Year-end results For the year ended 31 December 2016 24 February 2017

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Agenda 2 Overview Financial review Portfolio review Summary Mary Ricks Fraser Kennedy Peter Collins Mary Ricks Agenda 2

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Overview Mary Ricks, CEO Overview 3 3

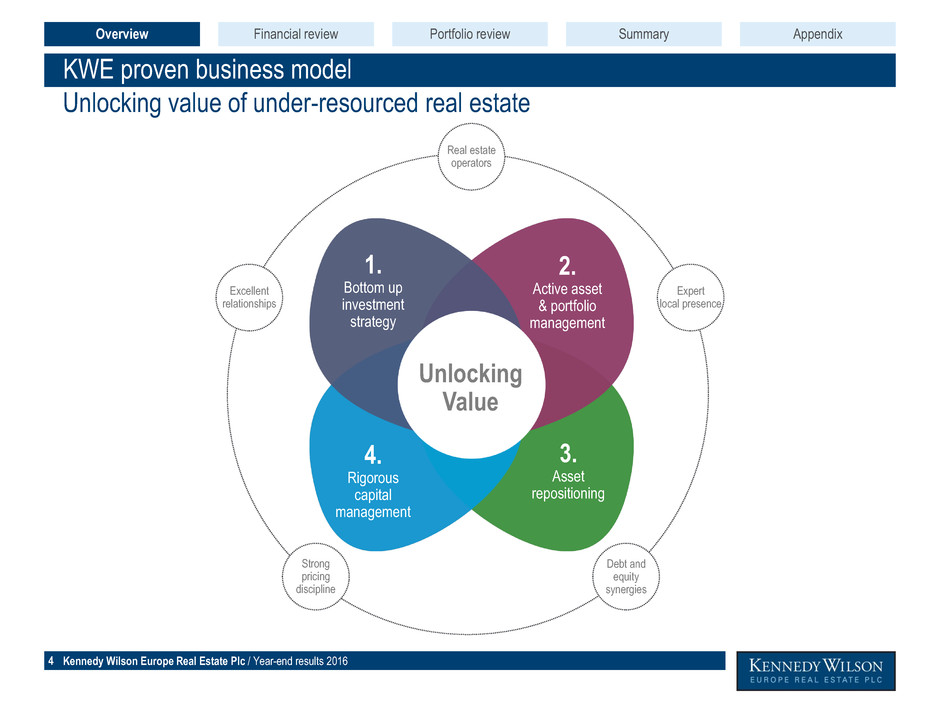

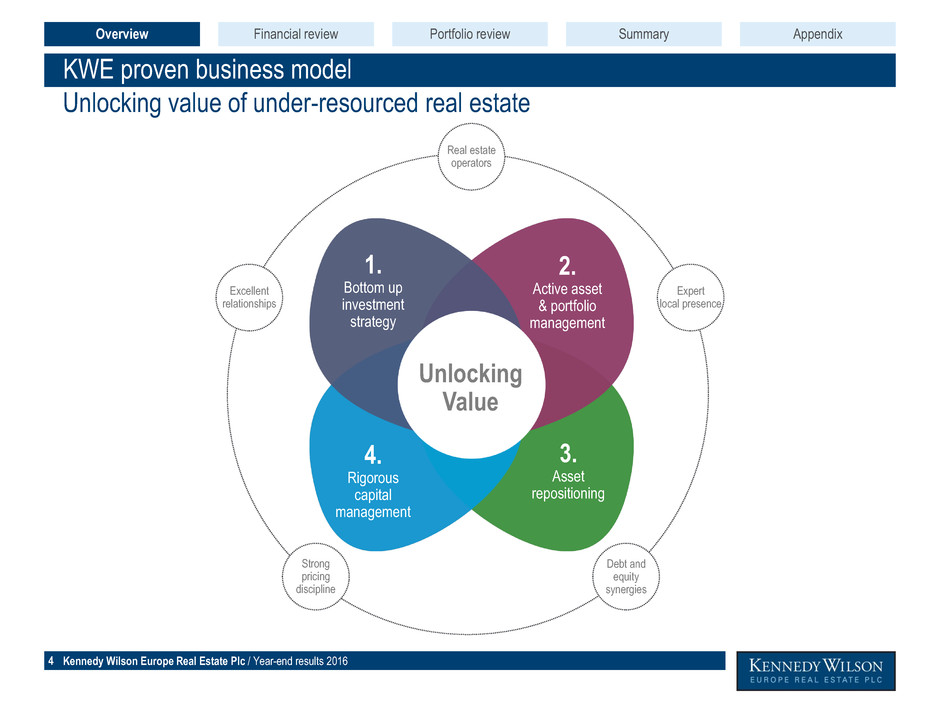

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 KWE proven business model Unlocking value of under-resourced real estate Overview Financial review Portfolio review AppendixSummary 4 Unlocking Value 1. Bottom up investment strategy 2. Active asset & portfolio management 4. Rigorous capital management 3. Asset repositioning Real estate operators Expert local presence Strong pricing discipline Debt and equity synergies Excellent relationships

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 KWE investment proposition - 2016 achievements 5 Premium to BV on disposals +4.8% Target incremental NOI from selected asset management £14.5m Successful capital recycling No. of asset sales 89 Disposals ROC +31.8% Growing income through asset management Ahead of passing rent on previously occupied space +11.4% Ahead of valuers’ ERV +3.1% Diversified cash flows underpin robust dividends Topped-up NOI £163.7m WAULT to break/expiry (years) 7.1 / 8.9 FY 16 DPS paid 48p 1 Comprising 86 assets completed and 3 assets exchanged in 2016 2 Annualised topped-up NOI at 31 December 2016 includes expiration of rent-free periods and contracted rent steps over the next two years Overview Financial review Portfolio review AppendixSummary 21

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 ` Successful capital management – net neutral, as guided 6 £413.1m Disposals £391.1m Capital uses £184.4m Acquisitions £106.7m Capex £100.0m Share buyback Overview Financial review Portfolio review AppendixSummary 1 Comprising £377.5m of asset sales completed and £35.6m of asset sales exchanged in 2016 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Growing income through asset management 7 Material upside in passing rents of £47 psf Completed reception & Sky Lobby at 111 BPR, Victoria, SW1 Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Diversified cash flows underpin robust dividends 8 Continue to diversify asset base and income across Europe 44% Euro assets 37% Euro income 1 Annualised topped-up NOI at 31 December 2016 includes expiration of rent-free periods and contracted rent steps over the next two years UK: 56% Ireland: 31% Spain: 7% Italy: 6% Portfolio value £2,882.2m Portfolio NOI £163.7m UK: 63% Ireland: 26% Italy: 6% Spain: 5% Overview Financial review Portfolio review AppendixSummary 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 2016 highlights 9 Financial Net investments 2016 Adjusted NAV YoY change per share 1,216p +3.5% NOI growth (FY 16 vs FY 15) +23.2% Cost of debt 3.0% Accounting return 7.6% Total valuation YoY change movement -£8.6m -0.3% Adjusted earnings YoY change per share (FY 16 vs FY 15) 55.2p +15.2% Disposals £413.1m 21mths Yield spread (YOC vs exit yield) 180bps Acquisitions £184.4m Overview Financial review Portfolio review AppendixSummary 1 Comprising £377.5m of asset sales completed and £35.6m of asset sales exchanged in 2016 1 Avg. hold period

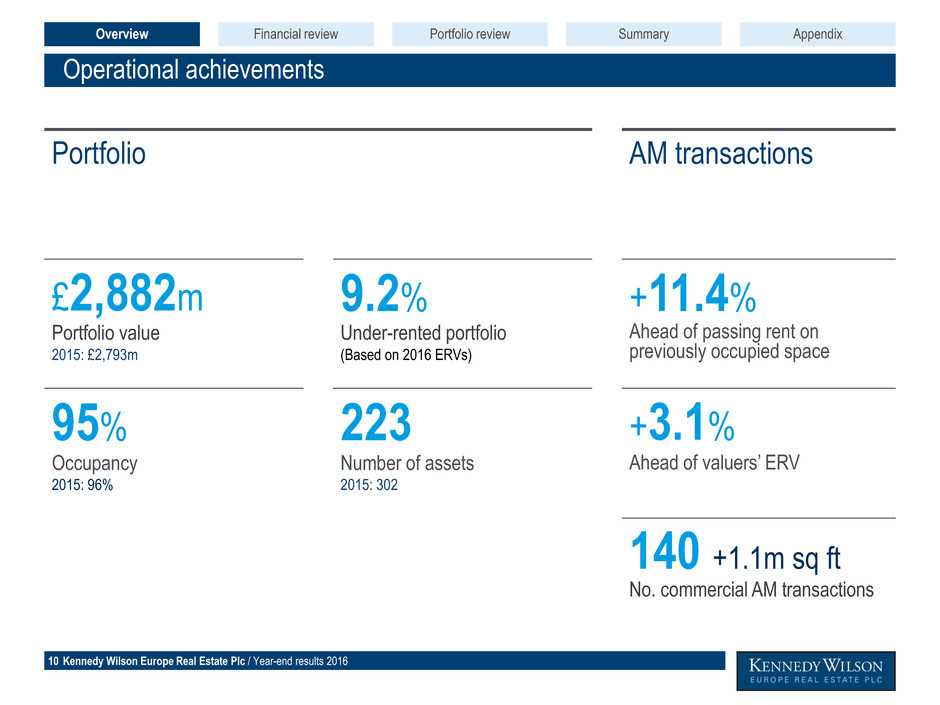

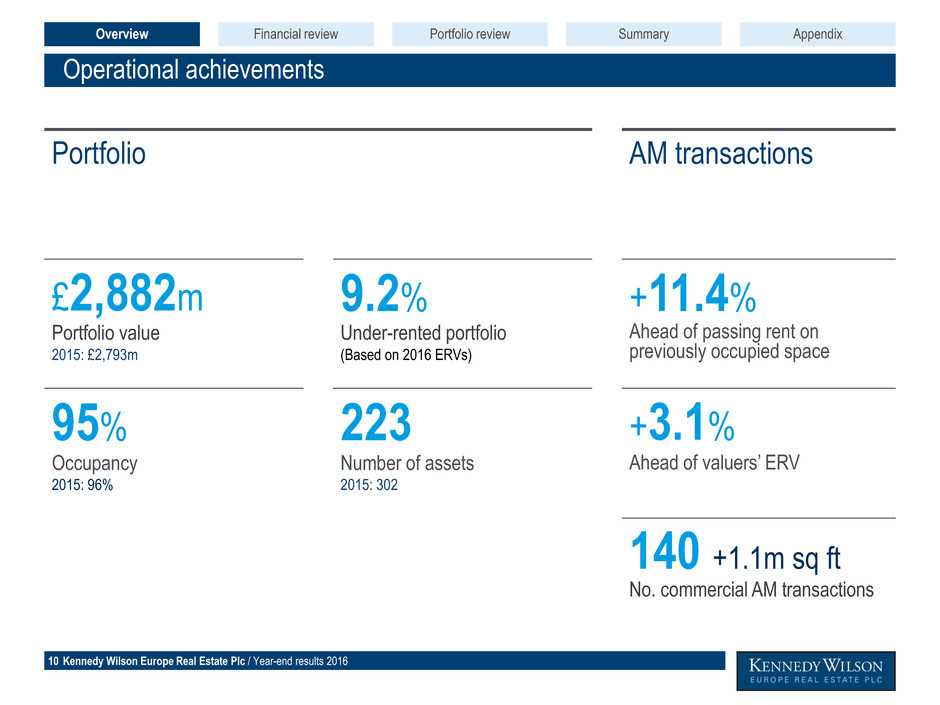

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Operational achievements 10 Portfolio AM transactions Portfolio value 2015: £2,793m £2,882m Occupancy 2015: 96% 95% Under-rented portfolio (Based on 2016 ERVs) 9.2% Number of assets 2015: 302 223 Ahead of passing rent on previously occupied space +11.4% Ahead of valuers’ ERV +3.1% No. commercial AM transactions 140 +1.1m sq ft Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Financial review Fraser Kennedy, Head of Finance Overview 11

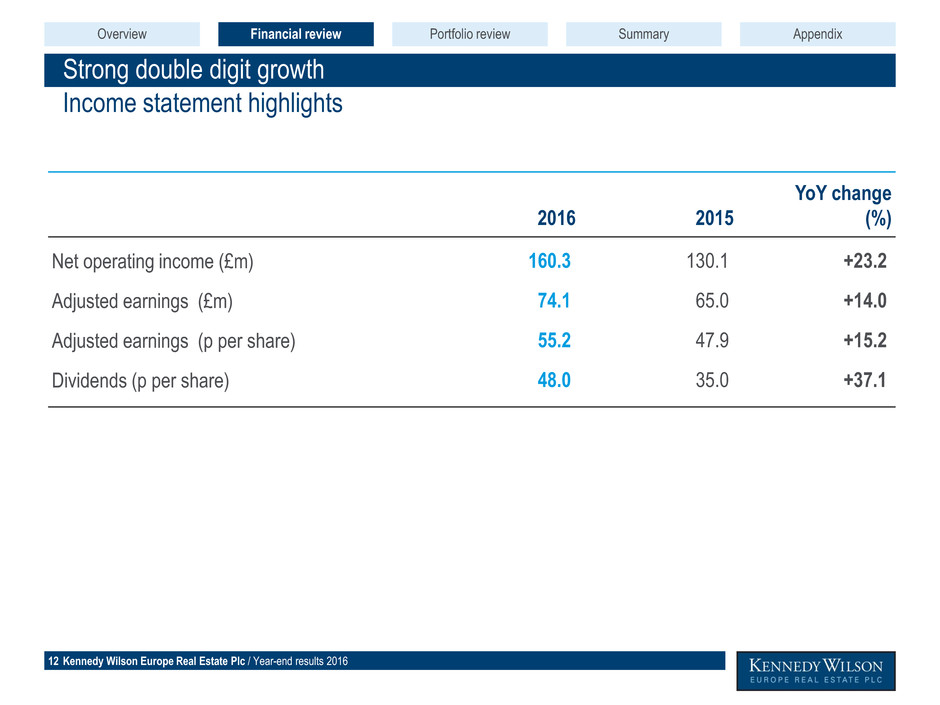

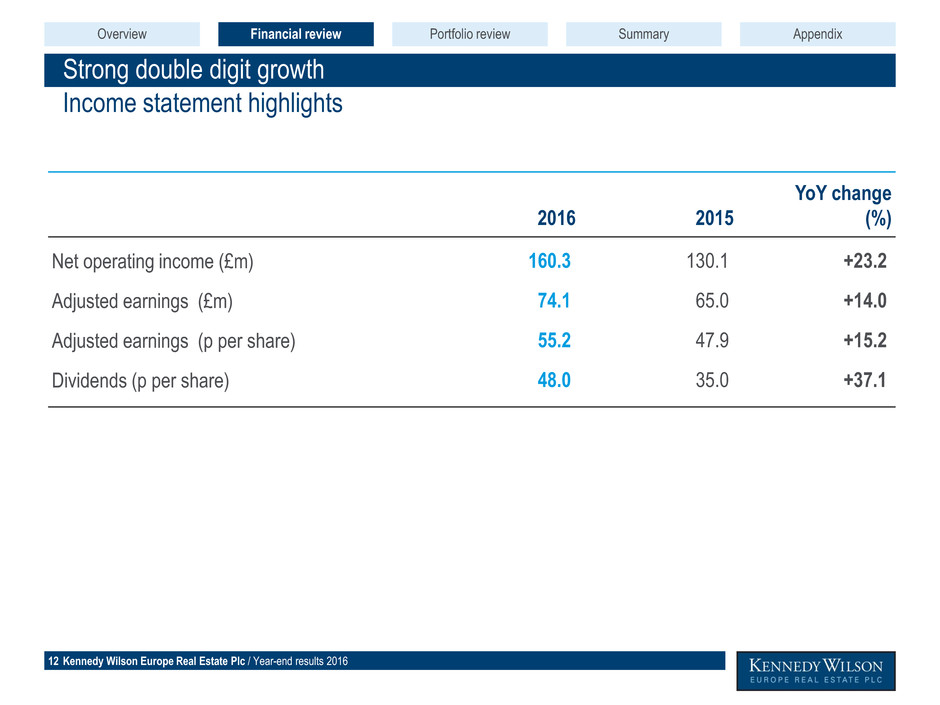

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Strong double digit growth 12 Income statement highlights 2016 2015 YoY change (%) Net operating income (£m) 160.3 130.1 +23.2 Adjusted earnings (£m) 74.1 65.0 +14.0 Adjusted earnings (p per share) 55.2 47.9 +15.2 Dividends (p per share) 48.0 35.0 +37.1 Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Delivering an attractive stable dividend 13 20 16 a dj us te d e arn in gs (£m ) 160.3 74.1 64.4 -11.6 -16.3 -57.1 -7.3 +6.1 0 20 40 60 80 100 120 140 160 180 NOI Admin costs Investment management fee Net finance cost Tax EPRA adjustments Adjusted earnings Dividends paid Dividend cover: 1.1x 48p/share Overview Financial review Portfolio review AppendixSummary

