Quarterly Report | May 31, 2020

2020 2nd Quarter Report

Closed-End Funds

| |

| |

| |

| |

| Tortoise |

| 2020 2nd Quarter Report to Stockholders |

| |

This combined report provides you with a comprehensive review of our funds that span essential assets.

| |

| Table of contents |

| |

| Closed-end Fund Comparison | | 1 | | TPZ: Fund Focus | | 17 | |

| Letter to Stockholders | | 2 | | TEAF: Fund Focus | | 20 | |

| TYG: Fund Focus | | 5 | | Financial Statements | | 24 | |

| NTG: Fund Focus | | 8 | | Notes to Financial Statements | | 64 | |

| TTP: Fund Focus | | 11 | | Additional Information | | 85 | |

| NDP: Fund Focus | | 14 | | | | | |

|

TTP and TPZ distribution policies |

Tortoise Pipeline & Energy Fund, Inc. (“TTP”) and Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ”) are relying on exemptive relief permitting them to make long-term capital gain distributions throughout the year. Each of TTP and TPZ, with approval of its Board of Directors (the “Board”), has adopted a distribution policy (the “Policy”) with the purpose of distributing over the course of each year, through periodic distributions as nearly equal as practicable and any required special distributions, an amount closely approximating the total taxable income of TTP and TPZ during such year and, if so determined by the Board, all or a portion of the return of capital paid by portfolio companies to TTP and TPZ during such year. In accordance with its Policy, TTP distributes a fixed amount per common share, currently $0.16, each quarter to its common shareholders. Prior to May 2020, the quarterly distribution rate was $0.285. TPZ distributes a fixed amount per common share, currently $0.125, each month to its common shareholders. These amounts are subject to change from time to time at the discretion of the Board. Although the level of distributions is independent of TTP’s and TPZ’s performance, TTP and TPZ expect such distributions to correlate with its performance over time. Each quarterly and monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions in light of TTP’s and TPZ’s performance for the entire calendar year and to enable TTP and TPZ to comply with the distribution requirements imposed by the Internal Revenue Code. The Board may amend, suspend or terminate the Policy without prior notice to shareholders if it deems such action to be in the best interests of TTP, TPZ and their respective shareholders. For example, the Board might take such action if the Policy had the effect of shrinking TTP’s or TPZ’s assets to a level that was determined to be detrimental to TTP or TPZ shareholders. The suspension or termination of the Policy could have the effect of creating a trading discount (if TTP’s or TPZ’s stock is trading at or above net asset value), widening an existing trading discount, or decreasing an existing premium. You should not draw any conclusions about TTP’s or TPZ’s investment performance from the amount of the distribution or from the terms of TTP’s or TPZ’s distribution policy. Each of TTP and TPZ estimates that it has distributed more than its income and net realized capital gains; therefore, a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in TTP or TPZ is paid back to you. A return of capital distribution does not necessarily reflect TTP’s or TPZ’s investment performance and should not be confused with “yield” or “income.” The amounts and sources of distributions reported are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon TTP’s and TPZ’s investment experience during the remainder of their fiscal year and may be subject to changes based on tax regulations. TTP and TPZ will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

| |

| |

| 2020 2nd Quarter Report | May 31, 2020 |

| Closed-end Fund Comparison |

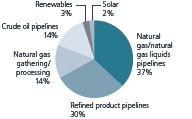

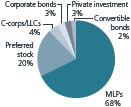

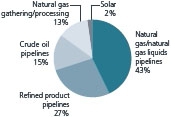

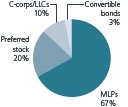

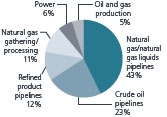

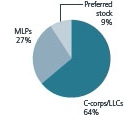

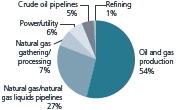

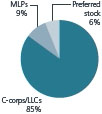

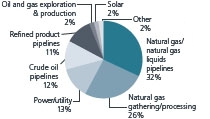

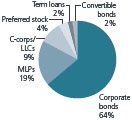

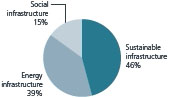

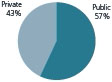

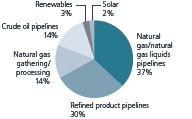

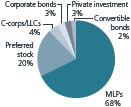

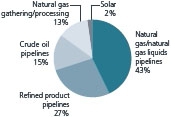

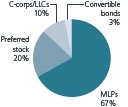

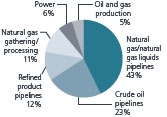

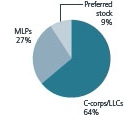

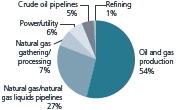

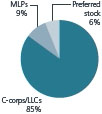

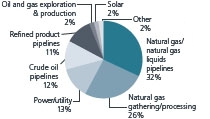

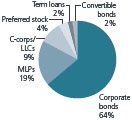

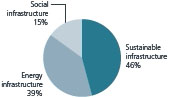

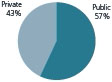

| Name/Ticker | | Primary

focus | | Structure | | Total assets

($ millions)1 | | Portfolio mix

by asset type2 | | Portfolio mix

by structure2 |

| Tortoise Energy Infrastructure Corp. NYSE: TYG

Inception: 2/2004 | | Midstream MLPs | | C-corp | | $467.0 | |  | |  |

Tortoise Midstream Energy Fund, Inc. NYSE: NTG

Inception: 7/2010 | | Natural gas infrastructure MLPs | | C-corp | | $226.2 | |  | |  |

Tortoise Pipeline & Energy Fund, Inc. NYSE: TTP

Inception: 10/2011 | | North American pipeline companies | | Regulated investment company | | $72.1 | |  | |  |

| Tortoise Energy Independence Fund, Inc. NYSE: NDP

Inception: 7/2012 | | North American oil & gas producers | | Regulated investment company | | $33.0 | |  | |  |

| Tortoise Power and Energy Infrastructure Fund, Inc. NYSE: TPZ

Inception: 7/2009 | | Power & energy infrastructure companies (Fixed income & equity) | | Regulated investment company | | $108.3 | |  | |  |

| Tortoise Essential Assets Income Term Fund NYSE: TEAF

Inception: 3/2019 | | Essential assets | | Regulated investment company | | $236.4 | |  | |  |

| 1 | As of 6/30/2020 |

| 2 | As of 5/31/2020 |

| |

| |

| |

| |

| Tortoise |

| Second Quarter 2020 Report to closed-end fund stockholders |

| |

Dear stockholder,

The second fiscal quarter ending in May certainly had its highs and lows. When the period started, COVID-19 was just starting to become a serious concern in the U.S. and many other countries across the globe. There weren’t yet shelter-at-home orders and basic shutdowns of countries and economies. By the end of the period, some parts of the world, including the U.S. began to emerge from several months of quarantine-induced economic slumber. While the virus is still gaining momentum in some parts of the globe, it is slowing in others and we are seeing more indicators that life is slowly making the first hesitant steps back towards normalcy. This has taken the form of direct data showing the narrowing gaps between oil and gas supply/ demand, as well as untraditional metrics showing more people out on the roads requesting driving directions.

Energy infrastructure

During the period, the broad equity markets were driven by hopes and possibilities that the world could be closer to a COVID-19 vaccine. Markets vacillated as each drug saw successes or failures during trials. Energy markets improved throughout the period as oil inventories declined with transportation demand increases and supply cuts, and the market saw signs that we are getting closer to balance. The broader energy sector, as represented by the S&P Energy Select Sector® Index, faced headwinds, returning -13.6% in the second fiscal quarter ending May 31, 2020.

Rarely have we seen a sector experience two consecutive months with more extremes than energy did in April and May. In April, oil prices plummeted to negative $37 around expiration of the front-month futures contract. May’s front-month futures contract expiration did not result in similar theatrics. The massively oversupplied global oil market in April that resulted in higher inventories subsided, resulting in higher prices. In fact, oil prices had the largest monthly gain in history in May. Crude oil spot prices, represented by West Texas Intermediate (WTI), began the fiscal period at $44.76 per barrel, troughed at -$37.63 on April 20 and ended the period at $35.49.

