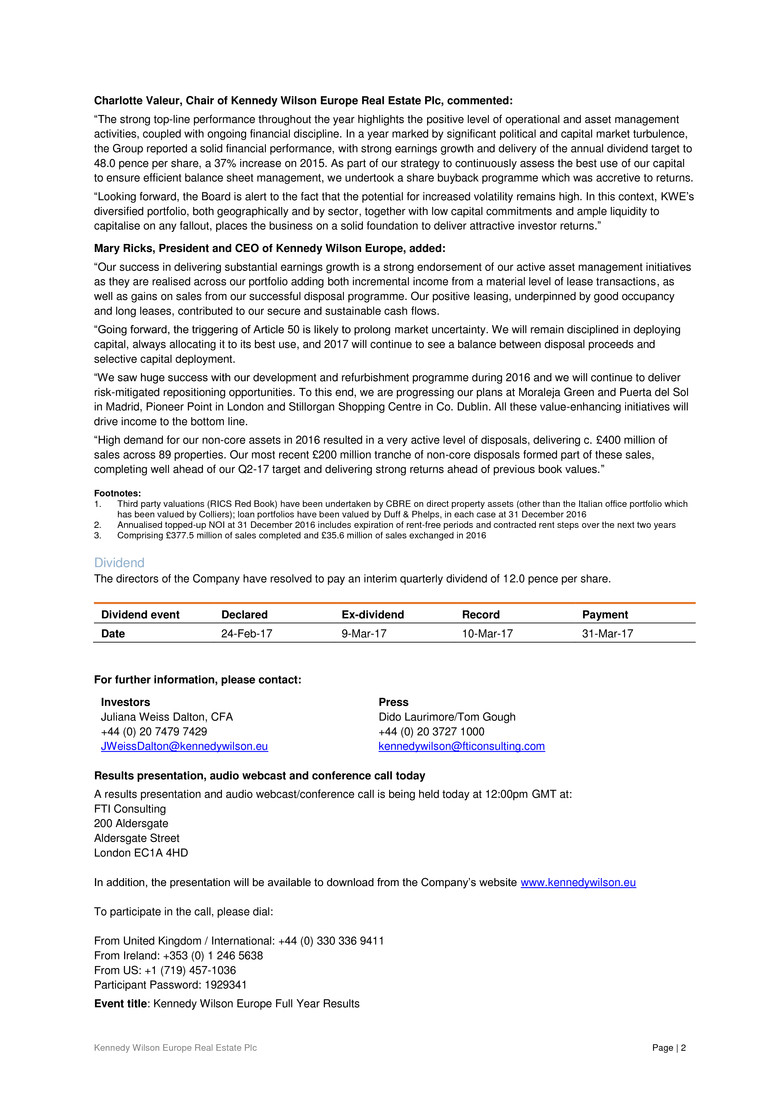

Kennedy Wilson Europe Real Estate Plc Page | 2 Charlotte Valeur, Chair of Kennedy Wilson Europe Real Estate Plc, commented: “The strong top-line performance throughout the year highlights the positive level of operational and asset management activities, coupled with ongoing financial discipline. In a year marked by significant political and capital market turbulence, the Group reported a solid financial performance, with strong earnings growth and delivery of the annual dividend target to 48.0 pence per share, a 37% increase on 2015. As part of our strategy to continuously assess the best use of our capital to ensure efficient balance sheet management, we undertook a share buyback programme which was accretive to returns. “Looking forward, the Board is alert to the fact that the potential for increased volatility remains high. In this context, KWE’s diversified portfolio, both geographically and by sector, together with low capital commitments and ample liquidity to capitalise on any fallout, places the business on a solid foundation to deliver attractive investor returns.” Mary Ricks, President and CEO of Kennedy Wilson Europe, added: “Our success in delivering substantial earnings growth is a strong endorsement of our active asset management initiatives as they are realised across our portfolio adding both incremental income from a material level of lease transactions, as well as gains on sales from our successful disposal programme. Our positive leasing, underpinned by good occupancy and long leases, contributed to our secure and sustainable cash flows. “Going forward, the triggering of Article 50 is likely to prolong market uncertainty. We will remain disciplined in deploying capital, always allocating it to its best use, and 2017 will continue to see a balance between disposal proceeds and selective capital deployment. “We saw huge success with our development and refurbishment programme during 2016 and we will continue to deliver risk-mitigated repositioning opportunities. To this end, we are progressing our plans at Moraleja Green and Puerta del Sol in Madrid, Pioneer Point in London and Stillorgan Shopping Centre in Co. Dublin. All these value-enhancing initiatives will drive income to the bottom line. “High demand for our non-core assets in 2016 resulted in a very active level of disposals, delivering c. £400 million of sales across 89 properties. Our most recent £200 million tranche of non-core disposals formed part of these sales, completing well ahead of our Q2-17 target and delivering strong returns ahead of previous book values.” Footnotes: 1. Third party valuations (RICS Red Book) have been undertaken by CBRE on direct property assets (other than the Italian office portfolio which has been valued by Colliers); loan portfolios have been valued by Duff & Phelps, in each case at 31 December 2016 2. Annualised topped-up NOI at 31 December 2016 includes expiration of rent-free periods and contracted rent steps over the next two years 3. Comprising £377.5 million of sales completed and £35.6 million of sales exchanged in 2016 Dividend The directors of the Company have resolved to pay an interim quarterly dividend of 12.0 pence per share. Dividend event Declared Ex-dividend Record Payment Date 24-Feb-17 9-Mar-17 10-Mar-17 31-Mar-17 For further information, please contact: Investors Juliana Weiss Dalton, CFA +44 (0) 20 7479 7429 JWeissDalton@kennedywilson.eu Press Dido Laurimore/Tom Gough +44 (0) 20 3727 1000 kennedywilson@fticonsulting.com Results presentation, audio webcast and conference call today A results presentation and audio webcast/conference call is being held today at 12:00pm GMT at: FTI Consulting 200 Aldersgate Aldersgate Street London EC1A 4HD In addition, the presentation will be available to download from the Company’s website www.kennedywilson.eu To participate in the call, please dial: From United Kingdom / International: +44 (0) 330 336 9411 From Ireland: +353 (0) 1 246 5638 From US: +1 (719) 457-1036 Participant Password: 1929341 Event title: Kennedy Wilson Europe Full Year Results

Kennedy Wilson Europe Real Estate Plc Page | 3 The live audio webcast will be available on the Company’s website www.kennedywilson.eu About Kennedy Wilson Europe Kennedy Wilson Europe Real Estate Plc is an LSE listed property company that invests in real estate across the UK, Ireland, Spain and Italy. It aims to generate superior shareholder returns by unlocking value of under-resourced real estate across its target geographies. Its existing portfolio is primarily invested across office and retail in the UK and Ireland, weighted towards London, the South East and Dublin. For further information on Kennedy Wilson Europe Real Estate Plc, please visit www.kennedywilson.eu About Kennedy Wilson Kennedy Wilson Europe Real Estate Plc is externally managed by a wholly-owned Jersey incorporated subsidiary of Kennedy-Wilson Holdings, Inc. Kennedy-Wilson Holdings, Inc. (NYSE:KW) is a global real estate investment company. KW owns, operates, and invests in real estate both on its own and through its investment management platform. KW focuses on multifamily and commercial properties located in the Western U.S., UK, Ireland, Spain, Italy and Japan. To complement KW’s investment business, it also provides real estate services primarily to financial services clients. For further information on Kennedy Wilson, please visit www.kennedywilson.com Cautionary Statement and Forward Looking Statements This announcement has been prepared for, and only for the members of the Company, as a body, and no other persons. The Company, its directors, employees, agents or advisers do not accept or assume responsibility to any other person to whom this document is shown or into whose hands it may come and any such responsibility or liability is expressly disclaimed. By their nature, the statements concerning the risks and uncertainties facing the Company and/ or the Group in this announcement involve uncertainty since future events and circumstances can cause results and developments to differ materially from those anticipated. This announcement may contain certain forward-looking statements with respect to Kennedy Wilson Europe Real Estate Plc (the “Company”) and its subsidiaries (together, the “Group”), and the Group’s financial condition, results of operations, business, future plans and strategies, anticipated events or trends, and similar matters, that are not historical facts. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results of operations, performance or achievements of the Group or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward- looking statements speak only as at the date of this announcement. The Company undertakes no obligation to release publicly any revisions or updates to these forward-looking statements to reflect future events, circumstances, unanticipated events, new information or otherwise except as required by law or any appropriate regulatory authority. Past performance is no guide to future performance and persons needing advice should consult an independent financial adviser. Nothing in this announcement should be construed as a profit forecast.

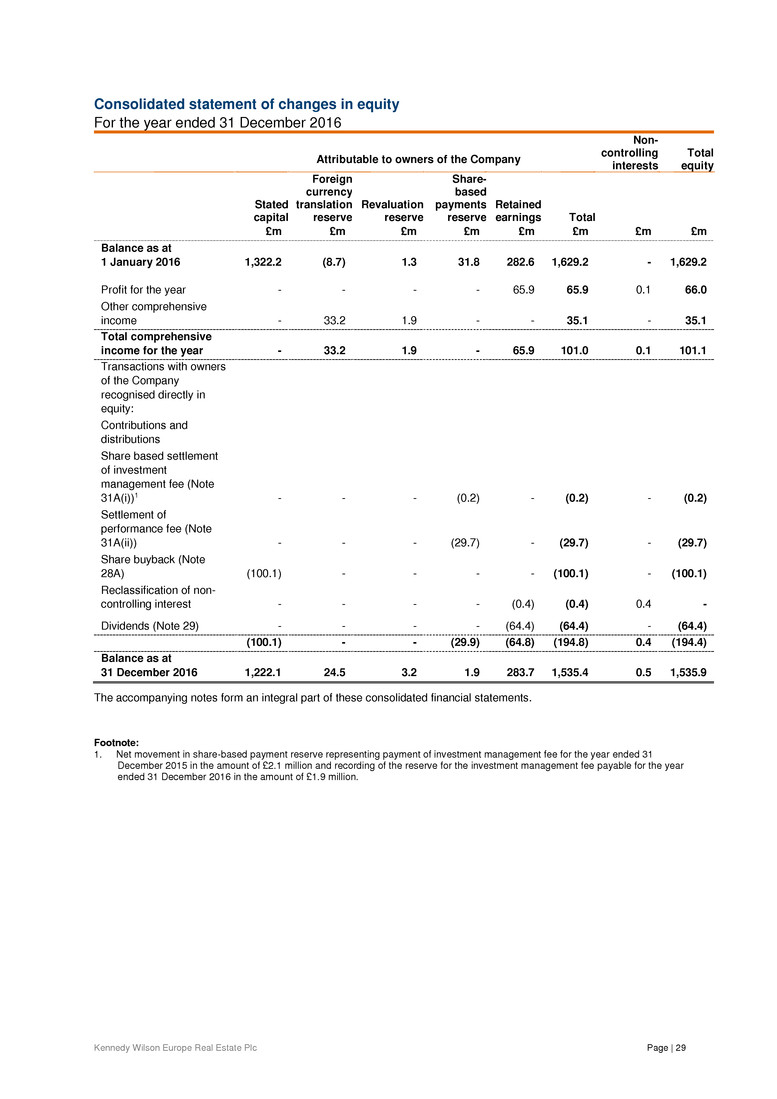

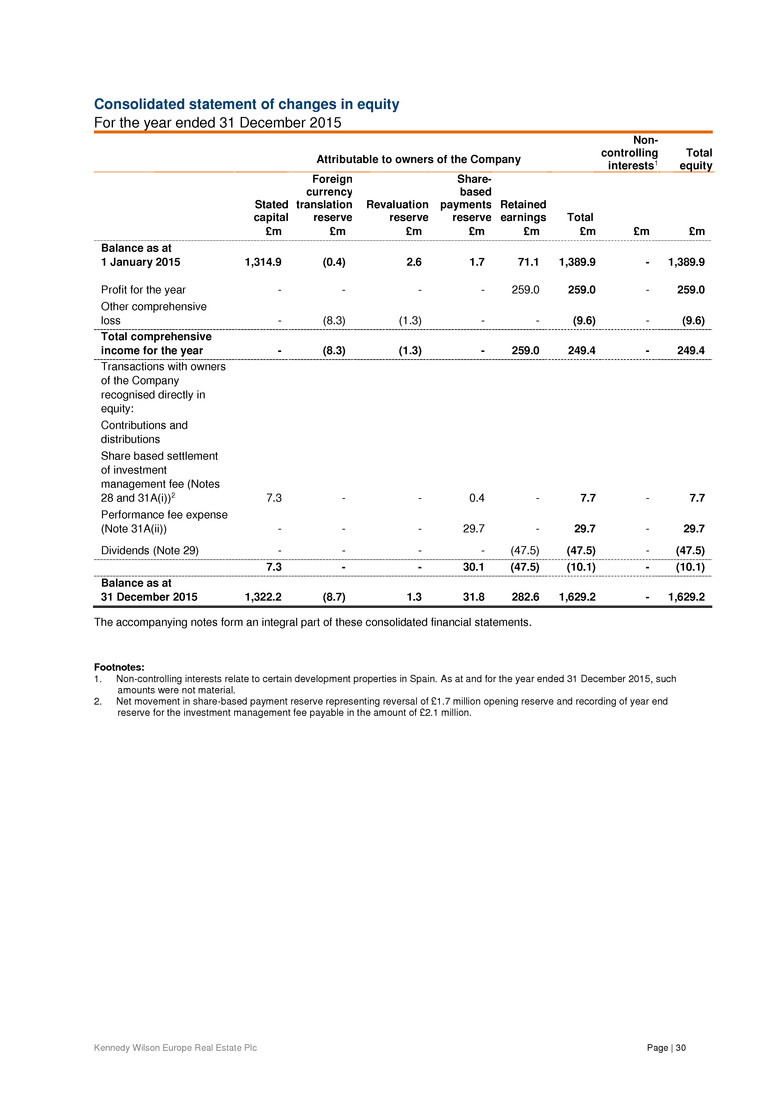

Kennedy Wilson Europe Real Estate Plc Page | 4 Chair’s introduction On behalf of the Board, I am pleased to present our full-year results for 2016. The investment management team delivered significant operational wins across the portfolio, delivering its best leasing results to date; a notable achievement in a year marked by significant political and capital market turbulence. In this context, the Group delivered a solid financial performance, growing earnings and delivering on the annual dividend target. At the same time the team improved the mix of unsecured debt and extended debt maturities whilst keeping our average cost of debt low. The portfolio stands at £2,882.2 million, primarily driven by £295.9 million of acquisition and capital expenditure activity and £165.1 million in foreign exchange gain, owing to material Euro appreciation relative to Sterling. This was offset by very profitable disposal activity and a modest portfolio valuation decline of £8.6 million or only -0.3%. The team also delivered considerable development projects, achieving practical completion, on time and budget, at both Baggot Plaza, Dublin 4, which is let to Bank of Ireland for 25 years, and Block K, Central Park, Dublin 18, where 166 new PRS units were built adjacent to our existing Vantage scheme. Notably, we have already let 72% of the units in the three months to December 2016. Furthermore, the significant refurbishments completions at 111 Buckingham Palace Road, Victoria, London SW1 and Portmarnock Hotel, Co. Dublin, have transformed both properties and are expected to drive income to the bottom line. The business benefitted from active balance sheet management in the year, utilising both of KWE’s unsecured bonds, raising £318.6 million by tapping the 2025 Euro bond by €150 million and the 2022 Sterling bond by £200 million, increasing the bonds outstanding to €550 million and £500 million, respectively. Together they extended our debt maturities to 6.1 years and locked in additional fixed rate debt. Along with the rest of the UK listed real estate sector, and despite strong progress across all parts of the business, we witnessed a material disconnect between KWE’s share price and the underlying business. As part of our ongoing commitment to balance sheet management, we undertook a £100 million share buyback programme, which was accretive to both earnings and NAV per share. We continue to monitor how we can best deliver sustainable total returns for shareholders and have distributed £164.4 million in 2016 through a combination of dividends and share buybacks. Results The Group delivered Adjusted NAV per share of 1,215.9 pence, up 3.5% over December 2015. Adjusted earnings per share were 55.2 pence per share (£74.1 million in total) and basic earnings per share were 49.1 pence per share (£66.0 million in total). Dividends Dividends of 48.0 pence per share, or £64.4 million were paid during the year, reflecting a dividend cover based on 2016 adjusted earnings of 1.1 times, and a 37% increase on the 35.0 pence per share paid in 2015. Today, the Board announces a quarterly interim dividend of 12.0 pence per share. The quarterly dividend will be paid on 31 March 2017 to shareholders on the register at the close of business on 10 March 2017. In the context of the material disposals delivered to date, the Board is comfortable with the level of the dividend being both sustainable and offering an attractive dividend yield to shareholders of c. 5%. The Board will continue to assess the appropriate dividend pay-out on a quarterly basis. Industry achievements In March 2016, the shares of KWE became constituent members of the FTSE EPRA/NAREIT Global Real Estate Index Series and the GPR 250 Index Series. These are both important specialist indices for our investors, in addition to the FTSE 250 Index, which KWE has been a member of since 2014. The Company is a fee-paying member of EPRA, the European trade body for listed real estate securities, and follows EPRA’s Best Practice Recommendations for both operational (EPRA BPRs) and sustainability (EPRA sBPRs) reporting disclosure. In 2015, we achieved EPRA Silver and Bronze for operational and sustainable reporting disclosures respectively, and aim to further improve on this. Outlook The investment and occupier markets across our business remain open and active, illustrated by our record-breaking leasing and disposal activity, both ahead of preceding valuations and delivering attractive returns. We expect the period of market uncertainty to persist and market volatility to potentially increase, as it remains too early to ascertain the impact of the UK’s negotiations to exit the EU and the impact that will have on the UK and the rest of Europe. The Board remains alert to both potential risks and opportunities for KWE’s business. With £539.7 million of disposals since 2015, the natural evolution away from smaller lot sizes demonstrates that our wholesale to retail strategy is working. It has not only improved the portfolio quality but also delivered solid occupancy, longer leases and attractive profits. KWE benefits from a diversified portfolio, both geographically and by sector, low