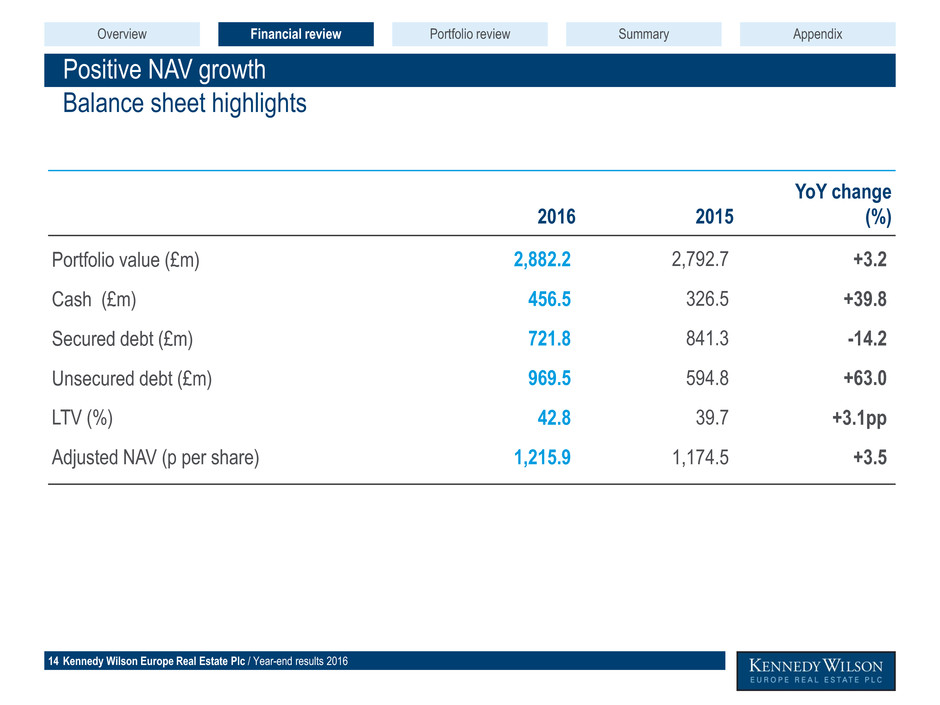

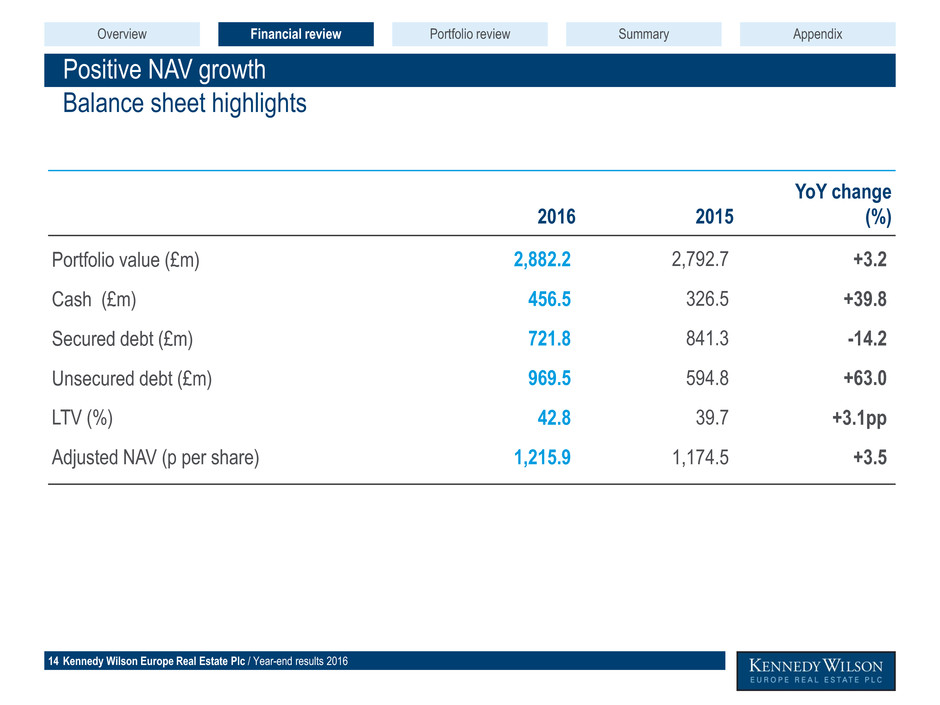

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Positive NAV growth 14 Balance sheet highlights 2016 2015 YoY change (%) Portfolio value (£m) 2,882.2 2,792.7 +3.2 Cash (£m) 456.5 326.5 +39.8 Secured debt (£m) 721.8 841.3 -14.2 Unsecured debt (£m) 969.5 594.8 +63.0 LTV (%) 42.8 39.7 +3.1pp Adjusted NAV (p per share) 1,215.9 1,174.5 +3.5 Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 1,596.5 1,533.7 -8.6 +82.6 -64.4 -100.0 +27.6 1,000.0 1,050.0 1,100.0 1,150.0 1,200.0 1,250.0 1,400 1,500 1,600 1,700 1,800 Adjusted NAV 31 Dec 15 Valuation movement Retained earnings Dividends paid Share buyback FX / Other Adjusted NAV 31 Dec 16 Adj. NAV (LHS) Adj. NAV per share (RHS) Accretive share buyback 15 1,174.5pps 1,215.9pps M ov em en t in a djus te d N AV (£m ) Adjus ted N AV ( pence per s hare ) ≈ ≈ Overview Financial review Portfolio review AppendixSummary NAV summary +74.1 Gain on sale: £8.5m

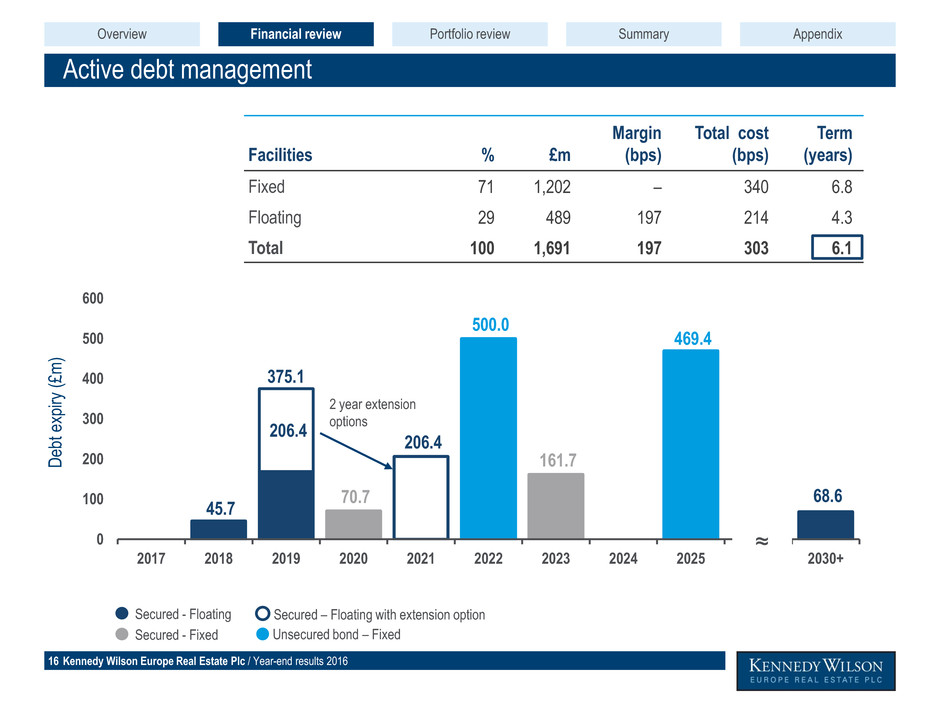

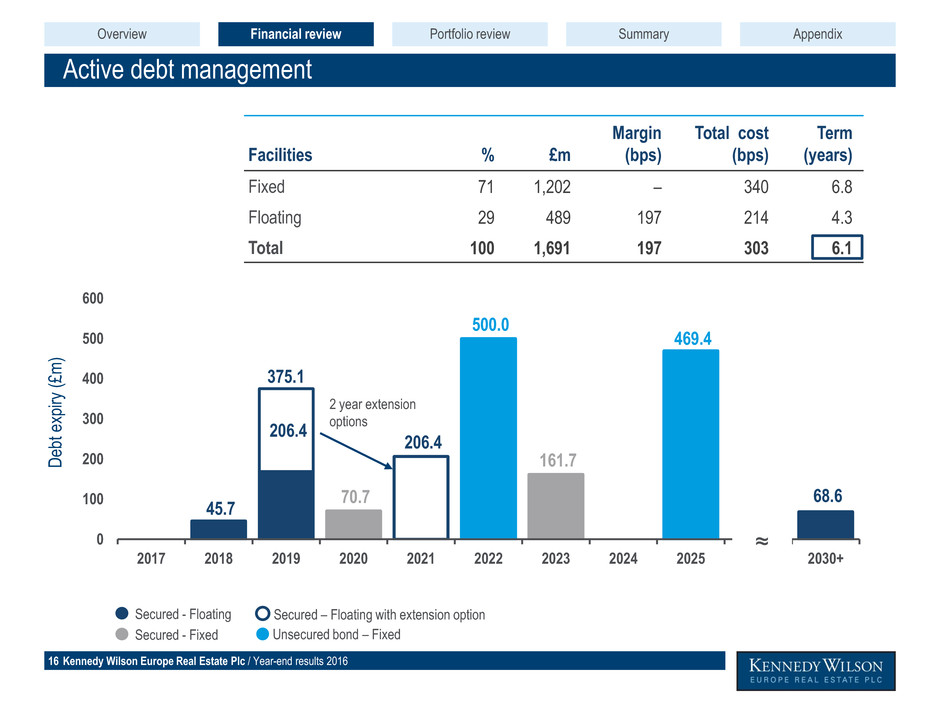

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 45.7 375.1 70.7 206.4 500.0 161.7 469.4 206.4 68.6 0 100 200 300 400 500 600 2017 2018 2019 2020 2021 2022 2023 2024 2025 2030+ Active debt management D eb t e xp iry (£m ) Facilities % £m Margin (bps) Total cost (bps) Term (years) Fixed 71 1,202 – 340 6.8 Floating 29 489 197 214 4.3 Total 100 1,691 197 303 6.1 Unsecured bond – Fixed Secured - Floating Secured - Fixed Secured – Floating with extension option 2 year extension options Overview Financial review Portfolio review AppendixSummary ≈ 16

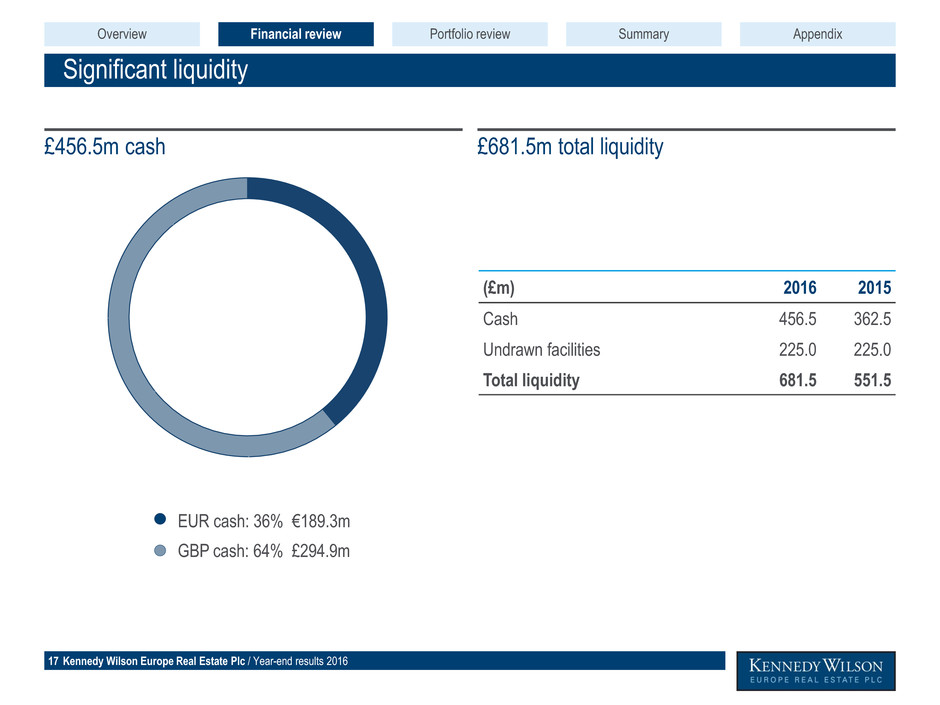

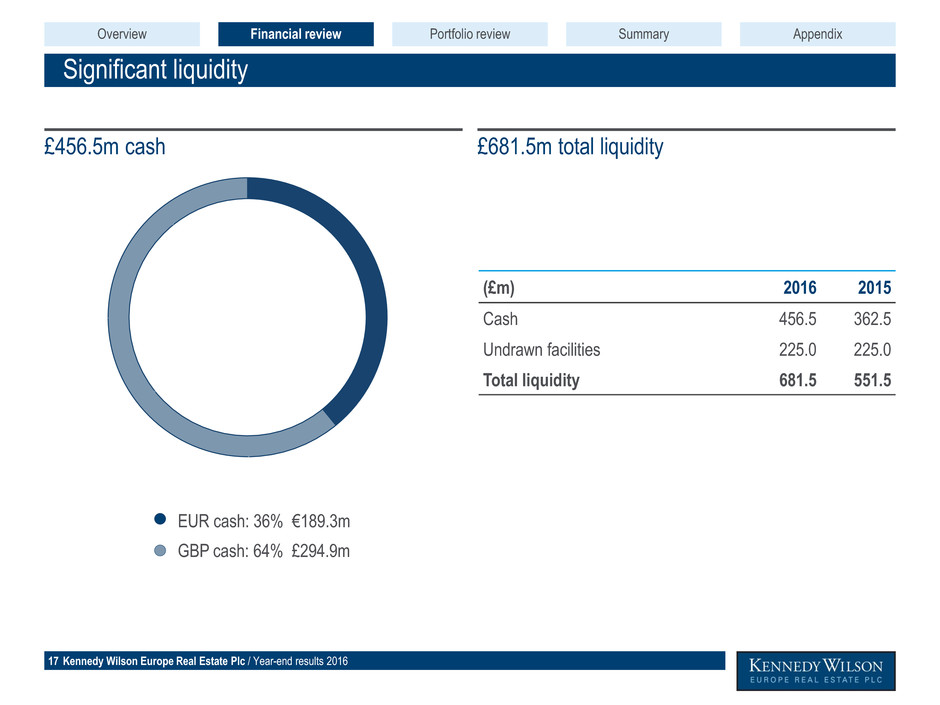

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Significant liquidity 17 EUR cash: 36% €189.3m GBP cash: 64% £294.9m (£m) 2016 2015 Cash 456.5 362.5 Undrawn facilities 225.0 225.0 Total liquidity 681.5 551.5 £456.5m cash Overview Financial review Portfolio review AppendixSummary £681.5m total liquidity

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Portfolio review Peter Collins, COO Overview 18

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 +1,402.5 +1,135.5 +184.4 +4.9 +57.0 +106.7 -126.6 -413.1 -600 -100 400 900 1,400 Our story so far – 2016 asset management becomes dominant focus 19 1 Includes original purchase of loan portfolios; excludes Asset Via Loan (AVL) conversions 2 Comprising 86 asset sales completed and 3 asset sales exchanged in 2016 Portfolio value £1,489.0m No. of assets 111 89 assets £m 2014 2016 Overview Financial review Portfolio review AppendixSummary 35 assets 2015 226 assets 111 assets 7 assets 1 2 DisposalsCapex Acquisitions Portfolio value £2,792.7m No. of assets 302 Portfolio value £2,882.2m No. of assets 223