Indications are that China oil demand is approaching pre-COVID levels. U.S. demand appears to be increasing as well. Increased demand from two of the largest energy consumers in the world are helping balance the global oil supply and demand equation. Meanwhile, on the supply side, Saudi Arabia, Russia, and other OPEC nations are cutting production along with the U.S. In fact, the U.S. rig count is at its lowest level since 2009, indicating further production declines. According to Energy Information Administration (EIA) estimates, U.S. crude oil production fell from a record 12.9 million barrels per day (b/d) in November 2019 to 11.4 million b/d in May 2020. Baker Hughes reported that the U.S. had the fewest active drilling wells on record dating back to 1987. EIA forecasts that U.S. crude oil production will average 11.6 million b/d in 2020, and 10.8 million b/d in 2021, which would mark the first annual decline since 2016.1

While oil dominated the headlines, natural gas has continued to provide a cleaner burning energy source. As a result, we continue to see natural gas as a critical source of energy supply going forward. A reduction in natural gas demand caused by COVID-19 has resulted in the convergence of global natural gas prices. Natural gas prices, represented by Henry Hub, opened the fiscal quarter at $1.79 per million British Thermal Units (mmbtu), bottomed at $1.50 on April 3 and then peaked on May 5 at $1.93 before ending the fiscal quarter close to where it began at $1.70.

In the short term, the convergence of gas prices restricts the global liquefied natural gas (LNG) trade. It was reported that potentially 35-45 U.S. LNG cargoes scheduled for July loading could be canceled. However, low natural gas prices encourage coal-to-gas switching. We expect low natural gas prices in Europe to result in coal-to-gas fuel switching for electricity generation in countries like Germany this summer. Also, South Korea and Japan are expected to switch to natural gas from coal due to low prices as well. Clearly, more natural gas and less coal will reduce carbon emissions. According to the EIA, U.S. dry natural gas production averaged 92.2 billion cubic feet per day (Bcf/d) in 2019, setting a new record. EIA forecasts dry natural gas production will average 89.7 Bcf/d in 2020 and 85.4 Bcf/d in 2021 before production is expected to begin rising in the second quarter of 2021 in response to higher prices.1

On the demand side, EIA expects U.S. LNG exports to decline through the end of the summer as a result of reduced global demand for natural gas. COVID-19 has reduced global energy consumption, thereby reducing CO2 emissions significantly in 2020, and a further increase of natural gas usage and less coal will accelerate CO2 emissions reductions.

Longer term, lower natural gas prices are causing deferrals and cancellations of several LNG projects. Therefore, the global LNG market is expected to balance faster than analysts expected and there will likely be fewer players in the global LNG market. Existing LNG providers with stable cash flows backed by long-term contracts, will likely benefit from fewer market participants as LNG demand and commodity prices rise in the future.

Midstream energy was on par with broad energy in the second fiscal quarter with the Tortoise North American Pipeline IndexSM return of -14.0% and the Tortoise MLP Index® return of -13.9% during the period. In general, first quarter earnings for midstream companies were treated as a non-event, with an exclusive focus on company outlooks. Conditions appear to be improving, but are still far from normal. Full year guidance is now 8% lower on average. Companies with significant natural gas businesses and/or take or pay contracts reaffirmed guidance, whereas others with cash flows tied to wellhead volumes provided a wider range of outcomes. This falls in line with the sensitivity analysis we’ve conducted. Management teams are seeking to insulate and improve their balance sheets while investor focus has remained on their sustainability of cash flows and ultimately, the dividends. Companies continued to reduce spending to better align activity with the new environment and we estimate capex at the end of the fiscal quarter is 25% lower than original 2020 plans. Although in most cases these projects did shift out of 2020 capital budgets, we believe many of these projects will be necessary when demand stabilizes and may reappear in 2021 capital programs or beyond.

| |

| |

| 2020 2nd Quarter Report | May 31, 2020 |

| |

| |

| |

Capital markets activity was driven solely by debt issuance with midstream companies raising approximately $11.9 billion of debt during the second fiscal quarter of 2020, down from the first fiscal quarter. Merger and acquisition activity was minimal with less than $600 million for the period. The largest deal was Plains All American (PAA) selling its natural gas liquids (NGL) terminal assets to Crestwood Equity Partners (CEQP) totaling approximately $160 million.

On the regulatory front, New York regulators denied a water permit for William’s proposed Northeast Supply Enhancement natural gas pipeline. Now, it is unlikely that Williams will pursue this project, which would have resulted in lower heating bills for certain New York residents. The project cancellation would immediately improve Williams’ free cash flow. And as we are emphasizing a free cash flow focus to management teams, we consequently view this and other project cancellations and deferrals favorably.

Sustainable infrastructure

Renewables and utilities have seen fairly modest overall impacts to fundamentals and valuations throughout the pandemic. The sector has remained highly defensive while maintaining its overall growth outlook. In terms of short-term impact across regions, the primary issue is intense disruptions from ‘stay in place’ policies. Europe has proved to be the most impacted, with short-run electricity demand falling in a range of 5% to 20% versus last year, which relates to a more significant short-term disruption in manufacturing and industrial activity versus other regions. We expect these declines to recover sharply over the next few months, consistent with a gradual relaxation of lockdowns, which will favor essential business activities. Regarding renewables, growth continues unabated. Renewable power generation technologies are the cheapest options globally, accounting for 72% of all new capacity additions in 2019.2

In the U.S. we have seen far more limited impacts, with electricity demand flat to down 5% broadly year-over-year, in part because U.S. industrial and commercial activity has been less disrupted. In China, which experienced an earlier disruption and recovery cycle, we are seeing signs of not only full power demand recovery, but also the potential for annualized power demand to continue to be higher year-over-year for the rest of 2020. Unsurprisingly, residential usage appears to have increased compared to last year, almost everywhere. ‘‘Stay in place” has fueled more usage of appliances, lighting, computers and general activity in the home that relies on ever more plug-in nodes. And importantly, residential mix tends to be more profitable for utility companies. Our views before the crisis and now, are consistent: we expect power demand to remain relatively well underpinned, outperforming overall economic impacts during the economic downturn and to see gradual recovery as manufacturing activity bottoms and re-starts, especially in Europe. General sentiment from the International Energy Agency (IEA) concurs that renewables are growing and will continue to grow despite the generally weak economic environment and the decline in overall energy consumption in 2020.3

Social Infrastructure

Education

COVID-19 has required almost every industry to rethink how they do business and provide services, and education is no exception. Schools have had to rely exclusively on virtual learning, putting a strain on teachers and parents. It is our belief that education inside of facilities is imperative. Parents and children need brick and mortar facilities not only for education, but also for face-to-face social interaction, security, discipline, and in many cases, for a reliable meal. There are some full-time virtual charter schools, but data shows that in a given year full-time virtual charter school students overall make no gains in math and less than half the gains in reading realized by their peers in traditional schools.4

With regard to funding, for K-12 public education, it has proven extremely reliable over time. State level public school funding increased every year from 1985 through 2017, including during the recessions of the late 80’s and late 90’s. The only exception of positive state level growth was due to the recession in 2009 and 2010. Even in 2009, when state level funding declined, the federal stimulus kicked in and continued to demonstrate positive year-over-year growth for total funding (state and federal) in that year. Public school funding growth year-over-year in 2010 was negative for the first time with a nearly 2% decline. Since then, year-over-year growth has been positive. State level funding grew every year since 2011 with the exception of the stimulus pull back in 2012 due to the funding rebound at the state levels.5

To reach full enrollment, we typically need less than 3% of the age-based population in a catchment area. In the event that there is a population shift in a given area or a broad change in parent sentiment regarding allowing their children back into a school building, our underwriting strategy should allow for quite a bit of attrition before showing signs of weakness. For funding, there is a buffer in the revenue side of our underwriting in that we underestimate projected enrollment, funding per pupil, and the year-over-year growth of the revenue per child. In addition, we have cushion in debt service coverage. We think the expertise of our underwriting strategy is a key advantage of working with a strong and experienced team.

Senior Living

The key to handling any crisis is communication. In the case of COVID-19, and its effect on senior living facilities, over communication, being open and very honest with families and employees through not only written communication, but also through webinars and meetings has been essential. It is important to be very clear about the protocols in place to give families, residents and employees comfort that it is a safe environment. Another effect of the pandemic has been the increased expense of personal protective equipment, disinfectant supplies, and staffing. Facilities have always had these items on hand but not at current levels. Cleaning products and anything related to sanitation have increased in price and quantity needed. Many facilities will be tracking four categories of PPEs in key performance indicator formats and will be breaking out the surge pay for those differentials. Additional staff has been hired in some facilities to help maintain distancing of residents. For example, additional staff has been

transporting meals three times a day to each room. If outside staffing agencies are utilized, some are now charging $35 - $40 an hour for a nurse’s aide that is typically paid $14.