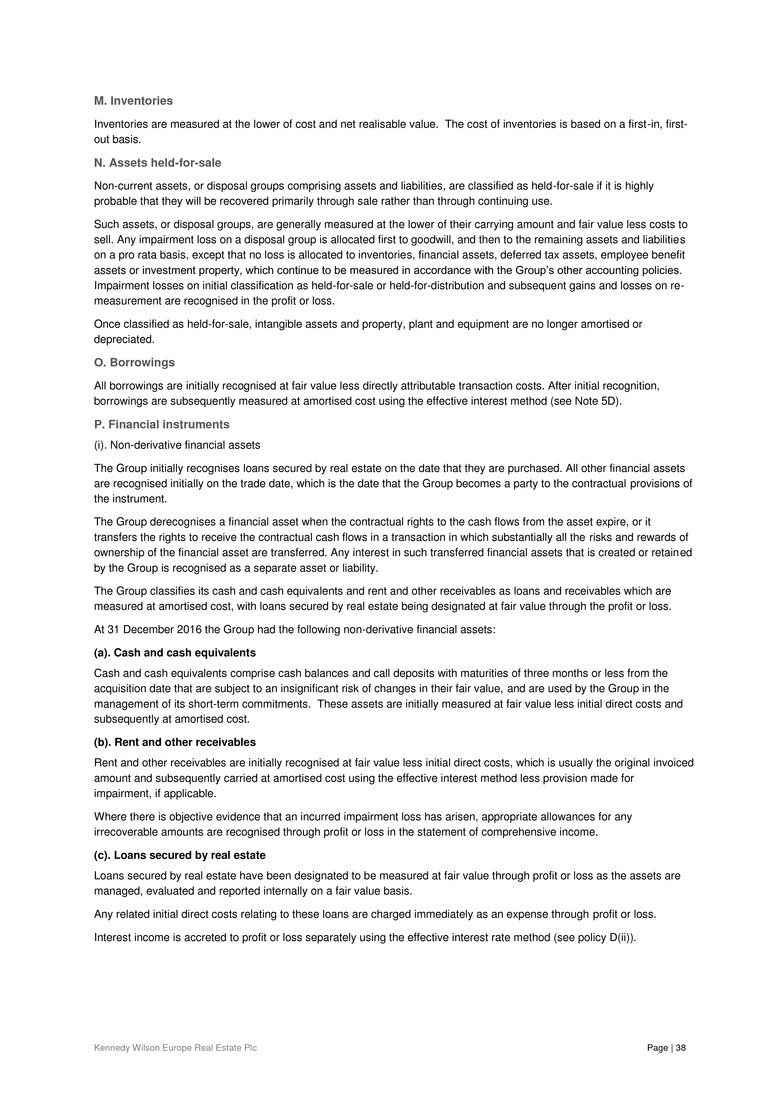

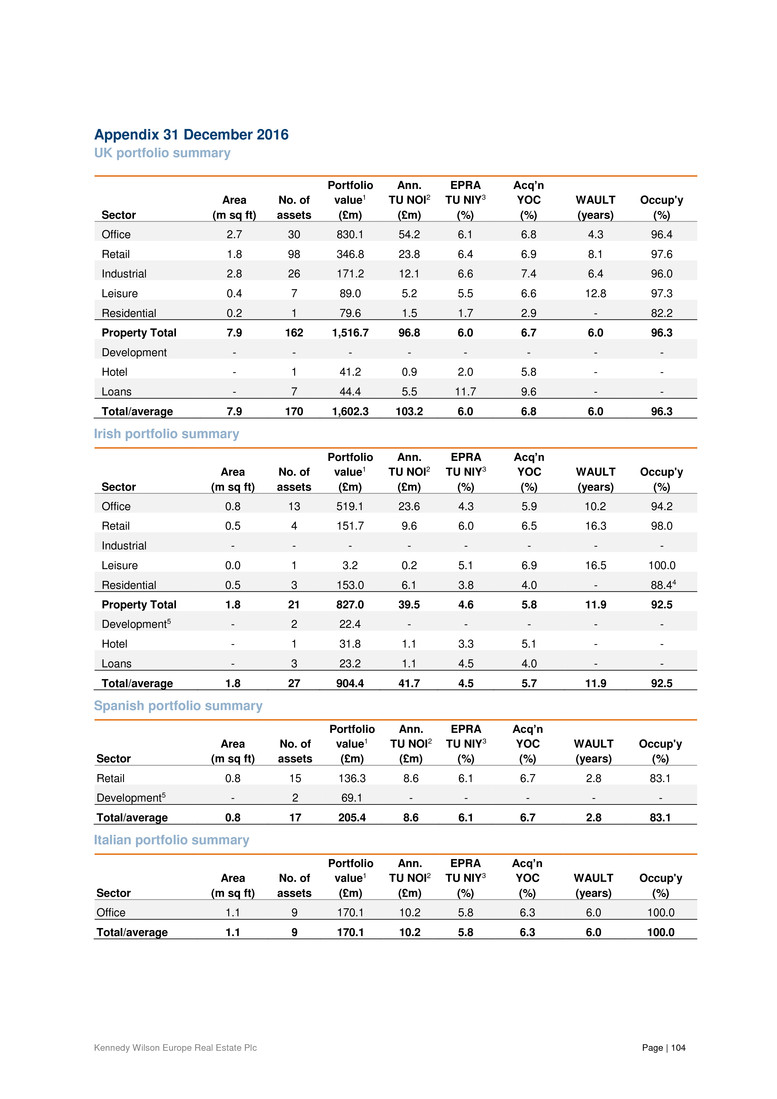

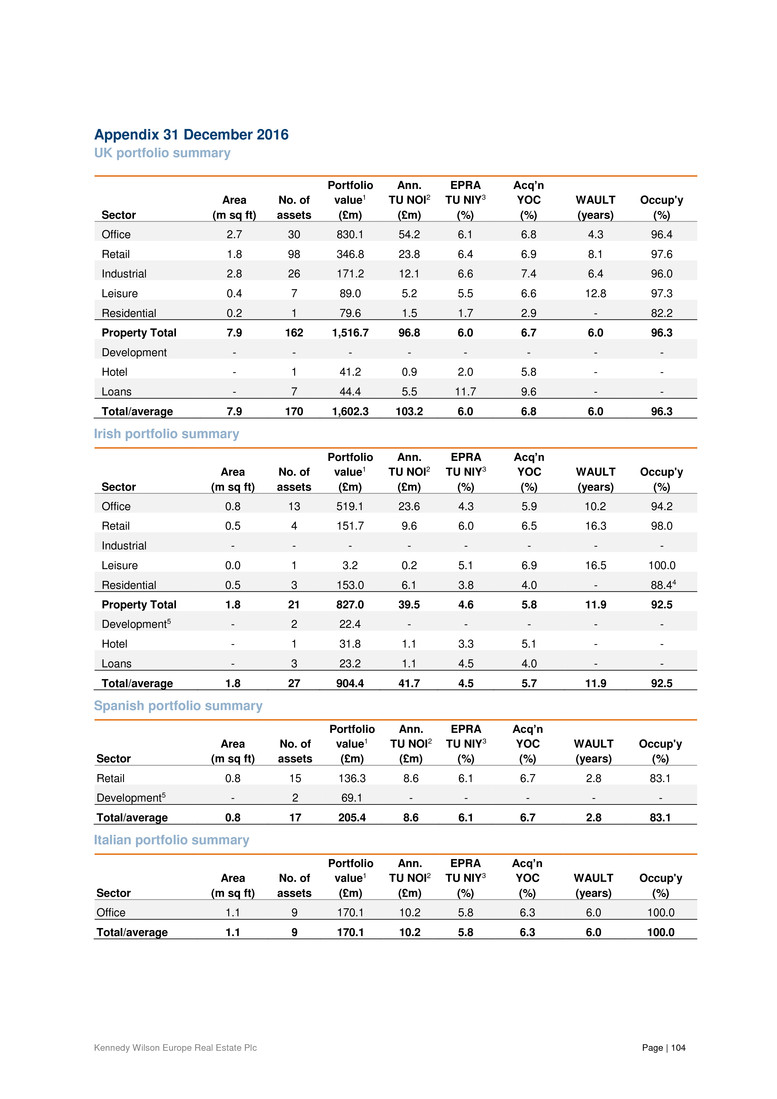

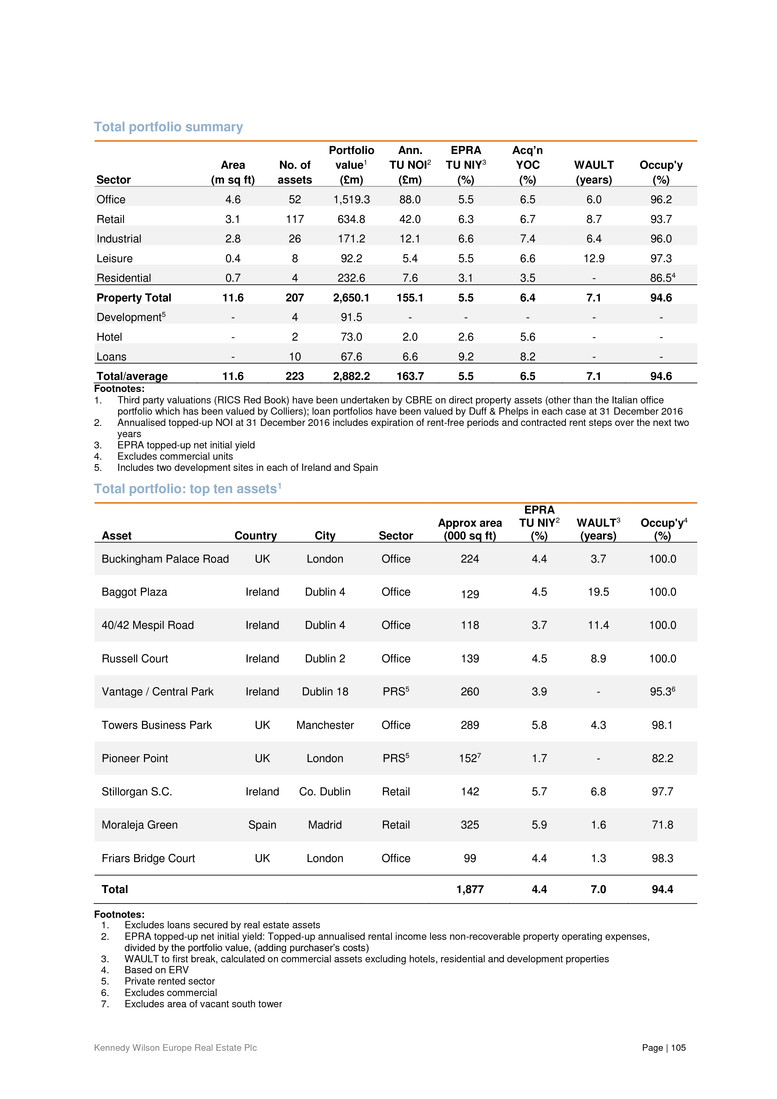

Kennedy Wilson Europe Real Estate Plc Page | 5 capital commitments and ample liquidity to capitalise on potential opportunities. This, combined with KWE’s unique blend of debt and equity skills, strong market relationships and a wealth of experience working through market dislocations, places the business on a solid foundation. Performance review Our progress On behalf of the Investment Manager, we are pleased to present our review report for the year ended 31 December 2016. The £2,882.2 million property portfolio comprises 223 directly owned assets with a total commercial area in excess of 11.6 million sq ft. This consists of a direct real estate and hotel portfolio of £2,814.6 million and a further two loan portfolios secured by collateral on two portfolios, with a value of £67.6 million. The portfolio continues to exhibit solid occupancy at 95% with relatively long lease maturities of 7.1 years (8.9 years to expiry), generating annualised topped-up NOI of £163.7 million at 31 December 2016, of which c. 16% of our rent roll benefits from fixed or inflation-linked uplifts. KWE delivered its best operational performance to date during 2016, notwithstanding significant macro market uncertainties. Notably, we have completed 140 commercial leasing transactions across 1.1 million sq ft, adding £4.0 million of incremental annualised income. Occupier demand for our underlying markets remains robust, not only resulting in a strong volume of leasing wins but, importantly, on attractive terms, with deals completed at 11.4% ahead of previous passing rent and at a premium of 3.1% against valuers’ ERVs. We have witnessed a similarly strong performance across our disposals, which continue to offer an appealing yield profile to the high net worth and smaller institutional market. We have reduced our asset pool by a net of c. 25% from 302 properties at the end 2015 to 223 at the end of 2016, with a further three properties exchanged but not completed at year- end. By capitalising on the strong market demand for our smaller lot sizes, our net investment activity continues to transform the portfolio as we position ourselves to acquire larger assets in strong locations with asset management upside. Our c. 100 assets with individual asset values in excess of £5 million are the main engine of the portfolio contributing c. 90% of portfolio value and annualised topped-up NOI, and it is where 99% of capital expenditure was invested. We have successfully executed on our Asset Via Loan (AVL) strategy and took direct title of Pioneer Point (294 PRS units) in February 2016. This, combined with the disposal of the underlying collateral of the Avon loan portfolio in January 2016, has resulted in loans now comprising 2.3% of the portfolio, primarily comprising the Park Inn portfolio and the Herberton PRS scheme in Dublin from the Elliot portfolio. Investments We announced last year that we expected to be neutral between our capital investments and disposal activity. We strategically acquired significantly less in 2016 compared to the two preceding years where acquisitions were £1,402.5 million and £1,135.5 million in 2014 and 2015, respectively. Our 2016 purchases amounted to £184.4 million across seven assets, and we invested £106.7 million in capital expenditure across our development and refurbishment programme, as well as a further £100 million on a share buyback programme. Table 1: 2016 acquisitions Name Sector Purch. date Purchase price (£m) Cap value (£ psf) YOC (%) Avg rent (£ psf) WAULT (years) Occup’y (%) IRL Schoolhouse Lane Dev/O 24-Feb 7.7 Na Na Na Na Na IRL Blackrock Bus. Park Office 4-Mar 11.2 222 6.8 15.60 5.2 98.5 IRL Leisureplex Dev/R 21-Apr 11.9 Na Na Na Na Na IRL The Chase Office 3-May 49.5 282 3.8 12.40 3.4 68.2 GBP Towers Bus. Park Office 4-May 82.0 284 6.7 19.40 5.0 96.3 GBP Chelmsford Industrial 8-Jun 10.5 66 6.8 4.80 2.9 100.0 GBP Ipswich Industrial 29-Nov 11.6 57 8.1 4.90 7.9 100.0 2016 total/average 184.4 188 5.9 11.80 4.8 89.4 2016 disposals were delivered well ahead of business plans, and saw us undertake 89 sales for total proceeds of £413.1 million, including three deals exchanged, but not completed in 2016. This has concluded our previously announced £200 million non-core disposal programme six months ahead of our June 2017 target. These sales across 1.6 million sq ft crystallised a yield spread of 180bps between yield on cost and exit yield on sale, at a premium to prior book value of 4.8%, delivering a return on cost of 31.8% over a 21 month hold period. These disposals delivered a material £104 million of total profit (income and capital gain), with just under one-quarter coming from our smaller assets of £5 million and under.

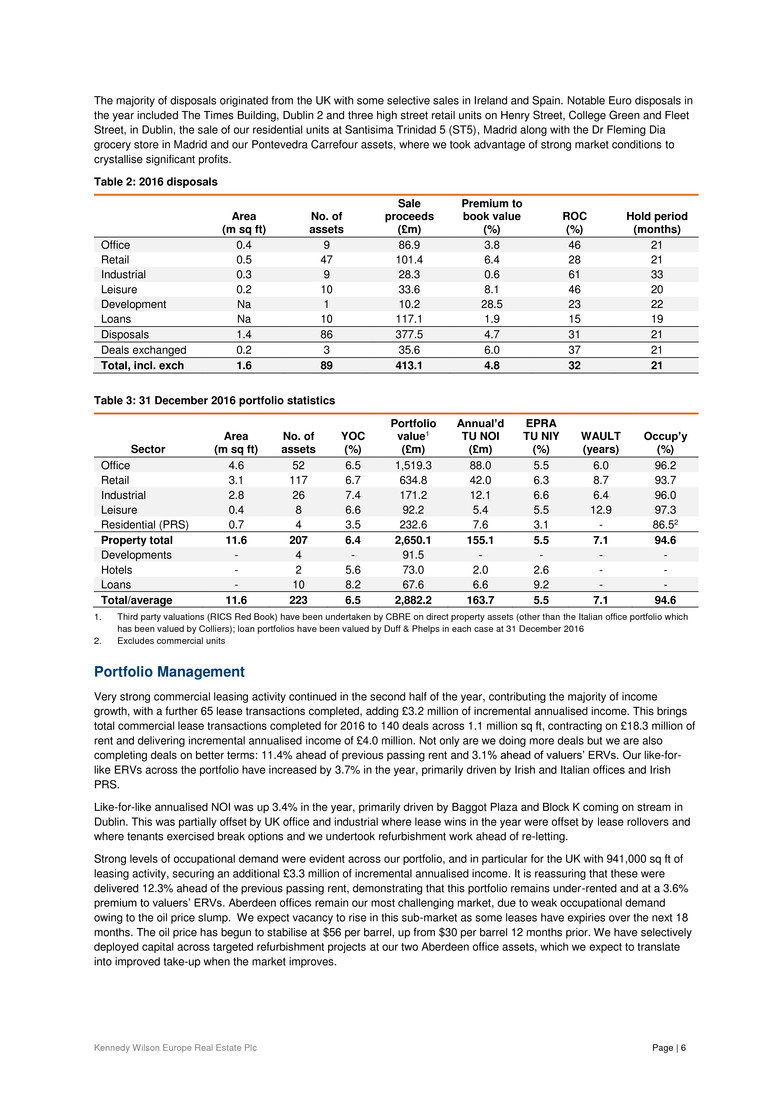

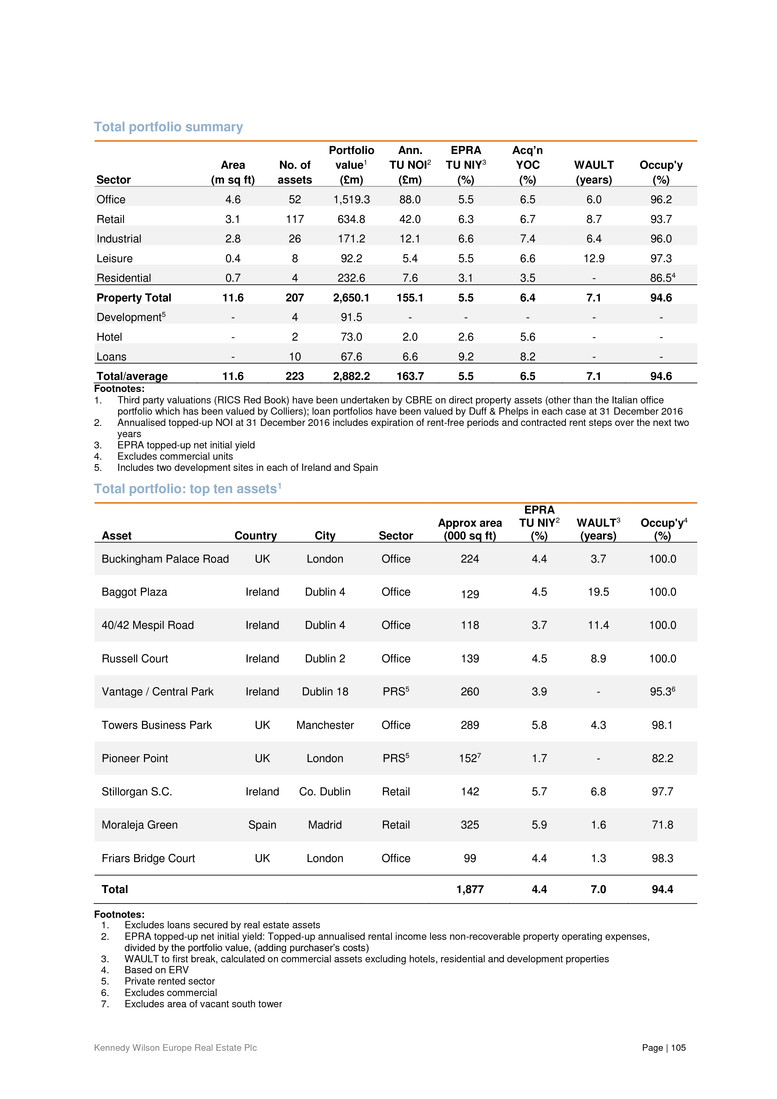

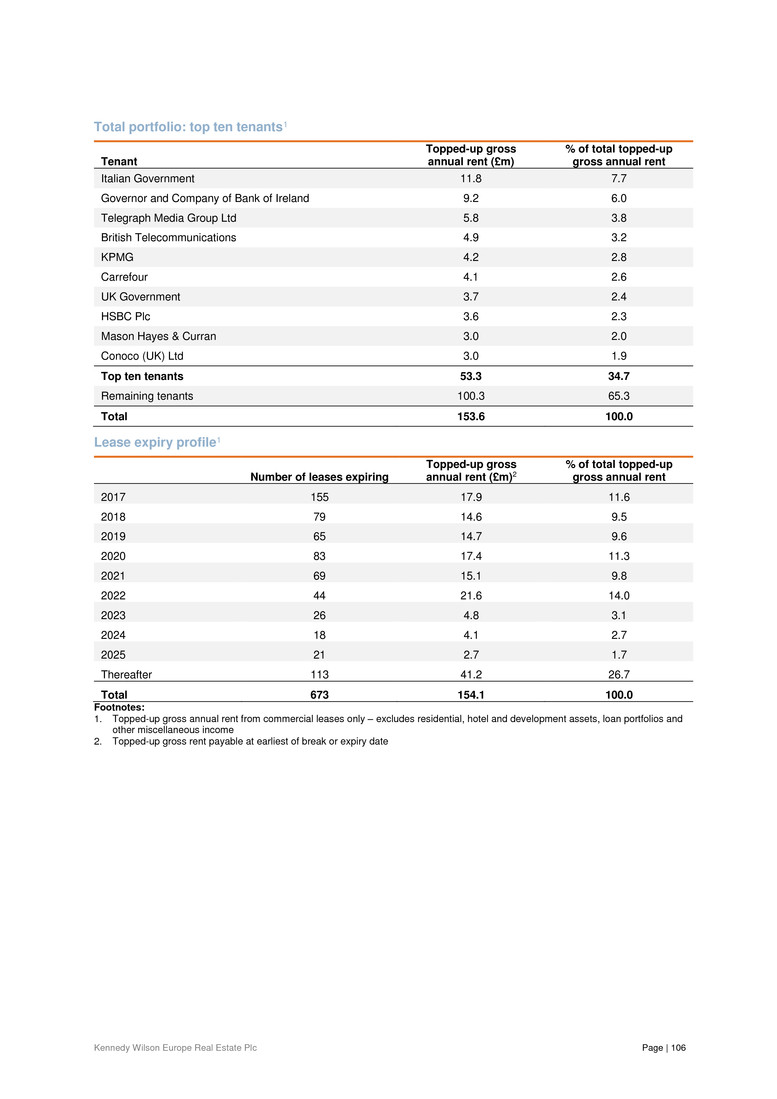

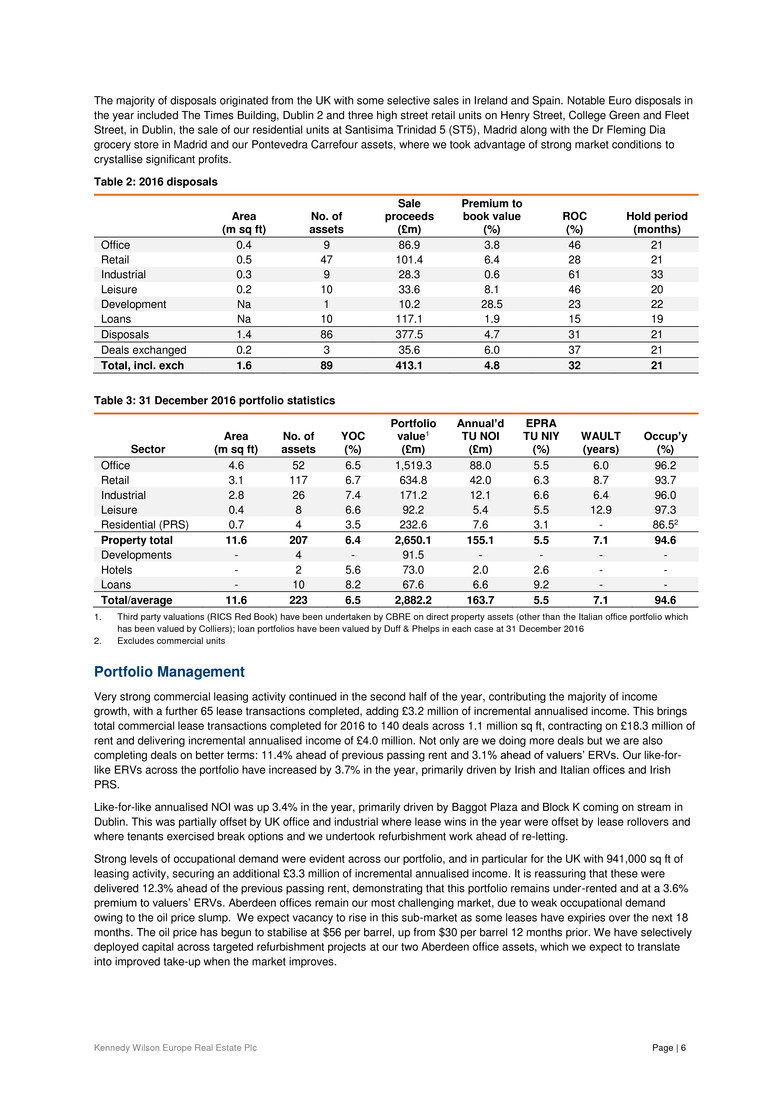

Kennedy Wilson Europe Real Estate Plc Page | 6 The majority of disposals originated from the UK with some selective sales in Ireland and Spain. Notable Euro disposals in the year included The Times Building, Dublin 2 and three high street retail units on Henry Street, College Green and Fleet Street, in Dublin, the sale of our residential units at Santisima Trinidad 5 (ST5), Madrid along with the Dr Fleming Dia grocery store in Madrid and our Pontevedra Carrefour assets, where we took advantage of strong market conditions to crystallise significant profits. Table 2: 2016 disposals Area (m sq ft) No. of assets Sale proceeds (£m) Premium to book value (%) ROC (%) Hold period (months) Office 0.4 9 86.9 3.8 46 21 Retail 0.5 47 101.4 6.4 28 21 Industrial 0.3 9 28.3 0.6 61 33 Leisure 0.2 10 33.6 8.1 46 20 Development Na 1 10.2 28.5 23 22 Loans Na 10 117.1 1.9 15 19 Disposals 1.4 86 377.5 4.7 31 21 Deals exchanged 0.2 3 35.6 6.0 37 21 Total, incl. exch 1.6 89 413.1 4.8 32 21 Table 3: 31 December 2016 portfolio statistics Sector Area (m sq ft) No. of assets YOC (%) Portfolio value1 (£m) Annual’d TU NOI (£m) EPRA TU NIY (%) WAULT (years) Occup’y (%) Office 4.6 52 6.5 1,519.3 88.0 5.5 6.0 96.2 Retail 3.1 117 6.7 634.8 42.0 6.3 8.7 93.7 Industrial 2.8 26 7.4 171.2 12.1 6.6 6.4 96.0 Leisure 0.4 8 6.6 92.2 5.4 5.5 12.9 97.3 Residential (PRS) 0.7 4 3.5 232.6 7.6 3.1 - 86.52 Property total 11.6 207 6.4 2,650.1 155.1 5.5 7.1 94.6 Developments - 4 - 91.5 - - - - Hotels - 2 5.6 73.0 2.0 2.6 - - Loans - 10 8.2 67.6 6.6 9.2 - - Total/average 11.6 223 6.5 2,882.2 163.7 5.5 7.1 94.6 1. Third party valuations (RICS Red Book) have been undertaken by CBRE on direct property assets (other than the Italian office portfolio which has been valued by Colliers); loan portfolios have been valued by Duff & Phelps in each case at 31 December 2016 2. Excludes commercial units Portfolio Management Very strong commercial leasing activity continued in the second half of the year, contributing the majority of income growth, with a further 65 lease transactions completed, adding £3.2 million of incremental annualised income. This brings total commercial lease transactions completed for 2016 to 140 deals across 1.1 million sq ft, contracting on £18.3 million of rent and delivering incremental annualised income of £4.0 million. Not only are we doing more deals but we are also completing deals on better terms: 11.4% ahead of previous passing rent and 3.1% ahead of valuers’ ERVs. Our like-for- like ERVs across the portfolio have increased by 3.7% in the year, primarily driven by Irish and Italian offices and Irish PRS. Like-for-like annualised NOI was up 3.4% in the year, primarily driven by Baggot Plaza and Block K coming on stream in Dublin. This was partially offset by UK office and industrial where lease wins in the year were offset by lease rollovers and where tenants exercised break options and we undertook refurbishment work ahead of re-letting. Strong levels of occupational demand were evident across our portfolio, and in particular for the UK with 941,000 sq ft of leasing activity, securing an additional £3.3 million of incremental annualised income. It is reassuring that these were delivered 12.3% ahead of the previous passing rent, demonstrating that this portfolio remains under-rented and at a 3.6% premium to valuers’ ERVs. Aberdeen offices remain our most challenging market, due to weak occupational demand owing to the oil price slump. We expect vacancy to rise in this sub-market as some leases have expiries over the next 18 months. The oil price has begun to stabilise at $56 per barrel, up from $30 per barrel 12 months prior. We have selectively deployed capital across targeted refurbishment projects at our two Aberdeen office assets, which we expect to translate into improved take-up when the market improves.

Kennedy Wilson Europe Real Estate Plc Page | 7 Table 4: 2016 asset management transactions No. of lease transactions Commercial area (sq ft) Incremental annual income (£m) % ahead of prev. rent % ahead of valuers’ ERV GBP 101 941,000 3.3 12.3 3.6 IRL 29 108,500 0.6 9.6 2.1 ESP 10 8,500 0.1 -4.9 -4.6 Total 140 1,058,000 4.0 11.4 3.1 No. of lease transactions Commercial area (sq ft) Incremental annual income (£m) % ahead of prev. rent % ahead of valuers’ ERV Lettings 34 139,100 2.4 Na 4.1 Re-gears 64 582,000 0.7 9.7 3.8 Rent reviews 42 336,900 0.9 13.3 2.1 Total 140 1,058,000 4.0 11.4 3.1 A significant level of PRS renewal and letting activity was undertaken over the year at our three properties: Pioneer Point in the UK, Vantage (including Block K) and Liffey Trust in Ireland. Overall, occupancy was down, driven by the continued transition of Pioneer Point from short term lets to Assured Shorthold Tenancies (ASTs). Our Irish PRS assets remain under-rented and we witnessed strong ERV growth per unit of 19.2% over the year, driven by Vantage, as we continued to let existing units at attractive levels and Block K where our leasing efforts have exceeded all targets. We achieved practical completion of the 166-unit Block K development in the second half of the year and began our formal leasing in October 2016. At year end, we had already let 120 of 166 units (72%), which is well ahead of business plan. Table 5: Notable lease transactions completed in H2-16 Scheme Lease transaction Acq’n port. Property, city Sector Area (sq ft) Type Tenant Area (sq ft) Term (years) % over prev. rent GBP Jupiter Friars Bridge Court, London Office 99,100 Re-gear London & South Eastern Railway 25,300 2 +63 GBP Artemis Douglas House, Reigate Office 26,500 Re-gear Kimberly Clark 26,500 5 +14 GBP Na Great Blakenham, Ipswich Industrial 203,400 Re-gear Magnus Group 98,500 15 +8 GBP Gatsby Portlethen Retail Park, Aberdeen Retail 96,600 Re-gear Homebase 44,400 10 -6 GBP Artemis Theta House, Camberley Office 50,700 Re-gear Amer Sports 16,600 51 +2 GBP Artemis Marsh Street, Bristol Office 36,100 Re-gear AON 21,100 5 +37 GBP Gatsby Eley Road Indust. Estate, Edmonton Industrial 41,300 Re-gear SIG Trading 19.600 102 +74 GBP Artemis Theta House, Camberley Office 50,700 New lease Surrey & Boarders NHS Trust 16,500 73 Prev. vacant GBP Gatsby Portlethen Retail Park, Aberdeen Retail 96,600 New lease B&M 23,000 15 Prev. vacant GBP Artemis 8 Wells Place, Merstham Industrial 19,400 New lease FG Curtis 19,400 102 Prev. vacant GBP Artemis 6 Lochside, Edinburgh Office 40,000 New lease HSBC 9,000 51 Prev. vacant GBP Gatsby Park Farm Indust. Park, Wellingboro. Industrial 25,000 Rent review TNT 25,000 Na +12 1. 10-year lease to expiry with tenant break option (TBO) at year five 2. 15-year lease to expiry with TBO at year ten 3. 14-year lease to expiry with TBO at year seven