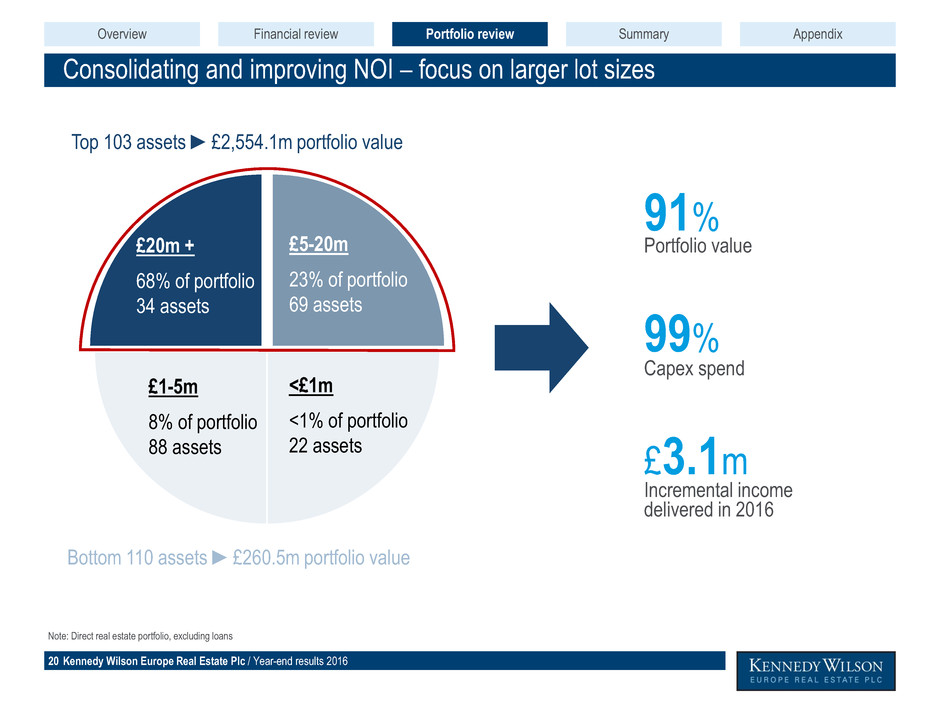

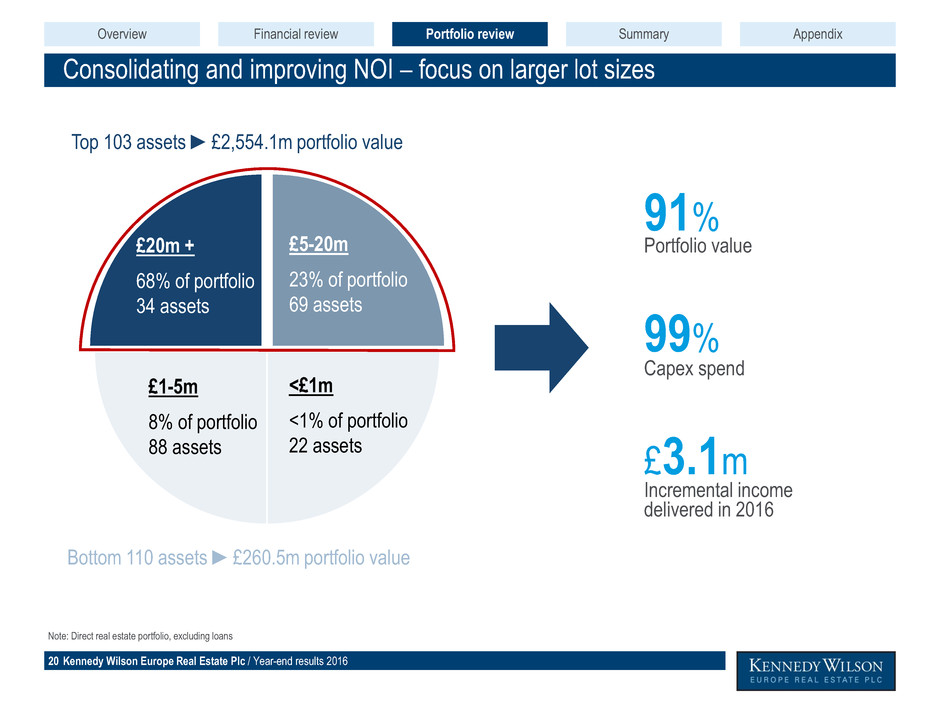

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Consolidating and improving NOI – focus on larger lot sizes 20 £20m + 68% of portfolio 34 assets £5-20m 23% of portfolio 69 assets £1-5m 8% of portfolio 88 assets <£1m <1% of portfolio 22 assets Note: Direct real estate portfolio, excluding loans Top 103 assets ►£2,554.1m portfolio value Bottom 110 assets ►£260.5m portfolio value 91% Portfolio value £3.1m Incremental income delivered in 2016 99% Capex spend Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Asset management focus – 3 key pillars 21 Bartley Wood, Hook Theta House, Camberley Intensive day to day AM 111 BPR, Victoria, London Pioneer Point, Ilford Progressing key projects, development & refurbs MXL Centre, Banbury Icon, Stevenage Smart recycling of capital Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Intensive day to day asset management 22 Before After No. commercial leases signed 140 Incremental income £4.0m Completed refurbishment Pre-let ground floor to NHS1 Re-gear + new letting to existing tenant Amer Sports2 1.1m sq ft of leases signedTheta, Camberley (Artemis portfolio) 1 Total annualised rent from all leasing transactions completed during 2016 Ahead of valuers’ ERV 3.1% Ahead of rent on space previously occupied 11.4% Avg. Lease length / term extension to break/expiry (years) 6.8 / 8.5 Contracted rent per annum £18.3m Total capex £1.9m Stabilised YOC post capex 10.5% Overview Financial review Portfolio review AppendixSummary 1

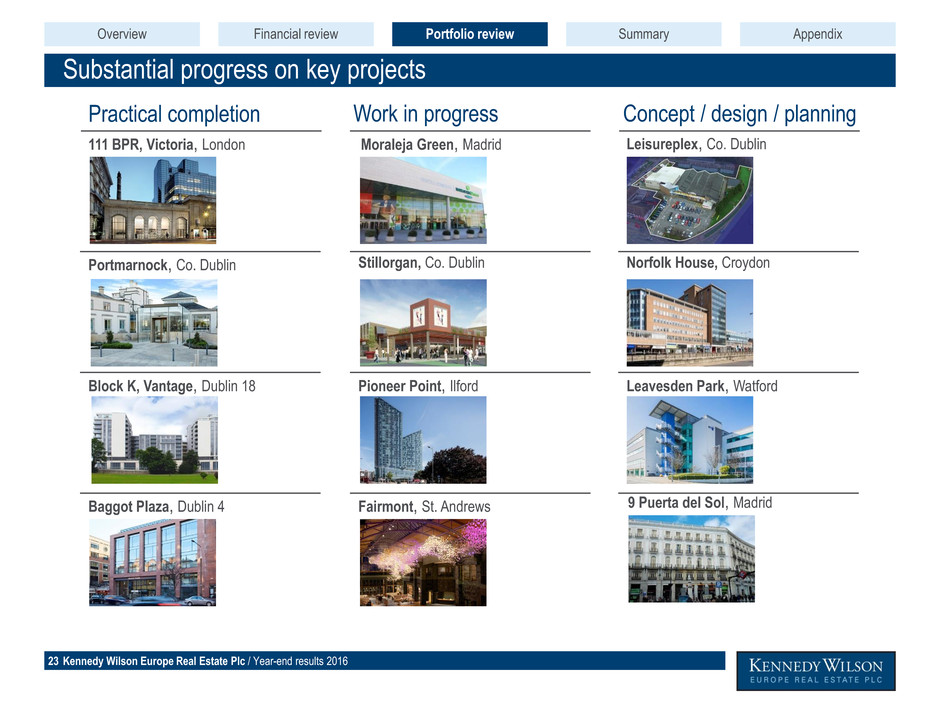

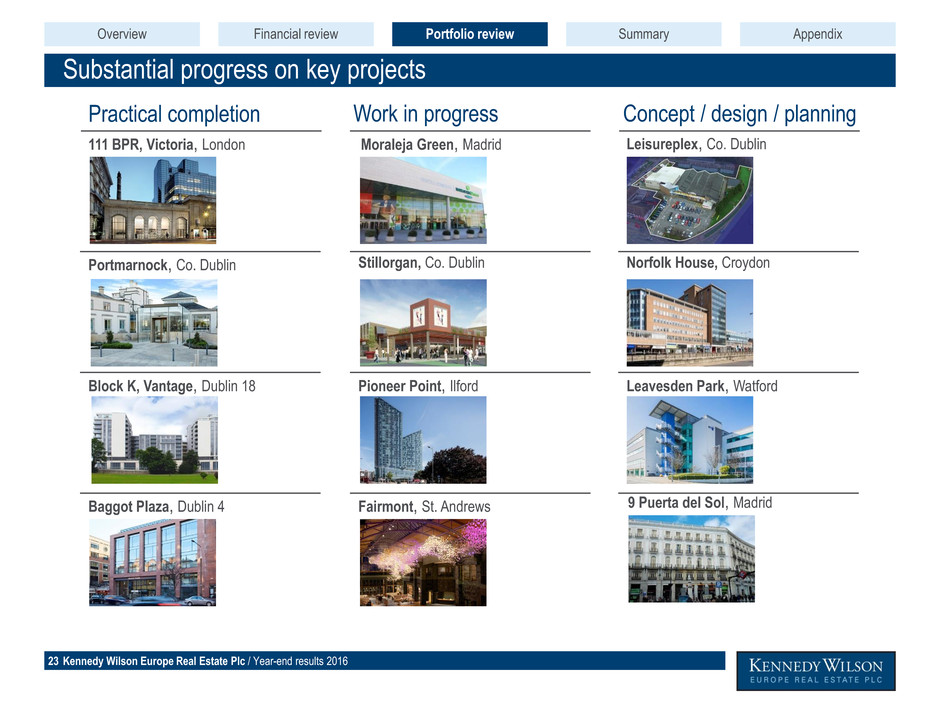

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Substantial progress on key projects 23 Concept / design / planningWork in progressPractical completion Norfolk House, Croydon Block K, Vantage, Dublin 18 9 Puerta del Sol, Madrid Leisureplex, Co. Dublin Baggot Plaza, Dublin 4 Leavesden Park, Watford 111 BPR, Victoria, London Portmarnock, Co. Dublin Overview Financial review Portfolio review AppendixSummary Pioneer Point, Ilford Stillorgan, Co. Dublin Fairmont, St. Andrews Moraleja Green, Madrid

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Successful developments 24 Tenant amenities Penthouse suite Before After Capex spend €49.2m Target stabilised YOC 6.1% Capex spend €9.8m Target stabilised YOC 6.9% Vantage, Central Park – Block K: PRS development in Dublin 18 Portmarnock Hotel & Golf course: 4* hotel & golf course upgrade in Dublin 1 Since acquisition 2 Irish Tour Operators Association, 2016 Units leased since October 2016 72% Completed Block K development 166 units ADR growth 57% Golf resort of the year Overview Financial review Portfolio review AppendixSummary 1 2

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Portmarnock Hotel and Golf links 25 Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Smart capital recycling 26 Yield spread (YOC vs exit yield) 180bps Return on cost 31.8% Target stabilised yield on cost 7.5% 2016 disposals: £413.1m 2016 acquisitions: £184.4m Total return £104m Acquisition yield on cost 5.9% Santisima Trinidad 5, Madrid Newbury House, Kings Road West, Newbury Kings Road, Bradford Avon loan portfolio, Belmont business park, Durham Towers Business Park, Manchester Leisureplex Site, Stillorgan, Co. Dublin The Chase, Sandyford, Co. Dublin Dukes Park Industrial Estate, Chelmsford Overview Financial review Portfolio review AppendixSummary 1 Comprising £377.5m of asset sales completed and £35.6m of asset sales exchanged in 2016 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Smart recycling of industrial portfolio 27 Ashville Way, Wokingham Return on cost 63.4% Hold period 33months Attractive portfolio sale returns Purchase price £18.0m Sale proceeds £27.4m Yield on cost 7.2% Exit yield 6.1%-114bps +52% Overview Financial review Portfolio review AppendixSummary Fishponds, Wokingham Hambridge Lane, Newbury MXL Centre, Banbury

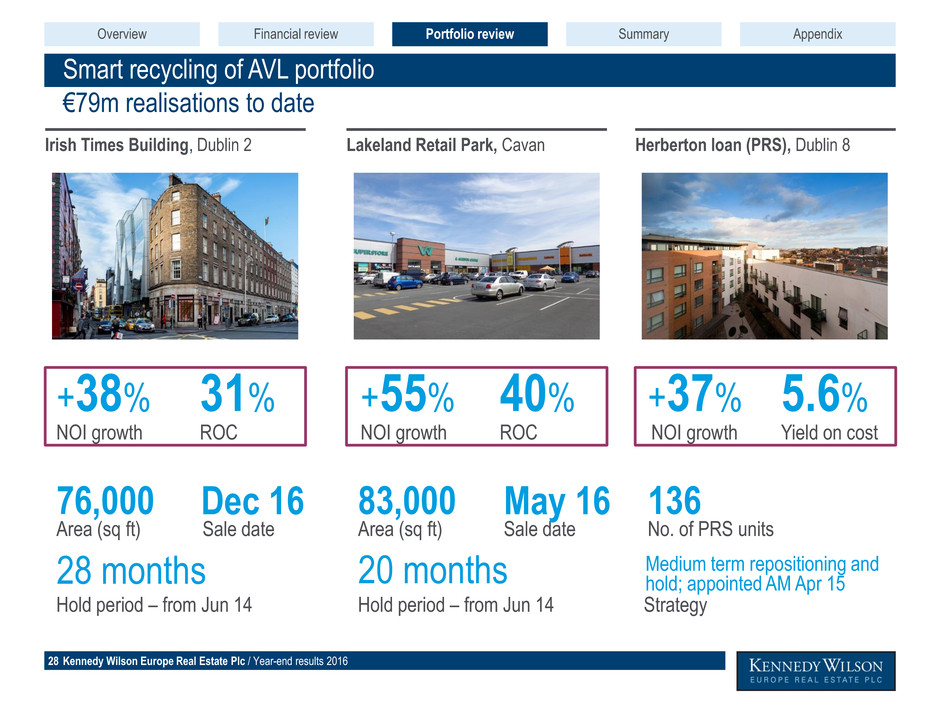

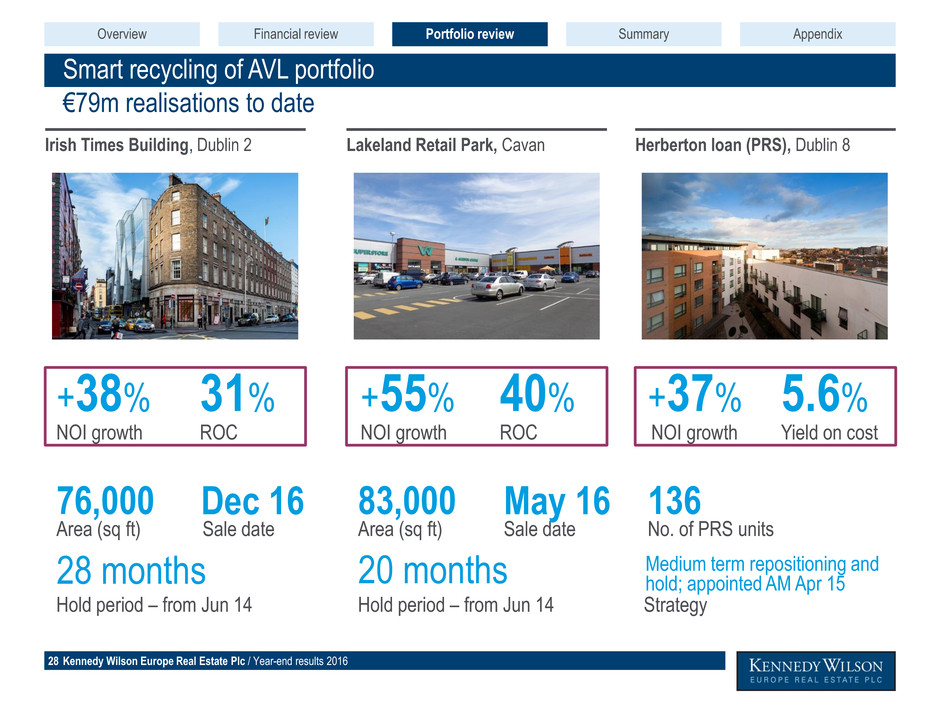

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Smart recycling of AVL portfolio 28 Irish Times Building, Dublin 2 Lakeland Retail Park, Cavan Herberton loan (PRS), Dublin 8 €79m realisations to date Area (sq ft) 76,000 Sale date Dec 16 Hold period – from Jun 14 28 months Strategy NOI growth +38% ROC 31% NOI growth +55% ROC 40% Hold period – from Jun 14 20 months Area (sq ft) 83,000 Sale date May 16 NOI growth +37% Yield on cost 5.6% No. of PRS units 136 Overview Financial review Portfolio review AppendixSummary Medium term repositioning and hold; appointed AM Apr 15