Fortunately, there has been access to financial support through the government initiatives in the form of Paycheck Protection Program loans. It is required that 75% of those funds go toward payroll, which can be used for the additional hazard pay. The majority of our investments have received PPP to help offset additional payroll and PPE expenses.

We believe that the spectrum of senior living options will see different levels of demand in the near future. After COVID-19, because of the strict visitation restrictions in place, some families may want to modify their homes to accommodate their aging parents in lieu of senior living facilities, but it’s very hard to provide the level of care and socialization that residents thrive on. There will be little to no change in the tremendous need for memory care because of the specific nature of the care. The need for independent living facilities may slow down a bit because it can be considered discretionary depending on the healthcare needs of the individual.

From an investment standpoint, we believe that cap rates may increase. Evaluations may change somewhat because of the perceived risk, particularly with institutional investors. Facilities that are successful should not have trouble accessing capital or refinancing. We continue to be bullish on the senior living sector and believe that there will continue to be a strong need once our communities bounce back, which will take some time.

Project Finance

The COVID-19 pandemic and related economic shutdown impacted the project finance sector late in the first quarter and throughout the second quarter. However, the impact did not hit each sub-sector equally. The sub-sectors hardest hit include recycling and liquid fuels. Demand for recycled content, such as plastics and metals, plummeted across several sub-sectors, as many new-product production facilities were temporarily shuttered or operated at significantly reduced capacities. Demand for liquid fuels, including ethanol, renewable diesel, and renewable jet fuel, also plummeted, due to the contraction of the transportation sector. Demand reduction was exacerbated by the hardship-based switch to lower-cost virgin raw materials (instead of recycled content) and fossil fuels (instead of biomass-based fuels). Finally, many planned or under-construction facilities were paused until economic re-openings bolster the demand for finished products. We expect the recovery in these sectors to follow the general recovery of the overall economy in general and the transportation sector in particular.

The renewable natural gas (RNG) sector was relatively unaffected during the crisis, with the landfill gas, wastewater treatment plant, and anaerobic digester sub-sectors performing particularly well. From a supply perspective, the production of methane at landfills and water treatment facilities, the collection of manure at farms, and the production of food processing waste remained relatively consistent. From a demand perspective, RNG production is typically contracted and benefits from various tax credits, such as the federal Renewable Identification Number (RIN) and California’s Low Carbon Fuel Standard (LCFS). Pricing for RINs and LCFS has held steady during the crisis, which helped insulate RNG-producing facilities from economic hardship. We expect these sectors to receive further underlying support as other states pass LCFS mandates similar to California’s standard.

Concluding thoughts

Despite the ripple effect that the COVID-19 crisis has had on the economy, we remain optimistic about the recovery potential as the world works hard to return to a new version of normal. We believe that energy markets will continue to improve and the energy demand and usage mix will continue to transition to natural gas and renewables. Our social infrastructure investments continued to be secure and are using the opportunity to plan for the future through this difficult experience. We believe that the need for these essential assets will prevail.

The S&P Energy Select Sector® Index is a capitalization-weighted index of S&P 500® Index companies in the energy sector involved in the development or production of energy products. The Tortoise North American Oil and Gas Producers IndexSM is a float-adjusted, capitalization-weighted index of North American energy companies engaged primarily in the production of crude oil, condensate, natural gas or natural gas liquids (NGLs). The Tortoise North American Pipeline IndexSM is a float adjusted, capitalization-weighted index of energy pipeline companies domiciled in the United States and Canada. The Tortoise MLP Index® is a float-adjusted, capitalization-weighted index of energy master limited partnerships.

The Tortoise indices are the exclusive property of Tortoise Index Solutions, LLC, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Tortoise MLP Index®, Tortoise North American Pipeline IndexSM and Tortoise North American Oil and Gas Producers IndexSM (the “Indices”). The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices LLC”). S&P Dow Jones Indices will not be liable for any errors or omission in calculating the Indices. “Calculated by S&P Dow Jones Indices” and its related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Tortoise Index Solutions, LLC and its affiliates. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

It is not possible to invest directly in an index.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost.

| 1. | EIA, June 2020 STEO |

| 2. | The International Renewable Energy Agency: Renewable Power Generation Costs in 2019 |

| 3. | IEA Renewable Energy Market Update, Outlook for 2020 and 2021 |

| 4. | NWEA, The COVID-19 Slide: What summer learning loss can tell us about the potential on student academic achievement, April 2020 |

| 5. | BMO Capital Markets, The Education Industry: 2018 |

| |

| |

| 2020 2nd Quarter Report | May 31, 2020 |

| |

| Tortoise |

| Energy Infrastructure Corp. (TYG) |

| |

Fund description

TYG seeks a high level of total return with an emphasis on current distributions paid to stockholders. TYG invests primarily in equity securities of master limited partnerships (MLPs) and their affiliates that transport, gather, process or store natural gas, natural gas liquids (NGLs), crude oil and refined petroleum products.

Fund performance review

Midstream energy was on par with broad energy in the second fiscal quarter with the Tortoise MLP Index® returning -13.9% during the period. In general, first quarter earnings for midstream companies were treated as a non-event, with an exclusive focus on company outlooks. Conditions appear to be improving, but are still far from normal. Full year guidance is now 8% lower on average. Companies with significant natural gas businesses and/or take or pay contracts reaffirmed guidance, whereas others with cash flows tied to wellhead volumes provided a wider range of outcomes. The average coverage ratio for the fund’s portfolio companies was 2.7x in 1Q20 while average leverage was 3.9x. Since the fund’s inception, it has paid out more than $144 in cumulative distributions to stockholders. The fund’s market-based and NAV-based returns for the fiscal quarter ending May 31, 2020 were -63.0% and -57.5%, respectively (including the reinvestment of distributions).

| Second fiscal quarter highlights | | |

| Distributions paid per share | | None |

| Distribution rate (as of 5/31/2020) | | 0.0% |

| Quarter-over-quarter distribution increase (decrease) | | (100.0)% |

| Year-over-year distribution increase (decrease) | | (100.0)% |

| Cumulative distributions paid per share to | | |

| stockholders since inception in February 2004 | | $144.3900 |

| Market-based total return | | (63.0)% |

| NAV-based total return | | (57.5)% |

| Premium (discount) to NAV (as of 5/31/2020) | | (25.4)% |

| Key asset performance drivers |

| |

| Top five contributors | | Company type | | Performance driver |

Crestwood Equity

Partners LP, 9.250% | | Natural gas pipeline company | | Preferred structure provided downside protection |

Noble Midstream

Partners LP | | Gathering and processing MLP | | Relatively strong counterparty amid market volatility |

Targa Resources Corp.,

9.500% | | Gathering and processing company | | Convertible debt structure provided downside protection |

BP Midstream

Partners LP | | Crude oil pipelines MLP | | Combination of steady outlook for Gulf of Mexico crude oil production and minimum volume commitments |

Altus Midstream

Company Preferred | | Natural gas pipeline company | | Sponsor (Apache) reducing drilling activity |

| Bottom five contributors | | Company type | | Performance driver |

| Targa Resources Corp. | | Gathering and processing company | | Relatively high leverage |

| Energy Transfer LP | | Natural gas/natural gas liquids pipeline MLP | | Relatively high leverage |

| ONEOK, Inc. | | Natural gas/natural gas liquids pipeline company | | Concern about declining crude oil volumes negatively impacting natural gas and natural gas liquids (NGL) volumes |

Enterprise Products

Partners L.P. | | Natural gas/natural gas liquids pipeline MLP | | Concerns regarding U.S. crude oil and natural gas liquids (NGL) production volumes |

Magellan Midstream

Partners, L.P. | | Refined product pipeline MLP | | Concerns regarding reduced refined product demand and Permian crude oil volumes |

Unlike the fund return, index return is pre-expenses and taxes.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule of Investments for portfolio weighting at the end of the fiscal quarter.

| |

| |

| |

| |

| Tortoise |

| Energy Infrastructure Corp. (TYG) (continued) |

| |

Fund structure and distribution policy

The fund is structured as a corporation and is subject to federal and state income tax on its taxable income. The fund has adopted a distribution policy in which the Board of Directors considers many factors in determining distributions to stockholders, including NAV performance and distributable cash flow (DCF). The fund’s Board of Directors reviews the distribution rate at least quarterly, and may adjust the quarterly distribution throughout the year. Although the level of distributions is independent of the funds’ performance in the short term, the fund expects such distributions to correlate with its performance over time.