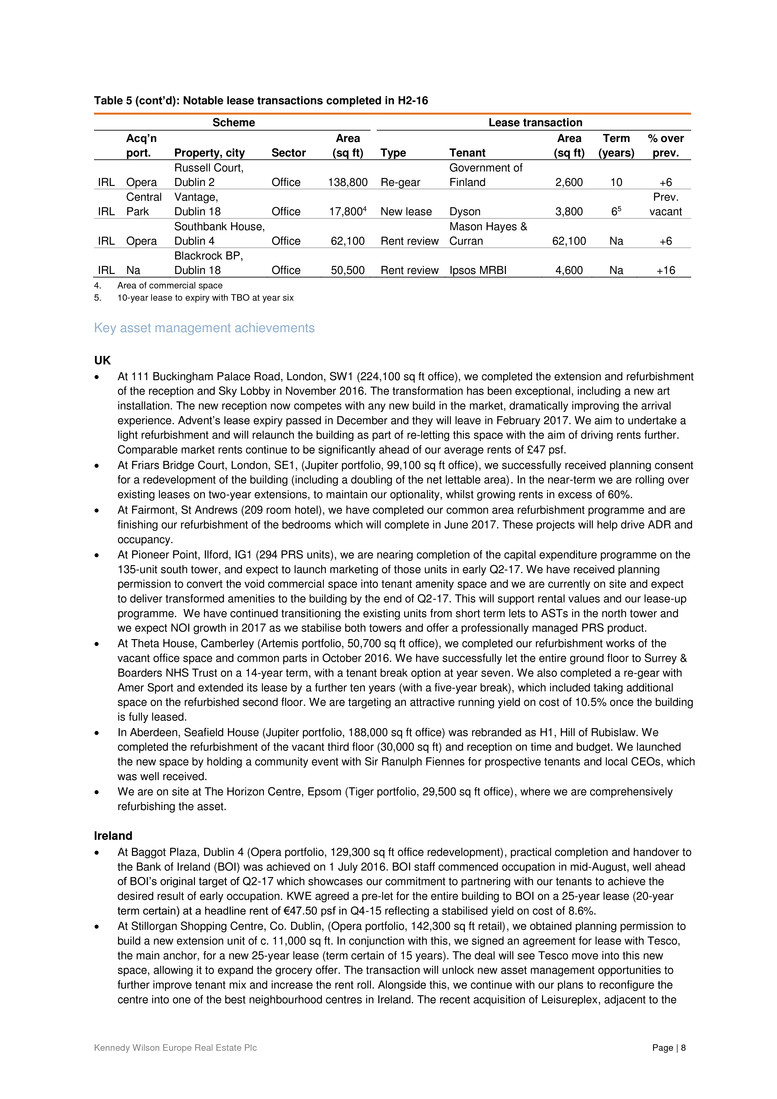

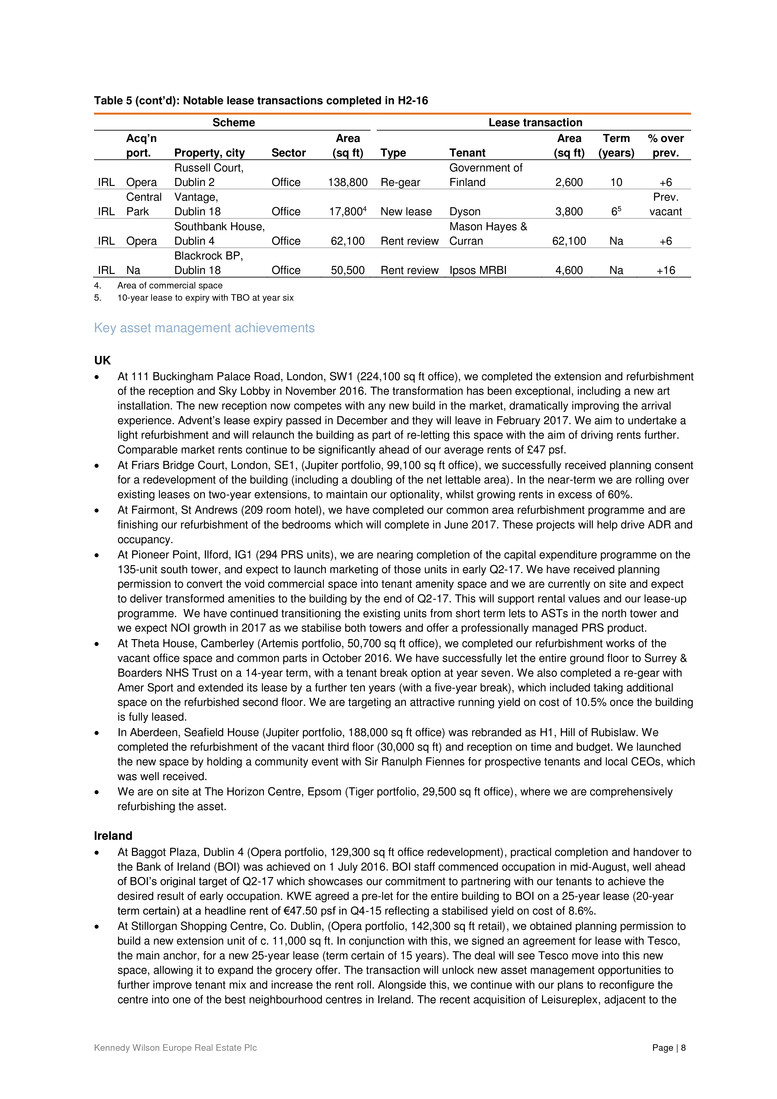

Kennedy Wilson Europe Real Estate Plc Page | 8 Table 5 (cont’d): Notable lease transactions completed in H2-16 Scheme Lease transaction Acq’n port. Property, city Sector Area (sq ft) Type Tenant Area (sq ft) Term (years) % over prev. IRL Opera Russell Court, Dublin 2 Office 138,800 Re-gear Government of Finland 2,600 10 +6 IRL Central Park Vantage, Dublin 18 Office 17,8004 New lease Dyson 3,800 65 Prev. vacant IRL Opera Southbank House, Dublin 4 Office 62,100 Rent review Mason Hayes & Curran 62,100 Na +6 IRL Na Blackrock BP, Dublin 18 Office 50,500 Rent review Ipsos MRBI 4,600 Na +16 4. Area of commercial space 5. 10-year lease to expiry with TBO at year six Key asset management achievements UK At 111 Buckingham Palace Road, London, SW1 (224,100 sq ft office), we completed the extension and refurbishment of the reception and Sky Lobby in November 2016. The transformation has been exceptional, including a new art installation. The new reception now competes with any new build in the market, dramatically improving the arrival experience. Advent’s lease expiry passed in December and they will leave in February 2017. We aim to undertake a light refurbishment and will relaunch the building as part of re-letting this space with the aim of driving rents further. Comparable market rents continue to be significantly ahead of our average rents of £47 psf. At Friars Bridge Court, London, SE1, (Jupiter portfolio, 99,100 sq ft office), we successfully received planning consent for a redevelopment of the building (including a doubling of the net lettable area). In the near-term we are rolling over existing leases on two-year extensions, to maintain our optionality, whilst growing rents in excess of 60%. At Fairmont, St Andrews (209 room hotel), we have completed our common area refurbishment programme and are finishing our refurbishment of the bedrooms which will complete in June 2017. These projects will help drive ADR and occupancy. At Pioneer Point, Ilford, IG1 (294 PRS units), we are nearing completion of the capital expenditure programme on the 135-unit south tower, and expect to launch marketing of those units in early Q2-17. We have received planning permission to convert the void commercial space into tenant amenity space and we are currently on site and expect to deliver transformed amenities to the building by the end of Q2-17. This will support rental values and our lease-up programme. We have continued transitioning the existing units from short term lets to ASTs in the north tower and we expect NOI growth in 2017 as we stabilise both towers and offer a professionally managed PRS product. At Theta House, Camberley (Artemis portfolio, 50,700 sq ft office), we completed our refurbishment works of the vacant office space and common parts in October 2016. We have successfully let the entire ground floor to Surrey & Boarders NHS Trust on a 14-year term, with a tenant break option at year seven. We also completed a re-gear with Amer Sport and extended its lease by a further ten years (with a five-year break), which included taking additional space on the refurbished second floor. We are targeting an attractive running yield on cost of 10.5% once the building is fully leased. In Aberdeen, Seafield House (Jupiter portfolio, 188,000 sq ft office) was rebranded as H1, Hill of Rubislaw. We completed the refurbishment of the vacant third floor (30,000 sq ft) and reception on time and budget. We launched the new space by holding a community event with Sir Ranulph Fiennes for prospective tenants and local CEOs, which was well received. We are on site at The Horizon Centre, Epsom (Tiger portfolio, 29,500 sq ft office), where we are comprehensively refurbishing the asset. Ireland At Baggot Plaza, Dublin 4 (Opera portfolio, 129,300 sq ft office redevelopment), practical completion and handover to the Bank of Ireland (BOI) was achieved on 1 July 2016. BOI staff commenced occupation in mid-August, well ahead of BOI’s original target of Q2-17 which showcases our commitment to partnering with our tenants to achieve the desired result of early occupation. KWE agreed a pre-let for the entire building to BOI on a 25-year lease (20-year term certain) at a headline rent of €47.50 psf in Q4-15 reflecting a stabilised yield on cost of 8.6%. At Stillorgan Shopping Centre, Co. Dublin, (Opera portfolio, 142,300 sq ft retail), we obtained planning permission to build a new extension unit of c. 11,000 sq ft. In conjunction with this, we signed an agreement for lease with Tesco, the main anchor, for a new 25-year lease (term certain of 15 years). The deal will see Tesco move into this new space, allowing it to expand the grocery offer. The transaction will unlock new asset management opportunities to further improve tenant mix and increase the rent roll. Alongside this, we continue with our plans to reconfigure the centre into one of the best neighbourhood centres in Ireland. The recent acquisition of Leisureplex, adjacent to the

Kennedy Wilson Europe Real Estate Plc Page | 9 shopping centre, provides further opportunities for the centre. We are in early stages of design for a potential mixed- use scheme offering retail and PRS uses. At Block K Vantage at Central Park, Dublin 18 (166 PRS units and 15,000 sq ft of commercial space), practical completion was achieved at the end of July 2016 and we began letting units in October 2016. By the year end, we had successfully let 120 of the 166 units, a significant achievement and at rents ahead of business plan. The development complements the existing 276-unit Vantage scheme and brings KWE’s total ownership at Central Park to 442 PRS units and 34,000 sq ft of commercial space. At The Chase in Dublin 18 (175,600 sq ft), the partial fit-out works of the vacant office space (55,200 sq ft) completed by year-end. We have also engaged a design team to undertake a refurbishment and remodelling of some of the ground floor to create an impressive reception commensurate with the quality and size of the building. Contractors are now onsite and we expect to complete these works by Q3-17. At Schoolhouse Lane, Dublin 2 (13,300 sq ft office redevelopment), we received our planning consent in Q3-16 to extend the building to approximately 16,000 sq ft. We are currently on site and expect to complete the full works by summer 2017 and are targeting a stabilised yield of approximately 6.3% once the building is fully let. At Portmarnock Hotel & Golf Links, Co. Dublin (135 room hotel), extensive refurbishment to the exterior entrance, bedrooms, lounges, reception and restaurant areas completed in the year. Customers’ reaction to the improvements have been very positive and culminated with the Irish Golf Tour Operators awarding the hotel Irish Golf Resort of the Year for 2016. Spain At Puerta del Sol 9, Madrid (37,000 sq ft commercial/residential conversion to retail redevelopment), which is located on one of Madrid’s busiest squares, we submitted a planning application to convert the asset to retail use as a flagship store. We have received positive preliminary feedback from both the municipality and potential retail tenants. At Santisima Trinidad 5, Madrid (31,750 sq ft commercial to residential conversion), we have completed the sale of 22 of 24 available units in this high-end residential block with 28 parking spaces. Since year-end, we sold one further unit, leaving one penthouse unit available for sale. Our markets UK UK GDP for Q4-16 was up 0.7% according to the ONS, slightly ahead of the previous two quarters and resulting in 1.8% total GDP growth for 2016, down slightly from 2.2% in 2015. The occupational market saw rental values holding steady in the second half of the year, as tenant demand remained firm. CBRE reports that rental values for UK commercial property increased by 1.7% for 2016 as a whole. Across our own portfolio we have seen healthy levels of occupier demand, allowing us to complete leases at favourable terms, beating our leasing target for 2016 and generating a good pipeline of deals in solicitors' hands. The Central London occupational market continued to hold up despite initial uncertainty post the EU referendum vote. Take-up was still in line with the 10-year average, although 18% below 2015 numbers, according to CBRE. Investment demand remained strong with the weaker pound attracting new foreign entrants to the market and driving demand, particularly for prime, stabilised assets. In the Victoria submarket take-up hit 445,000 sq ft, ahead of the 5-year average, with prime rents holding firm at £82.50 psf, according to Cushman & Wakefield. Following the completion of other new build schemes in the area, the benefit of the improved amenity continues to enhance the overall tenant experience and the attractiveness of the submarket. For South East offices, take-up fell to 2.8 million sq ft, 11% below the 10-year average, according to CBRE. Notwithstanding this fact, the lack of availability in several submarkets drove continued rental growth in markets to which we have exposure, such as Maidenhead, Croydon and Watford. The industrial sector continues to perform strongly with increasing take-up, benefiting from ongoing structural shifts to online retail. Across the UK as a whole, industrial property performed the strongest with total returns of 7.2% over the last 12 months, according to CBRE, the only sector to see rising capital values over the year. We have seen strong high street retail investment demand and have taken advantage of the strong liquidity for our small lot size disposals to achieve sales ahead of valuations, across the UK. In particular, the demand for small lot sizes has been driven by demand from high net worth investors, given the ongoing low yield environment and recent stamp duty and buy-to-let tax changes diminishing the relative attractiveness to traditional residential investment for this buyer group. The Aberdeen office market remains challenging and may see signs of improvement with the oil price now at $56 per barrel up from $30 per barrel 12 months earlier, a more sustainable level for the industry. The investment market continues to benefit from strong levels of demand for smaller lot sizes and well-let prime assets. Investment volumes are down relative to peak 2015 volumes, however 2016 volumes were still ahead of the 10-year average, according to CBRE. According to the CBRE index, capital values for UK property fell by 2.4% in 2016, driven by

Kennedy Wilson Europe Real Estate Plc Page | 10 the 1% increase in stamp duty and weakening sentiment following the UK’s referendum vote to leave the EU. Valuation falls in office and retail sectors offset a positive performance by industrial assets, with sharp falls in Q3-16 being followed by a recovery towards the end of the year with capital values up by 1.2% in Q4-16. Ireland The Irish economy continues to outperform, with unemployment down to 7.2% at the end of the year and with employment numbers pushing past the two million mark for the first time since 2009, according to the Central Statistics Office. This has supported consumer spending, with retail sales up 3.4% year-on-year to December 2016. This has led to retailer expansions and new entrants in the market, according to CBRE, and we expect our shopping centres to benefit from this in due course. Across the hotel market, ADR and RevPAR metrics are up significantly, according to CBRE, and we expect Portmarnock Hotel and Golf Links to benefit now that the works are complete – its award as 2016 Irish Golf Resort of the Year is a very positive early win, given the importance of tour operators in this market. Property investment volumes were up a healthy 29% year-on-year to €4.5 billion, according to CBRE. It is worth noting that almost one-third of the improvement was owing to Blanchardstown and Liffey Valley shopping centres, which are positive endorsements to the institutional interest from new entrants to the market. Year-on-year Dublin office take-up was 2.6 million sq ft, nearly on par with 2015, according to CBRE, and the Dublin city centre vacancy rate reduced to 4.7%. Prime rents ended the year at €62.50 psf, up 14% year-on-year, according to CBRE, with prime office yields at 4.65%. This bodes well for our under-rented Dublin CBD office portfolio, where average passing rents are €40.65 psf and average ERVs are €47.50 psf. The Dublin suburban office market represented almost one-quarter of all take-up in 2016, with nearly three-quarters of the Q4-16 suburban leasing activity focused on the South suburbs, according to CBRE. Prime rents are now €27.50 psf, significantly in excess of our average South Dublin suburban office passing rents of €17.35 psf. Our portfolio remains reversionary, with ERVs at €24.35 psf. Dublin is expected to benefit from potential job relocations from companies seeking to realign their geographic footprint after the EU referendum. A number of UK-based financial services firms have already announced that they have either settled on Dublin as their new EU base, or are seriously considering it. The PRS market performed well throughout the year, and we benefited from continued growth at both Vantage (including Block K) and Liffey Trust. In December 2016, the Irish Government imposed a 4% rental cap on ‘rent pressure zones’ for a period of three years. This relates to areas where rents have increased 7% or more in four of the last six quarters and in the first instance impacts the Dublin market. Our recently developed Block K units, at Vantage are exempt from this rental cap, as will be any existing unit which has undergone substantial refurbishment. Spain Spain’s economy continues its growth trajectory after 13 consecutive quarters of growth. The expectation is for 2016 GDP growth to be 3.1%, on track with 2015’s 3.2%, according to the IMF, which recently revised its growth targets for the next two years. After almost a year without a government, the newly-formed Partido Popular minority government has been in place since November 2016. Political uncertainty has started to wane and Spain is set to achieve one of the faster growth rates in the Eurozone this year, according to the Bank of Spain. Investment volumes for 2016 have increased year-on-year by 7.7% to €13.9 billion, according to CBRE, exceeding their 2007 peak by 38%. Yields remain at historic lows and for prime CBD offices and prime high street shops, according to CBRE, and are being pushed down further by continued levels of institutional demand. Year-on-year retail sales rose 3.0% in December, according to the Institute of Spanish Statistics, representing 29 consecutive months of year-on-year growth. Continued recovery in employment, low inflation and a record number of tourists have all positively contributed to this improvement. This strong retail activity continues to fuel our retail portfolio. We are seeing positive signs that the high street retail occupational and investment market in central Madrid is picking up momentum. Against this backdrop, current rents continue to sit significantly below prior cycles, and we expect rental increases across the sector as a whole. Italy The Italian economy continues its steady, albeit moderate, growth with expected GDP growth of 0.8% in 2016, increasing to 1.0% by 2018, according to the OECD. Following the outcome of the constitutional referendum Matteo Renzi resigned as Prime Minister in December 2016 and a caretaker government was formed with new elections likely in 2017, or 2018 at the latest. One of the new government’s first acts was to approve up to €20 billion in capital to support the troubled banking sector which should help banks clean up their balance sheets. On the employment front, Istat reports that the economy added 242,000 jobs in 2016 while the unemployment rate edged up slightly to 12% as new people entered the labour market.

Kennedy Wilson Europe Real Estate Plc Page | 11 Despite the political instability, the investment market continues to improve with total transaction volume of €9.1 billion in 2016, according to CBRE, a 12% increase over the prior year. While the investment market continues to be dominated by international investors, domestic investors have become significantly more active, bringing additional liquidity to the market. Investor focus continues to be on the office market, particularly Milan, where CBRE reports prime office yields of 3.75%, a 25 basis point decrease over the prior year. Annual absorption was 304,000 sq m, 7% above the 10-year average and helping generate a 2% increase in prime office rents to €500psm per annum, according to CBRE. The Rome market is also improving with annual take-up of 150,000 sq m, a 43% increase over the prior year, and CBRE also reports that prime rents in the CBD and EUR submarkets increased by 5.3% and 3.1%, respectively, over the prior year. The ongoing improvement in both the occupational and investment markets should positively affect our Rome and Milan office assets, which account for a combined c. 60% of our Italian portfolio, by value.

Kennedy Wilson Europe Real Estate Plc Page | 12 Managing risks KWE’s approach to risk management At KWE, assessment of risk is a cornerstone of our strategy and our risk management framework is fundamental to its delivery. Our integrated approach reflects a combination of a top-down strategic view with complementary bottom-up operational processes. The top-down approach involves a review of the external environment in which we operate, to guide an assessment of the risks which we are comfortable exposing the business to in pursuit of our strategy. The bottom-up process involves the identification, management and monitoring of risks in each area of our business to ensure that risk management is embedded in the business operations and policies. Oversight of this process is provided through maintenance of a composite risk register at the Group-level as well as regional risk registers in target markets where we operate through regulated vehicles. This approach ensures that operational risks are fully considered in determining the risk appetite and corresponding strategy of the business. Board’s role in the process The Board is ultimately responsible for determining the nature and extent of the principal risks it is willing to take to achieve its strategic objectives. Its policy is to have systems in place which optimise the Company’s abil ity to manage risk in an effective and appropriate manner. By regularly reviewing the risk appetite of the business, the Board ensures that the risk exposure remains appropriate at any point in the cycle. Importantly the Board perceives risk not only as having a potential negative influence on the business but also as an opportunity for financial outperformance as we have access to the Investment Manager’s expertise to take and manage risks. As a property company in the post-Brexit world, exposure to risk is inherent in our business but is subject to an extensive range of mitigating controls. Audit Committee’s role in the process The Board has delegated responsibility for detailed assessment of the risk management process to the Audit Committee. At each quarterly meeting, the Audit Committee carries out a detailed review of the risk register, the control processes run by the Investment Manager, and the manner in which any required corrective action is to be taken by the Investment Manager and reports its findings to the Board. Investment Manager’s role in the process The Investment Manager acts as KWE’s Alternative Investment Fund Manager (AIFM) for the purposes of the Jersey Financial Services Commission’s (JFSC) The Alternate Investment Fund Managers Directive (AIFMD) related regulations, and is responsible for risk management. The Investment Manager is responsible for the ongoing process of identifying, evaluating, monitoring, and managing risks facing the business, together with maintaining controls to manage these risks. The Investment Manager in turn places reliance on its advisory teams to monitor and manage operational risk on an ongoing basis, as well as identifying emerging risks and putting appropriate responses in place. Risk registers, which exist at both the Group and regional levels where the Group invests through regulated vehicles, provide a framework for all staff of the Investment Manager group to contribute to delivering our strategy by recognising their shared responsibility for the effective management of risk. PRINCIPAL RISKS AND UNCERTAINTIES Macro-economic risks Risk Impact Mitigation General economic conditions Impact: Medium Likelihood: High Change on 2015: Increased - Low European growth and weak productivity indicators, coupled with the UK exit from the EU and an increase in protectionist rhetoric in the USA (albeit alongside an apparently expansionary fiscal policy) remain a concern in our current markets of operation - A slowdown in economic growth increases the risk of lower than expected rental levels, occupancy deterioration and asset valuation uncertainty - Regular review of the economic environment to assess whether any changes in outlook present risks, as well as opportunities, which impact execution of our strategy - Broad mandate to investment management team allowing for flexible approach to investing across real estate markets in Europe, with limited restrictions across asset class, sector or capital structure, resulting in risk diversification across the portfolio - High occupancy levels (95%) and long WAULT (7.1 years to first break), making any deterioration in the occupier market have a muted short-term effect on the Group’s turnover

Kennedy Wilson Europe Real Estate Plc Page | 13 Macro-economic risks (cont’d) Risk Impact Mitigation Availability of finance Impact: Low Likelihood: Low/Medium Change on 2015: Reduced - Reduced appetite for real estate lending may adversely affect our ability to refinance facilities and reduce our financing capacity for future investments - Diversified borrowings between secured and unsecured debt and a weighted average expiry of 6.1 years - BBB (stable) credit rating reaffirmed by S&P during the year - Strong relationships with our financing partners, credit rating agencies and advisors - Ready access to debt markets through EMTN programme Strategic risks Risk Impact Mitigation Failure to implement and poor execution of the investment strategy Impact: Medium/High Likelihood: Low Change on 2015: No change - Poor execution of our investment strategy could result in significant underperformance and reduced profitability. Specific execution risks include, among others: o timing of investment and divestment decisions o incorrect allocation of capital o exposure to any development risk or significant refurbishment programme o failure to implement the approved business plan o excessive exposure to one particular sector, asset, tenant or regional concentration - Benefits from strong investment sourcing capability: long-standing market relationships ensure access to future opportunities - Expert local knowledge, combined with significant and continued investment in people and infrastructure - Investment decisions subject to risk evaluation; post acquisition, continuous monitoring of KPIs, business plan targets and financial metrics Development and construction Impact: Medium Likelihood: Low Change on 2015: Reduced - Property development projects inherently carry risks with them. These include: o planning risk: the inability to secure planning consent due to political, legislative, regulatory and other risks inherent in the planning environment o construction risk: timing delays, reliance on third parties, including the risk of contractor failure, and additional cost overruns o occupier risk: occupiers may be reluctant to take space upon project completion - Currently no significant development project exposures. 15% NAV limits on aggregate development costs reducing the overall potential impact of development risk - Access to strong and experienced construction and development management team - Strong discipline of extensive consultation, design and technical work pre-project commencement - Assessment of market cycle and likely customer demand pre-commitment to new developments and pre-lets