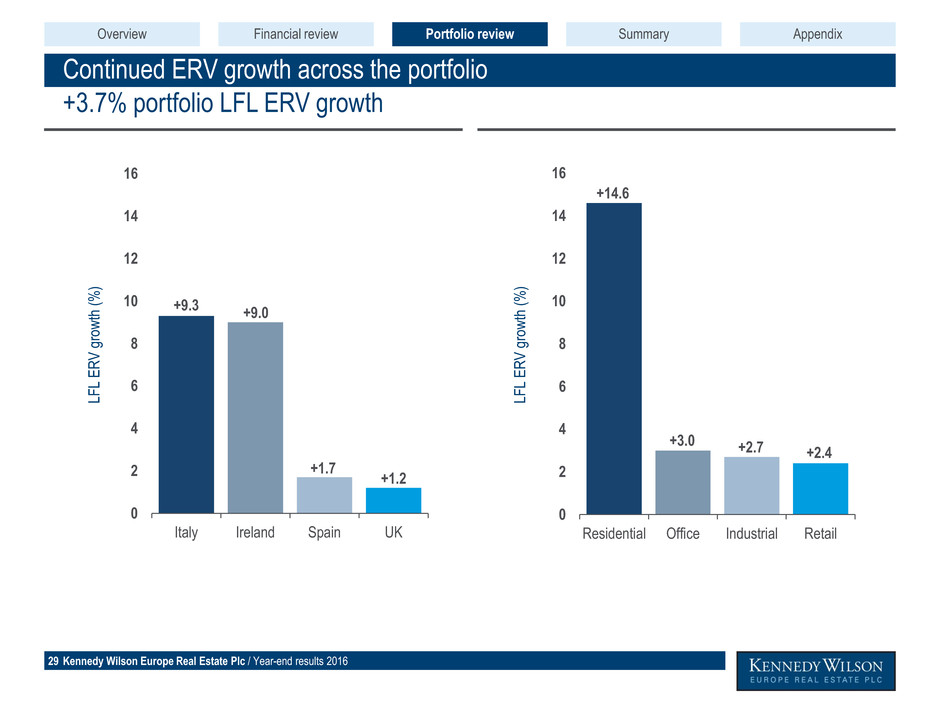

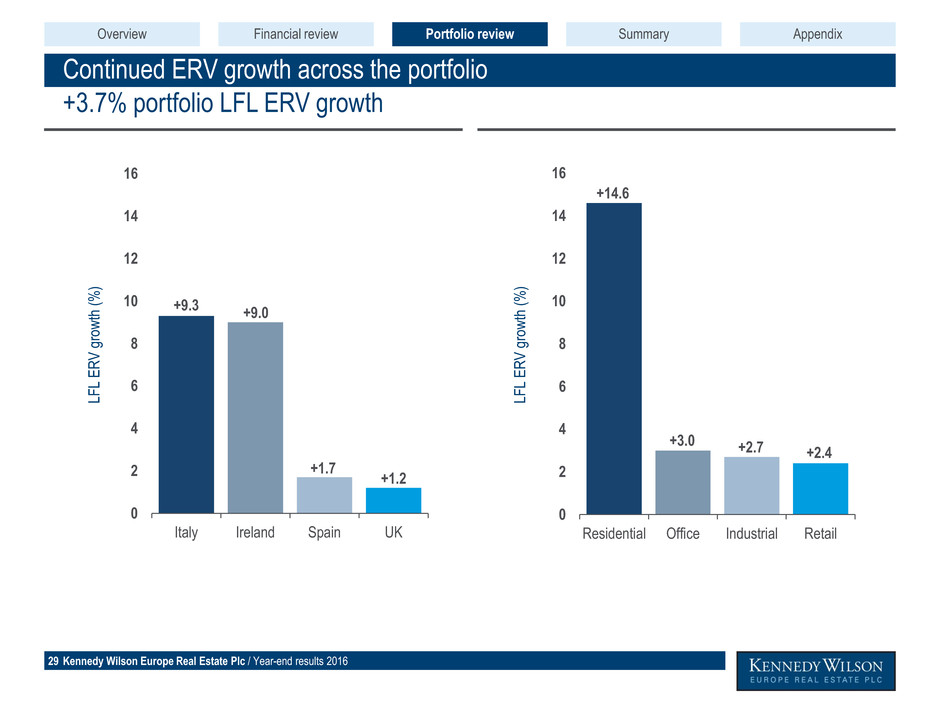

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Continued ERV growth across the portfolio 29 +3.7% portfolio LFL ERV growth +9.3 +9.0 +1.7 +1.2 0 2 4 6 8 10 12 14 16 Italy Ireland Spain UK +14.6 +3.0 +2.7 +2.4 0 2 4 6 8 10 12 14 16 Residential Office Industrial Retail Overview Financial review Portfolio review AppendixSummary LF L E R V g rowt h ( % ) LF L E R V g rowt h ( % )

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 +7.5 +0.5 -2.6 -3.6 -6 -4 -2 0 2 4 6 8 Residential Retail Office Industrial Euro area strength offsets weaker UK 30 -0.6% portfolio LFL valuation movement +6.5 +5.0 +3.6 -5.2 -6 -4 -2 0 2 4 6 8 Ireland Spain Italy UK LF L v alu atio n gr ow th ( % ) LF L v alu ati on g rowt h (% ) 1 Development assets reclassified across sectors included in analysis Overview Financial review Portfolio review AppendixSummary 1

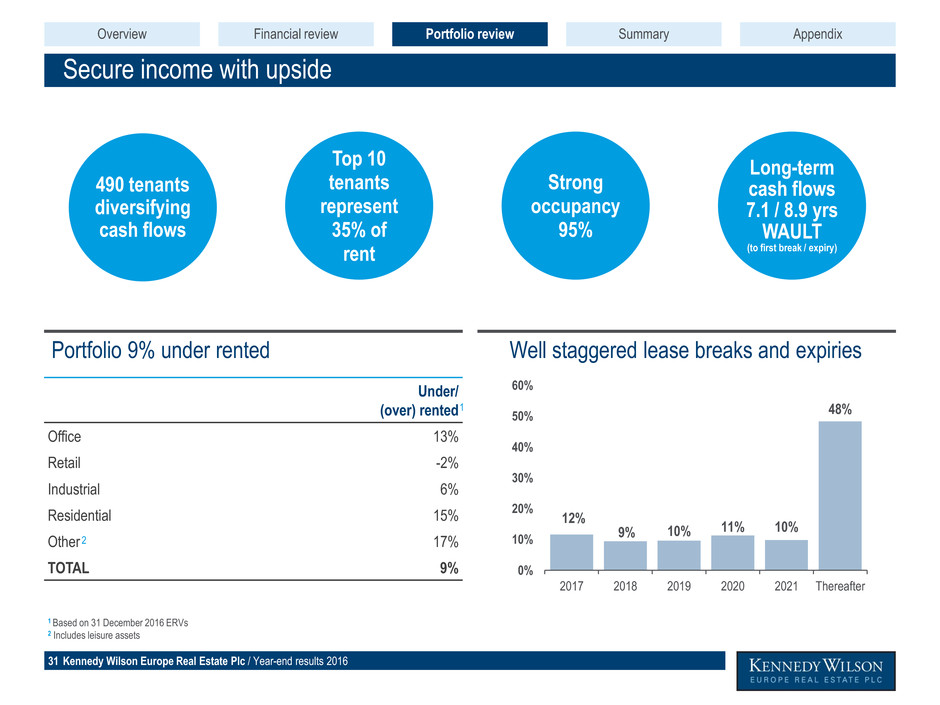

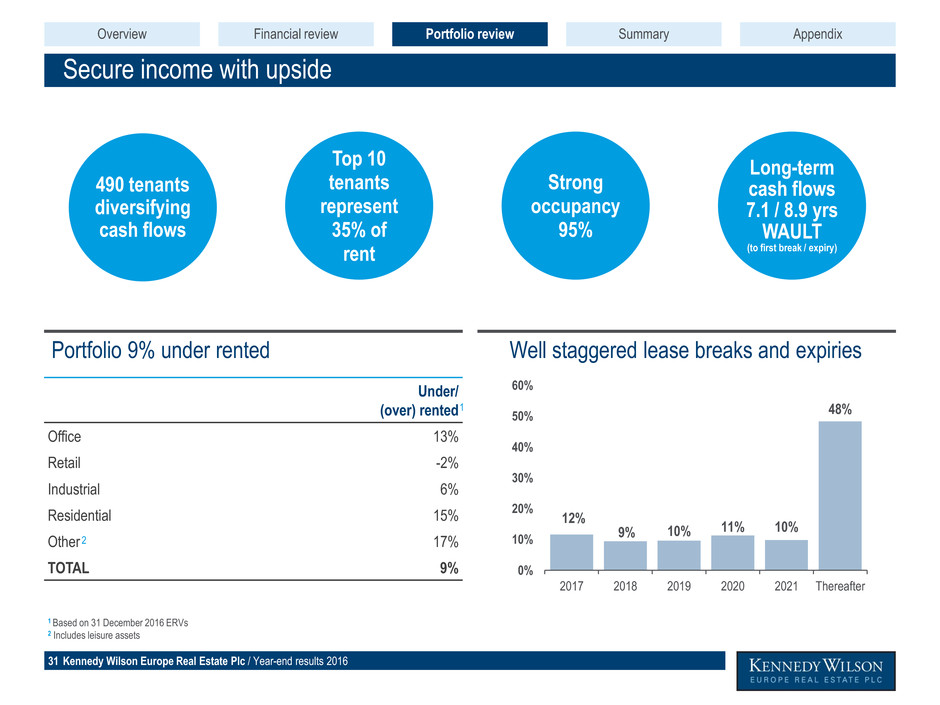

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Secure income with upside 31 Portfolio 9% under rented Well staggered lease breaks and expiries 490 tenants diversifying cash flows Top 10 tenants represent 35% of rent Strong occupancy 95% Long-term cash flows 7.1 / 8.9 yrs WAULT (to first break / expiry) Under/ (over) rented Office 13% Retail -2% Industrial 6% Residential 15% Other 17% TOTAL 9% 12% 9% 10% 11% 10% 48% 0% 10% 20% 30% 40% 50% 60% 2017 2018 2019 2020 2021 Thereafter Overview Financial review Portfolio review AppendixSummary 1 Based on 31 December 2016 ERVs 2 Includes leisure assets 1 2

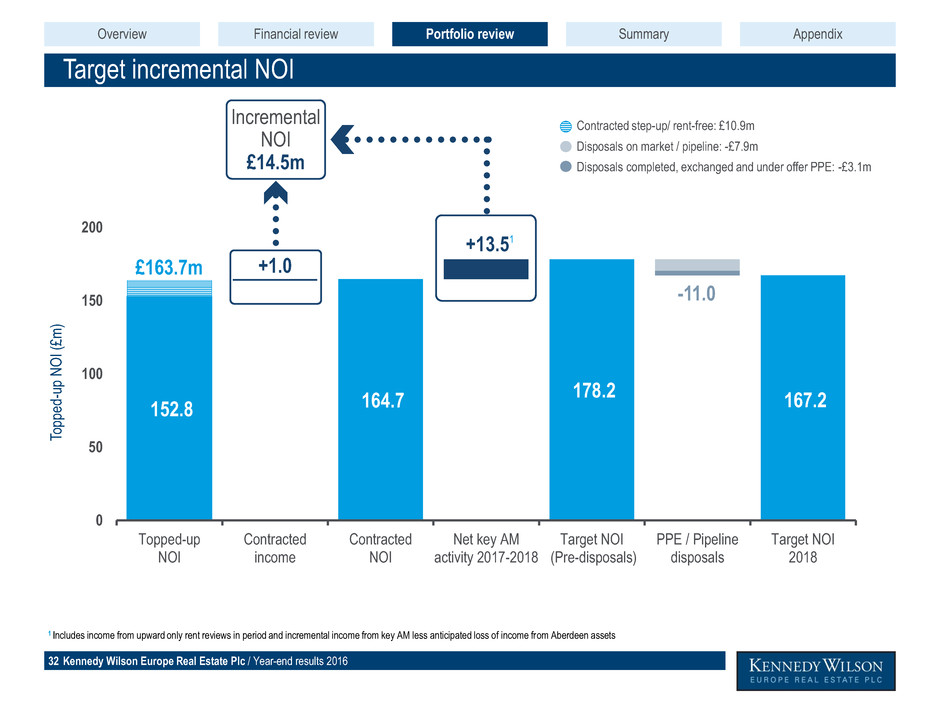

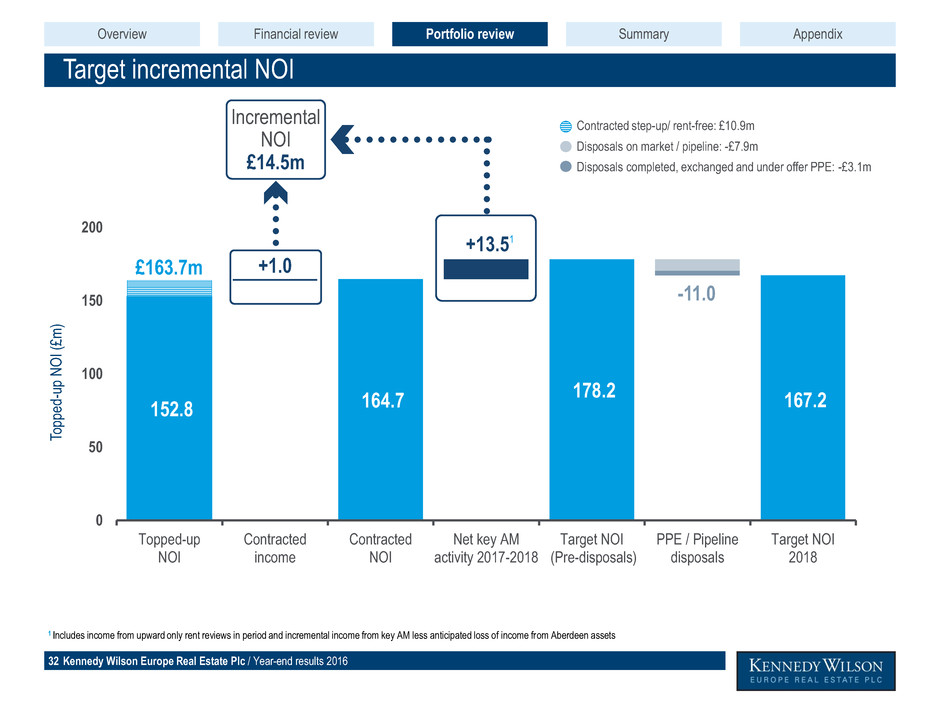

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 152.8 164.7 178.2 167.2 +1.0 +13.5 -11.0 0 50 100 150 200 Topped-up NOI Contracted income Contracted NOI Net key AM activity 2017-2018 Target NOI (Pre-disposals) PPE / Pipeline disposals Target NOI 2018 To pp ed -u p NOI (£m ) Incremental NOI £14.5m Target incremental NOI £163.7m Overview Financial review Portfolio review AppendixSummary 32 Contracted step-up/ rent-free: £10.9m Disposals on market / pipeline: -£7.9m Disposals completed, exchanged and under offer PPE: -£3.1m 1 1 Includes income from upward only rent reviews in period and incremental income from key AM less anticipated loss of income from Aberdeen assets

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Summary Mary Ricks, CEO Overview 33 33

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Capitalising on our proven business model 34 Overview Financial review Portfolio review AppendixSummary Thank you

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Appendix Overview 35

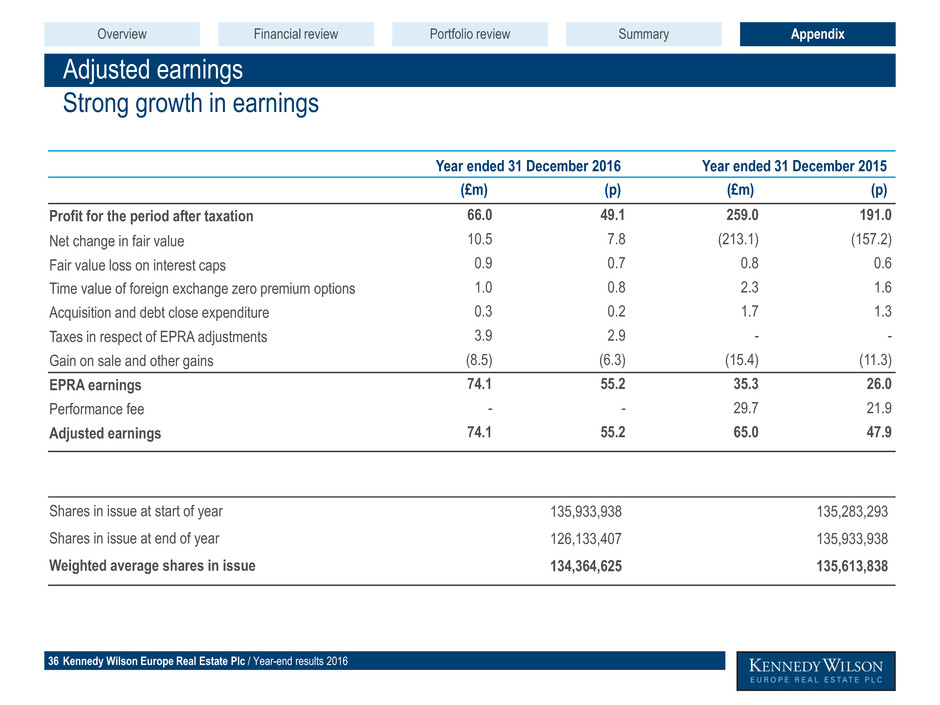

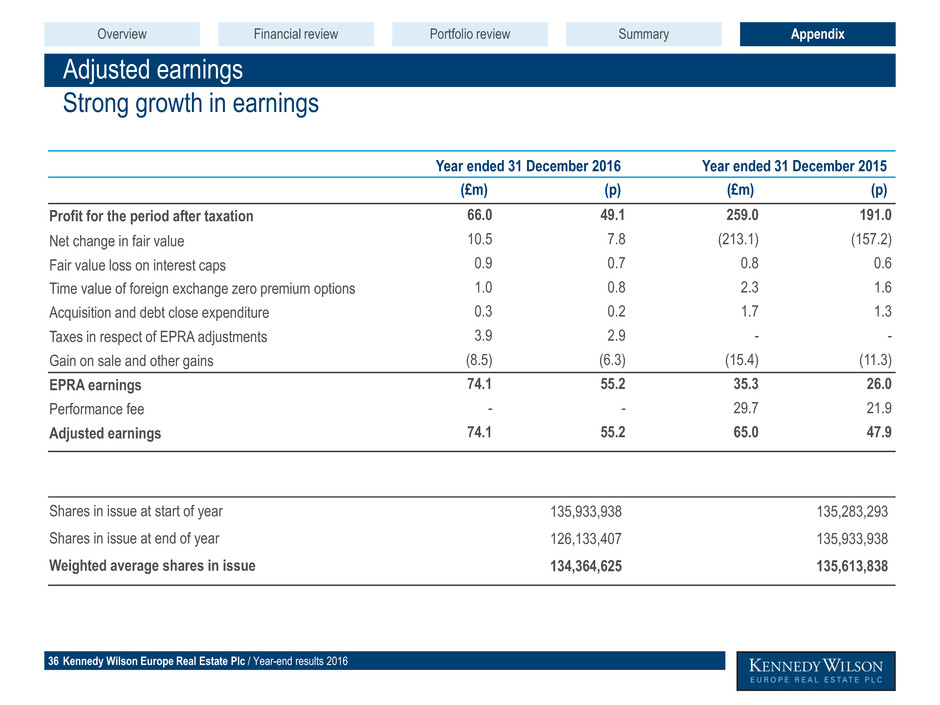

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Adjusted earnings 36 Strong growth in earnings Year ended 31 December 2016 Year ended 31 December 2015 (£m) (p) (£m) (p) Profit for the period after taxation 66.0 49.1 259.0 191.0 Net change in fair value 10.5 7.8 (213.1) (157.2) Fair value loss on interest caps 0.9 0.7 0.8 0.6 Time value of foreign exchange zero premium options 1.0 0.8 2.3 1.6 Acquisition and debt close expenditure 0.3 0.2 1.7 1.3 Taxes in respect of EPRA adjustments 3.9 2.9 - - Gain on sale and other gains (8.5) (6.3) (15.4) (11.3) EPRA earnings 74.1 55.2 35.3 26.0 Performance fee - - 29.7 21.9 Adjusted earnings 74.1 55.2 65.0 47.9 Overview Financial review Portfolio review AppendixSummary Shares in issue at start of year 135,933,938 135,283,293 Shares in issue at end of year 126,133,407 135,933,938 Weighted average shares in issue 134,364,625 135,613,838