Distributable cash flow and distributions

DCF is distributions received from investments less expenses. The total distributions received from investments include the amount received as cash distributions from investments, paid-in-kind distributions, and dividend and interest payments. Income also includes the premiums received from sales of covered call options, net of amounts paid to buy back out-of-the-money options. The total expenses include current or anticipated operating expenses, leverage costs and current income taxes. Current income taxes include taxes paid on net investment income, in addition to foreign taxes, if any. Taxes incurred from realized gains on the sale of investments, expected tax benefits and deferred taxes are not included in DCF.

Income from investments decreased approximately 74% as compared to 1st quarter 2020 primarily due to trading activity within the fund’s portfolio to fund leverage reductions. Operating expenses, consisting primarily of fund advisory fees, decreased approximately 63% during the quarter due mainly to lower asset-based fees. Overall leverage costs decreased approximately 42% as compared to 1st quarter 2020 as the fund materially reduced leverage during the quarter. As a result of the changes in income and expenses, DCF decreased approximately 81% as compared to 1st quarter 2020. The fund announced the temporary suspension of distributions during the quarter and did not pay any distributions during the 2nd quarter. Subsequent to quarter-end, the fund announced reinstatement of the distribution at a lower level in the 3rd quarter 2020. The fund has paid cumulative distributions to stockholders of $144.39 per share since its inception in Feb. 2004.

The Key Financial Data table discloses the calculation of DCF and should be read in conjunction with this discussion. The difference between distributions received from investments in the DCF calculation and total investment income as reported in the Statement of Operations, is reconciled as follows: the Statement of Operations, in conformity with U.S. generally accepted accounting principles (GAAP), recognizes distribution income from MLPs and other investments on their ex-dates, whereas the DCF calculation may reflect distribution income on their pay dates; GAAP recognizes that a significant portion of the cash distributions received from MLPs and other investments are characterized as a return of capital and therefore excluded from investment income, whereas the DCF calculation includes the return of capital (net of any distributions deemed to be return of principal); and distributions received from investments in the DCF calculation include the value of dividends paid-in-kind (additional stock or MLP units), whereas such amounts may not be included as income for GAAP purposes and includes distributions related to direct investments when the purchase price is reduced in lieu of receiving cash distributions. Net premiums on options written (premiums received less amounts paid to buy back out-of-the-money options) with expiration dates during the fiscal quarter are included in the DCF calculation, whereas GAAP recognizes the net effect of options written as realized and unrealized gains (losses). Income for DCF purposes is reduced by amortizing the cost of certain investments that may not have a residual value after a known time period and by distributions received from investments deemed to be return of principal. The treatment of expenses in the DCF calculation also differs from what is reported in the Statement of Operations. In addition to the total operating expenses, including fee waiver, as disclosed in the Statement of Operations, the DCF calculation reflects interest expense, realized and unrealized gains (losses) on interest rate swap settlements, distributions to preferred stockholders, other recurring leverage expenses, as well as taxes paid on net investment income.

“Net Investment Income (Loss), before Income Taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF for YTD and 2nd quarter 2020 (in thousands):

| | YTD 2020 | | 2nd Qtr 2020 |

| Net Investment Loss, | | | | | | | | |

| before Income Taxes | | $ | (11,524 | ) | | $ | (7,990 | ) |

| Adjustments to reconcile to DCF: | | | | | | | | |

| Distributions characterized as | | | | | | | | |

| return of capital, net | | | 44,577 | | | | 10,102 | |

| Premiums on redemption of | | | | | | | | |

| senior notes and MRP stock | | | 3,659 | | | | 3,659 | |

| Other | | | 262 | | | | 55 | |

| DCF | | $ | 36,974 | | | $ | 5,826 | |

Leverage

The fund’s leverage utilization decreased $436.2 million during 2nd quarter 2020 and represented 25.4% of total assets at May 31, 2020. The fund was not in compliance with its applicable coverage ratios at March 31, 2020 and took action to materially reduce leverage outstanding. At quarter-end, the fund was in compliance with applicable coverage ratios. At quarter-end, 100% of the leverage cost was fixed, the weighted-average maturity was 3.5 years and the weighted-average annual rate on leverage was 4.50%. These rates will vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage and swaps mature or are redeemed. During the quarter, $233.2 million of Senior Notes and $132.7 million of MRP stock was redeemed. A prepayment premium of 1% was paid upon redemption of the Senior Notes and MRP stock.

Income taxes

During 2nd quarter 2020, due primarily to a decrease in the value of its investment portfolio, the fund’s deferred tax liability was reduced to zero. The fund had net realized losses of approximately $572 million during the quarter. To the extent that the fund has taxable income, it will owe federal and state income taxes. Tax payments can be funded from investment earnings, fund assets, or borrowings.

Please see the Financial Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund information.

For further information regarding the calculation of distributable cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseadvisors.com.

| |

| |

| 2020 2nd Quarter Report | May 31, 2020 |

| |

| TYG Key Financial Data (supplemental unaudited information) |

| (dollar amounts in thousands unless otherwise indicated) |

| |

The information presented below regarding Distributable Cash Flow and Selected Financial Information is supplemental non-GAAP financial information, which the fund believes is meaningful to understanding operating performance. The Distributable Cash Flow Ratios include the functional equivalent of EBITDA for non-investment companies, and the fund believes they are an important supplemental measure of performance and promote comparisons from period-to-period. This information is supplemental, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction with the full financial statements.

| | 2019 | | | | 2020 |

| | Q2(1) | | | | Q3(1) | | | | Q4(1) | | | | Q1(1) | | | | Q2(1) |

| Total Income from Investments | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions and dividends from investments | | $ | 44,564 | | | | $ | 42,910 | | | | $ | 44,074 | | | | $ | 40,436 | | | | $ | 10,138 | | |

| Dividends paid in kind | | | 117 | | | | | 269 | | | | | 300 | | | | | 178 | | | | | 179 | | |

| Interest earned on corporate bonds | | | — | | | | | 119 | | | | | 348 | | | | | 712 | | | | | 604 | | |

| Premiums on options written | | | 1,092 | | | | | 668 | | | | | 714 | | | | | 250 | | | | | — | | |

| Total from investments | | | 45,773 | | | | | 43,966 | | | | | 45,436 | | | | | 41,576 | | | | | 10,921 | | |

| Operating Expenses Before Leverage | | | | | | | | | | | | | | | | | | | | | | | | | |

| Costs and Current Taxes | | | | | | | | | | | | | | | | | | | | | | | | | |

| Advisory fees | | | 5,215 | | | | | 4,979 | | | | | 4,479 | | | | | 4,143 | | | | | 1,373 | | |

| Other operating expenses | | | 420 | | | | | 407 | | | | | 382 | | | | | 407 | | | | | 313 | | |

| | | 5,635 | | | | | 5,386 | | | | | 4,861 | | | | | 4,550 | | | | | 1,686 | | |

| Distributable cash flow before leverage costs and current taxes | | | 40,138 | | | | | 38,580 | | | | | 40,575 | | | | | 37,026 | | | | | 9,235 | | |

| Leverage costs(2) | | | 6,637 | | | | | 6,607 | | | | | 6,347 | | | | | 5,878 | | | | | 3,409 | | |

| Current income tax expense(3) | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | |

| Distributable Cash Flow(4) | | $ | 33,501 | | | | $ | 31,973 | | | | $ | 34,228 | | | | $ | 31,148 | | | | $ | 5,826 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net realized gain (loss), net of income taxes, | | | | | | | | | | | | | | | | | | | | | | | | | |

| for the period | | $ | 10,905 | | | | $ | 34,895 | | | | $ | (6,537 | ) | | | $ | (17,195 | ) | | | $ | (572,057 | ) | |

| As a percent of average total assets(5) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total from investments | | | 8.42 | | % | | | 8.38 | | % | | | 9.71 | | % | | | 10.04 | | % | | | 5.58 | | % |