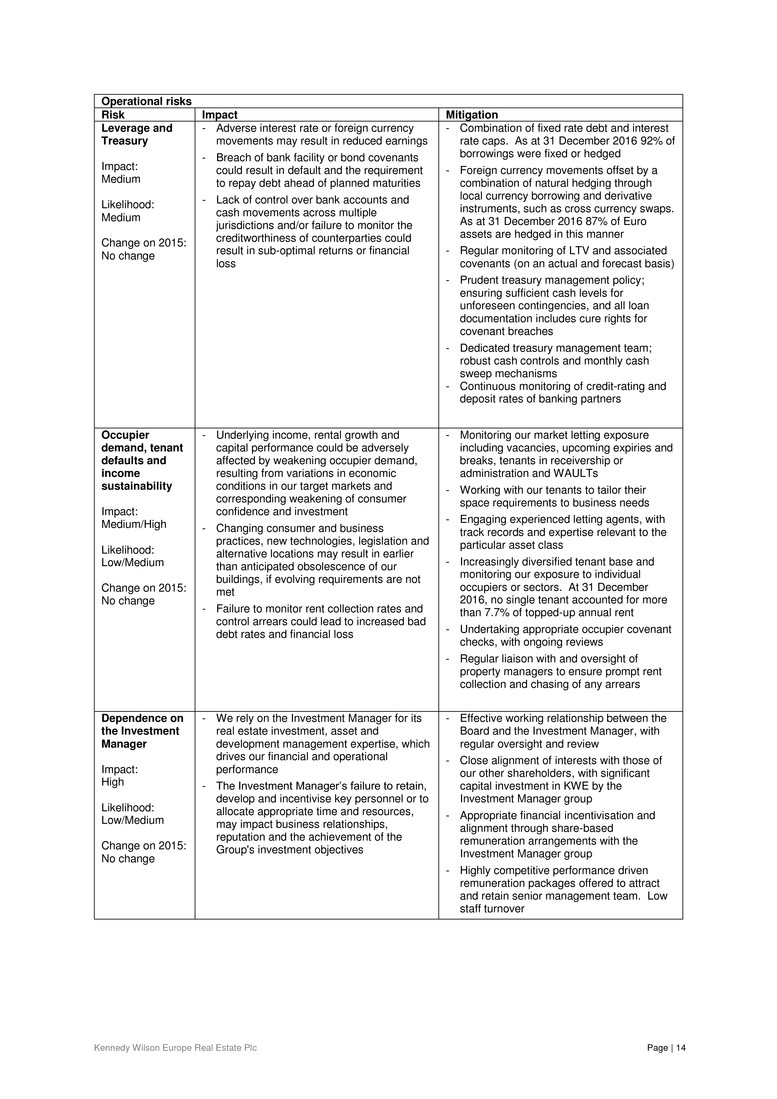

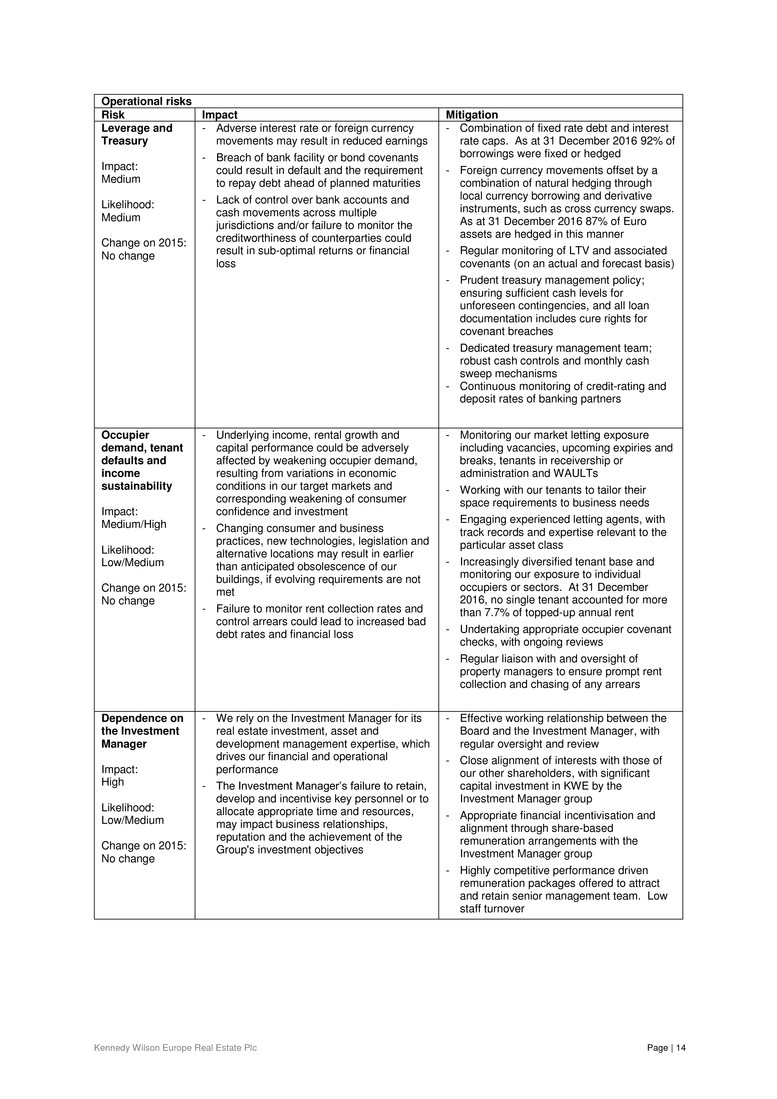

Kennedy Wilson Europe Real Estate Plc Page | 14 Operational risks Risk Impact Mitigation Leverage and Treasury Impact: Medium Likelihood: Medium Change on 2015: No change - Adverse interest rate or foreign currency movements may result in reduced earnings - Breach of bank facility or bond covenants could result in default and the requirement to repay debt ahead of planned maturities - Lack of control over bank accounts and cash movements across multiple jurisdictions and/or failure to monitor the creditworthiness of counterparties could result in sub-optimal returns or financial loss - Combination of fixed rate debt and interest rate caps. As at 31 December 2016 92% of borrowings were fixed or hedged - Foreign currency movements offset by a combination of natural hedging through local currency borrowing and derivative instruments, such as cross currency swaps. As at 31 December 2016 87% of Euro assets are hedged in this manner - Regular monitoring of LTV and associated covenants (on an actual and forecast basis) - Prudent treasury management policy; ensuring sufficient cash levels for unforeseen contingencies, and all loan documentation includes cure rights for covenant breaches - Dedicated treasury management team; robust cash controls and monthly cash sweep mechanisms - Continuous monitoring of credit-rating and deposit rates of banking partners Occupier demand, tenant defaults and income sustainability Impact: Medium/High Likelihood: Low/Medium Change on 2015: No change - Underlying income, rental growth and capital performance could be adversely affected by weakening occupier demand, resulting from variations in economic conditions in our target markets and corresponding weakening of consumer confidence and investment - Changing consumer and business practices, new technologies, legislation and alternative locations may result in earlier than anticipated obsolescence of our buildings, if evolving requirements are not met - Failure to monitor rent collection rates and control arrears could lead to increased bad debt rates and financial loss - Monitoring our market letting exposure including vacancies, upcoming expiries and breaks, tenants in receivership or administration and WAULTs - Working with our tenants to tailor their space requirements to business needs - Engaging experienced letting agents, with track records and expertise relevant to the particular asset class - Increasingly diversified tenant base and monitoring our exposure to individual occupiers or sectors. At 31 December 2016, no single tenant accounted for more than 7.7% of topped-up annual rent - Undertaking appropriate occupier covenant checks, with ongoing reviews - Regular liaison with and oversight of property managers to ensure prompt rent collection and chasing of any arrears Dependence on the Investment Manager Impact: High Likelihood: Low/Medium Change on 2015: No change - We rely on the Investment Manager for its real estate investment, asset and development management expertise, which drives our financial and operational performance - The Investment Manager’s failure to retain, develop and incentivise key personnel or to allocate appropriate time and resources, may impact business relationships, reputation and the achievement of the Group's investment objectives - Effective working relationship between the Board and the Investment Manager, with regular oversight and review - Close alignment of interests with those of our other shareholders, with significant capital investment in KWE by the Investment Manager group - Appropriate financial incentivisation and alignment through share-based remuneration arrangements with the Investment Manager group - Highly competitive performance driven remuneration packages offered to attract and retain senior management team. Low staff turnover

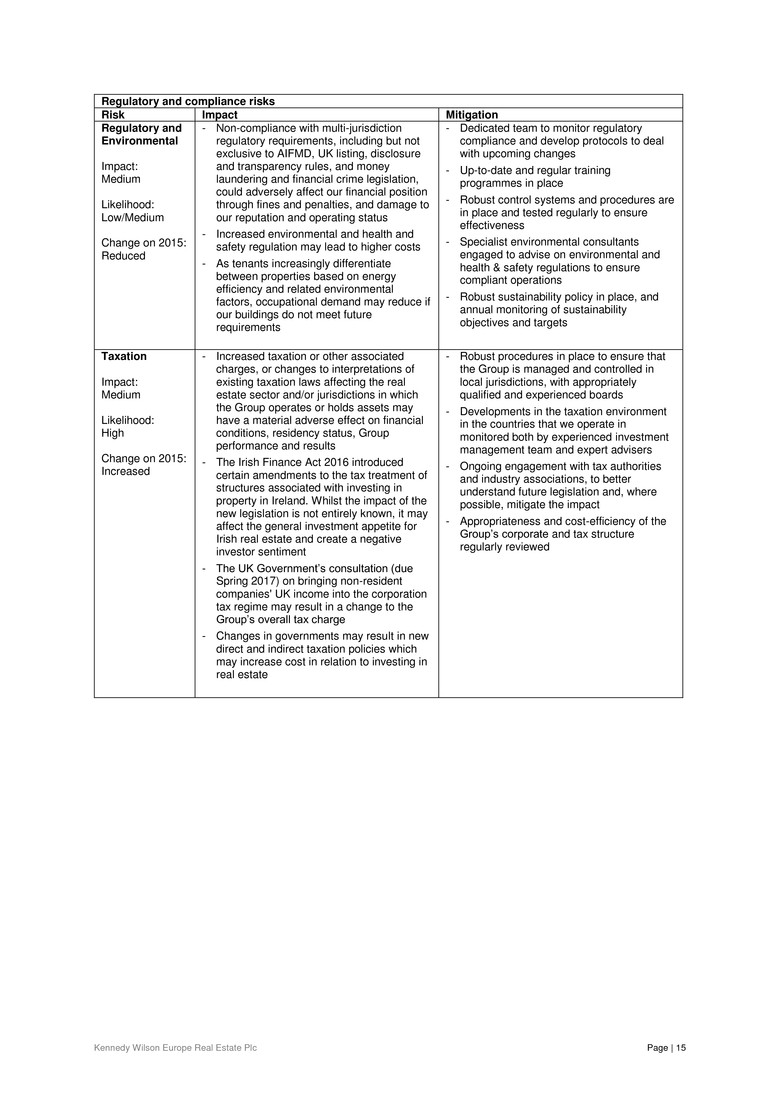

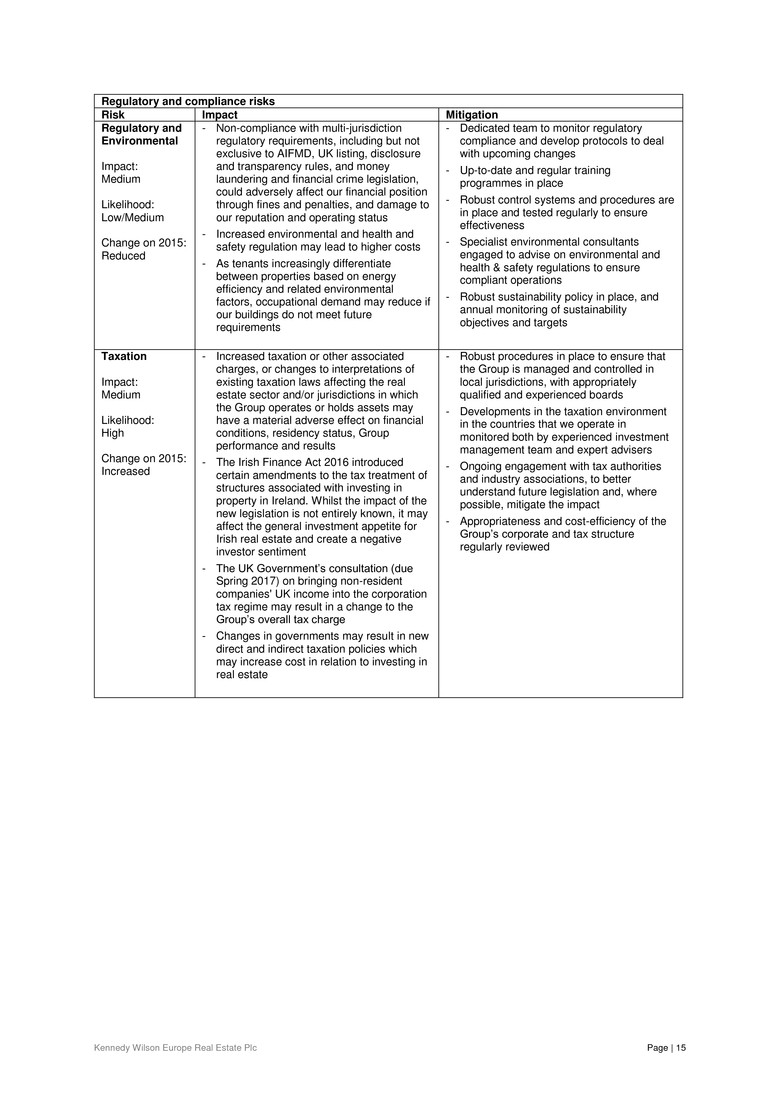

Kennedy Wilson Europe Real Estate Plc Page | 15 Regulatory and compliance risks Risk Impact Mitigation Regulatory and Environmental Impact: Medium Likelihood: Low/Medium Change on 2015: Reduced - Non-compliance with multi-jurisdiction regulatory requirements, including but not exclusive to AIFMD, UK listing, disclosure and transparency rules, and money laundering and financial crime legislation, could adversely affect our financial position through fines and penalties, and damage to our reputation and operating status - Increased environmental and health and safety regulation may lead to higher costs - As tenants increasingly differentiate between properties based on energy efficiency and related environmental factors, occupational demand may reduce if our buildings do not meet future requirements - Dedicated team to monitor regulatory compliance and develop protocols to deal with upcoming changes - Up-to-date and regular training programmes in place - Robust control systems and procedures are in place and tested regularly to ensure effectiveness - Specialist environmental consultants engaged to advise on environmental and health & safety regulations to ensure compliant operations - Robust sustainability policy in place, and annual monitoring of sustainability objectives and targets Taxation Impact: Medium Likelihood: High Change on 2015: Increased - Increased taxation or other associated charges, or changes to interpretations of existing taxation laws affecting the real estate sector and/or jurisdictions in which the Group operates or holds assets may have a material adverse effect on financial conditions, residency status, Group performance and results - The Irish Finance Act 2016 introduced certain amendments to the tax treatment of structures associated with investing in property in Ireland. Whilst the impact of the new legislation is not entirely known, it may affect the general investment appetite for Irish real estate and create a negative investor sentiment - The UK Government’s consultation (due Spring 2017) on bringing non-resident companies' UK income into the corporation tax regime may result in a change to the Group’s overall tax charge - Changes in governments may result in new direct and indirect taxation policies which may increase cost in relation to investing in real estate - Robust procedures in place to ensure that the Group is managed and controlled in local jurisdictions, with appropriately qualified and experienced boards - Developments in the taxation environment in the countries that we operate in monitored both by experienced investment management team and expert advisers - Ongoing engagement with tax authorities and industry associations, to better understand future legislation and, where possible, mitigate the impact - Appropriateness and cost-efficiency of the Group’s corporate and tax structure regularly reviewed

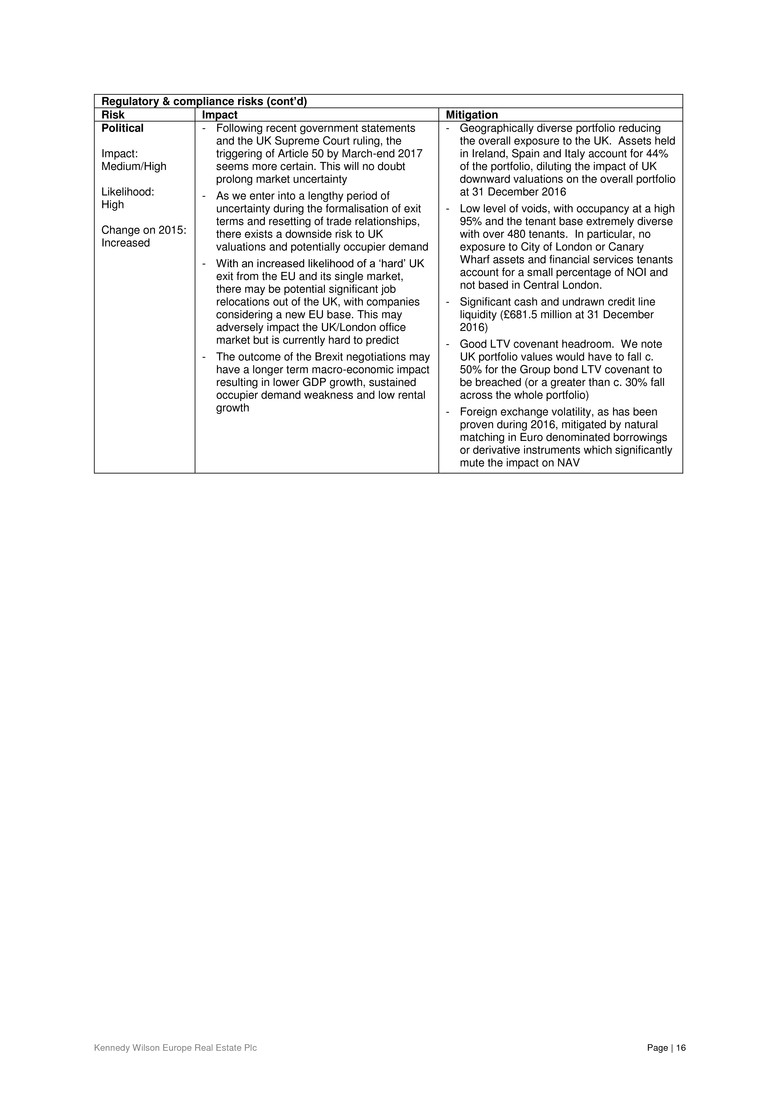

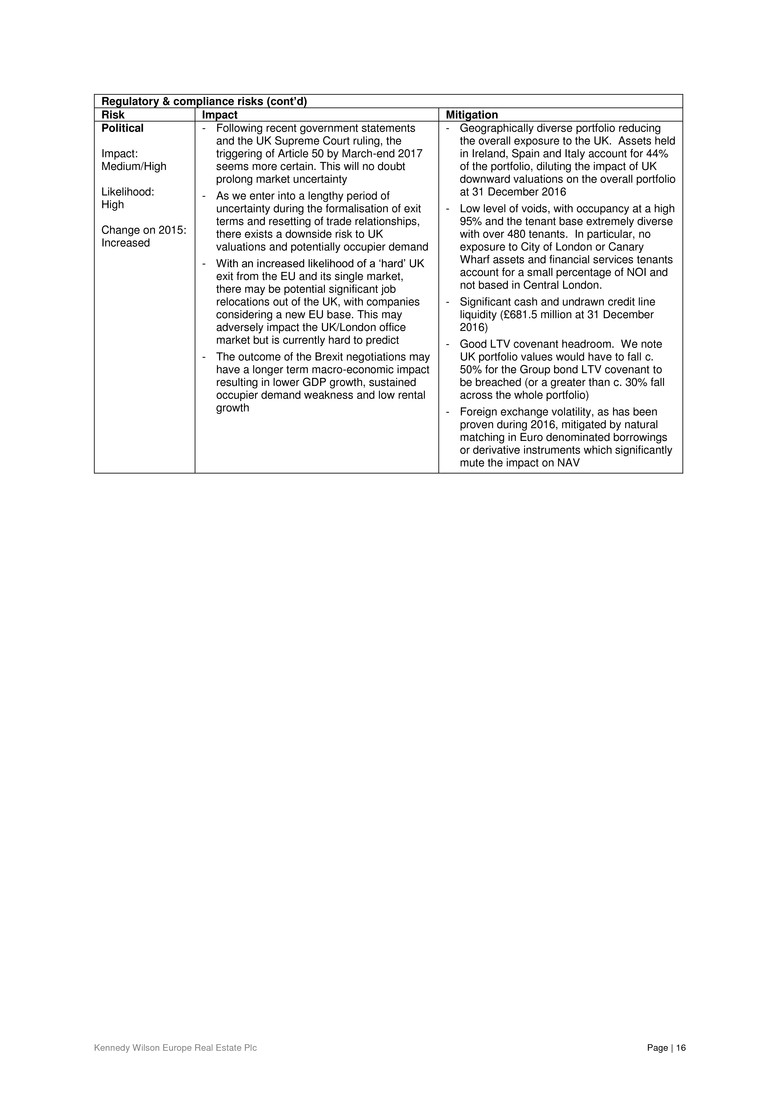

Kennedy Wilson Europe Real Estate Plc Page | 16 Regulatory & compliance risks (cont’d) Risk Impact Mitigation Political Impact: Medium/High Likelihood: High Change on 2015: Increased - Following recent government statements and the UK Supreme Court ruling, the triggering of Article 50 by March-end 2017 seems more certain. This will no doubt prolong market uncertainty - As we enter into a lengthy period of uncertainty during the formalisation of exit terms and resetting of trade relationships, there exists a downside risk to UK valuations and potentially occupier demand - With an increased likelihood of a ‘hard’ UK exit from the EU and its single market, there may be potential significant job relocations out of the UK, with companies considering a new EU base. This may adversely impact the UK/London office market but is currently hard to predict - The outcome of the Brexit negotiations may have a longer term macro-economic impact resulting in lower GDP growth, sustained occupier demand weakness and low rental growth - Geographically diverse portfolio reducing the overall exposure to the UK. Assets held in Ireland, Spain and Italy account for 44% of the portfolio, diluting the impact of UK downward valuations on the overall portfolio at 31 December 2016 - Low level of voids, with occupancy at a high 95% and the tenant base extremely diverse with over 480 tenants. In particular, no exposure to City of London or Canary Wharf assets and financial services tenants account for a small percentage of NOI and not based in Central London. - Significant cash and undrawn credit line liquidity (£681.5 million at 31 December 2016) - Good LTV covenant headroom. We note UK portfolio values would have to fall c. 50% for the Group bond LTV covenant to be breached (or a greater than c. 30% fall across the whole portfolio) - Foreign exchange volatility, as has been proven during 2016, mitigated by natural matching in Euro denominated borrowings or derivative instruments which significantly mute the impact on NAV