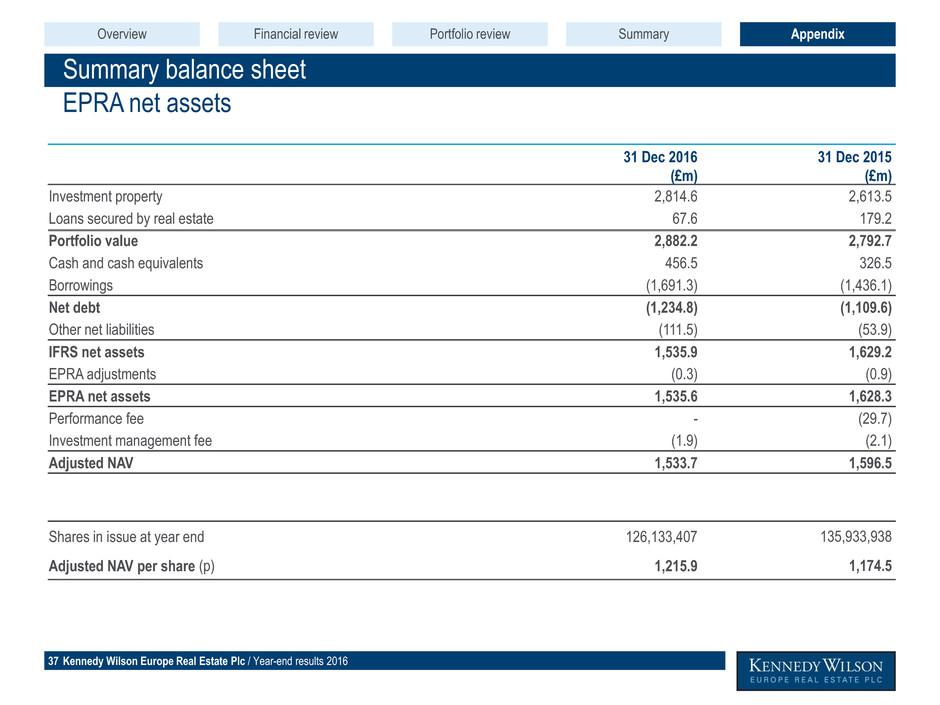

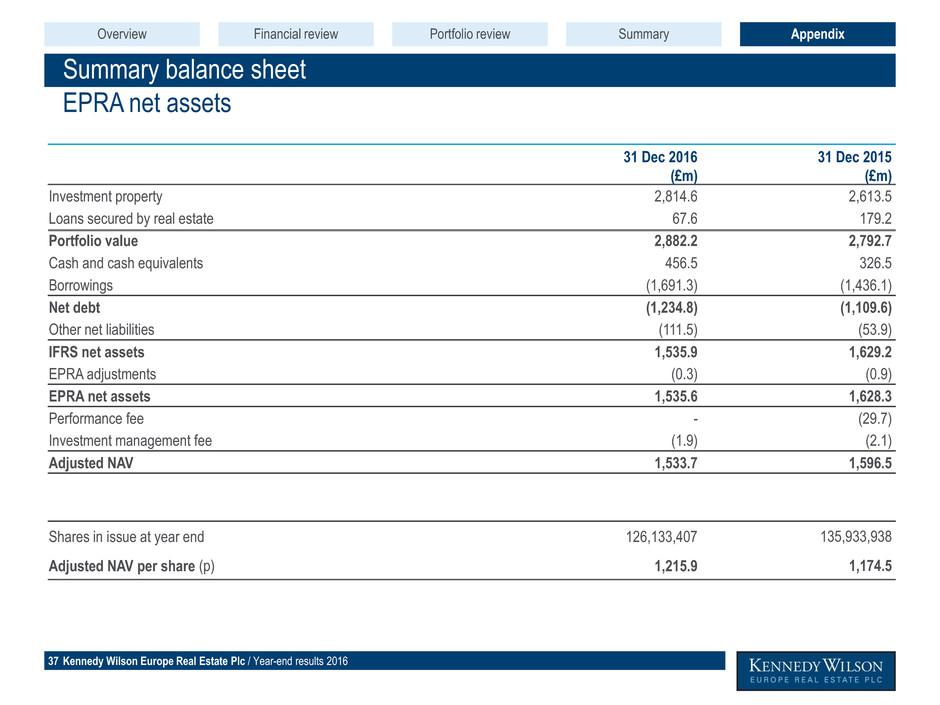

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Summary balance sheet 37 EPRA net assets 31 Dec 2016 (£m) 31 Dec 2015 (£m) Investment property 2,814.6 2,613.5 Loans secured by real estate 67.6 179.2 Portfolio value 2,882.2 2,792.7 Cash and cash equivalents 456.5 326.5 Borrowings (1,691.3) (1,436.1) Net debt (1,234.8) (1,109.6) Other net liabilities (111.5) (53.9) IFRS net assets 1,535.9 1,629.2 EPRA adjustments (0.3) (0.9) EPRA net assets 1,535.6 1,628.3 Performance fee - (29.7) Investment management fee (1.9) (2.1) Adjusted NAV 1,533.7 1,596.5 Shares in issue at year end 126,133,407 135,933,938 Adjusted NAV per share (p) 1,215.9 1,174.5 Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Balanced debt structure 38 1 Term to maturity Secured debt: 43% Unsecured debt: 57% Unsecured debt £969.5m Secured debt £721.8m TTM : Total fixed cost: Fixed debt: TTM : Total fixed cost: Fixed debt: 7.1 years 3.5% 100% 4.6 years 2.4% 80% Total debt £1,691.3m Overview Financial review Portfolio review AppendixSummary 11

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Good covenant headroom 39 0% 10% 20% 30% 40% 50% 60% 70% 80% 0.0 1.0 2.0 3.0 4.0 5.0 ICR (x ) Group interest cover NOI headroom of 57% ICR minimum: 1.5x 3.4x LT V ( % ) Group leverage Valuation headroom of 30% LTV maximum covenant: 60% 42.8% Overview Financial review Portfolio review AppendixSummary

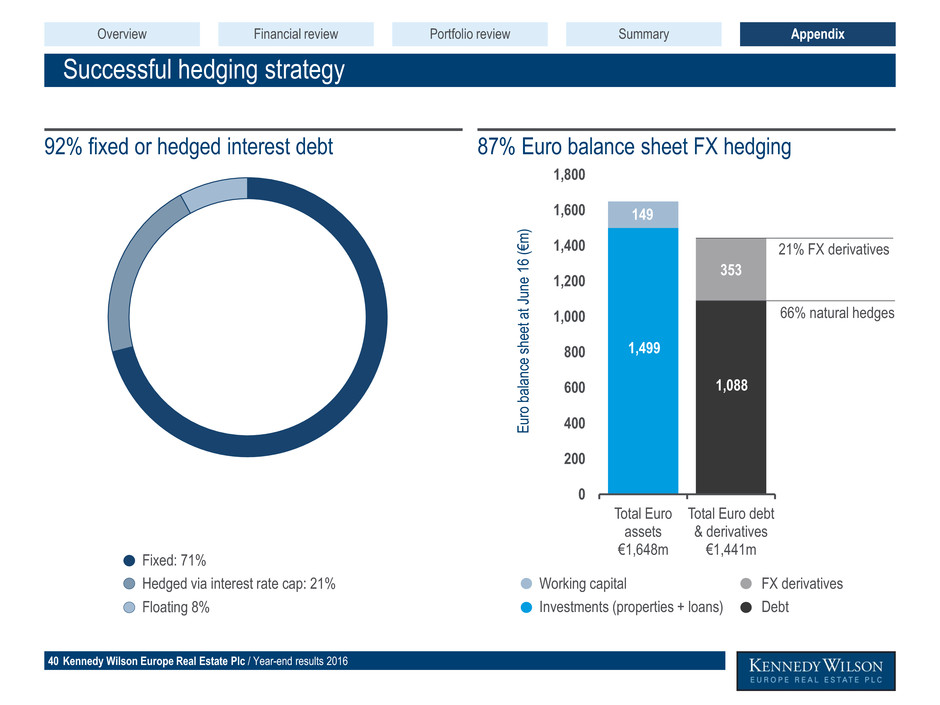

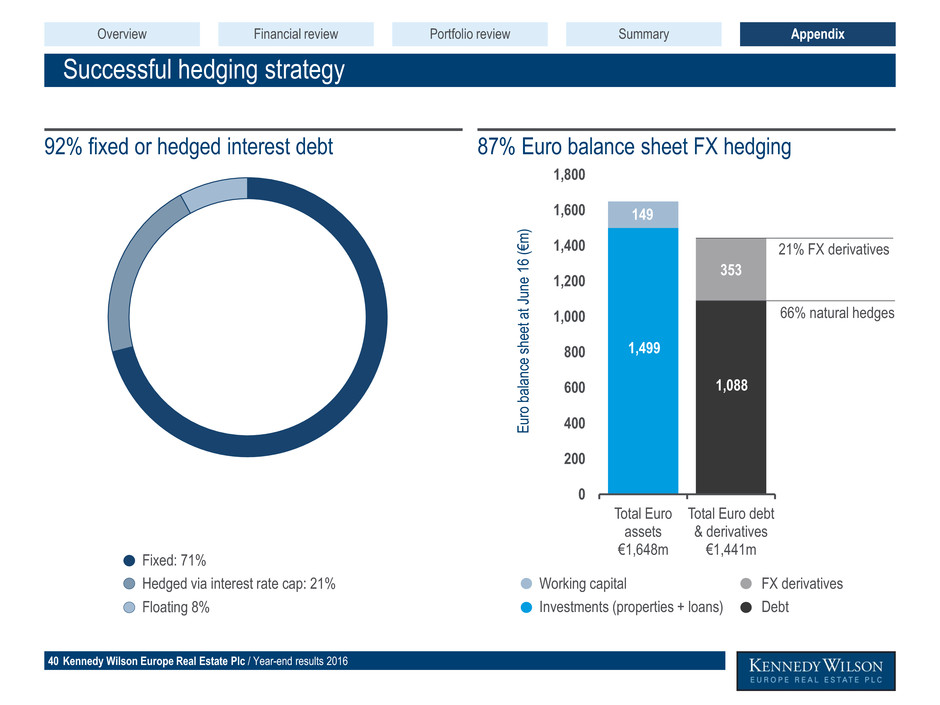

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 1,499 1,088 149 353 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 Total Euro assets €1,648m Total Euro debt & derivatives €1,441m Successful hedging strategy 40 Fixed: 71% Hedged via interest rate cap: 21% Floating 8% 87% Euro balance sheet FX hedging92% fixed or hedged interest debt 66% natural hedges 21% FX derivatives E uro b ala nc e sh ee t a t J un e 16 ( €m ) Working capital Investments (properties + loans) FX derivatives Debt Overview Financial review Portfolio review AppendixSummary

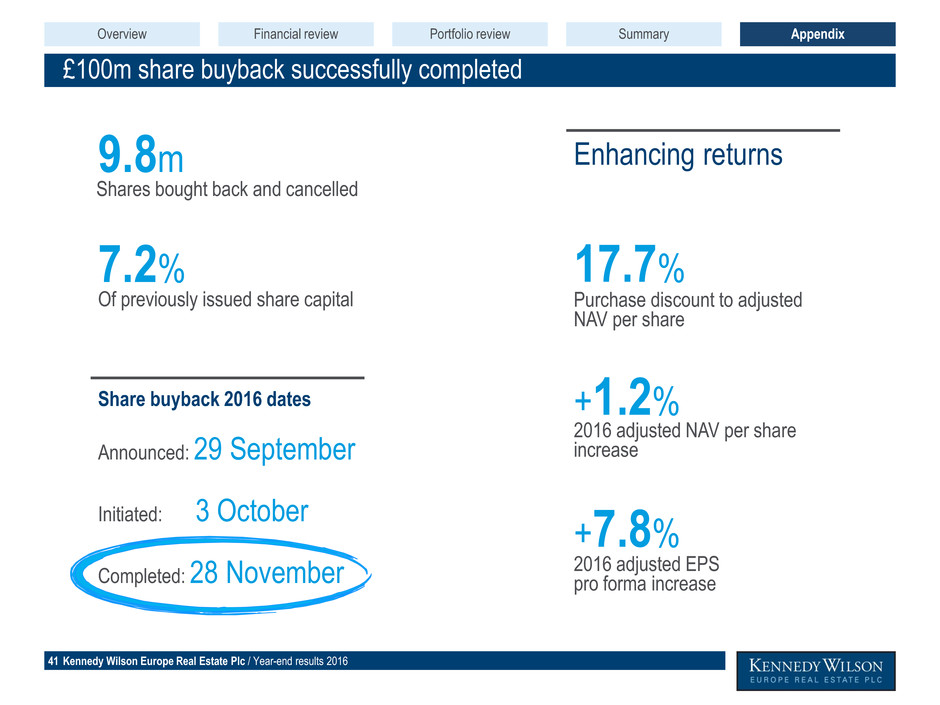

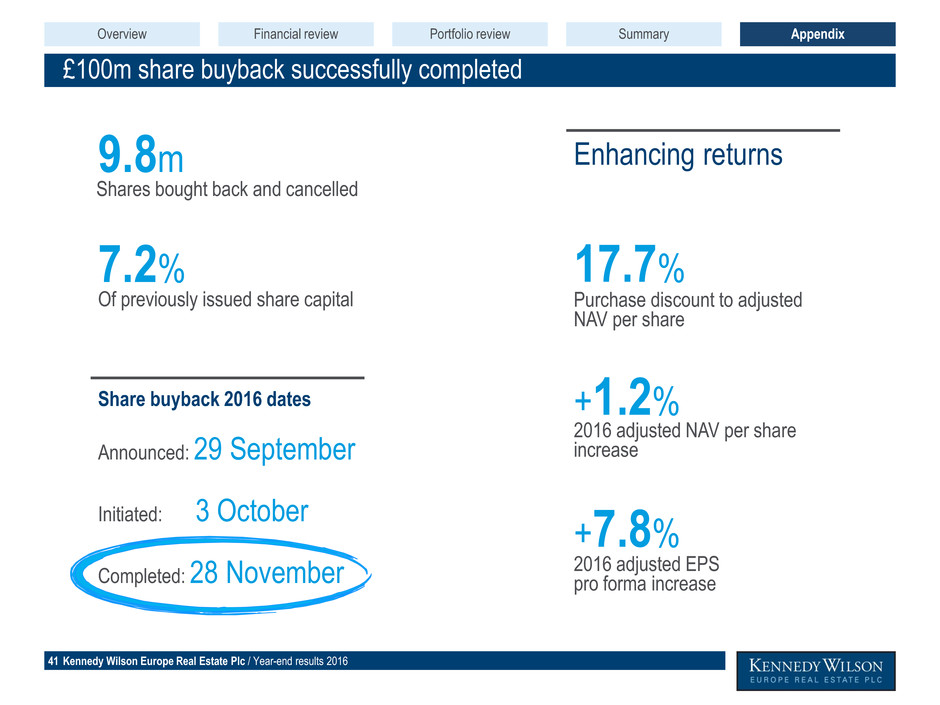

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 £100m share buyback successfully completed 41 Of previously issued share capital 7.2% Share buyback 2016 dates Announced: 29 September Completed: 28 November Enhancing returns Purchase discount to adjusted NAV per share 17.7% 2016 adjusted NAV per share increase +1.2% 2016 adjusted EPS pro forma increase +7.8% Shares bought back and cancelled 9.8m Initiated: 3 October Overview Financial review Portfolio review AppendixSummary