| Operating expenses before leverage costs and current taxes | | | 1.04 | | % | | | 1.03 | | % | | | 1.04 | | % | | | 1.10 | | % | | | 0.86 | | % |

| Distributable cash flow before leverage costs and current taxes | | | 7.38 | | % | | | 7.35 | | % | | | 8.67 | | % | | | 8.94 | | % | | | 4.72 | | % |

| As a percent of average net assets(5) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total from investments | | | 14.01 | | % | | | 14.41 | | % | | | 17.12 | | % | | | 16.87 | | % | | | 14.35 | | % |

| Operating expenses before leverage costs and current taxes | | | 1.72 | | % | | | 1.77 | | % | | | 1.83 | | % | | | 1.85 | | % | | | 2.22 | | % |

| Leverage costs and current taxes | | | 2.03 | | % | | | 2.17 | | % | | | 2.39 | | % | | | 2.38 | | % | | | 4.48 | | % |

| Distributable cash flow | | | 10.26 | | % | | | 10.47 | | % | | | 12.90 | | % | | | 12.64 | | % | | | 7.65 | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Financial Information | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions paid on common stock | | $ | 35,131 | | | | $ | 35,131 | | | | $ | 35,195 | | | | $ | 21,224 | | | | $ | — | | |

| Distributions paid on common stock per share(7) | | | 2.6200 | | | | | 2.6200 | | | | | 2.6200 | | | | | 1.5800 | | | | | — | | |

| Total assets, end of period(6) | | | 2,110,273 | | | | | 1,951,035 | | | | | 1,680,775 | | | | | 1,416,246 | | | | | 508,235 | | |

| Average total assets during period(6)(8) | | | 2,157,919 | | | | | 2,080,591 | | | | | 1,876,534 | | | | | 1,665,499 | | | | | 778,359 | | |

| Leverage(9) | | | 683,700 | | | | | 688,900 | | | | | 623,900 | | | | | 565,300 | | | | | 129,100 | | |

| Leverage as a percent of total assets | | | 32.4 | | % | | | 35.3 | | % | | | 37.1 | | % | | | 39.9 | | % | | | 25.4 | | % |

| Net unrealized depreciation, end of period | | | (300,530 | ) | | | | (421,920 | ) | | | | (543,310 | ) | | | | (662,820 | ) | | | | (526,684 | ) | |

| Net assets, end of period | | | 1,220,946 | | | | | 1,097,489 | | | | | 930,286 | | | | | 769,227 | | | | | 334,413 | | |

| Average net assets during period(10) | | | 1,296,336 | | | | | 1,210,078 | | | | | 1,064,735 | | | | | 991,440 | | | | | 302,755 | | |

| Net asset value per common share(7) | | | 91.04 | | | | | 81.72 | | | | | 69.24 | | | | | 57.28 | | | | | 25.08 | | |

| Market value per share(7) | | | 87.60 | | | | | 81.56 | | | | | 67.28 | | | | | 50.60 | | | | | 18.70 | | |

| Shares outstanding (000’s) | | | 53,635 | | | | | 53,732 | | | | | 53,732 | | | | | 53,732 | | | | | 13,334 | | |

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Leverage costs include interest expense, distributions to preferred stockholders, interest rate swap expenses and other recurring leverage expenses. |

| (3) | Includes taxes paid on net investment income and foreign taxes, if any. Taxes related to realized gains are excluded from the calculation of Distributable Cash Flow (“DCF”). |

| (4) | “Net investment income (loss), before income taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF: increased by the return of capital on distributions, the dividends paid in stock and increased liquidation value, the premium on dividends paid in kind, the net premiums on options written and amortization of debt issuance costs; and decreased by realized and unrealized gains (losses) on interest rate swap settlements, distributions received that are excluded for DCF purposes and amortization on certain investments. |

| (5) | Annualized. |

| (6) | Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (7) | Adjusted to reflect 1 for 4 reverse stock split effective May 1, 2020. |

| (8) | Computed by averaging month-end values within each period. |

| (9) | Leverage consists of senior notes, preferred stock and outstanding borrowings under credit facilities. |

| (10) | Computed by averaging daily net assets within each period. |

| |

| |

| |

| |

| Tortoise |

| Midstream Energy Fund, Inc. (NTG) |

| |

Fund description

NTG seeks to provide stockholders with a high level of total return with an emphasis on current distributions. NTG invests primarily in midstream energy equities that own and operate a network of pipeline and energy related logistical infrastructure assets with an emphasis on those that transport, gather, process and store natural gas and natural gas liquids (NGLs). NTG targets midstream energy equities, including MLPs benefiting from U.S. natural gas production and consumption expansion, with minimal direct commodity exposure.

Fund performance review

Midstream energy was on par with broad energy in the second fiscal quarter with the Tortoise MLP Index® returning -13.9% during the period. In general, first quarter earnings for midstream companies were treated as a non-event, with an exclusive focus on company outlooks. Conditions appear to be improving, but are still far from normal. Full year guidance is now 8% lower on average. Companies with significant natural gas businesses and/or take or pay contracts reaffirmed guidance, whereas others with cash flows tied to wellhead volumes provided a wider range of outcomes. The average coverage ratio for the fund’s portfolio companies was 2.6x in 1Q20 while average leverage was 3.9x. The fund’s market-based and NAV-based returns for the fiscal quarter ending May 31, 2020 were -73.1% and -70.8%, respectively (including the reinvestment of distributions).

| Second fiscal quarter highlights |

| Distributions paid per share | | None |

| Distribution rate (as of 5/31/2020) | | 0.0% |

| Quarter-over-quarter distribution increase (decrease) | | (100.0)% |

| Year-over-year distribution increase (decrease) | | (100.0)% |

| Cumulative distributions paid per share to | | |

| stockholders since inception in July 2010 | | $156.9500 |

| Market-based total return | | (73.1)% |

| NAV-based total return | | (70.8)% |

| Premium (discount) to NAV (as of 5/31/2020) | | (18.5)% |

Key asset performance drivers

| Top five contributors | | Company type | | Performance driver |

| Crestwood Equity Partners LP, 9.250% | | Natural gas pipeline company | | Preferred structure provided downside protection |

| MPLX LP | | Refined products pipeline MLP | | Protection from minimum volume commitments and business diversification with Northeast midstream business |

| Noble Midstream Partners LP | | Gathering and processing MLP | | Relatively strong counterparty amid market volatility |

| Targa Resources Corp., 9.500% | | Gathering and processing company | | Convertible debt structure provided downside protection |

| DCP Midstream, LP | | Natural gas pipeline MLP | | Aggressive cost cutting initiative amid energy market volatility |

| Bottom five contributors | | Company type | | Performance driver |

| Energy Transfer LP | | Natural gas pipeline company | | Relatively high leverage |

| Targa Resources Corp. | | Gathering and processing company | | Relatively high leverage |

| Enterprise Products Partners L.P. | | Natural gas pipeline MLP | | Concerns regarding U.S. crude oil and natural gas liquids (NGL) production volumes |

| ONEOK, Inc. | | Natural gas pipeline company | | Concern about declining crude oil volumes negatively impacting natural gas and natural gas liquids (NGL) volumes |

| Holly Energy Partners, L.P. | | Refined products pipeline MLP | | Reduced distribution following lower refined product demand |

Unlike the fund return, index return is pre-expenses and taxes.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule of Investments for portfolio weighting at the end of the fiscal quarter.

| |

| |

| 2020 2nd Quarter Report | May 31, 2020 |

| |

| |

| |

| |

Fund structure and distribution policy

The fund is structured as a corporation and is subject to federal and state income tax on its taxable income. The fund has adopted a distribution policy in which the Board of Directors considers many factors in determining distributions to stockholders, including NAV performance and distributable cash flow (DCF). The fund’s Board of Directors reviews the distribution rate at least quarterly, and may adjust the quarterly distribution throughout the year. Although the level of distributions is independent of the funds’ performance in the short term, the fund expects such distributions to correlate with its performance over time.

Distributable cash flow and distributions

DCF is distributions received from investments less expenses. The total distributions received from investments include the amount received as cash distributions from MLPs, paid-in-kind distributions, and dividend and interest payments. Income also includes the premiums received from sales of covered call options, net of amounts paid to buy back out-of-the-money options. The total expenses include current or anticipated operating expenses, leverage costs and current income taxes. Current income taxes include taxes paid on net investment income in addition to foreign taxes, if any. Taxes incurred from realized gains on the sale of investments, expected tax benefits and deferred taxes are not included in DCF.