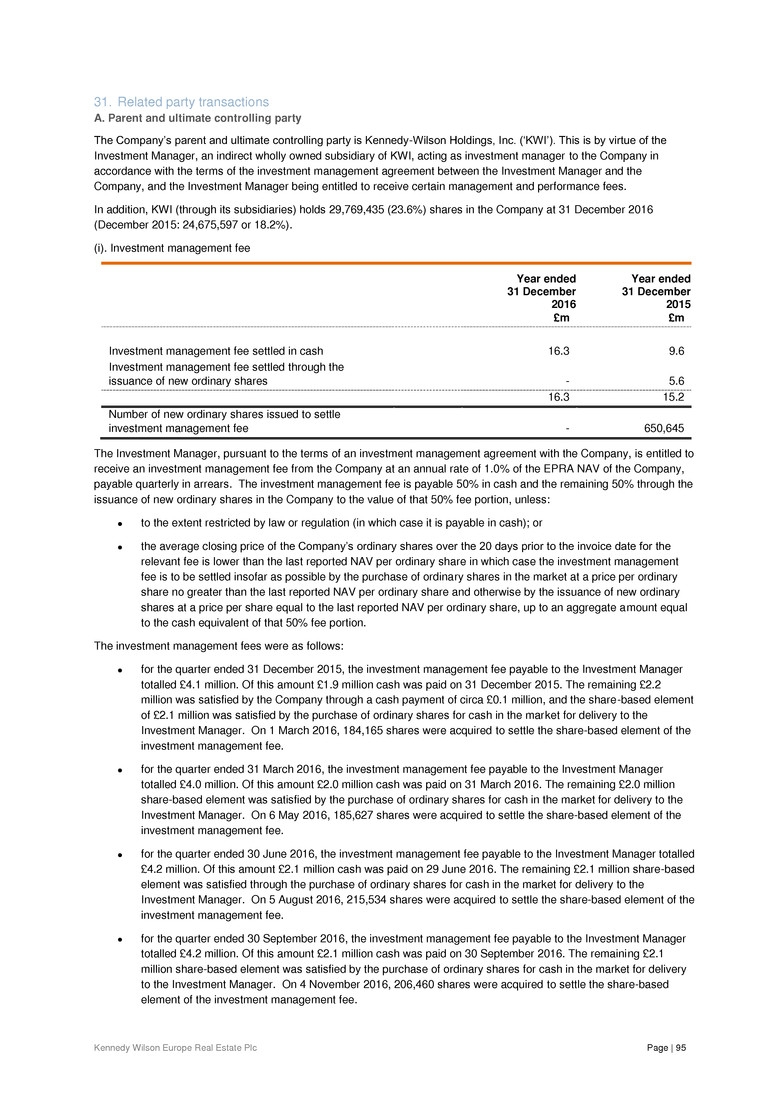

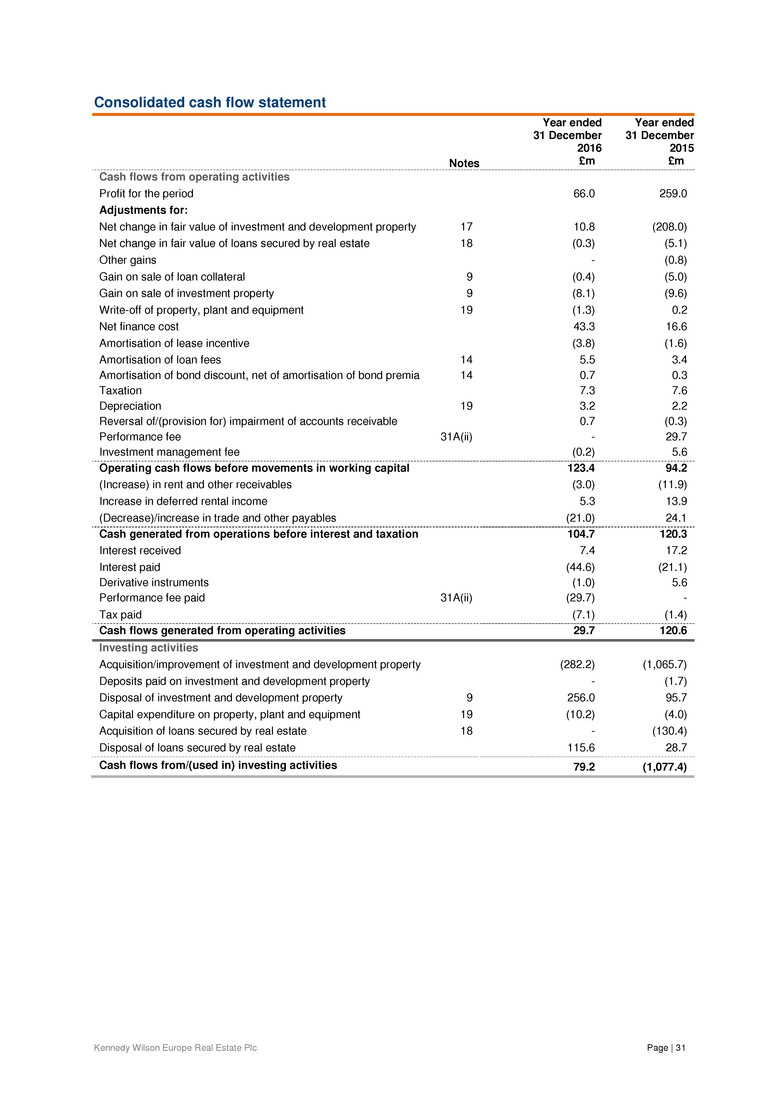

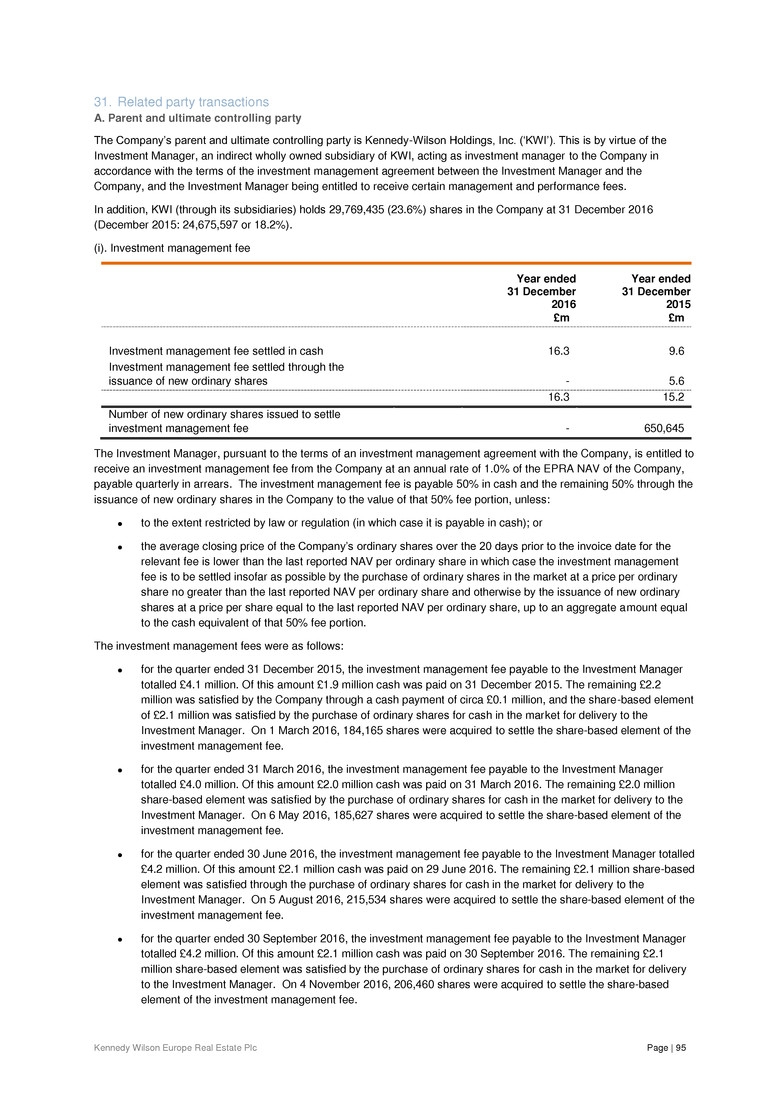

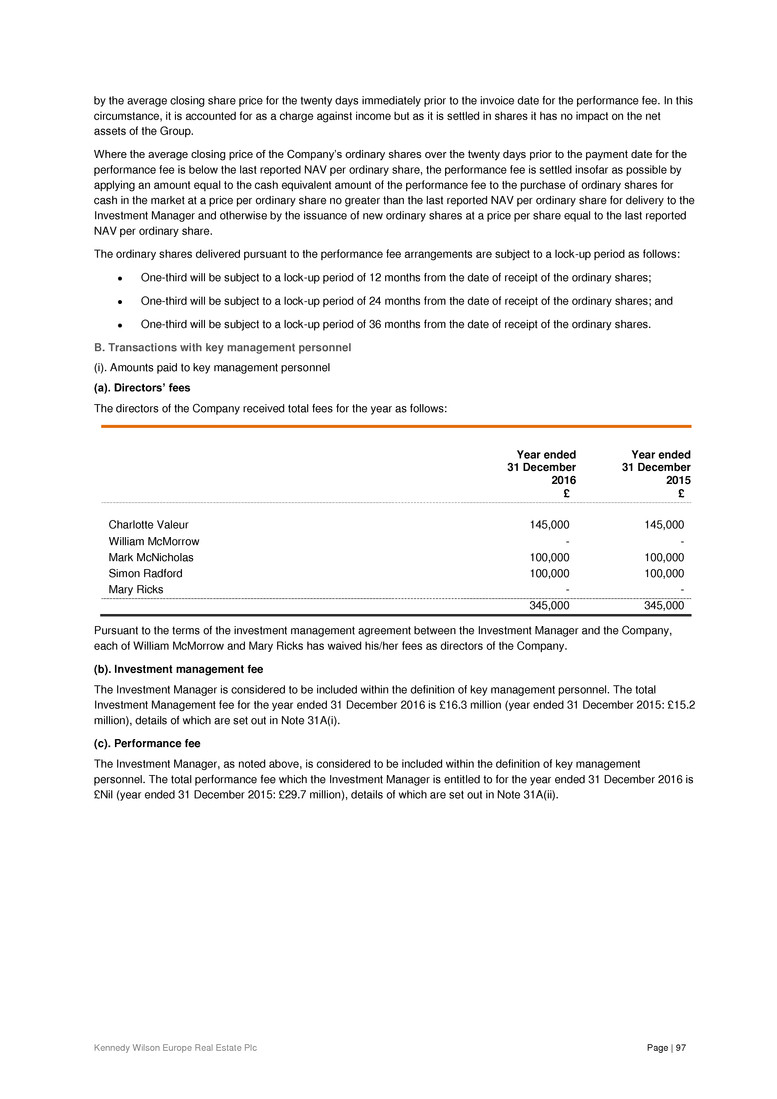

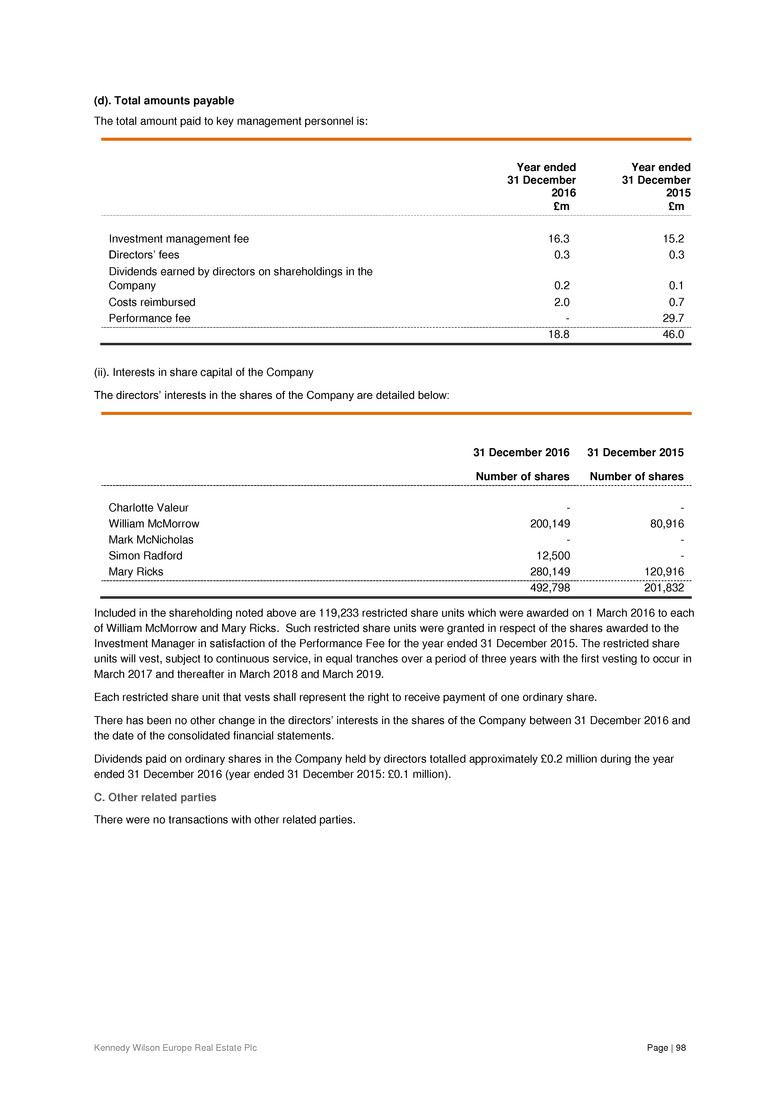

Kennedy Wilson Europe Real Estate Plc Page | 17 Finance review Table 6: Financial key performance indicators (KPIs) 31 December 2016 31 December 2015 Total accounting return (%) 7.6 18.0 Adjusted NAV per share (p) 1,215.9 1,174.5 Adjusted earnings per share (p) 55.2 47.9 Dividends paid (p) 48.0 35.0 LTV (%) 42.8 39.7 Weighted average cost of debt (%) 3.0 2.9 Overview The 2016 financial results reflect continued positive profits and earnings growth. NOI grew to £160.3 million, an increase of 23% on the prior year primarily owing to the benefit of acquisitions along with successful leasing levels; partly offset by disposals activity. This resulted in increased adjusted earnings of 55.2 pence per share, a 15.2% increase on 2015. Increased earnings have been reflected in dividend levels paid in the year which amounted to 48.0 pence per share, 2015: 35.0 pence per share, a 37% year on year increase and meeting the target we set last year. The dividend cover from adjusted earnings was 1.1 times during 2016. The first interim dividend of 2017 declared by the Board of 12.0 pence per share will continue to provide a sustainable and attractive dividend yield for our investors. The total accounting return for the year was 7.6% which was the combination of NAV per share growth primarily driven by the accretive share buyback programme, solid retained earnings as well as a small element of foreign exchange gain plus dividends paid, which contributed 4.1% to the total return. In June 2016, our investment grade credit rating was reaffirmed by S&P and we have continued to actively manage our debt profile to increase the mix of unsecured debt. This was achieved through a successful £200 million tap of our 2022 £300 million notes which were issued in June 2015 and a €150 million tap of our 2025 €400 million notes issued in November 2015. Secured debt principal totalling £230.0 million was repaid in the year and, as a consequence, unsecured debt represents 57% of all debt drawn at year end. This positive financing activity has resulted in our average term to maturity increasing to 6.1 years (2015: 5.9 years). Our weighted average cost of debt is a competitive 3.0% which also enjoys a high level of certainty given 92% of borrowings are fixed rate or hedged by way of interest rate caps. In September 2016, we announced a share buyback programme of £100 million which completed on 28 November. This added 1.2% to the NAV per share return in the year and demonstrates our ongoing commitment to proactive balance sheet management. Net operating income Net operating income consists of net rental income, the hotel earnings and loan portfolio interest income. The chief drivers of the notable net operating income growth in the year are the full period impact of acquisitions completed in 2015 and part period impact of those acquisitions completed in the year, along with a successful level of leasing activity. This was partly offset by increased disposals for 2016, in excess of our targets. Administrative expenses Total administrative expenses (excluding hotel operations, which are included in NOI) are £11.6 million (2015: £10.9 million). A significant proportion of the expenses are fixed in nature which means that as the Group has become more fully invested the administrative expenses as a percentage of NOI have dropped to 7.2% from 8.4% in 2015. The cost to portfolio value ratio of 40bps is in-line with the expectation at the half-year. Investment Management fees Investment Manager fees The Investment Manager receives a management fee at an annual rate of 1.0% of the Group’s EPRA NAV, payable quarterly. The fee is settled 50% in cash and 50% in shares, in line with the investment management agreement. Where the prevailing share price is at a discount to IFRS NAV, an amount equivalent to the fee is applied insofar as possible towards market purchases of existing shares. The total management fee for 2016 is £16.3 million (2015: £15.2 million). The management fee in respect of the fourth quarter is £3.9 million, where the 50% share component is expected to be settled through market purchases of existing shares.