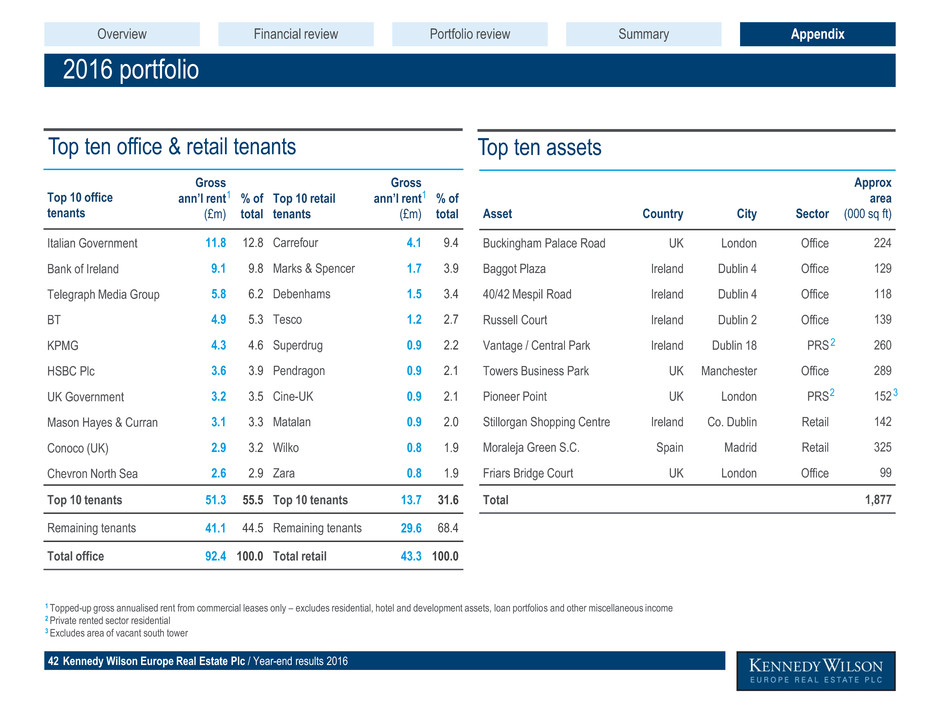

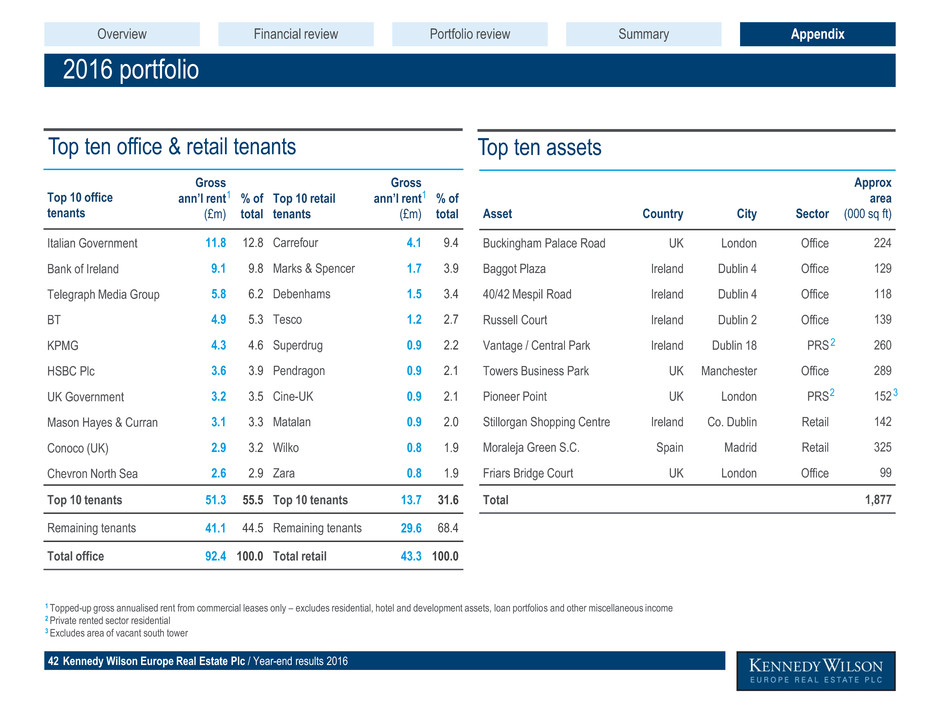

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 2016 portfolio 42 Top 10 office tenants Gross ann’l rent (£m) % of total Top 10 retail tenants Gross ann’l rent (£m) % of total Italian Government 11.8 12.8 Carrefour 4.1 9.4 Bank of Ireland 9.1 9.8 Marks & Spencer 1.7 3.9 Telegraph Media Group 5.8 6.2 Debenhams 1.5 3.4 BT 4.9 5.3 Tesco 1.2 2.7 KPMG 4.3 4.6 Superdrug 0.9 2.2 HSBC Plc 3.6 3.9 Pendragon 0.9 2.1 UK Government 3.2 3.5 Cine-UK 0.9 2.1 Mason Hayes & Curran 3.1 3.3 Matalan 0.9 2.0 Conoco (UK) 2.9 3.2 Wilko 0.8 1.9 Chevron North Sea 2.6 2.9 Zara 0.8 1.9 Top 10 tenants 51.3 55.5 Top 10 tenants 13.7 31.6 Remaining tenants 41.1 44.5 Remaining tenants 29.6 68.4 Total office 92.4 100.0 Total retail 43.3 100.0 Top ten office & retail tenants Top ten assets Asset Country City Sector Approx area (000 sq ft) Buckingham Palace Road UK London Office 224 Baggot Plaza Ireland Dublin 4 Office 129 40/42 Mespil Road Ireland Dublin 4 Office 118 Russell Court Ireland Dublin 2 Office 139 Vantage / Central Park Ireland Dublin 18 PRS 260 Towers Business Park UK Manchester Office 289 Pioneer Point UK London PRS 152 Stillorgan Shopping Centre Ireland Co. Dublin Retail 142 Moraleja Green S.C. Spain Madrid Retail 325 Friars Bridge Court UK London Office 99 Total 1,877 1 Topped-up gross annualised rent from commercial leases only – excludes residential, hotel and development assets, loan portfolios and other miscellaneous income 2 Private rented sector residential 3 Excludes area of vacant south tower Overview Financial review Portfolio review AppendixSummary 1 1 2 2 3

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 2016 sector break down 43 Sector Area (m sq ft) No. of assets Port. value (£m) Ann’l TU NOI (£m) EPRA TU NIY (%) Acq'n YOC (%) WAULT (years) Occupancy (%) Office 2.7 30 830.1 54.2 6.1 6.8 4.3 96.4 Retail 1.8 98 346.8 23.8 6.4 6.9 8.1 97.6 Industrial 2.8 26 171.2 12.1 6.6 7.4 6.4 96.0 Leisure 0.4 7 89.0 5.2 5.5 6.6 12.8 97.3 Residential 0.2 1 79.6 1.5 1.7 2.9 - 82.2 Property total 7.9 162 1,516.7 96.8 6.0 6.7 6.0 96.3 Development - - - - - - - - Hotel - 1 41.2 0.9 2.0 5.8 - - Loans - 7 44.4 5.5 11.7 9.6 - - Total / Average 7.9 170 1,602.3 103.2 6.0 6.8 6.0 96.3 UK portfolio summary Sector Area (m sq ft) No. of assets Port. value (£m) Ann’l TU NOI (£m) EPRA TU NIY (%) Acq'n YOC (%) WAULT (years) Occupancy (%) Office 0.8 13 519.1 23.6 4.3 5.9 10.2 94.2 Retail 0.5 4 151.7 9.6 6.0 6.5 16.3 98.0 Industrial - - - - - - - - Leisure 0.0 1 3.2 0.2 5.1 6.9 16.5 100.0 Residential 0.5 3 153.0 6.1 3.8 4.0 - 88.4 Property total 1.8 21 827.0 39.5 4.6 5.8 11.9 92.5 Development - 2 22.4 - - - - - Hotel - 1 31.8 1.1 3.3 5.1 - - Loans - 3 23.2 1.1 4.5 4.0 - - Total / Average 1.8 27 904.4 41.7 4.5 5.7 11.9 92.5 Ireland portfolio summary 1 Third party valuations (RICS Red Book) have been undertaken by CBRE on direct property assets (other than Italian office portfolio which was valued by Colliers); loan portfolios have been valued by Duff & Phelps 2 in each case at 31 December 2016 2 Annualised topped-up NOI at 31 December 2016 includes expiration of rent-free periods and contracted rent steps over the next two years 3 Excludes commercial units Overview Financial review Portfolio review AppendixSummary 1 2 1 2 3

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 2016 sector break down 44 Sector Area (m sq ft) No. of assets Port. value (£m) Ann’l TU NOI (£m) EPRA TU NIY (%) Acq'n YOC (%) WAULT (years) Occupancy (%) Retail 0.8 15 136.3 8.6 6.1 6.7 2.8 83.1 Development - 2 69.1 - - - - - Total / Average 0.8 17 205.4 8.6 6.1 6.7 2.8 83.1 Spain portfolio summary Sector Area (m sq ft) No. of assets Port. value (£m) Ann’l TU NOI (£m) EPRA TU NIY (%) Acq'n YOC (%) WAULT (years) Occupancy (%) Office 4.6 52 1,519.3 88.0 5.5 6.5 6.0 96.2 Retail 3.1 117 634.8 42.0 6.3 6.7 8.7 93.7 Industrial 2.8 26 171.2 12.1 6.6 7.4 6.4 96.0 Leisure 0.4 8 92.2 5.4 5.5 6.6 12.9 97.3 Residential 0.7 4 232.6 7.6 3.1 3.5 - 86.5 Property total 11.6 207 2,650.1 155.1 5.5 6.4 7.1 94.6 Development - 4 91.5 - - - - - Hotel - 2 73.0 2.0 2.6 5.6 - - Loans - 10 67.6 6.6 9.2 8.2 - - Total / Average 11.6 223 2,882.2 163.7 5.5 6.5 7.1 94.6 Total portfolio summary Sector Area (m sq ft) No. of assets Port. value (£m) Ann’l TU NOI (£m) EPRA TU NIY (%) Acq'n YOC (%) WAULT (years) Occupancy (%) Office 1.1 9 170.1 10.2 5.8 6.3 6.0 100.0 Total / Average 1.1 9 170.1 10.2 5.8 6.3 6.0 100.0 Italy portfolio summary Overview Financial review Portfolio review AppendixSummary 1 Third party valuations (RICS Red Book) have been undertaken by CBRE on direct property assets (other than Italian office portfolio which was valued by Colliers); loan portfolios have been fair valued by Duff & Phelps 2 in each case at 31 December 2016 2 Annualised topped-up NOI at 31 December 2016 includes expiration of rent-free periods and contracted rent steps over the next two years 3 Excludes commercial units 1 2 1 2 1 2 3

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 2016 portfolio assembly 45 IrelandUK Schoolhouse Lane Dublin 2, Ireland Purchase date No. of assets Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 24 Feb 1 7.7 na na na na Leisureplex Co. Dublin, Ireland Purchase date No. of assets Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 21 Apr 1 11.9 na na na na Blackrock Business Park Co. Dublin, Ireland Purchase date No. of buildings Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 4 Mar 2 11.2 6.8 222 5.2 98.5 The Chase Dublin 18, Ireland Purchase date No. of assets Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 3 May 1 49.5 3.8 282 3.4 68.2 Orion Business Park Ipswich, UK Purchase date No. of buildings Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 29 Nov 1 11.6 8.1 57 7.9 100.0 Pioneer Point Ilford Purchase date No. of assets Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 5 Feb 1 na na 456 na 87.5 Towers Business Park Manchester, UK Purchase date No. of buildings Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 4 May 10 82.0 6.7 284 5.0 96.3 Dukes Park Chelmsford, UK Purchase date No. of assets Purchase price (£m) YOC (%) Cap value (£ psf) WAULT (years) Occupancy (%) 8 Jun 1 10.5 6.8 66 2.9 100.0 Loan converted to direct real estate Overview Financial review Portfolio review AppendixSummary 1 Cashless transfer 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 £200m disposal programme complete 46 Disposals Area (000 sq ft) No. of assets Gross sale proceeds (£m) Premium to BV (%) Return on cost (%) Hold period (months) Office 388 9 86.9 3.8 46 21 Retail 509 47 101.4 6.4 28 21 Industrial 338 9 28.3 0.6 61 33 Leisure 178 10 33.6 8.1 46 20 Development Na 1 10.2 28.5 23 22 Loans Na 10 117.1 1.9 15 19 Disposals 1,413 86 377.5 4.7 31 21 Deals exchanged 152 3 35.6 6.0 37 21 Total incl. exchanged 1,565 89 413.1 4.8 32 21 Overview Financial review Portfolio review AppendixSummary

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 2016 redevelopments and refurbishments 47 Overview Financial review Portfolio review AppendixSummary Sector 2016 additions Key projects Photos Office £46.2m • Baggot Plaza – office redevelopment • 111 BPR – refurbishment and extension of reception Development £21.9m • Puerta del Sol – acquisition of adjacent unit • ST5 – residential conversion Residential £18.7m • Block K, Vantage – ground up residential development • Pioneer Point – refurbishment and tenant amenity space Retail £9.9m • Moraleja Green – acquisition of adjacent unit • Portlethen – extension of tenant units Hotel £8.2m • Fairmont – renovation of common areas and phase 1 of bedrooms • Portmarnock – renovation of common areas and bedrooms Other £1.9m Grand total £106.7m

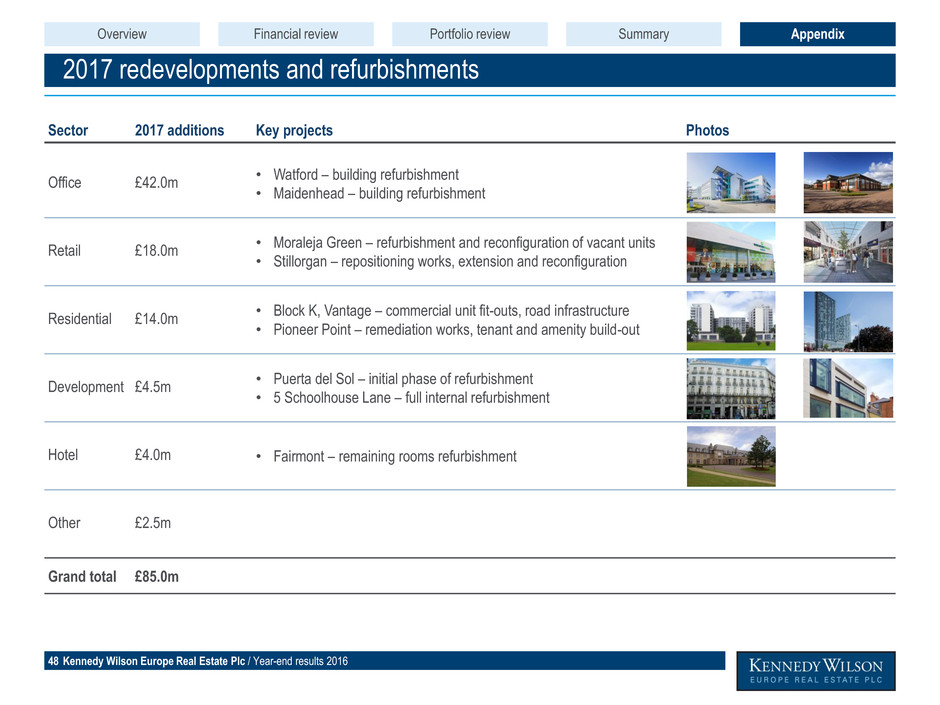

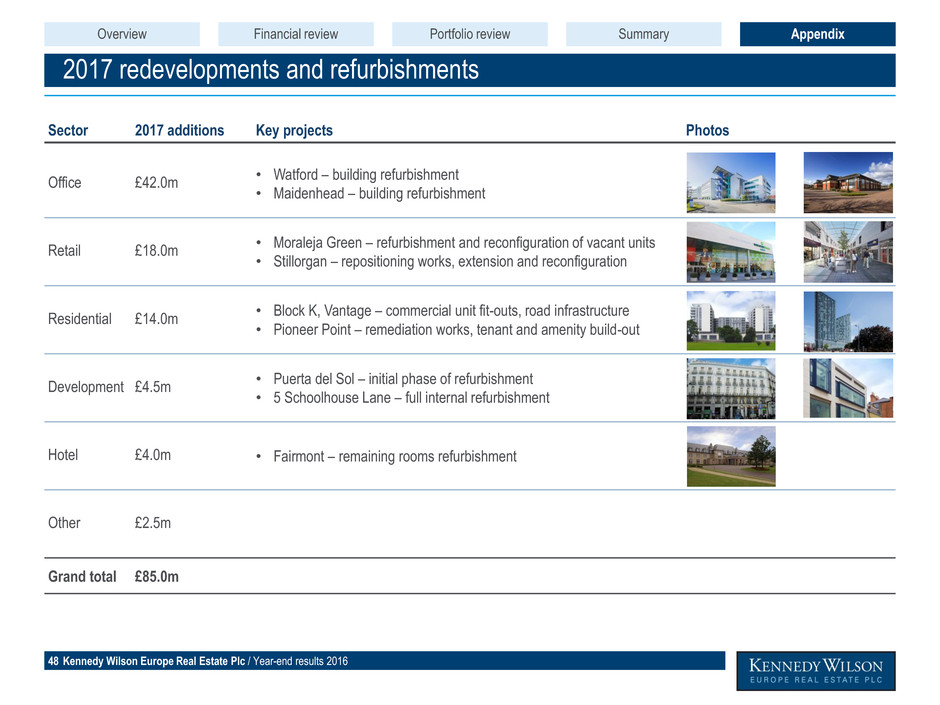

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 2017 redevelopments and refurbishments 48 Overview Financial review Portfolio review AppendixSummary Sector 2017 additions Key projects Photos Office £42.0m • Watford – building refurbishment • Maidenhead – building refurbishment Retail £18.0m • Moraleja Green – refurbishment and reconfiguration of vacant units • Stillorgan – repositioning works, extension and reconfiguration Residential £14.0m • Block K, Vantage – commercial unit fit-outs, road infrastructure • Pioneer Point – remediation works, tenant and amenity build-out Development £4.5m • Puerta del Sol – initial phase of refurbishment • 5 Schoolhouse Lane – full internal refurbishment Hotel £4.0m • Fairmont – remaining rooms refurbishment Other £2.5m Grand total £85.0m