Income from investments decreased approximately 79% as compared to 1st quarter 2020 primarily due to trading activity within the fund’s portfolio to fund leverage reductions. Operating expenses, consisting primarily of fund advisory fees, decreased approximately 75% during the quarter due primarily to lower asset-based fees. Leverage costs decreased approximately 54% as compared to 1st quarter 2020 as the fund materially reduced leverage during the quarter. As a result of the changes in income and expenses, DCF decreased approximately 86% as compared to 1st quarter 2020. The fund announced the temporary suspension of distributions during the quarter and did not pay any distributions during the 2nd quarter. Subsequent to quarter-end, the fund announced reinstatement of the distribution at a lower level in the 3rd quarter 2020. The fund has paid cumulative distributions to stockholders of $156.95 per share since its inception in July 2010.

The Key Financial Data table discloses the calculation of DCF and should be read in conjunction with this discussion. The difference between distributions received from investments in the DCF calculation and total investment income as reported in the Statement of Operations, is reconciled as follows: the Statement of Operations, in conformity with U.S. generally accepted accounting principles (GAAP), recognizes distribution income from MLPs, common stock and other investments on their ex-dates, whereas the DCF calculation may reflect distribution income on their pay dates; GAAP recognizes that a significant portion of the cash distributions received from MLPs, common stock and other investments are characterized as a return of capital and therefore excluded from investment income, whereas the DCF calculation includes the return of capital; and distributions received from investments in the DCF calculation include the value of dividends paid-in-kind (additional stock or MLP units), whereas such amounts may not be included as income for GAAP purposes, and includes distributions related to direct investments when the purchase price is reduced in lieu of receiving cash distributions. Net premiums on options written (premiums received less amounts paid to buy back out-of-the-money options) with expiration dates during the fiscal quarter are included in the DCF calculation, whereas GAAP recognizes the net effect of options written as realized and unrealized gains (losses). The treatment of expenses in the DCF calculation also differs from what is reported in the Statement of Operations. In addition to the total operating expenses, including fee waiver, as disclosed in the Statement of Operations, the DCF calculation reflects interest expense, distributions to preferred stockholders, other recurring leverage expenses, as well as taxes paid on net investment income.

“Net Investment Income (Loss), before Income Taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF for YTD and 2nd quarter 2020 (in thousands):

| | YTD 2020 | | 2nd Qtr 2020 |

| Net Investment Loss, | | | | | | | | |

| before Income Taxes | | $ | (7,754 | ) | | $ | (3,615 | ) |

| Adjustments to reconcile to DCF: | | | | | | | | |

| Distributions characterized as | | | | | | | | |

| return of capital (ROC) | | | 30,164 | | | | 25,303 | |

| Premiums on redemption of | | | | | | | | |

| senior notes and MRP stock | | | 4,081 | | | | 4,081 | |

| Prior year ROC re-class | | | (1,606 | ) | | | (1,606 | ) |

| Other | | | 461 | | | | 128 | |

| DCF | | $ | 25,346 | | | $ | 3,325 | |

Leverage

The fund’s leverage utilization decreased by $358.6 million during 2nd quarter 2020 and represented 21.2% of total assets at May 31, 2020. The fund was not in compliance with its applicable coverage ratios at March 31, 2020 and took action to materially reduce leverage outstanding. At quarter-end, the fund was in compliance with applicable coverage ratios. At quarter-end, 100% of the leverage cost was fixed, the weighted-average maturity was 2.1 years and the weighted-average annual rate on leverage was 5.25%. These rates will vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed. During the quarter, $218.8 million of Senior Notes and $119.3 million of MRP stock was redeemed. Prepayment premiums of approximately 1.3% and 1% were paid upon redemption of the Senior Notes and MRP stock, respectfully.

Income taxes

During 2nd quarter 2020, the fund’s deferred tax asset was reduced to zero, primarily due to application of a valuation allowance as a result of the decrease in value of its investment portfolio. The fund had net realized losses of approximately $520 million during the quarter. As of November 30, 2019, the fund had net operating losses of $1.3 million and capital loss carryforwards of $26.9 million for federal income tax purposes. To the extent that the fund has taxable income in the future that is not offset by net operating losses, it will owe federal and state income taxes. Tax payments can be funded from investment earnings, fund assets, or borrowings.

Please see the Financial Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund information.

For further information regarding the calculation of distributable cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseadvisors.com.

| |

| |

| |

| |

| NTG Key Financial Data (supplemental unaudited information) |

| (dollar amounts in thousands unless otherwise indicated) |

| |

The information presented below regarding Distributable Cash Flow and Selected Financial Information is supplemental non-GAAP financial information, which the fund believes is meaningful to understanding operating performance. The Distributable Cash Flow Ratios include the functional equivalent of EBITDA for non-investment companies, and the fund believes they are an important supplemental measure of performance and promote comparisons from period-to-period. This information is supplemental, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction with the full financial statements.

| | 2019 | | | | 2020 |

| | Q2(1) | | | | Q3(1) | | | | Q4(1) | | | | Q1(1) | | | | Q2(1) |

| Total Income from Investments | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions and dividends from investments | | $ | 31,824 | | | | $ | 31,244 | | | | $ | 31,315 | | | | $ | 28,806 | | | | $ | 6,309 | | |

| Dividends paid in kind | | | 70 | | | | | 179 | | | | | 200 | | | | | 127 | | | | | 130 | | |

| Interest earned on corporate bonds | | | — | | | | | 85 | | | | | 230 | | | | | 489 | | | | | 317 | | |

| Premiums on options written | | | 890 | | | | | 927 | | | | | 941 | | | | | 216 | | | | | — | | |

| Total from investments | | | 32,784 | | | | | 32,435 | | | | | 32,686 | | | | | 29,638 | | | | | 6,756 | | |

| Operating Expenses Before Leverage | | | | | | | | | | | | | | | | | | | | | | | | | |

| Costs and Current Taxes | | | | | | | | | | | | | | | | | | | | | | | | | |

| Advisory fees, net of fees waived | | | 3,715 | | | | | 3,526 | | | | | 3,145 | | | | | 2,868 | | | | | 873 | | |

| Other operating expenses | | | 324 | | | | | 312 | | | | | 301 | | | | | 321 | | | | | 156 | | |

| | | 4,039 | | | | | 3,838 | | | | | 3,446 | | | | | 3,189 | | | | | 1,029 | | |

| Distributable cash flow before leverage costs and current taxes | | | 28,745 | | | | | 28,597 | | | | | 29,240 | | | | | 26,449 | | | | | 5,727 | | |

| Leverage costs(2) | | | 5,175 | | | | | 5,088 | | | | | 4,859 | | | | | 4,428 | | | | | 2,402 | | |

| Current income tax expense(3) | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | |

| Distributable Cash Flow(4) | | $ | 23,570 | | | | $ | 23,509 | | | | $ | 24,381 | | | | $ | 22,021 | | | | $ | 3,325 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net realized gain (loss), net of income taxes, | | | | | | | | | | | | | | | | | | | | | | | | | |

| for the period | | $ | (6,278 | ) | | | $ | 9,631 | | | | $ | (8,640 | ) | | | $ | (6,917 | ) | | | $ | (518,170 | ) | |

| As a percent of average total assets(5) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total from investments | | | 8.46 | | % | | | 8.73 | | % | | | 9.96 | | % | | | 10.37 | | % | | | 5.77 | | % |

| Operating expenses before leverage costs and current taxes | | | 1.04 | | % | | | 1.03 | | % | | | 1.05 | | % | | | 1.12 | | % | | | 0.88 | | % |

| Distributable cash flow before leverage costs and current taxes | | | 7.42 | | % | | | 7.70 | | % | | | 8.91 | | % | | | 9.25 | | % | | | 4.89 | | % |

| As a percent of average net assets(5) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total from investments | | | 13.79 | | % | | | 14.70 | | % | | | 17.18 | | % | | | 16.80 | | % | | | 16.18 | | % |

| Operating expenses before leverage costs and current taxes | | | 1.70 | | % | | | 1.74 | | % | | | 1.81 | | % | | | 1.81 | | % | | | 2.46 | | % |