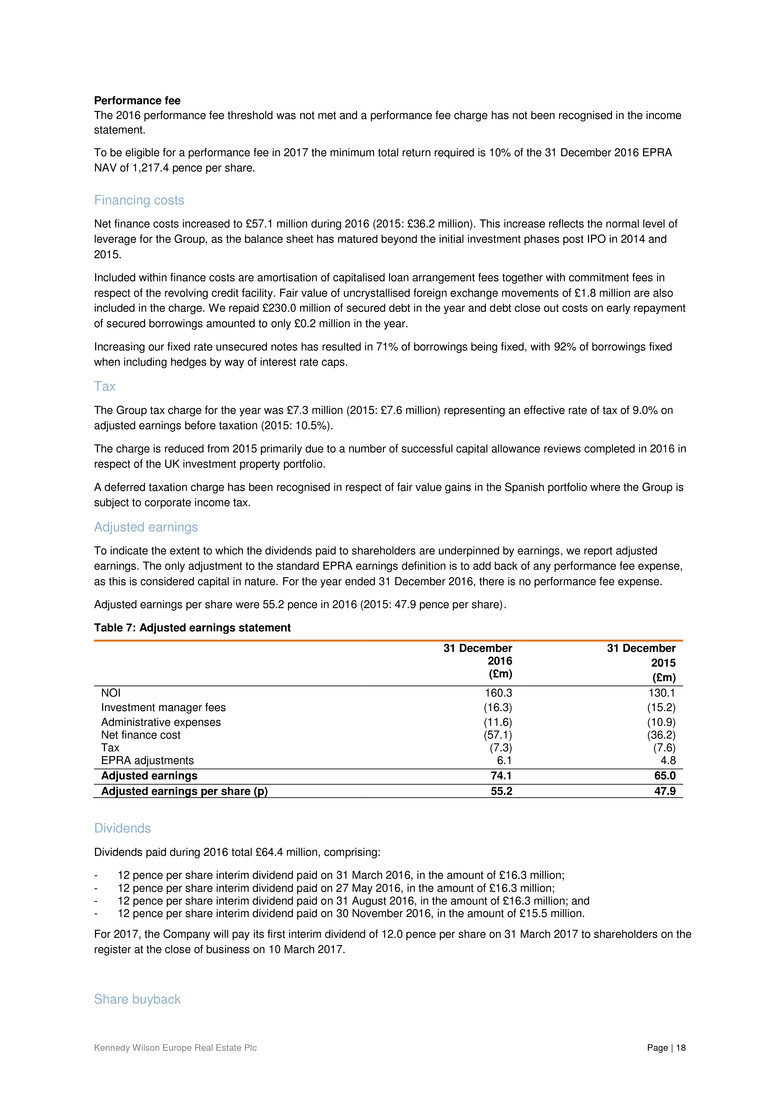

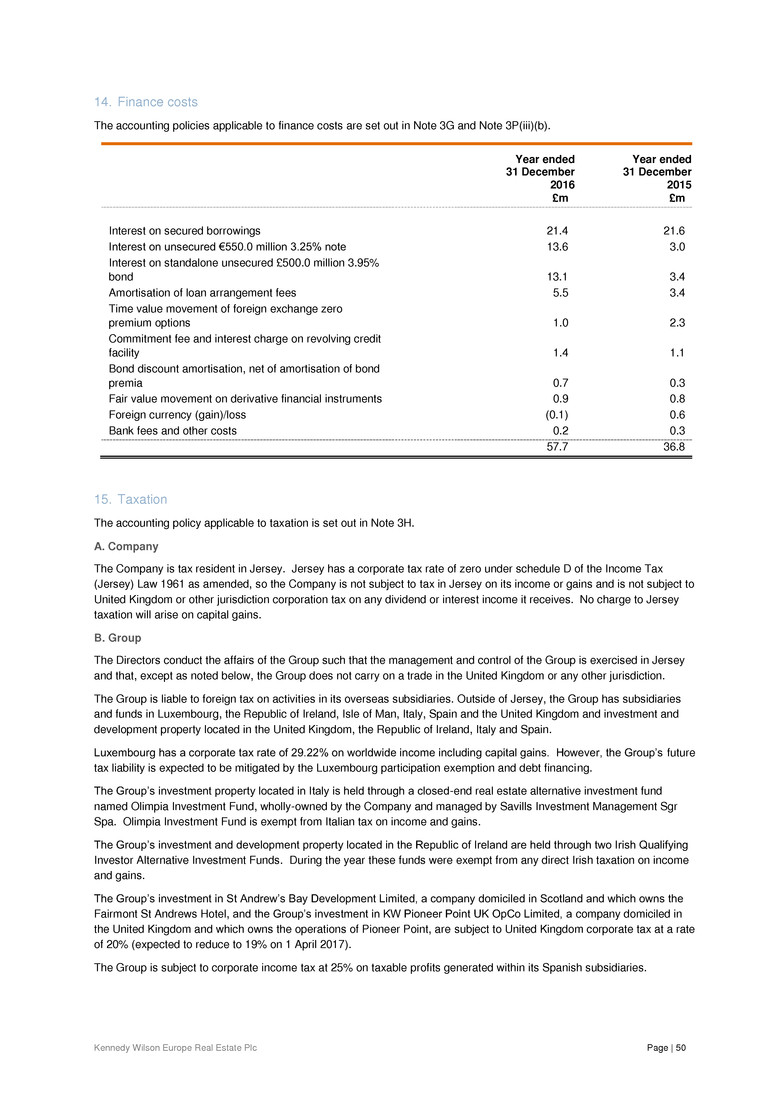

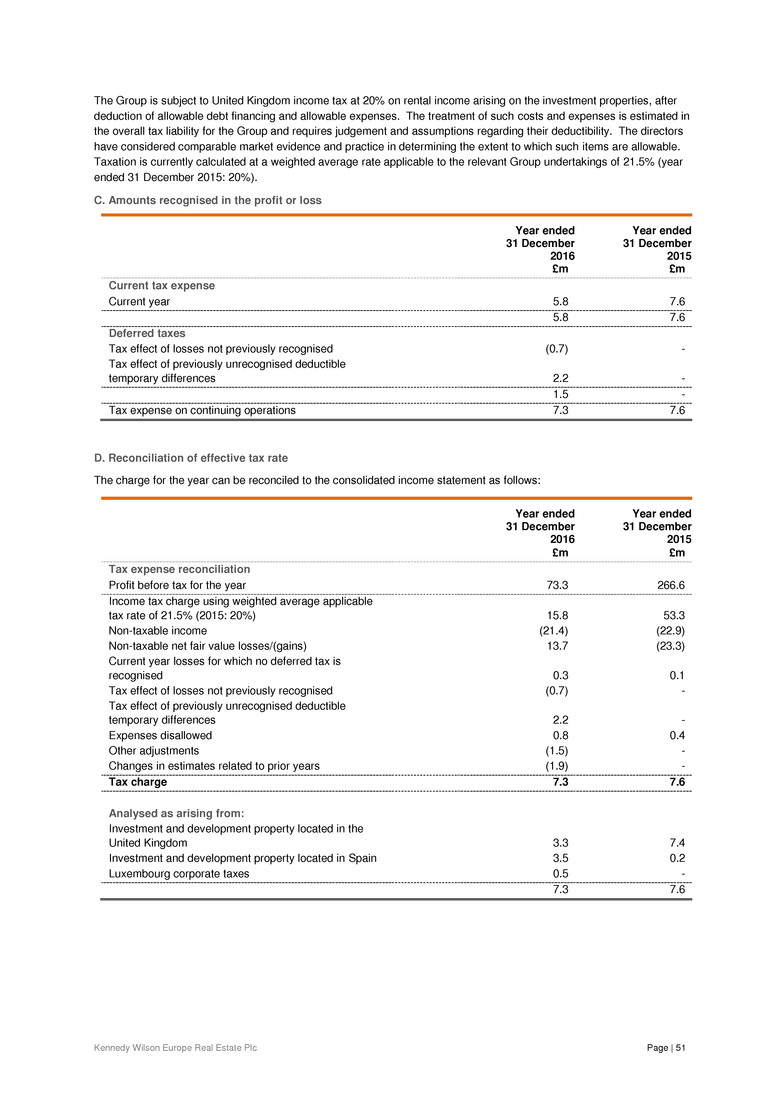

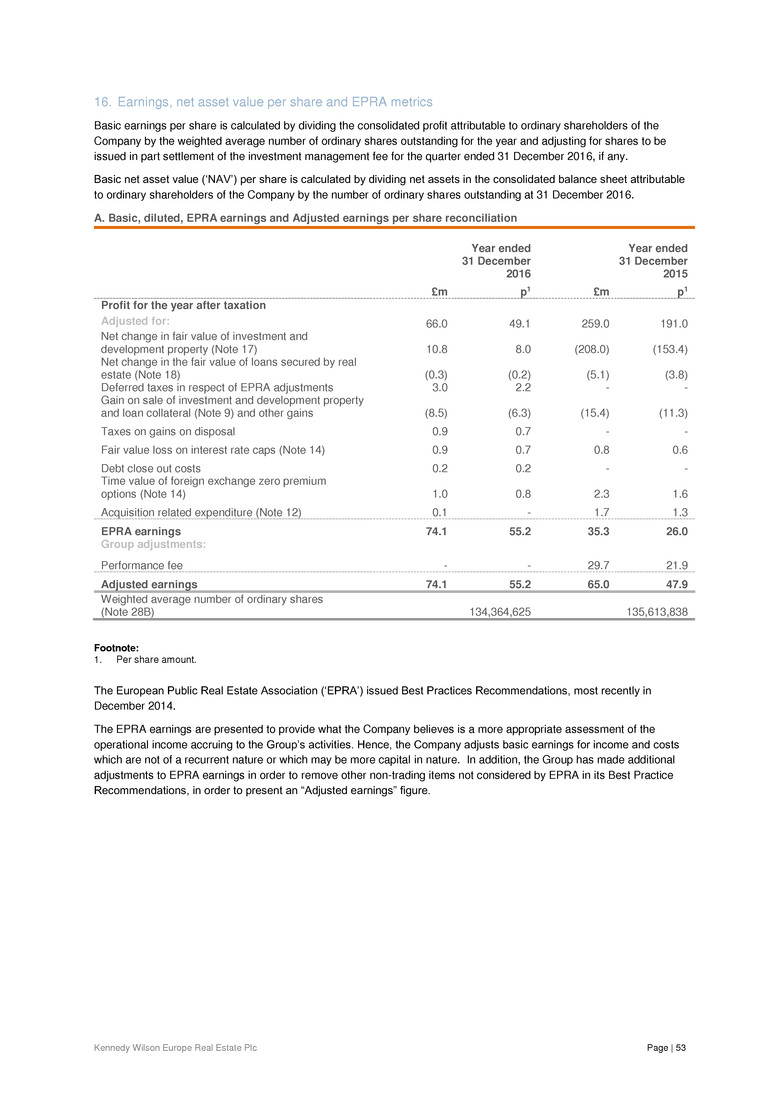

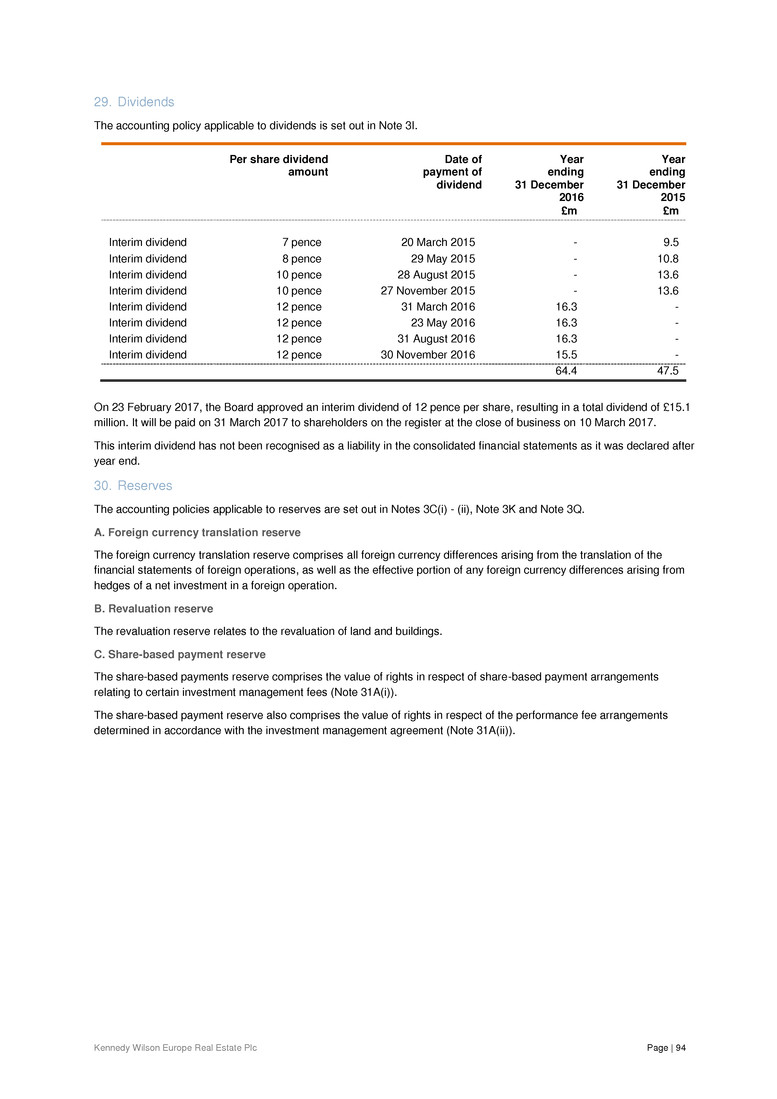

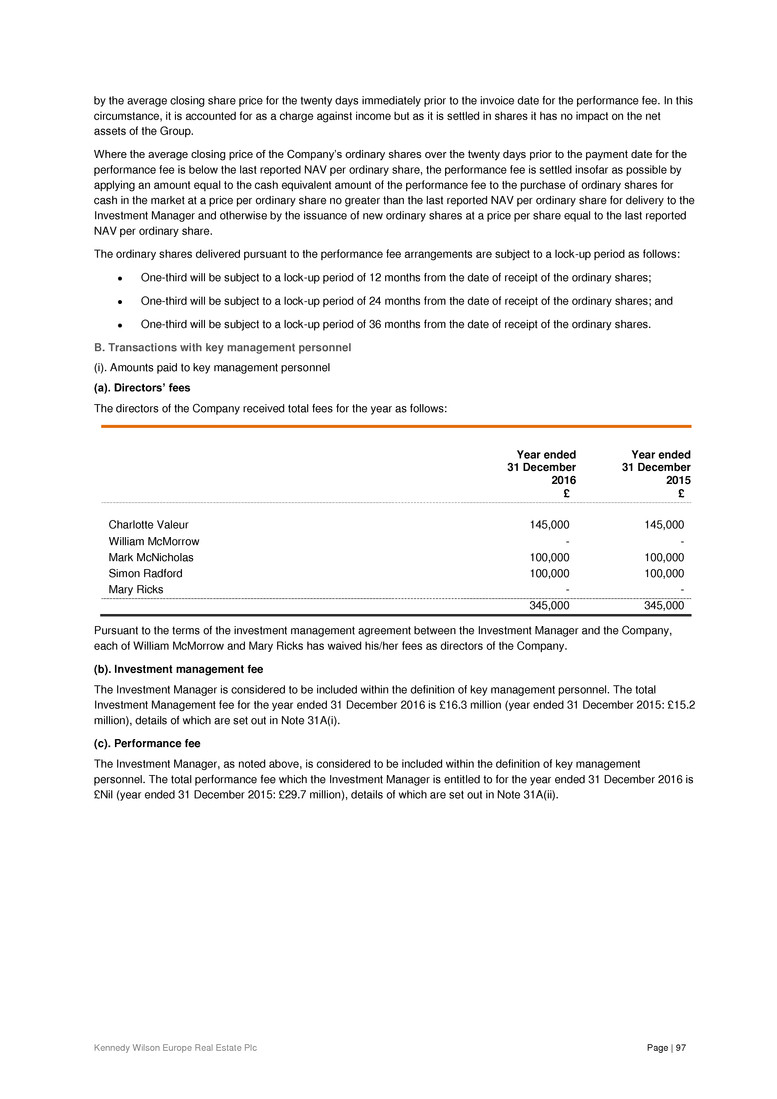

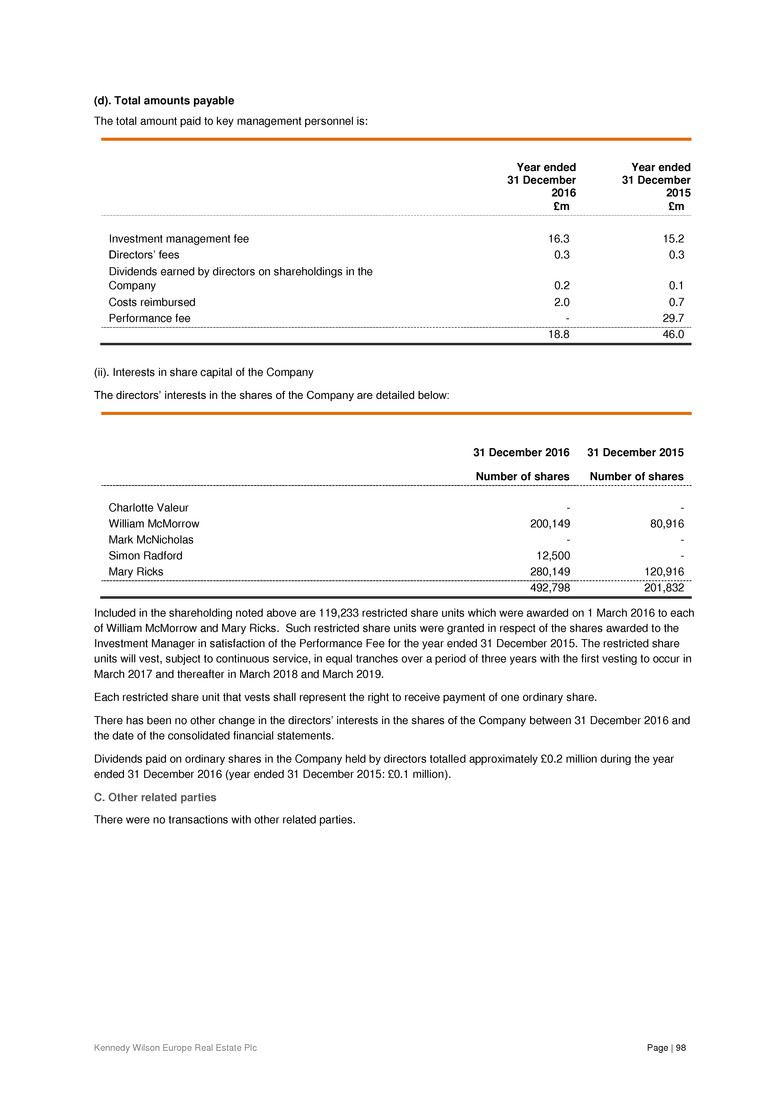

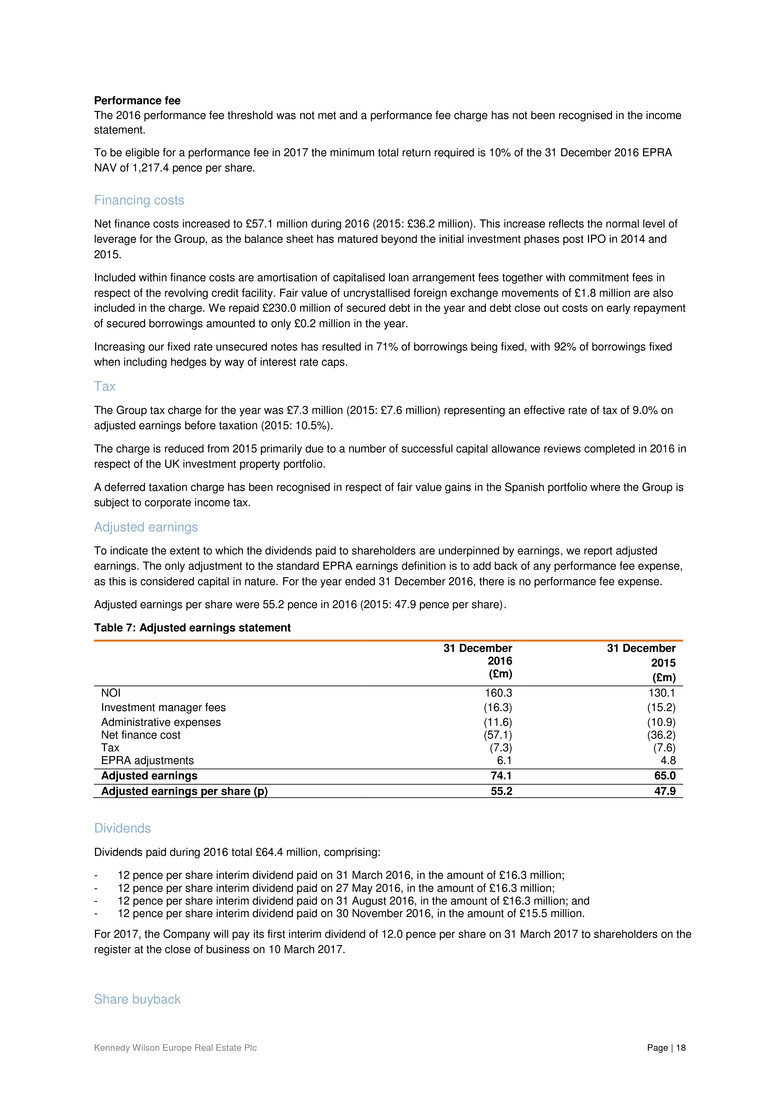

Kennedy Wilson Europe Real Estate Plc Page | 18 Performance fee The 2016 performance fee threshold was not met and a performance fee charge has not been recognised in the income statement. To be eligible for a performance fee in 2017 the minimum total return required is 10% of the 31 December 2016 EPRA NAV of 1,217.4 pence per share. Financing costs Net finance costs increased to £57.1 million during 2016 (2015: £36.2 million). This increase reflects the normal level of leverage for the Group, as the balance sheet has matured beyond the initial investment phases post IPO in 2014 and 2015. Included within finance costs are amortisation of capitalised loan arrangement fees together with commitment fees in respect of the revolving credit facility. Fair value of uncrystallised foreign exchange movements of £1.8 million are also included in the charge. We repaid £230.0 million of secured debt in the year and debt close out costs on early repayment of secured borrowings amounted to only £0.2 million in the year. Increasing our fixed rate unsecured notes has resulted in 71% of borrowings being fixed, with 92% of borrowings fixed when including hedges by way of interest rate caps. Tax The Group tax charge for the year was £7.3 million (2015: £7.6 million) representing an effective rate of tax of 9.0% on adjusted earnings before taxation (2015: 10.5%). The charge is reduced from 2015 primarily due to a number of successful capital allowance reviews completed in 2016 in respect of the UK investment property portfolio. A deferred taxation charge has been recognised in respect of fair value gains in the Spanish portfolio where the Group is subject to corporate income tax. Adjusted earnings To indicate the extent to which the dividends paid to shareholders are underpinned by earnings, we report adjusted earnings. The only adjustment to the standard EPRA earnings definition is to add back of any performance fee expense, as this is considered capital in nature. For the year ended 31 December 2016, there is no performance fee expense. Adjusted earnings per share were 55.2 pence in 2016 (2015: 47.9 pence per share). Table 7: Adjusted earnings statement 31 December 2016 (£m) 31 December 2015 (£m) NOI 160.3 130.1 Investment manager fees (16.3) (15.2) Administrative expenses (11.6) (10.9) Net finance cost (57.1) (36.2) Tax (7.3) (7.6) EPRA adjustments 6.1 4.8 Adjusted earnings 74.1 65.0 Adjusted earnings per share (p) 55.2 47.9 Dividends Dividends paid during 2016 total £64.4 million, comprising: - 12 pence per share interim dividend paid on 31 March 2016, in the amount of £16.3 million; - 12 pence per share interim dividend paid on 27 May 2016, in the amount of £16.3 million; - 12 pence per share interim dividend paid on 31 August 2016, in the amount of £16.3 million; and - 12 pence per share interim dividend paid on 30 November 2016, in the amount of £15.5 million. For 2017, the Company will pay its first interim dividend of 12.0 pence per share on 31 March 2017 to shareholders on the register at the close of business on 10 March 2017. Share buyback

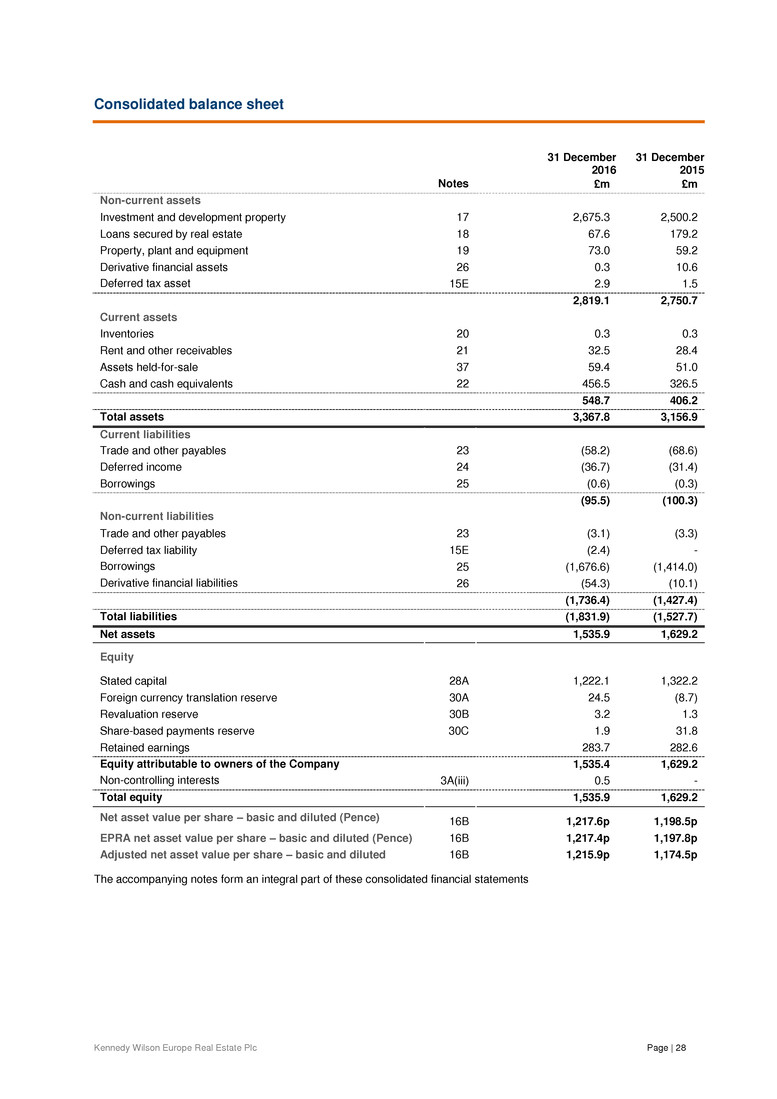

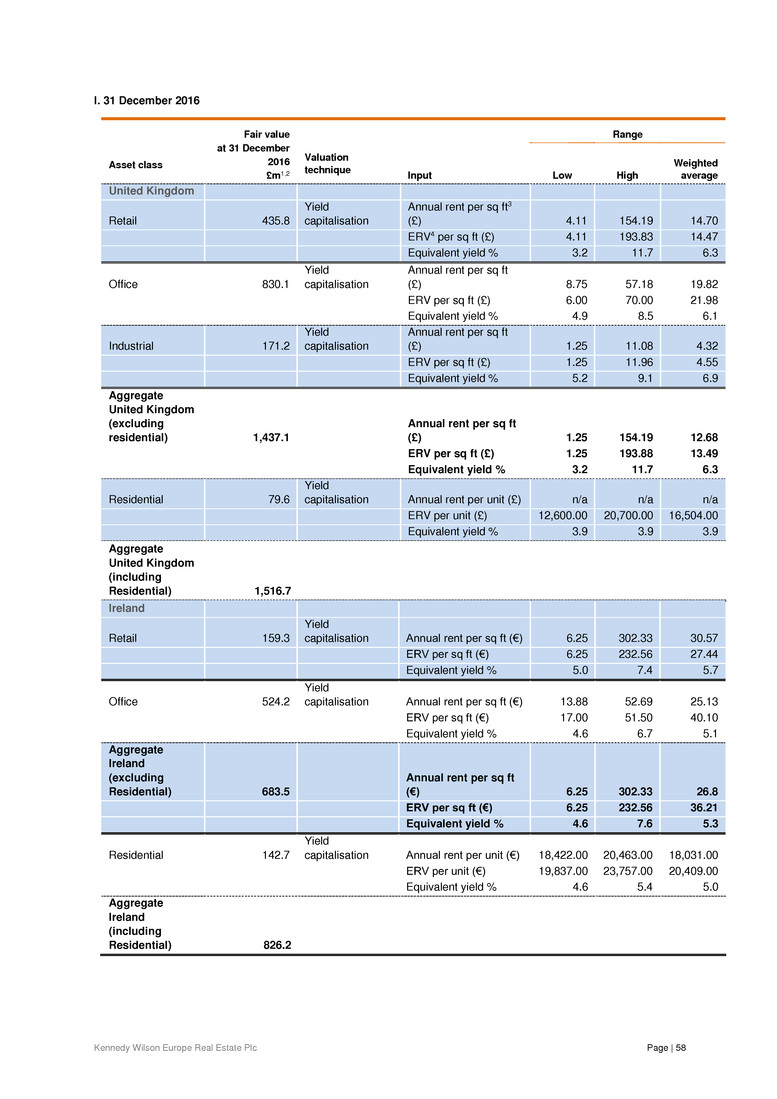

Kennedy Wilson Europe Real Estate Plc Page | 19 Part of our rigorous capital management is considering not just the appropriate debt mix, cost and leverage but also equity management, particularly when in the Board’s opinion there is a disconnect between the prevailing KWE share price and the underlying business fundamentals. The successful completion of the £100 million share buyback programme in November 2016 saw 9,800,531 shares bought at an average price of 1,020 pence per share, and cancelled. This constituted 7.2% of issued share capital. The buyback crystallised for investors the benefit of a 17.7% discount to preceding September 2016 adjusted NAV of 1,240 pence per share. The buyback was accretive to both NAV per share and earnings per share; the NAV per share movement in 2016 was enhanced by 1.2% and we expect the benefit to earnings per share growth, on an annualised pro forma basis, to be 7.8%. Balance Sheet Table 8: Balance sheet 31 December 2016 (£m) 31 December 2015 (£m) Portfolio value 2,882.2 2,792.7 Cash 456.5 326.5 Gross debt (1,691.3) (1,436.1) Other assets and liabilities (111.5) (53.9) IFRS net assets 1,535.9 1,629.2 Adjusted for: Mark-to-market of derivative financial assets (0.3) (0.9) EPRA net assets 1,535.6 1,628.3 Adjust for share based payment reserve: Performance fee: - (29.7) Investment management fee (1.9) (2.1) Adjusted net assets 1,533.7 1,596.5 Adjusted NAV per share (p) 1,215.9 1,174.5 Portfolio valuation As at 31 December 2016, the investment portfolio value was £2,882.2 million, reflecting net selling activity in the year, offset by foreign exchange gains. Notably, the small negative valuation movement was only £8.6 million or -0.3%, reflecting strong performance of our Euro assets (+£69.0 million) offsetting falls in the UK (-£77.6 million), illustrating the benefits of our geographically diversified portfolio. Table 9: Portfolio valuation movements 2015 portfolio valuation 2,792.7 Valuation movement (8.6) Acquisitions 189.2 Disposals (362.9) Capital expenditure 106.7 Foreign exchange/other 165.1 2016 portfolio valuation 2,882.2 Adjusted NAV We report Adjusted NAV to illustrate EPRA NAV after the impact of the fees recognised in the share-based payments reserve. The 3.5% Adjusted NAV per share growth reflects retained earnings, including gains on sale from disposals, which reflected a 4.8% premium over preceding valuation, and the benefit of the share buyback. Foreign exchange also contributed but comparing to the portfolio level gain it is clear that our hedging policy worked well during the year to significantly reduce the impact of substantial Euro strengthening. At year end, 87% of Euro assets were hedged, 66% through local currency borrowing and 21% through derivative instruments.