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Office 49 1 Includes Schoolhouse Lane Overview Financial review Portfolio review AppendixSummary 13 Dublin Rome Milan Florence 3Aberdeen Edinburgh 3 Manchester Leeds Sheffield Birmingham Bristol London 13 3 South East £170m 11% Valuation 1,068 Area (‘000 sq ft) 9 Assets £528m 35% Valuation 851 Area (‘000 sq ft) 14 Assets £830m 54% Valuation 2,726 Area (‘000 sq ft) 30 Assets 2 2 Dublin County 1 UK Ireland Italy 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 KWE office portfolio summary 50 Total Passing rent (£m) 82.7 Topped-up NOI (£m) 88.0 Portfolio valuation (£m) 1,528.3 Portfolio valuation (£psf) 329.1 Valuation movement (£m) -30.4 Occupancy (%) 96.2 WAULT break (years) 6.0 WAULT expiry (years) 7.2 Portfolio value: £1,528.3m 2016 office asset management wins Re-gear/ renewal New lease Rent review Total No. of transactions 10 9 8 27 Area (000 sq ft) 167.9 43.2 109.0 320.1 NOI uplift (£m) 0.5 1.1 0.5 2.1 Term to break (years) 4.4 5.7 – 4.7 Dublin: 35% Central London: 19% Other UK: 18% South East: 17% Italy: 11% 1 Includes Schoolhouse Lane Discovery Place, Farnborough Bartley Wood Business Park, Hook Overview Financial review Portfolio review AppendixSummary 1

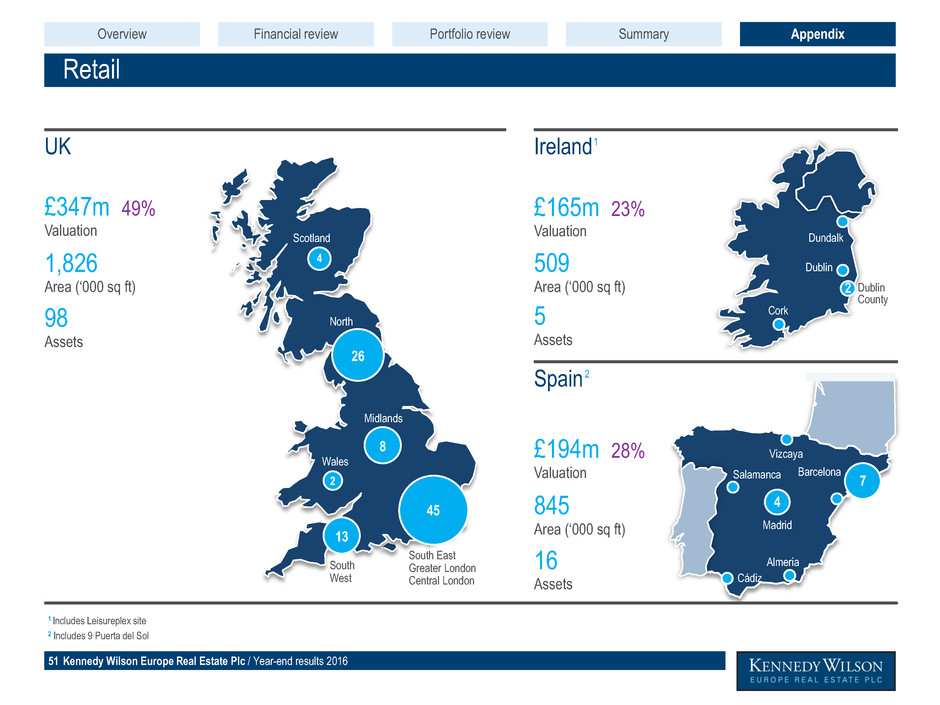

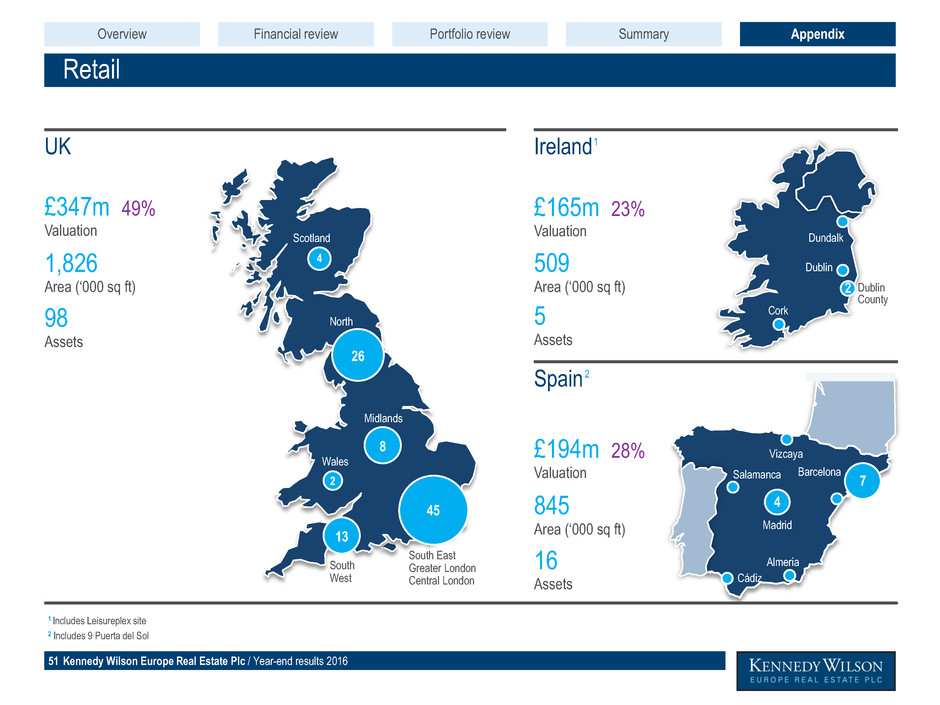

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Retail 51 1 Includes Leisureplex site 2 Includes 9 Puerta del Sol £194m 28% Valuation 845 Area (‘000 sq ft) 16 Assets £165m 23% Valuation 509 Area (‘000 sq ft) 5 Assets £347m 49% Valuation 1,826 Area (‘000 sq ft) 98 Assets 4 Scotland 2 Wales 13 South West 8 Midlands 45 26 North South East Greater London Central London Almeria Cádiz Salamanca Madrid 4 Vizcaya 7 Barcelona Cork Dundalk Dublin Dublin County 2 Overview Financial review Portfolio review AppendixSummary UK Ireland Spain 1 2

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 KWE retail portfolio summary 52 Total Passing rent (£m) 43.0 Topped-up NOI (£m) 42.0 Portfolio valuation (£m) 706.2 Portfolio valuation (£psf) 222.1 Valuation movement (£m) 5.5 Occupancy (%) 93.7 WAULT break (years) 8.7 WAULT expiry (years) Portfolio value: £706.2m 2016 retail asset management wins Re-gear/ renewal New lease Rent review Total No. of transactions 33 25 29 87 Area (000 sq ft) 170.7 57.7 104.2 332.6 NOI uplift (£m) -0.1 0.9 0.3 1.1 Term to break (years) 8.9 7.0 - 7.7 Spain: 28% London & SE: 25% North: 14% Dublin: 12% Other UK: 11% Ireland regions: 10% 1 Includes Leisureplex site and 9 Puerta del Sol Moraleja Green, Madrid Overview Financial review Portfolio review AppendixSummary 11 Gentleman’s Walk, Norwich 1

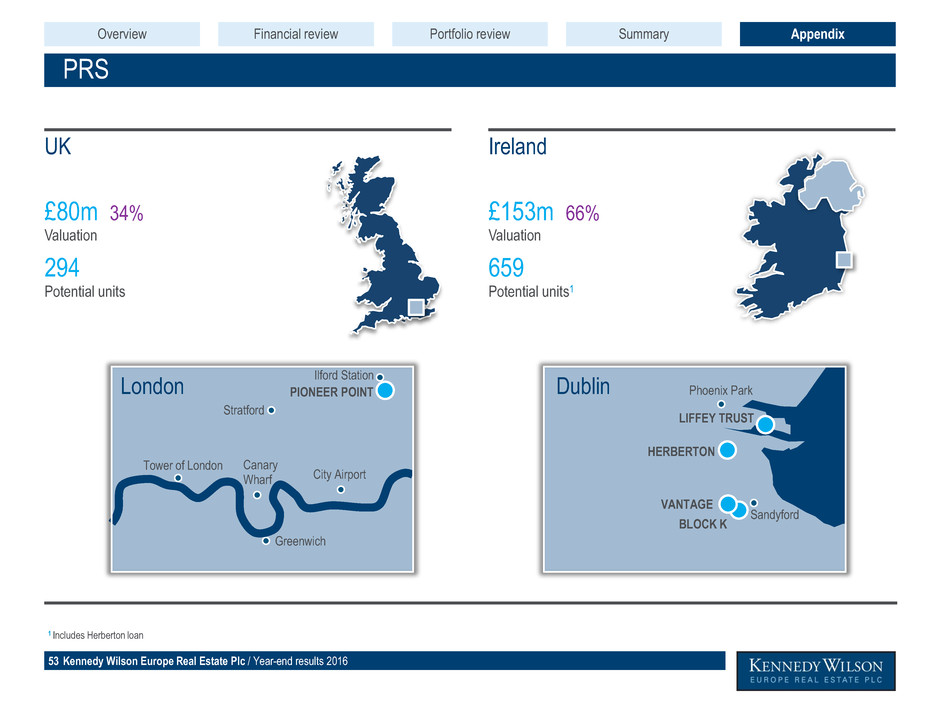

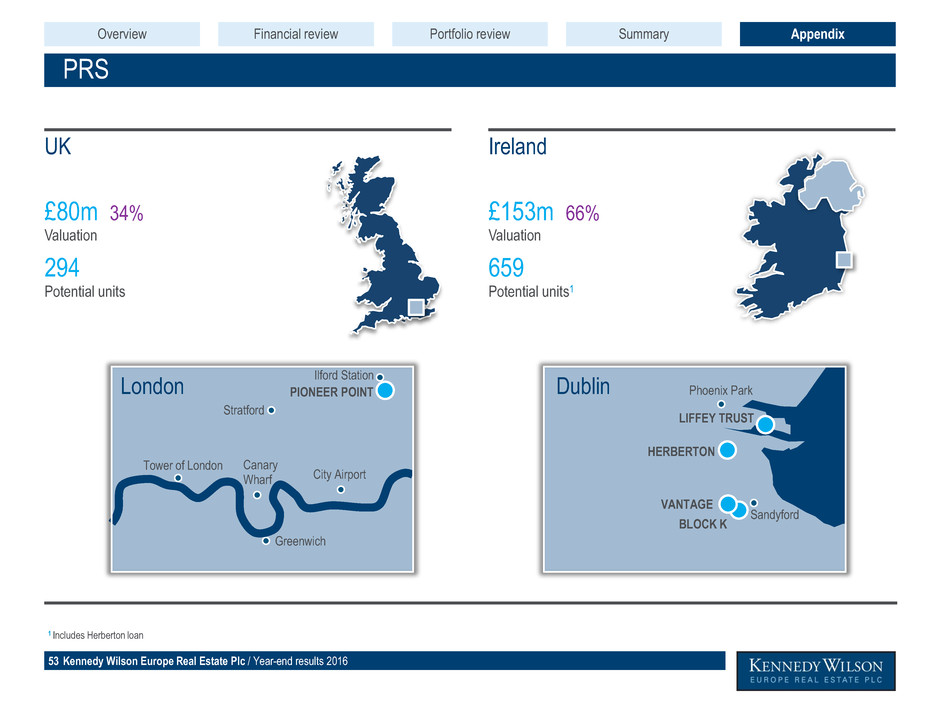

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 PRS 53 Stratford Canary Wharf City Airport Greenwich Tower of London PIONEER POINT £80m 34% Valuation London £153m 66% Valuation 659 Potential units 294 Potential units Dublin VANTAGE LIFFEY TRUST Phoenix Park Sandyford Ilford Station BLOCK K Overview Financial review Portfolio review AppendixSummary UK Ireland 1 Includes Herberton loan HERBERTON 1

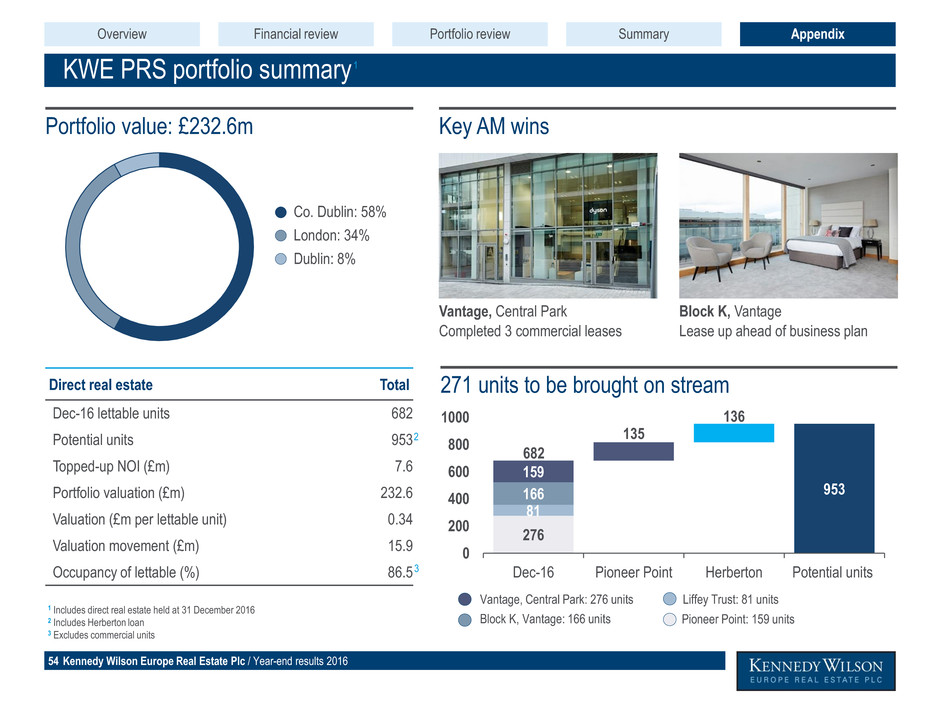

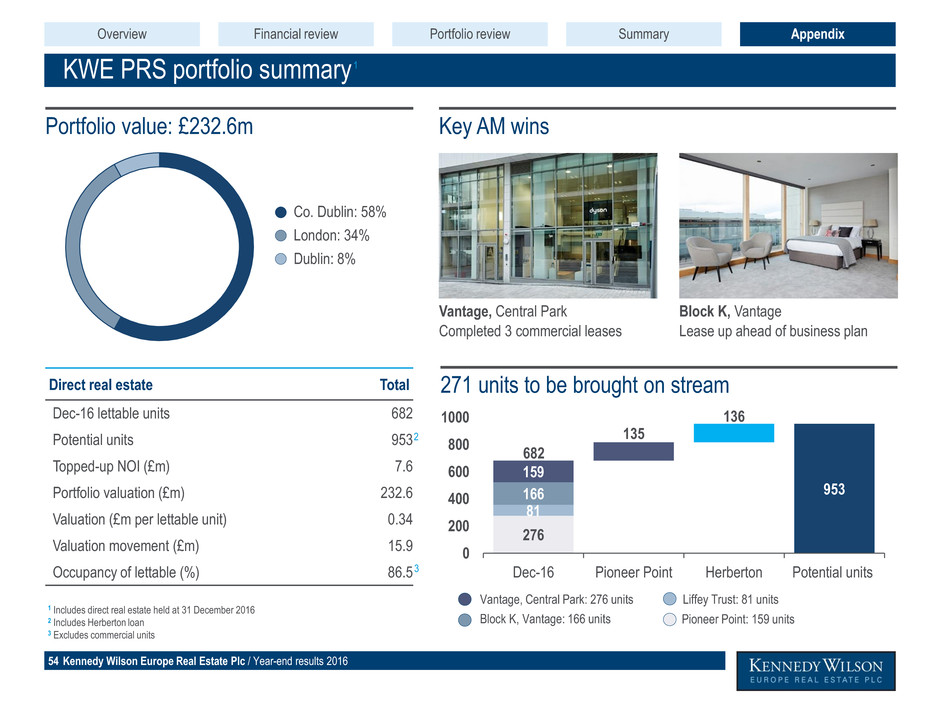

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 271 units to be brought on stream KWE PRS portfolio summary 54 Direct real estate Total Dec-16 lettable units 682 Potential units 953 Topped-up NOI (£m) 7.6 Portfolio valuation (£m) 232.6 Valuation (£m per lettable unit) 0.34 Valuation movement (£m) 15.9 Occupancy of lettable (%) 86.5 1 Includes direct real estate held at 31 December 2016 2 Includes Herberton loan 3 Excludes commercial units Portfolio value: £232.6m Key AM wins Vantage, Central Park Completed 3 commercial leases Block K, Vantage Lease up ahead of business plan 953 135 136 276 81 166 159 0 200 400 600 800 1000 Dec-16 Pioneer Point Herberton Potential units 682 Vantage, Central Park: 276 units Block K, Vantage: 166 units Pioneer Point: 159 units Liffey Trust: 81 units Co. Dublin: 58% London: 34% Dublin: 8% Overview Financial review Portfolio review AppendixSummary 1 2 3