| Leverage costs and current taxes | | | 2.18 | | % | | | 2.31 | | % | | | 2.55 | | % | | | 2.51 | | % | | | 5.75 | | % |

| Distributable cash flow | | | 9.91 | | % | | | 10.65 | | % | | | 12.82 | | % | | | 12.48 | | % | | | 7.97 | | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Financial Information | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions paid on common stock | | $ | 26,705 | | | | $ | 26,706 | | | | $ | 26,705 | | | | $ | 14,854 | | | | $ | — | | |

| Distributions paid on common stock per share(7) | | | 4.2250 | | | | | 4.2250 | | | | | 4.2250 | | | | | 2.3500 | | | | | — | | |

| Total assets, end of period(6) | | | 1,498,278 | | | | | 1,380,446 | | | | | 1,163,500 | | | | | 964,276 | | | | | 239,673 | | |

| Average total assets during period(6)(8) | | | 1,536,794 | | | | | 1,473,596 | | | | | 1,316,053 | | | | | 1,149,464 | | | | | 466,040 | | |

| Leverage(9) | | | 527,300 | | | | | 528,100 | | | | | 462,600 | | | | | 409,500 | | | | | 50,900 | | |

| Leverage as a percent of total assets | | | 35.2 | | % | | | 38.3 | | % | | | 39.8 | | % | | | 42.5 | | % | | | 21.2 | | % |

| Net unrealized appreciation (depreciation), end of period | | | 93,595 | | | | | 15,163 | | | | | (64,329 | ) | | | | (157,875 | ) | | | | (22,960 | ) | |

| Net assets, end of period | | | 886,270 | | | | | 786,294 | | | | | 667,708 | | | | | 549,293 | | | | | 162,369 | | |

| Average net assets during period(10) | | | 943,080 | | | | | 875,555 | | | | | 762,956 | | | | | 709,609 | | | | | 166,096 | | |

| Net asset value per common share(7) | | | 140.20 | | | | | 124.40 | | | | | 105.60 | | | | | 86.90 | | | | | 25.69 | | |

| Market value per common share(7) | | | 132.10 | | | | | 120.30 | | | | | 98.80 | | | | | 78.00 | | | | | 20.95 | | |

| Shares outstanding (000’s) | | | 63,208 | | | | | 63,208 | | | | | 63,208 | | | | | 63,208 | | | | | 6,321 | | |

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Leverage costs include interest expense, distributions to preferred stockholders and other recurring leverage expenses. |

| (3) | Includes taxes paid on net investment income and foreign taxes, if any. Taxes related to realized gains are excluded from the calculation of Distributable Cash Flow (“DCF”). |

| (4) | “Net investment income (loss), before income taxes” on the Statement of Operations is adjusted as follows to reconcile to DCF: increased by the return of capital on distributions, the dividends paid in stock and increased liquidation value, the premium on dividends paid in kind and amortization of debt issuance costs. |

| (5) | Annualized. |

| (6) | Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (7) | Adjusted to reflect 1 for 10 reverse stock split effective May 1, 2020. |

| (8) | Computed by averaging month-end values within each period. |

| (9) | Leverage consists of senior notes, preferred stock and outstanding borrowings under the credit facility. |

| (10) | Computed by averaging daily net assets within each period. |

| |

| |

| 2020 2nd Quarter Report | May 31, 2020 |

| |

| Tortoise |

| Pipeline & Energy Fund, Inc. (TTP) |

| |

Fund description

TTP seeks a high level of total return with an emphasis on current distributions paid to stockholders. TTP invests primarily in equity securities of North American pipeline companies that transport natural gas, natural gas liquids (NGLs), crude oil and refined products and, to a lesser extent, in other energy infrastructure companies.

Fund performance review

Midstream energy was on par with broad energy in the second fiscal quarter with the Tortoise North American Pipeline IndexSM returning -14.0%. In general, first quarter earnings for midstream companies were treated as a non-event, with an exclusive focus on company outlooks. Conditions appear to be improving, but are still far from normal. Full year guidance is now 8% lower on average. Companies with significant natural gas businesses and/or take or pay contracts reaffirmed guidance, whereas others with cash flows tied to wellhead volumes provided a wider range of outcomes. The fund’s market-based and NAV-based returns for the fiscal quarter ending May 31, 2020 were -56.6% and -53.8%, respectively (including the reinvestment of distributions).

| Second fiscal quarter highlights | | |

| Distributions paid per share | | $0.1600 |

| Distribution rate (as of 5/31/2020) | | 3.8% |

| Quarter-over-quarter distribution increase (decrease) | | (86.0)% |

| Year-over-year distribution increase (decrease) | | (90.2)% |

Cumulative distributions paid per share to

stockholders since inception in October 2011 | | $53.7500 |

| Market-based total return | | (56.6)% |

| NAV-based total return | | (53.8)% |

| Premium (discount) to NAV (as of 5/31/2020) | | (16.2)% |

Please refer to the inside front cover of the report for important information about the fund’s distribution policy.

The fund utilizes a covered call strategy when appropriate, which seeks to generate income while reducing overall volatility. No covered calls were written during the quarter.

Key asset performance drivers

| Top five contributors | | Company type | | Performance driver |

| Equitrans Midstream Corporation | | Gathering and processing company | | Relatively steady natural gas outlook amid market volatility |

| Cabot Oil & Gas Corporation | | Natural gas producing company | | View of natural gas prices being a beneficiary of lower crude oil production |

| Noble Midstream Partners LP | | Gathering and processing MLP | | Relatively strong counterparty amid market volatility |

| Targa Resources Corp., 9.500% | | Gathering and processing company | | Convertible debt structure provided downside protection |

| Cimarex Energy Co. | | Oil and gas producing company | | Diversified production provided more stability in volatile market |

| Bottom five contributors | | Company type | | Performance driver |

| ONEOK, Inc. | | Natural gas pipeline company | | Concern about declining crude oil volumes negatively impacting natural gas and natural gas liquids (NGL) volumes |

| Targa Resources Corp. | | Gathering and processing company | | Relatively high leverage |

| Energy Transfer LP | | Natural gas pipeline MLP | | Relatively high leverage |

| Plains GP Holdings, L.P. | | Crude oil pipeline company | | Reduced crude oil volume outlook |

| Inter Pipeline Ltd. | | Crude oil pipeline company | | Relatively high leverage due to growth capex spend |

Unlike the fund return, index return is pre-expenses.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule of Investments for portfolio weighting at the end of the fiscal quarter.

| |

| |

| |

| |

| Tortoise |

| Pipeline & Energy Fund, Inc. (TTP) (continued) |

| |

Fund structure and distribution policy

The fund is structured to qualify as a Regulated Investment Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income. RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net capital gains to avoid a 4 percent excise tax.

The fund has adopted a distribution policy which is included on the inside front cover of this report. To summarize, the fund intends to distribute an amount closely approximating the total taxable income for the year and, if so determined by the Board, distribute all or a portion of the return of capital paid by portfolio companies during the year. The fund may designate a portion of its distributions as capital gains and may also distribute additional capital gains in the last calendar quarter of the year to meet annual excise distribution requirements. Distribution amounts are subject to change from time to time at the discretion of the Board. Although the level of distributions is independent of the funds’ performance in the short term, the fund expects such distributions to correlate with its performance over time.

Distributable cash flow and distributions

Distributable cash flow (DCF) is income from investments less expenses. Income from investments includes the amount received as cash or paid-in-kind distributions from common stock, master limited partnerships (MLPs), affiliates of MLPs, and pipeline and other energy companies in which the fund invests, and dividend payments on short-term investments. Income also includes the premiums received from sales of covered call options, net of amounts paid to buy back out-of-the-money options. The total expenses include current or anticipated operating expenses and leverage costs.

Income from investments decreased approximately 64% as compared to 1st quarter 2020, primarily due to trading activity within the fund’s portfolio to fund leverage reductions. Operating expenses, consisting primarily of fund advisory fees, decreased approximately 47% during the quarter, primarily due to lower asset-based fees. Leverage costs decreased approximately 30% as compared to 1st quarter 2020 as the fund materially reduced leverage during the quarter. As a result of the changes in income and expenses, DCF decreased approximately 74% as compared to 1st quarter 2020. In addition, the fund had net realized losses on investments of $86.7 million during 2nd quarter 2020. The fund paid a quarterly distribution of $0.16 per share, a decrease of approximately 86% from the distribution paid in the prior quarter and a decrease of approximately 90% from the 2nd quarter 2020. The fund has paid cumulative distributions to stockholders of $53.75 per share since its inception in October 2011.