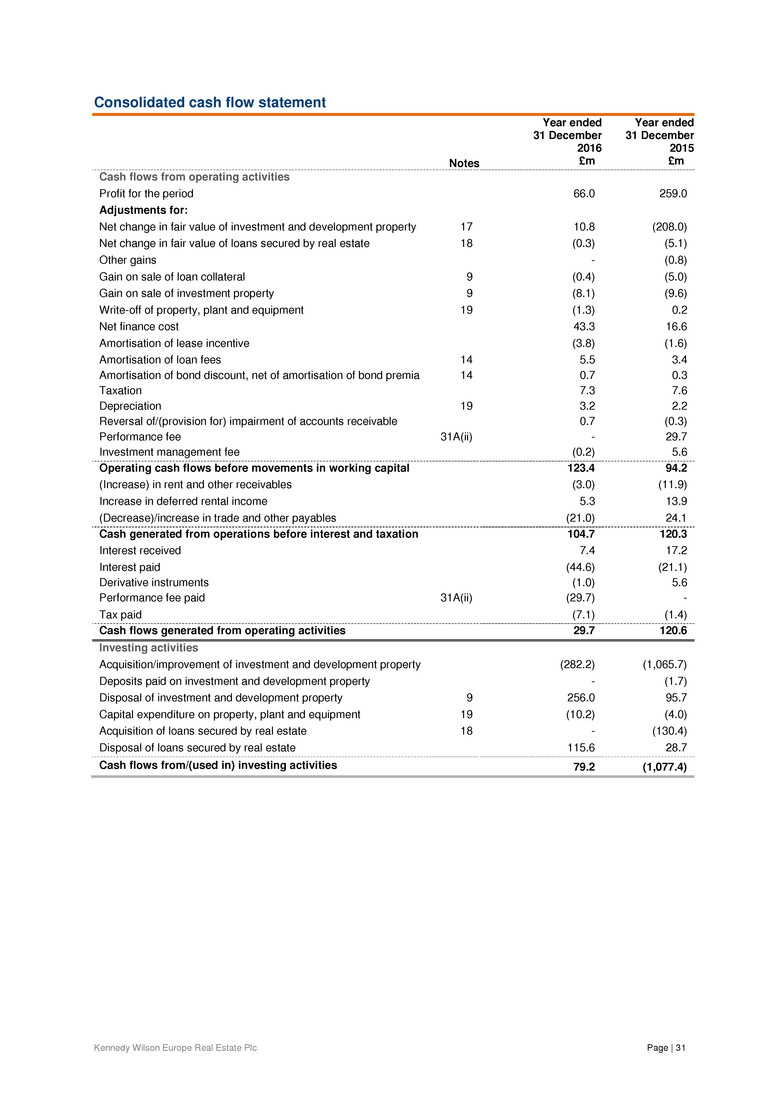

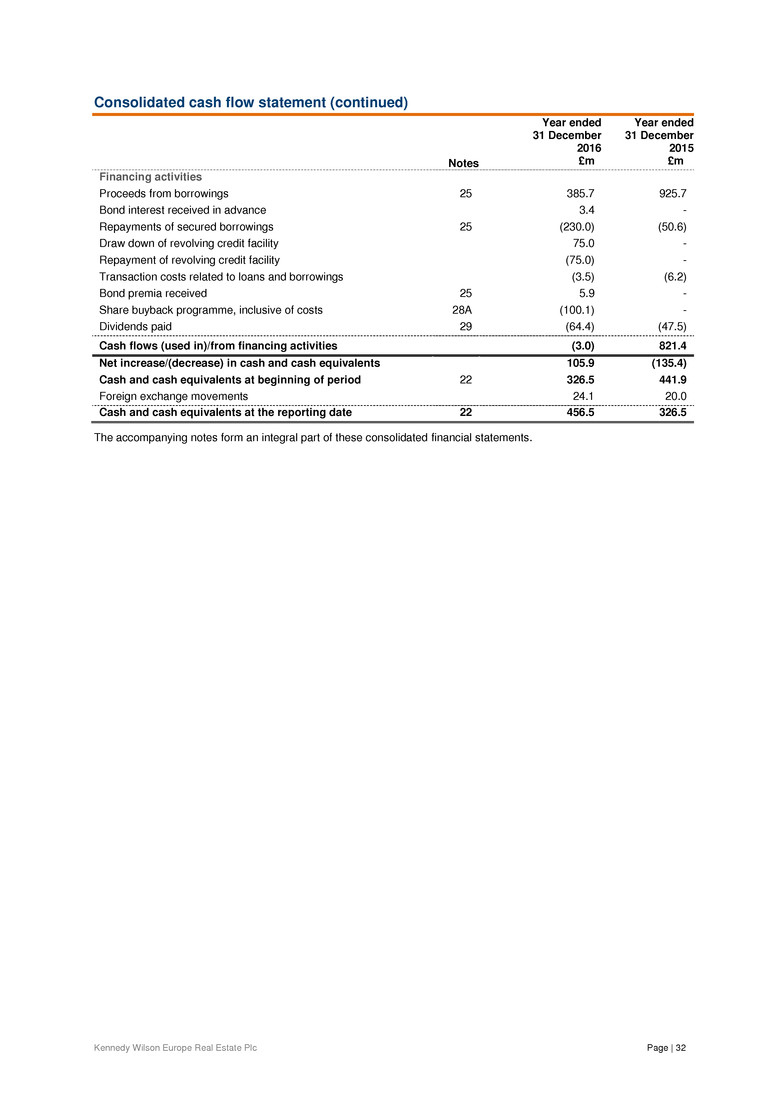

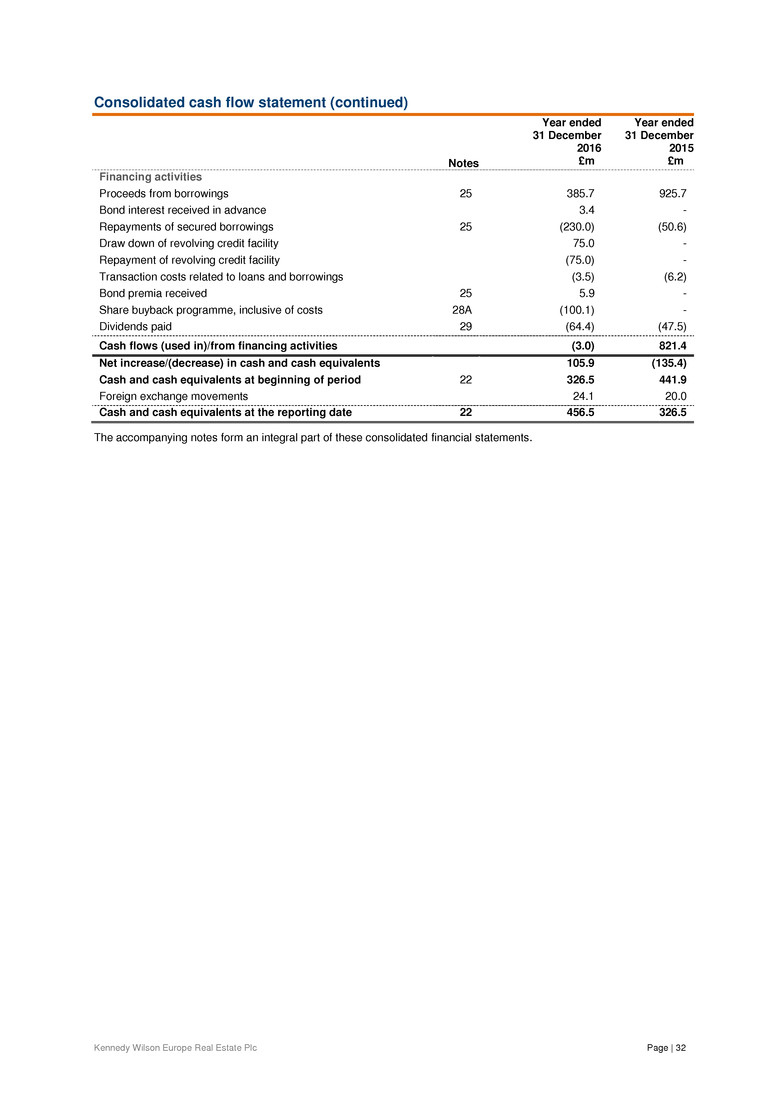

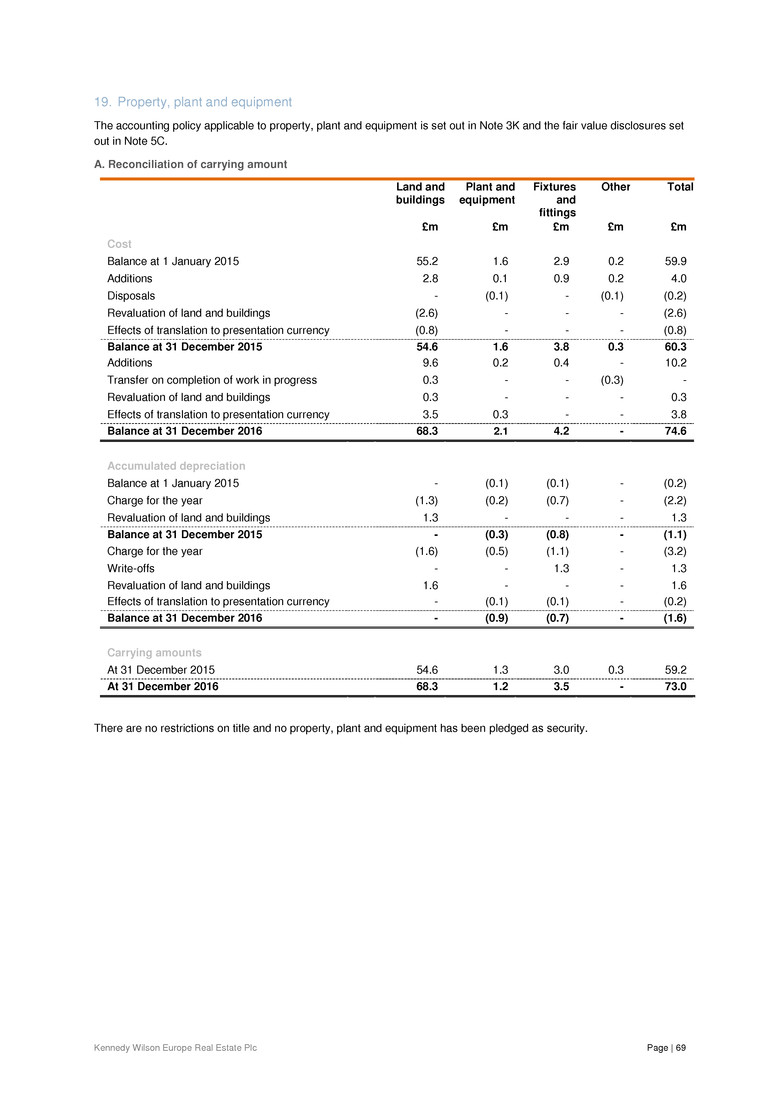

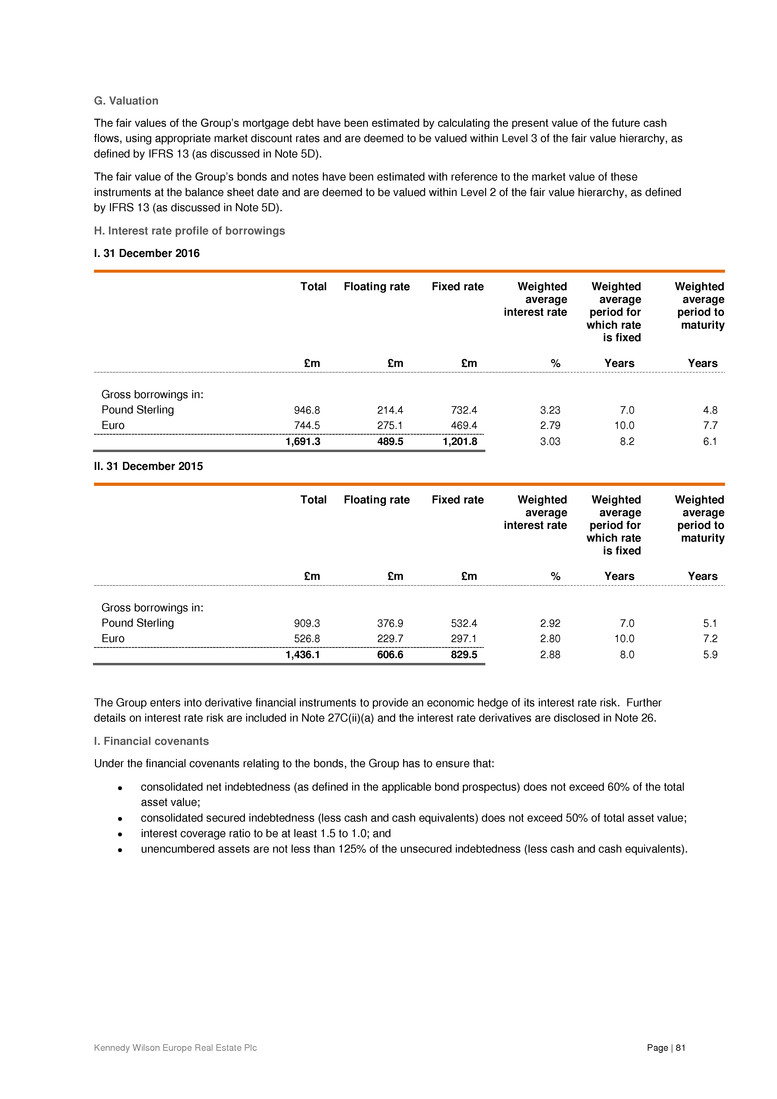

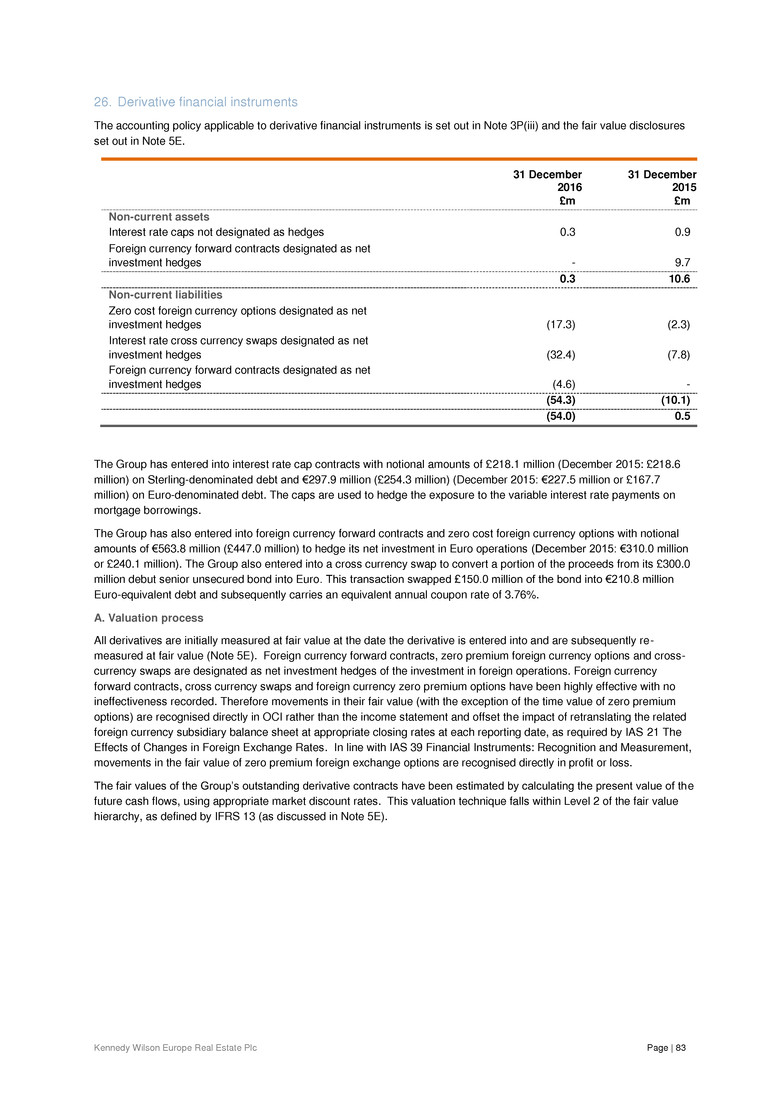

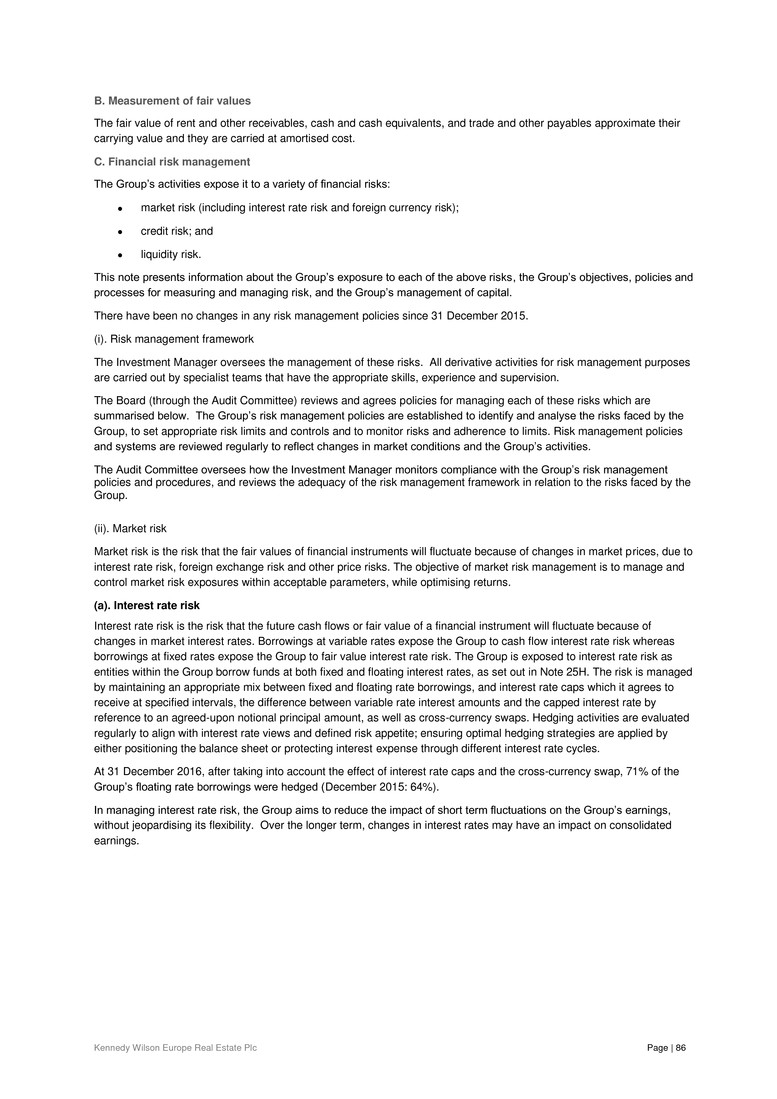

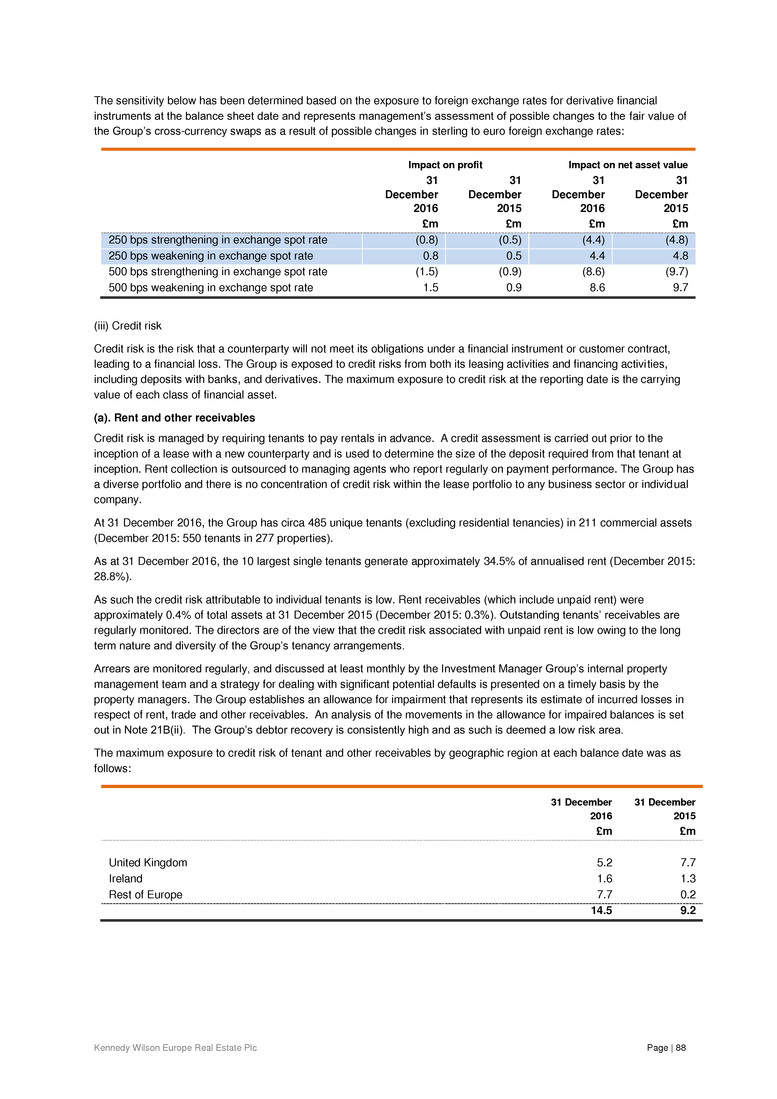

Kennedy Wilson Europe Real Estate Plc Page | 20 Table 10: EPRA NAV movements (£m) (p per share) 2015 adjusted NAV 1,596.5 1,174.5 Valuation movement (8.6) Gains on sale 8.5 Adjusted earnings 74.1 Dividends (64.4) Share buyback (100.0) Foreign exchange/other 27.6 2016 adjusted NAV 1,533.7 1,215.9 Cash flow and treasury management Liquidity, comprising cash and undrawn facilities, totals £681.5 million at 31 December 2016, compared with £551.5 million at 31 December 2015. The major sources of cash during the year were: - Proceeds from predominantly unsecured financing activity of £391.6 million - Proceeds on disposal of assets, which generated cash of £371.6 million KWE maintains a £225.0 million multi-currency revolving credit facility. At 31 December 2016, the full £225.0 million facility was available to be drawn. The Group’s interest rate hedging policy is to eliminate substantially the risk associated with interest rate vo latility, through a combination of fixed rate borrowings and, in respect of floating rate debt, the use of interest rate caps. Financing activity Table 11: Key debt measures 2016 2015 Gross debt (£m) 1,691.3 1,436.1 Cash (£m) 456.5 326.5 Undrawn facilities (£m) 225.0 225.0 LTV (%) 42.8 39.7 Cost of debt (%) 3.0 2.9 Fixed rate or hedged debt proportion (%) 92.0 85.0 Fixed charge cover (x) 2.4 2.9 Continuing our strategy to increase the mix of unsecured debt, on 19 April 2016 we completed a €150 million tap to the €400 million outstanding senior unsecured notes issued by KWE under its EMTN Programme established in November 2015 creating a benchmark size of €550 million. These new notes were issued at a yield of 3.039%. On 10 June 10 2016 Standard & Poor’s affirmed its 'BBB' long-term corporate credit ratings for KWE and its listed Euro and Sterling bonds. The stable outlook reflected the benefit of our diverse portfolio of real estate assets supporting stable cash flows and ample interest cover, as well as relatively low debt maturities in the coming years, coupled with a high level of available liquidity sources. We successfully issued a £200 million tap on 19 September 2016 at an issue yield of 3.572%. This increased the aggregate principal amount of our 2022 £300 million notes which were issued in June 2015 to £500 million. £135.8 million of bond proceeds were voluntarily used to repay certain secured borrowings. A further £94.2 million debt was repaid from the disposal of secured assets. At 31 December 2016, LTV stood at 42.8%, well within our long term target range of 40%-45%. The fixed charge cover (the ratio of adjusted earnings before finance costs to finance costs) for the year was a comfortable 2.4 times. Throughout 2016 and as at 31 December 2016, the Group reported compliance with its debt covenants. Exchange rate: Where Balance Sheet amounts in this document are presented in both £ and €, the £ amount has been calculated based on an exchange rate of €1: £0.85352, which was the rate on 31 December 2016. Income Statement amounts were translated at the average rate for the year.

Kennedy Wilson Europe Real Estate Plc Page | 21 Responsibility statement of the Directors The responsibility statement has been prepared in connection with the Company's full annual report for the year ended 31 December 2016. Certain parts of the annual report are not included in this announcement. We confirm that to the best of our knowledge: the consolidated financial statements, prepared in accordance with IFRS, give a true and fair view of the assets, liabilities, financial position and profit or loss of the Company and the undertakings included in the consolidation taken as a whole the management report, to be contained in the 2016 annual report, includes a fair review of the development and performance of the business and the position of the Company and the undertakings included in the consolidation taken as a whole, together with a description of the principal risks and uncertainties that they face By order of the Board Charlotte Valeur Chair Simon Radford Director 23 February 2017

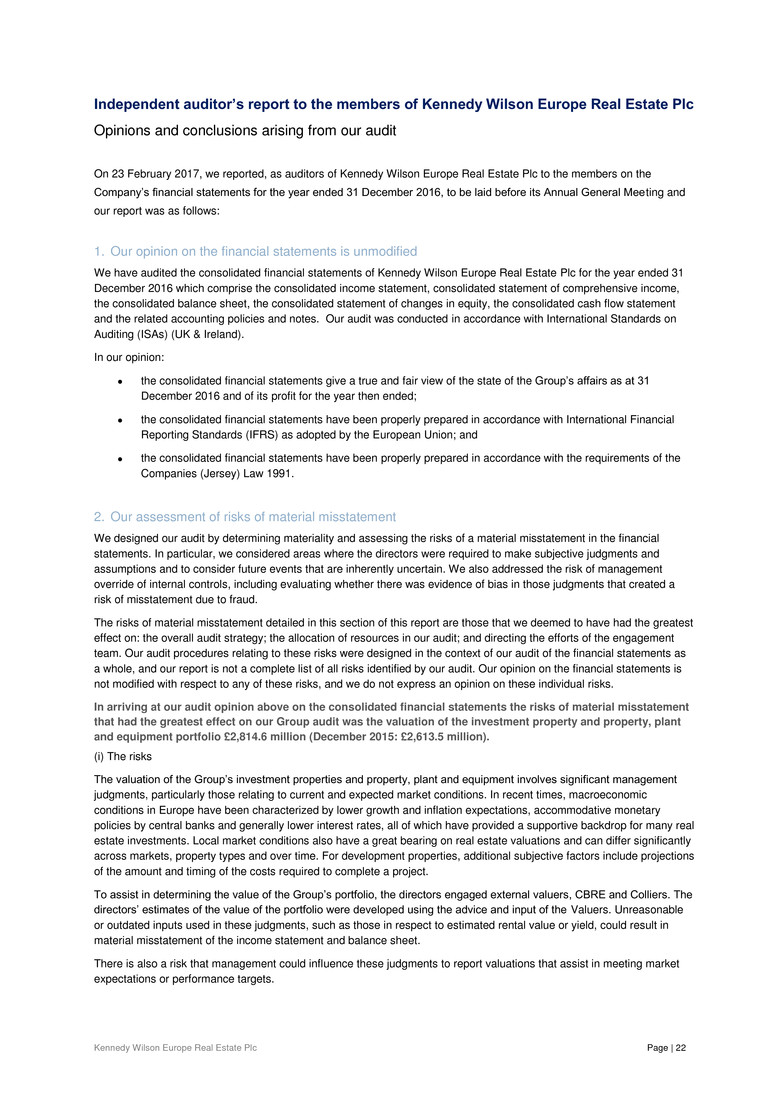

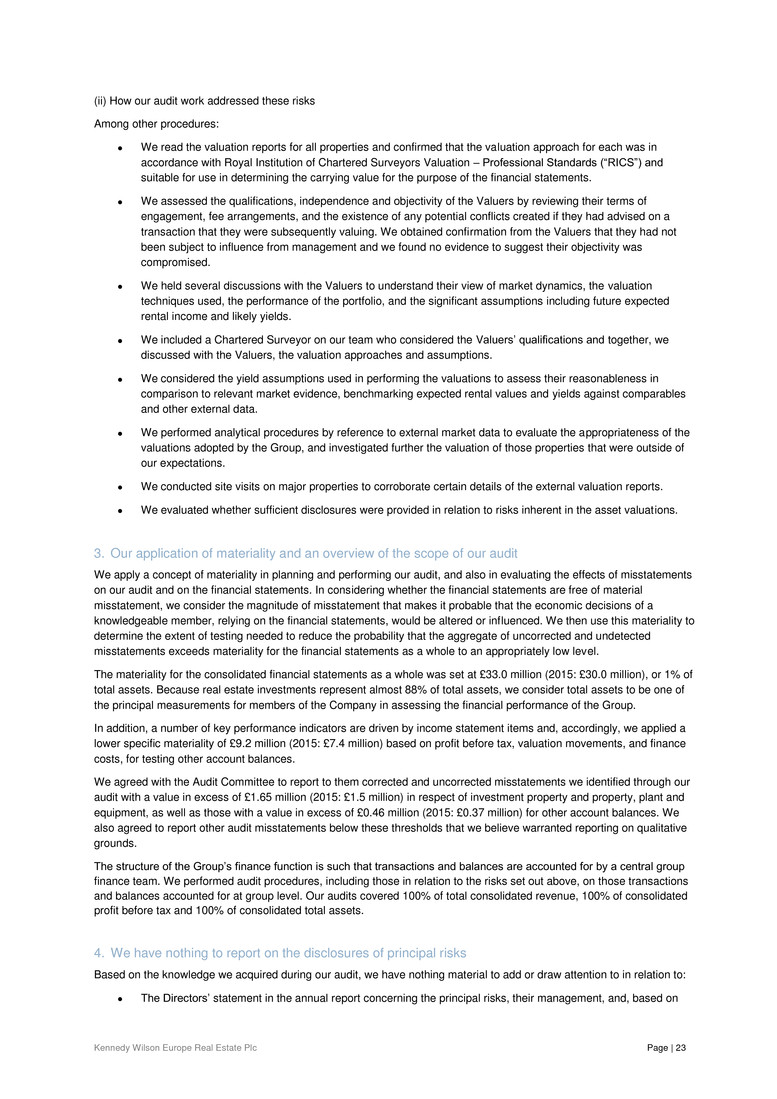

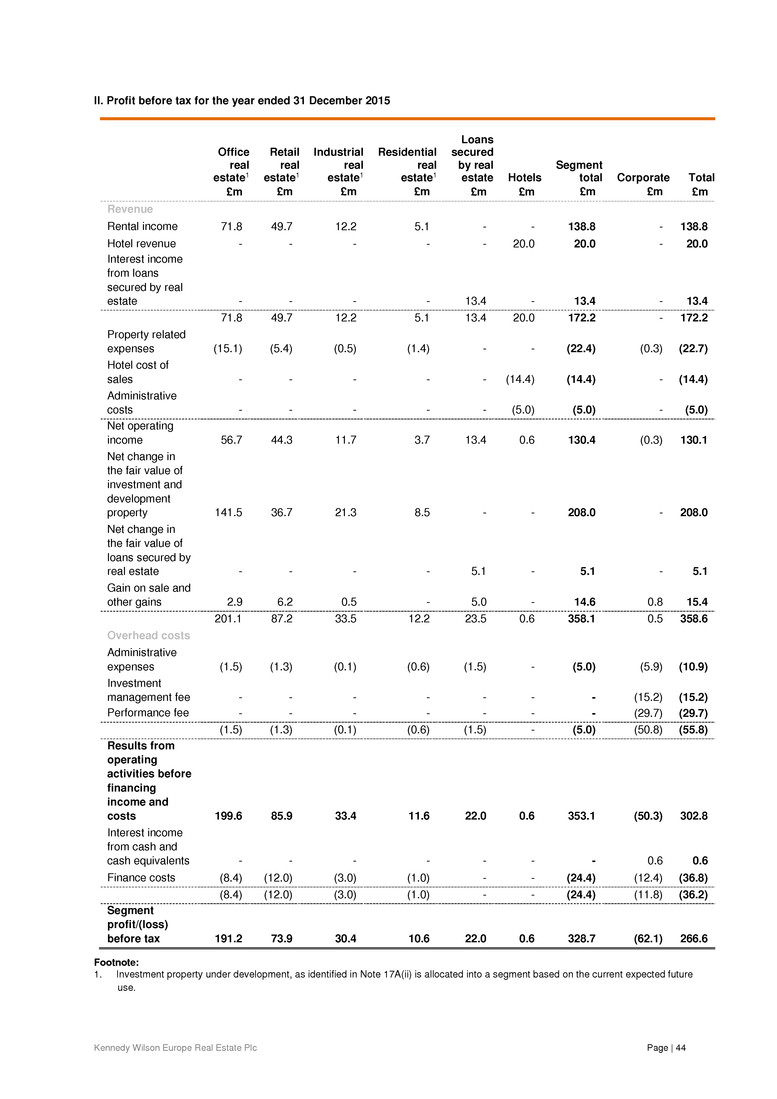

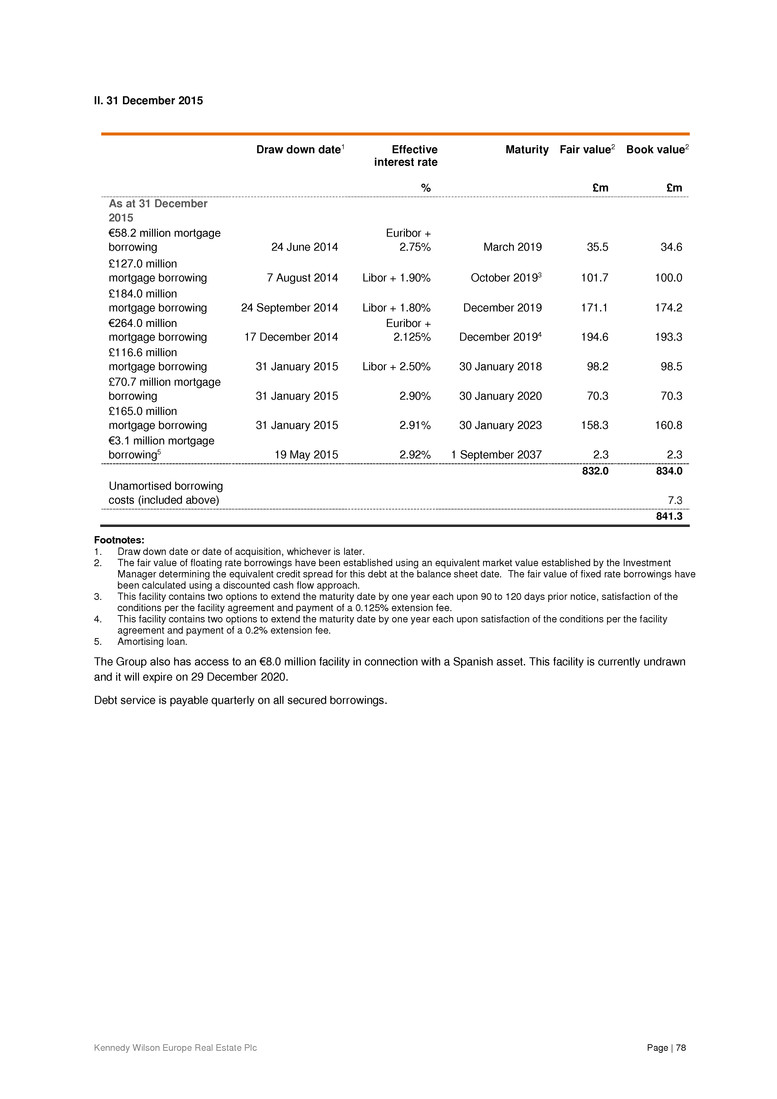

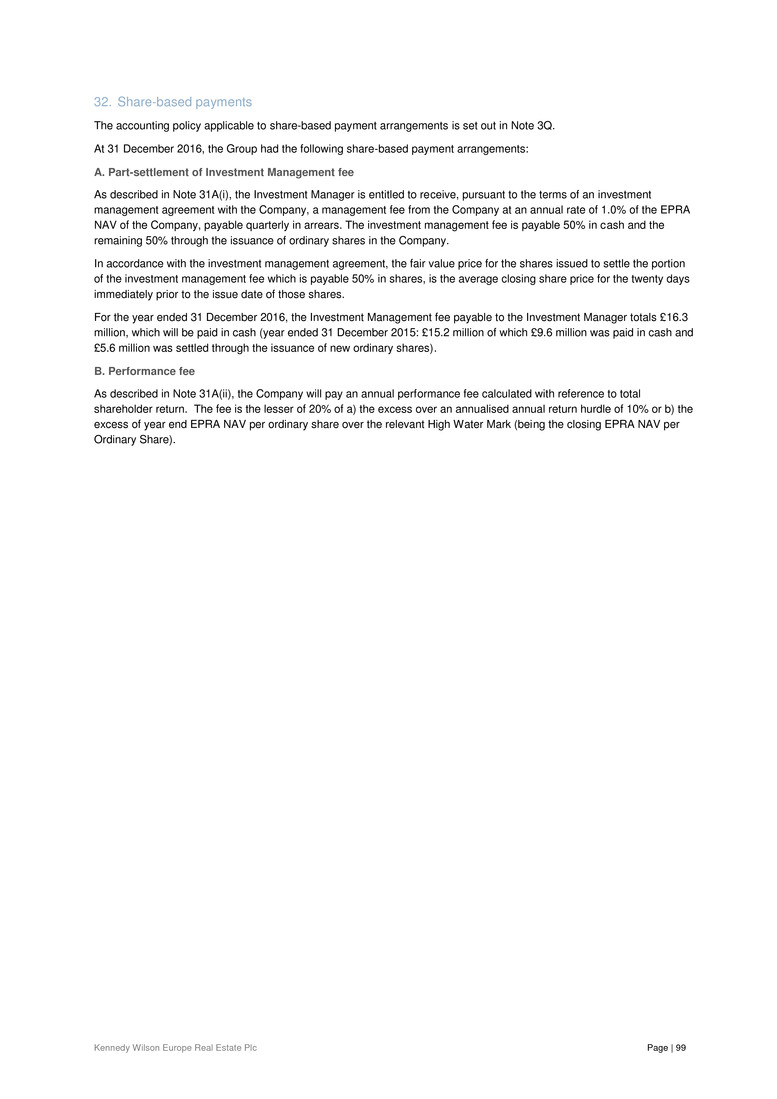

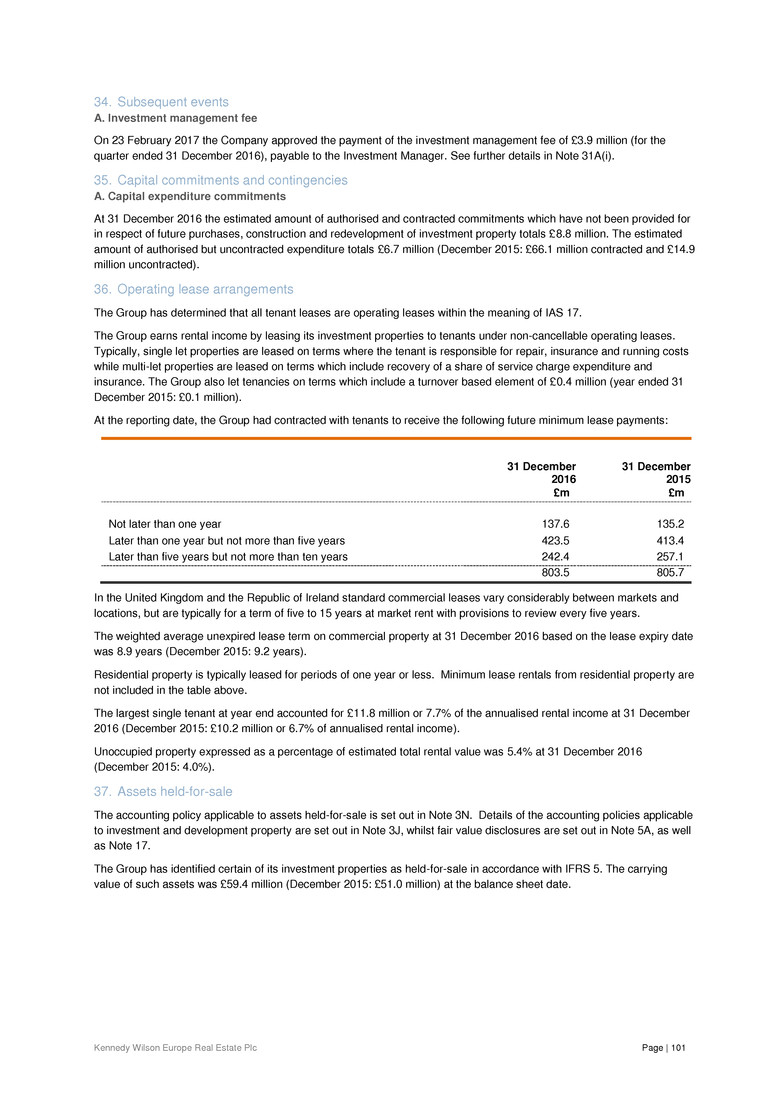

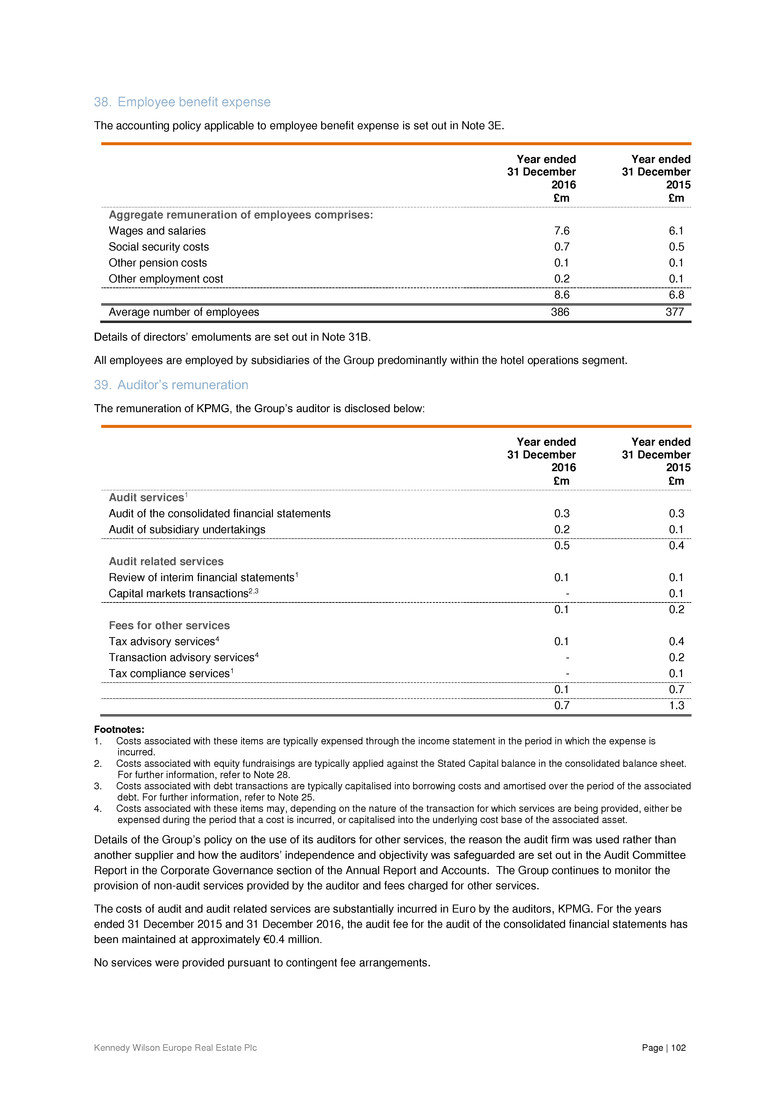

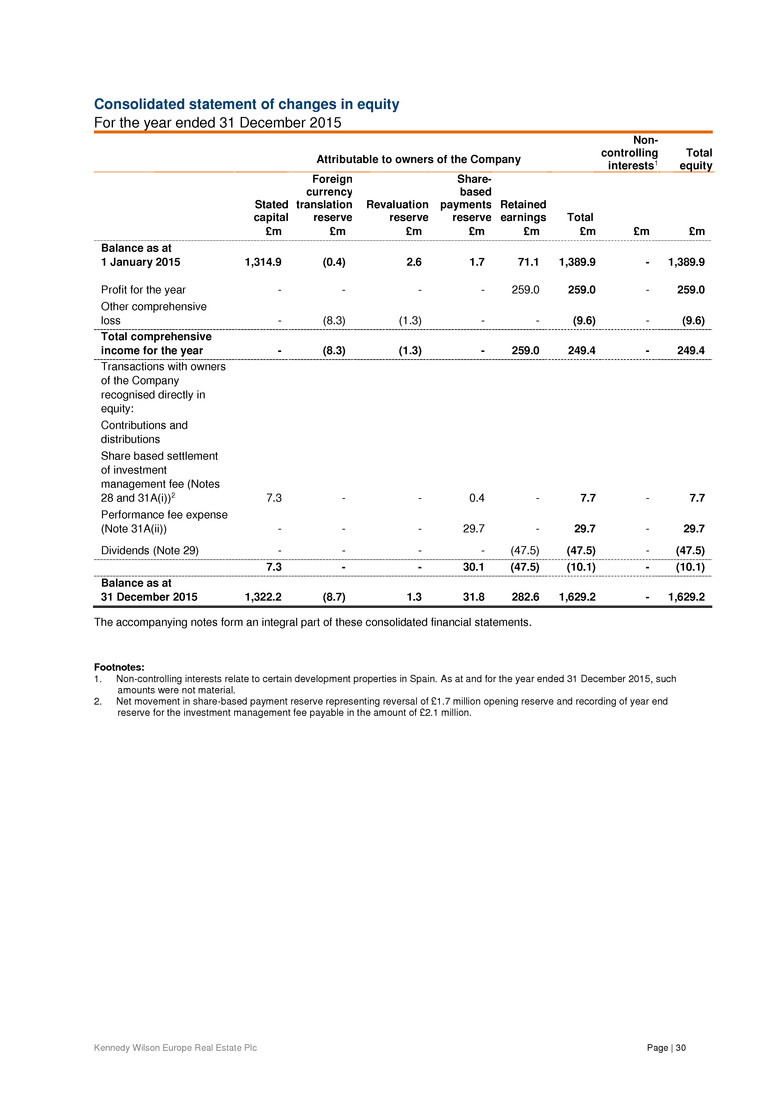

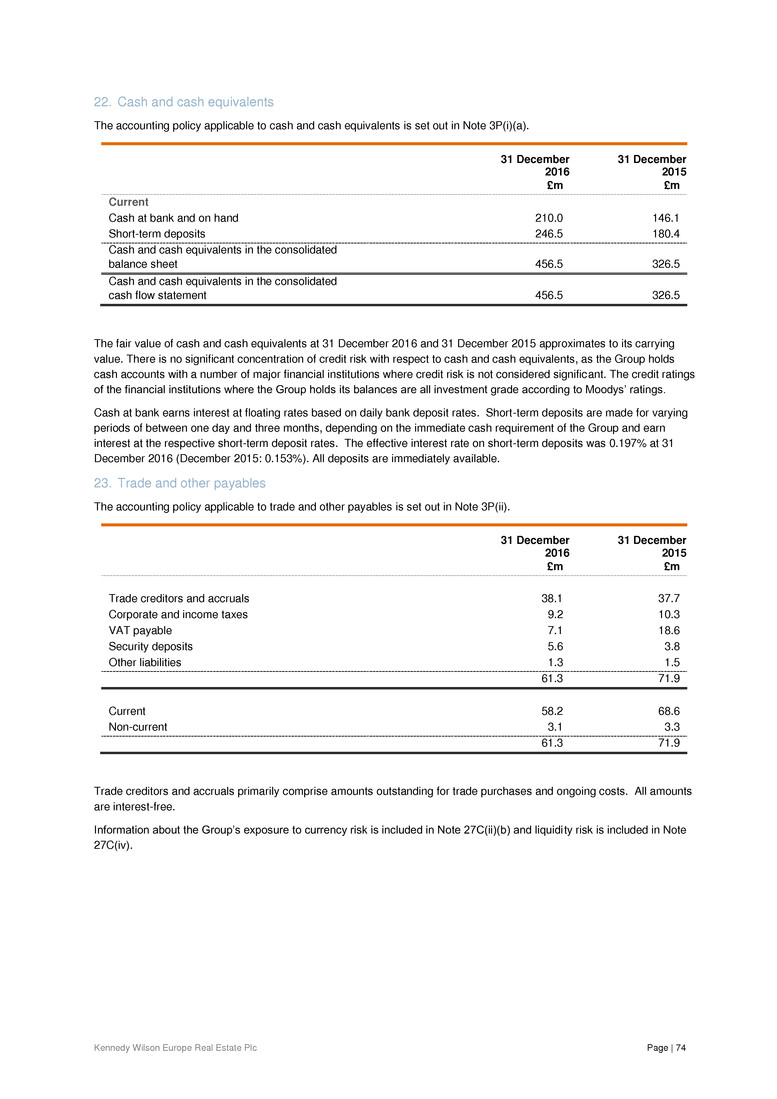

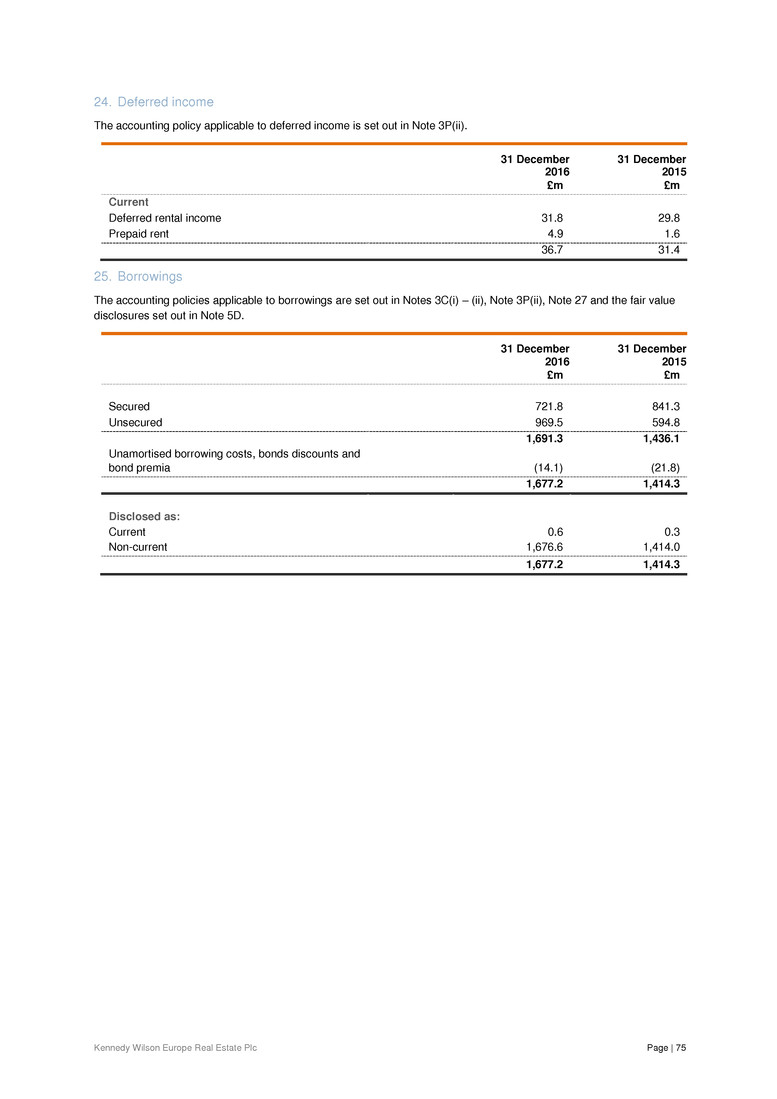

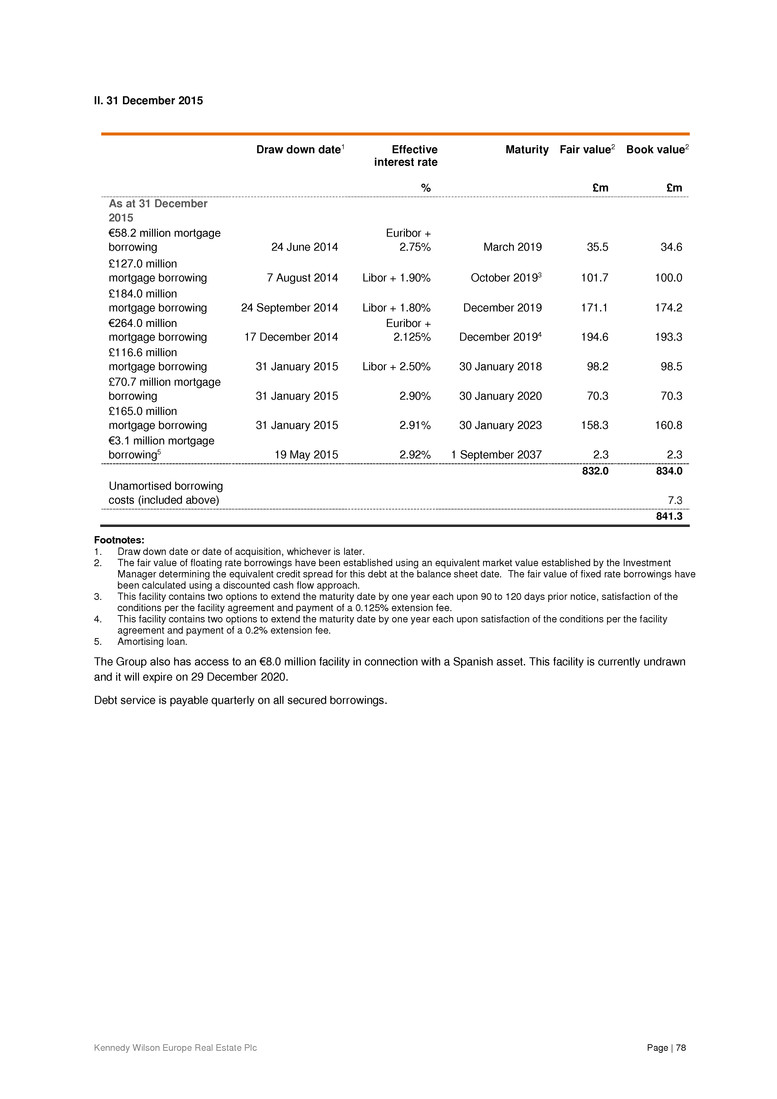

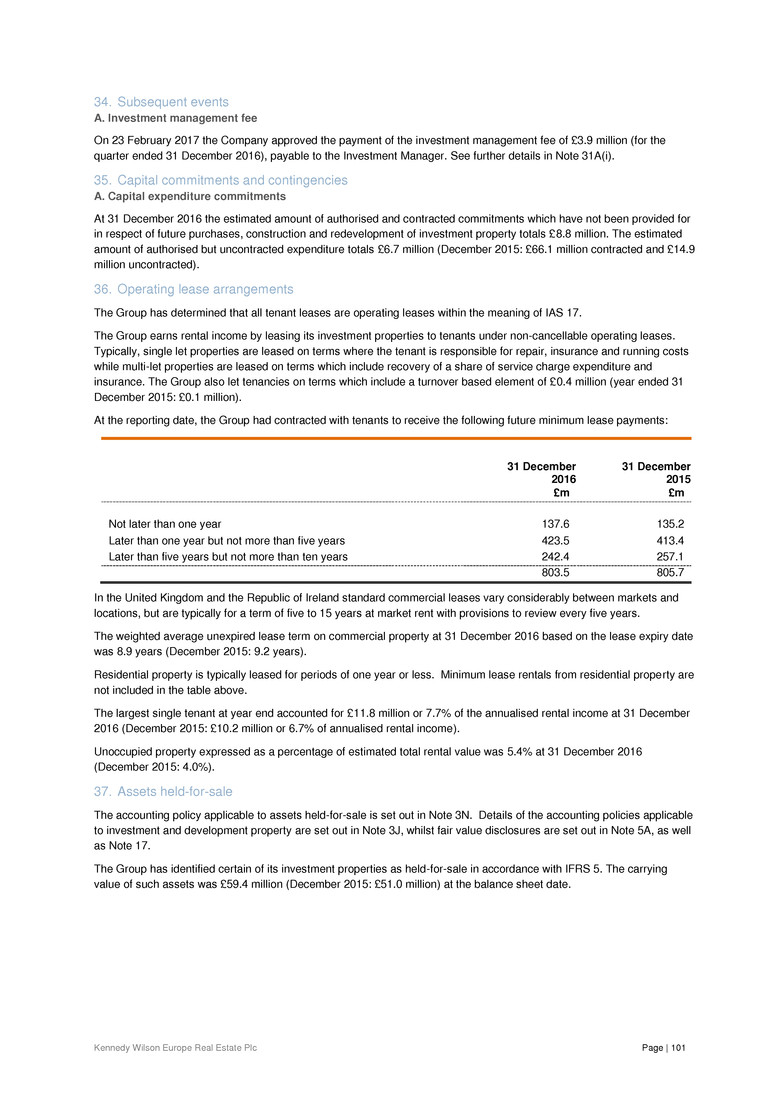

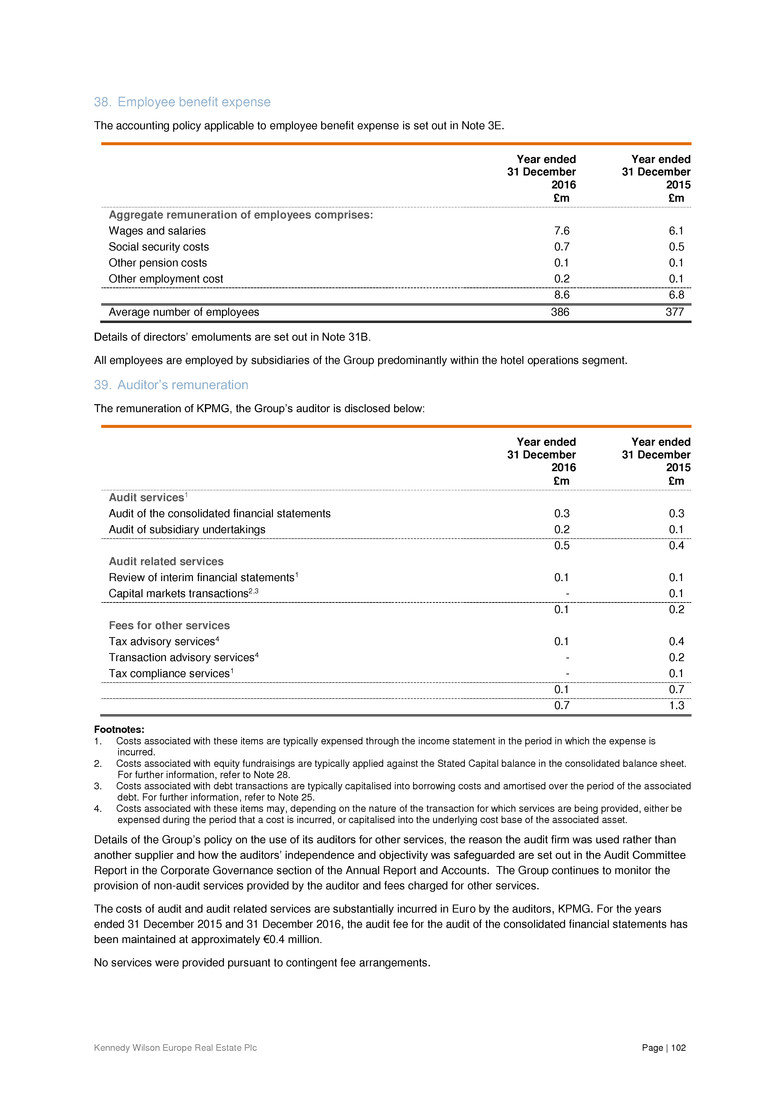

Kennedy Wilson Europe Real Estate Plc Page | 22 Independent auditor’s report to the members of Kennedy Wilson Europe Real Estate Plc Opinions and conclusions arising from our audit On 23 February 2017, we reported, as auditors of Kennedy Wilson Europe Real Estate Plc to the members on the Company’s financial statements for the year ended 31 December 2016, to be laid before its Annual General Meeting and our report was as follows: 1. Our opinion on the financial statements is unmodified We have audited the consolidated financial statements of Kennedy Wilson Europe Real Estate Plc for the year ended 31 December 2016 which comprise the consolidated income statement, consolidated statement of comprehensive income, the consolidated balance sheet, the consolidated statement of changes in equity, the consolidated cash flow statement and the related accounting policies and notes. Our audit was conducted in accordance with International Standards on Auditing (ISAs) (UK & Ireland). In our opinion: the consolidated financial statements give a true and fair view of the state of the Group’s affairs as at 31 December 2016 and of its profit for the year then ended; the consolidated financial statements have been properly prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union; and the consolidated financial statements have been properly prepared in accordance with the requirements of the Companies (Jersey) Law 1991. 2. Our assessment of risks of material misstatement We designed our audit by determining materiality and assessing the risks of a material misstatement in the financial statements. In particular, we considered areas where the directors were required to make subjective judgments and assumptions and to consider future events that are inherently uncertain. We also addressed the risk of management override of internal controls, including evaluating whether there was evidence of bias in those judgments that created a risk of misstatement due to fraud. The risks of material misstatement detailed in this section of this report are those that we deemed to have had the greatest effect on: the overall audit strategy; the allocation of resources in our audit; and directing the efforts of the engagement team. Our audit procedures relating to these risks were designed in the context of our audit of the financial statements as a whole, and our report is not a complete list of all risks identified by our audit. Our opinion on the financial statements is not modified with respect to any of these risks, and we do not express an opinion on these individual risks. In arriving at our audit opinion above on the consolidated financial statements the risks of material misstatement that had the greatest effect on our Group audit was the valuation of the investment property and property, plant and equipment portfolio £2,814.6 million (December 2015: £2,613.5 million). (i) The risks The valuation of the Group’s investment properties and property, plant and equipment involves significant management judgments, particularly those relating to current and expected market conditions. In recent times, macroeconomic conditions in Europe have been characterized by lower growth and inflation expectations, accommodative monetary policies by central banks and generally lower interest rates, all of which have provided a supportive backdrop for many real estate investments. Local market conditions also have a great bearing on real estate valuations and can differ significantly across markets, property types and over time. For development properties, additional subjective factors include projections of the amount and timing of the costs required to complete a project. To assist in determining the value of the Group’s portfolio, the directors engaged external valuers, CBRE and Colliers. The directors’ estimates of the value of the portfolio were developed using the advice and input of the Valuers. Unreasonable or outdated inputs used in these judgments, such as those in respect to estimated rental value or yield, could result in material misstatement of the income statement and balance sheet. There is also a risk that management could influence these judgments to report valuations that assist in meeting market expectations or performance targets.