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Industrial 55 Glasgow Manchester2 Leeds Walsall Middlewich Wellingborough Swindon London 10 4 South East £171m 100% Valuation 2,786 Area (‘000 sq ft) 26 Assets M25 Merstham Sittingbourne Chelmsford Luton Wolverton Ipswich Benfleet 2 Edmonton Croydon Alperton M25 3 2 Overview Financial review Portfolio review AppendixSummary UK South East LondonHull Spennymoor Leamington Spa Redditch

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 KWE industrial portfolio summary 56 Total Passing rent (£m) 11.8 Topped-up NOI (£m) 12.1 Portfolio valuation (£m) 171.2 Portfolio valuation (£psf) 61.5 Valuation movement (£m) -5.0 Occupancy (%) 96.0 WAULT break (years) 6.4 WAULT expiry (years) 7.7 Portfolio value: £171.2m 2016 industrial asset management wins Re-gear/ renewal New lease Rent review Total No. of transactions 6 9 4 19 Area (000 sq ft) 168.2 112.0 74.5 354.7 NOI uplift (£m) 0.1 0.5 0.1 0.7 Term to break (years) 13.8 7.8 – 11.0 South East: 35% North: 29% London: 15% Midlands: 12% Other UK: 9% Dukes Park Industrial Estate, Chelmsford Angel Road Estate, London Overview Financial review Portfolio review AppendixSummary

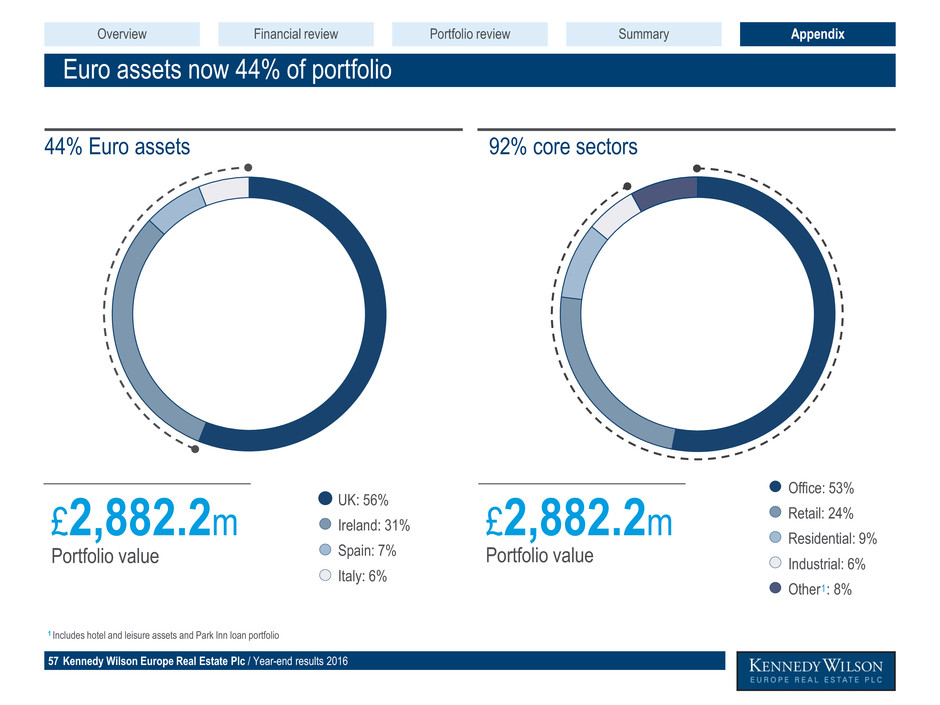

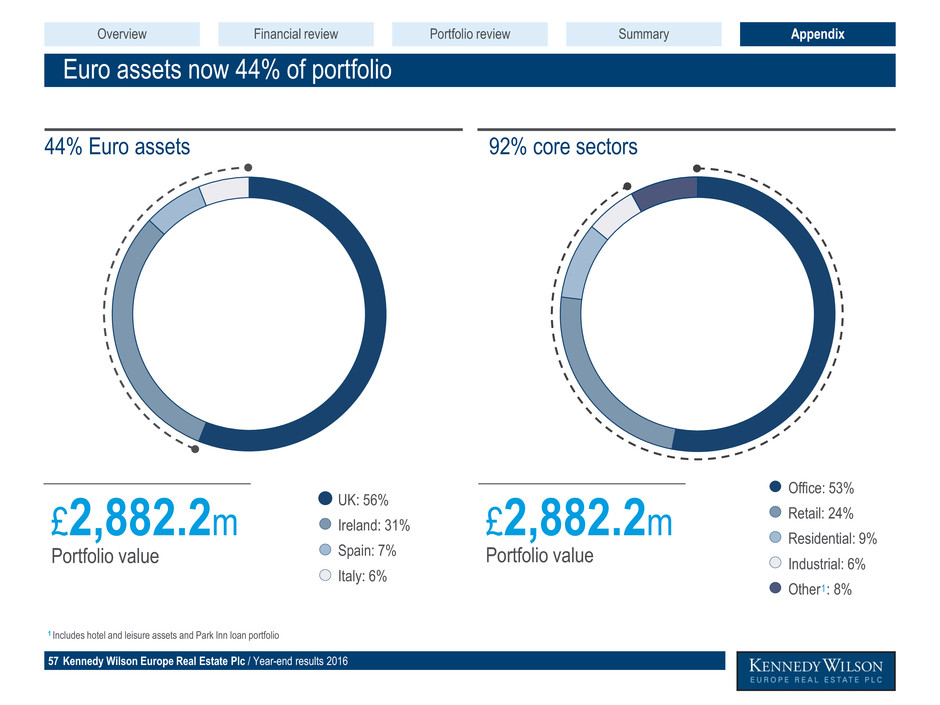

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Euro assets now 44% of portfolio 57 44% Euro assets 92% core sectors Portfolio value £2,882.2m Portfolio value £2,882.2m Office: 53% Retail: 24% Residential: 9% Industrial: 6% Other : 8% 1 Includes hotel and leisure assets and Park Inn loan portfolio Overview Financial review Portfolio review AppendixSummary 1 UK: 56% Ireland: 31% Spain: 7% Italy: 6%

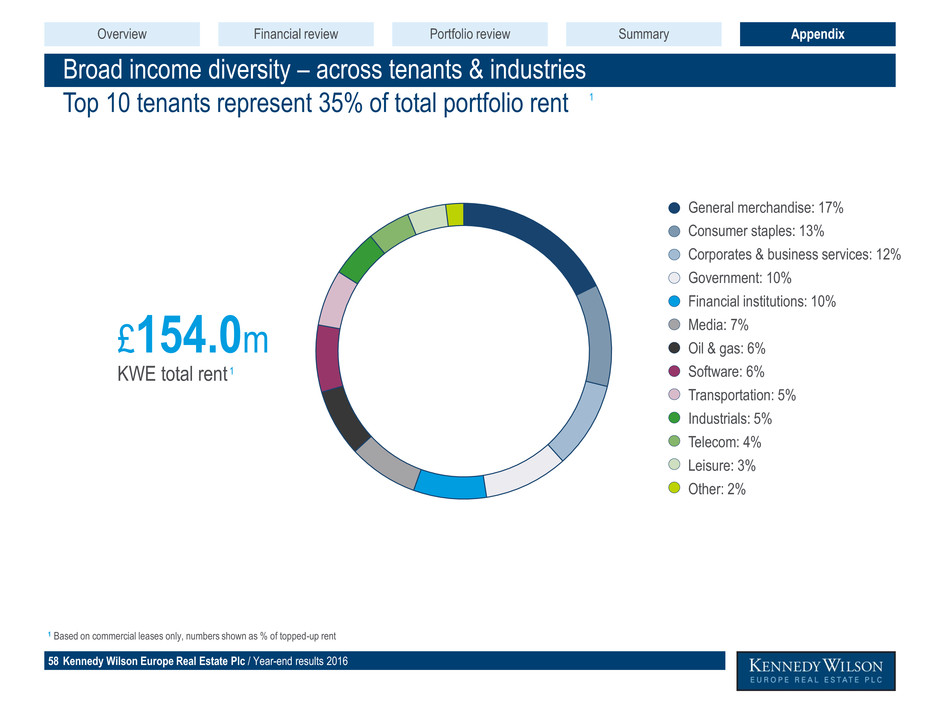

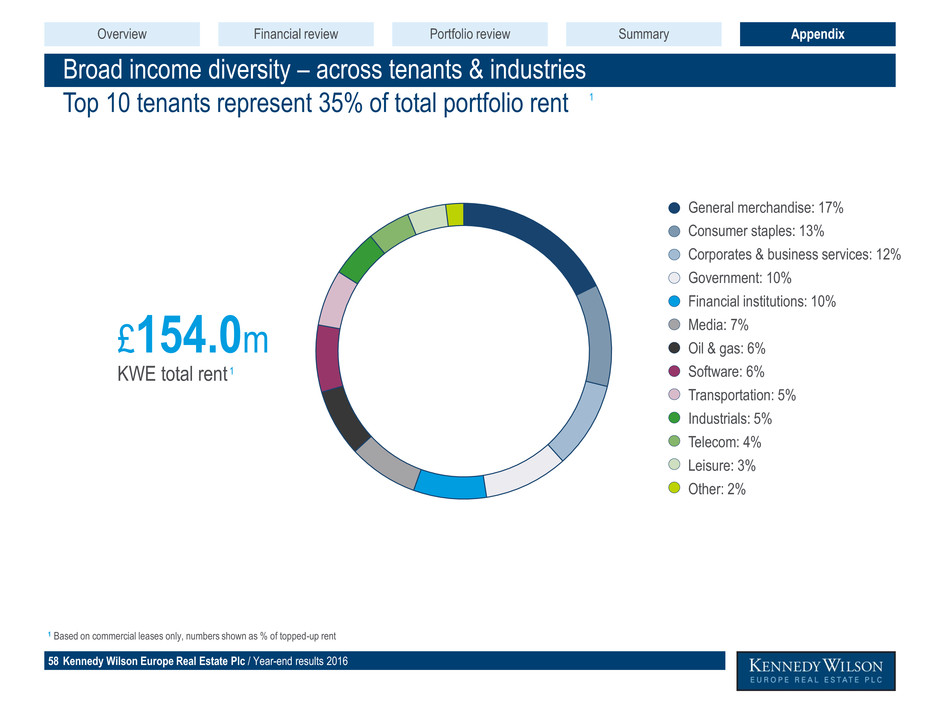

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Broad income diversity – across tenants & industries 58 1 Based on commercial leases only, numbers shown as % of topped-up rent KWE total rent £154.0m Top 10 tenants represent 35% of total portfolio rent Overview Financial review Portfolio review AppendixSummary General merchandise: 17% Consumer staples: 13% Corporates & business services: 12% Government: 10% Financial institutions: 10% Media: 7% Oil & gas: 6% Software: 6% Transportation: 5% Industrials: 5% Telecom: 4% Leisure: 3% Other: 2% 1 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Broad income diversity – across UK tenants & industries 59 1 Based on commercial leases only, numbers shown as % of topped-up rent UK total rent £98.9m Top 10 UK tenants represent 33% of total portfolio rent Overview Financial review Portfolio review AppendixSummary General merchandise: 18% Media: 11% Consumer staples: 10% Oil & gas: 9% Transportation: 8% Software: 8% Industrials: 7% Corporates & business services: 7% Financial institutions: 6% Telecom: 5% Leisure: 5% Government: 4% Other: 2% 1 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 UK portfolio highly diversified across sectors 60 1 Annualised topped-up NOI at 31 December 2016 includes expiration of rent-free periods and contracted rent steps over the next two years Regional office: 42% Retail: 24% Central London office: 14% Industrial: 12% PRS: 2% Hotel: 1% Leisure: 5% UK NOI £97.7m Overview Financial review Portfolio review AppendixSummary 1

Kennedy Wilson Europe Real Estate Plc / Year-end results 2016 Disclaimer 61 Overview Financial review Portfolio review AppendixSummary This presentation is being provided to you for information purposes only. This presentation does not constitute an offering of securities or otherwise constitute an offer or invitation or inducement to any person to underwrite, subscribe for or otherwise acquire or dispose of securities in Kennedy Wilson Europe Real Estate Plc (“KWE”, and together with its subsidiaries, the “PLC Group”). KWE has not been, and will not be, registered under the US Investment Company Act of 1940, as amended. KWE's assets are managed by KW Investment Management Ltd (the “Investment Manager”), an indirect wholly owned subsidiary of Kennedy-Wilson Holdings, Inc. This presentation may not be reproduced in any form, further distributed or passed on, directly or indirectly, to any other person, or published, in whole or in part, for any purpose. Certain statements in this presentation are forward-looking statements which are based on the PLC Group's expectations, intentions and projections regarding its future performance, anticipated events or trends and other matters that are not historical facts. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that would cause actual results or events to differ from current expectations, intentions or projections might include, amongst other things, changes in property prices, changes in equity markets, political risks, changes to regulations affecting the PLC Group's activities and delays in obtaining or failure to obtain any required regulatory approval. Given these risks and uncertainties, readers should not place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, no member of the PLC Group undertakes any obligation to update or revise publicly any forward- looking statements, whether as a result of new information, future events or otherwise. Past performance is no guide to future performance and persons needing advice should consult an independent financial adviser. Nothing in this presentation should be construed as a profit forecast. The information in this presentation, which does not purport to be comprehensive, has not been verified by the PLC Group or any other person. No representation or warranty, express or implied, is or will be given by any member of the PLC Group or its directors, officers, employees or advisers or any other person as to the accuracy or completeness of the presentation or any projections, targets, estimates, forecasts or opinions contained therein and, so far as permitted by law, no responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or miss- statements, negligent or otherwise, relating thereto. In particular, but without limitation, (subject as aforesaid) no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on any projections, targets, estimates or forecasts and nothing in this presentation is or should be relied on as a promise or representation as to the future. Accordingly, (subject as aforesaid), no member of the PLC Group, nor any of its directors, officers, employees or advisers, nor any other person, shall be liable for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on any statement in or omission from the presentation or any other written or oral communication with the recipient or its advisers in connection with the presentation and (save in the case of fraudulent misrepresentation or wilful non-disclosure) any such liability is expressly disclaimed. The market data in the presentation has been sourced from third parties and has been so identified. In furnishing this presentation, the PLC Group does not undertake any obligation to provide any additional information or to update this presentation or to correct any inaccuracies that may become apparent. All property valuations in this presentation at 31 December 2016 have been undertaken by third party external valuers under RICS Red Book. CBRE have valued the direct property assets (other than the Italian office portfolio which was valued by Colliers) and the loan portfolios have been valued by Duff & Phelps, in each case at 31 December 2016. Unless stated otherwise, information presented “to date” is information as at 23 February 2017 or for the period from 1 January 2017 to 23 February 2017, and any PPE information presented under “PPE” is information for the period from 1 January 2017 to 23 February 2017. Unless stated otherwise, where balance sheet amounts in this presentation are presented in both £ and €, the £ amount has been calculated based on an exchange rate of €1:£0.85352, which was the rate on 31 December 2016. Income Statement amounts were translated at the average rate for the year.