The Key Financial Data table discloses the calculation of DCF and should be read in conjunction with this discussion. The difference between income from investments in the DCF calculation and total investment income as reported in the Statement of Operations, is reconciled as follows: (1) the Statement of Operations, in conformity with U.S. generally accepted accounting principles (GAAP), recognizes distributions and dividend income from MLPs, common stock and other investments on their ex-dates, whereas the DCF calculation may reflect distributions and dividend income on their pay dates; (2) GAAP recognizes that a significant portion of the cash distributions received from MLPs, common stock and other investments are characterized as a return of capital and therefore excluded from investment income, whereas the DCF calculation includes the return of capital; (3) income from investments in the DCF calculation includes the value of dividends paid-in-kind (additional stock or units), whereas such amounts may not be included as income for GAAP purposes; and (4) net premiums on options written (premiums received less amounts paid to buy back out-of-the-money options) with expiration dates during the fiscal quarter are included in the DCF calculation, whereas GAAP recognizes the net effect of options written as realized and unrealized gains (losses).

“Net Investment Income (Loss)” on the Statement of Operations is adjusted as follows to reconcile to DCF for YTD and 2nd quarter 2020 (in thousands):

| | YTD 2020 | | 2nd Qtr 2020 |

| Net Investment Income (loss) | | $ | 52 | | | $ | 99 | |

| Adjustments to reconcile to DCF: | | | | | | | | |

| Net premiums on options written | | | 747 | | | | 208 | |

Distributions characterized as

return of capital | | | 3,321 | | | | 849 | |

Premiums on redemption of

senior notes and MRP stock | | | 195 | | | | 195 | |

| Prior year ROC re-class | | | (580 | ) | | | (580 | ) |

| Other | | | 63 | | | | 15 | |

| DCF | | $ | 3,798 | | | $ | 786 | |

Leverage

The fund’s leverage utilization decreased by $33.5 million during 2nd quarter 2020 and represented 32.4% of total assets at May 31, 2020. The fund was not in compliance with its applicable coverage ratios at March 31, 2020 and took action to materially reduce leverage outstanding. At quarter-end, the fund was in compliance with applicable coverage ratios. At quarter-end, 100% of the leverage cost was fixed, the weighted-average maturity was 2.6 years and the weighted-average annual rate on leverage was 4.72%. These rates will vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed. During the quarter, $15.6 million of Senior Notes and $9.9 million of MRP stock was redeemed. Prepayment premiums of approximately 0.6% and 1% were paid upon redemption of the Senior Notes and MRP stock, respectfully.

Please see the Financial Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage and other important fund information.

For further information regarding the calculation of distributable cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseadvisors.com.

| |

| |

| 2020 2nd Quarter Report | May 31, 2020 |

| |

| TTP Key Financial Data (supplemental unaudited information) |

| (dollar amounts in thousands unless otherwise indicated) |

| |

The information presented below regarding Distributable Cash Flow and Selected Financial Information is supplemental non-GAAP financial information, which the fund believes is meaningful to understanding operating performance. The Distributable Cash Flow Ratios include the functional equivalent of EBITDA for non-investment companies, and the fund believes they are an important supplemental measure of performance and promote comparisons from period-to-period. This information is supplemental, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction with the full financial statements.

| | 2019 | | 2020 |

| | Q2(1) | | Q3(1) | | Q4(1) | | Q1(1) | | Q2(1) |

| Total Income from Investments | | | | | | | | | | | | | | | | | | | | |

Dividends and distributions from investments,

net of foreign taxes withheld | | $ | 4,032 | | | $ | 3,905 | | | $ | 3,890 | | | $ | 3,744 | | | $ | 1,349 | |

| Dividends paid in kind | | | 54 | | | | 62 | | | | 68 | | | | 9 | | | | 10 | |

| Net premiums on options written | | | 1,039 | | | | 967 | | | | 483 | | | | 539 | | | | 208 | |

| Total from investments | | | 5,125 | | | | 4,934 | | | | 4,441 | | | | 4,292 | | | | 1,567 | |

| Operating Expenses Before Leverage Costs | | | | | | | | | | | | | | | | | | | | |

| Advisory fees, net of fees waived | | | 643 | | | | 602 | | | | 563 | | | | 548 | | | | 235 | |

| Other operating expenses | | | 149 | | | | 138 | | | | 116 | | | | 147 | | | | 137 | |

| | | 792 | | | | 740 | | | | 679 | | | | 695 | | | | 372 | |

| Distributable cash flow before leverage costs | | | 4,333 | | | | 4,194 | | | | 3,762 | | | | 3,597 | | | | 1,195 | |

| Leverage costs(2) | | | 633 | | | | 626 | | | | 609 | | | | 585 | | | | 409 | |

| Distributable Cash Flow(3) | | $ | 3,700 | | | $ | 3,568 | | | $ | 3,153 | | | $ | 3,012 | | | $ | 786 | |

Net realized loss on investments and foreign

currency translation, for the period | | $ | (5,479 | ) | | $ | (2,745 | ) | | $ | (1,524 | ) | | $ | (5,807 | ) | | $ | (86,692 | ) |

| As a percent of average total assets(4) | | | | | | | | | | | | | | | | | | | | |

| Total from investments | | | 8.84 | % | | | 8.96 | % | | | 8.74 | % | | | 8.96 | % | | | 5.82 | % |

| Operating expenses before leverage costs | | | 1.37 | % | | | 1.34 | % | | | 1.34 | % | | | 1.45 | % | | | 1.38 | % |

| Distributable cash flow before leverage costs | | | 7.47 | % | | | 7.62 | % | | | 7.40 | % | | | 7.51 | % | | | 4.44 | % |

| As a percent of average net assets(4) | | | | | | | | | | | | | | | | | | | | |

| Total from investments | | | 11.97 | % | | | 12.63 | % | | | 12.46 | % | | | 12.31 | % | | | 12.85 | % |

| Operating expenses before leverage costs | | | 1.85 | % | | | 1.89 | % | | | 1.91 | % | | | 1.99 | % | | | 3.05 | % |

| Leverage costs | | | 1.48 | % | | | 1.60 | % | | | 1.71 | % | | | 1.68 | % | | | 3.35 | % |

| Distributable cash flow | | | 8.64 | % | | | 9.14 | % | | | 8.84 | % | | | 8.64 | % | | | 6.45 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Selected Financial Information | | | | | | | | | | | | | | | | | | | | |

| Distributions paid on common stock | | $ | 4,081 | | | $ | 2,855 | | | $ | 2,855 | | | $ | 2,855 | | | $ | 401 | |

| Distributions paid on common stock per share(5) | | | 1.6300 | | | | 1.1400 | | | | 1.1400 | | | | 1.1400 | | | | 0.1600 | |

| Total assets, end of period(6) | | | 222,673 | | | | 207,072 | | | | 192,751 | | | | 169,680 | | | | 75,700 | |

| Average total assets during period(6)(7) | | | 229,950 | | | | 218,436 | | | | 203,852 | | | | 192,750 | | | | 107,094 | |

| Leverage(8) | | | 63,100 | | | | 61,500 | | | | 61,800 | | | | 58,000 | | | | 24,500 | |

| Leverage as a percent of total assets | | | 28.3 | % | | | 29.7 | % | | | 32.1 | % | | | 34.2 | % | | | 32.4 | % |

| Net unrealized depreciation, end of period | | | (19,404 | ) | | | (28,190 | ) | | | (37,569 | ) | | | (48,038 | ) | | | (20,652 | ) |

| Net assets, end of period | | | 157,061 | | | | 143,463 | | | | 129,887 | | | | 110,707 | | | | 50,721 | |

| Average net assets during period(9) | | | 169,837 | | | | 155,032 | | | | 142,932 | | | | 140,195 | | | | 48,522 | |

| Net asset value per common share(5) | | | 62.72 | | | | 57.28 | | | | 51.88 | | | | 44.20 | | | | 20.26 | |

| Market value per common share(5) | | | 56.08 | | | | 51.36 | | | | 46.08 | | | | 39.44 | | | | 16.98 | |

| Shares outstanding (000’s) | | | 10,016 | | | | 10,016 | | | | 10,016 | | | | 10,016 | | | | 2,504 | |

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |